Investor Presentation Fourth Quarter 2025 .2

Forward Looking Statement Disclaimer and Basis of Presentation • This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Heritage Bank (the "Bank") and its holding company, Heritage Commerce Corp (the "Company"). Forward-looking statements are based on management’s knowledge, assumptions and beliefs as of today and include information concerning the possible or assumed future financial condition, results of operations, business and earnings outlook for the Company and the Bank. These forward-looking statements are subject to risks and uncertainties. For a discussion of risk factors which could cause results to differ, please see the Company’s reports on Forms 10-K and 10-Q as filed with the Securities and Exchange Commission and the Company’s press releases. For more information on factors that could cause our expectations regarding the proposed merger with CVB Financial Corp. to differ, potentially materially, please refer to our Current Report on Form 8-K filed with the Securities and Exchange Commission on December 17, 2025. Readers should not place undue reliance on the forward-looking statements, which reflect management's view only as of the date hereof. The Company undertakes no obligation to publicly revise these forward- looking statements to reflect subsequent events or circumstances. • Financial results are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and prevailing practices in the banking industry. However, certain non-GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. These measures include “adjusted” operating metrics that have been adjusted to exclude notable expenses incurred in the second and fourth quarters of 2025 as well as other performance measures and ratios adjusted for notable items. Management believes these non-GAAP financial measures enhance comparability between periods and in some instances are common in the banking industry. These non-GAAP financial measures should be supplemental to primary GAAP financial measures and should not be read in isolation or relied upon as a substitute for primary GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures are also presented in the Company’s Fourth quarter earnings release, which is available on the Company’s website at https://heritagecommercecorp.com. 2

