| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 143 EXHIBIT 15.3 Exhibit 15.3 Westpac Group 2025 Annual Report on Form 20-F Section 1 144 Strategic review 144 Corporate governance 188 Directors’ report 208 Remuneration report 222 Risk factors 254 Information on Westpac 268 Section 2 Financial statements 287 Section 3 289 Reading this report 290 Shareholder information 302 Other Westpac business information 321 Glossary of abbreviations and defined terms 324 |

| 144 WESTPAC GROUP 2025 ANNUAL REPORT ABOUT WESTPAC As Australia's first bank, we've been taking action to support people, businesses and communities for more than 200 years. Established in New South Wales in 1817, Westpac has grown to be one of Australia’s largest companies and employers. We’re proud to contribute to the prosperity of Australia and New Zealand. We support 13 million customers with a range of banking products and services, including helping them into homes, starting and growing businesses and supporting large corporates with their banking needs. We help foster stronger, more inclusive communities by promoting financial inclusion and literacy, investing in regional banking services and respecting human rights. Since founding our first charity in 1879, we've broadened our social impact through the independent Foundations and Trusts1 . These have contributed more than $100 million in the past decade to create meaningful change in people’s lives. For our 35,000 employees, we strive to create a workplace where they feel valued, inspired and motivated to reach their potential. As part of our environmental commitment, we support businesses in transitioning to a low-carbon future and adapting to climate change, while continuing to reduce our operational emissions and build climate resilience. This year, we paid $6.6 billion in salaries, $5.2 billion in shareholder dividends, $3.5 billion in taxes and levies and spent $4.74 billion with suppliers inside Australia2 . As we evolve, we're inspired by customers, their needs and our purpose of taking action now to create a better future. Market share AUSTRALIA NEW ZEALAND Household depositsaa 21% Consumer lendingb 18% Mortgagesa 21% Depositsb 17% Business lendinga 16% Business lendingb 16% a. APRA Banking Statistics, September 2025. b. RBNZ, September 2025. 1. In FY25, Westpac Group provided support to the Westpac Community Trust and the Westpac Buckland Fund (known as the Westpac Foundation), Westpac Scholars Trust and the St George Foundation Trust (known as St George Foundation, BankSA Foundation and the Bank of Melbourne Foundation). While Westpac was involved in establishing these foundations, they are non-profit organisations that are separate to the Westpac Group. The trustee of St George Foundation Trust (St George Foundation Limited) is a related body corporate of Westpac. 2. Refer to the 2025 Sustainability Index and Datasheet for details. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 145 OPERATING ENVIRONMENT1 Australian economy recovering despite productivity challenges The Australian economy is showing signs of improvement after a sustained period of below trend growth. However, the transition from the public to the private sector as the dominant driver of activity has been more challenging than expected. GDP growth is improving and expected to rise to 2.4% in 2026. Stronger growth should be underpinned by rising real wages, falling interest rates and a robust labour market. Productivity growth remains elusive with improvement requiring a coordinated response across both public and private sectors. Households navigate uneven recovery After an extended period of cost-of-living pressures, Australian households have begun to experience some relief. Real disposable incomes are rising, supported by easing inflation, declining interest rates and steady wage growth. Spending has recovered yet consumers remain cautious. Mortgage stress remains evident but has started to decline. Both demand and supply side factors are contributing to housing under-supply. This structural imbalance is expected to persist with house prices and credit demand expected to increase by 9% and 6.5% respectively in 2026. Business conditions improve as SMEs show green shoots Australian businesses have begun to emerge from a period of subdued activity, supported by easing inflation and interest rates. A recovery is underway though it remains uneven as the economy transitions from public to private sector led growth. Larger businesses have fared better than small and medium-sized businesses (SME). However, the share of SMEs experiencing an improvement in cash flows has risen for the third consecutive quarter in 2025 to its highest level since 2022. While private sector investment has moderated, total business credit demand remains strong and is expected to grow by 7.2% in 2026. New Zealand economy slows amid policy support New Zealand’s economic recovery has been slower than anticipated, despite the Reserve Bank of New Zealand delivering 300 basis points of monetary easing since mid 2024 to stimulate the economy. Export activity has been dampened by global trade uncertainty and broad-based industry weakness. Household spending remains constrained by elevated living costs, labour market softness and the delayed impact of rate cuts due to the prevalence of fixed rate mortgages. While the recovery in economic activity has been delayed, lower interest rates has supported housing demand with credit growth expected to rise to 5.7% in 2025 and 6.3% in 2026. Monetary easing supports a balanced global outlook The global economic backdrop remains mixed. Inflation is broadly within target ranges across most advanced economies, enabling a gradual easing in monetary policy. This has supported modest global growth, with GDP expected to expand by around 3% in both 2025 and 2026. However, risks to the outlook remain elevated. These include ongoing global trade tensions, geopolitical uncertainties and lingering inflationary pressures, all of which continue to weigh on sentiment and investment. 1. All dates refer to calendar years unless otherwise stated. Forecasts by Westpac Economics and Westpac NZ Economics. |

| 146 WESTPAC GROUP 2025 ANNUAL REPORT OUR STRATEGY Our refreshed strategy outlines five priorities that will help us achieve our ambition: To be our customers' number one bank and partner through life. PERFORMANCE CUSTOMER TRANSFORMATION PEOPLE RISK For customers, we are focused on delivering a seamless banking experience across every channel; in branch, digitally and by phone. A whole-of-bank approach seeks to bring our people together, to offer the full breadth of our products with more timely, personalised service. This, combined with digital innovation and investment in platforms such as BizEdge, Westpac One and Digital Banker, supports our ambition to lead in Consumer and Business Net Promoter Score (NPS1 ) and for Institutional, to achieve the number one position in the Relationship Strength Index (RSI2 ). For our people, we recognise we must provide a market-leading employee proposition to deliver superior customer experiences. To sustain high engagement and attract and retain the best talent, we’re committed to equipping our people with future-ready skills and creating a more rewarding, supportive work environment. Proactive risk management is central to Westpac's strength and resilience. Through the completion of the CORE program, we’ve taken steps to significantly transform our risk culture, governance and management practices. Sustaining and continuously strengthening these improvements across Westpac remains a priority. Transformation is critical to our future success. Our cornerstone program UNITE aims to unlock long-term value simplifying products, processes and systems to help deliver improved customer experience, make work easier for our people and reduce operating costs. Complementing UNITE are two flagship digital innovations, BizEdge and Westpac One. We measure performance by market position and return on tangible equity (ROTE). We are pursuing growth that delivers sustainable returns, focusing on areas where we can differentiate Westpac's customer offering. Maintaining cost discipline remains important, with simplification through UNITE expected to play a key role in reducing our cost base and closing our cost to income gap relative to peers. 1. Refer to the Glossary (pages 324-327) for more information on NPS. 2. Coalition Greenwich Voice of Client 2025 Australia Large Corporate Relationship Banking Study. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 147 Foundations for sustainable growth BALANCE SHEET STRENGTH DIVERSIFIED PORTFOLIO EMPLOYEE ENGAGEMENT Capacity to invest and grow for the long term Enviable portfolio mix across four business segments Top quartile of workplaces globally (OHI) Our business segments Segment Who we serve Key execution focus areas Consumer Helping more Australians into their home, save for the future and manage their money through a range of banking products and services offered through the Westpac, St.George, BankSA and Bank of Melbourne brands. • Elevate experiences through personalised, digital first service; • Deepen relationships and expand in priority segments; and • Grow proportion of proprietary lending. Business & Wealth Serving the needs of small to medium businesses, commercial and agribusiness customers across Australia. The segment includes Private Wealth, supporting high-net-worth individuals, as well as BT Financial Group, which provides wealth management platform services. It also includes Westpac Pacific, operating in Fiji and Papua New Guinea. • Continue lending momentum through BizEdge; • Deepen relationships and enhance transaction banking capability; and • Expand banker presence, training and expertise. Institutional Delivering financial services to corporate, institutional and government clients through three areas of specialisation: Corporate & Institutional Banking, Global Transaction Services and Financial Markets. Clients are supported throughout Australia and via branches and subsidiaries located in New Zealand, New York, London, Frankfurt and Singapore. • Rollout Westpac One and payments innovation; • Deepen client relationships and grow share of FX and commodities; and • Invest in expert bankers enabled by data, analytics and AI. New Zealand Providing banking and wealth services for consumer, business and institutional customers in New Zealand, through the Westpac New Zealand, Westpac Life and BT Funds Management (NZ) brands. • Target growth in business lending; • Invest in digital capability; and • Improve market position and returns. |

| 148 WESTPAC GROUP 2025 ANNUAL REPORT Top and emerging risks We regularly assess our operating environment to identify changes, emerging risks and opportunities. The factors1 below may affect Westpac’s ability to create value over the short, medium or long term. For further information, refer to Risk Management (pages 180-187) and 2025 Risk Factors. Geopolitical risk Uncertainty around world trade policy remains a key global risk, with potential impacts on trade, supply chains and investor confidence. Combined with broader geopolitical tensions and ongoing global conflicts, these factors may influence export demand, commodity prices and inflation not only in Australia and New Zealand but also in other markets where Westpac operates. Our response Credit markets where Westpac operates remain resilient, supported by strong domestic fundamentals and a stable financial system. Westpac’s capital position and balance sheet remain strong. We will continue to monitor developments closely and, as part of our origination process, assess all known risks at the time of origination to help manage risk whilst meeting customer needs. Refer to Credit Risk and Market Risk (pages 182-187). Technology risk Technology remains a key priority for Westpac, enhancing our ability to create long term value for stakeholders. The adoption of AI is progressing rapidly within the financial services industry. AI will have positive impacts such as improving operational efficiency however it is important to ensure its safe and responsible use. Our response Westpac continues to invest in technology and has introduced Responsible AI Principles and an AI Risk Management Standard, which is designed to support effective management of AI-related risks. Its implementation is supported by awareness campaigns and training programs aimed at strengthening overall risk management capabilities. Refer to Strategic Risk (pages 182-187). Cyber risk The cyber threat landscape poses a risk to financial stability by targeting critical infrastructure, undermining public trust, and exposing institutions to operational, legal and reputational harm. High levels of interconnectedness and dependence on third party suppliers, combined with rapid technological change, such as the adoption of AI and a rise in international threats, are contributing to increased cyber risk. Our response We continually assess and strengthen our cyber resilience to defend against increasingly sophisticated and capable threat actors. We also actively work with government, regulators, and industry stakeholders to bolster Australia’s cyber defences, including through threat intelligence sharing and support for cyber security reforms. Refer to Cyber Risk and Operational Risk (pages 182-187). Culture and capability Managing and responding to expectations from customers, regulators and the community requires strong risk management. Poor conduct, negative customer experience, or failing to adequately respond to risks such as scams can impact our integrity and the trust of our stakeholders. Our response Risk is one of our top five strategic priorities. We regularly assess our risk culture and have strengthened our risk management and governance through the successful delivery of the CORE program. We aim to build on these improvements by ensuring our people and processes are aligned to deliver our purpose and strategy. Refer to Reputational and Sustainability Risk and Compliance and Conduct Risk (pages 182-187). Competition Competition in the lending market remains elevated, driven by financial institutions and non-bank lenders seeking to expand market share. At the same time the increasing share of brokers is placing pressure on returns. The potential for regulatory arbitrage between bank and non-bank lenders is reshaping the lending landscape, influencing how lenders compete across risk, capital and service delivery. Our response We actively manage the impact of external changes that may affect our ability to deliver on our strategy. Continued simplification, innovation, and investment in technology are critical to delivering more consistent high quality customer service, products and value at scale and maintaining operational resilience in a competitive environment. Refer to Credit Risk and Strategic Risk (pages 182-187). 1. Not exhaustive. Refer to Risk Management (pages 180-187) for full table of material risk categories. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 149 Our approach to sustainability At Westpac, sustainability is about creating long-term value for our stakeholders. By identifying what matters most to them, we aim to ensure their priorities and concerns are considered in our decision-making, helping to strengthen our long-term value. Our approach is anchored in our Sustainability Strategy which aligns with our corporate strategy and refreshed purpose. It outlines how we will embed sustainability across the strategic pillars and the focus areas of climate transition, housing affordability and regional prosperity. The Chief Sustainability Officer (CSO) reports directly to the CEO and is responsible for developing and overseeing the Sustainability Strategy and a suite of supporting policies, positions and plans. Progress on how we manage, implement and deliver our strategy, frameworks and initiatives is regularly reviewed through Board and executive-level governance forums. External engagement with our stakeholders also plays an important role by bringing wider perspectives to inform our approach. This supports our decision making and the annual materiality assessment. Our Sustainability Strategy is available on our website. Sustainability-related disclosures Westpac’s sustainability reporting aims to provide stakeholders with insights into performance over time and against key benchmarks. It covers progress on climate action, natural capital, human rights and support for Indigenous Australians, providing details of our impact and connection with global standards. This includes the Sustainability Report and Sustainability Index and Datasheet, available on our website. Sustainability Report The 2025 Sustainability Report details Westpac’s strategy, targets, and approach for managing climate-related risks and opportunities. The report also provides updates on our efforts to reduce emissions, assist customers in their transition and improve climate resilience. Replacing Westpac’s previous Climate Report, the document prepares us for mandatory climate reporting from next year. Climate Transition Plan This year marked the end of the 2023-2025 Climate Change Position Statement and Action Plan. This has been replaced by a Climate Transition Plan (CTP). Built on stakeholder feedback, the CTP outlines our targets and approach to achieving our climate ambition of becoming a net-zero, climate resilient bank. Our sustainability disclosures can be found on the website. Material sustainability topics Our method for determining material topics is guided by the Global Reporting Initiative (GRI) Universal Standards. We report on material topics throughout this report. For detailed information on how we engage with our stakeholders, identify and assess these topics, please visit our website. Financial Performance Compliance and Regulation Technology Simplification (UNITE) Refer to pages 152- 159 Vulnerable customers Data Privacy and Security Financial Inclusion Housing affordability and security Fraud and scams Refer to pages 160-165 Employee engagement Health and safety Diversity, equity and inclusion Communities Indigenous peoples Refer to pages 166-169 Human rights and modern slavery Sustainable supply chain Tax transparency Refer to pages 170-173 Climate Change Natural Capital Refer to pages 174-177 Artificial Intelligence, Cybersecurity and Data Refer to page 179 Ethics and business conduct Refer to page 188 Anti-money laundering/ Counter-Terrorism Financing Refer to page 268 |

| HOW WE CREATE VALUE • 208-year heritage • Customer needs • Competition • Regulatory environment • Technology and artificial intelligence (AI) • Geopolitical and climate risks • Financial strength • Customer relationships • 35,000 motivated people • Proactive risk management • Digital and physical infrastructure • Diverse partnerships Provide financial products and services to 13 million customers in our core markets of Australia and New Zealand, focusing on five priorities: What shapes us What we do What we rely on Customer: Customer obsessed People: Best team, trusted experts Transformation: Brilliant at delivery Risk: Safe and Strong Performance: Execution Excellence Our purpose TAKING ACTION NOW TO CREATE A BETTER FUTURE 150 WESTPAC GROUP 2025 ANNUAL REPORT |

| The value we create Shareholders Deliver sustainable returns and disciplined growth. Customers Support customers and businesses to achieve their financial goals. Our People Develop engaged, empowered and accountable people, working as a team. Community Foster financial inclusion and prosperity while advancing human rights. Environment Support the energy transition, manage our climate risk and reduce our carbon footprint. 29% Refer to pages 153 to 159 total shareholder return 13M Refer to pages 160 to 165 Customers 80 Refer to pages 166 to 169 OHI score $199M Refer to pages 170 to 173 in community investment1 37% Refer to pages 174 to 177 increase in sustainable finance lending2 1. Figure includes commercial sponsorships and foregone fee revenue. 2. Refer to 2025 Sustainability Report for definitions and detail. FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 151 |

| Jordan Mobile Lending Manager Broadbeach, QLD 152 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR SHAREHOLDERS By maintaining a strong balance sheet and focusing on service excellence, we aim to strengthen our market position and deliver long-term value for shareholders. Related material topics (refer to page 149) • Financial performance • Compliance and regulation • Technology simplification (UNITE) Key highlights 153c FULL YEAR ORDINARY DIVIDENDS PER SHARE 29% TOTAL SHAREHOLDER RETURN 201.9c BASIC EARNINGS PER SHARE 12.5% CET1 CAPITAL RATIO |

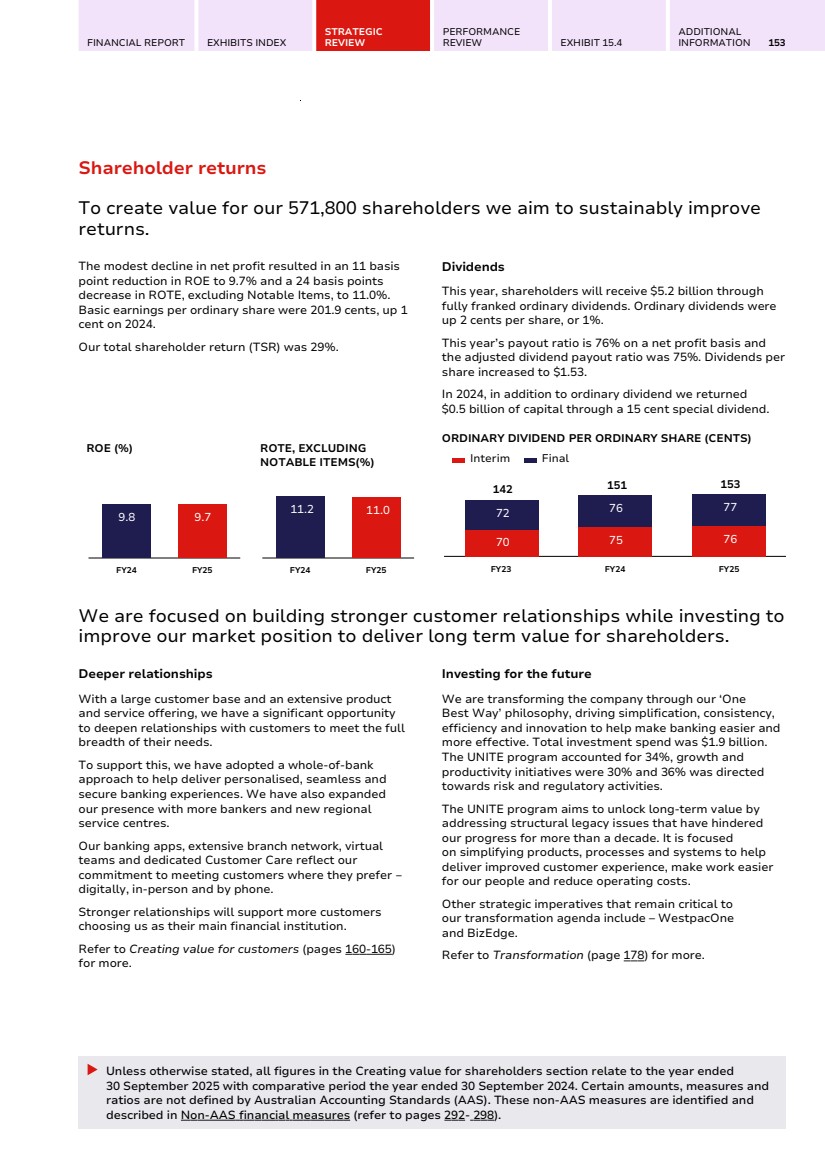

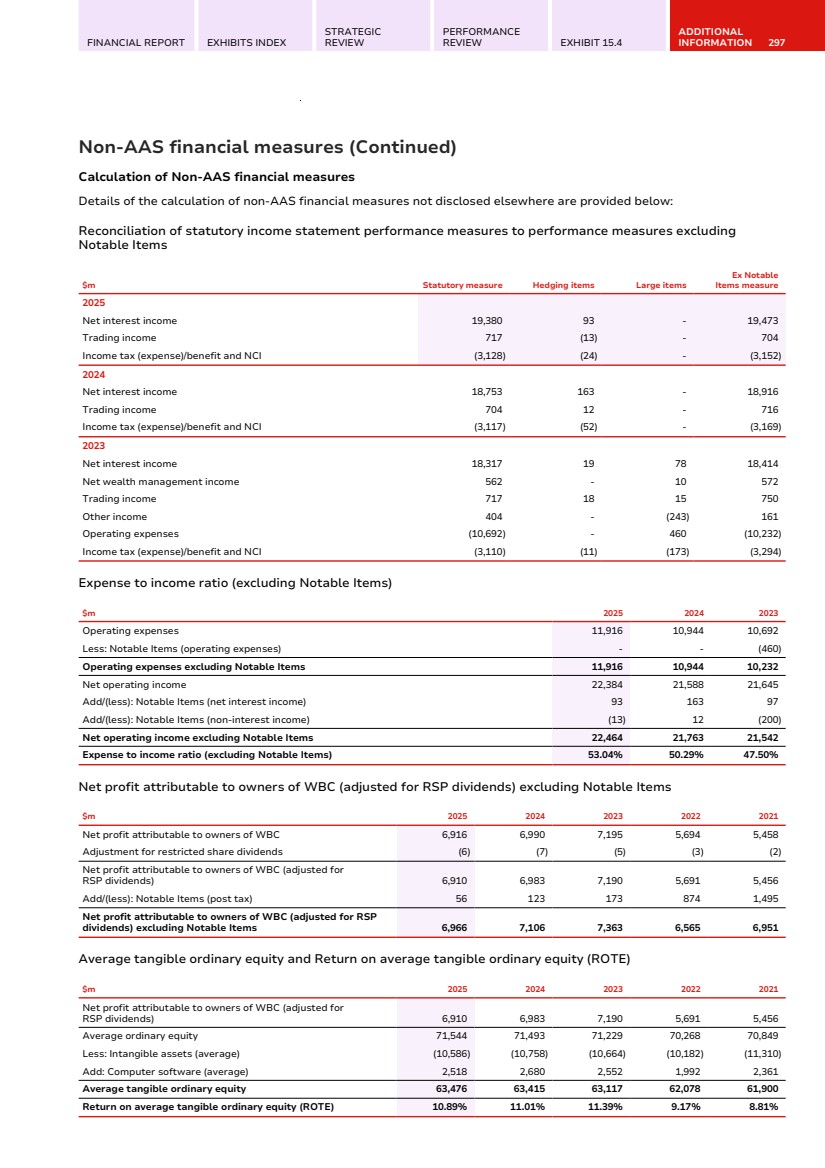

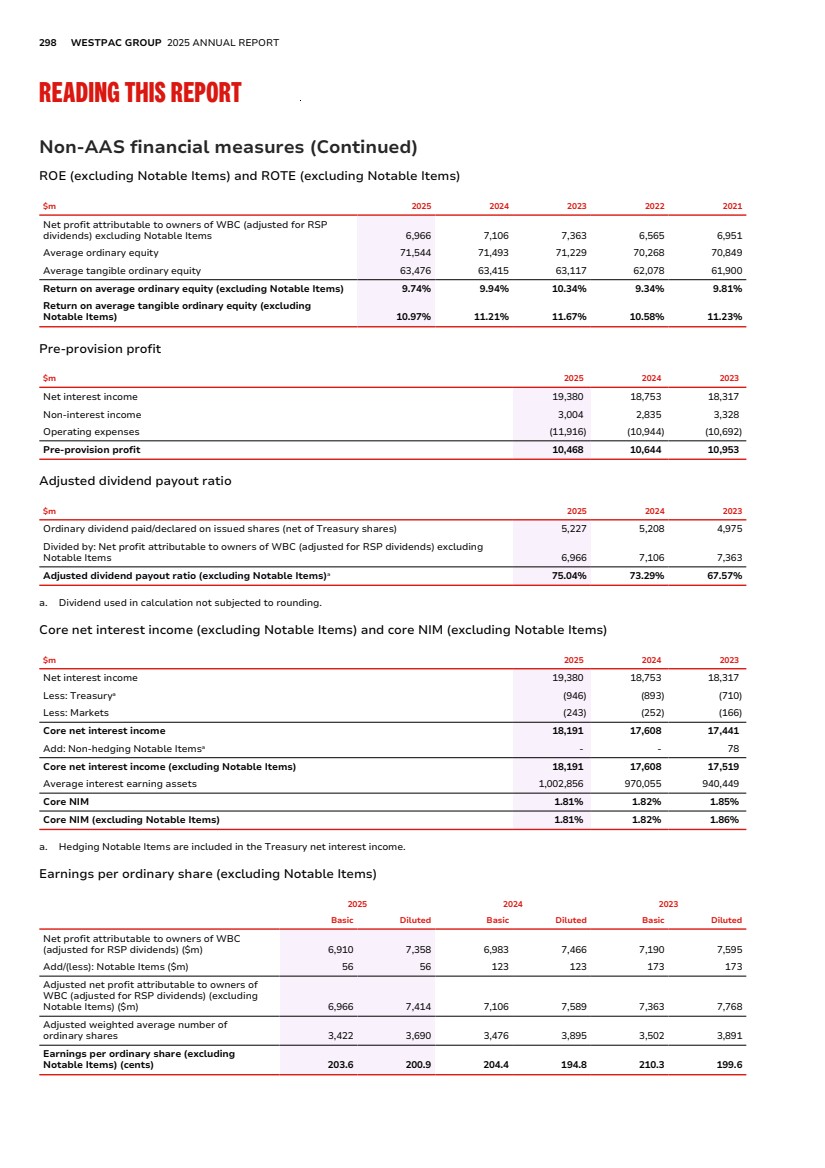

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 153 Shareholder returns To create value for our 571,800 shareholders we aim to sustainably improve returns. The modest decline in net profit resulted in an 11 basis point reduction in ROE to 9.7% and a 24 basis points decrease in ROTE, excluding Notable Items, to 11.0%. Basic earnings per ordinary share were 201.9 cents, up 1 cent on 2024. Our total shareholder return (TSR) was 29%. ROE (%) 9.8 9.7 FY24 FY25 ROTE, EXCLUDING NOTABLE ITEMS(%) 11.2 11.0 FY24 FY25 Dividends This year, shareholders will receive $5.2 billion through fully franked ordinary dividends. Ordinary dividends were up 2 cents per share, or 1%. This year’s payout ratio is 76% on a net profit basis and the adjusted dividend payout ratio was 75%. Dividends per share increased to $1.53. In 2024, in addition to ordinary dividend we returned $0.5 billion of capital through a 15 cent special dividend. ORDINARY DIVIDEND PER ORDINARY SHARE (CENTS) 142 151 153 70 75 76 72 76 77 Interim Final FY23 FY24 FY25 We are focused on building stronger customer relationships while investing to improve our market position to deliver long term value for shareholders. Deeper relationships With a large customer base and an extensive product and service offering, we have a significant opportunity to deepen relationships with customers to meet the full breadth of their needs. To support this, we have adopted a whole-of-bank approach to help deliver personalised, seamless and secure banking experiences. We have also expanded our presence with more bankers and new regional service centres. Our banking apps, extensive branch network, virtual teams and dedicated Customer Care reflect our commitment to meeting customers where they prefer ‒ digitally, in-person and by phone. Stronger relationships will support more customers choosing us as their main financial institution. Refer to Creating value for customers (pages 160-165) for more. Investing for the future We are transforming the company through our ‘One Best Way’ philosophy, driving simplification, consistency, efficiency and innovation to help make banking easier and more effective. Total investment spend was $1.9 billion. The UNITE program accounted for 34%, growth and productivity initiatives were 30% and 36% was directed towards risk and regulatory activities. The UNITE program aims to unlock long-term value by addressing structural legacy issues that have hindered our progress for more than a decade. It is focused on simplifying products, processes and systems to help deliver improved customer experience, make work easier for our people and reduce operating costs. Other strategic imperatives that remain critical to our transformation agenda include – WestpacOne and BizEdge. Refer to Transformation (page 178) for more. Unless otherwise stated, all figures in the Creating value for shareholders section relate to the year ended 30 September 2025 with comparative period the year ended 30 September 2024. Certain amounts, measures and ratios are not defined by Australian Accounting Standards (AAS). These non-AAS measures are identified and described in Non-AAS financial measures (refer to pages 292- 298). |

