Beyond ordinary banking Investor Presentation H o r i z o n B a n c o r p , I n c . ( N A S D A Q : H B N C ) Ye a r E n d e d D e c e m b e r 3 1 , 2 0 2 5 J a n u a r y 2 2 , 2 0 2 6

Important Information Forward-Looking Statements This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs, changes within the domestic and international macroeconomic environment, including trade policy, monetary and fiscal policy, inflation levels, and conditions in the investment, credit, interest rate, and derivatives markets, and their impact on Horizon and its customers; current financial conditions within the banking industry; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, and the effects of foreign and military policies of the U.S. government; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. 2

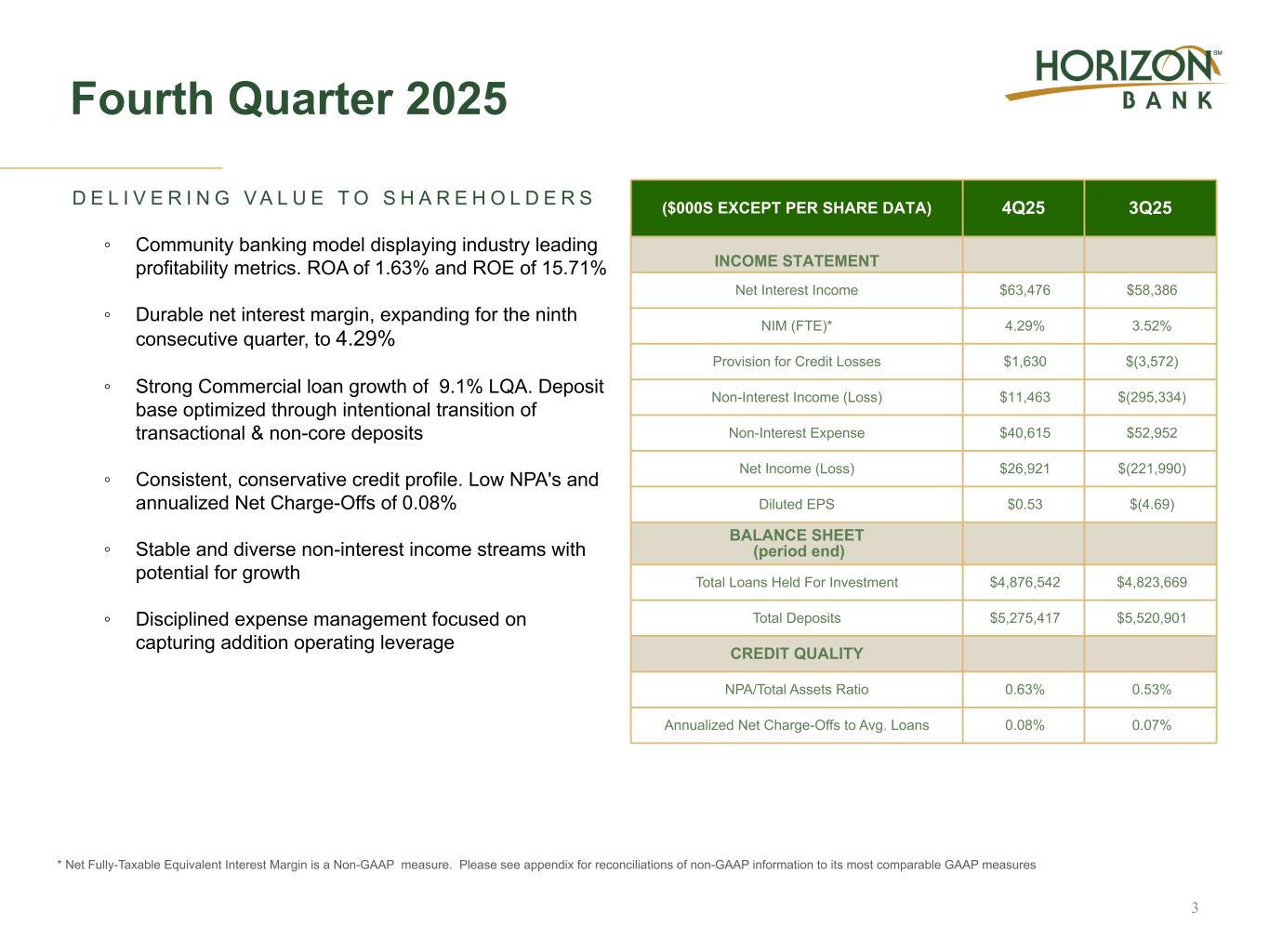

Fourth Quarter 2025 * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures 3 D E L I V E R I N G V A L U E T O S H A R E H O L D E R S ◦ Community banking model displaying industry leading profitability metrics. ROA of 1.63% and ROE of 15.71% ◦ Durable net interest margin, expanding for the ninth consecutive quarter, to 4.29% ◦ Strong Commercial loan growth of 9.1% LQA. Deposit base optimized through intentional transition of transactional & non-core deposits ◦ Consistent, conservative credit profile. Low NPA's and annualized Net Charge-Offs of 0.08% ◦ Stable and diverse non-interest income streams with potential for growth ◦ Disciplined expense management focused on capturing addition operating leverage ($000S EXCEPT PER SHARE DATA) 4Q25 3Q25 INCOME STATEMENT Net Interest Income $63,476 $58,386 NIM (FTE)* 4.29% 3.52% Provision for Credit Losses $1,630 $(3,572) Non-Interest Income (Loss) $11,463 $(295,334) Non-Interest Expense $40,615 $52,952 Net Income (Loss) $26,921 $(221,990) Diluted EPS $0.53 $(4.69) BALANCE SHEET (period end) Total Loans Held For Investment $4,876,542 $4,823,669 Total Deposits $5,275,417 $5,520,901 CREDIT QUALITY NPA/Total Assets Ratio 0.63% 0.53% Annualized Net Charge-Offs to Avg. Loans 0.08% 0.07%

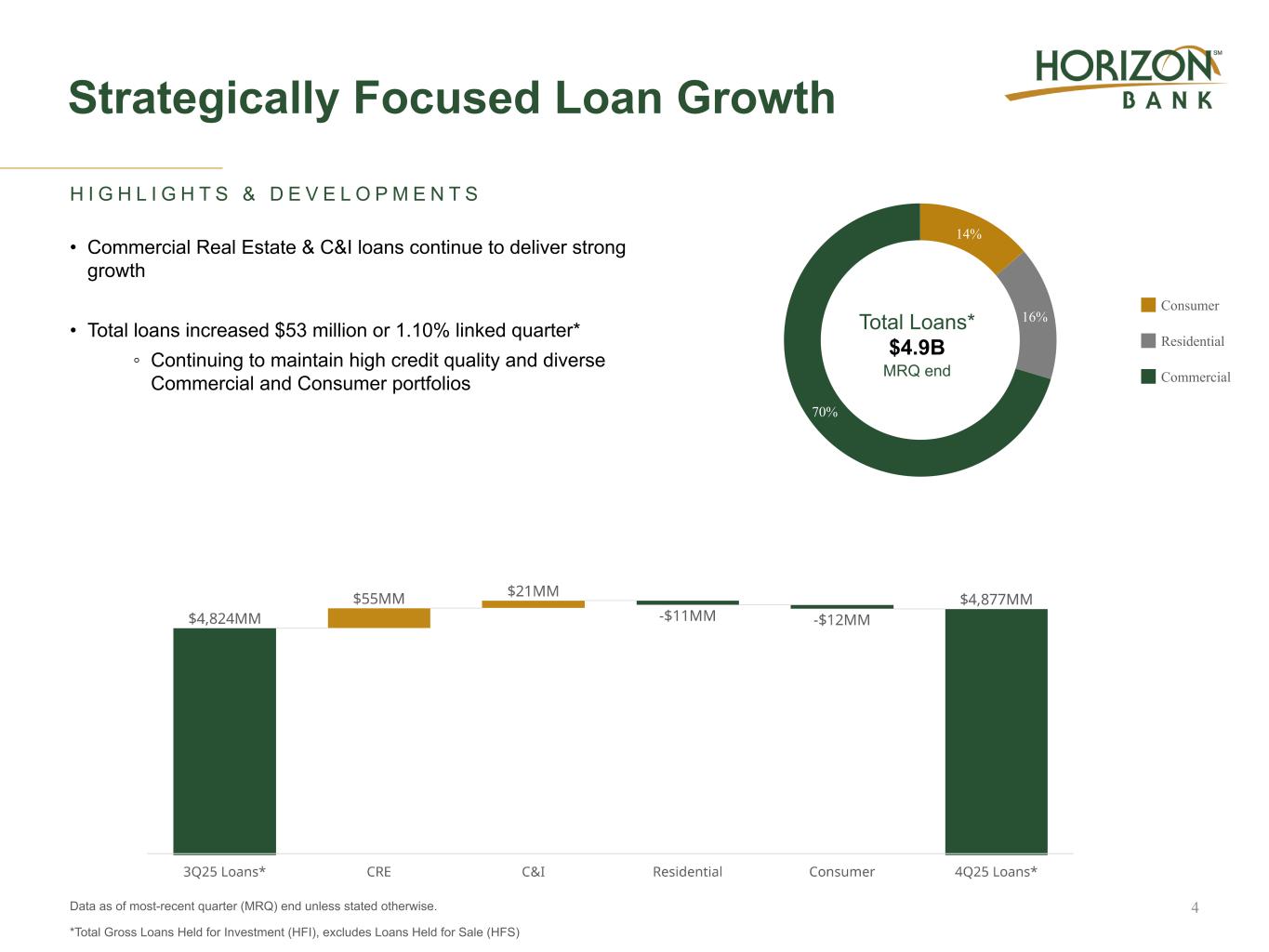

Strategically Focused Loan Growth Data as of most-recent quarter (MRQ) end unless stated otherwise. *Total Gross Loans Held for Investment (HFI), excludes Loans Held for Sale (HFS) 4 14% 16% 70% Consumer Residential Commercial H I G H L I G H T S & D E V E L O P M E N T S • Commercial Real Estate & C&I loans continue to deliver strong growth • Total loans increased $53 million or 1.10% linked quarter* ◦ Continuing to maintain high credit quality and diverse Commercial and Consumer portfolios Total Loans* $4.9B MRQ end

