Fiscal 1Q26 Results January 28, 2026

Forward-looking statements Certain statements made in this presentation and the associated conference call may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions (including changes in interest rates, inflation, and international trade policies), demand for and pricing of our products (including cash sweep and deposit offerings), anticipated timing and benefits of our acquisitions or divestitures, and our level of success in integrating acquired businesses, anticipated results of litigation, regulatory developments, and general economic conditions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K and Current Reports on Form 8-K, which are available at www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise. 2

Strategic Overview Paul Shoukry Chief Executive Officer, Raymond James Financial 3

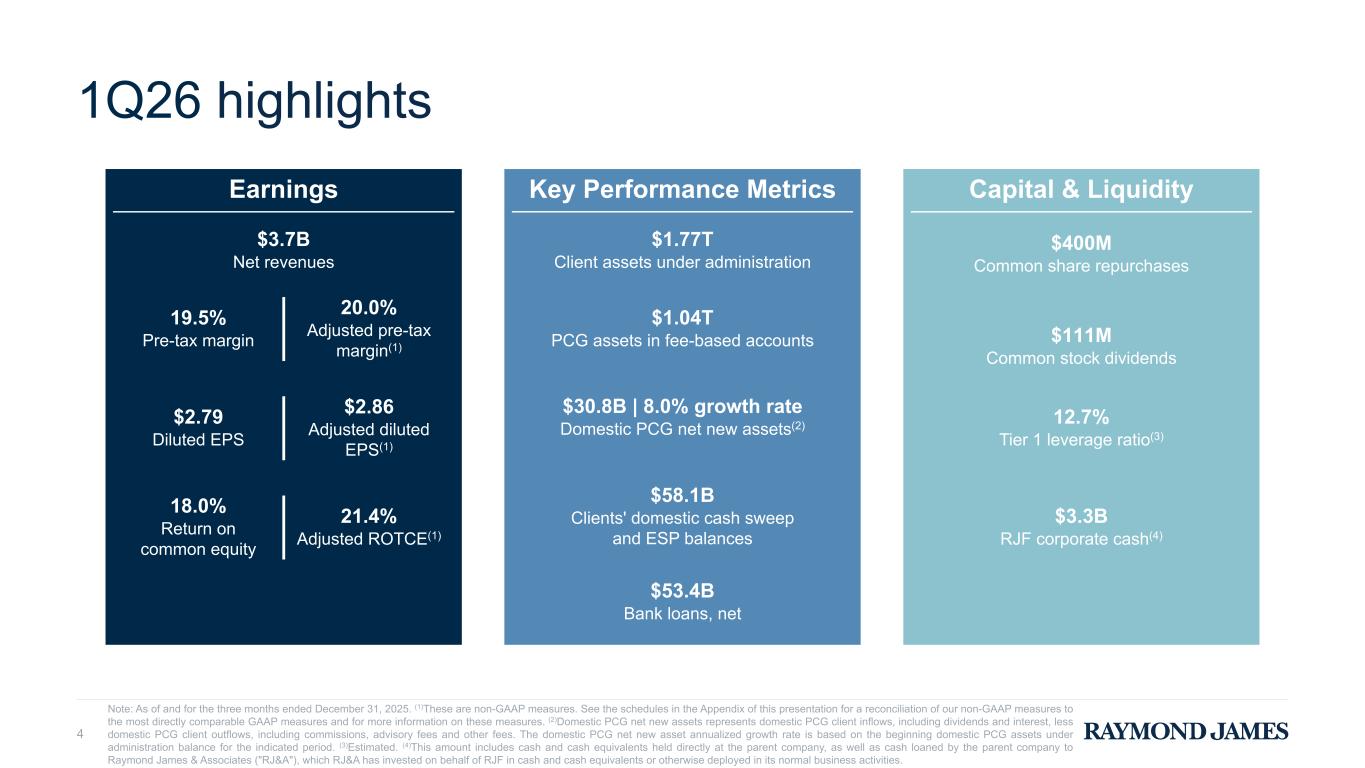

4 1Q26 highlights Earnings Key Performance Metrics Capital & Liquidity $3.7B Net revenues $1.77T Client assets under administration $400M Common share repurchases 19.5% Pre-tax margin 20.0% Adjusted pre-tax margin(1) $1.04T PCG assets in fee-based accounts $111M Common stock dividends $30.8B | 8.0% growth rate Domestic PCG net new assets(2)$2.79 Diluted EPS $2.86 Adjusted diluted EPS(1) 12.7% Tier 1 leverage ratio(3) $58.1B Clients' domestic cash sweep and ESP balances 18.0% Return on common equity 21.4% Adjusted ROTCE(1) $3.3B RJF corporate cash(4) $53.4B Bank loans, net Note: As of and for the three months ended December 31, 2025. (1)These are non-GAAP measures. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. (2)Domestic PCG net new assets represents domestic PCG client inflows, including dividends and interest, less domestic PCG client outflows, including commissions, advisory fees and other fees. The domestic PCG net new asset annualized growth rate is based on the beginning domestic PCG assets under administration balance for the indicated period. (3)Estimated. (4)This amount includes cash and cash equivalents held directly at the parent company, as well as cash loaned by the parent company to Raymond James & Associates ("RJ&A"), which RJ&A has invested on behalf of RJF in cash and cash equivalents or otherwise deployed in its normal business activities.

Financial Review Butch Oorlog Chief Financial Officer, Raymond James Financial 5

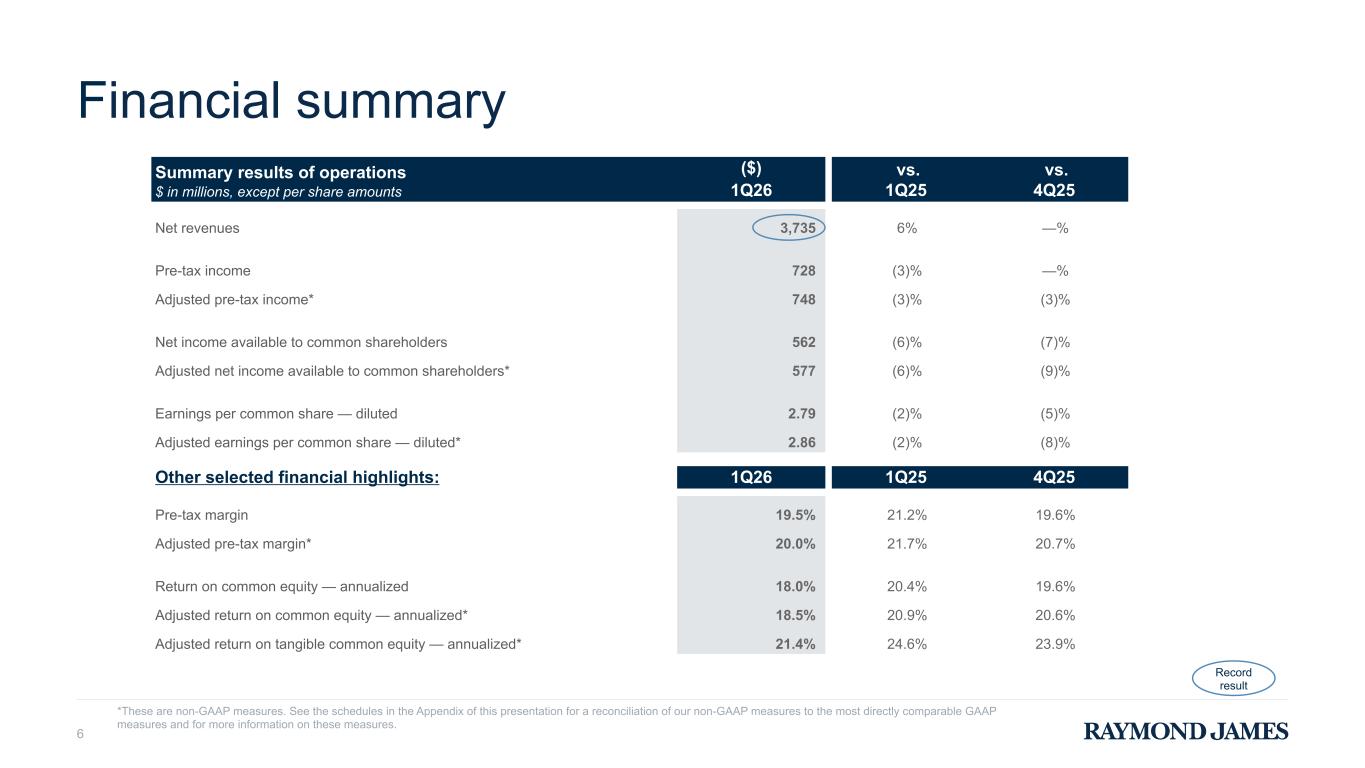

Summary results of operations $ in millions, except per share amounts ($) vs. 1Q25 vs. 4Q251Q26 Net revenues 3,735 6% —% Pre-tax income 728 (3)% —% Adjusted pre-tax income* 748 (3)% (3)% Net income available to common shareholders 562 (6)% (7)% Adjusted net income available to common shareholders* 577 (6)% (9)% Earnings per common share — diluted 2.79 (2)% (5)% Adjusted earnings per common share — diluted* 2.86 (2)% (8)% Other selected financial highlights: 1Q26 1Q25 4Q25 Pre-tax margin 19.5 % 21.2% 19.6% Adjusted pre-tax margin* 20.0 % 21.7% 20.7% Return on common equity — annualized 18.0 % 20.4% 19.6% Adjusted return on common equity — annualized* 18.5 % 20.9% 20.6% Adjusted return on tangible common equity — annualized* 21.4 % 24.6% 23.9% 6 *These are non-GAAP measures. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. Financial summary Record result

