INVESTOR PRESENTATION Fourth Quarter 2025

2 CAUTIONARY STATEMENTS This presentation contains “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, certain statements may be contained in Colony Bankcorp, Inc.’s (the “Company” or “Colony”) future filings with the Securities and Exchange Commission (the “SEC”), in press releases, and in oral and written statements made by or with the approval of the Company that are not statements of historical fact and constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Examples of forward-looking statements include, but are not limited to: (i) projections and/or expectations of revenues, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statement of plans and objectives of Colony Bankcorp, Inc. or its management or Board of Directors, including those relating to products or services; (iii) statements of future economic performance; (iv) statements regarding growth strategy, capital management, liquidity and funding, and future profitability; (v) statements relating to the timing, benefits, costs, and synergies of the recently completed acquisition of TC Bancshares, Inc. (“TC Bancshares”) (the “Merger”), and (vi) statements of assumptions underlying such statements. Words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: the impact of current and future economic conditions, particularly those affecting the financial services industry, including the effects of declines in the real estate market, tariffs or trade wars (including the resulting reduced consumer spending, lower economic growth or recession, reduced demand for U.S. exports, disruptions to supply chains, and decreased demand for other banking products and services), high unemployment rates, inflationary pressures, changes in interest rates (including the impact of prolonged elevated interest rates on our financial projections and models) and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing; the risk of reductions in benchmark interest rates and the resulting impacts on net interest income; potential impacts of adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto; risks arising from negative media coverage and perceived instability in the banking industry; risks arising from perceived instability in the banking sector; the risks of changes in interest rates and their effects on the level, cost, and composition of, and competition for, deposits, loan demand and timing of payments, the values of loan collateral, securities, and interest sensitive assets and liabilities; the ability to attract new or retain existing deposits, to retain or grow loans or additional interest and fee income, or to control noninterest expense; the effect of pricing pressures on the Company’s net interest margin; the failure of assumptions underlying the establishment of reserves for possible credit losses, fair value for loans and other real estate owned; changes in real estate values; the Company’s ability to implement its various strategic and growth initiatives; increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; economic conditions, either nationally or locally, in areas in which the Company conducts operations being less favorable than expected; changes in the prices, values and sales volumes of residential and commercial real estate; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; legislation or regulatory changes which adversely affect the ability of the consolidated Company to conduct business combinations or new operations; adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs, those related to credit card interest rates, and legislative, regulatory or supervisory actions related to so-called "de-banking," including any new prohibitions, requirements or enforcement priorities that could affect customer relationships, compliance obligations, or operational practices; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in the stock market prices on our investment securities; the effects of war or other conflicts, including civil unrest; general risks related to the Company's merger and acquisition activity, Including risks associated with

3 CAUTIONARY STATEMENTS integrating and realizing the expected financial benefits of previous or pending acquisitions, and the Company’s pursuit of future acquisitions; risks associated with the Merger, including (a) the risk that the cost savings and any revenue synergies may not be realized or take longer than anticipated to be realized, (b) disruption with customers, suppliers, employee or other business partners relationships, (c) the risk of successful integration of TC Bancshares' business into the Company, (d) the risk of successful integration of TC Bancshares’ business into the Company, (e) the reaction of each of the Company's and TC Bancshares' customers, suppliers, employees or other business partners to the Merger, (f) the risk that the integration of TC Bancshares' operations into the operations of the Company will be materially delayed or will be more costly or difficult that expected, (g) the timing and achievement of expected cost reductions following the Merger, and (h) the timing and achievement of the recovery of the reduction of tangible book value resulting from the Merger; general competitive, economic, political, and market conditions; the impact of emerging technologies, such as generative artificial intelligence; fraud or misconduct by internal or external actors, and system failures, cybersecurity threats or security breaches and the cost of defending against them; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding debt ceiling and the federal budget; and general competitive, economic, political and market conditions or other unexpected factors or events. These and other factors, risks and uncertainties could cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict. Forward-looking statements speak only as of the date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

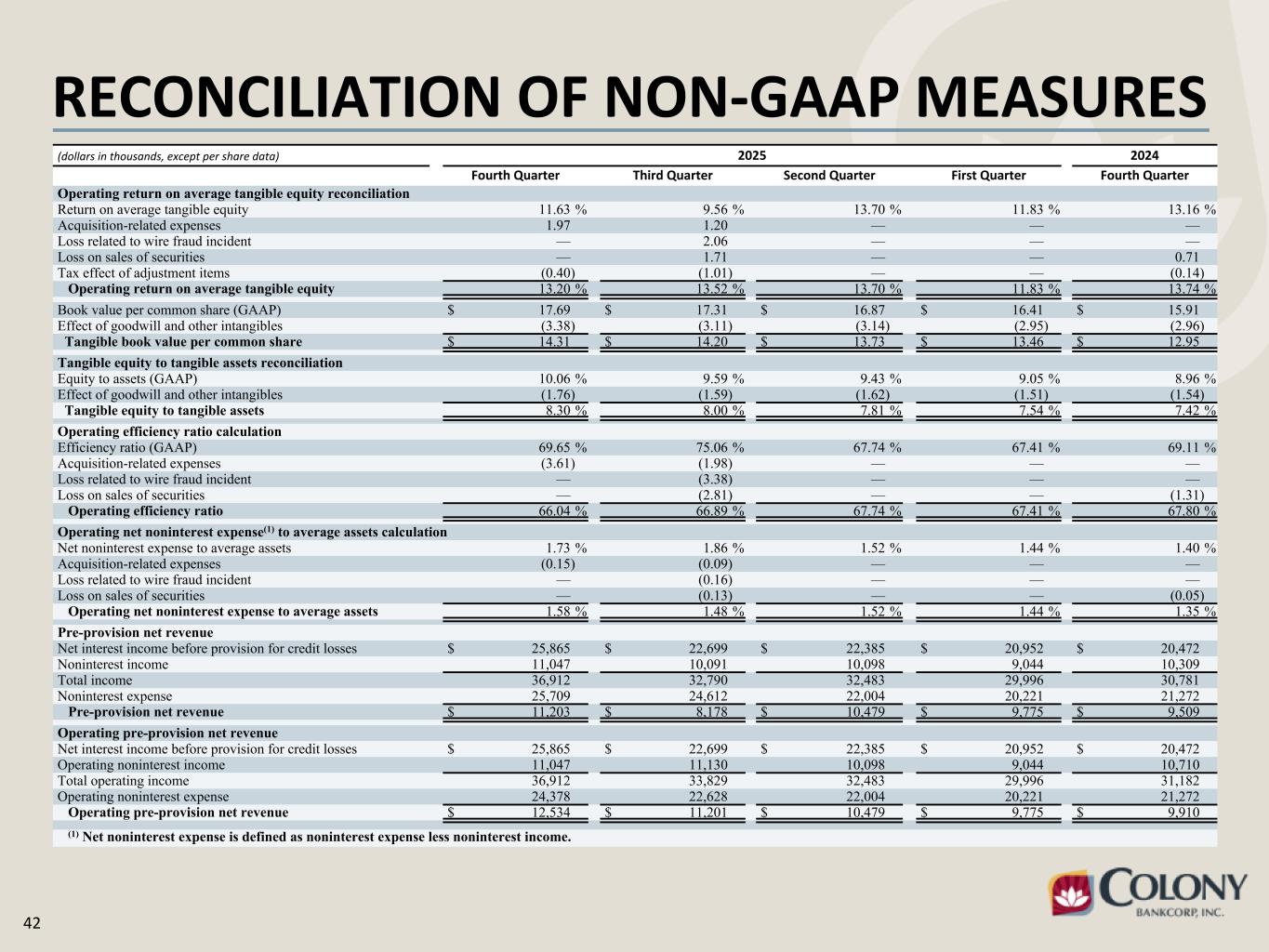

4 NON-GAAP FINANCIAL MEASURES Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of non-GAAP financial measures to GAAP financial measures. The non-GAAP financial measures used in this presentation include the following: operating noninterest income, operating noninterest expense, operating net income, adjusted earnings per diluted share, operating return on average assets, operating return on average equity, tangible book value per common share, tangible equity to tangible assets, operating efficiency ratio, operating net noninterest expense to average assets and pre-provision net revenue. The most comparable GAAP measures are noninterest income, noninterest expense, net income, diluted earnings per share, return on average assets, return on average equity, book value per common share, total equity to total assets, efficiency ratio, net noninterest expense to average assets and net interest income before provision for credit losses, respectively. Operating noninterest income excludes loss on sales of securities. Operating noninterest expense excludes severance costs, acquisition-related expenses and loss related to wire fraud incident. Operating net income, operating return on average assets, operating return on average equity and operating efficiency ratio all exclude severance costs, acquisition-related expenses, loss on sales of securities, and loss related to wire fraud incident from net income, return on average assets, return on average equity and efficiency ratio, respectively. Operating net noninterest expense to average assets ratio excludes from net noninterest expense, severance costs, acquisition-related expenses, loss on sales of securities, and loss related to wire fraud incident. Acquisition-related expenses includes fees associated with acquisitions and vendor contract buyouts. Severance costs includes costs associated with termination and retirement of employees. Adjusted earnings per diluted share includes the adjustments to operating net income. Tangible book value per common share and tangible equity to tangible assets exclude goodwill and other intangibles from book value per common share and total equity to total assets, respectively. Pre-provision net revenue is calculated by adding noninterest income to net interest income before provision for credit losses, and subtracting noninterest expense. Management uses these non-GAAP financial measures in its analysis of the Company's performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance, and if not provided would be requested by the investor community. The Company believes the non-GAAP measures enhance investors' understanding of the Company's business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider Colony Bankcorp, Inc. performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of Colony Bankcorp, Inc. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

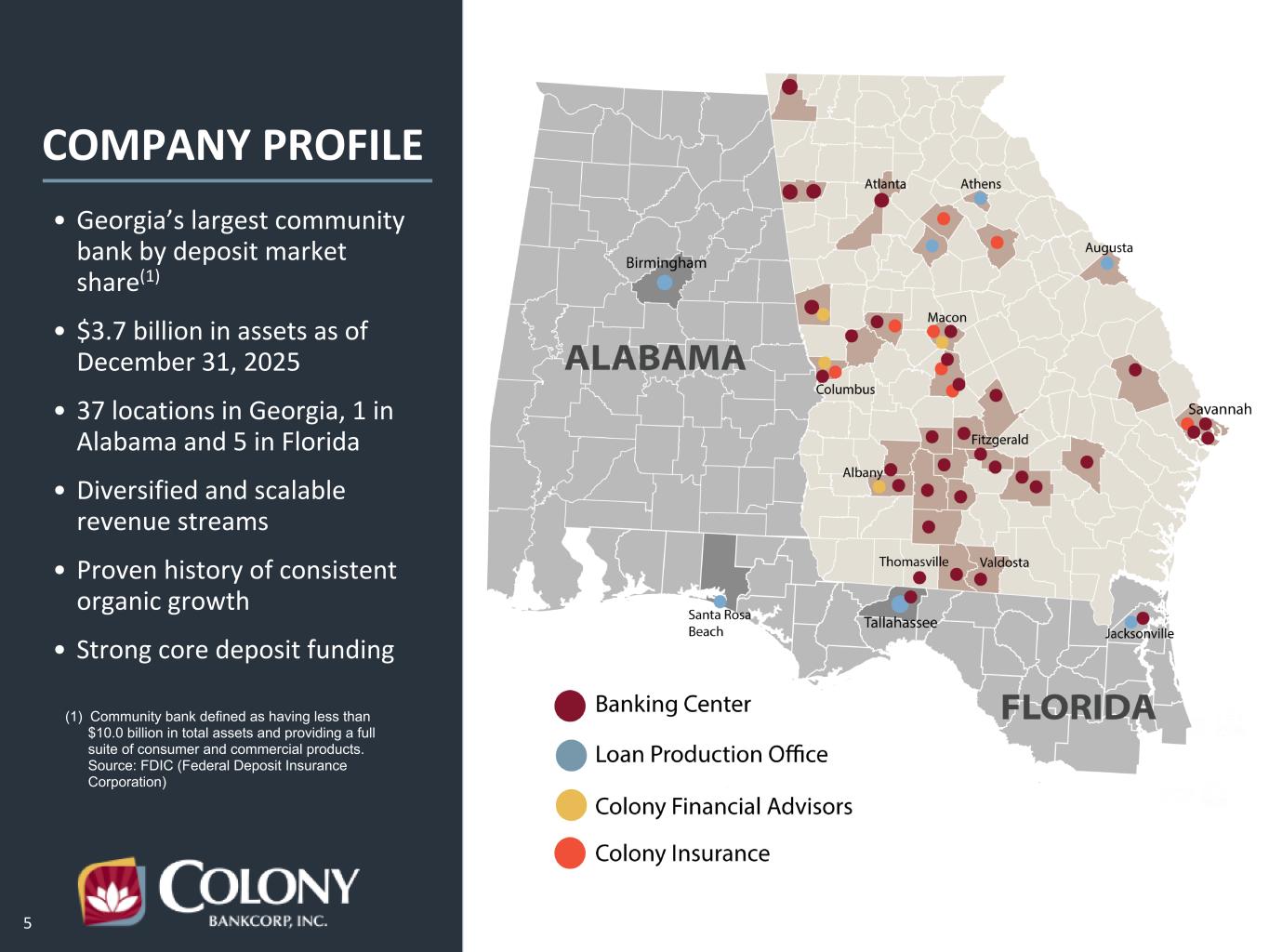

5 (1) Community bank defined as having less than $10.0 billion in total assets and providing a full suite of consumer and commercial products. Source: FDIC (Federal Deposit Insurance Corporation) • Georgia’s largest community bank by deposit market share(1) • $3.7 billion in assets as of December 31, 2025 • 37 locations in Georgia, 1 in Alabama and 5 in Florida • Diversified and scalable revenue streams • Proven history of consistent organic growth • Strong core deposit funding COMPANY PROFILE

6

7

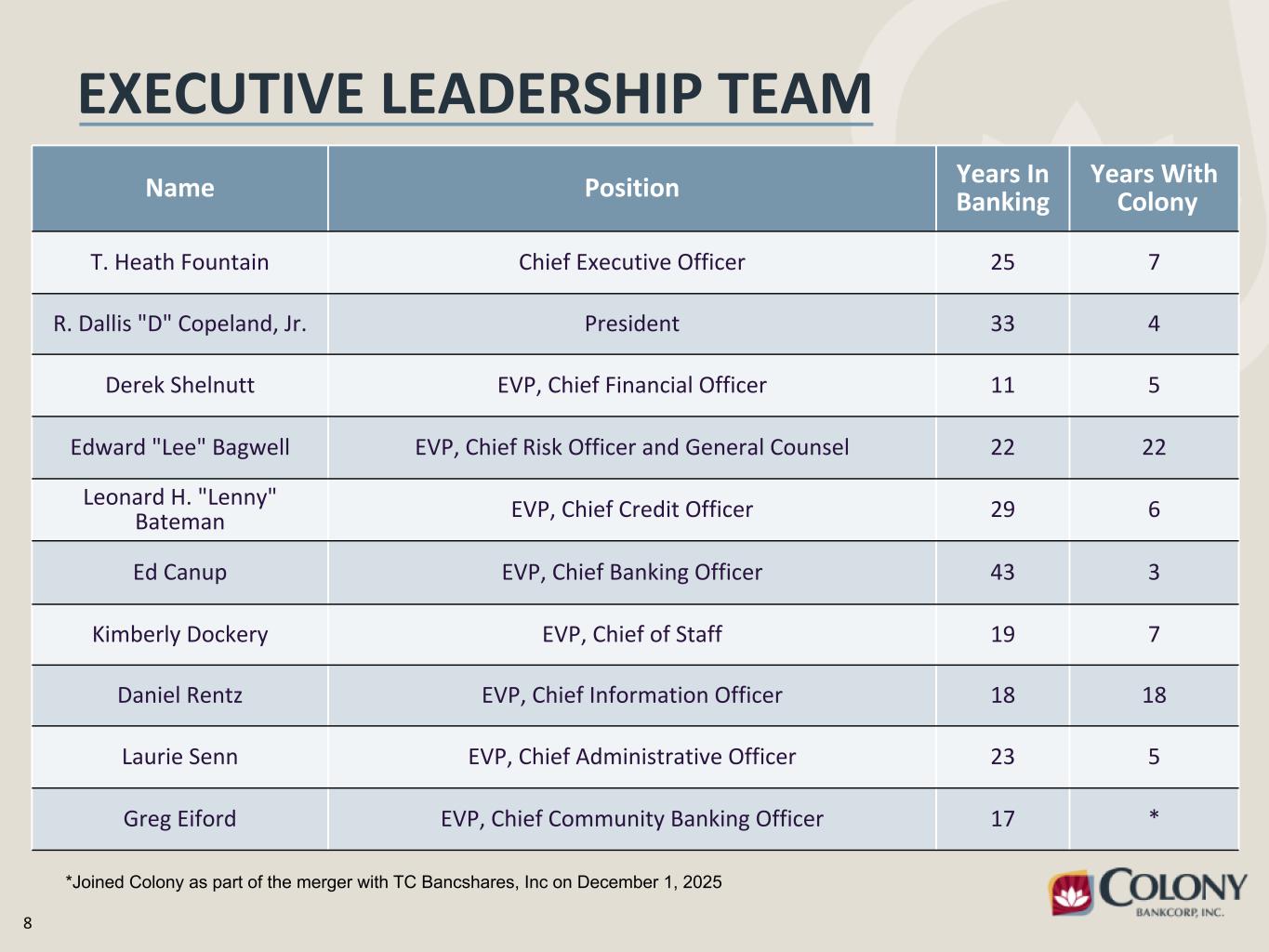

8 Name Position Years In Banking Years With Colony T. Heath Fountain Chief Executive Officer 25 7 R. Dallis "D" Copeland, Jr. President 33 4 Derek Shelnutt EVP, Chief Financial Officer 11 5 Edward "Lee" Bagwell EVP, Chief Risk Officer and General Counsel 22 22 Leonard H. "Lenny" Bateman EVP, Chief Credit Officer 29 6 Ed Canup EVP, Chief Banking Officer 43 3 Kimberly Dockery EVP, Chief of Staff 19 7 Daniel Rentz EVP, Chief Information Officer 18 18 Laurie Senn EVP, Chief Administrative Officer 23 5 Greg Eiford EVP, Chief Community Banking Officer 17 * *Joined Colony as part of the merger with TC Bancshares, Inc on December 1, 2025 EXECUTIVE LEADERSHIP TEAM

