Dolphin TopCo, Inc. Condensed Consolidated Financial Statements (Unaudited) for the Six Months Ended June 30, 2025 .2

Page(s) Condensed Consolidated Financial Statements (Unaudited) Condensed Consolidated Balance Sheet As of June 30, 2025 .............................................................................................................................. 1 Condensed Consolidated Statement of Operations and Comprehensive Loss for the Six Months Ended June 30, 2025.................................................................. 2 Condensed Consolidated Statement of Shareholders' Equity and Mezzanine Equity for the Six Months Ended June 30, 2025 ........................................................................................... 3 Condensed Consolidated Statement of Cash Flows for the Six Months Ended June 30, 2025 ........................................................................................... 4 Notes to Condensed Consolidated Financial Statements (Unaudited) ......................................... 5 - 25 Dolphin TopCo, Inc. Index

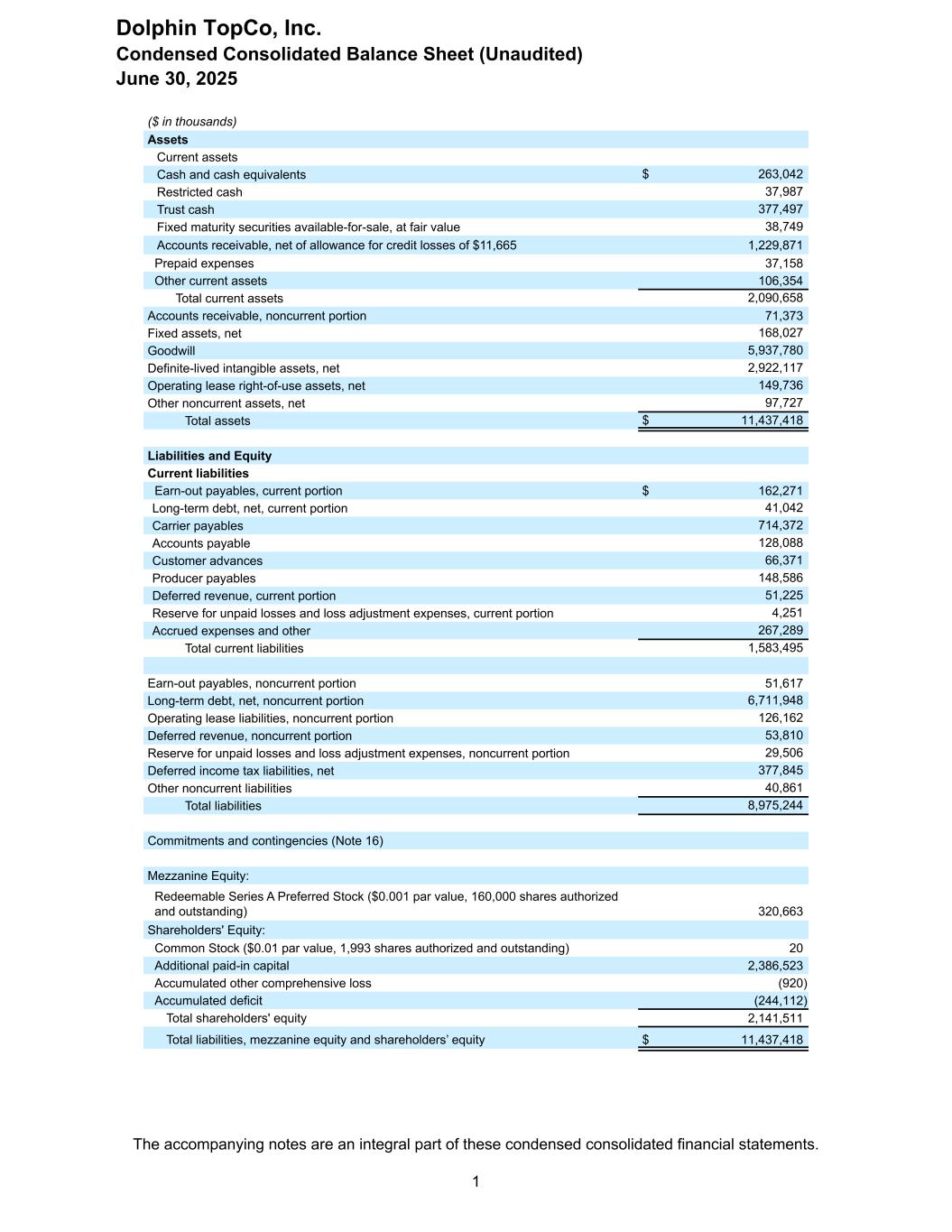

($ in thousands) Assets Current assets Cash and cash equivalents $ 263,042 Restricted cash 37,987 Trust cash 377,497 Fixed maturity securities available-for-sale, at fair value 38,749 Accounts receivable, net of allowance for credit losses of $11,665 1,229,871 Prepaid expenses 37,158 Other current assets 106,354 Total current assets 2,090,658 Accounts receivable, noncurrent portion 71,373 Fixed assets, net 168,027 Goodwill 5,937,780 Definite-lived intangible assets, net 2,922,117 Operating lease right-of-use assets, net 149,736 Other noncurrent assets, net 97,727 Total assets $ 11,437,418 Liabilities and Equity Current liabilities Earn-out payables, current portion $ 162,271 Long-term debt, net, current portion 41,042 Carrier payables 714,372 Accounts payable 128,088 Customer advances 66,371 Producer payables 148,586 Deferred revenue, current portion 51,225 Reserve for unpaid losses and loss adjustment expenses, current portion 4,251 Accrued expenses and other 267,289 Total current liabilities 1,583,495 Earn-out payables, noncurrent portion 51,617 Long-term debt, net, noncurrent portion 6,711,948 Operating lease liabilities, noncurrent portion 126,162 Deferred revenue, noncurrent portion 53,810 Reserve for unpaid losses and loss adjustment expenses, noncurrent portion 29,506 Deferred income tax liabilities, net 377,845 Other noncurrent liabilities 40,861 Total liabilities 8,975,244 Commitments and contingencies (Note 16) Mezzanine Equity: Redeemable Series A Preferred Stock ($0.001 par value, 160,000 shares authorized and outstanding) 320,663 Shareholders' Equity: Common Stock ($0.01 par value, 1,993 shares authorized and outstanding) 20 Additional paid-in capital 2,386,523 Accumulated other comprehensive loss (920) Accumulated deficit (244,112) Total shareholders' equity 2,141,511 Total liabilities, mezzanine equity and shareholders’ equity $ 11,437,418 Dolphin TopCo, Inc. Condensed Consolidated Balance Sheet (Unaudited) June 30, 2025 The accompanying notes are an integral part of these condensed consolidated financial statements. 1

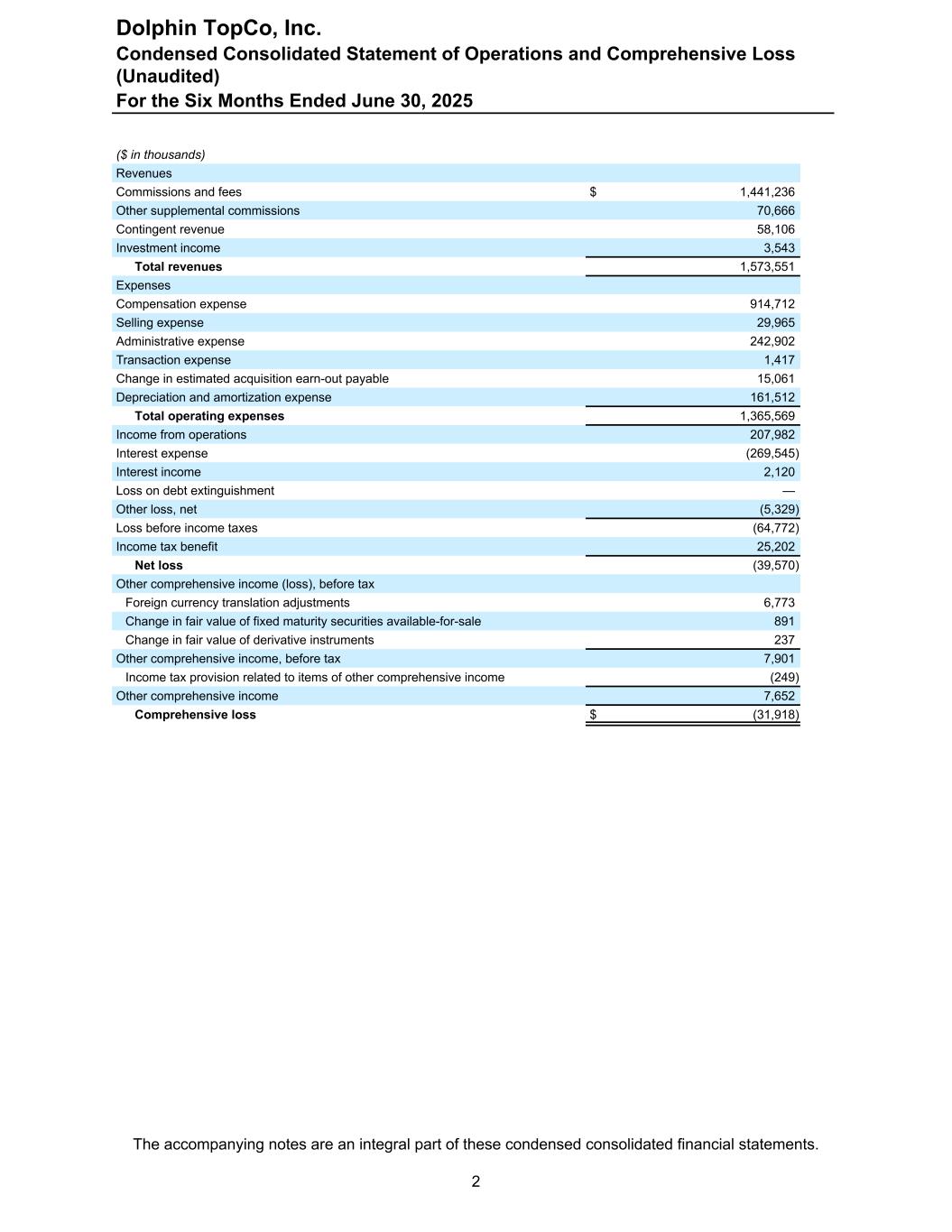

($ in thousands) Revenues Commissions and fees $ 1,441,236 Other supplemental commissions 70,666 Contingent revenue 58,106 Investment income 3,543 Total revenues 1,573,551 Expenses Compensation expense 914,712 Selling expense 29,965 Administrative expense 242,902 Transaction expense 1,417 Change in estimated acquisition earn-out payable 15,061 Depreciation and amortization expense 161,512 Total operating expenses 1,365,569 Income from operations 207,982 Interest expense (269,545) Interest income 2,120 Loss on debt extinguishment — Other loss, net (5,329) Loss before income taxes (64,772) Income tax benefit 25,202 Net loss (39,570) Other comprehensive income (loss), before tax Foreign currency translation adjustments 6,773 Change in fair value of fixed maturity securities available-for-sale 891 Change in fair value of derivative instruments 237 Other comprehensive income, before tax 7,901 Income tax provision related to items of other comprehensive income (249) Other comprehensive income 7,652 Comprehensive loss $ (31,918) Dolphin TopCo, Inc. Condensed Consolidated Statement of Operations and Comprehensive Loss (Unaudited) For the Six Months Ended June 30, 2025 The accompanying notes are an integral part of these condensed consolidated financial statements. 2

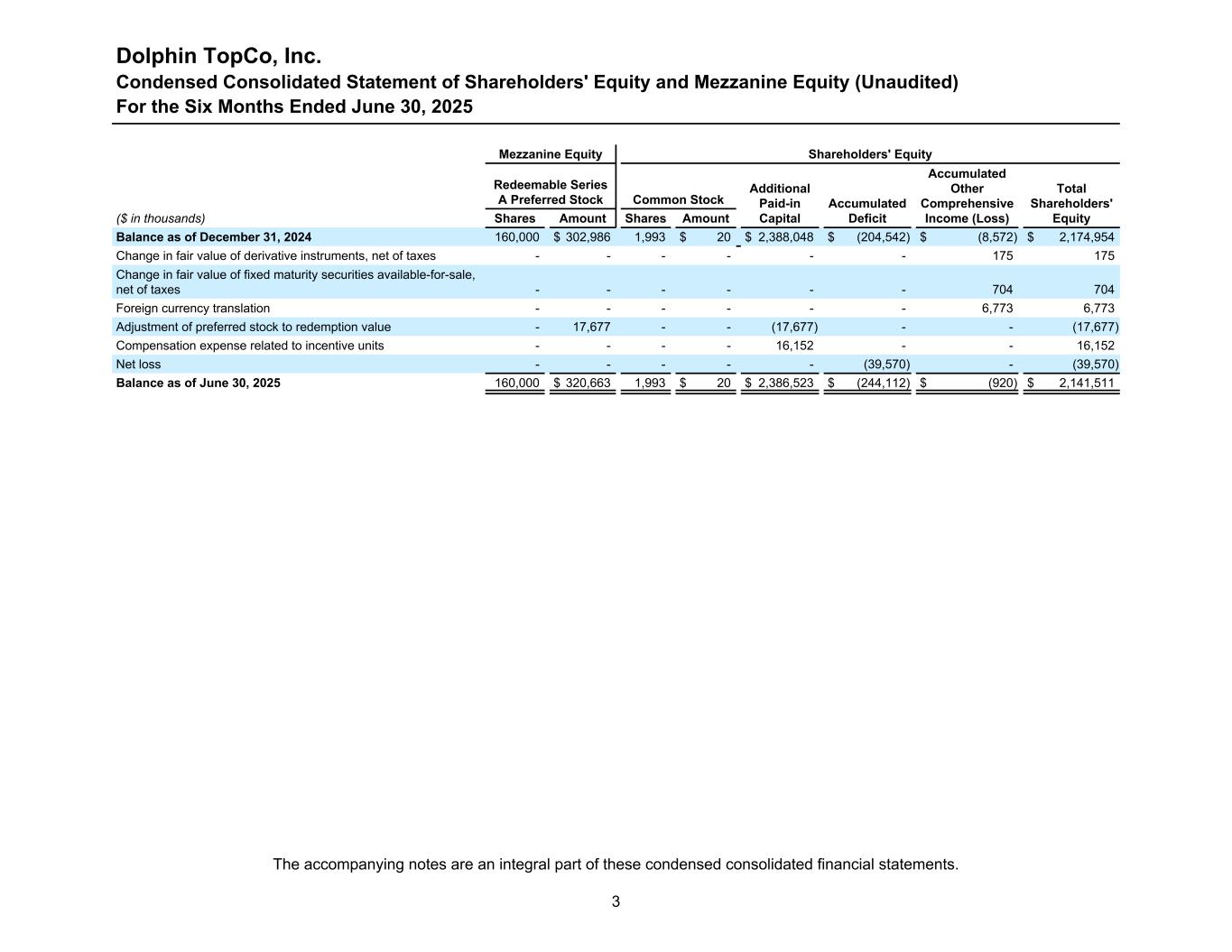

Mezzanine Equity Shareholders' Equity Redeemable Series A Preferred Stock Common Stock Additional Paid-in Capital Accumulated Deficit Accumulated Other Comprehensive Income (Loss) Total Shareholders' Equity($ in thousands) Shares Amount Shares Amount Balance as of December 31, 2024 160,000 $ 302,986 1,993 $ 20 $ 2,388,048 $ (204,542) $ (8,572) $ 2,174,954 Change in fair value of derivative instruments, net of taxes - - - - - - 175 175 Change in fair value of fixed maturity securities available-for-sale, net of taxes - - - - - - 704 704 Foreign currency translation - - - - - - 6,773 6,773 Adjustment of preferred stock to redemption value - 17,677 - - (17,677) - - (17,677) Compensation expense related to incentive units - - - - 16,152 - - 16,152 Net loss - - - - - (39,570) - (39,570) Balance as of June 30, 2025 160,000 $ 320,663 1,993 $ 20 $ 2,386,523 $ (244,112) $ (920) $ 2,141,511 Dolphin TopCo, Inc. Condensed Consolidated Statement of Shareholders' Equity and Mezzanine Equity (Unaudited) For the Six Months Ended June 30, 2025 The accompanying notes are an integral part of these condensed consolidated financial statements. 3

