.3 Fourth Quarter 2025 Financial Results Presentation January 28, 2026 Quarterly Earnings Report

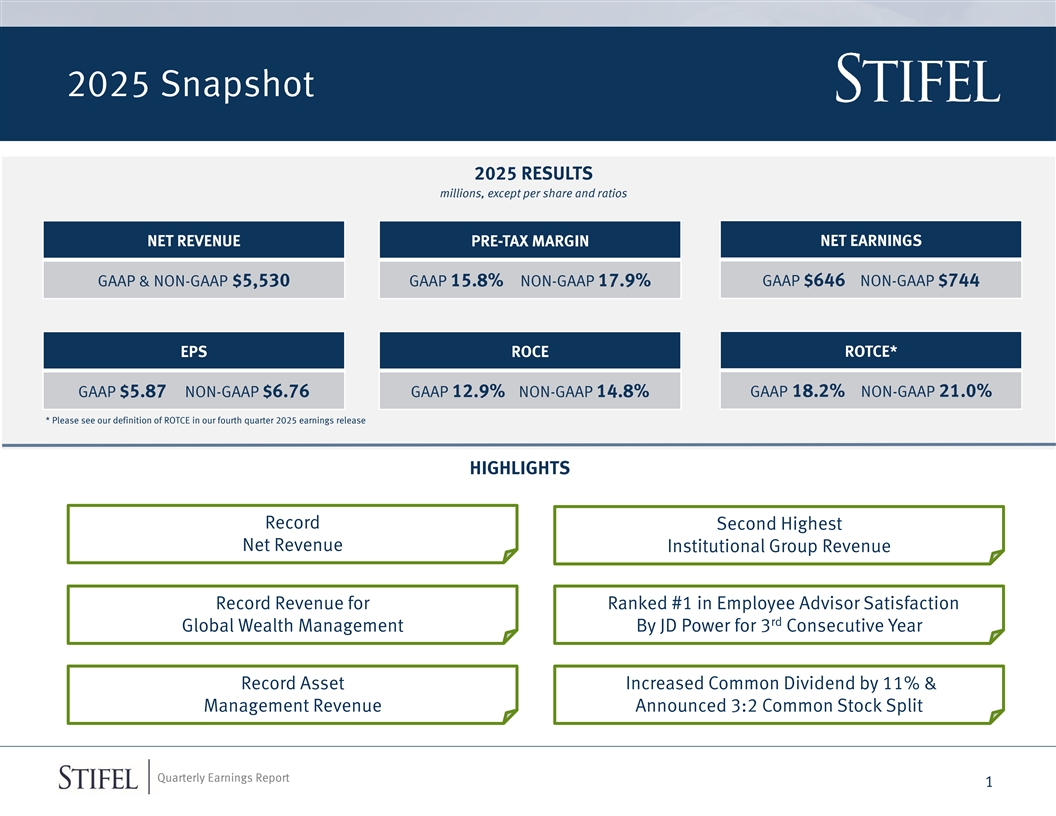

2025 Snapshot 2025 RESULTS millions, except per share and ratios NET REVENUE PRE-TAX MARGIN NET EARNINGS GAAP & NON-GAAP $5,530 GAAP 15.8% NON-GAAP 17.9% GAAP $646 NON-GAAP $744 EPS ROCE ROTCE* GAAP $5.87 NON-GAAP $6.76 GAAP 12.9% NON-GAAP 14.8% GAAP 18.2% NON-GAAP 21.0% * Please see our definition of ROTCE in our fourth quarter 2025 earnings release HIGHLIGHTS Record Second Highest Net Revenue Institutional Group Revenue Record Revenue for Ranked #1 in Employee Advisor Satisfaction rd Global Wealth Management By JD Power for 3 Consecutive Year Record Asset Increased Common Dividend by 11% & Management Revenue Announced 3:2 Common Stock Split Quarterly Earnings Report 1