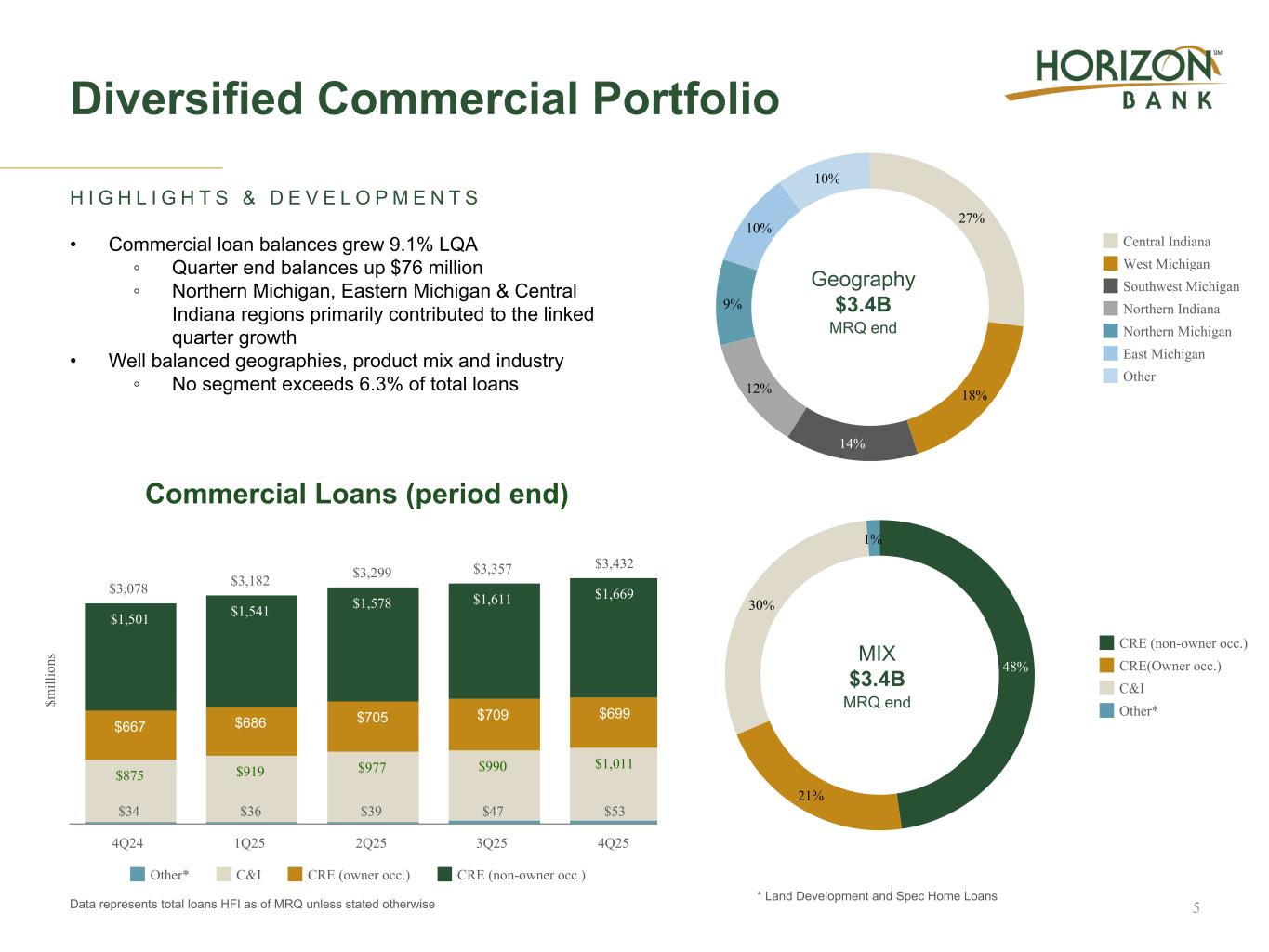

Diversified Commercial Portfolio * Land Development and Spec Home Loans H I G H L I G H T S & D E V E L O P M E N T S • Commercial loan balances grew 9.1% LQA ◦ Quarter end balances up $76 million ◦ Northern Michigan, Eastern Michigan & Central Indiana regions primarily contributed to the linked quarter growth • Well balanced geographies, product mix and industry ◦ No segment exceeds 6.3% of total loans Data represents total loans HFI as of MRQ unless stated otherwise 5 27% 18% 14% 12% 9% 10% 10% Central Indiana West Michigan Southwest Michigan Northern Indiana Northern Michigan East Michigan Other $m ill io ns Commercial Loans (period end) $3,078 $3,182 $3,299 $3,357 $3,432 $34 $36 $39 $47 $53 $875 $919 $977 $990 $1,011 $667 $686 $705 $709 $699 $1,501 $1,541 $1,578 $1,611 $1,669 Other* C&I CRE (owner occ.) CRE (non-owner occ.) 4Q24 1Q25 2Q25 3Q25 4Q25 Geography $3.4B MRQ end 48% 21% 30% 1% CRE (non-owner occ.) CRE(Owner occ.) C&I Other* MIX $3.4B MRQ end

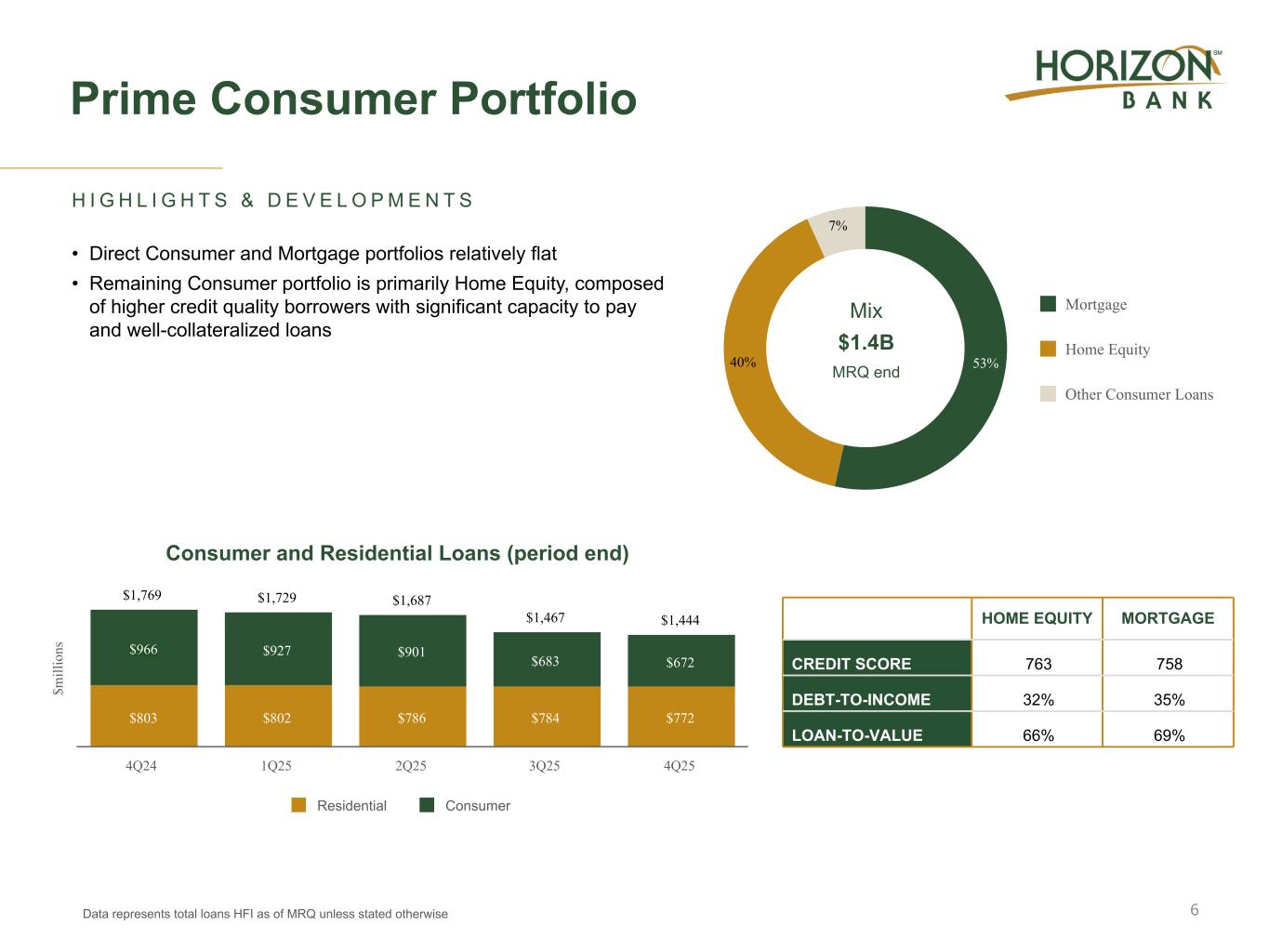

Prime Consumer Portfolio H I G H L I G H T S & D E V E L O P M E N T S • Direct Consumer and Mortgage portfolios relatively flat • Remaining Consumer portfolio is primarily Home Equity, composed of higher credit quality borrowers with significant capacity to pay and well-collateralized loans 6Data represents total loans HFI as of MRQ unless stated otherwise HOME EQUITY MORTGAGE CREDIT SCORE 763 758 DEBT-TO-INCOME 32% 35% LOAN-TO-VALUE 66% 69% 53%40% 7% Mortgage Home Equity Other Consumer Loans Mix $1.4B MRQ end $m ill io ns Consumer and Residential Loans (period end) $1,769 $1,729 $1,687 $1,467 $1,444 $803 $802 $786 $784 $772 $966 $927 $901 $683 $672 Residential Consumer 4Q24 1Q25 2Q25 3Q25 4Q25

