Dolphin TopCo, Inc. Consolidated Financial Statements As of and for the year ended December 31, 2024

Page(s) Report of Independent Auditors ....................................................................................................... 3-4 Consolidated Financial Statements Consolidated Balance Sheet as of December 31, 2024 .................................................................. 5 Consolidated Statement of Operations and Comprehensive Loss For the Year Ended December 31, 2024 ............................................................................................ 6 Consolidated Statement of Shareholders' Equity and Mezzanine Equity For the Year Ended December 31, 2024 ............................................................................................ 7 Consolidated Statement of Cash Flows For the Year Ended December 31, 2024 ............................................................................................ 8 Notes to Consolidated Financial Statements ..................................................................................... 9 - 39 Dolphin TopCo, Inc. Index

Report of Independent Auditors To the Board of Directors of Dolphin TopCo, Inc. Opinion We have audited the accompanying consolidated financial statements of Dolphin TopCo, Inc. and its subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2024 and the related consolidated statement of operations and comprehensive loss, of shareholders' equity and mezzanine equity and of cash flow for the year then ended, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024, and the result of its operations and its cash flow for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the consolidated financial statements are available to be issued. Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are

considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: ● Exercise professional judgment and maintain professional skepticism throughout the audit. ● Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. ● Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed. ● Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. ● Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. /s/ PricewaterhouseCoopers LLP Tampa, Florida March 31, 2025

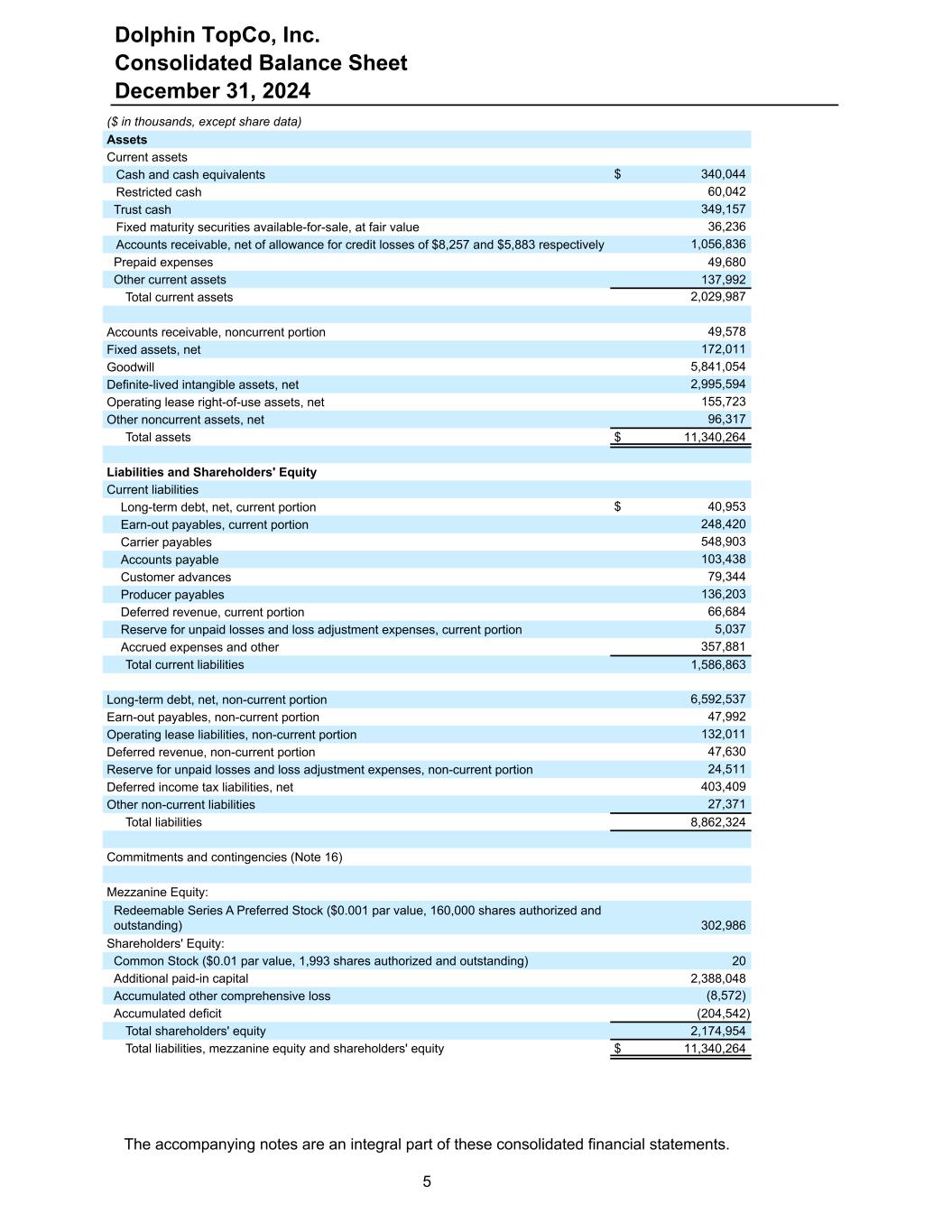

($ in thousands, except share data) Assets Current assets Cash and cash equivalents $ 340,044 Restricted cash 60,042 Trust cash 349,157 Fixed maturity securities available-for-sale, at fair value 36,236 Accounts receivable, net of allowance for credit losses of $8,257 and $5,883 respectively 1,056,836 Prepaid expenses 49,680 Other current assets 137,992 Total current assets 2,029,987 Accounts receivable, noncurrent portion 49,578 Fixed assets, net 172,011 Goodwill 5,841,054 Definite-lived intangible assets, net 2,995,594 Operating lease right-of-use assets, net 155,723 Other noncurrent assets, net 96,317 Total assets $ 11,340,264 Liabilities and Shareholders' Equity Current liabilities Long-term debt, net, current portion $ 40,953 Earn-out payables, current portion 248,420 Carrier payables 548,903 Accounts payable 103,438 Customer advances 79,344 Producer payables 136,203 Deferred revenue, current portion 66,684 Reserve for unpaid losses and loss adjustment expenses, current portion 5,037 Accrued expenses and other 357,881 Total current liabilities 1,586,863 Long-term debt, net, non-current portion 6,592,537 Earn-out payables, non-current portion 47,992 Operating lease liabilities, non-current portion 132,011 Deferred revenue, non-current portion 47,630 Reserve for unpaid losses and loss adjustment expenses, non-current portion 24,511 Deferred income tax liabilities, net 403,409 Other non-current liabilities 27,371 Total liabilities 8,862,324 Commitments and contingencies (Note 16) Mezzanine Equity: Redeemable Series A Preferred Stock ($0.001 par value, 160,000 shares authorized and outstanding) 302,986 Shareholders' Equity: Common Stock ($0.01 par value, 1,993 shares authorized and outstanding) 20 Additional paid-in capital 2,388,048 Accumulated other comprehensive loss (8,572) Accumulated deficit (204,542) Total shareholders' equity 2,174,954 Total liabilities, mezzanine equity and shareholders' equity $ 11,340,264 Dolphin TopCo, Inc. Consolidated Balance Sheet December 31, 2024 The accompanying notes are an integral part of these consolidated financial statements. 5

($ in thousands) Revenues Commissions and fees $ 2,708,186 Other supplemental commissions 109,998 Contingent revenue 120,875 Investment income 6,625 Total revenues 2,945,684 Expenses Compensation expense 1,599,586 Selling expense 60,677 Administrative expense 432,607 Transaction expense 5,827 Change in estimated acquisition earn-out payables 67,998 Depreciation and amortization expense 357,782 Total operating expenses 2,524,477 Income from operations 421,207 Interest expense (580,813) Interest income 18,261 Loss on debt extinguishment (10,107) Other (loss) income, net (14,647) Loss before income taxes (166,099) Benefit for income taxes 17,280 Net loss $ (148,819) Other comprehensive income (loss), before tax Foreign currency translation adjustments (3,380) Change in fair value of fixed maturity securities available-for-sale 128 Change in fair value of derivative instruments 1,940 Other comprehensive loss, before tax (1,312) Income tax (provision) benefit related to items of other comprehensive income (loss) (526) Other comprehensive loss (1,838) Comprehensive loss $ (150,657) Dolphin TopCo, Inc. Consolidated Statement of Operations and Comprehensive Loss For the Year Ended December 31, 2024 The accompanying notes are an integral part of these consolidated financial statements. 6

Mezzanine Equity Shareholders' Equity Redeemable Series A Preferred Stock Common Stock Additional Paid-in Capital Accumulated Deficit Accumulated Other Comprehensive Income (Loss) Total Shareholders' Equity($ in thousands, except share data) Shares Amount Shares Amount Balance as of January 1, 2024 160,000 273,207 2,000 20 2,413,757 (55,723) (6,734) 2,351,320 Change in fair value of derivative instruments, net of taxes - - - - - - 1,442 1,442 Change in fair value of fixed maturity securities available-for-sale, net of taxes - - - - - - 100 100 Adjustment of preferred stock to redemption value - 29,779 - - (29,779) - - (29,779) Foreign currency translation - - - - - - (3,380) (3,380) Return of Capital to Parent - - (7) - (25,508) - - (25,508) Compensation expense related to incentive units - - - - 29,578 - - 29,578 Net loss - - - - - (148,819) - (148,819) Balance as of December 31, 2024 160,000 $ 302,986 1,993 $ 20 $ 2,388,048 $ (204,542) $ (8,572) $ 2,174,954 Dolphin TopCo, Inc. Consolidated Statement of Shareholders' Equity and Mezzanine Equity For the Year Ended December 31, 2024 The accompanying notes are an integral part of these consolidated financial statements. 7

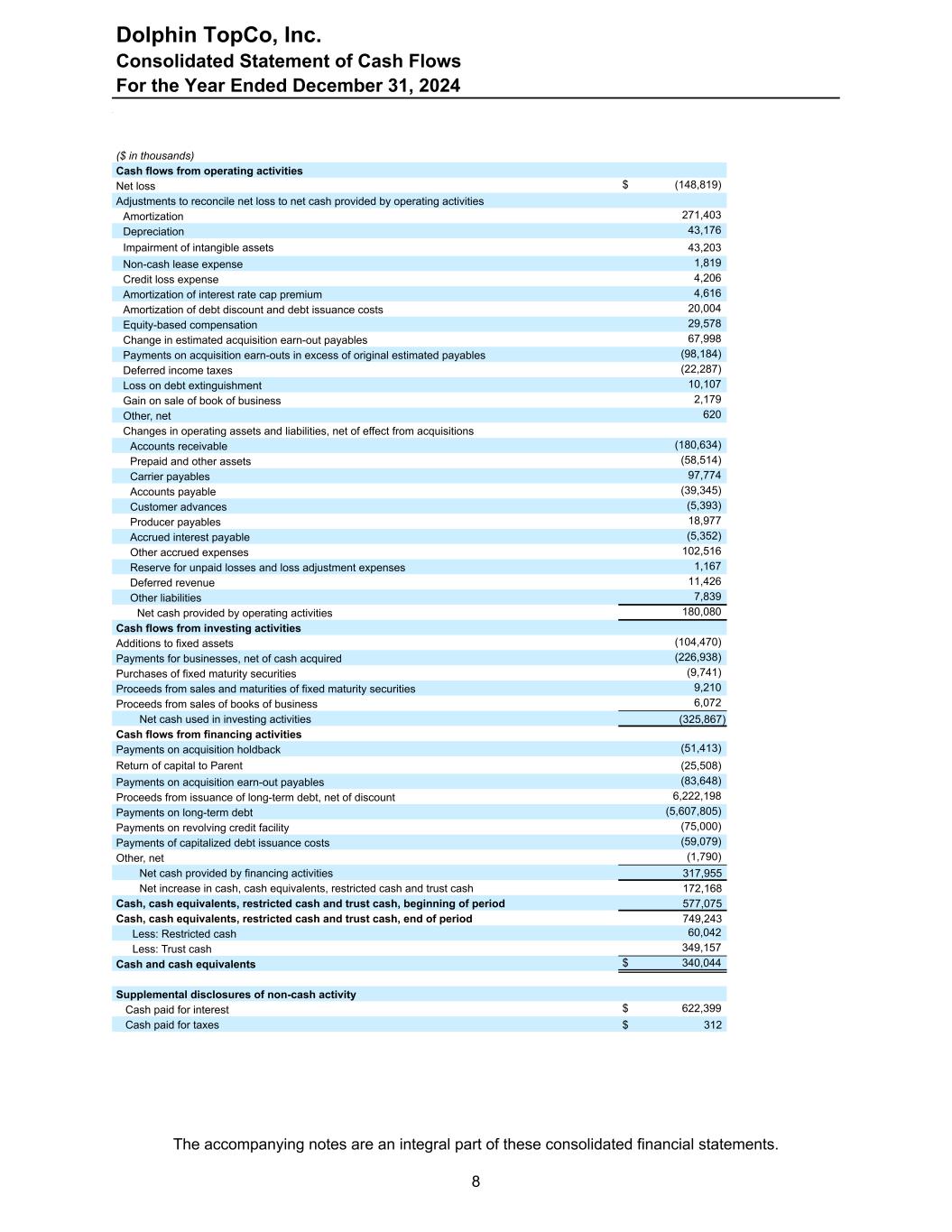

+ ($ in thousands) Cash flows from operating activities Net loss $ (148,819) Adjustments to reconcile net loss to net cash provided by operating activities Amortization 271,403 Depreciation 43,176 Impairment of intangible assets 43,203 Non-cash lease expense 1,819 Credit loss expense 4,206 Amortization of interest rate cap premium 4,616 Amortization of debt discount and debt issuance costs 20,004 Equity-based compensation 29,578 Change in estimated acquisition earn-out payables 67,998 Payments on acquisition earn-outs in excess of original estimated payables (98,184) Deferred income taxes (22,287) Loss on debt extinguishment 10,107 Gain on sale of book of business 2,179 Other, net 620 Changes in operating assets and liabilities, net of effect from acquisitions Accounts receivable (180,634) Prepaid and other assets (58,514) Carrier payables 97,774 Accounts payable (39,345) Customer advances (5,393) Producer payables 18,977 Accrued interest payable (5,352) Other accrued expenses 102,516 Reserve for unpaid losses and loss adjustment expenses 1,167 Deferred revenue 11,426 Other liabilities 7,839 Net cash provided by operating activities 180,080 Cash flows from investing activities Additions to fixed assets (104,470) Payments for businesses, net of cash acquired (226,938) Purchases of fixed maturity securities (9,741) Proceeds from sales and maturities of fixed maturity securities 9,210 Proceeds from sales of books of business 6,072 Net cash used in investing activities (325,867) Cash flows from financing activities Payments on acquisition holdback (51,413) Return of capital to Parent (25,508) Payments on acquisition earn-out payables (83,648) Proceeds from issuance of long-term debt, net of discount 6,222,198 Payments on long-term debt (5,607,805) Payments on revolving credit facility (75,000) Payments of capitalized debt issuance costs (59,079) Other, net (1,790) Net cash provided by financing activities 317,955 Net increase in cash, cash equivalents, restricted cash and trust cash 172,168 Cash, cash equivalents, restricted cash and trust cash, beginning of period 577,075 Cash, cash equivalents, restricted cash and trust cash, end of period 749,243 Less: Restricted cash 60,042 Less: Trust cash 349,157 Cash and cash equivalents $ 340,044 Supplemental disclosures of non-cash activity Cash paid for interest $ 622,399 Cash paid for taxes $ 312 Dolphin TopCo, Inc. Consolidated Statement of Cash Flows For the Year Ended December 31, 2024 The accompanying notes are an integral part of these consolidated financial statements. 8

