Janney CEO Forum Scottsdale, AZ February 4th - 5th, 2026 www.bankatcity.com

FORWARD LOOKING STATEMENTS This news release contains certain forward-looking statements that are included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements express only management’s beliefs regarding future results or events and are subject to inherent uncertainty, risks, and changes in circumstances, many of which are outside of management’s control. Uncertainty, risks, changes in circumstances and other factors could cause the Company’s actual results to differ materially from those projected in the forward-looking statements. Factors that could cause actual results to differ from those discussed in such forward-looking statements include, but are not limited to those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 under “ITEM 1A Risk Factors” and the following: (1) general economic conditions, especially in the communities and markets in which we conduct our business; (2) credit risk, including risk that negative credit quality trends may lead to a deterioration of asset quality, risk that our allowance for credit losses may not be sufficient to absorb actual losses in our loan portfolio, and risk from concentrations in our loan portfolio; (3) changes in the real estate market, including the value of collateral securing portions of our loan portfolio; (4) changes in the interest rate environment; (5) operational risk, including cybersecurity risk and risk of fraud, data processing system failures, and network breaches; (6) changes in technology and increased competition, including competition from non-bank financial institutions; (7) changes in consumer preferences, spending and borrowing habits, demand for our products and services, and customers’ performance and creditworthiness; (8) difficulty growing loan and deposit balances; (9) our ability to effectively execute our business plan, including with respect to future acquisitions; (10) changes in regulations, laws, taxes, government policies, monetary policies and accounting policies affecting bank holding companies and their subsidiaries, including changes in deposit insurance premiums; (11) deterioration in the financial condition of the U.S. banking system may impact the valuations of investments the Company has made in the securities of other financial institutions; (12) regulatory enforcement actions and adverse legal actions; (13) difficulty attracting and retaining key employees; and (14) other economic, competitive, technological, operational, governmental, regulatory, and market factors affecting our operations. Forward-looking statements made herein reflect management's expectations as of the date such statements are made. Such information is provided to assist stockholders and potential investors in understanding current and anticipated financial operations of the Company and is included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made. Further, the Company is required to evaluate subsequent events through the filing of its December 31, 2025 Form 10-K. The Company will continue to evaluate the impact of any subsequent events on the preliminary December 31, 2025 results and will adjust the amounts if necessary.

934 FTE $1.8 BILLION Market Cap $6.7 BILLION Total Assets 96 Branches SNAPSHOT CITY HOLDING MARKETS Stable, slow growing, & less competitive CUSTOMERS Robust retail customer base ASSET QUALITY Demonstrated strong track record PERFORMANCE Long record as a high performer GROWTH Succeeding in slow-growth markets & expanding into new markets

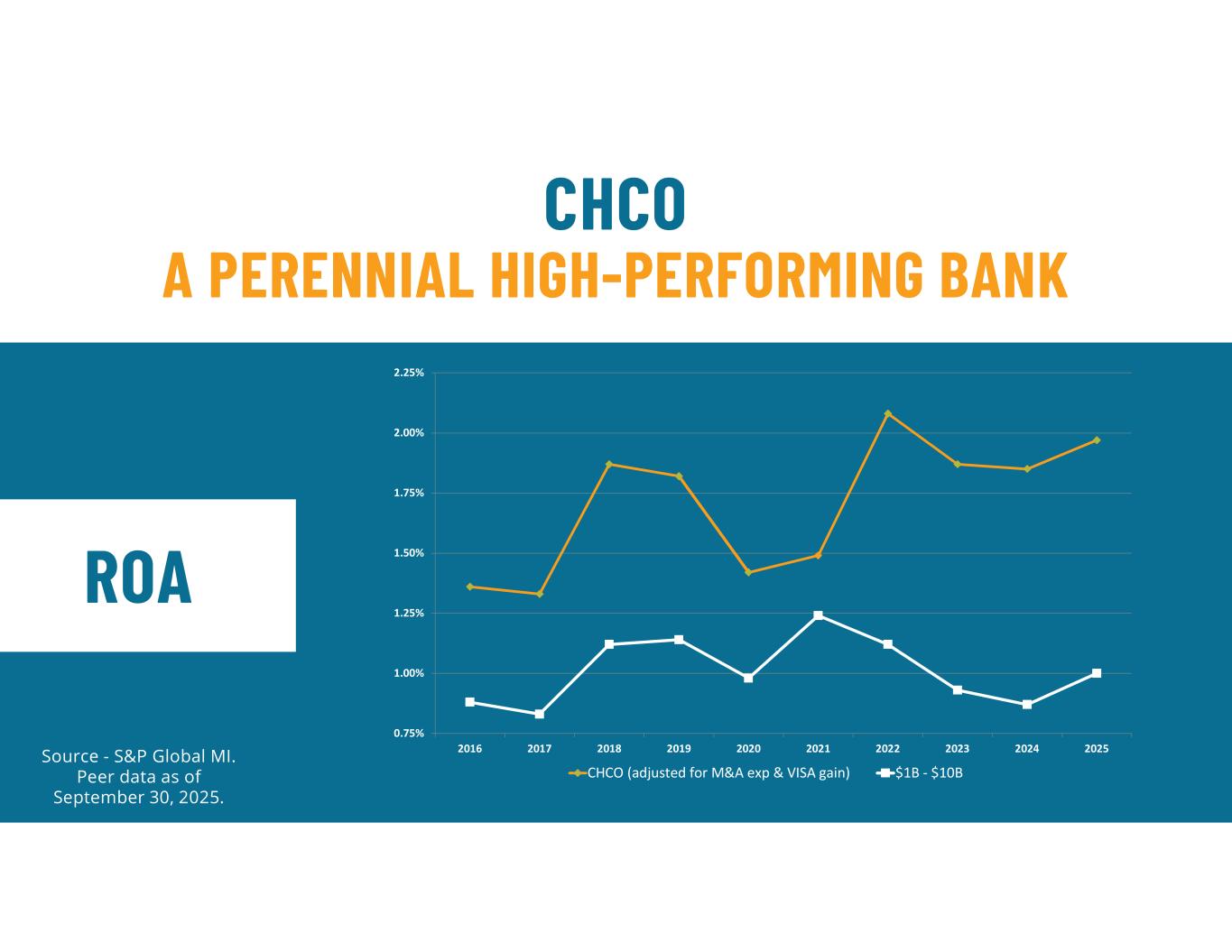

CHCO A PERENNIAL HIGH-PERFORMING BANK ROA Source - S&P Global MI. Peer data as of September 30, 2025. 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 CHCO (adjusted for M&A exp & VISA gain) $1B - $10B

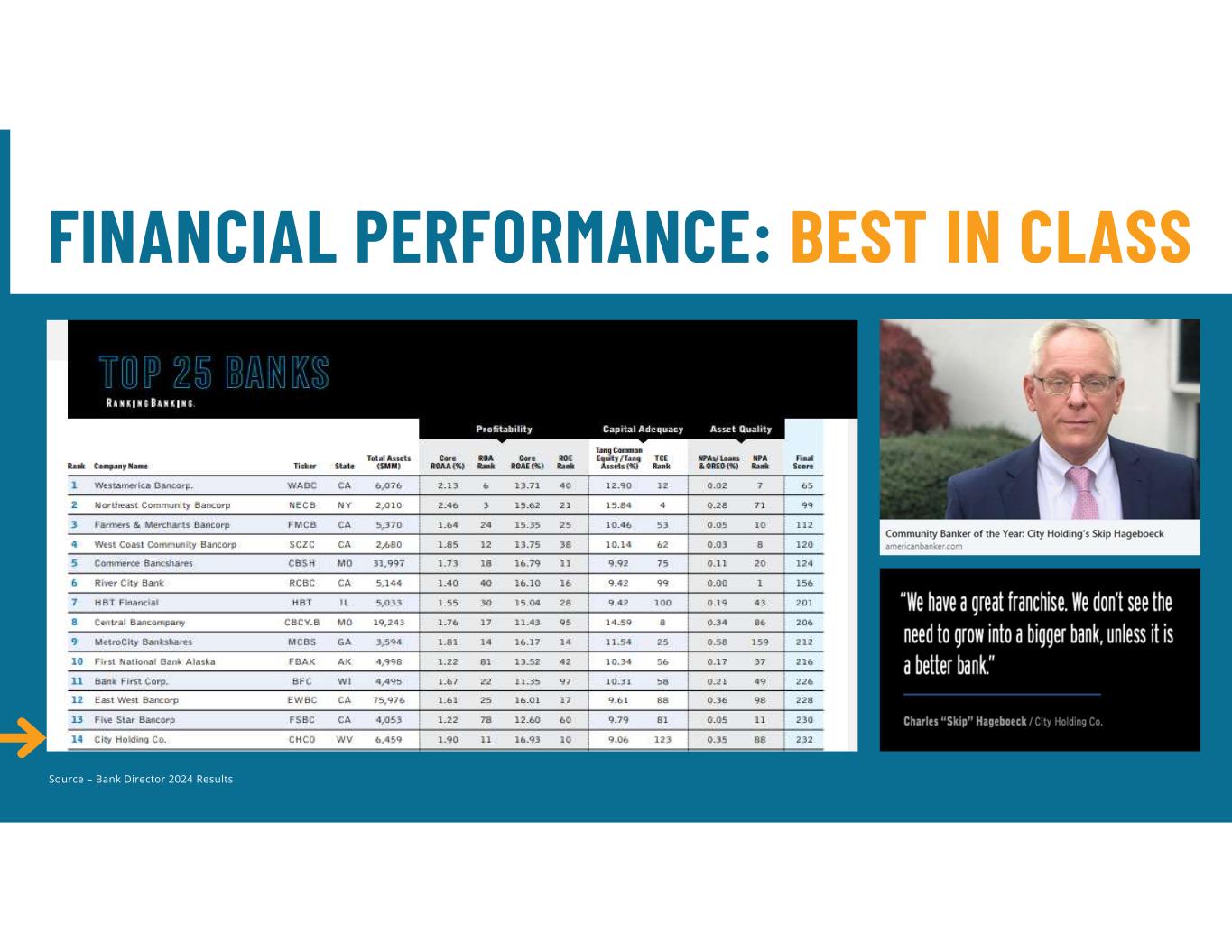

FINANCIAL PERFORMANCE: BEST IN CLASS Source – Bank Director 2024 Results

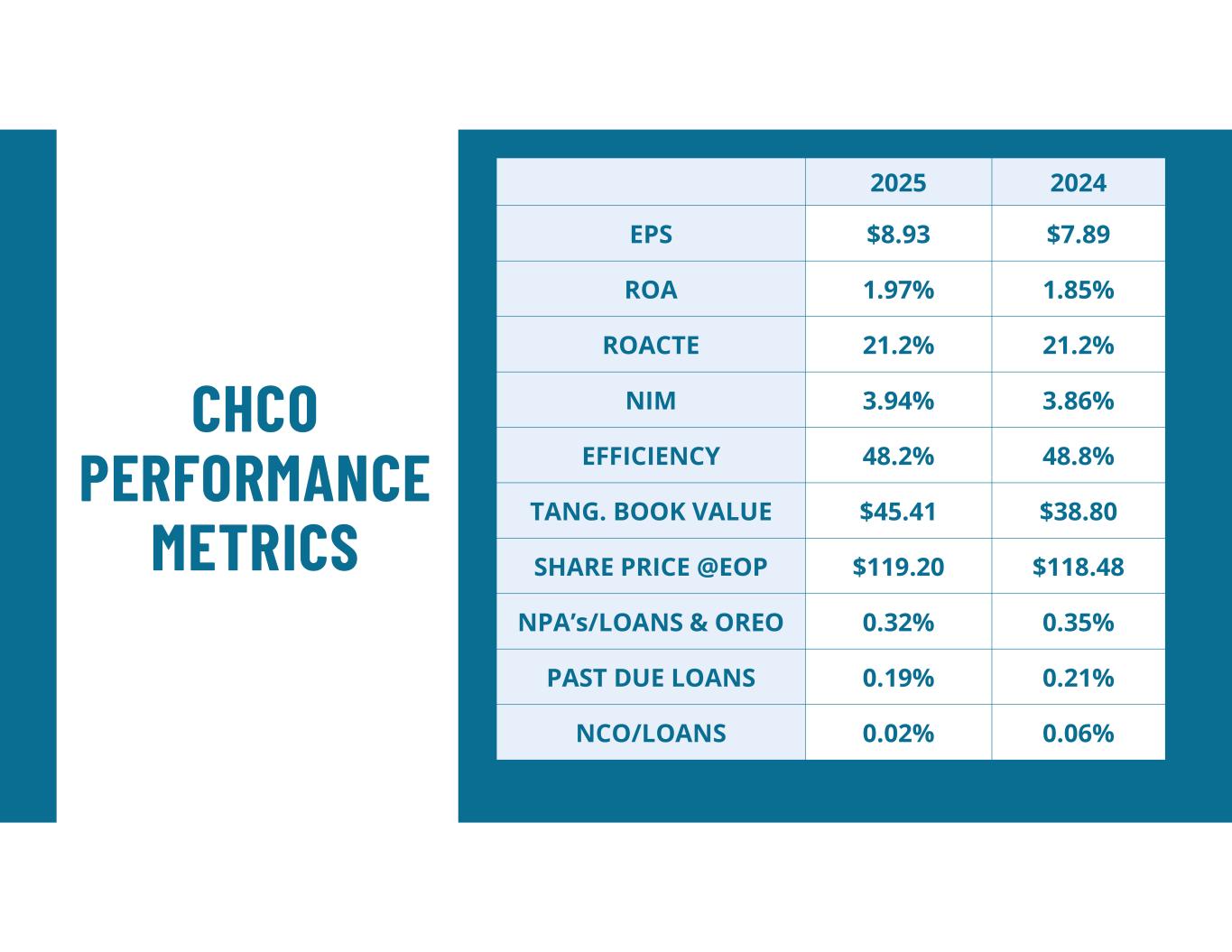

20242025 $7.89$8.93EPS 1.85%1.97%ROA 21.2%21.2%ROACTE 3.86%3.94%NIM 48.8%48.2%EFFICIENCY $38.80$45.41TANG. BOOK VALUE $118.48$119.20SHARE PRICE @EOP 0.35%0.32%NPA’s/LOANS & OREO 0.21%0.19%PAST DUE LOANS 0.06%0.02%NCO/LOANS CHCO PERFORMANCE METRICS

