UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☒ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a-12

|

PAR TECHNOLOGY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

Supplement to the Proxy Statement dated April 17, 2025

for the 2025 Annual Meeting of Shareholders of

PAR Technology Corporation to be held on June 2, 2025

MAY 21, 2025

To our Shareholders:

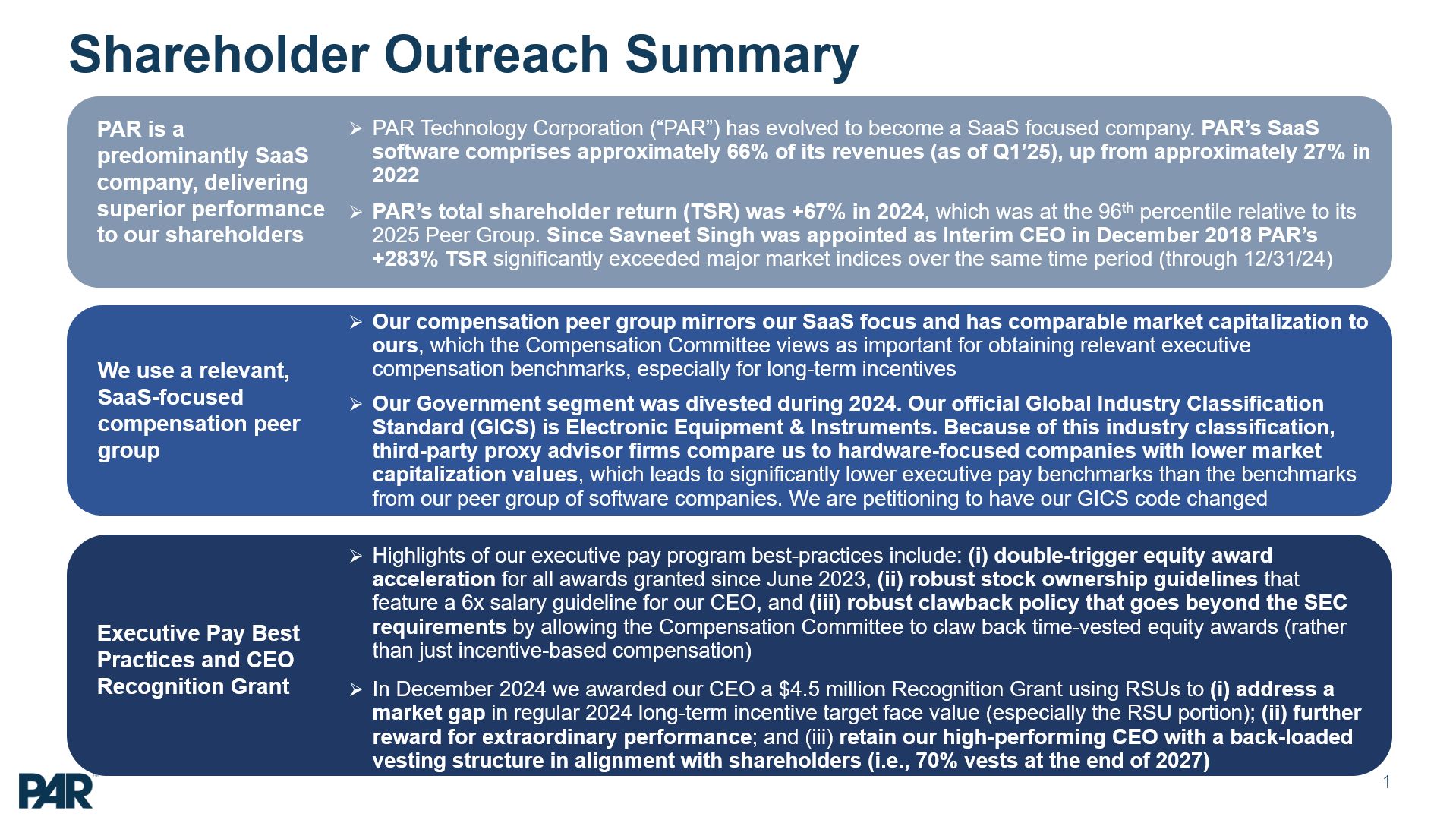

On or about April 17, 2025, PAR Technology Corporation (the “Company”) made available a proxy statement (the “Proxy Statement”) to its shareholders describing the matters to be voted on at the Company’s 2025 Annual

