4th Quarter 2025 Investment Thesis February 9, 2026

Slides 5 — 18 Executive Summary

3 These materials contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”), Section 27A of the Securities Act of 1933 and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934 and Rule 3b-6 promulgated thereunder, notwithstanding that such statements are not specifically identified as such. In addition, certain statements may be contained in our future filings with the Securities and Exchange Commission ("SEC"), in press releases, and in oral and written statements made by us that are not statements of historical fact and constitute forward-looking statements within the meaning of the Act. These statements include, but are not limited to, descriptions of Old National’s financial condition, results of operations, asset and credit quality trends, profitability and business plans or opportunities. Forward-looking statements can be identified by the use of words such as "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "guidance," "intend," "may," "outlook," "plan," "potential," "predict," "should," "would," and "will," and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties. There are a number of factors that could cause actual results or outcomes to differ materially from those in such statements, including, but not limited to: competition; government legislation, regulations and policies, including trade and tariff policies; the ability of Old National to execute its business plan; unanticipated changes in our liquidity position, including but not limited to changes in our access to sources of liquidity and capital to address our liquidity needs; changes in economic conditions and economic and business uncertainty which could materially impact credit quality trends and the ability to generate loans and gather deposits; inflation and governmental responses to inflation, including increasing interest rates; market, economic, operational, liquidity, credit, and interest rate risks associated with our business; our ability to successfully manage our credit risk and the sufficiency of our allowance for credit losses; the expected cost savings, synergies and other financial benefits from the merger (the “Merger”) between Old National and Bremer Financial Corporation (“Bremer”) not being realized within the expected time frames and costs or difficulties relating to integration matters being greater than expected; potential adverse reactions or changes to business or employee relationships, including those resulting from the Merger; the impact of purchase accounting with respect to the Merger, or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine their fair value and credit marks; the potential impact of future business combinations on our performance and financial condition, including our ability to successfully integrate the businesses, the success of revenue-generating and cost reduction initiatives and the diversion of management’s attention from ongoing business operations and opportunities; failure or circumvention of our internal controls; operational risks or risk management failures by us or critical third parties, including without limitation with respect to data processing, information technology systems, cybersecurity, technological changes, vendor issues, business interruption, and fraud risks; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities; disruptive technologies in payment systems and other services traditionally provided by banks; adverse effects on our information technology systems, or those of third parties, resulting from failures, disruptions or cybersecurity attacks, including ransomware; security breaches, including denial of services attacks, hacking, social engineering attacks, malware intrusion and other cybersecurity threats; the effects of climate change on Old National and its customers, borrowers, or service providers; political and economic uncertainty and instability; the impacts of pandemics, epidemics and other infectious disease outbreaks; other matters discussed in these materials; and other factors identified in our Annual Report on Form 10-K for the year ended December 31, 2024 and other filings with the SEC. These forward-looking statements are based on assumptions and estimates, which although believed to be reasonable, may turn out to be incorrect. Therefore, undue reliance should not be placed upon these estimates and statements. We cannot assure that any of these statements, estimates, or beliefs will be realized and actual results or outcomes may differ from those contemplated in these forward-looking statements. Old National does not undertake an obligation to update these forward-looking statements to reflect events or conditions after the date of these materials. You are advised to consult further disclosures we may make on related subjects in our filings with the SEC. Forward-Looking Statements

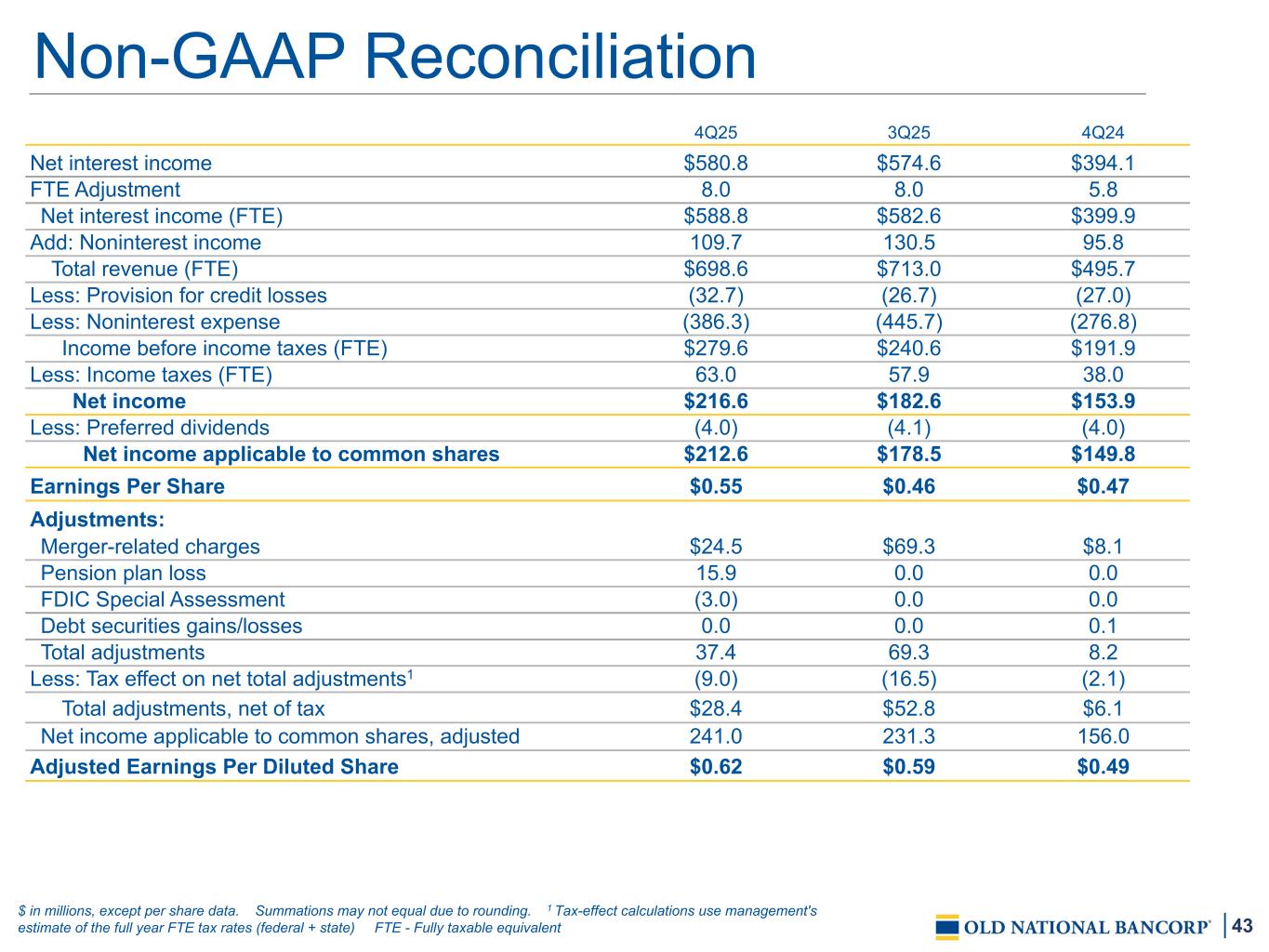

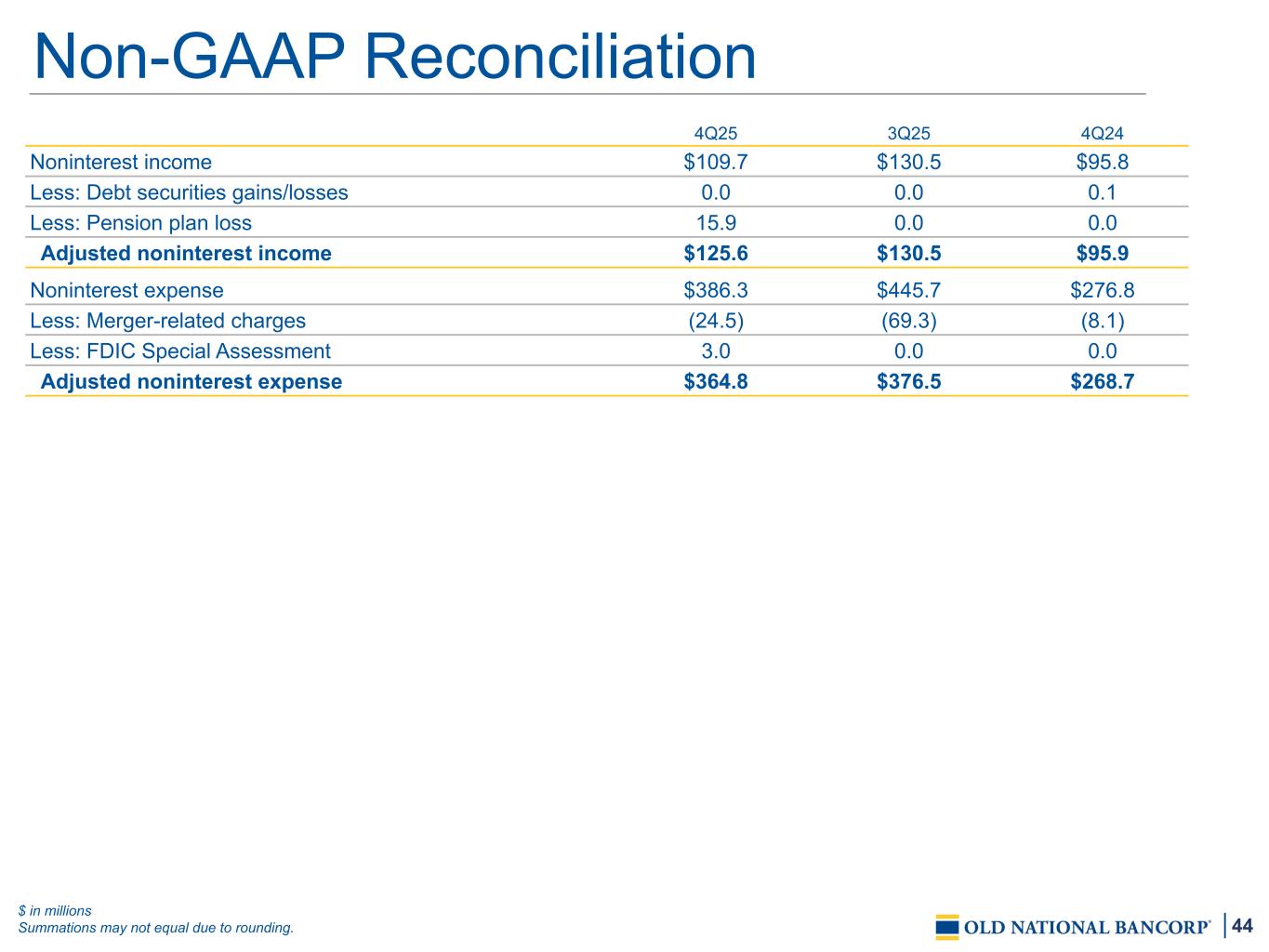

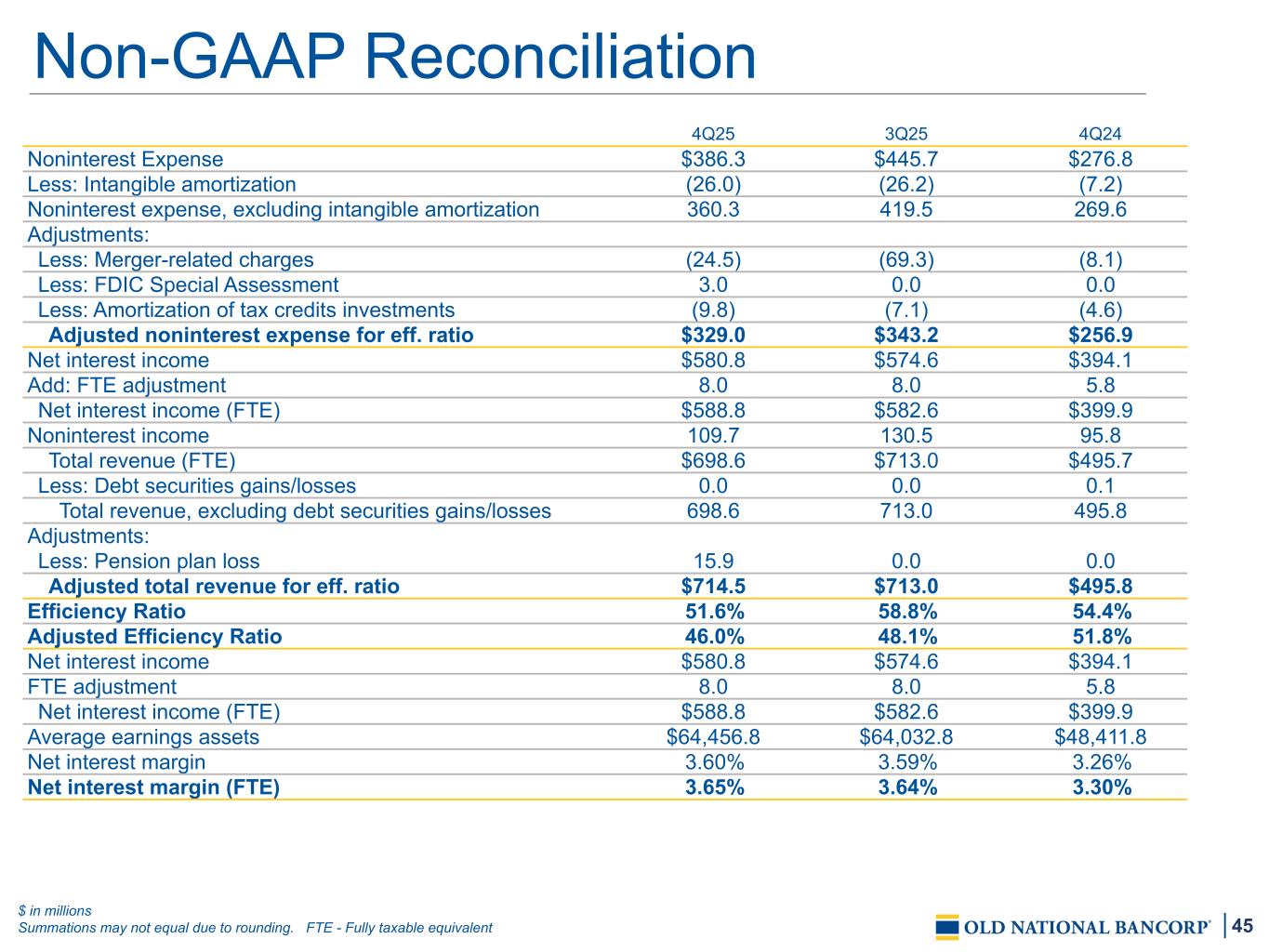

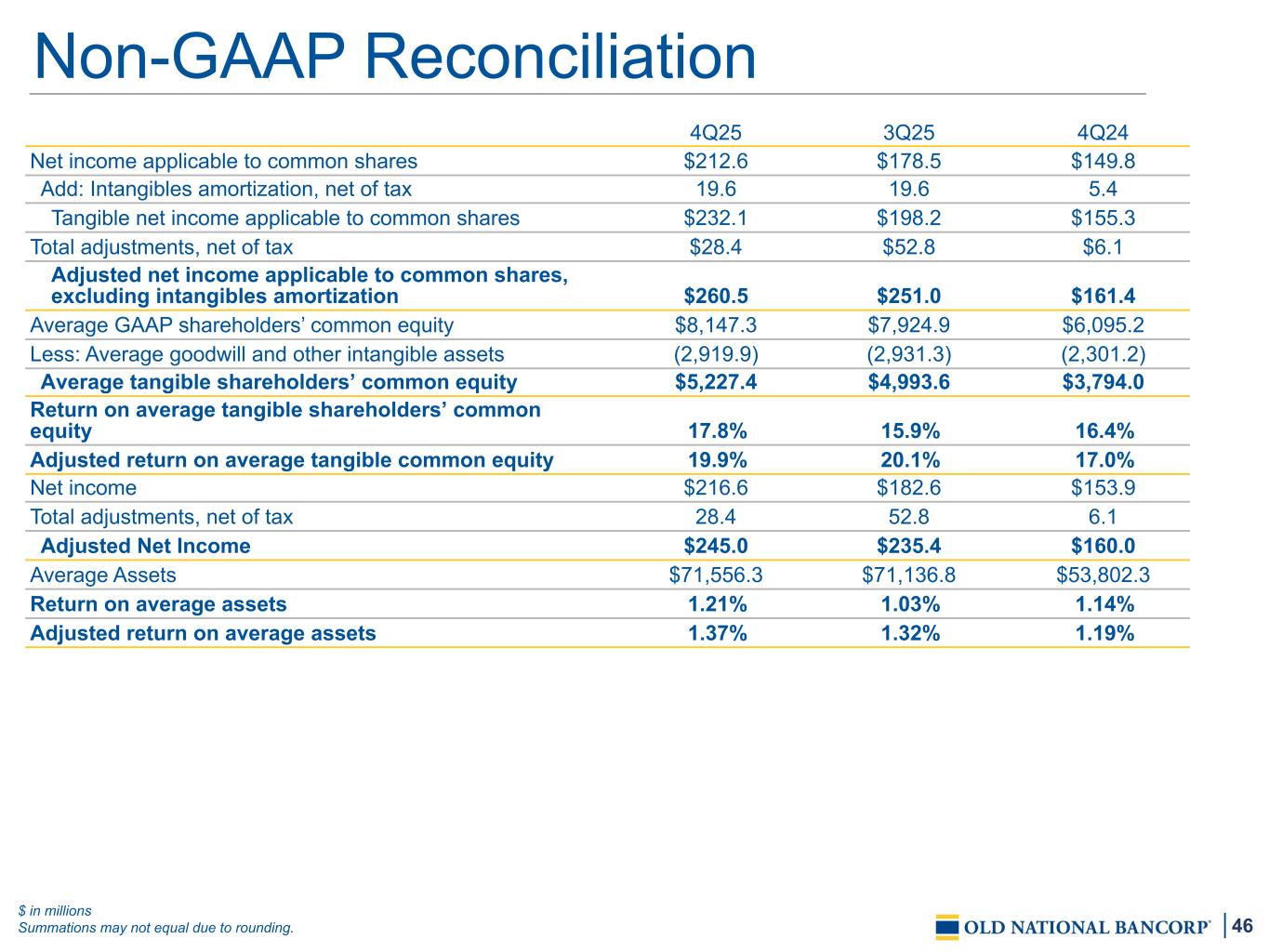

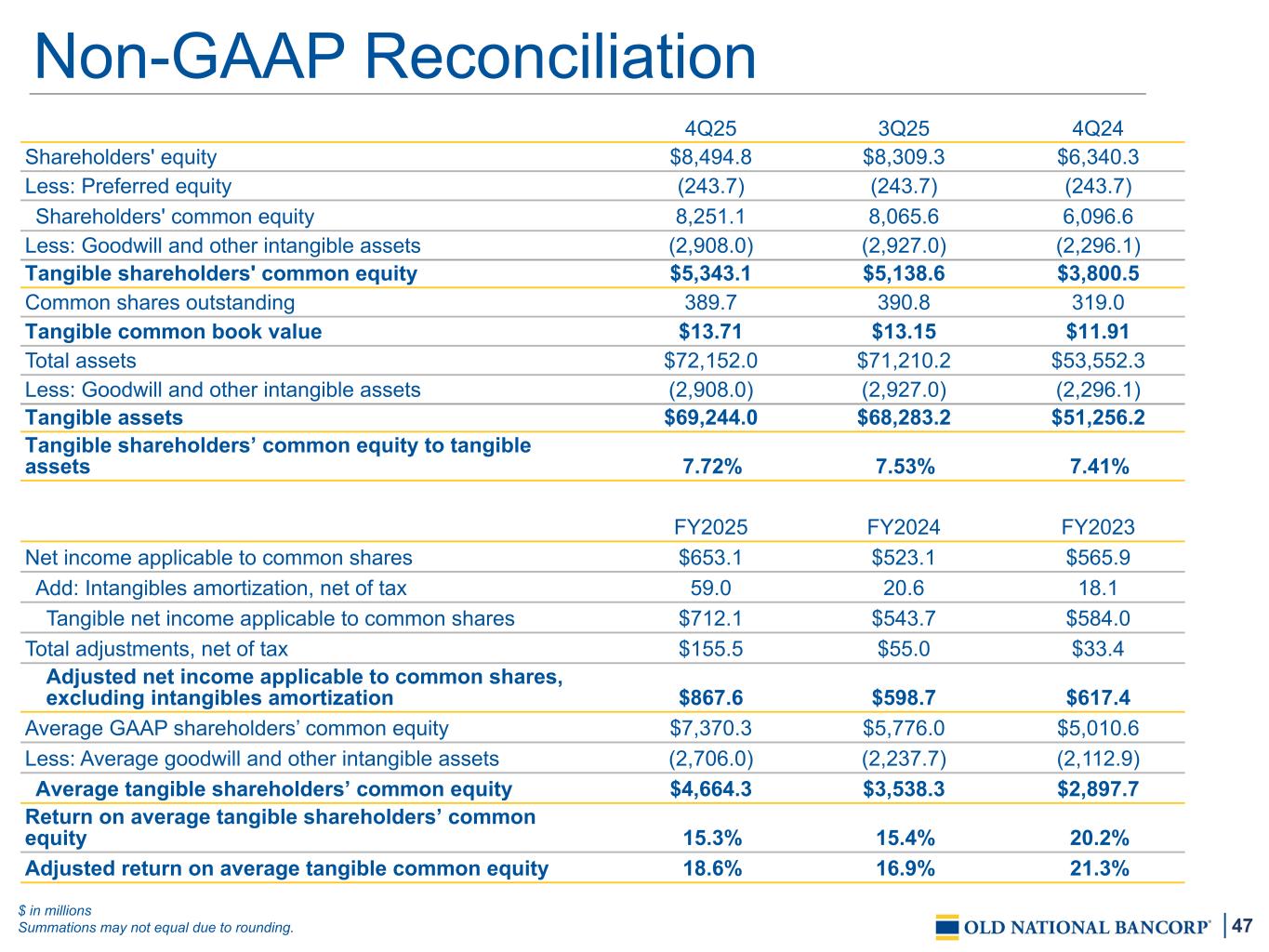

4 Non-GAAP Financial Measures The Company's accounting and reporting policies conform to U.S. generally accepted accounting principles ("GAAP") and general practices within the banking industry. As a supplement to GAAP, the Company provides non-GAAP performance results, which the Company believes are useful because they assist investors in assessing the Company's operating performance. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the appendix to this financial review. The Company presents EPS, the efficiency ratio, return on average common equity, return on average tangible common equity, and net income applicable to common shares, all adjusted for certain notable items. These items include merger-related charges associated with completed and pending acquisitions, a pension plan gain/loss, FDIC special assessment expense, debt securities gains/losses, CECL Day 1 non-PCD provision expense, distribution of excess pension assets expense, and separation expense. Management believes excluding these items from EPS, the efficiency ratio, return on average common equity, and return on average tangible common equity may be useful in assessing the Company's underlying operational performance since these items do not pertain to its core business operations and their exclusion may facilitate better comparability between periods. Management believes that excluding merger-related charges from these metrics may be useful to the Company, as well as analysts and investors, since these expenses can vary significantly based on the size, type, and structure of each acquisition. Additionally, management believes excluding these items from these metrics may enhance comparability for peer comparison purposes. The Company presents adjusted noninterest expense, which excludes merger-related charges associated with completed and pending acquisitions, FDIC special assessment expense, distribution of excess pension assets expense, and separation expense, as well as adjusted noninterest income, which excludes a pension plan gain/ loss and debt securities gains/losses. Management believes that excluding these items from noninterest expense and noninterest income may be useful in assessing the Company’s underlying operational performance as these items either do not pertain to its core business operations or their exclusion may facilitate better comparability between periods and for peer comparison purposes. The tax-equivalent adjustment to net interest income and net interest margin recognizes the income tax savings when comparing taxable and tax-exempt assets. Interest income and yields on tax-exempt securities and loans are presented using the current federal income tax rate of 21%. Management believes that it is standard practice in the banking industry to present net interest income and net interest margin on a fully tax-equivalent basis and that it may enhance comparability for peer comparison purposes. In management's view, tangible common equity measures are capital adequacy metrics that may be meaningful to the Company, as well as analysts and investors, in assessing the Company's use of equity and in facilitating comparisons with peers. These non-GAAP measures are valuable indicators of a financial institution's capital strength since they eliminate intangible assets from stockholders' equity and retain the effect of accumulated other comprehensive loss in stockholders' equity. Although intended to enhance investors' understanding of the Company's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. In addition, these non-GAAP financial measures may differ from those used by other financial institutions to assess their business and performance. See the following reconciliations in the "Non-GAAP Reconciliations" section for details on the calculation of these measures to the extent presented herein.

