z INVESTOR PRESENTATION Data as of or for the period ended September 30, 2025 unless otherwise noted

Forward-Looking Statements 2 This presentation may contain forward-looking statements with respect to Fulton Financial Corporation's (the "Corporation“ or “Fulton”) financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s "2025 Operating Guidance" contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2024, Quarterly Reports on Form 10-Q for the quarters ending March 31, 2025 and June 30, 2025 and other periodic reports, which have been, or will be, filed with the Securities and Exchange Commission (the "SEC") and are, or will be, available in the Investor Relations section of the Corporation’s website (www.fultonbank.com) and on the SEC’s website (www.sec.gov). The Corporation uses certain financial measures in this presentation that have been derived by methods other than generally accepted accounting principles ("GAAP"). These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation.

QUARTERLY FINANCIAL PERFORMANCE

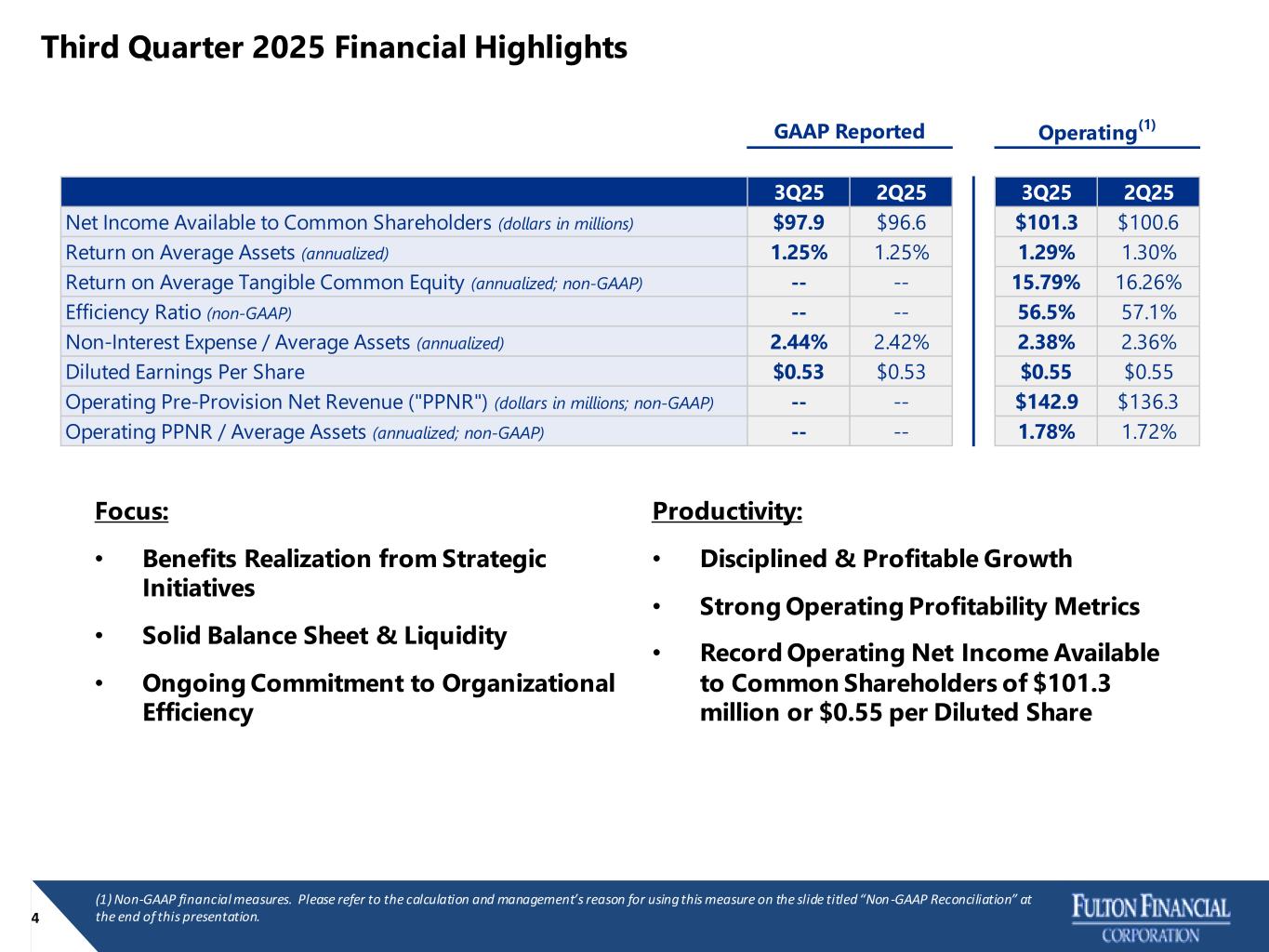

4 Third Quarter 2025 Financial Highlights (1) Non-GAAP financial measures. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non -GAAP Reconciliation” at the end of this presentation. Productivity: • Disciplined & Profitable Growth • Strong Operating Profitability Metrics • Record Operating Net Income Available to Common Shareholders of $101.3 million or $0.55 per Diluted Share Focus: • Benefits Realization from Strategic Initiatives • Solid Balance Sheet & Liquidity • Ongoing Commitment to Organizational Efficiency 3Q25 2Q25 3Q25 2Q25 Net Income Available to Common Shareholders (dollars in millions) $97.9 $96.6 $101.3 $100.6 Return on Average Assets (annualized) 1.25% 1.25% 1.29% 1.30% Return on Average Tangible Common Equity (annualized; non-GAAP) -- -- 15.79% 16.26% Efficiency Ratio (non-GAAP) -- -- 56.5% 57.1% Non-Interest Expense / Average Assets (annualized) 2.44% 2.42% 2.38% 2.36% Diluted Earnings Per Share $0.53 $0.53 $0.55 $0.55 Operating Pre-Provision Net Revenue ("PPNR") (dollars in millions; non-GAAP) -- -- $142.9 $136.3 Operating PPNR / Average Assets (annualized; non-GAAP) -- -- 1.78% 1.72% GAAP Reported Operating (1)

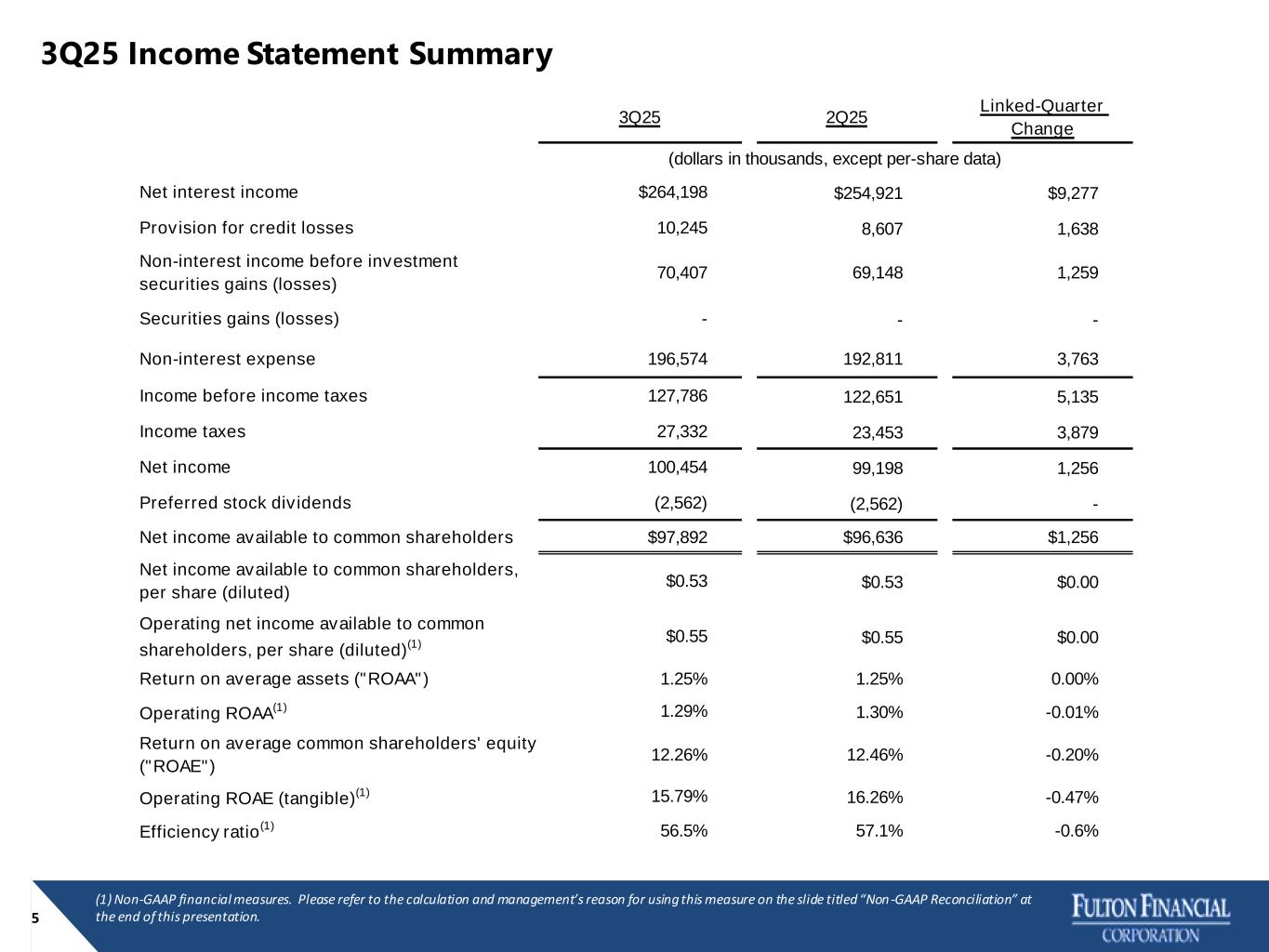

3Q25 Income Statement Summary 5 (1) Non-GAAP financial measures. Please refer to the calculation and management’s reason for using this measure on the slide titled “Non -GAAP Reconciliation” at the end of this presentation. 3Q25 2Q25 Linked-Quarter Change Net interest income $264,198 $254,921 $9,277 Provision for credit losses 10,245 8,607 1,638 Non-interest income before investment securities gains (losses) 70,407 69,148 1,259 Securities gains (losses) - - - Non-interest expense 196,574 192,811 3,763 Income before income taxes 127,786 122,651 5,135 Income taxes 27,332 23,453 3,879 Net income 100,454 99,198 1,256 Preferred stock dividends (2,562) (2,562) - Net income available to common shareholders $97,892 $96,636 $1,256 Net income available to common shareholders, per share (diluted) $0.53 $0.53 $0.00 Operating net income available to common shareholders, per share (diluted)(1) $0.55 $0.55 $0.00 Return on average assets ("ROAA") 1.25% 1.25% 0.00% Operating ROAA(1) 1.29% 1.30% -0.01% Return on average common shareholders' equity ("ROAE") 12.26% 12.46% -0.20% Operating ROAE (tangible)(1) 15.79% 16.26% -0.47% Efficiency ratio(1) 56.5% 57.1% -0.6% (dollars in thousands, except per-share data)

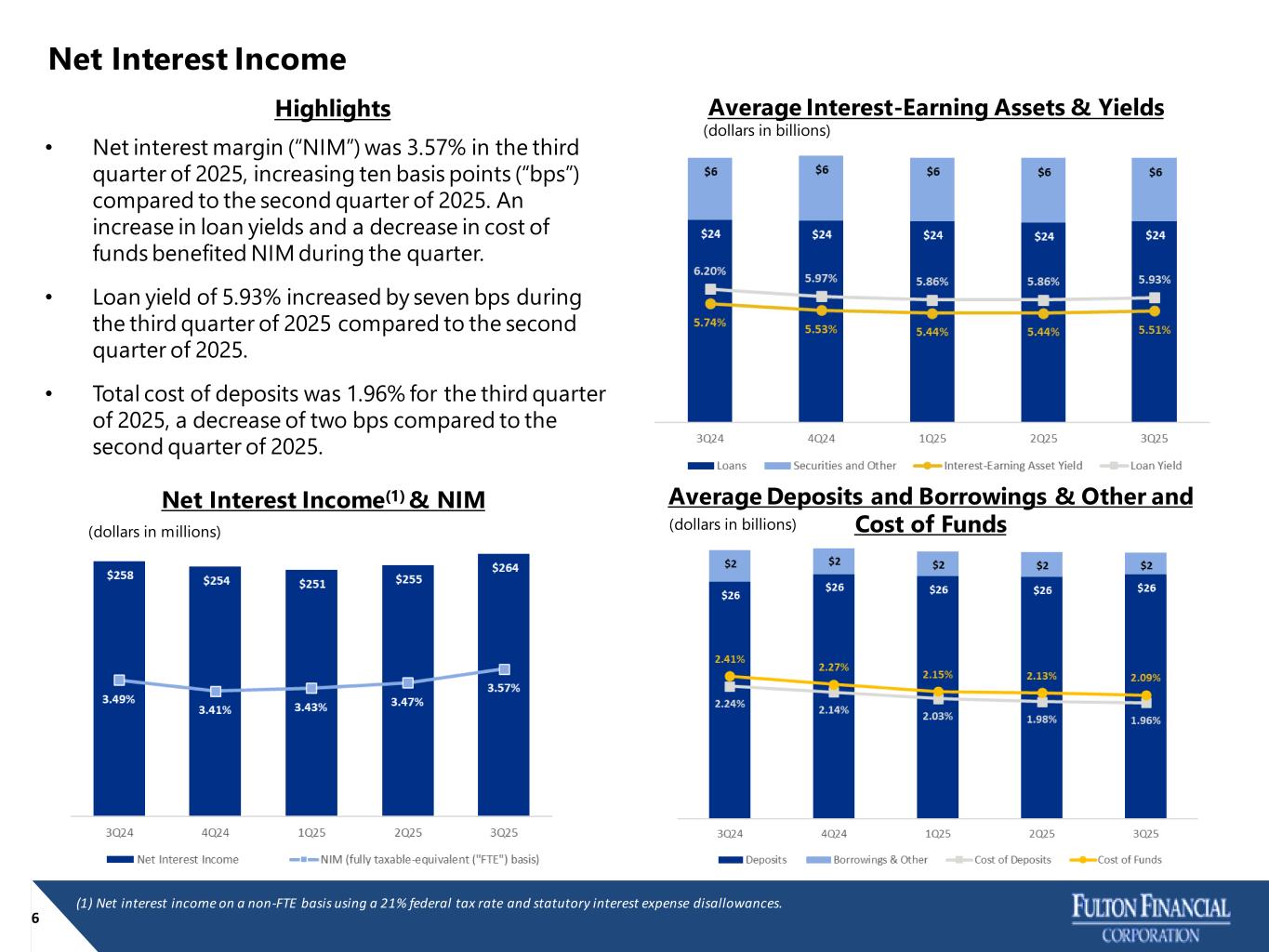

Net Interest Income 6 (1) Net interest income on a non-FTE basis using a 21% federal tax rate and statutory interest expense disallowances. • Net interest margin (“NIM”) was 3.57% in the third quarter of 2025, increasing ten basis points (“bps”) compared to the second quarter of 2025. An increase in loan yields and a decrease in cost of funds benefited NIM during the quarter. • Loan yield of 5.93% increased by seven bps during the third quarter of 2025 compared to the second quarter of 2025. • Total cost of deposits was 1.96% for the third quarter of 2025, a decrease of two bps compared to the second quarter of 2025. Highlights Net Interest Income(1) & NIM Average Deposits and Borrowings & Other and Cost of Funds Average Interest-Earning Assets & Yields (dollars in millions) (dollars in billions) (dollars in billions)

