.2

Fiscal 2026 First Quarter Financial Results February 2026 Investor

Presentation

Forward-Looking Statements and Non-GAAP Measures Forward-Looking

Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as expectations regarding

future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify

forward-looking statements and such forward-looking statements are made based upon management’s current expectations, assumptions and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be

no assurance that future developments will be in accordance with management’s expectations, assumptions and beliefs or that the effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this

earnings presentation include, but are not limited to, statements regarding NJR’s NFEPS guidance for fiscal 2026, including NFEPS guidance by Segment, long-term growth targets and guidance range and anticipated drivers of such growth

targets, long-term annual growth projections and targets, our CIP, IIP and SAVEGREEN programs, NFEPS expectations from utility operations, Capital Plan expectations, the inclusion of our 5-year capital expenditure projections through 2030,

our credit metrics, projections of dividend and financing activities, customer growth at NJNG, future NJR and NJNG capital expenditures, potential CEV capital projects, project pipeline, changes to tax laws and regulations, including those

changes brought about by the passage of the Inflation Reduction Act of 2022 and the One Big Beautiful Bill Act, total shareholder return projections, dividend growth, CEV revenue and service projections, our debt repayment schedule,

contributions from Leaf River as well as its potential cavern expansion, Steckman Ridge and Adelphia Gateway, SREC Hedging and long option strategies and Asset Management Agreements, our Energy Efficiency Expansion as approved by the BPU,

our current and future base rate cases, our solar project pipeline and commercial solar growth goals, emissions reduction strategies and clean energy goals, changing interest rates, and other legal and regulatory expectations, and

statements that include other projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Additional information and factors that could cause actual results to differ

materially from NJR’s expectations are contained in NJR’s filings with the SEC, including NJR’s Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are

available at the SEC’s web site, http://www.sec.gov. Information included in this presentation is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations

and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including

this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of new information future events or otherwise, except as required by law. Non-GAAP Measures This presentation

includes the non-GAAP financial measures NFE/net financial loss, NFE per basic share, financial margin, utility gross margin, adjusted funds from operations, adjusted debt, and adjusted EBITDA. A reconciliation of these non-GAAP financial

measures to the most directly comparable financial measures calculated and reported in accordance with GAAP can be found in the appendix to this presentation. As an indicator of NJR’s operating performance, these measures should not be

considered an alternative to, or more meaningful than, net income or operating revenues as determined in accordance with GAAP. This information has been provided pursuant to the requirements of SEC Regulation G. NFE and financial margin

exclude unrealized gains or losses on derivative instruments related to NJR’s unregulated subsidiaries and certain realized gains and losses on derivative instruments related to natural gas that has been placed into storage at Energy

Services, net of applicable tax adjustments as described below. Financial margin also differs from gross margin as defined on a GAAP basis as it excludes certain operations and maintenance expense and depreciation and amortization

[expenses] as well as the effects of derivatives as discussed above. Volatility associated with the change in value of these financial instruments and physical commodity reported on the income statement in the current period. In order to

manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by changes in value of these financial instruments and physical commodity contracts prior to

the completion of the planned transaction because it shows changes in value currently instead of when the planned transaction ultimately is settled. An annual estimated effective tax rate is calculated for NFE purposes and any necessary

quarterly tax adjustment is applied to NJR Energy Services Company. NJNG’s utility gross margin is defined as operating revenues less natural gas purchases, sales tax, and regulatory rider expense. This measure differs from gross margin as

presented on a GAAP basis as it excludes certain operations and maintenance expense and depreciation and amortization. Utility gross margin may also not be comparable to the definition of gross margin used by others in the natural gas

distribution business and other industries. Management believes that utility gross margin provides a meaningful basis for evaluating utility operations since natural gas costs, sales tax and regulatory rider expenses are included in

operating revenues and passed through to customers and, therefore, have no effect on utility gross margin. Adjusted funds from operations is cash flows from operating activities, plus components of working capital, cash paid for interest

(net of amounts capitalized), capitalized interest, the incremental change in SAVEGREEN loans, grants, rebates, and related investments, and operating lease expense. Adjusted debt is total long-term and short-term debt, net of cash and

cash equivalents, excluding solar asset financing obligations but including solar contractually committed payments for sale lease-backs, debt issuance costs, and other Fitch credit metric adjustments. Adjusted EBITDA is earnings, including

equity in earnings of affiliates, before interest, income taxes, depreciation and amortization, and Other Income, net, which includes non-cash earnings of AFUDC from our wholly owned subsidiaries Leaf River and Adelphia Gateway. Management

uses NFE/net financial loss, utility gross margin, financial margin, adjusted funds from operations and adjusted debt as supplemental measures to other GAAP results to provide a more complete understanding of the Company’s performance.

Management believes these non-GAAP measures are more reflective of the Company’s business model, provide transparency to investors and enable period-to-period comparability of financial performance. In providing NFE guidance, management is

aware that there could be differences between reported GAAP earnings and NFE/net financial loss due to matters such as, but not limited to, the positions of our energy-related derivatives. Management is not able to reasonably estimate the

aggregate impact or significance of these items on reported earnings and therefore is not able to provide a reconciliation to the corresponding GAAP equivalent for its operating earnings guidance without unreasonable efforts. In addition,

in making forecasts relating to S&T’s Adjusted EBITDA and adjusted funds from operations and adjusted debt, management is aware that there could be differences between reported GAAP earnings, cash flows from operations and total

long-term and short-term debt due to matters such as, but not limited to, the unpredictability and variability of future earnings, working capital and cash positions. Management is not able to reasonably estimate the aggregate impact or

significance of these items on reported GAAP measures and therefore is not able to provide a reconciliation to the corresponding GAAP equivalent for such forecasts without unreasonable efforts. NFE/net financial loss, utility gross margin

and financial margin are discussed more fully in Item 7 of our Report on Form 10-K and, we have provided presentations of the most directly comparable GAAP financial measure and a reconciliation of our non-GAAP financial measures, NFE/net

financial loss, utility gross margin, financial margin, adjusted funds from operations, adjusted debt, and adjusted EBITDA to the most directly comparable GAAP financial measures, in the appendix to this presentation. This information has

been provided pursuant to the requirements of SEC Regulation G.

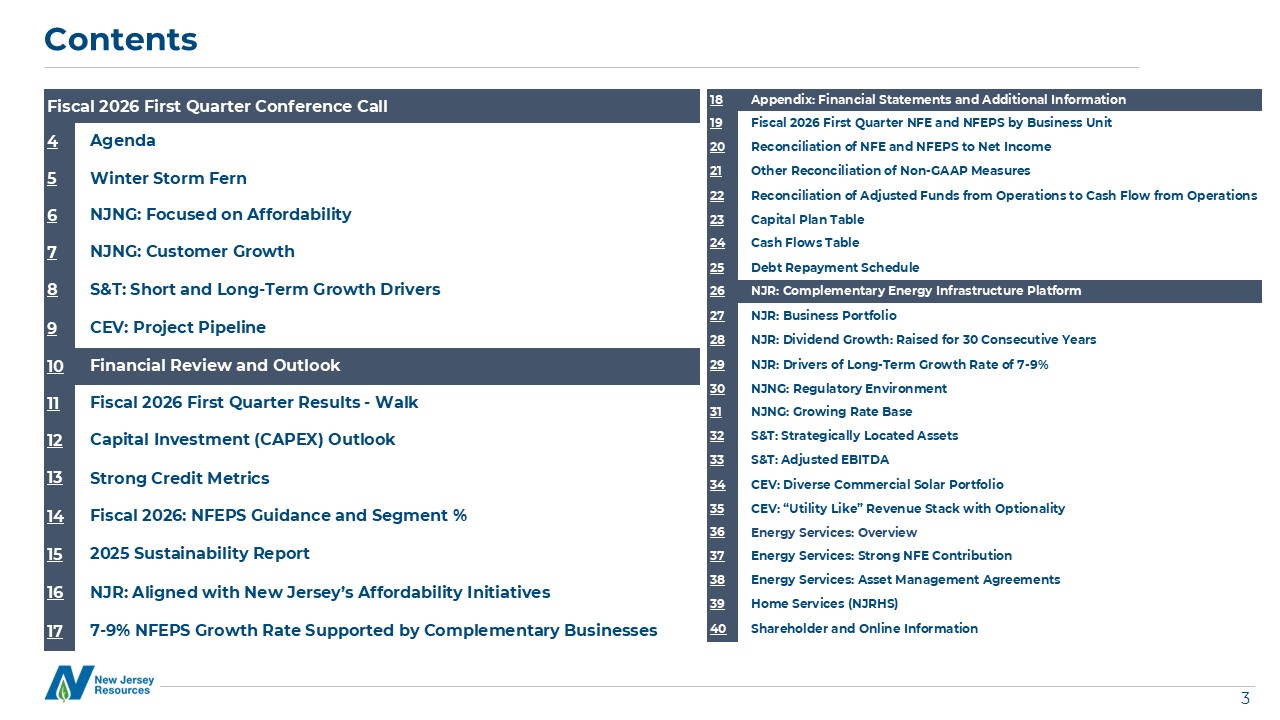

Contents Fiscal 2026 First Quarter Conference Call 4 Agenda 5 Winter

Storm Fern 6 NJNG: Focused on Affordability 7 NJNG: Customer Growth 8 S&T: Short and Long-Term Growth Drivers 9 CEV: Project Pipeline 10 Financial Review and Outlook 11 Fiscal 2026 First Quarter Results - Walk 12 Capital

Investment (CAPEX) Outlook 13 Strong Credit Metrics 14 Fiscal 2026: NFEPS Guidance and Segment % 15 2025 Sustainability Report 16 NJR: Aligned with New Jersey’s Affordability Initiatives 17 7-9% NFEPS Growth Rate Supported by

Complementary Businesses 18 Appendix: Financial Statements and Additional Information 19 Fiscal 2026 First Quarter NFE and NFEPS by Business Unit 20 Reconciliation of NFE and NFEPS to Net Income 21 Other Reconciliation of Non-GAAP

Measures 22 Reconciliation of Adjusted Funds from Operations to Cash Flow from Operations 23 Capital Plan Table 24 Cash Flows Table 25 Debt Repayment Schedule 26 NJR: Complementary Energy Infrastructure Platform 27 NJR:

Business Portfolio 28 NJR: Dividend Growth: Raised for 30 Consecutive Years 29 NJR: Drivers of Long-Term Growth Rate of 7-9% 30 NJNG: Regulatory Environment 31 NJNG: Growing Rate Base 32 S&T: Strategically Located

Assets 33 S&T: Adjusted EBITDA 34 CEV: Diverse Commercial Solar Portfolio 35 CEV: “Utility Like” Revenue Stack with Optionality 36 Energy Services: Overview 37 Energy Services: Strong NFE Contribution 38 Energy Services:

Asset Management Agreements 39 Home Services (NJRHS) 40 Shareholder and Online Information

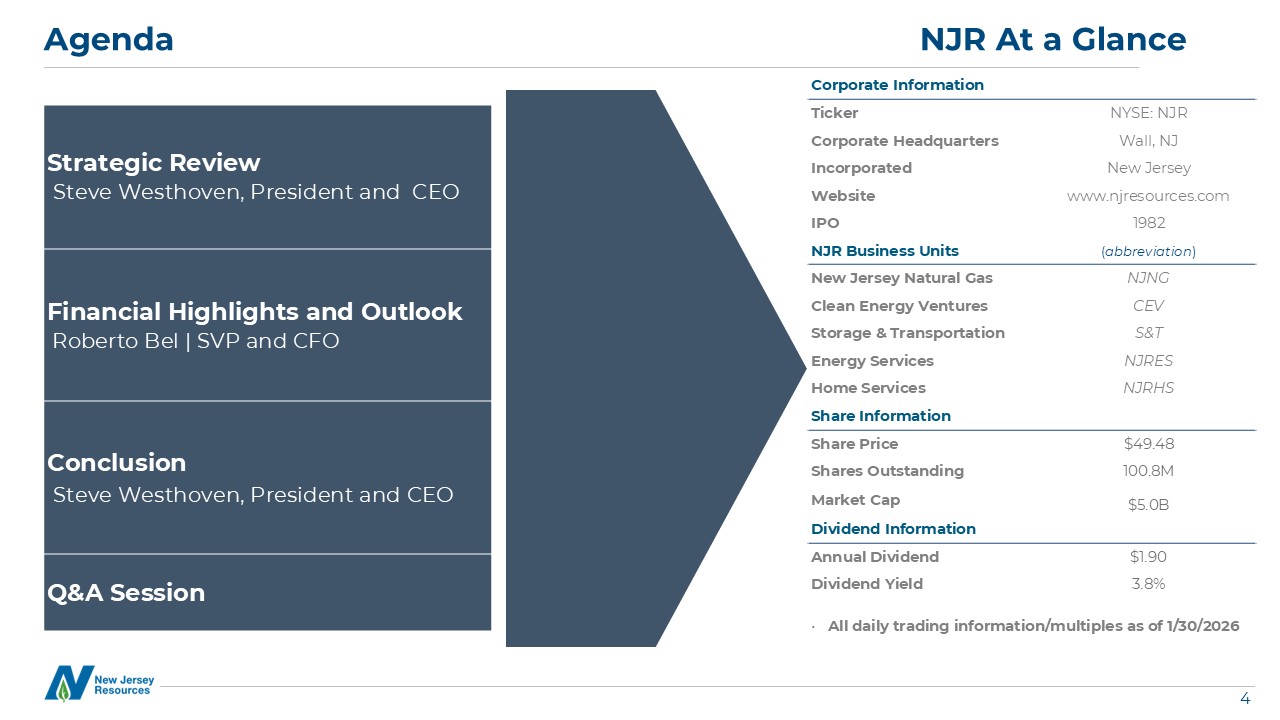

Strategic Review Steve Westhoven, President and CEO Financial Highlights

and Outlook Roberto Bel | SVP and CFO Conclusion Steve Westhoven, President and CEO Q&A Session Agenda NJR At a Glance Corporate Information Ticker NYSE: NJR Corporate Headquarters Wall, NJ Incorporated New

Jersey Website www.njresources.com IPO 1982 NJR Business Units (abbreviation) New Jersey Natural Gas NJNG Clean Energy Ventures CEV Storage & Transportation S&T Energy Services NJRES Home Services NJRHS Share

Information Share Price $49.48 Shares Outstanding 100.8M Market Cap $5.0B Dividend Information Annual Dividend $1.90 Dividend Yield 3.8% All daily trading information/multiples as of 1/30/2026

Strong Operating Performance During Storm Event Across all of NJR's

Businesses New Jersey Natural Gas: Uninterrupted service during a period of record sendout Storage & Transportation: Continued strong execution at Adelphia Gateway and Leaf River Energy Services: Leveraged geographically diverse

storage and transportation assets throughout the U.S. to capture significant value during heightened nationwide demand and volatility Winter Storm Fern NJR delivered reliable performance during Winter Storm Fern and the prolonged period

of cold weather, underscoring the resiliency of our lifeline systems and the effectiveness of our supply and risk‑management strategies NJR Raises Fiscal 2026 NFEPS1 Guidance by $0.25 to a Range of $3.28 to $3.43 as a Result of Energy

Services Outperformance 1. A reconciliation from NFE to net income can be found in the Appendix.

