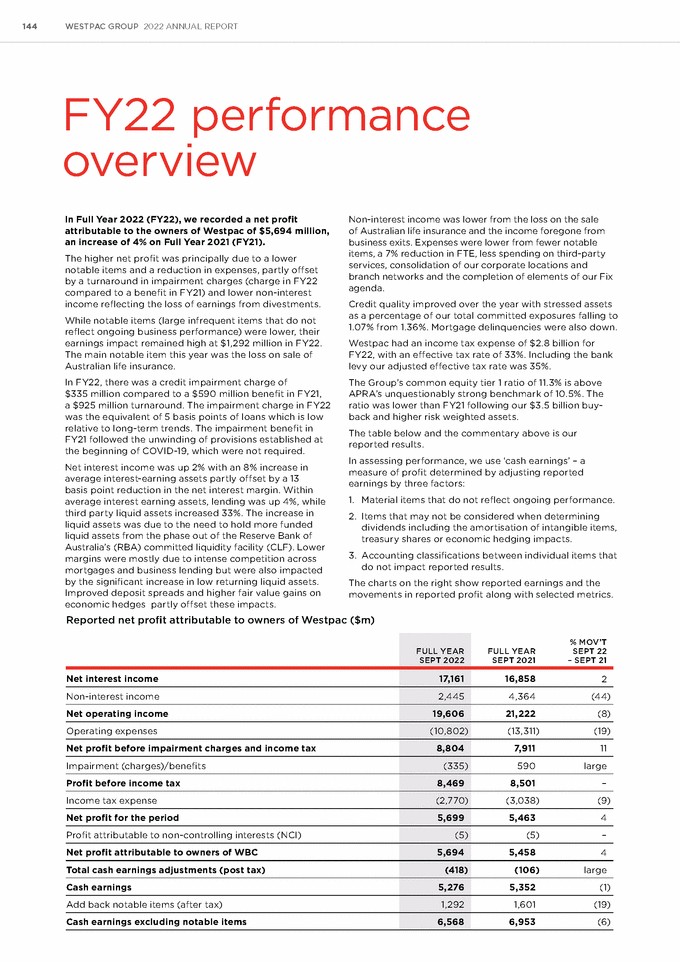

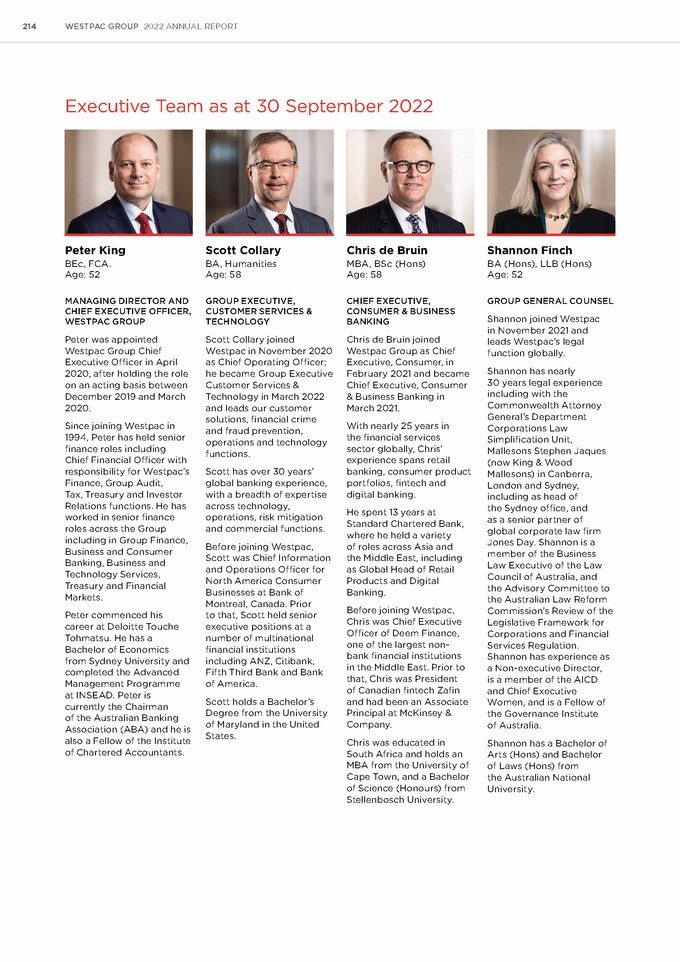

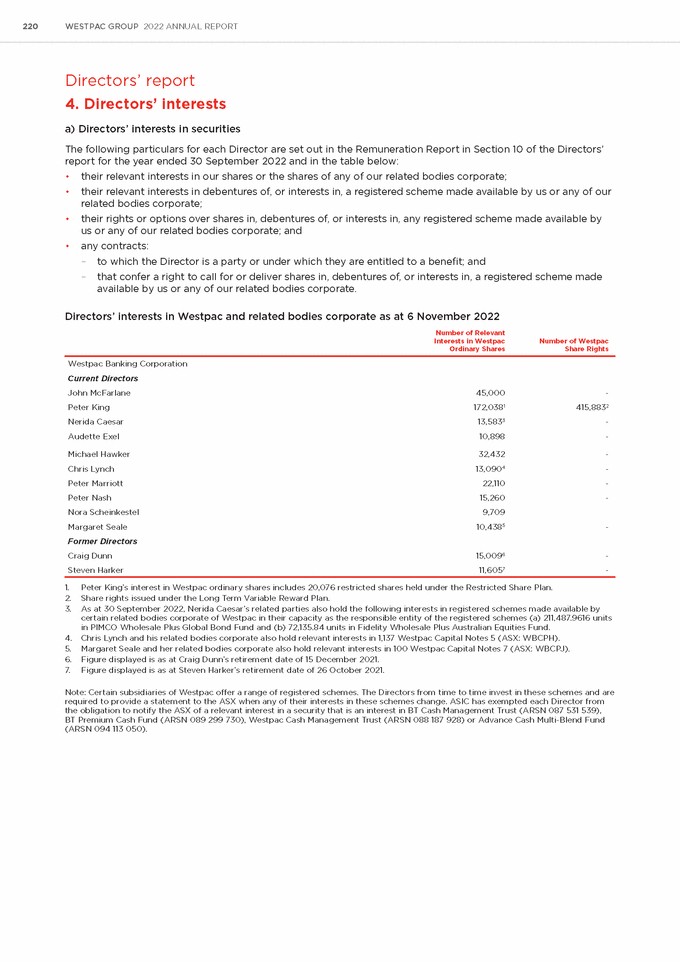

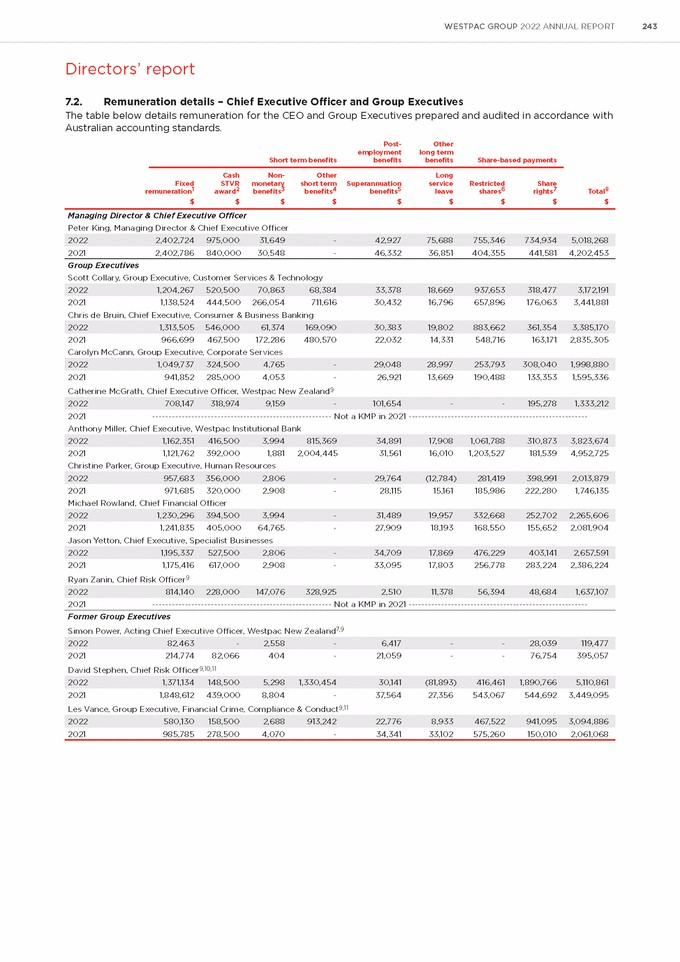

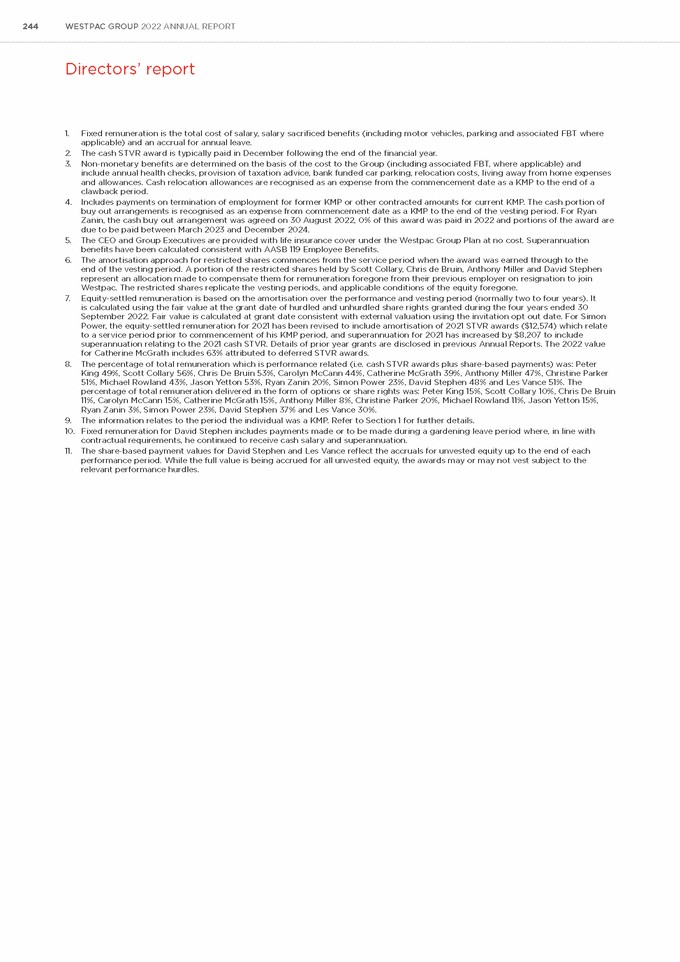

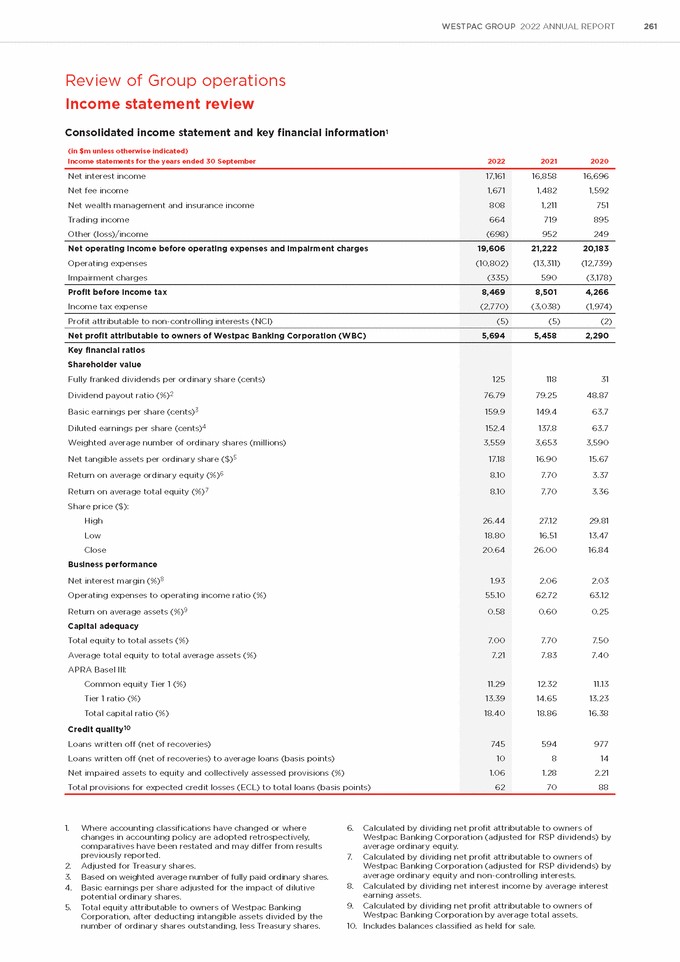

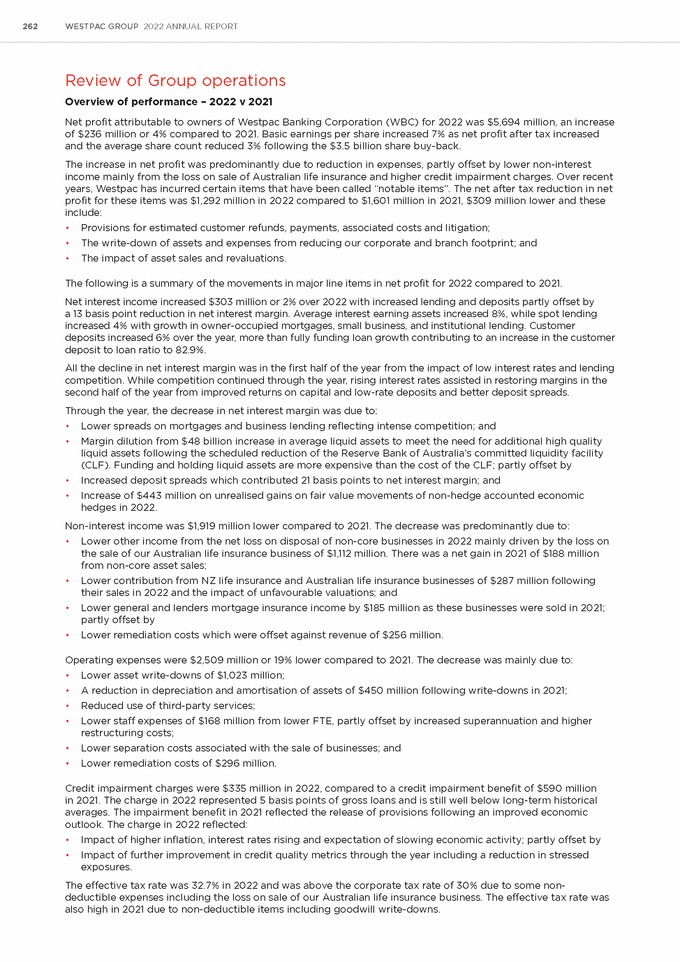

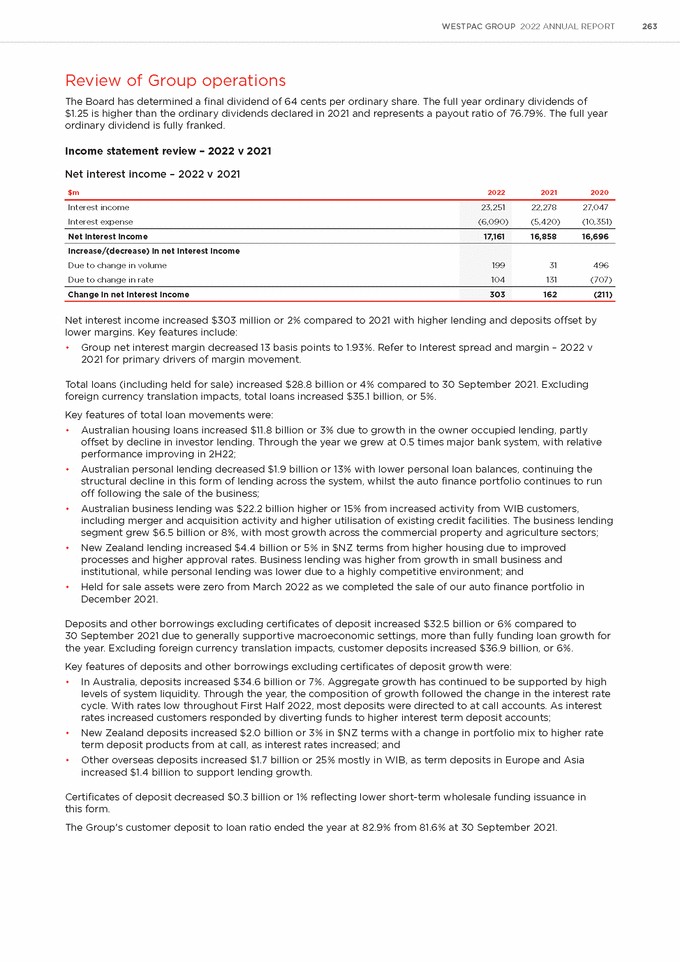

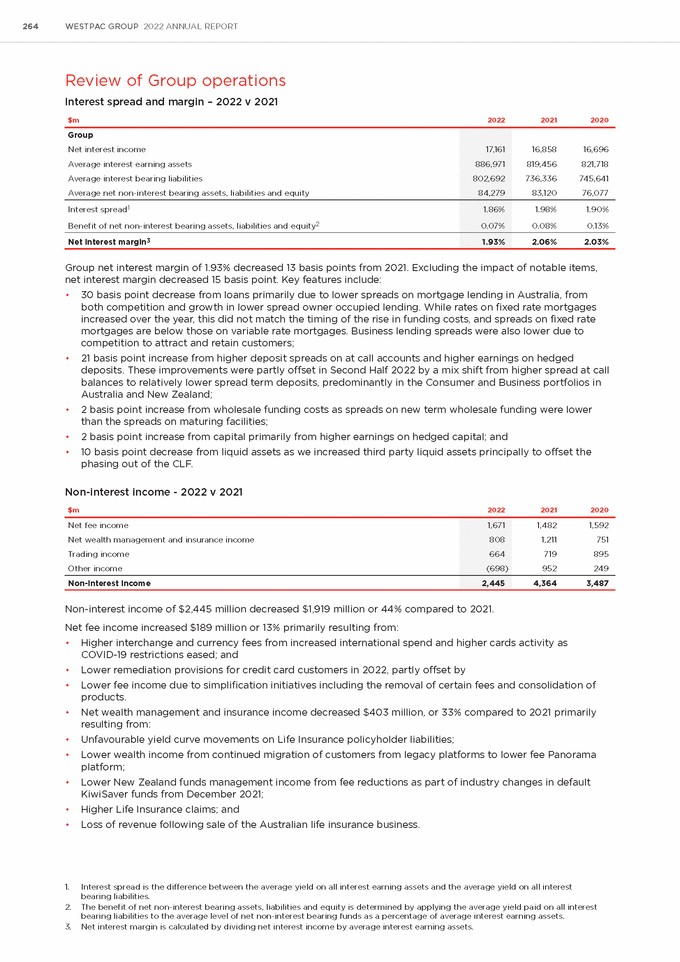

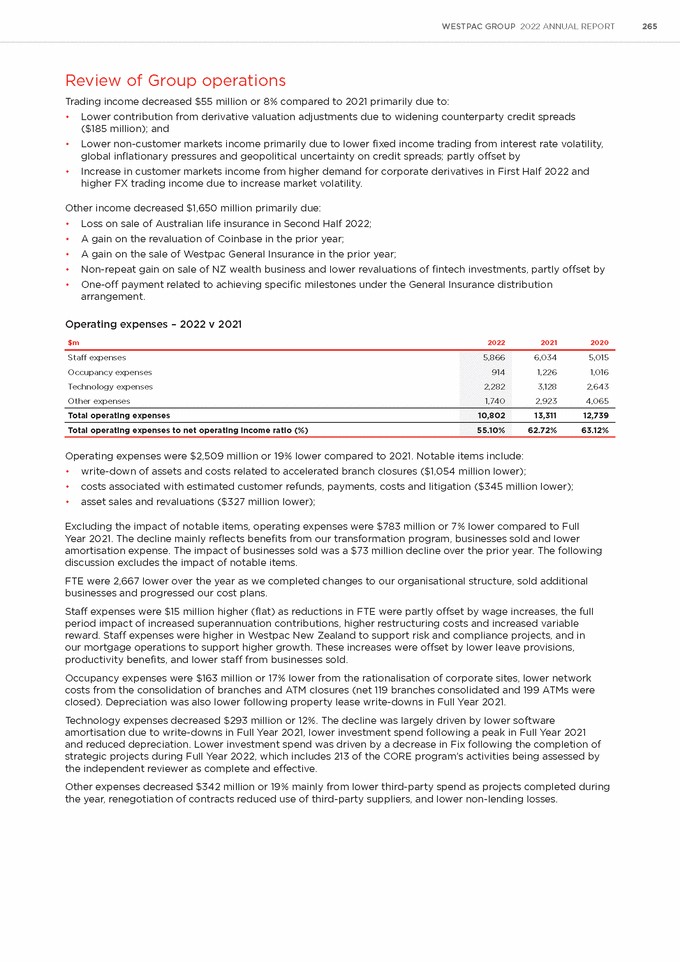

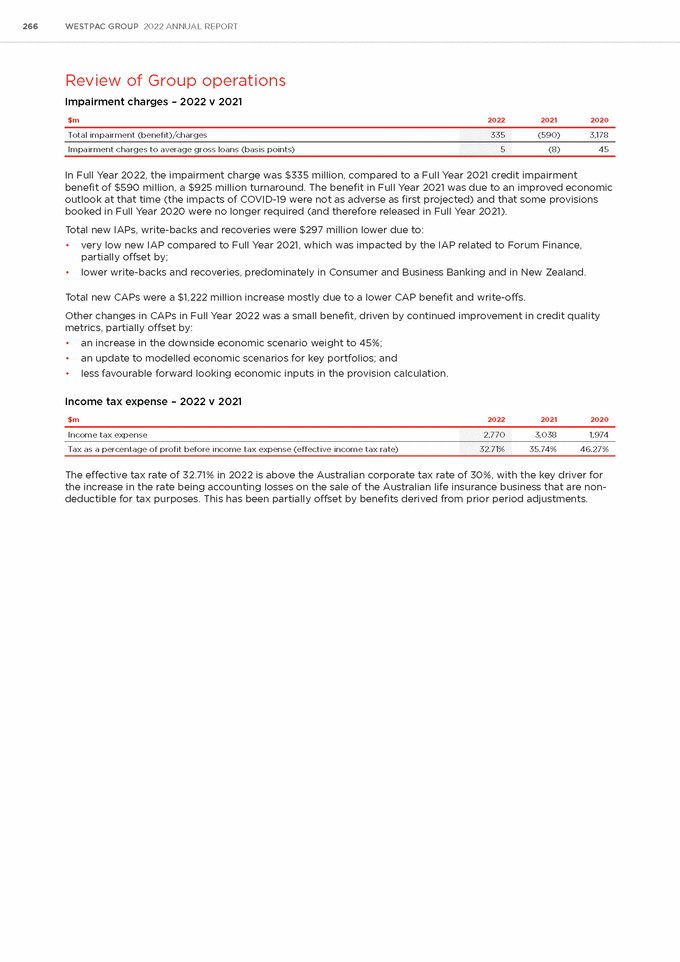

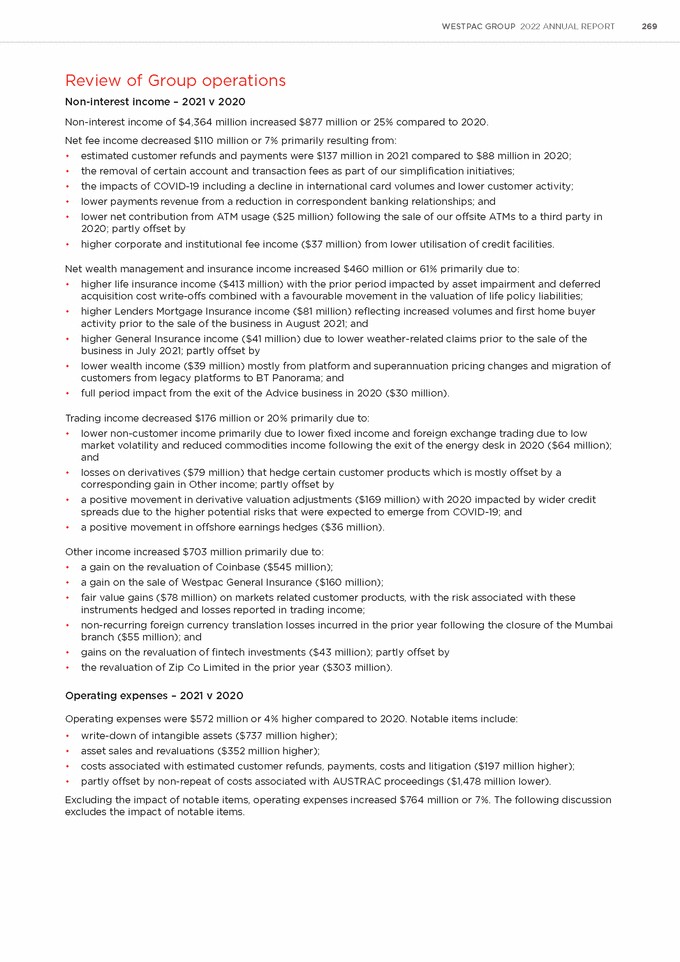

