.2 Merger with Heritage Commerce California’s Top Performing Business Bank Expands into the Bay Area cbbank.com

Forward Looking Statements CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction (including statements about the future financial and operating results and impact on CVBF’s earnings and tangible book value per share), the plans, objectives, expectations and intentions of CVB Financial Corp. (“CVBF”) and Heritage Commerce Corp (“Heritage”), the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, estimates, uncertainties and other important factors that may change over time and could cause actual results to differ materially from any results, performance, or events expressed or implied by such forward-looking statements, including as a result of the factors referenced below. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, project, continue, believe, intend, estimate, plan, trend, objective, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. Although there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements or historical performance: difficulties and delays in integrating Heritage’s business, key personnel and customers into CVBF’s business and operations, and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and other business disruption following the merger, including difficulties in maintaining relationships with employees; supply and demand for commercial or residential real estate and periodic deterioration in real estate prices and/or values in California or other states where CVBF and Heritage lend; a sharp or prolonged slowdown or decline in real estate construction, sales or leasing activities; CVBF’s or Heritage’s ability to retain and increase market share, to retain and grow customers and to control expenses; the costs or effects of mergers, acquisitions or dispositions CVBF may make, whether CVBF and Heritage are able to obtain any required governmental approvals in connection with any such mergers, acquisitions or dispositions, and/or CVBF’s ability to realize the contemplated financial or business benefits associated with any such mergers, acquisitions or dispositions; CVBF’s timely development and implementation of new banking products and services and the perceived overall value of these products and services by customers and potential customers; CVBF’s or Heritage’s relationships with and reliance upon outside vendors with respect to certain of CVBF’s or Heritage’s key internal and external systems, applications and controls; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the Agreement and Plan of Reorganization and Merger to which CVBF and Heritage are parties; changes in commercial or consumer spending, borrowing and savings patterns, preferences or behaviors; technological changes and the expanding use of technology in banking and financial services (including the adoption of mobile banking, funds transfer applications, electronic marketplaces for loans, blockchain technology, fintech, artificial intelligence, and other financial products, systems or services); changes in the financial performance and/or condition of CVBF’s or Heritage’s borrowers or depositors; fluctuations in CVBF’s or Heritage’s share price before closing, and the resulting impact on CVBF’s ability to raise capital or to make acquisitions, including as a result of the financial performance of the other party prior to closing, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies; CVBF’s ability to recruit and retain key executives, board members and other employees; the failure of CVBF or Heritage to obtain regulatory or shareholder approvals, as applicable, or to satisfy any of the other conditions to the closing of the proposed merger on a timely basis or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction; the dilution caused by the issuance of shares of CVBF’s common stock in the transaction; possible impairment charges to goodwill, including any impairment that may result from increased volatility in CVBF’s or Heritage’s stock price; possible credit- related impairments or declines in the fair value of loans and securities held by CVBF or Heritage; volatility in the credit and equity markets and its effect on the general economy, and local, regional, national and international economic and market conditions, political events and public health developments and the impact they may have on CVBF or Heritage, their customers and their capital, deposits, assets and liabilities; CVBF’s or Heritage’s ability to attract deposits and other sources of funding or liquidity; changes in general economic, political, or industry conditions, and in conditions impacting the banking industry specifically; catastrophic events or natural disasters, including earthquakes, drought, climate change or extreme weather events that may affect CVBF’s or Heritage’s assets, communications or computer services, customers, employees or third-party vendors; public health crises and pandemics, and their effects on the economic and business environments in which CVBF and Heritage operate; changes in the competitive environment among banks and other financial services and technology providers, and competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; the strength of the United States economy and the strength of the local economies in which we conduct business; the effects of, and changes in, immigration, trade, tariff, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market and monetary fluctuations; changes in interest rates that could significantly reduce net interest income and negatively affect asset yields and valuations and funding sources, including impacts on prepayment speeds; the impact of changes in financial services policies, laws, regulations, and ongoing or unanticipated regulatory or legal proceedings or outcomes, including those concerning banking, taxes, securities, and insurance, and the application thereof by regulatory agencies; the effectiveness of CVBF’s or Heritage’s risk management framework, quantitative models and ability to manage the risks involved in regulatory, legal or policy changes; the risks associated with CVBF’s or Heritage’s loan portfolios, including the risks of any geographic and industry concentrations; the impact of systemic or non-systemic failures, crisis or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; cybersecurity threats and fraud and the costs of defending against them, including the costs of compliance with legislation or regulations to combat fraud and cybersecurity threats; the costs and effects of legal, compliance and regulatory actions, changes and developments, including the initiation and resolution of any legal proceedings relating to the proposed merger (including any securities, shareholder class actions, lender liability, bank operations, check or wire fraud, financial product or service, data privacy, health and safety, consumer or employee class action litigation); regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations or reviews; CVBF’s or Heritage’s ongoing relations with various federal and state regulators, including, but not limited to, the SEC, Federal Reserve Board, FDIC, Office of the Comptroller of the Currency, and California DFPI; and other factors that may affect the future results of CVBF and Heritage. Additional factors that could cause results to differ materially from those described above can be found in CVBF’s Annual Report on Form 10-K for the year ended December 31, 2024 (available here) and subsequently filed Quarterly Reports on Form 10-Q, which are on file with the SEC and available on CVBF’s website at http://www.cbbank.com under the “Investors” tab, and in other documents CVBF files with the SEC, and in Heritage’s Annual Report on Form 10-K for the year ended December 31, 2024 (available here) and subsequently filed Quarterly Reports on Form 10-Q, which are on file with the SEC and available on Heritage’s website, https://www.heritagecommercecorp.com, under the “Investor Relations” tab and in other documents Heritage files with the SEC. All forward-looking statements are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither CVBF nor Heritage assumes any obligation to update forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in circumstances or other factors affecting forward- looking statements that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. If CVBF or Heritage updates one or more forward- looking statements, no inference should be drawn that CVBF or Heritage will make additional updates with respect to those or other forward-looking statements. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. cbbank.com 2

