| ASXRELEASE Westpac Banking Corporation Level 18, 275 Kent Street Sydney, NSW, 2000 3 November 2025 Pillar 3 Report as at 30 September 2025 Westpac Banking Corporation (“Westpac”) today provides the attached Pillar 3 Report (September 2025). For further information: Hayden Cooper Justin McCarthy Group Head of Media Relations General Manager, Investor Relations 0402 393 619 0422 800 321 This document has been authorised for release by Tim Hartin, Company Secretary. |

| PILLAR 3 REPORT WESTPAC SEPTEMBER 2025 INCORPORATING THE REQUIREMENTS OF APS 330 WESTPAC BANKING CORPORATION ABN 33 007 457 141 |

| Acknowledgement of Indigenous Peoples Westpac acknowledges the First Peoples of Australia. We recognise their ongoing role as Traditional Owners of the land and waters of this country and pay our respects to Elders, past and present. We extend our respect to Westpac’s Aboriginal and Torres Strait Islander employees, partners and stakeholders and to the Indigenous Peoples in the other locations where we operate. In Aotearoa (New Zealand) we also acknowledge tāngata whenua and the unique relationship that Indigenous Peoples share with all New Zealanders under Te Tiriti o Waitangi. 2 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT Contents OVERVIEW 3 Introduction 4 Key Metrics 5 Group Structure 8 Capital Overview 10 Risk Management Approach 20 Linkages to Financial Statements 27 Asset Encumbrance 29 CREDIT RISK 30 Credit Risk Management 31 Counterparty Credit Risk 59 Credit Valuation Adjustment Risk 65 Securitisation 66 OTHER RISKS 72 Market Risk 73 Interest Rate Risk in the Banking Book (IRRBB) 78 Operational Risk 80 Leverage Ratio 84 Macro-prudential Supervisory Measures 86 Funding and Liquidity Risk Management 87 OTHER INFORMATION 91 Prudential Disclosure Policy 92 Management's Declaration 93 Appendices 94 Glossary 98 Disclosure regarding forward-looking statements 101 In this report references to ‘Westpac’, 'WBC', ‘Westpac Group’, ‘the Group’, ‘we’, ‘us’ and ‘our’ are to Westpac Banking Corporation ABN 33 007 457 141 and its subsidiaries unless it clearly means just Westpac Banking Corporation. In this report, unless otherwise stated or the context otherwise requires, references to 'dollars', 'dollar amounts', ‘$’, ‘AUD’ or ‘A$’ are to Australian dollars. References to ‘US$’, ‘USD’ or ‘US dollars’ are to United States dollars, references to ‘NZ$’, ‘NZD’ or ‘NZ dollars’ are to New Zealand dollars, references to 'GBP' are to British Pound Sterling and references to 'EUR' are to European Euro. Any discrepancies between totals and sums of components in tables contained in this report are due to rounding. In this report, unless otherwise stated, disclosures reflect the Australian Prudential Regulation Authority’s (APRA) implementation of Basel III. Information contained in or accessible through the websites mentioned in this report does not form part of this report unless we specifically state that it is incorporated by reference and forms part of this report. Information on those websites owned by Westpac is current as at the date of this report. Except as required by law, we assume no obligation to revise or update those websites after the date of this report. We are not in a position to verify information on websites owned and/or operated by third parties. Westpac Banking Corporation ABN 33 007 457 141 |

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 3 OVERVIEW INTRODUCTION KEY METRICS KM1: Key metrics GROUP STRUCTURE CAPITAL OVERVIEW CC1: Composition of regulatory capital OV1: Overview of Risk Weighted Assets (RWA) Summary of Credit Risk CC2: Reconciliation of regulatory capital to balance sheet CMS1: Comparison of modelled and standardised RWA at risk level CMS2: Comparison of modelled and standardised RWA for credit risk at asset class level RISK MANAGEMENT APPROACH LINKAGES TO FINANCIAL STATEMENTS LIA: Explanations of differences between accounting and regulatory exposure amounts LI1: Differences between accounting and regulatory scopes of consolidation and mapping of financial statement categories with regulatory risk categories LI2: Main sources of differences between regulatory exposure amounts and carrying values in financial statements ASSET ENCUMBRANCE ENC: Asset encumbrance |

| 4 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT INTRODUCTION Introduction Westpac Banking Corporation is an Authorised Deposit-taking Institution (ADI) subject to regulation by the Australian Prudential Regulation Authority (APRA). Westpac is primarily accredited to use the Advanced Internal Ratings-Based Approach (A-IRB) for credit risk, the Standardised Measurement Approach (SMA) for operational risk and is required to apply the Pillar 1 Basel capital framework in our assessment of traded market risk and interest rate risk in the banking book (IRRBB). This report has been prepared in accordance with APS 330 Public Disclosure (APS 330) and Westpac's Board approved Prudential Disclosure Policy. This report provides prudential information about our risk management practices and measures. Under the revised APS 330 standard (effective on 1 January 2025), Westpac is required to comply with the disclosure requirements issued by the BCBS, subject to certain amendments by APRA. These disclosure requirements include new and amended disclosures, where the presentation format is usually prescribed. Disclosures requirements vary, for quarterly, semi-annual and annual Pillar 3 reports. On transition to the revised standard, APRA permits ADIs to omit comparatives where new disclosures are reported for the first time. However, where comparatives are available, this information has been included. In addition to this report, the regulatory disclosures section of Westpac's website1 contains the reporting requirements for capital instruments under paragraph 37 of APS 330 and CCA: Main features of regulatory capital instruments. Capital instruments disclosures are updated when: • A new capital instrument is issued that will form part of regulatory capital; or • A capital instrument is redeemed, converted into Common equity tier 1 (CET1) capital, written off, or its terms and conditions are changed. 1. http://www.westpac.com.au/about-westpac/investor-centre/financial-information/regulatory-disclosures/ |

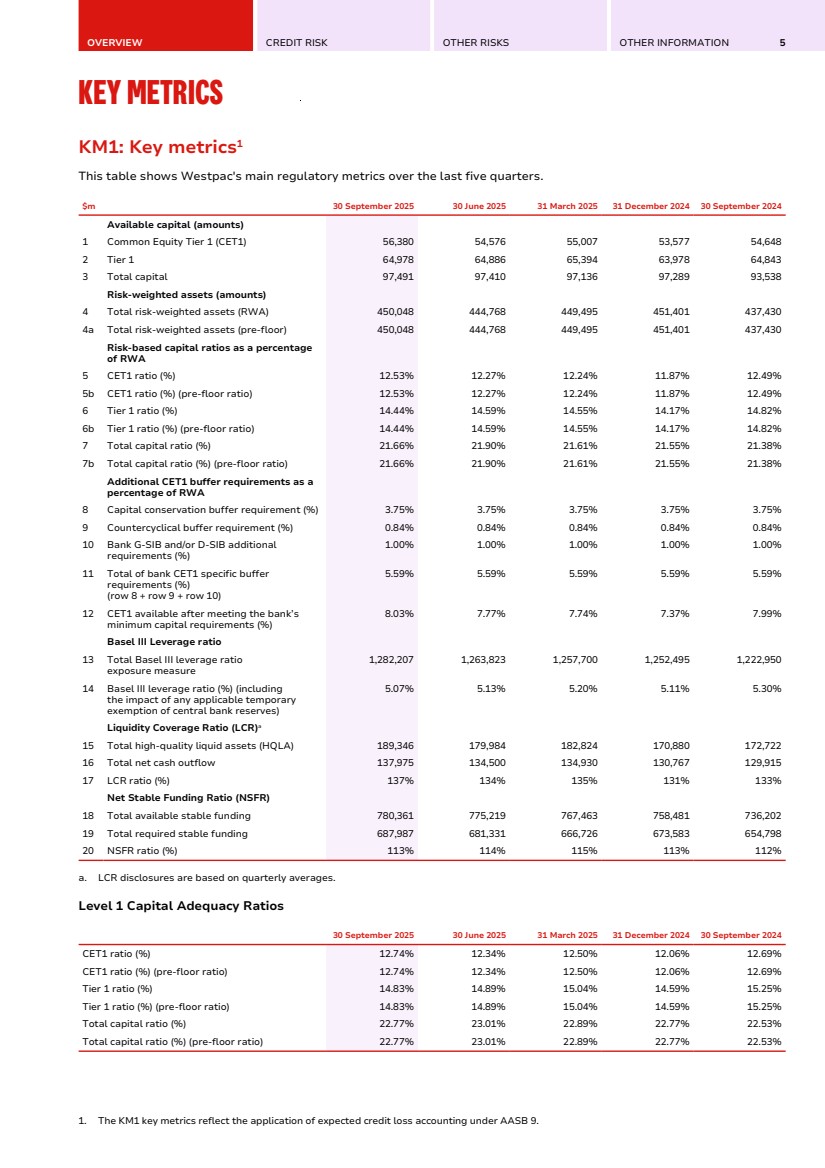

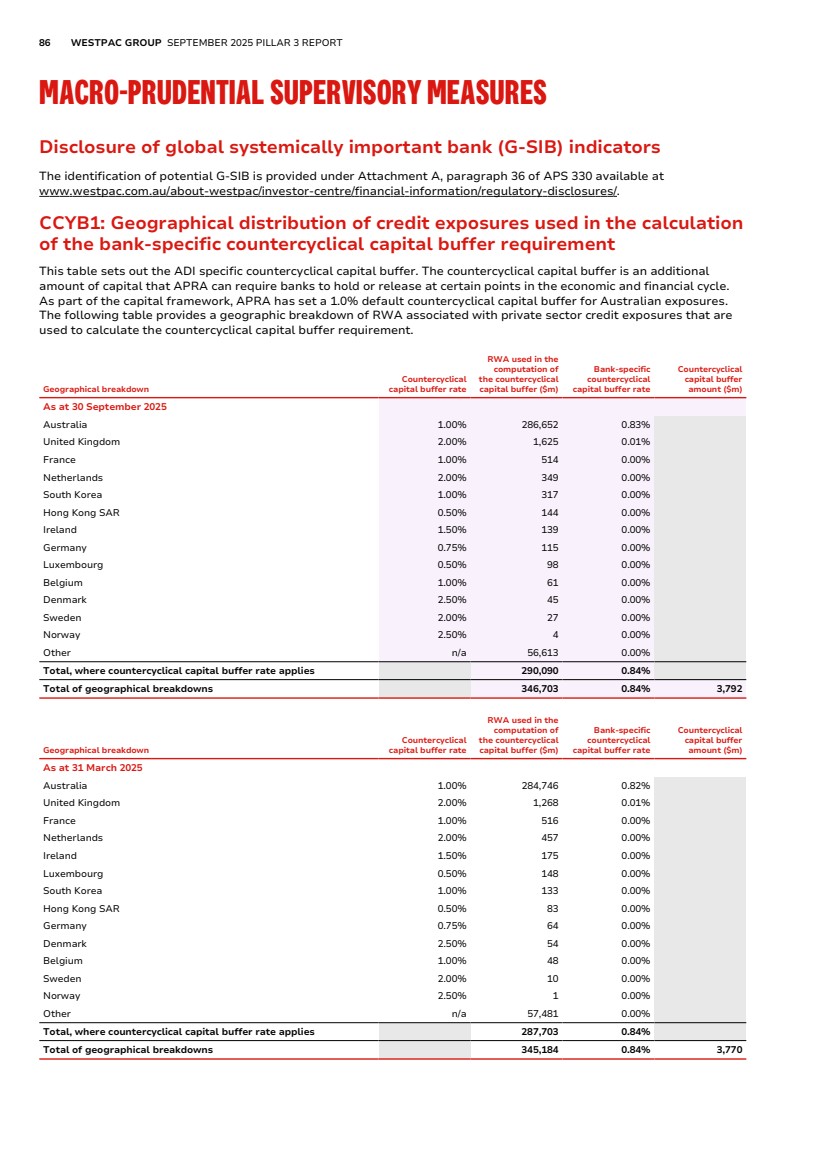

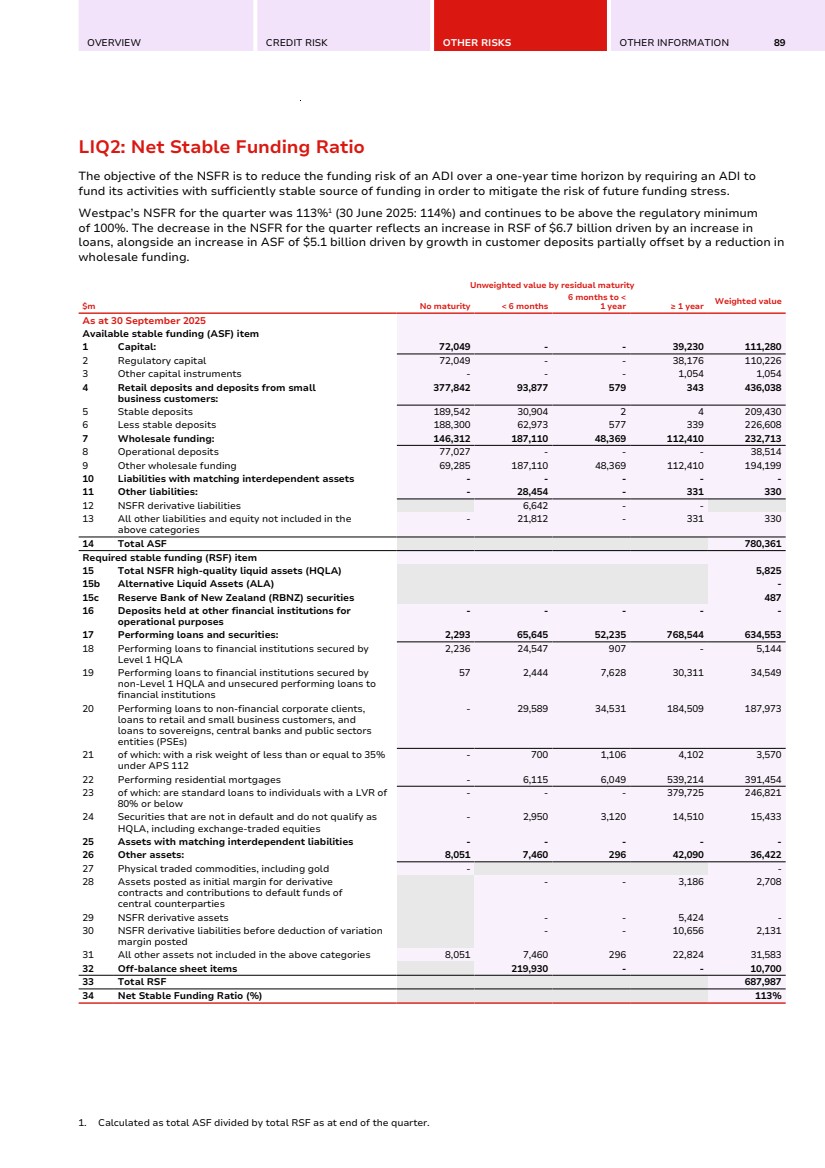

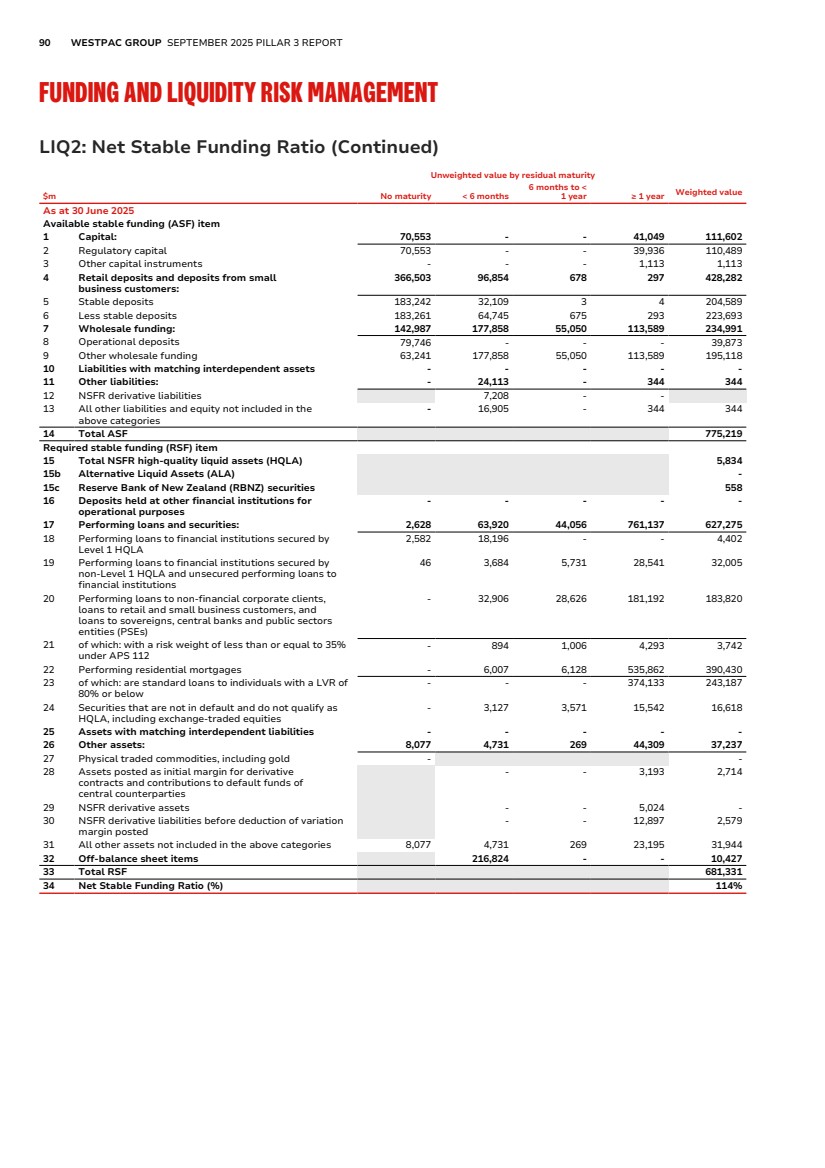

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 5 KEY METRICS KM1: Key metrics1 Key Metrics KM1: Key metrics1 This table shows Westpac's main regulatory metrics over the last five quarters. $m 30 September 2025 30 June 2025 31 March 2025 31 December 2024 30 September 2024 Available capital (amounts) 1 Common Equity Tier 1 (CET1) 56,380 54,576 55,007 53,577 54,648 2 Tier 1 64,978 64,886 65,394 63,978 64,843 3 Total capital 97,491 97,410 97,136 97,289 93,538 Risk-weighted assets (amounts) 4 Total risk-weighted assets (RWA) 450,048 444,768 449,495 451,401 437,430 4a Total risk-weighted assets (pre-floor) 450,048 444,768 449,495 451,401 437,430 Risk-based capital ratios as a percentage of RWA 5 CET1 ratio (%) 12.53% 12.27% 12.24% 11.87% 12.49% 5b CET1 ratio (%) (pre-floor ratio) 12.53% 12.27% 12.24% 11.87% 12.49% 6 Tier 1 ratio (%) 14.44% 14.59% 14.55% 14.17% 14.82% 6b Tier 1 ratio (%) (pre-floor ratio) 14.44% 14.59% 14.55% 14.17% 14.82% 7 Total capital ratio (%) 21.66% 21.90% 21.61% 21.55% 21.38% 7b Total capital ratio (%) (pre-floor ratio) 21.66% 21.90% 21.61% 21.55% 21.38% Additional CET1 buffer requirements as a percentage of RWA 8 Capital conservation buffer requirement (%) 3.75% 3.75% 3.75% 3.75% 3.75% 9 Countercyclical buffer requirement (%) 0.84% 0.84% 0.84% 0.84% 0.84% 10 Bank G-SIB and/or D-SIB additional requirements (%) 1.00% 1.00% 1.00% 1.00% 1.00% 11 Total of bank CET1 specific buffer requirements (%) (row 8 + row 9 + row 10) 5.59% 5.59% 5.59% 5.59% 5.59% 12 CET1 available after meeting the bank’s minimum capital requirements (%) 8.03% 7.77% 7.74% 7.37% 7.99% Basel III Leverage ratio 13 Total Basel III leverage ratio exposure measure 1,282,207 1,263,823 1,257,700 1,252,495 1,222,950 14 Basel III leverage ratio (%) (including the impact of any applicable temporary exemption of central bank reserves) 5.07% 5.13% 5.20% 5.11% 5.30% Liquidity Coverage Ratio (LCR)a 15 Total high-quality liquid assets (HQLA) 189,346 179,984 182,824 170,880 172,722 16 Total net cash outflow 137,975 134,500 134,930 130,767 129,915 17 LCR ratio (%) 137% 134% 135% 131% 133% Net Stable Funding Ratio (NSFR) 18 Total available stable funding 780,361 775,219 767,463 758,481 736,202 19 Total required stable funding 687,987 681,331 666,726 673,583 654,798 20 NSFR ratio (%) 113% 114% 115% 113% 112% a. LCR disclosures are based on quarterly averages. Level 1 Capital Adequacy Ratios 30 September 2025 30 June 2025 31 March 2025 31 December 2024 30 September 2024 CET1 ratio (%) 12.74% 12.34% 12.50% 12.06% 12.69% CET1 ratio (%) (pre-floor ratio) 12.74% 12.34% 12.50% 12.06% 12.69% Tier 1 ratio (%) 14.83% 14.89% 15.04% 14.59% 15.25% Tier 1 ratio (%) (pre-floor ratio) 14.83% 14.89% 15.04% 14.59% 15.25% Total capital ratio (%) 22.77% 23.01% 22.89% 22.77% 22.53% Total capital ratio (%) (pre-floor ratio) 22.77% 23.01% 22.89% 22.77% 22.53% 1. The KM1 key metrics reflect the application of expected credit loss accounting under AASB 9. |

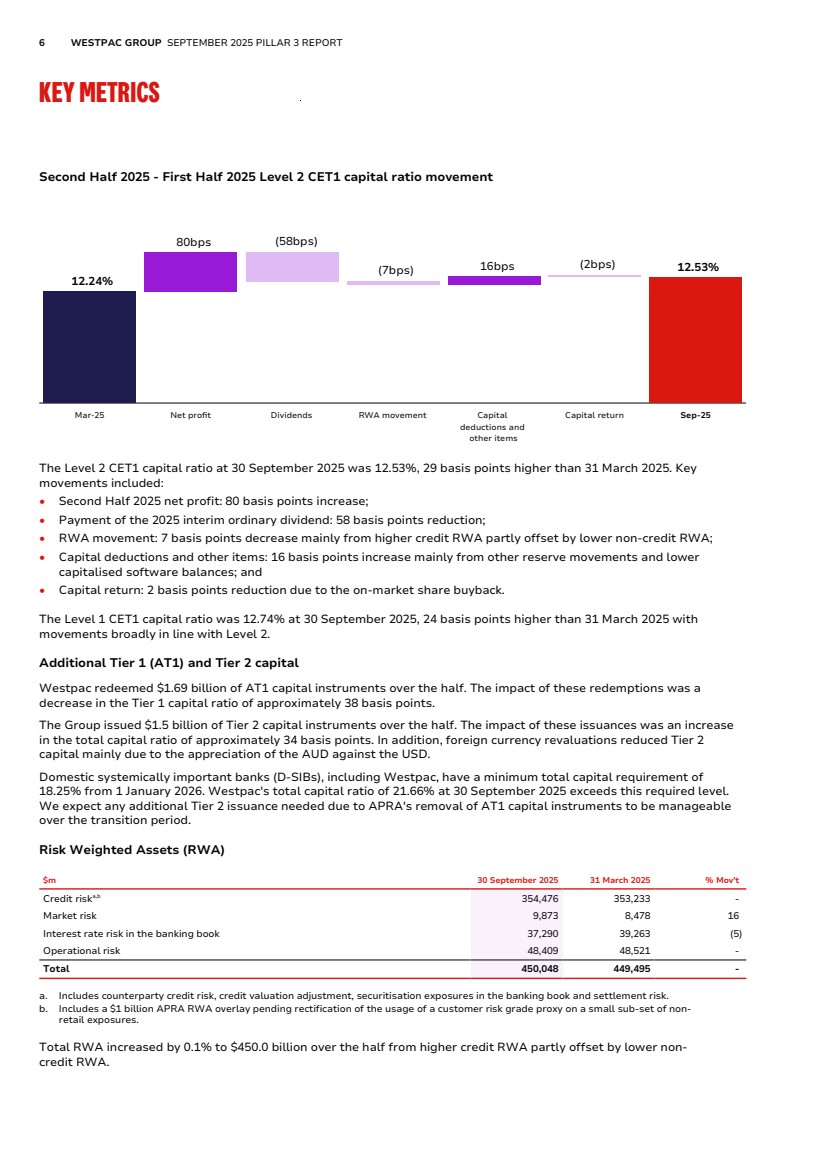

| 6 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT KEY METRICS Second Half 2025 - First Half 2025 Level 2 CET1 capital ratio movement 12.24% 80bps (58bps) (7bps) 16bps (2bps) 12.53% Mar-25 Net profit Dividends RWA movement Capital deductions and other items Capital return Sep-25 The Level 2 CET1 capital ratio at 30 September 2025 was 12.53%, 29 basis points higher than 31 March 2025. Key movements included: • Second Half 2025 net profit: 80 basis points increase; • Payment of the 2025 interim ordinary dividend: 58 basis points reduction; • RWA movement: 7 basis points decrease mainly from higher credit RWA partly offset by lower non-credit RWA; • Capital deductions and other items: 16 basis points increase mainly from other reserve movements and lower capitalised software balances; and • Capital return: 2 basis points reduction due to the on-market share buyback. The Level 1 CET1 capital ratio was 12.74% at 30 September 2025, 24 basis points higher than 31 March 2025 with movements broadly in line with Level 2. Additional Tier 1 (AT1) and Tier 2 capital Westpac redeemed $1.69 billion of AT1 capital instruments over the half. The impact of these redemptions was a decrease in the Tier 1 capital ratio of approximately 38 basis points. The Group issued $1.5 billion of Tier 2 capital instruments over the half. The impact of these issuances was an increase in the total capital ratio of approximately 34 basis points. In addition, foreign currency revaluations reduced Tier 2 capital mainly due to the appreciation of the AUD against the USD. Domestic systemically important banks (D-SIBs), including Westpac, have a minimum total capital requirement of 18.25% from 1 January 2026. Westpac's total capital ratio of 21.66% at 30 September 2025 exceeds this required level. We expect any additional Tier 2 issuance needed due to APRA's removal of AT1 capital instruments to be manageable over the transition period. Risk Weighted Assets (RWA) $m 30 September 2025 31 March 2025 % Mov't Credit riska,b 354,476 353,233 - Market risk 9,873 8,478 16 Interest rate risk in the banking book 37,290 39,263 (5) Operational risk 48,409 48,521 - Total 450,048 449,495 - a. Includes counterparty credit risk, credit valuation adjustment, securitisation exposures in the banking book and settlement risk. b. Includes a $1 billion APRA RWA overlay pending rectification of the usage of a customer risk grade proxy on a small sub-set of non-retail exposures. Total RWA increased by 0.1% to $450.0 billion over the half from higher credit RWA partly offset by lower non-credit RWA. |