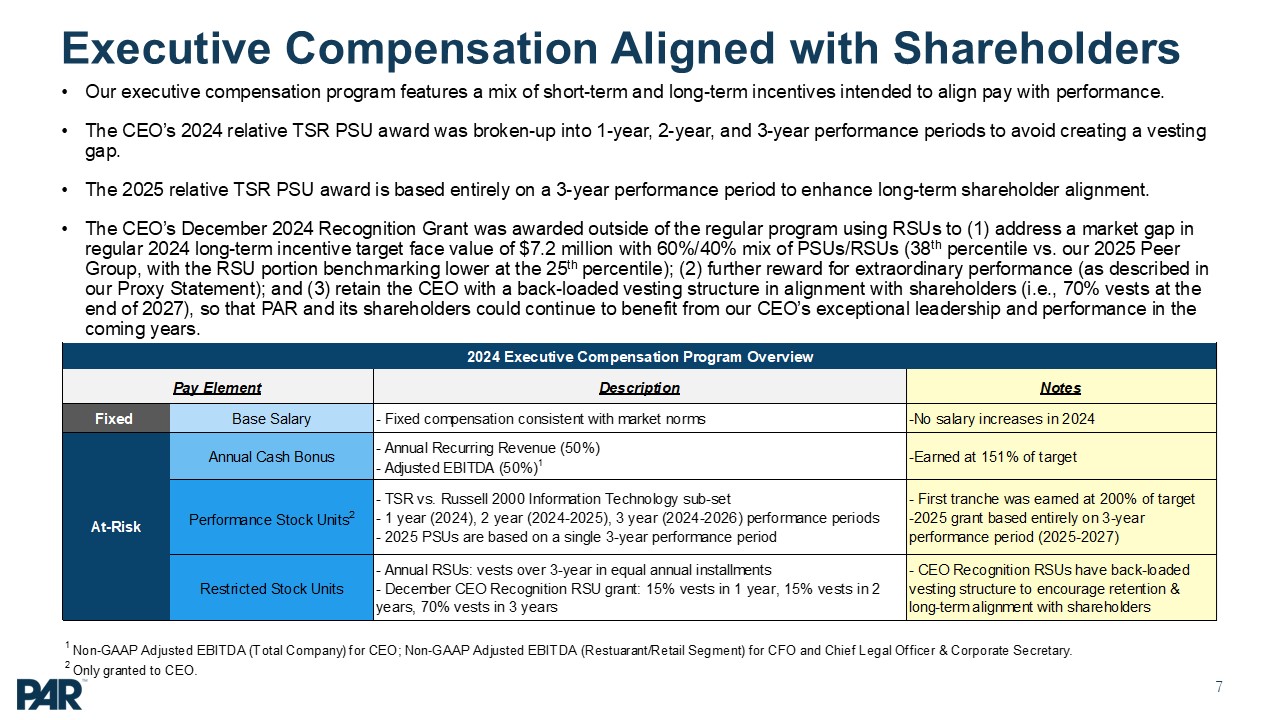

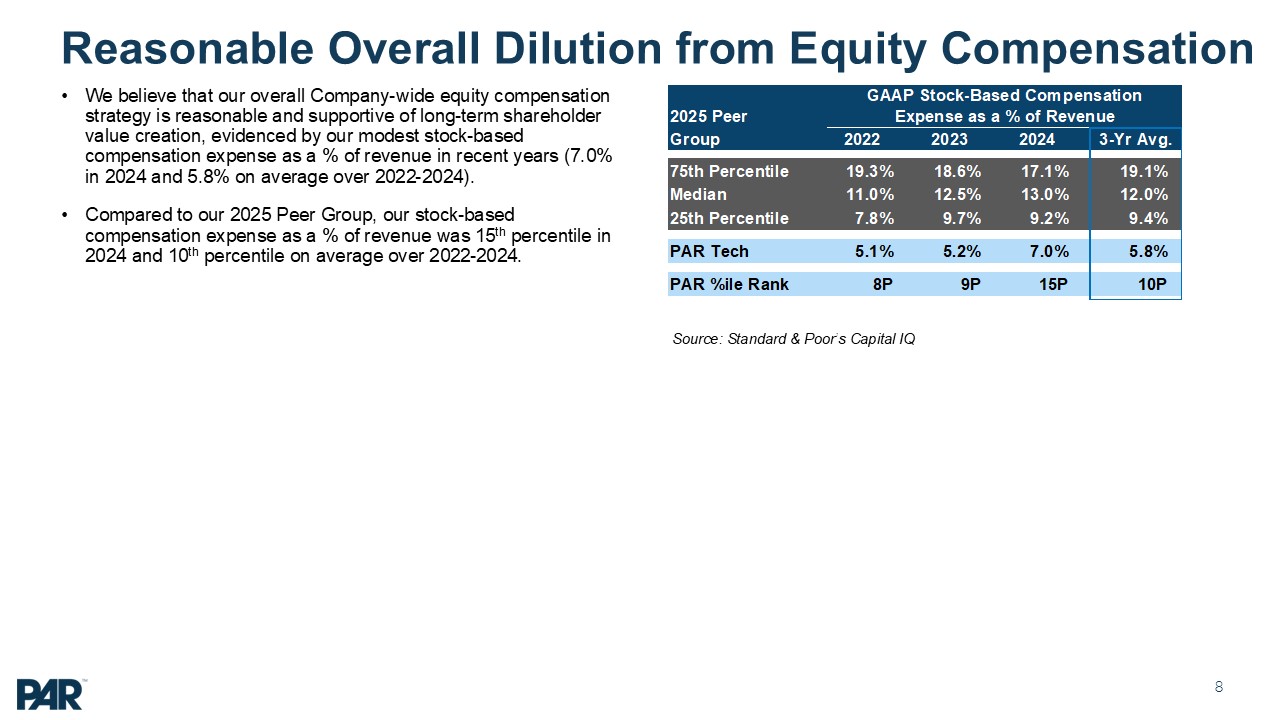

Meeting of Shareholders (the “Annual Meeting”). We are writing to urge you to vote FOR on Proposal 4 to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (the “Say-on-Pay Proposal”).

