ALASKA AIR GROUP Q3 2025 Earnings | October 23, 2025 1

2 Safe Harbor This presentation may contain forward - looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933 , Section 21E of the Securities Exchange Act of 1934 , and the Private Securities Litigation Reform Act of 1995 . These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by our forward - looking statements, assumptions or beliefs . For a discussion of risks and uncertainties that may cause our forward - looking statements to differ materially, see Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 . Some of these risks include competition, labor costs, relations and availability, general economic conditions, increases in operating costs including fuel, uncertainties regarding the ability to successfully integrate the operations of the recently completed acquisition of Hawaiian Holdings, Inc . and the ability to realize anticipated cost savings, synergies, or growth from the acquisition, inability to meet cost reduction and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, cybersecurity risks, and changes in laws and regulations that impact our business . All of the forward - looking statements are qualified in their entirety by reference to the risk factors discussed in our most recent Form 10-K . We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward - looking statements . We expressly disclaim any obligation to publicly update or revise any forward - looking statements made today to conform them to actual results . Over time, our actual results, performance or achievements may differ from the anticipated results, performance or achievements that are expressed or implied by our forward -looking statements, assumptions or beliefs and such differences might be significant and materially adverse . Non -GAAP Financial Information The Company has made reference in this presentation to financial metrics which are not in accordance with GAAP . Pursuant to Regulation G, we have provided reconciliations of non-GAAP financial measures to their most directly comparable financial measures reported on a GAAP basis within the Third Quarter 2025 Earnings Release filed concurrently with this presentation . Prior year non-GAAP financial metrics have been reconciled in previous SEC filings, and can be referenced therein.

