4Q25 Financial Results January 21, 2026

2 Forward-looking statements and use of non-GAAP financial measures This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward- looking statement. These statements often include the words "believes," "expects," "anticipates," "estimates," "intends," "plans," "goals," "targets," "initiatives," "potentially," "probably," "projects," "outlook," "guidance" or similar expressions or future conditional verbs such as "may," "will," "likely," "should," "would," and "could." Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: • Negative economic, business and political conditions, including as a result of the interest rate environment, supply chain disruptions, tariffs, inflationary pressures, and labor shortages that adversely affect the general economy, housing prices, the job market, consumer confidence, and spending habits; • The general state of the economy and employment, as well as general business and economic conditions, and changes in the competitive environment; • Our capital and liquidity requirements under regulatory standards and our ability to generate capital and liquidity on favorable terms; • The effect of changes in our credit ratings on our cost of funding, access to capital markets, ability to market our securities, and overall liquidity position; • The effect of changes in the level of commercial and consumer deposits on our funding costs and net interest margin; • Our ability to execute on our strategic business initiatives and achieve our financial performance goals across our Consumer and Commercial businesses, including our Private Bank; • The effects of geopolitical instability, including the wars in Ukraine and the Middle East, on economic and market conditions, inflationary pressures and the interest rate environment, commodity price and foreign exchange rate volatility, and heightened cybersecurity risks; • Our ability to comply with heightened supervisory requirements and expectations as well as new or amended regulations; • Liabilities and business restrictions resulting from litigation and regulatory investigations; • The effect of changes in interest rates on our net interest income, net interest margin, mortgage originations, mortgage servicing rights, and mortgages held for sale; • Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources, and affect the ability to originate and distribute financial products in the primary and secondary markets; • Financial services reform and other current, pending, or future legislation or regulation that could have a negative effect on our revenue and businesses; • Environmental risks, such as physical or transition risks associated with climate change, and social and governance risks that could adversely affect our reputation, operations, business, and customers; • A failure in, or breach of, our compliance with laws, as well as operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyberattacks; and • Management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, balance sheet growth, market conditions, and regulatory considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares from, or pay any dividends to, holders of our common stock, or as to the amount of any such repurchases or dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in the “Risk Factors” section in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 as filed with the Securities and Exchange Commission. Non-GAAP Financial Measures: This document contains non-GAAP financial measures, with those denoted as Underlying for any given reporting period excluding certain items that may occur in that period which management does not consider indicative of the Company’s on-going financial performance. We believe these non-GAAP financial measures provide useful information to investors because they are used by our management to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe those measures denoted as Underlying in any given reporting period reflect our on-going financial performance in that period and, accordingly, are useful to consider in addition to our GAAP financial results. The Appendix presents reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures. We caution investors not to place undue reliance on such non-GAAP financial measures, but to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for our results reported under GAAP.

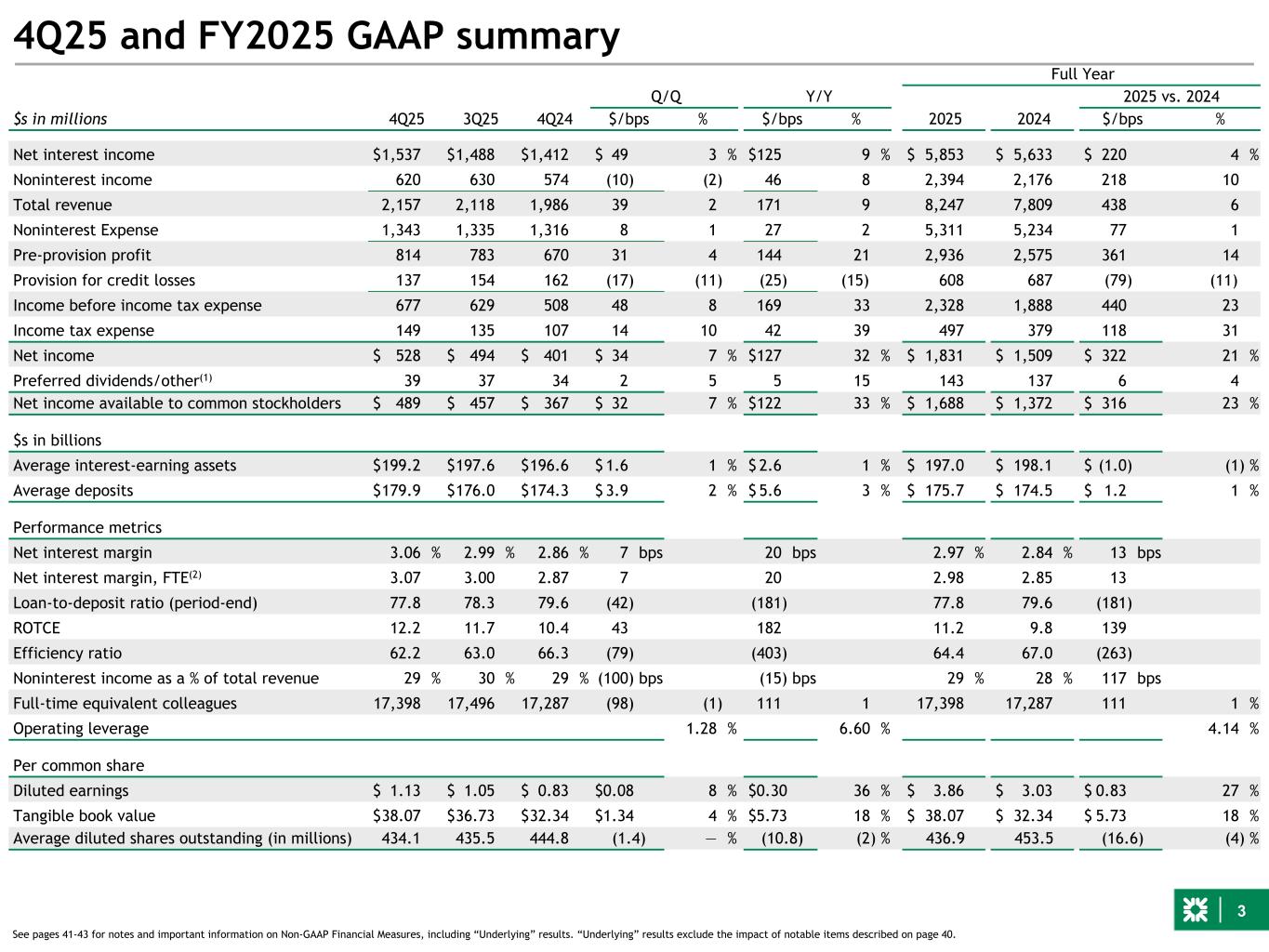

3 4Q25 and FY2025 GAAP summary Full Year 4Q25 3Q25 4Q24 Q/Q Y/Y 2025 vs. 2024 $s in millions $/bps % $/bps % 2025 2024 $/bps % Net interest income $ 1,537 $ 1,488 $ 1,412 $ 49 3 % $ 125 9 % $ 5,853 $ 5,633 $ 220 4 % Noninterest income 620 630 574 (10) (2) 46 8 2,394 2,176 218 10 Total revenue 2,157 2,118 1,986 39 2 171 9 8,247 7,809 438 6 Noninterest Expense 1,343 1,335 1,316 8 1 27 2 5,311 5,234 77 1 Pre-provision profit 814 783 670 31 4 144 21 2,936 2,575 361 14 Provision for credit losses 137 154 162 (17) (11) (25) (15) 608 687 (79) (11) Income before income tax expense 677 629 508 48 8 169 33 2,328 1,888 440 23 Income tax expense 149 135 107 14 10 42 39 497 379 118 31 Net income $ 528 $ 494 $ 401 $ 34 7 % $ 127 32 % $ 1,831 $ 1,509 $ 322 21 % Preferred dividends/other(1) 39 37 34 2 5 5 15 143 137 6 4 Net income available to common stockholders $ 489 $ 457 $ 367 $ 32 7 % $ 122 33 % $ 1,688 $ 1,372 $ 316 23 % $s in billions Average interest-earning assets $ 199.2 $ 197.6 $ 196.6 $ 1.6 1 % $ 2.6 1 % $ 197.0 $ 198.1 $ (1.0) (1) % Average deposits $ 179.9 $ 176.0 $ 174.3 $ 3.9 2 % $ 5.6 3 % $ 175.7 $ 174.5 $ 1.2 1 % Performance metrics Net interest margin 3.06 % 2.99 % 2.86 % 7 bps 20 bps 2.97 % 2.84 % 13 bps Net interest margin, FTE(2) 3.07 3.00 2.87 7 20 2.98 2.85 13 Loan-to-deposit ratio (period-end) 77.8 78.3 79.6 (42) (181) 77.8 79.6 (181) ROTCE 12.2 11.7 10.4 43 182 11.2 9.8 139 Efficiency ratio 62.2 63.0 66.3 (79) (403) 64.4 67.0 (263) Noninterest income as a % of total revenue 29 % 30 % 29 % (100) bps (15) bps 29 % 28 % 117 bps Full-time equivalent colleagues 17,398 17,496 17,287 (98) (1) 111 1 17,398 17,287 111 1 % Operating leverage 1.28 % 6.60 % 4.14 % Per common share Diluted earnings $ 1.13 $ 1.05 $ 0.83 $ 0.08 8 % $ 0.30 36 % $ 3.86 $ 3.03 $ 0.83 27 % Tangible book value $ 38.07 $ 36.73 $ 32.34 $ 1.34 4 % $ 5.73 18 % $ 38.07 $ 32.34 $ 5.73 18 % Average diluted shares outstanding (in millions) 434.1 435.5 444.8 (1.4) — % (10.8) (2) % 436.9 453.5 (16.6) (4) % See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

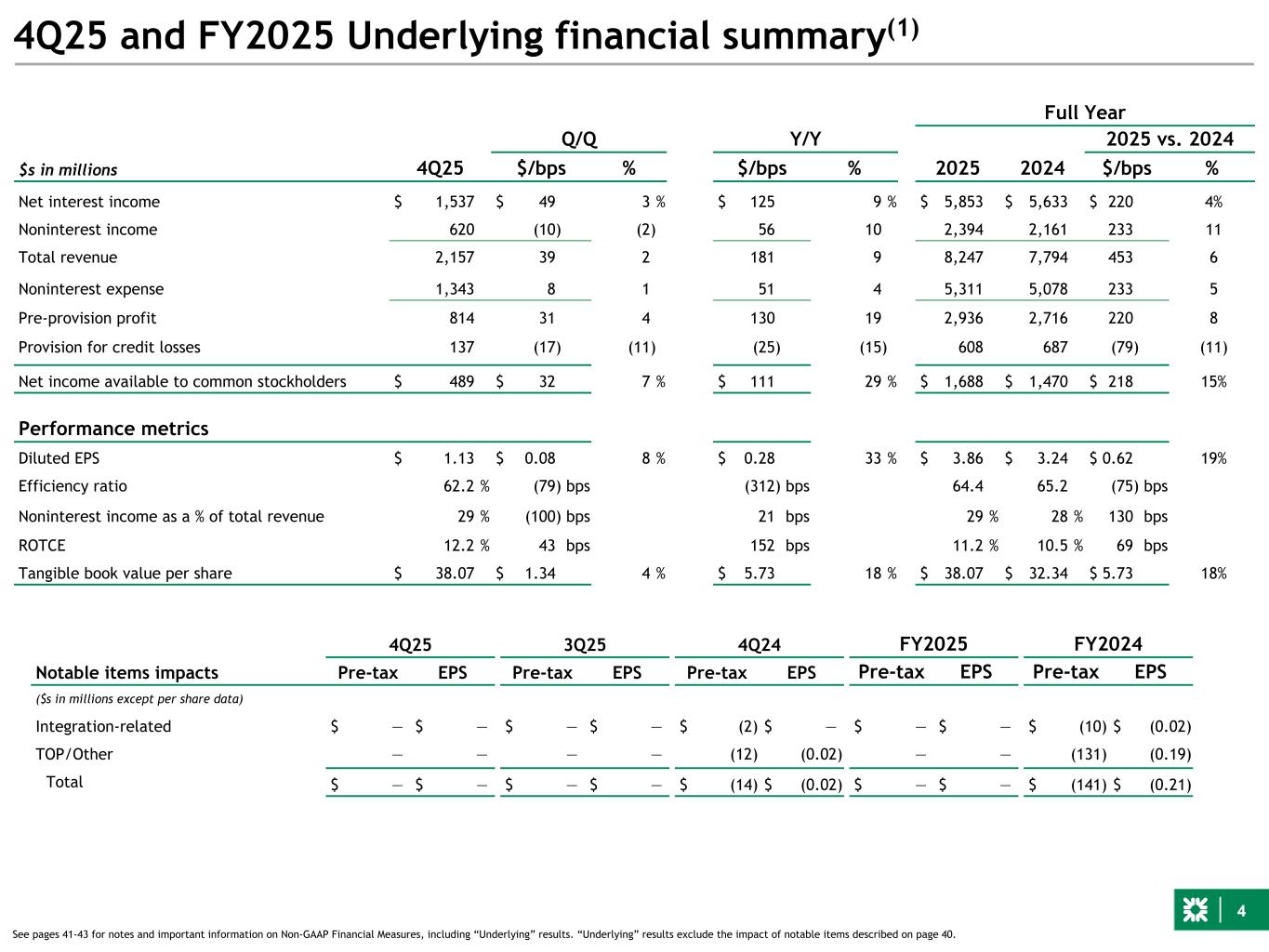

4 4Q25 and FY2025 Underlying financial summary(1) Full Year Q/Q Y/Y 2025 2024 2025 vs. 2024 $s in millions 4Q25 $/bps % $/bps % $/bps % Net interest income $ 1,537 $ 49 3 % $ 125 9 % $ 5,853 $ 5,633 $ 220 4% Noninterest income 620 (10) (2) 56 10 2,394 2,161 233 11 Total revenue 2,157 39 2 181 9 8,247 7,794 453 6 Noninterest expense 1,343 8 1 51 4 5,311 5,078 233 5 Pre-provision profit 814 31 4 130 19 2,936 2,716 220 8 Provision for credit losses 137 (17) (11) (25) (15) 608 687 (79) (11) Net income available to common stockholders $ 489 $ 32 7 % $ 111 29 % $ 1,688 $ 1,470 $ 218 15% Performance metrics Diluted EPS $ 1.13 $ 0.08 8 % $ 0.28 33 % $ 3.86 $ 3.24 $ 0.62 19% Efficiency ratio 62.2 % (79) bps (312) bps 64.4 65.2 (75) bps Noninterest income as a % of total revenue 29 % (100) bps 21 bps 29 % 28 % 130 bps ROTCE 12.2 % 43 bps 152 bps 11.2 % 10.5 % 69 bps Tangible book value per share $ 38.07 $ 1.34 4 % $ 5.73 18 % $ 38.07 $ 32.34 $ 5.73 18% See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. 4Q25 3Q25 4Q24 FY2025 FY2024 Notable items impacts Pre-tax EPS Pre-tax EPS Pre-tax EPS Pre-tax EPS Pre-tax EPS ($s in millions except per share data) Integration-related $ — $ — $ — $ — $ (2) $ — $ — $ — $ (10) $ (0.02) TOP/Other — — — — (12) (0.02) — — (131) (0.19) Total $ — $ — $ — $ — $ (14) $ (0.02) $ — $ — $ (141) $ (0.21)

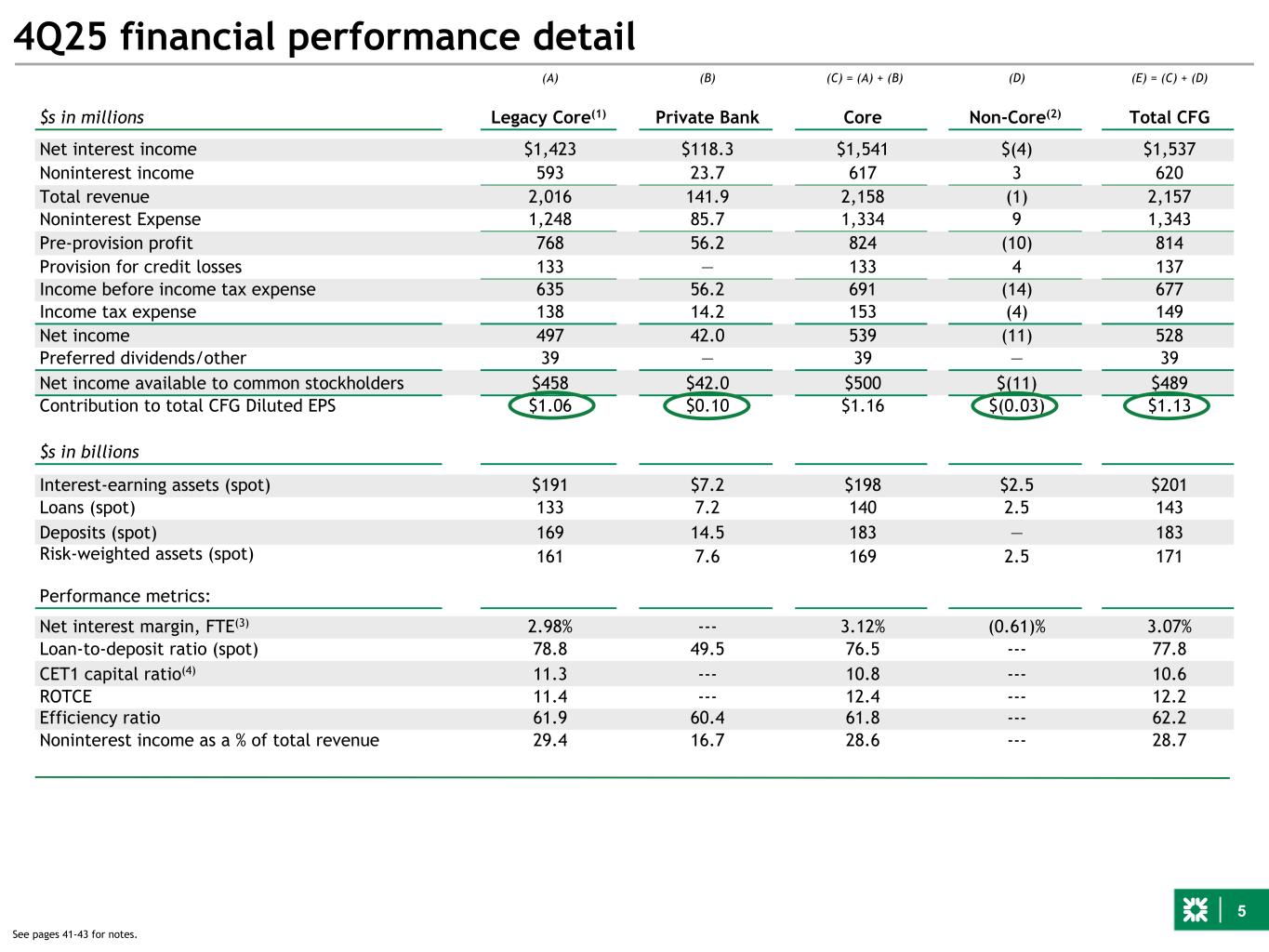

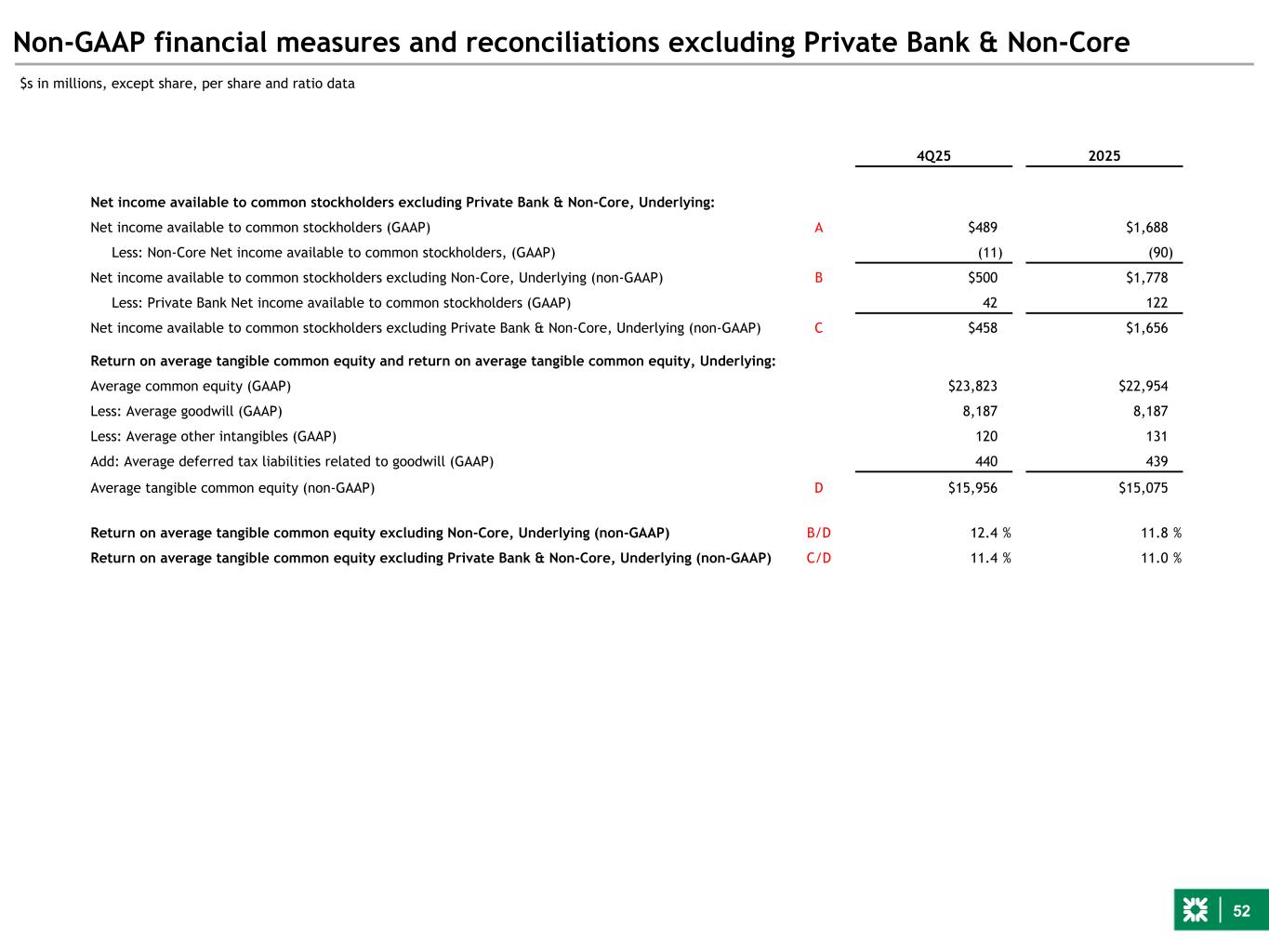

5 4Q25 financial performance detail (A) (B) (C) = (A) + (B) (D) (E) = (C) + (D) $s in millions Legacy Core(1) Private Bank Core Non-Core(2) Total CFG Net interest income $1,423 $118.3 $1,541 $(4) $1,537 Noninterest income 593 23.7 617 3 620 Total revenue 2,016 141.9 2,158 (1) 2,157 Noninterest Expense 1,248 85.7 1,334 9 1,343 Pre-provision profit 768 56.2 824 (10) 814 Provision for credit losses 133 — 133 4 137 Income before income tax expense 635 56.2 691 (14) 677 Income tax expense 138 14.2 153 (4) 149 Net income 497 42.0 539 (11) 528 Preferred dividends/other 39 — 39 — 39 Net income available to common stockholders $458 $42.0 $500 $(11) $489 Contribution to total CFG Diluted EPS $1.06 $0.10 $1.16 $(0.03) $1.13 $s in billions Interest-earning assets (spot) $191 $7.2 $198 $2.5 $201 Loans (spot) 133 7.2 140 2.5 143 Deposits (spot) 169 14.5 183 — 183 Risk-weighted assets (spot) 161 7.6 169 2.5 171 Performance metrics: Net interest margin, FTE(3) 2.98% --- 3.12% (0.61)% 3.07% Loan-to-deposit ratio (spot) 78.8 49.5 76.5 --- 77.8 CET1 capital ratio(4) 11.3 --- 10.8 --- 10.6 ROTCE 11.4 --- 12.4 --- 12.2 Efficiency ratio 61.9 60.4 61.8 --- 62.2 Noninterest income as a % of total revenue 29.4 16.7 28.6 --- 28.7 See pages 41-43 for notes.

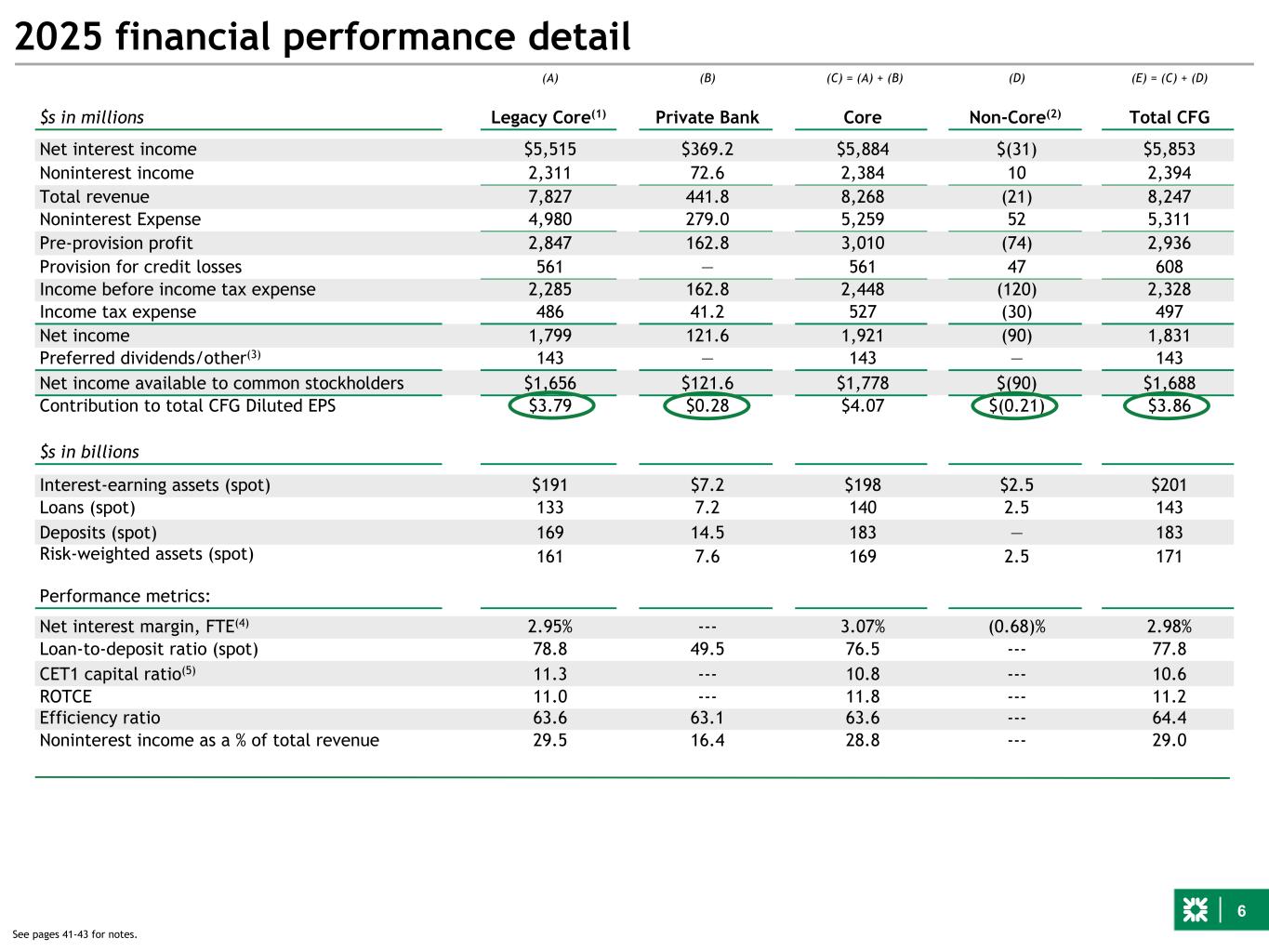

6 2025 financial performance detail (A) (B) (C) = (A) + (B) (D) (E) = (C) + (D) $s in millions Legacy Core(1) Private Bank Core Non-Core(2) Total CFG Net interest income $5,515 $369.2 $5,884 $(31) $5,853 Noninterest income 2,311 72.6 2,384 10 2,394 Total revenue 7,827 441.8 8,268 (21) 8,247 Noninterest Expense 4,980 279.0 5,259 52 5,311 Pre-provision profit 2,847 162.8 3,010 (74) 2,936 Provision for credit losses 561 — 561 47 608 Income before income tax expense 2,285 162.8 2,448 (120) 2,328 Income tax expense 486 41.2 527 (30) 497 Net income 1,799 121.6 1,921 (90) 1,831 Preferred dividends/other(3) 143 — 143 — 143 Net income available to common stockholders $1,656 $121.6 $1,778 $(90) $1,688 Contribution to total CFG Diluted EPS $3.79 $0.28 $4.07 $(0.21) $3.86 $s in billions Interest-earning assets (spot) $191 $7.2 $198 $2.5 $201 Loans (spot) 133 7.2 140 2.5 143 Deposits (spot) 169 14.5 183 — 183 Risk-weighted assets (spot) 161 7.6 169 2.5 171 Performance metrics: Net interest margin, FTE(4) 2.95% --- 3.07% (0.68)% 2.98% Loan-to-deposit ratio (spot) 78.8 49.5 76.5 --- 77.8 CET1 capital ratio(5) 11.3 --- 10.8 --- 10.6 ROTCE 11.0 --- 11.8 --- 11.2 Efficiency ratio 63.6 63.1 63.6 --- 64.4 Noninterest income as a % of total revenue 29.5 16.4 28.8 --- 29.0 See pages 41-43 for notes.

