UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

About Us

Who We Are

Adtalem Global Education is the largest healthcare educator in the U.S., shaping the future of healthcare by preparing a practice-ready workforce with high-quality academic programs. We innovate education pathways, align with industry needs and empower individuals to reach their full potential. Our commitment to excellence and access is reflected in our expansive network of institutions, serving over 90,000 students and supported by a strong community of approximately 365,000 alumni and nearly 10,000 dedicated employees. Adtalem is the parent organization of American University of the Caribbean School of Medicine, Chamberlain University, Ross University School of Medicine, Ross University School of Veterinary Medicine, and Walden University.

STUDENT FOCUSED

|

|

|

|

| ||||||

MISSION |

| VISION |

| PURPOSE | ||||||

We provide global |

| To create a dynamic global |

| We empower students to | ||||||

WE ARE 5 institutions |

| NEARLY 10,000 employees |

| |

|

|

|

|

|

WITH A NETWORK OF APPROXIMATELY 365,000 alumni Helping to alleviate critical healthcare workforce shortages, particularly in underserved communities |

|

| WITH 27 operating campuses |

|

As of September 23, 2025

Message from our Chairman and CEO,

Steve Beard

October 2, 2025 |

|

Fellow Shareholders,

Fiscal 2025 stands as both a proof point and an inflection point for Adtalem—validating our thesis while positioning us for our next phase of growth as a vital component of healthcare infrastructure.

A Proof Point: Operational Excellence Drives Value Creation

This year proved the transformative power of our Growth with Purpose strategy. Our integrated operating model delivered exceptional results that validated operational excellence as our primary vehicle for sustainable value creation.

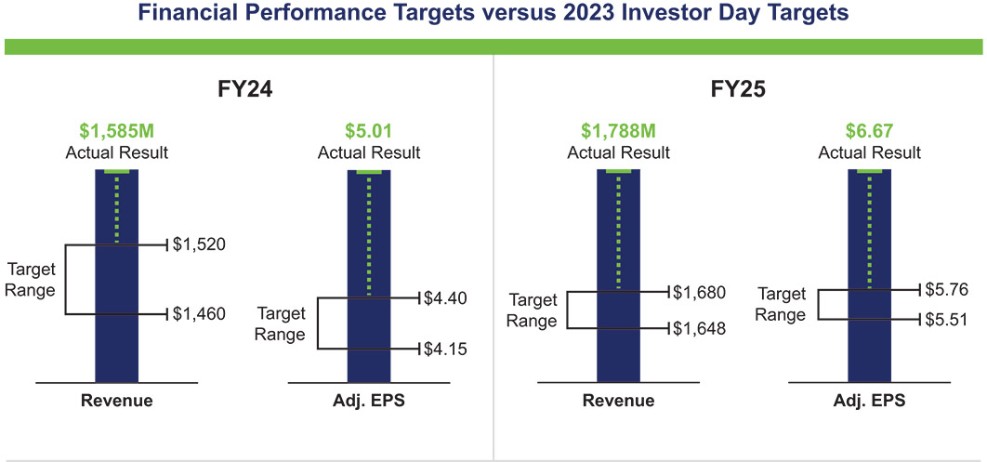

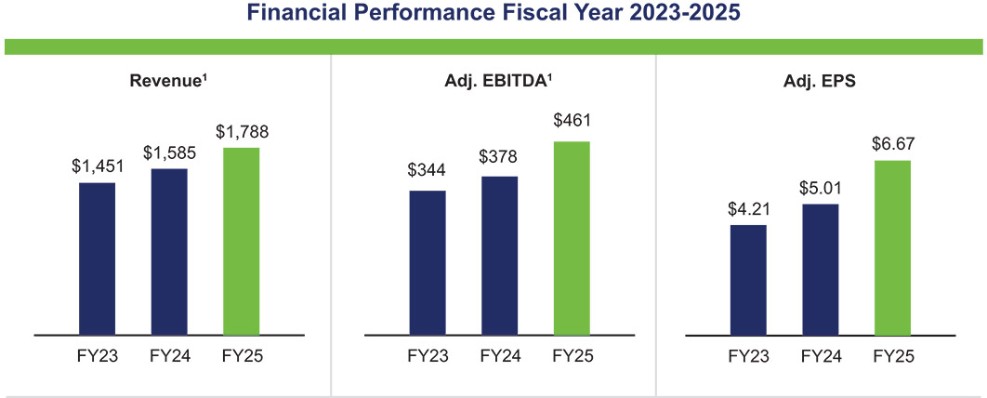

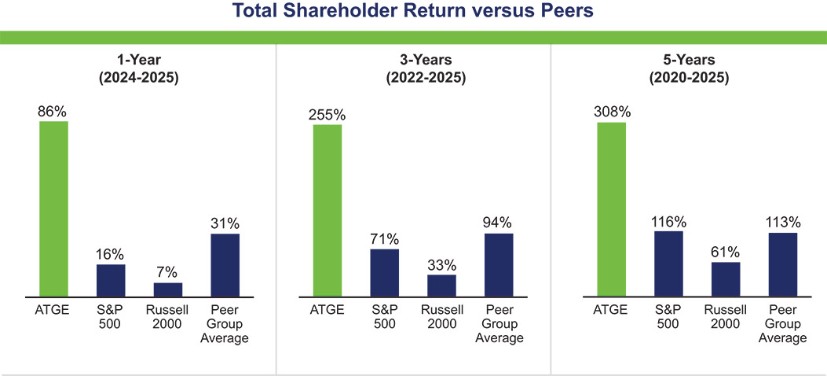

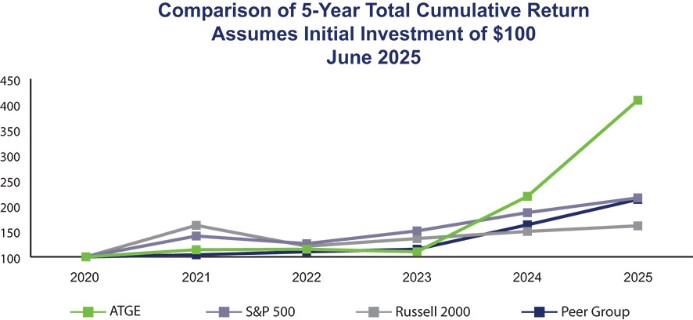

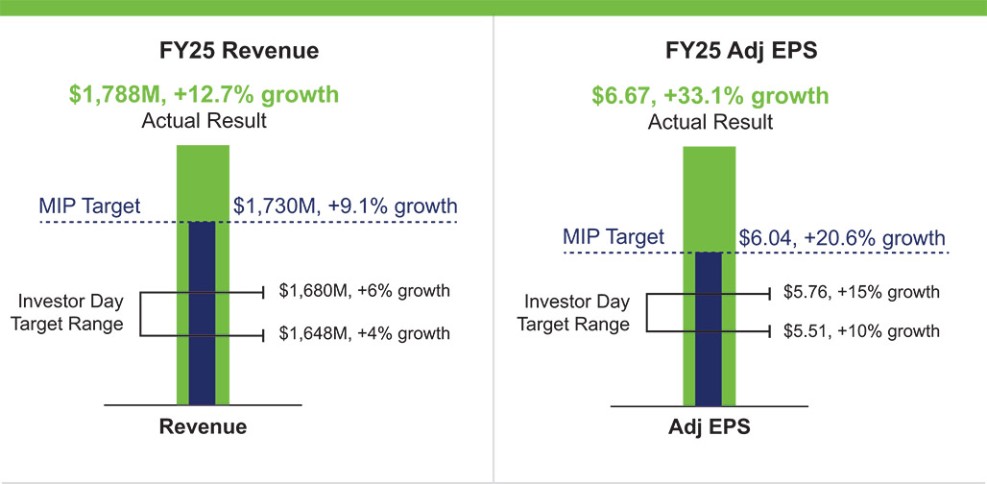

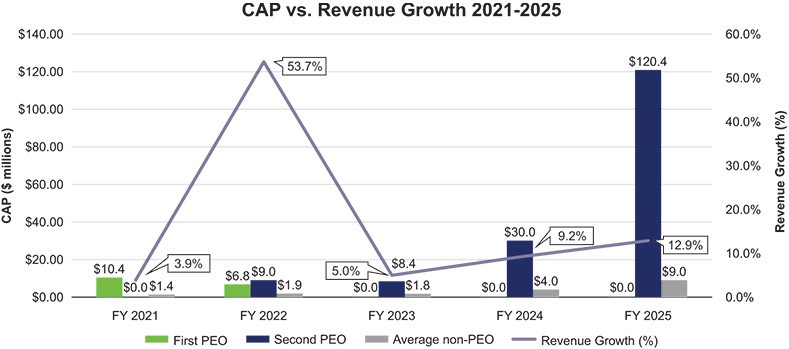

The numbers speak for themselves: revenue of $1.79 billion representing 12.9% growth that more than doubled our 2023 investor day targets. Adjusted earnings per share of $6.67 grew 33.1%. Total enrollment surpassed 91,000 students with over 10% average quarterly growth. We graduated 29,000 students—90% into healthcare professions—who now serve in underserved rural communities and urban centers nationwide.