5 Corporate Strategy Old National’s primary strategic objective is to be a top quartile performing “basic bank” that is a primary, trusted partner to our clients in the communities we serve, and a highly respected, highly valued employer that continually empowers our team members to grow, develop and succeed.

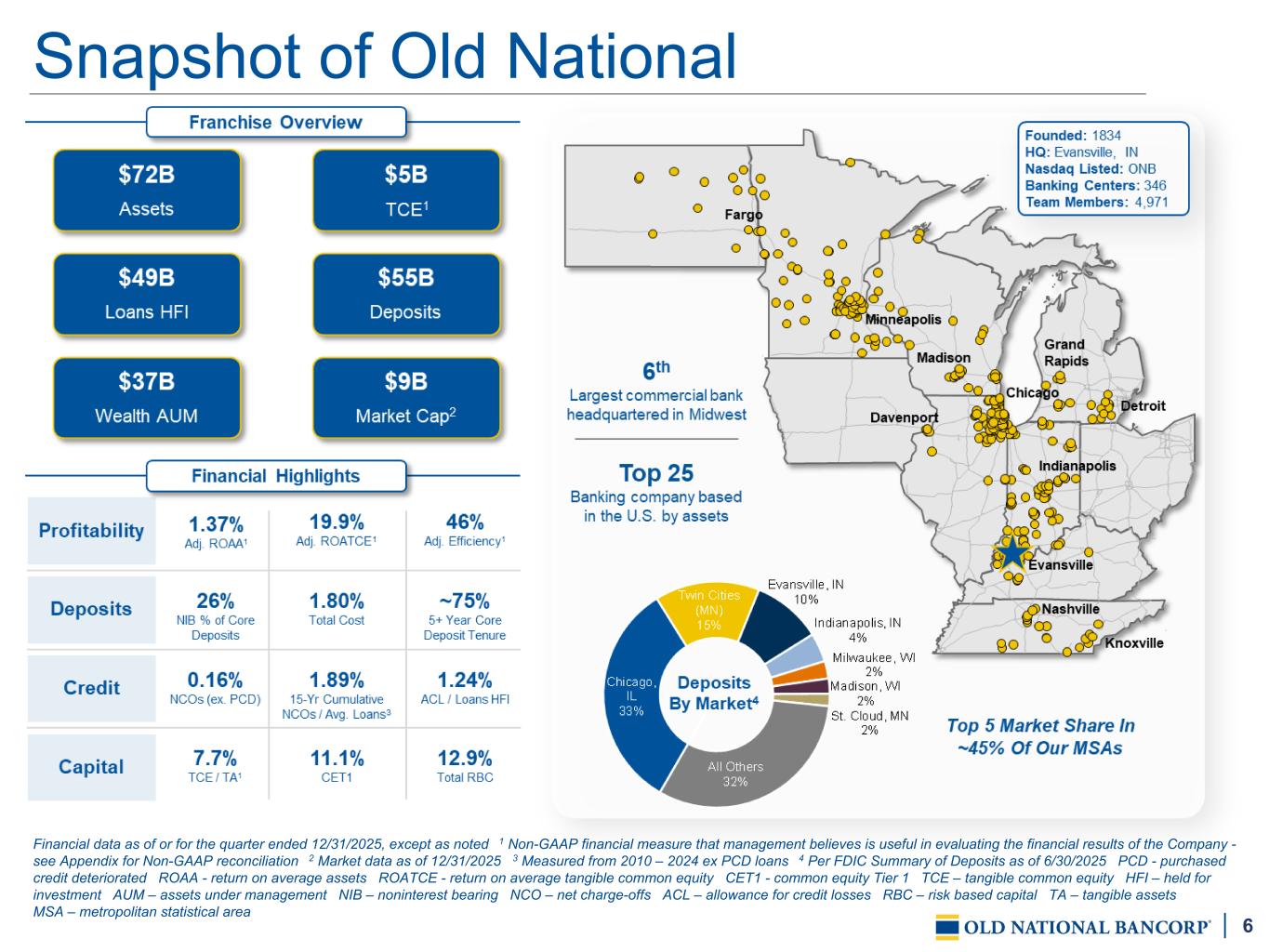

6 Snapshot of Old National Financial data as of or for the quarter ended 12/31/2025, except as noted 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Market data as of 12/31/2025 3 Measured from 2010 – 2024 ex PCD loans 4 Per FDIC Summary of Deposits as of 6/30/2025 PCD - purchased credit deteriorated ROAA - return on average assets ROATCE - return on average tangible common equity CET1 - common equity Tier 1 TCE – tangible common equity HFI – held for investment AUM – assets under management NIB – noninterest bearing NCO – net charge-offs ACL – allowance for credit losses RBC – risk based capital TA – tangible assets MSA – metropolitan statistical area

7 Financial data as of or for the quarter ended 12/31/2025, except as noted 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Includes loans held-for-sale ROAA - Return on average assets ROATCE - Return of average tangible common equity CET1 - common equity tier 1 RWA - risk-weighted assets TBV - tangible book value PCD - purchased credit deteriorated YoY - year-over-year The Best of Offense and Defense OFFENSE Top quartile 4Q2025 financial metrics • 1.37% Adj. ROAA1 • 19.9% Adj. ROATCE1 • 46.0% Adj. Efficiency. Ratio1 Ample liquidity and capital • 89% loan-to-deposit ratio2 • 11.08% CET1 capital to RWA • TBV1 up 15% YoY • 1.1 million shares of common stock repurchased • Prioritizing organic growth and capital growth over M&A DEFENSE Quality, peer-leading deposit franchise • Growth in total deposits of 4.9% YoY (ex. Bremer) • Low total deposit costs of 180 bps for 4Q25 • 75% of core deposits have tenure >5 years • NIB deposits represent 26% of core deposits Strong credit culture • Well-reserved — 100% weighted Moody’s S-2 scenario • $605 million allowance for credit losses, or 1.24% of total loans, includes ~4% reserve on PCD loans • Additionally, $50 million of credit discount remaining on Bremer non-PCD loans • Granular and diversified loan portfolio • Low net charge-offs of 16 bps, excluding PCD loans

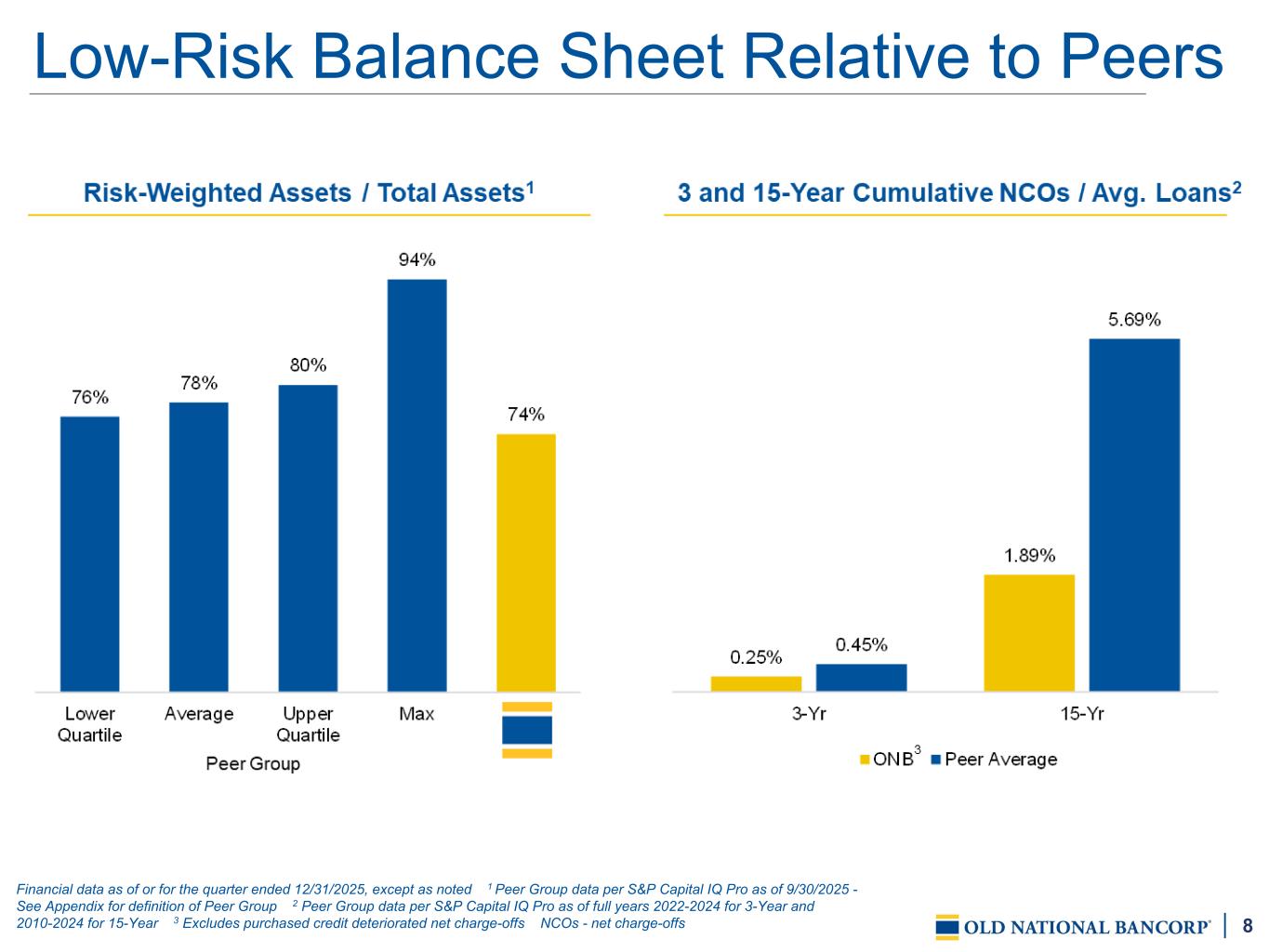

8 Financial data as of or for the quarter ended 12/31/2025, except as noted 1 Peer Group data per S&P Capital IQ Pro as of 9/30/2025 - See Appendix for definition of Peer Group 2 Peer Group data per S&P Capital IQ Pro as of full years 2022-2024 for 3-Year and 2010-2024 for 15-Year 3 Excludes purchased credit deteriorated net charge-offs NCOs - net charge-offs Low-Risk Balance Sheet Relative to Peers

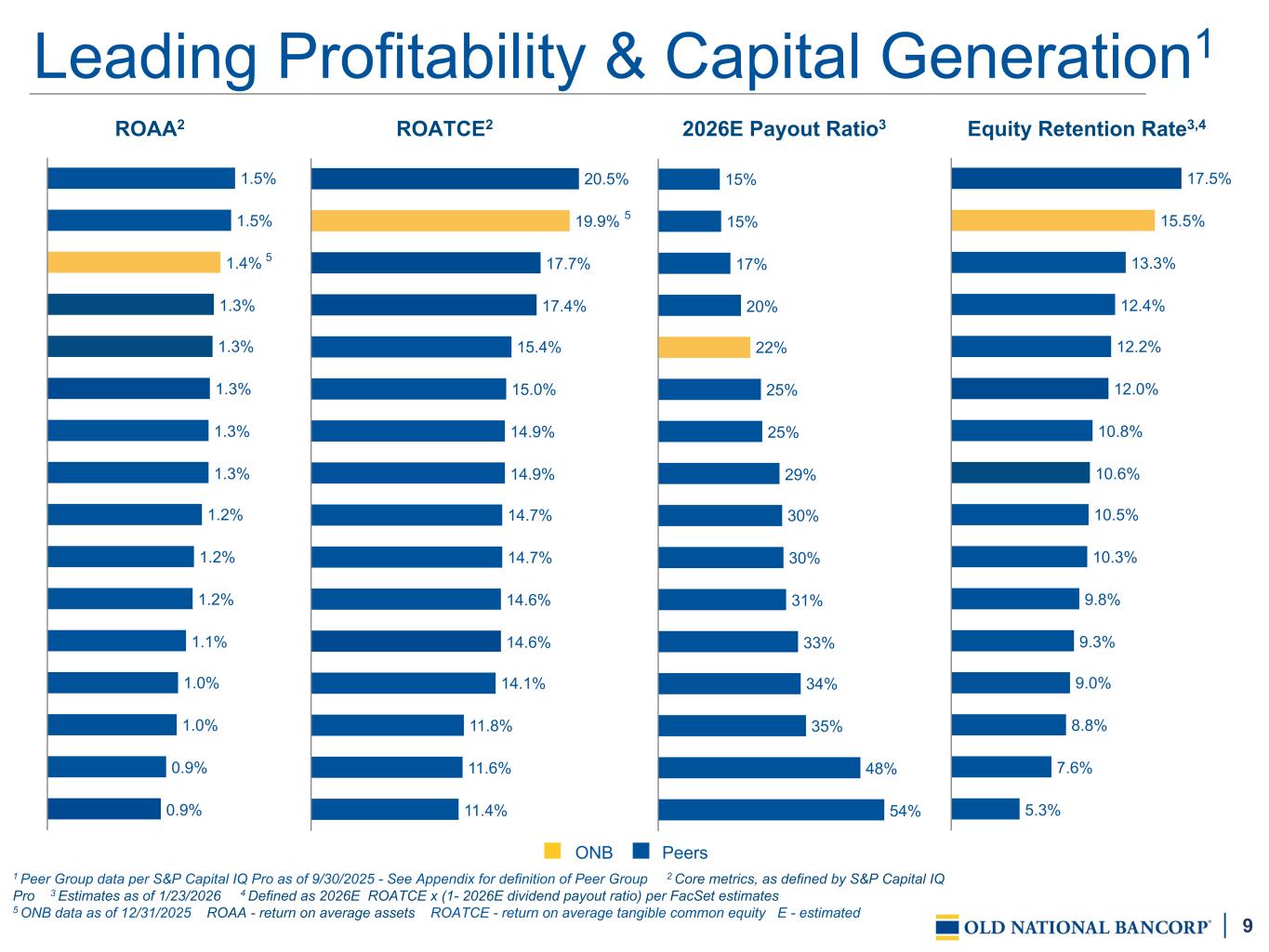

9 Leading Profitability & Capital Generation1 1.5% 1.5% 1.4% 1.3% 1.3% 1.3% 1.3% 1.3% 1.2% 1.2% 1.2% 1.1% 1.0% 1.0% 0.9% 0.9% 20.5% 19.9% 17.7% 17.4% 15.4% 15.0% 14.9% 14.9% 14.7% 14.7% 14.6% 14.6% 14.1% 11.8% 11.6% 11.4% 15% 15% 17% 20% 22% 25% 25% 29% 30% 30% 31% 33% 34% 35% 48% 54% 1 Peer Group data per S&P Capital IQ Pro as of 9/30/2025 - See Appendix for definition of Peer Group 2 Core metrics, as defined by S&P Capital IQ Pro 3 Estimates as of 1/23/2026 4 Defined as 2026E ROATCE x (1- 2026E dividend payout ratio) per FacSet estimates 5 ONB data as of 12/31/2025 ROAA - return on average assets ROATCE - return on average tangible common equity E - estimated 2026E Payout Ratio3ROATCE2ROAA2 Equity Retention Rate3,4 17.5% 15.5% 13.3% 12.4% 12.2% 12.0% 10.8% 10.6% 10.5% 10.3% 9.8% 9.3% 9.0% 8.8% 7.6% 5.3% 5 5 ONB Peers

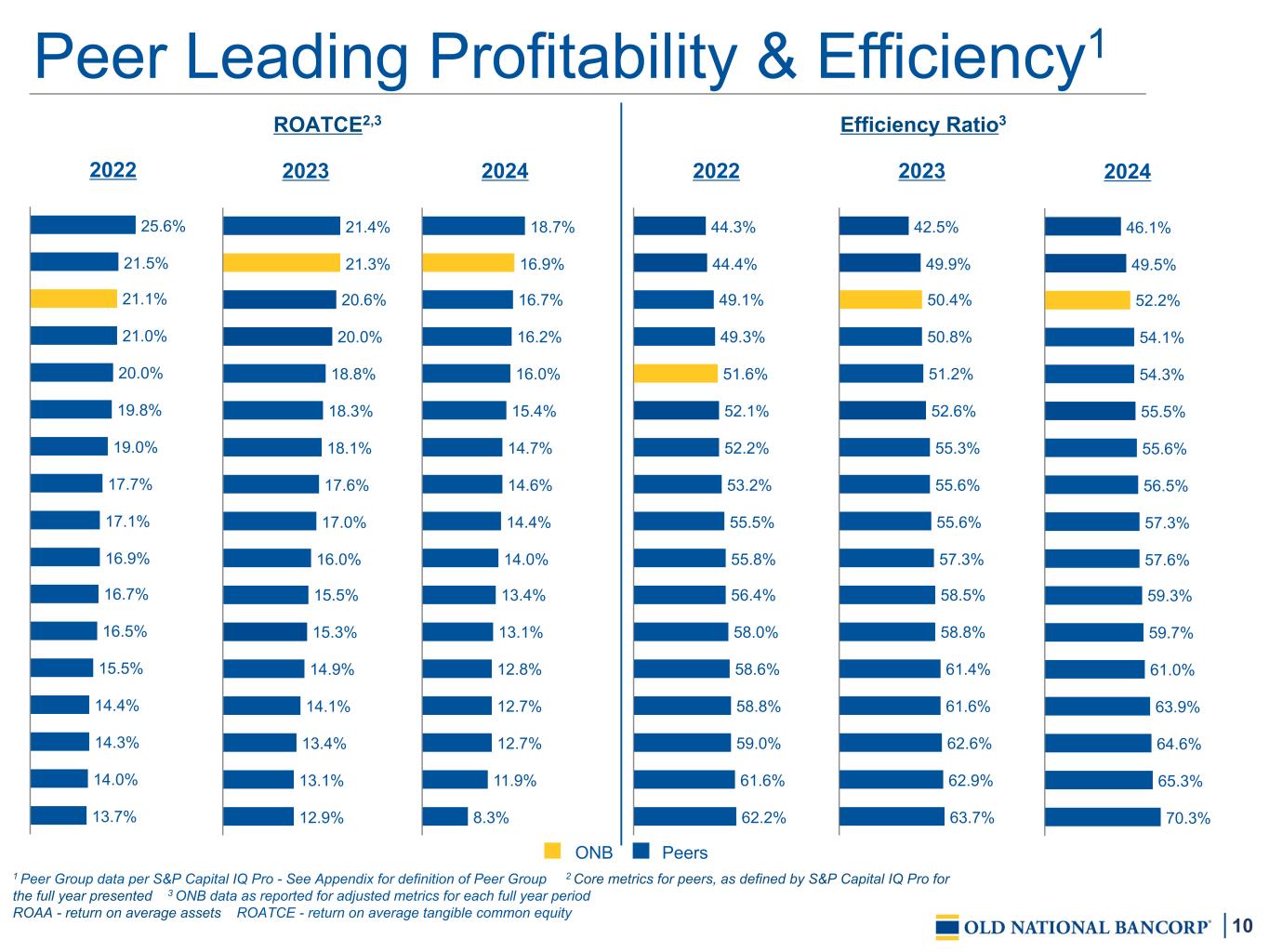

10 Peer Leading Profitability & Efficiency1 2022 25.6% 21.5% 21.1% 21.0% 20.0% 19.8% 19.0% 17.7% 17.1% 16.9% 16.7% 16.5% 15.5% 14.4% 14.3% 14.0% 13.7% 2023 21.4% 21.3% 20.6% 20.0% 18.8% 18.3% 18.1% 17.6% 17.0% 16.0% 15.5% 15.3% 14.9% 14.1% 13.4% 13.1% 12.9% 2024 18.7% 16.9% 16.7% 16.2% 16.0% 15.4% 14.7% 14.6% 14.4% 14.0% 13.4% 13.1% 12.8% 12.7% 12.7% 11.9% 8.3% 1 Peer Group data per S&P Capital IQ Pro - See Appendix for definition of Peer Group 2 Core metrics for peers, as defined by S&P Capital IQ Pro for the full year presented 3 ONB data as reported for adjusted metrics for each full year period ROAA - return on average assets ROATCE - return on average tangible common equity ROATCE2,3 Efficiency Ratio3 2023 42.5% 49.9% 50.4% 50.8% 51.2% 52.6% 55.3% 55.6% 55.6% 57.3% 58.5% 58.8% 61.4% 61.6% 62.6% 62.9% 63.7% 2024 46.1% 49.5% 52.2% 54.1% 54.3% 55.5% 55.6% 56.5% 57.3% 57.6% 59.3% 59.7% 61.0% 63.9% 64.6% 65.3% 70.3% 2022 44.3% 44.4% 49.1% 49.3% 51.6% 52.1% 52.2% 53.2% 55.5% 55.8% 56.4% 58.0% 58.6% 58.8% 59.0% 61.6% 62.2% ONB Peers