Additional Information ADDITIONAL INFORMATION ABOUT THE PROPOSED MERGER AND WHERE TO FIND IT In connection with the proposed merger, CVBF will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of CVBF and Heritage and a Prospectus of CVBF (the “Joint Proxy Statement/Prospectus”), as well as other relevant documents concerning the Mergers. Certain matters in respect of the proposed merger involving CVBF and Heritage will be submitted to CVBF’s shareholders or Heritage’s shareholders, as applicable, for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Before making any voting or investment decision, security holders of CVBF and security holders of Heritage are urged to carefully read the entire registration statement and the Joint Proxy Statement/Prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed merger. The documents filed by CVBF and Heritage with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by CVBF may be obtained free of charge at CVBF’s website at http://www.cbbank.com under the “Investors” tab or at Heritage’s website at http://www.heritagecommercecorp.com under the “Investor Relations” tab. Alternatively, these documents, when available, can be obtained free of charge by directing a written request to CVBF, Attention: Investor Relations, 701 North Haven Avenue, Ontario, CA 91764, or by calling (909) 980-4030, or to Heritage Commerce Corp, Attention: Investor Relations, 224 Airport Parkway, San Jose, CA 95110, or by calling (408) 947-6900. PARTICIPANTS IN THE SOLICITATION CVBF, Heritage, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from CVBF’s shareholders or Heritage’s shareholders in connection with the proposed merger under the rules of the SEC. Information regarding CVBF’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in CVBF’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 28, 2025 (available here); in the sections entitled “Board Oversight and Structure,” “Our Executive Officers,” “The Nominees” “Certain Relationships and Related Person Transactions,” “Director Compensation,” “Compensation Arrangements with our President and Chief Executive Officer,” “Compensation Arrangements with our Other Named Executive Officers,” “Summary of Compensation Table” and “How Much Stock Do CVB Financial Corp.’s Directors and Executive Officers Own” in CVBF’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2025 (available here); in the Form 8-K filed with the SEC on October 23, 2025 regarding the election of a new director (available here); and in other documents filed by CVBF with the SEC. Information regarding Heritage’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Heritage’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on March 10, 2025 (available here); in the sections entitled “The Board and Corporate Governance,” “Director Compensation,” “Our Executive Officers,” “Executive Compensation,” “Beneficial Ownership of Common Stock,” and “Transactions with Management” in Heritage’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on April 7, 2025 (available here); and in other documents filed by Heritage with the SEC, and in each case, in particular, the discussion of “Risk Factors” set forth in such filings. To the extent holdings of CVBF’s common stock by the CVBF directors and executive officers, or holdings of Heritage’s common stock by the Heritage directors and executive officers, have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC (available here, in the case of CVBF, and available here, in the case of Heritage). Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus relating to the proposed merger. Free copies of this document and the above-mentioned Joint Proxy Statement/Prospectus when it becomes available, may be obtained as described in the preceding section titled “Additional Information About the Proposed Merger and Where to Find It.” cbbank.com 3

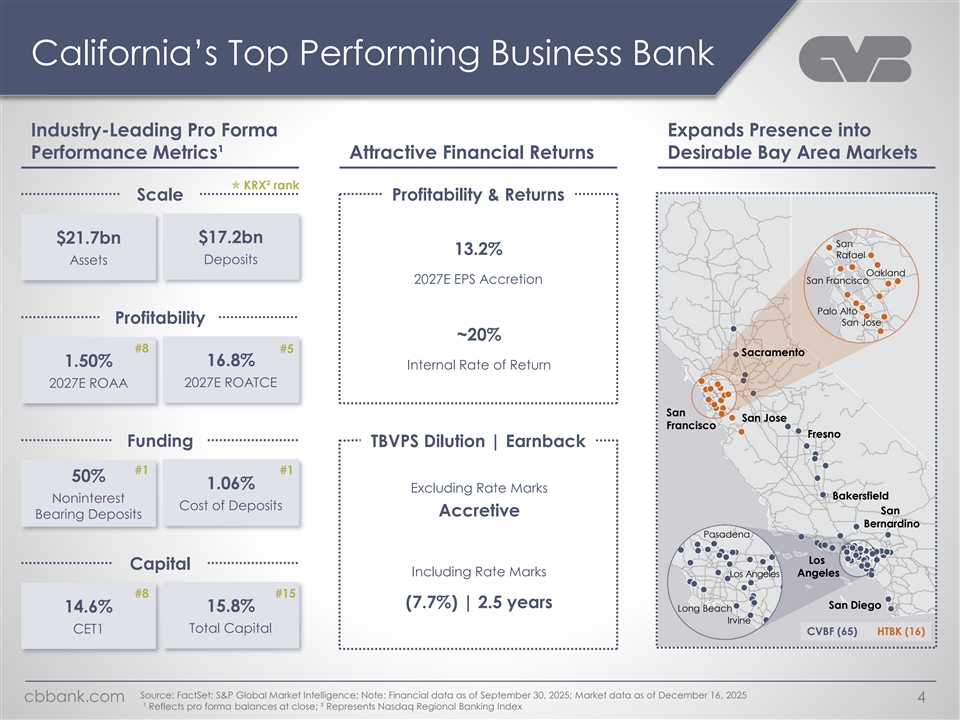

California’s Top Performing Business Bank Industry-Leading Pro Forma Expands Presence into Performance Metrics¹ Attractive Financial Returns Desirable Bay Area Markets KRX² rank Scale Profitability & Returns $21.7bn $17.2bn San 13.2% Rafael Deposits Assets Oakland 2027E EPS Accretion San Francisco Palo Alto Profitability San Jose ~20% #8 #5 Sacramento 1.50% 16.8% Internal Rate of Return 2027E ROAA 2027E ROATCE San San Jose Francisco Fresno Funding TBVPS Dilution | Earnback #1 #1 50% 1.06% Excluding Rate Marks Bakersfield Noninterest Cost of Deposits San Accretive Bearing Deposits Bernardino Pasadena Los Capital Including Rate Marks Los Angeles Angeles #8 #15 (7.7%) | 2.5 years San Diego 15.8% Long Beach 14.6% Irvine CET1 Total Capital CVBF (65) HTBK (16) Source: FactSet; S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025 cbbank.com 4 ¹ Reflects pro forma balances at close; ² Represents Nasdaq Regional Banking Index

