.3

Engine Capital LP

1345 Avenue of the Americas, 2nd Floor

New York, NY 10105

(212) 321-0048

October 31, 2025

UniFirst Corporation

68 Jonspin Road

Wilmington, Massachusetts 01887

Attention: Board of Directors, Ms. Carol Croatti, Ms. Cecelia Levenstein, and Mr. Matthew Croatti

Dear Members of the Board and Trustees:

Engine Capital LP (together with its affiliates, “Engine” or “we”) is a meaningful shareholder of UniFirst Corporation (NYSE: UNF) (“UniFirst” or the “Company”) with ownership of approximately 3% of the Company. We invested in UniFirst because of its leading position in the uniform rental business, the attractive nature of its recurring revenue and diversified customer base, and our belief that there are opportunities readily within the control of the Board of Directors (the “Board”) to significantly increase shareholder value. As part of our due diligence, we have discussed the Company and its prospects with management, competitors, and more than 20 former employees.

We have great respect for the achievements of former CEO Ron Croatti, who grew UniFirst’s revenue by 15x and shaped the uniform service and supply industry during his more than 25-year tenure. However, our extensive analysis of the Company’s strategy, execution, and performance over the last eight years has revealed significant issues. Based on our diligence, we believe UniFirst’s prospects as a standalone company are increasingly challenged, and management and the Board have demonstrated no credible plan to reverse the Company’s pattern of worsening profitability and growth amid intensifying competition. We therefore urge the Board to explore a sale of the Company – both to preserve Mr. Croatti’s legacy and safeguard UniFirst’s future for all its stakeholders. In this letter, we outline the factors that have led us to conclude that the status quo is no longer tenable and explain why the Board has a narrow but critical window of opportunity to carve a viable path forward.

Summary of Where UniFirst Sits Today

| · | Mishandled Leadership Succession Has Driven Disastrous Share Price Performance: Since Mr. Croatti’s passing in May 2017, UniFirst – a once-thriving company with a strong culture – has become stagnant and consistently surrendered market share. Under his successor, President and CEO Steven Sintros, the Company has delivered subpar growth and declining margins. Alarmingly, its Q4 2025 earnings results and 2026 financial outlook show no signs of a recovery. UniFirst’s disappointing results have resulted in abysmal share price performance compared to Cintas Corporation (NASDAQ: CTAS) (“Cintas”) over the last eight years. |

| · | Poor Execution and Misallocation of Corporate Resources: The Company’s sustained underperformance stems from poor operational execution, excessive costs, and misguided capital allocation. Our conversations with former employees made clear that many of the Company’s problems are self-inflicted by management and the Board. The Board, including director Cynthia Croatti1, has failed in its oversight responsibilities to such an extent that the Company’s standalone prospects are now increasingly challenging. |

1 In addition to her role as a director, Ms. Croatti is also Special Consultant and Advisor to the CEO and the Senior Leadership Team.

| 1 |

| · | Low Morale, Worsening Culture, and Ineffective Governance: Based on our discussions with former employees, morale at the Company appears low and getting worse. Many lament the loss of the family-oriented culture that made UniFirst so special for decades. Under Mr. Croatti’s leadership, UniFirst thrived on a close partnership between corporate leaders and field managers, with senior executives deeply engaged in day-to-day operations. That hands-on, collaborative culture has since eroded. Former employees attribute much of this decline to the Company’s ineffective governance structure, which has created a lack of accountability at the top. |

| · | The Board Rejected a Golden Opportunity to Realize Value: When the Board rejected Cintas’ acquisition offer of $275 per share earlier this year, it squandered a golden opportunity to realize extraordinary value for its shareholders – shocking investors and analysts alike. We could not identify another instance during the last five years in which a credible buyer made a public acquisition offer exceeding a 50% premium that did not ultimately result in a transaction.2 Given that UniFirst’s trajectory as a standalone company is unlikely to produce anywhere close to the value that Cintas offered, rejecting that offer risks being profoundly value-destructive – potentially costing shareholders and the Croatti family hundreds of millions of dollars. |

