.2

© 2025 Fulton Financial Corporation. All rights reserved. the “Securities Act”) • • • • • • • • 2

© 2025 Fulton Financial Corporation. All rights reserved. 3

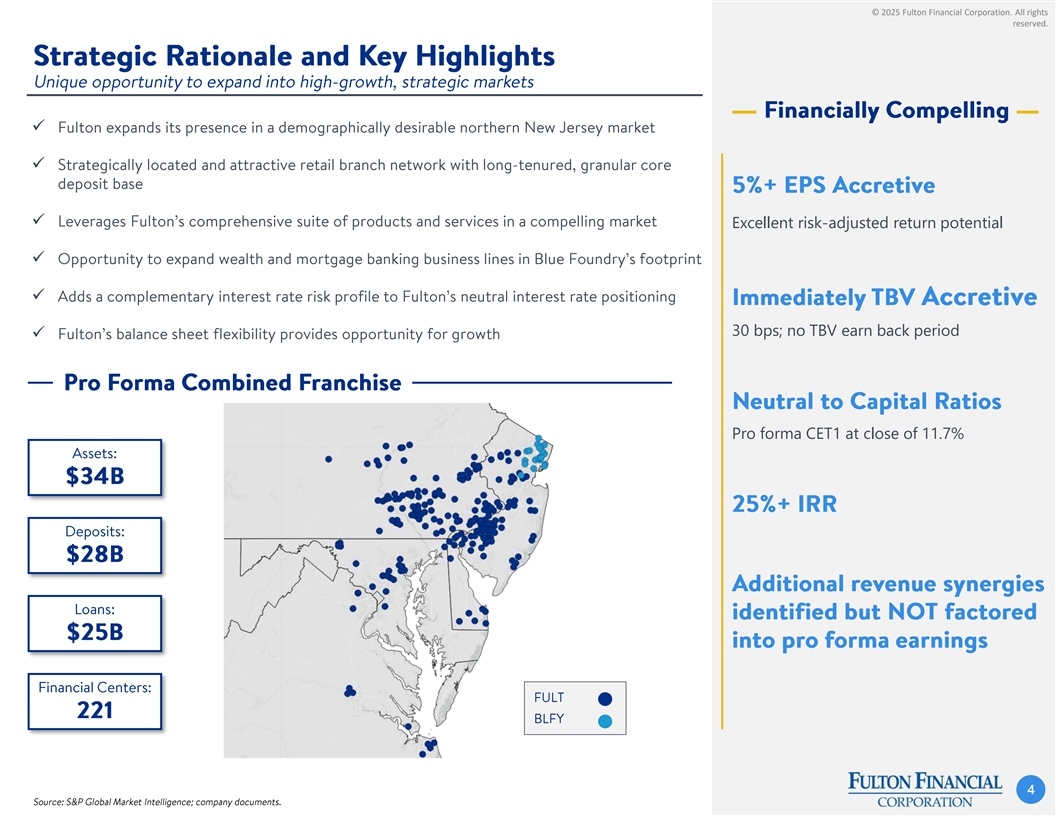

© 2025 Fulton Financial Corporation. All rights reserved. ✓ ✓ ✓ Excellent risk-adjusted return potential ✓ ✓ 30 bps; no TBV earn back period ✓ Pro forma CET1 at close of 11.7% 4 4

