Please wait

The Toro Company0000737758DEF 14Afalseiso4217:USDxbrli:pure00007377582024-11-012025-10-3100007377582023-11-012024-10-3100007377582022-11-012023-10-3100007377582021-11-012022-10-3100007377582020-11-012021-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2024-11-012025-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2024-11-012025-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-11-012024-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2023-11-012024-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-11-012023-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2022-11-012023-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-11-012022-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2021-11-012022-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-11-012021-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2020-11-012021-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-11-012025-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-11-012025-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-11-012025-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-11-012024-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-11-012024-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-11-012024-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-11-012023-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-11-012023-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-11-012023-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-11-012022-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-11-012022-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-11-012022-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-11-012021-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-11-012021-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-11-012021-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ttc:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTablePreviouslyReportedMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-11-012025-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-11-012024-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-11-012023-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2021-11-012022-10-310000737758ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-11-012021-10-310000737758ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-11-012021-10-31000073775812024-11-012025-10-31000073775822024-11-012025-10-31000073775832024-11-012025-10-31000073775842024-11-012025-10-31000073775852024-11-012025-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☒ | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☐ | Soliciting Material under §240.14a-12 |

The Toro Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF 2026

ANNUAL MEETING AND

PROXY STATEMENT

MARCH 17, 2026

www.virtualshareholdermeeting.com/TTC2026

| | |

| |

| Worldwide Headquarters |

| 8111 Lyndale Avenue South |

| Bloomington, MN 55420-1196 |

| 952-888-8801 |

Dear Fellow Stockholders:

On behalf of The Toro Company Board of Directors and management team, we are pleased to invite you to join us for The Toro Company 2026 Annual Meeting of Stockholders to be held virtually on Tuesday, March 17, 2026 at 2:00 p.m., Central Daylight Time.

We have designed the virtual annual meeting to ensure that stockholders are afforded the same opportunity to participate as they would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform. Details about the annual meeting, nominees for election to the Board of Directors and other matters to be acted on at the annual meeting are presented in the notice and proxy statement that follow. Information regarding attending the virtual annual meeting can be found on page 90 of the proxy statement.

It is important that your shares are represented at the annual meeting, regardless of the number of shares you hold. Accordingly, please exercise your right to vote by following the instructions for voting contained in the Notice Regarding the Availability of Proxy Materials or the paper or electronic copy of our proxy materials you received for the meeting.

Thank you for your continued support of our Company.

Sincerely,

Richard M. Olson

Chairman of the Board and CEO

February 3, 2026

NOTICE OF 2026 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| Date: | Tuesday, March 17, 2026 |

| Time: | 2:00 p.m., Central Daylight Time |

| Location: | Virtual www.virtualshareholdermeeting.com/TTC2026 |

| | |

| Agenda: | 1. Election of directors: Dianne C. Craig, Eric P. Hansotia and D. Christian Koch for a term of three years ending at the 2029 Annual Meeting of Stockholders; |

| | 2. Ratification of the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending October 31, 2026; |

| | 3. Approval of, on an advisory basis, our executive compensation; |

| | 4. Approval of The Toro Company 2026 Equity Plan; |

| 5. Approval of an amendment to the Company's Restated Certificate of Incorporation to eliminate or limit the liability of officers as provided under Delaware law; |

| 6. Approval of an amendment to the Company's Restated Certificate of Incorporation to change the par value of all capital stock from $1.00 to $0.01 per share; and |

| 7. To transact any other business properly brought before the annual meeting or any adjournment or postponement of the annual meeting. |

We currently are not aware of any other business to be brought before the annual meeting. Stockholders of record at the close of business on January 20, 2026, the record date, will be entitled to vote at the annual meeting or at any adjournment or postponement of the annual meeting. A stockholder list will be made available at our principal executive offices during ordinary business hours beginning March 6, 2026, for examination by any stockholder registered on our stock ledger as of the record date for any purpose germane to the annual meeting.

Your vote is important. A majority of the outstanding shares of our common stock must be present either by attending the virtual meeting or by proxy to constitute a quorum for the conduct of business. Please promptly vote your shares by following the instructions for voting contained in the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic version of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet, telephone or mobile device voting as described on your proxy card.

February 3, 2026

| | |

| BY ORDER OF THE BOARD OF DIRECTORS |

|

Joanna M. Totsky Vice President, General Counsel and Corporate Secretary |

TABLE OF CONTENTS

| | | | | | | | |

| LETTER TO STOCKHOLDERS | | |

| NOTICE OF 2026 ANNUAL MEETING OF STOCKHOLDERS | | |

| EXECUTIVE SUMMARY | | |

| Business Overview | | |

| Highlights of Our Financial, Operational and Strategic Achievements for Fiscal 2025 | | |

| The Toro Company's Commitment to Sustainability | | |

| 2026 Annual Meeting of Stockholders | | |

| Meeting Agenda, Voting Matters and Recommendations | | |

| How to Cast Your Vote | | |

| Corporate Governance Highlights | | |

| Executive Compensation | | |

| Fiscal 2025 Executive Compensation Summary | | |

| PROXY STATEMENT | | |

PROPOSAL ONE—ELECTION OF DIRECTORS | | |

Board Size and Structure | | |

| Nominees for Director | | |

| Board Recommendation | | |

Information About Director Nominees and Continuing Directors | | |

DIRECTOR COMPENSATION | | |

Director Compensation Program for Fiscal 2025 | | |

| Director Compensation Highlights | | |

Director Compensation for Fiscal 2025 | | |

CORPORATE GOVERNANCE | | |

| Overview | | |

Corporate Governance Guidelines | | |

| Staggered Board Structure | | |

Policy Regarding Separation of Chair and CEO | | |

| Current Board Leadership Structure | | |

Director Attendance; Executive Sessions | | |

Board Committees | | |

Director Refreshment, Recruitment, Nomination and Qualifications | | |

Director Independence | | |

| Board and Committee Evaluations | | |

| Management Succession Planning | | |

| Director Orientation and Continuing Education | | |

Board's Role in Risk Oversight | | |

Executive Compensation Process | | |

Related Person Transactions and Policies and Procedures Regarding Related Person Transactions | | |

Board of Directors Business Ethics Policy Statement | | |

Code of Conduct and Code of Ethics for our CEO and Senior Financial Personnel | | |

Communications with Directors | | |

Complaint Procedures | | |

| | | | | | | | |

| Insider Trading Policy | | |

PROPOSAL TWO—RATIFICATION OF THE SELECTION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR FISCAL YEAR ENDING OCTOBER 31, 2026 | | |

Annual Evaluation and Selection of Independent Registered Public Accounting Firm | | |

Audit, Audit-Related, Tax and Other Fees | | |

Pre-Approval Policies and Procedures | | |

Board Recommendation | | |

Audit Committee Report | | |

PROPOSAL THREE—APPROVAL OF, ON AN ADVISORY BASIS, OUR EXECUTIVE COMPENSATION | | |

Background | | |

Our Pay Philosophy | | |

Best Practices | | |

Proposed Resolution | | |

Next Say-on-Pay Vote | | |

Board Recommendation | | |

COMPENSATION DISCUSSION AND ANALYSIS | | |

Executive Summary: Fiscal 2025 Incentive Compensation Changes | | |

Executive Summary: Fiscal 2025 Compensation Actions and Incentive Compensation Outcomes | | |

Compensation Philosophy | | |

Compensation Highlights and Best Practices | | |

Pay for Performance and Pay Mix | | |

Elements of Our Executive Compensation Program | | |

Employment, Severance and Change in Control Arrangements | | |

Stock Ownership Guidelines | | |

Anti-Hedging and Anti-Pledging | | |

Tax Considerations | | |

Risk Assessment | | |

Clawback Policy and Provisions | | |

Competitive Considerations and Use of Market Data | | |

How We Make Compensation Decisions | | |

Compensation & Human Resources Committee Report | | |

EXECUTIVE COMPENSATION | | |

Summary Compensation Table | | |

All Other Compensation for Fiscal 2025 | | |

Grants of Plan-Based Awards for Fiscal 2025 | | |

| Policies and Practices Related to the Grant of Certain Equity Awards Close in Time to the Release of Material Nonpublic Information | | |

| Outstanding Equity Awards at Fiscal Year-End for 2025 | | |

Option Exercises and Stock Vested for Fiscal 2025 | | |

Nonqualified Deferred Compensation for Fiscal 2025 | | |

| Pay Versus Performance (PvP) | | |

Potential Payments Upon Termination or Change in Control | | |

Pay Ratio Disclosure | | |

| | | | | | | | |

Compensation & Human Resources Committee Interlocks and Insider Participation | | |