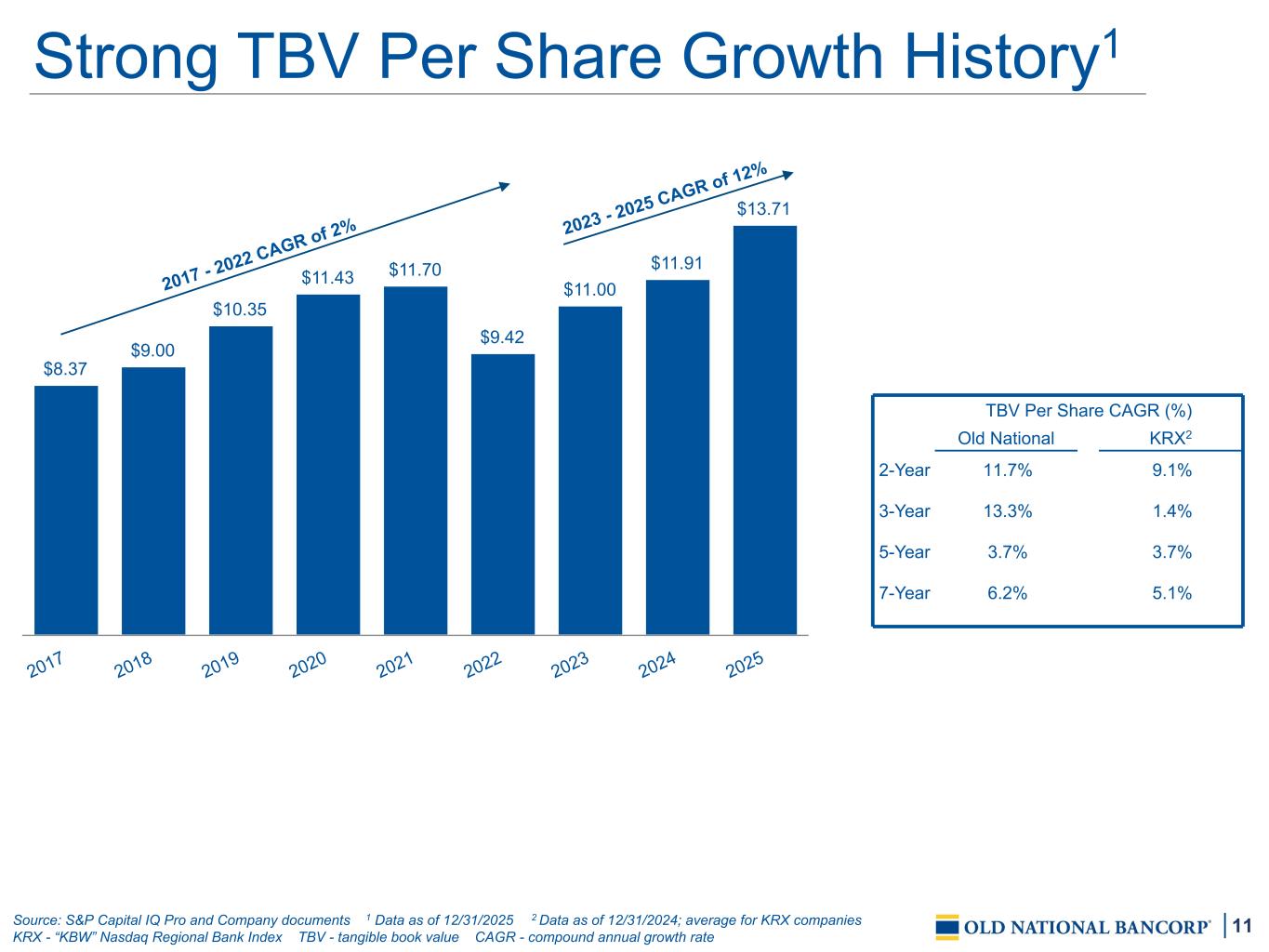

11 $8.37 $9.00 $10.35 $11.43 $11.70 $9.42 $11.00 $11.91 $13.71 2017 2018 2019 2020 2021 2022 2023 2024 2025 Strong TBV Per Share Growth History1 TBV Per Share CAGR (%) Old National KRX2 2-Year 11.7% 9.1% 3-Year 13.3% 1.4% 5-Year 3.7% 3.7% 7-Year 6.2% 5.1% Source: S&P Capital IQ Pro and Company documents 1 Data as of 12/31/2025 2 Data as of 12/31/2024; average for KRX companies KRX - “KBW” Nasdaq Regional Bank Index TBV - tangible book value CAGR - compound annual growth rate 2017 - 2022 CAGR of 2% 2023 - 2025 CAGR of 12%

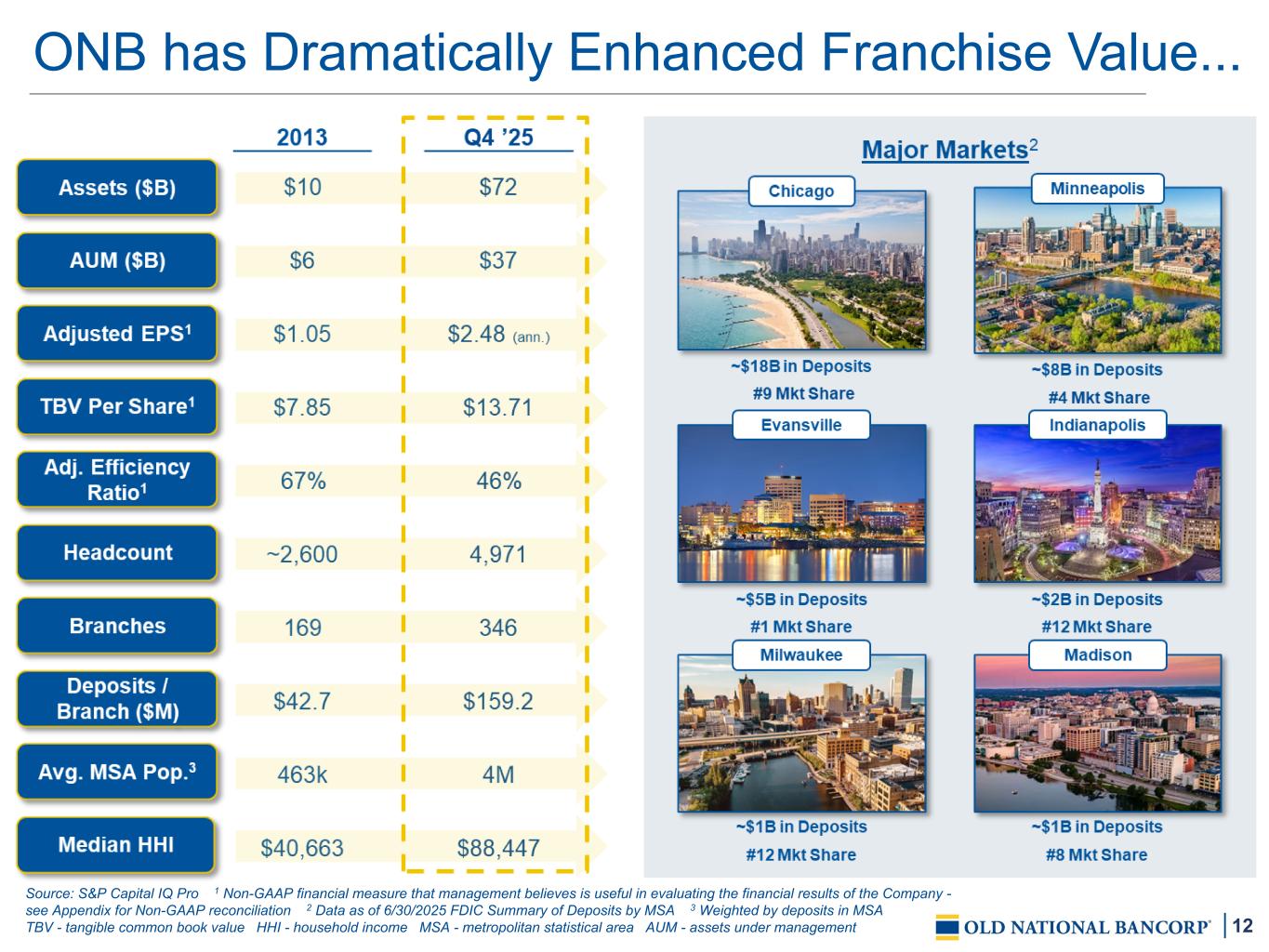

12 ONB has Dramatically Enhanced Franchise Value... Source: S&P Capital IQ Pro 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Data as of 6/30/2025 FDIC Summary of Deposits by MSA 3 Weighted by deposits in MSA TBV - tangible common book value HHI - household income MSA - metropolitan statistical area AUM - assets under management

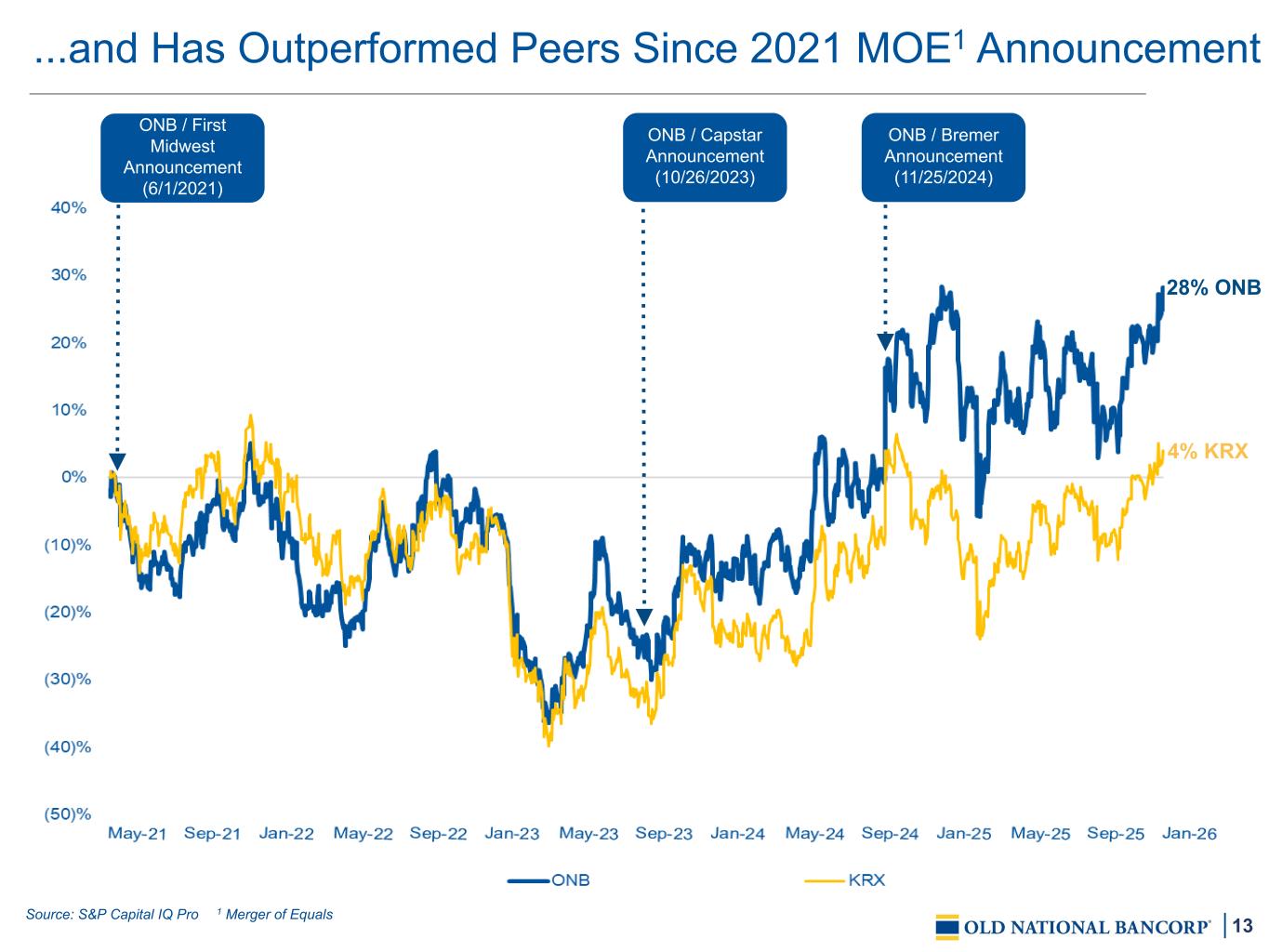

13 ...and Has Outperformed Peers Since 2021 MOE1 Announcement Source: S&P Capital IQ Pro 1 Merger of Equals 4% KRX 28% ONB ONB / First Midwest Announcement (6/1/2021) ONB / Capstar Announcement (10/26/2023) ONB / Bremer Announcement (11/25/2024)

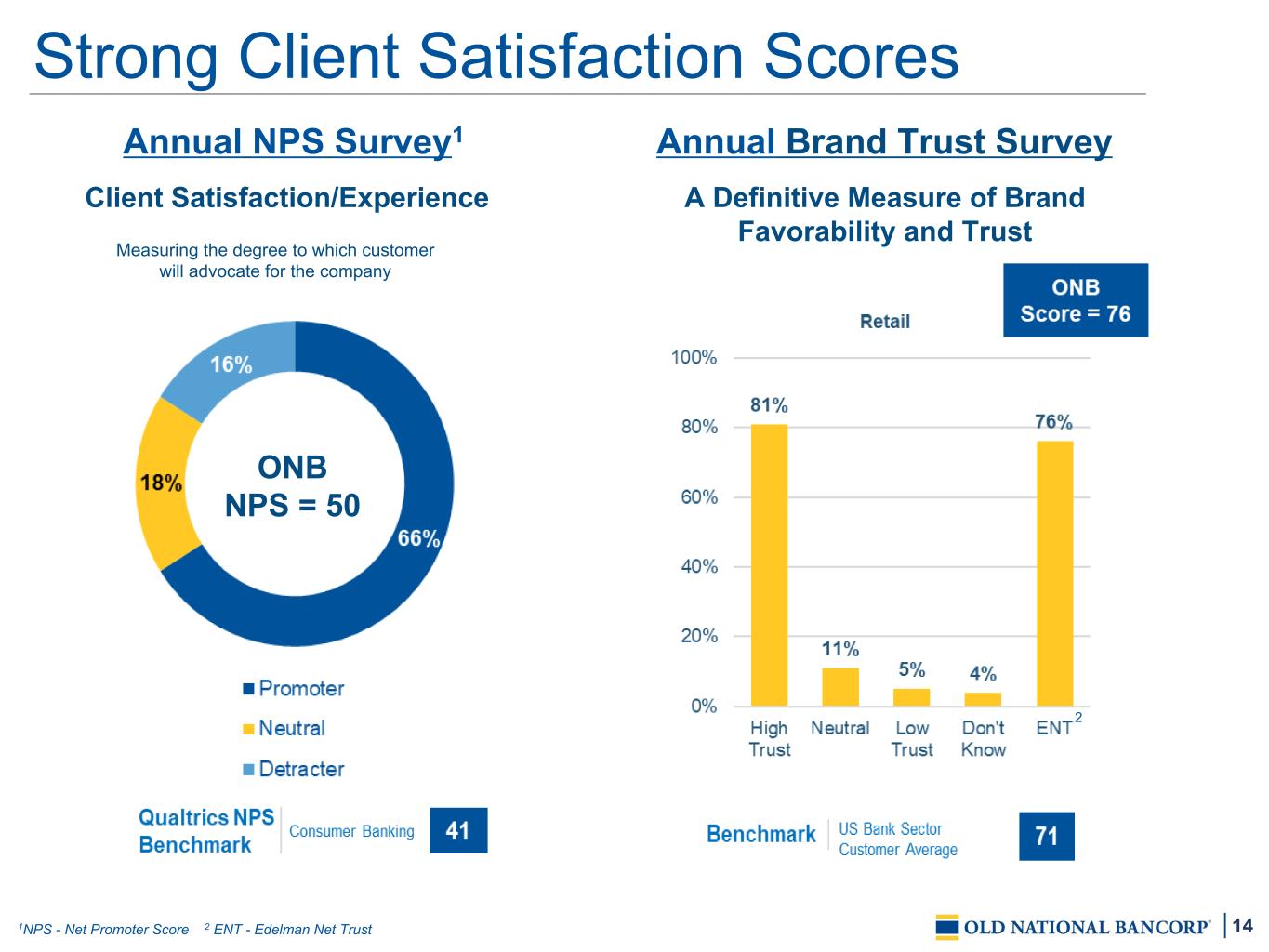

14 Strong Client Satisfaction Scores 1NPS - Net Promoter Score 2 ENT - Edelman Net Trust Annual NPS Survey1 Annual Brand Trust Survey Client Satisfaction/Experience A Definitive Measure of Brand Favorability and Trust Measuring the degree to which customer will advocate for the company ONB NPS = 50 2

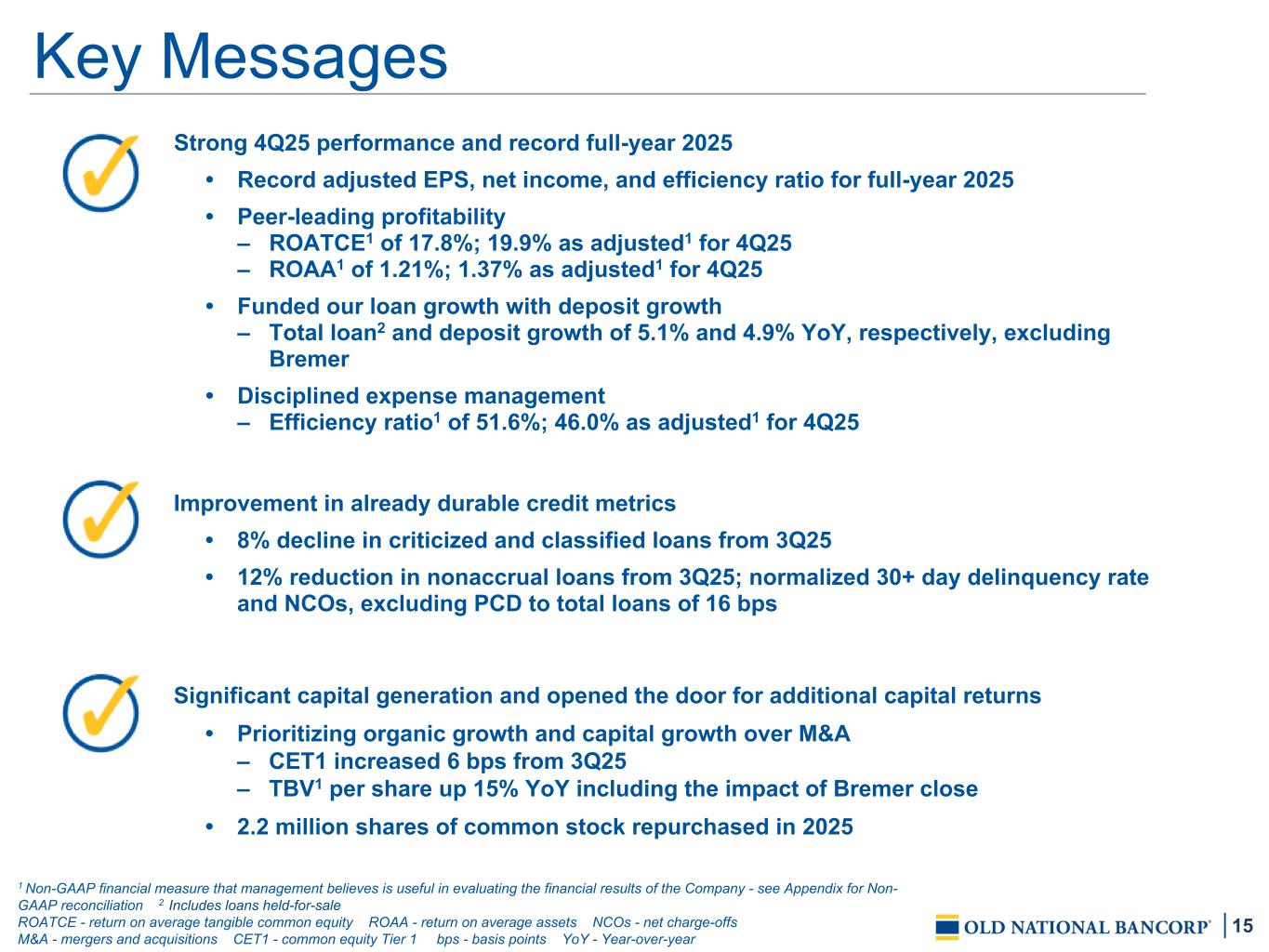

15 Key Messages Strong 4Q25 performance and record full-year 2025 • Record adjusted EPS, net income, and efficiency ratio for full-year 2025 • Peer-leading profitability – ROATCE1 of 17.8%; 19.9% as adjusted1 for 4Q25 – ROAA1 of 1.21%; 1.37% as adjusted1 for 4Q25 • Funded our loan growth with deposit growth – Total loan2 and deposit growth of 5.1% and 4.9% YoY, respectively, excluding Bremer • Disciplined expense management – Efficiency ratio1 of 51.6%; 46.0% as adjusted1 for 4Q25 Improvement in already durable credit metrics • 8% decline in criticized and classified loans from 3Q25 • 12% reduction in nonaccrual loans from 3Q25; normalized 30+ day delinquency rate and NCOs, excluding PCD to total loans of 16 bps Significant capital generation and opened the door for additional capital returns • Prioritizing organic growth and capital growth over M&A – CET1 increased 6 bps from 3Q25 – TBV1 per share up 15% YoY including the impact of Bremer close • 2.2 million shares of common stock repurchased in 2025 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non- GAAP reconciliation 2 Includes loans held-for-sale ROATCE - return on average tangible common equity ROAA - return on average assets NCOs - net charge-offs M&A - mergers and acquisitions CET1 - common equity Tier 1 bps - basis points YoY - Year-over-year

