|

December 15, 2011

| U.S. Securities and Exchange Commission Washington, D.C. 20549-4631 | ||

| Attention: | Rufus Decker, Accounting Branch Chief | |

| Jessica Kane, Staff Attorney | ||

| Nudrat Salik, Staff Accountant | ||

| Craig Slivka, Special Counsel | ||

| Re: | Kid Brands, Inc. (the “Company”) | |

| Form 10-K for the Year ended December 31, 2010 Filed March 31, 2011 Form 10-Q for the Period ended September 30, 2011 Filed November 9, 2011 | ||

| Response dated October 28, 2011 | ||

| File No. 1-8681 | ||

Dear Ladies and Gentlemen:

The following memorandum is in response to the comments of the Staff contained in your letter dated November 15, 2011, and follows our telephone conference call with the Staff on December 5, 2011 (the “Staff Call”). For convenience of reference, each Staff comment contained in your letter is reprinted below in bold, numbered to correspond with the paragraph numbers assigned in your letter, and is followed by the corresponding response of the Company. Unless the context indicates otherwise, references in this letter to “we,” “us” and “our” refer to the Company on a consolidated basis.

Form 10-K for the Fiscal Year ended December 31, 2010

Note 18. Litigation, Commitments and Contingencies, page 79

| 1. | We note your response to comment four in our letter dated October 6, 2011. The misstatements related to anti-dumping charges represented approximately 44% of pre-tax income (loss), 10% of after-tax income (loss), and 11% of basic earnings per share for the year ended December 31, 2009. In addition, it appears that the impact of recording the misstatements for the year ended December 31, 2009 and the year ended December 31, 2008 during the year ended December 31, 2010 represented approximately 20% of pre-tax income, 9% of after-tax income, and 10% of basic earnings per share for the year ended December 31, 2010. In this regard, please revise your financial statements to record the anti-dumping charges in the periods to which they relate. We remind you that when you file your amended Form 10-K for the year ended December 31, 2010, you should appropriately address the following: |

| • | an explanatory paragraph in the reissued audit opinion included in the Form 10-K/A; |

1

| • | full compliance with paragraphs ASC 250-10-45-22 through 24 and 250-10-50-7 through 10; |

| • | fully update all affected portions of the document, including MD&A, selected financial data, and quarterly financial data; |

| • | label the appropriate columns on your financial statements as restated; |

| • | updated disclosures under Item 9A of your Form 10-K/A should include the following: |

| • | a discussion of the restatement and the facts and circumstances surrounding it; |

| • | how the restatement impacted the CEO and CFO’s original conclusions regarding the effectiveness of their disclosure controls and procedures; |

| • | changes to internal controls over financial reporting; and |

| • | anticipated changes to disclosure controls and procedures and/or internal controls over financial reporting to prevent future misstatements of a similar nature. |

Refer to Items 307 and 308 of Regulation S-K; and

| • | include all updated certifications. |

We also remind you of the filing requirements of Item 4.02 of Form 8-K.

Response

As an initial matter, please be advised that, as stated on the Staff Call, prior to our recording of the relevant out-of-period adjustments: (i) we performed a thorough analysis of the related accounting and disclosure issues; (ii) we discussed each of these issues with KPMG LLP, our independent accountants; (iii) we ultimately made decisions with respect to such matters that we feel were appropriate and supported by accounting standards and securities guidance, and were in the best interests of the users of our financial statements; and (iv) KPMG concurred with such decisions.

It appears that the quantitative magnitude of the errors as a percentage of various financial metrics is an important driver in the Staff’s request for a restatement of our historical financial statements and an amendment of our 2010 Form 10-K. In connection therewith, we note that with respect to the cumulative impact of recording the misstatements in 2010, although your comment notes a 9% variance in after-tax income and a 10% variance in basic EPS for the year, we believe (and the charts below demonstrate), that the impacts for such line items are in fact only 6.57% and 6.21%, respectively. In addition, please note that we seriously considered the magnitude of the errors as part of our materiality analysis, and we believe that the errors are not quantitatively material. As the accounting literature on the topic makes clear, however, percentages alone should not control materiality decisions. Specifically, SAB 99 notes that “quantifying, in percentage terms, the magnitude of a misstatement is only the beginning of an analysis of materiality; it cannot appropriately be used as a substitute for a full analysis of all relevant considerations.” This sentiment is echoed in the guidance that we referenced in our response letter dated October 28, 2011, which clearly states that qualitative factors can cause large errors to be immaterial. We continue to believe that, when considered in connection with all relevant considerations, or the total mix of information, the variances were not material either quantitatively or qualitatively to the market for our public securities for either the 2009 or 2010 fiscal year.

2

In this regard, and in accordance with applicable accounting guidance, we performed a rigorous quantitative and qualitative analysis of the customs accruals and all relevant facts and circumstances pertaining to such accruals. We will address the quantitative elements of our analysis after the following description of the more significant qualitative factors that guided our determination of immateriality.

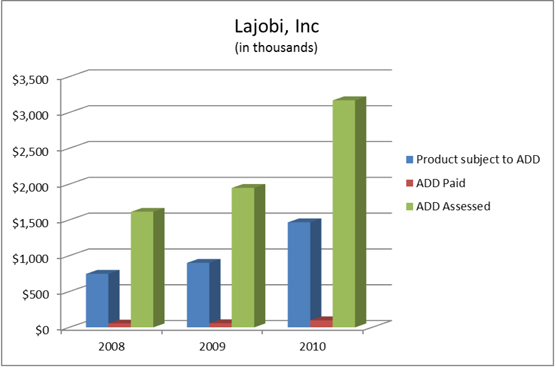

Prior to a description of such qualitative factors, please note that, as stated on the Staff Call, only a very small portion of the goods imported by LaJobi are subject to anti-dumping duties. These duty-able goods consist primarily of case goods (and specifically exclude cribs and changing tables), and only those imported from China. In fact, as we have noted in our prior responses, during the almost 3 year period at issue – from April 2008 through December 2010 – LaJobi purchased a total of $174 million of products and only $3.1 million, or less than 2%, of those products were subject to anti-dumping duties.

The amount of the duty is determined by a rate applied to the Chinese vendor that manufactures the goods. The Department of Commerce publishes a list of vendors who are entitled to relatively favorable duty rates, with the most common rate applied to these “listed” manufacturers being 7.24% of the cost of the goods. Any Chinese manufacturer not on the list is subject to an “all other”

anti-dumping duty rate that was 216% during the periods in question. As we emphasized during the Staff Call, LaJobi could not have imported product with a duty rate in excess of 200% – thereby instantly tripling the product’s cost – without incurring a substantial loss on each related sale. This is especially true with respect to the products that LaJobi imports from China, which are already among the least expensive and lowest margin products LaJobi sells.

Based on a thorough investigation by outside counsel, it appears that beginning before Kid Brands acquired LaJobi in April 2008, as a result of misconduct, certain executives of LaJobi made it appear as if a “listed” company had been the actual manufacturer of the products, which in fact was not the case. As a result, contemporaneously with each relevant importation of goods within the scope of the anti-dumping duty order, LaJobi paid the applicable anti-dumping duties, but at the “listed” rate of 7.24% rather than the “non-listed” rate of 216%. As noted in the “Qualitative Analysis” section below, the dramatic and highly unusual delta between the “listed” and “non-listed” manufacturer rates explains the size of the accrual in relation to such a small amount of product, and is one of the principal qualitative factors to consider.

Qualitative Analysis

Please be advised that in addition to carefully reviewing the quantitative nature of the charges at issue (discussed below), we reviewed numerous qualitative factors that comprised part of the total mix of information considered, the most significant of which include the following:

3

Small Portion of LaJobi Business and Extraordinary Nature of Customs Duty Rates Applied

As set forth above, a minimal portion of finished products purchased by LaJobi – less than 2% over the applicable period of almost 3 years – are subject to the anti-dumping duties that make up the accrual. The chart set forth below (also provided in connection with the Staff Call), clearly illustrates this point.

In fact, as discussed above, the size of the customs duty charges recorded resulted not from a large amount of product subject to anti-dumping duties, but from the fact that misconduct concealed the identity of the actual manufacturer and, upon discovery of the situation, the Company was required to accrue the substantial differential between the rate for “non-listed” manufacturers as opposed to “listed” manufacturers. The chart set forth below, also provided in connection with the Staff Call, illustrates the amount of the anti-dumping duty that was paid at the “listed” rate, and the amount of duty that we anticipate will be paid based on the “non-listed” rate. Please note that the anti-dumping duties incurred at the “listed” rate were paid contemporaneously with each Customs entry, and the Company’s historical financial statements therefore reflect the Customs duties that would have been incurred in the ordinary course of business, assuming that the products had been properly sourced.

