Exhibit 1

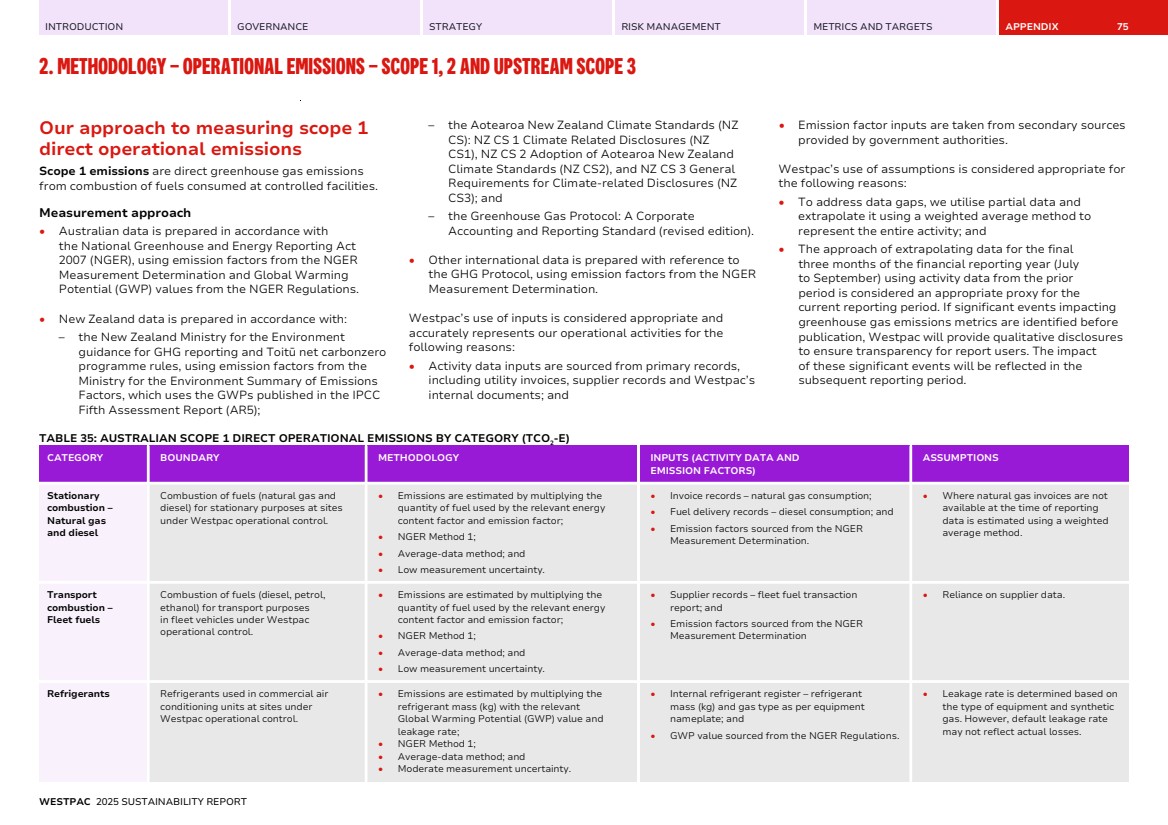

| ASX RELEASE Westpac Banking Corporation Level 18, 275 Kent Street Sydney, NSW, 2000 3 November 2025 Westpac 2025 Sustainability Report Westpac Banking Corporation (“Westpac”) today provides the attached Westpac 2025 Sustainability Report. For further information: Hayden Cooper Justin McCarthy Group Head of Media Relations General Manager, Investor Relations 0402 393 619 0422 800 321 This document has been authorised for release by Tim Hartin, Company Secretary. |

| 2025 SUSTAINABILITY REPORT WESTPAC BANKING CORPORATION ABN 33 007 457 141 THIS REPORT INCLUDES CLIMATE-RELATED DISCLOSURES FOCUSED ON ALIGNING WITH AUSTRALIAN AND NEW ZEALAND STANDARDS. WESTPAC |

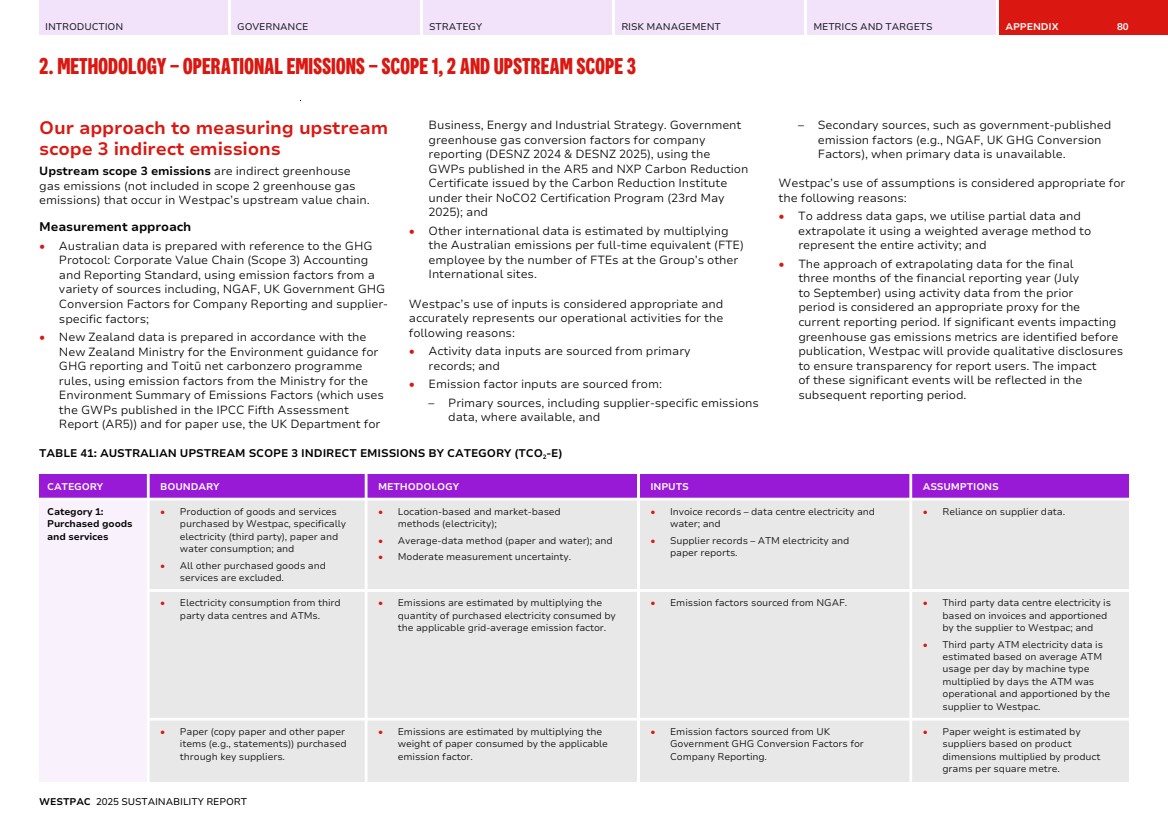

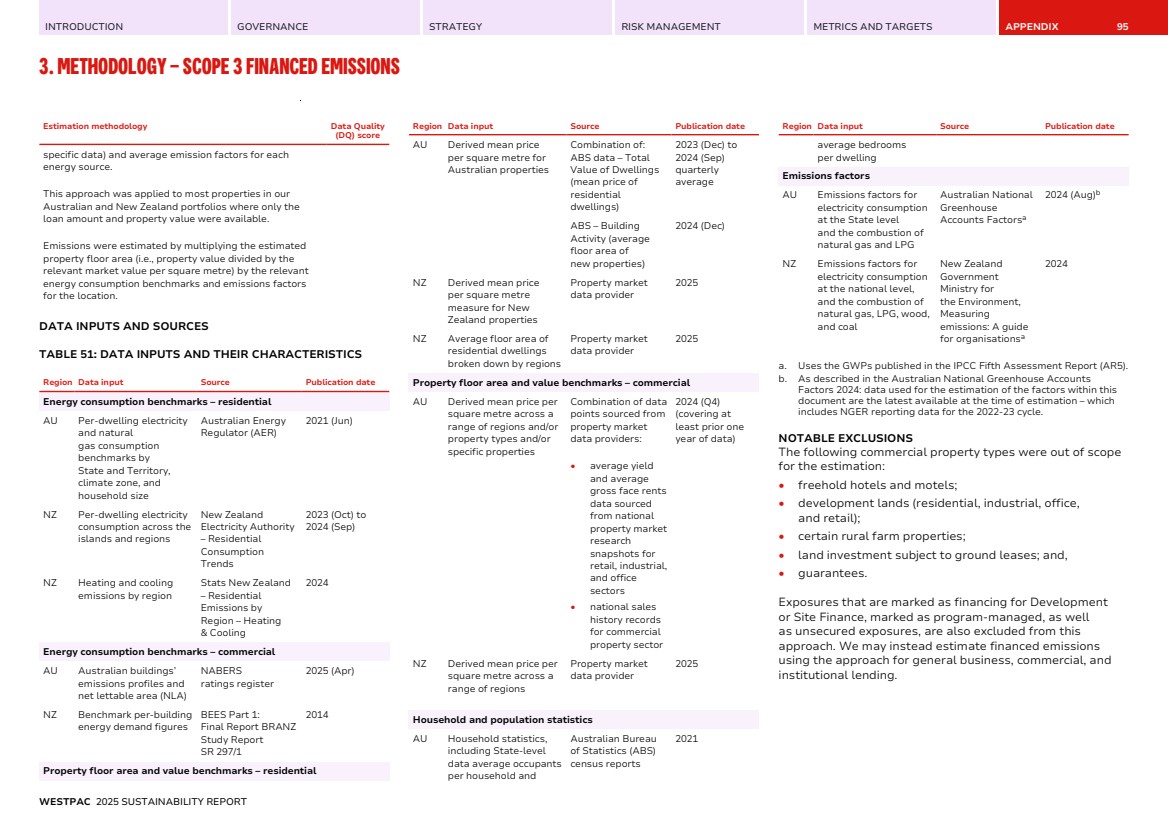

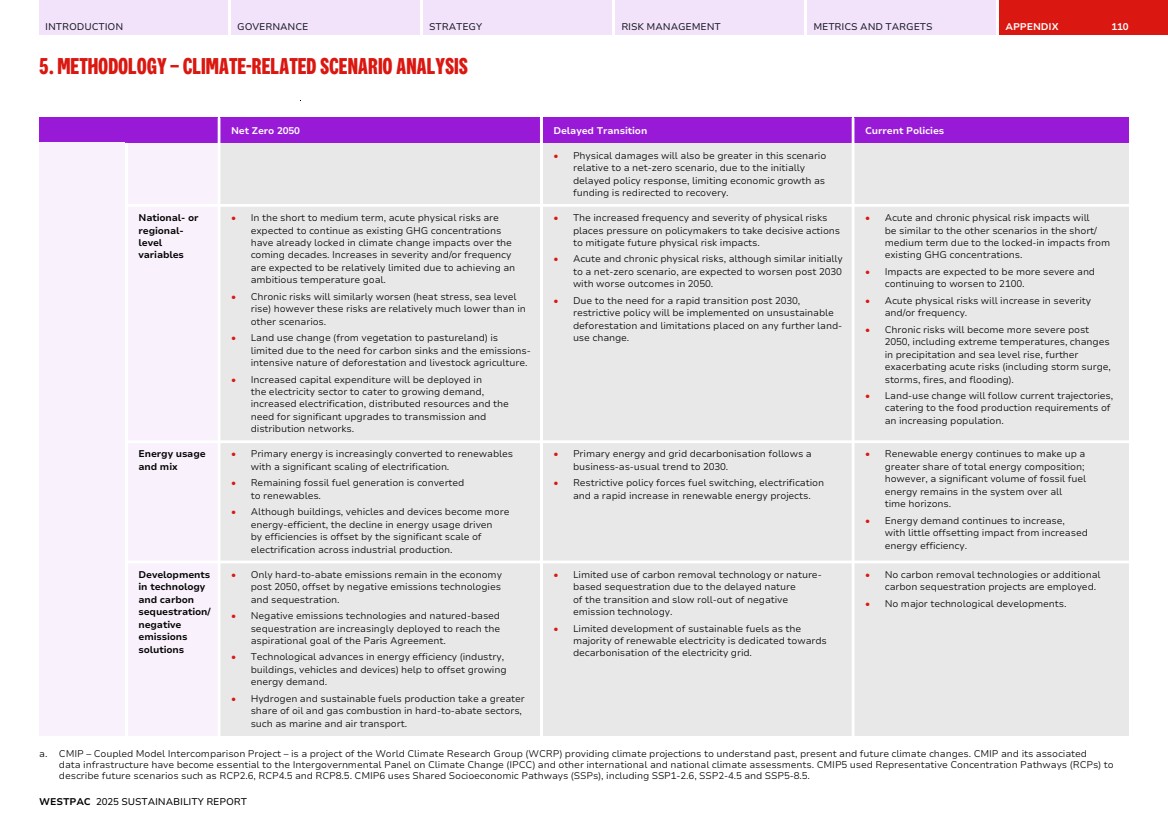

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 1 CONTENTS INTRODUCTION 2 GOVERNANCE 7 STRATEGY 12 Climate-related risks and opportunities 14 Our Climate Transition Plan 36 RISK MANAGEMENT 38 METRICS AND TARGETS 50 APPENDIX 70 1.Glossary 71 2. Methodology – Operational Emissions – Scope 1, 2 and Upstream Scope 3 74 3. Methodology – Scope 3 financed emissions 88 4. Methodology – Financed emissions sector targets 96 5. Methodology – Climate-related scenario analysis 107 6. Independent Assurance Statement 113 7.Disclaimer 117 “OUR PURPOSE IS TAKING ACTION NOW TO CREATE A BETTER FUTURE. ONE WAY WE ARE SEEKING TO DELIVER ON THIS IS THROUGH OUR AMBITION TO BECOME A NET-ZERO, CLIMATE RESILIENT BANK. IN THIS SUSTAINABILITY REPORT, WE OUTLINE OUR STRATEGIC APPROACH TO ADDRESSING CLIMATE-RELATED RISKS AND OPPORTUNITIES. WE SHARE OUR PROGRESS, THE CHALLENGES WE'VE ENCOUNTERED, AND THE ACTIONS WE'RE TAKING TO DELIVER ON OUR AMBITION AND DRIVE LONG-TERM VALUE.” WESTPAC CEO, ANTHONY MILLER Cover photo: Close-up photo of drops of water balancing delicately on a blade of grass. Three drops form the shape of the Westpac logo (AI-generated). ACKNOWLEDGEMENT OF INDIGENOUS PEOPLES We acknowledge the First Peoples of Australia and recognise their ongoing role as Traditional Owners of the land and waters of this country. We acknowledge Westpac’s Aboriginal and Torres Strait Islander employees, partners, and stakeholders, and pay our respects to their Elders, both past and present. In Aotearoa New Zealand we also acknowledge tāngata whenua and the unique relationship that Indigenous Peoples share with all New Zealanders under Te Tiriti o Waitangi. WESTPAC 2025 SUSTAINABILITY REPORT |