Each institution validated our strategy: Chamberlain University achieved its tenth consecutive quarter of growth, reaching a record 40,000+ students. Walden University delivered eight consecutive quarters of accelerating growth, surpassing 48,000 students and pre-pandemic levels. Our Medical and Veterinary segment maintained excellence with over 5,000 enrolled students.

This performance proves that accessible, career-focused healthcare education, delivered through modern programs and tech-enabled learning, creates a virtuous cycle of student success, employer satisfaction and investor returns.

An Inflection Point: Expanding Our Role in Critical Healthcare Infrastructure

Our sustained execution has earned us the right to seek a larger and more visible role in America's critical healthcare infrastructure. At a time when the U.S. faces acute workforce shortages across all healthcare professions, we aspire to become the systemically important, highly integrated partner that healthcare employers and policymakers increasingly rely on to build their talent pipeline.

Our 350,000+ alumni, 91,000+ current students and 10,000+ colleagues represent more than an educational institution; we are essential infrastructure for healthcare delivery. Our graduates serve in critical roles that keep communities healthy; from nurses providing essential care in small-town clinics to emergency specialists responding to life-threatening situations in metropolitan hospitals.

This positioning reflects both our scale and our responsibility. We are not merely participants in healthcare education; we are positioned to play an increasingly vital role in ensuring America's healthcare system has the skilled professionals it needs to function effectively.

The Higher Education Context: Leading Innovation When It Matters Most

At a time when higher education faces important questions about accessibility, career relevance and value, our mission of democratizing education has never been more important. We are proud to complement the broader higher education ecosystem by innovating the student journey and expanding access to clinical and healthcare careers for learners who might not otherwise have these opportunities.

Our focus on accessible, flexible, career-focused education fills critical gaps in the educational landscape. We serve working adults, career changers and first-generation college students who need different pathways to meaningful careers. Through technology-enabled learning and competency-based programs, we are innovating how education is delivered and making quality healthcare education more accessible to diverse communities.

Our graduates enter essential roles with clear career pathways and immediate impact in their communities. Healthcare employers increasingly rely on us to meet critical staffing needs across underserved markets. Our regulators and accreditors recognize us as a partner in ensuring both educational quality and healthcare workforce development.

This positions us as an innovator in educational delivery: we are demonstrating how to democratize access to high-demand careers while maintaining rigorous standards and outstanding outcomes.

Creating Sustained Value for All Stakeholders

This success creates expanding opportunities. For our investors, we continue deploying capital to high-return growth opportunities while returning excess capital to shareholders. For our students, we provide accessible pathways to meaningful healthcare careers. For our colleagues, we offer the opportunity to serve a mission that transforms lives and communities. For healthcare employers, we deliver the skilled workforce they desperately need. For policymakers and communities, we address critical infrastructure needs that government alone cannot solve.

Our commitment remains unwavering: delivering outstanding student outcomes at scale while building the healthcare workforce America needs. We are not just growing a business—we are strengthening the foundation of our nation's healthcare system.

Thank you for your continued confidence in our purpose and our execution.

Sincerely,

Steve Beard

Chairman and Chief Executive Officer

Notice of Annual Meeting of Shareholders

DATE AND TIME November 12, 2025 Online check-in will be available beginning at 9:15 a.m. Central Standard Time. Please allow ample time for the online check-in process.

PLACE The Annual Meeting will be held entirely online at: www.virtualshareholdermeeting .com/ATGE2025.

RECORD DATE September 23, 2025 | ITEMS OF BUSINESS |

| Board Voting | Page | ||

Proposal No. 1: | FOR | 11 | ||||

Proposal No. 2: | FOR | 31 | ||||

Proposal No. 3: | FOR | 34 | ||||

Shareholders will also consider such other business as may come properly before the Annual Meeting or any adjournment thereof. To participate in the 2025 Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability, the proxy card or voting instruction forms that accompanied your proxy materials. This notice and Proxy Statement and Adtalem Global Education Inc.’s 2025 Annual Report to Shareholders are being first sent or given to shareholders on or about October 2, 2025.

Douglas G. Beck Senior Vice President, General Counsel, Corporate Secretary | ||||||

YOU MAY VOTE IN ONE OF FOUR WAYS:

|

|

|

|

|

|

|

VIA THE INTERNET | BY TELEPHONE |

| BY MAIL |

| VIRTUALLY | |

Visit the website listed on your Notice of Internet Availability or proxy card |

| Call the telephone number on your Notice of Internet Availability or proxy card |

| Complete, sign, date, and return your proxy card or voting instructions form in the enclosed envelope |

| Attend the Annual Meeting online at www.virtualshareholdermeeting.com/ ATGE2025. |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on November 12, 2025. This Notice of Annual Meeting, the accompanying Proxy Statement, the 2025 Adtalem Global Education Inc. Annual Report to Shareholders (which includes our Form 10-K for the year ended June 30, 2025), and a proxy card are available online at www.proxyvote.com as well as at our investor relations website, http://investors.adtalem.com. |

Proxy Summary

This summary highlights selected information about the items to be voted on at the Annual Meeting. It does not contain all of the information that you should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

OUR NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Balanced mix of backgrounds, current and former CEOs, a medical professional, a former finance executive at a leading global company, and corporate and academic leadership expertise.

Name and Principal Occupation | Independent | Age | Director | Other Public | |||

|

| Stephen W. Beard Adtalem Global Education Inc. | 54 | 2021 | |||

|

| William W. Burke Austin Highlands Advisors, LLC | | 66 | 2017 | Ceribell, Inc. Tactile Systems Technology Inc. | |

|

| Donna J. Hrinak Royal Caribbean Group | | 74 | 2018 | ||

|

| Georgette Kiser The Carlyle Group | | 57 | 2018 | Aflac Inc. Jacobs Solutions Inc. | |

|

| Liam Krehbiel Topography Hospitality, LLC | | 49 | 2022 | ||

|

| Michael W. Malafronte Adtalem Global Education Inc. Senior Advisor, Derby Copeland Capital | | 51 | 2016 | ||

|

| Sharon L. O’Keefe University of Chicago Medical Center | | 73 | 2020 | Conva Tec Group PLC | |

|

| Kenneth J. Phelan Oliver Wyman Inc. | | 66 | 2020 | Huntington Bancshares Inc. | |

| Betty Vandenbosch Coursera, Inc. | | 69 | 2024 | |||

|

| Lisa W. Wardell Adtalem Global Education Inc. | 56 | 2008 | American Express Co. | ||

BOARD HIGHLIGHTS

BOARD INDEPENDENCE | ||||||||||

Independent | 80% | |||||||||

Not Independent | ||||||||||

TENURE

Less than 3 years | 3 to 8 years | Over 8 years | Average Tenure | |||||||||||||||||||||||||||

6.4 years | ||||||||||||||||||||||||||||||

AGE

Under 50 | 50 to 60 | 61 to 75 | Average Age | |||||||||||||||||||||||||||

61.5 years | ||||||||||||||||||||||||||||||

The matrix below sets forth certain skills, qualifications, and experiences that we consider important for our director nominees in light of our current business strategy and structure. The list of skills and the following matrix are a valuable tool for the Board as they consider skills and experiences that may need to be replaced, updated or added.

Adtalem Global Education Inc. | 2025 Proxy Statement 5 |

Adtalem Global Education Director Skills Matrix 2025

Competencies | Stephen W. | William W. | Donna J. | Georgette | Liam | Michael W. | Sharon L. | Kenneth J. | Betty Vandenbosch | Lisa W. | |

CEO experience | | ⏺ | | | ⏺ | | ⏺ | ⏺ | | ||

CFO/audit function expertise | ⏺ | | ⏺ | | ⏺ | | | ||||

Healthcare expertise/ medical education and/or services | ⏺ | | | ⏺ | | ||||||

Technology | ⏺ | | ⏺ | ⏺ | ⏺ | | ⏺ | ||||

Understanding of education sector trends, including accreditation, credentialing, etc. | | ⏺ | | | ⏺ | | | | | ||

Strategy | | | ⏺ | | | ⏺ | | ⏺ | ⏺ | | |

Governance | | | | | | | | | ⏺ | | |

M&A/joint ventures/ business development | | | ⏺ | | ⏺ | ⏺ | | ||||

Compensation | | | | ⏺ | | | | | |||

Human capital management | | ⏺ | ⏺ | | | | | ⏺ | ⏺ | | |

Global markets | | ⏺ | | | | ⏺ | | ||||

Cybersecurity | ⏺ | ⏺ | | ⏺ | ⏺ | ⏺ | |||||

Finance and/or financial planning | | | | ⏺ | | | |

Considerable expertise ⏺ Some expertise

6 2025 Proxy Statement | Adtalem Global Education Inc. |

CORPORATE GOVERNANCE HIGHLIGHTS

Shareholder Engagement

We conduct regular outreach and engagement with our shareholders and value their insight and feedback.

OUR OUTREACH

We reached out to our shareholders representing more than 70% of shares owned.