4

As noted previously, it would be impossible to profitably import products with a duty rate in excess of 200% of the total cost of the product, as the product would have a significant negative gross margin, even before selling, general and administrative expenses associated with the business. It bears emphasizing that had we been aware of the fact that the actual manufacturer of the products in question was “non-listed”, alternate arrangements would have been put into place, and the Company would never have incurred the customs charges in question. In fact, promptly upon discovery of the issue, alternate vendor arrangements (subject to typical customs duty rates, or no import duties at all) were in fact established. Accordingly, the Company determined that the accrual was not reflective of the ordinary course of the ongoing operation of the Company’s business.

Importance to Investment Community of Measures Reflecting Ordinary Course of Operations

Please also be advised that we strongly believe that the market for our securities is focused on financial measures that are indicative of the normal course of operations of our business and our ability to service our debt requirements, such as revenues, cash flows from operations, and, at least in recent periods, Adjusted Net Income. Analysts that follow our Company, as well as our investors, appear to be less concerned with period-to-period swings in income statement line items that do not reflect our normal operations. With respect to the LaJobi matters, we believe this is evidenced by the muted reaction of analysts to our disclosures regarding the customs charges in question, as is described below. The fact that customs duties were recorded in 2010 (instead of over the course of the applicable period) has not resulted in any voiced concern on the part of the analysts or other members of the investment community with whom we have spoken.

5

With respect to analysts, evidence of this can be found in various analysts’ reports issued on March 16, 2011, the day after we first disclosed our customs issues, as well as our first 2011 earnings guidance (which was not impacted by the customs charge), via press release and 8-K. Although our stock price declined after such press release, we believe that this was due primarily to the guidance that we issued for 2011 in the press release (which was materially below the analysts’ consensus estimates at the time) and other external factors affecting the broader market (including the aftermath of the Japanese tsunami and its impact on equity markets). For example, Needham’s report, which did maintain its “strong buy” recommendation, stated that, with respect to our customs disclosure: “we believe the ongoing impact to [the] business will be minimal.” They also stated that: “it is important to note that this $7MM payment is not indicative of an ongoing cost, nor is it a recognition of how much higher the ‘true’ cost of sales ‘should’ have been, because Kid will no longer source the product from vendors with the higher duty rate.” This last point emphasizes most clearly the unusual nature of the charge, which figured largely into the Company’s analysis. The report then discussed our guidance, and Needham’s lowered expectations in response thereto. Similarly, the report of Roth Capital Partners stated: “we believe yesterday’s selloff was an overreaction as we believe Kid continues to dominate the categories it is in...[a]ccordingly, we retain our buy rating...” They also stated that “reflecting management’s revenue guidance and expected sourcing pressures, we are lowering our FY2011 EPS estimate.” Again, we believe this to be the primary reason for the market reaction to our March 15th disclosures. The report from CJS Securities, which reiterated its “market outperform” rating, noted that in their opinion, “...the investigation and related repercussions could be resolved in the near-term and we do not expect a material impact on business fundamentals...[t]he lack of earnout could virtually offset the customs expense and penalty with no material change to the balance sheet.”1

With respect to the investment community, investors have had the opportunity to completely absorb our numerous disclosures on the LaJobi customs topic since our initial disclosure. In fact, promptly after our March 15th disclosures, we reached out to many of our larger shareholders, none of which expressed any significant concerns with these issues. Most telling is that since our initial disclosure, we have not received any questions from the investment community on either: (i) the facts underlying the out-of-period adjustments we recorded in 2010; or (ii) the impact on prior periods if we had recorded the errors in those periods, and we have only received a handful of calls that in any other way related to the customs events. As a result, we believe that most of our investors view the financial implications of the LaJobi events in much the same way we do – as an isolated and artificial occurrence that is not indicative of the normal course of our operations.

Please also note that these unusual events were not deemed critical to our senior lender either, as the negotiated financial covenants in our prior and existing credit agreements have always been based on Adjusted EBITDA. As a result, the impact of specific items is excluded from such measure. As we have disclosed in our public filings, the customs matter in particular was addressed in both a permanent waiver to our credit agreement in March of 2011 and in our August 2011 refinancing.

| 1 | References to analysts reports herein should not be construed as endorsement or confirmation by the Company of the estimates of such analysts, but only as examples of such analysts’ reactions to the Company’s March 15, 2011 disclosures. |

6

No Change to Published Guidance

Another important qualitative consideration is the fact that the out-of-period adjustments did not change any financial measures with respect to which the Company provided guidance to the analyst/investor community – the customs accrual was reversed in our Non-GAAP Adjusted Net Income measure for the fourth quarter and full year ended December 31, 2010, as we did not consider it reflective of our ongoing operating performance. In addition, the adjustments will not impact the future financial results of the Company, as the practices resulting in the charge have been discontinued, all as has been previously disclosed to investors. We believe that as a result, the errors are not material to investors making current investment decisions, an important factor in the applicable literature (as we have noted in detail in our October 28, 2011 response letter).

No Significant Negative Impact on Cash Flows

In addition, from a cash flow perspective, as a result of the additional $6.9 million of anticipated anti-dumping duties and related interest and other costs that we will be required to pay, the Company determined that no earnout was due to the LaJobi seller. Prior to these events, we anticipated that we would likely have paid an earn-out in the approximate range of $12.0–$15.0 million in respect of our 2008 purchase of the LaJobi assets, a fact previously disclosed to investors and noted by analysts as discussed above. The importance of this fact is demonstrated by our reliance on cash flows as an indicator of the Company’s strength. As we have stated in our periodic reports throughout the period (and currently): “Management views operating cash flows as a good indicator of financial strength. Strong operating cash flows provide opportunities for growth both internally and through acquisitions, and also enable us to pay down debt.” We believe that the reduction (to zero) of the amount of the LaJobi earnout that we anticipate we will pay, and the fact that this will offset all or substantially all of the out-of-pocket cash impact of the additional LaJobi customs accrual (including related professional fees), is significant to the readers of our financial statements.2

Broader Market Context

Our qualitative analysis also considered the broad context within which investors viewed our financial statements during the relevant period, which included the onset of the global economic downturn and difficult industry conditions; increasing margin pressure resulting from such conditions and other factors; and the complete transformation of our business, demonstrated by our purchases of each of LaJobi and CoCaLo, the divestiture of our legacy gift business, several refinancings, and the re-engineering of our Sassy subsidiary, all of which were the subject of lengthy discussions in our periodic reports and earnings calls throughout the relevant period. It is within the context of this background that we considered – and investors viewed – the materiality of the out-of-period adjustments recorded in 2010.

| 2 | Note that as stated in the Sept 10-Q, the Company has received a letter from counsel to Lawrence Bivona demanding payment of the LaJobi earnout to Mr. Bivona in the amount of $15 million. Also as stated in the Sept 10-Q, the Company does not intend to pay the LaJobi Earnout Consideration to Mr. Bivona, has so advised counsel for Mr. Bivona, and intends to vigorously defend any related action that Mr. Bivona may bring. |

7

Detailed Disclosure in Market

As a further important factor, please note that the Company self-reported and then fully disclosed the out-of-period adjustments, including detailed disclosure regarding the nature of the charge and the facts and circumstances requiring it, in both the notes to the financial statements and MD&A section our 2010 10-K (and subsequent periodic reports). We believe that, as the errors resulting in the need for the accruals have been corrected and fully disclosed, restatement of prior period financial statements would serve only to increase our expenses without any incremental benefit, all to the detriment of our shareholders, as is explained in further detail at the conclusion of this response.

SAB 99 Qualitative Factors

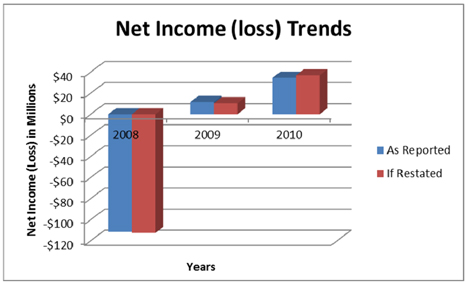

In addition to the foregoing factors, an analysis of the specific qualitative factors set forth in SAB 99 for each of the years in question yield the following conclusions (a full SAB 99 analysis is contained in our previous responses): (i) the misstatements did not hide a failure to meet analyst’s consensus expectations; (ii) correction of the misstatements would not change a loss into income or vice versa in any of the relevant years; (iii) the underpayment of anti-dumping duties was the result of misconduct of which the Company’s senior management and LaJobi financial staff were unaware, (iv) with respect to 2010, such charge resulted in several members of management becoming ineligible for specified bonus amounts; and (v) the misstatements did not mask a change in earnings (loss) or any other trends of the Company. With respect to this last point, we refer you to the chart below, provided in connection with the Staff Call, which illustrates our net income or loss trends for the relevant periods. As the chart demonstrates, the effect of the potential restatement would have little impact in this regard.