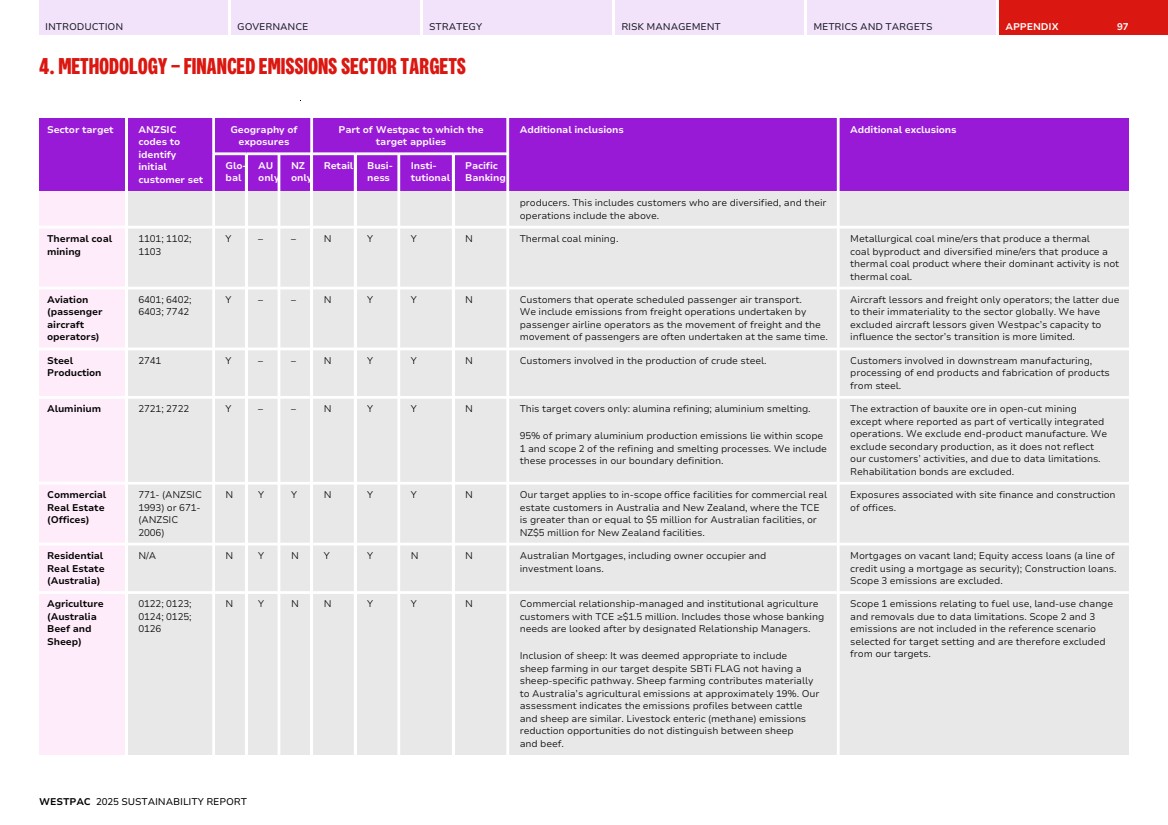

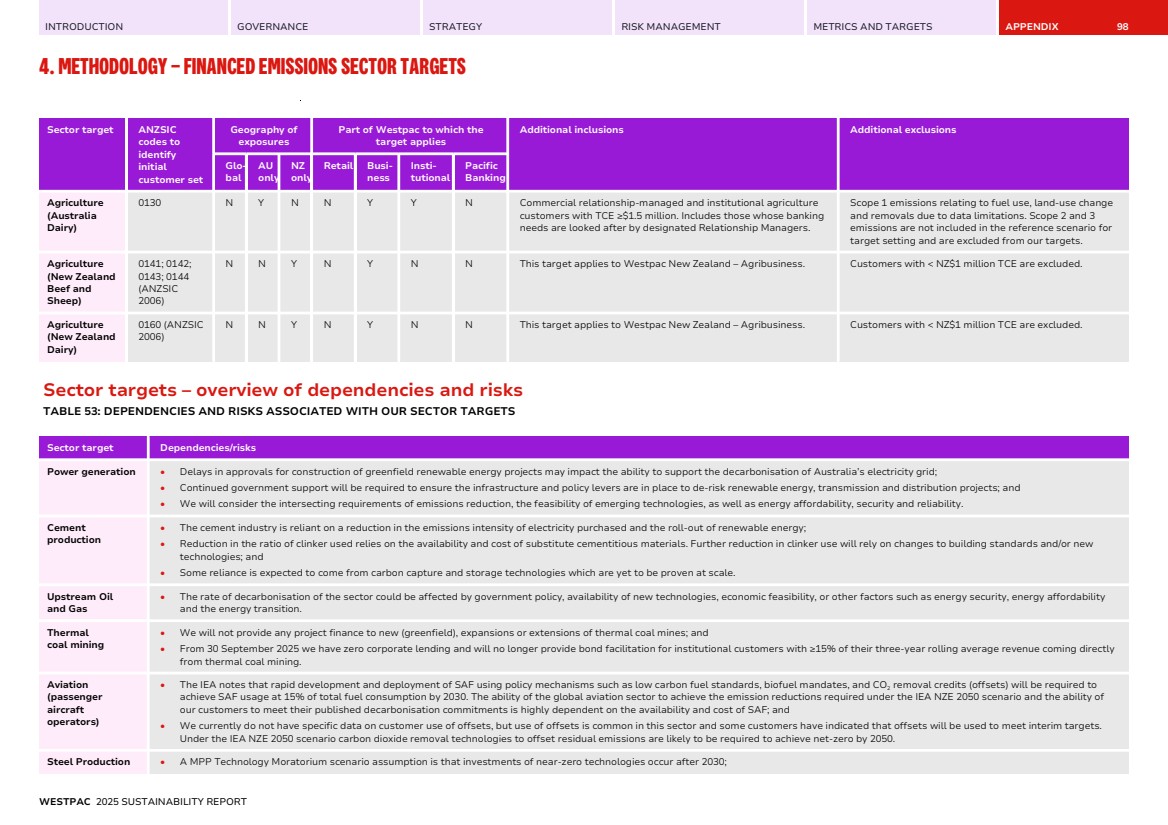

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 2 Important information ABOUT THIS REPORT The Westpac 2025 Sustainability Report (“Report”) outlines Westpac’s strategy, targets, and approach for addressing the risks and opportunities presented by climate change. The Appendix includes a Glossary of definitions along with methodologies for calculating our emissions and additional detail behind our scenario analysis. This Report forms part of Westpac’s 2025 reporting suite including our Annual Report, our Sustainability Index and Datasheet and other annual disclosures. Access the full suite at westpac.com.au. This Report covers the same consolidated reporting entity and reporting period as the Group’s 2025 Annual Report, unless indicated otherwise. It includes climate-related disclosures for Westpac and its subsidiaries across the markets it operates. This includes our operations within Westpac’s BT business in Australia. Certain scope 3 emissions for BT have not been calculated as they are immaterial. References to ‘Westpac’, ‘Group’, ‘Westpac Group’, ‘we’, ‘us’ and ‘our’ are to Westpac Banking Corporation ABN 33 007 457 141 and its subsidiaries unless stated otherwise. Our ambition is to become a net-zero climate resilient bank which means working towards net-zero emissions across our operations and our lending while building resilience to the physical impacts of climate change. This Report includes forward-looking statements – such as commitments, goals, targets, plans, estimates, assumptions and metrics – that inherently carry uncertainty, particularly in the context of climate reporting. These risks and uncertainties need to be considered when interpreting this Report. For an explanation of forward-looking statements and the risks, uncertainties and assumptions to which they are subject, see the Disclaimer in the Appendix. We define some of these forward-looking statements as follows: • Targets: Outcomes where we have identified one or more pathways for achievement by a set date. These are subject to certain assumptions, dependencies and limitations; • Commitments: Actions we are dedicated to taking and are within our direct control; • Aim: Actions we are striving to achieve that are outside our direct control and require a degree of collaboration or influence; and • Goal: A desired result or outcome that we intend to achieve. These may not always have a defined path or be within our direct control. CONSIDERATION OF CLIMATE-RELATED DISCLOSURE STANDARDS This Report was guided by the Australian Accounting Standards Board (AASB) S2 Climate-related Disclosures Standard but does not yet fully align. We are required to comply with AASB S2 for the year ended 30 September 2026. As we work towards compliance against AASB S2 and Aotearoa New Zealand Climate Standards (NZ CS), there are nuances between these Standards in how the impacts from climate-related risks and opportunities should be considered and disclosed. Under the NZ CS, climate-related impacts encompass all impacts arising from climate. In contrast, AASB S2 defines climate-related risks and opportunities as the potential negative and positive effects, respectively, that are associated specifically with climate change. OUR APPROACH TO CLIMATE REPORTING Outlining our approach to managing climate change risks and opportunities is challenging as measuring, reporting and the setting of targets relies on estimates, inexact data and the availability of appropriate methodologies. We strive to apply the best available data and consistent principles in our climate metrics noting estimates have inherent uncertainties. We ask readers to consider these limitations and focus on our intent. Over time, our climate-related data will evolve as new methodologies and technologies emerge and our stakeholders improve the measurement of their climate impacts, risks and opportunities. Our operational greenhouse gas (GHG) emissions metrics are reported using both location-based and market-based methods. Operational targets are absolute emission reduction targets set by applying a market-based accounting approach. Carbon offsets are not considered. Unless indicated otherwise, data in this Report is for the 2025 financial year, being the 12 months ended 30 September 2025 or at 30 September 2025. All amounts are in Australian dollars and emissions data is in a carbon dioxide equivalent (CO2-e). Due to timing of reporting and data availability, some information is reported using different time periods as set out below or as otherwise stated. KPMG has provided independent reasonable assurance over our scope 1, 2 and 3 upstream emissions, and limited assurance over selected metrics and targets within this Report. Their independent assurance statement is on page 113 to 116 of this Report. STATEMENT OF COMPLIANCE TO AOTEAROA NEW ZEALAND CLIMATE STANDARDS This Report complies with the NZ CS issued by the External Reporting Board. Westpac is a Climate Reporting Entity under the New Zealand Financial Markets Conduct Act 2013. Westpac is a listed issuer and registered bank in New Zealand. In preparing this Report, Westpac has elected to use the following adoption provisions from NZ CS 2 published by the External Reporting Board: • Adoption Provision 2: Anticipated financial impacts – exempts Westpac from disclosing anticipated financial impacts of climate risks and opportunities and a description of time horizons over which the anticipated financial impacts could reasonably be expected to occur; • Adoption Provision 4: Scope 3 Greenhouse Gas emissions – exempts Westpac from disclosing some categories of scope 3 gross Greenhouse Gas (GHG) emissions; • Adoption Provision 5: Comparatives for Scope 3 Greenhouse Gas emissions – exempts Westpac from disclosing comparative information for scope 3 GHG emissions; • Adoption Provision 6: Comparatives for metrics – permits Westpac to disclose comparative information for only one prior year for each metric disclosed in this Report; and • Adoption Provision 7: Analysis of trends – exempts Westpac from providing an analysis of main trends evident from a comparison of each metric to the prior two years. The NZ CS are broadly consistent with AASB S2, but where there are differences we have supplemented our disclosure to fully meet the NZ CS. By complying with the NZ CS for the Group we are no longer publishing a separate Climate Report for the Westpac New Zealand Branch. On behalf of Westpac on 2 November 2025: Metrics or Targets Reporting period • Operational emissions targets progress Reported for the 12 months ended 30 June 2025. • Financed emissions • Financed emissions sector target progress Reported one year in arrears. Latest reported period is for the 12 months to 30 September 2024. ___________________________ Anthony Miller Managing Director & CEO ___________________________ Steven Gregg Chairman WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 3 MESSAGE FROM THE CEO Our ambition is to become a net-zero, climate resilient bank. Welcome to Westpac’s Sustainability Report highlighting our strategy, plans and progress on addressing the risks and opportunities of climate change. Westpac has an established history of addressing climate change through our ambition to become a net-zero, climate-resilient bank and we are dedicated to continued action. We remain committed to supporting the goals of the Paris Agreement to limit global warming to well below 2 degrees Celsius, and to pursue efforts to limit warming to 1.5 degrees Celsius above pre-industrial levels. Achieving this is incredibly difficult as we aim to reduce our emissions and build resilience while also assisting customers with their unique paths to net-zero. We highlighted some of these complexities in our submission to the Australian Economic Reform Roundtable. We outlined the need to accelerate Australia’s energy transition through streamlining approvals, clear generation and storage targets and strengthening the electricity grid, while fostering community support along the way. Our approach to climate change is anchored in our Sustainability Strategy, which has been updated to align with our corporate strategy and refreshed purpose. Our Sustainability Strategy has three focus areas: climate transition, housing affordability and regional prosperity. Our Climate Transition Plan outlines how we will deliver on the climate transition focus area. 2025 Progress This year, we focused on turning ambition into action. Working to deliver on the targets we have set in prior years, expanding engagement with customers, strengthening resilience, and streamlining our approach for the years ahead. Highlights included: • reduced to zero our corporate lending to institutional thermal coal mining customers;1 • over 70% of our financed emissions sector targets showed reduced emissions or intensity in FY24 (our latest year of reporting)2 . Most of these are ahead of their science-based reference pathway; • increased our sustainable finance lending by 37% with sustainable cumulative bond facilitation up 40%; • reduced our scope 1 and 2 operational emissions by 22% over the year; • continued to source the equivalent of 100% renewable electricity for our direct operations; • completed a physical climate risk assessment of the locations where we operate; • refreshed our transition risk methodology. This included identifying and monitoring high transition risk sectors and enhancing our transition risk appetite measure; and • implemented a Climate Risk Policy. This sets out our principles and requirements for managing climate-related risks across our business. Our Carbon-Intensive Sector Requirements (lending and bond facilitation for these sectors) were also refreshed, including strengthening our Customer Climate Transition Plan Evaluations. Improving Climate Resilience With growing evidence of the impacts of climate-related events, we have worked to improve our understanding of the physical risks of climate change. This has included expanding both our scenario analysis and our assessment of physical risks on our properties and operations. We practically tested our resilience this year through a Group-wide crisis exercise simulating a major weather event on Australia’s eastern seaboard. Climate opportunities We are determined to identify the opportunities to support customers through the transition to a low carbon economy, grow responsibly, and contribute to a more sustainable economy. In addition to our growth in sustainable finance, over the last year we have: • remained the largest financier to renewable projects in Australia3 ; and • helped our residential lending customers improve their energy efficiency through sustainable finance. Delivering on the transition requires action from everybody in society and we’re working to make our contribution alongside customers, communities, governments and other stakeholders. Anthony Miller CEO 1 At 30 September 2025. In line with our Sustainability Customer Requirements, we have zero corporate lending and will no longer provide bond facilitation for institutional customers with ≥15% of their three-year rolling average revenue coming directly from thermal coal mining. 2 Refer to page 25 for summary of progress on our financed emissions targets. 3 Based on IJGlobal and Westpac Research Data for the period from 1 October 2024 to 30 September 2025. WESTPAC 2025 SUSTAINABILITY REPORT |

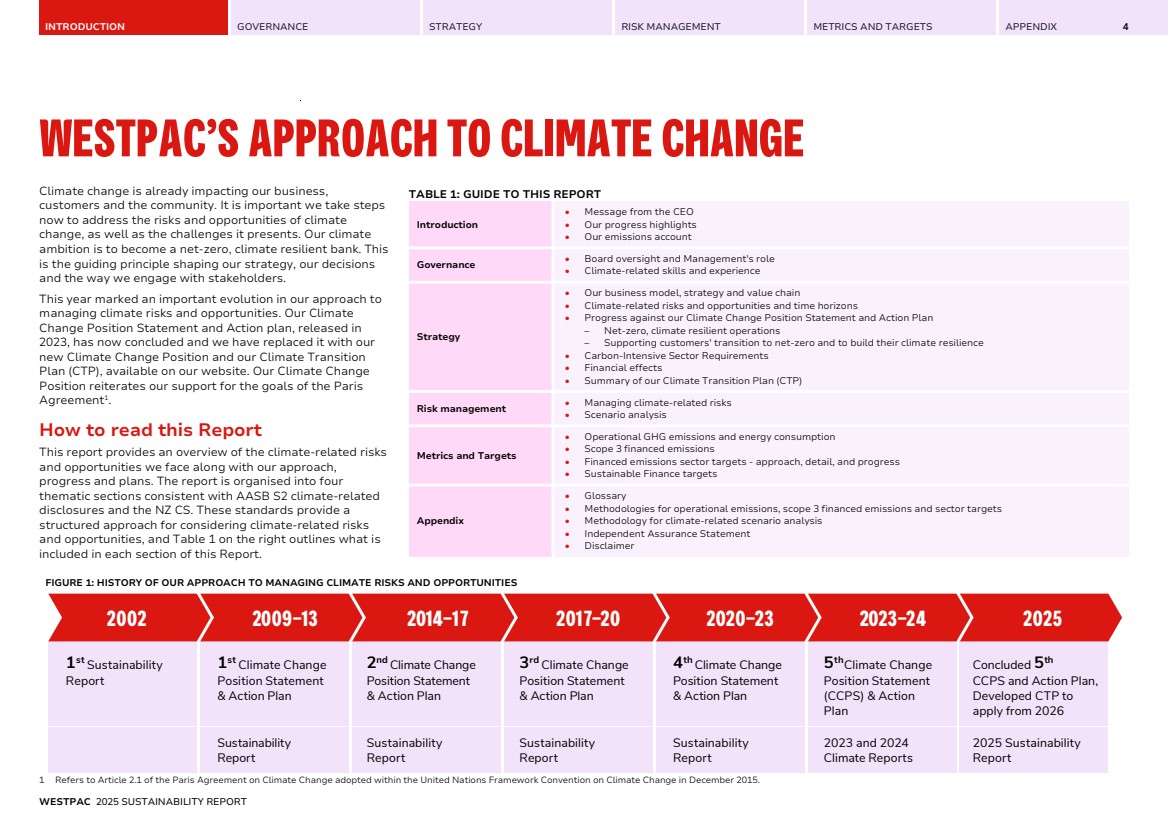

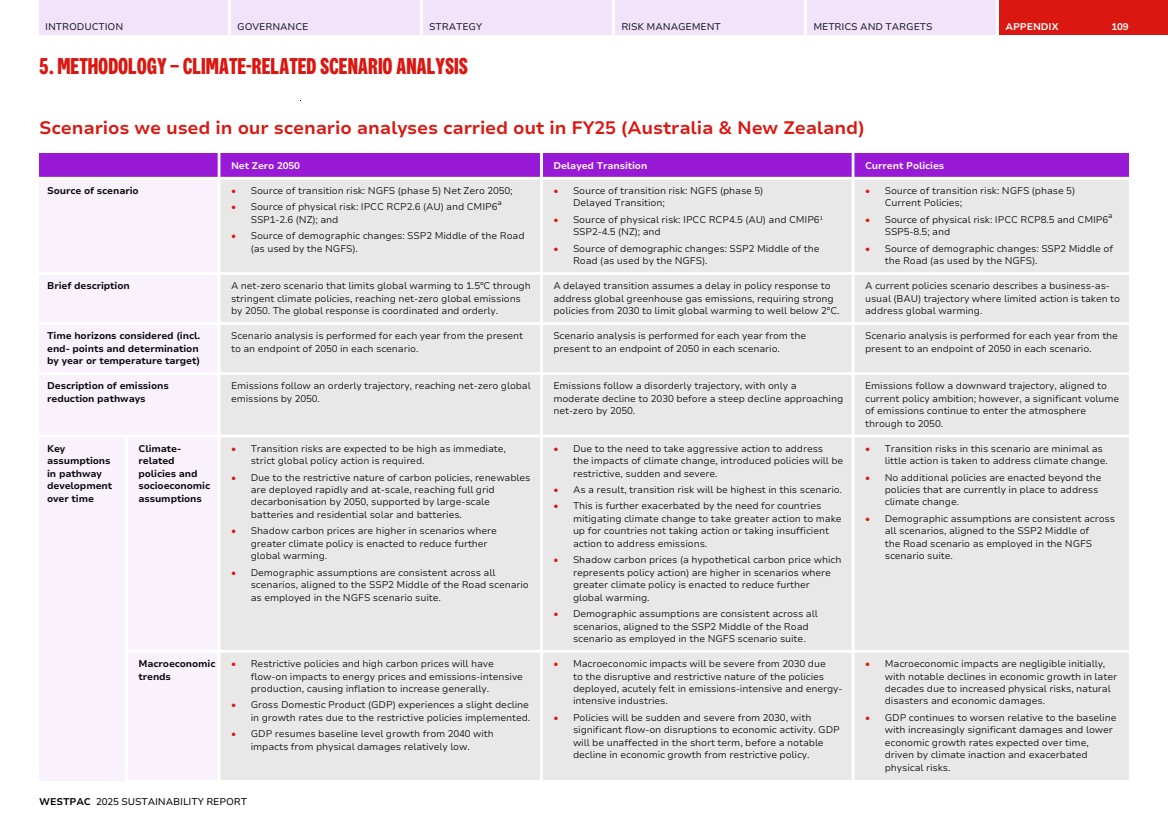

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 4 WESTPAC’S APPROACH TO CLIMATE CHANGE Climate change is already impacting our business, customers and the community. It is important we take steps now to address the risks and opportunities of climate change, as well as the challenges it presents. Our climate ambition is to become a net-zero, climate resilient bank. This is the guiding principle shaping our strategy, our decisions and the way we engage with stakeholders. This year marked an important evolution in our approach to managing climate risks and opportunities. Our Climate Change Position Statement and Action plan, released in 2023, has now concluded and we have replaced it with our new Climate Change Position and our Climate Transition Plan (CTP), available on our website. Our Climate Change Position reiterates our support for the goals of the Paris Agreement1 . How to read this Report This report provides an overview of the climate-related risks and opportunities we face along with our approach, progress and plans. The report is organised into four thematic sections consistent with AASB S2 climate-related disclosures and the NZ CS. These standards provide a structured approach for considering climate-related risks and opportunities, and Table 1 on the right outlines what is included in each section of this Report. FIGURE 1: HISTORY OF OUR APPROACH TO MANAGING CLIMATE RISKS AND OPPORTUNITIES 1st Sustainability Report 1st Climate Change Position Statement & Action Plan 2ndClimate Change Position Statement & Action Plan 3rd Climate Change Position Statement & Action Plan 4thClimate Change Position Statement & Action Plan 5thClimate Change Position Statement (CCPS) & Action Plan Concluded 5th CCPS and Action Plan, Developed CTP to apply from 2026 Sustainability Report Sustainability Report Sustainability Report Sustainability Report 2023 and 2024 Climate Reports 2025 Sustainability Report 2002 2009–13 2014–17 2017–20 2020–23 2023–24 2025 1 Refers to Article 2.1 of the Paris Agreement on Climate Change adopted within the United Nations Framework Convention on Climate Change in December 2015. TABLE 1: GUIDE TO THIS REPORT Introduction • Message from the CEO • Our progress highlights • Our emissions account Governance • Board oversight and Management's role • Climate-related skills and experience Strategy • Our business model, strategy and value chain • Climate-related risks and opportunities and time horizons • Progress against our Climate Change Position Statement and Action Plan – Net-zero, climate resilient operations – Supporting customers' transition to net-zero and to build their climate resilience • Carbon-Intensive Sector Requirements • Financial effects • Summary of our Climate Transition Plan (CTP) Risk management • Managing climate-related risks • Scenario analysis Metrics and Targets • Operational GHG emissions and energy consumption • Scope 3 financed emissions • Financed emissions sector targets - approach, detail, and progress • Sustainable Finance targets Appendix • Glossary • Methodologies for operational emissions, scope 3 financed emissions and sector targets • Methodology for climate-related scenario analysis • Independent Assurance Statement • Disclaimer WESTPAC 2025 SUSTAINABILITY REPORT |

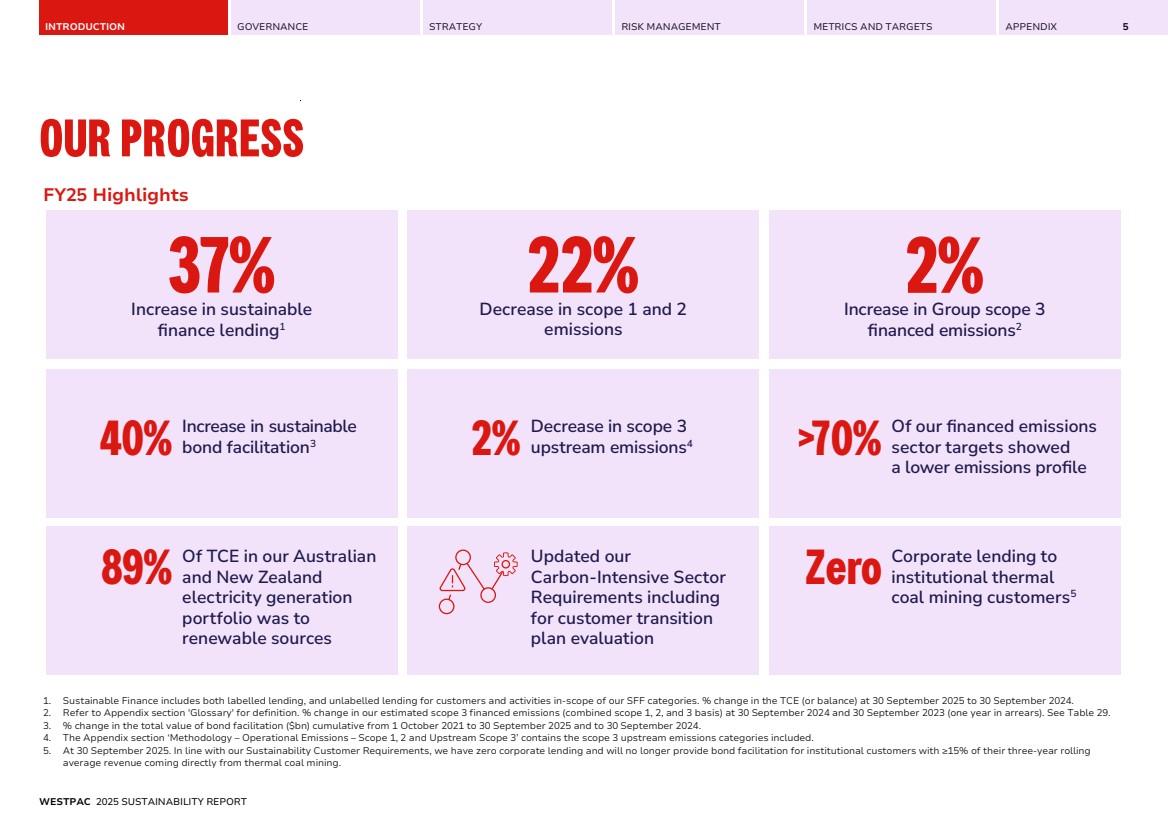

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 5 OUR PROGRESS FY25 Highlights Increase in sustainable 37% finance lending1 Decrease in scope 1 and 2 emissions 22% Increase in Group scope 3 2% financed emissions2 2% Decrease in scope 3 upstream emissions 40% 4 Increase in sustainable bond facilitation3 >70% 89% Zero Of our financed emissions sector targets showed a lower emissions profile Of TCE in our Australian and New Zealand electricity generation portfolio was to renewable sources Updated our Carbon-Intensive Sector Requirements including for customer transition plan evaluation Corporate lending to institutional thermal coal mining customers5 1. Sustainable Finance includes both labelled lending, and unlabelled lending for customers and activities in-scope of our SFF categories. % change in the TCE (or balance) at 30 September 2025 to 30 September 2024. 2. Refer to Appendix section 'Glossary' for definition. % change in our estimated scope 3 financed emissions (combined scope 1, 2, and 3 basis) at 30 September 2024 and 30 September 2023 (one year in arrears). See Table 29. 3. % change in the total value of bond facilitation ($bn) cumulative from 1 October 2021 to 30 September 2025 and to 30 September 2024. 4. The Appendix section ‘Methodology – Operational Emissions – Scope 1, 2 and Upstream Scope 3’ contains the scope 3 upstream emissions categories included. 5. At 30 September 2025. In line with our Sustainability Customer Requirements, we have zero corporate lending and will no longer provide bond facilitation for institutional customers with ≥15% of their three-year rolling average revenue coming directly from thermal coal mining. WESTPAC 2025 SUSTAINABILITY REPORT |

