earnings presentation • Fourth Quarter 2025 .2

forward looking statements disclosure 2 Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements. As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements include the following, without limitation: • economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; • future credit quality and performance, including our expectations regarding future loan losses and our allowance for credit losses; • the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation relating to the banking industry; (iv) management’s ability to effectively execute its business plans; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; • the possibility that any of the anticipated benefits of the Company’s acquisitions will not be realized or will not be realized within the expected time period; • the effect of changes in accounting policies and practices; • changes in consumer spending, borrowing and saving and changes in unemployment; • changes in customers’ performance and creditworthiness; • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; • current and future economic and market conditions, including the effects of changes in housing prices, fluctuations in unemployment rates, U.S. fiscal debt, budget and tax matters, geopolitical matters, trade and tariff policies, and any slowdown in global economic growth; • our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

forward looking statements disclosure 3 • financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; • the effect of the current interest rate environment or changes in interest rates or in the level or composition of our assets or liabilities on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgage loans held for sale; • the effect of a fall in stock market prices on our brokerage, asset and wealth management businesses; • a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber attacks; • the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; and • our ability to develop and execute effective business plans and strategies. Additional factors that may cause our actual results to differ materially from those described in our forward-looking statements can be found in our Form 10-K for the year ended December 31, 2024, as well as our other filings with the SEC, which are available on the SEC website at www.sec.gov. All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, the Company does not assume any obligation to update any forward-looking statement.