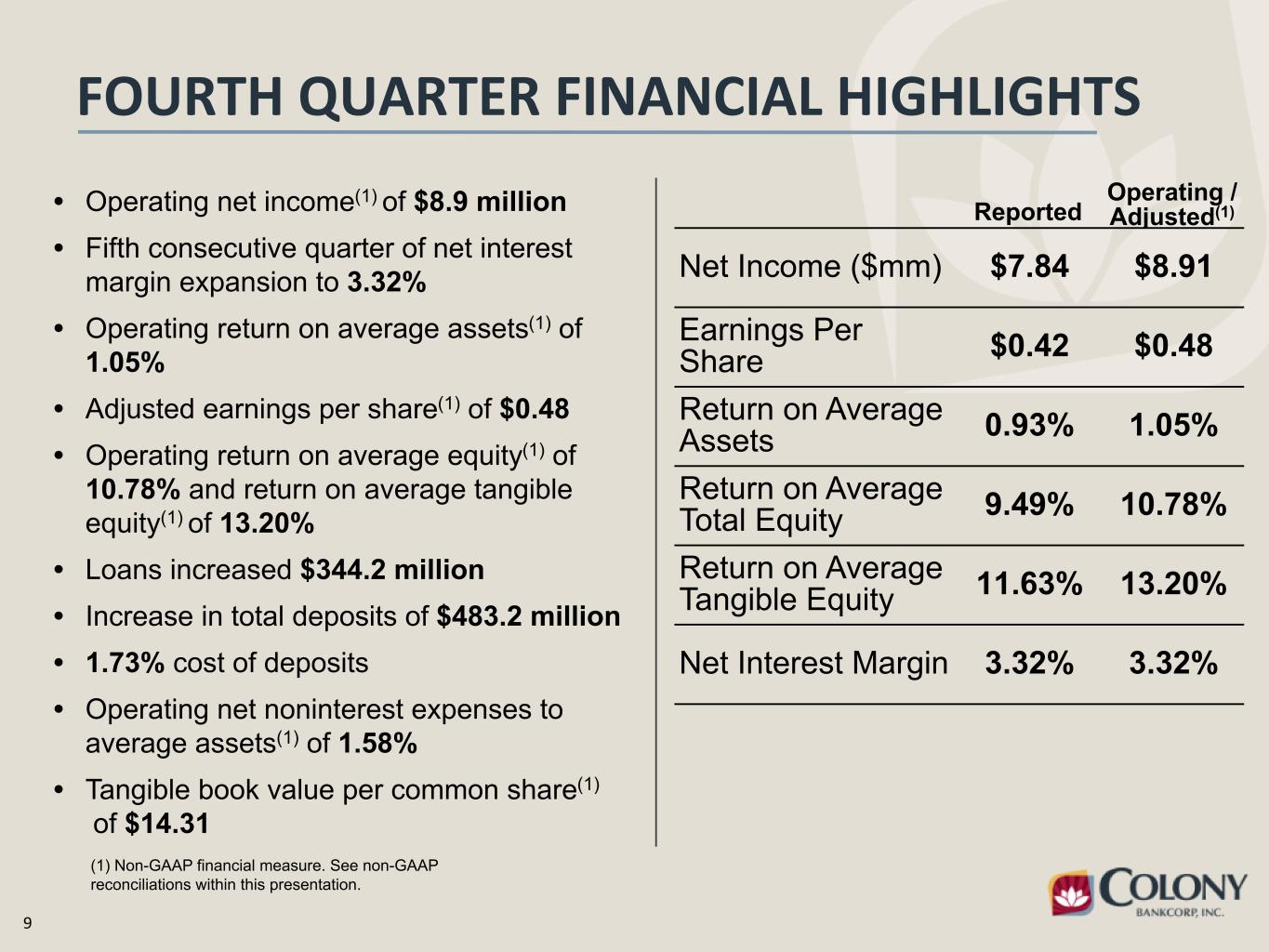

9 FOURTH QUARTER FINANCIAL HIGHLIGHTS • Operating net income(1) of $8.9 million • Fifth consecutive quarter of net interest margin expansion to 3.32% • Operating return on average assets(1) of 1.05% • Adjusted earnings per share(1) of $0.48 • Operating return on average equity(1) of 10.78% and return on average tangible equity(1) of 13.20% • Loans increased $344.2 million • Increase in total deposits of $483.2 million • 1.73% cost of deposits • Operating net noninterest expenses to average assets(1) of 1.58% • Tangible book value per common share(1) of $14.31 Reported Operating / Adjusted(1) Net Income ($mm) $7.84 $8.91 Earnings Per Share $0.42 $0.48 Return on Average Assets 0.93% 1.05% Return on Average Total Equity 9.49% 10.78% Return on Average Tangible Equity 11.63% 13.20% Net Interest Margin 3.32% 3.32% (1) Non-GAAP financial measure. See non-GAAP reconciliations within this presentation.

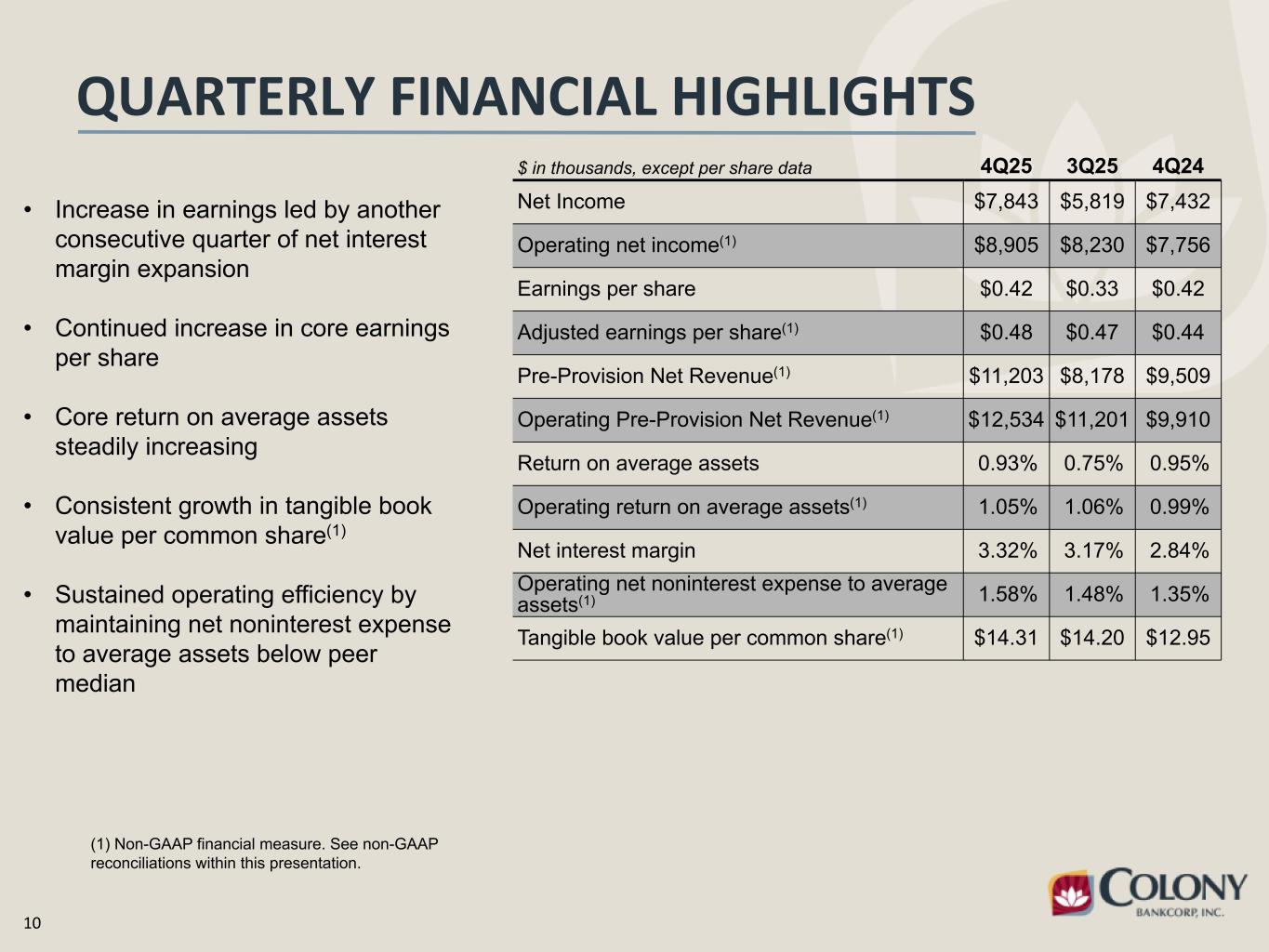

10 QUARTERLY FINANCIAL HIGHLIGHTS (1) Non-GAAP financial measure. See non-GAAP reconciliations within this presentation. $ in thousands, except per share data 4Q25 3Q25 4Q24 Net Income $7,843 $5,819 $7,432 Operating net income(1) $8,905 $8,230 $7,756 Earnings per share $0.42 $0.33 $0.42 Adjusted earnings per share(1) $0.48 $0.47 $0.44 Pre-Provision Net Revenue(1) $11,203 $8,178 $9,509 Operating Pre-Provision Net Revenue(1) $12,534 $11,201 $9,910 Return on average assets 0.93% 0.75% 0.95% Operating return on average assets(1) 1.05% 1.06% 0.99% Net interest margin 3.32% 3.17% 2.84% Operating net noninterest expense to average assets(1) 1.58% 1.48% 1.35% Tangible book value per common share(1) $14.31 $14.20 $12.95 • Increase in earnings led by another consecutive quarter of net interest margin expansion • Continued increase in core earnings per share • Core return on average assets steadily increasing • Consistent growth in tangible book value per common share(1) • Sustained operating efficiency by maintaining net noninterest expense to average assets below peer median

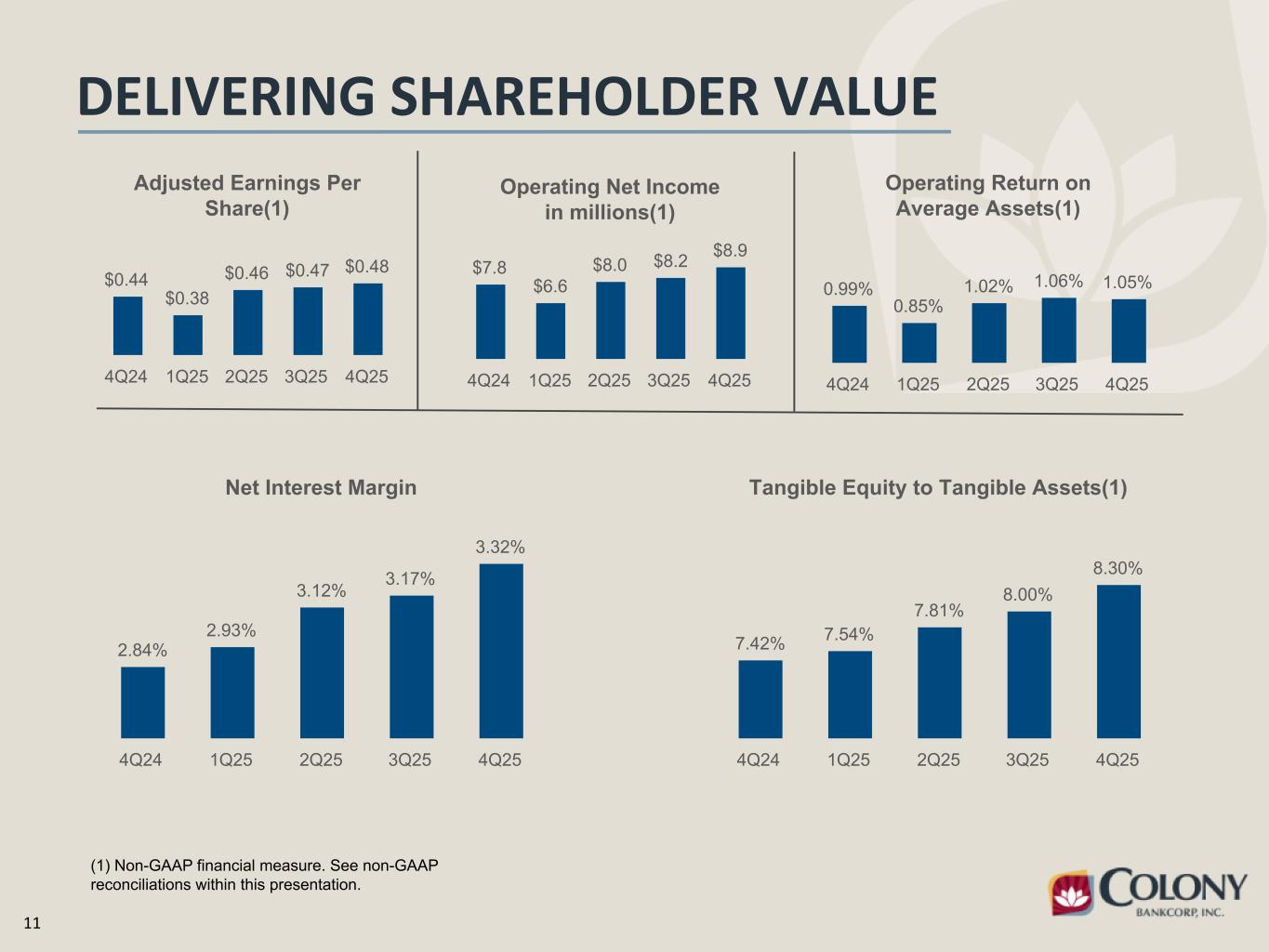

11 DELIVERING SHAREHOLDER VALUE Adjusted Earnings Per Share(1) $0.44 $0.38 $0.46 $0.47 $0.48 4Q24 1Q25 2Q25 3Q25 4Q25 (1) Non-GAAP financial measure. See non-GAAP reconciliations within this presentation. Operating Return on Average Assets(1) 0.99% 0.85% 1.02% 1.06% 1.05% 4Q24 1Q25 2Q25 3Q25 4Q25 Net Interest Margin 2.84% 2.93% 3.12% 3.17% 3.32% 4Q24 1Q25 2Q25 3Q25 4Q25 Tangible Equity to Tangible Assets(1) 7.42% 7.54% 7.81% 8.00% 8.30% 4Q24 1Q25 2Q25 3Q25 4Q25 Operating Net Income in millions(1) $7.8 $6.6 $8.0 $8.2 $8.9 4Q24 1Q25 2Q25 3Q25 4Q25

12 OBJECTIVES AND FOCUS • Achieve performance objectives in complementary lines of business • Maintain noninterest expense discipline to align with growth expectations • Achieve return on assets target of 1.20% • Focus on growing core deposits and customer relationships • Growing wallet share and revenue per customer using data advancements Short-Term Objectives Long-Term Objectives • 5 complementary lines of business > $1 million in net income • Improve efficiency through economies of scale • Return on assets in top quartile of peers • Continue to benefit from industry consolidation • Grow our customer base by 8 - 12% per year