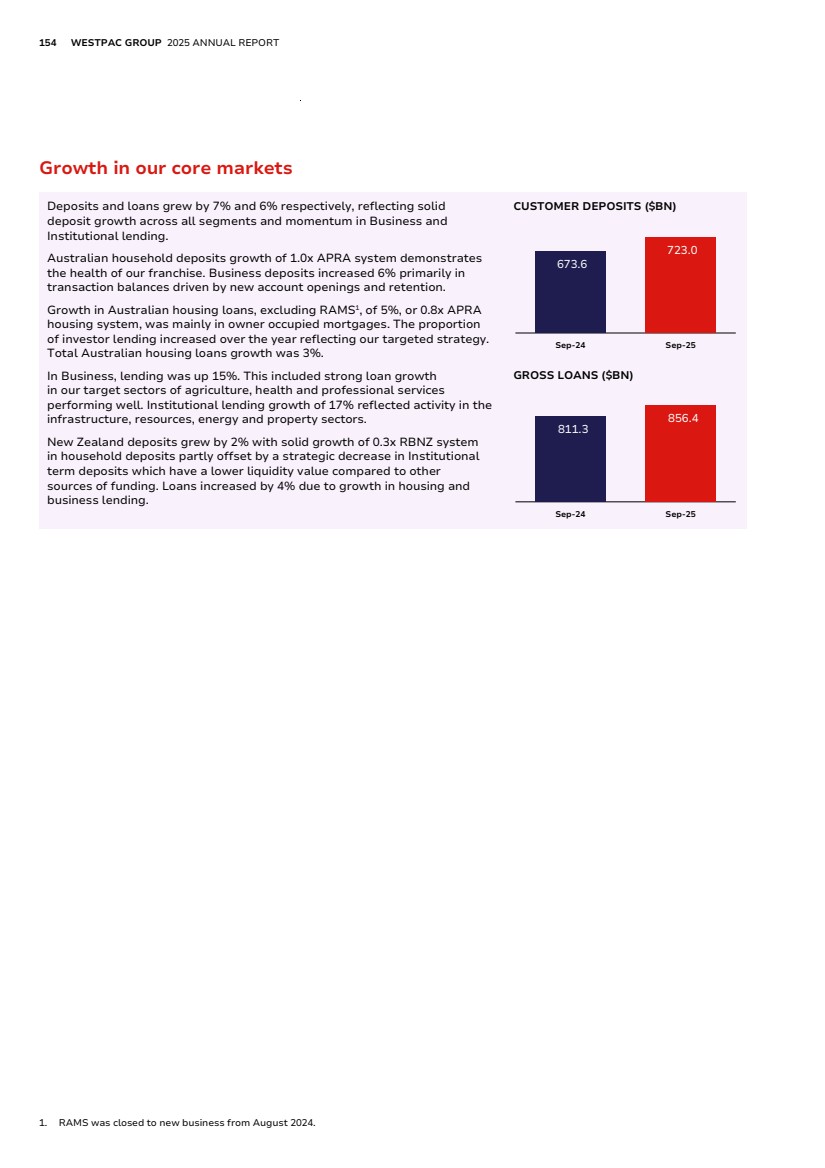

| 154 WESTPAC GROUP 2025 ANNUAL REPORT Growth in our core markets Deposits and loans grew by 7% and 6% respectively, reflecting solid deposit growth across all segments and momentum in Business and Institutional lending. Australian household deposits growth of 1.0x APRA system demonstrates the health of our franchise. Business deposits increased 6% primarily in transaction balances driven by new account openings and retention. Growth in Australian housing loans, excluding RAMS1 , of 5%, or 0.8x APRA housing system, was mainly in owner occupied mortgages. The proportion of investor lending increased over the year reflecting our targeted strategy. Total Australian housing loans growth was 3%. In Business, lending was up 15%. This included strong loan growth in our target sectors of agriculture, health and professional services performing well. Institutional lending growth of 17% reflected activity in the infrastructure, resources, energy and property sectors. New Zealand deposits grew by 2% with solid growth of 0.3x RBNZ system in household deposits partly offset by a strategic decrease in Institutional term deposits which have a lower liquidity value compared to other sources of funding. Loans increased by 4% due to growth in housing and business lending. CUSTOMER DEPOSITS ($BN) 673.6 723.0 Sep-24 Sep-25 GROSS LOANS ($BN) 811.3 856.4 Sep-24 Sep-25 1. RAMS was closed to new business from August 2024. |

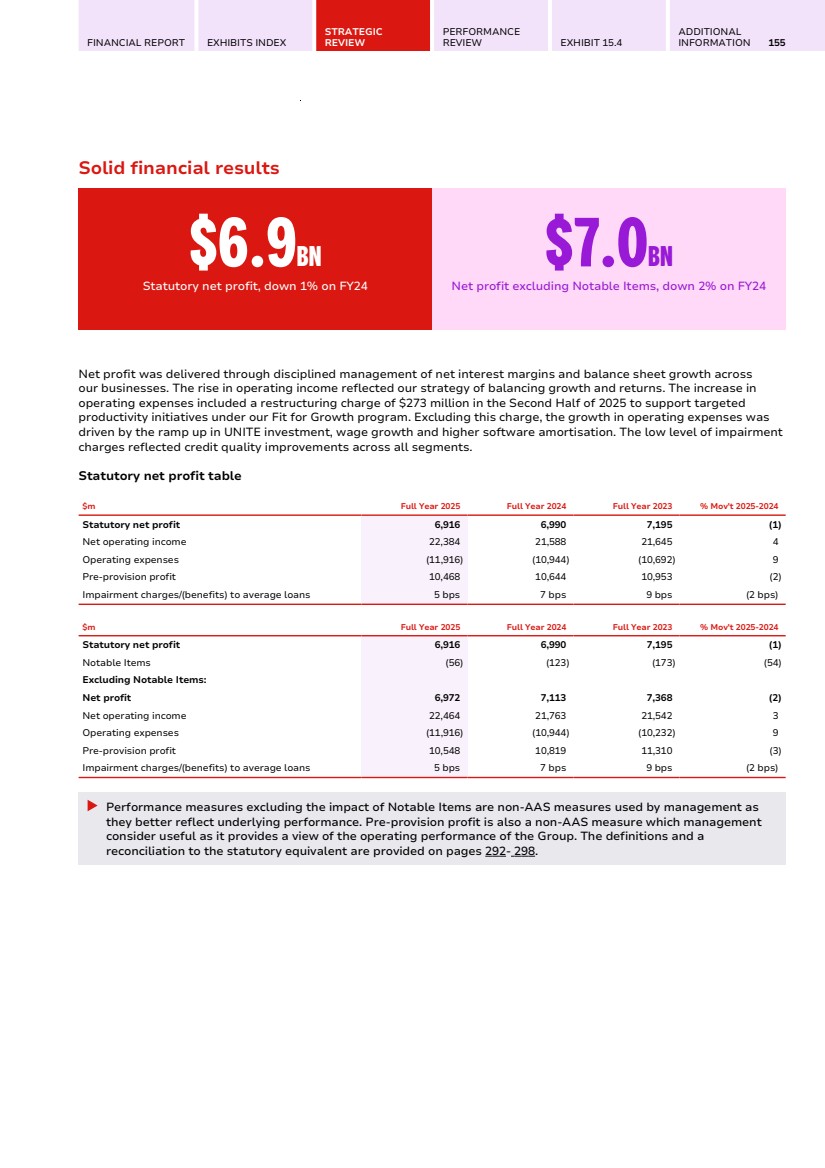

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 155 Solid financial results $6.9BN Statutory net profit, down 1% on FY24 $7.0BN Net profit excluding Notable Items, down 2% on FY24 Net profit was delivered through disciplined management of net interest margins and balance sheet growth across our businesses. The rise in operating income reflected our strategy of balancing growth and returns. The increase in operating expenses included a restructuring charge of $273 million in the Second Half of 2025 to support targeted productivity initiatives under our Fit for Growth program. Excluding this charge, the growth in operating expenses was driven by the ramp up in UNITE investment, wage growth and higher software amortisation. The low level of impairment charges reflected credit quality improvements across all segments. Statutory net profit table $m Full Year 2025 Full Year 2024 Full Year 2023 % Mov't 2025-2024 Statutory net profit 6,916 6,990 7,195 (1) Net operating income 22,384 21,588 21,645 4 Operating expenses (11,916) (10,944) (10,692) 9 Pre-provision profit 10,468 10,644 10,953 (2) Impairment charges/(benefits) to average loans 5 bps 7 bps 9 bps (2 bps) $m Full Year 2025 Full Year 2024 Full Year 2023 % Mov't 2025-2024 Statutory net profit 6,916 6,990 7,195 (1) Notable Items (56) (123) (173) (54) Excluding Notable Items: Net profit 6,972 7,113 7,368 (2) Net operating income 22,464 21,763 21,542 3 Operating expenses (11,916) (10,944) (10,232) 9 Pre-provision profit 10,548 10,819 11,310 (3) Impairment charges/(benefits) to average loans 5 bps 7 bps 9 bps (2 bps) Performance measures excluding the impact of Notable Items are non-AAS measures used by management as they better reflect underlying performance. Pre-provision profit is also a non-AAS measure which management consider useful as it provides a view of the operating performance of the Group. The definitions and a reconciliation to the statutory equivalent are provided on pages 292- 298. |

| 156 WESTPAC GROUP 2025 ANNUAL REPORT Net operating income Net interest income increased 3%. Key drivers included: • Higher core net interest income due to balance sheet growth; and • Notable Items reduced income by $93 million compared to a reduction of $163 million in the prior year. The NIM was 1.93% and comprised: • Core NIM of 1.81%, down 1 basis point, with slightly lower lending and deposit spreads more than offsetting benefits from higher earnings on capital and hedged deposits; • Treasury and Markets, contribution of 13 basis points; and • Notable Items from hedging items including unrealised revaluations of economic hedges of term funding detracted 1 basis point. Average interest-earning assets increased by 3% to $1,003 billion, including growth of 11% in business and 2% in housing loans. $19.4bn Net interest income FY24 $18.8bn 1.93% Net interest margin (NIM) FY24 1.93% Non-interest income increased by 6%. Key movements included: • Fee income increased reflecting higher Institutional lending and cards fees. • Trading and other income increased mainly due to higher foreign exchange income and favourable derivative value adjustments. Notable Items increased income by $13 million compared to a reduction of $12 million in the prior year. • Net wealth management income increased from higher funds under administration. $3.0bn Non-interest income FY24 $2.8bn The above commentary is on a statutory reporting basis. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 157 Net operating income excluding Notable Items Net interest income increased 3% driven by growth in average interest earning assets. The NIM was 1.94% and comprised: • Core NIM of 1.81%, down 1 basis point, with slightly lower lending and deposit spreads more than offsetting benefits from higher earnings on capital and hedged deposits. • Treasury and Markets, contribution of 13 basis points. Average interest-earning assets increased by 3% to $1,003 billion, including growth of 11% in business and 2% in housing loans. Non-interest income increased by 5%. Key movements included: Fee income increased by 4% mainly reflecting higher Institutional lending and cards fees. Trading and other income increased by 7% mainly due to higher foreign exchange income and favourable derivative value adjustments. Net wealth management income increased by 8% from higher funds under administration. $19.5bn Net interest income FY24 $18.9bn 1.94% Net interest margin (NIM) FY24 1.95% $3.0bn Non-interest income FY24 $2.8bn Performance measures above exclude the impact of Notable Items. These measures together with Core net interest income and Core NIM are non-AAS measures used by management as they better reflect underlying performance. The definitions and a reconciliation to the statutory equivalent are provided on pages 292- 298. Operating expenses Operating expenses increased 9%. The increase included a restructuring charge of $273 million in the Second Half of 2025 to support targeted productivity initiatives under our Fit for Growth program. Excluding this cost, operating expenses increased by 6%. Key movements included: Staff expenses increased by 7%a mainly due to wage growth, UNITE and the investment in bankers. Average FTE increased by 1% with the increase to support UNITE and the investment in bankers more than offsetting reductions from productivity initiatives. Occupancy expenses decreased by 7% with further reductions in the Group's corporate and branch footprint. Technology expenses were up 13% due to higher costs related to the UNITE program, an increase in software amortisation related to projects completed in prior years and higher software maintenance and licensing costs. Other Expenses decreased by 3%a due to lower professional and servicing costs and higher costs in the prior year from the closure of RAMS, partly offset by higher litigation and remediation costs, and advertising spend. Fit for Growth restructuring expenses to support targeted productivity initiatives were $273 million in the Second Half of 2025. The expense to income ratio increased to 53.2% and excluding Notable Items the ratio increased to 53.0%. $11.9bn Operating expenses FY24 $10.9bn 53.2% Expense to income ratio FY24 50.7% 53.0% Expense to income ratio excluding Notable Items FY24 50.3% a. Excluding the impact of the Fit for Growth restructuring expenses. There were no Notable Items impacting operating expenses in FY25 or FY24. The expense to Income ratio excluding Notable Items is a non-AAS financial performance measures used by management as it better reflects underlying performance. The definition of these items is provided on pages 292- 293. |

| 158 WESTPAC GROUP 2025 ANNUAL REPORT Credit quality sound, strong balance sheet Credit quality improved and we maintained a strong financial position with capital, funding and liquidity all above regulatory minimums. Credit quality Credit impairment charges represented 5 basis points of average gross loans compared to 7 basis points in the prior year. The low level of impairment charges was driven by our prudent lending practices and customer resilience across both households and businesses. The improvement in credit quality metrics reflects a more favourable operating environment and the reduction in household cost of living pressures as inflation has eased and interest rates have declined in both Australia and New Zealand. We remain appropriately provisioned with credit impairment provisions of $4,987 million, $1.9 billion above the expected losses of our base case economic scenario. Over the year provisions decreased by 2% with an overall improvement in portfolio credit quality more than offsetting an increase in the downside scenario weight and higher overlays. STRESSED EXPOSURES AS A % OF TCE 1.45 1.28 Sep-24 Sep-25 Capital The CET1 capital ratio of 12.5% is above our target ratio of 11.25% in normal operating conditions. This equates to $3.1 billion of capital above the target after payment of the second half 2025 dividend. The CET1 capital ratio increased 4 basis points as net profit was largely offset by the payment of dividends and increases in Risk Weighted Assets (RWA). CET1 CAPITAL RATIO 12.5 12.5 18.3 18.3 APRA basis Internationally comparable Sep-24 Sep-25 Funding and liquidity The September quarterly average liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR) were both above regulatory minimums. The deposit to loan ratio increased slightly, with deposit growth broadly funding loan growth during the year. The Group raised $28 billion of new long term wholesale funding. Long term wholesale funding needs in 2025 were lower compared to recent financial years, reflecting growth in household deposits and lower wholesale funding maturities. The bank maintained stable short term wholesale funding balances, with movement mainly driven by changes in FX rates. Long term wholesale funding where the residual maturity is less than one year increased. LCR AND NSFR (%) 133 112 137 113 LCR NSFR 84.9% Deposit to loan ratio, up 137bps on Sep-24 |

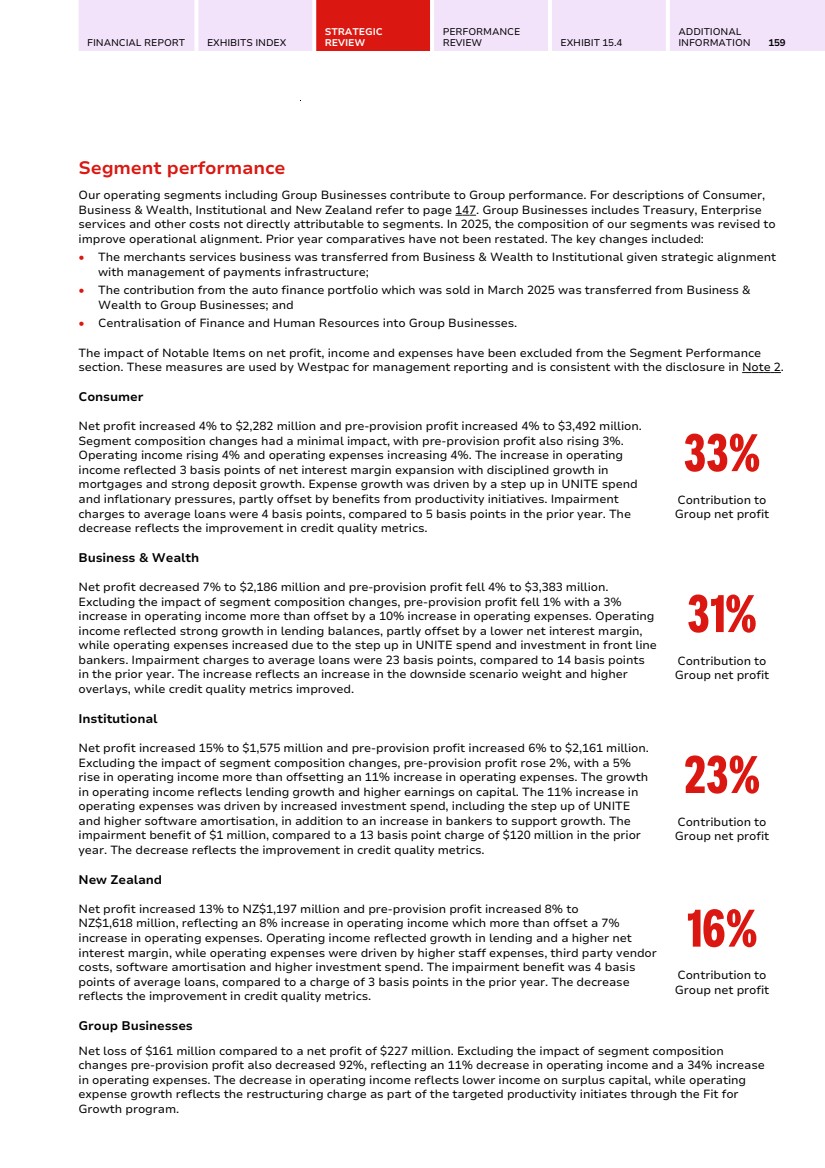

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 159 Segment performance Our operating segments including Group Businesses contribute to Group performance. For descriptions of Consumer, Business & Wealth, Institutional and New Zealand refer to page 147. Group Businesses includes Treasury, Enterprise services and other costs not directly attributable to segments. In 2025, the composition of our segments was revised to improve operational alignment. Prior year comparatives have not been restated. The key changes included: • The merchants services business was transferred from Business & Wealth to Institutional given strategic alignment with management of payments infrastructure; • The contribution from the auto finance portfolio which was sold in March 2025 was transferred from Business & Wealth to Group Businesses; and • Centralisation of Finance and Human Resources into Group Businesses. The impact of Notable Items on net profit, income and expenses have been excluded from the Segment Performance section. These measures are used by Westpac for management reporting and is consistent with the disclosure in Note 2. Consumer Net profit increased 4% to $2,282 million and pre-provision profit increased 4% to $3,492 million. Segment composition changes had a minimal impact, with pre-provision profit also rising 3%. Operating income rising 4% and operating expenses increasing 4%. The increase in operating income reflected 3 basis points of net interest margin expansion with disciplined growth in mortgages and strong deposit growth. Expense growth was driven by a step up in UNITE spend and inflationary pressures, partly offset by benefits from productivity initiatives. Impairment charges to average loans were 4 basis points, compared to 5 basis points in the prior year. The decrease reflects the improvement in credit quality metrics. 33% Contribution to Group net profit Business & Wealth Net profit decreased 7% to $2,186 million and pre-provision profit fell 4% to $3,383 million. Excluding the impact of segment composition changes, pre-provision profit fell 1% with a 3% increase in operating income more than offset by a 10% increase in operating expenses. Operating income reflected strong growth in lending balances, partly offset by a lower net interest margin, while operating expenses increased due to the step up in UNITE spend and investment in front line bankers. Impairment charges to average loans were 23 basis points, compared to 14 basis points in the prior year. The increase reflects an increase in the downside scenario weight and higher overlays, while credit quality metrics improved. 31% Contribution to Group net profit Institutional Net profit increased 15% to $1,575 million and pre-provision profit increased 6% to $2,161 million. Excluding the impact of segment composition changes, pre-provision profit rose 2%, with a 5% rise in operating income more than offsetting an 11% increase in operating expenses. The growth in operating income reflects lending growth and higher earnings on capital. The 11% increase in operating expenses was driven by increased investment spend, including the step up of UNITE and higher software amortisation, in addition to an increase in bankers to support growth. The impairment benefit of $1 million, compared to a 13 basis point charge of $120 million in the prior year. The decrease reflects the improvement in credit quality metrics. 23% Contribution to Group net profit New Zealand Net profit increased 13% to NZ$1,197 million and pre-provision profit increased 8% to NZ$1,618 million, reflecting an 8% increase in operating income which more than offset a 7% increase in operating expenses. Operating income reflected growth in lending and a higher net interest margin, while operating expenses were driven by higher staff expenses, third party vendor costs, software amortisation and higher investment spend. The impairment benefit was 4 basis points of average loans, compared to a charge of 3 basis points in the prior year. The decrease reflects the improvement in credit quality metrics. 16% Contribution to Group net profit Group Businesses Net loss of $161 million compared to a net profit of $227 million. Excluding the impact of segment composition changes pre-provision profit also decreased 92%, reflecting an 11% decrease in operating income and a 34% increase in operating expenses. The decrease in operating income reflects lower income on surplus capital, while operating expense growth reflects the restructuring charge as part of the targeted productivity initiates through the Fit for Growth program. |

| 160 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR CUSTOMERS By adopting a whole-of-bank approach, we are creating more personalised, seamless and secure banking experiences that build long-term trust and value. Related material topics (refer to page 149) • Vulnerable customers • Data privacy and security • Financial inclusion • Housing affordability and security • Fraud and scams Key highlights 13M CUSTOMERS # 1 MOBILE BANKING APP1 21% AUSTRALIAN MORTGAGE MARKET SHARE2 #2 CONSUMER NPS3 RANKED EQUAL SECOND 1. The Forrester Digital Experience Review: Australian Mobile Banking Apps, Q3 2025. 2. APRA Banking Statistics, September 2025. 3. Refer to the Glossary (pages 324-327) for more information on NPS. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 161 Australia’s best banking app Westpac’s banking app continues to set the benchmark for digital banking in Australia, ranked #1 for a third consecutive year1 . To recognise and reward customer loyalty, we launched a dedicated Westpac Rewards hub. This is designed to make it easy for customers to find, track and redeem rewards across multiple channels. Customers received more than $159 million in rewards value across multiple loyalty channels, including our market first partnerships with ShopBack and Woolworths Everyday Rewards. Westpac customers can access essential everyday banking features alongside valuable money management tools, such as Cashflow and Smart Search, which support decision making and financial goal setting. The Savings Finder feature analyses annual spending on subscriptions and recurring expenses to identify potential savings opportunities, enhancing customer value and engagement. Across all digital channels, an average of 1.1 million customers each month use money management tools to budget, track spending and understand their financial position. To support safe digital banking, we expanded our market-leading security features designed to protect customers from scams and fraud. Westpac SafeCall and SafeBlock are our latest Australian-first innovations. Refer to Innovating to protect customers (page 163) for more information on our suite of digital innovations. Enhancing financial literacy We are committed to improving the financial wellbeing of customers and the community through free financial education initiatives. We have a long-standing partnership with Year13, an online financial literacy platform designed for young Australians. The program offers engaging and practical content to build lasting financial habits. We connect with this important demographic through relatable examples and interactive content, such as videos, quizzes and self-paced modules, delivered via the social channels they use most. We also invest in digital tools and youth engagement programs. Our banking app’s Pocket Money and Chores feature supports parents in teaching children about saving and spending in a fun, engaging way. An online Financial Literacy Hub offers tailored learning resources for kids, teens and school leavers. In a new collaboration with an online influencer, we produced a 12-part series called Financial Fresh Start, focused on building good financial habits and awareness, along with steps customers can take with support from their bank. In New Zealand, 12,206 people participated in Managing Your Money workshops, representing a 9% increase on the previous year. These were delivered alongside targeted seminars through our partnerships with Chambers of Commerce. In the Pacific, we deliver culturally relevant financial education in Fiji and Papua New Guinea, reaching thousands of people and small business owners through webinars and workshops such as Financial Basics for My Business. 1. The Forrester Digital Experience Review: Australian Mobile Banking Apps, Q3 2025. SECURE LIVE CHAT SUPPORT Customers now enjoy secure conversations with bankers via the Westpac Live app, with the ability to access chat history for up to 30 days and receive push notifications. All conversations are encrypted through Westpac’s secure messaging network. This enhancement, delivered under UNITE, involved consolidating two chat platforms into one and migrating approximately 8 million customers to a single live person chat system. The initiative cost $7.3 million and is expected to deliver $3.7 million in annual expense savings. |

| 162 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR CUSTOMERS Delivering service excellence Exceptional customer experiences depend on many factors, including ensuring our people, systems and processes work together seamlessly to deliver timely, consistent and personalised service. We are focusing on connecting the full breadth of our capabilities, across every operating segment and customer touchpoint, to bring the whole bank to customers. This integrated approach aims to remove customer pain points, strengthen advocacy and build deeper relationships over time. Through mapping, measuring and improving more than 15 critical customer journeys across our Australian operations, we are helping teams to walk in customers’ shoes and drive cross-functional collaboration. This also provides us with better insights to help customers achieve their financial goals. While the program is a recent initiative, early feedback indicates customers are engaging with a broader range of our products and services. In addition, we are extending the rollout of the single banker platform, Digital Banker, to support approximately 20,000 employees across Consumer and Business. This portal captures customer interactions and needs, providing better insights and experiences for customers and bankers. Prioritising safety in products and services We were proud to develop Australia’s first Safety by Design Toolkit for financial institutions, placing customer safety and rights at the centre of product and service design. In collaboration with the Australian Banking Association, the toolkit includes customer vulnerability personas, lived experience videos and mandatory eLearning for product managers. It has been shared with peer organisations to help support more Australians, regardless of who they bank with. Westpac remains committed to sector-wide reform, advocating for Safety by Design across banking and beyond, so customer safety is built-in from the start. Providing support in tough times We understand that anyone can fall on tough times so our Assist team provide a range of tailored solutions to help customers regain financial stability. This can include short-term options such as payment pauses and reduced repayments, as well as longer-term assistance plans designed to support recovery. We also connect customers with our wider network of external partners, extending support into wellbeing and financial empowerment. By collaborating with respected organisations, we hope to help strengthen families and communities, break cycles of disadvantage and build lasting financial confidence. We supported customers with 46,485 tailored hardship assistance and disaster relief packages, giving customers financial reprieve and the chance to get back on track. At the end of the financial year, 10,870 accounts remained in hardship. Through UNITE's collections migration, we are consolidating multiple legacy systems into a single platform to support customers and reduce complexity. It includes new tools to help teams respond to customers in hardship with greater consistency and care. Resolving complaints Complaints are a second chance for us to make things right for customers. Our monthly average resolution time is stable, with 94% of complaints resolved without need for escalation. Our Customer Advocate also provides advice, while recommending policy changes and supporting vulnerable customers. Listening to feedback helps us to continuously improve our products and services. Importantly, we are using complaints as a key input into the customer journeys initiative, ensuring we have a genuine view of pain points and the end to end customer experience. For example, through UNITE, we introduced the option for eligible Westpac home loan customers to set up multiple offset accounts with no additional fee – providing more choice and control in how they manage their finances. More than 35,000 offset accounts have been set up since February. Listening to customers We proactively and continuously seek customer feedback, using insights from Net Promoter Score (NPS)1 surveys, complaints and direct feedback which helps us to measure progress and identify areas for improvement. To be Australia’s best bank, we recognise there is more work needed to lift customer and brand advocacy. In Consumer, NPS1 improved during the year, despite intense competition. We are currently ranked equal second in Consumer NPS1 . In Business, we hold an NPS1 score of minus one and have established clear leadership in the SME and Commercial sub-segments. We are prioritising improvements in our service offering for small business customers, recognising the importance of this segment to our Business & Wealth strategy. For our Institutional customers, we aim to be their bank of choice, supporting all their banking needs through strong relationships and comprehensive solutions. Our Relationship Strength Index (RSI2 ) rose by 19 points, marking our highest score in a decade. While we are currently in equal third position, our focus on deepening relationships positions us well for continued growth in this segment. 1. Refer to the Glossary (pages 324-327) for more information on NPS. 2. Coalition Greenwich Voice of Client 2025 Australia Large Corporate Relationship Banking Study. |