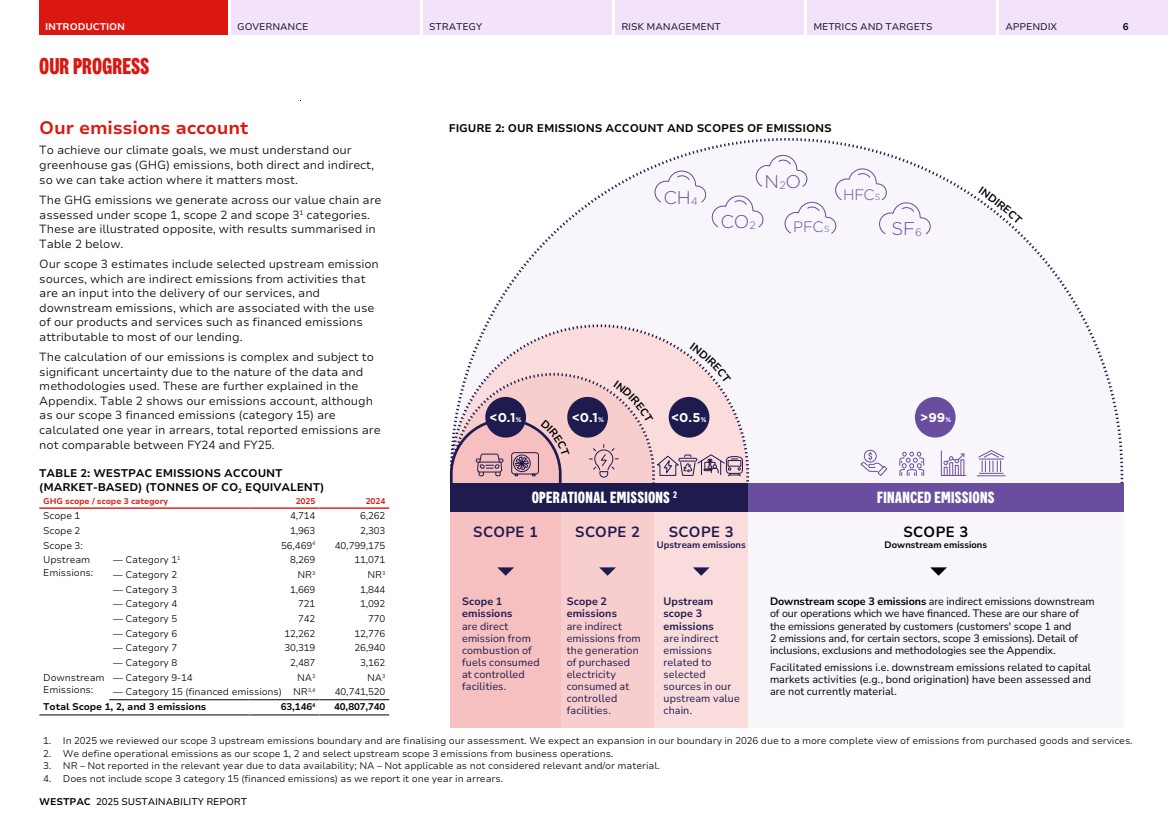

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX OUR PROGRESS 6 Our emissions account To achieve our climate goals, we must understand our greenhouse gas (GHG) emissions, both direct and indirect, so we can take action where it matters most. The GHG emissions we generate across our value chain are assessed under scope 1, scope 2 and scope 31 categories. These are illustrated opposite, with results summarised in Table 2 below. Our scope 3 estimates include selected upstream emission sources, which are indirect emissions from activities that are an input into the delivery of our services, and downstream emissions, which are associated with the use of our products and services such as financed emissions attributable to most of our lending. The calculation of our emissions is complex and subject to significant uncertainty due to the nature of the data and methodologies used. These are further explained in the Appendix. Table 2 shows our emissions account, although as our scope 3 financed emissions (category 15) are calculated one year in arrears, total reported emissions are not comparable between FY24 and FY25. TABLE 2: WESTPAC EMISSIONS ACCOUNT (MARKET-BASED) (TONNES OF CO2 EQUIVALENT) GHG scope / scope 3 category 2025 2024 Scope 1 4,714 6,262 Scope 2 1,963 2,303 Scope 3: 56,4694 40,799,175 Upstream Emissions: — Category 11 8,269 11,071 — Category 2 NR3 NR3 — Category 3 1,669 1,844 — Category 4 721 1,092 — Category 5 742 770 — Category 6 12,262 12,776 — Category 7 30,319 26,940 — Category 8 2,487 3,162 Downstream Emissions: — Category 9-14 NA3 NA3 — Category 15 (financed emissions) NR3,4 40,741,520 Total Scope 1, 2, and 3 emissions 63,1464 40,807,740 FIGURE 2: OUR EMISSIONS ACCOUNT AND SCOPES OF EMISSIONS >99% INDIRECT Downstream scope 3 emissions are indirect emissions downstream of our operations which we have financed. These are our share of the emissions generated by customers (customers' scope 1 and 2 emissions and, for certain sectors, scope 3 emissions). Detail of inclusions, exclusions and methodologies see the Appendix. Facilitated emissions i.e. downstream emissions related to capital markets activities (e.g., bond origination) have been assessed and are not currently material. CH4 CO2 N2O HFCS PFCS SF6 D <0.1% <0.5% IRECT INDIRECT INDIRECT <0.1% SCOPE 1 SCOPE 2 SCOPE 3 Downstream emissions SCOPE 3 Upstream emissions Upstream scope 3 emissions are indirect emissions related to selected sources in our upstream value chain. Scope 2 emissions are indirect emissions from the generation of purchased electricity consumed at controlled facilities. Scope 1 emissions are direct emission from combustion of fuels consumed at controlled facilities. OPERATIONAL EMISSIONS 2 FINANCED EMISSIONS 1. In 2025 we reviewed our scope 3 upstream emissions boundary and are finalising our assessment. We expect an expansion in our boundary in 2026 due to a more complete view of emissions from purchased goods and services. 2. We define operational emissions as our scope 1, 2 and select upstream scope 3 emissions from business operations. 3. NR – Not reported in the relevant year due to data availability; NA – Not applicable as not considered relevant and/or material. 4. Does not include scope 3 category 15 (financed emissions) as we report it one year in arrears. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 7 GOVERNANCE |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 8 GOVERNANCE Westpac’s governance reflects the key role that sustainability plays in our performance, prospects and strategy. A summary of our governance structure is provided on the following page, and comprises the Board, its Committees along with a range of executive and management committees. This summary also shows how climate-related information flows through our governance structure. Board oversight Under its Charter, the Board is responsible for considering the social, ethical and environmental impact of our activities, and for setting standards and monitoring compliance with our sustainability policies and practices. The Board approves key sustainability matters such as the sustainability strategy, the Climate Transition Plan and Human Rights Position Statement. It also monitors progress against certain targets and provides oversight of risks and opportunities. Committees in place to support Board oversight The following Board Committees operate under their respective Charters to support oversight responsibilities, including those related to sustainability and climate risk. • Board Risk Committee: Provides oversight of the implementation and operation of Westpac’s risk management framework. It also oversees the monitoring and management of our reputation and sustainability risk profile, performance and controls, including in relation to climate risk; • Board Audit Committee: Has oversight of the integrity of the financial statements and financial reporting and systems, including the sustainability disclosures in the Interim Financial Statements, Annual Report and the Sustainability Report. It also reviews the process by which management assures the integrity of information released in sustainability reporting; and • Board Remuneration Committee: Assists the Board by overseeing the design, operation and monitoring of the remuneration framework. It also assesses the Short-Term Variable Reward Scorecard, including climate-related measures. The Board and Board Committee Charters are on our website and are reviewed regularly. Board and Committee meeting agendas are structured to address each of the responsibilities contained in the relevant Charter, including climate-related topics and decisions. Agendas are approved by the relevant Board or Committee Chair with input from the Company Secretary and subject matter experts. Agenda items are ordinarily supported by a management paper or verbal update that either provides an update on the relevant matter for informational purposes or seeks formal approval from the Board or Committee. Refer to Table 3 for a non-exhaustive summary of matters considered by the Board and its Committees related to sustainability including climate-related risks and opportunities in FY25. Governance of climate strategy and targets The Board has approved Westpac’s strategy and has oversight of its implementation along with its business plan, and significant corporate initiatives. Sustainability risks and opportunities are incorporated in the strategic planning, capital deployment and funding decision-making processes. In FY25, the consideration of climate risks and opportunities as part of the Group’s strategy setting process included: • Outlining climate and sustainability strategic priorities for FY25-30 in Divisional strategies; • Conducting an analysis of potential growth in renewables and energy transition to identify climate-related opportunities and integrate them into our strategic and financial planning; and • Reviewing trade-offs associated with climate-related risks and opportunities. This included considering different strategic options for climate transition and assessing the emerging risks posed by the current global sentiment on Sustainability. We’ve set 2030 targets to support our climate strategy, guided by our Climate Transition Plan and ambition. Progress towards climate-related targets is monitored through internal management reporting of specific metrics. These include regular progress reports to the Board and management-level committees, as well as periodic reviews of performance against targets. WESTPAC 2025 SUSTAINABILITY REPORT |

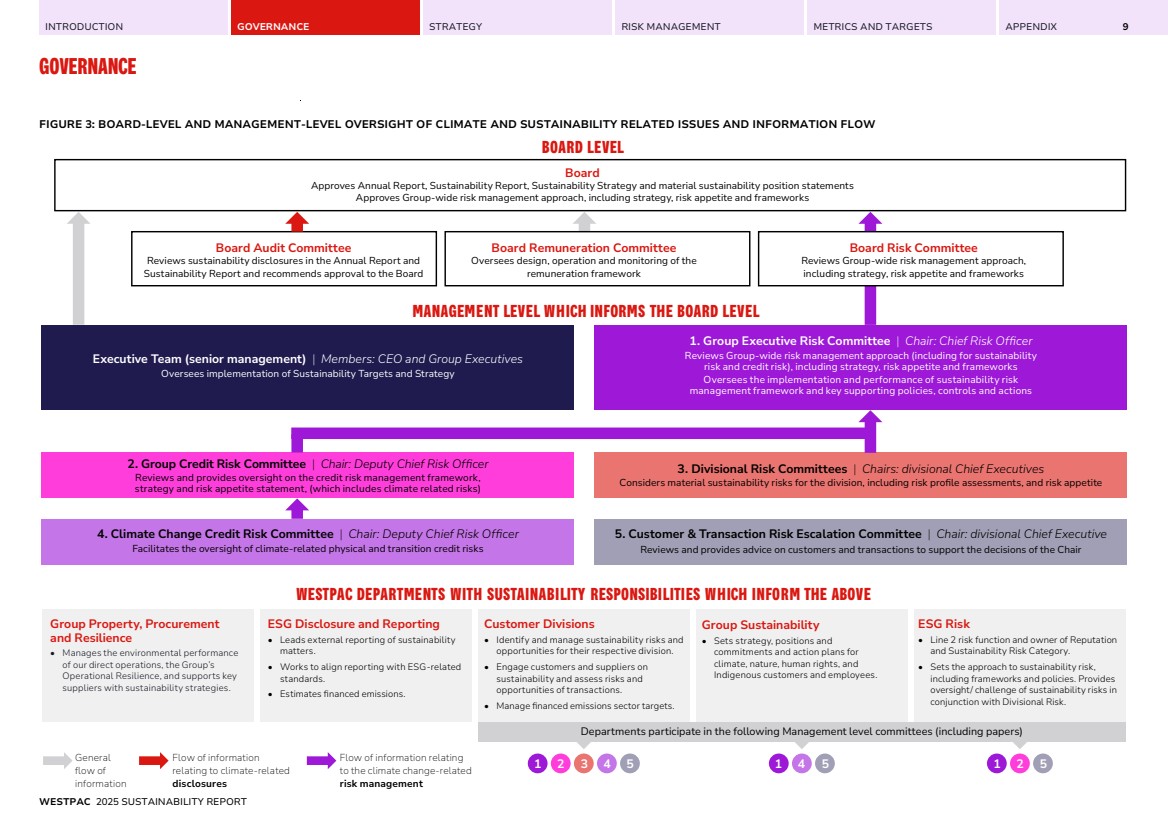

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX GOVERNANCE 9 FIGURE 3: BOARD-LEVEL AND MANAGEMENT-LEVEL OVERSIGHT OF CLIMATE AND SUSTAINABILITY RELATED ISSUES AND INFORMATION FLOW BOARD LEVEL Board Audit Committee Reviews sustainability disclosures in the Annual Report and Sustainability Report and recommends approval to the Board Board Remuneration Committee Oversees design, operation and monitoring of the remuneration framework Board Risk Committee Reviews Group-wide risk management approach, including strategy, risk appetite and frameworks Group Property, Procurement and Resilience • Manages the environmental performance of our direct operations, the Group’s Operational Resilience, and supports key suppliers with sustainability strategies. General flow of information Flow of information relating to climate-related disclosures Flow of information relating to the climate change-related risk management Departments participate in the following Management level committees (including papers) ESG Disclosure and Reporting • Leads external reporting of sustainability matters. • Works to align reporting with ESG-related standards. • Estimates financed emissions. Customer Divisions • Identify and manage sustainability risks and opportunities for their respective division. • Engage customers and suppliers on sustainability and assess risks and opportunities of transactions. • Manage financed emissions sector targets. Group Sustainability • Sets strategy, positions and commitments and action plans for climate, nature, human rights, and Indigenous customers and employees. ESG Risk • Line 2 risk function and owner of Reputation and Sustainability Risk Category. • Sets the approach to sustainability risk, including frameworks and policies. Provides oversight/ challenge of sustainability risks in conjunction with Divisional Risk. WESTPAC DEPARTMENTS WITH SUSTAINABILITY RESPONSIBILITIES WHICH INFORM THE ABOVE MANAGEMENT LEVEL WHICH INFORMS THE BOARD LEVEL Board Approves Annual Report, Sustainability Report, Sustainability Strategy and material sustainability position statements Approves Group-wide risk management approach, including strategy, risk appetite and frameworks 2. Group Credit Risk Committee | Chair: Deputy Chief Risk Officer Reviews and provides oversight on the credit risk management framework, strategy and risk appetite statement, (which includes climate related risks) 3. Divisional Risk Committees | Chairs: divisional Chief Executives Considers material sustainability risks for the division, including risk profile assessments, and risk appetite 4. Climate Change Credit Risk Committee | Chair: Deputy Chief Risk Officer Facilitates the oversight of climate-related physical and transition credit risks 5. Customer & Transaction Risk Escalation Committee | Chair: divisional Chief Executive Reviews and provides advice on customers and transactions to support the decisions of the Chair Executive Team (senior management) | Members: CEO and Group Executives Oversees implementation of Sustainability Targets and Strategy 1. Group Executive Risk Committee | Chair: Chief Risk Officer Reviews Group-wide risk management approach (including for sustainability risk and credit risk), including strategy, risk appetite and frameworks Oversees the implementation and performance of sustainability risk management framework and key supporting policies, controls and actions 1 2 3 4 5 1 4 5 1 2 5 WESTPAC 2025 SUSTAINABILITY REPORT |

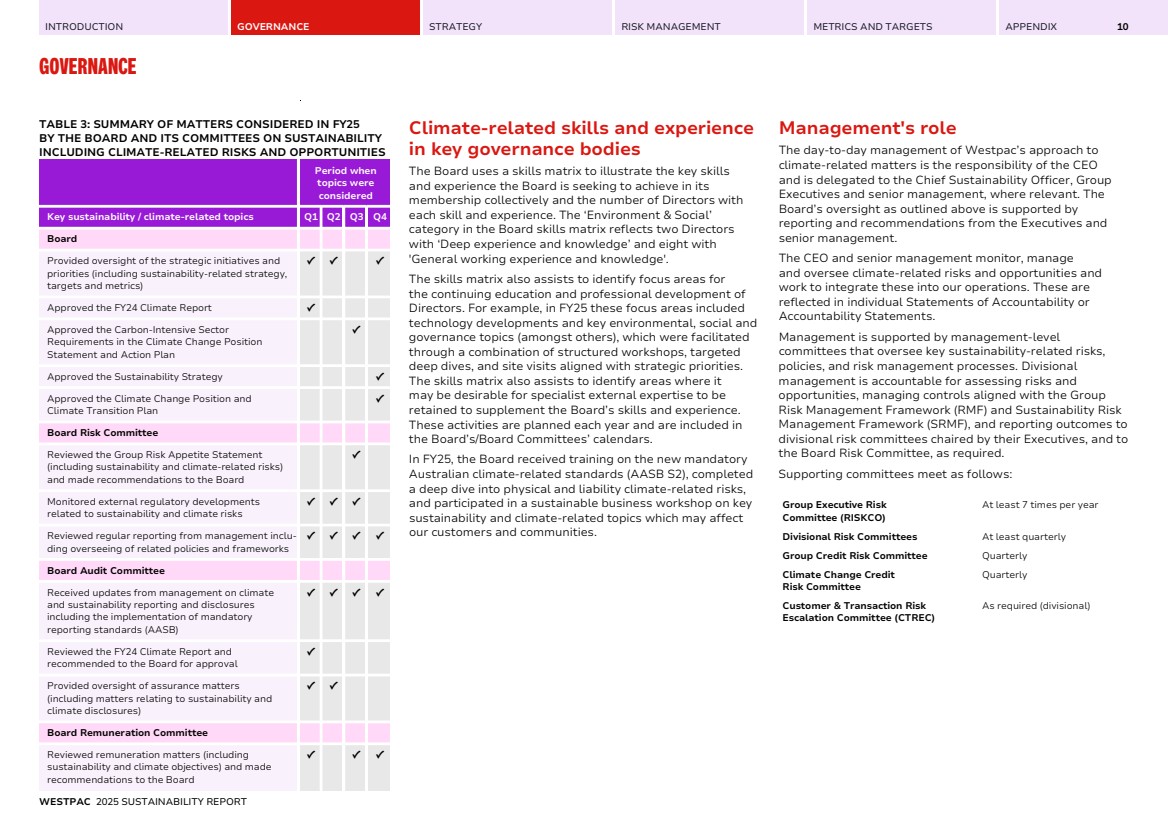

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX GOVERNANCE 10 TABLE 3: SUMMARY OF MATTERS CONSIDERED IN FY25 BY THE BOARD AND ITS COMMITTEES ON SUSTAINABILITY INCLUDING CLIMATE-RELATED RISKS AND OPPORTUNITIES Period when topics were considered Key sustainability / climate-related topics Q1 Q2 Q3 Q4 Board Provided oversight of the strategic initiatives and priorities (including sustainability-related strategy, targets and metrics) ✔ ✔ ✔ Approved the FY24 Climate Report ✔ Approved the Carbon-Intensive Sector Requirements in the Climate Change Position Statement and Action Plan ✔ Approved the Sustainability Strategy ✔ Approved the Climate Change Position and Climate Transition Plan ✔ Board Risk Committee Reviewed the Group Risk Appetite Statement (including sustainability and climate-related risks) and made recommendations to the Board ✔ Monitored external regulatory developments related to sustainability and climate risks ✔ ✔ ✔ Reviewed regular reporting from management inclu-ding overseeing of related policies and frameworks ✔ ✔ ✔ ✔ Board Audit Committee Received updates from management on climate and sustainability reporting and disclosures including the implementation of mandatory reporting standards (AASB) ✔ ✔ ✔ ✔ Reviewed the FY24 Climate Report and recommended to the Board for approval ✔ Provided oversight of assurance matters (including matters relating to sustainability and climate disclosures) ✔ ✔ Board Remuneration Committee Reviewed remuneration matters (including sustainability and climate objectives) and made recommendations to the Board ✔ ✔ ✔ Climate-related skills and experience in key governance bodies The Board uses a skills matrix to illustrate the key skills and experience the Board is seeking to achieve in its membership collectively and the number of Directors with each skill and experience. The ‘Environment & Social’ category in the Board skills matrix reflects two Directors with ‘Deep experience and knowledge’ and eight with 'General working experience and knowledge'. The skills matrix also assists to identify focus areas for the continuing education and professional development of Directors. For example, in FY25 these focus areas included technology developments and key environmental, social and governance topics (amongst others), which were facilitated through a combination of structured workshops, targeted deep dives, and site visits aligned with strategic priorities. The skills matrix also assists to identify areas where it may be desirable for specialist external expertise to be retained to supplement the Board’s skills and experience. These activities are planned each year and are included in the Board’s/Board Committees’ calendars. In FY25, the Board received training on the new mandatory Australian climate-related standards (AASB S2), completed a deep dive into physical and liability climate-related risks, and participated in a sustainable business workshop on key sustainability and climate-related topics which may affect our customers and communities. Management's role The day-to-day management of Westpac’s approach to climate-related matters is the responsibility of the CEO and is delegated to the Chief Sustainability Officer, Group Executives and senior management, where relevant. The Board’s oversight as outlined above is supported by reporting and recommendations from the Executives and senior management. The CEO and senior management monitor, manage and oversee climate-related risks and opportunities and work to integrate these into our operations. These are reflected in individual Statements of Accountability or Accountability Statements. Management is supported by management-level committees that oversee key sustainability-related risks, policies, and risk management processes. Divisional management is accountable for assessing risks and opportunities, managing controls aligned with the Group Risk Management Framework (RMF) and Sustainability Risk Management Framework (SRMF), and reporting outcomes to divisional risk committees chaired by their Executives, and to the Board Risk Committee, as required. Supporting committees meet as follows: Group Executive Risk Committee (RISKCO) At least 7 times per year Divisional Risk Committees At least quarterly Group Credit Risk Committee Quarterly Climate Change Credit Risk Committee Quarterly Customer & Transaction Risk Escalation Committee (CTREC) As required (divisional) WESTPAC 2025 SUSTAINABILITY REPORT |