| · | A Sale Represents the Best Path Forward: UniFirst can no longer close the widening competitive gap with Cintas, and continued market share losses will inevitably drive layoffs, employee departures, and declining morale – further eroding the Company’s intrinsic value over time. In this context, a sale to Cintas represents the best outcome for all stakeholders. Cintas represents the natural and most logical home for UniFirst. The two companies are highly complementary, sharing similar strategies, non-union operations, and the potential for substantial synergies. Given that UniFirst’s performance is likely to deteriorate further and the fact that there is a limited window to pursue a transaction under the current administration’s very business-friendly approach to antitrust, the Board must act immediately by: |

| o | Announcing a formal sale process to signal to prospective buyers that the Board and the Croatti family are serious about selling the Company. |

| o | Adding two directors who possess relevant experience and who are committed to pursuing a value-maximizing sale. We believe there is no better candidate than Michael Croatti to help the Board achieve this outcome, given his industry experience and his knowledge of the Company. In addition, we believe the appointment of a shareholder representative with significant M&A and capital allocation experience would be beneficial at this time, which is why we intend to nominate Michael and myself for election to the Board. |

| o | Establishing a special committee of independent directors to oversee the sale process. |

2 Engine Capital screened for publicly disclosed acquisition bids made in the last five years that included premiums greater than 50% at U.S. companies that have market capitalizations of greater than $1 billion.

| 2 |

The purpose of this letter is not to embarrass the Board or the Croatti family. It is our preference and desire to privately work together with you. We hope this letter presents you with an objective and independent perspective of the Company’s evolution, highlighting the significant issues UniFirst will face if it continues to go it alone and serving as a catalyst for a constructive dialogue that ultimately leads to a value-maximizing outcome. In this spirit, we are requesting a meeting with the Board, as well as with the Trustees, as soon as possible.

A Detailed Look at Why a Sale Is the Best Path Forward for UniFirst

| 1. | Mishandled Leadership Succession Has Driven Disastrous Share Price Performance |

