.4

Go-Private Continental Employee Shareholder Information & FAQ

.4

Go-Private Continental Employee Shareholder Information & FAQ

Go-Private Continental Employee Shareholder Information & FAQ Dear Continental employees, We are thrilled to announce that an agreement has been reached on the “take private” offer from the Hamm Family. As we anticipate this exciting new chapter at Continental, and subject to the close of this transaction, we are pleased to provide the following information: 1 The sequence of events prior to transaction closing. 2 The actions you may take with your currently vested shares. 3 Tax considerations for employee shareholders on currently vested shares. 4 Treatment of unvested shares scheduled to vest in 2023, 2024 and 2025. Each is explained in this booklet so that you will know what to expect and what choices you have as we embark on this new journey. We are committed to communicating with you as more information becomes available. Bill Berry Chief Executive Officer Doug Lawler President & Chief Operating Officer Shelly Lambertz Executive Vice President, Chief Culture & Administrative Officer

Sequence of events prior to transaction closing Our best estimate is that the “take private” transaction will close by year-end. This will require a two-step process. First, there will be a tender offer, which is an offer to purchase shares other than those owned by the Hamm Family (“Offer to Purchase”). Second, after the Offer to Purchase is completed, any shares remaining and not tendered will automatically be cashed out in a merger. Whether you tender your shares or they are cashed out in the merger, you will receive your cash a few days after the merger is completed. Please note that Continental’s filings are subject to SEC review, and if Continental needs to respond to SEC comments, it could extend the time needed to close the tender offer and complete the merger. We will provide updates at the appropriate time, if needed. If you would like more detailed information regarding the process between now and closing, please review the Offer to Purchase when it is filed. The “Summary Term Sheet” portion of the Offer to Purchase will be set up in a Q&A format and should answer the most frequently asked questions. Detailed information about the tender offer and merger will also be contained in “The Offer” portion of the Offer to Purchase, including a summary of your rights under Oklahoma law as a Continental shareholder.

Actions you may take with your currently vested shares Your vested shares will be cashed out at a price of $74.28 per share in the tender offer, if you choose to tender your shares. Otherwise, your shares will be cashed out in the merger at $74.28 per share. More detailed information can be found in the Offer to Purchase, which will be an exhibit to CLR’s “Schedule TO,” expected to be filed within the next 7-10 business days. When the Offer to Purchase is filed, we will send a follow up email with a link to this filing, since it will contain important information regarding the tender offer and merger. Pending the closing of the tender offer and the merger, you are free to sell any vested shares on the open market, subject to existing blackout rules applicable to covered employees. Simply follow the usual procedures that apply to any sale of shares. As always, you are not permitted to sell any shares if you are in possession of any material non-public information.

Tax considerations for employee shareholders on currently vested shares As described above, there are three ways that your shares can be sold: 1 They can be tendered in response to the Offer to Purchase. 2 They can be held until the merger closes. 3 They can be sold on the open market before closing. Each of these alternatives will result in a taxable sale at the time of closing. The amount of tax you will need to pay will vary based on how long you have held your shares. No tax will be withheld f rom the amount you receive. Additional information regarding the tax implications of the Offer to Purchase can be found in materials you will receive in connection with the Offer to Purchase. For additional questions about the tax implications about a sale of your vested shares, please consult your tax advisor. It is important to note that there is no tax withholding when you sell your shares, regardless of whether they are tendered, sold on the open market or held until closing.

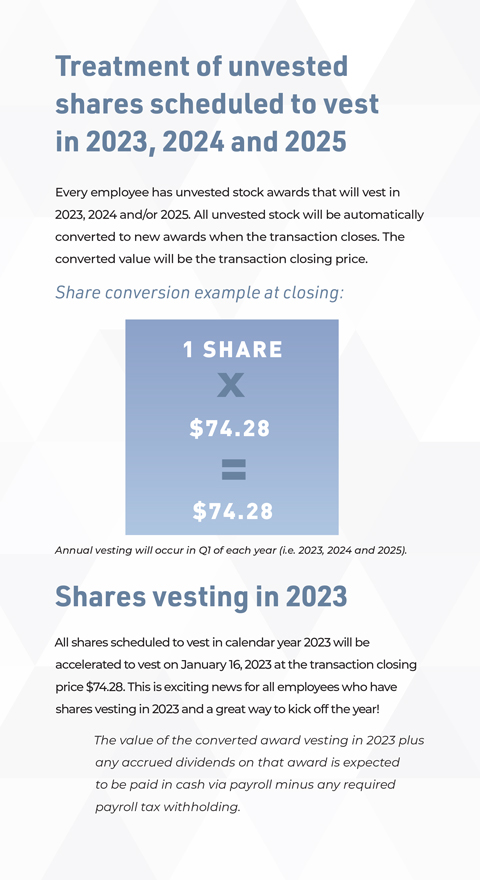

Treatment of unvested shares scheduled to vest in 2023, 2024 and 2025 Every employee has unvested stock awards that will vest in 2023, 2024 and/or 2025. All unvested stock will be automatically converted to new awards when the transaction closes. The converted value will be the transaction closing price. Share conversion example at closing: 1 SHARE X $74.28 = $74.28 Annual vesting will occur in Q1 of each year (i.e. 2023, 2024 and 2025). Shares vesting in 2023 All shares scheduled to vest in calendar year 2023 will be accelerated to vest on January 16, 2023 at the transaction closing price $74.28. This is exciting news for all employees who have shares vesting in 2023 and a great way to kick off the year! The value of the converted award vesting in 2023 plus any accrued dividends on that award is expected to be paid in cash via payroll minus any required payroll tax withholding.