1. Summary of Significant Accounting Policies Nature of Operations Dolphin TopCo, Inc. and its subsidiaries (the Company) is a wholly-owned subsidiary of The AssuredPartners Group LP (the Parent) and wholly-owns AssuredPartners, Inc. and its subsidiaries (AP Inc.). The Company is one of the leading insurance brokers in the United States (U.S.) and provides a broad array of insurance-related products and services on a retail basis to middle-market businesses, with a particular focus on property and casualty and employee benefits insurance products and solutions. As of December 31, 2024, the Company has over 10,900 employees in over 400 offices in forty states across the U.S., the District of Columbia, United Kingdom (U.K.), Ireland and Belgium. Since its founding in 2011, the Company has built a broad insurance distribution platform that is concentrated in the U.S. through a strategic acquisition program coupled with a focus on driving organic growth. Through its operations, the Company provides diversified services to its customers through a broad range of insurance products and services to commercial, public entity and professional and individual customers. Basis of Presentation and Principles of Consolidation The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and include the accounts of the Company and its subsidiaries. All intercompany account balances and transactions have been eliminated in the consolidated financial statements. Certain amounts have been reclassified in the prior year financial statements to conform to current year presentation. Beginning in 2024, the Company updated the presentation of revenues from contracts with customers in the Consolidated Statement of Operations and Comprehensive Loss to separately disclose other supplemental commissions. These revenues were previously presented within contingent commissions. Management believes this presentation improves the comparability of the Company’s financial performance with others in the industry. Revenues from contracts with customers for the comparable period have been recast to conform to this presentation. See Note 2 for additional discussion and presentation of these revenues on a disaggregated basis. There were no changes to total revenues, income from operations, net loss, or cash flows in any reported period as a result of these changes. Use of Estimates The preparation of these consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. These estimates and assumptions affect the reported amounts of assets and liabilities and revenues and expenses as well as disclosures of contingent assets and liabilities, at the date of the consolidated financial statements. The principal estimates used include, among others, the allocation of purchase price to the fair value of net assets acquired in connection with acquisitions, the valuation of earn-out payables, revenue recognition, equity-based compensation, assessments regarding potential impairment of assets, and the estimated fair value of financial instruments. Actual results may differ materially from those estimates. Acquisition Accounting Assets acquired and liabilities assumed are recorded based on their respective fair values at the date of acquisition. Goodwill and other intangible assets generally represent the largest components of the Company’s acquisitions. Intangible assets include non-compete agreements, and customer related and contract-based assets. Goodwill is calculated as the excess of the cost of the acquired agency over the net of the fair value of the assets acquired and the liabilities assumed. The principal factor that results in recognition of goodwill is a combination of the value the Company expects to receive as it provides additional markets and capabilities to the acquired companies, as well as the value the Company assigns Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 9

to the assembled workforce which may not be recognized as an intangible asset. Non-compete agreements, trade names, and customer-related and contract-based assets are valued using the income approach which is based on future cash flow projections. Contingent liabilities that arise from acquisitions, referred to as earn-out payables, are established and measured at fair value as of the acquisition date. The amounts recorded as earn-out payables are primarily based upon estimated future operating results of the acquired entities over a one- to three-year period and are recorded as part of the purchase price consideration. The fair value of the earn-out payables is based on the present value of the expected future payments to be made to the sellers of the acquired entities in accordance with the provisions outlined in the respective purchase agreements. The Company estimates future payments using the earn- out formula and performance targets specified in each purchase agreement and these financial projections. In determining fair value, the Company estimates the acquired entity’s future performance using financial projections developed by management and market participant assumptions that were derived for revenue growth and/or profitability. The Company utilizes an option-pricing approach to incorporate the risks associated with financial projections, counterparty credit risk, as well as the nature of the earn-out payout structure. The Company remeasures these estimated earn-out payables on a quarterly basis. Subsequent changes, including the accretion of discount and changes in fair value, are recorded in the Consolidated Statement of Operations and Comprehensive Loss. The Company also acquires other assets and assumes other liabilities that typically include accounts receivable, accounts payable and other working capital items. Due to their short-term nature, the carrying values of these other assets and liabilities generally approximate the fair values that are recorded on the balance sheet of the acquired business. Subsequent to recording the opening balance sheet of the acquiree, management may make measurement period adjustments to the acquired assets and liabilities. Measurement period adjustments are adjustments made to purchase price allocations of acquisitions after the recording of the opening balance sheet, but during the one-year period following the acquisition date. These adjustments generally consist of final allocations arising from third-party valuation reports and working capital adjustments. Cash and Cash Equivalents Cash and cash equivalents principally consist of demand deposits with financial institutions and highly liquid investments with quoted market prices with maturities not more than three months when purchased. Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents and restricted cash. The Company manages this risk by using high credit worthy financial institutions. Interest-bearing accounts and non-interest-bearing accounts are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000. Deposits exceed amounts insured by the FDIC. The Company has not experienced any losses from its deposits. Restricted Cash Certain of the Company’s cash balances are contractually limited or are generally designated for specific purposes arising out of other obligations. These cash balances are classified as restricted cash in the accompanying Consolidated Balance Sheet. Restricted cash includes amounts that have been pledged as collateral for an appeal bond in connection with a legal case. See Note 16 for further discussion. Trust Cash, Carrier Payables and Accounts Receivable, net Unremitted net insurance premiums are held by the Company until disbursement. The Company invests these unremitted funds primarily in cash and money market accounts. In certain states in which the Company operates, the use of investment alternatives for these funds are regulated and restricted by various state laws and agencies. These restricted funds are reported as trust cash and carrier payables Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 10

on the Consolidated Balance Sheet. The interest income earned on these unremitted funds is reported as investment income in the Consolidated Statement of Operations and Comprehensive Loss. The Company’s accounts receivable, net is comprised of premiums and commissions receivable. In its capacity as an insurance agent or broker, the Company typically collects premiums from insureds and, after deducting its authorized commissions, remits the net premiums to the appropriate insurance carrier or carriers. Accordingly, premium receivables are accounts receivable from the insureds. In other circumstances, insurance carriers collect premiums directly from the insureds themselves and upon collection, the insurance carriers remit to the Company its earned commissions. Accordingly, commissions receivables are accounts receivable from insurance carriers. Investments The Company indirectly owns a captive insurance company (the Captive) formed and domiciled in the state of Hawaii. The Captive’s investments are classified on the Consolidated Balance Sheet of the Company as available-for-sale, which are recorded at fair market value with unrealized gains or losses reported as a component of accumulated other comprehensive loss within the Consolidated Balance Sheet. The cost of investments sold is based on the specific identification method. Premiums and discounts are amortized using the interest method. For mortgage-backed securities (MBS) and asset-backed securities (ABS), the Company recognizes income using a constant effective yield based on anticipated prepayments over the economic life of the security. Prepayment assumptions are based on market expectations. When actual prepayments differ significantly from anticipated prepayments, the effective yield is recalculated to reflect actual payments to date and anticipated future payments, and any resulting adjustment is included in investment income within the Consolidated Statement of Operations and Comprehensive Loss. The Company reviews its available-for-sale debt securities for credit loss impairment at the individual security level on at least a quarterly basis. A security is impaired if its fair value is less than its amortized cost basis. A decline in fair value below amortized cost basis represents a credit loss impairment to the extent the Company does not expect to recover the amortized cost basis of the security. Impairments related to credit losses are recorded through an allowance for credit losses to the extent fair values are less than the amortized cost bases. Declines in fair value that have not been recorded through the allowance for credit losses are recorded through other comprehensive income (loss), net of applicable taxes. Fixed Assets, net Fixed assets, net are recorded at cost at the time of purchase or fair value at the date of acquisition and depreciated using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are carried at cost, less accumulated depreciation and amortization. Expenditures for leasehold improvements are capitalized, and expenditures for maintenance and repairs are expensed to operations as incurred. Upon sale or retirement, the cost and related accumulated depreciation and amortization are removed from the accounts and the resulting gain or loss, if any, is reflected in Other loss, net in the Consolidated Statement of Operations and Comprehensive Loss. The Company capitalizes certain costs incurred for internally developed and licensed software upon the establishment of technological feasibility. Costs incurred during the preliminary project stage and post- implementation stage of an internal-use software project are expensed as incurred while costs incurred during the application development stage of an internal-use software project are capitalized. Costs related to updates and enhancements to the software are only capitalized if they result in additional functionality to the Company. Software licenses which are part of cloud computing hosting arrangements are capitalized only if the Company can take possession of the software at any time without significant penalty and can run the software on its own (or on an independent third party’s) hardware; otherwise, Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 11

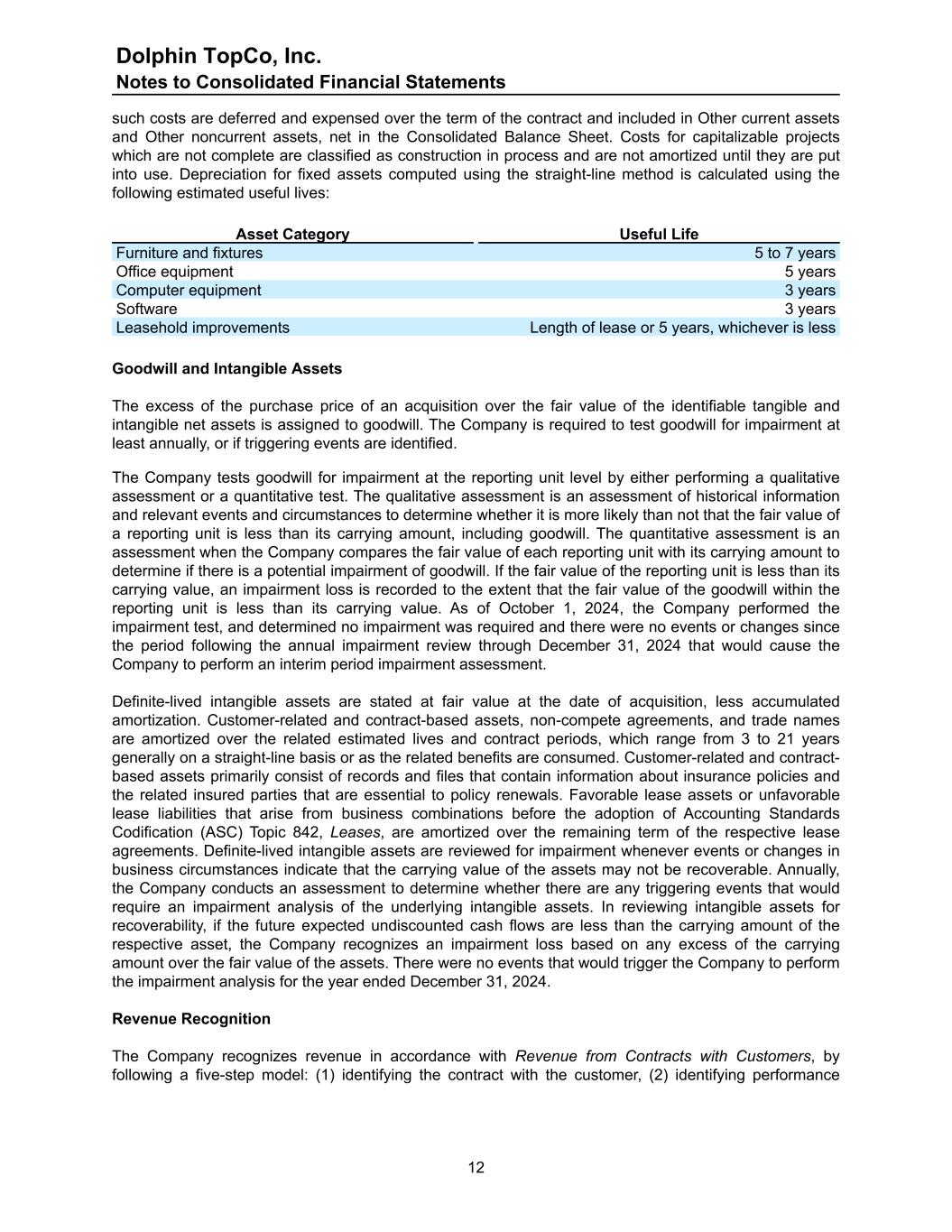

such costs are deferred and expensed over the term of the contract and included in Other current assets and Other noncurrent assets, net in the Consolidated Balance Sheet. Costs for capitalizable projects which are not complete are classified as construction in process and are not amortized until they are put into use. Depreciation for fixed assets computed using the straight-line method is calculated using the following estimated useful lives: Asset Category Useful Life Furniture and fixtures 5 to 7 years Office equipment 5 years Computer equipment 3 years Software 3 years Leasehold improvements Length of lease or 5 years, whichever is less Goodwill and Intangible Assets The excess of the purchase price of an acquisition over the fair value of the identifiable tangible and intangible net assets is assigned to goodwill. The Company is required to test goodwill for impairment at least annually, or if triggering events are identified. The Company tests goodwill for impairment at the reporting unit level by either performing a qualitative assessment or a quantitative test. The qualitative assessment is an assessment of historical information and relevant events and circumstances to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. The quantitative assessment is an assessment when the Company compares the fair value of each reporting unit with its carrying amount to determine if there is a potential impairment of goodwill. If the fair value of the reporting unit is less than its carrying value, an impairment loss is recorded to the extent that the fair value of the goodwill within the reporting unit is less than its carrying value. As of October 1, 2024, the Company performed the impairment test, and determined no impairment was required and there were no events or changes since the period following the annual impairment review through December 31, 2024 that would cause the Company to perform an interim period impairment assessment. Definite-lived intangible assets are stated at fair value at the date of acquisition, less accumulated amortization. Customer-related and contract-based assets, non-compete agreements, and trade names are amortized over the related estimated lives and contract periods, which range from 3 to 21 years generally on a straight-line basis or as the related benefits are consumed. Customer-related and contract- based assets primarily consist of records and files that contain information about insurance policies and the related insured parties that are essential to policy renewals. Favorable lease assets or unfavorable lease liabilities that arise from business combinations before the adoption of Accounting Standards Codification (ASC) Topic 842, Leases, are amortized over the remaining term of the respective lease agreements. Definite-lived intangible assets are reviewed for impairment whenever events or changes in business circumstances indicate that the carrying value of the assets may not be recoverable. Annually, the Company conducts an assessment to determine whether there are any triggering events that would require an impairment analysis of the underlying intangible assets. In reviewing intangible assets for recoverability, if the future expected undiscounted cash flows are less than the carrying amount of the respective asset, the Company recognizes an impairment loss based on any excess of the carrying amount over the fair value of the assets. There were no events that would trigger the Company to perform the impairment analysis for the year ended December 31, 2024. Revenue Recognition The Company recognizes revenue in accordance with Revenue from Contracts with Customers, by following a five-step model: (1) identifying the contract with the customer, (2) identifying performance Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 12

obligations, (3) determining the transaction price, (4) allocating the transaction price to performance obligations, and (5) recognizing revenue when the performance obligation is satisfied. Commissions and Fees: Commissions are fixed at the contract effective date and generally are based on a percentage of premiums for insurance coverage or employee headcount for employer sponsored benefit plans. Commissions depend on various factors, including the type of risk being placed, the particular underwriting enterprise’s demand, the expected loss experience of the particular risk coverage, and historical benchmarks surrounding the level of effort necessary for us to place and service the insurance contracts. Commission revenues are recognized on the effective date of the insurance policy, which is the date that the control of the insurance policy transfers to the customer upon satisfaction of the related performance obligation. Fee revenues, negotiated in lieu of commissions, are recognized in the same manner as commission revenue. Fee revenues generated from other services, which include but are not limited to third party claims administration and other risk management consulting services, are recognized throughout the contract term, typically within one year as the services are rendered, and the related performance obligation is satisfied. Fee revenues received in advance are deferred until the related performance obligation is satisfied which is either on effective date of the insurance policy or over the term of the insurance policy as services transfer to the customer. In certain circumstances, the Company provides more than one performance obligation to the customer that is comprised of placement of an insurance policy and other post-placement services. For consideration allocated to the placement of an insurance policy, the Company recognizes revenue on the policy effective date. For certain products, remaining consideration is allocated to other performance obligations based on their relative fair values over the term of the insurance policy, which is generally one year or less, as the services are rendered. Management reserves for estimated policy cancellations based upon historical cancellation experience adjusted in accordance with known circumstances. Other Supplemental Commissions. Other supplemental commissions are paid by an insurance carrier based on historical performance criteria and are generally established annually in advance of a contractual period. Other supplemental commissions includes incentives and guaranteed supplemental commissions. Other supplemental commissions are estimated and accrued on the effective date of an insurance policy. For supplemental revenue contracts, our obligation to the underwriting company is fully earned and recognized consistent with the performance of our obligations. Contingent Revenue: Profit-sharing contingent commissions represent variable consideration from insurance carriers that may be received in certain cases separate from commissions and fees and are generally received within one year. A profit-sharing contingent commission is a commission paid by an insurance carrier and is based on, among other things, the overall underwriting results and/or growth of the business placed with that insurance carrier during a particular performance year and is determined after the contractual period. These revenues are variable in nature until all contingencies are resolved and therefore estimated and recognized at which time significant reversal of contingent revenue is not probable. As such, an estimated amount of consideration that will be received from the insurance carrier the following year is accrued on the effective date of the insurance policy. Because our expectation of the ultimate contingent revenue amounts to be earned can vary from period to period, especially in contracts sensitive to loss ratios, our estimates might change significantly from quarter to quarter. Variable consideration is recognized when we conclude, based on all the facts and information available at the reporting date, that it is probable that a significant revenue reversal will not occur in future periods. Transaction Expenses In the process of acquiring companies, the Company incurs certain incremental costs associated with consummating the transactions. These costs are expensed as incurred and include, but are not limited to, fees paid for legal, advisory, accounting and valuation experts. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 13