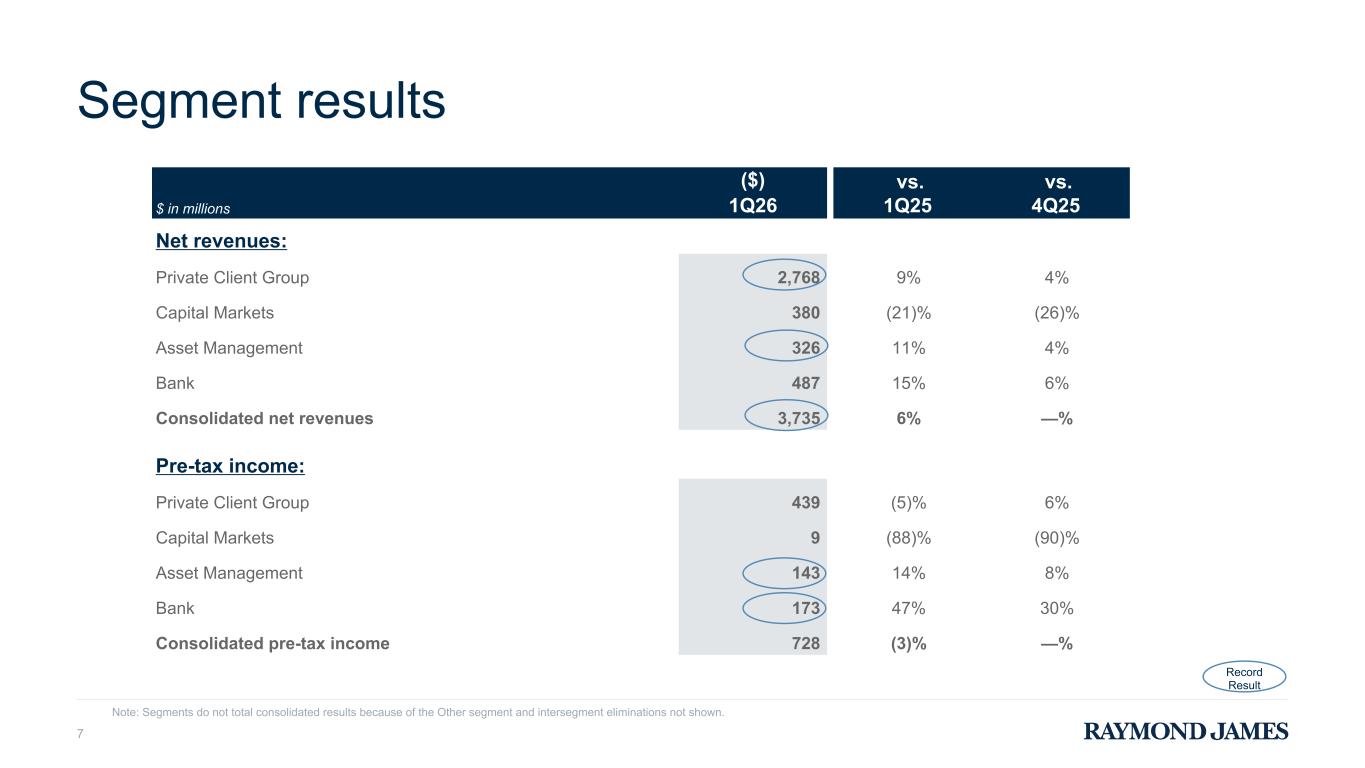

$ in millions ($) vs. 1Q25 vs. 4Q251Q26 Net revenues: Private Client Group 2,768 9% 4% Capital Markets 380 (21)% (26)% Asset Management 326 11% 4% Bank 487 15% 6% Consolidated net revenues 3,735 6% —% Pre-tax income: Private Client Group 439 (5)% 6% Capital Markets 9 (88)% (90)% Asset Management 143 14% 8% Bank 173 47% 30% Consolidated pre-tax income 728 (3)% —% Note: Segments do not total consolidated results because of the Other segment and intersegment eliminations not shown. Segment results 7 Record Result

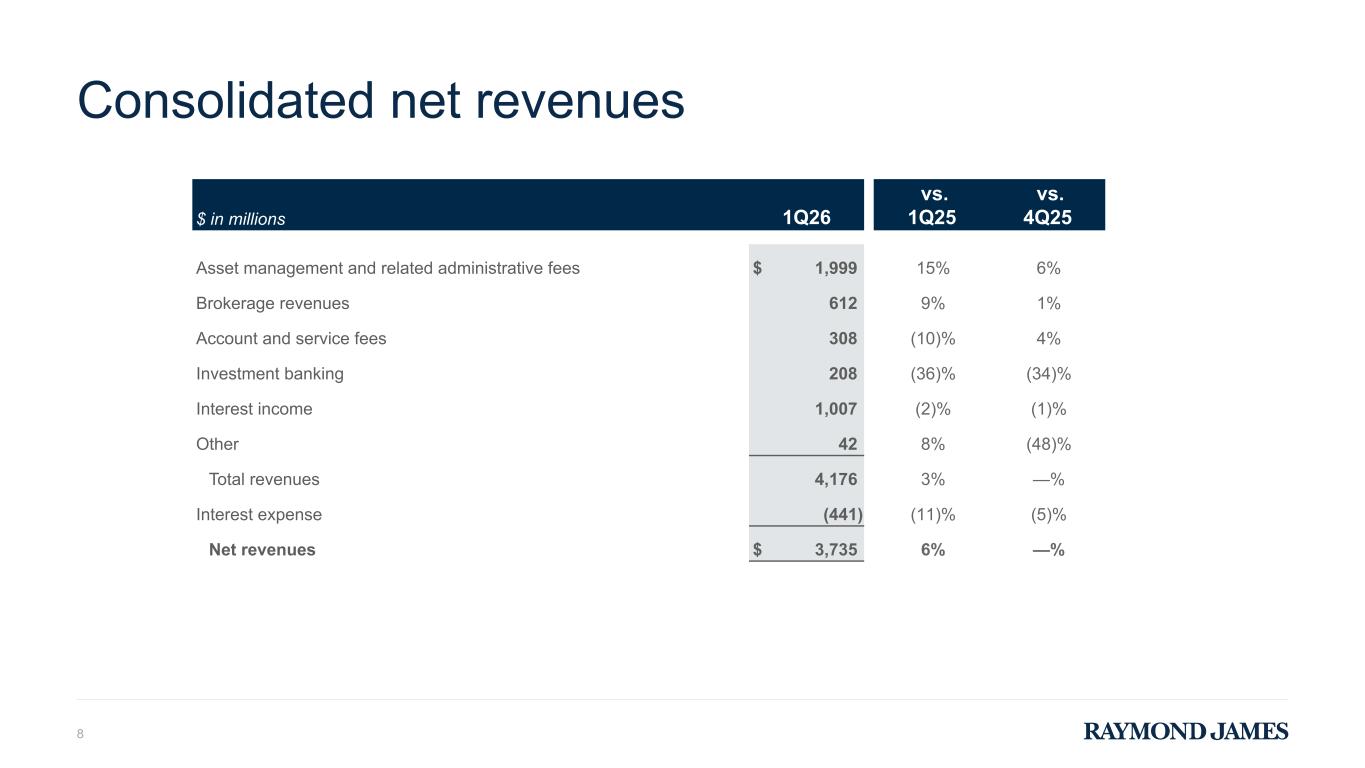

Consolidated net revenues 8 $ in millions 1Q26 vs. 1Q25 vs. 4Q25 Asset management and related administrative fees $ 1,999 15% 6% Brokerage revenues 612 9% 1% Account and service fees 308 (10)% 4% Investment banking 208 (36)% (34)% Interest income 1,007 (2)% (1)% Other 42 8% (48)% Total revenues 4,176 3% —% Interest expense (441) (11)% (5)% Net revenues $ 3,735 6% —%

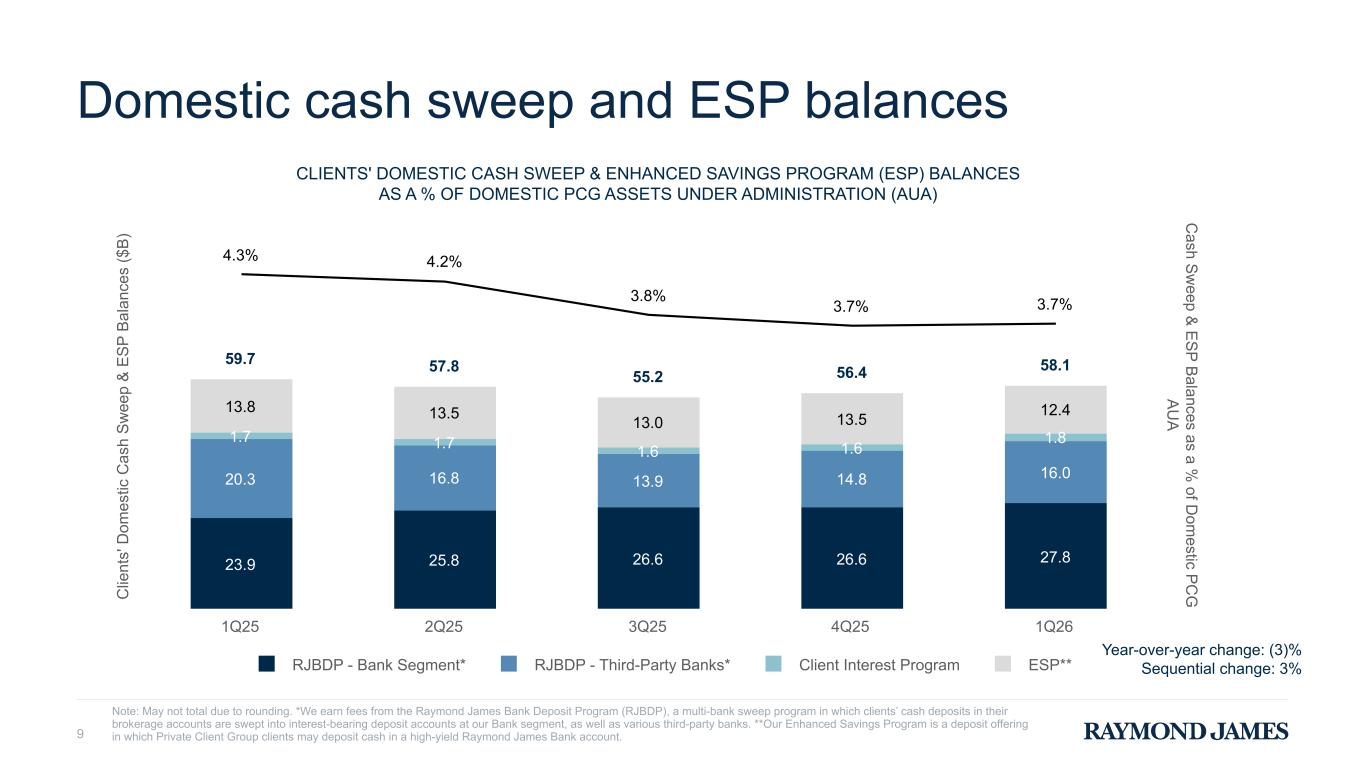

Domestic cash sweep and ESP balances 9 C lie nt s' D om es tic C as h S w ee p & E S P B al an ce s ($ B ) C ash S w eep & E S P B alances as a % of D om estic P C G A U A CLIENTS' DOMESTIC CASH SWEEP & ENHANCED SAVINGS PROGRAM (ESP) BALANCES AS A % OF DOMESTIC PCG ASSETS UNDER ADMINISTRATION (AUA) 23.9 25.8 26.6 26.6 27.8 20.3 16.8 13.9 14.8 16.0 1.7 1.7 1.6 1.6 1.8 13.8 13.5 13.0 13.5 12.4 59.7 57.8 55.2 56.4 58.1 4.3% 4.2% 3.8% 3.7% 3.7% RJBDP - Bank Segment* RJBDP - Third-Party Banks* Client Interest Program ESP** 1Q25 2Q25 3Q25 4Q25 1Q26 Note: May not total due to rounding. *We earn fees from the Raymond James Bank Deposit Program (RJBDP), a multi-bank sweep program in which clients’ cash deposits in their brokerage accounts are swept into interest-bearing deposit accounts at our Bank segment, as well as various third-party banks. **Our Enhanced Savings Program is a deposit offering in which Private Client Group clients may deposit cash in a high-yield Raymond James Bank account. Year-over-year change: (3)% Sequential change: 3%