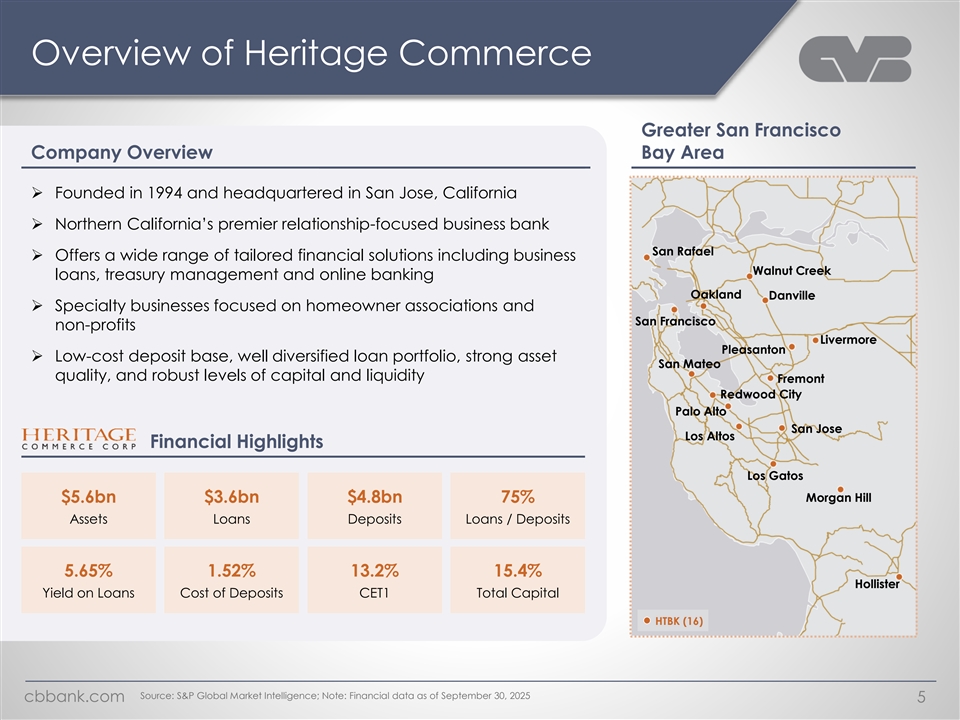

Overview of Heritage Commerce Greater San Francisco Company Overview Bay Area ➢ Founded in 1994 and headquartered in San Jose, California ➢ Northern California’s premier relationship-focused business bank San Rafael ➢ Offers a wide range of tailored financial solutions including business Walnut Creek loans, treasury management and online banking Oakland Danville ➢ Specialty businesses focused on homeowner associations and San Francisco non-profits Livermore Pleasanton ➢ Low-cost deposit base, well diversified loan portfolio, strong asset San Mateo quality, and robust levels of capital and liquidity Fremont Redwood City Palo Alto San Jose Los Altos Financial Highlights Los Gatos $5.6bn $3.6bn $4.8bn 75% Morgan Hill Assets Loans Deposits Loans / Deposits 5.65% 1.52% 13.2% 15.4% Hollister Yield on Loans Cost of Deposits CET1 Total Capital HTBK (16) Source: S&P Global Market Intelligence; Note: Financial data as of September 30, 2025 cbbank.com 5