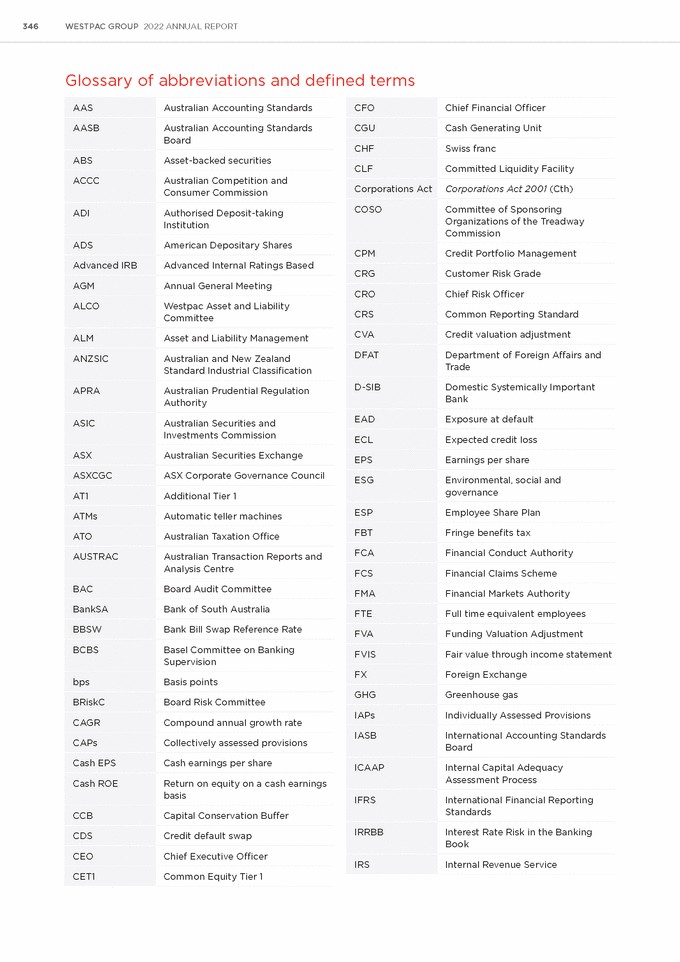

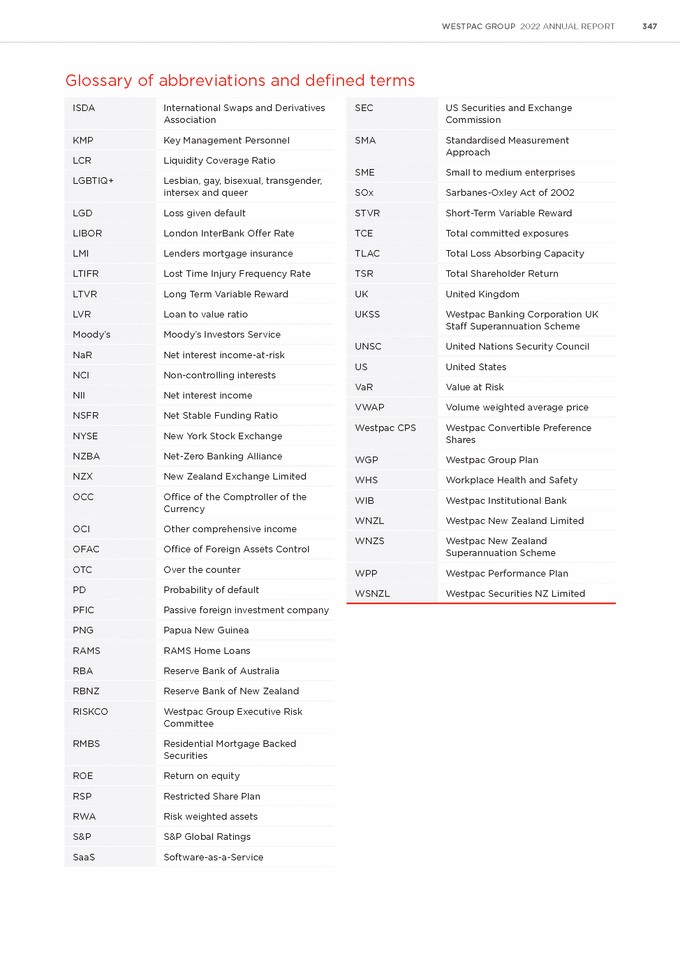

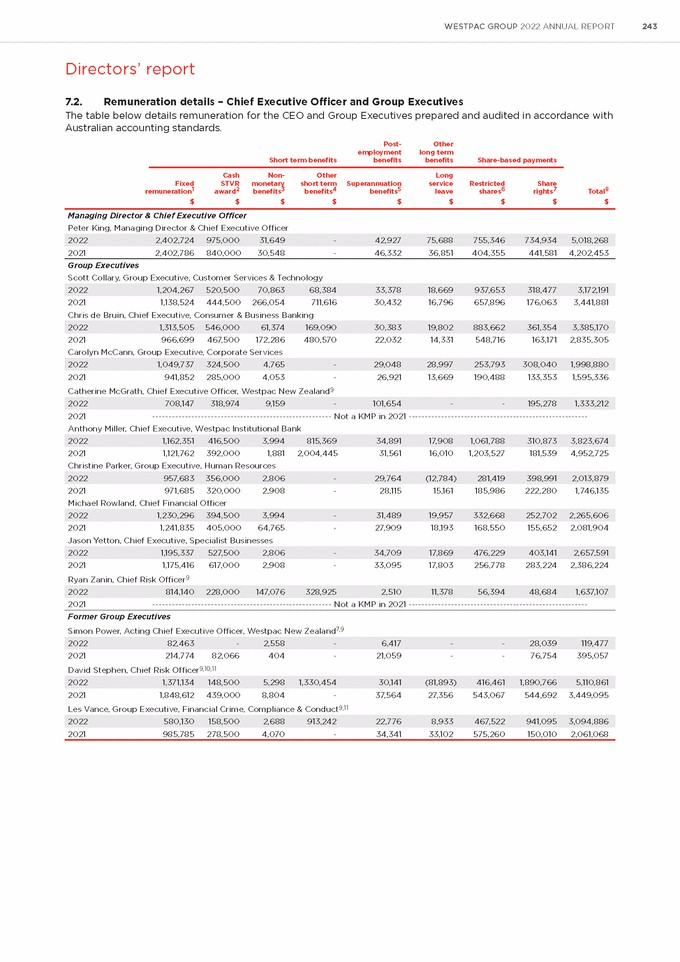

| WESTPAC GROUP 2022 ANNUAL REPORT 243 Directors’ report 7.2. Remuneration details – Chief Executive Officer and Group Executives The table below details remuneration for the CEO and Group Executives prepared and audited in accordance with Australian accounting standards. Post-employment benefits Other long term benefits Short term benefits Share-based