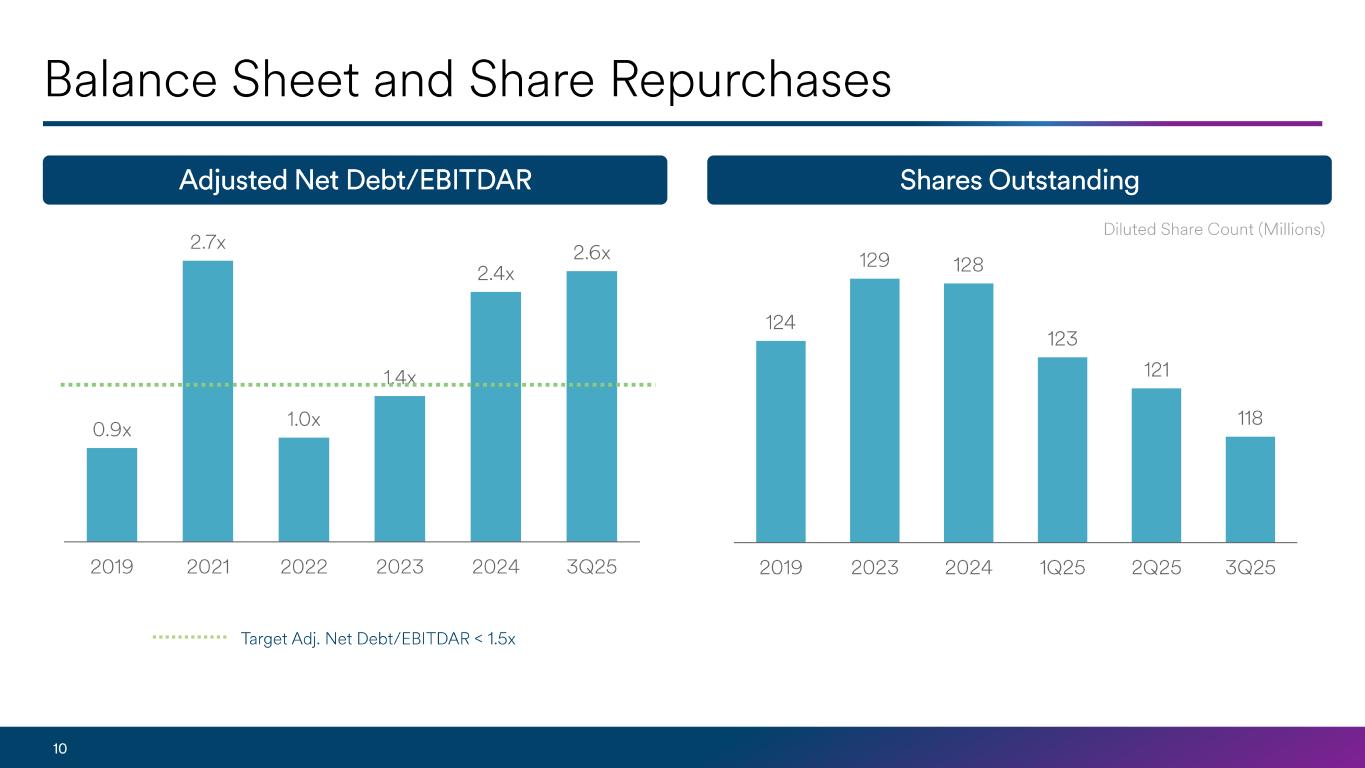

3 Earnings Update ❑ Reported Q3 2025 financials reflect consolidated results , with the comparable prior year period results including Hawaiian from September 18, 2024 onward . Commentary on Q3 performance and forward - looking guidance is compared to pro forma periods and assumes Hawaiian is included in both 2024 and 2025. We believe this basis of comparison is relevant for understanding our expected results. ❑ Air Group’s adjusted earnings per share of $1.05 came in line with revised mid -quarter expectations, primarily impacted by higher fuel and non -fuel cost pressure resulting from an IT outage in July and several weeks of irregular operations from challenging summer weather. Strength in revenue trends persisted throughout the quarter and commercial initiatives and synergies remain on track. ❑ Unit revenue increased 1.4% in Q3 2025, continuing to lead the industry as the inflection in demand that began in July persisted throughout the quarter, including a significant rebound in corporate traffic. ❑ Q3 2025 unit costs were up 8.6%, pressured from a combination of lower capacity and operational challenges during the summer period. ❑ Economic fuel cost per gallon averaged $2.51 for Q3 2025 as West Coast refining margins remained elevated throughout the quarter. ❑ Air Group’s balance sheet remains strong, with debt -to-cap at 60%, and adjusted net debt to EBITDAR at 2.6x.

4 Alaska Accelerate initiatives progressing well $100M $150M $150M Network Product Loyalty Cargo ▪ Industry - leading Q3 RASM (1) ▪ PDX banking strategy nearly tripled connecting passengers during Q3 ▪ Launched SEA -ICN in September 2025 ▪ Announced SEA to Rome, London, and Iceland starting Spring 2026 ▪ Premium revenue up 5% ▪ ~ 70% of 737 premium seat retrofits completed ▪ Announced Starlink Wi -Fi installations to begin this winter, bringing Atmos Rewards members free, unmatched connectivity ▪ Officially announced SAN lounge, construction to begin early 2027 ▪ Launched combined single loyalty platform, Atmos ▪ Card acquisitions up 48%, led by premium card; 10% of cardholders entirely new to Atmos ▪ Cash remuneration up 8%, 17% in Sep post - launch ▪ New card acquisitions exceeded YE target within 2 weeks of launch ▪ Cargo revenue increased 27 % y/y ▪ First quarter of full freighter fleet in service including 10 A330 Amazon aircraft ▪ Launch of second international route to ICN $400M Synergies on track Synergies on track Synergies on trackInitiatives on track 1 – Industry - leading Q3 y/y RASM expectation based on SEC filings and consensus estimates as of October 22, 2025