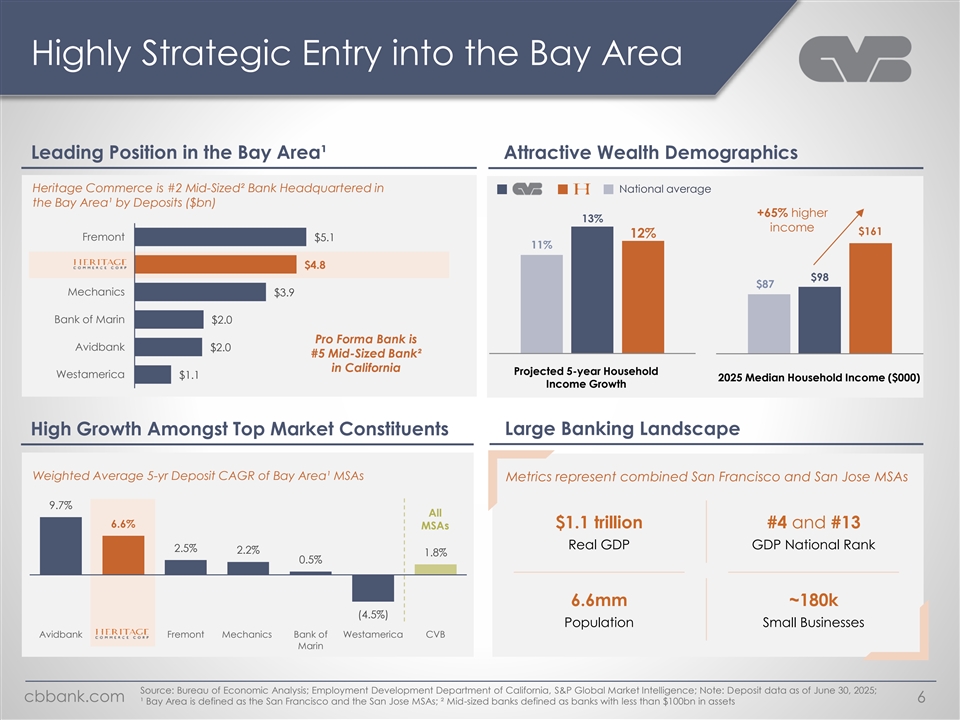

Highly Strategic Entry into the Bay Area Leading Position in the Bay Area¹ Attractive Wealth Demographics Heritage Commerce is #2 Mid-Sized² Bank Headquartered in National average the Bay Area¹ by Deposits ($bn) +65% higher 13% income $161 12% Fremont $5.1 11% $4.8 $98 $87 Mechanics $3.9 Bank of Marin $2.0 Pro Forma Bank is Avidbank $2.0 #5 Mid-Sized Bank² in California Projected 5-year Household Westamerica $1.1 2025 Median Household Income ($000) Income Growth Large Banking Landscape High Growth Amongst Top Market Constituents Weighted Average 5-yr Deposit CAGR of Bay Area¹ MSAs Metrics represent combined San Francisco and San Jose MSAs 9.7% All 6.6% $1.1 trillion #4 and #13 MSAs Real GDP GDP National Rank 2.5% 2.2% 1.8% 0.5% 6.6mm ~180k (4.5%) Population Small Businesses Avidbank Fremont Mechanics Bank of Westamerica CVB Marin Source: Bureau of Economic Analysis; Employment Development Department of California, S&P Global Market Intelligence; Note: Deposit data as of June 30, 2025; cbbank.com 6 ¹ Bay Area is defined as the San Francisco and the San Jose MSAs; ² Mid-sized banks defined as banks with less than $100bn in assets

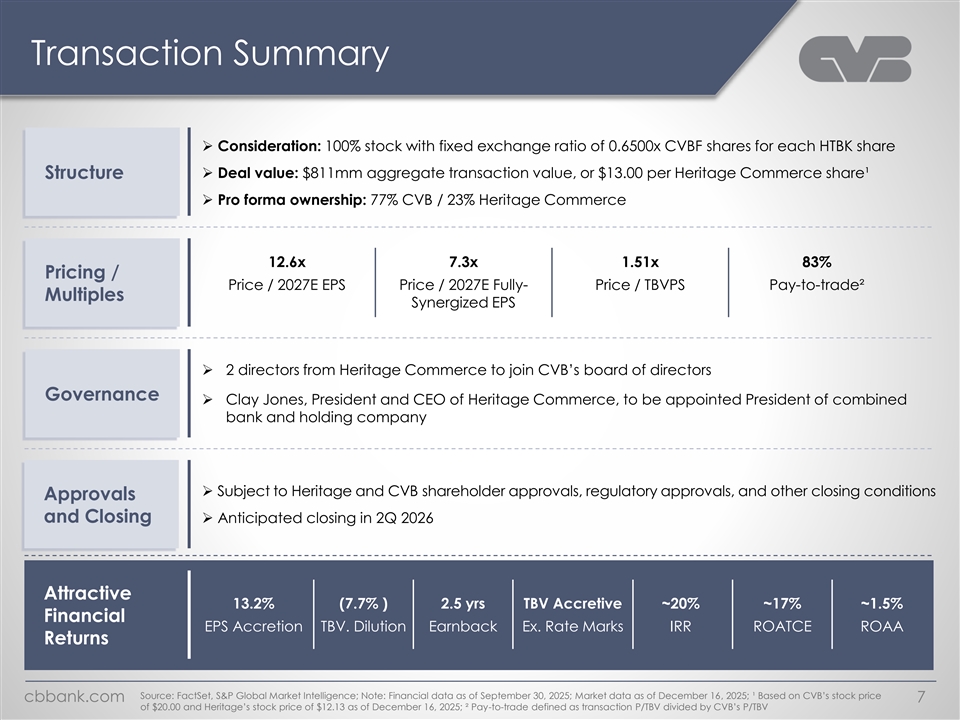

Transaction Summary ➢ Consideration: 100% stock with fixed exchange ratio of 0.6500x CVBF shares for each HTBK share Structure➢ Deal value: $811mm aggregate transaction value, or $13.00 per Heritage Commerce share¹ ➢ Pro forma ownership: 77% CVB / 23% Heritage Commerce 12.6x 7.3x 1.51x 83% Pricing / Price / 2027E EPS Price / 2027E Fully- Price / TBVPS Pay-to-trade² Multiples Synergized EPS ➢ 2 directors from Heritage Commerce to join CVB’s board of directors Governance ➢ Clay Jones, President and CEO of Heritage Commerce, to be appointed President of combined bank and holding company ➢ Subject to Heritage and CVB shareholder approvals, regulatory approvals, and other closing conditions Approvals and Closing➢ Anticipated closing in 2Q 2026 Attractive 13.2% (7.7% ) 2.5 yrs TBV Accretive ~20% ~17% ~1.5% Financial EPS Accretion TBV. Dilution Earnback Ex. Rate Marks IRR ROATCE ROAA Returns Source: FactSet, S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025; ¹ Based on CVB’s stock price cbbank.com 7 of $20.00 and Heritage’s stock price of $12.13 as of December 16, 2025; ² Pay-to-trade defined as transaction P/TBV divided by CVB’s P/TBV

