4th Quarter 2025 Earnings Supplement and Investor Presentation January 28, 2026

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements ("FLS") concerning, among other things: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, payment or nonpayment of dividends, net interest income, capital position, credit losses, net interest margin, or other financial items. These statements may also include the plans, objectives, and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services, and regulatory developments or actions. In addition, such statements may address anticipated economic performance, the expected impact of business initiatives, and the assumptions underlying any of the foregoing. Words such as "believe," "plan," "anticipate," "aim," "seek," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "estimate," "will," "should," "may," and other similar expressions are intended to identify FLS, although such terminology is not the exclusive means of doing so. While we believe that our FLS and their underlying assumptions are reasonably based, such statements are inherently subject to risks and uncertainties that may cause actual results to differ materially from expectations. Factors that may lead to such differences, include, but are not limited to: the persistence or resurgence of inflationary pressures in the United States and our market areas, and their effect on market interest rates, economic conditions, and credit quality; the impact of the current U.S. administration’s economic policies, including potential international tariffs, and other cost cutting initiatives; the adverse effects of bank failures on customer confidence, deposit behavior, liquidity, and regulatory responses; the effects of pandemics, epidemics, and other public health emergencies, including their impact on Hawaii's tourism and construction sectors and on our borrowers, customers, vendors and employees; supply chain disruptions, labor contract disputes, strikes; adverse trends in the real estate or construction industries, including rising inventory levels or declining property values; deterioration in borrowers' financial performance leading to increased loan delinquencies, asset quality issues, or loan losses; the impact of local, national, and international economic conditions and natural disasters (such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, or earthquakes) on our markets and major industries within Hawaii; weakness in domestic economic conditions, including instability in the financial industry, deterioration in real estate markets, and declines in consumer or business confidence; revisions to estimates of reserve requirements under applicable regulatory and accounting standards; the impact of legislative and regulatory developments, including the Dodd-Frank Act, changing capital and consumer protection rules, and new regulations affecting our operations and competitiveness; legal and regulatory proceedings, including actual or threatened litigation and the efforts of governmental and regulatory exams and orders, as well as the costs of ongoing or potential compliance efforts; the effects of accounting standard changes adopted by regulatory agencies, the PCAOB, or the FASB, and the cost and resources associated with implementation; changes in trade, monetary, or fiscal policy, including actions by the Federal Reserve; market volatility and monetary fluctuations, including the transition away from the LIBOR Index; declines in our market capitalization or the price of our common stock; the effects and cost of acquisitions, dispositions, or strategic transactions we may make or evaluate; political instability, acts of war, terrorism, or other geopolitical conflicts; shifts in consumer spending, borrowing, and savings behaviors; technological changes and developments; cybersecurity incidents, data privacy breaches, or fraud involving us or third-party vendors; deficiencies in internal control over financial reporting or disclosure controls, and our ability to remediate them; increased competition among financial institutions and other financial service providers; our ability to achieve efficiency ratio improvement goals; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and related reputational or regulatory exposures; and risks related to the United States fiscal debt, deficit, and budget uncertainties. For further information on factors that could cause actual results to differ materially from the expectations or projections expressed in our FLS, please refer to the Company's filings with the U.S. Securities and Exchange Commission, including the Company's most recent Forms 10-Q and 10-K, particularly, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances occurring after the date on which such statements are made, or to reflect the occurrence of unanticipated events, except as required by law.

3Central Pacific Financial Corp. Central Pacific Financial Corp. Overview Who We Are Strategic Focus 4Q 2025 Financial Results Appendix

4Central Pacific Financial Corp. MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CPB TOTAL ASSETS $7.4 BILLION MARKET CAP $822 MILLION SHARE PRICE $31.16, +57% 3Y1 DIVIDEND YIELD 3.6%2 Central Pacific Financial Corp. (CPF) is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 27 branches and 55 ATMs across the State. CPB was named to Newsweek’s “America’s Best Regional Banks” list for 2026. This marks the fifth consecutive year CPB has made this list. Central Pacific Financial – Who We Are 1 3-year stock price change from 12/31/2022 to 12/31/2025 2 Dividend yield is calculated based on quarterly cash dividend of $0.28 per share for 4Q25. Note: Total assets and other market information above is as of December 31, 2025.

5Central Pacific Financial Corp. Strategic Focus

6Central Pacific Financial Corp. CPF Strategic Focus We aim to be a high performing bank that delivers sustainable, growing returns and provides enhanced value to positively impact our employees, customers, community and long-term shareholders. Our focus is on our core business. We are positioned to drive strong results organically. Strengthening our brand and reputation enhances customer trust, loyalty and community relevance which drives sustained deposit growth, lower customer acquisition costs and long-term shareholder value. Brand and Reputation Relationship based Hawaii retail and small business deposits provide stable, low-cost funding to support balance sheet growth and margin optimization. Diversify funding sources through strategic partnerships with customers in Japan and Korea. Stable, Low-Cost Funding Focus on high-quality, relationship-driven lending and selective investments. Priority on durable spreads over rate speculation to drive consistent earnings and capital growth. Disciplined Asset Deployment Seek diversification through selective indirect and wholesale credit exposure to reduce concentration risk, access larger markets, and enhance returns, while maintaining disciplined, deposit-funded growth anchored in our Hawaii core franchise. Thoughtful Diversification

7Central Pacific Financial Corp. CPF Drivers of Growth & Diversification Core Hawaii Franchise • Strong commitment to the Hawaii market • Solid franchise built on 70+ year legacy • Relative size as 4th largest bank in Hawaii provides market share growth opportunity • Leader and advocate for small business and home ownership • Valuable low-cost core deposits COMPLEMENTING THE STRATEGY FOR DIVERSIFICATION: Japan and Korea • Deepen cross-border strategic partnerships to grow high net-worth relationships and business client acquisitions • Generates low-cost core U.S. dollar deposits Mainland • Provide geographic diversification, shorter duration, and better risk/return profile • Continue to target 15-20% of total loans • Mainland exposure comprises CRE, C&I and Consumer Loans

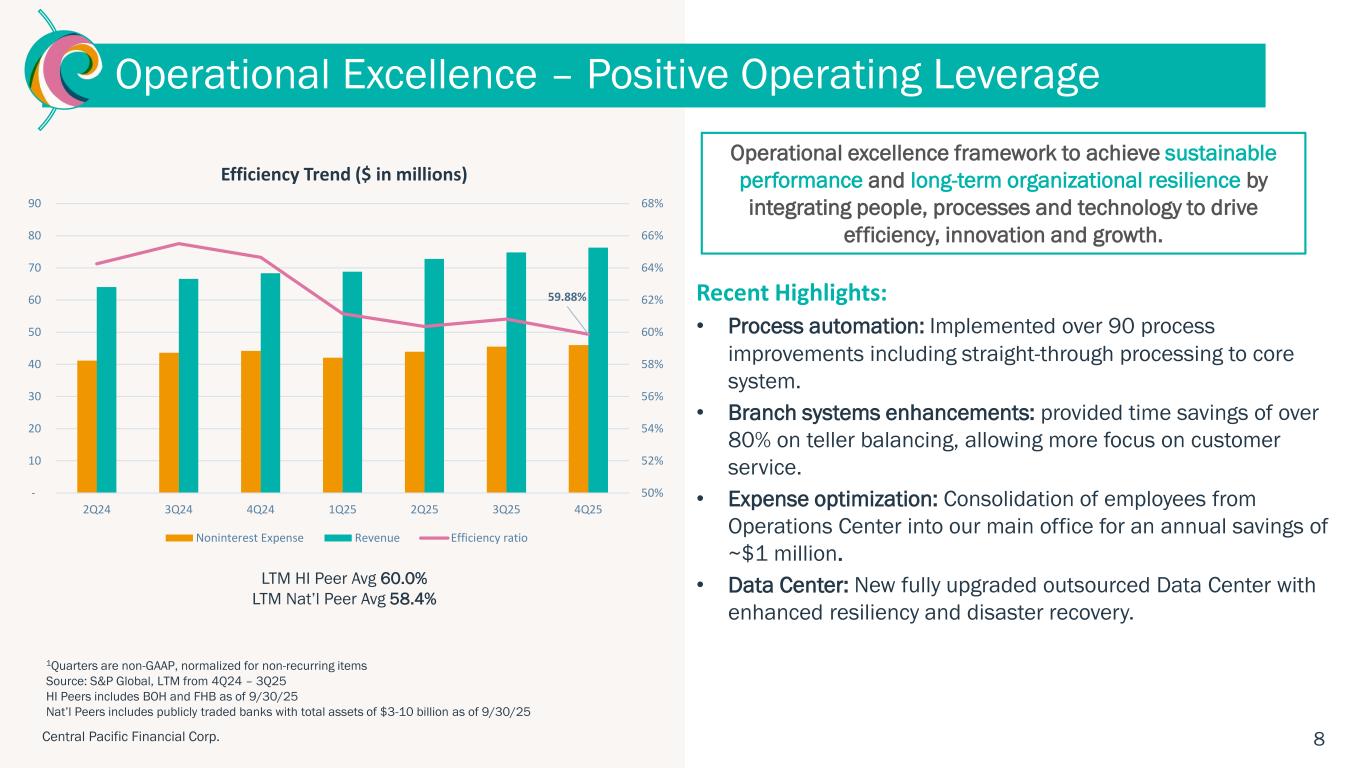

8Central Pacific Financial Corp. Operational Excellence – Positive Operating Leverage Recent Highlights: • Process automation: Implemented over 90 process improvements including straight-through processing to core system. • Branch systems enhancements: provided time savings of over 80% on teller balancing, allowing more focus on customer service. • Expense optimization: Consolidation of employees from Operations Center into our main office for an annual savings of ~$1 million. • Data Center: New fully upgraded outsourced Data Center with enhanced resiliency and disaster recovery. Operational excellence framework to achieve sustainable performance and long-term organizational resilience by integrating people, processes and technology to drive efficiency, innovation and growth. 59.88% 50% 52% 54% 56% 58% 60% 62% 64% 66% 68% - 10 20 30 40 50 60 70 80 90 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Efficiency Trend ($ in millions) Noninterest Expense Revenue Efficiency ratio LTM HI Peer Avg 60.0% LTM Nat’l Peer Avg 58.4% 1Quarters are non-GAAP, normalized for non-recurring items Source: S&P Global, LTM from 4Q24 – 3Q25 HI Peers includes BOH and FHB as of 9/30/25 Nat’l Peers includes publicly traded banks with total assets of $3-10 billion as of 9/30/25