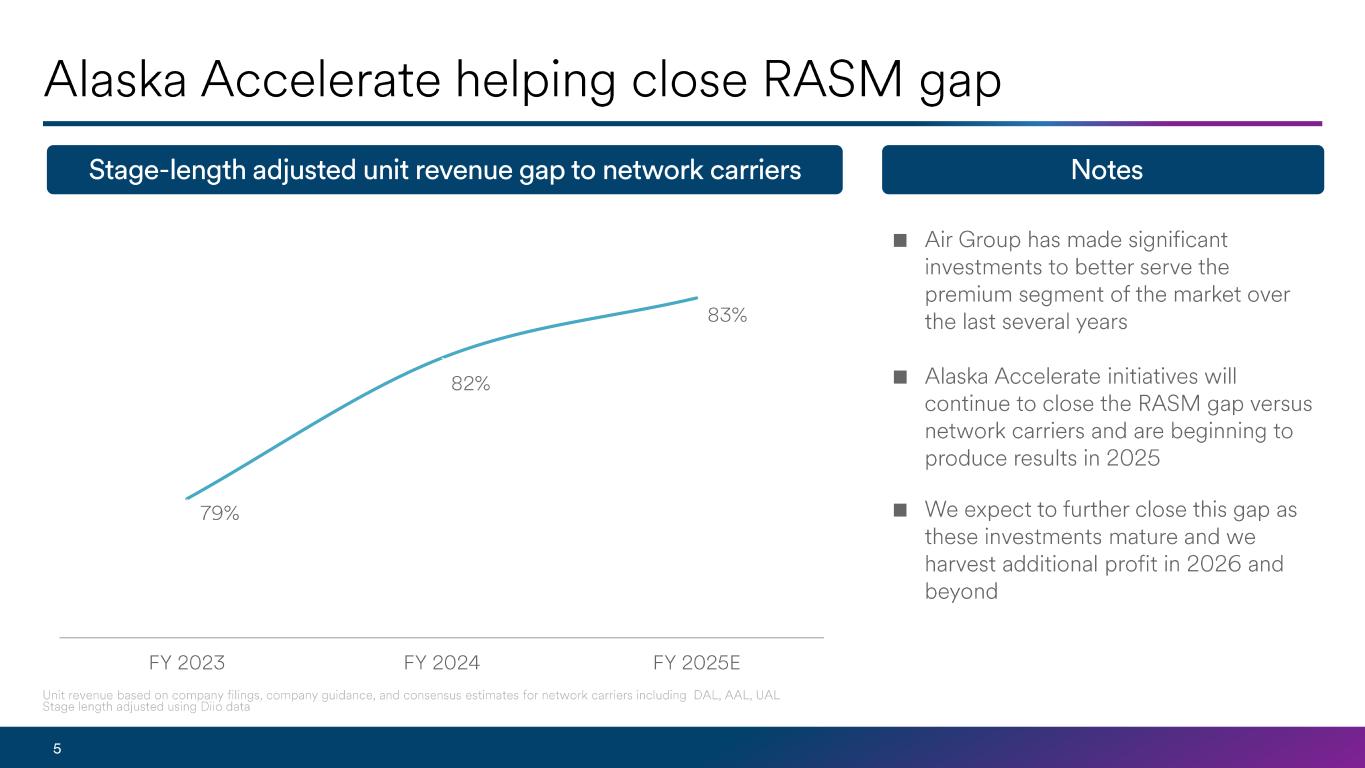

5 Alaska Accelerate helping close RASM gap Stage -length adjusted unit revenue gap to network carriers Notes 79% 82% 83% FY 2023 FY 2024 FY 2025E Unit revenue based on company filings, company guidance , and consensus estimates for network carriers including DAL, AAL, UAL Stag e length adjusted using Diio data ■ Air Group has made significant investments to better serve the premium segment of the market over the last several years ■ Alaska Accelerate initiatives will continue to close the RASM gap versus network carriers and are beginning to produce results in 2025 ■ We expect to further close this gap as these investments mature and we harvest additional profit in 2026 and beyond

6 Third consecutive quarter of leading unit revenue Unit revenue change y/y Notes ■ Q3 2025 unit revenue increased 1.4% y/y, on the better end of prior guidance ■ Premium demand remains strong with premium revenue up 5% on a system basis despite an overall capacity decline of (1%) while premium revenue was up 15% for Hawaiian Assets ■ Corporate travel demonstrated a strong inflection in Q3 2025, with revenue up 8% y/y compared to a low single -digit decline in Q2 2025 ■ Cargo revenue and loyalty cash remuneration revenue also outpaced system revenue growth, up 27% and 8% respectively 5.0% (0.6%) 1.4% 2.0% 1Q25 2Q25 3Q25 4Q25E ALK Big 4 Q3 2025 and Q4 2025E unit revenue based on company filings, company guidance and consensus estimates including DAL, AAL, UAL, LU V LSD %

7 Revenue and Cost dynamics show improving exit rate Y/Y RASM vs CASMex Spread Notes ■ With Alaska Accelerate investments underway, Air Group is beginning to harvest benefits that large industry peers are already fully capturing ■ Absent fuel impacts, margin profile to improve significantly into Q4 2025 as macro headwinds moderate and synergies and initiatives continue to ramp ■ Q2 and Q3 non -fuel costs impacted by reduced growth and elevated transitory costs while revenue faced weaker macroeconomic environment 3% (7%) (7%) (1%) Q1 Q2 Q3 Q4 Approaching flat

2.1% 6.5% 8.6% 2.9% 5.0% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 1Q25 2Q25 3Q25 4Q25E FY25E 8 Unit cost exit rate remains strong CASMex change y/y Chart not to scale Capacity Growth 3.9% 2.7% (0.7%) ~ 2% to 3% ~ 2% Notes ■ Unit costs were up 8.6% y/y in Q3 2025, pressured by a combination of low growth (~2pts) and elevated recovery costs from IT outage and challenging summer operations (~1pt) ■ Q4 2025 unit costs still pressured by low growth, but expected to show sequential improvement supported by cost synergy trajectory and return of capacity growth of 2% to 3% y/y ■ FY 2025 unit costs are expected to be up MSD, inclusive of ~2 pts of pressure from labor deals LSD % MSD %