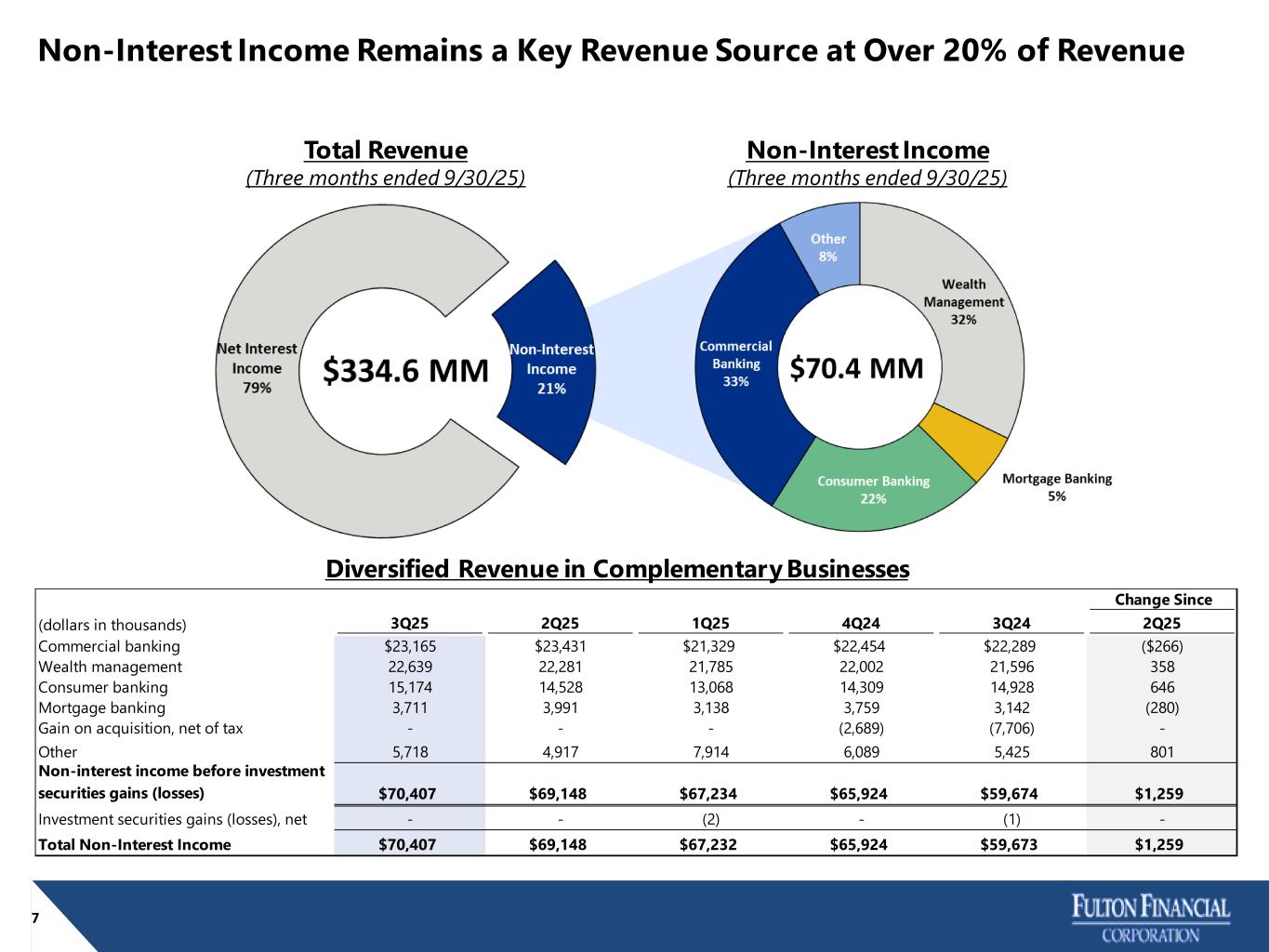

Non-Interest Income Remains a Key Revenue Source at Over 20% of Revenue 7 Total Revenue (Three months ended 9/30/25) Non-Interest Income (Three months ended 9/30/25) Diversified Revenue in Complementary Businesses Change Since (dollars in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 2Q25 Commercial banking $23,165 $23,431 $21,329 $22,454 $22,289 ($266) Wealth management 22,639 22,281 21,785 22,002 21,596 358 Consumer banking 15,174 14,528 13,068 14,309 14,928 646 Mortgage banking 3,711 3,991 3,138 3,759 3,142 (280) Gain on acquisition, net of tax - - - (2,689) (7,706) - Other 5,718 4,917 7,914 6,089 5,425 801 Non-interest income before investment securities gains (losses) $70,407 $69,148 $67,234 $65,924 $59,674 $1,259 Investment securities gains (losses), net - - (2) - (1) - Total Non-Interest Income $70,407 $69,148 $67,232 $65,924 $59,673 $1,259

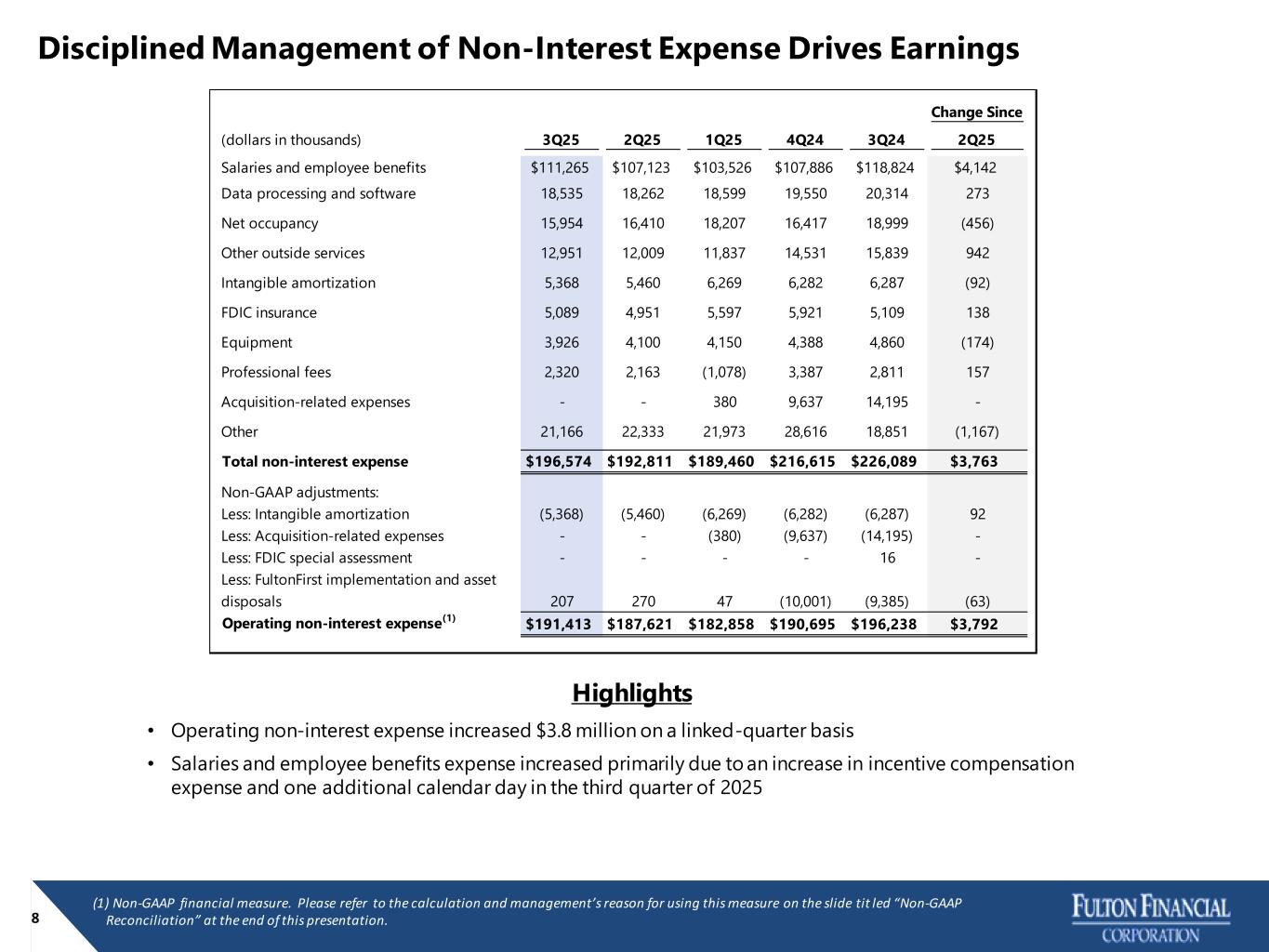

Disciplined Management of Non-Interest Expense Drives Earnings 8 (1) Non-GAAP financial measure. Please refer to the calculation and management’s reason for using this measure on the slide tit led “Non-GAAP Reconciliation” at the end of this presentation. Highlights • Operating non-interest expense increased $3.8 million on a linked-quarter basis • Salaries and employee benefits expense increased primarily due to an increase in incentive compensation expense and one additional calendar day in the third quarter of 2025 (dollars in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 2Q25 Salaries and employee benefits $111,265 $107,123 $103,526 $107,886 $118,824 $4,142 Data processing and software 18,535 18,262 18,599 19,550 20,314 273 Net occupancy 15,954 16,410 18,207 16,417 18,999 (456) Other outside services 12,951 12,009 11,837 14,531 15,839 942 Intangible amortization 5,368 5,460 6,269 6,282 6,287 (92) FDIC insurance 5,089 4,951 5,597 5,921 5,109 138 Equipment 3,926 4,100 4,150 4,388 4,860 (174) Professional fees 2,320 2,163 (1,078) 3,387 2,811 157 Acquisition-related expenses - - 380 9,637 14,195 - Other 21,166 22,333 21,973 28,616 18,851 (1,167) Total non-interest expense $196,574 $192,811 $189,460 $216,615 $226,089 $3,763 Non-GAAP adjustments: Less: Intangible amortization (5,368) (5,460) (6,269) (6,282) (6,287) 92 Less: Acquisition-related expenses - - (380) (9,637) (14,195) - Less: FDIC special assessment - - - - 16 - Less: FultonFirst implementation and asset disposals 207 270 47 (10,001) (9,385) (63) Operating non-interest expense(1) $191,413 $187,621 $182,858 $190,695 $196,238 $3,792 Change Since

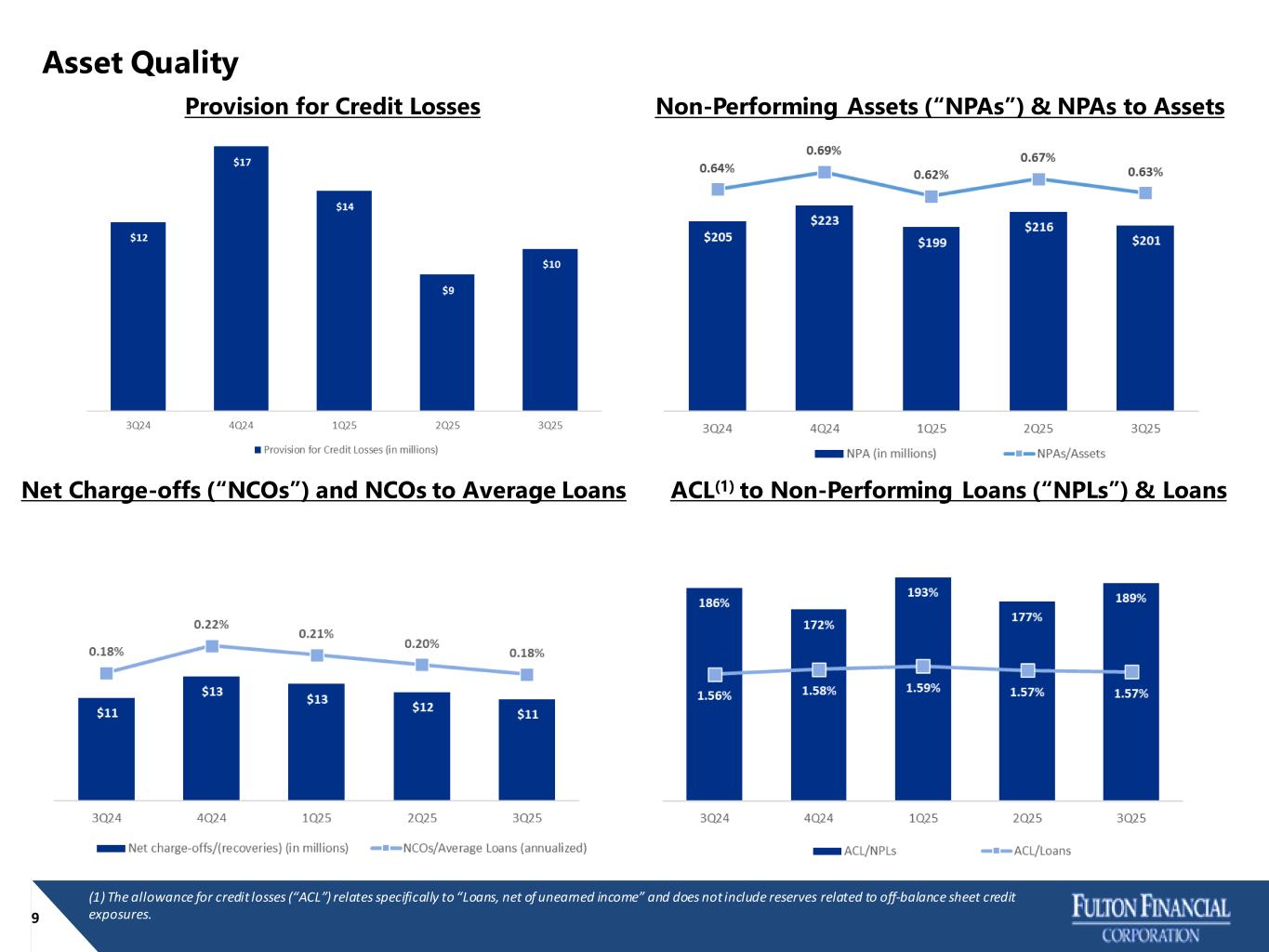

Asset Quality (1) The allowance for credit losses (“ACL”) relates specifically to “Loans, net of unearned income” and does not include reserves related to off-balance sheet credit exposures.9 Provision for Credit Losses Non-Performing Assets (“NPAs”) & NPAs to Assets Net Charge-offs (“NCOs”) and NCOs to Average Loans ACL(1) to Non-Performing Loans (“NPLs”) & Loans

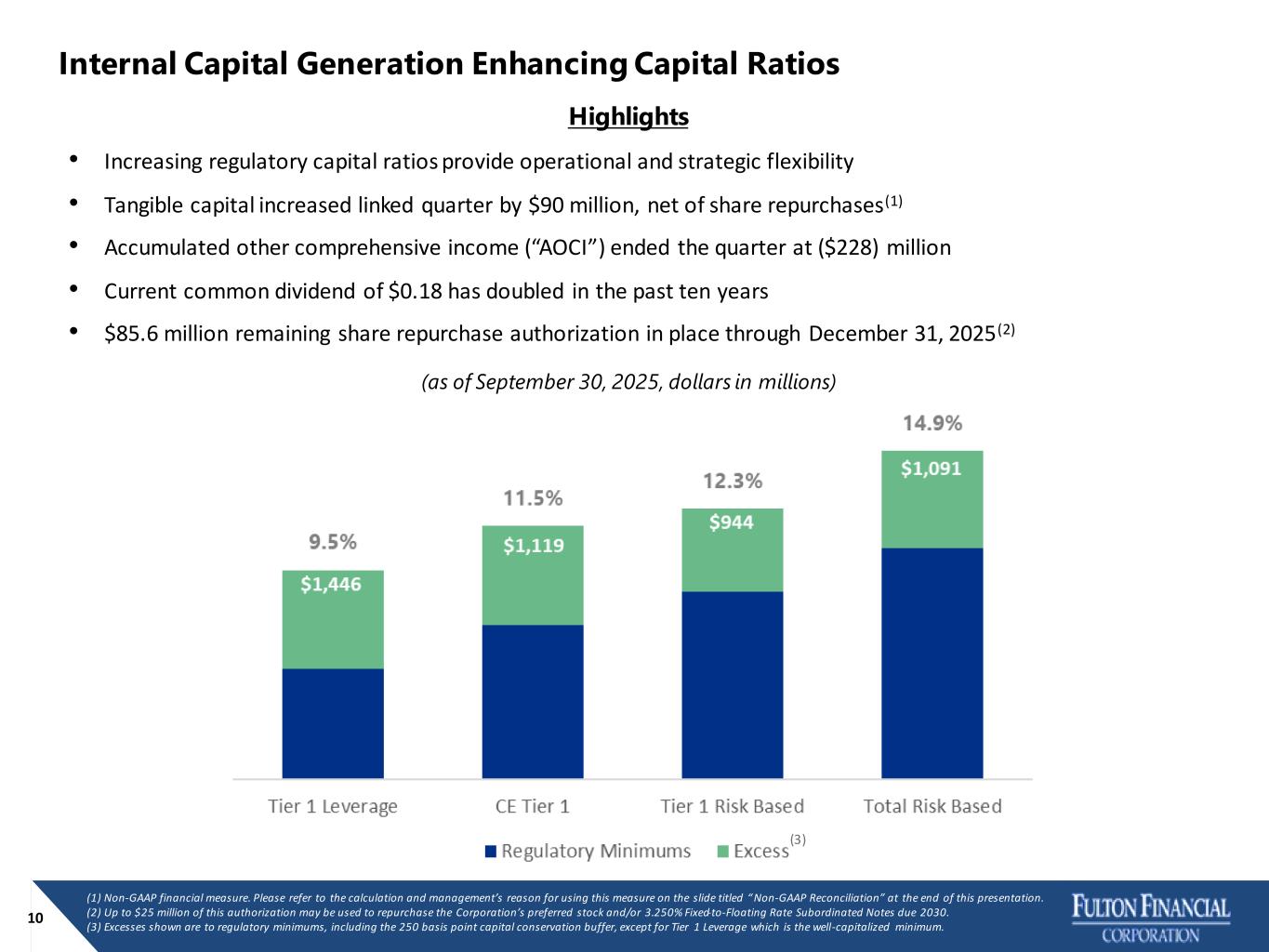

10 Internal Capital Generation Enhancing Capital Ratios • Increasing regulatory capital ratios provide operational and strategic flexibility • Tangible capital increased linked quarter by $90 million, net of share repurchases(1) • Accumulated other comprehensive income (“AOCI”) ended the quarter at ($228) million • Current common dividend of $0.18 has doubled in the past ten years • $85.6 million remaining share repurchase authorization in place through December 31, 2025(2) (1) Non-GAAP financial measure. Please refer to the calculation and management’s reason for using this measure on the slide titled “ Non-GAAP Reconciliation” at the end of this presentation. (2) Up to $25 million of this authorization may be used to repurchase the Corporation’s preferred stock and/or 3.250% Fixed-to-Floating Rate Subordinated Notes due 2030. (3) Excesses shown are to regulatory minimums, including the 250 basis point capital conservation buffer, except for Tier 1 Leverage which is the well-capitalized minimum. (3) (as of September 30, 2025, dollars in millions) Highlights