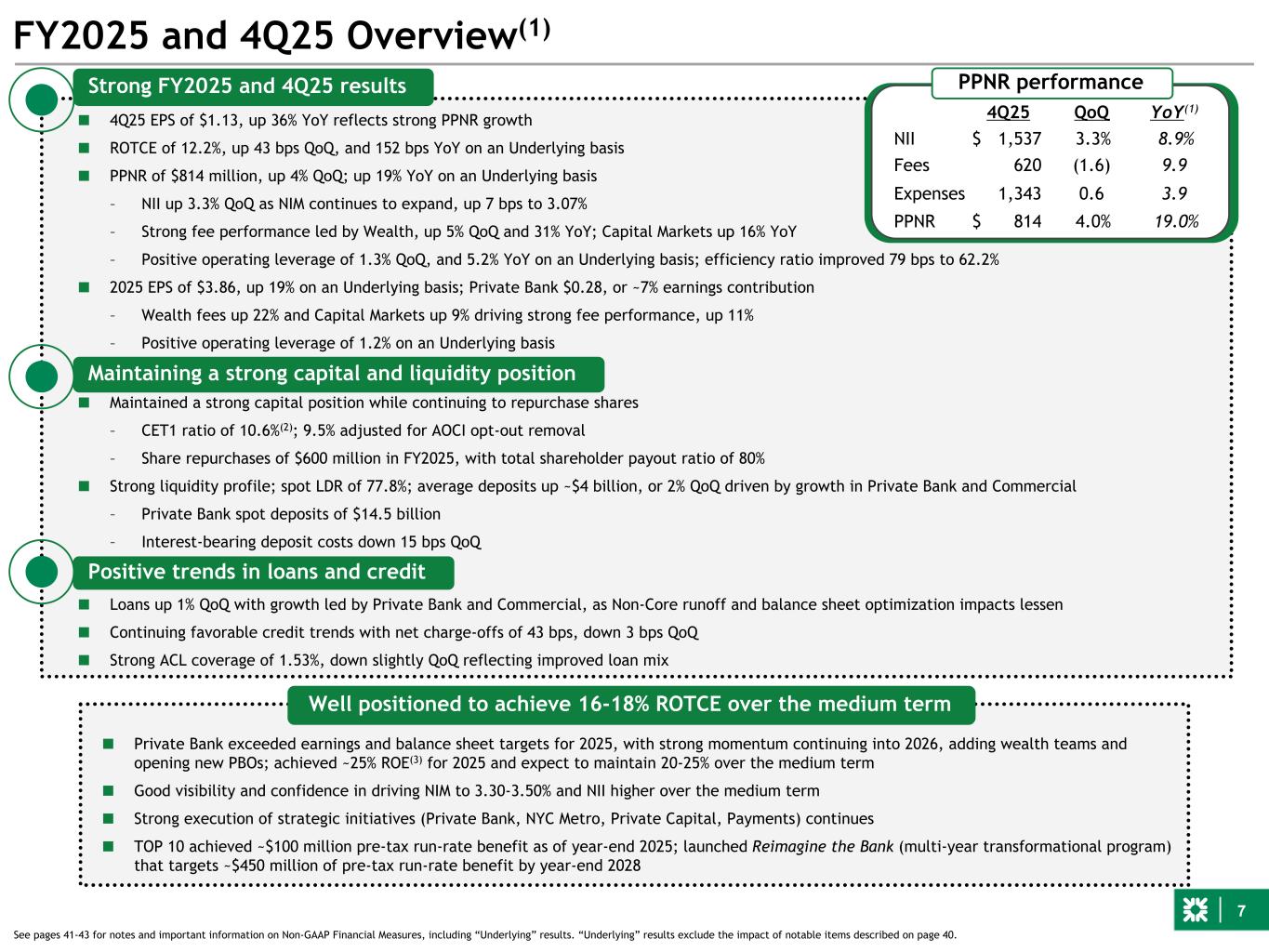

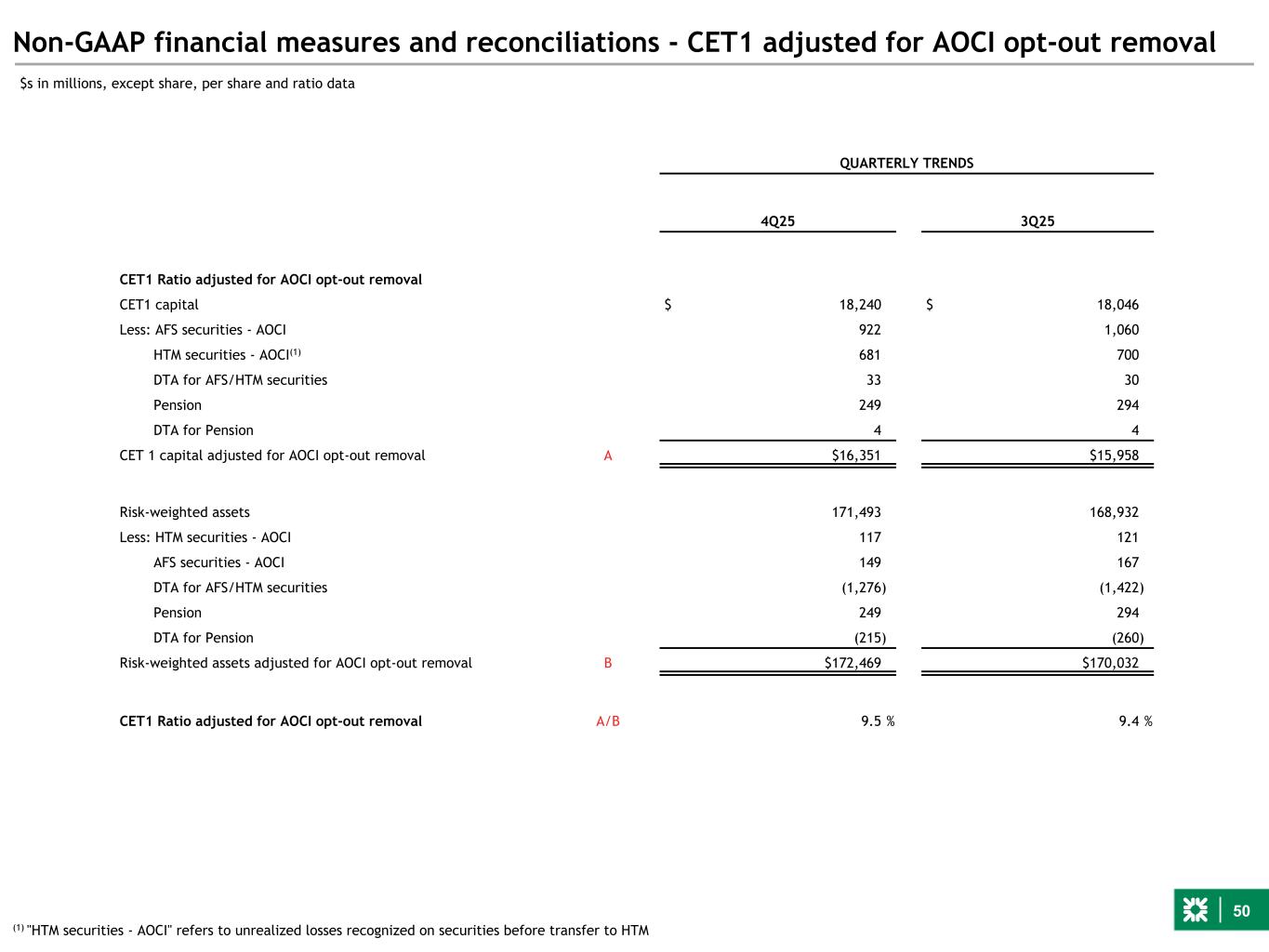

7 ■ Maintained a strong capital position while continuing to repurchase shares – CET1 ratio of 10.6%(2); 9.5% adjusted for AOCI opt-out removal – Share repurchases of $600 million in FY2025, with total shareholder payout ratio of 80% ■ Strong liquidity profile; spot LDR of 77.8%; average deposits up ~$4 billion, or 2% QoQ driven by growth in Private Bank and Commercial – Private Bank spot deposits of $14.5 billion – Interest-bearing deposit costs down 15 bps QoQ ■ Loans up 1% QoQ with growth led by Private Bank and Commercial, as Non-Core runoff and balance sheet optimization impacts lessen ■ Continuing favorable credit trends with net charge-offs of 43 bps, down 3 bps QoQ ■ Strong ACL coverage of 1.53%, down slightly QoQ reflecting improved loan mix ■ 4Q25 EPS of $1.13, up 36% YoY reflects strong PPNR growth ■ ROTCE of 12.2%, up 43 bps QoQ, and 152 bps YoY on an Underlying basis ■ PPNR of $814 million, up 4% QoQ; up 19% YoY on an Underlying basis – NII up 3.3% QoQ as NIM continues to expand, up 7 bps to 3.07% – Strong fee performance led by Wealth, up 5% QoQ and 31% YoY; Capital Markets up 16% YoY – Positive operating leverage of 1.3% QoQ, and 5.2% YoY on an Underlying basis; efficiency ratio improved 79 bps to 62.2% ■ 2025 EPS of $3.86, up 19% on an Underlying basis; Private Bank $0.28, or ~7% earnings contribution – Wealth fees up 22% and Capital Markets up 9% driving strong fee performance, up 11% – Positive operating leverage of 1.2% on an Underlying basis Strong FY2025 and 4Q25 results Maintaining a strong capital and liquidity position Positive trends in loans and credit FY2025 and 4Q25 Overview(1) ■ Private Bank exceeded earnings and balance sheet targets for 2025, with strong momentum continuing into 2026, adding wealth teams and opening new PBOs; achieved ~25% ROE(3) for 2025 and expect to maintain 20-25% over the medium term ■ Good visibility and confidence in driving NIM to 3.30-3.50% and NII higher over the medium term ■ Strong execution of strategic initiatives (Private Bank, NYC Metro, Private Capital, Payments) continues ■ TOP 10 achieved ~$100 million pre-tax run-rate benefit as of year-end 2025; launched Reimagine the Bank (multi-year transformational program) that targets ~$450 million of pre-tax run-rate benefit by year-end 2028 Well positioned to achieve 16-18% ROTCE over the medium term See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. PPNR performance 4Q25 QoQ YoY(1) NII $ 1,537 3.3% 8.9% Fees 620 (1.6) 9.9 Expenses 1,343 0.6 3.9 PPNR $ 814 4.0% 19.0%

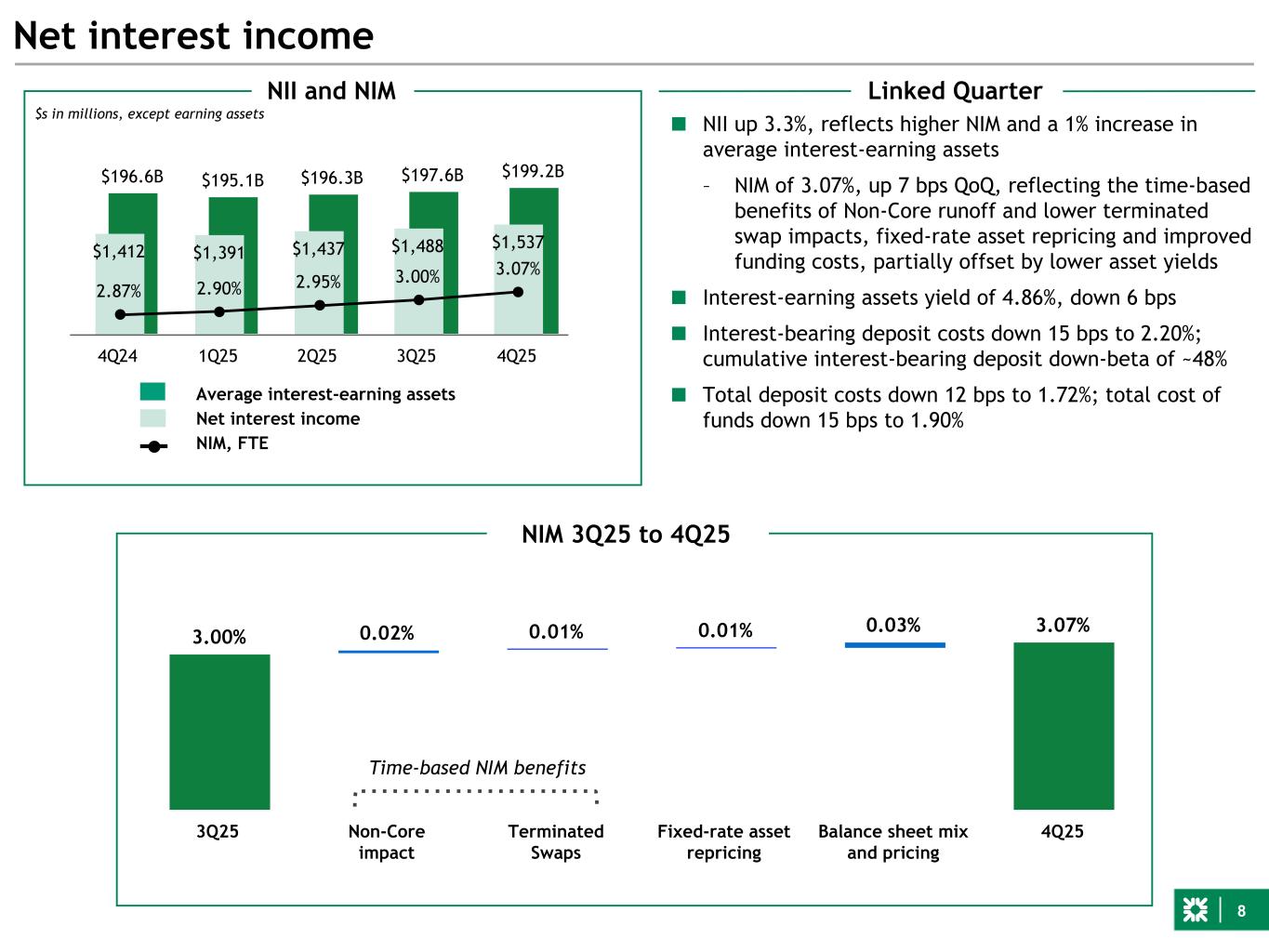

8 3.00% 0.02% 0.01% 0.01% 0.03% 3.07% 3Q25 Non-Core impact Terminated Swaps Fixed-rate asset repricing Balance sheet mix and pricing 4Q25 $196.6B $195.1B $196.3B $197.6B $199.2B $1,412 $1,391 $1,437 $1,488 $1,537 2.87% 2.90% 2.95% 3.00% 3.07% 4Q24 1Q25 2Q25 3Q25 4Q25 ■ NII up 3.3%, reflects higher NIM and a 1% increase in average interest-earning assets – NIM of 3.07%, up 7 bps QoQ, reflecting the time-based benefits of Non-Core runoff and lower terminated swap impacts, fixed-rate asset repricing and improved funding costs, partially offset by lower asset yields ■ Interest-earning assets yield of 4.86%, down 6 bps ■ Interest-bearing deposit costs down 15 bps to 2.20%; cumulative interest-bearing deposit down-beta of ~48% ■ Total deposit costs down 12 bps to 1.72%; total cost of funds down 15 bps to 1.90% Net interest income NII and NIM Average interest-earning assets Net interest income NIM, FTE Linked Quarter NIM 3Q25 to 4Q25 $s in millions, except earning assets Time-based NIM benefits *

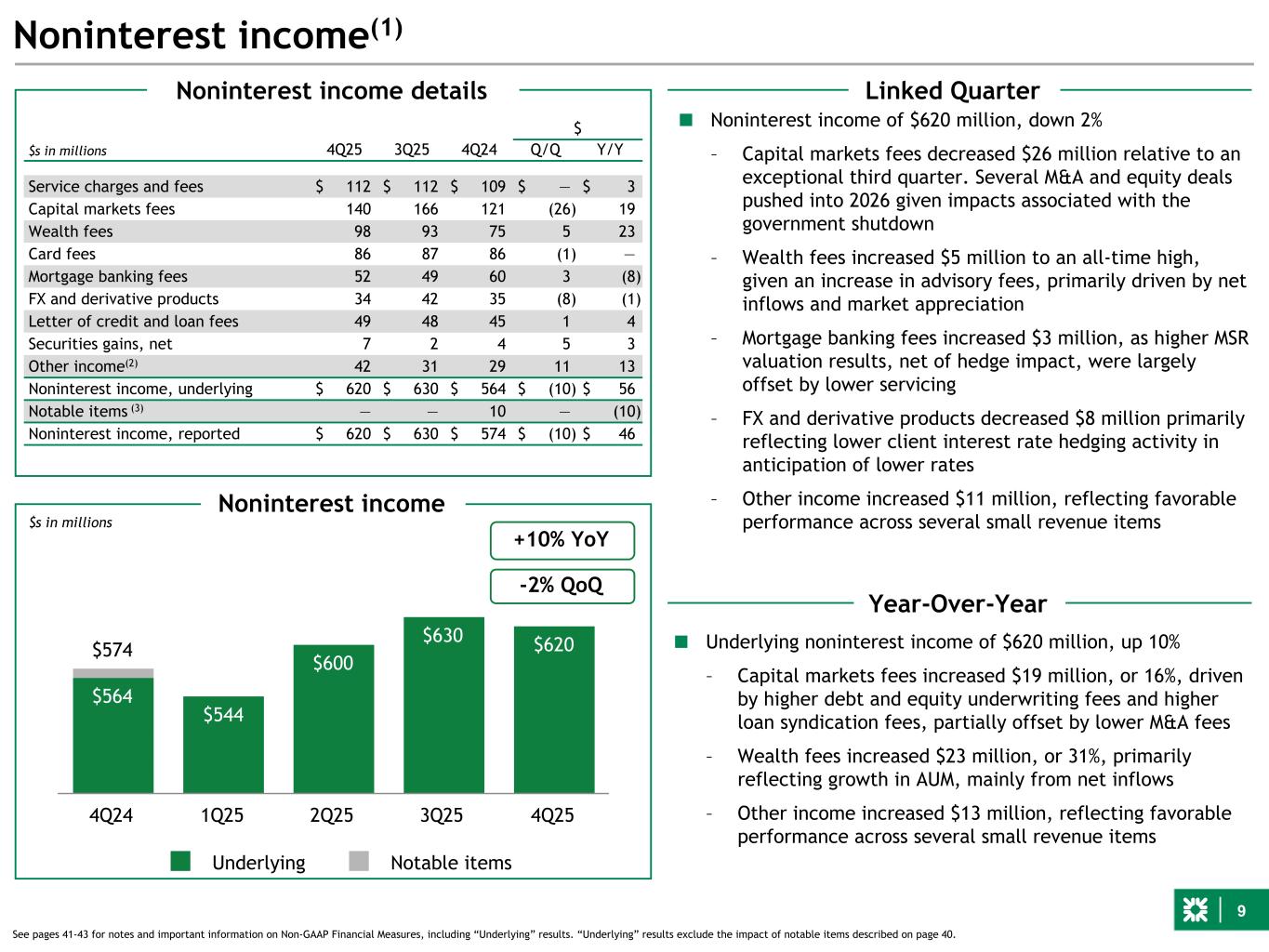

9 $574 $544 $600 $630 $620 $564 $544 $600 $630 $620 Underlying Notable items 4Q24 1Q25 2Q25 3Q25 4Q25 Noninterest income(1) $s in millions See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Linked Quarter Year-Over-Year Noninterest income $s in millions 4Q25 3Q25 4Q24 $ Q/Q Y/Y Service charges and fees $ 112 $ 112 $ 109 $ — $ 3 Capital markets fees 140 166 121 (26) 19 Wealth fees 98 93 75 5 23 Card fees 86 87 86 (1) — Mortgage banking fees 52 49 60 3 (8) FX and derivative products 34 42 35 (8) (1) Letter of credit and loan fees 49 48 45 1 4 Securities gains, net 7 2 4 5 3 Other income(2) 42 31 29 11 13 Noninterest income, underlying $ 620 $ 630 $ 564 $ (10) $ 56 Notable items (3) — — 10 — (10) Noninterest income, reported $ 620 $ 630 $ 574 $ (10) $ 46 Noninterest income details ■ Underlying noninterest income of $620 million, up 10% – Capital markets fees increased $19 million, or 16%, driven by higher debt and equity underwriting fees and higher loan syndication fees, partially offset by lower M&A fees – Wealth fees increased $23 million, or 31%, primarily reflecting growth in AUM, mainly from net inflows – Other income increased $13 million, reflecting favorable performance across several small revenue items +10% YoY -2% QoQ ■ Noninterest income of $620 million, down 2% – Capital markets fees decreased $26 million relative to an exceptional third quarter. Several M&A and equity deals pushed into 2026 given impacts associated with the government shutdown – Wealth fees increased $5 million to an all-time high, given an increase in advisory fees, primarily driven by net inflows and market appreciation – Mortgage banking fees increased $3 million, as higher MSR valuation results, net of hedge impact, were largely offset by lower servicing – FX and derivative products decreased $8 million primarily reflecting lower client interest rate hedging activity in anticipation of lower rates – Other income increased $11 million, reflecting favorable performance across several small revenue items

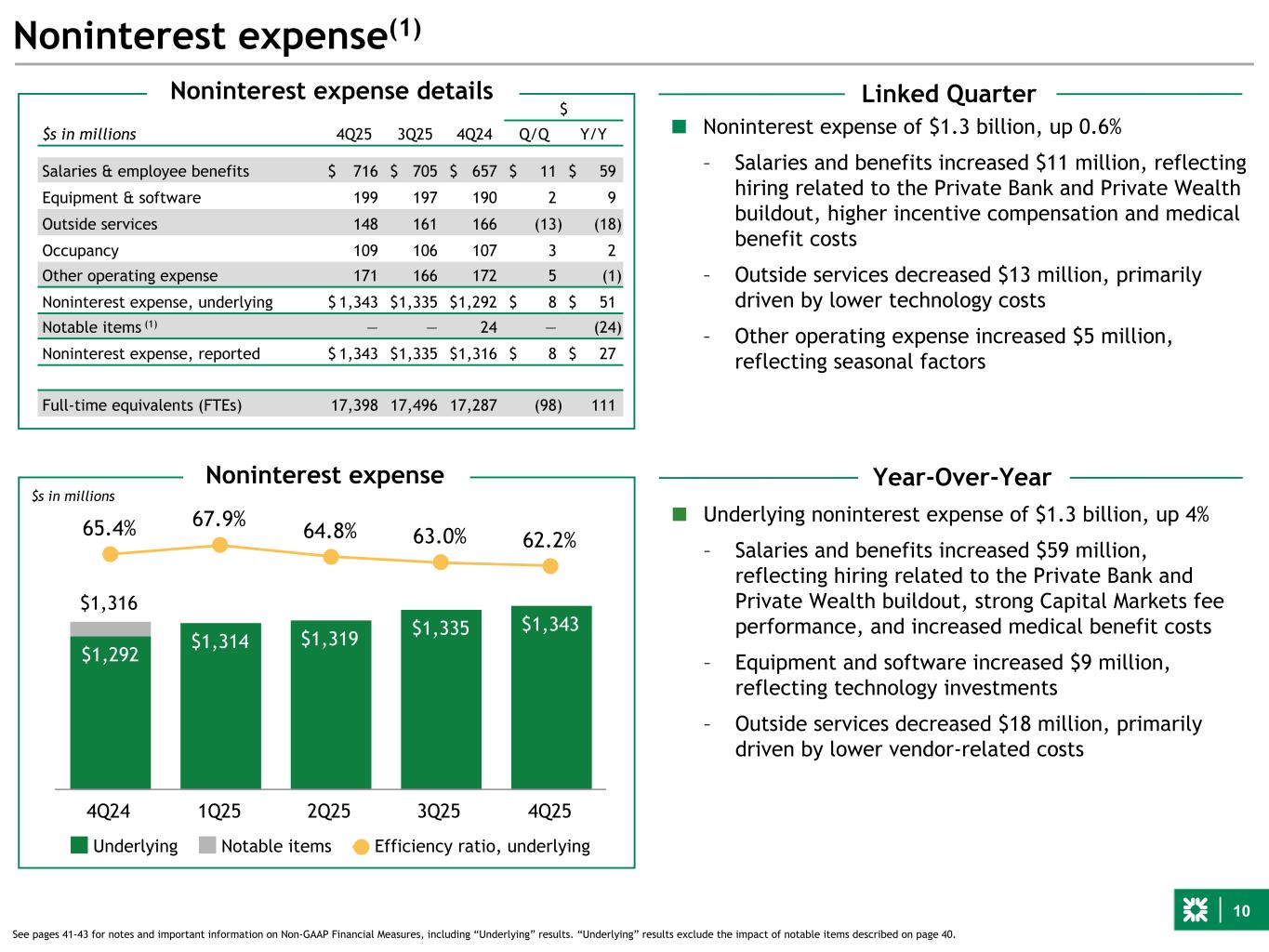

10 Noninterest expense(1) See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Linked Quarter Year-Over-Year 4Q25 3Q25 4Q24 $ $s in millions Q/Q Y/Y Salaries & employee benefits $ 716 $ 705 $ 657 $ 11 $ 59 Equipment & software 199 197 190 2 9 Outside services 148 161 166 (13) (18) Occupancy 109 106 107 3 2 Other operating expense 171 166 172 5 (1) Noninterest expense, underlying $ 1,343 $ 1,335 $ 1,292 $ 8 $ 51 Notable items (1) — — 24 — (24) Noninterest expense, reported $ 1,343 $ 1,335 $ 1,316 $ 8 $ 27 Full-time equivalents (FTEs) 17,398 17,496 17,287 (98) 111 Noninterest expense details $1,316 $1,314 $1,292 $1,314 $1,319 $1,335 $1,343 65.4% 67.9% 64.8% 63.0% 62.2% Underlying Notable items Efficiency ratio, underlying 4Q24 1Q25 2Q25 3Q25 4Q25 ■ Noninterest expense of $1.3 billion, up 0.6% – Salaries and benefits increased $11 million, reflecting hiring related to the Private Bank and Private Wealth buildout, higher incentive compensation and medical benefit costs – Outside services decreased $13 million, primarily driven by lower technology costs – Other operating expense increased $5 million, reflecting seasonal factors ■ Underlying noninterest expense of $1.3 billion, up 4% – Salaries and benefits increased $59 million, reflecting hiring related to the Private Bank and Private Wealth buildout, strong Capital Markets fee performance, and increased medical benefit costs – Equipment and software increased $9 million, reflecting technology investments – Outside services decreased $18 million, primarily driven by lower vendor-related costs $s in millions Noninterest expense

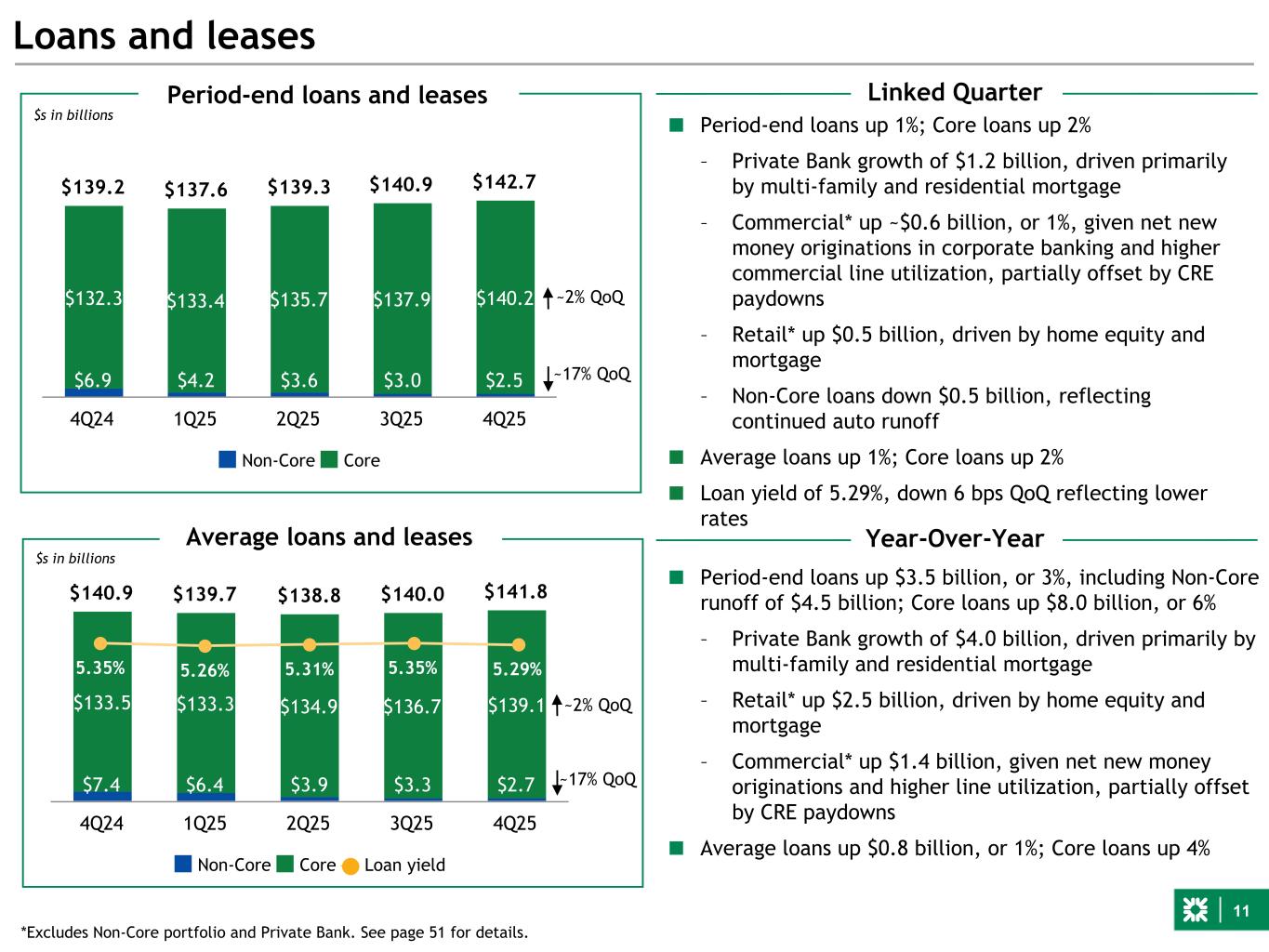

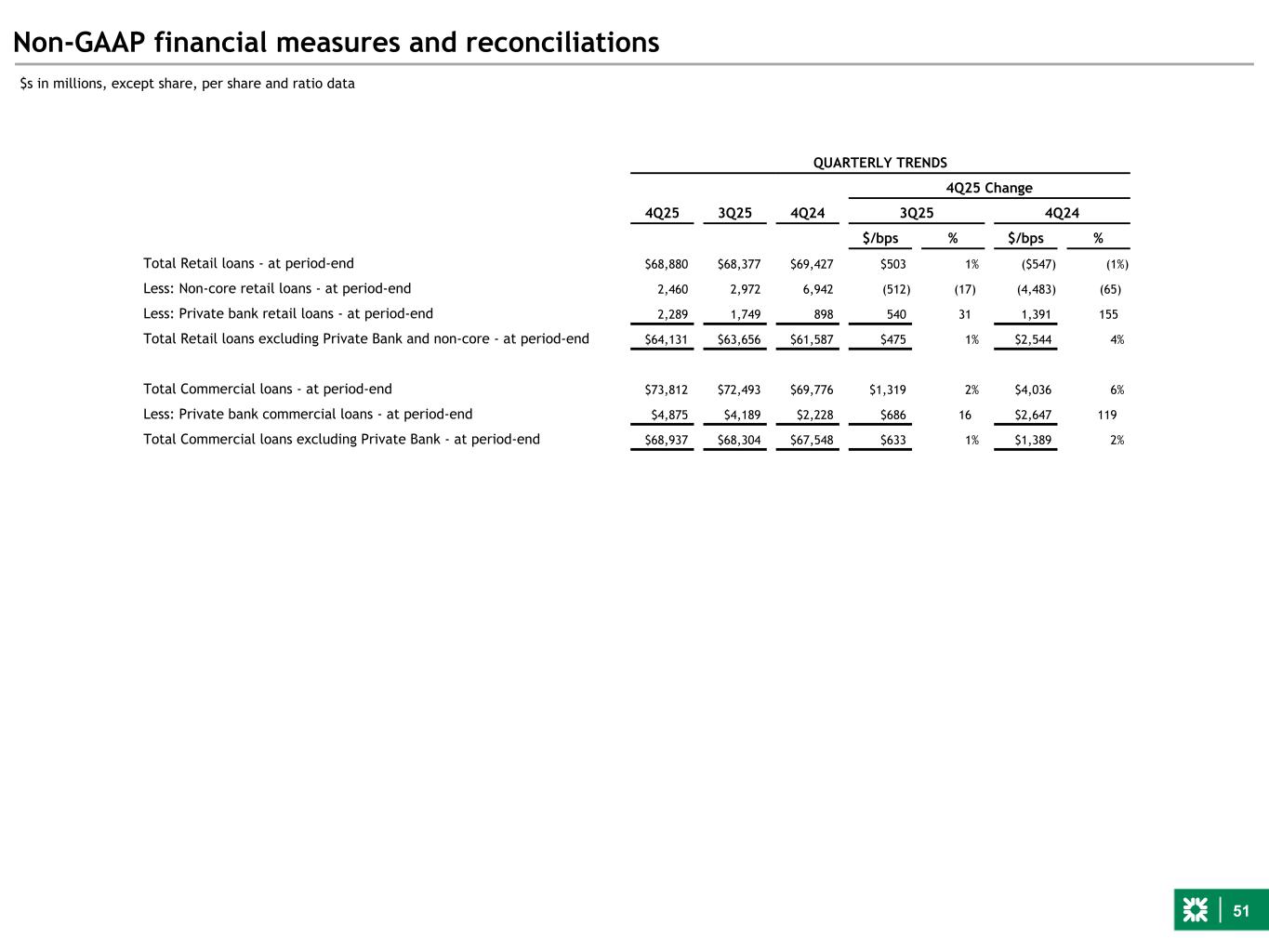

11 $140.9 $139.7 $138.8 $140.0 $141.8 $7.4 $6.4 $3.9 $3.3 $2.7 $133.5 $133.3 $134.9 $136.7 $139.1 Non-Core Core Loan yield 4Q24 1Q25 2Q25 3Q25 4Q25 ~17% QoQ ■ Period-end loans up 1%; Core loans up 2% – Private Bank growth of $1.2 billion, driven primarily by multi-family and residential mortgage – Commercial* up ~$0.6 billion, or 1%, given net new money originations in corporate banking and higher commercial line utilization, partially offset by CRE paydowns – Retail* up $0.5 billion, driven by home equity and mortgage – Non-Core loans down $0.5 billion, reflecting continued auto runoff ■ Average loans up 1%; Core loans up 2% ■ Loan yield of 5.29%, down 6 bps QoQ reflecting lower rates Loans and leases $s in billions Average loans and leases $139.2 $137.6 $139.3 $140.9 $142.7 $6.9 $4.2 $3.6 $3.0 $2.5 $132.3 $133.4 $135.7 $137.9 $140.2 Non-Core Core 4Q24 1Q25 2Q25 3Q25 4Q25 $s in billions Period-end loans and leases 5.35% 5.26% 5.31% 5.35% 5.29% Linked Quarter Year-Over-Year ~17% QoQ ~2% QoQ ~2% QoQ *Excludes Non-Core portfolio and Private Bank. See page 51 for details. ■ Period-end loans up $3.5 billion, or 3%, including Non-Core runoff of $4.5 billion; Core loans up $8.0 billion, or 6% – Private Bank growth of $4.0 billion, driven primarily by multi-family and residential mortgage – Retail* up $2.5 billion, driven by home equity and mortgage – Commercial* up $1.4 billion, given net new money originations and higher line utilization, partially offset by CRE paydowns ■ Average loans up $0.8 billion, or 1%; Core loans up 4%