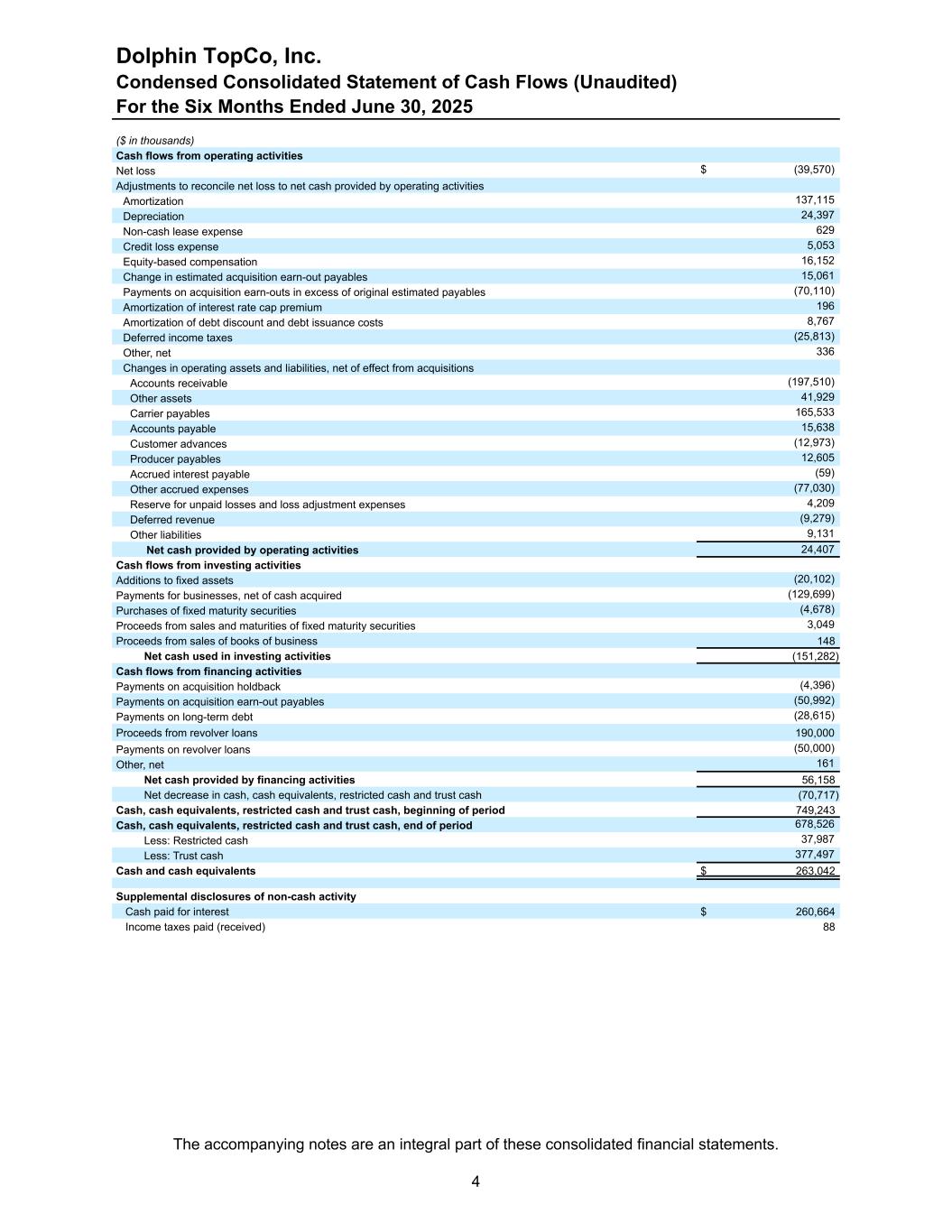

+ ($ in thousands) Cash flows from operating activities Net loss $ (39,570) Adjustments to reconcile net loss to net cash provided by operating activities Amortization 137,115 Depreciation 24,397 Non-cash lease expense 629 Credit loss expense 5,053 Equity-based compensation 16,152 Change in estimated acquisition earn-out payables 15,061 Payments on acquisition earn-outs in excess of original estimated payables (70,110) Amortization of interest rate cap premium 196 Amortization of debt discount and debt issuance costs 8,767 Deferred income taxes (25,813) Other, net 336 Changes in operating assets and liabilities, net of effect from acquisitions Accounts receivable (197,510) Other assets 41,929 Carrier payables 165,533 Accounts payable 15,638 Customer advances (12,973) Producer payables 12,605 Accrued interest payable (59) Other accrued expenses (77,030) Reserve for unpaid losses and loss adjustment expenses 4,209 Deferred revenue (9,279) Other liabilities 9,131 Net cash provided by operating activities 24,407 Cash flows from investing activities Additions to fixed assets (20,102) Payments for businesses, net of cash acquired (129,699) Purchases of fixed maturity securities (4,678) Proceeds from sales and maturities of fixed maturity securities 3,049 Proceeds from sales of books of business 148 Net cash used in investing activities (151,282) Cash flows from financing activities Payments on acquisition holdback (4,396) Payments on acquisition earn-out payables (50,992) Payments on long-term debt (28,615) Proceeds from revolver loans 190,000 Payments on revolver loans (50,000) Other, net 161 Net cash provided by financing activities 56,158 Net decrease in cash, cash equivalents, restricted cash and trust cash (70,717) Cash, cash equivalents, restricted cash and trust cash, beginning of period 749,243 Cash, cash equivalents, restricted cash and trust cash, end of period 678,526 Less: Restricted cash 37,987 Less: Trust cash 377,497 Cash and cash equivalents $ 263,042 Supplemental disclosures of non-cash activity Cash paid for interest $ 260,664 Income taxes paid (received) 88 Dolphin TopCo, Inc. Condensed Consolidated Statement of Cash Flows (Unaudited) For the Six Months Ended June 30, 2025 The accompanying notes are an integral part of these consolidated financial statements. 4

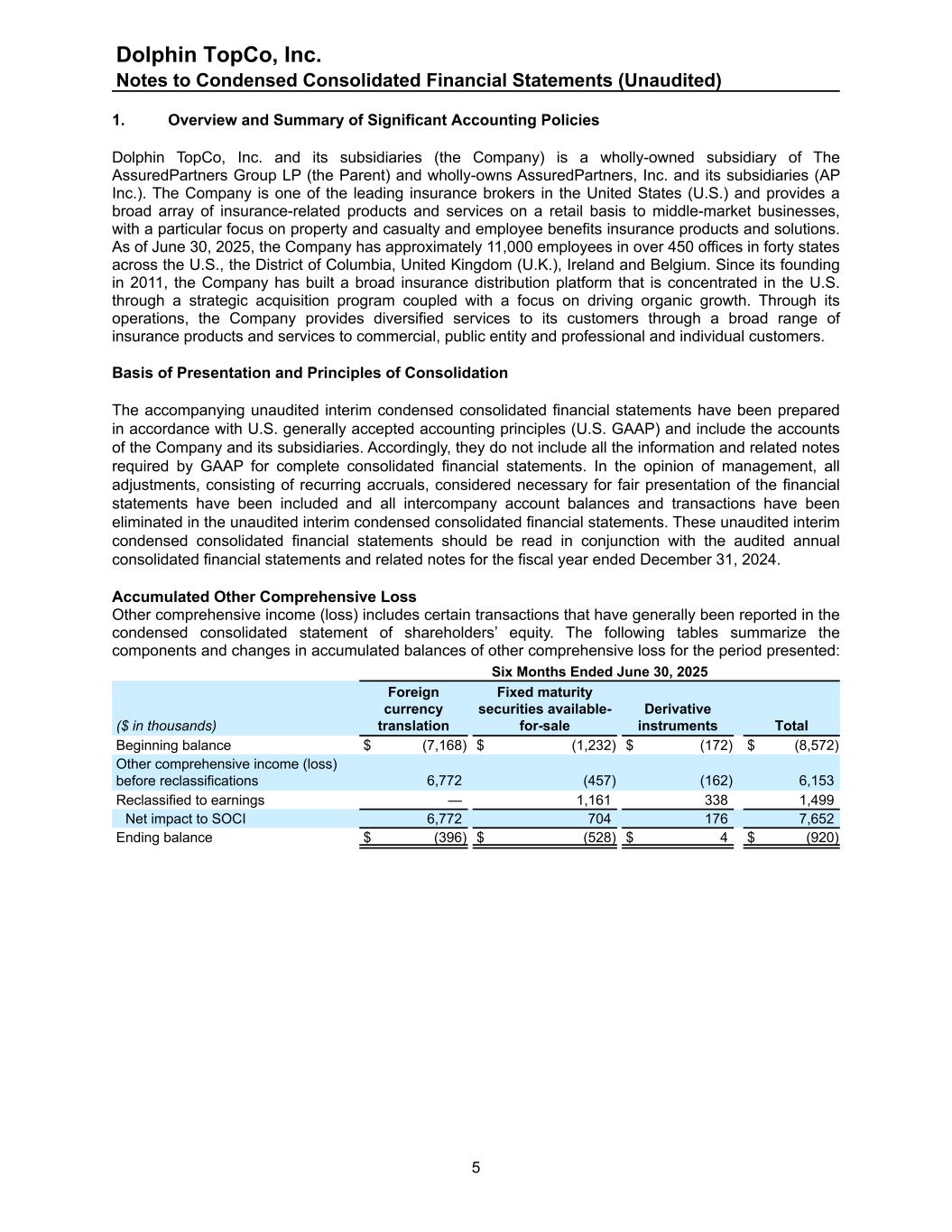

1. Overview and Summary of Significant Accounting Policies Dolphin TopCo, Inc. and its subsidiaries (the Company) is a wholly-owned subsidiary of The AssuredPartners Group LP (the Parent) and wholly-owns AssuredPartners, Inc. and its subsidiaries (AP Inc.). The Company is one of the leading insurance brokers in the United States (U.S.) and provides a broad array of insurance-related products and services on a retail basis to middle-market businesses, with a particular focus on property and casualty and employee benefits insurance products and solutions. As of June 30, 2025, the Company has approximately 11,000 employees in over 450 offices in forty states across the U.S., the District of Columbia, United Kingdom (U.K.), Ireland and Belgium. Since its founding in 2011, the Company has built a broad insurance distribution platform that is concentrated in the U.S. through a strategic acquisition program coupled with a focus on driving organic growth. Through its operations, the Company provides diversified services to its customers through a broad range of insurance products and services to commercial, public entity and professional and individual customers. Basis of Presentation and Principles of Consolidation The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and include the accounts of the Company and its subsidiaries. Accordingly, they do not include all the information and related notes required by GAAP for complete consolidated financial statements. In the opinion of management, all adjustments, consisting of recurring accruals, considered necessary for fair presentation of the financial statements have been included and all intercompany account balances and transactions have been eliminated in the unaudited interim condensed consolidated financial statements. These unaudited interim condensed consolidated financial statements should be read in conjunction with the audited annual consolidated financial statements and related notes for the fiscal year ended December 31, 2024. Accumulated Other Comprehensive Loss Other comprehensive income (loss) includes certain transactions that have generally been reported in the condensed consolidated statement of shareholders’ equity. The following tables summarize the components and changes in accumulated balances of other comprehensive loss for the period presented: Six Months Ended June 30, 2025 ($ in thousands) Foreign currency translation Fixed maturity securities available- for-sale Derivative instruments Total Beginning balance $ (7,168) $ (1,232) $ (172) $ (8,572) Other comprehensive income (loss) before reclassifications 6,772 (457) (162) 6,153 Reclassified to earnings — 1,161 338 1,499 Net impact to SOCI 6,772 704 176 7,652 Ending balance $ (396) $ (528) $ 4 $ (920) Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 5