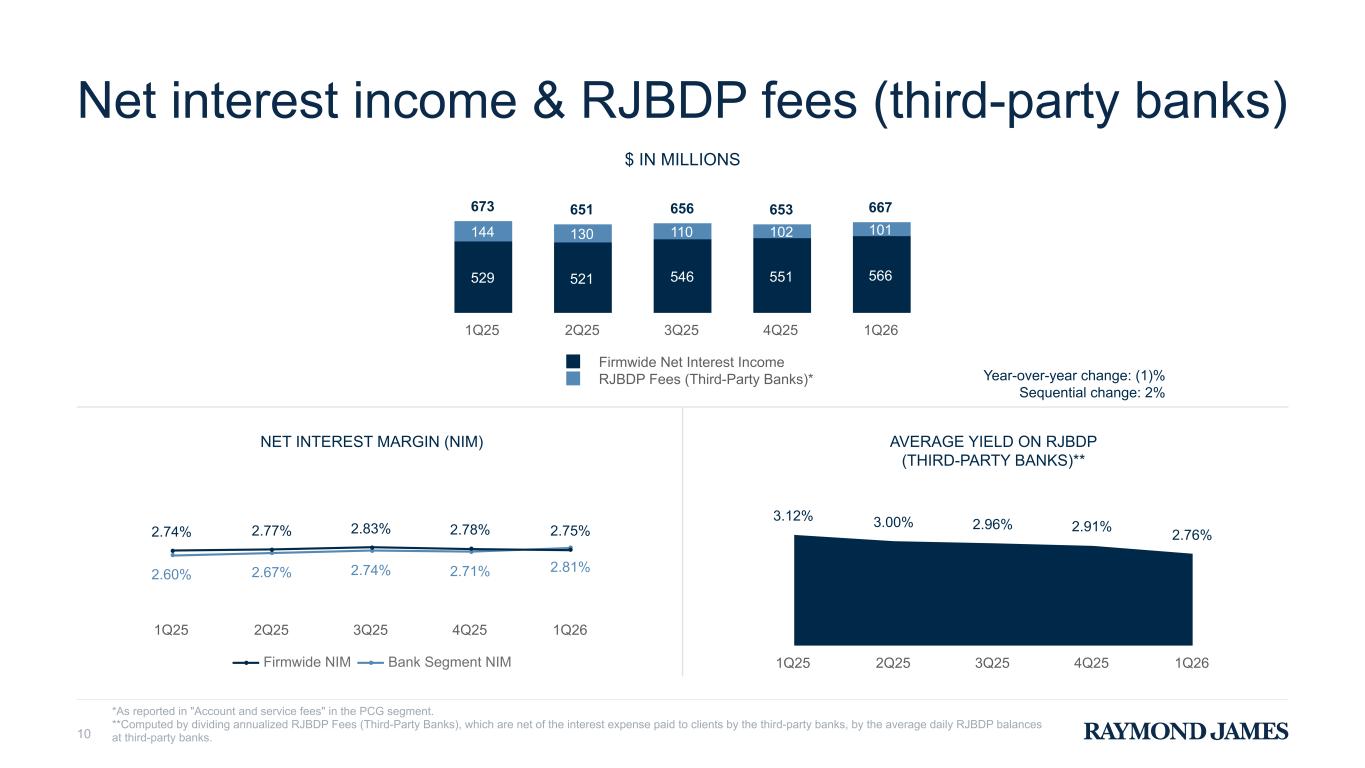

Net interest income & RJBDP fees (third-party banks) 10 *As reported in "Account and service fees" in the PCG segment. **Computed by dividing annualized RJBDP Fees (Third-Party Banks), which are net of the interest expense paid to clients by the third-party banks, by the average daily RJBDP balances at third-party banks. $ IN MILLIONS 673 651 656 653 667 529 521 546 551 566 144 130 110 102 101 Firmwide Net Interest Income RJBDP Fees (Third-Party Banks)* 1Q25 2Q25 3Q25 4Q25 1Q26 NET INTEREST MARGIN (NIM) 2.60% 2.67% 2.74% 2.71% 2.81% 2.74% 2.77% 2.83% 2.78% 2.75% Firmwide NIM Bank Segment NIM 1Q25 2Q25 3Q25 4Q25 1Q26 AVERAGE YIELD ON RJBDP (THIRD-PARTY BANKS)** 3.12% 3.00% 2.96% 2.91% 2.76% 1Q25 2Q25 3Q25 4Q25 1Q26 Year-over-year change: (1)% Sequential change: 2%

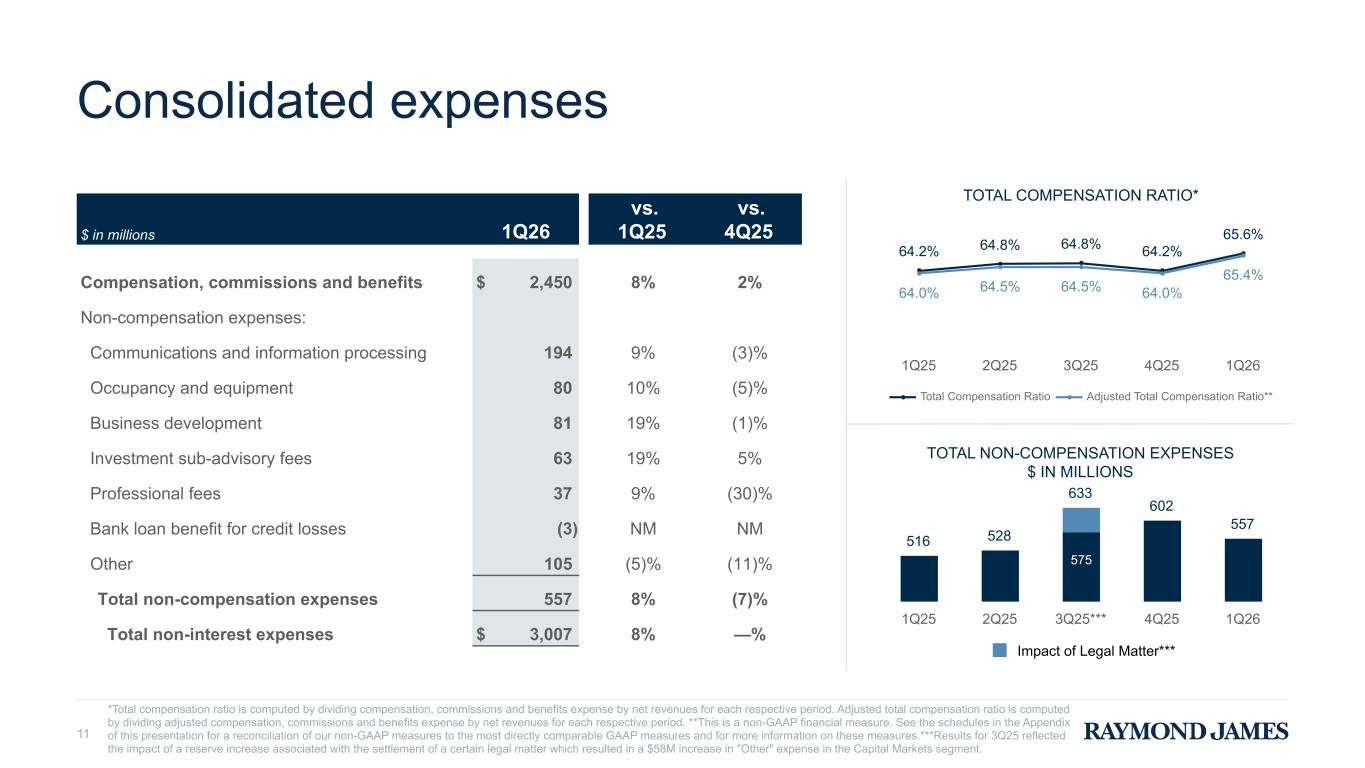

Consolidated expenses 11 $ in millions 1Q26 vs. 1Q25 vs. 4Q25 Compensation, commissions and benefits $ 2,450 8% 2% Non-compensation expenses: Communications and information processing 194 9% (3)% Occupancy and equipment 80 10% (5)% Business development 81 19% (1)% Investment sub-advisory fees 63 19% 5% Professional fees 37 9% (30)% Bank loan benefit for credit losses (3) NM NM Other 105 (5)% (11)% Total non-compensation expenses 557 8% (7)% Total non-interest expenses $ 3,007 8% —% *Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period. Adjusted total compensation ratio is computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. **This is a non-GAAP financial measure. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures.***Results for 3Q25 reflected the impact of a reserve increase associated with the settlement of a certain legal matter which resulted in a $58M increase in "Other" expense in the Capital Markets segment. TOTAL NON-COMPENSATION EXPENSES $ IN MILLIONS 516 528 633 602 557 Impact of Legal Matter*** 1Q25 2Q25 3Q25*** 4Q25 1Q26 TOTAL COMPENSATION RATIO* 64.2% 64.8% 64.8% 64.2% 65.6% 64.0% 64.5% 64.5% 64.0% 65.4% Total Compensation Ratio Adjusted Total Compensation Ratio** 1Q25 2Q25 3Q25 4Q25 1Q26 575