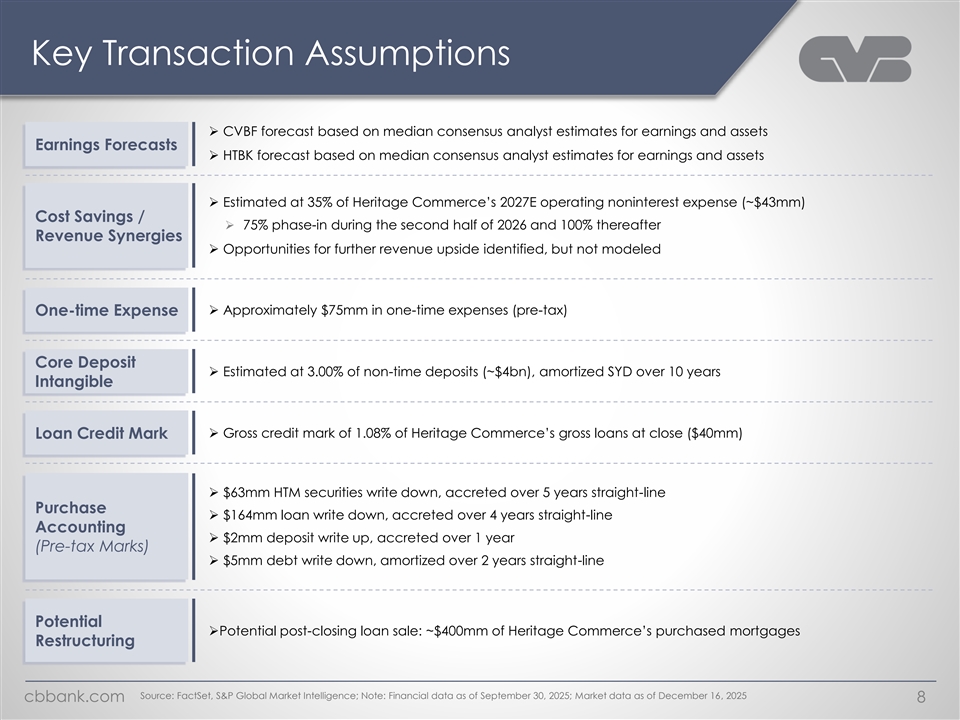

Key Transaction Assumptions ➢ CVBF forecast based on median consensus analyst estimates for earnings and assets Earnings Forecasts ➢ HTBK forecast based on median consensus analyst estimates for earnings and assets ➢ Estimated at 35% of Heritage Commerce’s 2027E operating noninterest expense (~$43mm) Cost Savings / ➢ 75% phase-in during the second half of 2026 and 100% thereafter Revenue Synergies ➢ Opportunities for further revenue upside identified, but not modeled ➢ Approximately $75mm in one-time expenses (pre-tax) One-time Expense Core Deposit ➢ Estimated at 3.00% of non-time deposits (~$4bn), amortized SYD over 10 years Intangible ➢ Gross credit mark of 1.08% of Heritage Commerce’s gross loans at close ($40mm) Loan Credit Mark ➢ $63mm HTM securities write down, accreted over 5 years straight-line Purchase ➢ $164mm loan write down, accreted over 4 years straight-line Accounting ➢ $2mm deposit write up, accreted over 1 year (Pre-tax Marks) ➢ $5mm debt write down, amortized over 2 years straight-line Potential ➢Potential post-closing loan sale: ~$400mm of Heritage Commerce’s purchased mortgages Restructuring Source: FactSet, S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025 cbbank.com 8

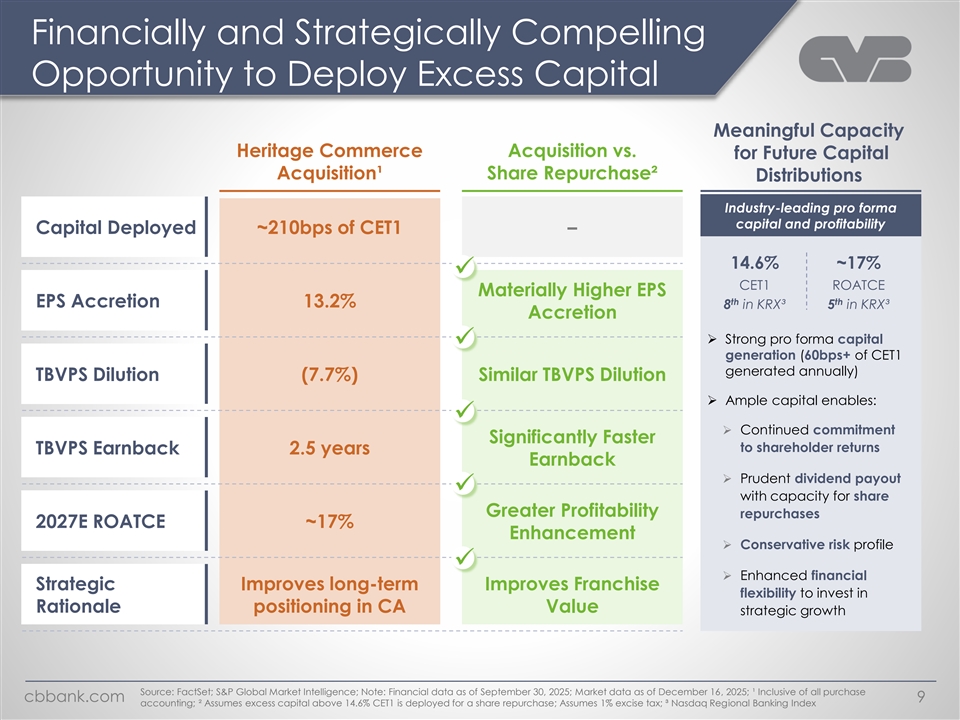

Financially and Strategically Compelling Opportunity to Deploy Excess Capital Meaningful Capacity Heritage Commerce Acquisition vs. for Future Capital Acquisition¹ Share Repurchase² Distributions Industry-leading pro forma capital and profitability Capital Deployed ~210bps of CET1 – 14.6% ~17% ✓ CET1 ROATCE Materially Higher EPS th th EPS Accretion 13.2% 8 in KRX³ 5 in KRX³ Accretion ➢ Strong pro forma capital ✓ generation (60bps+ of CET1 generated annually) TBVPS Dilution (7.7%) Similar TBVPS Dilution ➢ Ample capital enables: ✓ ➢ Continued commitment Significantly Faster to shareholder returns TBVPS Earnback 2.5 years Earnback ➢ Prudent dividend payout ✓ with capacity for share Greater Profitability repurchases 2027E ROATCE ~17% Enhancement ➢ Conservative risk profile ✓ ➢ Enhanced financial Strategic Improves long-term Improves Franchise flexibility to invest in Rationale positioning in CA Value strategic growth Source: FactSet; S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025; ¹ Inclusive of all purchase cbbank.com 9 accounting; ² Assumes excess capital above 14.6% CET1 is deployed for a share repurchase; Assumes 1% excise tax; ³ Nasdaq Regional Banking Index