Ongoing Enhancements

Our Board continually monitors best practices in corporate governance and, consistent with feedback from shareholders and other stakeholders, has taken the following actions in recent years:

2025 | ||||

● Held its second annual two-day offsite strategy meeting to analyze Adtalem’s strategic goals and other topics, including innovation in higher education, artificial intelligence in healthcare, and healthcare and education market dynamics ● Engaged Spencer Stuart to work with our Board members and key management to support and enhance our work on board effectiveness and board succession | ||||

2024 | ||||

● Added a new director who has significant expertise in bringing successful degree and nondegree programs to market ● Appointed a Lead Independent Director when our CEO was appointed as our Chairman of the Board ● Increased stock ownership requirements for our CEO and other executive officers | ||||

2023 | ||||

|

|

| ● Conducted a Board composition analysis to align the current and future skills and experiences represented on the Board with our strategic objectives ● Updated our Stock Ownership Guidelines to limit the type of equity awards that count toward compliance to only the pre-tax value of unvested restricted stock units | |

|

|

|

| |

|

|

| 2022 | |

|

|

| ● Amended our Director Nominating Process to consider expertise on cybersecurity | |

|

|

| 2021 | |

|

|

| ||

|

|

| ● Refreshed our Board by adding three new directors including our new CEO | |

|

|

|

| |

|

|

| 2020 | |

|

|

| ||

|

|

| ● Refreshed our Board by adding two new directors with significant expertise in healthcare and risk oversight |

Adtalem Global Education Inc. | 2025 Proxy Statement 7 |

Ongoing Best Practices

| BOARD COMMITTEES |

|

|

| |

| ✓ We have five Board committees – Academic Quality, Audit and Finance, Compensation, External Relations, and Nominating & Governance, each of which typically meets at least four times per year ✓ The Chair of each committee, in consultation with the committee members, determines the frequency and length of committee meetings ✓ Our Board and each of its committees are authorized to retain independent advisors at Adtalem’s expense | |

| DIRECTOR STOCK OWNERSHIP |

|

|

| |

| ✓ 60% of our non-employee directors’ annual compensation (excluding fees for additional (e.g. chair) roles) is in the form of restricted stock units (“RSUs”) ✓ Our non-employee directors are required to own shares worth at least three times their annual retainer | |

| CONTINUOUS IMPROVEMENT |

|

|

| |

| ✓ New directors receive a tailored, two-day, live training introduction to Adtalem and its institutions from management ✓ Our directors are encouraged to participate in director-oriented training and board education programs ✓ The Board annually undergoes a self-assessment process to critically evaluate its performance at a committee and Board level | |

| COMMUNICATION |

|

|

| |

| ✓ Our Board engages in open and frank discussions with each other and with senior management ✓ Our directors have access to all members of management | |

8 2025 Proxy Statement | Adtalem Global Education Inc. |

EXECUTIVE COMPENSATION HIGHLIGHTS

Our Compensation Framework

2025 COMPENSATION SNAPSHOT

| Objective | Time | Performance | Additional Explanation | ||

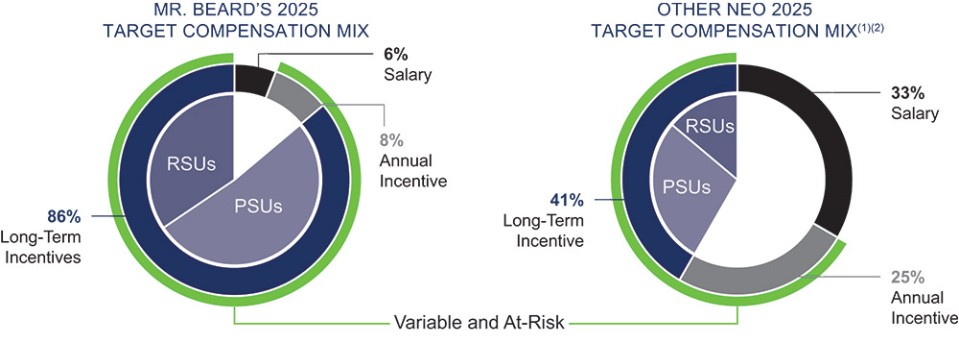

Salary | Base Salary | Reflect experience, market competition and scope of responsibilities | Reviewed Annually | ● Assessment of performance in prior year. | ● Represents 6% and 33% (on average) of target Total Direct Compensation for Mr. Beard and other NEOs, respectively. | |

|

| |||||

|

| |||||

Annual | Management Incentive Plan (“MIP”) | Reward achievement of short-term operational business priorities | 1 year | ● Revenue* ● Adjusted earnings per share (“EPS”)* ● Individual performance modifier | ● Represents 8% and 25% (on average) of target Total Direct Compensation for Mr. Beard and other NEOs respectively. | |

| ||||||

| ||||||

Long-Term Incentive (equity) | RSUs | Align interests of management and shareholders, and retain key talent | 3 year ratable vest | ● Stock price growth | ● Represents 40% of NEO regular annual LTI granted in FY25.** | |

Revenue Growth PSUs | Reward achievement of multi-year financial goals, align interests of management and shareholders, and retain key talent | 3 year cliff vest | ● Revenue Growth | ● Represents 30% of NEO regular annual LTI granted in FY25.** | ||

Adjusted EBITDA Margin PSUs | ● Adjusted EBITDA margin | ● Represents 30% of NEO regular annual LTI granted in FY25.** |

* | The MIP payout for executive leadership of the institutions is based on revenue and adjusted operating income at such executive’s institution(s). |

** | The total regular annual long-term incentive (“LTI”) award consisting of both RSUs and Performance Share Units (PSUs) represents 86% of target Total Direct Compensation for Mr. Beard and 41% of target Total Direct Compensation for other NEOs (on average), respectively. |

Adtalem Global Education Inc. | 2025 Proxy Statement 9 |

Table of Contents

1 |

| |

3 | ||

4 | ||

4 | ||

5 | ||

6 | ||

7 | ||

9 | ||

11 | ||

12 | ||

19 | ||

19 | ||

22 | ||

25 | ||

28 | ||

29 | ||

31 | ||

31 | Selection and Engagement of Independent Registered Public Accounting Firm | |

31 | ||

32 | ||

33 | ||

34 | ||

34 | ||

63 | ||

64 | ||

64 | ||

65 | ||

66 | ||

67 | ||

68 | ||

69 | ||

69 | 2025 Potential Payments Upon Termination or Change-In-Control | |

71 | ||

72 | ||

76 | ||

77 | ||

77 | ||

78 | ||

79 | ||

79 | ||

81 | ||

82 | ||

82 | ||

82 | ||

82 | ||

82 | ||

83 | ||

83 | ||

A-1 |

PROPOSAL NO. 1

Election of Directors

The Board has nominated each of Adtalem’s ten incumbent directors and recommends their re-election, each for a term to expire at the 2026 Annual Meeting. All of the nominees have consented to serve as directors if elected at the Annual Meeting.

It is intended that all shares represented by proxy at the Annual Meeting will be voted for the election of each of Stephen W. Beard, William W. Burke, Donna J. Hrinak, Georgette Kiser, Liam Krehbiel, Michael W. Malafronte, Sharon L. O’Keefe, Kenneth J. Phelan, Betty Vandenbosch, and Lisa W. Wardell as directors unless otherwise specified in such proxy. A proxy cannot be voted for more than ten persons. If a nominee becomes unable to serve as a director, the proxy committee (appointed by the Board) will vote for the substitute nominee that the Board designates. The Board has no reason to believe that any of the nominees will become unavailable for election.

Each nominee for election as a director is listed below, along with a brief statement of his or her current or most recent principal occupation, business experience, and other information, including directorships in other public companies held as of the date of this Proxy Statement or within the previous five years. Under the heading “Reasons for Nomination,” we describe briefly the particular experience, qualifications, attributes, or skills that led to the conclusion that these nominees should serve on the Board. As explained below under the heading “Director Nominating Process,” the Nominating & Governance Committee evaluates the Board holistically to ensure it is constituted with a balance of competencies and professional experiences to promote effective governance.

APPROVAL BY SHAREHOLDERS

You have the option to vote FOR, AGAINST or ABSTAIN with respect to the election of each director nominee. The election of each of the ten nominees for director listed below requires the affirmative vote of a majority of the shares of Common Stock of Adtalem represented at the Annual Meeting. Adtalem maintains a majority voting standard for uncontested elections (when the number of nominees is the same as the number of directors to be elected), so for a nominee to be elected as a member of the Board, the nominee must receive the affirmative vote of a majority of the shares of Common Stock of Adtalem represented at the Annual Meeting. Abstentions, if any, will be counted as votes AGAINST each director nominee, and broker non-votes, if any, will not be counted as votes represented and entitled to vote and, therefore, will have no effect on the results of the vote for this proposal. See VOTING INFORMATION – Effect of Not Casting Your Vote. Shareholders may not cumulate their votes in the election of directors. If a nominee for re-election fails to receive the requisite majority vote when the election is uncontested, such director must promptly tender his or her resignation to Adtalem’s Chairman or Adtalem’s General Counsel and Corporate Secretary, subject to acceptance by the Board.