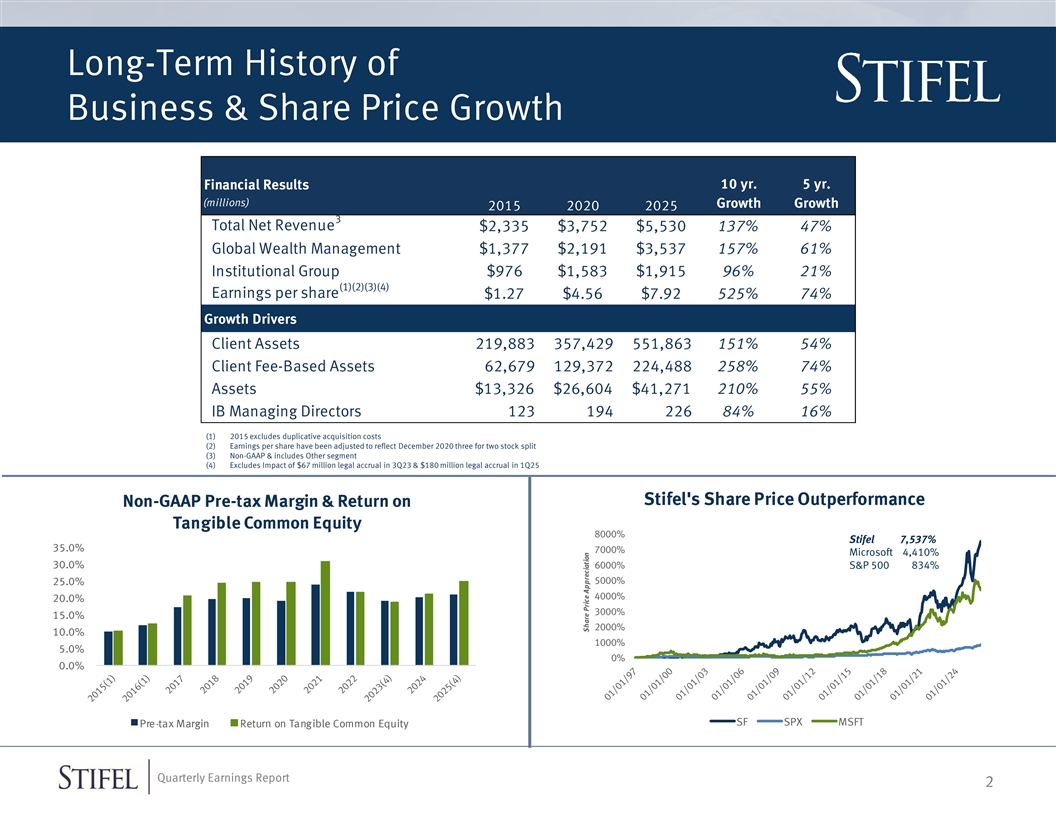

Long-Term History of Business & Share Price Growth Financial Results 10 yr. 5 yr. (millions) Growth Growth 2015 2020 2025 3 Total Net Revenue $2,335 $3,752 $5,530 137% 47% Global Wealth Management $1,377 $2,191 $3,537 157% 61% Institutional Group $976 $1,583 $1,915 96% 21% (1)(2)(3)(4) Earnings per share $1.27 $4.56 $7.92 525% 74% Growth Drivers Client Assets 219,883 357,429 551,863 151% 54% Client Fee-Based Assets 62,679 129,372 224,488 258% 74% Assets $13,326 $26,604 $41,271 210% 55% IB Managing Directors 123 194 226 84% 16% (1) 2015 excludes duplicative acquisition costs (2) Earnings per share have been adjusted to reflect December 2020 three for two stock split (3) Non-GAAP & includes Other segment (4) Excludes Impact of $67 million legal accrual in 3Q23 & $180 million legal accrual in 1Q25 Stifel's Share Price Outperformance Non-GAAP Pre-tax Margin & Return on Tangible Common Equity 8000% Stifel 7,537% 35.0% 7000% Microsoft 4,410% 30.0% 6000% S&P 500 834% 5000% 25.0% 4000% 20.0% 3000% 15.0% 2000% 10.0% 1000% 5.0% 0% 0.0% SF SPX MSFT *Excludes iP mpa re-c ta t of x M $67 ar g mi in llion in one Re t tu ime rn lo en ga T l a re n serv gibe ls e Common Equity *Excludes impact of $67 million in one time legal reserves Quarterly Earnings Report 2 Share Price Appreciation