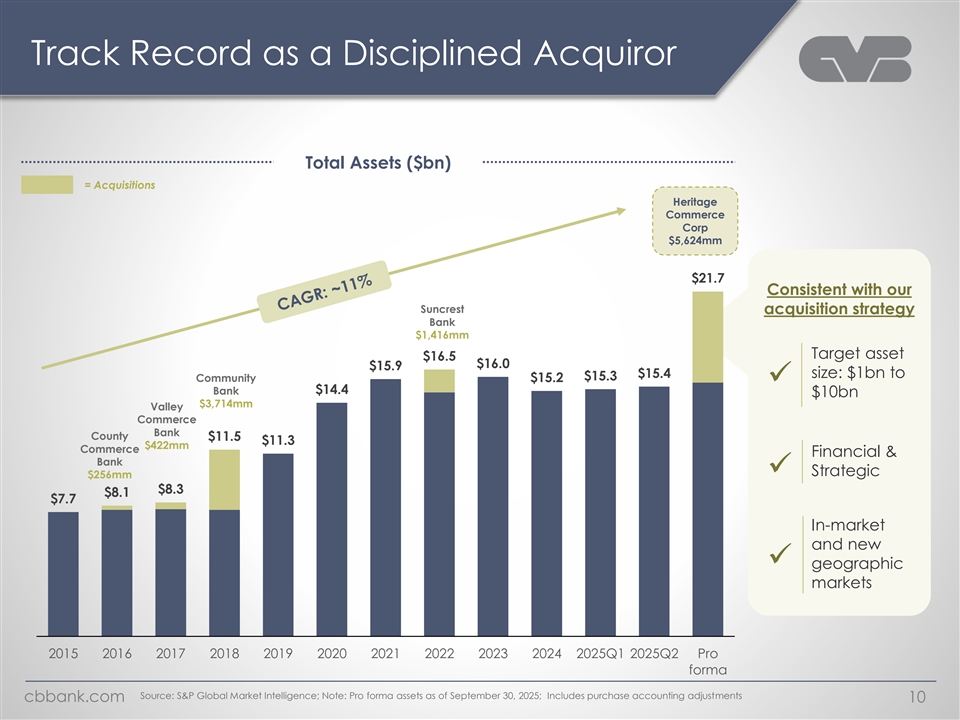

Track Record as a Disciplined Acquiror Total Assets ($bn) = Acquisitions Heritage Commerce Corp $5,624mm $21.7 Consistent with our Suncrest acquisition strategy Bank $1,416mm Target asset $16.5 $16.0 $15.9 $15.4 size: $1bn to $15.3 Community $15.2 ✓ Bank $14.4 $10bn $3,714mm Valley Commerce Bank County $11.5 $11.3 $422mm Commerce Financial & Bank Strategic ✓ $256mm $8.3 $8.1 $7.7 In-market and new ✓ geographic markets 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025Q1 2025Q2 Pro forma Source: S&P Global Market Intelligence; Note: Pro forma assets as of September 30, 2025; Includes purchase accounting adjustments cbbank.com 10