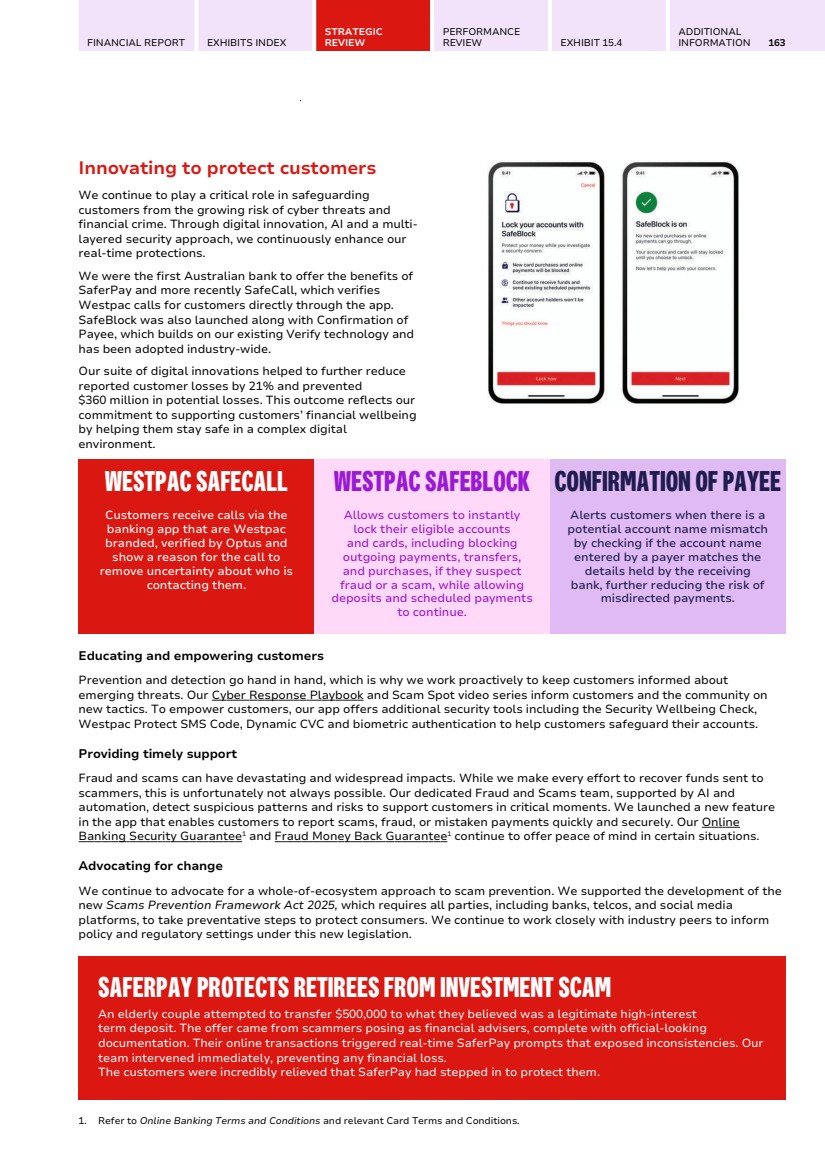

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 163 Innovating to protect customers We continue to play a critical role in safeguarding customers from the growing risk of cyber threats and financial crime. Through digital innovation, AI and a multi-layered security approach, we continuously enhance our real-time protections. We were the first Australian bank to offer the benefits of SaferPay and more recently SafeCall, which verifies Westpac calls for customers directly through the app. SafeBlock was also launched along with Confirmation of Payee, which builds on our existing Verify technology and has been adopted industry-wide. Our suite of digital innovations helped to further reduce reported customer losses by 21% and prevented $360 million in potential losses. This outcome reflects our commitment to supporting customers’ financial wellbeing by helping them stay safe in a complex digital environment. WESTPAC SAFECALL Customers receive calls via the banking app that are Westpac branded, verified by Optus and show a reason for the call to remove uncertainty about who is contacting them. WESTPAC SAFEBLOCK Allows customers to instantly lock their eligible accounts and cards, including blocking outgoing payments, transfers, and purchases, if they suspect fraud or a scam, while allowing deposits and scheduled payments to continue. CONFIRMATION OF PAYEE Alerts customers when there is a potential account name mismatch by checking if the account name entered by a payer matches the details held by the receiving bank, further reducing the risk of misdirected payments. Educating and empowering customers Prevention and detection go hand in hand, which is why we work proactively to keep customers informed about emerging threats. Our Cyber Response Playbook and Scam Spot video series inform customers and the community on new tactics. To empower customers, our app offers additional security tools including the Security Wellbeing Check, Westpac Protect SMS Code, Dynamic CVC and biometric authentication to help customers safeguard their accounts. Providing timely support Fraud and scams can have devastating and widespread impacts. While we make every effort to recover funds sent to scammers, this is unfortunately not always possible. Our dedicated Fraud and Scams team, supported by AI and automation, detect suspicious patterns and risks to support customers in critical moments. We launched a new feature in the app that enables customers to report scams, fraud, or mistaken payments quickly and securely. Our Online Banking Security Guarantee 1 and Fraud Money Back Guarantee 1 continue to offer peace of mind in certain situations. Advocating for change We continue to advocate for a whole-of-ecosystem approach to scam prevention. We supported the development of the new Scams Prevention Framework Act 2025, which requires all parties, including banks, telcos, and social media platforms, to take preventative steps to protect consumers. We continue to work closely with industry peers to inform policy and regulatory settings under this new legislation. SAFERPAY PROTECTS RETIREES FROM INVESTMENT SCAM An elderly couple attempted to transfer $500,000 to what they believed was a legitimate high-interest term deposit. The offer came from scammers posing as financial advisers, complete with official-looking documentation. Their online transactions triggered real-time SaferPay prompts that exposed inconsistencies. Our team intervened immediately, preventing any financial loss. The customers were incredibly relieved that SaferPay had stepped in to protect them. 1. Refer to Online Banking Terms and Conditions and relevant Card Terms and Conditions. |

| 164 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR CUSTOMERS Maintaining community presence We recognise that many customers prefer face-to-face support, particularly when making important financial decisions. We provide trusted support across 621 branches which includes 125 co-located branches. This represents the second-largest branch network in Australia, with more than 37% of these located in regional areas. We have the largest fee-free ATM network in the country. Complementing our branch network is a Virtual Banking team, providing secure, expert support via phone, video, and chat. From early 2026, customers will also have access to a new Book a Banker tool, facilitating appointments with lenders when it suits them. Our long-standing partnership with Australia Post offers another face-to-face banking option through 3,300 Bank@Post outlets nationwide. Supporting Indigenous customers Westpac supports Indigenous customers across multiple channels including a dedicated Indigenous Call Centre with translators to support Indigenous languages. On-the-ground teams in remote areas of every State and Territory work in partnership with community groups to help empower Indigenous customers and support their banking needs. Promoting regional prosperity Regional Australia plays a vital role in the nation’s success and we believe unlocking its full potential is key to driving sustainable economic growth. This is a focus of our refreshed sustainability strategy, which aims to support regional business growth, local employment and positive community and environmental outcomes. In response to the unique needs of regional communities, we listened to customer and community feedback by reflecting on how we could improve our service offering. We have introduced a new regional banking model through integrated service centres that bring retail and business banking under one roof. This model delivers a more personalised and comprehensive banking experience, which helps to build trust and stronger, more enduring relationships over time. We committed to three service centres in new locations, with more planned in the future. This was bolstered by our growing business banking and agribusiness team with deep industry expertise. Our pledge to keep regional branches open has been extended to mid-2027, providing greater certainty for customers, employees and communities. Importantly, our focus isn’t limited to financial support and services. A resilient and stronger future for regional and rural Australia also relies on unlocking potential through innovation. Our agri-tech investments combined with agriculture-related sponsorships, scholarships and partnerships are fostering the next generation of farmers, helping them to solve critical industry issues. Faster lending decisions Following our operational improvements last year to reduce time to decision for home loan customers, we’ve continued to simplify mortgages end-to-end by streamlining policies and processes and accelerating automation. We have also improved our home loan same-day settlement performance, now ranked number one among Australia’s major banks1 . This supports our strategic focus on improving service and fostering deeper customer relationships. We halved documentation requirements for self-employed applicants through the introduction of a one-year income assessment option. This is helping to make the home-buying journey simpler for self-employed Australians. In addition, we commenced the roll-out of a simplified digital experience for personal loans. The initiative aims to reduce manual processing and improve turnaround times for both new and existing customers. ANNUAL MEDIAN HOME LOAN TIME TO DECISION (DAYS)a 5.6 5.2 4.6 9.7 5.8 5.0 1st Party 3rd Party FY23 FY24 FY25 a. Prior periods have been restated Driving efficiency for businesses In March we launched BizEdge, a new digital platform that simplifies and accelerates loan decisions. This streamlines the end-to-end lending process and reducing manual effort for bankers and customers alike. Since launch, it has facilitated $4.8 billion in business lending applications. (Refer to page 178) We were the first Australian bank to activate Mastercard’s mobile virtual card solution to simplify business payments for corporate and government clients. This capability replaces manual processes with faster, safer payments, real-time visibility and automated reconciliation. To support our ambition to restore Institutional to number one, we're investing in our people and fostering enduring client relationships through expert, personalised service across all channels. Our bankers and product specialists bring deep sector expertise and long-standing partnerships, helping clients to navigate complexity and unlock opportunities. Meanwhile, our investment in Westpac One aims to bring together real-time treasury management, foreign exchange, trade and lending with powerful data insights. (Refer to Modernising technology on page 178) 1. According to Property Exchange Australia (PEXA) data as at September 2025. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 165 Inclusive and accessible banking Inclusive and accessible design is part of how we serve and support customers. Our new Access & Inclusion Plan 2025-2028 outlines how we’ll continue to enhance banking so every customer can engage in a way that suits their needs. We are committed to meeting diverse accessibility needs by, for example: • Providing space for assisted devices and personal support in branches; • Promoting awareness of assistive technologies such as screen readers, chatbots and text-to-speech functionality; • Supporting customers who wear a Hidden Disabilities Sunflower accessory; • Offering multiple communication options including interpreters, translation services, AUSLAN and the National Relay Service; • Delivering cultural awareness training for staff; and • Providing training and resources to support non-binary and gender-affirming customers. Responsible marketing and advertising We regularly review and enhance our policies, procedures, and processes to ensure they consistently support positive customer outcomes. This commitment also applies to how we market our products and services towards suitable customers, as detailed in our Responsible Marketing and Advertising policy on our website. Safeguarding data and privacy Earning and maintaining customer trust is essential to our long-term success. All employees complete mandatory annual training on data privacy and cybersecurity. Our Privacy Statement outlines how we protect personal information, while our Cybersecurity Statement details our alignment with global and ISO standards. We continue to invest in secure-by-design policies and infrastructure to meet evolving expectations and requirements. Supporting female entrepreneurs We have doubled our commitment to supporting women in business, increasing this to $1 billion to help more women overcome the challenges of starting or growing a business. Since launching the initiative two years ago, we have helped more than 1,800 women in a range of industries, including retail, healthcare, creative services and hospitality. Assisting vulnerable customers We continue to strengthen protections for vulnerable customers through specialist support teams and proactive monitoring of payment descriptions and power of attorney accounts to identify potential misuse. We also offer self-serve product features such as gambling blocks and parental controls. To respond to threats and improve safeguards, we work closely with community organisations and law enforcement. Customers with eligible government concession cards can also open a basic bank account, which has no monthly account keeping or overdrawn fees. Our teams are trained and equipped to identify and support vulnerable customers, and to connect them with external partners where additional assistance is needed. PRACTICAL PATHWAYS TO HOME OWNERSHIP Westpac is proud to be the founding partner of Head Start Homes, supporting more Australians into safe and stable housing through practical pathways to home ownership. This partnership supports First Nations and single-parents to become proud homeowners through bespoke services such as savings plans and home-buying guidance. Head Start Homes has supported more than 225 households to begin their journey to home ownership while helping to free up social housing for other families in need. Learn more about Kamini (pictured) on the Head Start Homes website. |

| Brittany Mobile Home Finance Manager Broadbeach, QLD 166 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR OUR PEOPLE We strive to be Australia’s best workplace, where people feel valued, supported and inspired to deliver for customers and reach their potential. Related material topics (refer to page 149) • Employee engagement • Health and safety • Diversity, equity and inclusion Key highlights 80 ORGANISATIONAL HEALTH INDEX 49% WOMEN IN SENIOR LEADERSHIP1 $6.3BN PAID IN SALARIES 35,236 EMPLOYEES2 1. Senior Leadership includes Executive Team, General Managers and their direct reports (excluding administrative or support roles). 2. Refers to Full-Time Equivalent as at 30 September 2025. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 167 190,000 employee recognition moments AMPLIFY new employee listening platform 3,600 employees participated in AI Shark Tank Creating a culture where people thrive To become Australia’s best workplace, we are shaping a high-performance culture where people feel supported, accountability is clear, positive behaviours are recognised and it is safe to speak up. Receiving the ‘Employer of Choice’ award for large organisations at the Australian HR Awards recognises the progress we’ve made in making Westpac a great place to work. We are building on this momentum under the guidance of a new Chief People Officer, while executing UNITE to help make our working environment simpler and more rewarding for our people. With a renewed Purpose, our values were updated in July to three clear, actionable commitments: Always deliver, safely; Make an impact; and Own it. We are embedding these into processes to align expectations and shape a service mindset. We’re actively supporting our leaders to help shape our culture. One way we do this is by embedding skill boost sessions into weekly team rhythms. These activities encourage open conversations around positive risk behaviours such as speaking up, admitting mistakes and taking initiative. In June 2025, our final Voice+ survey including the Organisational Health Index (OHI) was completed. The score remained at 80, reinforcing Westpac's position in the top quartile of organisations globally. This reflects our progress in recent years to reset culture and strengthen risk practices through the CORE program, which is now complete. For more detail, refer to page 181. Listening and acting on feedback Feedback is essential to building a culture of trust and continuous improvement. It ensures people feel heard, empowered to act, and aligned to our purpose. To capture more dynamic employee insights and drive further improvement, we’ve transitioned from Voice+ to a new Amplify platform. Amplify enables leaders at all levels to act on team feedback, strengthening engagement and risk management. Insights help leaders and teams agree on priorities and turn feedback into measurable change, supporting our goal of becoming the best place to work. We also engaged with our people to understand how they want to use AI to work more effectively and provide better service to customers. Our inaugural CEO-sponsored AI Shark Tank program drew significant engagement, with 3,600 employees participating and 1,200 ideas submitted. It highlighted a keen interest in embracing AI across the company. 10 standout opportunities were selected by Executives for implementation. We also responded to employee feedback through our continuous improvement platform Ignite, which uncovered valuable ways to boost productivity, improve customer experience and reduce risk. In addition, leaders have regular conversations with their team members to provide performance and development feedback to engage and motivate our people. RECOGNISING GREAT OUTCOMES The recognition of our people is embedded in our culture. We have formal mechanisms in place to encourage and recognise high performance, including those linked to excellent risk outcomes. The Great Employee Moments (GEM) platform captured 190,000 recognition moments, which informed our award winners. The annual CEO Awards (pictured) at the end of each calendar year are the pinnacle of our recognition framework, celebrating individuals and teams who exemplify excellence, leadership and impact across the business. Each quarter, the Board directly recognise individuals who demonstrate positive risk outcomes, exceptional courage, innovation or leadership beyond the expectations of their role. |

| 168 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR OUR PEOPLE Attracting and retaining talent Attracting and retaining talent sparks innovation and builds a workforce that reflects the diversity and capability needed to deliver great results. We are advancing this through several targeted strategies. Onboarding and Orientation: We introduced a refreshed onboarding and orientation program for new talent, featuring customer immersion sessions, hands-on activities and engagement with our Executive team. Graduate Program: We rank in the top ten of Australian Financial Review 'Top Grad Employers for 2025’ for our award-winning graduate program. We hired 135 graduates, comprising 58% female and 52% from a STEM background. Licensed to recruit: A new Licenced to Recruit training program is strengthening the capability of People Leaders making hiring decisions. To date, more than 1,500 leaders have completed face-to-face training across Australia. Internal talent mobility: We saw a second consecutive year of improvement in internal talent mobility, which is up 5% from FY23. This was driven by the launch of a new Internal Careers site with enhanced employee tools and the introduction of the Westpac Talent Community. We continue to support redeployed employees through job-matching tools and reporting dashboards that help identify opportunities and track outcomes. Diverse hiring: We maintained our commitment to diverse hiring, with 49% overall female representation, even as recruitment efforts pivoted towards male dominated technology-focused roles. Notably, MobTech welcomed 11 new Indigenous cadets. Our dedicated female talent initiative, EmPOWERUp, creates a pathway for women to reignite their careers after an extended leave break. It continues to build a strong candidate pool across all levels and disciplines, with approximately 1,300 women engaged to date. Developing leadership capability People leaders are critical to our success. They shape our culture, drive performance and role model the behaviours that enable teams to thrive. We have three signature leadership programs to develop leaders at all levels. The Horizon program for executive leaders resumed with its fourth cohort. This is part of a broader leadership development strategy aimed at strengthening executive capability and driving cultural transformation. To further align broader leadership behaviours with performance outcomes, we launched the Westpac Leadership Qualities framework, which will be reinforced in a new Executive Leadership Group1 Scorecard from FY26. We introduced two new leadership programs designed to strengthen capability for more than 4,000 employees through to FY27. Elevate supports our senior leadership cohort, while LEAD is tailored for mid-level and emerging leaders. These programs focus on executive coaching and developing adaptive leadership, high-performance and an enterprise mindset. We are committed to supporting the development and progression of women at Westpac. This includes accelerating the impact of programs such as Illuminate, our female sponsorship initiative and Step-Up, a new career development program. Refer to page 169 for more information. Investing in skills for the future Equipping our people with future skills and capabilities is at the heart of our learning and talent strategy. It encompasses both mandatory and optional training, leadership development as well as addressing capability gaps across the organisation. Mandatory training is completed by all employees and covers compliance, privacy and data protection, risk awareness, identifying hazards and conflicts of interest. We expanded optional learning in emerging areas such as AI, sustainability and cybersecurity. More than 10,000 employees completed training in generative AI through our Microsoft 365 Copilot rollout. See Data, Digital and AI on page 179 for more information. In Business & Wealth, we relaunched The Business Performance Academy, offering targeted training to 3,000 employees to build confidence and advance their careers. This is complemented by learning programs designed to build confidence in discussing sustainability matters with customers. A new self-directed leadership program, IMPROVE, was developed by the NeuroLeadership Institute and is designed to enhance feedback skills for leaders using contemporary research. Our people also accessed degree programs and certification training, supported by paid study leave. 1. Includes approximately 190 senior leaders, including Group Executive direct reports (General Managers (GM) and Chief of Staffs) and key GM1 roles. |

| FINANCIAL REPORT EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW EXHIBIT 15.4 ADDITIONAL INFORMATION 169 11,000+ employee advocacy group members 135 new graduates joined Westpac 10,600 Microsoft 365 Copilot licences Strengthening diversity, equity and inclusion We are a proudly inclusive employer, committed to fostering a workplace where our people feel valued, respected and safe. One way we advance inclusion is through 10 employee advocacy groups, connecting more than 11,000 people who champion diversity across areas such as gender, disability, LGBTQ+ communities and cultural backgrounds. We also refreshed the Access and Inclusion Plan, marking a 25 year commitment. We have a zero-tolerance approach to sexual harassment and related unlawful conduct, encouraging respectful behaviour and accountability. We encourage our people to be upstanders and speak up against inappropriate behaviours. Our policy includes training, dedicated reporting channels, a no-bystander rule and investigation and support processes. We also delivered training to the Board and Executive Team on their positive duty obligations under recent legislative reforms. We continue to champion gender diversity, with women holding 49% of senior leadership roles. To build on this, we aim to achieve a 40:40:20 balance at all levels by FY30, with 40% women, 40% men and 20% of any gender. In a submission to the Workplace Gender Equality Agency (WGEA), we reported an overall average gender pay difference of 2% based on similar roles or levels. The median gender pay gap reduced by 1.2% to 28.1% and this figure is heavily influenced by the composition of our workforce, with many women employed in contact centres, operations and branches. Our new gender diversity target is designed to help address this. The Illuminate program supported 82 aspiring female leaders through GM sponsorship, with more than 35% advancing to new or expanded roles. As the first bank to join Diversity Council Australia’s RISE Project, we are supporting 20 women from diverse racial and cultural backgrounds to advance their leadership careers. We are investing in specialised programs to recruit, retain and develop Aboriginal and Torres Strait Islander people, supported by a dedicated First Nations Engagement Manager. Refer to page 173 for more information. Prioritising health, safety and wellbeing We recognise health, safety and wellbeing play a vital role in how our people show up at work. We are committed to fostering a safe, secure and supportive environment, focused on protecting people from physical and psychological harm, supporting mental health and providing a respectful and inclusive workplace. The mental health strategy is shaped by our Chief Mental Health Officer. Reviews of each segment were conducted, which helped develop targeted action plans to address psycho-social risks and better understand the factors influencing wellbeing at work. This was complemented by mental health training in partnership with the Black Dog Institute. For our Retail bankers' safety, we delivered face to face de-escalation training to 157 branches and psychological first aid training to 375 Consumer leaders. Wellbeing remains a core part of our employee value proposition. We launched a new mobile Wellbeing App with personalised content and holistic wellbeing assessments to encourage healthy living. This complements our other health initiatives including fitness incentives, access to 24/7 counselling and free flu vaccinations. Flexible working arrangements support a healthy work-life balance. In addition, our latest EVP introduced new leave benefits including doubling Culture, Lifestyle and Wellbeing Leave to four days, increasing Compassionate Leave from three to five days per occasion, as well as five days leave to support employees to attend appointments related to fertility treatment, surrogacy, adoption and foster care. We also make superannuation payments during unpaid parental leave, rather than waiting until employees return to work. We offer market-leading banking benefits for employees, contractors and their families. Eligible employees receive a Salary Continuance Insurance benefit, also known as Income Protection Insurance, in case of illness and injury. In addition, a MyDiscounts employee portal continues to offer exclusive offers and discounts from leading brands. BUILDING STRONGER CUSTOMER CONNECTIONS We believe it’s essential for our people to understand how their roles contribute to better customer outcomes. We created opportunities for all teams, including business functions like risk, legal and compliance, to connect with customer experiences supported by Customer Obsession Learning and Service Mindset sessions attended by 1,000 people. Additionally, 2,500 people completed Immersion training and 600 participated in Customer Journey Bootcamps. We're building a workplace where everyone feels empowered to deliver great customer outcomes. |