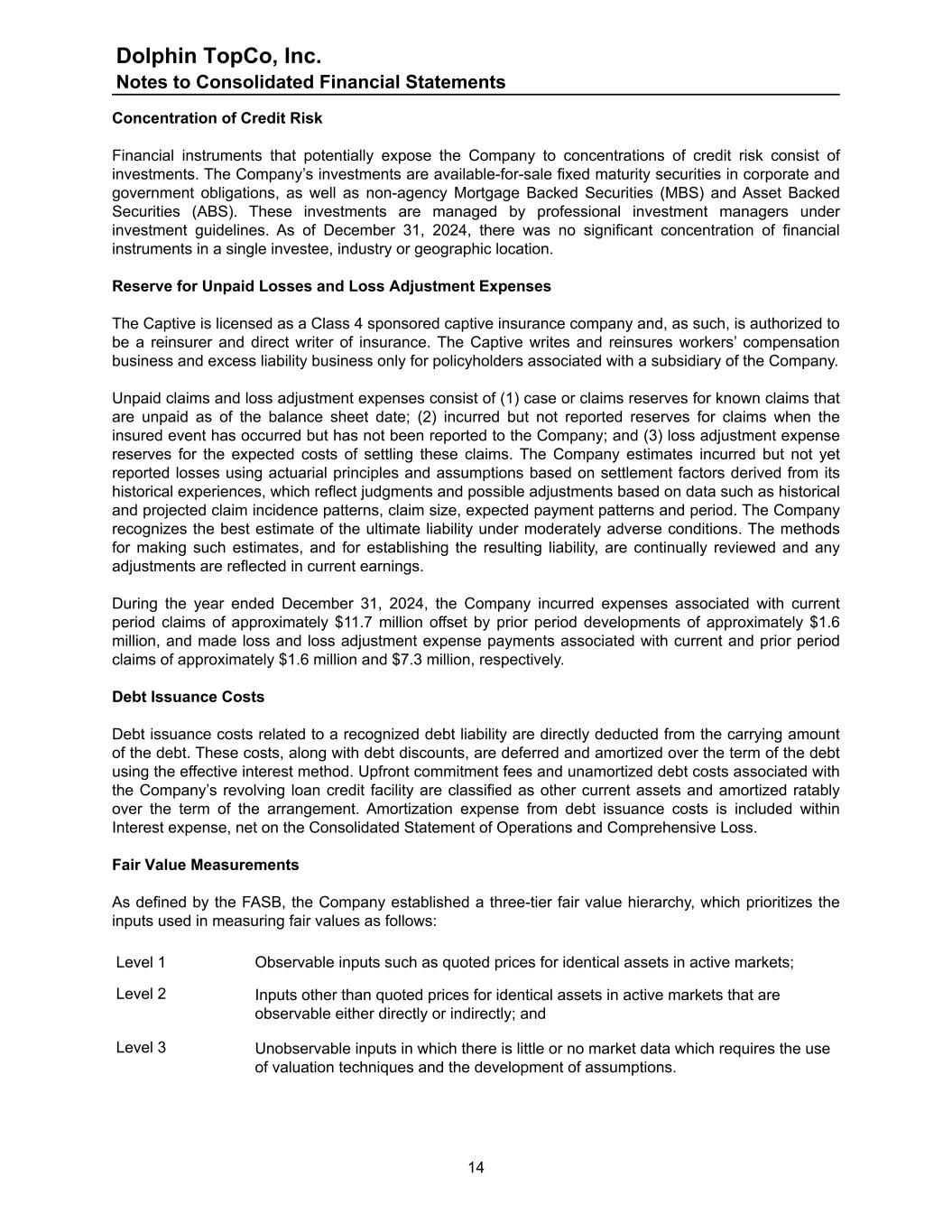

Concentration of Credit Risk Financial instruments that potentially expose the Company to concentrations of credit risk consist of investments. The Company’s investments are available-for-sale fixed maturity securities in corporate and government obligations, as well as non-agency Mortgage Backed Securities (MBS) and Asset Backed Securities (ABS). These investments are managed by professional investment managers under investment guidelines. As of December 31, 2024, there was no significant concentration of financial instruments in a single investee, industry or geographic location. Reserve for Unpaid Losses and Loss Adjustment Expenses The Captive is licensed as a Class 4 sponsored captive insurance company and, as such, is authorized to be a reinsurer and direct writer of insurance. The Captive writes and reinsures workers’ compensation business and excess liability business only for policyholders associated with a subsidiary of the Company. Unpaid claims and loss adjustment expenses consist of (1) case or claims reserves for known claims that are unpaid as of the balance sheet date; (2) incurred but not reported reserves for claims when the insured event has occurred but has not been reported to the Company; and (3) loss adjustment expense reserves for the expected costs of settling these claims. The Company estimates incurred but not yet reported losses using actuarial principles and assumptions based on settlement factors derived from its historical experiences, which reflect judgments and possible adjustments based on data such as historical and projected claim incidence patterns, claim size, expected payment patterns and period. The Company recognizes the best estimate of the ultimate liability under moderately adverse conditions. The methods for making such estimates, and for establishing the resulting liability, are continually reviewed and any adjustments are reflected in current earnings. During the year ended December 31, 2024, the Company incurred expenses associated with current period claims of approximately $11.7 million offset by prior period developments of approximately $1.6 million, and made loss and loss adjustment expense payments associated with current and prior period claims of approximately $1.6 million and $7.3 million, respectively. Debt Issuance Costs Debt issuance costs related to a recognized debt liability are directly deducted from the carrying amount of the debt. These costs, along with debt discounts, are deferred and amortized over the term of the debt using the effective interest method. Upfront commitment fees and unamortized debt costs associated with the Company’s revolving loan credit facility are classified as other current assets and amortized ratably over the term of the arrangement. Amortization expense from debt issuance costs is included within Interest expense, net on the Consolidated Statement of Operations and Comprehensive Loss. Fair Value Measurements As defined by the FASB, the Company established a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair values as follows: Level 1 Observable inputs such as quoted prices for identical assets in active markets; Level 2 Inputs other than quoted prices for identical assets in active markets that are observable either directly or indirectly; and Level 3 Unobservable inputs in which there is little or no market data which requires the use of valuation techniques and the development of assumptions. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 14

The carrying amounts of the Company’s financial assets and liabilities, including cash and cash equivalents; restricted cash; trust cash; accounts receivable; carrier payables; accounts payable; customer advances; producer payables; reserve for unpaid losses and loss adjustment expenses; contract assets; contract liabilities and deferred revenue as of December 31, 2024 approximate fair value because of the short-term maturity of these instruments. Accumulated Other Comprehensive Income (Loss) Other comprehensive income (loss) includes certain transactions that have generally been reported in the Consolidated Statement of Shareholders’ Equity and Mezzanine Equity. The following tables summarize the components and changes in accumulated balances of other comprehensive income (loss) for the year ended December 31, 2024: ($ in thousands) Foreign currency translation Fixed maturity securities available-for- sale Derivative instruments Total Beginning balance $ (3,788) $ (1,332) $ (1,614) $ (6,734) Other comprehensive income (loss) before reclassifications (3,380) (2,523) (1,464) (7,367) Reclassified to earnings — 2,623 2,906 5,529 Net impact to SOCI (3,380) 100 1,442 (1,838) Ending balance $ (7,168) $ (1,232) $ (172) $ (8,572) Interest Rate Contracts Interest rate contracts are valued using pricing models that are based on certain assumptions and readily observable market-based inputs, including yield curves and implied volatilities of closely related instruments, for which transparent pricing is available. The Company reflects the credit considerations inherent in the derivative contracts with both positive and negative exposures over the remaining life of the derivative. The credit spreads calculated for each party (e.g., the hedging entity and the bank counterparty) are converted into default probabilities. The default probabilities of the hedging entity are applied to the negative exposures, resulting in a positive credit adjustment, and the default probabilities of the bank counterparty are applied to the positive exposures, resulting in a negative credit adjustment. The bilateral credit valuation adjustment is the sum of the positive and negative adjustments. The Company enters into hedging contracts (generally, interest rate swaps and caps) to manage the associated interest rate risk in its variable interest rate debt obligations at what management believes are acceptable levels. These debt obligations expose the Company to variability in interest payments due to changes in interest rates. The Company believes it is prudent to limit the variability of a portion of its interest payments and the Company has protected against future increases in interest rates by entering into interest rate contracts whereby the Company receives variable interest rate payments and makes fixed interest rate payments on a portion of its debt to a designated counterparty (for swaps), or the Company receives payments from a designated counterparty when variable rates exceed the specified strike rate of the contract (for caps). The fair value of these interest rate contracts is recorded on the Consolidated Balance Sheet as an asset or liability with the related gains or losses reported as a component of accumulated other comprehensive income (loss) in the Consolidated Statement of Operations and Comprehensive Loss. Changes in fair value are reclassified from accumulated other comprehensive income (loss) into earnings as an adjustment to interest expense in the same period that the hedged items affect earnings. The Company does not hold or issue derivative financial instruments for trading or speculative purposes. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 15

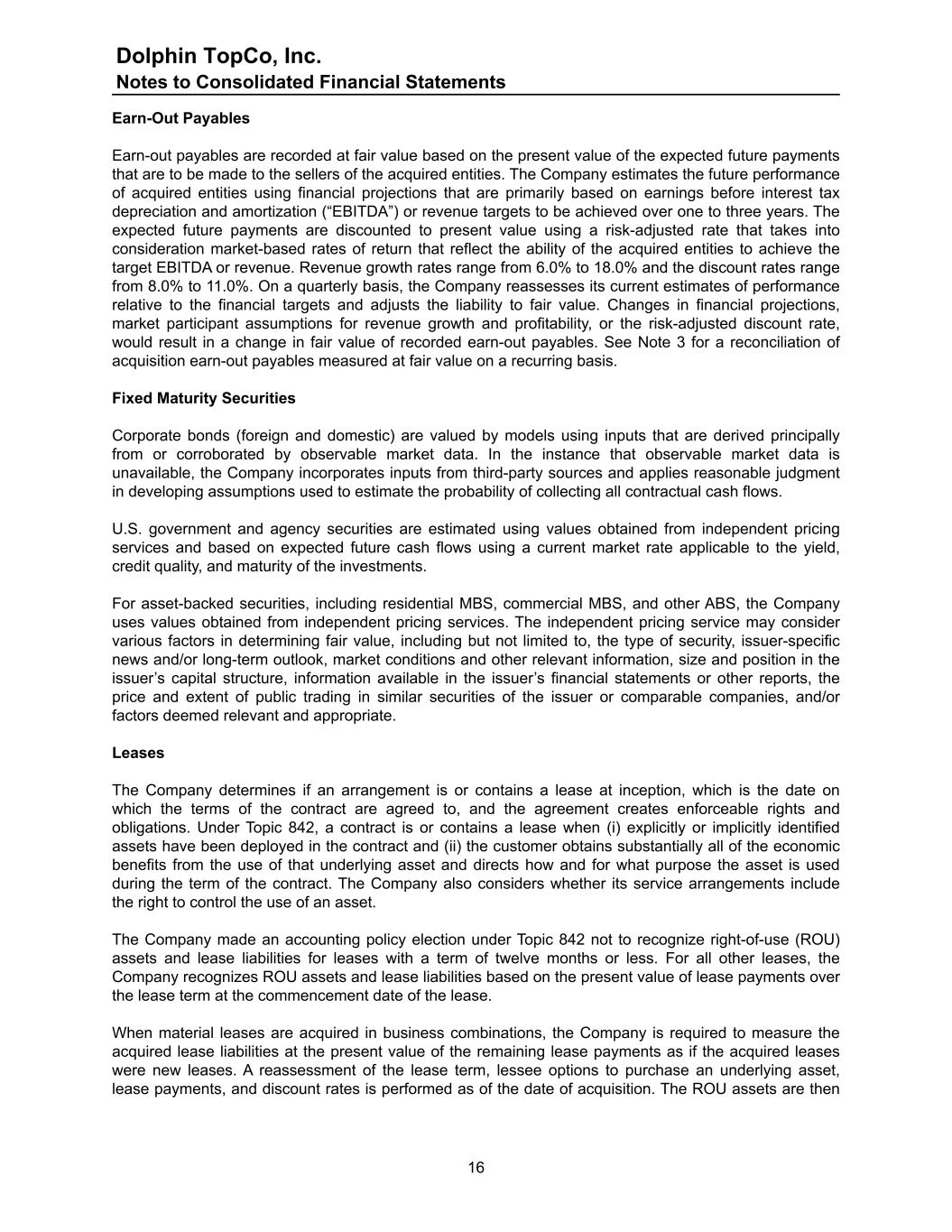

Earn-Out Payables Earn-out payables are recorded at fair value based on the present value of the expected future payments that are to be made to the sellers of the acquired entities. The Company estimates the future performance of acquired entities using financial projections that are primarily based on earnings before interest tax depreciation and amortization (“EBITDA”) or revenue targets to be achieved over one to three years. The expected future payments are discounted to present value using a risk-adjusted rate that takes into consideration market-based rates of return that reflect the ability of the acquired entities to achieve the target EBITDA or revenue. Revenue growth rates range from 6.0% to 18.0% and the discount rates range from 8.0% to 11.0%. On a quarterly basis, the Company reassesses its current estimates of performance relative to the financial targets and adjusts the liability to fair value. Changes in financial projections, market participant assumptions for revenue growth and profitability, or the risk-adjusted discount rate, would result in a change in fair value of recorded earn-out payables. See Note 3 for a reconciliation of acquisition earn-out payables measured at fair value on a recurring basis. Fixed Maturity Securities Corporate bonds (foreign and domestic) are valued by models using inputs that are derived principally from or corroborated by observable market data. In the instance that observable market data is unavailable, the Company incorporates inputs from third-party sources and applies reasonable judgment in developing assumptions used to estimate the probability of collecting all contractual cash flows. U.S. government and agency securities are estimated using values obtained from independent pricing services and based on expected future cash flows using a current market rate applicable to the yield, credit quality, and maturity of the investments. For asset-backed securities, including residential MBS, commercial MBS, and other ABS, the Company uses values obtained from independent pricing services. The independent pricing service may consider various factors in determining fair value, including but not limited to, the type of security, issuer-specific news and/or long-term outlook, market conditions and other relevant information, size and position in the issuer’s capital structure, information available in the issuer’s financial statements or other reports, the price and extent of public trading in similar securities of the issuer or comparable companies, and/or factors deemed relevant and appropriate. Leases The Company determines if an arrangement is or contains a lease at inception, which is the date on which the terms of the contract are agreed to, and the agreement creates enforceable rights and obligations. Under Topic 842, a contract is or contains a lease when (i) explicitly or implicitly identified assets have been deployed in the contract and (ii) the customer obtains substantially all of the economic benefits from the use of that underlying asset and directs how and for what purpose the asset is used during the term of the contract. The Company also considers whether its service arrangements include the right to control the use of an asset. The Company made an accounting policy election under Topic 842 not to recognize right-of-use (ROU) assets and lease liabilities for leases with a term of twelve months or less. For all other leases, the Company recognizes ROU assets and lease liabilities based on the present value of lease payments over the lease term at the commencement date of the lease. When material leases are acquired in business combinations, the Company is required to measure the acquired lease liabilities at the present value of the remaining lease payments as if the acquired leases were new leases. A reassessment of the lease term, lessee options to purchase an underlying asset, lease payments, and discount rates is performed as of the date of acquisition. The ROU assets are then Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 16