8

Quantitative Analysis

With respect to our quantitative analysis, we believe that the additional customs charges in question are quantitatively immaterial when viewed as absolute amounts in the overall context of the Company’s financial statements. In addition, it is important to note that, as stated above, although your comment refers to a 9% pre-tax impact and a 10% basic EPS impact for 2010, our calculations result in only a 6.57% and 6.21% difference for such line items, respectively, which constitute far less significant percentages (see charts below which describe the impacts to specified line items and the percentages that such impacts represent).

In connection with quantitative matters, please note that the accrual for customs duties and interest of approximately $6.9 million, after the related tax effect, results in an aggregate negative impact to net income of approximately $4.2 million. If a restatement were required, this amount would be distributed approximately $1.0 million in 2008, $1.2 million in 2009 and $1.9 million in 2010. With respect to basic EPS, a restatement would result in a negative difference of $0.06 (from $0.55 to $0.49) for 2009, and a positive difference of $0.10 (from $1.61 to $1.71) for 2010. We do not believe any of these adjustments would meaningfully change the way our investors viewed our results for the relevant periods, and in any event, the impact on 2010 has been fully disclosed.

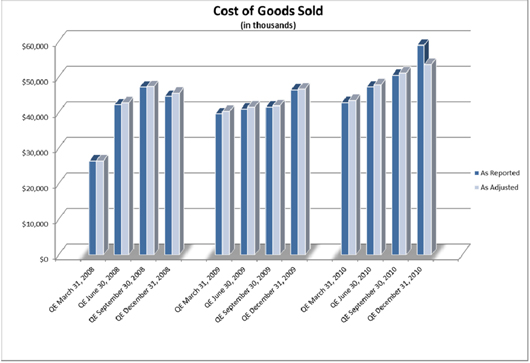

As requested on the Staff Call, we have included below bar graphs and tables illustrating the impact of the LaJobi customs matters on following line items for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis: Cost of sales; Gross profit; Income/loss from continuing operations before income tax (benefit) (“PTI”); Net income/(loss); and basic Net income/(loss) per share (“basic EPS”). As an initial matter, please note that as such tables demonstrate, with respect to both annual and quarterly periods, the variances had no impact on the trends of the various line items affected for any of the periods shown (with the sole exception being Gross profit for the fourth quarter of 2010, the period in which the cumulative effect of the accrual was recorded). In addition, as is discussed below, even though the percentages represented by certain of such variances may appear to be large, the actual amounts of such variances are much less significant when viewed in the context of the overall size of our business (revenues of $276 million in 2010, revenues of $244 million in 2009, and revenues of $229 million in 2008).

Please note that below is a bar graph and a table showing the impact of the LaJobi customs matters on Cost of sales for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis. As such materials demonstrate, the variances for all periods presented were under 2.0%, except for the fourth quarter of 2010, which amounted to an under 10.0% variance, resulting primarily from the cumulative impact of reversing the charge that was recorded in such quarter. We note that even the fourth quarter 2010 variance is reduced to a variance of 1.73% for the full 2010 calendar year.

9

Cost of Goods Sold:

Effect on Cost of Goods Sold from the LaJobi Customs Adjustment

(Dollars in thousands)

| Fiscal Period |

As Reported | Total Adjustments |

As Adjusted | % Increase (Decrease) |

||||||||||||

| Fiscal Year 2008 (1) |

$ | 160,470 | $ | 1,560 | $ | 162,030 | 0.97 | % | ||||||||

| Fiscal Year 2009 |

$ | 168,741 | $ | 1,889 | $ | 170,630 | 1.12 | % | ||||||||

| Fiscal Year 2010 |

$ | 199,483 | $ | (3,449 | ) | $ | 196,034 | -1.73 | % | |||||||

| Fiscal Year 2008 by Quarter (1) |

||||||||||||||||

| Quarter Ended March 31, 2008 |

$ | 26,457 | $ | — | $ | 26,457 | 0.00 | % | ||||||||

| Quarter Ended June 30, 2008 |

$ | 42,234 | $ | 532 | $ | 42,766 | 1.26 | % | ||||||||

| Quarter Ended September 30, 2008 |

$ | 47,192 | $ | 145 | $ | 47,337 | 0.31 | % | ||||||||

| Quarter Ended December 31, 2008 |

$ | 44,587 | $ | 883 | $ | 45,470 | 1.98 | % | ||||||||

| Fiscal Year 2009 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2009 |

$ | 39,663 | $ | 706 | $ | 40,369 | 1.78 | % | ||||||||

| Quarter Ended June 30, 2009 |

$ | 41,013 | $ | 614 | $ | 41,627 | 1.50 | % | ||||||||

| Quarter Ended September 30, 2009 |

$ | 41,613 | $ | 353 | $ | 41,966 | 0.85 | % | ||||||||

| Quarter Ended December 31, 2009 |

$ | 46,452 | $ | 216 | $ | 46,668 | 0.46 | % | ||||||||

10

| Fiscal Year 2010 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2010 |

$ | 42,806 | $ | 656 | $ | 43,462 | 1.53 | % | ||||||||

| Quarter Ended June 30, 2010 |

$ | 47,215 | $ | 604 | $ | 47,819 | 1.28 | % | ||||||||

| Quarter Ended September 30, 2010 |

$ | 50,490 | $ | 694 | $ | 51,184 | 1.37 | % | ||||||||

| Quarter Ended December 31, 2010 |

$ | 58,972 | $ | (5,403 | ) | $ | 53,569 | -9.16 | % | |||||||

| 1. | Results reflect reclassification for discontinued operations resulting from the sale of the Company’s legacy gift business in December 2008. |

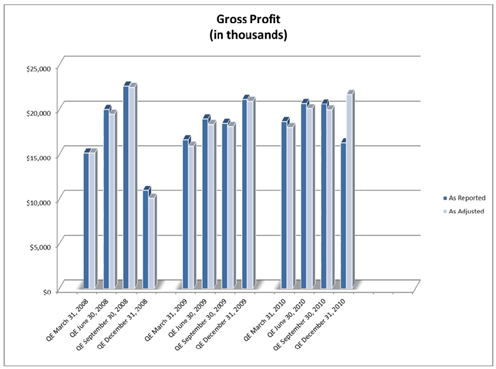

Please note that below is a bar graph and a table showing the impact of the LaJobi customs matters on Gross profit for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis. As such materials demonstrate, with respect to gross profit, the largest percentage annual impact in any of 2008, 2009 or 2010 was only 4.52%. With respect to quarterly periods, the largest percentage variance in 2008, which occurred in the fourth quarter of 2008, amounts to 8.06% (only $883,000). As is described in footnote 2 to the table below, however, excluding the impact of $3.7 million in specified charges, the percentage impact of the LaJobi matters on this line item for the quarter would have been 6.02%, a statistically less significant percentage. None of the other quarterly percentage variances for this line item exceeded 4.25%, other than the variance of $5.4 million in the fourth quarter of 2010 (representing a 33% variance), which results primarily from the cumulative impact of reversing the charge that was recorded in such quarter. We note that even the fourth quarter 2010 variance is reduced to a variance of under 4.6% for the full 2010 calendar year.