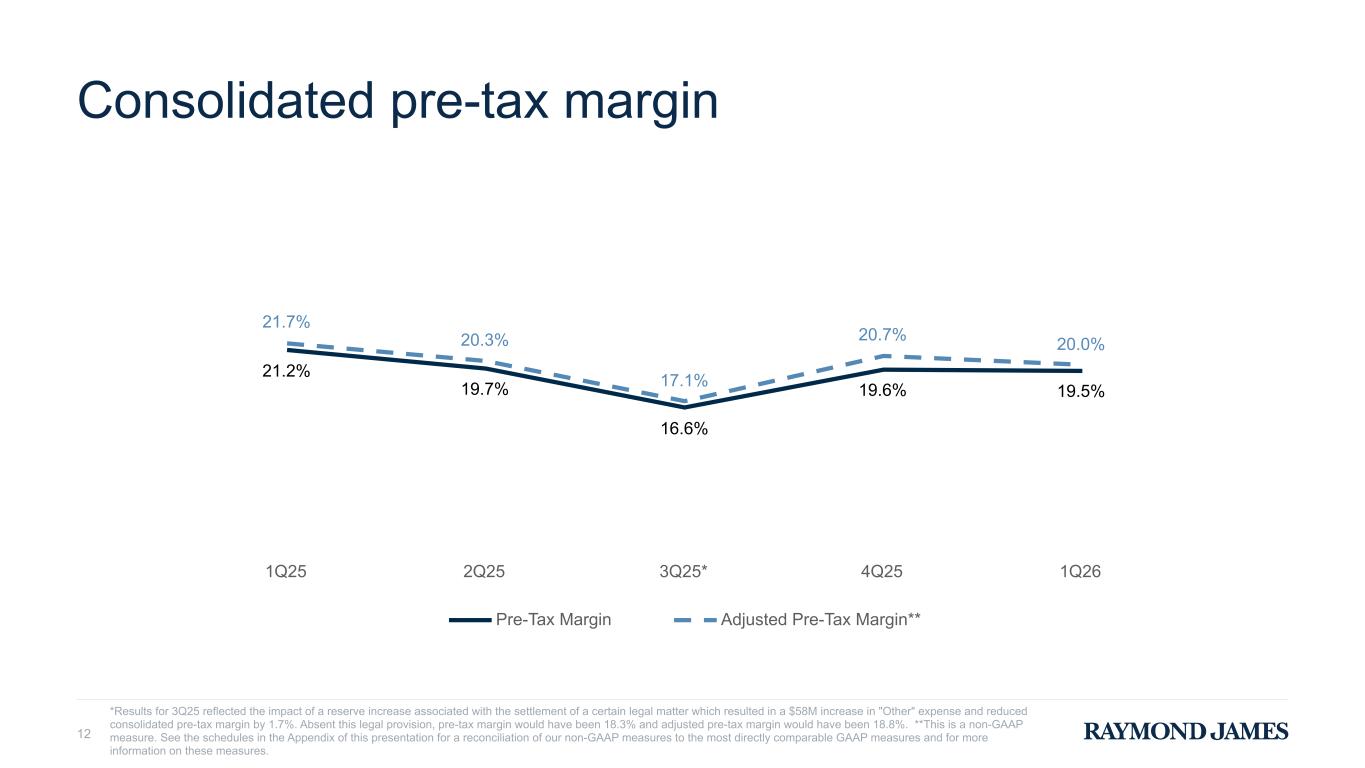

*Results for 3Q25 reflected the impact of a reserve increase associated with the settlement of a certain legal matter which resulted in a $58M increase in "Other" expense and reduced consolidated pre-tax margin by 1.7%. Absent this legal provision, pre-tax margin would have been 18.3% and adjusted pre-tax margin would have been 18.8%. **This is a non-GAAP measure. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. Consolidated pre-tax margin 12 21.2% 19.7% 16.6% 19.6% 19.5% 21.7% 20.3% 17.1% 20.7% 20.0% Pre-Tax Margin Adjusted Pre-Tax Margin** 1Q25 2Q25 3Q25* 4Q25 1Q26

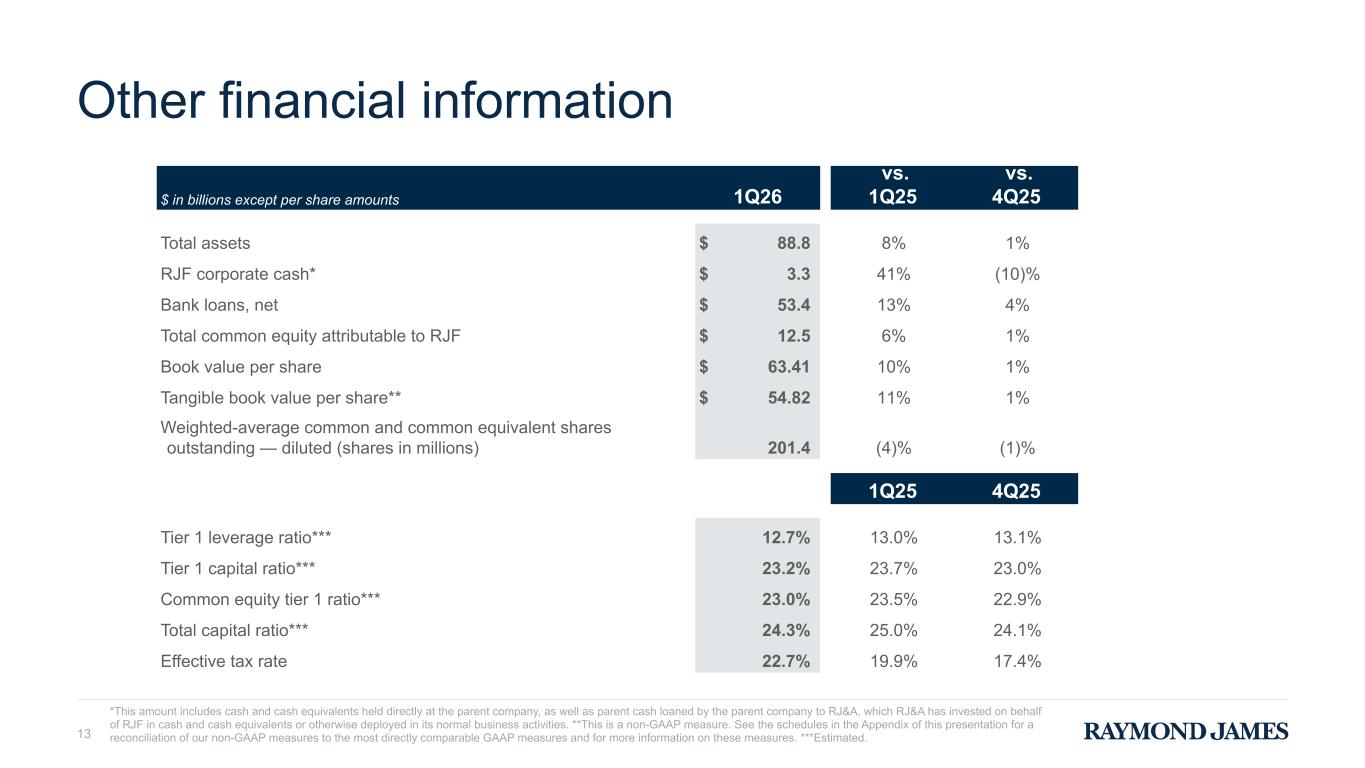

Other financial information 13 *This amount includes cash and cash equivalents held directly at the parent company, as well as parent cash loaned by the parent company to RJ&A, which RJ&A has invested on behalf of RJF in cash and cash equivalents or otherwise deployed in its normal business activities. **This is a non-GAAP measure. See the schedules in the Appendix of this presentation for a reconciliation of our non-GAAP measures to the most directly comparable GAAP measures and for more information on these measures. ***Estimated. $ in billions except per share amounts 1Q26 vs. 1Q25 vs. 4Q25 Total assets $ 88.8 8% 1% RJF corporate cash* $ 3.3 41% (10)% Bank loans, net $ 53.4 13% 4% Total common equity attributable to RJF $ 12.5 6% 1% Book value per share $ 63.41 10% 1% Tangible book value per share** $ 54.82 11% 1% Weighted-average common and common equivalent shares outstanding — diluted (shares in millions) 201.4 (4)% (1)% 1Q25 4Q25 Tier 1 leverage ratio*** 12.7 % 13.0% 13.1% Tier 1 capital ratio*** 23.2 % 23.7% 23.0% Common equity tier 1 ratio*** 23.0 % 23.5% 22.9% Total capital ratio*** 24.3 % 25.0% 24.1% Effective tax rate 22.7 % 19.9% 17.4%

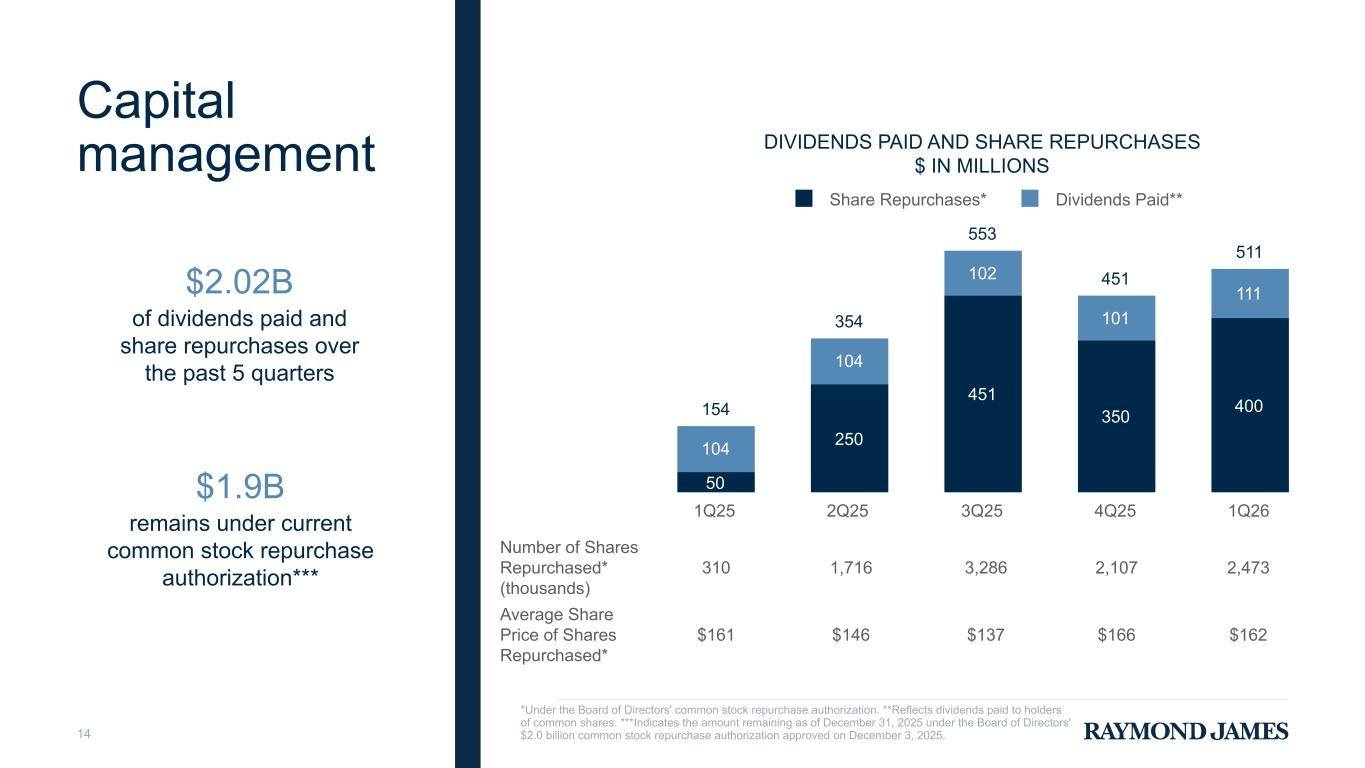

$2.02B of dividends paid and share repurchases over the past 5 quarters Capital management 14 DIVIDENDS PAID AND SHARE REPURCHASES $ IN MILLIONS 154 354 553 451 511 50 250 451 350 400 104 104 102 101 111 Share Repurchases* Dividends Paid** 1Q25 2Q25 3Q25 4Q25 1Q26 Number of Shares Repurchased* (thousands) 310 1,716 3,286 2,107 2,473 Average Share Price of Shares Repurchased* $161 $146 $137 $166 $162 *Under the Board of Directors' common stock repurchase authorization. **Reflects dividends paid to holders of common shares. ***Indicates the amount remaining as of December 31, 2025 under the Board of Directors' $2.0 billion common stock repurchase authorization approved on December 3, 2025. $1.9B remains under current common stock repurchase authorization***