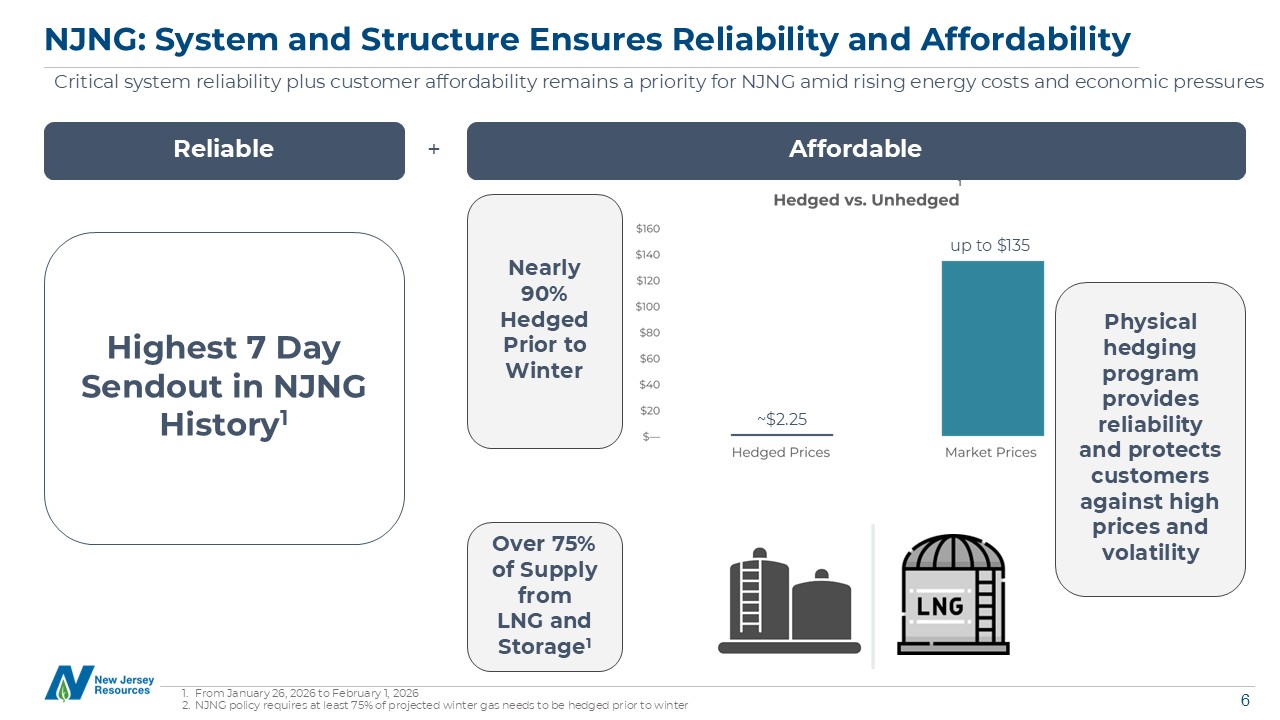

NJNG: System and Structure Ensures Reliability and Affordability Highest 7

Day Sendout in NJNG History1 From January 26, 2026 to February 1, 2026 NJNG policy requires at least 75% of projected winter gas needs to be hedged prior to winter Affordable Reliable + Physical hedging program provides reliability

and protects customers against high prices and volatility Nearly 90% Hedged Prior to Winter Over 75% of Supply from LNG and Storage1 1 up to $135 ~$2.25 Critical system reliability plus customer affordability remains a priority for

NJNG amid rising energy costs and economic pressures

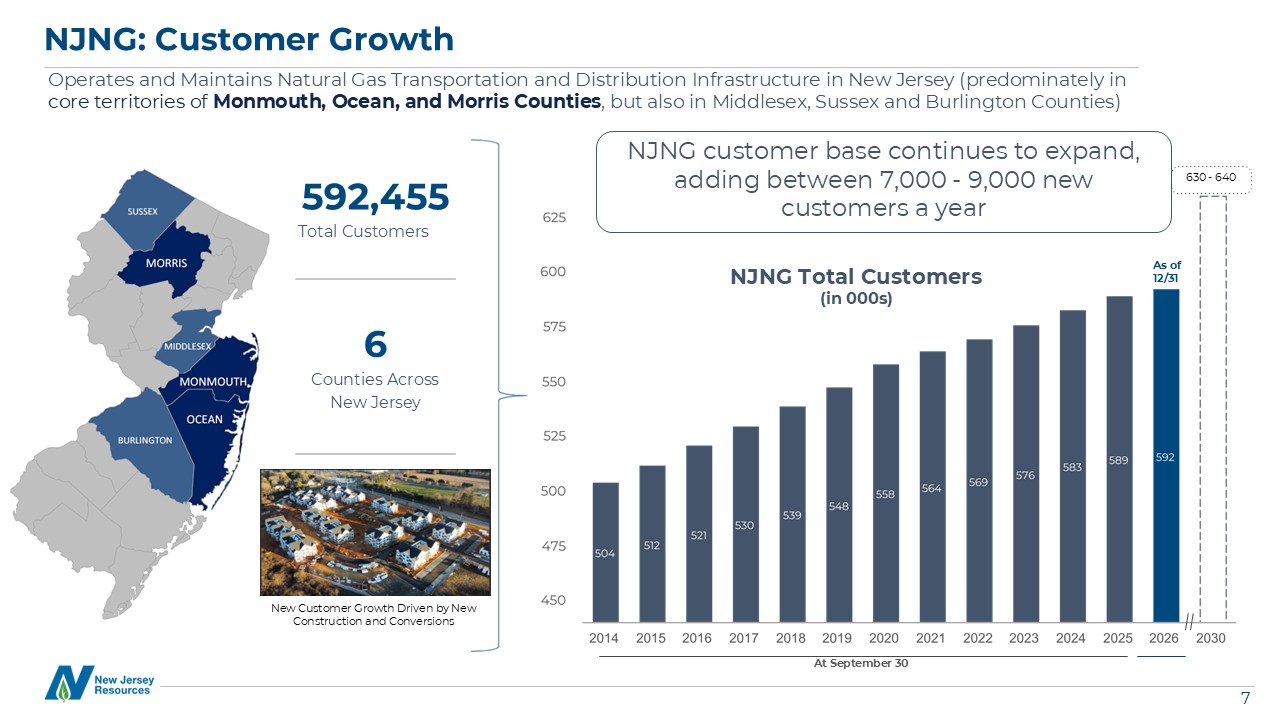

NJNG: Customer Growth Operates and Maintains Natural Gas Transportation and

Distribution Infrastructure in New Jersey (predominately in core territories of Monmouth, Ocean, and Morris Counties, but also in Middlesex, Sussex and Burlington Counties) 592,455 Total Customers 6 Counties Across New Jersey NJNG

Total Customers (in 000s) 630 - 640 NJNG customer base continues to expand, adding between 7,000 - 9,000 new customers a year New Customer Growth Driven by New Construction and Conversions As of 12/31 At September 30

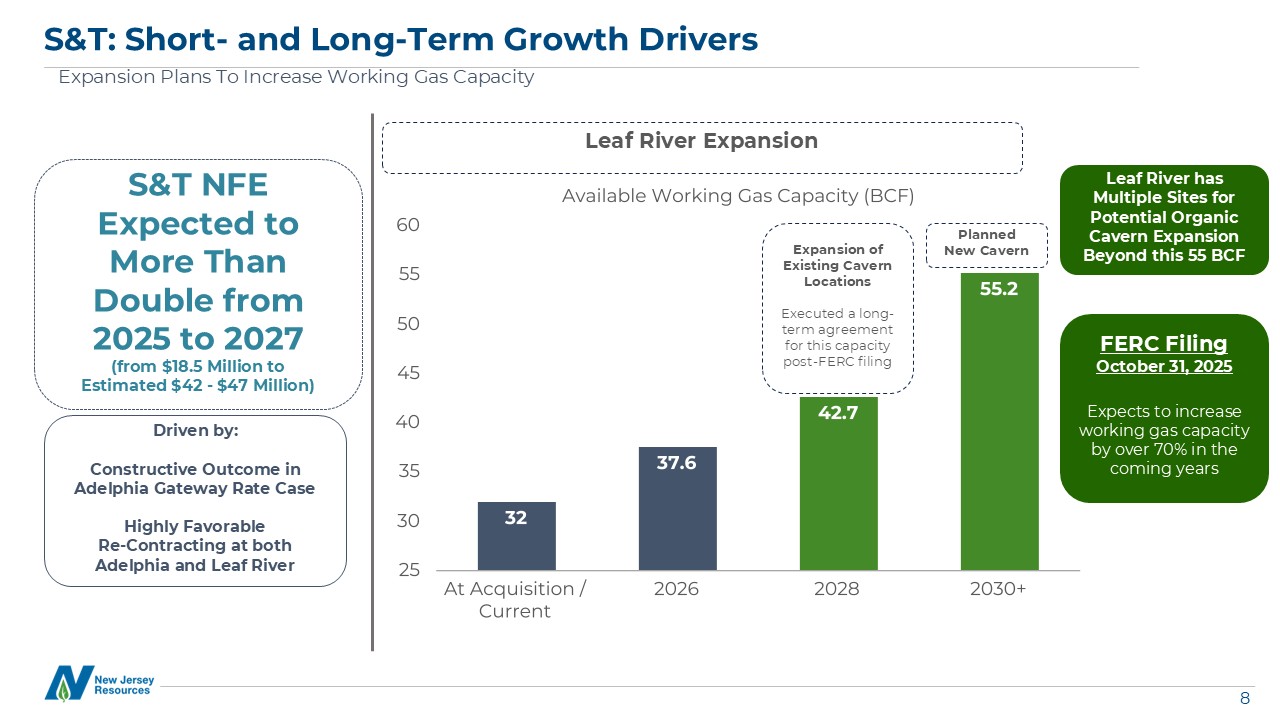

Driven by: Constructive Outcome in Adelphia Gateway Rate Case Highly

Favorable Re-Contracting at both Adelphia and Leaf River S&T: Short- and Long-Term Growth Drivers Expansion Plans To Increase Working Gas Capacity Leaf River Expansion Expansion of Existing Cavern Locations Executed a long-term

agreement for this capacity post-FERC filing Planned New Cavern Leaf River has Multiple Sites for Potential Organic Cavern Expansion Beyond this 55 BCF FERC Filing October 31, 2025 Expects to increase working gas capacity by over 70%

in the coming years S&T NFE Expected to More Than Double from 2025 to 2027 (from $18.5 Million to Estimated $42 - $47 Million)

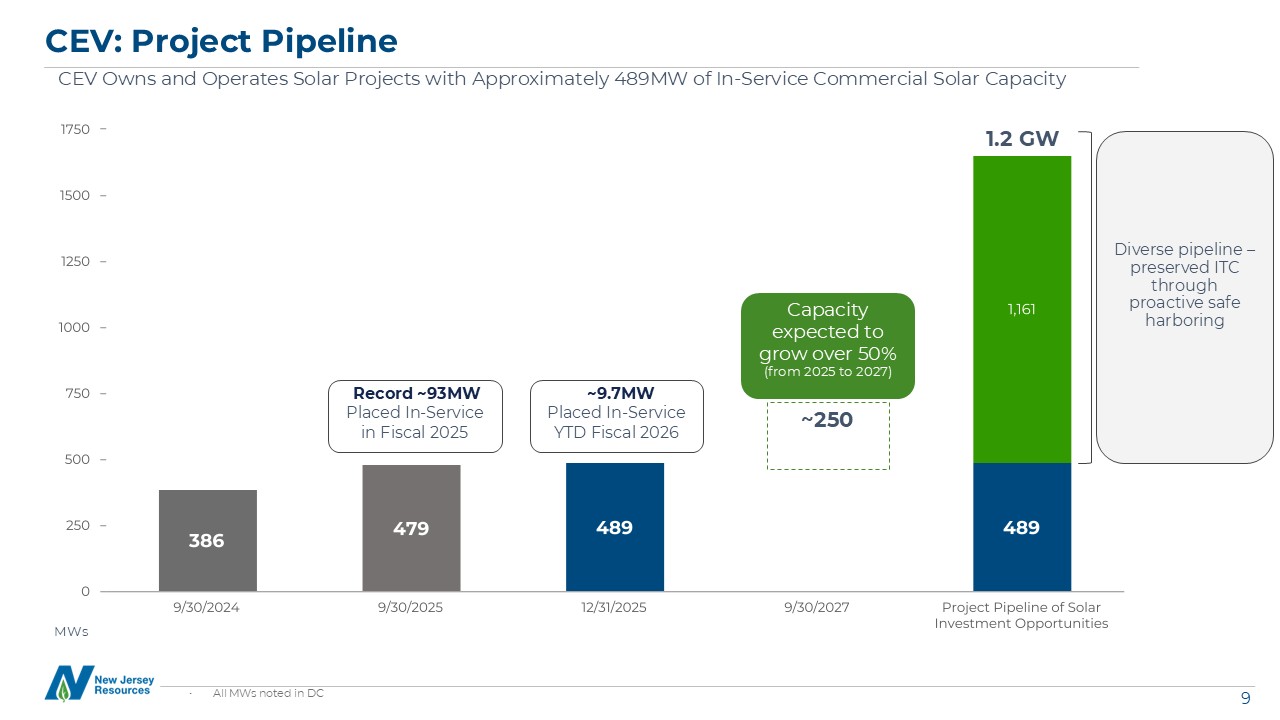

CEV: Project Pipeline CEV Owns and Operates Solar Projects with Approximately

489MW of In-Service Commercial Solar Capacity MWs Record ~93MW Placed In-Service in Fiscal 2025 1.2 GW Diverse pipeline – preserved ITC through proactive safe harboring Capacity expected to grow over 50% (from 2025 to 2027) All