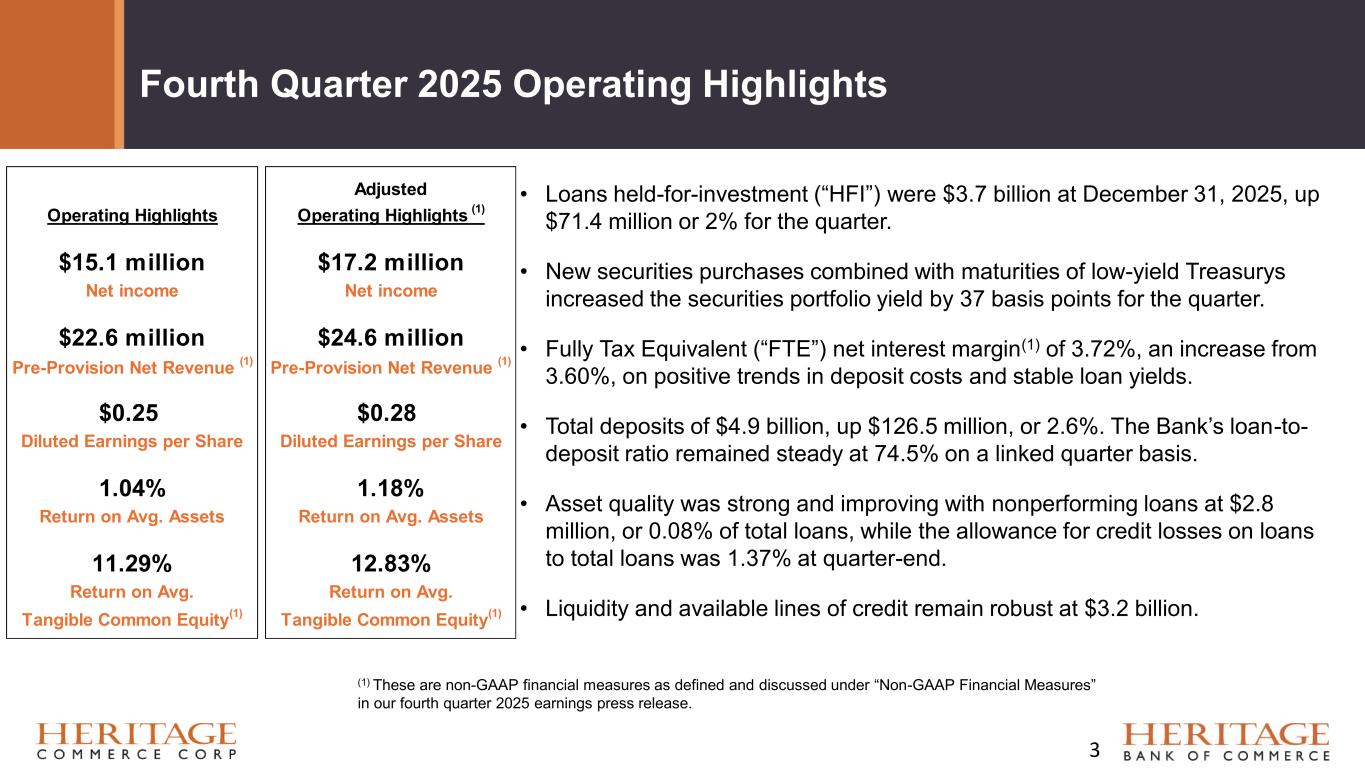

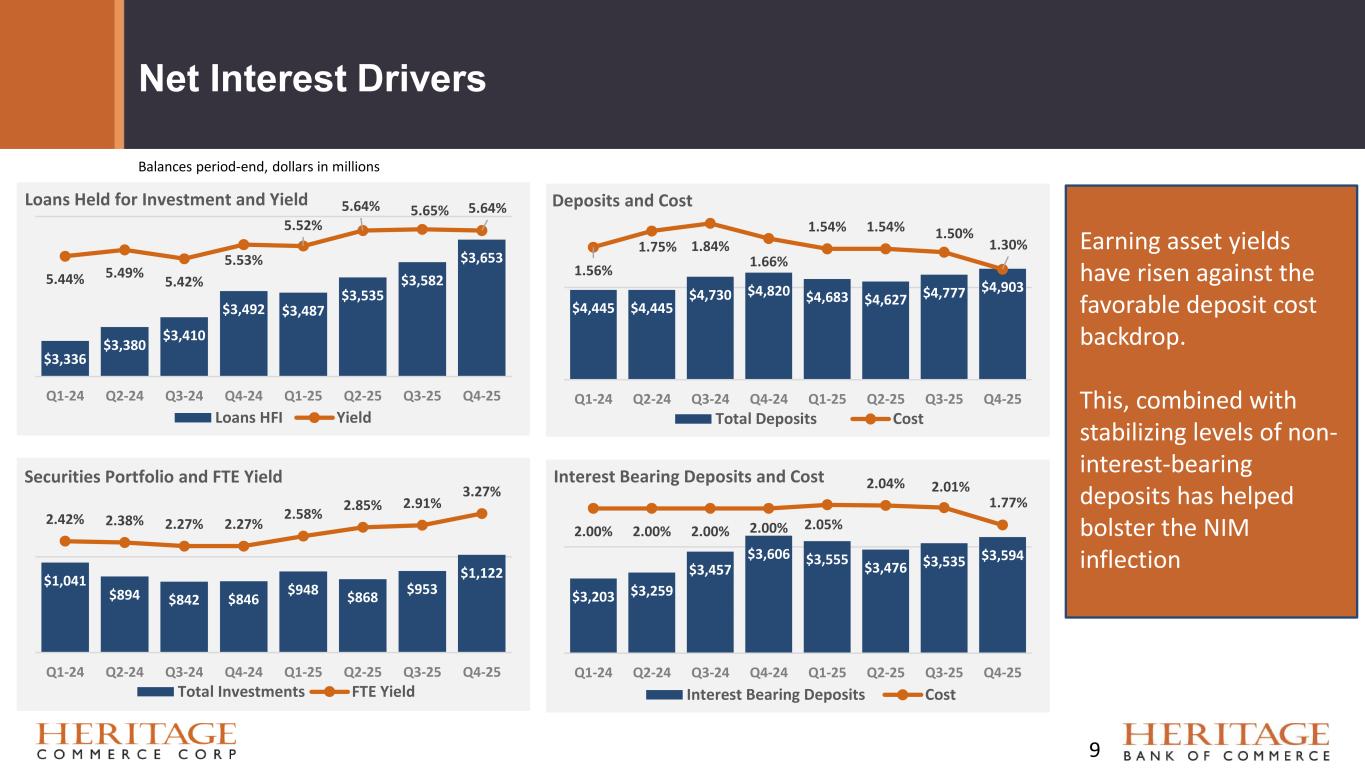

• Loans held-for-investment (“HFI”) were $3.7 billion at December 31, 2025, up $71.4 million or 2% for the quarter. • New securities purchases combined with maturities of low-yield Treasurys increased the securities portfolio yield by 37 basis points for the quarter. • Fully Tax Equivalent (“FTE”) net interest margin(1) of 3.72%, an increase from 3.60%, on positive trends in deposit costs and stable loan yields. • Total deposits of $4.9 billion, up $126.5 million, or 2.6%. The Bank’s loan-to- deposit ratio remained steady at 74.5% on a linked quarter basis. • Asset quality was strong and improving with nonperforming loans at $2.8 million, or 0.08% of total loans, while the allowance for credit losses on loans to total loans was 1.37% at quarter-end. • Liquidity and available lines of credit remain robust at $3.2 billion. Fourth Quarter 2025 Operating Highlights (1) These are non-GAAP financial measures as defined and discussed under “Non-GAAP Financial Measures” in our fourth quarter 2025 earnings press release. 3 Adjusted Operating Highlights Operating Highlights (1) $15.1 million $17.2 million Net income Net income $22.6 million $24.6 million Pre-Provision Net Revenue (1) Pre-Provision Net Revenue (1) $0.25 $0.28 Diluted Earnings per Share Diluted Earnings per Share 1.04% 1.18% Return on Avg. Assets Return on Avg. Assets 11.29% 12.83% Return on Avg. Return on Avg. Tangible Common Equity (1) Tangible Common Equity (1)

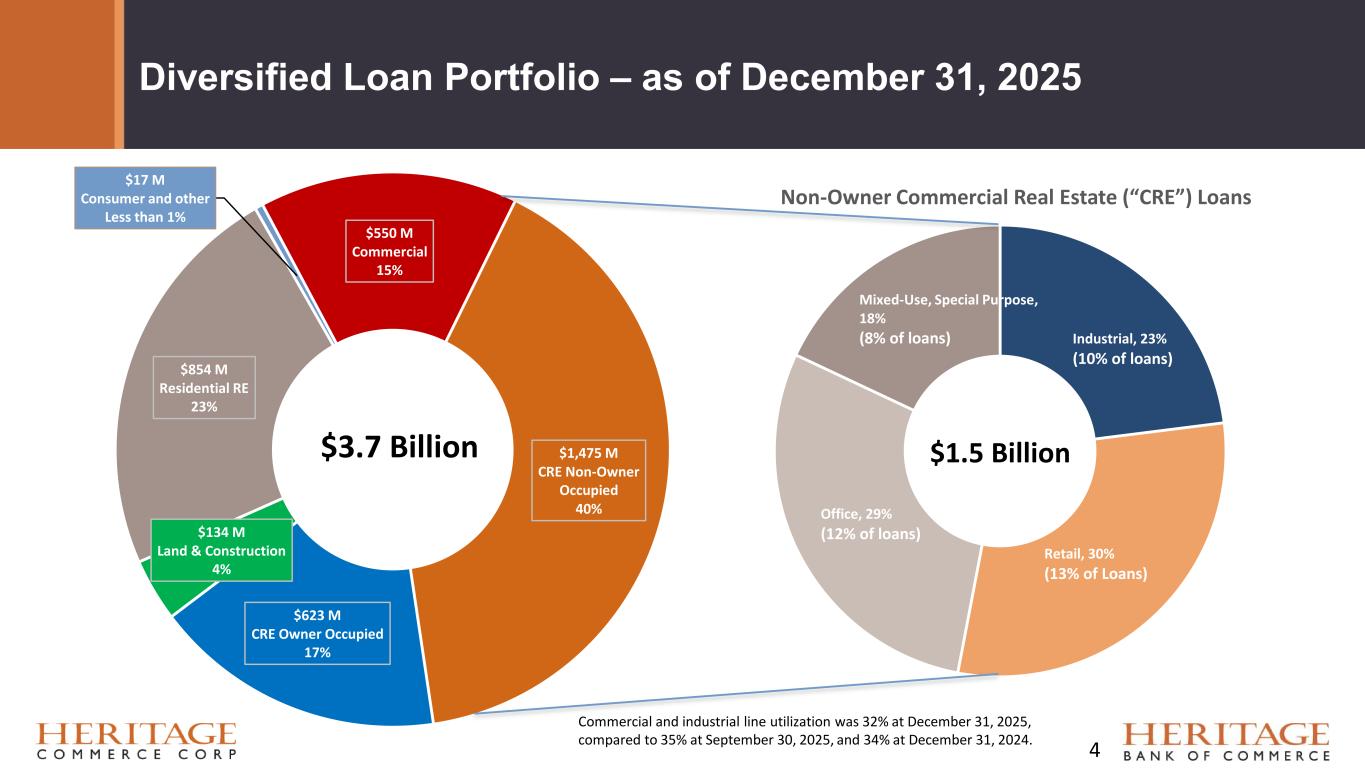

Diversified Loan Portfolio – as of December 31, 2025 Industrial, 23% (10% of loans) Retail, 30% (13% of Loans) Office, 29% (12% of loans) Mixed-Use, Special Purpose, 18% (8% of loans) Non-Owner Commercial Real Estate (“CRE”) Loans $1.5 Billion $550 M Commercial 15% $1,475 M CRE Non-Owner Occupied 40% $623 M CRE Owner Occupied 17% $134 M Land & Construction 4% $854 M Residential RE 23% $17 M Consumer and other Less than 1% $3.7 Billion 4 Commercial and industrial line utilization was 32% at December 31, 2025, compared to 35% at September 30, 2025, and 34% at December 31, 2024.