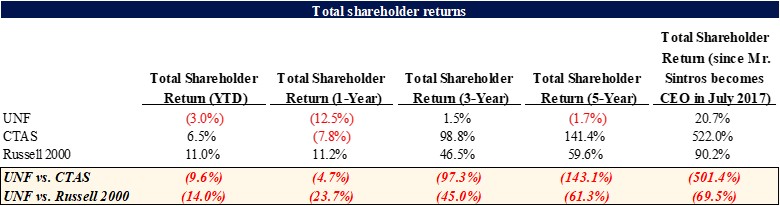

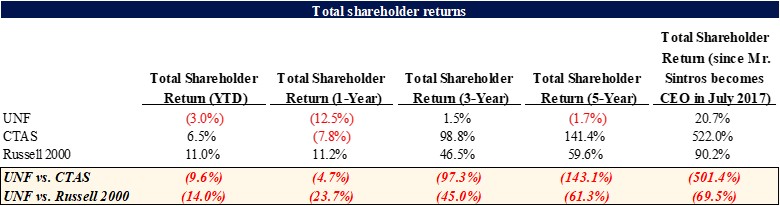

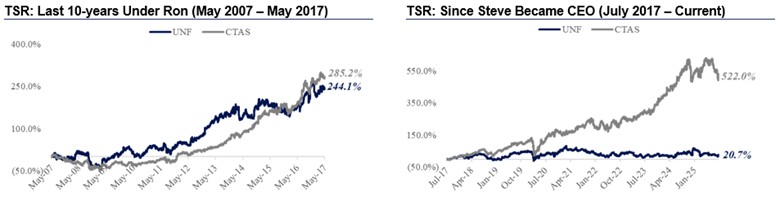

Mr. Croatti had groomed his son, Michael, to succeed him as CEO. In fact, Ron publicly stated on a 2011 episode of Undercover Boss that “Michael will be the next CEO.” Yet, in a surprising move – and despite Carol Croatti possessing the voting control necessary to promote Michael, a 28-year veteran of the Company – Mr. Sintros, UniFirst’s former CFO, was appointed CEO instead. Cynthia Croatti, formerly a human resources (“HR”) executive, later assumed the role of Special Consultant and Advisor to the CEO and Senior Leadership. These decisions, which directly contradicted Mr. Croatti’s expressed wishes, marked the beginning of UniFirst’s decline. The stock performance tells the story unmistakably: since these leadership changes, the Company has delivered deeply disappointing total shareholder returns across every relevant time period, as shown in the table below.3

Even more striking is the contrast in share price performance between UniFirst and Cintas before and after Mr. Croatti’s passing, as shown in the graphs below. In the decade prior to Mr. Croatti’s death, the companies delivered comparable returns. Since leadership transitioned to Mr. Sintros and Cynthia Croatti, however, UniFirst’s stock has largely stagnated while Cintas’ has soared – a stark illustration of UniFirst’s strategic and operational decline under its current leadership.

3 Total shareholder return calculated as of the close on October 22, 2025.

| 3 |

| 2. | Poor Execution and Misallocation of Corporate Resources |

The Company’s sustained underperformance stems from poor execution, excessive costs, and misguided capital allocation. To better understand UniFirst’s subpar performance since Mr. Croatti’s passing, we spoke with more than 20 former senior employees. These discussions made clear that many of the Company’s issues are self-inflicted and attributable to senior management and the Board. Below are the key issues the Company faces today, based on our extensive due diligence:

Execution Failures and a Lost Decade of Technology Mismanagement

UniFirst has consistently disappointed shareholders from an execution standpoint. As an example, management launched its newest CRM initiative in 2018. Since then, we estimate the Company has spent in excess of $200 million on CRM investments, with the system fully going live in 2024 – yet shareholders have seen no measurable benefit. In fact, since beginning its IT modernization efforts more than a decade ago, we estimate UniFirst has spent more than $450 million on both its CRM and ERP initiatives. Despite failing to translate these capital investments into tangible operational improvements, we believe the management team plans on deploying an incremental $85 million to $100 million of shareholder capital to complete the Company’s ERP update. Management suggests that the ERP project will lead to cost savings by 2028, but we and many former employees are skeptical and view it as a last-ditch effort to justify the tremendous spend.

What is truly astounding is that, after more than a decade and hundreds of millions of dollars invested, UniFirst’s core operating system still runs on outdated AS400 technology – a decades-old platform patched together with various add-ons to fill functionality gaps. Ironically, these repeated “modernization” efforts have only made the IT architecture more complex and difficult to maintain, reducing efficiency and providing management with yet another excuse for the Company’s margin decline.

Despite repeated assurances that the new CRM would streamline driver workflows and enhance customer retention, the opposite has occurred. Customer churn has increased from roughly 8% historically to about 9% today, well above that of Cintas, which operates closer to 6.5%. Ironically, management has partly blamed this elevated churn on the CRM rollout itself, with the rest of the issues caused by aggressive pricing tactics that have driven many customers to rebid contracts with competitors. Furthermore, management’s long-term growth targets of mid-single digits – which assume churn can be brought down to Cintas-like levels – are, in our view, wholly unrealistic. As one former senior employee noted: “When you take away the large price increases and the M&A, the underlying business is going backwards. I don’t see how they can get to 5% growth rates. I just can’t see it without increasing their pricing materially, which isn’t an option anymore.”