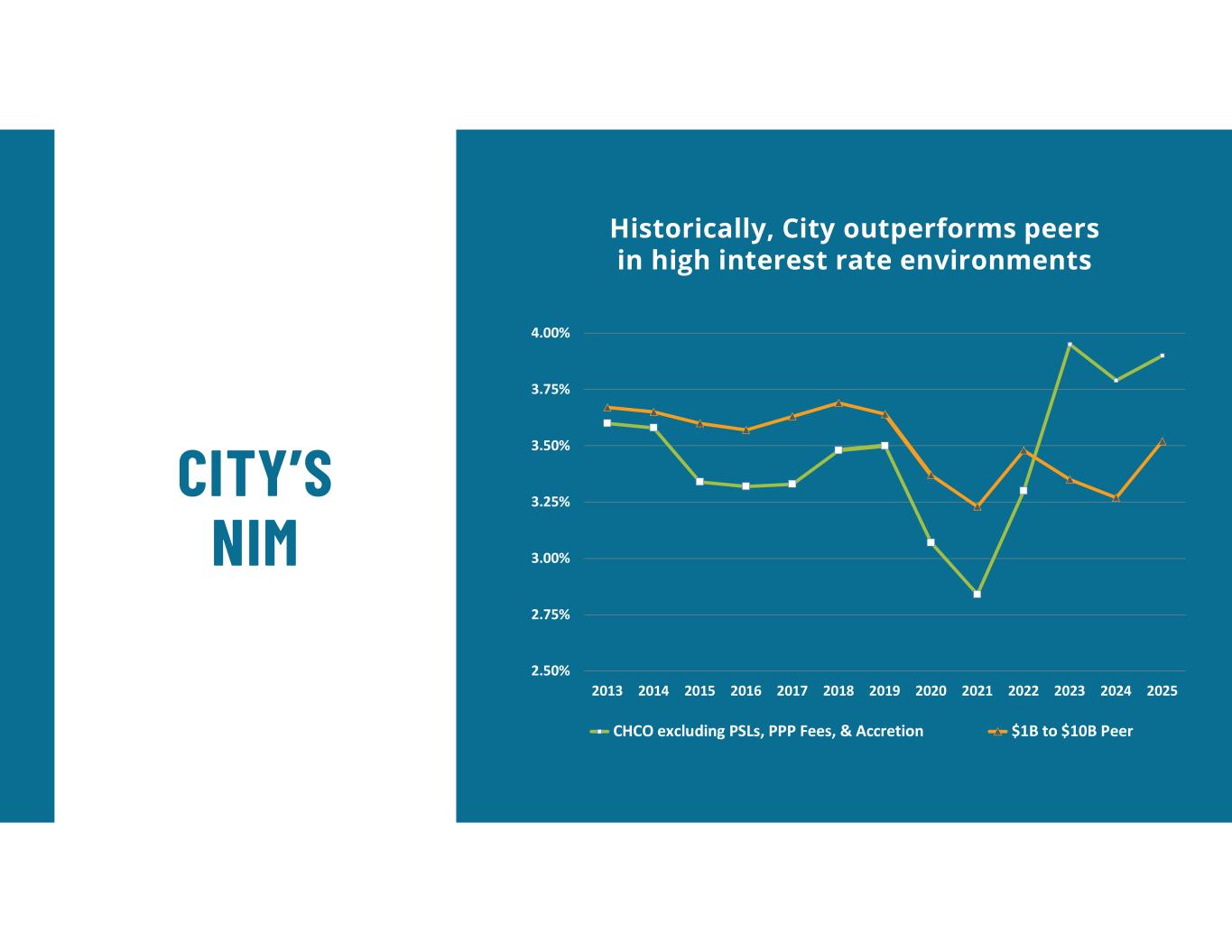

CITY’S NIM Historically, City outperforms peers in high interest rate environments 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 CHCO excluding PSLs, PPP Fees, & Accretion $1B to $10B Peer

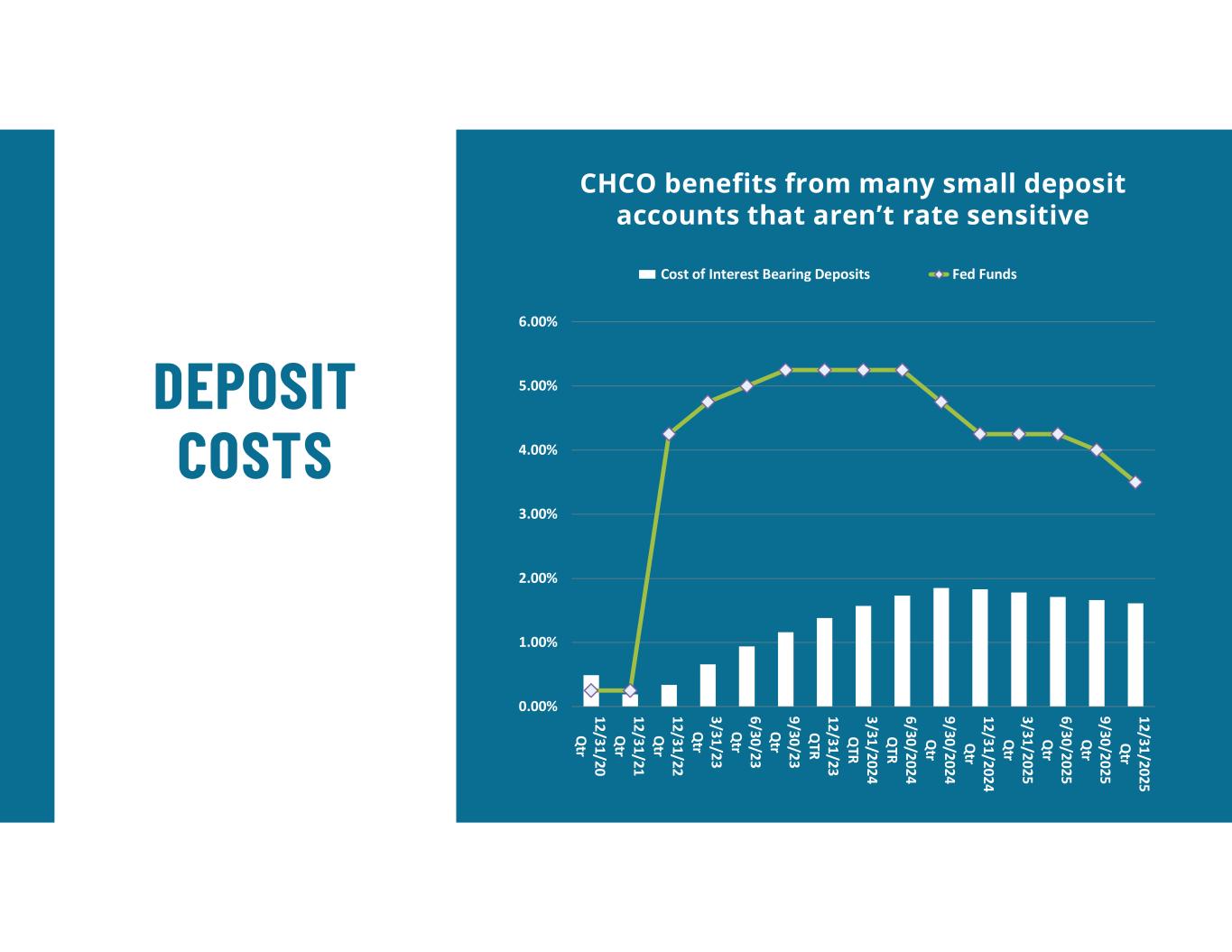

DEPOSIT COSTS CHCO benefits from many small deposit accounts that aren’t rate sensitive 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 12/31/20 Q tr 12/31/21 Q tr 12/31/22 Q tr 3/31/23 Q tr 6/30/23 Q tr 9/30/23 Q tr 12/31/23 Q TR 3/31/2024 Q TR 6/30/2024 Q TR 9/30/2024 Q tr 12/31/2024 Q tr 3/31/2025 Q tr 6/30/2025 Q tr 9/30/2025 Q tr 12/31/2025 Q tr Cost of Interest Bearing Deposits Fed Funds

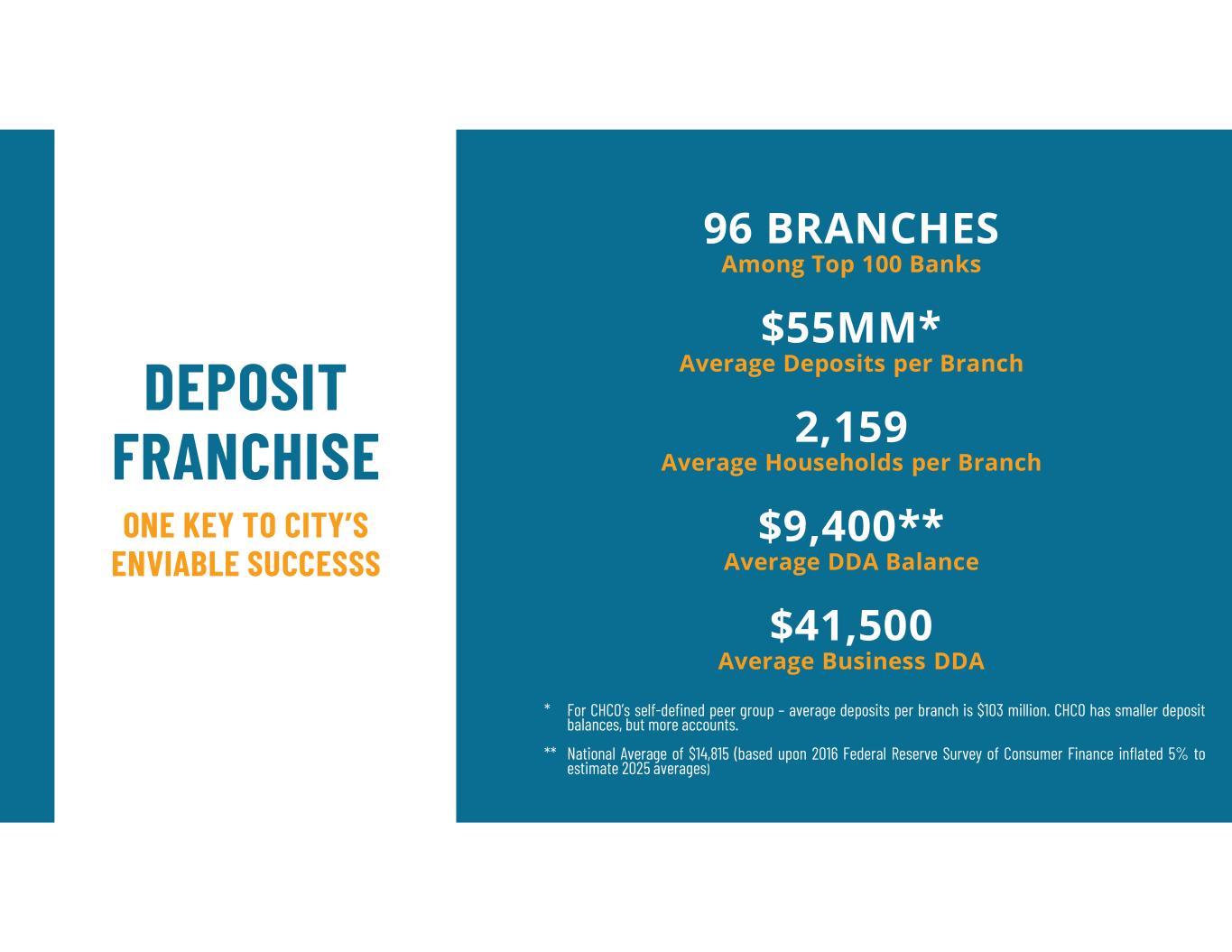

DEPOSIT FRANCHISE 96 BRANCHES Among Top 100 Banks $55MM* Average Deposits per Branch 2,159 Average Households per Branch $9,400** Average DDA Balance $41,500 Average Business DDA ONE KEY TO CITY’S ENVIABLE SUCCESSS * For CHCO’s self-defined peer group – average deposits per branch is $103 million. CHCO has smaller deposit balances, but more accounts. ** National Average of $14,815 (based upon 2016 Federal Reserve Survey of Consumer Finance inflated 5% to estimate 2025 averages)