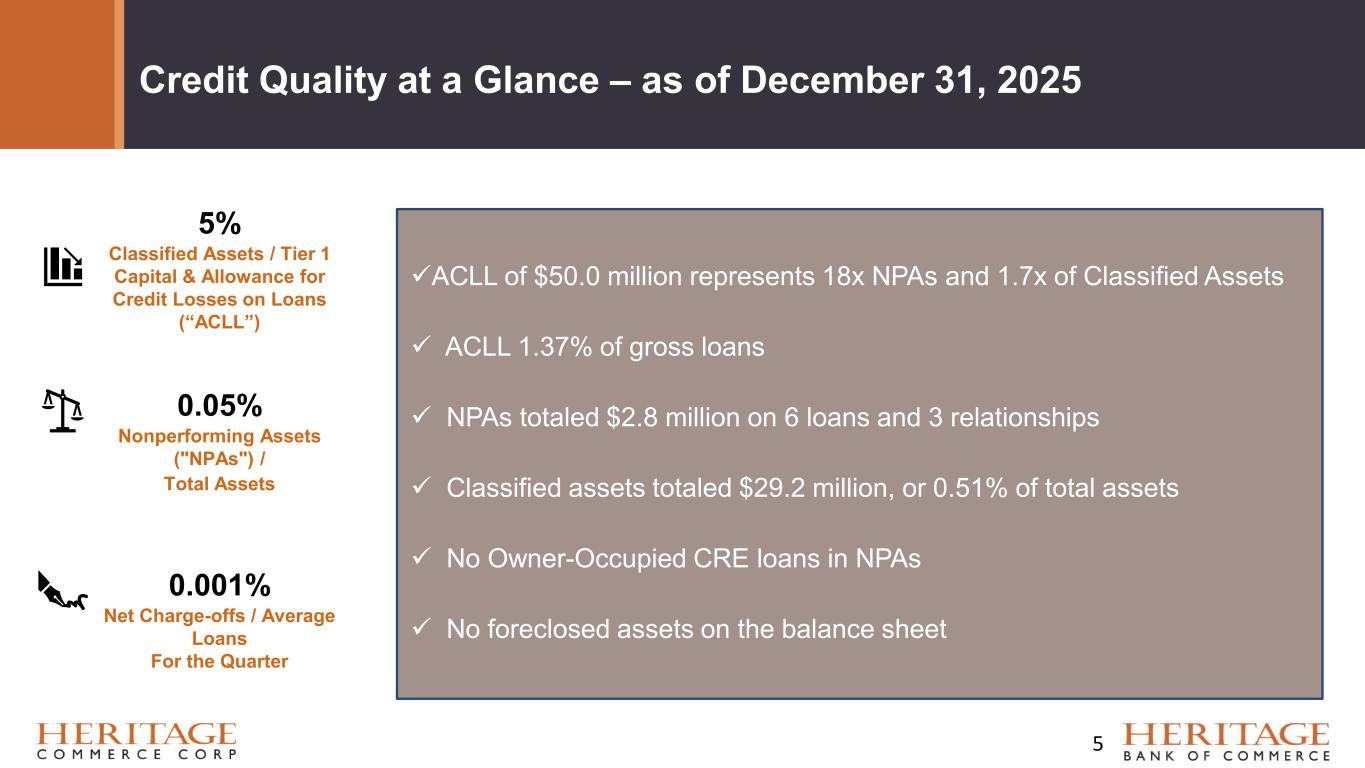

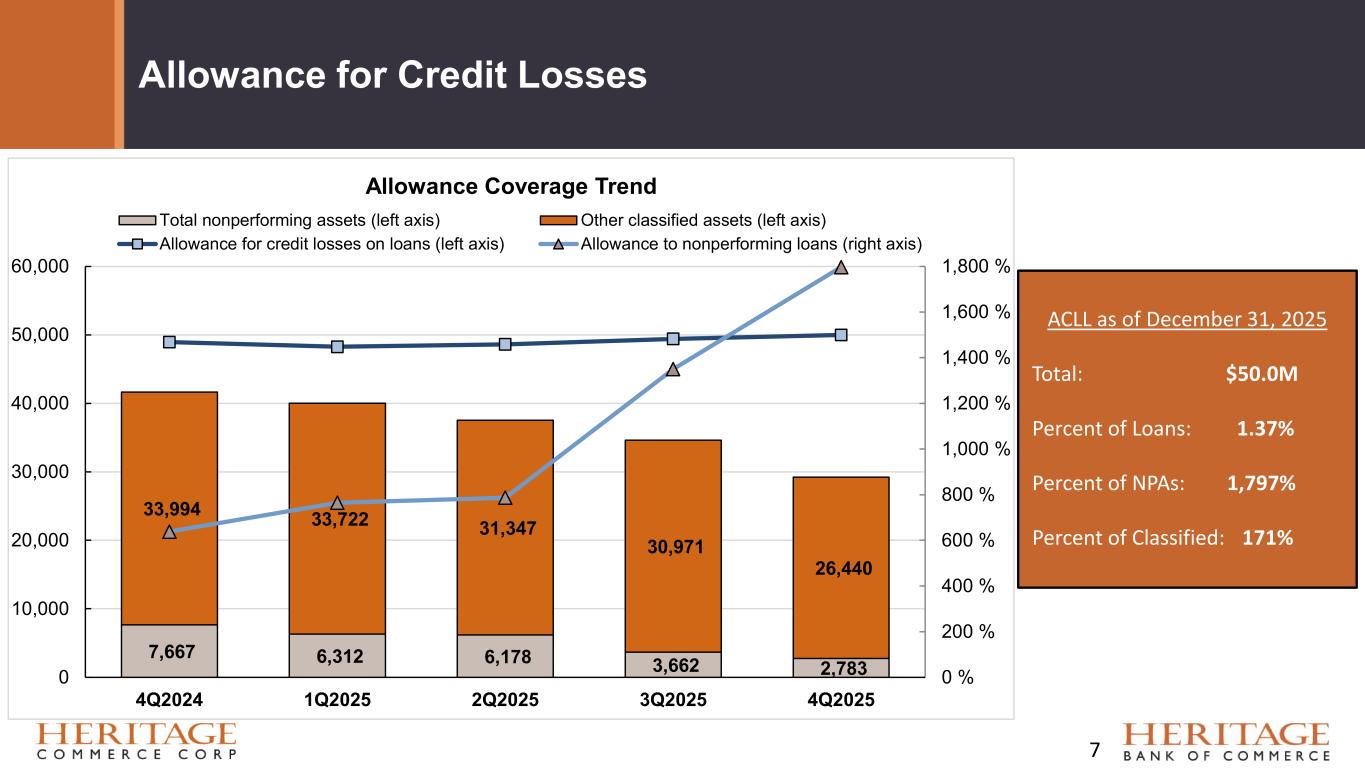

Credit Quality at a Glance – as of December 31, 2025 ✓ACLL of $50.0 million represents 18x NPAs and 1.7x of Classified Assets ✓ ACLL 1.37% of gross loans ✓ NPAs totaled $2.8 million on 6 loans and 3 relationships ✓ Classified assets totaled $29.2 million, or 0.51% of total assets ✓ No Owner-Occupied CRE loans in NPAs ✓ No foreclosed assets on the balance sheet 5% Classified Assets / Tier 1 Capital & Allowance for Credit Losses on Loans (“ACLL”) 0.05% Nonperforming Assets ("NPAs") / Total Assets 0.001% Net Charge-offs / Average Loans For the Quarter 5