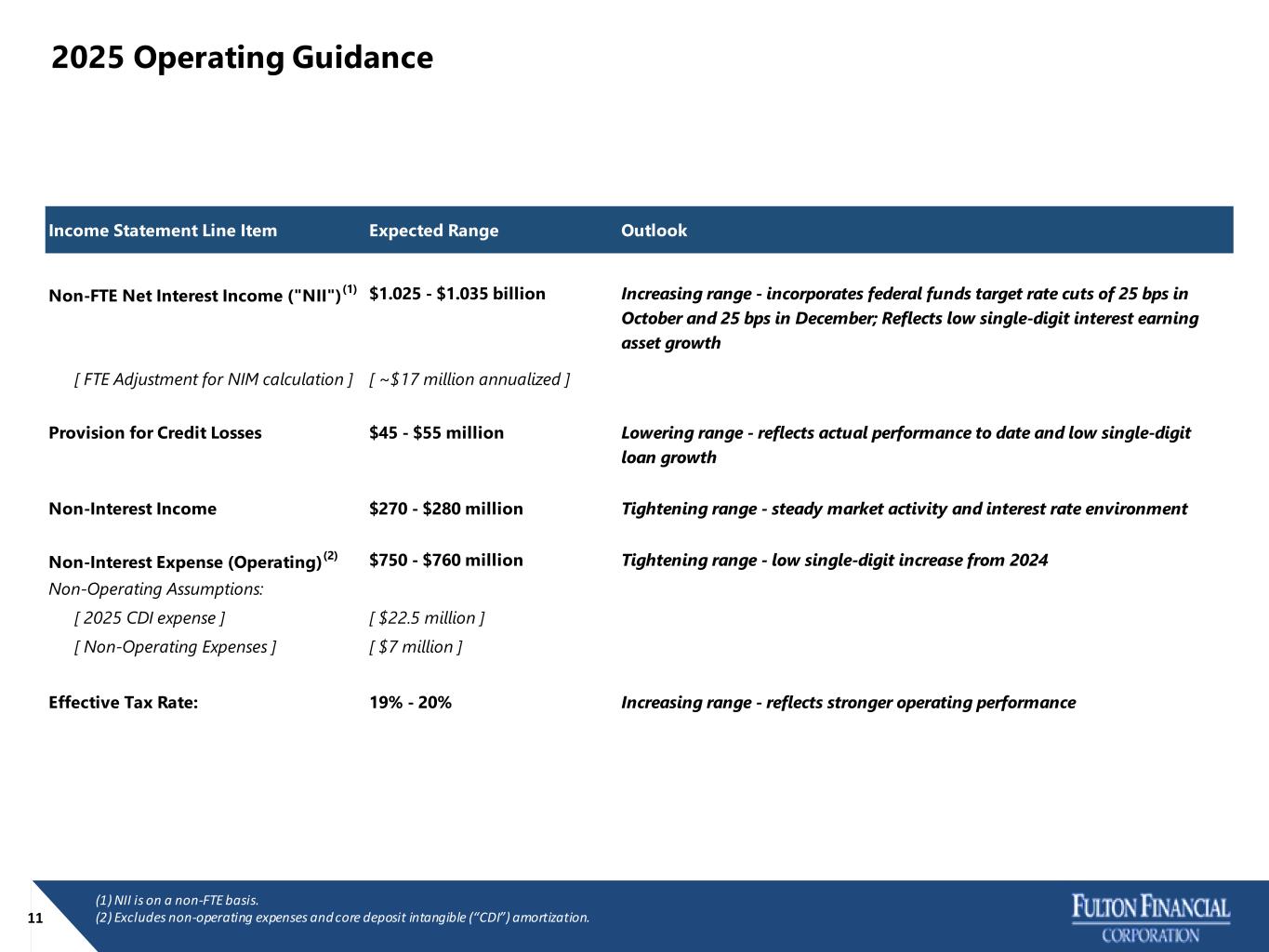

11 2025 Operating Guidance (1) NII is on a non-FTE basis. (2) Excludes non-operating expenses and core deposit intangible (“CDI”) amortization. Income Statement Line Item Expected Range Outlook Non-FTE Net Interest Income ("NII") (1) $1.025 - $1.035 billion Increasing range - incorporates federal funds target rate cuts of 25 bps in October and 25 bps in December; Reflects low single-digit interest earning asset growth [ FTE Adjustment for NIM calculation ] [ ~$17 million annualized ] Provision for Credit Losses $45 - $55 million Lowering range - reflects actual performance to date and low single-digit loan growth Non-Interest Income $270 - $280 million Tightening range - steady market activity and interest rate environment Non-Interest Expense (Operating) (2) $750 - $760 million Tightening range - low single-digit increase from 2024 Non-Operating Assumptions: [ 2025 CDI expense ] [ $22.5 million ] [ Non-Operating Expenses ] [ $7 million ] Effective Tax Rate: 19% - 20% Increasing range - reflects stronger operating performance

CORPORATE HIGHLIGHTS

A Community Bank Strategy, Operating on a Regional Scale 13 Our Differentiator: Customer Intimacy Execution of our Strategic Objectives has provided us with long-term growth in customers, exceptional customer experience, enhanced operational metrics, delivering results to our stakeholders Our Strategic Objectives

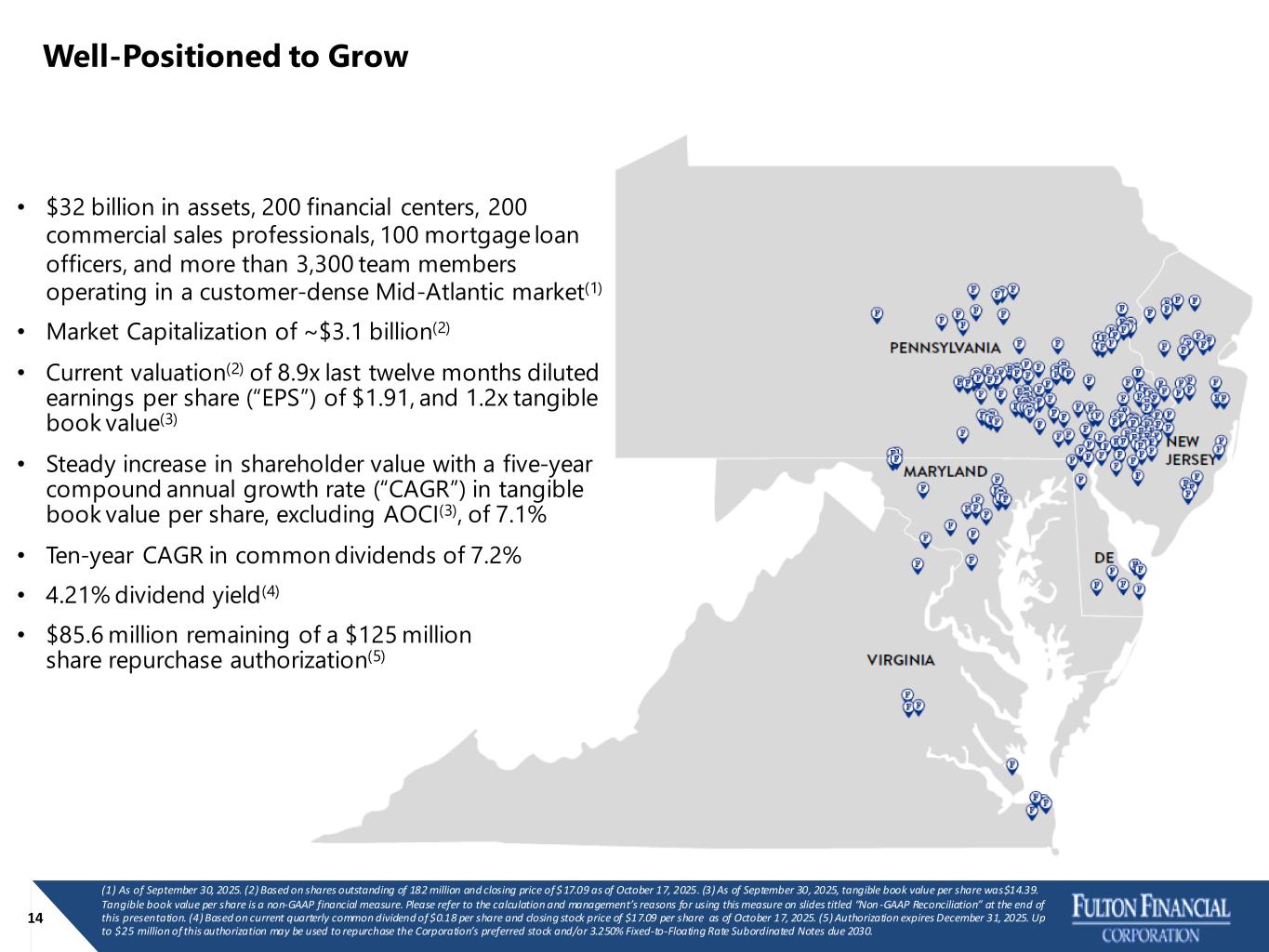

• $32 billion in assets, 200 financial centers, 200 commercial sales professionals, 100 mortgage loan officers, and more than 3,300 team members operating in a customer-dense Mid-Atlantic market(1) • Market Capitalization of ~$3.1 billion(2) • Current valuation(2) of 8.9x last twelve months diluted earnings per share (“EPS”) of $1.91, and 1.2x tangible book value(3) • Steady increase in shareholder value with a five-year compound annual growth rate (“CAGR”) in tangible book value per share, excluding AOCI(3), of 7.1% • Ten-year CAGR in common dividends of 7.2% • 4.21% dividend yield(4) • $85.6 million remaining of a $125 million share repurchase authorization(5) 14 Well-Positioned to Grow (1) As of September 30, 2025. (2) Based on shares outstanding of 182 million and closing price of $17.09 as of October 17, 2025. (3) As of September 30, 2025, tangible book value per share was$14.39. Tangible book value per share is a non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on slides titled “Non -GAAP Reconciliation” at the end of this presentation. (4) Based on current quarterly common dividend of $0.18 per share and closing stock price of $17.09 per share as of October 17, 2025. (5) Authorization expires December 31, 2025. Up to $25 million of this authorization may be used to repurchase the Corporation’s preferred stock and/or 3.250% Fixed-to-Floating Rate Subordinated Notes due 2030.

With a Robust and Scalable Product Suite Well positioned to compete in and serve our market • Significant technology spend over the past five years o New commercial origination system, new mortgage origination system, new mortgage loan servicing system, new consumer origination system, new customer relationship management system o Focus on digital enablement as a driver of growth, efficiency and service 15

16 We Do What Is Right Corporate Social Responsibility • Our most recent Corporate Social Responsibility Report with key metrics is available at www.fultonbank.com/About-Fulton-Bank. • Integrity is fundamental to governance at Fulton. The Corporation’s established Board governance and oversight support management’s efforts to build maturity and capability that drives impact. • The Climate Impact Working Group underscores the Corporation’s commitment to progressing its understanding of, and reporting on, climate-related risks and activities. READ THE REPORT Protecting the Environment Changing Lives for the Better Corporate Governance Environment The Corporation is committed to practicing environmental stewardship in its everyday operations Operational measures like waste reduction and smart energy use, as well as financing sustainable projects, are core to these efforts Governance Core values and guiding behavior lead the Corporation to demonstrate the highest professional and ethical standards in all business activities The Corporation operates under a robust board- and management-level enterprise risk management structure Employees The Corporation is committed to creating a workforce culture that is welcoming, engaging and inclusive Customers Fulton Bank has a proven track record of fair and responsible banking – rated “Outstanding” for Community Reinvestment Act performance Community Employees live and work in the communities we serve and want to see these communities thrive. Through the Fulton Forward® initiative, the Corporation gives back by paying it forward 16

