| ASX RELEASE Westpac Banking Corporation Level 18, 275 Kent Street Sydney, NSW, 2000 2 December 2025 WESTPAC SUSTAINABILITY UPDATE Following is Westpac’s Sustainability Update. For further information: Hayden Cooper Justin McCarthy Group Head of Media Relations General Manager, Investor Relations 0402 393 619 0422 800 321 This document has been authorised for release by Tim Hartin, Company Secretary. |

| SUSTAINABILITY MARKET UPDATE WESTPAC 2 DECEMBER 2025 Westpac Banking Corporation ABN 33 007 457 141 |

| DR FIONA WILD Chief Sustainability Officer |

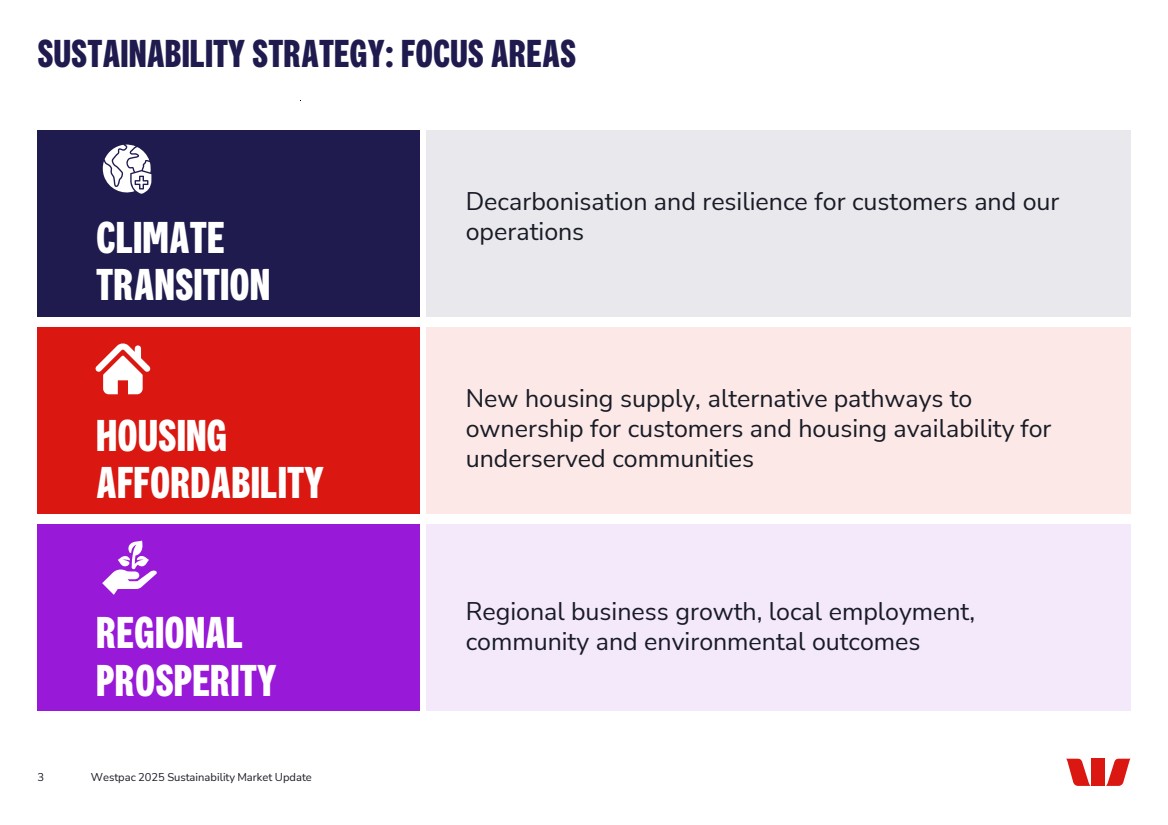

| SUSTAINABILITY STRATEGY: FOCUS AREAS 3 Westpac 2025 Sustainability Market Update CLIMATE TRANSITION Decarbonisation and resilience for customers and our operations HOUSING AFFORDABILITY New housing supply, alternative pathways to ownership for customers and housing availability for underserved communities REGIONAL PROSPERITY Regional business growth, local employment, community and environmental outcomes |

