.2

October 31, 2025 Third Quarter 2025 Results Webcast THIRD QUARTER 2025 RESULTS WEBCAST 1

THIRD QUARTER 2025 RESULTS WEBCAST 2 Vice President, Investor Relations Louis Tonelli

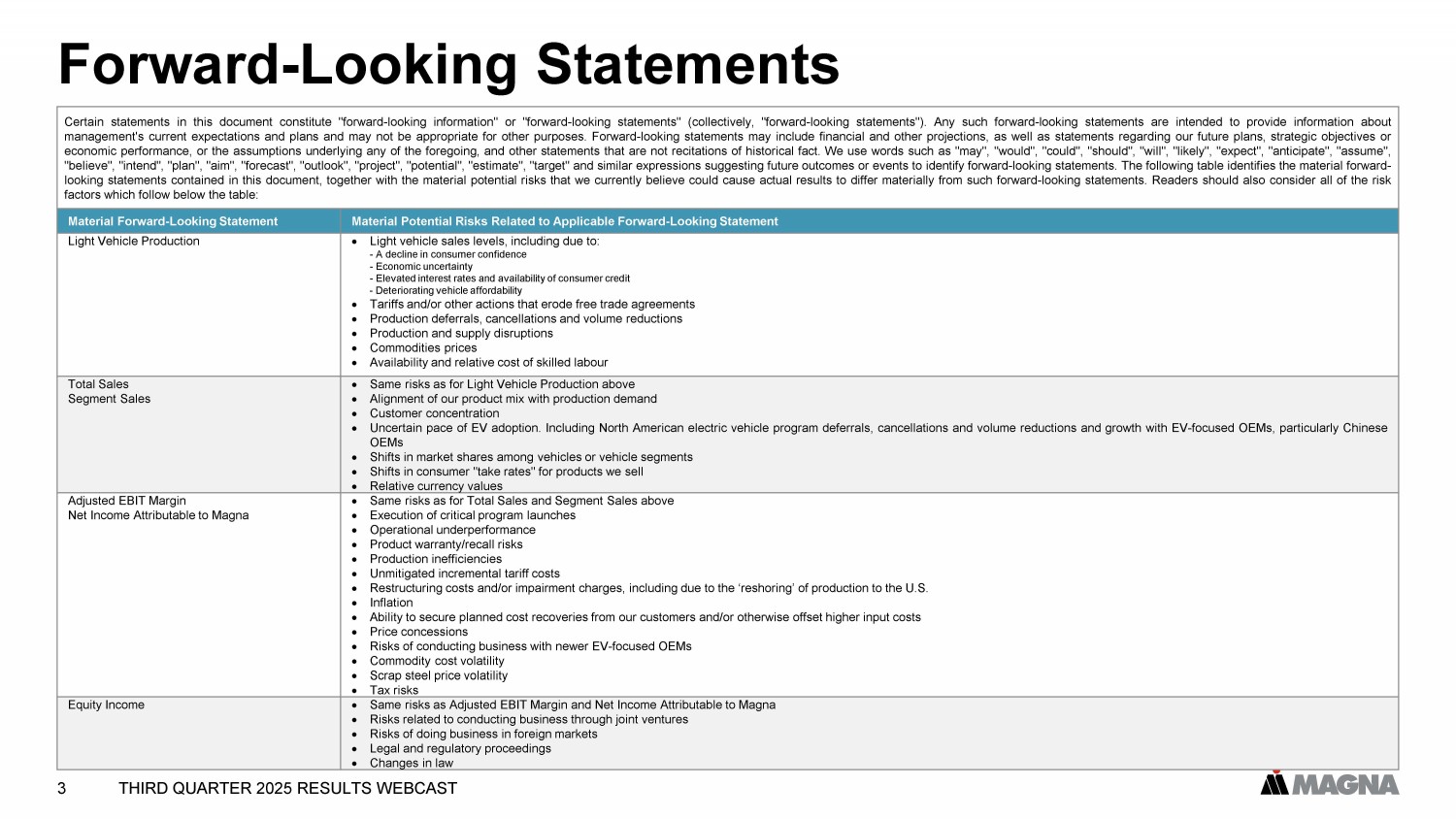

THIRD QUARTER 2025 RESULTS WEBCAST 3 Forward - Looking Statements Certain statements in this document constitute "forward - looking information" or "forward - looking statements" (collectively, "forward - looking statements") . Any such forward - looking statements are intended to provide information about management's current expectations and plans and may not be appropriate for other purposes . Forward - looking statements may include financial and other projections, as well as statements regarding our future plans, strategic objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements that are not recitations of historical fact . We use words such as "may", "would", "could", "should", "will", "likely", "expect", "anticipate", "assume", "believe", "intend", "plan", "aim", "forecast", "outlook", "project", "potential", "estimate", "target" and similar expressions suggesting future outcomes or events to identify forward - looking statements . The following table identifies the material forward - looking statements contained in this document, together with the material potential risks that we currently believe could cause actual results to differ materially from such forward - looking statements . Readers should also consider all of the risk factors which follow below the table : Material Potential Risks Related to Applicable Forward - Looking Statement Material Forward - Looking Statement Light vehicle sales levels, including due to : - A decline in consumer confidence - Economic uncertainty - Elevated interest rates and availability of consumer credit - Deteriorating vehicle affordability Tariffs and/or other actions that erode free trade agreements Production deferrals, cancellations and volume reductions Production and supply disruptions Commodities prices Availability and relative cost of skilled labour Light Vehicle Production Same risks as for Light Vehicle Production above Alignment of our product mix with production demand Customer concentration Uncertain pace of EV adoption . Including North American electric vehicle program deferrals, cancellations and volume reductions and growth with EV - focused OEMs, particularly Chinese OEMs Shifts in market shares among vehicles or vehicle segments Shifts in consumer "take rates" for products we sell Relative currency values Total Sales Segment Sales Same risks as for Total Sales and Segment Sales above Execution of critical program launches Operational underperformance Product warranty/recall risks Production inefficiencies Unmitigated incremental tariff costs Restructuring costs and/or impairment charges, including due to the ‘reshoring’ of production to the U . S . Inflation Ability to secure planned cost recoveries from our customers and/or otherwise offset higher input costs Price concessions Risks of conducting business with newer EV - focused OEMs Commodity cost volatility Scrap steel price volatility Tax risks Adjusted EBIT Margin Net Income Attributable to Magna Same risks as Adjusted EBIT Margin and Net Income Attributable to Magna Risks related to conducting business through joint ventures Risks of doing business in foreign markets Legal and regulatory proceedings Changes in law Equity Income

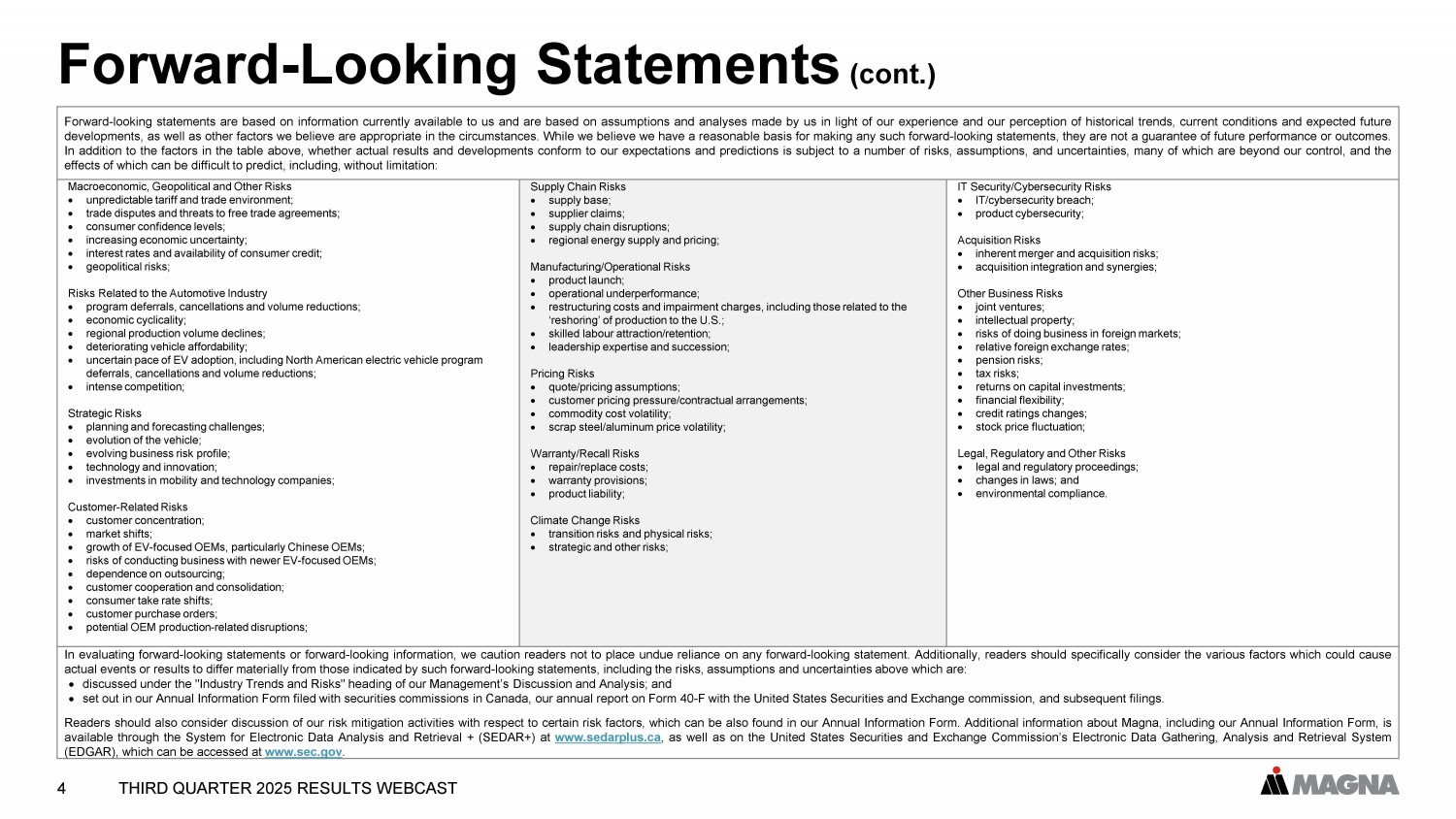

THIRD QUARTER 2025 RESULTS WEBCAST 4 Forward - Looking Statements (cont.) Forward - looking statements are based on information currently available to us and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances . While we believe we have a reasonable basis for making any such forward - looking statements, they are not a guarantee of future performance or outcomes . In addition to the factors in the table above, whether actual results and developments conform to our expectations and predictions is subject to a number of risks, assumptions, and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including, without limitation : IT Security/Cybersecurity Risks IT/cybersecurity breach; product cybersecurity; Acquisition Risks inherent merger and acquisition risks; acquisition integration and synergies; Other Business Risks joint ventures; intellectual property; risks of doing business in foreign markets; relative foreign exchange rates; pension risks; tax risks; returns on capital investments; financial flexibility; credit ratings changes; stock price fluctuation; Legal, Regulatory and Other Risks legal and regulatory proceedings; changes in laws; and environmental compliance. Supply Chain Risks supply base; supplier claims; supply chain disruptions; regional energy supply and pricing; Manufacturing/Operational Risks product launch; operational underperformance; restructuring costs and impairment charges, including those related to the ‘reshoring’ of production to the U.S.; skilled labour attraction/retention; leadership expertise and succession; Pricing Risks quote/pricing assumptions; customer pricing pressure/contractual arrangements; commodity cost volatility; scrap steel/aluminum price volatility; Warranty/Recall Risks repair/replace costs; warranty provisions; product liability; Climate Change Risks transition risks and physical risks; strategic and other risks; Macroeconomic, Geopolitical and Other Risks unpredictable tariff and trade environment; trade disputes and threats to free trade agreements; consumer confidence levels; increasing economic uncertainty; interest rates and availability of consumer credit; geopolitical risks; Risks Related to the Automotive Industry program deferrals, cancellations and volume reductions; economic cyclicality; regional production volume declines; deteriorating vehicle affordability; uncertain pace of EV adoption, including North American electric vehicle program deferrals, cancellations and volume reductions; intense competition; Strategic Risks planning and forecasting challenges; evolution of the vehicle; evolving business risk profile; technology and innovation; investments in mobility and technology companies; Customer - Related Risks customer concentration; market shifts; growth of EV - focused OEMs, particularly Chinese OEMs; risks of conducting business with newer EV - focused OEMs; dependence on outsourcing; customer cooperation and consolidation; consumer take rate shifts; customer purchase orders; potential OEM production - related disruptions; In evaluating forward - looking statements or forward - looking information, we caution readers not to place undue reliance on any forward - looking statement . Additionally, readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward - looking statements, including the risks, assumptions and uncertainties above which are : discussed under the "Industry Trends and Risks" heading of our Management’s Discussion and Analysis ; and set out in our Annual Information Form filed with securities commissions in Canada, our annual report on Form 40 - F with the United States Securities and Exchange commission, and subsequent filings . Readers should also consider discussion of our risk mitigation activities with respect to certain risk factors, which can be also found in our Annual Information Form . Additional information about Magna, including our Annual Information Form, is available through the System for Electronic Data Analysis and Retrieval + (SEDAR+) at www . sedarplus . ca , as well as on the United States Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval System (EDGAR), which can be accessed at www . sec . gov .