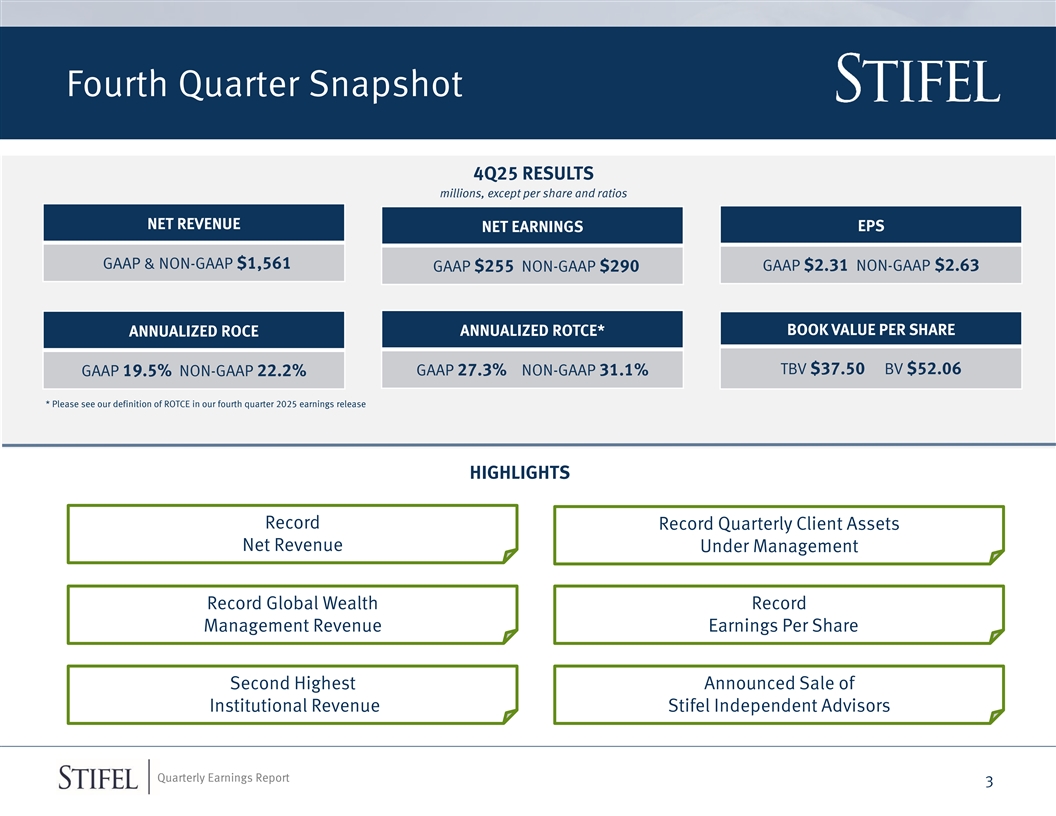

Fourth Quarter Snapshot 4Q25 RESULTS millions, except per share and ratios NET REVENUE NET EARNINGS EPS GAAP & NON-GAAP $1,561 GAAP $2.31 NON-GAAP $2.63 GAAP $255 NON-GAAP $290 BOOK VALUE PER SHARE ANNUALIZED ROTCE* ANNUALIZED ROCE TBV $37.50 BV $52.06 GAAP 19.5% NON-GAAP 22.2% GAAP 27.3% NON-GAAP 31.1% * Please see our definition of ROTCE in our fourth quarter 2025 earnings release HIGHLIGHTS Record Record Quarterly Client Assets Net Revenue Under Management Record Global Wealth Record Management Revenue Earnings Per Share Second Highest Announced Sale of Institutional Revenue Stifel Independent Advisors Quarterly Earnings Report 3