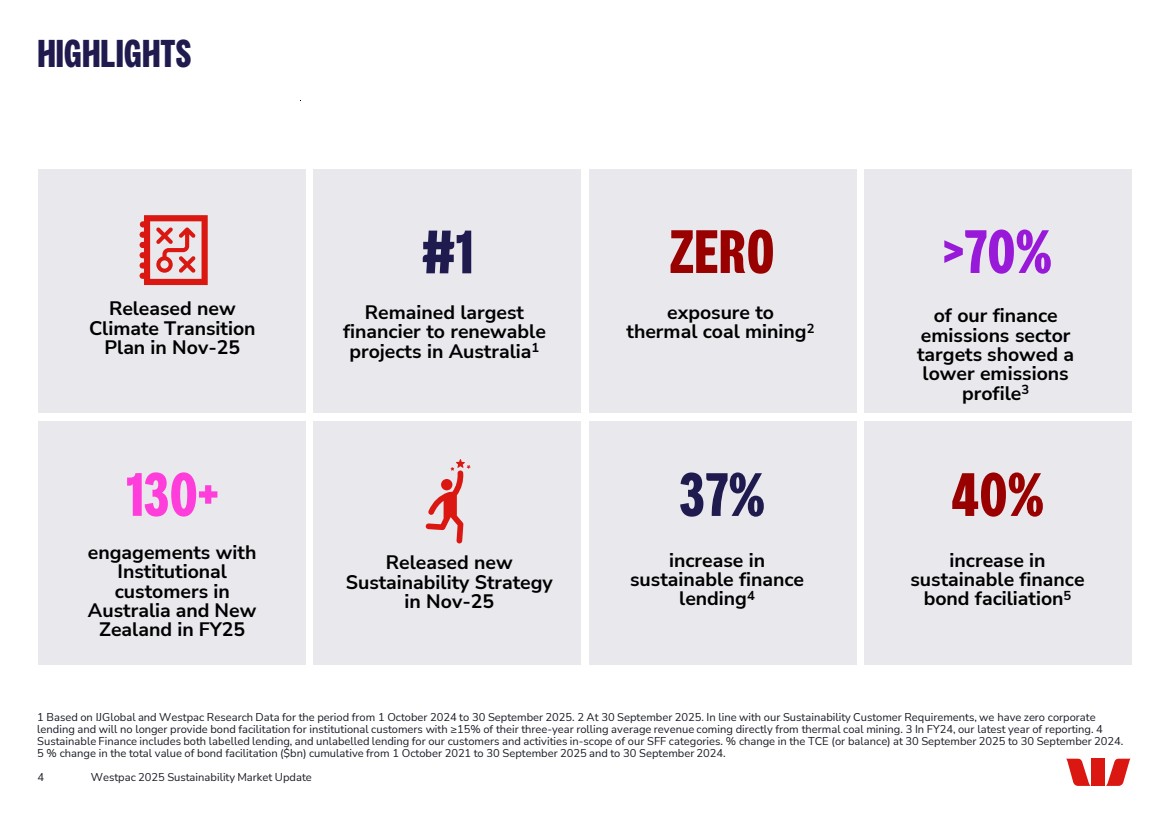

| HIGHLIGHTS 4 Westpac 2025 Sustainability Market Update Released new Climate Transition Plan in Nov-25 #1 Remained largest financier to renewable projects in Australia1 ZERO exposure to thermal coal mining2 >70% of our finance emissions sector targets showed a lower emissions profile3 130+ engagements with Institutional customers in Australia and New Zealand in FY25 Released new Sustainability Strategy in Nov-25 37% increase in sustainable finance lending4 40% increase in sustainable finance bond faciliation5 1 Based on IJGlobal and Westpac Research Data for the period from 1 October 2024 to 30 September 2025. 2 At 30 September 2025. In line with our Sustainability Customer Requirements, we have zero corporate lending and will no longer provide bond facilitation for institutional customers with ≥15% of their three-year rolling average revenue coming directly from thermal coal mining. 3 In FY24, our latest year of reporting. 4 Sustainable Finance includes both labelled lending, and unlabelled lending for our customers and activities in-scope of our SFF categories. % change in the TCE (or balance) at 30 September 2025 to 30 September 2024. 5 % change in the total value of bond facilitation ($bn) cumulative from 1 October 2021 to 30 September 2025 and to 30 September 2024. |