13 ORGANIC GROWTH • Presence in dynamic growth markets of Atlanta, Augusta, Birmingham, Jacksonville, Tallahassee, the Florida Panhandle, and Savannah provides opportunity for above average growth • Second-tier MSA markets of Albany, Columbus, Macon, Valdosta, and Tifton have significant market share held by large regional and national banks, creating the opportunity for growth in market share • Smaller markets where Colony has stable deposits and significant market shares creates the opportunity to grow insurance, wealth management and other complementary lines of business • Industry consolidation is creating favorable opportunities for us to leverage our scale, strengthen market position, and drive disciplined growth. • Utilization of data improves the effectiveness of marketing and business development activity • Proactive calling effort by bankers, including executive and senior management, to develop new business and deepen relationships • Long term organic growth target of 8 - 12%

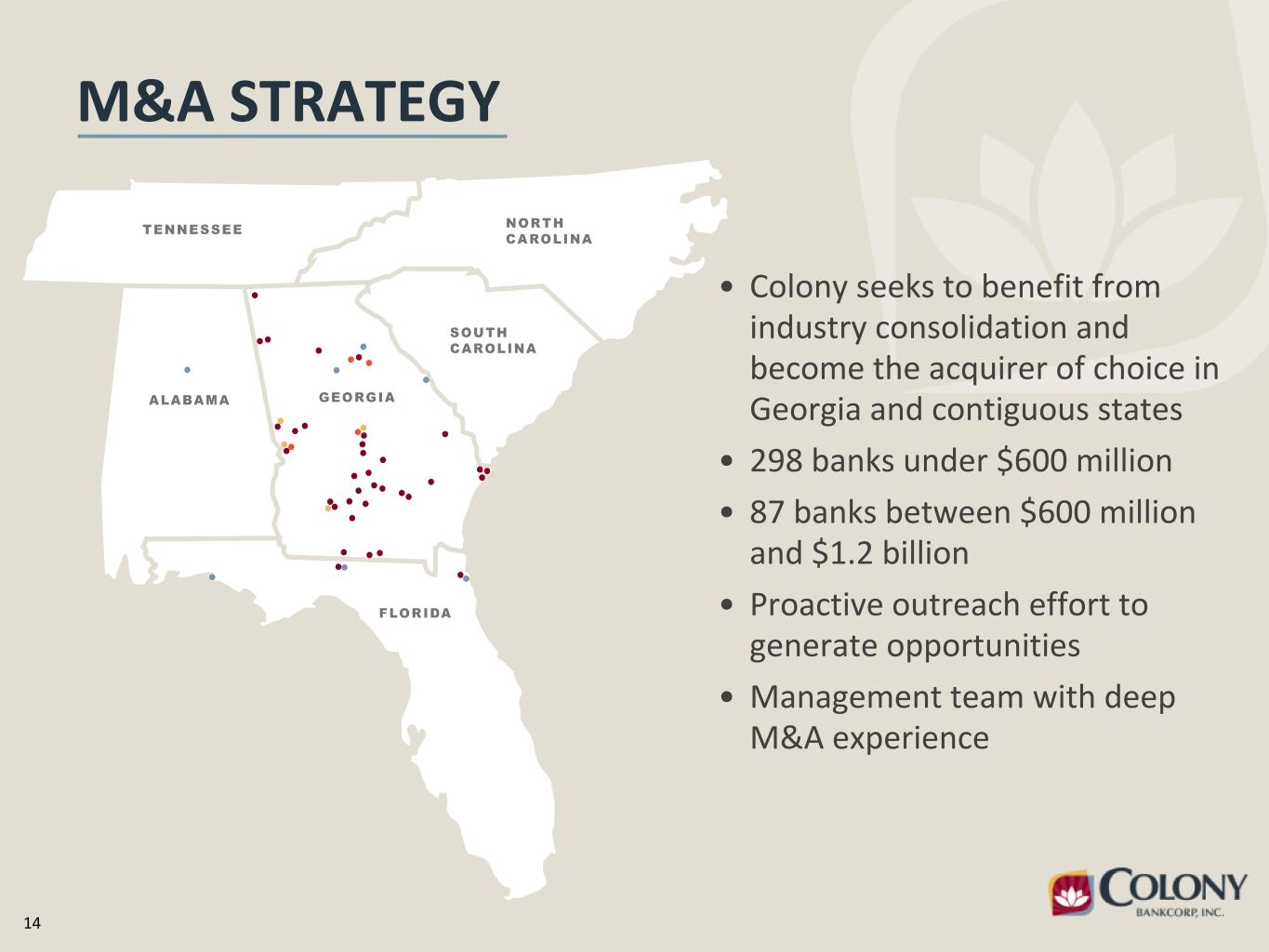

14 M&A STRATEGY • Colony seeks to benefit from industry consolidation and become the acquirer of choice in Georgia and contiguous states • 298 banks under $600 million • 87 banks between $600 million and $1.2 billion • Proactive outreach effort to generate opportunities • Management team with deep M&A experience

15 TC FEDERAL ACQUISITION • Expands in-state franchise with entry into Thomasville market and strengthens presence in coastal Georgia with complementary market overlap in Savannah MSA • Enhances Florida presence with full service entry into the dynamic, high-growth Tallahassee and Jacksonville markets, complementing Colony’s existing LPO operations • Enables cross-sell of noninterest income products, such as insurance, mortgage, merchant services, and credit cards, into TC Bancshares’ existing customer base and across new markets • Legal close occurred December 1st, 2025 • Core system conversion and customer integration scheduled for first quarter 2026

16 TC FEDERAL ACQUISITION - FINANCIAL HIGHLIGHTS • Total deal value $81.3 million • $13 million of goodwill created • Loan fair value marks $12.5 million, accreted into income over time • Core Deposit Intangible of $4.6 million • On track to achieve total cost savings of $5.6 million • TBV earnback expected to be less than 2.5 years compared to earlier modeling of less than 3.0 years Loans HFI fair value mark accretion Time-deposit mark amortization Core Deposit Intangible (CDI) amortization ~$2.7 million ~$133 thousand ~$833 thousand Projected 2026 Earnings Impact

17 EFFICIENCY AND SCALING • Focused on process improvement and ensuring it is easy to do business with Colony Bank • Hired a Director of Optimization with experience from a large regional bank to oversee process improvement and customer experience • Utilization of Robotic Process Automation ("RPA") and other innovative technology to improve the customer experience • Leveraging AI to streamline workflows, reduce manual processes, and scale operations efficiently • Implementation of cross functional teams to reduce friction and improve the customer experience • Building operational capacity in order to maintain efficiency through organic growth and M&A

18 INNOVATION AND DATA STRATEGY • Investing in Innovation: Participating in fintech funds that connect us with leading technology partners and emerging solutions shaping the future of banking • Expanding Through Fintech Partnerships: Partnering with innovative fintechs to deliver modern products and services that allow us to compete with regional and national banks • Building a Data-Driven Foundation: Implementing a data warehouse to unify information across the organization and deliver smarter, faster decisions • Turning Insights into Growth: Leveraging data and advanced analytics to deepen relationships and drive targeted market disruption campaigns • Enhancing the Customer Experience: Using technology to deliver greater convenience while maintaining the personal touch that defines us

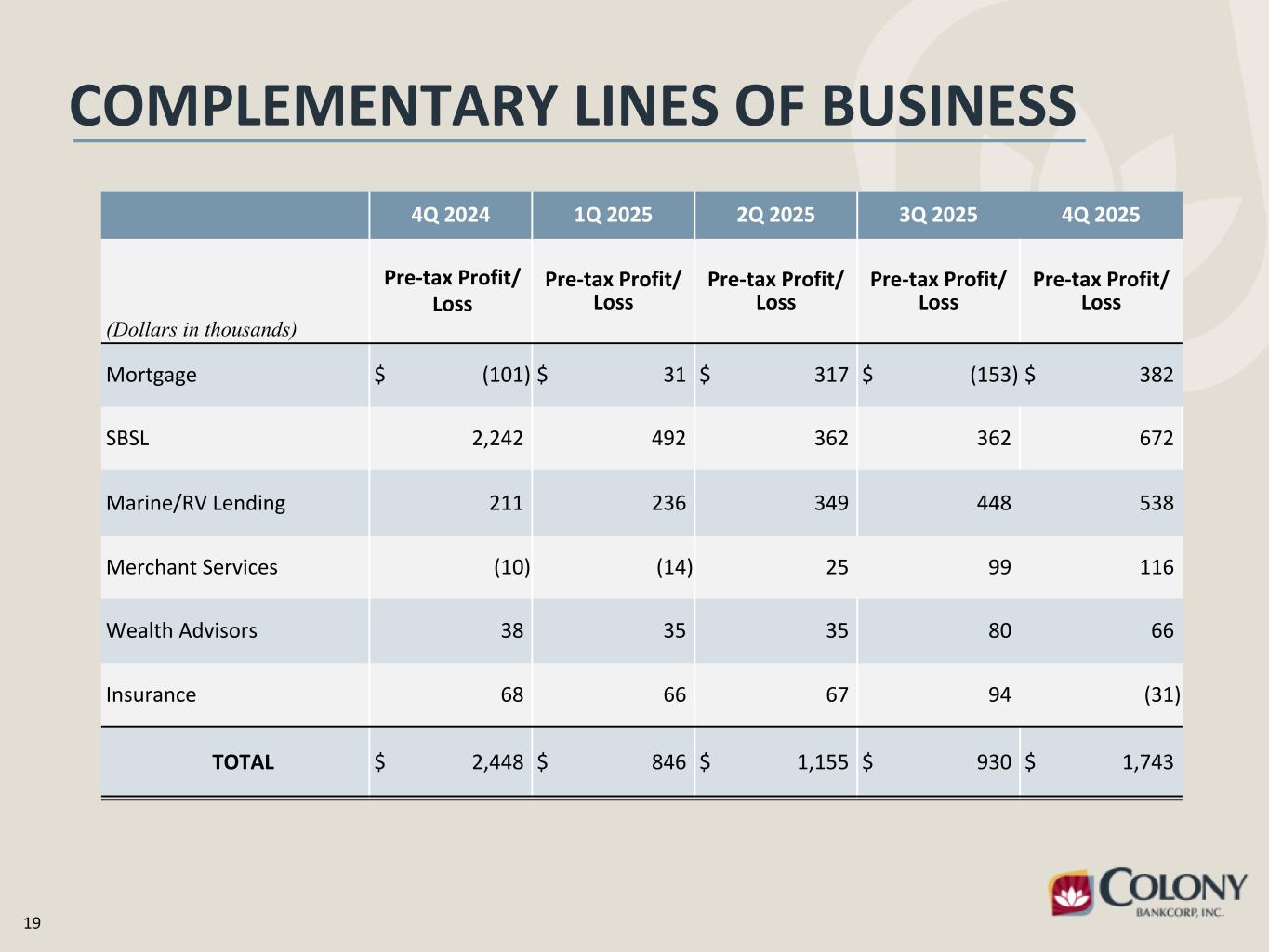

19 COMPLEMENTARY LINES OF BUSINESS 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 (Dollars in thousands) Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Mortgage $ (101) $ 31 $ 317 $ (153) $ 382 SBSL 2,242 492 362 362 672 Marine/RV Lending 211 236 349 448 538 Merchant Services (10) (14) 25 99 116 Wealth Advisors 38 35 35 80 66 Insurance 68 66 67 94 (31) TOTAL $ 2,448 $ 846 $ 1,155 $ 930 $ 1,743

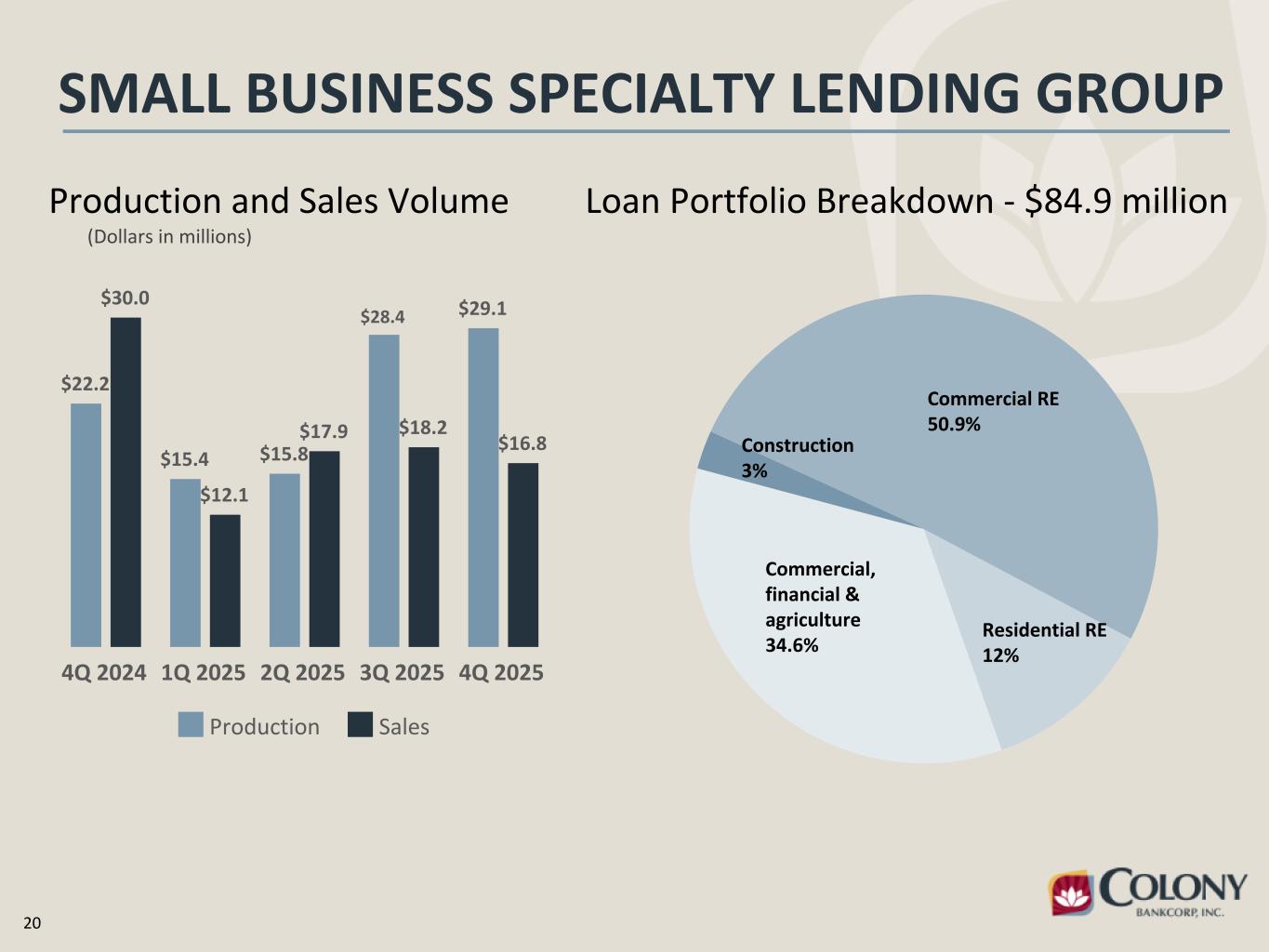

20 SMALL BUSINESS SPECIALTY LENDING GROUP (Dollars in millions) Production and Sales Volume $22.2 $15.4 $15.8 $28.4 $29.1$30.0 $12.1 $17.9 $18.2 $16.8 Production Sales 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Loan Portfolio Breakdown - $84.9 million Construction 3% Commercial RE 50.9% Residential RE 12% Commercial, financial & agriculture 34.6%