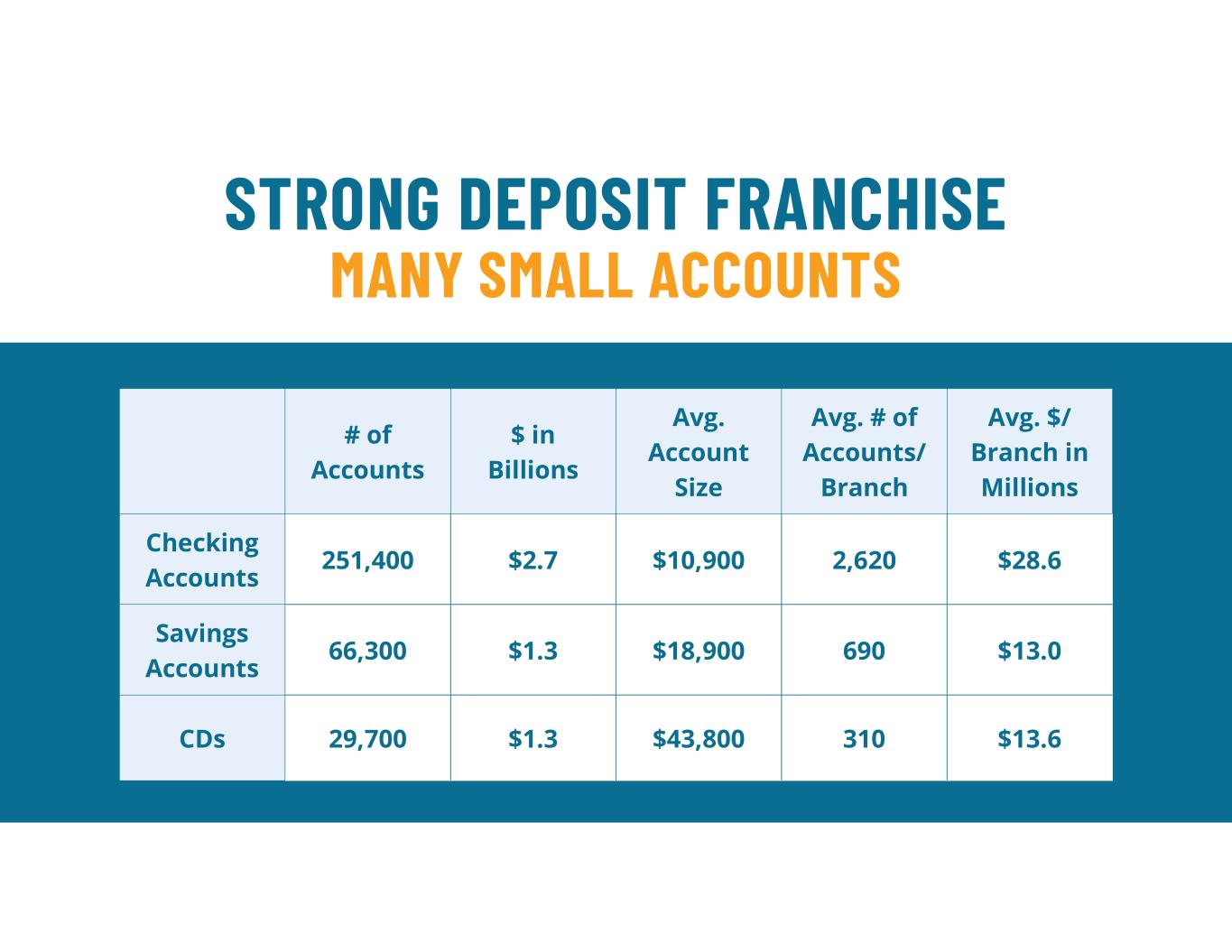

STRONG DEPOSIT FRANCHISE MANY SMALL ACCOUNTS Avg. $/ Branch in Millions Avg. # of Accounts/ Branch Avg. Account Size $ in Billions # of Accounts $28.62,620$10,900$2.7251,400 Checking Accounts $13.0690$18,900$1.366,300 Savings Accounts $13.6310$43,800$1.329,700CDs

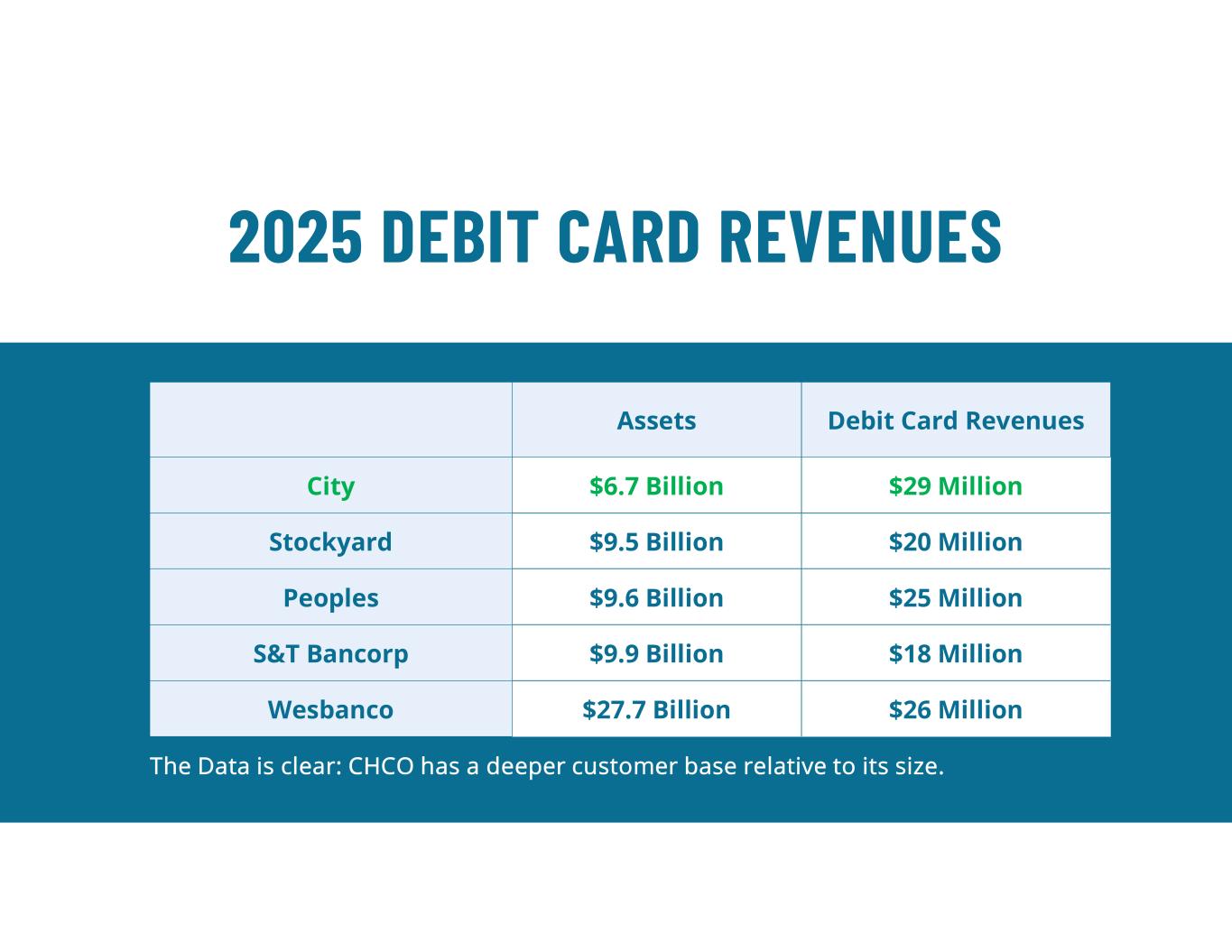

2025 DEBIT CARD REVENUES Debit Card RevenuesAssets $29 Million$6.7 BillionCity $20 Million$9.5 BillionStockyard $25 Million$9.6 BillionPeoples $18 Million$9.9 BillionS&T Bancorp $26 Million$27.7 BillionWesbanco The Data is clear: CHCO has a deeper customer base relative to its size.

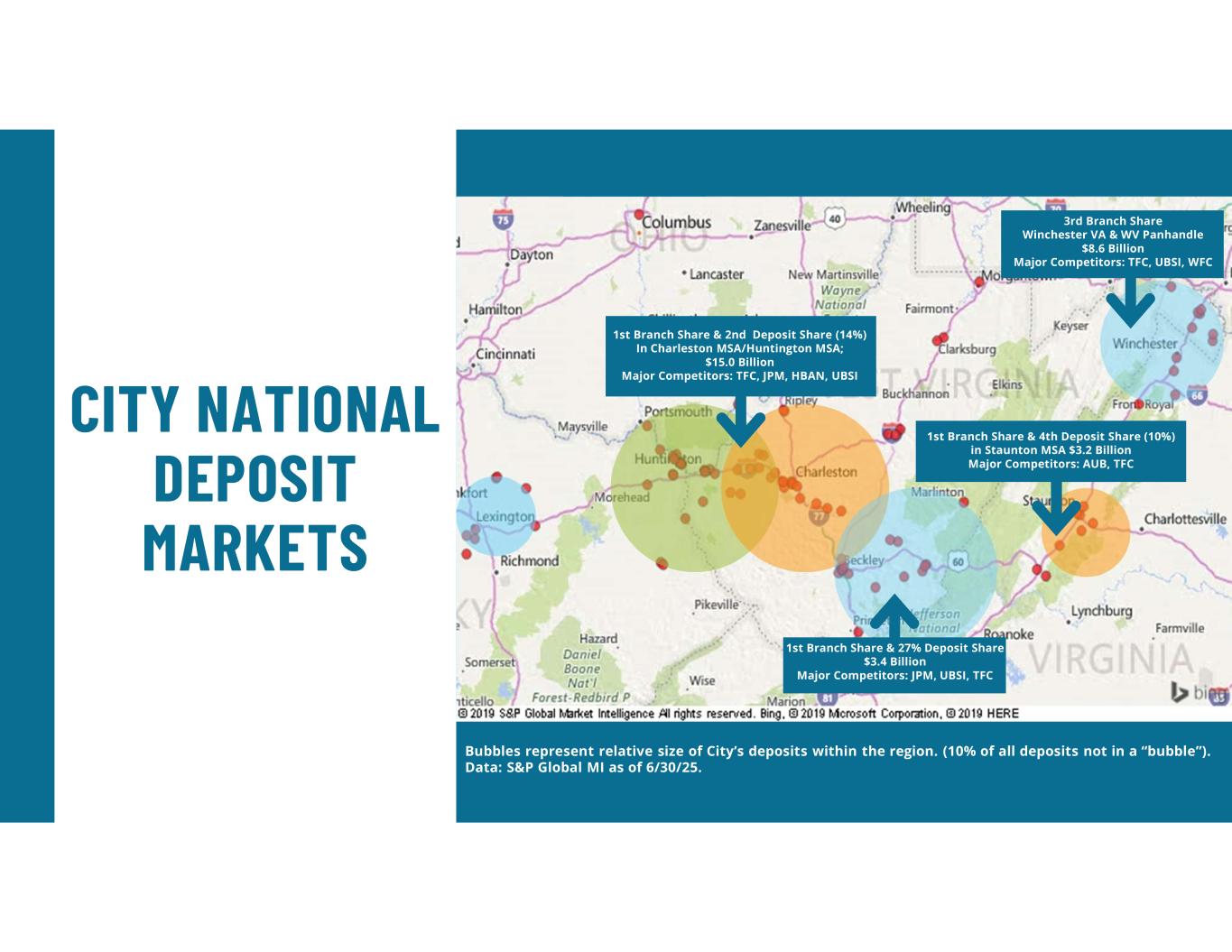

Bubbles represent relative size of City’s deposits within the region. (10% of all deposits not in a “bubble”). Data: S&P Global MI as of 6/30/25. CITY NATIONAL DEPOSIT MARKETS 1st Branch Share & 2nd Deposit Share (14%) In Charleston MSA/Huntington MSA; $15.0 Billion Major Competitors: TFC, JPM, HBAN, UBSI 3rd Branch Share Winchester VA & WV Panhandle $8.6 Billion Major Competitors: TFC, UBSI, WFC 1st Branch Share & 4th Deposit Share (10%) in Staunton MSA $3.2 Billion Major Competitors: AUB, TFC 1st Branch Share & 27% Deposit Share $3.4 Billion Major Competitors: JPM, UBSI, TFC

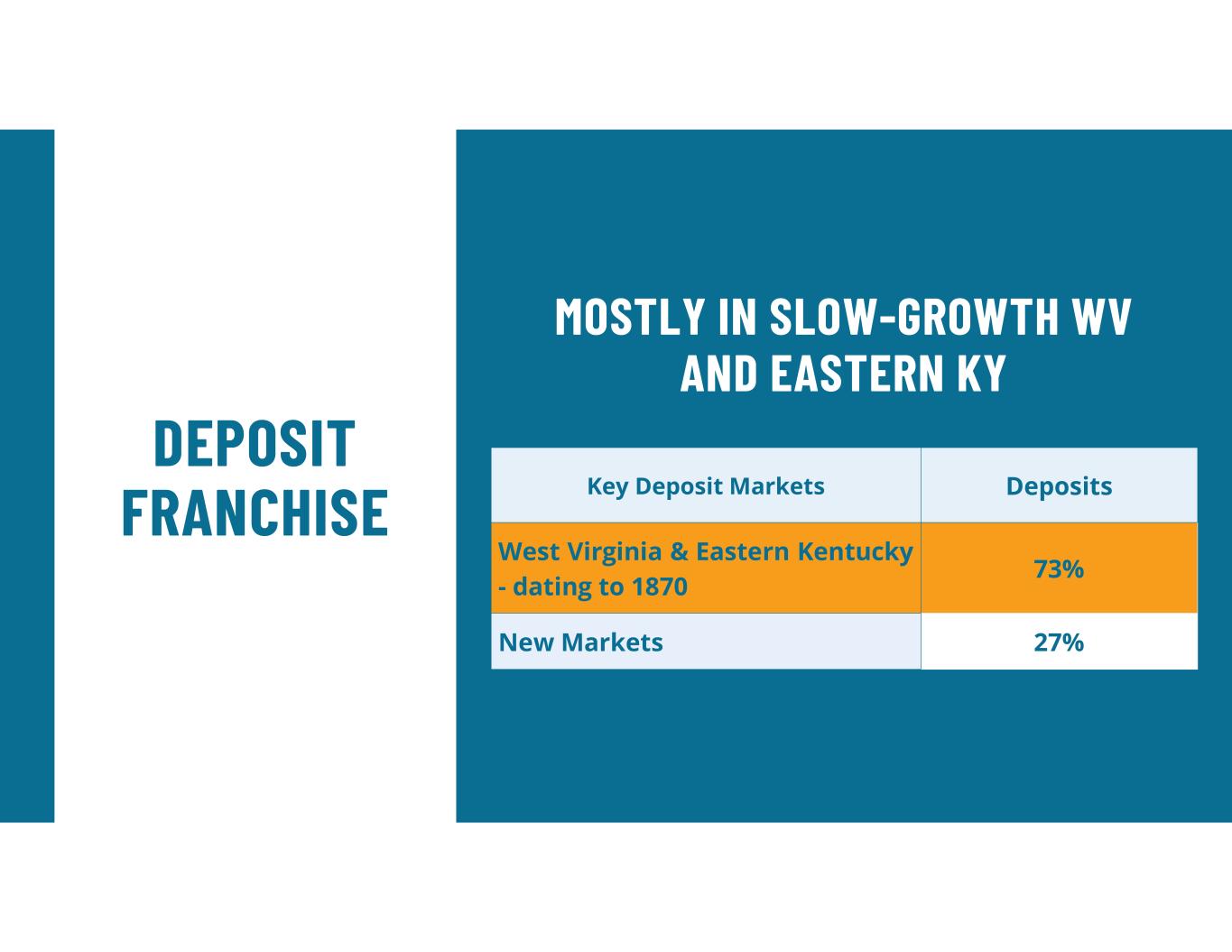

DEPOSIT FRANCHISE DepositsKey Deposit Markets 73% West Virginia & Eastern Kentucky - dating to 1870 27%New Markets MOSTLY IN SLOW-GROWTH WV AND EASTERN KY