THIRD QUARTER 2025 RESULTS WEBCAST 5 All amounts are in U.S. Dollars Today's discussion excludes the impact of other expense (income), net ("Unusual Items") and amortization of acquired intangible assets. Please refer to the reconciliation of Non - GAAP measures in our press release dated October 31, 2025 for further information. "Organic", in the context of sales movements, means "excluding the impact of foreign exchange, acquisitions and divestitures". Weighted Sales Growth over Market ( GoM ) compares organic sales growth (%) to vehicle production change (%) after applying Magna geographic sales weighting, excluding Complete Vehicles, to regional production. Reminders

THIRD QUARTER 2025 RESULTS WEBCAST 6 Chief Executive Officer Swamy Kotagiri

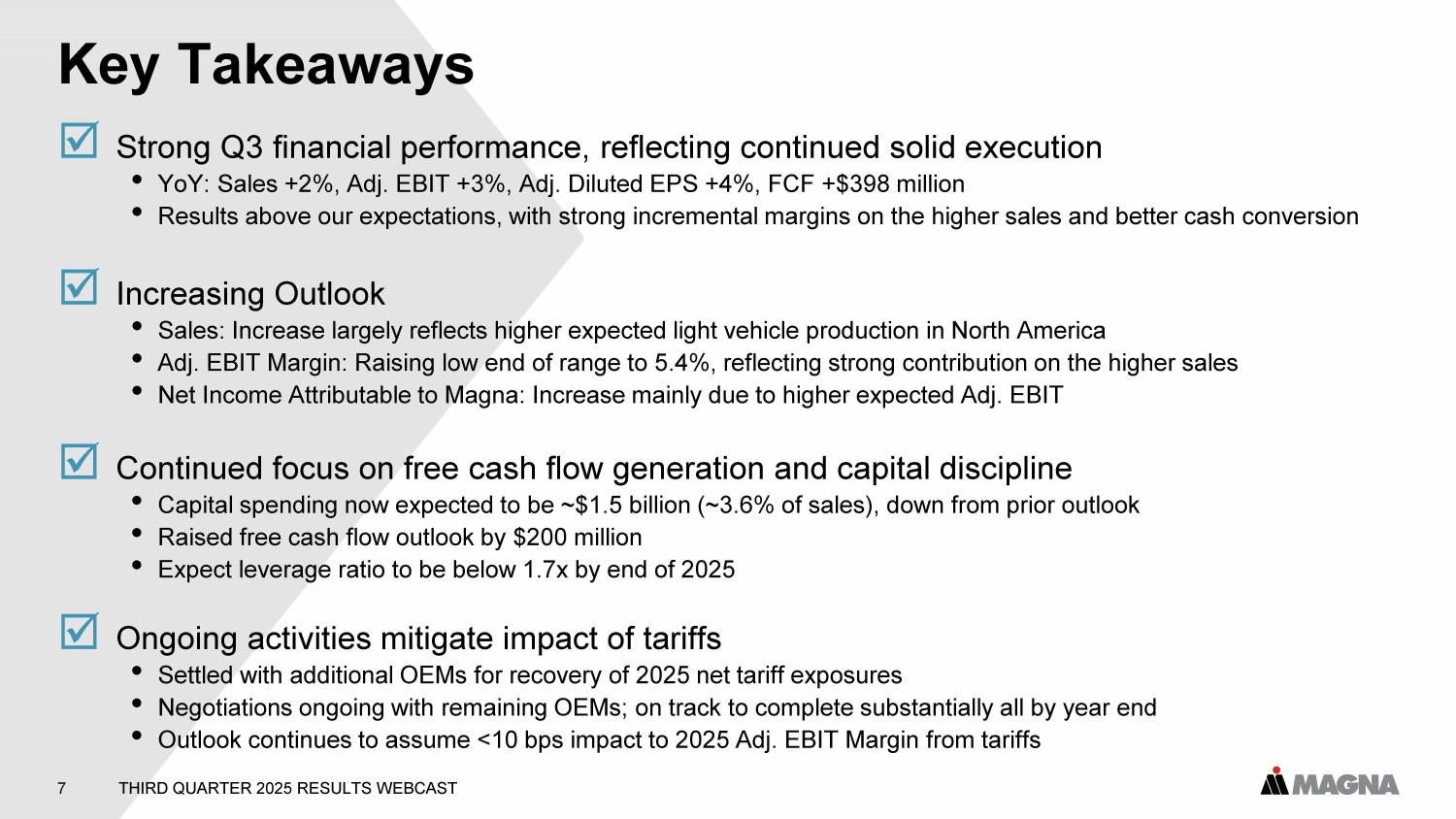

THIRD QUARTER 2025 RESULTS WEBCAST 7 Key Takeaways Strong Q3 financial performance, reflecting continued solid execution • YoY: Sales +2%, Adj. EBIT +3%, Adj. Diluted EPS +4%, FCF +$398 million • Results above our expectations, with strong incremental margins on the higher sales and better cash conversion Increasing Outlook • Sales: Increase largely reflects higher expected light vehicle production in North America • Adj. EBIT Margin: Raising low end of range to 5.4%, reflecting strong contribution on the higher sales • Net Income Attributable to Magna: Increase mainly due to higher expected Adj. EBIT Continued focus on free cash flow generation and capital discipline • Capital spending now expected to be ~$1.5 billion (~3.6% of sales), down from prior outlook • Raised free cash flow outlook by $200 million • Expect leverage ratio to be below 1.7x by end of 2025 Ongoing activities mitigate impact of tariffs • Settled with additional OEMs for recovery of 2025 net tariff exposures • Negotiations ongoing with remaining OEMs; on track to complete substantially all by year end • Outlook continues to assume <10 bps impact to 2025 Adj. EBIT Margin from tariffs

THIRD QUARTER 2025 RESULTS WEBCAST 8 Awarded Business with XPENG • Marks the first Chinese automaker to utilize Magna’s complete vehicle operations to serve European market • Magna to assemble two fully electric vehicle models; serial production SOP Q3 2025 Business Win with second China - based OEM • Program further reinforces Magna’s strong position in complete vehicle manufacturing • Serial production underway on initial program; second program launching in 2026 New Complete Vehicle Assembly Business with China - based OEMs

THIRD QUARTER 2025 RESULTS WEBCAST 9 • Hybrid drive with leading China - based OEM • New 800V solution offers consumers efficiency, versatility and comfort • Comprehensive driveline book of business across all powertrain configurations (ICE, mild hybrid, high - voltage hybrid, EV) • Satisfying growing global demand for DMS technology • 2024 Automotive News PACE Award winner • Launching with multiple customers globally, volumes expected to reach several million units annually Continue to Launch New Technologies Dedicated Hybrid Drive Mirror - integrated Driver and Occupant Monitoring System

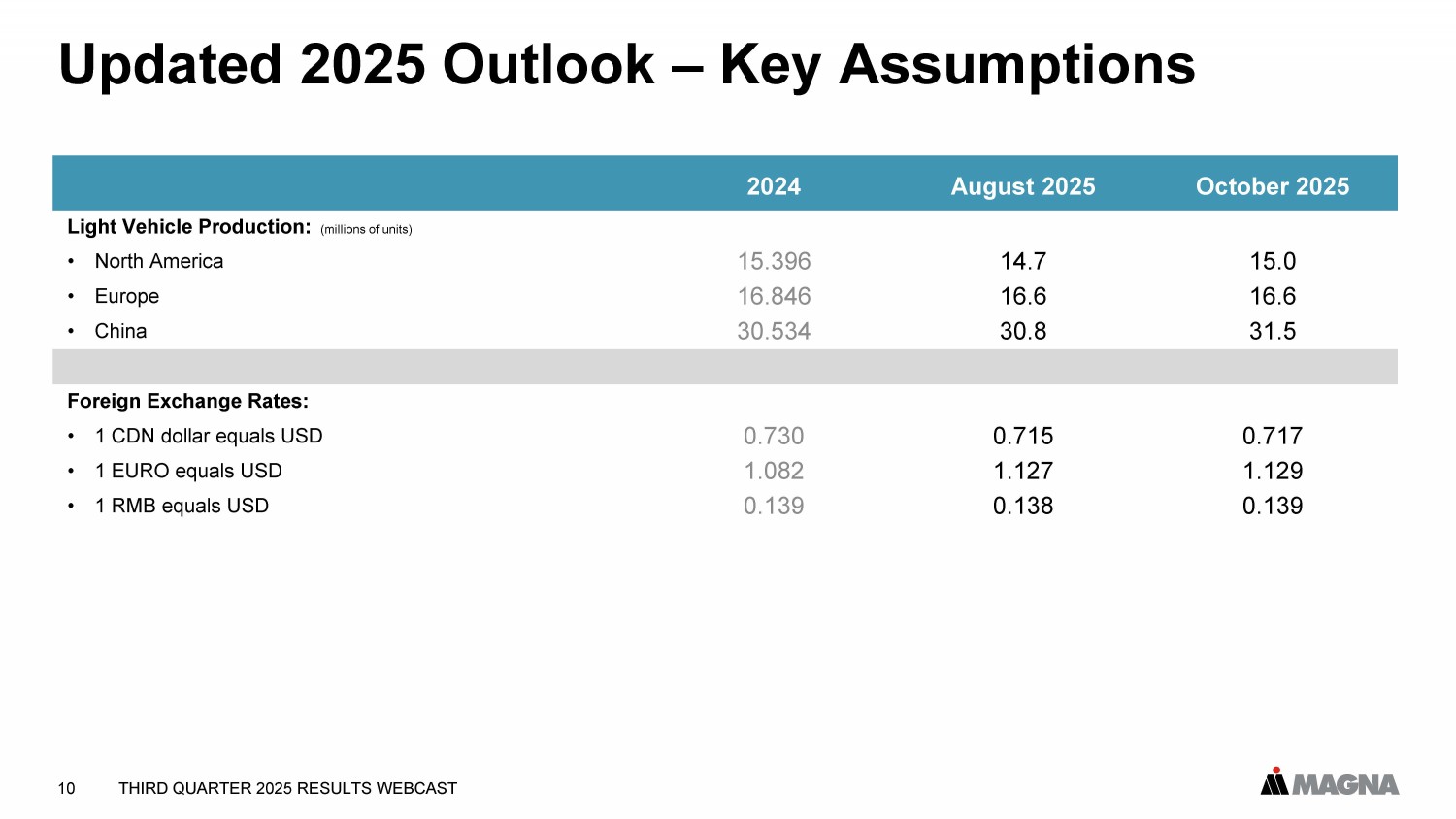

THIRD QUARTER 2025 RESULTS WEBCAST 10 Updated 2025 Outlook – Key Assumptions October 2025 August 2025 2024 Light Vehicle Production: (millions of units) 15.0 14.7 15.396 • North America 16.6 16.6 16.846 • Europe 31.5 30.8 30.534 • China Foreign Exchange Rates: 0.717 0.715 0.730 • 1 CDN dollar equals USD 1.129 1.127 1.082 • 1 EURO equals USD 0.139 0.138 0.139 • 1 RMB equals USD