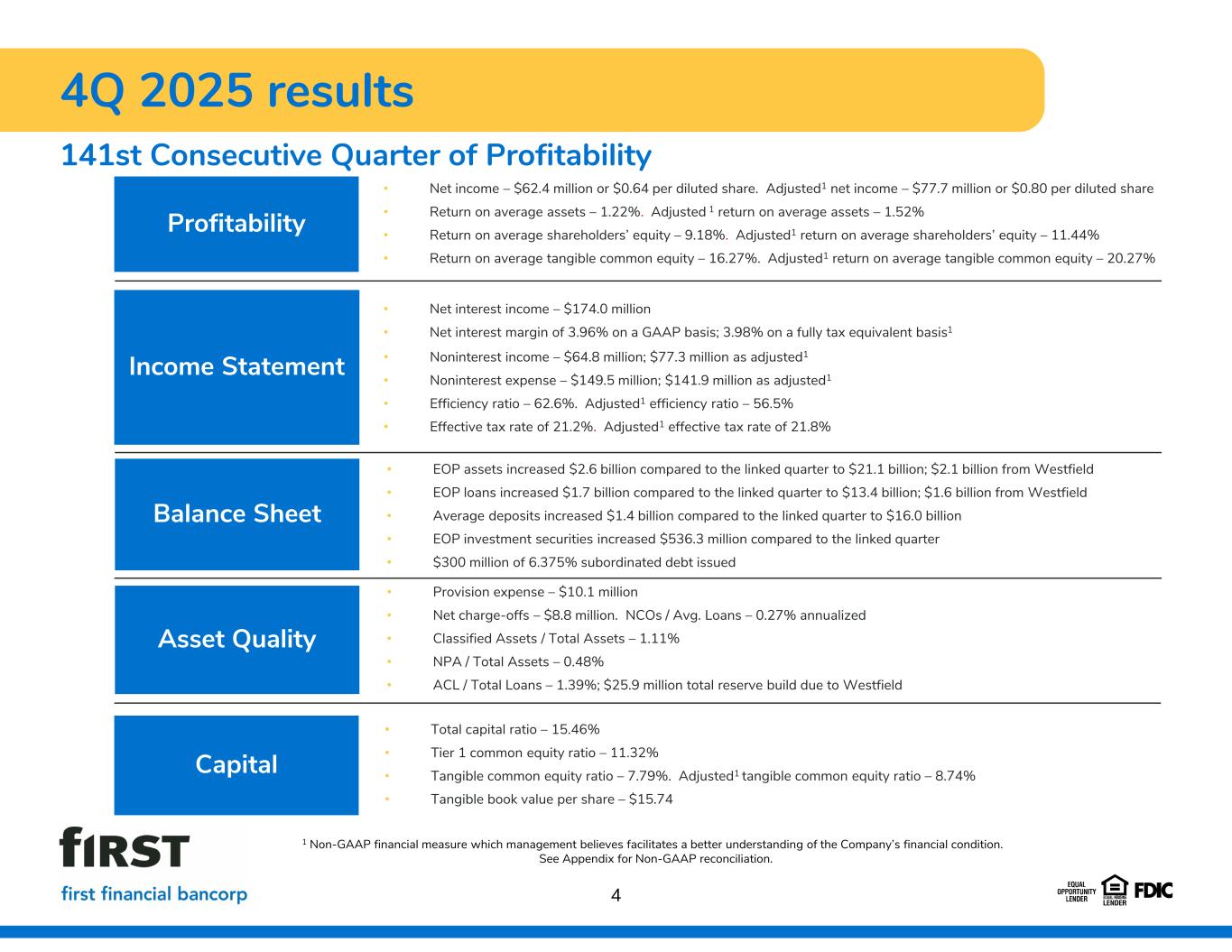

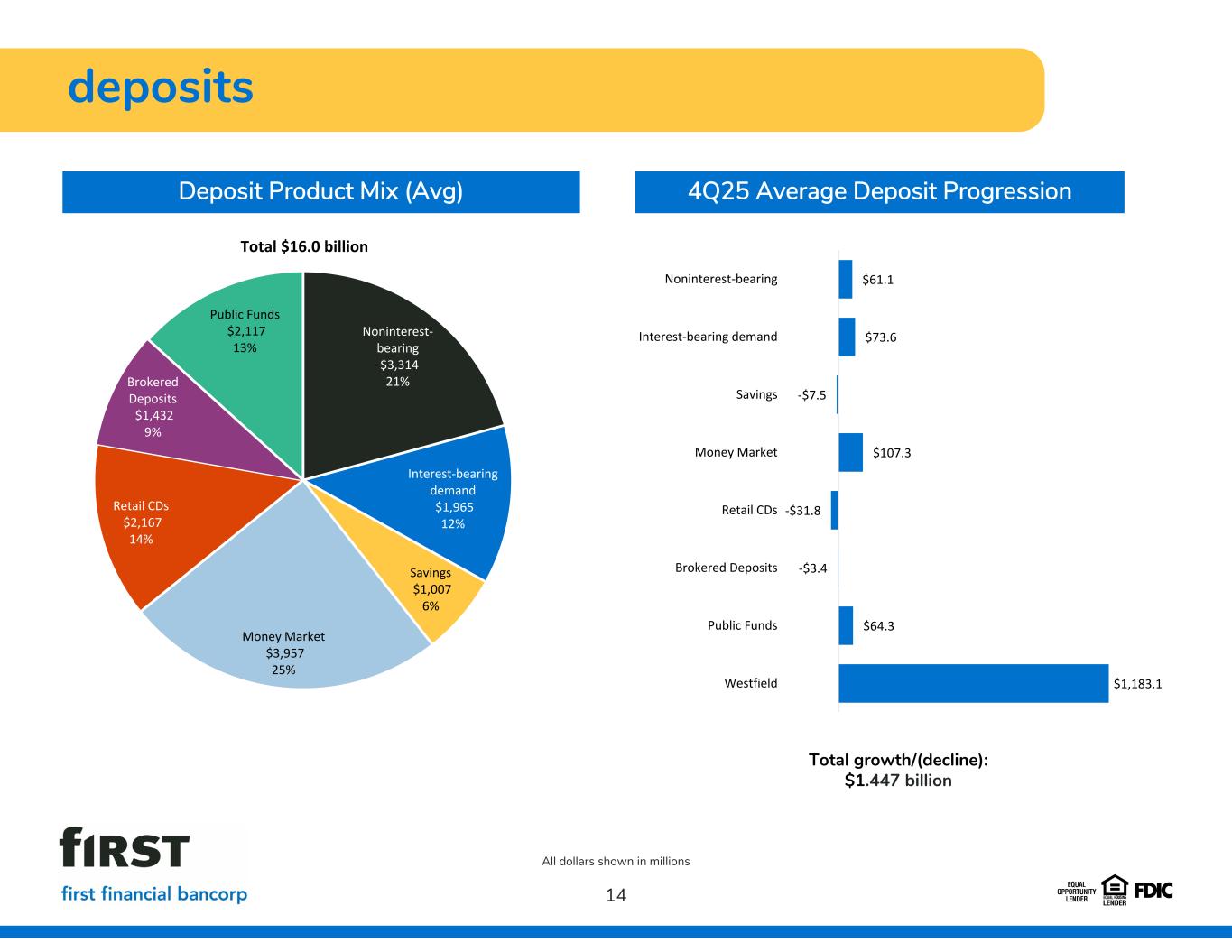

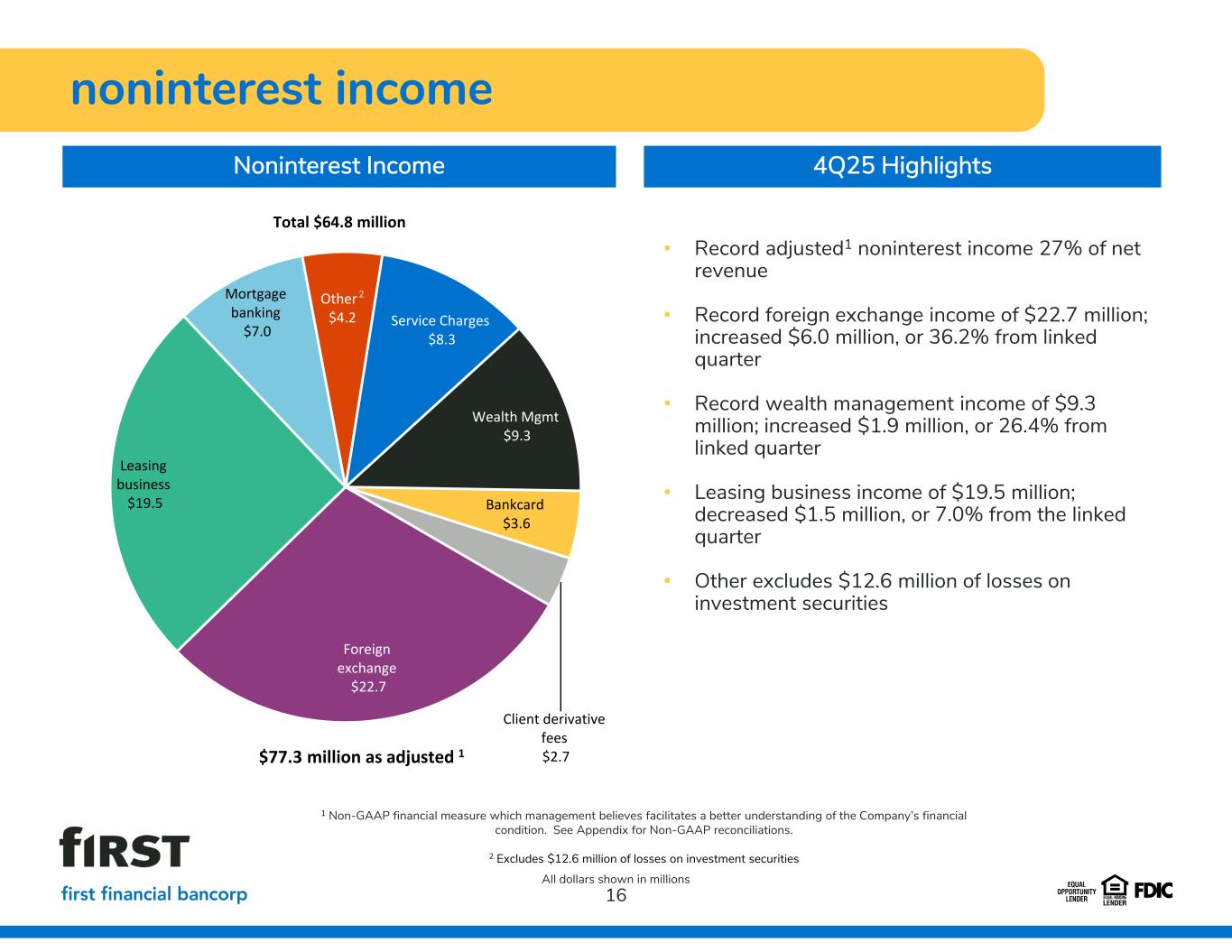

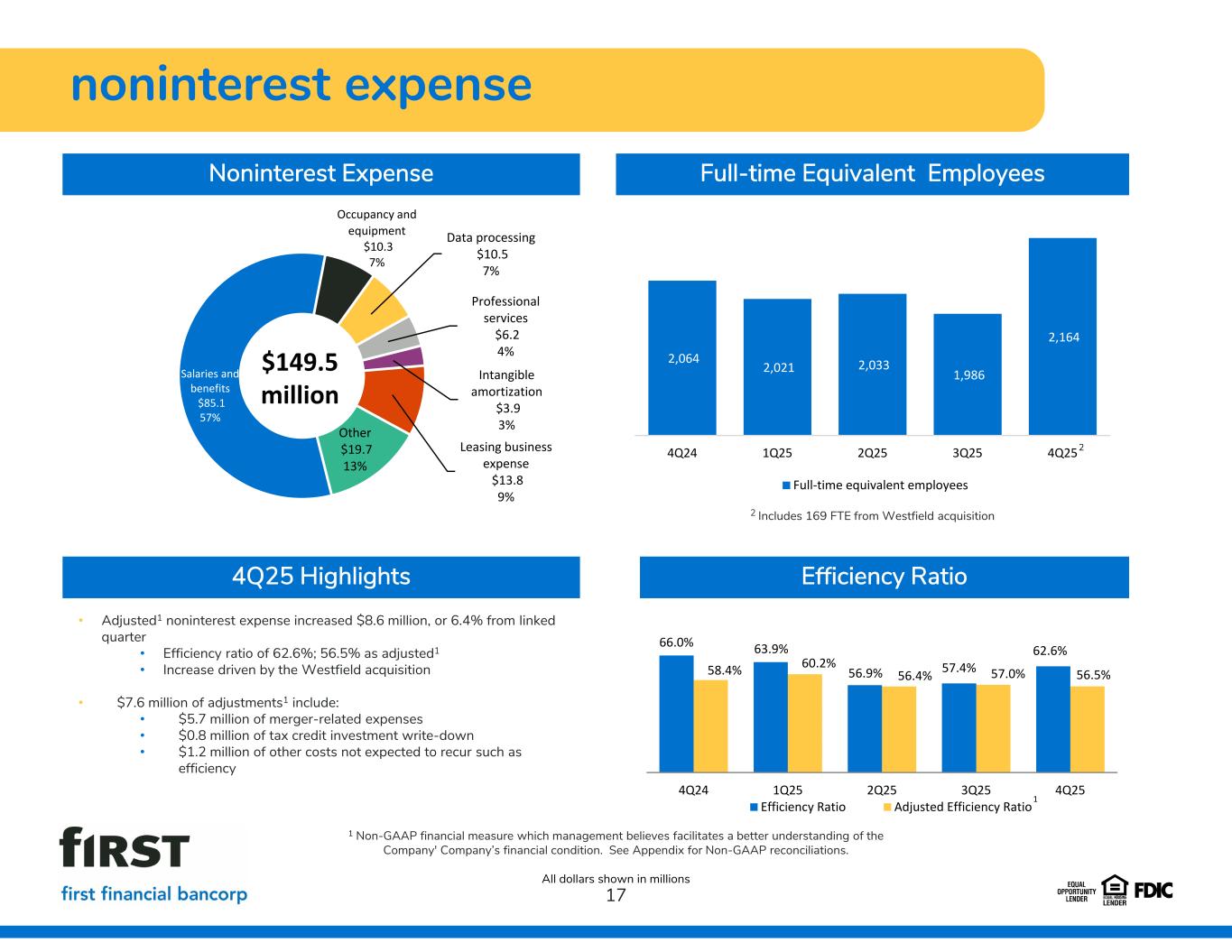

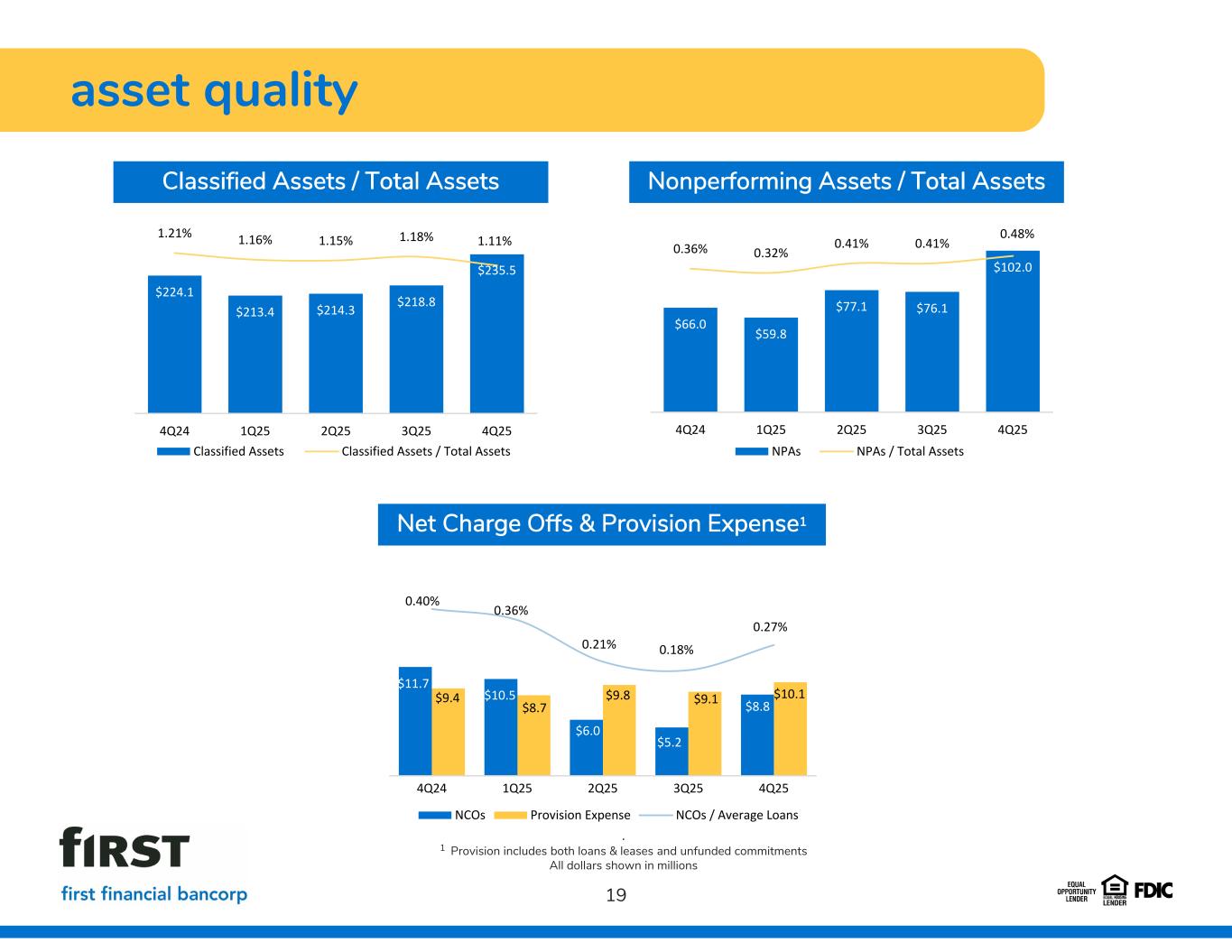

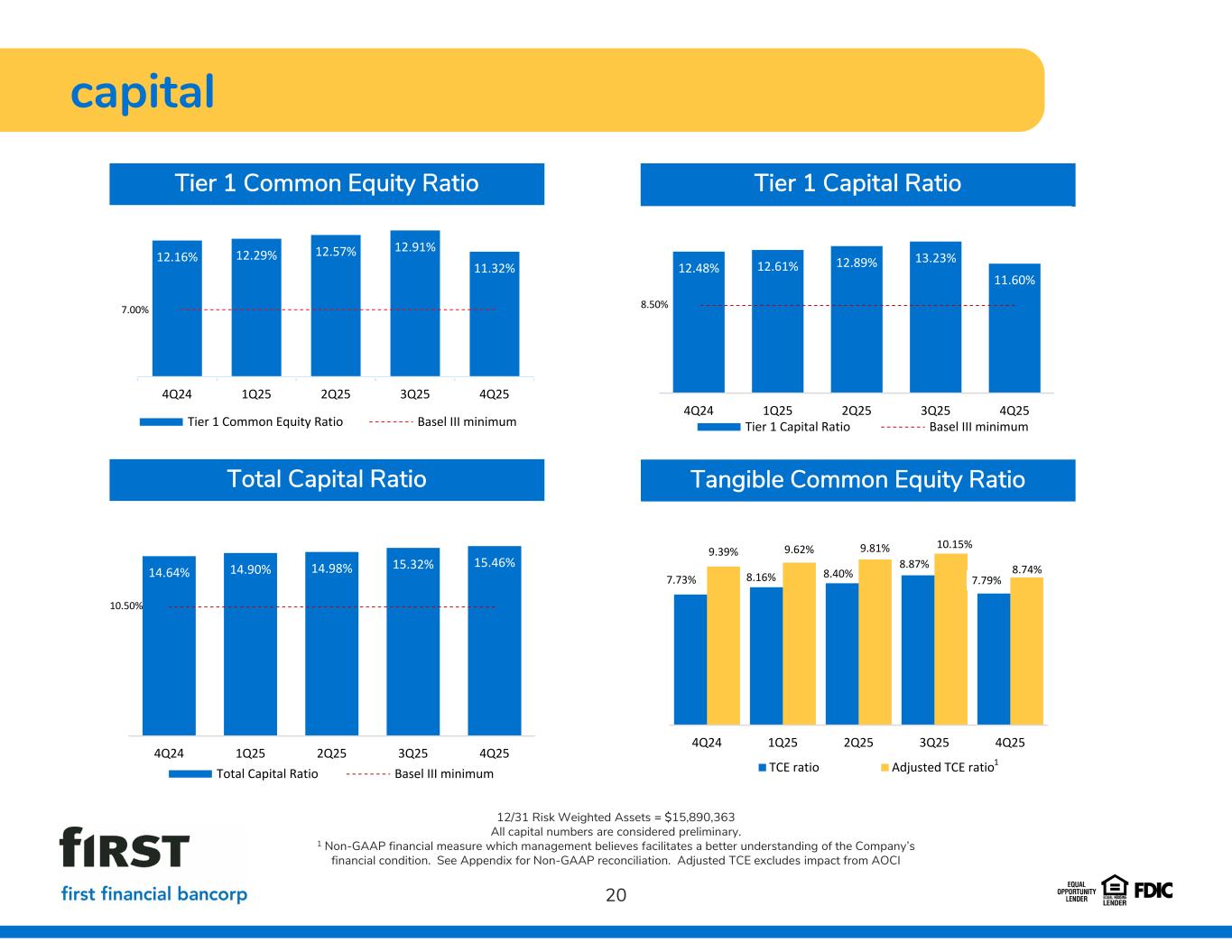

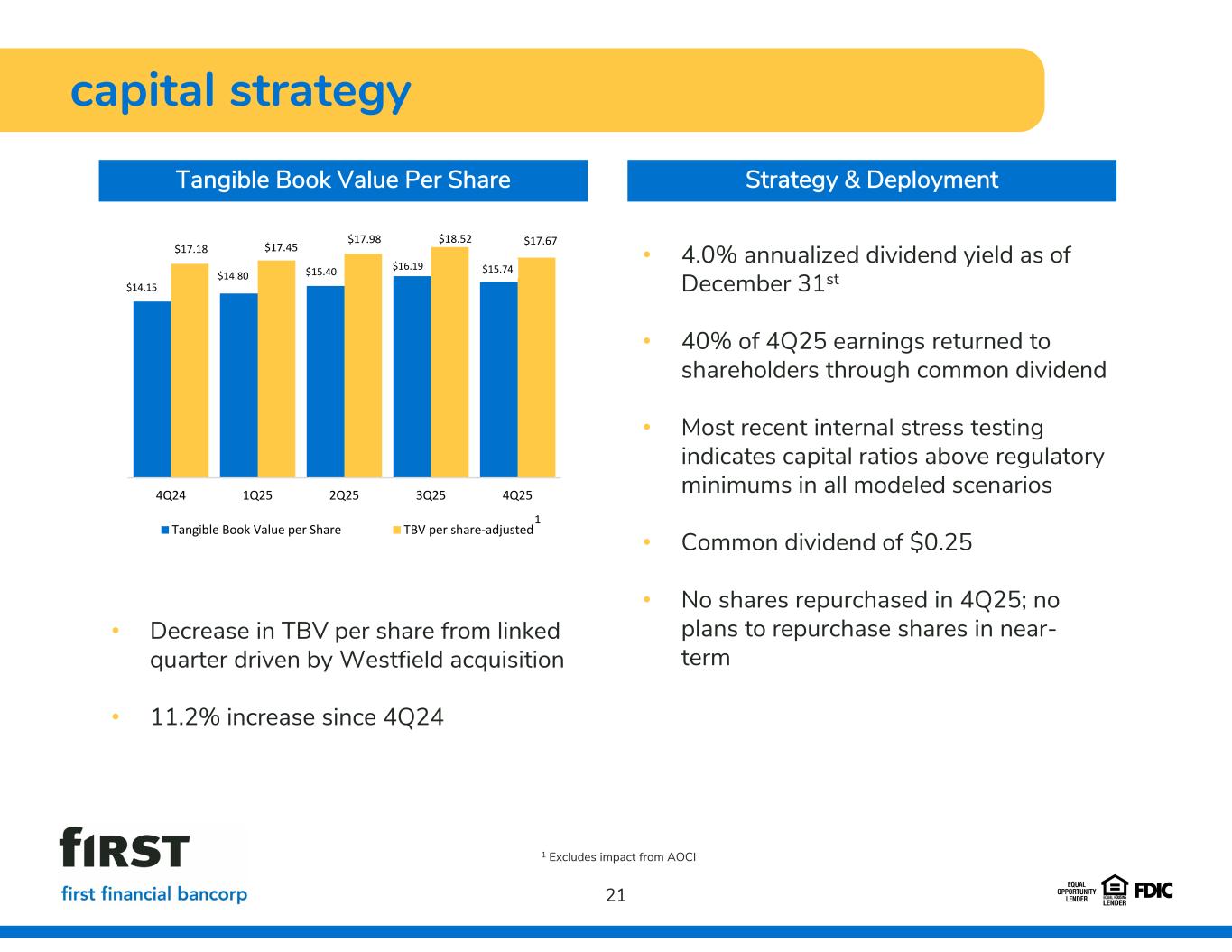

4Q 2025 results 141st Consecutive Quarter of Profitability 4 • EOP assets increased $2.6 billion compared to the linked quarter to $21.1 billion; $2.1 billion from Westfield • EOP loans increased $1.7 billion compared to the linked quarter to $13.4 billion; $1.6 billion from Westfield • Average deposits increased $1.4 billion compared to the linked quarter to $16.0 billion • EOP investment securities increased $536.3 million compared to the linked quarter • $300 million of 6.375% subordinated debt issued Balance Sheet Profitability Asset Quality Income Statement Capital • Noninterest income – $64.8 million; $77.3 million as adjusted1 • Noninterest expense – $149.5 million; $141.9 million as adjusted1 • Efficiency ratio – 62.6%. Adjusted1 efficiency ratio – 56.5% • Effective tax rate of 21.2%. Adjusted1 effective tax rate of 21.8% • Net interest income – $174.0 million • Net interest margin of 3.96% on a GAAP basis; 3.98% on a fully tax equivalent basis1 • Net income – $62.4 million or $0.64 per diluted share. Adjusted1 net income – $77.7 million or $0.80 per diluted share • Return on average assets – 1.22%. Adjusted 1 return on average assets – 1.52% • Return on average shareholders’ equity – 9.18%. Adjusted1 return on average shareholders’ equity – 11.44% • Return on average tangible common equity – 16.27%. Adjusted1 return on average tangible common equity – 20.27% • Provision expense – $10.1 million • Net charge-offs – $8.8 million. NCOs / Avg. Loans – 0.27% annualized • Classified Assets / Total Assets – 1.11% • NPA / Total Assets – 0.48% • ACL / Total Loans – 1.39%; $25.9 million total reserve build due to Westfield • Total capital ratio – 15.46% • Tier 1 common equity ratio – 11.32% • Tangible common equity ratio – 7.79%. Adjusted1 tangible common equity ratio – 8.74% • Tangible book value per share – $15.74 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation.