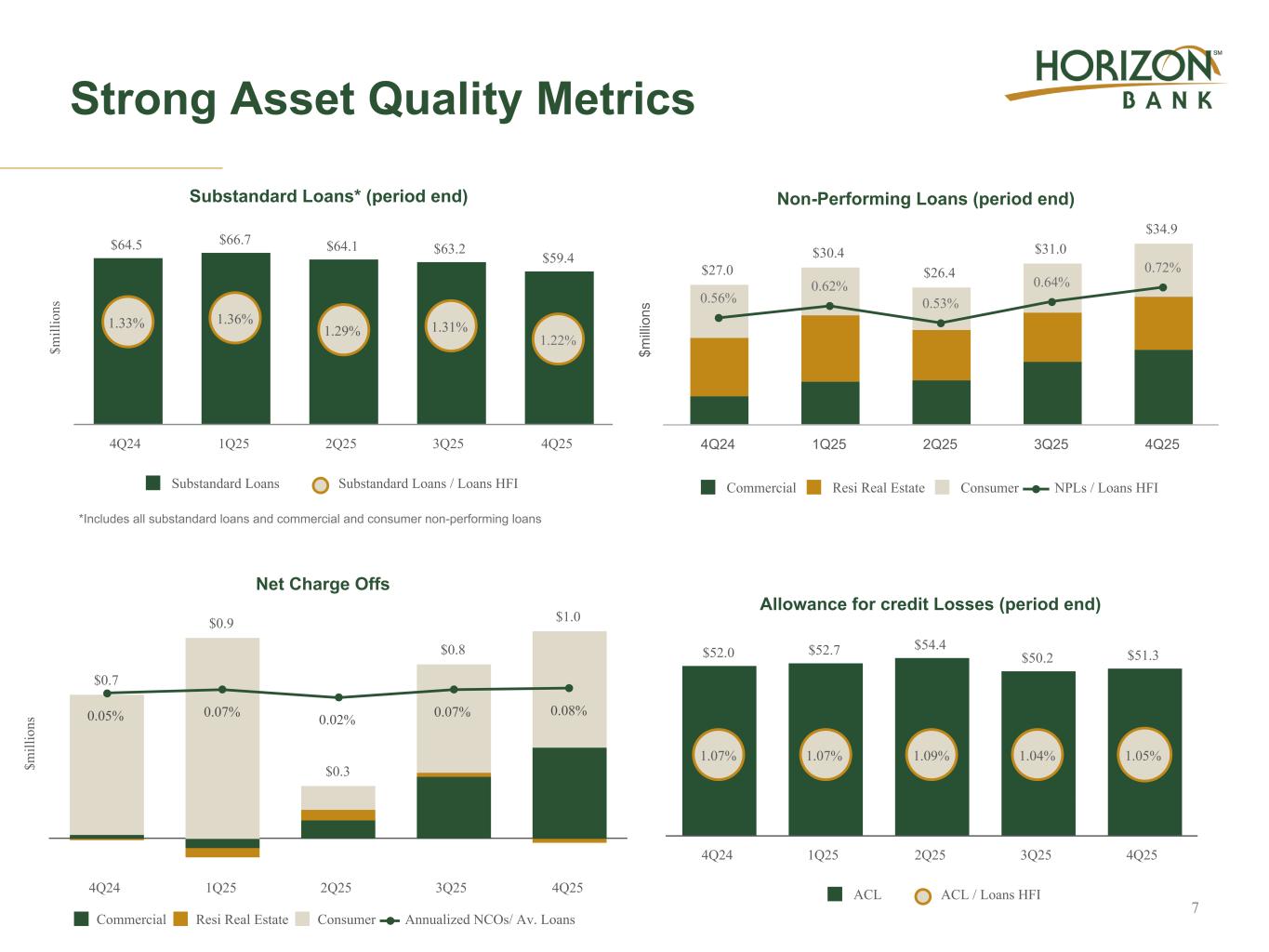

Strong Asset Quality Metrics 7 *Includes all substandard loans and commercial and consumer non-performing loans $m ill io ns Substandard Loans* (period end) $64.5 $66.7 $64.1 $63.2 $59.4 1.33% 1.36% 1.29% 1.31% 1.22% Substandard Loans Substandard Loans / Loans HFI 4Q24 1Q25 2Q25 3Q25 4Q25 $m ill io ns Non-Performing Loans (period end) $27.0 $30.4 $26.4 $31.0 $34.9 0.56% 0.62% 0.53% 0.64% 0.72% Commercial Resi Real Estate Consumer NPLs / Loans HFI 4Q24 1Q25 2Q25 3Q25 4Q25 $m ill io ns Net Charge Offs $0.7 $0.9 $0.3 $0.8 $1.0 0.05% 0.07% 0.02% 0.07% 0.08% Commercial Resi Real Estate Consumer Annualized NCOs/ Av. Loans 4Q24 1Q25 2Q25 3Q25 4Q25 Allowance for credit Losses (period end) $52.0 $52.7 $54.4 $50.2 $51.3 1.07% 1.07% 1.09% 1.04% 1.05% ACL ACL / Loans HFI 4Q24 1Q25 2Q25 3Q25 4Q25