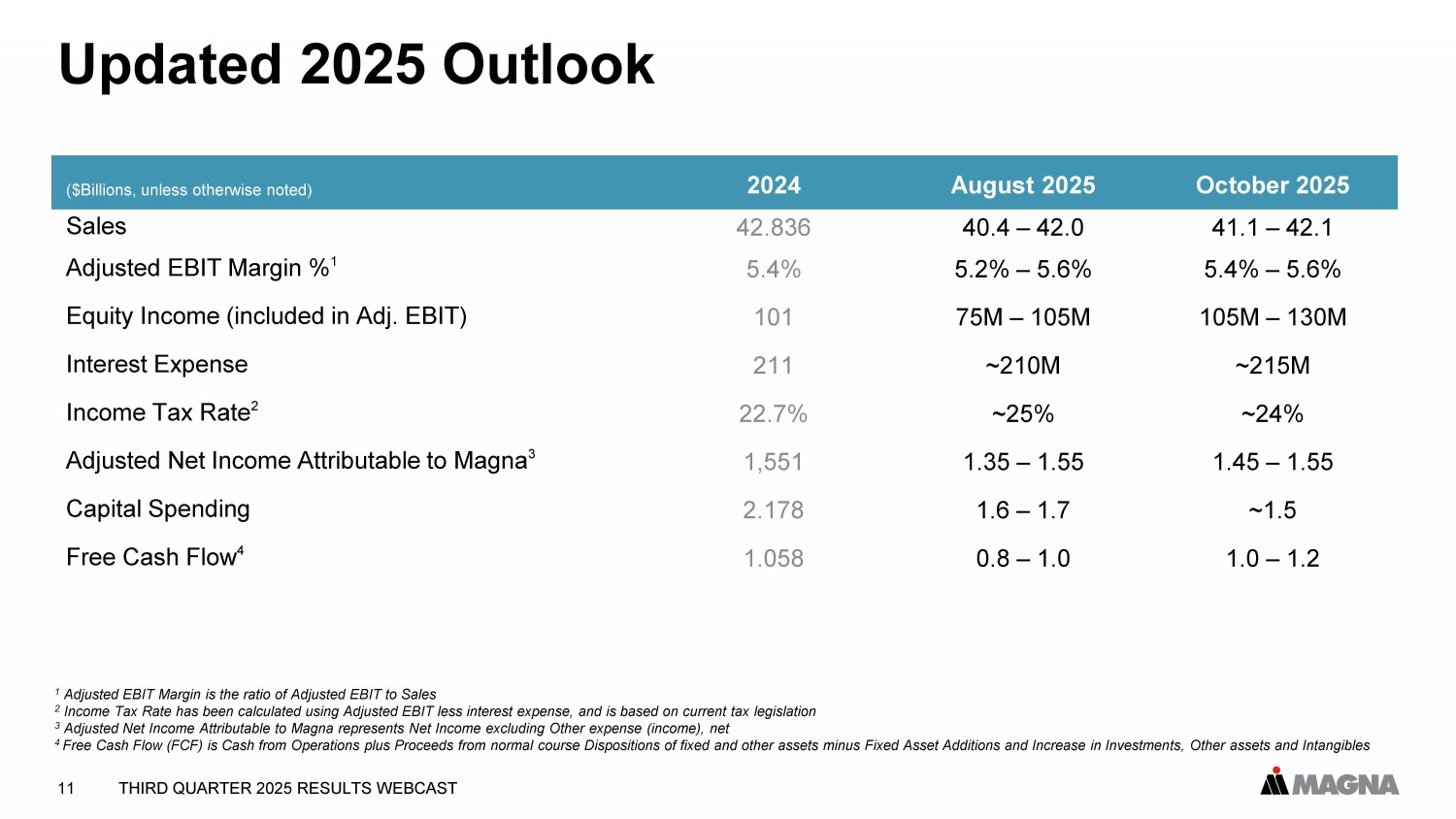

THIRD QUARTER 2025 RESULTS WEBCAST 11 Updated 2025 Outlook October 2025 August 2025 2024 ($Billions, unless otherwise noted) 41.1 – 42.1 40.4 – 42.0 42.836 Sales 5.4% – 5.6% 5.2% – 5.6% 5.4% Adjusted EBIT Margin % 1 105M – 130M 75M – 105M 101 Equity Income (included in Adj. EBIT) ~215M ~210M 211 Interest Expense ~24% ~25% 22.7% Income Tax Rate 2 1.45 – 1.55 1.35 – 1.55 1,551 Adjusted Net Income Attributable to Magna 3 ~1.5 1.6 – 1.7 2.178 Capital Spending 1.0 – 1.2 0.8 – 1.0 1.058 Free Cash Flow 4 1 Adjusted EBIT Margin is the ratio of Adjusted EBIT to Sales 2 Income Tax Rate has been calculated using Adjusted EBIT less interest expense, and is based on current tax legislation 3 Adjusted Net Income Attributable to Magna represents Net Income excluding Other expense (income), net 4 Free Cash Flow (FCF) is Cash from Operations plus Proceeds from normal course Dispositions of fixed and other assets minus Fi xed Asset Additions and Increase in Investments, Other assets and Intangibles

THIRD QUARTER 2025 RESULTS WEBCAST 12 • Phil Fracassa named CFO in September • Twenty years spent with The Timken Company, where he served as CFO for more than a decade • Extensive automotive and industrial sector experience, and a proven track record of driving profitable growth and shareholder value creation through disciplined capital allocation • Phil succeeds Pat McCann, who stepped down from the CFO role and is serving in an advisory capacity until his retirement in February 2026 New CFO Named Philip Fracassa, EVP & CFO

THIRD QUARTER 2025 RESULTS WEBCAST 13 Executive Vice President & Chief Financial Officer Philip Fracassa

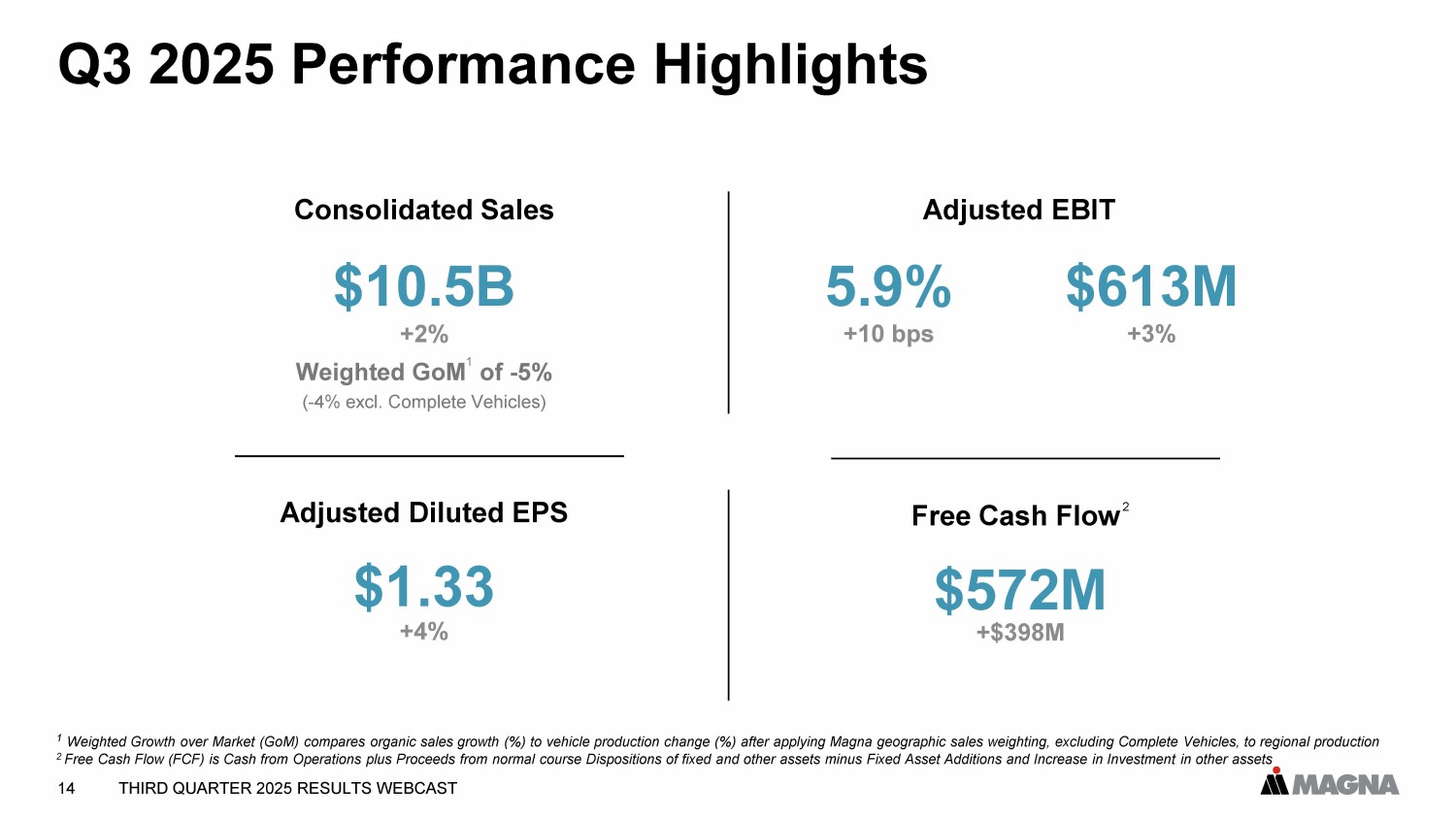

THIRD QUARTER 2025 RESULTS WEBCAST 14 Q3 2025 Performance Highlights Consolidated Sales $10.5B Weighted GoM 1 of - 5% ( - 4% excl. Complete Vehicles) +2% Adjusted Diluted EPS $1.33 +4% Free Cash Flow 2 $572M 1 Weighted Growth over Market (GoM) compares organic sales growth (%) to vehicle production change (%) after applying Magna geo gra phic sales weighting, excluding Complete Vehicles, to regional production 2 Free Cash Flow (FCF) is Cash from Operations plus Proceeds from normal course Dispositions of fixed and other assets minus Fi xed Asset Additions and Increase in Investment in other assets Adjusted EBIT 5.9% +10 bps $613M +3% +$398M