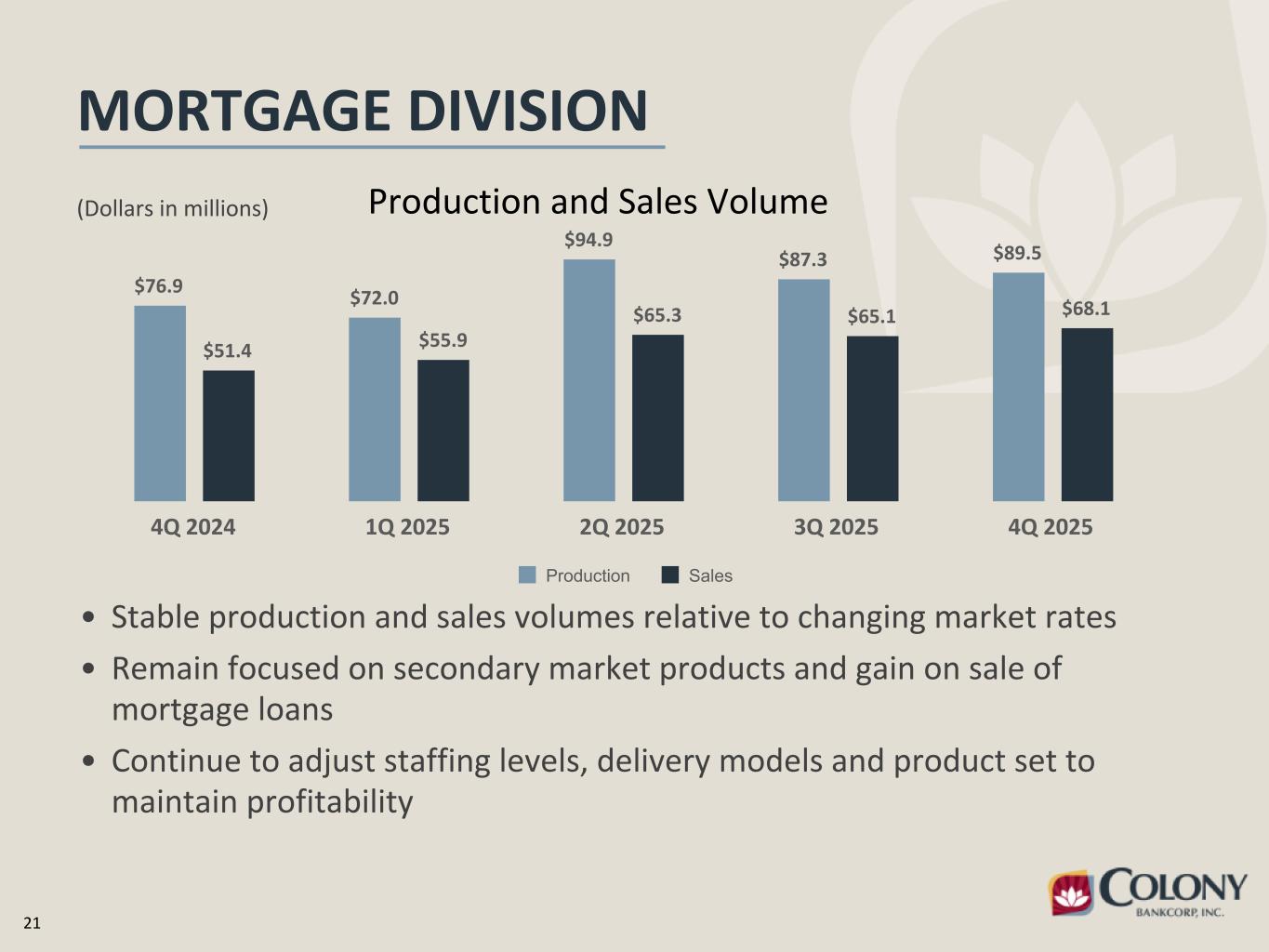

21 MORTGAGE DIVISION (Dollars in millions) • Stable production and sales volumes relative to changing market rates • Remain focused on secondary market products and gain on sale of mortgage loans • Continue to adjust staffing levels, delivery models and product set to maintain profitability $76.9 $72.0 $94.9 $87.3 $89.5 $51.4 $55.9 $65.3 $65.1 $68.1 Production Sales 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Production and Sales Volume

22 COLONY FINANCIAL ADVISORS Strong year over year growth in assets under management Total Assets Under Management (AUM) of $462 million as of December 31st, 2025, compared to $202 million as of December 31st, 2024 Year over year growth of Assets Under Management and Gross Dealer Commissions of 51% Experienced and knowledgeable team Our financial advisor team is well established and experienced, further strengthened by the recent addition of two seasoned advisors who bring deep client relationships and proven advisory expertise. Attractive opportunities for growth in key markets of Atlanta, Jacksonville, Savannah, and Tallahassee Investing in talent to drive long-term growth and performance Focused on attracting and recruiting top financial advisors to continue building a strong, experienced team that drives client growth, deepens relationships, and supports long-term business line performance.

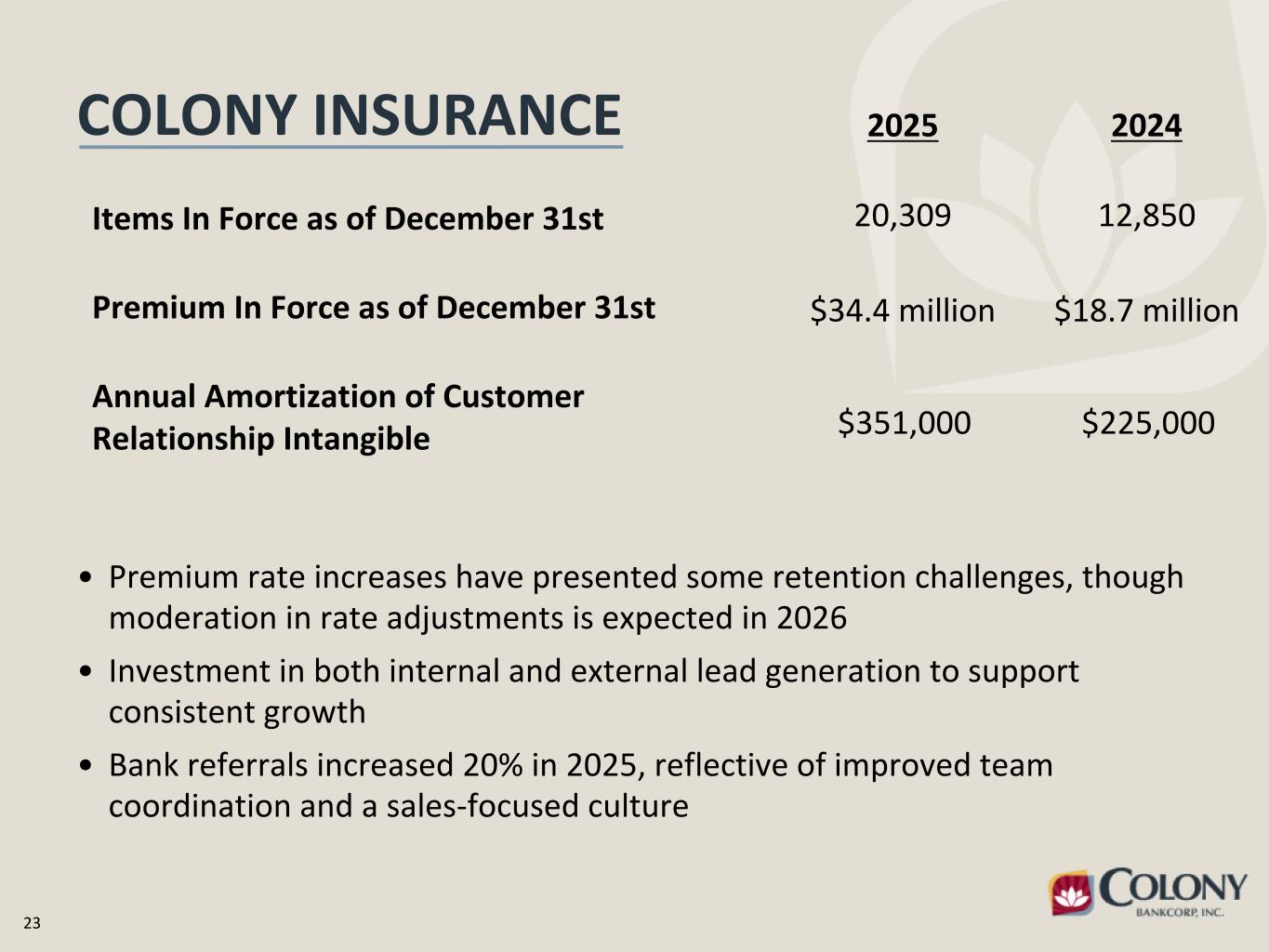

23 COLONY INSURANCE • Premium rate increases have presented some retention challenges, though moderation in rate adjustments is expected in 2026 • Investment in both internal and external lead generation to support consistent growth • Bank referrals increased 20% in 2025, reflective of improved team coordination and a sales-focused culture Items In Force as of December 31st Premium In Force as of December 31st Annual Amortization of Customer Relationship Intangible 2025 2024 20,309 12,850 $34.4 million $18.7 million $351,000 $225,000

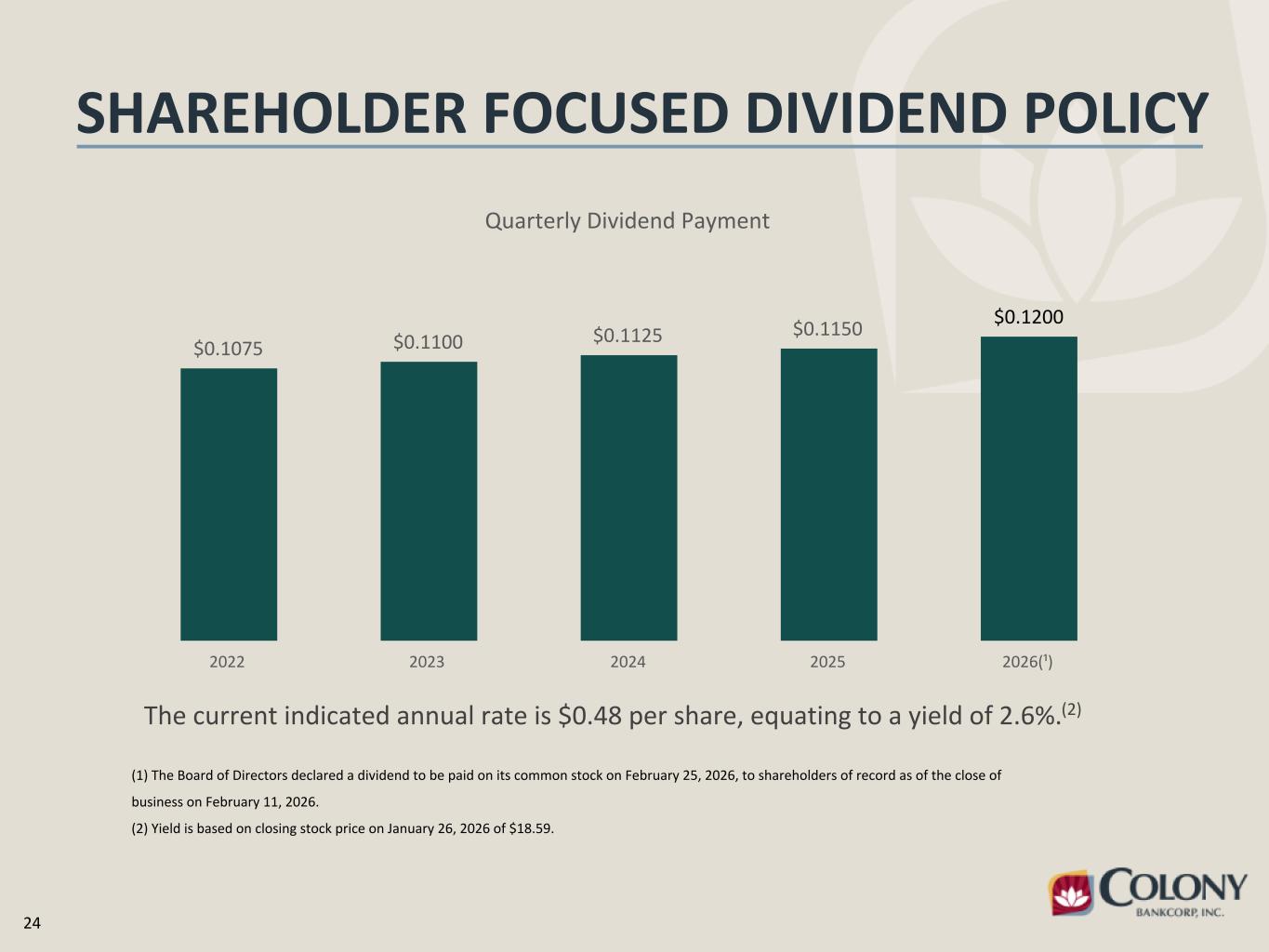

24 The current indicated annual rate is $0.48 per share, equating to a yield of 2.6%.(2) SHAREHOLDER FOCUSED DIVIDEND POLICY (1) The Board of Directors declared a dividend to be paid on its common stock on February 25, 2026, to shareholders of record as of the close of business on February 11, 2026. (2) Yield is based on closing stock price on January 26, 2026 of $18.59. Quarterly Dividend Payment $0.1075 $0.1100 $0.1125 $0.1150 $0.1200 2022 2023 2024 2025 2026(¹)

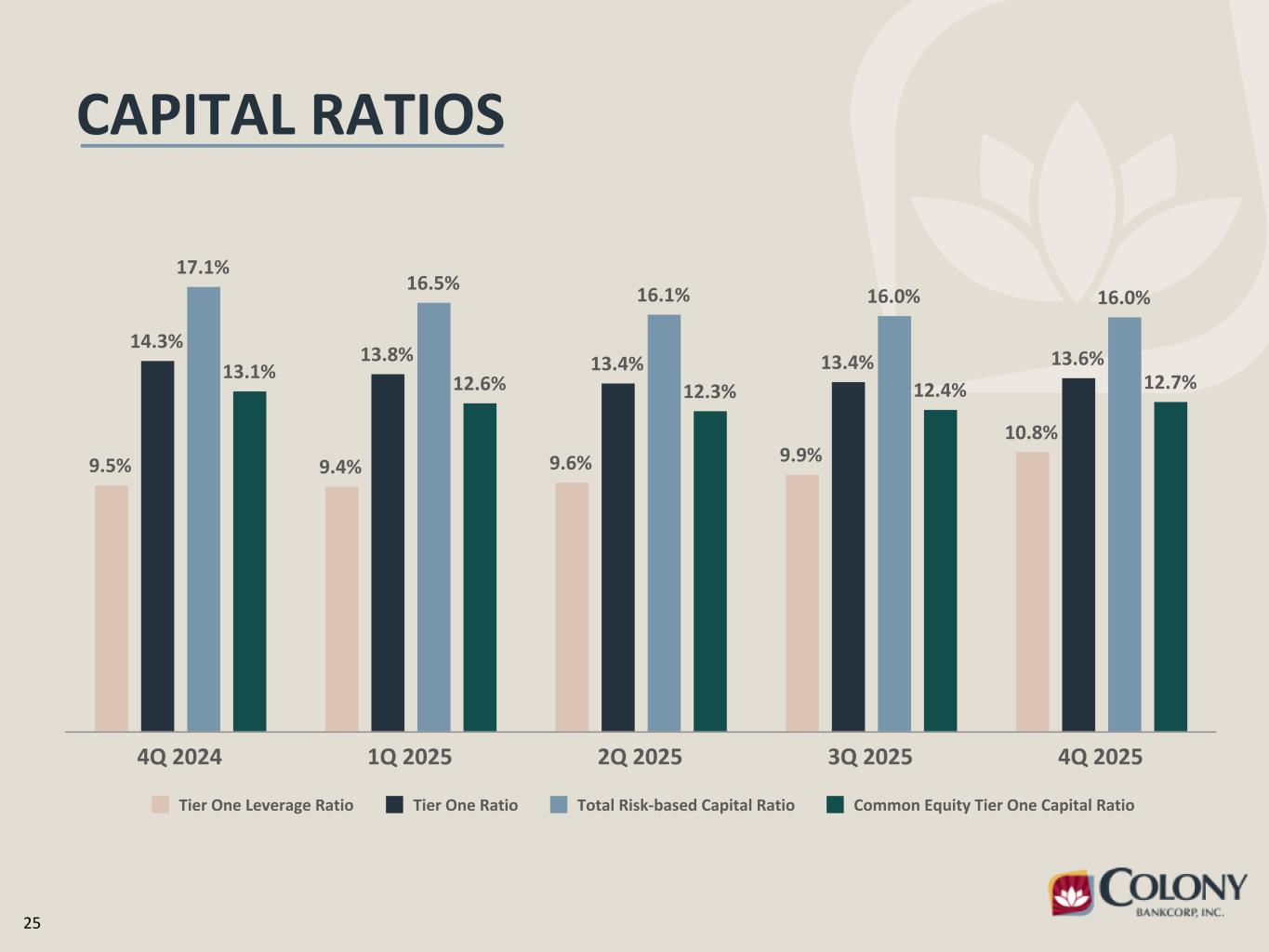

25 CAPITAL RATIOS 9.5% 9.4% 9.6% 9.9% 10.8% 14.3% 13.8% 13.4% 13.4% 13.6% 17.1% 16.5% 16.1% 16.0% 16.0% 13.1% 12.6% 12.3% 12.4% 12.7% Tier One Leverage Ratio Tier One Ratio Total Risk-based Capital Ratio Common Equity Tier One Capital Ratio 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025