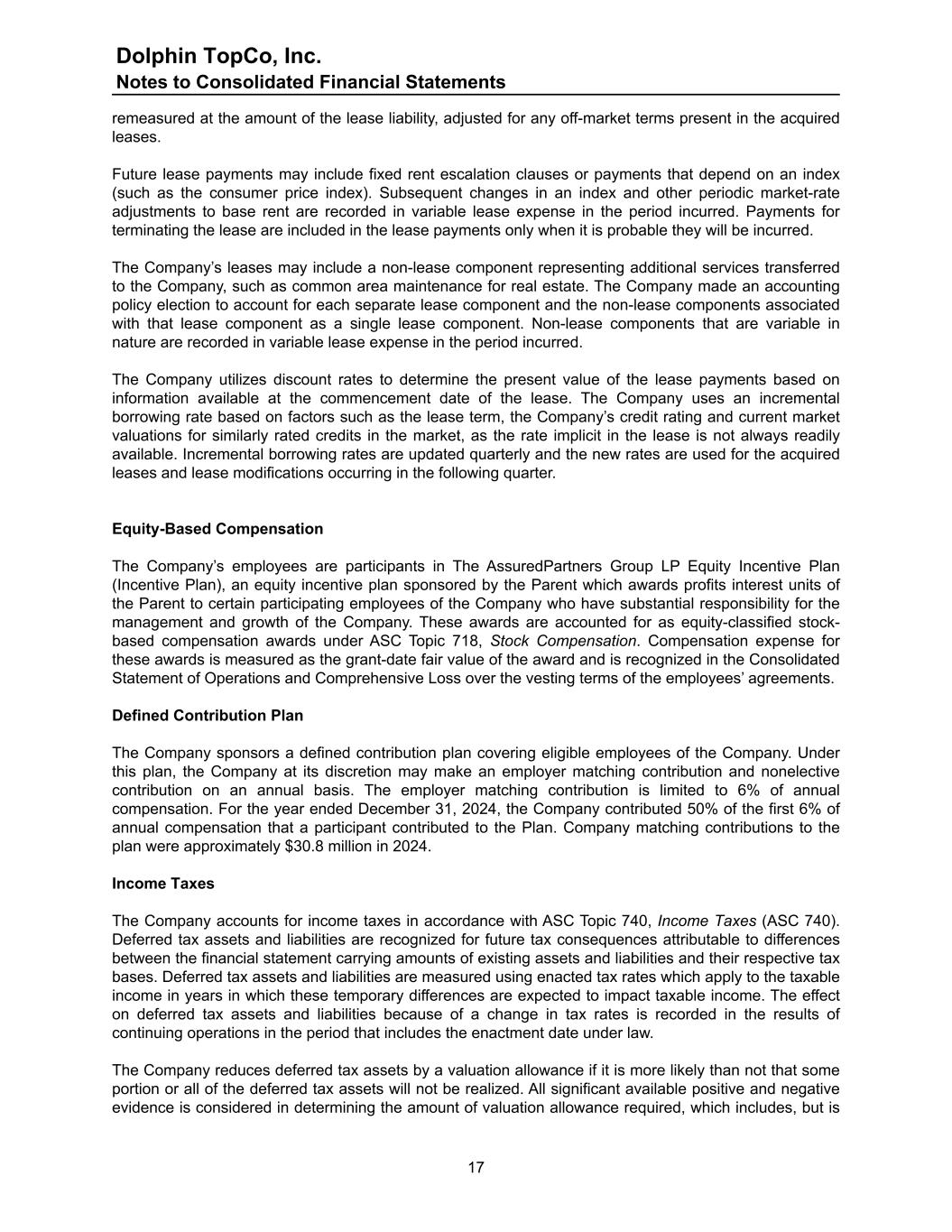

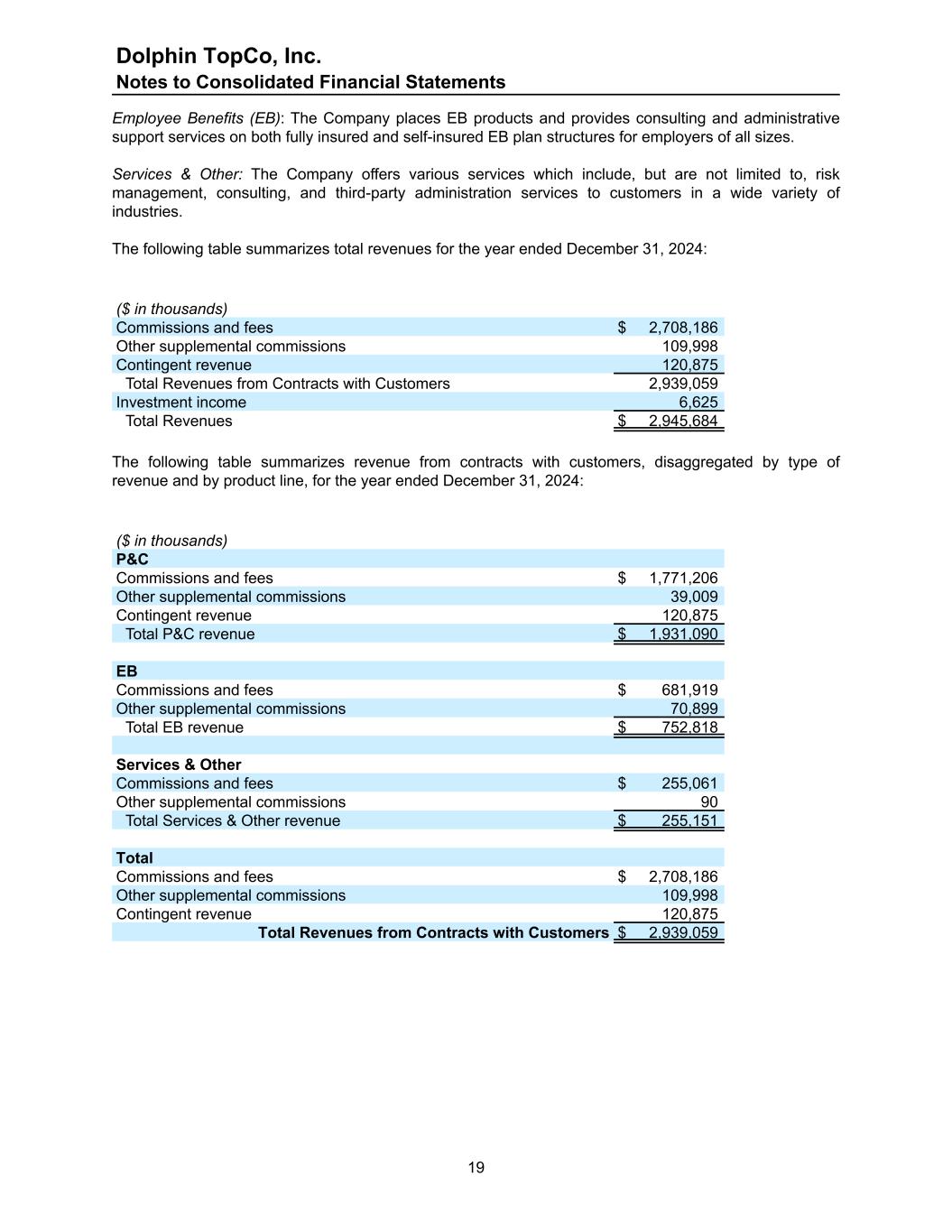

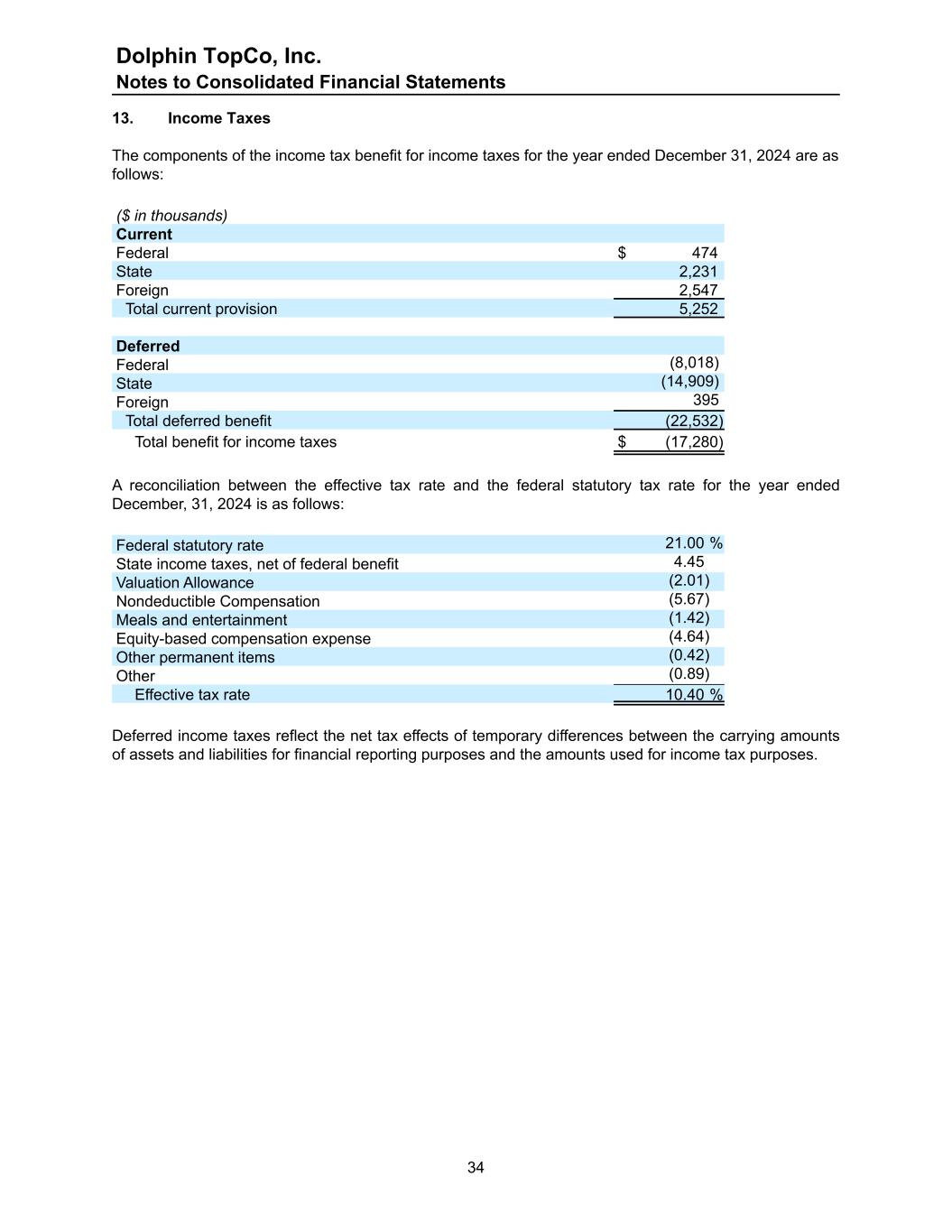

remeasured at the amount of the lease liability, adjusted for any off-market terms present in the acquired leases. Future lease payments may include fixed rent escalation clauses or payments that depend on an index (such as the consumer price index). Subsequent changes in an index and other periodic market-rate adjustments to base rent are recorded in variable lease expense in the period incurred. Payments for terminating the lease are included in the lease payments only when it is probable they will be incurred. The Company’s leases may include a non-lease component representing additional services transferred to the Company, such as common area maintenance for real estate. The Company made an accounting policy election to account for each separate lease component and the non-lease components associated with that lease component as a single lease component. Non-lease components that are variable in nature are recorded in variable lease expense in the period incurred. The Company utilizes discount rates to determine the present value of the lease payments based on information available at the commencement date of the lease. The Company uses an incremental borrowing rate based on factors such as the lease term, the Company’s credit rating and current market valuations for similarly rated credits in the market, as the rate implicit in the lease is not always readily available. Incremental borrowing rates are updated quarterly and the new rates are used for the acquired leases and lease modifications occurring in the following quarter. Equity-Based Compensation The Company’s employees are participants in The AssuredPartners Group LP Equity Incentive Plan (Incentive Plan), an equity incentive plan sponsored by the Parent which awards profits interest units of the Parent to certain participating employees of the Company who have substantial responsibility for the management and growth of the Company. These awards are accounted for as equity-classified stock- based compensation awards under ASC Topic 718, Stock Compensation. Compensation expense for these awards is measured as the grant-date fair value of the award and is recognized in the Consolidated Statement of Operations and Comprehensive Loss over the vesting terms of the employees’ agreements. Defined Contribution Plan The Company sponsors a defined contribution plan covering eligible employees of the Company. Under this plan, the Company at its discretion may make an employer matching contribution and nonelective contribution on an annual basis. The employer matching contribution is limited to 6% of annual compensation. For the year ended December 31, 2024, the Company contributed 50% of the first 6% of annual compensation that a participant contributed to the Plan. Company matching contributions to the plan were approximately $30.8 million in 2024. Income Taxes The Company accounts for income taxes in accordance with ASC Topic 740, Income Taxes (ASC 740). Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates which apply to the taxable income in years in which these temporary differences are expected to impact taxable income. The effect on deferred tax assets and liabilities because of a change in tax rates is recorded in the results of continuing operations in the period that includes the enactment date under law. The Company reduces deferred tax assets by a valuation allowance if it is more likely than not that some portion or all of the deferred tax assets will not be realized. All significant available positive and negative evidence is considered in determining the amount of valuation allowance required, which includes, but is Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 17