11

Gross Profit:

Effect on Gross Profit from the LaJobi Customs Adjustments

(Dollars in thousands)

| Fiscal Period |

As Reported | Total Adjustments |

As Adjusted | % Increase (Decrease) |

||||||||||||

| Fiscal Year 2008 (1) |

$ | 68,724 | $ | (1,560 | ) | $ | 67,164 | -2.27 | % | |||||||

| Fiscal Year 2009 |

$ | 75,195 | $ | (1,889 | ) | $ | 73,306 | -2.51 | % | |||||||

| Fiscal Year 2010 |

$ | 76,294 | $ | 3,449 | $ | 79,743 | 4.52 | % | ||||||||

| Fiscal Year 2008 by Quarter (1) |

||||||||||||||||

| Quarter Ended March 31, 2008 |

$ | 15,155 | $ | — | $ | 15,155 | 0.00 | % | ||||||||

| Quarter Ended June 30, 2008 |

$ | 19,997 | $ | (532 | ) | $ | 19,465 | -2.66 | % | |||||||

| Quarter Ended September 30, 2008 |

$ | 22,611 | $ | (145 | ) | $ | 22,466 | -0.64 | % | |||||||

| Quarter Ended December 31, 2008 |

$ | 10,961 | $ | (883 | ) | $ | 10,078 | -8.06 | %(2) | |||||||

| Fiscal Year 2009 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2009 |

$ | 16,615 | $ | (706 | ) | $ | 15,909 | -4.25 | % | |||||||

| Quarter Ended June 30, 2009 |

$ | 18,953 | $ | (614 | ) | $ | 18,339 | -3.24 | % | |||||||

| Quarter Ended September 30, 2009 |

$ | 18,472 | $ | (353 | ) | $ | 18,119 | -1.91 | % | |||||||

| Quarter Ended December 31, 2009 |

$ | 21,155 | $ | (216 | ) | $ | 20,939 | -1.02 | % | |||||||

| Fiscal Year 2010 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2010 |

$ | 18,668 | $ | (656 | ) | $ | 18,012 | -3.51 | % | |||||||

| Quarter Ended June 30, 2010 |

$ | 20,706 | $ | (604 | ) | $ | 20,102 | -2.92 | % | |||||||

| Quarter Ended September 30, 2010 |

$ | 20,638 | $ | (694 | ) | $ | 19,944 | -3.36 | % | |||||||

| Quarter Ended December 31, 2010 |

$ | 16,282 | $ | 5,403 | $ | 21,685 | 33.18 | % | ||||||||

| 1. | Results reflect reclassification for discontinued operations resulting from the sale of the Company’s legacy gift business in December 2008. |

| 2. | Results for the quarter include the impact of a $3.7 million charge pertaining to the impairment of intangible assets, which was excluded from non-GAAP adjusted pre-tax income in the Company’s earnings release for the period as non-reflective of ongoing operations. Excluding this amount, the percentage impact of the LaJobi Matters on gross profit for this quarter would have been 6.02%, a statistically less significant percentage. |

Please note that below is a bar graph and a table showing the impact of the LaJobi customs matters on PTI for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis. With respect to PTI, the significant

12

annual percentage variances amount to only $2.0 million with respect to the entire 2009 annual period and $3.7 million for the entire 2010 annual period (on revenues of $244 million and $276 million, respectively). As is described in footnote 2 to the table below, excluding the impact of an aggregate of $16.5 million in specified charges, the percentage impact of the LaJobi matters for the year on this line item would have been 9.36% (instead of 44.31%), a substantially less significant percentage. The Company does not believe that the LaJobi customs error became material to this particular period solely because other large charges were appropriately recorded in the same period.

With respect to quarterly periods, the largest percentage variance in PTI in 2008 (in the second quarter) amounts to only $595,000. In addition, the largest percentage variance in 2009 (in the first quarter) for this line item amounts to only $762,000. As is described in footnote 3 to the table below, excluding the impact of an aggregate of $889,000 in specified charges, the percentage impact of the LaJobi matters for the first quarter of 2009 on PTI would have been reduced by approximately 10%, a substantial reduction. The largest percentage variance in 2010 (in the fourth quarter) amounts to $5.7 million, primarily as a result of the cumulative impact of recording the charge in such quarter, which resulted in a smaller aggregate impact of $3.7 million for the full year period.

13

Income (loss) from continuing operations before income tax (benefit):

Effect on Income (loss) from Continuing Operations before Income Tax (Benefit) from the LaJobi Customs Adjustments

(Dollars in thousands)

| Fiscal Period |

As Reported | Total Adjustments |

As Adjusted | % Increase (Decrease) |

||||||||||||

| Fiscal Year 2008 (1) |

$ | (128,371 | ) | $ | (1,720 | ) | $ | (130,091 | ) | -1.34 | % | |||||

| Fiscal Year 2009 |

$ | 4,543 | $ | (2,013 | ) | $ | 2,530 | -44.31 | %(2) | |||||||

| Fiscal Year 2010 |

$ | 18,464 | $ | 3,733 | $ | 22,197 | 20.22 | % | ||||||||

| Fiscal Year 2008 by Quarter (1) |

||||||||||||||||

| Quarter Ended March 31, 2008 |

$ | 5,181 | $ | — | $ | 5,181 | 0.00 | % | ||||||||

| Quarter Ended June 30, 2008 |

$ | 4,307 | $ | (595 | ) | $ | 3,712 | -13.81 | % | |||||||

| Quarter Ended September 30, 2008 |

$ | 7,120 | $ | (161 | ) | $ | 6,959 | -2.26 | % | |||||||

| Quarter Ended December 31, 2008 |

$ | (144,979 | ) | $ | (964 | ) | $ | (145,943 | ) | -0.66 | % | |||||

| Fiscal Year 2009 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2009 |

$ | 2,191 | $ | (762 | ) | $ | 1,429 | -34.78 | %(3) | |||||||

| Quarter Ended June 30, 2009 |

$ | (9,540 | ) | $ | (654 | ) | $ | (10,194 | ) | -6.86 | % | |||||

| Quarter Ended September 30, 2009 |

$ | 4,777 | $ | (372 | ) | $ | 4,405 | -7.79 | % | |||||||

| Quarter Ended December 31, 2009 |

$ | 7,115 | $ | (225 | ) | $ | 6,890 | -3.16 | % | |||||||

| Fiscal Year 2010 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2010 |

$ | 5,702 | $ | (680 | ) | $ | 5,022 | -11.93 | % | |||||||

| Quarter Ended June 30, 2010 |

$ | 7,057 | $ | (618 | ) | $ | 6,439 | -8.76 | % | |||||||

| Quarter Ended September 30, 2010 |

$ | 6,149 | $ | (704 | ) | $ | 5,445 | -11.45 | % | |||||||

| Quarter Ended December 31, 2010 |

$ | (444 | ) | $ | 5,735 | $ | 5,291 | -1291.67 | % | |||||||

| 1. | Results reflect reclassification for discontinued operations resulting from the sale of the Company’s legacy gift business in December 2008. |

| 2. | Fiscal year 2009 includes a non-cash charge in the amount of $15.6 million recorded in the second quarter of 2009 pertaining to the Company’s Applause® trade name and the consideration received by the Company in connection with the sale of its former gift business, as well as severance charges of $853,000, which were each excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Income before Income Tax Benefit for the year would have been 9.36%, a substantially less significant percentage. |

14

| 3. | Results for the quarter include the impact of $394,000 in severance charges and $495,000 in charges for the write-off of deferred financing costs, each of which was excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Income before Income Tax Benefit for the quarter would have been 24.74%, a statistically less significant percentage.” |

Please note that below is a bar graph and a table showing the impact of the LaJobi customs matters on Net income/(loss) for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis. With respect to Net income/loss, the largest annual percentage variance (in 2009) amounts to only $1.2 million.

With respect to quarterly periods, no variance on Net income/loss reaches 3% in 2008. In addition, the largest percentage variance to this line item in 2009 (in the first quarter) amounts to only $465,000. In addition, as is described in footnote 3 to the table below, excluding the impact of an aggregate of $889,000 in specified charges, the percentage impact of the LaJobi matters for the year on this line item would have been reduced by approximately 10%, a substantial reduction. The largest percentage variance to this line item in 2010 amounts to $3.4 million (in the fourth quarter), primarily as a result of the cumulative impact of recording the charge in such quarter, which resulted in an aggregate impact of only $2.2 million (6.57%) for the full year period.