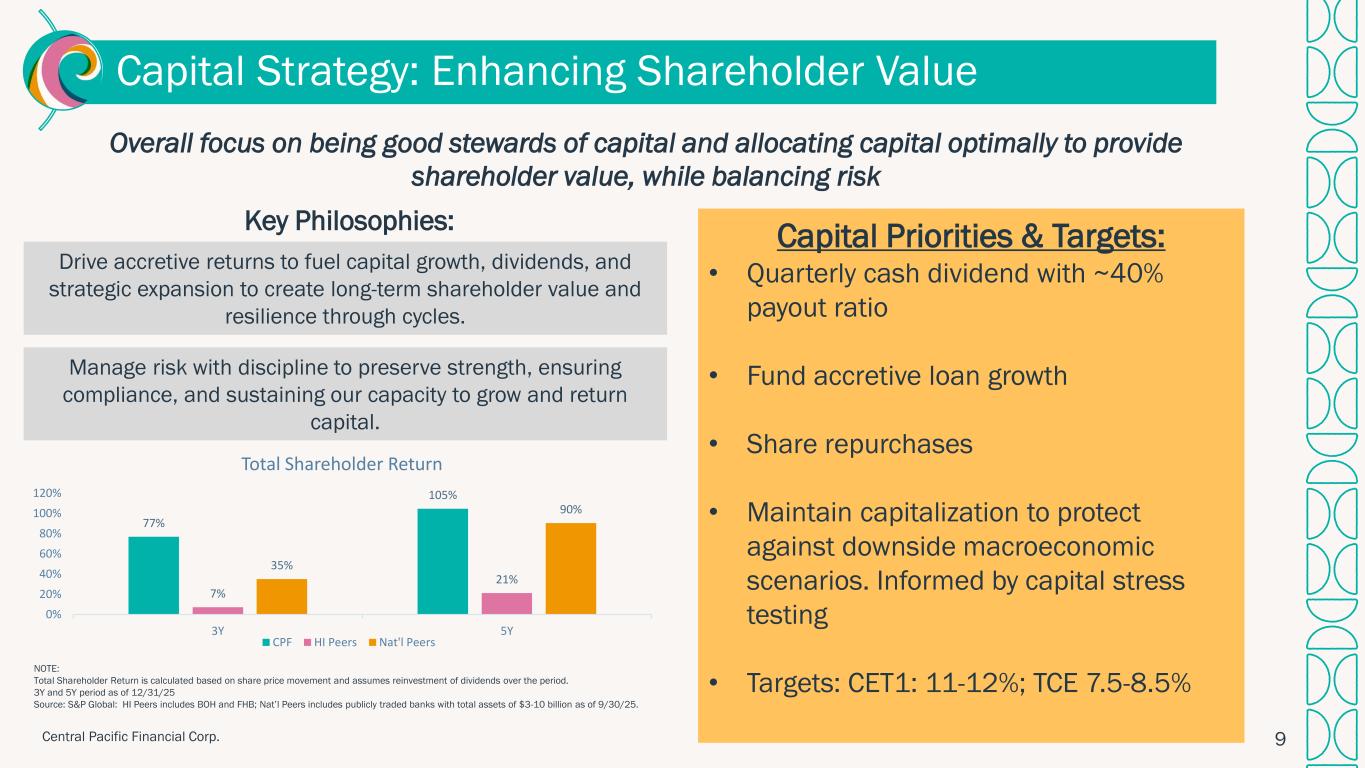

9Central Pacific Financial Corp. Capital Strategy: Enhancing Shareholder Value Overall focus on being good stewards of capital and allocating capital optimally to provide shareholder value, while balancing risk Drive accretive returns to fuel capital growth, dividends, and strategic expansion to create long-term shareholder value and resilience through cycles. Manage risk with discipline to preserve strength, ensuring compliance, and sustaining our capacity to grow and return capital. Key Philosophies: NOTE: Total Shareholder Return is calculated based on share price movement and assumes reinvestment of dividends over the period. 3Y and 5Y period as of 12/31/25 Source: S&P Global: HI Peers includes BOH and FHB; Nat’l Peers includes publicly traded banks with total assets of $3-10 billion as of 9/30/25. Capital Priorities & Targets: • Quarterly cash dividend with ~40% payout ratio • Fund accretive loan growth • Share repurchases • Maintain capitalization to protect against downside macroeconomic scenarios. Informed by capital stress testing • Targets: CET1: 11-12%; TCE 7.5-8.5% 77% 105% 7% 21% 35% 90% 0% 20% 40% 60% 80% 100% 120% 3Y 5Y Total Shareholder Return CPF HI Peers Nat'l Peers

10Central Pacific Financial Corp. 4Q 2025 Financial Results

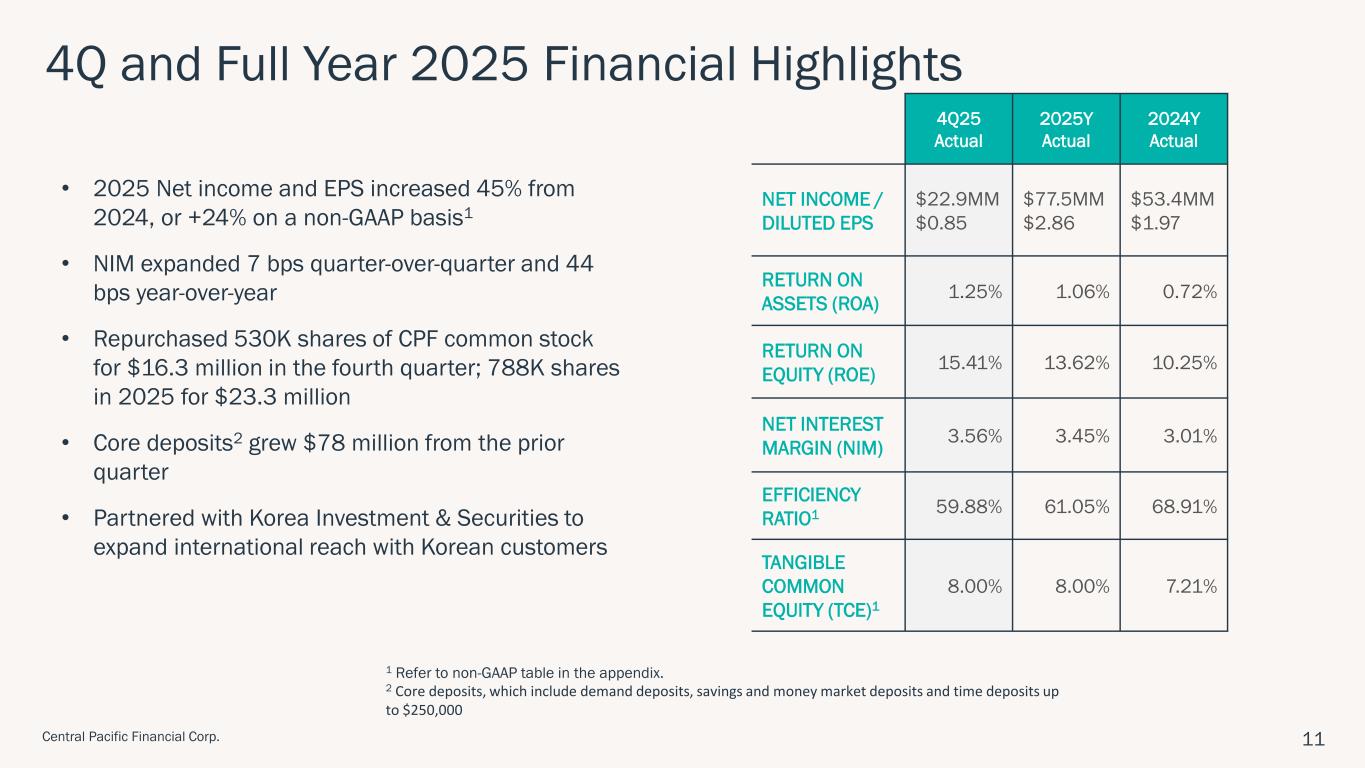

11Central Pacific Financial Corp. • 2025 Net income and EPS increased 45% from 2024, or +24% on a non-GAAP basis1 • NIM expanded 7 bps quarter-over-quarter and 44 bps year-over-year • Repurchased 530K shares of CPF common stock for $16.3 million in the fourth quarter; 788K shares in 2025 for $23.3 million • Core deposits2 grew $78 million from the prior quarter • Partnered with Korea Investment & Securities to expand international reach with Korean customers 4Q and Full Year 2025 Financial Highlights 4Q25 Actual 2025Y Actual 2024Y Actual NET INCOME / DILUTED EPS $22.9MM $0.85 $77.5MM $2.86 $53.4MM $1.97 RETURN ON ASSETS (ROA) 1.25% 1.06% 0.72% RETURN ON EQUITY (ROE) 15.41% 13.62% 10.25% NET INTEREST MARGIN (NIM) 3.56% 3.45% 3.01% EFFICIENCY RATIO1 59.88% 61.05% 68.91% TANGIBLE COMMON EQUITY (TCE)1 8.00% 8.00% 7.21% 1 Refer to non-GAAP table in the appendix. 2 Core deposits, which include demand deposits, savings and money market deposits and time deposits up to $250,000

