UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☑ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a-12

|

|

|

(Name of Registrant as Specified in its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☑ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

LCI INDUSTRIES

3501 County Road 6 East

Elkhart, Indiana 46514

Supplement to Definitive Proxy Statement for the 2025 Annual Meeting of Stockholders

To Be Held on May 15, 2025

This proxy statement supplement (this “Supplement”) supplements and amends the definitive proxy statement (the “Proxy Statement”) filed with the Securities and Exchange Commission on March 28, 2025, regarding the

2025 Annual Meeting of Stockholders of LCI Industries (the “Company”) to be held in a virtual format only on May 15, 2025, at 9:00 a.m. ET (the “2025 Annual Meeting”).

The purpose of this Supplement is to update the Proxy Statement as to a change in the employment of one of the director nominees, and to provide additional information and updates on certain compensation matters

disclosed in the Proxy Statement.

Except as specifically set forth herein, this Supplement does not otherwise modify or update any other disclosures presented in the Proxy Statement. We encourage you to read this Supplement carefully and in its

entirety, together with the Proxy Statement. Capitalized terms used but not defined in this Supplement have the meanings set forth in the Proxy Statement.

If you have already submitted your proxy, you do not need to take any action unless you wish to change your vote. Proxy voting instructions already returned by stockholders will remain valid and will be voted at the

2025 Annual Meeting unless revoked. Important information regarding how to vote your shares and revoke proxies is available in the Proxy Statement under the caption “General Information” on page 12 of the Proxy Statement.

Director Nominee Update

Subsequent to the filing of the Proxy Statement, there has been a change in the principal occupation of one of the members of the Company’s Board of Directors (the “Board”) who is standing for re-election. Stephanie

K. Mains has retired from her position as the Chief Executive Officer of LSC Communications MCL, LLC, a portfolio company of Atlas Holdings.

Pursuant to the Company’s Governance Principles, because Ms. Mains’ employment retirement constituted a change in her employment and principal occupation, she tendered her resignation from the Board. The Company’s

Corporate Governance, Nominating, and Sustainability Committee reviewed Ms. Mains’ continuation on the Board and as a director nominee for re-election at the 2025 Annual Meeting. The Committee determined and recommended to the Board, and the Board

agreed, to not accept Ms. Mains’ offer to resign from the Board. As a result, Ms. Mains remains a director of the Company and a director nominee for election at the 2025 Annual Meeting.

Incentive Compensation Updates

2024 Annual Incentive Plan

As described in the Proxy Statement, the 2024 Annual Incentive Plan (“AIP”) had two components: (1) Adjusted EBIT, and (2) Cash Flow from Operations (“CFO”). CFO means cash flow from operations as presented on the

Consolidated Statement of Cash Flows. Adjusted EBIT remained the primary metric for the 2024 AIP, consistent with prior years. For named executive officers to become eligible for an additional payout tied to CFO, 90% or more of target Adjusted EBIT

must be achieved.

As noted in the Proxy Statement, the 2024 Adjusted EBIT target goal was set at $244 million. The following table provides additional information about the other potential payout levels, as well as the actual payout

level for 2024, under the 2024 AIP:

|

AIP Payout %

|

Adj. EBIT ($mm)

|

Level

|

|||||

|

0

|

%

|

$

|

0

|

Threshold

|

|||

|

50

|

%

|

$

|

122

|

|

|||

|

89.56

|

%

|

$

|

218

|

Actual

|

|||

|

100

|

%

|

$

|

244

|

Target

|

|||

|

200

|

%

|

$

|

487

|

|

|||

|

402

|

%

|

$

|

980

|

Maximum

|

|||

As further described in the Proxy Statement, under the 2024 AIP, in addition to the Adjusted EBIT component, the named executive officers had an opportunity to earn an additional payout if the Company achieved at

least 90% of its Adjusted EBIT target and exceeded its CFO target of $357 million. If these targets are exceeded, the named executive officers would share 3% of the amount that actual CFO exceeds target CFO. While the Proxy Statement indicated that

there was no cap with respect to the CFO amount, the 2024 AIP did in fact include a cap of $1.95 million, as shown below:

|

Excess CFO (3% sharing)

|

|||||||

|

Millions over CFO target

|

Total pool available for allocation

|

Ranges

|

|||||

|

$

|

5

|

$

|

150,000

|

Threshold

|

|||

|

$

|

15

|

$

|

450,000

|

|

|||

|

$

|

25

|

$

|

750,000

|

||||

|

$

|

35

|

$

|

1,050,000

|

|

|||

|

$

|

55

|

$

|

1,650,000

|

||||

|

$

|

65

|

$

|

1,950,000

|

Maximum Cap

|

|||

The 2024 AIP provided that any excess CFO would be distributed according to the following percentages:

|

Name

|

Percentage of

Excess CFO |

|

Mr. Jason D. Lippert

|

40%

|

|

Ms. Lillian D. Etzkorn

|

9%

|

|

Mr. Ryan R. Smith

|

25%

|

|

Mr. Jamie M. Schnur

|

17%

|

|

Mr. Andrew J. Namenye

|

9%

|

As described in the Proxy Statement, in February 2025, the Compensation and Human Capital Committee met and determined the degree to which the EBIT and CFO goals under the 2024 AIP were achieved. Actual Adjusted EBIT

results in 2024 were $218 million, resulting in a payout level of 89.56% of the Target Incentive amount for all of the named executive officers. As the Company failed to achieve at least 90% of its Adjusted EBIT target in 2024, the Committee

determined that the named executive officers did not qualify for the additional CFO cash payout even though the Company’s actual CFO amount of $370.3 million exceeded the CFO target of $357 million.

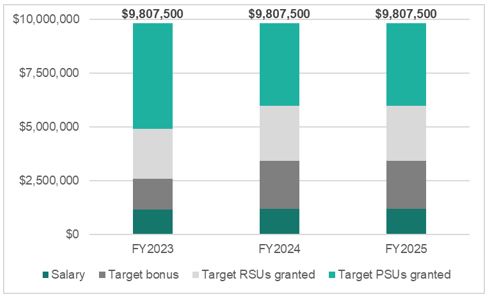

Total Target Compensation

As information supplemental to the discussion of the executive compensation components in the “Compensation Discussion and Analysis” section of the Proxy Statement, the following chart highlights the total target

compensation for each of fiscal years 2023, 2024, and 2025. As shown, the total compensation has not changed over this period, but the mix has been adjusted to reflect the more significant cash focus in RV industry compensation practices.

Compensation Table Update

In the Proxy Statement under “Compensation Discussion and Analysis – Analysis of 2024 Compensation Decisions – Annual Cash Incentive,” the Company disclosed the minimum, target, and maximum incentive payments that

could be made under the 2024 AIP to each of the named executive officers as follows:

|

Target Percentage

|

Minimum Incentive

|

Target Incentive

|

Maximum Incentive(1)

|

|||||||||||||

|

Mr. Jason D. Lippert

|

0.92

|

%

|

$

|

—

|

$

|

2,237,625

|

$

|

9,000,000

|

||||||||

|

Ms. Lillian D. Etzkorn

|

0.88

|

%

|

$

|

—

|

$

|

550,000

|

$

|

9,000,000

|

||||||||

|

Mr. Ryan R. Smith

|

0.56

|

%

|

$

|

—

|

$

|

2,141,750

|

$

|

9,000,000

|

||||||||

|

Mr. Jamie M. Schnur

|

0.23

|

%

|

$

|

—

|

$

|

1,362,000

|

$

|

9,000,000

|

||||||||

|

Mr. Andrew J. Namenye

|

0.25

|

%

|

$

|

—

|

$

|

600,000

|

$

|

9,000,000

|

||||||||

|

(1)

|

The maximum incentive payout reflects the cap established by the 2018 Omnibus Incentive Plan.

|

While the correct amounts were included in the Proxy Statement in the table as set forth above, due to an administrative error, the minimum and maximum incentive payout amounts under the 2024 AIP were not properly

reflected in the “Grants of Plan-Based Awards in 2024” table in the Proxy Statement. The target payout amount was properly reflected in such table for each named executive officer. Further, the actual amount earned and paid under the 2024 AIP to

each named executive officer was correct in the Proxy Statement.

The following updates and corrects the amounts in the “Threshold” and “Maximum” columns under the heading “Estimated Possible Payouts Under Non-Equity Incentive Plan Awards” of the “Grants of Plan-Based Awards in

2024” table.