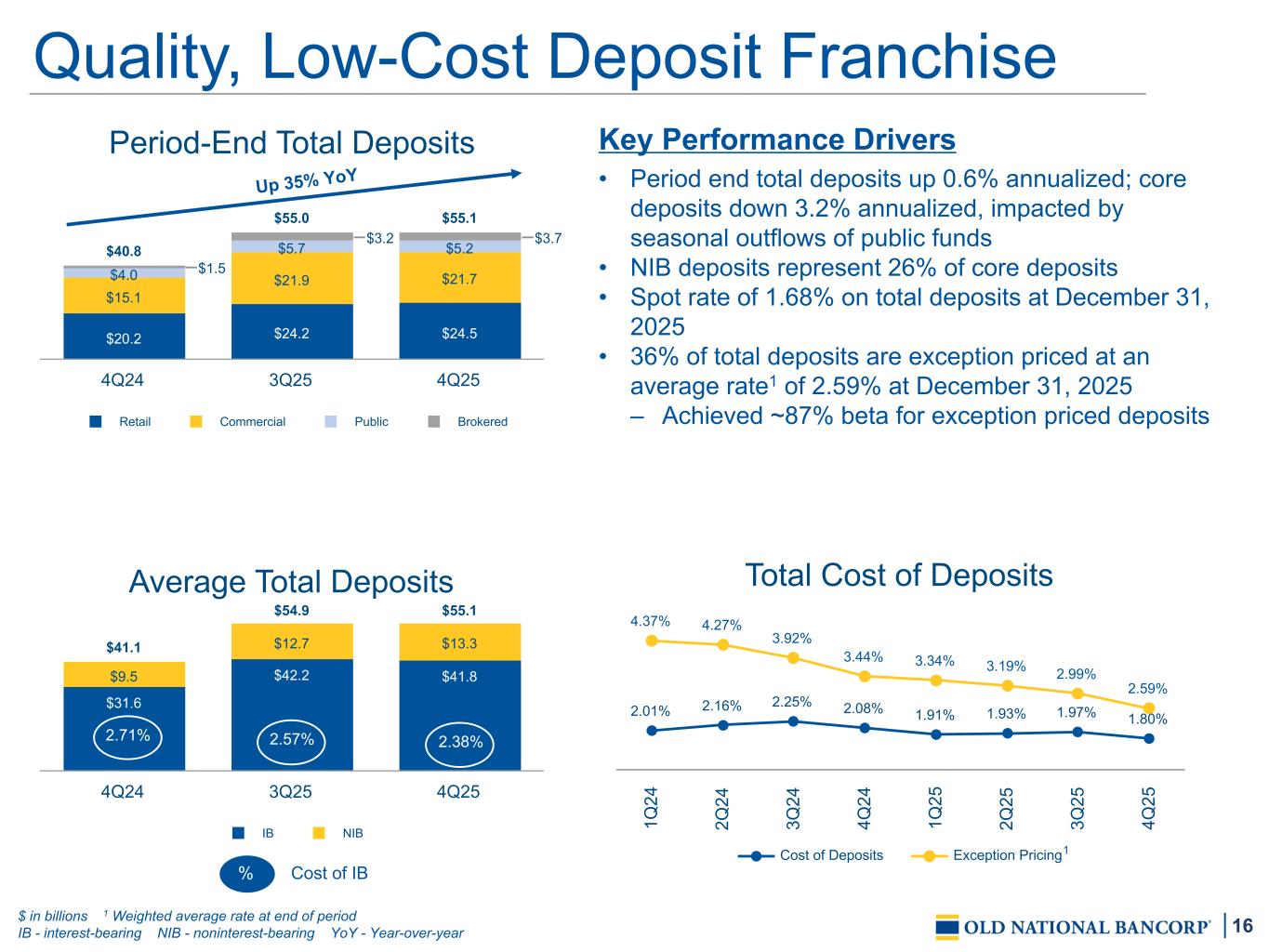

16 Average Total Deposits $41.1 $54.9 $55.1 $31.6 $42.2 $41.8$9.5 $12.7 $13.3 IB NIB 4Q24 3Q25 4Q25 % Quality, Low-Cost Deposit Franchise Key Performance Drivers • Period end total deposits up 0.6% annualized; core deposits down 3.2% annualized, impacted by seasonal outflows of public funds • NIB deposits represent 26% of core deposits • Spot rate of 1.68% on total deposits at December 31, 2025 • 36% of total deposits are exception priced at an average rate1 of 2.59% at December 31, 2025 – Achieved ~87% beta for exception priced deposits $ in billions 1 Weighted average rate at end of period IB - interest-bearing NIB - noninterest-bearing YoY - Year-over-year Period-End Total Deposits $40.8 $55.0 $55.1 $20.2 $24.2 $24.5 $15.1 $21.9 $21.7$4.0 $5.7 $5.2 Retail Commercial Public Brokered 4Q24 3Q25 4Q25 Cost of IB 2.57%2.71% 2.38% Total Cost of Deposits 2.01% 2.16% 2.25% 2.08% 1.91% 1.93% 1.97% 1.80% 4.37% 4.27% 3.92% 3.44% 3.34% 3.19% 2.99% 2.59% Cost of Deposits Exception Pricing 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 $1.5 $3.2 $3.7 1 Up 35% YoY

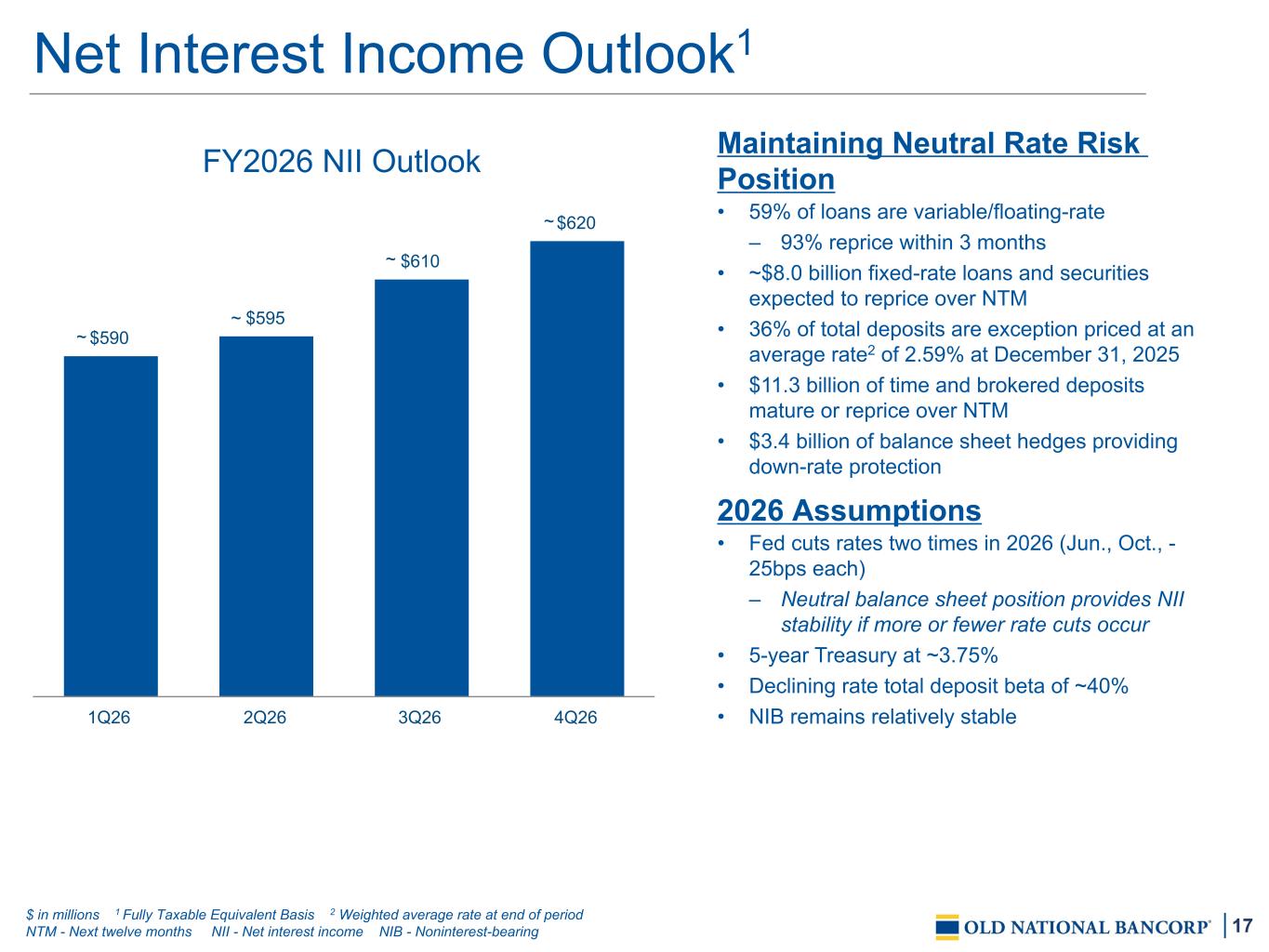

17 Net Interest Income Outlook1 Maintaining Neutral Rate Risk Position • 59% of loans are variable/floating-rate – 93% reprice within 3 months • ~$8.0 billion fixed-rate loans and securities expected to reprice over NTM • 36% of total deposits are exception priced at an average rate2 of 2.59% at December 31, 2025 • $11.3 billion of time and brokered deposits mature or reprice over NTM • $3.4 billion of balance sheet hedges providing down-rate protection 2026 Assumptions • Fed cuts rates two times in 2026 (Jun., Oct., - 25bps each) – Neutral balance sheet position provides NII stability if more or fewer rate cuts occur • 5-year Treasury at ~3.75% • Declining rate total deposit beta of ~40% • NIB remains relatively stable $ in millions 1 Fully Taxable Equivalent Basis 2 Weighted average rate at end of period NTM - Next twelve months NII - Net interest income NIB - Noninterest-bearing $590 $595 $610 $620 1Q26 2Q26 3Q26 4Q26 ~ ~ ~ ~ FY2026 NII Outlook

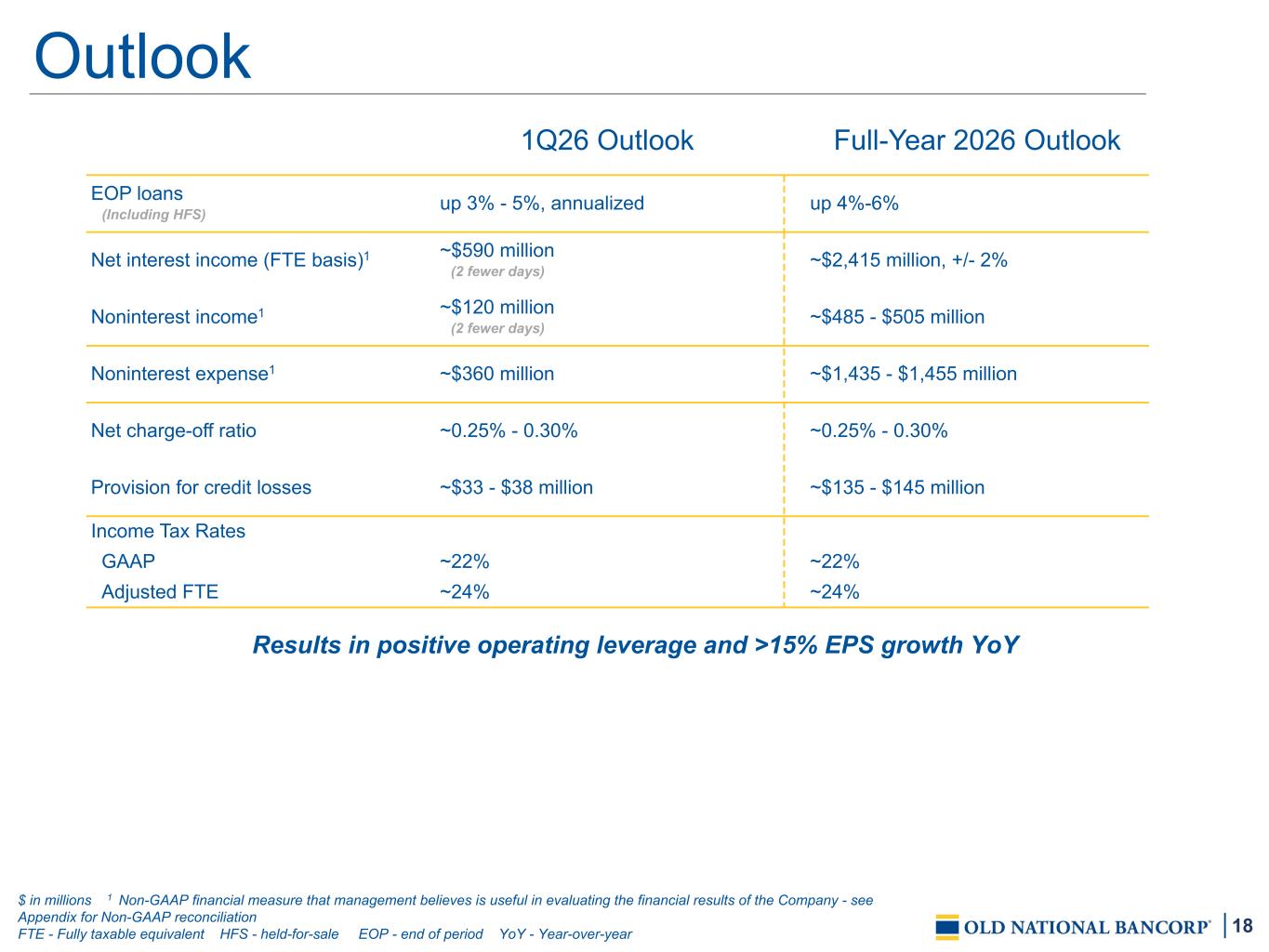

18 Outlook 1Q26 Outlook Full-Year 2026 Outlook EOP loans (Including HFS) up 3% - 5%, annualized up 4%-6% Net interest income (FTE basis)1 ~$590 million (2 fewer days) ~$2,415 million, +/- 2% Noninterest income1 ~$120 million (2 fewer days) ~$485 - $505 million Noninterest expense1 ~$360 million ~$1,435 - $1,455 million Net charge-off ratio ~0.25% - 0.30% ~0.25% - 0.30% Provision for credit losses ~$33 - $38 million ~$135 - $145 million Income Tax Rates GAAP ~22% ~22% Adjusted FTE ~24% ~24% $ in millions 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation FTE - Fully taxable equivalent HFS - held-for-sale EOP - end of period YoY - Year-over-year Results in positive operating leverage and >15% EPS growth YoY

Financial Details Data as of December 31, 2025

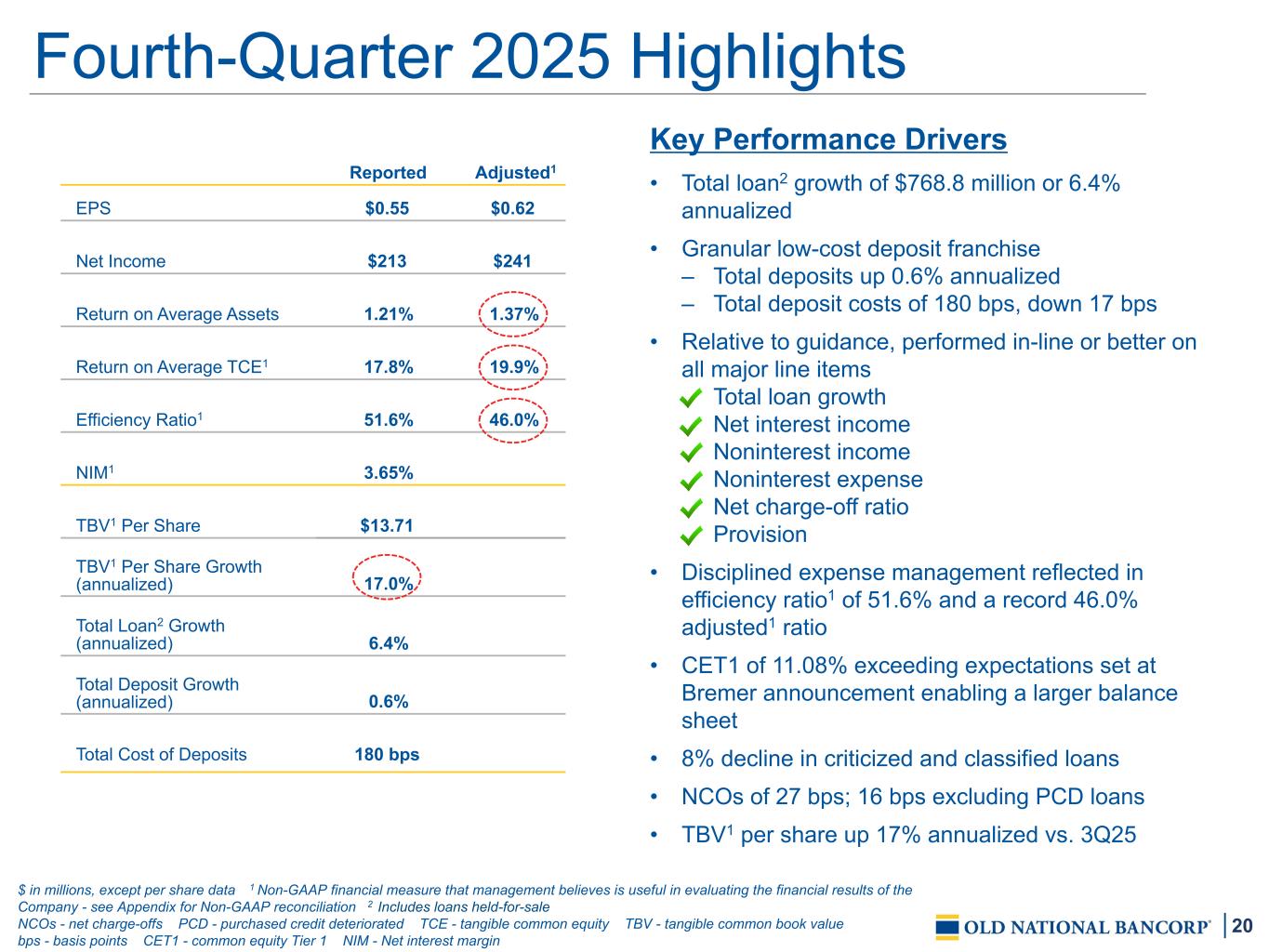

20 Fourth-Quarter 2025 Highlights Key Performance Drivers • Total loan2 growth of $768.8 million or 6.4% annualized • Granular low-cost deposit franchise – Total deposits up 0.6% annualized – Total deposit costs of 180 bps, down 17 bps • Relative to guidance, performed in-line or better on all major line items Total loan growth Net interest income Noninterest income Noninterest expense Net charge-off ratio Provision • Disciplined expense management reflected in efficiency ratio1 of 51.6% and a record 46.0% adjusted1 ratio • CET1 of 11.08% exceeding expectations set at Bremer announcement enabling a larger balance sheet • 8% decline in criticized and classified loans • NCOs of 27 bps; 16 bps excluding PCD loans • TBV1 per share up 17% annualized vs. 3Q25 $ in millions, except per share data 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Includes loans held-for-sale NCOs - net charge-offs PCD - purchased credit deteriorated TCE - tangible common equity TBV - tangible common book value bps - basis points CET1 - common equity Tier 1 NIM - Net interest margin Reported Adjusted1 EPS $0.55 $0.62 Net Income $213 $241 Return on Average Assets 1.21% 1.37% Return on Average TCE1 17.8% 19.9% Efficiency Ratio1 51.6% 46.0% NIM1 3.65% TBV1 Per Share $13.71 TBV1 Per Share Growth (annualized) 17.0% Total Loan2 Growth (annualized) 6.4% Total Deposit Growth (annualized) 0.6% Total Cost of Deposits 180 bps

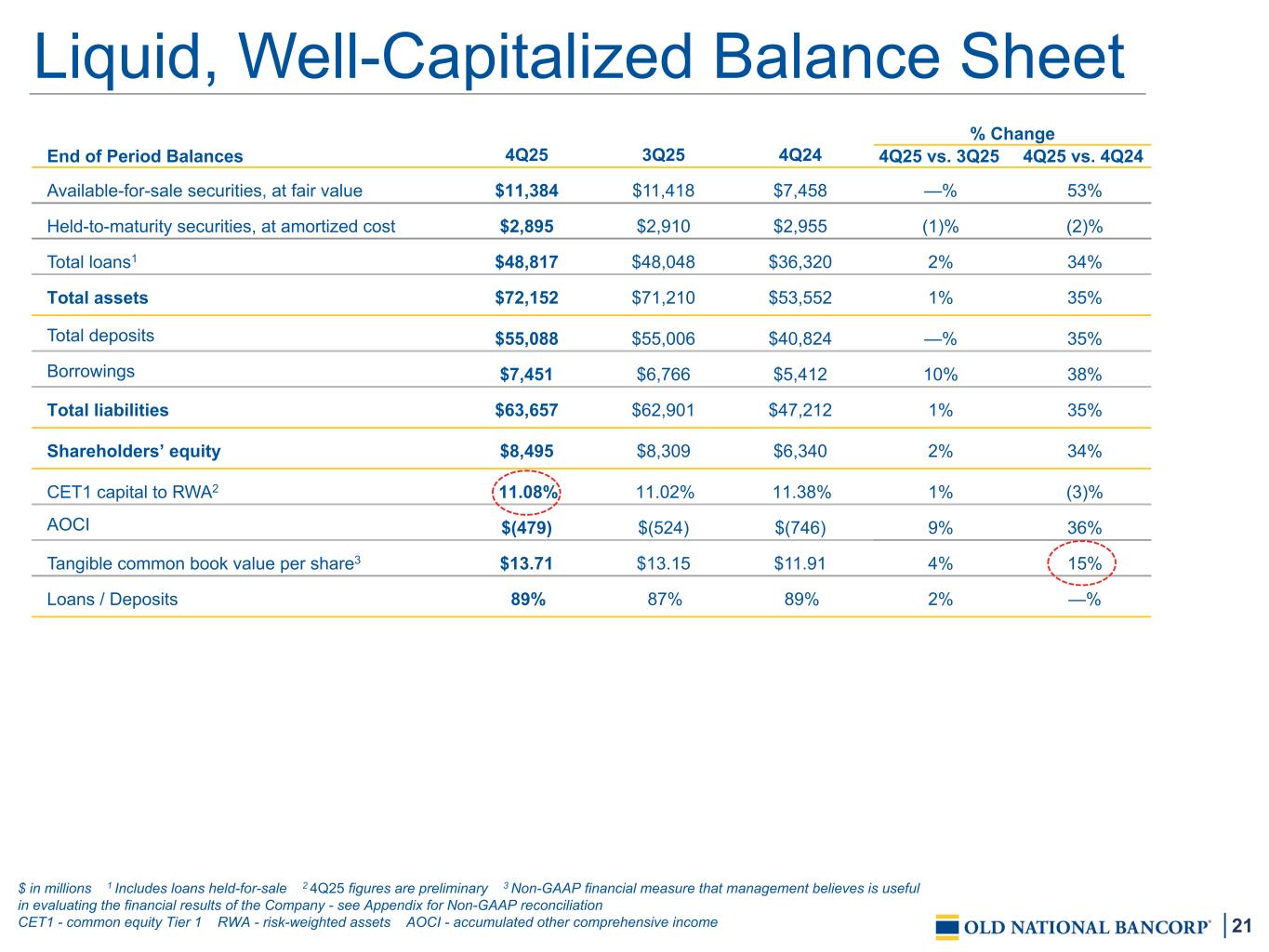

21 4Q25 3Q25 4Q24 % Change End of Period Balances 4Q25 vs. 3Q25 4Q25 vs. 4Q24 Available-for-sale securities, at fair value $11,384 $11,418 $7,458 —% 53% Held-to-maturity securities, at amortized cost $2,895 $2,910 $2,955 (1)% (2)% Total loans1 $48,817 $48,048 $36,320 2% 34% Total assets $72,152 $71,210 $53,552 1% 35% Total deposits $55,088 $55,006 $40,824 —% 35% Borrowings $7,451 $6,766 $5,412 10% 38% Total liabilities $63,657 $62,901 $47,212 1% 35% Shareholders’ equity $8,495 $8,309 $6,340 2% 34% CET1 capital to RWA2 11.08% 11.02% 11.38% 1% (3)% AOCI $(479) $(524) $(746) 9% 36% Tangible common book value per share3 $13.71 $13.15 $11.91 4% 15% Loans / Deposits 89% 87% 89% 2% —% Liquid, Well-Capitalized Balance Sheet $ in millions 1 Includes loans held-for-sale 2 4Q25 figures are preliminary 3 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation CET1 - common equity Tier 1 RWA - risk-weighted assets AOCI - accumulated other comprehensive income