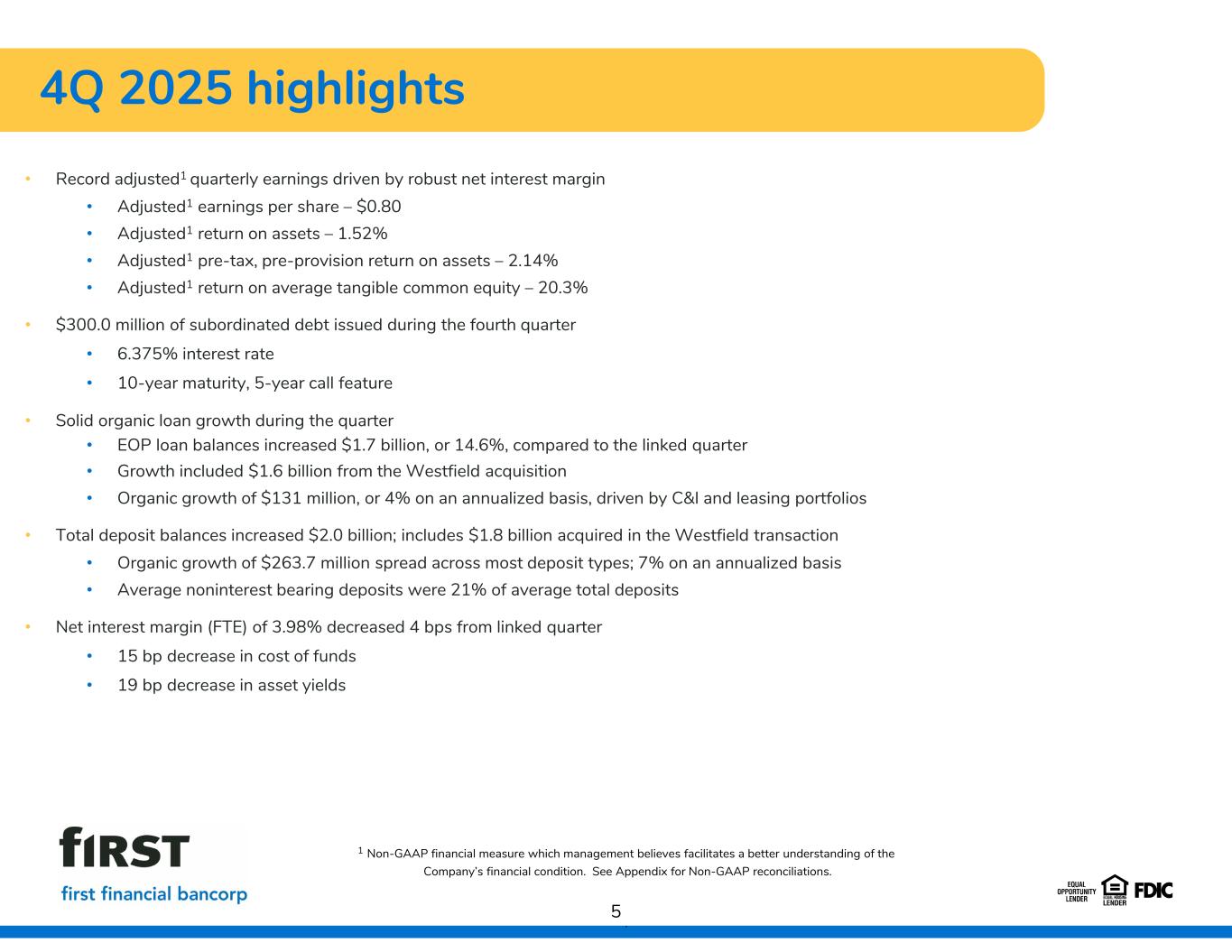

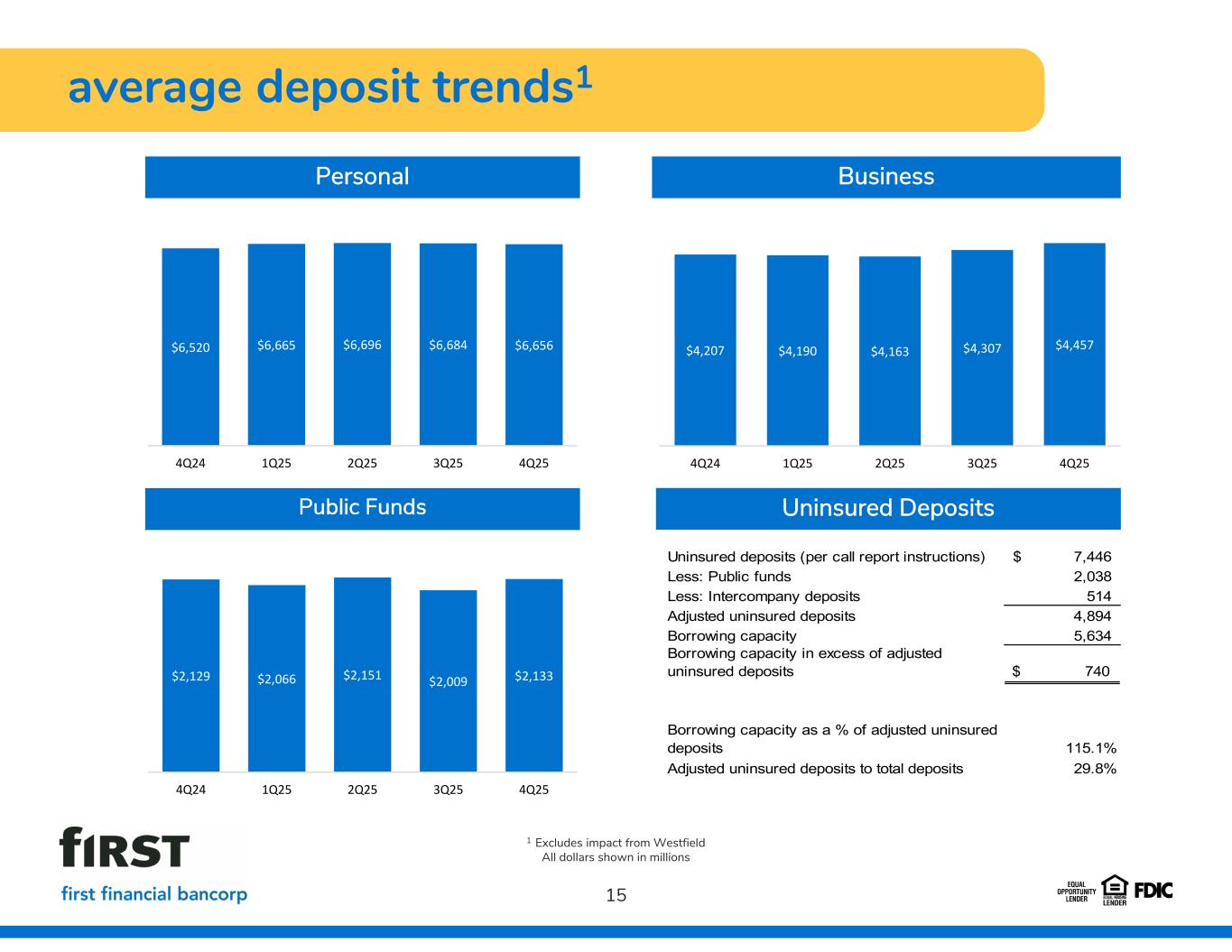

4Q 2025 highlights • Record adjusted1 quarterly earnings driven by robust net interest margin • Adjusted1 earnings per share – $0.80 • Adjusted1 return on assets – 1.52% • Adjusted1 pre-tax, pre-provision return on assets – 2.14% • Adjusted1 return on average tangible common equity – 20.3% • $300.0 million of subordinated debt issued during the fourth quarter • 6.375% interest rate • 10-year maturity, 5-year call feature • Solid organic loan growth during the quarter • EOP loan balances increased $1.7 billion, or 14.6%, compared to the linked quarter • Growth included $1.6 billion from the Westfield acquisition • Organic growth of $131 million, or 4% on an annualized basis, driven by C&I and leasing portfolios • Total deposit balances increased $2.0 billion; includes $1.8 billion acquired in the Westfield transaction • Organic growth of $263.7 million spread across most deposit types; 7% on an annualized basis • Average noninterest bearing deposits were 21% of average total deposits • Net interest margin (FTE) of 3.98% decreased 4 bps from linked quarter • 15 bp decrease in cost of funds • 19 bp decrease in asset yields 5 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. .

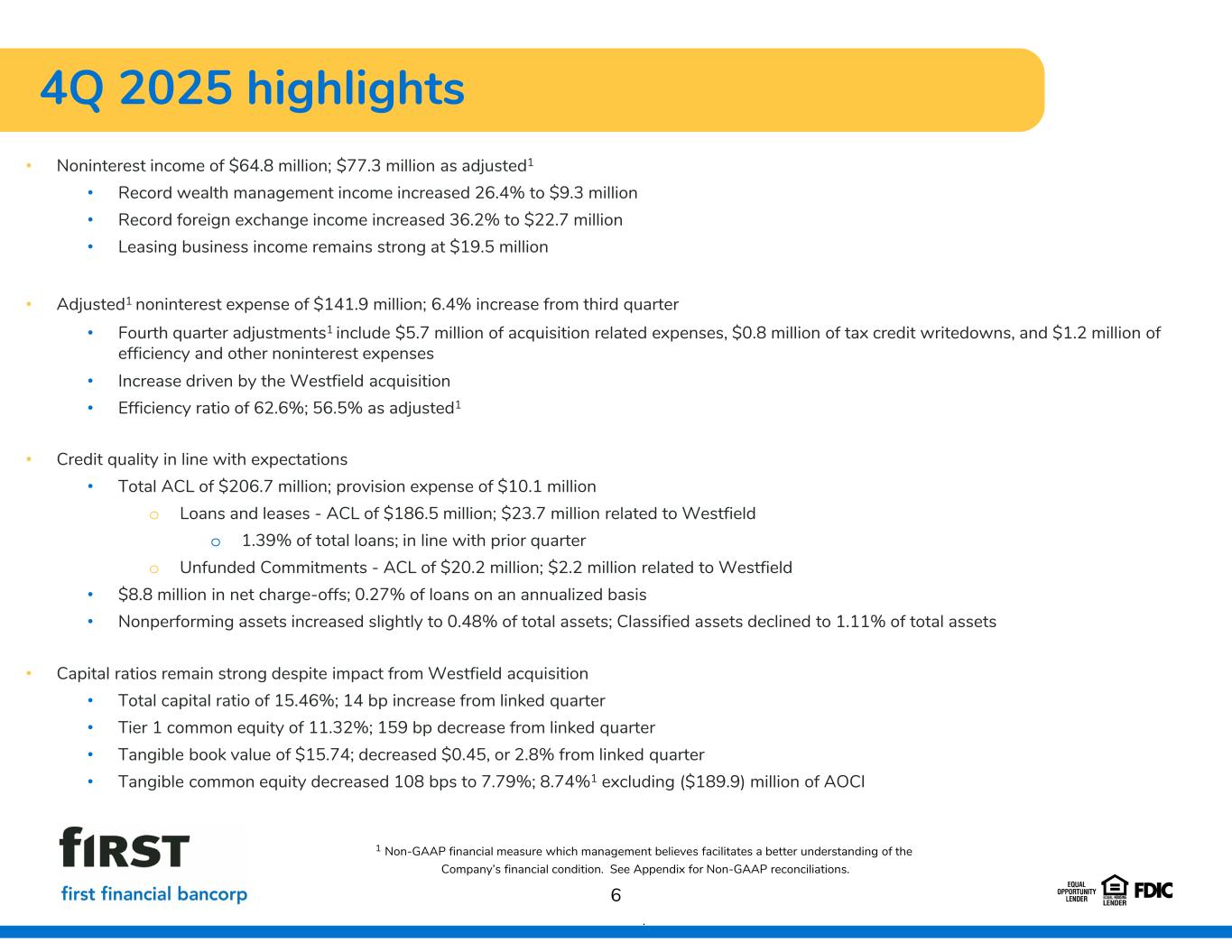

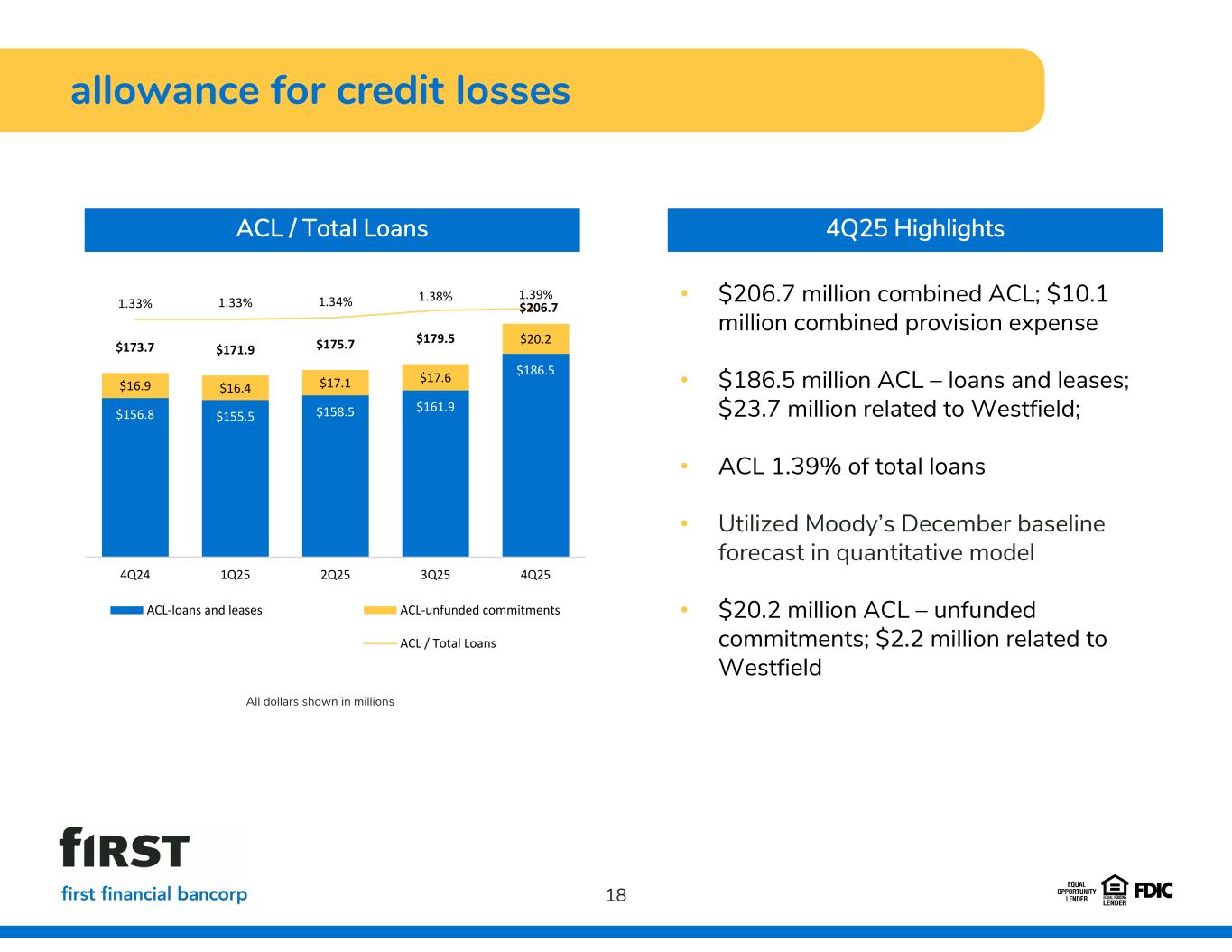

4Q 2025 highlights • Noninterest income of $64.8 million; $77.3 million as adjusted1 • Record wealth management income increased 26.4% to $9.3 million • Record foreign exchange income increased 36.2% to $22.7 million • Leasing business income remains strong at $19.5 million • Adjusted1 noninterest expense of $141.9 million; 6.4% increase from third quarter • Fourth quarter adjustments1 include $5.7 million of acquisition related expenses, $0.8 million of tax credit writedowns, and $1.2 million of efficiency and other noninterest expenses • Increase driven by the Westfield acquisition • Efficiency ratio of 62.6%; 56.5% as adjusted1 • Credit quality in line with expectations • Total ACL of $206.7 million; provision expense of $10.1 million o Loans and leases - ACL of $186.5 million; $23.7 million related to Westfield o 1.39% of total loans; in line with prior quarter o Unfunded Commitments - ACL of $20.2 million; $2.2 million related to Westfield • $8.8 million in net charge-offs; 0.27% of loans on an annualized basis • Nonperforming assets increased slightly to 0.48% of total assets; Classified assets declined to 1.11% of total assets • Capital ratios remain strong despite impact from Westfield acquisition • Total capital ratio of 15.46%; 14 bp increase from linked quarter • Tier 1 common equity of 11.32%; 159 bp decrease from linked quarter • Tangible book value of $15.74; decreased $0.45, or 2.8% from linked quarter • Tangible common equity decreased 108 bps to 7.79%; 8.74%1 excluding ($189.9) million of AOCI 6 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. .