PROPOSAL FOUR—APPROVAL OF THE TORO COMPANY 2026 EQUITY PLAN | | |

Proposed 2026 Equity and Incentive Plan | | |

| Reasons Why You Should Vote to Approve the 2026 Plan | | |

| Summary of Sound Governance Features of the 2026 Plan | | |

| Background for Shares Authorized for Issuance Under the 2026 Plan | | |

| Summary of the 2026 Plan Features | | |

| U.S. Federal Income Tax Information | | |

| New Plan Benefits | | |

| Board Recommendation | | |

| PROPOSAL FIVE—APPROVAL OF AMENDMENT TO COMPANY'S RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE OR LIMIT LIABILITY OF OFFICERS AS PROVIDED UNDER DELAWARE LAW | | |

| Overview of Proposed Exculpation Charter Amendment | | |

| Background of Proposed Exculpation Charter Amendment | | |

| Reasons for Proposed Exculpation Charter Amendment | | |

| Board Recommendation | | |

| PROPOSAL SIX—APPROVAL OF AMENDMENT TO COMPANY'S RESTATED CERTIFICATE OF INCORPORATION TO CHANGE PAR VALUE OF ALL CAPITAL STOCK FROM $1.00 to $0.01 PER SHARE | | |

| Overview of Proposed Par Value Amendment | | |

| Reasons for Proposed Par Value Amendment | | |

| Effect of Proposed Par Value Amendment | | |

| Timing and Effect of Proposed Par Value Amendment | | |

| Board Recommendation | | |

STOCK OWNERSHIP | | |

Significant Beneficial Owners | | |

Directors and Executive Officers | | |

Stock Ownership Guidelines | | |

Anti-Hedging and Anti-Pledging Policies | | |

Delinquent Section 16(a) Reports | | |

EQUITY COMPENSATION PLAN INFORMATION | | |

| GENERAL INFORMATION ABOUT THE 2026 ANNUAL MEETING AND VOTING | | |

| Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Tuesday, March 17, 2026 | | |

| When and Where Will the Annual Meeting Be Held? | | |

| Why is the Annual Meeting Being Held Virtually? | | |

| How Can I Attend the Virtual Annual Meeting? | | |

| What Are the Purposes of the Annual Meeting? | | |

| Are There Any Matters To Be Voted On at the Annual Meeting that Are Not Included in this Proxy Statement? | | |

| Who Is Entitled to Vote and How Many Shares Must Be Present to Hold the Annual Meeting? | | |

| How Do I Vote My Shares? | | |

| How Does the Board Recommend that I Vote and What Vote is Required for Each Proposal? | | |

| How Will My Shares Be Voted? | | |

| What Does It Mean If I Receive More Than One Notice or Set of Proxy Materials? | | |

| | | | | | | | |

| How Can I Revoke or Change My Vote? | | |

| Who Will Count the Votes? | | |

| How Will Business Be Conducted at the Annual Meeting? | | |

| How Can I Ask Questions In Advance of and During the Annual Meeting? | | |

OTHER INFORMATION | | |

Stockholder Proposals and Director Nominations for the 2027 Annual Meeting | | |

Householding of Annual Meeting Materials | | |

Annual Report | | |

Cost and Method of Solicitation | | |

| APPENDIX A - NON GAAP RECONCILIATIONS | | |

| APPENDIX B - THE TORO COMPANY 2026 EQUITY PLAN | | |

| APPENDIX C - OFFICER EXCULPATION AMENDMENT (in relevant part) | | |

| APPENDIX D - PAR VALUE AMENDMENT (in relevant part) | | |

_____________________

References in this proxy statement to:

•"TTC," "we," "us," "our," or the "Company" refer to The Toro Company;

•"Board" refer to the Board of Directors of TTC;

•"annual meeting" refer to our 2026 Annual Meeting of Stockholders;

•2025 Annual Report refer to our Annual Report to Stockholders for fiscal 2025, which includes our Annual Report on Form 10-K for the fiscal year ended October 31, 2025, being made available together with this proxy statement; and

•Restated Certificate of Incorporation refer to the Company's Restated Certificate of Incorporation, as amended.

Information on our website and any other websites referenced herein is not incorporated by reference into, and does not constitute a part of, this proxy statement.

Business Overview

The Toro Company, founded in 1914, is a leading global provider of solutions for the outdoor environment including turf and landscape maintenance, snow and ice management, underground construction, rental and specialty construction, and irrigation and outdoor lighting solutions. With its worldwide headquarters in Bloomington, Minnesota, The Toro Company's global presence extends to more than 125 countries through a family of brands that includes Toro, Ditch Witch, Exmark, BOSS, Ventrac, Tornado, HammerHead, American Augers, Spartan, Subsite, Radius, Hayter, Perrot, Unique Lighting Systems, Irritrol, and Lawn-Boy. Through constant innovation and caring relationships built on trust and integrity, The Toro Company and its family of brands have built a legacy of excellence by helping customers work on golf courses, sports fields, construction sites, public green spaces, commercial and residential properties and agricultural operations.

| | | | | | | | | | | | | | |

OUR PURPOSE To help our customers enrich the beauty, productivity and sustainability of the land. | | OUR VISION To be the most trusted leader in solutions for the outdoor environment. Every day. Everywhere. | | OUR MISSION To deliver superior innovation and to deliver superior customer care. |

| | |

OUR GUIDING PRINCIPLES Our success is founded on a long history of caring relationships based on trust and integrity. These relationships are the foundation on which we build market leadership with the best in innovative products and solutions to make outdoor environments beautiful, productive, and sustainable. We are entrusted to strengthen this legacy of excellence. |

Highlights of Our Financial, Operational and Strategic Achievements for Fiscal 2025

| | | | | |

Financial1 | |

| $4.51 billion | Net Sales Achieved $4.51 billion in total net sales, consisting of professional segment net sales of $3.62 billion, and residential segment net sales of $0.86 billion. |

| $4.20 | Adjusted Earnings Per Share Achieved adjusted diluted earnings per share, or Adjusted EPS, of $4.20 per share. |

| $0.38 share | Quarterly Cash Dividend Paid a $0.38 per share quarterly cash dividend, a 5.6% increase over our fiscal 2024 quarterly cash dividend, and announced a $0.39 per share quarterly cash dividend for fiscal 2026. |

| Operational | |

| ✓ | Sustainability Released our Fiscal 2024 Sustainability Report in June 2025, which highlights key achievements, metrics and sustainability goals through the lens of our Product, People and Process sustainability pillars. The report builds on our longstanding commitment to making a positive impact financially, socially and environmentally worldwide. |

| | | | | |

| Strategic | |

| ✓ | Accelerating Profitable Growth, Driving Productivity and Operational Excellence and Empowering our People Continued our key strategic priorities of accelerating profitable growth, driving productivity and operational excellence, and empowering our people. |

| ✓ | Research and Development Investment We invested $162.3 million in R&D initiatives. |

| ✓ | Continued Focus on Alternative Power, Smart-Connected Products and Autonomous Solutions Our creative, hard-working teams drove innovative advancements in technology, focusing on alternative power, smart-connected products and autonomous solutions. |

1 Certain measures are non-GAAP. A reconciliation of these non-GAAP measures to their most comparable GAAP measures can be found in Appendix A hereto. |

The Toro Company's Commitment to Sustainability

| | | | | |

✓ Deeply rooted in our purpose and strategic business priorities ✓ Continue to advance our sustainability goals through our focus on Product, Process and People, facilitated by Planning ✓ Demonstrate our commitment with an executive leadership role leading our efforts and enhancing our focus ✓ Released our Fiscal 2024 Sustainability Report in June 2025 ✓ Our priorities are in alignment with six United Nations Sustainable Development Goals to address environmental and social issues globally ✓ Conducted an ESG double materiality assessment and Environmental Scenario Analysis to engage internal and external stakeholders to confirm our sustainability priorities |

For additional information about our commitment to sustainability, please see our most recent Sustainability Report, which is available on our website at www.thetorocompany.com under the Sustainability tab.