payments Cash Non-Other Long service leave $ Fixed remuneration1 $ STVR award2 $ monetary benefits3 $ short term benefits4 $ Superannuation benefits5 $ Restricted shares6 $ Share rights7 $ Total8 $ Managing Director & Chief Executive Officer Peter King, Managing Director & Chief Executive Officer 2021 2,402,786 840,000 30,548 - 46,332 36,851 404,355 441,581 4,202,453 Group Executives Scott Collary, Group Executive, Customer Services & Technology 2021 1,138,524444,500 266,054 711,616 30,432 16,796 657,896 176,063 3,441,881 Chris de Bruin, Chief Executive, Consumer & Business Banking 2021 966,699 467,500 172,286 480,570 22,032 14,331 548,716 163,171 2,835,305 Carolyn McCann, Group Executive, Corporate Services 2021 941,852 285,000 4,053 - 26,921 13,669 190,488 133,353 1,595,336 Catherine McGrath, Chief Executive Officer, Westpac New Zealand9 2021 -------------------------------------------------------Not a KMP in 2021 -------------------------------------------------------Anthony Miller, Chief Executive, Westpac Institutional Bank 2021 1,121,762392,000 1,881 2,004,445 31,561 16,010 1,203,527 181,539 4,952,725 Christine Parker, Group Executive, Human Resources 2021 971,685 320,000 2,908 - 28,115 15,161 185,986 222,280 1,746,135 Michael Rowland, Chief Financial Officer 2021 1,241,835405,000 64,765 - 27,909 18,193 168,550 155,652 2,081,904 Jason Yetton, Chief Executive, Specialist Businesses 2021 1,175,416 617,000 2,908 - 33,095 17,803 256,778 283,224 