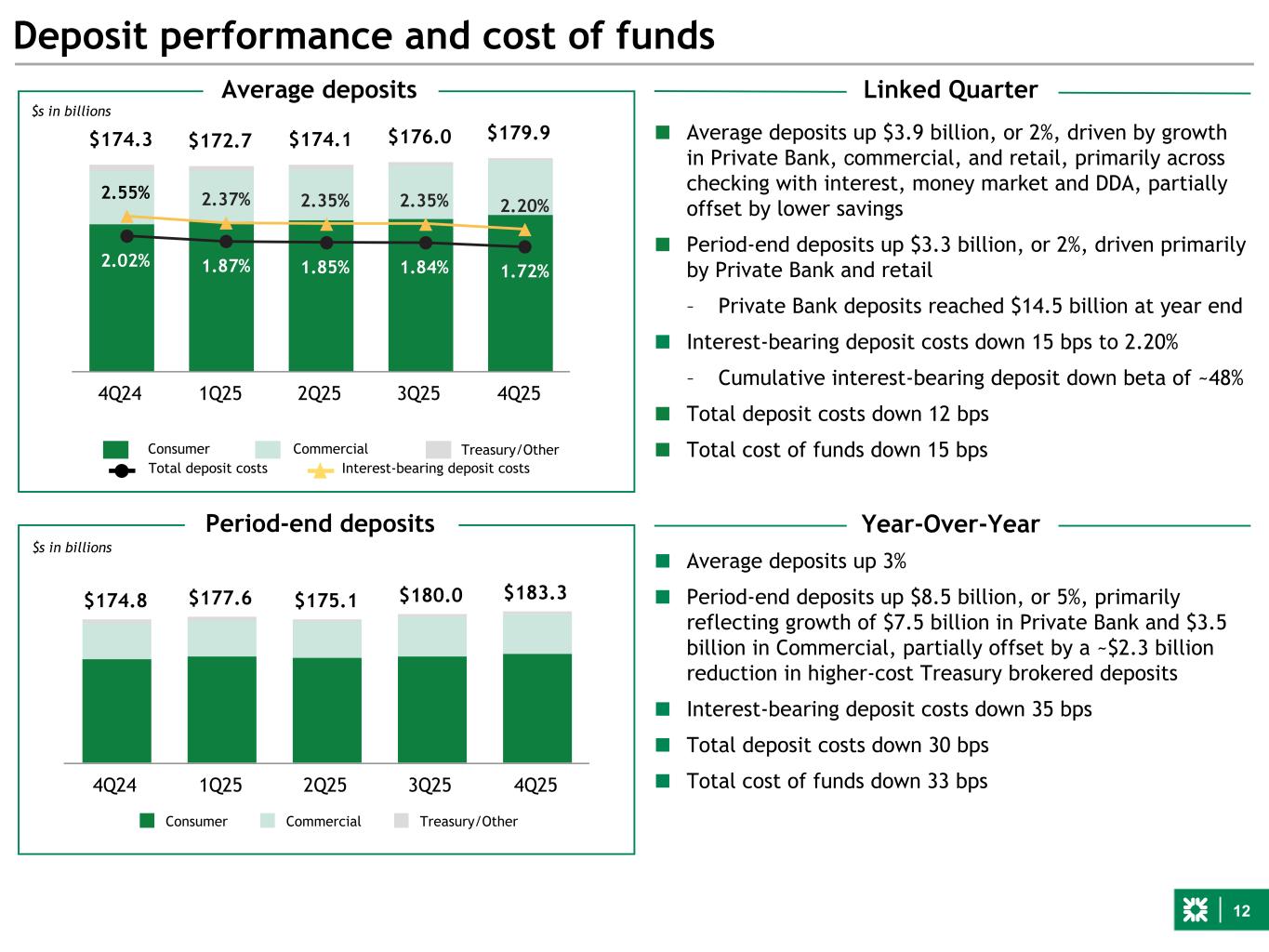

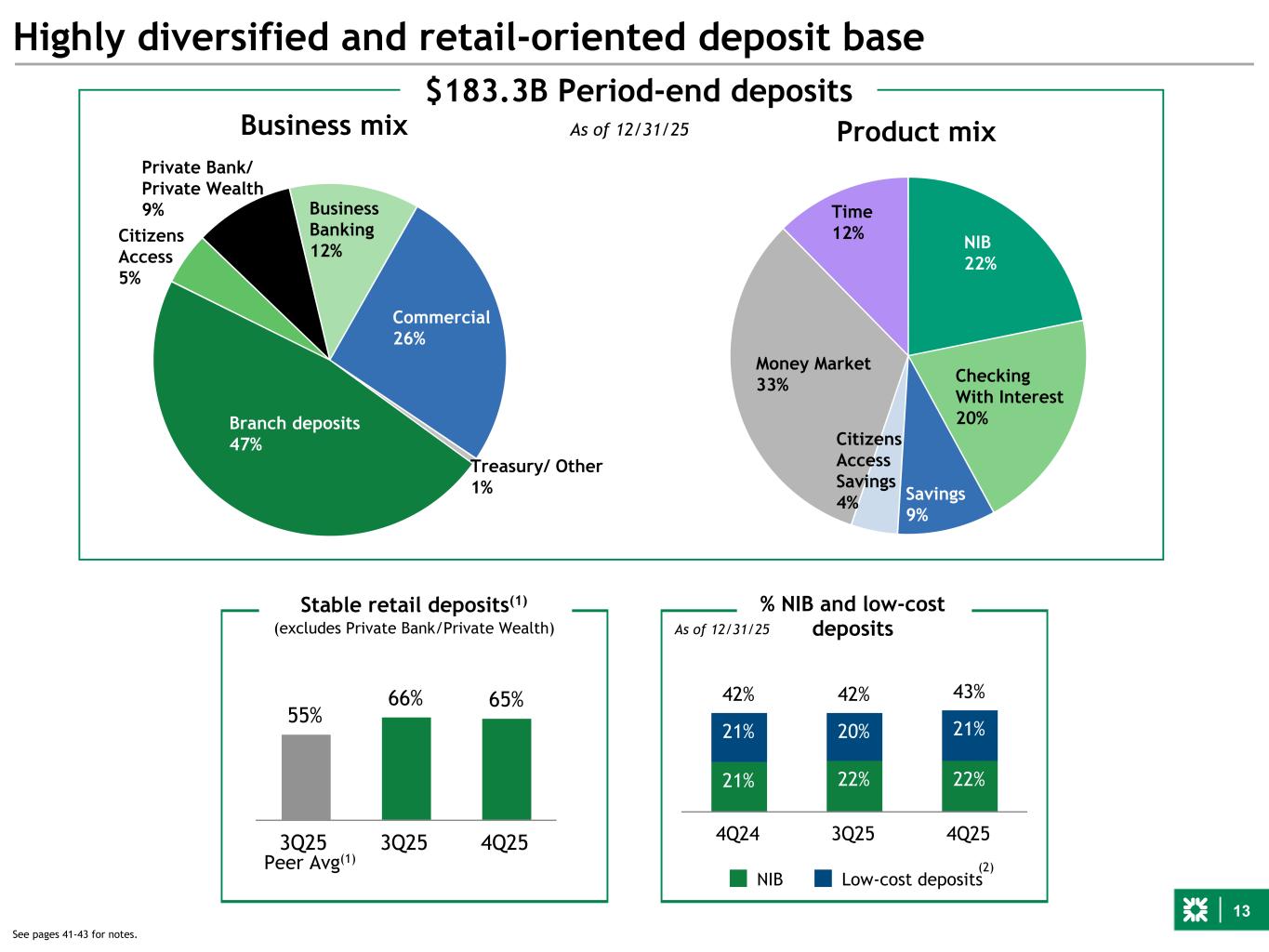

12 $174.3 $172.7 $174.1 $176.0 $179.9 4Q24 1Q25 2Q25 3Q25 4Q25 Deposit performance and cost of funds $s in billions Average deposits 2.02% 1.87% 1.85% 1.84% 1.72% 2.55% 2.37% 2.35% 2.35% 2.20% Total deposit costs Interest-bearing deposit costs CommercialConsumer Treasury/Other Year-Over-YearPeriod-end deposits Linked Quarter ■ Average deposits up $3.9 billion, or 2%, driven by growth in Private Bank, commercial, and retail, primarily across checking with interest, money market and DDA, partially offset by lower savings ■ Period-end deposits up $3.3 billion, or 2%, driven primarily by Private Bank and retail – Private Bank deposits reached $14.5 billion at year end ■ Interest-bearing deposit costs down 15 bps to 2.20% – Cumulative interest-bearing deposit down beta of ~48% ■ Total deposit costs down 12 bps ■ Total cost of funds down 15 bps $s in billions ■ Average deposits up 3% ■ Period-end deposits up $8.5 billion, or 5%, primarily reflecting growth of $7.5 billion in Private Bank and $3.5 billion in Commercial, partially offset by a ~$2.3 billion reduction in higher-cost Treasury brokered deposits ■ Interest-bearing deposit costs down 35 bps ■ Total deposit costs down 30 bps ■ Total cost of funds down 33 bps $174.8 $177.6 $175.1 $180.0 $183.3 Consumer Commercial Treasury/Other 4Q24 1Q25 2Q25 3Q25 4Q25

13 Branch deposits 47% Citizens Access 5% Private Bank/ Private Wealth 9% Business Banking 12% Commercial 26% Treasury/ Other 1% As of 12/31/25 Highly diversified and retail-oriented deposit base $183.3B Period-end deposits Peer Avg(1) Business mix Product mix Stable retail deposits(1) (excludes Private Bank/Private Wealth) 42% 42% 43% 21% 22% 22% 21% 20% 21% NIB Low-cost deposits 4Q24 3Q25 4Q25 % NIB and low-cost deposits (2) 55% 66% 65% 3Q25 3Q25 4Q25 See pages 41-43 for notes. NIB 22% Checking With Interest 20% Savings 9% Citizens Access Savings 4% Money Market 33% Time 12% As of 12/31/25

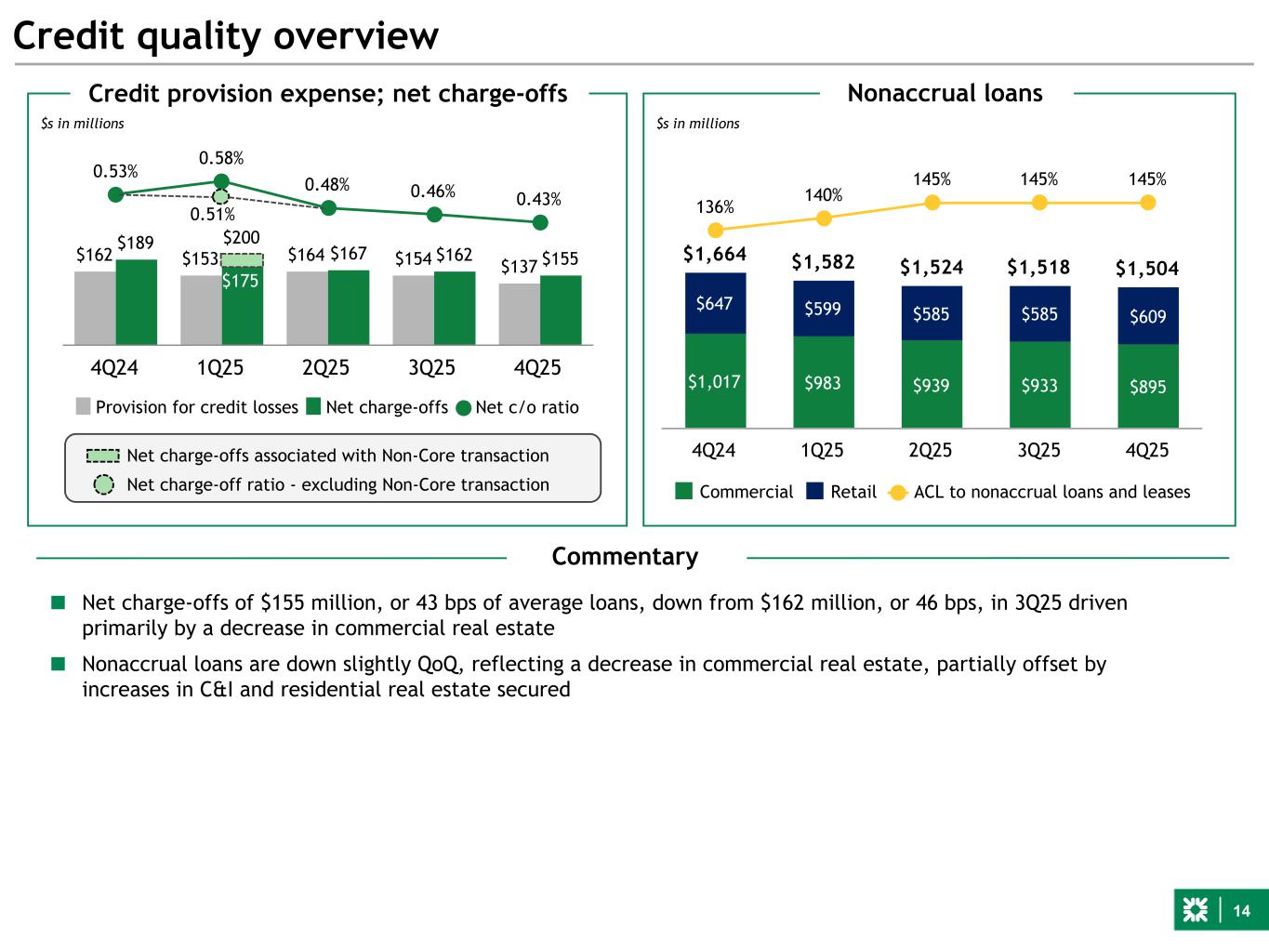

14 $162 $153 $164 $154 $137 $189 $200 $167 $162 $155 0.53% 0.58% 0.48% 0.46% 0.43% Provision for credit losses Net charge-offs Net c/o ratio 4Q24 1Q25 2Q25 3Q25 4Q25 0.51% Credit quality overview $s in millions $s in millions Credit provision expense; net charge-offs $1,664 $1,582 $1,524 $1,518 $1,504 $1,017 $983 $939 $933 $895 $647 $599 $585 $585 $609 136% 140% 145% 145% 145% Commercial Retail ACL to nonaccrual loans and leases 4Q24 1Q25 2Q25 3Q25 4Q25 Nonaccrual loans Net charge-offs associated with Non-Core transaction $175 Net charge-off ratio - excluding Non-Core transaction Commentary ■ Net charge-offs of $155 million, or 43 bps of average loans, down from $162 million, or 46 bps, in 3Q25 driven primarily by a decrease in commercial real estate ■ Nonaccrual loans are down slightly QoQ, reflecting a decrease in commercial real estate, partially offset by increases in C&I and residential real estate secured

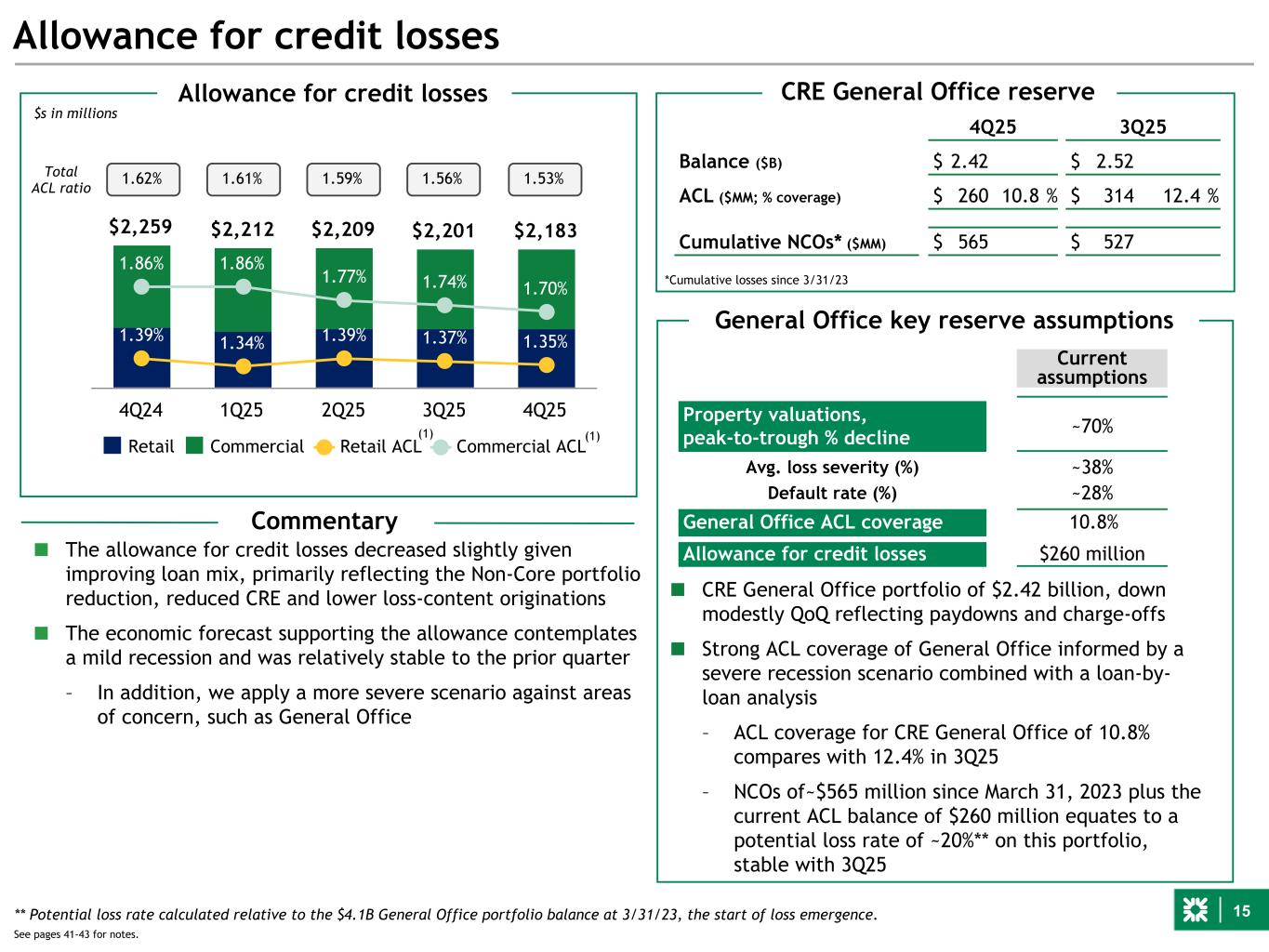

15 Allowance for credit losses Current assumptions Property valuations, peak-to-trough % decline ~70% Avg. loss severity (%) ~38% Default rate (%) ~28% General Office ACL coverage 10.8% Allowance for credit losses $260 million General Office key reserve assumptions ■ CRE General Office portfolio of $2.42 billion, down modestly QoQ reflecting paydowns and charge-offs ■ Strong ACL coverage of General Office informed by a severe recession scenario combined with a loan-by- loan analysis – ACL coverage for CRE General Office of 10.8% compares with 12.4% in 3Q25 – NCOs of~$565 million since March 31, 2023 plus the current ACL balance of $260 million equates to a potential loss rate of ~20%** on this portfolio, stable with 3Q25 4Q25 3Q25 Balance ($B) $ 2.42 $ 2.52 ACL ($MM; % coverage) $ 260 10.8 % $ 314 12.4 % Cumulative NCOs* ($MM) $ 565 $ 527 CRE General Office reserve *Cumulative losses since 3/31/23 $2,259 $2,212 $2,209 $2,201 $2,183 1.39% 1.34% 1.39% 1.37% 1.35% 1.86% 1.86% 1.77% 1.74% 1.70% Retail Commercial Retail ACL Commercial ACL 4Q24 1Q25 2Q25 3Q25 4Q25 $s in millions Allowance for credit losses (1) ** Potential loss rate calculated relative to the $4.1B General Office portfolio balance at 3/31/23, the start of loss emergence. ■ The allowance for credit losses decreased slightly given improving loan mix, primarily reflecting the Non-Core portfolio reduction, reduced CRE and lower loss-content originations ■ The economic forecast supporting the allowance contemplates a mild recession and was relatively stable to the prior quarter – In addition, we apply a more severe scenario against areas of concern, such as General Office Commentary 1.62% 1.61% 1.59% 1.56% 1.53%Total ACL ratio See pages 41-43 for notes. (1)

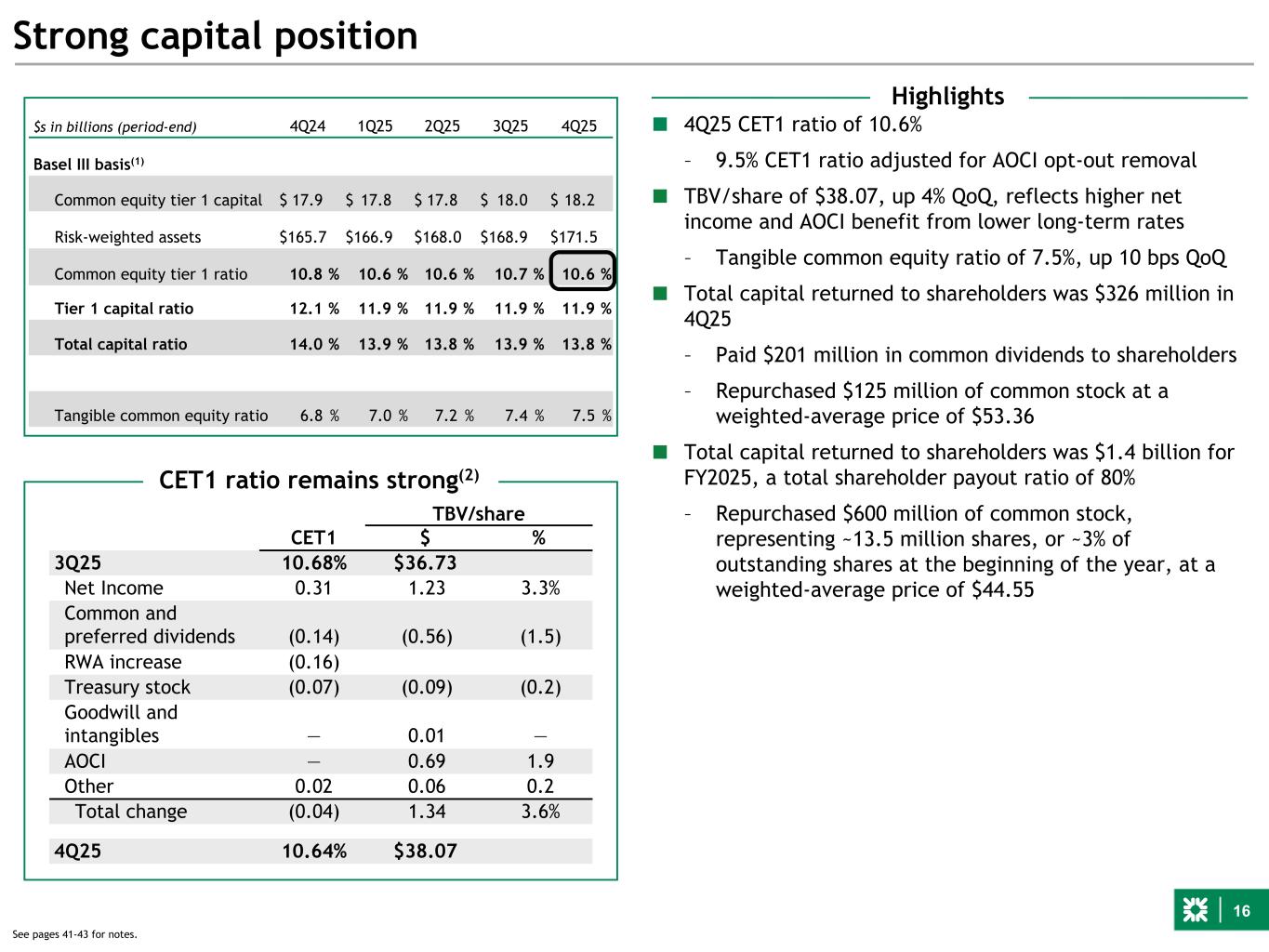

16 Strong capital position $s in billions (period-end) 4Q24 1Q25 2Q25 3Q25 4Q25 Basel III basis(1) Common equity tier 1 capital $ 17.9 $ 17.8 $ 17.8 $ 18.0 $ 18.2 Risk-weighted assets $ 165.7 $ 166.9 $ 168.0 $ 168.9 $ 171.5 Common equity tier 1 ratio 10.8 % 10.6 % 10.6 % 10.7 % 10.6 % Tier 1 capital ratio 12.1 % 11.9 % 11.9 % 11.9 % 11.9 % Total capital ratio 14.0 % 13.9 % 13.8 % 13.9 % 13.8 % Tangible common equity ratio 6.8 % 7.0 % 7.2 % 7.4 % 7.5 % TBV/share CET1 $ % 3Q25 10.68% $36.73 Net Income 0.31 1.23 3.3% Common and preferred dividends (0.14) (0.56) (1.5) RWA increase (0.16) Treasury stock (0.07) (0.09) (0.2) Goodwill and intangibles — 0.01 — AOCI — 0.69 1.9 Other 0.02 0.06 0.2 Total change (0.04) 1.34 3.6% 4Q25 10.64% $38.07 CET1 ratio remains strong(2) Highlights ■ 4Q25 CET1 ratio of 10.6% – 9.5% CET1 ratio adjusted for AOCI opt-out removal ■ TBV/share of $38.07, up 4% QoQ, reflects higher net income and AOCI benefit from lower long-term rates – Tangible common equity ratio of 7.5%, up 10 bps QoQ ■ Total capital returned to shareholders was $326 million in 4Q25 – Paid $201 million in common dividends to shareholders – Repurchased $125 million of common stock at a weighted-average price of $53.36 ■ Total capital returned to shareholders was $1.4 billion for FY2025, a total shareholder payout ratio of 80% – Repurchased $600 million of common stock, representing ~13.5 million shares, or ~3% of outstanding shares at the beginning of the year, at a weighted-average price of $44.55 See pages 41-43 for notes.

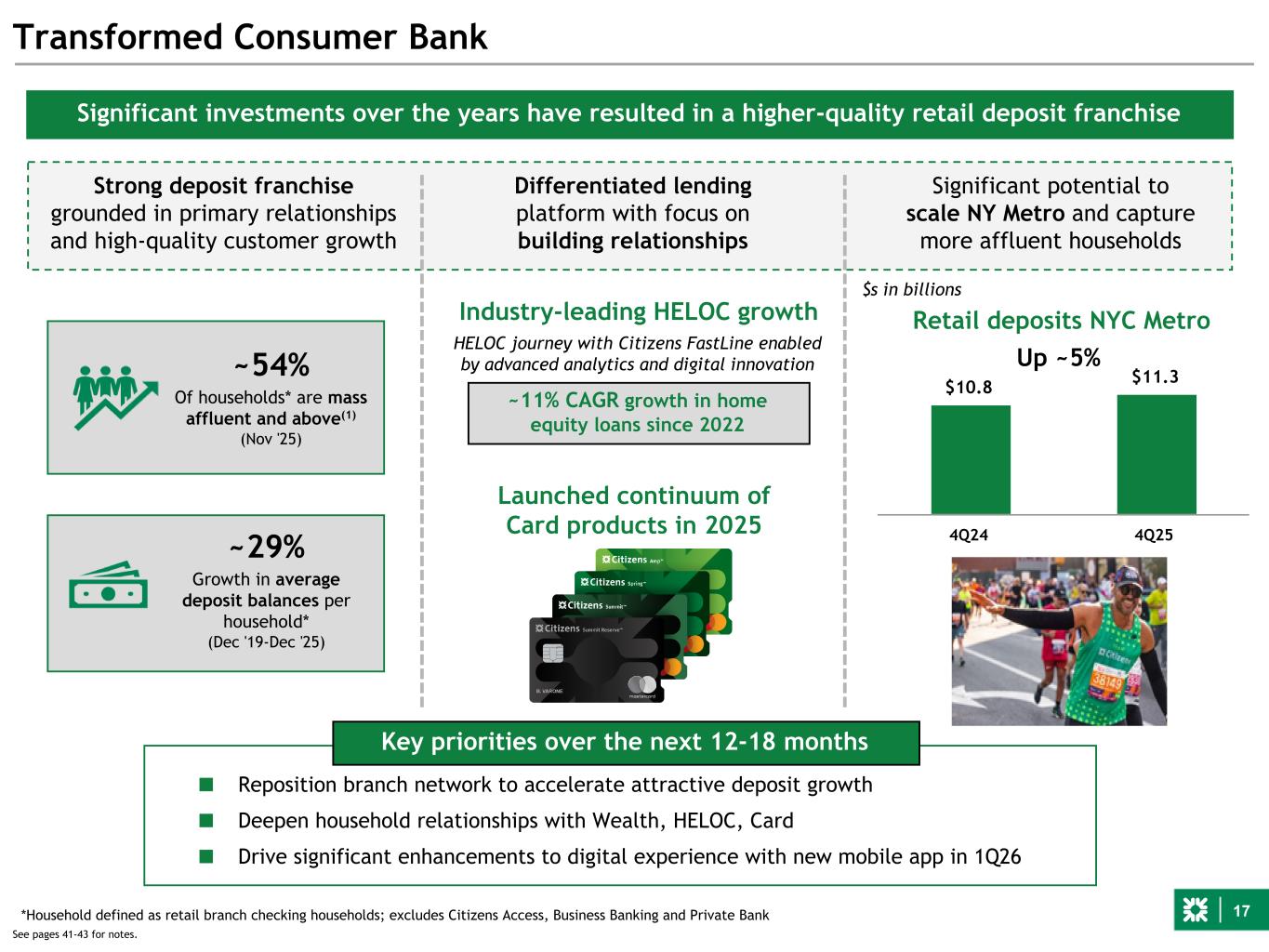

17 Transformed Consumer Bank Strong deposit franchise grounded in primary relationships and high-quality customer growth Differentiated lending platform with focus on building relationships Significant potential to scale NY Metro and capture more affluent households ~54% Of households* are mass affluent and above(1) (Nov '25) ~29% Growth in average deposit balances per household* (Dec '19-Dec '25) $10.8 $11.3 4Q24 4Q25 Retail deposits NYC Metro Up ~5% Significant investments over the years have resulted in a higher-quality retail deposit franchise ■ Reposition branch network to accelerate attractive deposit growth ■ Deepen household relationships with Wealth, HELOC, Card ■ Drive significant enhancements to digital experience with new mobile app in 1Q26 Key priorities over the next 12-18 months Launched continuum of Card products in 2025 ~11% CAGR growth in home equity loans since 2022 HELOC journey with Citizens FastLine enabled by advanced analytics and digital innovation *Household defined as retail branch checking households; excludes Citizens Access, Business Banking and Private Bank $s in billions See pages 41-43 for notes. Industry-leading HELOC growth

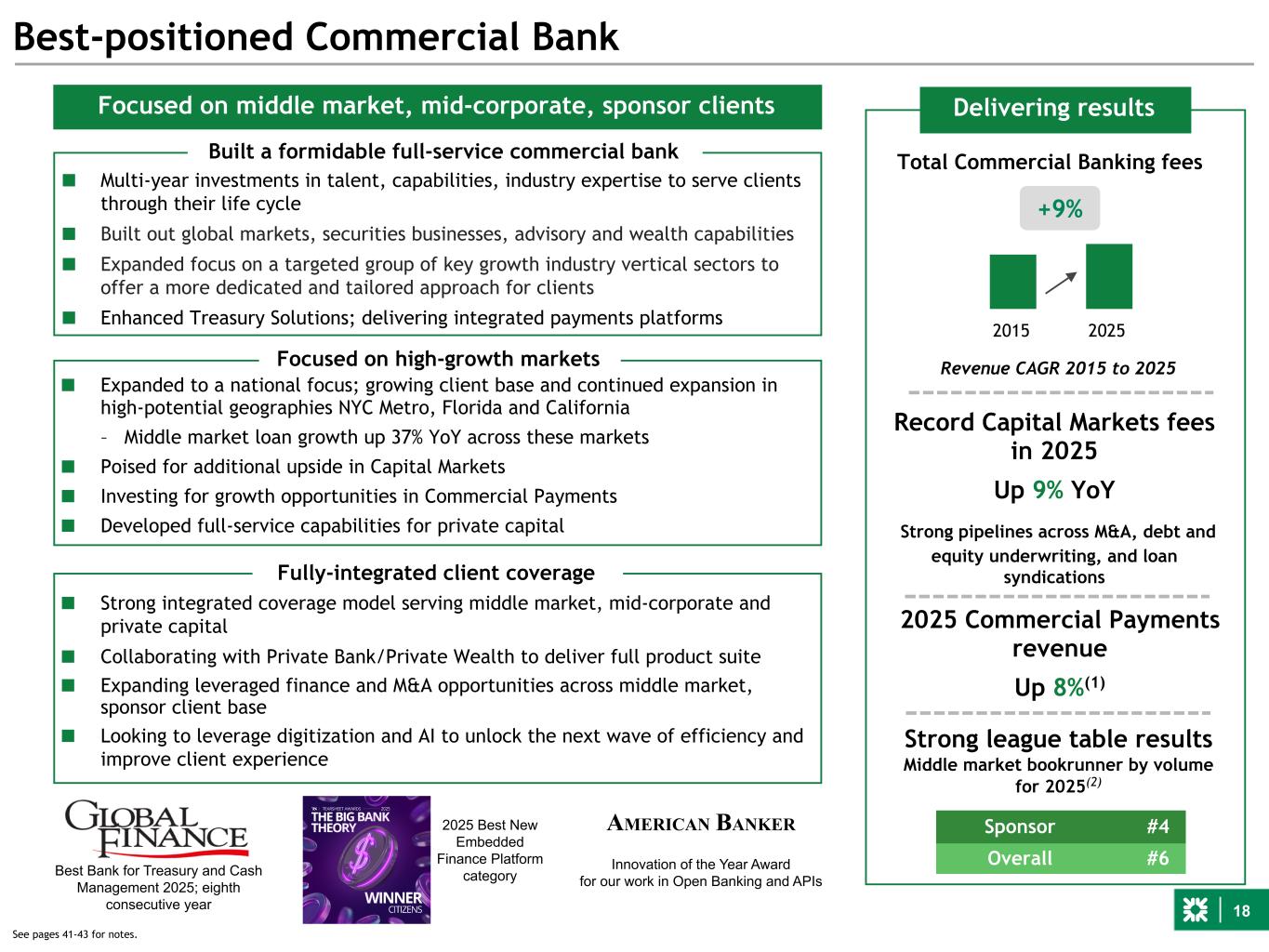

18 Best-positioned Commercial Bank Delivering results Strong league table results Middle market bookrunner by volume for 2025(2) Sponsor #4 Overall #6 Revenue CAGR 2015 to 2025 Total Commercial Banking fees Record Capital Markets fees in 2025 Up 9% YoY Strong pipelines across M&A, debt and equity underwriting, and loan syndications ■ Multi-year investments in talent, capabilities, industry expertise to serve clients through their life cycle ■ Built out global markets, securities businesses, advisory and wealth capabilities ■ Expanded focus on a targeted group of key growth industry vertical sectors to offer a more dedicated and tailored approach for clients ■ Enhanced Treasury Solutions; delivering integrated payments platforms Focused on high-growth markets Fully-integrated client coverage Built a formidable full-service commercial bank ■ Expanded to a national focus; growing client base and continued expansion in high-potential geographies NYC Metro, Florida and California – Middle market loan growth up 37% YoY across these markets ■ Poised for additional upside in Capital Markets ■ Investing for growth opportunities in Commercial Payments ■ Developed full-service capabilities for private capital ■ Strong integrated coverage model serving middle market, mid-corporate and private capital ■ Collaborating with Private Bank/Private Wealth to deliver full product suite ■ Expanding leveraged finance and M&A opportunities across middle market, sponsor client base ■ Looking to leverage digitization and AI to unlock the next wave of efficiency and improve client experience Focused on middle market, mid-corporate, sponsor clients Best Bank for Treasury and Cash Management 2025; eighth consecutive year AMERICAN BANKER Innovation of the Year Award for our work in Open Banking and APIs 2015 2025 +9% 2025 Commercial Payments revenue Up 8%(1) 2025 Best New Embedded Finance Platform category See pages 41-43 for notes.