Unless otherwise indicated on the proxy, the shares will be voted FOR each of the nominees identified below.

| The Board of Directors recommends a vote FOR each of the nominees identified below. | |

BOARD COMPOSITION

Director Nominees

Age: 54 Director since: 2021 Chairman since 2024 Committees: none Education: ● Bachelor’s degree from the University of Illinois at Urbana-Champaign ● Juris Doctor degree from the Maurer School of Law at Indiana University | Stephen W. Beard | ||

Chairman of the Board and CEO, Adtalem Global Education Inc. | |||

Career Highlights Mr. Beard was appointed Adtalem’s President and CEO and a director on our Board in September 2021. Mr. Beard was elected Chairman of our Board in November 2024. As Adtalem’s Chief Operating Officer (COO), he architected Adtalem’s portfolio repositioning while delivering strong operational performance across both healthcare education and financial services segments. Prior to taking on the responsibility of COO in 2019 and responsibility for the former Financial Services vertical in 2020, Mr. Beard served as Senior Vice President, General Counsel and Corporate Secretary in 2018. Before joining Adtalem, Mr. Beard served as executive vice president and chief administrative officer at Heidrick & Struggles International, Inc. (NASDAQ: HSII), where he led the firm’s expansion into organizational consulting and culture shaping. His earlier career included corporate and securities law practice at Schiff Hardin, LLP in Chicago, specializing in mergers and acquisitions and corporate governance for regulated industries. He began his legal career as a law clerk for the Honorable Frank Sullivan, Jr. (ret.), associate justice of the Indiana Supreme Court. Mr. Beard has been active in a variety of community and civic matters and currently serves on the board of the venture philanthropy fund, A Better Chicago. Reasons for Nomination Mr. Beard’s experience as our CEO and his prior service as Adtalem’s COO and General Counsel give him deep knowledge of Adtalem’s operations and strategy. Mr. Beard’s experience in refining Adtalem’s portfolio strategy, executing the DeVry University, Carrington College and Adtalem Brazil divestitures, and spearheading the acquisition of Walden University, coupled with his success in leading the Financial Services segment prior to its divestiture, have played an integral role in positioning Adtalem for long-term growth. | |||

Age: 66 Director since: 2017 Committees: ● Audit and Finance (Chair) ● Compensation Education: ● Bachelor’s degree in Finance from the University of Texas at Austin ● MBA from the Wharton School of the University of Pennsylvania | William W. Burke | Independent | |

Former President, Austin Highlands Advisors, LLC | |||

Career Highlights Mr. Burke has been a director of Adtalem since January 2017. He served as our Lead Independent Director from July 2019 through November 2022. From November 2015 to June 2024, Mr. Burke served as President of Austin Highlands Advisors, LLC, a provider of corporate advisory services. He served as Executive Vice President & Chief Financial Officer of IDEV Technologies, a peripheral vascular devices company, from November 2009 until the company was acquired by Abbott Laboratories in August 2013. From August 2004 to December 2007, he served as Executive Vice President & Chief Financial Officer of ReAble Therapeutics, a diversified orthopedic device company which was sold to The Blackstone Group in a going private transaction in 2006 and subsequently merged with DJO Incorporated in November 2007. Mr. Burke remained with ReAble Therapeutics until June 2008. From 2001 to 2004, he served as Chief Financial Officer of Cholestech Corporation, a medical diagnostic products company. Board Service Mr. Burke has served on numerous public and private company boards including serving as a board chairman and a lead independent director. He has served on the board of Tactile Systems Technology, Inc. (NASDAQ: TCMD) since 2015 and currently serves as Chairman of the Board and as a member of its nominating and governance committee. Since 2022, he has served on the board of directors of Ceribell Inc., (NASDAQ: CBLL), a medical technology company. Mr. Burke also currently chairs Ceribell’s audit committee and serves on the nominating and governance committee. In 2024, he joined the board of Nalu Medical, Inc., a privately-held, medical technology company. He previously served on the board of Invuity, Inc. (acquired by Stryker Corp. in 2018), LDR Holding Corporation (acquired by Zimmer Biomet in 2016), and Medical Action Industries (acquired by Owens & Minor in 2014). Reasons for Nomination Mr. Burke has significant experience as a senior executive and as a board member of multiple public companies, including growth-oriented healthcare technology companies. His extensive understanding of culture, financing, and operating strategy enhances the Board’s corporate governance and strategy capabilities. | |||

Age: 74 Director since: 2018 Committees: ● External Relations (Chair) ● Audit & Finance ● Nominating & Governance Education: ● Bachelor’s degree in Multidisciplinary Social Science from Michigan State University ● Attended The George Washington University and the University of Notre Dame School of Law | Donna J. Hrinak | Independent | |

Retired Senior Vice President, Corporate Affairs, Royal Caribbean Group | |||

Career Highlights Ms. Hrinak has been a director of Adtalem since October 2018. Ms. Hrinak served as Senior Vice President, Corporate Affairs, Royal Caribbean Group from 2020 through 2023. Previously she served as President of Boeing Latin America (2011-2020) where she opened Boeing’s first three offices in the region and oversaw all aspects of operations, from commercial and defense product sales to research and technology. Prior to Boeing, she served as Vice President Global Public Policy and Governmental Affairs/Vice President for Public Policy at PepsiCo (2008-2011) and also held a role at Kraft Foods (2006-2008), where she managed the Latin American and European Corporate Affairs teams. Prior to that, she served as a Senior Counselor for Trade and Competition at the law firm of Steel Hector & Davis and held a role with the strategic advisory firm of Kissinger McLarty Associates. Before entering the private sector, Ms. Hrinak was a career officer in the U.S. Foreign Service, and served as U.S. Ambassador to Brazil, Venezuela, Bolivia, and the Dominican Republic, as well as Deputy Assistant Secretary in the State Department. Reasons for Nomination Ms. Hrinak’s extensive experience at a senior level in both the public and private sectors overseeing complex multi-cultural organizations and regulatory policy brings insight to the Board directly applicable to Adtalem’s regulatory environment and the international operations of its institutions. | |||

Age: 57 Director since: 2018 Committees: ● Academic Quality (Chair) ● Nominating & Governance Education: ● Bachelor’s degree in Mathematics with a concentration in Computer Science from the University of Maryland ● M.S. in Mathematics from Villanova University ● MBA from the University of Baltimore | Georgette Kiser | Independent | |

Former Managing Director and CIO, The Carlyle Group | |||

Career Highlights Ms. Kiser has been a director of Adtalem since May 2018. Ms. Kiser is an operating executive/independent advisor who helps lead due diligence and technical strategies across various private equity and venture capital firms. Previously, she was managing director and chief information officer (CIO) at The Carlyle Group, responsible for leading the firm’s global technology and solutions organization and driving IT strategies. Prior to her role at The Carlyle Group, she was in various executive roles at T. Rowe Price from 1996 to 2015, including Vice President and Head of Enterprise Solutions and Capabilities. She was a consultant and Software Engineer at Martin Marietta Management Data Systems from 1993 to 1995, and a Software Design Engineer in the Aerospace Division of the General Electric Company from 1989 to 1993. Board Service Since 2019, Ms. Kiser has served on the boards of Aflac Incorporated (NYSE: AFL), a leading supplemental insurer, and Jacobs Solutions, Inc. (NYSE: JEC), a leading global professional services company. She serves on the audit and risk committee and compensation committee for Aflac, and the compensation committee and nominating and corporate governance committee for Jacobs. She served on the board of NCR Corporation (NYSE: NCR), an American software, professional services, consulting and tech company from 2019 through 2024. Reasons for Nomination Ms. Kiser’s experience in information technology at the senior leadership level in organizations with an international reach brings expertise to Adtalem which enhances both the Board’s oversight of its business as well as Adtalem’s internal technology matters. | |||

Age: 49 Director since: 2022 Committees: ● Compensation ● External Relations Education: ● Bachelor of Arts degree from Dartmouth College ● Master of Business Administration degree with a major in business administration and a double concentration in finance and marketing from Northwestern University's Kellogg School of Management | Liam Krehbiel | Independent | |

Chief Executive Officer and Founder, Topography Hospitality, LLC | |||

Career Highlights Mr. Krehbiel has been a director of Adtalem since June 2022. In 2021, Mr. Krehbiel founded Topography Hospitality, LLC, and has served as its Chief Executive Officer since then. He is also the co-owner of Ballyfin Demesne, a luxury hotel in Ireland, which opened in 2011. In 2010, Mr. Krehbiel founded A Better Chicago, a nonprofit venture philanthropy fund, and served as its CEO until 2019. A Better Chicago invests in the most promising nonprofits helping children escape poverty. From 2007 to 2010, Mr. Krehbiel was a management consultant at Bain and Company. Prior to joining Bain, Mr. Krehbiel worked with the Edna McConnell Clark Foundation in New York. Board Service Mr. Krehbiel is a director of A Better Chicago and One Future Illinois. Reasons for Nomination Mr. Krehbiel’s commitment to improving education for low-income communities closely aligns with Adtalem’s mission of expanding access to education. Mr. Krehbiel has spent most of his career as a venture philanthropist dramatically improving educational opportunities for low-income students by funding and scaling the most effective schools and programs in the Chicago area. This experience adds depth and insight as Adtalem continues to focus on serving its students and employers in the growing healthcare education industry. | |||