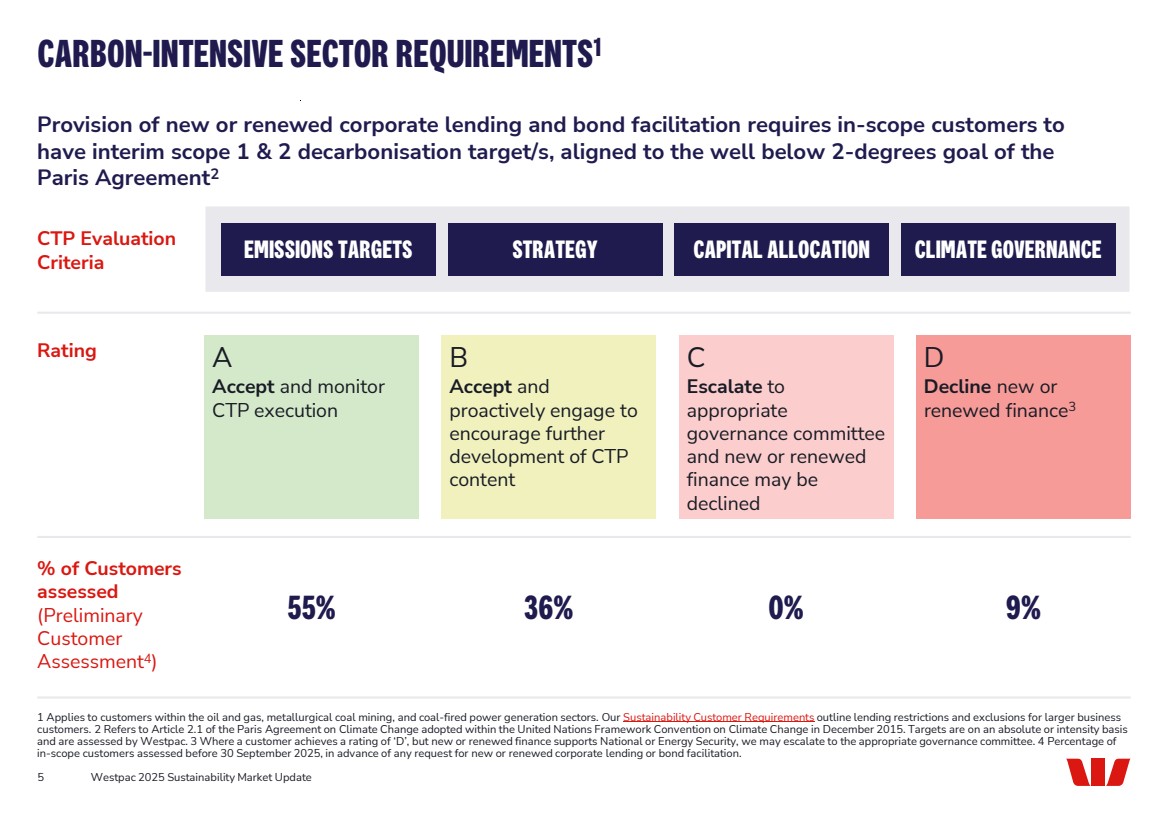

| CARBON-INTENSIVE SECTOR REQUIREMENTS1 5 Westpac 2025 Sustainability Market Update Provision of new or renewed corporate lending and bond facilitation requires in-scope customers to have interim scope 1 & 2 decarbonisation target/s, aligned to the well below 2-degrees goal of the Paris Agreement2 EMISSIONS TARGETS STRATEGY CAPITAL ALLOCATION CLIMATE GOVERNANCE CTP Evaluation Criteria 1 Applies to customers within the oil and gas, metallurgical coal mining, and coal-fired power generation sectors. Our Sustainability Customer Requirements outline lending restrictions and exclusions for larger business customers. 2 Refers to Article 2.1 of the Paris Agreement on Climate Change adopted within the United Nations Framework Convention on Climate Change in December 2015. Targets are on an absolute or intensity basis and are assessed by Westpac. 3 Where a customer achieves a rating of ‘D’, but new or renewed finance supports National or Energy Security, we may escalate to the appropriate governance committee. 4 Percentage of in-scope customers assessed before 30 September 2025, in advance of any request for new or renewed corporate lending or bond facilitation. A Accept and monitor CTP execution B Accept and proactively engage to encourage further development of CTP content C Escalate to appropriate governance committee and new or renewed finance may be declined D Decline new or renewed finance3 Rating % of Customers assessed (Preliminary Customer Assessment4) 55% 36% 0% 9% |

| PHILIPPA SJOQUIST Head of Sustainability Institutional Bank |

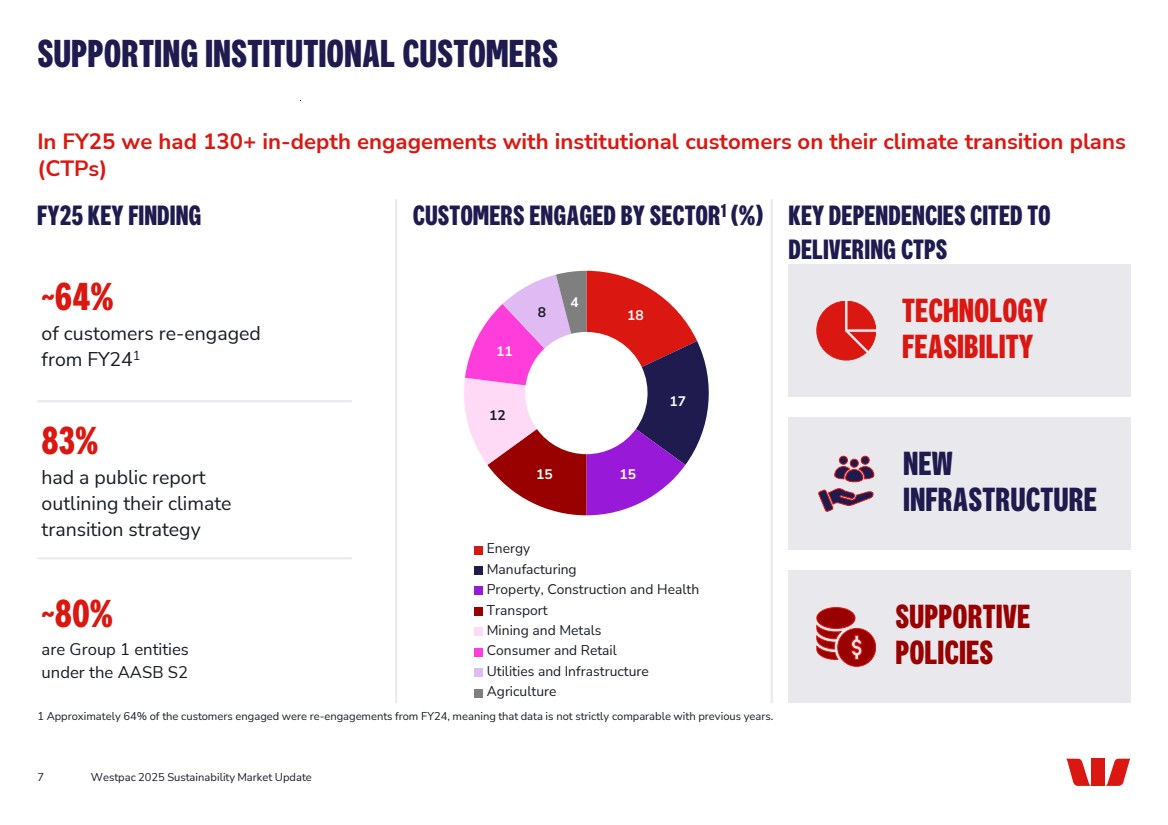

| SUPPORTING INSTITUTIONAL CUSTOMERS 7 Westpac 2025 Sustainability Market Update In FY25 we had 130+ in-depth engagements with institutional customers on their climate transition plans (CTPs) 1 Approximately 64% of the customers engaged were re-engagements from FY24, meaning that data is not strictly comparable with previous years. TECHNOLOGY FEASIBILITY NEW INFRASTRUCTURE SUPPORTIVE POLICIES CUSTOMERS ENGAGED BY SECTOR1 (%) 18 17 15 15 12 11 8 4 Energy Manufacturing Property, Construction and Health Transport Mining and Metals Consumer and Retail Utilities and Infrastructure Agriculture FY25 KEY FINDING ~64% of customers re-engaged from FY241 83% had a public report outlining their climate transition strategy ~80% are Group 1 entities under the AASB S2 KEY DEPENDENCIES CITED TO DELIVERING CTPS |