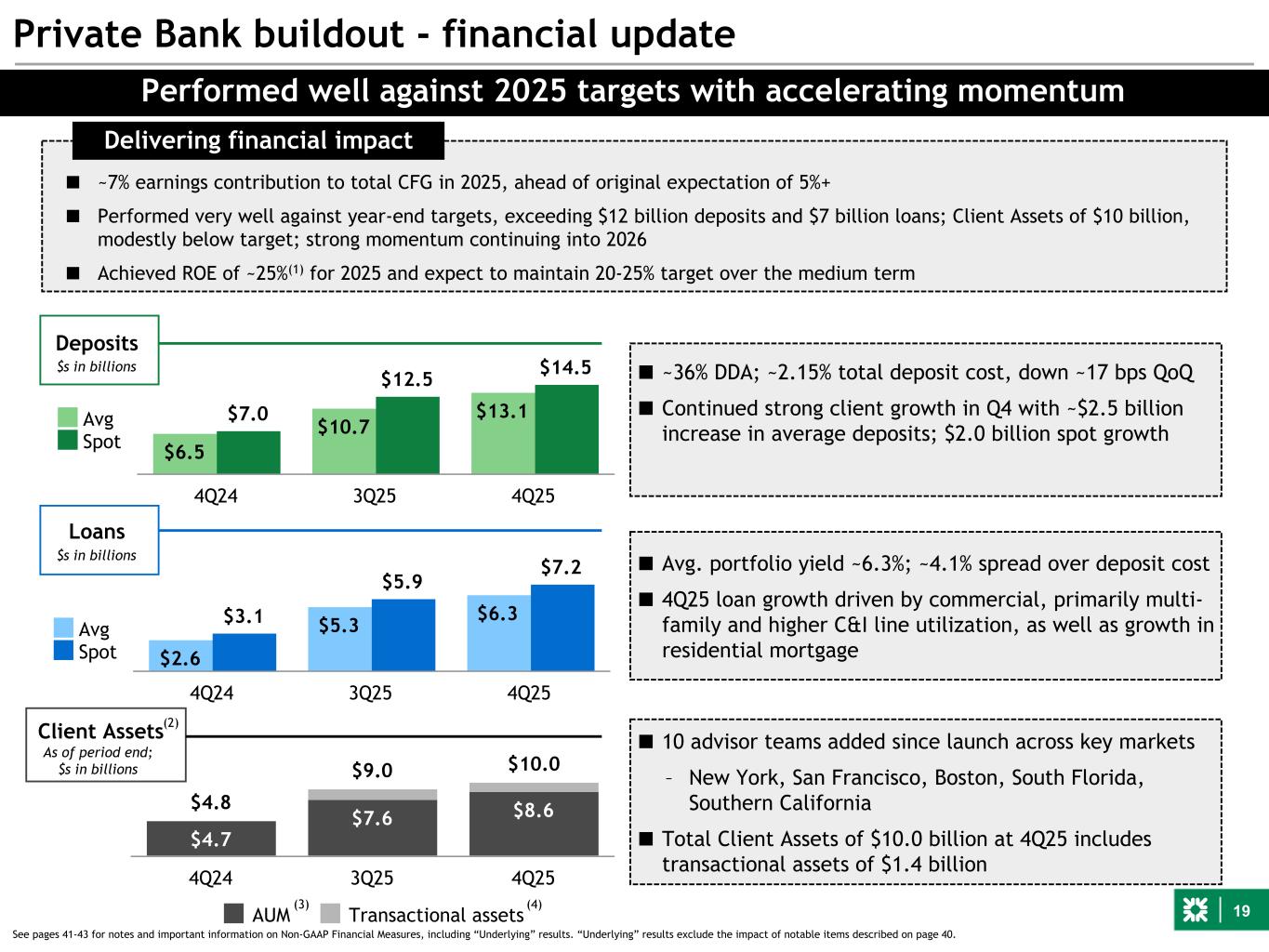

19 Deposits $2.6 $5.3 $6.3$3.1 $5.9 $7.2 Avg Spot 4Q24 3Q25 4Q25 $6.5 $10.7 $13.1$7.0 $12.5 $14.5 Avg Spot 4Q24 3Q25 4Q25 $s in billions Loans Private Bank buildout - financial update ■ ~7% earnings contribution to total CFG in 2025, ahead of original expectation of 5%+ ■ Performed very well against year-end targets, exceeding $12 billion deposits and $7 billion loans; Client Assets of $10 billion, modestly below target; strong momentum continuing into 2026 ■ Achieved ROE of ~25%(1) for 2025 and expect to maintain 20-25% target over the medium term Delivering financial impact Performed well against 2025 targets with accelerating momentum $s in billions $4.8 $9.0 $10.0 $4.7 $7.6 $8.6 AUM Transactional assets 4Q24 3Q25 4Q25 As of period end; $s in billions Client Assets ■ Avg. portfolio yield ~6.3%; ~4.1% spread over deposit cost ■ 4Q25 loan growth driven by commercial, primarily multi- family and higher C&I line utilization, as well as growth in residential mortgage ■ 10 advisor teams added since launch across key markets – New York, San Francisco, Boston, South Florida, Southern California ■ Total Client Assets of $10.0 billion at 4Q25 includes transactional assets of $1.4 billion ■ ~36% DDA; ~2.15% total deposit cost, down ~17 bps QoQ ■ Continued strong client growth in Q4 with ~$2.5 billion increase in average deposits; $2.0 billion spot growth (3) (2) (4) See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

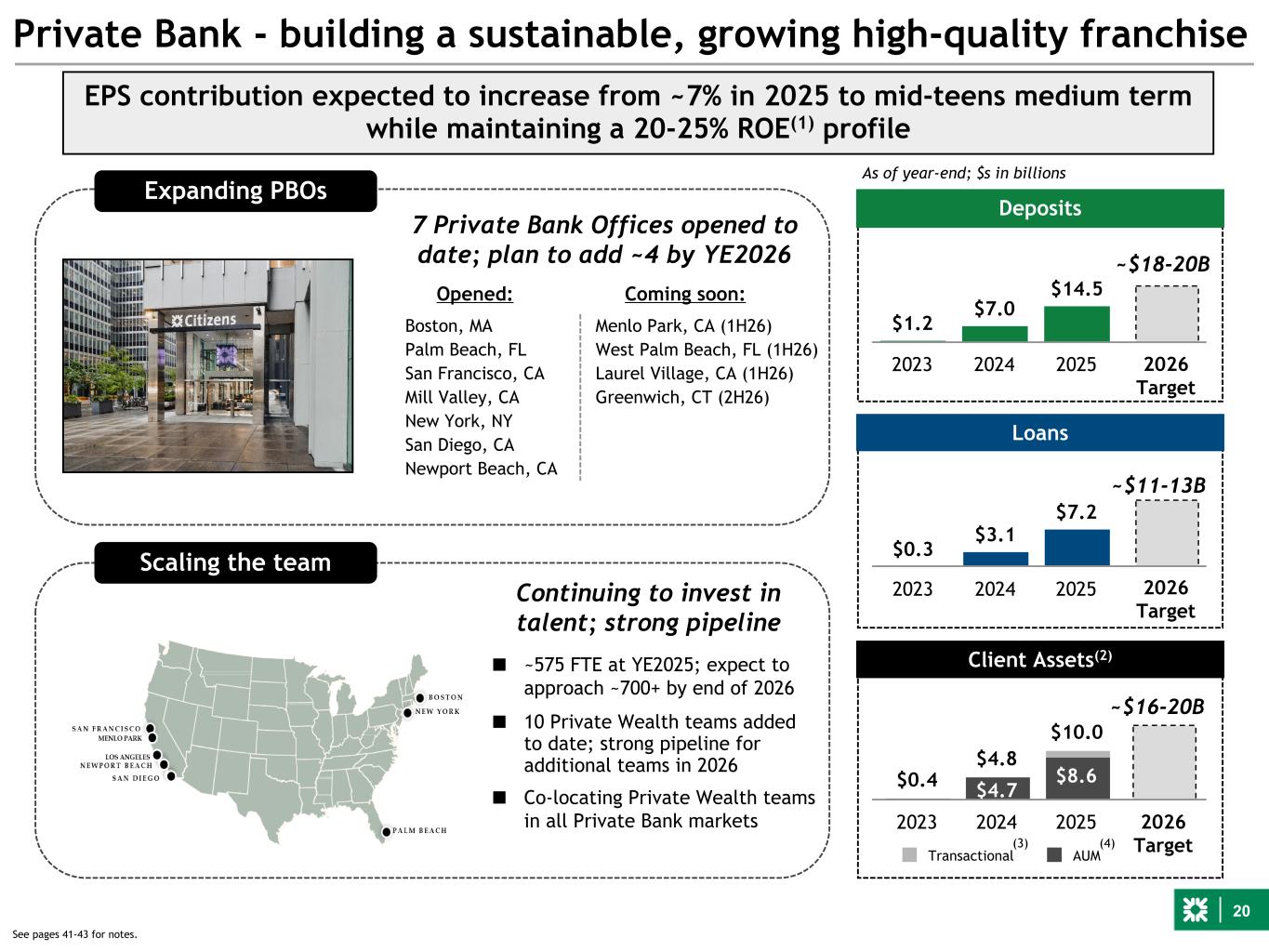

20 $1.2 $7.0 $14.5 2023 2024 2025 $0.4 $4.8 $10.0 $4.7 $8.6 Transactional AUM 2023 2024 2025 Private Bank - building a sustainable, growing high-quality franchise See pages 41-43 for notes. As of year-end; $s in billions Deposits $0.3 $3.1 $7.2 2023 2024 2025 2026 Target 2026 Target 2026 Target EPS contribution expected to increase from ~7% in 2025 to mid-teens medium term while maintaining a 20-25% ROE(1) profile Loans Client Assets(2) ~$18-20B ~$11-13B ~$16-20B Expanding PBOs Opened: 7 Private Bank Offices opened to date; plan to add ~4 by YE2026 Scaling the team ■ ~575 FTE at YE2025; expect to approach ~700+ by end of 2026 ■ 10 Private Wealth teams added to date; strong pipeline for additional teams in 2026 ■ Co-locating Private Wealth teams in all Private Bank markets Boston, MA Menlo Park, CA (1H26) Palm Beach, FL West Palm Beach, FL (1H26) San Francisco, CA Laurel Village, CA (1H26) Mill Valley, CA Greenwich, CT (2H26) New York, NY San Diego, CA Newport Beach, CA Coming soon: Continuing to invest in talent; strong pipeline (3) (4)

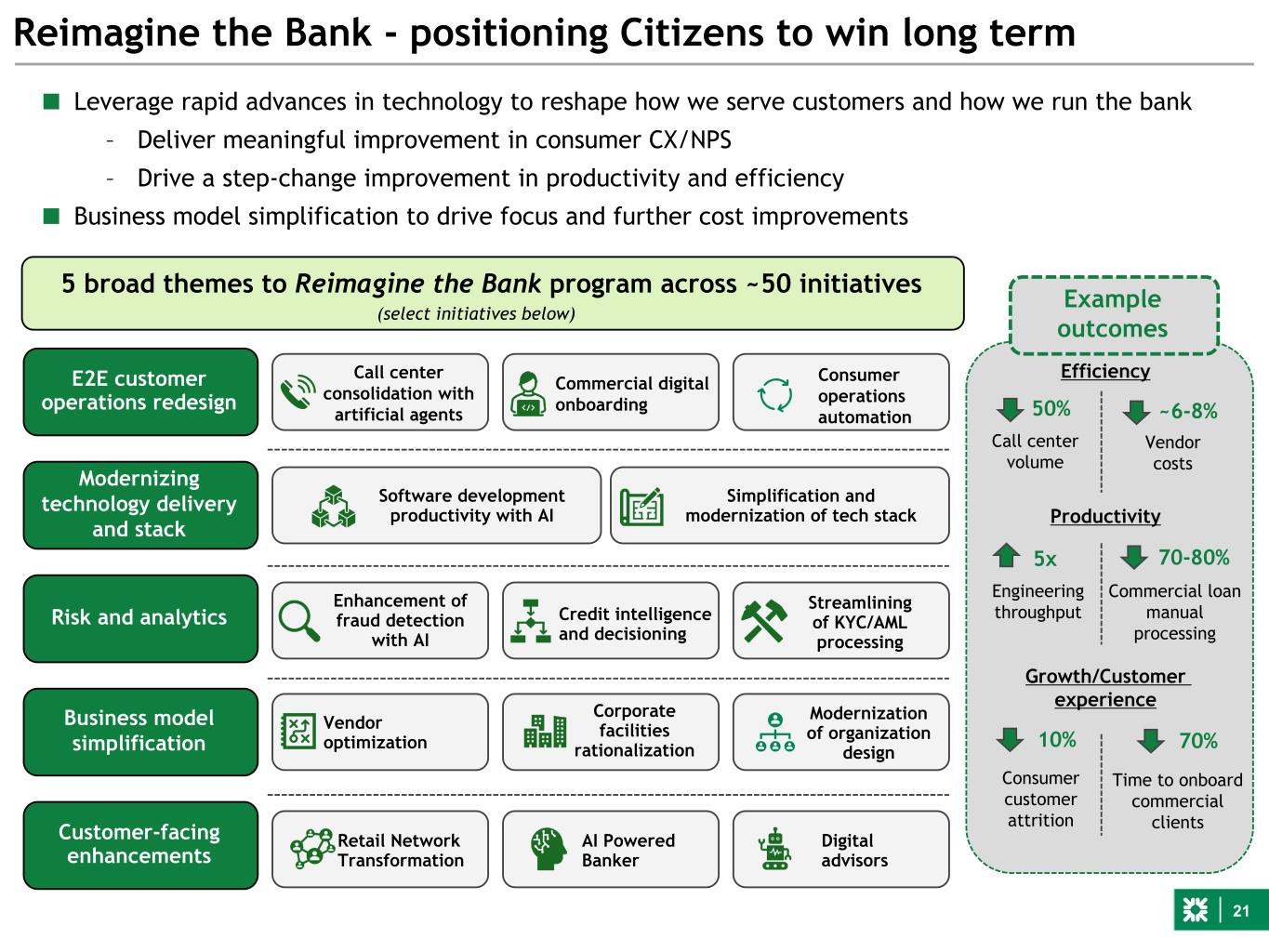

21 Call center consolidation with artificial agents ■ Leverage rapid advances in technology to reshape how we serve customers and how we run the bank – Deliver meaningful improvement in consumer CX/NPS – Drive a step-change improvement in productivity and efficiency ■ Business model simplification to drive focus and further cost improvements Reimagine the Bank - positioning Citizens to win long term 5 broad themes to Reimagine the Bank program across ~50 initiatives Modernizing technology delivery and stack Risk and analytics E2E customer operations redesign Customer-facing enhancements Business model simplification Call center volume Commercial loan manual processing Consumer customer attrition Vendor costs Engineering throughput 5x ~6-8% 10% 70-80% 50% (select initiatives below) Example outcomes Commercial digital onboarding Software development productivity with AI Simplification and modernization of tech stack Enhancement of fraud detection with AI Credit intelligence and decisioning Streamlining of KYC/AML processing AI Powered Banker Digital advisors Retail Network Transformation Vendor optimization Corporate facilities rationalization Consumer operations automation Efficiency Modernization of organization design Productivity Growth/Customer experience Time to onboard commercial clients 70%

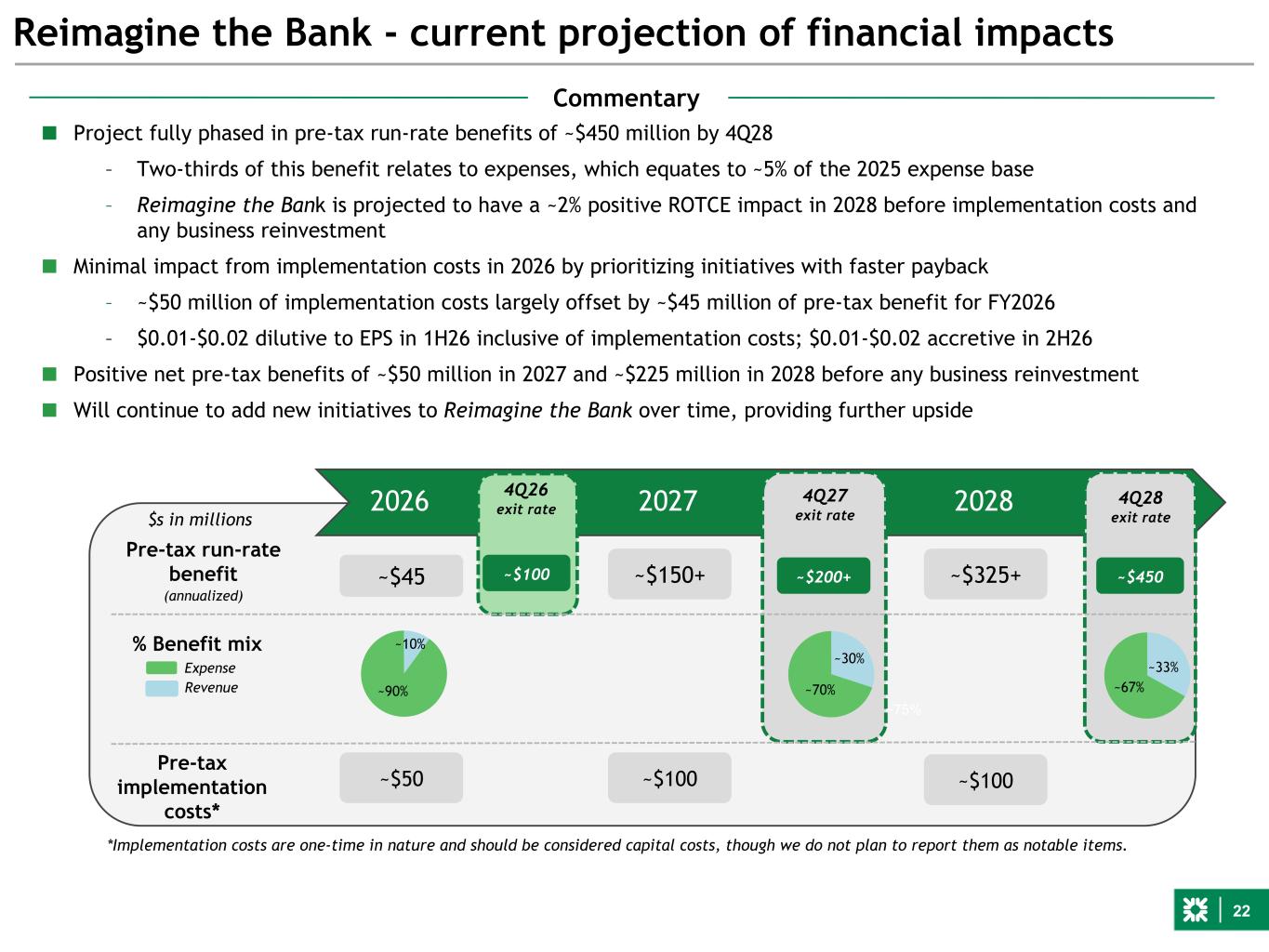

22 Pre-tax run-rate benefit (annualized) Reimagine the Bank - current projection of financial impacts 2026 $s in millions ~$45 ~$450 % Benefit mix Expense Revenue ~75% ~67% Pre-tax implementation costs* ~$50 *Implementation costs are one-time in nature and should be considered capital costs, though we do not plan to report them as notable items. ~$200+ ~70%~90% ~10% ~30% ~33% 4Q26 exit rate ~$100 ■ Project fully phased in pre-tax run-rate benefits of ~$450 million by 4Q28 – Two-thirds of this benefit relates to expenses, which equates to ~5% of the 2025 expense base – Reimagine the Bank is projected to have a ~2% positive ROTCE impact in 2028 before implementation costs and any business reinvestment ■ Minimal impact from implementation costs in 2026 by prioritizing initiatives with faster payback – ~$50 million of implementation costs largely offset by ~$45 million of pre-tax benefit for FY2026 – $0.01-$0.02 dilutive to EPS in 1H26 inclusive of implementation costs; $0.01-$0.02 accretive in 2H26 ■ Positive net pre-tax benefits of ~$50 million in 2027 and ~$225 million in 2028 before any business reinvestment ■ Will continue to add new initiatives to Reimagine the Bank over time, providing further upside Commentary 4Q27 exit rate 4Q28 exit rate ~$100 2027 2028 ~$100 ~$150+ ~$325+

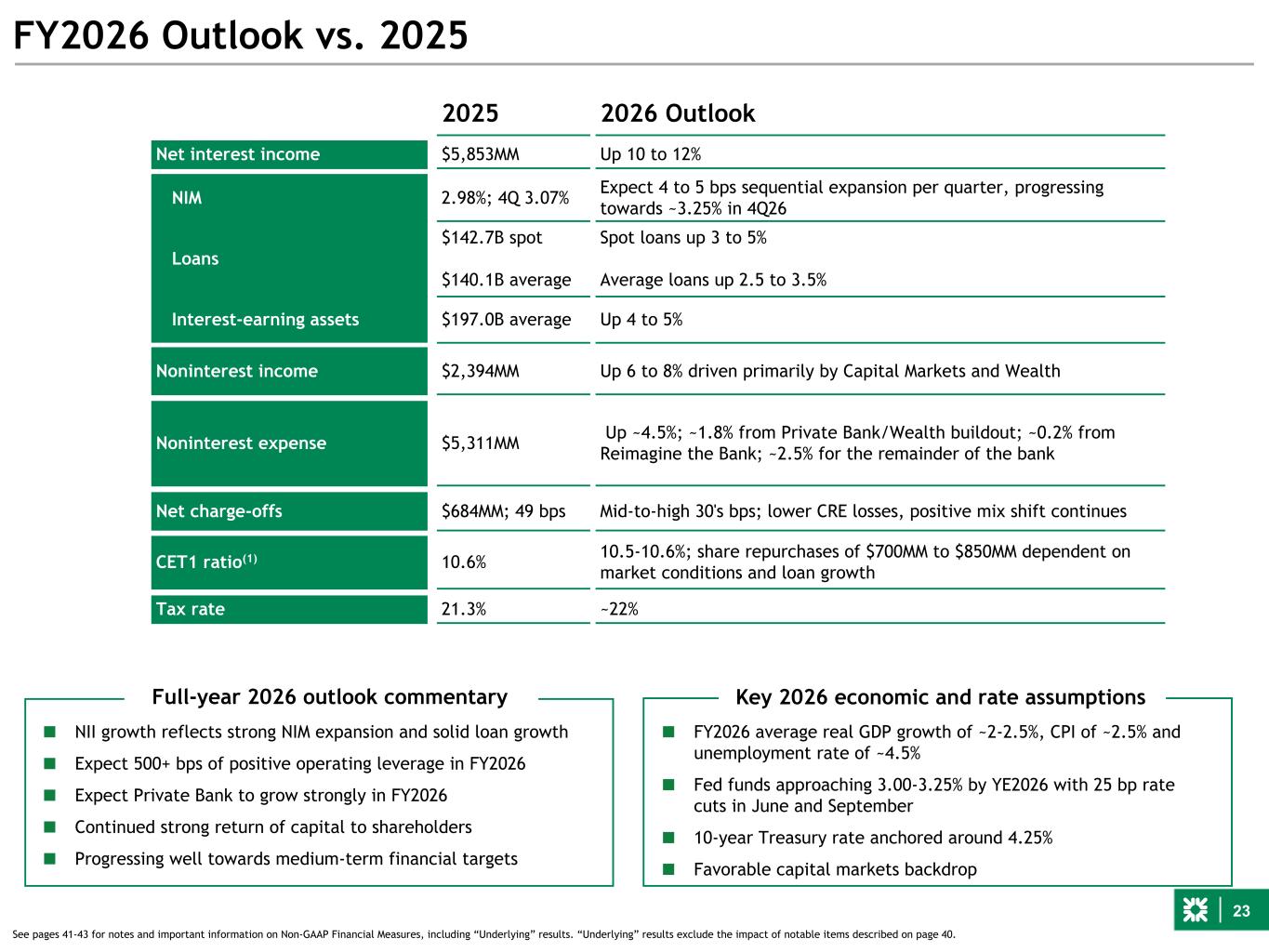

23 FY2026 Outlook vs. 2025 2025 2026 Outlook Net interest income $5,853MM Up 10 to 12% NIM 2.98%; 4Q 3.07% Expect 4 to 5 bps sequential expansion per quarter, progressing towards ~3.25% in 4Q26 Loans $142.7B spot $140.1B average Spot loans up 3 to 5% Average loans up 2.5 to 3.5% Interest-earning assets $197.0B average Up 4 to 5% Noninterest income $2,394MM Up 6 to 8% driven primarily by Capital Markets and Wealth Noninterest expense $5,311MM Up ~4.5%; ~1.8% from Private Bank/Wealth buildout; ~0.2% from Reimagine the Bank; ~2.5% for the remainder of the bank Net charge-offs $684MM; 49 bps Mid-to-high 30's bps; lower CRE losses, positive mix shift continues CET1 ratio(1) 10.6% 10.5-10.6%; share repurchases of $700MM to $850MM dependent on market conditions and loan growth Tax rate 21.3% ~22% ■ FY2026 average real GDP growth of ~2-2.5%, CPI of ~2.5% and unemployment rate of ~4.5% ■ Fed funds approaching 3.00-3.25% by YE2026 with 25 bp rate cuts in June and September ■ 10-year Treasury rate anchored around 4.25% ■ Favorable capital markets backdrop ■ NII growth reflects strong NIM expansion and solid loan growth ■ Expect 500+ bps of positive operating leverage in FY2026 ■ Expect Private Bank to grow strongly in FY2026 ■ Continued strong return of capital to shareholders ■ Progressing well towards medium-term financial targets Full-year 2026 outlook commentary Key 2026 economic and rate assumptions See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

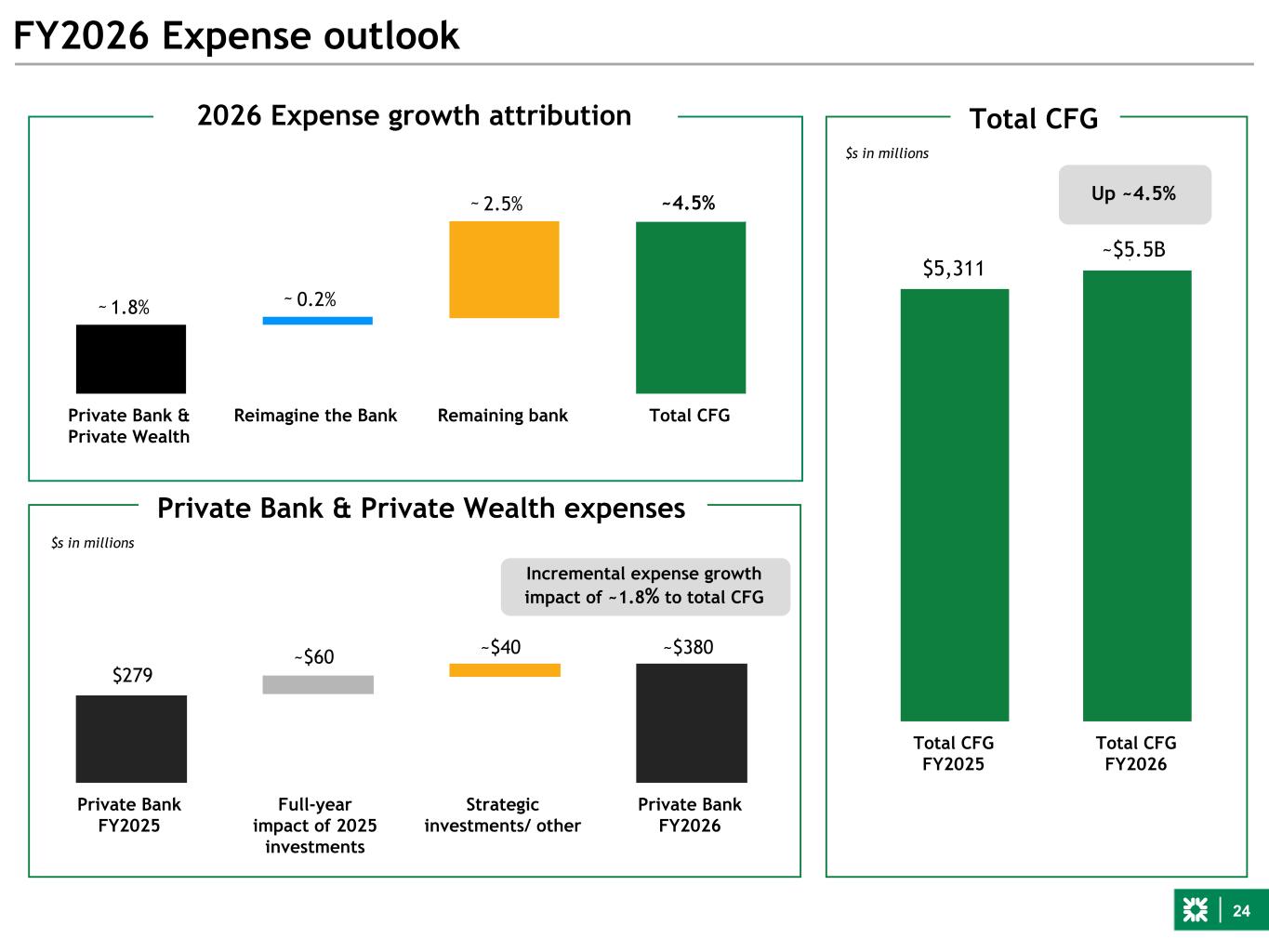

24 1.8% 0.2% 2.5% 4.5% Private Bank & Private Wealth Reimagine the Bank Remaining bank Total CFG Private Bank FY2025 Full-year impact of 2025 investments Strategic investments/ other Private Bank FY2026 $s in millions FY2026 Expense outlook Incremental expense growth impact of ~1.8% to total CFG $5,311 $5,543 Total CFG FY2025 Total CFG FY2026 Total CFG Up ~4.5% ~$60 ~$380 Private Bank & Private Wealth expenses 2026 Expense growth attribution ~$40 ~$5.5B $279 ~ . ~ ~ ~ $s in millions