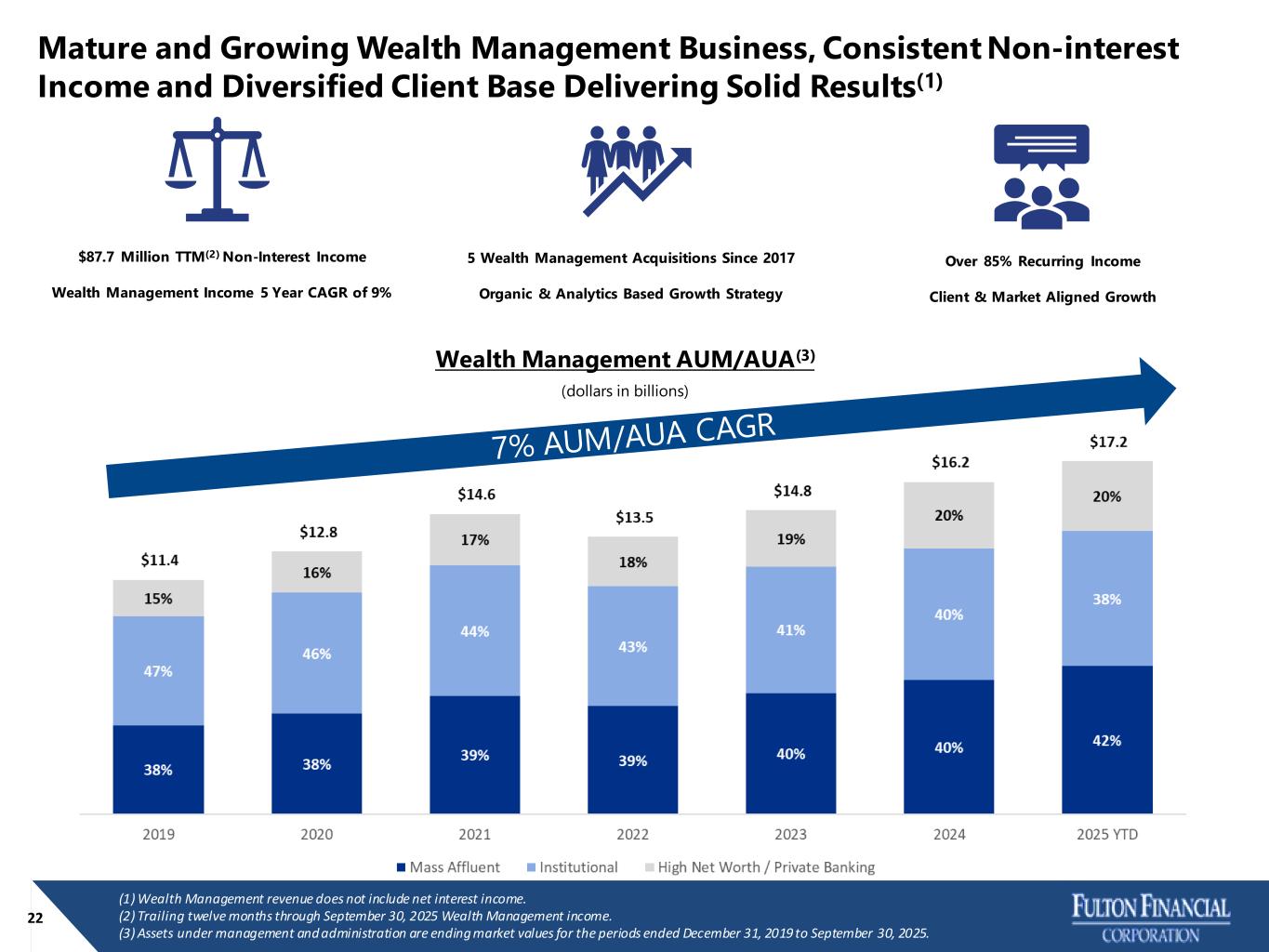

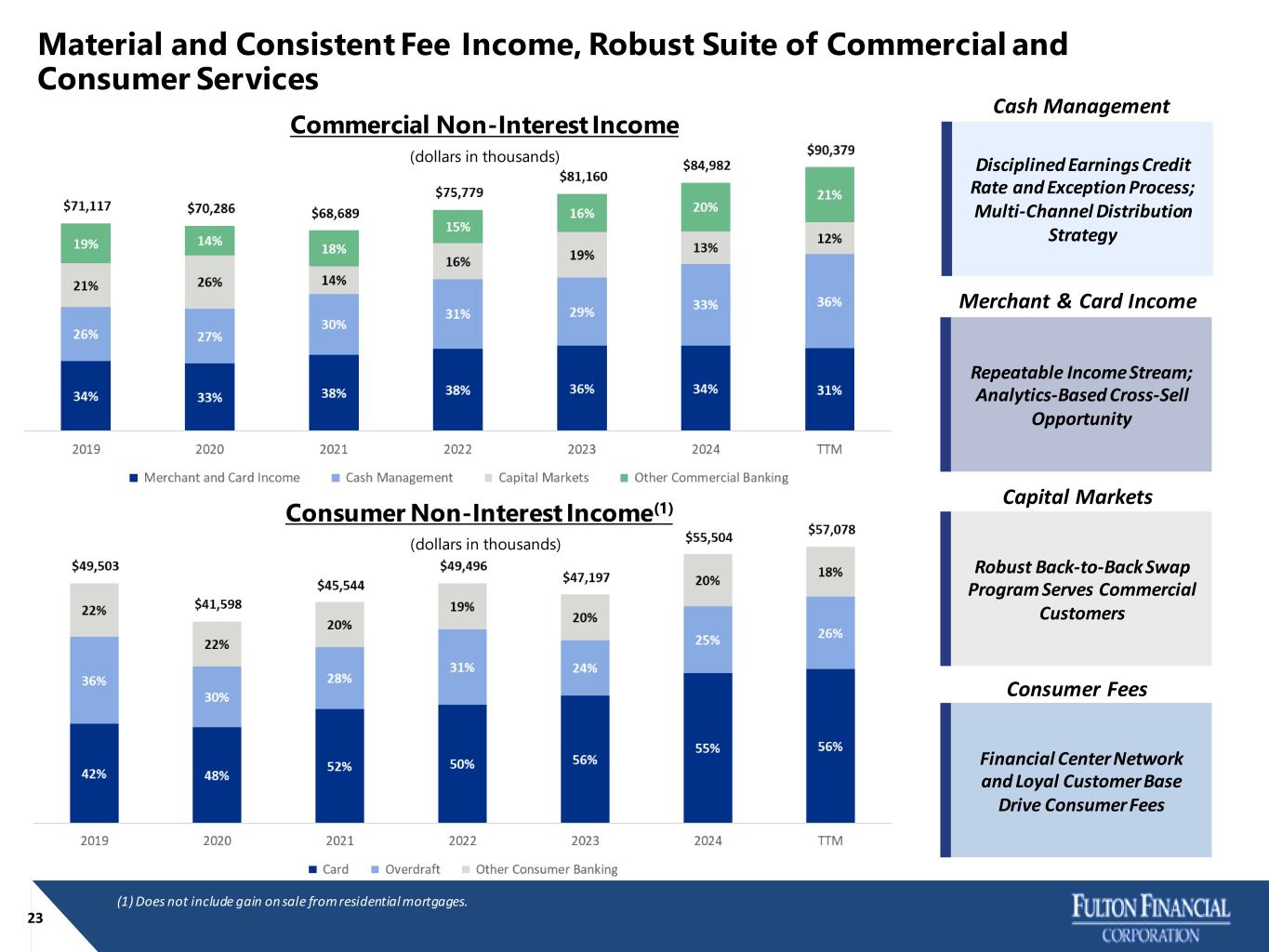

A Balanced Business Model Delivering Strong Returns • Non-interest income as a percentage of revenue of approximately 21% • Wealth management accounts for approximately 1/3 of total non-interest income, delivering a 9% 5-year CAGR, AUM/AUA(1) of $17.2 billion and over 85% in recurring income • Commercial banking businesses representing approximately 1/3 of total non-interest income • Fulton Mortgage Company caters to the new home purchase business with the ability to leverage refinance activity into gain on sale revenue 17 • A full-service commercial bank with robust treasury services, payment technology solutions, wealth management and full-service mortgage company • Ongoing investment in technology, digitally enabling a growing customer base • Serving a diversified, dense and economically stable market • Room to grow in existing markets and continue to penetrate both organically and inorganically • Organic growth strategy supplemented by inorganic, in-market opportunities • Low commercial real estate (“CRE”) concentration compared to peers (2) • Reduced financial center infrastructure over the last ten years, driving average deposits per financial center over $100 million per financial center • Completed $5.2 billion Republic First Bank (“Republic”) transaction in 2024, $1.2 billion acquisition in 2022 and acquired five wealth management firms since 2018 • Operates in a target-rich market with over 40 in-market banking institutions that fit our mergers and acquisitions criteria and strategy • 3Q25 operating diluted EPS of $0.55(3) • Operating return on average assets of 1.29% (3) in 3Q25 compared to 1.30%(3) in 2Q25 • 3Q25 operating return on average tangible common shareholders equity of 15.79% (3) compared to 16.26%(3) in 2Q25 • Efficiency ratio of 56.5%(3) and 57.1%(3) in 3Q25 and 2Q25, respectively • 3Q25 net charge-offs to average loans (annualized) of 18 basis points; allowance for credit losses to loans of 1.57% in addition to on-balance sheet purchase accounting marks Source: Management reporting and internal financials at September 30, 2025. (1) AUM/AUA defined as assets under management and assets under administration. (2) For a list of peers please see page 36 of the Corporation’s proxy statement dated April 1, 2025. (3) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on slides titled “Non -GAAP Reconciliation” at the end of this presentation. Premier Franchise that Provides Expanding and Innovative Solutions Robust Combination of Diversified Business Lines and Fee Income Businesses Dynamic Growth Strategy Blending an Organic Engine with Inorganic Opportunities Attractive Risk- Adjusted Profitability and Returns

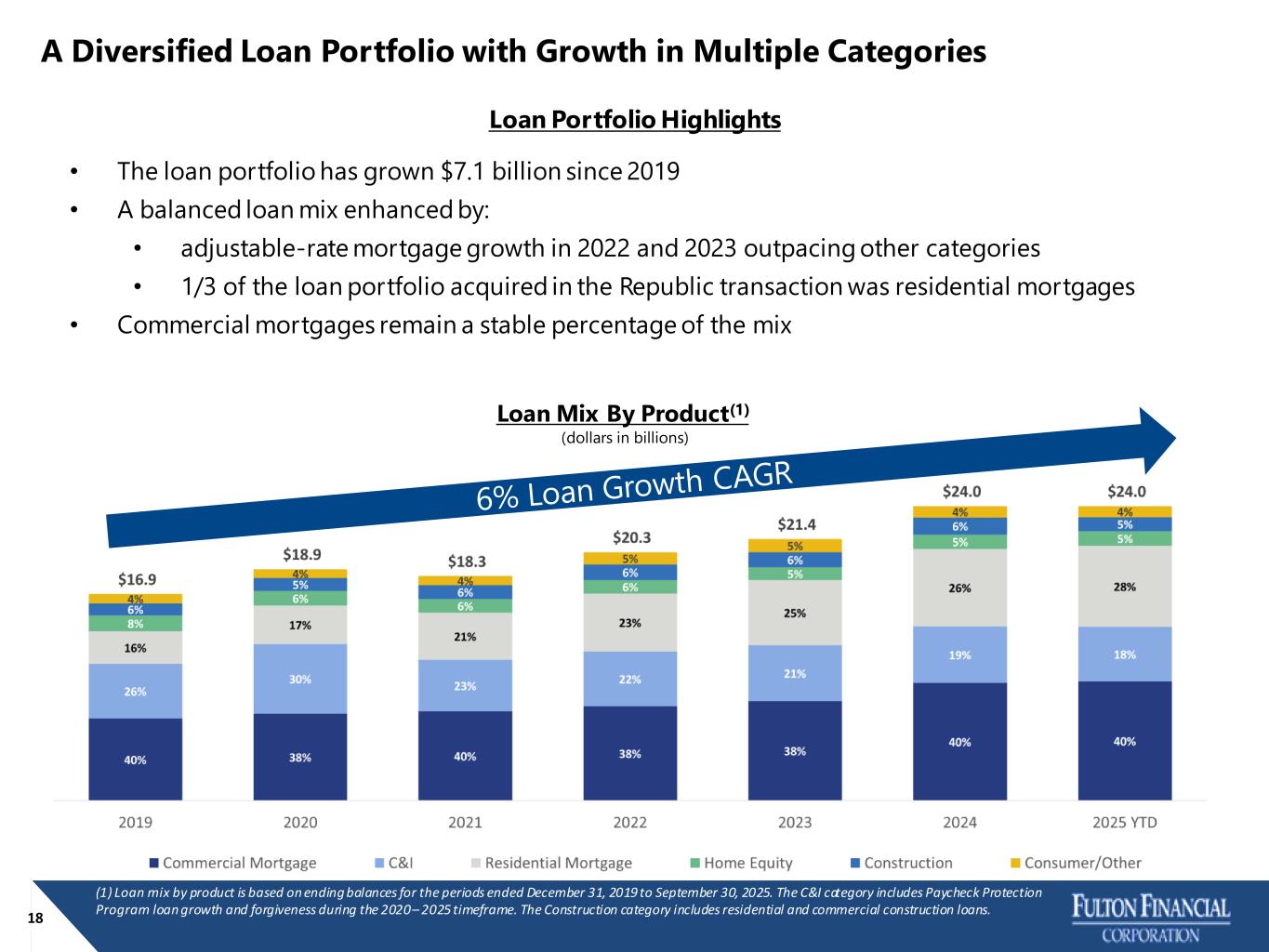

18 A Diversified Loan Portfolio with Growth in Multiple Categories Loan Portfolio Highlights • The loan portfolio has grown $7.1 billion since 2019 • A balanced loan mix enhanced by: • adjustable-rate mortgage growth in 2022 and 2023 outpacing other categories • 1/3 of the loan portfolio acquired in the Republic transaction was residential mortgages • Commercial mortgages remain a stable percentage of the mix (1) Loan mix by product is based on ending balances for the periods ended December 31, 2019 to September 30, 2025. The C&I category includes Paycheck Protection Program loan growth and forgiveness during the 2020 – 2025 timeframe. The Construction category includes residential and commercial construction loans. Loan Mix By Product(1) (dollars in billions)

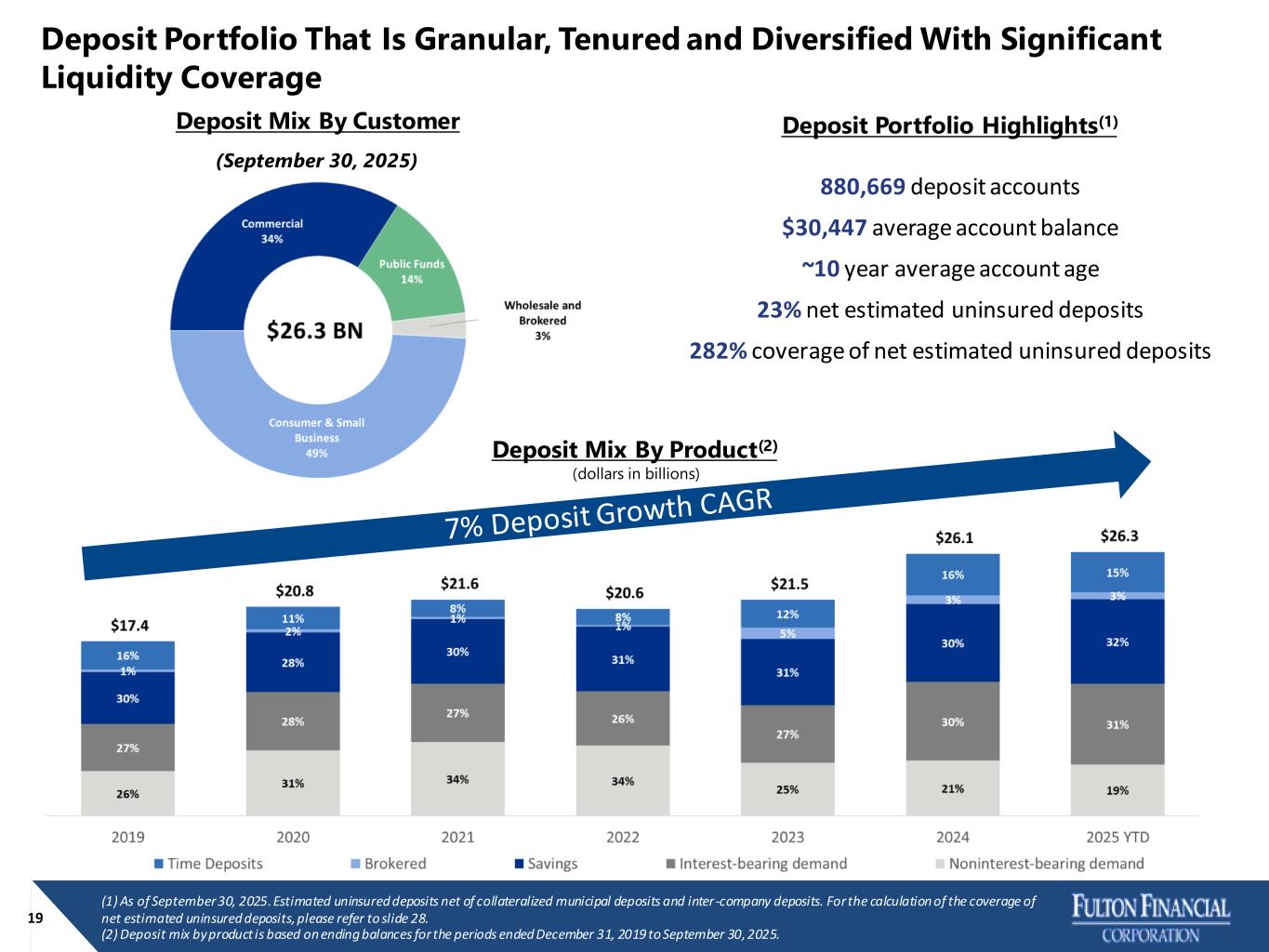

Deposit Portfolio That Is Granular, Tenured and Diversified With Significant Liquidity Coverage 19 (1) As of September 30, 2025. Estimated uninsured deposits net of collateralized municipal deposits and inter-company deposits. For the calculation of the coverage of net estimated uninsured deposits, please refer to slide 28. (2) Deposit mix by product is based on ending balances for the periods ended December 31, 2019 to September 30, 2025. Deposit Mix By Customer (September 30, 2025) Deposit Portfolio Highlights(1) 880,669 deposit accounts $30,447 average account balance ~10 year average account age 23% net estimated uninsured deposits 282% coverage of net estimated uninsured deposits Deposit Mix By Product(2) (dollars in billions)