| NICK WANDKE Head of Sustainability Business & Wealth |

| SUPPORTING BUSINESS & WEALTH CUSTOMERS 9 Westpac 2025 Sustainability Market Update 1 Since launch of ESG Risk Assessment process for commercial customers in FY24. ESG RISK ASSESSMENT Sustainability positions ESG & climate policy DIGITAL BANKER Embedded digital solution within strategic tech stack FIJI & PAPUA NEW GUINEA Extended ESG engagement to our pacific banking business customers PATHWAYS TO SUSTAINABILITY Launched a suite of new sustainability learning content for our people SPECIALIST TEAM Deep industry expertise CUSTOMER ENGAGEMENT Driving practice and performance improvement Sustainability Engagement 400+ Transactions reviewed by the specialist ESG advisory team1 150+ Commercial customer engagements on climate and transition readiness Customer level ESG risk assessments completed for Business & Wealth customers1 >9,000 |

| APPENDIX |

| These Sustainability pages contain forward-looking statements and statements of expectation. Refer to the disclaimer at the back of this pack. Details on our sustainability commitments, targets and other supporting information is in our 2025 Annual Report, 2025 Sustainability Report and 2025 Sustainability Index and Datasheet. See website for more information on our sustainability strategy. 1 Refer to our Sustainable Finance Framework for definitions on sustainable lending and bond facilitation. Refer to the Climate Transition Plan for details on the sustainable finance targets. SUSTAINABILITY STRATEGY 11 HOW WHAT To be our customers’ #1 bank and partner through life FOCUS AREAS Westpac 2025 Sustainability Market Update TAKING ACTION NOW TO CREATE A BETTER FUTURE Customer CUSTOMER OBSESSED Proactively support customers’ sustainability goals through finance, expertise and advocacy • Support the goals of the Paris Agreement by achieving our Scope 1, 2 and 3 greenhouse gas emissions targets by 2030 • Partner with customers to implement green, transition, social (including housing affordability) or sustainability activities by providing $55bn sustainable lending and $40bn sustainable bond facilitation activities by 20301 • Support customers’ economic resilience and prosperity by increasing our footprint and growing lending to regional businesses and communities faster than in metro Australia People BEST TEAM, TRUSTED EXPERTS Strengthen sustainability learning so our people bring expertise and balance into every decision and interaction Change BRILLIANT AT DELIVERY Partner with customers to help deliver our positions on key sustainability topics, including climate, natural capital, human rights and equitable Indigenous participation Risk SAFE AND STRONG Actively manage material sustainability risks and impacts to customers, our business and community Performance EXECUTION EXCELLENCE Create Sustainability outcomes for our customers, communities and shareholders Climate Transition Decarbonisation and resilience for customers and our operations Housing Affordability New housing supply, alternative pathways to ownership for customers and housing availability for underserved communities Regional Prosperity Regional business growth, local employment, community and environmental outcomes SUSTAINABILITY OUTCOMES WE COMMIT TO ALWAYS DELIVER, SAFELY MAKE AN IMPACT OWN IT |

| 12 Westpac 2025 Sustainability Market Update SUSTAINABILITY CLIMATE TRANSITION PLAN 76% reduction in scope 1 and 2 absolute emissions by 2030 (2021 baseline) 50% reduction in upstream scope 3 absolute emissions by 2030 (2021 baseline) 2030 scope 3 financed emissions sector targets (see page x for details) $55 billion in sustainable finance lending at 30 Sep-30 $40 billion in sustainable bond facilitation between 1 Oct-21 and 30 Sep-30 NET-ZERO, CLIMATE RESILIENT OPERATIONS SUPPORTING OUR CUSTOMERS’ PHYSICAL RESILIENCE PARTNERING WITH CUSTOMERS TO DECARBONISE TARGETS FOCUS AREAS Other sustainability disclosures include Modern Slavery Statement Human Rights Position Statement and Action Plan Natural Capital Position Statement Sustainable Finance Framework Climate Transition Plan New Zealand – 2025 Sustainability Update and Climate Report Reports available at westpac.com.au/sustainability Key climate and sustainability disclosures 2025 Annual Report: Details financial and non-financial performance 2025 Sustainability Report: Details our approach to managing climate-related risks and opportunities 2025 Sustainability Index and Datasheet: Details key sustainability performance metrics in one place Maintain operational resilience to the physical impacts of climate change. Transition our lending portfolios to support the goals of the Paris Agreement. Adopt a portfolio-wide view of exposure and vulnerability to physical climate risks. ASPIRATIONS AMBITION TO BECOME A NET-ZERO, CLIMATE RESILIENT BANK |