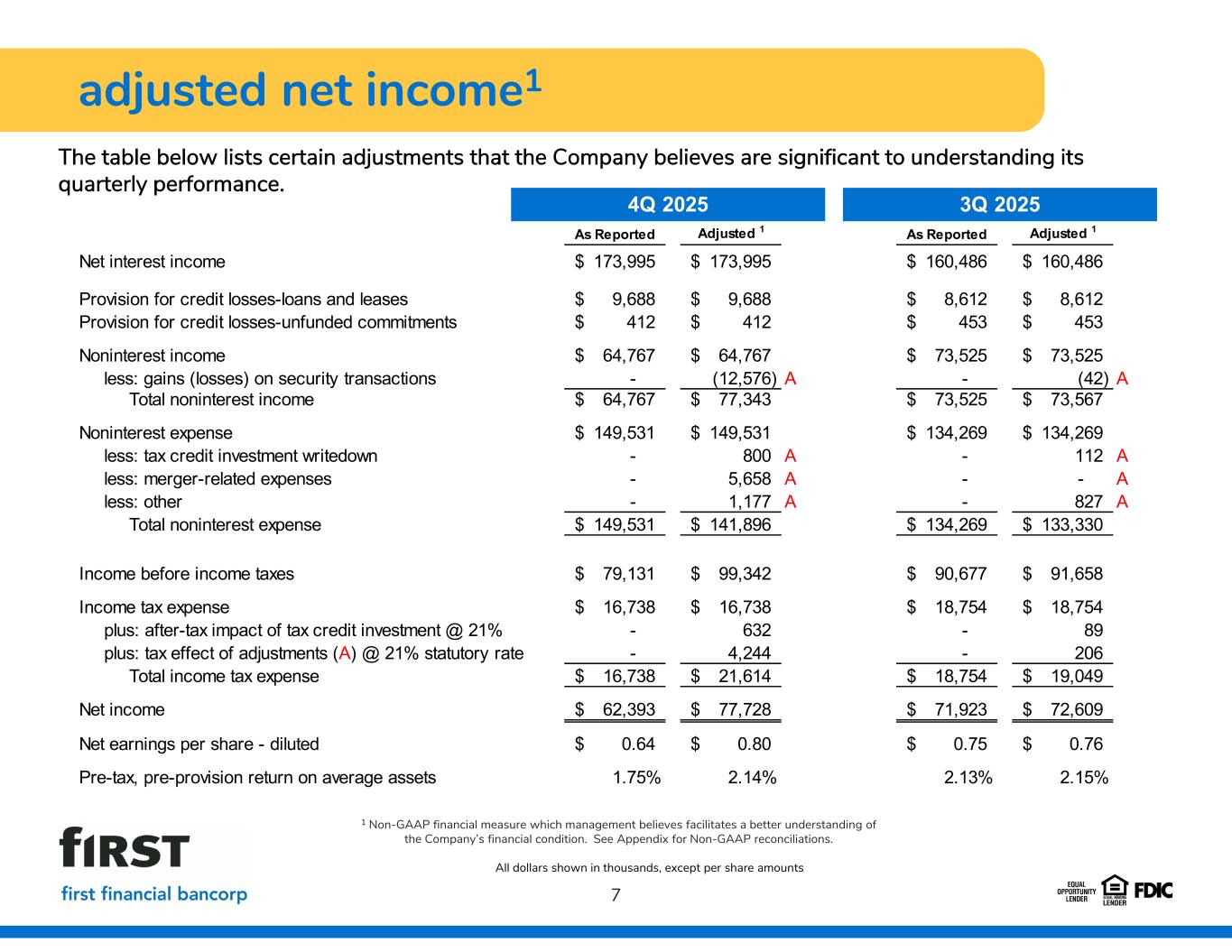

adjusted net income1 7 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. All dollars shown in thousands, except per share amounts The table below lists certain adjustments that the Company believes are significant to understanding its quarterly performance. As Reported Adjusted 1 As Reported Adjusted 1 Net interest income 173,995$ 173,995$ 160,486$ 160,486$ Provision for credit losses-loans and leases 9,688$ 9,688$ 8,612$ 8,612$ Provision for credit losses-unfunded commitments 412$ 412$ 453$ 453$ Noninterest income 64,767$ 64,767$ 73,525$ 73,525$ less: gains (losses) on security transactions - (12,576) A - (42) A Total noninterest income 64,767$ 77,343$ 73,525$ 73,567$ Noninterest expense 149,531$ 149,531$ 134,269$ 134,269$ less: tax credit investment writedown - 800 A - 112 A less: merger-related expenses - 5,658 A - - A less: other - 1,177 A - 827 A Total noninterest expense 149,531$ 141,896$ 134,269$ 133,330$ Income before income taxes 79,131$ 99,342$ 90,677$ 91,658$ Income tax expense 16,738$ 16,738$ 18,754$ 18,754$ plus: after-tax impact of tax credit investment @ 21% - 632 - 89 plus: tax effect of adjustments (A) @ 21% statutory rate - 4,244 - 206 Total income tax expense 16,738$ 21,614$ 18,754$ 19,049$ Net income 62,393$ 77,728$ 71,923$ 72,609$ Net earnings per share - diluted 0.64$ 0.80$ 0.75$ 0.76$ Pre-tax, pre-provision return on average assets 1.75% 2.14% 2.13% 2.15% 4Q 2025 3Q 2025

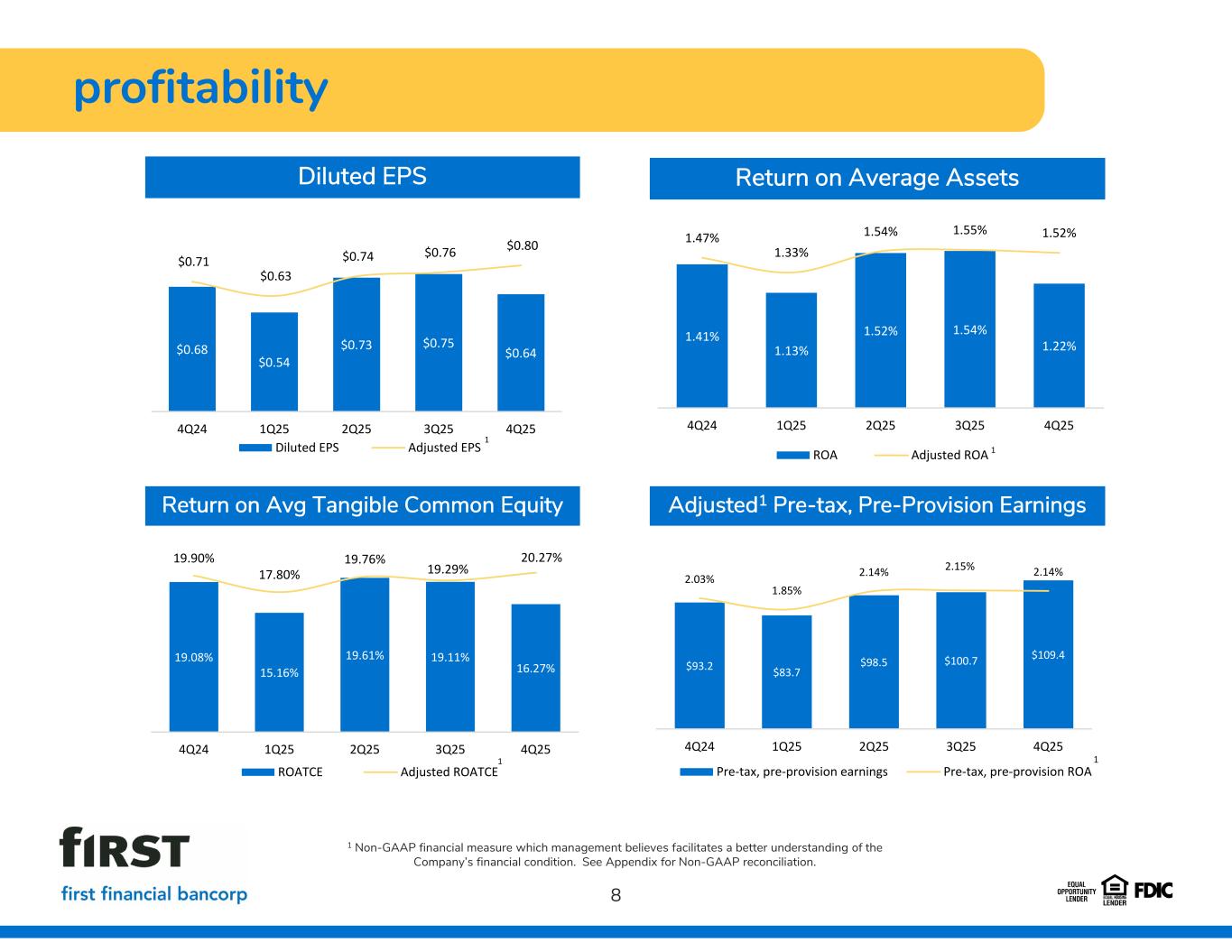

profitability 8 Return on Average Assets Return on Avg Tangible Common Equity Diluted EPS 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. Adjusted1 Pre-tax, Pre-Provision Earnings 1.22% 1.54%1.52% 1.13% 1.41% 1.52%1.55%1.54% 1.33% 1.47% 4Q253Q252Q251Q254Q24 ROA Adjusted ROA 1 $0.64 $0.75$0.73 $0.54 $0.68 $0.80 $0.76 $0.74 $0.63 $0.71 4Q253Q252Q251Q254Q24 Diluted EPS Adjusted EPS 1 16.27% 19.11%19.61% 15.16% 19.08% 20.27% 19.29% 19.76% 17.80% 19.90% 4Q253Q252Q251Q254Q24 ROATCE Adjusted ROATCE 1 $109.4$100.7$98.5 $83.7$93.2 2.14%2.15%2.14% 1.85% 2.03% 4Q253Q252Q251Q254Q24 Pre-tax, pre-provision earnings Pre-tax, pre-provision ROA 1

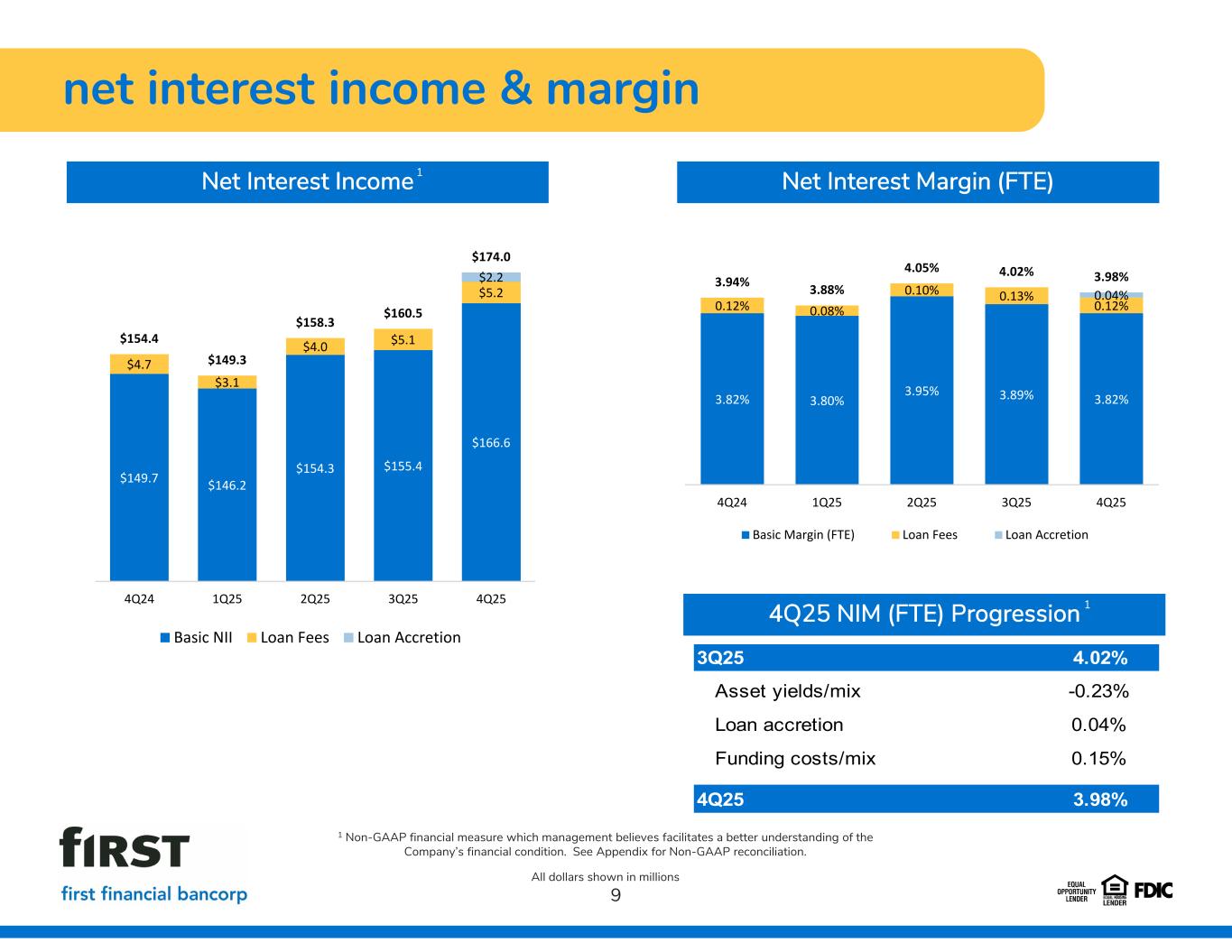

net interest income & margin 9 4Q25 NIM (FTE) Progression Net Interest Income All dollars shown in millions 1 1 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 1 3.82%3.89%3.95% 3.80%3.82% 0.12% 0.13%0.10% 0.08%0.12% 0.04% 3.98%4.02%4.05% 3.88%3.94% 4Q253Q252Q251Q254Q24 Basic Margin (FTE) Loan Fees Loan Accretion $166.6 $155.4$154.3 $146.2$149.7 $5.2 $5.1$4.0 $3.1 $4.7 $2.2 $174.0 $160.5$158.3 $149.3 $154.4 4Q253Q252Q251Q254Q24 Basic NII Loan Fees Loan Accretion Net Interest Margin (FTE) 3Q25 4.02% Asset yields/mix -0.23% Loan accretion 0.04% Funding costs/mix 0.15% 4Q25 3.98%

