Hooper Holmes, Inc.

560 N. Rogers Road

Olathe, KS 66062

Tel: 913-764-1045

Hooper–Provant combined entity will be is the largest Health &

Wellness examiner network in the U.S. and the only end-to-end

Health & Wellness provider

Screened over 500,000 individuals in 2015; Additional ~250,000

individuals on portal

Serving over 3,000 employers; 200 direct clients and 95+ channel

partners

$7.2 billion Corporate Wellness industry grew 6.3% in the U.S. in

2015, expected to grow avg. 7.8% annually, to $10.5 billion, by 2020*

Biometric collections clinical research market $2.5B**

FY ‘16 - $34.3mm Health & Wellness revenue - YTD Revenue

increased 6.7% compared to 2015

Adjusted EBITDA near break-even

Higher percentage of FY revenues from top Channel Partner

and Clinical customers

Ended 2015 with record Health & Wellness revenues and

significant reduction in net adjusted EBITDA loss

Expanding delivery model to serve growing markets including

onsite flu vaccines, MinuteClinic®, Tobacco DetectSM and

mental health conditions

Hooper Holmes Solutions Focus On Educating Employees

To Drive Behavior Change To Help PREVENT Those High-

Cost Conditions That Drive Employer Medical Costs Today

COMPANY PROFILE

Hooper Holmes mobilizes a national network of health professionals to provide on-site

health screenings, laboratory testing, risk assessment and sample collection services to

wellness and disease management companies, employers and brokers, government

organizations and academic institutions nationwide. Under the Accountable Health

Solutions brand, the Company combines smart technology, healthcare and behavior change

expertise to offer comprehensive health and wellness programs that improve health,

increase efficiencies and reduce healthcare delivery costs.

COMPANY SNAPSHOT:

Symbol: HH

Recent Close: $0.76*

Exchange: NYSE

52-Wk Range: $0.73 - $2.70

Shares Outst: 11.8M

Market Cap: $9M*

*As of 03/09/17

CORPORATE FACT SHEET

March 2017

On March 8, 2017 Hooper Holmes announced plans to merge with Provant, creating one of the largest,

pure-play health and wellness companies in the United States. Merger expected to close Q2 2017.

Investment Highlights

*(http://www.inc.com/graham-winfrey/best-industries-2016-the-best-industries-for-starting-a-business.html)

**(Ken Research 2012 Internal Analysis)

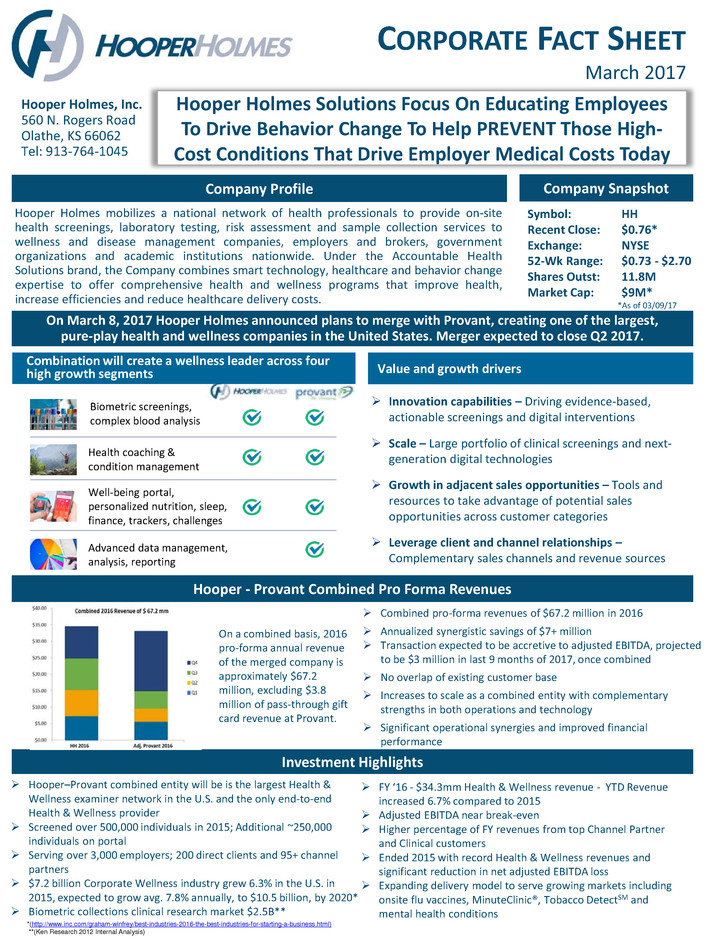

On a combined basis, 2016

pro-forma annual revenue

of the merged company is

approximately $67.2

million, excluding $3.8

million of pass-through gift

card revenue at Provant.