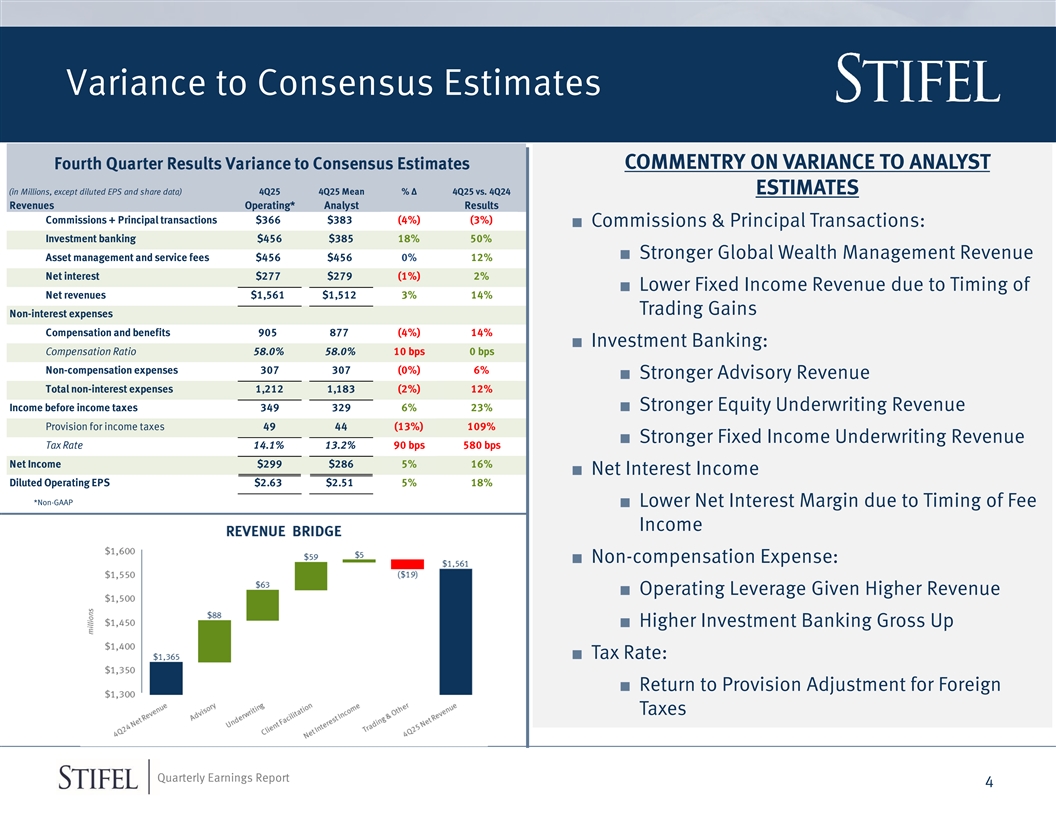

Variance to Consensus Estimates Fourth Quarter Results Variance to Consensus Estimates COMMENTRY ON VARIANCE TO ANALYST (in Millions, except diluted EPS and share data) 4Q25 4Q25 Mean % ∆ 4Q25 vs. 4Q24 ESTIMATES Revenues Operating* Analyst Results Commissions + Principal transactions $366 $383 (4%) (3%) ■ Commissions & Principal Transactions: Investment banking $456 $385 18% 50% ■ Stronger Global Wealth Management Revenue Asset management and service fees $456 $456 0% 12% Net interest $277 $279 (1%) 2% ■ Lower Fixed Income Revenue due to Timing of Net revenues $1,561 $1,512 3% 14% Trading Gains Non-interest expenses Compensation and benefits 905 877 (4%) 14% ■ Investment Banking: Compensation Ratio 58.0% 58.0% 10 bps 0 bps Non-compensation expenses 307 307 (0%) 6% ■ Stronger Advisory Revenue Total non-interest expenses 1,212 1,183 (2%) 12% ■ Stronger Equity Underwriting Revenue Income before income taxes 349 329 6% 23% Provision for income taxes 49 44 (13%) 109% ■ Stronger Fixed Income Underwriting Revenue Tax Rate 14.1% 13.2% 90 bps 580 bps Net Income $299 $286 5% 16% ■ Net Interest Income Diluted Operating EPS $2.63 $2.51 5% 18% *Non-GAAP ■ Lower Net Interest Margin due to Timing of Fee Income * Impact of Legal Reserves calculated as legal reserves of $67 million, an adjusted tax rate of 25%, divided by the diluted average share count. ■ Non-compensation Expense: ■ Operating Leverage Given Higher Revenue ■ Higher Investment Banking Gross Up ■ Tax Rate: ■ Return to Provision Adjustment for Foreign Taxes Quarterly Earnings Report 4