Appendix 15

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 16 We utilize certain non-GAAP financial measures as additional measures to aid in, and enhance, the understanding of our financial results and related measures. These non- GAAP financial measures have been separately identified in this document. We believe certain of these non-GAAP financial measures provide useful information to management and investors by excluding certain material items that may not be indicative of our core operating results. We utilize these non-GAAP financial measures in assessing the financial performance of the business, as they facilitate a comparison of current- and prior-period results. We believe that return on tangible common equity and tangible book value per share are meaningful to investors as they facilitate comparisons of our results to the results of other companies. In the following tables, the tax effect of non-GAAP adjustments reflects the statutory rate associated with each non-GAAP item. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures of other companies. The following tables provide a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures for those periods which include non-GAAP adjustments. Note: Please refer to the footnotes on slide 25 for additional information. continued on next slide

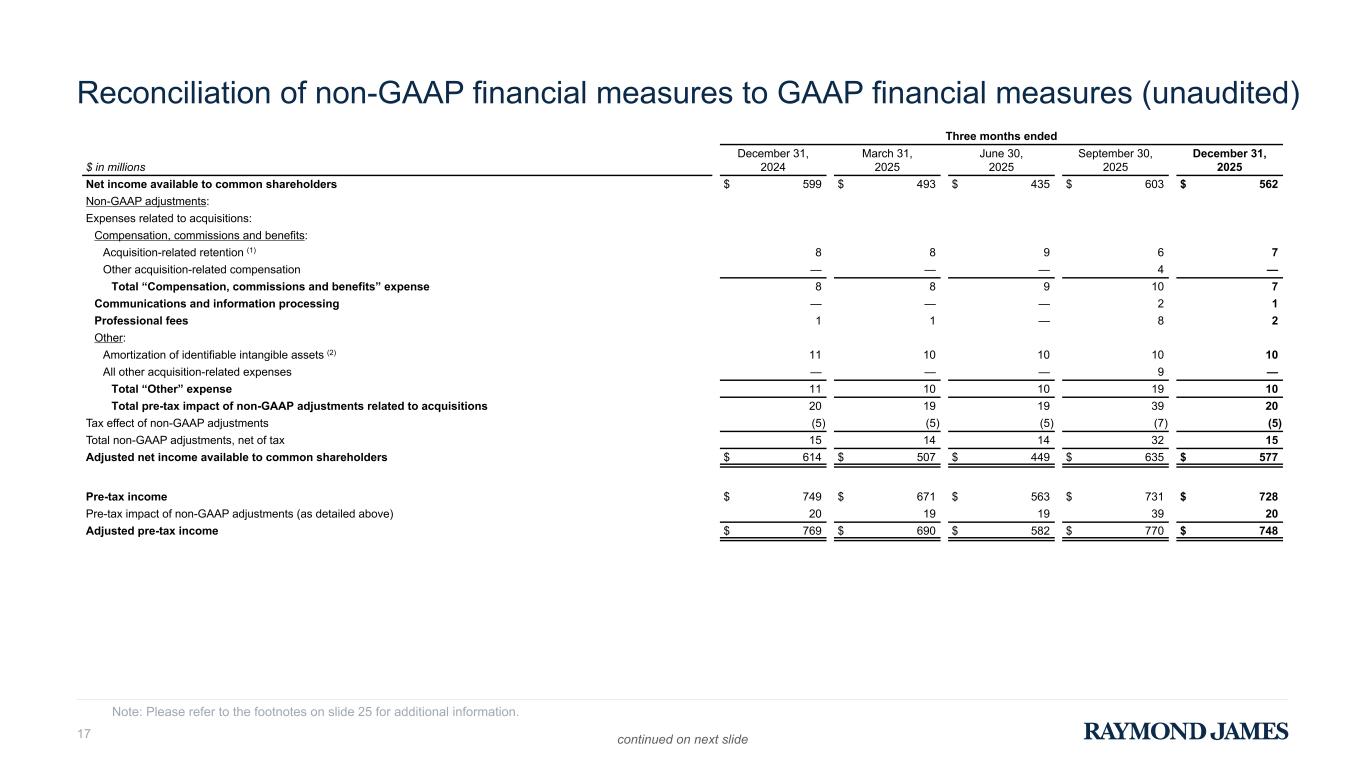

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) Note: Please refer to the footnotes on slide 25 for additional information. continued on next slide Three months ended $ in millions December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 December 31, 2025 Net income available to common shareholders $ 599 $ 493 $ 435 $ 603 $ 562 Non-GAAP adjustments: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 8 8 9 6 7 Other acquisition-related compensation — — — 4 — Total “Compensation, commissions and benefits” expense 8 8 9 10 7 Communications and information processing — — — 2 1 Professional fees 1 1 — 8 2 Other: Amortization of identifiable intangible assets (2) 11 10 10 10 10 All other acquisition-related expenses — — — 9 — Total “Other” expense 11 10 10 19 10 Total pre-tax impact of non-GAAP adjustments related to acquisitions 20 19 19 39 20 Tax effect of non-GAAP adjustments (5) (5) (5) (7) (5) Total non-GAAP adjustments, net of tax 15 14 14 32 15 Adjusted net income available to common shareholders $ 614 $ 507 $ 449 $ 635 $ 577 Pre-tax income $ 749 $ 671 $ 563 $ 731 $ 728 Pre-tax impact of non-GAAP adjustments (as detailed above) 20 19 19 39 20 Adjusted pre-tax income $ 769 $ 690 $ 582 $ 770 $ 748 17

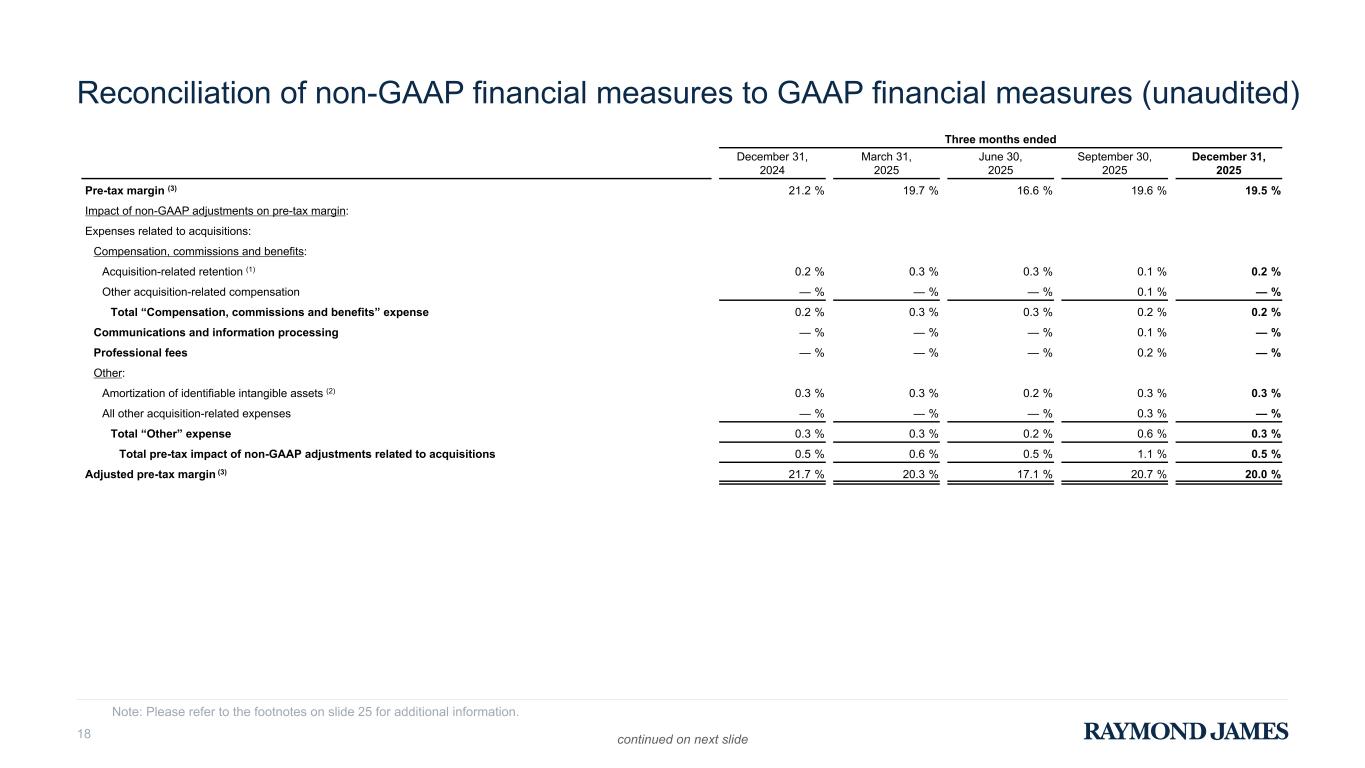

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) Three months ended December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 December 31, 2025 Pre-tax margin (3) 21.2 % 19.7 % 16.6 % 19.6 % 19.5 % Impact of non-GAAP adjustments on pre-tax margin: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 0.2 % 0.3 % 0.3 % 0.1 % 0.2 % Other acquisition-related compensation — % — % — % 0.1 % — % Total “Compensation, commissions and benefits” expense 0.2 % 0.3 % 0.3 % 0.2 % 0.2 % Communications and information processing — % — % — % 0.1 % — % Professional fees — % — % — % 0.2 % — % Other: Amortization of identifiable intangible assets (2) 0.3 % 0.3 % 0.2 % 0.3 % 0.3 % All other acquisition-related expenses — % — % — % 0.3 % — % Total “Other” expense 0.3 % 0.3 % 0.2 % 0.6 % 0.3 % Total pre-tax impact of non-GAAP adjustments related to acquisitions 0.5 % 0.6 % 0.5 % 1.1 % 0.5 % Adjusted pre-tax margin (3) 21.7 % 20.3 % 17.1 % 20.7 % 20.0 % Note: Please refer to the footnotes on slide 25 for additional information. continued on next slide18