MWs noted in DC ~250 ~9.7MW Placed In-Service YTD Fiscal 2026

10 Financial Review and Outlook

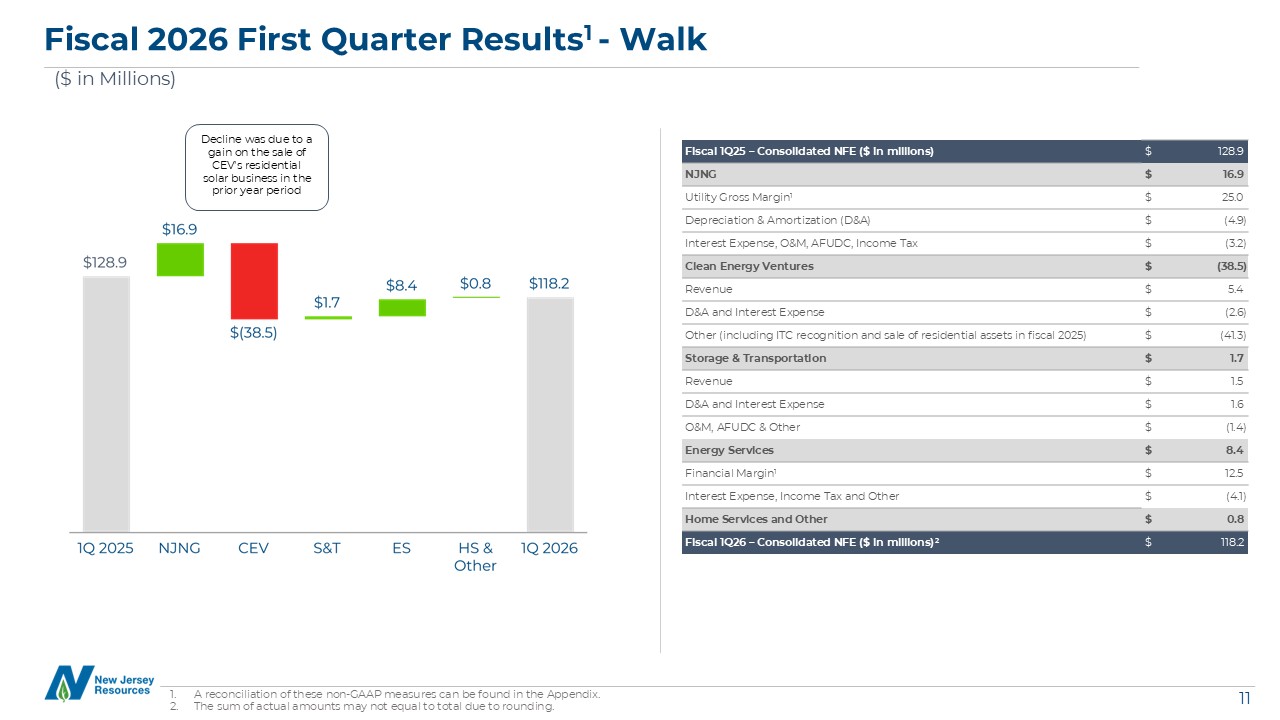

A reconciliation of these non-GAAP measures can be found in the Appendix. The

sum of actual amounts may not equal to total due to rounding. Fiscal 2026 First Quarter Results1 - Walk ($ in Millions) Fiscal 1Q25 – Consolidated NFE ($ in millions) $ 128.9 NJNG $ 16.9 Utility Gross Margin1 $ 25.0 Depreciation

& Amortization (D&A) $ (4.9) Interest Expense, O&M, AFUDC, Income Tax $ (3.2) Clean Energy Ventures $ (38.5) Revenue $ 5.4 D&A and Interest Expense $ (2.6) Other (including ITC recognition and sale of

residential assets in fiscal 2025) $ (41.3) Storage & Transportation $ 1.7 Revenue $ 1.5 D&A and Interest Expense $ 1.6 O&M, AFUDC & Other $ (1.4) Energy Services $ 8.4 Financial Margin1 $ 12.5 Interest

Expense, Income Tax and Other $ (4.1) Home Services and Other $ 0.8 Fiscal 1Q26 – Consolidated NFE ($ in millions)2 $ 118.2 Decline was due to a gain on the sale of CEV's residential solar business in the prior year period

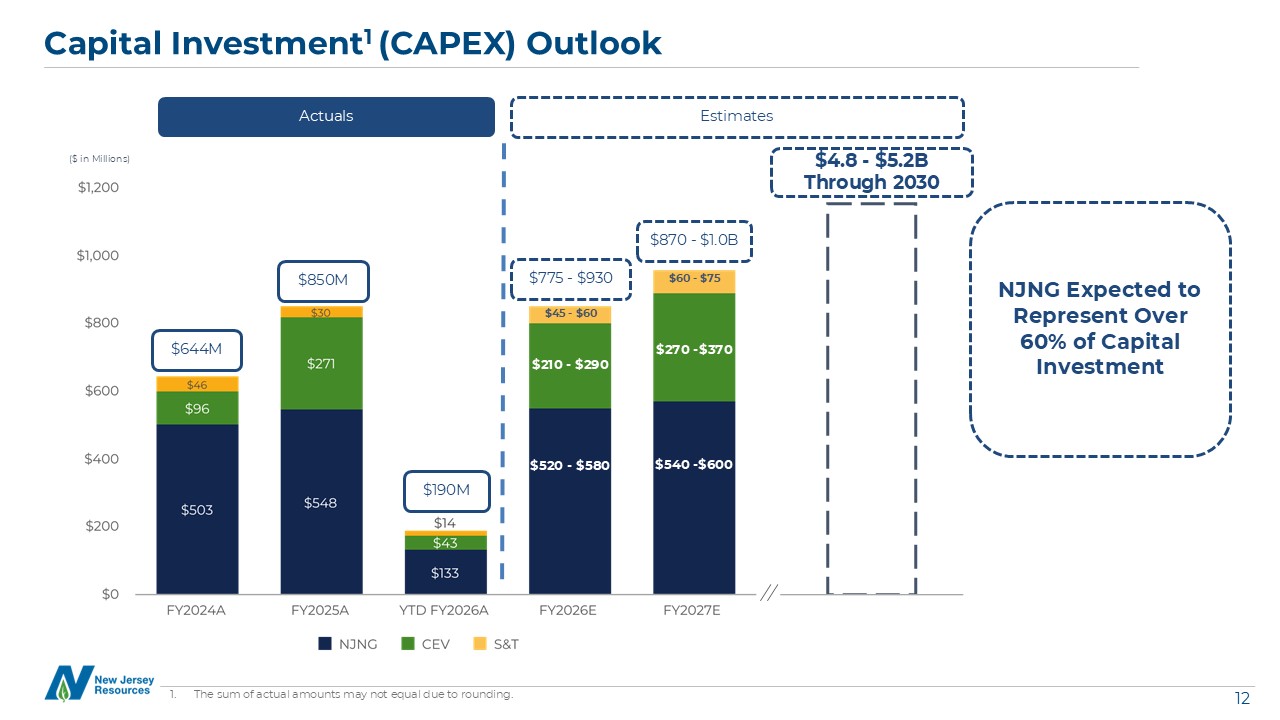

Capital Investment1 (CAPEX) Outlook $775 - $930 Actuals Estimates $4.8 -

$5.2B Through 2030 $870 - $1.0B NJNG Expected to Represent Over 60% of Capital Investment $45 - $60 $60 - $75 $210 - $290 $270 -$370 $520 - $580 $540 -$600 $190M $850M ($ in Millions) The sum of actual amounts may not equal due

to rounding. $644M

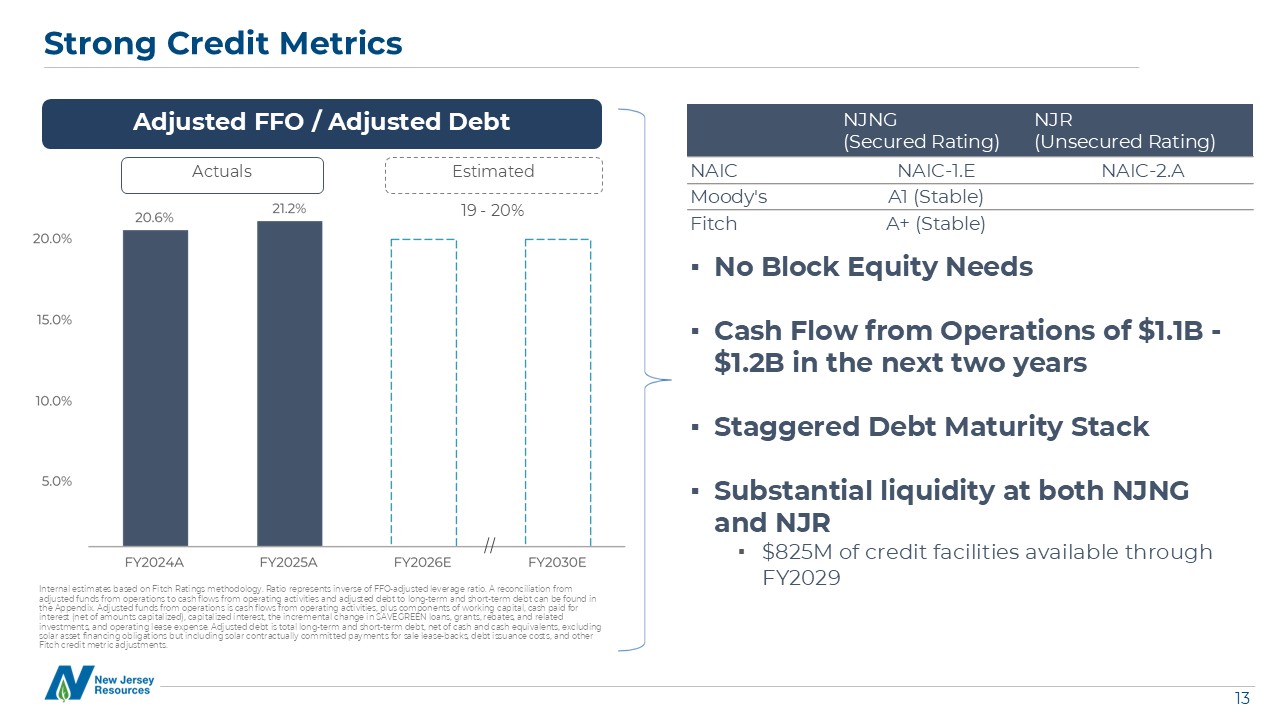

No Block Equity Needs Cash Flow from Operations of $1.1B - $1.2B in the next

two years Staggered Debt Maturity Stack Substantial liquidity at both NJNG and NJR $825M of credit facilities available through FY2029 Strong Credit Metrics Adjusted FFO / Adjusted Debt NJNG (Secured Rating) NJR (Unsecured

Rating) NAIC NAIC-1.E NAIC-2.A Moody's A1 (Stable) Fitch A+ (Stable) Internal estimates based on Fitch Ratings methodology. Ratio represents inverse of FFO-adjusted leverage ratio. A reconciliation from adjusted funds from

operations to cash flows from operating activities and adjusted debt to long-term and short-term debt can be found in the Appendix. Adjusted funds from operations is cash flows from operating activities, plus components of working capital,

cash paid for interest (net of amounts capitalized), capitalized interest, the incremental change in SAVEGREEN loans, grants, rebates, and related investments, and operating lease expense. Adjusted debt is total long-term and short-term

debt, net of cash and cash equivalents, excluding solar asset financing obligations but including solar contractually committed payments for sale lease-backs, debt issuance costs, and other Fitch credit metric adjustments.

Actuals Estimated 19 - 20%

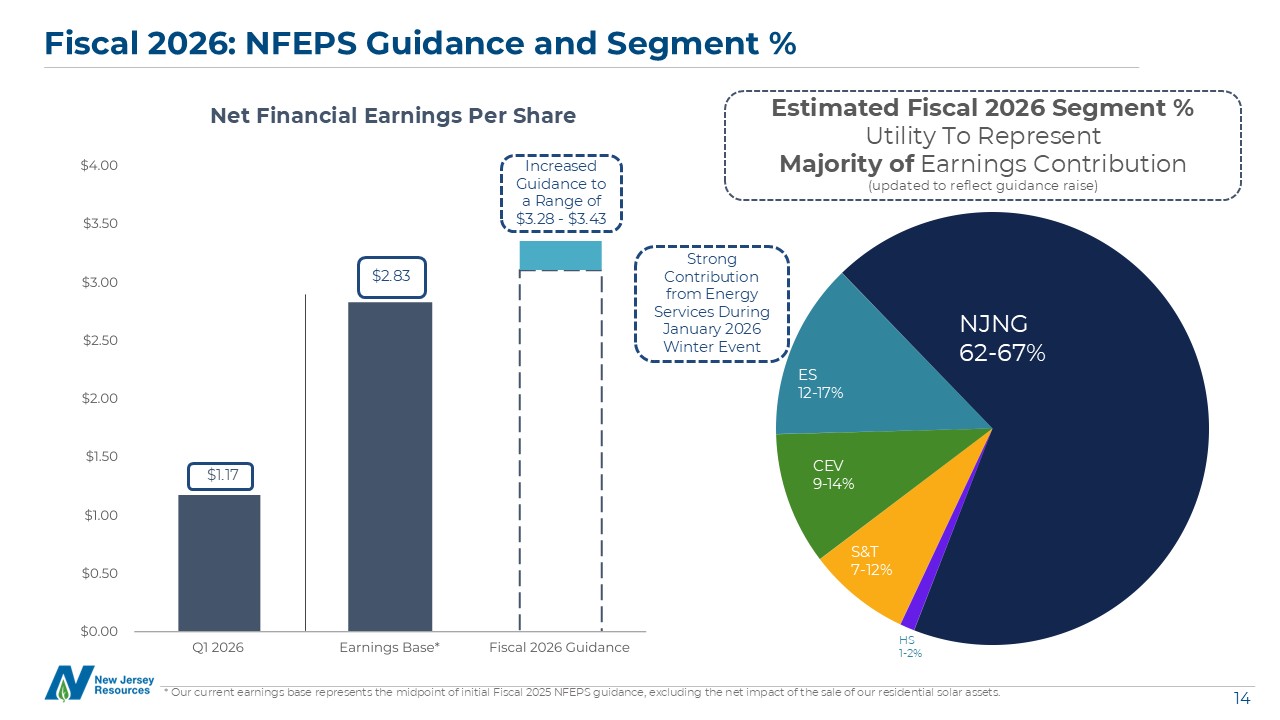

Fiscal 2026: NFEPS Guidance and Segment % Net Financial Earnings Per

Share Increased Guidance to a Range of $3.28 - $3.43 $2.83 * Our current earnings base represents the midpoint of initial Fiscal 2025 NFEPS guidance, excluding the net impact of the sale of our residential solar

assets. $1.17 Estimated Fiscal 2026 Segment % Utility To Represent Majority of Earnings Contribution (updated to reflect guidance raise) NJNG 62-67% S&T 7-12% CEV 9-14% ES 12-17% HS 1-2% Strong Contribution from Energy