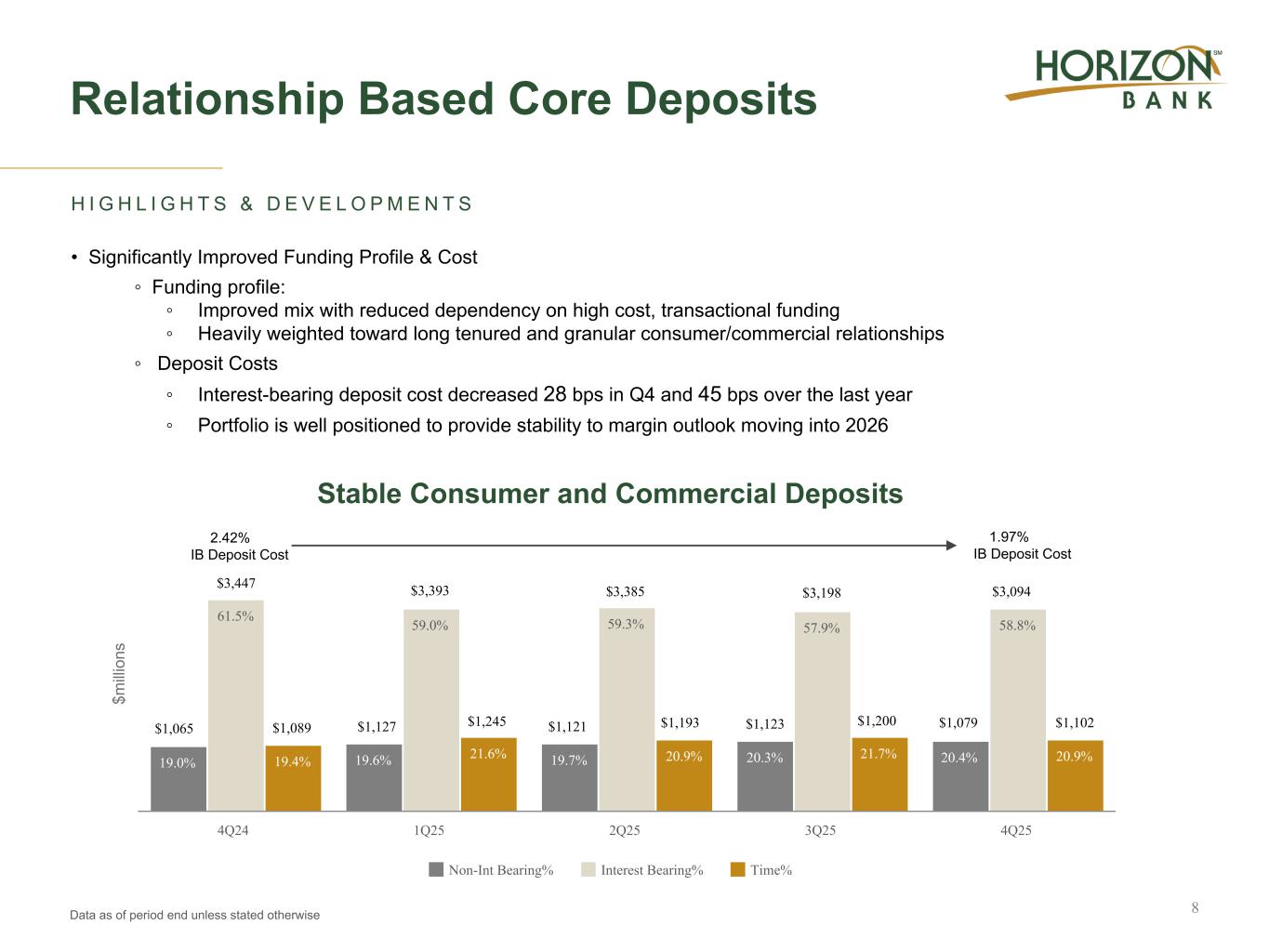

Data as of period end unless stated otherwise Relationship Based Core Deposits 8 H I G H L I G H T S & D E V E L O P M E N T S • Significantly Improved Funding Profile & Cost ◦ Funding profile: ◦ Improved mix with reduced dependency on high cost, transactional funding ◦ Heavily weighted toward long tenured and granular consumer/commercial relationships ◦ Deposit Costs ◦ Interest-bearing deposit cost decreased 28 bps in Q4 and 45 bps over the last year ◦ Portfolio is well positioned to provide stability to margin outlook moving into 2026 $m illi on s Stable Consumer and Commercial Deposits 19.0% 19.6% 19.7% 20.3% 20.4% 61.5% 59.0% 59.3% 57.9% 58.8% 19.4% 21.6% 20.9% 21.7% 20.9% Non-Int Bearing% Interest Bearing% Time% 4Q24 1Q25 2Q25 3Q25 4Q25 $1,065 $3,447 $1,089 $1,127 $3,393 $1,245 $1,193 $3,385 $1,121 $1,200 $3,198 $1,123 $1,102 $3,094 $1,079 2.42% IB Deposit Cost 1.97% IB Deposit Cost

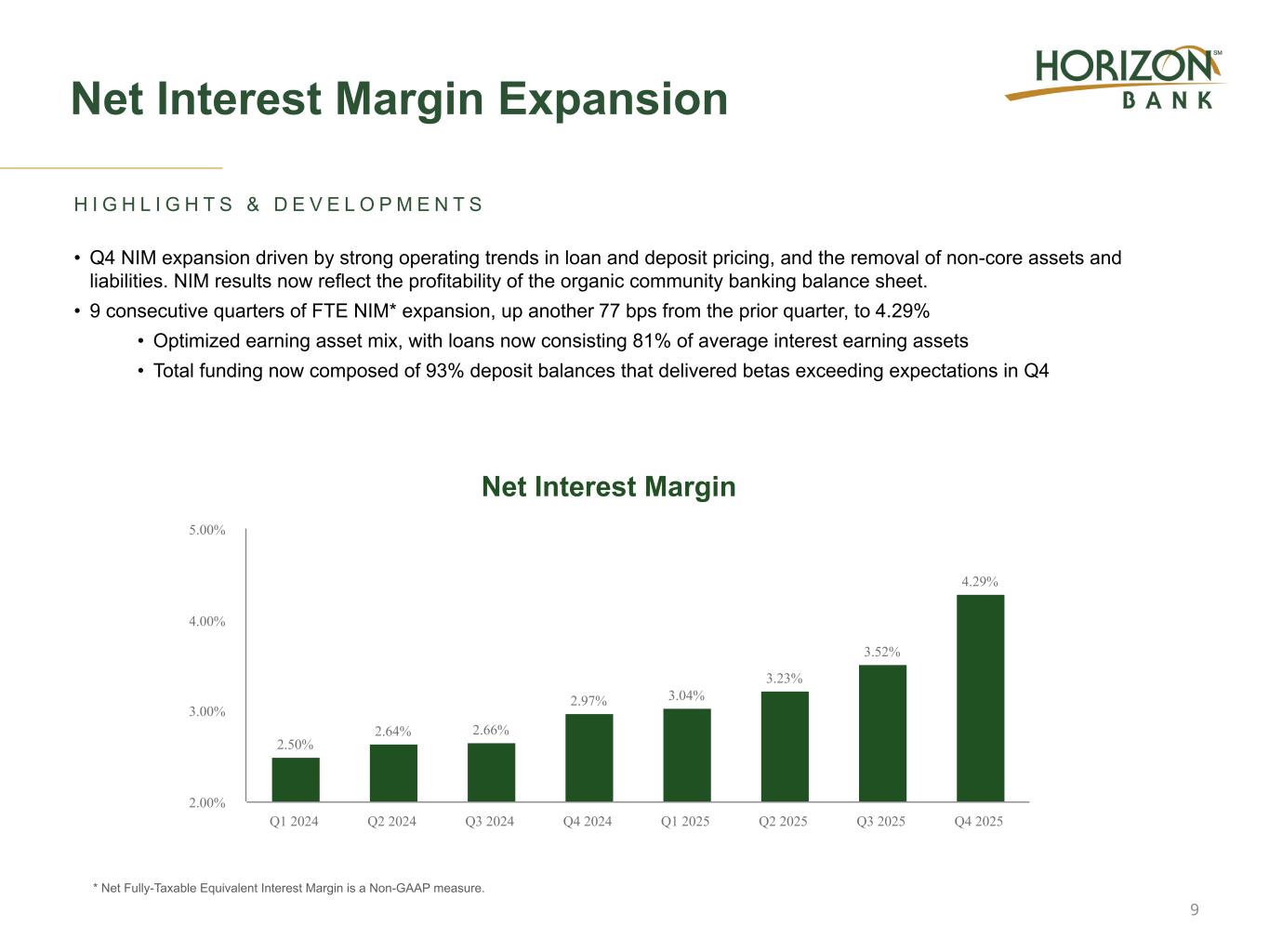

Net Interest Margin Expansion * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. 9 Net Interest Margin 2.50% 2.64% 2.66% 2.97% 3.04% 3.23% 3.52% 4.29% Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 2.00% 3.00% 4.00% 5.00% H I G H L I G H T S & D E V E L O P M E N T S • Q4 NIM expansion driven by strong operating trends in loan and deposit pricing, and the removal of non-core assets and liabilities. NIM results now reflect the profitability of the organic community banking balance sheet. • 9 consecutive quarters of FTE NIM* expansion, up another 77 bps from the prior quarter, to 4.29% • Optimized earning asset mix, with loans now consisting 81% of average interest earning assets • Total funding now composed of 93% deposit balances that delivered betas exceeding expectations in Q4