Declining Margins and Bloated Corporate Structure

Since reaching operating margins of 12.8% in 2019, UniFirst’s profitability has deteriorated sharply, declining by roughly 50% (or 640 basis points) to an expected 6.4% in FY2026 – underscoring the Company’s sustained margin erosion. In contrast, since 2019, Cintas’ operating margins have expanded by more than 635 basis points to 22.8% in FY2025, with expectations to surpass 23% in FY2026 – highlighting the widening profitability gap between the two companies. UniFirst can simply no longer compete with Cintas. Alarmingly, even after years of heavy investment in technology, personnel, and adjacent initiatives such as Direct Sales and First Aid & Safety, management’s current longer-term plan of high-teens EBITDA margins merely aims to return the Company to the margin levels achieved six years ago – hardly a vision of progress.

| 4 |

Additionally, since 2019, corporate expenses have ballooned from roughly $165 million to $273 million in 2024, representing a compound annual growth rate exceeding 20% – far outpacing the Company’s revenue growth. Over this period, the corporate office has expanded dramatically, fostering a top-down culture where initiatives appear driven by the need to justify headcount rather than to support field operations.

Departments that were once lean and effective have become bloated. Purchasing, which historically operated with six to seven employees, now has nearly 20. HR, once a modest six- to seven-person function, has swelled to over 50 employees. Field leaders express growing frustration with HR, which increasingly attempts to control operations under the guise of compliance, rather than supporting operational performance. It is telling that these areas – HR and Purchasing – have expanded most aggressively since Mr. Croatti’s passing, likely reflecting Cynthia Croatti’s influence, given her prior roles in both functions.

The Company’s efforts to centralize various functions have added unnecessary complexity to business processes, creating frustration for both customers and employees. For example, Accounts Receivable, once managed locally, was centralized following the rollout of new software. The system is reportedly outdated, forcing the Company to hire additional IT and finance staff just to maintain it. Even simple tasks, such as processing a credit card payment, now require customers to contact corporate, adding needless steps and wasting valuable time.

Based on our due diligence, it is evident that the corporate organization is overbuilt, disconnected from operational realities, and in urgent need of restructuring.

Unoptimized Balance Sheet and Poor Capital Allocation

Unlike Cintas, UniFirst has historically maintained a net cash position despite strong free cash flow and the capacity to carry significantly more debt. By not leveraging its balance sheet, the Company has limited its ability to pursue inorganic growth – a critical misstep in an industry where scale and route density are key competitive advantages. Operating with a net cash position also raises the Company’s cost of capital, making acquisitions less accretive than they would be under appropriate leverage. In contrast, Cintas has strategically optimized its balance sheet, providing the firepower to pursue large, accretive acquisitions such as G&K Services (“G&K”), which materially expanded its scale and strengthened its strategic position relative to UniFirst.

UniFirst’s M&A runway has also been further constrained by its prolonged focus on failed technology initiatives, which have absorbed significant capital with little to show in return. Additionally, it is unclear how much value has been created through the Company’s M&A strategy. Between 2019 and 2025, the Company invested over $1.4 billion in capital expenditures and acquisitions, yet adjusted EBITDA fell by roughly $4 million during the same period – and is projected to decline by over $21 million in 2026.

| 3. | Low Morale, Worsening Culture, and Ineffective Governance |

In discussions with us, many employees lamented the loss of the family-oriented culture that made UniFirst special for so long under Mr. Croatti’s leadership. They consistently described a sharp cultural shift following his passing and the subsequent appointment of Mr. Sintros as CEO.

| 5 |

Under Mr. Croatti’s leadership, UniFirst fostered a close partnership between corporate leaders and field managers, with senior executives deeply involved in day-to-day operations. That hands-on, collaborative culture has since dissipated. Today, senior management increasingly views operational engagement as beneath them – limiting interaction with the field and focusing instead on top-down strategy. As one former employee put it, “Ron was constantly on the road visiting locations, while Steve manages the Company from the corporate office, seldom engaging with the field.” As a result, the corporate office has grown isolated from the front lines, with executives operating in silos and delegating day-to-day operating responsibilities to lower-level managers. This detachment has led to weak alignment, poor accountability, and a widening disconnect between leadership, operations, and the field. Unsurprisingly, the Company’s performance reflects these negative changes.