Use of Estimates The preparation of these unaudited interim condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. These estimates and assumptions affect the reported amounts of assets, liabilities, revenues and expenses as well as disclosures of contingent assets and liabilities at the date of the consolidated financial statements. The principal estimates used include, among others, the allocation of purchase price to the fair value of net assets acquired in connection with acquisitions, the valuation of earn-out payables, goodwill and other intangible assets, revenue recognition, equity-based compensation, assessments regarding potential impairment of assets, and the estimated fair value of financial instruments. Actual results may differ from those estimates. New Accounting Pronouncements Not Yet Adopted In December 2023, the Financial Accounting Standards Board (FASB) issued ASU 2023-09, Improvements to Income Tax Disclosures (ASU 2023-09). The standard requires disaggregated income tax information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 requires non-public business entities to provide qualitative disclosures about specific categories of reconciling items and individual jurisdictions that result in a significant difference between the statutory tax rate and the effective tax rate. Additionally, ASU 2023-09 requires that disclosures of taxes paid by non-public business entities must be disaggregated into federal, state and foreign tax components, and separate disclosure of taxes paid to individual jurisdictions to which greater than 5% of the total taxes are paid. The Company is subject to the provisions of this standard for annual periods beginning after December 15, 2025 and is currently evaluating the impact of this standard on its disclosures. In November 2024, the FASB issued ASU 2024-03, Income Statement Reporting-Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40), Disaggregation of Income Statement Expenses. The standard update improves the disclosures about a public business entity’s expenses by requiring more detailed information about the types of expenses (including purchases of inventory, employee compensation, depreciation and amortization) included within income statement expense captions. The guidance will be effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods within annual reporting periods beginning after December 15, 2027. Early adoption is permitted. The standard updates are to be applied prospectively with the option for retrospective application. The Company is currently evaluating the impact of adoption of the standard update on its financial statement disclosures. In July 2025, the FASB issued ASU 2025-05, Measurement of Credit Losses for Accounts Receivable and Contract Assets, which provides guidance for estimating credit losses under the current expected credit losses (CECL) model for current accounts receivable and current contract assets arising from transactions accounted for under ASC 606, Revenue from Contracts with Customers (ASC 606). The guidance is effective for periods beginning after December 15, 2025 and will be adopted prospectively. Early adoption is permitted. The Company is currently evaluating the impact of adoption of this standard on its financial statements. 2. Revenue from Contracts with Customers The Company recognizes revenue in accordance with ASC 606 by following a five-step model: (1) identifying the contract with the customer, (2) identifying performance obligations, (3) determining the Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 6

transaction price, (4) allocating the transaction price to performance obligations, and (5) recognizing revenue when the performance obligation is satisfied. Commissions and Fees: Commissions are fixed at the contract effective date and generally are based on a percentage of premiums for insurance coverage or employee headcount for employer sponsored benefit plans. Commissions depend on various factors, including the type of risk being placed, the particular underwriting enterprise’s demand, the expected loss experience of the particular risk coverage, and historical benchmarks surrounding the level of effort necessary for us to place and service the insurance contracts. Commission revenues are recognized on the effective date of the insurance policy, which is the date that the control of the insurance policy transfers to the customer upon satisfaction of the related performance obligation. Fee revenues, negotiated in lieu of commissions, are recognized in the same manner as commission revenue. Fee revenues generated from other services, which include but are not limited to third party claims administration and other risk management consulting services, are recognized throughout the contract term, typically within one year as the services are rendered, and the related performance obligation is satisfied. Fee revenues received in advance are deferred until the related performance obligation is satisfied which is either on effective date of the insurance policy or over the term of the insurance policy as services transfer to the customer. In certain circumstances, the Company provides more than one performance obligation to the customer that is comprised of placement of an insurance policy and other post-placement services. For consideration allocated to the placement of an insurance policy, the Company recognizes revenue on the policy effective date. For certain products, remaining consideration is allocated to other performance obligations based on their relative fair values over the term of the insurance policy, which is generally one year or less, as the services are rendered. Management reserves for estimated policy cancellations based upon historical cancellation experience adjusted in accordance with known circumstances. Other Supplemental Commissions. Other supplemental commissions are paid by an insurance carrier based on historical performance criteria and are generally established annually in advance of a contractual period. Other supplemental commissions includes incentives and guaranteed supplemental commissions. Other supplemental commissions are estimated and accrued on the effective date of an insurance policy. For supplemental revenue contracts, our obligation to the underwriting company is fully earned and recognized consistent with the performance of our obligations. Contingent Revenue: Profit-sharing contingent commissions represent variable consideration from insurance carriers that may be received in certain cases separate from commissions and fees and are generally received within one year. A profit-sharing contingent commission is a commission paid by an insurance carrier and is based on, among other things, the overall underwriting results and/or growth of the business placed with that insurance carrier during a particular performance year and is determined after the contractual period. These revenues are variable in nature until all contingencies are resolved and therefore estimated and recognized at which time significant reversal of contingent revenue is not probable. As such, an estimated amount of consideration that will be received from the insurance carrier the following year is accrued on the effective date of the insurance policy. Because our expectation of the ultimate contingent revenue amounts to be earned can vary from period to period, especially in contracts sensitive to loss ratios, our estimates might change significantly from quarter to quarter. Variable consideration is recognized when we conclude, based on all the facts and information available at the reporting date, that it is probable that a significant revenue reversal will not occur in future periods. Disaggregation of Revenue Property & Casualty (P&C): The Company’s commissions earned from P&C products and services are comprised of a broad range of insurance lines that are offered to middle-market businesses, public institutions, and individuals. Employee Benefits (EB): The Company places EB products and provides consulting and administrative support services on both fully insured and self-insured EB plan structures for employers of all sizes. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 7

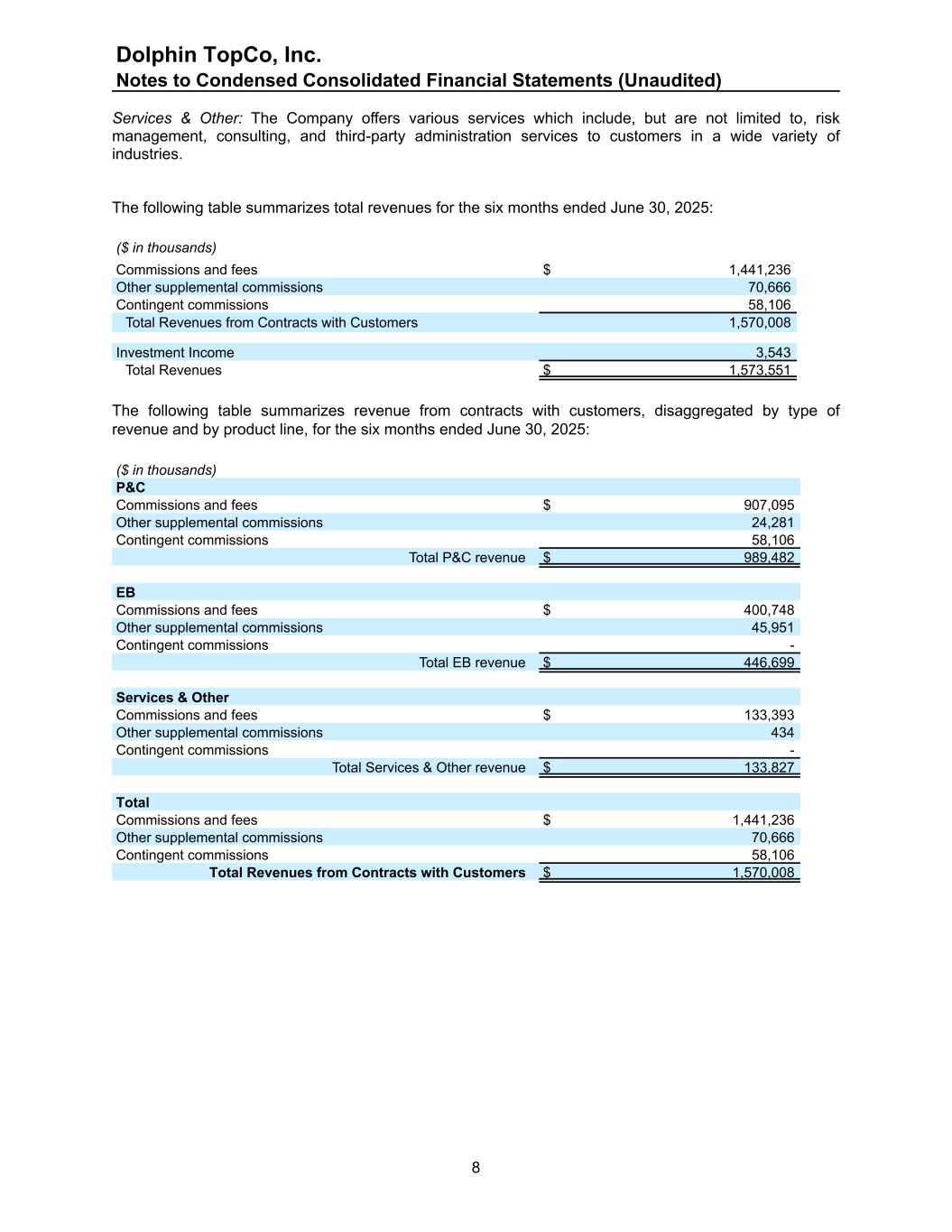

Services & Other: The Company offers various services which include, but are not limited to, risk management, consulting, and third-party administration services to customers in a wide variety of industries. The following table summarizes total revenues for the six months ended June 30, 2025: ($ in thousands) Commissions and fees $ 1,441,236 Other supplemental commissions 70,666 Contingent commissions 58,106 Total Revenues from Contracts with Customers 1,570,008 Investment Income 3,543 Total Revenues $ 1,573,551 The following table summarizes revenue from contracts with customers, disaggregated by type of revenue and by product line, for the six months ended June 30, 2025: ($ in thousands) P&C Commissions and fees $ 907,095 Other supplemental commissions 24,281 Contingent commissions 58,106 Total P&C revenue $ 989,482 EB Commissions and fees $ 400,748 Other supplemental commissions 45,951 Contingent commissions - Total EB revenue $ 446,699 Services & Other Commissions and fees $ 133,393 Other supplemental commissions 434 Contingent commissions - Total Services & Other revenue $ 133,827 Total Commissions and fees $ 1,441,236 Other supplemental commissions 70,666 Contingent commissions 58,106 Total Revenues from Contracts with Customers $ 1,570,008 Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 8

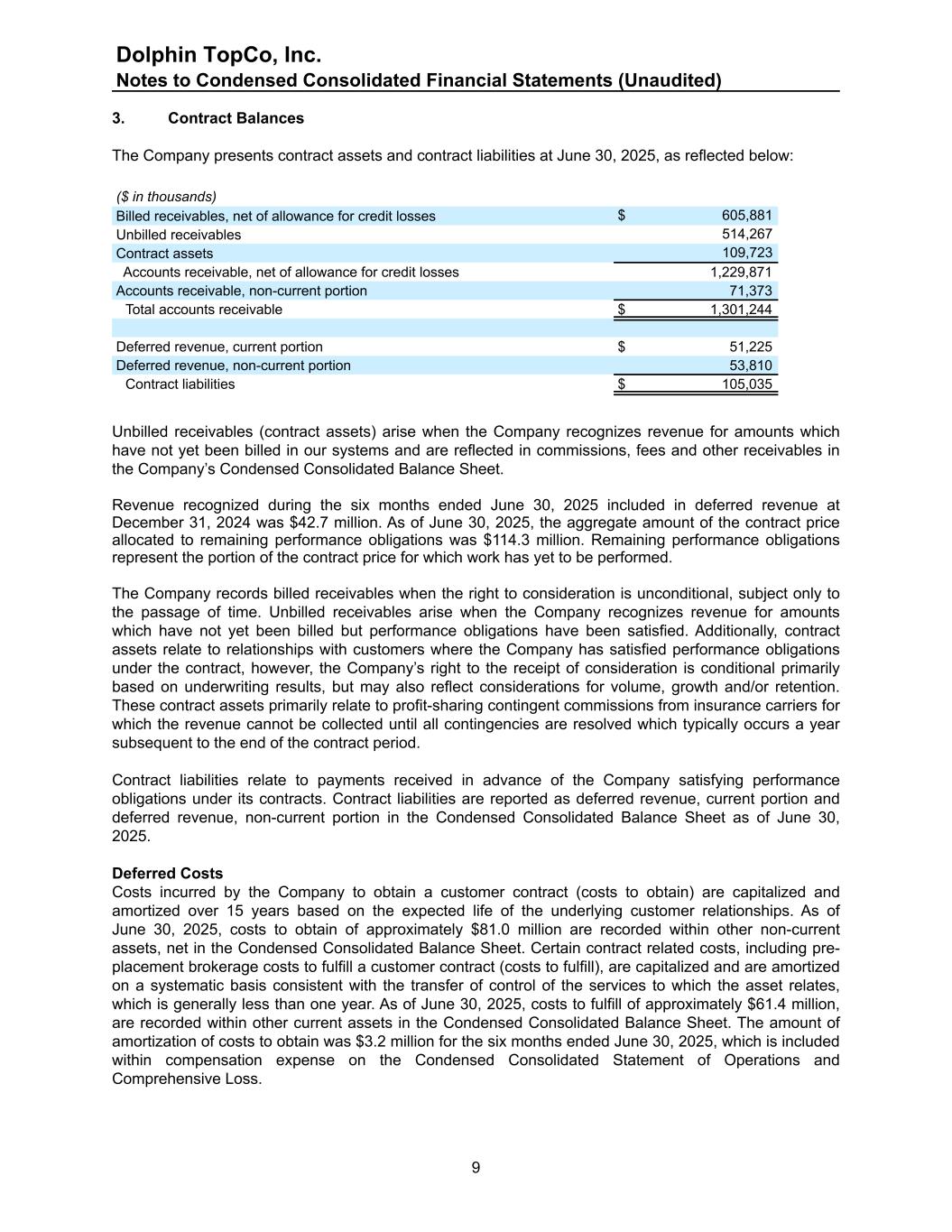

3. Contract Balances The Company presents contract assets and contract liabilities at June 30, 2025, as reflected below: ($ in thousands) Billed receivables, net of allowance for credit losses $ 605,881 Unbilled receivables 514,267 Contract assets 109,723 Accounts receivable, net of allowance for credit losses 1,229,871 Accounts receivable, non-current portion 71,373 Total accounts receivable $ 1,301,244 Deferred revenue, current portion $ 51,225 Deferred revenue, non-current portion 53,810 Contract liabilities $ 105,035 Unbilled receivables (contract assets) arise when the Company recognizes revenue for amounts which have not yet been billed in our systems and are reflected in commissions, fees and other receivables in the Company’s Condensed Consolidated Balance Sheet. Revenue recognized during the six months ended June 30, 2025 included in deferred revenue at December 31, 2024 was $42.7 million. As of June 30, 2025, the aggregate amount of the contract price allocated to remaining performance obligations was $114.3 million. Remaining performance obligations represent the portion of the contract price for which work has yet to be performed. The Company records billed receivables when the right to consideration is unconditional, subject only to the passage of time. Unbilled receivables arise when the Company recognizes revenue for amounts which have not yet been billed but performance obligations have been satisfied. Additionally, contract assets relate to relationships with customers where the Company has satisfied performance obligations under the contract, however, the Company’s right to the receipt of consideration is conditional primarily based on underwriting results, but may also reflect considerations for volume, growth and/or retention. These contract assets primarily relate to profit-sharing contingent commissions from insurance carriers for which the revenue cannot be collected until all contingencies are resolved which typically occurs a year subsequent to the end of the contract period. Contract liabilities relate to payments received in advance of the Company satisfying performance obligations under its contracts. Contract liabilities are reported as deferred revenue, current portion and deferred revenue, non-current portion in the Condensed Consolidated Balance Sheet as of June 30, 2025. Deferred Costs Costs incurred by the Company to obtain a customer contract (costs to obtain) are capitalized and amortized over 15 years based on the expected life of the underlying customer relationships. As of June 30, 2025, costs to obtain of approximately $81.0 million are recorded within other non-current assets, net in the Condensed Consolidated Balance Sheet. Certain contract related costs, including pre- placement brokerage costs to fulfill a customer contract (costs to fulfill), are capitalized and are amortized on a systematic basis consistent with the transfer of control of the services to which the asset relates, which is generally less than one year. As of June 30, 2025, costs to fulfill of approximately $61.4 million, are recorded within other current assets in the Condensed Consolidated Balance Sheet. The amount of amortization of costs to obtain was $3.2 million for the six months ended June 30, 2025, which is included within compensation expense on the Condensed Consolidated Statement of Operations and Comprehensive Loss. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 9