15

Net Income (loss):

Effect on Net Income (loss) from the LaJobi Customs Adjustments

(Dollars in thousands)

| Fiscal Period |

As Reported | Total Adjustments (1) |

As Adjusted | % Increase (Decrease) |

||||||||||||

| Fiscal Year 2008 |

$ | (111,556 | ) | $ | (1,049 | ) | $ | (112,605 | ) | -0.94 | % | |||||

| Fiscal Year 2009 |

$ | 11,705 | $ | (1,228 | ) | $ | 10,477 | -10.49 | %(2) | |||||||

| Fiscal Year 2010 |

$ | 34,672 | $ | 2,277 | $ | 36,949 | 6.57 | % | ||||||||

| Fiscal Year 2008 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2008 |

$ | 2,000 | $ | — | $ | 2,000 | 0.00 | % | ||||||||

| Quarter Ended June 30, 2008 |

$ | (12,139 | ) | $ | (363 | ) | $ | (12,502 | ) | 2.99 | % | |||||

| Quarter Ended September 30, 2008 |

$ | 8,205 | $ | (98 | ) | $ | 8,107 | -1.19 | % | |||||||

| Quarter Ended December 31, 2008 |

$ | (109,622 | ) | $ | (588 | ) | $ | (110,210 | ) | -0.54 | % | |||||

| Fiscal Year 2009 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2009 |

$ | 1,336 | $ | (465 | ) | $ | 871 | -34.81 | %(3) | |||||||

| Quarter Ended June 30, 2009 |

$ | (5,689 | ) | $ | (399 | ) | $ | (6,088 | ) | -7.01 | % | |||||

| Quarter Ended September 30, 2009 |

$ | 2,868 | $ | (227 | ) | $ | 2,641 | -7.91 | % | |||||||

| Quarter Ended December 31, 2009 |

$ | 13,190 | $ | (137 | ) | $ | 13,053 | -1.04 | % | |||||||

| Fiscal Year 2010 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2010 |

$ | 3,468 | $ | (415 | ) | $ | 3,053 | -11.97 | % | |||||||

| Quarter Ended June 30, 2010 |

$ | 4,476 | $ | (377 | ) | $ | 4,099 | -8.42 | % | |||||||

| Quarter Ended September 30, 2010 |

$ | 3,960 | $ | (429 | ) | $ | 3,531 | -10.83 | % | |||||||

| Quarter Ended December 31, 2010 |

$ | 22,768 | $ | 3,498 | $ | 26,266 | 15.36 | % | ||||||||

| 1. | Assumes an effective tax rate of 39% for duty charges and interest expense adjustments. |

| 2. | Fiscal year 2009 includes a non-cash charge in the amount of $15.6 million recorded in the second quarter of 2009 pertaining to the Company’s Applause® trade name and the consideration received by the Company in connection with the sale of its former gift business, as well as severance charges of $853,000, and a tax benefit of $7.2 million, which were each excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Net Income for the year would have been 8.25%, a statistically less significant percentage. |

16

| 3. | Results for the quarter include the impact of $394,000 in severance charges and $495,000 in charges for the write-off of deferred financing costs, each of which was excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Net Income for the quarter would have been 24.76%, a statistically less significant percentage. |

Please note that below is a bar graph and a table showing the impact of the LaJobi customs matters on basic EPS for each of 2008, 2009 and 2010 (and the quarterly periods within such fiscal years), on both an “as reported” and “as adjusted” basis. With respect to basic EPS, please note that the largest annual percentage variance (in 2009) amounts to only $0.06.

With respect to quarterly periods, the largest variance on basic EPS was 3.51% in 2008. The largest percentage variance in 2009 (in the first quarter) for this line item amounts to only $0.02. In addition, as is described in footnote 3 to the table below, excluding the impact of an aggregate of $889,000 in specified charges, the percentage impact of the LaJobi matters for the quarter on this line item would have been reduced by approximately 11%, a substantial reduction. The largest percentage variance in 2010 (in the fourth quarter) on basic EPS amounts to $0.16, primarily as a result of the cumulative impact of recording the charge in such quarter, which resulted in a smaller impact of only $0.10 (6.21%) for the full year period.

17

Basic Earning Per Share:

Effect on Basic Earning (loss) Per Share from the LaJobi Customs Adjustments

| Fiscal Period |

As Reported | Total Adjustments (1) |

As Adjusted | % Increase (Decrease) |

||||||||||||

| Fiscal Year 2008 |

$ | (5.23 | ) | $ | (0.06 | ) | $ | (5.29 | ) | -1.15 | % | |||||

| Fiscal Year 2009 |

$ | 0.55 | $ | (0.06 | ) | $ | 0.49 | -10.91 | %(2) | |||||||

| Fiscal Year 2010 |

$ | 1.61 | $ | 0.10 | $ | 1.71 | 6.21 | % | ||||||||

| Fiscal Year 2008 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2008 |

$ | 0.09 | $ | — | $ | 0.09 | 0.00 | % | ||||||||

| Quarter Ended June 30, 2008 |

$ | (0.57 | ) | $ | (0.02 | ) | $ | (0.59 | ) | -3.51 | % | |||||

| Quarter Ended September 30, 2008 |

$ | 0.39 | $ | (0.01 | ) | $ | 0.38 | -2.56 | % | |||||||

| Quarter Ended December 31, 2008 |

$ | (5.14 | ) | $ | (0.03 | ) | $ | (5.17 | ) | -0.58 | % | |||||

| Fiscal Year 2009 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2009 |

$ | 0.06 | $ | (0.02 | ) | $ | 0.04 | -33.33 | %(3) | |||||||

| Quarter Ended June 30, 2009 |

$ | (0.26 | ) | $ | (0.02 | ) | $ | (0.28 | ) | -7.69 | % | |||||

| Quarter Ended September 30, 2009 |

$ | 0.13 | $ | (0.01 | ) | $ | 0.12 | -7.69 | % | |||||||

| Quarter Ended December 31, 2009 |

$ | 0.62 | $ | (0.01 | ) | $ | 0.61 | -1.61 | % | |||||||

| Fiscal Year 2010 by Quarter |

||||||||||||||||

| Quarter Ended March 31, 2010 |

$ | 0.16 | $ | (0.02 | ) | $ | 0.14 | -12.50 | % | |||||||

| Quarter Ended June 30, 2010 |

$ | 0.21 | $ | (0.02 | ) | $ | 0.19 | -9.52 | % | |||||||

| Quarter Ended September 30, 2010 |

$ | 0.18 | $ | (0.02 | ) | $ | 0.16 | -11.11 | % | |||||||

| Quarter Ended December 31, 2010 |

$ | 1.06 | $ | 0.16 | $ | 1.22 | 15.09 | % | ||||||||

| 1. | Assumes an effective tax rate of 39% for duty charges and interest expense adjustments. |

| 2. | Fiscal year 2009 includes a non-cash charge in the amount of $15.6 million recorded in the second quarter of 2009 pertaining to the Company’s Applause® trade name and the consideration received by the Company in connection with the sale of its former gift business, as well as severance charges of $853,000, and a tax benefit of $7.2 million, which were each excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Basic EPS for the year would have been 8.57%, a statistically less significant percentage |

| 3. | Results for the quarter include the impact of $394,000 in severance charges and $495,000 in charges for the write-off of deferred financing costs, each of which was excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, the percentage impact of the LaJobi Matters on Basic EPS for the quarter would have been 22.22%, a statistically less significant percentage. |

Finally, please be advised that our operating and net income increased from 2008 to 2009 and from 2009 to 2010. If we had recorded the corrections in the appropriate prior-year periods, the trend remains the same.

18

As a result of the foregoing quantitative and qualitative analysis, we concluded that our investors would not view these adjustments (either quarterly or annually) as important in light of the total mix of information that we have described herein. We respectfully reiterate that we believe our investors are more focused on metrics that provide an indication of our liquidity and our ability to service our debt – such as revenues, cash flows and Adjusted Net Income or Adjusted EBITDA. The customs error had absolutely no impact on these important metrics. In addition, we determined that this was truly a highly unusual situation that was not reflective of our ordinary course of business. Accordingly, we concluded that in the context of the totality of circumstances surrounding the event, the out-of-period adjustments were not material.

No Benefit to Restatement

We respectfully suggest that, even if the Staff were to disagree with our conclusions, we truly believe that there would be no benefit to our shareholders from a restatement. As the errors resulting in the need for the accruals have been corrected and fully disclosed, restatement of prior period financial statements would only increase our expenses to the detriment of our financial results. In addition, we believe that the errors impacting prior periods are now of even less relevance to the market for our securities, as the aggregate amount of the out-of-period adjustments made in 2010 to correct prior period errors has been fully disclosed and assimilated by the market. As a result, pushing those errors back to 2008 and 2009 will not change the way an investor views our Company. Additionally, the adjustments would not impact our operating income or net income trends, and would have zero impact on revenues and Adjusted Net Income or EBITDA. Moreover, please note that we will soon be filing our 2011 Form 10-K. With respect to the financial statements to be contained therein, the proposed adjustments would have no impact on 2011, and would improve 2010 by increasing net income by only $2.3 million and decreasing 2009 net income by only $1.2 million. As a result, we believe that a restatement whose most notable result would be to move $2.3 million of aggregate net income to 2010 (and require increased expenses to our shareholders) is more likely to create confusion than provide meaningful additional information to investors.