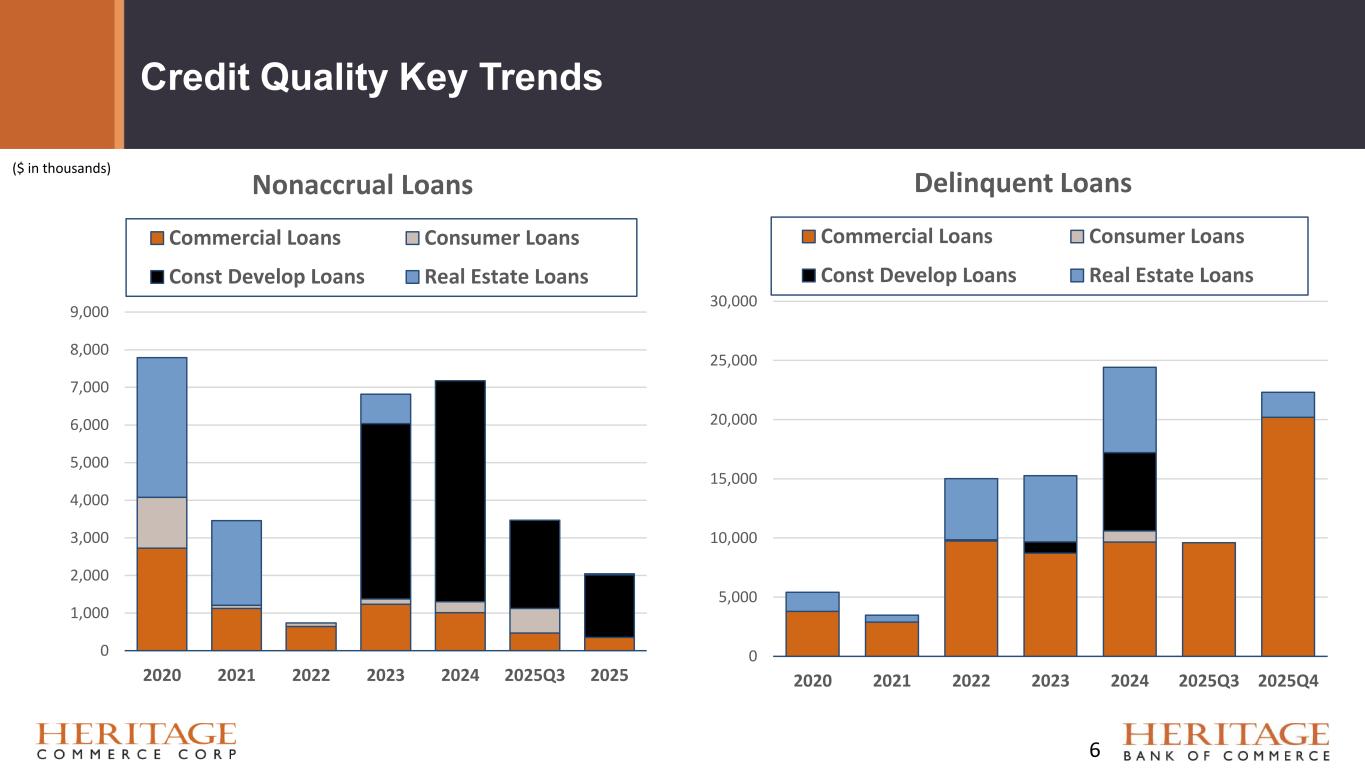

Credit Quality Key Trends ($ in thousands) 6 0 5,000 10,000 15,000 20,000 25,000 30,000 2020 2021 2022 2023 2024 2025Q3 2025Q4 Delinquent Loans Commercial Loans Consumer Loans Const Develop Loans Real Estate Loans 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2020 2021 2022 2023 2024 2025Q3 2025 Nonaccrual Loans Commercial Loans Consumer Loans Const Develop Loans Real Estate Loans

Allowance for Credit Losses ACLL as of December 31, 2025 Total: $50.0M Percent of Loans: 1.37% Percent of NPAs: 1,797% Percent of Classified: 171% 7 7,667 6,312 6,178 3,662 2,783 33,994 33,722 31,347 30,971 26,440 0 % 200 % 400 % 600 % 800 % 1,000 % 1,200 % 1,400 % 1,600 % 1,800 % 0 10,000 20,000 30,000 40,000 50,000 60,000 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 Allowance Coverage Trend Total nonperforming assets (left axis) Other classified assets (left axis) Allowance for credit losses on loans (left axis) Allowance to nonperforming loans (right axis)

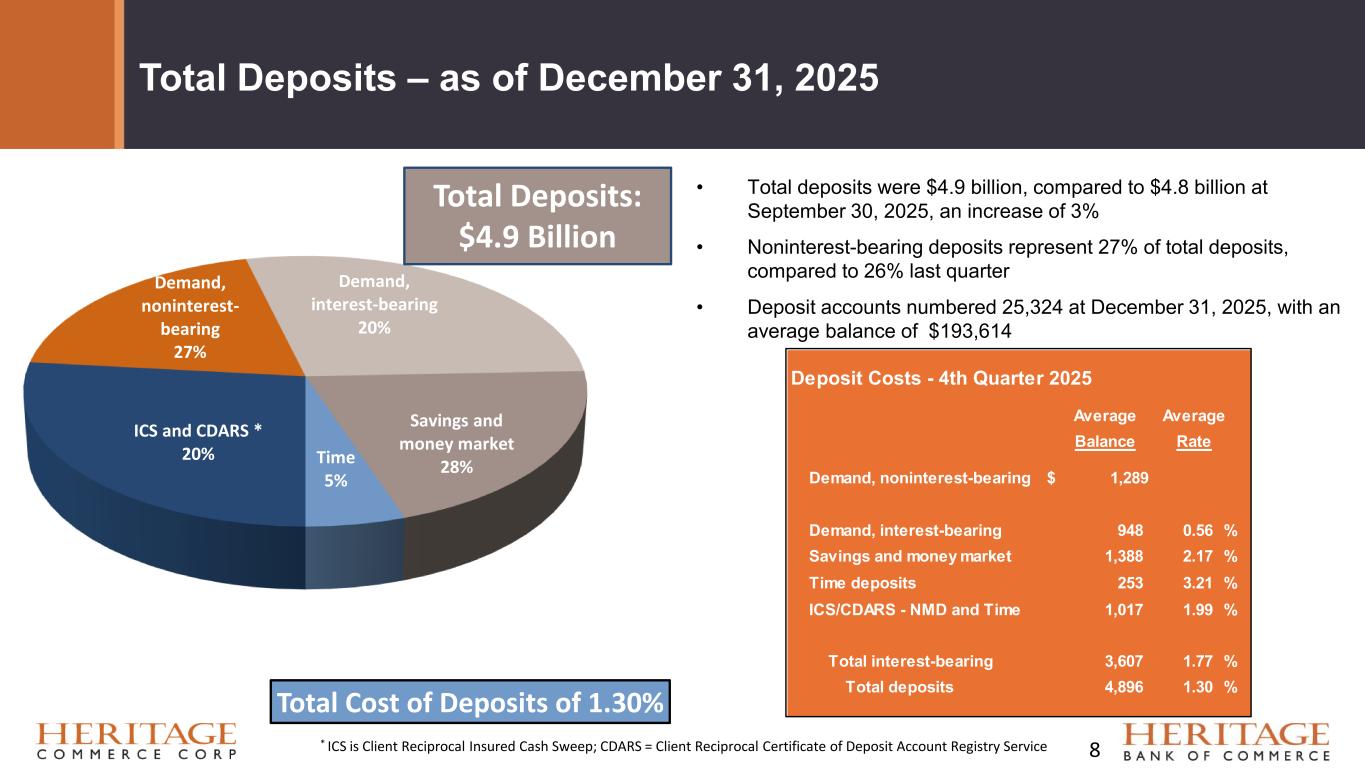

Demand, noninterest- bearing 27% Demand, interest-bearing 20% Savings and money market 28% ICS and CDARS * 20% Time 5% Total Cost of Deposits of 1.30% Total Deposits – as of December 31, 2025 • Total deposits were $4.9 billion, compared to $4.8 billion at September 30, 2025, an increase of 3% • Noninterest-bearing deposits represent 27% of total deposits, compared to 26% last quarter • Deposit accounts numbered 25,324 at December 31, 2025, with an average balance of $193,614 Total Deposits: $4.9 Billion * ICS is Client Reciprocal Insured Cash Sweep; CDARS = Client Reciprocal Certificate of Deposit Account Registry Service 8 Deposit Costs - 4th Quarter 2025 Average Average Balance Rate Demand, noninterest-bearing $ 1,289 Demand, interest-bearing 948 0.56 % Savings and money market 1,388 2.17 % Time deposits 253 3.21 % ICS/CDARS - NMD and Time 1,017 1.99 % Total interest-bearing 3,607 1.77 % Total deposits 4,896 1.30 %