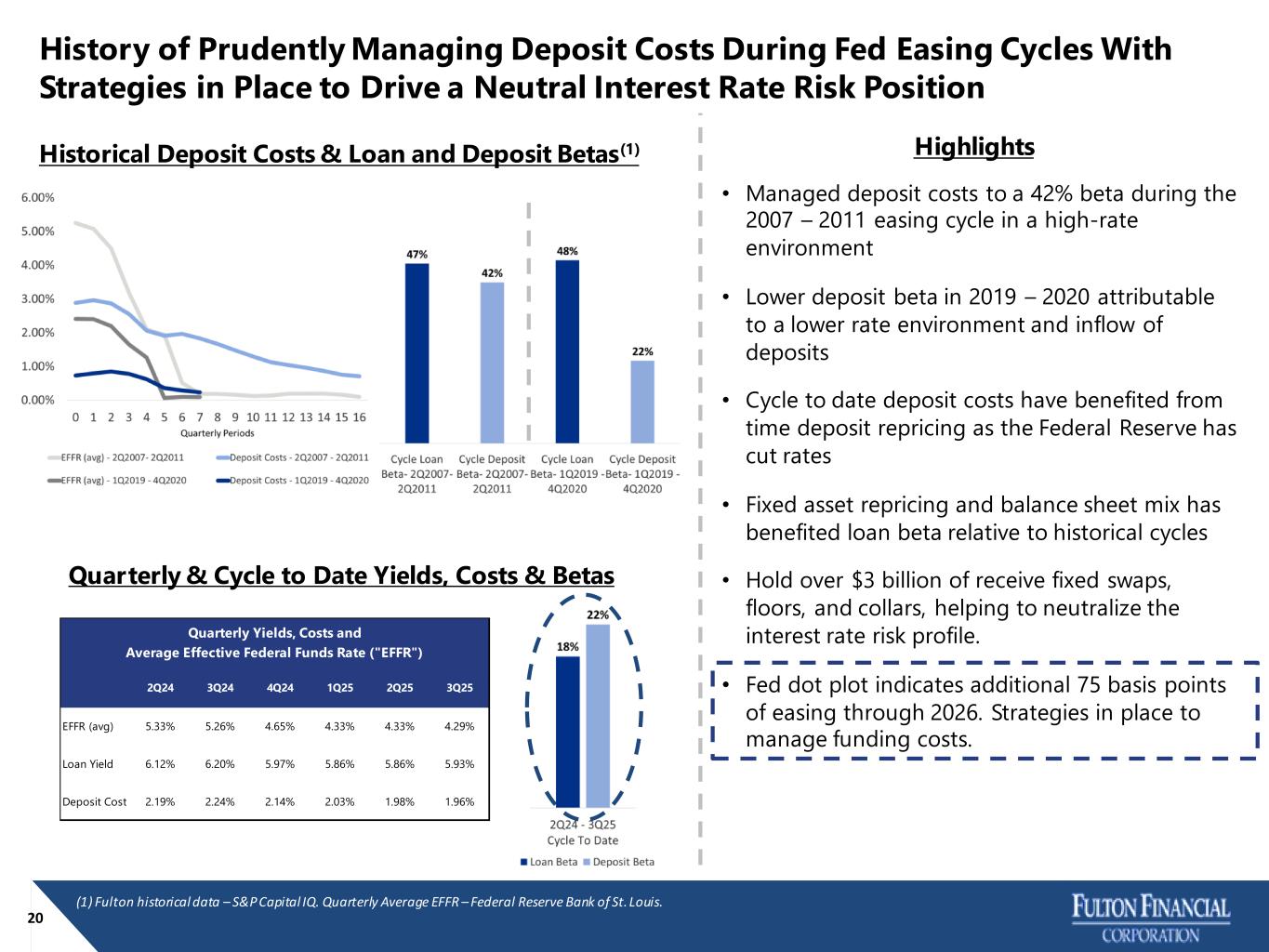

History of Prudently Managing Deposit Costs During Fed Easing Cycles With Strategies in Place to Drive a Neutral Interest Rate Risk Position 20 Quarterly & Cycle to Date Yields, Costs & Betas Historical Deposit Costs & Loan and Deposit Betas(1) • Managed deposit costs to a 42% beta during the 2007 – 2011 easing cycle in a high-rate environment • Lower deposit beta in 2019 – 2020 attributable to a lower rate environment and inflow of deposits • Cycle to date deposit costs have benefited from time deposit repricing as the Federal Reserve has cut rates • Fixed asset repricing and balance sheet mix has benefited loan beta relative to historical cycles • Hold over $3 billion of receive fixed swaps, floors, and collars, helping to neutralize the interest rate risk profile. • Fed dot plot indicates additional 75 basis points of easing through 2026. Strategies in place to manage funding costs. Highlights (1) Fulton historical data – S&P Capital IQ. Quarterly Average EFFR – Federal Reserve Bank of St. Louis. 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 EFFR (avg) 5.33% 5.26% 4.65% 4.33% 4.33% 4.29% Loan Yield 6.12% 6.20% 5.97% 5.86% 5.86% 5.93% Deposit Cost 2.19% 2.24% 2.14% 2.03% 1.98% 1.96% Quarterly Yields, Costs and Average Effective Federal Funds Rate ("EFFR")

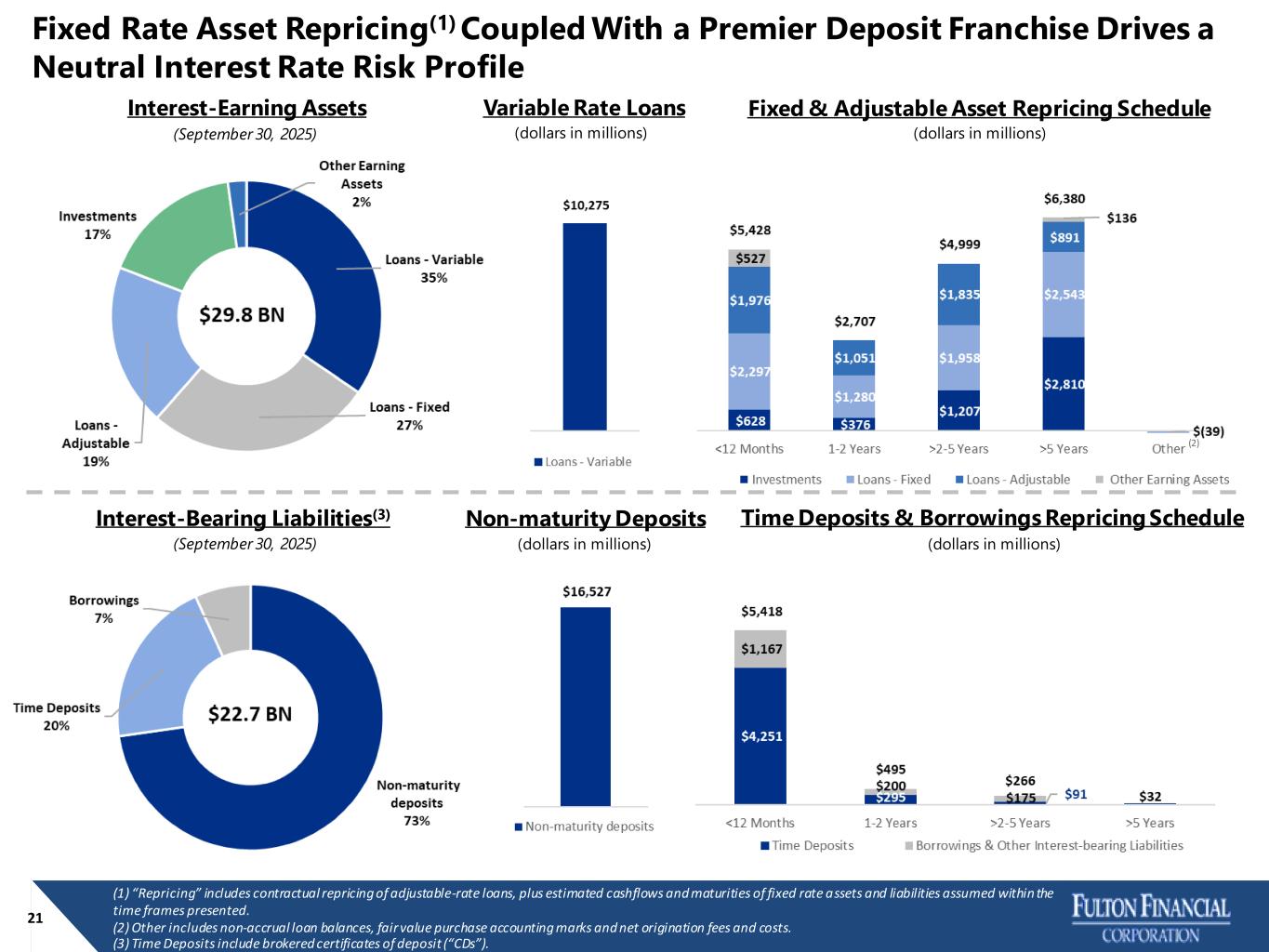

(1) “Repricing” includes contractual repricing of adjustable-rate loans, plus estimated cashflows and maturities of fixed rate assets and liabilities assumed within the time frames presented. (2) Other includes non-accrual loan balances, fair value purchase accounting marks and net origination fees and costs. (3) Time Deposits include brokered certificates of deposit (“CDs”). Fixed Rate Asset Repricing(1) Coupled With a Premier Deposit Franchise Drives a Neutral Interest Rate Risk Profile 21 Interest-Earning Assets Interest-Bearing Liabilities(3) Variable Rate Loans Non-maturity Deposits Time Deposits & Borrowings Repricing Schedule Fixed & Adjustable Asset Repricing Schedule (dollars in millions) (dollars in millions) (dollars in millions) (dollars in millions) (September 30, 2025) (September 30, 2025) (2)

Mature and Growing Wealth Management Business, Consistent Non-interest Income and Diversified Client Base Delivering Solid Results(1) 22 Over 85% Recurring Income Client & Market Aligned Growth $87.7 Million TTM(2) Non-Interest Income Wealth Management Income 5 Year CAGR of 9% 5 Wealth Management Acquisitions Since 2017 Organic & Analytics Based Growth Strategy Wealth Management AUM/AUA(3) (dollars in billions) (1) Wealth Management revenue does not include net interest income. (2) Trailing twelve months through September 30, 2025 Wealth Management income. (3) Assets under management and administration are ending market values for the periods ended December 31, 2019 to September 30, 2025.

Material and Consistent Fee Income, Robust Suite of Commercial and Consumer Services 23 Commercial Non-Interest Income Consumer Non-Interest Income(1) Repeatable Income Stream; Analytics-Based Cross-Sell Opportunity Disciplined Earnings Credit Rate and Exception Process; Multi-Channel Distribution Strategy Robust Back-to-Back Swap Program Serves Commercial Customers Financial Center Network and Loyal Customer Base Drive Consumer Fees (dollars in thousands) (dollars in thousands) Merchant & Card Income Cash Management Capital Markets Consumer Fees (1) Does not include gain on sale from residential mortgages.

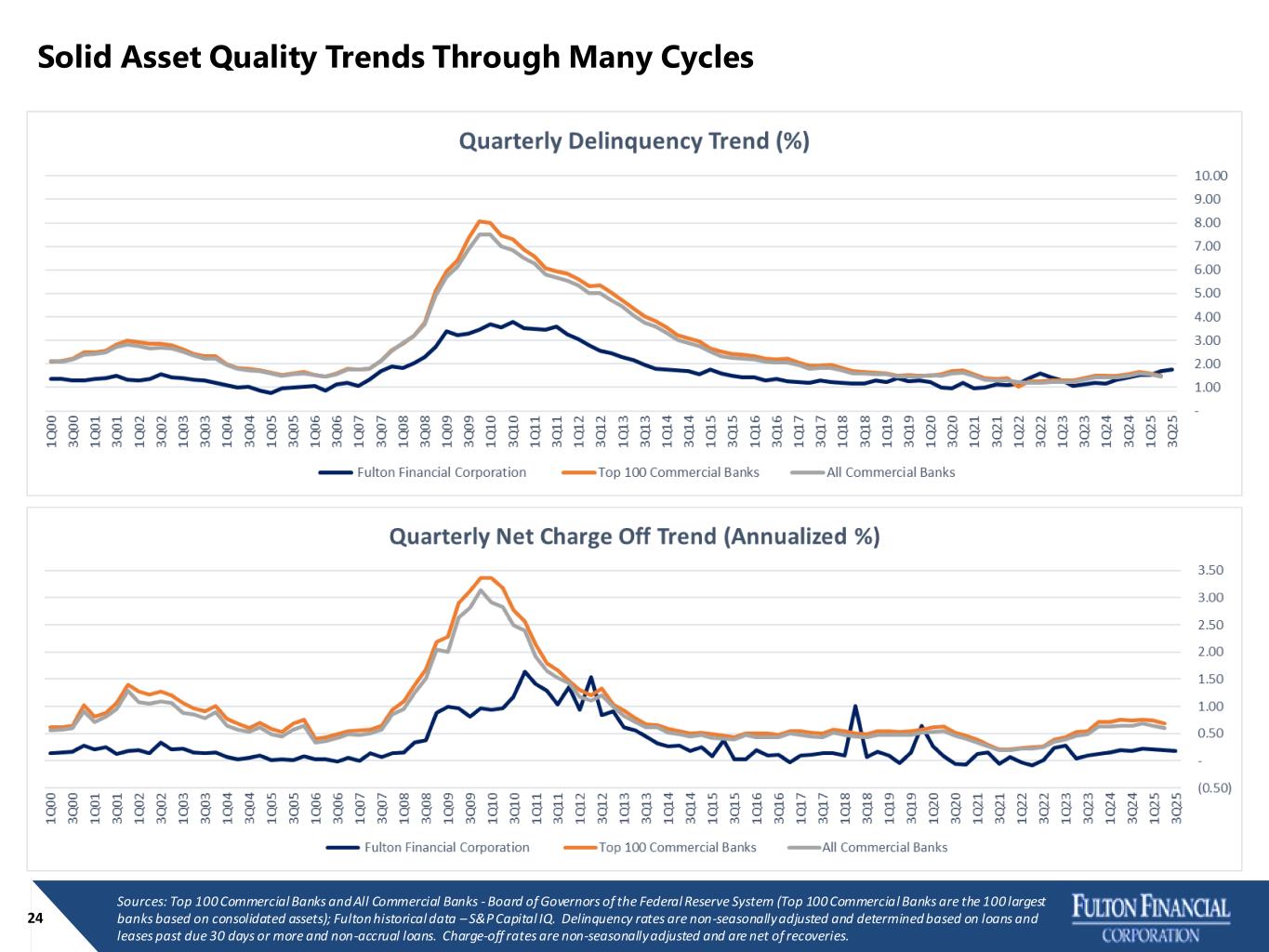

Solid Asset Quality Trends Through Many Cycles 24 Sources: Top 100 Commercial Banks and All Commercial Banks - Board of Governors of the Federal Reserve System (Top 100 Commercial Banks are the 100 largest banks based on consolidated assets); Fulton historical data – S&P Capital IQ. Delinquency rates are non-seasonally adjusted and determined based on loans and leases past due 30 days or more and non-accrual loans. Charge-off rates are non-seasonally adjusted and are net of recoveries.

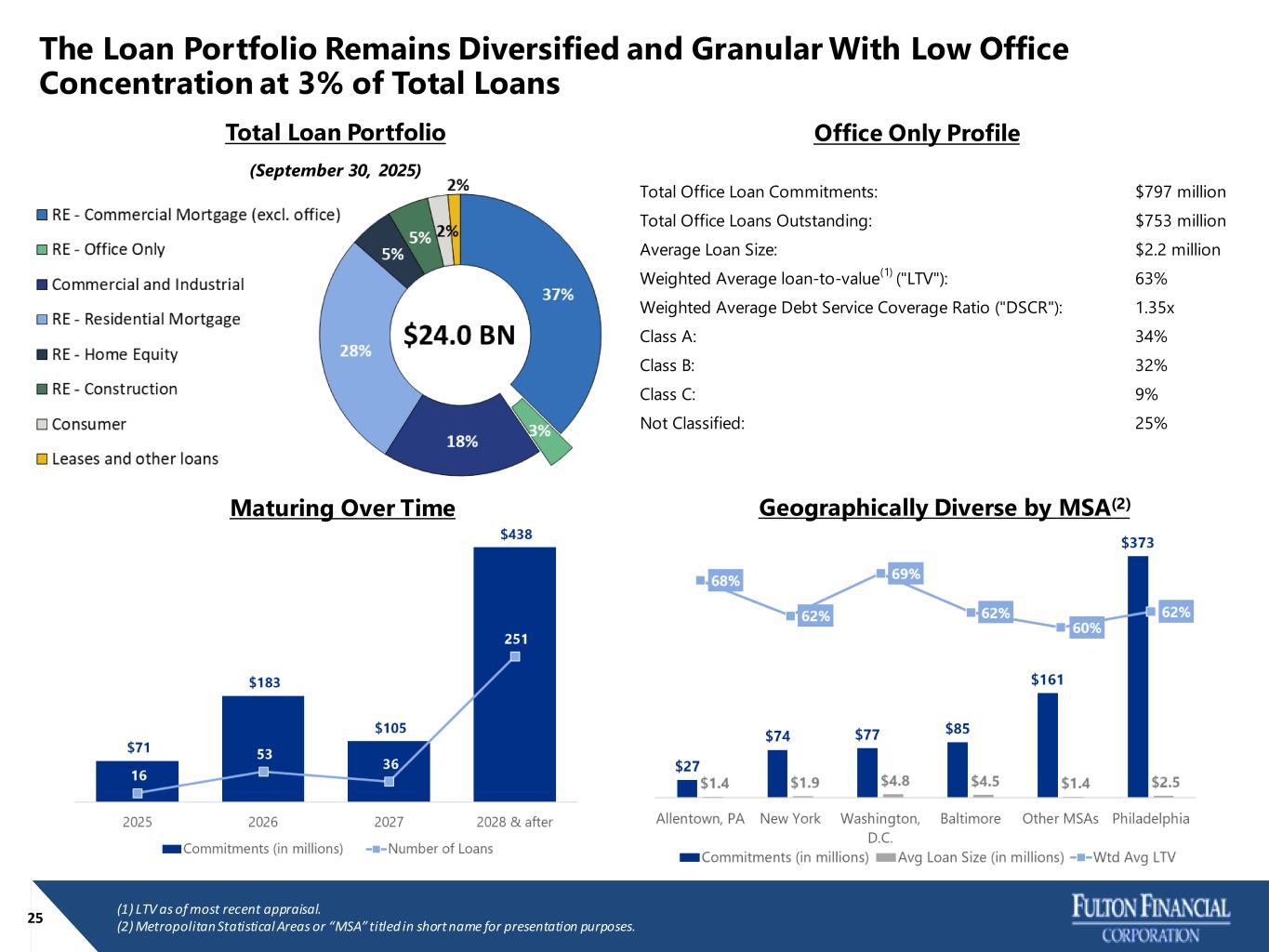

25 The Loan Portfolio Remains Diversified and Granular With Low Office Concentration at 3% of Total Loans (1) LTV as of most recent appraisal. (2) Metropolitan Statistical Areas or “MSA” titled in short name for presentation purposes. Geographically Diverse by MSA(2)Maturing Over Time Total Loan Portfolio (September 30, 2025) Office Only Profile Total Office Loan Commitments: $797 million Total Office Loans Outstanding: $753 million Average Loan Size: $2.2 million Weighted Average loan-to-value (1) ("LTV"): 63% Weighted Average Debt Service Coverage Ratio ("DSCR"): 1.35x Class A: 34% Class B: 32% Class C: 9% Not Classified: 25%