26 STRENGTH IN OUR LIQUIDITY POSITION Significant liquidity sources (dollars in millions) FRB Reserves $ 205.7 Other Cash and Due from Banks 50.4 Unencumbered Securities 369.3 FHLB Borrowing Capacity 747.0 Fed Fund Lines 143.0 FRB Discount Window 115.8 Total Liquidity Sources $ 1,631.2 $24.2 $24.2 $24.2 $24.2 $24.2 $38.8 $38.8 $38.9 $38.9 $38.9 $185.0 $185.0 $185.0 $185.0 $195.0 Trust Preferred Securities Subordinated Debentures FRB Discount Window FHLB Borrowings 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Debt Funding* (dollars in millions) *Reported as of last day of each period As of December 31, 2025

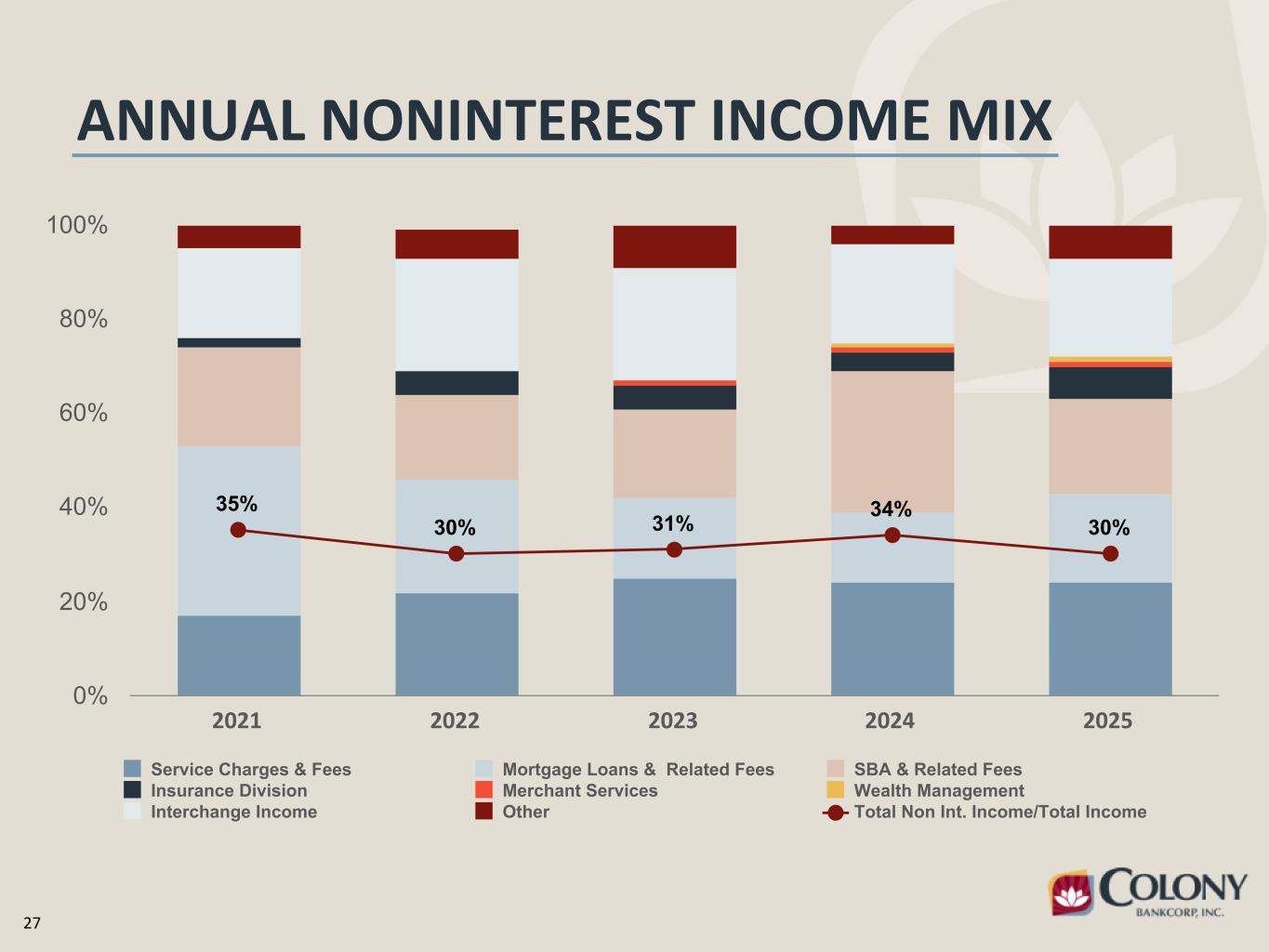

27 35% 30% 31% 34% 30% Service Charges & Fees Mortgage Loans & Related Fees SBA & Related Fees Insurance Division Merchant Services Wealth Management Interchange Income Other Total Non Int. Income/Total Income 2021 2022 2023 2024 2025 0% 20% 40% 60% 80% 100% ANNUAL NONINTEREST INCOME MIX

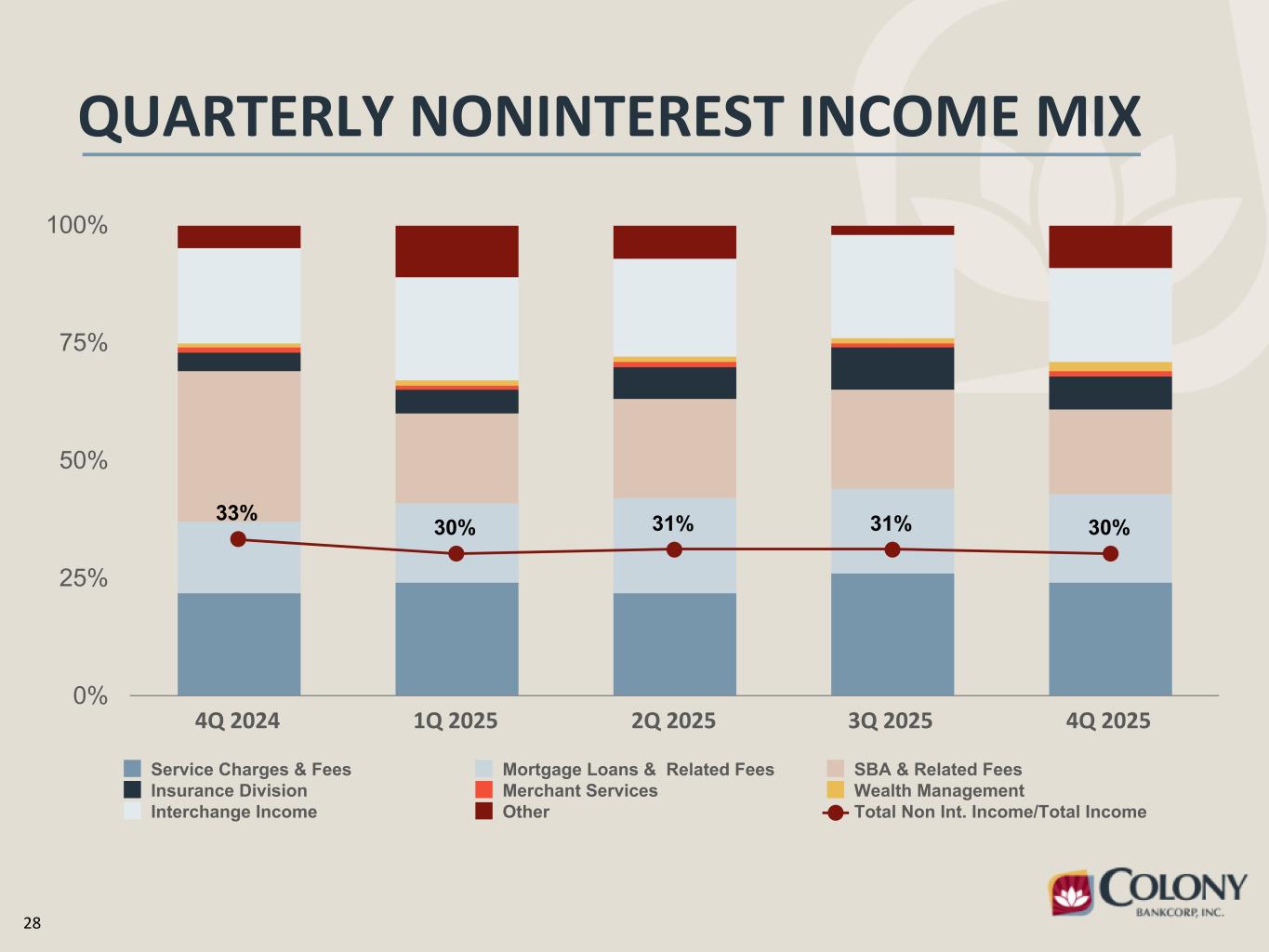

28 33% 30% 31% 31% 30% Service Charges & Fees Mortgage Loans & Related Fees SBA & Related Fees Insurance Division Merchant Services Wealth Management Interchange Income Other Total Non Int. Income/Total Income 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 0% 25% 50% 75% 100% QUARTERLY NONINTEREST INCOME MIX

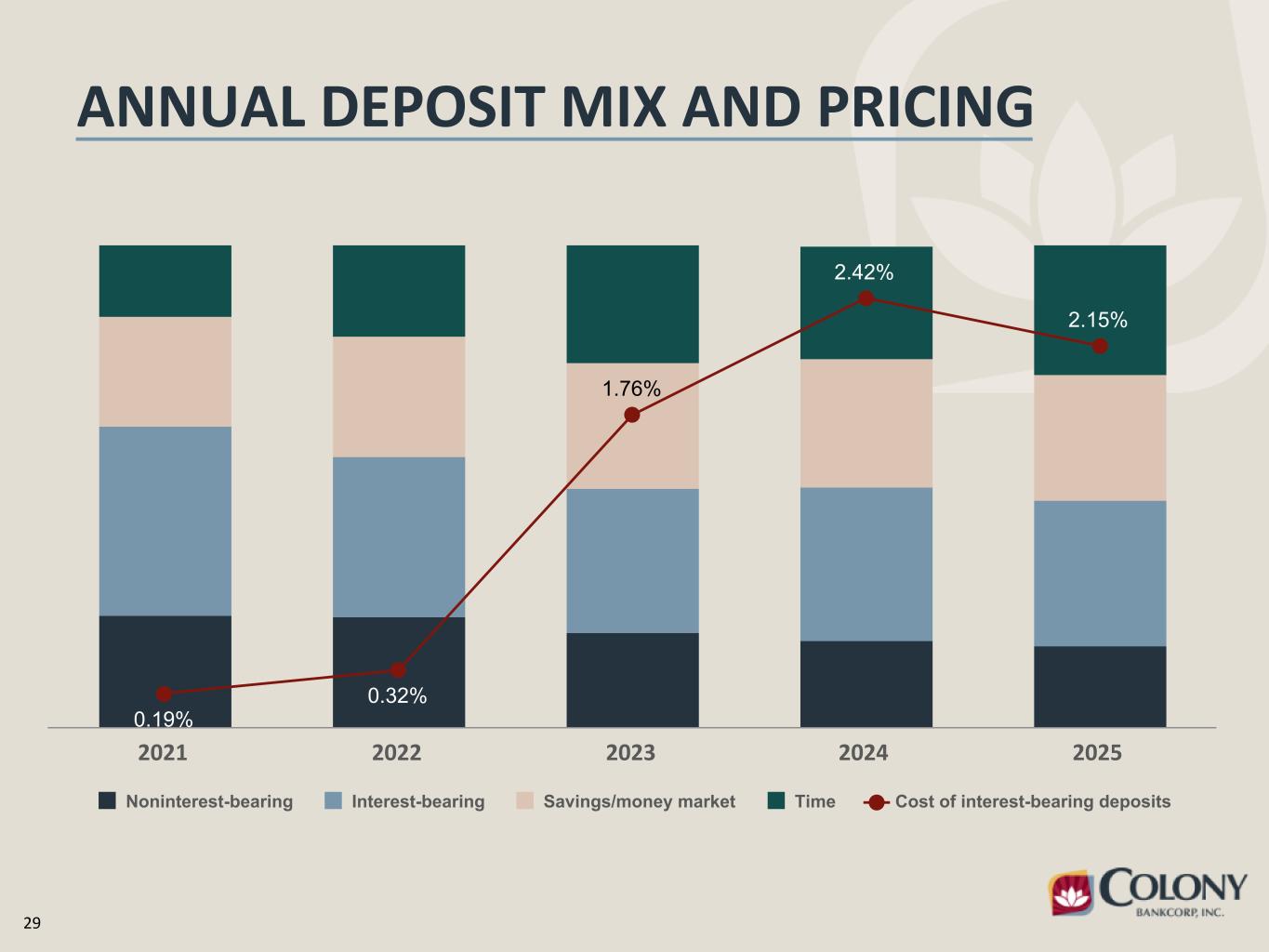

29 0.19% 0.32% 1.76% 2.42% 2.15% Noninterest-bearing Interest-bearing Savings/money market Time Cost of interest-bearing deposits 2021 2022 2023 2024 2025 ANNUAL DEPOSIT MIX AND PRICING

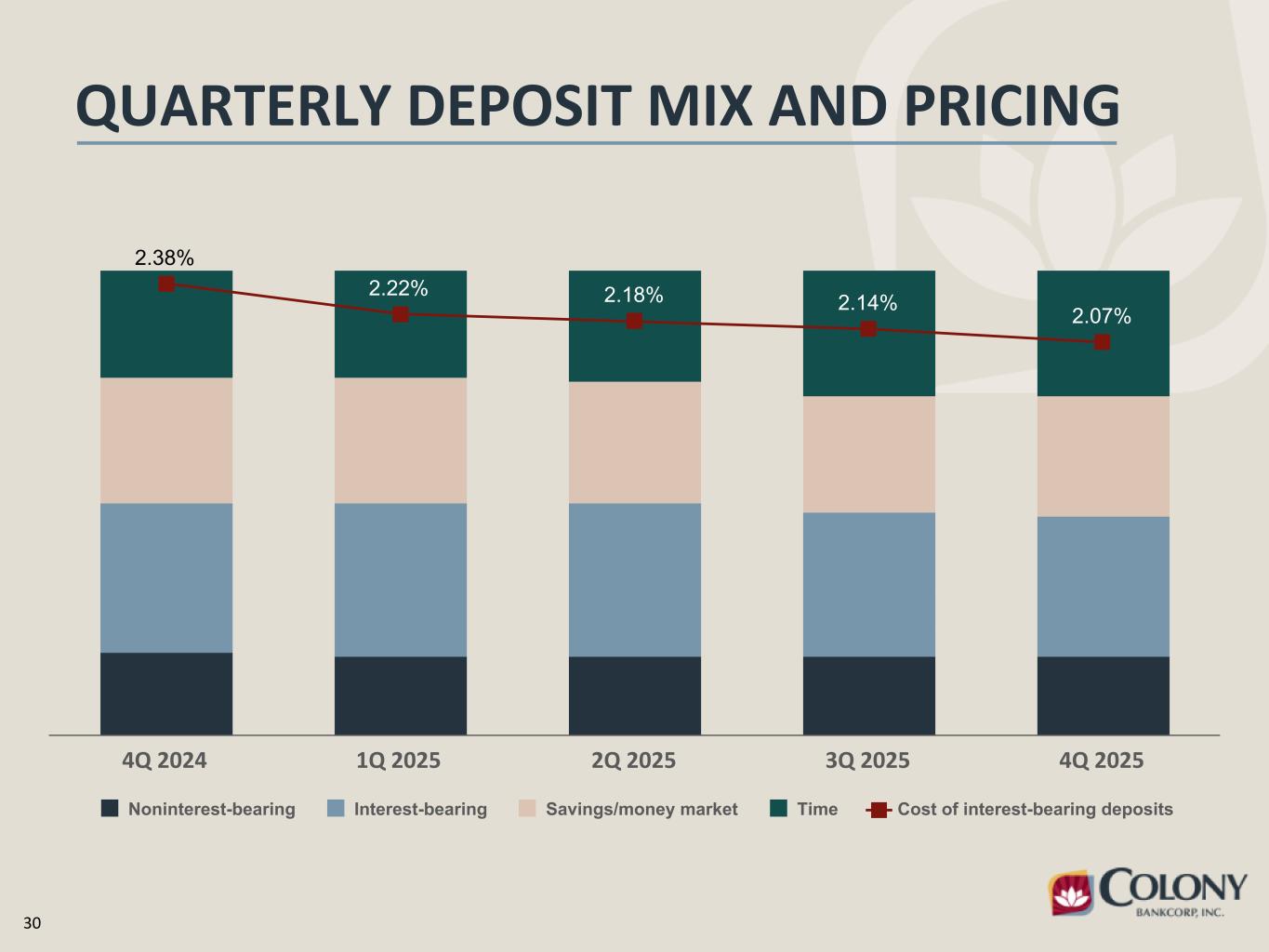

30 2.38% 2.22% 2.18% 2.14% 2.07% Noninterest-bearing Interest-bearing Savings/money market Time Cost of interest-bearing deposits 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 QUARTERLY DEPOSIT MIX AND PRICING