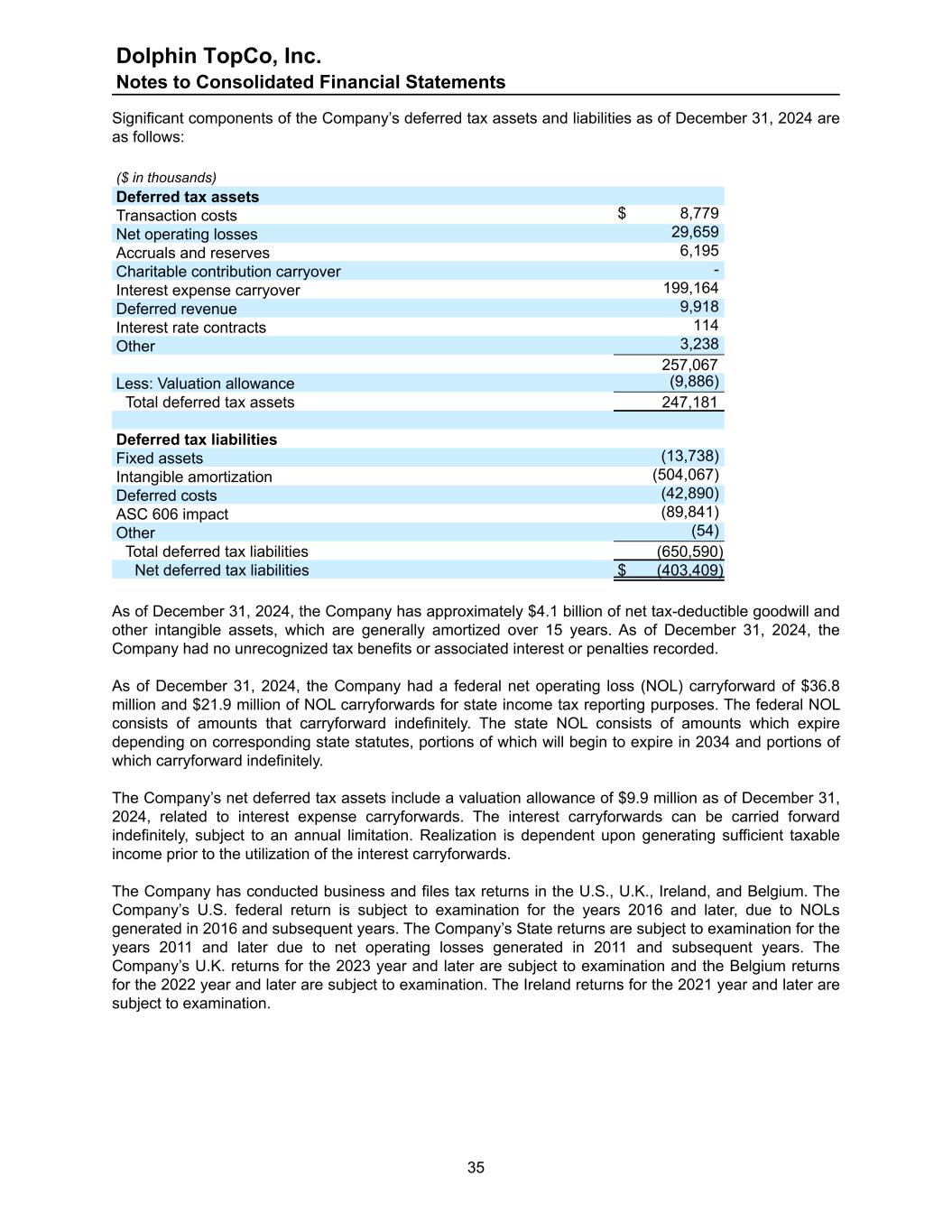

not limited to, the Company’s estimate of future taxable income and any applicable tax-planning strategies. Establishment or reversal of certain valuation allowances may have a significant impact on both current and future results. For uncertain tax positions, ASC 740 prescribes a minimum probability threshold that a tax position must meet before a financial statement benefit is recognized. The minimum threshold is defined as a tax position that is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefit to be recognized is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. The Company records interest and penalties, if any, related to unrecognized tax benefits in the provision for income taxes. Foreign Currency Transactions The Company’s functional currency is the U.S. dollar. The Company has exposure to foreign currency translation gains and losses arising from foreign operations. The revenues, expenses, and financial results of these foreign subsidiaries are recorded in their respective functional currencies. The financial statements of these subsidiaries are translated into U.S. dollars using a current rate of exchange, with gains or losses, net of tax as applicable, included in accumulated other comprehensive income (loss) within the Consolidated Statement of Shareholders’ Equity and Mezzanine Equity. Realized gains and losses on foreign exchange resulting from the settlement of the Company’s foreign currency assets and liabilities and unrealized impacts on foreign exchange resulting from remeasurement recognized as a component of Other loss, net on the Consolidated Statement of Operations and Comprehensive Loss. New Accounting Pronouncements Not Yet Adopted In December 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures. The standard requires disaggregated income tax information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 requires non-public business entities to provide qualitative disclosures about specific categories of reconciling items and individual jurisdictions that result in a significant difference between the statutory tax rate and the effective tax rate. Additionally, ASU 2023-09 requires that disclosures of taxes paid by non-public business entities must be disaggregated into federal, state and foreign tax components, and separate disclosure of taxes paid to individual jurisdictions to which greater than 5% of the total taxes are paid. The Company is subject to the provisions of this standard for annual periods beginning after December 15, 2024 and is currently evaluating the impact of this standard on its disclosures. In November 2024, the FASB issued ASU 2024-03, Income Statement Reporting-Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40), Disaggregation of Income Statement Expenses. The standard update improves the disclosures about a public business entity’s expenses by requiring more detailed information about the types of expenses (including purchases of inventory, employee compensation, depreciation and amortization) included within income statement expense captions. The guidance will be effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. The standard updates are to be applied prospectively with the option for retrospective application. We are currently evaluating the impact of adoption of the standard update on its financial statement disclosures. 2. Revenue from Contracts with Customers Disaggregation of Revenue Property & Casualty (P&C): The Company’s commissions earned from P&C products and services are comprised of a broad range of insurance lines that are offered to middle-market businesses, public institutions, and individuals. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 18

Employee Benefits (EB): The Company places EB products and provides consulting and administrative support services on both fully insured and self-insured EB plan structures for employers of all sizes. Services & Other: The Company offers various services which include, but are not limited to, risk management, consulting, and third-party administration services to customers in a wide variety of industries. The following table summarizes total revenues for the year ended December 31, 2024: ($ in thousands) Commissions and fees $ 2,708,186 Other supplemental commissions 109,998 Contingent revenue 120,875 Total Revenues from Contracts with Customers 2,939,059 Investment income 6,625 Total Revenues $ 2,945,684 The following table summarizes revenue from contracts with customers, disaggregated by type of revenue and by product line, for the year ended December 31, 2024: ($ in thousands) P&C Commissions and fees $ 1,771,206 Other supplemental commissions 39,009 Contingent revenue 120,875 Total P&C revenue $ 1,931,090 EB Commissions and fees $ 681,919 Other supplemental commissions 70,899 Total EB revenue $ 752,818 Services & Other Commissions and fees $ 255,061 Other supplemental commissions 90 Total Services & Other revenue $ 255,151 Total Commissions and fees $ 2,708,186 Other supplemental commissions 109,998 Contingent revenue 120,875 Total Revenues from Contracts with Customers $ 2,939,059 Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 19

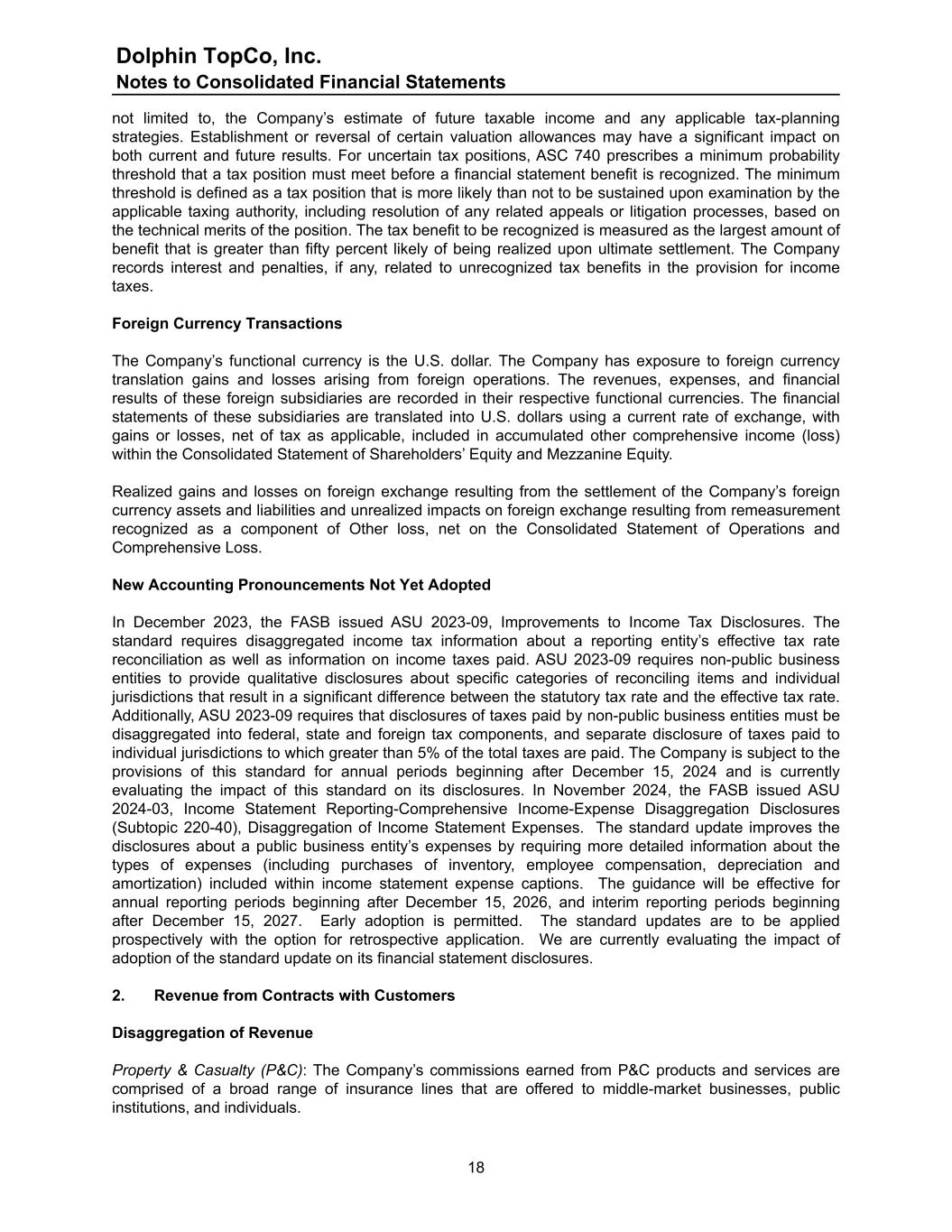

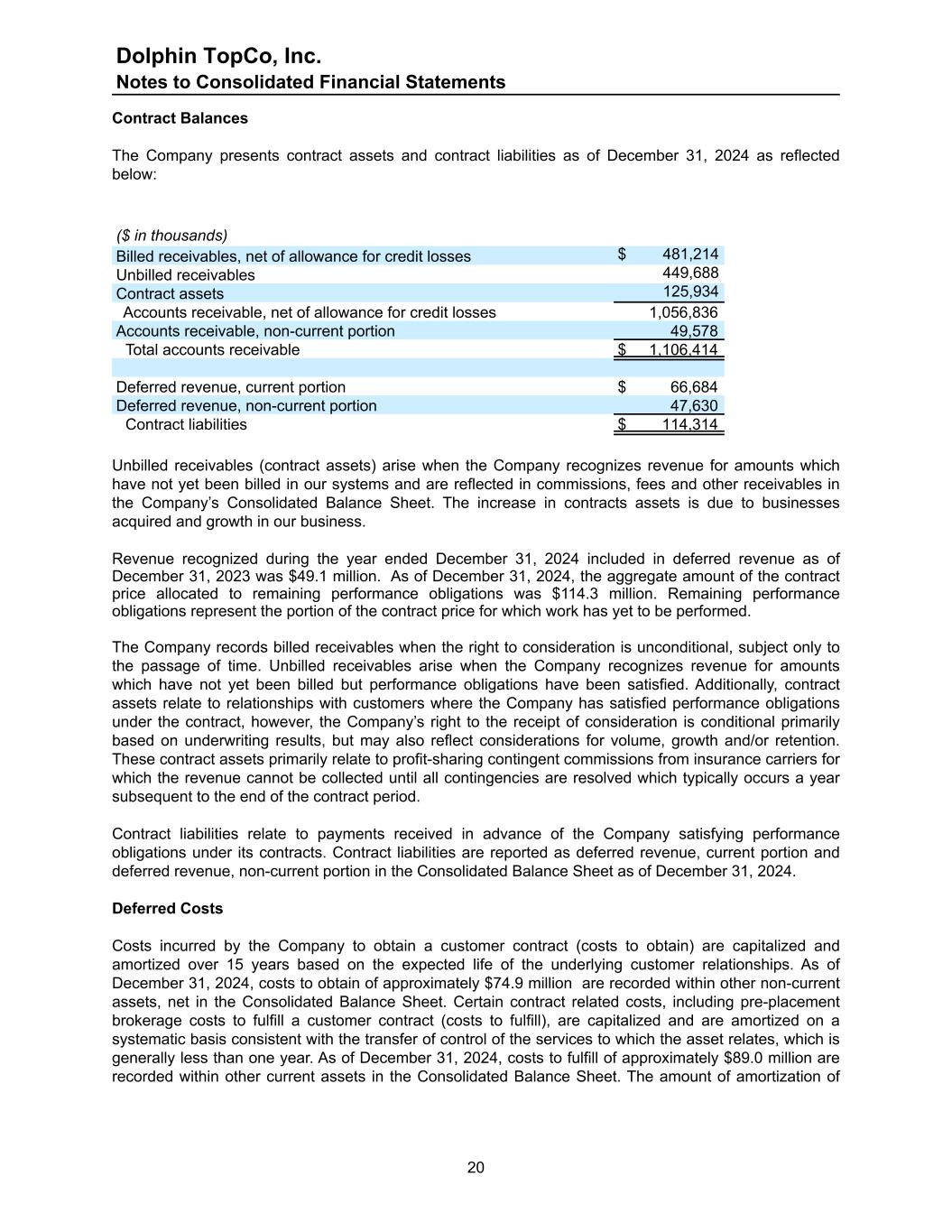

Contract Balances The Company presents contract assets and contract liabilities as of December 31, 2024 as reflected below: ($ in thousands) Billed receivables, net of allowance for credit losses $ 481,214 Unbilled receivables 449,688 Contract assets 125,934 Accounts receivable, net of allowance for credit losses 1,056,836 Accounts receivable, non-current portion 49,578 Total accounts receivable $ 1,106,414 Deferred revenue, current portion $ 66,684 Deferred revenue, non-current portion 47,630 Contract liabilities $ 114,314 Unbilled receivables (contract assets) arise when the Company recognizes revenue for amounts which have not yet been billed in our systems and are reflected in commissions, fees and other receivables in the Company’s Consolidated Balance Sheet. The increase in contracts assets is due to businesses acquired and growth in our business. Revenue recognized during the year ended December 31, 2024 included in deferred revenue as of December 31, 2023 was $49.1 million. As of December 31, 2024, the aggregate amount of the contract price allocated to remaining performance obligations was $114.3 million. Remaining performance obligations represent the portion of the contract price for which work has yet to be performed. The Company records billed receivables when the right to consideration is unconditional, subject only to the passage of time. Unbilled receivables arise when the Company recognizes revenue for amounts which have not yet been billed but performance obligations have been satisfied. Additionally, contract assets relate to relationships with customers where the Company has satisfied performance obligations under the contract, however, the Company’s right to the receipt of consideration is conditional primarily based on underwriting results, but may also reflect considerations for volume, growth and/or retention. These contract assets primarily relate to profit-sharing contingent commissions from insurance carriers for which the revenue cannot be collected until all contingencies are resolved which typically occurs a year subsequent to the end of the contract period. Contract liabilities relate to payments received in advance of the Company satisfying performance obligations under its contracts. Contract liabilities are reported as deferred revenue, current portion and deferred revenue, non-current portion in the Consolidated Balance Sheet as of December 31, 2024. Deferred Costs Costs incurred by the Company to obtain a customer contract (costs to obtain) are capitalized and amortized over 15 years based on the expected life of the underlying customer relationships. As of December 31, 2024, costs to obtain of approximately $74.9 million are recorded within other non-current assets, net in the Consolidated Balance Sheet. Certain contract related costs, including pre-placement brokerage costs to fulfill a customer contract (costs to fulfill), are capitalized and are amortized on a systematic basis consistent with the transfer of control of the services to which the asset relates, which is generally less than one year. As of December 31, 2024, costs to fulfill of approximately $89.0 million are recorded within other current assets in the Consolidated Balance Sheet. The amount of amortization of Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 20