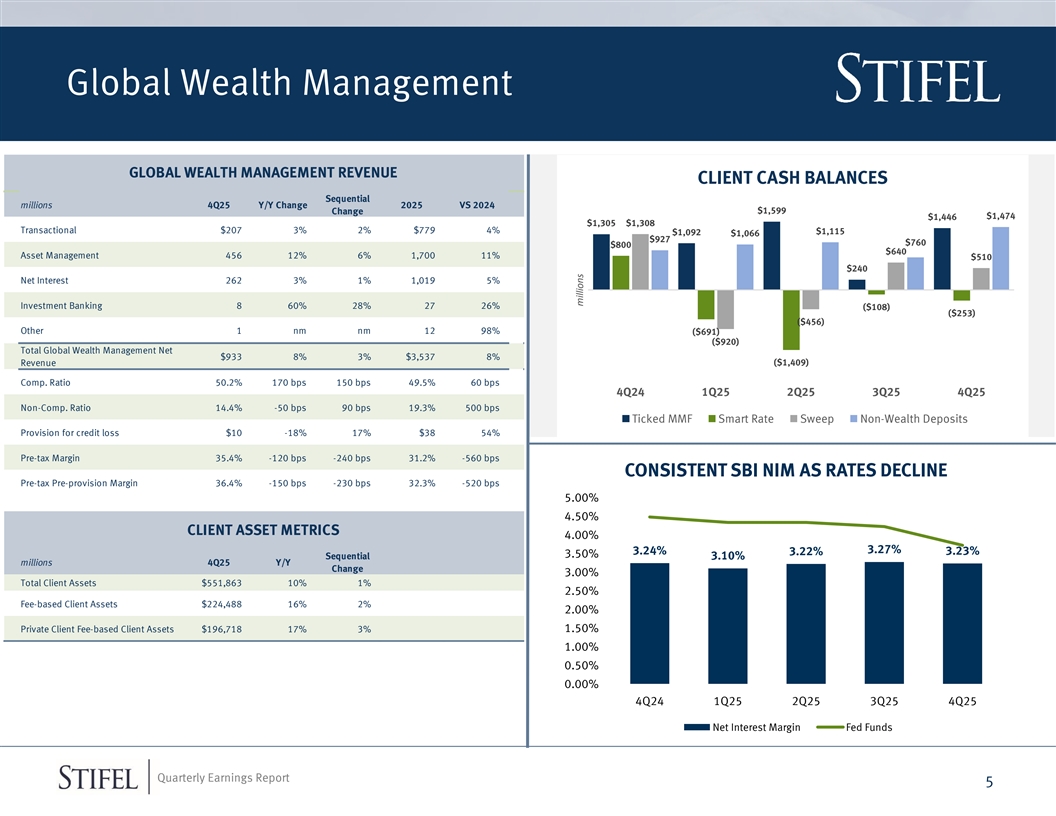

Global Wealth Management GLOBAL WEALTH MANAGEMENT REVENUE CLIENT CASH BALANCES Sequential millions 4Q25 Y/Y Change 2025 VS 2024 $1,599 Change $1,474 $1,446 $1,305 $1,308 Transactional $207 3% 2% $779 4% $1,115 $1,092 $1,066 $927 $760 $800 $640 Asset Management 456 12% 6% 1,700 11% $510 $240 Net Interest 262 3% 1% 1,019 5% Investment Banking 8 60% 28% 27 26% ($108) ($253) ($456) Other 1 nm nm 12 98% ($691) ($920) Total Global Wealth Management Net $933 8% 3% $3,537 8% ($1,409) Revenue Comp. Ratio 50.2% 170 bps 150 bps 49.5% 60 bps 4Q24 1Q25 2Q25 3Q25 4Q25 Non-Comp. Ratio 14.4% -50 bps 90 bps 19.3% 500 bps Ticked MMF Smart Rate Sweep Non-Wealth Deposits Provision for credit loss $10 -18% 17% $38 54% Pre-tax Margin 35.4% -120 bps -240 bps 31.2% -560 bps CONSISTENT SBI NIM AS RATES DECLINE Pre-tax Pre-provision Margin 36.4% -150 bps -230 bps 32.3% -520 bps 5.00% 4.50% CLIENT ASSET METRICS 4.00% 3.27% 3.24% 3.23% 3.22% 3.50% Sequential 3.10% millions 4Q25 Y/Y Change 3.00% Total Client Assets $551,863 10% 1% 2.50% Fee-based Client Assets $224,488 16% 2% 2.00% 1.50% Private Client Fee-based Client Assets $196,718 17% 3% 1.00% 0.50% 0.00% 4Q24 1Q25 2Q25 3Q25 4Q25 Net Interest Margin Fed Funds Quarterly Earnings Report 5 millions