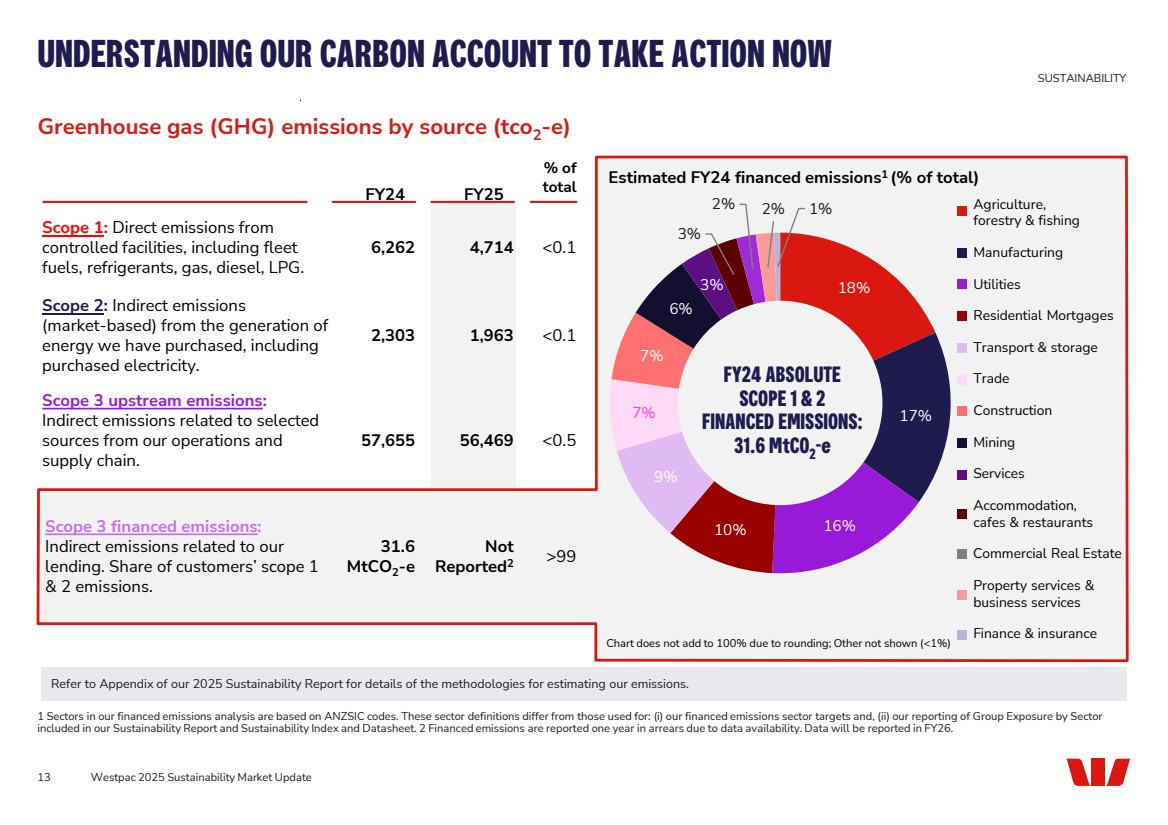

| Refer to Appendix of our 2025 Sustainability Report for details of the methodologies for estimating our emissions. 13 Westpac 2025 Sustainability Market Update SUSTAINABILITY UNDERSTANDING OUR CARBON ACCOUNT TO TAKE ACTION NOW 1 Sectors in our financed emissions analysis are based on ANZSIC codes. These sector definitions differ from those used for: (i) our financed emissions sector targets and, (ii) our reporting of Group Exposure by Sector included in our Sustainability Report and Sustainability Index and Datasheet. 2 Financed emissions are reported one year in arrears due to data availability. Data will be reported in FY26. Estimated FY24 financed emissions1 (% of total) Chart does not add to 100% due to rounding; Other not shown (<1%) Scope 1: Direct emissions from controlled facilities, including fleet fuels, refrigerants, gas, diesel, LPG. 6,262 4,714 <0.1 Scope 3 financed emissions: Indirect emissions related to our lending. Share of customers’ scope 1 & 2 emissions. Not Reported2 >99 31.6 MtCO2-e Scope 2: Indirect emissions (market-based) from the generation of energy we have purchased, including purchased electricity. 2,303 1,963 <0.1 Scope 3 upstream emissions: Indirect emissions related to selected sources from our operations and supply chain. 57,655 56,469 <0.5 Greenhouse gas (GHG) emissions by source (tco2-e) % of total FY24 FY25 18% 17% 10% 16% 9% 7% 7% 6% 3% 3% 2% 2% 1% Agriculture, forestry & fishing Manufacturing Utilities Residential Mortgages Transport & storage Trade Construction Mining Services Accommodation, cafes & restaurants Property services & business services Commercial Real Estate Finance & insurance FY24 ABSOLUTE SCOPE 1 & 2 FINANCED EMISSIONS: 31.6 MtCO2-e |