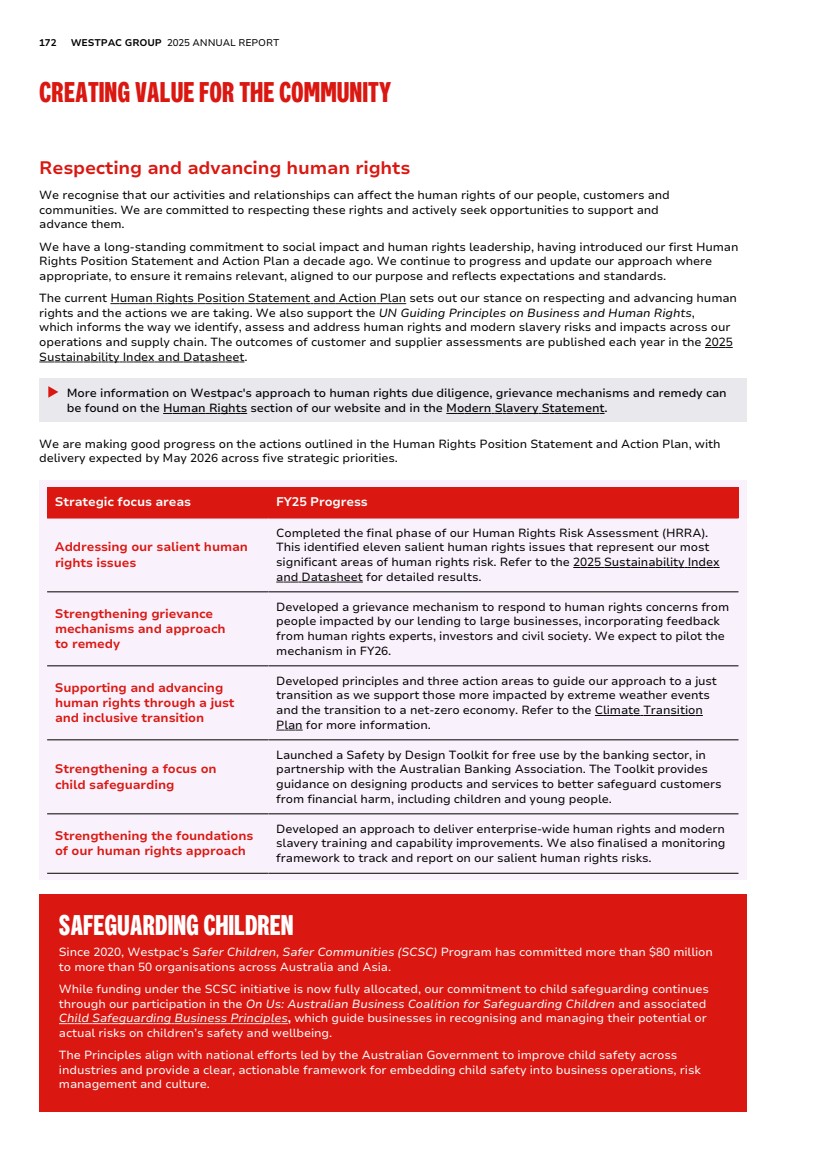

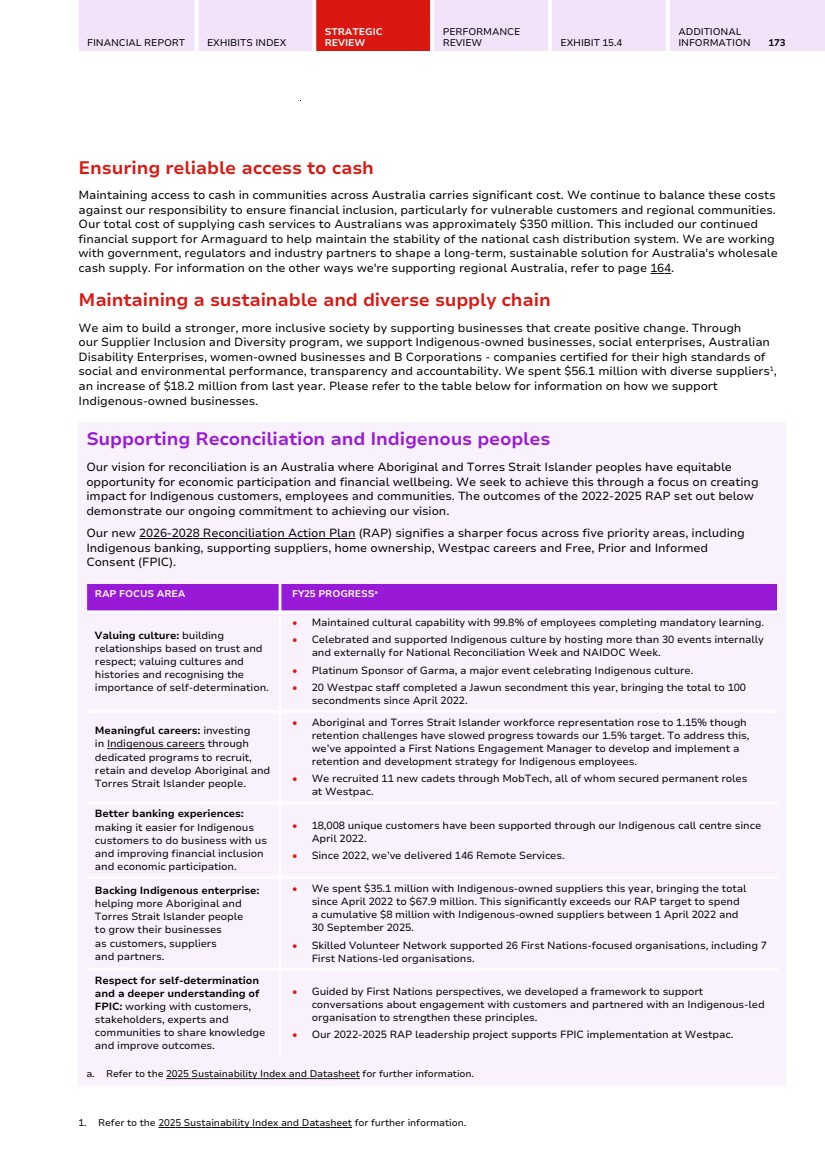

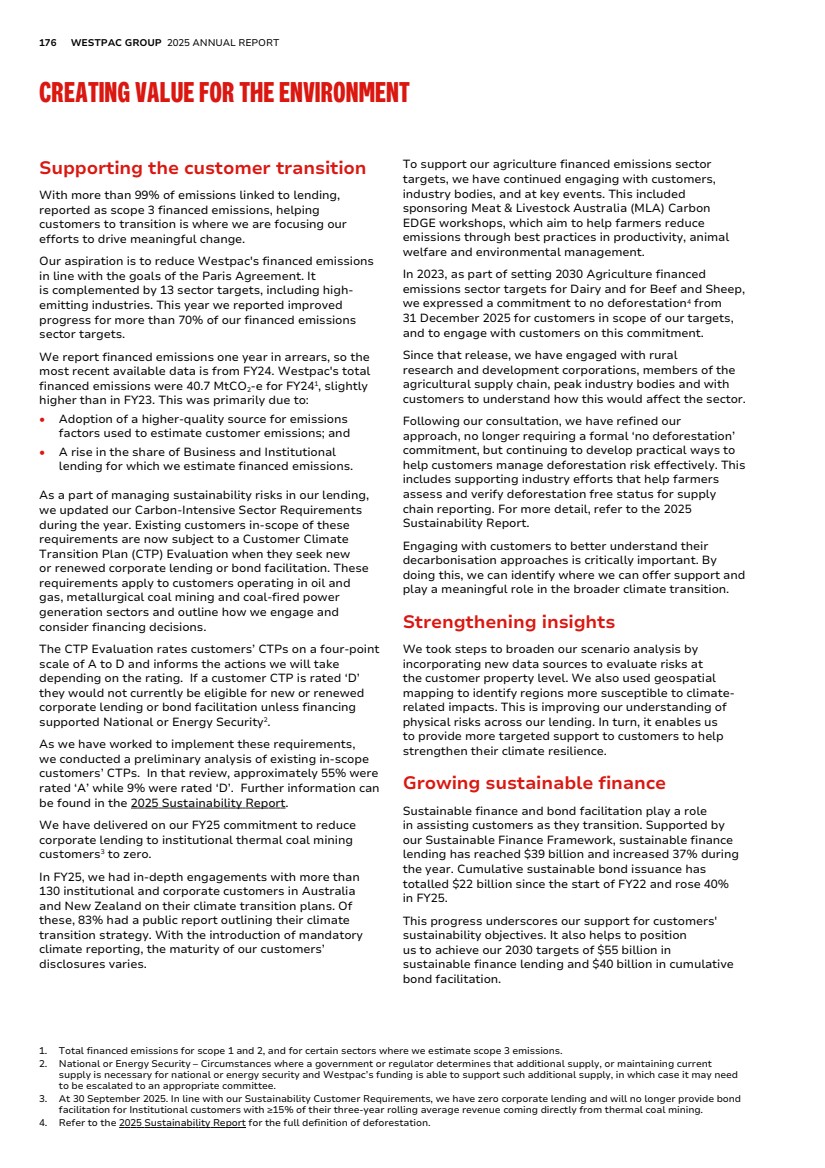

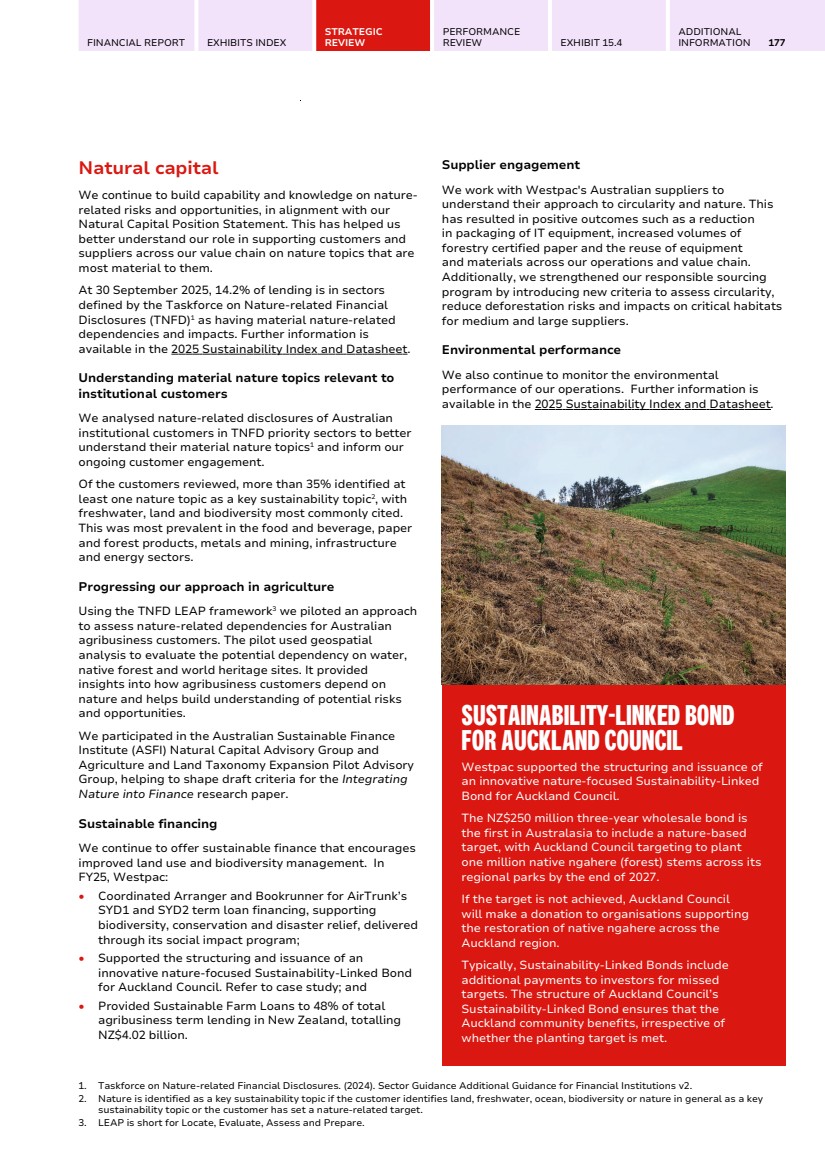

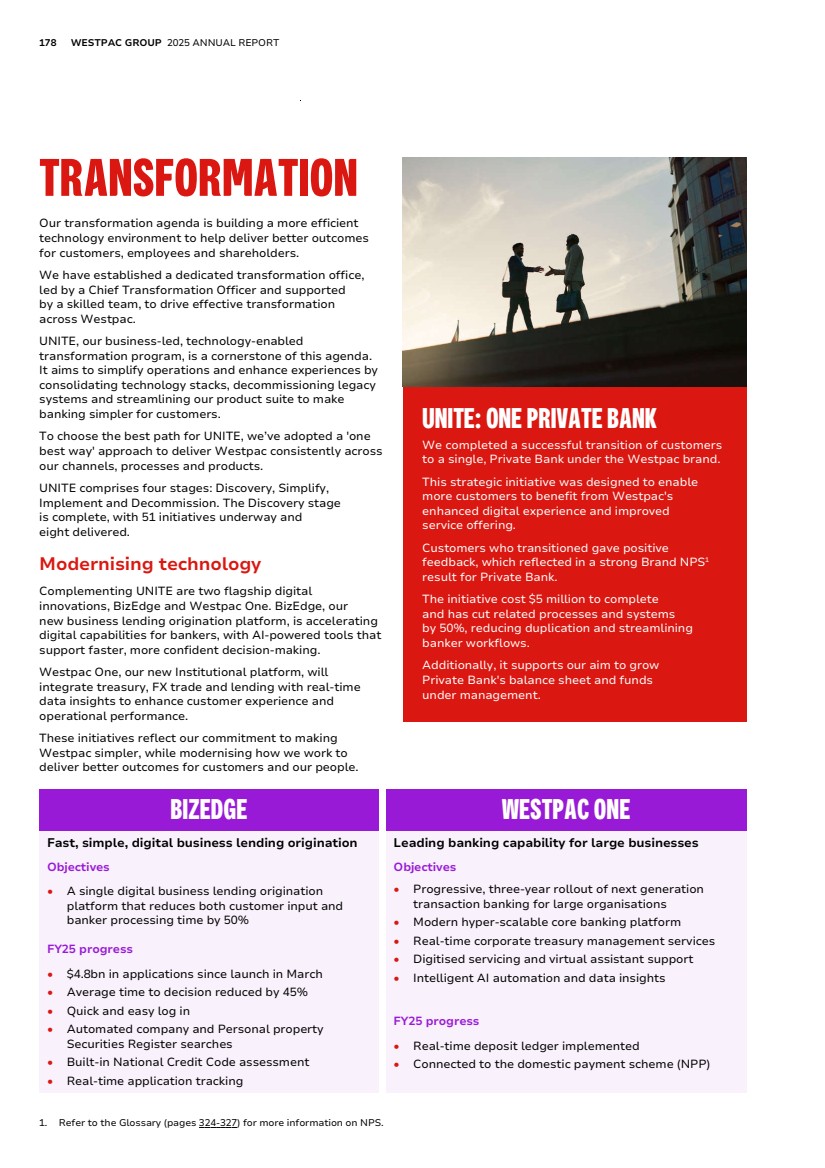

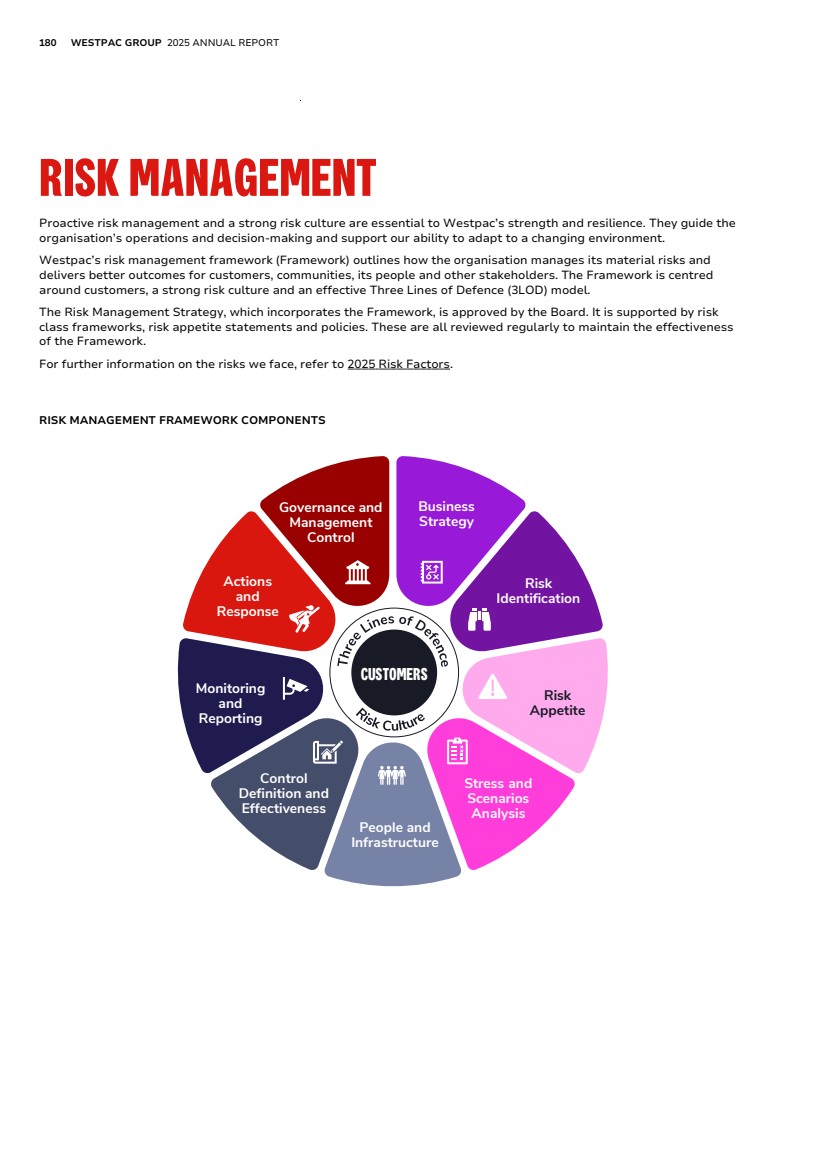

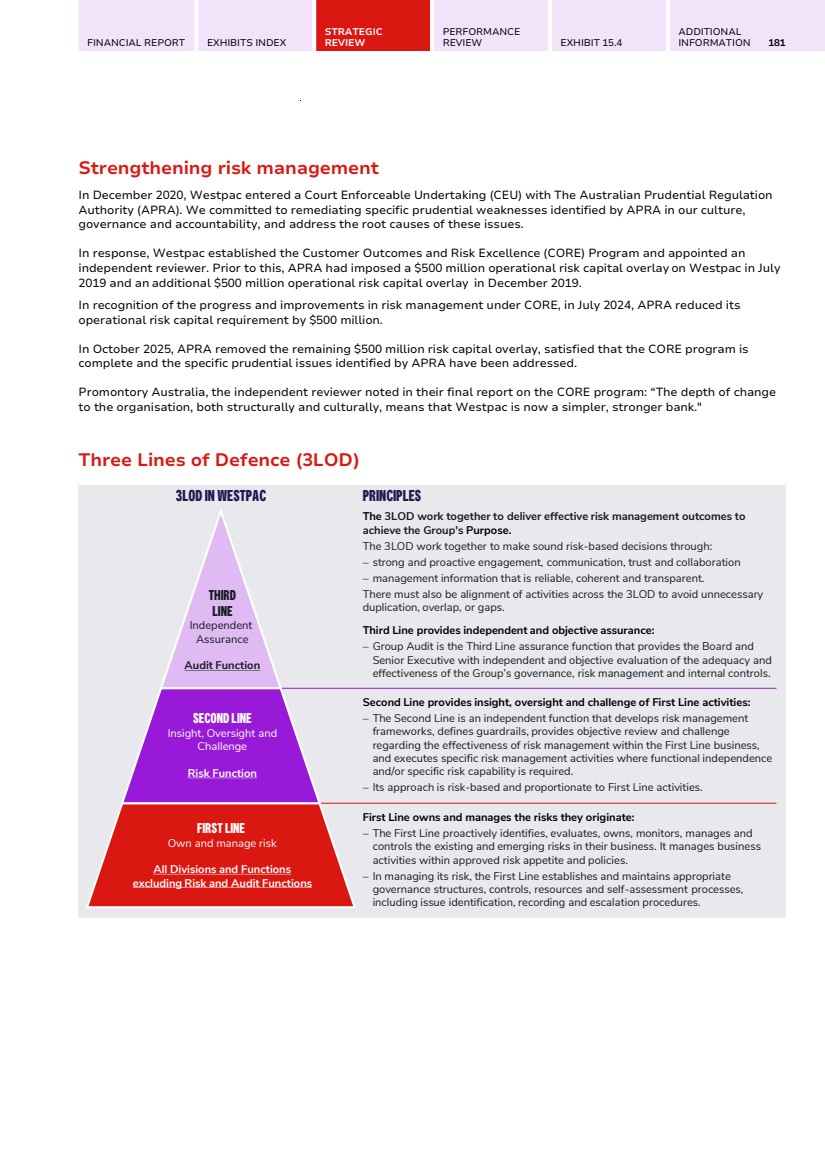

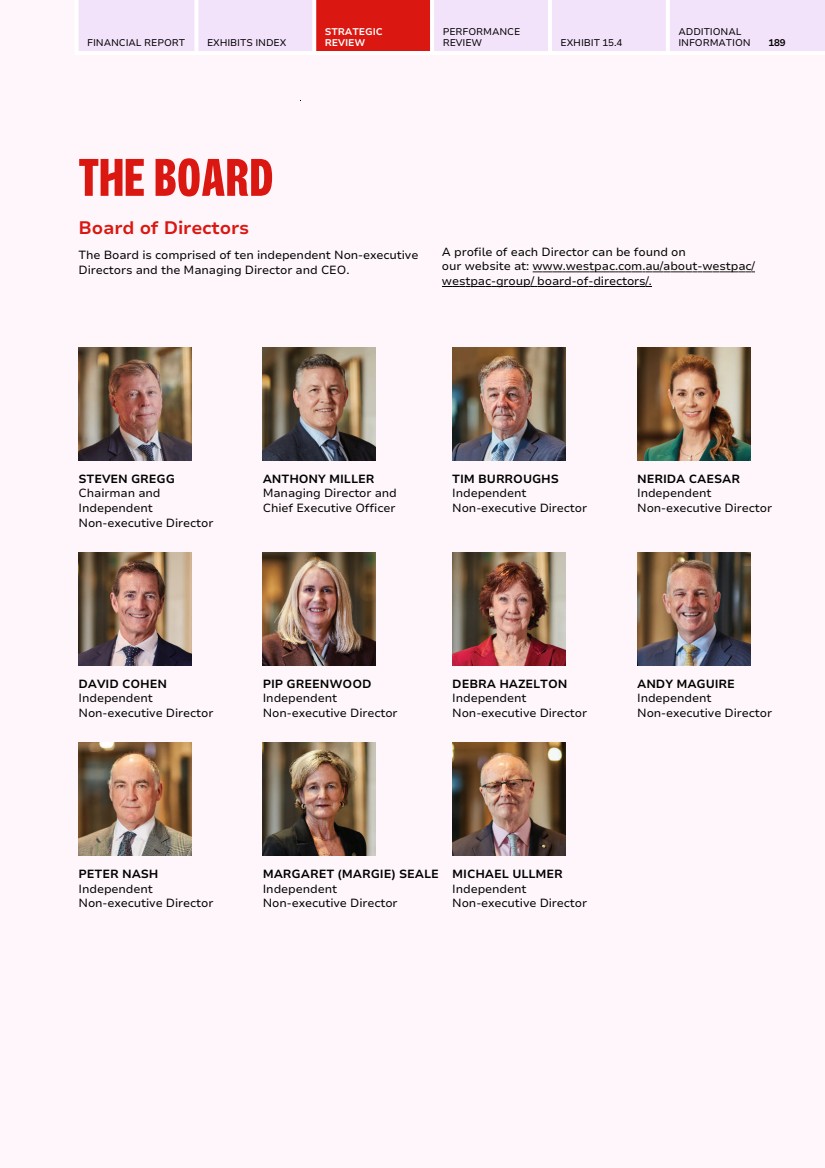

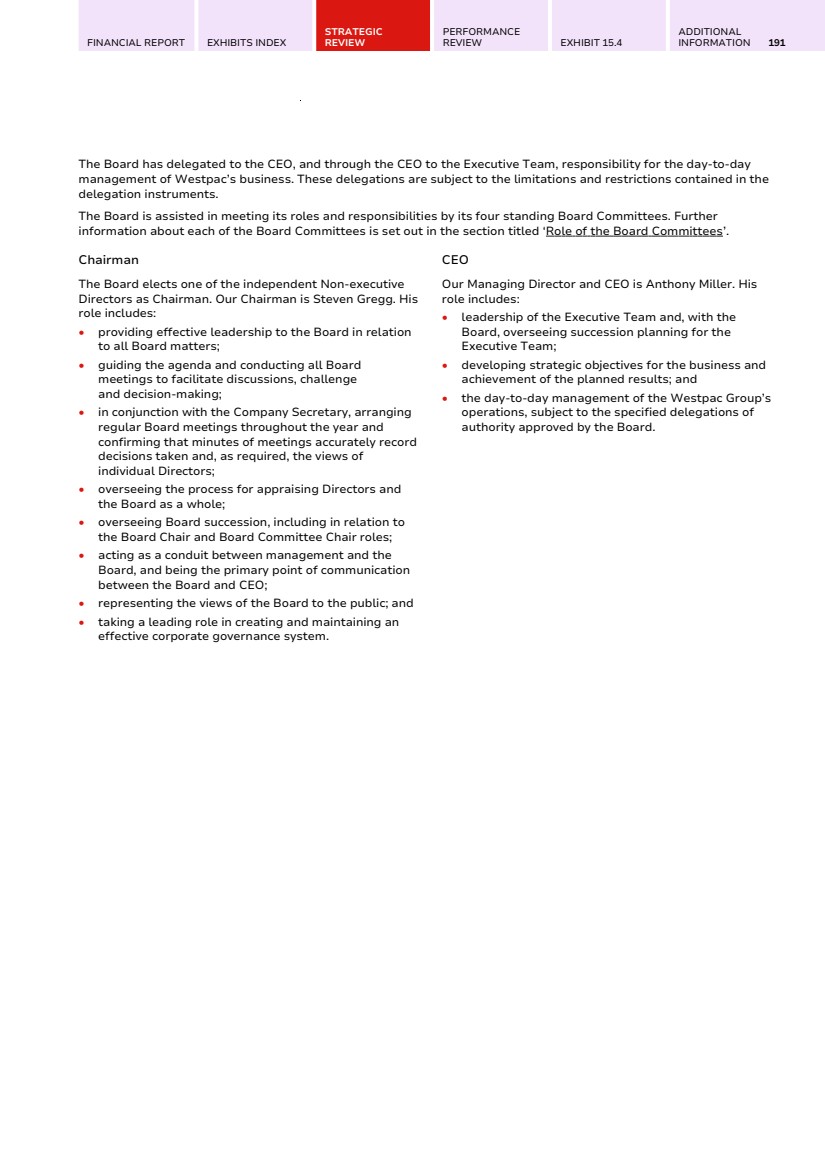

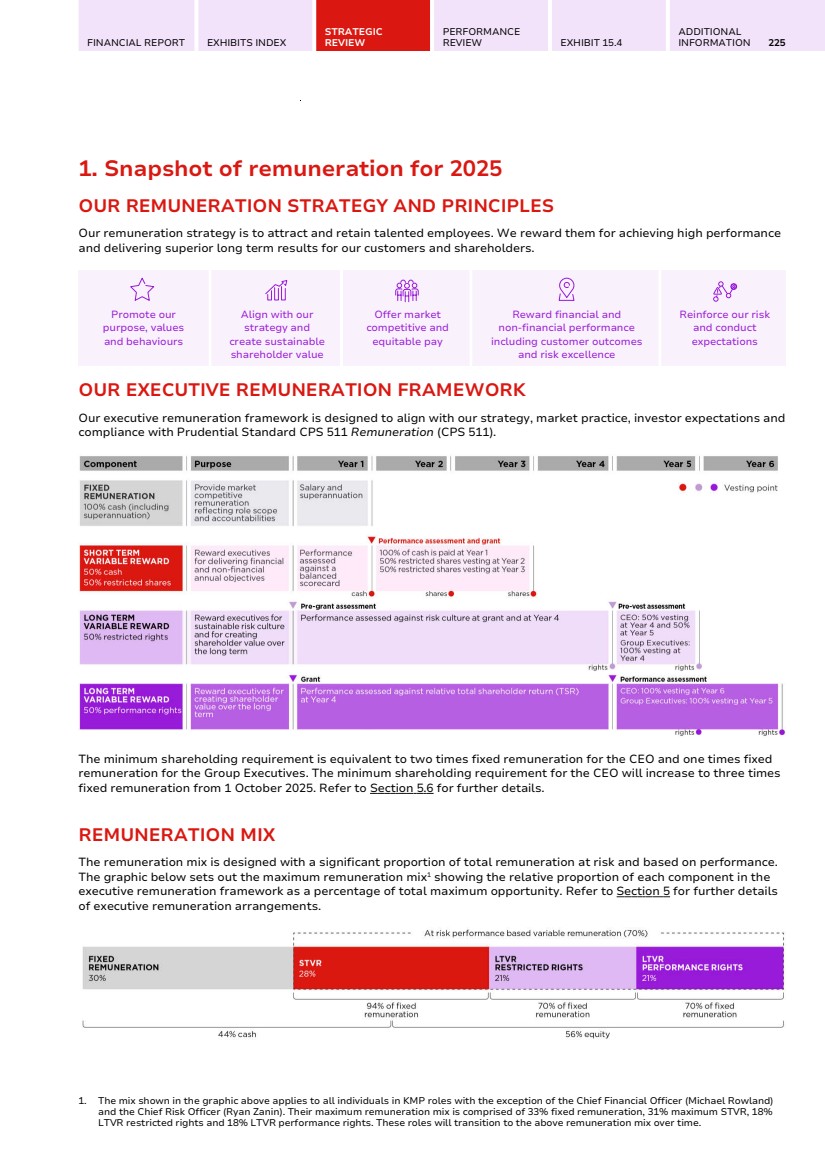

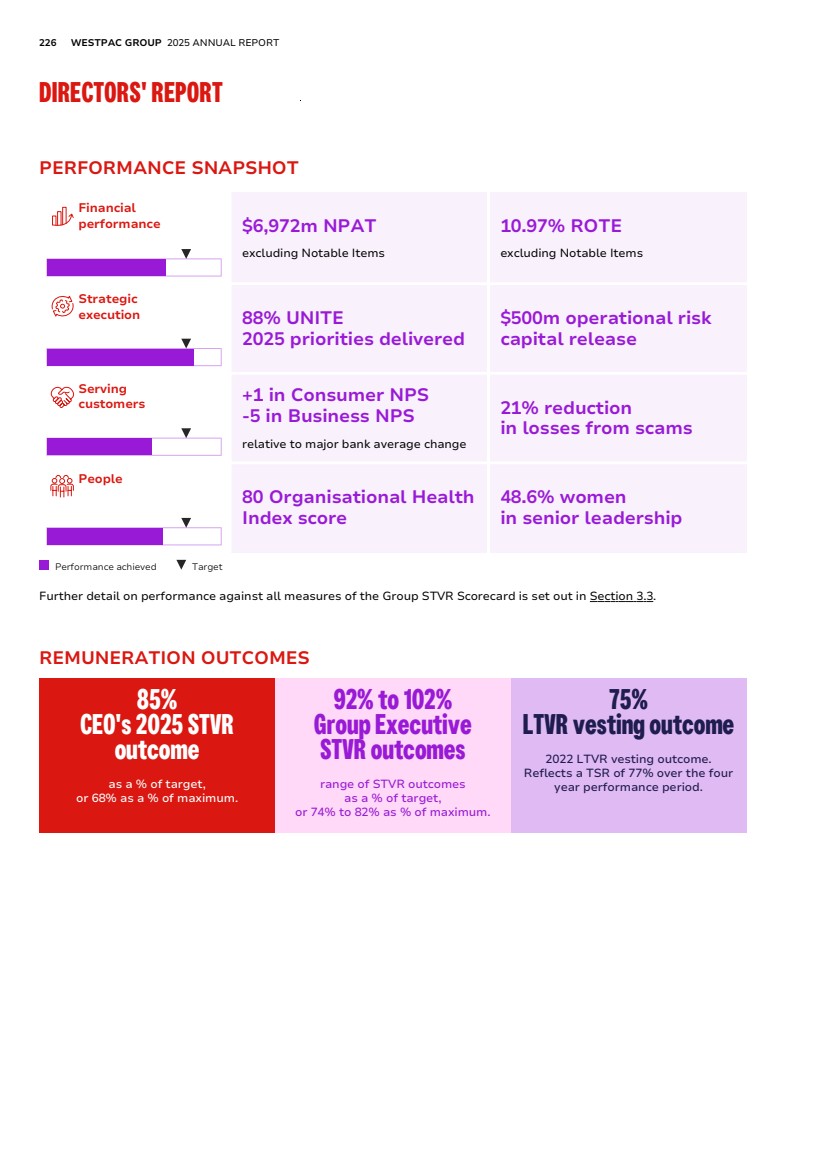

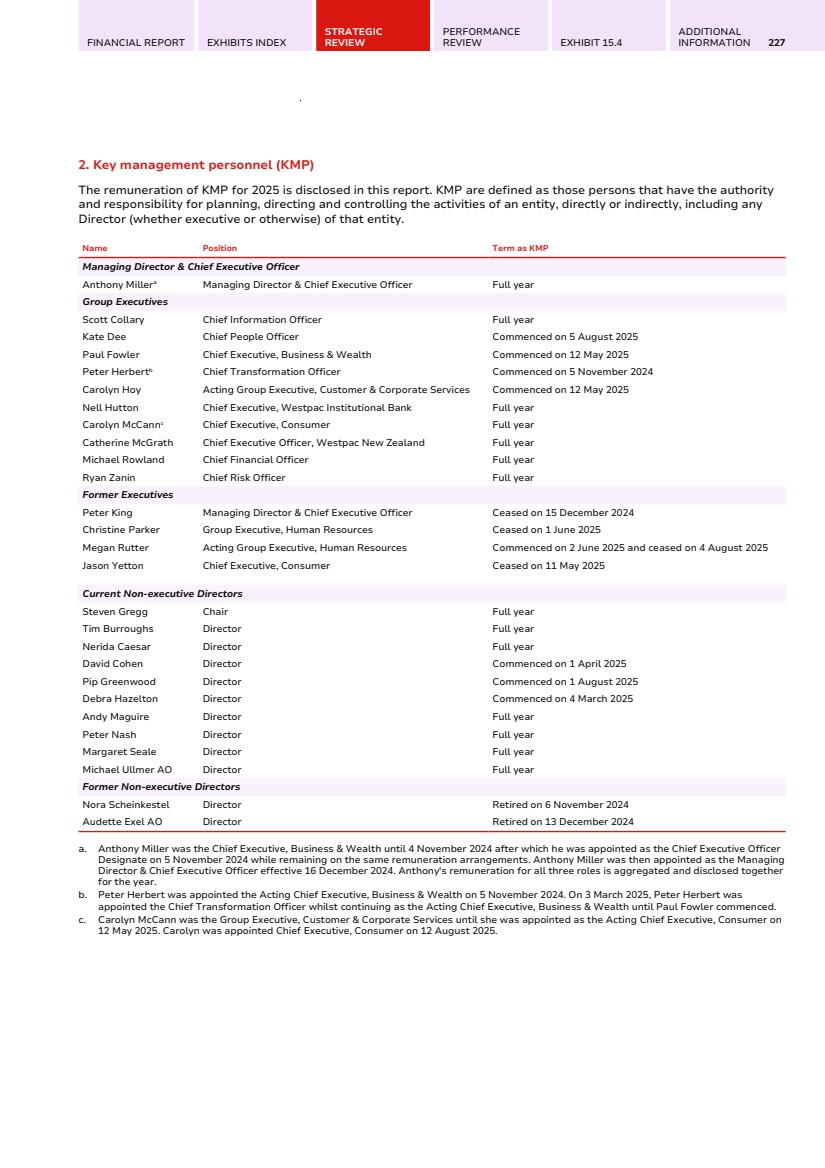

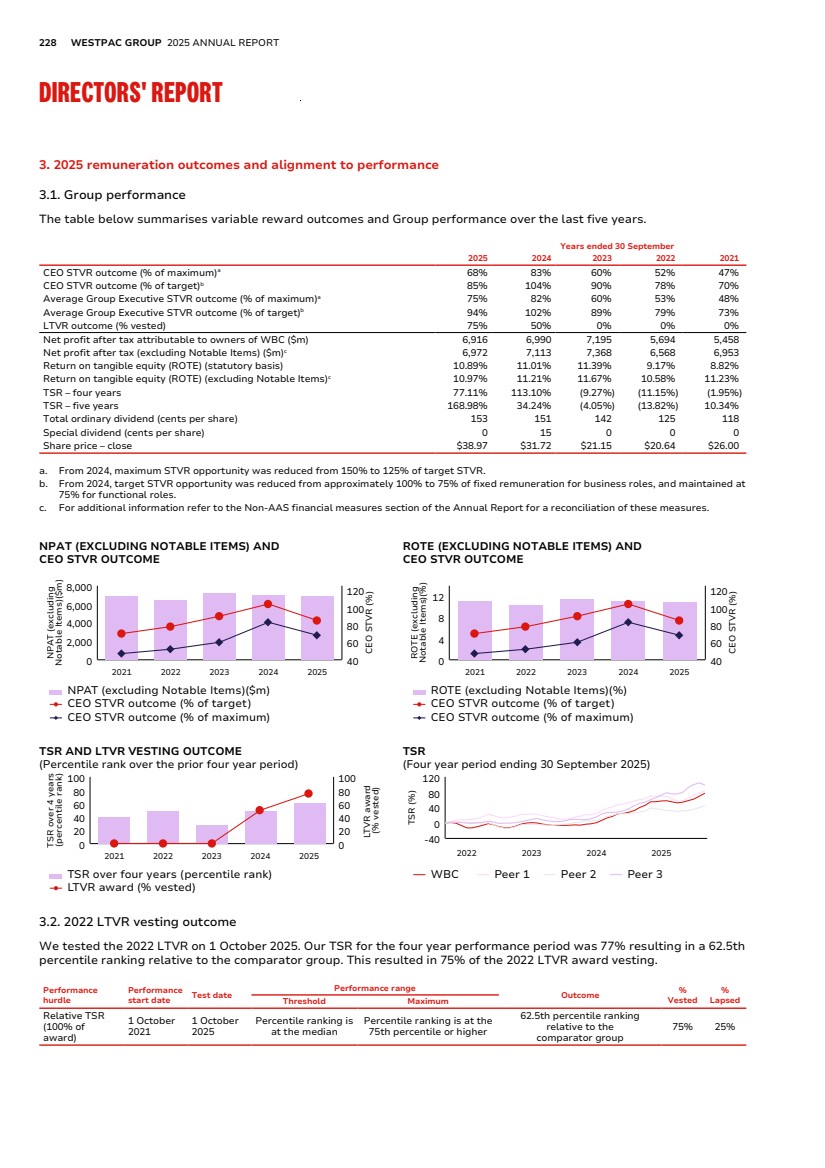