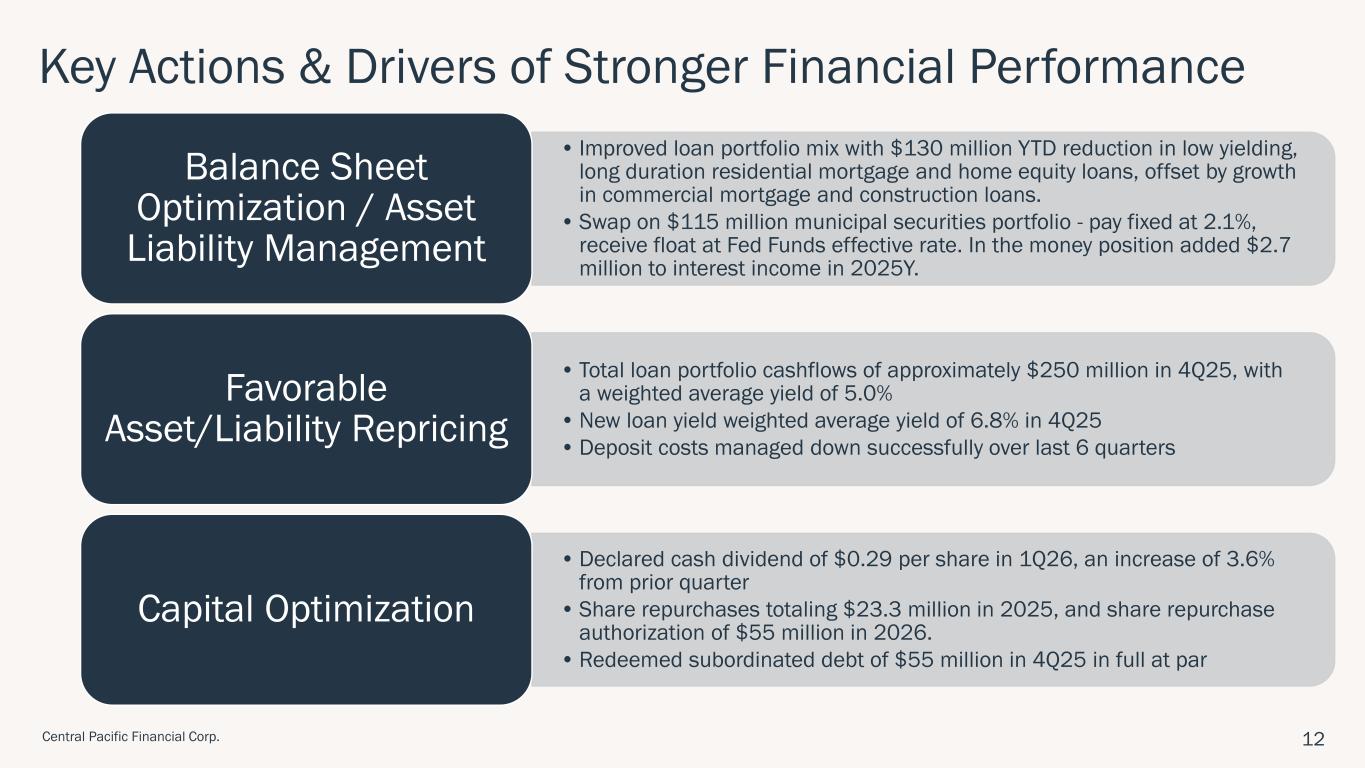

12Central Pacific Financial Corp. Key Actions & Drivers of Stronger Financial Performance • Improved loan portfolio mix with $130 million YTD reduction in low yielding, long duration residential mortgage and home equity loans, offset by growth in commercial mortgage and construction loans. • Swap on $115 million municipal securities portfolio - pay fixed at 2.1%, receive float at Fed Funds effective rate. In the money position added $2.7 million to interest income in 2025Y. Balance Sheet Optimization / Asset Liability Management • Total loan portfolio cashflows of approximately $250 million in 4Q25, with a weighted average yield of 5.0% • New loan yield weighted average yield of 6.8% in 4Q25 • Deposit costs managed down successfully over last 6 quarters Favorable Asset/Liability Repricing • Declared cash dividend of $0.29 per share in 1Q26, an increase of 3.6% from prior quarter • Share repurchases totaling $23.3 million in 2025, and share repurchase authorization of $55 million in 2026. • Redeemed subordinated debt of $55 million in 4Q25 in full at par Capital Optimization

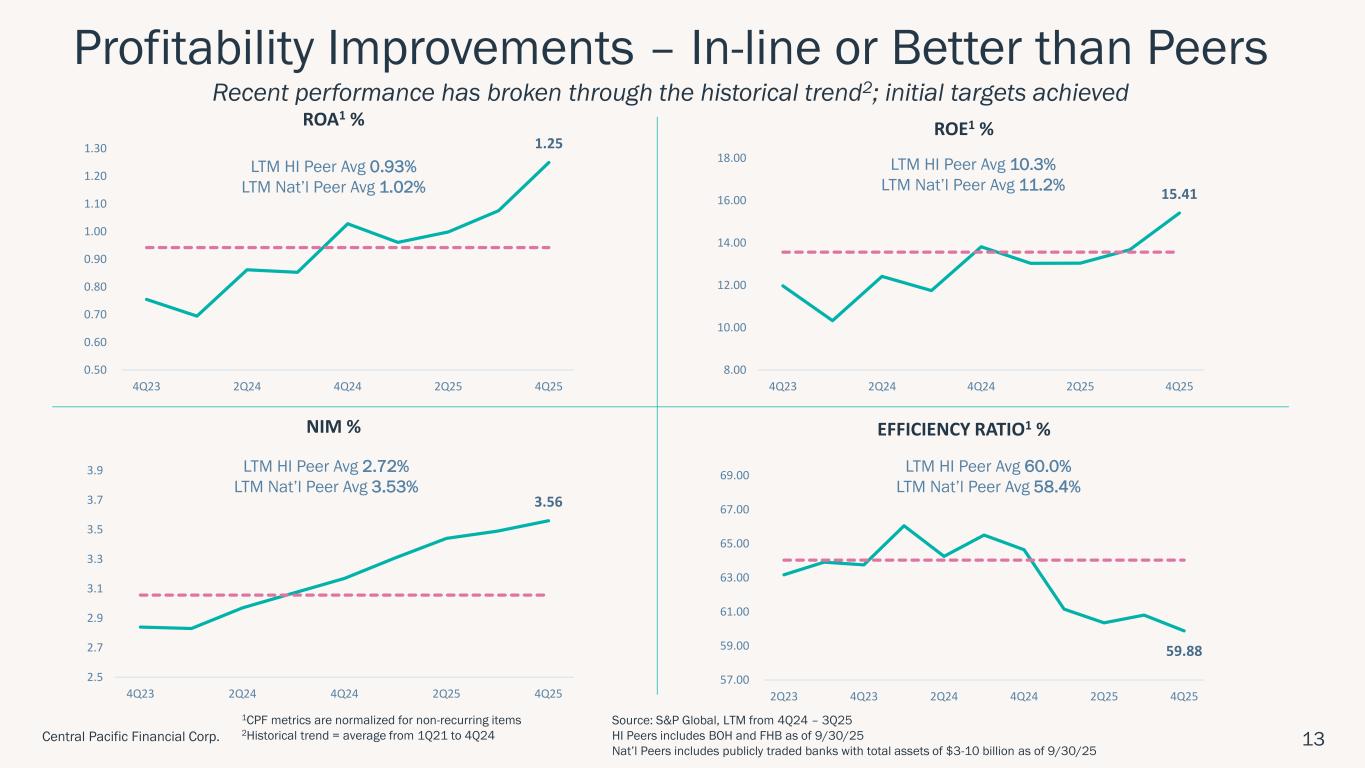

13Central Pacific Financial Corp. Profitability Improvements – In-line or Better than Peers Recent performance has broken through the historical trend2; initial targets achieved 1CPF metrics are normalized for non-recurring items 2Historical trend = average from 1Q21 to 4Q24 Source: S&P Global, LTM from 4Q24 – 3Q25 HI Peers includes BOH and FHB as of 9/30/25 Nat’l Peers includes publicly traded banks with total assets of $3-10 billion as of 9/30/25 LTM HI Peer Avg 0.93% LTM Nat’l Peer Avg 1.02% LTM HI Peer Avg 10.3% LTM Nat’l Peer Avg 11.2% LTM HI Peer Avg 60.0% LTM Nat’l Peer Avg 58.4% LTM HI Peer Avg 2.72% LTM Nat’l Peer Avg 3.53% 1.25 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 4Q23 2Q24 4Q24 2Q25 4Q25 ROA1 % 15.41 8.00 10.00 12.00 14.00 16.00 18.00 4Q23 2Q24 4Q24 2Q25 4Q25 ROE1 % 3.56 2.5 2.7 2.9 3.1 3.3 3.5 3.7 3.9 4Q23 2Q24 4Q24 2Q25 4Q25 NIM % 59.88 57.00 59.00 61.00 63.00 65.00 67.00 69.00 2Q23 4Q23 2Q24 4Q24 2Q25 4Q25 EFFICIENCY RATIO1 %