GRANTS OF PLAN-BASED AWARDS IN 2024

|

Estimated Possible Payouts

Under Non-Equity Incentive Plan Awards(1)

|

Estimated Future Payouts Under

Equity Incentive Plan Awards

|

|||||||||||||||||||||||||||||||||

| Name |

Grant

Date

|

Date of

Compensation

and Human

Capital

Committee

Approval

|

Threshold

|

Target

|

Maximum

|

Threshold

|

Target |

Maximum

|

All

Other

Stock

Awards:

Number

of

Shares of

Stock or

Units

|

Grant Date

Fair Value of

Stock and

Option Awards

|

||||||||||||||||||||||||

|

|

03/01/24 | 02/20/24 |

--

|

--

|

--

|

21,109

|

(2)

|

$

|

2,672,610

|

|||||||||||||||||||||||||

|

Jason D.

|

03/01/24

|

02/20/24

|

--

|

(3)

|

31,664

|

(3)

|

63,328

|

(3)

|

--

|

$

|

4,008,980

|

|||||||||||||||||||||||

|

Lippert

|

--

|

2,237,625

|

9,000,000

|

|||||||||||||||||||||||||||||||

|

|

03/01/24 |

02/20/24

|

--

|

--

|

--

|

3,726

|

(2)

|

$

|

471,749

|

|||||||||||||||||||||||||

|

Lillian D.

|

03/01/24

|

02/20/24

|

--

|

(3)

|

5,588

|

(3)

|

11,176

|

(3)

|

--

|

$

|

707,496

|

|||||||||||||||||||||||

|

Etzkorn

|

|

02/20/24 |

--

|

550,000

|

9,000,000

|

|||||||||||||||||||||||||||||

|

|

03/01/24

|

02/20/24

|

--

|

--

|

10,261

|

(2)

|

$

|

1,299,145

|

||||||||||||||||||||||||||

|

Ryan R.

|

03/01/24

|

02/20/24

|

--

|

(3)

|

15,392

|

(3)

|

30,784

|

(3)

|

--

|

$

|

1,948,792

|

|||||||||||||||||||||||

|

Smith

|

|

02/20/24

|

--

|

2,141,750

|

9,000,000

|

|||||||||||||||||||||||||||||

|

|

03/01/24

|

02/20/24

|

--

|

--

|

7,010

|

(2)

|

$

|

887,536

|

||||||||||||||||||||||||||

|

Jamie M.

|

03/01/24

|

02/20/24

|

--

|

(3)

|

10,515

|

(3)

|

21,030

|

(3)

|

--

|

$

|

1,331,304

|

|||||||||||||||||||||||

|

Schnur

|

|

02/20/24

|

--

|

1,362,000

|

9,000,000

|

|||||||||||||||||||||||||||||

| 03/01/24 |

02/20/24

|

--

|

--

|

3,726

|

(2)

|

$

|

471,749

|

|||||||||||||||||||||||||||

|

Andrew J.

|

03/01/24

|

02/20/24

|

--

|

(3)

|

5,588

|

(3)

|

11,176

|

(3)

|

--

|

$

|

707,496

|

|||||||||||||||||||||||

|

Namenye

|

|

02/20/24

|

--

|

600,000

|

9,000,000

|

|||||||||||||||||||||||||||||

| (1) |

Amounts shown in this column represent the potential cash payout amounts under the 2024 AIP for all of the NEOs. The actual payout amounts related to 2024 performance are disclosed in the Summary Compensation Table in the “Non-Equity

Incentive Plan Compensation” column.

|

| (2) |

Represents the annual grant of RSUs, which vest ratably each year on the first through the third anniversaries of the respective grant date.

|

| (3) |

Represents 2024 PSUs that would be earned depending on the level of achievement of ROIC and FCF performance goals over the three-year measurement period of 2024-2026. The final number of units earned could be from 0% of target for

performance at the threshold level up to 200% of target for maximum performance. Earned 2024 PSUs will vest on March 1, 2027.

|

| (4) |

Amounts represent the grant date fair value of the awards determined in accordance with ASC 718. For a discussion of assumptions made in determining the grant date fair value, see Note 2 of the Notes to Consolidated Financial Statements

included in our Annual Report on Form 10-K for the year ended December 31, 2024. Amounts related to PSUs represent the value at the grant date based upon the probable outcome of the performance conditions.

|

Competitive Pay Factors

While not a change from the disclosures in the Proxy Statement, the Compensation and Human Capital Committee desires to reiterate and emphasize that defining the Company’s executive compensation peer group is

challenging, due in large part to the fact that the Company’s concentrated geographic footprint is in Elkhart County, Indiana, where there is geographic proximity to many competitors and industry peers, leading to high competition for talent.

Further, many of the Company’s competitors are not publicly traded companies or are subsidiaries of publicly traded companies, and/or their employees who would be in the closest comparator positions to some of our

named executive officers are not named executive officers of those companies. As a result, compensation data for many of our primary business competitors or the comparative positions for which we compete for talent is not publicly available.

Therefore, in order to incentivize and engage the Company’s talented senior leadership team and broader workforce, the Compensation and Human Capital Committee does not limit its consideration of compensation data to

traditional publicly traded peer group information, but also considers local RV industry pay practices and models.