| Acquisition of ClearPoint Federal Bank & Trust COMMUNITY FINANCIAL SYSTEM, INC . | NYSE: CBU JANUARY 1 5 , 2026 |

| 1 Disclaimers Community Financial System, Inc. | Acquisition of ClearPoint Federal Bank & Trust Forward ‐Looking Statements This presentation contains comments or information that constitute forward -looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995), which involve significant risks and uncertainties. Forward -looking statements often use words such as “anticipate,” “could,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “forecast,” “believe,” or other words of similar meaning. These statements are based on the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from the results discussed in the f orward-looking statements. Moreover, the Company’s plans, objectives and intentions are subject to change based on various factors (some of which are beyond the Company’s control). Factors that could cause actual results to differ from those discussed in the forward-looking statements include: (1) adverse developments in the banking industry related to bank failures and the potentia l impact of such developments on customer confidence and regulatory responses to these developments; (2) current and future eco nomic and market conditions, including the effects of changes in housing or vehicle prices, higher unemployment rates, disruptions in the commercial real estate market, labor shortages, supply chain disruption, inability to obtain raw materials and supplies, U.S. fiscal debt, budget and tax matters, geopolitical matters and conflicts, the effects of announced or future tariff increases, changes in global trade policies, and any changes in global economic growth; (3) the effect of, and changes in, mo netary and fiscal policies and laws, including future changes in Federal and state statutory income tax rates and interest rate and other policy actions of the Board of Governors of the Federal Reserve System; (4) the effect of changes in the level of check ing or savings account deposits on the Company’s funding costs and net interest margin including the possibility of a sudden withdrawal of the Company’s deposits due to rapid spread of information or disinformation regarding the Company’s well -being; (5 ) future provisions for credit losses on loans and debt securities; (6) changes in nonperforming assets; (7) the effect of a fall in stock market or bond prices on the Company’s fee income businesses, including its employee benefit services, wealth managemen t, and insurance businesses; (8) risks related to credit quality; (9) inflation, interest rate, liquidity, market and monetary fluctuations; (10) the strength of the U.S. economy in general and the strength of the local economies where the Company con duc ts its business; (11) the timely development of new products and services and customer perception of the overall value there of (including features, pricing and quality) compared to competing products and services; (12) changes in consumer spending, bo rrowing and savings habits; (13) technological changes and implementation and financial risks associated with transitioning to new technology -based systems involving large multi -year contracts; (14) the ability of the Company to maintain the security, in cluding cybersecurity, of its financial, accounting, technology, data processing and other operating systems, facilities and data, including customer data; (15) effectiveness of the Company’s risk management processes and procedures, reliance on models wh ich may be inaccurate or misinterpreted, the Company’s ability to manage its credit or interest rate risk, the sufficiency of its allowance for credit losses and the accuracy of the assumptions or estimates used in preparing the Company’s financial statem ents and disclosures; (16) failure of third parties to provide various services that are important to the Company’s operations; (17) any acquisitions or mergers that might be considered or consummated by the Company and the costs and factors associated there with, including differences in the actual financial results of the acquisition or merger compared to expectations and the realization of anticipated cost savings and revenue enhancements; (18) the ability to maintain and increase market share and control expenses; (19) the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of the Company and its subsidiaries, including changes in laws and regulatio ns concerning taxes, accounting, banking, service fees, risk management, securities, capital requirements and other aspects of the financial services industry; (20) changes in the Company’s organization, compensation and benefit plans and in the avail ability of, and compensation levels for, employees in its geographic markets; (21) the outcome of pending or future litigation and government proceedings; (22) the effect of opening new branches to expand the Company’s geographic footprint, including the c ost associated with opening and operating the branches and the uncertainty surrounding their success including the ability to meet expectations for future deposit and loan levels and commensurate revenues; (23) the effects of natural disasters could create economic and financial disruption; (24) the effects from changes in governmental leadership which expose the Company and its customers to a variety of political, economic, and regulatory risks, including the risk of changes in laws (including labor, trade, tax and other laws) and the potential for disruption in governmental agencies, services provided by the governmen t, and funding of government sponsored projects; (25) the effect of total or partial governmental shutdowns; (26) material differenc es in the actual financial results of investment activities compared with the Company's initial expectations, including the grow th of the Insurtech market; (27) other risk factors outlined in the Company’s filings with the SEC from time to time; and (28) the suc cess of the Company at managing the risks of the foregoing. The foregoing list of important factors is not all -inclusive. For more information about factors that could cause actual result s to differ materially from the Company’s expectations, refer to the discussion under the heading “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10 -K for the fiscal year ended December 31, 2024 as filed with the SEC on February 28, 2025. An y forward -looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to update any forward -looking statement, whether written or oral, to reflect events or circumstances after the date o n which such statement is made. If the Company does update or correct one or more forward -looking statements, investors and others should not conclude that the Company will make additional updates or corrections with respect thereto or with respect to other forward -looking statements. Unaudited The disclosures within this presentation are unaudited. |