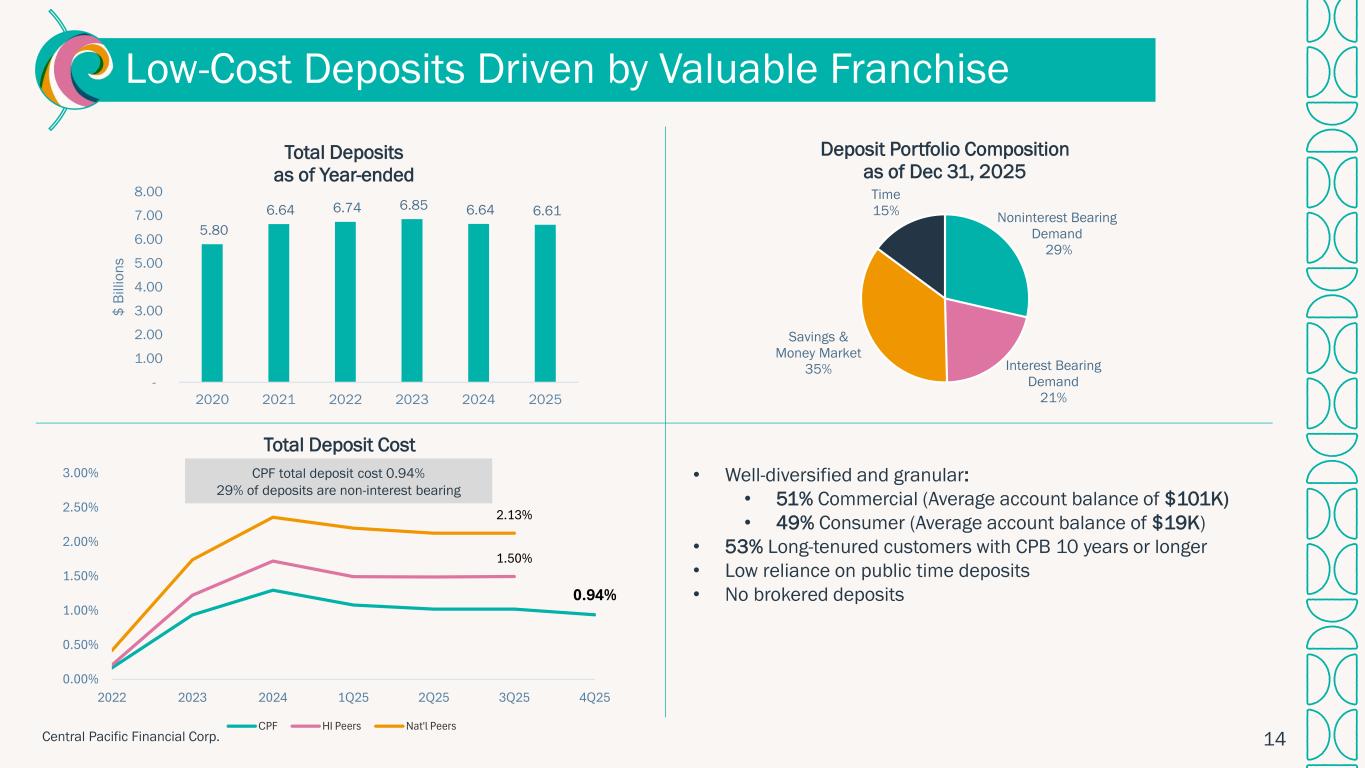

14Central Pacific Financial Corp. Low-Cost Deposits Driven by Valuable Franchise • Well-diversified and granular: • 51% Commercial (Average account balance of $101K) • 49% Consumer (Average account balance of $19K) • 53% Long-tenured customers with CPB 10 years or longer • Low reliance on public time deposits • No brokered deposits Noninterest Bearing Demand 29% Interest Bearing Demand 21% Savings & Money Market 35% Time 15% Deposit Portfolio Composition as of Dec 31, 2025 5.80 6.64 6.74 6.85 6.64 6.61 - 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 2020 2021 2022 2023 2024 2025 $ B il li o n s Total Deposits as of Year-ended 0.94% 1.50% 2.13% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2022 2023 2024 1Q25 2Q25 3Q25 4Q25 Total Deposit Cost CPF HI Peers Nat'l Peers CPF total deposit cost 0.94% 29% of deposits are non-interest bearing

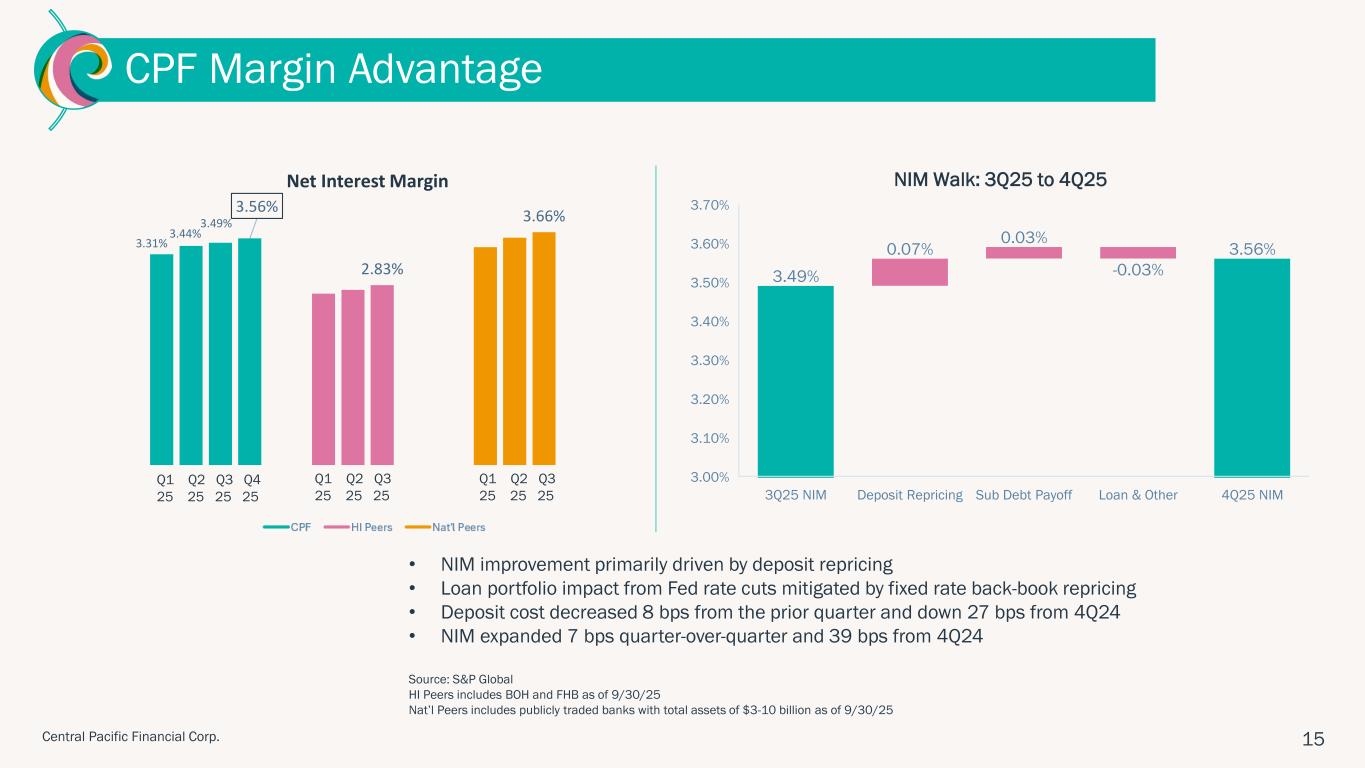

15Central Pacific Financial Corp. CPF Margin Advantage • NIM improvement primarily driven by deposit repricing • Loan portfolio impact from Fed rate cuts mitigated by fixed rate back-book repricing • Deposit cost decreased 8 bps from the prior quarter and down 27 bps from 4Q24 • NIM expanded 7 bps quarter-over-quarter and 39 bps from 4Q24 Source: S&P Global HI Peers includes BOH and FHB as of 9/30/25 Nat’l Peers includes publicly traded banks with total assets of $3-10 billion as of 9/30/25 Q1 Q2 Q3 Q4 25 25 25 25 3.31% 3.44% 3.49% 2.83% 3.66% 3.56% Net Interest Margin Q1 Q2 Q3 25 25 25 Q1 Q2 Q3 25 25 25 3.49% 0.07% 0.03% -0.03% 3.56% 3Q25 NIM Deposit Repricing Sub Debt Payoff Loan & Other 4Q25 NIM 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% NIM Walk: 3Q25 to 4Q25