Net Interest Drivers $3,336 $3,380 $3,410 $3,492 $3,487 $3,535 $3,582 $3,653 5.44% 5.49% 5.42% 5.53% 5.52% 5.64% 5.65% 5.64% Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q4-25 Loans Held for Investment and Yield Loans HFI Yield $1,041 $894 $842 $846 $948 $868 $953 $1,122 2.42% 2.38% 2.27% 2.27% 2.58% 2.85% 2.91% 3.27% Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q4-25 Securities Portfolio and FTE Yield Total Investments FTE Yield $4,445 $4,445 $4,730 $4,820 $4,683 $4,627 $4,777 $4,903 1.56% 1.75% 1.84% 1.66% 1.54% 1.54% 1.50% 1.30% Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q4-25 Deposits and Cost Total Deposits Cost $3,203 $3,259 $3,457 $3,606 $3,555 $3,476 $3,535 $3,594 2.00% 2.00% 2.00% 2.00% 2.05% 2.04% 2.01% 1.77% Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q4-25 Interest Bearing Deposits and Cost Interest Bearing Deposits Cost Balances period-end, dollars in millions 9 Earning asset yields have risen against the favorable deposit cost backdrop. This, combined with stabilizing levels of non- interest-bearing deposits has helped bolster the NIM inflection

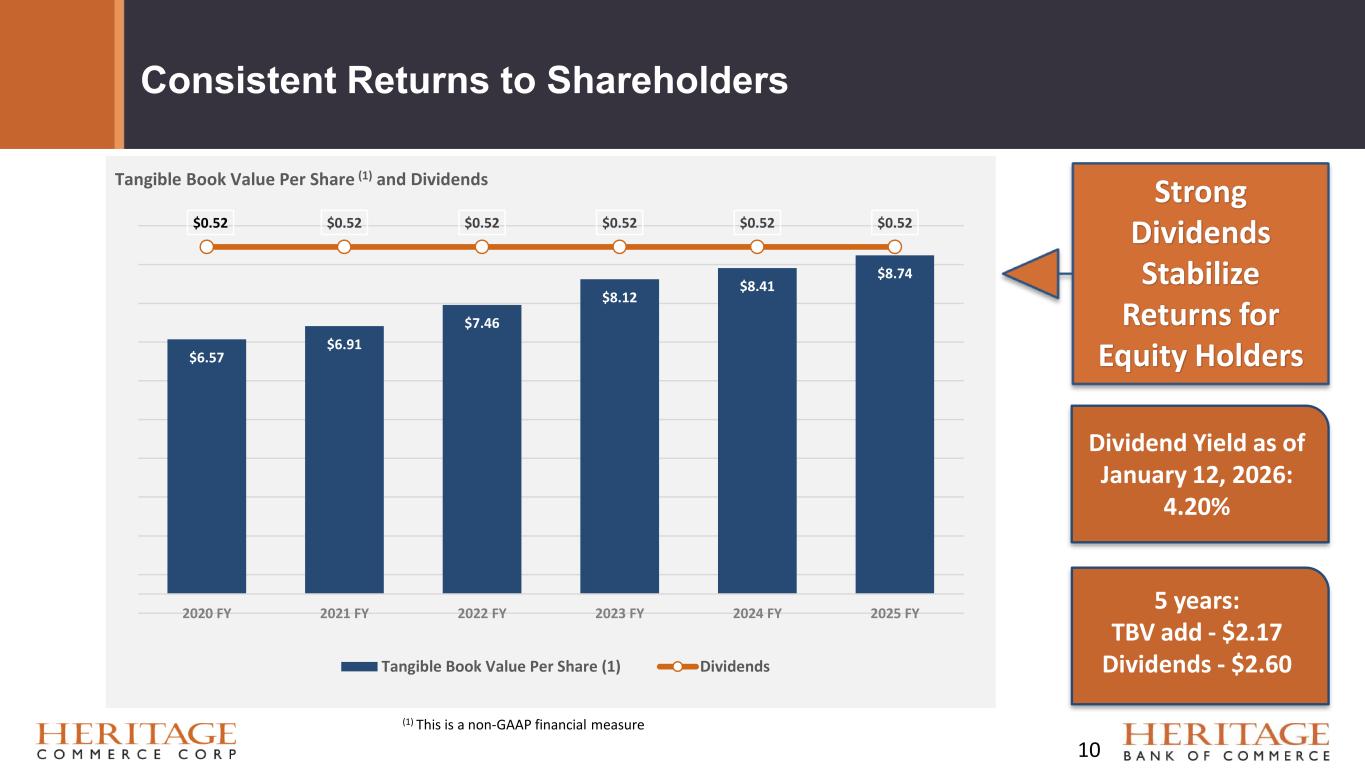

Consistent Returns to Shareholders Strong Dividends Stabilize Returns for Equity Holders Dividend Yield as of January 12, 2026: 4.20% $6.57 $6.91 $7.46 $8.12 $8.41 $8.74 $0.52 $0.52 $0.52 $0.52 $0.52 $0.52 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 FY Tangible Book Value Per Share (1) and Dividends Tangible Book Value Per Share (1) Dividends 10 (1) This is a non-GAAP financial measure 5 years: TBV add - $2.17 Dividends - $2.60