the deferred contract costs was $5.4 million for the year ended December 31, 2024, which is included within compensation expense on the Consolidated Statement of Operations and Comprehensive Loss. 3. Business Combinations During the years ended December 31, 2024, the Company completed 25 acquisitions. The Company acquired substantially all the net assets of the companies primarily in exchange for cash and accounted for these acquisitions using the acquisition method for recording business combinations. The results of the acquired companies are included in the Consolidated Statement of Operations and Comprehensive Loss from the date of acquisition. Certain amounts recorded reflect management’s best estimate as of the balance sheet date and may change during the measurement period (not to exceed one year from date of acquisition). During the year ended December 31, 2024, adjustments made within the permitted measurement period as well as certain reclassifications resulted in a decrease to goodwill as disclosed in Note 6. Total consideration transferred during the year ended December 31, 2024 was as follows: ($ in thousands) Location Multiple Date of Acquisition Multiple Cash $ 243,674 Purchase price holdback 4,163 Earn-out payables 30,170 Total consideration transferred $ 278,007 Maximum potential earn-out payable $ 103,242 Amounts of identifiable assets acquired and liabilities assumed for the business combinations consummated during the year ended December 31, 2024 were as follows: ($ in thousands) Cash $ 3,814 Trust cash 15,029 Other current assets 14,830 Fixed assets 1,874 Goodwill 162,515 Definite-lived intangibles 109,435 Operating lease right-of-use assets 3,748 Total assets acquired $ 311,245 Current liabilities 29,806 Lease liability 3,432 Total liabilities assumed 33,238 Total net assets acquired $ 278,007 During the year ended December 31, 2024, approximately $2.1 million in cash was paid for certain measurement period adjustments associated with prior acquisitions. Of the $162.5 million of goodwill acquired in 2024, approximately $147.6 million is expected to be tax deductible and is amortized over 15 years for income tax purposes starting in the current year. The remaining $14.9 million relates to international acquisitions that are not tax deductible for income tax purposes. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 21

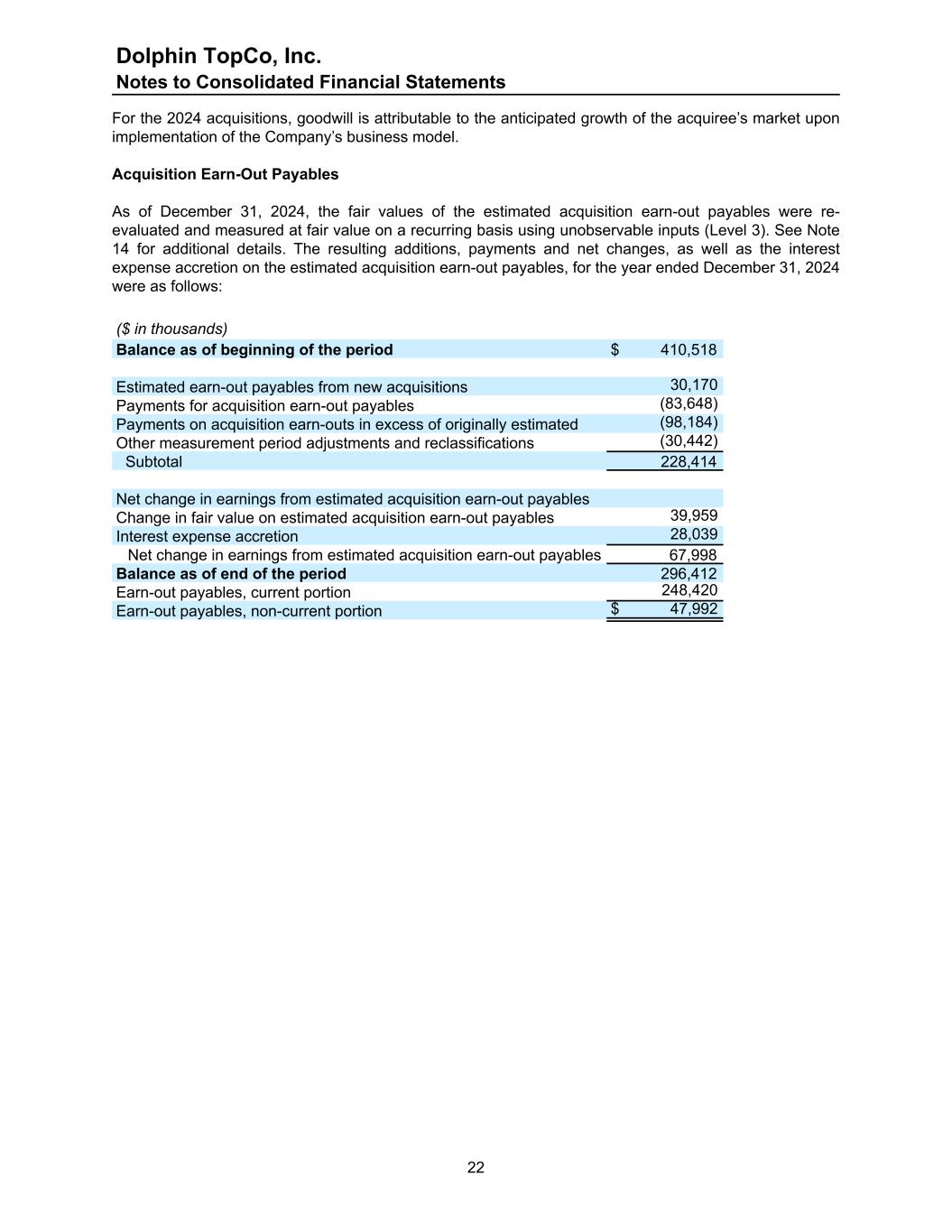

For the 2024 acquisitions, goodwill is attributable to the anticipated growth of the acquiree’s market upon implementation of the Company’s business model. Acquisition Earn-Out Payables As of December 31, 2024, the fair values of the estimated acquisition earn-out payables were re- evaluated and measured at fair value on a recurring basis using unobservable inputs (Level 3). See Note 14 for additional details. The resulting additions, payments and net changes, as well as the interest expense accretion on the estimated acquisition earn-out payables, for the year ended December 31, 2024 were as follows: ($ in thousands) Balance as of beginning of the period $ 410,518 Estimated earn-out payables from new acquisitions 30,170 Payments for acquisition earn-out payables (83,648) Payments on acquisition earn-outs in excess of originally estimated (98,184) Other measurement period adjustments and reclassifications (30,442) Subtotal 228,414 Net change in earnings from estimated acquisition earn-out payables Change in fair value on estimated acquisition earn-out payables 39,959 Interest expense accretion 28,039 Net change in earnings from estimated acquisition earn-out payables 67,998 Balance as of end of the period 296,412 Earn-out payables, current portion 248,420 Earn-out payables, non-current portion $ 47,992 Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 22

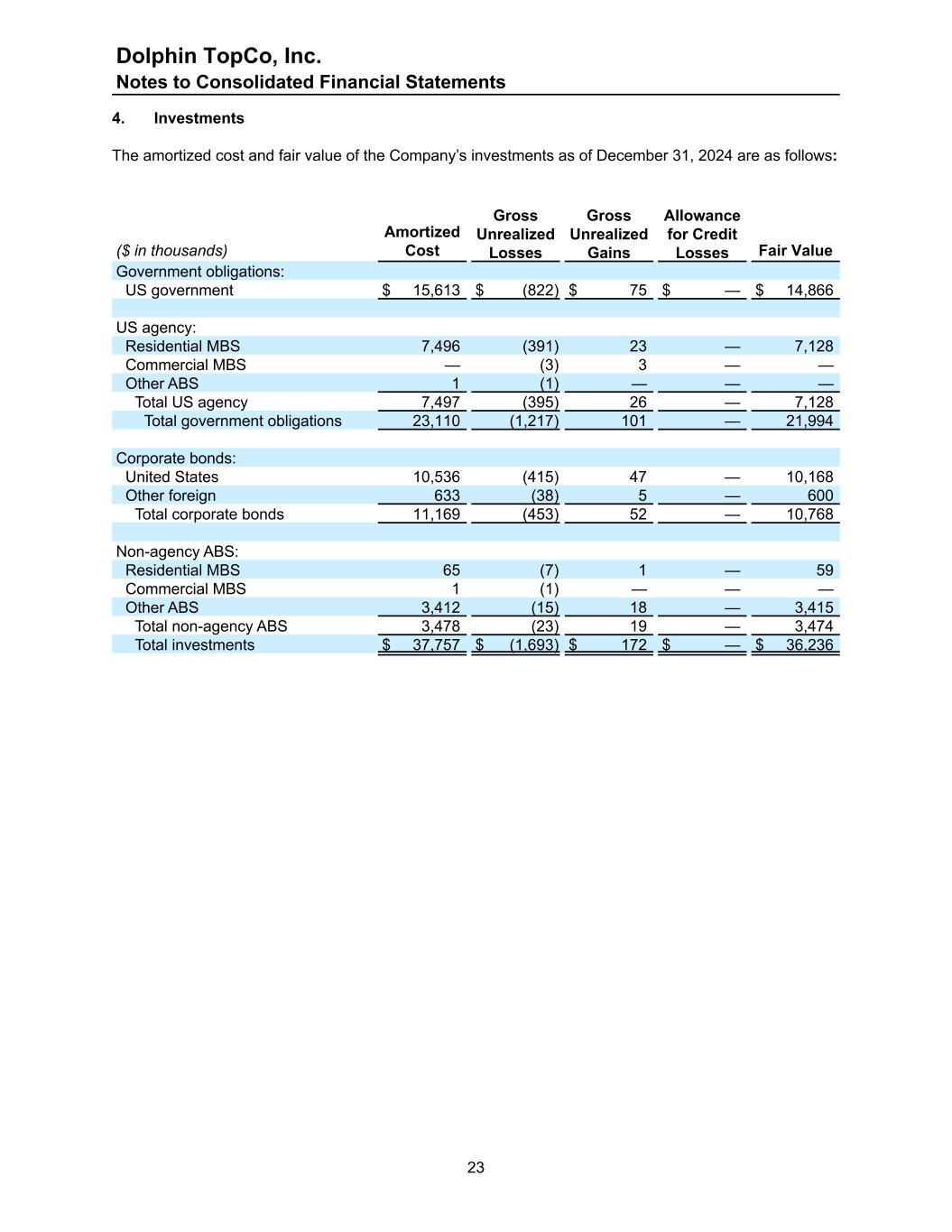

4. Investments The amortized cost and fair value of the Company’s investments as of December 31, 2024 are as follows: ($ in thousands) Amortized Cost Gross Unrealized Losses Gross Unrealized Gains Allowance for Credit Losses Fair Value Government obligations: US government $ 15,613 $ (822) $ 75 $ — $ 14,866 US agency: Residential MBS 7,496 (391) 23 — 7,128 Commercial MBS — (3) 3 — — Other ABS 1 (1) — — — Total US agency 7,497 (395) 26 — 7,128 Total government obligations 23,110 (1,217) 101 — 21,994 Corporate bonds: United States 10,536 (415) 47 — 10,168 Other foreign 633 (38) 5 — 600 Total corporate bonds 11,169 (453) 52 — 10,768 Non-agency ABS: Residential MBS 65 (7) 1 — 59 Commercial MBS 1 (1) — — — Other ABS 3,412 (15) 18 — 3,415 Total non-agency ABS 3,478 (23) 19 — 3,474 Total investments $ 37,757 $ (1,693) $ 172 $ — $ 36,236 Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 23

The number, fair values, and duration of investments in a continuous loss position as of December 31, 2024, are as follows: Less than 12 Months Greater than 12 Months ($ in thousands, except for investment quantities) Number of Investments Gross Unrealized Losses Estimated Fair Value Number of Investments Gross Unrealized Losses Estimated Fair Value Government obligations: US government 15 $ (165) $ 6,570 18 $ (657) $ 6,406 US agency: Residential MBS 39 (89) 3,122 61 (302) 3,251 Commercial MBS — — — 1 (3) — Other ABS 1 (1) — — — — Total US agency 40 (90) 3,122 62 (305) 3,251 Total government obligations 55 (255) 9,692 80 (962) 9,657 Corporate bonds: United States 114 (92) 4,000 110 (323) 3,644 Other foreign 9 (5) 25 14 (33) 428 Total corporate bonds 123 (97) 4,025 124 (356) 4,072 Non-agency ABS: Residential MBS 3 (4) 25 3 (3) 34 Commercial MBS 2 (1) — — — — Other ABS 23 (15) 1,299 3 — 80 Total non-agency ABS 28 (20) 1,324 6 (3) 114 Total investments 206 $ (372) $ 15,041 210 $ (1,321) $ 13,843 No securities were determined to be credit loss impaired during the years ended December 31, 2024. As of December 31, 2024, the Company did not have an intent to sell securities that were in unrealized loss positions and it was more likely than not that the Company would not be required to sell these securities before recovery of the amortized cost basis, which may be at maturity. In making this determination, the Company considered its current and projected liquidity position, its investment policy as to permissible holdings and concentration limits, regulatory requirements, and other relevant factors. A summary of the amortized cost and fair value of fixed maturity securities as of December 31, 2024, by contractual maturity, is as follows: ($ in thousands) Amortized Cost Fair Value Due in one year or less $ 628 $ 657 Due in over one year through five years 14,743 14,289 Due after five through ten years 11,205 10,485 Due after ten years 206 203 Total fixed maturity investments 26,782 25,634 Agency and non-agency MBS and ABS 10,975 10,602 Total investments $ 37,757 $ 36,236 Expected maturities may differ from stated due dates because borrowers may have the right to call or prepay obligations. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 24