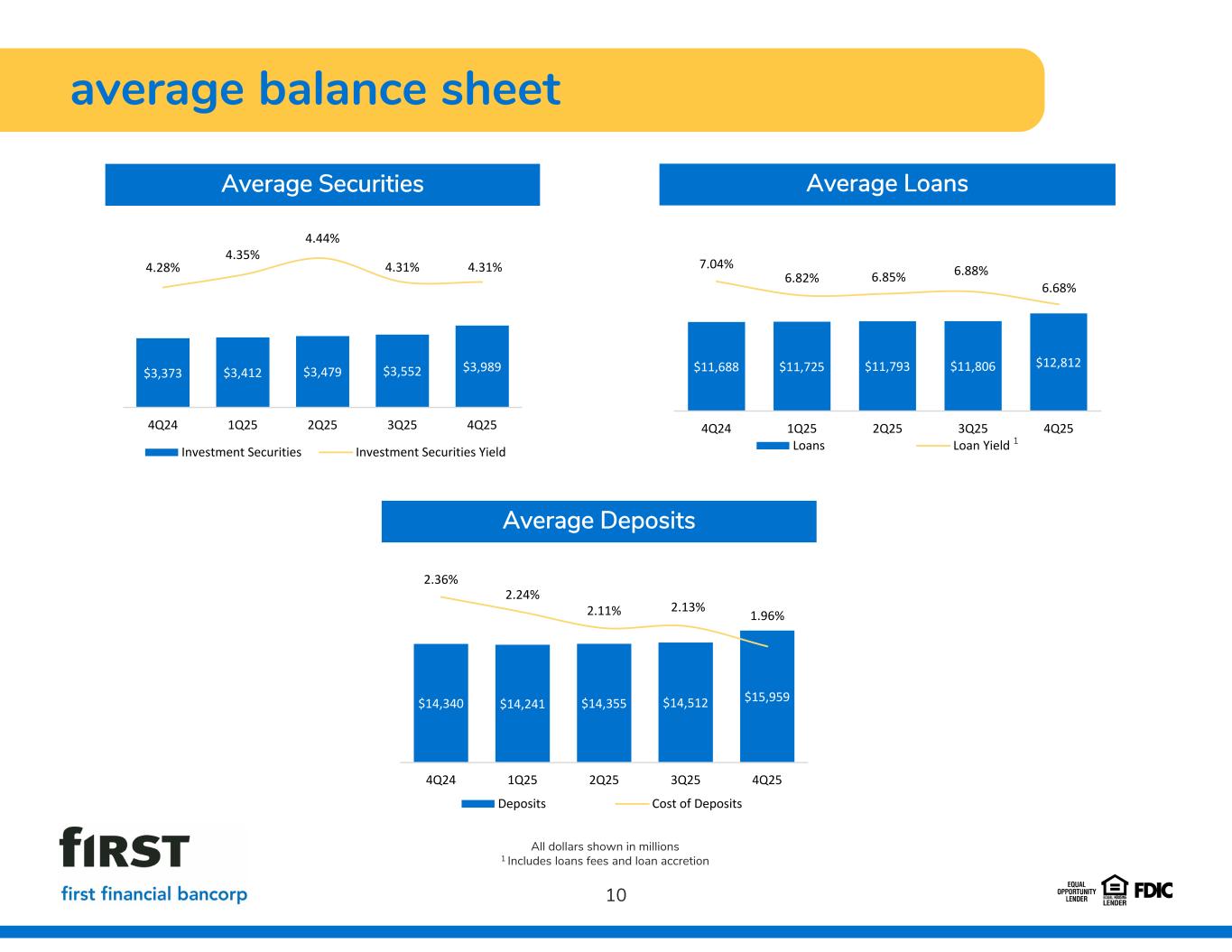

average balance sheet 10 Average Securities All dollars shown in millions 1 Includes loans fees and loan accretion $3,989$3,552$3,479$3,412$3,373 4.31%4.31% 4.44% 4.35% 4.28% 4Q253Q252Q251Q254Q24 Investment Securities Investment Securities Yield $15,959$14,512$14,355$14,241$14,340 1.96%2.13%2.11% 2.24% 2.36% 4Q253Q252Q251Q254Q24 Deposits Cost of Deposits $12,812$11,806$11,793$11,725$11,688 6.68% 6.88%6.85%6.82% 7.04% 4Q253Q252Q251Q254Q24 Loans Loan Yield Average Loans Average Deposits 1

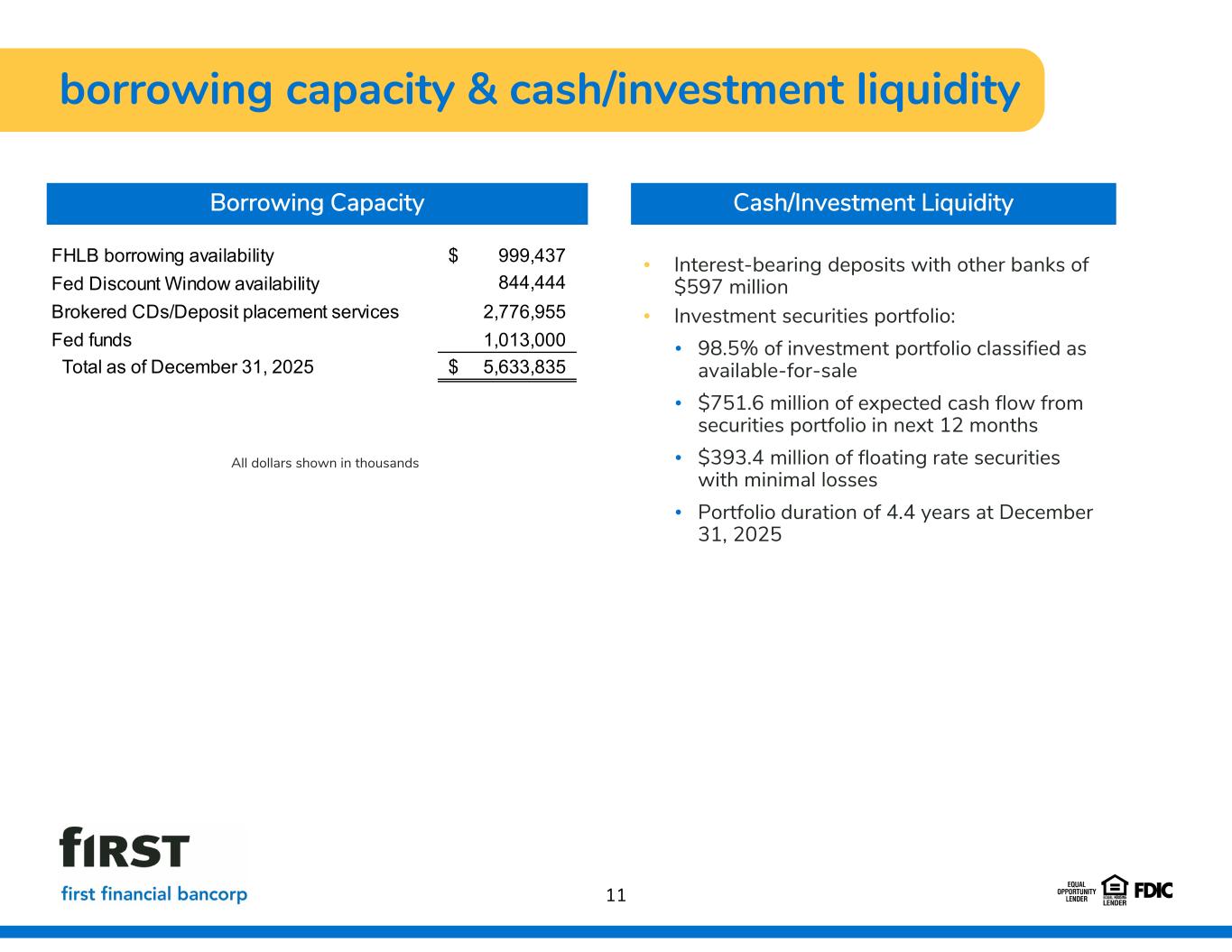

11 Borrowing Capacity • Interest-bearing deposits with other banks of $597 million • Investment securities portfolio: • 98.5% of investment portfolio classified as available-for-sale • $751.6 million of expected cash flow from securities portfolio in next 12 months • $393.4 million of floating rate securities with minimal losses • Portfolio duration of 4.4 years at December 31, 2025 borrowing capacity & cash/investment liquidity Cash/Investment Liquidity All dollars shown in thousands FHLB borrowing availability 999,437$ Fed Discount Window availability 844,444 Brokered CDs/Deposit placement services 2,776,955 Fed funds 1,013,000 Total as of December 31, 2025 5,633,835$

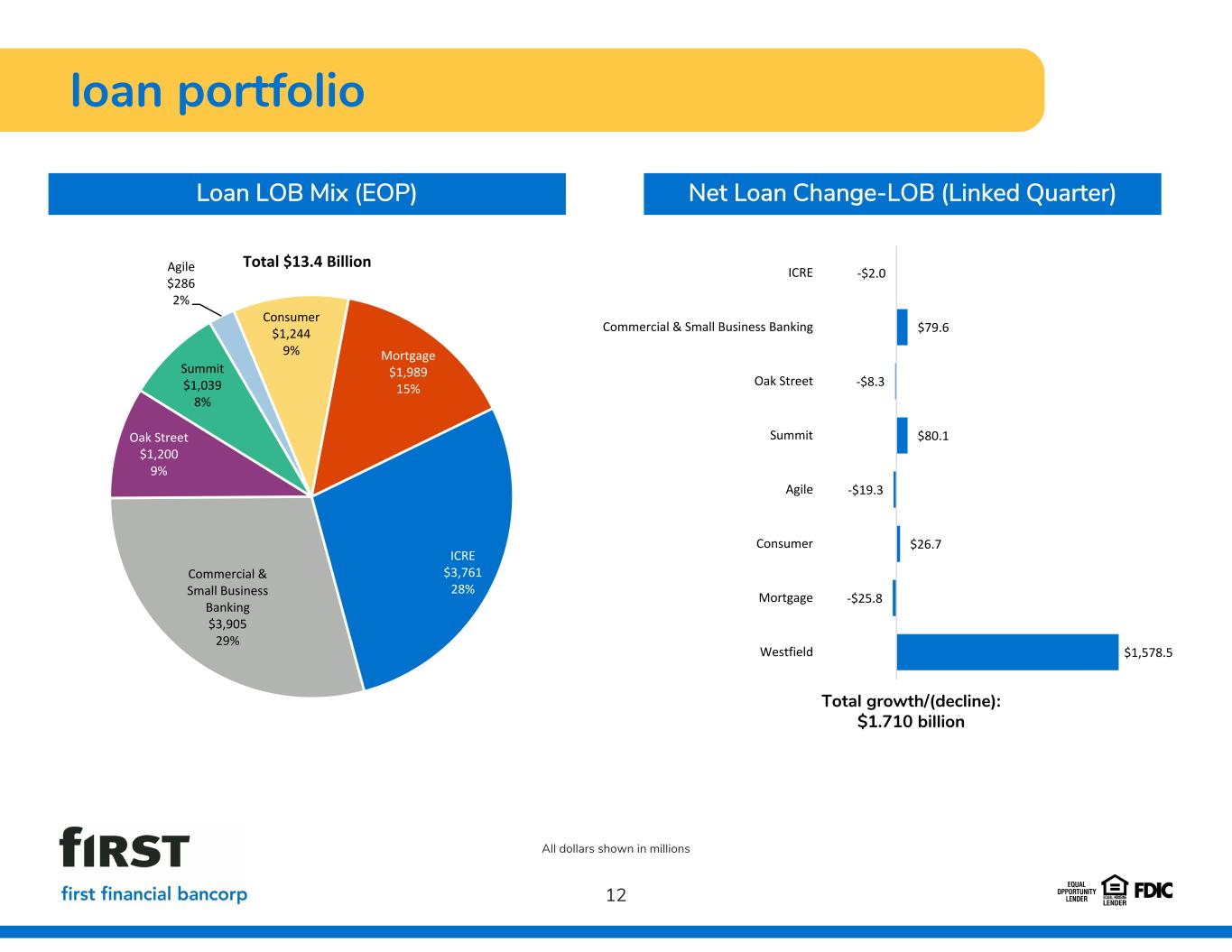

loan portfolio 12 Loan LOB Mix (EOP) Net Loan Change-LOB (Linked Quarter) All dollars shown in millions Total growth/(decline): $1.710 billion ICRE $3,761 28% Commercial & Small Business Banking $3,905 29% Oak Street $1,200 9% Summit $1,039 8% Agile $286 2% Consumer $1,244 9% Mortgage $1,989 15% Total $13.4 Billion -$2.0 $79.6 -$8.3 $80.1 -$19.3 $26.7 -$25.8 $1,578.5 ICRE Commercial & Small Business Banking Oak Street Summit Agile Consumer Mortgage Westfield