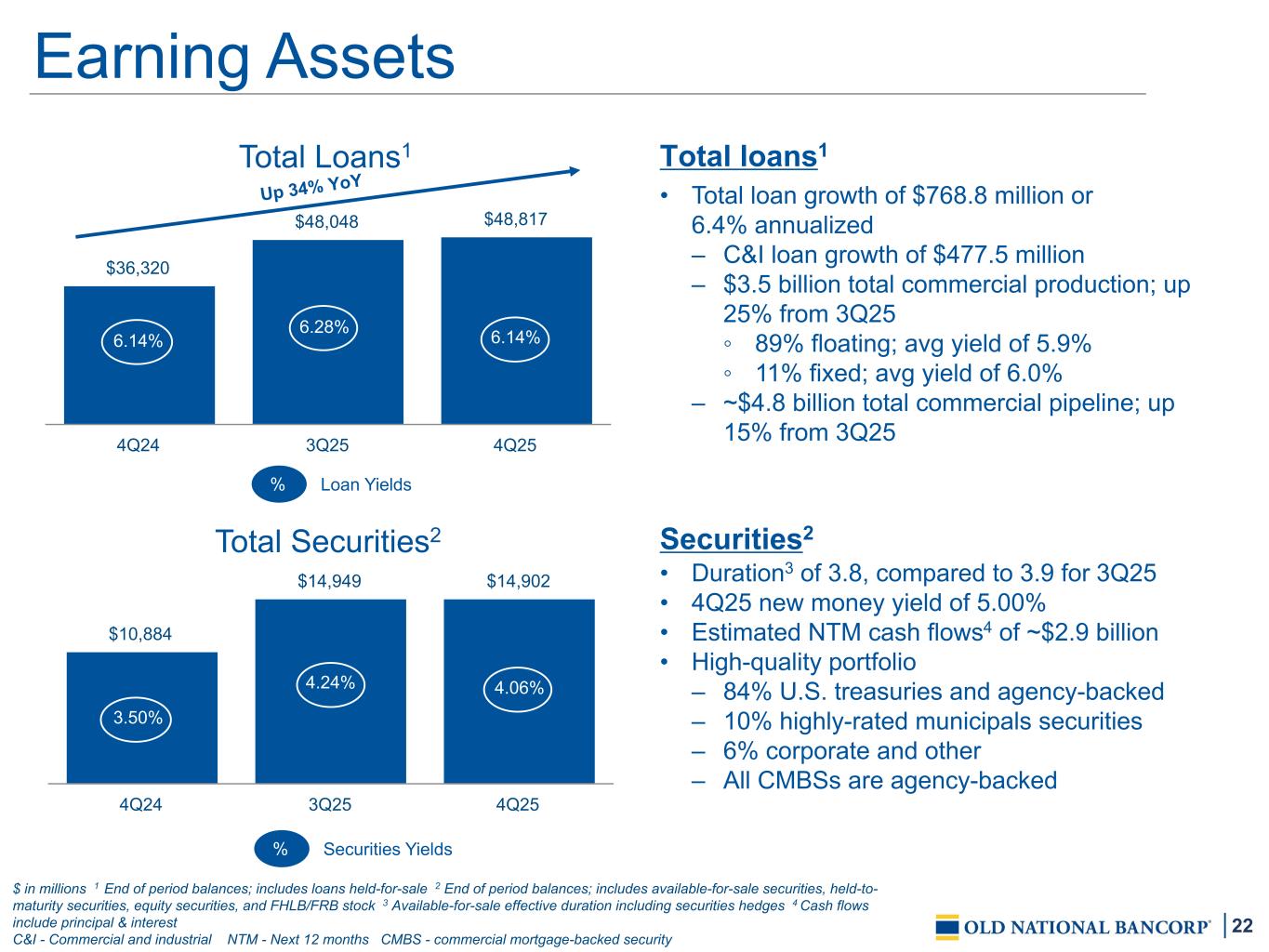

22 $36,320 $48,048 $48,817 4Q24 3Q25 4Q25 6.14% % 6.28% Loan Yields Earning Assets Total loans1 • Total loan growth of $768.8 million or 6.4% annualized – C&I loan growth of $477.5 million – $3.5 billion total commercial production; up 25% from 3Q25 ◦ 89% floating; avg yield of 5.9% ◦ 11% fixed; avg yield of 6.0% – ~$4.8 billion total commercial pipeline; up 15% from 3Q25 Securities2 • Duration3 of 3.8, compared to 3.9 for 3Q25 • 4Q25 new money yield of 5.00% • Estimated NTM cash flows4 of ~$2.9 billion • High-quality portfolio – 84% U.S. treasuries and agency-backed – 10% highly-rated municipals securities – 6% corporate and other – All CMBSs are agency-backed Total Loans1 Up 34% YoY $ in millions 1 End of period balances; includes loans held-for-sale 2 End of period balances; includes available-for-sale securities, held-to- maturity securities, equity securities, and FHLB/FRB stock 3 Available-for-sale effective duration including securities hedges 4 Cash flows include principal & interest C&I - Commercial and industrial NTM - Next 12 months CMBS - commercial mortgage-backed security 6.14% $10,884 $14,949 $14,902 4Q24 3Q25 4Q25 4.06% % 4.24% Securities Yields 3.50% Total Securities2

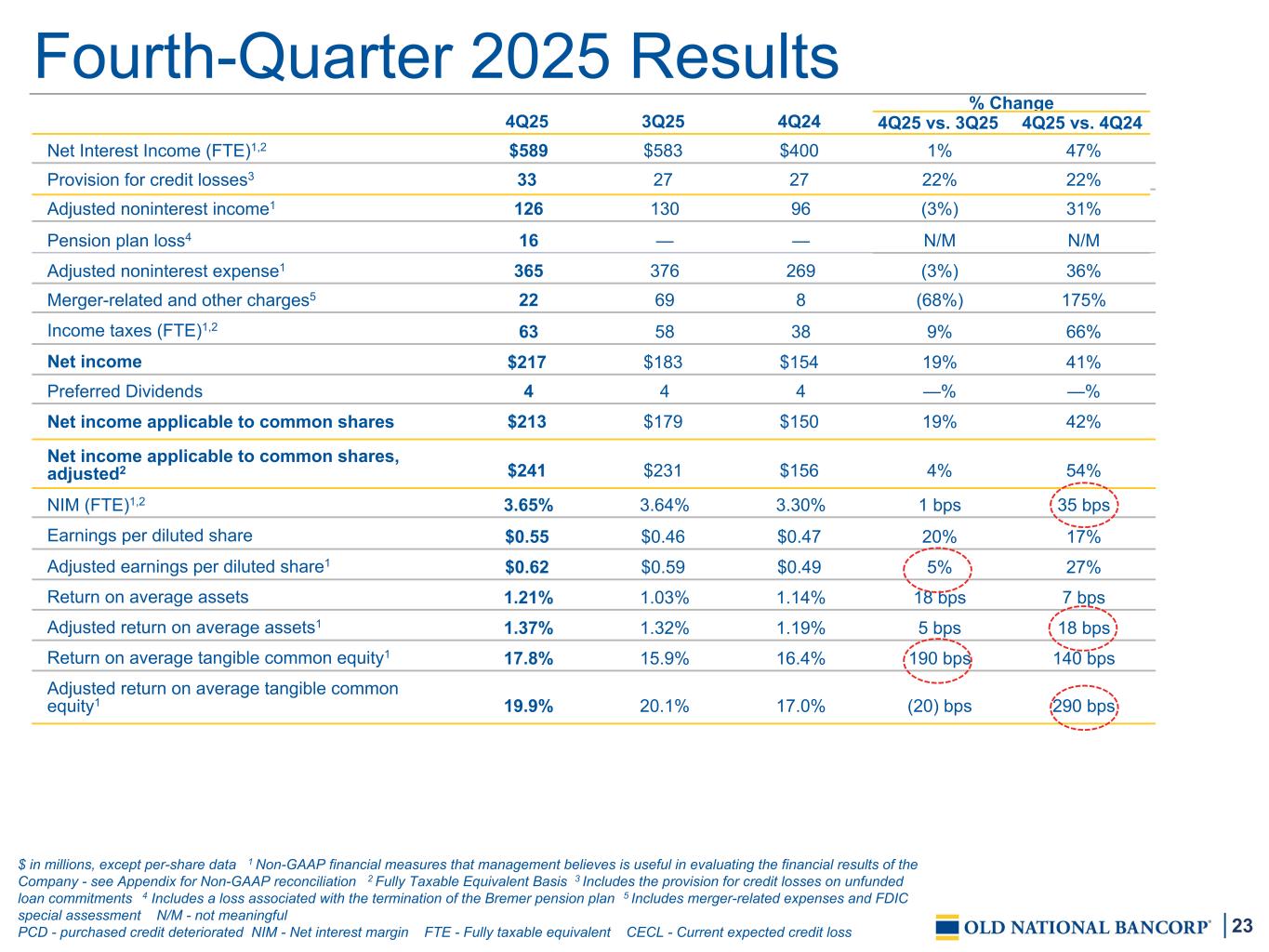

23 $ in millions, except per-share data 1 Non-GAAP financial measures that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Fully Taxable Equivalent Basis 3 Includes the provision for credit losses on unfunded loan commitments 4 Includes a loss associated with the termination of the Bremer pension plan 5 Includes merger-related expenses and FDIC special assessment N/M - not meaningful PCD - purchased credit deteriorated NIM - Net interest margin FTE - Fully taxable equivalent CECL - Current expected credit loss Fourth-Quarter 2025 Results 4Q25 3Q25 4Q24 % Change 4Q25 vs. 3Q25 4Q25 vs. 4Q24 Net Interest Income (FTE)1,2 $589 $583 $400 1% 47% Provision for credit losses3 33 27 27 22% 22% Adjusted noninterest income1 126 130 96 (3%) 31% Pension plan loss4 16 — — N/M N/M Adjusted noninterest expense1 365 376 269 (3%) 36% Merger-related and other charges5 22 69 8 (68%) 175% Income taxes (FTE)1,2 63 58 38 9% 66% Net income $217 $183 $154 19% 41% Preferred Dividends 4 4 4 —% —% Net income applicable to common shares $213 $179 $150 19% 42% Net income applicable to common shares, adjusted2 $241 $231 $156 4% 54% NIM (FTE)1,2 3.65% 3.64% 3.30% 1 bps 35 bps Earnings per diluted share $0.55 $0.46 $0.47 20% 17% Adjusted earnings per diluted share1 $0.62 $0.59 $0.49 5% 27% Return on average assets 1.21% 1.03% 1.14% 18 bps 7 bps Adjusted return on average assets1 1.37% 1.32% 1.19% 5 bps 18 bps Return on average tangible common equity1 17.8% 15.9% 16.4% 190 bps 140 bps Adjusted return on average tangible common equity1 19.9% 20.1% 17.0% (20) bps 290 bps

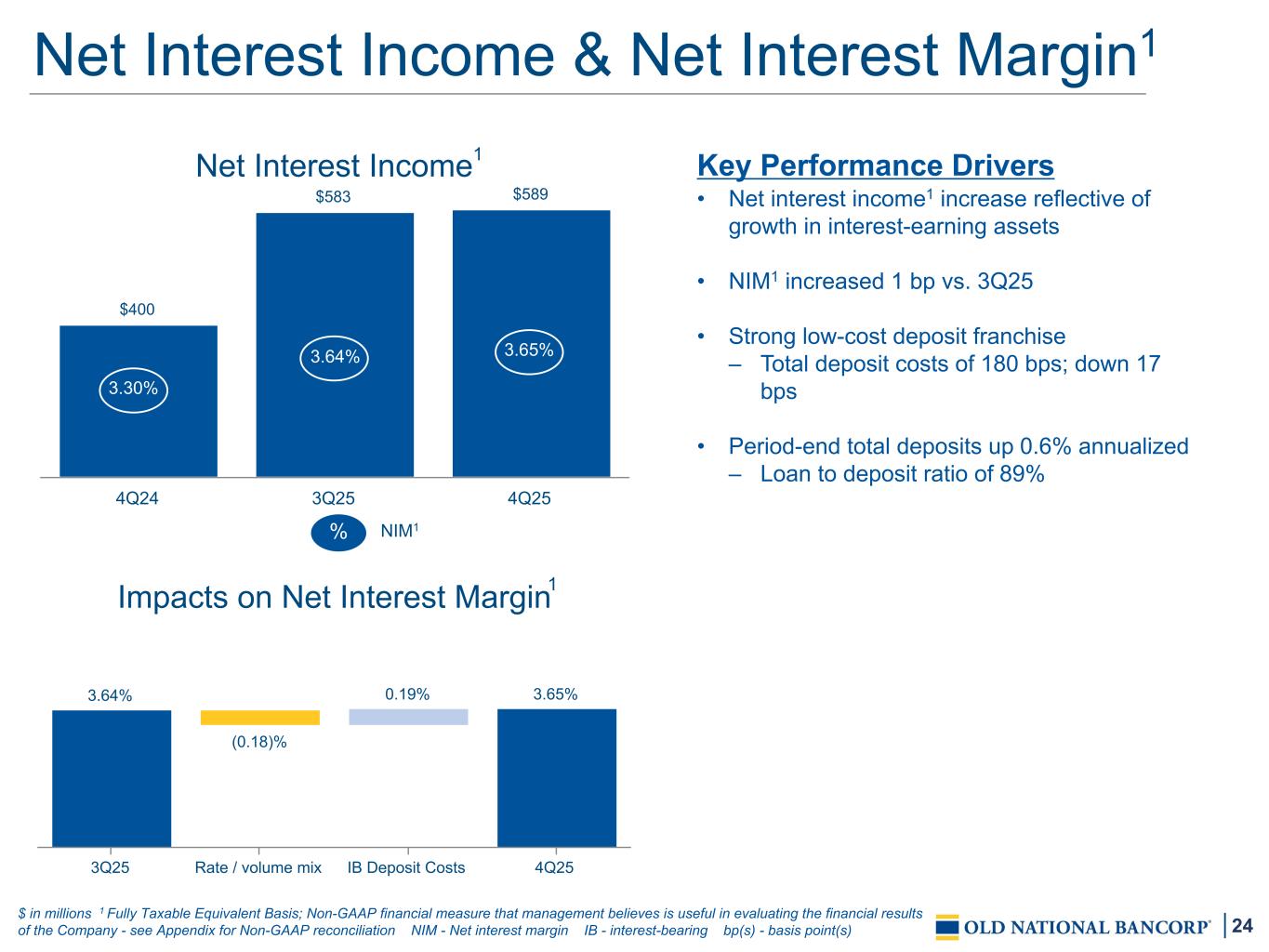

24 Impacts on Net Interest Margin 3.64% (0.18)% 0.19% 3.65% 3Q25 Rate / volume mix IB Deposit Costs 4Q25 $ in millions 1 Fully Taxable Equivalent Basis; Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation NIM - Net interest margin IB - interest-bearing bp(s) - basis point(s) 1 Key Performance Drivers • Net interest income1 increase reflective of growth in interest-earning assets • NIM1 increased 1 bp vs. 3Q25 • Strong low-cost deposit franchise – Total deposit costs of 180 bps; down 17 bps • Period-end total deposits up 0.6% annualized – Loan to deposit ratio of 89% Net Interest Income $400 $583 $589 4Q24 3Q25 4Q25 NIM1% 3.65%3.64% 3.30% 1 Net Interest Income & Net Interest Margin1

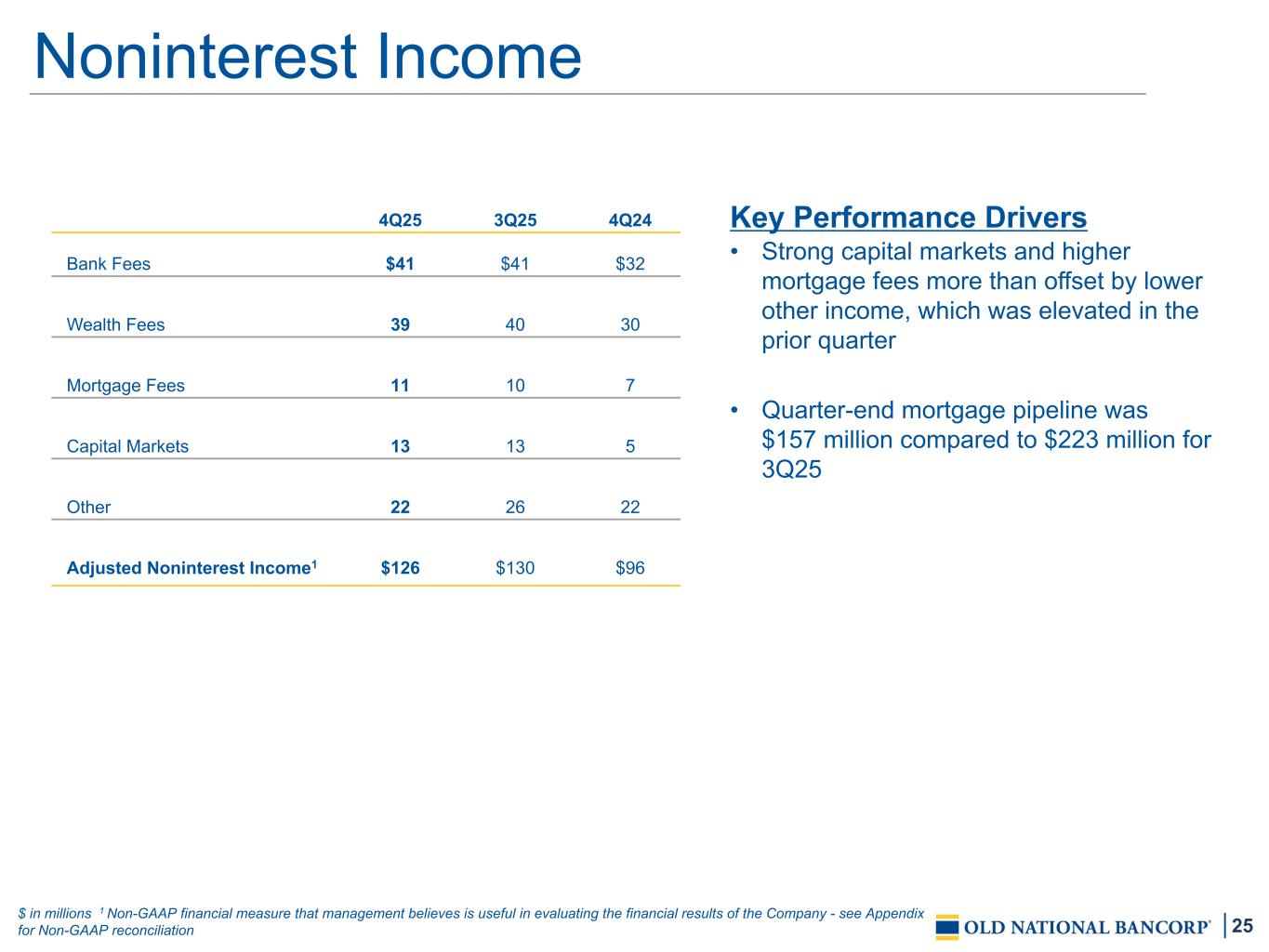

25 Noninterest Income $ in millions 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation Key Performance Drivers • Strong capital markets and higher mortgage fees more than offset by lower other income, which was elevated in the prior quarter • Quarter-end mortgage pipeline was $157 million compared to $223 million for 3Q25 4Q25 3Q25 4Q24 Bank Fees $41 $41 $32 Wealth Fees 39 40 30 Mortgage Fees 11 10 7 Capital Markets 13 13 5 Other 22 26 22 Adjusted Noninterest Income1 $126 $130 $96

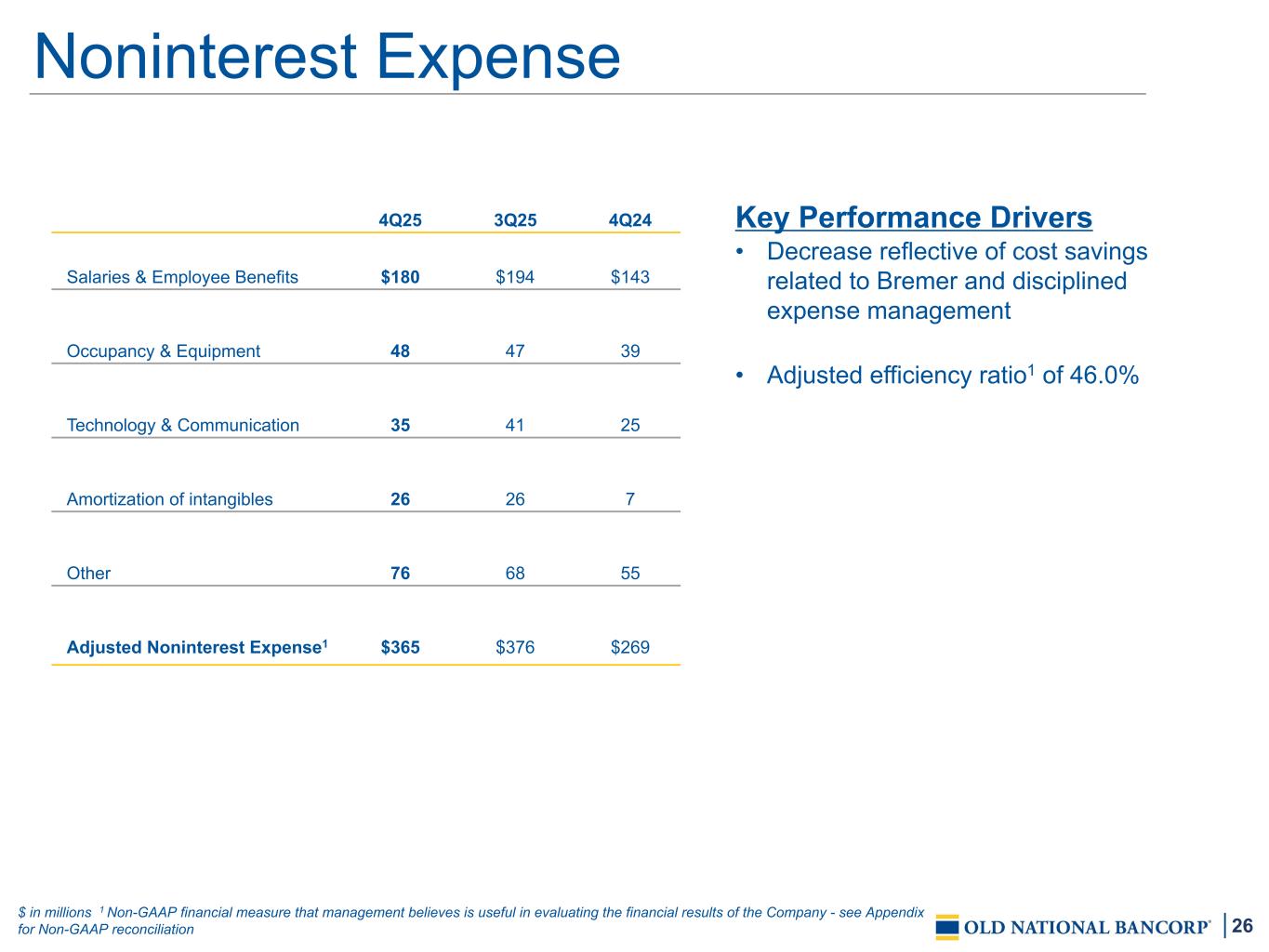

26 Noninterest Expense $ in millions 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation Key Performance Drivers • Decrease reflective of cost savings related to Bremer and disciplined expense management • Adjusted efficiency ratio1 of 46.0% 4Q25 3Q25 4Q24 Salaries & Employee Benefits $180 $194 $143 Occupancy & Equipment 48 47 39 Technology & Communication 35 41 25 Amortization of intangibles 26 26 7 Other 76 68 55 Adjusted Noninterest Expense1 $365 $376 $269