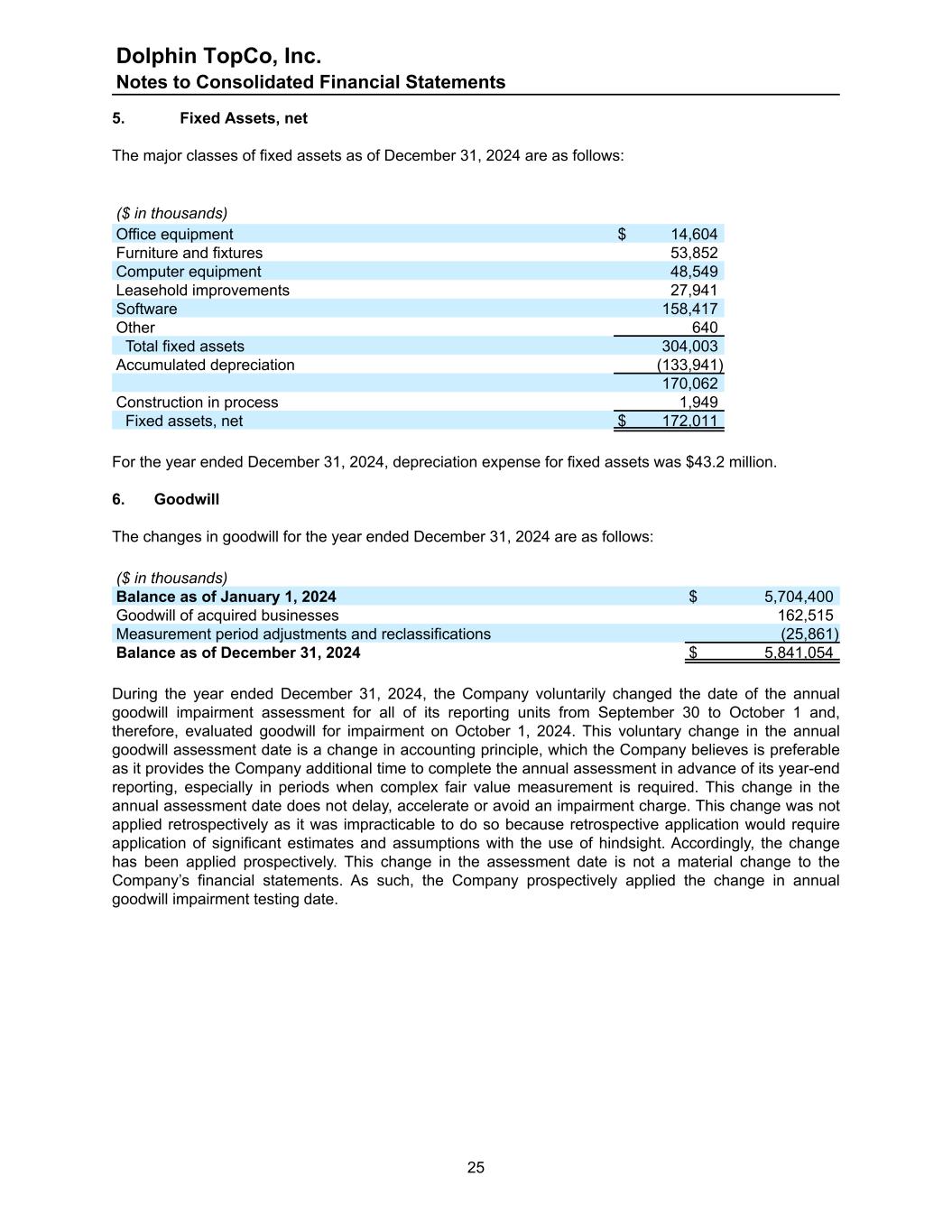

5. Fixed Assets, net The major classes of fixed assets as of December 31, 2024 are as follows: ($ in thousands) Office equipment $ 14,604 Furniture and fixtures 53,852 Computer equipment 48,549 Leasehold improvements 27,941 Software 158,417 Other 640 Total fixed assets 304,003 Accumulated depreciation (133,941) 170,062 Construction in process 1,949 Fixed assets, net $ 172,011 For the year ended December 31, 2024, depreciation expense for fixed assets was $43.2 million. 6. Goodwill The changes in goodwill for the year ended December 31, 2024 are as follows: ($ in thousands) Balance as of January 1, 2024 $ 5,704,400 Goodwill of acquired businesses 162,515 Measurement period adjustments and reclassifications (25,861) Balance as of December 31, 2024 $ 5,841,054 During the year ended December 31, 2024, the Company voluntarily changed the date of the annual goodwill impairment assessment for all of its reporting units from September 30 to October 1 and, therefore, evaluated goodwill for impairment on October 1, 2024. This voluntary change in the annual goodwill assessment date is a change in accounting principle, which the Company believes is preferable as it provides the Company additional time to complete the annual assessment in advance of its year-end reporting, especially in periods when complex fair value measurement is required. This change in the annual assessment date does not delay, accelerate or avoid an impairment charge. This change was not applied retrospectively as it was impracticable to do so because retrospective application would require application of significant estimates and assumptions with the use of hindsight. Accordingly, the change has been applied prospectively. This change in the assessment date is not a material change to the Company’s financial statements. As such, the Company prospectively applied the change in annual goodwill impairment testing date. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 25

7. Definite-Lived Intangible Assets, net The carrying amount of the definite-lived intangible assets, net, as of December 31, 2024, are as follows: ($ in thousands) Gross Carrying Value Accumulated Amortization Net Carrying Value Weighted Average Life Customer-related and contract-based $ 4,146,580 $ (1,176,397) $ 2,970,183 11.1 Non-compete agreements 11,084 (10,580) 504 1.2 Trade name 25,888 (2,702) 23,186 17.5 Other 3,895 (2,174) 1,721 7.8 Balances as of December 31, 2024 $ 4,187,447 $ (1,191,853) $ 2,995,594 During 2024, customer-related and contract-based assets with a gross carrying value of $53.8 million and a net book value of $42.6 million, and noncompete agreements with a gross carrying value of $1.6 million and a net book value of $0.6 million, were determined to be fully impaired. The impairment charges for these assets are included within depreciation and amortization expense on the Consolidated Statement of Operations and Comprehensive Loss. The estimated future amortization expense for definite-lived intangible assets is as follows: ($ in thousands) 2025 $ 271,751 2026 272,494 2027 271,231 2028 270,251 2029 269,056 Thereafter 1,640,811 $ 2,995,594 8. Other Current Assets The other current assets balance consists of the following as of December 31, 2024: ($ in thousands) Deferred compensation $ 89,023 Deferred financing costs 1,280 Deferred costs on cloud computing hosting arrangements 12,204 Tax receivable 11,945 Other 23,540 Total other current assets $ 137,992 As of December 31, 2024, the Company had approximately $12.2 million included in other current assets on the Company's Consolidated Balance Sheet related to certain implementation costs for software as a service arrangements. Implementation costs relate primarily to back office systems including the Company's ERP system for use beginning in 2025. See Note 1 Summary of Significant Accounting Policies. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 26

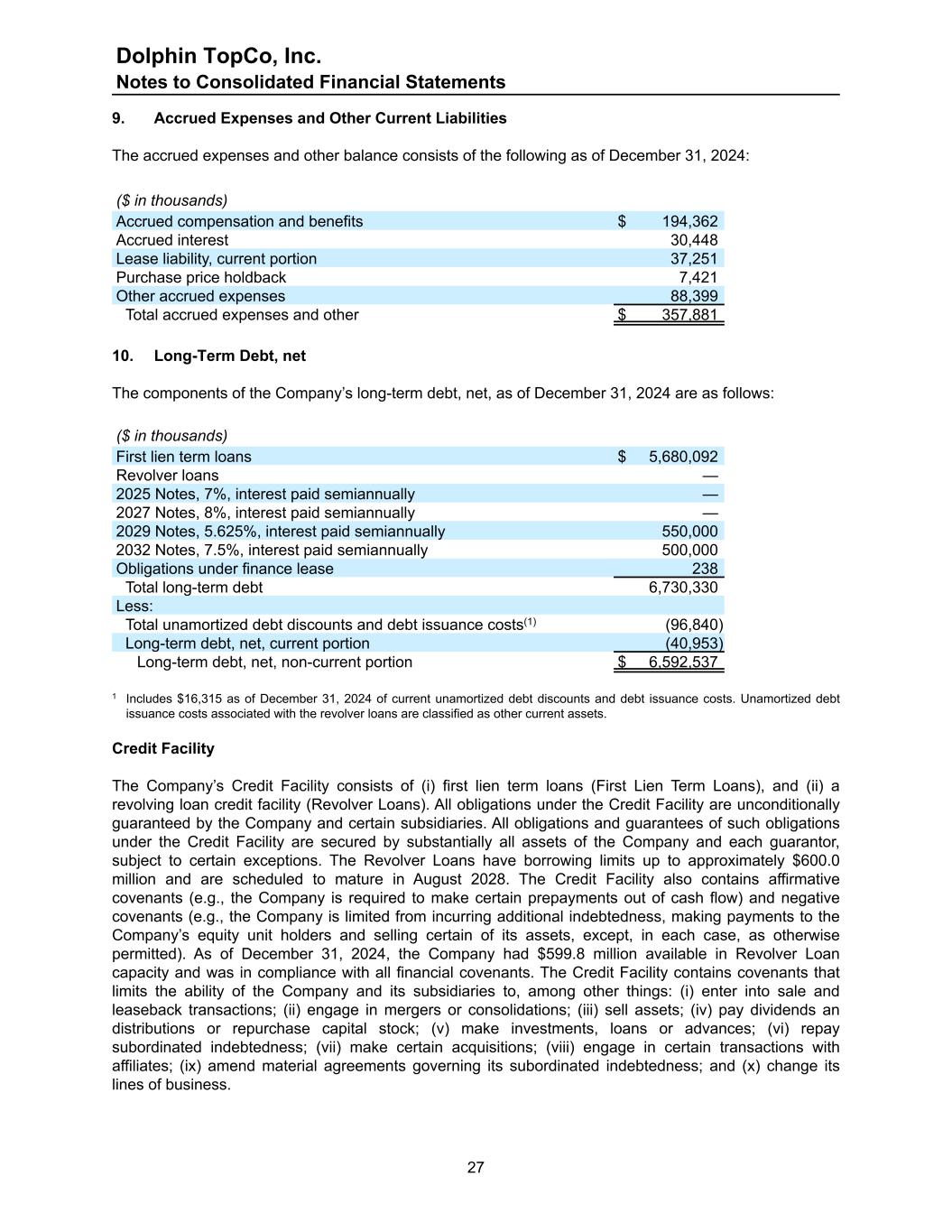

9. Accrued Expenses and Other Current Liabilities The accrued expenses and other balance consists of the following as of December 31, 2024: ($ in thousands) Accrued compensation and benefits $ 194,362 Accrued interest 30,448 Lease liability, current portion 37,251 Purchase price holdback 7,421 Other accrued expenses 88,399 Total accrued expenses and other $ 357,881 10. Long-Term Debt, net The components of the Company’s long-term debt, net, as of December 31, 2024 are as follows: ($ in thousands) First lien term loans $ 5,680,092 Revolver loans — 2025 Notes, 7%, interest paid semiannually — 2027 Notes, 8%, interest paid semiannually — 2029 Notes, 5.625%, interest paid semiannually 550,000 2032 Notes, 7.5%, interest paid semiannually 500,000 Obligations under finance lease 238 Total long-term debt 6,730,330 Less: Total unamortized debt discounts and debt issuance costs(1) (96,840) Long-term debt, net, current portion (40,953) Long-term debt, net, non-current portion $ 6,592,537 1 Includes $16,315 as of December 31, 2024 of current unamortized debt discounts and debt issuance costs. Unamortized debt issuance costs associated with the revolver loans are classified as other current assets. Credit Facility The Company’s Credit Facility consists of (i) first lien term loans (First Lien Term Loans), and (ii) a revolving loan credit facility (Revolver Loans). All obligations under the Credit Facility are unconditionally guaranteed by the Company and certain subsidiaries. All obligations and guarantees of such obligations under the Credit Facility are secured by substantially all assets of the Company and each guarantor, subject to certain exceptions. The Revolver Loans have borrowing limits up to approximately $600.0 million and are scheduled to mature in August 2028. The Credit Facility also contains affirmative covenants (e.g., the Company is required to make certain prepayments out of cash flow) and negative covenants (e.g., the Company is limited from incurring additional indebtedness, making payments to the Company’s equity unit holders and selling certain of its assets, except, in each case, as otherwise permitted). As of December 31, 2024, the Company had $599.8 million available in Revolver Loan capacity and was in compliance with all financial covenants. The Credit Facility contains covenants that limits the ability of the Company and its subsidiaries to, among other things: (i) enter into sale and leaseback transactions; (ii) engage in mergers or consolidations; (iii) sell assets; (iv) pay dividends an distributions or repurchase capital stock; (v) make investments, loans or advances; (vi) repay subordinated indebtedness; (vii) make certain acquisitions; (viii) engage in certain transactions with affiliates; (ix) amend material agreements governing its subordinated indebtedness; and (x) change its lines of business. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 27