14 2025 Proxy Statement | Adtalem Global Education Inc. |

Age: 51 Director since: 2016 Lead Independent Director since November 2024 Committees: ● Compensation (Chair) ● Academic Quality Education: ● Bachelor’s degree in Finance from Babson College | Michael W. Malafronte | Independent | |

Lead Independent Director, Adtalem Global Education Inc. Senior Advisor, Derby Copeland Capital | |||

Career Highlights Mr. Malafronte has been a director of Adtalem since June 2016 and was appointed our Lead Independent Director upon Mr. Beard’s election as Chairman in November 2024. Mr. Malafronte has served as a Senior Advisor to Derby Copeland Capital since September 2022. Derby Copeland is a private equity firm that specializes in opportunistic real estate-related debt finance and equity investment. Mr. Malafronte is a Founding Partner of International Value Advisers, LLC (“IVA”) and served as Managing Partner for 13 years until December 2020. He was responsible for overseeing all aspects of IVA, including company strategy and managing resources. He also served as President of IVA Funds. Prior to founding IVA in 2007, Mr. Malafronte was a Senior Vice President at Arnhold & S. Bleichroeder Advisers, LLC where he worked for two years as a senior analyst for the First Eagle Funds, owned by Arnhold & S. Bleichroeder Advisers, LLC. There he worked under Charles de Vaulx and Jean-Marie Eveillard within the Global Value Group for the value funds, including the First Eagle Overseas, Global, U.S. Value Funds as well as the offshore funds, inclusive of the Sofire Fund Ltd. Similarly, he was responsible for covering the oil and gas, media, real estate, financial services, and retail industries on a global basis, as well as companies within the United Kingdom, Germany, and Japan. Moreover, Mr. Malafronte was responsible for covering the larger names within the portfolio such as Pargesa Holdings, ConocoPhillips, Petroleo Brasileiro, SK Corp., News Corp., Dow Jones, and Comcast. Prior to the First Eagle Funds, Mr. Malafronte worked for nine years as a Portfolio Manager at Oppenheimer & Close, a dually-registered broker dealer and investment adviser; an adviser on three domestic hedge funds, one offshore partnership and a registered investment adviser and broker dealer. While at Oppenheimer & Close, Mr. Malafronte assisted in the launch of a domestic hedge fund in 1996 and an offshore partnership in 1998. Mr. Malafronte was responsible for all facets of portfolio management for the investment partnerships, including idea generation, in-depth research, and stock selection. In addition, he was also responsible for hiring and training both operations staff and research analysts. Board Service Mr. Malafronte has previously served on the boards of two publicly traded companies: Bresler & Reiner Inc. (2002-2008) and Century Realty Trust (2005-2006). Reasons for Nomination Mr. Malafronte’s experience as a financial analyst covering institutions globally, and as a founder of a global investment firm, provides the Board with a firm understanding of Adtalem’s shareholders’ perspective and deeply informs Adtalem’s financial planning. | |||

Adtalem Global Education Inc. | 2025 Proxy Statement 15 |

Age: 73 Director since: 2020 Committees: ● Nominating & Governance (Chair) ● Compensation Education: ● Bachelor’s degree in Nursing from Northern Illinois University ● M.S. degree in Nursing from Loyola University of Chicago | Sharon L. O’Keefe | Independent | |

Retired President, University of Chicago Medical Center | |||

Career Highlights Ms. O’Keefe served as the President of the University of Chicago Medical Center from February 2011 through July 2020. From April 2009 through February 2011, Ms. O’Keefe served as President of Loyola University Medical Center. Prior to her role at Loyola, she served from July 2002 to April 2009 as Chief Operating Officer for Barnes Jewish Hospital, a member of BJC Healthcare, St. Louis. In addition, Ms. O’Keefe has served in a variety of senior management roles at The Johns Hopkins Hospital, Montefiore Medical Center, University of Maryland Medical System, and Beth Israel Deaconess Medical Center in Boston, a teaching affiliate of Harvard Medical School. She has also served as a healthcare consultant with Ernst & Young. In addition, Ms. O’Keefe has served on the National Institutes of Health Advisory Board for Clinical Research, the Finance Committee of the National Institutes of Health Advisory Board, the Board of Trustees of the Illinois Hospital Association, and an Examiner for the Malcolm Baldrige National Quality Award. Board Service Since March 2022, Ms. O’Keefe has served on the board of directors of Conva Tec Group PLC, a global medical products and technologies company focused on therapies for the management of chronic conditions. From July 2022 to May 2023, Ms. O’Keefe served on the board of directors of Apollo Endosurgery, a medical technology company focused on development of minimally invasive devices for advanced endoscopy therapies. From 2012 until February 2022, Ms. O’Keefe served on the board of directors of Vocera Communications Inc., a provider of communication and clinical workforce solutions, where she was a member of the compensation committee. Ms. O’Keefe previously served on the board of Aviv Reit Inc. from 2013 to 2015. Reasons for Nomination Ms. O’Keefe’s prior leadership roles at numerous medical centers including the University of Chicago Medical Center and Loyola University of Chicago Medical Center and as a board member of other public companies provide the Board with insights into how Adtalem can best serve the needs of our employer partners and drive superior student outcomes for our healthcare and medical students and graduates. | |||

Age: 66 Director since: 2020 Committees: ● Audit and Finance ● External Relations Education: ● Bachelor’s degree in Business Administration and Finance from Old Dominion University ● M.S. in Economics from Trinity College, Dublin ● J.D. from Villanova University | Kenneth J. Phelan | Independent | |

Senior Advisor, Oliver Wyman Inc. | |||

Career Highlights Mr. Phelan has been a Senior Advisor at Oliver Wyman Inc., a global management consulting firm, since 2019. Prior to that he served as the first Chief Risk Officer for the U.S. Department of the Treasury (“Treasury”) from 2014 to 2019. As Chief Risk Officer of the Treasury, he was responsible for establishing and building the Treasury’s Office of Risk Management to provide senior Treasury and other administration officials with analysis of key risks including credit, market, liquidity, operational, governance, and reputational risk. From 2018 to 2019, Mr. Phelan also served as Acting Director for the Office of Financial Research, an independent bureau within the Treasury charged with supporting the Financial Stability Oversight Council and conducting research about systemic risk. Prior to joining the Treasury, Mr. Phelan served as the chief risk officer for RBS America from 2011 to 2014, as chief risk officer for Fannie Mae from 2009 to 2011, and as chief risk officer for Wachovia Corporation from 2008 to 2009. Earlier in his career, Mr. Phelan held a variety of senior risk roles at JPMorgan Chase, UBS, and Credit Suisse. Board Service Since 2019 Mr. Phelan has served as a director of Huntington Bancshares, Inc. (NASDAQ. HBAN), a regional bank holding company whose primary subsidiary is The Huntington National Bank. Mr. Phelan is the Chair of Huntington’s risk committee and serves on its human resources and compensation committee. Reasons for Nomination Mr. Phelan possesses broad risk oversight expertise and risk management experience. His knowledge and experience strengthen the Board’s governance and risk oversight. | |||

16 2025 Proxy Statement | Adtalem Global Education Inc. |

Age: 69 Director since: 2024 Committees: ● Academic Quality Education: ● Bachelor of Science degree in Computer Science ● Master of Business Administration degree from Western University ● PhD in Management Information Systems from the Ivey Business School at Western University | Betty Vandenbosch | Independent | |

Former Senior Advisor, Coursera, Inc. | |||

Career Highlights Dr. Vandenbosch has been a director of Adtalem since January 2024. She served as the Senior Advisor to the Chief Executive Officer of Coursera, Inc., an online university course provider and facilitator, from 2022 to 2023. Dr. Vandenbosch joined Coursera in 2020 and served as a Senior Vice President and Chief Content Officer from 2020 to 2022. Prior to Coursera, Dr. Vandenbosch was the Chancellor of Purdue University Global from 2018 to 2020, where she oversaw academics for nearly 30,000 students, most of whom earned their degrees online. From 2008 to 2018, Dr. Vandenbosch held several roles of increasing responsibility at Kaplan University, including Provost from 2013-2014, and President from 2015 through 2018. From 1993 through 2008, Dr. Vandenbosch served in a variety of roles at Case Western University, including Associate Dean of Executive Education Programs and Associate Dean of External Relations. Reasons for Nomination Dr. Vandenbosch brings nearly thirty years of corporate and academic leadership, research and teaching experience to the Board. She is a leading expert on bringing successful degree and nondegree programs to market with a strong perspective on marketing data and analytics to drive growth, student success, and positive completion outcomes. | |||

Adtalem Global Education Inc. | 2025 Proxy Statement 17 |

Age: 56 Director since: 2008 Committees: ● External Relations Education: ● Bachelor’s degree from Vassar College ● Law degree from Stanford Law School ● MBA in Finance and Entrepreneurial Management from the Wharton School of Business at the University of Pennsylvania | Lisa W. Wardell | ||