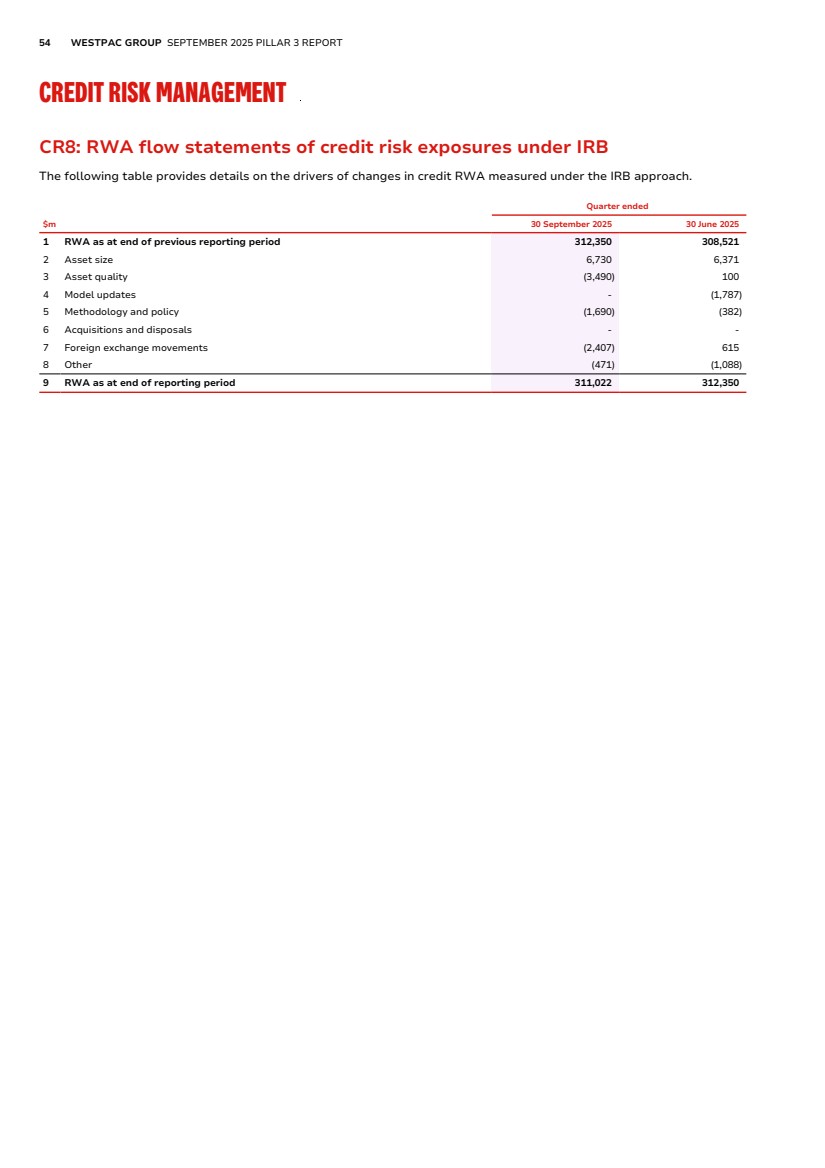

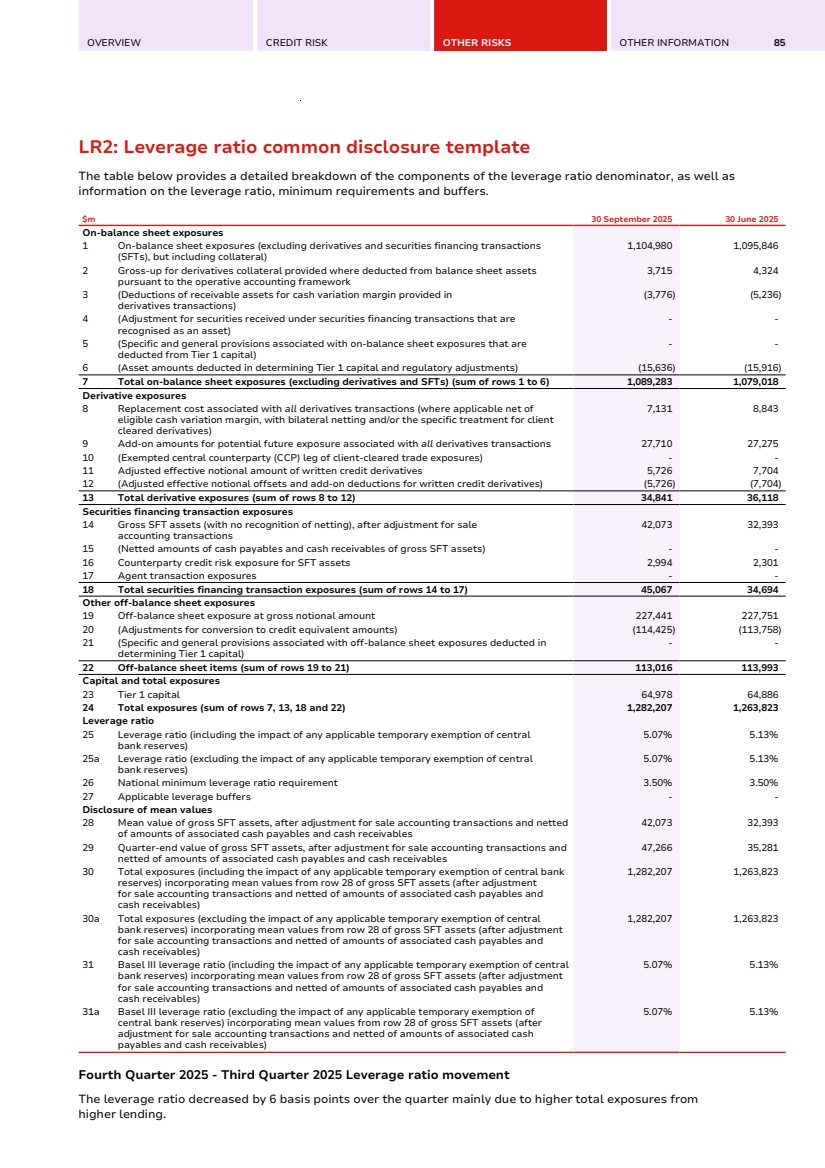

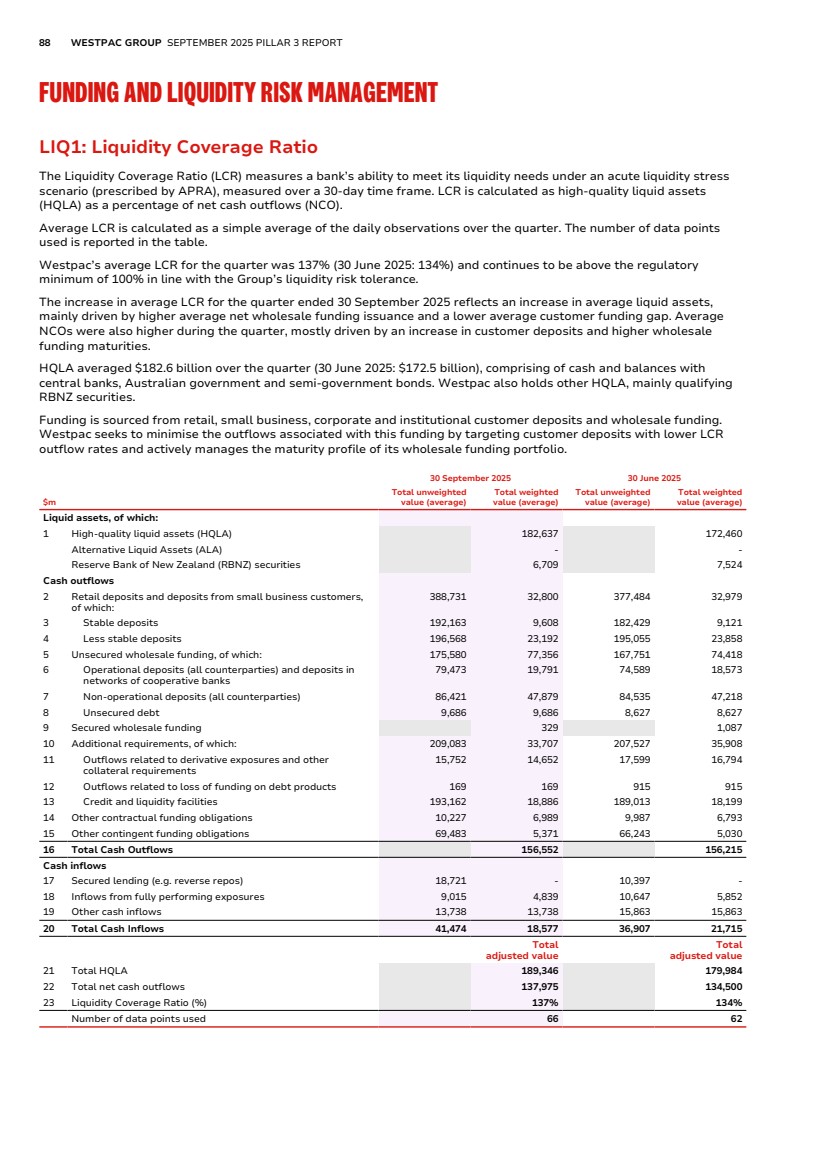

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 7 Credit RWA increased by $1.2 billion. Key movements included: • A $12.6 billion increase from higher lending primarily in Corporate and Large Corporate; • A $5.9 billion decrease from model updates, methodology and policy changes and other data refinements mainly in RBNZ Regulated Entities and Corporate; • A $3.0 billion decrease mainly due to improvements in residential mortgages delinquency rates; • A $1.8 billion decrease from foreign currency translation impacts, predominantly the appreciation of the AUD against the NZD; and • A $0.8 billion decrease from credit valuation adjustments. Non-credit RWA decreased by $0.7 billion. Key movements included: • IRRBB RWA: $2.0 billion decrease from: – A $1.2 billion net decrease across repricing and yield curve, basis and optionality risk in line with underlying banking book positions; and – A $0.8 billion decrease from lower interest rates resulting in the regulatory embedded gain increasing to $3.9 billion • Market RWA: $1.4 billion increase mainly from higher market risk exposures. Leverage ratio The leverage ratio represents the percentage of Tier 1 capital relative to the Exposure Measure1 . At 30 September 2025, Westpac's leverage ratio was 5.07%, down 13 basis points from 31 March 2025. The ratio remains well above APRA's regulatory minimum requirement of 3.5%. The decrease in the leverage ratio was mainly due to higher total exposures from higher lending. APRA has announced changes to banks' capital requirements with effect from 1 January 2027, as outlined in the Capital Overview section. This includes changes to CET1, Tier 1, Total capital and the Leverage ratio. Liquidity Coverage Ratio (LCR) Westpac’s average LCR for the quarter ended 30 September 2025 was 137% (30 June 2025: 134%), well above the regulatory minimum of 100%. The increase in the ratio was due to higher average liquid assets. Net Stable Funding Ratio (NSFR) Westpac had an NSFR of 113% as of 30 September 2025 (30 June 2025: 114%) and continues to be above the regulatory minimum of 100%. The decrease in the ratio was due to a net increase in required stable funding. Fourth Quarter 2025 - Third Quarter 2025 CET1 capital ratio movement The Level 2 CET1 capital ratio increased by 26 basis points over the quarter from net profit and other reserve movements partly offset by higher IRRBB RWA. 1. As defined under Attachment D of APS110: Capital Adequacy. |

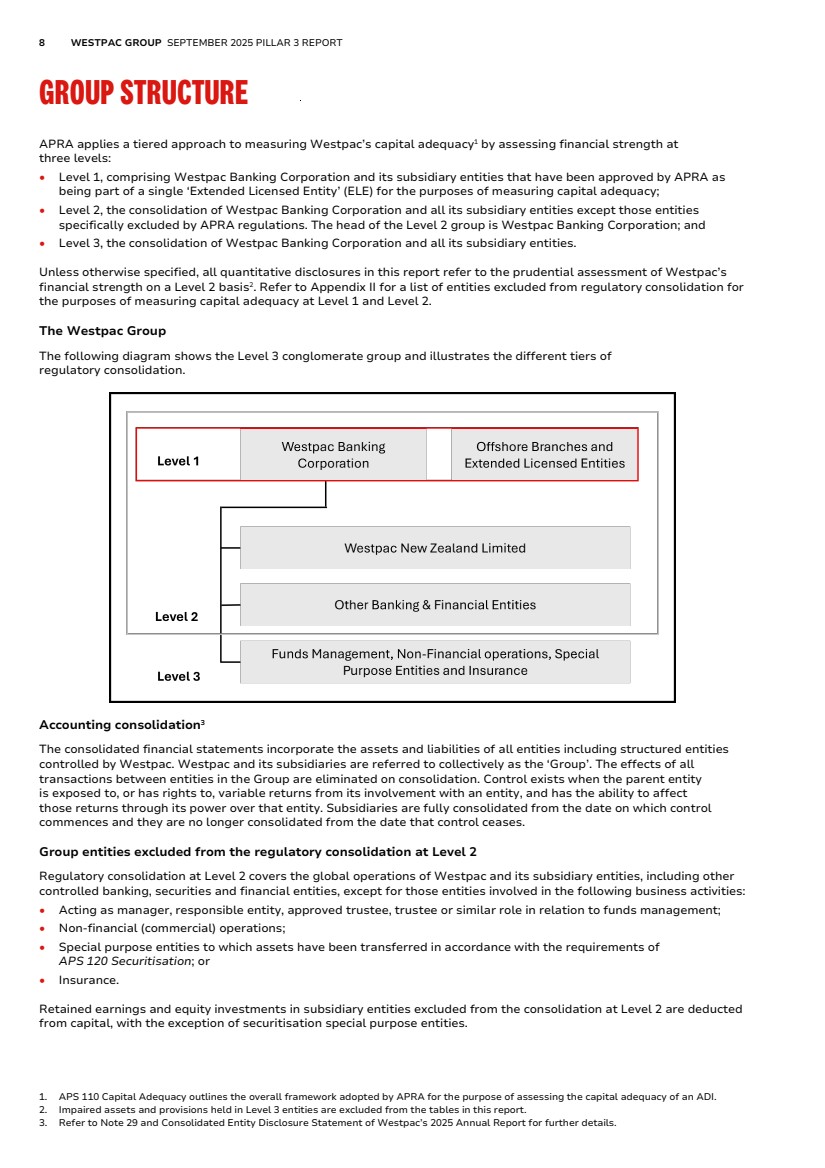

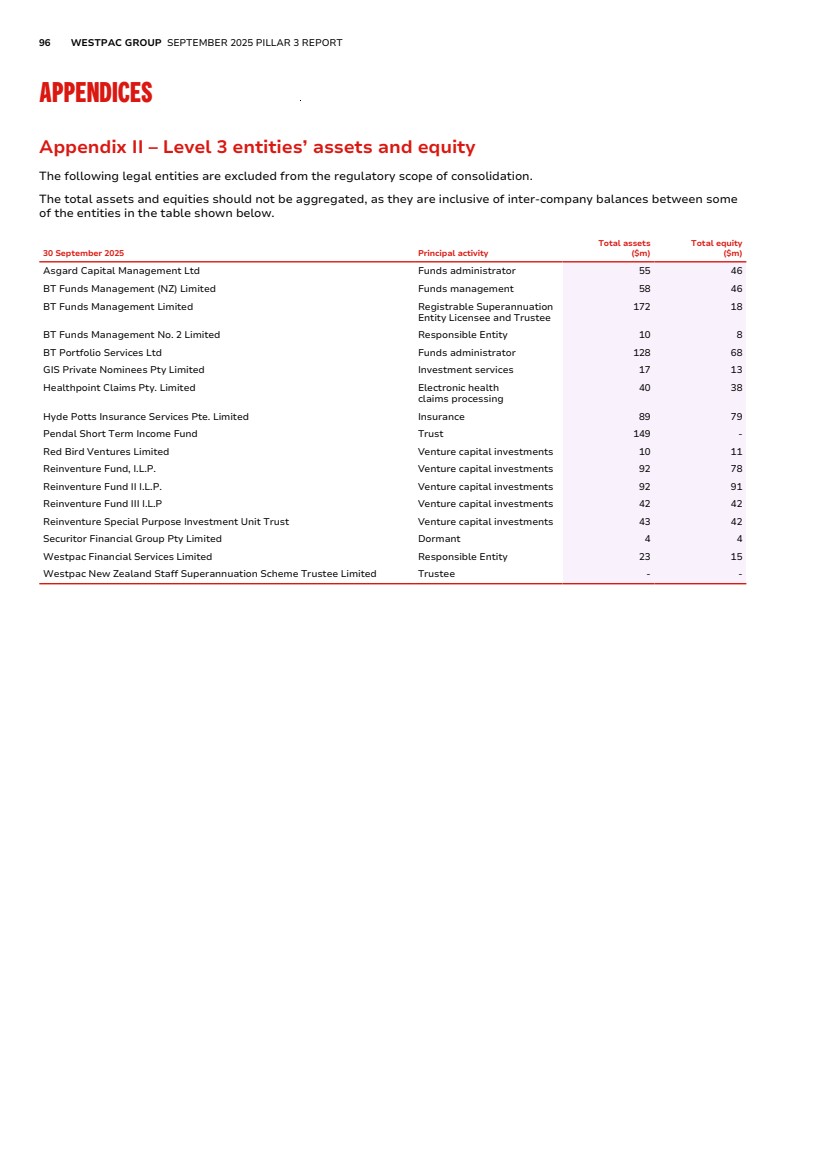

| 8 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT GROUP STRUCTURE Group Structure APRA applies a tiered approach to measuring Westpac’s capital adequacy1 by assessing financial strength at three levels: • Level 1, comprising Westpac Banking Corporation and its subsidiary entities that have been approved by APRA as being part of a single ‘Extended Licensed Entity’ (ELE) for the purposes of measuring capital adequacy; • Level 2, the consolidation of Westpac Banking Corporation and all its subsidiary entities except those entities specifically excluded by APRA regulations. The head of the Level 2 group is Westpac Banking Corporation; and • Level 3, the consolidation of Westpac Banking Corporation and all its subsidiary entities. Unless otherwise specified, all quantitative disclosures in this report refer to the prudential assessment of Westpac’s financial strength on a Level 2 basis2 . Refer to Appendix II for a list of entities excluded from regulatory consolidation for the purposes of measuring capital adequacy at Level 1 and Level 2. The Westpac Group The following diagram shows the Level 3 conglomerate group and illustrates the different tiers of regulatory consolidation. Accounting consolidation3 The consolidated financial statements incorporate the assets and liabilities of all entities including structured entities controlled by Westpac. Westpac and its subsidiaries are referred to collectively as the ‘Group’. The effects of all transactions between entities in the Group are eliminated on consolidation. Control exists when the parent entity is exposed to, or has rights to, variable returns from its involvement with an entity, and has the ability to affect those returns through its power over that entity. Subsidiaries are fully consolidated from the date on which control commences and they are no longer consolidated from the date that control ceases. Group entities excluded from the regulatory consolidation at Level 2 Regulatory consolidation at Level 2 covers the global operations of Westpac and its subsidiary entities, including other controlled banking, securities and financial entities, except for those entities involved in the following business activities: • Acting as manager, responsible entity, approved trustee, trustee or similar role in relation to funds management; • Non-financial (commercial) operations; • Special purpose entities to which assets have been transferred in accordance with the requirements of APS 120 Securitisation; or • Insurance. Retained earnings and equity investments in subsidiary entities excluded from the consolidation at Level 2 are deducted from capital, with the exception of securitisation special purpose entities. 1. APS 110 Capital Adequacy outlines the overall framework adopted by APRA for the purpose of assessing the capital adequacy of an ADI. 2. Impaired assets and provisions held in Level 3 entities are excluded from the tables in this report. 3. Refer to Note 29 and Consolidated Entity Disclosure Statement of Westpac’s 2025 Annual Report for further details. |

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 9 Subsidiary banking entities Westpac New Zealand Limited (WNZL), a wholly owned subsidiary entity, is a registered bank incorporated in New Zealand and regulated by, among others, the Reserve Bank of New Zealand (RBNZ) for prudential purposes. WNZL uses both A-IRB and Standardised methodologies for credit risk and the SMA for operational risk. Other subsidiary banking entities in the Group include Westpac Bank PNG Limited and Westpac Europe GMBH. For the purposes of determining Westpac’s capital adequacy, subsidiary banking entities are consolidated at Level 2. Customer operations Westpac is one of Australia's leading providers of banking and certain financial services, operating under multiple brands in Australia and in New Zealand, with a small presence in Europe, North America, Asia and the Pacific. Westpac provides banking products and services through its digital and online channels, supported by a branch and ATM network, contact centres and relationship and product managers. Restrictions and major impediments on the transfer of funds or regulatory capital within the Group Certain subsidiary banking and trustee entities are subject to specific and local prudential regulation in their own right, including capital adequacy requirements and investment or intra-group exposure limits. Westpac seeks to ensure that its subsidiary entities are adequately capitalised and adhere to regulatory requirements at all times. Dividends and capital are repatriated in line with the Group’s policy subject to subsidiary Board approval and local regulations. Intra-group exposure limits Exposures to related entities are managed within the prudential limits prescribed by APRA in APS 222 Associations with Related Entities1 . Westpac has an internal limit structure and approval process governing credit exposures to related entities. This limit structure and approval process, combined with APRA’s prudential limits, is designed to reduce the potential for unacceptable contagion risk. 1. For the purposes of APS 222, subsidiaries controlled by Westpac, other than subsidiaries that form part of the ELE, represent ‘related entities’. Prudential and internal limits apply to intra-group exposures between the ELE and related entities, both on an individual and aggregate basis. |

| 10 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CAPITAL OVERVIEW Capital Overview Capital management strategy Westpac's capital management strategy is reviewed on an ongoing basis, including through an annual Internal Capital Adequacy Assessment Process (ICAAP). Key considerations include: • Regulatory capital minimums together with the capital conservation buffer and countercyclical capital buffer comprise the Total CET1 Requirement. The total CET1 requirement is currently at least 10.25% and 10.50% effective 1 January 20271 ; • Strategy, business mix and operations and contingency plans; • Perspectives of external stakeholders including rating agencies as well as equity and debt investors; and • A stress testing framework that tests our resilience under a range of adverse economic scenarios. The Board has determined a target post dividend CET1 capital ratio of above 11.25% in normal operating conditions. This target includes consideration of APRA's increase in the minimum CET1 ratio of 0.25% to 10.50% effective 1 January 2027 and replaces the previous CET1 capital operating range of between 11.00% and 11.50%. Regulatory developments Interest Rate Risk in the Banking Book APRA’s revised APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book came into effect on 1 October 2025. The revised requirements include implementation of APRA’s reaccreditation outcomes for Westpac’s IRRBB models. Reporting under the revised standard will be reflected in the 31 December 2025 Pillar 3 report. Operational risk capital overlays In 2019, APRA applied $1 billion of additional capital overlays to our operational risk capital requirement. These overlays were applied through an increase in risk weighted assets (RWA). On 19 July 2024, APRA announced its decision to reduce Westpac’s total operational risk capital overlay from $1 billion to $500 million. On 15 October 2025, APRA announced its decision to lift the Court Enforceable Undertaking and remove Westpac's remaining $500 million operational risk capital overlay. The removal of the $500 million capital overlay will mean Westpac’s CET1 capital ratio will increase by approximately 17 basis points, reflecting a reduction in risk weighted assets of $6,250 million. This change applied with immediate effect. Refer to Operational Risk section for further details. APRA announcement to phase out Additional Tier 1 (AT1) capital as eligible bank capital On 8 July 2025 APRA released a consultation paper on implementing the phase out of AT1 capital instruments. This included changes to APRA's prudential and reporting frameworks resulting from the removal of AT1 capital instruments. Under the revisions, large internationally active banks such as Westpac will replace 1.5% of AT1 capital with 1.25% of Tier 2 capital and 0.25% of CET1 capital. The total CET1 requirement, including regulatory buffers, will increase from 10.25% to 10.50%. There is no overall increase in total capital requirements for banks. APRA has also proposed changes to the leverage ratio, which will see the leverage ratio calculation based on CET1 capital rather than Tier 1 capital. Should the changes be implemented as proposed, this will result in a reduction in the reported leverage ratio. The minimum leverage ratio of 3.5% is proposed to remain unchanged. APRA intends to finalise changes to the relevant prudential standards in 2025, with the updated framework coming into effect from 1 January 2027. In addition, from this date, existing AT1 capital instruments would be eligible to be included as Tier 2 capital, until their first scheduled call date. Existing Westpac AT1 capital instruments would reach their first scheduled optional redemption dates by 2031 at the latest. 1. Noting that APRA may apply higher CET1 requirements for an individual ADI. |

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 11 RBNZ capital review1 On 31 March 2025, the RBNZ announced a review of the key capital settings for deposit takers. On 25 August 2025, it released a consultation paper. For Group 1 deposit takers (including WNZL) the key proposals include: • Removal of AT1 instruments from the capital stack. • Two options for capital ratio requirements: – Option 1: A total CET1 capital ratio requirement of 14%, with a total capital ratio requirement of 17% (including a prudential capital buffer (‘PCB’) ratio of 8%). – Option 2: A total CET1 capital ratio requirement of 12%, with a total capital ratio requirement of 15% (including a PCB ratio of 6%) and an additional Loss Absorbing Capacity (LAC) requirement of 6%. Tier 2 capital and LAC instruments would be required to be issued internally (for example to WBC) and LAC would take a form similar to Tier 2 capital. • More granular standardised risk weights, including lower risk weights in some areas. • Setting the long-run level for the counter-cyclical capital buffer component of the PCB at 1%. The RBNZ is expected to make its final decision in December 2025 with the implementation timeline to be announced in the first quarter of the 2026 calendar year. The outcome of the review remains uncertain. 1. WNZL’s references to CET1, AT1 and other capital measures are subject to RBNZ's specific requirements and may not align with Australian requirements or definitions in the Glossary. |

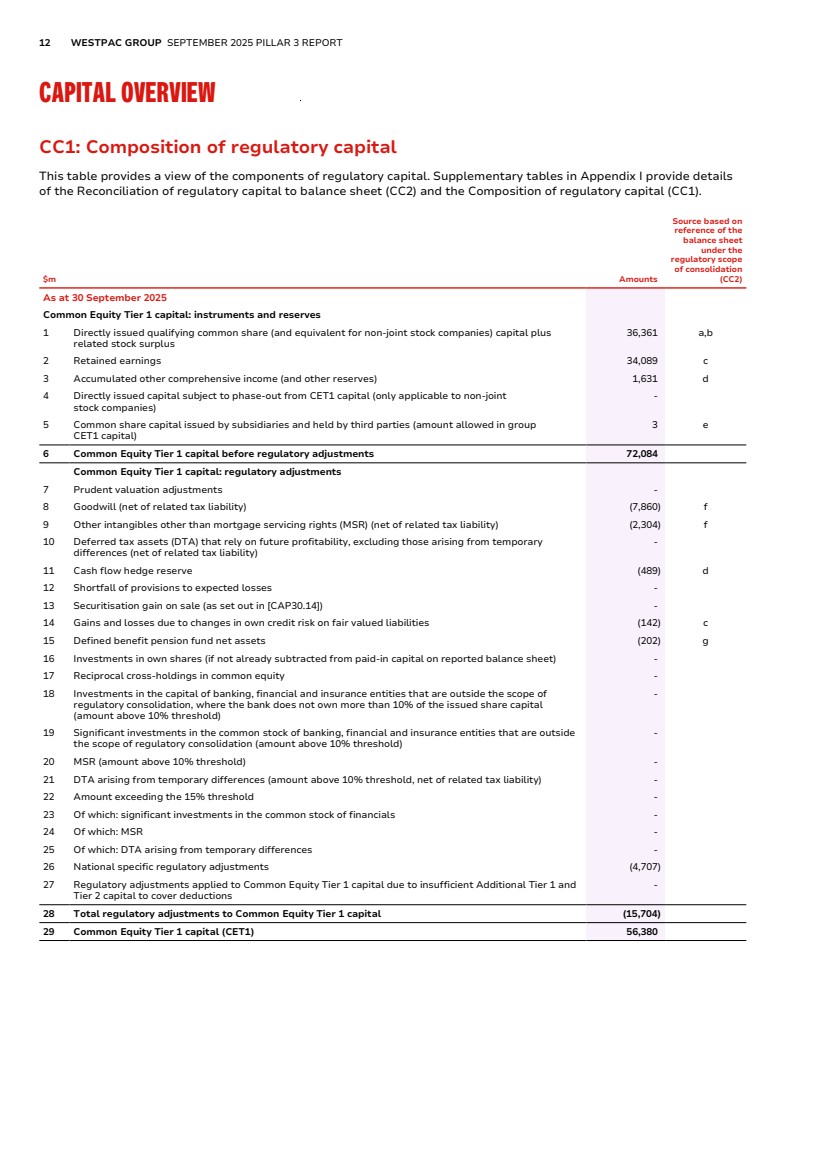

| 12 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CAPITAL OVERVIEW CC1: Composition of regulatory capital CC1: Composition of regulatory capital This table provides a view of the components of regulatory capital. Supplementary tables in Appendix I provide details of the Reconciliation of regulatory capital to balance sheet (CC2) and the Composition of regulatory capital (CC1). $m Amounts Source based on reference of the balance sheet under the regulatory scope of consolidation (CC2) As at 30 September 2025 Common Equity Tier 1 capital: instruments and reserves 1 Directly issued qualifying common share (and equivalent for non-joint stock companies) capital plus related stock surplus 36,361 a,b 2 Retained earnings 34,089 c 3 Accumulated other comprehensive income (and other reserves) 1,631 d 4 Directly issued capital subject to phase-out from CET1 capital (only applicable to non-joint stock companies) - 5 Common share capital issued by subsidiaries and held by third parties (amount allowed in group CET1 capital) 3 e 6 Common Equity Tier 1 capital before regulatory adjustments 72,084 Common Equity Tier 1 capital: regulatory adjustments 7 Prudent valuation adjustments - 8 Goodwill (net of related tax liability) (7,860) f 9 Other intangibles other than mortgage servicing rights (MSR) (net of related tax liability) (2,304) f 10 Deferred tax assets (DTA) that rely on future profitability, excluding those arising from temporary differences (net of related tax liability) - 11 Cash flow hedge reserve (489) d 12 Shortfall of provisions to expected losses - 13 Securitisation gain on sale (as set out in [CAP30.14]) - 14 Gains and losses due to changes in own credit risk on fair valued liabilities (142) c 15 Defined benefit pension fund net assets (202) g 16 Investments in own shares (if not already subtracted from paid-in capital on reported balance sheet) - 17 Reciprocal cross-holdings in common equity - 18 Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, where the bank does not own more than 10% of the issued share capital (amount above 10% threshold) - 19 Significant investments in the common stock of banking, financial and insurance entities that are outside the scope of regulatory consolidation (amount above 10% threshold) - 20 MSR (amount above 10% threshold) - 21 DTA arising from temporary differences (amount above 10% threshold, net of related tax liability) - 22 Amount exceeding the 15% threshold - 23 Of which: significant investments in the common stock of financials - 24 Of which: MSR - 25 Of which: DTA arising from temporary differences - 26 National specific regulatory adjustments (4,707) 27 Regulatory adjustments applied to Common Equity Tier 1 capital due to insufficient Additional Tier 1 and Tier 2 capital to cover deductions - 28 Total regulatory adjustments to Common Equity Tier 1 capital (15,704) 29 Common Equity Tier 1 capital (CET1) 56,380 |