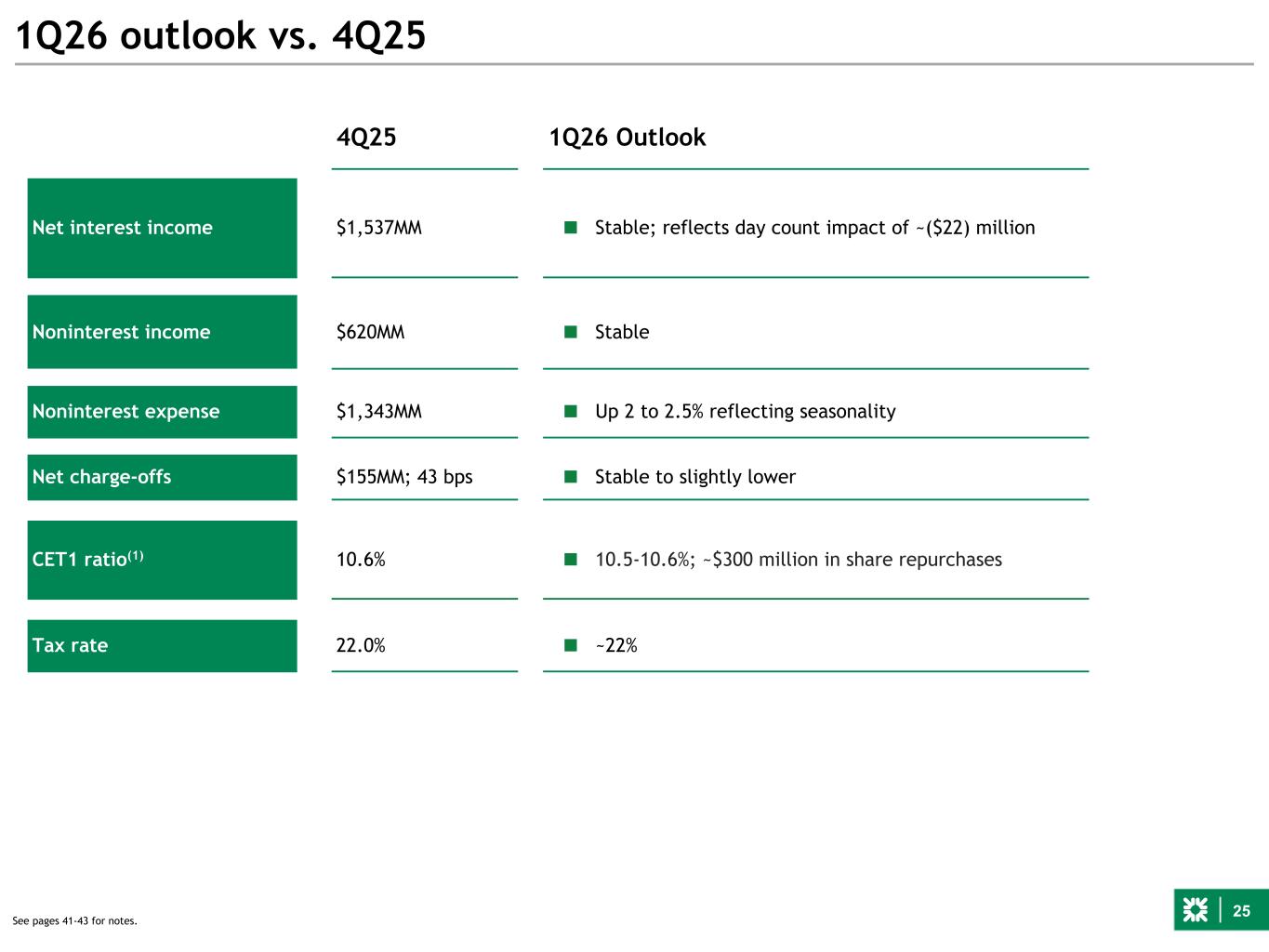

25 1Q26 outlook vs. 4Q25 See pages 41-43 for notes. 4Q25 1Q26 Outlook Net interest income $1,537MM ■ Stable; reflects day count impact of ~($22) million Noninterest income $620MM ■ Stable Noninterest expense $1,343MM ■ Up 2 to 2.5% reflecting seasonality Net charge-offs $155MM; 43 bps ■ Stable to slightly lower CET1 ratio(1) 10.6% ■ 10.5-10.6%; ~$300 million in share repurchases Tax rate 22.0% ■ ~22%

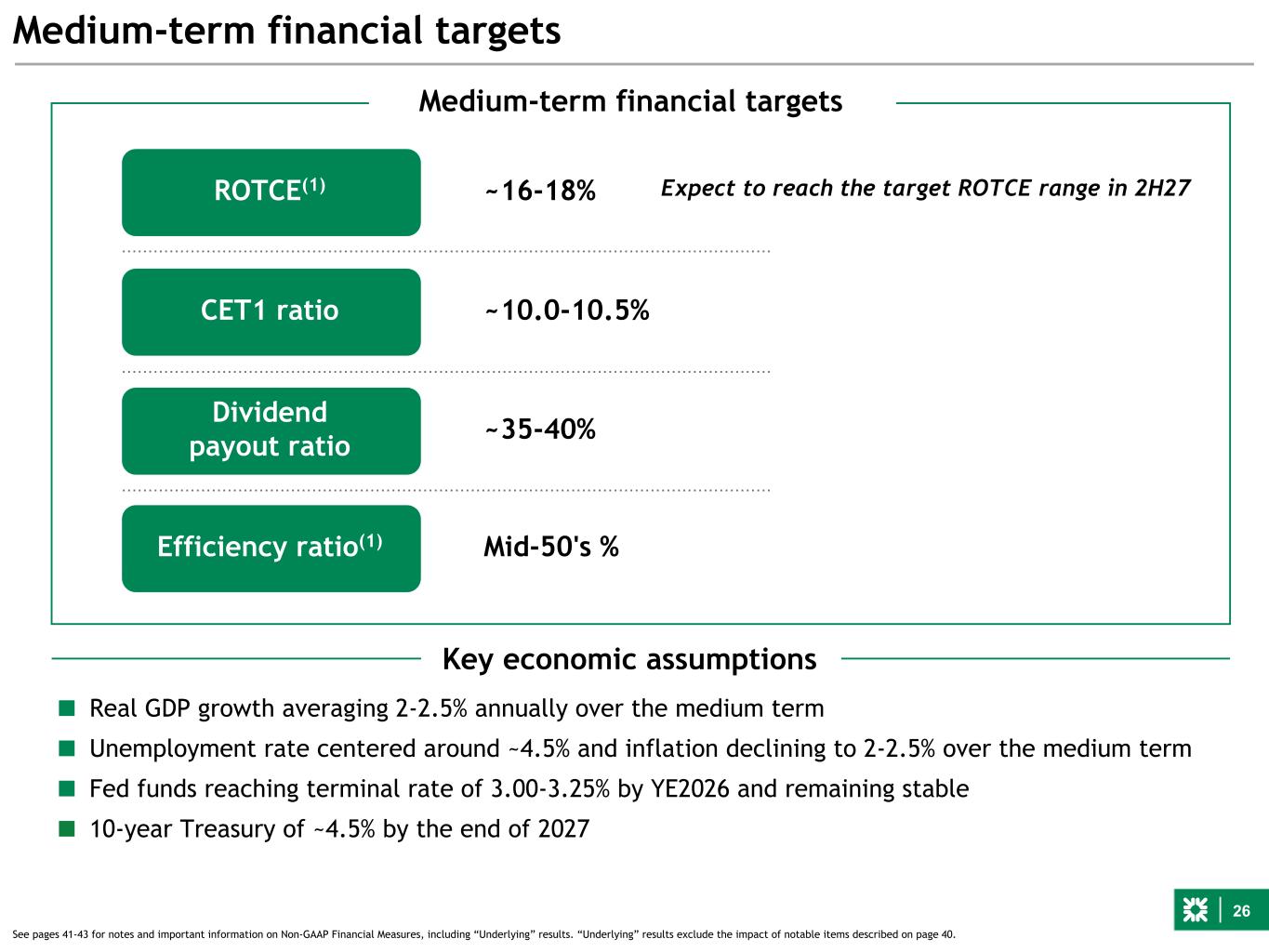

26 Medium-term financial targets Medium-term financial targets ROTCE(1) CET1 ratio Dividend payout ratio Efficiency ratio(1) ~16-18% ~10.0-10.5% ~35-40% Mid-50's % Key economic assumptions ■ Real GDP growth averaging 2-2.5% annually over the medium term ■ Unemployment rate centered around ~4.5% and inflation declining to 2-2.5% over the medium term ■ Fed funds reaching terminal rate of 3.00-3.25% by YE2026 and remaining stable ■ 10-year Treasury of ~4.5% by the end of 2027 Expect to reach the target ROTCE range in 2H27 See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

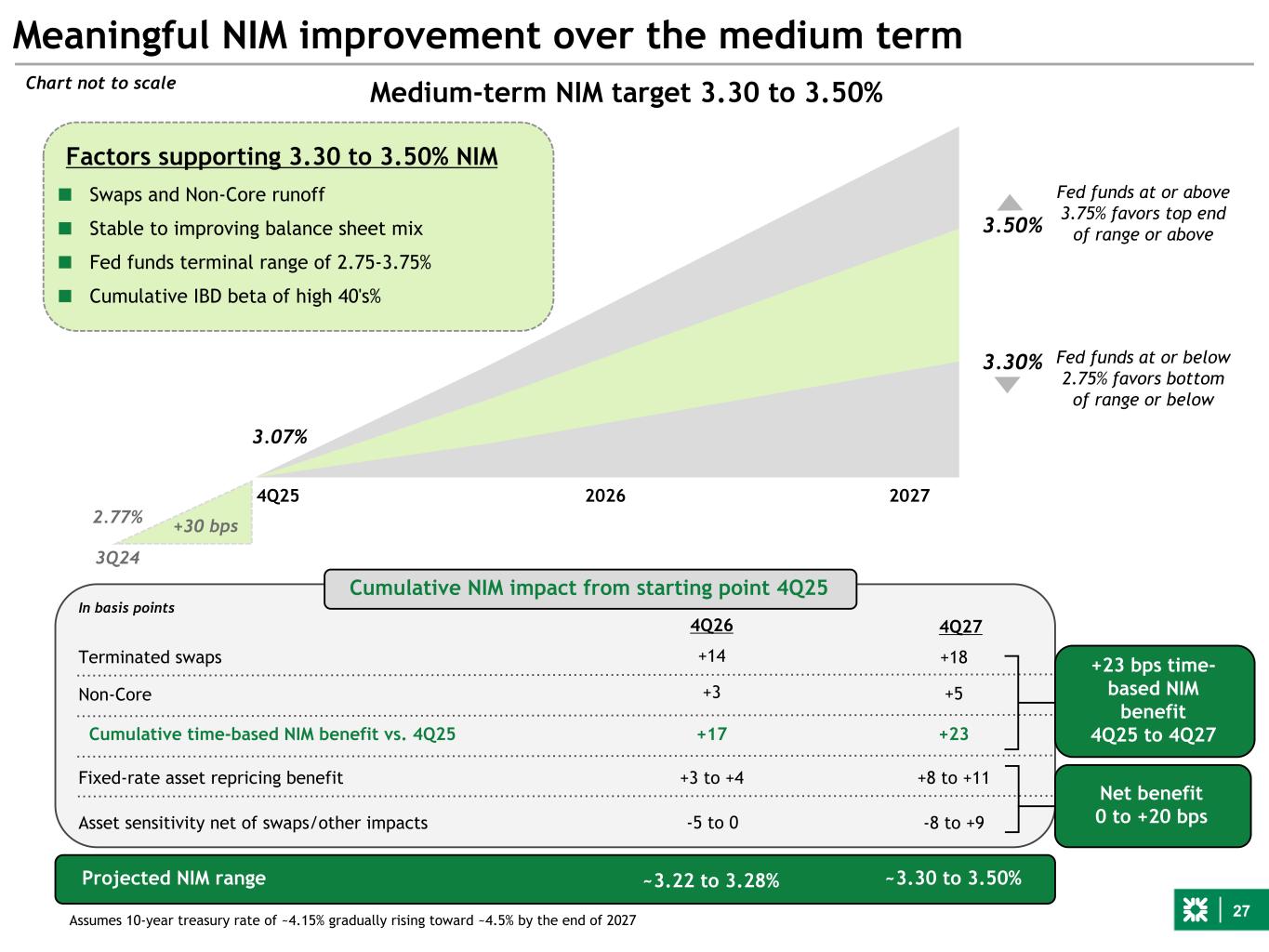

27 Meaningful NIM improvement over the medium term Medium-term NIM target 3.30 to 3.50% Terminated swaps Non-Core Asset sensitivity net of swaps/other impacts Projected NIM range Fixed-rate asset repricing benefit Cumulative time-based NIM benefit vs. 4Q25 4Q26 4Q27 In basis points +14 +3 +17 +18 +5 +23 +8 to +11 -8 to +9 ~3.30 to 3.50% Chart not to scale Net benefit 0 to +20 bps 3.30% 3.50% Fed funds at or above 3.75% favors top end of range or above Fed funds at or below 2.75% favors bottom of range or below Factors supporting 3.30 to 3.50% NIM ■ Swaps and Non-Core runoff ■ Stable to improving balance sheet mix ■ Fed funds terminal range of 2.75-3.75% ■ Cumulative IBD beta of high 40's% +23 bps time- based NIM benefit 4Q25 to 4Q27 Assumes 10-year treasury rate of ~4.15% gradually rising toward ~4.5% by the end of 2027 +3 to +4 Cumulative NIM impact from starting point 4Q25 3Q24 2.77% 4Q25 3.07% 2026 2027 +30 bps -5 to 0 ~3.22 to 3.28%

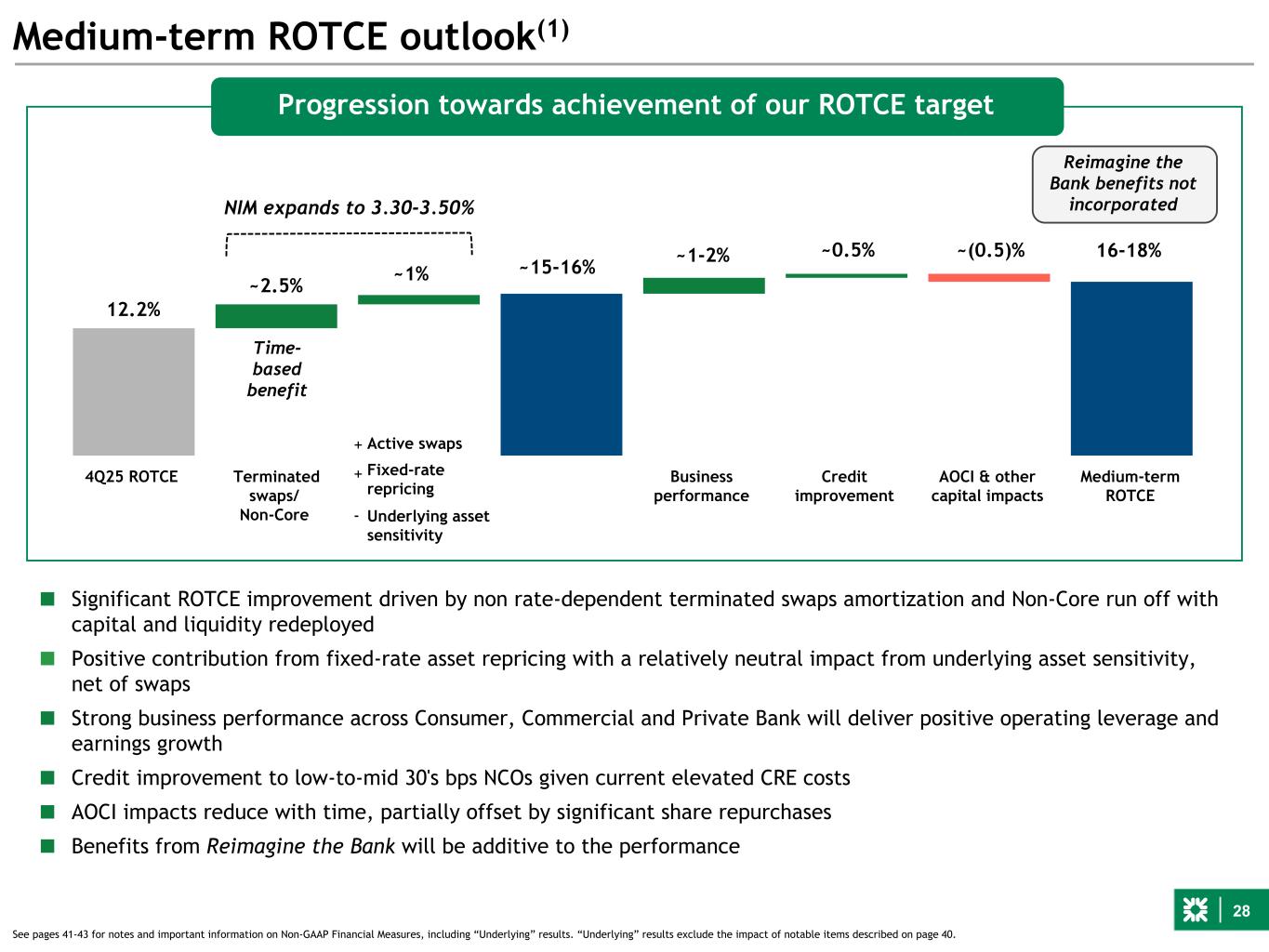

28 4Q25 ROTCE Terminated swaps/ Non-Core Business performance Credit improvement AOCI & other capital impacts Medium-term ROTCE Medium-term ROTCE outlook(1) ■ Significant ROTCE improvement driven by non rate-dependent terminated swaps amortization and Non-Core run off with capital and liquidity redeployed ■ Positive contribution from fixed-rate asset repricing with a relatively neutral impact from underlying asset sensitivity, net of swaps ■ Strong business performance across Consumer, Commercial and Private Bank will deliver positive operating leverage and earnings growth ■ Credit improvement to low-to-mid 30's bps NCOs given current elevated CRE costs ■ AOCI impacts reduce with time, partially offset by significant share repurchases ■ Benefits from Reimagine the Bank will be additive to the performance Progression towards achievement of our ROTCE target 12.2% ~1% ~15-16% ~0.5% ~(0.5)%~1-2% ~2.5% NIM expands to 3.30-3.50% Active swaps Fixed-rate repricing Underlying asset sensitivity + + - Time- based benefit 16-18% Reimagine the Bank benefits not incorporated See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

29 ■ Track record of strong execution; excellence in our capabilities, highly competitive with mega-banks and peers ■ TOP 10 achieved ~$100 million pre-tax run-rate benefit as of year-end 2025; launched Reimagine the Bank (multi- year transformational program) that targets ~$450 million of pre-tax run-rate benefit by 4Q28 ■ Robust capital and liquidity position; further enhancing performance with balance sheet optimization ■ Credit allowance remains strong; credit metrics continue to trend favorably ■ Flexibility to support customers and invest while continuing to return capital to shareholders – Increased the quarterly common dividend by 9.5% to $0.46; total shareholder payout ratio of 80% in 2025 Citizens is an attractive investment opportunity Maintaining a robust balance sheet Citizens has transformed since IPO given sound strategy, capable and experienced leadership and a strong customer-focused culture Well positioned to deliver ~16 to 18% ROTCE in 2H27 given strategic initiatives and NII tailwinds ■ Transformed Consumer Bank with leading retail deposit franchise; well positioned in NYC Metro to gain market share; performance tracking well ■ Best-positioned Commercial Bank ready to serve private capital and high-growth sectors of the U.S. economy ■ Building premier Private Bank/Wealth franchise – Continued to make strong progress, contributing $0.10 to EPS in 4Q25 and a 7% earnings contribution in 2025 – Investing for growth while sustaining attractive 20-25% ROE(1) ■ Significant NII tailwind from Non-Core and swaps over the medium term; confident in target NIM range of ~3.30 to 3.50% ■ Execution of strategic initiatives, positive operating leverage, lower credit costs and share repurchases contribute to the improving ROTCE Continue to have a series of unique initiatives that will lead to relative medium-term outperformance See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

Appendix ■ FY2025 Scorecard ■ FY2025 and 4Q25 Private Bank financial performance ■ Interest rate risk management ■ Non-Core portfolio and balance sheet optimization ■ Credit

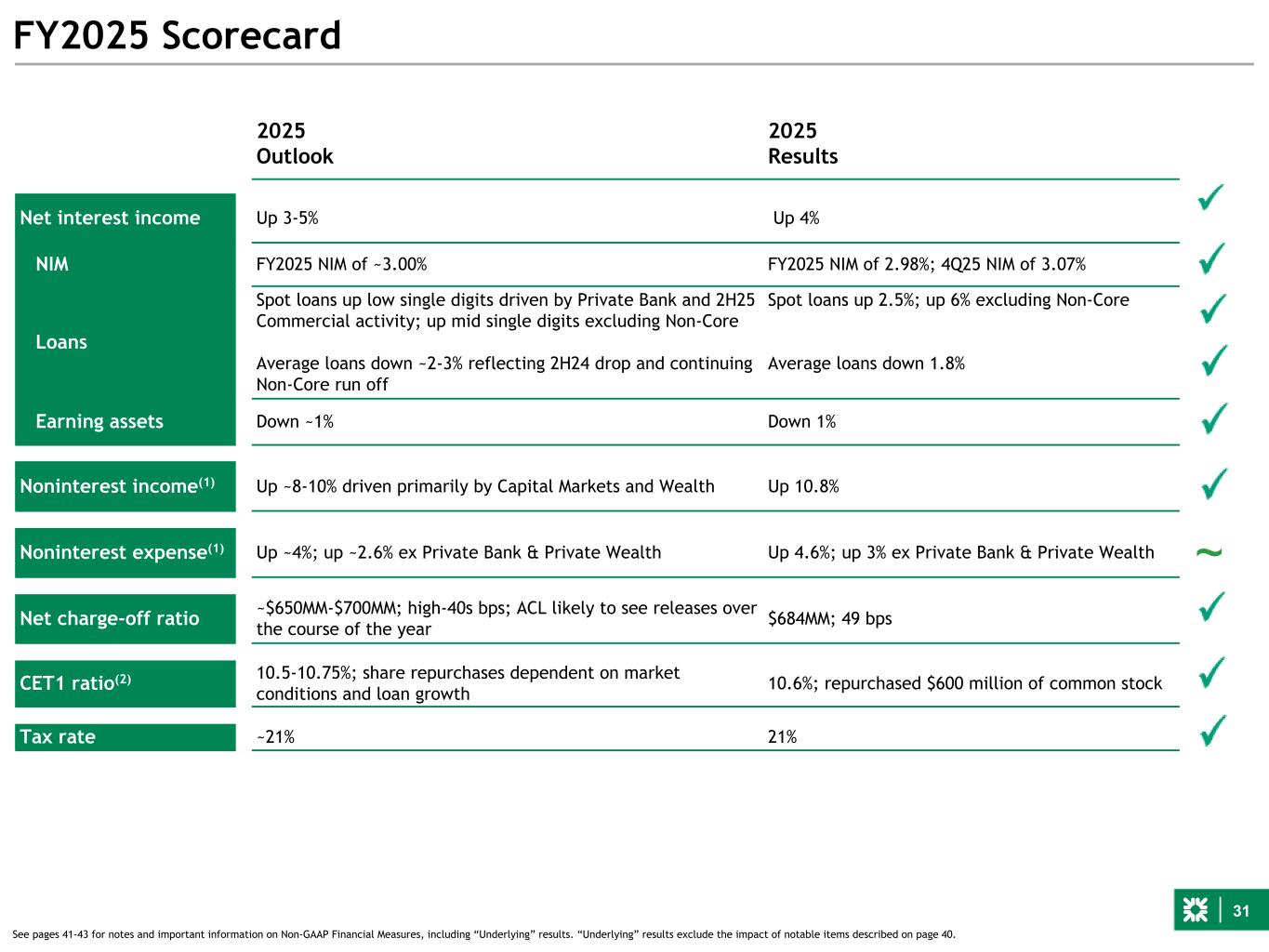

31 FY2025 Scorecard FY24 Underlying outlook(1) FY24 Underlying results Net interest income Down 6-9% Noninterest income Up 6-9%, market dependent Noninterest expense Up ~1-1.5% Net charge-offs [$750MM]; 50 bps $748MM; 52 bps CET1 ratio(2) ~10.5% Tax rate ~21-22% 2025 Outlook 2025 Results Net interest income Up 3-5% Up 4% NIM FY2025 NIM of ~3.00% FY2025 NIM of 2.98%; 4Q25 NIM of 3.07% Loans Spot loans up low single digits driven by Private Bank and 2H25 Commercial activity; up mid single digits excluding Non-Core Average loans down ~2-3% reflecting 2H24 drop and continuing Non-Core run off Spot loans up 2.5%; up 6% excluding Non-Core Average loans down 1.8% Earning assets Down ~1% Down 1% Noninterest income(1) Up ~8-10% driven primarily by Capital Markets and Wealth Up 10.8% Noninterest expense(1) Up ~4%; up ~2.6% ex Private Bank & Private Wealth Up 4.6%; up 3% ex Private Bank & Private Wealth Net charge-off ratio ~$650MM-$700MM; high-40s bps; ACL likely to see releases over the course of the year $684MM; 49 bps CET1 ratio(2) 10.5-10.75%; share repurchases dependent on market conditions and loan growth 10.6%; repurchased $600 million of common stock Tax rate ~21% 21% ~ See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

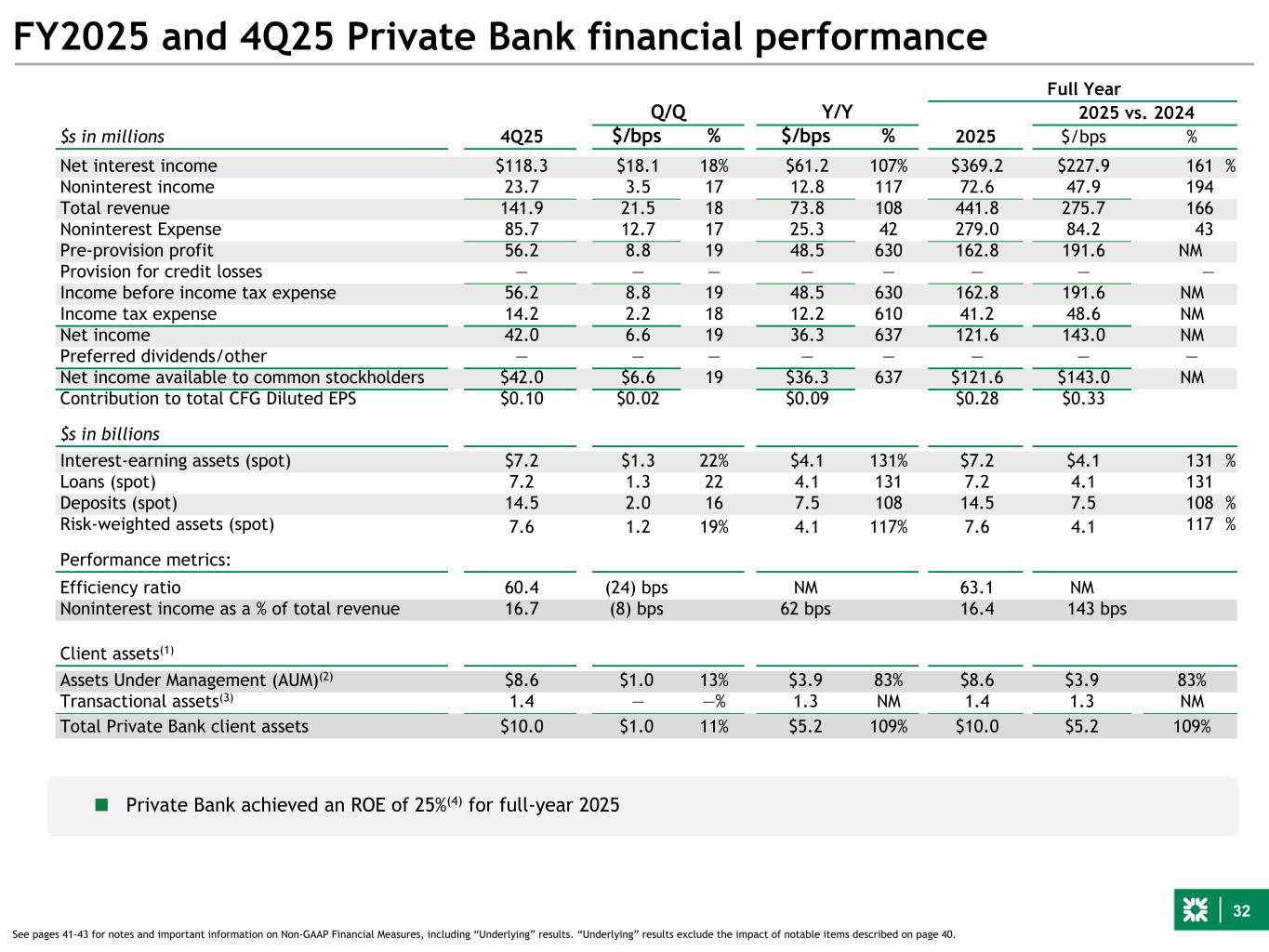

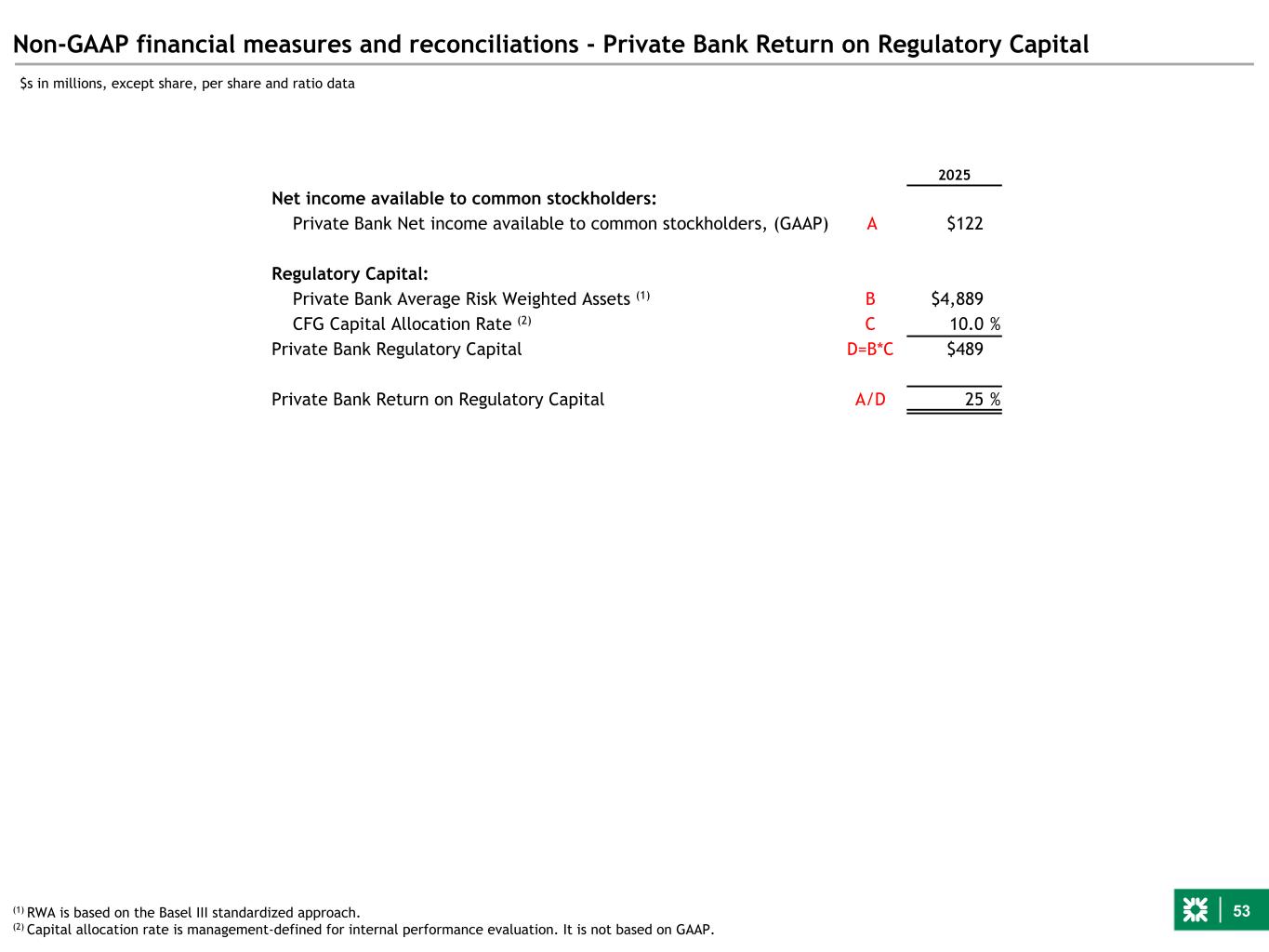

32 FY2025 and 4Q25 Private Bank financial performance Full Year Q/Q Y/Y 2025 vs. 2024 $s in millions 4Q25 $/bps % $/bps % 2025 $/bps % Net interest income $118.3 $18.1 18% $61.2 107% $369.2 $227.9 161 % Noninterest income 23.7 3.5 17 12.8 117 72.6 47.9 194 Total revenue 141.9 21.5 18 73.8 108 441.8 275.7 166 Noninterest Expense 85.7 12.7 17 25.3 42 279.0 84.2 43 Pre-provision profit 56.2 8.8 19 48.5 630 162.8 191.6 NM Provision for credit losses — — — — — — — — Income before income tax expense 56.2 8.8 19 48.5 630 162.8 191.6 NM Income tax expense 14.2 2.2 18 12.2 610 41.2 48.6 NM Net income 42.0 6.6 19 36.3 637 121.6 143.0 NM Preferred dividends/other — — — — — — — — Net income available to common stockholders $42.0 $6.6 19 $36.3 637 $121.6 $143.0 NM Contribution to total CFG Diluted EPS $0.10 $0.02 $0.09 $0.28 $0.33 $s in billions Interest-earning assets (spot) $7.2 $1.3 22% $4.1 131% $7.2 $4.1 131 % Loans (spot) 7.2 1.3 22 4.1 131 7.2 4.1 131 Deposits (spot) 14.5 2.0 16 7.5 108 14.5 7.5 108 % Risk-weighted assets (spot) 7.6 1.2 19% 4.1 117% 7.6 4.1 117 % Performance metrics: Efficiency ratio 60.4 (24) bps NM 63.1 NM Noninterest income as a % of total revenue 16.7 (8) bps 62 bps 16.4 143 bps Client assets(1) Assets Under Management (AUM)(2) $8.6 $1.0 13% $3.9 83% $8.6 $3.9 83% Transactional assets(3) 1.4 — —% 1.3 NM 1.4 1.3 NM Total Private Bank client assets $10.0 $1.0 11% $5.2 109% $10.0 $5.2 109% ■ Private Bank achieved an ROE of 25%(4) for full-year 2025 See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