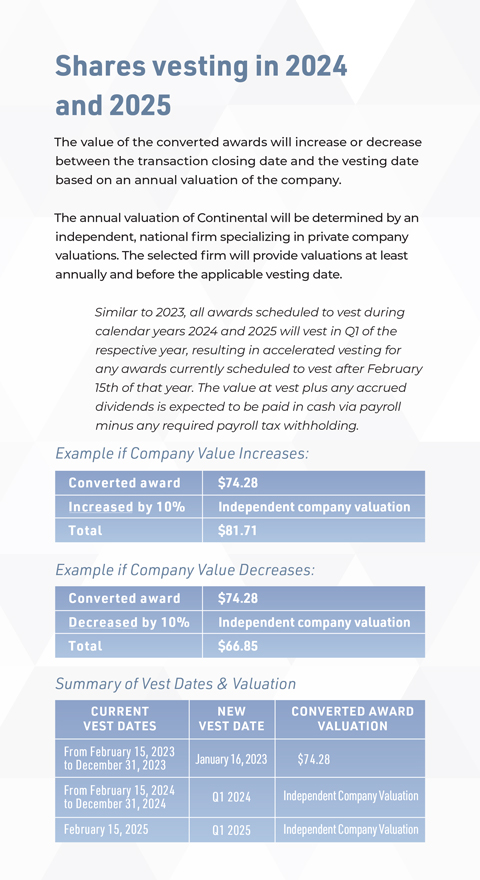

Shares vesting in 2024 and 2025 The value of the converted awards will increase or decrease between the transaction closing date and the vesting date based on an annual valuation of the company. The annual valuation of Continental will be determined by an independent, national firm specializing in private company valuations. The selected firm will provide valuations at least annually and before the applicable vesting date. Similar to 2023, all awards scheduled to vest during calendar years 2024 and 2025 will vest in Q1 of the respective year, resulting in accelerated vesting for any awards currently scheduled to vest after February 15th of that year. The value at vest plus any accrued dividends is expected to be paid in cash via payroll minus any required payroll tax withholding. Example if Company Value Increases: Converted award Increased by 10% Total $74.28 Independent company valuation $81.71 Example if Company Value Decreases: Converted award Decreased by 10% Total $74.28 Independent company valuation $66.85 Summary of Vest Dates & Valuation CURRENT VEST DATES From February 15, 2023 to December 31, 2023 From February 15, 2024 to December 31, 2024 February 15, 2025 NEW VEST DATE January 16, 2023 Q1 2024 Q1 2025 CONVERTED AWARD VALUATION $74.28 Independent Company Valuation Independent Company Valuation

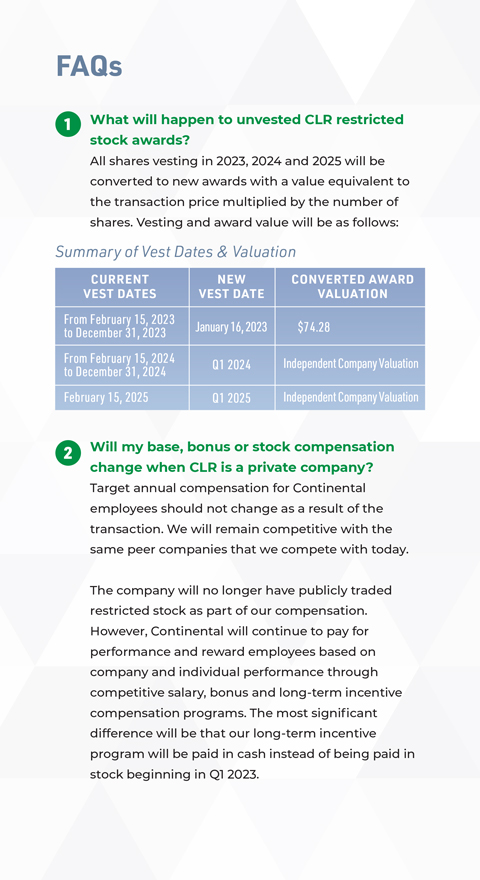

FAQs 1 What will happen to unvested CLR restricted stock awards? All shares vesting in 2023, 2024 and 2025 will be converted to new awards with a value equivalent to the transaction price multiplied by the number of shares. Vesting and award value will be as follows: Summary of Vest Dates & Valuation CURRENT VEST DATES From February 15, 2023 to December 31, 2023 From February 15, 2024 to December 31, 2024 February 15, 2025 NEW VEST DATE January 16, 2023 Q1 2024 Q1 2025 CONVERTED AWARD VALUATION $74.28 Independent Company Valuation Independent Company Valuation 2 Will my base, bonus or stock compensation change when CLR is a private company? Target annual compensation for Continental employees should not change as a result of the transaction. We will remain competitive with the same peer companies that we compete with today. The company will no longer have publicly traded restricted stock as part of our compensation. However, Continental will continue to pay for performance and reward employees based on company and individual performance through competitive salary, bonus and long-term incentive compensation programs. The most significant difference will be that our long-term incentive program will be paid in cash instead of being paid in stock beginning in Q1 2023.

3 Will my compensation result in ownership in CLR? No. Compensation will no longer be paid in shares of Continental stock. 4 Can I purchase shares or ownership in CLR? No. Employees will no longer be able to purchase shares of stock in Continental. 5 How will my compensation compare to compensation at public E&P companies? Employee compensation will continue to be competitive with the compensation for our existing peer group for base salary, bonus and LTI awards. The primary difference will be that LTI awards are expected to be paid in cash instead of stock. The new Compensation Program will be rolled out in the near future.