Services During January 2026 Winter Event

17th Corporate Sustainability Report Dating Back to 2008 Link to: 2025

Sustainability Report Record $98M investment in energy efficiency: SAVEGREEN® programs helped customers reduce energy usage and cut CO₂ emissions. Expanded renewable energy portfolio: NJR Clean Energy Ventures added 93 MW of solar,

powering 73,000+ homes and avoiding 340,000+ metric tons of CO₂ annually. Industry-leading pipeline modernization: Achieved just 0.06 leaks per mile and used advanced methane detection and cross-compression to further reduce

emissions. Coastal Climate Initiative for resilience: Funded nature-based projects to protect communities from extreme weather and enhance local ecosystems. Significant social impact: Provided $16.5M in energy assistance, supported 2,000+

organizations, and unified educational outreach for 800+ students. Highlights 2025 Sustainability Report

NJR: Aligned with New Jersey’s Affordability Initiatives Governor Sherrill

was sworn in on January 20, 2026 and immediately issued two Executive Orders focused on affordability of electric bills Executive Order 1 Electric Affordability and Rate Relief Directive to pause or offset 2026 electric rate

increases Executive Order 2 Accelerating In‑State Energy Supply Directive to rapidly expand solar, storage, and distributed resources NJR Well-Positioned for Opportunities from EOs Natural gas remains New Jersey’s most affordable

and reliable energy option NJR’s diversified model supports growth in in‑state energy supply Energy‑efficiency programs continue lowering customer bills for 110,000+ customers CEV is well aligned with the state’s accelerated solar and

storage development

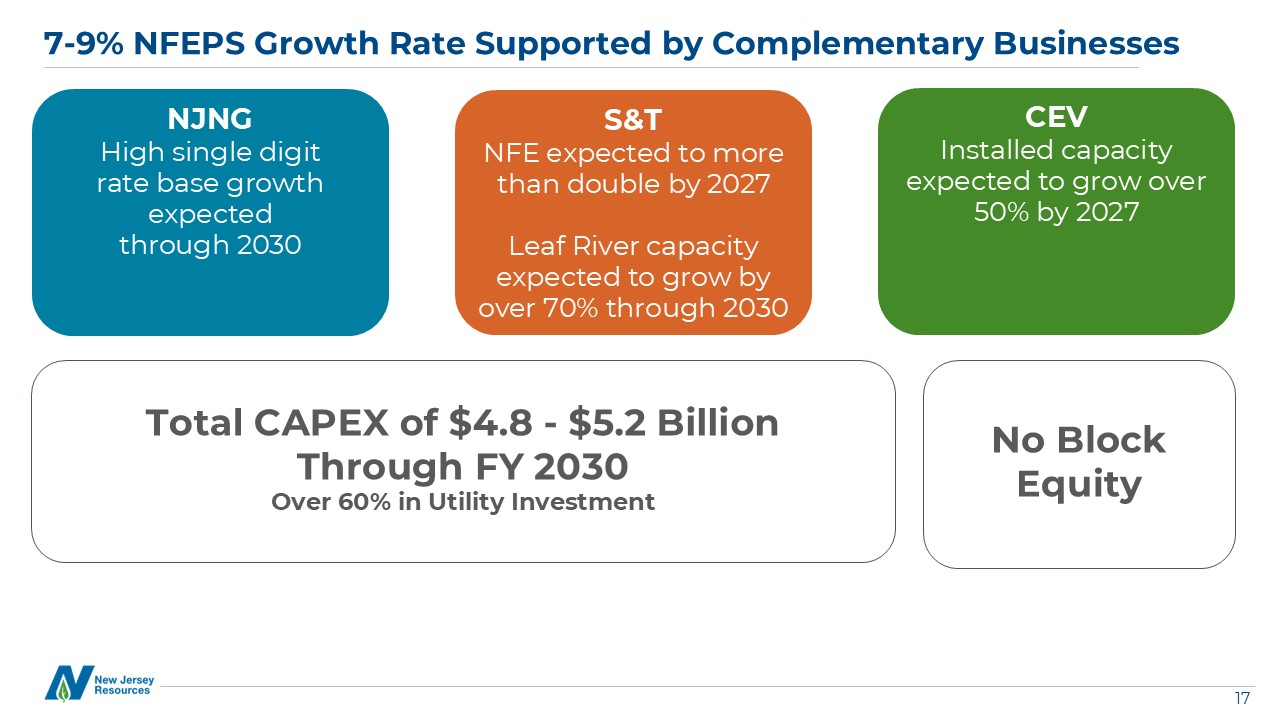

7-9% NFEPS Growth Rate Supported by Complementary Businesses Total CAPEX of

$4.8 - $5.2 Billion Through FY 2030 Over 60% in Utility Investment No Block Equity NJNG High single digit rate base growth expected through 2030 CEV Installed capacity expected to grow over 50% by 2027 S&T NFE expected to

more than double by 2027 Leaf River capacity expected to grow by over 70% through 2030

Appendix: Financial Statements and Additional Information 18 19 Fiscal

2026 First Quarter NFE and NFEPS by Business Unit 20 Reconciliation of NFE and NFEPS to Net Income 21 Other Reconciliation of Non-GAAP Measures 22 Reconciliation of Adjusted Funds from Operations to Cash Flow from

Operations 23 Capital Plan Table - Two Year Detailed 24 Cash Flows - Two Year Projected 25 Debt Repayment Schedule

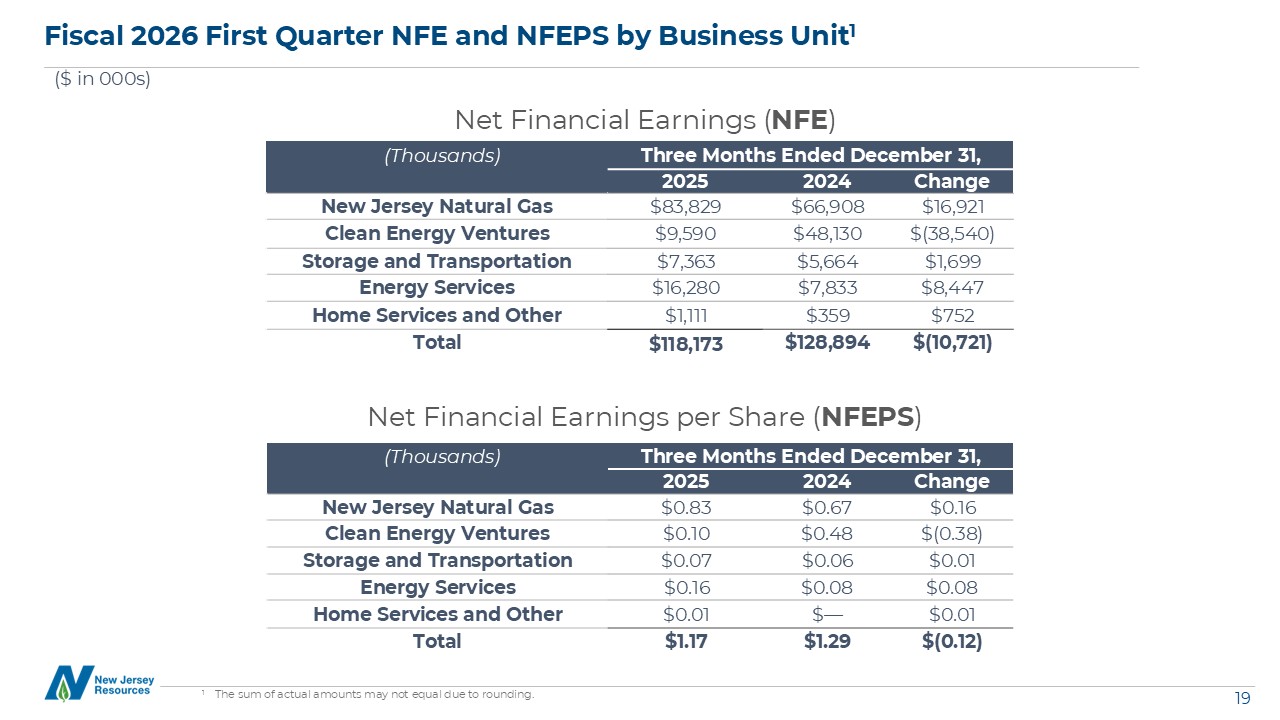

Fiscal 2026 First Quarter NFE and NFEPS by Business Unit1 ($ in 000s) Net

Financial Earnings (NFE) Net Financial Earnings per Share (NFEPS) (Thousands) Three Months Ended December 31, 2025 2024 Change New Jersey Natural Gas $83,829 $66,908 $16,921 Clean Energy

Ventures $9,590 $48,130 $(38,540) Storage and Transportation $7,363 $5,664 $1,699 Energy Services $16,280 $7,833 $8,447 Home Services and Other $1,111 $359 $752 Total $118,173 $128,894 $(10,721) (Thousands) Three

Months Ended December 31, 2025 2024 Change New Jersey Natural Gas $0.83 $0.67 $0.16 Clean Energy Ventures $0.10 $0.48 $(0.38) Storage and Transportation $0.07 $0.06 $0.01 Energy Services $0.16 $0.08 $0.08 Home Services

and Other $0.01 $— $0.01 Total $1.17 $1.29 $(0.12) 1 The sum of actual amounts may not equal due to rounding.

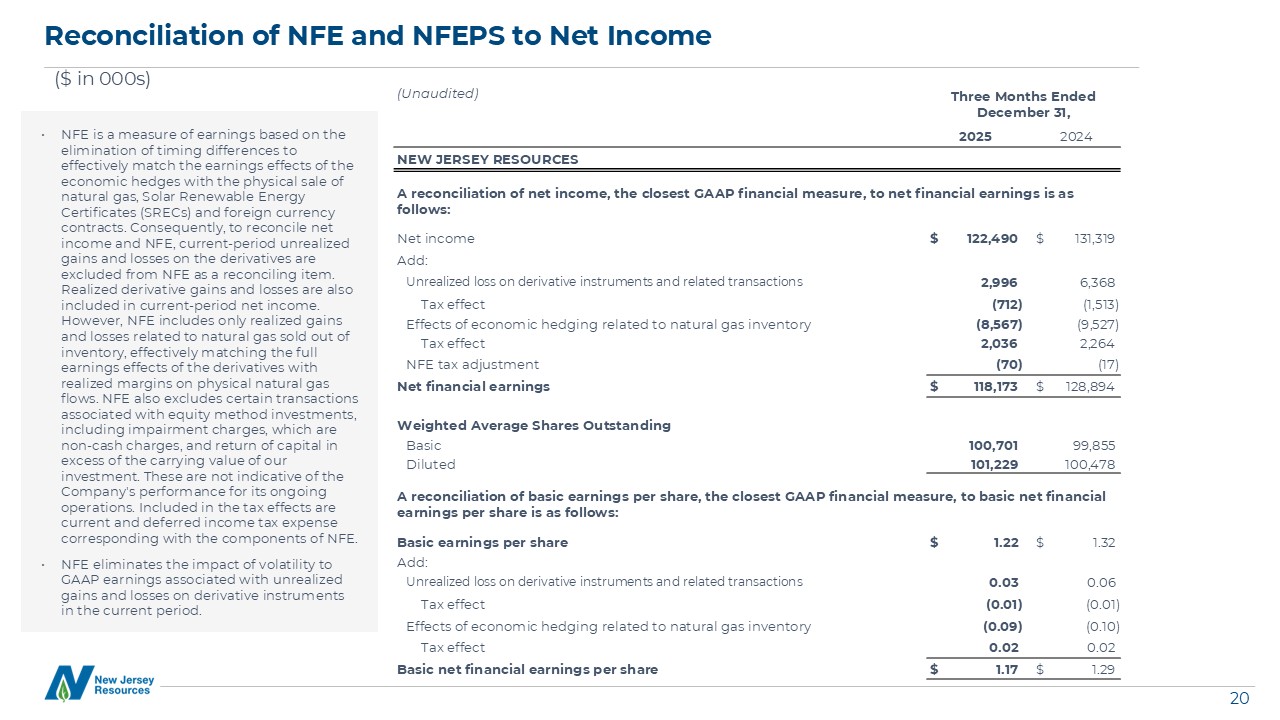

Reconciliation of NFE and NFEPS to Net Income ($ in 000s) NFE is a measure

of earnings based on the elimination of timing differences to effectively match the earnings effects of the economic hedges with the physical sale of natural gas, Solar Renewable Energy Certificates (SRECs) and foreign currency contracts.

Consequently, to reconcile net income and NFE, current-period unrealized gains and losses on the derivatives are excluded from NFE as a reconciling item. Realized derivative gains and losses are also included in current-period net income.