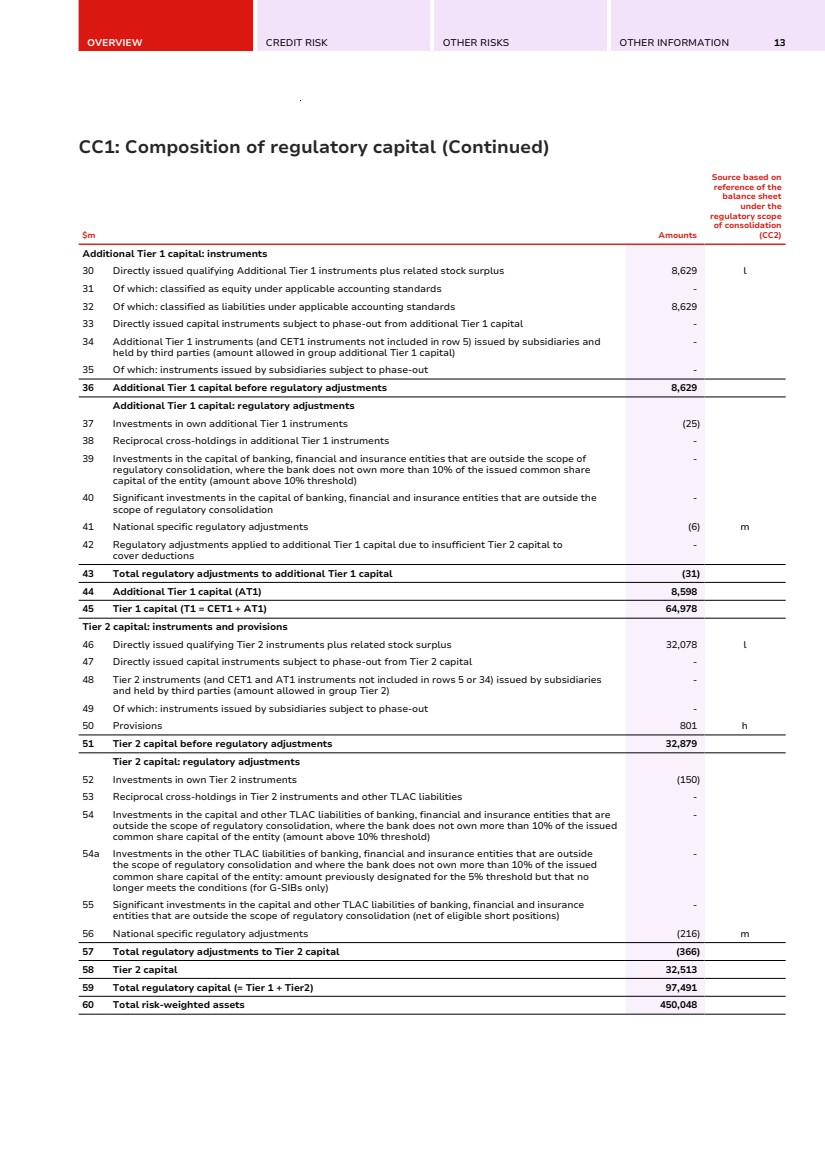

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 13 CC1: Composition of regulatory capital (Continued) $m Amounts Source based on reference of the balance sheet under the regulatory scope of consolidation (CC2) Additional Tier 1 capital: instruments 30 Directly issued qualifying Additional Tier 1 instruments plus related stock surplus 8,629 l 31 Of which: classified as equity under applicable accounting standards - 32 Of which: classified as liabilities under applicable accounting standards 8,629 33 Directly issued capital instruments subject to phase-out from additional Tier 1 capital - 34 Additional Tier 1 instruments (and CET1 instruments not included in row 5) issued by subsidiaries and held by third parties (amount allowed in group additional Tier 1 capital) - 35 Of which: instruments issued by subsidiaries subject to phase-out - 36 Additional Tier 1 capital before regulatory adjustments 8,629 Additional Tier 1 capital: regulatory adjustments 37 Investments in own additional Tier 1 instruments (25) 38 Reciprocal cross-holdings in additional Tier 1 instruments - 39 Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, where the bank does not own more than 10% of the issued common share capital of the entity (amount above 10% threshold) - 40 Significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation - 41 National specific regulatory adjustments (6) m 42 Regulatory adjustments applied to additional Tier 1 capital due to insufficient Tier 2 capital to cover deductions - 43 Total regulatory adjustments to additional Tier 1 capital (31) 44 Additional Tier 1 capital (AT1) 8,598 45 Tier 1 capital (T1 = CET1 + AT1) 64,978 Tier 2 capital: instruments and provisions 46 Directly issued qualifying Tier 2 instruments plus related stock surplus 32,078 l 47 Directly issued capital instruments subject to phase-out from Tier 2 capital - 48 Tier 2 instruments (and CET1 and AT1 instruments not included in rows 5 or 34) issued by subsidiaries and held by third parties (amount allowed in group Tier 2) - 49 Of which: instruments issued by subsidiaries subject to phase-out - 50 Provisions 801 h 51 Tier 2 capital before regulatory adjustments 32,879 Tier 2 capital: regulatory adjustments 52 Investments in own Tier 2 instruments (150) 53 Reciprocal cross-holdings in Tier 2 instruments and other TLAC liabilities - 54 Investments in the capital and other TLAC liabilities of banking, financial and insurance entities that are outside the scope of regulatory consolidation, where the bank does not own more than 10% of the issued common share capital of the entity (amount above 10% threshold) - 54a Investments in the other TLAC liabilities of banking, financial and insurance entities that are outside the scope of regulatory consolidation and where the bank does not own more than 10% of the issued common share capital of the entity: amount previously designated for the 5% threshold but that no longer meets the conditions (for G-SIBs only) - 55 Significant investments in the capital and other TLAC liabilities of banking, financial and insurance entities that are outside the scope of regulatory consolidation (net of eligible short positions) - 56 National specific regulatory adjustments (216) m 57 Total regulatory adjustments to Tier 2 capital (366) 58 Tier 2 capital 32,513 59 Total regulatory capital (= Tier 1 + Tier2) 97,491 60 Total risk-weighted assets 450,048 |

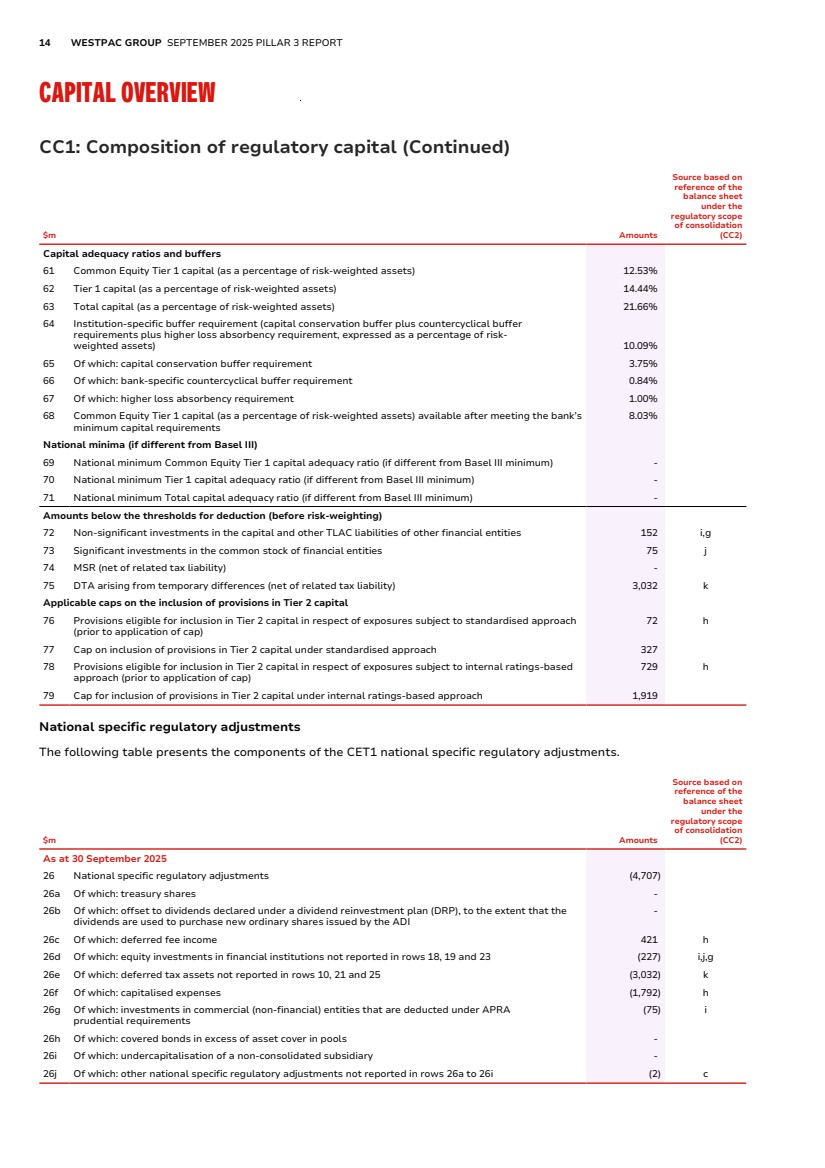

| 14 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CAPITAL OVERVIEW CC1: Composition of regulatory capital (Continued) $m Amounts Source based on reference of the balance sheet under the regulatory scope of consolidation (CC2) Capital adequacy ratios and buffers 61 Common Equity Tier 1 capital (as a percentage of risk-weighted assets) 12.53% 62 Tier 1 capital (as a percentage of risk-weighted assets) 14.44% 63 Total capital (as a percentage of risk-weighted assets) 21.66% 64 Institution-specific buffer requirement (capital conservation buffer plus countercyclical buffer requirements plus higher loss absorbency requirement, expressed as a percentage of risk-weighted assets) 10.09% 65 Of which: capital conservation buffer requirement 3.75% 66 Of which: bank-specific countercyclical buffer requirement 0.84% 67 Of which: higher loss absorbency requirement 1.00% 68 Common Equity Tier 1 capital (as a percentage of risk-weighted assets) available after meeting the bank’s minimum capital requirements 8.03% National minima (if different from Basel III) 69 National minimum Common Equity Tier 1 capital adequacy ratio (if different from Basel III minimum) - 70 National minimum Tier 1 capital adequacy ratio (if different from Basel III minimum) - 71 National minimum Total capital adequacy ratio (if different from Basel III minimum) - Amounts below the thresholds for deduction (before risk-weighting) 72 Non-significant investments in the capital and other TLAC liabilities of other financial entities 152 i,g 73 Significant investments in the common stock of financial entities 75 j 74 MSR (net of related tax liability) - 75 DTA arising from temporary differences (net of related tax liability) 3,032 k Applicable caps on the inclusion of provisions in Tier 2 capital 76 Provisions eligible for inclusion in Tier 2 capital in respect of exposures subject to standardised approach (prior to application of cap) 72 h 77 Cap on inclusion of provisions in Tier 2 capital under standardised approach 327 78 Provisions eligible for inclusion in Tier 2 capital in respect of exposures subject to internal ratings-based approach (prior to application of cap) 729 h 79 Cap for inclusion of provisions in Tier 2 capital under internal ratings-based approach 1,919 National specific regulatory adjustments The following table presents the components of the CET1 national specific regulatory adjustments. $m Amounts Source based on reference of the balance sheet under the regulatory scope of consolidation (CC2) As at 30 September 2025 26 National specific regulatory adjustments (4,707) 26a Of which: treasury shares - 26b Of which: offset to dividends declared under a dividend reinvestment plan (DRP), to the extent that the dividends are used to purchase new ordinary shares issued by the ADI - 26c Of which: deferred fee income 421 h 26d Of which: equity investments in financial institutions not reported in rows 18, 19 and 23 (227) i,j,g 26e Of which: deferred tax assets not reported in rows 10, 21 and 25 (3,032) k 26f Of which: capitalised expenses (1,792) h 26g Of which: investments in commercial (non-financial) entities that are deducted under APRA prudential requirements (75) i 26h Of which: covered bonds in excess of asset cover in pools - 26i Of which: undercapitalisation of a non-consolidated subsidiary - 26j Of which: other national specific regulatory adjustments not reported in rows 26a to 26i (2) c |

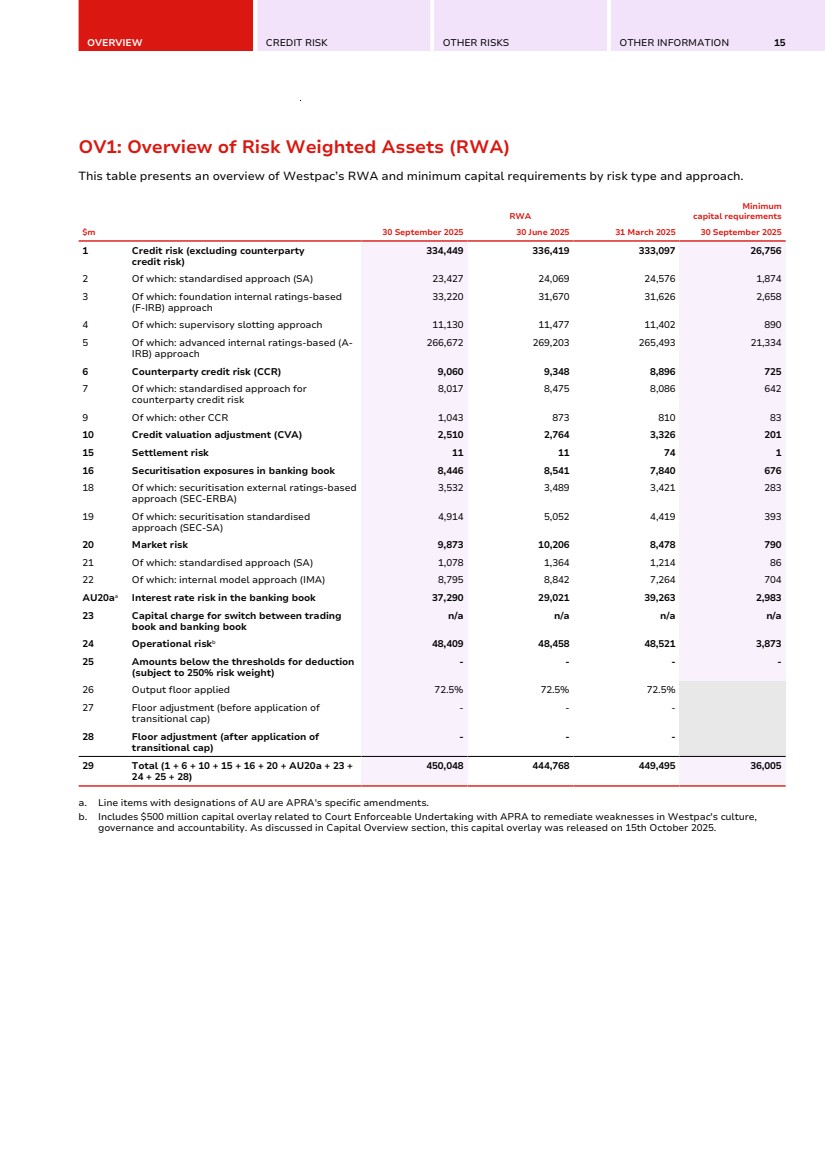

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 15 OV1: Overview of Risk Weighted Assets (RWA) OV1: Overview of Risk Weighted Assets (RWA) This table presents an overview of Westpac’s RWA and minimum capital requirements by risk type and approach. $m RWA Minimum capital requirements 30 September 2025 30 June 2025 31 March 2025 30 September 2025 1 Credit risk (excluding counterparty credit risk) 334,449 336,419 333,097 26,756 2 Of which: standardised approach (SA) 23,427 24,069 24,576 1,874 3 Of which: foundation internal ratings-based (F-IRB) approach 33,220 31,670 31,626 2,658 4 Of which: supervisory slotting approach 11,130 11,477 11,402 890 5 Of which: advanced internal ratings-based (A-IRB) approach 266,672 269,203 265,493 21,334 6 Counterparty credit risk (CCR) 9,060 9,348 8,896 725 7 Of which: standardised approach for counterparty credit risk 8,017 8,475 8,086 642 9 Of which: other CCR 1,043 873 810 83 10 Credit valuation adjustment (CVA) 2,510 2,764 3,326 201 15 Settlement risk 11 11 74 1 16 Securitisation exposures in banking book 8,446 8,541 7,840 676 18 Of which: securitisation external ratings-based approach (SEC-ERBA) 3,532 3,489 3,421 283 19 Of which: securitisation standardised approach (SEC-SA) 4,914 5,052 4,419 393 20 Market risk 9,873 10,206 8,478 790 21 Of which: standardised approach (SA) 1,078 1,364 1,214 86 22 Of which: internal model approach (IMA) 8,795 8,842 7,264 704 AU20aa Interest rate risk in the banking book 37,290 29,021 39,263 2,983 23 Capital charge for switch between trading book and banking book n/a n/a n/a n/a 24 Operational riskb 48,409 48,458 48,521 3,873 25 Amounts below the thresholds for deduction (subject to 250% risk weight) - - - - 26 Output floor applied 72.5% 72.5% 72.5% 27 Floor adjustment (before application of transitional cap) - - - 28 Floor adjustment (after application of transitional cap) - - - 29 Total (1 + 6 + 10 + 15 + 16 + 20 + AU20a + 23 + 24 + 25 + 28) 450,048 444,768 449,495 36,005 a. Line items with designations of AU are APRA's specific amendments. b. Includes $500 million capital overlay related to Court Enforceable Undertaking with APRA to remediate weaknesses in Westpac's culture, governance and accountability. As discussed in Capital Overview section, this capital overlay was released on 15th October 2025. |

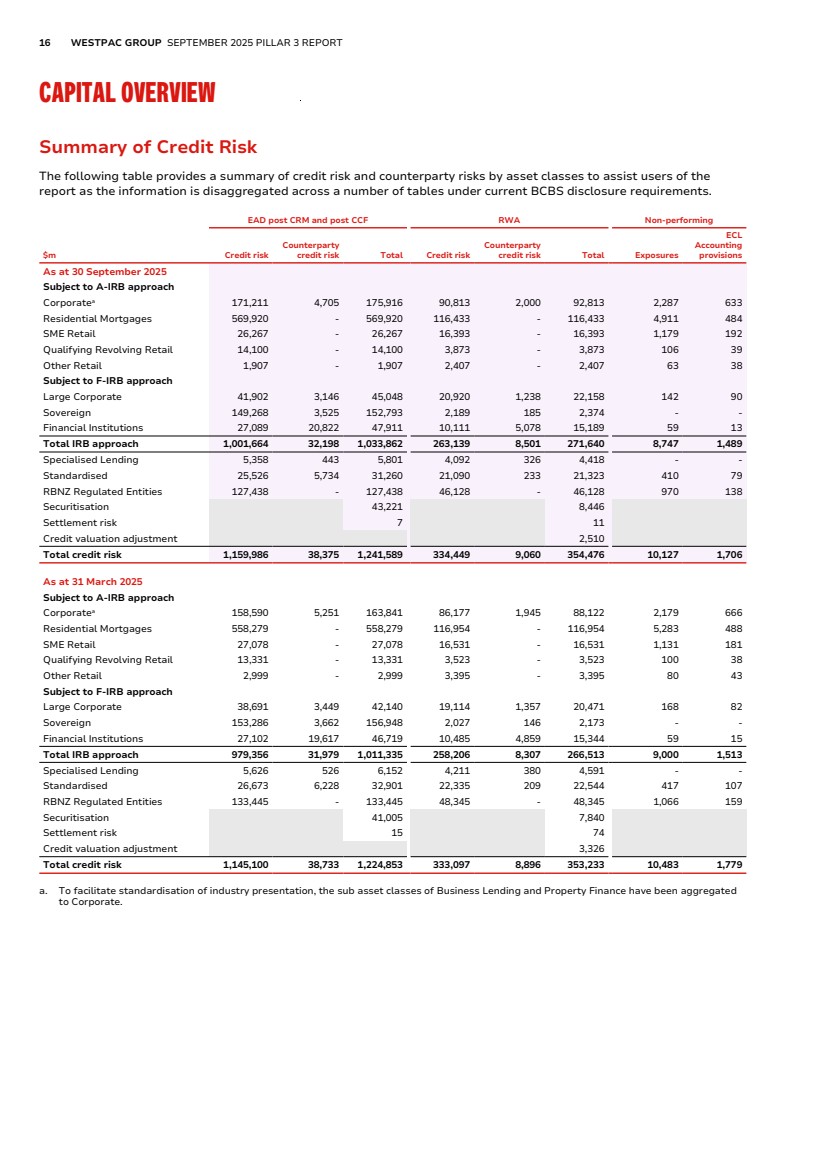

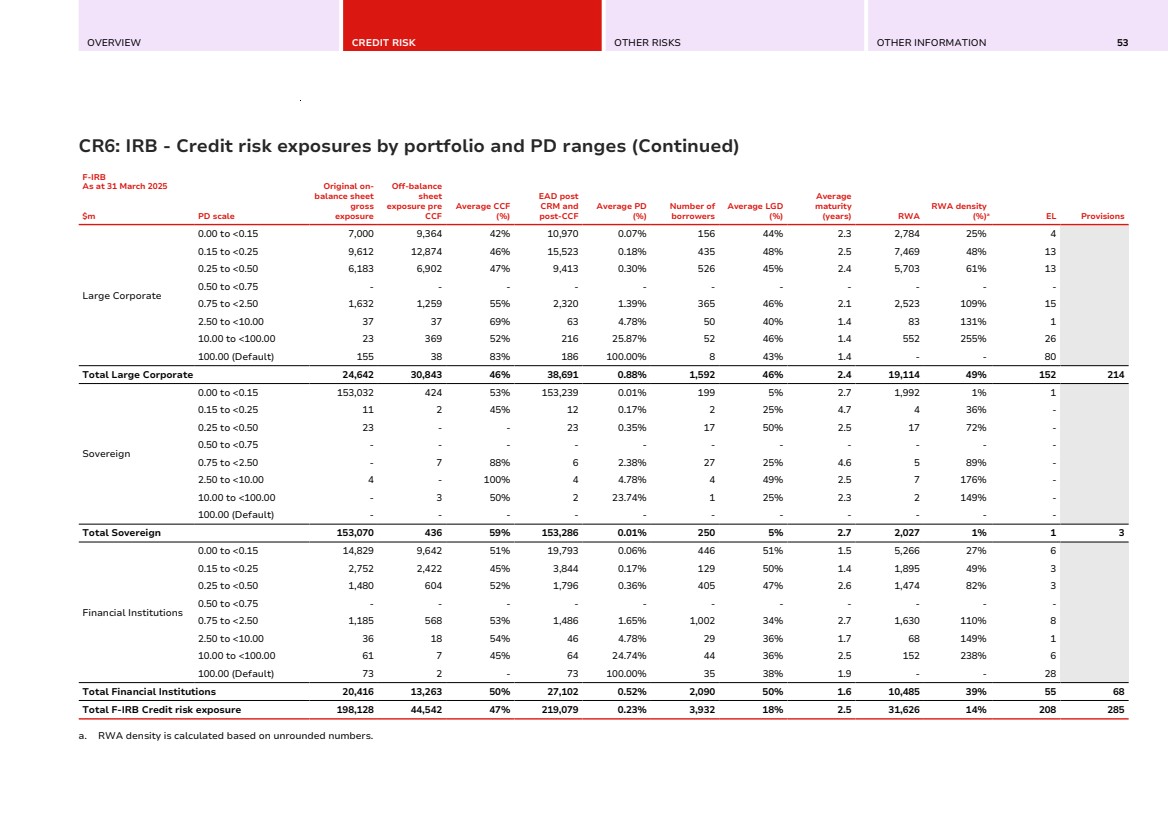

| 16 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CAPITAL OVERVIEW Summary of Credit Risk Summary of Credit Risk The following table provides a summary of credit risk and counterparty risks by asset classes to assist users of the report as the information is disaggregated across a number of tables under current BCBS disclosure requirements. EAD post CRM and post CCF RWA Non-performing $m Credit risk Counterparty credit risk Total Credit risk Counterparty credit risk Total Exposures ECL Accounting provisions As at 30 September 2025 Subject to A-IRB approach Corporatea 171,211 4,705 175,916 90,813 2,000 92,813 2,287 633 Residential Mortgages 569,920 - 569,920 116,433 - 116,433 4,911 484 SME Retail 26,267 - 26,267 16,393 - 16,393 1,179 192 Qualifying Revolving Retail 14,100 - 14,100 3,873 - 3,873 106 39 Other Retail 1,907 - 1,907 2,407 - 2,407 63 38 Subject to F-IRB approach Large Corporate 41,902 3,146 45,048 20,920 1,238 22,158 142 90 Sovereign 149,268 3,525 152,793 2,189 185 2,374 - - Financial Institutions 27,089 20,822 47,911 10,111 5,078 15,189 59 13 Total IRB approach 1,001,664 32,198 1,033,862 263,139 8,501 271,640 8,747 1,489 Specialised Lending 5,358 443 5,801 4,092 326 4,418 - - Standardised 25,526 5,734 31,260 21,090 233 21,323 410 79 RBNZ Regulated Entities 127,438 - 127,438 46,128 - 46,128 970 138 Securitisation 43,221 8,446 Settlement risk 7 11 Credit valuation adjustment 2,510 Total credit risk 1,159,986 38,375 1,241,589 334,449 9,060 354,476 10,127 1,706 As at 31 March 2025 Subject to A-IRB approach Corporatea 158,590 5,251 163,841 86,177 1,945 88,122 2,179 666 Residential Mortgages 558,279 - 558,279 116,954 - 116,954 5,283 488 SME Retail 27,078 - 27,078 16,531 - 16,531 1,131 181 Qualifying Revolving Retail 13,331 - 13,331 3,523 - 3,523 100 38 Other Retail 2,999 - 2,999 3,395 - 3,395 80 43 Subject to F-IRB approach Large Corporate 38,691 3,449 42,140 19,114 1,357 20,471 168 82 Sovereign 153,286 3,662 156,948 2,027 146 2,173 - - Financial Institutions 27,102 19,617 46,719 10,485 4,859 15,344 59 15 Total IRB approach 979,356 31,979 1,011,335 258,206 8,307 266,513 9,000 1,513 Specialised Lending 5,626 526 6,152 4,211 380 4,591 - - Standardised 26,673 6,228 32,901 22,335 209 22,544 417 107 RBNZ Regulated Entities 133,445 - 133,445 48,345 - 48,345 1,066 159 Securitisation 41,005 7,840 Settlement risk 15 74 Credit valuation adjustment 3,326 Total credit risk 1,145,100 38,733 1,224,853 333,097 8,896 353,233 10,483 1,779 a. To facilitate standardisation of industry presentation, the sub asset classes of Business Lending and Property Finance have been aggregated to Corporate. |

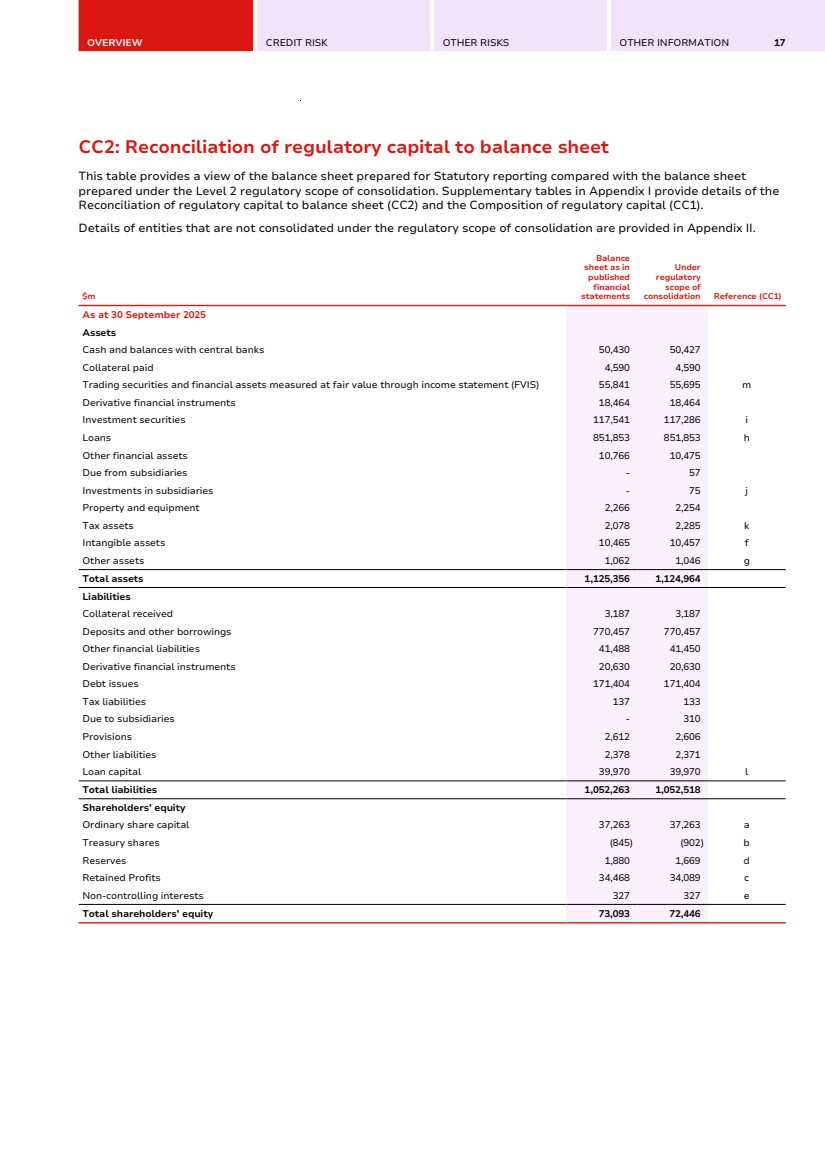

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 17 CC2: Reconciliation of regulatory capital to balance sheet CC2: Reconciliation of regulatory capital to balance sheet This table provides a view of the balance sheet prepared for Statutory reporting compared with the balance sheet prepared under the Level 2 regulatory scope of consolidation. Supplementary tables in Appendix I provide details of the Reconciliation of regulatory capital to balance sheet (CC2) and the Composition of regulatory capital (CC1). Details of entities that are not consolidated under the regulatory scope of consolidation are provided in Appendix II. $m Balance sheet as in published financial statements Under regulatory scope of consolidation Reference (CC1) As at 30 September 2025 Assets Cash and balances with central banks 50,430 50,427 Collateral paid 4,590 4,590 Trading securities and financial assets measured at fair value through income statement (FVIS) 55,841 55,695 m Derivative financial instruments 18,464 18,464 Investment securities 117,541 117,286 i Loans 851,853 851,853 h Other financial assets 10,766 10,475 Due from subsidiaries - 57 Investments in subsidiaries - 75 j Property and equipment 2,266 2,254 Tax assets 2,078 2,285 k Intangible assets 10,465 10,457 f Other assets 1,062 1,046 g Total assets 1,125,356 1,124,964 Liabilities Collateral received 3,187 3,187 Deposits and other borrowings 770,457 770,457 Other financial liabilities 41,488 41,450 Derivative financial instruments 20,630 20,630 Debt issues 171,404 171,404 Tax liabilities 137 133 Due to subsidiaries - 310 Provisions 2,612 2,606 Other liabilities 2,378 2,371 Loan capital 39,970 39,970 l Total liabilities 1,052,263 1,052,518 Shareholders’ equity Ordinary share capital 37,263 37,263 a Treasury shares (845) (902) b Reserves 1,880 1,669 d Retained Profits 34,468 34,089 c Non-controlling interests 327 327 e Total shareholders’ equity 73,093 72,446 |