Please also consider that, as noted on the Staff Call by our KPMG engagement partner, KPMG: (i) carefully considered management’s position, including that the Company’s disclosure was robust and not misleading; (ii) believed that the Company’s accounting treatment was consistent with the preference for current period treatment expressed by Wayne Carnall in his December 2010 speech to its SEC reviewing partners; and (iii) consulted with members of KPMG’s national office, who concurred with the conclusions of the engagement partners and the Company.

As a result of all of the foregoing, we respectfully submit that a restatement is not merited in this case.

19

Form 10-Q for the Period ended September 30, 2011

Notes to the Financial Statements

Note 10 — Litigation, Commitments and Contingencies, page 20

| 2. | In regards to the anti-dumping duty matters related to your LaJobi subsidiary, your disclosures on page 21 indicate that you recorded an additional $382,000 for the quarter ended March 31, 2011, $55,000 for the quarter ended June 30, 2011, and $56,000 for the quarter ended September 30, 2011. Following the discovery of the matters with respect to your LaJobi subsidiary, you also performed a review of customs compliance practices at non—LaJobi operating subsidiaries. As a result of this review, you estimate that you will incur aggregate costs of approximately $2.4 million relating to customs duty for the years ended 2006 through 2010 and the nine months ended September 30, 2011. You determined that the impact on prior periods was immaterial to the previously reported financial statements and therefore the anticipated amounts were accrued in the period they were identified. In this regard, please address the following: |

| • | Please tell us how you determined that the impact on prior periods was immaterial to previously reported financial statements. For each quarter in 2011 for which you recorded these charges, please tell us the prior period to which the charges relate; |

| • | In your response to comment 4 of our letter dated October 6, 2011, one of the qualitative factors that you considered in your materiality analysis was that the misstatements arose from items capable of precise measurement. Please help us understand how you made this determination in light of the additional charges recorded during 2011 related to the LaJobi matters; and |

| • | If you determined that there is at least a reasonable possibility that a loss in excess of the amounts accrued may have been incurred, please disclose this in future filings and also the amount of loss or range of possible loss or state that such a loss cannot be estimated. Refer to ASC 450-20-50. Please show us in your supplemental response what the revisions will look like. |

Response

A. Periods to Which Non-LaJobi Customs Charges Relate and Impact on Prior Periods

Please be advised that as stated in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2011 (the “June 10-Q”), following the discovery of the LaJobi matters, our Board authorized a review of customs compliance practices at the Company’s non-LaJobi operating subsidiaries. As a result of the findings of such review to date, in our June 10-Q and again in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2011 (the “Sept 10-Q”), we estimated that we will incur aggregate costs of approximately $2.4 million (pre-tax) relating to additional customs duty for the years ended 2006 through 2010 and the year-to-date periods ended June 30, 2011 and September 30, 2011, respectively.

20

As a background matter, please note that the customs charges with respect to the non-LaJobi subsidiaries resulted from incorrect entries and invoices filed with U.S. Customs as a result of, in the case of Kids Line, incorrect descriptions, classifications and valuations of certain products imported by Kids Line and, in the case of CoCaLo, incorrect classifications of certain products imported by CoCaLo, and had nothing to do with LaJobi or anti-dumping duties. The relevant period commences in 2006 as a result of the applicable 5-year statute of limitations.

Periods to Which Charges Relate

Please be advised that with respect to the most recent accrual, the $30,000 recorded for the quarter ended September 30, 2011 represents interest for such quarter alone on the entire amount previously accrued, as the duties have not yet been paid. As a result, these charges do not relate to a specific prior period.

Of the remaining amount accrued, the Company recorded approximately $2.2 million in cost of sales and $0.2 million in interest expense for the three and six months ended June 30, 2011 (the period during which the errors were identified). The prior periods to which the charges recorded in the quarter ended June 30, 2011 relate are set forth below:

| ($000) |

Total | Six Months Ended 6/30/2011 |

2010 | 2009 | 2008 | 2007 | Six Months Ended 12/31/2006 |

|||||||||||||||||||||

| $ | 2,354 | $ | 396 | $ | 783 | $ | 482 | $ | 402 | $ | 219 | $ | 72 | |||||||||||||||

Impact on Prior Periods

As with respect to the LaJobi matters, please be advised that, prior to our recording of the relevant out-of-period adjustments: (i) we performed a thorough analysis of the related accounting and disclosure issues; (ii) we discussed each of these issues with KPMG; (iii) we ultimately made decisions with respect to such matters that we feel were appropriate and supported by accounting standards and securities guidance, and were in the best interests of the users of our financial statements; and (iv) KPMG concurred with such decisions.

In accordance with applicable accounting guidance, we performed a rigorous quantitative and qualitative analysis of the customs accruals and all relevant facts and circumstances pertaining to such accruals. We concluded that, when considered in connection with all relevant considerations, or the total mix of information, the variances were not material to the market for our public securities, for any of the particular periods impacted.

Quantitative Analysis

Of the amount accrued, the following bar graphs and tables set forth the impact of the errors on prior period financial statements with respect to Cost of sales; Gross profit; Income/loss from

21

continuing operations before income tax (benefit) (“PTI”); Net income/loss; and basic Earnings/loss per share (“basic EPS”):

22

(Dollars in thousands)