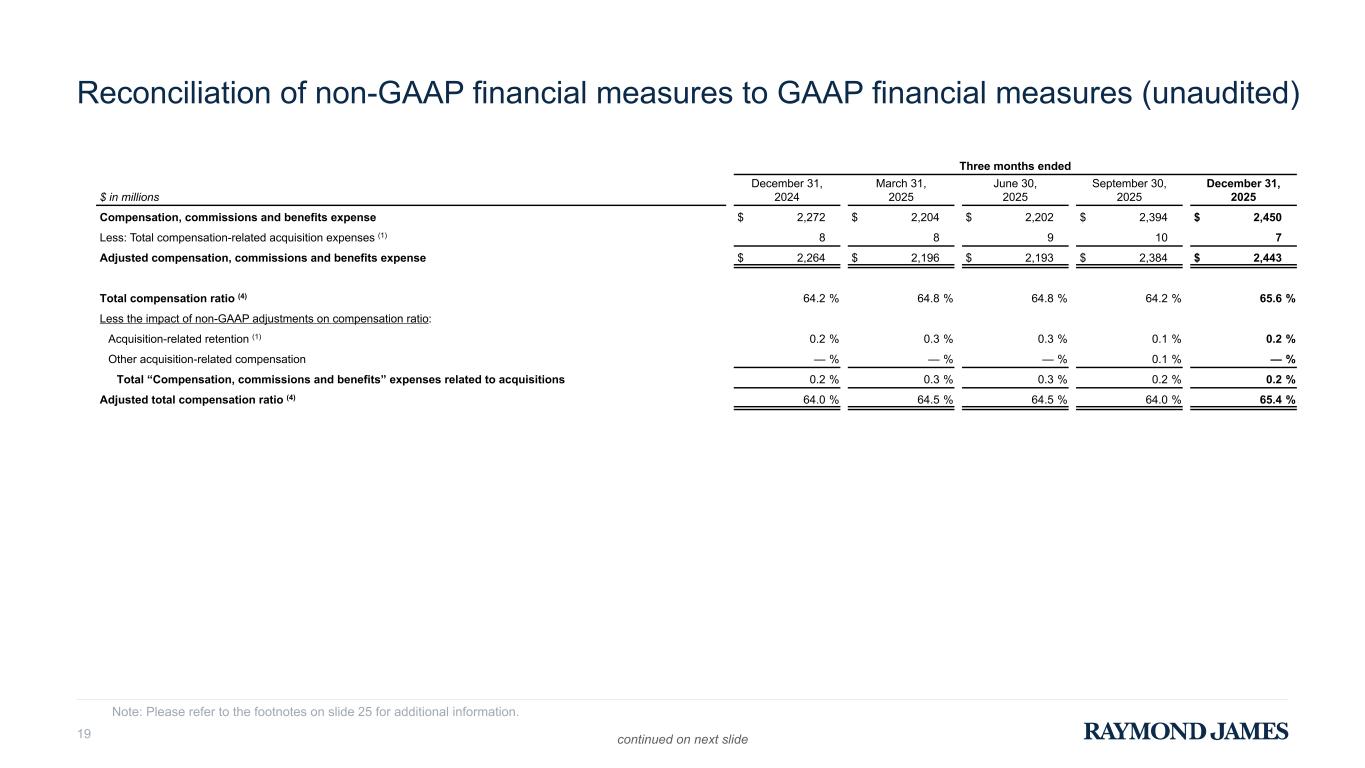

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 19 Note: Please refer to the footnotes on slide 25 for additional information. continued on next slide Three months ended $ in millions December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 December 31, 2025 Compensation, commissions and benefits expense $ 2,272 $ 2,204 $ 2,202 $ 2,394 $ 2,450 Less: Total compensation-related acquisition expenses (1) 8 8 9 10 7 Adjusted compensation, commissions and benefits expense $ 2,264 $ 2,196 $ 2,193 $ 2,384 $ 2,443 Total compensation ratio (4) 64.2 % 64.8 % 64.8 % 64.2 % 65.6 % Less the impact of non-GAAP adjustments on compensation ratio: Acquisition-related retention (1) 0.2 % 0.3 % 0.3 % 0.1 % 0.2 % Other acquisition-related compensation — % — % — % 0.1 % — % Total “Compensation, commissions and benefits” expenses related to acquisitions 0.2 % 0.3 % 0.3 % 0.2 % 0.2 % Adjusted total compensation ratio (4) 64.0 % 64.5 % 64.5 % 64.0 % 65.4 %

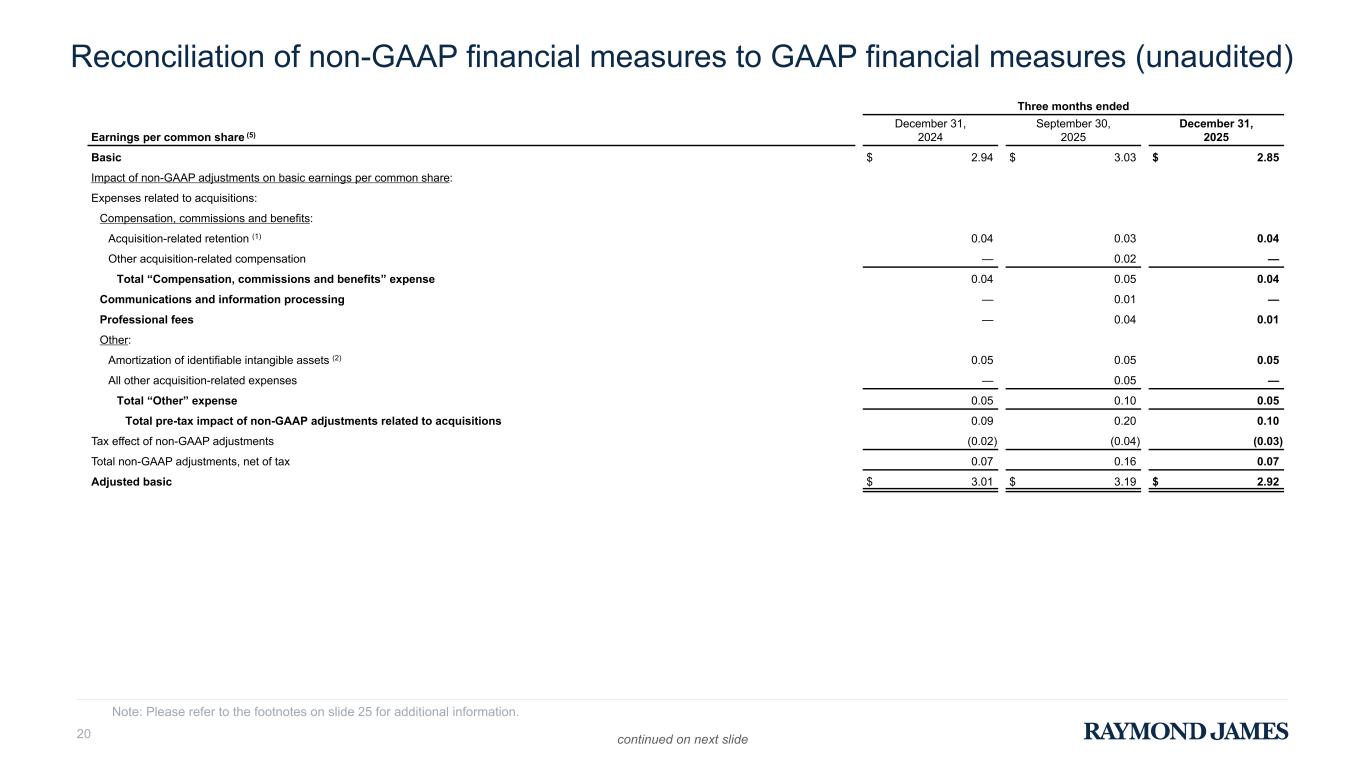

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 20 Note: Please refer to the footnotes on slide 25 for additional information. Three months ended Earnings per common share (5) December 31, 2024 September 30, 2025 December 31, 2025 Basic $ 2.94 $ 3.03 $ 2.85 Impact of non-GAAP adjustments on basic earnings per common share: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 0.04 0.03 0.04 Other acquisition-related compensation — 0.02 — Total “Compensation, commissions and benefits” expense 0.04 0.05 0.04 Communications and information processing — 0.01 — Professional fees — 0.04 0.01 Other: Amortization of identifiable intangible assets (2) 0.05 0.05 0.05 All other acquisition-related expenses — 0.05 — Total “Other” expense 0.05 0.10 0.05 Total pre-tax impact of non-GAAP adjustments related to acquisitions 0.09 0.20 0.10 Tax effect of non-GAAP adjustments (0.02) (0.04) (0.03) Total non-GAAP adjustments, net of tax 0.07 0.16 0.07 Adjusted basic $ 3.01 $ 3.19 $ 2.92 continued on next slide