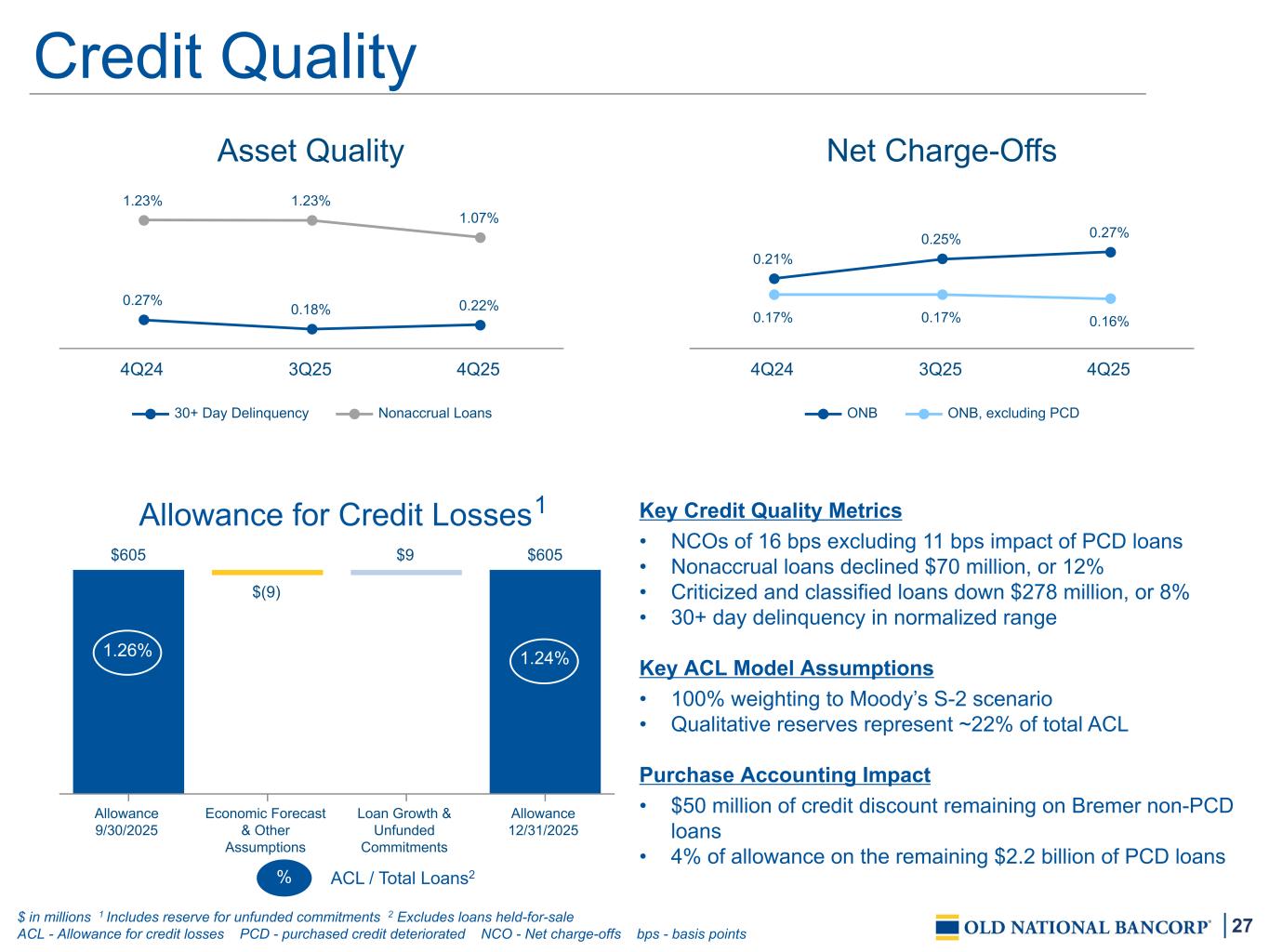

27 Allowance for Credit Losses $605 $(9) $9 $605 Allowance 9/30/2025 Economic Forecast & Other Assumptions Loan Growth & Unfunded Commitments Allowance 12/31/2025 1.26% Credit Quality Asset Quality 0.27% 0.18% 0.22% 1.23% 1.23% 1.07% 30+ Day Delinquency Nonaccrual Loans 4Q24 3Q25 4Q25 $ in millions 1 Includes reserve for unfunded commitments 2 Excludes loans held-for-sale ACL - Allowance for credit losses PCD - purchased credit deteriorated NCO - Net charge-offs bps - basis points Key Credit Quality Metrics • NCOs of 16 bps excluding 11 bps impact of PCD loans • Nonaccrual loans declined $70 million, or 12% • Criticized and classified loans down $278 million, or 8% • 30+ day delinquency in normalized range Key ACL Model Assumptions • 100% weighting to Moody’s S-2 scenario • Qualitative reserves represent ~22% of total ACL Purchase Accounting Impact • $50 million of credit discount remaining on Bremer non-PCD loans • 4% of allowance on the remaining $2.2 billion of PCD loans ACL / Total Loans2% 1.24% 1 Net Charge-Offs 0.21% 0.25% 0.27% 0.17% 0.17% 0.16% ONB ONB, excluding PCD 4Q24 3Q25 4Q25

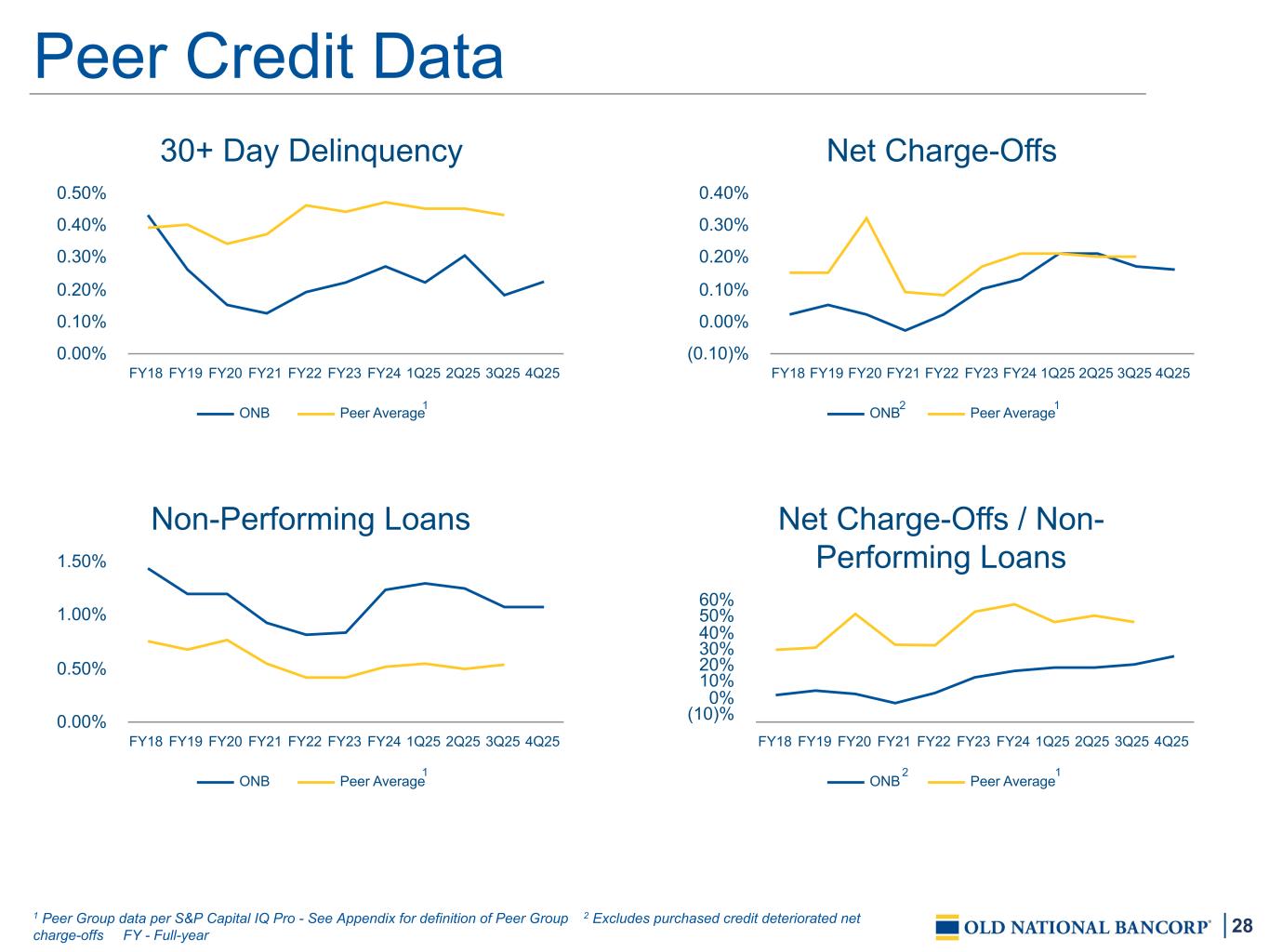

28 Peer Credit Data 30+ Day Delinquency ONB Peer Average FY18 FY19 FY20 FY21 FY22 FY23 FY24 1Q25 2Q25 3Q25 4Q25 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% Net Charge-Offs ONB Peer Average FY18 FY19 FY20 FY21 FY22 FY23 FY24 1Q25 2Q25 3Q25 4Q25 (0.10)% 0.00% 0.10% 0.20% 0.30% 0.40% Non-Performing Loans ONB Peer Average FY18 FY19 FY20 FY21 FY22 FY23 FY24 1Q25 2Q25 3Q25 4Q25 0.00% 0.50% 1.00% 1.50% Net Charge-Offs / Non- Performing Loans ONB Peer Average FY18 FY19 FY20 FY21 FY22 FY23 FY24 1Q25 2Q25 3Q25 4Q25 (10)% 0% 10% 20% 30% 40% 50% 60% 1 Peer Group data per S&P Capital IQ Pro - See Appendix for definition of Peer Group 2 Excludes purchased credit deteriorated net charge-offs FY - Full-year 1 1 1 1 2 2

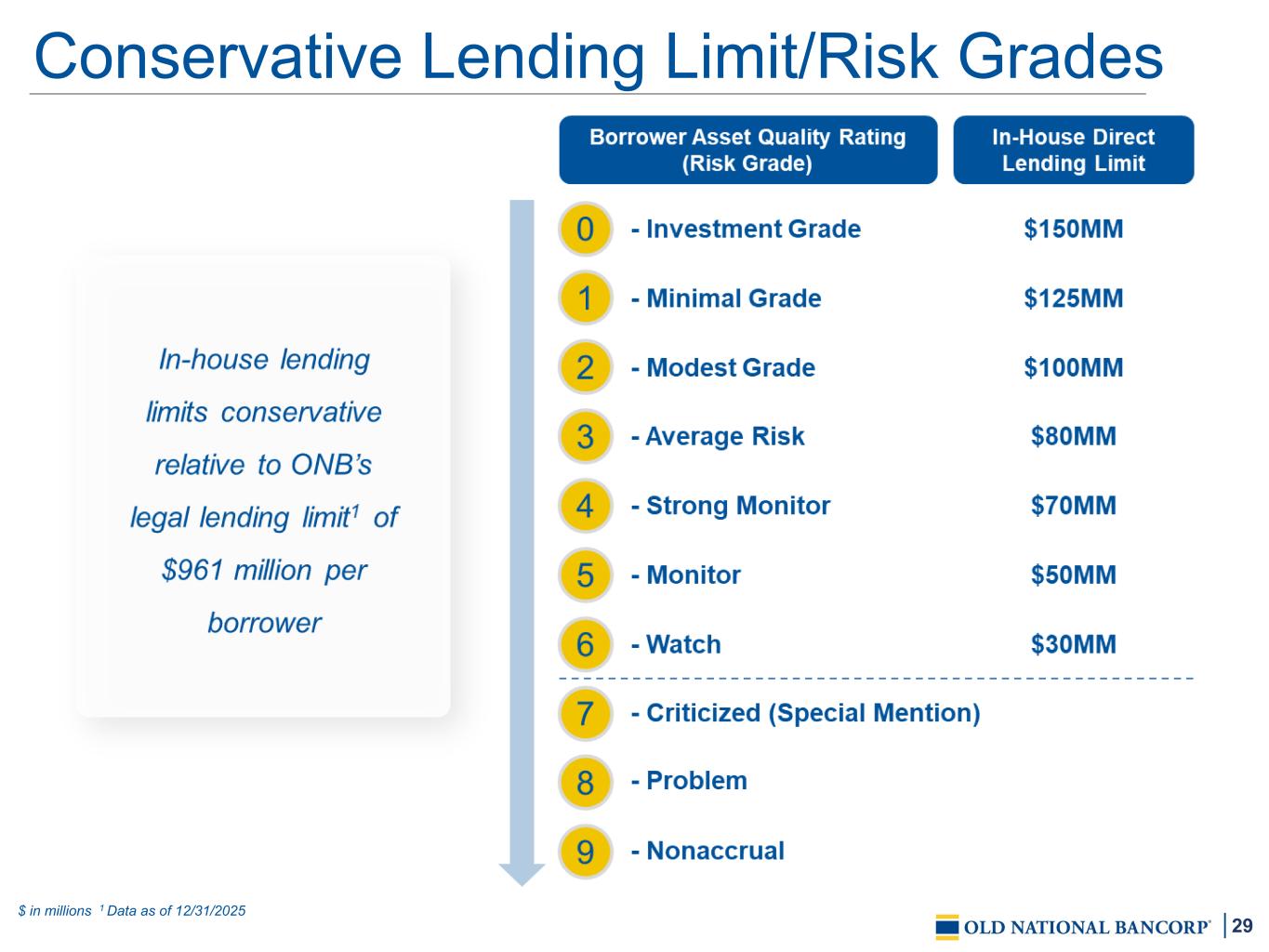

29 Conservative Lending Limit/Risk Grades $ in millions 1 Data as of 12/31/2025

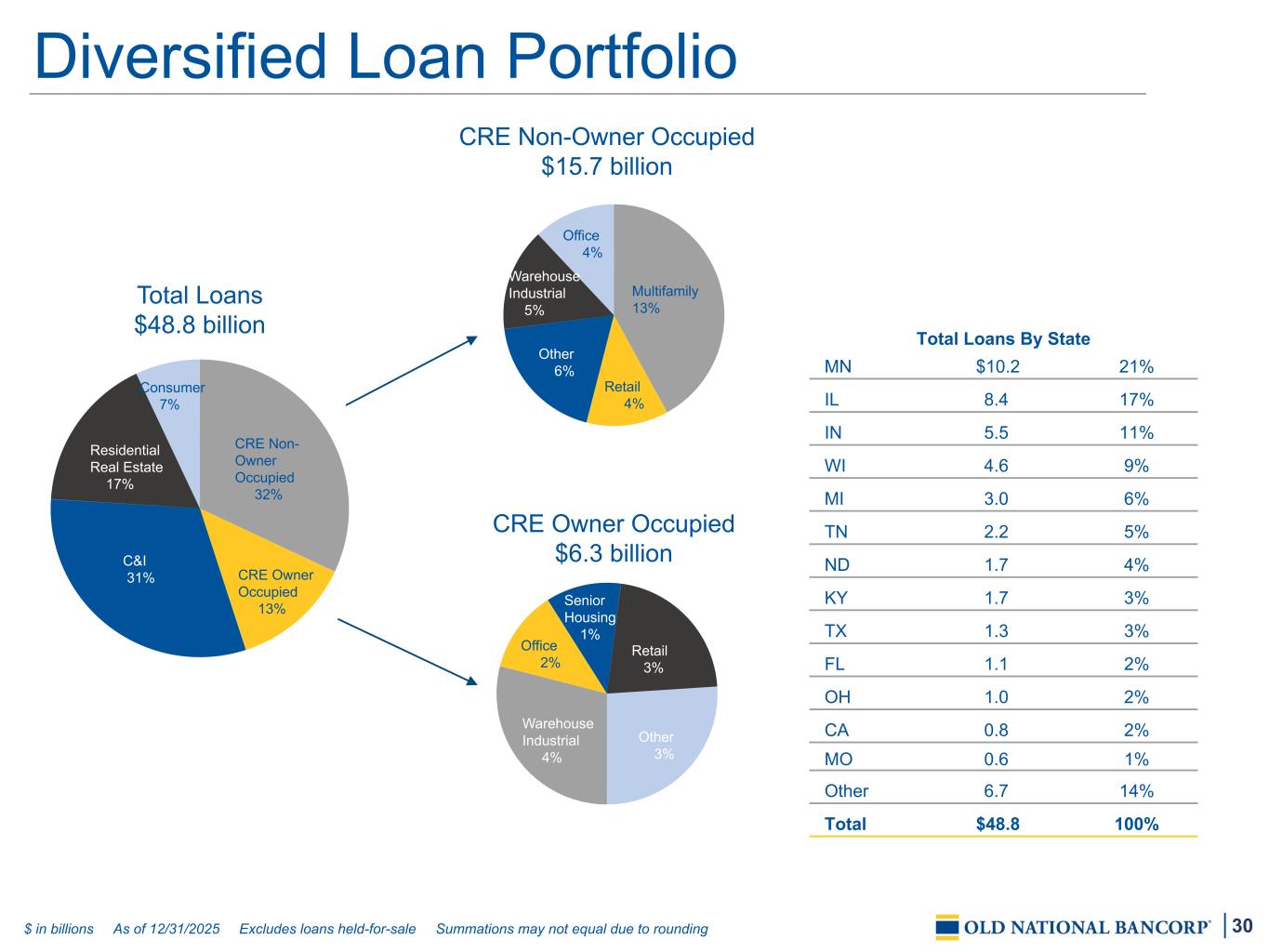

30 CRE Non- Owner Occupied 32% CRE Owner Occupied 13% C&I 31% Residential Real Estate 17% Consumer 7% Multifamily 13% Retail 4% Other 6% Warehouse Industrial 5% Office 4% Warehouse Industrial 4% Office 2% Senior Housing 1% Retail 3% Other 3% Total Loans By State MN $10.2 21% IL 8.4 17% IN 5.5 11% WI 4.6 9% MI 3.0 6% TN 2.2 5% ND 1.7 4% KY 1.7 3% TX 1.3 3% FL 1.1 2% OH 1.0 2% CA 0.8 2% MO 0.6 1% Other 6.7 14% Total $48.8 100% Diversified Loan Portfolio Total Loans $48.8 billion CRE Non-Owner Occupied $15.7 billion CRE Owner Occupied $6.3 billion $ in billions As of 12/31/2025 Excludes loans held-for-sale Summations may not equal due to rounding

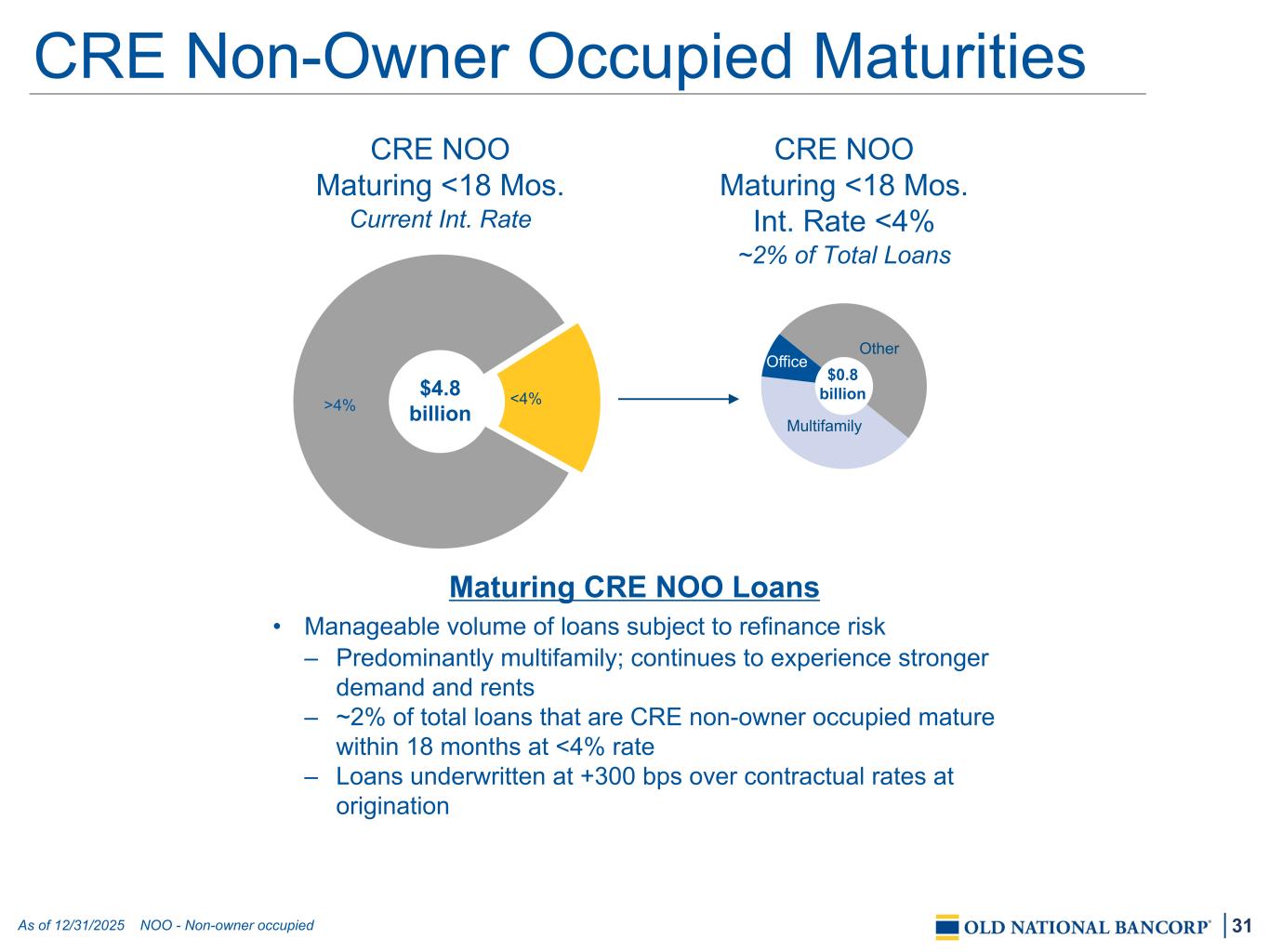

31 Multifamily Office Other $0.8 billion >4% <4% CRE Non-Owner Occupied Maturities As of 12/31/2025 NOO - Non-owner occupied $4.8 billion CRE NOO Maturing <18 Mos. Current Int. Rate CRE NOO Maturing <18 Mos. Int. Rate <4% ~2% of Total Loans Maturing CRE NOO Loans • Manageable volume of loans subject to refinance risk – Predominantly multifamily; continues to experience stronger demand and rents – ~2% of total loans that are CRE non-owner occupied mature within 18 months at <4% rate – Loans underwritten at +300 bps over contractual rates at origination