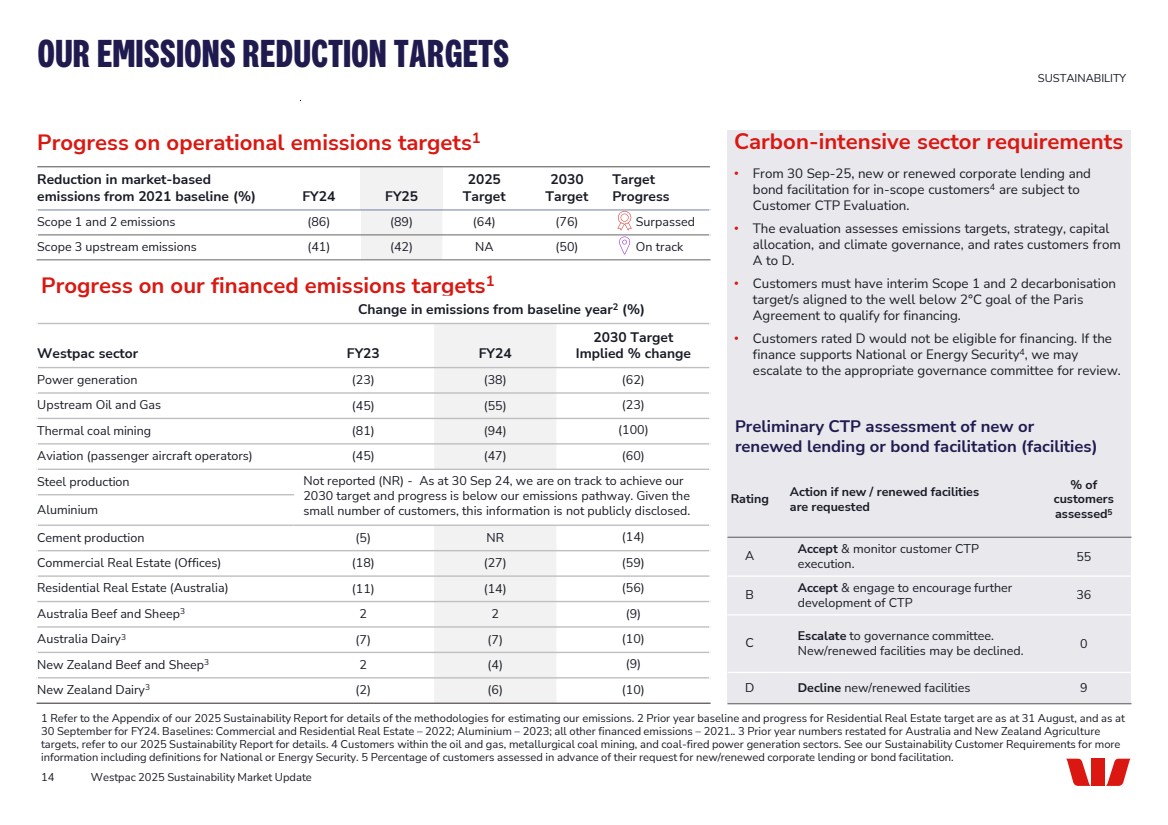

| Reduction in market-based emissions from 2021 baseline (%) FY24 FY25 2025 Target 2030 Target Target Progress Scope 1 and 2 emissions (86) (89) (64) (76) Surpassed Scope 3 upstream emissions (41) (42) NA (50) On track Progress on operational emissions targets1 14 Progress on our financed emissions targets1 Westpac 2025 Sustainability Market Update OUR EMISSIONS REDUCTION TARGETS SUSTAINABILITY 1 Refer to the Appendix of our 2025 Sustainability Report for details of the methodologies for estimating our emissions. 2 Prior year baseline and progress for Residential Real Estate target are as at 31 August, and as at 30 September for FY24. Baselines: Commercial and Residential Real Estate – 2022; Aluminium – 2023; all other financed emissions – 2021.. 3 Prior year numbers restated for Australia and New Zealand Agriculture targets, refer to our 2025 Sustainability Report for details. 4 Customers within the oil and gas, metallurgical coal mining, and coal-fired power generation sectors. See our Sustainability Customer Requirements for more information including definitions for National or Energy Security. 5 Percentage of customers assessed in advance of their request for new/renewed corporate lending or bond facilitation. Carbon-intensive sector requirements Rating Action if new / renewed facilities are requested % of customers assessed5 A Accept & monitor customer CTP execution. 55 B Accept & engage to encourage further development of CTP 36 C Escalate to governance committee. New/renewed facilities may be declined. 0 D Decline new/renewed facilities 9 Preliminary CTP assessment of new or renewed lending or bond facilitation (facilities) • From 30 Sep-25, new or renewed corporate lending and bond facilitation for in-scope customers4 are subject to Customer CTP Evaluation. • The evaluation assesses emissions targets, strategy, capital allocation, and climate governance, and rates customers from A to D. • Customers must have interim Scope 1 and 2 decarbonisation target/s aligned to the well below 2°C goal of the Paris Agreement to qualify for financing. • Customers rated D would not be eligible for financing. If the finance supports National or Energy Security4, we may escalate to the appropriate governance committee for review. Change in emissions from baseline year2 (%) Westpac sector FY23 FY24 2030 Target Implied % change Power generation (23) (38) (62) Upstream Oil and Gas (45) (55) (23) Thermal coal mining (81) (94) (100) Aviation (passenger aircraft operators) (45) (47) (60) Steel production Not reported (NR) - As at 30 Sep 24, we are on track to achieve our 2030 target and progress is below our emissions pathway. Given the Aluminium small number of customers, this information is not publicly disclosed. Cement production (5) NR (14) Commercial Real Estate (Offices) (18) (27) (59) Residential Real Estate (Australia) (11) (14) (56) Australia Beef and Sheep3 2 2 (9) Australia Dairy3 (7) (7) (10) New Zealand Beef and Sheep3 2 (4) (9) New Zealand Dairy3 (2) (6) (10) |