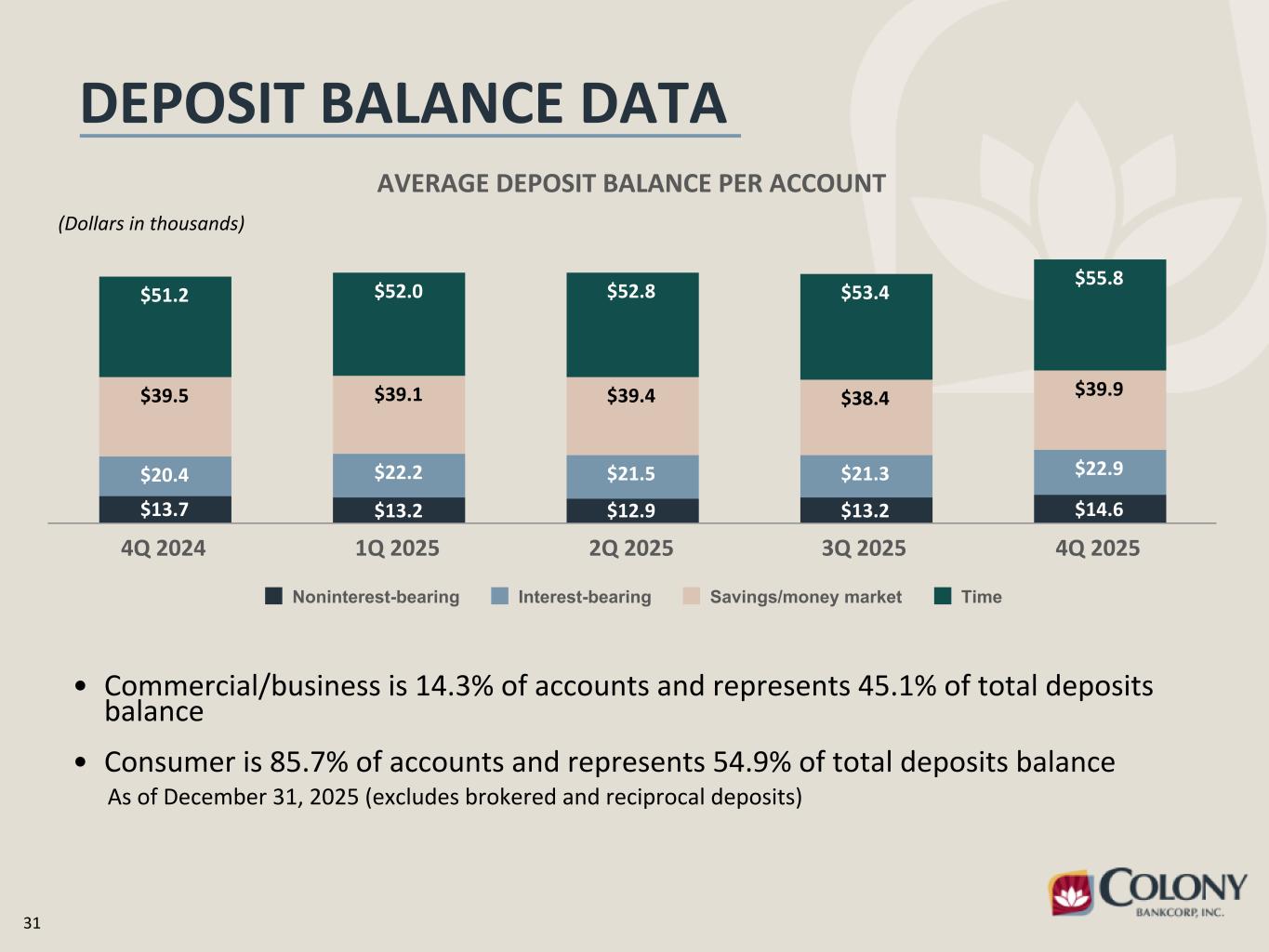

31 AVERAGE DEPOSIT BALANCE PER ACCOUNT $13.7 $13.2 $12.9 $13.2 $14.6 $20.4 $22.2 $21.5 $21.3 $22.9 $39.5 $39.1 $39.4 $38.4 $39.9 $51.2 $52.0 $52.8 $53.4 $55.8 Noninterest-bearing Interest-bearing Savings/money market Time 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 DEPOSIT BALANCE DATA • Commercial/business is 14.3% of accounts and represents 45.1% of total deposits balance • Consumer is 85.7% of accounts and represents 54.9% of total deposits balance As of December 31, 2025 (excludes brokered and reciprocal deposits) (Dollars in thousands)

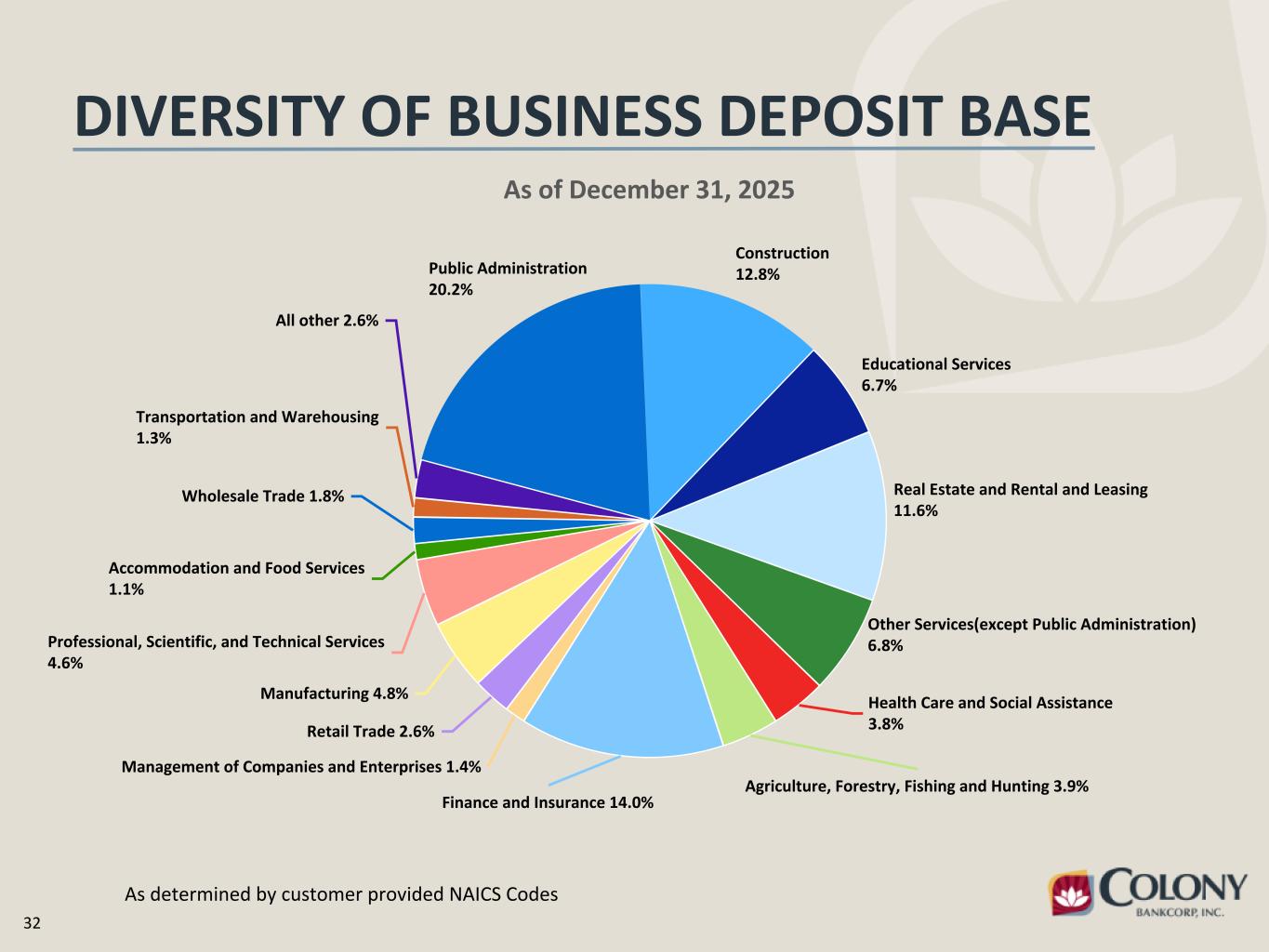

32 DIVERSITY OF BUSINESS DEPOSIT BASE As of December 31, 2025 Public Administration 20.2% Construction 12.8% Educational Services 6.7% Real Estate and Rental and Leasing 11.6% Other Services(except Public Administration) 6.8% Health Care and Social Assistance 3.8% Agriculture, Forestry, Fishing and Hunting 3.9% Finance and Insurance 14.0% Management of Companies and Enterprises 1.4% Retail Trade 2.6% Manufacturing 4.8% Professional, Scientific, and Technical Services 4.6% Accommodation and Food Services 1.1% Wholesale Trade 1.8% Transportation and Warehousing 1.3% All other 2.6% As determined by customer provided NAICS Codes

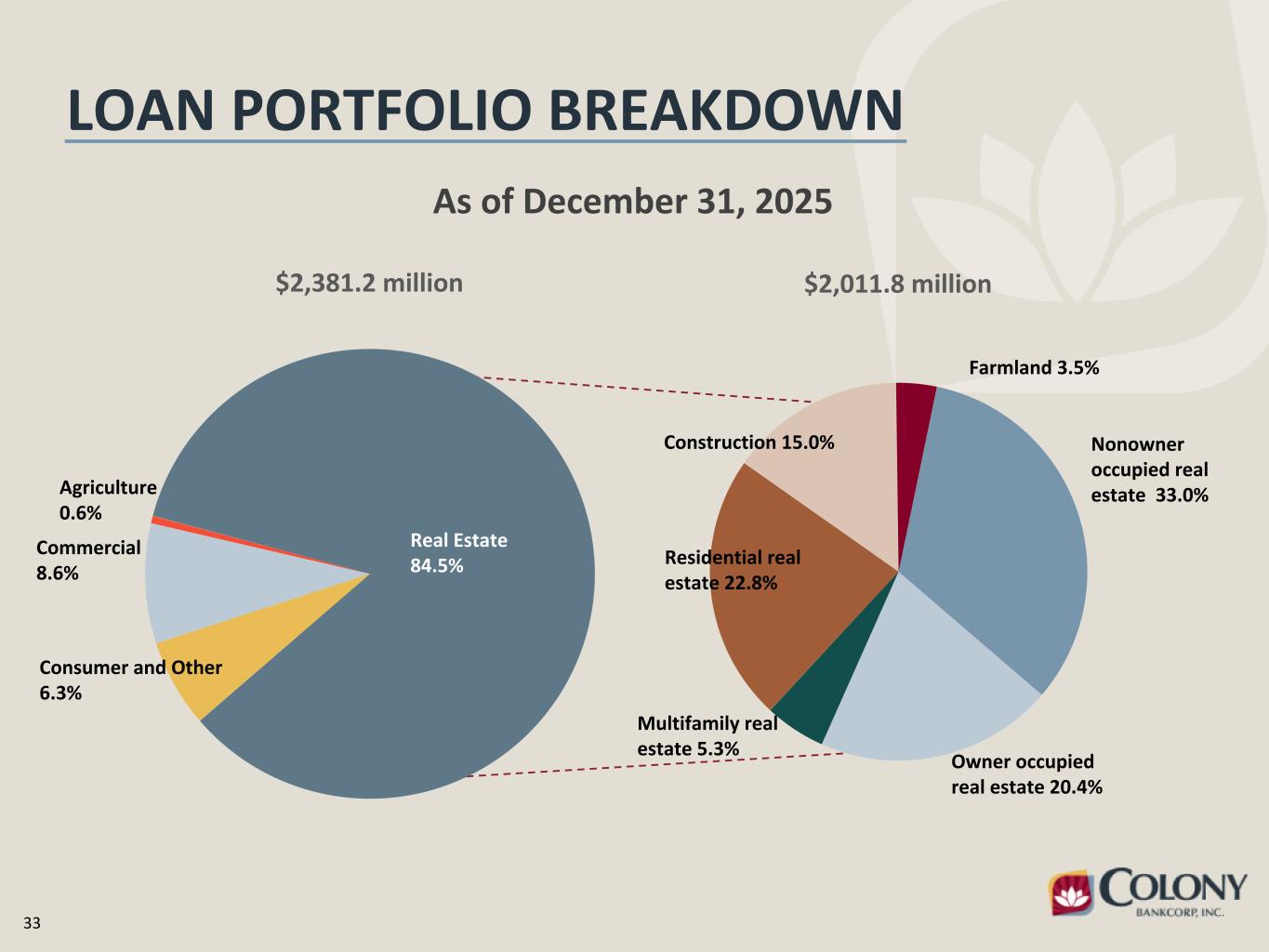

33 LOAN PORTFOLIO BREAKDOWN As of December 31, 2025 $2,381.2 million Real Estate 84.5% Consumer and Other 6.3% Commercial 8.6% Agriculture 0.6% $2,011.8 million Multifamily real estate 5.3% Residential real estate 22.8% Construction 15.0% Farmland 3.5% Nonowner occupied real estate 33.0% Owner occupied real estate 20.4%

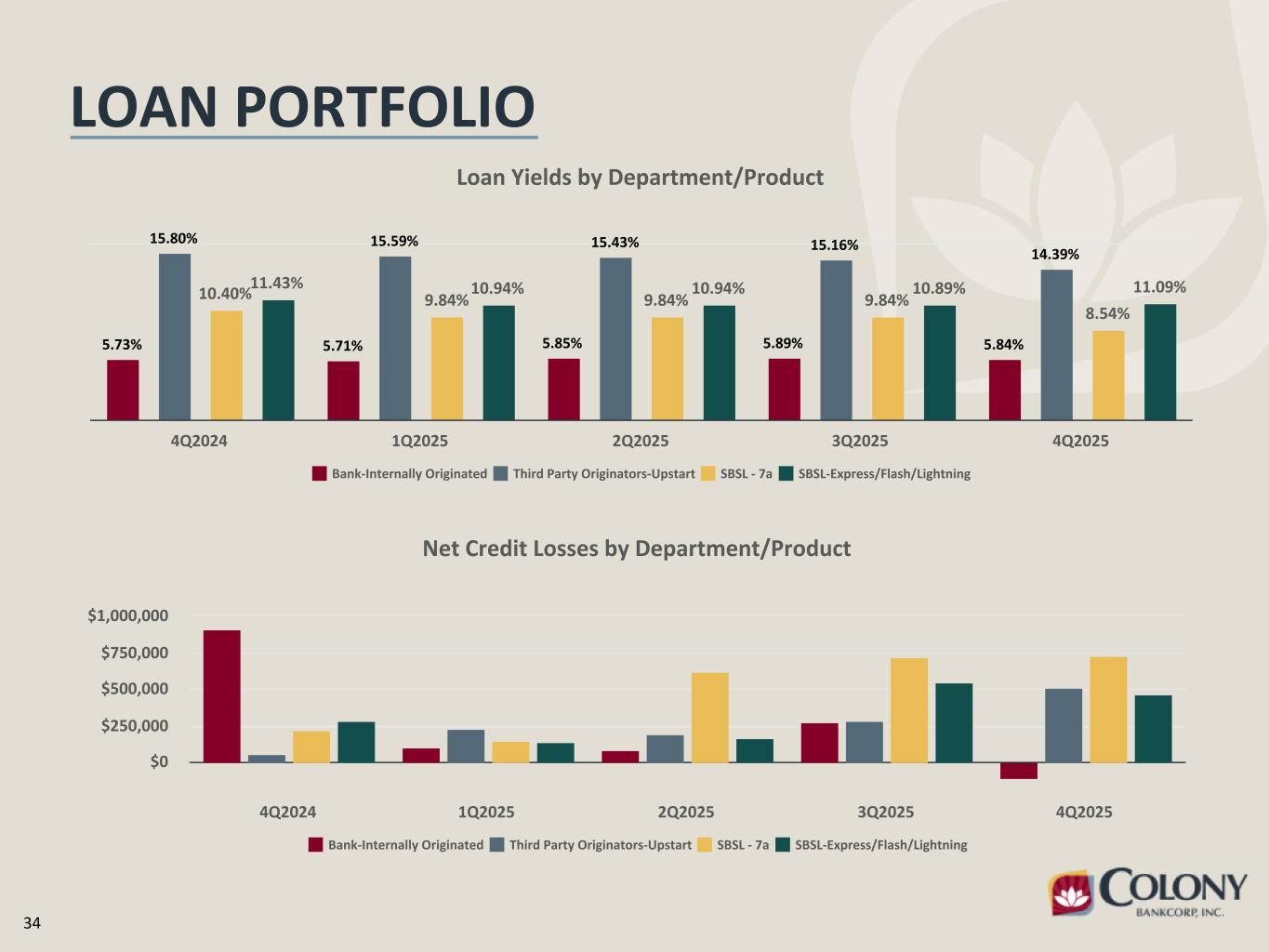

34 LOAN PORTFOLIO Net Credit Losses by Department/Product Bank-Internally Originated Third Party Originators-Upstart SBSL - 7a SBSL-Express/Flash/Lightning 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 $0 $250,000 $500,000 $750,000 $1,000,000 Loan Yields by Department/Product 5.73% 5.71% 5.85% 5.89% 5.84% 15.80% 15.59% 15.43% 15.16% 14.39% 10.40% 9.84% 9.84% 9.84% 8.54% 11.43% 10.94% 10.94% 10.89% 11.09% Bank-Internally Originated Third Party Originators-Upstart SBSL - 7a SBSL-Express/Flash/Lightning 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025