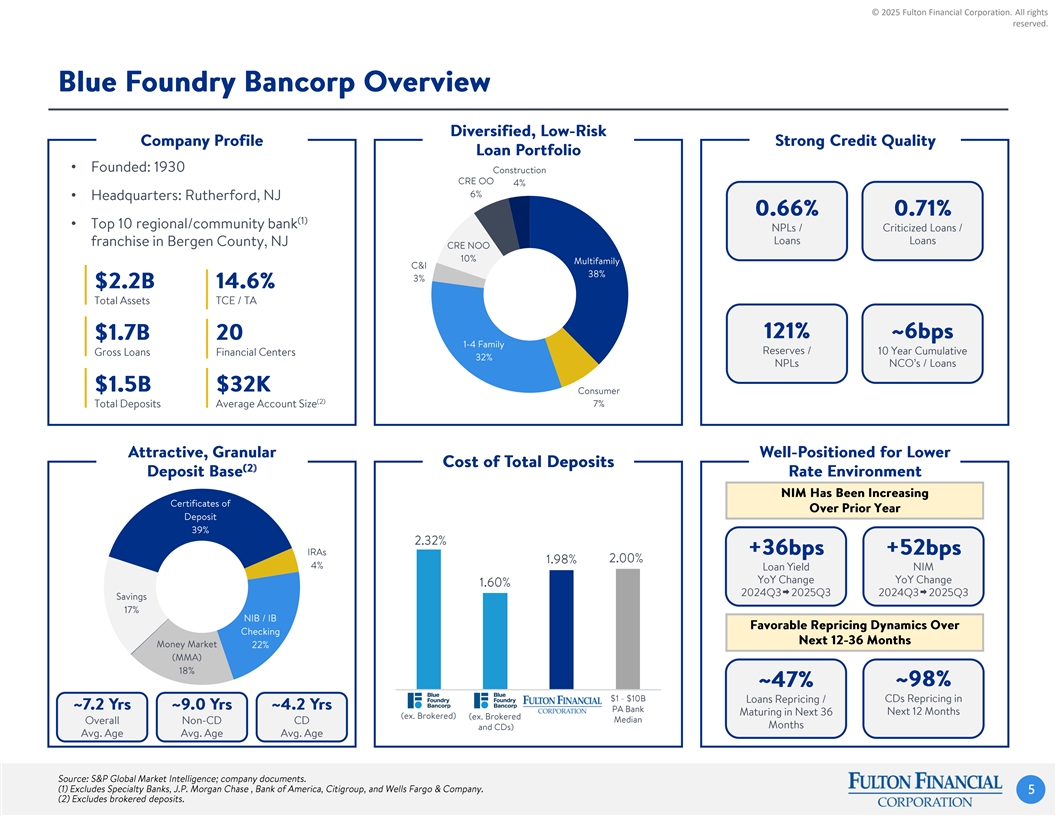

© 2025 Fulton Financial Corporation. All rights reserved. • • • A B C 5

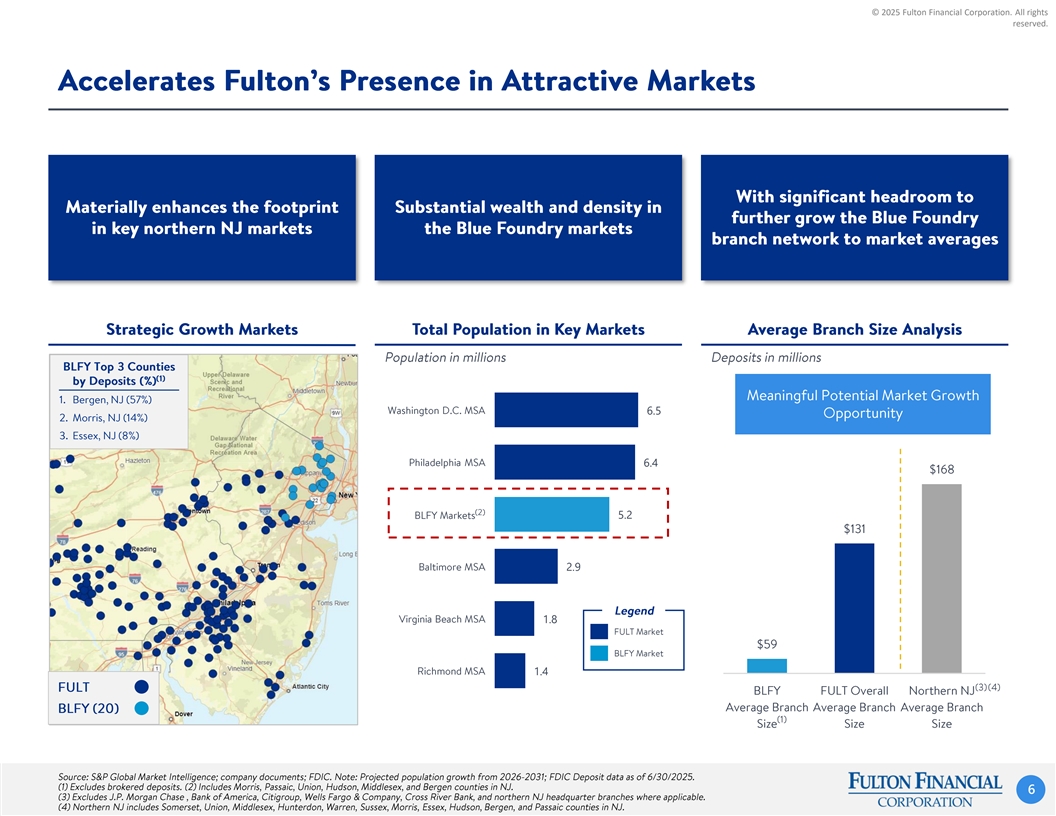

© 2025 Fulton Financial Corporation. All rights reserved. 6.5 6.4 5.2 2.9 1.8 1.4 6