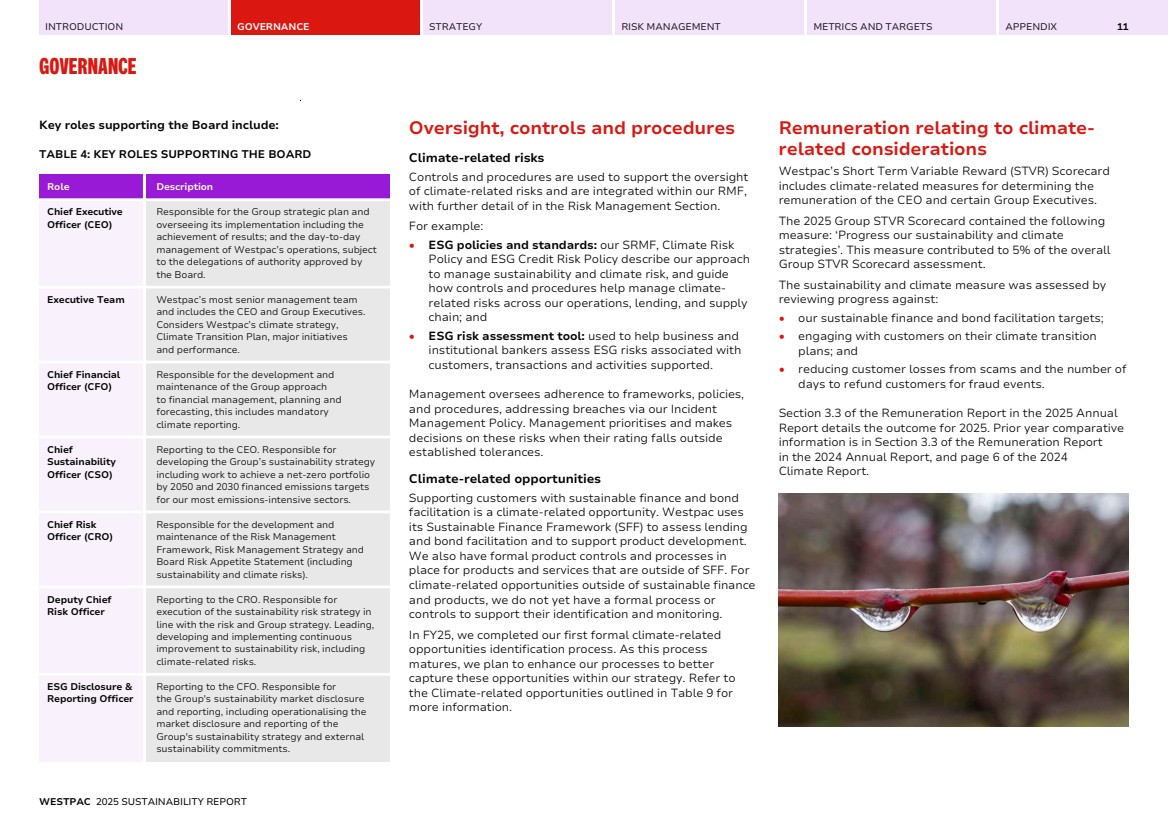

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX GOVERNANCE 11 Key roles supporting the Board include: TABLE 4: KEY ROLES SUPPORTING THE BOARD Role Description Chief Executive Officer (CEO) Responsible for the Group strategic plan and overseeing its implementation including the achievement of results; and the day-to-day management of Westpac’s operations, subject to the delegations of authority approved by the Board. Executive Team Westpac’s most senior management team and includes the CEO and Group Executives. Considers Westpac’s climate strategy, Climate Transition Plan, major initiatives and performance. Chief Financial Officer (CFO) Responsible for the development and maintenance of the Group approach to financial management, planning and forecasting, this includes mandatory climate reporting. Chief Sustainability Officer (CSO) Reporting to the CEO. Responsible for developing the Group’s sustainability strategy including work to achieve a net-zero portfolio by 2050 and 2030 financed emissions targets for our most emissions-intensive sectors. Chief Risk Officer (CRO) Responsible for the development and maintenance of the Risk Management Framework, Risk Management Strategy and Board Risk Appetite Statement (including sustainability and climate risks). Deputy Chief Risk Officer Reporting to the CRO. Responsible for execution of the sustainability risk strategy in line with the risk and Group strategy. Leading, developing and implementing continuous improvement to sustainability risk, including climate-related risks. ESG Disclosure & Reporting Officer Reporting to the CFO. Responsible for the Group's sustainability market disclosure and reporting, including operationalising the market disclosure and reporting of the Group's sustainability strategy and external sustainability commitments. Oversight, controls and procedures Climate-related risks Controls and procedures are used to support the oversight of climate-related risks and are integrated within our RMF, with further detail of in the Risk Management Section. For example: • ESG policies and standards: our SRMF, Climate Risk Policy and ESG Credit Risk Policy describe our approach to manage sustainability and climate risk, and guide how controls and procedures help manage climate-related risks across our operations, lending, and supply chain; and • ESG risk assessment tool: used to help business and institutional bankers assess ESG risks associated with customers, transactions and activities supported. Management oversees adherence to frameworks, policies, and procedures, addressing breaches via our Incident Management Policy. Management prioritises and makes decisions on these risks when their rating falls outside established tolerances. Climate-related opportunities Supporting customers with sustainable finance and bond facilitation is a climate-related opportunity. Westpac uses its Sustainable Finance Framework (SFF) to assess lending and bond facilitation and to support product development. We also have formal product controls and processes in place for products and services that are outside of SFF. For climate-related opportunities outside of sustainable finance and products, we do not yet have a formal process or controls to support their identification and monitoring. In FY25, we completed our first formal climate-related opportunities identification process. As this process matures, we plan to enhance our processes to better capture these opportunities within our strategy. Refer to the Climate-related opportunities outlined in Table 9 for more information. Remuneration relating to climate-related considerations Westpac’s Short Term Variable Reward (STVR) Scorecard includes climate-related measures for determining the remuneration of the CEO and certain Group Executives. The 2025 Group STVR Scorecard contained the following measure: ‘Progress our sustainability and climate strategies’. This measure contributed to 5% of the overall Group STVR Scorecard assessment. The sustainability and climate measure was assessed by reviewing progress against: • our sustainable finance and bond facilitation targets; • engaging with customers on their climate transition plans; and • reducing customer losses from scams and the number of days to refund customers for fraud events. Section 3.3 of the Remuneration Report in the 2025 Annual Report details the outcome for 2025. Prior year comparative information is in Section 3.3 of the Remuneration Report in the 2024 Annual Report, and page 6 of the 2024 Climate Report. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 12 STRATEGY CONTENTS OUR STRATEGY 13 CLIMATE-RELATED RISKS AND OPPORTUNITIES 14 NET-ZERO, CLIMATE RESILIENT OPERATIONS 19 SUPPORTING CUSTOMERS' TRANSITION TO NET-ZERO AND TO BUILD THEIR CLIMATE RESILIENCE 23 FINANCIAL EFFECTS 34 OUR CLIMATE TRANSITION PLAN 36 |

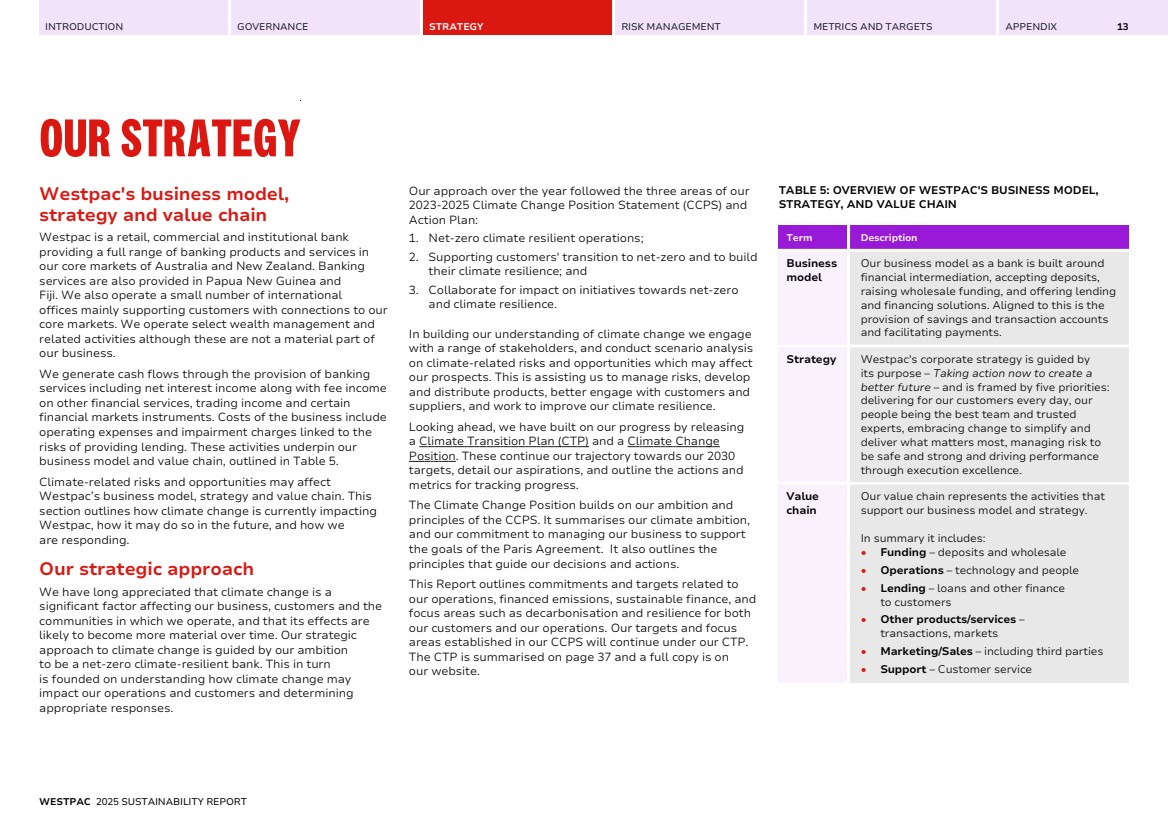

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 13 OUR STRATEGY Westpac's business model, strategy and value chain Westpac is a retail, commercial and institutional bank providing a full range of banking products and services in our core markets of Australia and New Zealand. Banking services are also provided in Papua New Guinea and Fiji. We also operate a small number of international offices mainly supporting customers with connections to our core markets. We operate select wealth management and related activities although these are not a material part of our business. We generate cash flows through the provision of banking services including net interest income along with fee income on other financial services, trading income and certain financial markets instruments. Costs of the business include operating expenses and impairment charges linked to the risks of providing lending. These activities underpin our business model and value chain, outlined in Table 5. Climate-related risks and opportunities may affect Westpac’s business model, strategy and value chain. This section outlines how climate change is currently impacting Westpac, how it may do so in the future, and how we are responding. Our strategic approach We have long appreciated that climate change is a significant factor affecting our business, customers and the communities in which we operate, and that its effects are likely to become more material over time. Our strategic approach to climate change is guided by our ambition to be a net-zero climate-resilient bank. This in turn is founded on understanding how climate change may impact our operations and customers and determining appropriate responses. Our approach over the year followed the three areas of our 2023-2025 Climate Change Position Statement (CCPS) and Action Plan: 1. Net-zero climate resilient operations; 2. Supporting customers' transition to net-zero and to build their climate resilience; and 3. Collaborate for impact on initiatives towards net-zero and climate resilience. In building our understanding of climate change we engage with a range of stakeholders, and conduct scenario analysis on climate-related risks and opportunities which may affect our prospects. This is assisting us to manage risks, develop and distribute products, better engage with customers and suppliers, and work to improve our climate resilience. Looking ahead, we have built on our progress by releasing a Climate Transition Plan (CTP) and a Climate Change Position. These continue our trajectory towards our 2030 targets, detail our aspirations, and outline the actions and metrics for tracking progress. The Climate Change Position builds on our ambition and principles of the CCPS. It summarises our climate ambition, and our commitment to managing our business to support the goals of the Paris Agreement. It also outlines the principles that guide our decisions and actions. This Report outlines commitments and targets related to our operations, financed emissions, sustainable finance, and focus areas such as decarbonisation and resilience for both our customers and our operations. Our targets and focus areas established in our CCPS will continue under our CTP. The CTP is summarised on page 37 and a full copy is on our website. TABLE 5: OVERVIEW OF WESTPAC'S BUSINESS MODEL, STRATEGY, AND VALUE CHAIN Term Description Business model Our business model as a bank is built around financial intermediation, accepting deposits, raising wholesale funding, and offering lending and financing solutions. Aligned to this is the provision of savings and transaction accounts and facilitating payments. Strategy Westpac's corporate strategy is guided by its purpose – Taking action now to create a better future – and is framed by five priorities: delivering for our customers every day, our people being the best team and trusted experts, embracing change to simplify and deliver what matters most, managing risk to be safe and strong and driving performance through execution excellence. Value chain Our value chain represents the activities that support our business model and strategy. In summary it includes: • Funding – deposits and wholesale • Operations – technology and people • Lending – loans and other finance to customers • Other products/services – transactions, markets • Marketing/Sales – including third parties • Support – Customer service WESTPAC 2025 SUSTAINABILITY REPORT |