However, NFE includes only realized gains and losses related to natural gas sold out of inventory, effectively matching the full earnings effects of the derivatives with realized margins on physical natural gas flows. NFE also excludes

certain transactions associated with equity method investments, including impairment charges, which are non-cash charges, and return of capital in excess of the carrying value of our investment. These are not indicative of the Company's

performance for its ongoing operations. Included in the tax effects are current and deferred income tax expense corresponding with the components of NFE. NFE eliminates the impact of volatility to GAAP earnings associated with unrealized

gains and losses on derivative instruments in the current period. (Unaudited) Three Months Ended December 31, 2025 2024 NEW JERSEY RESOURCES A reconciliation of net income, the closest GAAP financial measure, to net financial

earnings is as follows: Net income $ 122,490 $ 131,319 Add: Unrealized loss on derivative instruments and related transactions 2,996 6,368 Tax effect (712) (1,513) Effects of economic hedging related to natural gas

inventory (8,567) (9,527) Tax effect 2,036 2,264 NFE tax adjustment (70) (17) Net financial earnings $ 118,173 $ 128,894 Weighted Average Shares Outstanding Basic 100,701 99,855 Diluted 101,229 100,478 A

reconciliation of basic earnings per share, the closest GAAP financial measure, to basic net financial earnings per share is as follows: Basic earnings per share $ 1.22 $ 1.32 Add: Unrealized loss on derivative instruments and

related transactions 0.03 0.06 Tax effect (0.01) (0.01) Effects of economic hedging related to natural gas inventory (0.09) (0.10) Tax effect 0.02 0.02 Basic net financial earnings per share $ 1.17 $ 1.29

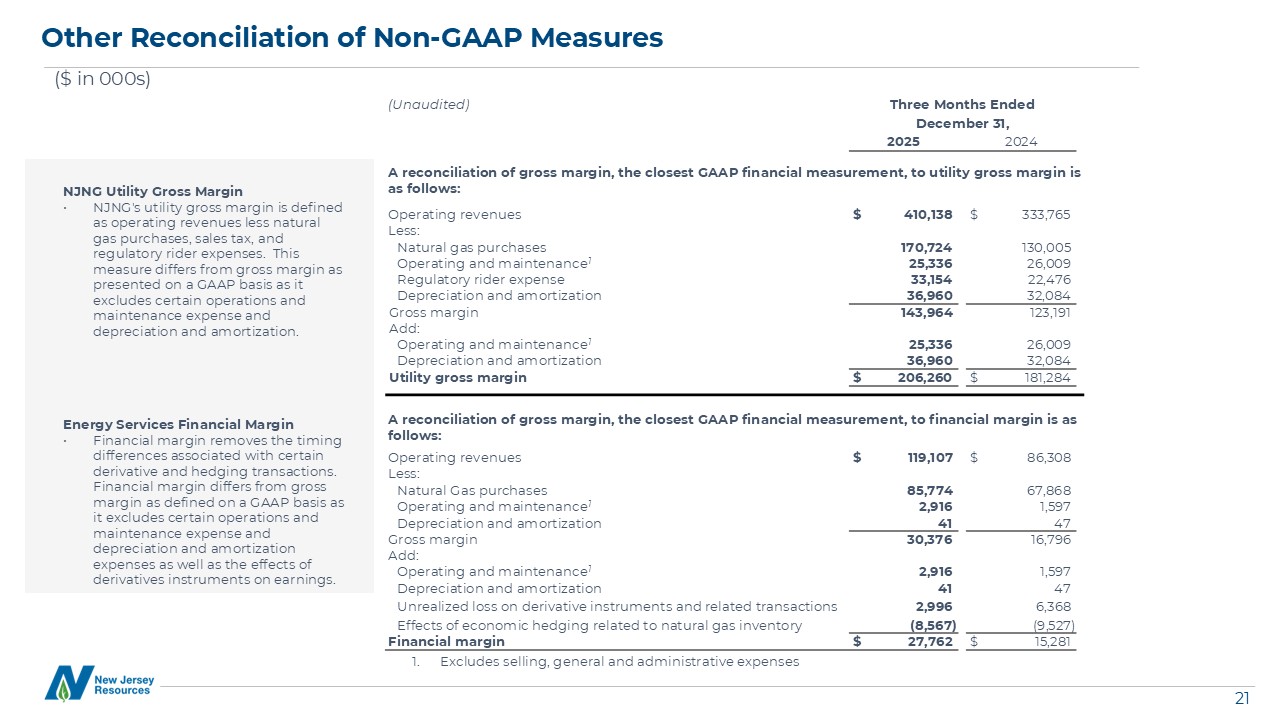

Other Reconciliation of Non-GAAP Measures NJNG Utility Gross Margin NJNG's

utility gross margin is defined as operating revenues less natural gas purchases, sales tax, and regulatory rider expenses. This measure differs from gross margin as presented on a GAAP basis as it excludes certain operations and

maintenance expense and depreciation and amortization. Energy Services Financial Margin Financial margin removes the timing differences associated with certain derivative and hedging transactions. Financial margin differs from gross

margin as defined on a GAAP basis as it excludes certain operations and maintenance expense and depreciation and amortization expenses as well as the effects of derivatives instruments on earnings. ($ in 000s) (Unaudited) Three Months

Ended December 31, 2025 2024 A reconciliation of gross margin, the closest GAAP financial measurement, to utility gross margin is as follows: Operating revenues $ 410,138 $ 333,765 Less: Natural gas purchases 170,724 130,005

Operating and maintenance1 25,336 26,009 Regulatory rider expense 33,154 22,476 Depreciation and amortization 36,960 32,084 Gross margin 143,964 123,191 Add: Operating and maintenance1 25,336 26,009

Depreciation and amortization 36,960 32,084 Utility gross margin $ 206,260 $ 181,284 A reconciliation of gross margin, the closest GAAP financial measurement, to financial margin is as follows: Operating revenues $ 119,107

$ 86,308 Less: Natural Gas purchases 85,774 67,868 Operating and maintenance1 2,916 1,597 Depreciation and amortization 41 47 Gross margin 30,376 16,796 Add: Operating and maintenance1 2,916 1,597

Depreciation and amortization 41 47 Unrealized loss on derivative instruments and related transactions 2,996 6,368 Effects of economic hedging related to natural gas inventory (8,567) (9,527) Financial margin $ 27,762

$ 15,281 Excludes selling, general and administrative expenses

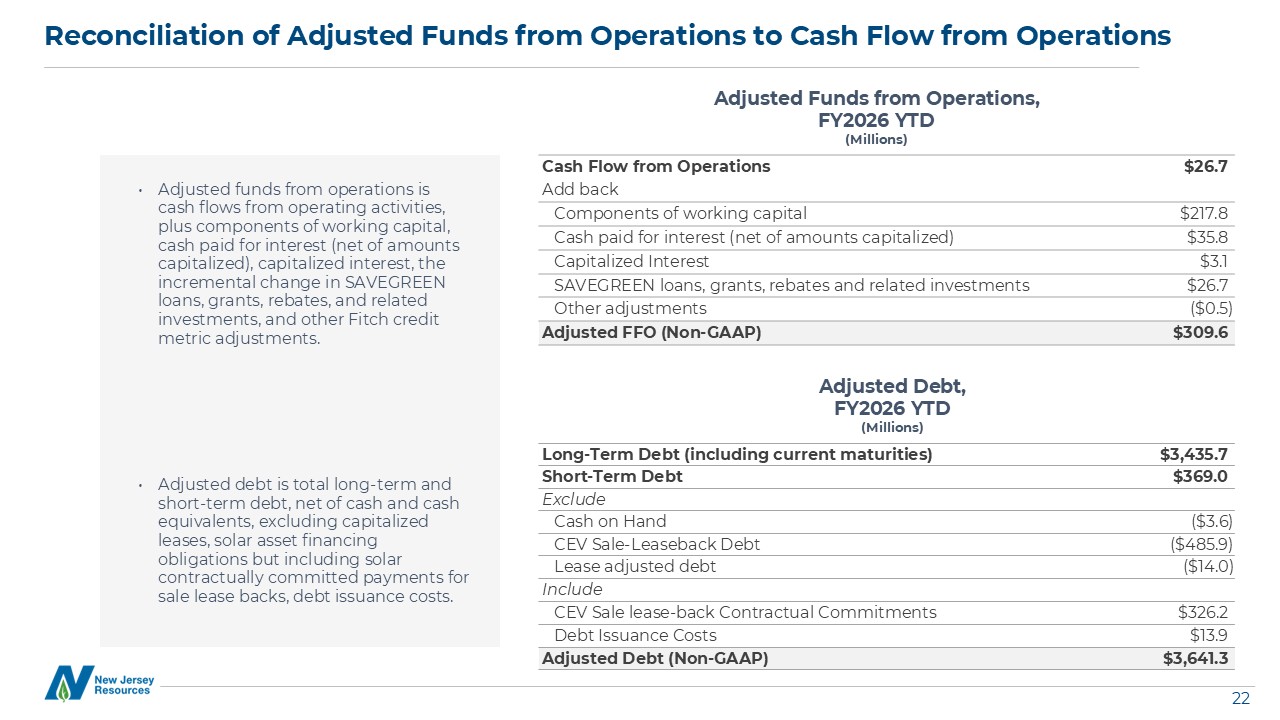

Reconciliation of Adjusted Funds from Operations to Cash Flow from

Operations Adjusted funds from operations is cash flows from operating activities, plus components of working capital, cash paid for interest (net of amounts capitalized), capitalized interest, the incremental change in SAVEGREEN loans,

grants, rebates, and related investments, and other Fitch credit metric adjustments. Adjusted debt is total long-term and short-term debt, net of cash and cash equivalents, excluding capitalized leases, solar asset financing obligations

but including solar contractually committed payments for sale lease backs, debt issuance costs. Cash Flow from Operations $26.7 Add back Components of working capital $217.8 Cash paid for interest (net of amounts capitalized)

$35.8 Capitalized Interest $3.1 SAVEGREEN loans, grants, rebates and related investments $26.7 Other adjustments ($0.5) Adjusted FFO (Non-GAAP) $309.6 Long-Term Debt (including current maturities) $3,435.7 Short-Term

Debt $369.0 Exclude Cash on Hand ($3.6) CEV Sale-Leaseback Debt ($485.9) Lease adjusted debt ($14.0) Include CEV Sale lease-back Contractual Commitments $326.2 Debt Issuance Costs $13.9 Adjusted Debt (Non-GAAP)

$3,641.3 Adjusted Debt, FY2026 YTD (Millions) Adjusted Funds from Operations, FY2026 YTD (Millions)

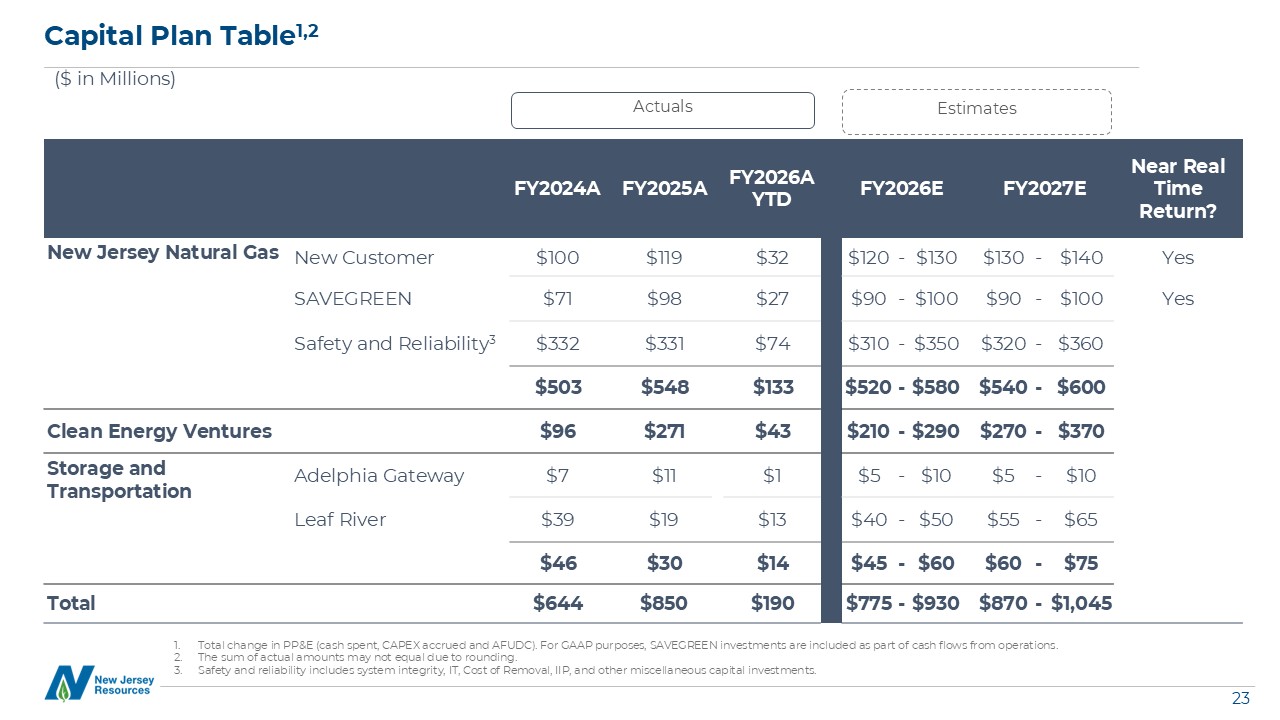

Capital Plan Table1,2 ($ in Millions) Total change in PP&E (cash spent,

CAPEX accrued and AFUDC). For GAAP purposes, SAVEGREEN investments are included as part of cash flows from operations. The sum of actual amounts may not equal due to rounding. Safety and reliability includes system integrity, IT, Cost of

Removal, IIP, and other miscellaneous capital investments. Actuals Estimates FY2024A FY2025A FY2026A YTD FY2026E FY2027E Near Real Time Return? New Jersey Natural Gas New

Customer $100 $119 $32 $120 - $130 $130 - $140 Yes SAVEGREEN $71 $98 $27 $90 - $100 $90 - $100 Yes Safety and

Reliability3 $332 $331 $74 $310 - $350 $320 - $360 $503 $548 $133 $520 - $580 $540 - $600 Clean Energy Ventures $96 $271 $43 $210 - $290 $270 - $370 Storage and Transportation Adelphia

Gateway $7 $11 $1 $5 - $10 $5 - $10 Leaf River $39 $19 $13 $40 - $50 $55 - $65 $46 $30 $14 $45 - $60 $60 - $75 Total $644 $850 $190 $775 - $930 $870 - $1,045