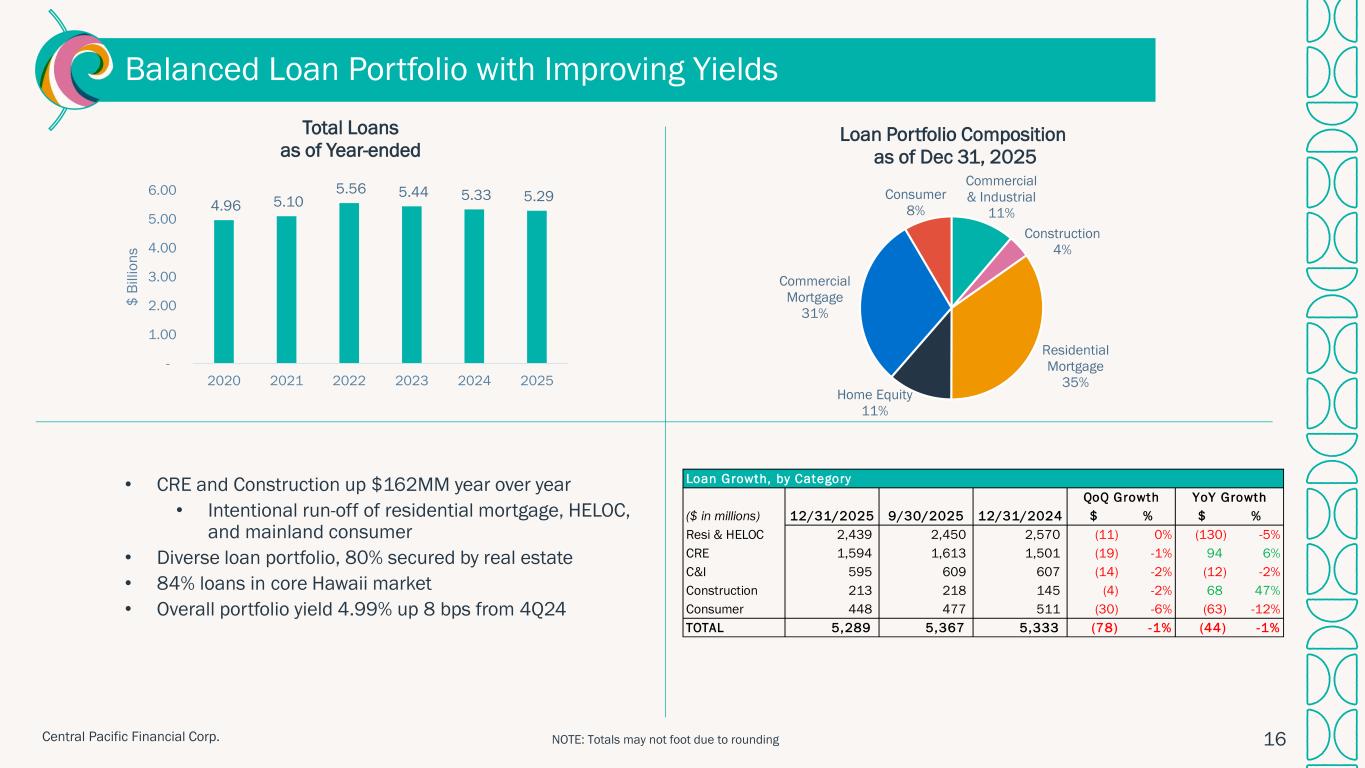

16Central Pacific Financial Corp. Balanced Loan Portfolio with Improving Yields • CRE and Construction up $162MM year over year • Intentional run-off of residential mortgage, HELOC, and mainland consumer • Diverse loan portfolio, 80% secured by real estate • 84% loans in core Hawaii market • Overall portfolio yield 4.99% up 8 bps from 4Q24 Commercial & Industrial 11% Construction 4% Residential Mortgage 35% Home Equity 11% Commercial Mortgage 31% Consumer 8% Loan Portfolio Composition as of Dec 31, 2025 4.96 5.10 5.56 5.44 5.33 5.29 - 1.00 2.00 3.00 4.00 5.00 6.00 2020 2021 2022 2023 2024 2025 $ B il li o n s Total Loans as of Year-ended NOTE: Totals may not foot due to rounding ($ in millions) 12/31/2025 9/30/2025 12/31/2024 $ % $ % Resi & HELOC 2,439 2,450 2,570 (11) 0% (130) -5% CRE 1,594 1,613 1,501 (19) -1% 94 6% C&I 595 609 607 (14) -2% (12) -2% Construction 213 218 145 (4) -2% 68 47% Consumer 448 477 511 (30) -6% (63) -12% TOTAL 5,289 5,367 5,333 (78) -1% (44) -1% Loan Growth, by Category YoY GrowthQoQ Growth

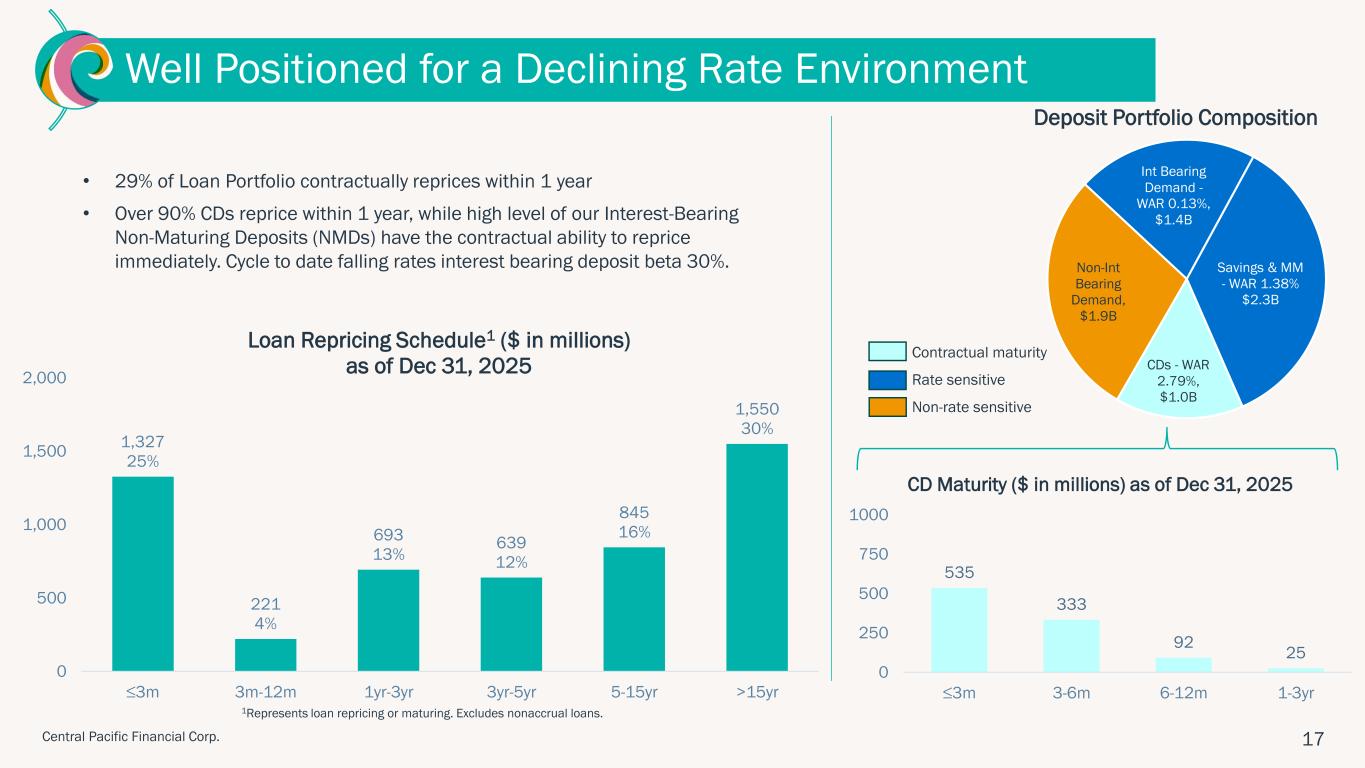

17Central Pacific Financial Corp. Well Positioned for a Declining Rate Environment • 29% of Loan Portfolio contractually reprices within 1 year • Over 90% CDs reprice within 1 year, while high level of our Interest-Bearing Non-Maturing Deposits (NMDs) have the contractual ability to reprice immediately. Cycle to date falling rates interest bearing deposit beta 30%. 535 333 92 25 0 250 500 750 1000 ≤3m 3-6m 6-12m 1-3yr CD Maturity ($ in millions) as of Dec 31, 2025 1,327 25% 221 4% 693 13% 639 12% 845 16% 1,550 30% 0 500 1,000 1,500 2,000 ≤3m 3m-12m 1yr-3yr 3yr-5yr 5-15yr >15yr Loan Repricing Schedule1 ($ in millions) as of Dec 31, 2025 ▪ Contractual maturity ▪ Rate sensitive ▪ Non-rate sensitive Non-Int Bearing Demand, $1.9B Int Bearing Demand - WAR 0.13%, $1.4B Savings & MM - WAR 1.38% $2.3B CDs - WAR 2.79%, $1.0B Deposit Portfolio Composition 1Represents loan repricing or maturing. Excludes nonaccrual loans.

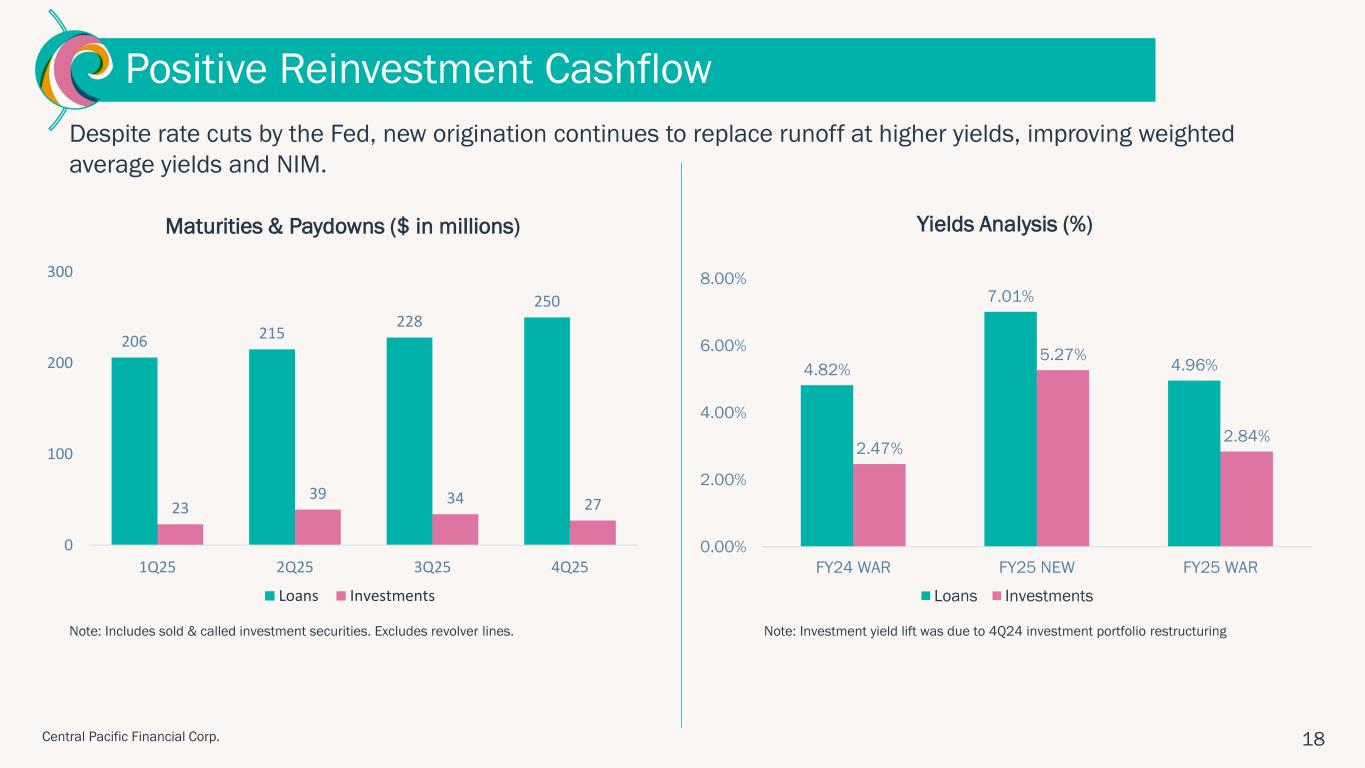

18Central Pacific Financial Corp. Positive Reinvestment Cashflow Despite rate cuts by the Fed, new origination continues to replace runoff at higher yields, improving weighted average yields and NIM. Note: Includes sold & called investment securities. Excludes revolver lines. 4.82% 7.01% 4.96% 2.47% 5.27% 2.84% 0.00% 2.00% 4.00% 6.00% 8.00% FY24 WAR FY25 NEW FY25 WAR Yields Analysis (%) Loans Investments 206 215 228 250 23 39 34 27 0 100 200 300 1Q25 2Q25 3Q25 4Q25 Maturities & Paydowns ($ in millions) Loans Investments Note: Investment yield lift was due to 4Q24 investment portfolio restructuring