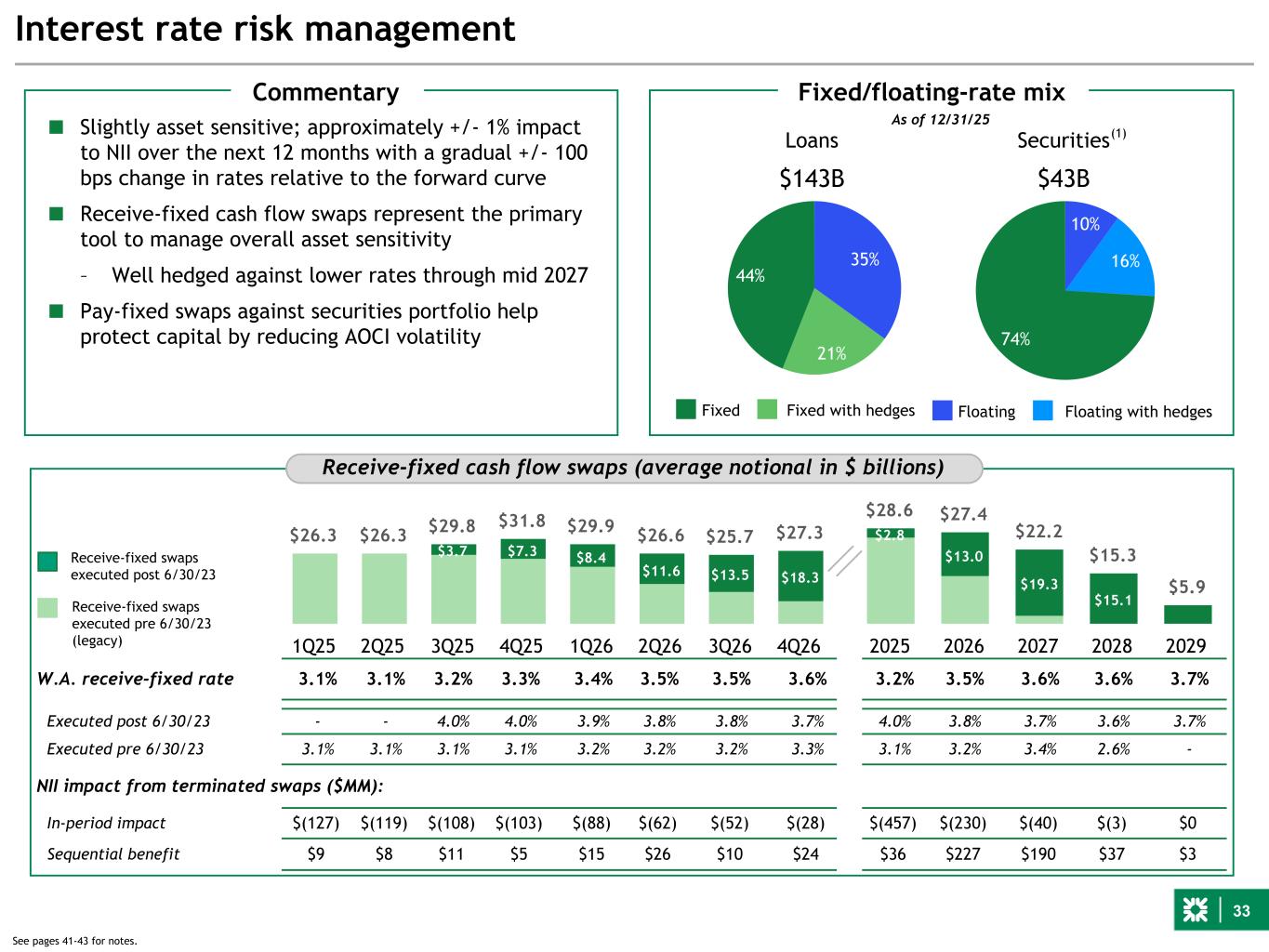

33 $26.3 $26.3 $29.8 $31.8 $29.9 $26.6 $25.7 $27.3 $3.7 $7.3 $8.4 $11.6 $13.5 $18.3 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 3Q26 4Q26 $28.6 $27.4 $22.2 $15.3 $5.9 $2.8 $13.0 $19.3 $15.1 2025 2026 2027 2028 2029 Interest rate risk management W.A. receive-fixed rate 3.1% 3.1% 3.2% 3.3% 3.4% 3.5% 3.5% 3.6% 3.2% 3.5% 3.6% 3.6% 3.7% Executed post 6/30/23 - - 4.0% 4.0% 3.9% 3.8% 3.8% 3.7% 4.0% 3.8% 3.7% 3.6% 3.7% Executed pre 6/30/23 3.1% 3.1% 3.1% 3.1% 3.2% 3.2% 3.2% 3.3% 3.1% 3.2% 3.4% 2.6% - NII impact from terminated swaps ($MM): In-period impact $(127) $(119) $(108) $(103) $(88) $(62) $(52) $(28) $(457) $(230) $(40) $(3) $0 Sequential benefit $9 $8 $11 $5 $15 $26 $10 $24 $36 $227 $190 $37 $3 Receive-fixed cash flow swaps (average notional in $ billions) ■ Slightly asset sensitive; approximately +/- 1% impact to NII over the next 12 months with a gradual +/- 100 bps change in rates relative to the forward curve ■ Receive-fixed cash flow swaps represent the primary tool to manage overall asset sensitivity – Well hedged against lower rates through mid 2027 ■ Pay-fixed swaps against securities portfolio help protect capital by reducing AOCI volatility Receive-fixed swaps executed post 6/30/23 Receive-fixed swaps executed pre 6/30/23 (legacy) Fixed/floating-rate mix 10% 16% 74% Securities $43B 35% 21% 44% Loans $143B Fixed Fixed with hedges Floating Floating with hedges Commentary 15% 15% 70% 37% 16% 47% As of 12/31/25 (1) See pages 41-43 for notes.

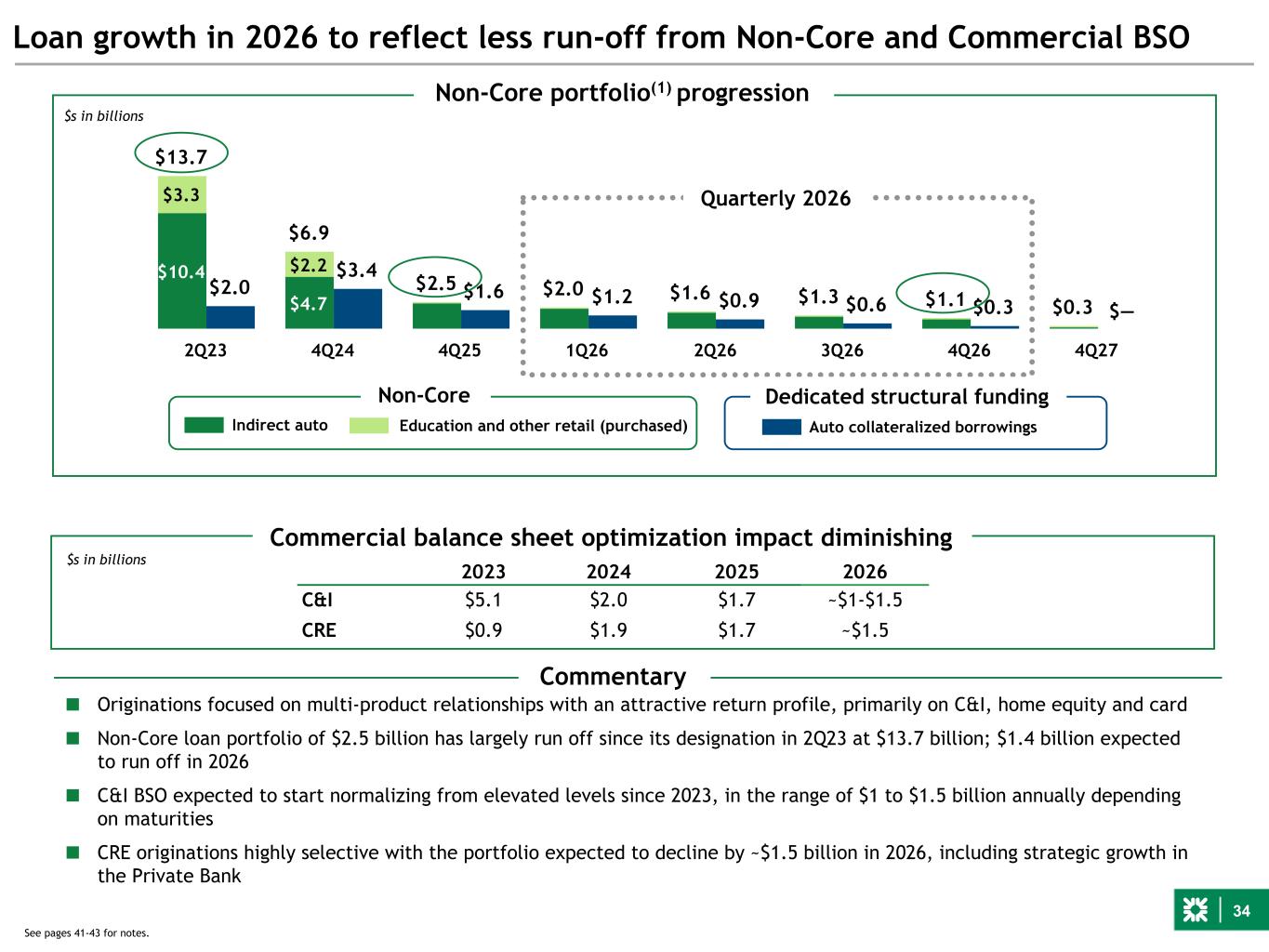

34 $13.7 $6.9 $2.5 $2.0 $1.6 $1.3 $1.1 $0.3 $2.0 $3.4 $1.6 $1.2 $0.9 $0.6 $0.3 $— $10.4 $4.7 $3.3 $2.2 2Q23 4Q24 4Q25 1Q26 2Q26 3Q26 4Q26 4Q27 2023 2024 2025 2026 C&I $5.1 $2.0 $1.7 ~$1-$1.5 CRE $0.9 $1.9 $1.7 ~$1.5 Loan growth in 2026 to reflect less run-off from Non-Core and Commercial BSO Non-Core Dedicated structural funding Indirect auto Auto collateralized borrowings $s in billions ■ Originations focused on multi-product relationships with an attractive return profile, primarily on C&I, home equity and card ■ Non-Core loan portfolio of $2.5 billion has largely run off since its designation in 2Q23 at $13.7 billion; $1.4 billion expected to run off in 2026 ■ C&I BSO expected to start normalizing from elevated levels since 2023, in the range of $1 to $1.5 billion annually depending on maturities ■ CRE originations highly selective with the portfolio expected to decline by ~$1.5 billion in 2026, including strategic growth in the Private Bank See pages 41-43 for notes. Non-Core portfolio(1) progression Commentary Commercial balance sheet optimization impact diminishing Quarterly 2026 Education and other retail (purchased) $s in billions

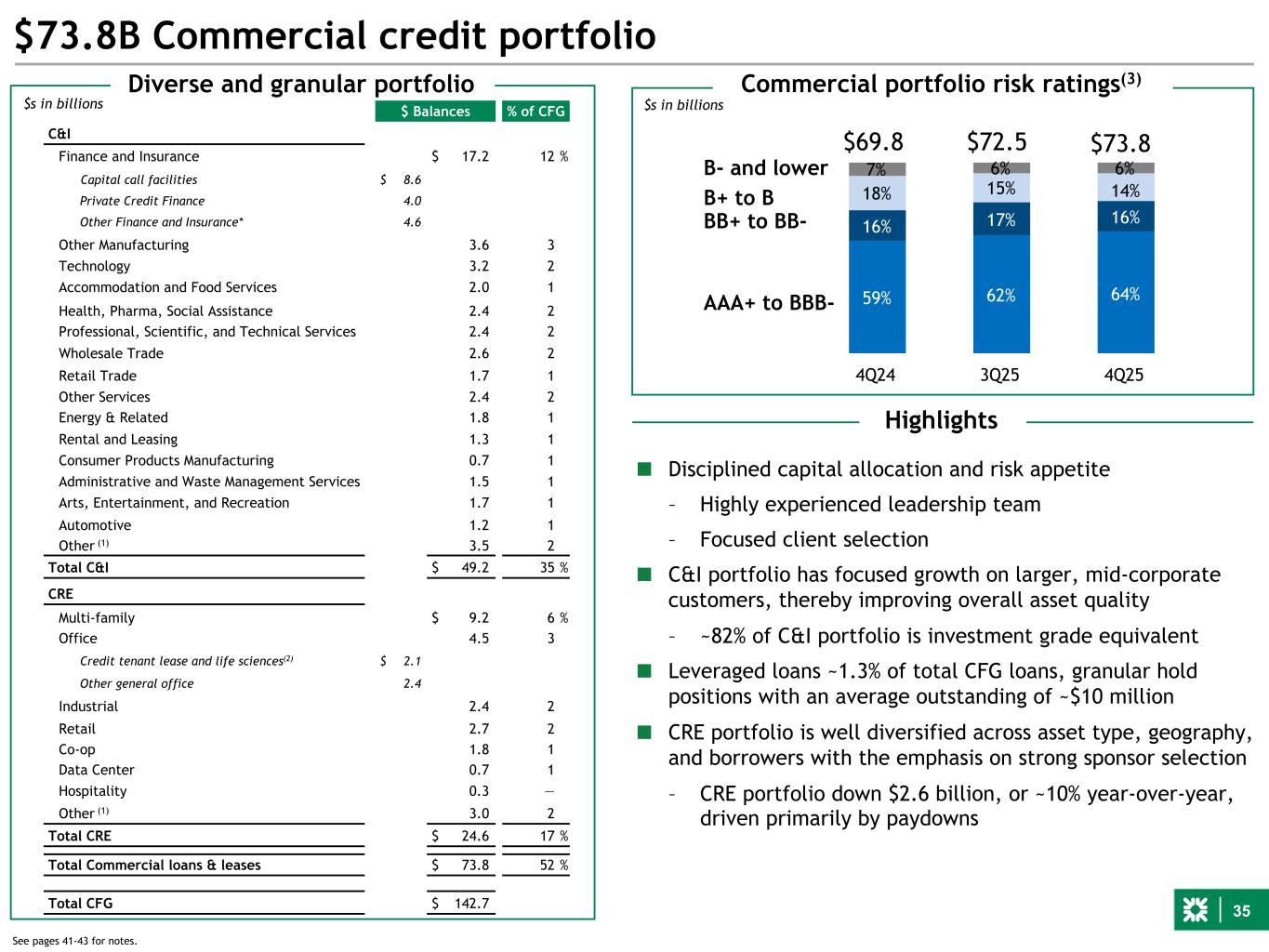

35 $73.8B Commercial credit portfolio Commercial portfolio risk ratings(3) $s in billions 59% 62% 64% 16% 17% 16% 18% 15% 14% 7% 6% 6% 4Q24 3Q25 4Q25 B- and lower B+ to B BB+ to BB- AAA+ to BBB- $73.8 Highlights $72.5 $ Balances % of CFG C&I Finance and Insurance $ 17.2 12 % Capital call facilities $ 8.6 Private Credit Finance 4.0 Other Finance and Insurance* 4.6 Other Manufacturing 3.6 3 Technology 3.2 2 Accommodation and Food Services 2.0 1 Health, Pharma, Social Assistance 2.4 2 Professional, Scientific, and Technical Services 2.4 2 Wholesale Trade 2.6 2 Retail Trade 1.7 1 Other Services 2.4 2 Energy & Related 1.8 1 Rental and Leasing 1.3 1 Consumer Products Manufacturing 0.7 1 Administrative and Waste Management Services 1.5 1 Arts, Entertainment, and Recreation 1.7 1 Automotive 1.2 1 Other (1) 3.5 2 Total C&I $ 49.2 35 % CRE Multi-family $ 9.2 6 % Office 4.5 3 Credit tenant lease and life sciences(2) $ 2.1 Other general office 2.4 Industrial 2.4 2 Retail 2.7 2 Co-op 1.8 1 Data Center 0.7 1 Hospitality 0.3 — Other (1) 3.0 2 Total CRE $ 24.6 17 % Total Commercial loans & leases $ 73.8 52 % Total CFG $ 142.7 Diverse and granular portfolio ■ Disciplined capital allocation and risk appetite – Highly experienced leadership team – Focused client selection ■ C&I portfolio has focused growth on larger, mid-corporate customers, thereby improving overall asset quality – ~82% of C&I portfolio is investment grade equivalent ■ Leveraged loans ~1.3% of total CFG loans, granular hold positions with an average outstanding of ~$10 million ■ CRE portfolio is well diversified across asset type, geography, and borrowers with the emphasis on strong sponsor selection – CRE portfolio down $2.6 billion, or ~10% year-over-year, driven primarily by paydowns $69.8 See pages 41-43 for notes. $s in billions ■ [Non-depository financial institution (NDFI) balance under regulatory definition of [$15.9] billion; BBB- ratings equivalent]

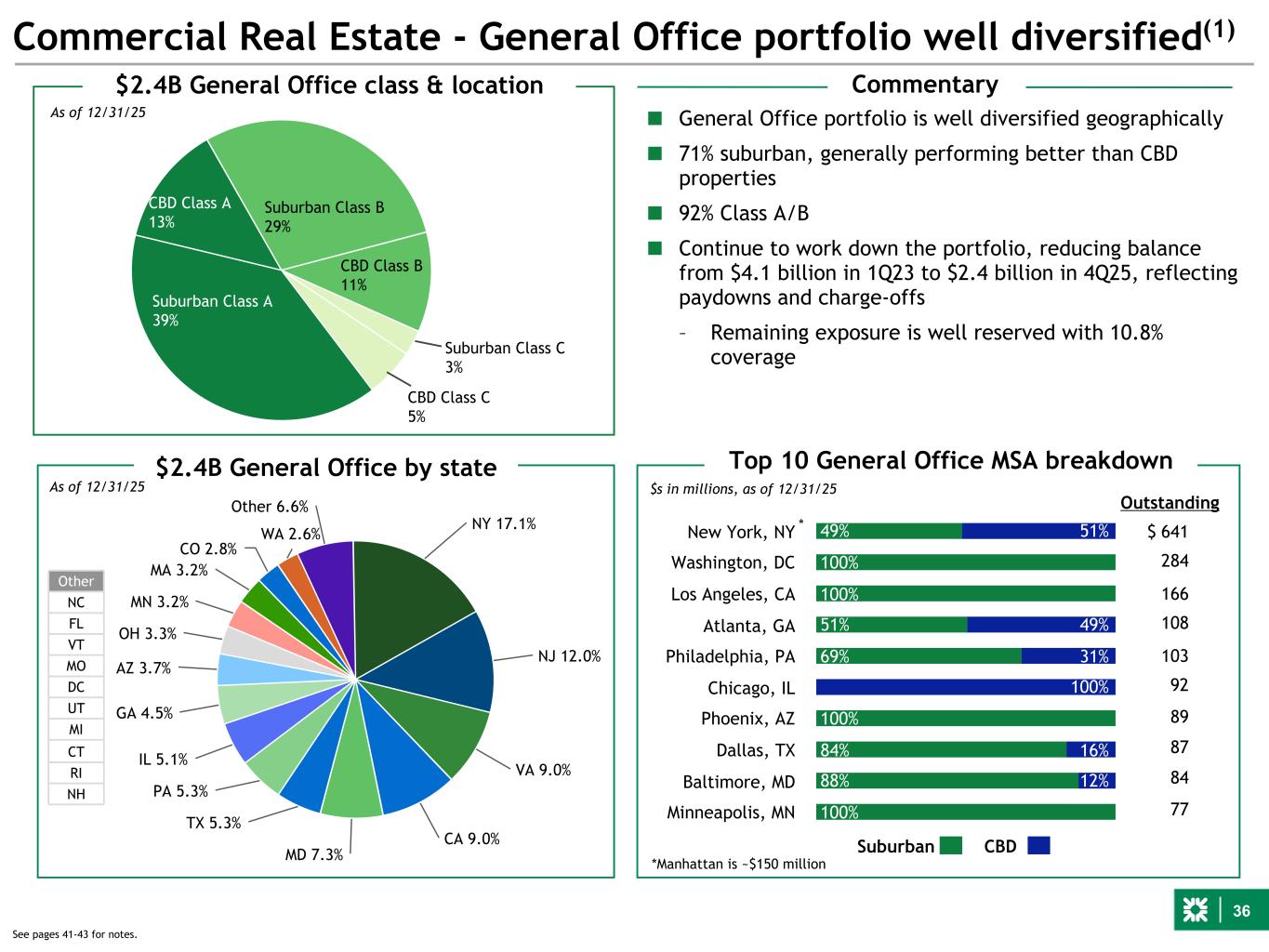

36 Suburban Class C 3% CBD Class C 5% Suburban Class A 39% CBD Class A 13% Suburban Class B 29% CBD Class B 11% 49% 100% 100% 51% 69% 100% 84% 88% 100% 51% 49% 31% 100% 16% 12% New York, NY Washington, DC Los Angeles, CA Atlanta, GA Philadelphia, PA Chicago, IL Phoenix, AZ Dallas, TX Baltimore, MD Minneapolis, MN Suburban CBD NY 17.1% NJ 12.0% VA 9.0% CA 9.0% MD 7.3% TX 5.3% PA 5.3% IL 5.1% GA 4.5% AZ 3.7% OH 3.3% MN 3.2% MA 3.2% CO 2.8% WA 2.6% Other 6.6% Commercial Real Estate - General Office portfolio well diversified(1) $2.4B General Office by state Other NC FL VT MO DC UT MI CT RI NH $2.4B General Office class & location Outstanding *Manhattan is ~$150 million $ 641 284 166 108 103 92 89 87 84 77 $s in millions, as of 12/31/25 See pages 41-43 for notes. As of 12/31/25 As of 12/31/25 Commentary ■ General Office portfolio is well diversified geographically ■ 71% suburban, generally performing better than CBD properties ■ 92% Class A/B ■ Continue to work down the portfolio, reducing balance from $4.1 billion in 1Q23 to $2.4 billion in 4Q25, reflecting paydowns and charge-offs – Remaining exposure is well reserved with 10.8% coverage Top 10 General Office MSA breakdown *

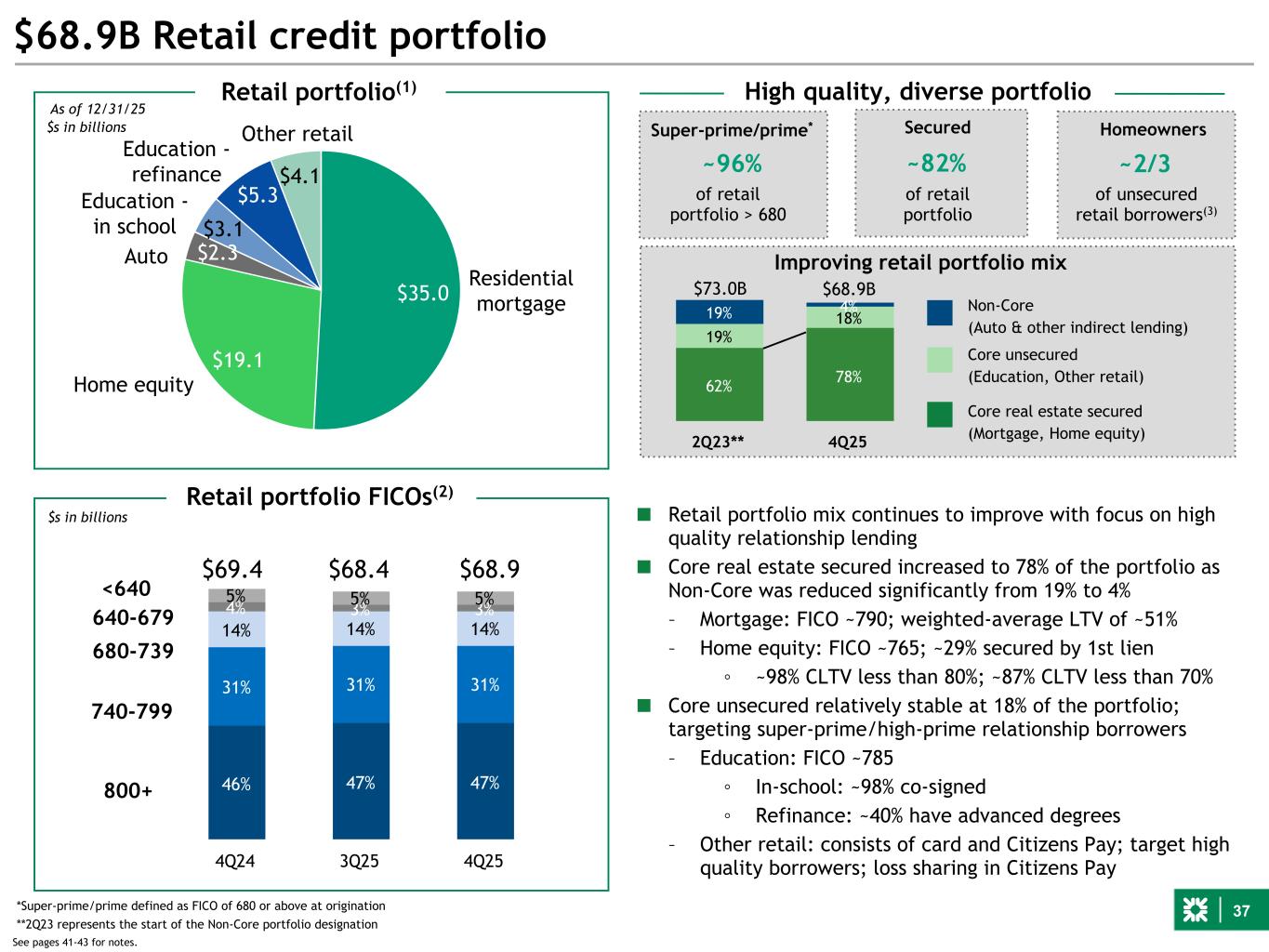

37 46% 47% 47% 31% 31% 31% 14% 14% 14% 4% 3% 3% 5% 5% 5% 4Q24 3Q25 4Q25 $35.0 $19.1 $2.3 $3.1 $5.3 $4.1 $68.9B Retail credit portfolio 800+ 740-799 680-739 640-679 <640 $68.9 $s in billions $68.4 Home equity Retail portfolio(1) Residential mortgage Auto Education - in school Education - refinance Other retail ~96% Super-prime/prime* ~82% Secured ■ Retail portfolio mix continues to improve with focus on high quality relationship lending ■ Core real estate secured increased to 78% of the portfolio as Non-Core was reduced significantly from 19% to 4% – Mortgage: FICO ~790; weighted-average LTV of ~51% – Home equity: FICO ~765; ~29% secured by 1st lien ◦ ~98% CLTV less than 80%; ~87% CLTV less than 70% ■ Core unsecured relatively stable at 18% of the portfolio; targeting super-prime/high-prime relationship borrowers – Education: FICO ~785 ◦ In-school: ~98% co-signed ◦ Refinance: ~40% have advanced degrees – Other retail: consists of card and Citizens Pay; target high quality borrowers; loss sharing in Citizens Pay High quality, diverse portfolio *Super-prime/prime defined as FICO of 680 or above at origination Retail portfolio FICOs(2) $69.4 Homeowners ~2/3 See pages 41-43 for notes. As of 12/31/25 62% 78% 19% 18%19% 4% 2Q23** 4Q25 Non-Core (Auto & other indirect lending) Core unsecured (Education, Other retail) Core real estate secured (Mortgage, Home equity) of unsecured retail borrowers(3) of retail portfolio > 680 Improving retail portfolio mix of retail portfolio **2Q23 represents the start of the Non-Core portfolio designation $68.9B$73.0B $s in billions

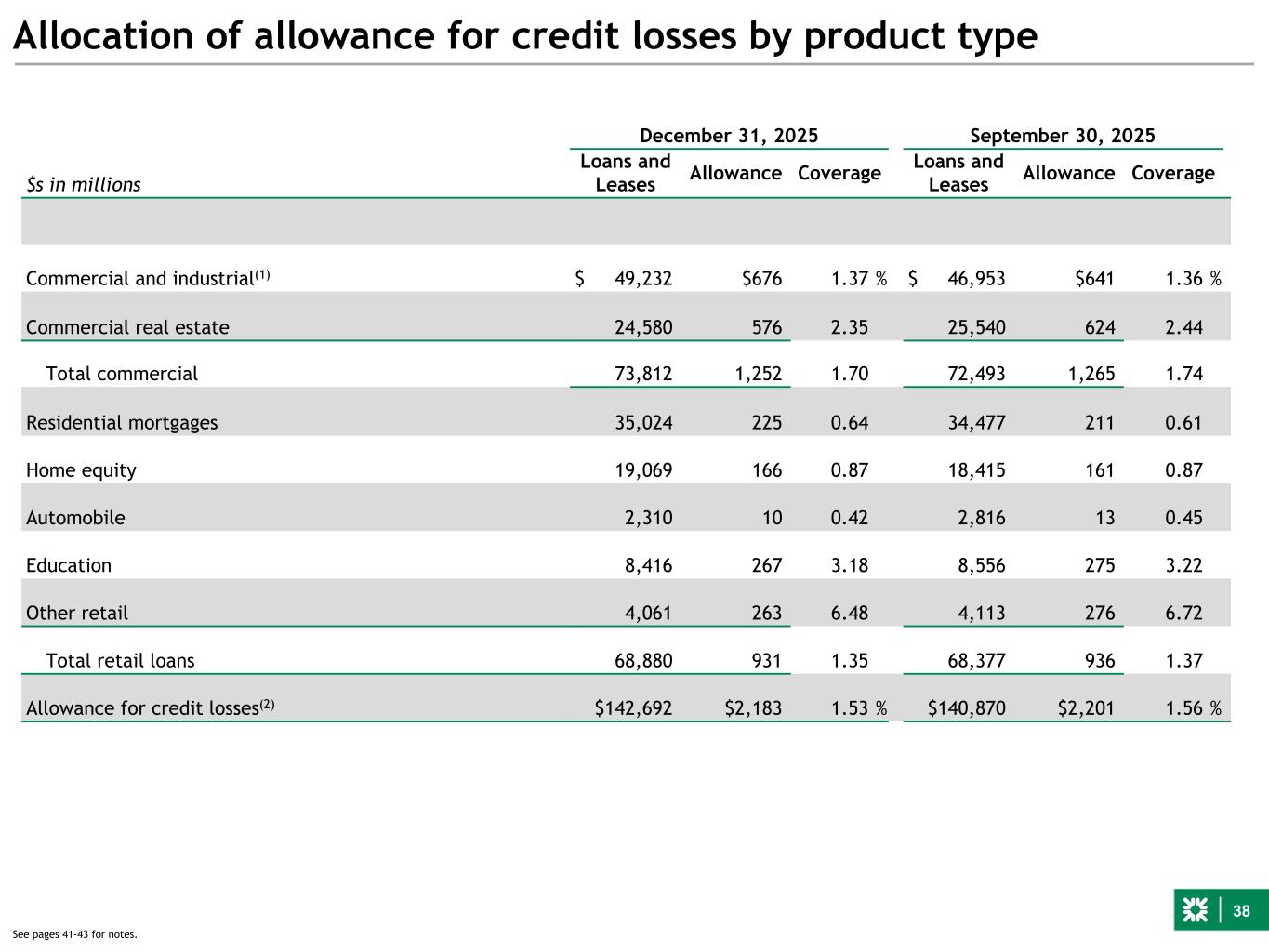

38 Allocation of allowance for credit losses by product type December 31, 2025 September 30, 2025 $s in millions Loans and Leases Allowance Coverage Loans and Leases Allowance Coverage Commercial and industrial(1) $ 49,232 $676 1.37 % $ 46,953 $641 1.36 % Commercial real estate 24,580 576 2.35 25,540 624 2.44 Total commercial 73,812 1,252 1.70 72,493 1,265 1.74 Residential mortgages 35,024 225 0.64 34,477 211 0.61 Home equity 19,069 166 0.87 18,415 161 0.87 Automobile 2,310 10 0.42 2,816 13 0.45 Education 8,416 267 3.18 8,556 275 3.22 Other retail 4,061 263 6.48 4,113 276 6.72 Total retail loans 68,880 931 1.35 68,377 936 1.37 Allowance for credit losses(2) $142,692 $2,183 1.53 % $140,870 $2,201 1.56 % See pages 41-43 for notes.