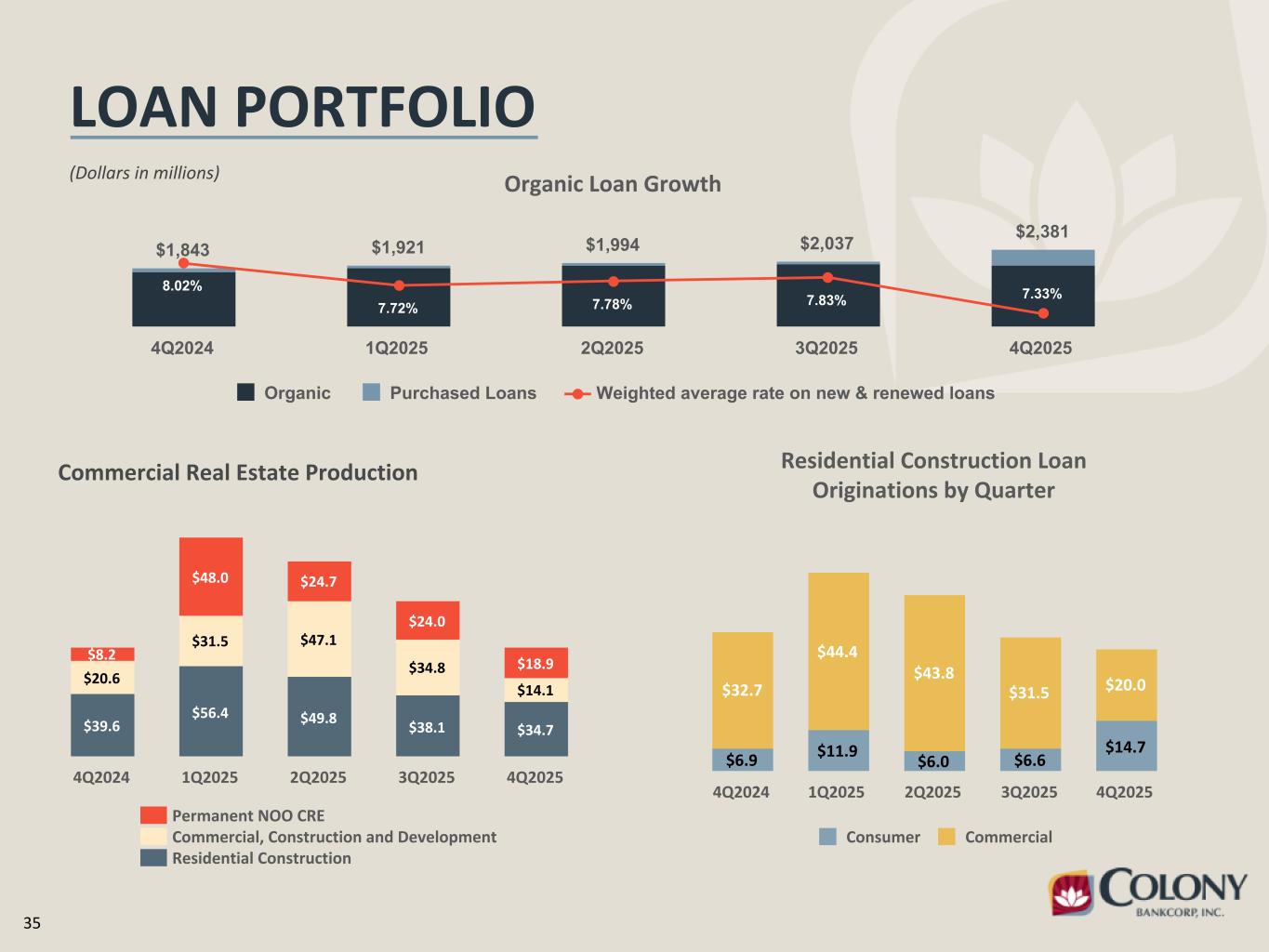

35 LOAN PORTFOLIO (Dollars in millions) $39.6 $56.4 $49.8 $38.1 $34.7 $20.6 $31.5 $47.1 $34.8 $14.1 $8.2 $48.0 $24.7 $24.0 $18.9 Permanent NOO CRE Commercial, Construction and Development Residential Construction 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 Commercial Real Estate Production Residential Construction Loan Originations by Quarter $6.9 $11.9 $6.0 $6.6 $14.7 $32.7 $44.4 $43.8 $31.5 $20.0 Consumer Commercial 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 Organic Loan Growth $1,843 $1,921 $1,994 $2,037 $2,381 8.02% 7.72% 7.78% 7.83% 7.33% Organic Purchased Loans Weighted average rate on new & renewed loans 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025

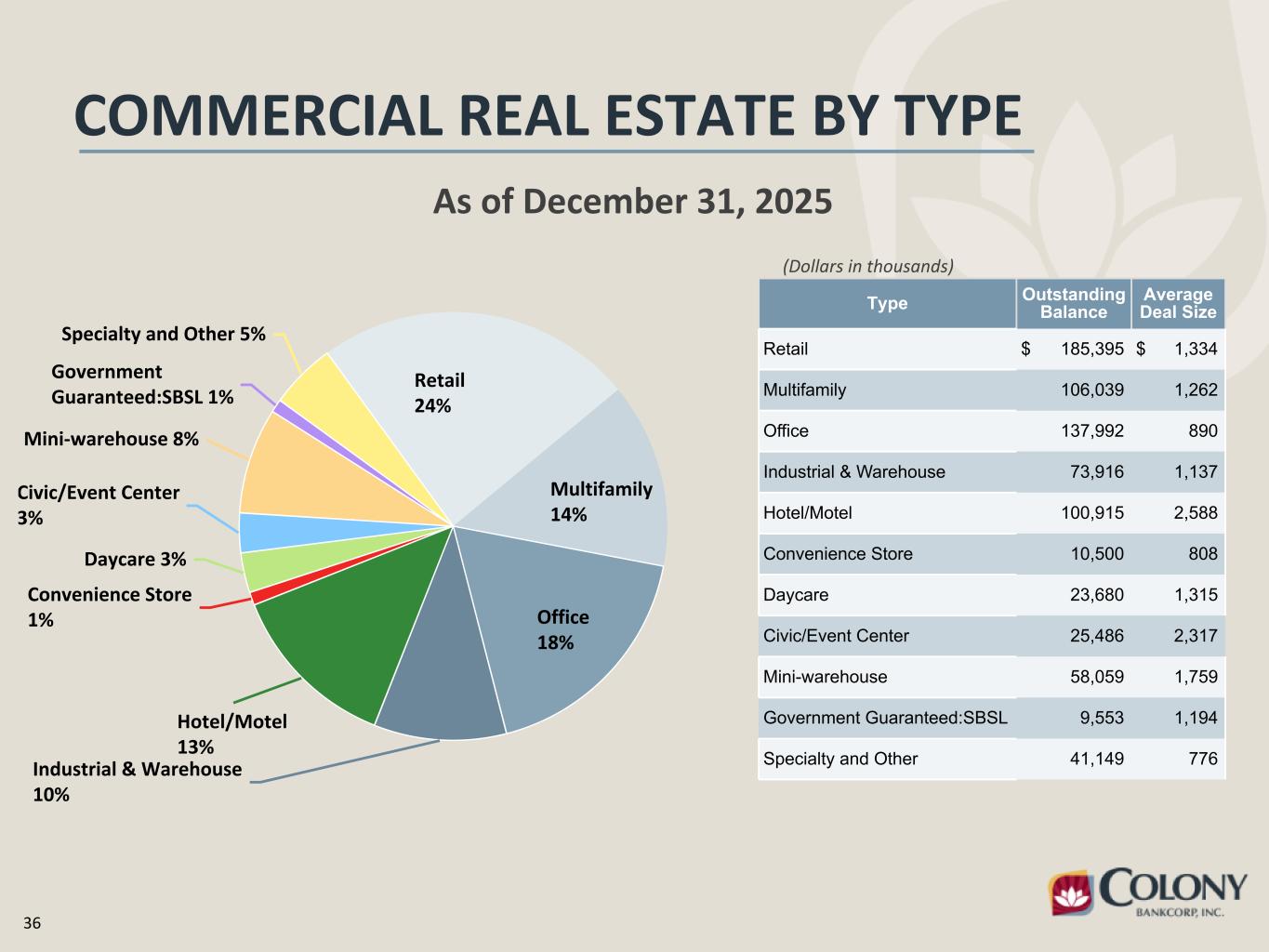

36 COMMERCIAL REAL ESTATE BY TYPE Retail 24% Multifamily 14% Office 18% Industrial & Warehouse 10% Hotel/Motel 13% Convenience Store 1% Daycare 3% Civic/Event Center 3% Mini-warehouse 8% Government Guaranteed:SBSL 1% Specialty and Other 5% Type Outstanding Balance Average Deal Size Retail $ 185,395 $ 1,334 Multifamily 106,039 1,262 Office 137,992 890 Industrial & Warehouse 73,916 1,137 Hotel/Motel 100,915 2,588 Convenience Store 10,500 808 Daycare 23,680 1,315 Civic/Event Center 25,486 2,317 Mini-warehouse 58,059 1,759 Government Guaranteed:SBSL 9,553 1,194 Specialty and Other 41,149 776 (Dollars in thousands) As of December 31, 2025

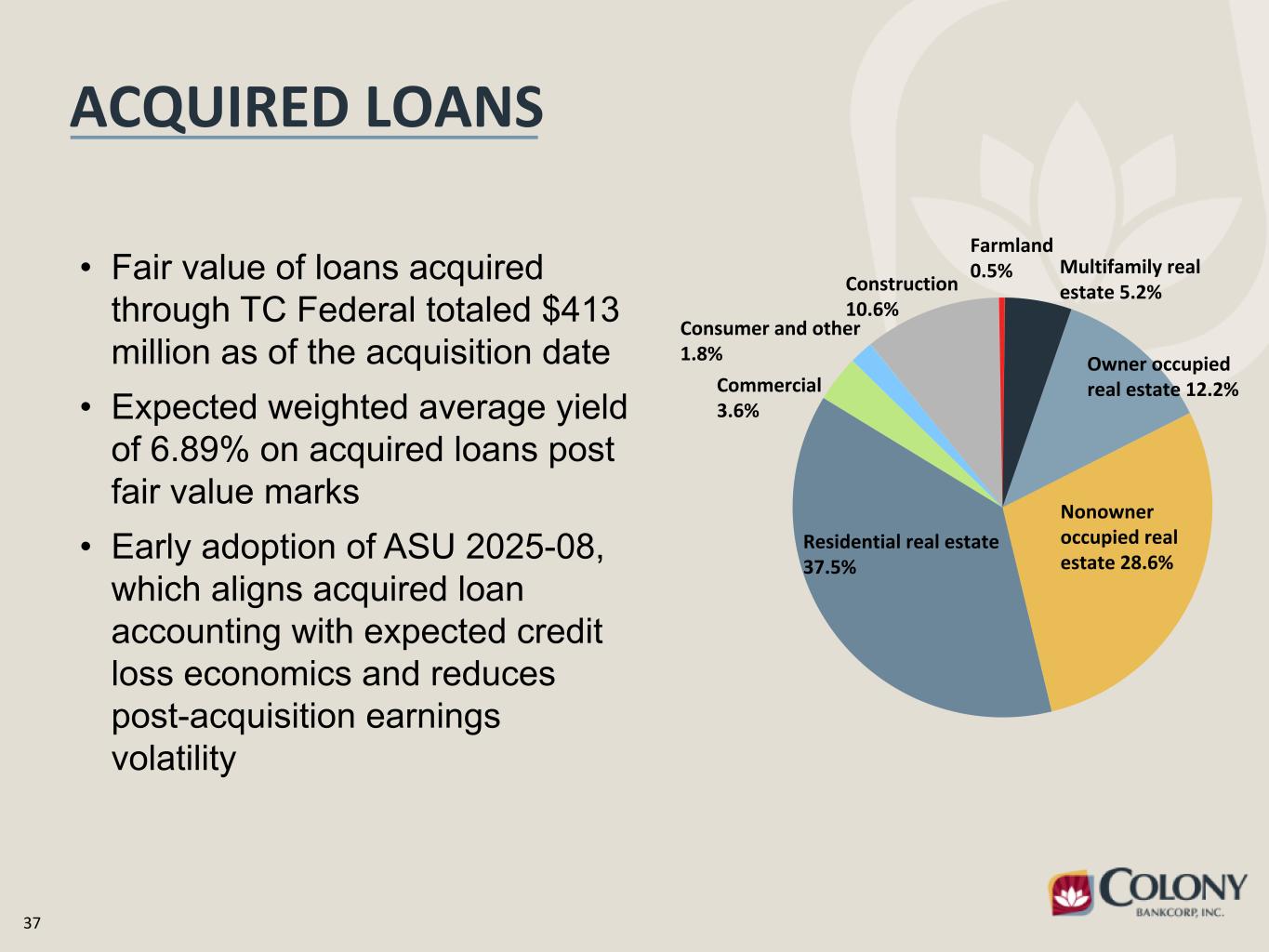

37 ACQUIRED LOANS • Fair value of loans acquired through TC Federal totaled $413 million as of the acquisition date • Expected weighted average yield of 6.89% on acquired loans post fair value marks • Early adoption of ASU 2025-08, which aligns acquired loan accounting with expected credit loss economics and reduces post-acquisition earnings volatility Construction 10.6% Farmland 0.5% Multifamily real estate 5.2% Owner occupied real estate 12.2% Nonowner occupied real estate 28.6% Residential real estate 37.5% Commercial 3.6% Consumer and other 1.8%

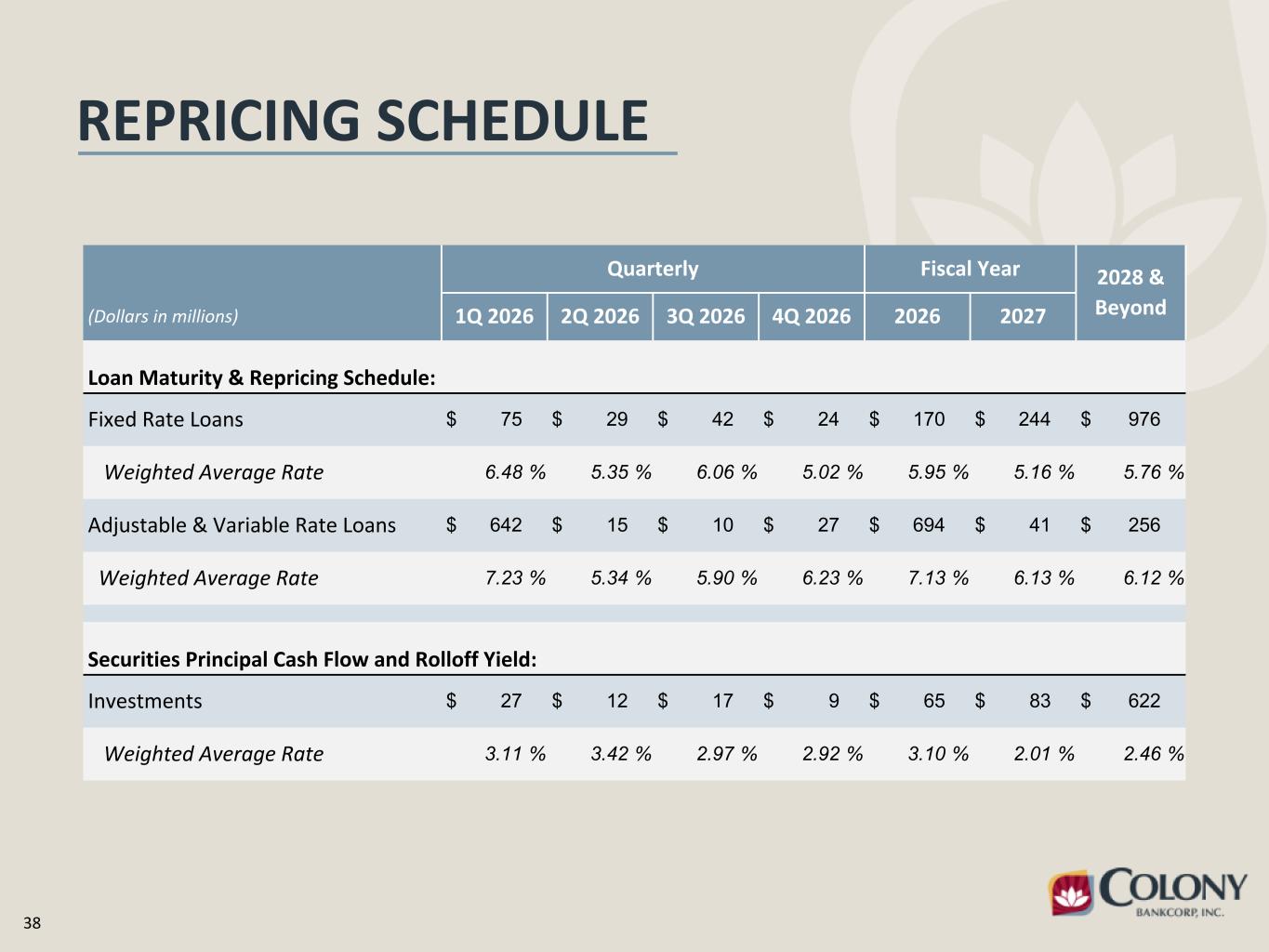

38 REPRICING SCHEDULE Quarterly Fiscal Year 2028 & (Dollars in millions) 1Q 2026 2Q 2026 3Q 2026 4Q 2026 2026 2027 Beyond Loan Maturity & Repricing Schedule: Fixed Rate Loans $ 75 $ 29 $ 42 $ 24 $ 170 $ 244 $ 976 Weighted Average Rate 6.48 % 5.35 % 6.06 % 5.02 % 5.95 % 5.16 % 5.76 % Adjustable & Variable Rate Loans $ 642 $ 15 $ 10 $ 27 $ 694 $ 41 $ 256 Weighted Average Rate 7.23 % 5.34 % 5.90 % 6.23 % 7.13 % 6.13 % 6.12 % Securities Principal Cash Flow and Rolloff Yield: Investments $ 27 $ 12 $ 17 $ 9 $ 65 $ 83 $ 622 Weighted Average Rate 3.11 % 3.42 % 2.97 % 2.92 % 3.10 % 2.01 % 2.46 %