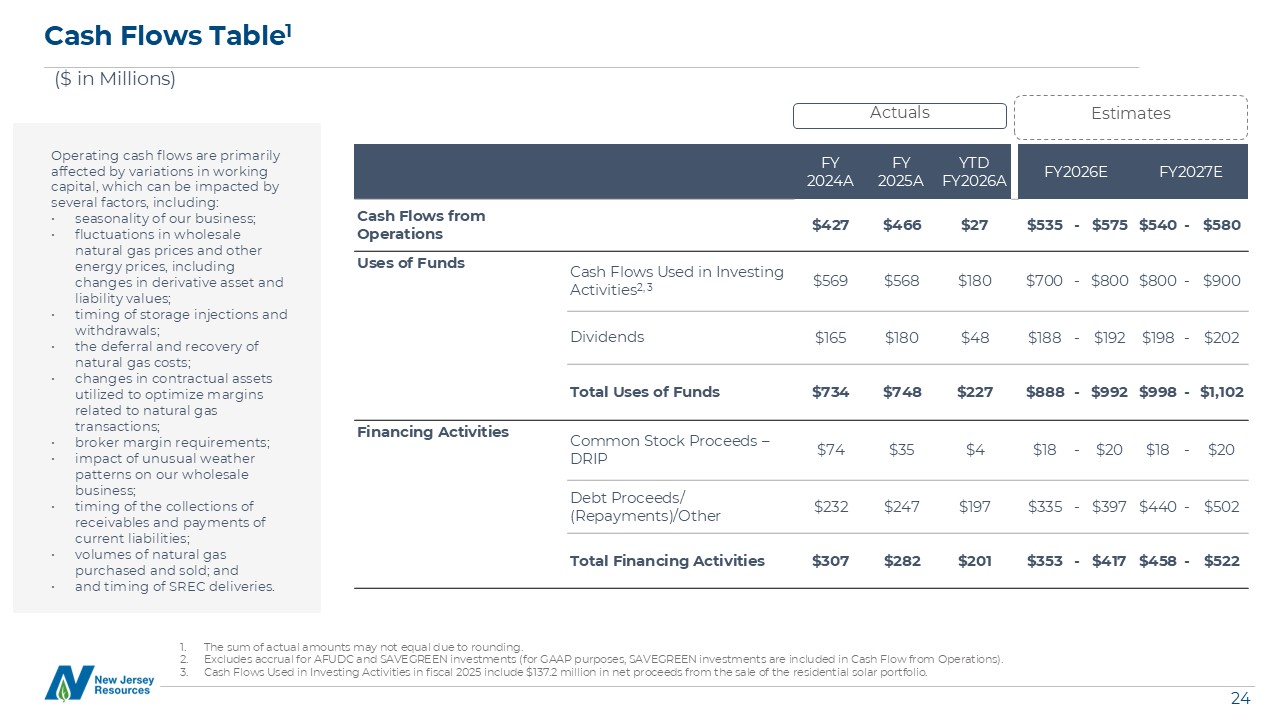

The sum of actual amounts may not equal due to rounding. Excludes accrual for

AFUDC and SAVEGREEN investments (for GAAP purposes, SAVEGREEN investments are included in Cash Flow from Operations). Cash Flows Used in Investing Activities in fiscal 2025 include $137.2 million in net proceeds from the sale of the

residential solar portfolio. Cash Flows Table1 ($ in Millions) Actuals Estimates Operating cash flows are primarily affected by variations in working capital, which can be impacted by several factors, including: seasonality of our

business; fluctuations in wholesale natural gas prices and other energy prices, including changes in derivative asset and liability values; timing of storage injections and withdrawals; the deferral and recovery of natural gas costs;

changes in contractual assets utilized to optimize margins related to natural gas transactions; broker margin requirements; impact of unusual weather patterns on our wholesale business; timing of the collections of receivables and

payments of current liabilities; volumes of natural gas purchased and sold; and and timing of SREC deliveries. FY 2024A FY 2025A YTD FY2026A FY2026E FY2027E Cash Flows from

Operations $427 $466 $27 $535 - $575 $540 - $580 Uses of Funds Cash Flows Used in Investing Activities2, 3 $569 $568 $180 $700 - $800 $800 - $900 Dividends $165 $180 $48 $188 - $192 $198 - $202 Total Uses of

Funds $734 $748 $227 $888 - $992 $998 - $1,102 Financing Activities Common Stock Proceeds – DRIP $74 $35 $4 $18 - $20 $18 - $20 Debt Proceeds/ (Repayments)/Other $232 $247 $197 $335 - $397 $440 - $502 Total

Financing Activities $307 $282 $201 $353 - $417 $458 - $522

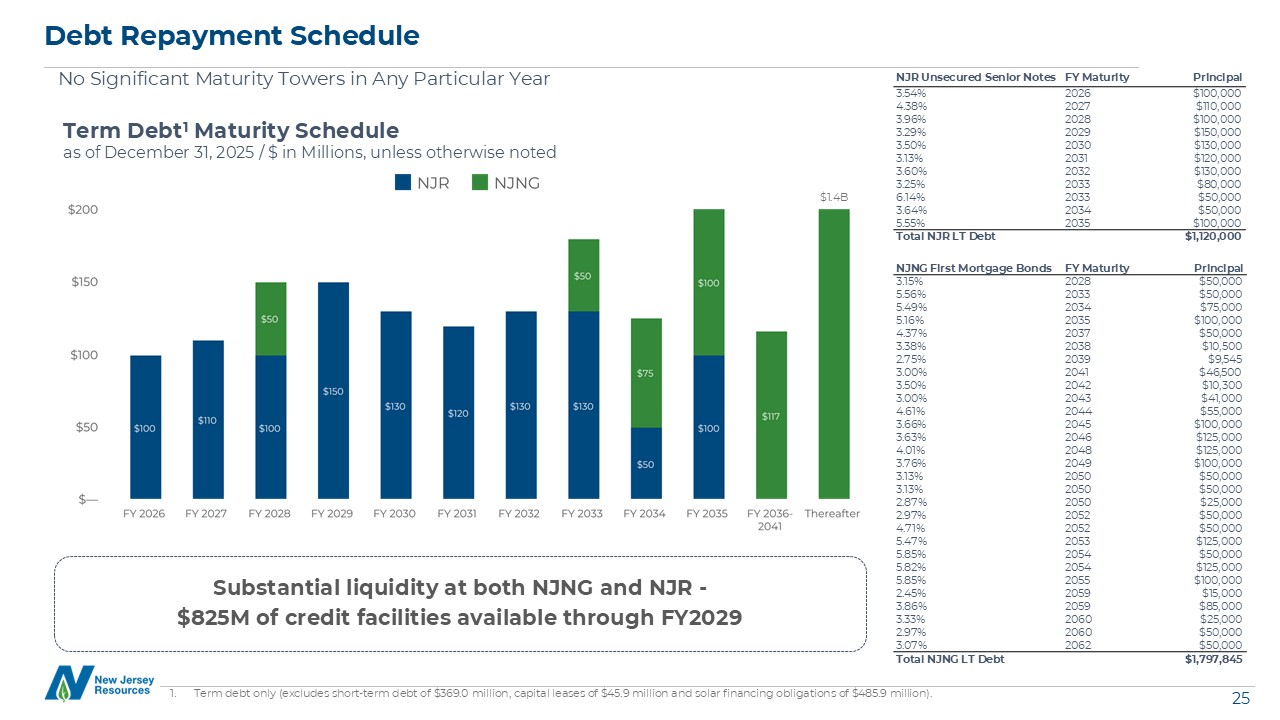

Debt Repayment Schedule No Significant Maturity Towers in Any Particular

Year Term debt only (excludes short-term debt of $369.0 million, capital leases of $45.9 million and solar financing obligations of $485.9 million). NJR Unsecured Senior Notes FY Maturity Principal 3.54% 2026 $100,000

4.38% 2027 $110,000 3.96% 2028 $100,000 3.29% 2029 $150,000 3.50% 2030 $130,000 3.13% 2031 $120,000 3.60% 2032 $130,000 3.25% 2033 $80,000 6.14% 2033 $50,000 3.64% 2034 $50,000 5.55% 2035

$100,000 Total NJR LT Debt $1,120,000 NJNG First Mortgage Bonds FY Maturity Principal 3.15% 2028 $50,000 5.56% 2033 $50,000 5.49% 2034 $75,000 5.16% 2035 $100,000 4.37% 2037 $50,000 3.38% 2038 $10,500

2.75% 2039 $9,545 3.00% 2041 $46,500 3.50% 2042 $10,300 3.00% 2043 $41,000 4.61% 2044 $55,000 3.66% 2045 $100,000 3.63% 2046 $125,000 4.01% 2048 $125,000 3.76% 2049 $100,000 3.13% 2050

$50,000 3.13% 2050 $50,000 2.87% 2050 $25,000 2.97% 2052 $50,000 4.71% 2052 $50,000 5.47% 2053 $125,000 5.85% 2054 $50,000 5.82% 2054 $125,000 5.85% 2055 $100,000 2.45% 2059 $15,000

3.86% 2059 $85,000 3.33% 2060 $25,000 2.97% 2060 $50,000 3.07% 2062 $50,000 Total NJNG LT Debt $1,797,845 Substantial liquidity at both NJNG and NJR - $825M of credit facilities available through FY2029 Term

Debt1 Maturity Schedule as of December 31, 2025 / $ in Millions, unless otherwise noted $1.4B

Originated from Expertise in Energy Value Chain Clean Energy

Ventures (CEV) Flexible Renewable Project Platform Storage and Transportation (S&T) Long-Term Energy Infrastructure Energy Services (ES) Capital-light Cash Generator NJR Home Services (NJRHS) Customer Focused Field

Services New Jersey Natural Gas (NJNG) Stable, Regulated Utility Growth NJR: Complementary Energy Infrastructure Platform Predictable Net Financial Earnings and Incremental Organic Growth Opportunities 27 NJR: Business Portfolio

28 NJR: Dividend Growth: Raised for 30 Consecutive Years 29 NJR: Drivers of Long-Term Growth Rate of 7-9% 30 NJNG: Regulatory Environment 31 NJNG: Growing Rate Base 32 S&T: Strategically Located Assets 33 S&T: Adjusted

EBITDA 34 CEV: Diverse Commercial Solar Portfolio 35 CEV: “Utility Like” Revenue Stack with Optionality 36 Energy Services: Overview 37 Energy Services: Strong NFE Contribution 38 Energy Services: Asset Management

Agreements 39 Home Services (NJRHS) 40 Shareholder and Online Information

NJR Home Services offers customers home comfort solutions. NJR: Business

Portfolio Natural Gas and Renewable Fuel Distribution; Solar Investments; Wholesale Energy Markets; Storage & Transportation Infrastructure; Retail Operations Operates and maintains Natural Gas transportation and distribution

infrastructure. New Jersey Natural Gas (NJNG) Clean Energy Ventures (CEV) Storage and Transportation (S&T) Energy Services (ES) NJR Home Services (NJRHS) CEV develops, invests in, owns and operates energy projects that

generate clean power and provide low carbon energy solutions. Invests in, owns and operates midstream assets including natural gas pipeline and storage facilities. Provides unregulated, wholesale natural gas to consumers across the Gulf

Coast, Eastern Seaboard, Southwest, Mid-continent and Canada. Demonstrated leadership as a premier energy infrastructure and environmentally-forward thinking company

NJR Dividend Growth: Raised for 30 Consecutive Years Committed to Returning

Capital to Shareholders Dividend History Dividends per Share Record Date Payable Date Amount Per

Share 12/12/2025 1/2/2025 $0.475 9/22/2025 10/1/2025 $0.475 6/10/2025 7/01/2025 $0.45 3/11/2025 4/01/2025 $0.45 12/11/2024 1/02/2025 $0.45 9/23/2024 10/01/2024 $0.45 6/12/2024 7/01/2024 $0.42 3/13/2024 4/01/2024 $0.42 12/13/2023 1/02/2024 $0.42 9/20/2023 10/02/2023 $0.42 6/14/2023 7/03/2023 $0.39 3/15/2023 4/03/2023 $0.39 12/14/2022 1/03/2023 $0.39 9/26/2022 10/03/2022 $0.39 6/15/2022 7/01/2022 $0.3625 3/16/2022 4/01/2022 $0.3625 12/15/2021 1/03/2022 $0.3625 9/20/2021 10/01/2021 $0.3625 6/16/2021 7/01/2021 $0.3325 3/17/2021 4/01/2021 $0.3325 12/16/2020 1/04/2021 $0.3325 Highlighted

Rows Reflect Changes in Quarterly Cash Dividends $1.90 FY 2026 Dividend

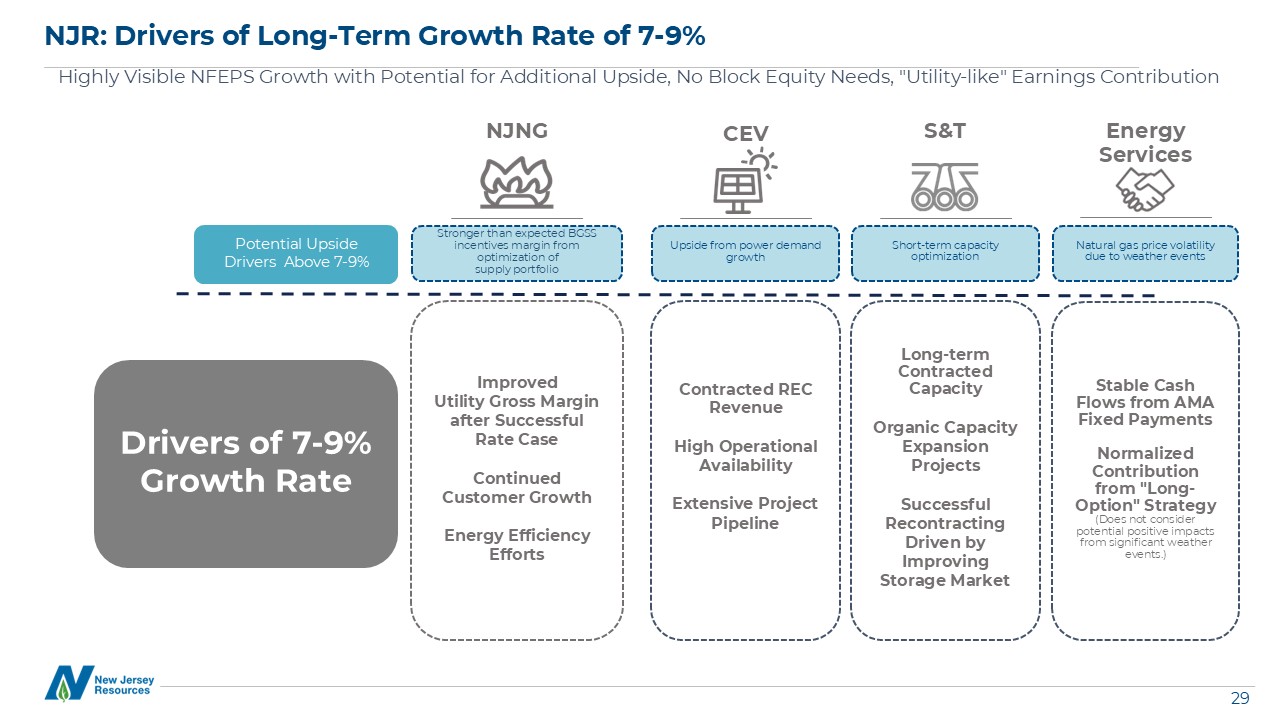

NJR: Drivers of Long-Term Growth Rate of 7-9% Highly Visible NFEPS Growth

with Potential for Additional Upside, No Block Equity Needs, "Utility-like" Earnings Contribution NJNG CEV S&T Energy Services Improved Utility Gross Margin after Successful Rate Case Continued Customer Growth Energy