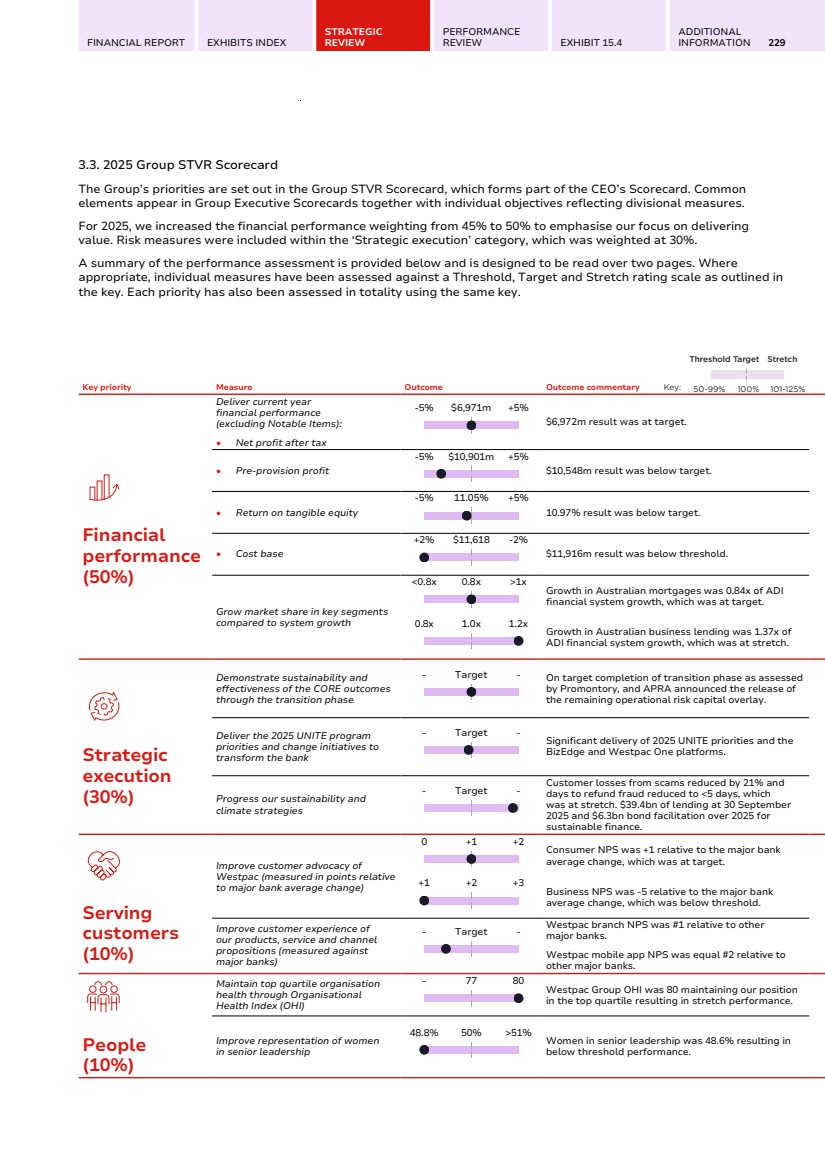

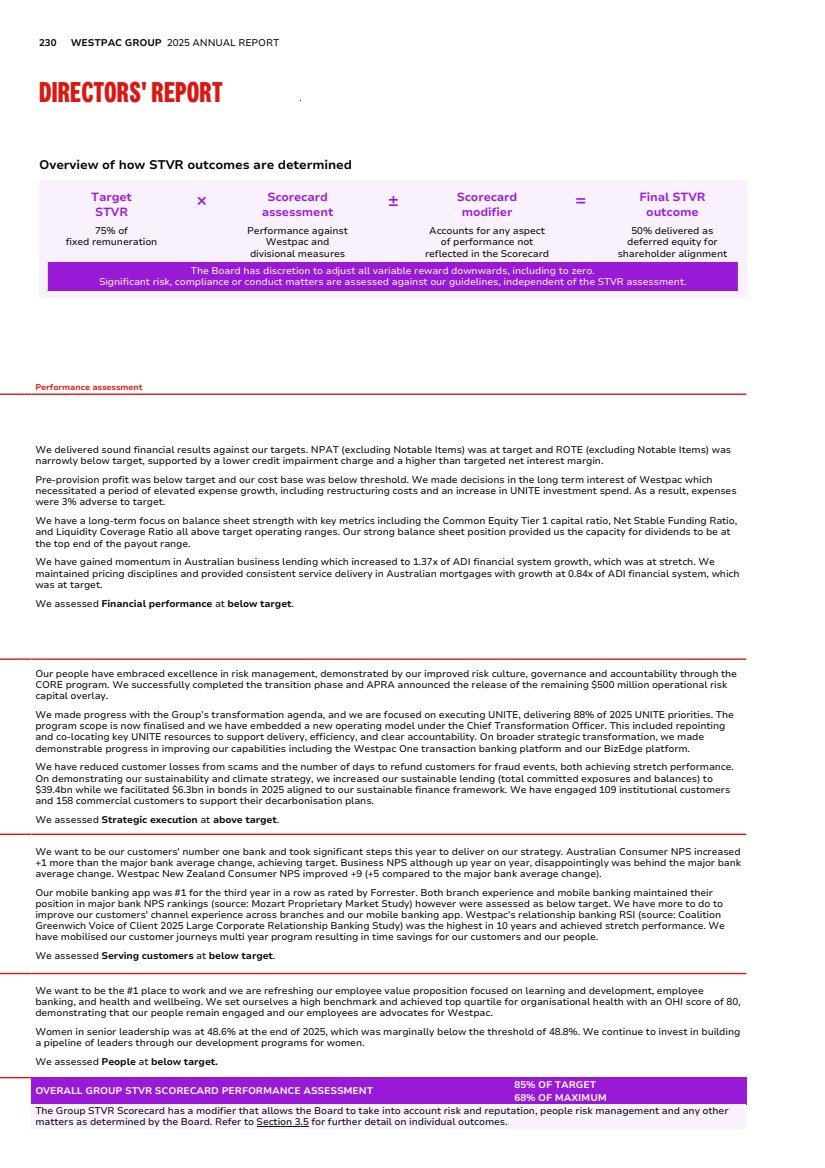

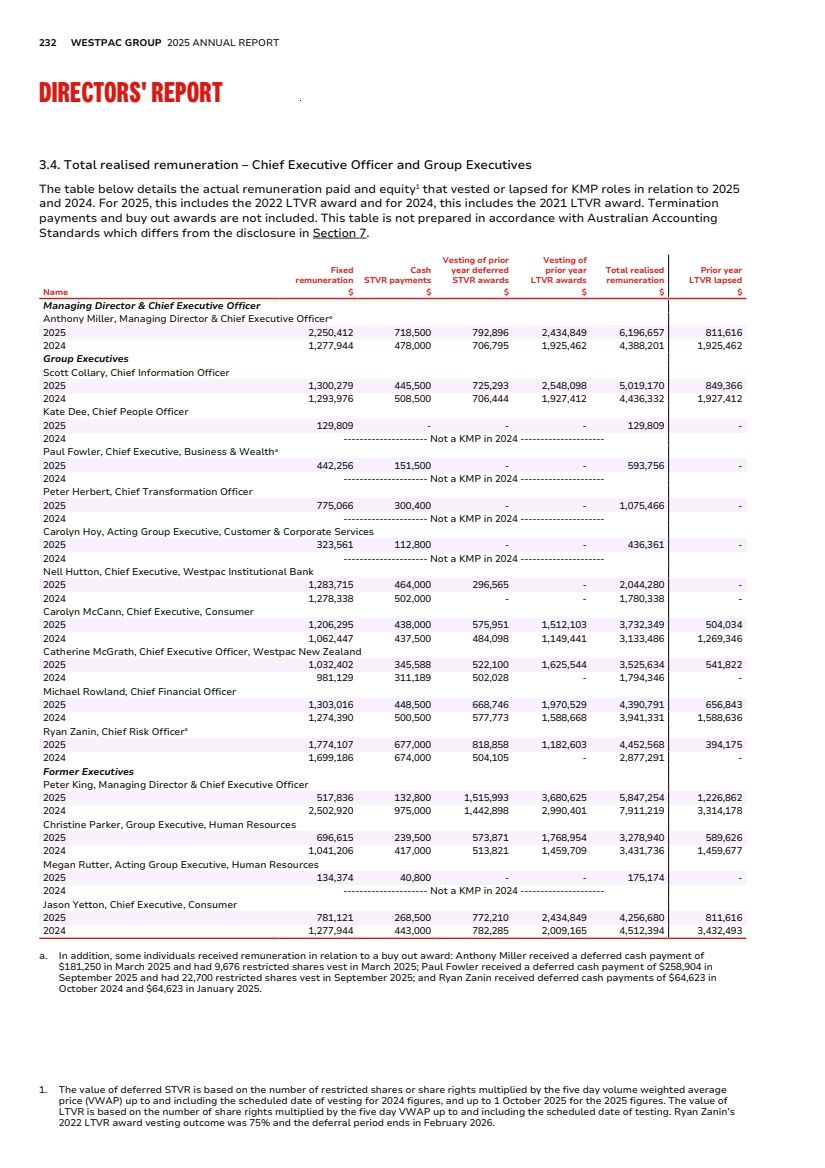

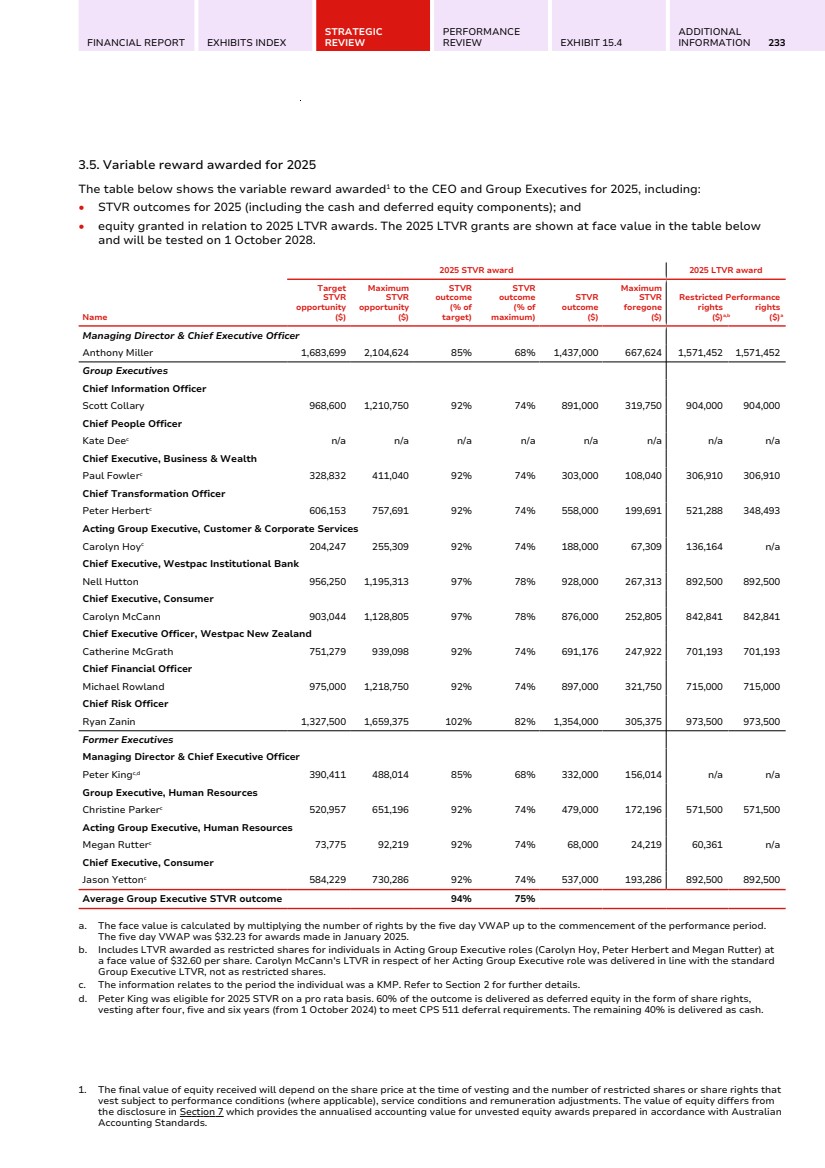

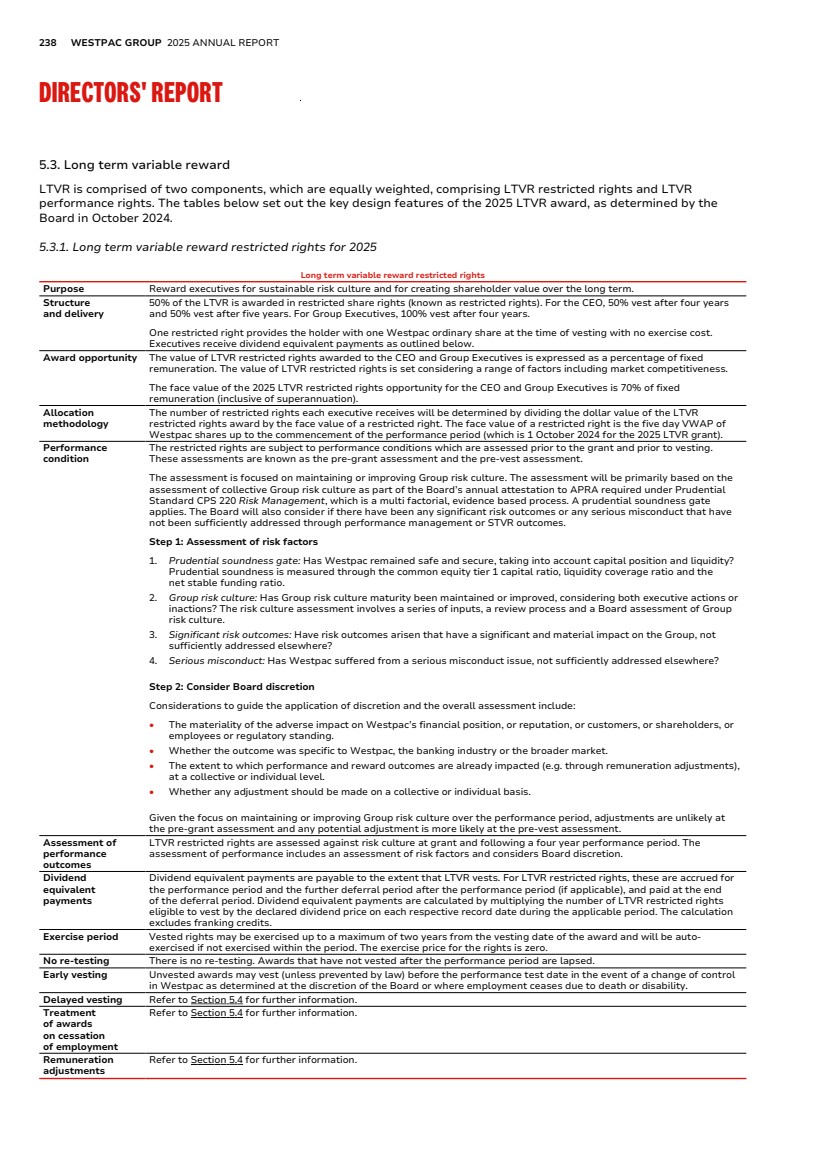

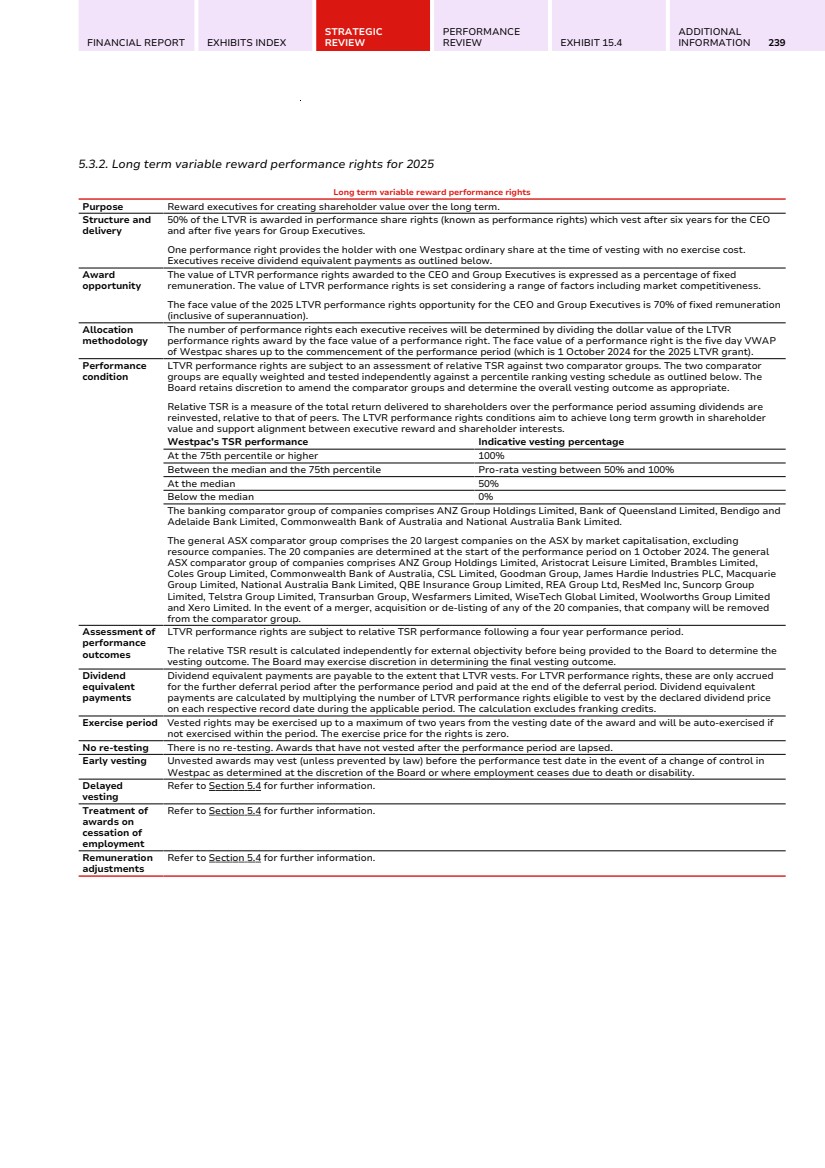

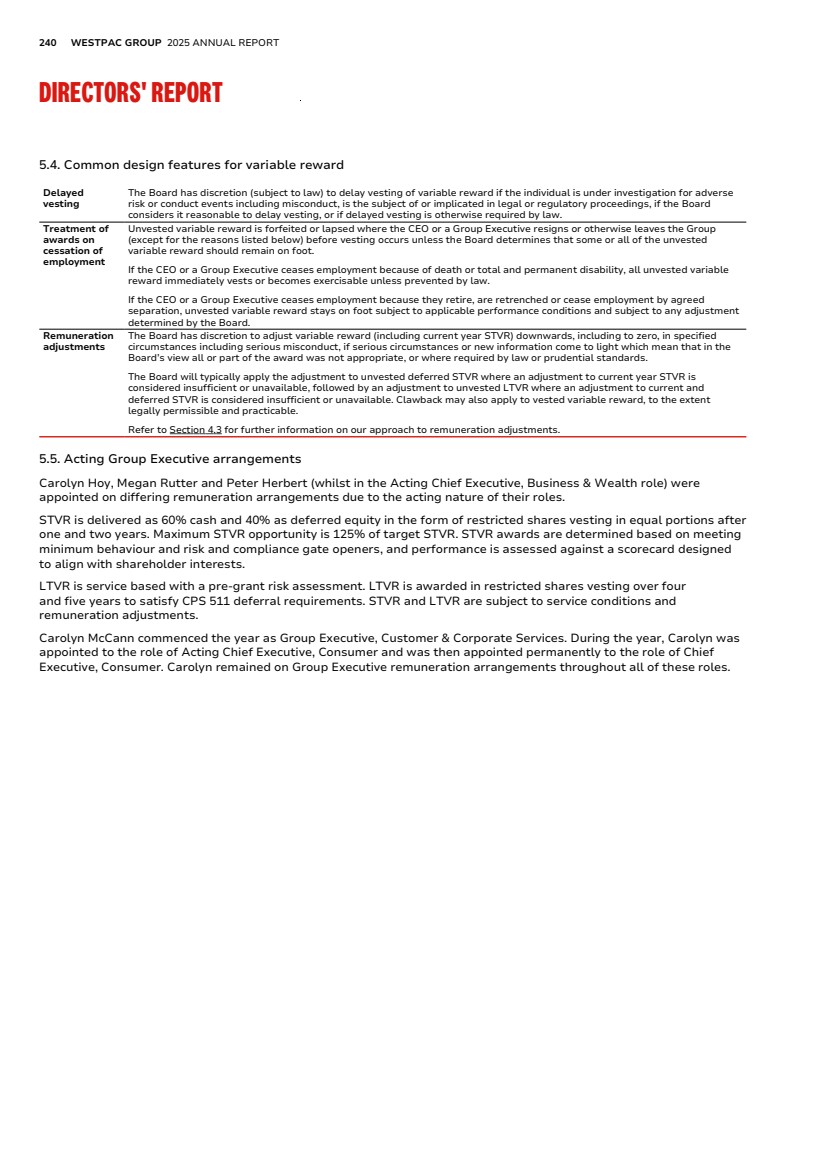

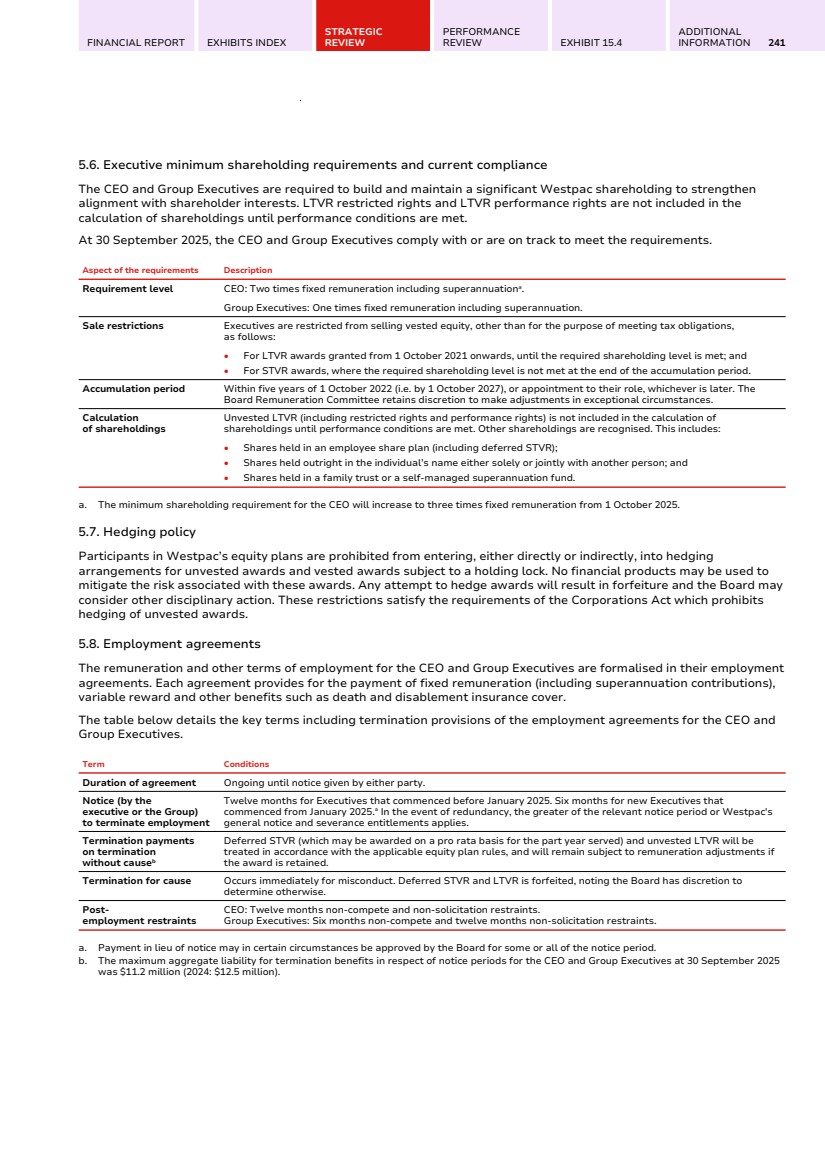

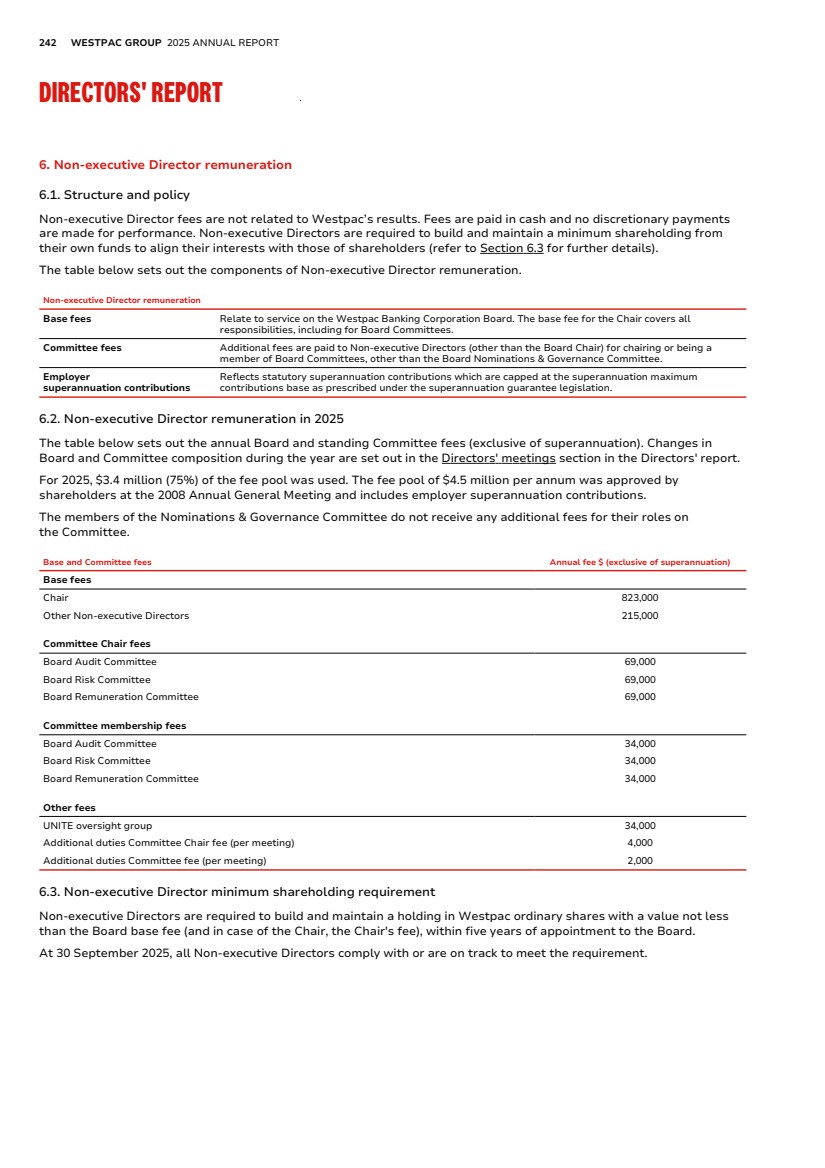

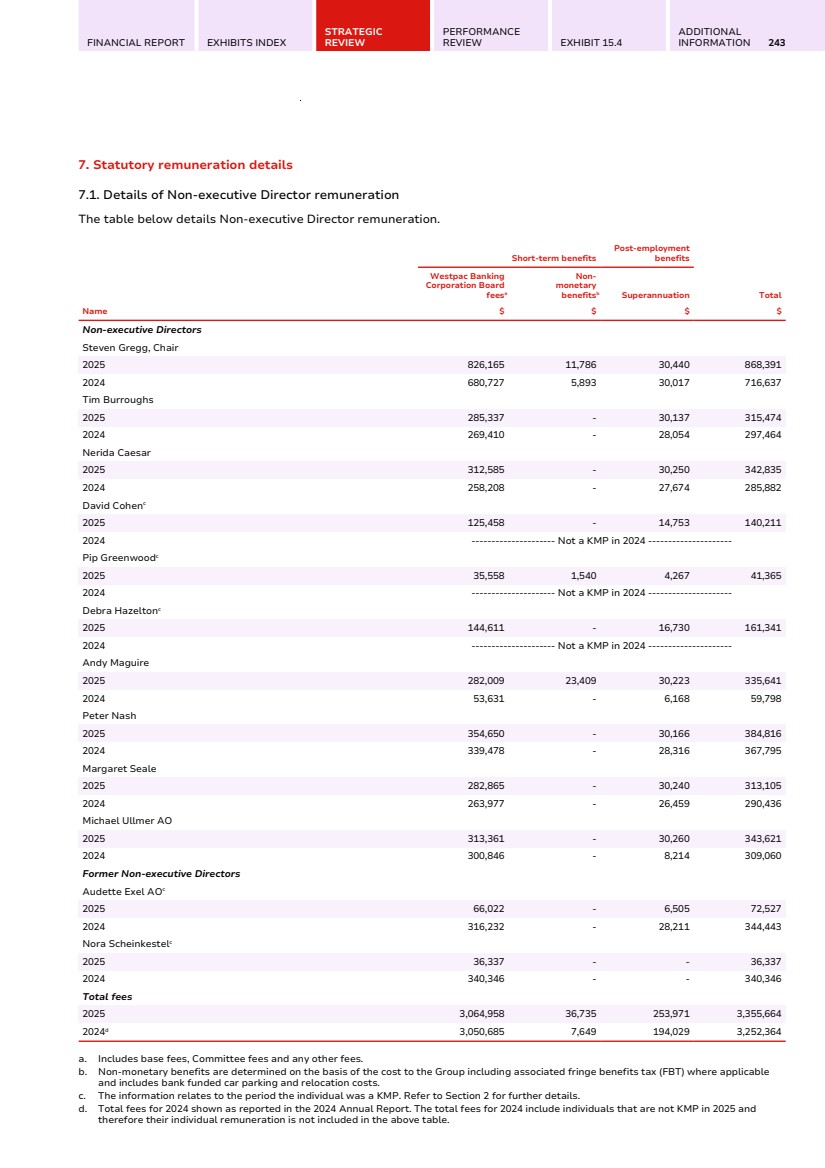

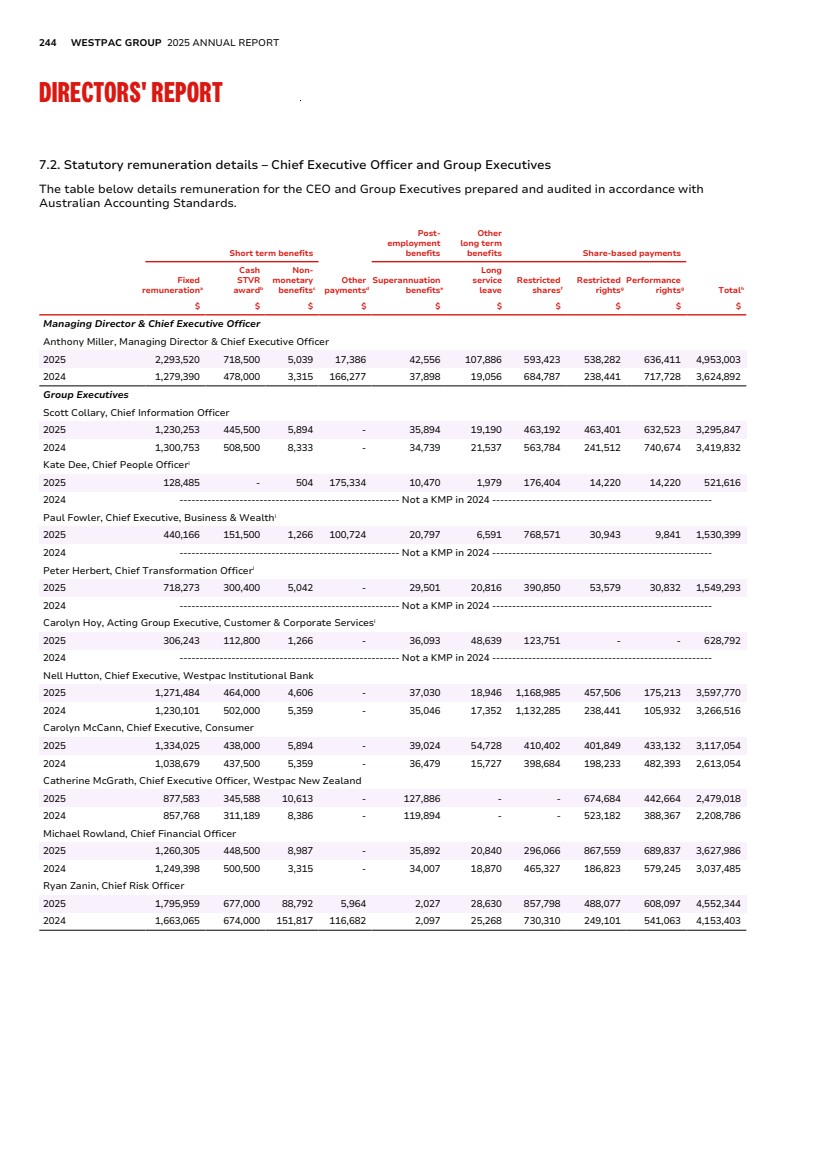

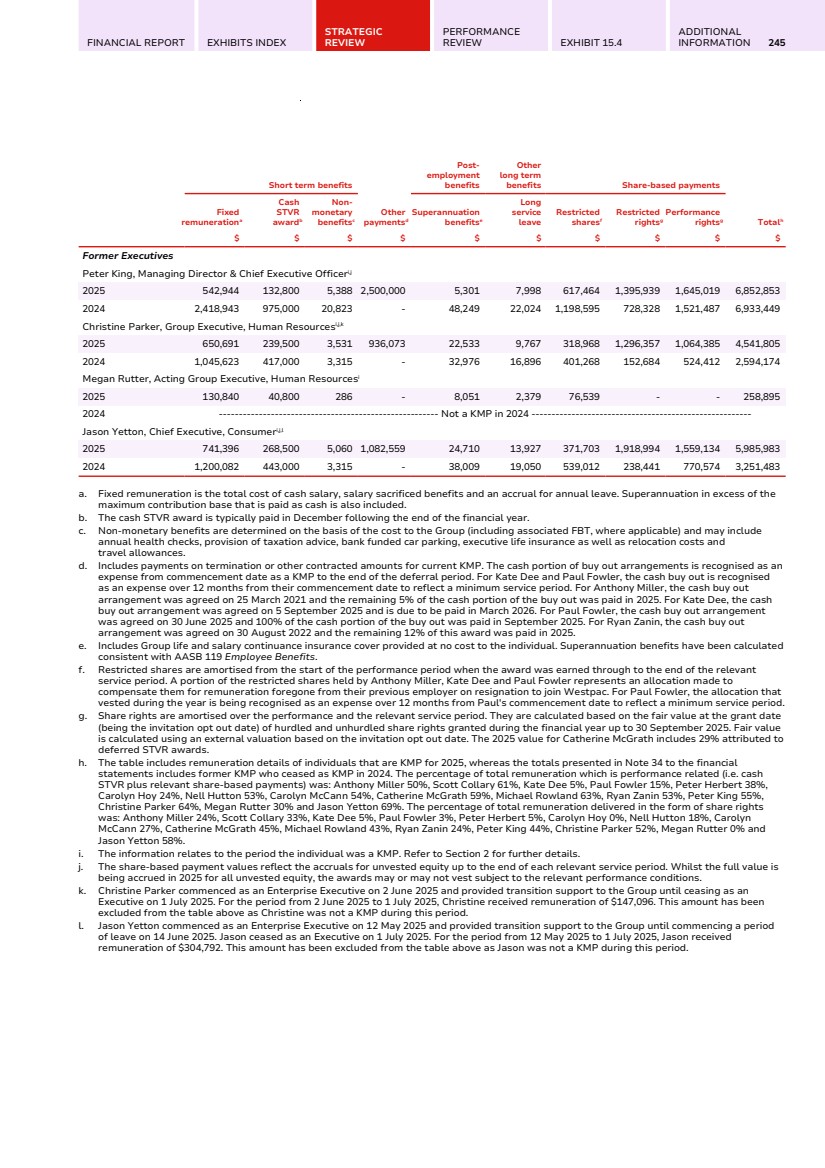

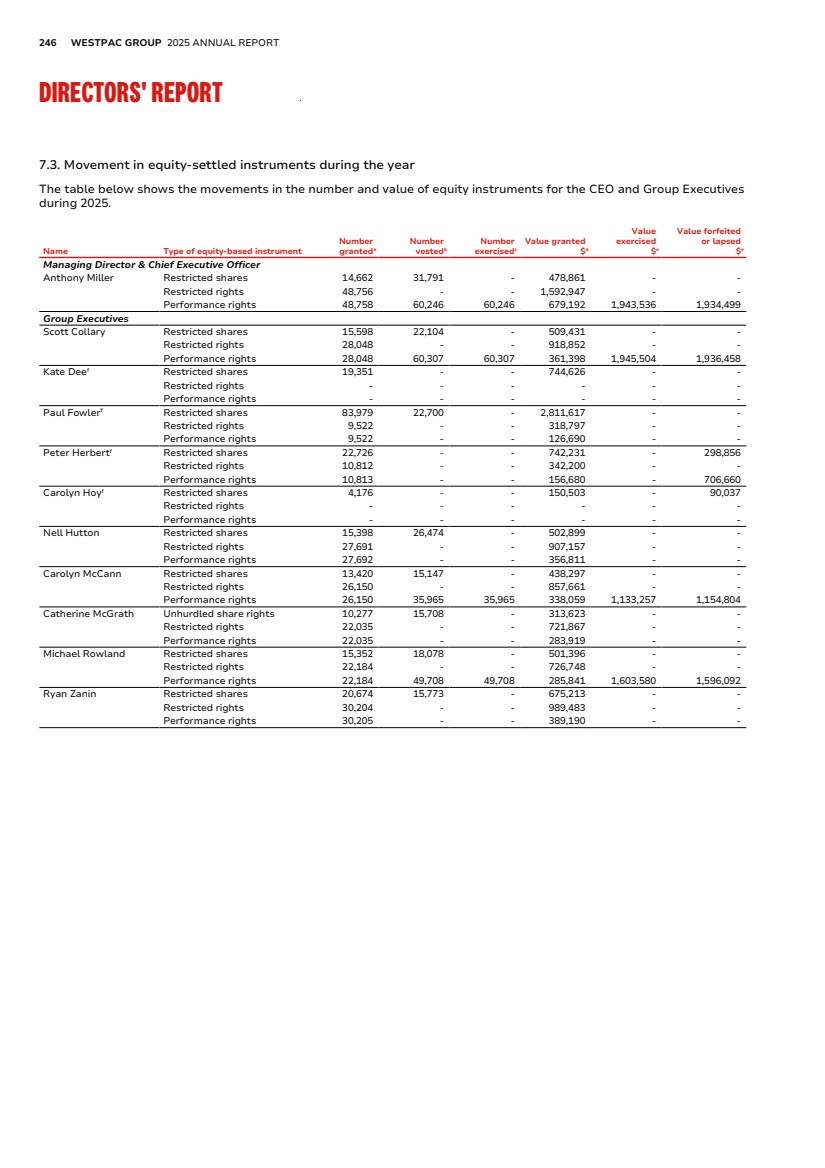