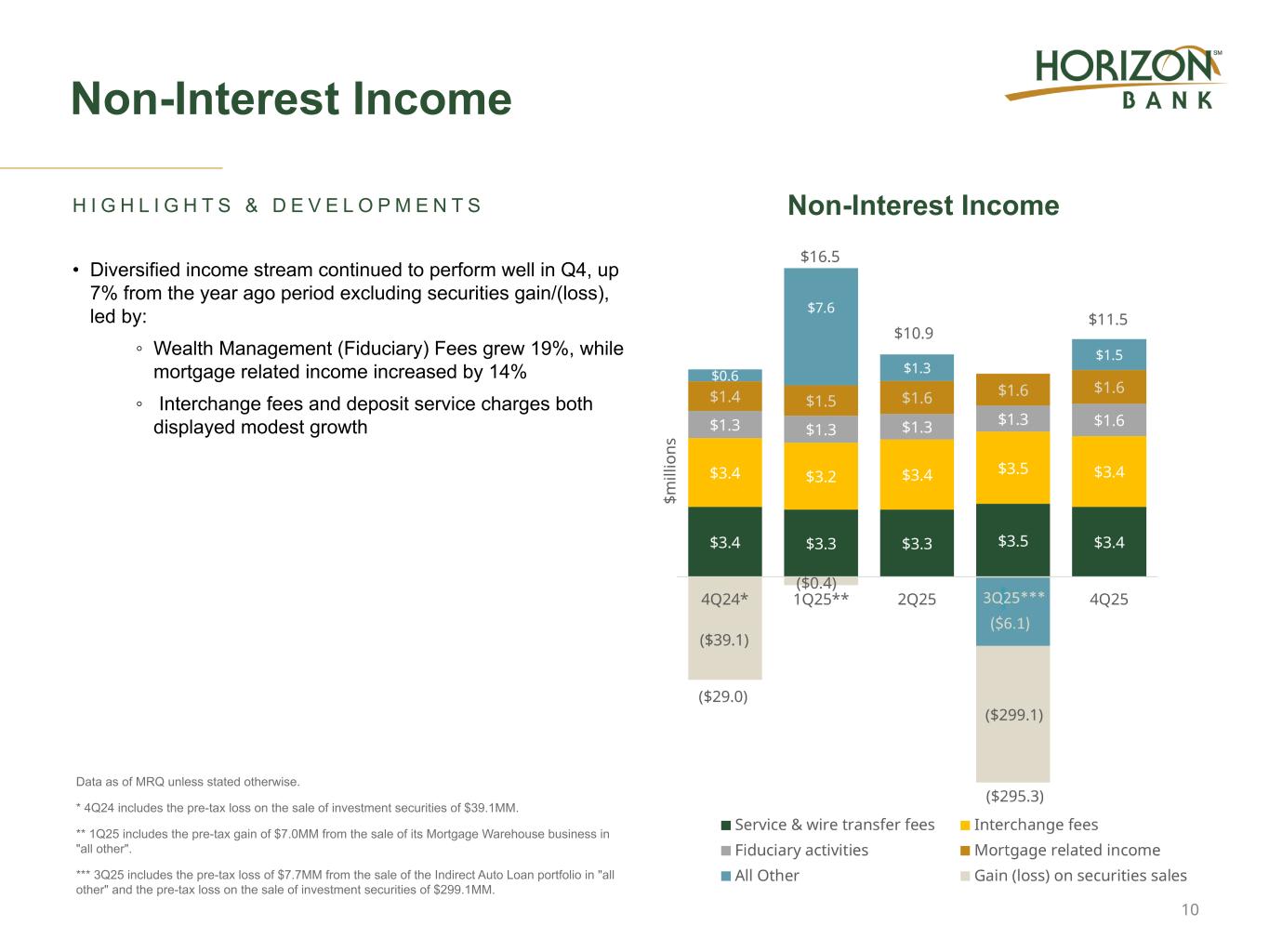

H I G H L I G H T S & D E V E L O P M E N T S • Diversified income stream continued to perform well in Q4, up 7% from the year ago period excluding securities gain/(loss), led by: ◦ Wealth Management (Fiduciary) Fees grew 19%, while mortgage related income increased by 14% ◦ Interchange fees and deposit service charges both displayed modest growth 10 Data as of MRQ unless stated otherwise. * 4Q24 includes the pre-tax loss on the sale of investment securities of $39.1MM. ** 1Q25 includes the pre-tax gain of $7.0MM from the sale of its Mortgage Warehouse business in "all other". *** 3Q25 includes the pre-tax loss of $7.7MM from the sale of the Indirect Auto Loan portfolio in "all other" and the pre-tax loss on the sale of investment securities of $299.1MM. Non-Interest Income Non-Interest Income

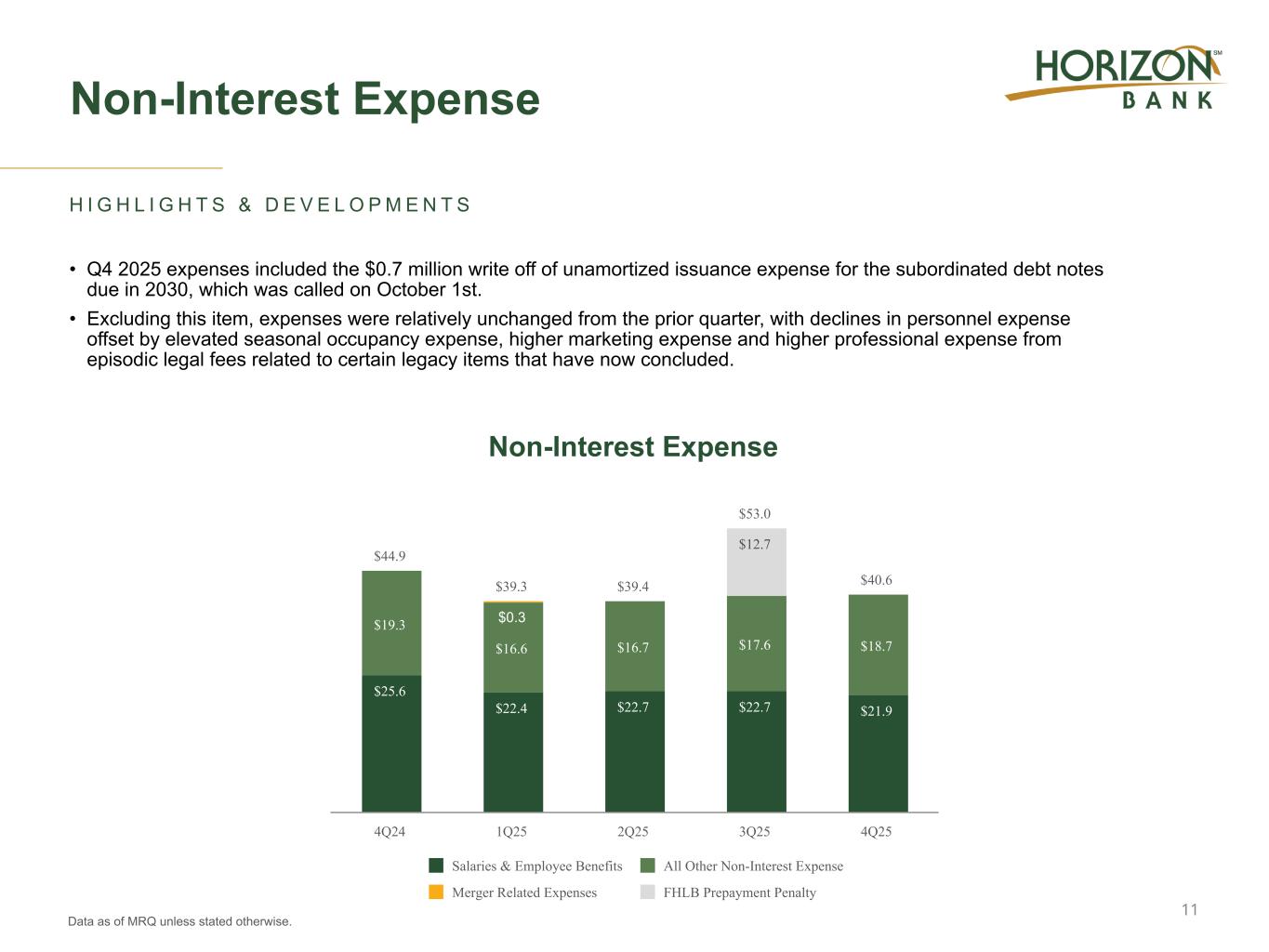

Non-Interest Expense 11 Data as of MRQ unless stated otherwise. H I G H L I G H T S & D E V E L O P M E N T S • Q4 2025 expenses included the $0.7 million write off of unamortized issuance expense for the subordinated debt notes due in 2030, which was called on October 1st. • Excluding this item, expenses were relatively unchanged from the prior quarter, with declines in personnel expense offset by elevated seasonal occupancy expense, higher marketing expense and higher professional expense from episodic legal fees related to certain legacy items that have now concluded. Non-Interest Expense $44.9 $39.3 $39.4 $53.0 $40.6 $25.6 $22.4 $22.7 $22.7 $21.9 $19.3 $16.6 $16.7 $17.6 $18.7 $0.3 $12.7 Salaries & Employee Benefits All Other Non-Interest Expense Merger Related Expenses FHLB Prepayment Penalty 4Q24 1Q25 2Q25 3Q25 4Q25

