| ASX RELEASE Westpac Banking Corporation Level 18, 275 Kent Street Sydney, NSW, 2000 13 February 2026 Westpac First Quarter 2026 Update Westpac Banking Corporation (“Westpac”) today provides the attached First Quarter 2026 Update. For further information: Hayden Cooper Justin McCarthy Group Head of Media Relations General Manager, Investor Relations 0402 393 619 0422 800 321 This document has been authorised for release by Tim Hartin, Company Secretary. |

| ASX ANNOUNCEMENT I WESTPAC 1Q26 UPDATE ASX ANNOUNCEMENT 1Q26 UPDATE 13 FEBRUARY 2026 HIGHLIGHTS $1.9bn Unaudited statutory net profit up 5% on 2H25 average $1.9bn Unaudited net profit ex Notable Items up 6% on 2H25 average 12.3% CET1 capital ratio above target ratio of 11.25% in normal operating conditions This quarter we delivered a sound financial result, reflecting the disciplined execution of our strategic priorities. Our focus on improving customer service through additional bankers, simpler ways of working and more consistent experiences supported improved customer advocacy and operating performance. This was reflected in: • Increased transaction account sales, particularly through our digital channels; • The proportion of new home lending through the proprietary channel rising for the second consecutive quarter; and • Strong growth in institutional lending and a higher proprietary lending mix in business. For regional customers, we announced a Community Banking Service pilot and the extension of our regional branch closure moratorium through to 2030. To support the workforce of the future, all employees now have access to AI training and Microsoft 365 Copilot. This is the largest roll-out in the financial services sector across Asia Pacific. Our transformation agenda, which includes UNITE, BizEdge1 and Westpac One, is focused on simplifying our operating environment across products, processes and systems, while accelerating innovation and improving service. With the UNITE discovery phase complete, the program is in execution. The program's first large scale customer migration to our wealth management platform Panorama in 1H26 is on track. The progressive rollout of BizEdge functionality continued, with customers up to a total committed exposure limit of $20 million now able to access a faster lending pathway. BizEdge saves bankers approximately 90 minutes per deal and is delivering improved customer satisfaction. In Institutional, we began the customer trial of Westpac One; our cloud-based digital platform that will provide deeper insights and transform how clients manage their liquidity, payments and FX. In November we entered into an agreement to sell the RAMS mortgage portfolio2 . In addition to contributing to the streamlining of mortgage operations, the sale provides capacity to lend more across higher returning portfolios. "We are optimistic on the outlook for the economy and expect demand for both business and household credit to remain resilient. Our strong financial foundations provide us with the stability and capacity to support our people, customers, shareholders and the broader economy," Westpac CEO Anthony Miller said. |