| As Reported | Total Adjustments |

As Adjusted | % Increase (Decrease) |

|||||||||||||

| Cost of Sales: |

||||||||||||||||

| Fiscal Year 2006 (1)(2) |

$ | 84,338 | $ | 70 | $ | 84,408 | 0.08 | % | ||||||||

| Fiscal Year 2007 (1) |

$ | 111,361 | $ | 199 | $ | 111,560 | 0.18 | % | ||||||||

| Fiscal Year 2008 (1) |

$ | 160,470 | $ | 369 | $ | 160,839 | 0.23 | % | ||||||||

| Fiscal Year 2009 |

$ | 168,741 | $ | 443 | $ | 169,184 | 0.26 | % | ||||||||

| Fiscal Year 2010 |

$ | 199,483 | $ | 721 | $ | 200,204 | 0.36 | % | ||||||||

| Six month ended 6/30/11 |

$ | 89,524 | $ | (1,802 | ) | $ | 87,722 | -2.01 | % | |||||||

| Gross Profit: |

||||||||||||||||

| Fiscal Year 2006 (1)(2) |

$ | 62,762 | $ | (70 | ) | $ | 62,692 | -0.11 | % | |||||||

| Fiscal Year 2007 (1) |

$ | 51,705 | $ | (199 | ) | $ | 51,506 | -0.38 | % | |||||||

| Fiscal Year 2008 (1) |

$ | 68,724 | $ | (369 | ) | $ | 68,355 | -0.54 | % | |||||||

| Fiscal Year 2009 |

$ | 75,195 | $ | (443 | ) | $ | 74,752 | -0.59 | % | |||||||

| Fiscal Year 2010 |

$ | 76,294 | $ | (721 | ) | $ | 75,573 | -0.95 | % | |||||||

| Six month ended 6/30/11 |

$ | 30,604 | $ | 1,802 | $ | 32,406 | 5.89 | % | ||||||||

| Income/loss from Continuing Operations before Income Tax (Benefit): |

||||||||||||||||

| Fiscal Year 2006 (1)(2) |

$ | 24,429 | $ | (72 | ) | $ | 24,357 | -0.29 | % | |||||||

| Fiscal Year 2007 (1) |

$ | 13,222 | $ | (219 | ) | $ | 13,003 | -1.66 | % | |||||||

| Fiscal Year 2008 (1) |

$ | (128,371 | ) | $ | (402 | ) | $ | (128,773 | ) | 0.31 | % | |||||

| Fiscal Year 2009 |

$ | 4,543 | $ | (482 | ) | $ | 4,061 | -10.61 | %(3) | |||||||

| Fiscal Year 2010 |

$ | 18,464 | $ | (783 | ) | $ | 17,681 | -4.24 | % | |||||||

| Six month ended 6/30/11 |

$ | 253 | $ | 1,958 | $ | 2,211 | 773.91 | %(4) | ||||||||

23

| Net Income/loss: |

$ | (9,436 | ) | $ | (44 | ) | $ | (9,480 | ) | 0.47 | % | |||||

| Fiscal Year 2006 (1)(2) |

$ | 8,908 | $ | (134 | ) | $ | 8,774 | -1.50 | % | |||||||

| Fiscal Year 2007 (1) |

$ | (111,556 | ) | $ | (245 | ) | $ | (111,801 | ) | 0.22 | % | |||||

| Fiscal Year 2008 (1) |

$ | 11,705 | $ | (294 | ) | $ | 11,411 | -2.51 | % | |||||||

| Fiscal Year 2009 |

$ | 34,672 | $ | (478 | ) | $ | 34,194 | -1.38 | % | |||||||

| Fiscal Year 2010 |

$ | (4,175 | ) | $ | 1,194 | $ | (2,981 | ) | -28.60 | %(5) | ||||||

| Six month ended 6/30/11 |

||||||||||||||||

| Basic Earnings/loss Per Share: |

$ | (0.45 | ) | $ | — | $ | (0.45 | ) | 0.00 | % | ||||||

| Fiscal Year 2006 (1)(2) |

$ | 0.42 | $ | — | $ | 0.42 | 0.00 | % | ||||||||

| Fiscal Year 2007 (1) |

$ | (5.23 | ) | $ | (0.01 | ) | $ | (5.24 | ) | 0.19 | % | |||||

| Fiscal Year 2008 (1) |

$ | 0.54 | $ | (0.02 | ) | $ | 0.52 | -3.70 | % | |||||||

| Fiscal Year 2009 |

$ | 1.61 | $ | (0.02 | ) | $ | 1.59 | -1.24 | % | |||||||

| Fiscal Year 2010 |

$ | (0.19 | ) | $ | 0.05 | $ | (0.14 | ) | -26.32 | %(5) | ||||||

| Six month ended 6/30/11 |

||||||||||||||||

| 1. | Results reflect reclassification for discontinued operations resulting from the sale of the Company’s legacy gift business in December of 2008. |

| 2. | As a result of the relevant statute of limitations, the customs adjustment is for a period of 5 years prior to the time of notification (i.e., commencing the last six months of 2006). |

| 3. | Fiscal year 2009 includes a non-cash charge in the amount of $15.6 million recorded in the second quarter of 2009 pertaining to the Company’s Applause® trade name and the consideration received by the Company in connection with the sale of its former gift business, as well as severance charges of $853,000, which were each excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding these amounts, this percentage would have been only 2.24%. |

| 4. | The six-month period ended June 30, 2011was impacted by the following: (i) $3.1 million in LaJobi investigative costs; (ii) an accrual of $1.1 million for potential liabilities to the landlord under a lease assigned to the buyer of our former gift business; (iii) $2.0 million taken into income in Q2 2011 by reducing the valuation allowance previously recorded in June 2009 against the note receivable from the sale of our former gift business; (iv) a $0.1 million accrual for interest on additional anticipated LaJobi import duties; and (v) fees of $0.1 million associated with the Q1 2011 amendment to the Company’s credit agreement (collectively, the “Other Impacts”), which were each excluded from non-GAAP adjusted net income in the Company’s earnings release for the relevant period as non-reflective of ongoing operations. Excluding the Other Impacts, this percentage would have been substantially reduced (to 53.4%). |

| 5. | Note that these variances were also impacted by the Other Impacts. |

With respect to our quantitative analysis, we believe that the additional customs charges in question are quantitatively immaterial when viewed as absolute amounts in the overall context of the Company’s financial statements. On a tax-effected basis, these adjustments amount to variances in the approximate amount of $44,000 for 2006, the year of the smallest impact, and less than $500,000 for 2010, the year of greatest impact. The adjustments would result in improving Net income/loss for the six months ended June 30, 2011 by only $1.2 million, and would not reverse the loss for the period into income. With respect to basic EPS, the adjustment for such period would result in a difference of only $0.05 (again, with a significant loss per basic share remaining). As a result, we do not believe these adjustments (which have been fully disclosed) would meaningfully change the way our investors viewed our 2011 or prior period results.

24

With respect to PTI, the only annual period during 2006 through 2010 in which these charges exceeded 4.5% was 2009, where the variance was 10.61%. However, had the Company’s results of operations for 2009 not been significantly impacted by aggregate charges of $16.5 million described in footnote 3 to the table above, this percentage would have been an immaterial 2.4%. We do not believe that this customs error became material to such period solely because other charges were appropriately recorded in the same period. In addition, with respect to annual periods during 2006 through 2010, the charges represent an approximate 2.51% variance in Net income/loss in the year of greatest impact (2008), and an approximate 3.7% variance in basic EPS in the year of greatest impact (2009), which amounted to only $0.02 for such year.

With respect to the six-month period ended June 30, 2011, while the percentage variances may appear significant for PTI, Net income/loss, and basic EPS, as is demonstrated by the tables above and as discussed below, the actual amounts of such variances appear far less significant when viewed in the context of the overall size of our business (and, in addition, such line items were also significantly affected by the Other Impacts). As we have stated in our response to Comment 1 above, the accounting literature specifies that percentages alone should not control materiality decisions. We believe that, when considered in light of all relevant considerations, the non-LaJobi customs variances were not material to the market for our public securities during 2011 despite their quantitative size.

In addition, we note that materiality for interim periods is better expressed in relation to the projected income/loss for the full year. Therefore, in accordance with APB 28, management assessed the materiality of the cumulative adjustment relative to projected net income for 2011, and determined that the out-of-period adjustment (slightly less than $1.2 million for the full year) was not material. In order to determine materiality, we utilized historical net revenue, because we believe that reported net income for the relevant periods is a far less representative measure of the Company’s size and performance, given other Company-specific and macro-economic factors affecting our business during such periods. Specifically, we noted that projected revenues ranging at the time from approximately $253 million to $257 million for 2011 are not materially different from actual 2010 revenues of $276 million and actual 2009 revenues of $244 million, whereas net income (as reported) has fluctuated widely, from $9.0 million in net income in 2007, a $111.6 million net loss in 2008, $11.7 million in net income in 2009, and $34.7 million in net income in 2010. These variations (which are expected to continue in 2011) support our conclusion that the cumulative adjustment is not material to 2011 when viewed in the context of the size of the Company’s business. In addition, any comparison to the 2011 then-projected results would result in a large percentage, as any variance would most likely appear quantitatively significant under anticipated circumstances. We also considered the level of shareholders’ equity ($125 million at June 30, 2011) in determining that the projected net income for 2011 is not truly representative of the size of the Company’s operations. When these factors are combined with our assessment of the qualitative factors noted below, we concluded that recognition of the cumulative customs duty charges in 2011 does not materially impact the results of operations for the fiscal year.

25

Qualitative Analysis

Please be advised that in addition to carefully reviewing the quantitative nature of the charges at issue, we reviewed numerous qualitative factors that comprised part of the total mix of information considered, the most significant of which are discussed below.

As set forth in our response to Comment 1 above, we believe that analysts that follow our Company, as well as most of our investors, appear to be less concerned with period-to-period swings in income statement line items that do not reflect our normal operations. Similar to the LaJobi matters, the fact that customs duties were recorded in 2011 (instead of over the course of the applicable period) has not resulted in any voiced concern on the part of the investors, analysts or other members of the investment community with whom we have spoken.

Please also note that, as with the LaJobi matters, this situation was not deemed critical to our senior lender either, as the negotiated financial covenants in our prior and existing credit agreements are based on Adjusted EBITDA.

Another important qualitative consideration is the fact that the out-of-period adjustments did not change any financial measures with respect to which the Company provided guidance to the analyst/investor community – the customs accrual was reversed in our Non-GAAP Adjusted Net Income measure for the three and six months ended June 30, 2011, as we did not consider it reflective of our ongoing operating performance, as has been disclosed to our investors.

In addition, please note that the Company self-reported and then fully disclosed the out-of-period adjustments, including detailed disclosure regarding the nature of the charge and the facts and circumstances requiring it, in both the notes to the financial statements and MD&A section our June 10-Q (and subsequent periodic reports).