2026 Annual Meeting of Stockholders

| | | | | | | | | | | | | | |

Date and Time Tuesday, March 17, 2026 2:00 p.m. CDT | | Location www.virtualshareholdermeeting.com/TTC2026 | | Record Date January 20, 2026 |

Meeting Agenda, Voting Matters and Recommendations

| | | | | | | | | | | |

Proposal One Election of directors: Dianne C. Craig, Eric P. Hansotia and D. Christian Koch for a term of three years ending at the 2029 Annual Meeting of Stockholders. | ☑ | FOR each nominee | |

| | | | |

Proposal Two Ratification of the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending October 31, 2026. | ☑ | FOR | |

| | | | |

Proposal Three Approval of, on an advisory basis, our executive compensation. | ☑ | FOR | |

| | | |

Proposal Four Approval The Toro Company 2026 Equity Plan. | ☑ | FOR | |

| | | |

Proposal Five Approval of an amendment to the Company's Restated Certificate of Incorporation to eliminate and limit the liability of officers as provided under Delaware Law. | ☑ | FOR | |

| | | |

Proposal Six Approval of an amendment to the Company's Restated Certificate of Incorporation to change the par value of all capital stock from $1.00 to $0.01 per share. | ☑ | FOR | |

How to Cast Your Vote

Your vote is important! Please vote your shares promptly using one of the methods listed below. See page 91 for additional voting information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

By Internet Go to www.proxyvote.com | | By Phone Call 800-690- 6903 | | By Mail Return your proxy card | | By Mobile Device Scan the QR code

| | By Attending the Meeting Virtually Visit: www.virtualshareholdermeeting.com/TTC2026 |

| | | | | | | | |

Corporate Governance Highlights

The Toro Company is committed to strong corporate governance practices. Highlights of the Company’s corporate governance practices include:

| | | | | |

| Board of Directors |

✓ | Independent Board (other than CEO), with 100% independent Board committees |

✓ | Effective lead independent director structure |

✓ | Director resignation policy |

✓ | Annual Board and Committee self-evaluations |

✓ | Limits on public company board and audit committee service |

✓ | Regular executive sessions of independent directors, typically at each meeting |

✓ | Ongoing Board refreshment with three new independent directors added in the last five years |

✓ | Board skills and experience have continued to evolve with strategy, with appropriate mix of skills, backgrounds and tenure |

| | | | | | | | |

✓ Anti-hedging and anti-pledging policy ✓ Clawback policy ✓ Codes of conduct and ethics ✓ Comprehensive director onboarding process ✓ Stock ownership guidelines | | ✓ Meaningful Board oversight of strategy, risk and sustainability ✓ Effective director continuing education program ✓ Board access to management ✓ No poison pill ✓ Robust insider trading program |

| |

| |

| |

| |

| |

| | | | | | | | |

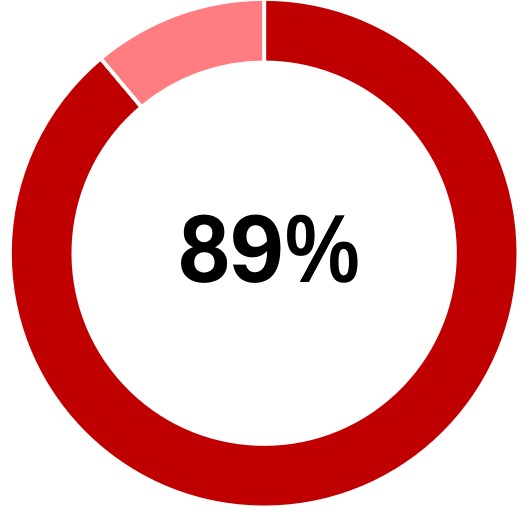

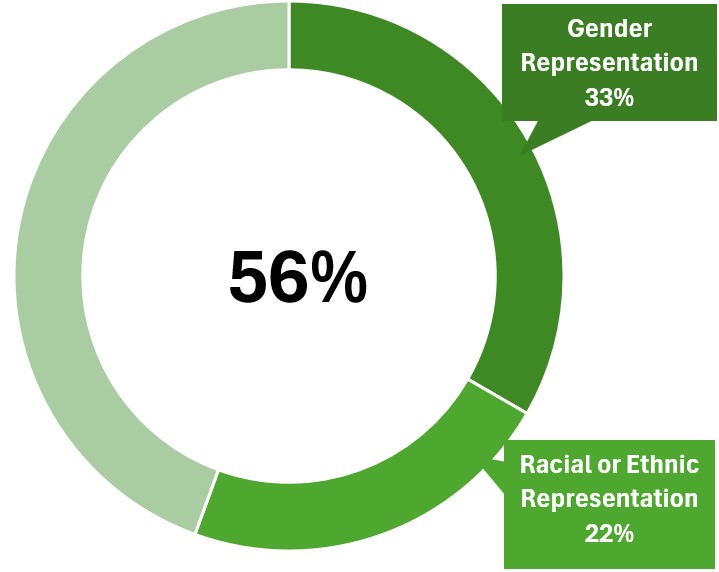

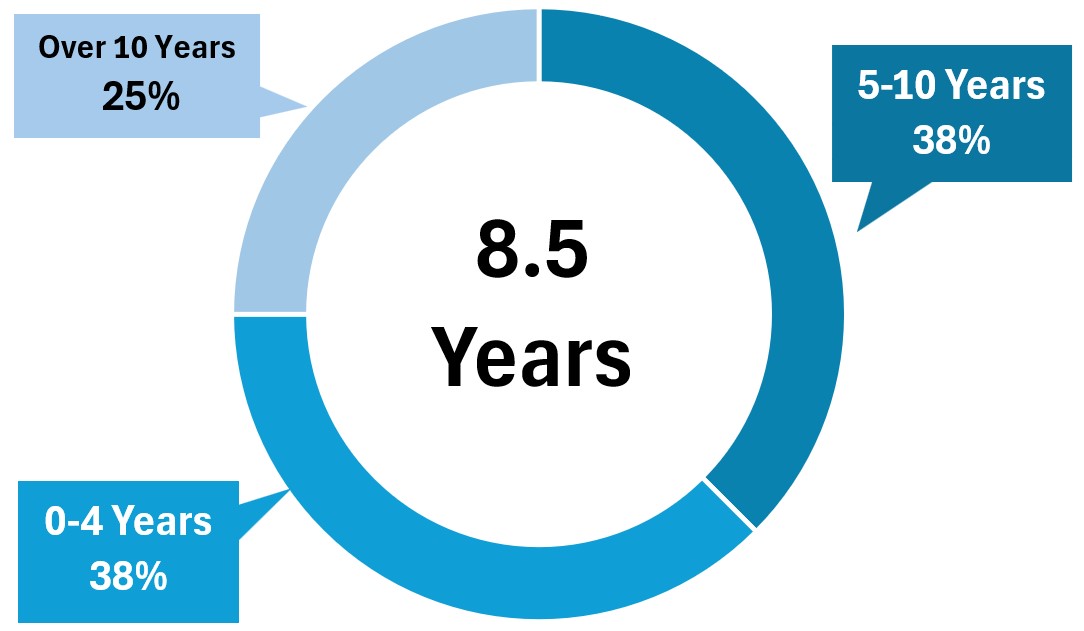

| Independent Directors | Gender, Racial or Ethnic Representation (rounded) | Average Tenure

(Independent Directors) |

| | |

Executive Compensation

| | |

Executive Compensation Program Philosophy Our executive compensation philosophy is to maintain programs and plans that allows us to attract, retain, motivate and reward highly qualified and talented executive officers. |

| | | | | | | | | | | | | | |

Align interests of executive officers with stockholder interests | | Link pay to performance | | Provide competitive target total direct compensation opportunities |