Value and growth drivers

Combination will create a wellness leader across four

high growth segments

Biometric screenings,

complex blood analysis

Health coaching &

condition management

Well-being portal,

personalized nutrition, sleep,

finance, trackers, challenges

Advanced data management,

analysis, reporting

Innovation capabilities – Driving evidence-based,

actionable screenings and digital interventions

Scale – Large portfolio of clinical screenings and next-

generation digital technologies

Growth in adjacent sales opportunities – Tools and

resources to take advantage of potential sales

opportunities across customer categories

Leverage client and channel relationships –

Complementary sales channels and revenue sources

Hooper - Provant Combined Pro Forma Revenues

Combined pro-forma revenues of $67.2 million in 2016

Annualized synergistic savings of $7+ million

Transaction expected to be accretive to adjusted EBITDA, projected

to be $3 million in last 9 months of 2017, once combined

No overlap of existing customer base

Increases to scale as a combined entity with complementary

strengths in both operations and technology

Significant operational synergies and improved financial

performance

Invest ent Highlights

Company Profile Company Snapshot

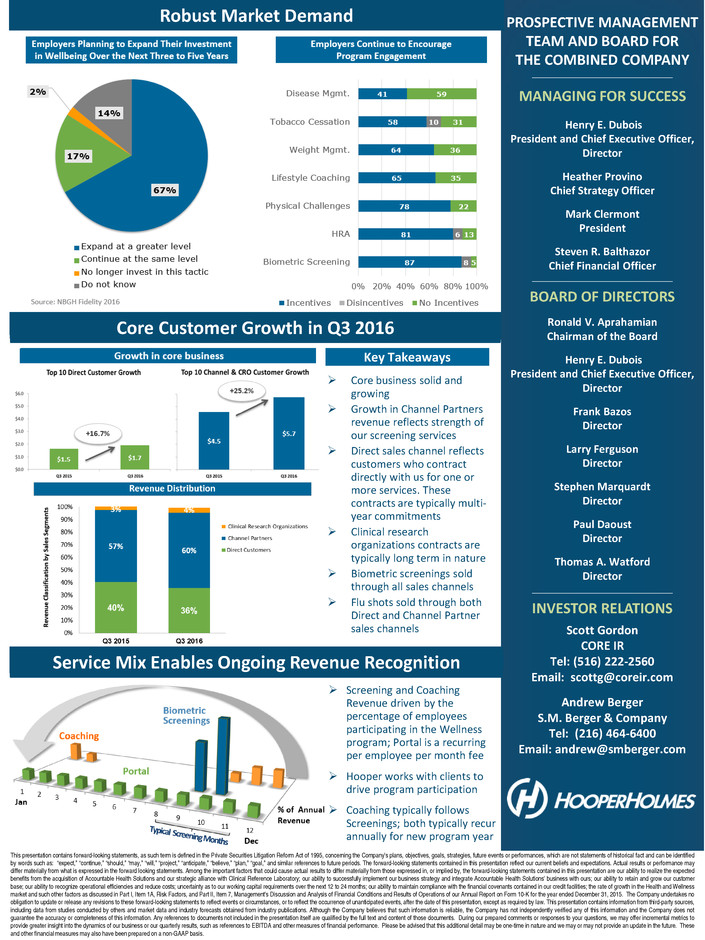

Core business solid and

growing

Growth in Channel Partners

revenue reflects strength of

our screening services

Direct sales channel reflects

customers who contract

directly with us for one or

more services. These

contracts are typically multi-

year commitments

Clinical research

organizations contracts are

typically long term in nature

Biometric screenings sold

through all sales channels

Flu shots sold through both

Direct and Channel Partner

sales channels

Core Customer Growth in Q3 2016

PROSPECTIVE MANAGEMENT

TEAM AND BOARD FOR

THE COMBINED COMPANY

________________________________

MANAGING FOR SUCCESS

Henry E. Dubois

President and Chief Executive Officer,

Director

Heather Provino

Chief Strategy Officer

Mark Clermont

President

Steven R. Balthazor

Chief Financial Officer

________________________________

BOARD OF DIRECTORS

Ronald V. Aprahamian

Chairman of the Board

Henry E. Dubois

President and Chief Executive Officer,

Director

Frank Bazos

Director

Larry Ferguson

Director

Stephen Marquardt

Director

Paul Daoust

Director

Thomas A. Watford

Director

________________________________

INVESTOR RELATIONS

Scott Gordon

CORE IR

Tel: (516) 222-2560

Email: scottg@coreir.com

Andrew Berger

S.M. Berger & Company

Tel: (216) 464-6400

Email: andrew@smberger.com

This presentation contains forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995, concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact and can be identified

by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,” “goal,” and similar references to future periods. The forward-looking statements contained in this presentation reflect our current beliefs and expectations. Actual results or performance may

differ materially from what is expressed in the forward looking statements. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-looking statements contained in this presentation are our ability to realize the expected

benefits from the acquisition of Accountable Health Solutions and our strategic alliance with Clinical Reference Laboratory; our ability to successfully implement our business strategy and integrate Accountable Health Solutions’ business with ours; our ability to retain and grow our customer

base; our ability to recognize operational efficiencies and reduce costs; uncertainty as to our working capital requirements over the next 12 to 24 months; our ability to maintain compliance with the financial covenants contained in our credit facilities; the rate of growth in the Health and Wellness