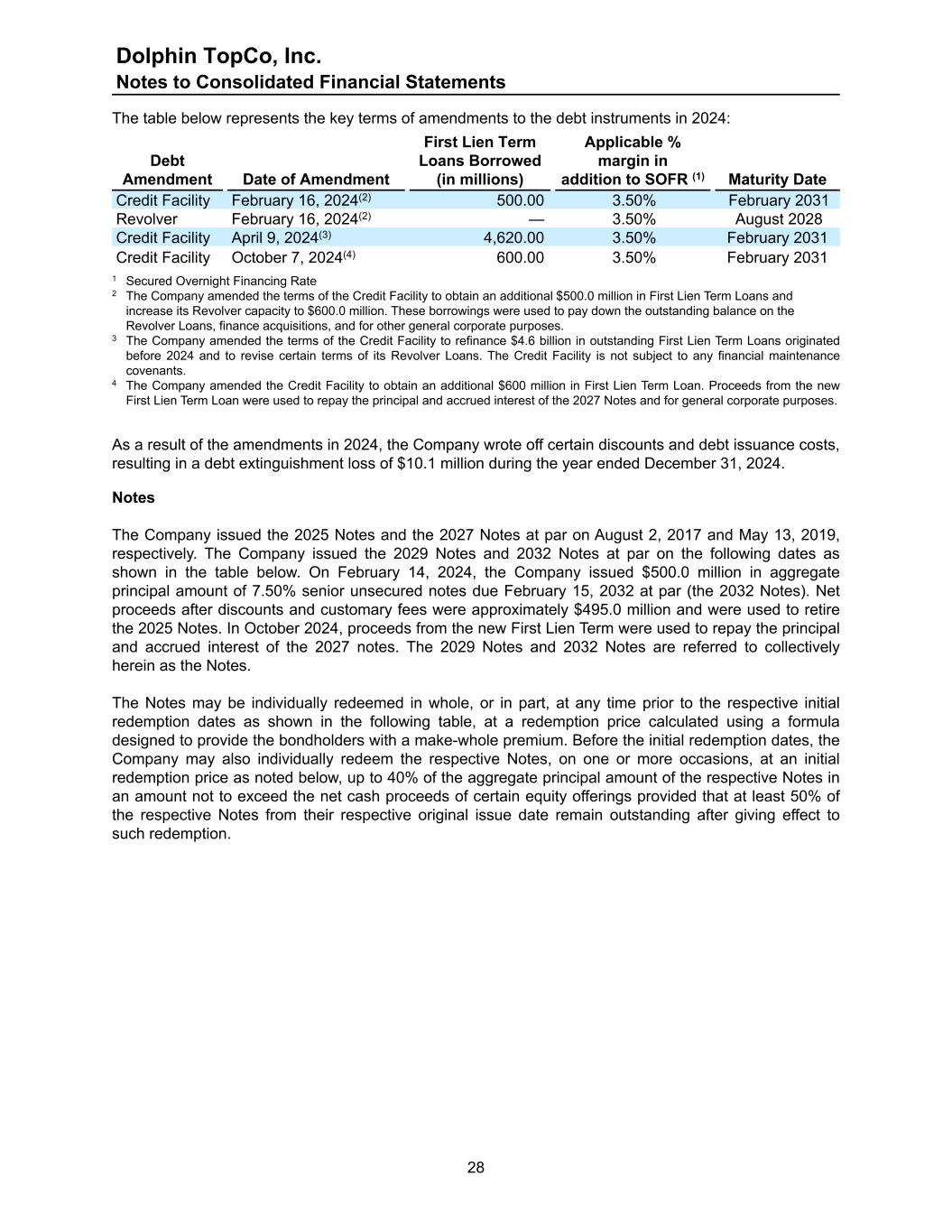

The table below represents the key terms of amendments to the debt instruments in 2024: Debt Amendment Date of Amendment First Lien Term Loans Borrowed (in millions) Applicable % margin in addition to SOFR (1) Maturity Date Credit Facility February 16, 2024(2) 500.00 3.50% February 2031 Revolver February 16, 2024(2) — 3.50% August 2028 Credit Facility April 9, 2024(3) 4,620.00 3.50% February 2031 Credit Facility October 7, 2024(4) 600.00 3.50% February 2031 1 Secured Overnight Financing Rate 2 The Company amended the terms of the Credit Facility to obtain an additional $500.0 million in First Lien Term Loans and increase its Revolver capacity to $600.0 million. These borrowings were used to pay down the outstanding balance on the Revolver Loans, finance acquisitions, and for other general corporate purposes. 3 The Company amended the terms of the Credit Facility to refinance $4.6 billion in outstanding First Lien Term Loans originated before 2024 and to revise certain terms of its Revolver Loans. The Credit Facility is not subject to any financial maintenance covenants. 4 The Company amended the Credit Facility to obtain an additional $600 million in First Lien Term Loan. Proceeds from the new First Lien Term Loan were used to repay the principal and accrued interest of the 2027 Notes and for general corporate purposes. As a result of the amendments in 2024, the Company wrote off certain discounts and debt issuance costs, resulting in a debt extinguishment loss of $10.1 million during the year ended December 31, 2024. Notes The Company issued the 2025 Notes and the 2027 Notes at par on August 2, 2017 and May 13, 2019, respectively. The Company issued the 2029 Notes and 2032 Notes at par on the following dates as shown in the table below. On February 14, 2024, the Company issued $500.0 million in aggregate principal amount of 7.50% senior unsecured notes due February 15, 2032 at par (the 2032 Notes). Net proceeds after discounts and customary fees were approximately $495.0 million and were used to retire the 2025 Notes. In October 2024, proceeds from the new First Lien Term were used to repay the principal and accrued interest of the 2027 notes. The 2029 Notes and 2032 Notes are referred to collectively herein as the Notes. The Notes may be individually redeemed in whole, or in part, at any time prior to the respective initial redemption dates as shown in the following table, at a redemption price calculated using a formula designed to provide the bondholders with a make-whole premium. Before the initial redemption dates, the Company may also individually redeem the respective Notes, on one or more occasions, at an initial redemption price as noted below, up to 40% of the aggregate principal amount of the respective Notes in an amount not to exceed the net cash proceeds of certain equity offerings provided that at least 50% of the respective Notes from their respective original issue date remain outstanding after giving effect to such redemption. Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 28

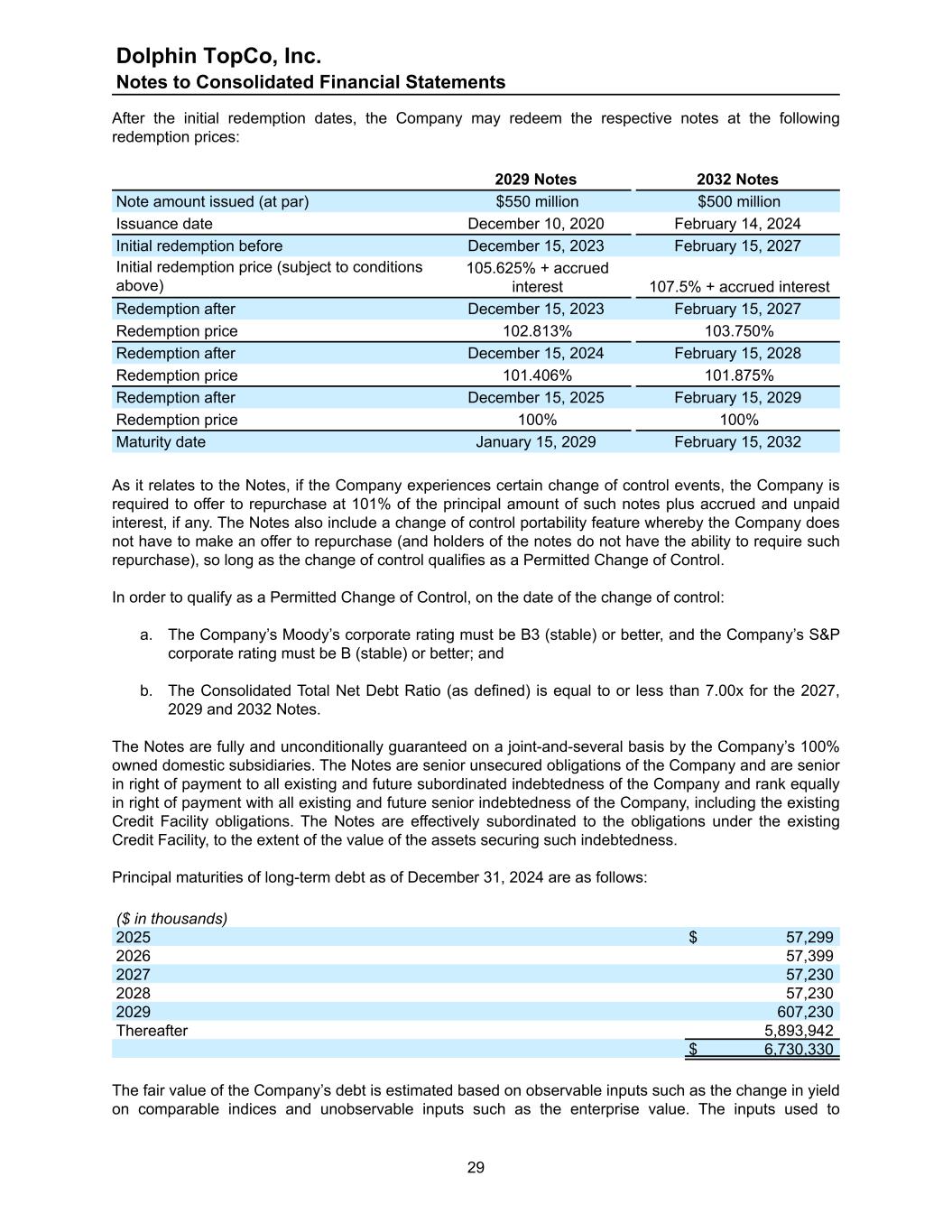

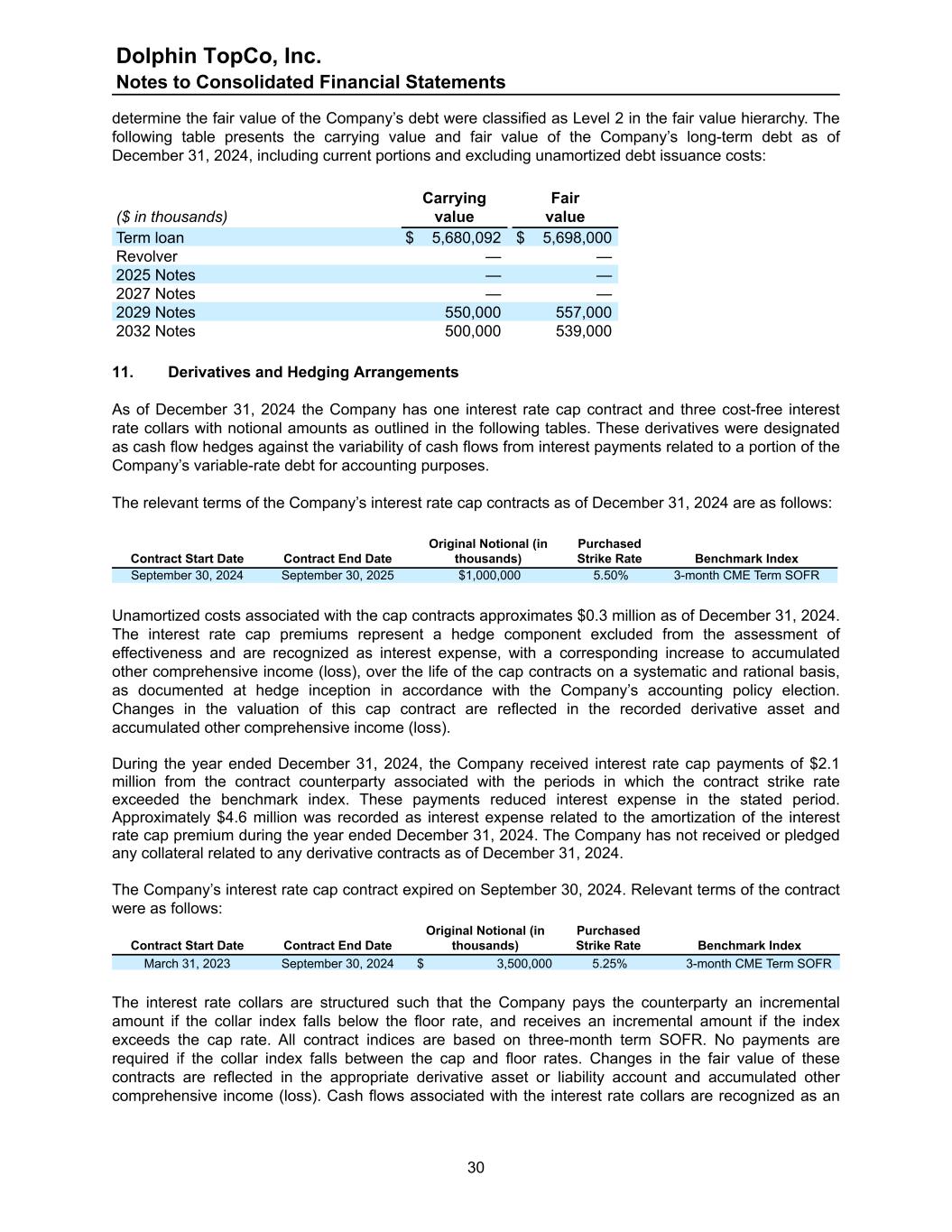

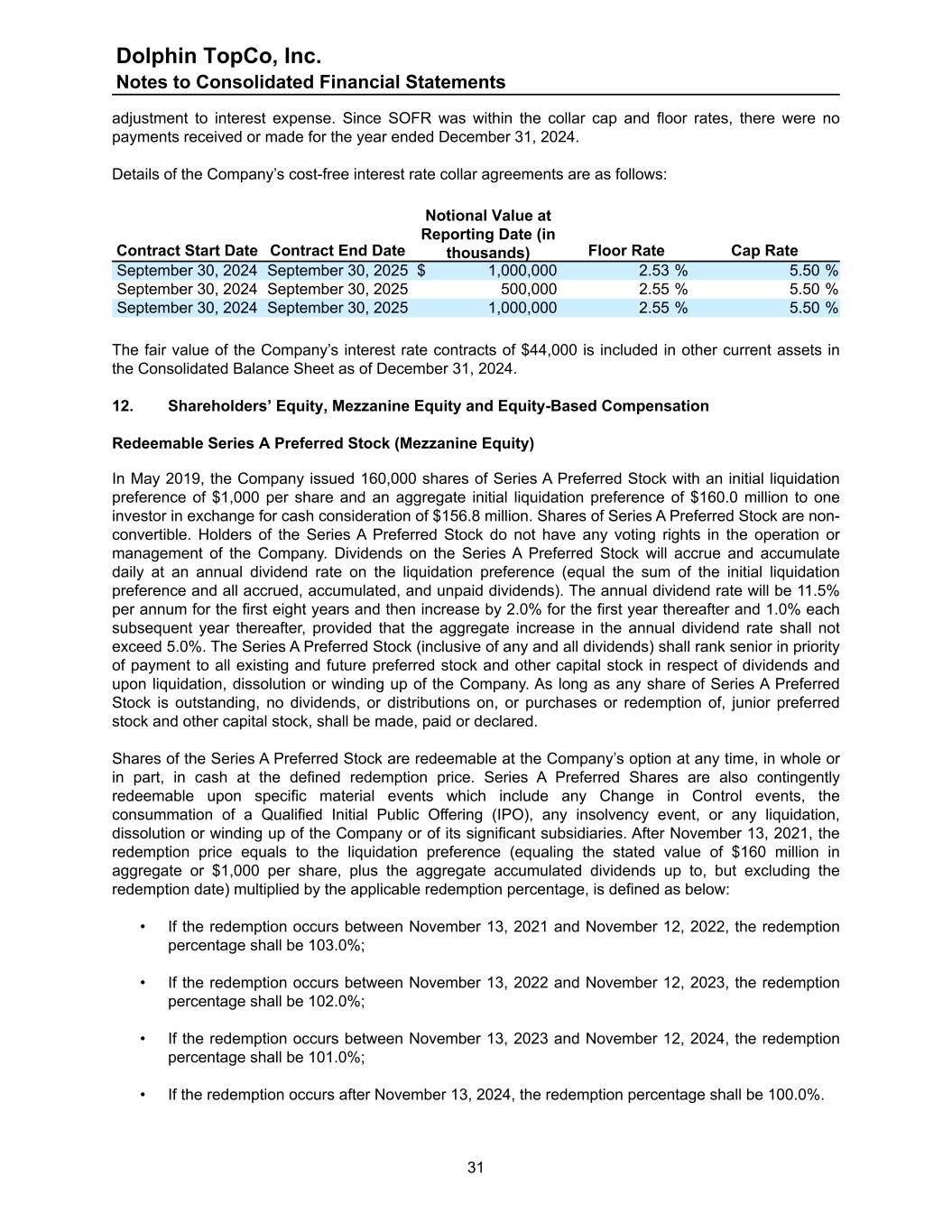

After the initial redemption dates, the Company may redeem the respective notes at the following redemption prices: 2029 Notes 2032 Notes Note amount issued (at par) $550 million $500 million Issuance date December 10, 2020 February 14, 2024 Initial redemption before December 15, 2023 February 15, 2027 Initial redemption price (subject to conditions above) 105.625% + accrued interest 107.5% + accrued interest Redemption after December 15, 2023 February 15, 2027 Redemption price 102.813% 103.750% Redemption after December 15, 2024 February 15, 2028 Redemption price 101.406% 101.875% Redemption after December 15, 2025 February 15, 2029 Redemption price 100% 100% Maturity date January 15, 2029 February 15, 2032 As it relates to the Notes, if the Company experiences certain change of control events, the Company is required to offer to repurchase at 101% of the principal amount of such notes plus accrued and unpaid interest, if any. The Notes also include a change of control portability feature whereby the Company does not have to make an offer to repurchase (and holders of the notes do not have the ability to require such repurchase), so long as the change of control qualifies as a Permitted Change of Control. In order to qualify as a Permitted Change of Control, on the date of the change of control: a. The Company’s Moody’s corporate rating must be B3 (stable) or better, and the Company’s S&P corporate rating must be B (stable) or better; and b. The Consolidated Total Net Debt Ratio (as defined) is equal to or less than 7.00x for the 2027, 2029 and 2032 Notes. The Notes are fully and unconditionally guaranteed on a joint-and-several basis by the Company’s 100% owned domestic subsidiaries. The Notes are senior unsecured obligations of the Company and are senior in right of payment to all existing and future subordinated indebtedness of the Company and rank equally in right of payment with all existing and future senior indebtedness of the Company, including the existing Credit Facility obligations. The Notes are effectively subordinated to the obligations under the existing Credit Facility, to the extent of the value of the assets securing such indebtedness. Principal maturities of long-term debt as of December 31, 2024 are as follows: ($ in thousands) 2025 $ 57,299 2026 57,399 2027 57,230 2028 57,230 2029 607,230 Thereafter 5,893,942 $ 6,730,330 The fair value of the Company’s debt is estimated based on observable inputs such as the change in yield on comparable indices and unobservable inputs such as the enterprise value. The inputs used to Dolphin TopCo, Inc. Notes to Consolidated Financial Statements 29