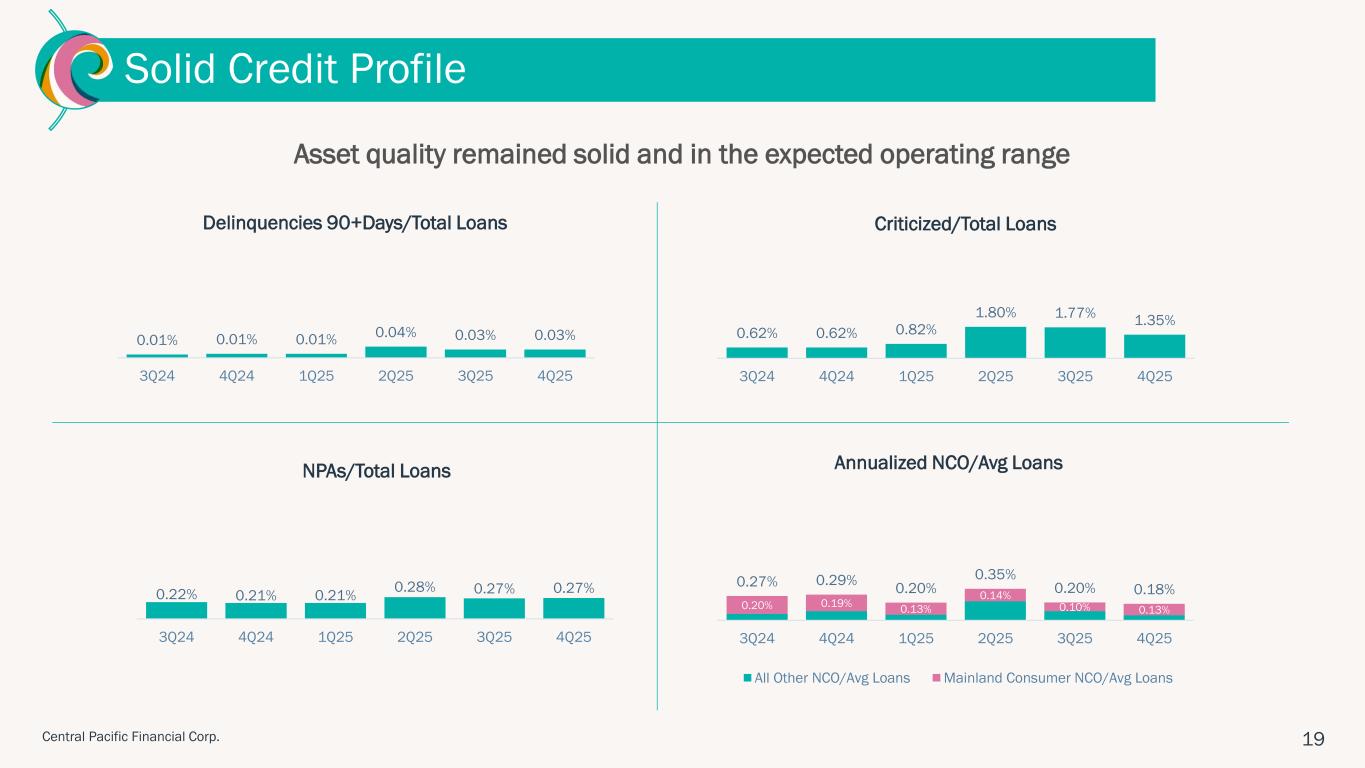

19Central Pacific Financial Corp. 5 Asset quality remained solid and in the expected operating range Solid Credit Profile 0.01% 0.01% 0.01% 0.04% 0.03% 0.03% 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Delinquencies 90+Days/Total Loans 0.22% 0.21% 0.21% 0.28% 0.27% 0.27% 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 NPAs/Total Loans 0.20% 0.19% 0.13% 0.14% 0.10% 0.13% 0.27% 0.29% 0.20% 0.35% 0.20% 0.18% 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Annualized NCO/Avg Loans All Other NCO/Avg Loans Mainland Consumer NCO/Avg Loans 0.62% 0.62% 0.82% 1.80% 1.77% 1.35% 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Criticized/Total Loans

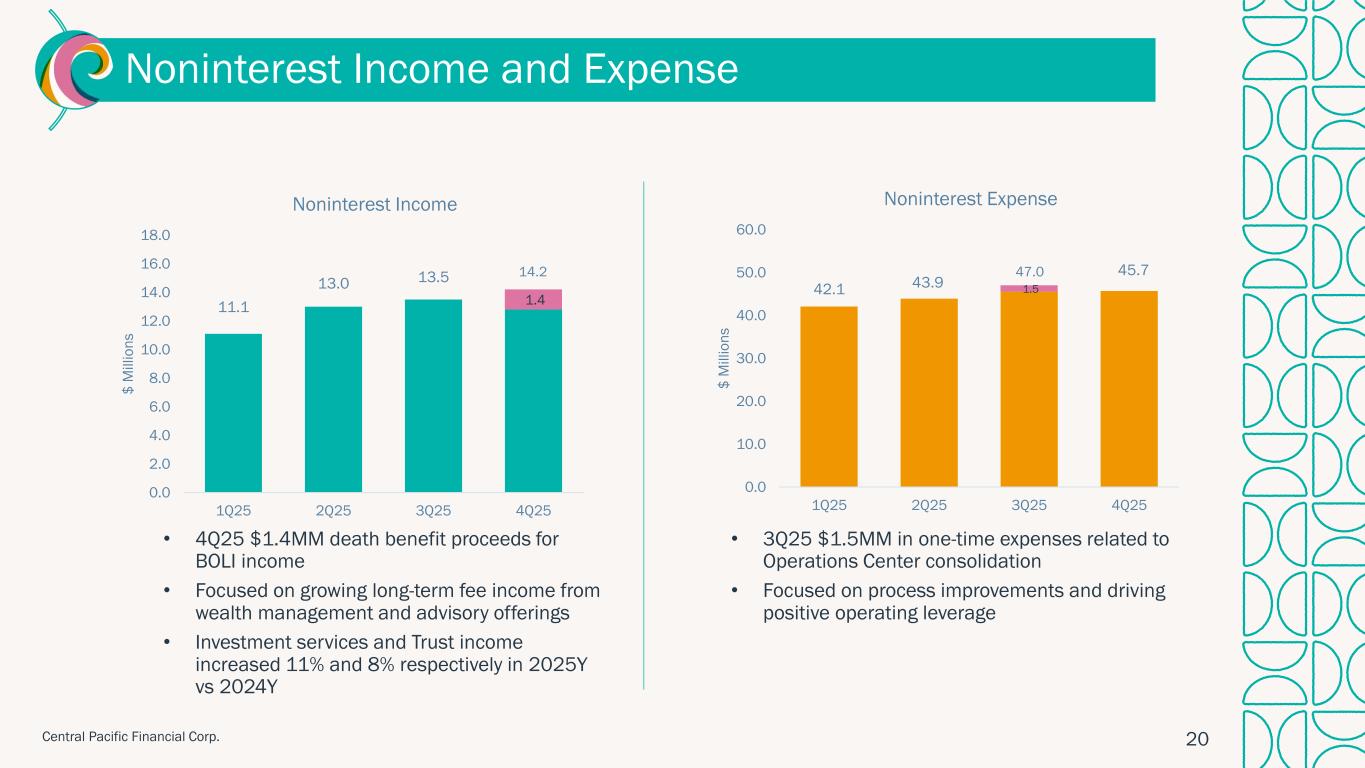

20Central Pacific Financial Corp. Noninterest Income and Expense • 4Q25 $1.4MM death benefit proceeds for BOLI income • Focused on growing long-term fee income from wealth management and advisory offerings • Investment services and Trust income increased 11% and 8% respectively in 2025Y vs 2024Y • 3Q25 $1.5MM in one-time expenses related to Operations Center consolidation • Focused on process improvements and driving positive operating leverage 11.1 13.0 13.5 1.4 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 1Q25 2Q25 3Q25 4Q25 $ M il li o n s Noninterest Income 42.1 43.9 45.7 1.5 0.0 10.0 20.0 30.0 40.0 50.0 60.0 1Q25 2Q25 3Q25 4Q25 $ M il li o n s Noninterest Expense 14.2 47.0