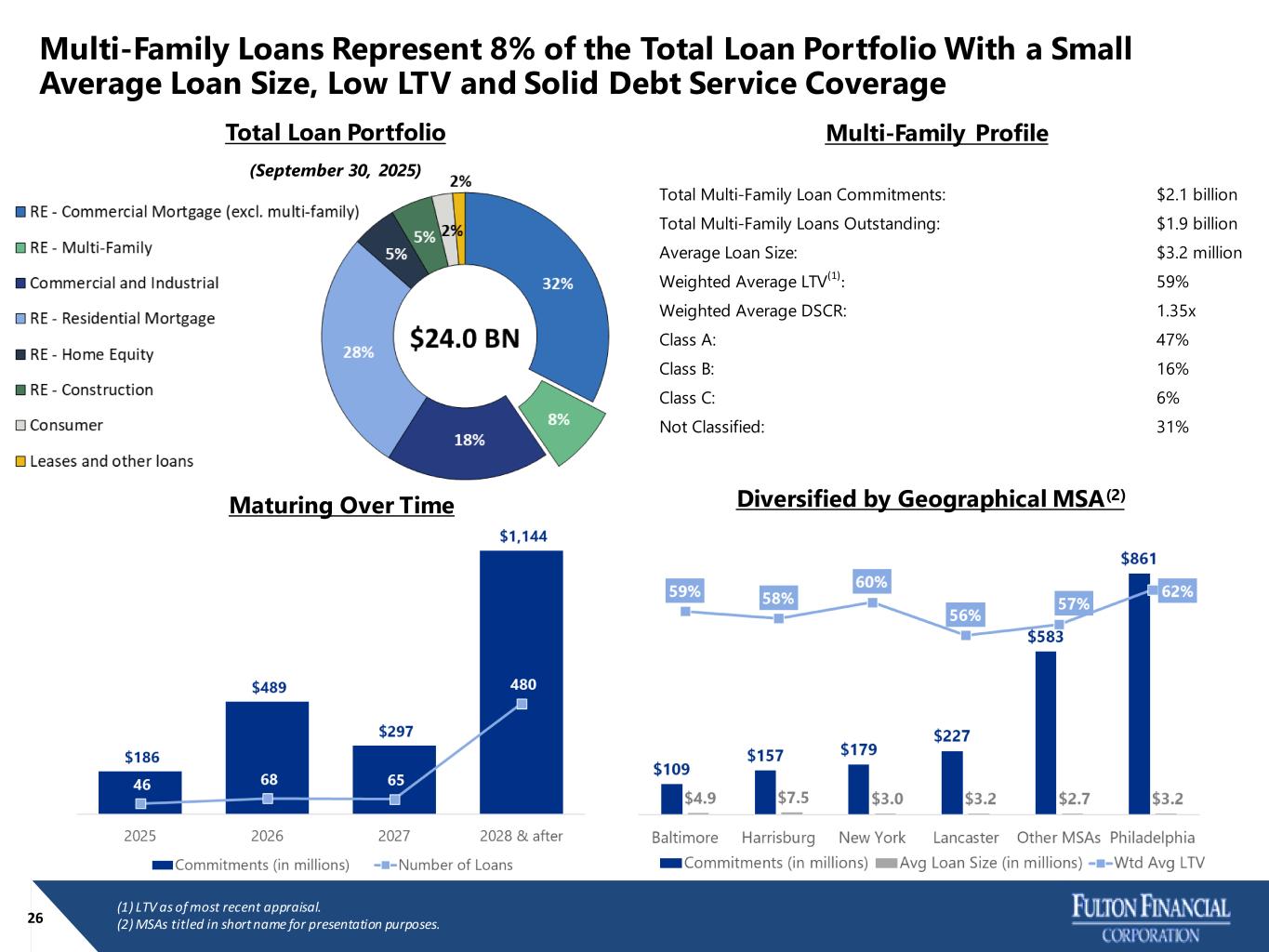

26 Multi-Family Loans Represent 8% of the Total Loan Portfolio With a Small Average Loan Size, Low LTV and Solid Debt Service Coverage (1) LTV as of most recent appraisal. (2) MSAs titled in short name for presentation purposes. Diversified by Geographical MSA(2) Total Loan Portfolio (September 30, 2025) Multi-Family Profile Maturing Over Time Total Multi-Family Loan Commitments: $2.1 billion Total Multi-Family Loans Outstanding: $1.9 billion Average Loan Size: $3.2 million Weighted Average LTV (1): 59% Weighted Average DSCR: 1.35x Class A: 47% Class B: 16% Class C: 6% Not Classified: 31%

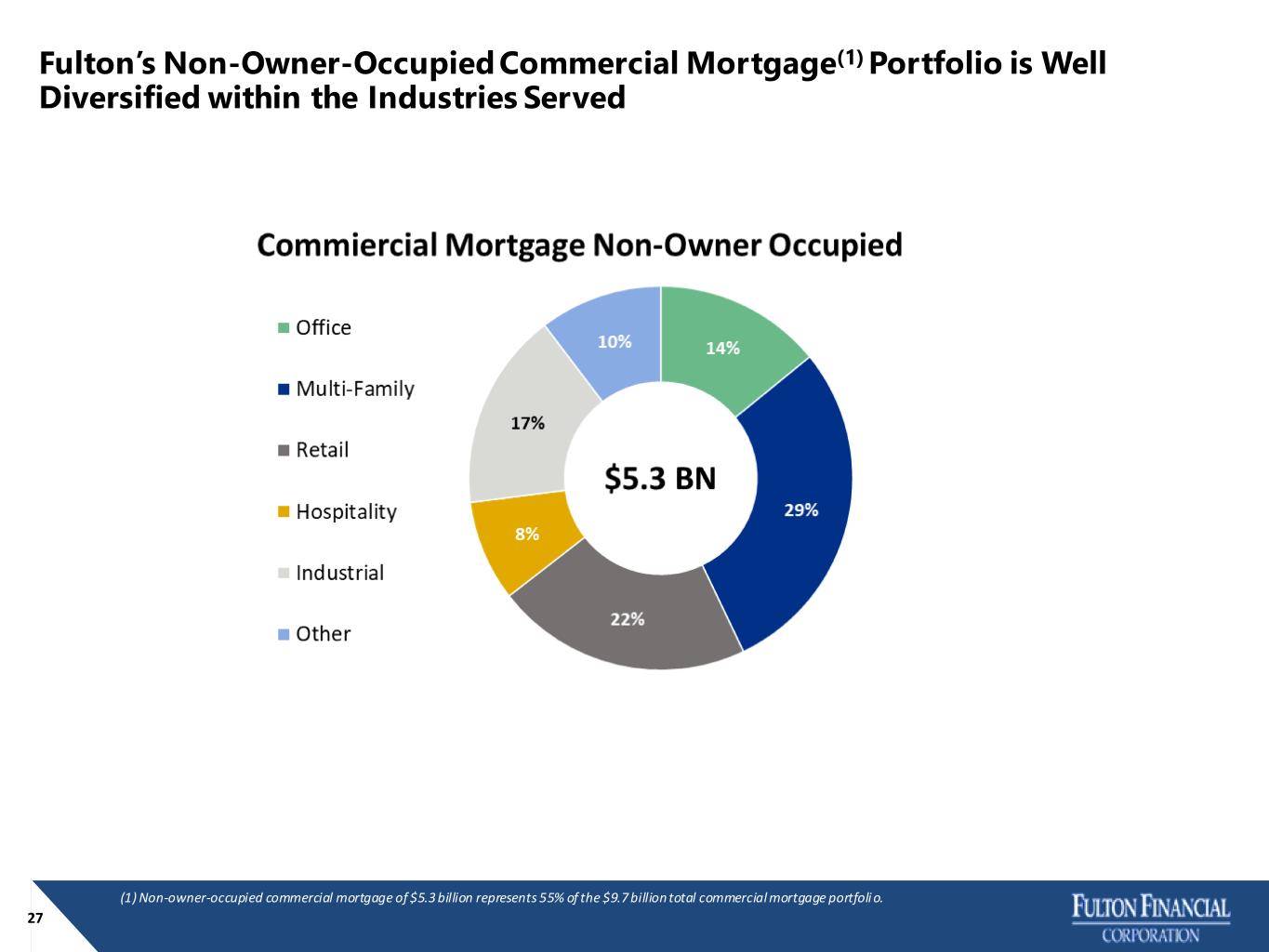

Fulton’s Non-Owner-Occupied Commercial Mortgage(1) Portfolio is Well Diversified within the Industries Served 27 (1) Non-owner-occupied commercial mortgage of $5.3 billion represents 55% of the $9.7 billion total commercial mortgage portfoli o.

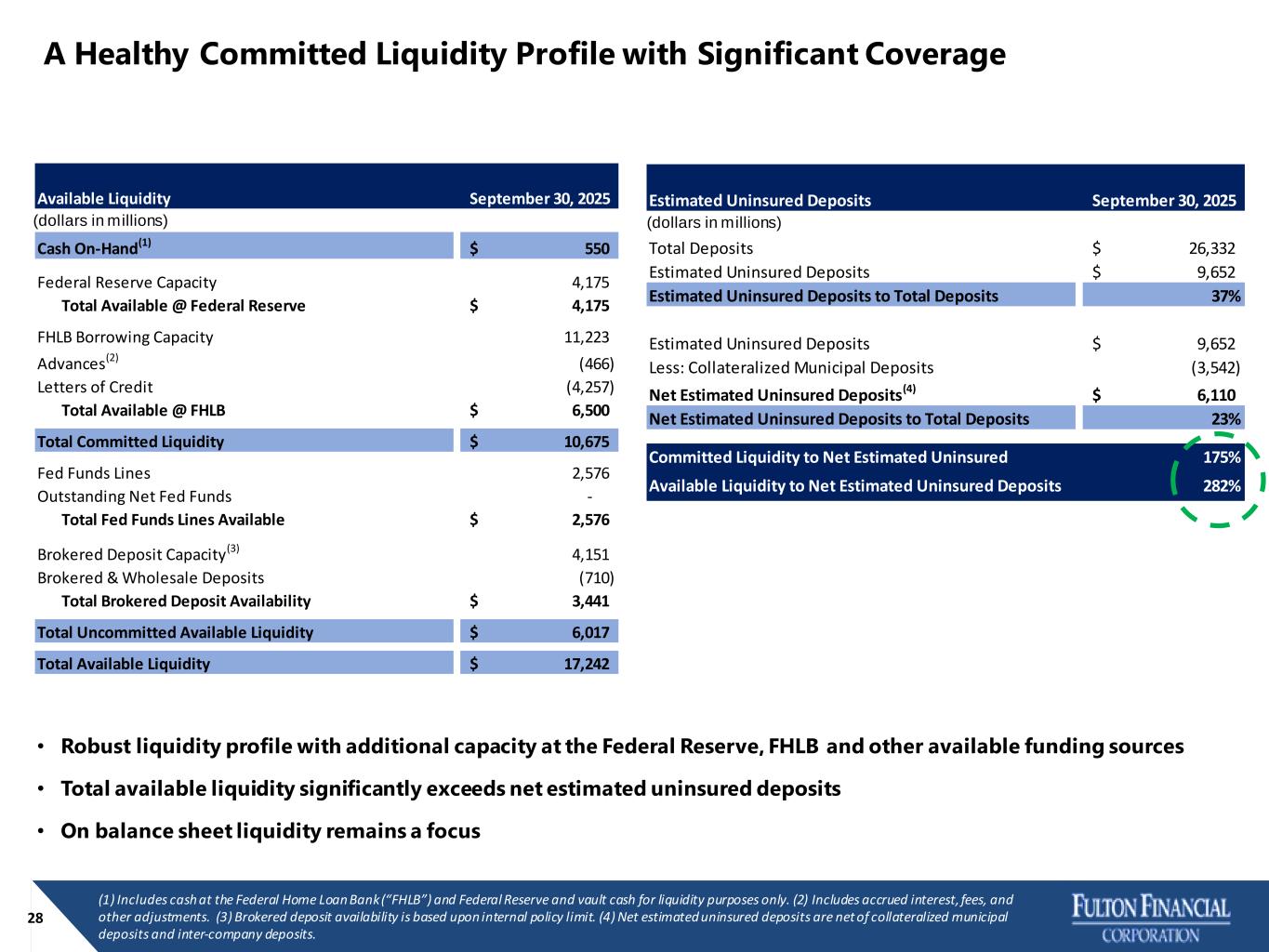

Estimated Uninsured Deposits September 30, 2025 Total Deposits 26,332$ Estimated Uninsured Deposits 9,652$ Estimated Uninsured Deposits to Total Deposits 37% Estimated Uninsured Deposits 9,652$ Less: Collateralized Municipal Deposits (3,542) Net Estimated Uninsured Deposits(4) 6,110$ Net Estimated Uninsured Deposits to Total Deposits 23% Committed Liquidity to Net Estimated Uninsured Deposits 175% Available Liquidity to Net Estimated Uninsured Deposits 282% Available Liquidity September 30, 2025 Cash On-Hand(1) 550$ Federal Reserve Capacity 4,175 Total Available @ Federal Reserve 4,175$ FHLB Borrowing Capacity 11,223 Advances(2) (466) Letters of Credit (4,257) Total Available @ FHLB 6,500$ Total Committed Liquidity 10,675$ Fed Funds Lines 2,576 Outstanding Net Fed Funds - Total Fed Funds Lines Available 2,576$ Brokered Deposit Capacity(3) 4,151 Brokered & Wholesale Deposits (710) Total Brokered Deposit Availability 3,441$ Total Uncommitted Available Liquidity 6,017$ Total Available Liquidity 17,242$ 28 (1) Includes cash at the Federal Home Loan Bank (“FHLB”) and Federal Reserve and vault cash for liquidity purposes only. (2) Includes accrued interest, fees, and other adjustments. (3) Brokered deposit availability is based upon internal policy limit. (4) Net estimated uninsured deposits are net of collateralized municipal deposits and inter-company deposits. A Healthy Committed Liquidity Profile with Significant Coverage • Robust liquidity profile with additional capacity at the Federal Reserve, FHLB and other available funding sources • Total available liquidity significantly exceeds net estimated uninsured deposits • On balance sheet liquidity remains a focus (dollars in millions) (dollars in millions)

NON-GAAP RECONCILIATION

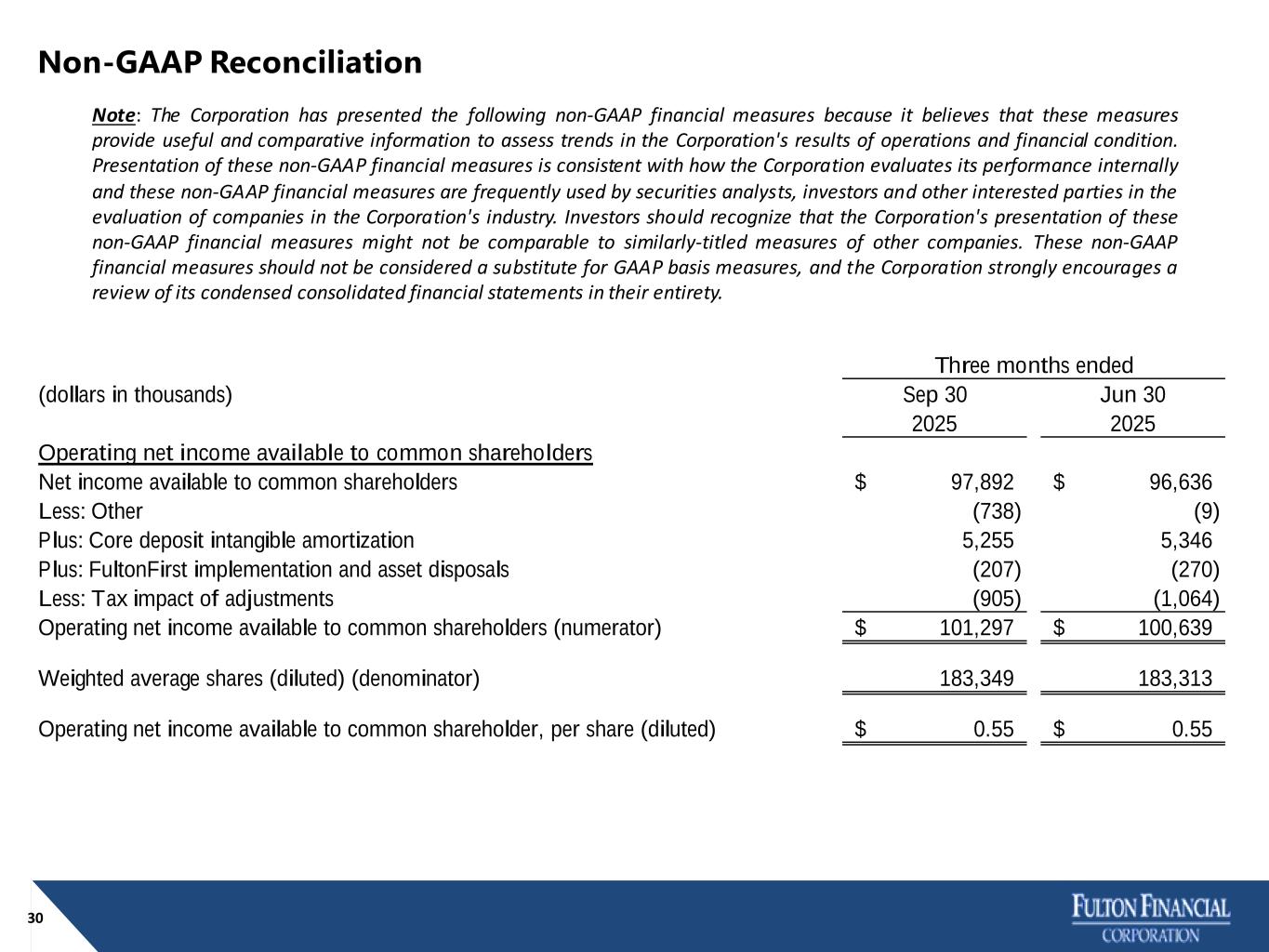

Non-GAAP Reconciliation 30 Note: The Corporation has presented the following non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures, and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Three months ended (dollars in thousands) Sep 30 Jun 30 2025 2025 Operating net income available to common shareholders Net income available to common shareholders 97,892$ 96,636$ Less: Other (738) (9) Plus: Core deposit intangible amortization 5,255 5,346 Plus: FultonFirst implementation and asset disposals (207) (270) Less: Tax impact of adjustments (905) (1,064) Operating net income available to common shareholders (numerator) 101,297$ 100,639$ Weighted average shares (diluted) (denominator) 183,349 183,313 Operating net income available to common shareholder, per share (diluted) 0.55$ 0.55$