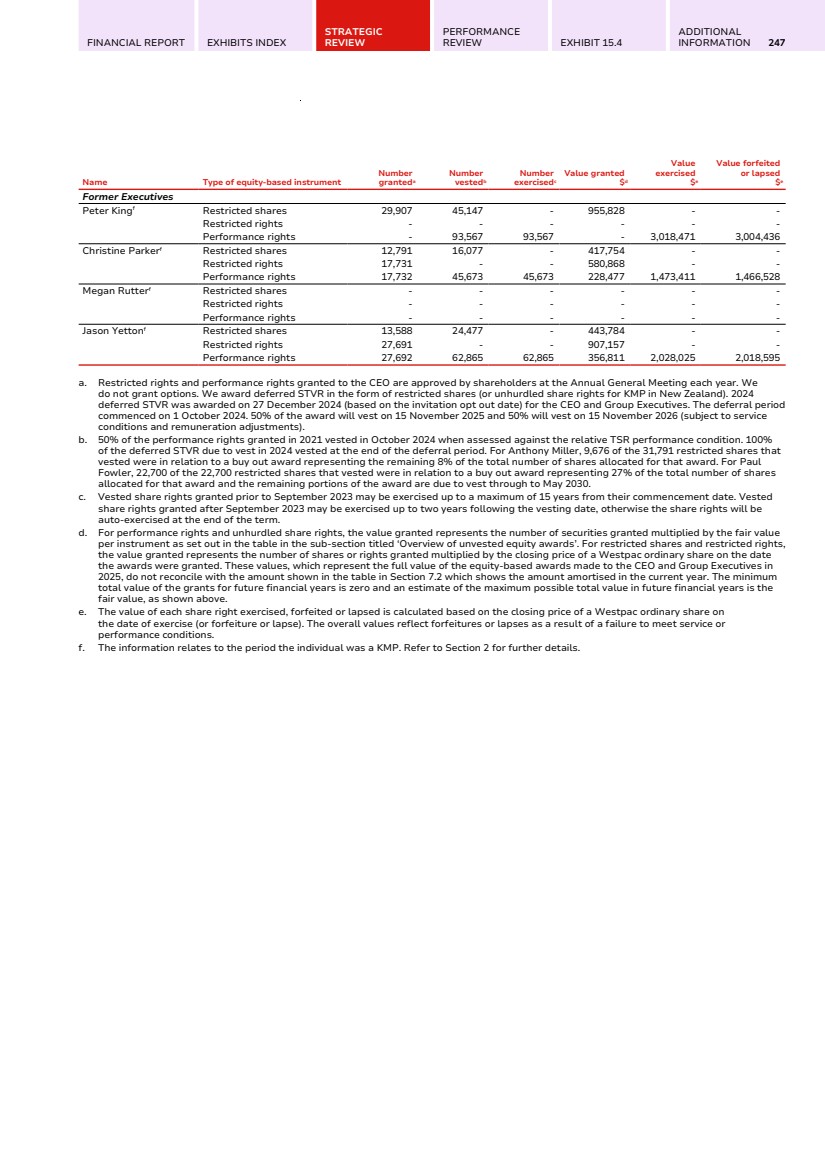

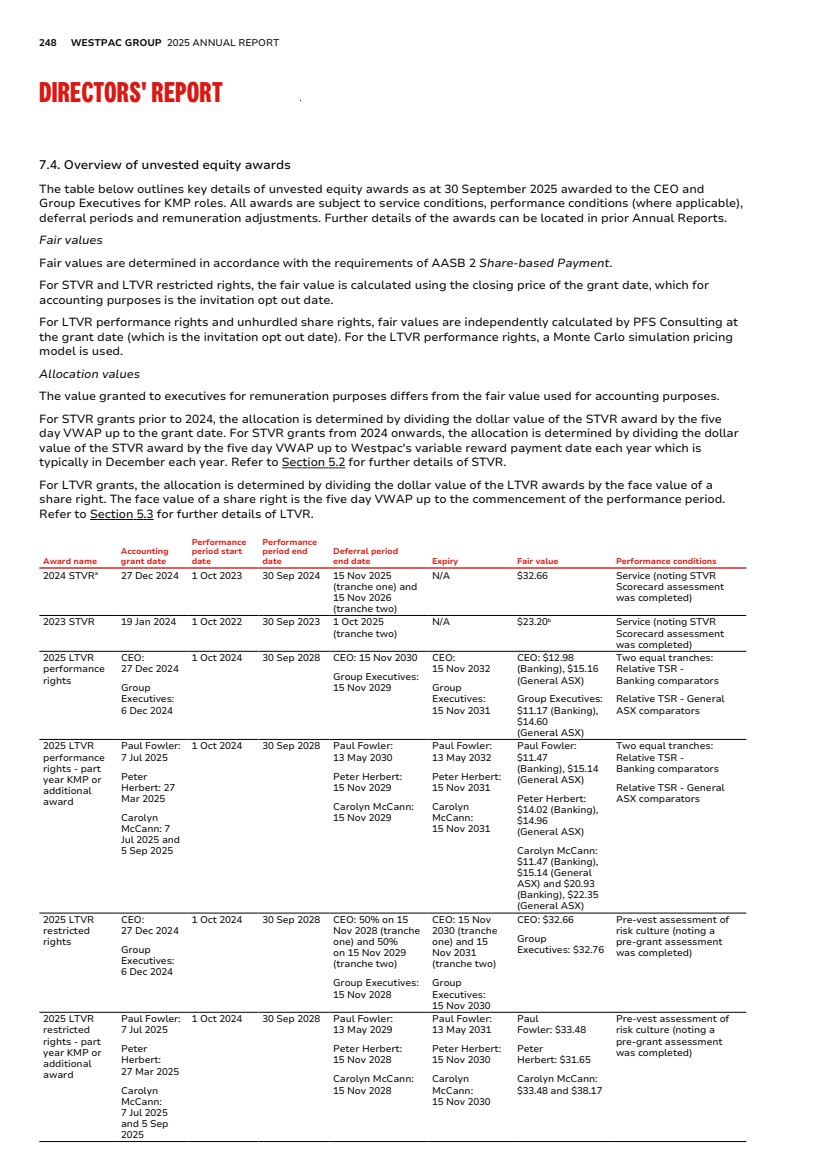

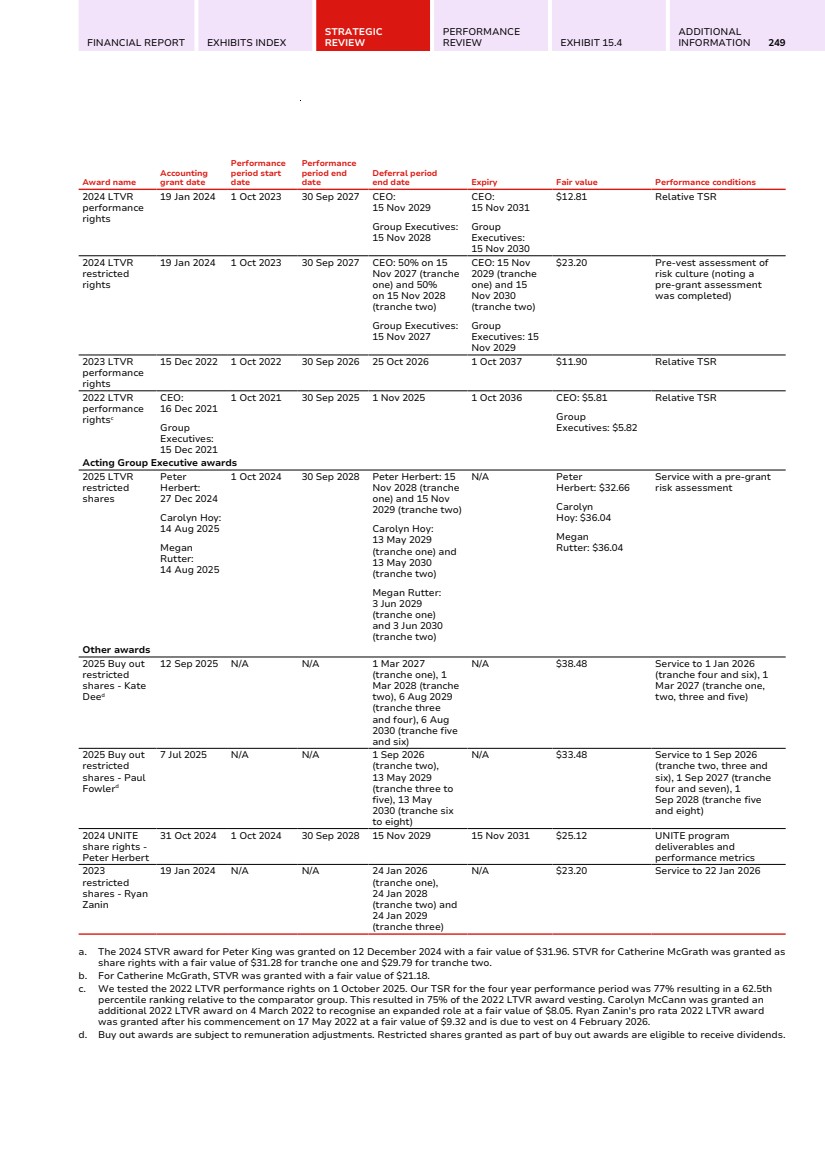

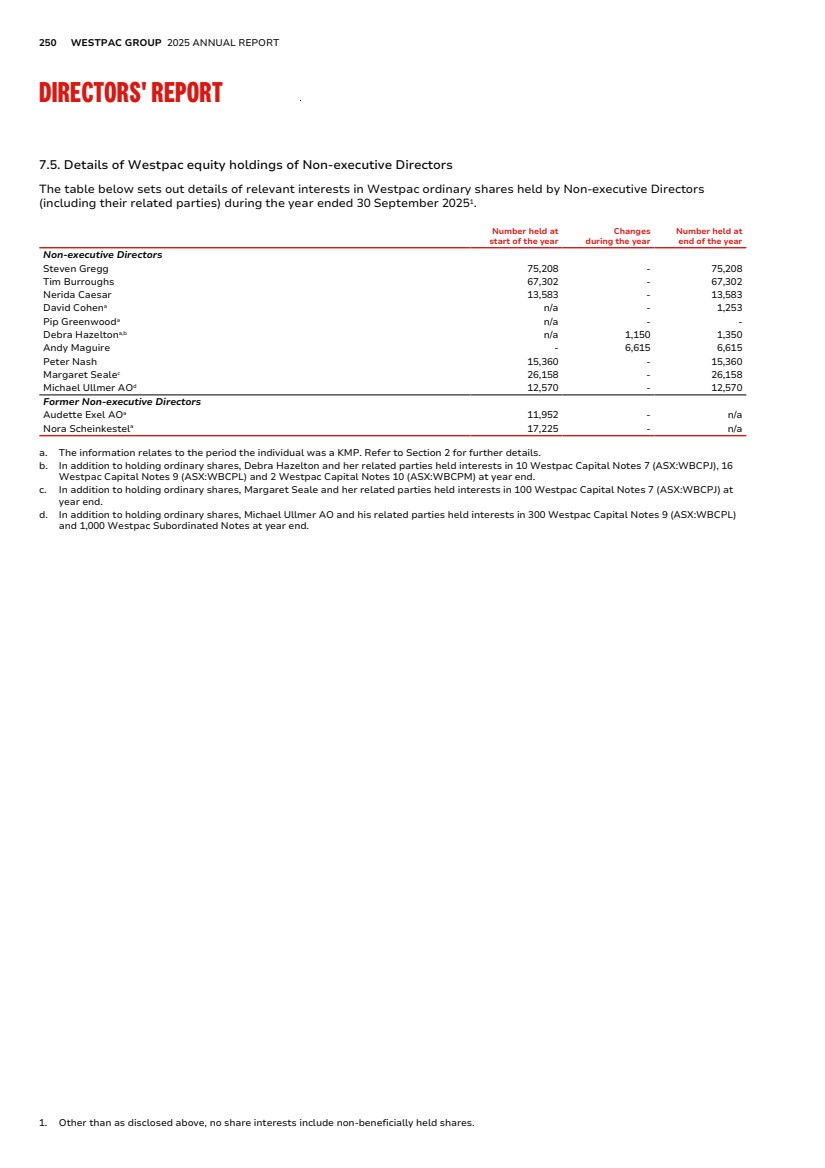

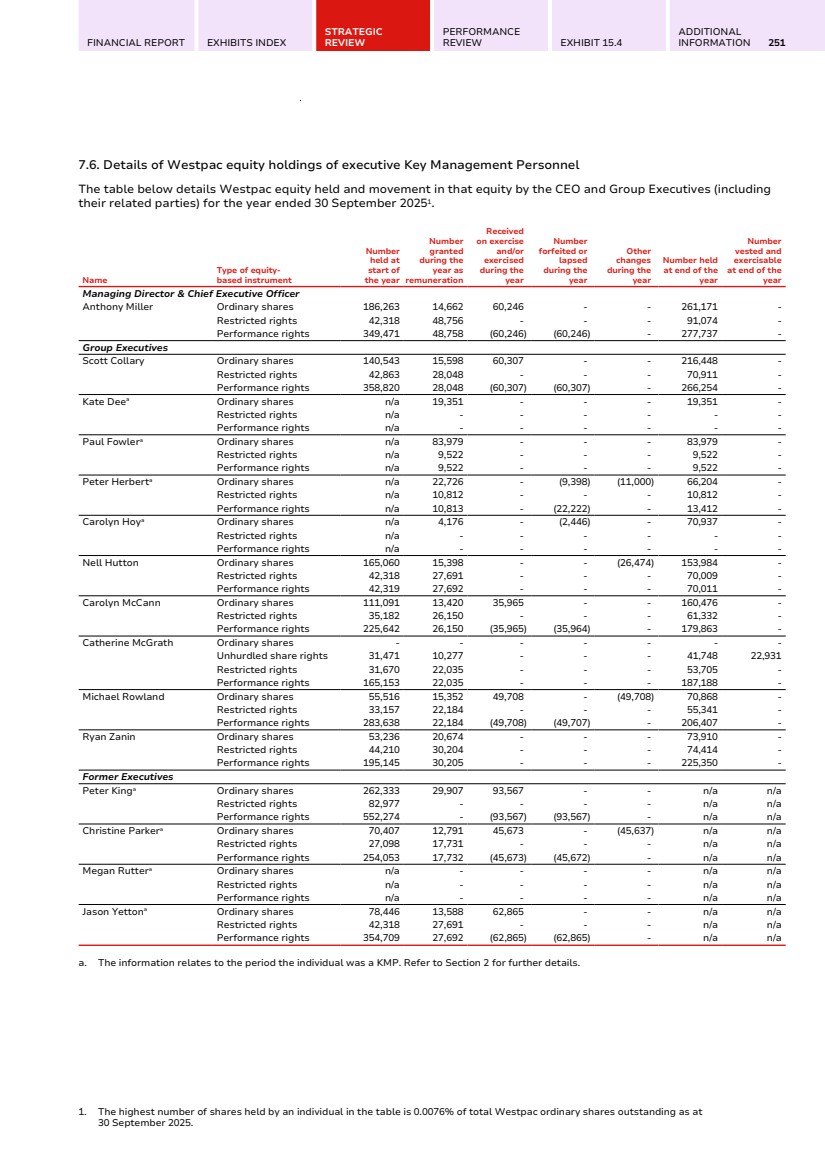

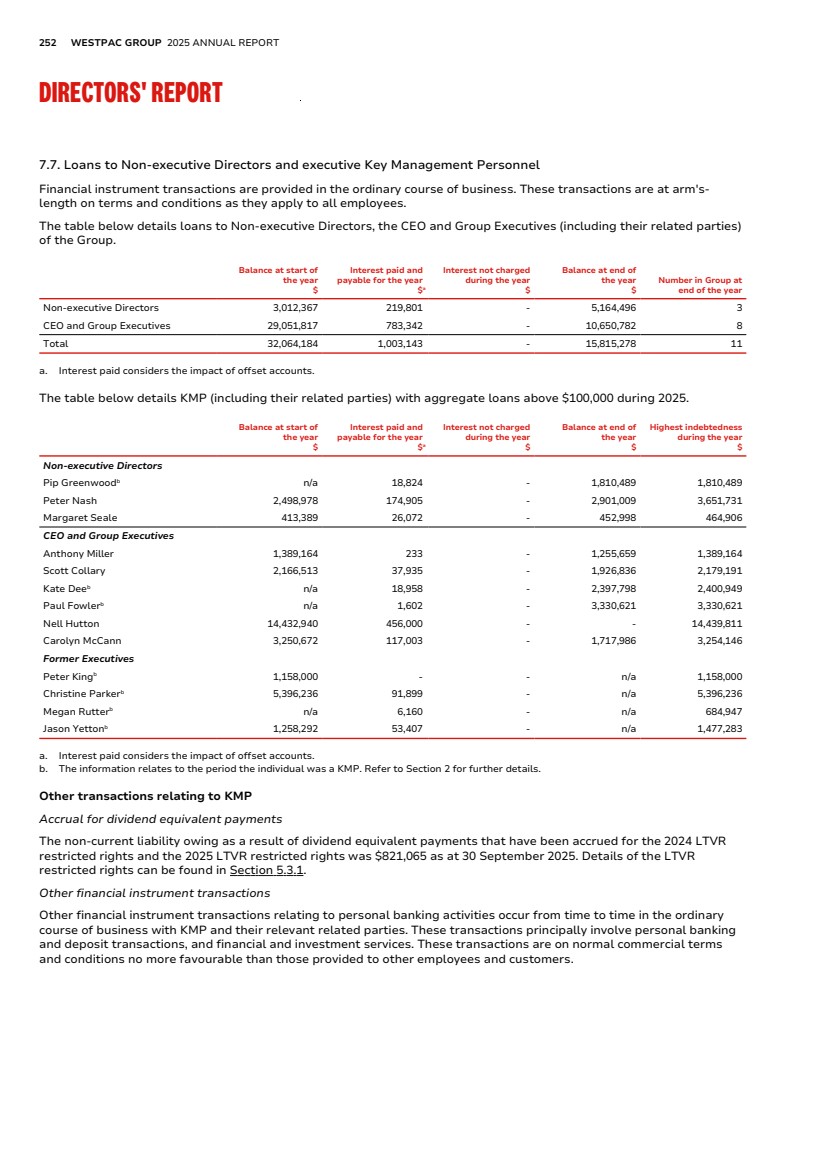

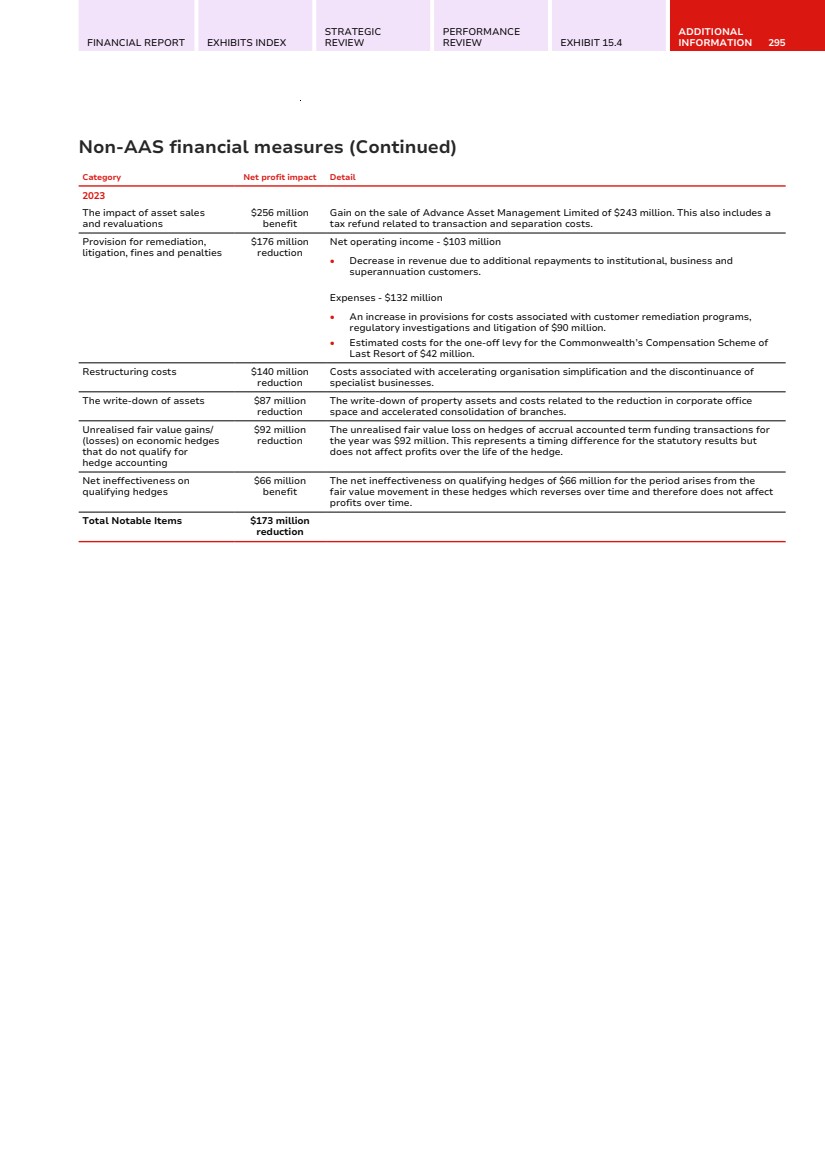

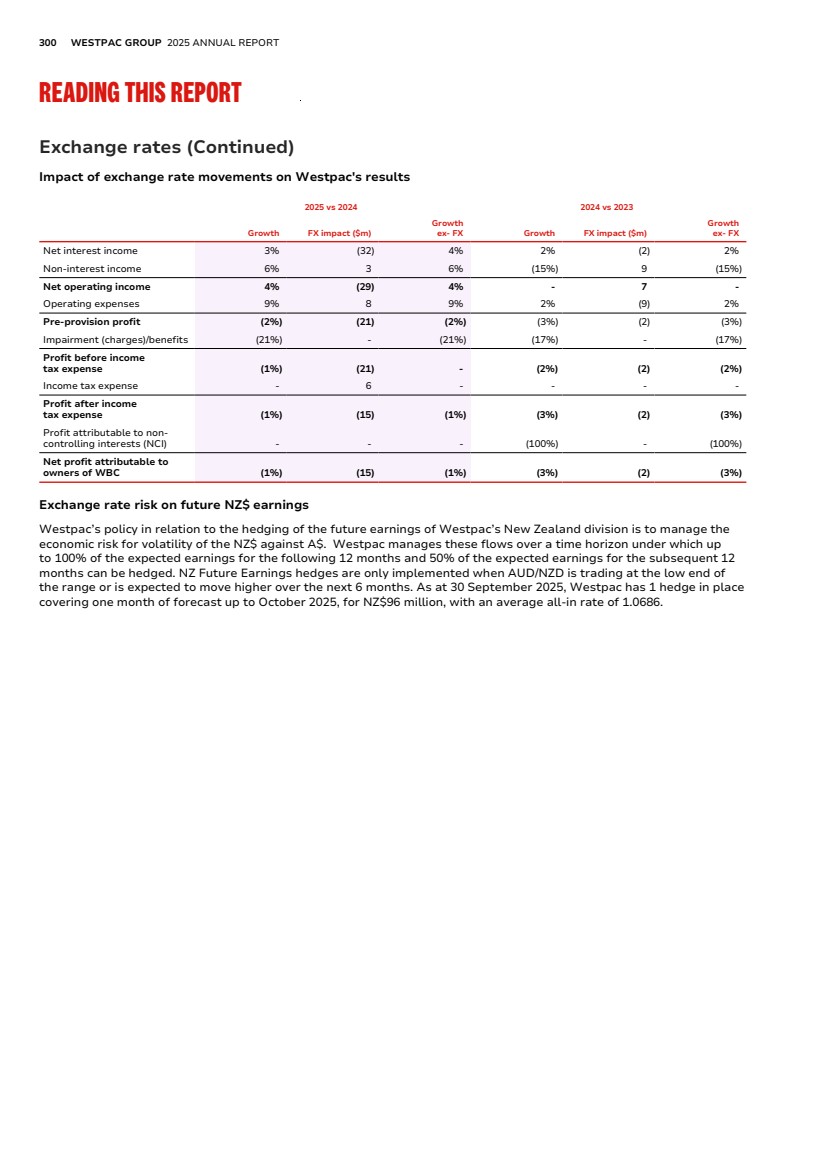

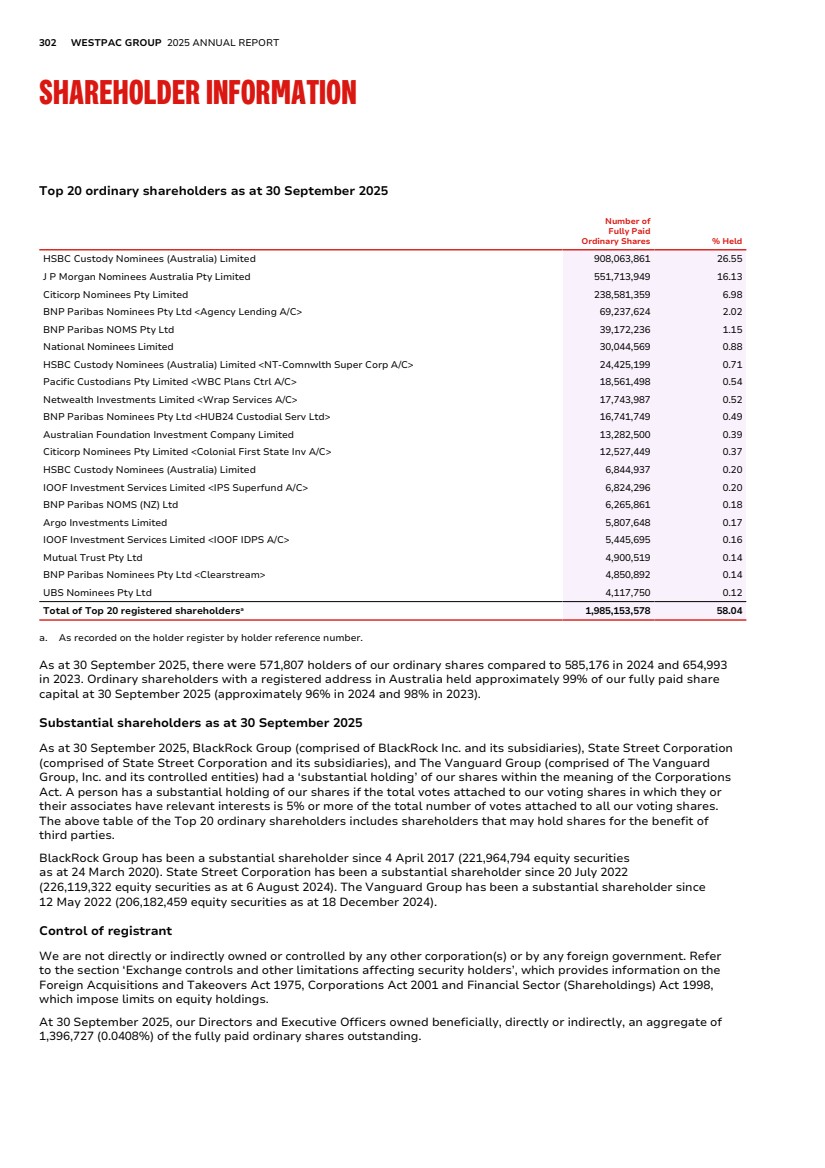

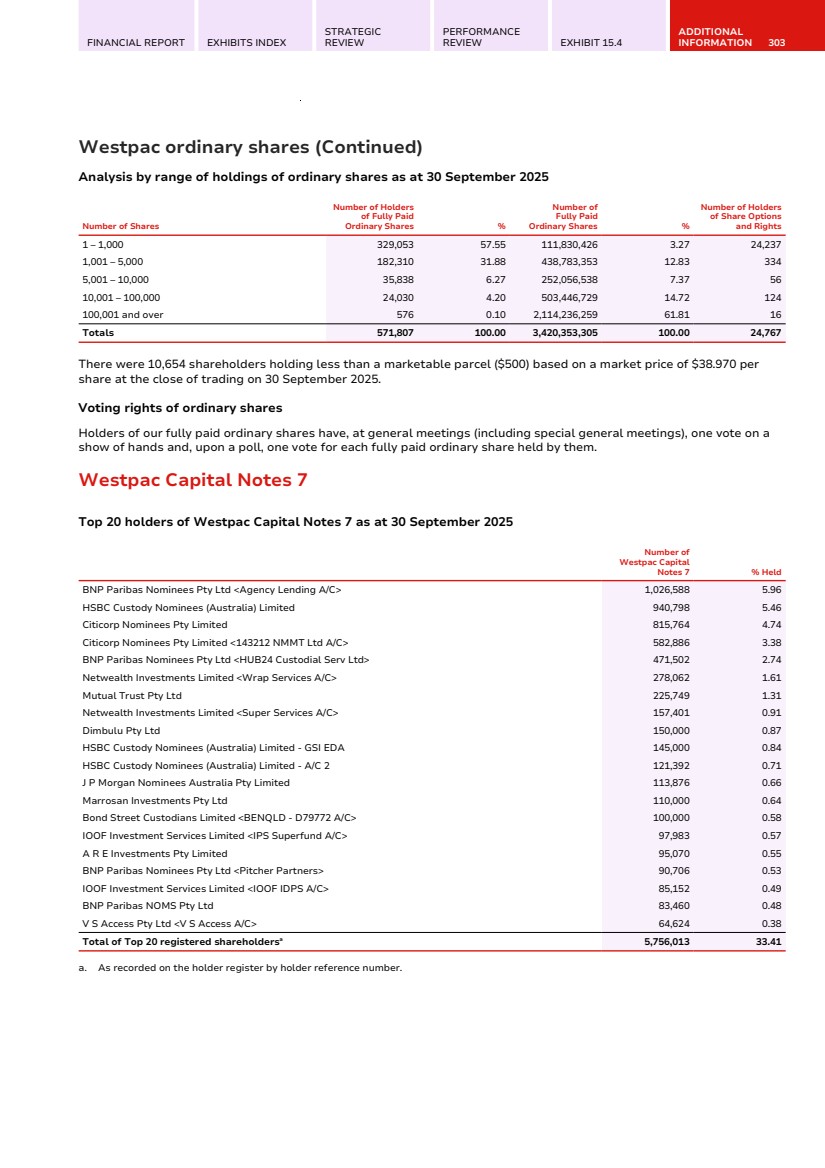

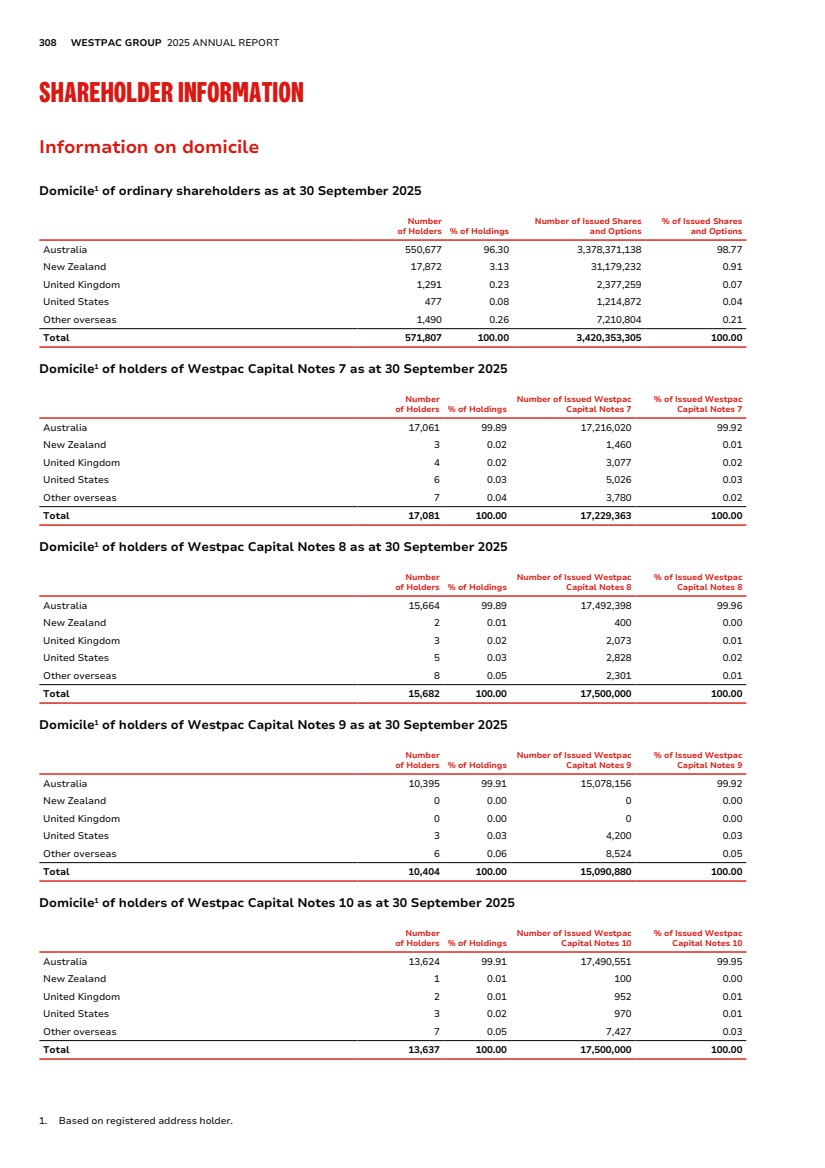

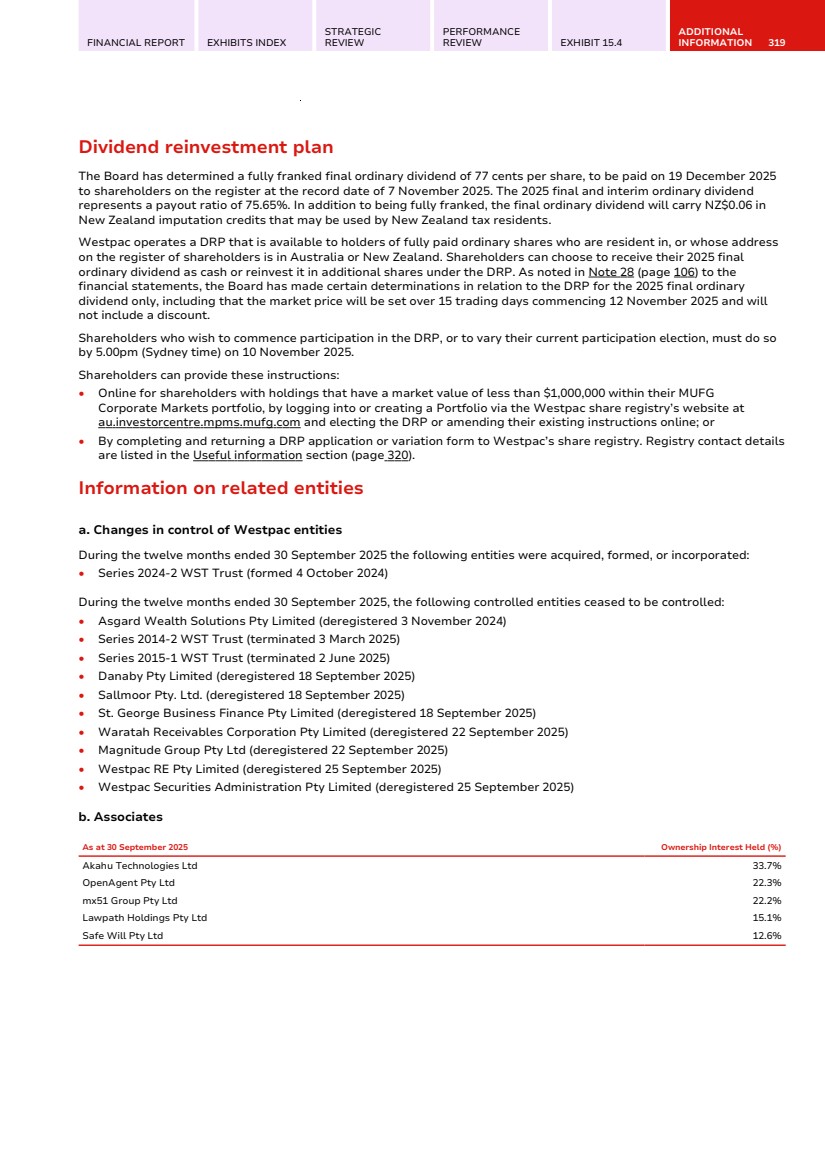