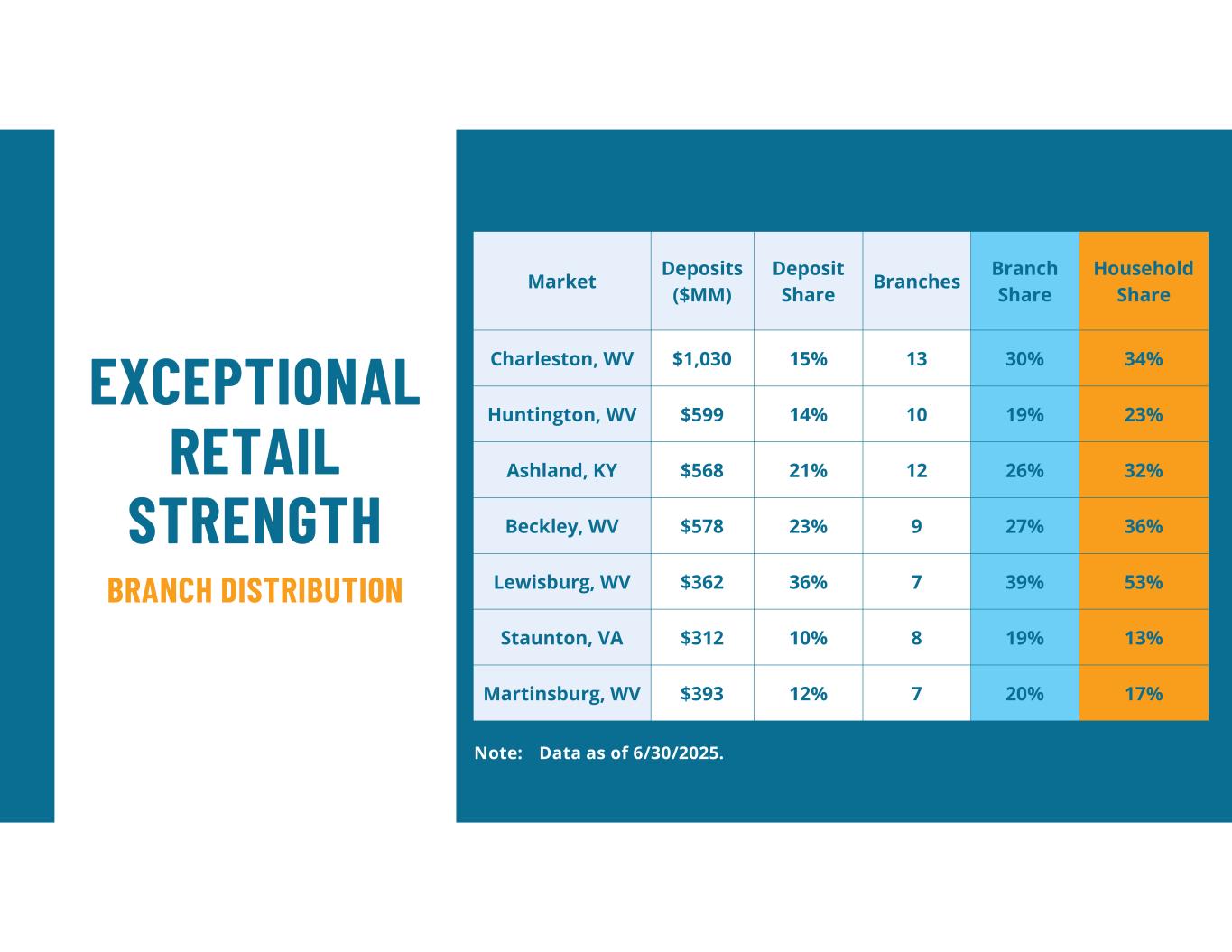

Household Share Branch Share Branches Deposit Share Deposits ($MM) Market 34%30%1315%$1,030Charleston, WV 23%19%1014%$599Huntington, WV 32%26%1221%$568Ashland, KY 36%27%923%$578Beckley, WV 53%39%736%$362Lewisburg, WV 13%19%810%$312Staunton, VA 17%20%712%$393Martinsburg, WV Note: Data as of 6/30/2025. EXCEPTIONAL RETAIL STRENGTH BRANCH DISTRIBUTION

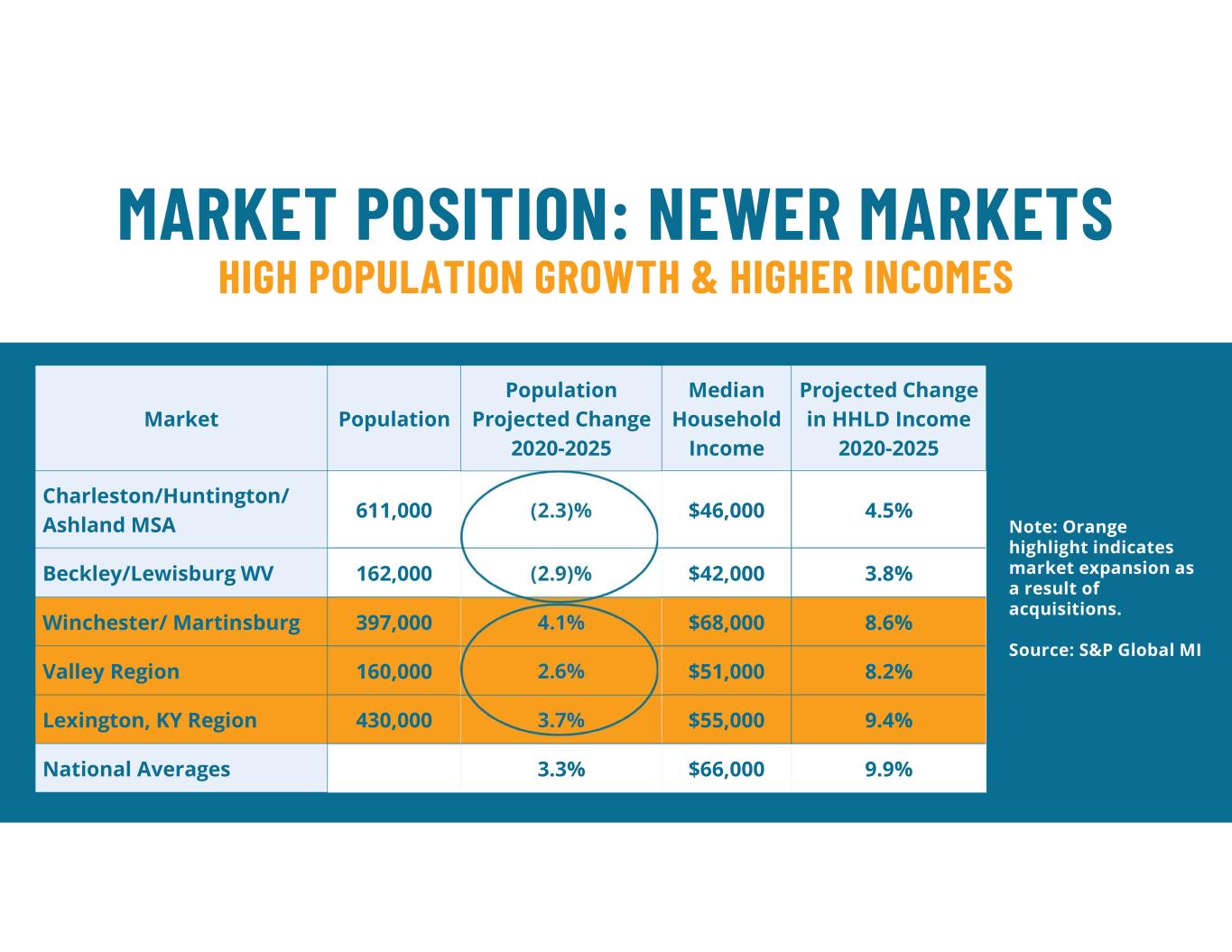

Projected Change in HHLD Income 2020-2025 Median Household Income Population Projected Change 2020-2025 PopulationMarket 4.5%$46,000(2.3)%611,000 Charleston/Huntington/ Ashland MSA 3.8%$42,000(2.9)%162,000Beckley/Lewisburg WV 8.6%$68,0004.1%397,000Winchester/ Martinsburg 8.2%$51,0002.6%160,000Valley Region 9.4%$55,0003.7%430,000Lexington, KY Region 9.9%$66,0003.3%National Averages MARKET POSITION: NEWER MARKETS HIGH POPULATION GROWTH & HIGHER INCOMES Note: Orange highlight indicates market expansion as a result of acquisitions. Source: S&P Global MI

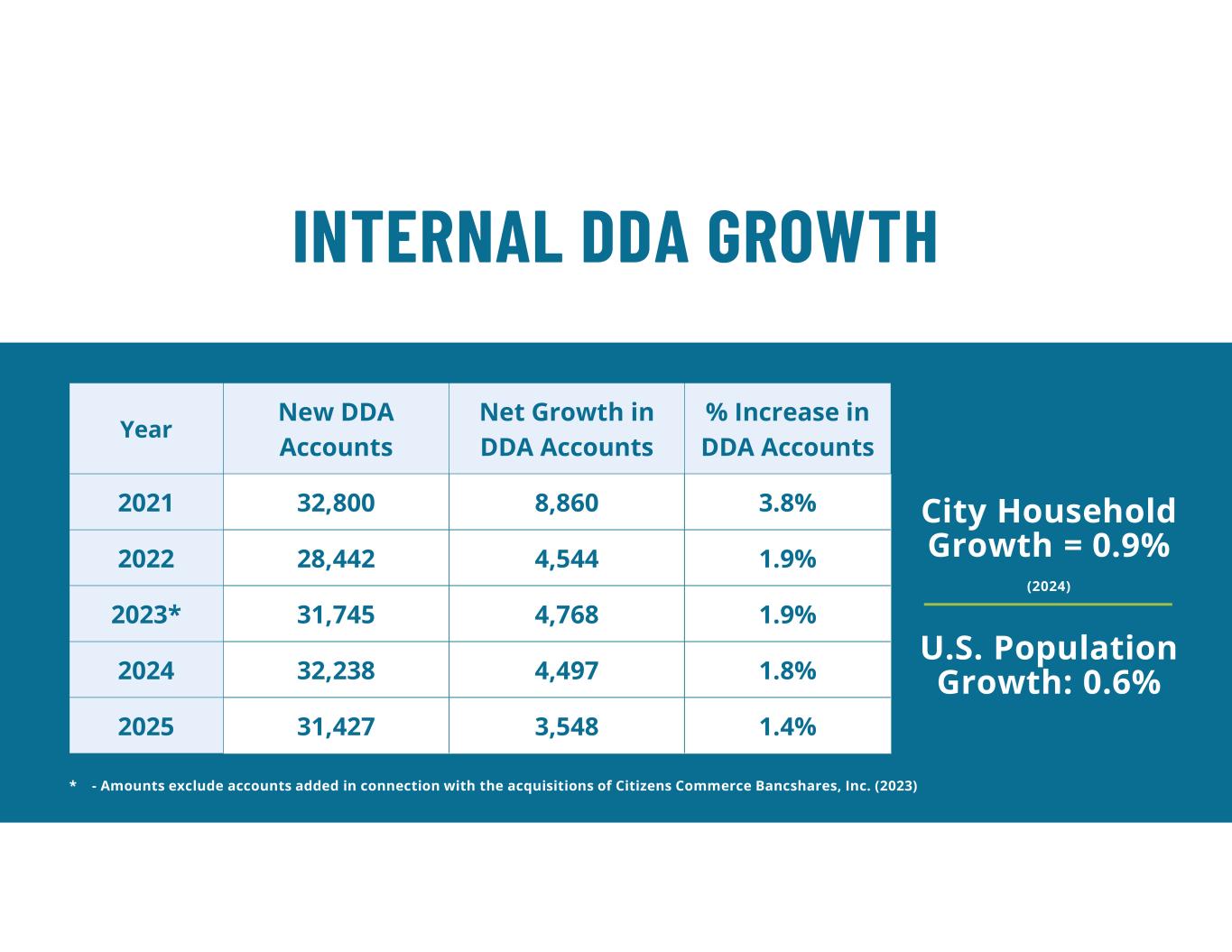

INTERNAL DDA GROWTH % Increase in DDA Accounts Net Growth in DDA Accounts New DDA Accounts Year 3.8%8,86032,8002021 1.9%4,54428,4422022 1.9%4,76831,7452023* 1.8%4,49732,2382024 1.4%3,54831,4272025 * - Amounts exclude accounts added in connection with the acquisitions of Citizens Commerce Bancshares, Inc. (2023) City Household Growth = 0.9% (2024) U.S. Population Growth: 0.6%