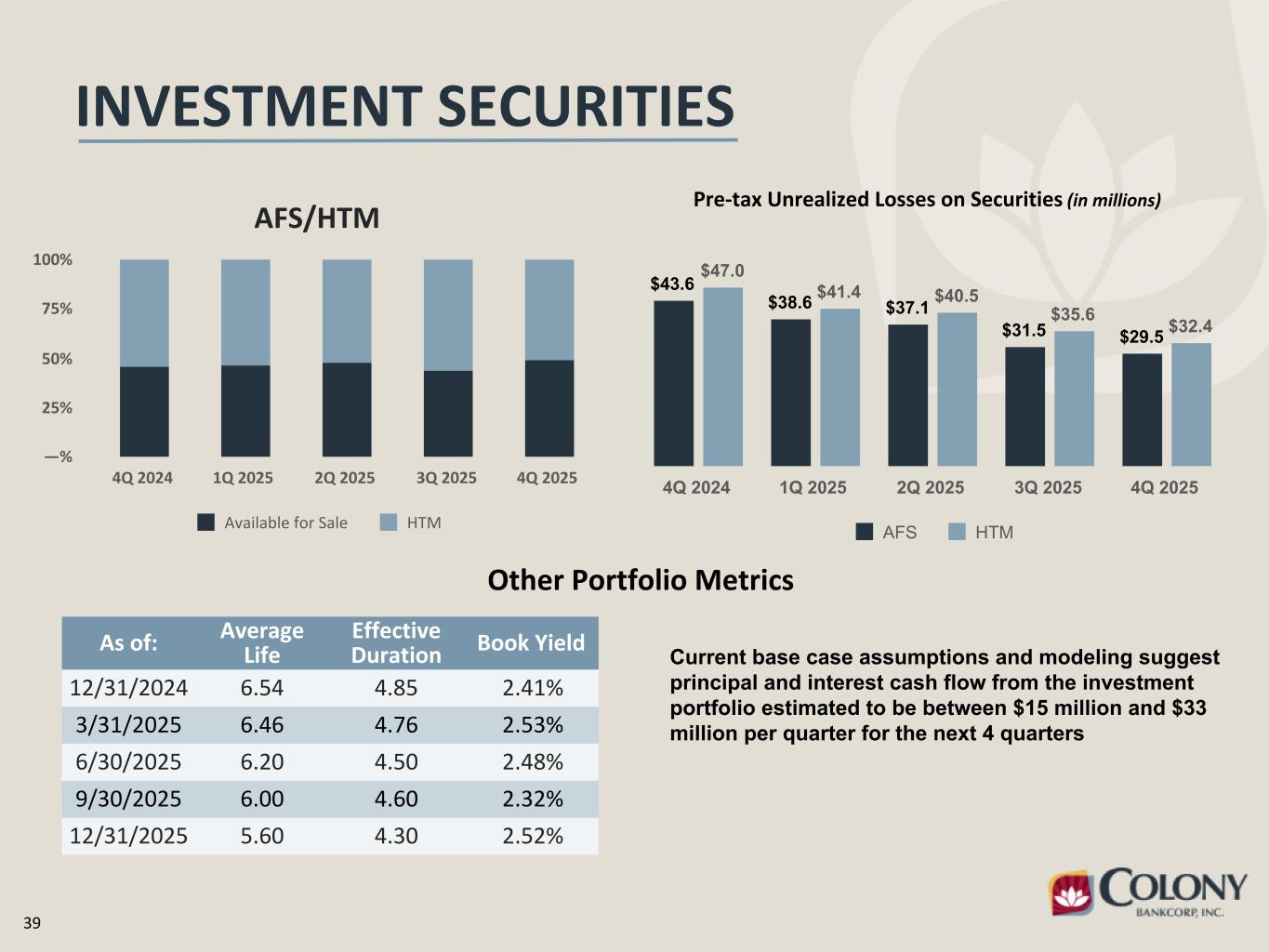

39 INVESTMENT SECURITIES As of: Average Life Effective Duration Book Yield 12/31/2024 6.54 4.85 2.41% 3/31/2025 6.46 4.76 2.53% 6/30/2025 6.20 4.50 2.48% 9/30/2025 6.00 4.60 2.32% 12/31/2025 5.60 4.30 2.52% Other Portfolio Metrics Pre-tax Unrealized Losses on Securities (in millions) AFS/HTM Available for Sale HTM 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 —% 25% 50% 75% 100% $43.6 $38.6 $37.1 $31.5 $29.5 $47.0 $41.4 $40.5 $35.6 $32.4 AFS HTM 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Current base case assumptions and modeling suggest principal and interest cash flow from the investment portfolio estimated to be between $15 million and $33 million per quarter for the next 4 quarters

40 INVESTMENT CONSIDERATIONS • Premier Southeast community bank located in growing markets • Core deposit funded with minimal reliance on wholesale funding • Diversified sources of revenue • Improving earnings outlook as new business lines and markets mature • Upside potential to tangible book value as unrealized losses recover • Deep leadership bench with a proven track record • Focused on scalability and efficiency • Investing in technology and leveraging data for revenue growth • Positioned to be the acquirer of choice in the Southeast

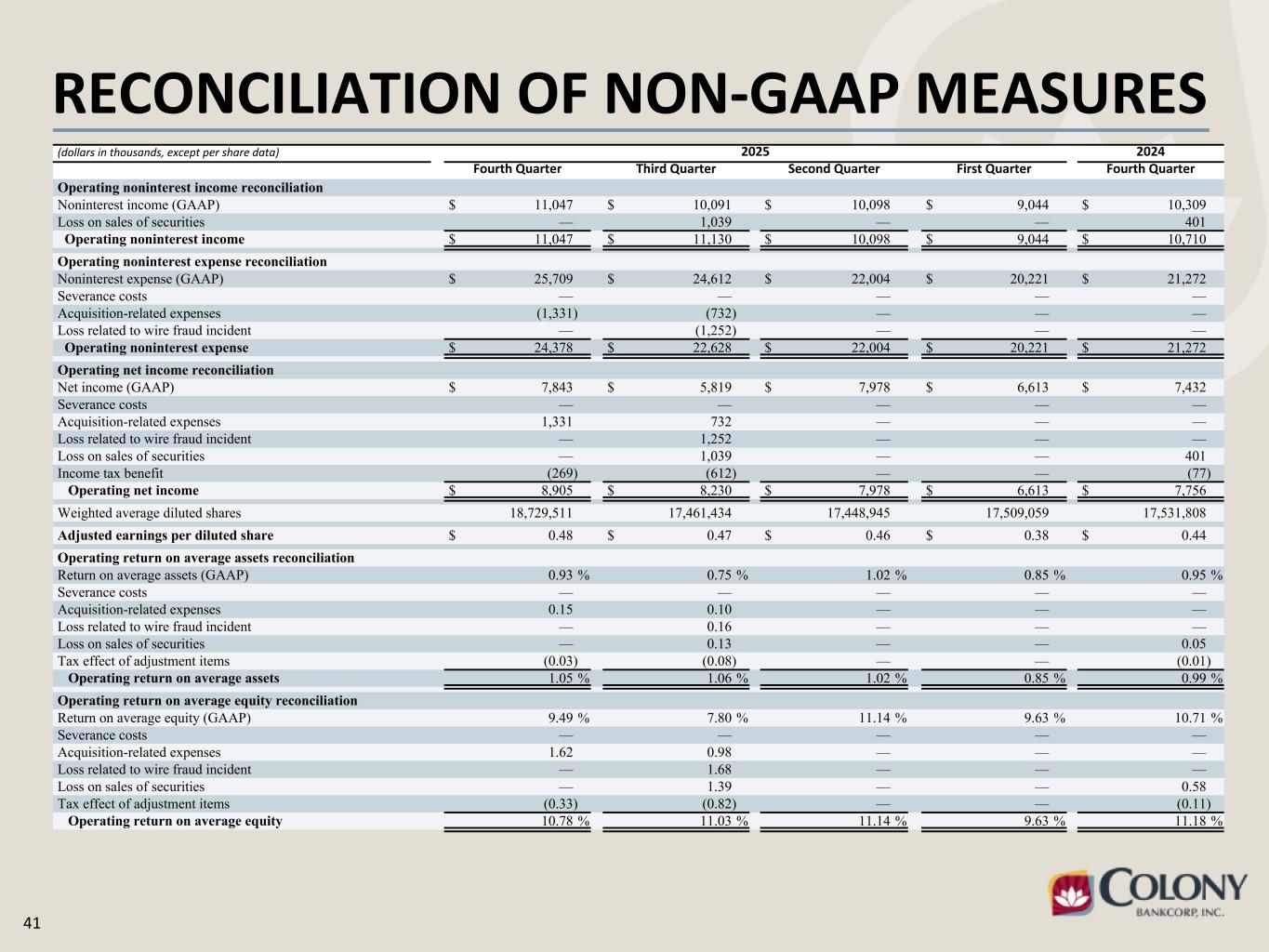

41 RECONCILIATION OF NON-GAAP MEASURES (dollars in thousands, except per share data) 2025 2024 Fourth Quarter Third Quarter Second Quarter First Quarter Fourth Quarter Operating noninterest income reconciliation Noninterest income (GAAP) $ 11,047 $ 10,091 $ 10,098 $ 9,044 $ 10,309 Loss on sales of securities — 1,039 — — 401 Operating noninterest income $ 11,047 $ 11,130 $ 10,098 $ 9,044 $ 10,710 Operating noninterest expense reconciliation Noninterest expense (GAAP) $ 25,709 $ 24,612 $ 22,004 $ 20,221 $ 21,272 Severance costs — — — — — Acquisition-related expenses (1,331) (732) — — — Loss related to wire fraud incident — (1,252) — — — Operating noninterest expense $ 24,378 $ 22,628 $ 22,004 $ 20,221 $ 21,272 Operating net income reconciliation Net income (GAAP) $ 7,843 $ 5,819 $ 7,978 $ 6,613 $ 7,432 Severance costs — — — — — Acquisition-related expenses 1,331 732 — — — Loss related to wire fraud incident — 1,252 — — — Loss on sales of securities — 1,039 — — 401 Income tax benefit (269) (612) — — (77) Operating net income $ 8,905 $ 8,230 $ 7,978 $ 6,613 $ 7,756 Weighted average diluted shares 18,729,511 17,461,434 17,448,945 17,509,059 17,531,808 Adjusted earnings per diluted share $ 0.48 $ 0.47 $ 0.46 $ 0.38 $ 0.44 Operating return on average assets reconciliation Return on average assets (GAAP) 0.93 % 0.75 % 1.02 % 0.85 % 0.95 % Severance costs — — — — — Acquisition-related expenses 0.15 0.10 — — — Loss related to wire fraud incident — 0.16 — — — Loss on sales of securities — 0.13 — — 0.05 Tax effect of adjustment items (0.03) (0.08) — — (0.01) Operating return on average assets 1.05 % 1.06 % 1.02 % 0.85 % 0.99 % Operating return on average equity reconciliation Return on average equity (GAAP) 9.49 % 7.80 % 11.14 % 9.63 % 10.71 % Severance costs — — — — — Acquisition-related expenses 1.62 0.98 — — — Loss related to wire fraud incident — 1.68 — — — Loss on sales of securities — 1.39 — — 0.58 Tax effect of adjustment items (0.33) (0.82) — — (0.11) Operating return on average equity 10.78 % 11.03 % 11.14 % 9.63 % 11.18 %

42 RECONCILIATION OF NON-GAAP MEASURES (dollars in thousands, except per share data) 2025 2024 Fourth Quarter Third Quarter Second Quarter First Quarter Fourth Quarter Operating return on average tangible equity reconciliation Return on average tangible equity 11.63 % 9.56 % 13.70 % 11.83 % 13.16 % Acquisition-related expenses 1.97 1.20 — — — Loss related to wire fraud incident — 2.06 — — — Loss on sales of securities — 1.71 — — 0.71 Tax effect of adjustment items (0.40) (1.01) — — (0.14) Operating return on average tangible equity 13.20 % 13.52 % 13.70 % 11.83 % 13.74 % Book value per common share (GAAP) $ 17.69 $ 17.31 $ 16.87 $ 16.41 $ 15.91 Effect of goodwill and other intangibles (3.38) (3.11) (3.14) (2.95) (2.96) Tangible book value per common share $ 14.31 $ 14.20 $ 13.73 $ 13.46 $ 12.95 Tangible equity to tangible assets reconciliation Equity to assets (GAAP) 10.06 % 9.59 % 9.43 % 9.05 % 8.96 % Effect of goodwill and other intangibles (1.76) (1.59) (1.62) (1.51) (1.54) Tangible equity to tangible assets 8.30 % 8.00 % 7.81 % 7.54 % 7.42 % Operating efficiency ratio calculation Efficiency ratio (GAAP) 69.65 % 75.06 % 67.74 % 67.41 % 69.11 % Acquisition-related expenses (3.61) (1.98) — — — Loss related to wire fraud incident — (3.38) — — — Loss on sales of securities — (2.81) — — (1.31) Operating efficiency ratio 66.04 % 66.89 % 67.74 % 67.41 % 67.80 % Operating net noninterest expense(1) to average assets calculation Net noninterest expense to average assets 1.73 % 1.86 % 1.52 % 1.44 % 1.40 % Acquisition-related expenses (0.15) (0.09) — — — Loss related to wire fraud incident — (0.16) — — — Loss on sales of securities — (0.13) — — (0.05) Operating net noninterest expense to average assets 1.58 % 1.48 % 1.52 % 1.44 % 1.35 % Pre-provision net revenue Net interest income before provision for credit losses $ 25,865 $ 22,699 $ 22,385 $ 20,952 $ 20,472 Noninterest income 11,047 10,091 10,098 9,044 10,309 Total income 36,912 32,790 32,483 29,996 30,781 Noninterest expense 25,709 24,612 22,004 20,221 21,272 Pre-provision net revenue $ 11,203 $ 8,178 $ 10,479 $ 9,775 $ 9,509 Operating pre-provision net revenue Net interest income before provision for credit losses $ 25,865 $ 22,699 $ 22,385 $ 20,952 $ 20,472 Operating noninterest income 11,047 11,130 10,098 9,044 10,710 Total operating income 36,912 33,829 32,483 29,996 31,182 Operating noninterest expense 24,378 22,628 22,004 20,221 21,272 Operating pre-provision net revenue $ 12,534 $ 11,201 $ 10,479 $ 9,775 $ 9,910 (1) Net noninterest expense is defined as noninterest expense less noninterest income.