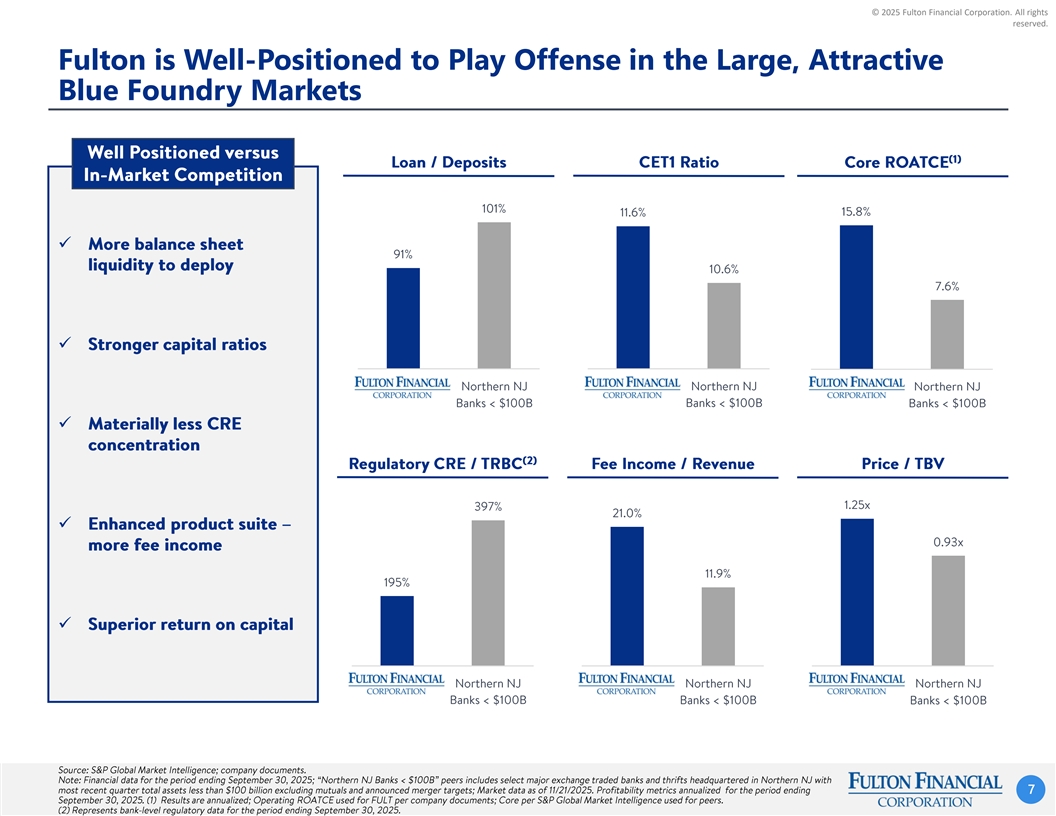

© 2025 Fulton Financial Corporation. All rights reserved. Fulton is Well-Positioned to Play Offense in the Large, Attractive Blue Foundry Markets ✓ ✓ ✓ ✓ ✓ 7