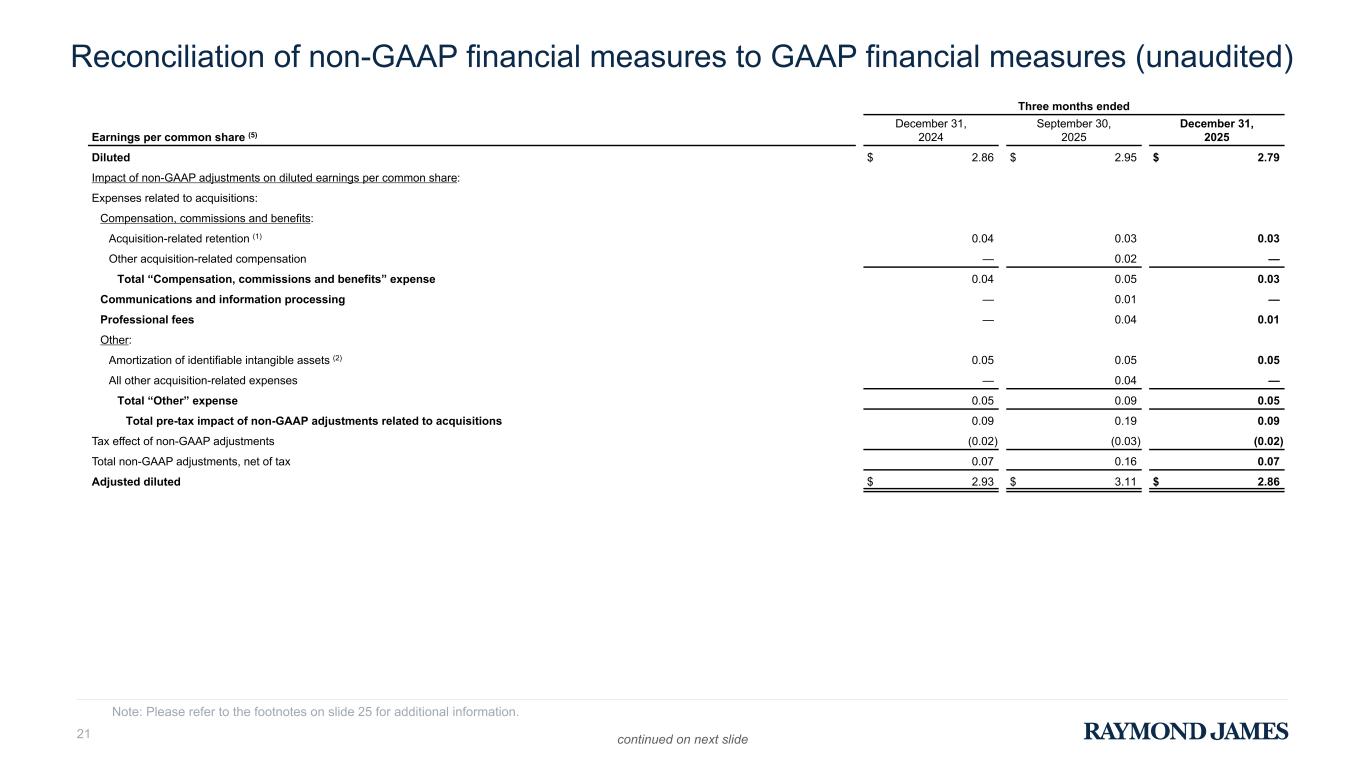

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 21 Note: Please refer to the footnotes on slide 25 for additional information. Three months ended Earnings per common share (5) December 31, 2024 September 30, 2025 December 31, 2025 Diluted $ 2.86 $ 2.95 $ 2.79 Impact of non-GAAP adjustments on diluted earnings per common share: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 0.04 0.03 0.03 Other acquisition-related compensation — 0.02 — Total “Compensation, commissions and benefits” expense 0.04 0.05 0.03 Communications and information processing — 0.01 — Professional fees — 0.04 0.01 Other: Amortization of identifiable intangible assets (2) 0.05 0.05 0.05 All other acquisition-related expenses — 0.04 — Total “Other” expense 0.05 0.09 0.05 Total pre-tax impact of non-GAAP adjustments related to acquisitions 0.09 0.19 0.09 Tax effect of non-GAAP adjustments (0.02) (0.03) (0.02) Total non-GAAP adjustments, net of tax 0.07 0.16 0.07 Adjusted diluted $ 2.93 $ 3.11 $ 2.86 continued on next slide

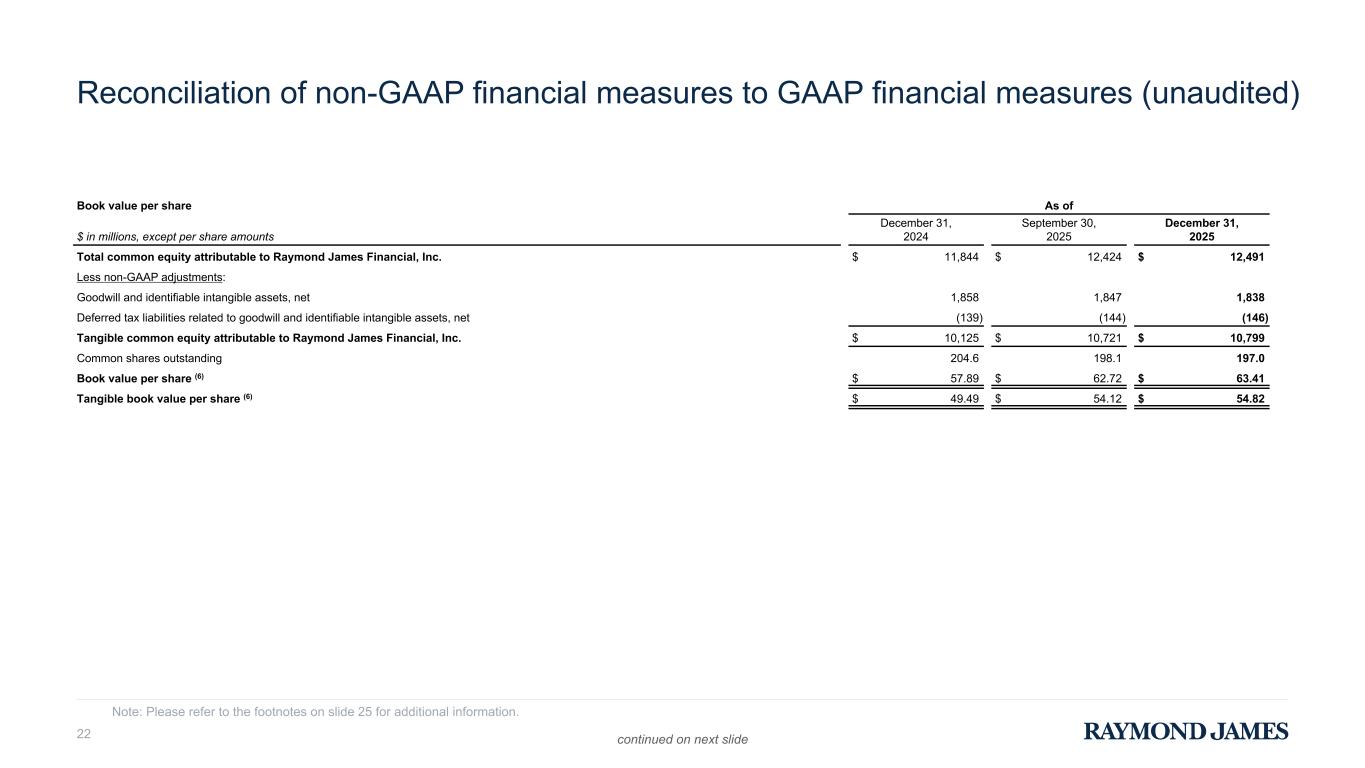

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 22 Note: Please refer to the footnotes on slide 25 for additional information. Book value per share As of $ in millions, except per share amounts December 31, 2024 September 30, 2025 December 31, 2025 Total common equity attributable to Raymond James Financial, Inc. $ 11,844 $ 12,424 $ 12,491 Less non-GAAP adjustments: Goodwill and identifiable intangible assets, net 1,858 1,847 1,838 Deferred tax liabilities related to goodwill and identifiable intangible assets, net (139) (144) (146) Tangible common equity attributable to Raymond James Financial, Inc. $ 10,125 $ 10,721 $ 10,799 Common shares outstanding 204.6 198.1 197.0 Book value per share (6) $ 57.89 $ 62.72 $ 63.41 Tangible book value per share (6) $ 49.49 $ 54.12 $ 54.82 continued on next slide

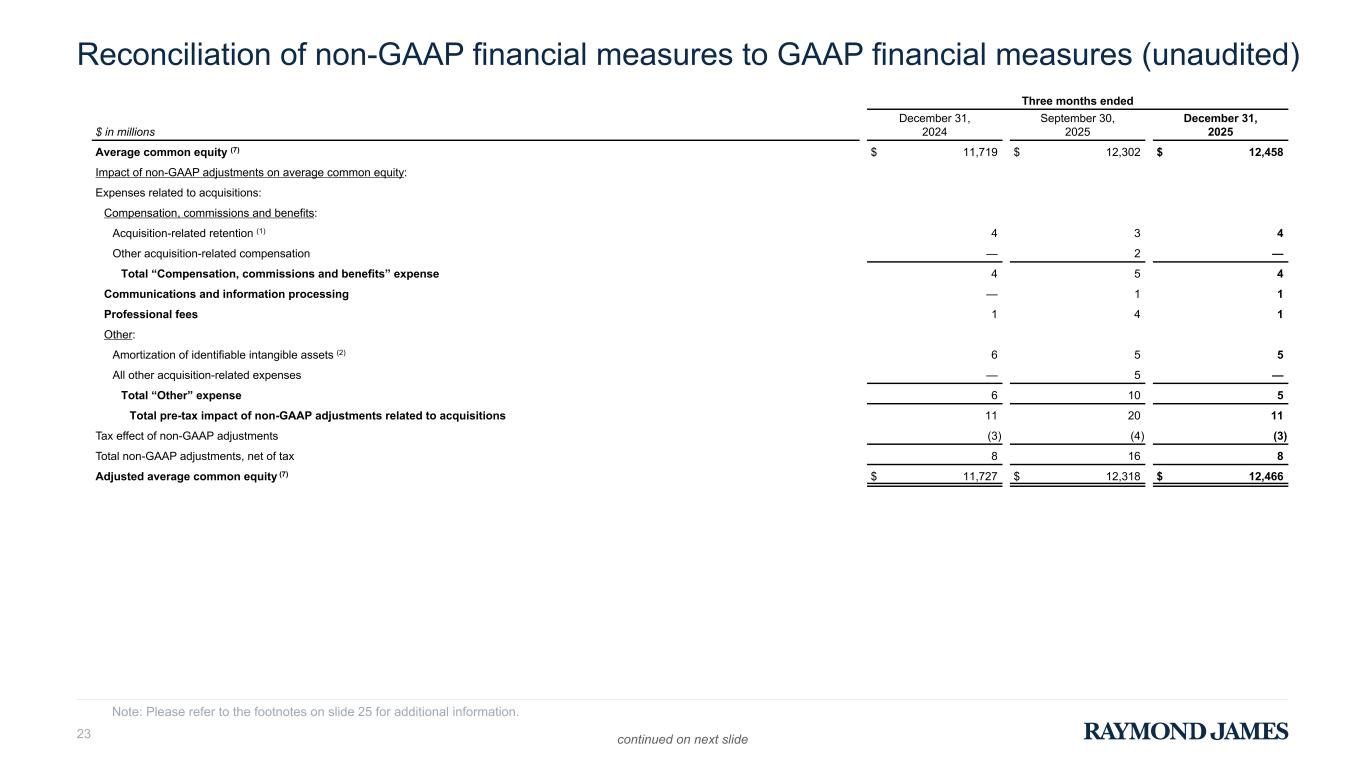

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 23 Note: Please refer to the footnotes on slide 25 for additional information. Three months ended $ in millions December 31, 2024 September 30, 2025 December 31, 2025 Average common equity (7) $ 11,719 $ 12,302 $ 12,458 Impact of non-GAAP adjustments on average common equity: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 4 3 4 Other acquisition-related compensation — 2 — Total “Compensation, commissions and benefits” expense 4 5 4 Communications and information processing — 1 1 Professional fees 1 4 1 Other: Amortization of identifiable intangible assets (2) 6 5 5 All other acquisition-related expenses — 5 — Total “Other” expense 6 10 5 Total pre-tax impact of non-GAAP adjustments related to acquisitions 11 20 11 Tax effect of non-GAAP adjustments (3) (4) (3) Total non-GAAP adjustments, net of tax 8 16 8 Adjusted average common equity (7) $ 11,727 $ 12,318 $ 12,466 continued on next slide