4. Business Combinations During the six months ended June 30, 2025, the Company completed six acquisitions. The Company acquired substantially all the net assets of the companies primarily in exchange for cash and accounted for these acquisitions using the acquisition method for recording business combinations. The results of the acquired companies are included in the Condensed Consolidated Statement of Operations and Comprehensive Loss from the date of acquisition. Certain amounts recorded reflect management’s best estimate as of the balance sheet date and may change during the measurement period (not to exceed one year from date of acquisition). During the six months ended June 30, 2025, adjustments made within the permitted measurement period as well as certain reclassifications resulted in a change to goodwill as disclosed in Note 6. Total consideration transferred during the six months ended June 30, 2025 was as follows: ($ in thousands) City Financial Marketing Group Other Total Location Dublin, IE Multiple Multiple Date of Acquisition May 1. 2025 Multiple Multiple Cash $ 138,109 $ 13,585 $ 151,694 Notes or other payables 3,227 — 3,227 Purchase price holdback 1,135 — 1,135 Recorded earn-out payable 27,485 1,690 29,175 Total consideration transferred $ 169,956 $ 15,275 $ 185,231 Maximum potential earn-out payable $ 66,055 $ 4,839 $ 70,894 Amounts of identifiable assets acquired and liabilities assumed for the business combinations consummated during the six months ended June 30, 2025 were as follows: ($ in thousands) City Financial Marketing Group Other Total Cash $ 13,750 - $ 13,750 Trust cash 8,709 - 8,709 Fixed assets 301 $ 10 311 Other current assets 3,560 - 3,560 Goodwill 95,390 9,544 104,934 Customer-related and contract based 58,133 5,721 63,854 Total assets acquired 179,843 15,275 195,118 Current liabilities 9,887 - 9,887 Total liabilities assumed 9,887 - 9,887 Total net assets acquired $ 169,956 $ 15,275 $ 185,231 Of the $104.9 million of goodwill acquired in 2025 approximately $7.8 million is expected to be tax deductible and is amortized over 15 years for income tax purposes starting in the current year. For the 2025 acquisitions, goodwill is attributable to the anticipated growth of the acquiree’s market upon implementation of the Company’s business model. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 10

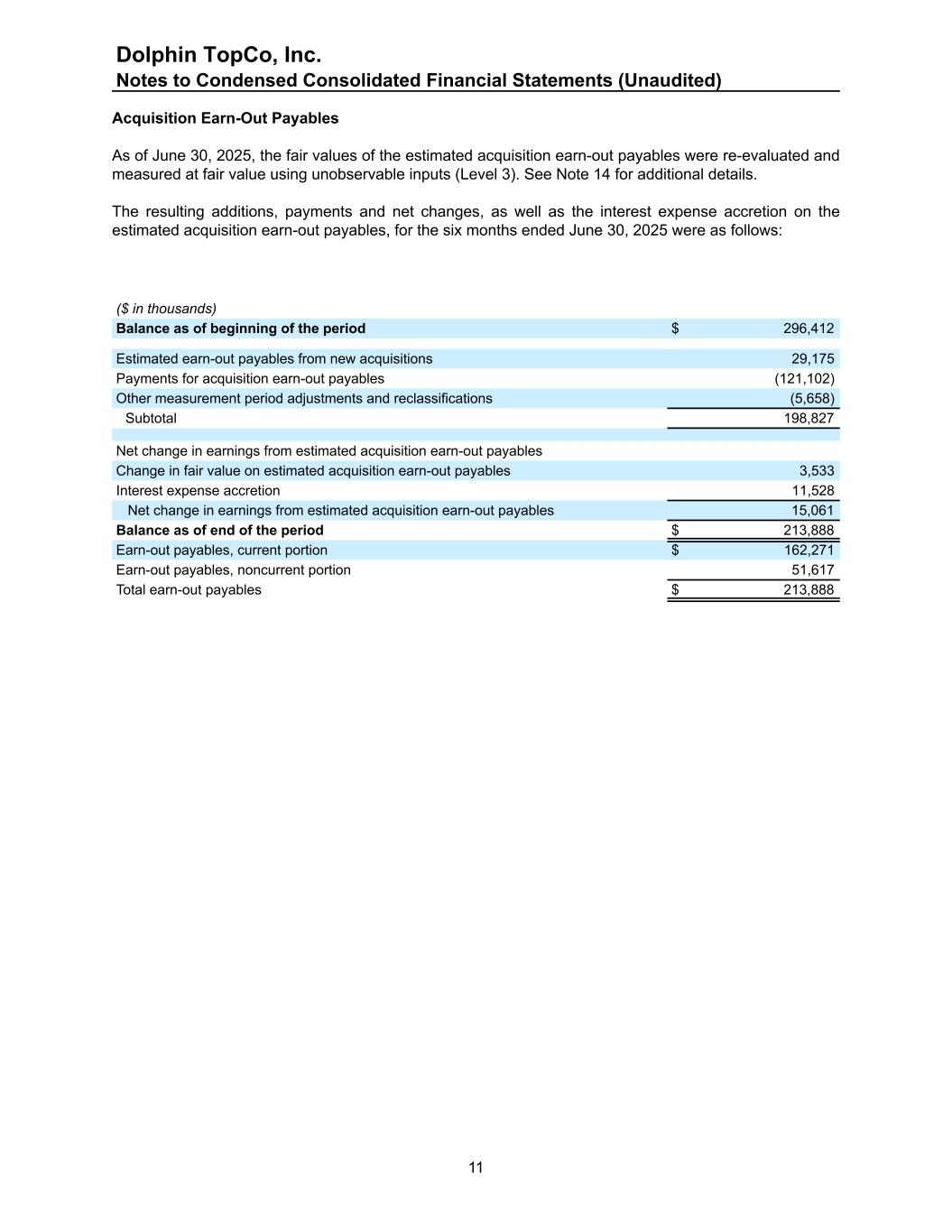

Acquisition Earn-Out Payables As of June 30, 2025, the fair values of the estimated acquisition earn-out payables were re-evaluated and measured at fair value using unobservable inputs (Level 3). See Note 14 for additional details. The resulting additions, payments and net changes, as well as the interest expense accretion on the estimated acquisition earn-out payables, for the six months ended June 30, 2025 were as follows: ($ in thousands) Balance as of beginning of the period $ 296,412 Estimated earn-out payables from new acquisitions 29,175 Payments for acquisition earn-out payables (121,102) Other measurement period adjustments and reclassifications (5,658) Subtotal 198,827 Net change in earnings from estimated acquisition earn-out payables Change in fair value on estimated acquisition earn-out payables 3,533 Interest expense accretion 11,528 Net change in earnings from estimated acquisition earn-out payables 15,061 Balance as of end of the period $ 213,888 Earn-out payables, current portion $ 162,271 Earn-out payables, noncurrent portion 51,617 Total earn-out payables $ 213,888 Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 11

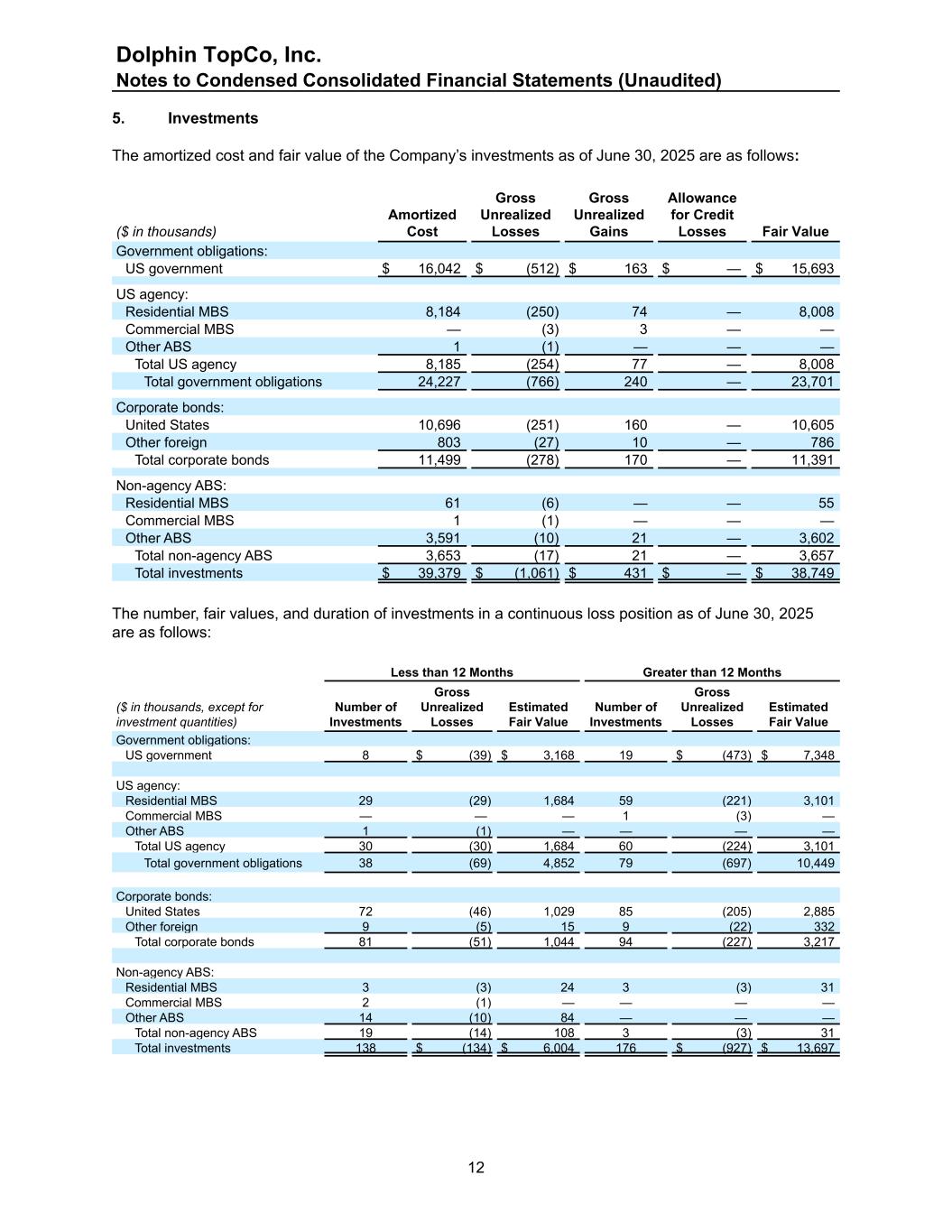

5. Investments The amortized cost and fair value of the Company’s investments as of June 30, 2025 are as follows: ($ in thousands) Amortized Cost Gross Unrealized Losses Gross Unrealized Gains Allowance for Credit Losses Fair Value Government obligations: US government $ 16,042 $ (512) $ 163 $ — $ 15,693 US agency: Residential MBS 8,184 (250) 74 — 8,008 Commercial MBS — (3) 3 — — Other ABS 1 (1) — — — Total US agency 8,185 (254) 77 — 8,008 Total government obligations 24,227 (766) 240 — 23,701 Corporate bonds: United States 10,696 (251) 160 — 10,605 Other foreign 803 (27) 10 — 786 Total corporate bonds 11,499 (278) 170 — 11,391 Non-agency ABS: Residential MBS 61 (6) — — 55 Commercial MBS 1 (1) — — — Other ABS 3,591 (10) 21 — 3,602 Total non-agency ABS 3,653 (17) 21 — 3,657 Total investments $ 39,379 $ (1,061) $ 431 $ — $ 38,749 The number, fair values, and duration of investments in a continuous loss position as of June 30, 2025 are as follows: Less than 12 Months Greater than 12 Months ($ in thousands, except for investment quantities) Number of Investments Gross Unrealized Losses Estimated Fair Value Number of Investments Gross Unrealized Losses Estimated Fair Value Government obligations: US government 8 $ (39) $ 3,168 19 $ (473) $ 7,348 US agency: Residential MBS 29 (29) 1,684 59 (221) 3,101 Commercial MBS — — — 1 (3) — Other ABS 1 (1) — — — — Total US agency 30 (30) 1,684 60 (224) 3,101 Total government obligations 38 (69) 4,852 79 (697) 10,449 Corporate bonds: United States 72 (46) 1,029 85 (205) 2,885 Other foreign 9 (5) 15 9 (22) 332 Total corporate bonds 81 (51) 1,044 94 (227) 3,217 Non-agency ABS: Residential MBS 3 (3) 24 3 (3) 31 Commercial MBS 2 (1) — — — — Other ABS 14 (10) 84 — — — Total non-agency ABS 19 (14) 108 3 (3) 31 Total investments 138 $ (134) $ 6,004 176 $ (927) $ 13,697 Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 12