2,386,224 Ryan Zanin, Chief Risk Officer9 2021 -------------------------------------------------------Not a KMP in 2021 -------------------------------------------------------Former Group Executives Simon Power, Acting Chief Executive Officer, Westpac New Zealand7,9 2021 214,774 82,066 404 - 21,059 - - 76,754 395,057 David Stephen, Chief Risk Officer9,10,11 2021 1,848,612439,000 8,804 - 37,564 27,356 543,067 544,692 3,449,095 Les Vance, Group Executive, Financial Crime, Compliance & Conduct9,11 2021 985,785 278,500 4,070 - 34,341 33,102 575,260 150,010 2,061,068 2022 580,130 158,500 2,688 913,242 22,776 8,933 467,522 941,0953,094,886 2022 1,371,134148,500 5,298 1,330,454 30,141(81,893) 416,4611,890,766 5,110,861 2022 82,463 - 2,558 - 6,417-- 28,039 119,477 2022 814,140 228,000 147,076328,925 2,510 11,37856,39448,684 1,637,107 2022 1,195,337527,500 2,806 - 34,70917,869 476,229 403,1412,657,591 2022 1,230,296 394,500 3,994 - 31,489 19,957 332,668252,702 2,265,606 2022 957,683356,000 2,806 - 29,764 (12,784) 281,419398,991 2,013,879 2022 1,162,351416,500 3,994 815,369 34,891 17,908 1,061,788310,873 3,823,674 2022 708,147 318,974 9,159-101,654-- 195,278 1,333,212 2022 1,049,737324,500 4,765 - 29,04828,997 253,793 308,040 1,998,880 2022 1,313,505 546,000 61,374 169,09030,383 19,802 883,662361,354 3,385,170 2022 1,204,267 520,500 70,86368,38433,378 18,669 937,653 318,477 3,172,191 2022 2,402,724975,000 31,649 - 42,927 75,688 755,346 734,934 5,018,268 |