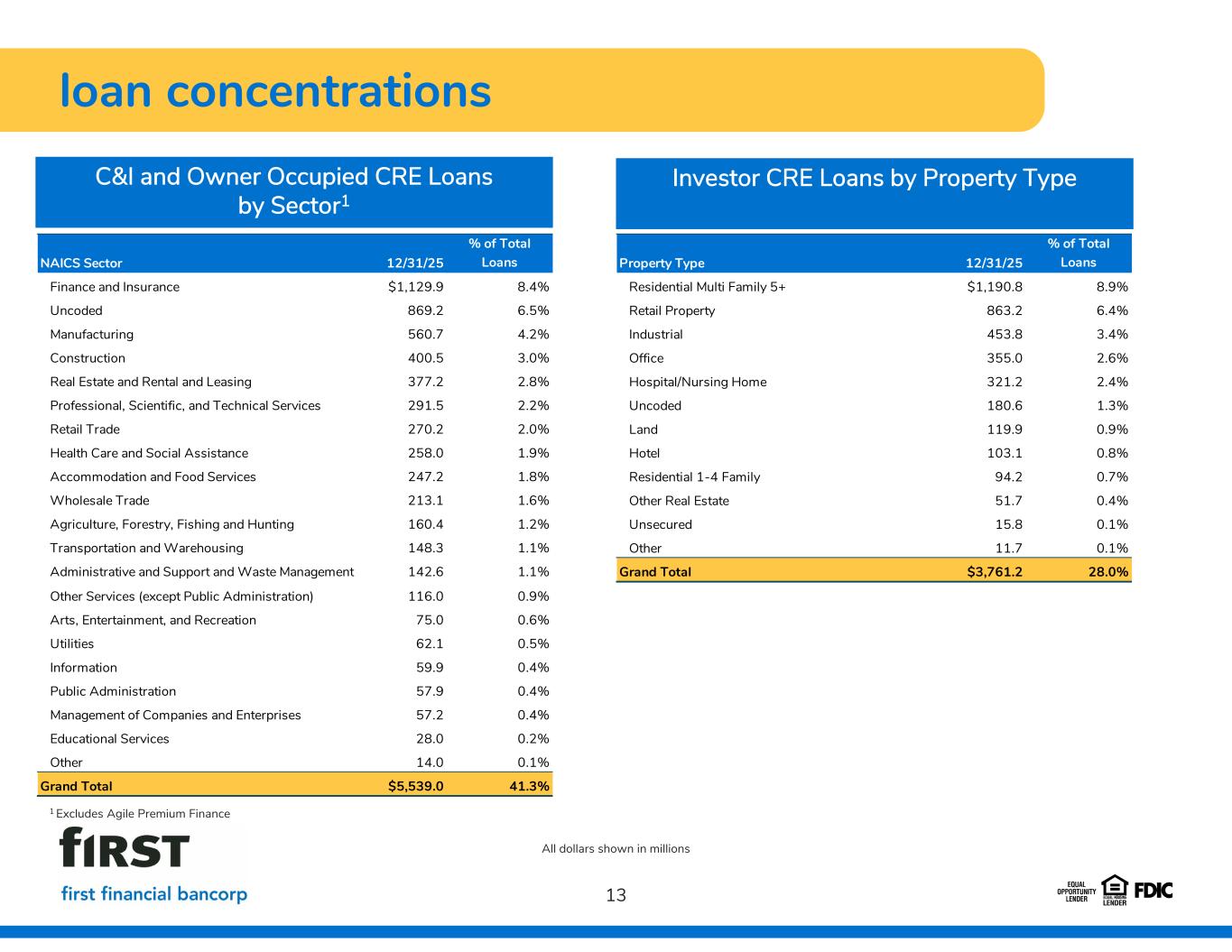

loan concentrations 13 C&I and Owner Occupied CRE Loans by Sector1 Investor CRE Loans by Property Type All dollars shown in millions 1 Excludes Agile Premium Finance NAICS Sector 12/31/25 % of Total Loans Finance and Insurance $1,129.9 8.4% Uncoded 869.2 6.5% Manufacturing 560.7 4.2% Construction 400.5 3.0% Real Estate and Rental and Leasing 377.2 2.8% Professional, Scientific, and Technical Services 291.5 2.2% Retail Trade 270.2 2.0% Health Care and Social Assistance 258.0 1.9% Accommodation and Food Services 247.2 1.8% Wholesale Trade 213.1 1.6% Agriculture, Forestry, Fishing and Hunting 160.4 1.2% Transportation and Warehousing 148.3 1.1% Administrative and Support and Waste Management 142.6 1.1% Other Services (except Public Administration) 116.0 0.9% Arts, Entertainment, and Recreation 75.0 0.6% Utilities 62.1 0.5% Information 59.9 0.4% Public Administration 57.9 0.4% Management of Companies and Enterprises 57.2 0.4% Educational Services 28.0 0.2% Other 14.0 0.1% Grand Total $5,539.0 41.3% Property Type 12/31/25 % of Total Loans Residential Multi Family 5+ $1,190.8 8.9% Retail Property 863.2 6.4% Industrial 453.8 3.4% Office 355.0 2.6% Hospital/Nursing Home 321.2 2.4% Uncoded 180.6 1.3% Land 119.9 0.9% Hotel 103.1 0.8% Residential 1-4 Family 94.2 0.7% Other Real Estate 51.7 0.4% Unsecured 15.8 0.1% Other 11.7 0.1% Grand Total $3,761.2 28.0%

deposits 14 Deposit Product Mix (Avg) 4Q25 Average Deposit Progression All dollars shown in millions Total growth/(decline): $1.447 billion Noninterest- bearing $3,314 21% Interest-bearing demand $1,965 12% Savings $1,007 6% Money Market $3,957 25% Retail CDs $2,167 14% Brokered Deposits $1,432 9% Public Funds $2,117 13% Total $16.0 billion $61.1 $73.6 -$7.5 $107.3 -$31.8 -$3.4 $64.3 $1,183.1 Noninterest-bearing Interest-bearing demand Savings Money Market Retail CDs Brokered Deposits Public Funds Westfield

average deposit trends1 15 1 Excludes impact from Westfield All dollars shown in millions Business Public Funds Personal $6,656$6,684$6,696$6,665$6,520 4Q253Q252Q251Q254Q24 $4,457$4,307$4,163$4,190$4,207 4Q253Q252Q251Q254Q24 $2,133$2,009$2,151$2,066$2,129 4Q253Q252Q251Q254Q24 Uninsured deposits (per call report instructions) 7,446$ Less: Public funds 2,038 Less: Intercompany deposits 514 Adjusted uninsured deposits 4,894 Borrowing capacity 5,634 Borrowing capacity in excess of adjusted uninsured deposits $ 740 Borrowing capacity as a % of adjusted uninsured deposits 115.1% Adjusted uninsured deposits to total deposits 29.8% Uninsured Deposits

noninterest income 16 Noninterest Income 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. 2 Excludes $12.6 million of losses on investment securities 4Q25 Highlights • Record adjusted1 noninterest income 27% of net revenue • Record foreign exchange income of $22.7 million; increased $6.0 million, or 36.2% from linked quarter • Record wealth management income of $9.3 million; increased $1.9 million, or 26.4% from linked quarter • Leasing business income of $19.5 million; decreased $1.5 million, or 7.0% from the linked quarter • Other excludes $12.6 million of losses on investment securities All dollars shown in millions Service Charges $8.3 Wealth Mgmt $9.3 Bankcard $3.6 Client derivative fees $2.7 Foreign exchange $22.7 Leasing business $19.5 Mortgage banking $7.0 Other $4.2 Total $64.8 million $77.3 million as adjusted 1 2

noninterest expense 17 Noninterest Expense 4Q25 Highlights 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company' Company’s financial condition. See Appendix for Non-GAAP reconciliations. All dollars shown in millions • Adjusted1 noninterest expense increased $8.6 million, or 6.4% from linked quarter • Efficiency ratio of 62.6%; 56.5% as adjusted1 • Increase driven by the Westfield acquisition • $7.6 million of adjustments1 include: • $5.7 million of merger-related expenses • $0.8 million of tax credit investment write-down • $1.2 million of other costs not expected to recur such as efficiency Full-time Equivalent Employees Salaries and benefits $85.1 57% Occupancy and equipment $10.3 7% Data processing $10.5 7% Professional services $6.2 4% Intangible amortization $3.9 3% Leasing business expense $13.8 9% Other $19.7 13% $149.5 million Efficiency Ratio 2,164 1,986 2,033 2,021 2,064 4Q253Q252Q251Q254Q24 Full-time equivalent employees 2 66.0% 63.9% 56.9% 57.4% 62.6% 58.4% 60.2% 56.4% 57.0% 56.5% 4Q24 1Q25 2Q25 3Q25 4Q25 Efficiency Ratio Adjusted Efficiency Ratio 1 2 Includes 169 FTE from Westfield acquisition

allowance for credit losses 18 4Q25 Highlights All dollars shown in millions • $206.7 million combined ACL; $10.1 million combined provision expense • $186.5 million ACL – loans and leases; $23.7 million related to Westfield; • ACL 1.39% of total loans • Utilized Moody’s December baseline forecast in quantitative model • $20.2 million ACL – unfunded commitments; $2.2 million related to Westfield $156.8 $155.5 $158.5 $161.9 $186.5 $16.9 $16.4 $17.1 $17.6 $20.2$173.7 $171.9 $175.7 $179.5 $206.71.33% 1.33% 1.34% 1.38% 1.39% 4Q24 1Q25 2Q25 3Q25 4Q25 ACL-loans and leases ACL-unfunded commitments ACL / Total Loans ACL / Total Loans

asset quality 19 Classified Assets / Total Assets . 1 Provision includes both loans & leases and unfunded commitments All dollars shown in millions Nonperforming Assets / Total Assets Net Charge Offs & Provision Expense1 $11.7 $10.5 $6.0 $5.2 $8.8 $9.4 $8.7 $9.8 $9.1 $10.1 0.27% 0.18%0.21% 0.36% 0.40% 4Q24 1Q25 2Q25 3Q25 4Q25 NCOs Provision Expense NCOs / Average Loans $235.5 $218.8$214.3$213.4 $224.1 1.11%1.18%1.15%1.16%1.21% 4Q253Q252Q251Q254Q24 Classified Assets Classified Assets / Total Assets $102.0 $76.1$77.1 $59.8 $66.0 0.48% 0.41%0.41% 0.32%0.36% 4Q253Q252Q251Q254Q24 NPAs NPAs / Total Assets

capital 20 Tangible Common Equity Ratio 12/31 Risk Weighted Assets = $15,890,363 All capital numbers are considered preliminary. 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. Adjusted TCE excludes impact from AOCI Tier 1 Capital Ratio 11.32% 12.91%12.57%12.29%12.16% 7.00% 4Q253Q252Q251Q254Q24 Tier 1 Common Equity Ratio Basel III minimum Tier 1 Common Equity Ratio 11.60% 13.23%12.89%12.61%12.48% 8.50% 4Q253Q252Q251Q254Q24 Tier 1 Capital Ratio Basel III minimum 15.46%15.32%14.98%14.90%14.64% 10.50% 4Q253Q252Q251Q254Q24 Total Capital Ratio Basel III minimum Total Capital Ratio 7.73% 8.16% 8.40% 8.87% 7.79% 9.39% 9.62% 9.81% 10.15% 8.74% 4Q24 1Q25 2Q25 3Q25 4Q25 TCE ratio Adjusted TCE ratio1

capital strategy 21 Strategy & DeploymentTangible Book Value Per Share • 4.0% annualized dividend yield as of December 31st • 40% of 4Q25 earnings returned to shareholders through common dividend • Most recent internal stress testing indicates capital ratios above regulatory minimums in all modeled scenarios • Common dividend of $0.25 • No shares repurchased in 4Q25; no plans to repurchase shares in near- term • Decrease in TBV per share from linked quarter driven by Westfield acquisition • 11.2% increase since 4Q24 1 Excludes impact from AOCI $14.15 $14.80 $15.40 $16.19 $15.74 $17.18 $17.45 $17.98 $18.52 $17.67 4Q24 1Q25 2Q25 3Q25 4Q25 Tangible Book Value per Share TBV per share-adjusted 1

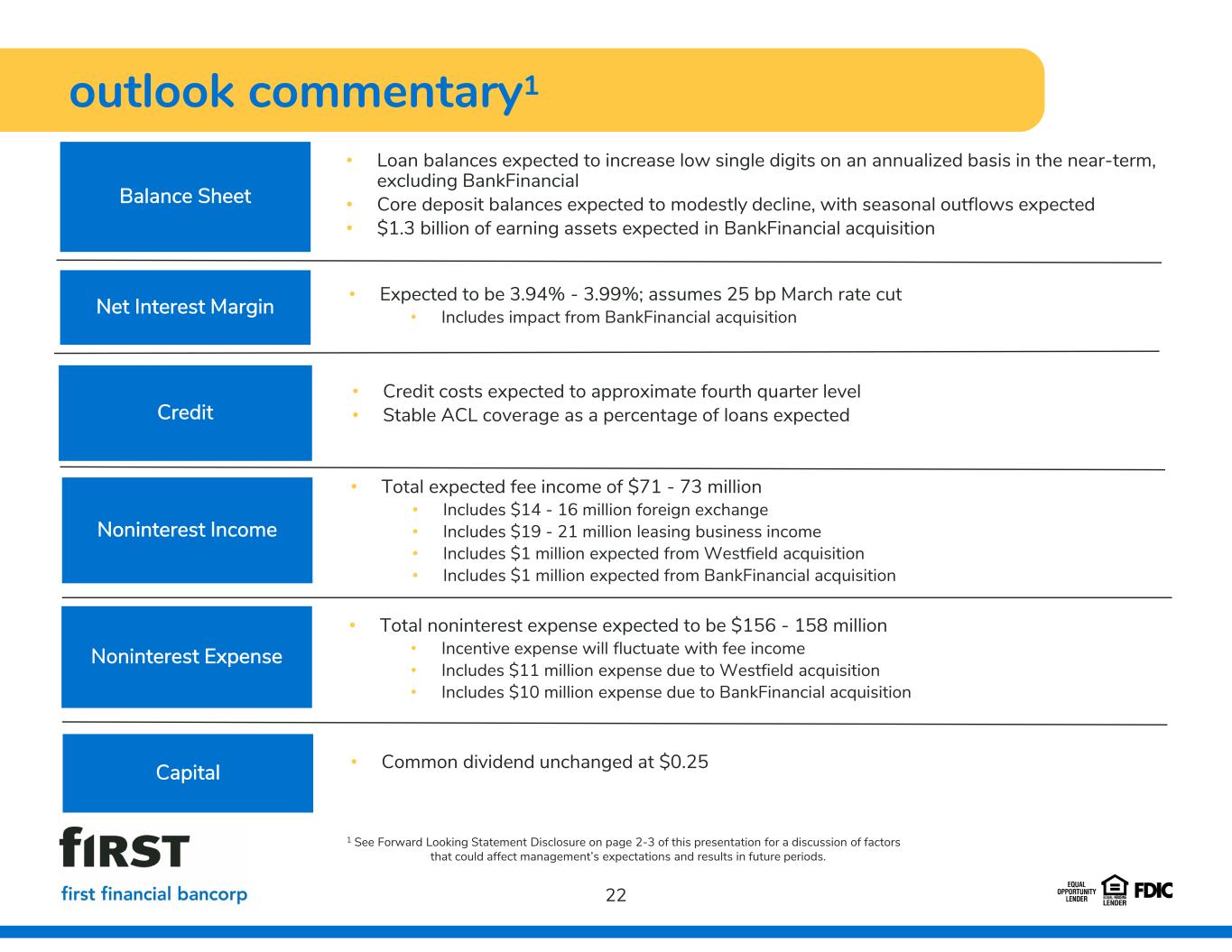

outlook commentary1 • Loan balances expected to increase low single digits on an annualized basis in the near-term, excluding BankFinancial • Core deposit balances expected to modestly decline, with seasonal outflows expected • $1.3 billion of earning assets expected in BankFinancial acquisition 22 • Total noninterest expense expected to be $156 - 158 million • Incentive expense will fluctuate with fee income • Includes $11 million expense due to Westfield acquisition • Includes $10 million expense due to BankFinancial acquisition Noninterest Expense Net Interest Margin Balance Sheet Credit • Credit costs expected to approximate fourth quarter level • Stable ACL coverage as a percentage of loans expected Noninterest Income • Total expected fee income of $71 - 73 million • Includes $14 - 16 million foreign exchange • Includes $19 - 21 million leasing business income • Includes $1 million expected from Westfield acquisition • Includes $1 million expected from BankFinancial acquisition 1 See Forward Looking Statement Disclosure on page 2-3 of this presentation for a discussion of factors that could affect management’s expectations and results in future periods. • Expected to be 3.94% - 3.99%; assumes 25 bp March rate cut • Includes impact from BankFinancial acquisition Capital • Common dividend unchanged at $0.25