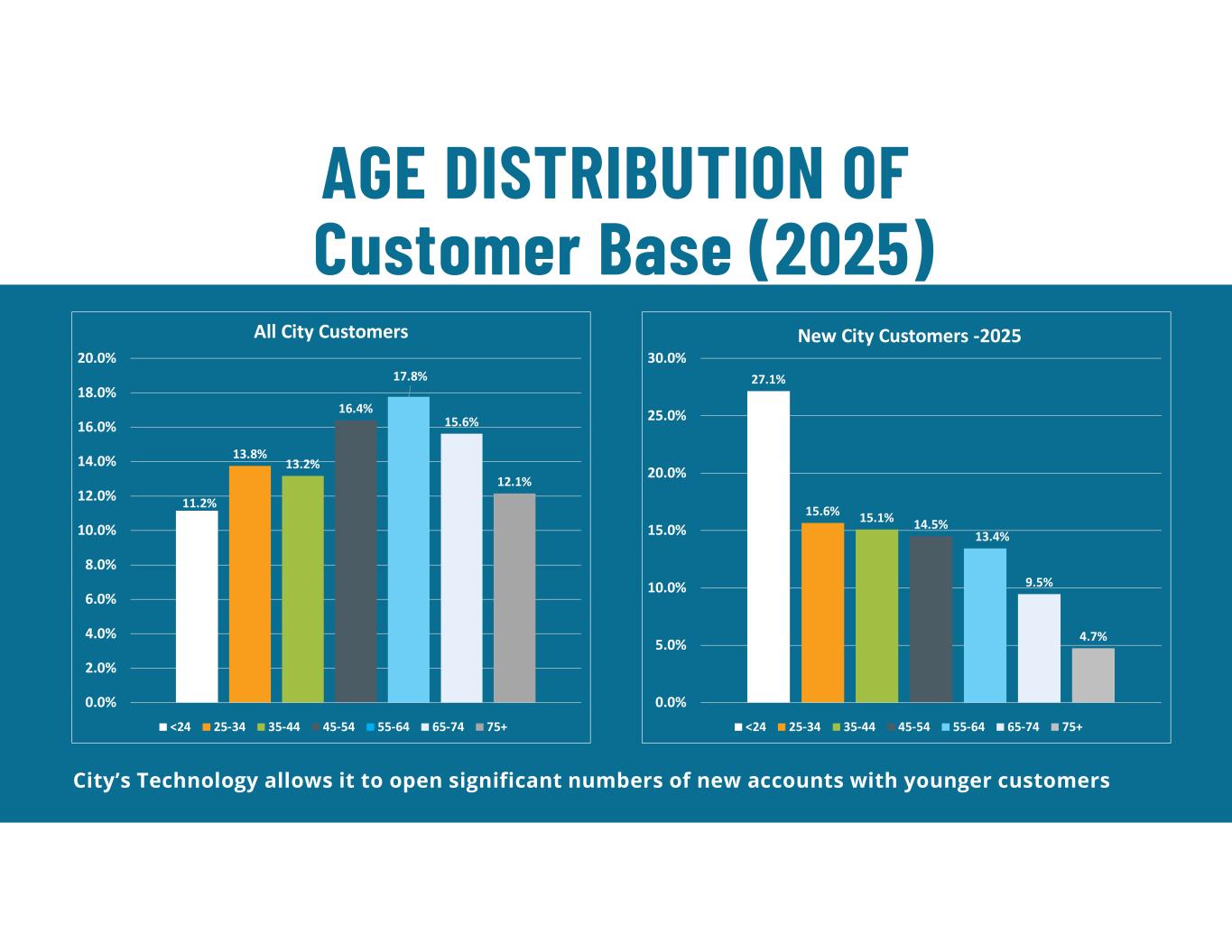

AGE DISTRIBUTION OF Customer Base (2025) City’s Technology allows it to open significant numbers of new accounts with younger customers 11.2% 13.8% 13.2% 16.4% 17.8% 15.6% 12.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% All City Customers <24 25-34 35-44 45-54 55-64 65-74 75+ 27.1% 15.6% 15.1% 14.5% 13.4% 9.5% 4.7% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% New City Customers -2025 <24 25-34 35-44 45-54 55-64 65-74 75+

CUSTOMER EXPERIENCE: BEST IN CLASS 2018 | 2019 | 2020 | 2022 | 2024 Voted Best in Customer Satisfaction for Consumer Banking in the North Central Region

MARKET DISRUPTIONS STRONG GROWTH OPPORTUNITIES In 2017, there were 4 banks with branches in this market In 2018 one closed In 2020 another closed In 2023 – two banks – City and Truist St. Albans, WV $59 $70 $78 $95 $112 $102 $101 $107 $110 3,723 3,898 4,068 4,262 4,795 4,821 4,914 4,871 4,915 3,000 3,500 4,000 4,500 5,000 5,500 $0 $20 $40 $60 $80 $100 $120 2017 2018 2019 2020 2021 2022 2023 2024 2025 M ill io ns City's Branch Deposit City HHLDs

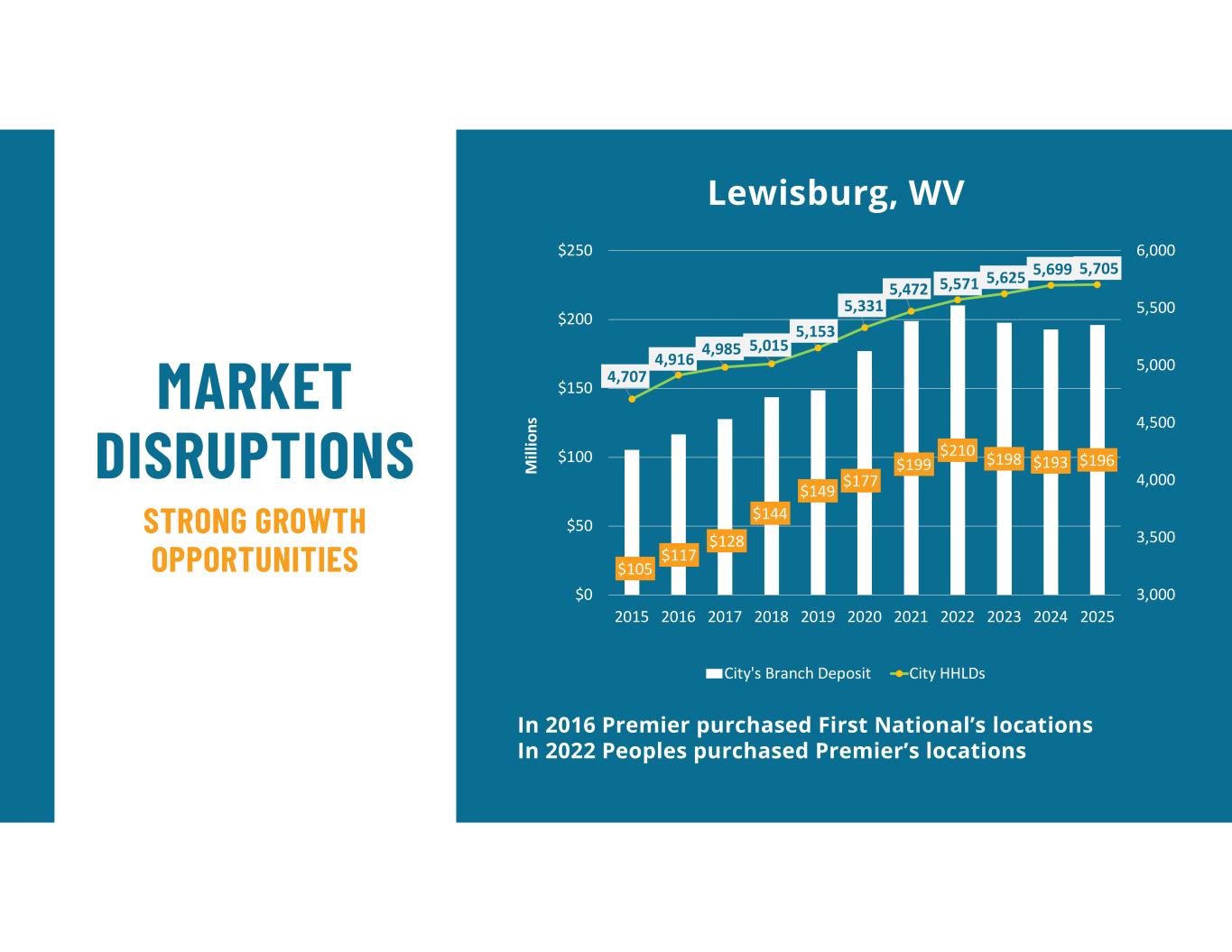

MARKET DISRUPTIONS STRONG GROWTH OPPORTUNITIES In 2016 Premier purchased First National’s locations In 2022 Peoples purchased Premier’s locations Lewisburg, WV $105 $117 $128 $144 $149 $177 $199 $210 $198 $193 $196 4,707 4,916 4,985 5,015 5,153 5,331 5,472 5,571 5,625 5,699 5,705 3,000 3,500 4,000 4,500 5,000 5,500 6,000 $0 $50 $100 $150 $200 $250 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 M ill io ns City's Branch Deposit City HHLDs

CHARLOTTE Size of bubbles are representative of City’s loan distribution LOAN MARKETS

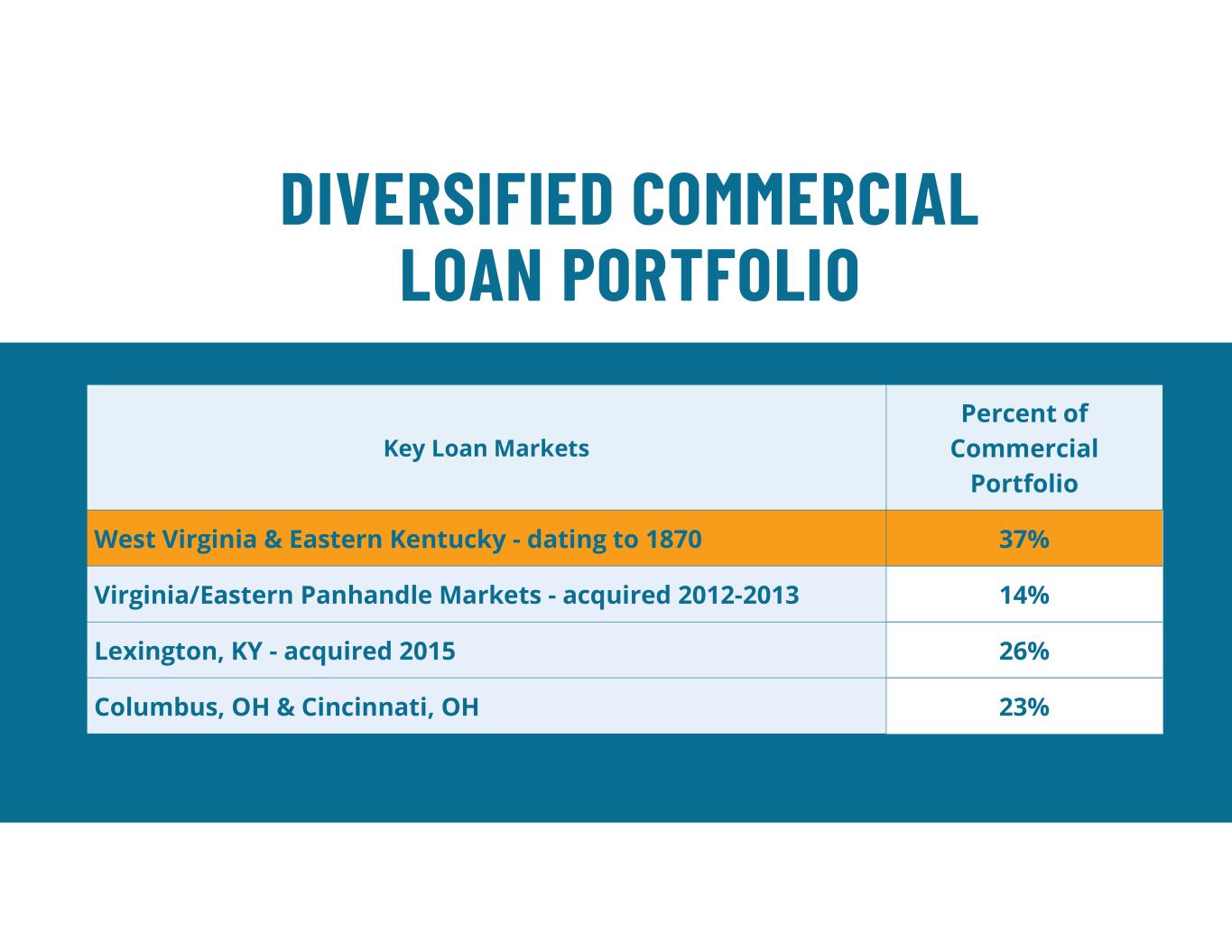

DIVERSIFIED COMMERCIAL LOAN PORTFOLIO Percent of Commercial Portfolio Key Loan Markets 37%West Virginia & Eastern Kentucky - dating to 1870 14%Virginia/Eastern Panhandle Markets - acquired 2012-2013 26%Lexington, KY - acquired 2015 23%Columbus, OH & Cincinnati, OH