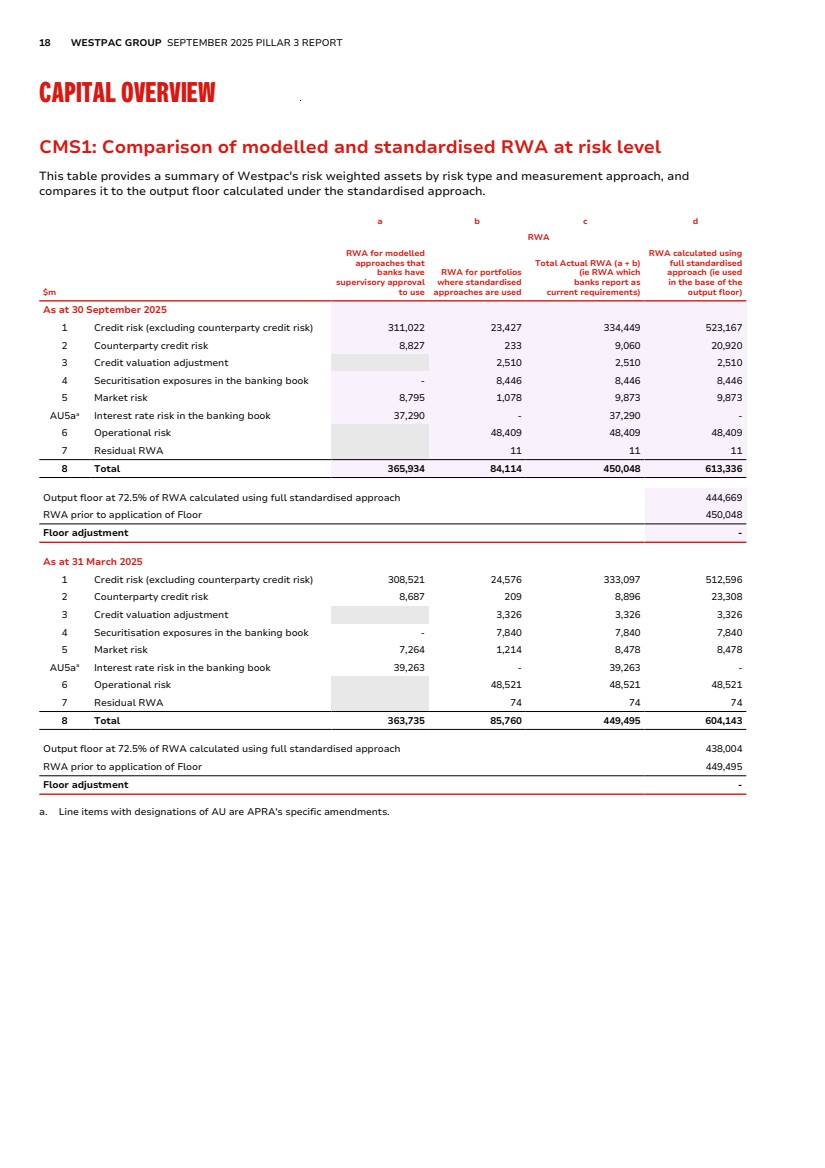

| 18 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CAPITAL OVERVIEW CMS1: Comparison of modelled and standardised RWA at risk level CMS1: Comparison of modelled and standardised RWA at risk level This table provides a summary of Westpac's risk weighted assets by risk type and measurement approach, and compares it to the output floor calculated under the standardised approach. $m a b c d RWA RWA for modelled approaches that banks have supervisory approval to use RWA for portfolios where standardised approaches are used Total Actual RWA (a + b) (ie RWA which banks report as current requirements) RWA calculated using full standardised approach (ie used in the base of the output floor) As at 30 September 2025 1 Credit risk (excluding counterparty credit risk) 311,022 23,427 334,449 523,167 2 Counterparty credit risk 8,827 233 9,060 20,920 3 Credit valuation adjustment 2,510 2,510 2,510 4 Securitisation exposures in the banking book - 8,446 8,446 8,446 5 Market risk 8,795 1,078 9,873 9,873 AU5aa Interest rate risk in the banking book 37,290 - 37,290 - 6 Operational risk 48,409 48,409 48,409 7 Residual RWA 11 11 11 8 Total 365,934 84,114 450,048 613,336 Output floor at 72.5% of RWA calculated using full standardised approach 444,669 RWA prior to application of Floor 450,048 Floor adjustment - As at 31 March 2025 1 Credit risk (excluding counterparty credit risk) 308,521 24,576 333,097 512,596 2 Counterparty credit risk 8,687 209 8,896 23,308 3 Credit valuation adjustment 3,326 3,326 3,326 4 Securitisation exposures in the banking book - 7,840 7,840 7,840 5 Market risk 7,264 1,214 8,478 8,478 AU5aa Interest rate risk in the banking book 39,263 - 39,263 - 6 Operational risk 48,521 48,521 48,521 7 Residual RWA 74 74 74 8 Total 363,735 85,760 449,495 604,143 Output floor at 72.5% of RWA calculated using full standardised approach 438,004 RWA prior to application of Floor 449,495 Floor adjustment - a. Line items with designations of AU are APRA's specific amendments. |

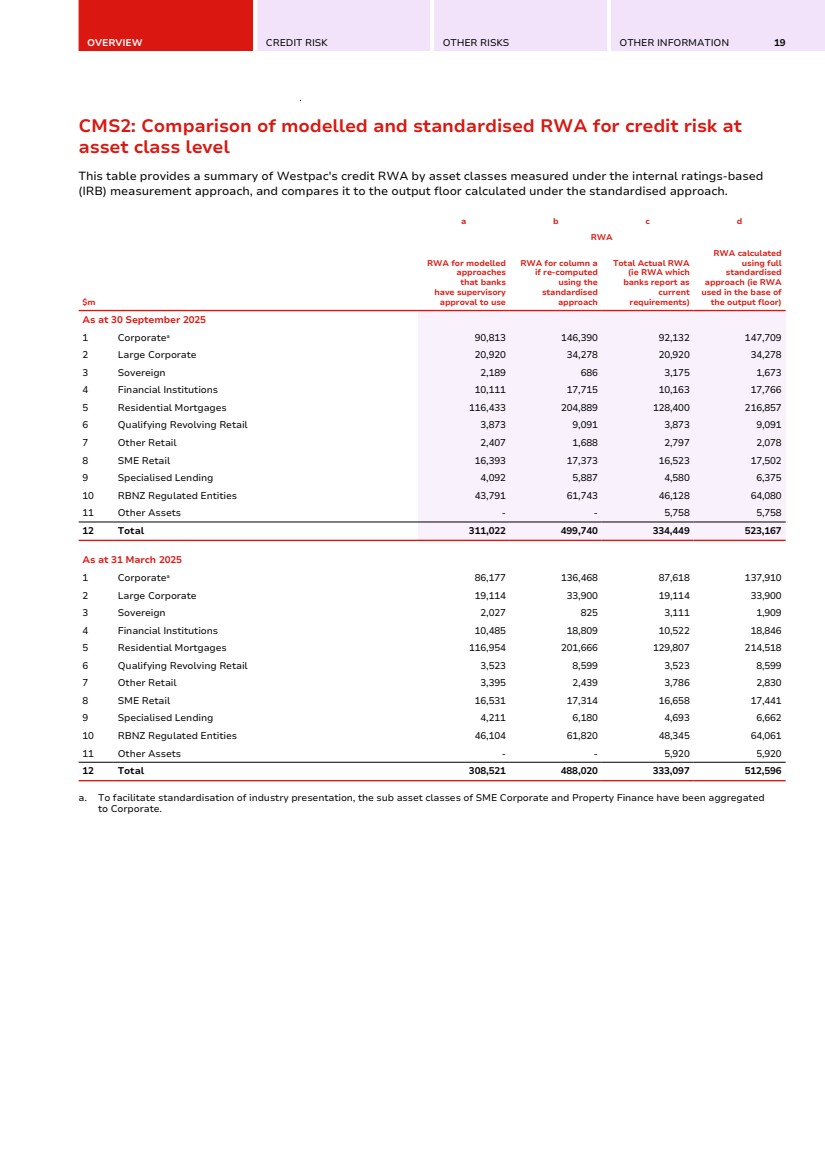

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 19 CMS2: Comparison of modelled and standardised RWA for credit risk at asset class level CMS2: Comparison of modelled and standardised RWA for credit risk at asset class level This table provides a summary of Westpac's credit RWA by asset classes measured under the internal ratings-based (IRB) measurement approach, and compares it to the output floor calculated under the standardised approach. $m a b c d RWA RWA for modelled approaches that banks have supervisory approval to use RWA for column a if re-computed using the standardised approach Total Actual RWA (ie RWA which banks report as current requirements) RWA calculated using full standardised approach (ie RWA used in the base of the output floor) As at 30 September 2025 1 Corporatea 90,813 146,390 92,132 147,709 2 Large Corporate 20,920 34,278 20,920 34,278 3 Sovereign 2,189 686 3,175 1,673 4 Financial Institutions 10,111 17,715 10,163 17,766 5 Residential Mortgages 116,433 204,889 128,400 216,857 6 Qualifying Revolving Retail 3,873 9,091 3,873 9,091 7 Other Retail 2,407 1,688 2,797 2,078 8 SME Retail 16,393 17,373 16,523 17,502 9 Specialised Lending 4,092 5,887 4,580 6,375 10 RBNZ Regulated Entities 43,791 61,743 46,128 64,080 11 Other Assets - - 5,758 5,758 12 Total 311,022 499,740 334,449 523,167 As at 31 March 2025 1 Corporatea 86,177 136,468 87,618 137,910 2 Large Corporate 19,114 33,900 19,114 33,900 3 Sovereign 2,027 825 3,111 1,909 4 Financial Institutions 10,485 18,809 10,522 18,846 5 Residential Mortgages 116,954 201,666 129,807 214,518 6 Qualifying Revolving Retail 3,523 8,599 3,523 8,599 7 Other Retail 3,395 2,439 3,786 2,830 8 SME Retail 16,531 17,314 16,658 17,441 9 Specialised Lending 4,211 6,180 4,693 6,662 10 RBNZ Regulated Entities 46,104 61,820 48,345 64,061 11 Other Assets - - 5,920 5,920 12 Total 308,521 488,020 333,097 512,596 a. To facilitate standardisation of industry presentation, the sub asset classes of SME Corporate and Property Finance have been aggregated to Corporate. |

| 20 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT RISK MANAGEMENT APPROACH Risk Management Approach Risk Appetite and Risk Types Westpac's operations expose us to risks. Westpac’s appetite for risk is informed by its strategic objectives and business plans, regulatory rules and ratios, and the potential for adverse outcomes that may result in material impacts on Westpac's customers, people, reputation, regulatory relationships and/or financial position including the potential for capital and liquidity ratios to fall below target levels in stressed scenarios. Westpac distinguishes between different types of risk and takes an integrated approach toward identifying, assessing, and managing risks. The Risk Management Strategy, which incorporates the risk management framework model, and the Board Risk Appetite Statement, together with monitoring and controls are key to identifying and managing risk. Westpac's key risks are: • capital adequacy risk – the risk that Westpac has an inadequate level or composition of capital to support its normal business activities and to meet its regulatory capital requirements under both normal and stressed operating environments; • compliance and conduct risk – the risk of failing to abide by compliance obligations required of Westpac or otherwise failing to have behaviours and practices that deliver suitable, fair, and clear outcomes for our customers and that support market integrity; • credit risk – the risk of financial loss where a customer or counterparty fails to meet their financial obligations to Westpac; • cyber risk – the risk that Westpac or its third parties’ data or technology are inappropriately accessed, manipulated, or damaged from cyber threats or vulnerabilities; • financial crime risk – the risk that Westpac fails to prevent products and services being used to facilitate financial crime, fails to protect our customers and Westpac from fraud and scam events or fails to comply with applicable global financial crime regulatory obligations; • funding and liquidity risk – the risk that Westpac cannot meet its payment obligations or that it does not have the appropriate amount, tenor and composition of funding and liquidity to support its assets; • market risk – the risk of an adverse impact on Westpac’s earnings and economic value resulting from changes in the value of Westpac's positions as a result of a change in financial market factors, such as foreign exchange rates, commodity prices, equity prices, credit spreads and interest rates. This includes earnings at risk - the risk to net interest income from interest rate changes and economic value sensitivity - the risk of variability in the Group's banking book capital requirements; • operational risk – the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events; • reputational and sustainability risk − the risk of failing to recognise or address environmental, social or governance (ESG) issues and the risk that an action, inaction, transaction, investment, or event will reduce trust in Westpac’s integrity and competence by clients, counterparties, investors, regulators, employees, or the public; • risk culture – the risk that Westpac's culture does not promote and reinforce behavioural expectations or structures to identify, understand, discuss and act on risks; and • strategic risk – the risk that Westpac makes inappropriate strategic choices, does not implement its strategies successfully, or does not respond effectively to changes in the environment. Risk Management Strategy Westpac has put in place a Risk Management Strategy (incorporating the risk management framework model) that: • is proactive in the management of risk and risk culture to achieve Westpac’s purpose of creating better futures together; • embeds a consistent and integrated risk management approach in its processes and culture; • continues to improve the management of risk; • is resilient to operational risks and disruptions and manages the risks that arise arising from service providers; • understands the reward-to-risk balance and where required, reduces risks to acceptable levels. The Risk Management Strategy and Board Risk Appetite Statement were approved by the Board during the 12 months to 30 September 2025. |

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 21 Roles and responsibilities We have adopted and continue to embed a Three Lines of Defence model which enables all our people to understand their roles and responsibilities in the active management of risk. First Line of Defence (1LOD) The 1LOD under the Three Lines of Defence Model refers to all Divisions and Functions excluding the Risk and Audit functions. The 1LOD proactively identifies, evaluates, owns, monitors, manages and controls the existing and emerging risks in their business. It manages business activities within approved risk appetite and policies. In managing its risk, the 1LOD establishes and maintains appropriate governance structures, controls, resources and self-assessment processes, including issue identification, recording and escalation procedures. Second Line of Defence (2LOD) The 2LOD under the Three Lines of Defence Model refers to the Risk Function. It is an independent function that develops risk management frameworks, defines guardrails, provides objective review and challenge regarding the effectiveness of risk management within the 1LOD business, and executes specific risk management activities where functional independence and/or specific risk capability is required. Its approach is risk-based and proportionate to 1LOD activities. Third Line of Defence (3LOD) Group Audit is the 3LOD assurance function that provides the Board and Senior Executive with independent and objective evaluation of the adequacy and effectiveness of the Group’s governance, risk management and internal controls. Risk management governance structure Governance Structure Functions and responsibilities Board • approves the overall risk management framework for managing financial and non-financial risks, as well as Westpac’s Risk Management Strategy and Board Risk Appetite Statement, and monitors the effectiveness of risk management by Westpac; • forms a view of Westpac’s risk culture and oversees the identification of, and steps taken to address, any changes to risk culture; • approves the Internal Capital Adequacy Assessment Process (ICAAP), including reviewing Group stress testing scenarios/outcomes, and approves Westpac's recovery and exit plans and material relevant to resolution planning; • approves the strategic direction of the Westpac Group; and • makes its annual declaration to APRA on risk management in accordance with APRA prudential standard CPS 220 Risk Management. |

| 22 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT RISK MANAGEMENT APPROACH Governance Structure Functions and responsibilities Board Risk Committee (BRiskC) From the perspective of specific types of risk, the BRiskC’s role includes reviewing and approving risk management frameworks and material supporting policies and limits as required, and in addition: • credit risk – reviewing and approving Westpac’s Credit Risk Management Strategy and Credit Risk Appetite Statement and material policies and limits supporting Westpac’s Credit Risk Management Framework, noting credit provisioning levels, and monitoring the risk profile, performance, and management of our credit portfolio; • funding and liquidity risk – reviewing and approving Westpac’s annual funding strategy, and liquidity targets and limits, reviewing and recommending recovery and exit plans and resolution plans to the Board for approval, and monitoring the liquidity position and requirements; • capital adequacy risk – reviewing and recommending the ICAAP to the Board for approval including target capital ranges (where appropriate) and reviewing and monitoring capital levels for consistency with the Board Risk Appetite Statement; • market risk – reviewing Westpac’s trading and non-trading market risk profiles and their respective exposure against limits; • non-financial risks, including operational risk, compliance and conduct risk, cyber risk, financial crime risk, and reputational and sustainability risk and monitoring the performance of risk class management and controls; and • risk culture – forming a view on Westpac’s risk culture and the extent to which it supports our ability to operate consistently within Westpac’s Risk Management Strategy and Board Risk Appetite Statement, and overseeing the identification of, and steps taken to address, any desirable changes to risk culture. The Board Risk Committee also: • reviews the Westpac Group stress testing results, monitors management response and, together with the Board provides recommendations for future scenarios; • provides relevant periodic assurances and reports (as appropriate) to the Board Audit Committee; • refers or recommends to the Board and any other Board Committees (as appropriate) any matters that have come to the attention of the Board Risk Committee that are relevant for the Board or the respective Board Committee; and • in its capacity as the Westpac Group’s US Risk Committee, oversees the key risks, risk management framework and policies of Westpac’s US operations. Assists the Board to: • consider and approve Westpac’s overall risk management framework for managing financial and non-financial risks; • oversee risk culture across Westpac; • oversee Westpac’s risk profile and set risk appetite for material risks; • review and approve the Risk Management Strategy and Board Risk Appetite Statement; • make its annual declaration to APRA on risk management under APRA prudential standard CPS 220 Risk Management; and • oversee compliance risk management within Westpac. The Committee is also responsible for: • reviewing and monitoring Westpac’s risk profile and controls for consistency with the Board Risk Appetite Statement; • reviewing and recommending Westpac's recovery and exit plan and material relevant to resolution planning to the Board for approval; • reviewing and approving the limits and conditions that apply to the delegated credit risk approval authorities; • monitoring changes anticipated for the economic and business environment including consideration of emerging risks and other factors considered relevant to risk profile and risk appetite; • reviewing and where appropriate approving risks beyond the approval discretion provided to management; and • overseeing material legal and regulatory change relevant to Westpac and the management of material litigation and regulatory investigations and associated remediation activities. |

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 23 Governance Structure Functions and responsibilities Board Committees with a Risk Focus Board Audit Committee (BAC) Assists the Board by overseeing the: • integrity of financial statements and financial reporting systems of Westpac and its related bodies corporate; • external audit engagement, including the external auditor’s qualifications, performance, independence and fees; • performance of the internal audit function; and • integrity of the Group’s corporate reporting including Westpac’s financial reporting and compliance with prudential regulatory reporting and professional accounting requirements. Board Remuneration Committee (BRemC) • the Board Remuneration Committee assists the Board to discharge its responsibility by overseeing the design, operation and monitoring of the remuneration framework; • the Board Remuneration Committee seeks feedback from and considers matters raised by the CEO, CRO, and the Board Risk Committee Chair with respect to remuneration outcomes, adjustments to remuneration in light of relevant matters and alignment of remuneration with the risk management framework; • cross membership of the Board Remuneration Committee and the Board Risk Committee also supports alignment between risk and remuneration; and • independent input is received from the Chief Risk Officer on risk, compliance and conduct matters that may need to be considered in remuneration outcomes. Executive Team Westpac Executive Team (ET) • executes the Board-approved strategy; • delivers Westpac’s various strategic and performance goals within the approved risk appetite; and • endorse climate change and human rights position statements for approval by the Board. All other position statements on sustainability issues are approved by the CEO. Executive risk committees Westpac Group Executive Risk Committee (RISKCO) • informs the CEO, Chief Risk Officer and other accountable individuals in making risk-related decisions in respect of the Westpac Group; • informs attendees in making material decisions in their area of responsibility, with due consideration of Westpac’s risk profile and risk culture; • reviews and discusses the Risk Management Strategy for approval by the Board; • oversees the implementation and performance of the Risk Management Strategy as well as required controls and actions; • reviews and notes material changes to risk class frameworks and material supporting policies, as required; • reviews and discusses the measures and thresholds in the Board Risk Appetite Statement (Board RAS) for approval by the Board, and monitors Westpac’s risk profile against its Board RAS measures and thresholds; • monitors the Westpac's risk culture, its alignment to risk appetite and related actions; • reviews and notes emerging risks and oversees the adequacy of Westpac’s response; and • reviews and discusses annual stress testing scenarios and outcomes, the ICAAP, Westpac’s Recovery and Exit Plan and material relevant to resolution planning. Westpac Group Asset & Liability Committee (ALCO) • oversees the balance sheet risk profile, including funding and liquidity risk, capital adequacy risk and interest rate risk in the banking book; • reviews the level and quality of capital (including the ICAAP), liquidity and funding to ensure that it is commensurate with Westpac’s risk profile, business strategy and risk appetite; • facilitates the optimisation of funding allocation across Westpac; • oversees the Liquidity Risk Management Framework, Capital Adequacy Risk Management Framework and key supporting policies; and • identifies emerging funding, liquidity, and interest rate risk in the banking book risks and oversees actions to respond as appropriate. |

| 24 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT RISK MANAGEMENT APPROACH Governance Structure Functions and responsibilities Executive risk committees (continued) Westpac Group Credit Risk Committee (CREDCO) • reviews and discusses the Credit Risk Management Framework, Credit Risk Management Strategy, Credit Risk Appetite Statement, and key supporting policies and limits; • reviews and discusses business activity with material credit risk-related impacts; • monitors Westpac’s credit risk profile against the Board Risk Appetite Statement measures and thresholds • monitors Westpac’s credit risks that are outside of risk appetite or approaching tolerance limits and monitors remediation plans and actions; • reviews reporting from the Climate Change Credit Risk Committee on the potential impact on credit exposures from climate-related transition and physical risks; and • reviews and notes emerging risks, regulatory issues, and implications of changes in the regulatory and external environment on Westpac's credit risk exposures. Westpac Group Market Risk Committee (MARCO) • reviews and discusses the Market Risk Management Framework and key market risk management policies; • reviews and provides input on policies and limits for managing traded and non-traded market risk; and • monitors Westpac’s market risk profile, appetite and exposures. Westpac Group Operational Risk, Compliance and Resilience Committee (ORCR) • reviews and discusses the Operational Risk Management Framework, the Cyber Risk Management Framework and the Compliance and Conduct Risk Management Framework, and key supporting policies; • monitors Westpac’s operational risk, cyber risk, and compliance and conduct risk profiles; • analyses emerging operational, cyber, compliance and conduct risks; and • reviews the Group-wide operational risk scenarios for exposure to high-severity loss events. Westpac Group Remuneration Oversight Committee (ROC) • supports the BRemC and the Board in fulfilling their responsibility to oversee the design, operation and monitoring of the remuneration framework. Model Risk Committee • oversees the operational effectiveness of the Group Model Risk Policy and key supporting artefacts; • monitors the model risk profile and material model risk exposures, taking into account the regulatory and external environment; • oversees approvals for significant changes to Westpac’s material models; and • oversees material model risk matters raised by associated committees. Stress Testing Committee • reviews and provides input on the Westpac Group Stress Testing Policy, stress testing results and mitigating actions; • reviews and monitors the effectiveness of Westpac’s Group stress-testing framework; and • oversees the generation and selection of Group stress testing scenarios, with reference to emerging risks. Westpac Group Financial Crime Risk Committee • reviews and discusses the Financial Crime measures and thresholds in the Board RAS; • reviews and discusses Westpac's Financial Crime Risk Management Framework and Financial Crime Policy framework; • monitors Westpac’s aggregate Financial Crime risk exposures, regulatory matters and measures; and • analyses emerging financial crime risks developments and implications of changes in the regulatory and external environment. |

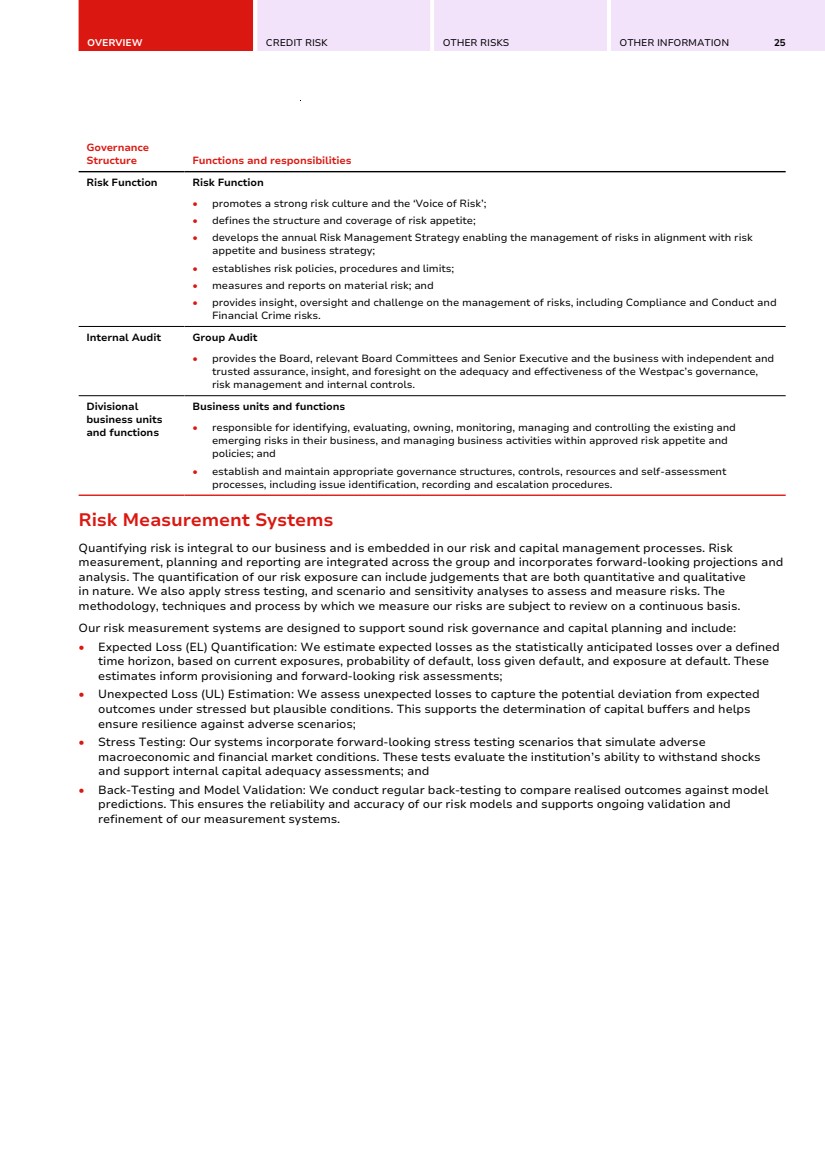

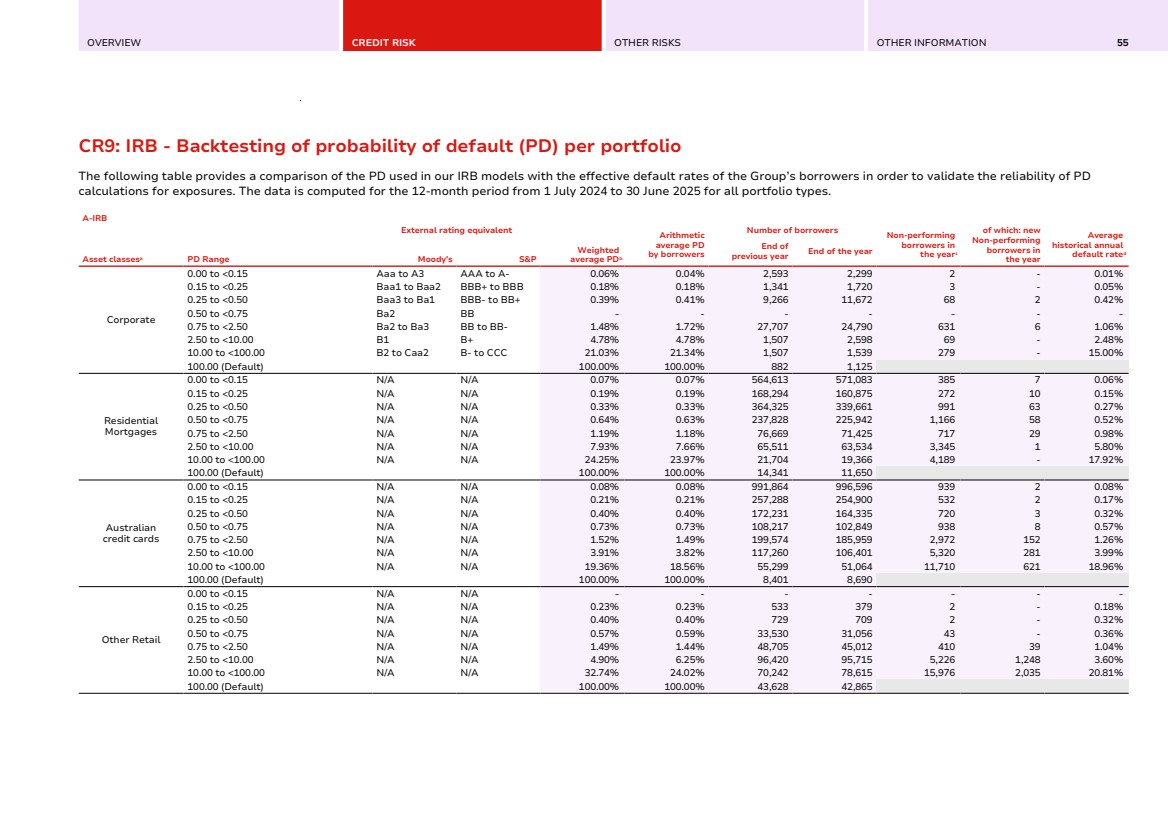

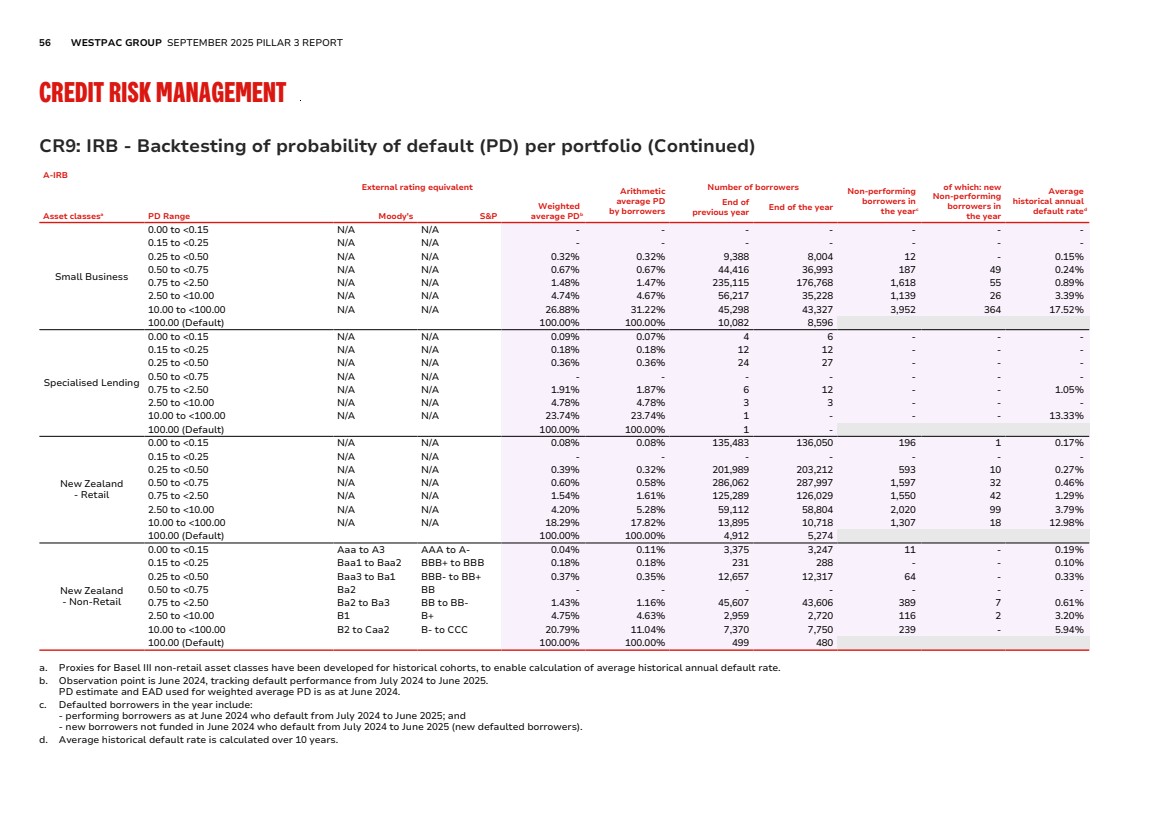

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 25 Governance Structure Functions and responsibilities Risk Function Risk Function • promotes a strong risk culture and the ‘Voice of Risk’; • defines the structure and coverage of risk appetite; • develops the annual Risk Management Strategy enabling the management of risks in alignment with risk appetite and business strategy; • establishes risk policies, procedures and limits; • measures and reports on material risk; and • provides insight, oversight and challenge on the management of risks, including Compliance and Conduct and Financial Crime risks. Internal Audit Group Audit • provides the Board, relevant Board Committees and Senior Executive and the business with independent and trusted assurance, insight, and foresight on the adequacy and effectiveness of the Westpac’s governance, risk management and internal controls. Divisional business units and functions Business units and functions • responsible for identifying, evaluating, owning, monitoring, managing and controlling the existing and emerging risks in their business, and managing business activities within approved risk appetite and policies; and • establish and maintain appropriate governance structures, controls, resources and self-assessment processes, including issue identification, recording and escalation procedures. Risk Measurement Systems Quantifying risk is integral to our business and is embedded in our risk and capital management processes. Risk measurement, planning and reporting are integrated across the group and incorporates forward-looking projections and analysis. The quantification of our risk exposure can include judgements that are both quantitative and qualitative in nature. We also apply stress testing, and scenario and sensitivity analyses to assess and measure risks. The methodology, techniques and process by which we measure our risks are subject to review on a continuous basis. Our risk measurement systems are designed to support sound risk governance and capital planning and include: • Expected Loss (EL) Quantification: We estimate expected losses as the statistically anticipated losses over a defined time horizon, based on current exposures, probability of default, loss given default, and exposure at default. These estimates inform provisioning and forward-looking risk assessments; • Unexpected Loss (UL) Estimation: We assess unexpected losses to capture the potential deviation from expected outcomes under stressed but plausible conditions. This supports the determination of capital buffers and helps ensure resilience against adverse scenarios; • Stress Testing: Our systems incorporate forward-looking stress testing scenarios that simulate adverse macroeconomic and financial market conditions. These tests evaluate the institution’s ability to withstand shocks and support internal capital adequacy assessments; and • Back-Testing and Model Validation: We conduct regular back-testing to compare realised outcomes against model predictions. This ensures the reliability and accuracy of our risk models and supports ongoing validation and refinement of our measurement systems. |