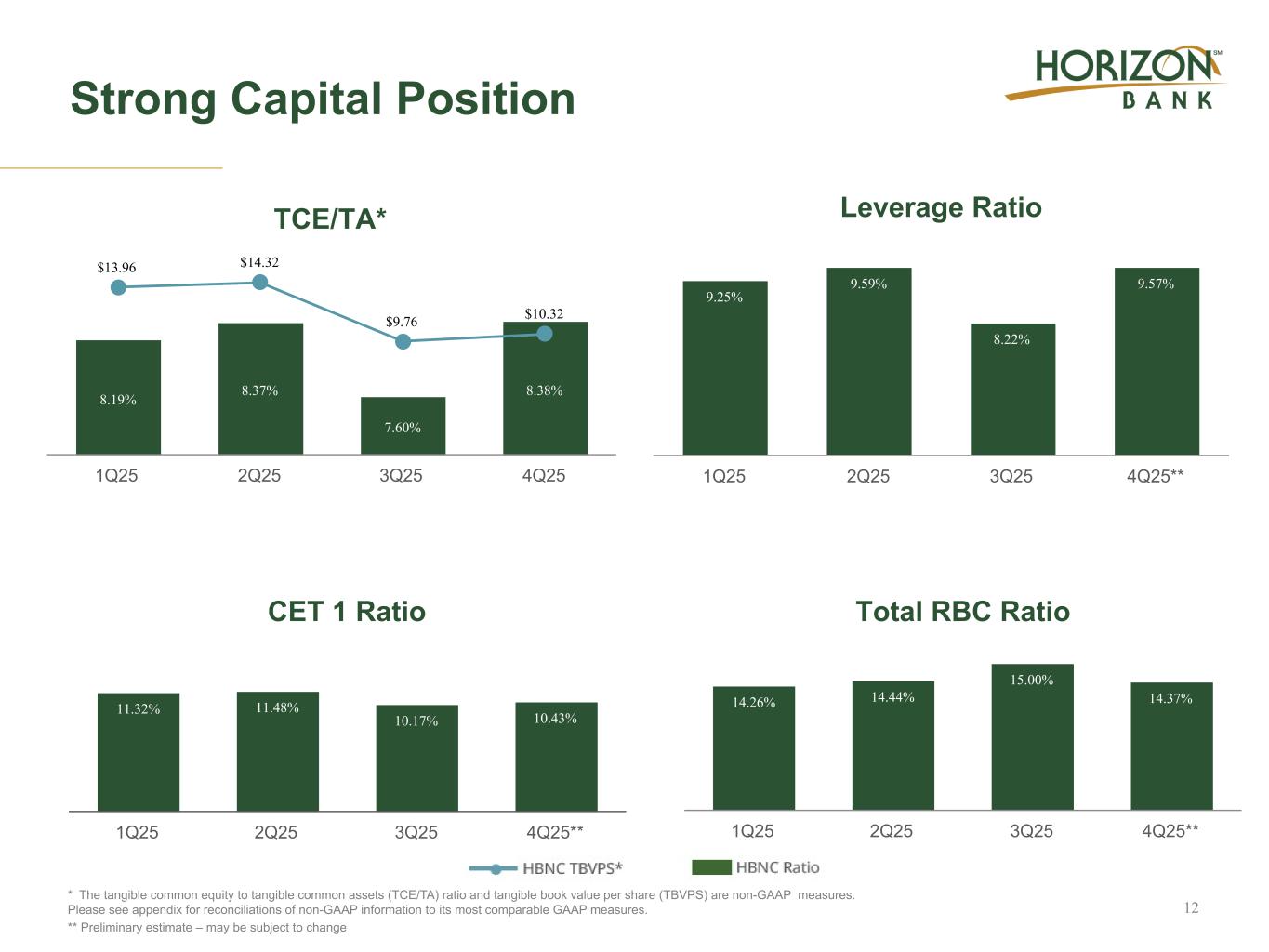

Strong Capital Position * The tangible common equity to tangible common assets (TCE/TA) ratio and tangible book value per share (TBVPS) are non-GAAP measures. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Preliminary estimate – may be subject to change 12 TCE/TA* 8.19% 8.37% 7.60% 8.38% $13.96 $14.32 $9.76 $10.32 1Q25 2Q25 3Q25 4Q25 Leverage Ratio 9.25% 9.59% 8.22% 9.57% 1Q25 2Q25 3Q25 4Q25** CET 1 Ratio 11.32% 11.48% 10.17% 10.43% 1Q25 2Q25 3Q25 4Q25** Total RBC Ratio 14.26% 14.44% 15.00% 14.37% 1Q25 2Q25 3Q25 4Q25**

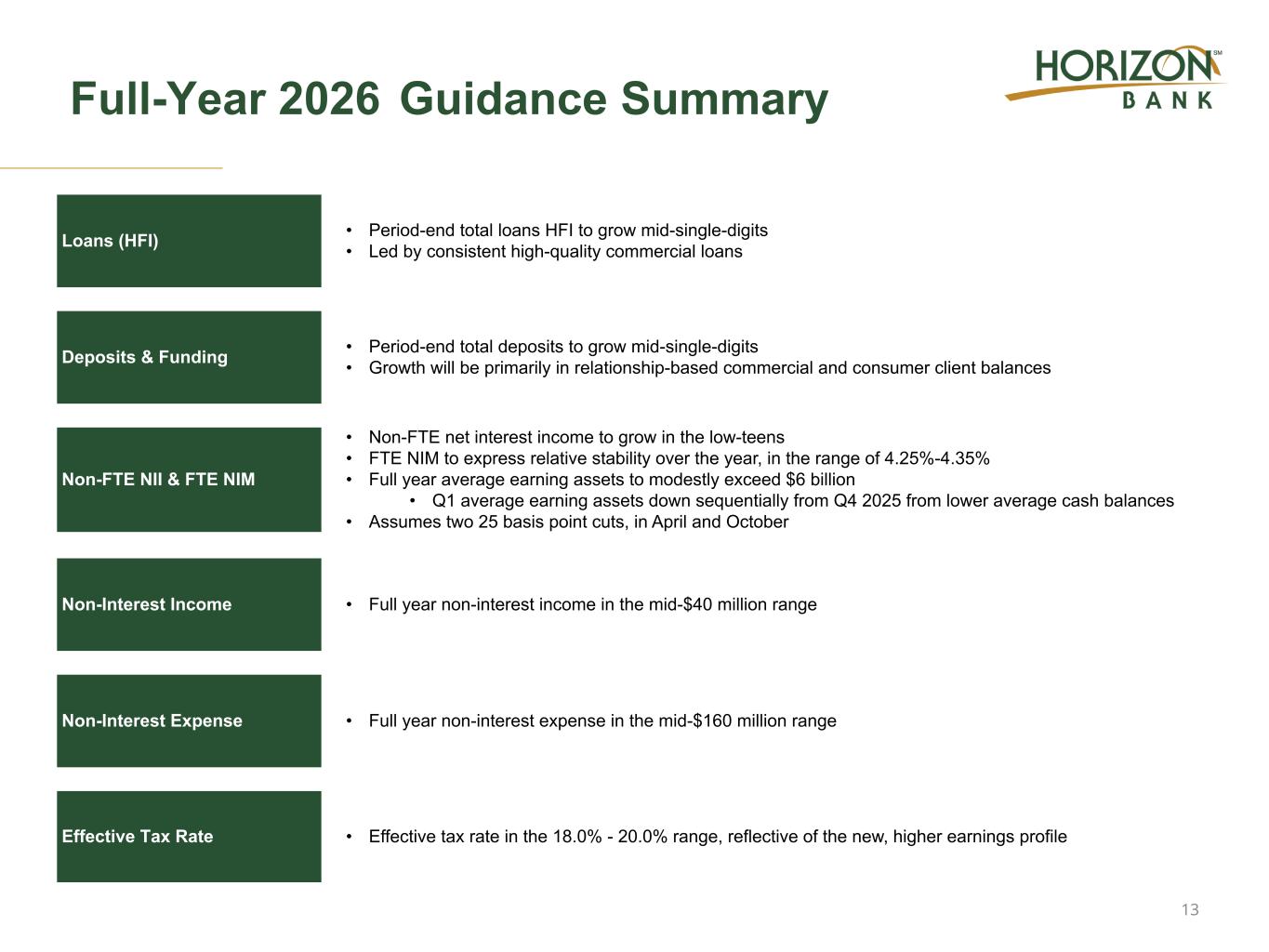

Full-Year 2026 Guidance Summary Loans (HFI) • Period-end total loans HFI to grow mid-single-digits • Led by consistent high-quality commercial loans Deposits & Funding • Period-end total deposits to grow mid-single-digits • Growth will be primarily in relationship-based commercial and consumer client balances Non-FTE NII & FTE NIM • Non-FTE net interest income to grow in the low-teens • FTE NIM to express relative stability over the year, in the range of 4.25%-4.35% • Full year average earning assets to modestly exceed $6 billion • Q1 average earning assets down sequentially from Q4 2025 from lower average cash balances • Assumes two 25 basis point cuts, in April and October Non-Interest Income • Full year non-interest income in the mid-$40 million range Non-Interest Expense • Full year non-interest expense in the mid-$160 million range Effective Tax Rate • Effective tax rate in the 18.0% - 20.0% range, reflective of the new, higher earnings profile 13