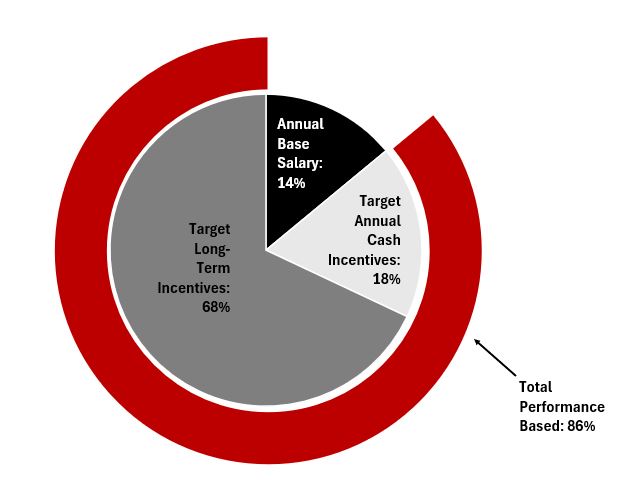

Fiscal 2025 Executive Compensation Summary

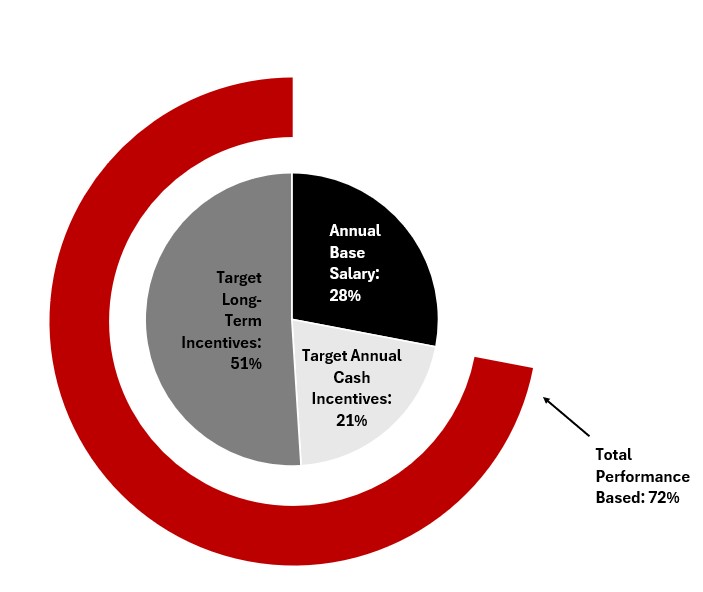

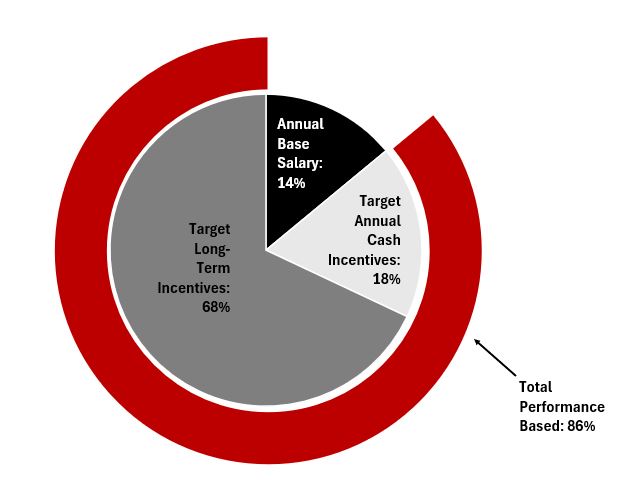

We seek to motivate executive officers to achieve improved financial performance of our Company through incentive plans that reward better performance with increased incentive payouts and hold executive officers accountable for financial performance that falls below targeted levels by paying reduced or no incentive payouts. Accordingly, a significant portion of the target total direct compensation for our Chairman and CEO and other executive officers is comprised of short- and long-term variable performance-based, or at risk, compensation to directly link their pay to performance. Generally, higher level executive positions have a higher level of pay that is performance-based.

The breakdown of variable, at-risk, pay (broken out between target annual cash incentives and target long-term incentives) compared fixed pay (i.e., annual base salary) for our Chairman and CEO and other Named Executive Officers is shown below:

| | | | | | | | |

Chairman and CEO

Target Total Direct Compensation Mix | | All Other Named Executive Officers

Target Total Direct Compensation Mix |

| | |

| | | | | | | | |

| What we do | ✓ | Emphasize long-term performance in our equity-based incentive awards |

| ✓ | Use a mix of performance measures in our incentive plans |

| ✓ | Establish threshold levels of performance and caps on payouts |

| ✓ | Maintain a robust clawback policy and provisions |

What we don't do | Х | No guaranteed base salary increases |

| Х | No guaranteed incentives or bonuses |

Х | No excessive perquisites |

Х | No individual executive employment agreements |

Х | No gross-up payments |

| | |

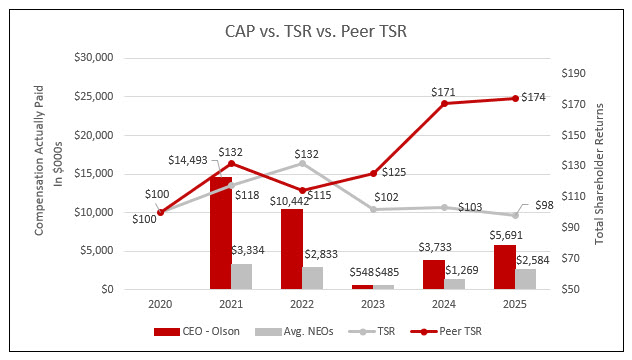

| Our fiscal 2025 financial performance resulted in the following: |

| Annual cash incentives at the corporate level were paid at 81.6% of target. |

Three-year performance awards for the fiscal 2023 to fiscal 2025 performance period

were paid at 22.2% of target. |

THE TORO COMPANY

8111 Lyndale Avenue South

Bloomington, Minnesota 55420-1196

PROXY STATEMENT

2026 ANNUAL MEETING OF STOCKHOLDERS

TUESDAY, MARCH 17, 2026

2:00 p.m. Central Daylight Time

The Toro Company Board of Directors is using this proxy statement to solicit your proxy for use at The Toro Company 2026 Annual Meeting of Stockholders. We intend to send a Notice Regarding the Availability of Proxy Materials for the annual meeting and make proxy materials available to stockholders (or for certain stockholders and for those who request, a paper version of this proxy statement and the form of proxy) on or about February 3, 2026.

| | |

| PROPOSAL ONE—ELECTION OF DIRECTORS |

Board Size and Structure

Our Restated Certificate of Incorporation provides that our Board of Directors may be comprised of between eight and twelve directors. Currently, our Board is comprised of nine directors until the Board determines to change the number. As provided in our Restated Certificate of Incorporation, our Board is divided into three staggered classes of directors of the same or nearly the same number, with each class elected in a different year for a term of three years. Our current directors and their respective current terms are as follows:

| | | | | | | | |

Current Term Ending at 2026 Annual Meeting | Current Term Ending at 2027 Annual Meeting | Current Term Ending at 2028 Annual Meeting |

| Dianne C. Craig | Gary L. Ellis | Jeffrey L. Harmening |

| Eric P. Hansotia | Richard M. Olson | Joyce A. Mullen |

| D. Christian Koch | Jill M. Pemberton | James C. O'Rourke |

Nominees for Director

The Board has nominated Dianne C. Craig, Eric P. Hansotia and D. Christian Koch to serve three-year terms expiring at the 2029 annual meeting. Each director nominee is a current member of the Board and has consented to serve if elected. Proxies only can be voted for the number of persons named as nominees in this proxy statement, which is three.

If prior to the annual meeting the Board learns that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for that nominee will be voted for a substitute nominee as selected by the Board. Alternatively, at the Board's discretion, the proxies may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that any of the three nominees will be unable to serve.

| | | | | |

| The Board of Directors Recommends a Vote FOR Each Nominee for Director | ☑ |

Information About Director Nominees and Continuing Directors

The following pages provide information about the nominees for election to the Board at the annual meeting, each of whom is a current Board member, and each of the other continuing members of the Board.