| 26 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT RISK MANAGEMENT APPROACH Risk Reporting to the Board and Senior Management We have in place risk monitoring and reporting processes on a Groupwide and business segment level to support senior management and the Board to effectively assess, manage and oversee risks. The ongoing monitoring of our risk profile seeks to: • Ensure that our businesses operate within the approved risk appetite; • Assess business activity and growth potential relative to our risk profile; • Assess the impact of stress and unanticipated events; and • Identify matters requiring actions. The Board Risk Committee and the Board meet regularly to consider the information provided by senior management, which includes, among others matters, emerging risks, industry trends, our current risk profiles, and/or other notable items. Senior management are provided with monthly analysis of our operations, and information related to our risk profile, including our credit risk profiles. In addition to our regular risk monitoring, other risk-specific presentations are provided to, and discussed with, senior management and the Board as required. We also publish external reports on risk matters to comply with regulatory requirements on a quarterly, semi-annual and annual basis. Further information on our risk reporting for each of our primary risks are also discussed within this report in the sections for these respective risks. Stress Testing We conduct regular stress testing throughout the year to: • Identify and manage key economic risks that we are exposed to; • Assess the potential impact on our financial position and performance from extreme hypothetical economic shocks; and • Assess the adequacy of our liquidity and capital position to withstand extreme shock events. Further information on our stress testing for our primary risks is also discussed in their respective sections. Risk Mitigation We mitigate our primary risks using various approaches. Further details are provided for each of the primary risks in their respective section. |

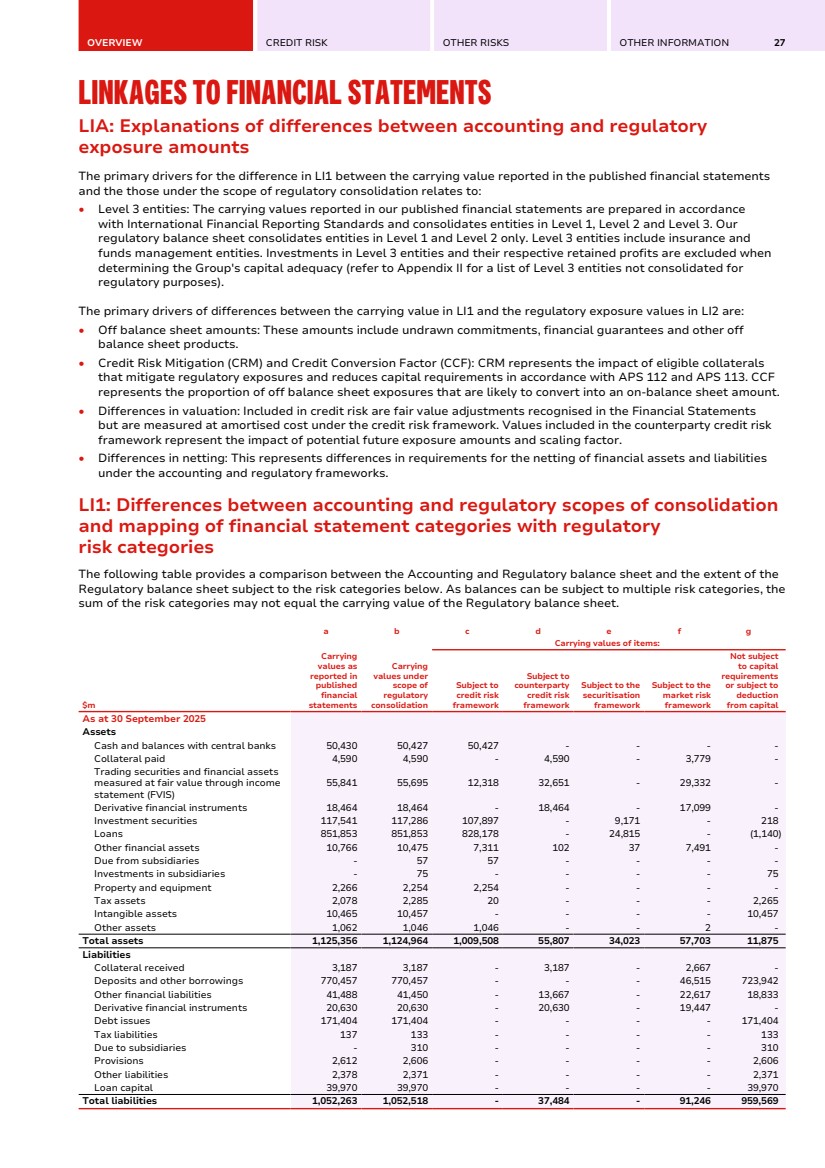

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 27 LINKAGES TO FINANCIAL STATEMENTS LIA: Explanations of differences between accounting and regulatory exposure amounts Linkages to Financial Statements LIA: Explanations of differences between accounting and regulatory exposure amounts The primary drivers for the difference in LI1 between the carrying value reported in the published financial statements and the those under the scope of regulatory consolidation relates to: • Level 3 entities: The carrying values reported in our published financial statements are prepared in accordance with International Financial Reporting Standards and consolidates entities in Level 1, Level 2 and Level 3. Our regulatory balance sheet consolidates entities in Level 1 and Level 2 only. Level 3 entities include insurance and funds management entities. Investments in Level 3 entities and their respective retained profits are excluded when determining the Group's capital adequacy (refer to Appendix II for a list of Level 3 entities not consolidated for regulatory purposes). The primary drivers of differences between the carrying value in LI1 and the regulatory exposure values in LI2 are: • Off balance sheet amounts: These amounts include undrawn commitments, financial guarantees and other off balance sheet products. • Credit Risk Mitigation (CRM) and Credit Conversion Factor (CCF): CRM represents the impact of eligible collaterals that mitigate regulatory exposures and reduces capital requirements in accordance with APS 112 and APS 113. CCF represents the proportion of off balance sheet exposures that are likely to convert into an on-balance sheet amount. • Differences in valuation: Included in credit risk are fair value adjustments recognised in the Financial Statements but are measured at amortised cost under the credit risk framework. Values included in the counterparty credit risk framework represent the impact of potential future exposure amounts and scaling factor. • Differences in netting: This represents differences in requirements for the netting of financial assets and liabilities under the accounting and regulatory frameworks. LI1: Differences between accounting and regulatory scopes of consolidation and mapping of financial statement categories with regulatory risk categories LI1: Differences between accounting and regulatory scopes of consolidation and mapping of financial statement categories with regulatory risk categories The following table provides a comparison between the Accounting and Regulatory balance sheet and the extent of the Regulatory balance sheet subject to the risk categories below. As balances can be subject to multiple risk categories, the sum of the risk categories may not equal the carrying value of the Regulatory balance sheet. $m a b c d e f g Carrying values as reported in published financial statements Carrying values under scope of regulatory consolidation Carrying values of items: Subject to credit risk framework Subject to counterparty credit risk framework Subject to the securitisation framework Subject to the market risk framework Not subject to capital requirements or subject to deduction from capital As at 30 September 2025 Assets Cash and balances with central banks 50,430 50,427 50,427 - - - - Collateral paid 4,590 4,590 - 4,590 - 3,779 - Trading securities and financial assets measured at fair value through income statement (FVIS) 55,841 55,695 12,318 32,651 - 29,332 - Derivative financial instruments 18,464 18,464 - 18,464 - 17,099 - Investment securities 117,541 117,286 107,897 - 9,171 - 218 Loans 851,853 851,853 828,178 - 24,815 - (1,140) Other financial assets 10,766 10,475 7,311 102 37 7,491 - Due from subsidiaries - 57 57 - - - - Investments in subsidiaries - 75 - - - - 75 Property and equipment 2,266 2,254 2,254 - - - - Tax assets 2,078 2,285 20 - - - 2,265 Intangible assets 10,465 10,457 - - - - 10,457 Other assets 1,062 1,046 1,046 - - 2 - Total assets 1,125,356 1,124,964 1,009,508 55,807 34,023 57,703 11,875 Liabilities Collateral received 3,187 3,187 - 3,187 - 2,667 - Deposits and other borrowings 770,457 770,457 - - - 46,515 723,942 Other financial liabilities 41,488 41,450 - 13,667 - 22,617 18,833 Derivative financial instruments 20,630 20,630 - 20,630 - 19,447 - Debt issues 171,404 171,404 - - - - 171,404 Tax liabilities 137 133 - - - - 133 Due to subsidiaries - 310 - - - - 310 Provisions 2,612 2,606 - - - - 2,606 Other liabilities 2,378 2,371 - - - - 2,371 Loan capital 39,970 39,970 - - - - 39,970 Total liabilities 1,052,263 1,052,518 - 37,484 - 91,246 959,569 |

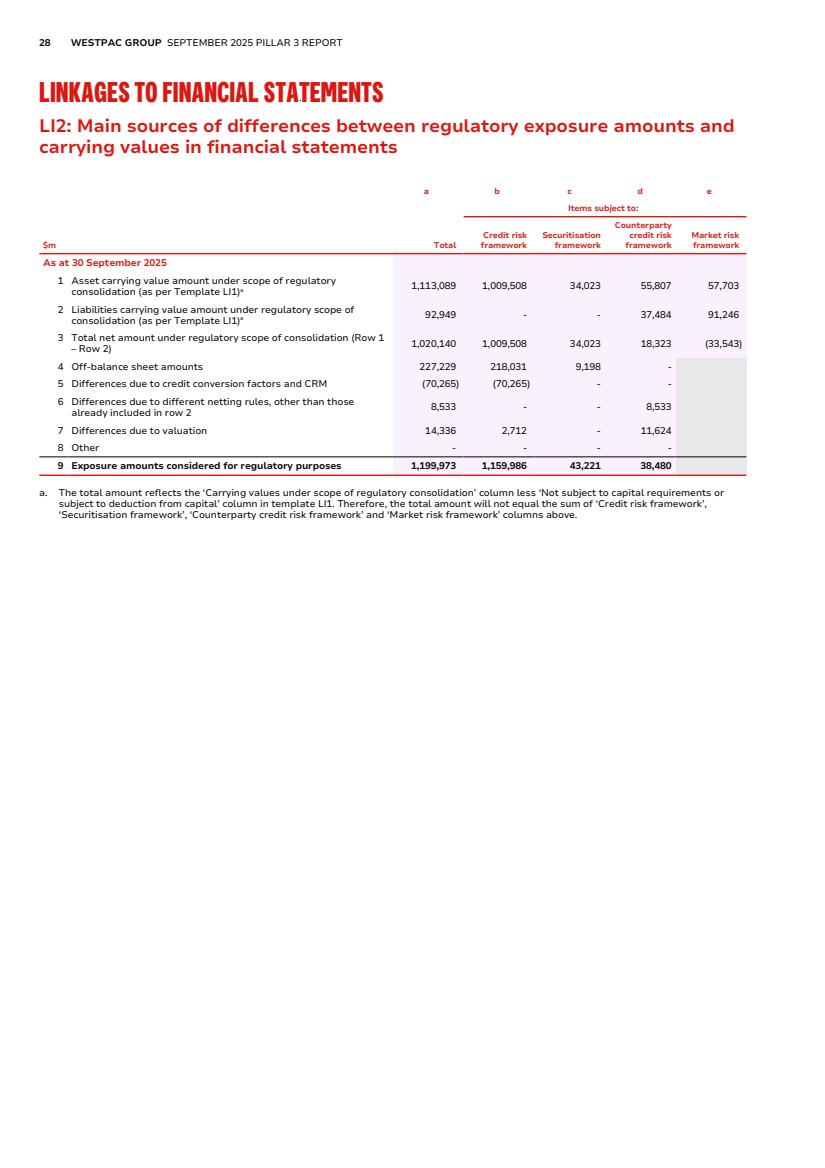

| 28 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT LINKAGES TO FINANCIAL STATEMENTS LI2: Main sources of differences between regulatory exposure amounts and carrying values in financial statements LI2: Main sources of differences between regulatory exposure amounts and carrying values in financial statements $m a b c d e Total Items subject to: Credit risk framework Securitisation framework Counterparty credit risk framework Market risk framework As at 30 September 2025 1 Asset carrying value amount under scope of regulatory consolidation (as per Template LI1)a 1,113,089 1,009,508 34,023 55,807 57,703 2 Liabilities carrying value amount under regulatory scope of consolidation (as per Template LI1)a 92,949 - - 37,484 91,246 3 Total net amount under regulatory scope of consolidation (Row 1 – Row 2) 1,020,140 1,009,508 34,023 18,323 (33,543) 4 Off-balance sheet amounts 227,229 218,031 9,198 - 5 Differences due to credit conversion factors and CRM (70,265) (70,265) - - 6 Differences due to different netting rules, other than those already included in row 2 8,533 - - 8,533 7 Differences due to valuation 14,336 2,712 - 11,624 8 Other - - - - 9 Exposure amounts considered for regulatory purposes 1,199,973 1,159,986 43,221 38,480 a. The total amount reflects the ‘Carrying values under scope of regulatory consolidation’ column less ‘Not subject to capital requirements or subject to deduction from capital’ column in template LI1. Therefore, the total amount will not equal the sum of ‘Credit risk framework’, ‘Securitisation framework’, ‘Counterparty credit risk framework’ and ‘Market risk framework’ columns above. |

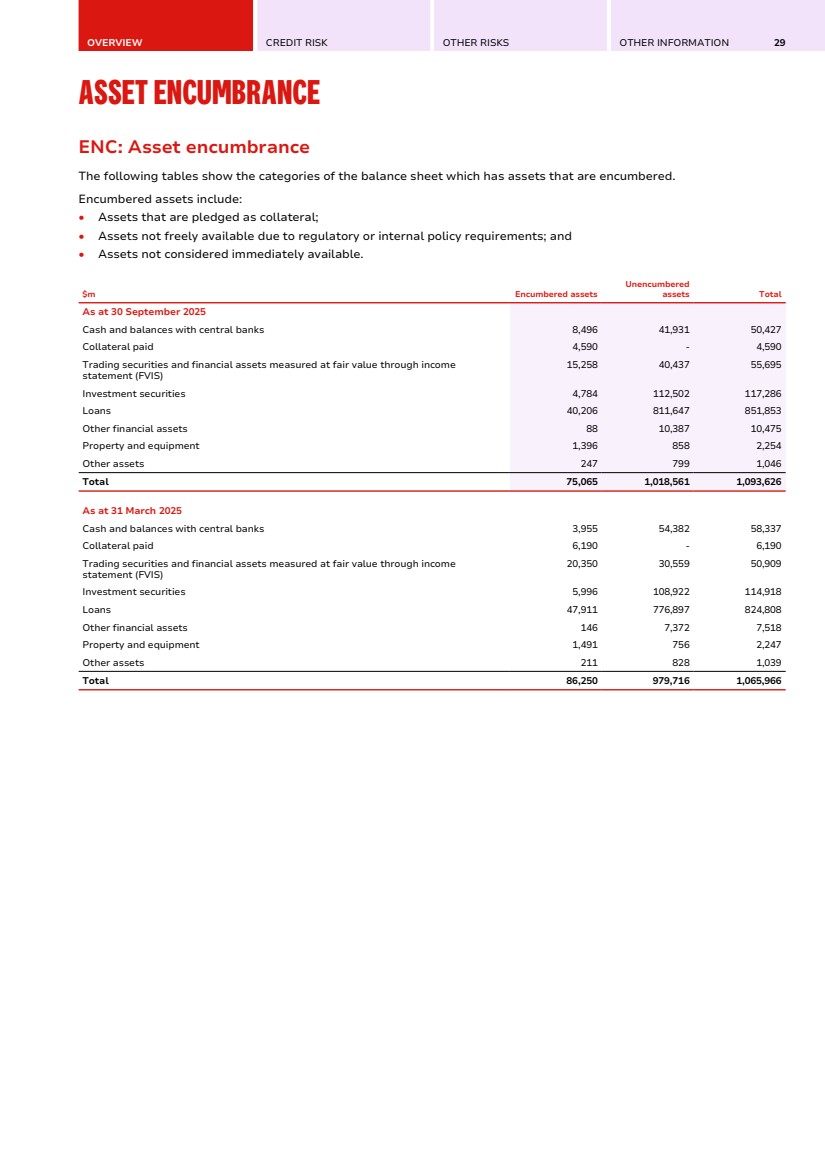

| OVERVIEW CREDIT RISK OTHER RISKS OTHER INFORMATION 29 ASSET ENCUMBRANCE ENC: Asset encumbrance Asset Encumbrance ENC: Asset encumbrance The following tables show the categories of the balance sheet which has assets that are encumbered. Encumbered assets include: • Assets that are pledged as collateral; • Assets not freely available due to regulatory or internal policy requirements; and • Assets not considered immediately available. $m Encumbered assets Unencumbered assets Total As at 30 September 2025 Cash and balances with central banks 8,496 41,931 50,427 Collateral paid 4,590 - 4,590 Trading securities and financial assets measured at fair value through income statement (FVIS) 15,258 40,437 55,695 Investment securities 4,784 112,502 117,286 Loans 40,206 811,647 851,853 Other financial assets 88 10,387 10,475 Property and equipment 1,396 858 2,254 Other assets 247 799 1,046 Total 75,065 1,018,561 1,093,626 As at 31 March 2025 Cash and balances with central banks 3,955 54,382 58,337 Collateral paid 6,190 - 6,190 Trading securities and financial assets measured at fair value through income statement (FVIS) 20,350 30,559 50,909 Investment securities 5,996 108,922 114,918 Loans 47,911 776,897 824,808 Other financial assets 146 7,372 7,518 Property and equipment 1,491 756 2,247 Other assets 211 828 1,039 Total 86,250 979,716 1,065,966 |