Appendix

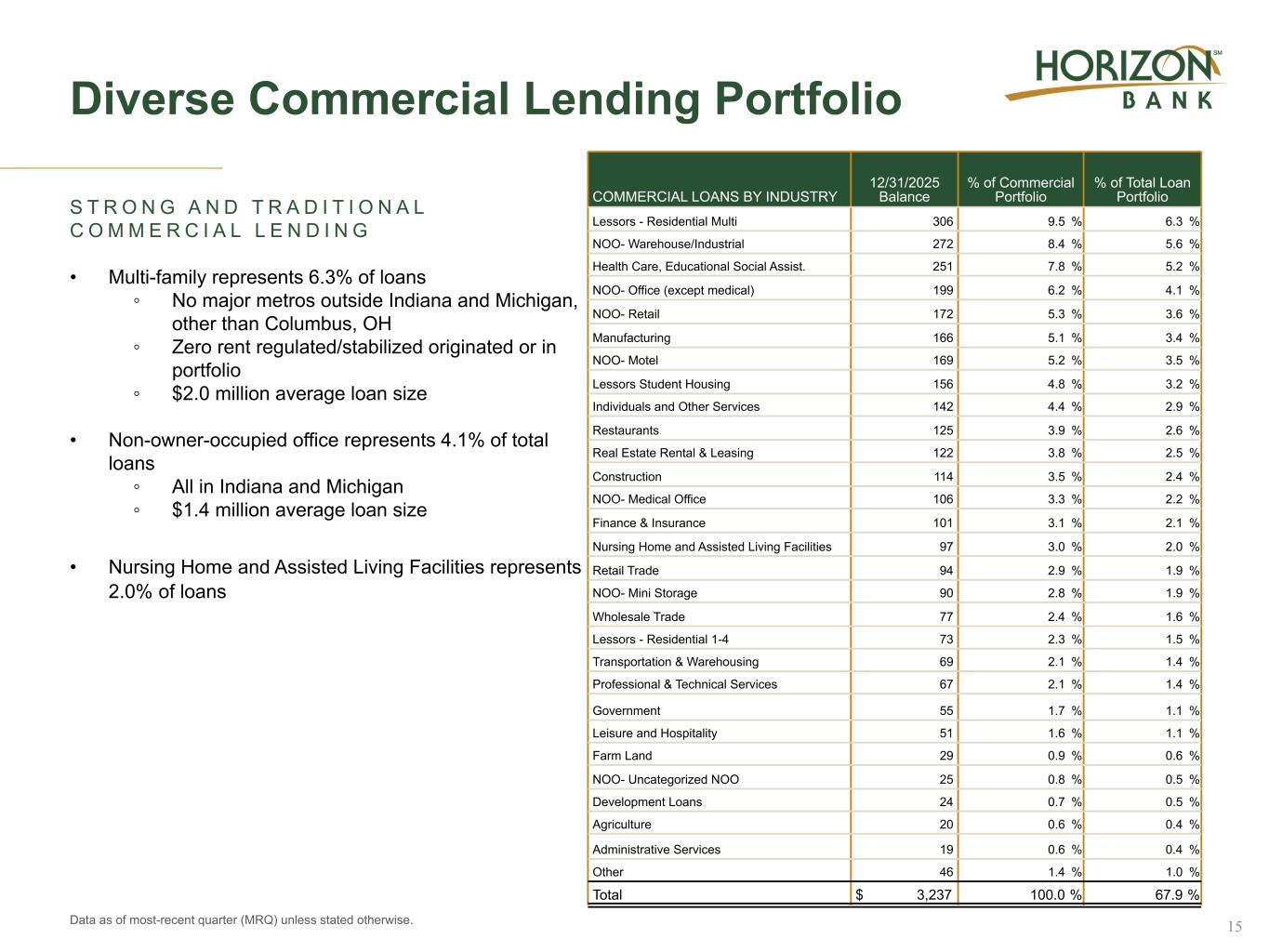

Diverse Commercial Lending Portfolio S T R O N G A N D T R A D I T I O N A L C O M M E R C I A L L E N D I N G • Multi-family represents 6.3% of loans ◦ No major metros outside Indiana and Michigan, other than Columbus, OH ◦ Zero rent regulated/stabilized originated or in portfolio ◦ $2.0 million average loan size • Non-owner-occupied office represents 4.1% of total loans ◦ All in Indiana and Michigan ◦ $1.4 million average loan size • Nursing Home and Assisted Living Facilities represents 2.0% of loans Data as of most-recent quarter (MRQ) unless stated otherwise. 15 COMMERCIAL LOANS BY INDUSTRY 12/31/2025 Balance % of Commercial Portfolio % of Total Loan Portfolio Lessors - Residential Multi 306 9.5 % 6.3 % NOO- Warehouse/Industrial 272 8.4 % 5.6 % Health Care, Educational Social Assist. 251 7.8 % 5.2 % NOO- Office (except medical) 199 6.2 % 4.1 % NOO- Retail 172 5.3 % 3.6 % Manufacturing 166 5.1 % 3.4 % NOO- Motel 169 5.2 % 3.5 % Lessors Student Housing 156 4.8 % 3.2 % Individuals and Other Services 142 4.4 % 2.9 % Restaurants 125 3.9 % 2.6 % Real Estate Rental & Leasing 122 3.8 % 2.5 % Construction 114 3.5 % 2.4 % NOO- Medical Office 106 3.3 % 2.2 % Finance & Insurance 101 3.1 % 2.1 % Nursing Home and Assisted Living Facilities 97 3.0 % 2.0 % Retail Trade 94 2.9 % 1.9 % NOO- Mini Storage 90 2.8 % 1.9 % Wholesale Trade 77 2.4 % 1.6 % Lessors - Residential 1-4 73 2.3 % 1.5 % Transportation & Warehousing 69 2.1 % 1.4 % Professional & Technical Services 67 2.1 % 1.4 % Government 55 1.7 % 1.1 % Leisure and Hospitality 51 1.6 % 1.1 % Farm Land 29 0.9 % 0.6 % NOO- Uncategorized NOO 25 0.8 % 0.5 % Development Loans 24 0.7 % 0.5 % Agriculture 20 0.6 % 0.4 % Administrative Services 19 0.6 % 0.4 % Other 46 1.4 % 1.0 % Total $ 3,237 100.0 % 67.9 %