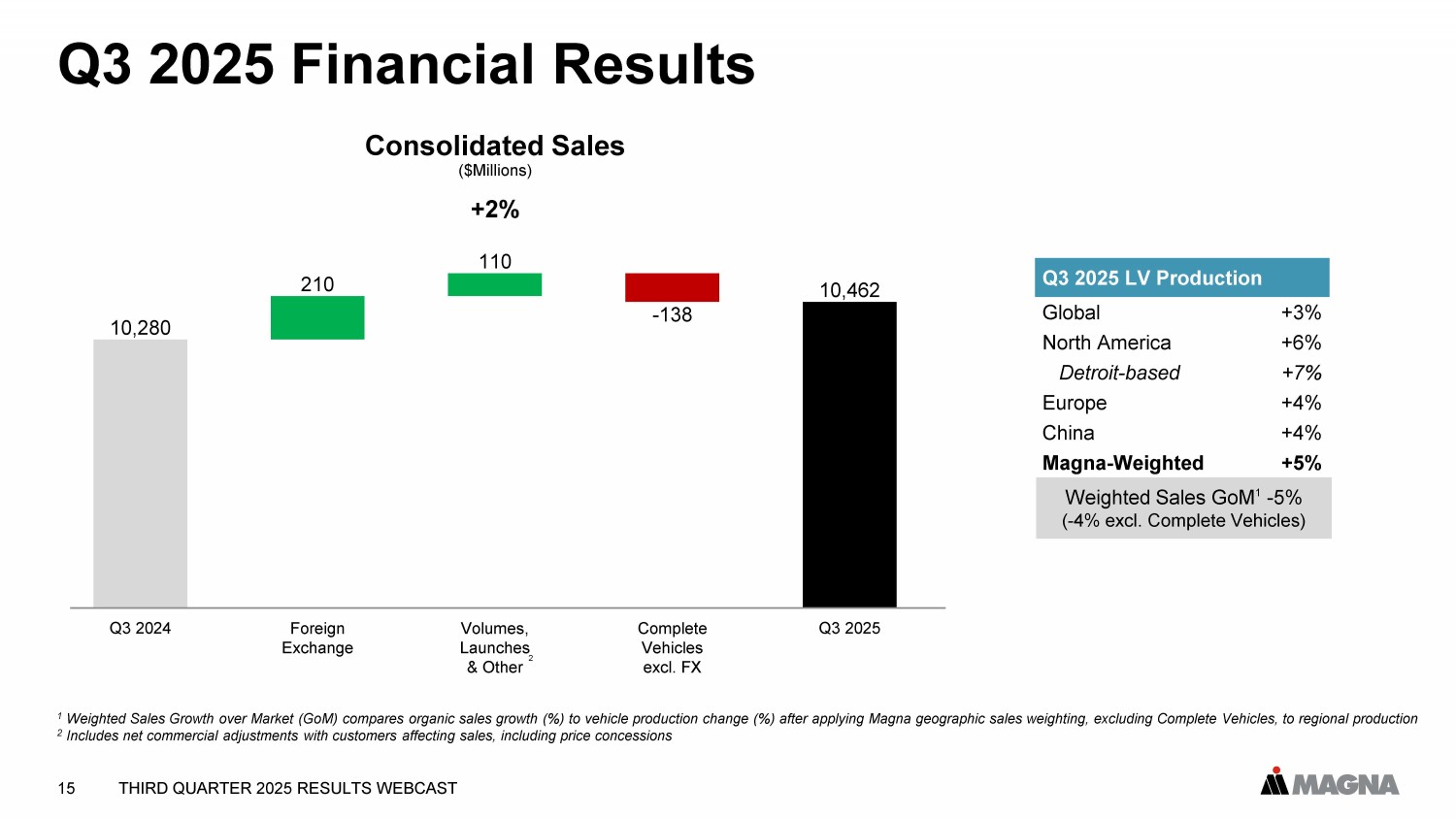

THIRD QUARTER 2025 RESULTS WEBCAST 15 Q3 2025 Financial Results Weighted Sales GoM 1 - 5% ( - 4% excl. Complete Vehicles) Q3 2025 LV Production +3% Global +6% North America +7% Detroit - based +4% Europe +4% China +5% Magna - Weighted 1 Weighted Sales Growth over Market ( GoM ) compares organic sales growth (%) to vehicle production change (%) after applying Magna geographic sales weighting, excludi ng Complete Vehicles, to regional production 2 Includes net commercial adjustments with customers affecting sales, including price concessions Consolidated Sales ($Millions) +2% 10,280 210 110 - 138 10,462 Q3 2024 Foreign Exchange Volumes, Launches & Other Complete Vehicles excl. FX Q3 2025 2

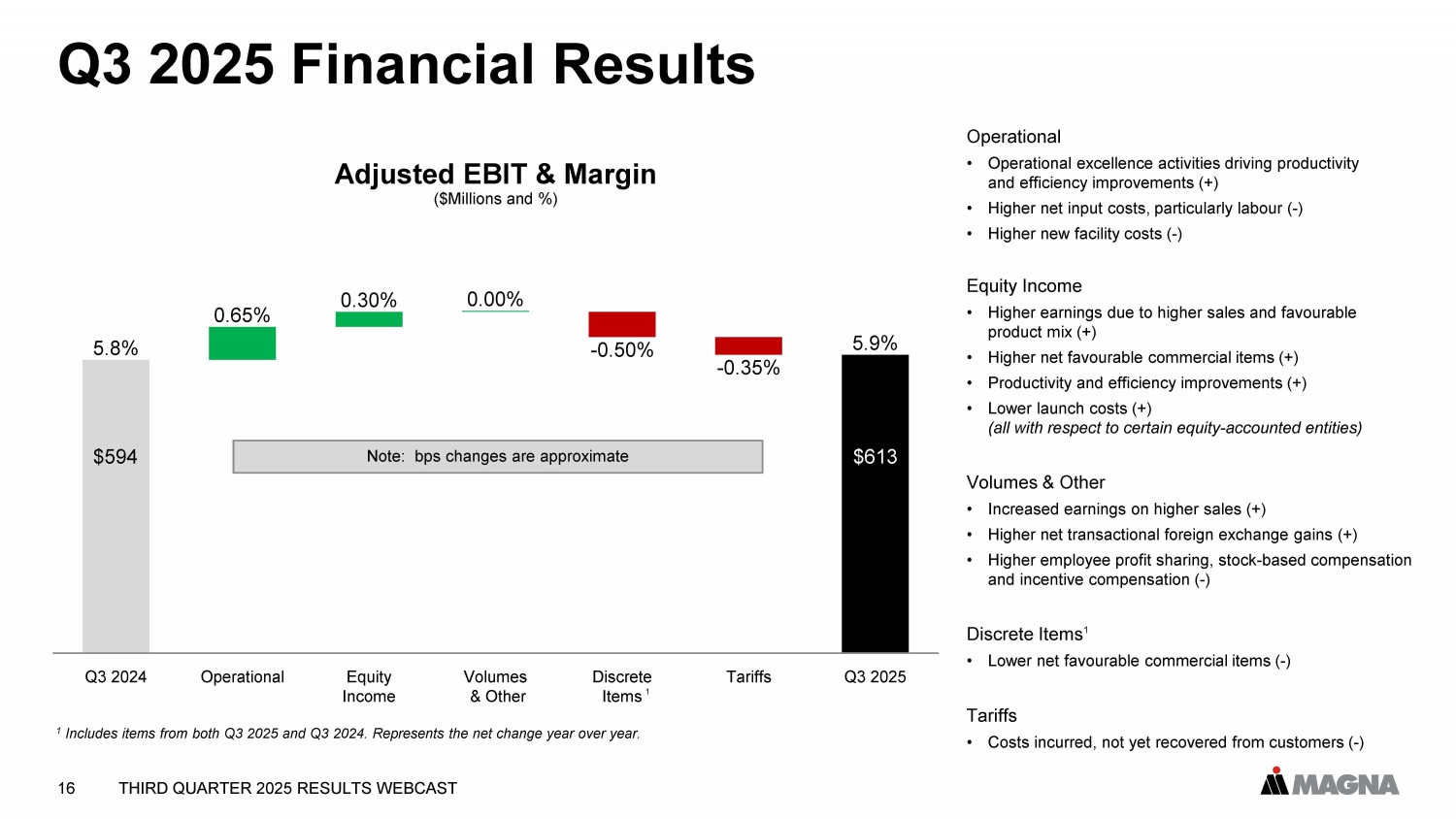

THIRD QUARTER 2025 RESULTS WEBCAST 16 Q3 2025 Financial Results 0.65% 0.30% 0.00% - 0.50% - 0.35% 5.8% 5.9% Q3 2024 Operational Equity Income Volumes & Other Discrete Items Tariffs Q3 2025 $613 $594 Adjusted EBIT & Margin ($Millions and %) Note: bps changes are approximate 1 Operational • Operational excellence activities driving productivity and efficiency improvements (+) • Higher net input costs, particularly labour ( - ) • Higher new facility costs ( - ) Equity Income • Higher earnings due to higher sales and favourable product mix (+) • Higher net favourable commercial items (+) • Productivity and efficiency improvements (+) • Lower launch costs (+) (all with respect to certain equity - accounted entities) Volumes & Other • Increased earnings on higher sales (+) • Higher net transactional foreign exchange gains (+) • Higher employee profit sharing, stock - based compensation and incentive compensation ( - ) Discrete Items 1 • Lower net favourable commercial items ( - ) Tariffs • Costs incurred, not yet recovered from customers ( - ) 1 Includes items from both Q3 2025 and Q3 2024. Represents the net change year over year.

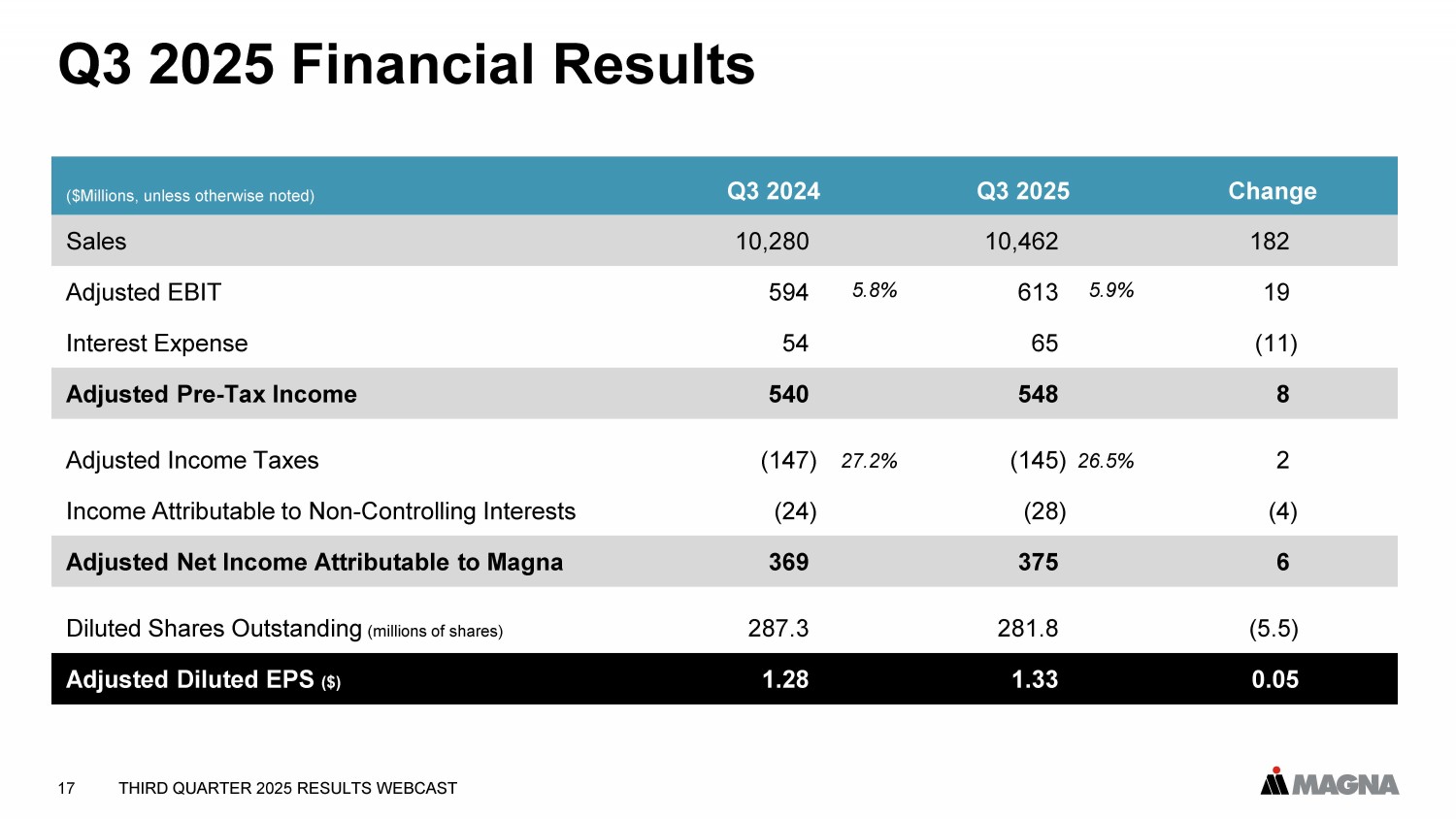

THIRD QUARTER 2025 RESULTS WEBCAST 17 Q3 2025 Financial Results Change Q3 2025 Q3 2024 ($Millions, unless otherwise noted) 182 10,462 10,280 Sales 19 613 594 Adjusted EBIT (11) 65 54 Interest Expense 8 548 540 Adjusted Pre - Tax Income 2 (145) (147) Adjusted Income Taxes (4) (28) (24) Income Attributable to Non - Controlling Interests 6 375 369 Adjusted Net Income Attributable to Magna (5.5) 281.8 287.3 Diluted Shares Outstanding (millions of shares) 0.05 1.33 1.28 Adjusted Diluted EPS ($) 27.2% 26.5% 5.8% 5.9%