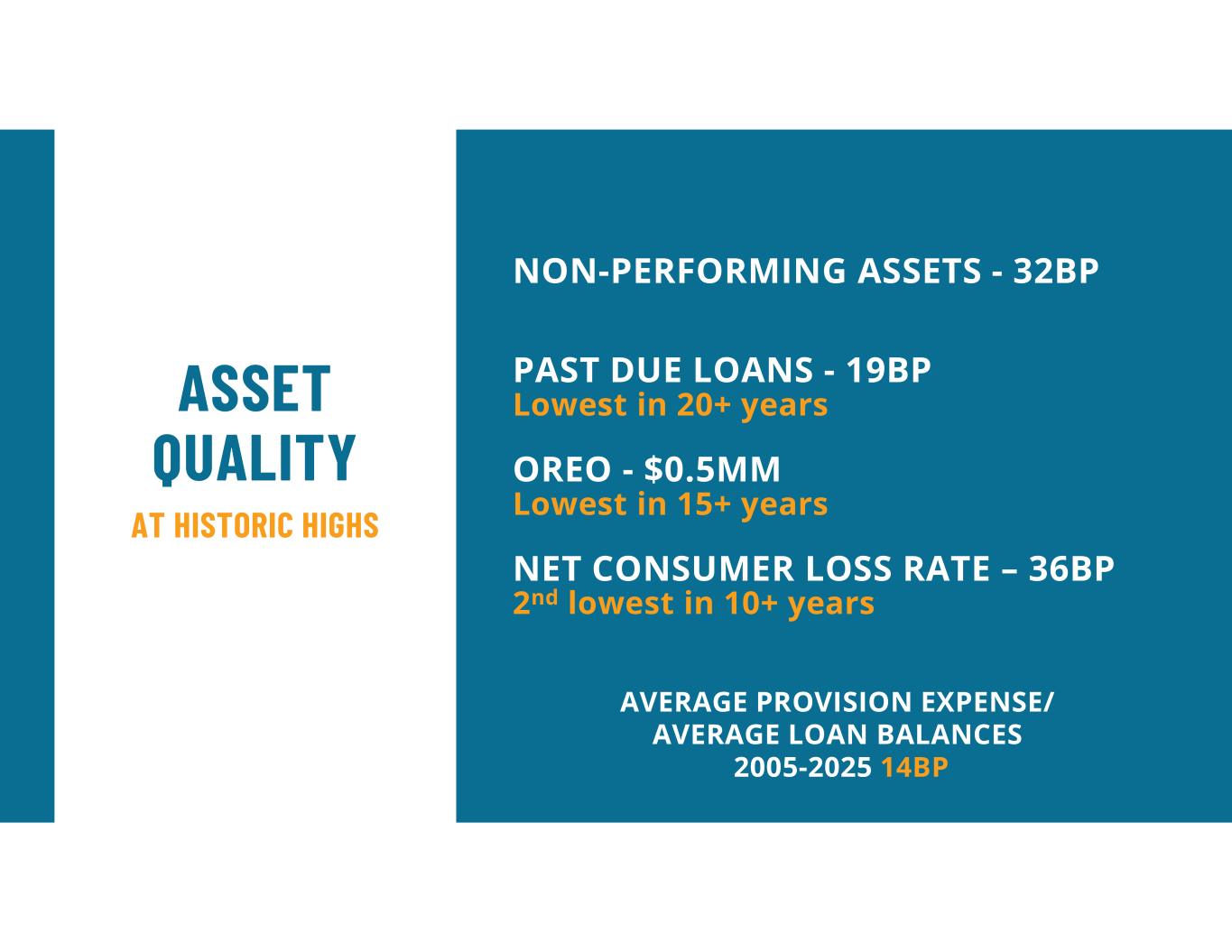

ASSET QUALITY NON-PERFORMING ASSETS - 32BP PAST DUE LOANS - 19BP Lowest in 20+ years OREO - $0.5MM Lowest in 15+ years NET CONSUMER LOSS RATE – 36BP 2nd lowest in 10+ years AT HISTORIC HIGHS AVERAGE PROVISION EXPENSE/ AVERAGE LOAN BALANCES 2005-2025 14BP

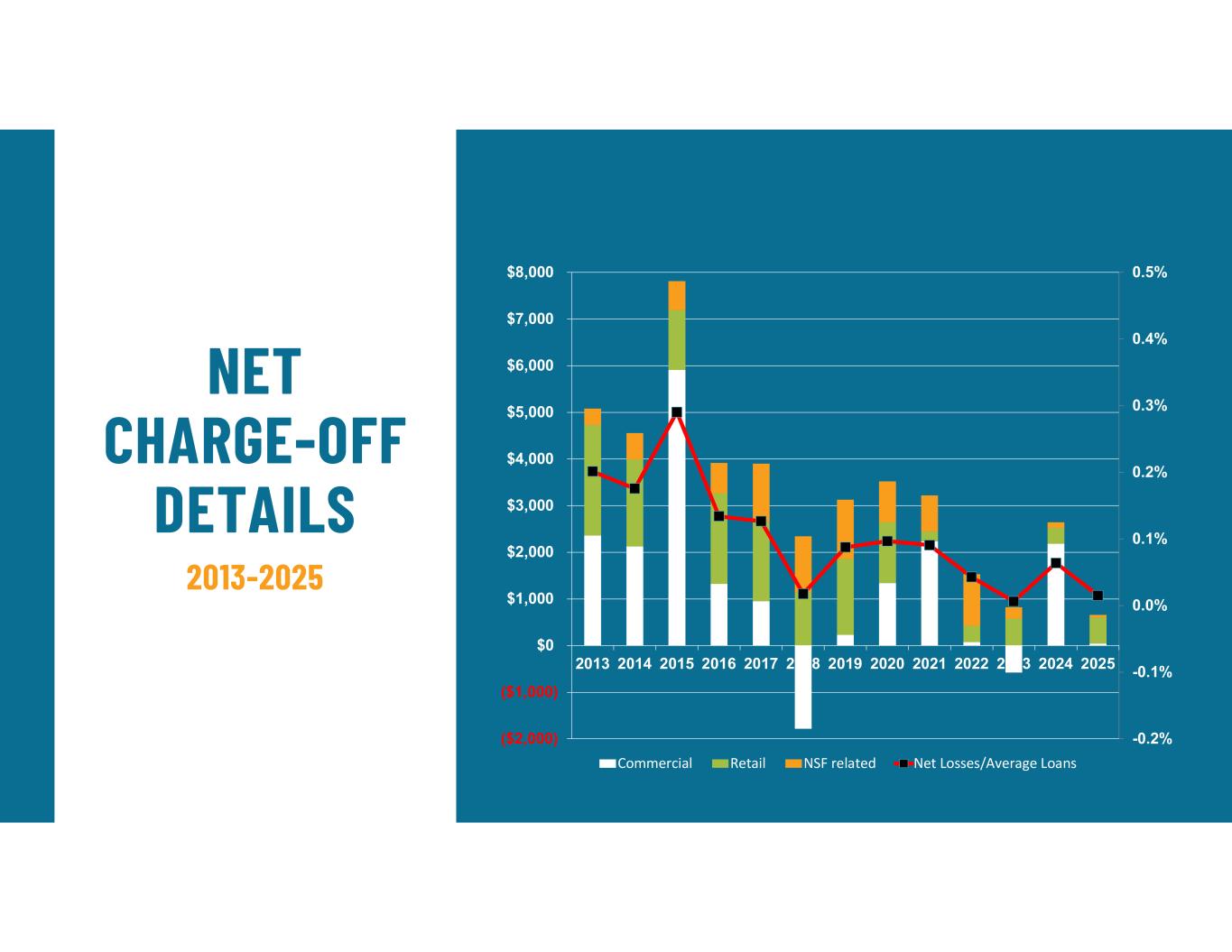

NET CHARGE-OFF DETAILS 2013-2025 -0.2% -0.1% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% ($2,000) ($1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Commercial Retail NSF related Net Losses/Average Loans

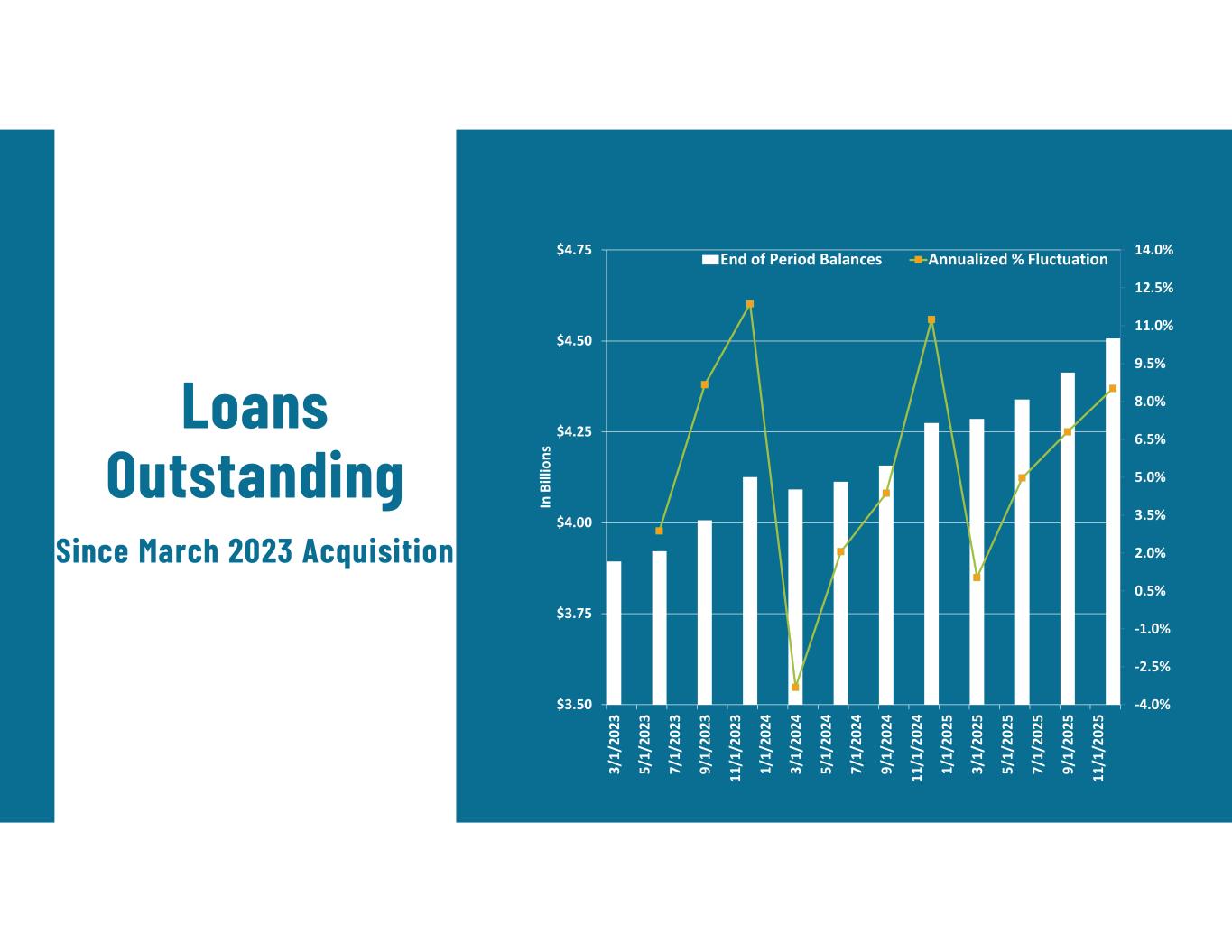

Loans Outstanding Since March 2023 Acquisition -4.0% -2.5% -1.0% 0.5% 2.0% 3.5% 5.0% 6.5% 8.0% 9.5% 11.0% 12.5% 14.0% $3.50 $3.75 $4.00 $4.25 $4.50 $4.75 3/ 1/ 20 23 5/ 1/ 20 23 7/ 1/ 20 23 9/ 1/ 20 23 11 /1 /2 02 3 1/ 1/ 20 24 3/ 1/ 20 24 5/ 1/ 20 24 7/ 1/ 20 24 9/ 1/ 20 24 11 /1 /2 02 4 1/ 1/ 20 25 3/ 1/ 20 25 5/ 1/ 20 25 7/ 1/ 20 25 9/ 1/ 20 25 11 /1 /2 02 5 In B ill io ns End of Period Balances Annualized % Fluctuation

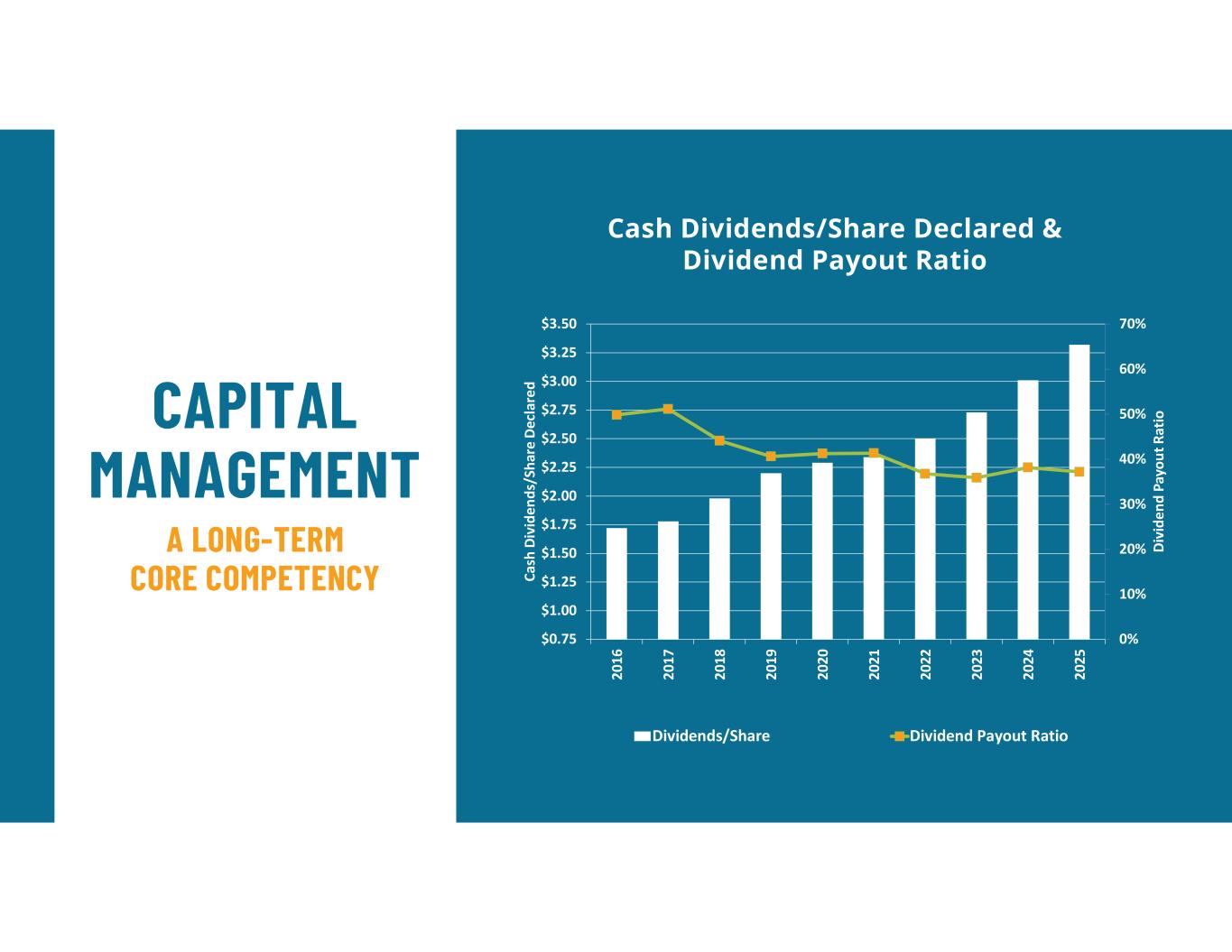

CAPITAL MANAGEMENT A LONG-TERM CORE COMPETENCY 0% 10% 20% 30% 40% 50% 60% 70% $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 D iv id en d Pa yo ut R at io Ca sh D iv id en ds /S ha re D ec la re d Dividends/Share Dividend Payout Ratio Cash Dividends/Share Declared & Dividend Payout Ratio