For more information email: InvestorRelations@herbank.com 11

Reconciliation of Non-GAAP Financial Measures Appendix 12

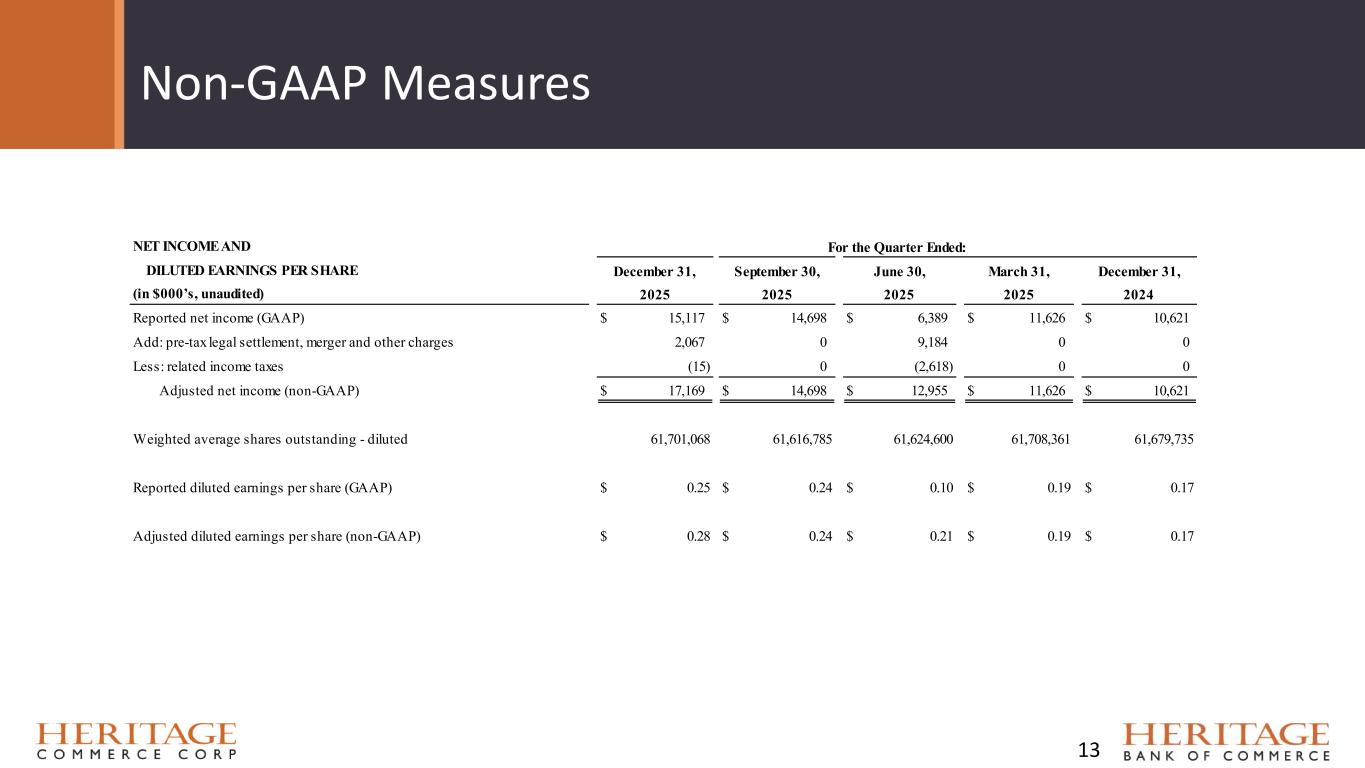

Non-GAAP Measures 13 NET INCOME AND DILUTED EARNINGS PER SHARE (in $000’s, unaudited) Reported net income (GAAP) $ 15,117 $ 14,698 $ 6,389 $ 11,626 $ 10,621 Add: pre-tax legal settlement, merger and other charges 2,067 0 9,184 0 0 Less: related income taxes (15) 0 (2,618) 0 0 Adjusted net income (non-GAAP) $ 17,169 $ 14,698 $ 12,955 $ 11,626 $ 10,621 Weighted average shares outstanding - diluted 61,701,068 61,616,785 61,624,600 61,708,361 61,679,735 Reported diluted earnings per share (GAAP) $ 0.25 $ 0.24 $ 0.10 $ 0.19 $ 0.17 Adjusted diluted earnings per share (non-GAAP) $ 0.28 $ 0.24 $ 0.21 $ 0.19 $ 0.17 December 31, 2025 2025 September 30, For the Quarter Ended: June 30, March 31, December 31, 202420252025

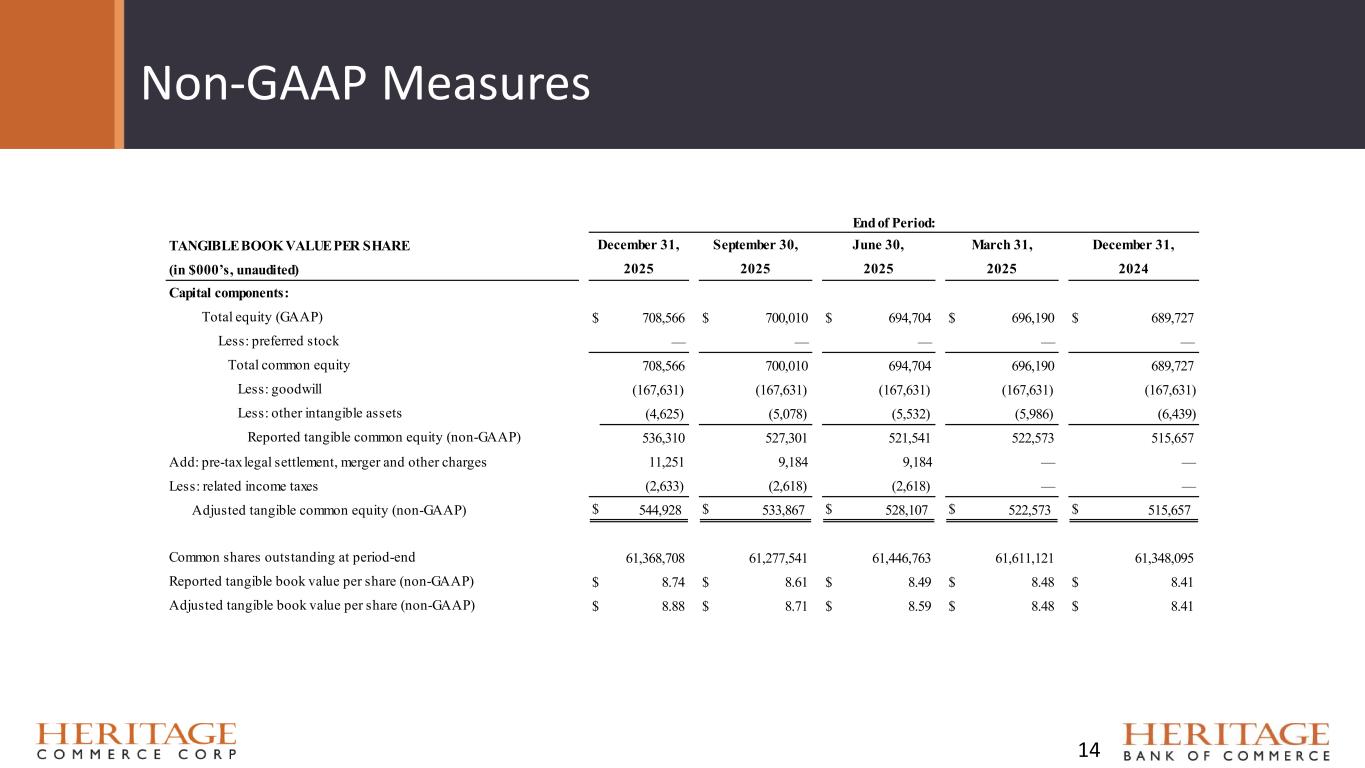

Non-GAAP Measures 14 TANGIBLE BOOK VALUE PER SHARE (in $000’s, unaudited) Capital components: Total equity (GAAP) $ 708,566 $ 700,010 $ 694,704 $ 696,190 $ 689,727 Less: preferred stock — — — — — Total common equity 708,566 700,010 694,704 696,190 689,727 Less: goodwill (167,631) (167,631) (167,631) (167,631) (167,631) Less: other intangible assets (4,625) (5,078) (5,532) (5,986) (6,439) Reported tangible common equity (non-GAAP) 536,310 527,301 521,541 522,573 515,657 Add: pre-tax legal settlement, merger and other charges 11,251 9,184 9,184 — — Less: related income taxes (2,633) (2,618) (2,618) — — Adjusted tangible common equity (non-GAAP) $ 544,928 $ 533,867 $ 528,107 $ 522,573 $ 515,657 Common shares outstanding at period-end 61,368,708 61,277,541 61,446,763 61,611,121 61,348,095 Reported tangible book value per share (non-GAAP) $ 8.74 $ 8.61 $ 8.49 $ 8.48 $ 8.41 Adjusted tangible book value per share (non-GAAP) $ 8.88 $ 8.71 $ 8.59 $ 8.48 $ 8.41 December 31, 2025 2025 September 30, End of Period: June 30, March 31, December 31, 202420252025