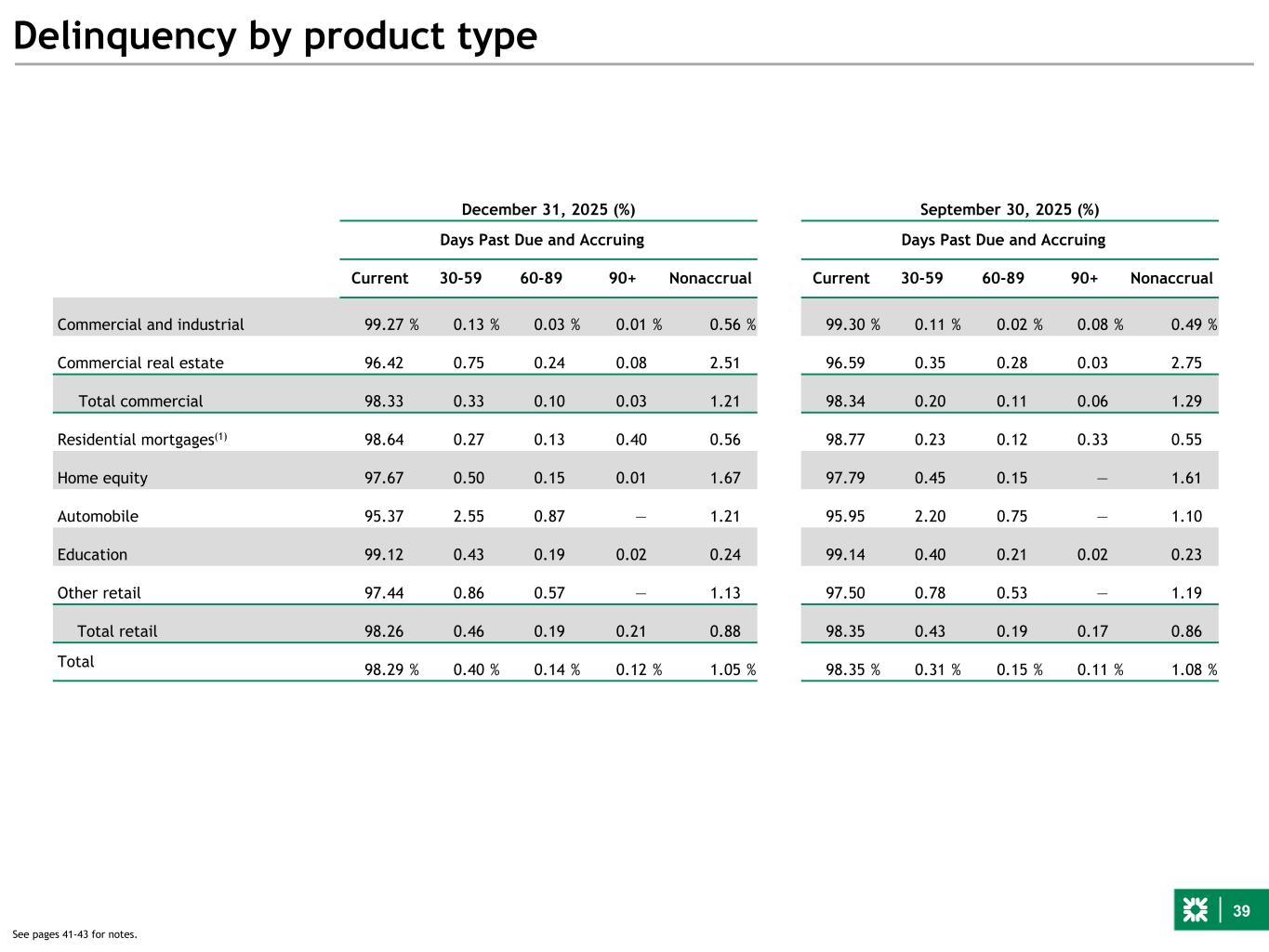

39 Delinquency by product type December 31, 2025 (%) September 30, 2025 (%) Days Past Due and Accruing Days Past Due and Accruing Current 30-59 60-89 90+ Nonaccrual Current 30-59 60-89 90+ Nonaccrual Commercial and industrial 99.27 % 0.13 % 0.03 % 0.01 % 0.56 % 99.30 % 0.11 % 0.02 % 0.08 % 0.49 % Commercial real estate 96.42 0.75 0.24 0.08 2.51 96.59 0.35 0.28 0.03 2.75 Total commercial 98.33 0.33 0.10 0.03 1.21 98.34 0.20 0.11 0.06 1.29 Residential mortgages(1) 98.64 0.27 0.13 0.40 0.56 98.77 0.23 0.12 0.33 0.55 Home equity 97.67 0.50 0.15 0.01 1.67 97.79 0.45 0.15 — 1.61 Automobile 95.37 2.55 0.87 — 1.21 95.95 2.20 0.75 — 1.10 Education 99.12 0.43 0.19 0.02 0.24 99.14 0.40 0.21 0.02 0.23 Other retail 97.44 0.86 0.57 — 1.13 97.50 0.78 0.53 — 1.19 Total retail 98.26 0.46 0.19 0.21 0.88 98.35 0.43 0.19 0.17 0.86 Total 98.29 % 0.40 % 0.14 % 0.12 % 1.05 % 98.35 % 0.31 % 0.15 % 0.11 % 1.08 % See pages 41-43 for notes.

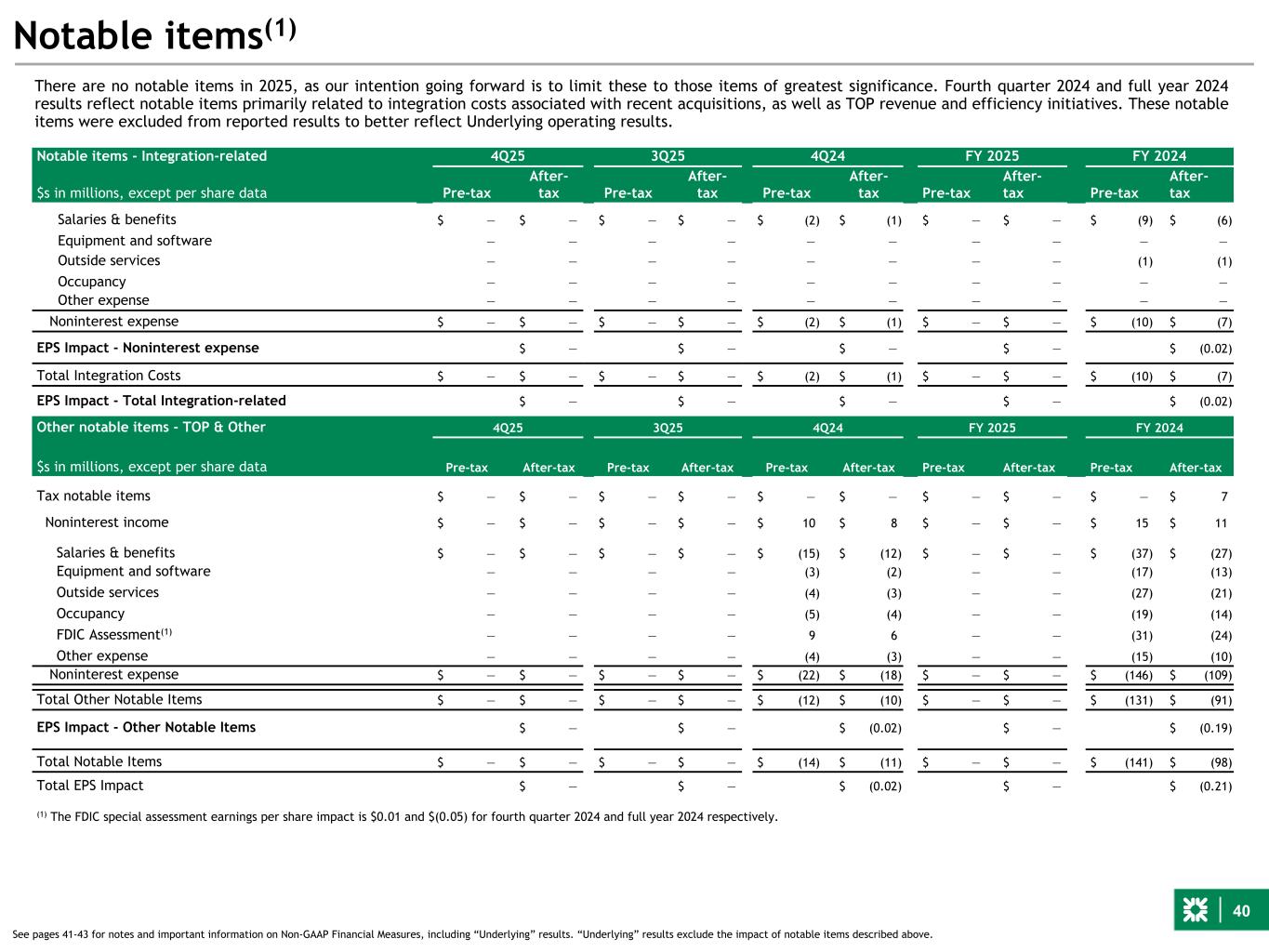

40 Notable items(1) There are no notable items in 2025, as our intention going forward is to limit these to those items of greatest significance. Fourth quarter 2024 and full year 2024 results reflect notable items primarily related to integration costs associated with recent acquisitions, as well as TOP revenue and efficiency initiatives. These notable items were excluded from reported results to better reflect Underlying operating results. See pages 41-43 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described above. Notable items - Integration-related 4Q25 3Q25 4Q24 FY 2025 FY 2024 $s in millions, except per share data Pre-tax After- tax Pre-tax After- tax Pre-tax After- tax Pre-tax After- tax Pre-tax After- tax Salaries & benefits $ — $ — $ — $ — $ (2) $ (1) $ — $ — $ (9) $ (6) Equipment and software — — — — — — — — — — Outside services — — — — — — — — (1) (1) Occupancy — — — — — — — — — — Other expense — — — — — — — — — — Noninterest expense $ — $ — $ — $ — $ (2) $ (1) $ — $ — $ (10) $ (7) EPS Impact - Noninterest expense $ — $ — $ — $ — $ (0.02) Total Integration Costs $ — $ — $ — $ — $ (2) $ (1) $ — $ — $ (10) $ (7) EPS Impact - Total Integration-related $ — $ — $ — $ — $ (0.02) Other notable items - TOP & Other 4Q25 3Q25 4Q24 FY 2025 FY 2024 $s in millions, except per share data Pre-tax After-tax Pre-tax After-tax Pre-tax After-tax Pre-tax After-tax Pre-tax After-tax Tax notable items $ — $ — $ — $ — $ — $ — $ — $ — $ — $ 7 Noninterest income $ — $ — $ — $ — $ 10 $ 8 $ — $ — $ 15 $ 11 Salaries & benefits $ — $ — $ — $ — $ (15) $ (12) $ — $ — $ (37) $ (27) Equipment and software — — — — (3) (2) — — (17) (13) Outside services — — — — (4) (3) — — (27) (21) Occupancy — — — — (5) (4) — — (19) (14) FDIC Assessment(1) — — — — 9 6 — — (31) (24) Other expense — — — — (4) (3) — — (15) (10) Noninterest expense $ — $ — $ — $ — $ (22) $ (18) $ — $ — $ (146) $ (109) Total Other Notable Items $ — $ — $ — $ — $ (12) $ (10) $ — $ — $ (131) $ (91) EPS Impact - Other Notable Items $ — $ — $ (0.02) $ — $ (0.19) Total Notable Items $ — $ — $ — $ — $ (14) $ (11) $ — $ — $ (141) $ (98) Total EPS Impact $ — $ — $ (0.02) $ — $ (0.21) (1) The FDIC special assessment earnings per share impact is $0.01 and $(0.05) for fourth quarter 2024 and full year 2024 respectively.

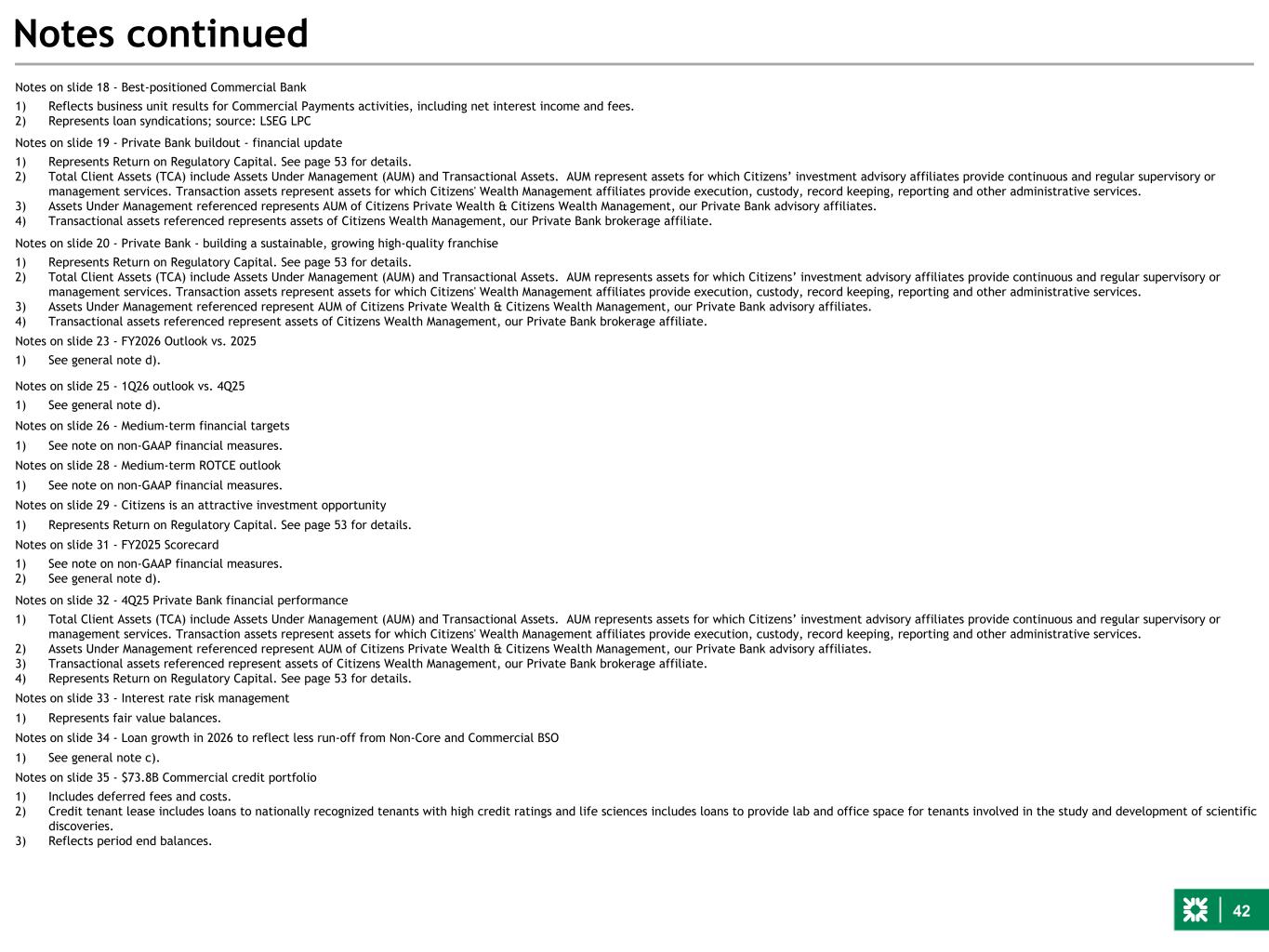

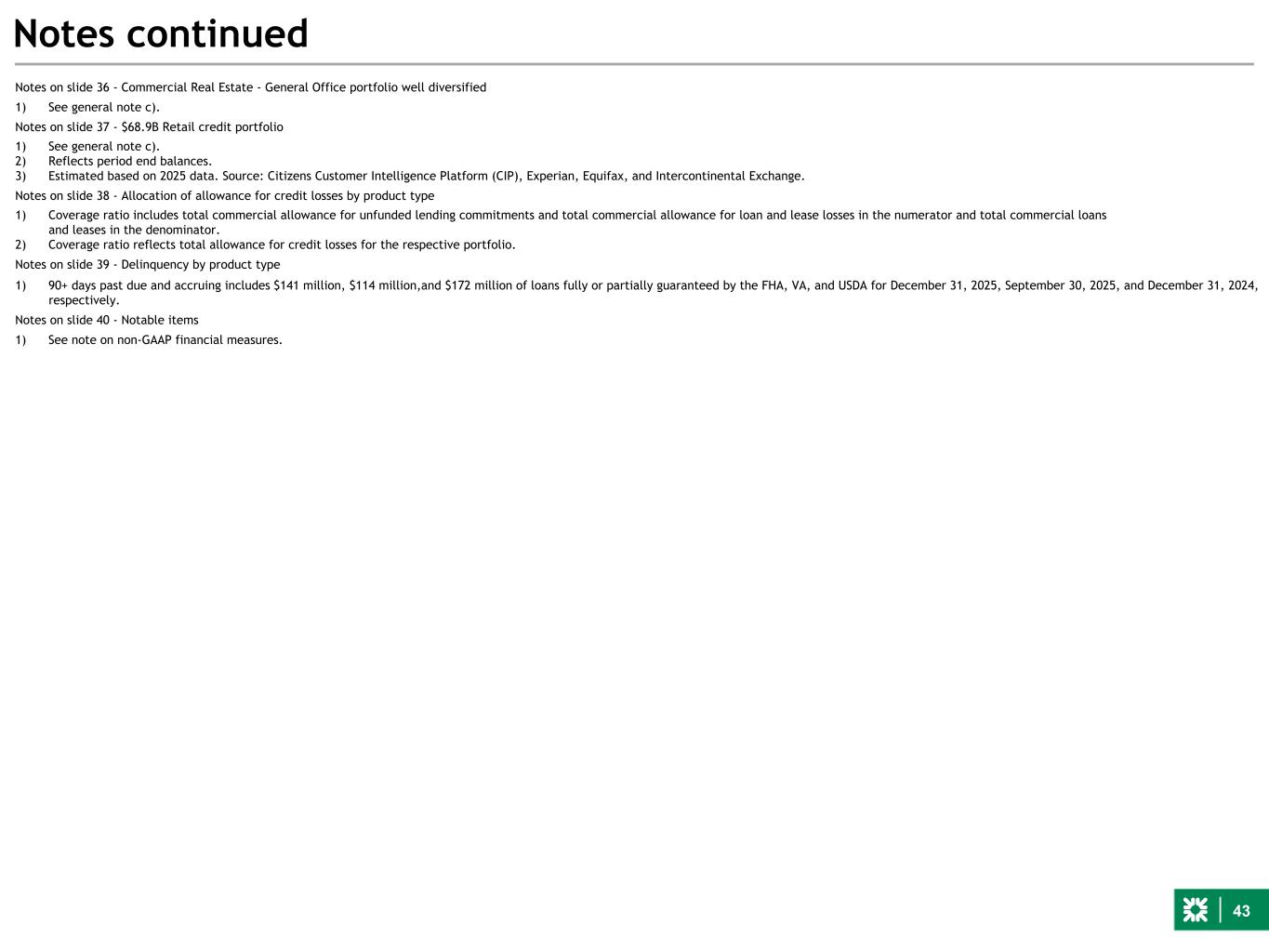

41 Notes on Non-GAAP Financial Measures See important information on our use of Non-GAAP Financial Measures at the beginning this presentation and reconciliations to GAAP financial measures at the end of this presentation. Non-GAAP measures are herein defined as Underlying results. Where there is a reference to Underlying results in a paragraph or table, all measures that follow these references are on the same basis, when applicable. Allowance coverage ratios for loans and leases includes the allowance for funded loans and leases in the numerator and funded loans and leases in the denominator. Allowance coverage ratios for credit losses includes the allowance for funded loans and leases and allowance for unfunded lending commitments in the numerator and funded loans and leases in the denominator. General Notes a. References to net interest margin are on a fully taxable equivalent ("FTE") basis. b. Throughout this presentation, references to consolidated and/or commercial loans and loan growth include leases. Loans held for sale are also referred to as LHFS. c. Select totals may not sum due to rounding. d. Based on Basel III standardized approach. Capital Ratios are preliminary. e. Throughout this presentation, reference to balance sheet items are on an average basis and loans exclude held for sale unless otherwise noted. Notes Notes on slide 3 - 4Q25 and FY2025 GAAP Summary 1) 3Q25 includes preferred stock early redemption costs of $5MM. 2) See general note a). Notes on slide 4 - 4Q25 and FY2025 Underlying financial summary 1) See note on non-GAAP financial measures. Notes on slide 5 - 4Q25 financial performance detail 1) Legacy Core consists of Commercial, Consumer excluding Private Bank and Non-Core, and Other. 2) At December 31, 2025, the Non-Core segment was fully funded with marginal high-cost funding comprised of FHLB, collateralized auto debt, and brokered certificates of deposit. 3) See general note a). 4) See general note d). Notes on slide 6 - 2025 financial performance detail 1) Legacy Core consists of Commercial, Consumer excluding Private Bank and Non-Core, and Other. 2) At December 31, 2025, the Non-Core segment was fully funded with marginal high-cost funding comprised of FHLB, collateralized auto debt, and brokered certificates of deposit. 3) 3Q25 includes preferred stock early redemption costs of $5MM. 4) See general note a). 5) See general note d). Notes on slide 7 - FY2025 and4Q25 Overview 1) See note on non-GAAP financial measures. 2) See general note d). 3) Represents Return on Regulatory Capital. See page 53 for details. Notes on slide 9 - Noninterest income 1) See note on non-GAAP financial measures. 2) Includes bank-owned life insurance income and other miscellaneous income for all periods presented. 3) See above note on non-GAAP financial measures. See Notable Items slide 40 for more detail. Notes on slide 10 - Noninterest expense 1) See above note on non-GAAP financial measures. See Notable Items slide 40 for more detail. Notes on slide 13 - Highly diversified and retail-oriented deposit base 1) Estimated based on available company disclosures; Citizens stable deposits calculated using average Consumer deposits. 2) Includes branch-based checking with interest and savings. Notes on slide 15 - Allowance for credit losses 1) Allowance for credit losses to nonaccrual loans and leases. Notes on slide 16 - Strong capital position 1) See general note d). 2) See general note c). Notes on slide 17 - Transformed Consumer Bank 1) Mass affluent and above are retail households with the higher value of IXI or current month deposit/investment balances greater than or equal to $100K. For slide 18 - *AUM as of 9/30/2025. As Assets Under Management referenced above represents aggregated AUM [of the Private Bank] across our investment advisory affiliates.

42 Notes continued Notes on slide 18 - Best-positioned Commercial Bank 1) Reflects business unit results for Commercial Payments activities, including net interest income and fees. 2) Represents loan syndications; source: LSEG LPC Notes on slide 19 - Private Bank buildout - financial update 1) Represents Return on Regulatory Capital. See page 53 for details. 2) Total Client Assets (TCA) include Assets Under Management (AUM) and Transactional Assets. AUM represent assets for which Citizens’ investment advisory affiliates provide continuous and regular supervisory or management services. Transaction assets represent assets for which Citizens' Wealth Management affiliates provide execution, custody, record keeping, reporting and other administrative services. 3) Assets Under Management referenced represents AUM of Citizens Private Wealth & Citizens Wealth Management, our Private Bank advisory affiliates. 4) Transactional assets referenced represents assets of Citizens Wealth Management, our Private Bank brokerage affiliate. Notes on slide 20 - Private Bank - building a sustainable, growing high-quality franchise 1) Represents Return on Regulatory Capital. See page 53 for details. 2) Total Client Assets (TCA) include Assets Under Management (AUM) and Transactional Assets. AUM represents assets for which Citizens’ investment advisory affiliates provide continuous and regular supervisory or management services. Transaction assets represent assets for which Citizens' Wealth Management affiliates provide execution, custody, record keeping, reporting and other administrative services. 3) Assets Under Management referenced represent AUM of Citizens Private Wealth & Citizens Wealth Management, our Private Bank advisory affiliates. 4) Transactional assets referenced represent assets of Citizens Wealth Management, our Private Bank brokerage affiliate. Notes on slide 23 - FY2026 Outlook vs. 2025 1) See general note d). Notes on slide 25 - 1Q26 outlook vs. 4Q25 1) See general note d). Notes on slide 26 - Medium-term financial targets 1) See note on non-GAAP financial measures. Notes on slide 28 - Medium-term ROTCE outlook 1) See note on non-GAAP financial measures. Notes on slide 29 - Citizens is an attractive investment opportunity 1) Represents Return on Regulatory Capital. See page 53 for details. Notes on slide 31 - FY2025 Scorecard 1) See note on non-GAAP financial measures. 2) See general note d). Notes on slide 32 - 4Q25 Private Bank financial performance 1) Total Client Assets (TCA) include Assets Under Management (AUM) and Transactional Assets. AUM represents assets for which Citizens’ investment advisory affiliates provide continuous and regular supervisory or management services. Transaction assets represent assets for which Citizens' Wealth Management affiliates provide execution, custody, record keeping, reporting and other administrative services. 2) Assets Under Management referenced represent AUM of Citizens Private Wealth & Citizens Wealth Management, our Private Bank advisory affiliates. 3) Transactional assets referenced represent assets of Citizens Wealth Management, our Private Bank brokerage affiliate. 4) Represents Return on Regulatory Capital. See page 53 for details. Notes on slide 33 - Interest rate risk management 1) Represents fair value balances. Notes on slide 34 - Loan growth in 2026 to reflect less run-off from Non-Core and Commercial BSO 1) See general note c). Notes on slide 35 - $73.8B Commercial credit portfolio 1) Includes deferred fees and costs. 2) Credit tenant lease includes loans to nationally recognized tenants with high credit ratings and life sciences includes loans to provide lab and office space for tenants involved in the study and development of scientific discoveries. 3) Reflects period end balances.

43 Notes continued Notes on slide 36 - Commercial Real Estate - General Office portfolio well diversified 1) See general note c). Notes on slide 37 - $68.9B Retail credit portfolio 1) See general note c). 2) Reflects period end balances. 3) Estimated based on 2025 data. Source: Citizens Customer Intelligence Platform (CIP), Experian, Equifax, and Intercontinental Exchange. Notes on slide 38 - Allocation of allowance for credit losses by product type 1) Coverage ratio includes total commercial allowance for unfunded lending commitments and total commercial allowance for loan and lease losses in the numerator and total commercial loans and leases in the denominator. 2) Coverage ratio reflects total allowance for credit losses for the respective portfolio. Notes on slide 39 - Delinquency by product type 1) 90+ days past due and accruing includes $141 million, $114 million,and $172 million of loans fully or partially guaranteed by the FHA, VA, and USDA for December 31, 2025, September 30, 2025, and December 31, 2024, respectively. Notes on slide 40 - Notable items 1) See note on non-GAAP financial measures.

