Exhibit 10.1

SECOND AMENDMENT TO LOAN AND SECURITY AGREEMENT

This Second Amendment to Loan and Security Agreement (this “Amendment”) dated as of November 5, 2025 is by and among RF INDUSTRIES, LTD., a Nevada corporation, CABLES UNLIMITED, INC., a New York corporation, REL-TECH ELECTRONICS, INC., a Connecticut corporation, C ENTERPRISES, INC., a California corporation, SCHROFF TECHNOLOGIES INTERNATIONAL, INC., a Rhode Island corporation, and MICROLAB/FXR LLC, a New Jersey limited liability company (collectively, the “Borrowers”), ECLIPSE BUSINESS CAPITAL LLC, as agent for the Lenders, (in such capacity, “Agent”), and the Lenders party hereto.

BACKGROUND

A. The Borrowers, Agent and the Lenders entered into that certain Loan and Security Agreement dated as of March 15, 2024 (as amended, and may be further amended, modified, extended, or restated from time to time prior to the date hereof, the “Existing Agreement” and the Existing Agreement, as modified by this Amendment, the “Agreement”), pursuant to which Agent and the Lenders extended certain financing arrangements to the Borrowers.

B. The parties hereto have agreed to modify the terms and conditions of the Existing Agreement as more fully set forth herein.

C. Capitalized terms used but not otherwise defined herein shall have the meanings given to such terms in the Agreement.

NOW THEREFORE, in consideration of the terms, conditions and covenants set forth below, and other good and valuable consideration, the receipt of which is hereby acknowledged, the parties, intending to be legally bound hereby, promise and agree as follows:

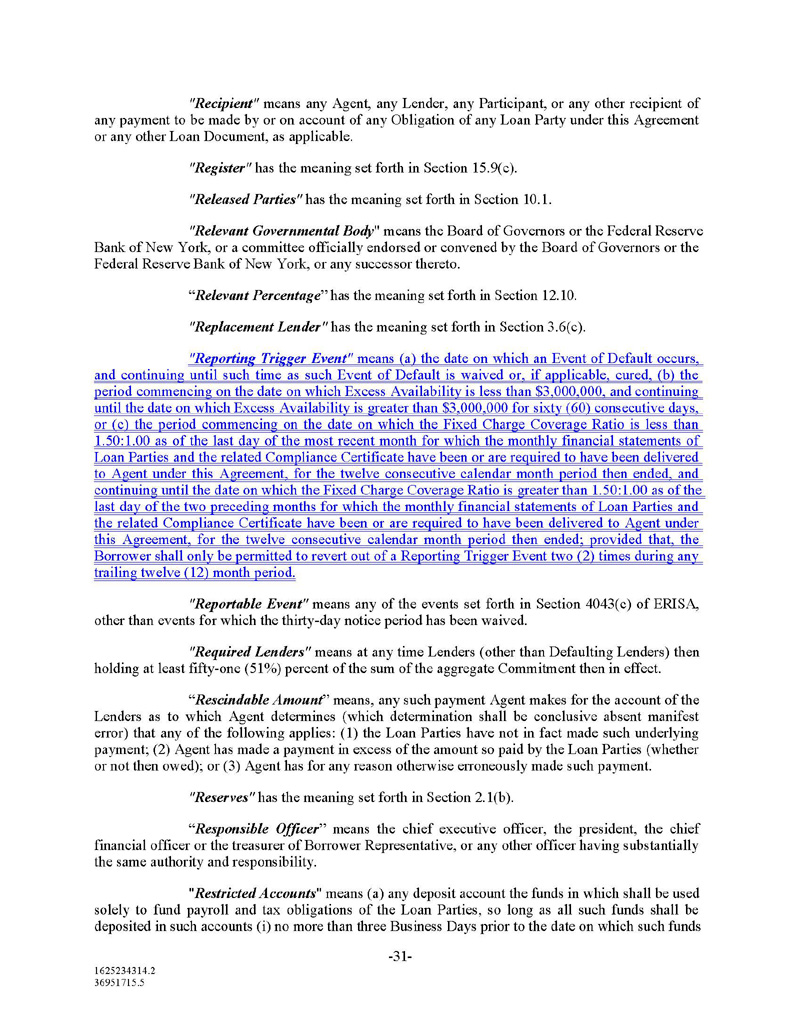

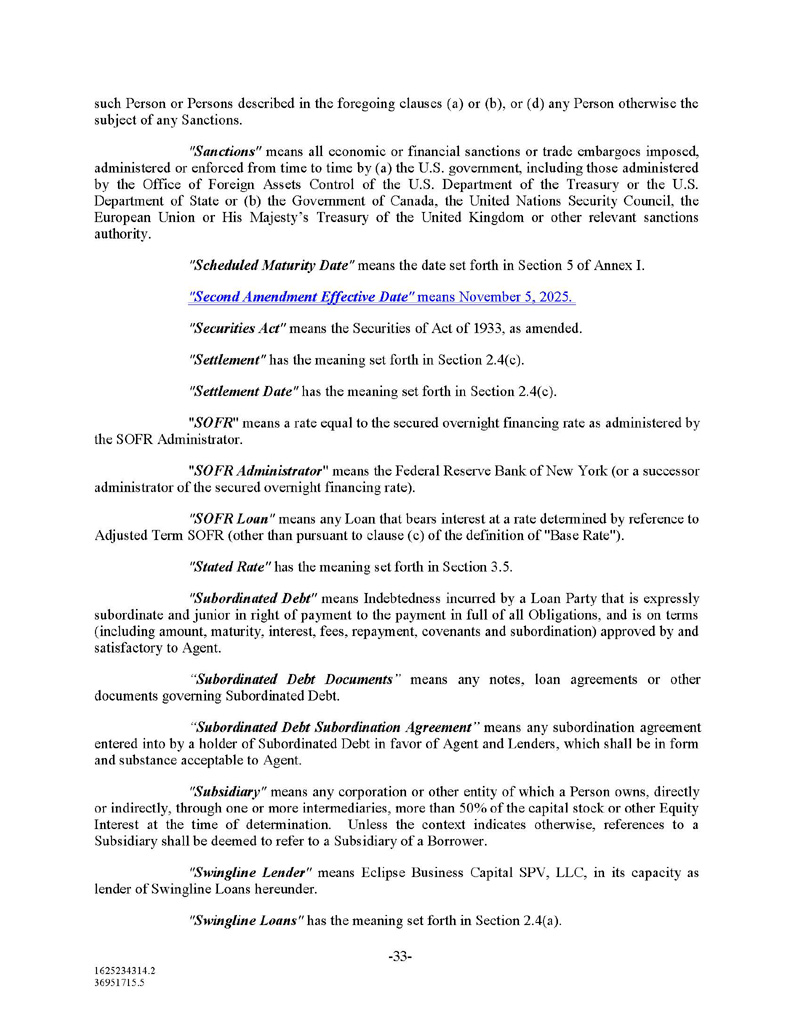

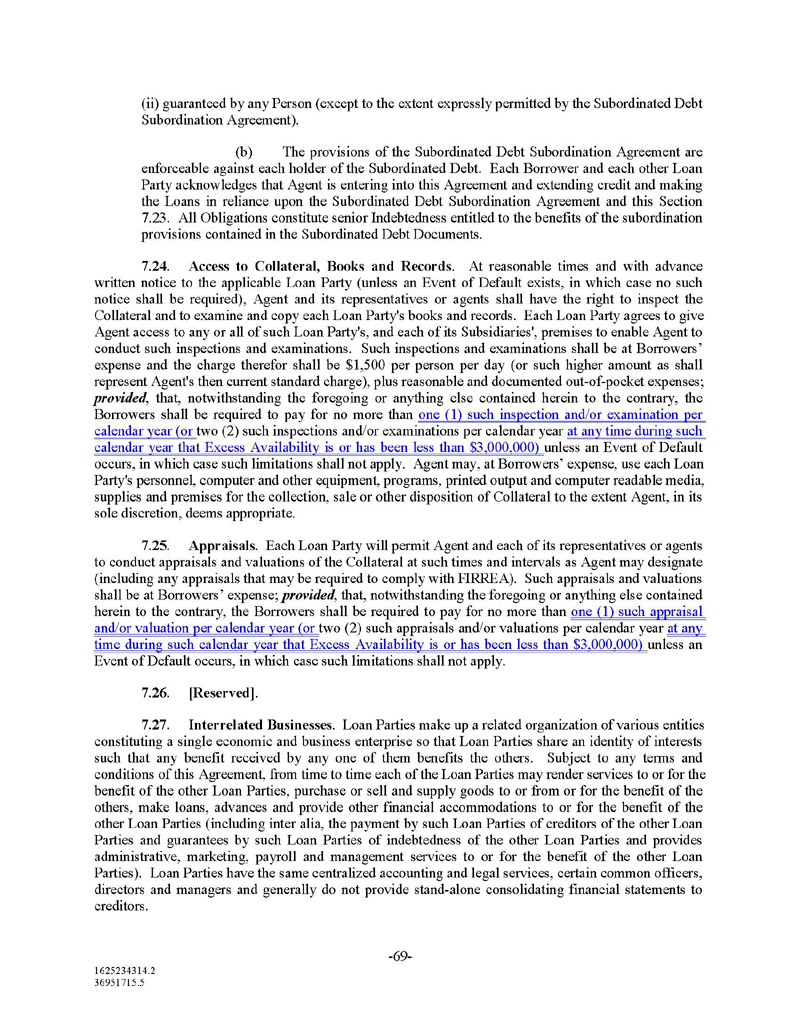

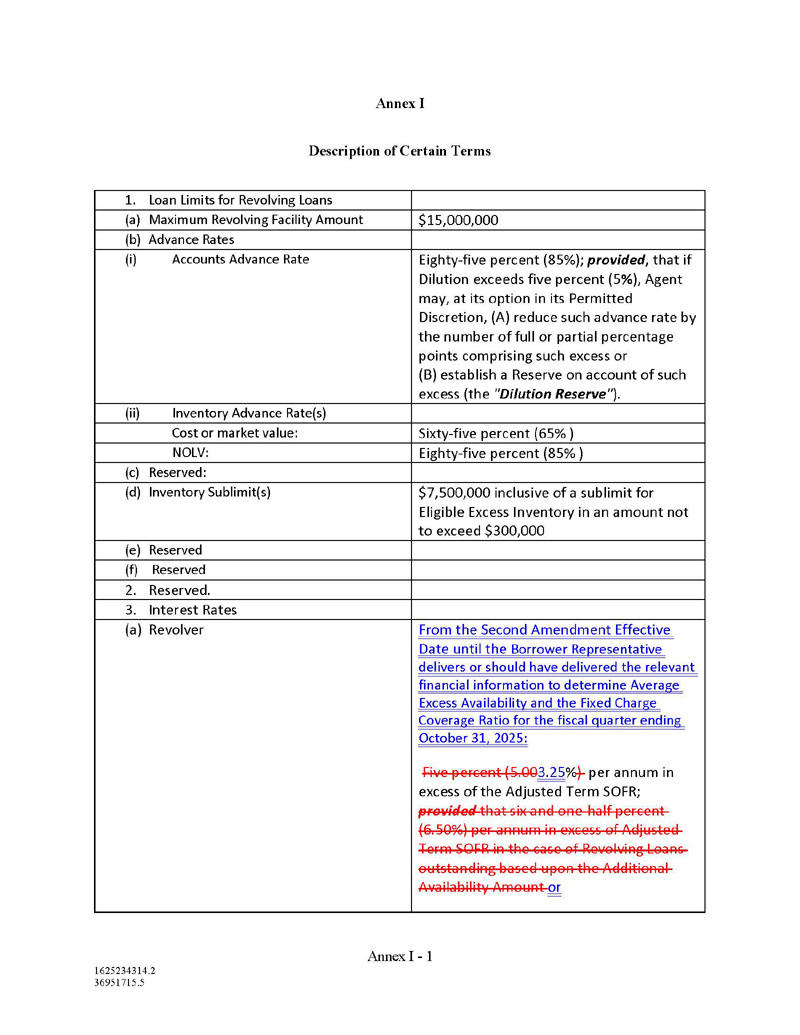

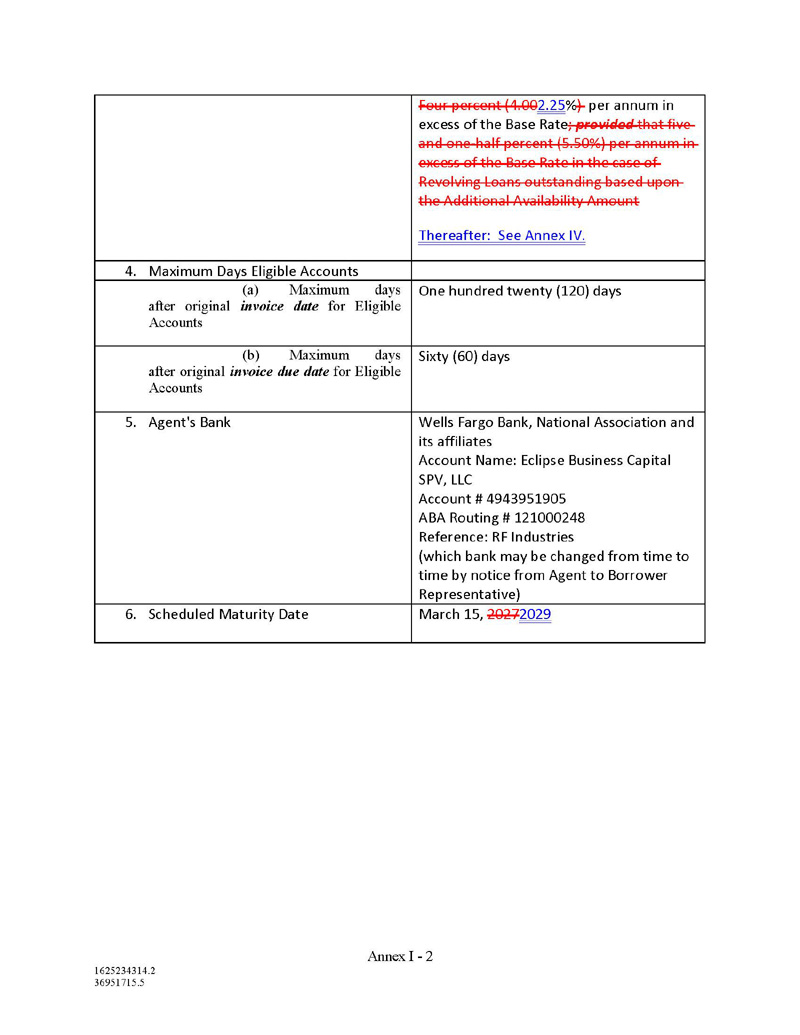

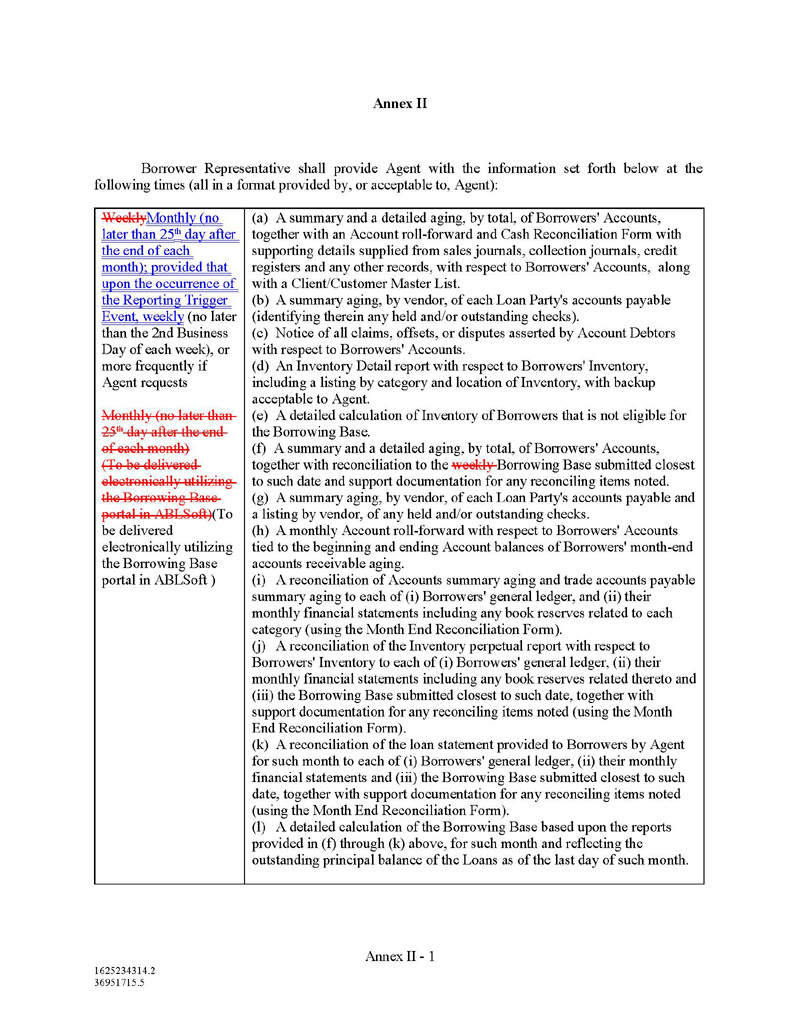

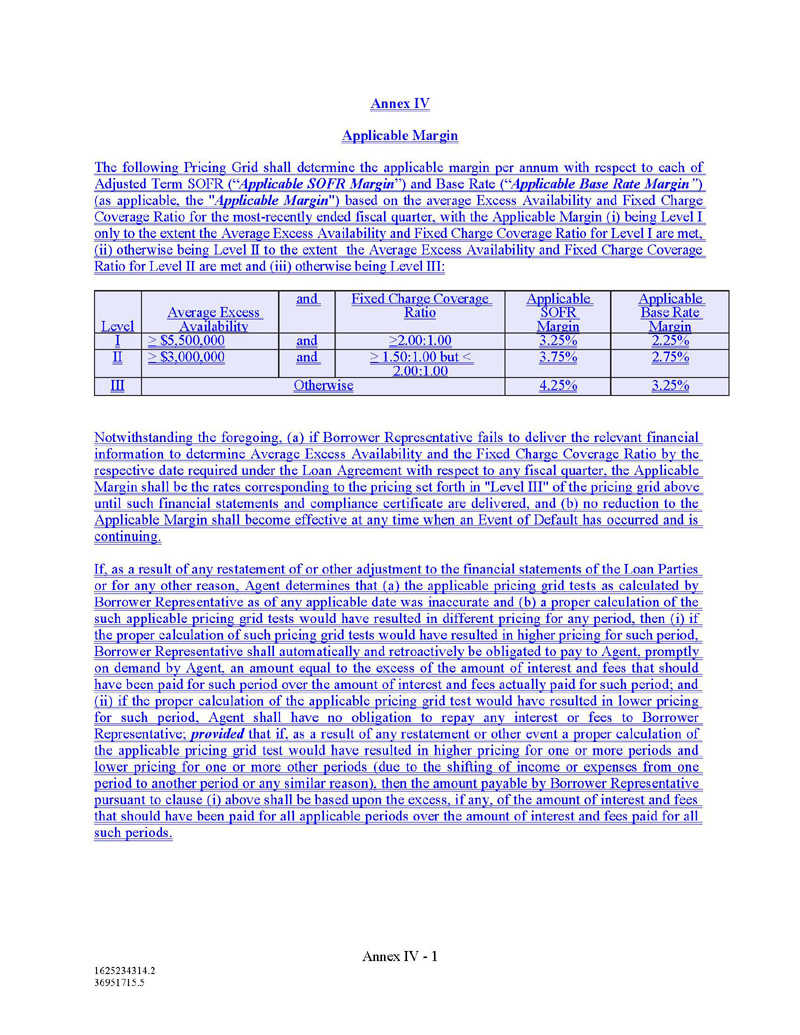

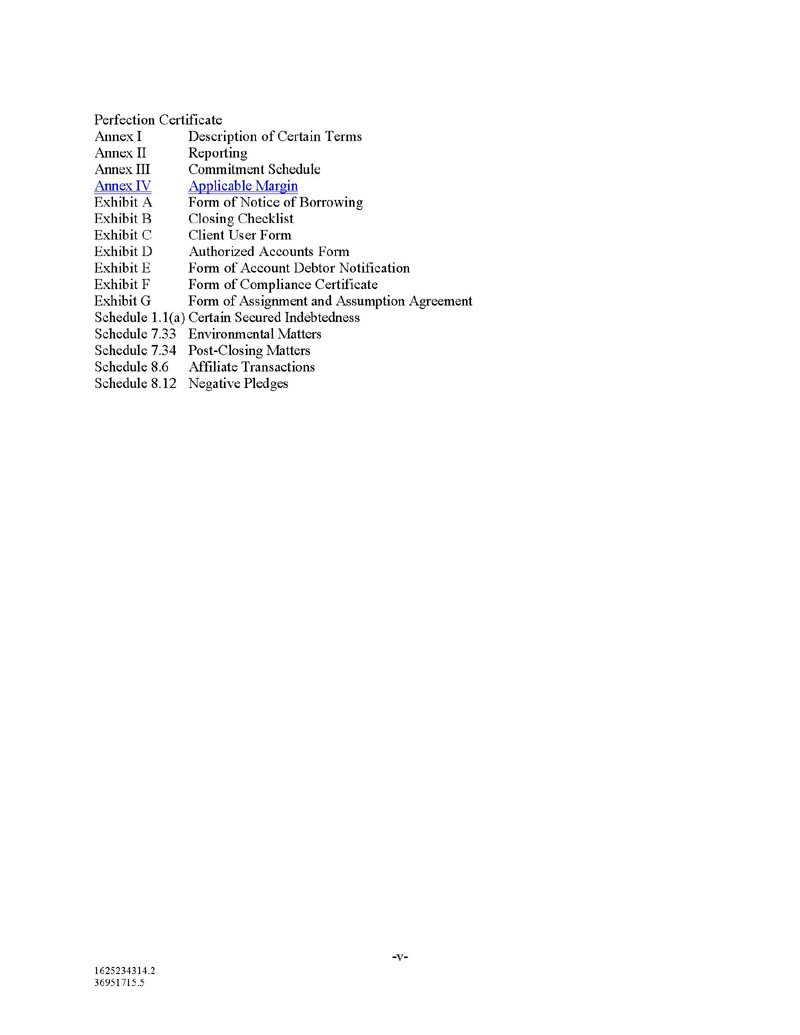

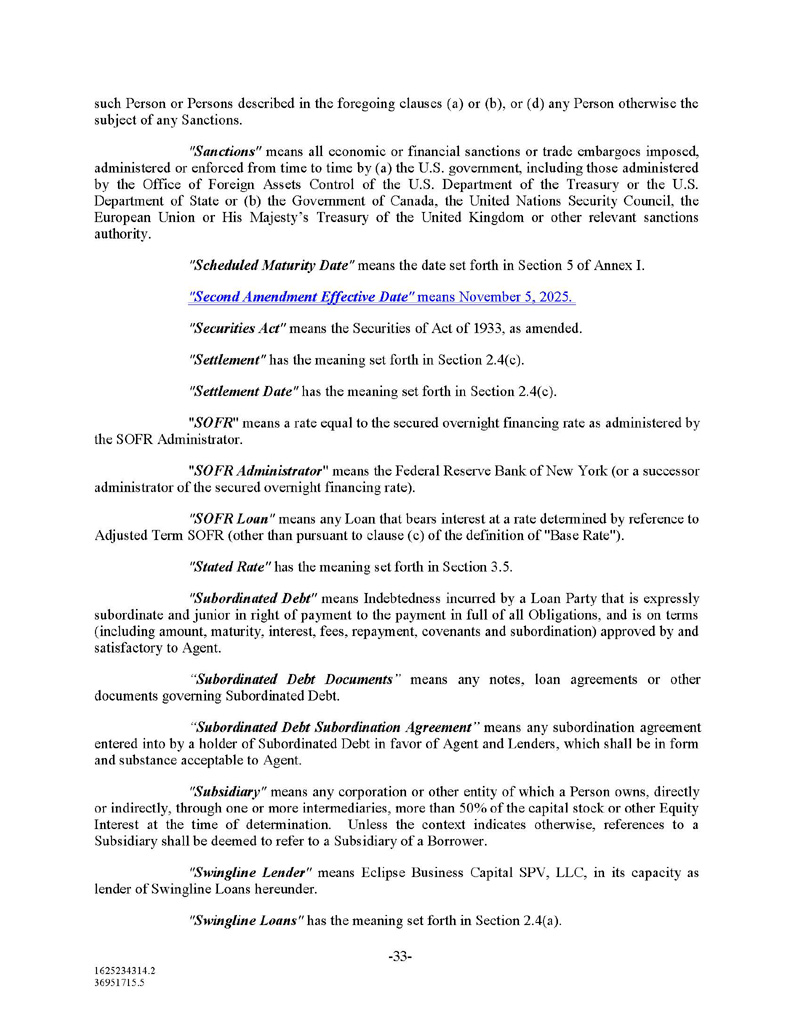

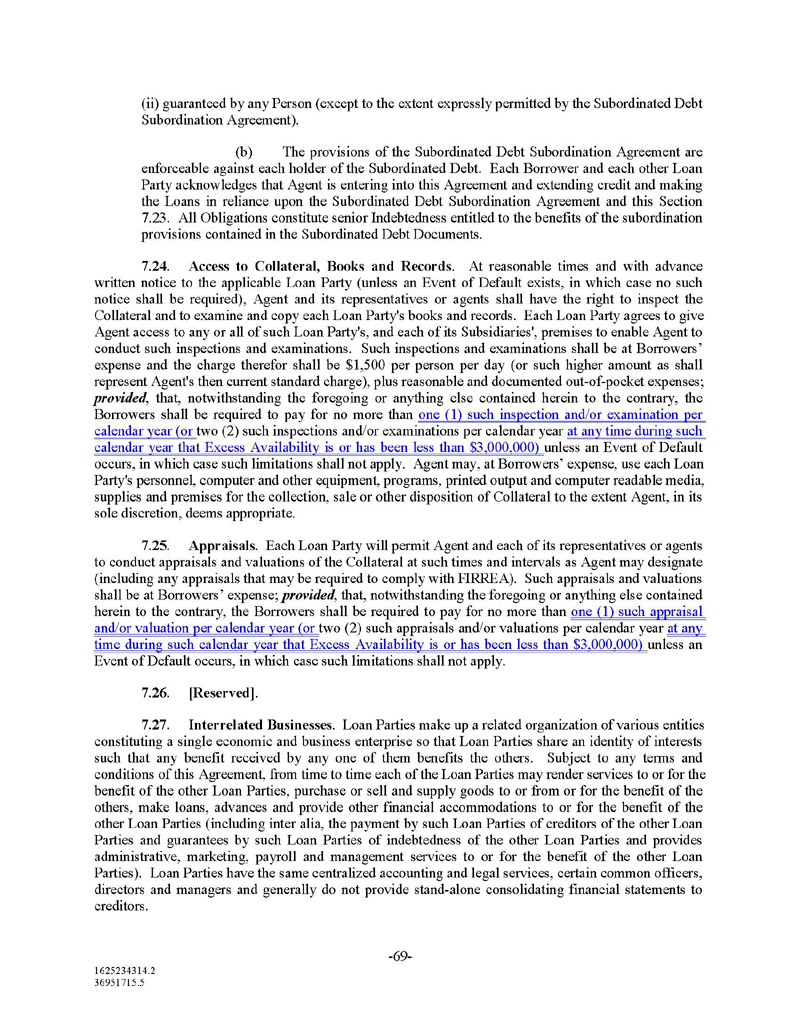

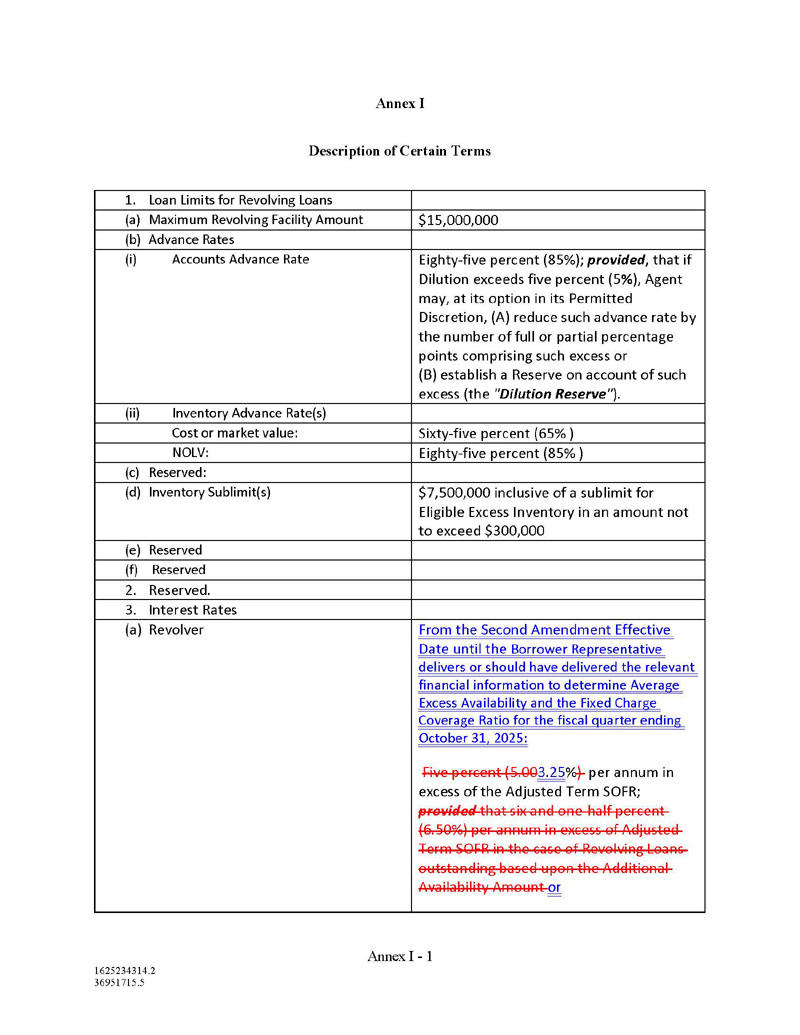

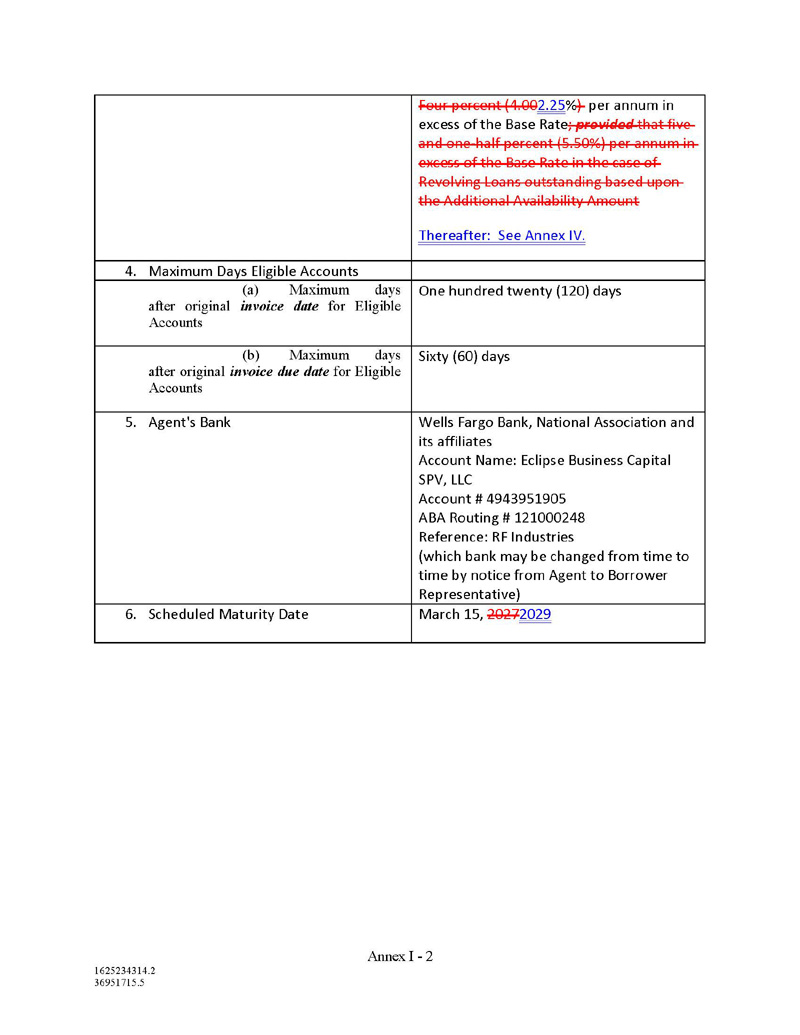

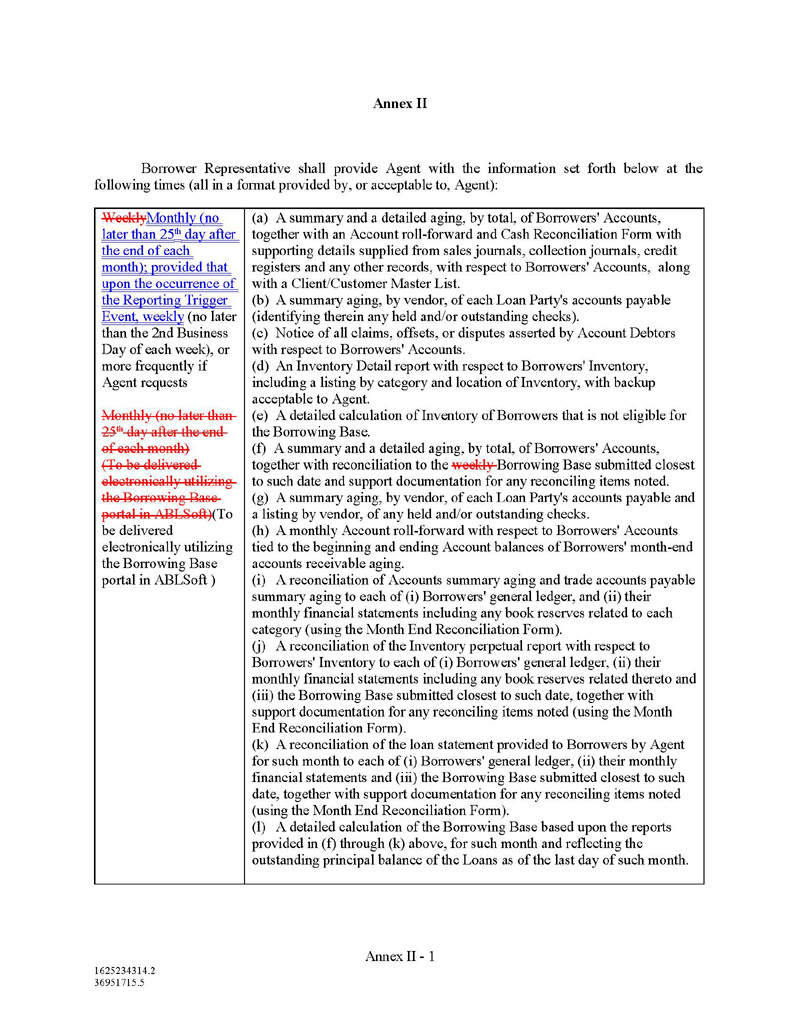

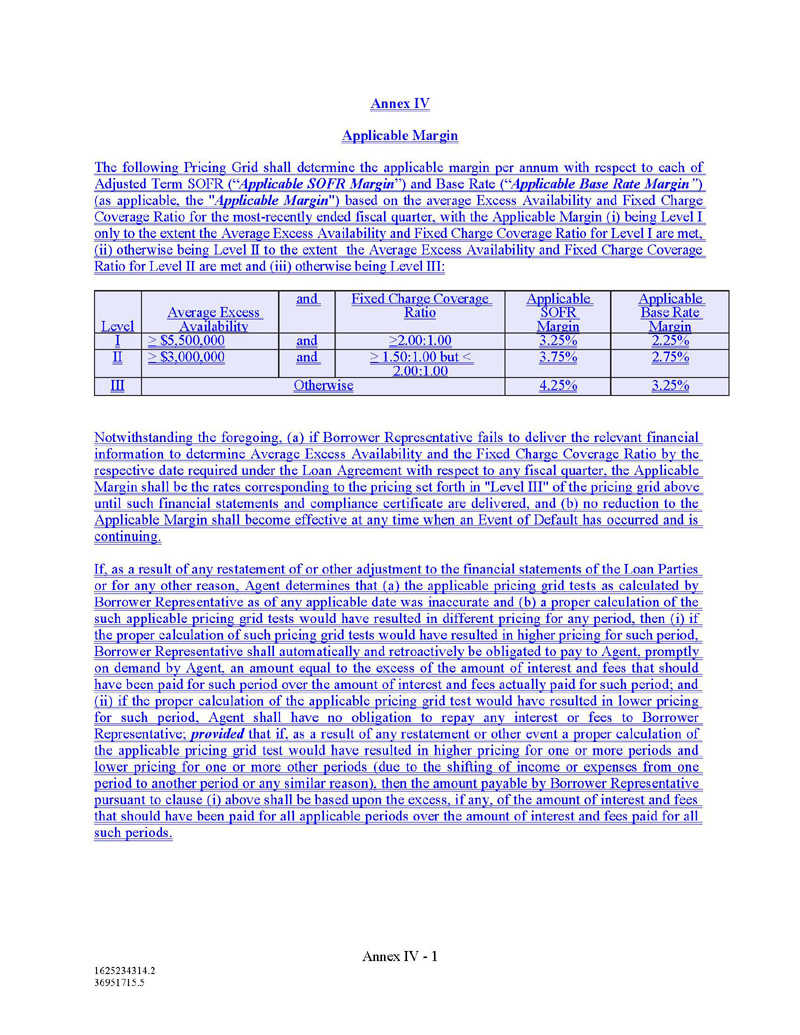

1. Amendments. Subject to the satisfaction of the conditions precedent set forth below, and in reliance on the representations, warranties, covenants and other agreements of the Borrowers contained herein, the Existing Agreement is hereby amended to (i) delete red or green stricken text (indicated textually in the same manner as the following examples: stricken text and stricken text) and (ii) add the blue or green double-underlined