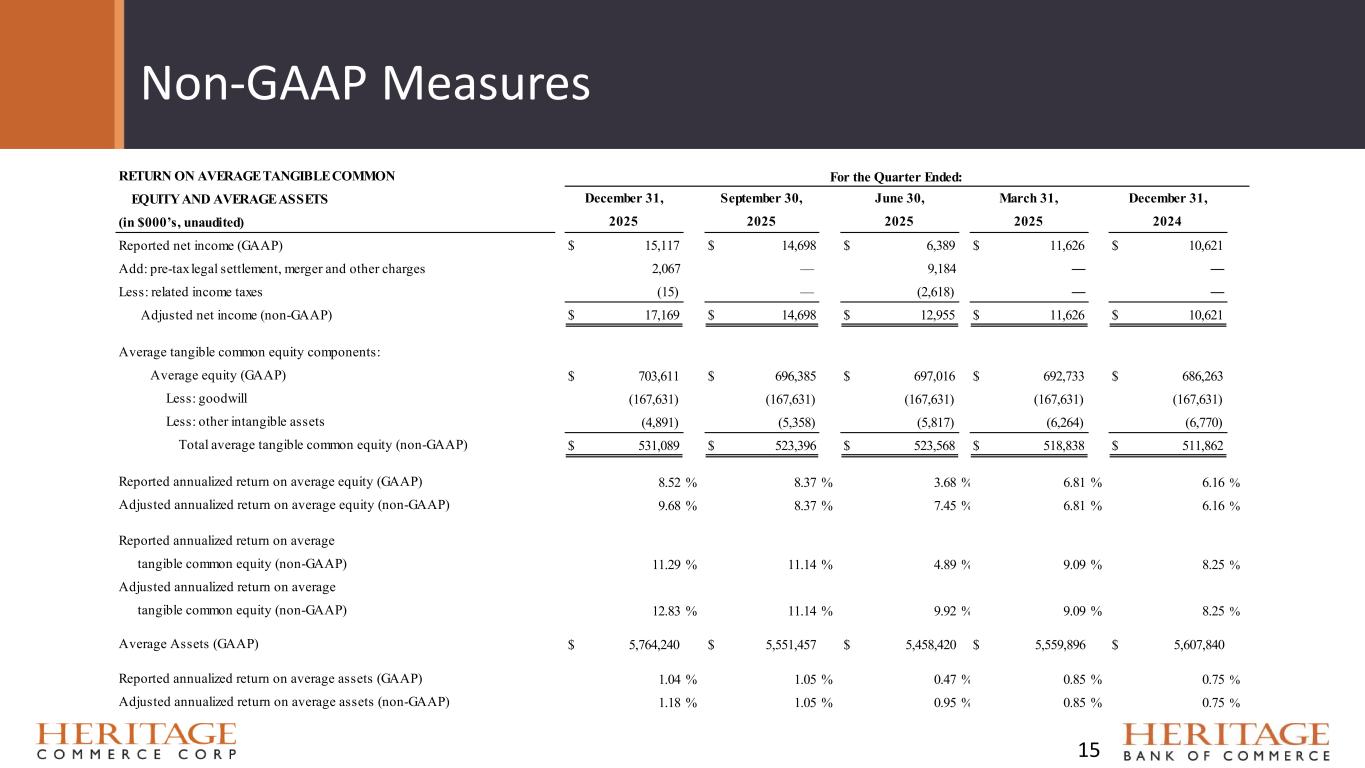

Non-GAAP Measures 15 RETURN ON AVERAGE TANGIBLE COMMON EQUITY AND AVERAGE ASSETS (in $000’s, unaudited) Reported net income (GAAP) $ 15,117 $ 14,698 $ 6,389 $ 11,626 $ 10,621 Add: pre-tax legal settlement, merger and other charges 2,067 — 9,184 — — Less: related income taxes (15) — (2,618) — — Adjusted net income (non-GAAP) $ 17,169 $ 14,698 $ 12,955 $ 11,626 $ 10,621 Average tangible common equity components: Average equity (GAAP) $ 703,611 $ 696,385 $ 697,016 $ 692,733 $ 686,263 Less: goodwill (167,631) (167,631) (167,631) (167,631) (167,631) Less: other intangible assets (4,891) (5,358) (5,817) (6,264) (6,770) Total average tangible common equity (non-GAAP) $ 531,089 $ 523,396 $ 523,568 $ 518,838 $ 511,862 Reported annualized return on average equity (GAAP) 8.52 % 8.37 % 3.68 % 6.81 % 6.16 % Adjusted annualized return on average equity (non-GAAP) 9.68 % 8.37 % 7.45 % 6.81 % 6.16 % Reported annualized return on average tangible common equity (non-GAAP) 11.29 % 11.14 % 4.89 % 9.09 % 8.25 % Adjusted annualized return on average tangible common equity (non-GAAP) 12.83 % 11.14 % 9.92 % 9.09 % 8.25 % Average Assets (GAAP) $ 5,764,240 $ 5,551,457 $ 5,458,420 $ 5,559,896 $ 5,607,840 Reported annualized return on average assets (GAAP) 1.04 % 1.05 % 0.47 % 0.85 % 0.75 % Adjusted annualized return on average assets (non-GAAP) 1.18 % 1.05 % 0.95 % 0.85 % 0.75 % December 31, 2025 2025 September 30, For the Quarter Ended: June 30, March 31, December 31, 202420252025