market and such other factors as discussed in Part I, Item 1A, Risk Factors, and Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2015. The Company undertakes no

obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances, or to reflect the occurrence of unanticipated events, after the date of this presentation, except as required by law. This presentation contains information from third-party sources,

including data from studies conducted by others and market data and industry forecasts obtained from industry publications. Although the Company believes that such information is reliable, the Company has not independently verified any of this information and the Company does not

guarantee the accuracy or completeness of this information. Any references to documents not included in the presentation itself are qualified by the full text and content of those documents. During our prepared comments or responses to your questions, we may offer incremental metrics to

provide greater insight into the dynamics of our business or our quarterly results, such as references to EBITDA and other measures of financial performance. Please be advised that this additional detail may be one-time in nature and we may or may not provide an update in the future. These

and other financial measures may also have been prepared on a non-GAAP basis.

Service Mix Enables Ongoing Revenue Recognition

Screening and Coaching

Revenue driven by the

percentage of employees

participating in the Wellness

program; Portal is a recurring

per employee per month fee

Hooper works with clients to

drive program participation

Coaching typically follows

Screenings; both typically recur

annually for new program year

Robust Market Demand

Key Takeaways

Additional Information about the Proposed Merger and Where to Find It

• In connection with the previously disclosed proposed merger with Provant, the

Company has filed a registration statement on Form S-4 with the Securities and

Exchange Commission (the “SEC”) (SEC file number 333-216760), including a proxy

statement/prospectus, but the registration statement has not yet become effective.

Shareholders of the Company are urged to read these materials because they

contain important information about the Company, Provant, and the proposed

merger. The proxy statement/prospectus and other documents filed by the

Company with the SEC may be obtained free of charge at the SEC web site at

www.sec.gov. In addition, investors and security holders may obtain free copies of

the documents filed with the SEC by the Company by directing a written request to:

Hooper Holmes, Inc., 560 N. Rogers Road, Olathe, Kansas 66062, Attention: Legal

Department. Shareholders of the Company are urged to read the proxy

statement/prospectus and the other relevant materials before making any voting or

investment decision with respect to the proposed merger.

• This communication shall not constitute an offer to sell or the solicitation of an offer

to sell or the solicitation of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities in connection with the proposed merger shall

be made except by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended.

Participants in the Solicitation

• The Company and its directors and executive officers and Provant and its directors

and executive officers may be deemed to be participants in the solicitation of

proxies from the shareholders of the Company in connection with the proposed

merger. Information regarding the special interests of these directors and executive

officers in the merger is included in the proxy statement/prospectus referred to

above. Additional information regarding the directors and executive officers of the

Company is also included in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2016, which is available free of charge at the SEC web

site (www.sec.gov) and from the Company at the address described above.