text (indicated textually in the same manner as the following examples: double-underlined text and double-underlined text), in each case, as set forth in the conformed copy of the Agreement attached hereto as Annex I.

2. Conditions to Effectiveness. This Amendment shall be effective upon completion of the following (each of such documents and/or actions to be in form and substance acceptable to Agent in its sole discretion):

|

(a) |

Execution and delivery of this Amendment by all parties hereto; |

|

(b) |

Execution and delivery of the Amended and Restated Fee Letter by all parties thereto; |

|

(c) |

Agent shall have received updated lien searches for the Borrowers; |

|

(d) |

Agent shall have received fully executed resolutions of the Borrowers certifying that (i) all requisite action has been taken in connection with the transactions contemplated hereby and (ii) the names, signatures and authority of the Borrowers’ authorized signers executing this Amendment and the other Loan Documents to which it is a party; and |

|

(e) |

Agent shall have received good standing certificates for the Borrowers by the Secretary of State or other appropriate official of the Borrowers’ jurisdiction of organization or incorporation, as applicable. |

3. Representations and Warranties. The Borrowers represent and warrant to Agent and the Lenders:

|

(a) |

The execution, delivery and performance by the Borrowers of this Amendment and the transactions contemplated herein (i) are and will be within the powers of the Borrowers, (ii) have been authorized by all necessary actions of the Borrowers, (iii) are not in contravention of (x) any court order, or (y) any law to which the Borrowers or any property of the Borrowers is bound, except, with respect to this clause (y), where any such violation, individually or in the aggregate, could not reasonably be expected to have a Material Adverse Effect, and (iv) are not in conflict with, or result in a breach of or constitute (with due notice and/or lapse of time) a default