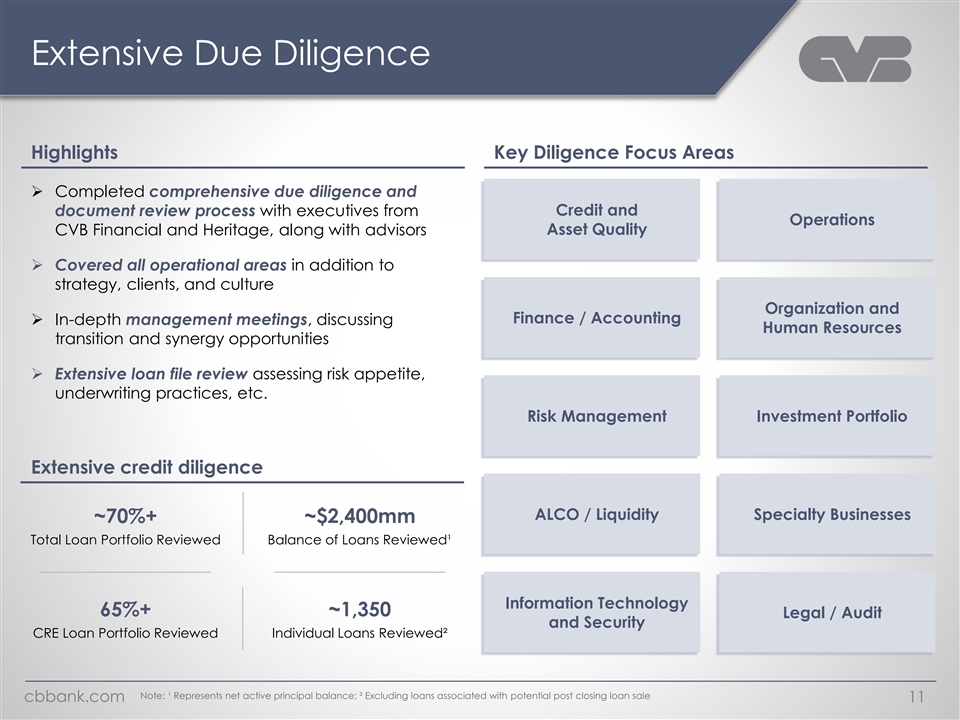

Extensive Due Diligence Highlights Key Diligence Focus Areas ➢ Completed comprehensive due diligence and document review process with executives from Credit and Operations Asset Quality CVB Financial and Heritage, along with advisors ➢ Covered all operational areas in addition to strategy, clients, and culture Organization and Finance / Accounting ➢ In-depth management meetings, discussing Human Resources transition and synergy opportunities ➢ Extensive loan file review assessing risk appetite, underwriting practices, etc. Risk Management Investment Portfolio Extensive credit diligence ALCO / Liquidity Specialty Businesses ~70%+ ~$2,400mm Total Loan Portfolio Reviewed Balance of Loans Reviewed¹ Information Technology 65%+ ~1,350 Legal / Audit and Security CRE Loan Portfolio Reviewed Individual Loans Reviewed² Note: ¹ Represents net active principal balance; ² Excluding loans associated with potential post closing loan sale cbbank.com 11

Transaction Highlights Bolsters California’s Top Performing Business bank Highly Strategic Entry into the Bay Area Attractive, Low-Risk Financial Returns Compelling Deployment of Excess Capital Conservative Assumptions Supported by Robust Due Diligence Successful Track Record as a Highly Disciplined Acquirer cbbank.com 12

Appendix cbbank.com 13

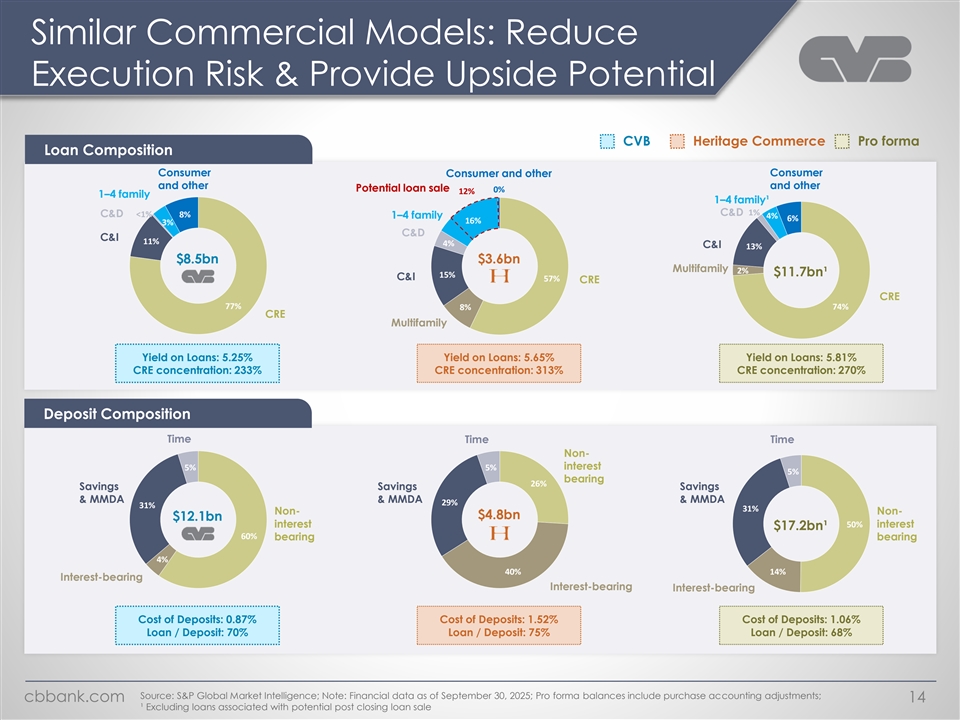

Similar Commercial Models: Reduce Execution Risk & Provide Upside Potential CVB Heritage Commerce Pro forma Loan Composition Consumer Consumer Consumer and other and other and other Potential loan sale 0% 12% 1–4 family 1–4 family¹ C&D 1% C&D <1% 8% 1–4 family 4% 6% 16% 3% C&D C&I 11% 4% C&I 13% $8.5bn $3.6bn Multifamily 2% $11.7bn¹ 15% C&I 57% CRE CRE 77% 74% 8% CRE Multifamily Yield on Loans: 5.25% Yield on Loans: 5.65% Yield on Loans: 5.81% CRE concentration: 233% CRE concentration: 313% CRE concentration: 270% Deposit Composition Time Time Time Non- 5% 5% interest 5% bearing 26% Savings Savings Savings & MMDA & MMDA & MMDA 29% 31% 31% Non- Non- $4.8bn $12.1bn interest 50% interest $17.2bn¹ 60% bearing bearing 4% 40% 14% Interest-bearing Interest-bearing Interest-bearing Cost of Deposits: 0.87% Cost of Deposits: 1.52% Cost of Deposits: 1.06% Loan / Deposit: 70% Loan / Deposit: 75% Loan / Deposit: 68% Source: S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Pro forma balances include purchase accounting adjustments; cbbank.com 14 ¹ Excluding loans associated with potential post closing loan sale