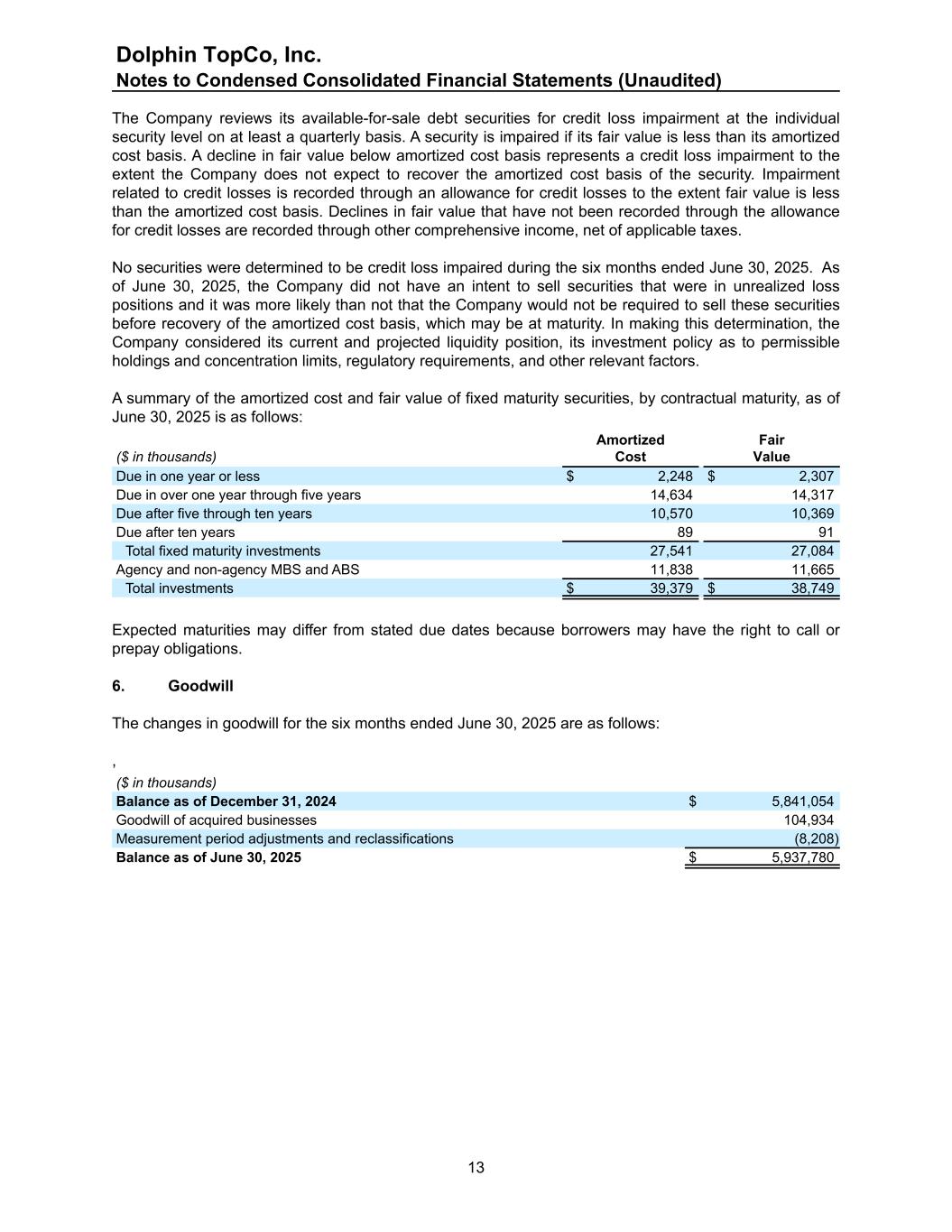

The Company reviews its available-for-sale debt securities for credit loss impairment at the individual security level on at least a quarterly basis. A security is impaired if its fair value is less than its amortized cost basis. A decline in fair value below amortized cost basis represents a credit loss impairment to the extent the Company does not expect to recover the amortized cost basis of the security. Impairment related to credit losses is recorded through an allowance for credit losses to the extent fair value is less than the amortized cost basis. Declines in fair value that have not been recorded through the allowance for credit losses are recorded through other comprehensive income, net of applicable taxes. No securities were determined to be credit loss impaired during the six months ended June 30, 2025. As of June 30, 2025, the Company did not have an intent to sell securities that were in unrealized loss positions and it was more likely than not that the Company would not be required to sell these securities before recovery of the amortized cost basis, which may be at maturity. In making this determination, the Company considered its current and projected liquidity position, its investment policy as to permissible holdings and concentration limits, regulatory requirements, and other relevant factors. A summary of the amortized cost and fair value of fixed maturity securities, by contractual maturity, as of June 30, 2025 is as follows: ($ in thousands) Amortized Cost Fair Value Due in one year or less $ 2,248 $ 2,307 Due in over one year through five years 14,634 14,317 Due after five through ten years 10,570 10,369 Due after ten years 89 91 Total fixed maturity investments 27,541 27,084 Agency and non-agency MBS and ABS 11,838 11,665 Total investments $ 39,379 $ 38,749 Expected maturities may differ from stated due dates because borrowers may have the right to call or prepay obligations. 6. Goodwill The changes in goodwill for the six months ended June 30, 2025 are as follows: , ($ in thousands) Balance as of December 31, 2024 $ 5,841,054 Goodwill of acquired businesses 104,934 Measurement period adjustments and reclassifications (8,208) Balance as of June 30, 2025 $ 5,937,780 Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 13

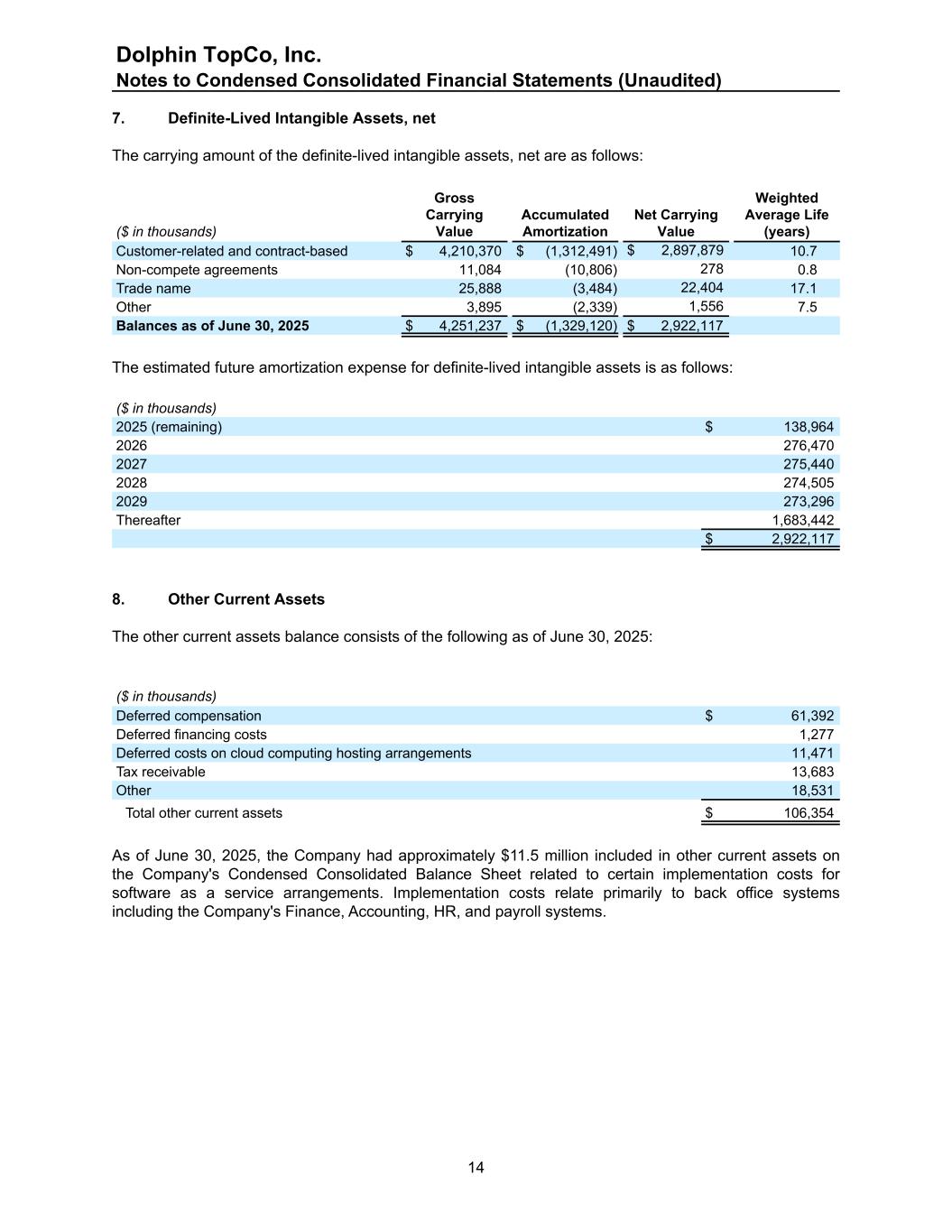

7. Definite-Lived Intangible Assets, net The carrying amount of the definite-lived intangible assets, net are as follows: ($ in thousands) Gross Carrying Value Accumulated Amortization Net Carrying Value Weighted Average Life (years) Customer-related and contract-based $ 4,210,370 $ (1,312,491) $ 2,897,879 10.7 Non-compete agreements 11,084 (10,806) 278 0.8 Trade name 25,888 (3,484) 22,404 17.1 Other 3,895 (2,339) 1,556 7.5 Balances as of June 30, 2025 $ 4,251,237 $ (1,329,120) $ 2,922,117 The estimated future amortization expense for definite-lived intangible assets is as follows: ($ in thousands) 2025 (remaining) $ 138,964 2026 276,470 2027 275,440 2028 274,505 2029 273,296 Thereafter 1,683,442 $ 2,922,117 8. Other Current Assets The other current assets balance consists of the following as of June 30, 2025: ($ in thousands) Deferred compensation $ 61,392 Deferred financing costs 1,277 Deferred costs on cloud computing hosting arrangements 11,471 Tax receivable 13,683 Other 18,531 Total other current assets $ 106,354 As of June 30, 2025, the Company had approximately $11.5 million included in other current assets on the Company's Condensed Consolidated Balance Sheet related to certain implementation costs for software as a service arrangements. Implementation costs relate primarily to back office systems including the Company's Finance, Accounting, HR, and payroll systems. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 14

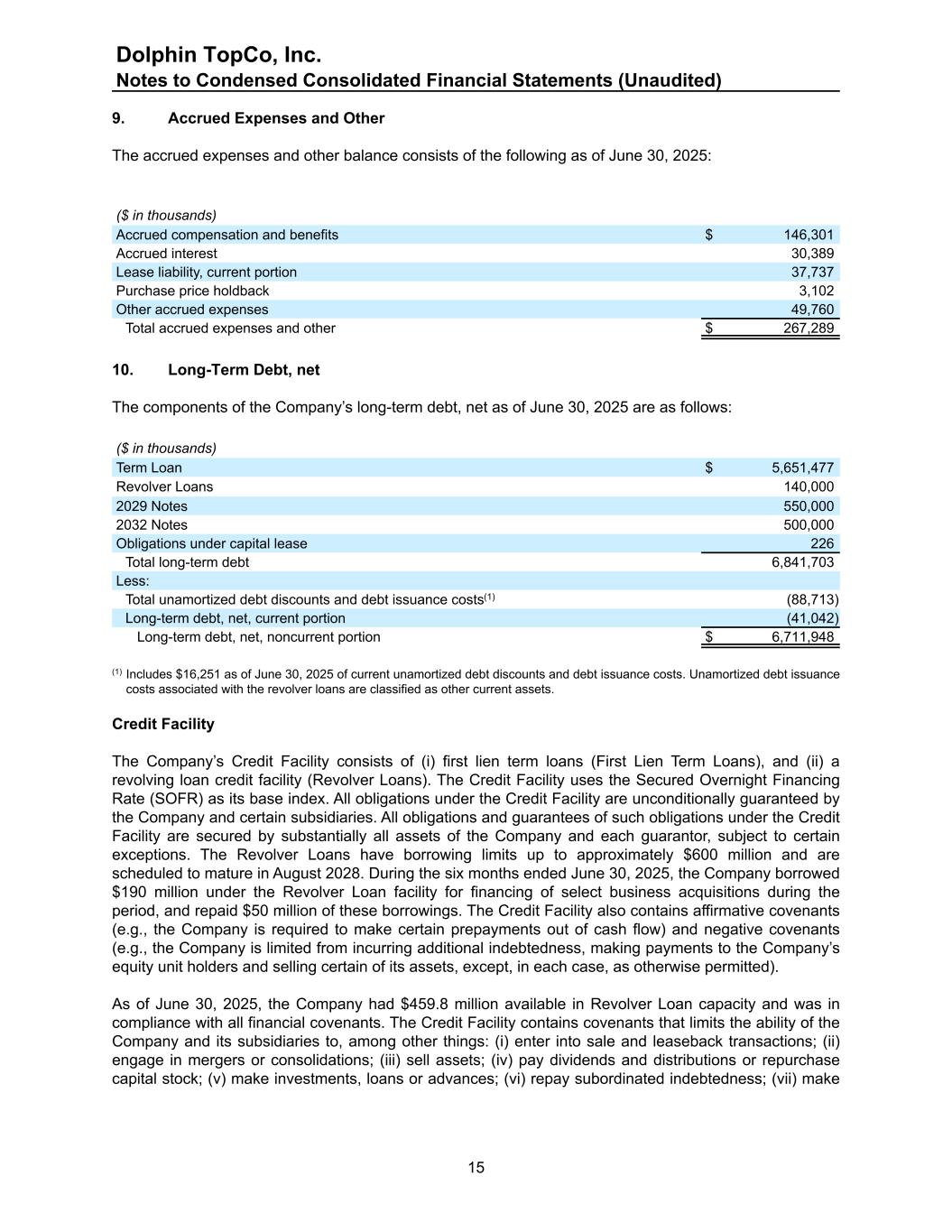

9. Accrued Expenses and Other The accrued expenses and other balance consists of the following as of June 30, 2025: ($ in thousands) Accrued compensation and benefits $ 146,301 Accrued interest 30,389 Lease liability, current portion 37,737 Purchase price holdback 3,102 Other accrued expenses 49,760 Total accrued expenses and other $ 267,289 10. Long-Term Debt, net The components of the Company’s long-term debt, net as of June 30, 2025 are as follows: ($ in thousands) Term Loan $ 5,651,477 Revolver Loans 140,000 2029 Notes 550,000 2032 Notes 500,000 Obligations under capital lease 226 Total long-term debt 6,841,703 Less: Total unamortized debt discounts and debt issuance costs(1) (88,713) Long-term debt, net, current portion (41,042) Long-term debt, net, noncurrent portion $ 6,711,948 (1) Includes $16,251 as of June 30, 2025 of current unamortized debt discounts and debt issuance costs. Unamortized debt issuance costs associated with the revolver loans are classified as other current assets. Credit Facility The Company’s Credit Facility consists of (i) first lien term loans (First Lien Term Loans), and (ii) a revolving loan credit facility (Revolver Loans). The Credit Facility uses the Secured Overnight Financing Rate (SOFR) as its base index. All obligations under the Credit Facility are unconditionally guaranteed by the Company and certain subsidiaries. All obligations and guarantees of such obligations under the Credit Facility are secured by substantially all assets of the Company and each guarantor, subject to certain exceptions. The Revolver Loans have borrowing limits up to approximately $600 million and are scheduled to mature in August 2028. During the six months ended June 30, 2025, the Company borrowed $190 million under the Revolver Loan facility for financing of select business acquisitions during the period, and repaid $50 million of these borrowings. The Credit Facility also contains affirmative covenants (e.g., the Company is required to make certain prepayments out of cash flow) and negative covenants (e.g., the Company is limited from incurring additional indebtedness, making payments to the Company’s equity unit holders and selling certain of its assets, except, in each case, as otherwise permitted). As of June 30, 2025, the Company had $459.8 million available in Revolver Loan capacity and was in compliance with all financial covenants. The Credit Facility contains covenants that limits the ability of the Company and its subsidiaries to, among other things: (i) enter into sale and leaseback transactions; (ii) engage in mergers or consolidations; (iii) sell assets; (iv) pay dividends and distributions or repurchase capital stock; (v) make investments, loans or advances; (vi) repay subordinated indebtedness; (vii) make Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 15