Compounding these cultural shifts, the recent appointment of Chief Operating Officer Kelly Rooney represents a notable break from UniFirst’s long-standing practice of promoting from within. Historically, internal advancement served as a powerful motivator for field leaders. However, this external hire – coupled with the decision to fill three recent VP openings with external hires – has sent a discouraging signal to the more than 70 general managers who once viewed those roles as attainable career goals. Not surprisingly, morale across the field organization has suffered significantly. Many current and former employees have also questioned the logic of appointing Ms. Rooney – a former Chief Human Resources Officer – as COO given UniFirst’s long-standing technology challenges, the complexity of its ERP implementation, and the operational intricacies of the business.

Making matters worse, management recently divided the Company into two groups of five regions and elevated two inexperienced VPs into senior leadership roles – both reporting directly to Ms. Rooney. In short, UniFirst is moving in the wrong direction. Rather than empowering proven leaders with deep institutional knowledge, the Company has centralized decision-making in the hands of individuals who lack both the operational expertise, and the credibility needed to inspire the organization.

Ineffective Governance

Many of UniFirst’s operational and cultural challenges stem from its ineffective governance structure, which lacks meaningful checks and balances. The Company’s dual-class share structure and the concentration of power among a small group of individuals have insulated both the Board and management from accountability. As a result, leadership is incentivized to prioritize the preferences of this select group, with little to no oversight from the broader shareholder base or from a typical board, regardless of what is best for the Company, employees, or shareholders.

As an example, following Mr. Croatti’s passing, Cynthia Croatti started to assume an increasing level of authority without having the appropriate experience. As one former senior employee put it: “The standalone prospects of the business are concerning and as Cindy continues to wield control over the Board and executive team, I believe UniFirst’s prospects will only get worse. Based on how the Company has been run and the decisions made under her watch, it seems like she wants to wipe Ron’s legacy out of the books because many of the things she’s pushing for have reversed the way Ron would have wanted it done.”

These dynamics have fostered a culture in which certain members of senior management and the Board act as sycophants, desperate to curry favor with those they perceive to hold power. Nothing better captures this culture of self-congratulation and dysfunction than the recent launch of the “Cynthia Croatti Leadership Award,” which, astonishingly, was awarded to Cynthia Croatti herself.

It is time for the Company and the Board to return to the core values that once defined UniFirst – Customer Focus, Commitment to Quality, and Respect for Others – values embodied by Aldo Croatti and his son, Ron. Today, those principles have been abandoned: customers are being squeezed by rising fees, quality and service have deteriorated, and neither employees nor shareholders feel respected by the Croatti family.

| 6 |

We also have serious concerns about the independence and effectiveness of the Board’s leadership. Chairman Raymond Zemlin’s long-standing personal and professional relationship with UniFirst and the Croatti family – as the Company’s lead lawyer for 30+ years while at Goodwin Procter LLP, as the executor of Aldo Croatti’s estate, and as manager of the various Croatti family trusts – raises significant questions about his ability to act in the best interests of all shareholders.4 Such long-standing personal and financial ties raise serious concerns about his ability to exercise objective oversight. Moreover, unusually long Board tenures run counter to corporate governance best practices and further undermine true independence. Michael Iandoli’s 18-year tenure exemplifies the risk of entrenched behavior, and a Board increasingly insulated from shareholder interests.

| 4. | The Board Rejected a Golden Opportunity to Realize Value |

The Company’s Standalone Prospects Are Increasingly Challenged

Based on the litany of execution issues at the Company, we believe its standalone prospects are bleak and bring considerable execution risk. Conversations with former employees reinforce our skepticism – these former employees uniformly doubt the Company’s ability to achieve the projected 150–200 basis points of margin improvement from the ERP rollout. As one former executive put it, “This ERP implementation will only level the playing field and bring UniFirst into the 21st century. It won’t enhance the P&L. Just look at their CRM, it’s been live and there’s been no financial improvement.” At the same time, the Company is losing customers, with churn moving in the wrong direction, and the performance gap versus Cintas widening further. With pricing no longer a lever to mask underlying weakness in the business, we believe UniFirst’s growth trajectory and earnings profile is likely to materially deteriorate over time. This is further evidenced by the Company’s disappointing 2026 financial outlook.