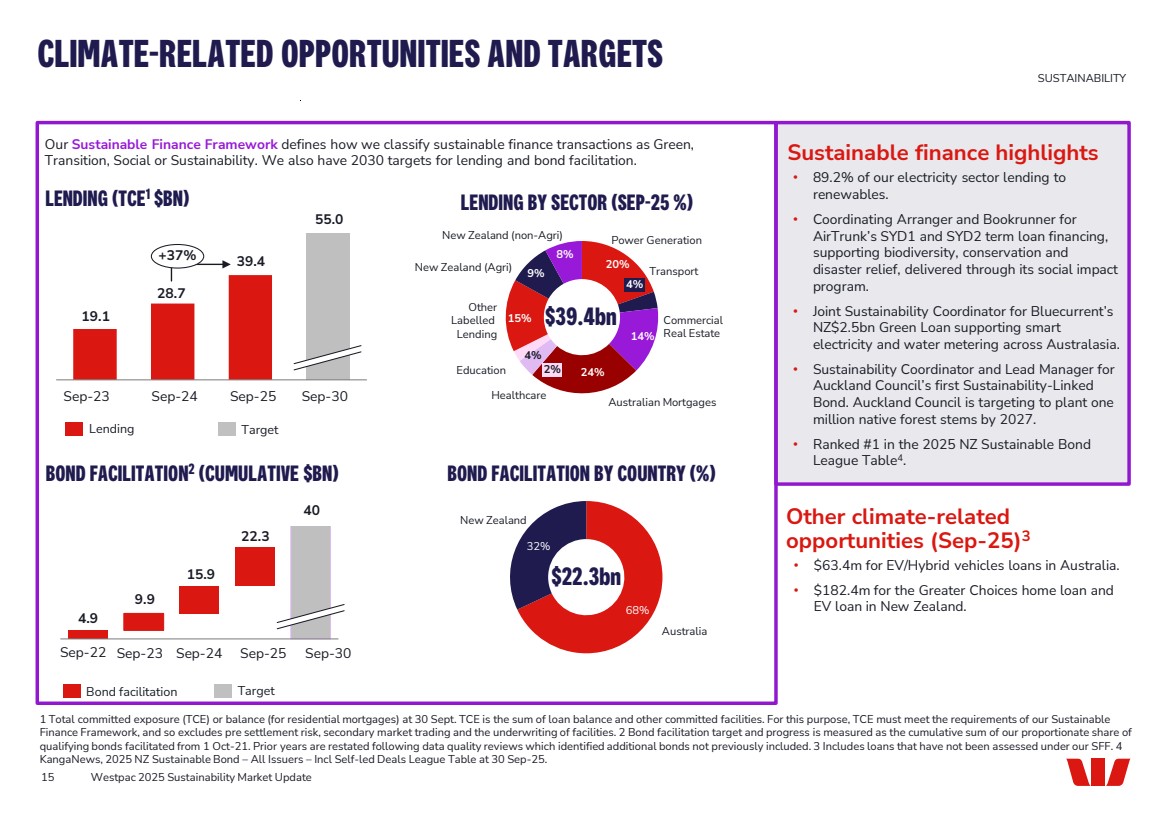

| 68% 32% 15 Our Sustainable Finance Framework defines how we classify sustainable finance transactions as Green, Transition, Social or Sustainability. We also have 2030 targets for lending and bond facilitation. • 89.2% of our electricity sector lending to renewables. • Coordinating Arranger and Bookrunner for AirTrunk’s SYD1 and SYD2 term loan financing, supporting biodiversity, conservation and disaster relief, delivered through its social impact program. • Joint Sustainability Coordinator for Bluecurrent’s NZ$2.5bn Green Loan supporting smart electricity and water metering across Australasia. • Sustainability Coordinator and Lead Manager for Auckland Council’s first Sustainability-Linked Bond. Auckland Council is targeting to plant one million native forest stems by 2027. • Ranked #1 in the 2025 NZ Sustainable Bond League Table4. Westpac 2025 Sustainability Market Update CLIMATE-RELATED OPPORTUNITIES AND TARGETS SUSTAINABILITY 1 Total committed exposure (TCE) or balance (for residential mortgages) at 30 Sept. TCE is the sum of loan balance and other committed facilities. For this purpose, TCE must meet the requirements of our Sustainable Finance Framework, and so excludes pre settlement risk, secondary market trading and the underwriting of facilities. 2 Bond facilitation target and progress is measured as the cumulative sum of our proportionate share of qualifying bonds facilitated from 1 Oct-21. Prior years are restated following data quality reviews which identified additional bonds not previously included. 3 Includes loans that have not been assessed under our SFF. 4 KangaNews, 2025 NZ Sustainable Bond – All Issuers – Incl Self-led Deals League Table at 30 Sep-25. • $63.4m for EV/Hybrid vehicles loans in Australia. • $182.4m for the Greater Choices home loan and EV loan in New Zealand. BOND FACILITATION2 (CUMULATIVE $BN) LENDING (TCE1 $BN) Sep-23 Sep-24 Sep-30 19.1 28.7 55.0 Sep-22 Sep-23 Sep-24 Sep-30 4.9 9.9 40 Lending Target Bond facilitation Target 20% 14% 24% 4% 15% 9% 8% Power Generation 4% Transport Commercial Real Estate Australian Mortgages Healthcare Education 2% Other Labelled Lending New Zealand (Agri) New Zealand (non-Agri) LENDING BY SECTOR (SEP-25 %) BOND FACILITATION BY COUNTRY (%) $39.4bn Australia New Zealand $22.3bn +37% Sep-25 Sep-25 Sustainable finance highlights 39.4 22.3 Other climate-related opportunities (Sep-25)3 15.9 |