Efficiency Efforts Drivers of 7-9% Growth Rate Potential Upside Drivers Above 7-9% Contracted REC Revenue High Operational Availability Extensive Project Pipeline Stronger than expected BGSS incentives margin from optimization of

supply portfolio Upside from power demand growth Long-term Contracted Capacity Organic Capacity Expansion Projects Successful Recontracting Driven by Improving Storage Market Short-term capacity optimization Stable Cash Flows from

AMA Fixed Payments Normalized Contribution from "Long-Option" Strategy (Does not consider potential positive impacts from significant weather events.) Natural gas price volatility due to weather events

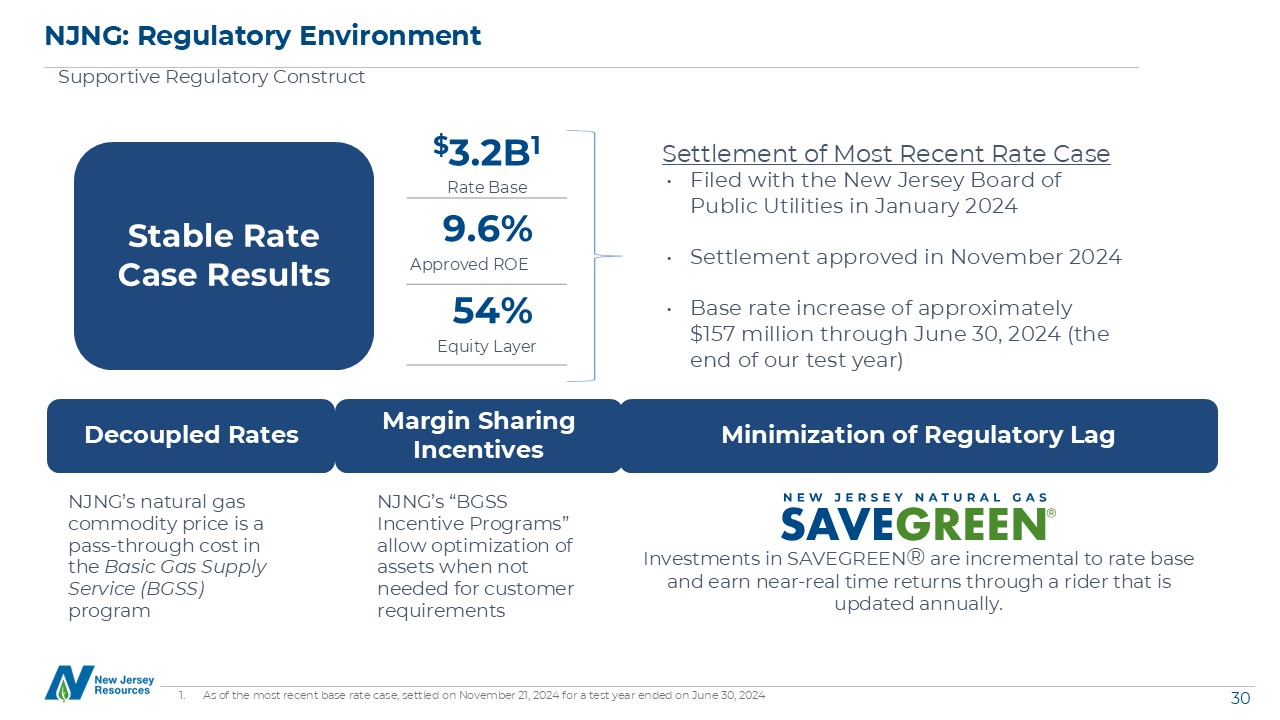

NJNG: Regulatory Environment $3.2B1 Rate Base 9.6% Approved ROE As of the

most recent base rate case, settled on November 21, 2024 for a test year ended on June 30, 2024 54% Equity Layer Supportive Regulatory Construct Stable Rate Case Results Decoupled Rates Minimization of Regulatory Lag Margin Sharing

Incentives Filed with the New Jersey Board of Public Utilities in January 2024 Settlement approved in November 2024 Base rate increase of approximately $157 million through June 30, 2024 (the end of our test year) Settlement of Most

Recent Rate Case Investments in SAVEGREEN® are incremental to rate base and earn near-real time returns through a rider that is updated annually. NJNG’s natural gas commodity price is a pass-through cost in the Basic Gas Supply Service

(BGSS) program NJNG’s “BGSS Incentive Programs” allow optimization of assets when not needed for customer requirements

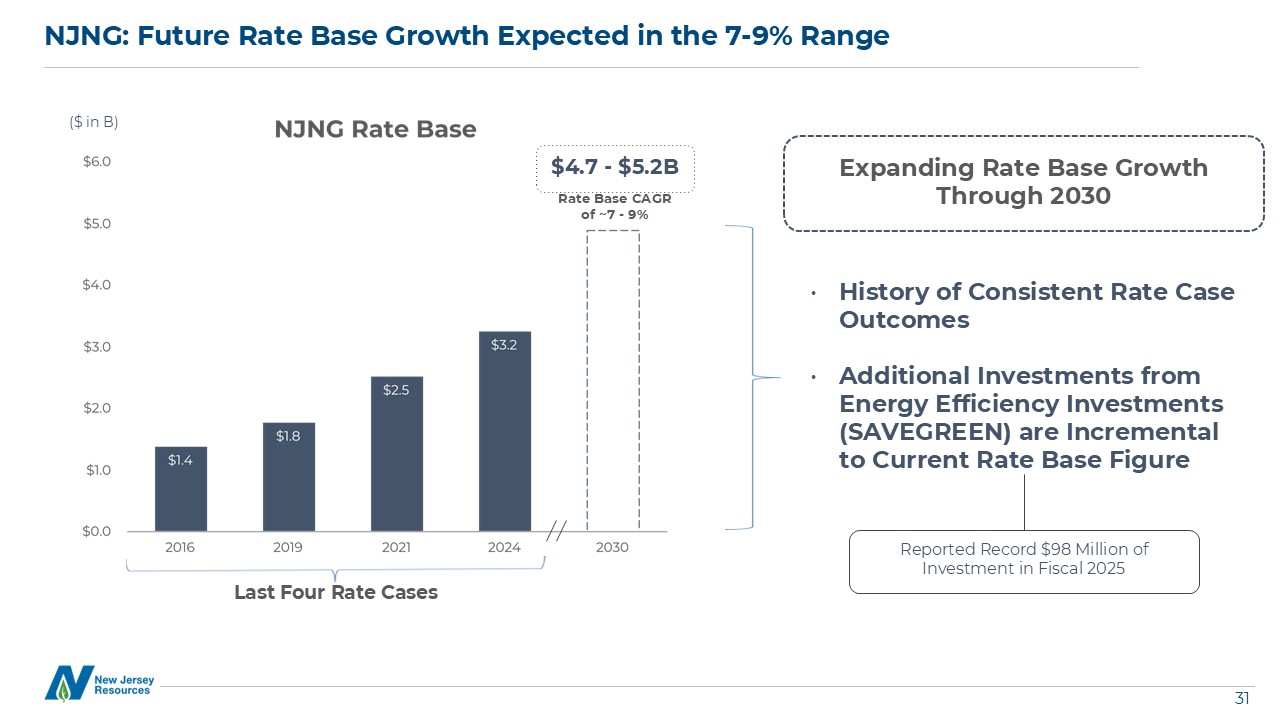

NJNG: Future Rate Base Growth Expected in the 7-9% Range Expanding Rate Base

Growth Through 2030 History of Consistent Rate Case Outcomes Additional Investments from Energy Efficiency Investments (SAVEGREEN) are Incremental to Current Rate Base Figure Last Four Rate Cases $4.7 - $5.2B ($ in B) Rate Base CAGR

of ~7 - 9% Reported Record $98 Million of Investment in Fiscal 2025

S&T: Strategically Located Assets Leaf River (storage), Steckman Ridge

(storage), and Adelphia Gateway (transportation) 32.2 mmdth high deliverability salt cavern storage facility in southeastern Mississippi Acquired October 2019 100% owner & operator Serves the fastest growing natural gas market in

North America 12.6 mmdth reservoir storage facility in southern PA Placed in service April 2009 50% ownership interest Serving the Northeast Region with a high dependence on storage and increasingly constrained pipeline capacity 0.9

mmdth/d interstate pipeline from NE PA to greater Philadelphia area Acquired January 2020 / Placed in-service September 2022 100% owner & operator Serving the Northeast region, where the current pipeline grid is constrained Maximize

capabilities of existing assets as pipeline and storage constraints highlight the benefit of storage and transportation infrastructure

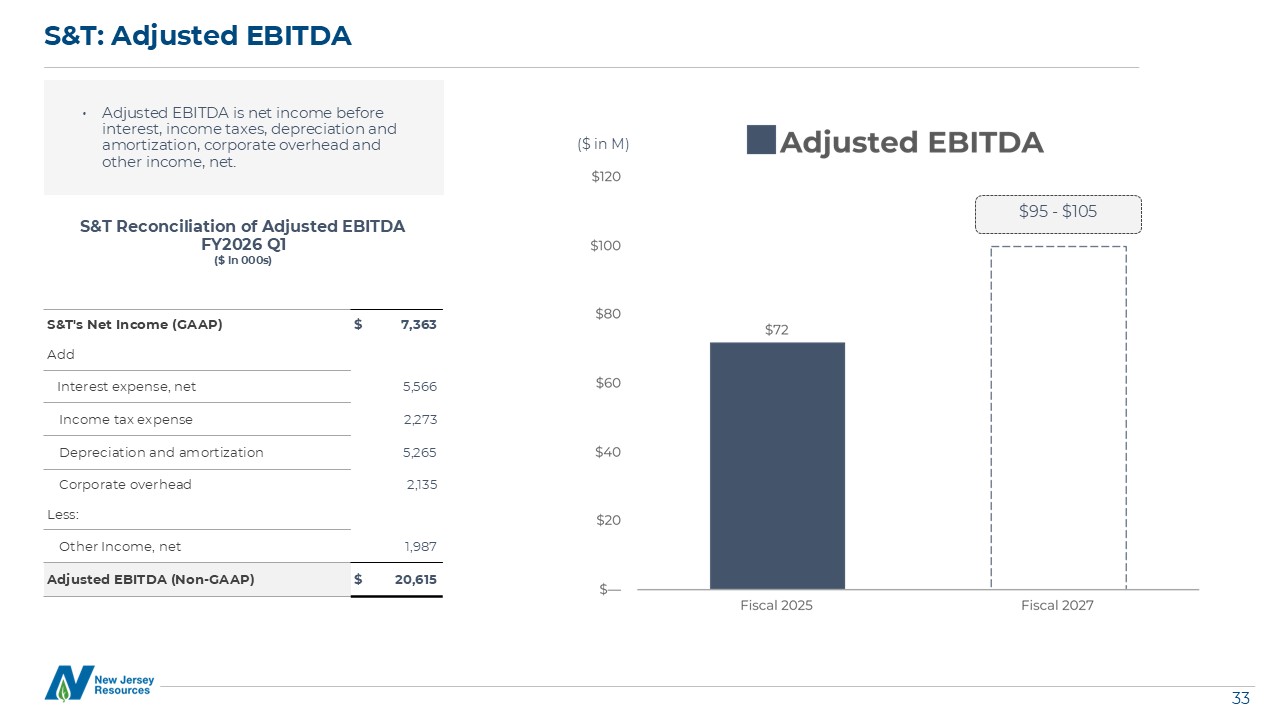

S&T: Adjusted EBITDA Adjusted EBITDA is net income before interest,

income taxes, depreciation and amortization, corporate overhead and other income, net. S&T's Net Income (GAAP) $ 7,363 Add Interest expense, net 5,566 Income tax expense 2,273 Depreciation and amortization 5,265

Corporate overhead 2,135 Less: Other Income, net 1,987 Adjusted EBITDA (Non-GAAP) $ 20,615 S&T Reconciliation of Adjusted EBITDA FY2026 Q1 ($ in 000s) ($ in M) $95 - $105

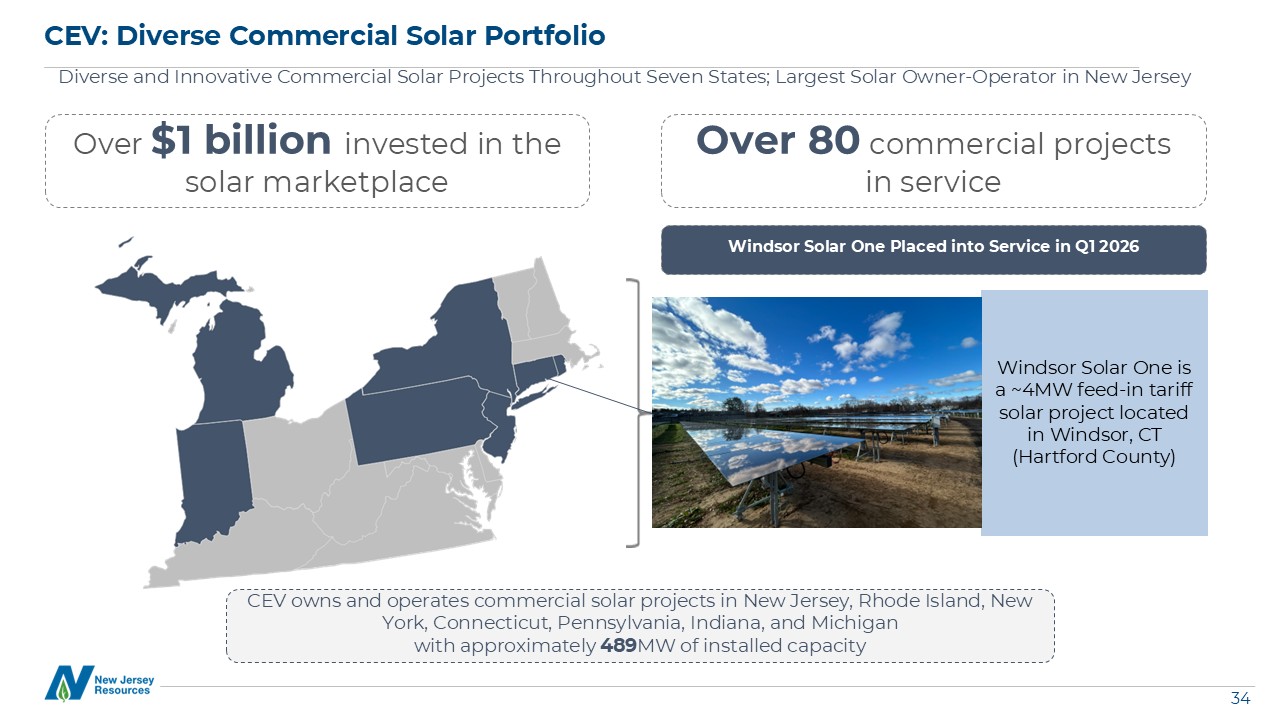

CEV: Diverse Commercial Solar Portfolio Diverse and Innovative Commercial

Solar Projects Throughout Seven States; Largest Solar Owner-Operator in New Jersey CEV owns and operates commercial solar projects in New Jersey, Rhode Island, New York, Connecticut, Pennsylvania, Indiana, and Michigan with approximately