Please also note the following summary of the qualitative impacts of the errors with respect to the factors described in SAB 99.

| Factors |

Comments | |

| Whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate. | The misstatements were capable of precise measurement (the amount of customs duties owed is quantifiable — see Item B of response below) | |

| Whether the misstatement masks a change in earnings or other trends. | The misstatements do not mask a change in earnings or any other trends applicable to the Company for any relevant period. | |

26

| Whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise. | For 2006 - 2009, there were no published earnings estimates of analysts with respect to the Company, and during 2010 and 2011, although there were such estimates, the misstatements did not hide a failure to meet such analysts’ consensus expectations, as the Company reversed the customs accruals in its press releases and guidance, and clearly discloses (and reconciles to GAAP) any adjustments it makes with respect to its own earnings estimates. | |

| Whether the misstatement changes a loss into income or vice versa. | Correction of these misstatements would not change a loss into income or vice versa for the applicable periods. | |

| Whether the misstatement concerns a segment or other portion of the registrant’s business that has been identified as playing a significant role in the registrant’s operations or profitability. | The Company operates through four subsidiaries. Our Kids Line subsidiary is significant to our consolidated operations. | |

| Whether the misstatement affects the registrant’s compliance with regulatory requirements. | An investigation into these matters, supervised by the Special Committee of the Company’s Board of Directors and conducted by outside counsel, is currently ongoing. | |

| Whether the misstatement affects the registrant’s compliance with loan covenants or other contractual requirements. | The misstatements had no effect on the Company’s compliance with loan covenants or other contractual requirements. | |

| Whether the misstatement has the effect of increasing management’s compensation — for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation. | The misstatements did not result in a material benefit to management through additional compensation or otherwise. | |

| Whether the misstatement involves concealment of an unlawful transaction. | An investigation into these matters, supervised by the Special Committee of the Company’s Board of Directors and conducted by outside counsel, is currently ongoing. | |

The Company has concluded that, after considering the quantitative and qualitative factors discussed above, these misstatements are not deemed to be material to any previously issued financial statements. Similarly, based upon the discussion above, management also concluded that recording the cumulative adjustment in the second quarter of 2011 was not material to the Company’s financial statements for the three and six months ended June 30, 2011, or the projected results of operations for the year ended December 31, 2011. As a result, we determined that the additional customs duty charges should be accounted for in the period of discovery, which was the second quarter of 2011. In addition, management concluded that in light of the analysis above, a reasonable person would not find corrections of these misstatements to be important.

27

B. Items Capable of Precise Measurement

Please be advised that, as discussed on the Staff Call, the applicable items (customs duties) are capable of precise measurement, by applying the applicable customs duty rate to each entry of the relevant products into the United States. With respect to the LaJobi matters, note that the Focused Assessment was commenced on January 19, 2011. As a result, we recorded an additional $382,000 for the quarter ended March 31, 2011, as the practices resulting in the imposition of the customs duty rates in question were not discontinued until January 2011. Of the aggregate $382,000 recorded as of March 31, 2011, $327,000 represents anticipated customs duties for relevant products imported in January 2011, and $55,000 of such amount represents interest for the quarter on the entire accrued amount of anticipated customs duties (including the approximately $6.7 million accrued during the fourth quarter of 2010), as such anticipated duties have not yet been paid. We also recorded $55,000 for the quarter ended June 30, 2011, and $56,000 for the quarter ended September 30, 2011. Similarly, such amounts represent accrued interest for each such quarter on the entire amount accrued to such date.

In connection with the foregoing charges, please note that interest will continue to accrue in subsequent quarters until the Focused Assessment and the Company’s voluntary prior disclosures have been completed, and the final amount of customs duty owed is determined by U.S. Customs and paid by the Company.

C. Reasonable Possibility of Loss in Excess of Amounts Accrued

Please be advised that in accordance with ASC 450-20-50, we accrued those contingencies that we deemed to be probable and reasonably estimable – i.e., the anticipated additional customs duties (and related interest) owed to U.S. Customs. In addition, also in accordance with the ASC, we have disclosed that, in addition to continuing interest, amounts in excess of those accrued may be owed – i.e., potential penalty amounts – and have also disclosed our assessment of the range of such additional loss amounts (i.e., up to 100% of the duty owed). With respect to other potential negative ramifications that we believe are reasonably possible (such as additional fines, penalties or measures from U.S. Customs or other governmental authorities), we have disclosed that such losses are possible, but that we cannot currently estimate the amount of loss (or range of loss), if any, in connection therewith. As a result, we feel that our disclosures with respect to loss contingencies are in compliance with applicable accounting standards.

In connection therewith, please note the following disclosure set forth in Note 10 to the Notes to Unaudited Consolidated Financial Statements on pages 21 and 22 of the Sept 10-Q, copied below. We will modify this disclosure as appropriate in future periods to the extent our assessment of reasonably possible losses changes.

28

Page 21 of Sept 10-Q with respect to LaJobi accruals (emphasis supplied):

“Accordingly, the Company has recorded charges of approximately: (i) $6,860,000 (which includes approximately $340,000 of interest) for the quarter and year ended December 31, 2010; (ii) $382,000 (which includes approximately $55,000 of interest) for the quarter ended March 31, 2011; (iii) $55,000 in related interest for the quarter ended June 30, 2011; and (iv) $56,000 in related interest expense for the quarter ended September 30, 2011, in each case for duties (or related interest) the Company anticipates will be owed to U.S. Customs by LaJobi in respect of the matters discussed above. All of the foregoing charges were recorded in cost of sales (other than the interest portions, which were recorded in interest expense), and adversely affected gross margins and net (loss)/income for the affected periods. As the Focused Assessment is still pending, it is possible that the actual amount of duty owed for the period covered thereby will be higher upon completion thereof, and in any event, additional interest will continue to accrue on the amounts the Company currently anticipates the Company will owe until payment is made. In addition, it is possible that the Company may be assessed by U.S. Customs a penalty of up to 100% of such duty owed, as well as possibly being subject to additional fines, penalties or other measures from U.S. Customs or other governmental authorities. With respect to the actual amount of duty owed, and additional fines, penalties or other measures, the Company cannot currently estimate the amount of the loss (or range of loss), if any, in connection therewith.”

Page 22 of Sept 10-Q with respect to non- LaJobi accruals (emphasis supplied)

“Of the amount accrued, the Company recorded $2.2 million in cost of sales and $0.2 million in interest expense for the three months ended June 30, 2011 and an additional $30,000 in interest expense was recorded for the three months ended September 30, 2011. As the Customs Review is still pending, it is possible that the actual amount of duty owed will be higher upon its completion and, in any event, additional interest will continue to accrue until payment is made. In addition, it is possible that the Company may be assessed by U.S. Customs a penalty of up to 100% of any such duty owed, as well as possibly being subject to additional fines, penalties or other measures from U.S. Customs or other governmental authorities. With respect to the actual amount of duties owed, and additional fines, penalties or other measures, the Company cannot currently estimate the amount of loss (or range of loss), if any, in connection therewith.”

Item 4. Controls and Procedures

Changes in Internal Control over Financial Reporting, page 44

| 3. | There was no change in your internal control over financial reporting that occurred during the fiscal quarter ended June 30, 2011 that has materially affected, or is reasonably likely to materially affect, your internal control over financial reporting. Please help us understand how you made this determination in light of the enhancements that were initiated to your processes and procedures in areas where import duty underpayments were found. |

29

Response

Please be advised that as described in our October 28, 2011 response letter, we did initiate enhancements to our processes and procedures in areas where import duty underpayments were found. Importantly, however, the design of our internal control over financial reporting has not been materially changed.

We believe that the improvements that we have made, which include, among other things, some personnel education, enhancement of certain internal control procedures, and the retention of Customs counsel and an independent firm to review our procedures in order to identify opportunities to enhance internal controls, do not constitute control changes which would materially affect our overall internal control over financial reporting, such as the implementation of a new information system (an example given in Question 7 of the SEC’s 2007 FAQs regarding Management’s Report on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports), or the hiring of senior financial executives.

Applying traditional materiality standards to our internal control improvements (as instructed by Question 7 referred to above), we do not believe that there is a substantial likelihood that a reasonable shareholder would consider these enhancements as important in deciding how to vote their shares.

As a result, we concluded that the improvements we initiated were just that — incremental improvements — that did not materially alter the design of our internal controls over financial reporting, and our disclosures on page 44 of the June 10-Q, which are set forth below (emphasis supplied), are consistent with this conclusion.

“There was no change in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Exchange Act Rule 13a-15 or 15d-15 that occurred during the fiscal quarter ended June 30, 2011 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting. However, the Company has initiated certain enhancements to its processes and procedures in areas where import duty underpayments were found, and will continue to review its internal controls for areas of potential improvement.”

Closing Comments:

The Company hereby acknowledges that:

| • | the Company is responsible for the adequacy and accuracy of the disclosure in its filings; |

| • | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

30

We sincerely hope that we have addressed the Staff’s comments on our filings. We will be pleased to respond promptly to any additional requests for information or material that we may provide in order to facilitate your review.

Sincerely,

| KID BRANDS, INC. | ||

| By: | /s/ Guy A. Paglinco | |

| Name: | Guy A. Paglinco | |

| Title: | Vice President and | |

| Chief Financial Officer | ||

31