32 CRE Non-Owner Occupied - Office Our Lending Looks More Like This ...Less Like This • Total office portfolio of $2.0 billion; average loans size is $3.5 million – Largest exposure of ~$70 million (large, diversified MOB) • 86% located in bank’s footprint, diversified by submarket • 47% of portfolio is MOB and/or occupied by investment grade tenants • CBD office exposure is moderate (14% of NOO Office) and primarily within footprint, across 12 cities • Weighted averages – LTV of ~61% – DSC of ~1.53x As of 12/31/2025 CBD - Central business district NOO - Non-owner occupied LTV - loan-to-value DSC - debt service coverage ratio MOB - medical office building

33 CRE Non Owner Occupied - Multifamily Our Lending Looks More Like This ...Less Like This • Total multifamily portfolio of $6.6 billion; average loans size is $4.9 million – Largest exposure of ~$65 million • 87% located in bank’s footprint • Continued strong demand and rental rates in core markets (IL, MN, WI) • Multifamily remains dominant and stable CRE asset class with no material exposure to rent controlled properties • Weighted averages – LTV of ~60% – DSC of ~1.34x As of 12/31/2025 LTV - loan-to-value DSC - debt service coverage ratio

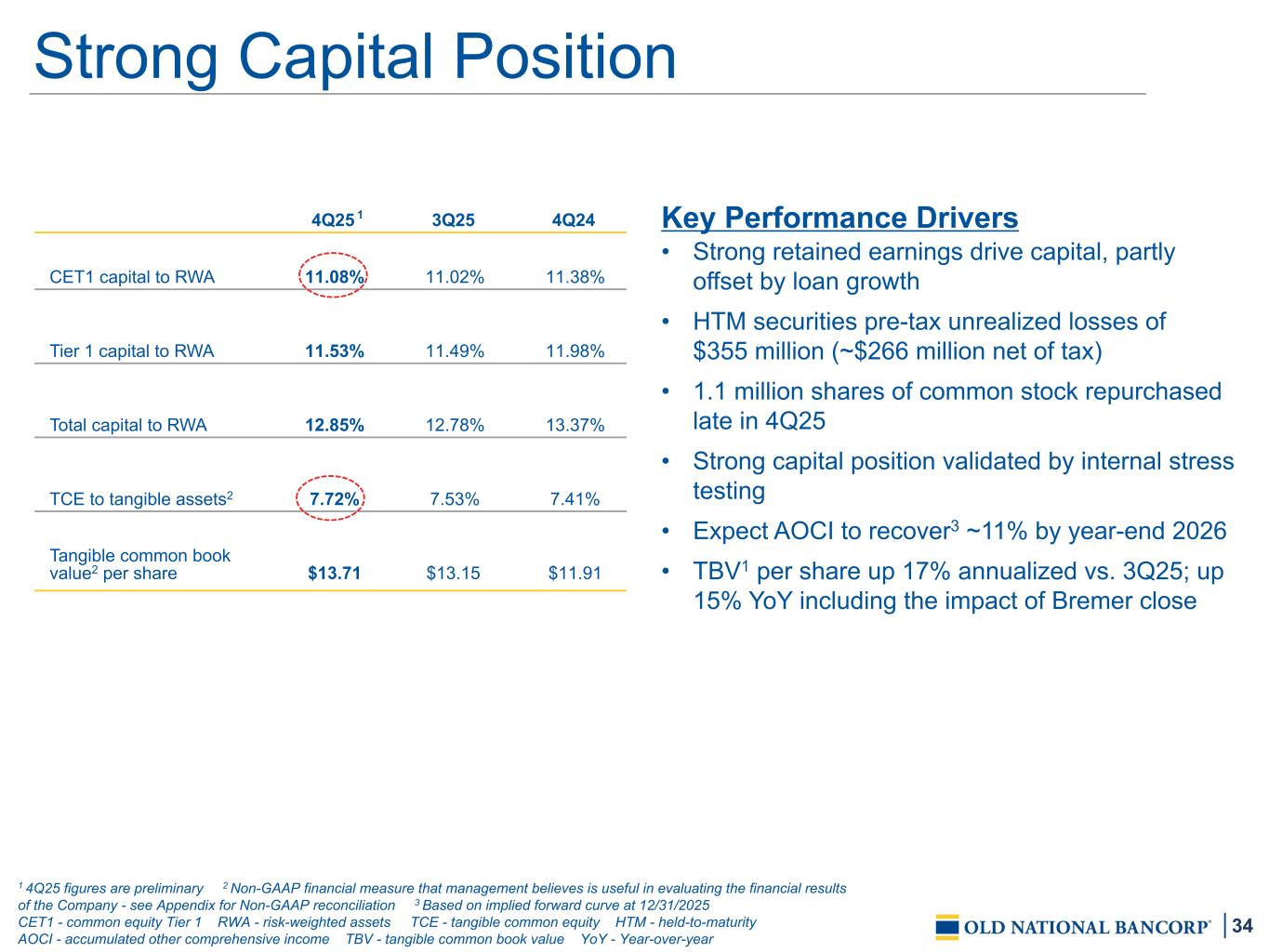

34 Key Performance Drivers • Strong retained earnings drive capital, partly offset by loan growth • HTM securities pre-tax unrealized losses of $355 million (~$266 million net of tax) • 1.1 million shares of common stock repurchased late in 4Q25 • Strong capital position validated by internal stress testing • Expect AOCI to recover3 ~11% by year-end 2026 • TBV1 per share up 17% annualized vs. 3Q25; up 15% YoY including the impact of Bremer close Strong Capital Position 1 4Q25 figures are preliminary 2 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 3 Based on implied forward curve at 12/31/2025 CET1 - common equity Tier 1 RWA - risk-weighted assets TCE - tangible common equity HTM - held-to-maturity AOCI - accumulated other comprehensive income TBV - tangible common book value YoY - Year-over-year 4Q25 3Q25 4Q24 CET1 capital to RWA 11.08% 11.02% 11.38% Tier 1 capital to RWA 11.53% 11.49% 11.98% Total capital to RWA 12.85% 12.78% 13.37% TCE to tangible assets2 7.72% 7.53% 7.41% Tangible common book value2 per share $13.71 $13.15 $11.91 1

Appendix Appendix

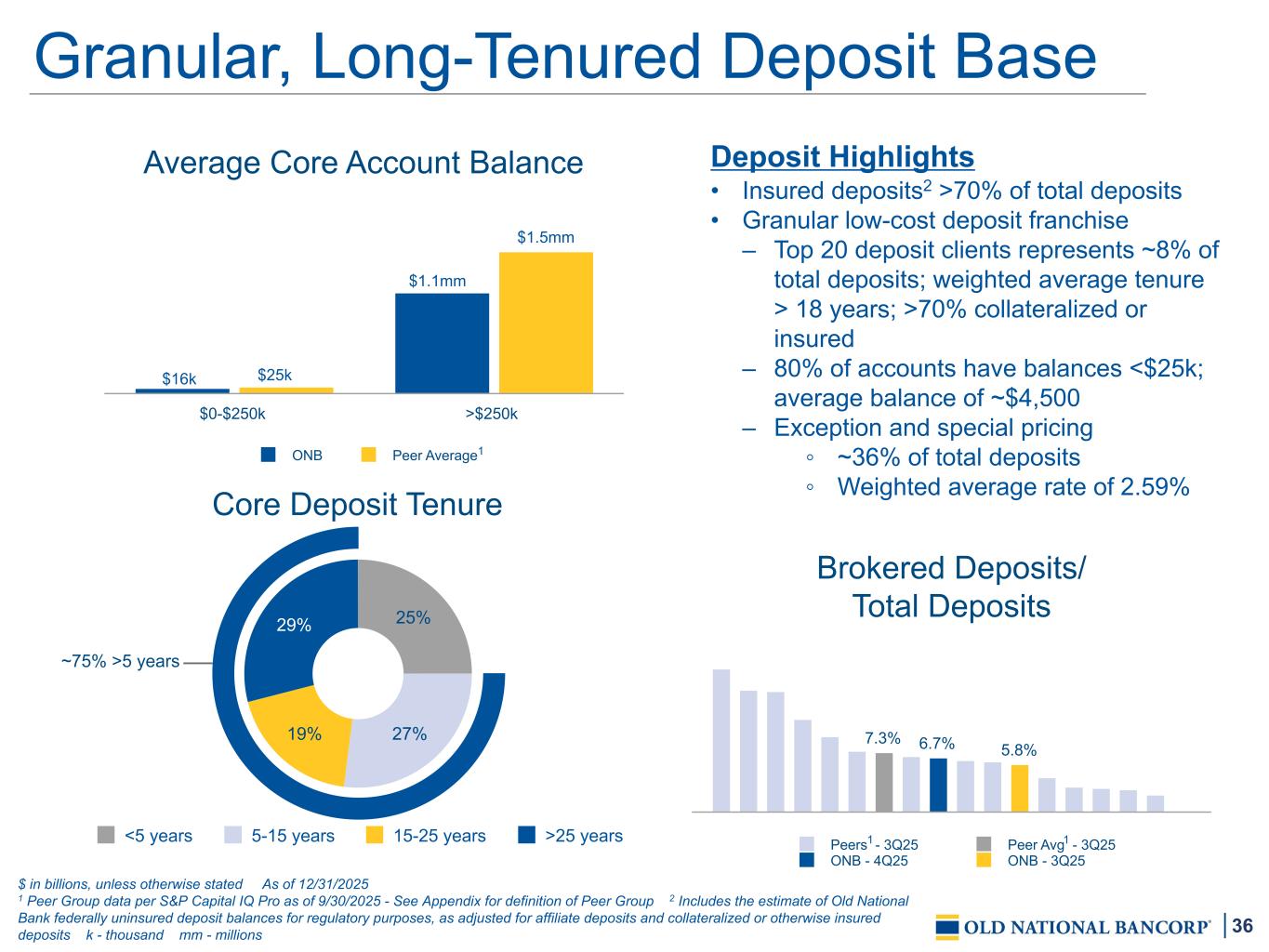

36 ~75% >5 years Core Deposit Tenure 25% 27%19% 29% <5 years 5-15 years 15-25 years >25 years Brokered Deposits/ Total Deposits 7.3% 6.7% 5.8% Peers - 3Q25 Peer Avg - 3Q25 ONB - 4Q25 ONB - 3Q25 Deposit Highlights • Insured deposits2 >70% of total deposits • Granular low-cost deposit franchise – Top 20 deposit clients represents ~8% of total deposits; weighted average tenure > 18 years; >70% collateralized or insured – 80% of accounts have balances <$25k; average balance of ~$4,500 – Exception and special pricing ◦ ~36% of total deposits ◦ Weighted average rate of 2.59% Average Core Account Balance ONB Peer Average $0-$250k >$250k $16k $1.1mm $25k $1.5mm 1 Granular, Long-Tenured Deposit Base $ in billions, unless otherwise stated As of 12/31/2025 1 Peer Group data per S&P Capital IQ Pro as of 9/30/2025 - See Appendix for definition of Peer Group 2 Includes the estimate of Old National Bank federally uninsured deposit balances for regulatory purposes, as adjusted for affiliate deposits and collateralized or otherwise insured deposits k - thousand mm - millions 11

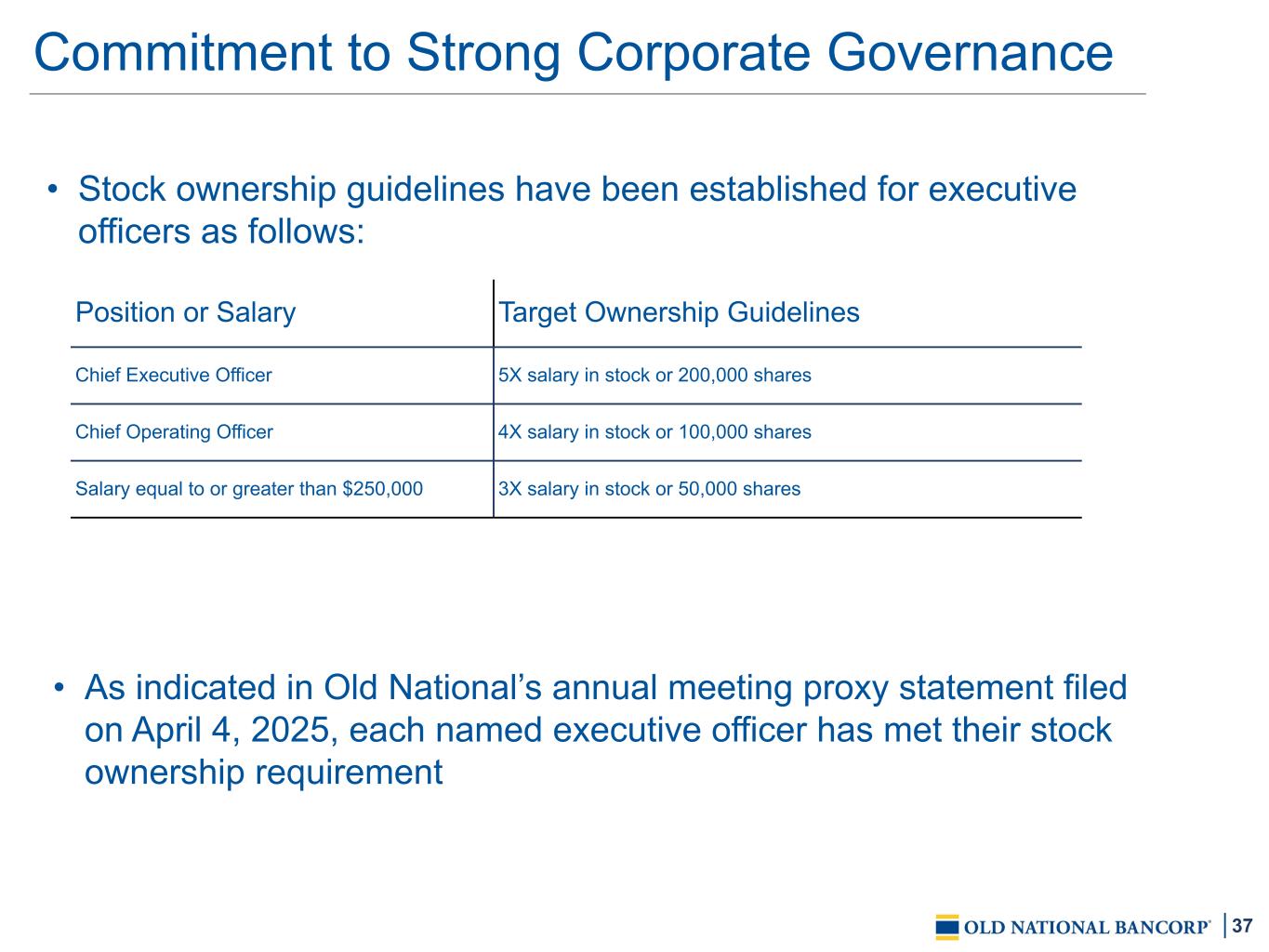

37 Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares • Stock ownership guidelines have been established for executive officers as follows: Commitment to Strong Corporate Governance • As indicated in Old National’s annual meeting proxy statement filed on April 4, 2025, each named executive officer has met their stock ownership requirement

38 Commitment to Excellence Trade names, trademarks and service marks of other companies appearing in this presentation are the property of their respective holders

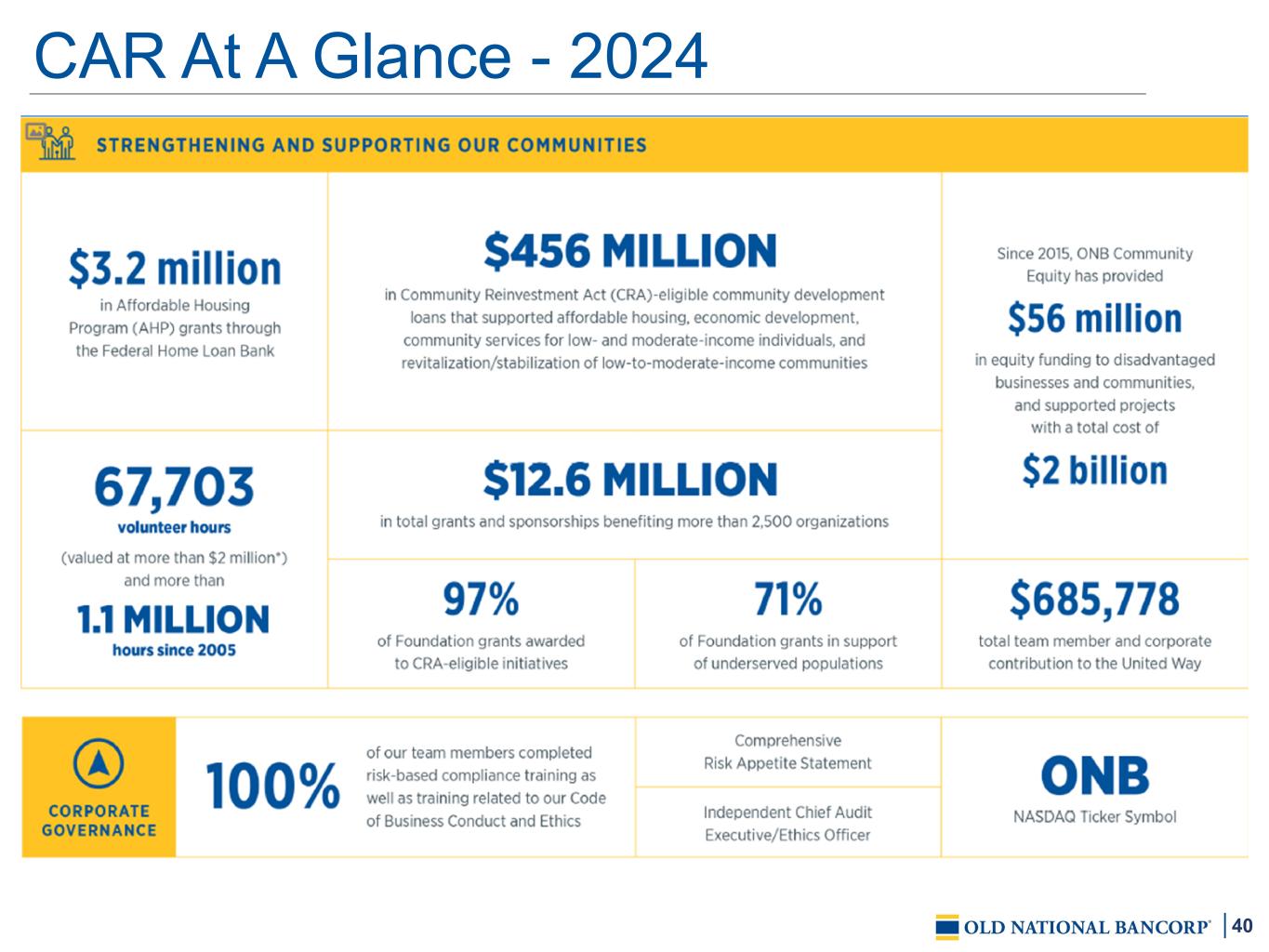

39 Old National’s 2024 Community Action Report (“CAR”) Report showcases our commitment to: • Strong risk management and corporate governance principles • Putting our clients at the center of all we do • Investing in our team members • Strengthening our communities • Sustainability To view ONB’s CAR Report and Sustainability Accounting Standards Board (“SASB”) Index, go to oldnational.com Commitment to the Communities We Serve