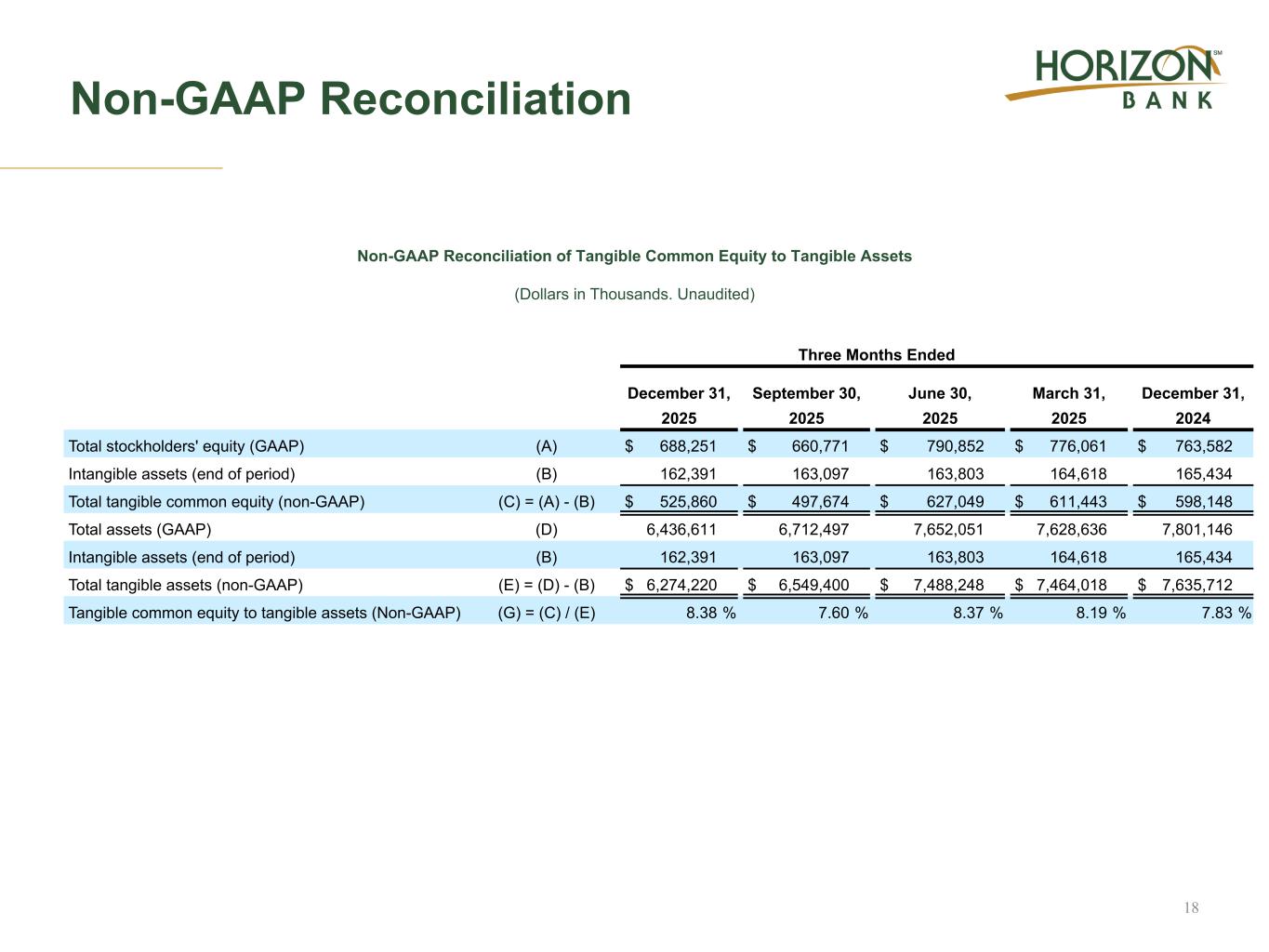

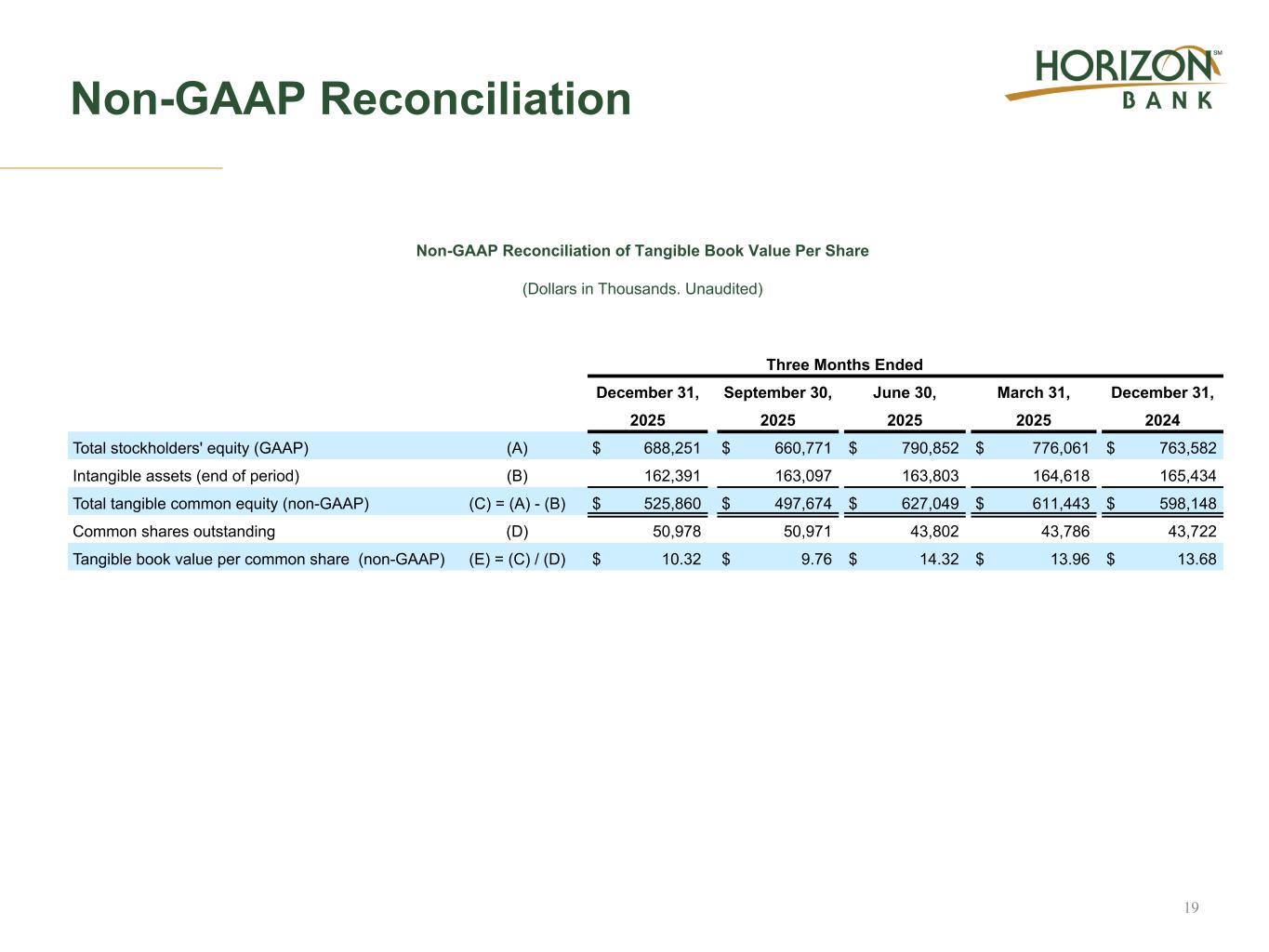

Use of Non-GAAP Financial Measures Certain information set forth in this press release refers to financial measures determined by methods other than in accordance with GAAP. Specifically, we have included non-GAAP financial measures relating to net income, diluted earnings per share, pre-tax, pre- provision net income, net interest margin, tangible stockholders’ equity and tangible book value per share, efficiency ratio, the return on average assets, the return on average common equity, and return on average tangible equity. In each case, we have identified special circumstances that we consider to be non-recurring and have excluded them. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business and financial results without giving effect to one-time costs and non–recurring items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. See the tables and other information below and contained elsewhere in this press release for reconciliations of the non-GAAP information identified herein and its most comparable GAAP measures. 16

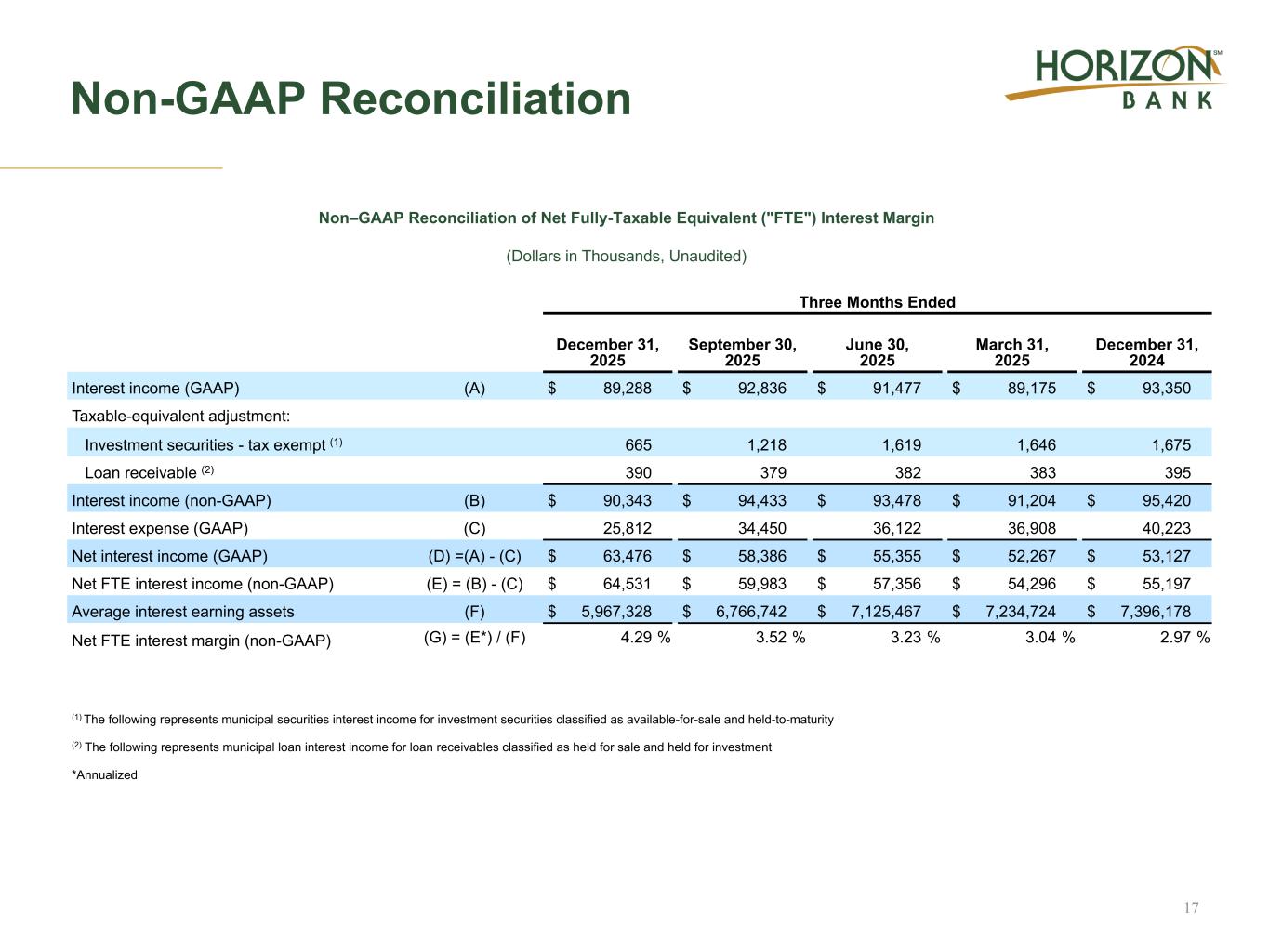

Non-GAAP Reconciliation 17 Three Months Ended December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Interest income (GAAP) (A) $ 89,288 $ 92,836 $ 91,477 $ 89,175 $ 93,350 Taxable-equivalent adjustment: Investment securities - tax exempt (1) 665 1,218 1,619 1,646 1,675 Loan receivable (2) 390 379 382 383 395 Interest income (non-GAAP) (B) $ 90,343 $ 94,433 $ 93,478 $ 91,204 $ 95,420 Interest expense (GAAP) (C) 25,812 34,450 36,122 36,908 40,223 Net interest income (GAAP) (D) =(A) - (C) $ 63,476 $ 58,386 $ 55,355 $ 52,267 $ 53,127 Net FTE interest income (non-GAAP) (E) = (B) - (C) $ 64,531 $ 59,983 $ 57,356 $ 54,296 $ 55,197 Average interest earning assets (F) $ 5,967,328 $ 6,766,742 $ 7,125,467 $ 7,234,724 $ 7,396,178 Net FTE interest margin (non-GAAP) (G) = (E*) / (F) 4.29 % 3.52 % 3.23 % 3.04 % 2.97 % (1) The following represents municipal securities interest income for investment securities classified as available-for-sale and held-to-maturity (2) The following represents municipal loan interest income for loan receivables classified as held for sale and held for investment *Annualized Non–GAAP Reconciliation of Net Fully-Taxable Equivalent ("FTE") Interest Margin (Dollars in Thousands, Unaudited)

Non-GAAP Reconciliation 18 Three Months Ended December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 Total stockholders' equity (GAAP) (A) $ 688,251 $ 660,771 $ 790,852 $ 776,061 $ 763,582 Intangible assets (end of period) (B) 162,391 163,097 163,803 164,618 165,434 Total tangible common equity (non-GAAP) (C) = (A) - (B) $ 525,860 $ 497,674 $ 627,049 $ 611,443 $ 598,148 Total assets (GAAP) (D) 6,436,611 6,712,497 7,652,051 7,628,636 7,801,146 Intangible assets (end of period) (B) 162,391 163,097 163,803 164,618 165,434 Total tangible assets (non-GAAP) (E) = (D) - (B) $ 6,274,220 $ 6,549,400 $ 7,488,248 $ 7,464,018 $ 7,635,712 Tangible common equity to tangible assets (Non-GAAP) (G) = (C) / (E) 8.38 % 7.60 % 8.37 % 8.19 % 7.83 % Non-GAAP Reconciliation of Tangible Common Equity to Tangible Assets (Dollars in Thousands. Unaudited)

Non-GAAP Reconciliation 19 Three Months Ended December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 Total stockholders' equity (GAAP) (A) $ 688,251 $ 660,771 $ 790,852 $ 776,061 $ 763,582 Intangible assets (end of period) (B) 162,391 163,097 163,803 164,618 165,434 Total tangible common equity (non-GAAP) (C) = (A) - (B) $ 525,860 $ 497,674 $ 627,049 $ 611,443 $ 598,148 Common shares outstanding (D) 50,978 50,971 43,802 43,786 43,722 Tangible book value per common share (non-GAAP) (E) = (C) / (D) $ 10.32 $ 9.76 $ 14.32 $ 13.96 $ 13.68 Non-GAAP Reconciliation of Tangible Book Value Per Share (Dollars in Thousands. Unaudited)

Thank you John R. Stewart, CFA® Executive Vice President & Chief Financial Officer 515 Franklin Street, Michigan City, IN 46360 219-814-5833 Investor.HorizonBank.com