UniFirst is also losing ground competitively to Cintas. For larger accounts, Cintas secures upfront payments, effectively treating new wins like small acquisitions – a practice commonly referred to as “customer buyouts.” This strategic tactic is likely to gain further steam and accelerate churn within UniFirst’s customer base going forward. Cintas’ materially larger scale – almost five times that of UniFirst – further enhances its ability to discount price and take additional share. For instance, in the core laundry business, scale drives the competitive moat: greater route density spreads fixed costs, enables higher margins, improves service levels, and supports superior pricing. As Cintas continues to grow organically and inorganically faster than UniFirst, the Company’s competitive advantage and value proposition to customers will continue to worsen. With tariffs looming, customers becoming increasingly price-conscious, and costs expected to rise further, Cintas is far better positioned to manage its cost base and capitalize on price-sensitive customers. Over time, this advantage will allow Cintas to further encroach on UniFirst’s core markets, with market share losses likely to accelerate. Given this competitive dynamic, time is not on UniFirst’s side. Instead of acquiring UniFirst outright, Cintas is likely to slowly bleed the Company dry by “buying” its customers one by one until little value remains. In this context, we question how the Board could let the opportunity of a lifetime pass by not transacting with Cintas – and suspect other shareholders feel the same disappointment. Based on our diligence, we understand there was very limited engagement between the two companies, which raises troubling questions about the Board’s willingness to fulfill its fiduciary duties.

4 Raymond Zemlin’s experience on Goodwin Procter LLP’s website includes “Mr. Zemlin has represented UniFirst for more than 30 years, including with respect to its IPO, follow-on offerings and scores of acquisitions. Mr. Zemlin is a trusted advisor to the company, its management and the family that controls it.”

| 7 |

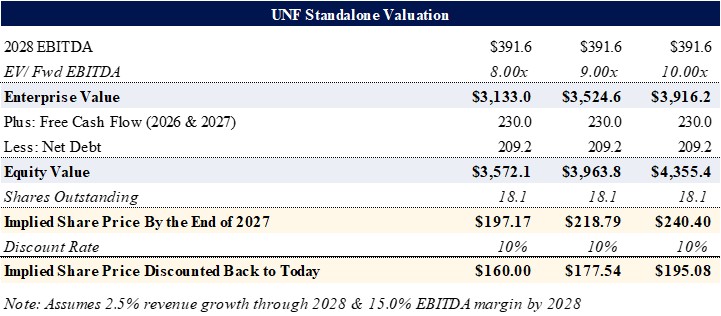

An Analysis of the Company’s Standalone Value

UniFirst’s standalone value, even under the most optimistic assumptions, falls far short of Cintas’ offer. Even if one assumes substantial operational improvements through 2028 and a multiple re-rating, the present value of UniFirst does not approach the value Cintas was prepared to pay. Yet, inexplicably and without explanation, the Board and the controlling shareholders – Cynthia Croatti, Carol Croatti, Cecelia Levenstein, and Matthew Croatti (as trustees of the various Croatti trusts) rejected this unique opportunity, effectively squandering significant shareholder value.

While we are concerned about UniFirst’s prospects, we have modeled a highly optimistic scenario purely for illustration (for clarity, we do not consider this scenario to be realistic). Even under these highly favorable and unrealistic assumptions, the present value of the Company fails to reach $200 per share – well below Cintas’ proposed transaction price.