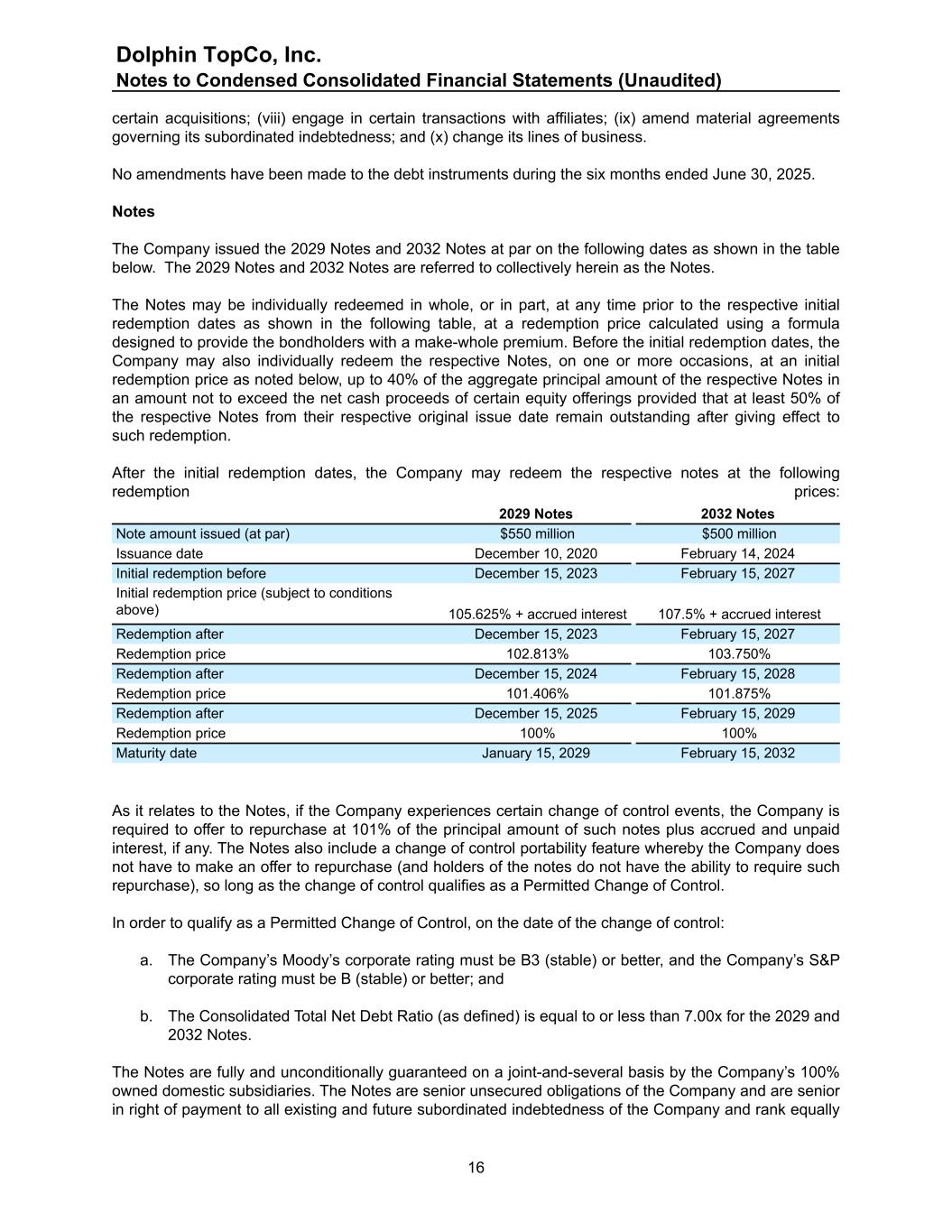

certain acquisitions; (viii) engage in certain transactions with affiliates; (ix) amend material agreements governing its subordinated indebtedness; and (x) change its lines of business. No amendments have been made to the debt instruments during the six months ended June 30, 2025. Notes The Company issued the 2029 Notes and 2032 Notes at par on the following dates as shown in the table below. The 2029 Notes and 2032 Notes are referred to collectively herein as the Notes. The Notes may be individually redeemed in whole, or in part, at any time prior to the respective initial redemption dates as shown in the following table, at a redemption price calculated using a formula designed to provide the bondholders with a make-whole premium. Before the initial redemption dates, the Company may also individually redeem the respective Notes, on one or more occasions, at an initial redemption price as noted below, up to 40% of the aggregate principal amount of the respective Notes in an amount not to exceed the net cash proceeds of certain equity offerings provided that at least 50% of the respective Notes from their respective original issue date remain outstanding after giving effect to such redemption. After the initial redemption dates, the Company may redeem the respective notes at the following redemption prices: 2029 Notes 2032 Notes Note amount issued (at par) $550 million $500 million Issuance date December 10, 2020 February 14, 2024 Initial redemption before December 15, 2023 February 15, 2027 Initial redemption price (subject to conditions above) 105.625% + accrued interest 107.5% + accrued interest Redemption after December 15, 2023 February 15, 2027 Redemption price 102.813% 103.750% Redemption after December 15, 2024 February 15, 2028 Redemption price 101.406% 101.875% Redemption after December 15, 2025 February 15, 2029 Redemption price 100% 100% Maturity date January 15, 2029 February 15, 2032 As it relates to the Notes, if the Company experiences certain change of control events, the Company is required to offer to repurchase at 101% of the principal amount of such notes plus accrued and unpaid interest, if any. The Notes also include a change of control portability feature whereby the Company does not have to make an offer to repurchase (and holders of the notes do not have the ability to require such repurchase), so long as the change of control qualifies as a Permitted Change of Control. In order to qualify as a Permitted Change of Control, on the date of the change of control: a. The Company’s Moody’s corporate rating must be B3 (stable) or better, and the Company’s S&P corporate rating must be B (stable) or better; and b. The Consolidated Total Net Debt Ratio (as defined) is equal to or less than 7.00x for the 2029 and 2032 Notes. The Notes are fully and unconditionally guaranteed on a joint-and-several basis by the Company’s 100% owned domestic subsidiaries. The Notes are senior unsecured obligations of the Company and are senior in right of payment to all existing and future subordinated indebtedness of the Company and rank equally Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 16

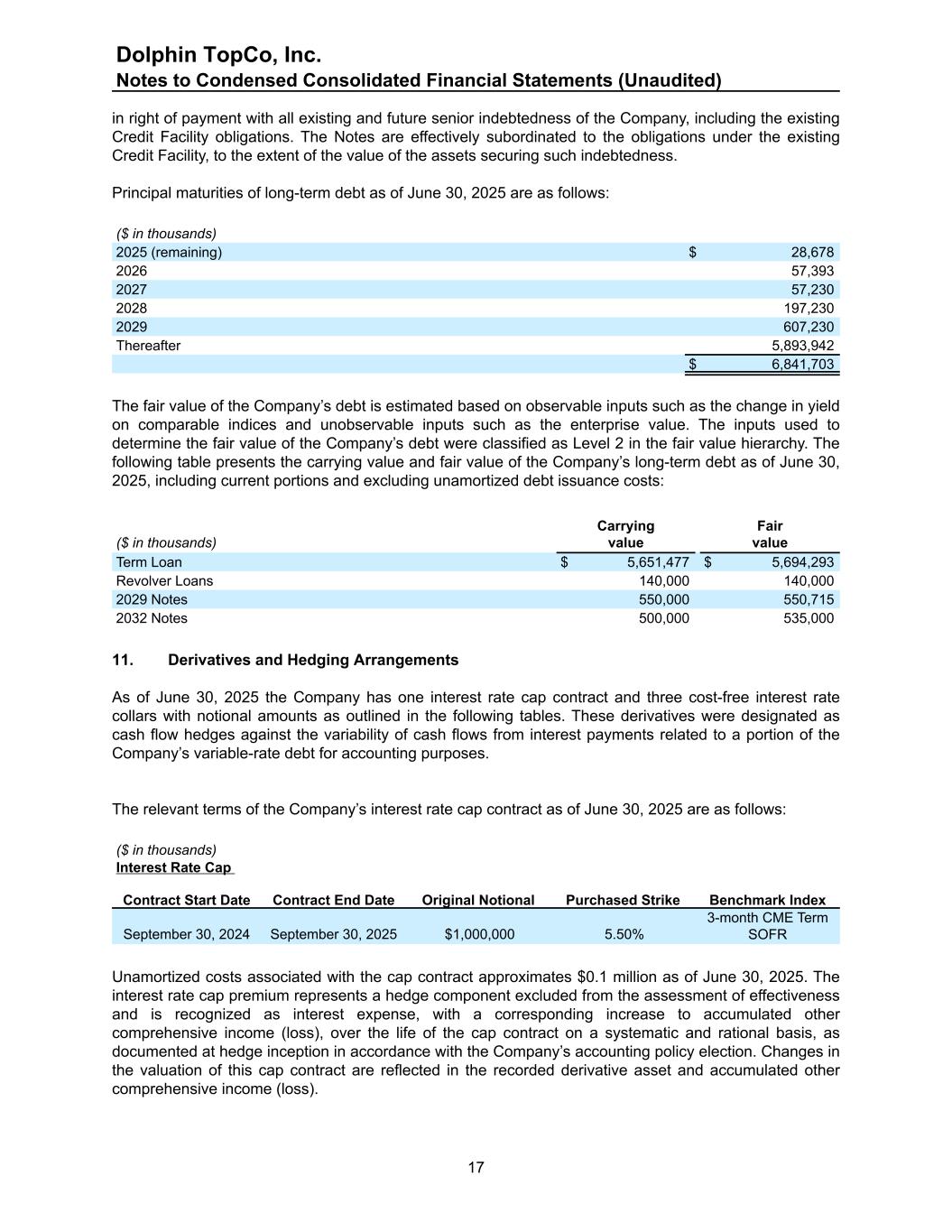

in right of payment with all existing and future senior indebtedness of the Company, including the existing Credit Facility obligations. The Notes are effectively subordinated to the obligations under the existing Credit Facility, to the extent of the value of the assets securing such indebtedness. Principal maturities of long-term debt as of June 30, 2025 are as follows: ($ in thousands) 2025 (remaining) $ 28,678 2026 57,393 2027 57,230 2028 197,230 2029 607,230 Thereafter 5,893,942 $ 6,841,703 The fair value of the Company’s debt is estimated based on observable inputs such as the change in yield on comparable indices and unobservable inputs such as the enterprise value. The inputs used to determine the fair value of the Company’s debt were classified as Level 2 in the fair value hierarchy. The following table presents the carrying value and fair value of the Company’s long-term debt as of June 30, 2025, including current portions and excluding unamortized debt issuance costs: ($ in thousands) Carrying value Fair value Term Loan $ 5,651,477 $ 5,694,293 Revolver Loans 140,000 140,000 2029 Notes 550,000 550,715 2032 Notes 500,000 535,000 11. Derivatives and Hedging Arrangements As of June 30, 2025 the Company has one interest rate cap contract and three cost-free interest rate collars with notional amounts as outlined in the following tables. These derivatives were designated as cash flow hedges against the variability of cash flows from interest payments related to a portion of the Company’s variable-rate debt for accounting purposes. The relevant terms of the Company’s interest rate cap contract as of June 30, 2025 are as follows: ($ in thousands) Interest Rate Cap Contract Start Date Contract End Date Original Notional Purchased Strike Benchmark Index September 30, 2024 September 30, 2025 $1,000,000 5.50% 3-month CME Term SOFR Unamortized costs associated with the cap contract approximates $0.1 million as of June 30, 2025. The interest rate cap premium represents a hedge component excluded from the assessment of effectiveness and is recognized as interest expense, with a corresponding increase to accumulated other comprehensive income (loss), over the life of the cap contract on a systematic and rational basis, as documented at hedge inception in accordance with the Company’s accounting policy election. Changes in the valuation of this cap contract are reflected in the recorded derivative asset and accumulated other comprehensive income (loss). Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 17