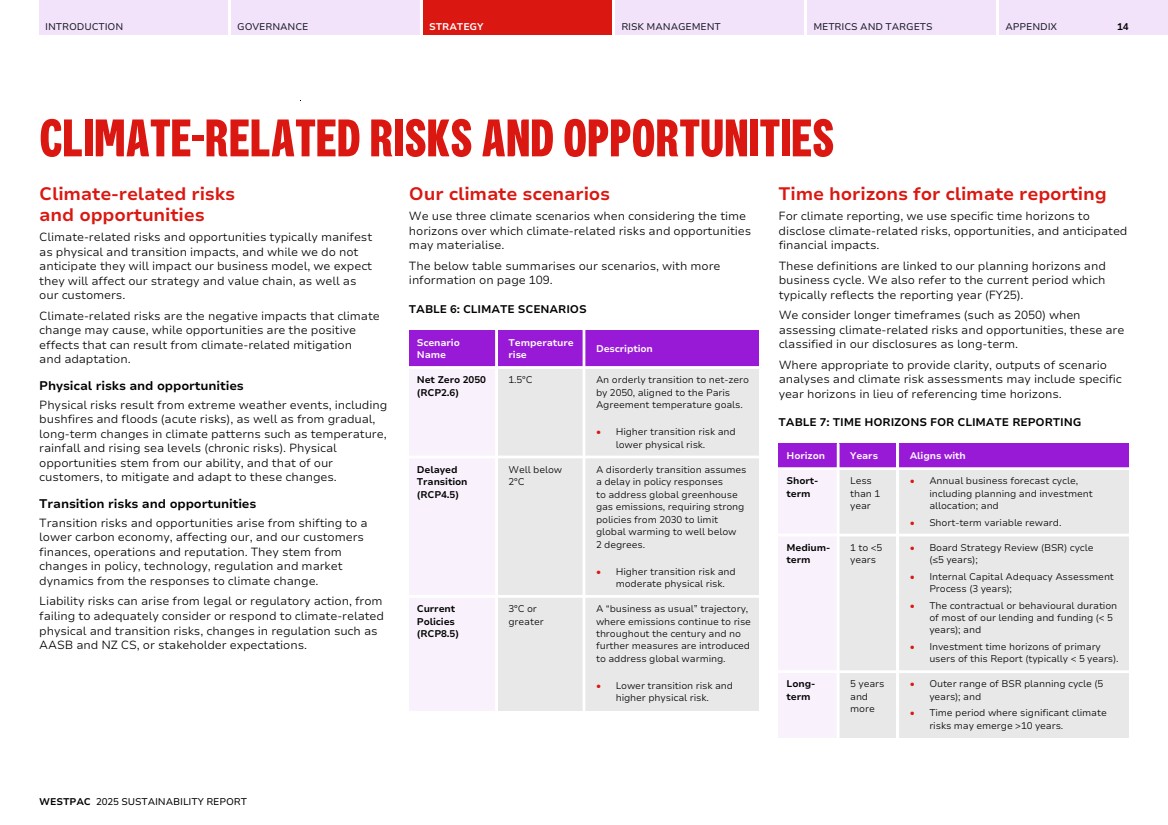

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 14 CLIMATE-RELATED RISKS AND OPPORTUNITIES Climate-related risks and opportunities Climate-related risks and opportunities typically manifest as physical and transition impacts, and while we do not anticipate they will impact our business model, we expect they will affect our strategy and value chain, as well as our customers. Climate-related risks are the negative impacts that climate change may cause, while opportunities are the positive effects that can result from climate-related mitigation and adaptation. Physical risks and opportunities Physical risks result from extreme weather events, including bushfires and floods (acute risks), as well as from gradual, long-term changes in climate patterns such as temperature, rainfall and rising sea levels (chronic risks). Physical opportunities stem from our ability, and that of our customers, to mitigate and adapt to these changes. Transition risks and opportunities Transition risks and opportunities arise from shifting to a lower carbon economy, affecting our, and our customers finances, operations and reputation. They stem from changes in policy, technology, regulation and market dynamics from the responses to climate change. Liability risks can arise from legal or regulatory action, from failing to adequately consider or respond to climate-related physical and transition risks, changes in regulation such as AASB and NZ CS, or stakeholder expectations. Our climate scenarios We use three climate scenarios when considering the time horizons over which climate-related risks and opportunities may materialise. The below table summarises our scenarios, with more information on page 109. TABLE 6: CLIMATE SCENARIOS Scenario Name Temperature rise Description Net Zero 2050 (RCP2.6) 1.5°C An orderly transition to net-zero by 2050, aligned to the Paris Agreement temperature goals. • Higher transition risk and lower physical risk. Delayed Transition (RCP4.5) Well below 2°C A disorderly transition assumes a delay in policy responses to address global greenhouse gas emissions, requiring strong policies from 2030 to limit global warming to well below 2 degrees. • Higher transition risk and moderate physical risk. Current Policies (RCP8.5) 3°C or greater A “business as usual” trajectory, where emissions continue to rise throughout the century and no further measures are introduced to address global warming. • Lower transition risk and higher physical risk. Time horizons for climate reporting For climate reporting, we use specific time horizons to disclose climate-related risks, opportunities, and anticipated financial impacts. These definitions are linked to our planning horizons and business cycle. We also refer to the current period which typically reflects the reporting year (FY25). We consider longer timeframes (such as 2050) when assessing climate-related risks and opportunities, these are classified in our disclosures as long-term. Where appropriate to provide clarity, outputs of scenario analyses and climate risk assessments may include specific year horizons in lieu of referencing time horizons. TABLE 7: TIME HORIZONS FOR CLIMATE REPORTING Horizon Years Aligns with Short-term Less than 1 year • Annual business forecast cycle, including planning and investment allocation; and • Short-term variable reward. Medium-term 1 to <5 years • Board Strategy Review (BSR) cycle (≤5 years); • Internal Capital Adequacy Assessment Process (3 years); • The contractual or behavioural duration of most of our lending and funding (< 5 years); and • Investment time horizons of primary users of this Report (typically < 5 years). Long-term 5 years and more • Outer range of BSR planning cycle (5 years); and • Time period where significant climate risks may emerge >10 years. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX CLIMATE-RELATED RISKS AND OPPORTUNITIES 15 Approach to climate-related risk and opportunity analysis Climate-related risk and opportunity identification In FY25, we expanded on our process for identifying climate-related risks that could reasonably be expected to impact Westpac’s prospects, drawing on a combination of internal reviews, stakeholder feedback and peer comparisons. Identification of our climate-related opportunities was informed by a review of international frameworks for assessing and categorising climate-related opportunities, peer analysis, and a series of cross-functional workshops to generate new ideas focused on how to support customers with new products and services. The work that informed the development of both our CCPS and new CTP actions has been considered in identifying the climate-related risks and opportunities highlighted in this section. Next year, as we continue to refine our approach and understanding we expect the list of disclosed climate-related risks and opportunities to evolve. Climate-related scenarios analysis We analysed our exposure to the identified risks using scenarios and time horizons outlined in Table 6 and Table 7 and undertook the approach described on page 42 to 44 in the Risk Management Section. The analysis considered the extent to which elements of our portfolio are exposed to higher physical and transition risks under specific scenarios and time horizons. While this analysis was mainly used to describe the time horizon of occurrence for risk, our findings have also helped inform how risks and opportunities may reasonably be anticipated to impact Westpac. We considered how climate scenarios may impact opportunities as part of a series of cross-functional workshops. Concentration of exposure to climate-related risks and opportunities In FY25 we have considered potential concentrations of exposure to physical and transition risks and opportunities through our application of climate scenarios, with information presented from page 45 to 49 and page 31 to 33. Reasonably anticipated impacts and current mitigation and adaptation efforts We outline the principal climate-related risks and opportunities and their existing and reasonably foreseeable impacts on the following pages. We also outline our current mitigation and adaptation efforts in reference to the three focus areas of our CCPS (refer to page 19 to 33). Where mitigation and adaptation efforts are within our control such as managing our operations or monitoring exposures, we have categorised them as direct. Where efforts apply to working with customers or our supply chain, we have categorised them as indirect. Sector and geography of climate-related risks and opportunities Given the nature and mix of our business, all climate-related risks and opportunities identified are considered within the context of the banking sector. As our activities are centred in Australia and New Zealand, our exposure to climate-related risks and opportunities is concentrated in these geographies. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX CLIMATE-RELATED RISKS AND OPPORTUNITIES 16 Climate-related risks TABLE 8: CLIMATE-RELATED RISKS WITH REASONABLY ANTICIPATED IMPACTS TO WESTPAC Risk Description of risk impact Reasonably anticipated impact to Westpaca Current mitigation and adaptation efforts aligned to our focus areas Transition-related impacts on customers, operations and revenue from policy, technology, or market shifts Category: Transition Time horizons of occurrence b • Net-zero 2050 (RCP2.6): Short-, Medium-, and Long-term • Delayed Transition (RCP4.5): Long-term • Current Policies (RCP8.5): N/Ac Changing consumer preferences and policy shifts may impact our customers’ profitability and therefore credit quality. Strategy • Portfolio adjustment due to exposure to sectors that are more likely to be impacted by transition risks. Value chain • Customer asset values may decline as demand for higher emissions goods decreases, reducing debts recovery. Customer insurance recoveries may also be lower; • Increased impairment charges; and • Loss of customers impacting earnings. SUPPORTING CUSTOMERS' TRANSITION AND RESILIENCE • Engaging with customers to understand their decarbonisation strategies and identifying decarbonisation challenges (indirect); • Supporting customers with resilience and adaptation through our products and services (indirect); • Monitoring exposure to industries with elevated transition risk (direct) (see Table 17 to 19); and • Progressing to achieve our financed emissions sector targets in carbon-intensive emissions sectors (direct). Acute and chronic physical risk impacts to our customers’ facilities, properties, operations, or supply chains Category: Physical Time horizons of occurrence b • All scenarios: Short-, Medium-, and Long-term Severe weather events (e.g., flood, cyclones) and longer-term shifts in climatic patterns (e.g., heat stress, sea level rise) can damage assets used as collateral for our lending or disrupt our customers’ operations, leading to decreased credit quality. Strategy • Portfolio adjustment due to exposure to sectors and areas that are more likely to be impacted by physical risk; and • Increased importance of climate considerations in risk assessments. Value chain • Increased hardship and delinquencies related to lending; • Customer asset values may decline as regions are exposed to more frequent and/or severe acute events, reducing debt recovery. Also includes lower levels of insurance; • Increased impairment charges; and • Loss of customers impacting earnings. SUPPORTING CUSTOMERS' TRANSITION AND RESILIENCE • Supporting customers with resilience and adaptation through our products and services (indirect) (see page 33); and • Monitoring exposure to regions of elevated physical risk (direct) (see Table 20 to 21). COLLABORATING FOR IMPACT • Industry discussions on insurance availability / transparency (indirect). Acute and chronic physical risk impacts to our operations and supply chain Category: Physical Time horizons of occurrence b • All scenarios: Short-, Medium-, and Long-term Severe weather events (e.g., flood, cyclones) and longer-term shifts in climatic patterns (e.g., heat stress, sea level rise) can impact our ability to provide services to customers or disrupt our supply chain, leading to operational impacts such as increased recovery costs or reduced service. Strategy • No anticipated impact to strategy. Value chain • Disruption to operations and supply chain; and • Higher costs to restore services or support customers. NET-ZERO, CLIMATE RESILIENT OPERATIONS • Understanding exposure of our operations to physical risks, and strengthening resilience (direct); • Considering climate risks in lease agreements (direct); and • Business continuity plans and testing (direct). Failure to recognise or address climate change risks or opportunities Category: Transition & Physical Time horizons of occurrence b • All scenarios: Short-, Medium-, and Long-term Reputational damage, such as loss of stakeholder or customer trust if Westpac fails to or is perceived to not act on or respond to physical or transition climate-related risks. Loss of customer confidence or reduced investor support may result in decreased market value or business opportunities. Strategy • Greater expectations to strategically respond to evolving climate-related risks and opportunities. Value chain • Negative publicity could reduce customer trust, attract protest activity; and • Loss of customers and business impacting earnings. NET-ZERO, CLIMATE RESILIENT OPERATIONS • Operational emissions targets (direct). SUPPORTING CUSTOMERS' TRANSITION AND RESILIENCE • Carbon-Intensive Sector Requirements (direct); • Financed emissions sector targets (direct); and • Reporting on progress (direct). COLLABORATING FOR IMPACT • Collaborating with stakeholders on initiatives towards net-zero and climate resilience (indirect). a. Our analysis has not identified any reasonably anticipated impacts to Westpac's business model in any scenario. b. Based on scenarios outlined in Climate-related Scenario Analysis section. c. Under a Current Policies scenario transition risks are minimal and not anticipated to increase beyond current levels – for detail on climate scenarios see Table 6 and Table 16. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX CLIMATE-RELATED RISKS AND OPPORTUNITIES 17 Climate-related opportunities TABLE 9: CLIMATE-RELATED OPPORTUNITIES WITH REASONABLY ANTICIPATED IMPACTS TO WESTPAC Opportunity Description of opportunity impact Reasonably anticipated impact to Westpaca Current mitigation and adaptation efforts aligned to our focus areas Improve customer relationships Category: Transition & Physical Time horizons of opportunity occurrence b • All scenarios: Short-, Medium-, and Long-term Through engagement, strengthen customer relationships by helping them better identify and manage climate-related risks. Strategy • Adjustment in strategy due to changes in customer engagement approach. Value chain • Improved customer service and deeper customer relationships; and • Increase in activity and/or market share (increasing revenue). SUPPORTING CUSTOMERS' TRANSITION AND RESILIENCE • Engaging with customers to understand their climate strategies and challenges (indirect); and • Building banker capability to enhance conversations with customers (direct). Increase revenue streams by developing and providing climate-related products and services for customers Category: Transition & Physical Time horizons of opportunity occurrence b • All scenarios: Short-, Medium-, and Long-term Selling more climate-related products and services to assist customers respond to their physical and transition climate change risks. Enhancing customer resilience and their transition plans improves their risk profile and ultimately the quality of our lending. Strategy • Changes in our product mix as demand for climate-related products and services changes. Value chain • Increase customers' resilience, positively impacting earnings; • Increased revenue from products that support climate-related activities; and • Decrease in financed emissions. SUPPORTING CUSTOMERS' TRANSITION AND RESILIENCE • Engaging with customers to understand their climate strategies and challenges (indirect); • Applying our Sustainable Finance Framework to increase sustainable financing (direct); and • Develop products and services to support customers achieve their climate-related goals (direct). Strengthening our operational resilience to help us remain available to customers through climate-related events. Category: Transition & Physical Time horizons of opportunity occurrence b • All scenarios: Short-, Medium-, and Long-term Strengthening operational resilience, including to the impacts of climate-related events, can help us prepare for, respond to, recover and learn from disruptions. Building climate resilience into our supply chain by better managing climate-related risks linked to our service providers. Strategy • No anticipated impact to strategy. Value chain • Lower costs from increased resilience to disruptions; and • Increased public trust and confidence. NET-ZERO, CLIMATE RESILIENT OPERATIONS • Strengthening how operational resilience processes, systems, and controls consider climate-related risks and opportunities (direct). a. Our analysis has not identified any reasonably anticipated impacts to Westpac's business model in any scenario. b. Based on scenarios outlined in Climate-related Scenario Analysis section. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX CLIMATE-RELATED RISKS AND OPPORTUNITIES 18 Current impacts Climate-related risks and opportunities are already impacting Westpac’s strategy and value chain. It is important to note that, while the effects and potential consequences of climate change are evident, it is difficult to determine its impact on any event. While broader effects are likely to increase, pinpointing its influence on incidents will remain challenging. As such, careful consideration is required when evaluating climate-related impacts on our operations and reporting. We are taking steps now to adapt to the challenges of a changing climate. While we currently assess the overall impact of climate change on our financial statements (see page 34), we have not yet analysed the financial impacts from specific climate-related risks or opportunities or their long-term financial implications. Some impacts from climate-related risks and opportunities experienced over the year have included: • Our response to major weather events, including supporting affected customers (physical risk); • Strengthening climate risk management processes (physical and transition risk); • Broadening climate risk (physical and transition risk) assessments across more customers, especially in carbon-intensive sectors; and • Significant growth in our sustainable finance and bond facilitation (transition risk). The above are not considered material to Westpac's financial statements as described on page 34. How we are responding Our strategic response to climate-related risks and opportunities in FY25 is described in the sections below, in line with three focus areas of our CCPS. WESTPAC 2025 SUSTAINABILITY REPORT |

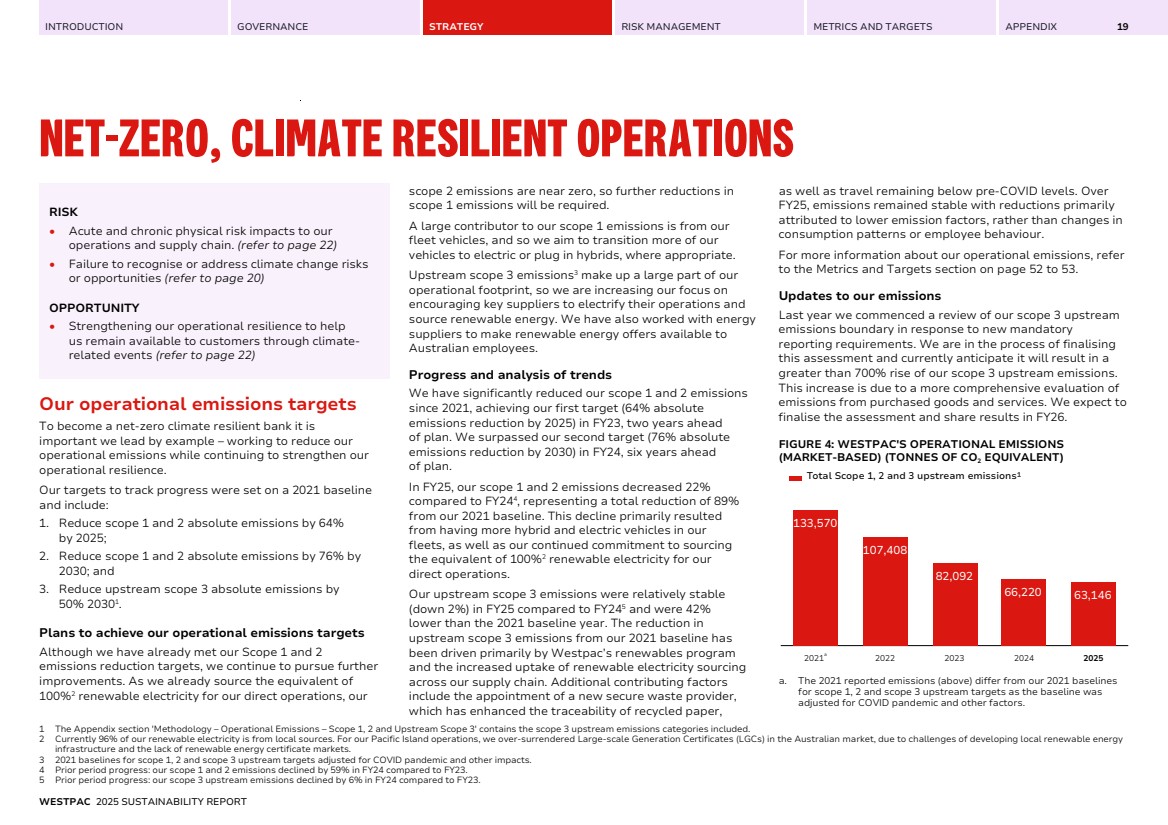

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX 19 NET-ZERO, CLIMATE RESILIENT OPERATIONS RISK • Acute and chronic physical risk impacts to our operations and supply chain. (refer to page 22) • Failure to recognise or address climate change risks or opportunities (refer to page 20) OPPORTUNITY • Strengthening our operational resilience to help us remain available to customers through climate-related events (refer to page 22) Our operational emissions targets To become a net-zero climate resilient bank it is important we lead by example – working to reduce our operational emissions while continuing to strengthen our operational resilience. Our targets to track progress were set on a 2021 baseline and include: 1. Reduce scope 1 and 2 absolute emissions by 64% by 2025; 2. Reduce scope 1 and 2 absolute emissions by 76% by 2030; and 3. Reduce upstream scope 3 absolute emissions by 50% 20301 . Plans to achieve our operational emissions targets Although we have already met our Scope 1 and 2 emissions reduction targets, we continue to pursue further improvements. As we already source the equivalent of 100%2 renewable electricity for our direct operations, our scope 2 emissions are near zero, so further reductions in scope 1 emissions will be required. A large contributor to our scope 1 emissions is from our fleet vehicles, and so we aim to transition more of our vehicles to electric or plug in hybrids, where appropriate. Upstream scope 3 emissions3 make up a large part of our operational footprint, so we are increasing our focus on encouraging key suppliers to electrify their operations and source renewable energy. We have also worked with energy suppliers to make renewable energy offers available to Australian employees. Progress and analysis of trends We have significantly reduced our scope 1 and 2 emissions since 2021, achieving our first target (64% absolute emissions reduction by 2025) in FY23, two years ahead of plan. We surpassed our second target (76% absolute emissions reduction by 2030) in FY24, six years ahead of plan. In FY25, our scope 1 and 2 emissions decreased 22% compared to FY244 , representing a total reduction of 89% from our 2021 baseline. This decline primarily resulted from having more hybrid and electric vehicles in our fleets, as well as our continued commitment to sourcing the equivalent of 100%2 renewable electricity for our direct operations. Our upstream scope 3 emissions were relatively stable (down 2%) in FY25 compared to FY245 and were 42% lower than the 2021 baseline year. The reduction in upstream scope 3 emissions from our 2021 baseline has been driven primarily by Westpac’s renewables program and the increased uptake of renewable electricity sourcing across our supply chain. Additional contributing factors include the appointment of a new secure waste provider, which has enhanced the traceability of recycled paper, as well as travel remaining below pre-COVID levels. Over FY25, emissions remained stable with reductions primarily attributed to lower emission factors, rather than changes in consumption patterns or employee behaviour. For more information about our operational emissions, refer to the Metrics and Targets section on page 52 to 53. Updates to our emissions Last year we commenced a review of our scope 3 upstream emissions boundary in response to new mandatory reporting requirements. We are in the process of finalising this assessment and currently anticipate it will result in a greater than 700% rise of our scope 3 upstream emissions. This increase is due to a more comprehensive evaluation of emissions from purchased goods and services. We expect to finalise the assessment and share results in FY26. FIGURE 4: WESTPAC'S OPERATIONAL EMISSIONS (MARKET-BASED) (TONNES OF CO2 EQUIVALENT) 133,570 107,408 82,092 66,220 63,146 Total Scope 1, 2 and 3 upstream emissions¹ 2021a 2022 2023 2024 2025 a. The 2021 reported emissions (above) differ from our 2021 baselines for scope 1, 2 and scope 3 upstream targets as the baseline was adjusted for COVID pandemic and other factors. 1 The Appendix section 'Methodology – Operational Emissions – Scope 1, 2 and Upstream Scope 3' contains the scope 3 upstream emissions categories included. 2 Currently 96% of our renewable electricity is from local sources. For our Pacific Island operations, we over-surrendered Large-scale Generation Certificates (LGCs) in the Australian market, due to challenges of developing local renewable energy infrastructure and the lack of renewable energy certificate markets. 3 2021 baselines for scope 1, 2 and scope 3 upstream targets adjusted for COVID pandemic and other impacts. 4 Prior period progress: our scope 1 and 2 emissions declined by 59% in FY24 compared to FY23. 5 Prior period progress: our scope 3 upstream emissions declined by 6% in FY24 compared to FY23. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX NET-ZERO, CLIMATE RESILIENT OPERATIONS 20 Actions supporting our targets Actions that support our targets to reduce our scope 1, scope 2 and upstream scope 3 emissions were outlined in our CCPS, and progress is summarised below. The actions presented in Table 10 are not formal climate-related targets for the purposes of the Climate Transition Plan and associated climate-related reporting. Moving forward, we will report progress in line with our Climate Transition Plan. TABLE 10: ACTIONS SUPPORTING OUR TARGETS ACTIONS 2025 PROGRESS Source the equivalent of 100% of our electricity demand from renewables • Achieved, refer to section “Approach to renewables” for details. Develop program to support Australian employees reduce their home emissions. • Launched employee renewables offers in partnership with Energy Australia and Flow Power; and • Continued our incentive program to promote the uptake of GreenPower (100% renewable electricity) by employees. Transition our Australian and New Zealand fleets to 100% electric (EVs) or plug-in hybrid (PHEVs) vehicles by 2030a Australia • EV pilot continues, with 8% of our fleet now transitioned to EVs (0% in 2024); and • Fuel efficiency has improved through the transition of 63% of our fleet to hybrid vehicles (19% in 2024). New Zealand • 98.5% of our fleet has been transitioned to EVs and PHEVsb (97% in 2024). In FY25, we installed 32 EV chargers across 8 sites to support this transition. Support key suppliers with their emissions reduction strategies and consider supplier climate strategies in sourcing decisions • Continued supplier engagement; and • Expanded our assessment of key suppliers' transition plans as part of our responsible sourcing program. Review our scope 3 upstream emissions reporting • Completed the review of our scope 3 upstream emissions boundary and are finalising our assessmentc . ACTIONS 2025 PROGRESS Develop our approach to assessing/managing physical climate risk to our operational sites • Assessed the physical climate risksd to our direct property portfolio; • Enhanced our Australian business leasing processes to consider climate matters in new and renewed leases; and • Continued to enhance climate risk considerations in our operational resilience practices. Divert 80% of operational waste from landfill at Australian commercial sites • Diverted 82% of waste from landfill (77% in 2024), primarily by maintaining waste diversion streams, including organics, secure paper, commingled recycling, and specialty recycling, across commercial sites; • Conducted employee education on organics diversion; • Continued our coffee cup re-use program and extended the program to include re-use food containers at Head Office; and • Began collecting select hard-to-recycle materials at our Victoria and New South Wales corporate offices. Pilot embodied carbon emission measurement for capital works with the aim to set an emissions reduction target for construction and refurbishment work by 2026 • Continued carbon pilot for our Adelaide, South Australia office fit-out and are monitoring reductions throughout the design stages; and • Continuing to explore how we measure embodied carbon and will continue to align to best practice standards (e.g., from the Green Building Council). Updates will be provided within our progress towards achieving upstream scope 3 emissions reduction targets. a. In Australia this may include hybrid where required to serve customers in locations where charging infrastructure is not widely available. Supply chain constraints and roll-out of charging infrastructure at a scale are challenges to this action. b. In December 2024, we converted 100% of our NZ passenger vehicle fleet to Electric or PHEV. However, in May 2025, we piloted a Mobile Community Banking program to support customers in areas without a permanent branch. This pilot now operates three commercial diesel vehicles. Including these vans, our total vehicle fleet was 98.5% Electric or PHEV at 30 September 2025. c. Refer to page 19 for more detail. d. Under IPCC climate scenarios SSP1/RCP2.6, SSP2/RCP4.5, SSP5/RCP8.5. Approach to renewables We have sourced the equivalent of 100% of our global electricity demand from renewable sources1 since midway through FY23 and continue to maintain this in FY25. As we procure most of our electricity from the grid, we purchase renewable electricity contracts equivalent to the amount of electricity we consume, including directly with local electricity producers (Virtual Power Purchase Agreements (VPPA)) or with electricity retailers (contracts with electricity suppliers) when possible, otherwise, through renewable energy attribute certificates (EACs), unbundled or separated from the electricity supply source. For FY25, our sources of renewable electricity included VPPAs (84%), retail supply contracts (15%) and unbundled EACs (1%). We have sought to support the development of new renewables capacity in the grid where possible, rather than purchasing from existing generation facilities. This effort involved years of collaboration with suppliers to support the development of the Bomen Solar Farm in Wagga Wagga, New South Wales and the Berri Solar Farm and Battery in South Australia. We have also sought to source renewable electricity in markets where it is consumed. Currently 96% of our renewable electricity is from local sources and we aim to reach 100%, but this is contingent on sourcing sufficient capacity in Fiji and Papua New Guinea (PNG) where renewable electricity markets are emerging. 1 The target to source the equivalent of 100% of our global electricity demand from renewable sources was set in 2019. At that time, we were not sourcing any of our global electricity demand from renewable sources. WESTPAC 2025 SUSTAINABILITY REPORT |