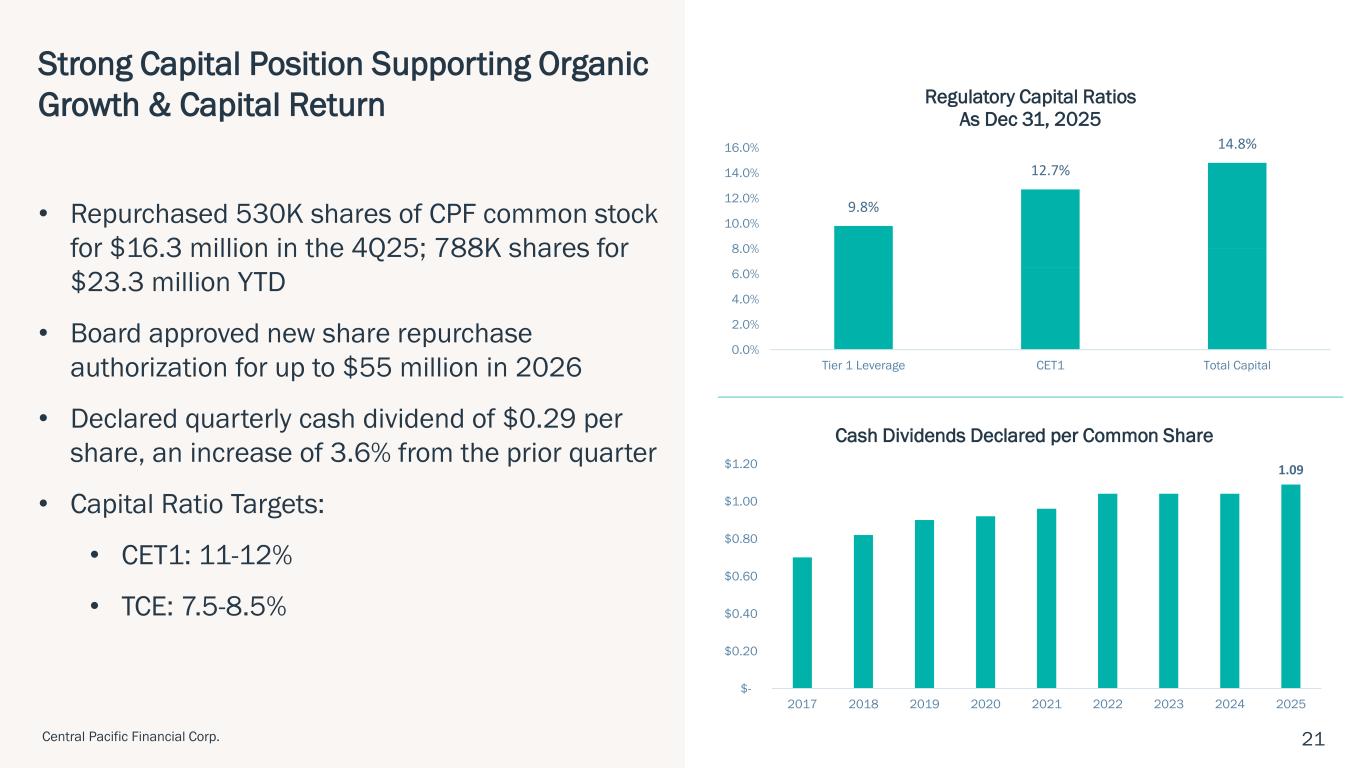

212Central Pacific Financial Corp. Strong Capital Position Supporting Organic Growth & Capital Return • Repurchased 530K shares of CPF common stock for $16.3 million in the 4Q25; 788K shares for $23.3 million YTD • Board approved new share repurchase authorization for up to $55 million in 2026 • Declared quarterly cash dividend of $0.29 per share, an increase of 3.6% from the prior quarter • Capital Ratio Targets: • CET1: 11-12% • TCE: 7.5-8.5% 1.09 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2017 2018 2019 2020 2021 2022 2023 2024 2025 Cash Dividends Declared per Common Share 9.8% 12.7% 14.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As Dec 31, 2025

Appendix

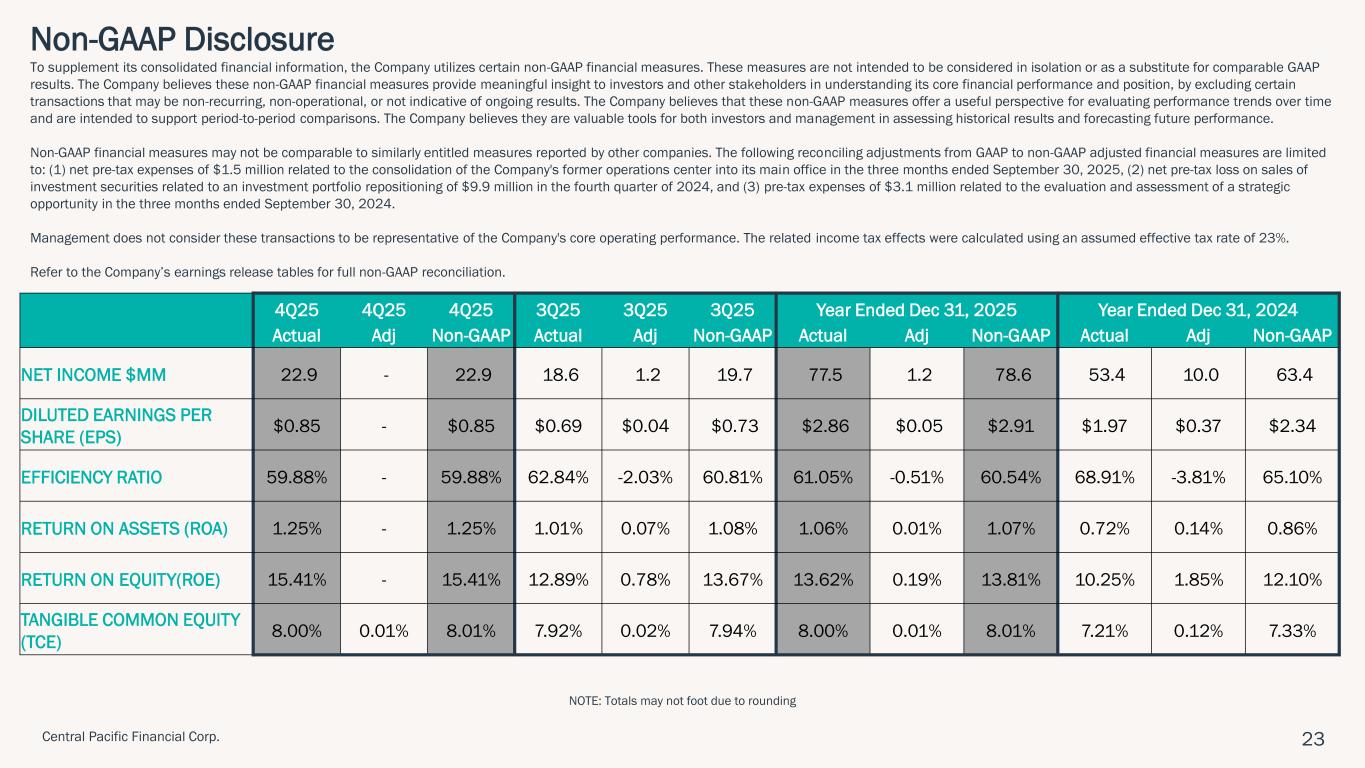

23Central Pacific Financial Corp. Non-GAAP Disclosure To supplement its consolidated financial information, the Company utilizes certain non-GAAP financial measures. These measures are not intended to be considered in isolation or as a substitute for comparable GAAP results. The Company believes these non-GAAP financial measures provide meaningful insight to investors and other stakeholders in understanding its core financial performance and position, by excluding certain transactions that may be non-recurring, non-operational, or not indicative of ongoing results. The Company believes that these non-GAAP measures offer a useful perspective for evaluating performance trends over time and are intended to support period-to-period comparisons. The Company believes they are valuable tools for both investors and management in assessing historical results and forecasting future performance. Non-GAAP financial measures may not be comparable to similarly entitled measures reported by other companies. The following reconciling adjustments from GAAP to non-GAAP adjusted financial measures are limited to: (1) net pre-tax expenses of $1.5 million related to the consolidation of the Company's former operations center into its main office in the three months ended September 30, 2025, (2) net pre-tax loss on sales of investment securities related to an investment portfolio repositioning of $9.9 million in the fourth quarter of 2024, and (3) pre-tax expenses of $3.1 million related to the evaluation and assessment of a strategic opportunity in the three months ended September 30, 2024. Management does not consider these transactions to be representative of the Company's core operating performance. The related income tax effects were calculated using an assumed effective tax rate of 23%. Refer to the Company’s earnings release tables for full non-GAAP reconciliation. 4Q25 4Q25 4Q25 3Q25 3Q25 3Q25 Year Ended Dec 31, 2025 Year Ended Dec 31, 2024 Actual Adj Non-GAAP Actual Adj Non-GAAP Actual Adj Non-GAAP Actual Adj Non-GAAP NET INCOME $MM 22.9 - 22.9 18.6 1.2 19.7 77.5 1.2 78.6 53.4 10.0 63.4 DILUTED EARNINGS PER SHARE (EPS) $0.85 - $0.85 $0.69 $0.04 $0.73 $2.86 $0.05 $2.91 $1.97 $0.37 $2.34 EFFICIENCY RATIO 59.88% - 59.88% 62.84% -2.03% 60.81% 61.05% -0.51% 60.54% 68.91% -3.81% 65.10% RETURN ON ASSETS (ROA) 1.25% - 1.25% 1.01% 0.07% 1.08% 1.06% 0.01% 1.07% 0.72% 0.14% 0.86% RETURN ON EQUITY(ROE) 15.41% - 15.41% 12.89% 0.78% 13.67% 13.62% 0.19% 13.81% 10.25% 1.85% 12.10% TANGIBLE COMMON EQUITY (TCE) 8.00% 0.01% 8.01% 7.92% 0.02% 7.94% 8.00% 0.01% 8.01% 7.21% 0.12% 7.33% NOTE: Totals may not foot due to rounding