489MW of installed capacity Over $1 billion invested in the solar marketplace Over 80 commercial projects in service Windsor Solar One Placed into Service in Q1 2026 Windsor Solar One is a ~4MW feed-in tariff solar project located

in Windsor, CT (Hartford County)

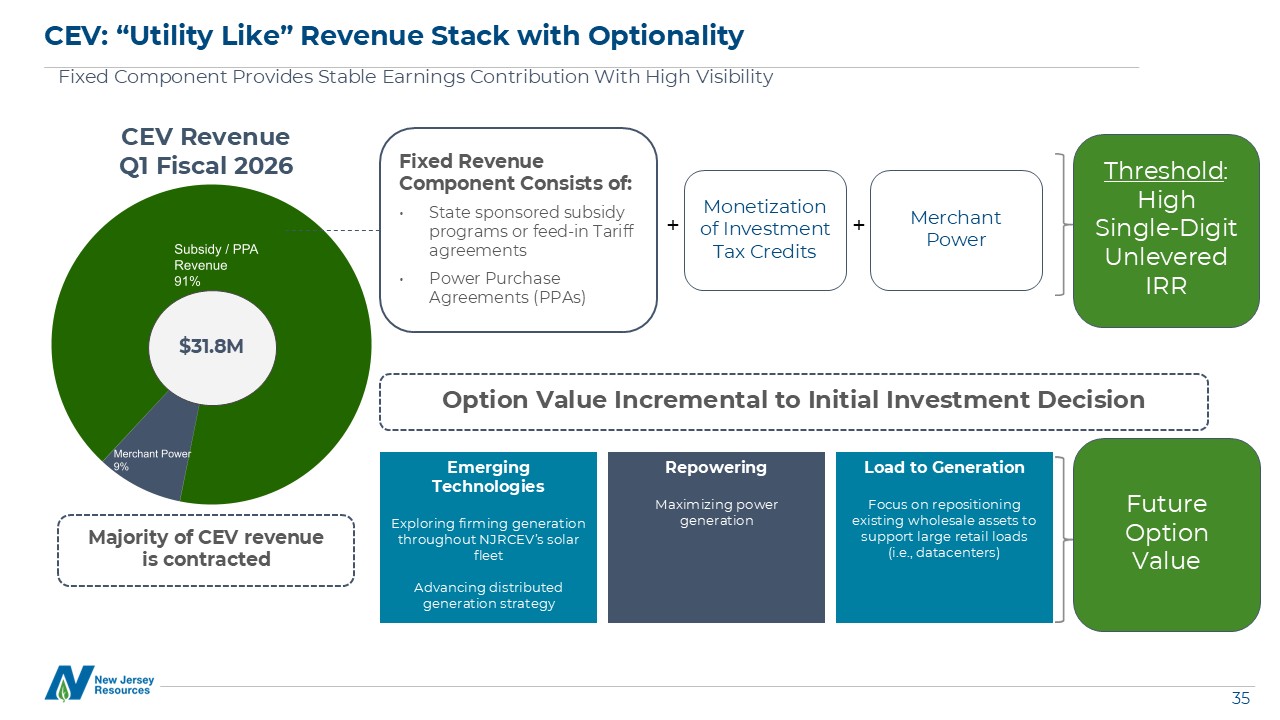

CEV: “Utility Like” Revenue Stack with Optionality Fixed Component Provides

Stable Earnings Contribution With High Visibility CEV Revenue Q1 Fiscal 2026 Majority of CEV revenue is contracted Fixed Revenue Component Consists of: State sponsored subsidy programs or feed-in Tariff agreements Power Purchase

Agreements (PPAs) Monetization of Investment Tax Credits Merchant Power Threshold: High Single-Digit Unlevered IRR + + Option Value Incremental to Initial Investment Decision Emerging Technologies Exploring firming generation

throughout NJRCEV’s solar fleet Advancing distributed generation strategy Repowering Maximizing power generation Future Option Value Load to Generation Focus on repositioning existing wholesale assets to support large retail loads

(i.e., datacenters) $31.8M

36 36 Energy Services (ES) Operates in key market zones across the U.S.,

utilizing pipeline and storage assets to create geographic and seasonal optimization opportunities Maintains a long-option position to generate value Capital-light, Fee-based earnings Cash Generating Service Businesses Support Growth of

Capital Investment 36

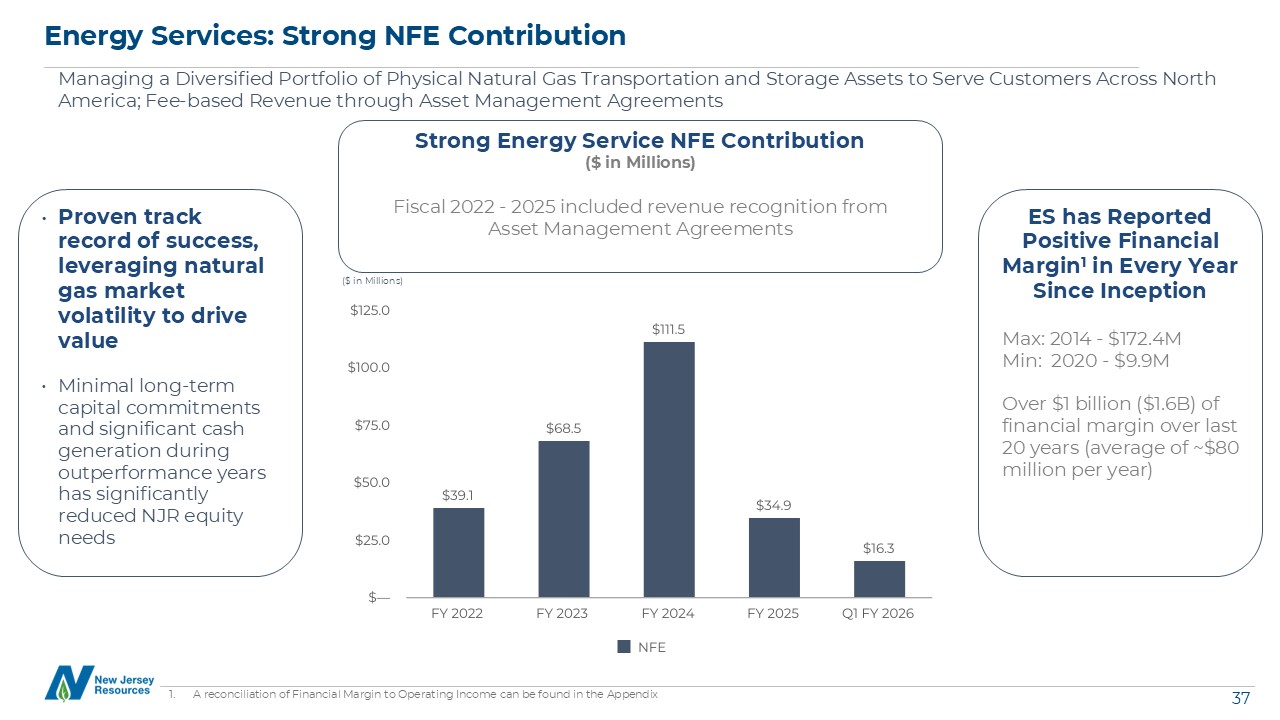

Energy Services: Strong NFE Contribution Managing a Diversified Portfolio of

Physical Natural Gas Transportation and Storage Assets to Serve Customers Across North America; Fee-based Revenue through Asset Management Agreements Proven track record of success, leveraging natural gas market volatility to drive

value Minimal long-term capital commitments and significant cash generation during outperformance years has significantly reduced NJR equity needs A reconciliation of Financial Margin to Operating Income can be found in the

Appendix Strong Energy Service NFE Contribution ($ in Millions) Fiscal 2022 - 2025 included revenue recognition from Asset Management Agreements ES has Reported Positive Financial Margin1 in Every Year Since Inception Max: 2014 -

$172.4M Min: 2020 - $9.9M Over $1 billion ($1.6B) of financial margin over last 20 years (average of ~$80 million per year) ($ in Millions)

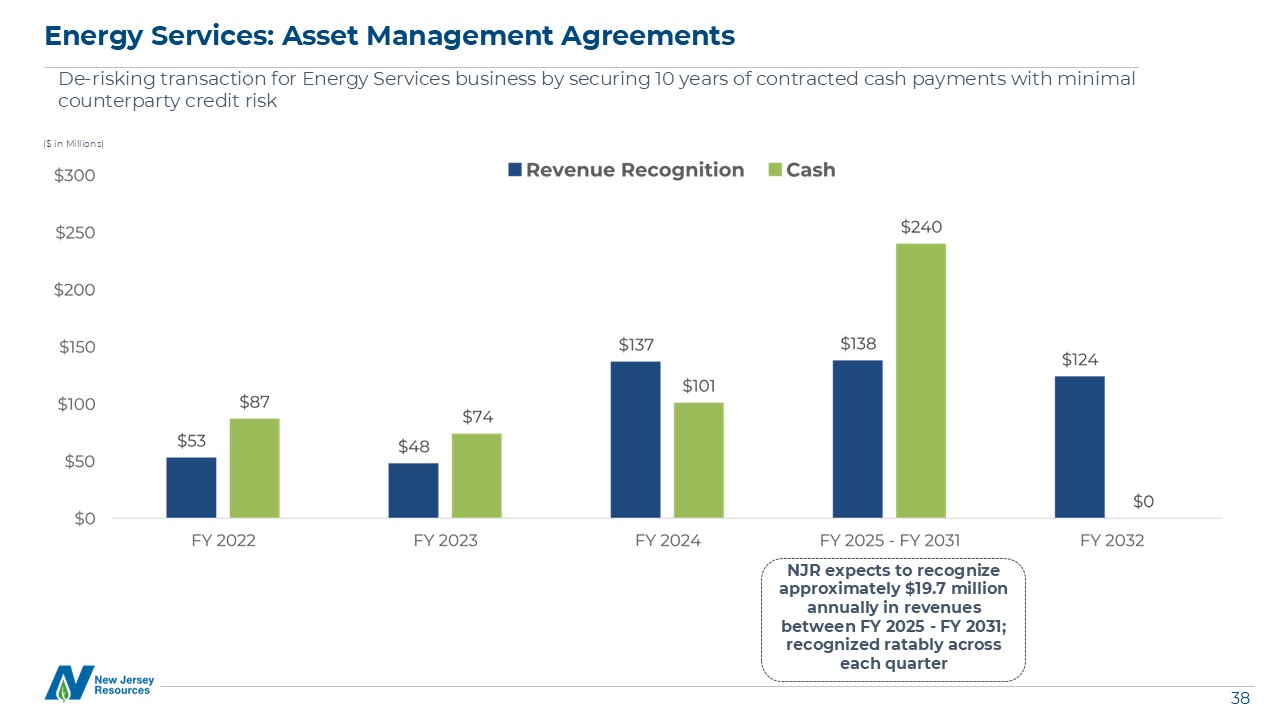

Energy Services: Asset Management Agreements De-risking transaction for

Energy Services business by securing 10 years of contracted cash payments with minimal counterparty credit risk NJR expects to recognize approximately $19.7 million annually in revenues between FY 2025 - FY 2031; recognized ratably across

each quarter ($ in Millions)

Home Services (NJRHS) Delivering Home Comfort Solutions ~ 150 licensed

technicians, installers, plumbers, electricians and skilled workers Provides residential service contracts for heating, cooling, water heating, electrical and standby generators Equipment sales and installations, plumbing and

electrical services and repairs and indoor air quality products Ruud Top Twenty Pro Partner Contractor for the 9th consecutive year Completed 79,000 service calls and 4,000 HVAC, plumbing and generator installations in Fiscal

2025 Maintains a nearly five-star customer satisfaction rating* * Rating determined by Shopper Approved. See njrhomeservices.com/reviews for more information. Cash Generating Service Businesses Support Growth of Capital Investment

The Transfer Agent and Registrar for the company’s common stock is Broadridge

Corporate Issuer Solutions, Inc. (Broadridge). Shareowners with questions about account activity should contact Broadridge investor relations representatives between 9 a.m. and 6 p.m. ET, Monday through Friday, by calling toll-free

800-817-3955. General written inquiries and address changes may be sent to: Broadridge Corporate Issuer Solutions P.O. Box 1342, Brentwood, NY 11717 or For certified and overnight delivery: Broadridge Corporate Issuer Solutions, ATTN:

IWS 1155 Long Island Avenue, Edgewood, NY 11717 Shareowners can view their account information online at shareholder.broadridge.com/NJR. Website: www.njresources.com Investor Relations: New Jersey Resources Investor

Relations Contact Information Adam Prior Director, Investor Relations 732-938-1145 aprior@njresources.com 1415 Wyckoff Road Wall, NJ 07719 (732) 938-1000 www.njresources.com Corporate Headquarters Online Information Shareholder

and Online Information Stock Transfer Agent and Registrar