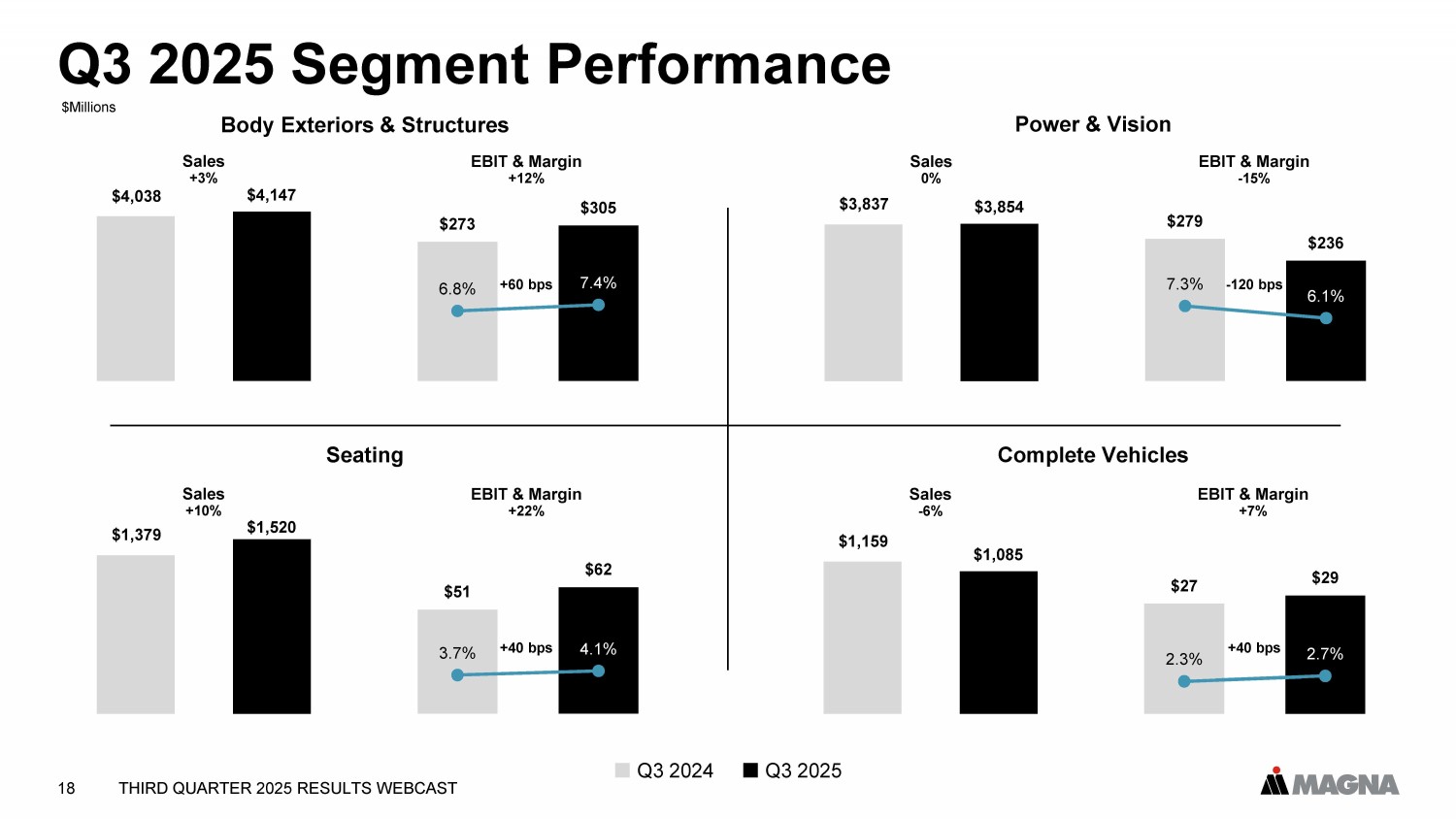

THIRD QUARTER 2025 RESULTS WEBCAST 18 Q3 2025 Segment Performance Q3 2024 Q3 2025 Seating Power & Vision Complete Vehicles Body Exteriors & Structures $4,038 $4,147 $0,000 $0,500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $273 $305 6.8% 7.4% 0.0 0.0 0.1 0.1 0.2 $0 $50 $100 $150 $200 $250 $300 $350 $400 Sales +3% EBIT & Margin +12% $1,379 $1,520 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $51 $62 3.7% 4.1% 0.0 0.0 0.1 0.1 0.2 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Sales +10% EBIT & Margin +22% $3,837 $3,854 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $279 $236 7.3% 6.1% 0.0 0.0 0.1 0.1 0.2 $0 $50 $100 $150 $200 $250 $300 $350 $400 Sales 0% EBIT & Margin - 15% $1,159 $1,085 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $27 $29 2.3% 2.7% 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.1 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 Sales - 6% EBIT & Margin +7% +60 bps +40 bps - 120 bps +40 bps $Millions

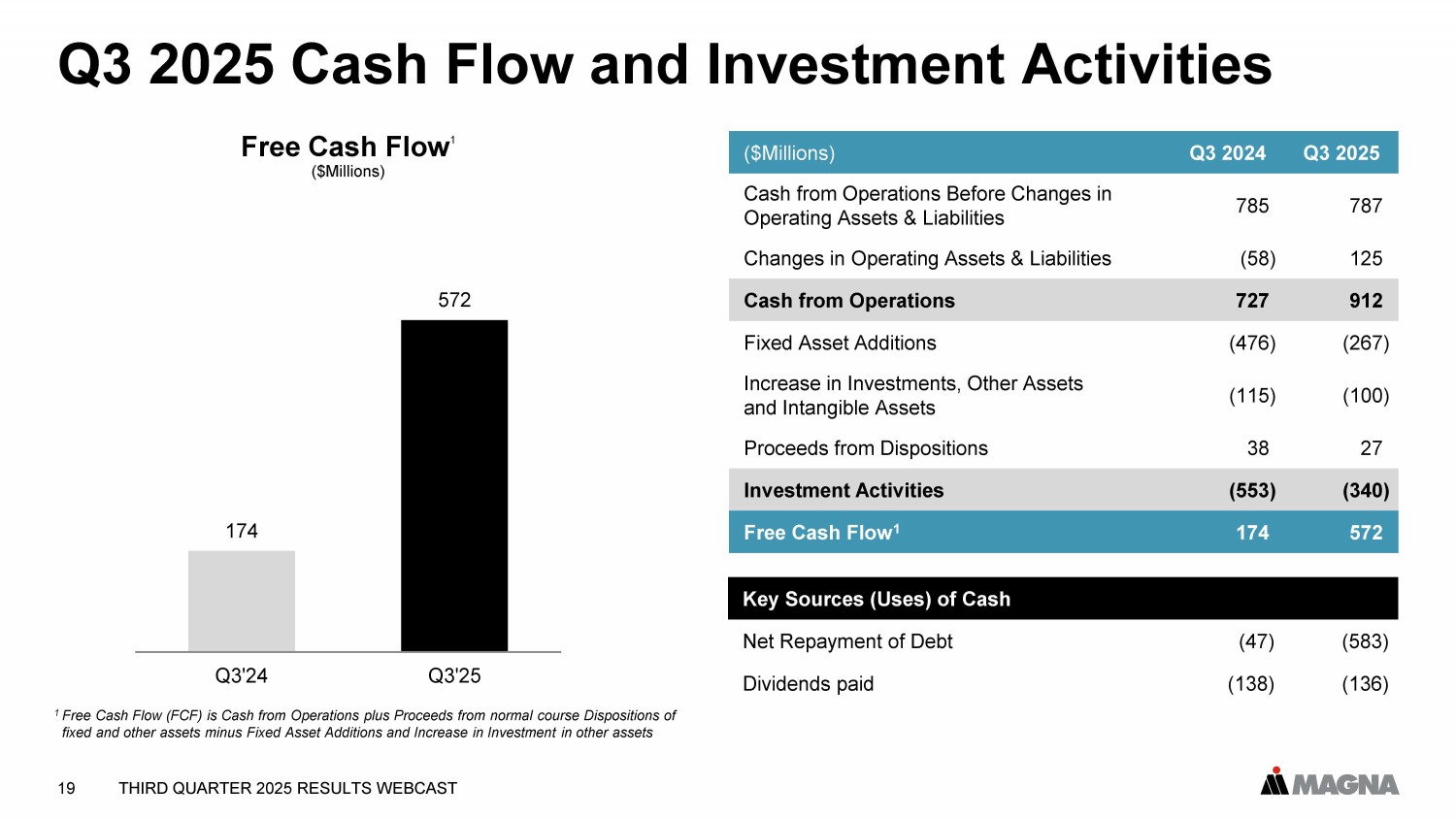

THIRD QUARTER 2025 RESULTS WEBCAST 19 Q3 2025 Cash Flow and Investment Activities Free Cash Flow 1 ($Millions) 174 572 0 100 200 300 400 500 600 700 Q3'24 Q3'25 1 Free Cash Flow (FCF) is Cash from Operations plus Proceeds from normal course Dispositions of fixed and other assets minus Fixed Asset Additions and Increase in Investment in other assets Key Sources (Uses) of Cash (583) (47) Net Repayment of Debt (136) (138) Dividends paid Q3 2025 Q3 2024 ($Millions) 787 785 Cash from Operations Before Changes in Operating Assets & Liabilities 125 (58) Changes in Operating Assets & Liabilities 912 727 Cash from Operations (267) (476) Fixed Asset Additions (100) (115) Increase in Investments, Other Assets and Intangible Assets 27 38 Proceeds from Dispositions (340) (553) Investment Activities 572 174 Free Cash Flow 1