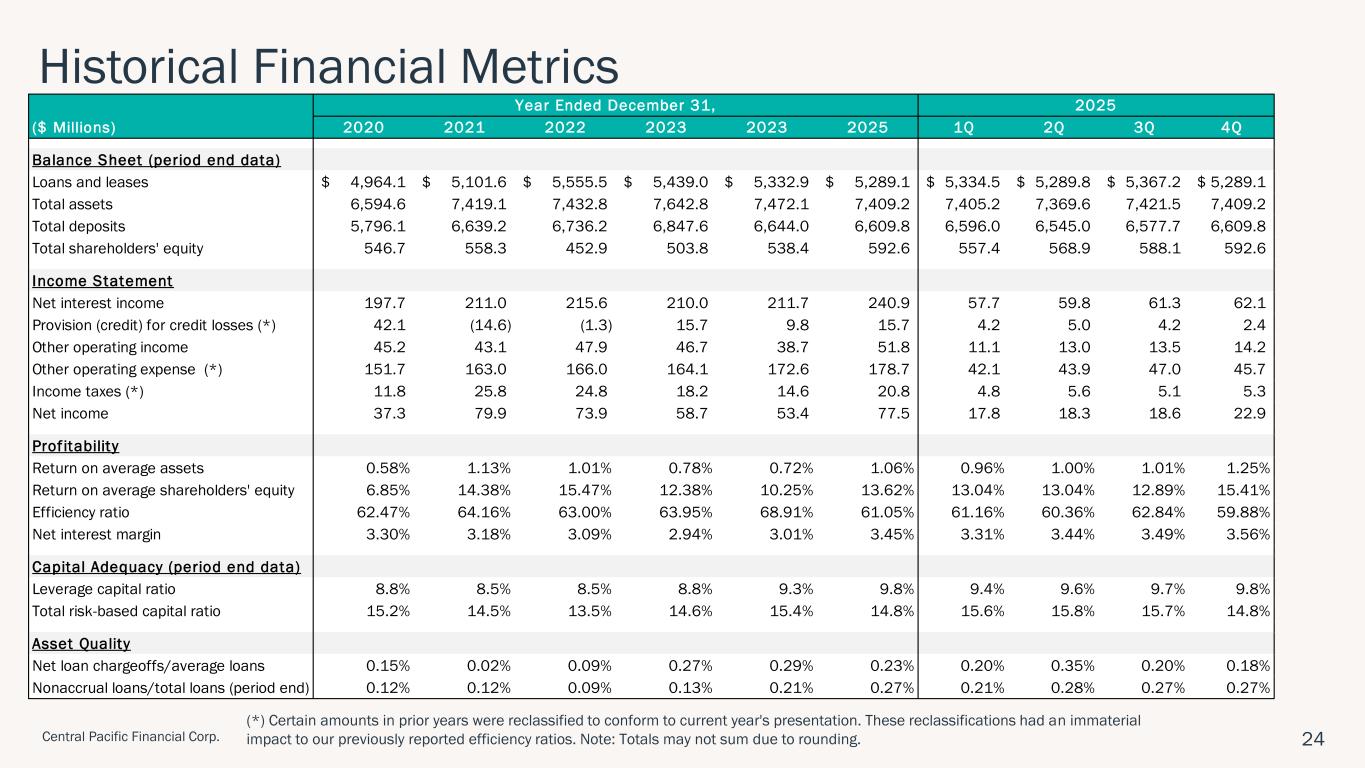

24Central Pacific Financial Corp. (*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our previously reported efficiency ratios. Note: Totals may not sum due to rounding. Historical Financial Metrics ($ Millions) 2020 2021 2022 2023 2023 2025 1Q 2Q 3Q 4Q Balance Sheet (period end data) Loans and leases 4,964.1$ 5,101.6$ 5,555.5$ 5,439.0$ 5,332.9$ 5,289.1$ 5,334.5$ 5,289.8$ 5,367.2$ 5,289.1$ Total assets 6,594.6 7,419.1 7,432.8 7,642.8 7,472.1 7,409.2 7,405.2 7,369.6 7,421.5 7,409.2 Total deposits 5,796.1 6,639.2 6,736.2 6,847.6 6,644.0 6,609.8 6,596.0 6,545.0 6,577.7 6,609.8 Total shareholders' equity 546.7 558.3 452.9 503.8 538.4 592.6 557.4 568.9 588.1 592.6 Income Statement Net interest income 197.7 211.0 215.6 210.0 211.7 240.9 57.7 59.8 61.3 62.1 Provision (credit) for credit losses (*) 42.1 (14.6) (1.3) 15.7 9.8 15.7 4.2 5.0 4.2 2.4 Other operating income 45.2 43.1 47.9 46.7 38.7 51.8 11.1 13.0 13.5 14.2 Other operating expense (*) 151.7 163.0 166.0 164.1 172.6 178.7 42.1 43.9 47.0 45.7 Income taxes (*) 11.8 25.8 24.8 18.2 14.6 20.8 4.8 5.6 5.1 5.3 Net income 37.3 79.9 73.9 58.7 53.4 77.5 17.8 18.3 18.6 22.9 Prof itability Return on average assets 0.58% 1.13% 1.01% 0.78% 0.72% 1.06% 0.96% 1.00% 1.01% 1.25% Return on average shareholders' equity 6.85% 14.38% 15.47% 12.38% 10.25% 13.62% 13.04% 13.04% 12.89% 15.41% Efficiency ratio 62.47% 64.16% 63.00% 63.95% 68.91% 61.05% 61.16% 60.36% 62.84% 59.88% Net interest margin 3.30% 3.18% 3.09% 2.94% 3.01% 3.45% 3.31% 3.44% 3.49% 3.56% Capital Adequacy (period end data) Leverage capital ratio 8.8% 8.5% 8.5% 8.8% 9.3% 9.8% 9.4% 9.6% 9.7% 9.8% Total risk-based capital ratio 15.2% 14.5% 13.5% 14.6% 15.4% 14.8% 15.6% 15.8% 15.7% 14.8% Asset Quality Net loan chargeoffs/average loans 0.15% 0.02% 0.09% 0.27% 0.29% 0.23% 0.20% 0.35% 0.20% 0.18% Nonaccrual loans/total loans (period end) 0.12% 0.12% 0.09% 0.13% 0.21% 0.27% 0.21% 0.28% 0.27% 0.27% Year Ended December 31, 2025

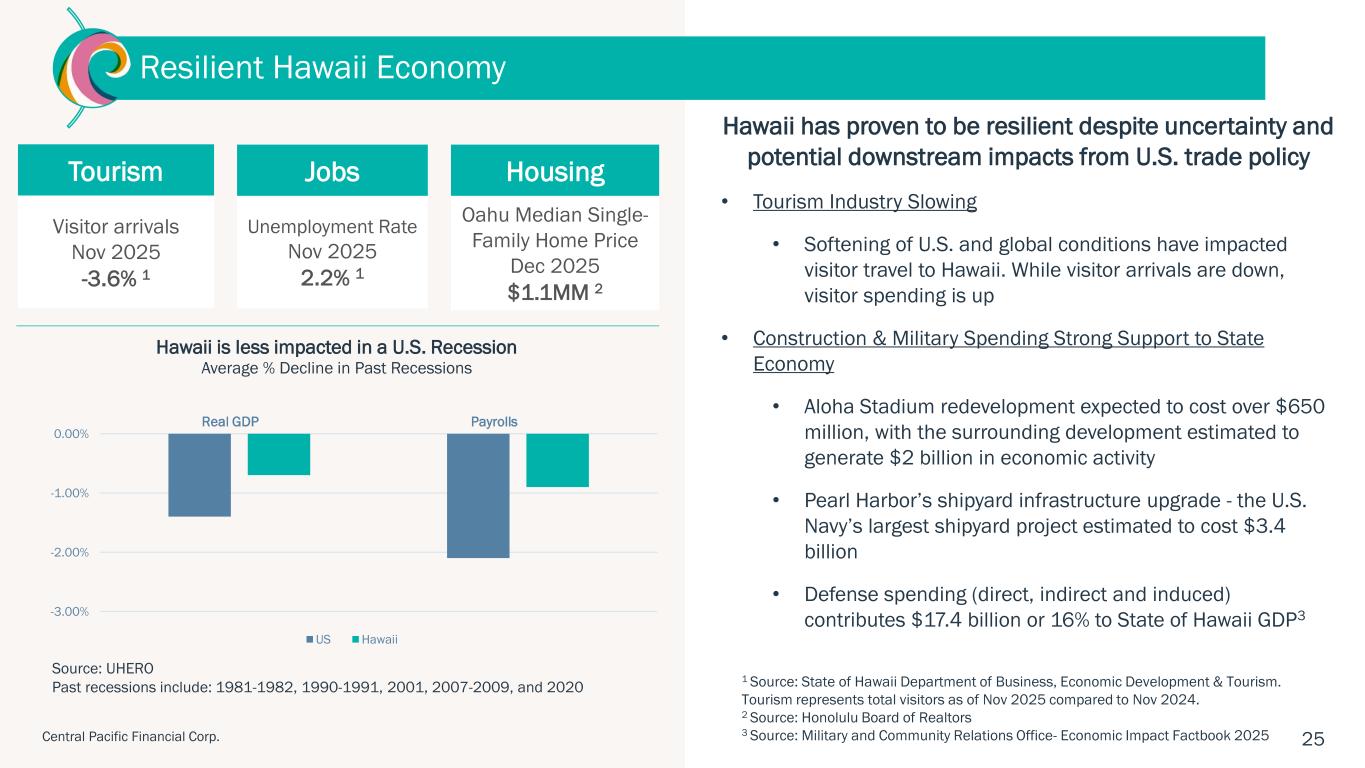

252Central Pacific Financial Corp. Tourism Visitor arrivals Nov 2025 -3.6% 1 Jobs Unemployment Rate Nov 2025 2.2% 1 Hawaii has proven to be resilient despite uncertainty and potential downstream impacts from U.S. trade policy • Tourism Industry Slowing • Softening of U.S. and global conditions have impacted visitor travel to Hawaii. While visitor arrivals are down, visitor spending is up • Construction & Military Spending Strong Support to State Economy • Aloha Stadium redevelopment expected to cost over $650 million, with the surrounding development estimated to generate $2 billion in economic activity • Pearl Harbor’s shipyard infrastructure upgrade - the U.S. Navy’s largest shipyard project estimated to cost $3.4 billion • Defense spending (direct, indirect and induced) contributes $17.4 billion or 16% to State of Hawaii GDP3 1 Source: State of Hawaii Department of Business, Economic Development & Tourism. Tourism represents total visitors as of Nov 2025 compared to Nov 2024. 2 Source: Honolulu Board of Realtors 3 Source: Military and Community Relations Office- Economic Impact Factbook 2025 Resilient Hawaii Economy Housing Oahu Median Single- Family Home Price Dec 2025 $1.1MM 2 -3.00% -2.00% -1.00% 0.00% Hawaii is less impacted in a U.S. Recession Average % Decline in Past Recessions US Hawaii Real GDP Source: UHERO Past recessions include: 1981-1982, 1990-1991, 2001, 2007-2009, and 2020 Payrolls

26Central Pacific Financial Corp. CPB Named Best Bank in Hawaii by Newsweek, Forbes, and Honolulu Star-Advertiser • Newsweek’s America’s Best Regional Banks 2026 • Forbes’ Best-In-State Banks 2025 • Forbes’ America’s Best Banks 2025 • Honolulu Star-Advertiser’s Best Bank in Hawaii 2024

Mahalo