SHARE ACTIVITY City’s strong capital and high profitability have allowed aggressive share repurchases $74.54 $63.68 $77.21 $81.50 $90.21 $100.24 $115.24260,674 572,917 760,033 324,513 666,575 178,529 397,090 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 $0 $10 $20 $30 $40 $50 $60 $70 20 19 20 20 20 21 20 22 20 23 20 24 20 25 M ill io ns Repurchase $ Shares Repurchased At December 31, 2025 CHCO has approximately $150 million available for share repurchases, dividends to shareholders, and other corporate expenses.

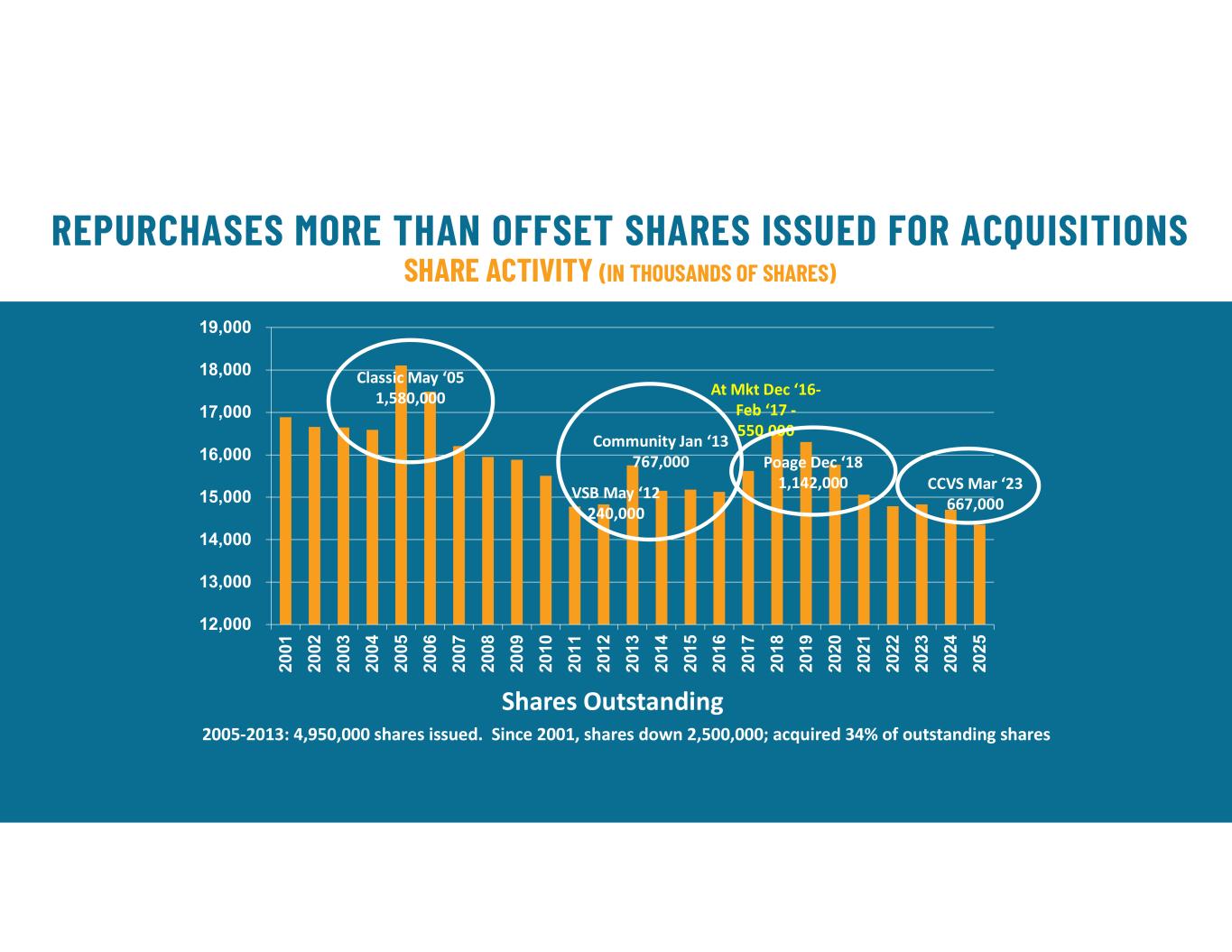

REPURCHASES MORE THAN OFFSET SHARES ISSUED FOR ACQUISITIONS SHARE ACTIVITY (IN THOUSANDS OF SHARES) 12,000 13,000 14,000 15,000 16,000 17,000 18,000 19,000 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 Classic May ‘05 1,580,000 2005-2013: 4,950,000 shares issued. Since 2001, shares down 2,500,000; acquired 34% of outstanding shares VSB May ‘12 240,000 Community Jan ‘13 767,000 At Mkt Dec ‘16- Feb ‘17 - 550,000 Poage Dec ‘18 1,142,000 CCVS Mar ‘23 667,000 Shares Outstanding

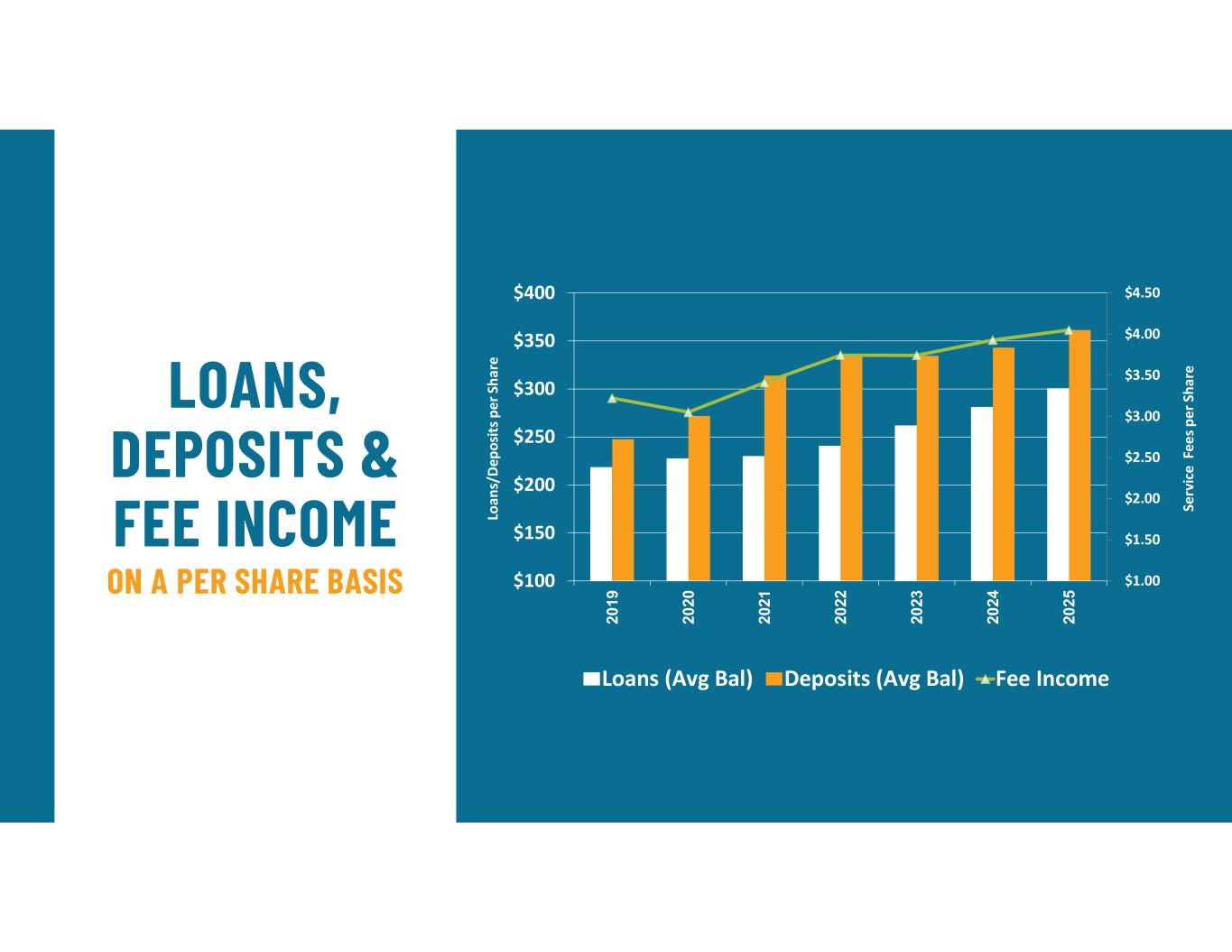

LOANS, DEPOSITS & FEE INCOME ON A PER SHARE BASIS $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $100 $150 $200 $250 $300 $350 $400 20 19 20 20 20 21 20 22 20 23 20 24 20 25 Loans (Avg Bal) Deposits (Avg Bal) Fee Income Lo an s/ D ep os its p er S ha re Se rv ic e F ee s p er S ha re