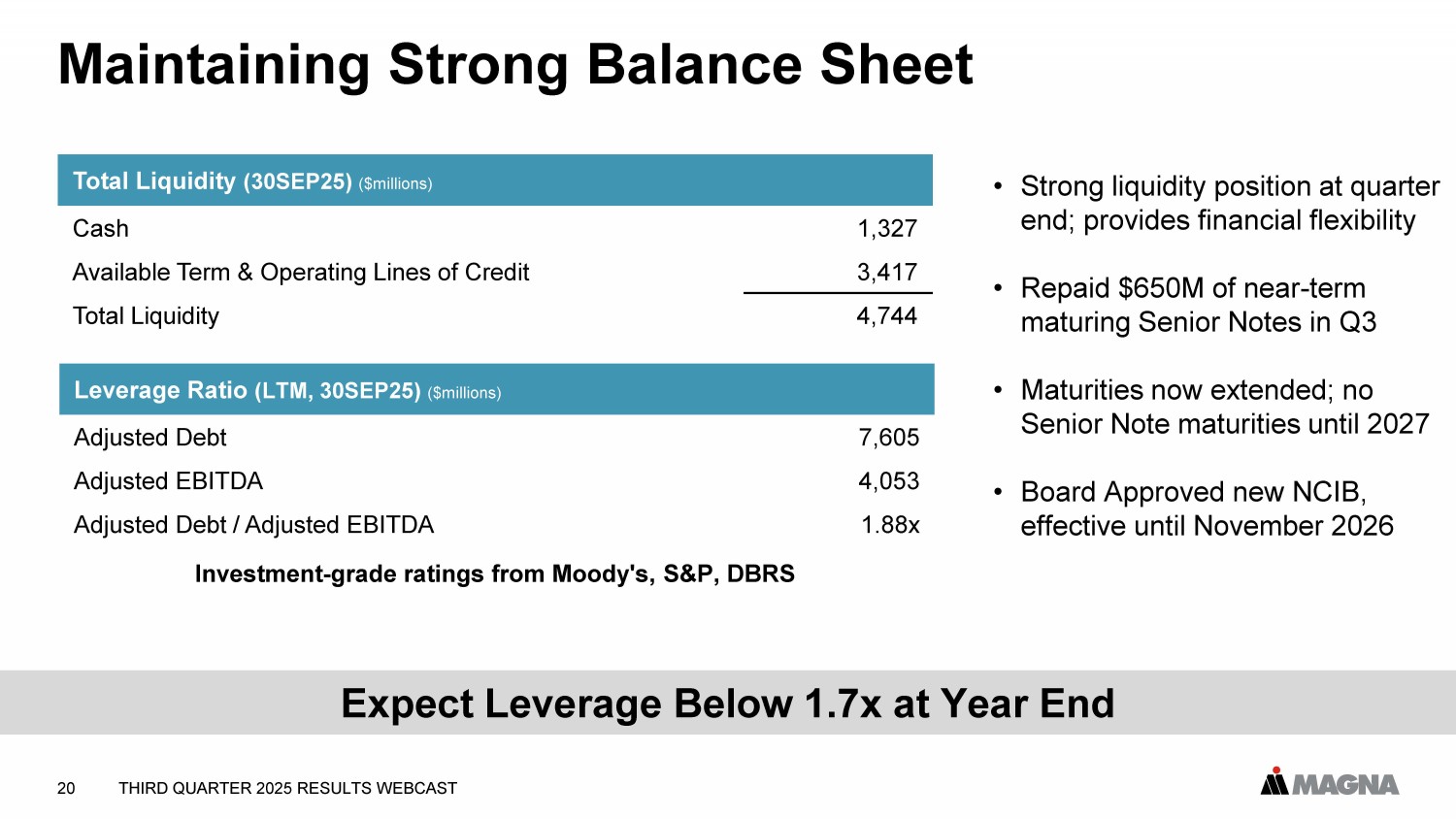

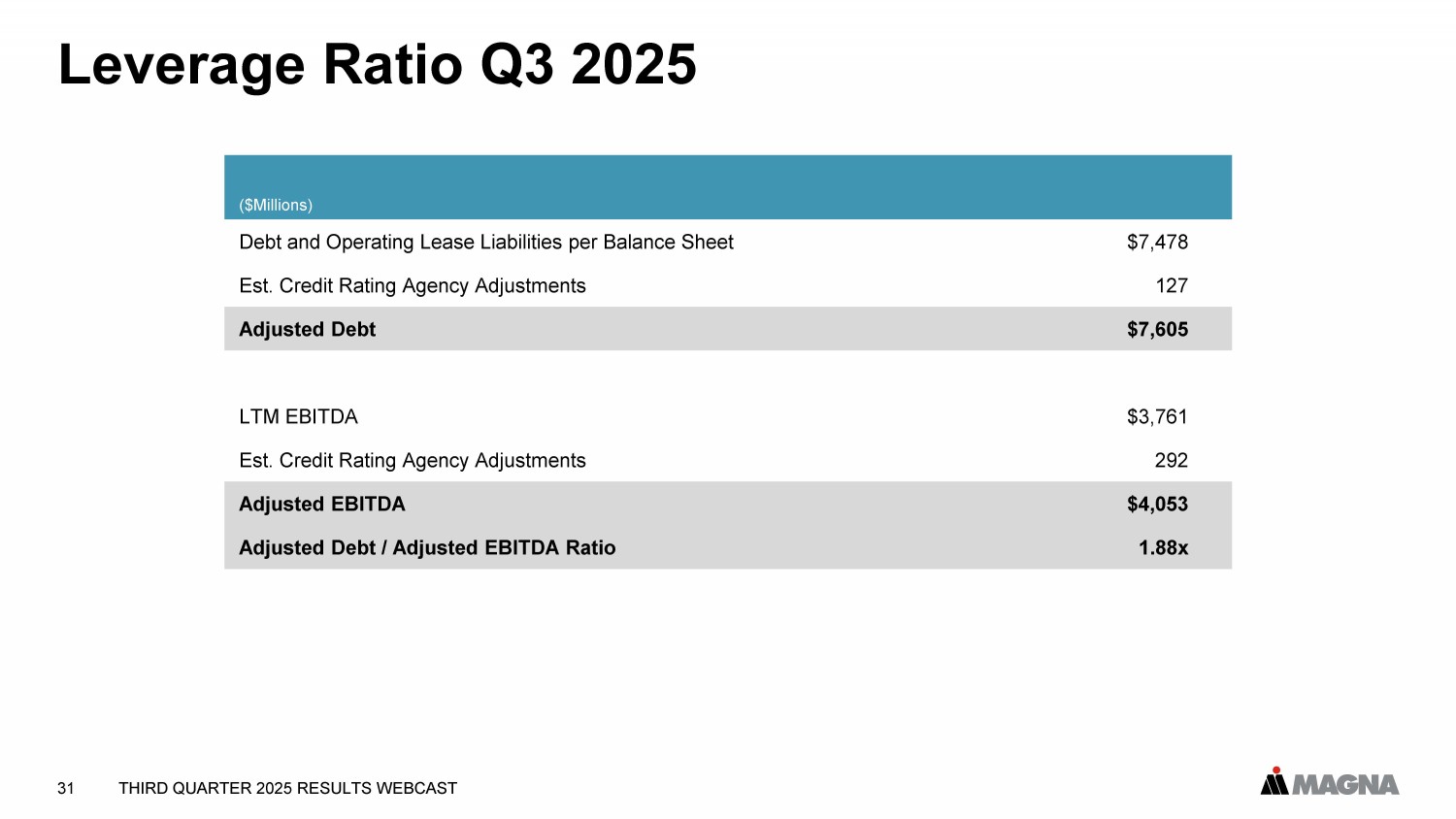

THIRD QUARTER 2025 RESULTS WEBCAST 20 Maintaining Strong Balance Sheet Leverage Ratio (LTM, 30SEP25) ($millions) 7,605 Adjusted Debt 4,053 Adjusted EBITDA 1.88x Adjusted Debt / Adjusted EBITDA Total Liquidity (30SEP25) ($millions) 1,327 Cash 3,417 Available Term & Operating Lines of Credit 4,744 Total Liquidity Investment - grade ratings from Moody's, S&P, DBRS • Strong liquidity position at quarter end; provides financial flexibility • Repaid $650M of near - term maturing Senior Notes in Q3 • Maturities now extended; no Senior Note maturities until 2027 • Board Approved new NCIB, effective until November 2026 Expect Leverage Below 1.7x at Year End

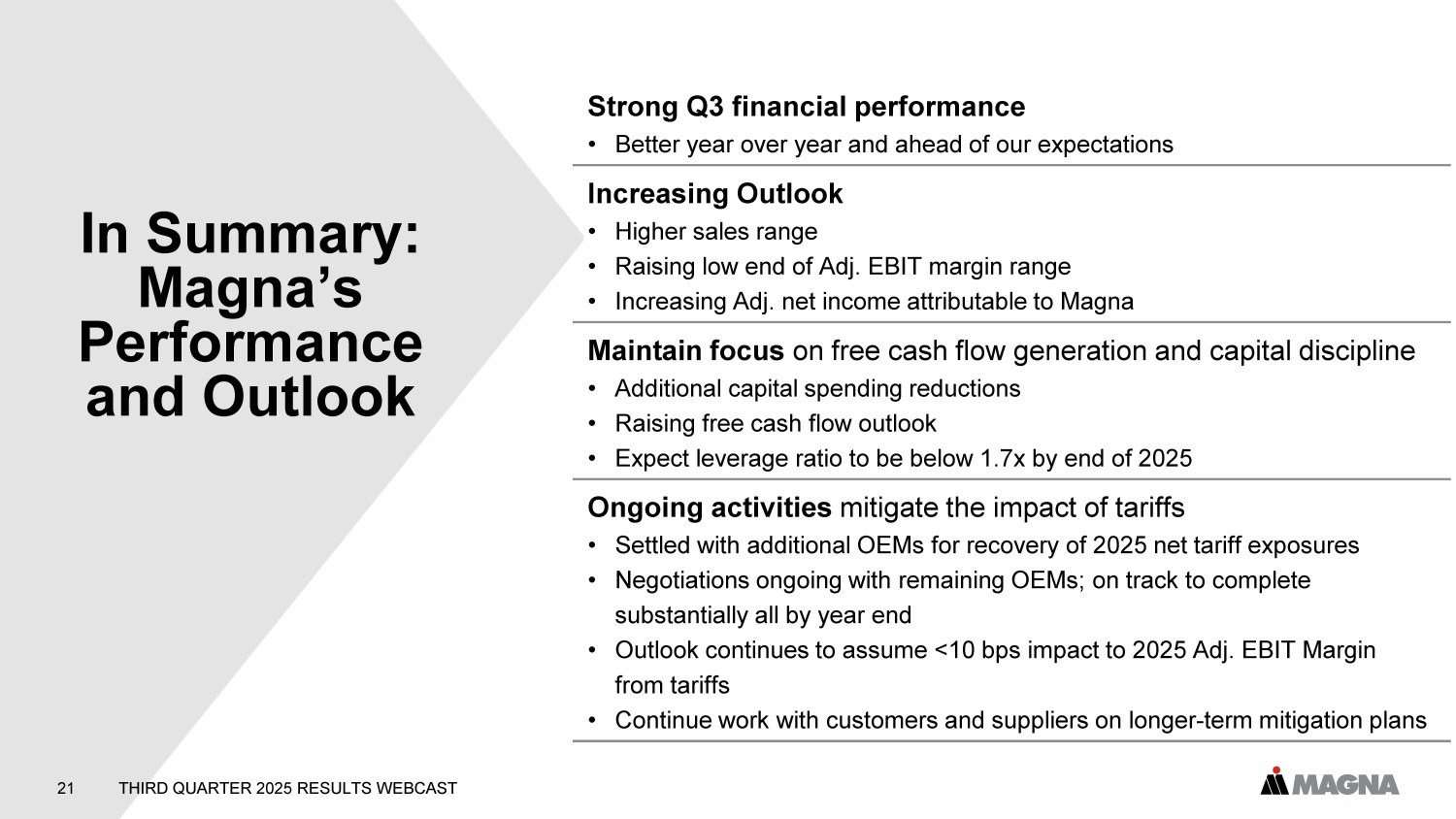

THIRD QUARTER 2025 RESULTS WEBCAST 21 In Summary: Magna’s Performance and Outlook Strong Q3 financial performance • Better year over year and ahead of our expectations Increasing Outlook • Higher sales range • Raising low end of Adj. EBIT margin range • Increasing Adj. net income attributable to Magna Maintain focus on free cash flow generation and capital discipline • Additional capital spending reductions • Raising free cash flow outlook • Expect leverage ratio to be below 1.7x by end of 2025 Ongoing activities mitigate the impact of tariffs • Settled with additional OEMs for recovery of 2025 net tariff exposures • Negotiations ongoing with remaining OEMs; on track to complete substantially all by year end • Outlook continues to assume <10 bps impact to 2025 Adj. EBIT Margin from tariffs • Continue work with customers and suppliers on longer - term mitigation plans

THIRD QUARTER 2025 RESULTS WEBCAST 22 Q&A

THIRD QUARTER 2025 RESULTS WEBCAST 23

THIRD QUARTER 2025 RESULTS WEBCAST 24 Appendix

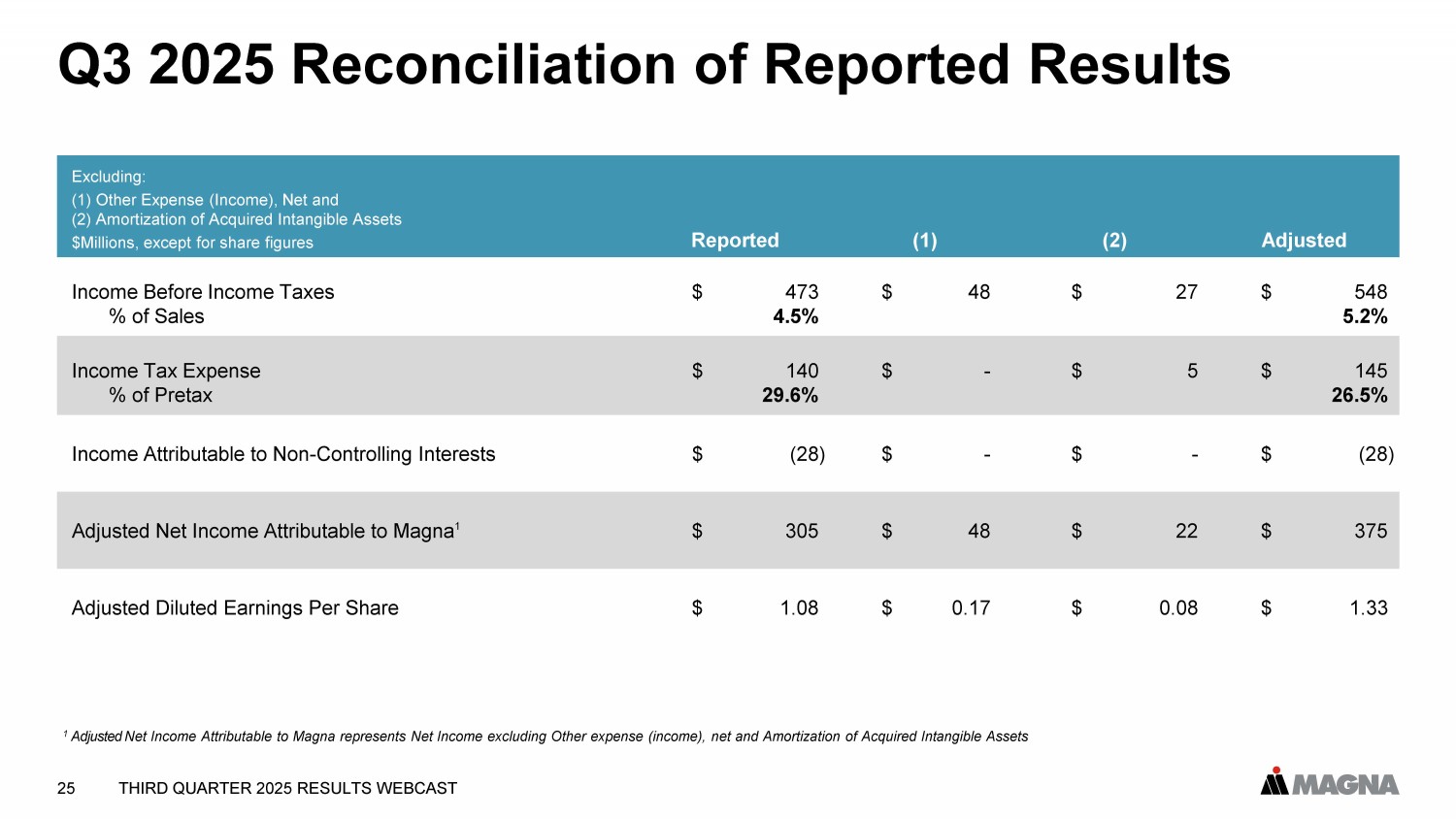

THIRD QUARTER 2025 RESULTS WEBCAST 25 Q3 2025 Reconciliation of Reported Results Adjusted (2) (1) Reported Excluding: (1) Other Expense (Income), Net and (2) Amortization of Acquired Intangible Assets $Millions, except for share figures $ 548 $ 27 $ 48 $ 473 Income Before Income Taxes 5.2% 4.5% % of Sales $ 145 $ 5 $ - $ 140 Income Tax Expense 26.5% 29.6% % of Pretax $ (28) $ - $ - $ (28) Income Attributable to Non - Controlling Interests $ 375 $ 22 $ 48 $ 305 Adjusted Net Income Attributable to Magna 1 $ 1.33 $ 0.08 $ 0.17 $ 1.08 Adjusted Diluted Earnings Per Share 1 Adjusted Net Income Attributable to Magna represents Net Income excluding Other expense (income), net and Amortization of Acquired Int ang ible Assets