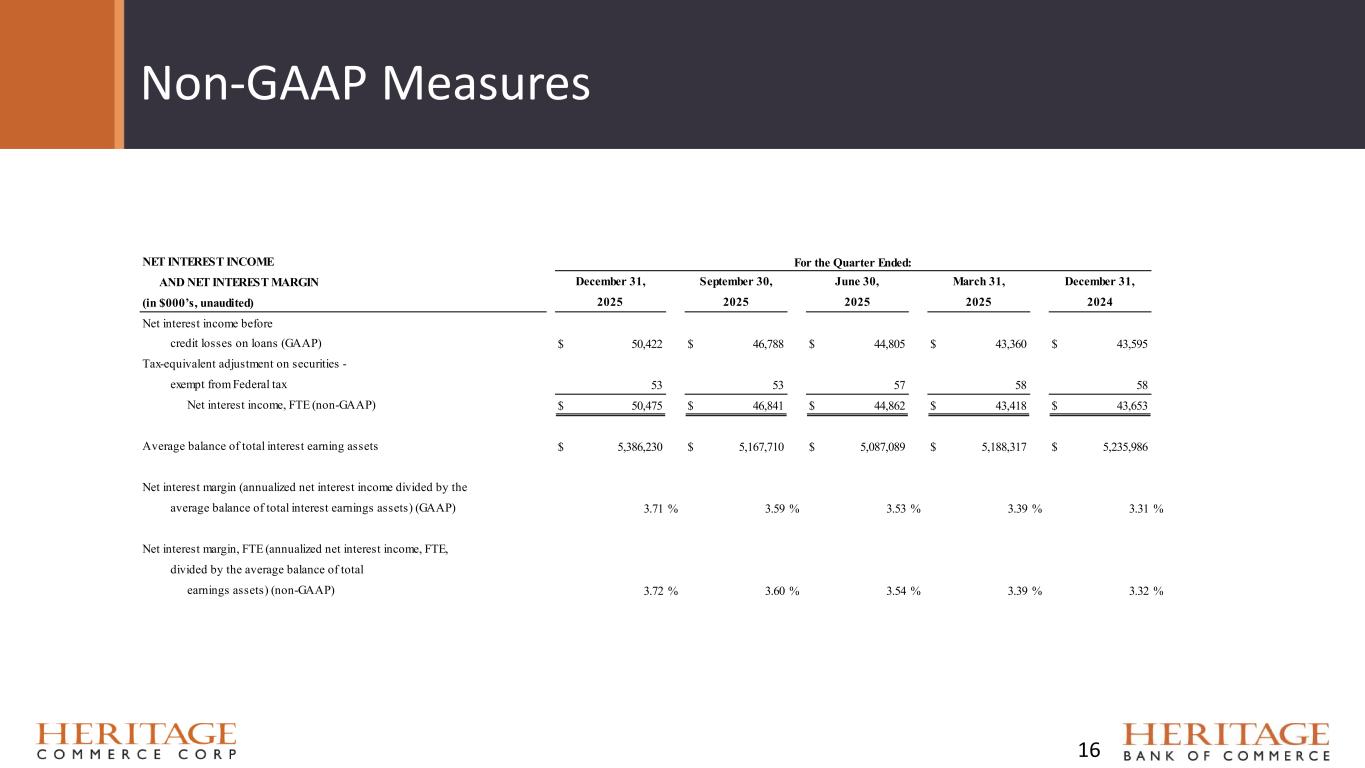

Non-GAAP Measures 16 NET INTEREST INCOME AND NET INTEREST MARGIN (in $000’s, unaudited) Net interest income before credit losses on loans (GAAP) $ 50,422 $ 46,788 $ 44,805 $ 43,360 $ 43,595 Tax-equivalent adjustment on securities - exempt from Federal tax 53 53 57 58 58 Net interest income, FTE (non-GAAP) $ 50,475 $ 46,841 $ 44,862 $ 43,418 $ 43,653 Average balance of total interest earning assets $ 5,386,230 $ 5,167,710 $ 5,087,089 $ 5,188,317 $ 5,235,986 Net interest margin (annualized net interest income divided by the average balance of total interest earnings assets) (GAAP) 3.71 % 3.59 % 3.53 % 3.39 % 3.31 % Net interest margin, FTE (annualized net interest income, FTE, divided by the average balance of total earnings assets) (non-GAAP) 3.72 % 3.60 % 3.54 % 3.39 % 3.32 % December 31, 2025 2025 September 30, For the Quarter Ended: June 30, March 31, December 31, 202420252025

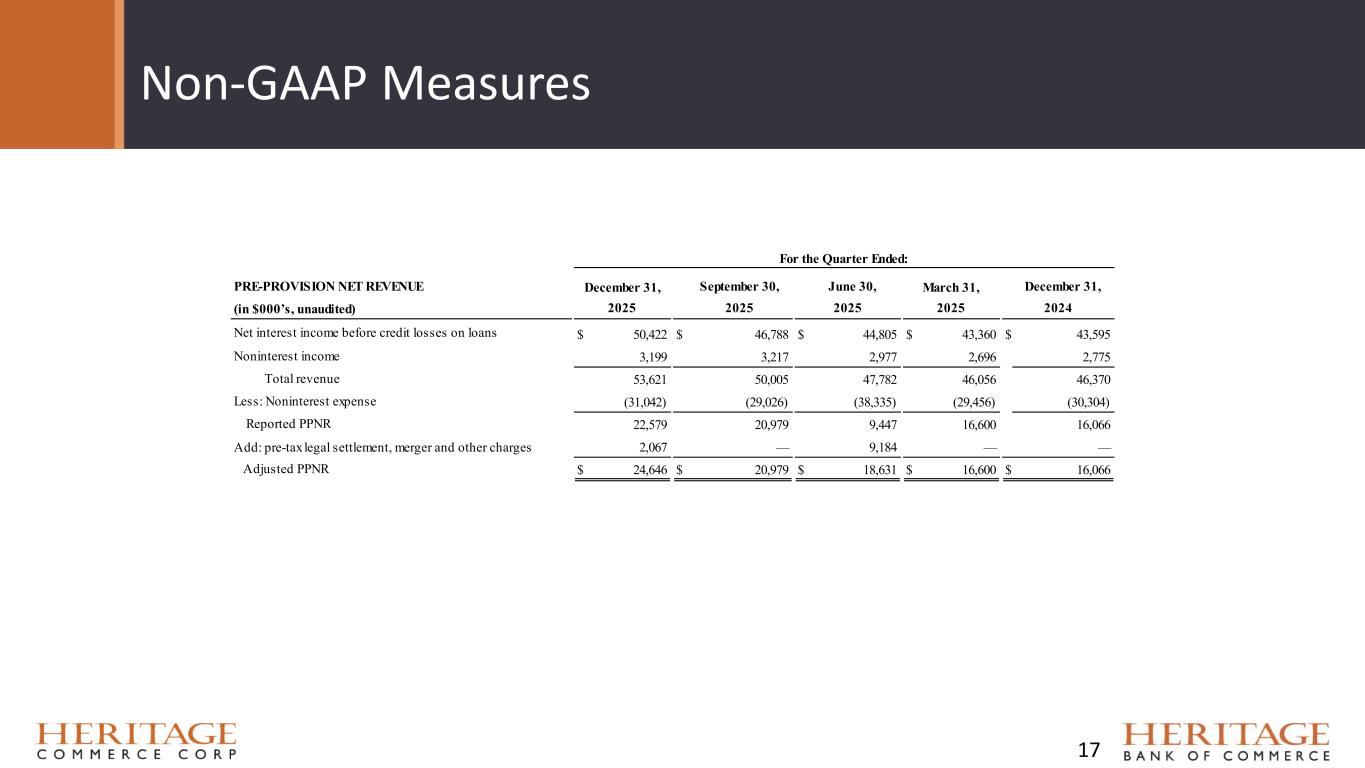

Non-GAAP Measures 17 PRE-PROVISION NET REVENUE September 30, June 30, December 31, (in $000’s, unaudited) 2025 Net interest income before credit losses on loans $ 50,422 $ 46,788 $ 44,805 $ 43,360 $ 43,595 Noninterest income 3,199 3,217 2,977 2,696 2,775 Total revenue 53,621 50,005 47,782 46,056 46,370 Less: Noninterest expense (31,042) (29,026) (38,335) (29,456) (30,304) Reported PPNR 22,579 20,979 9,447 16,600 16,066 Add: pre-tax legal settlement, merger and other charges 2,067 — 9,184 — — Adjusted PPNR $ 24,646 $ 20,979 $ 18,631 $ 16,600 $ 16,066 December 31, 2025 2025 For the Quarter Ended: March 31, 20242025