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX NET-ZERO, CLIMATE RESILIENT OPERATIONS 21 Our renewable strategy goes beyond sourcing renewable electricity, it’s also about giving back to the communities that host the facilities. We have worked with our partners to establish community funds supporting local initiatives. In FY25 this included: • Planted a further 4,600 seedlings in the valley opposite Bomen Solar Farm, marking the completion of the ~50,000 trees and shrubs regreening initiative since 2021; • Supported programs at Wagga Wagga’s Mt Austin High School, specifically, 42 students graduated from the Transition Program, supporting post-school pathways, and 17 students participated in the Girls @ the Centre Program, designed to help girls stay engaged in education; • Installation of two electric vehicles chargers within the Berri local community; and • Revegetation of land adjacent to the Berri Solar Farm, planting 100 trees and 300 shrubs. Our emissions intensity We report two emissions intensity metrics reflecting the nature of our business as a bank. The first metric measures operational emissions per full time equivalent (FTE) employee (for our total scope 1 and 2 emissions). This measure provides a perspective on the organisation's carbon efficiency relative to its footprint and workforce size. Refer to Table 24 in the Metrics and Targets section for more information on this metric. The second metric measures financed emissions per dollar of lending (for the total attributed share of our customers' scope 1, 2, and 3 emissions). Given the scale difference between our financed emissions and operational emissions, this distinction is essential. This measure provides a perspective of the emissions intensity of our loan portfolio. Refer to Table 29 in the Metrics and Targets section for more information on this metric. The combination of metrics also reflects the nature of the direct and indirect levers available to us to manage our emissions intensity: operational emissions can be reduced through direct actions including electrification and energy efficiency upgrades, while financed emissions require more indirect approaches such as portfolio alignment and client engagement. Offsetting emissions We recognise the role that carbon credits will play in achieving net-zero. Operational emissions In FY24, we used carbon credits to offset residual operational emissions, refer to Table 25 on page 52. Where we consider appropriate, we will continue to purchase and retire carbon credits to help offset our residual scope 1, scope 2 and selected upstream scope 3 emissions. In FY25, we decided to withdraw from Climate Active certification under the Australian Government’s Climate Active Carbon Neutral Standard for Organisations. We acknowledge the important role Climate Active plays in enabling Australian businesses to take climate action. The decision was made due to changes in the sustainability reporting landscape and ongoing consultations regarding the Climate Active Standards. We will review our participation after the updated Climate Active Standards are released. Where we purchase credits, we aim to do so from projects in our core markets and review our purchased carbon credits for quality. We aim to support the Australian Carbon Credit Units (ACCUs) market as it continues to make the improvements required in transparency and other areas, as identified in 'The Independent Review of Australian Carbon Credit Units (ACCU Review, 2022)'. The credits we retired for our Australian emission footprint were 100% ACCUs for 2024 and are expected to be 100% ACCUs for the 2025 period. In New Zealand, we are certified under the Toitū Net Carbon Zero programme. Westpac New Zealand has also offset certain residual operational emissions since 2019, in line with Toitū Net Carbon Zero programme requirements. In Australia and New Zealand, the purchased units are not verified independently beyond their certification under the ACCU and Toitū Net Carbon Zero schemes, respectively. Emissions reduction targets Operational targets are absolute emission reduction targets set by applying a market-based accounting approach. Carbon offsets are not considered. Our plans to reduce scope 3 financed emissions do not include the use of carbon credits. WESTPAC 2025 SUSTAINABILITY REPORT |