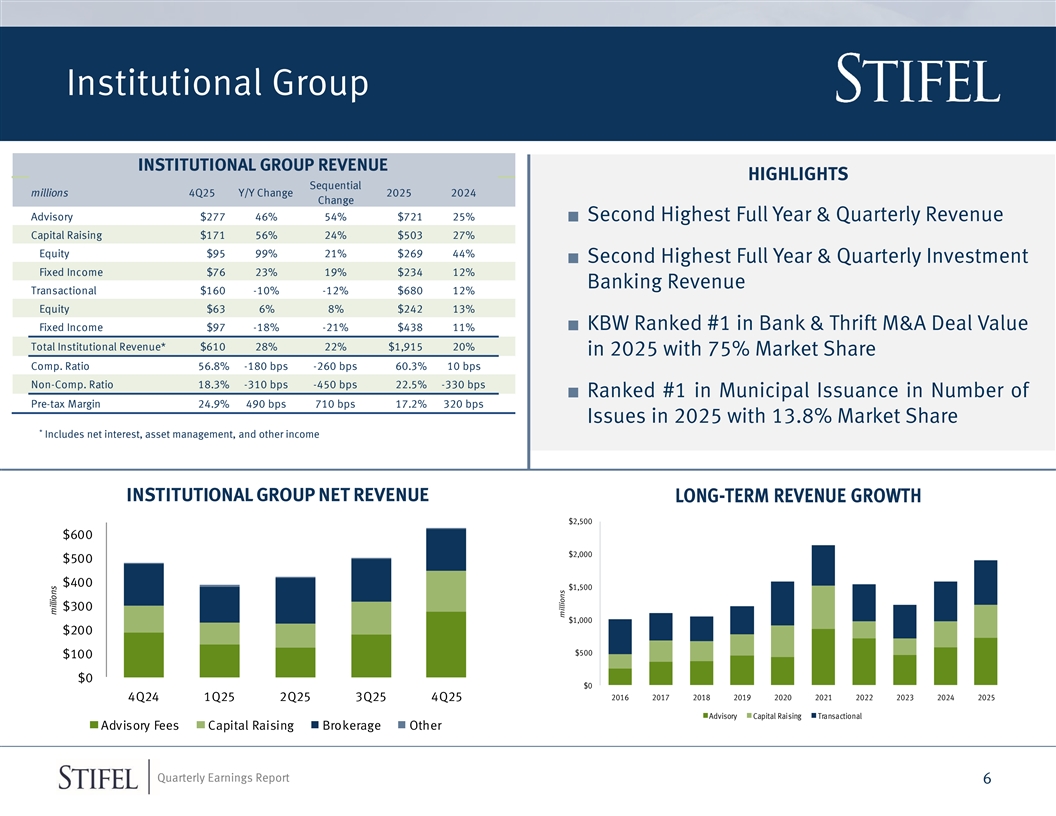

Institutional Group INSTITUTIONAL GROUP REVENUE HIGHLIGHTS Sequential millions 4Q25 Y/Y Change 2025 2024 Change Advisory $277 46% 54% $721 25%■ Second Highest Full Year & Quarterly Revenue Capital Raising $171 56% 24% $503 27% Equity $95 99% 21% $269 44% ■ Second Highest Full Year & Quarterly Investment Fixed Income $76 23% 19% $234 12% Banking Revenue Transactional $160 -10% -12% $680 12% Equity $63 6% 8% $242 13% ■ KBW Ranked #1 in Bank & Thrift M&A Deal Value Fixed Income $97 -18% -21% $438 11% Total Institutional Revenue* $610 28% 22% $1,915 20% in 2025 with 75% Market Share Comp. Ratio 56.8% -180 bps -260 bps 60.3% 10 bps Non-Comp. Ratio 18.3% -310 bps -450 bps 22.5% -330 bps ■ Ranked #1 in Municipal Issuance in Number of Pre-tax Margin 24.9% 490 bps 710 bps 17.2% 320 bps Issues in 2025 with 13.8% Market Share * Includes net interest, asset management, and other income INSTITUTIONAL GROUP NET REVENUE LONG-TERM REVENUE GROWTH $2,500 $600 $2,000 $500 $400 $1,500 $300 $1,000 $200 $500 $100 $0 $0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 4Q24 1Q25 2Q25 3Q25 4Q25 Advisory Capital Raising Transactional Advisory Fees Capital Raising Brokerage Other * 2021 revenue based on annualized results through 9/30/2021 Quarterly Earnings Report 6 millions millions

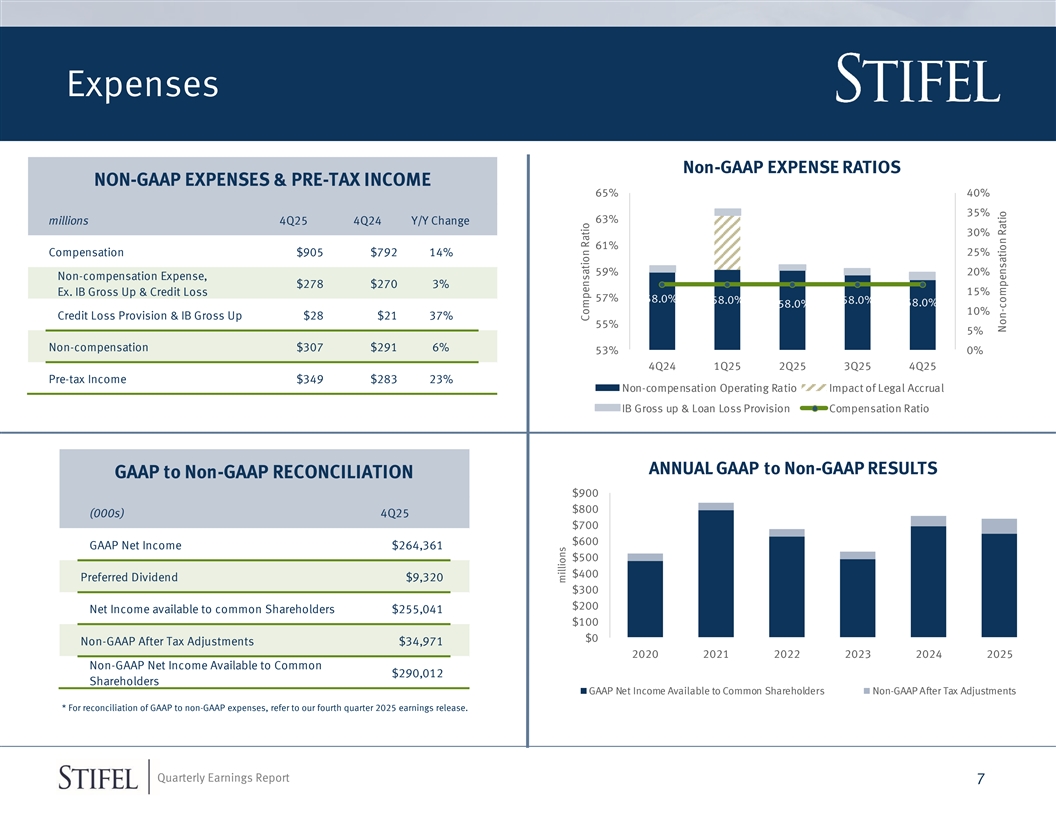

Expenses Non-GAAP EXPENSE RATIOS NON-GAAP EXPENSES & PRE-TAX INCOME 65% 40% 35% 63% millions 4Q25 4Q24 Y/Y Change 30% 61% Compensation $905 $792 14% 25% 59% 20% Non-compensation Expense, $278 $270 3% 15% Ex. IB Gross Up & Credit Loss 57% 58.0% 58.0% 58.0% 58.0% 58.0% 10% Credit Loss Provision & IB Gross Up $28 $21 37% 55% 5% Non-compensation $307 $291 6% 53% 0% 4Q24 1Q25 2Q25 3Q25 4Q25 Pre-tax Income $349 $283 23% Non-compensation Operating Ratio Impact of Legal Accrual IB Gross up & Loan Loss Provision Compensation Ratio ANNUAL GAAP to Non-GAAP RESULTS GAAP to Non-GAAP RECONCILIATION $900 $800 (000s) 4Q25 $700 Bar chart header numbers $600 GAAP Net Income $264,361 are a graphic $500 $400 Preferred Dividend $9,320 $300 $200 Net Income available to common Shareholders $255,041 $100 $0 Non-GAAP After Tax Adjustments $34,971 2020 2021 2022 2023 2024 2025 Non-GAAP Net Income Available to Common $290,012 Shareholders GAAP Net Income Available to Common Shareholders Non-GAAP After Tax Adjustments * For reconciliation of GAAP to non-GAAP expenses, refer to our fourth quarter 2025 earnings release. *2023 annual GAAP to non-GAAP results based on annualized results through 12/31/2023 Quarterly Earnings Report 7 millions Compensation Ratio Non-compensation Ratio