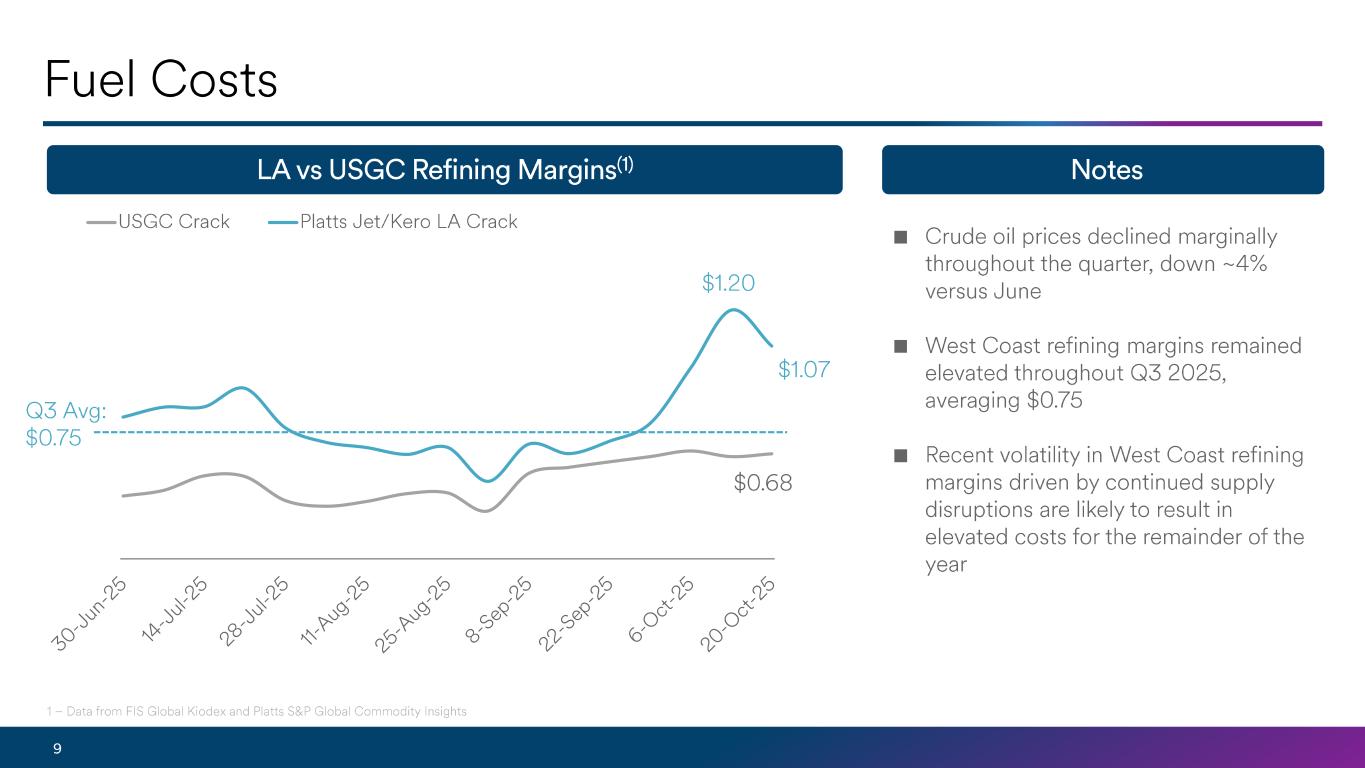

9 Fuel Costs LA vs USGC Refining Margins (1) Notes ■ Crude oil prices declined marginally throughout the quarter, down ~4% versus June ■ West Coast refining margins remained elevated throughout Q3 2025, averaging $0.75 ■ Recent volatility in West Coast refining margins driven by continued supply disruptions are likely to result in elevated costs for the remainder of the year USGC Crack Platts Jet/Kero LA Crack Q3 Avg: $0.75 1 – Data from FIS Global Kiodex and Platts S&P Global Commodity Insights $1.07 $0.68 $1.20

10 Balance Sheet and Share Repurchases Shares Outstanding Target Adj. Net Debt/EBITDAR < 1.5x 0.9x 2.7x 1.0x 1.4x 2.4x 2.6x 2019 2021 2022 2023 2024 3Q25 Adjusted Net Debt/EBITDAR 124 129 128 123 121 118 2019 2023 2024 1Q25 2Q25 3Q25 Diluted Share Count (Millions)