As another data point, it is worth highlighting that Wall Street analysts, typically optimistic by nature, have taken a negative stance on the Company, assigning a consensus “Reduce” or “Sell” rating due to concerns about revenue and earnings growth. The median 12-month price target stands at approximately $165 per share – implying minimal upside from current levels and representing a striking 40% discount to the price offered by Cintas, which the Board chose to reject. Our view can be summed up by J.P. Morgan’s research note following the Company’s Q4 2025 results: “UniFirst continues to lack a detailed, cohesive, publicly-articulated strategy for returning the business towards mid-single digit % revenue growth and high teens % EBITDA margins. We have written in the past that UniFirst’s decision to reject Cintas’ unsolicited takeout offer ‘puts the shortest route to maximum shareholder value creation in the rearview mirror.’ Today’s results suggest that the alternative path may prove bumpy and winding.” The stark contrast between UniFirst’s poor outlook and the very rich offer it received underscores the urgency of reconsidering Cintas’ proposal.

| 8 |

| 5. | A Sale Represents the Best Path Forward |

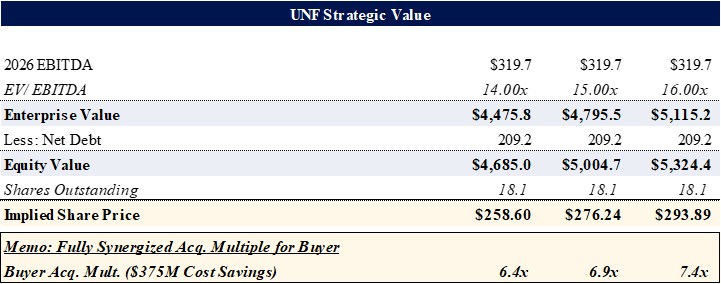

Despite numerous operational and strategic missteps by management and the Board, UniFirst continues to hold significant strategic value for Cintas. Our conversations and research reinforce our view that Cintas remains highly interested in acquiring the Company. To maximize value for shareholders, we believe it is essential that the Board publicly announce a formal strategic review process – signaling to potential buyers that both the Board and the Croatti family are genuinely open to a transaction. By engaging with multiple parties, the Board and its financial advisors can create competitive tension and extract the highest possible price from Cintas, which is likely to be the most motivated and highest bidder given the substantial synergies. Given these dynamics, we suspect UniFirst could transact within the following range.

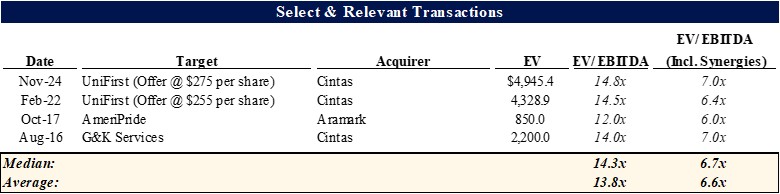

At the midpoint of this valuation range, the stock would be at ~$276 per share, close to Cintas’ initial offer and a premium of ~ 80% from the current price. Our base case transaction multiple of 15.0x would be in line with or higher than the multiples paid by Cintas in prior transactions, as the below table highlights:

Delaying a Sale Process Is Misguided and Very Risky

The Board may argue that a sale in a few years could yield a higher valuation once management’s current initiatives take hold. We believe this would be a profound mistake. UniFirst’s execution track record is weak, and these initiatives are unlikely to deliver the intended results. Even if they do, any benefits will be at least partially offset by the increasingly difficult competitive environment. The optimal time to sell UniFirst is now for the following reasons:

| 9 |

| · | Acquirers can already recognize and ascribe value today to the Company’s ongoing initiatives – such as the ERP roll-out and direct uniform sales efforts – through due diligence, without assuming execution risk. |

| · | Antitrust risk only increases with time as Cintas continues to grow organically and through acquisitions and UniFirst completes additional tuck-in acquisitions. If the Board fails to act now, it is taking the extraordinary risk that a future transaction becomes far more challenging or even impossible from an antitrust perspective. |

| · | UniFirst’s acquisition price is likely to decline over time. UniFirst’s competitive position is deteriorating as Cintas captures market share through customer buyouts, scale-driven efficiencies, and superior pricing and service capabilities. Rising tariffs and cost pressures will further amplify Cintas’ advantages, weakening UniFirst and reducing its value as an acquisition target over time. |