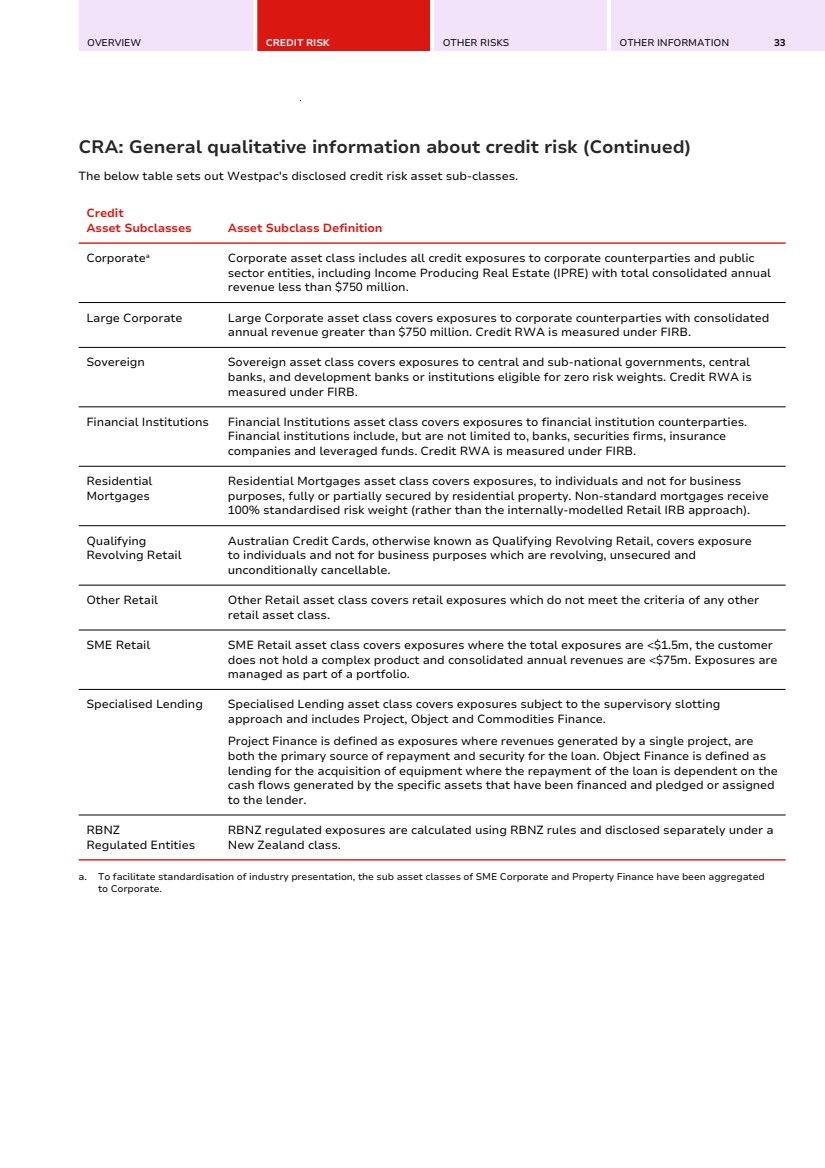

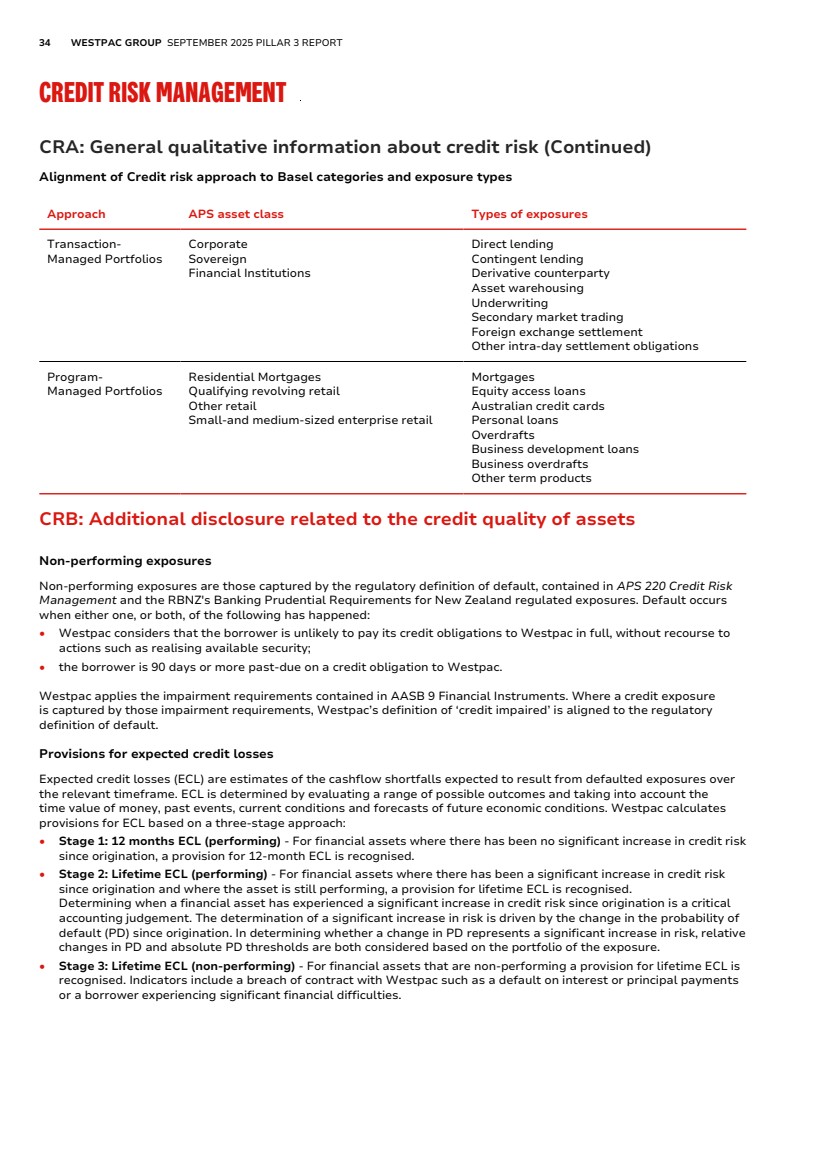

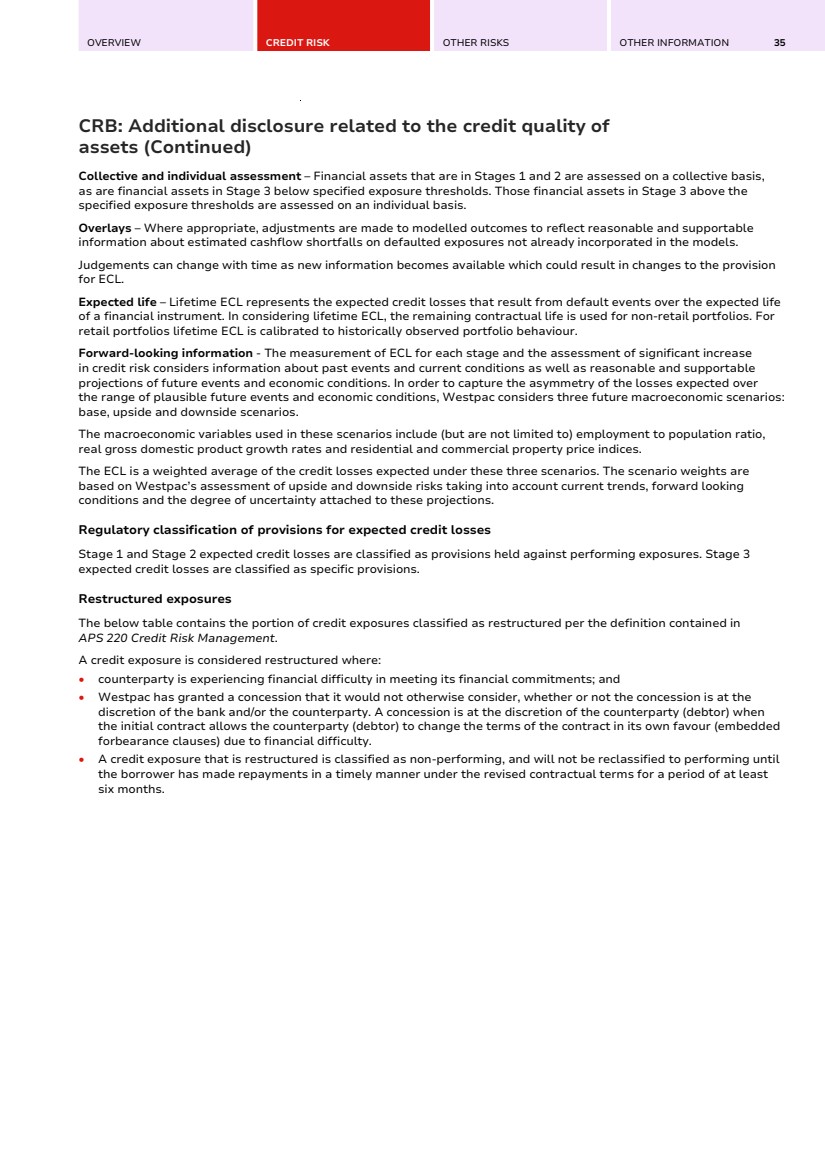

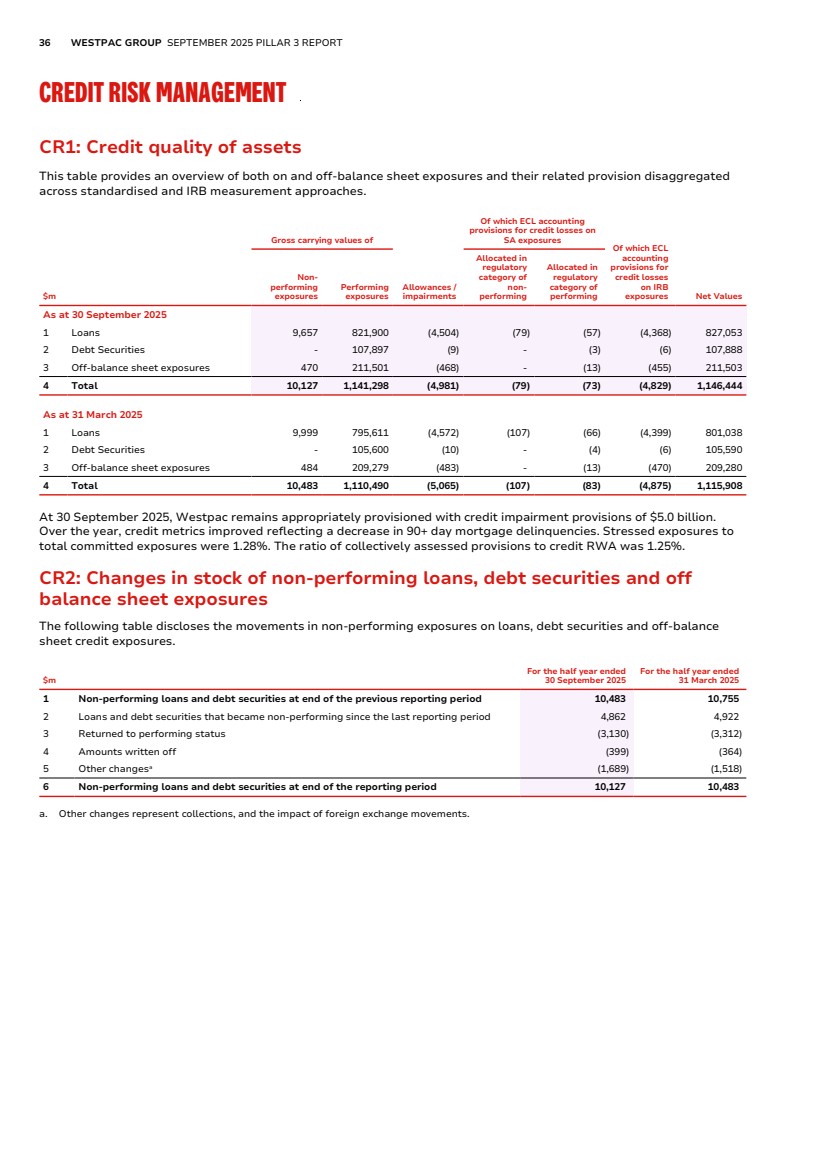

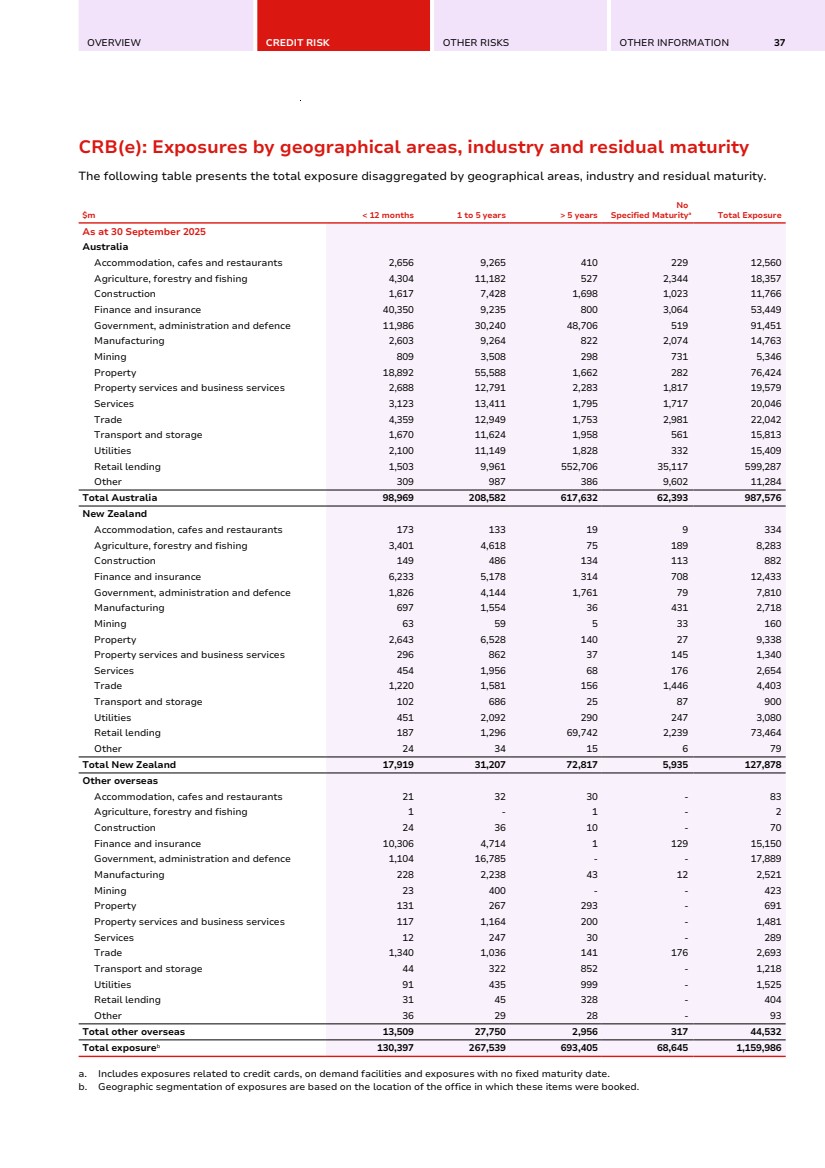

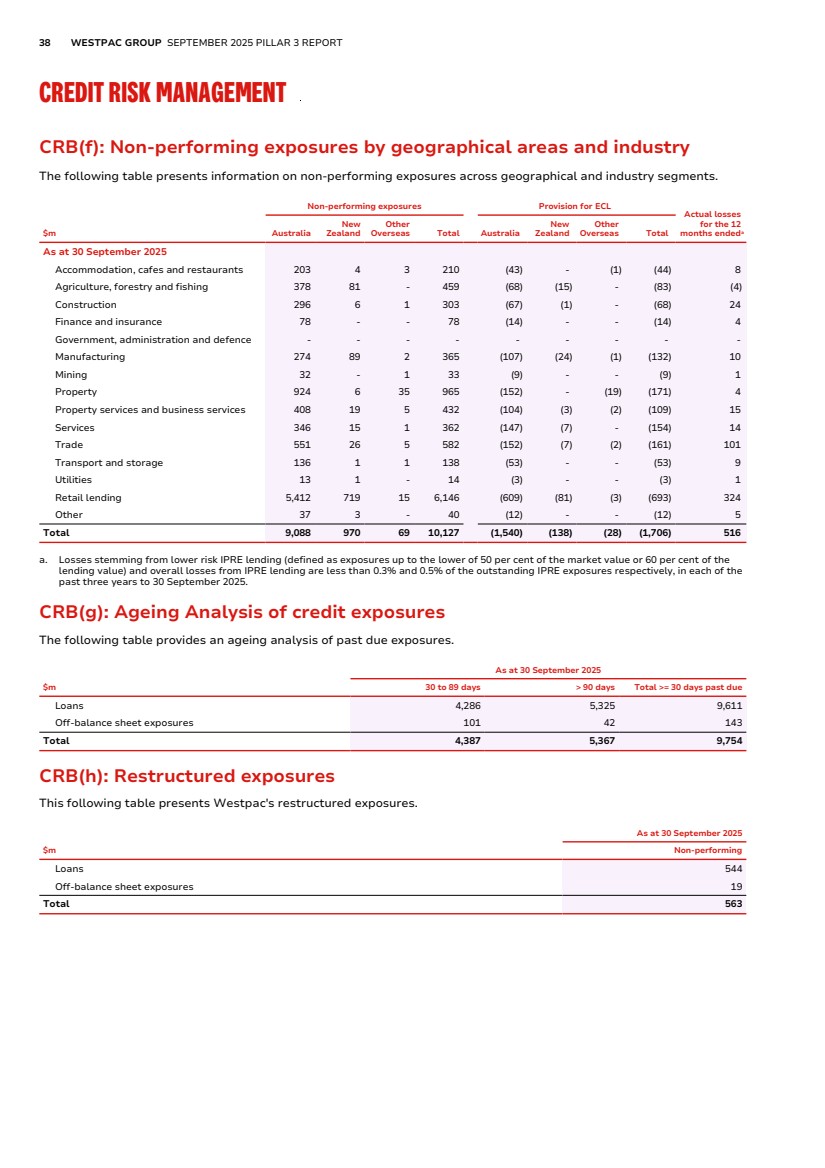

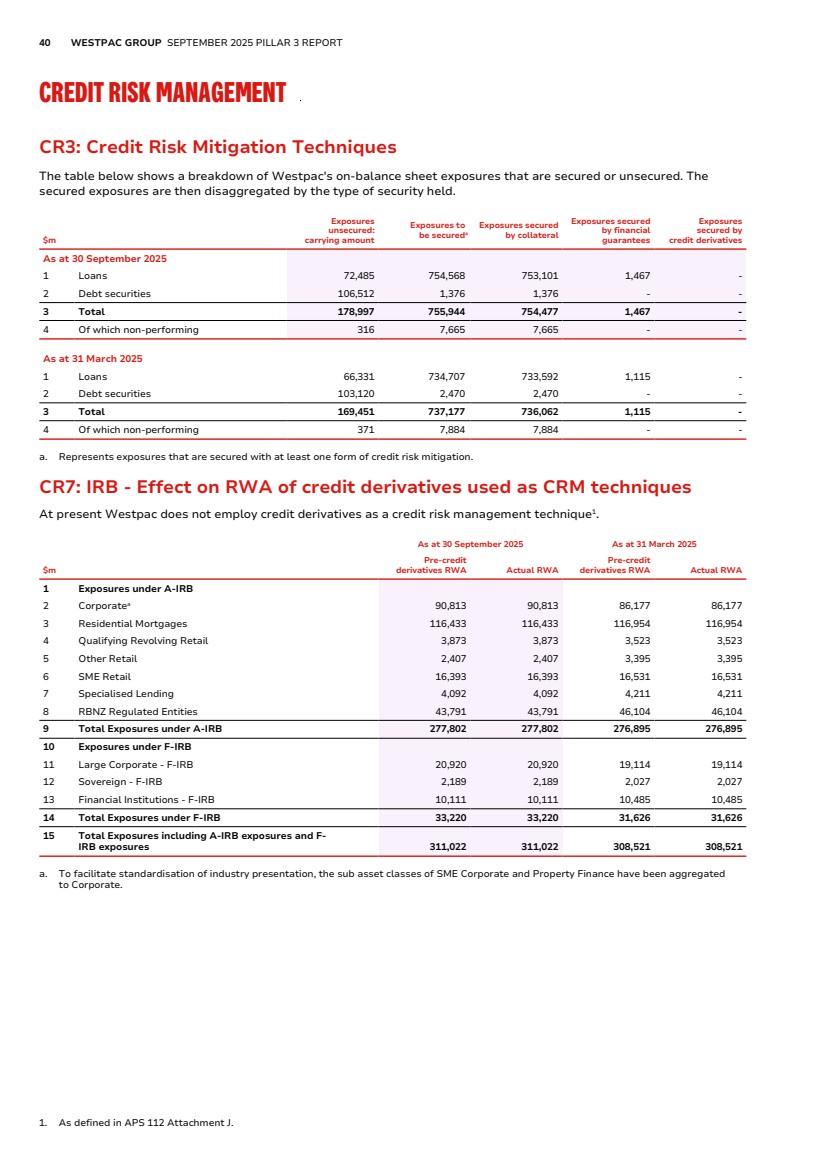

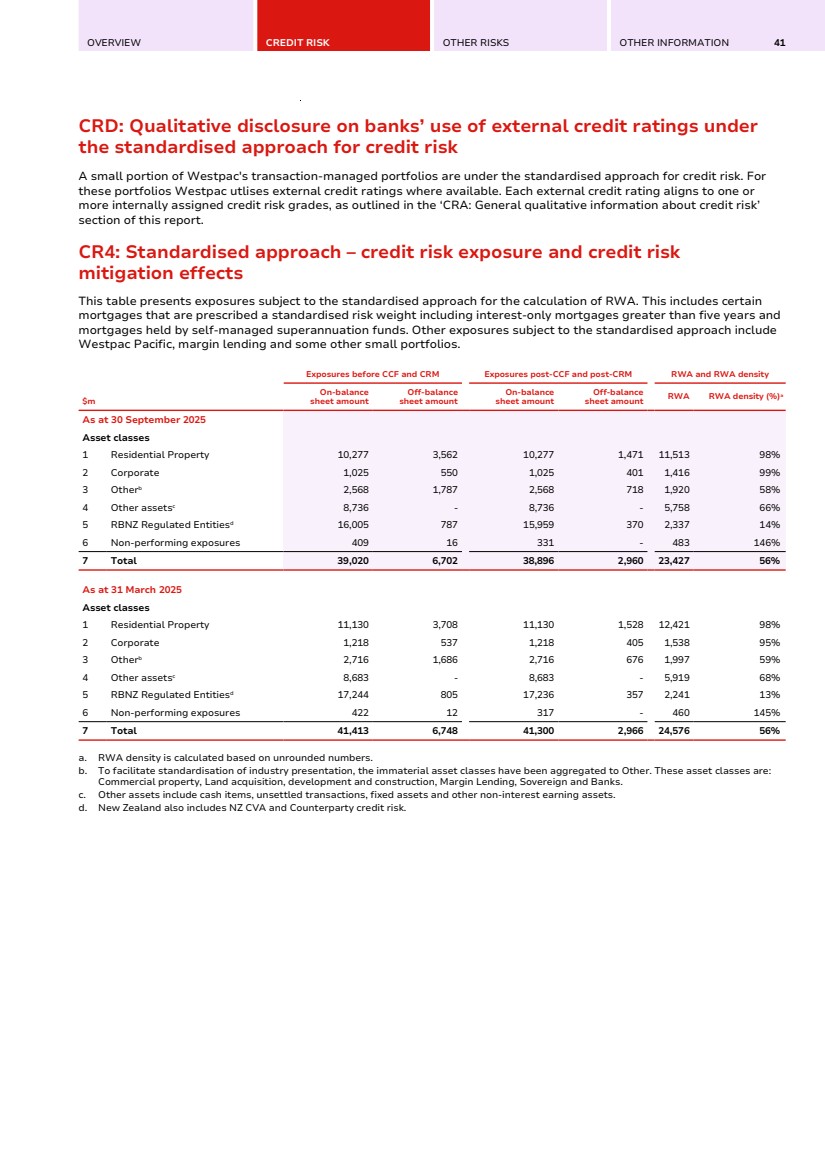

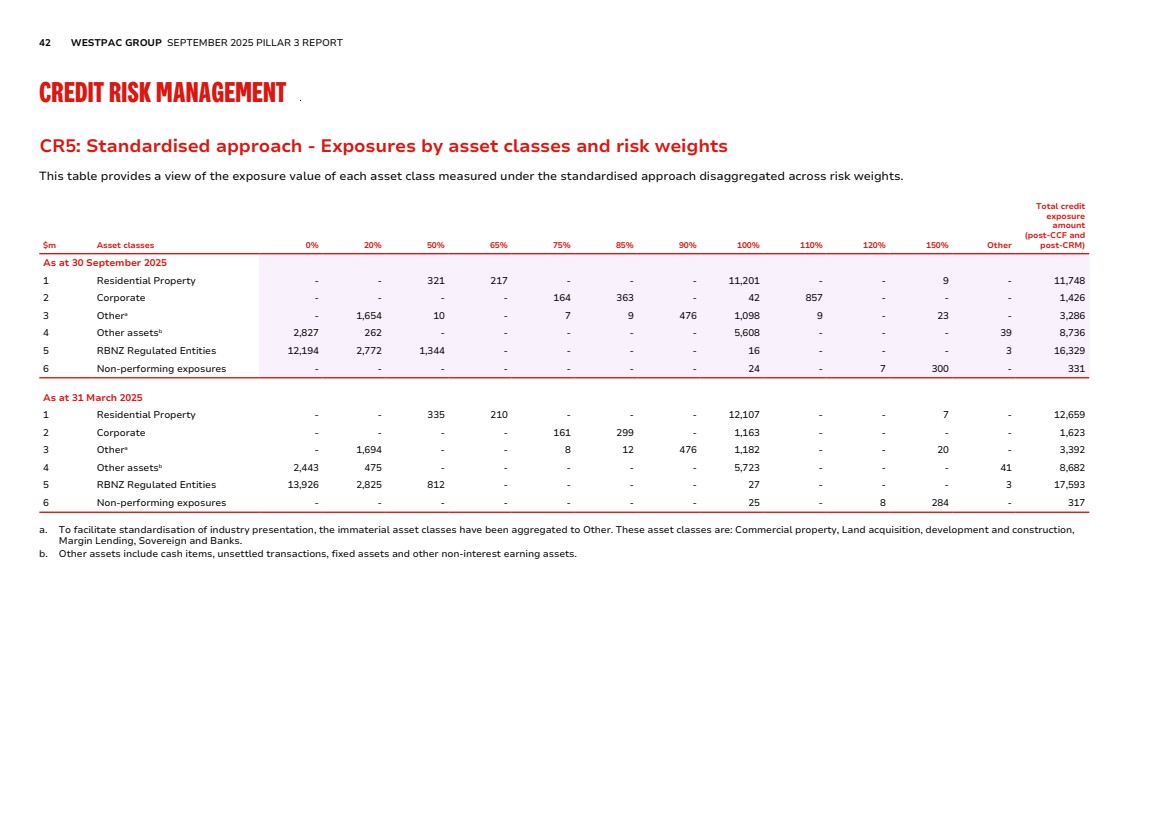

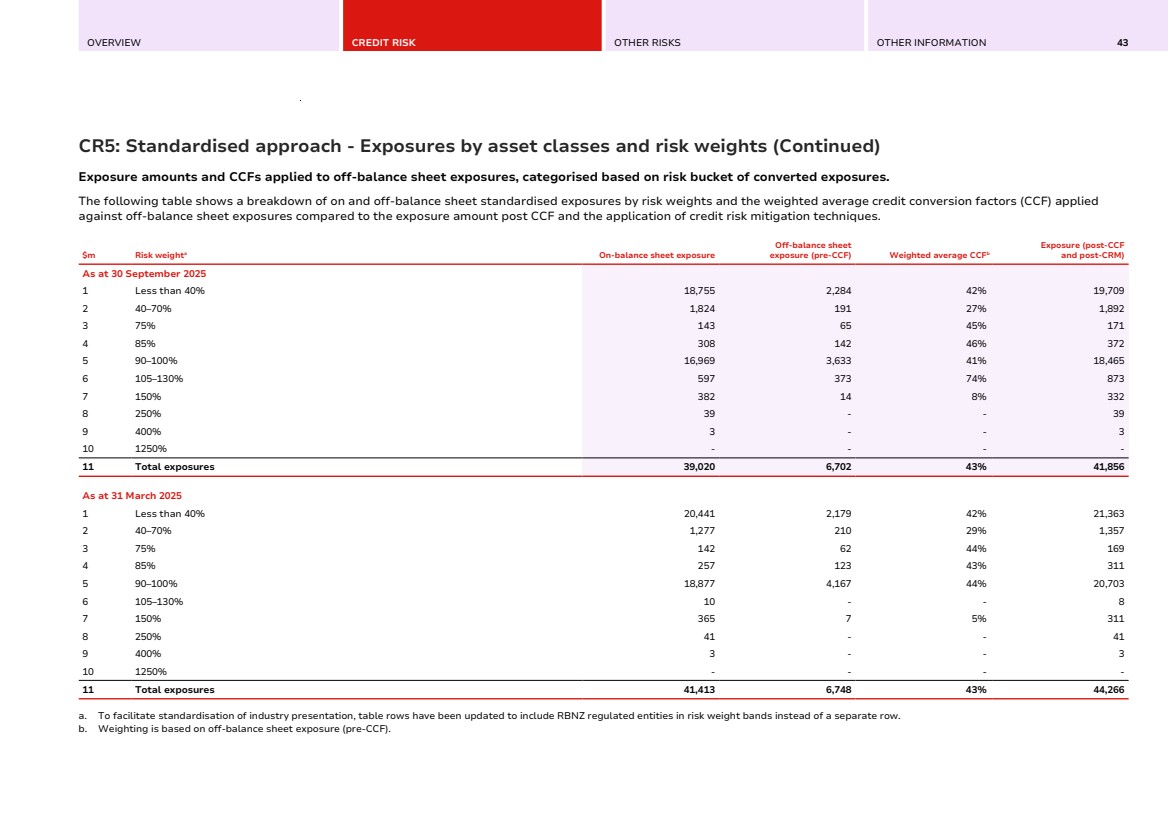

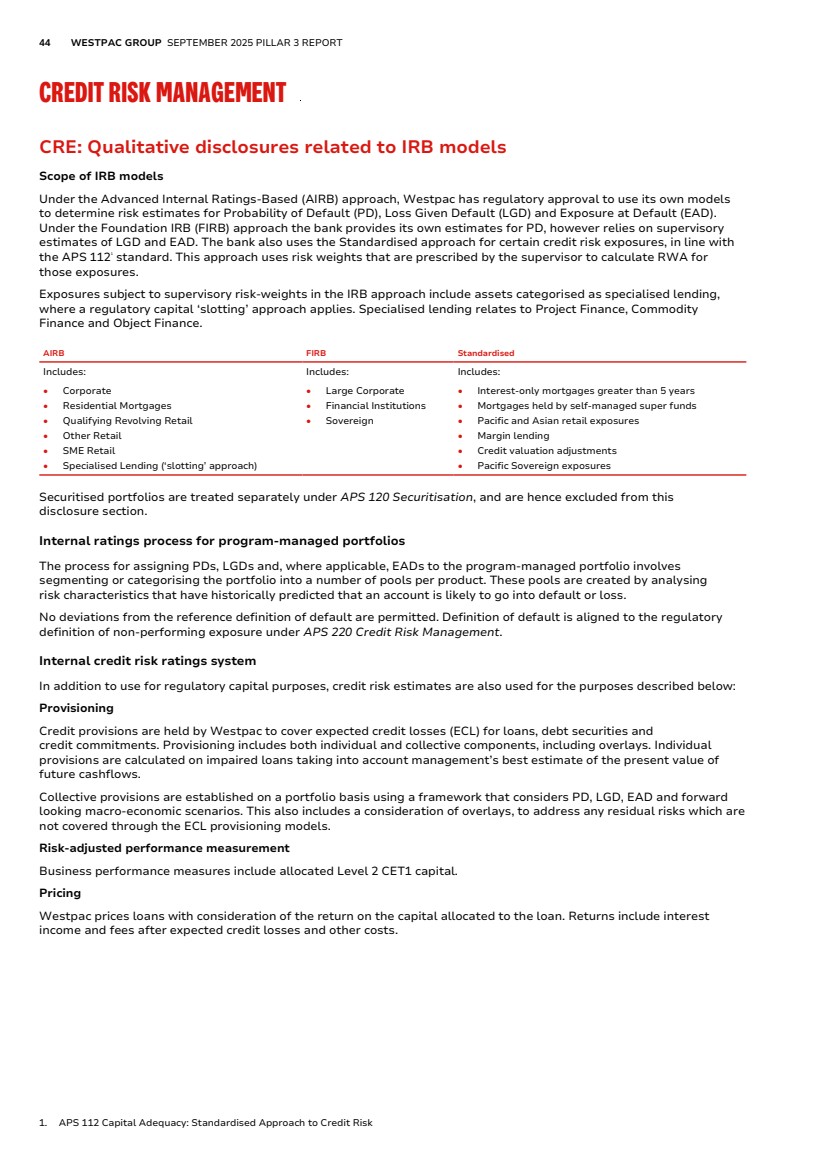

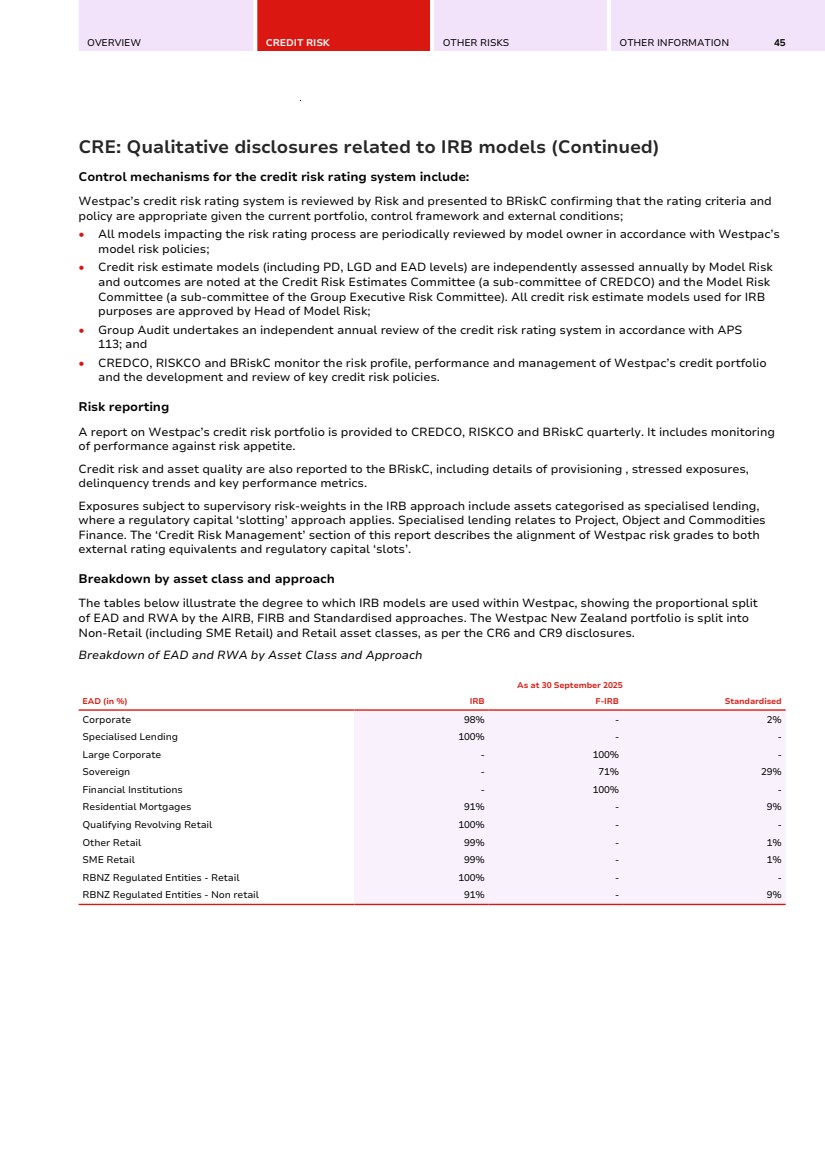

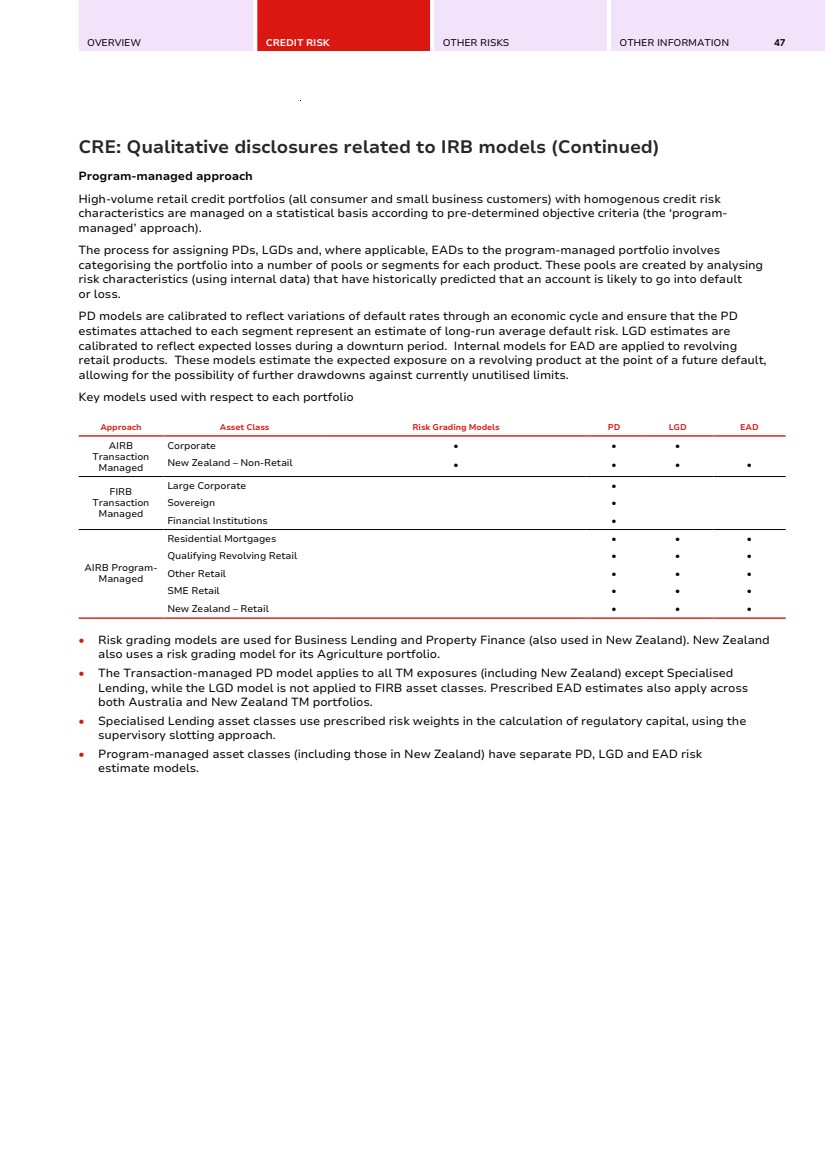

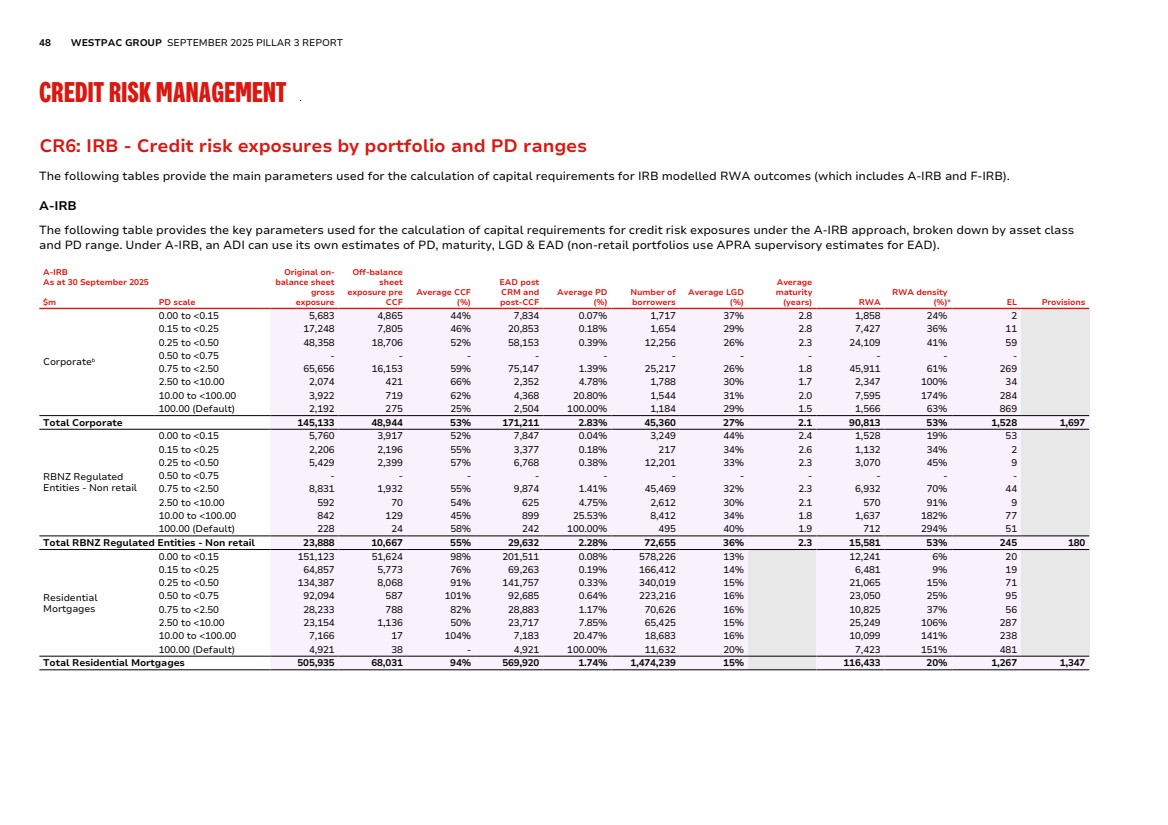

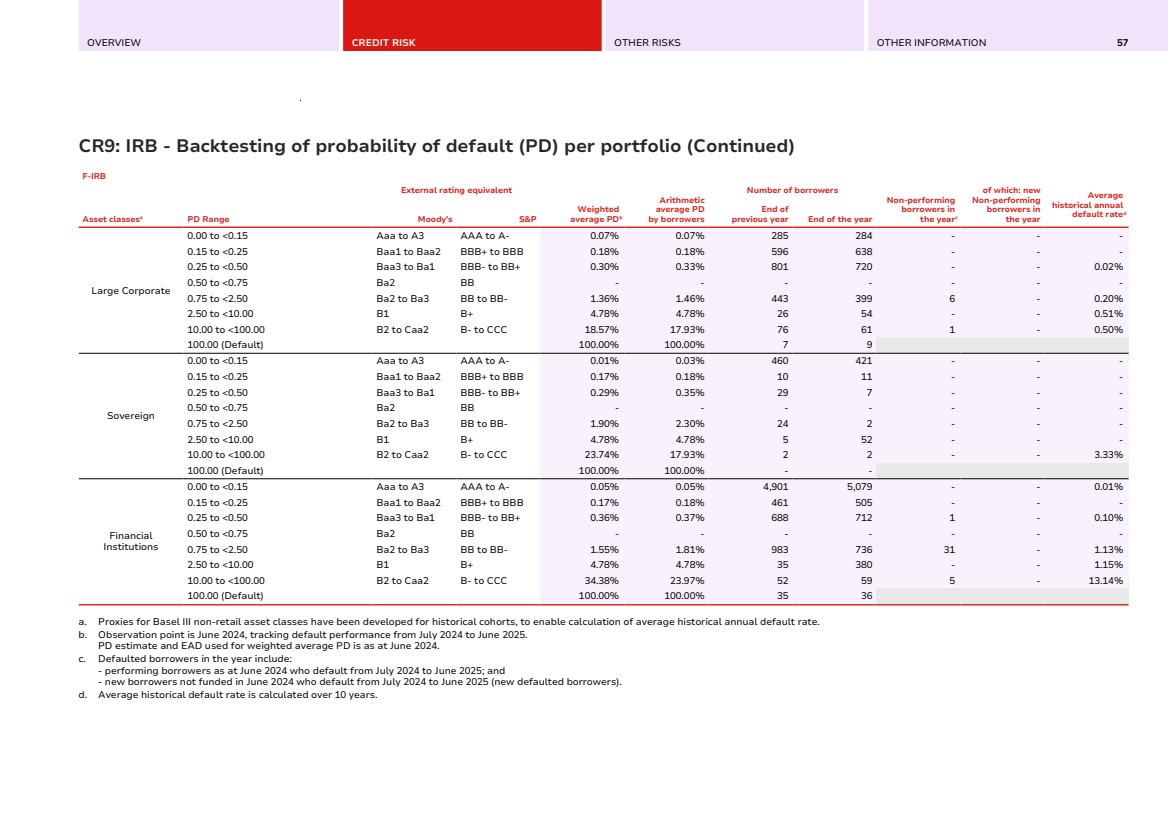

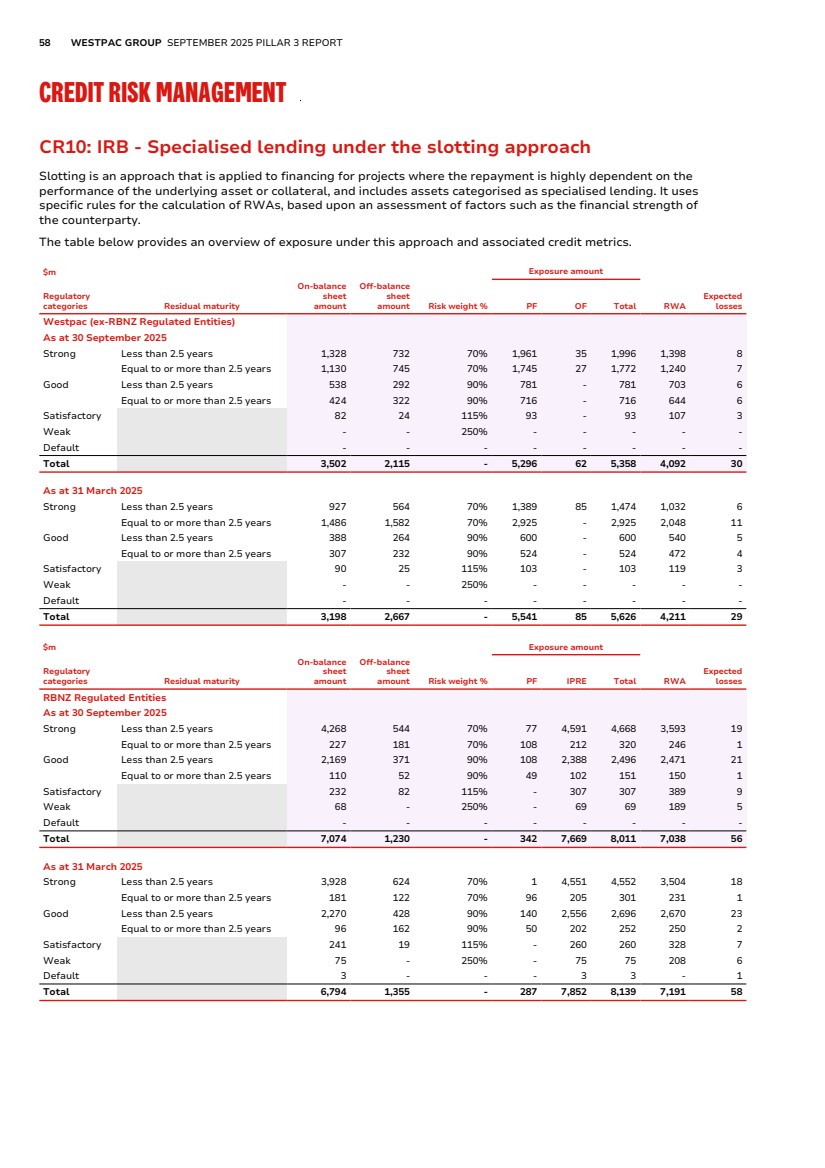

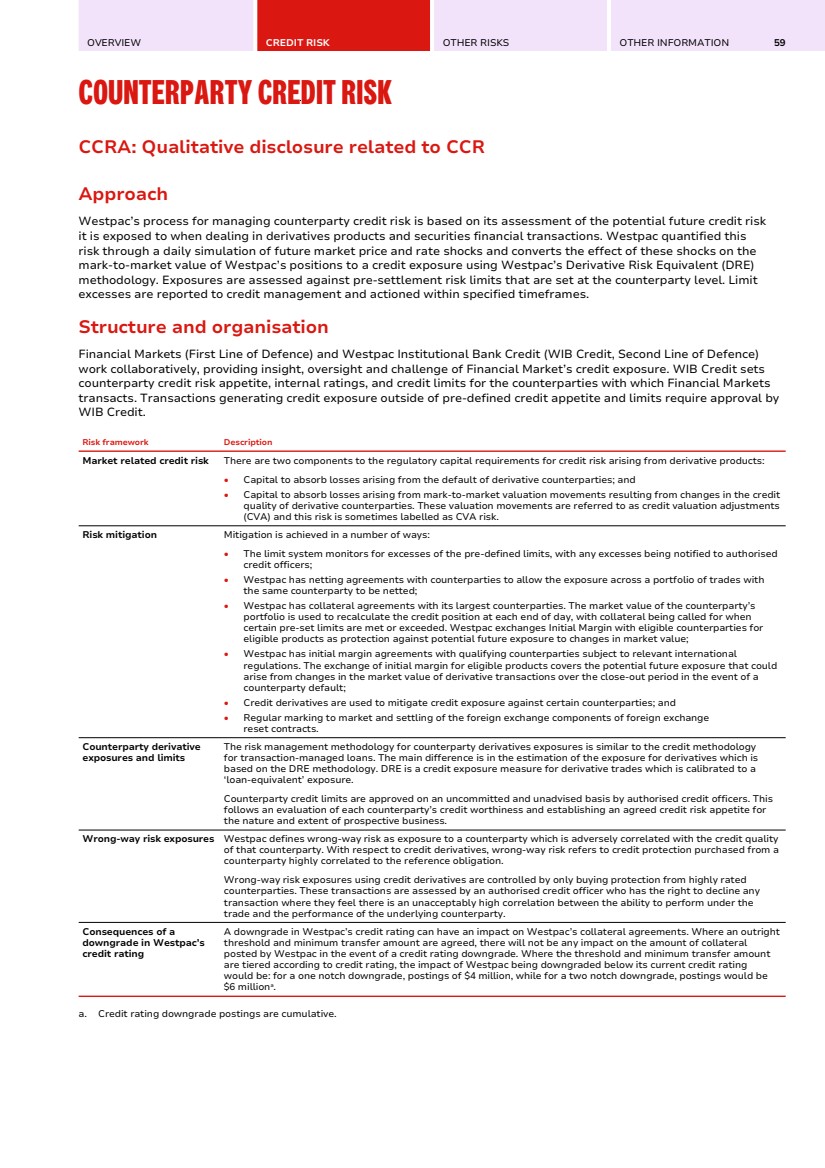

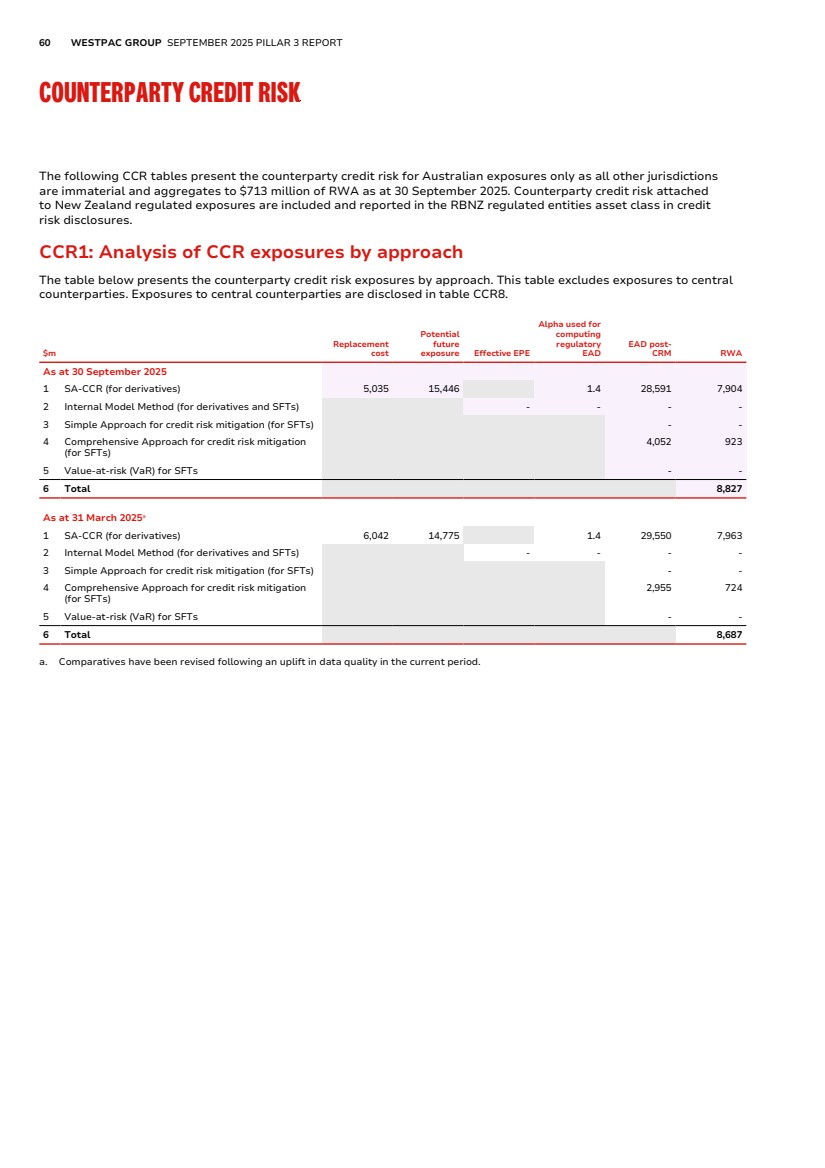

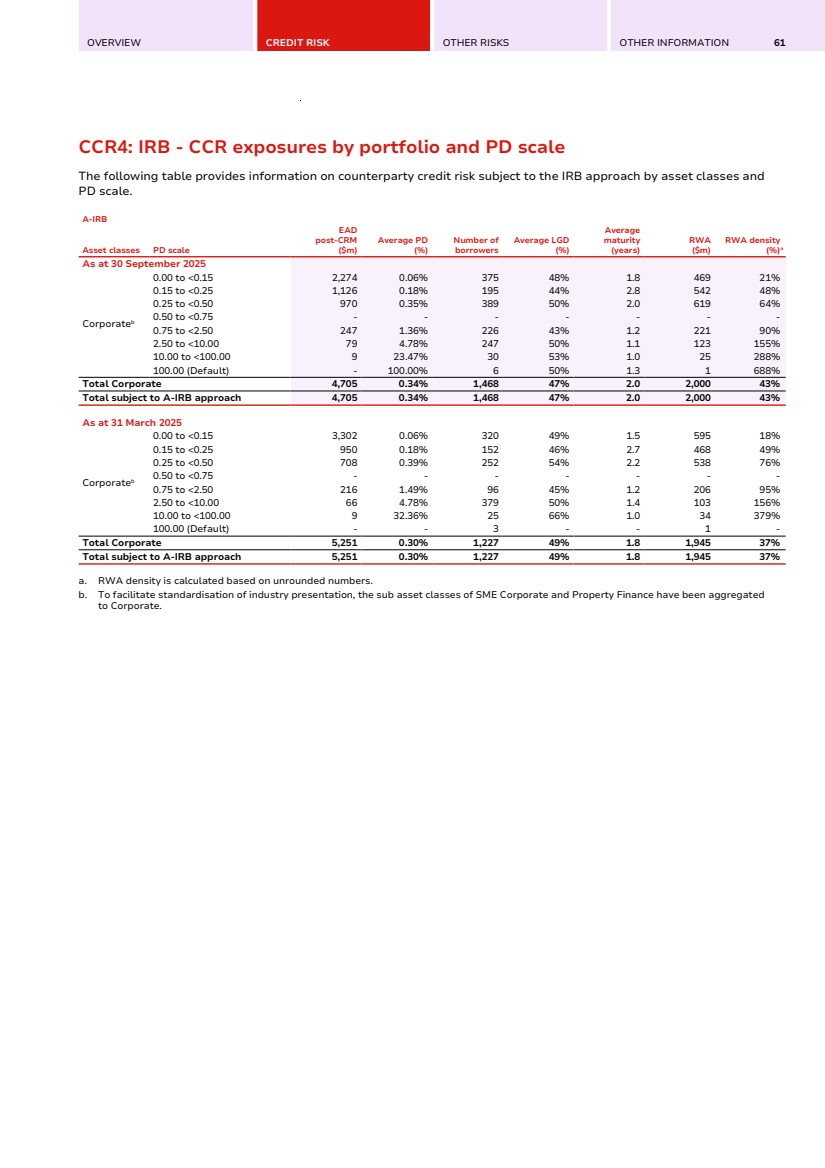

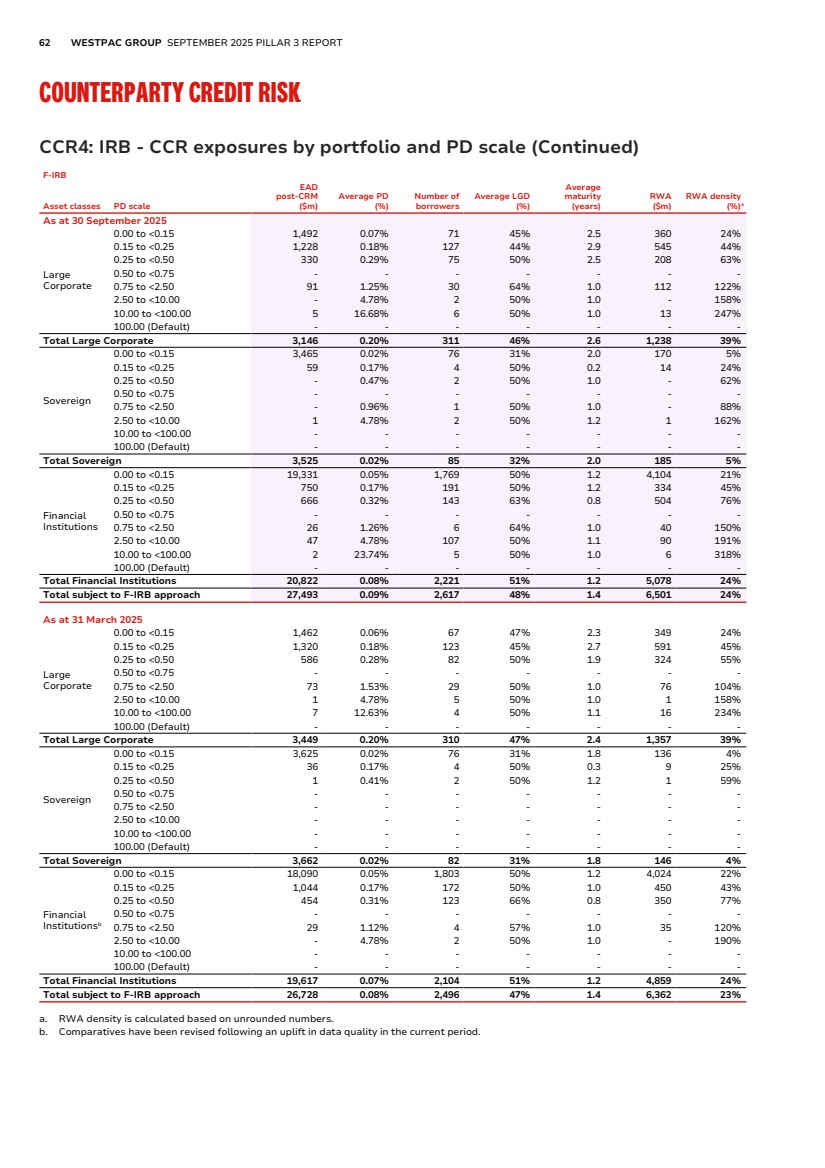

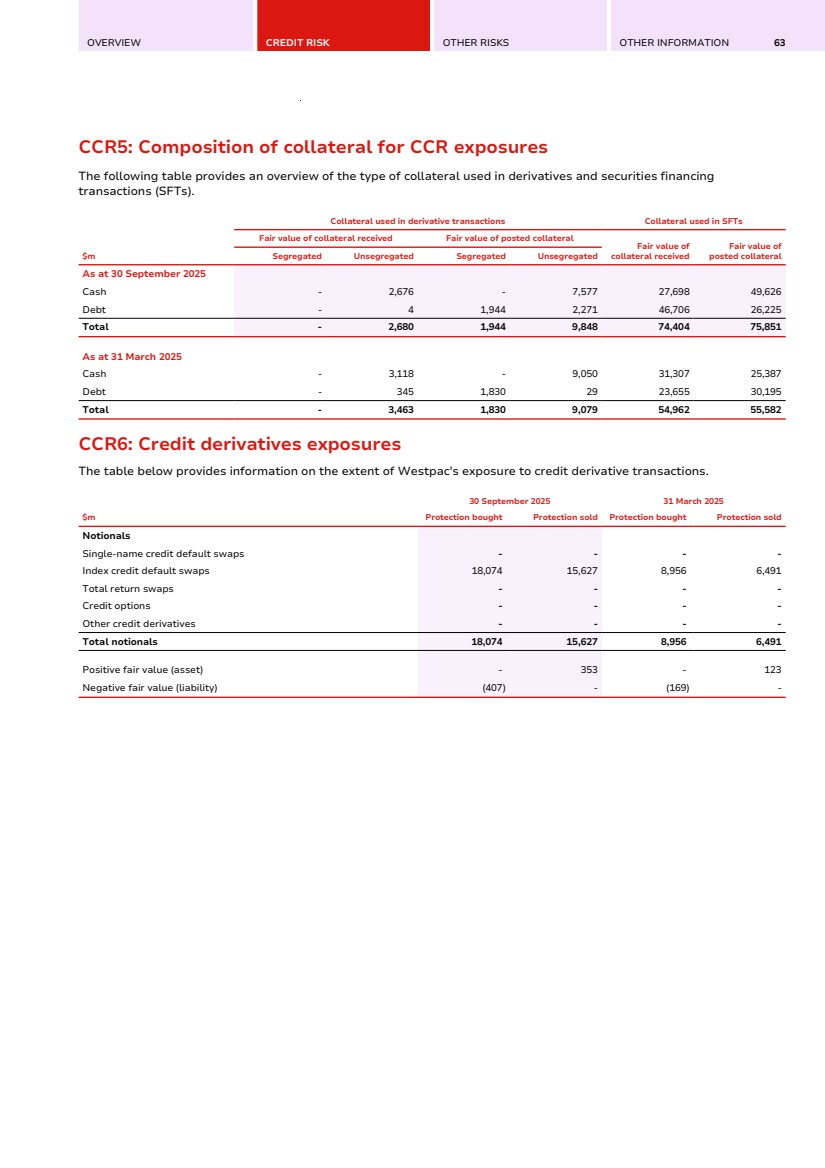

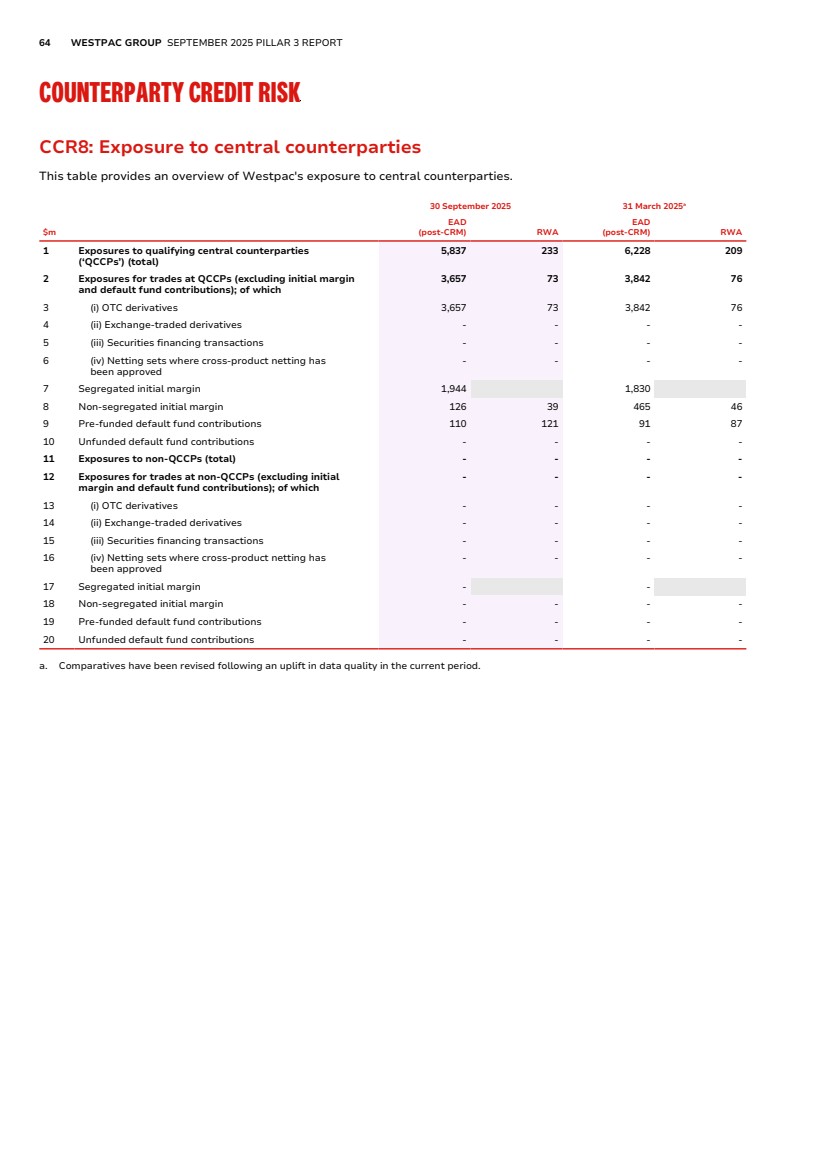

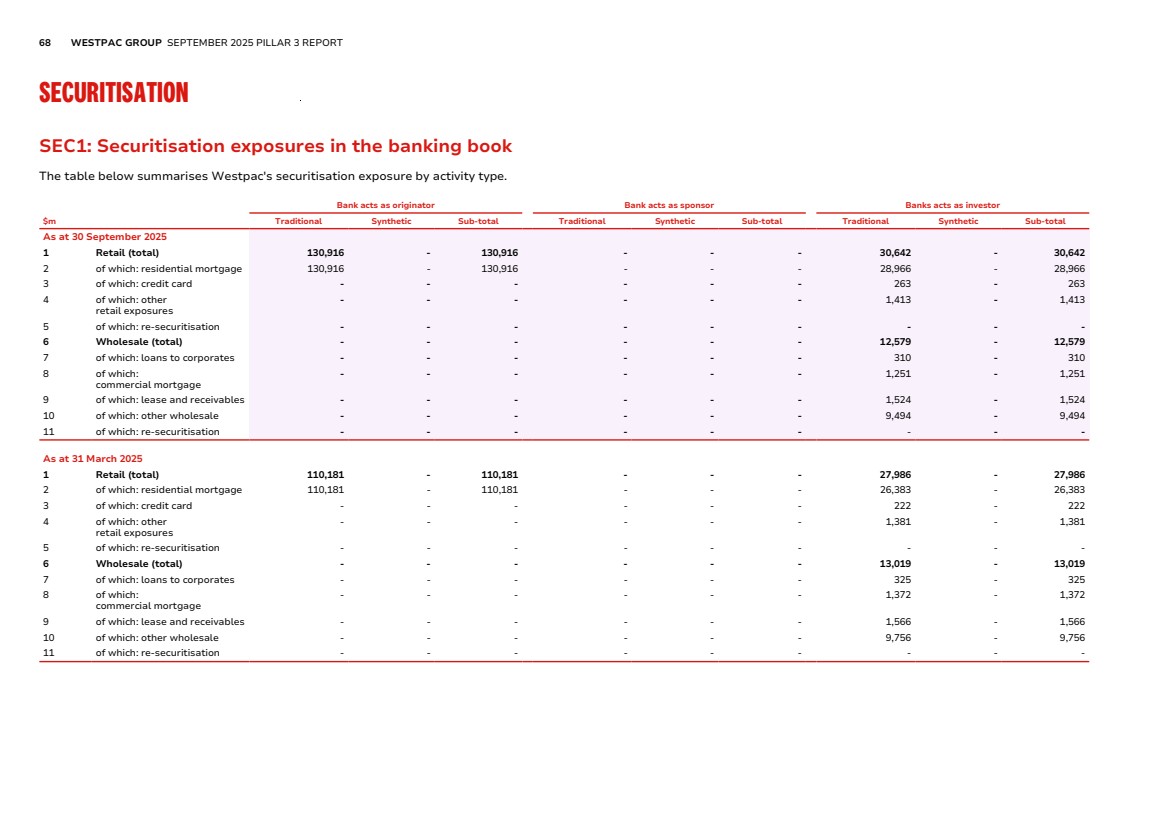

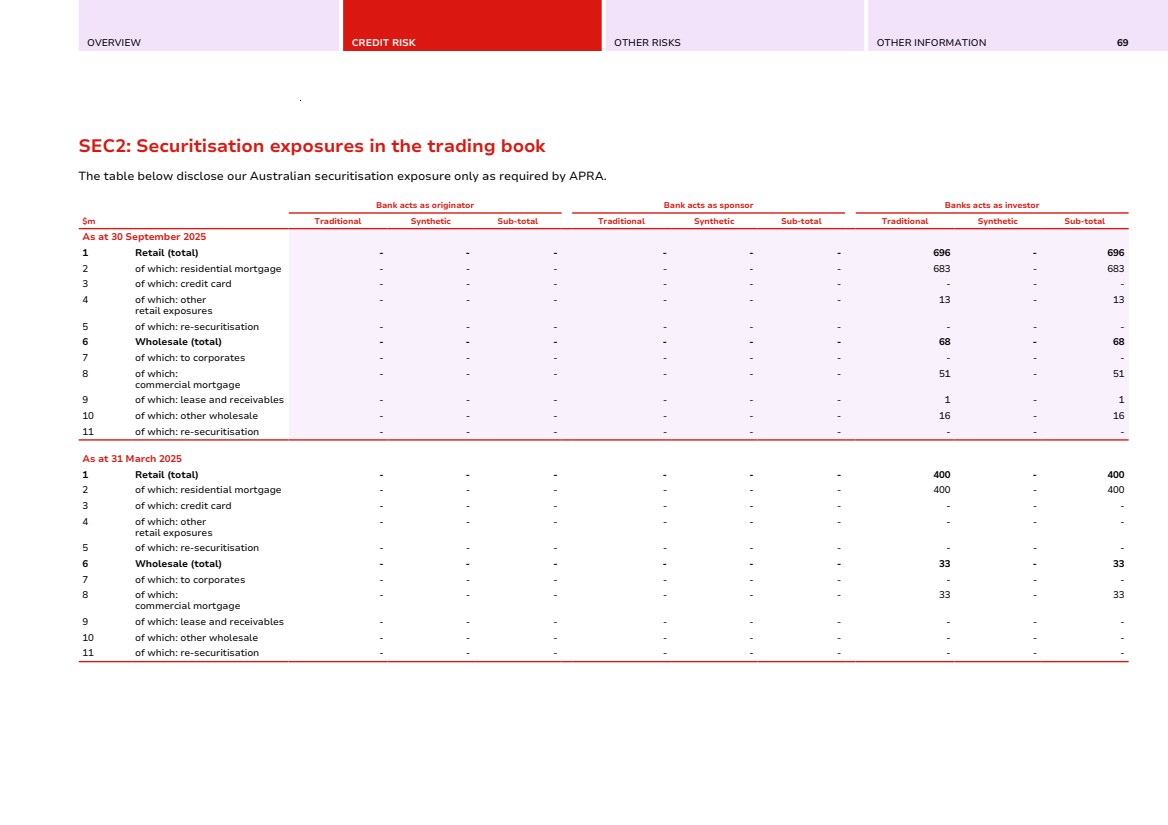

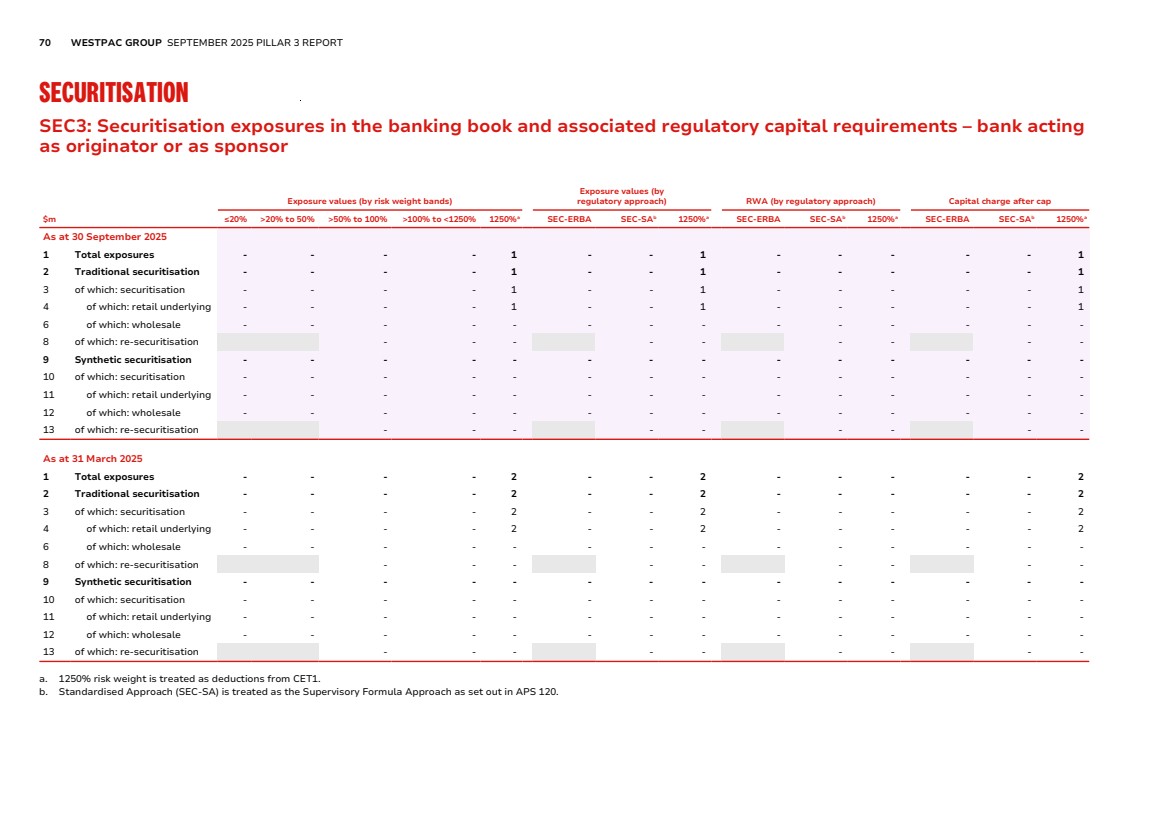

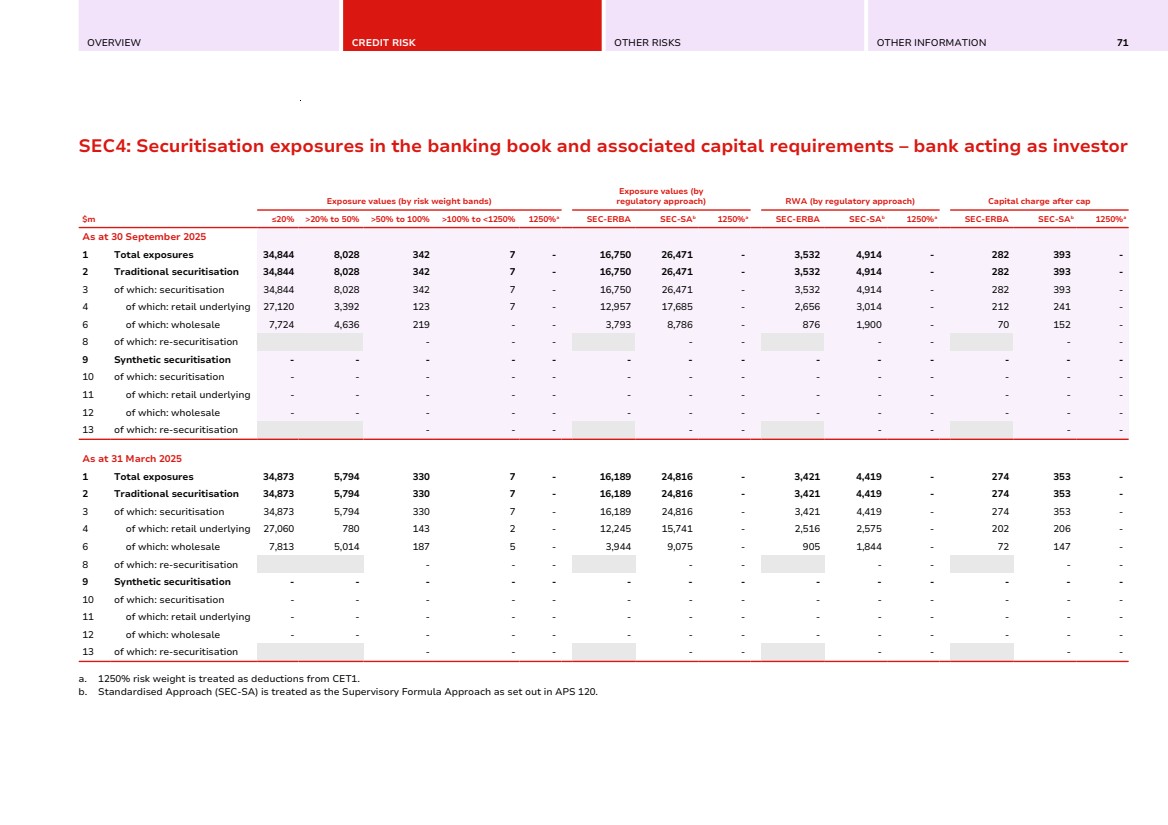

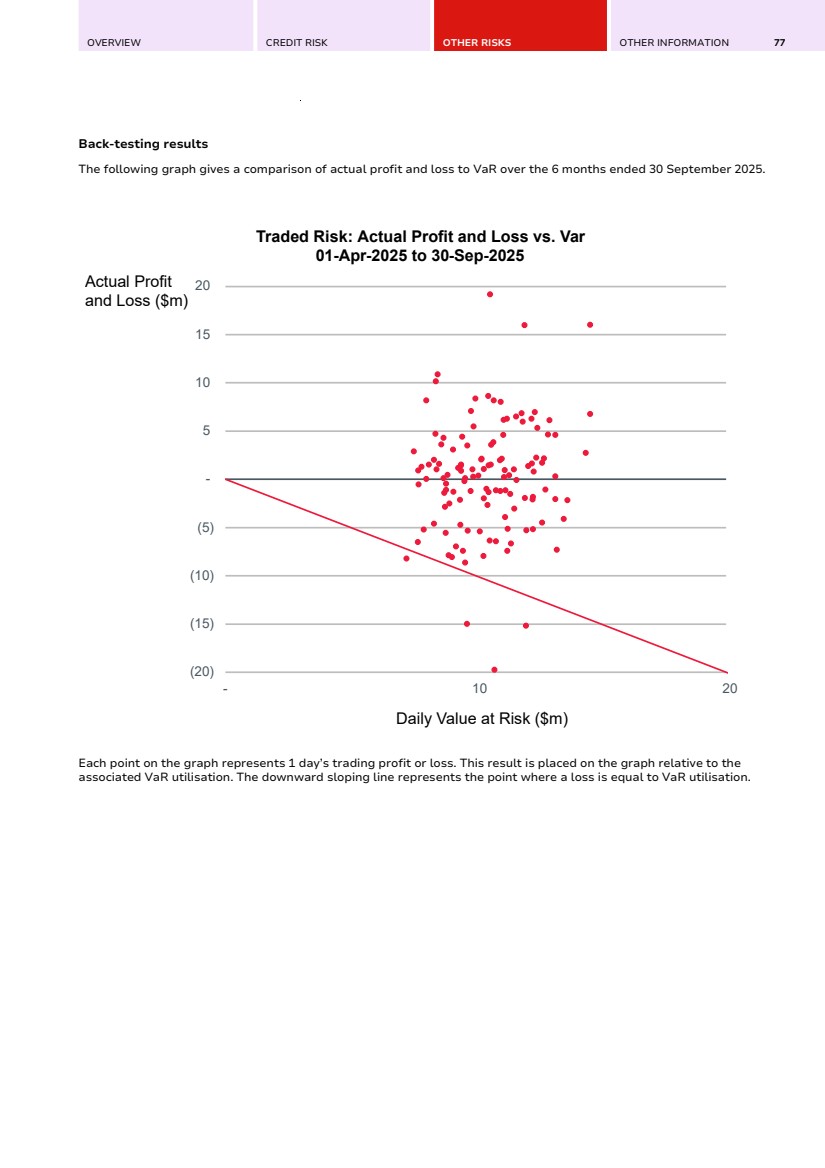

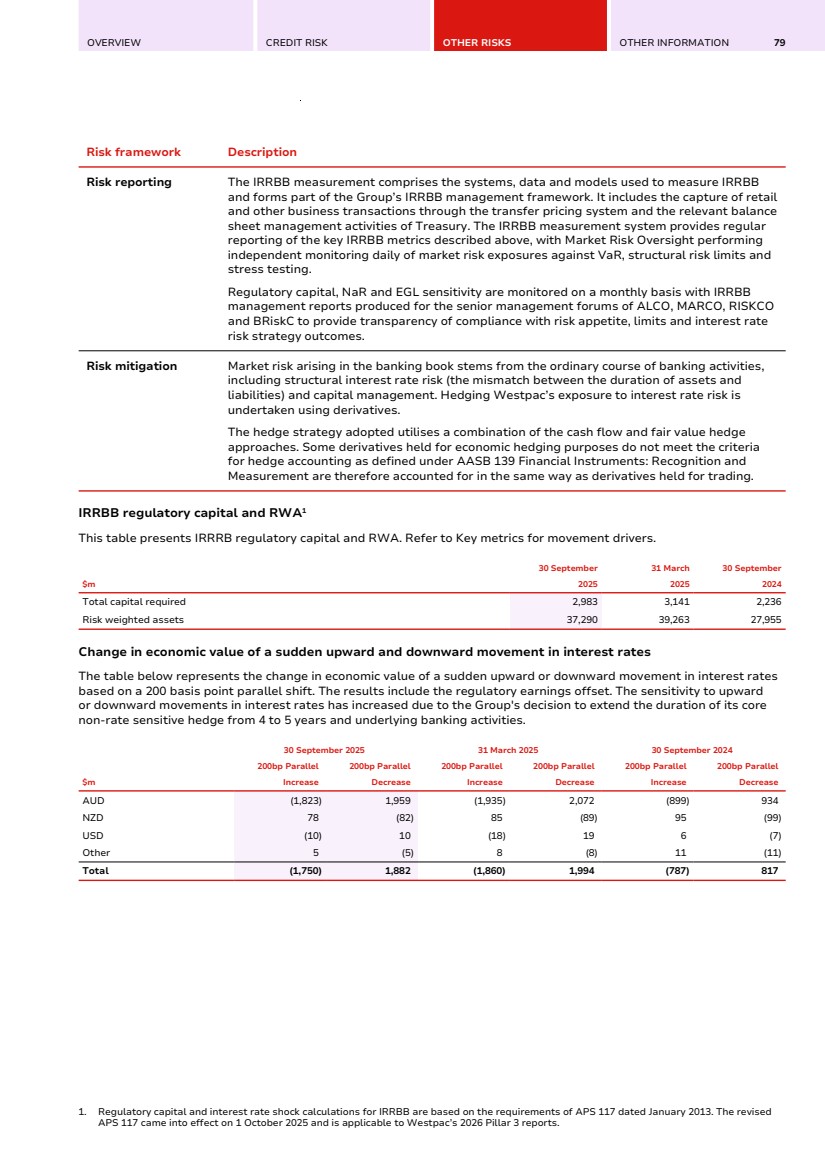