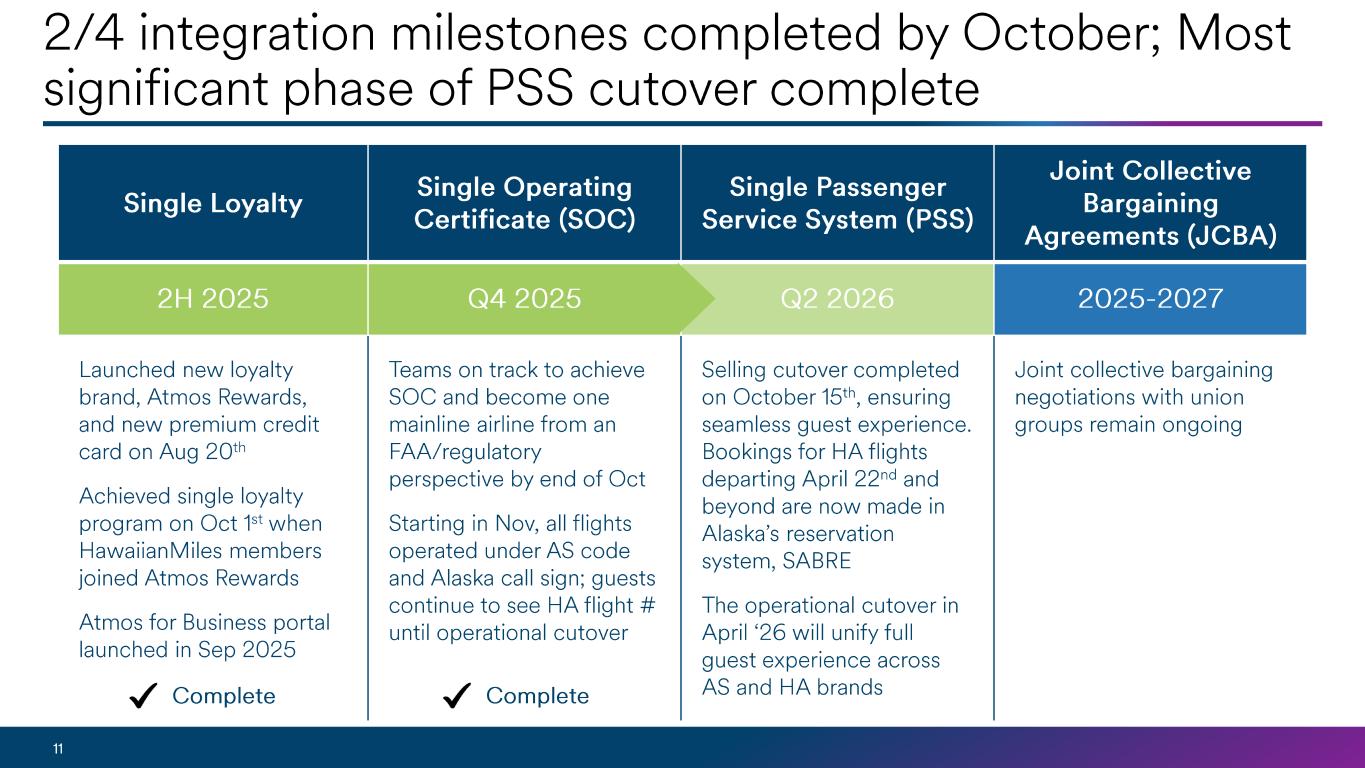

11 2/4 integration milestones completed by October; Most significant phase of PSS cutover complete Single Loyalty Single Operating Certificate (SOC) Single Passenger Service System (PSS) Joint Collective Bargaining Agreements (JCBA) 2H 2025 Q4 2025 Q2 2026 2025 - 2027 Launched new loyalty brand, Atmos Rewards, and new premium credit card on Aug 20 th Achieved single loyalty program on Oct 1 st when HawaiianMiles members joined Atmos Rewards Atmos for Business portal launched in Sep 2025 Teams on track to achieve SOC and become one mainline airline from an FAA/regulatory perspective by end of Oct Starting in Nov, all flights operated under AS code and Alaska call sign; guests continue to see HA flight # until operational cutover Selling cutover completed on October 15 th, ensuring seamless guest experience . Bookings for HA flights departing April 22 nd and beyond are now made in Alaska’s reservation system, SABRE The operational cutover in April ‘26 will unify full guest experience across AS and HA brands Joint collective bargaining negotiations with union groups remain ongoing Complete Complete