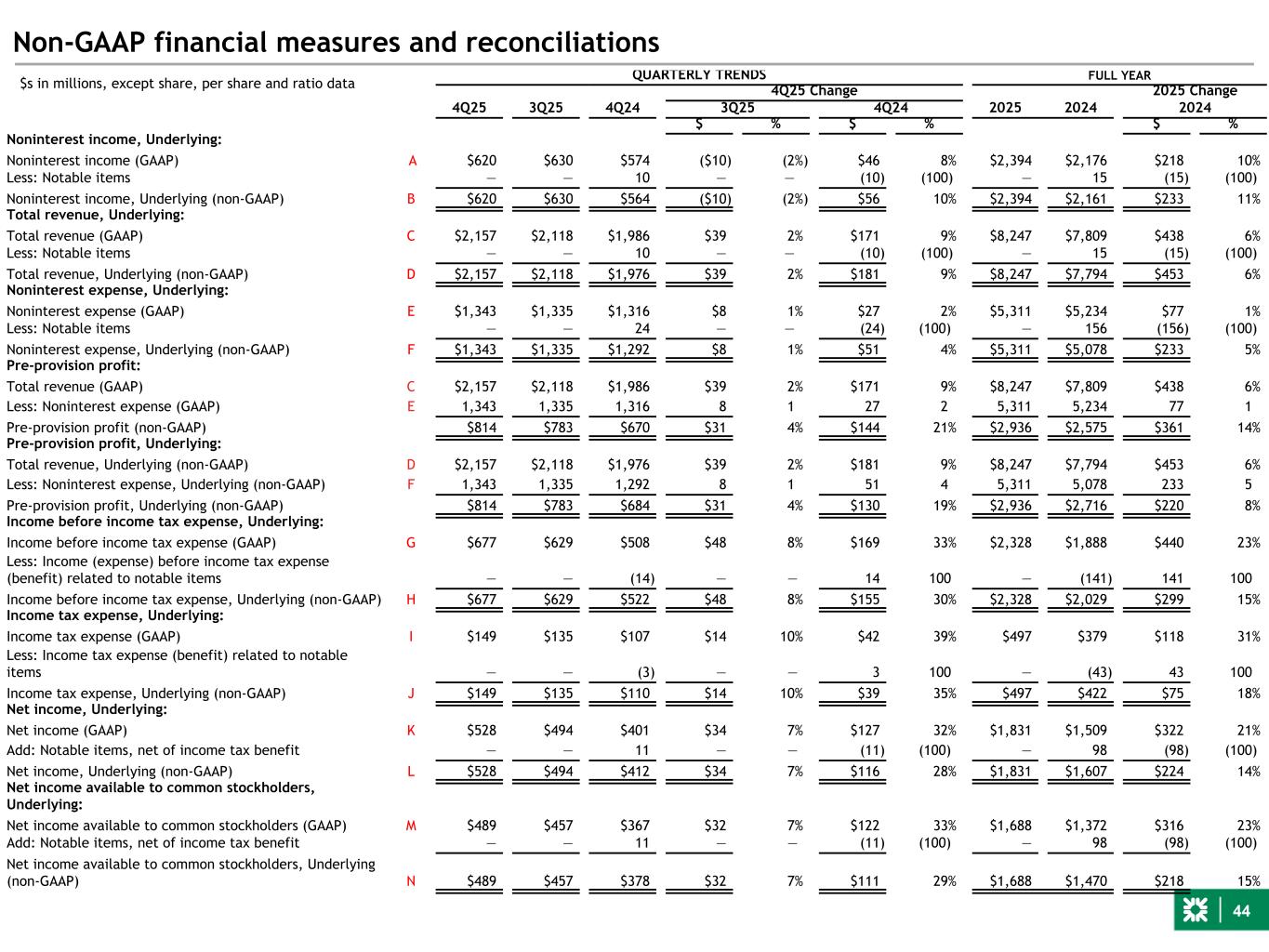

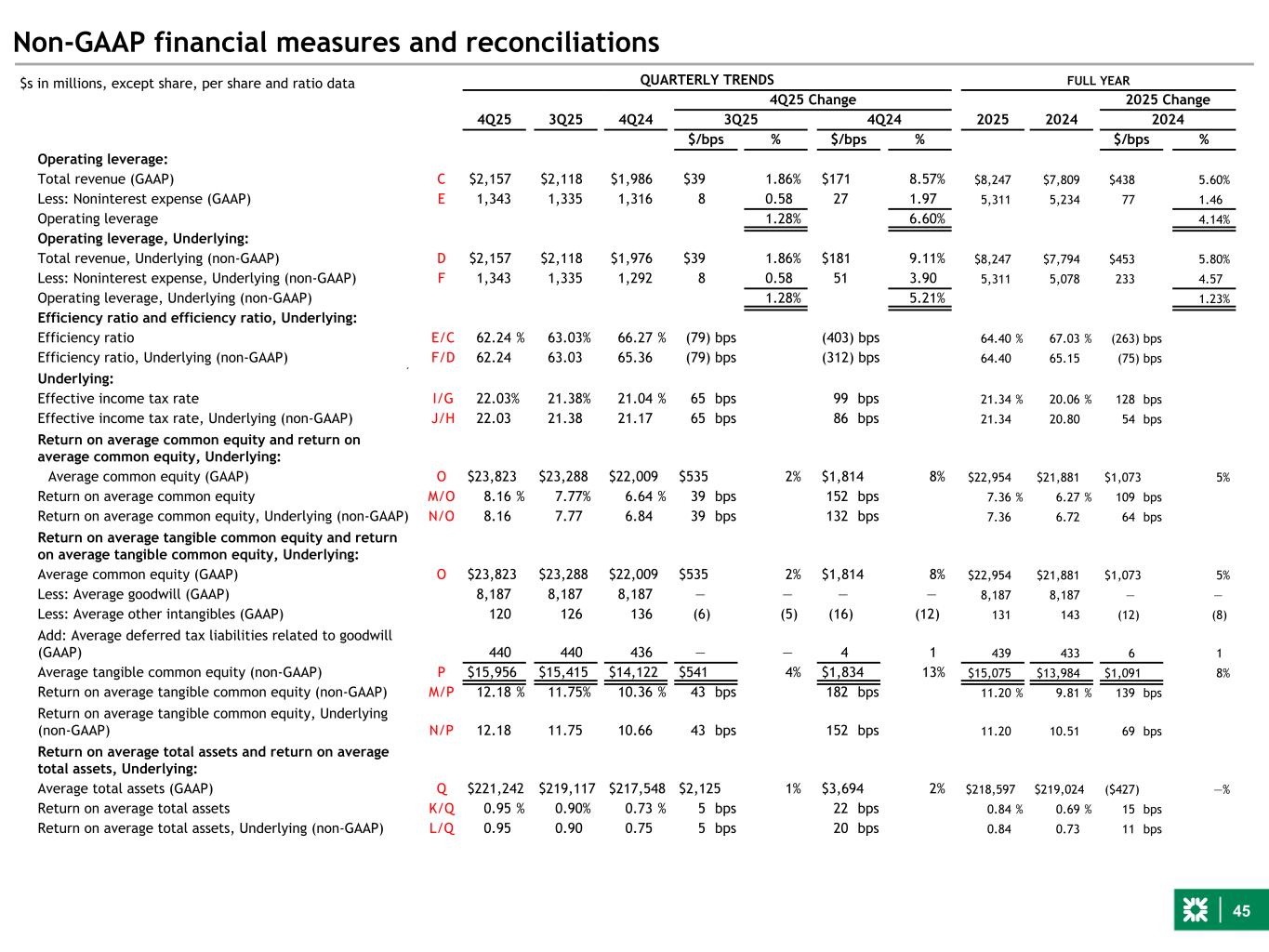

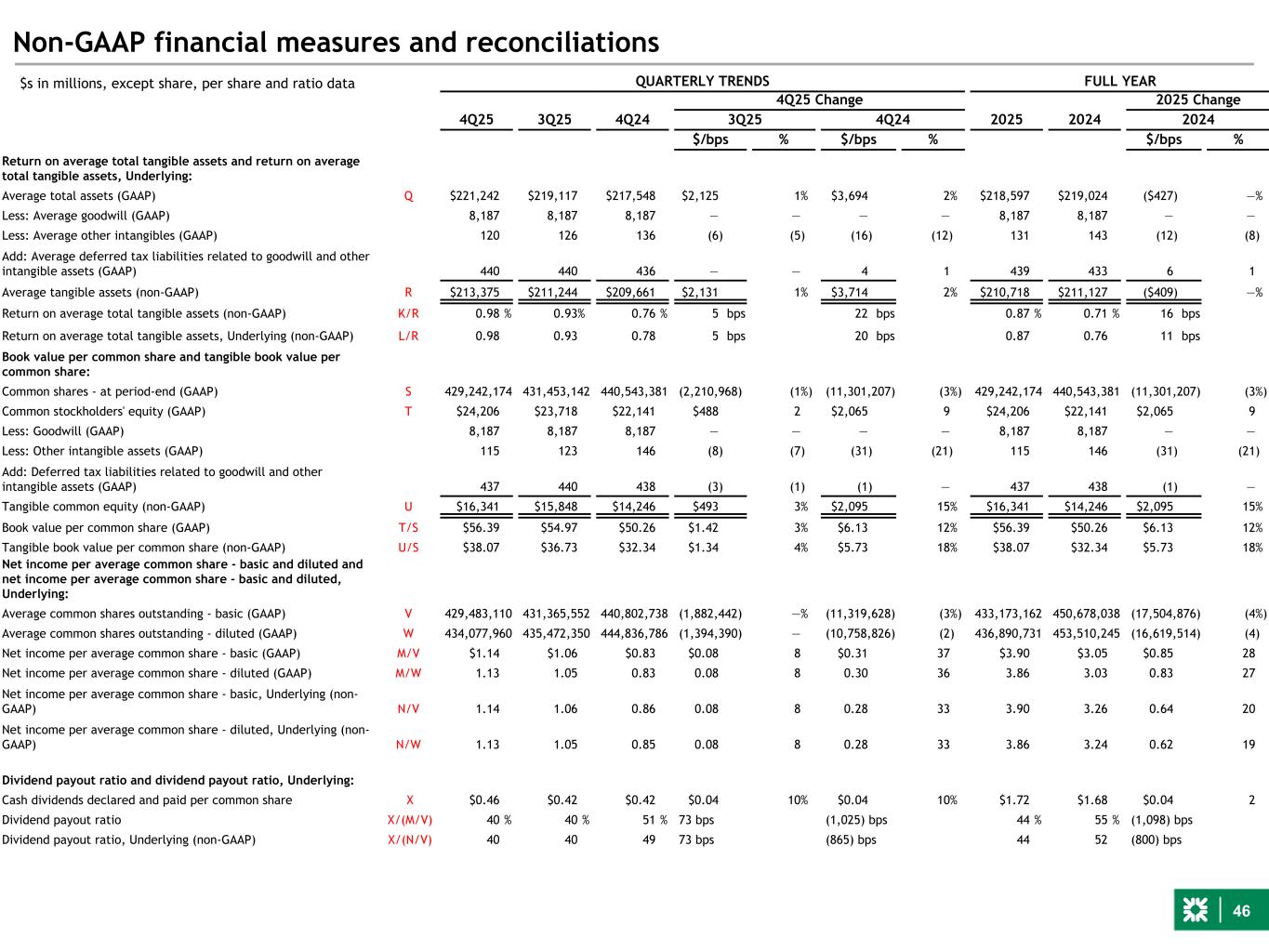

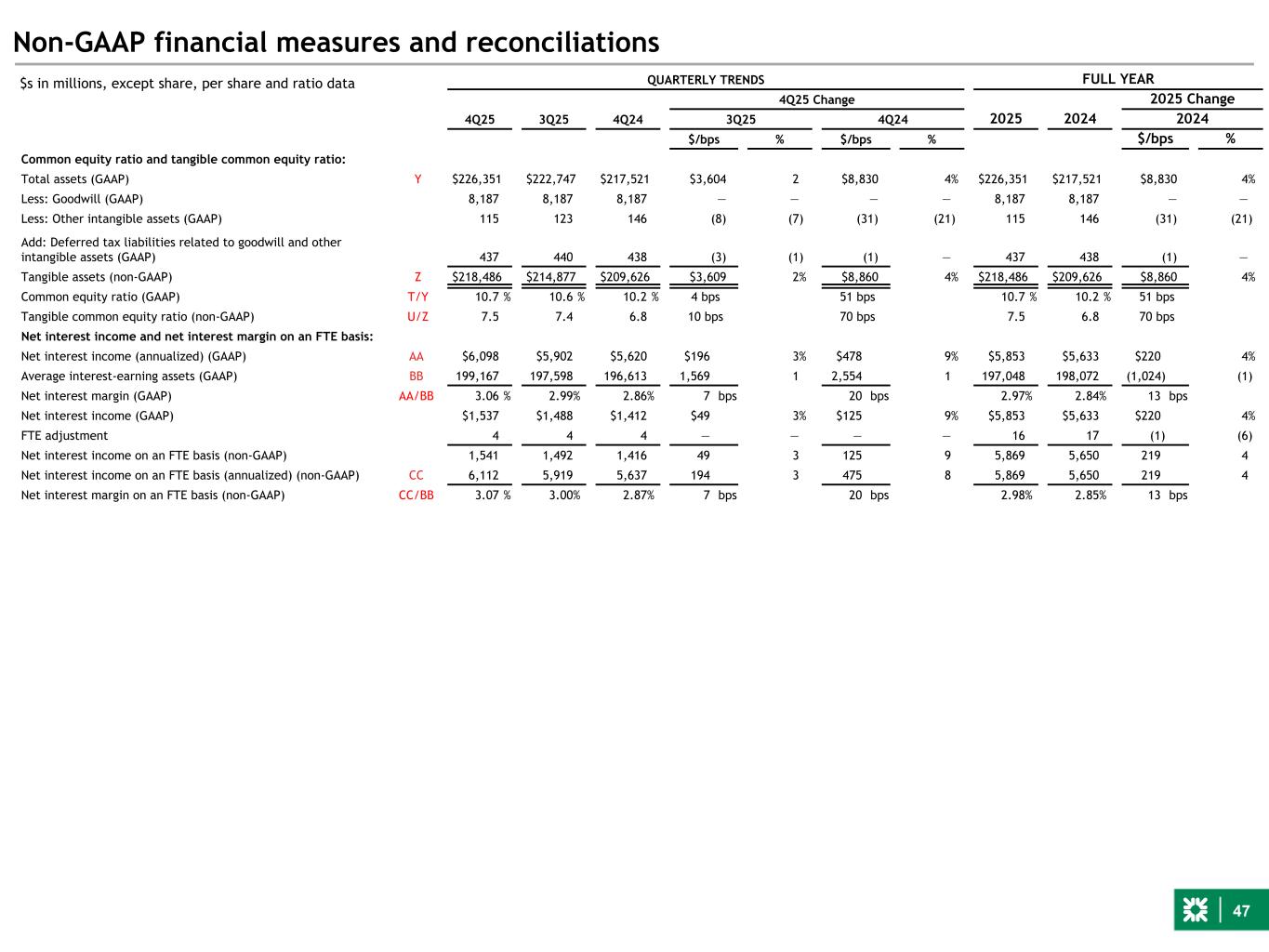

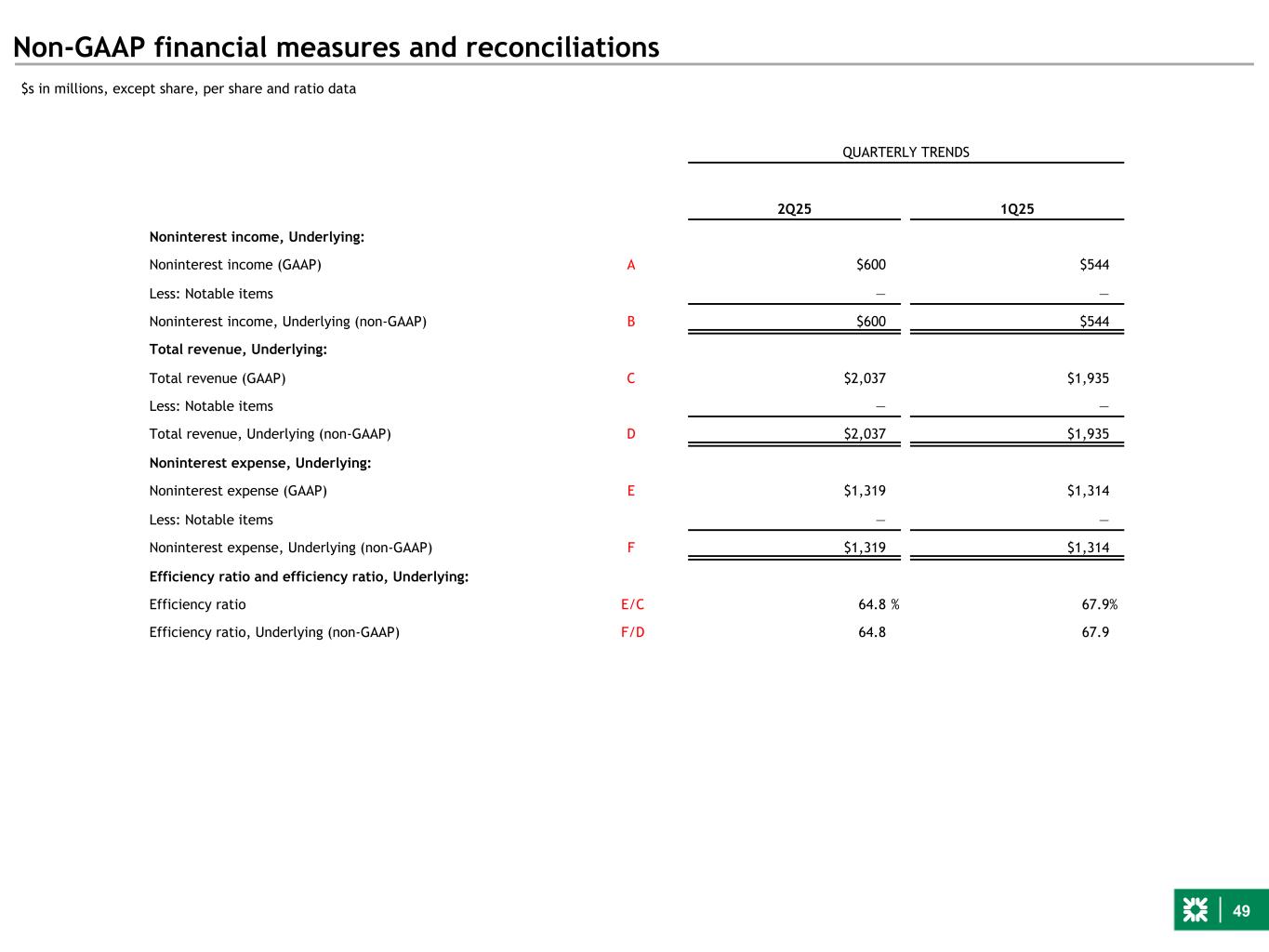

44 Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data QUARTERLY TRENDS FULL YEAR 4Q25 Change 2025 Change 4Q25 3Q25 4Q24 3Q25 4Q24 2025 2024 2024 $ % $ % $ % Noninterest income, Underlying: Noninterest income (GAAP) A $620 $630 $574 ($10) (2%) $46 8% $2,394 $2,176 $218 10% Less: Notable items — — 10 — — (10) (100) — 15 (15) (100) Noninterest income, Underlying (non-GAAP) B $620 $630 $564 ($10) (2%) $56 10% $2,394 $2,161 $233 11% Total revenue, Underlying: Total revenue (GAAP) C $2,157 $2,118 $1,986 $39 2% $171 9% $8,247 $7,809 $438 6% Less: Notable items — — 10 — — (10) (100) — 15 (15) (100) Total revenue, Underlying (non-GAAP) D $2,157 $2,118 $1,976 $39 2% $181 9% $8,247 $7,794 $453 6% Noninterest expense, Underlying: Noninterest expense (GAAP) E $1,343 $1,335 $1,316 $8 1% $27 2% $5,311 $5,234 $77 1% Less: Notable items — — 24 — — (24) (100) — 156 (156) (100) Noninterest expense, Underlying (non-GAAP) F $1,343 $1,335 $1,292 $8 1% $51 4% $5,311 $5,078 $233 5% Pre-provision profit: Total revenue (GAAP) C $2,157 $2,118 $1,986 $39 2% $171 9% $8,247 $7,809 $438 6% Less: Noninterest expense (GAAP) E 1,343 1,335 1,316 8 1 27 2 5,311 5,234 77 1 Pre-provision profit (non-GAAP) $814 $783 $670 $31 4% $144 21% $2,936 $2,575 $361 14% Pre-provision profit, Underlying: Total revenue, Underlying (non-GAAP) D $2,157 $2,118 $1,976 $39 2% $181 9% $8,247 $7,794 $453 6% Less: Noninterest expense, Underlying (non-GAAP) F 1,343 1,335 1,292 8 1 51 4 5,311 5,078 233 5 Pre-provision profit, Underlying (non-GAAP) $814 $783 $684 $31 4% $130 19% $2,936 $2,716 $220 8% Income before income tax expense, Underlying: Income before income tax expense (GAAP) G $677 $629 $508 $48 8% $169 33% $2,328 $1,888 $440 23% Less: Income (expense) before income tax expense (benefit) related to notable items — — (14) — — 14 100 — (141) 141 100 Income before income tax expense, Underlying (non-GAAP) H $677 $629 $522 $48 8% $155 30% $2,328 $2,029 $299 15% Income tax expense, Underlying: Income tax expense (GAAP) I $149 $135 $107 $14 10% $42 39% $497 $379 $118 31% Less: Income tax expense (benefit) related to notable items — — (3) — — 3 100 — (43) 43 100 Income tax expense, Underlying (non-GAAP) J $149 $135 $110 $14 10% $39 35% $497 $422 $75 18% Net income, Underlying: Net income (GAAP) K $528 $494 $401 $34 7% $127 32% $1,831 $1,509 $322 21% Add: Notable items, net of income tax benefit — — 11 — — (11) (100) — 98 (98) (100) Net income, Underlying (non-GAAP) L $528 $494 $412 $34 7% $116 28% $1,831 $1,607 $224 14% Net income available to common stockholders, Underlying: Net income available to common stockholders (GAAP) M $489 $457 $367 $32 7% $122 33% $1,688 $1,372 $316 23% Add: Notable items, net of income tax benefit — — 11 — — (11) (100) — 98 (98) (100) Net income available to common stockholders, Underlying (non-GAAP) N $489 $457 $378 $32 7% $111 29% $1,688 $1,470 $218 15%

45 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS FULL YEAR 4Q25 Change 2025 Change 4Q25 3Q25 4Q24 3Q25 4Q24 2025 2024 2024 $/bps % $/bps % $/bps % Operating leverage: Total revenue (GAAP) C $2,157 $2,118 $1,986 $39 1.86% $171 8.57% $8,247 $7,809 $438 5.60% Less: Noninterest expense (GAAP) E 1,343 1,335 1,316 8 0.58 27 1.97 5,311 5,234 77 1.46 Operating leverage 1.28% 6.60% 4.14% Operating leverage, Underlying: Total revenue, Underlying (non-GAAP) D $2,157 $2,118 $1,976 $39 1.86% $181 9.11% $8,247 $7,794 $453 5.80% Less: Noninterest expense, Underlying (non-GAAP) F 1,343 1,335 1,292 8 0.58 51 3.90 5,311 5,078 233 4.57 Operating leverage, Underlying (non-GAAP) 1.28% 5.21% 1.23% Efficiency ratio and efficiency ratio, Underlying: Efficiency ratio E/C 62.24 % 63.03% 66.27 % (79) bps (403) bps 64.40 % 67.03 % (263) bps Efficiency ratio, Underlying (non-GAAP) F/D 62.24 63.03 65.36 (79) bps (312) bps 64.40 65.15 (75) bpsEffective income tax rate and effective income tax rate, Underlying: Effective income tax rate I/G 22.03% 21.38% 21.04 % 65 bps 99 bps 21.34 % 20.06 % 128 bps Effective income tax rate, Underlying (non-GAAP) J/H 22.03 21.38 21.17 65 bps 86 bps 21.34 20.80 54 bps Return on average common equity and return on average common equity, Underlying: Average common equity (GAAP) O $23,823 $23,288 $22,009 $535 2% $1,814 8% $22,954 $21,881 $1,073 5% Return on average common equity M/O 8.16 % 7.77% 6.64 % 39 bps 152 bps 7.36 % 6.27 % 109 bps Return on average common equity, Underlying (non-GAAP) N/O 8.16 7.77 6.84 39 bps 132 bps 7.36 6.72 64 bps Return on average tangible common equity and return on average tangible common equity, Underlying: Average common equity (GAAP) O $23,823 $23,288 $22,009 $535 2% $1,814 8% $22,954 $21,881 $1,073 5% Less: Average goodwill (GAAP) 8,187 8,187 8,187 — — — — 8,187 8,187 — — Less: Average other intangibles (GAAP) 120 126 136 (6) (5) (16) (12) 131 143 (12) (8) Add: Average deferred tax liabilities related to goodwill (GAAP) 440 440 436 — — 4 1 439 433 6 1 Average tangible common equity (non-GAAP) P $15,956 $15,415 $14,122 $541 4% $1,834 13% $15,075 $13,984 $1,091 8% Return on average tangible common equity (non-GAAP) M/P 12.18 % 11.75% 10.36 % 43 bps 182 bps 11.20 % 9.81 % 139 bps Return on average tangible common equity, Underlying (non-GAAP) N/P 12.18 11.75 10.66 43 bps 152 bps 11.20 10.51 69 bps Return on average total assets and return on average total assets, Underlying: Average total assets (GAAP) Q $221,242 $219,117 $217,548 $2,125 1% $3,694 2% $218,597 $219,024 ($427) —% Return on average total assets K/Q 0.95 % 0.90% 0.73 % 5 bps 22 bps 0.84 % 0.69 % 15 bps Return on average total assets, Underlying (non-GAAP) L/Q 0.95 0.90 0.75 5 bps 20 bps 0.84 0.73 11 bps $s in millions, except share, per share and ratio data

46 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS FULL YEAR 4Q25 Change 2025 Change 4Q25 3Q25 4Q24 3Q25 4Q24 2025 2024 2024 $/bps % $/bps % $/bps % Return on average total tangible assets and return on average total tangible assets, Underlying: Average total assets (GAAP) Q $221,242 $219,117 $217,548 $2,125 1% $3,694 2% $218,597 $219,024 ($427) —% Less: Average goodwill (GAAP) 8,187 8,187 8,187 — — — — 8,187 8,187 — — Less: Average other intangibles (GAAP) 120 126 136 (6) (5) (16) (12) 131 143 (12) (8) Add: Average deferred tax liabilities related to goodwill and other intangible assets (GAAP) 440 440 436 — — 4 1 439 433 6 1 Average tangible assets (non-GAAP) R $213,375 $211,244 $209,661 $2,131 1% $3,714 2% $210,718 $211,127 ($409) —% Return on average total tangible assets (non-GAAP) K/R 0.98 % 0.93% 0.76 % 5 bps 22 bps 0.87 % 0.71 % 16 bps Return on average total tangible assets, Underlying (non-GAAP) L/R 0.98 0.93 0.78 5 bps 20 bps 0.87 0.76 11 bps Book value per common share and tangible book value per common share: Common shares - at period-end (GAAP) S 429,242,174 431,453,142 440,543,381 (2,210,968) (1%) (11,301,207) (3%) 429,242,174 440,543,381 (11,301,207) (3%) Common stockholders' equity (GAAP) T $24,206 $23,718 $22,141 $488 2 $2,065 9 $24,206 $22,141 $2,065 9 Less: Goodwill (GAAP) 8,187 8,187 8,187 — — — — 8,187 8,187 — — Less: Other intangible assets (GAAP) 115 123 146 (8) (7) (31) (21) 115 146 (31) (21) Add: Deferred tax liabilities related to goodwill and other intangible assets (GAAP) 437 440 438 (3) (1) (1) — 437 438 (1) — Tangible common equity (non-GAAP) U $16,341 $15,848 $14,246 $493 3% $2,095 15% $16,341 $14,246 $2,095 15% Book value per common share (GAAP) T/S $56.39 $54.97 $50.26 $1.42 3% $6.13 12% $56.39 $50.26 $6.13 12% Tangible book value per common share (non-GAAP) U/S $38.07 $36.73 $32.34 $1.34 4% $5.73 18% $38.07 $32.34 $5.73 18% Net income per average common share - basic and diluted and net income per average common share - basic and diluted, Underlying: Average common shares outstanding - basic (GAAP) V 429,483,110 431,365,552 440,802,738 (1,882,442) —% (11,319,628) (3%) 433,173,162 450,678,038 (17,504,876) (4%) Average common shares outstanding - diluted (GAAP) W 434,077,960 435,472,350 444,836,786 (1,394,390) — (10,758,826) (2) 436,890,731 453,510,245 (16,619,514) (4) Net income per average common share - basic (GAAP) M/V $1.14 $1.06 $0.83 $0.08 8 $0.31 37 $3.90 $3.05 $0.85 28 Net income per average common share - diluted (GAAP) M/W 1.13 1.05 0.83 0.08 8 0.30 36 3.86 3.03 0.83 27 Net income per average common share - basic, Underlying (non- GAAP) N/V 1.14 1.06 0.86 0.08 8 0.28 33 3.90 3.26 0.64 20 Net income per average common share - diluted, Underlying (non- GAAP) N/W 1.13 1.05 0.85 0.08 8 0.28 33 3.86 3.24 0.62 19 Dividend payout ratio and dividend payout ratio, Underlying: Cash dividends declared and paid per common share X $0.46 $0.42 $0.42 $0.04 10% $0.04 10% $1.72 $1.68 $0.04 2 Dividend payout ratio X/(M/V) 40 % 40 % 51 % 73 bps (1,025) bps 44 % 55 % (1,098) bps Dividend payout ratio, Underlying (non-GAAP) X/(N/V) 40 40 49 73 bps (865) bps 44 52 (800) bps $s in millions, except share, per share and ratio data

47 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS FULL YEAR 4Q25 Change 2025 Change 4Q25 3Q25 4Q24 3Q25 4Q24 2025 2024 2024 $/bps % $/bps % $/bps % Common equity ratio and tangible common equity ratio: Total assets (GAAP) Y $226,351 $222,747 $217,521 $3,604 2 $8,830 4% $226,351 $217,521 $8,830 4% Less: Goodwill (GAAP) 8,187 8,187 8,187 — — — — 8,187 8,187 — — Less: Other intangible assets (GAAP) 115 123 146 (8) (7) (31) (21) 115 146 (31) (21) Add: Deferred tax liabilities related to goodwill and other intangible assets (GAAP) 437 440 438 (3) (1) (1) — 437 438 (1) — Tangible assets (non-GAAP) Z $218,486 $214,877 $209,626 $3,609 2% $8,860 4% $218,486 $209,626 $8,860 4% Common equity ratio (GAAP) T/Y 10.7 % 10.6 % 10.2 % 4 bps 51 bps 10.7 % 10.2 % 51 bps Tangible common equity ratio (non-GAAP) U/Z 7.5 7.4 6.8 10 bps 70 bps 7.5 6.8 70 bps Net interest income and net interest margin on an FTE basis: Net interest income (annualized) (GAAP) AA $6,098 $5,902 $5,620 $196 3% $478 9% $5,853 $5,633 $220 4% Average interest-earning assets (GAAP) BB 199,167 197,598 196,613 1,569 1 2,554 1 197,048 198,072 (1,024) (1) Net interest margin (GAAP) AA/BB 3.06 % 2.99% 2.86% 7 bps 20 bps 2.97% 2.84% 13 bps Net interest income (GAAP) $1,537 $1,488 $1,412 $49 3% $125 9% $5,853 $5,633 $220 4% FTE adjustment 4 4 4 — — — — 16 17 (1) (6) Net interest income on an FTE basis (non-GAAP) 1,541 1,492 1,416 49 3 125 9 5,869 5,650 219 4 Net interest income on an FTE basis (annualized) (non-GAAP) CC 6,112 5,919 5,637 194 3 475 8 5,869 5,650 219 4 Net interest margin on an FTE basis (non-GAAP) CC/BB 3.07 % 3.00% 2.87% 7 bps 20 bps 2.98% 2.85% 13 bps $s in millions, except share, per share and ratio data

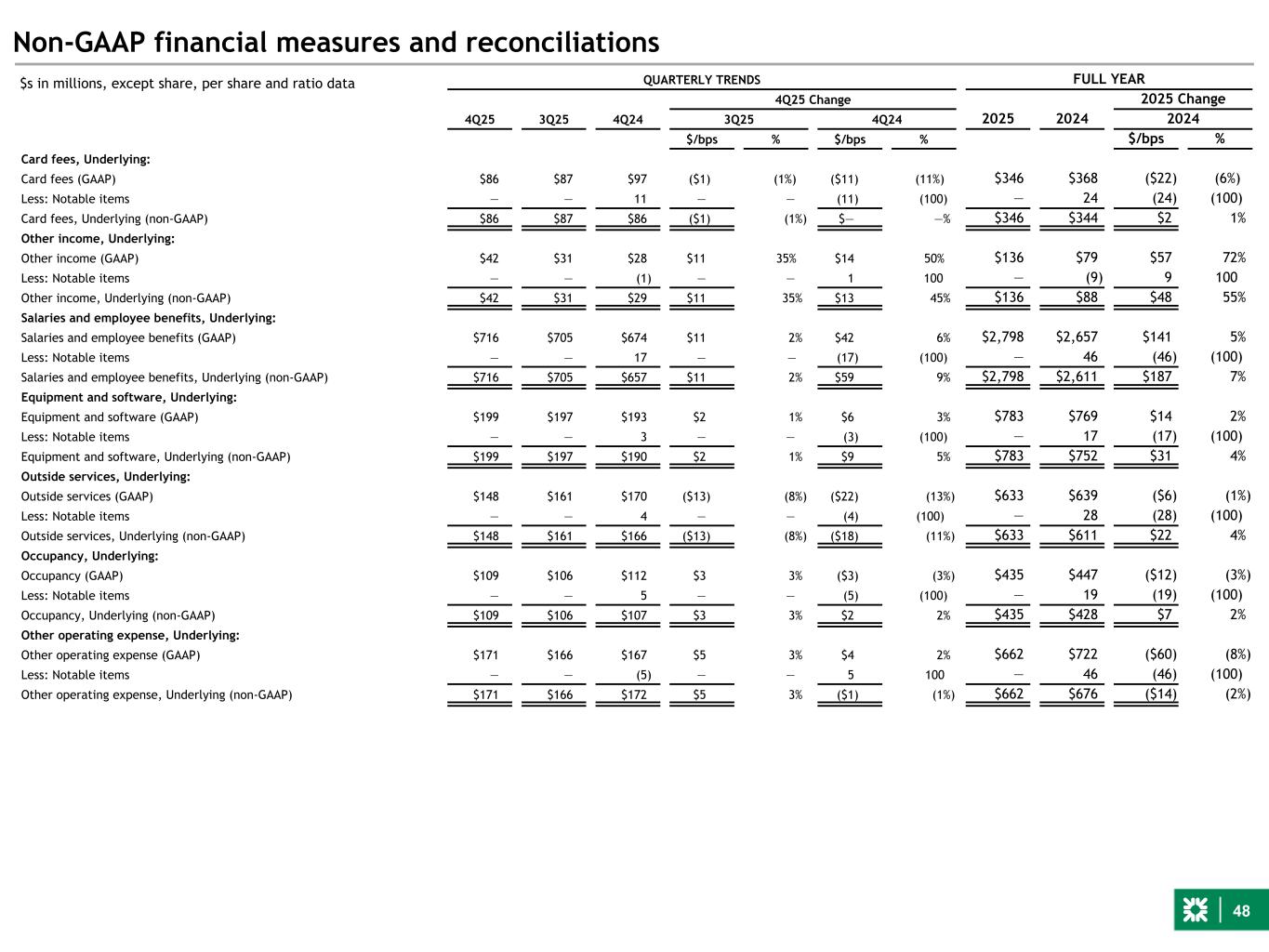

48 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS FULL YEAR 4Q25 Change 2025 Change 4Q25 3Q25 4Q24 3Q25 4Q24 2025 2024 2024 $/bps % $/bps % $/bps % Card fees, Underlying: Card fees (GAAP) $86 $87 $97 ($1) (1%) ($11) (11%) $346 $368 ($22) (6%) Less: Notable items — — 11 — — (11) (100) — 24 (24) (100) Card fees, Underlying (non-GAAP) $86 $87 $86 ($1) (1%) $— —% $346 $344 $2 1% Other income, Underlying: Other income (GAAP) $42 $31 $28 $11 35% $14 50% $136 $79 $57 72% Less: Notable items — — (1) — — 1 100 — (9) 9 100 Other income, Underlying (non-GAAP) $42 $31 $29 $11 35% $13 45% $136 $88 $48 55% Salaries and employee benefits, Underlying: Salaries and employee benefits (GAAP) $716 $705 $674 $11 2% $42 6% $2,798 $2,657 $141 5% Less: Notable items — — 17 — — (17) (100) — 46 (46) (100) Salaries and employee benefits, Underlying (non-GAAP) $716 $705 $657 $11 2% $59 9% $2,798 $2,611 $187 7% Equipment and software, Underlying: Equipment and software (GAAP) $199 $197 $193 $2 1% $6 3% $783 $769 $14 2% Less: Notable items — — 3 — — (3) (100) — 17 (17) (100) Equipment and software, Underlying (non-GAAP) $199 $197 $190 $2 1% $9 5% $783 $752 $31 4% Outside services, Underlying: Outside services (GAAP) $148 $161 $170 ($13) (8%) ($22) (13%) $633 $639 ($6) (1%) Less: Notable items — — 4 — — (4) (100) — 28 (28) (100) Outside services, Underlying (non-GAAP) $148 $161 $166 ($13) (8%) ($18) (11%) $633 $611 $22 4% Occupancy, Underlying: Occupancy (GAAP) $109 $106 $112 $3 3% ($3) (3%) $435 $447 ($12) (3%) Less: Notable items — — 5 — — (5) (100) — 19 (19) (100) Occupancy, Underlying (non-GAAP) $109 $106 $107 $3 3% $2 2% $435 $428 $7 2% Other operating expense, Underlying: Other operating expense (GAAP) $171 $166 $167 $5 3% $4 2% $662 $722 ($60) (8%) Less: Notable items — — (5) — — 5 100 — 46 (46) (100) Other operating expense, Underlying (non-GAAP) $171 $166 $172 $5 3% ($1) (1%) $662 $676 ($14) (2%) $s in millions, except share, per share and ratio data