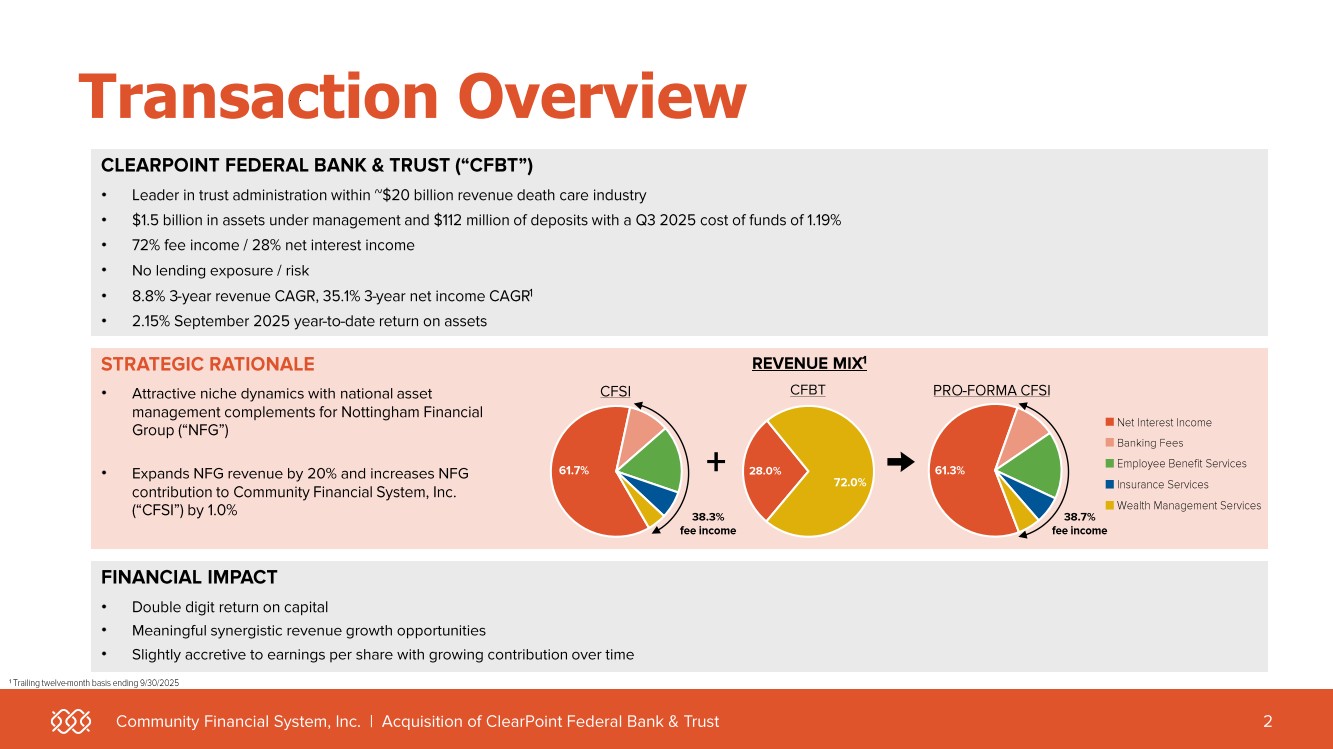

| CLEARPOINT FEDERAL BANK & TRUST (“CFBT”) • Leader in trust administration within ~$20 billion revenue death care industry • $1.5 billion in assets under management and $112 million of deposits with a Q3 2025 cost of funds of 1.19% • 72% fee income / 28% net interest income • No lending exposure / risk • 8.8% 3 -year revenue CAGR, 35.1% 3 -year net income CAGR 1 • 2.15% September 2025 year -to-date return on assets Community Financial System, Inc. | Acquisition of ClearPoint Federal Bank & Trust 2 Transaction Overview STRATEGIC RATIONALE • Attractive niche dynamics with national asset management complements for Nottingham Financial Group (“NFG”) • Expands NFG revenue by 20% and increases NFG contribution to Community Financial System, Inc. (“CFSI”) by 1.0% FINANCIAL IMPACT • Double digit return on capital • Meaningful synergistic revenue growth opportunities • Slightly accretive to earnings per share with growing contribution over time 61.7% CFSI 28.0% 72.0% CFBT 61.3% PRO -FORMA CFSI + → ■ Net Interest Income ■ Banking Fees ■ Employee Benefit Services ■ Insurance Services ■ Wealth Management Services 38.7% fee income 38.3% fee income 1 Trailing twelve -month basis ending 9/30/2025 REVENUE MIX 1 |

| Thank you! INVESTOR RELATIONS CONTACT Marya Burgio Wlos EVP & Chief Financial Officer Marya.Wlos@cbna.com 315.299.2946 |