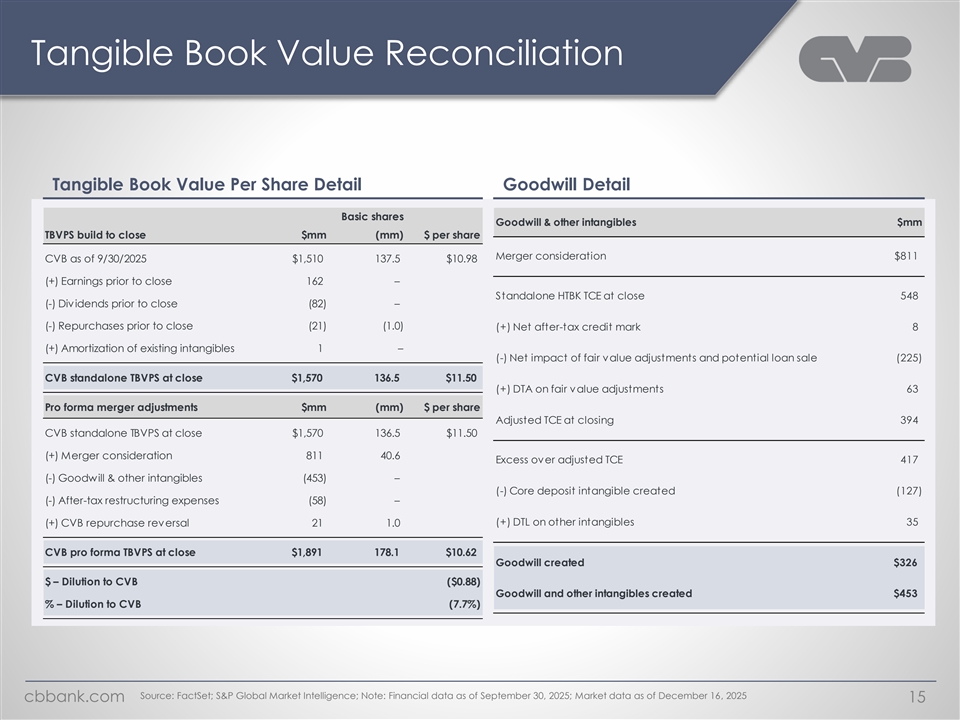

Tangible Book Value Reconciliation Tangible Book Value Per Share Detail Goodwill Detail Basic shares Goodwill & other intangibles $mm TBVPS build to close $mm (mm) $ per share Merger consideration $811 CVB as of 9/30/2025 $1,510 137.5 $10.98 (+) Earnings prior to close 162 – Standalone HTBK TCE at close 548 (-) Dividends prior to close (82) – (-) Repurchases prior to close (21) (1.0) (+) Net after-tax credit mark 8 (+) Amortization of existing intangibles 1 – (-) Net impact of fair value adjustments and potential loan sale (225) CVB standalone TBVPS at close $1,570 136.5 $11.50 (+) DTA on fair value adjustments 63 Pro forma merger adjustments $mm (mm) $ per share Adjusted TCE at closing 394 CVB standalone TBVPS at close $1,570 136.5 $11.50 (+) Merger consideration 811 40.6 Excess over adjusted TCE 417 (-) Goodwill & other intangibles (453) – (-) Core deposit intangible created (127) (-) After-tax restructuring expenses (58) – (+) DTL on other intangibles 35 (+) CVB repurchase reversal 21 1.0 CVB pro forma TBVPS at close $1,891 178.1 $10.62 Goodwill created $326 $ – Dilution to CVB ($0.88) Goodwill and other intangibles created $453 % – Dilution to CVB (7.7%) Source: FactSet; S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025 cbbank.com 15

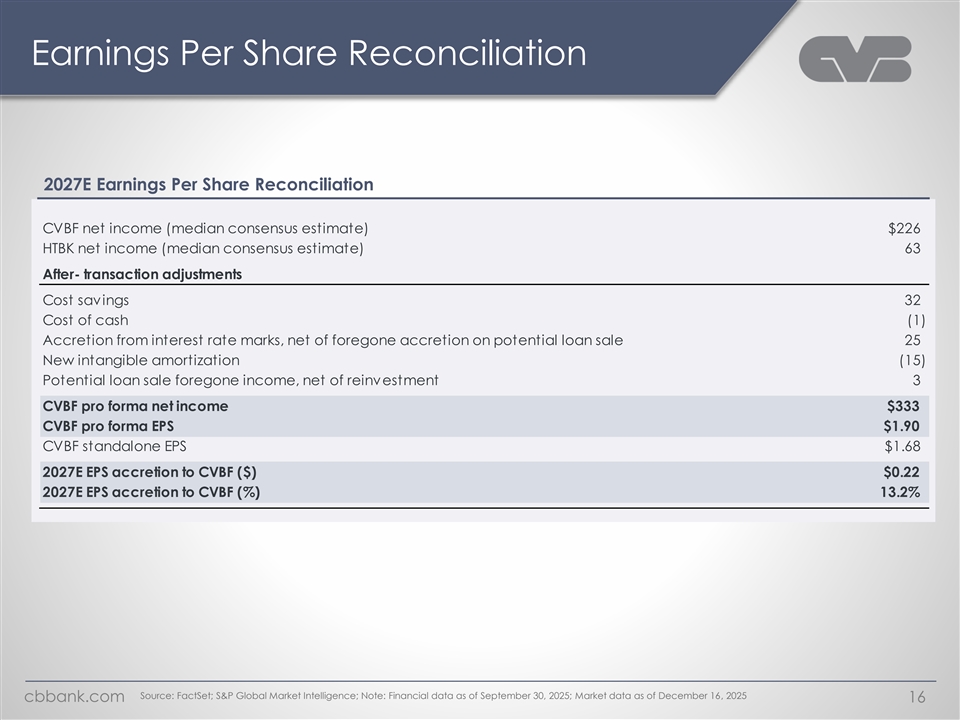

Earnings Per Share Reconciliation 2027E Earnings Per Share Reconciliation CVBF net income (median consensus estimate) $226 HTBK net income (median consensus estimate) 63 After- transaction adjustments Cost savings 32 Cost of cash (1) Accretion from interest rate marks, net of foregone accretion on potential loan sale 25 New intangible amortization (15) Potential loan sale foregone income, net of reinvestment 3 CVBF pro forma net income $333 CVBF pro forma EPS $1.90 CVBF standalone EPS $1.68 2027E EPS accretion to CVBF ($) $0.22 2027E EPS accretion to CVBF (%) 13.2% Source: FactSet; S&P Global Market Intelligence; Note: Financial data as of September 30, 2025; Market data as of December 16, 2025 cbbank.com 16