All of our director nominees and continuing directors bring to our Board a wealth of executive leadership experience as well as personal and professional integrity; appropriate levels of education and business experience; strong business acumen; an appropriate level of understanding of our business, industries and other relevant industries; the ability and willingness to devote adequate time to the work of our Board and its committees; a fit of skills and personality with those of our other directors that helps build a Board that is effective, collegial and responsive to the needs of our Company; strategic thinking acumen and a willingness to share ideas; a diversity of experiences, expertise, cultures and backgrounds; and the ability to represent the interests of all our stockholders.

The Board considers the following skills and experience to be integral to the success of our Company:

| | | | | | | | |

Current/Former CEO. Current or former experience as a chief executive officer is important for providing unique insights on complex global organizations, strategy, risk management, and how to drive change and growth. Finance/Financial Oversight. A strong understanding of accounting and finance is important in critically evaluating our performance and overseeing the integrity of our financial reporting. Corporate Governance. Experience with corporate governance, including with public company boards, fosters a deep understanding of the duties and responsibilities of a public company board of directors, promotes efficient and effective board processes, and enhances board effectiveness, which ultimately supports our goals of independent oversight, strong Board and management accountability, transparency, and long-term stockholder value. Manufacturing/Supply Chain/Operations. Experience in manufacturing, supply chain and operations is important for providing oversight of optimal manufacturing processes, supplier relationships and the capital needs of the Company. Distribution Channel. Understanding our distribution channel is key to providing important perspectives on our relationships with our distribution partners. Strategic Planning and Business Development. Strong strategic planning experience, including technology, is vital to assisting us with our short- and long-term strategic planning and key strategic decisions, including identifying growth opportunities, expanding market presence, building strategic partnerships and executing high-impact initiatives. Regulatory/Government. Significant governmental and policymaking experience play an increasingly important role on our Board as our products become more heavily regulated. | | Risk Management. Experience with risk management and compliance develops a director’s ability to appreciate, anticipate and effectively oversee risks, which is critical to the Board’s role in overseeing the risks facing the Company. Health and Safety. Ability to provide oversight of our manufacturing operations and employee programs supports our focus on a culture of wellness and safety in our manufacturing facilities and office environments. Sustainability/Climate. Our commitment to integrating sustainability considerations across our businesses is enhanced by the Board’s ability to support these efforts. Mergers and Acquisitions (M&A) and Other Transactions. Experience with M&A and other similar transactions, including divestitures, joint ventures and other partnerships, is critical to sound decisions for strategically pursuing acquisitions that are complementary to our businesses and growing our customer base and geographic penetration. International Operations. Experience with international operations is important in light of our global footprint and desire to grow our international business. Information Systems/Cybersecurity/Artificial Intelligence. Board oversight of our information systems, cybersecurity risk and use of artificial intelligence is critical in light of the increasing prevalence of cyber attacks, and evolving uses of artificial intelligence, that could result in reputational, legal, and operational issues for the Company. Previously Resided Outside the United States. A solid understanding of our global workforce and customers assists the Company with further developing our international strategy. |

The chart below summarizes the key experience of each director nominee and continuing director in these critical areas, and provides certain demographic information. Each director also contributes other important skills, knowledge, experience, viewpoints, and perspectives to our Board that are not reflected in the chart below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Experience as an Executive Leader in the Following Areas | Dianne

Craig | Gary Ellis | Eric

Hansotia | Jeffrey Harmening | D. Christian Koch | Joyce

Mullen | Richard Olson | James O'Rourke | Jill Pemberton |

| Current/Former CEO | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Finance/Financial Oversight | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Corporate Governance | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Manufacturing/Supply Chain/ Operations | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Distribution Channel | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | | ✓ |

| Strategic Planning and Business Development | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Regulatory/Government | ✓ | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Risk Management | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Health and Safety | ✓ | | | ✓ | ✓ | | ✓ | ✓ | |

| Sustainability/Climate | | ✓ | ✓ | ✓ | | | | | |

| M&A and Other Transactions | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| International Operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Information Systems/ Cybersecurity/Artificial Intelligence | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Previously Resided Outside the United States | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ |

| Demographics | | | | | | | | | |

| Race/Ethnicity Representation | | | ✓ | | | | | | ✓ |

| Gender Representation | ✓ | | | | | ✓ | | | ✓ |

| Age | 61 | 69 | 57 | 59 | 61 | 63 | 62 | 65 | 55 |

| Tenure (Years) | 2 | 20 | 4 | 7 | 10 | 7 | 10 | 14 | 4 |

Director Retirement Policy. Pursuant to the Company's Corporate Governance Guidelines, directors are not expected to be nominated for election or re-election to the Board after their seventieth (70th) birthday. However, upon the recommendation of the Nominating and Governance Committee, the Board may nominate director candidates who have reached their seventieth (70th) birthday, if it determines that doing so is in the best interest of the Company.

Director Resignation Policy. Pursuant to the Company's current Amended and Restated Bylaws, any director nominee in an uncontested election as to whom a majority of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors are designated to be “withheld” from or are voted “against” that director shall tender a resignation for consideration by the Nominating and Governance Committee. The Nominating and Governance Committee shall evaluate and recommend to the Board the action to be taken with respect to such tendered resignation.

The information presented on the following pages regarding each director nominee or continuing director also sets forth specific experience, qualifications, attributes and skills that led our Board to conclude that such director should serve as a director in light of our business and structure.

Director Nominees for Election to the Board for a Term Ending at the 2029 Annual Meeting

| | | | | | | | | | | |

Dianne C. Craig Age 61 Director since 2024 Independent Committees •Audit •Finance

| | Background |

| Dianne C. Craig was President of Lincoln, the luxury vehicle division of Ford Motor Company, Dearborn, Michigan (a designer, manufacturer and servicer of cars, trucks, sport utility vehicles and electric vehicles worldwide) until her retirement in April 2025. She held the following positions, all at Ford Motor:

•President, Lincoln (December 2022 - April 2025) •President, International Markets, Thailand (January 2021 – November 2022) •Chief Executive Officer, FordDirect (June 2018 – December 2020) •Executive Director, U.S. Sales (December 2016 – May 2018) •Chief Executive Officer, Ford Motor Company of Canada (November 2011 – November 2016 Qualifications |

| Ms. Craig brings to our Board a deep and diverse range of executive leadership experience in an industry applicable to our Company. She contributes a strategic perspective on digital technologies, brand enhancements and international operations. Furthermore, her extensive background in channel strategy, building dealer relationships and delivering best-in-class marketing solutions brings expertise in areas critical to the ongoing success of our Company. Other Public Company Boards |

| | Current | Past 5 Years |

| | None | None |

| | | | | | | | | | | |

Eric P. Hansotia Age 57 Director since 2022 Independent Committees •Compensation & Human Resources •Nominating and Governance

| | Background |

| Eric P. Hansotia is the Chairman, President and Chief Executive Officer of AGCO Corporation, Duluth, Georgia (a global leader in the design, manufacture and distribution of agricultural solutions). He holds or held the following positions at AGCO:

•Chairman, President and Chief Executive Officer (since January 2021) •Chief Operating Officer (January 2019 – December 2020) •Senior Vice President, Global Crop Cycle and Fuse Connected Services (January 2015 – January 2019) •Senior Vice President, Global Harvesting and Advanced Technology Solutions (July 2013 – January 2015)

Prior to joining AGCO, Mr. Hansotia spent 20 years at Deere & Company in various leadership positions, including at the senior vice president, vice president and general manager levels. Qualifications |

| Mr. Hansotia brings to our Board deep industry experience and a strong strategic perspective and extensive executive leadership experience in areas critical to our Company's success, including engineering, quality, technology transitions and opportunities, manufacturing, product management, mergers and acquisitions, channel development, and public company governance. He has significant international experience gained from leading global manufacturing and supply chain functions. Other Public Company Boards |

| | Current | Past 5 Years |

| | AGCO Corporation | None |

| | | | | | | | | | | |

D. Christian Koch Age 61 Director since 2016 Independent Committees •Compensation & Human Resources •Nominating and Governance (Chair)

| | Background |

| D. Christian Koch is the Chair, President and Chief Executive Officer of Carlisle Companies Incorporated, Scottsdale, Arizona (a portfolio of building product businesses). He holds or held the following positions, all at Carlisle:

•Chairman (since May 2020) •Chief Executive Officer (since January 2016) •President (since May 2014) •Chief Operating Officer (May 2014 – January 2016) •Group President, Carlisle Diversified Products (June 2012 – May 2014) •President, Carlisle Brake & Friction (January 2009 – June 2012) •President, Carlisle Asia-Pacific (February 2008 – January 2009) Qualifications |

| Mr. Koch brings to our Board his experience as a seasoned executive with strong business acumen and significant experience managing distribution, supply chain, manufacturing and sales operations around the world as well as with mergers and acquisitions and long-range planning. In addition, as a public company director and executive, Mr. Koch contributes a solid understanding of financial oversight, strategic planning, executive compensation, talent development and corporate governance. Other Public Company Boards |

| | Current | Past 5 Years |

| | Carlisle Companies Inc. | None |

Continuing Members of the Board — Current Term Ending at the 2027 Annual Meeting

| | | | | | | | | | | |

Gary L. Ellis Age 69 Director since 2006 Lead Independent Director Committees •Audit •Finance

| | Background |

| Gary L. Ellis retired from Medtronic plc, Dublin, Ireland (a global medical technology company). He held the following positions, all at Medtronic: •Executive Vice President, Global Operations, Information Technology and Facilities & Real Estate (June 2016 – December 2016) •Executive Vice President and Chief Financial Officer (April 2014 – June 2016) •Senior Vice President and Chief Financial Officer (May 2005 – April 2014) •Vice President, Corporate Controller and Treasurer (October 1999 – May 2005) Qualifications |

| Mr. Ellis brings extensive financial leadership experience to provide oversight regarding capital structure, financial condition and policies, long-range financial objectives, tax strategies, financing requirements and arrangements, capital budgets and expenditures, risk-management, insurance coverage and strategic planning matters. As our lead independent director, he provides balanced, collaborative and challenging support to both the Board and our Chairman and CEO. Mr. Ellis contributes enhanced knowledge of public company requirements and issues. Additionally, Mr. Ellis contributes his experience managing worldwide financial operations and analyzing financial implications of merger and acquisition transactions, as well as aligning business strategies and financial decisions. Other Public Company Boards |

| | Current | Past 5 Years |

| | Inspire Medical Systems, Inc. | Hill-Rom Holdings, Inc. |

| | | | | | | | | | | |

Richard M. Olson Age 62 Director since 2016 Committees None

| | Background |

| Richard M. Olson is our Chairman of the Board and Chief Executive Officer. He holds or held the following positions, all at The Toro Company: •Chairman (since November 2017) •Chief Executive Officer (since November 2016) •President (September 2015 - August 2025) •Chief Operating Officer (September 2015 – October 2016) •Group Vice President, International Business, Micro Irrigation Business and Distributor Development (June 2014 – September 2015) •Vice President, International Business (March 2013 – June 2014) •Vice President, Exmark (March 2012 – March 2013) Qualifications |

| In his nearly 40 years with our Company, Mr. Olson has developed and brings to our Board rich knowledge of the Company, including, in particular, our global businesses and operations, manufacturing processes, supply chain, distribution and channel development, and product development strategies. In addition, the broad experience he has gained through his past leadership of various businesses and manufacturing operations provides him with a unique perspective regarding our growth initiatives and strategic direction. He contributes a deep commitment to quality, technological advancements, innovation, sustainability, culture, ethical values and business conduct, and focus on customer service. As a result of his dual role as Chairman and CEO, Mr. Olson provides unique insight into our Company's future strategies, opportunities and challenges and serves as a unifying element between our Board and management. Other Public Company Boards |

| | Current | Past 5 Years |

| | Donaldson Company, Inc. | None |

| | | | | | | | | | | |

Jill M. Pemberton Age 55 Director since 2022 Independent Committees •Audit (Chair) •Finance | | Background |

| Jill M. Pemberton is the Chief Financial Officer, North America of LVMH Moët Hennessy Louis Vuitton, Paris, France (a global luxury product company), a position she has held since July 2020. Prior to her current role, she held the following positions:

•Senior Vice President, Corporate Financial Planning & Analysis, Viacom Inc. (now known as Paramount Global, a leading global media company) (July 2019 – January 2020) •Vice President, Finance, Source COE, Supply Chain (February 2017 – June 2019); Vice President, Finance, Global Franchise Organization, Consumer (March 2014 – February 2017; and Vice President, Finance (September 2013 – March 2014), all at Johnson & Johnson (a global health care company)

Prior to these roles, Ms. Pemberton served in various finance roles of increasing responsibility at the Kraft Heinz Company, Delta Air Lines, Inc. and ZF Group Inc. She holds a Directorship Certification from the National Association of Corporate Directors. Qualifications |

| Ms. Pemberton brings to our Board strong and broad financial experience and acumen, enterprise risk management knowledge including relating to cybersecurity and business continuity, investor perspective, strong brand experience and sourcing and supply chain oversight. In addition, she contributes a strategic perspective, with significant acquisition and integration experience, all of which assists our Board in providing guidance and oversight in these areas. Other Public Company Boards |

| | Current | Past 5 Years |

| | None | None |

Continuing Members of the Board — Current Term Ending at the 2028 Annual Meeting

| | | | | | | | | | | |

Jeffrey L. Harmening Age 59 Director since 2019 Independent Committees •Audit •Finance (Chair)

| | Background |

| Jeffrey L. Harmening is the Chairman and Chief Executive Officer of General Mills, Inc., Minneapolis, Minnesota (a global manufacturer, marketer and supplier of food products). He holds or held the following positions, all at General Mills:

•Chairman (since January 2018) •Chief Executive Officer (since June 2017) •President and Chief Operating Officer (July 2016 – May 2017) •Executive Vice President, Chief Operating Officer, U.S. Retail (May 2014 – June 2016) •Senior Vice President, Chief Executive Officer, Cereal Partners Worldwide (July 2012 – April 2014) Qualifications |

| Mr. Harmening brings to our Board extensive experience as a seasoned executive with strong business and financial acumen and experience implementing the strategic direction for a complex and publicly traded company with extensive distribution channels and supply chain operations. Furthermore, he brings experience in driving growth through customer-valued products and acquisitions and expertise in driving employee engagement through creating a culture of belonging. He demonstrates strong business discipline and commitment to best practices. In addition, he has significant experience managing operations around the world, including having lived in Europe for six years during his tenure at General Mills. Other Public Company Boards |

| | Current | Past 5 Years |

| | General Mills, Inc. | None |

| | | | | | | | | | | |

Joyce A. Mullen Age 63 Director since 2019 Independent Committees •Compensation & Human Resources •Nominating and Governance

| | Background |

| Joyce A. Mullen is the President and Chief Executive Officer of Insight Enterprises, Inc., Chandler, Arizona (an information technology company). She holds or has held the following positions at Insight: •President and Chief Executive Officer (since January 2022) •President of North American Businesses (October 2020 – December 2021) Previously, Ms. Mullen held various positions over a 21-year career at Dell Technologies (a digital technology solutions company), including: •President, Global Channel, OEM and IoT (November 2017 – August 2020) •Senior Vice President and General Manager, Global OEM and IoT Solutions (February 2015 – November 2017) •Vice President and General Manager, Global OEM Solutions (February 2012 – February 2015) Ms. Mullen also spent 10 years in leadership positions at Cummins Engine Company, including distribution, manufacturing and international business development. Qualifications |