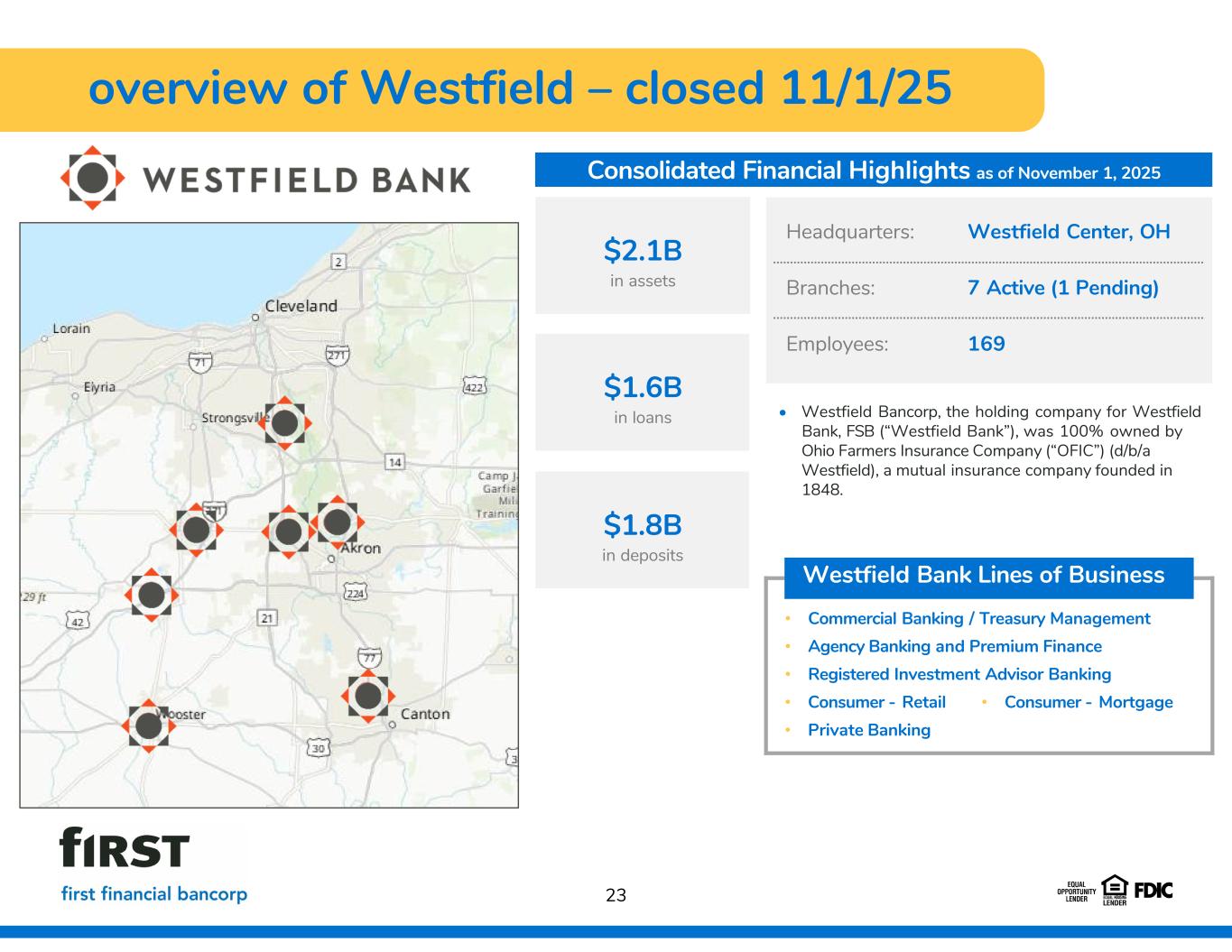

23 overview of Westfield – closed 11/1/25 Westfield Bank Lines of Business • Commercial Banking / Treasury Management • Agency Banking and Premium Finance • Registered Investment Advisor Banking • Consumer - Mortgage• Consumer - Retail • Private Banking $2.1B in assets Consolidated Financial Highlights as of November 1, 2025 $1.6B in loans Headquarters: Westfield Center, OH Branches: 7 Active (1 Pending) Employees: 169 • Westfield Bancorp, the holding company for Westfield Bank, FSB (“Westfield Bank”), was 100% owned by Ohio Farmers Insurance Company (“OFIC”) (d/b/a Westfield), a mutual insurance company founded in 1848. $1.8B in deposits

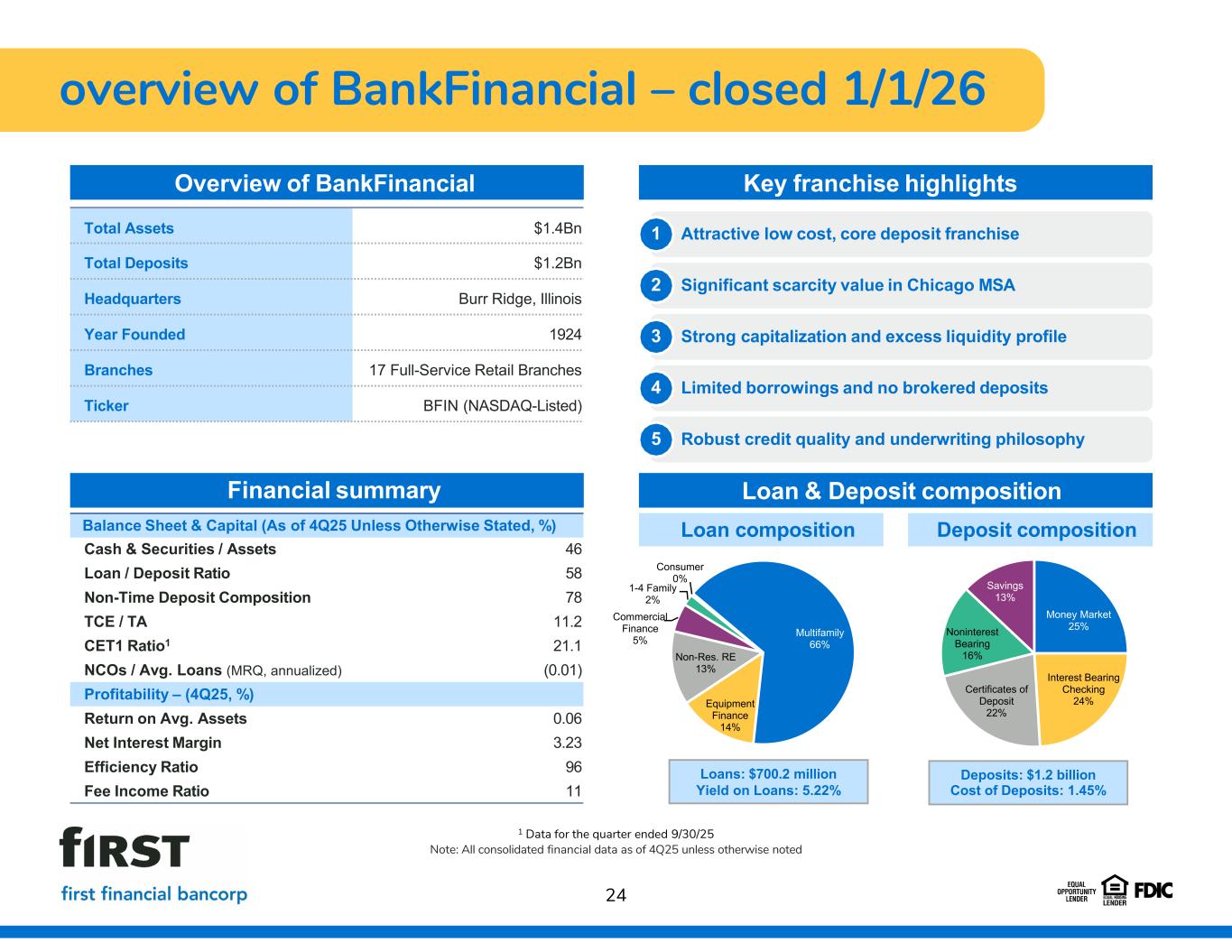

24 overview of BankFinancial – closed 1/1/26 Key franchise highlights Financial summary Balance Sheet & Capital (As of 4Q25 Unless Otherwise Stated, %) 46Cash & Securities / Assets 58Loan / Deposit Ratio 78Non-Time Deposit Composition 11.2TCE / TA 21.1CET1 Ratio1 (0.01)NCOs / Avg. Loans (MRQ, annualized) Profitability – (4Q25, %) 0.06Return on Avg. Assets 3.23Net Interest Margin 96Efficiency Ratio 11Fee Income Ratio Loan & Deposit composition $1.4BnTotal Assets $1.2BnTotal Deposits Burr Ridge, IllinoisHeadquarters 1924Year Founded 17 Full-Service Retail BranchesBranches BFIN (NASDAQ-Listed)Ticker 1 Attractive low cost, core deposit franchise 2 Significant scarcity value in Chicago MSA 3 Strong capitalization and excess liquidity profile 4 Limited borrowings and no brokered deposits 5 Robust credit quality and underwriting philosophy Loan composition Deposit composition Overview of BankFinancial 1 Data for the quarter ended 9/30/25 Note: All consolidated financial data as of 4Q25 unless otherwise noted Loans: $700.2 million Yield on Loans: 5.22% Deposits: $1.2 billion Cost of Deposits: 1.45% Money Market 25% Interest Bearing Checking 24% Certificates of Deposit 22% Noninterest Bearing 16% Savings 13% Multifamily 66% Equipment Finance 14% Non-Res. RE 13% Commercial Finance 5% 1-4 Family 2% Consumer 0%

The Company’s Investor Presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). Such non-GAAP financial information should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting provides meaningful information and therefore we use it to supplement our GAAP information. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments and to provide an additional measure of performance. We believe this information is helpful in understanding the results of operations separate and apart from items that may, or could, have a disproportional positive or negative impact in any given period. For a reconciliation of the differences between the non-GAAP financial measures and the most comparable GAAP measures, please refer to the following reconciliation tables. to GAAP Reconciliation 25 appendix: non-GAAP measures

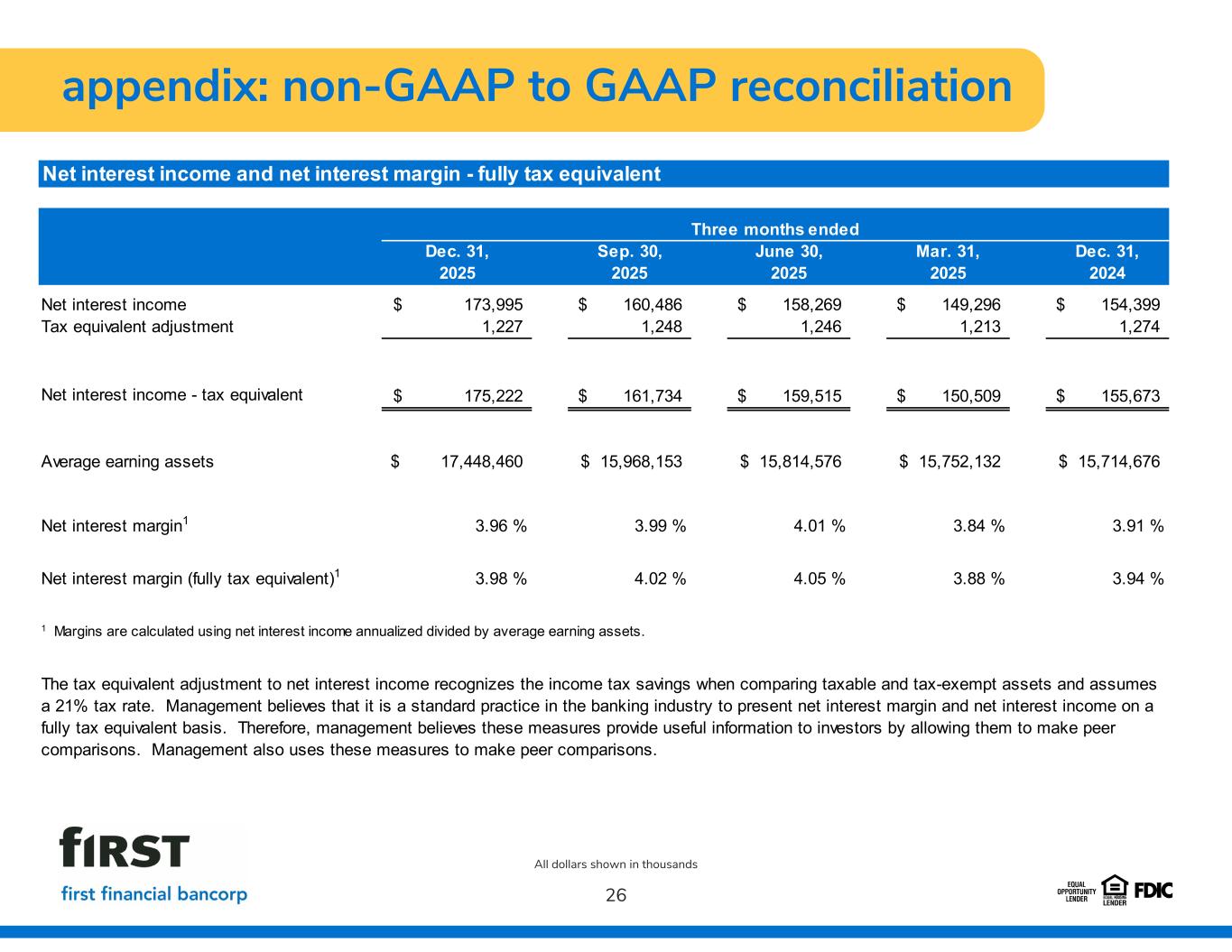

appendix: non-GAAP to GAAP reconciliation 26 All dollars shown in thousands Net interest income and net interest margin - fully tax equivalent Dec. 31, Sep. 30, June 30, Mar. 31, Dec. 31, 2025 2025 2025 2025 2024 Net interest income 173,995$ 160,486$ 158,269$ 149,296$ 154,399$ Tax equivalent adjustment 1,227 1,248 1,246 1,213 1,274 Net interest income - tax equivalent 175,222$ 161,734$ 159,515$ 150,509$ 155,673$ Average earning assets 17,448,460$ 15,968,153$ 15,814,576$ 15,752,132$ 15,714,676$ Net interest margin1 3.96 % 3.99 % 4.01 % 3.84 % 3.91 % Net interest margin (fully tax equivalent)1 3.98 % 4.02 % 4.05 % 3.88 % 3.94 % Three months ended 1 Margins are calculated using net interest income annualized divided by average earning assets. The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons.