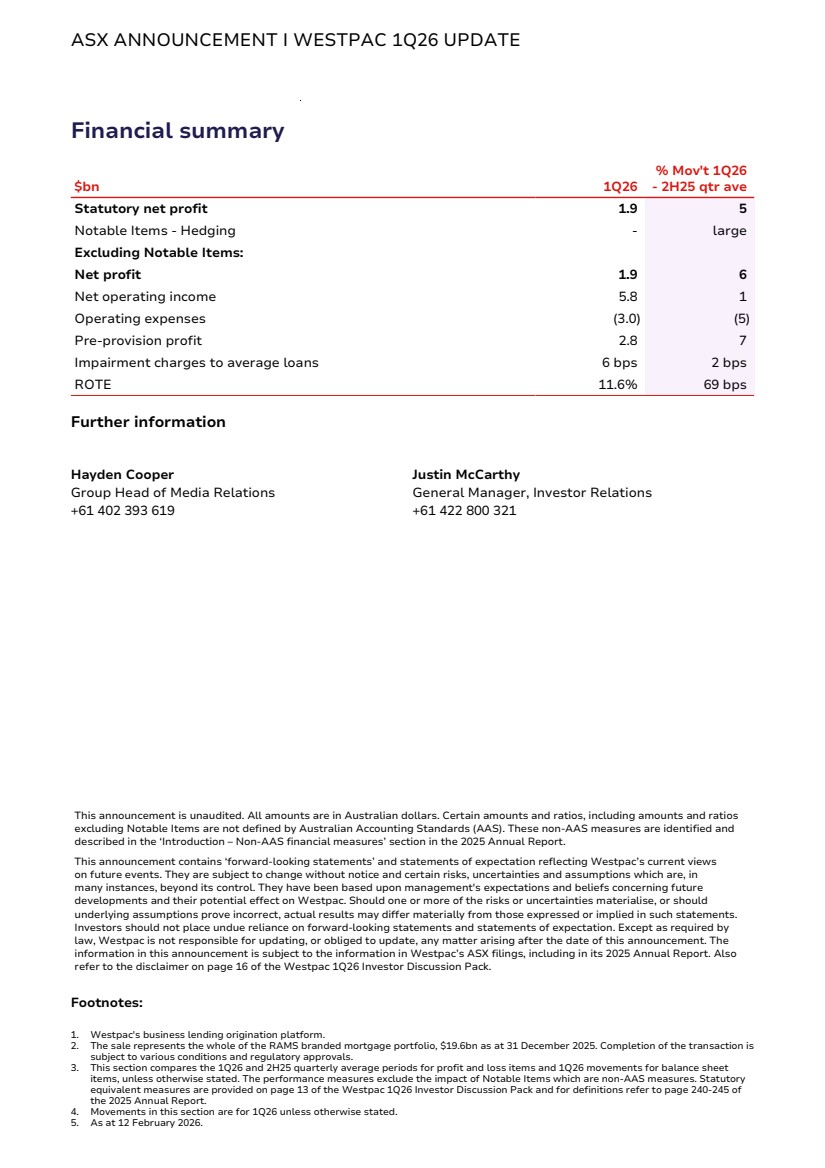

| ASX ANNOUNCEMENT I WESTPAC 1Q26 UPDATE Performance overview3 Net profit, excluding Notable Items, increased 6% to $1.9 billion and pre-provision profit rose 7%. Revenue increased 1% with a 2% rise in net interest income more than offsetting a 4% decline in non-interest income. The increase in net interest income was driven by balance sheet growth and a stronger Treasury performance. The decline in non-interest income reflected lower Markets revenue. Continued operating momentum drove solid customer deposit and loan growth. Deposit growth of $12 billion includes household deposit and business transactional deposit growth of 3% and 4% respectively. Lending grew by $22 billion, driven by growth of 7% in institutional and 3% in both Australian housing, excluding RAMS, and business. Net Interest Margin (NIM) decreased 1 basis point to 1.94%. NIM comprised: • Core NIM of 1.79%, down 3 basis points reflecting competition and the lower interest rate environment, including timing impacts. Liquid assets provided a slight benefit. Core NIM declined 1 basis point compared to 4Q25; and • Treasury and Markets contribution of 15 basis points, up from 13 basis points, reflecting favourable interest rate positioning in a more volatile market environment. To provide additional earnings stability the domestic deposit hedge was increased by $15 billion to $92 billion. The impact on NIM in the quarter was immaterial. Excluding the restructuring charge in 2H25, operating expenses were stable. Including the restructuring charge operating expenses were 5% lower. We are pursuing productivity savings of more than $500 million in FY26. Asset quality improved and impairment charges were low at 6 basis points of average gross loans. Financial strength4 The CET1 capital ratio was 12.3% as at 31 December 2025, well above the target ratio of 11.25%. The reduction in CET1 reflects the payment of the full year 2025 dividend more than offsetting earnings in the period. In addition, there were a range of other items that resulted in a net reduction of 5 basis points. The average liquidity coverage ratio of 133% and net stable funding ratio of 112% remain above regulatory minimums. We have issued $18 billion in long term wholesale funding for the financial year to date5 . The resilience of both households and businesses is reflected in lower levels of customer stress. Stressed exposures reduced 11 basis points to 1.17% of TCE. Credit impairment provisions were $5.0 billion as at 31 December 2025, $2.1 billion above expected losses of the base case economic scenario. The ratio of CAP to credit RWA was stable at 1.25%. Refer to the 1Q26 Investor Discussion Pack slides for further details. |

| ASX ANNOUNCEMENT I WESTPAC 1Q26 UPDATE Financial summary $bn 1Q26 % Mov't 1Q26 - 2H25 qtr ave Statutory net profit 1.9 5 Notable Items - Hedging - large Excluding Notable Items: Net profit 1.9 6 Net operating income 5.8 1 Operating expenses (3.0) (5) Pre-provision profit 2.8 7 Impairment charges to average loans 6 bps 2 bps ROTE 11.6% 69 bps Further information Hayden Cooper Justin McCarthy Group Head of Media Relations +61 402 393 619 General Manager, Investor Relations +61 422 800 321 This announcement is unaudited. All amounts are in Australian dollars. Certain amounts and ratios, including amounts and ratios excluding Notable Items are not defined by Australian Accounting Standards (AAS). These non-AAS measures are identified and described in the ‘Introduction – Non-AAS financial measures’ section in the 2025 Annual Report. This announcement contains ‘forward-looking statements’ and statements of expectation reflecting Westpac’s current views on future events. They are subject to change without notice and certain risks, uncertainties and assumptions which are, in many instances, beyond its control. They have been based upon management's expectations and beliefs concerning future developments and their potential effect on Westpac. Should one or more of the risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may differ materially from those expressed or implied in such statements. Investors should not place undue reliance on forward-looking statements and statements of expectation. Except as required by law, Westpac is not responsible for updating, or obliged to update, any matter arising after the date of this announcement. The information in this announcement is subject to the information in Westpac’s ASX filings, including in its 2025 Annual Report. Also refer to the disclaimer on page 16 of the Westpac 1Q26 Investor Discussion Pack. Footnotes: 1. Westpac's business lending origination platform. 2. The sale represents the whole of the RAMS branded mortgage portfolio, $19.6bn as at 31 December 2025. Completion of the transaction is subject to various conditions and regulatory approvals. 3. This section compares the 1Q26 and 2H25 quarterly average periods for profit and loss items and 1Q26 movements for balance sheet items, unless otherwise stated. The performance measures exclude the impact of Notable Items which are non-AAS measures. Statutory equivalent measures are provided on page 13 of the Westpac 1Q26 Investor Discussion Pack and for definitions refer to page 240-245 of the 2025 Annual Report. 4. Movements in this section are for 1Q26 unless otherwise stated. 5. As at 12 February 2026. |