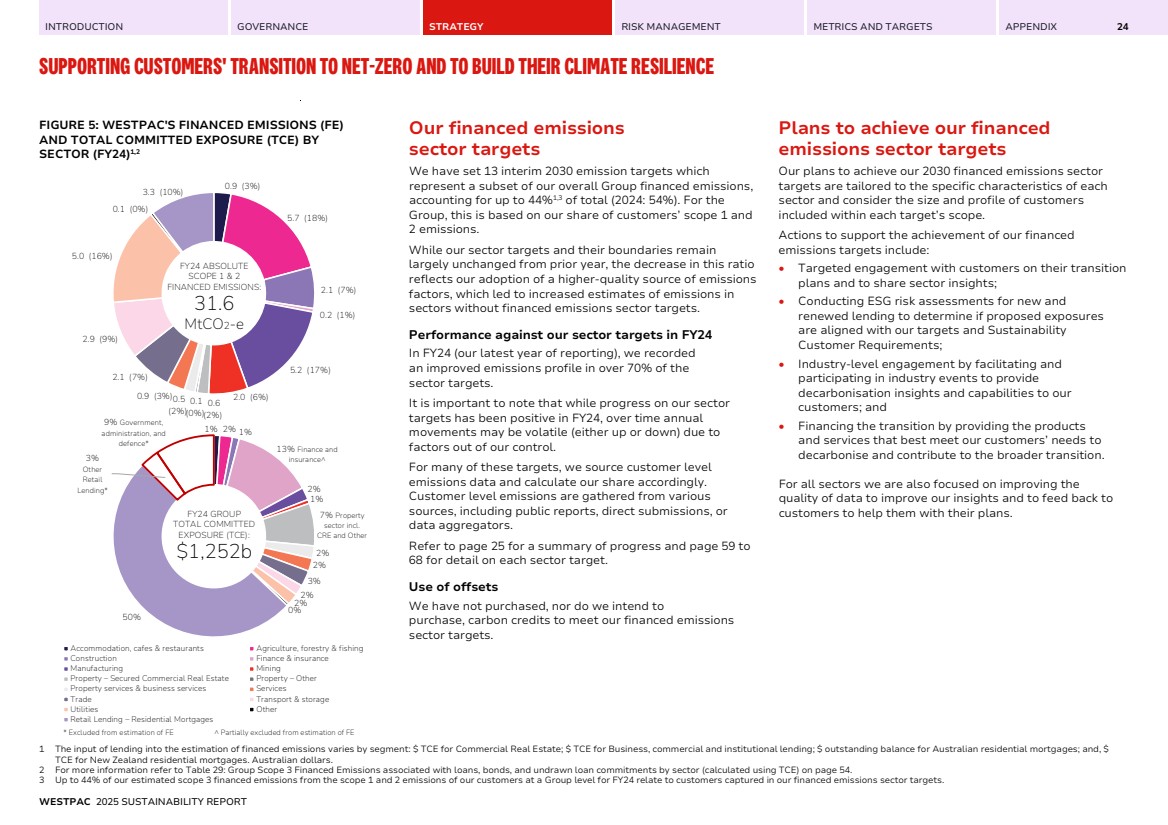

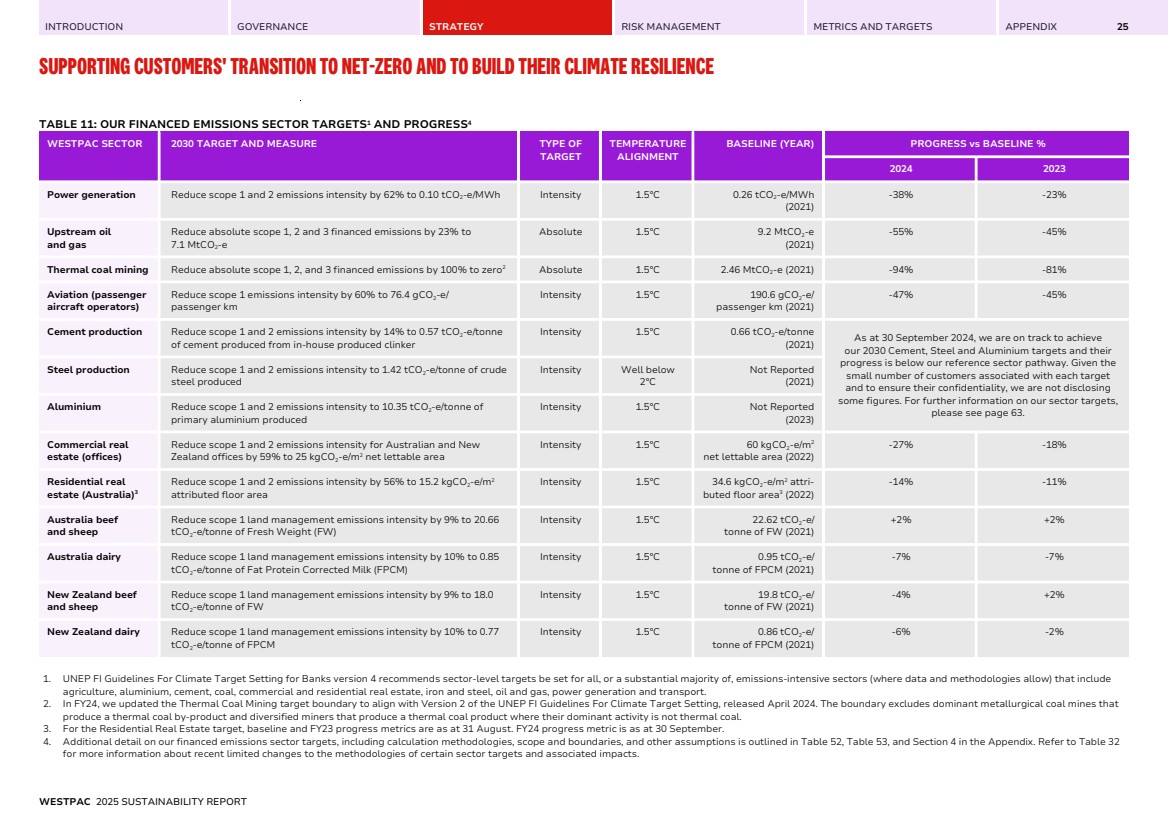

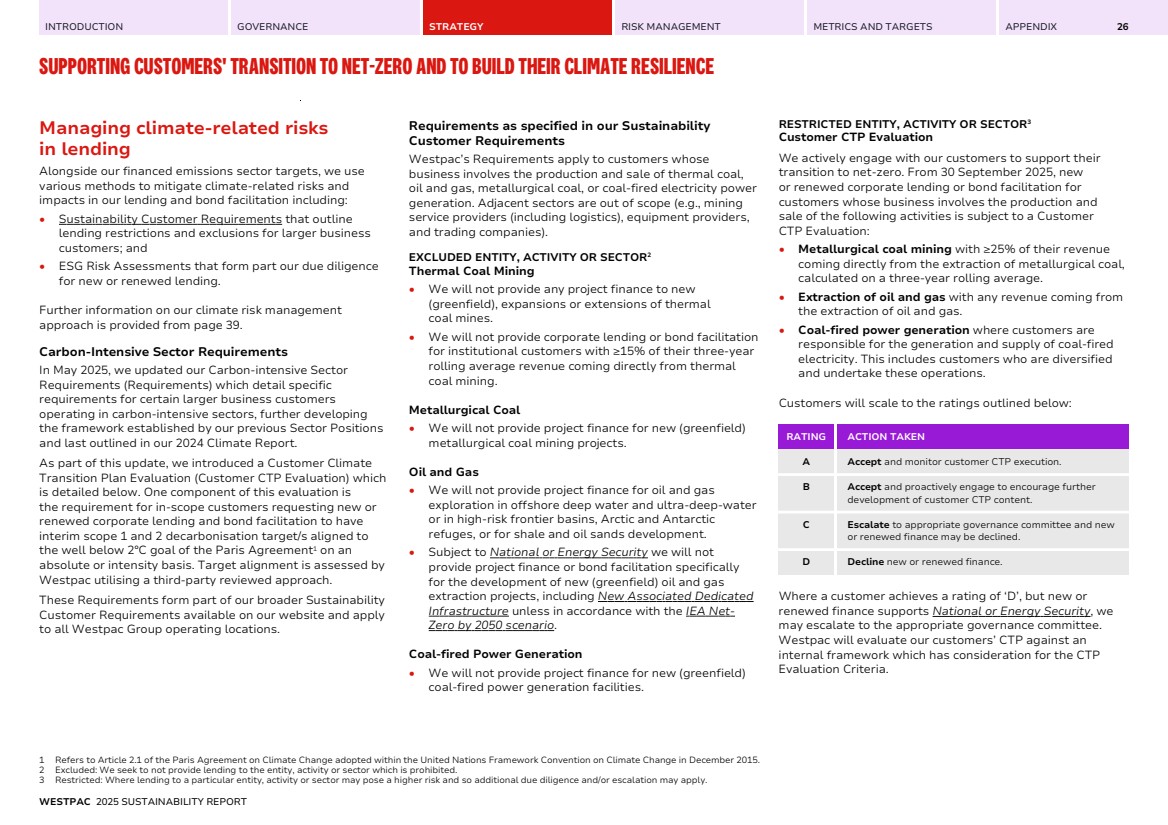

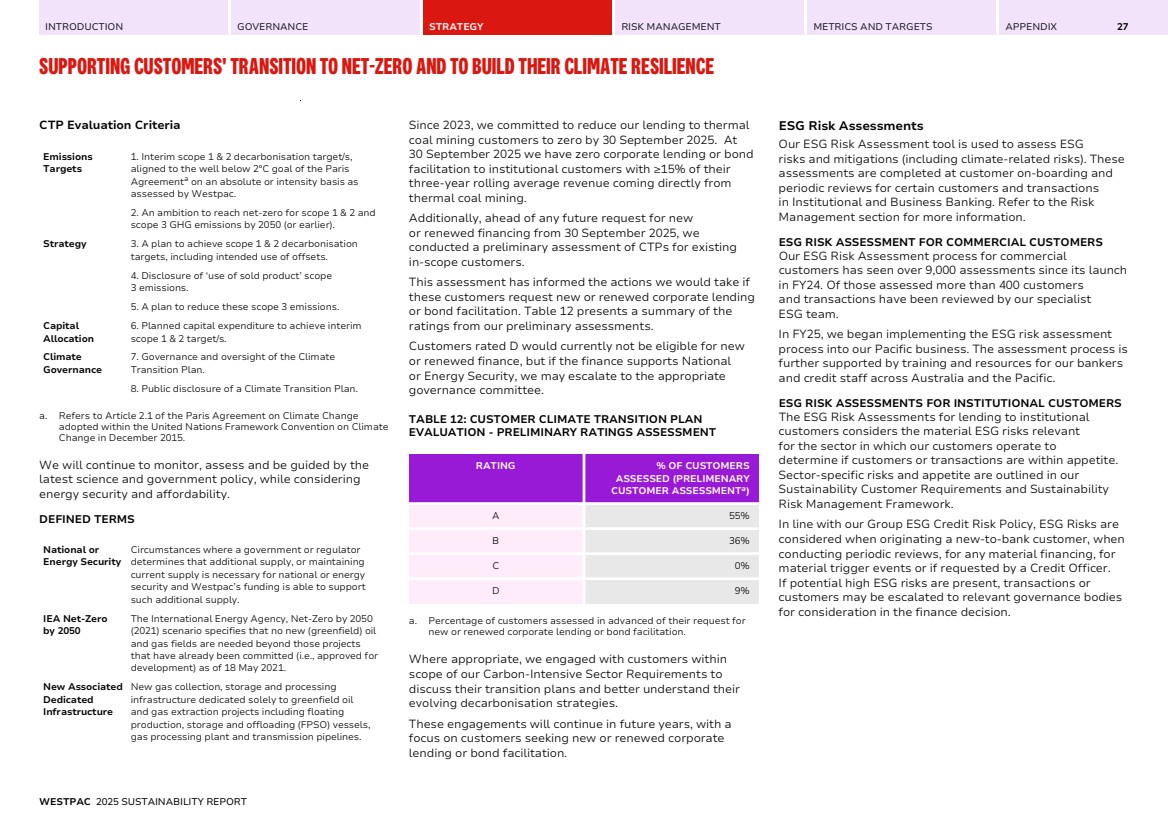

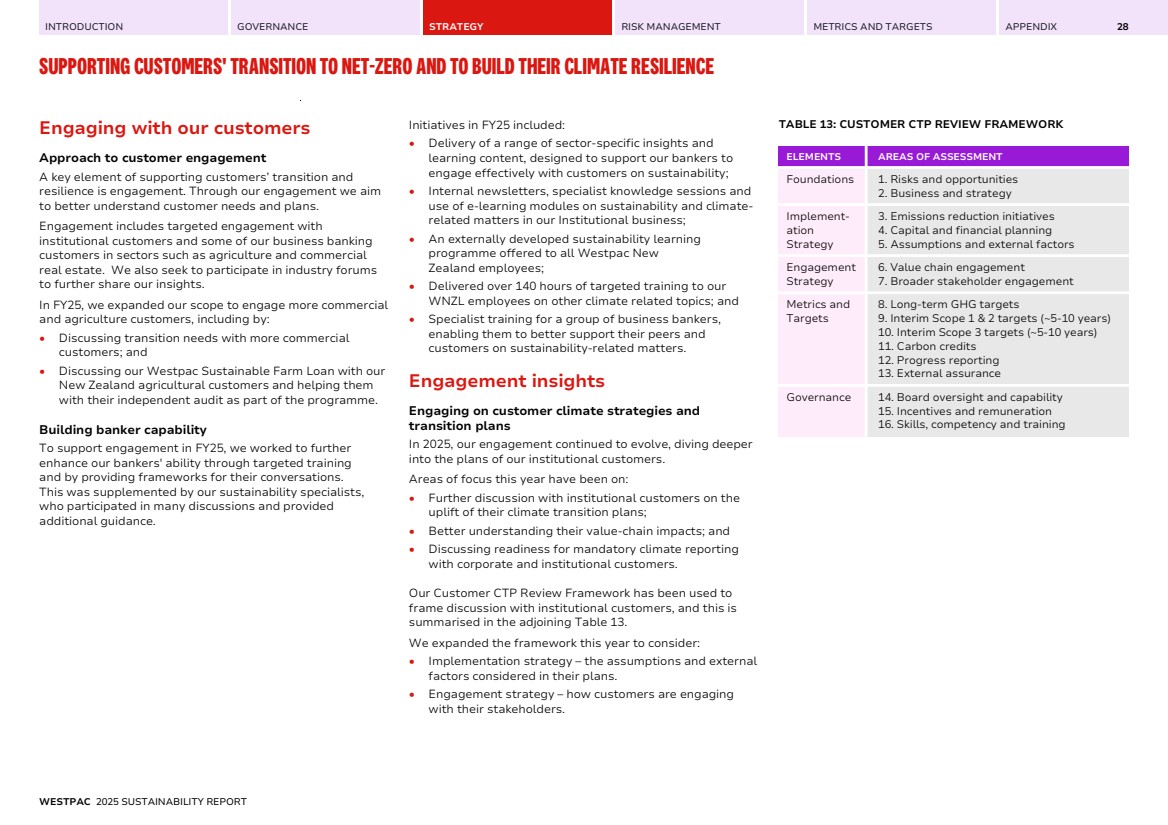

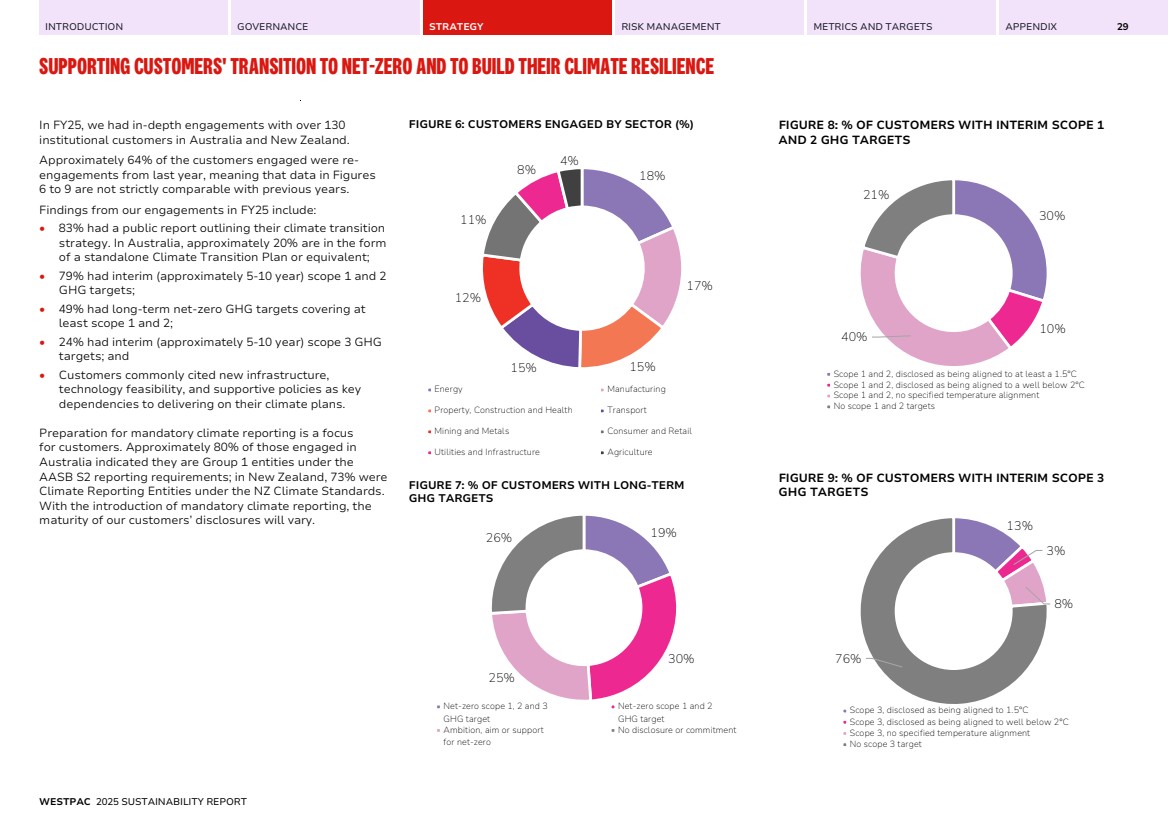

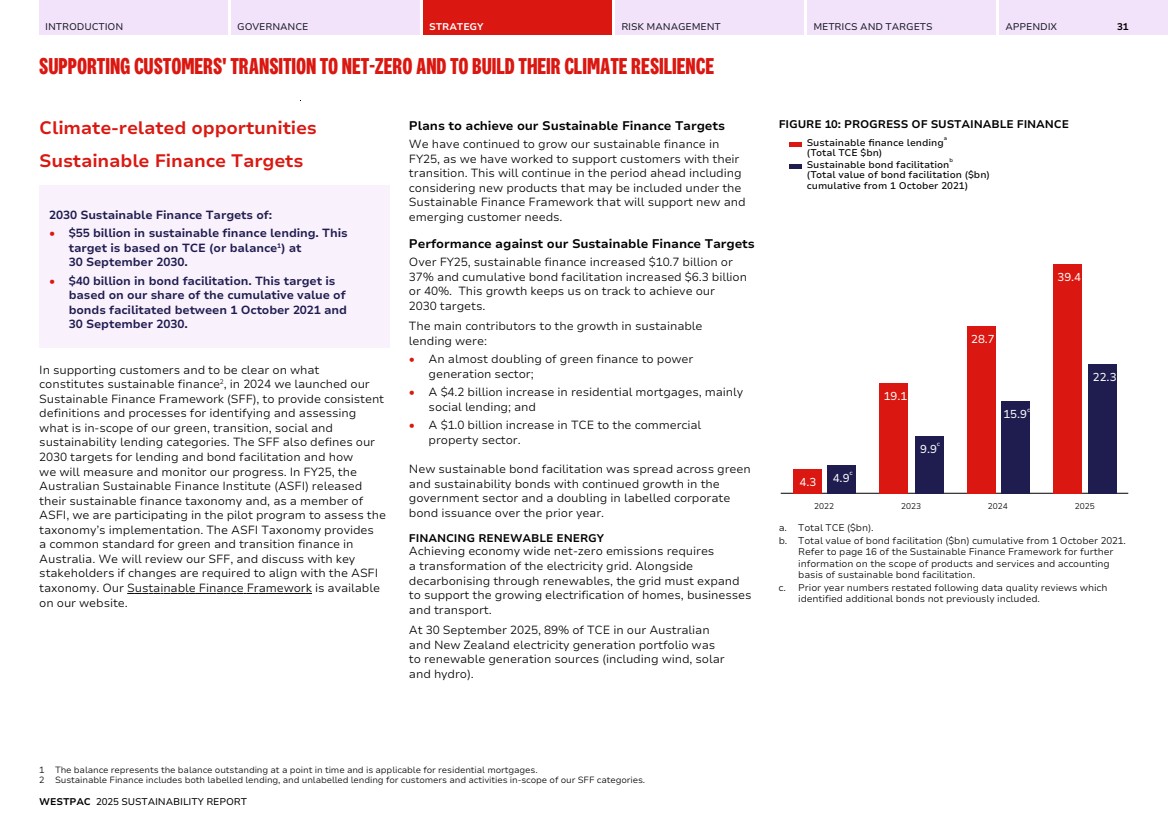

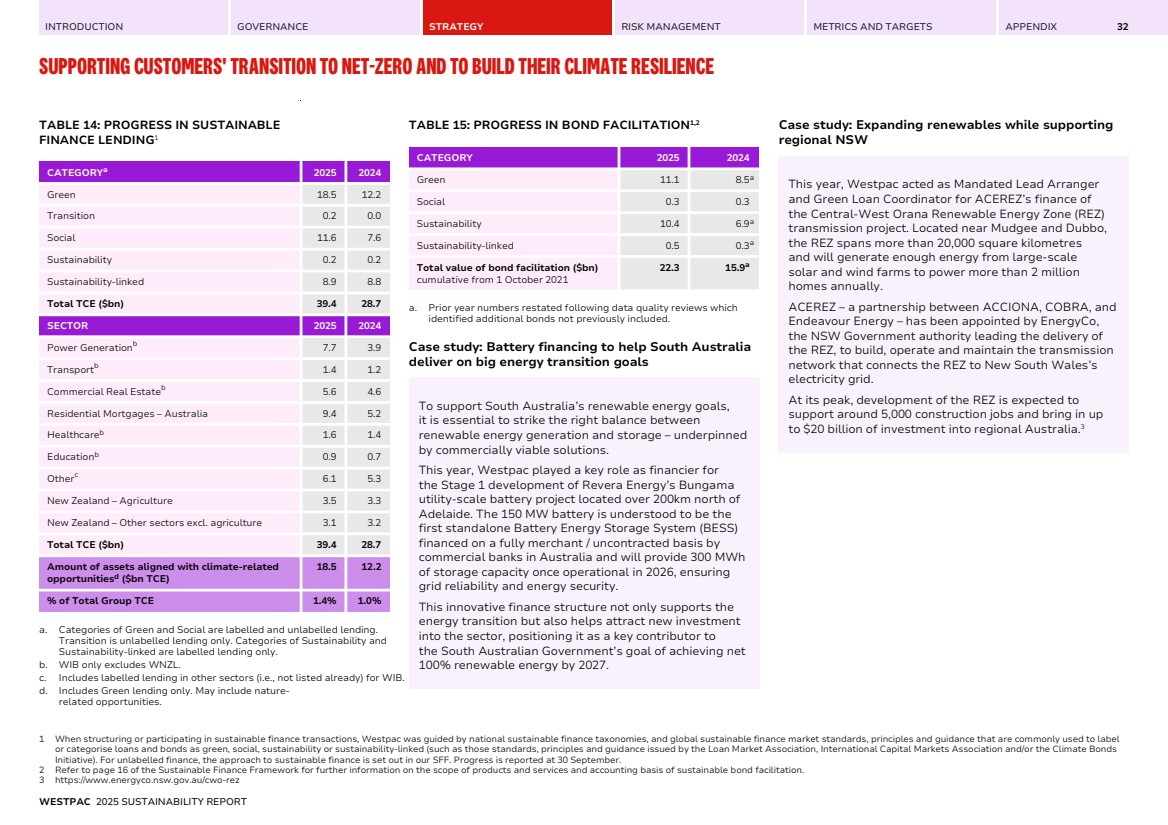

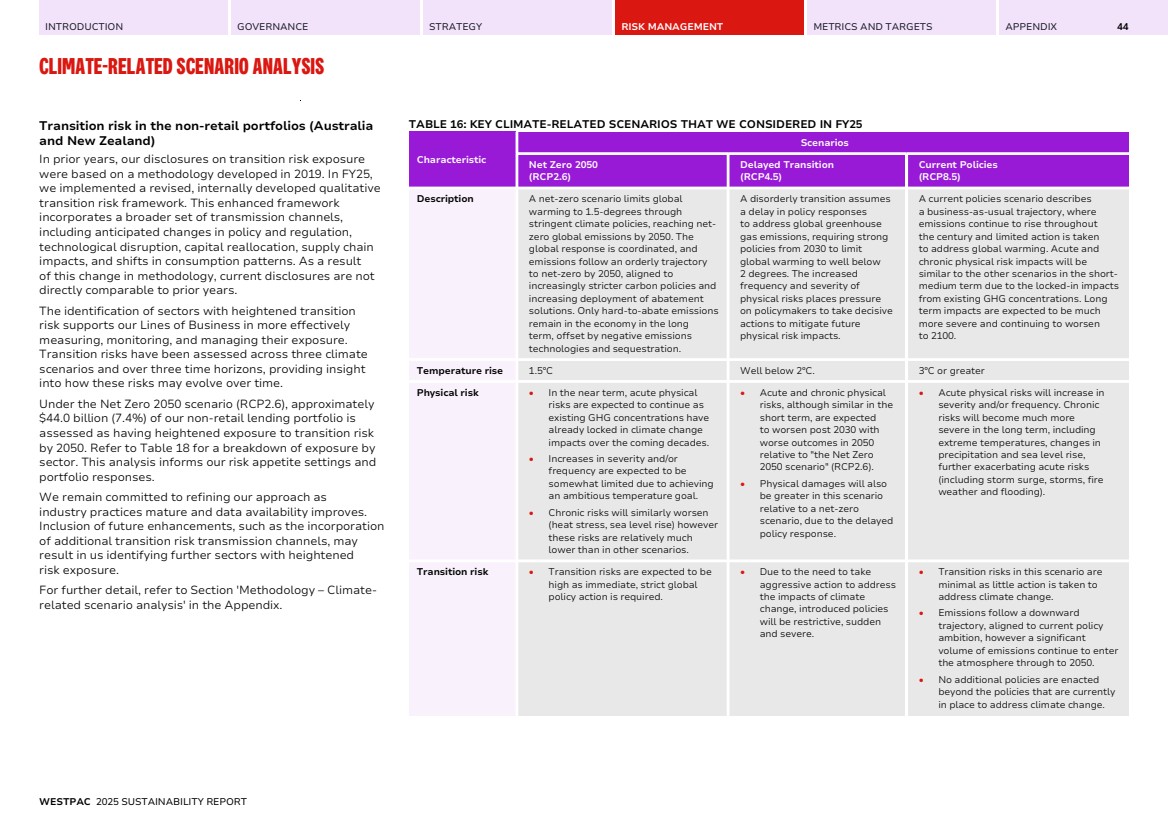

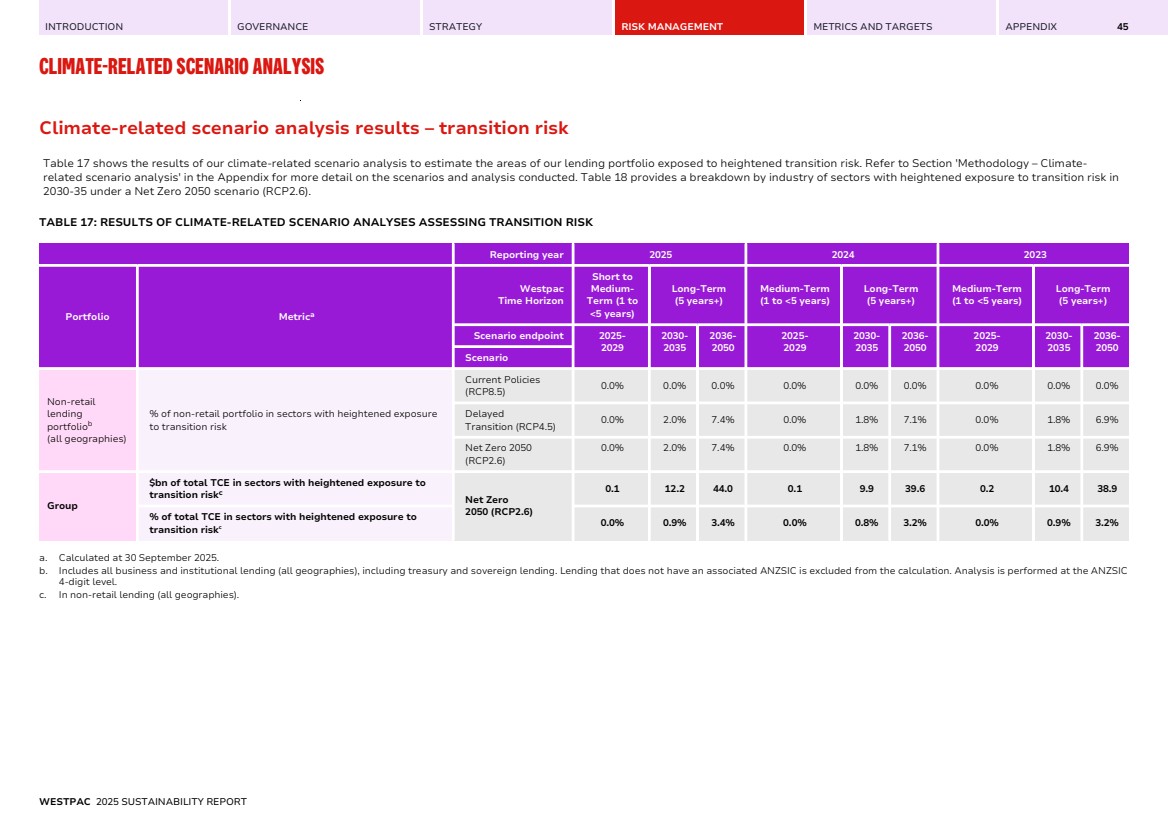

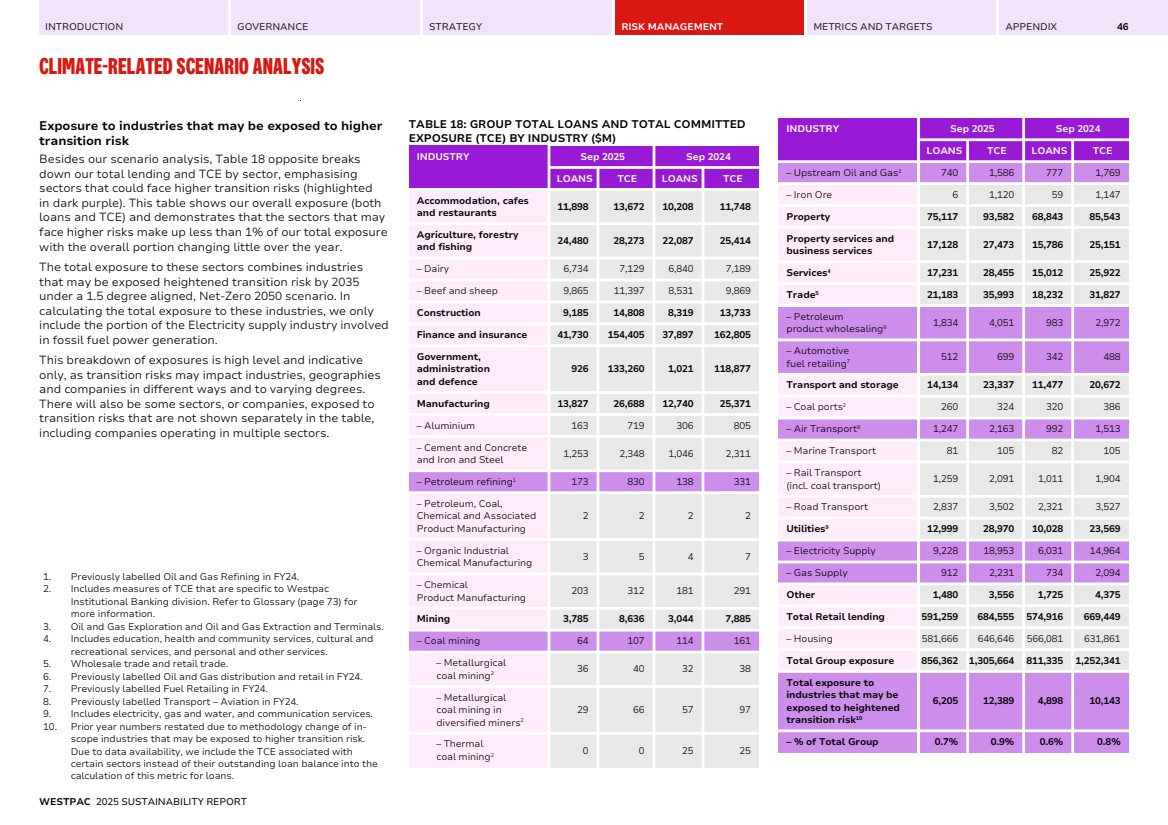

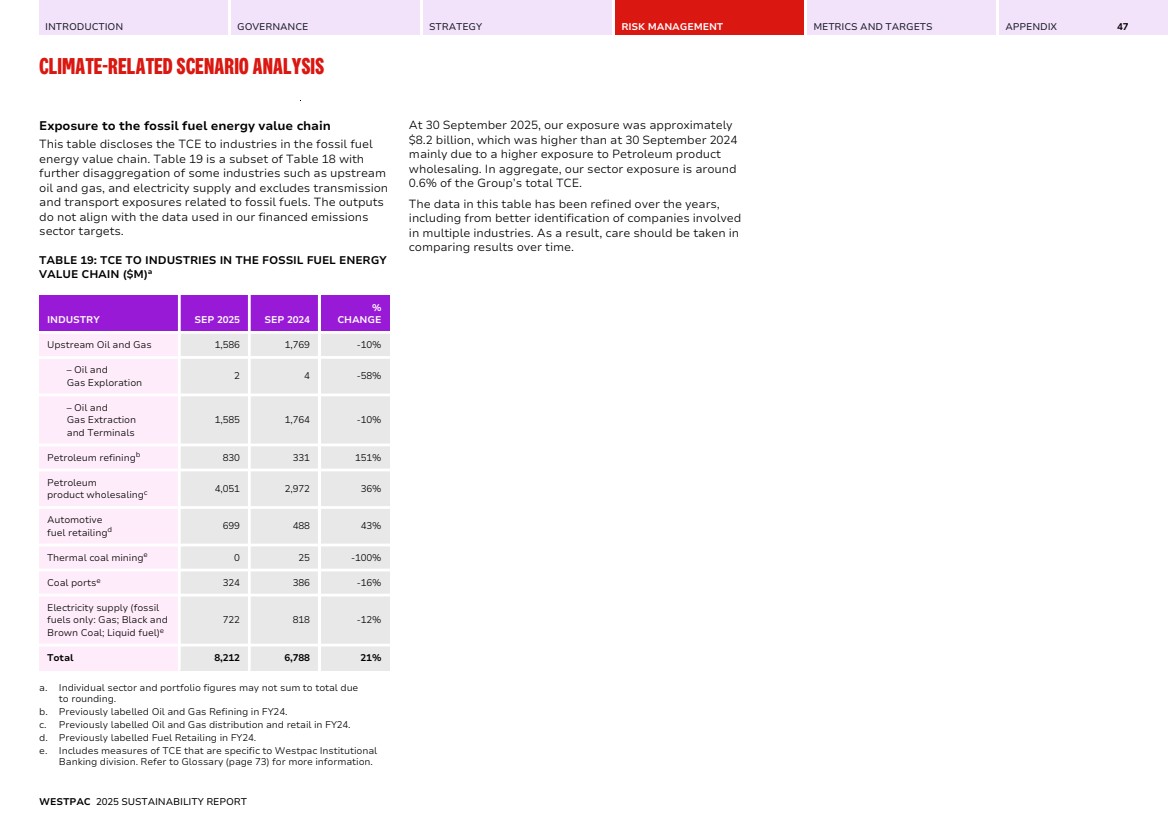

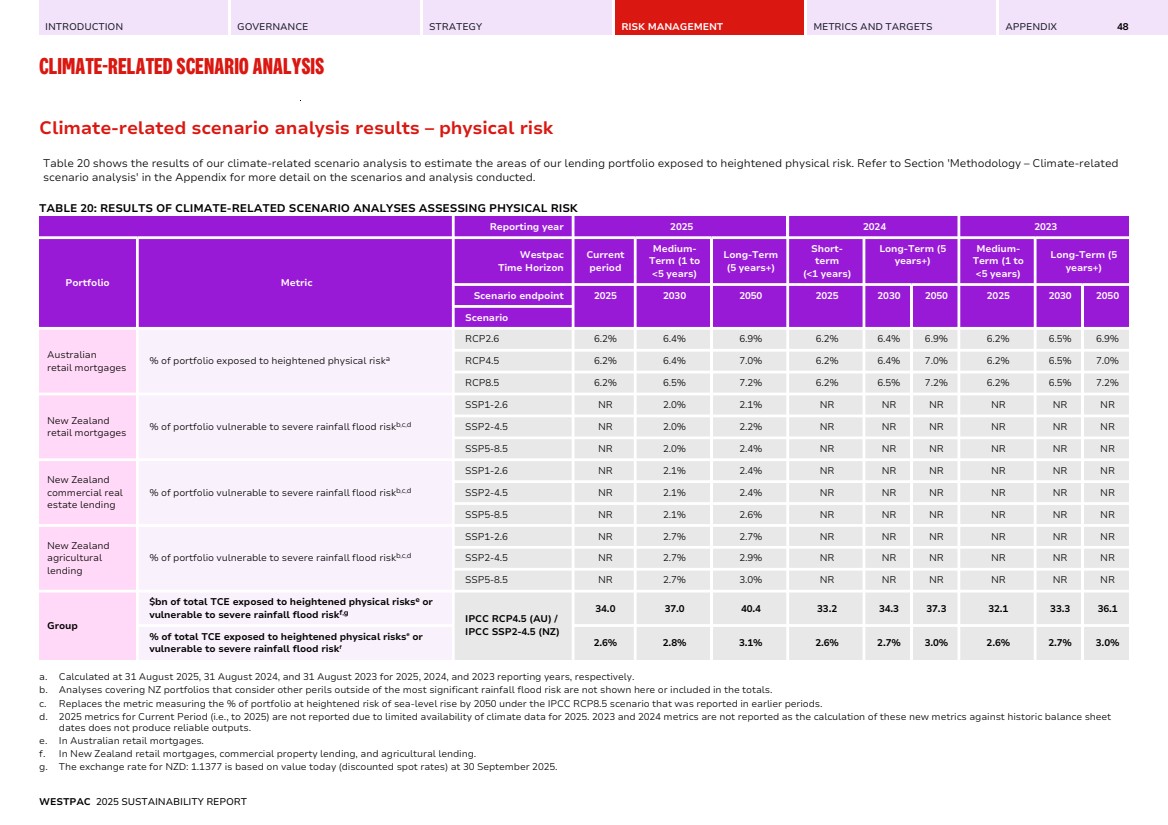

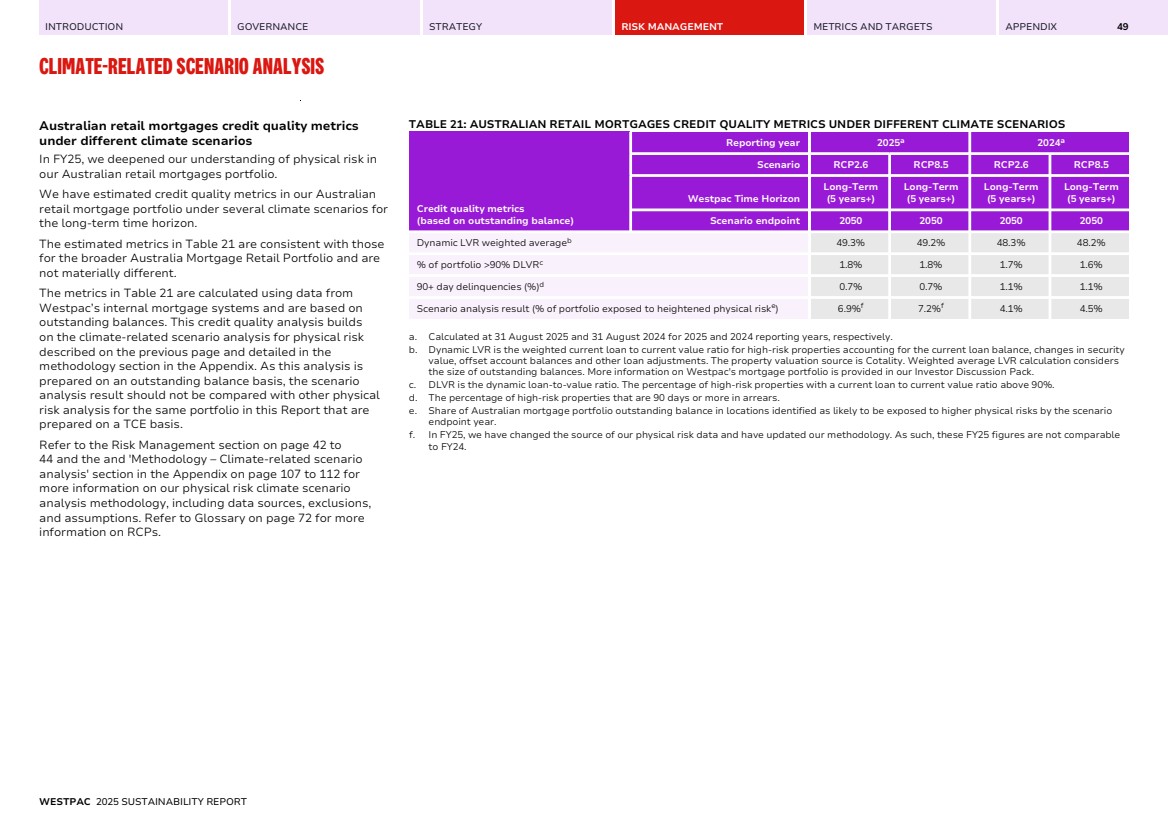

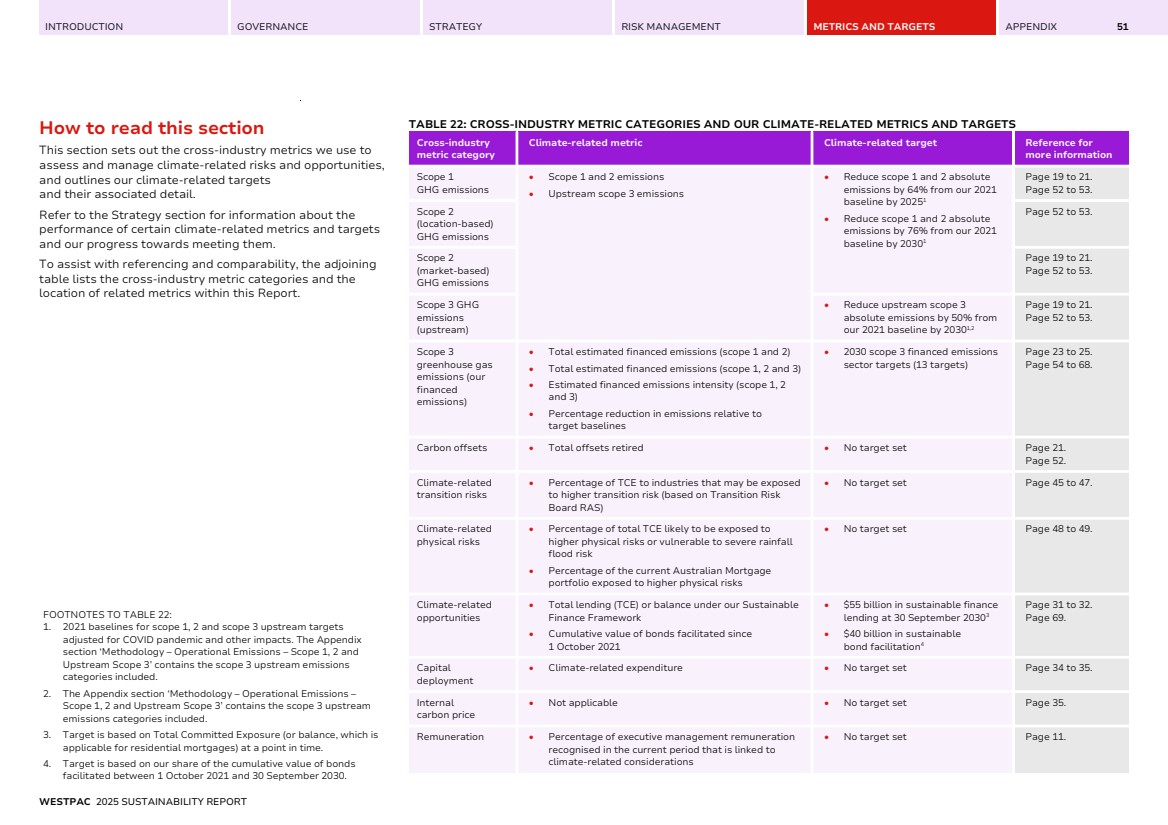

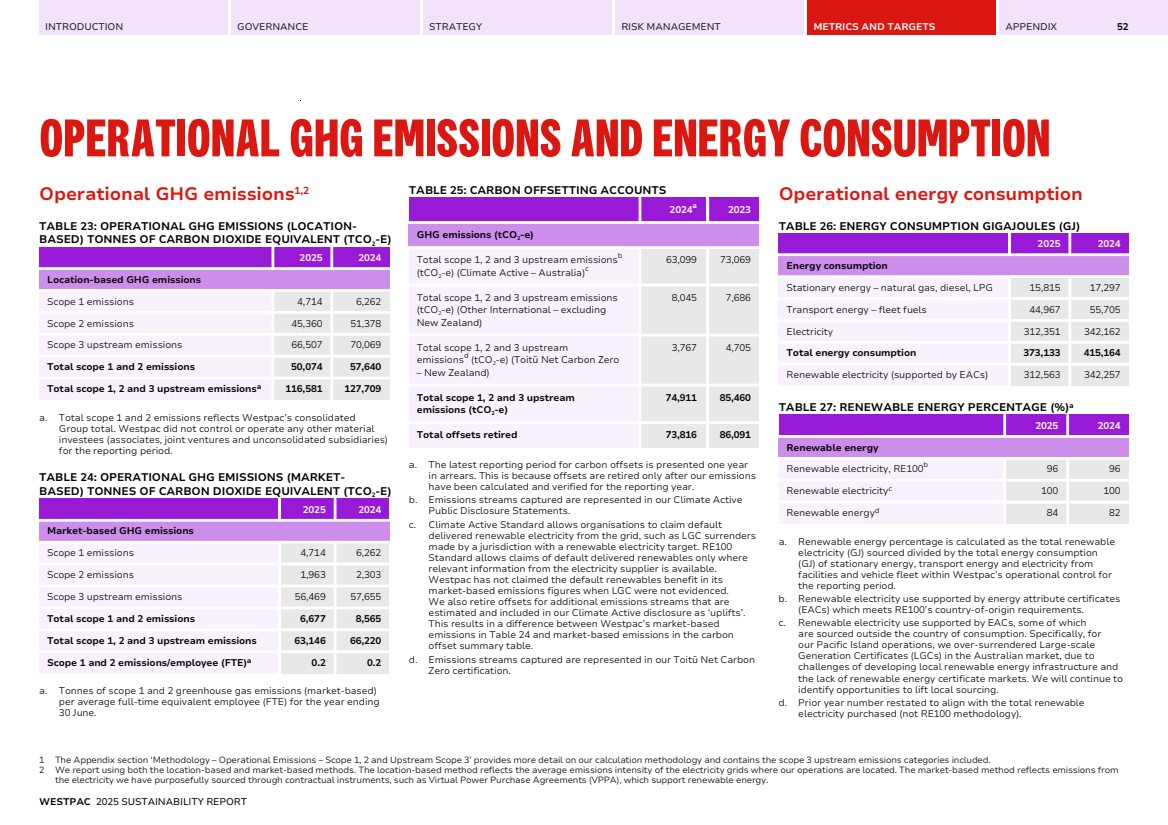

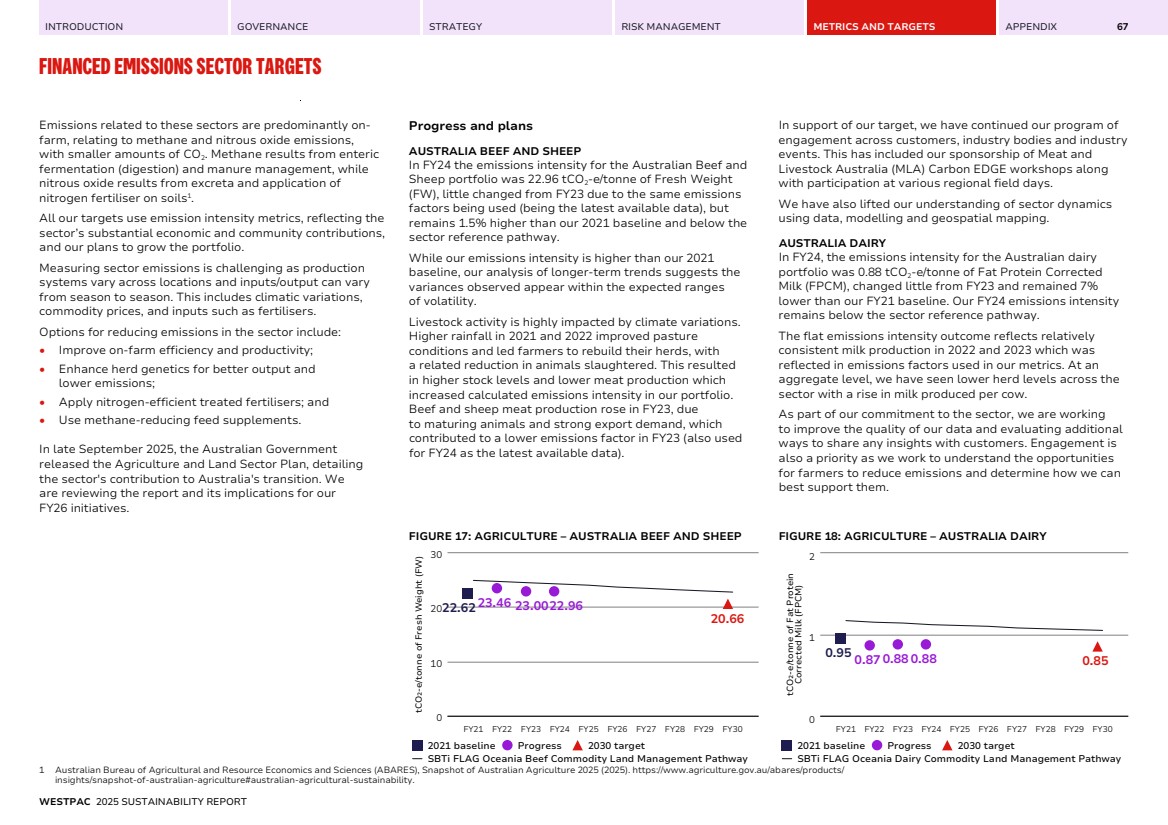

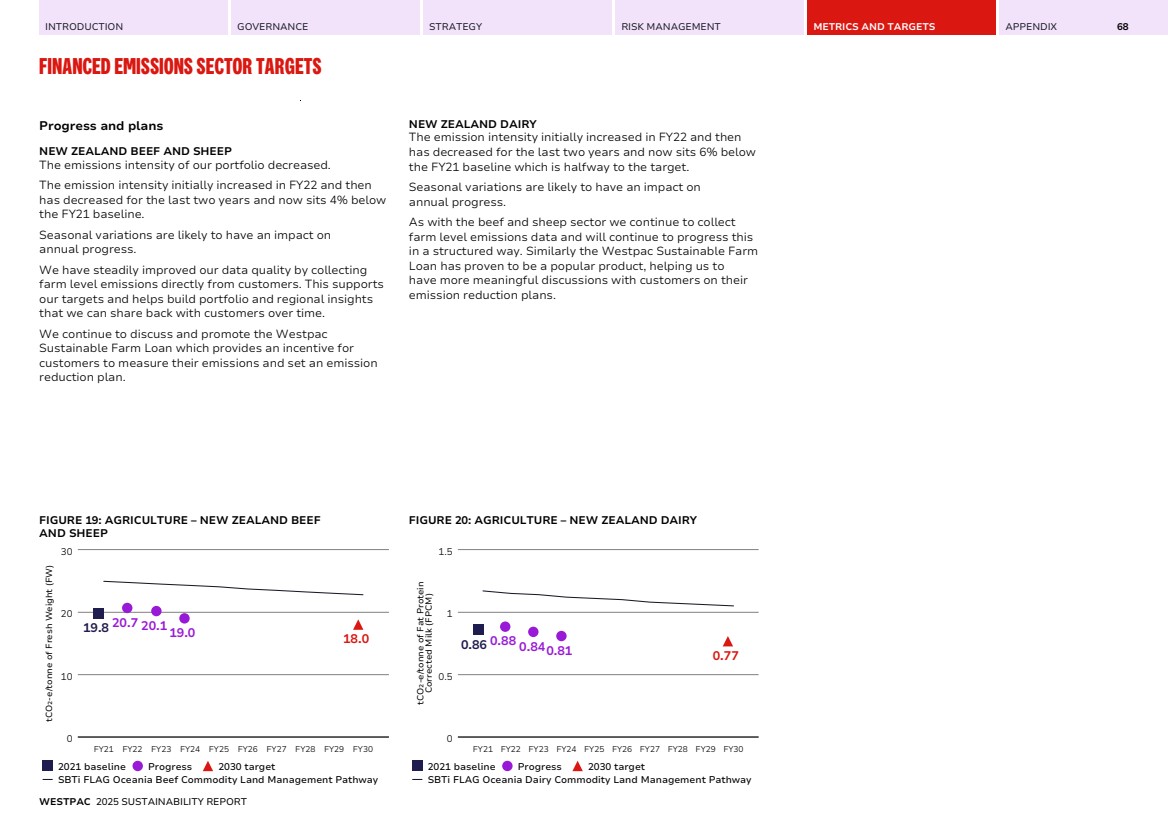

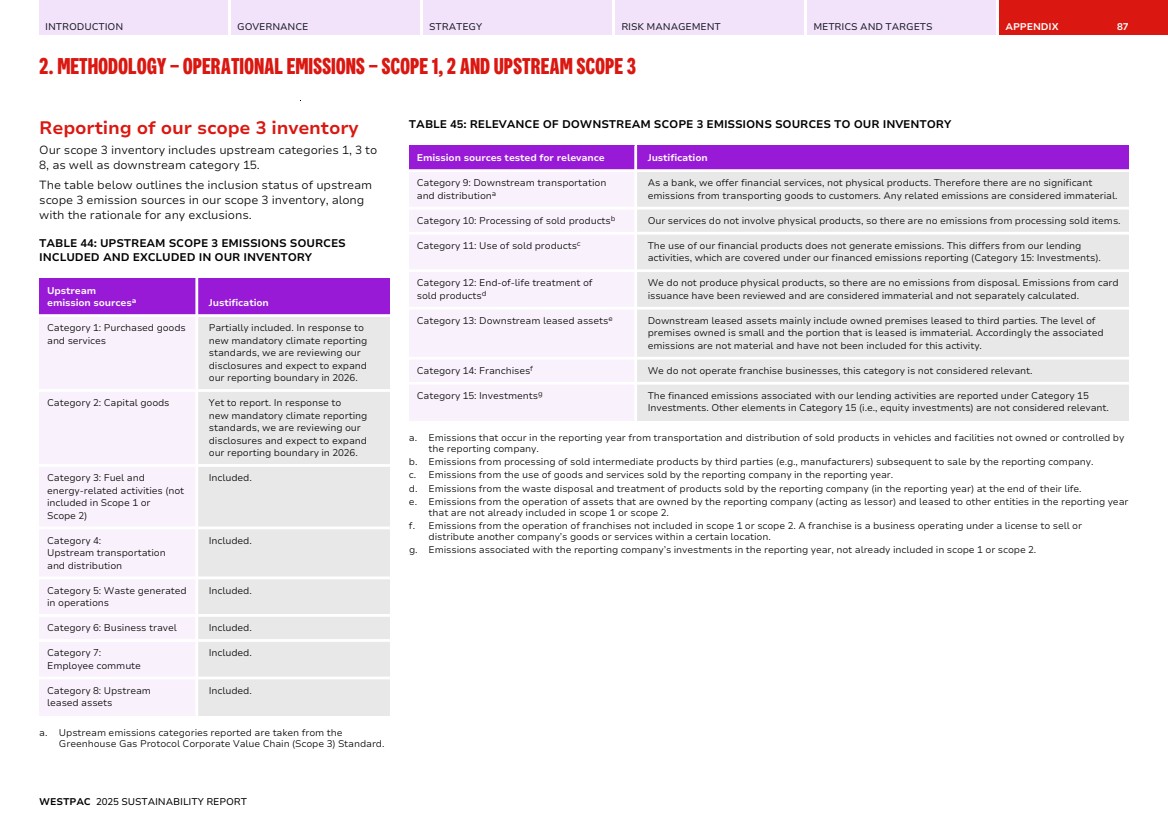

| INTRODUCTION GOVERNANCE STRATEGY RISK MANAGEMENT METRICS AND TARGETS APPENDIX NET-ZERO, CLIMATE RESILIENT OPERATIONS 22 Physical climate resilience of our operations As a bank, maintaining resilience, and being available for our customers is central to how we are organised and operate. Resilience considers our ability to prepare for, respond to, recover, and learn from disruptions, including those related to climate change. We already have detailed processes, systems and controls to support operational resilience and we are focused on further strengthening how these consider climate-related risks and opportunities. There are also several new and incoming regulatory changes in Australia supporting these efforts. These include the Australian Prudential Regulation Authority’s (APRA) Prudential Standards CPS 230 Operational Risk Management and Prudential Practice Guide CPG 229 Climate Change Financial Risks along