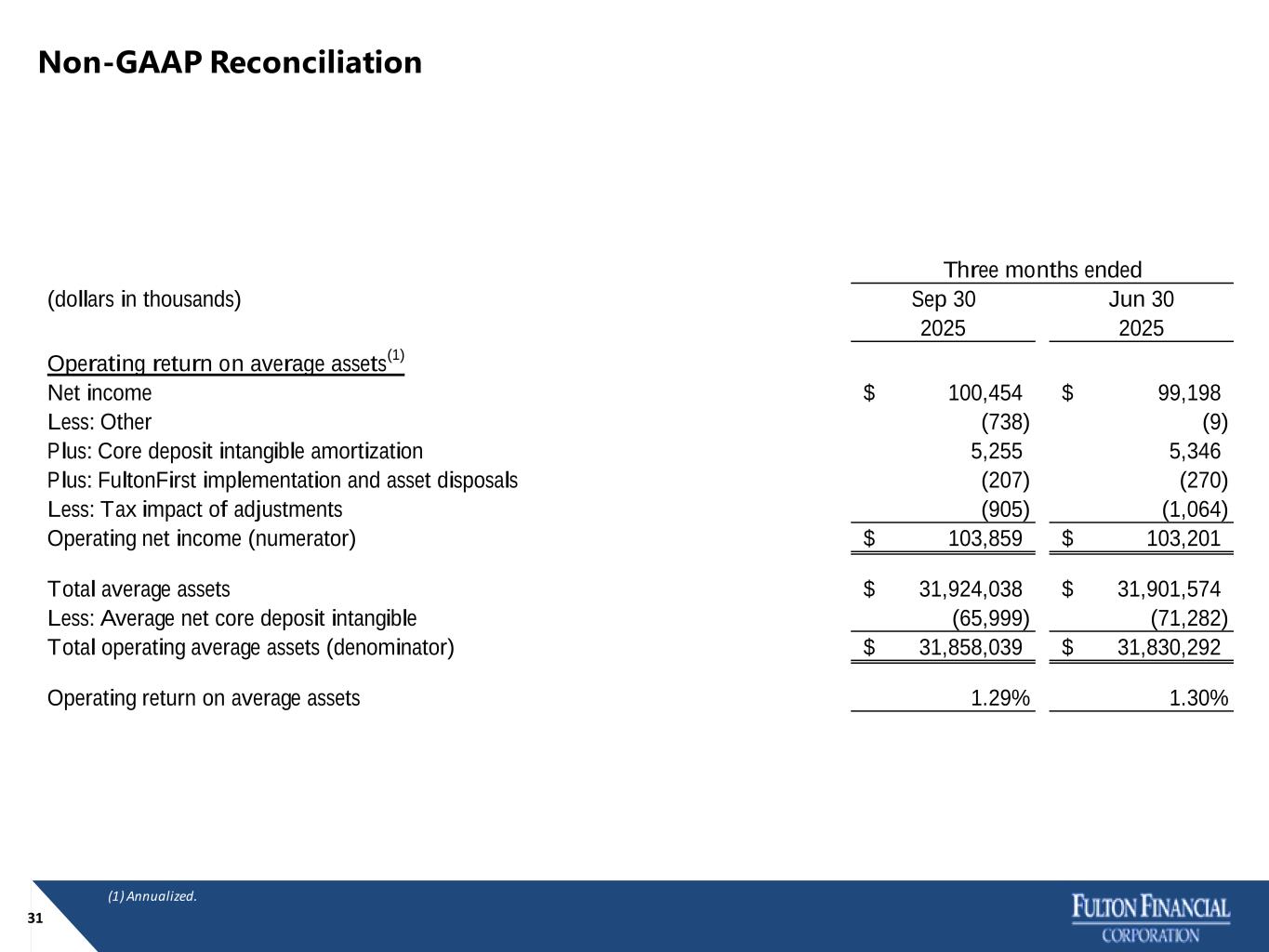

Non-GAAP Reconciliation 31 (1) Annualized. Three months ended (dollars in thousands) Sep 30 Jun 30 2025 2025 Operating return on average assets (1) Net income 100,454$ 99,198$ Less: Other (738) (9) Plus: Core deposit intangible amortization 5,255 5,346 Plus: FultonFirst implementation and asset disposals (207) (270) Less: Tax impact of adjustments (905) (1,064) Operating net income (numerator) 103,859$ 103,201$ Total average assets 31,924,038$ 31,901,574$ Less: Average net core deposit intangible (65,999) (71,282) Total operating average assets (denominator) 31,858,039$ 31,830,292$ Operating return on average assets 1.29% 1.30%

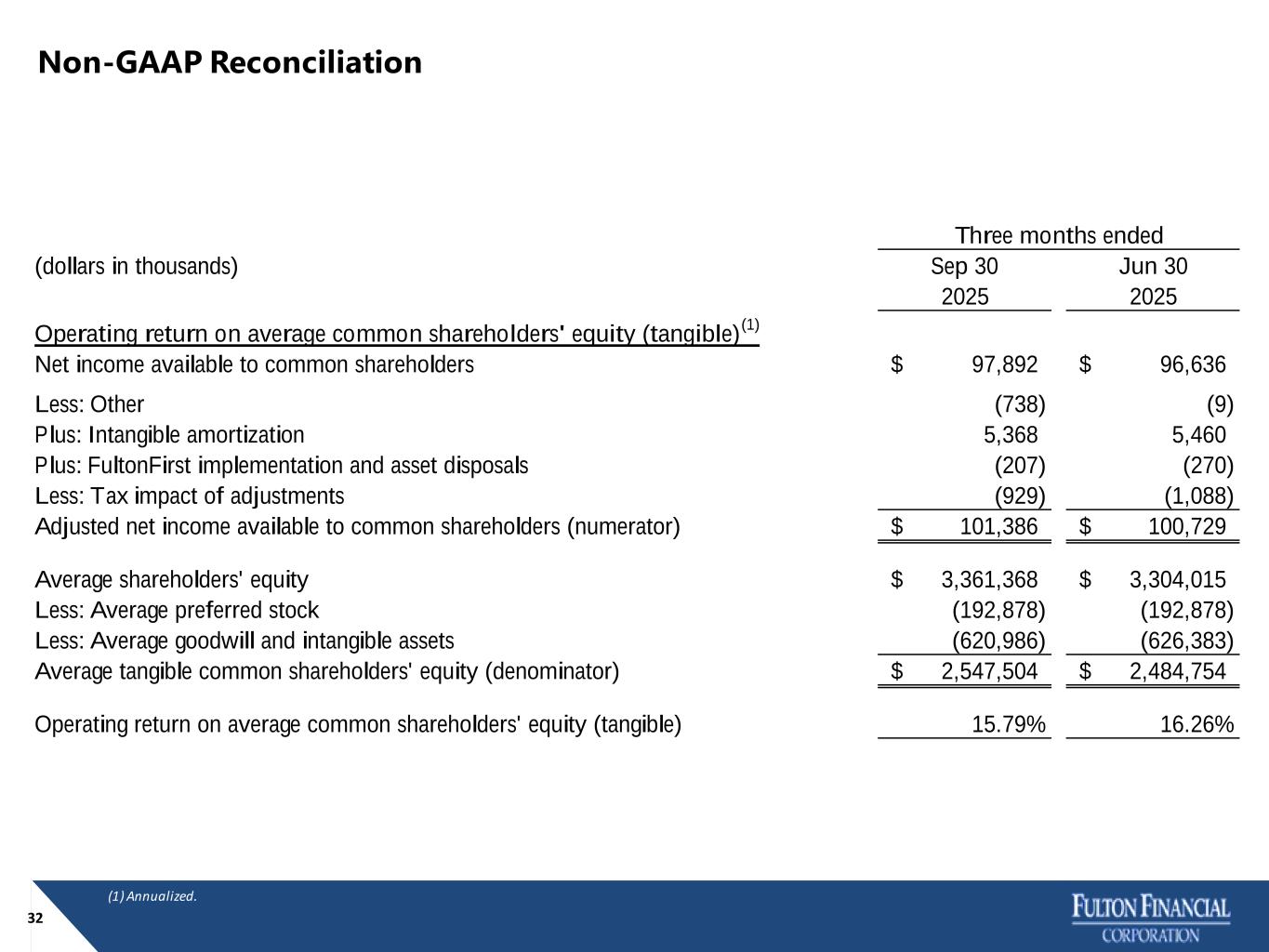

32 Non-GAAP Reconciliation (1) Annualized. Three months ended (dollars in thousands) Sep 30 Jun 30 2025 2025 Operating return on average common shareholders' equity (tangible) (1) Net income available to common shareholders 97,892$ 96,636$ Less: Other (738) (9) Plus: Intangible amortization 5,368 5,460 Plus: FultonFirst implementation and asset disposals (207) (270) Less: Tax impact of adjustments (929) (1,088) Adjusted net income available to common shareholders (numerator) 101,386$ 100,729$ Average shareholders' equity 3,361,368$ 3,304,015$ Less: Average preferred stock (192,878) (192,878) Less: Average goodwill and intangible assets (620,986) (626,383) Average tangible common shareholders' equity (denominator) 2,547,504$ 2,484,754$ Operating return on average common shareholders' equity (tangible) 15.79% 16.26%

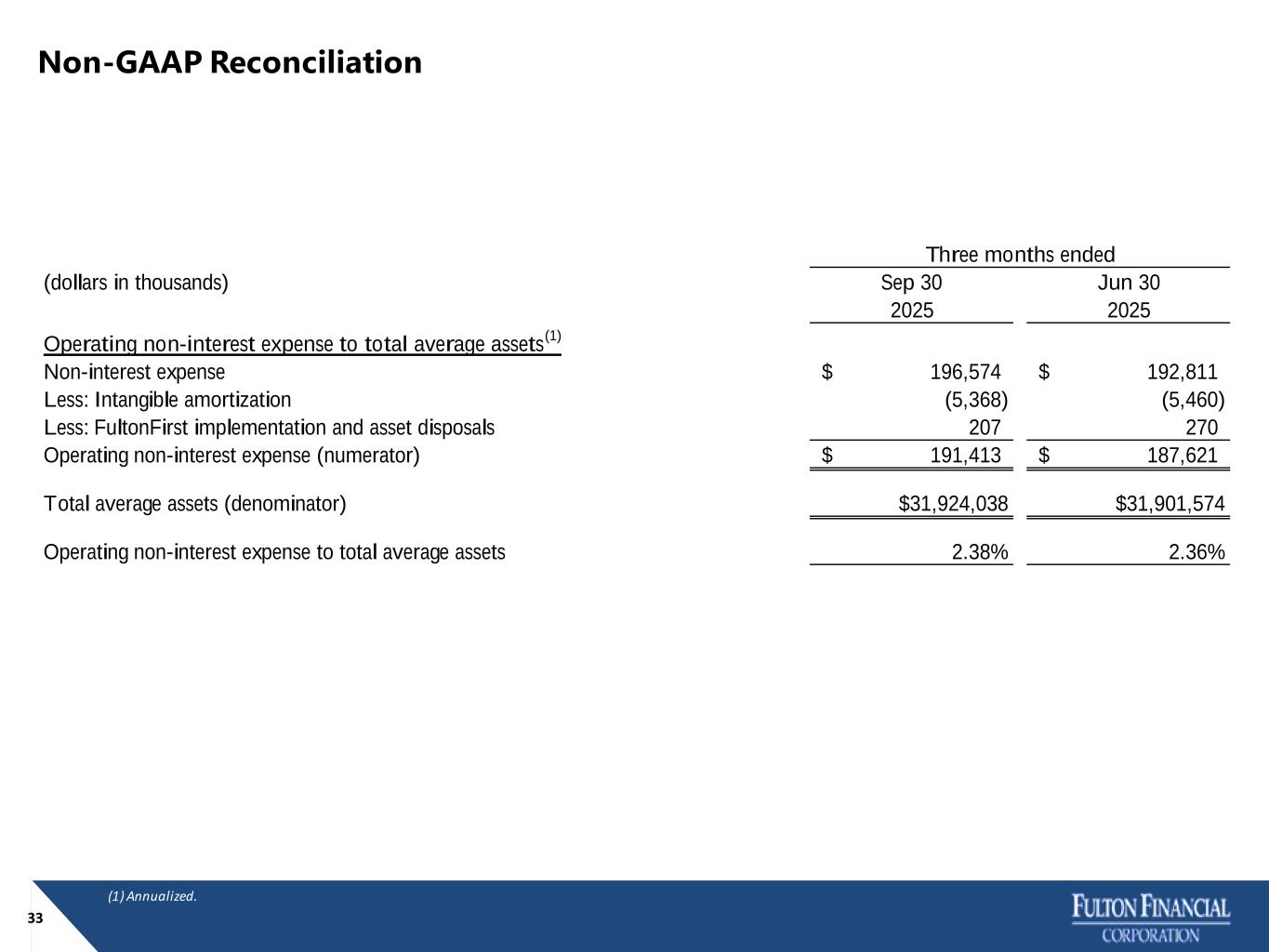

Non-GAAP Reconciliation 33 (1) Annualized. Three months ended (dollars in thousands) Sep 30 Jun 30 2025 2025 Operating non-interest expense to total average assets (1) Non-interest expense 196,574$ 192,811$ Less: Intangible amortization (5,368) (5,460) Less: FultonFirst implementation and asset disposals 207 270 Operating non-interest expense (numerator) 191,413$ 187,621$ Total average assets (denominator) $31,924,038 $31,901,574 Operating non-interest expense to total average assets 2.38% 2.36%