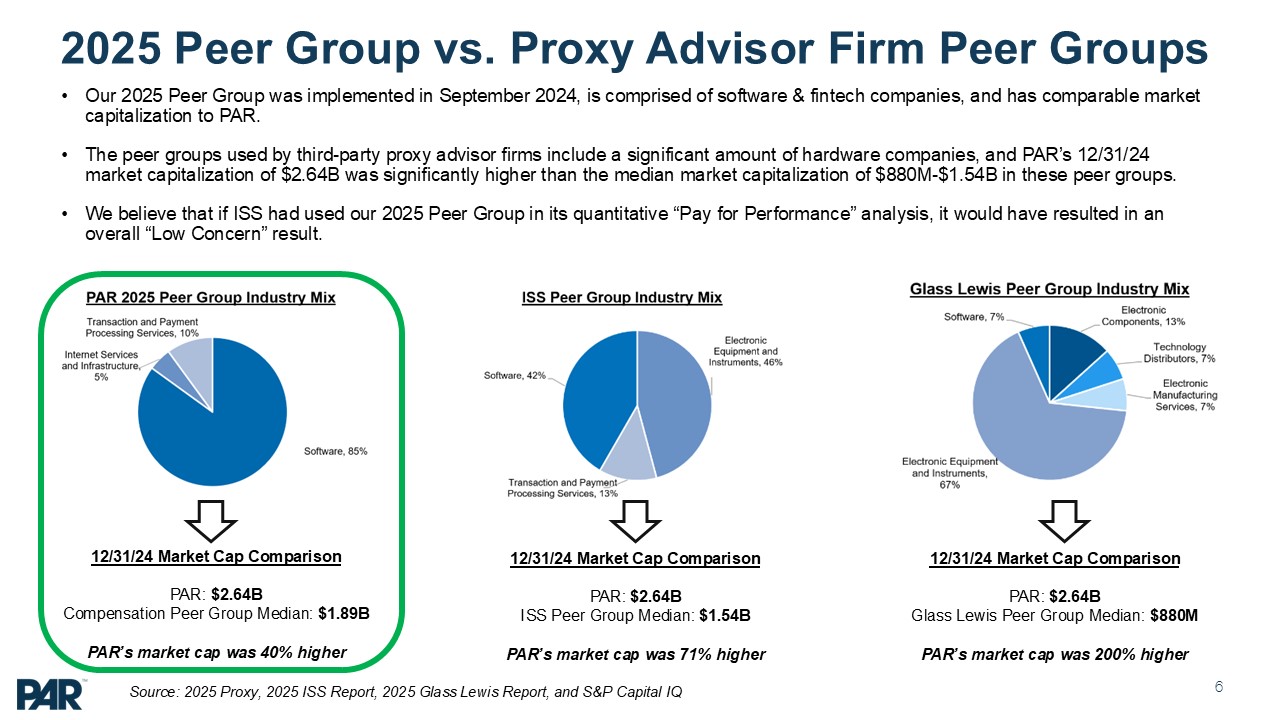

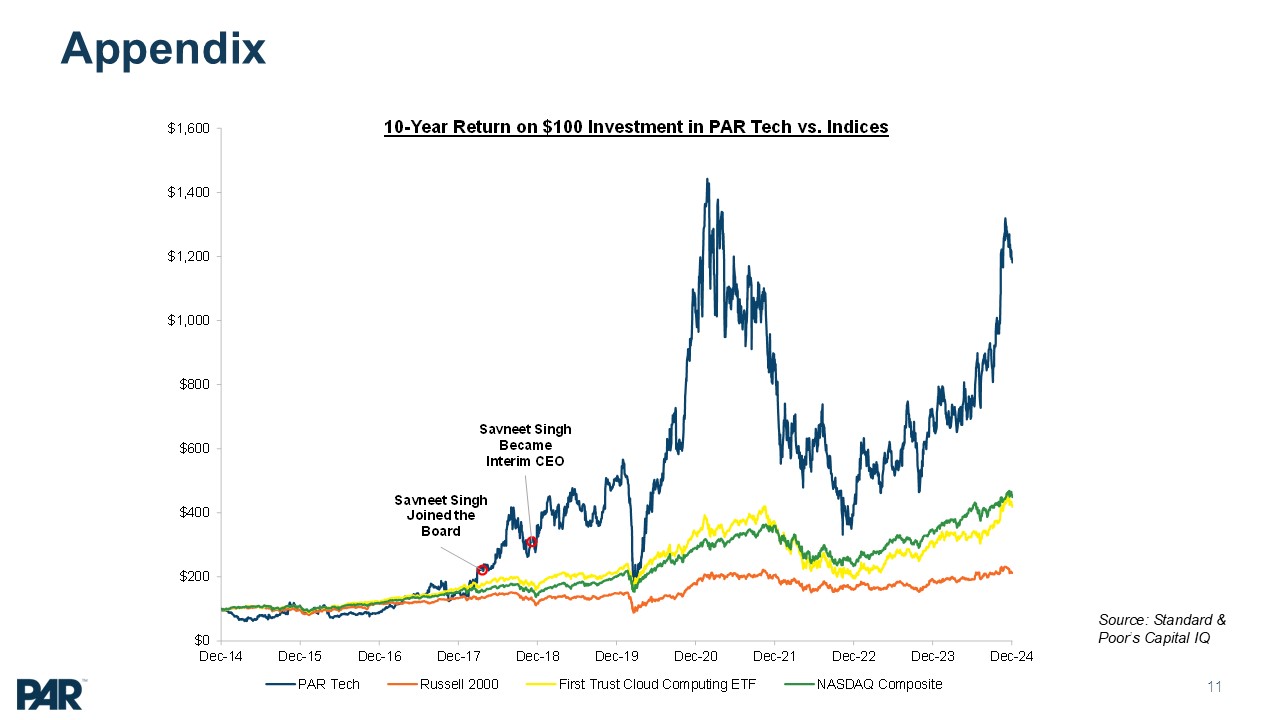

Recently, Institutional Shareholder Services (ISS) and Glass, Lewis & Co., LLC, proxy advisory firms, recommended voting against the Say-on-Pay Proposal primarily as a result of perceived pay for performance

misalignment resulting from the recognition equity award granted to Savneet Singh, the Company’s Chief Executive Officer, in December 2024. The Compensation Committee of the Company’s Board of Directors believes the award was appropriate, and

therefore, we encourage shareholders to vote “FOR” the Say-on-Pay Proposal for the reasons set forth herein.