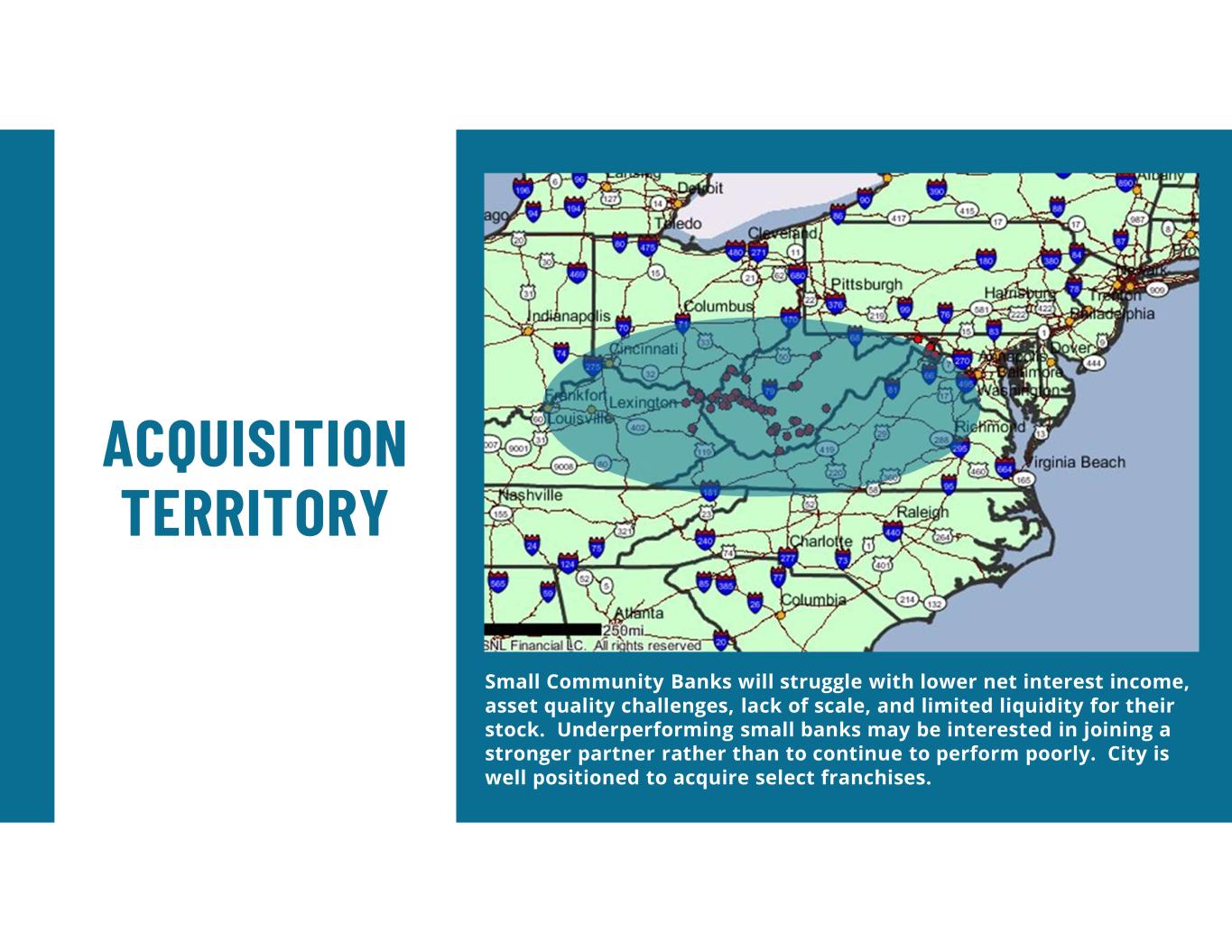

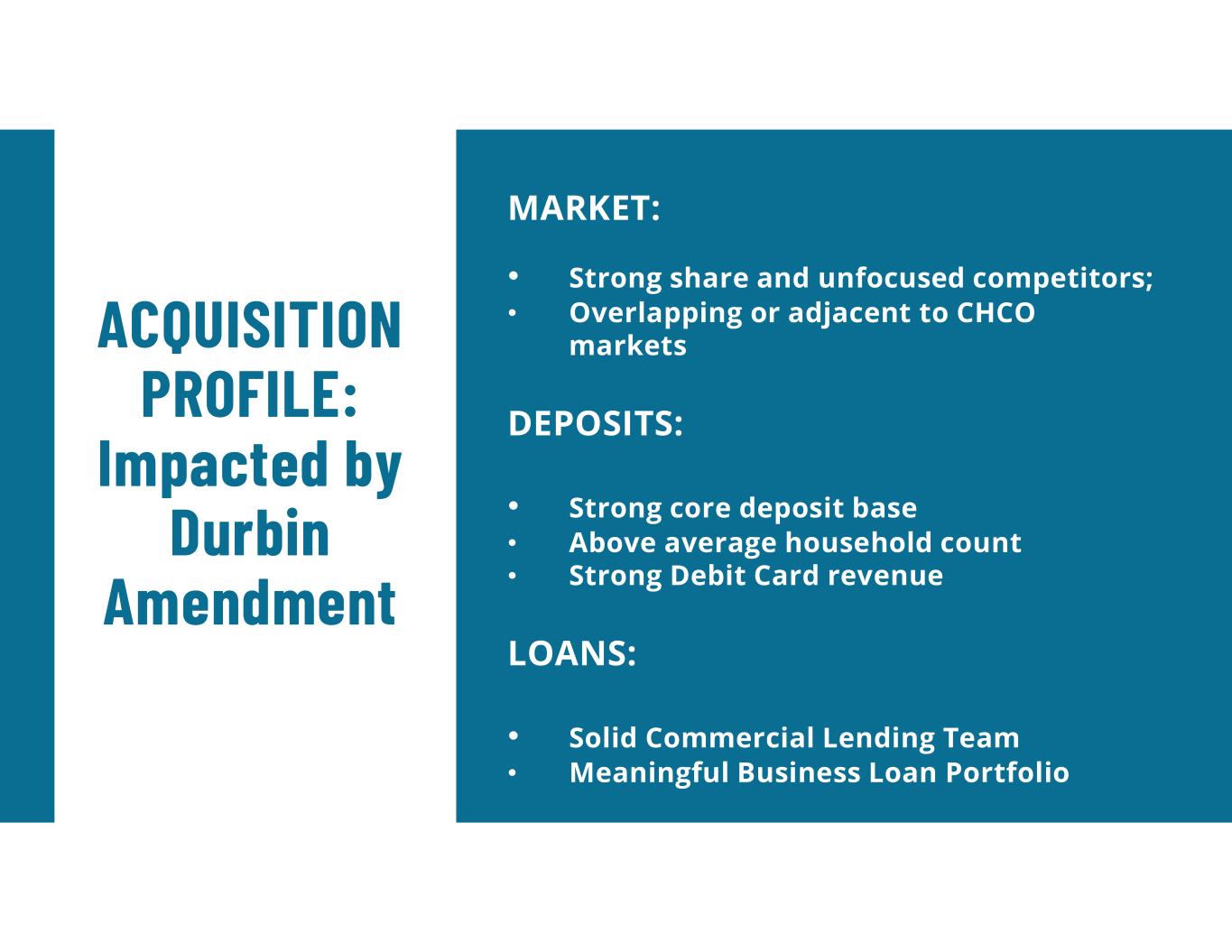

ACQUISITION TERRITORY Small Community Banks will struggle with lower net interest income, asset quality challenges, lack of scale, and limited liquidity for their stock. Underperforming small banks may be interested in joining a stronger partner rather than to continue to perform poorly. City is well positioned to acquire select franchises.

ACQUISITION HISTORY 2005: CLASSIC BANK, ASHLAND KY Approx. 25% Household Share, adjacent mkt 2012: VIRGINIA SAVINGS BANK, WINCHESTER VA 5 Branches in adjacent mkt; Strong Growth for City 2013: COMMUNITY BANK, STAUNTON VA Solid franchise in adjacent mkts; Was a “Problem Bank” and CHCO had significant financial gains from AQ 2015: 3 BRANCHES IN LEXINGTON KY Exceptional commercially focused team with very strong growth in 8 years 2018: TOWN SQUARE, ASHLAND & CENTRAL KY Took Ashland household share to 40%. Meaningfully built-out Central KY market 2018: FARMERS BANK: CENTRAL KY Extremely profitable small town markets in Central KY; Grew households 2023: CITIZENS COMMERCE: CENTRAL KY Approx 40% of Woodford Co. households; strong lender and strong deposit franchise

ACQUISITION PROFILE: Impacted by Durbin Amendment MARKET: • Strong share and unfocused competitors; • Overlapping or adjacent to CHCO markets DEPOSITS: • Strong core deposit base • Above average household count • Strong Debit Card revenue LOANS: • Solid Commercial Lending Team • Meaningful Business Loan Portfolio

CITY: Still a Community Bank and Engaged in our Communities

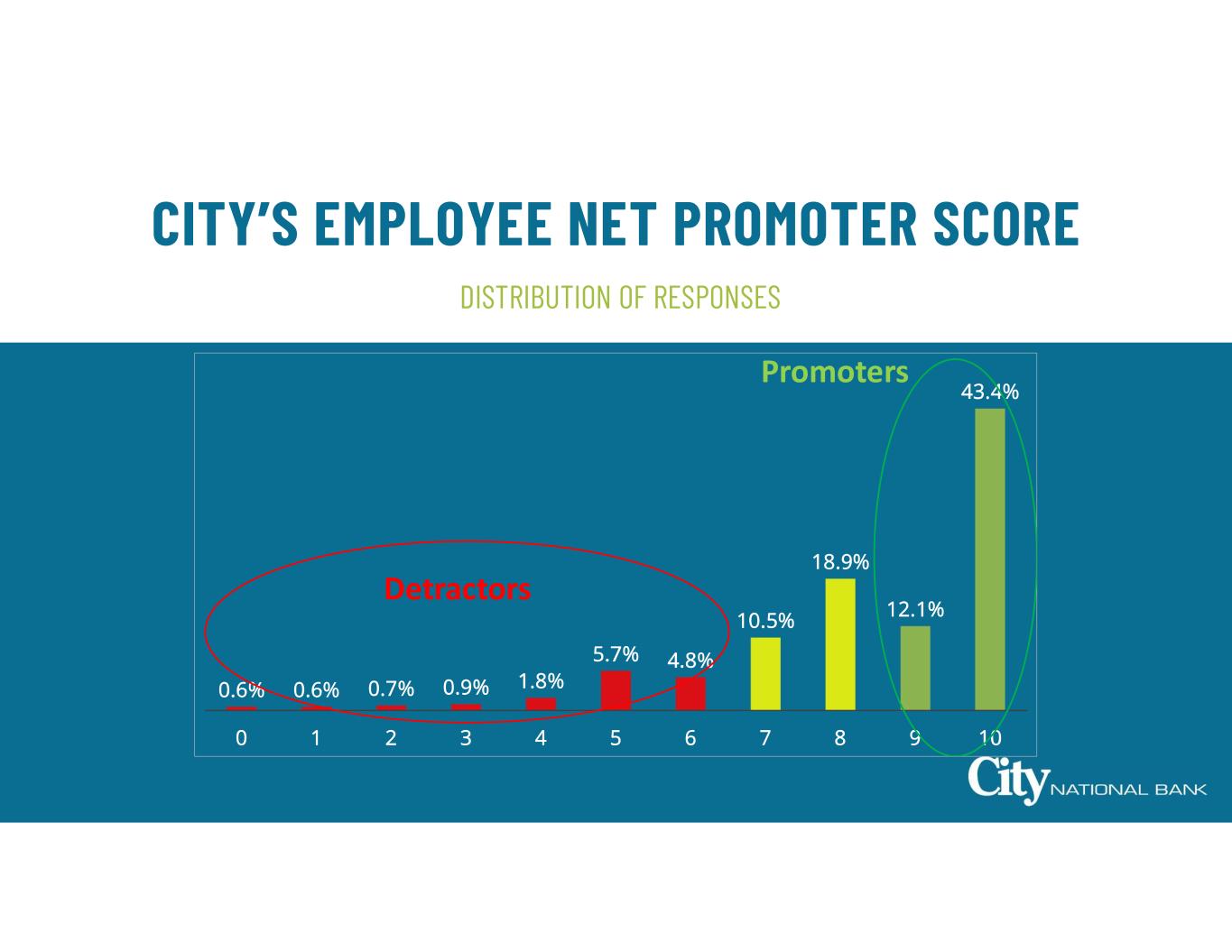

CITY’S EMPLOYEE NET PROMOTER SCORE DISTRIBUTION OF RESPONSES 0.6% 0.6% 0.7% 0.9% 1.8% 5.7% 4.8% 10.5% 18.9% 12.1% 43.4% 0 1 2 3 4 5 6 7 8 9 10 Promoters Detractors

INVESTMENT THESIS: CHCO’S FRANCHISE IS EXCEPTIONAL DUE TO: • Strong NIM driven by extraordinary Deposit Franchise • Proven culture of conservative lending • Shareholder focused capital management • Acquisition philosophy focused on earnings and not asset size • Community banking philosophy focused on customers and communities

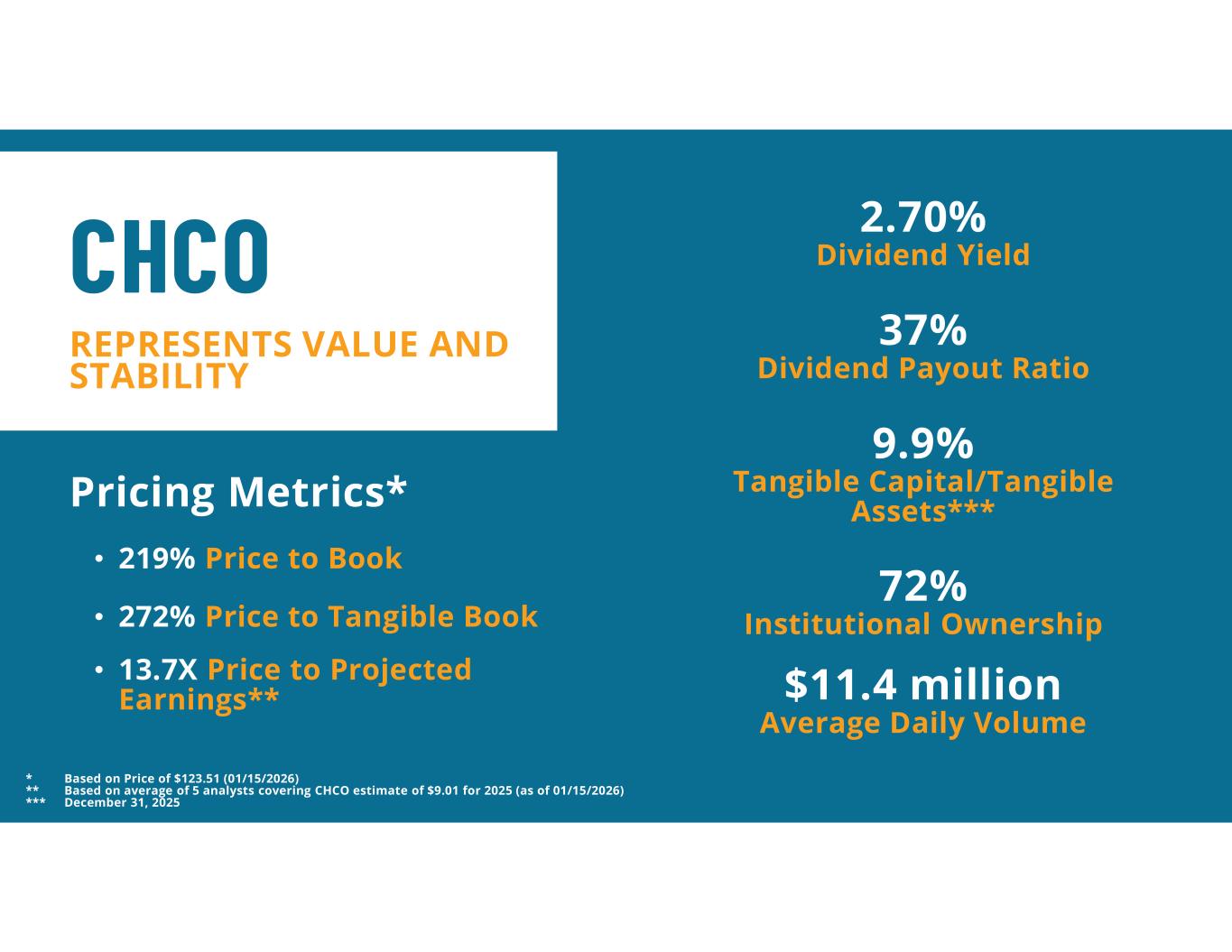

REPRESENTS VALUE AND STABILITY CHCO Pricing Metrics* • 219% Price to Book • 272% Price to Tangible Book • 13.7X Price to Projected Earnings** 2.70% Dividend Yield 37% Dividend Payout Ratio 9.9% Tangible Capital/Tangible Assets*** 72% Institutional Ownership $11.4 million Average Daily Volume * Based on Price of $123.51 (01/15/2026) ** Based on average of 5 analysts covering CHCO estimate of $9.01 for 2025 (as of 01/15/2026) *** December 31, 2025

Questions?