under the articles of organization, articles of incorporation, code of regulations, operating agreement, as applicable, or any Material Contract to which the Borrowers are a party or by which the Borrowers or any property of the Borrowers are bound; |

|

(b) |

This Amendment and any other agreements, instruments or documents executed and/or delivered in connection herewith, are enforceable against the Borrowers in accordance with their respective terms except to the extent enforceability may be limited by bankruptcy, insolvency, reorganization or similar laws affecting creditors’ rights generally or by general principles of equity (regardless of whether such enforcement is considered in a proceeding in equity or at law); |

|

(c) |

Each of the representations and warranties contained in, and each of the schedules attached to, the Agreement are true, correct and complete in all material respects as of the date hereof except that those representations and warranties which relate to a specific date shall remain true and correct in all material respects as of such date; |

|

(d) |

No event or condition which has had, or could reasonably be expected to have, a Material Adverse Effect as to the Borrowers has occurred from the Closing Date to the date hereof; and |

|

(e) |

Upon the effectiveness of this Amendment, no Default or Event of Default is outstanding under the Agreement. |

4. Confirmation of Security Interests. Borrower confirms and agrees that all prior security interests and liens granted to Agent and the Lenders under the Loan Documents remain unimpaired and in full force and effect and shall continue to cover and secure all Obligations. Borrower further confirms and represents that all of the Collateral of Borrower remains free and clear of all liens other than those in favor of Agent and the Lenders or as otherwise permitted in the Agreement. Nothing contained herein is intended to in any way impair or limit the validity, priority or extent of Agent and the Lenders’ security interest in and liens upon the Collateral of Borrower.

5. Obligations Absolute. The Borrowers covenant and agree (a) to pay the balance of any principal, together with all accrued interest, in connection with any promissory note executed and evidencing any indebtedness incurred in connection with the Agreement, as modified by this Amendment pursuant to the terms set forth therein and (b) to perform and observe covenants, agreements, stipulations and conditions on its part to be performed hereunder or under the Agreement and all other documents executed in connection herewith or thereof.

6. No Set-Offs Etc. The Borrowers hereby declare that, as of the date hereof, the Borrowers have no set-offs, counterclaims, defenses or other causes of action against Agent and the Lenders arising out of the Agreement or any related loan documents, and to the extent any such set-offs, counterclaims, defenses or other causes of action may exist as of the date hereof, whether known or unknown, such items are hereby waived by the Borrowers.