with the upcoming AASB S2. These developments will have several implications for Westpac including enhancing Board oversight of climate change risk and resilience and developing more comprehensive scenario analysis across the bank’s operations, lending, and value chain. On 1 July 2025, CPS 230 became effective, with an aim of strengthening the management of operational risks, maintaining critical operations through disruptions, and better management of risks linked to service providers. CPS 230 has already contributed to improving our management of resilience and we will use CPG 229 to further embed specific climate resilience requirements. Testing our operations In July 2025, the Executive Team and Board participated in a crisis exercise to test the Group’s response to a severe weather event that triggered a multi-day power outage in Sydney. This simulation tested the effectiveness of our critical operations in maintaining customer services during a major climate-related disruption. The scenario considered natural hazard and climate risk data for scenarios RCP2.6, RCP4.5, and RCP8.5. Improving the resilience of our physical property footprint In 2025, we implemented a new climate risk assessment tool to enhance our understanding of natural hazard and climate change risk related to our operational footprint. This tool evaluates the effects of climate change on our branches and corporate sites worldwide considering multiple scenarios and climate change stressors over the short, medium and long term. We also incorporated climate risk into our leasing processes so that assessments of natural hazards and climate change risks are reflected in our decision making. WESTPAC 2025 SUSTAINABILITY REPORT |