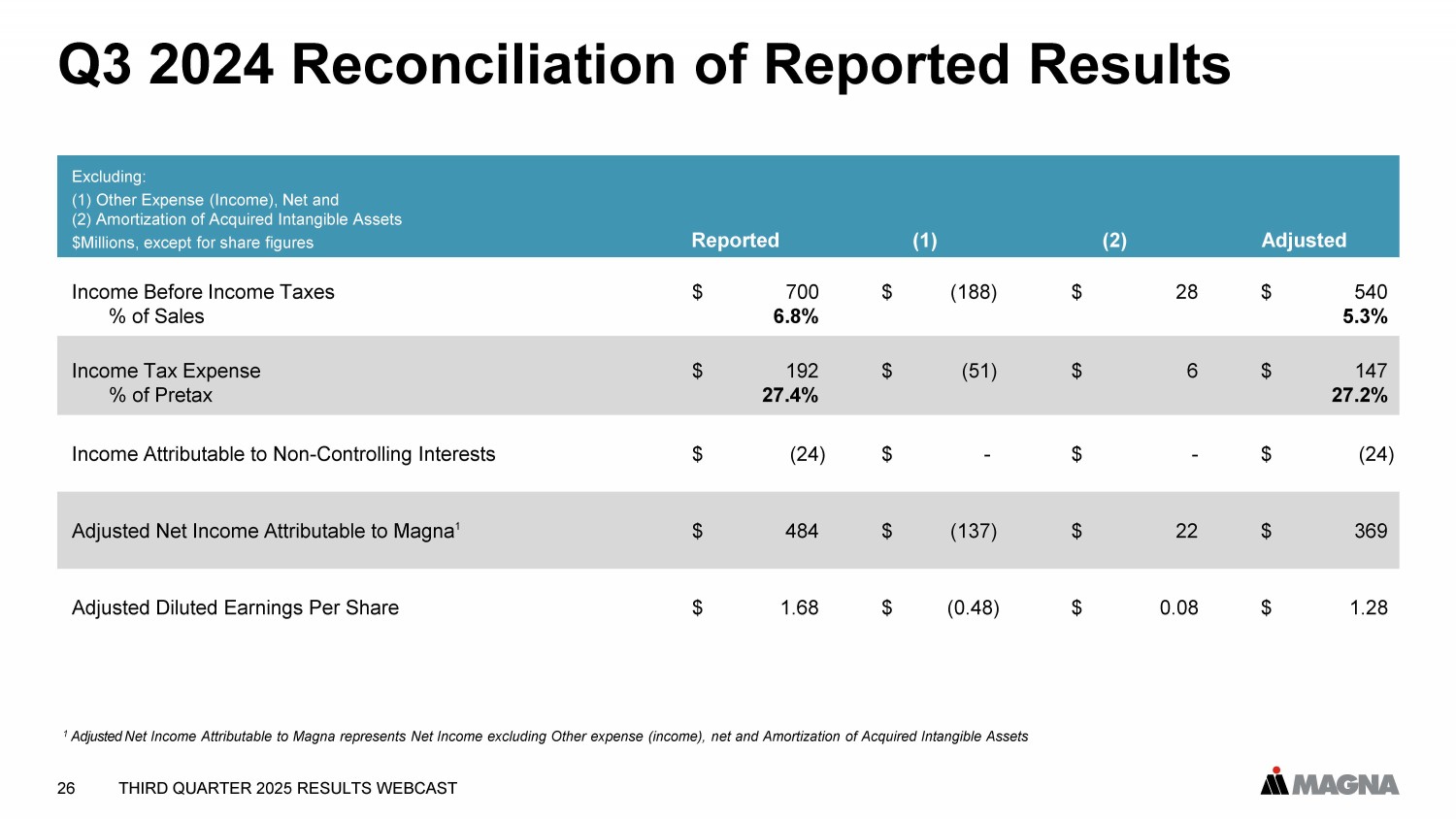

THIRD QUARTER 2025 RESULTS WEBCAST 26 Q3 2024 Reconciliation of Reported Results Adjusted (2) (1) Reported Excluding: (1) Other Expense (Income), Net and (2) Amortization of Acquired Intangible Assets $Millions, except for share figures $ 540 $ 28 $ (188) $ 700 Income Before Income Taxes 5.3% 6.8% % of Sales $ 147 $ 6 $ (51) $ 192 Income Tax Expense 27.2% 27.4% % of Pretax $ (24) $ - $ - $ (24) Income Attributable to Non - Controlling Interests $ 369 $ 22 $ (137) $ 484 Adjusted Net Income Attributable to Magna 1 $ 1.28 $ 0.08 $ (0.48) $ 1.68 Adjusted Diluted Earnings Per Share 1 Adjusted Net Income Attributable to Magna represents Net Income excluding Other expense (income), net and Amortization of Acquired Int ang ible Assets

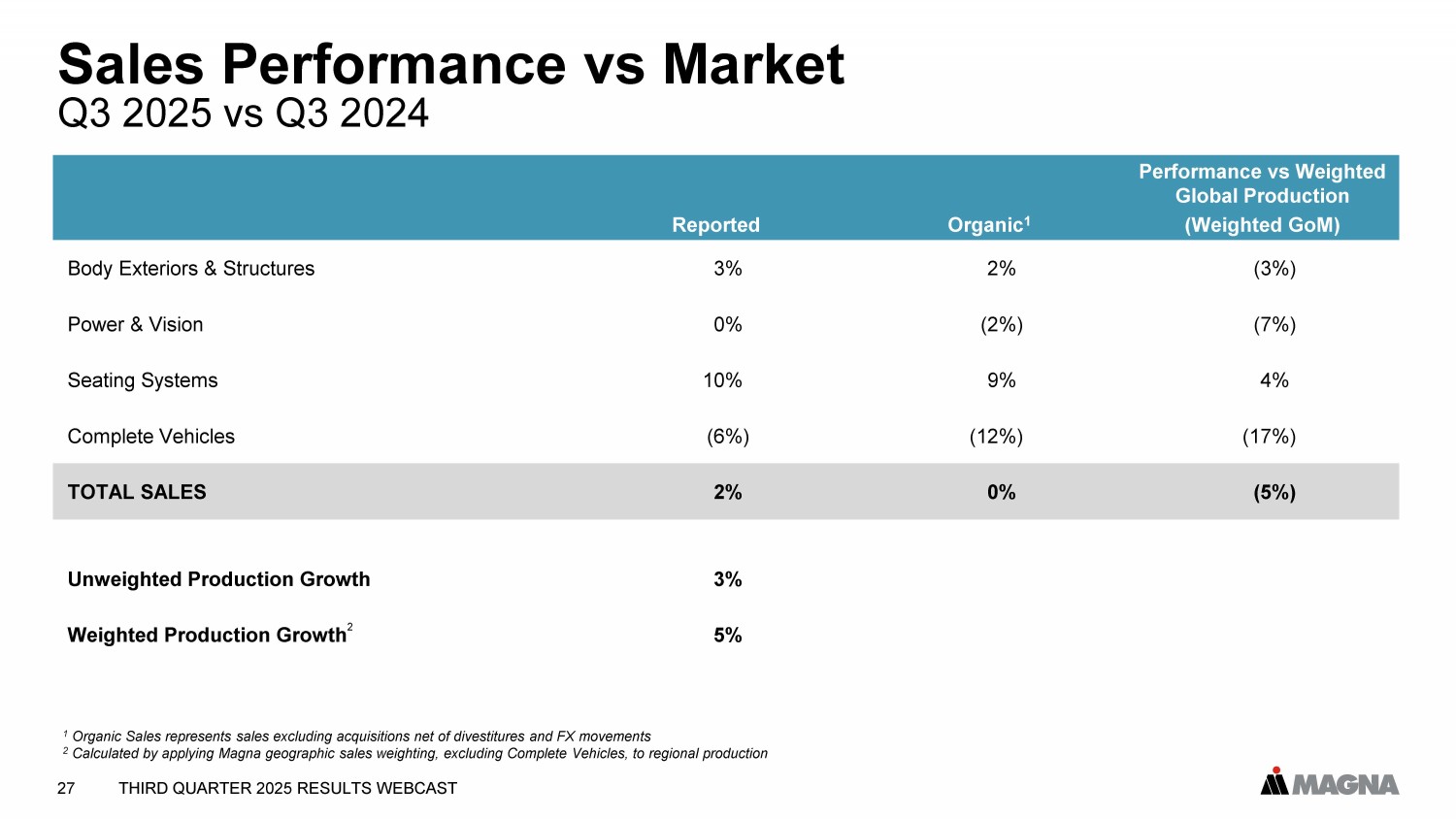

THIRD QUARTER 2025 RESULTS WEBCAST 27 Q3 2025 vs Q3 2024 Sales Performance vs Market Performance vs Weighted Global Production (Weighted GoM ) Organic 1 Reported (3%) 2% 3% Body Exteriors & Structures (7%) (2%) 0% Power & Vision 4% 9% 10% Seating Systems (17%) (12%) (6%) Complete Vehicles (5%) 0% 2% TOTAL SALES 3% Unweighted Production Growth 5% Weighted Production Growth 2 1 Organic Sales represents sales excluding acquisitions net of divestitures and FX movements 2 Calculated by applying Magna geographic sales weighting, excluding Complete Vehicles, to regional production