Former Chairman of the Board, Adtalem Global Education | |||

Career Highlights Ms. Wardell has been a director of Adtalem since November 2008. She is a business executive with more than 25 years of experience managing business strategy, operations, finance, and mergers and acquisitions, while driving shareholder value, stakeholder engagement, and company mission. After a successful three-year run as Adtalem’s president and CEO (2016-2019) she transitioned to CEO and Chairman (2019-2021) and Executive Chairman (2021-2022). Through her commitment to high performance and positive social impact, Ms. Wardell’s leadership has resulted in superior outcomes for Adtalem’s students and significant value creation for shareholders and positioned the company for long-term growth. Ms. Wardell has also led the higher education sector in implementing new standards in transparency and financial literacy, and in cultivating quality partnerships to fill critical global healthcare workforce needs. Prior to Adtalem, Ms. Wardell was executive vice president and chief operating officer for The RLJ Companies. During her tenure at RLJ, Ms. Wardell managed acquisitions and executed the formation of RML Automotive, a dealership network spanning seven states with over $1.5 billion in annual revenues. She also worked extensively in the media, entertainment, sports, gaming, and hotel industries, which included assisting with the founding and managing of Our Stories Films Studio and managing the now Charlotte Hornets (previously Charlotte Bobcats). Ms. Wardell also served on the board of the NBAPA, Inc., the for-profit portion of the NBA Players Association, from 2018 to 2021. Prior to joining The RLJ Companies, Ms. Wardell was a principal at Katalyst Venture Partners, a private equity firm that invested in start-up technology companies, and a senior consultant at Accenture in the organization’s communication and technology practice. Ms. Wardell has been featured on CNBC and Cheddar as well as in The Wall Street Journal, Washington Post, Business Insider, Black Enterprise, and other publications. Board Service Ms. Wardell has served on the board of American Express Company (NYSE:AXP) since 2021, where she is a member of the audit and compliance and risk committees. She served on the board of Lowe’s Companies, Inc. (NYSE:LOW) from March 2018 to March 2021 and GIII Apparel Group, Ltd. (NASDAQ:GIII) from March 2022 to June 2023. She is a member of The Business Council, and Co-Chair of the Alvin Ailey DC Foundation., Ms. Wardell also is a member of the board of the Economic Club of Chicago, the Executive Leadership Council, and the Fortune CEO Initiative. Reasons for Nomination Ms. Wardell’s prior roles as CEO and Executive Chairman give her deep knowledge of Adtalem’s academic and business operations and strategy and enhances the Board’s operations. Additionally, her experience as a senior business executive in private equity, operations, and strategy and financial analysis, including mergers and acquisitions, gives her important perspectives on the issues that come before the Board, including business, strategic, financial, and regulatory matters. | |||

18 2025 Proxy Statement | Adtalem Global Education Inc. |

DIRECTOR NOMINATING PROCESS

The Nominating & Governance Committee is responsible for making recommendations of nominees for directors to the Board. The Nominating & Governance Committee’s goal is to put before our shareholders candidates who, with the incumbent directors, will constitute a board that will provide effective oversight for Adtalem’s growing, complex, and global educational operations and reflect the broad spectrum of students that Adtalem serves. The Nominating & Governance Committee seeks a broad cross-section of thought, competencies, experience, and other criteria in candidates. To this end, Adtalem’s Governance Principles provide that nominees are to be selected on the basis of, among other things, knowledge, experience, skills, expertise, personal and professional integrity, business judgment, time availability in light of other commitments, absence of conflicts of interest, and such other relevant factors that the Nominating & Governance Committee considers appropriate in the context of the interests of Adtalem, its Board, and its shareholders.

BOARD SUCCESSION PLANNING

We are committed to ensuring that our Board represents the right balance of experience, tenure, and independence. Additionally, our Governance Principles provide that a director is required to retire from our Board when he or she reaches the age of 75, although on the recommendation of the Nominating & Governance Committee, our Board may waive this requirement if it determines that a waiver is in the best interests of Adtalem. Our Nominating & Governance Committee has led the gradual transformation of our Board, with four of our eight independent director nominees joining the Board since 2020. When considering nominees, the Nominating & Governance Committee intends that the Board as a whole and individual members possess at least two of the following criteria or areas of expertise: · Leadership · Strategic vision · Business judgment · Management · Experience as a CEO or similar function · Experience as a CFO or accounting and finance expertise · Industry knowledge · Healthcare, medical, and related education and services · Education sector and accreditation · Cybersecurity · Mergers, acquisitions, joint ventures, and strategic alliances · Public policy, particularly in higher education · Regulatory · Human capital management and/or compensation · Global markets and international experience ·Corporate governance | BOARD REFRESHMENT | ||

| |||

ANNUAL PROCESS FOR NOMINATION | |||

1

| Identify Candidates · Directors · Management · Shareholders · Independent Search Firm | ||

2

| Nominating & Governance Committee Review · Review qualifications · Examine Board composition and balance · Review independence and potential conflicts · Meet with potential nominees | ||

3 | Recommend Slate | ||

| |||

4 | Full Board Review and Nomination | ||

| |||

5 | Shareholder Review and Election | ||

Adtalem Global Education Inc. | 2025 Proxy Statement 19 |

The Nominating & Governance Committee implements this annual nomination process by evaluating each prospective director nominee as well as each incumbent director on the criteria described above both independently, and in the context of the composition of the full Board, to determine whether he or she should be nominated to stand for election or re-election. In screening director nominees, the Nominating & Governance Committee conducts a careful review of potential conflicts of interest, including interlocking directorships and substantial business, civic, and social relationships with other members of the Board that could impair the prospective nominee’s ability to act independently.

Identification and Consideration of New Nominees

The Nominating & Governance Committee has retained the services of Spencer Stuart, an international executive search firm, to help identify and determine which to recommend to the Board. For each vacancy, the Nominating & Governance Committee develops a specific set of ideal criteria for the vacant director position. The Nominating & Governance Committee evaluates director candidates that it has identified and any identified by shareholders on an equal basis using these criteria and the general considerations identified above.

Shareholder Nominations; Proxy Solicitation by Shareholders

The Nominating & Governance Committee will not only consider nominees that it identifies, but will consider nominees submitted by shareholders in accordance with the advance notice process for shareholder nominations identified in the By-Laws. In order to be considered under this process, all shareholder nominees must be submitted in writing to the attention of Adtalem’s General Counsel and Corporate Secretary, 233 South Wacker Drive, Suite 800, Chicago, IL 60606, not less than 120 days nor more than 150 days prior to the anniversary of the immediately preceding annual meeting of shareholders. As a result, in order to be considered as a nominee at our 2026 annual meeting, a shareholder nomination must be submitted by 5:00 pm Central Daylight Time no later than July 15, 2026 and no earlier than June 15, 2026. Such shareholder’s notice shall be signed by the shareholder of record who intends to make the nomination (or his duly authorized proxy) and shall also include, among other things, the following information:

| ● | the name and address, as they appear on Adtalem’s books, of such shareholder and the beneficial owner or owners, if any, on whose behalf the nomination is made; |

| ● | the number of shares of Adtalem’s Common Stock which are beneficially owned by such shareholder or beneficial owner or owners; |

| ● | a representation that such shareholder is a holder of record entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to make the nomination; |

| ● | the name, age, business address and residence address of the person or persons to be nominated; |

| ● | a description of all arrangements or understandings between such shareholder or beneficial owner or owners and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination is to be made by such shareholder; |

| ● | such other information regarding each nominee proposed by such shareholder as would be required to be disclosed in solicitations of proxies for elections of directors, or would otherwise be required to be disclosed, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including any information that would be required to be included in a proxy statement filed pursuant to Regulation 14A had the nominee been nominated by the Board; and |

| ● | the written consent of each nominee to be named in a proxy statement and to serve as a director if so elected. |

In addition, any shareholder who intends to solicit proxies in support of director nominees other than our nominees at the 2026 Annual Meeting of Shareholders, in order to comply with the SEC’s universal proxy rules, must provide notice of such intention no later than July 15, 2026 and no earlier than June 15, 2026 to our General Counsel and Corporate Secretary (at the same address previously set forth) and provide all other information required by Exchange Act Rule 14a-19. No director nominations were proposed for the 2025 Annual Meeting by any shareholder.

In addition to candidates submitted through the advance notice By-Law process for shareholder nominations described above, shareholders may also request that a director nominee be included in Adtalem’s proxy materials in accordance with the proxy access provision in the By-Laws. Any shareholder or group of up to 20 shareholders holding both investment and voting rights to at least 3% of Adtalem’s outstanding Common Stock continuously for at least three years may nominate the greater of (i) two or (ii) 20% of the Adtalem directors to be elected at an annual meeting of shareholders. Such requests must be received not less than 120 days and no more than 150 days prior to the anniversary date of the immediately preceding annual meeting of shareholders. As a result, any notice given by or on behalf of a shareholder pursuant to these provisions of the By-Laws must be received no earlier than June 15, 2026 and no later than July 15, 2026. However, if we hold our 2026 Annual Meeting of Shareholders more than 30 days from the first anniversary of this year’s Annual Meeting, then in order for notice by the shareholder to be timely, such notice must be received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever occurs first.