40 CAR At A Glance - 2024

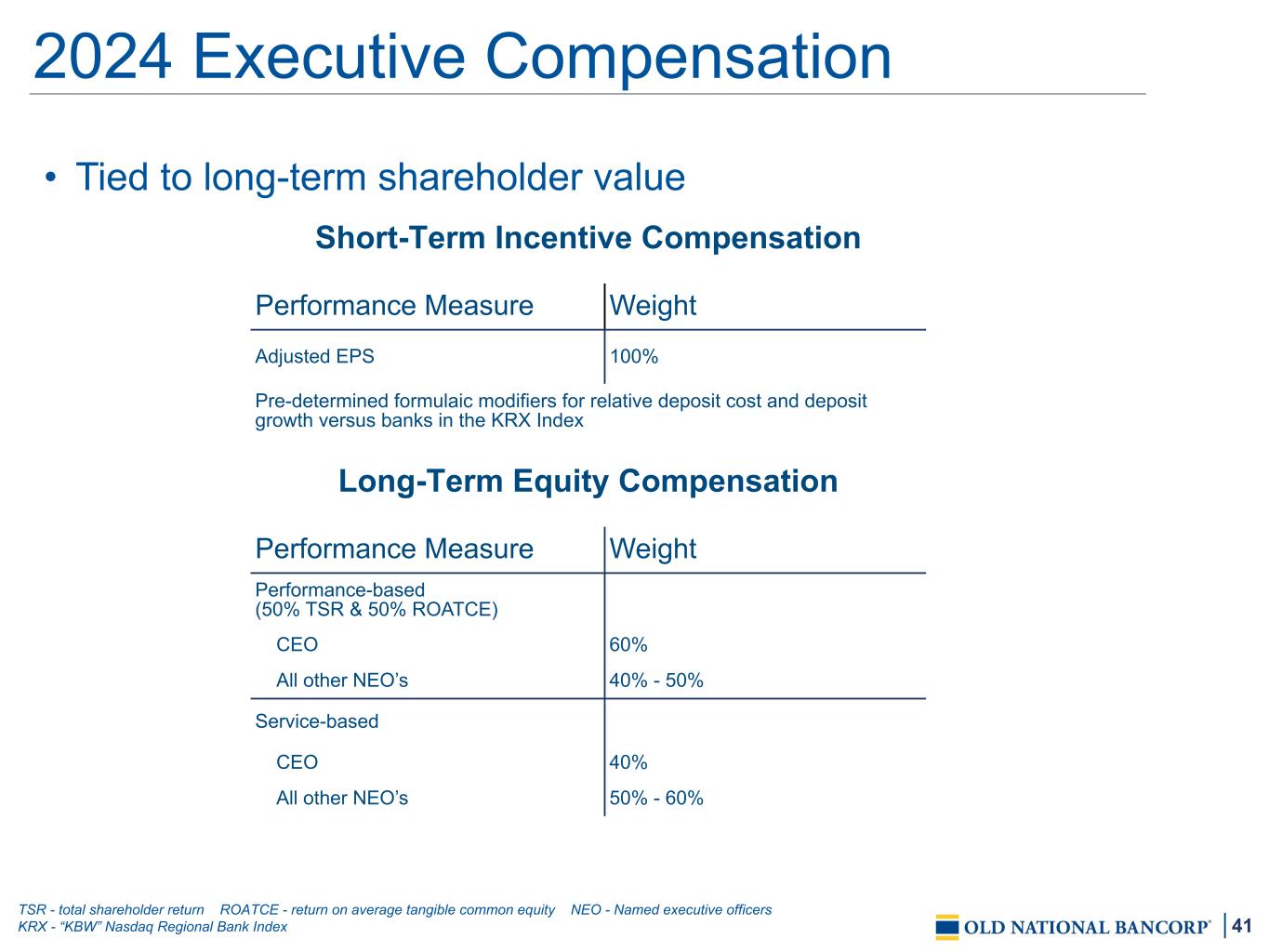

41 • Tied to long-term shareholder value 2024 Executive Compensation TSR - total shareholder return ROATCE - return on average tangible common equity NEO - Named executive officers KRX - “KBW” Nasdaq Regional Bank Index Short-Term Incentive Compensation Performance Measure Weight Adjusted EPS 100% Pre-determined formulaic modifiers for relative deposit cost and deposit growth versus banks in the KRX Index Long-Term Equity Compensation Performance Measure Weight Performance-based (50% TSR & 50% ROATCE) CEO 60% All other NEO’s 40% - 50% Service-based CEO 40% All other NEO’s 50% - 60%

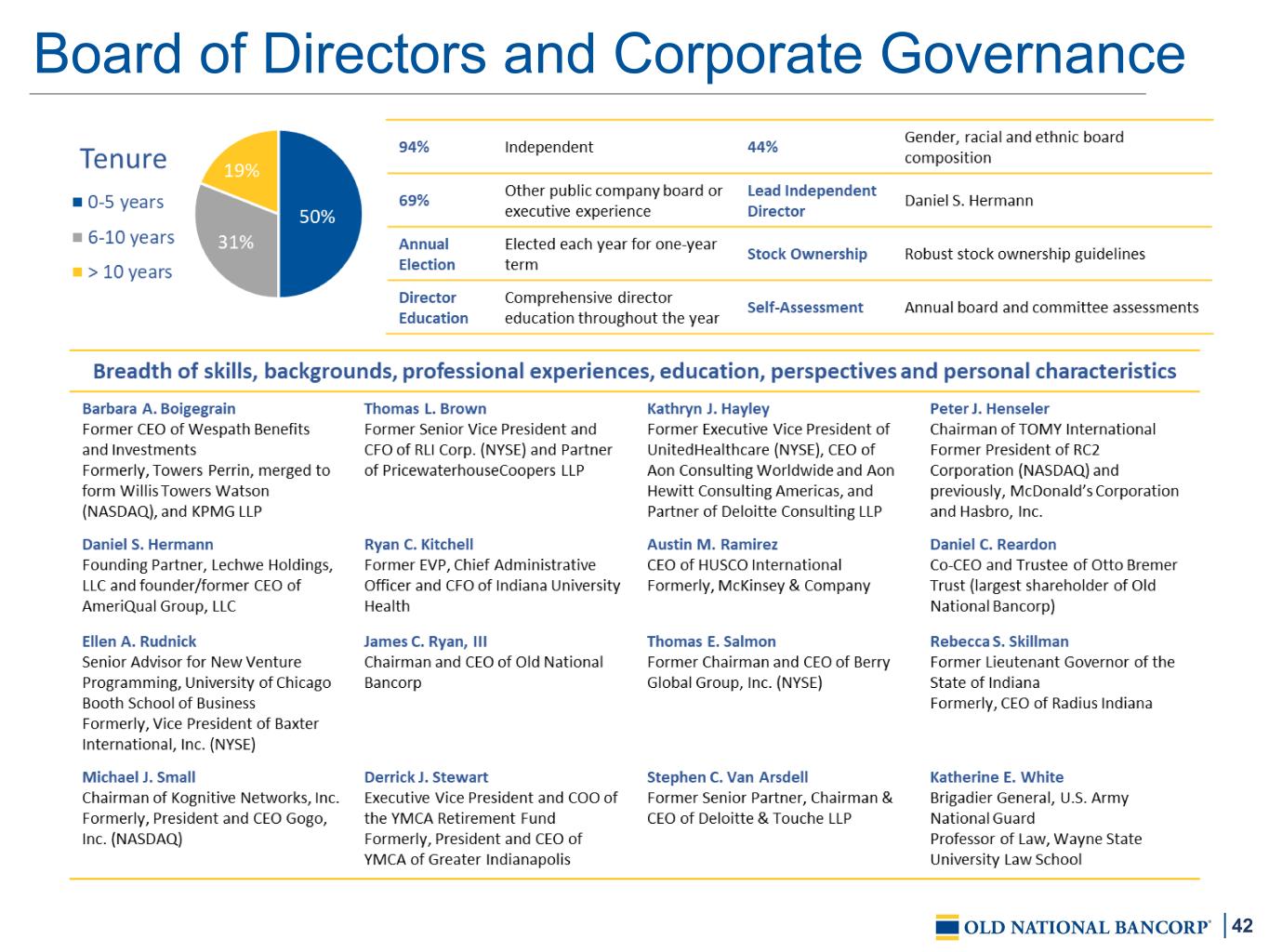

42 Board of Directors and Corporate Governance

43 4Q25 3Q25 4Q24 Net interest income $580.8 $574.6 $394.1 FTE Adjustment 8.0 8.0 5.8 Net interest income (FTE) $588.8 $582.6 $399.9 Add: Noninterest income 109.7 130.5 95.8 Total revenue (FTE) $698.6 $713.0 $495.7 Less: Provision for credit losses (32.7) (26.7) (27.0) Less: Noninterest expense (386.3) (445.7) (276.8) Income before income taxes (FTE) $279.6 $240.6 $191.9 Less: Income taxes (FTE) 63.0 57.9 38.0 Net income $216.6 $182.6 $153.9 Less: Preferred dividends (4.0) (4.1) (4.0) Net income applicable to common shares $212.6 $178.5 $149.8 Earnings Per Share $0.55 $0.46 $0.47 Adjustments: Merger-related charges $24.5 $69.3 $8.1 Pension plan loss 15.9 0.0 0.0 FDIC Special Assessment (3.0) 0.0 0.0 Debt securities gains/losses 0.0 0.0 0.1 Total adjustments 37.4 69.3 8.2 Less: Tax effect on net total adjustments1 (9.0) (16.5) (2.1) Total adjustments, net of tax $28.4 $52.8 $6.1 Net income applicable to common shares, adjusted 241.0 231.3 156.0 Adjusted Earnings Per Diluted Share $0.62 $0.59 $0.49 Non-GAAP Reconciliation $ in millions, except per share data. Summations may not equal due to rounding. 1 Tax-effect calculations use management's estimate of the full year FTE tax rates (federal + state) FTE - Fully taxable equivalent

44 4Q25 3Q25 4Q24 Noninterest income $109.7 $130.5 $95.8 Less: Debt securities gains/losses 0.0 0.0 0.1 Less: Pension plan loss 15.9 0.0 0.0 Adjusted noninterest income $125.6 $130.5 $95.9 Noninterest expense $386.3 $445.7 $276.8 Less: Merger-related charges (24.5) (69.3) (8.1) Less: FDIC Special Assessment 3.0 0.0 0.0 Adjusted noninterest expense $364.8 $376.5 $268.7 Non-GAAP Reconciliation $ in millions Summations may not equal due to rounding.

45 4Q25 3Q25 4Q24 Noninterest Expense $386.3 $445.7 $276.8 Less: Intangible amortization (26.0) (26.2) (7.2) Noninterest expense, excluding intangible amortization 360.3 419.5 269.6 Adjustments: Less: Merger-related charges (24.5) (69.3) (8.1) Less: FDIC Special Assessment 3.0 0.0 0.0 Less: Amortization of tax credits investments (9.8) (7.1) (4.6) Adjusted noninterest expense for eff. ratio $329.0 $343.2 $256.9 Net interest income $580.8 $574.6 $394.1 Add: FTE adjustment 8.0 8.0 5.8 Net interest income (FTE) $588.8 $582.6 $399.9 Noninterest income 109.7 130.5 95.8 Total revenue (FTE) $698.6 $713.0 $495.7 Less: Debt securities gains/losses 0.0 0.0 0.1 Total revenue, excluding debt securities gains/losses 698.6 713.0 495.8 Adjustments: Less: Pension plan loss 15.9 0.0 0.0 Adjusted total revenue for eff. ratio $714.5 $713.0 $495.8 Efficiency Ratio 51.6% 58.8% 54.4% Adjusted Efficiency Ratio 46.0% 48.1% 51.8% Net interest income $580.8 $574.6 $394.1 FTE adjustment 8.0 8.0 5.8 Net interest income (FTE) $588.8 $582.6 $399.9 Average earnings assets $64,456.8 $64,032.8 $48,411.8 Net interest margin 3.60% 3.59% 3.26% Net interest margin (FTE) 3.65% 3.64% 3.30% Non-GAAP Reconciliation $ in millions Summations may not equal due to rounding. FTE - Fully taxable equivalent

46 4Q25 3Q25 4Q24 Net income applicable to common shares $212.6 $178.5 $149.8 Add: Intangibles amortization, net of tax 19.6 19.6 5.4 Tangible net income applicable to common shares $232.1 $198.2 $155.3 Total adjustments, net of tax $28.4 $52.8 $6.1 Adjusted net income applicable to common shares, excluding intangibles amortization $260.5 $251.0 $161.4 Average GAAP shareholders’ common equity $8,147.3 $7,924.9 $6,095.2 Less: Average goodwill and other intangible assets (2,919.9) (2,931.3) (2,301.2) Average tangible shareholders’ common equity $5,227.4 $4,993.6 $3,794.0 Return on average tangible shareholders’ common equity 17.8% 15.9% 16.4% Adjusted return on average tangible common equity 19.9% 20.1% 17.0% Net income $216.6 $182.6 $153.9 Total adjustments, net of tax 28.4 52.8 6.1 Adjusted Net Income $245.0 $235.4 $160.0 Average Assets $71,556.3 $71,136.8 $53,802.3 Return on average assets 1.21% 1.03% 1.14% Adjusted return on average assets 1.37% 1.32% 1.19% Non-GAAP Reconciliation $ in millions Summations may not equal due to rounding.

47 4Q25 3Q25 4Q24 Shareholders' equity $8,494.8 $8,309.3 $6,340.3 Less: Preferred equity (243.7) (243.7) (243.7) Shareholders' common equity 8,251.1 8,065.6 6,096.6 Less: Goodwill and other intangible assets (2,908.0) (2,927.0) (2,296.1) Tangible shareholders' common equity $5,343.1 $5,138.6 $3,800.5 Common shares outstanding 389.7 390.8 319.0 Tangible common book value $13.71 $13.15 $11.91 Total assets $72,152.0 $71,210.2 $53,552.3 Less: Goodwill and other intangible assets (2,908.0) (2,927.0) (2,296.1) Tangible assets $69,244.0 $68,283.2 $51,256.2 Tangible shareholders’ common equity to tangible assets 7.72% 7.53% 7.41% FY2025 FY2024 FY2023 Net income applicable to common shares $653.1 $523.1 $565.9 Add: Intangibles amortization, net of tax 59.0 20.6 18.1 Tangible net income applicable to common shares $712.1 $543.7 $584.0 Total adjustments, net of tax $155.5 $55.0 $33.4 Adjusted net income applicable to common shares, excluding intangibles amortization $867.6 $598.7 $617.4 Average GAAP shareholders’ common equity $7,370.3 $5,776.0 $5,010.6 Less: Average goodwill and other intangible assets (2,706.0) (2,237.7) (2,112.9) Average tangible shareholders’ common equity $4,664.3 $3,538.3 $2,897.7 Return on average tangible shareholders’ common equity 15.3% 15.4% 20.2% Adjusted return on average tangible common equity 18.6% 16.9% 21.3% Non-GAAP Reconciliation $ in millions Summations may not equal due to rounding.

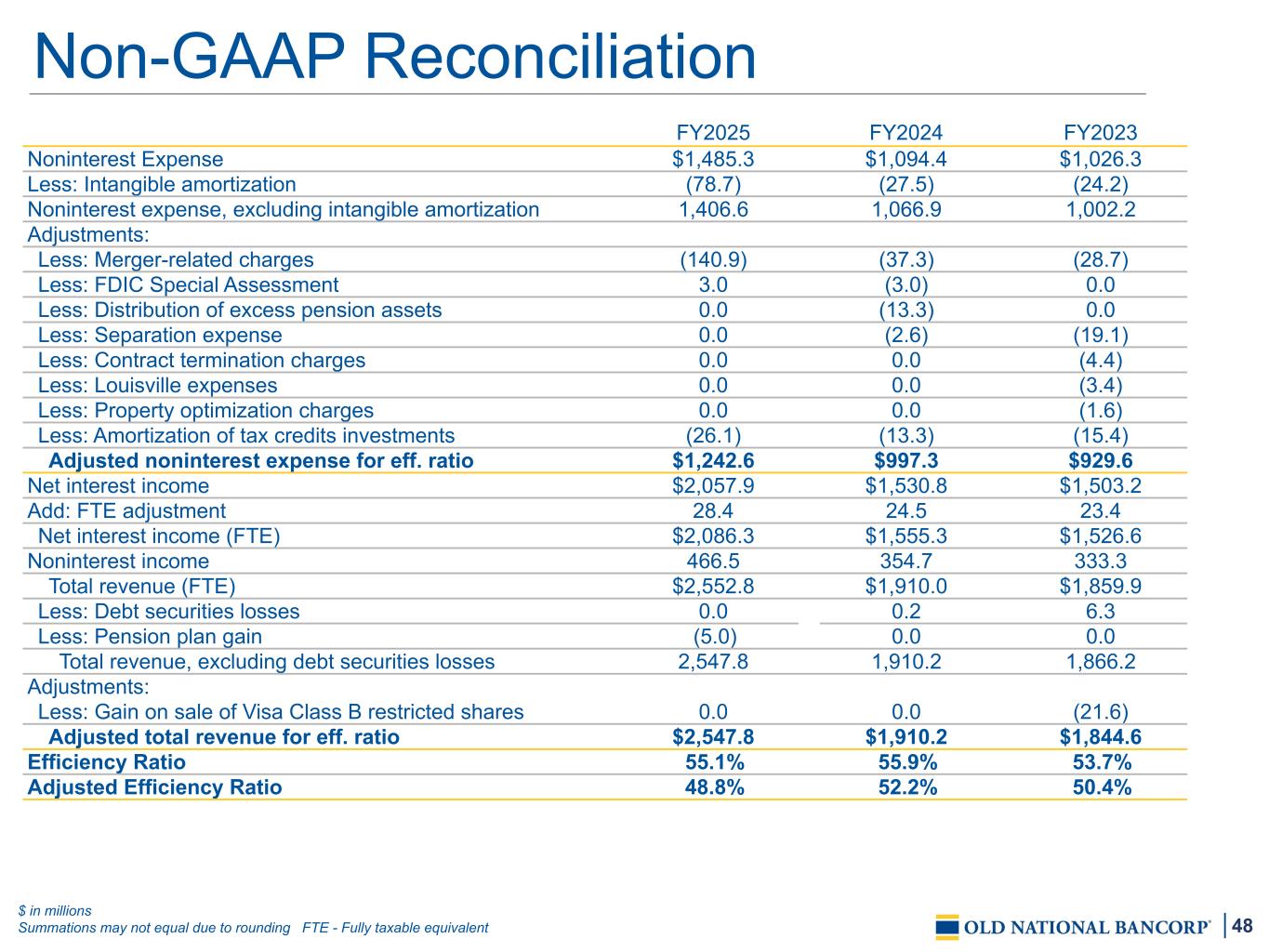

48 FY2025 FY2024 FY2023 Noninterest Expense $1,485.3 $1,094.4 $1,026.3 Less: Intangible amortization (78.7) (27.5) (24.2) Noninterest expense, excluding intangible amortization 1,406.6 1,066.9 1,002.2 Adjustments: Less: Merger-related charges (140.9) (37.3) (28.7) Less: FDIC Special Assessment 3.0 (3.0) 0.0 Less: Distribution of excess pension assets 0.0 (13.3) 0.0 Less: Separation expense 0.0 (2.6) (19.1) Less: Contract termination charges 0.0 0.0 (4.4) Less: Louisville expenses 0.0 0.0 (3.4) Less: Property optimization charges 0.0 0.0 (1.6) Less: Amortization of tax credits investments (26.1) (13.3) (15.4) Adjusted noninterest expense for eff. ratio $1,242.6 $997.3 $929.6 Net interest income $2,057.9 $1,530.8 $1,503.2 Add: FTE adjustment 28.4 24.5 23.4 Net interest income (FTE) $2,086.3 $1,555.3 $1,526.6 Noninterest income 466.5 354.7 333.3 Total revenue (FTE) $2,552.8 $1,910.0 $1,859.9 Less: Debt securities losses 0.0 0.2 6.3 Less: Pension plan gain (5.0) 0.0 0.0 Total revenue, excluding debt securities losses 2,547.8 1,910.2 1,866.2 Adjustments: Less: Gain on sale of Visa Class B restricted shares 0.0 0.0 (21.6) Adjusted total revenue for eff. ratio $2,547.8 $1,910.2 $1,844.6 Efficiency Ratio 55.1% 55.9% 53.7% Adjusted Efficiency Ratio 48.8% 52.2% 50.4% Non-GAAP Reconciliation $ in millions Summations may not equal due to rounding FTE - Fully taxable equivalent

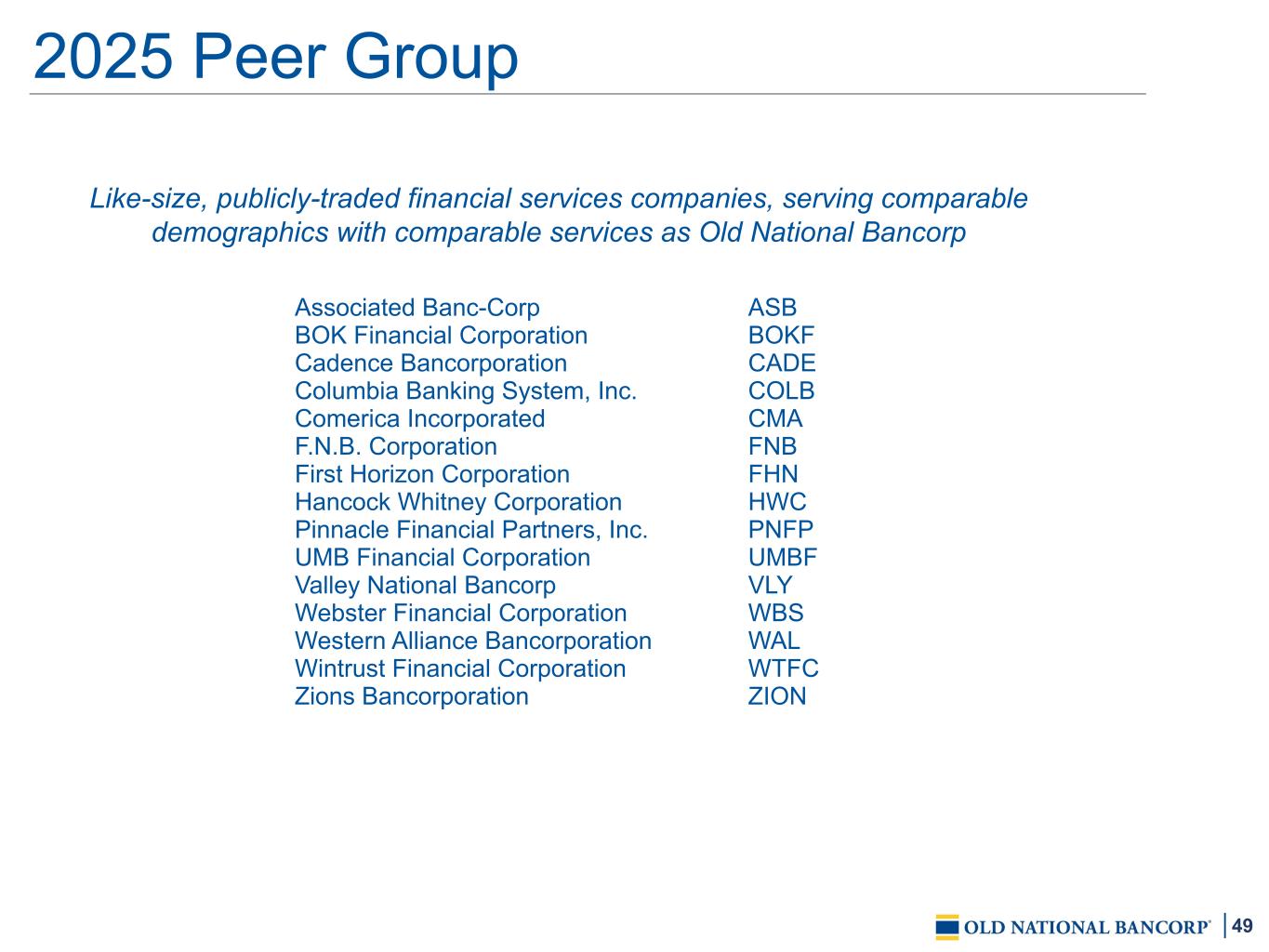

49 2025 Peer Group Associated Banc-Corp ASB BOK Financial Corporation BOKF Cadence Bancorporation CADE Columbia Banking System, Inc. COLB Comerica Incorporated CMA F.N.B. Corporation FNB First Horizon Corporation FHN Hancock Whitney Corporation HWC Pinnacle Financial Partners, Inc. PNFP UMB Financial Corporation UMBF Valley National Bancorp VLY Webster Financial Corporation WBS Western Alliance Bancorporation WAL Wintrust Financial Corporation WTFC Zions Bancorporation ZION Like-size, publicly-traded financial services companies, serving comparable demographics with comparable services as Old National Bancorp

50 Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Durchholz, CPA SVP - Director of Investor Relations 812-464-1366 lynell.durchholz@oldnational.com Old National Investor Relations Contact