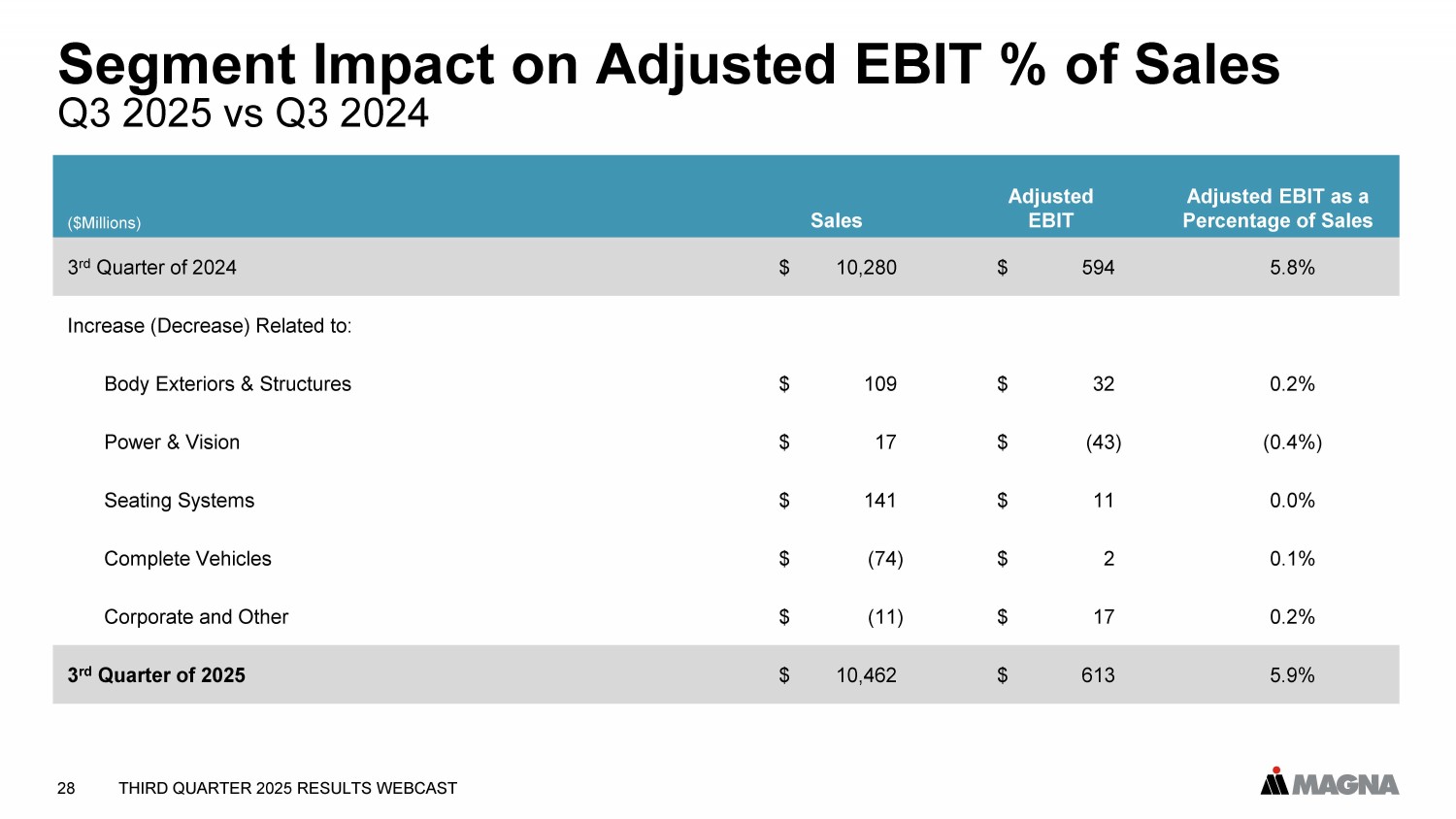

THIRD QUARTER 2025 RESULTS WEBCAST 28 Q3 2025 vs Q3 2024 Segment Impact on Adjusted EBIT % of Sales Adjusted EBIT as a Percentage of Sales Adjusted EBIT Sales ($Millions) 5.8% $ 594 $ 10,280 3 rd Quarter of 2024 Increase (Decrease) Related to: 0.2% $ 32 $ 109 Body Exteriors & Structures (0.4%) $ (43) $ 17 Power & Vision 0.0% $ 11 $ 141 Seating Systems 0.1% $ 2 $ (74) Complete Vehicles 0.2% $ 17 $ (11) Corporate and Other 5.9% $ 613 $ 10,462 3 rd Quarter of 2025

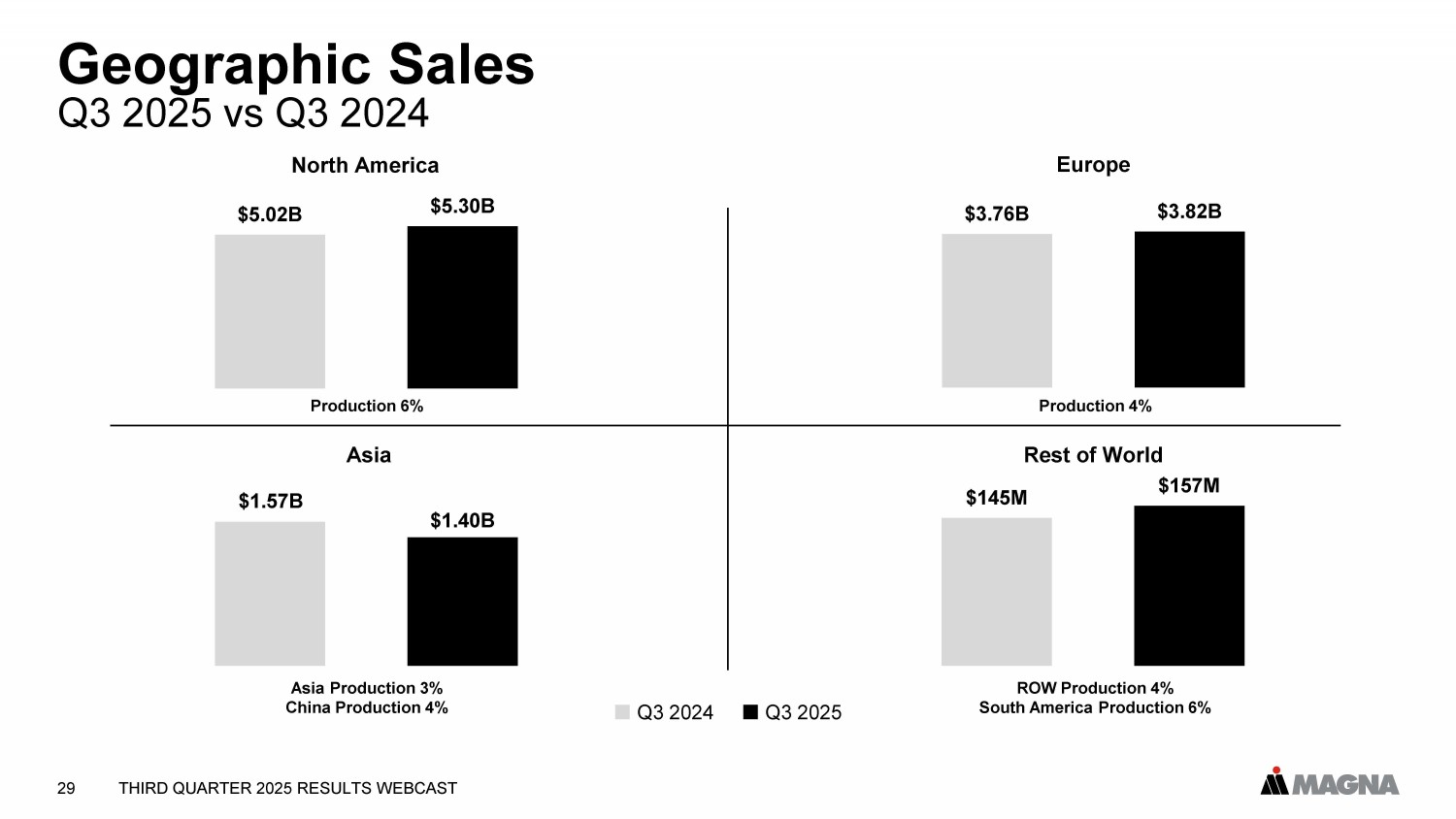

THIRD QUARTER 2025 RESULTS WEBCAST 29 Q3 2025 vs Q3 2024 Geographic Sales Q3 2024 Q3 2025 Asia Asia Production 3% China Production 4% $1.57B $1.40B $0.00B $0.20B $0.40B $0.60B $0.80B $1.00B $1.20B $1.40B $1.60B $1.80B $2.00B $5.02B $5.30B $0.00B $1.00B $2.00B $3.00B $4.00B $5.00B $6.00B North America Production 6% $3.76B $3.82B $0.00B $0.50B $1.00B $1.50B $2.00B $2.50B $3.00B $3.50B $4.00B $4.50B Europe Production 4% $145M $157M $0M $20M $40M $60M $80M $100M $120M $140M $160M $180M ROW Production 4% South America Production 6% Rest of World

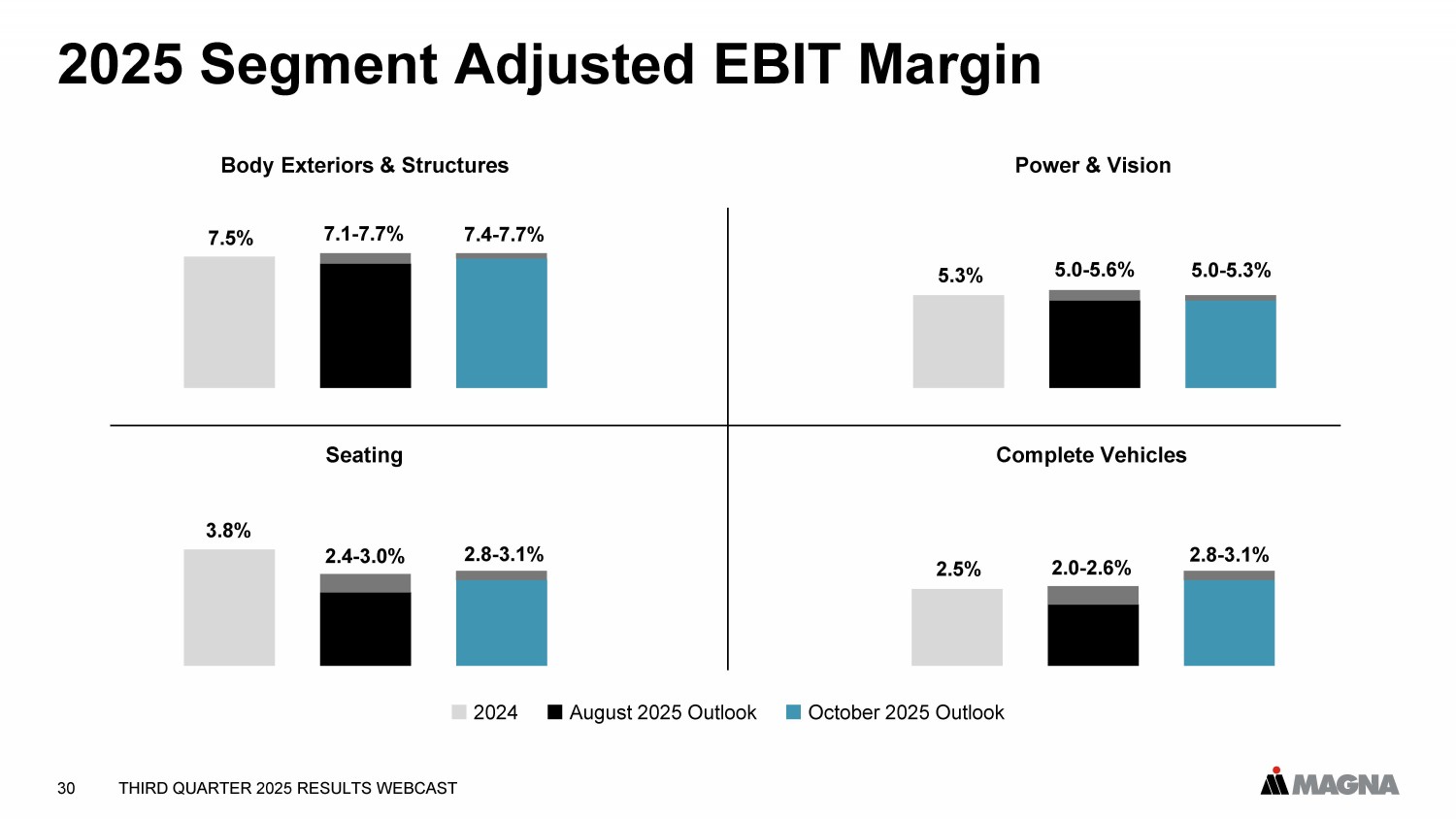

THIRD QUARTER 2025 RESULTS WEBCAST 30 2025 Segment Adjusted EBIT Margin 2024 August 2025 Outlook October 2025 Outlook Seating Body Exteriors & Structures Power & Vision Complete Vehicles 7.5% 7.1 - 7.7% 5.3% 5.0 - 5.6% 3.8% 2.4 - 3.0% 2.5% 2.0 - 2.6% 7.4 - 7.7% 2.8 - 3.1% 5.0 - 5.3% 2.8 - 3.1%

THIRD QUARTER 2025 RESULTS WEBCAST 31 Leverage Ratio Q3 2025 ($Millions) $7,478 Debt and Operating Lease Liabilities per Balance Sheet 127 Est. Credit Rating Agency Adjustments $7,605 Adjusted Debt $3,761 LTM EBITDA 292 Est. Credit Rating Agency Adjustments $4,053 Adjusted EBITDA 1.88x Adjusted Debt / Adjusted EBITDA Ratio

THIRD QUARTER 2025 RESULTS WEBCAST 32