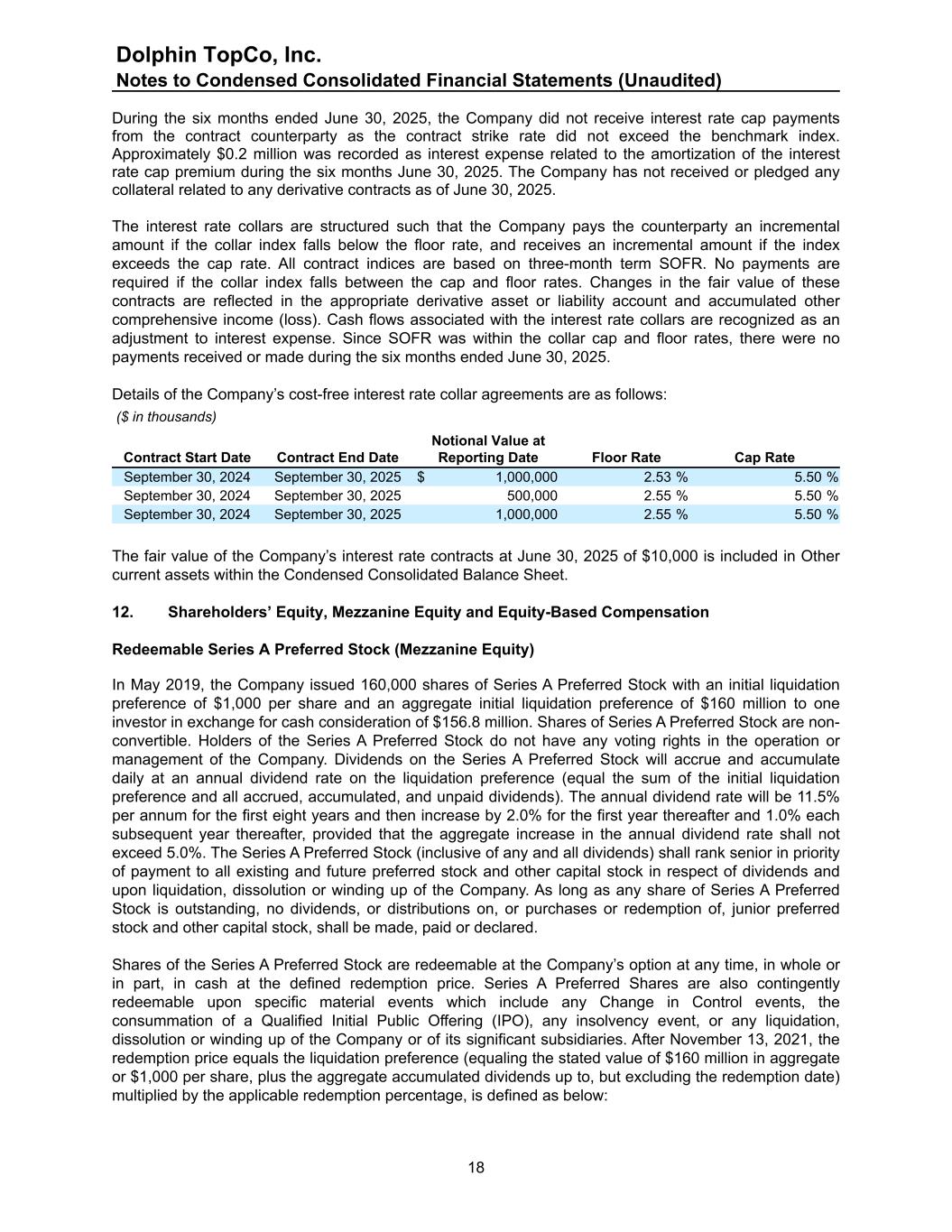

During the six months ended June 30, 2025, the Company did not receive interest rate cap payments from the contract counterparty as the contract strike rate did not exceed the benchmark index. Approximately $0.2 million was recorded as interest expense related to the amortization of the interest rate cap premium during the six months June 30, 2025. The Company has not received or pledged any collateral related to any derivative contracts as of June 30, 2025. The interest rate collars are structured such that the Company pays the counterparty an incremental amount if the collar index falls below the floor rate, and receives an incremental amount if the index exceeds the cap rate. All contract indices are based on three-month term SOFR. No payments are required if the collar index falls between the cap and floor rates. Changes in the fair value of these contracts are reflected in the appropriate derivative asset or liability account and accumulated other comprehensive income (loss). Cash flows associated with the interest rate collars are recognized as an adjustment to interest expense. Since SOFR was within the collar cap and floor rates, there were no payments received or made during the six months ended June 30, 2025. Details of the Company’s cost-free interest rate collar agreements are as follows: ($ in thousands) Contract Start Date Contract End Date Notional Value at Reporting Date Floor Rate Cap Rate September 30, 2024 September 30, 2025 $ 1,000,000 2.53 % 5.50 % September 30, 2024 September 30, 2025 500,000 2.55 % 5.50 % September 30, 2024 September 30, 2025 1,000,000 2.55 % 5.50 % The fair value of the Company’s interest rate contracts at June 30, 2025 of $10,000 is included in Other current assets within the Condensed Consolidated Balance Sheet. 12. Shareholders’ Equity, Mezzanine Equity and Equity-Based Compensation Redeemable Series A Preferred Stock (Mezzanine Equity) In May 2019, the Company issued 160,000 shares of Series A Preferred Stock with an initial liquidation preference of $1,000 per share and an aggregate initial liquidation preference of $160 million to one investor in exchange for cash consideration of $156.8 million. Shares of Series A Preferred Stock are non- convertible. Holders of the Series A Preferred Stock do not have any voting rights in the operation or management of the Company. Dividends on the Series A Preferred Stock will accrue and accumulate daily at an annual dividend rate on the liquidation preference (equal the sum of the initial liquidation preference and all accrued, accumulated, and unpaid dividends). The annual dividend rate will be 11.5% per annum for the first eight years and then increase by 2.0% for the first year thereafter and 1.0% each subsequent year thereafter, provided that the aggregate increase in the annual dividend rate shall not exceed 5.0%. The Series A Preferred Stock (inclusive of any and all dividends) shall rank senior in priority of payment to all existing and future preferred stock and other capital stock in respect of dividends and upon liquidation, dissolution or winding up of the Company. As long as any share of Series A Preferred Stock is outstanding, no dividends, or distributions on, or purchases or redemption of, junior preferred stock and other capital stock, shall be made, paid or declared. Shares of the Series A Preferred Stock are redeemable at the Company’s option at any time, in whole or in part, in cash at the defined redemption price. Series A Preferred Shares are also contingently redeemable upon specific material events which include any Change in Control events, the consummation of a Qualified Initial Public Offering (IPO), any insolvency event, or any liquidation, dissolution or winding up of the Company or of its significant subsidiaries. After November 13, 2021, the redemption price equals the liquidation preference (equaling the stated value of $160 million in aggregate or $1,000 per share, plus the aggregate accumulated dividends up to, but excluding the redemption date) multiplied by the applicable redemption percentage, is defined as below: Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 18

• If the redemption occurs between November 13, 2021 and November 12, 2022, the redemption percentage shall be 103.0%; • If the redemption occurs between November 13, 2022 and November 12, 2023, the redemption percentage shall be 102.0%; • If the redemption occurs between November 13, 2023 and November 12, 2024, the redemption percentage shall be 101.0%; • If the redemption occurs after November 13, 2024, the redemption percentage shall be 100.0%. As of June 30, 2025, the applicable redemption percentage was 100.0%. For the six months ended June 30, 2025, the accrued and unpaid dividend on Series A Preferred Stock amounted to approximately $17.7 million. As of June 30, 2025, the total accumulated unpaid dividends on Series A Preferred Stock amounted to approximately $160.7 million. The Board has not declared a distribution of dividends on the Series A Preferred Stock. Commencing on the 10th anniversary of the issue date, majority holders of the Series A Preferred Stock shall have a right to demand the Company to engage in a process to either effect an IPO or a sale that would result in a change of control of the Company. The Company shall use their reasonable best efforts to pursue an IPO or sale. If the Company breaches such covenant or fails to consummate such IPO or sale within 12 months after such demand is issued, the majority holders may take control of the process and consummate an IPO or sale; provided that such controlled transaction will be structured to maximize cash value to all shareholders. Additionally, such a breach or failure would result in a one-time increase of 2.0% per annum to the dividend rate. Shares of the Series A Preferred Stock issued and outstanding are accounted for as redeemable shares in the mezzanine section on the Company’s Condensed Consolidated Balance Sheet as the shares are redeemable outside of the Company’s control. As of June 30, 2025, shares of the Series A Preferred Stock were considered probable of becoming redeemable due to the existence of the sale demand provision. The Company has elected to adjust the carrying value of the redeemable Series A Preferred Stock to their earliest redemption value through the accretion method. In the absence of retained earnings, adjustments to the redemption value were recorded against additional paid-in capital. Common Stock The Company is authorized to issue 2,000 shares of Common Stock with a par value of $0.01 per share. The holder of each share of Common Stock is entitled to one vote on each matter presented before the shareholders. Profits Interest Units The employees of AP Inc. are participants in The AssuredPartners Group LP Equity Incentive Plan (Incentive Plan), an equity incentive plan sponsored by the Parent which awards equity units of the Parent to certain participating employees of AP Inc. who have substantial responsibility for the management and growth of the Company. The Class C Profits Interest Units are time-based incentive units awarded to select employees of AP Inc. under provisions of the Incentive Plan, which will vest over five years, generally, from the date of grant subject to the employees’ continued employment with the Company; certain awards provide for accelerated vesting upon a change of control of the Company. Total equity-based compensation expense for these Class C Profits Interest Units recognized in the Condensed Consolidated Statement of Operations and Comprehensive (Loss) Income was approximately $13.5 million for the six months ended Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 19

June 30, 2025. During the six months ended June 30, 2025, no Class C Profits Interest Units were issued or forfeited. On September 26, 2024, the Board approved a new class of Profits Interest Units, Class D Profits Interest Units. These units are time-based incentive units awarded to select employees of AP Inc. under provisions of the Incentive Plan, which will vest over four years, generally, from the date of grant subject to the employees’ continued employment with the Company; the awards provide for accelerated vesting upon a change of control of the Company. During the year ended December 31, 2024, the Company granted 36,000,000 Class D Profits Interest Units. Total equity-based compensation expense for these Class D Profits Interest Units recognized in the Condensed Consolidated Statement of Operations and Comprehensive (Loss) Income was approximately $2.7 million for the six months ended June 30, 2025. During the six months ended June 30, 2025, no new Class D Profits Interest Units were issued, and 3.0 million shares were forfeited. As of June 30, 2025, unrecognized compensation expense for Class C and D shares collectively is $78.8 million, which is expected to be recognized over a weighted-average period of 1.98 years. The Parent is a private company. The estimated fair value of the Award Units has been determined by a third-party valuation specialist in accordance with the guidance outlined in the American Institute of Certified Public Accountants’ Accounting and Valuation Guide, Valuation of Privately-Held-Company Equity Securities Issued as Compensation. The valuation starts with the estimate of the enterprise value of the Parent using generally accepted valuation methodologies, including discounted cash flow analysis and comparable public company analysis. The total equity value is then allocated among the different classes of equity units of the Parent using the Option-Pricing Method (OPM) to arrive at the fair value of the Award Units. During 2025, the Company did not require a valuation as there were no new award units issued or redeemed. 13. Income Taxes The effective tax rate for the six months ended June 30, 2025 was 39.0%. The change in the effective tax rate is primarily due to the impact of state taxes and permanent tax differences. A valuation allowance has been established against the deferred tax assets related to interest expense carryforwards for which it is not more likely than not that the benefit will be realized. The Company evaluates the recoverability of the deferred tax assets on a regular basis based upon all available positive and negative evidence. 14. Fair Value of Measurements and Financial Instruments As defined by the FASB, the Company established a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair values as follows: Level 1 Observable inputs such as quoted prices for identical assets in active markets; Level 2 Inputs other than quoted prices for identical assets in active markets, that are observable either directly or indirectly; and Level 3 Unobservable inputs in which there is little or no market data which requires the use of valuation techniques and the development of assumptions. The carrying amounts of the Company’s financial assets and liabilities, including cash and cash equivalents; restricted cash; trust cash; accounts receivable; carrier payables; accounts payable; customer advances; producer payables; reserve for unpaid losses and loss adjustment expenses; contract assets; contract liabilities and deferred revenue on June 30, 2025 approximate fair value because of the short-term maturity of these instruments. The following methods and assumptions are used to estimate the fair values of the Company’s financial instruments that are measured on a recurring basis: Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 20

Interest Rate Contracts Interest rate contracts are valued using pricing models that are based on certain assumptions and readily observable market-based inputs, including yield curves and implied volatility of closely related instruments, for which transparent pricing is available. The Company reflects the credit considerations inherent in the derivative contracts with both positive and negative exposures over the remaining life of the derivative. The credit spreads calculated for each party (e.g., the hedging entity and the bank counterparty) are converted into default probabilities. The default probabilities of the hedging entity are applied to the negative exposures, resulting in a positive credit adjustment, and the default probabilities of the bank counterparty are applied to the positive exposures, resulting in a negative credit adjustment. The bilateral credit valuation adjustment is the sum of the positive and negative adjustments. Earn-Out Payables Earn-out payables are recorded at fair value based on the present value of the expected future payments that are to be made to the sellers of the acquired entities. The Company estimates the future performance of acquired entities using financial projections that are primarily based on earnings before interest, income taxes, depreciation, and amortization (EBITDA) or revenue targets to be achieved over one to three years. The expected future payments are discounted to present value using a risk-adjusted rate that takes into consideration market-based rates of return that reflect the ability of the acquired entities to achieve the target EBITDA or revenue. Revenue growth rates range from 6.0% to 15.0% and the discount rates range from 6.8% to 9.4%. On a quarterly basis, the Company reassesses its current estimates of performance relative to the projection and adjusts the liability to fair value. Changes in financial projections, market participant assumptions for revenue growth and profitability, or the risk-adjusted discount rate, would result in a change in fair value of recorded earn-out payables. See Note 4 for a reconciliation of acquisition earn-out payables measured at fair value on a recurring basis. Fixed Maturity Securities Corporate bonds (foreign and domestic) are valued by models using inputs that are derived principally from or corroborated by observable market data. In the instance that observable market data is unavailable, the Company incorporates inputs from third-party sources and applies reasonable judgment in developing assumptions used to estimate the probability of collecting all contractual cash flows. U.S. government and agency securities are estimated using values obtained from independent pricing services and based on expected future cash flows using a current market rate applicable to the yield, credit quality, and maturity of the investments. For asset-backed securities, including residential MBS, commercial MBS, and other ABS, the Company uses values obtained from independent pricing services. The independent pricing service may consider various factors in determining fair value, including but not limited to, the type of security, issuer-specific news and/or long-term outlook, market conditions and other relevant information, size and position in the issuer’s capital structure, information available in the issuer’s financial statements or other reports, the price and extent of public trading in similar securities of the issuer or comparable companies, and/or factors deemed relevant and appropriate. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 21

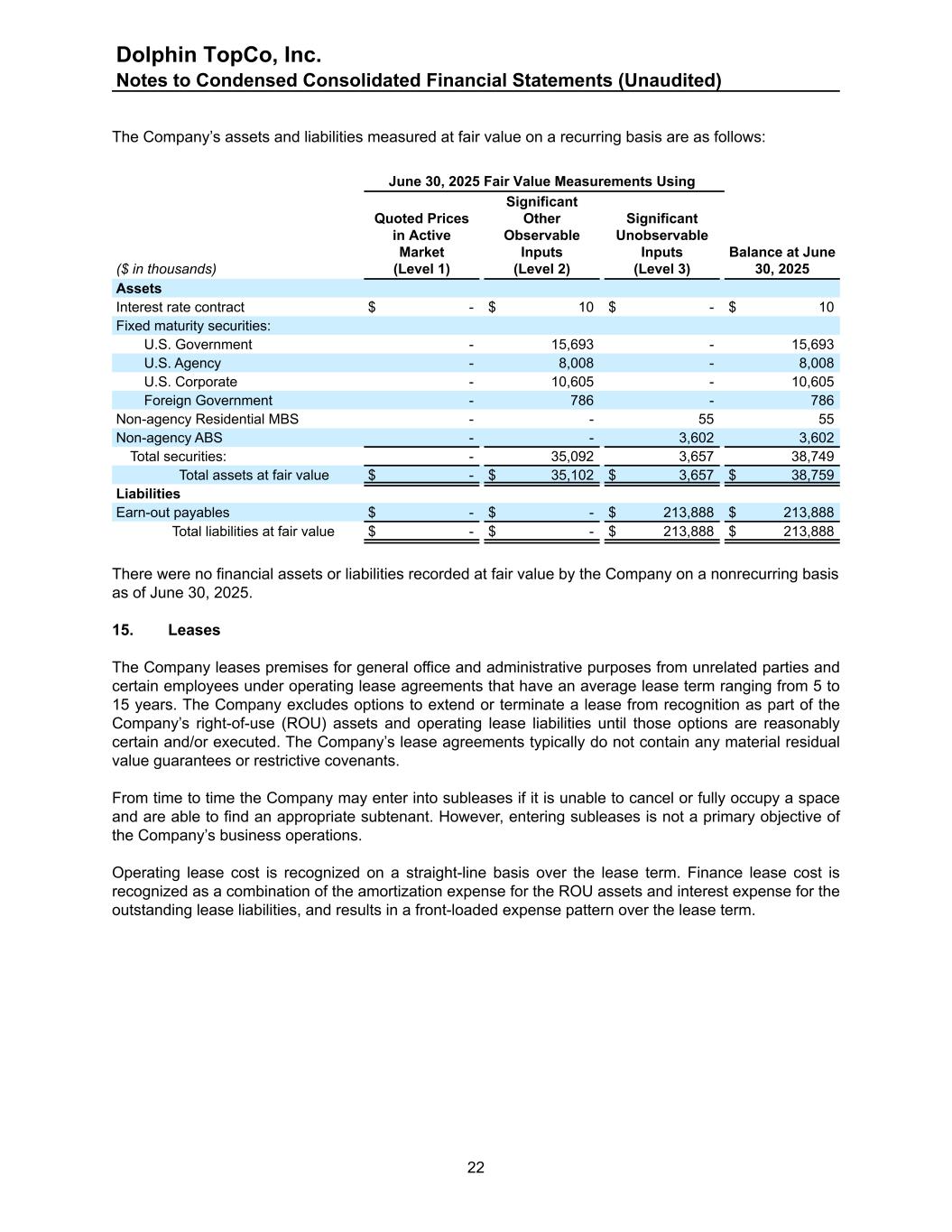

The Company’s assets and liabilities measured at fair value on a recurring basis are as follows: June 30, 2025 Fair Value Measurements Using ($ in thousands) Quoted Prices in Active Market (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Balance at June 30, 2025 Assets Interest rate contract $ - $ 10 $ - $ 10 Fixed maturity securities: U.S. Government - 15,693 - 15,693 U.S. Agency - 8,008 - 8,008 U.S. Corporate - 10,605 - 10,605 Foreign Government - 786 - 786 Non-agency Residential MBS - - 55 55 Non-agency ABS - - 3,602 3,602 Total securities: - 35,092 3,657 38,749 Total assets at fair value $ - $ 35,102 $ 3,657 $ 38,759 Liabilities Earn-out payables $ - $ - $ 213,888 $ 213,888 Total liabilities at fair value $ - $ - $ 213,888 $ 213,888 There were no financial assets or liabilities recorded at fair value by the Company on a nonrecurring basis as of June 30, 2025. 15. Leases The Company leases premises for general office and administrative purposes from unrelated parties and certain employees under operating lease agreements that have an average lease term ranging from 5 to 15 years. The Company excludes options to extend or terminate a lease from recognition as part of the Company’s right-of-use (ROU) assets and operating lease liabilities until those options are reasonably certain and/or executed. The Company’s lease agreements typically do not contain any material residual value guarantees or restrictive covenants. From time to time the Company may enter into subleases if it is unable to cancel or fully occupy a space and are able to find an appropriate subtenant. However, entering subleases is not a primary objective of the Company’s business operations. Operating lease cost is recognized on a straight-line basis over the lease term. Finance lease cost is recognized as a combination of the amortization expense for the ROU assets and interest expense for the outstanding lease liabilities, and results in a front-loaded expense pattern over the lease term. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 22