In addition to candidates submitted through the By-Laws process for shareholder nominations, shareholders may also recommend candidates by following the procedures set forth below under the caption “Communications with Directors.”

20 2025 Proxy Statement | Adtalem Global Education Inc. |

Director Independence

The Board annually reviews the continuing independence of Adtalem’s non-employee directors under applicable laws and rules of the New York Stock Exchange (“NYSE”). The Board, excluding any director who is the subject of an evaluation, reviews and evaluates director transactions or relationships with Adtalem, including the results of any investigation, and makes a determination with respect to whether a conflict or violation exists or will exist or whether a director’s independence is or would be impaired.

The Board has considered whether each director has any material relationship with Adtalem (either directly or as a partner, shareholder, or officer of an organization that has a relationship with Adtalem) and has otherwise complied with the requirements for independence under the applicable listing standards of the NYSE.

As a result of this review, the Board affirmatively determined that, with the exception of Mr. Beard and Ms. Wardell, all of Adtalem’s current directors, and all director nominees, are “independent” of Adtalem and its management within the meaning of the applicable NYSE rules. Mr. Beard is considered an inside director because of his employment as Chairman and CEO of Adtalem. Ms. Wardell is considered an inside director because of her previous employment as Chairman and CEO of Adtalem.

Adtalem Global Education Inc. | 2025 Proxy Statement 21 |

BOARD STRUCTURE AND OPERATIONS

Summary of Board and Committee Structure

Adtalem’s Board held five meetings during FY25, consisting of four regular meetings and one special meeting. Currently, the Board has five standing committees: Academic Quality, Audit and Finance, Compensation, External Relations, and Nominating & Governance. The following tables include, for each standing committee, , the committee chair, a list of members, key responsibilities, and the number of meetings held during FY25. Current copies of the charters of each of these committees, a current copy of Adtalem’s Governance Principles, and a current copy of Adtalem’s Code of Conduct and Ethics can be found on Adtalem’s website, www.adtalem.com, and are also available in print to any shareholder upon request from Adtalem’s General Counsel and Corporate Secretary, 233 South Wacker Drive, Suite 800, Chicago, IL 60606. The Board has determined that each of the members of the Audit and Finance, Compensation, and Nominating & Governance committees is independent within the meaning of applicable laws and NYSE listing standards in effect at the time of determination. The standing Audit and Finance Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act, the rules and regulations of the Securities and Exchange Commission (“SEC”), and the listing standards of the NYSE.

Academic Quality Committee

Members | Key Responsibilities |

Georgette Kiser Members: Michael Malafronte Betty Vandenbosch | ● Supports improvement in academic quality and assures that the academic perspective is heard and represented at the highest policy-setting level and incorporated in all of Adtalem’s activities and operations ● Reviews the academic programs, policies, and practices of Adtalem’s institutions ● Evaluates the academic quality and assessment process and evaluates curriculum and programs ● Provides oversight of management’s strategy for leveraging education technology to enhance student engagement and academic achievement ● Provides oversight regarding the effectiveness of technology implementation in driving student success |

Meetings in FY25: 4 |

Audit and Finance Committee

Members | Key Responsibilities |

William W. Burke Members: Donna J. Hrinak Kenneth J. Phelan | ● Monitors Adtalem’s financial reporting processes, including its internal control systems and the scope, approach, and results of audits ● Selects and evaluates Adtalem’s independent registered public accounting firm ● Reviews and recommends to the Board Adtalem’s financing policies and actions related to investment, capital structure, and financing strategies ● Provides oversight of Adtalem’s policies and processes established by management to identify, assess, monitor, manage, and control technology, cyber, information, and other risks ● Reviews and approves any potential related party transactions The Board has determined that Mr. Burke is an audit committee financial expert, as defined by SEC rules. |

Meetings in FY25: 8 Report: Page 33 |

22 2025 Proxy Statement | Adtalem Global Education Inc. |

Compensation Committee

Members | Key Responsibilities |

Michael W. Malafronte Members: William W. Burke Liam Krehbiel Sharon O’Keefe | ● Oversees all compensation practices and reviews eligibility criteria and award guidelines for Adtalem’s compensation program ● Selects the committee’s independent consultants and advisers ● Reviews and approves, following discussions with the other independent members of the Board, CEO annual goals and objectives ● Evaluates the CEO’s performance against established annual goals and objectives ● Recommends CEO compensation to the other independent members of the Board for approval ● Reviews recommendations made by the CEO and approves compensation for other executive officers, including base salary, annual incentive, and equity compensation ● Reviews and approves the total pay-out of short- and long-term incentive pools, including annual grants of equity awards ● Reviews and recommends to the Board compensation paid to non-employee directors ● Oversees and conducts planning for CEO succession and potential related risks |

Meetings in FY25: 4 Report: Page 63 |

External Relations Committee

Members | Key Responsibilities |

Donna Hrinak Members: Liam Krehbiel Kenneth J. Phelan Lisa Wardell | ● Provides awareness and oversight of Adtalem’s external relations strategy, policy, and practices ● Monitors, analyzes, and effectively oversees legislative and regulatory policy trends, issues, and risks ● Develops recommendations to the Board regarding formulating and adopting policies, programs, and communications strategy related to legislative, regulatory, and reputational risk ● Oversees risks and exposures related to higher education public policy, as well as compliance with laws and regulations applicable to Adtalem ● Provides oversight regarding significant public policy issues including environmental, social, health and safety, and public and community affairs ● Reviews Adtalem’s impact strategy |

Meetings in FY25: 4 |

Nominating & Governance Committee

Members | Key Responsibilities |

Sharon O’Keefe Members: Donna Hrinak Georgette Kiser | ● Reviews Board and committee structures and leads the Board self-evaluation process ● Assesses Board needs and periodically conducts director searches and recruiting to ensure appropriate Board composition ● Recommends candidates for nomination as directors to the Board ● Oversees and conducts planning for director succession ● Recommends governance policies and procedures |

Meetings in FY25: 4 |

Adtalem Global Education Inc. | 2025 Proxy Statement 23 |

Board Leadership Structure

Our Governance Principles reflect the Board’s belief that it should have the latitude to select the Chairman of the Board and the CEO in the way that the Board deems in the best interest of Adtalem and its shareholders. To ensure continued Board independence, the Board has adopted a policy that, in the event the Chairman of the Board and CEO roles are combined, or the Chairman of the Board is not otherwise independent, the Board shall appoint a Lead Independent Director. In November 2024, the Board elected Mr. Beard, who has served as our president and Chief Executive Officer and on our Board since September 2021, as our Chairman. In accordance with our Governance Principles, the Board concurrently appointed Mr. Michael Malafronte to serve as our Lead Independent Director. In evaluating the Board’s leadership structure, the Board considered the relevant merits of combining the roles of Chairman of the Board and Chief Executive Officer and appointing a strong Lead Independent Director, compared with keeping the roles of Chairman of the Board and CEO separate. The Board concluded that Mr. Beard was the person best suited to serve as Chairman of the Board at this time, as he continues to lead Adtalem to unprecedented growth and impact as a leader in healthcare education and workforce development. In addition, the Board reaffirmed its commitment to independent Board leadership by appointing Mr. Malafronte as our Lead Independent Director, after his service as Chairman of the Board from November 2022 to November 2024.

Our Board believes that the existing structure, with Mr. Beard as Chairman and Mr. Malafronte as Lead Independent Director, continues to be the most effective leadership structure at this time. The Company benefits from an executive Chairman with deep experience in the healthcare education industry and knowledge of the Company’s emerging risks and issues that derives from close coordination with the management team. The combined CEO and Chairman role allows the Company to communicate its strategy to employees, students, regulators, shareholders, and other stakeholders in a single voice. The Company likewise benefits from a Lead Independent Director with deep experience as an investor and shareholder who communicates regularly with the Chairman, other members of the Company’s management team, and the other independent directors. We believe that the joint efforts and coordination between our Chairman and Lead Independent Director exemplify effective Board leadership and fulfillment of the Board’s oversight responsibilities.

During FY25, the Board met in executive session without employee directors or other employees present at each regular Board meeting. Mr. Malafronte, as Adtalem’s Lead Independent Director, presided over these sessions.

Our Governance Principles provide that when we have a Lead Independent Director, he or she:

| ● | sets the agenda for, calls meeting of and leads executive sessions of the independent directors and reports to the Executive Chairman of the Board, as appropriate, concerning such meetings; |

| ● | acts as a liaison between the Executive Chairman of the Board and the independent directors; |

| ● | advises the Executive Chairman of the Board as to the quality, quantity, and timeliness of the flow of information from management that is necessary for the independent directors to perform their duties effectively and responsibly; |

| ● | when appropriate, makes recommendations to the Executive Chairman of the Board about calling full meetings of the Board; |

| ● | serves as a resource to consult with the Executive Chairman of the Board and other Board members on corporate governance practices and policies and assumes the primary leadership role in addressing issues of this nature if, under the circumstances, it is inappropriate for the Executive Chairman of the Board to assume such leadership; and |

| ● | performs such other duties as requested by the Board or Nominating & Governance Committee and as set forth in the Governance Principles. |

Director Attendance

During FY25, our Board met five times. Each of Adtalem’s directors attended at least 75% of the meetings of the Board and Board committees on which they served that occurred during their respective time of service on the Board in FY25.