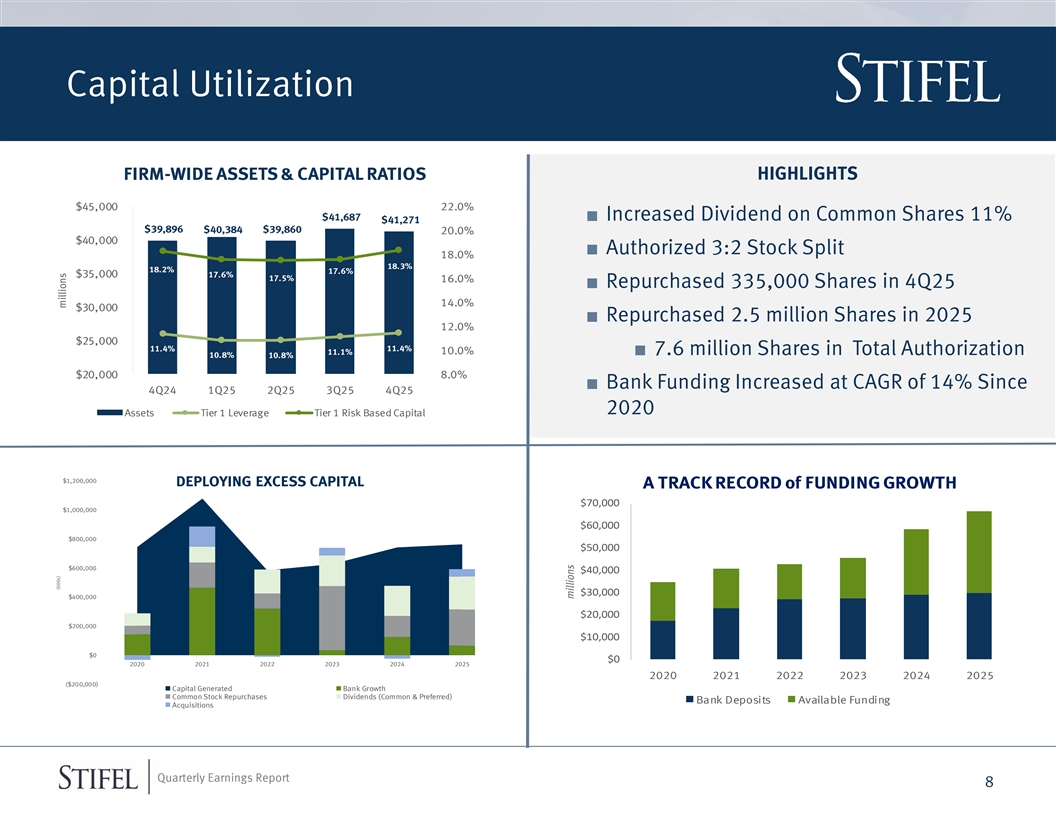

Capital Utilization FIRM-WIDE ASSETS & CAPITAL RATIOS HIGHLIGHTS $45,000 22.0% $41,687 ■ Increased Dividend on Common Shares 11% $41,271 $39,896 $40,384 $39,860 20.0% $40,000 ■ Authorized 3:2 Stock Split 18.0% 18.3% 18.2% 17.6% $35,000 17.6% 17.5% 16.0% ■ Repurchased 335,000 Shares in 4Q25 14.0% $30,000 ■ Repurchased 2.5 million Shares in 2025 12.0% $25,000 11.4% 11.4% 11.1% 10.0%■ 7.6 million Shares in Total Authorization 10.8% 10.8% $20,000 8.0% ■ Bank Funding Increased at CAGR of 14% Since 4Q24 1Q25 2Q25 3Q25 4Q25 2020 Assets Tier 1 Leverage Tier 1 Risk Based Capital $1,200,000 DEPLOYING EXCESS CAPITAL A TRACK RECORD of FUNDING GROWTH $70,000 $1,000,000 $60,000 $800,000 $50,000 $600,000 $40,000 $30,000 $400,000 $20,000 $200,000 $10,000 $0 $0 2020 2021 2022 2023 2024 2025 2020 2021 2022 2023 2024 2025 ($200,000) Capital Generated Bank Growth Common Stock Repurchases Dividends (Common & Preferred) Bank Deposits Available Funding Acquisitions *2023 based on results through 9/30/2023 Quarterly Earnings Report 8 (000s) millions millions