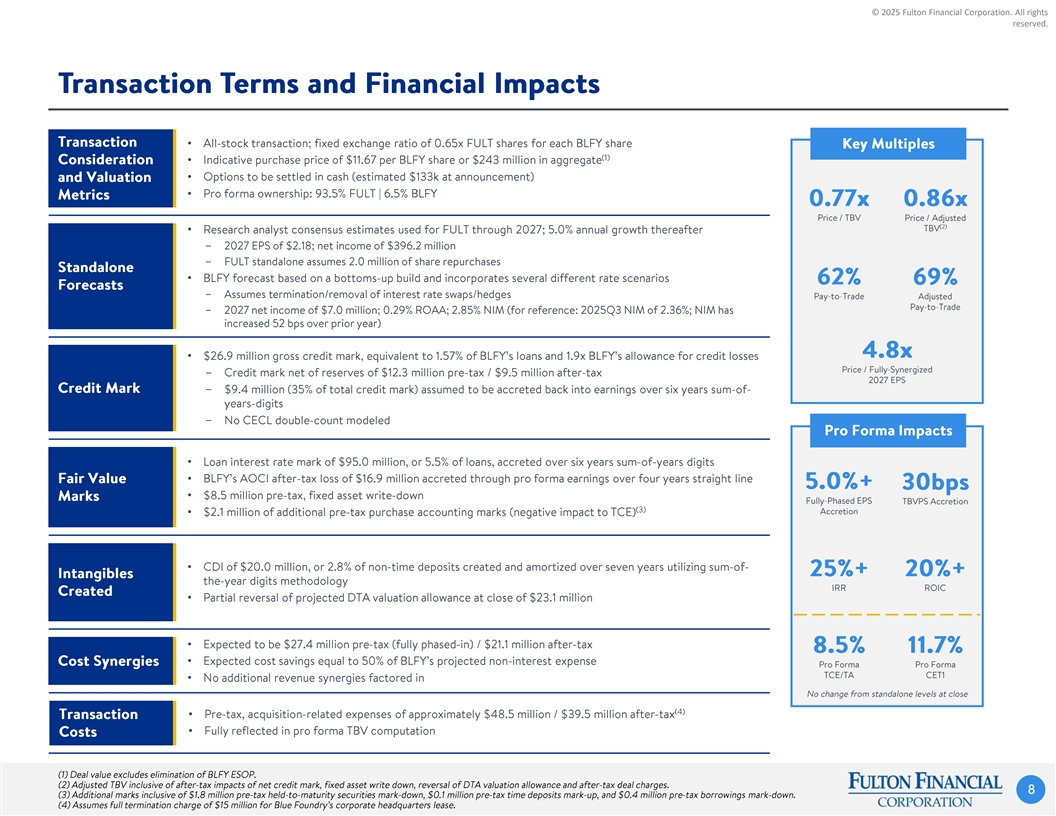

© 2025 Fulton Financial Corporation. All rights reserved. • • • • • − − • − − • − − − • • • • • • • • • • • 8