The Answer to the Company’s Problems Is Not Merely Hiring a New CEO

While we are critical of Mr. Sintros’ performance, merely replacing him as CEO would not address UniFirst’s underlying challenges. The Company’s competitive position has deteriorated so significantly that market share losses are likely to continue regardless of who holds the CEO role. Any turnaround under new leadership would be risky, slow to materialize – if it succeeds at all – and unlikely to achieve a valuation remotely comparable to what a sale to Cintas could deliver today. As a former senior employee observed, “Cintas is on a mission to win over UniFirst’s large national accounts – and it will succeed. Cintas offers a broader range of products and can offer more competitive pricing than UniFirst, and there is very little Steve can do to change that dynamic at this point. That’s why the Board’s refusal to sell to Cintas made no sense: instead of buying UniFirst, Cintas will simply buy its customers.”

A Sale Process Would Be Bolstered by the Appointment of Michael Croatti and Arnaud Ajdler

As the Company embarks on a strategic process, it is critical to strengthen the Board by adding two directors with deep operational expertise, extensive industry knowledge, and proven M&A experience. Michael Croatti is uniquely qualified for this role. His operational expertise, intimate understanding of the business, and relationships with potential acquirors position him to help the Board unlock shareholder value. We are confident that the Board and Trustees will recognize how Michael’s experience and knowledge can benefit the Company – a perspective we believe Ron would have fully endorsed. In addition, I believe I would bring significant M&A expertise and an investor mindset to the boardroom, which would add critical discipline and credibility to the Board’s strategic review process. I have served on more than ten public company boards and participated in the sale of multiple public companies.

We also recommend the Board establish a special committee of independent directors to oversee the sale process. We propose this committee include Joseph Nowicki, Sergio Pupkin, Michael Croatti, and me, all of whom bring the experience necessary to manage this critical process effectively. As part of this process, it is important to ensure that executives that are key to the transaction are appropriately motivated and aligned with shareholders. In our experience, given the size of the transaction, it would not be unusual for these executives to participate in a transaction bonus pool of approximately 0.5% of the transaction value, with a large percentage of the pool typically allocated to the CEO and CFO. Alternatively, the Board could amend the change-in-control provisions in the relevant executives’ contracts to achieve a similar objective.

| 10 |

The Current Administration Creates a Unique M&A Window

Antitrust considerations are important. The Board is undoubtedly aware that the current administration is highly M&A-friendly. This creates a rare window to complete the transaction – an opportunity that may not arise again for some time. We have consulted attorneys who were previously involved in Cintas’ acquisition of G&K. Based on these discussions, we believe there is a high likelihood of government approval, given the market definition, the large market size, and the multiple alternative uniform solutions available to customers – including both rental and direct-purchase options. With the right narrative, this is an unusually favorable environment to pursue a transaction. We would expect the Board to negotiate a substantial termination fee should the deal fail to close for unexpected reasons.5

Conclusion

We do not intend to make this letter or our views public at this time as it is our sincere hope that we can work cooperatively for the benefit of all stakeholders. However, we caution the Board against maintaining the status quo. Time is critical: the Company’s long-term prospects are deteriorating, and its value is likely to decline further as Cintas continues to gain market share. We hope to meet with the Board and Trustees at the earliest practical opportunity to discuss the matters raised in this letter.

Sincerely,

Arnaud Ajdler

/s/ Arnaud Ajdler

Managing Member

5 G&K secured a termination fee of approximately $100 million, or 4.5% of its deal value; this percentage should serve as a floor for UniFirst.

| 11 |