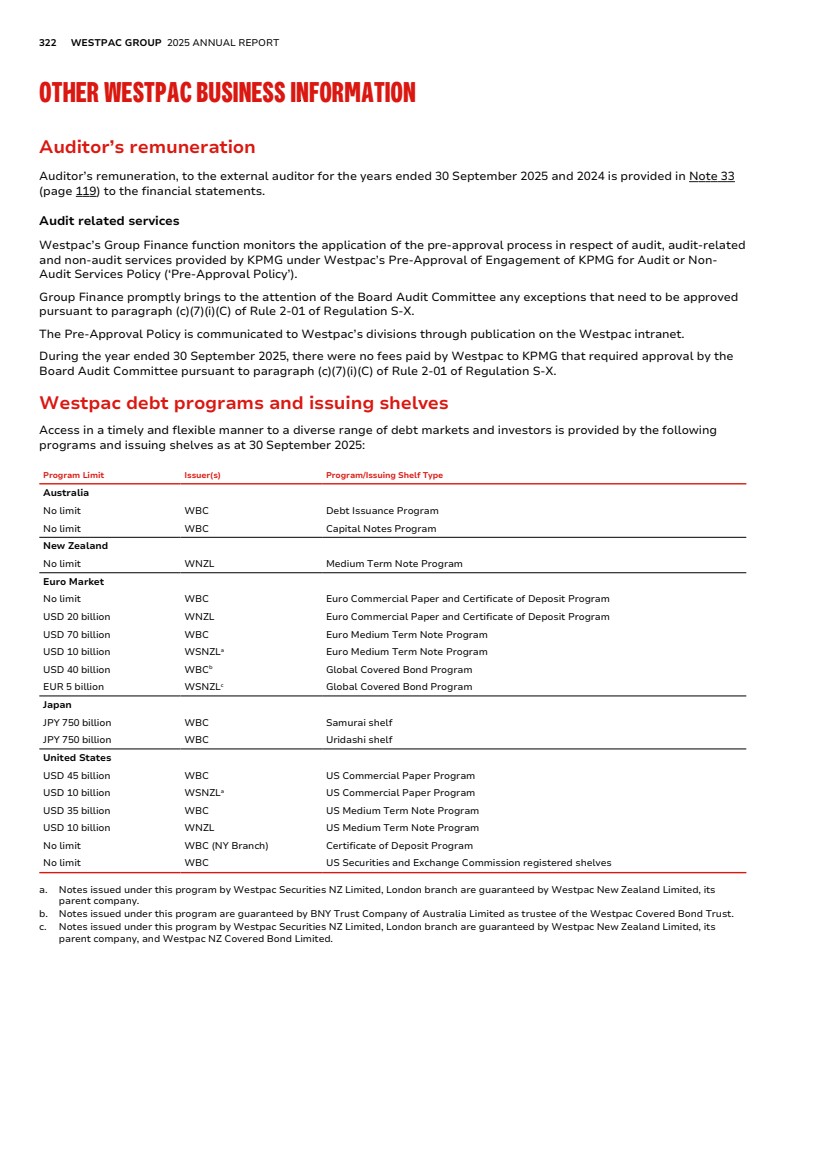

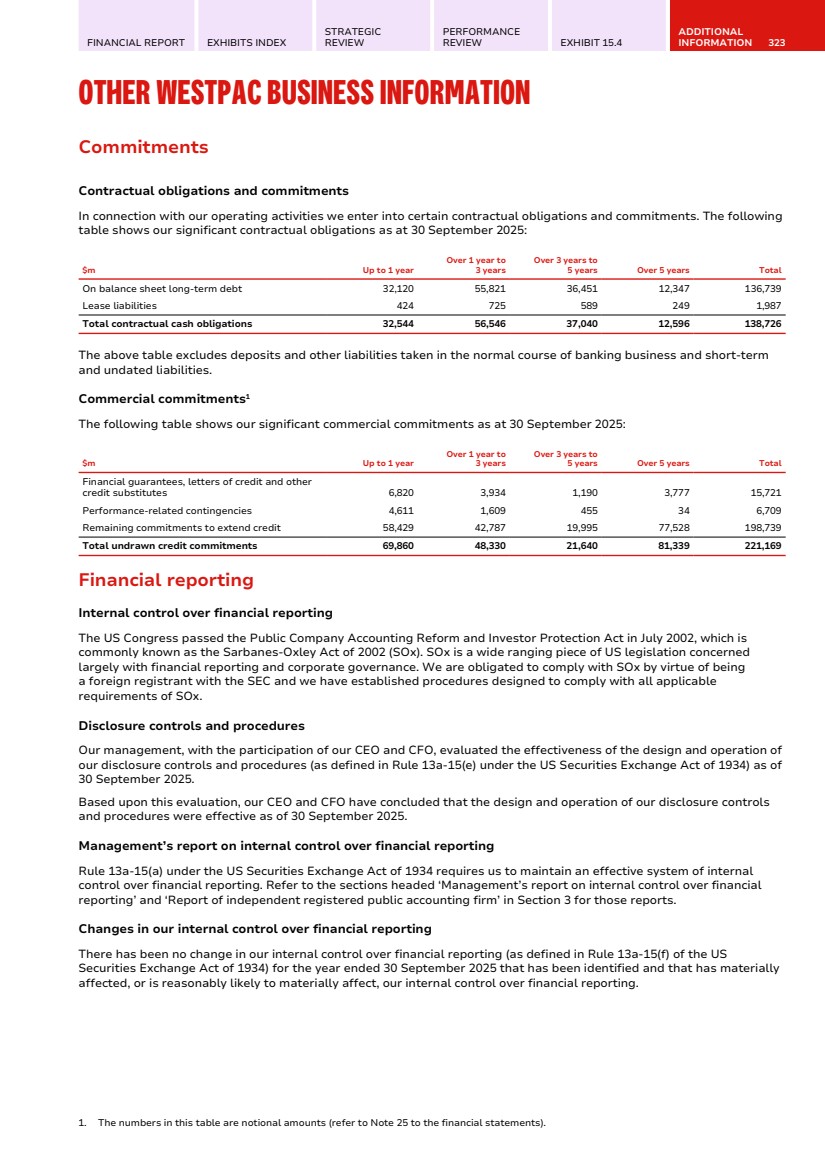

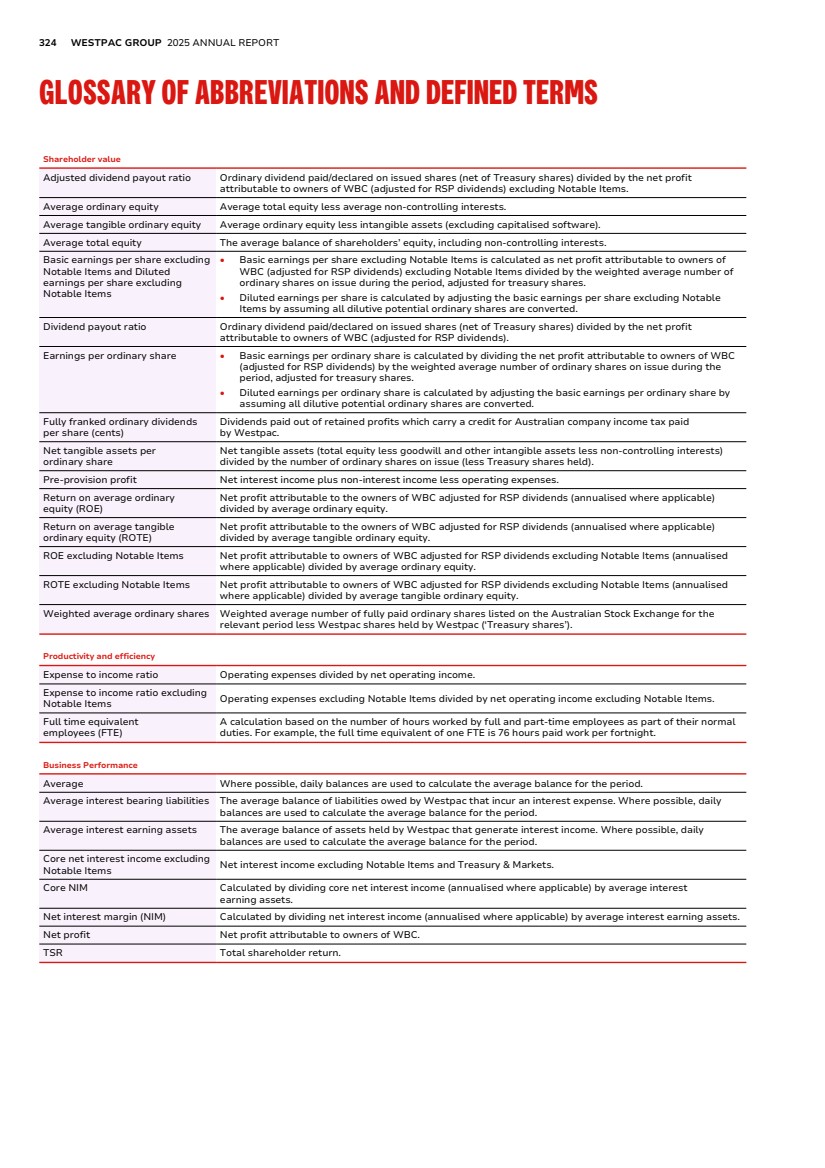

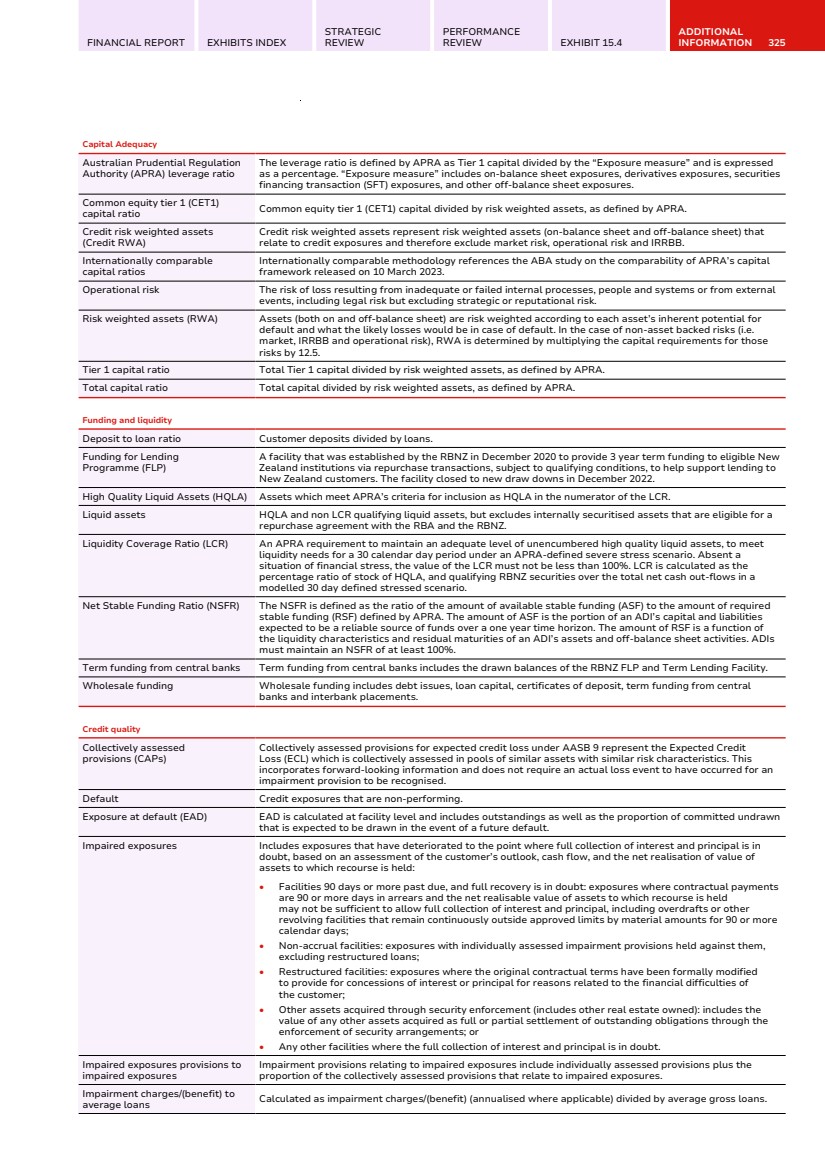

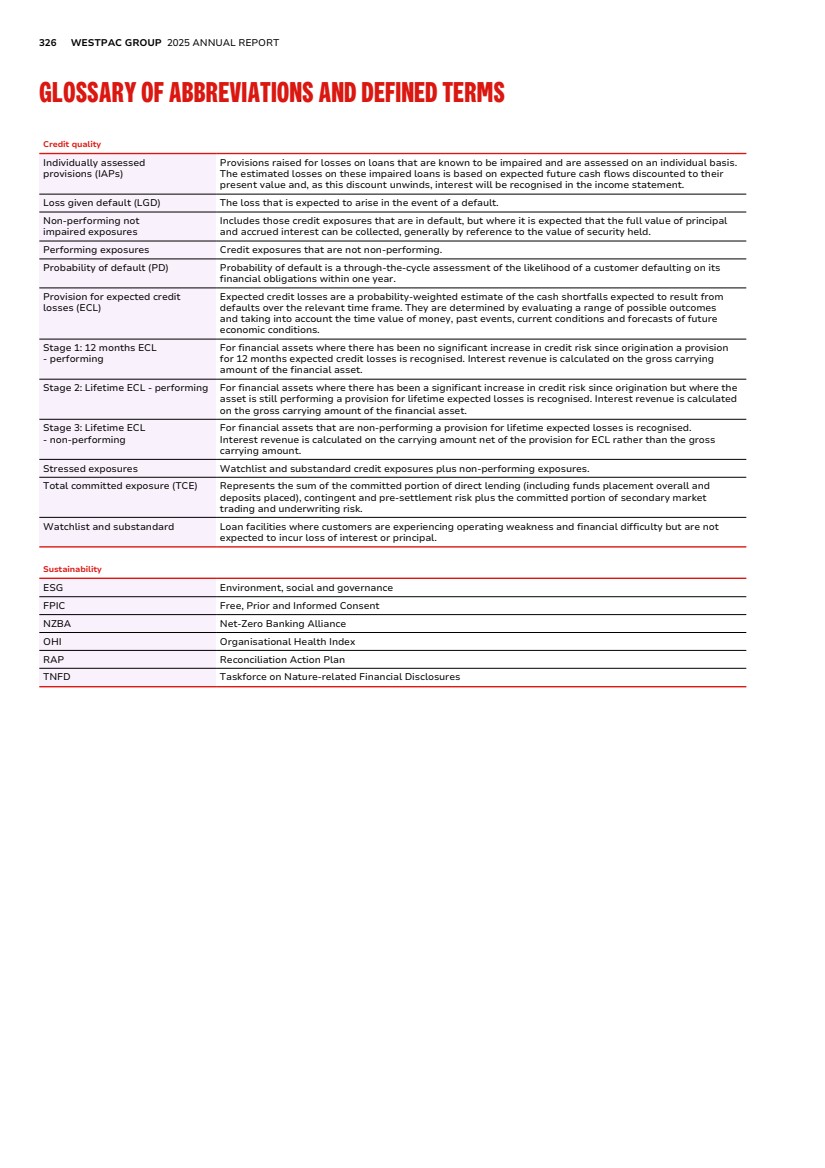

| 170 WESTPAC GROUP 2025 ANNUAL REPORT CREATING VALUE FOR THE COMMUNITY We are determined to make a meaningful difference in the community by empowering our people and the organisations we support. Related material topics (refer to page 149) • Communities • Indigenous peoples • Human rights and modern slavery • Sustainable supply chain • Tax transparency Photo: Ngutu child Thelma with her educator Melissa at Ngutu College, supported by BankSA Foundation. 100 SCHOLARSHIPS AWARDED EVERY YEAR1 65,538 HOURS VOLUNTEERED BY WESTPAC EMPLOYEES $199M IN COMMUNITY INVESTMENT2 $56.1M SPENT WITH DIVERSE SUPPLIERS3 1. By Westpac Scholars Trust which is supported by Westpac Group but operates independently as a non-profit organisation. 2. Figure includes commercial sponsorships and foregone fee revenue. 3. Refer to the 2025 Sustainability Index and Datasheet for definition. |