| INVESTOR RELATIONS TEAM – CONTACT US 16 Westpac 2025 Sustainability Market Update CONTACT US INVESTOR RELATIONS CONTACT SHARE REGISTRY CONTACT For all shareholding enquiries relating to: • Address details and communication preferences • Updating bank account details, and participation in the dividend reinvestment plan For all matters relating to Westpac’s strategy, performance and results 1800 804 255 westpac@cm.mpmas.mufg.com au.investorcentre.mpms.mufg.com +61 2 9178 2977 investorrelations@westpac.com.au westpac.com.au/investorcentre Lucy Wilson Head of Corporate Reporting and ESG Catherine Garcia Head of Investor Relations, Institutional Arthur Petratos Manager, Shareholder Services Laura Babaic Graduate, Investor Relations Jacqueline Boddy Head of Debt Investor Relations Justin McCarthy General Manager, Investor Relations James Wibberley Manager, Investor Relations Nathan Fontyne Senior Analyst, Investor Relations |

| DISCLAIMER 17 Westpac 2025 Sustainability Market Update The material contained in this presentation is intended to be general background information on Westpac Banking Corporation (Westpac) and its activities. The information is supplied in summary form and is therefore not necessarily complete. It is not intended that it be relied upon as advice to investors or potential investors, who should consider seeking independent professional advice depending upon their specific investment objectives, financial situation or particular needs. The material contained in this presentation may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. All amounts are in Australian dollars unless otherwise indicated. This presentation contains statements that constitute “forward-looking statements” within the meaning of Section 21E of the US Securities Exchange Act of 1934. Forward-looking statements are statements that are not historical facts. Forward-looking statements appear in a number of places in this presentation and include statements regarding our current intent, belief or expectations with respect to our business and operations, macro and micro economic and market conditions, results of operations and financial condition, capital adequacy, liquidity and risk management, including, without limitation, future loan loss provisions and financial support to certain borrowers, forecasted economic indicators and performance metric outcomes, indicative drivers, climate- and other sustainability-related statements, commitments, targets, projections and metrics, and other estimated and proxy data. We use words such as ‘will’, ‘may’, ‘expect’, ‘intend’, ‘seek’, ‘would’, ‘should’, ‘could’, ‘continue’, ‘plan’, ‘estimate’, ‘anticipate’, ‘believe’, ‘probability’, ‘indicative’, ‘risk’, ‘aim’, ‘outlook’, ‘forecast’, ‘f’cast’, ‘f’, ‘assumption’, ‘projection’, ‘target’, ‘goal’, ‘guidance’, ‘ambition’, ‘objective’ or other similar words to identify forward-looking statements, or otherwise identify forward-looking statements. These forward-looking statements reflect our current views on future events and are subject to change, certain known and unknown risks, uncertainties and assumptions and other factors which are, in many instances, beyond our control (and the control of our officers, employees, agents and advisors), and have been made based on management’s and/or the board’s current expectations or beliefs concerning future developments and their potential effect upon us. Forward-looking statements may also be made, verbally or in writing, by members of Westpac’s management or Board in connection with this presentation. Such statements are subject to the same limitations, uncertainties, assumptions and disclaimers set out in this presentation. There can be no assurance that future developments or performance will align with our expectations or that the effect of future developments on us will be those anticipated. Actual results could differ materially from those we expect or which are expressed or implied in forward-looking statements, depending on various factors including, but not limited to, those described in the sections titled ‘Our Operating Environment’ and ‘Risk Management' in our 2025 Annual Report as well as the 2025 Risk Factors document available at www.westpac.com.au. When relying on forward-looking statements to make decisions with respect to us, investors and others should carefully consider such factors and other uncertainties and events. Except as required by law, we assume no obligation to revise or update any forward-looking statements contained in this presentation, whether from new information, future events, conditions or otherwise, after the date of this presentation. We also make statements about our processes and policies (including what they are designed to do) as well as the availability of our systems or product features. Systems, processes and product features can be subject to disruption, and may not always work as intended, so these statements are limited by the factors described in the section titled ‘Risk Management’ in our 2025 Annual Report as well as the 2025 Risk Factors. Further important information regarding climate change and sustainability-related statements This presentation contains forward-looking statements and other representations relating to environment, social and governance (ESG) topics, including but not limited to climate change, net-zero, climate resilience, natural capital, emissions intensity, human rights and other sustainability related statements, commitments, targets, projections, scenarios, risk and opportunity assessments, pathways, forecasts, estimated projections and other proxy data. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics and modelling on which these statements rely. In particular, the metrics, methodologies and data relating to climate and sustainability are rapidly evolving and maturing, including variations in approaches and common standards in estimating and calculating emissions, and uncertainty around future climate and sustainability related policy and legislation. There are inherent limits in the current scientific understanding of climate change and its impacts. Some material contained in this presentation may include information including, without limitation, methodologies, modelling, scenarios, reports, benchmarks, tools and data, derived from publicly available or government or industry sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of such information. There is a risk that the estimates, judgements, assumptions, views, models, scenarios or projections used by Westpac may turn out to be incorrect. These risks may cause actual outcomes, including the ability to meet commitments and targets, to differ materially from those expressed or implied in this presentation. The climate and sustainability related forward-looking statements made in this presentation are not guarantees or predictions of future performance and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of these statements), nor guarantee that the occurrence of the events expressed or implied in any forward-looking statement will occur. There are usually differences between forecast and actual results because events and actual circumstances frequently do not occur as forecast and these differences may be material. Westpac will continue to review and develop its approach to ESG as this subject area matures DISCLAIMER |