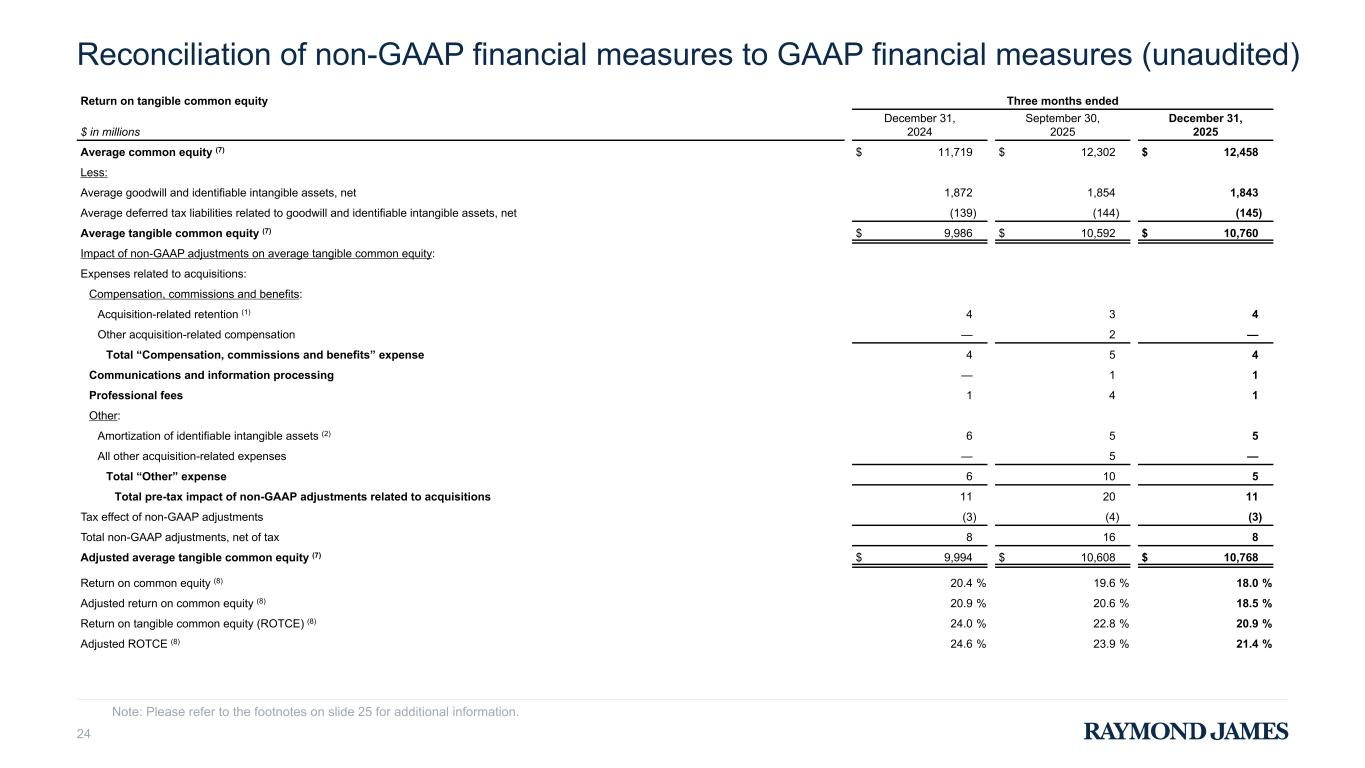

Reconciliation of non-GAAP financial measures to GAAP financial measures (unaudited) 24 Return on tangible common equity Three months ended $ in millions December 31, 2024 September 30, 2025 December 31, 2025 Average common equity (7) $ 11,719 $ 12,302 $ 12,458 Less: Average goodwill and identifiable intangible assets, net 1,872 1,854 1,843 Average deferred tax liabilities related to goodwill and identifiable intangible assets, net (139) (144) (145) Average tangible common equity (7) $ 9,986 $ 10,592 $ 10,760 Impact of non-GAAP adjustments on average tangible common equity: Expenses related to acquisitions: Compensation, commissions and benefits: Acquisition-related retention (1) 4 3 4 Other acquisition-related compensation — 2 — Total “Compensation, commissions and benefits” expense 4 5 4 Communications and information processing — 1 1 Professional fees 1 4 1 Other: Amortization of identifiable intangible assets (2) 6 5 5 All other acquisition-related expenses — 5 — Total “Other” expense 6 10 5 Total pre-tax impact of non-GAAP adjustments related to acquisitions 11 20 11 Tax effect of non-GAAP adjustments (3) (4) (3) Total non-GAAP adjustments, net of tax 8 16 8 Adjusted average tangible common equity (7) $ 9,994 $ 10,608 $ 10,768 Return on common equity (8) 20.4 % 19.6 % 18.0 % Adjusted return on common equity (8) 20.9 % 20.6 % 18.5 % Return on tangible common equity (ROTCE) (8) 24.0 % 22.8 % 20.9 % Adjusted ROTCE (8) 24.6 % 23.9 % 21.4 % Note: Please refer to the footnotes on slide 25 for additional information.

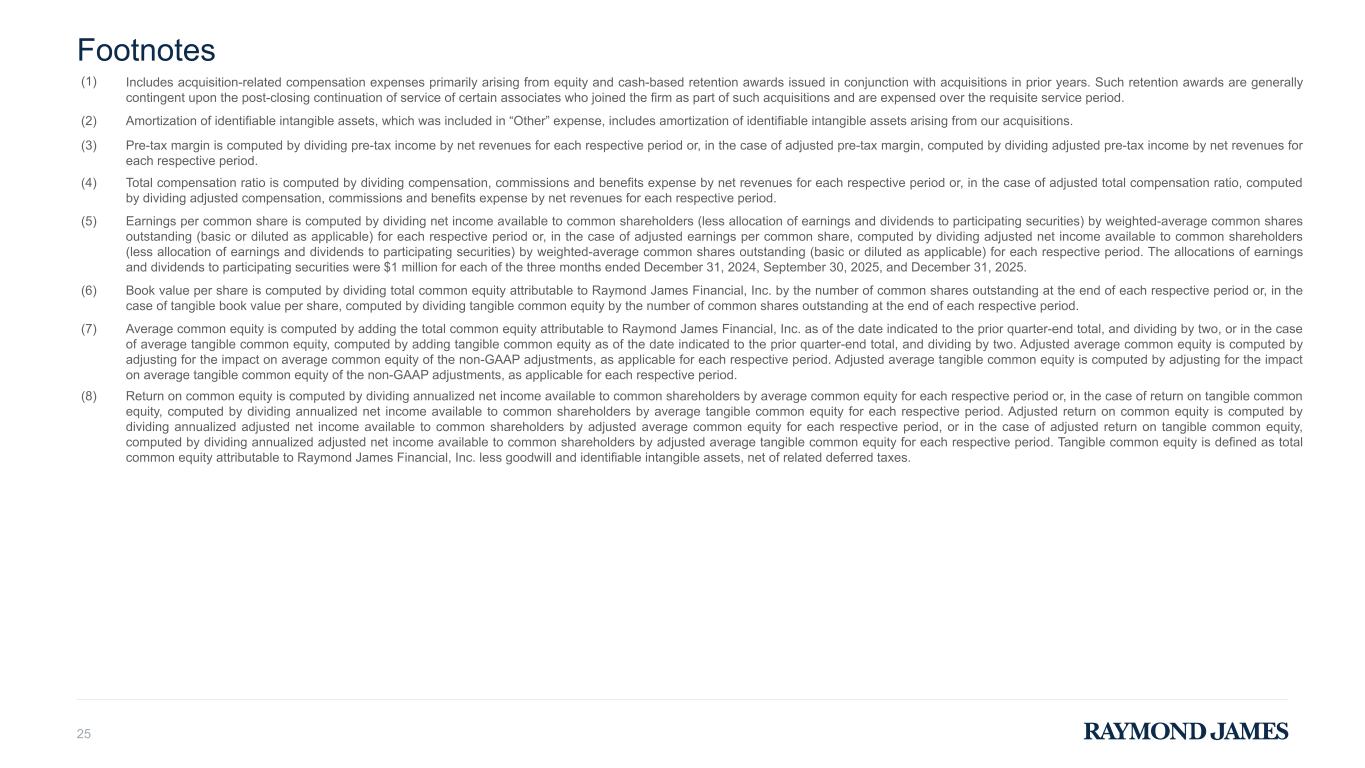

Footnotes 25 (1) Includes acquisition-related compensation expenses primarily arising from equity and cash-based retention awards issued in conjunction with acquisitions in prior years. Such retention awards are generally contingent upon the post-closing continuation of service of certain associates who joined the firm as part of such acquisitions and are expensed over the requisite service period. (2) Amortization of identifiable intangible assets, which was included in “Other” expense, includes amortization of identifiable intangible assets arising from our acquisitions. (3) Pre-tax margin is computed by dividing pre-tax income by net revenues for each respective period or, in the case of adjusted pre-tax margin, computed by dividing adjusted pre-tax income by net revenues for each respective period. (4) Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period or, in the case of adjusted total compensation ratio, computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. (5) Earnings per common share is computed by dividing net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period or, in the case of adjusted earnings per common share, computed by dividing adjusted net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period. The allocations of earnings and dividends to participating securities were $1 million for each of the three months ended December 31, 2024, September 30, 2025, and December 31, 2025. (6) Book value per share is computed by dividing total common equity attributable to Raymond James Financial, Inc. by the number of common shares outstanding at the end of each respective period or, in the case of tangible book value per share, computed by dividing tangible common equity by the number of common shares outstanding at the end of each respective period. (7) Average common equity is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of the date indicated to the prior quarter-end total, and dividing by two, or in the case of average tangible common equity, computed by adding tangible common equity as of the date indicated to the prior quarter-end total, and dividing by two. Adjusted average common equity is computed by adjusting for the impact on average common equity of the non-GAAP adjustments, as applicable for each respective period. Adjusted average tangible common equity is computed by adjusting for the impact on average tangible common equity of the non-GAAP adjustments, as applicable for each respective period. (8) Return on common equity is computed by dividing annualized net income available to common shareholders by average common equity for each respective period or, in the case of return on tangible common equity, computed by dividing annualized net income available to common shareholders by average tangible common equity for each respective period. Adjusted return on common equity is computed by dividing annualized adjusted net income available to common shareholders by adjusted average common equity for each respective period, or in the case of adjusted return on tangible common equity, computed by dividing annualized adjusted net income available to common shareholders by adjusted average tangible common equity for each respective period. Tangible common equity is defined as total common equity attributable to Raymond James Financial, Inc. less goodwill and identifiable intangible assets, net of related deferred taxes.