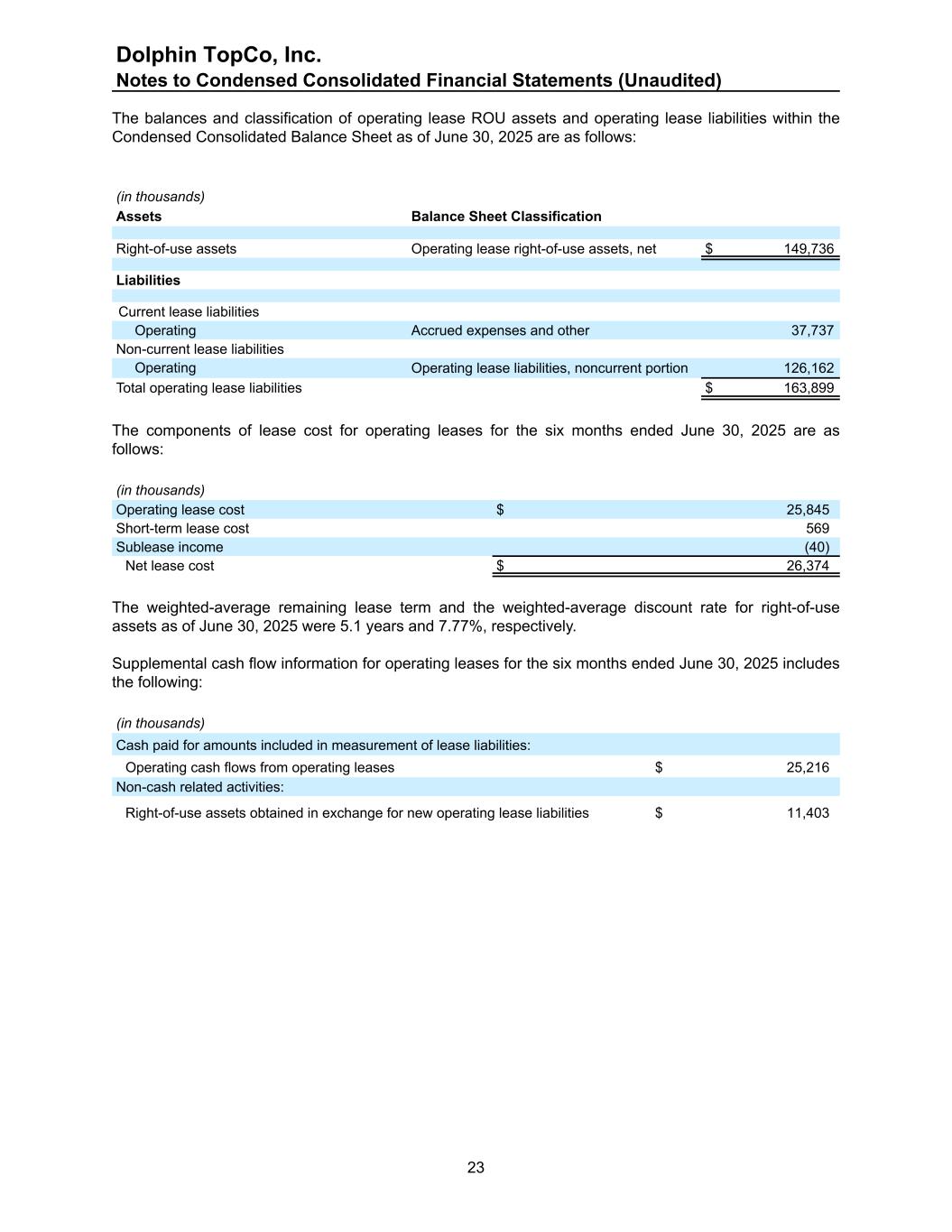

The balances and classification of operating lease ROU assets and operating lease liabilities within the Condensed Consolidated Balance Sheet as of June 30, 2025 are as follows: (in thousands) Assets Balance Sheet Classification Right-of-use assets Operating lease right-of-use assets, net $ 149,736 Liabilities Current lease liabilities Operating Accrued expenses and other 37,737 Non-current lease liabilities Operating Operating lease liabilities, noncurrent portion 126,162 Total operating lease liabilities $ 163,899 The components of lease cost for operating leases for the six months ended June 30, 2025 are as follows: (in thousands) Operating lease cost $ 25,845 Short-term lease cost 569 Sublease income (40) Net lease cost $ 26,374 The weighted-average remaining lease term and the weighted-average discount rate for right-of-use assets as of June 30, 2025 were 5.1 years and 7.77%, respectively. Supplemental cash flow information for operating leases for the six months ended June 30, 2025 includes the following: (in thousands) Cash paid for amounts included in measurement of lease liabilities: Operating cash flows from operating leases $ 25,216 Non-cash related activities: Right-of-use assets obtained in exchange for new operating lease liabilities $ 11,403 Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 23

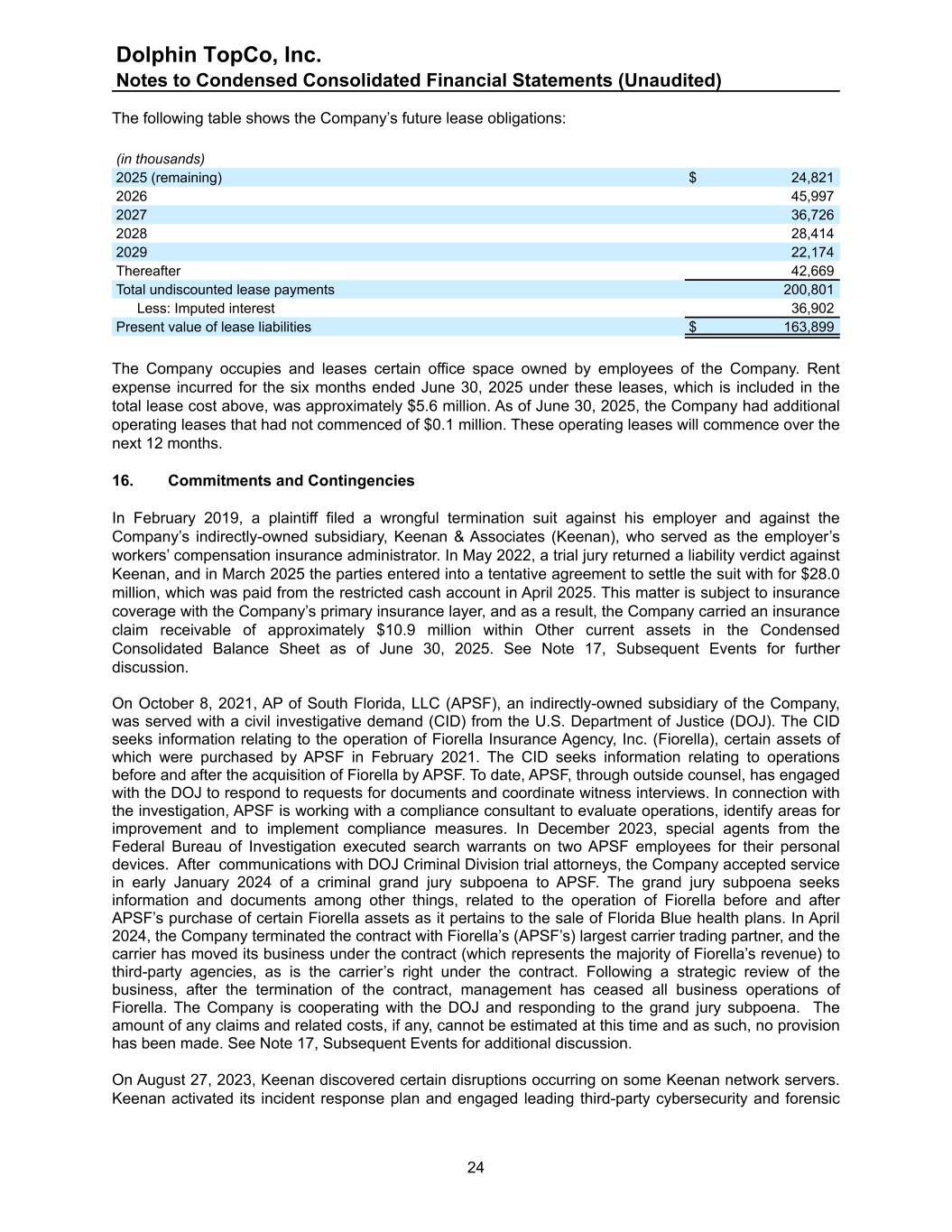

The following table shows the Company’s future lease obligations: (in thousands) 2025 (remaining) $ 24,821 2026 45,997 2027 36,726 2028 28,414 2029 22,174 Thereafter 42,669 Total undiscounted lease payments 200,801 Less: Imputed interest 36,902 Present value of lease liabilities $ 163,899 The Company occupies and leases certain office space owned by employees of the Company. Rent expense incurred for the six months ended June 30, 2025 under these leases, which is included in the total lease cost above, was approximately $5.6 million. As of June 30, 2025, the Company had additional operating leases that had not commenced of $0.1 million. These operating leases will commence over the next 12 months. 16. Commitments and Contingencies In February 2019, a plaintiff filed a wrongful termination suit against his employer and against the Company’s indirectly-owned subsidiary, Keenan & Associates (Keenan), who served as the employer’s workers’ compensation insurance administrator. In May 2022, a trial jury returned a liability verdict against Keenan, and in March 2025 the parties entered into a tentative agreement to settle the suit with for $28.0 million, which was paid from the restricted cash account in April 2025. This matter is subject to insurance coverage with the Company’s primary insurance layer, and as a result, the Company carried an insurance claim receivable of approximately $10.9 million within Other current assets in the Condensed Consolidated Balance Sheet as of June 30, 2025. See Note 17, Subsequent Events for further discussion. On October 8, 2021, AP of South Florida, LLC (APSF), an indirectly-owned subsidiary of the Company, was served with a civil investigative demand (CID) from the U.S. Department of Justice (DOJ). The CID seeks information relating to the operation of Fiorella Insurance Agency, Inc. (Fiorella), certain assets of which were purchased by APSF in February 2021. The CID seeks information relating to operations before and after the acquisition of Fiorella by APSF. To date, APSF, through outside counsel, has engaged with the DOJ to respond to requests for documents and coordinate witness interviews. In connection with the investigation, APSF is working with a compliance consultant to evaluate operations, identify areas for improvement and to implement compliance measures. In December 2023, special agents from the Federal Bureau of Investigation executed search warrants on two APSF employees for their personal devices. After communications with DOJ Criminal Division trial attorneys, the Company accepted service in early January 2024 of a criminal grand jury subpoena to APSF. The grand jury subpoena seeks information and documents among other things, related to the operation of Fiorella before and after APSF’s purchase of certain Fiorella assets as it pertains to the sale of Florida Blue health plans. In April 2024, the Company terminated the contract with Fiorella’s (APSF’s) largest carrier trading partner, and the carrier has moved its business under the contract (which represents the majority of Fiorella’s revenue) to third-party agencies, as is the carrier’s right under the contract. Following a strategic review of the business, after the termination of the contract, management has ceased all business operations of Fiorella. The Company is cooperating with the DOJ and responding to the grand jury subpoena. The amount of any claims and related costs, if any, cannot be estimated at this time and as such, no provision has been made. See Note 17, Subsequent Events for additional discussion. On August 27, 2023, Keenan discovered certain disruptions occurring on some Keenan network servers. Keenan activated its incident response plan and engaged leading third-party cybersecurity and forensic Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 24

experts to investigate and remediate. In relatively short order, Keenan restored full functionality to its systems and was able to minimize business disruption. The incident was the result of ransomware. Due to the nature of the incident, Keenan was obligated to provide legally-required notices regarding the incident to a number of its business partners and their respective employees and to certain government agencies. The Company subsequently became subject to a number of class action lawsuits regarding the incident. Following a recent mediation, the Company has entered into an agreement in principle on a nationwide settlement of the class action lawsuits. However, any potential settlement is not yet final or certain because it is subject to preliminary and final court approval, as well as an opt-out and objection process. Other than the matters mentioned above, there are a variety of legal proceedings pending or threatened against the Company. Accruals are recorded when it is probable a liability has been incurred and the amount of the liability can be reasonably estimated based on current law, progress of each case, opinions and views of legal counsel and other advisers, and the Company’s experience in similar matters and intended response to the litigation. These amounts, which are not discounted and are exclusive of claims against third parties, are adjusted periodically as assessment efforts progress or additional information becomes available. The Company expenses amounts for administering or litigating claims as incurred. Neither the outcomes of these matters nor their effect upon the Company’s business, financial condition or results of operations can be determined at this time. 17. Subsequent Events The Company is required to evaluate events and transactions occurring subsequent to June 30, 2025 through September 5, 2025, the date the accompanying condensed consolidated financial statements were available to be issued. In July 2025, as discussed in Note 16, Commitments and Contingencies, the Company received payment of the $10.9 million insurance receivable, and approximately $37.0 million of restricted funds related to the Keenan legal case were released from restriction and returned to AP Inc.’s operating cash accounts. In August 2025, in connection with the Keenan legal case, the Company signed an agreement with its excess carriers on an $8.5 million reimbursement of losses in excess of the Company’s primary insurance layer. On July 31, 2025, APSF was sold by the Company to a wholly-owned subsidiary of the Parent and is no longer part of the consolidated financial statements of the Company after this date. On August 18, 2025, Arthur J. Gallagher & Co. (“Gallagher”), a global insurance brokerage, risk management, and consulting services firm, closed its acquisition of the Company for $13.8 billion in cash. As part of the combination, the Company paid off its outstanding debt under the Credit Facility and redeemed its 2029 and 2032 Notes. Dolphin TopCo, Inc. Notes to Condensed Consolidated Financial Statements (Unaudited) 25