7. Release. THE BORROWERS HEREBY RELEASE, WAIVE AND FOREVER RELINQUISH ALL CLAIMS, DEMANDS, OBLIGATIONS, LIABILITIES AND CAUSES OF ACTION OF WHATEVER KIND OR NATURE, WHETHER KNOWN OR UNKNOWN, INCLUDING ANY SO-CALLED “LENDER LIABILITY” CLAIMS OR DEFENSES WHICH IT HAS, MAY HAVE, OR MIGHT ASSERT NOW OR IN THE FUTURE AGAINST AGENT, THE LENDERS AND/OR THEIR RESPECTIVE OFFICERS, DIRECTORS, EMPLOYEES, AGENTS, ATTORNEYS, ACCOUNTANTS, CONSULTANTS, SUCCESSORS, AND ASSIGNS (INDIVIDUALLY, A “RELEASEE” AND COLLECTIVELY, THE “RELEASEES”), DIRECTLY OR INDIRECTLY, ARISING OUT OF, BASED UPON, OR IN ANY MANNER CONNECTED WITH (A) ANY TRANSACTION, EVENT, CIRCUMSTANCE, ACTION, FAILURE TO ACT, OR OCCURRENCE OF ANY SORT OR TYPE, WHETHER KNOWN OR UNKNOWN, WHICH OCCURRED, EXISTED, OR WAS TAKEN OR PERMITTED PRIOR TO THE EXECUTION OF THIS AMENDMENT WITH RESPECT TO THE OBLIGATIONS, THE AGREEMENT, THE OTHER LOAN DOCUMENTS, OR THE ADMINISTRATION THEREOF, (B) ANY DISCUSSIONS, COMMITMENTS, NEGOTIATIONS, CONVERSATIONS, OR COMMUNICATIONS WITH RESPECT TO THE OBLIGATIONS PRIOR TO THE EXECUTION OF THIS AMENDMENT OR (C) ANY THING OR MATTER RELATED TO ANY OF THE FOREGOING PRIOR TO THE EXECUTION OF THIS AMENDMENT. THE INCLUSION OF THIS PARAGRAPH IN THIS AMENDMENT AND THE EXECUTION OF THIS AMENDMENT BY AGENT AND THE LENDERS DOES NOT CONSTITUTE AN ACKNOWLEDGMENT OR ADMISSION BY AGENT AND THE LENDERS OF LIABILITY FOR ANY MATTER, OR A PRECEDENT UPON WHICH ANY LIABILITY MAY BE ASSERTED.

8. Fees and Expenses. The Borrowers shall reimburse Agent for all out-of-pocket attorneys’ fees incurred in connection with this Amendment in accordance with Section 14.12 of the Agreement.

9. Non-Waiver. This Amendment does not obligate Agent and the Lenders to agree to any other extension or modification of the Agreement nor does it constitute a course of conduct or dealing on behalf of Agent and the Lenders or a waiver of any other rights or remedies of Agent and the Lenders. No omission or delay by Agent or the Lenders in exercising any right or power under the Agreement, this Amendment or any related instruments, agreements or documents will impair such right or power or be construed to be a waiver of any Default or Event of Default or an acquiescence therein, and any single or partial exercise of any such right or power will not preclude other or further exercise thereof or the exercise of any other right, and no waiver will be valid unless in writing and then only to the extent specified.

10. Incorporation. This Amendment is incorporated by reference into, and made part of, the Agreement which, except as expressly modified herein, remains in full force and effect in accordance with its terms.

11. No Modification. No modification of this Amendment or of any agreement referred to herein shall be binding or enforceable unless in writing and signed on behalf of the party against whom enforcement is sought.

12. Headings. The headings of any section or paragraph of this Amendment are for convenience only and shall not be used to interpret any provision of this Amendment.

13. Successors and Assigns. This Amendment will be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

14. Governing Law; Use of Terms Etc. Except as previously amended or as herein specifically amended, directly or by reference, all of the terms and conditions set forth in the Agreement are confirmed and ratified, and shall remain as originally written. This Amendment shall be construed in accordance with the laws of the State of New York, without regard to principles of conflict of laws. The Agreement and all other Loan Documents shall remain in full force and effect in all respects as if the unpaid balance of the principal outstanding, together with interest accrued thereon, had originally been payable and secured as provided for therein, as amended from time to time and as modified by this Amendment. Nothing herein shall affect or impair any rights and powers which Agent may have under the Agreement and any and all related Loan Documents.

15. Severability. The provisions of this Amendment are to be deemed severable, and the invalidity or unenforceability of any provision shall not affect or impair the remaining provisions which shall continue in full force and effect.

16. Counterparts, Facsimile and .pdf. This Amendment may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Signature by facsimile or .pdf shall have the same force and effect as an original signature hereto.

17. Jury Waiver. THE PARTIES HERETO HEREBY WAIVE ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING RELATING TO THIS AMENDMENT, ANY OF THE LOAN DOCUMENTS, ANY DOCUMENT DELIVERED HEREUNDER OR IN CONNECTION HEREWITH, OR ANY TRANSACTION ARISING FROM OR CONNECTED TO ANY OF THE FOREGOING. THE PARTIES REPRESENT THAT THIS WAIVER IS KNOWINGLY, WILLINGLY AND VOLUNTARILY GIVEN.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, each Borrower, Agent and each Lender have signed this Amendment as of the date first set forth above.

|

Agent:

ECLIPSE BUSINESS CAPITAL LLC

By: /s/ Thomas Stone Name: Thomas Stone |

|

|

Lenders:

ECLIPSE BUSINESS CAPITAL SPV, LLC

By: /s/ Thomas Stone Name: Thomas Stone |

|

Borrowers:

RF INDUSTRIES, LTD.

By: /s/ Peter Yin Name: Peter Yin Its: Chief Financial Officer

CABLES UNLIMITED, INC.

By: /s/ Peter Yin Name: Peter Yin

REL-TECH ELECTRONICS, INC.

By: /s/ Peter Yin Name: Peter Yin

C ENTERPRISES, INC.

By: /s/ Peter Yin Name: Peter Yin

SCHROFF TECHNOLOGIES INTERNATIONAL, INC.

By: /s/ Peter Yin Name: Peter Yin

MICROLAB/FXR LLC

By: /s/ Peter Yin Name: Peter Yin Its: Treasurer & Secretary |

ANNEX I

See attached.