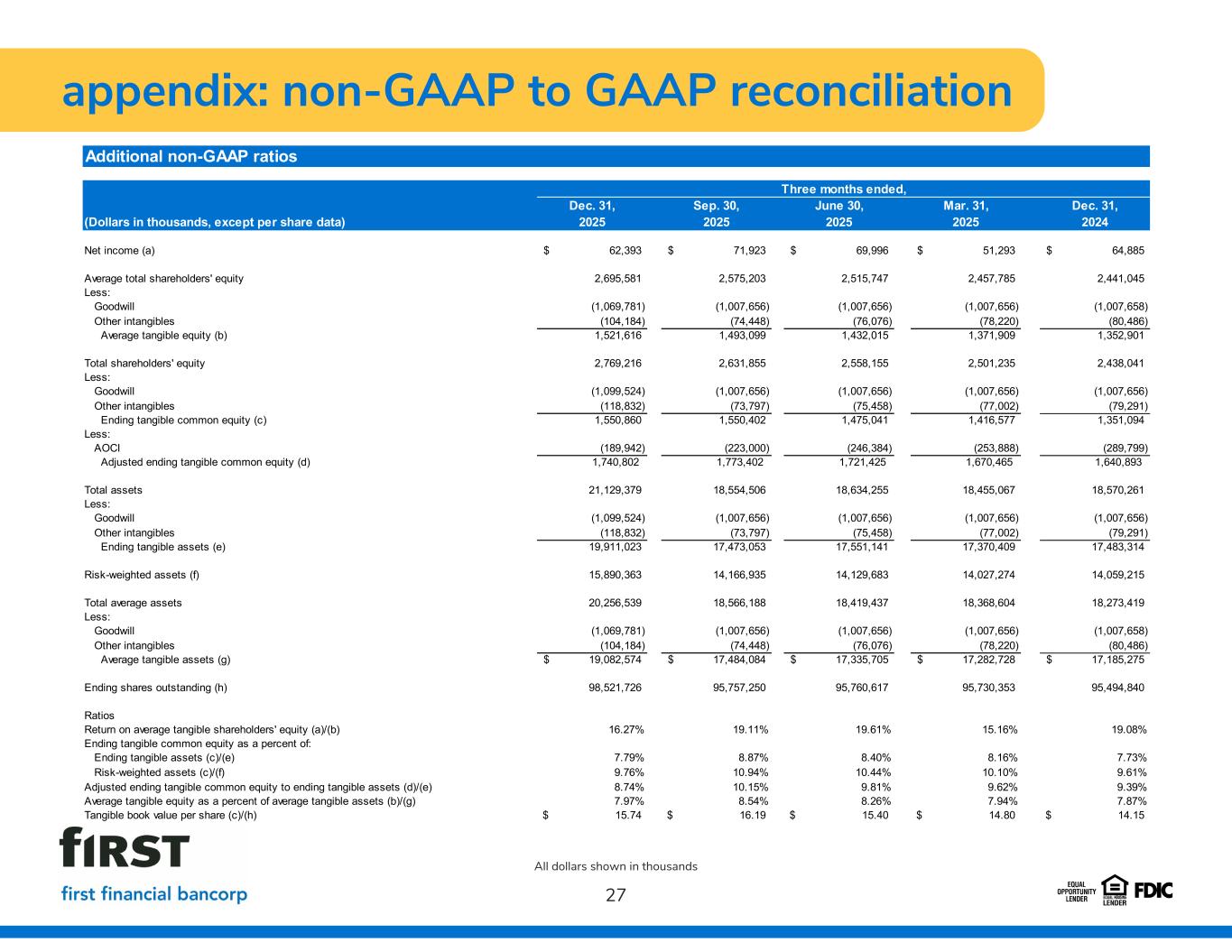

appendix: non-GAAP to GAAP reconciliation 27 All dollars shown in thousands Additional non-GAAP ratios Dec. 31, Sep. 30, June 30, Mar. 31, Dec. 31, (Dollars in thousands, except per share data) 2025 2025 2025 2025 2024 Net income (a) 62,393$ 71,923$ 69,996$ 51,293$ 64,885$ Average total shareholders' equity 2,695,581 2,575,203 2,515,747 2,457,785 2,441,045 Less: Goodwill (1,069,781) (1,007,656) (1,007,656) (1,007,656) (1,007,658) Other intangibles (104,184) (74,448) (76,076) (78,220) (80,486) Average tangible equity (b) 1,521,616 1,493,099 1,432,015 1,371,909 1,352,901 Total shareholders' equity 2,769,216 2,631,855 2,558,155 2,501,235 2,438,041 Less: Goodwill (1,099,524) (1,007,656) (1,007,656) (1,007,656) (1,007,656) Other intangibles (118,832) (73,797) (75,458) (77,002) (79,291) Ending tangible common equity (c) 1,550,860 1,550,402 1,475,041 1,416,577 1,351,094 Less: AOCI (189,942) (223,000) (246,384) (253,888) (289,799) Adjusted ending tangible common equity (d) 1,740,802 1,773,402 1,721,425 1,670,465 1,640,893 Total assets 21,129,379 18,554,506 18,634,255 18,455,067 18,570,261 Less: Goodwill (1,099,524) (1,007,656) (1,007,656) (1,007,656) (1,007,656) Other intangibles (118,832) (73,797) (75,458) (77,002) (79,291) Ending tangible assets (e) 19,911,023 17,473,053 17,551,141 17,370,409 17,483,314 Risk-weighted assets (f) 15,890,363 14,166,935 14,129,683 14,027,274 14,059,215 Total average assets 20,256,539 18,566,188 18,419,437 18,368,604 18,273,419 Less: Goodwill (1,069,781) (1,007,656) (1,007,656) (1,007,656) (1,007,658) Other intangibles (104,184) (74,448) (76,076) (78,220) (80,486) Average tangible assets (g) 19,082,574$ 17,484,084$ 17,335,705$ 17,282,728$ 17,185,275$ Ending shares outstanding (h) 98,521,726 95,757,250 95,760,617 95,730,353 95,494,840 Ratios Return on average tangible shareholders' equity (a)/(b) 16.27% 19.11% 19.61% 15.16% 19.08% Ending tangible common equity as a percent of: Ending tangible assets (c)/(e) 7.79% 8.87% 8.40% 8.16% 7.73% Risk-weighted assets (c)/(f) 9.76% 10.94% 10.44% 10.10% 9.61% Adjusted ending tangible common equity to ending tangible assets (d)/(e) 8.74% 10.15% 9.81% 9.62% 9.39% Average tangible equity as a percent of average tangible assets (b)/(g) 7.97% 8.54% 8.26% 7.94% 7.87% Tangible book value per share (c)/(h) 15.74$ 16.19$ 15.40$ 14.80$ 14.15$ Three months ended,

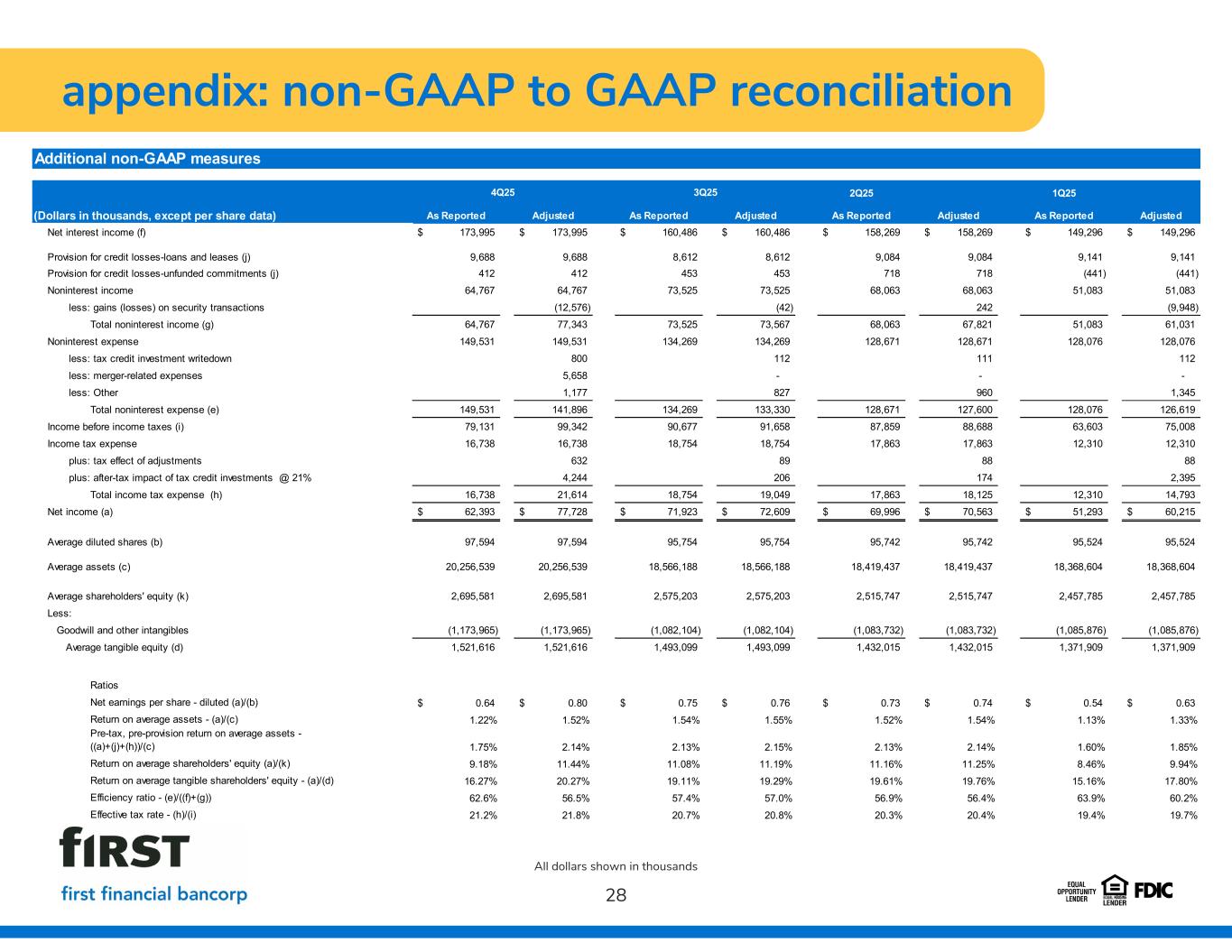

appendix: non-GAAP to GAAP reconciliation 28 All dollars shown in thousands Additional non-GAAP measures 2Q25 1Q25 As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted Net interest income (f) 173,995$ 173,995$ 160,486$ 160,486$ 158,269$ 158,269$ 149,296$ 149,296$ Provision for credit losses-loans and leases (j) 9,688 9,688 8,612 8,612 9,084 9,084 9,141 9,141 Provision for credit losses-unfunded commitments (j) 412 412 453 453 718 718 (441) (441) Noninterest income 64,767 64,767 73,525 73,525 68,063 68,063 51,083 51,083 less: gains (losses) on security transactions (12,576) (42) 242 (9,948) Total noninterest income (g) 64,767 77,343 73,525 73,567 68,063 67,821 51,083 61,031 Noninterest expense 149,531 149,531 134,269 134,269 128,671 128,671 128,076 128,076 less: tax credit investment writedown 800 112 111 112 less: merger-related expenses 5,658 - - - less: Other 1,177 827 960 1,345 Total noninterest expense (e) 149,531 141,896 134,269 133,330 128,671 127,600 128,076 126,619 Income before income taxes (i) 79,131 99,342 90,677 91,658 87,859 88,688 63,603 75,008 Income tax expense 16,738 16,738 18,754 18,754 17,863 17,863 12,310 12,310 plus: tax effect of adjustments 632 89 88 88 plus: after-tax impact of tax credit investments @ 21% 4,244 206 174 2,395 Total income tax expense (h) 16,738 21,614 18,754 19,049 17,863 18,125 12,310 14,793 Net income (a) 62,393$ 77,728$ 71,923$ 72,609$ 69,996$ 70,563$ 51,293$ 60,215$ Average diluted shares (b) 97,594 97,594 95,754 95,754 95,742 95,742 95,524 95,524 Average assets (c) 20,256,539 20,256,539 18,566,188 18,566,188 18,419,437 18,419,437 18,368,604 18,368,604 Average shareholders' equity (k) 2,695,581 2,695,581 2,575,203 2,575,203 2,515,747 2,515,747 2,457,785 2,457,785 Less: Goodwill and other intangibles (1,173,965) (1,173,965) (1,082,104) (1,082,104) (1,083,732) (1,083,732) (1,085,876) (1,085,876) Average tangible equity (d) 1,521,616 1,521,616 1,493,099 1,493,099 1,432,015 1,432,015 1,371,909 1,371,909 Ratios Net earnings per share - diluted (a)/(b) 0.64$ 0.80$ 0.75$ 0.76$ 0.73$ 0.74$ 0.54$ 0.63$ Return on average assets - (a)/(c) 1.22% 1.52% 1.54% 1.55% 1.52% 1.54% 1.13% 1.33% Pre-tax, pre-provision return on average assets - ((a)+(j)+(h))/(c) 1.75% 2.14% 2.13% 2.15% 2.13% 2.14% 1.60% 1.85% Return on average shareholders' equity (a)/(k) 9.18% 11.44% 11.08% 11.19% 11.16% 11.25% 8.46% 9.94% Return on average tangible shareholders' equity - (a)/(d) 16.27% 20.27% 19.11% 19.29% 19.61% 19.76% 15.16% 17.80% Efficiency ratio - (e)/((f)+(g)) 62.6% 56.5% 57.4% 57.0% 56.9% 56.4% 63.9% 60.2% Effective tax rate - (h)/(i) 21.2% 21.8% 20.7% 20.8% 20.3% 20.4% 19.4% 19.7% (Dollars in thousands, except per share data) 4Q25 3Q25

29 First Financial Bancorp First Financial Center 255 East Fifth Street Cincinnati, OH 45202