| Ms. Mullen brings to our Board significant executive leadership skills, technology and smart-connected products expertise, strategic and innovative thinking and strong international business experience. She also offers a valuable perspective with regard to evaluating and supporting talent. Additionally, she contributes substantial knowledge of worldwide manufacturing, distribution channels, cybersecurity, digital product development and supply chain strategies, including improving efficiencies in manufacturing operations using Six Sigma, Kaizen and Lean techniques. Other Public Company Boards |

| | Current | Past 5 Years |

| | Insight Enterprises, Inc. | None |

| | | | | | | | | | | |

James C. O'Rourke Age 65 Director since 2012 Committees •Compensation & Human Resources (Chair) •Nominating and Governance

| | Background |

| James C. O’Rourke served as Senior Advisor to The Mosaic Company, Tampa, Florida (a global producer and marketer of combined concentrated phosphate and potash crop nutrients for the global agriculture industry) until his retirement in June 2024. He held the following positions, all at The Mosaic Company: •Chief Executive Officer (August 2015 – December 2023) •President (August 2015 – August 2023) •Executive Vice President—Operations and Chief Operating Officer (August 2012 – August 2015) •Executive Vice President—Operations (January 2009 – August 2012) Qualifications |

| Mr. O'Rourke brings to our Board significant leadership skills, strategic and innovative thinking from a former chief executive officer perspective and strong international business expertise. He also contributes substantial knowledge of worldwide manufacturing, distribution and supply chain strategies and environmental, health and safety matters. In addition, as a public company director and executive, Mr. O'Rourke contributes a solid understanding of executive compensation and corporate governance matters. Other Public Company Boards |

| | Current | Past 5 Years |

| | Rio Tinto plc | The Mosaic Company |

| | Weyerhaeuser Company | |

Director Compensation Program for Fiscal 2025

Overview. Our non-employee director compensation program is designed to attract and retain experienced and knowledgeable directors and align the interests of our directors with those of our stockholders. In fiscal 2025, our non-employee director compensation was comprised of cash compensation, in the form of annual retainers, and equity compensation, in the form of annual stock awards and stock options. If desired, a director could elect to receive the cash compensation in the form of a stock award, causing a substantial portion of our non-employee director compensation to be linked to our stock performance. Each component of our non-employee director compensation is described in more detail below. All equity-based compensation paid to our non-employee directors is granted under our then current stockholder-approved plan. As an employee director, Mr. Olson does not receive any additional compensation for his service as a director.

Process for Consideration and Determination of Director Compensation. The Board has delegated to the Compensation & Human Resources Committee the responsibility, among other things, to review and recommend to the Board any proposed changes in non-employee director compensation. The Committee typically engages an independent external compensation consultant to assist the Committee in this regard.

The Compensation & Human Resources Committee engaged Willis Towers Watson to review our non-employee director compensation program for fiscal 2025. Willis Towers Watson's review consisted of, among other things, analysis of board and committee compensation trends, a competitive assessment based on a selected group of manufacturing companies operating in the United States that are similar in size to us from a revenue and market capitalization perspective, and a separate analysis of lead director compensation. For fiscal 2025, the Board, upon recommendation of the Compensation & Human Resources Committee approved certain changes, including a $10,000 increase to the annual stock award and a $1,500 increase to each of the annual retainers for the Finance Committee and the Nominating and Governance Committee Chair.

Elements of Our Non-Employee Director Compensation Program. The following table sets forth our fiscal 2025 non-employee director compensation program.

| | | | | |

| Non-Employee Director Compensation | ($) |

| Annual Stock Award Value | 95,000 |

| Annual Stock Option Award Value | 55,000 |

| Annual Board and Committee Member Retainers | |

| Board | 95,000 |

| Audit Committee Member | 12,500 |

| Compensation & Human Resources Committee Member | 7,000 |

| Nominating and Governance Committee Member | 6,000 |

| Finance Committee Member | 6,000 |

| Annual Lead Independent Director and Committee Chair Additional Retainers | |

| Lead Independent Director | 30,000 |

| Audit Committee Chair | 20,000 |

| Compensation & Human Resources Committee Chair | 15,000 |

| Nominating and Governance Committee Chair | 9,000 |

| Finance Committee Chair | 9,000 |

The following summarizes our non-employee director compensation program:

| | | | | |

| Element | Key Characteristics |

| Annual Retainers | Annual cash retainers are paid quarterly for service on the Board and its committees and in Board leadership roles, such as a Board committee chair or Lead Independent Director. |

| Annual Stock Awards | On the first business day of our fiscal year, a stock award is automatically granted under our then current stockholder-approved plan. The number of shares is determined by dividing the stock award value by the average of the closing prices of our common stock during the three months prior to the grant. The shares are fully vested at the time of grant. |

| Annual Stock Option Awards | On the first business day of our fiscal year, a stock option to purchase shares of our common stock is automatically granted under our then current stockholder-approved plan. The number of stock options is determined by dividing the stock option award value by the grant date fair value of a stock option to purchase one share of our common stock. See below for additional information regarding vesting of stock option grants. |

Common Stock In Lieu of Annual Retainers | Non-employee directors may elect to convert a portion or all of their calendar year annual retainers otherwise payable in cash into shares of our common stock. Retainers earned after the date a director makes such election for a calendar year are issued in shares of our common stock in December of that year, the number of which is determined by dividing the dollar amount of the retainers earned in the calendar year and elected to be converted into shares of our common stock by the closing price of our common stock on the date that the shares are issued. |

| Deferred Compensation Plan | Non-employee directors may elect to defer receipt of all or a part of their stock award and/or cash compensation on a calendar year basis under The Toro Company Deferred Compensation Plan for Non-Employee Directors, or the Deferred Plan for Directors. Because the value of a director's deferred compensation account fluctuates, as applicable, based on the market value of our common stock or based on a rate of return on funds that are comparable to funds available in The Toro Company Retirement Plan, or Retirement Plan, earnings on deferred compensation are not preferential. Dividends paid on our common stock are credited to a director's account as additional common stock units. A director is fully vested in his or her deferred compensation account. Distributions under the Deferred Plan for Directors are payable in accordance with the director participant's prior distribution elections upon the earliest of retirement, prior to retirement if a valid election has been made or in an unforeseeable financial emergency. |

| Company Products | Each of our non-employee directors is entitled to receive certain Company products and related parts, service and accessories for his or her personal use, at no cost; provided, however, that directors are responsible for payment of applicable taxes attributable to the value of such items. The value is deemed to be our distributor net price or its equivalent, which is also the price at which such items are generally available to our employees for purchase. |

| Charitable Giving | We offer a matching gift program for our non-employee directors, similar to the matching gift program offered to our employees, which provides that a gift or gifts by a director to one or more tax exempt 501(c)(3) charitable organizations located in the United States will be matched by us in an aggregate amount of up to $1,000 per director per year. |

| Indemnification and D&O Insurance | Each non-employee director is a party to an indemnification agreement with us pursuant to which we have agreed to provide indemnification and advancement of expenses to the fullest extent permitted by Delaware law and our Restated Certificate of Incorporation and continued coverage under our D&O insurance. |

Stock Option Vesting. Except as described below, stock options granted to our non-employee directors vest in three equal installments on each of the first, second and third year anniversaries of the grant date and remain exercisable for a term of ten years after the grant date.

If a director becomes disabled or dies, all outstanding unvested stock options will vest in full on the date the director's service ceases by reason of such disability or death and all outstanding stock options may be exercised up to the earlier of the date the stock options expire or one year after the date the director's service ceased by reason of such disability or death.

If a director has served as a member of the Board for ten full fiscal years or longer and terminates his or her service on the Board, other than due to death or disability, his or her outstanding unvested stock options will continue to vest in accordance with their terms and the director may exercise the vested portions of the stock options for up to four years after the director's date of termination, but not later than the date the stock options expire. If a director has served as a member of the Board for less than ten full fiscal years and terminates his or her service on the Board, other than due to death or disability, his or her outstanding unvested stock options will expire and be canceled and the director may exercise any vested portions of the stock options for up to three months after the director's date of termination, but not later than the date the stock options expire. The following

independent directors who served during all or part of fiscal 2025 have ten or more fiscal years of service: Gary L. Ellis, D. Christian Koch and James C. O'Rourke.