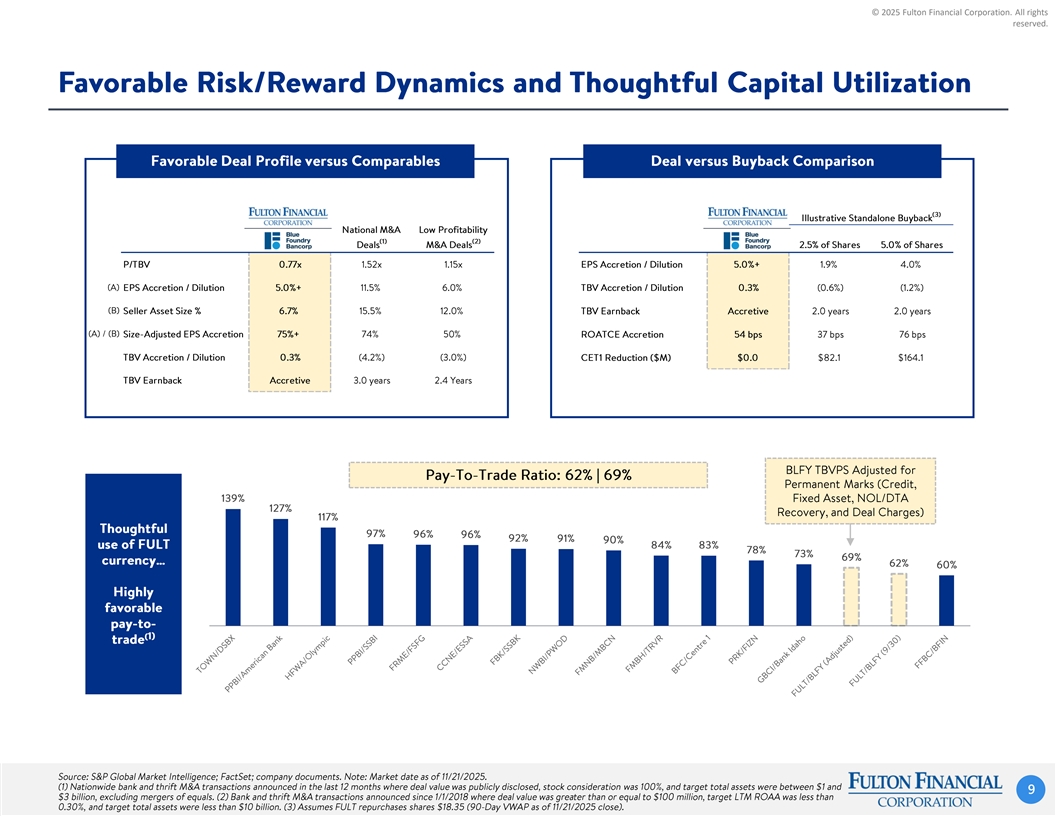

© 2025 Fulton Financial Corporation. All rights reserved. 9

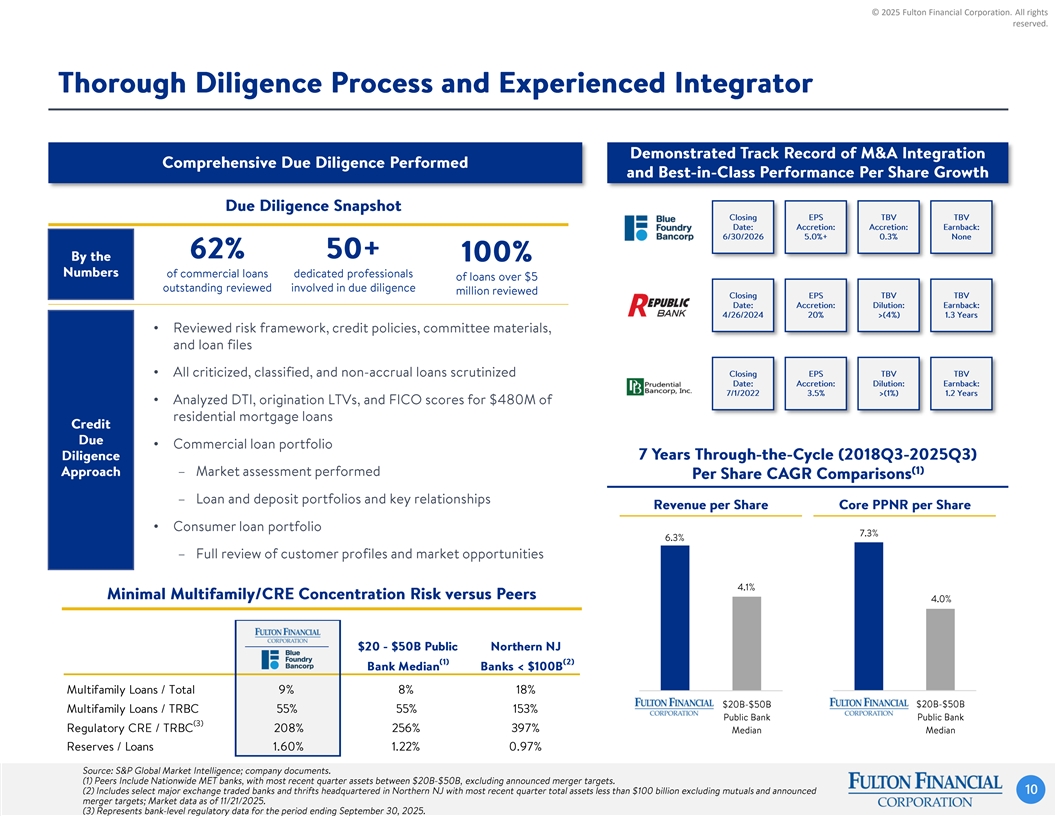

© 2025 Fulton Financial Corporation. All rights reserved. • • • • • 10

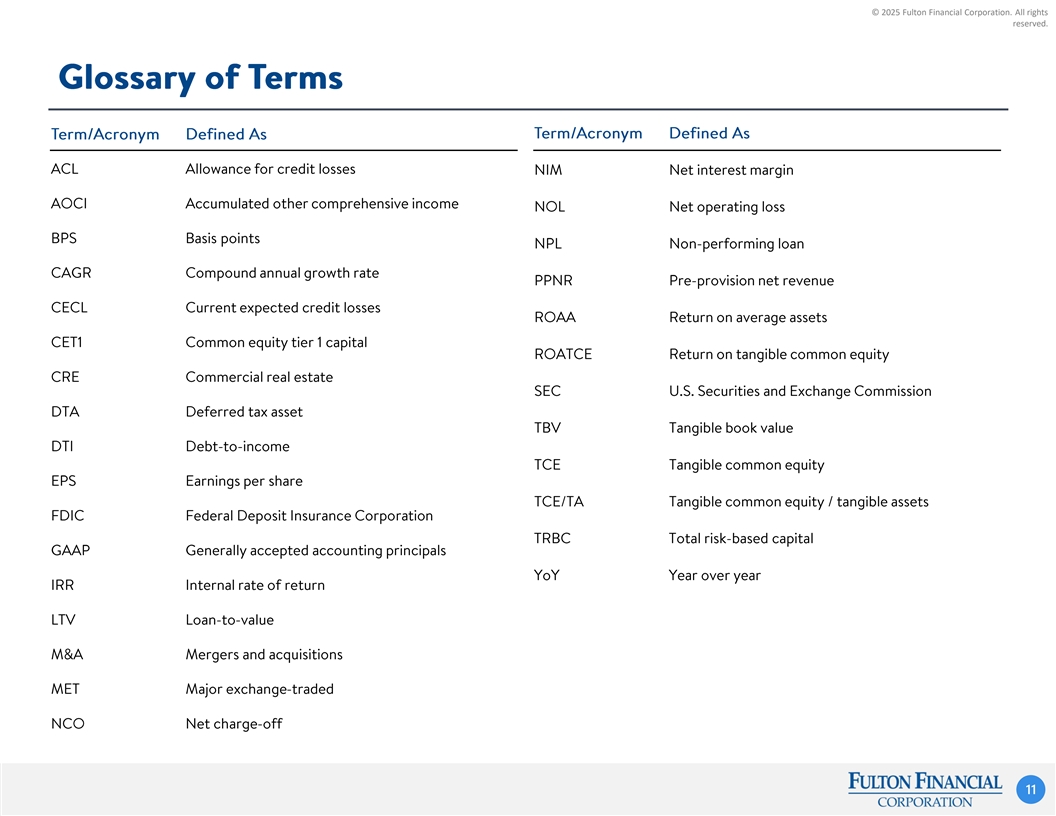

© 2025 Fulton Financial Corporation. All rights reserved. 11

© 2025 Fulton Financial Corporation. All rights reserved. 12

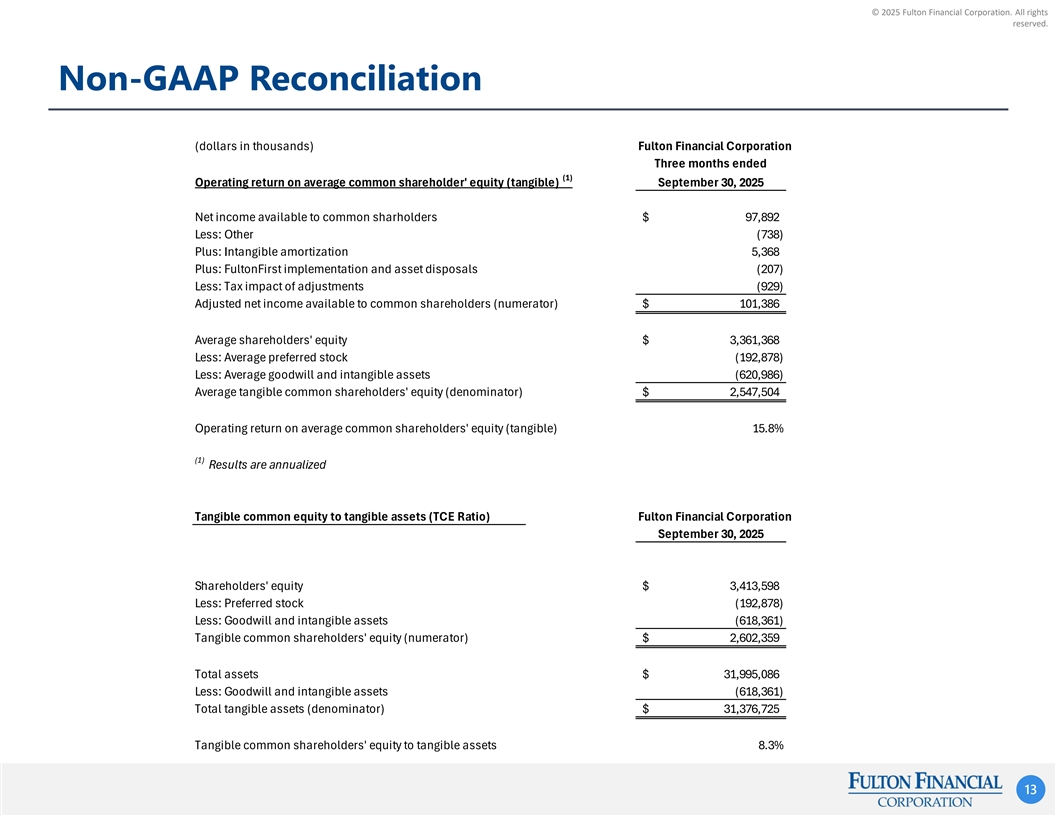

© 2025 Fulton Financial Corporation. All rights reserved. Non-GAAP Reconciliation (dollars in thousands) Fulton Financial Corporation Three months ended (1) Operating return on average common shareholder' equity (tangible) September 30, 2025 Net income available to common sharholders $ 97,892 Less: Other (738) Plus: Intangible amortization 5,368 Plus: FultonFirst implementation and asset disposals (207) Less: Tax impact of adjustments ( 929) Adjusted net income available to common shareholders (numerator) $ 101,386 Average shareholders' equity $ 3,361,368 Less: Average preferred stock (192,878) Less: Average goodwill and intangible assets (620,986) Average tangible common shareholders' equity (denominator) $ 2,547,504 Operating return on average common shareholders' equity (tangible) 15.8% (1) Results are annualized Tangible common equity to tangible assets (TCE Ratio) Fulton Financial Corporation September 30, 2025 Shareholders' equity $ 3,413,598 Less: Preferred stock (192,878) Less: Goodwill and intangible assets (618,361) Tangible common shareholders' equity (numerator) $ 2,602,359 Total assets $ 31,995,086 Less: Goodwill and intangible assets (618,361) Total tangible assets (denominator) $ 31,376,725 Tangible common shareholders' equity to tangible assets 8.3% 13