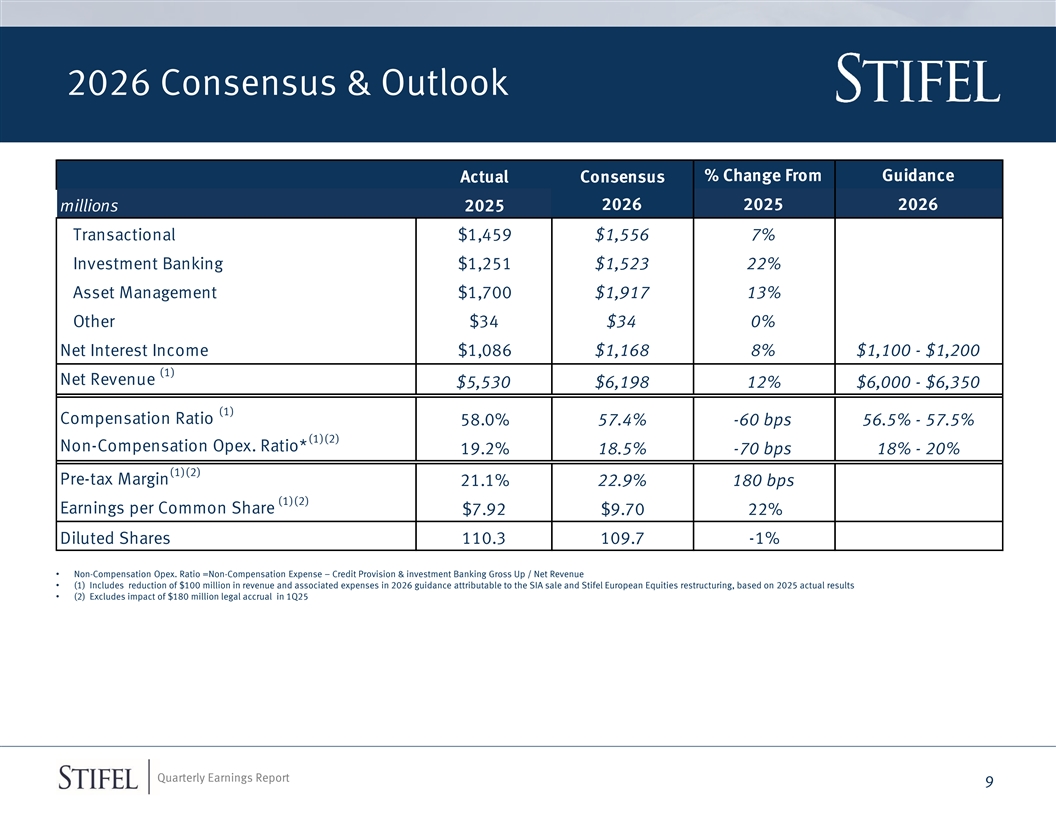

2026 Consensus & Outlook % Change From Guidance Actual Consensus 2026 2025 2026 millions 2025 Transactional $1,459 $1,556 7% Investment Banking $1,251 $1,523 22% Asset Management $1,700 $1,917 13% Other $34 $34 0% Net Interest Income $1,086 $1,168 8% $1,100 - $1,200 (1) Net Revenue $5,530 $6,198 12% $6,000 - $6,350 (1) Compensation Ratio 58.0% 57.4% -60 bps 56.5% - 57.5% (1)(2) Non-Compensation Opex. Ratio* 19.2% 18.5% -70 bps 18% - 20% (1)(2) Pre-tax Margin 21.1% 22.9% 180 bps (1)(2) Earnings per Common Share $7.92 $9.70 22% Diluted Shares 110.3 109.7 -1% • Non-Compensation Opex. Ratio =Non-Compensation Expense – Credit Provision & investment Banking Gross Up / Net Revenue • (1) Includes reduction of $100 million in revenue and associated expenses in 2026 guidance attributable to the SIA sale and Stifel European Equities restructuring, based on 2025 actual results • (2) Excludes impact of $180 million legal accrual in 1Q25 Quarterly Earnings Report 9

Fourth Quarter 2025 Financial Results Presentation January 28, 2026 Quarterly Earnings Report

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. All statements not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. For information about the risks and important factors that could affect the Company’s future results, financial condition and liquidity, see “Risk Factors” in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024. Forward-looking statements speak only as to the date they are made. The Company disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Use of Non-GAAP Financial Measures The Company prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S. GAAP). The Company may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. The Securities and Exchange Commission defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude, or include, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by the Company are provided as additional information to analysts, investors and other stakeholders in order to provide them with greater transparency about, or an alternative method for assessing the Company’s financial condition or operating results. These measures are not in accordance with, or a substitute for U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever the Company refers to a non-GAAP financial measure, it will also define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure it references and such comparable U.S. GAAP financial measure. Quarterly Earnings Report 11