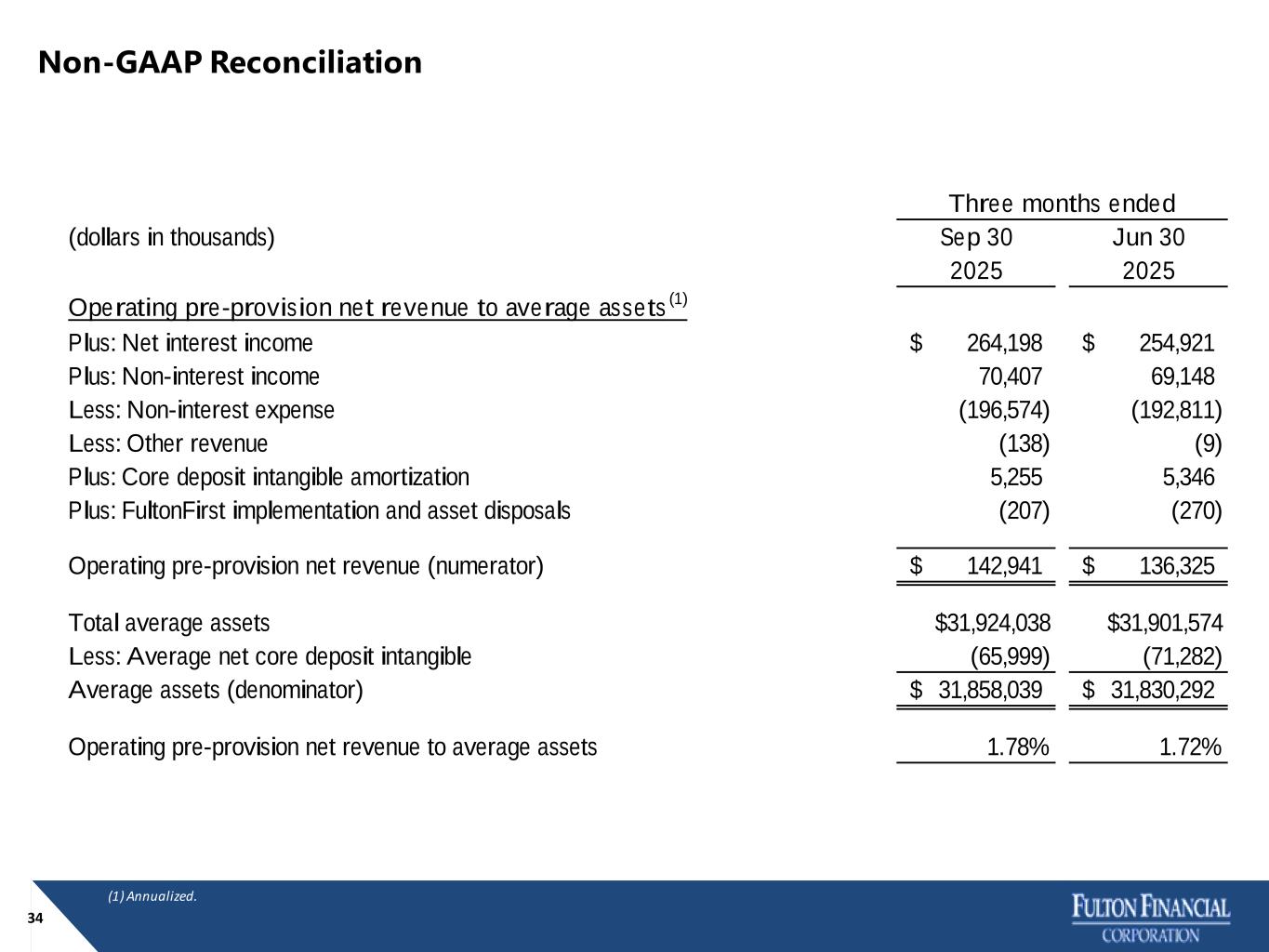

34 Non-GAAP Reconciliation (1) Annualized. Three months ended (dollars in thousands) Sep 30 Jun 30 2025 2025 Operating pre-provision net revenue to average assets (1) Plus: Net interest income 264,198$ 254,921$ Plus: Non-interest income 70,407 69,148 Less: Non-interest expense (196,574) (192,811) Less: Other revenue (138) (9) Plus: Core deposit intangible amortization 5,255 5,346 Plus: FultonFirst implementation and asset disposals (207) (270) Operating pre-provision net revenue (numerator) 142,941$ 136,325$ Total average assets $31,924,038 $31,901,574 Less: Average net core deposit intangible (65,999) (71,282) Average assets (denominator) 31,858,039$ 31,830,292$ Operating pre-provision net revenue to average assets 1.78% 1.72%

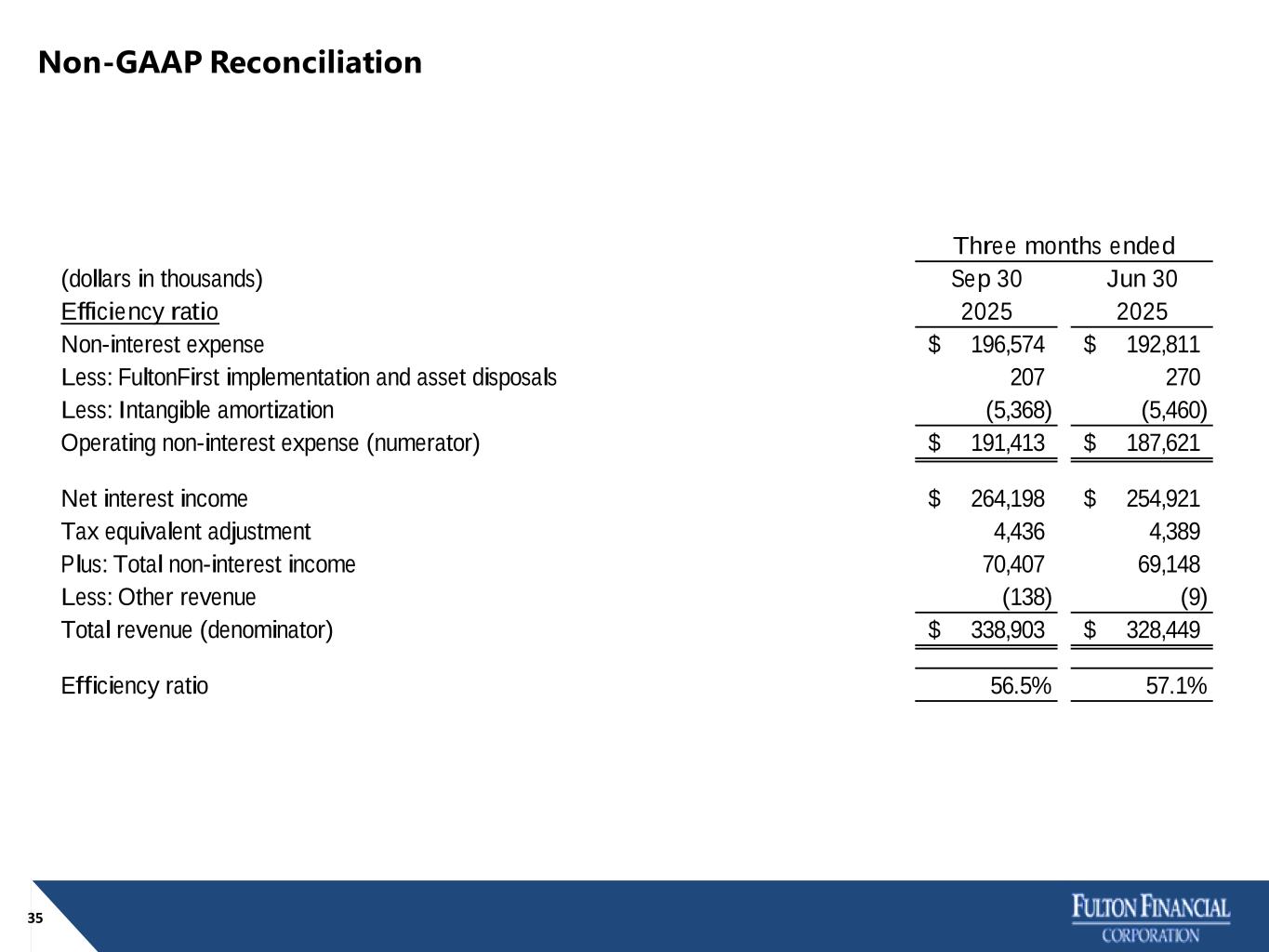

35 Non-GAAP Reconciliation Three months ended (dollars in thousands) Sep 30 Jun 30 Efficiency ratio 2025 2025 Non-interest expense 196,574$ 192,811$ Less: FultonFirst implementation and asset disposals 207 270 Less: Intangible amortization (5,368) (5,460) Operating non-interest expense (numerator) 191,413$ 187,621$ Net interest income 264,198$ 254,921$ Tax equivalent adjustment 4,436 4,389 Plus: Total non-interest income 70,407 69,148 Less: Other revenue (138) (9) Total revenue (denominator) 338,903$ 328,449$ Efficiency ratio 56.5% 57.1%

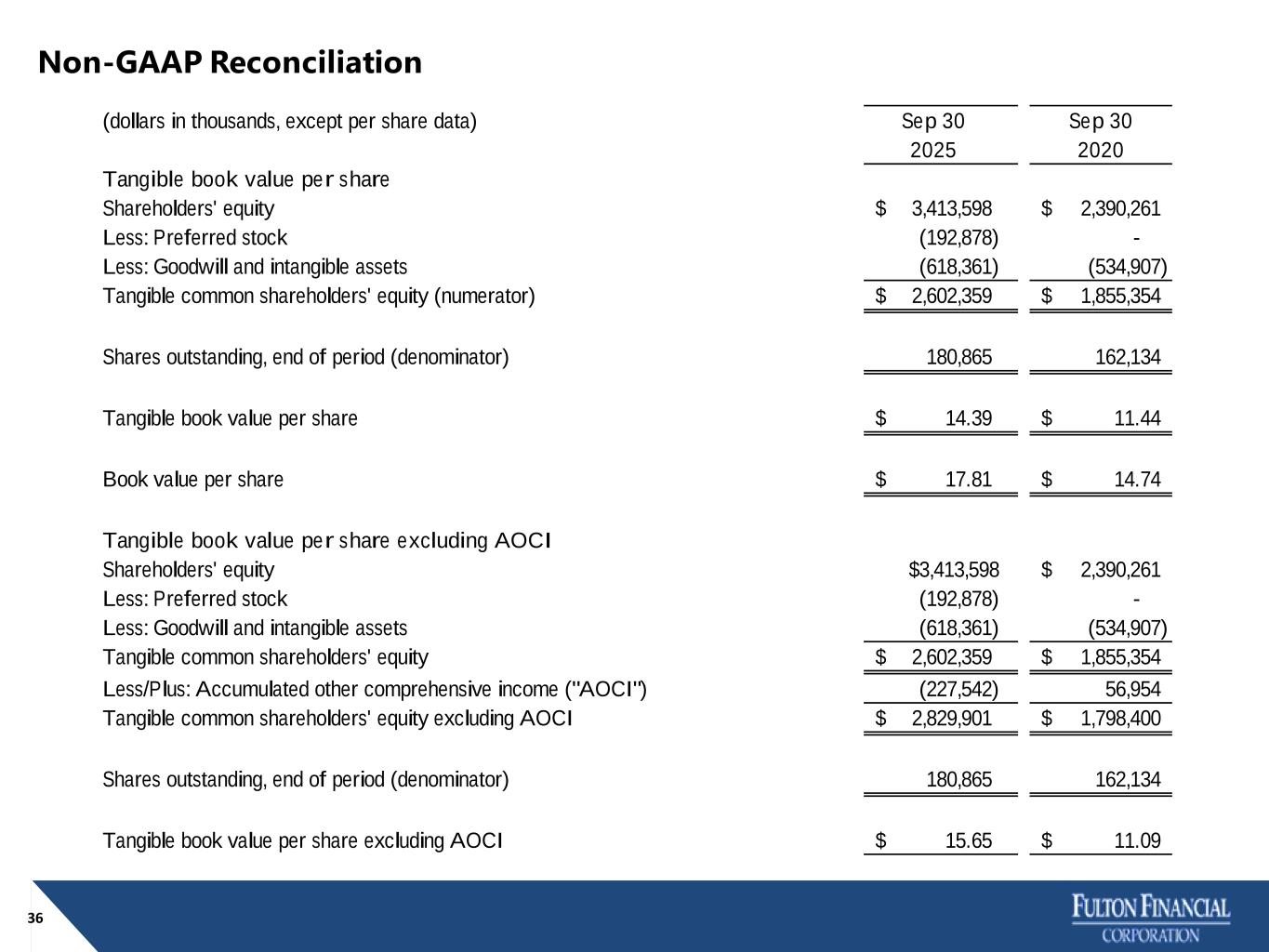

Non-GAAP Reconciliation 36 (dollars in thousands, except per share data) Sep 30 Sep 30 2025 2020 Tangible book value per share Shareholders' equity 3,413,598$ 2,390,261$ Less: Preferred stock (192,878) - Less: Goodwill and intangible assets (618,361) (534,907) Tangible common shareholders' equity (numerator) 2,602,359$ 1,855,354$ Shares outstanding, end of period (denominator) 180,865 162,134 Tangible book value per share 14.39$ 11.44$ Book value per share 17.81$ 14.74$ Tangible book value per share excluding AOCI Shareholders' equity $3,413,598 2,390,261$ Less: Preferred stock (192,878) - Less: Goodwill and intangible assets (618,361) (534,907) Tangible common shareholders' equity 2,602,359$ 1,855,354$ Less/Plus: Accumulated other comprehensive income ("AOCI") (227,542) 56,954 Tangible common shareholders' equity excluding AOCI 2,829,901$ 1,798,400$ Shares outstanding, end of period (denominator) 180,865 162,134 Tangible book value per share excluding AOCI 15.65$ 11.09$

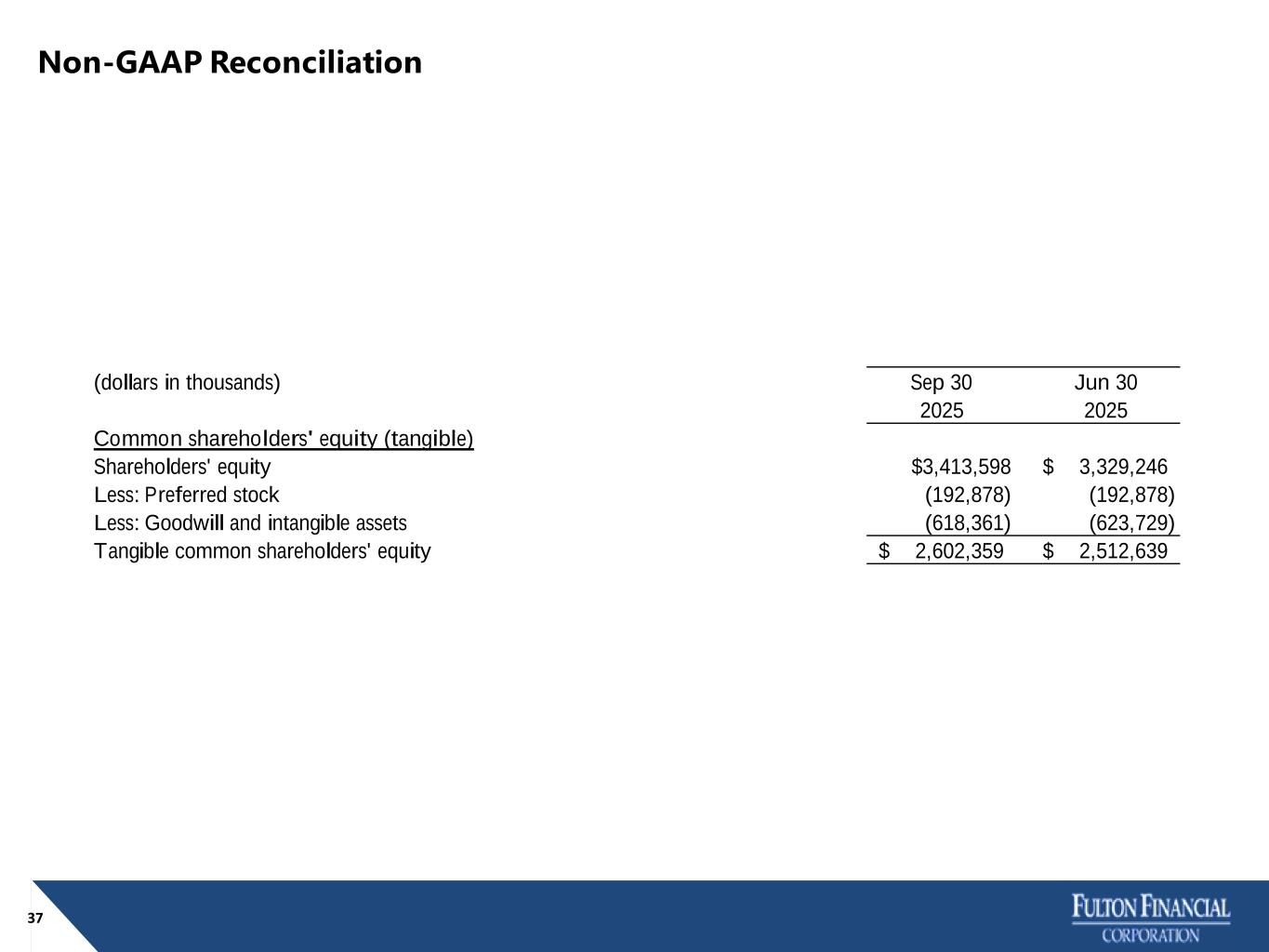

Non-GAAP Reconciliation 37 (dollars in thousands) Sep 30 Jun 30 2025 2025 Common shareholders' equity (tangible) Shareholders' equity $3,413,598 3,329,246$ Less: Preferred stock (192,878) (192,878) Less: Goodwill and intangible assets (618,361) (623,729) Tangible common shareholders' equity 2,602,359$ 2,512,639$

Investor Relations Contact Additional information can be found on our Investor Relations website at https://investor.fultonbank.com Investor inquiries can be directed to: Matthew Jozwiak Investor Relations Officer 717-327-2657 Mjozwiak@Fultonbank.com