If there is a change in control of our Company, stock options held by directors will vest immediately and remain exercisable for the remaining term. The general definition of a change in control for these purposes is described under "Potential Payments upon Termination or Change in Control - Change in Control."

Director Compensation Highlights

Some highlights of our non-employee director compensation program are:

| | | | | |

ü | No Fees for Board or Committee Meeting Attendance: Meeting attendance is an expected part of Board service. |

ü | Emphasis on Equity: There is an emphasis on equity in the overall compensation mix to further align interests with stockholders. |

ü | Recognition of Special Roles: Special roles (such as Lead Independent Director and Board committee chairs) are fairly recognized for their additional time commitments. |

ü | Annual Stock Grants with Immediate Vesting: Stock awards are granted annually with a fixed value and immediate vesting to support independence. |

ü | Limit on Total Non-Employee Director Compensation: Our current stockholder-approved incentive plan contains a limit on total non-employee director compensation. |

ü | Robust Stock Ownership Guidelines: A guideline of five times the annual Board cash retainer supports alignment with stockholders’ interests and mitigates potential compensation-related risk. |

ü | No Perquisites: Our directors receive no perquisites, personal benefits or other compensation, other than Company products for personal use and occasional travel for guests of non-employee directors and officers. |

Director Compensation for Fiscal 2025

The following table provides summary information concerning the compensation of each individual non-employee director who served during fiscal 2025. Amounts in the table are not reduced to reflect elections, if any, by the non-employee directors to defer receipt of compensation. Deferral elections are described in more detail in the footnotes to the table. Earnings on nonqualified deferred compensation are not on a basis that is considered to be above-market or preferential.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)1, 2 | | Stock Awards ($)3 | | Option Awards ($)4 | | All Other Compensation ($)5 | | Total ($) |

| Dianne C. Craig | | 113,542 | | 89,732 | | 54,998 | | | | 258,272 |

| Gary L. Ellis | | 143,500 | | 89,732 | | 54,998 | | | | 288,230 |

Eric P. Hansotia | | 108,000 | | 89,732 | | 54,998 | | | | 252,730 |

| Jeffrey L. Harmening | | 121,000 | | 89,732 | | 54,998 | | | | 265,730 |

| D. Christian Koch | | 117,035 | | 89,732 | | 54,998 | | | | 261,765 |

Joyce A. Mullen6 | | 108,000 | | 89,732 | | 54,998 | | | | 252,730 |

| James C. O'Rourke | | 122,500 | | 89,732 | | 54,998 | | 674 | | 267,904 |

Jill M. Pemberton | | 133,542 | | 89,732 | | 54,998 | | | | 278,272 |

1.Unless a director elected to defer receipt or convert a portion or all of his or her annual retainers into shares of our common stock, annual retainers were paid in cash at the beginning of each fiscal quarter.

2.The following directors elected to convert all or a portion of their calendar 2025 cash retainers into shares of our common stock, which number of shares received was based on the closing price of our common stock on December 15, 2025, of $73.48: Ms. Craig—1,544 shares; Mr. Koch—1,592 shares; and Ms. Pemberton—1,816 shares.

3.On November 1, 2024, 1,101 shares of our common stock were granted to each non-employee director with the calculation as to the number of shares based on the average of the closing prices of our common stock during the three months prior to the grant, which was $86.21. However, the amount reported in the table represents the grant date fair value of $81.50, the closing price on the grant date, computed in accordance

with Financial Accounting Standards Board (FASB) Accounting Standard Codification (ASC) Topic 718. These stock awards were the only stock awards granted to directors during fiscal 2025. As of October 31, 2025, no directors held any restricted stock or other unvested stock awards.

4.On November 1, 2024, a stock option to purchase 2,167 shares of our common stock was granted to each non-employee director. The amount reported in the table represents the grant date fair value computed in accordance with FASB ASC Topic 718. The following is a summary of the specific assumptions used in the valuation of the option awards:

| | | | | | | | | | | | | | | | | |

| Grant Date | Risk Free Rate | Expected Life | Expected Volatility | Expected Dividend Yield | Per Share Black-Scholes Value |

| 11/1/2024 | 4.20% | 6.8 | 27.68% | 1.40% | $25.38 |

The exercise price per share is $81.50, which is equal to 100% of the fair market value of our common stock on the grant date, determined by the closing price on that date. The actual value of the stock option awards, if any, to be realized by a director depends upon whether the price of our common stock at exercise is greater than the exercise price on the stock options. These stock option awards were the only stock option awards granted to directors during fiscal 2025. For the aggregate number of stock options (exercisable and unexercisable) held by each non-employee director who served during all or part of fiscal 2025, as of January 20, 2026, please see Footnote 2 in the section entitled "Stockholder Ownership - Directors and Executive Officers," beginning on page 86. 5.We generally do not provide perquisites and other personal benefits to our non-employee directors, other than Company products for personal use and occasional travel for guests of non-employee directors and officers. The amount reported for Mr. O'Rourke includes the value of products, parts, service or accessories, as described under Company Products above.

6.Under the Deferred Plan for Directors, Ms. Mullen elected to defer receipt of her: (i) calendar 2024 and calendar 2025 retainers earned in fiscal 2025; and (ii) the annual stock award granted on November 1, 2024.

Non-Employee Director Stock Ownership Guidelines. Our non-employee directors are required to hold an amount of Company shares equal to five times the annual Board cash retainer. For additional information, please see the section entitled "Stockholder Ownership - Stock Ownership Guidelines," 87. Anti-Hedging and Anti-Pledging. Under the Company's Insider Trading Policy, all directors, officers and employees of the Company are prohibited from engaging in speculative transactions in our Company's securities or other transactions which might give the appearance of impropriety. Specifically, all directors, officers and employees of the Company are prohibited from engaging in hedging transactions involving our Company's securities and purchasing our Company's securities on margin, borrowing against any account in which our Company's securities are held, or pledging our Company's securities as collateral for a loan. For additional information, please see the section entitled "Stockholder Ownership - Anti-Hedging and Anti-Pledging," beginning on page 87.

Overview

The following section provides an overview of The Toro Company's corporate governance practices and the Company’s commitment to strong corporate governance that supports the long-term value of the Company, as evidenced by the framework the Company currently has in place.

Board of Directors

•Board and Committee Independence and Lead Independent Director. All of our directors, except our Chairman and CEO, and including our Lead Independent Director, are independent. All of our Board committees are comprised solely of independent directors.

•Director Resignation Policy. If any nominee for director in an uncontested election receives a majority of “withheld” votes, such director shall tender a resignation for consideration by the Nominating and Governance Committee, which then shall recommend to the Board the action to be taken with respect to such tendered resignation.

•Annual Board and Committee Self-Evaluations. The Board, in coordination with the Nominating and Governance Committee, conducts an annual self-evaluation of the Board as a whole and each of its committees. Each committee also conducts an annual self-evaluation. This process helps inform the annual director nomination process and Board refreshment.

•Annual Board Evaluation of CEO. The Chair of the Board and the Chair of the Compensation & Human Resources Committee lead the annual evaluation process of the CEO.

•Limits on Public Company Board and Audit Committee Service. No independent director may serve on more than four public company boards (including the Company’s Board) and directors who are also serving as a chief executive officer, including the Company’s CEO, may not serve on more than two public company boards (including the Company’s Board). No member of the Audit Committee may simultaneously serve on the audit committee of more than three public companies (including the Company’s Audit Committee), unless the Board determines that such simultaneous service would not impair the effectiveness of the director's service on the Company’s Audit Committee. A director must seek approval of the Nominating and Governance Committee in advance of serving on the board of another entity.

•Regular Executive Sessions of Independent Directors. The independent directors hold regular executive sessions, generally at each regularly scheduled meeting of the Board and each committee, at which management, including the Chairman and CEO, is not present.

Stockholder Rights and Engagement

•No Stockholder Rights Plan. We do not have a stockholder rights agreement, also known as a poison pill.

•Stockholder Engagement. We regularly engage with stockholders, including our top institutional investors. At these meetings, we typically discuss board oversight, executive compensation and sustainability, among other topics.

Corporate Governance Guidelines