All of our directors who were directors at the time participated in the 2024 Annual Meeting of Shareholders, held virtually in November 2024. Our Board encourages all of its members to attend the Annual Meeting but understands there may be situations that prevent such attendance.

Director Continuing Education

Members of the Board are encouraged to participate in continuing education and enrichment classes and seminars. During FY25, the following directors attended the following classes and seminars: (i) Dr. Vandenbosch attended the Director’s Consortium at Stanford University’s Graduate School of Business; and (ii) Mr. Burke attended PwC’s Annual Corporate Directors Exchange. We also offer all of our directors a membership in NACD, an association for corporate board directors.

24 2025 Proxy Statement | Adtalem Global Education Inc. |

Board Self-Evaluation

Each year our Board undertakes a self-evaluation process to critically evaluate its performance and effectiveness. Each Board member also assesses the performance and contributions of all of their fellow Board members. Additionally, each committee conducts a self-evaluation to monitor its performance and effectiveness. The process is coordinated by the Board Chairman and the chair of the Nominating & Governance Committee. In FY25, the Board conducted the evaluation process with the assistance of Adtalem’s Legal Department. Board and committee members are asked to provide commentary about a variety of topics, including the following: overall Board performance, including strategy, challenges, and opportunities; Board and committee meeting logistics and materials; Board and committee culture; and human capital and succession planning. The results of the Board and evaluations were aggregated by Adtalem’s Legal Department and discussed at the Board’s Strategy Meeting in May 2025 and committee meetings in June 2025. The results of the peer evaluations are reviewed with the individual Board members by the Chairman.

Board Succession and Effectiveness

In FY25, our Board engaged Spencer Stuart, an international executive search and leadership advisory firm to work with our Board members and key management to support and enhance Adtalem’s work on board effectiveness and board succession. During FY23, our Board conducted a Board Composition Analysis (“Analysis”), part of which benchmarked Adtalem against a seven-company peer group, the overall S&P 500, and two companies identified as governance leaders. Adtalem was benchmarked against this group on financial performance, board demographics, committee structure, and board skills and competencies. The Analysis focused on the strategy-driven director criteria to inform future director recruitment. It reflected core experiences and expertise that would be additive to the Adtalem Board based on Company strategy. The Analysis provided the Board with a recruiting priority roadmap.

KEY BOARD RESPONSIBILITIES

Strategic Oversight

The Board actively reviews and provides oversight on Adtalem’s long-term strategy and annual operating plan. In 2024, our Board held an inaugural two-day offsite strategy retreat to conduct a deep analysis of Adtalem’s strategy, including goals, a timeline, and execution plans. These sessions provide a dedicated forum for an open exchange of ideas and viewpoints on Adtalem’s strategic direction and an opportunity to identify new opportunities and risks as management executes upon the Company’s strategy. The Board held its second annual two-day offsite strategy retreat in May 2025, covering topics including technology in health systems; disruptive technology in higher education; artificial intelligence in healthcare; healthcare talent; and healthcare and education market dynamics. Management reports its progress in executing on Adtalem’s strategies and operating plan throughout the year. In addition, throughout the year, segment leadership report to the Board regarding individual segment strategies and operating plans. The full Board has primary responsibility to review and provide oversight to management on our impact strategy, with support from our Audit and Finance, Compensation, External Relations, and Nominating & Governance Committees, each of which provides oversight for relevant areas such as risk, and talent strategies.

Risk Oversight

Adtalem’s full Board is responsible for assessing major risks facing Adtalem and overseeing management’s plans and actions directed toward the mitigation and/or elimination of such risk. The Board has assigned specific elements of the oversight of risk management of Adtalem to committees of the Board, as summarized below. Each committee meets periodically with members of management and, in some cases, with outside advisors regarding the matters described below and, in turn, reports to the full Board at least during each regular meeting regarding any findings.

Managing current and emerging business risks, from regulatory and market risks to global risks, is an important component of our governance and oversight system. Management undertakes a regular review of a broad set of risks across Adtalem’s business and operations to identify, assess, manage, and monitor existing and emerging threats and opportunities. Adtalem’s Enterprise Risk Management (“ERM”) team is responsible for leading our risk management program at the enterprise level. The ERM team places particular focus on key risks that have the potential for the highest impact to Adtalem and its operations, and the highest likelihood of risk occurrence based on Adtalem’s preparedness and potential impact to Adtalem’s strategy. As part of management’s proactive risk identification and mitigation efforts, the ERM team has developed Risk Appetite Statements for each critical enterprise risk. These Risk Appetite Statements provide a consistent framework to facilitate a shared and deepened understanding of risks across the enterprise and enable transparent communication and proactive risk management.

Adtalem Global Education Inc. | 2025 Proxy Statement 25 |

Board/Committee | Primary Areas of Risk Oversight |

Full Board | · Reputation · Legal and regulatory risk and compliance and ethical business practices · Strategic planning · Major organizational actions · Education public policy |

Academic | · Academic quality · Accreditation · Curriculum development and delivery · Student persistence · Student outcomes |

Audit and | · Accounting and disclosure practices · Information technology · Cybersecurity · Financial controls · Risk management policies and procedures · Legal and regulatory risk and compliance, including compliance and ethics program · Related party transactions · Capital structure ·Investments |

Compensation | · Compensation practices · Talent development · Retention · Management succession planning |

External | · Accreditation · Higher education public policy · Compliance with laws and regulations applicable to Adtalem · Public and community affairs |

Nominating & | · Corporate and institutional governance structures and processes · Board composition and function · Board and Chairman of the Board succession |

Succession Planning and Human Capital Management

The Board recognizes that one of its most important duties is to ensure continuity in Adtalem’s senior leadership by overseeing the retention and development of executive talent and planning for the effective succession of our CEO and the executive leadership team. To ensure that the succession planning and leadership development process supports and enhances our long-term strategic objectives, the Board periodically consults with our CEO and Chief Human Resources Officer (“CHRO”). Succession and development plans are regularly discussed with the CEO and CHRO as well as, without them present, in the executive session of the Board. The Board ensures that it has sufficient opportunity to meet with and assess development plans for potential CEO and senior management team successors and to consider external talent market opportunities.

26 2025 Proxy Statement | Adtalem Global Education Inc. |

Our Impact Commitment

advancing healthcare, education and opportunity

At Adtalem our Impact work is central to how we fulfill our mission to expand opportunity and improve lives. We take a comprehensive approach—shaped by our commitments to community engagement and strong governance—that allows us to contribute meaningfully to society while advancing our business strategy. Our institutions play a critical role in helping to address one of the most pressing challenges in U.S. healthcare today: workforce shortages. Adtalem is helping to close the gap by preparing practice-ready graduates in medicine, nursing, veterinary medicine, social work, and related fields. We are the number one grantor of nursing degrees and Master of Social Work degrees in the U.S., and our medical schools graduate more physicians annually than any U.S.-based institution. We expand access to education, strengthen clinical pathways, and partner directly with healthcare systems to meet the growing demand for qualified professionals.

Beyond the classroom, we invest in the communities where our students and colleagues live and work through philanthropic partnerships and grantmaking aligned with healthcare and education access, workforce development and meaningful scholarship programs that help reduce barriers to education and increase degree completion. These efforts reflect our belief that responsible action and long-term value creation go hand in hand.

More information on our Impact strategy and progress can be found at adtalem.com/sustainability.

Our Approach to Cybersecurity and Data Privacy

At Adtalem, safeguarding sensitive information about our students, employees, institutions, and operations is integral to our overall risk management strategy. Our Cyber Risk Management Framework is designed to strengthen our systems against potential risks or outside threats to foster the trust of our internal and external collaborators and partners.

We modeled our proprietary Enterprise Information Security Framework Policy and Information Governance and Security Procedures on the National Institute of Standards and Technology’s (NIST) 800-53 Framework. We manage information security in key areas such as cybersecurity, data privacy and information technology (IT) with functional teams that focus on their areas of expertise and collaborate on cross-disciplinary projects. We report to the Board on the maturity of our program in alignment with the updated NIST Cybersecurity Framework (NIST CSF v2.0).

We benchmark across verticals and perform internal and external reviews as part of our ongoing commitment to continuous improvement. Our IT environment and cybersecurity-related controls are reviewed by our internal audit function and external third parties. We obtain third-party assessments, including cyber risk reviews and penetration testing, to evaluate our cybersecurity program independently. To our knowledge, we have not experienced a significant information security breach in the past five years. We regularly conduct tabletop exercises to assess our preparedness for potential cyber attacks. In our most recent exercise, we simulated a ransomware attack with the executive leadership team participating to evaluate our response strategies.