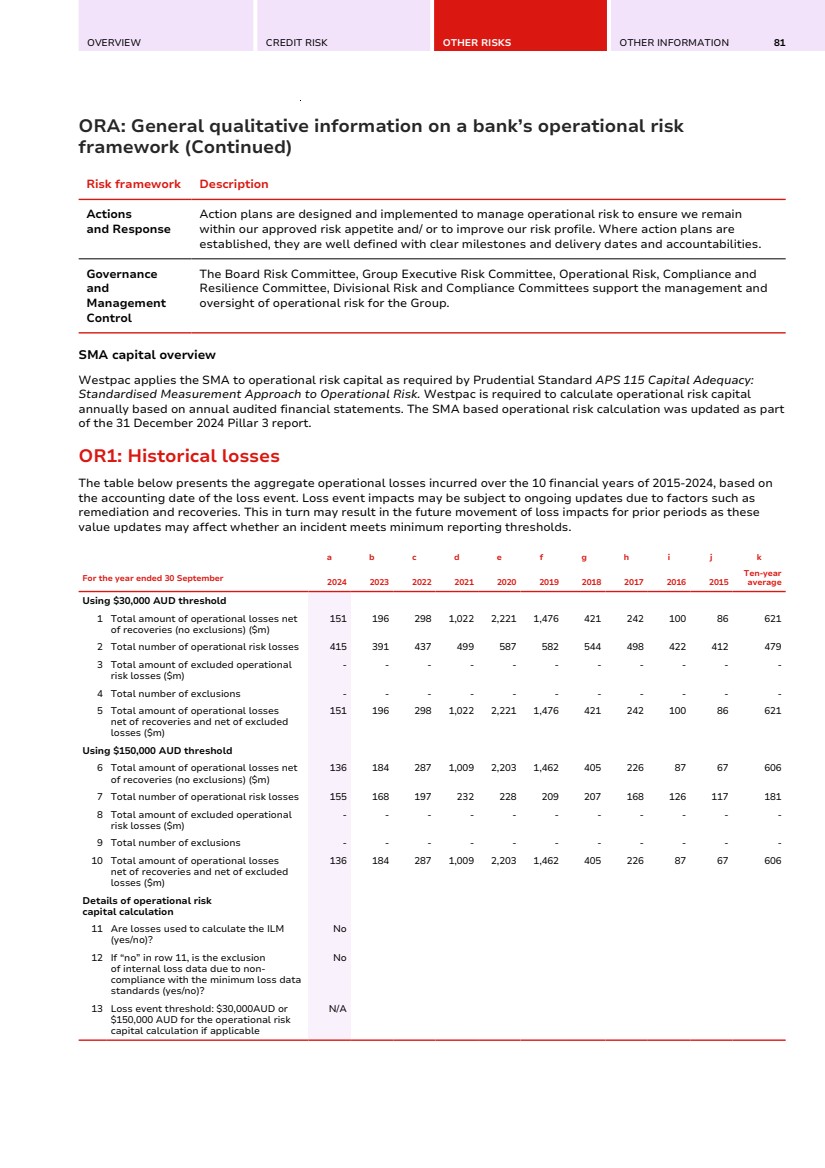

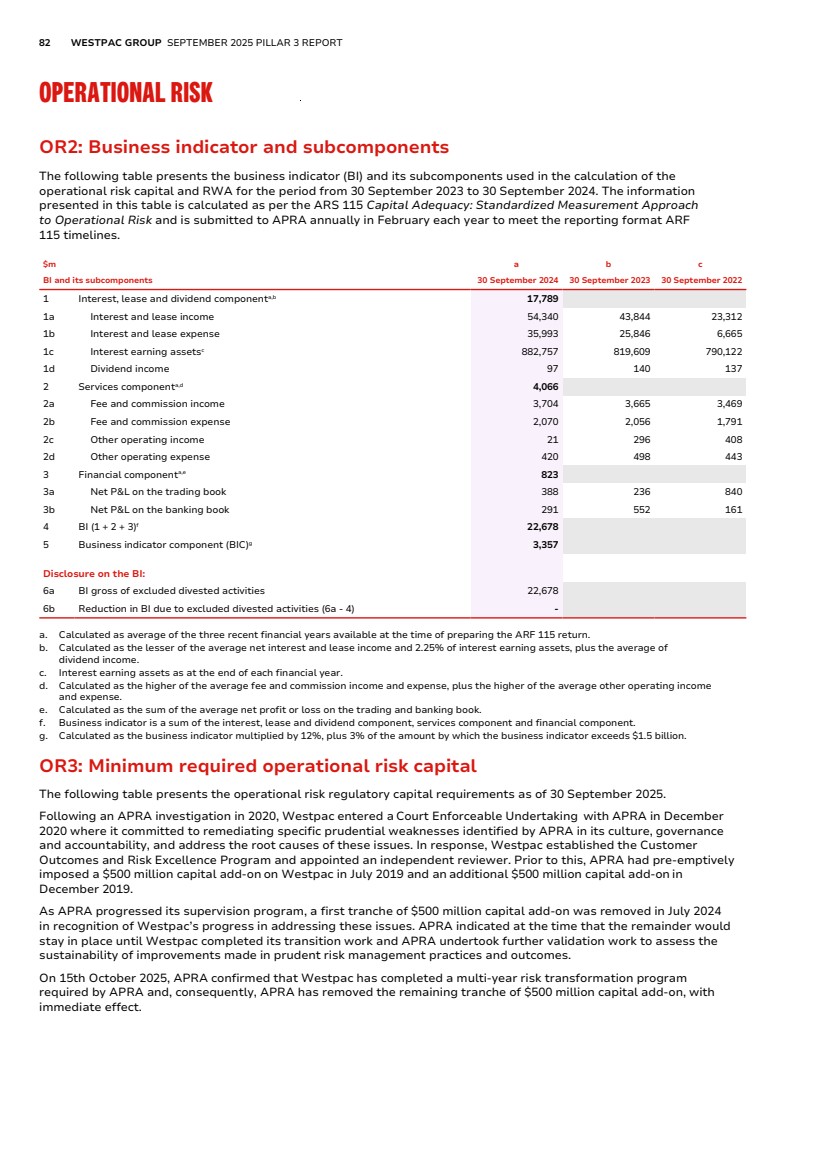

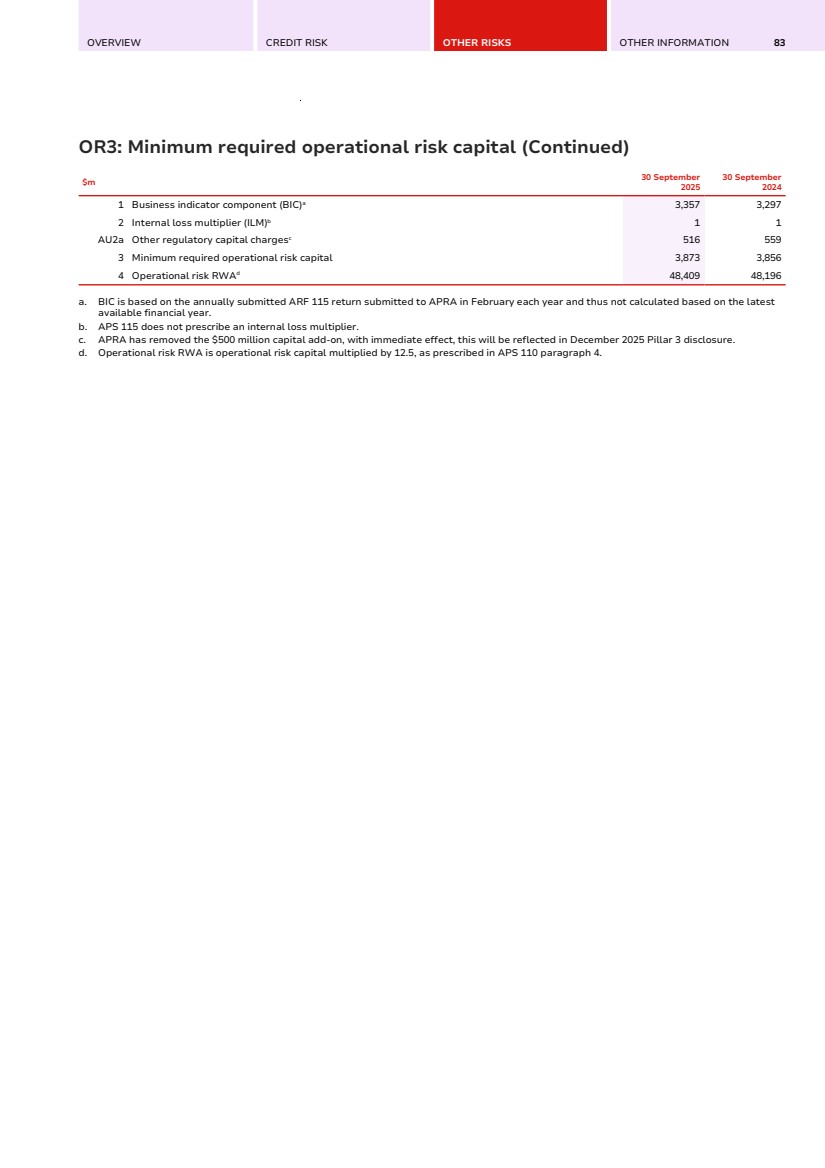

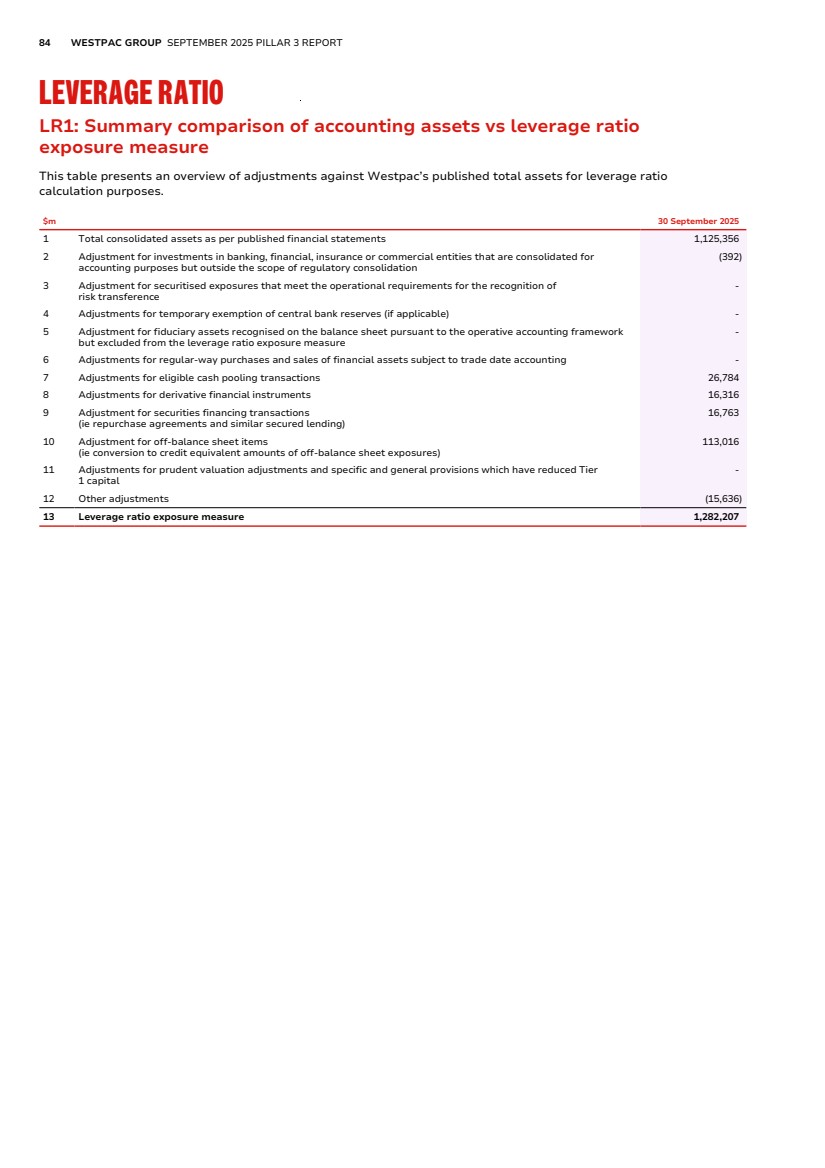

| 30 WESTPAC GROUP SEPTEMBER 2025 PILLAR 3 REPORT CREDIT RISK CREDIT RISK MANAGEMENT CRA: General qualitative information about credit risk CRB: Additional disclosure related to the credit quality of assets CR1: Credit quality of assets CR2: Changes in stock of non-performing loans, debt securities and off balance sheet exposures CRB(e): Exposures by geographical areas, industry and residual maturity CRB(f): Non-performing exposures by geographical areas and industry CRB(g): Ageing Analysis of credit exposures CRB(h): Restructured exposures CRC: Qualitative disclosure related to credit risk mitigation techniques CR3: Credit Risk Mitigation Techniques CR7: IRB - Effect on RWA of credit derivatives used as CRM techniques CRD: Qualitative disclosure on banks’ use of external credit ratings under the standardised approach for credit risk CR4: Standardised approach – credit risk exposure and credit risk mitigation effects CR5: Standardised approach - Exposures by asset classes and risk weights CRE: Qualitative disclosures related to IRB models CR6: IRB - Credit risk exposures by portfolio and PD ranges CR8: RWA flow statements of credit risk exposures under IRB CR9: IRB - Backtesting of probability of default (PD) per portfolio CR10: IRB - Specialised lending under the slotting approach COUNTERPARTY CREDIT RISK CCRA: Qualitative disclosure related to CCR CCR1: Analysis of CCR exposures by approach CCR4: IRB - CCR exposures by portfolio and PD scale CCR5: Composition of collateral for CCR exposures CCR6: Credit derivatives exposures CCR8: Exposure to central counterparties CREDIT VALUATION ADJUSTMENT RISK CVAA: General qualitative disclosure requirements related to CVA SECURITISATION SECA: Qualitative disclosure requirements related to securitisation exposures SEC1: Securitisation exposures in the banking book SEC2: Securitisation exposures in the trading book SEC3: Securitisation exposures in the banking book and associated regulatory capital requirements – bank acting as originator or as sponsor SEC4: Securitisation exposures in the banking book and associated capital requirements – bank acting as investor |