Please wait

Autodesk, Inc.DEF 14A0000769397FALSEiso4217:USD00007693972024-02-012025-01-3100007693972023-02-012024-01-3100007693972022-02-012023-01-3100007693972021-02-012022-01-3100007693972020-02-012021-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-02-012025-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-02-012024-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-02-012023-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-02-012022-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-02-012021-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-02-012025-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-02-012024-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-02-012023-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-02-012022-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-02-012021-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-02-012025-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-02-012024-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-02-012023-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-02-012022-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-02-012021-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-02-012025-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-02-012024-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-02-012023-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-02-012022-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-02-012021-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-02-012025-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-02-012024-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-02-012023-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-02-012022-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-02-012021-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-02-012025-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-02-012024-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-02-012023-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-02-012022-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-02-012021-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-02-012025-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-02-012024-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-02-012023-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-02-012022-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-02-012021-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-02-012021-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-02-012025-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-02-012024-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-02-012023-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-310000769397ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-02-012021-01-31000076939712024-02-012025-01-31000076939722024-02-012025-01-31000076939732024-02-012025-01-31000076939742024-02-012025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the registrant x Filed by a Party other than the registrant ¨

Check the appropriate box:

| | | | | | | | | | | | | | |

¨ | | Preliminary proxy statement |

¨ | | Confidential, for use of the commission only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive proxy statement |

| ¨ | | Definitive additional materials |

| ¨ | | Soliciting material under § 240.14a-12 |

| AUTODESK, INC. |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

May 6, 2025

Dear Autodesk Stockholder:

You are cordially invited to attend Autodesk’s 2025 Annual Meeting of Stockholders to be held on Wednesday, June 18, 2025, beginning at 3:00 p.m., Pacific Time. This year’s Annual Meeting will be held in a virtual format, through a live audio webcast. We will provide the webcast of the Annual Meeting at www.virtualshareholdermeeting.com/ADSK2025. Autodesk stockholders will have the opportunity to listen to the meeting live, submit questions, and vote online. A webcast with the entire Annual Meeting will be available on the Autodesk Investor Relations website after the meeting. For further information on how to participate in the meeting, please see the section titled “Information About the 2025 Annual Meeting of Stockholders” in this Proxy Statement.

This Notice of 2025 Annual Meeting of Stockholders and Proxy Statement contain details of the business to be conducted during the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. We urge you to promptly vote and submit your proxy card (1) via the Internet, (2) by phone, or (3) if you received your proxy materials by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience. Your vote is very important.

We hope you will be able to attend this year’s Annual Meeting. As in prior years, this year’s Annual Meeting will include an opportunity for stockholders to ask questions. Live questions may be submitted online beginning shortly before the start of the Annual Meeting through www.virtualshareholdermeeting.com/ADSK2025.

On behalf of the Board of Directors, I would like to express our appreciation for your continued support of Autodesk.

Very truly yours,

Andrew Anagnost

President and Chief Executive Officer

Notice of 2025 Annual Meeting of Stockholders

| | | | | | | | | | | | | | |

| Date | Wednesday, June 18, 2025 |

| Time | 3:00 p.m., Pacific Time |

| Virtual Meeting | This year’s meeting is a virtual stockholders meeting at www.virtualshareholdermeeting.com/ADSK2025. |

| Record Date | April 22, 2025. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. |

| Proxy Voting | Your vote is very important. Even if you plan to attend the Annual Meeting, we encourage you to vote in advance. You can vote your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form. If you attend the Annual Meeting, you may vote online during the Annual Meeting even if you previously voted. |

| Address of Corporate Headquarters | One Market Street, Suite #400

San Francisco, CA 94105

|

| Meeting Details | See the section titled “Information About the 2025 Annual Meeting of Stockholders” in this Proxy Statement. |

| | | | | | | | | | | |

| ITEMS OF BUSINESS | BOARD RECOMMENDATION |

| (1) | | To elect the 10 directors listed in the accompanying Proxy Statement to serve for the coming year and until their successors are duly elected and qualified. | FOR each director nominee |

| (2) | | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2026. | FOR |

| (3) | | To hold a non-binding vote to approve compensation for our named executive officers. | FOR |

| (4) | | To approve the amendment and restatement of the 2022 Equity Incentive Plan. | FOR |

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on June 18, 2025. Our Proxy Statement and Annual Report to Stockholders are available at:

https://materials.proxyvote.com/052769.

By Order of the Board of Directors,

| | |

| Ruth Ann Keene |

| Executive Vice President, Corporate Affairs, Chief Legal Officer and Corporate Secretary |

|

| May 6, 2025 |

Special Note About Forward-Looking Statements

This proxy statement includes statements regarding future plans, expectations, beliefs, intentions and prospects that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this proxy statement. The words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding our focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this proxy statement involves risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section titled “Risk Factors” of our Forms 10-K and 10-Q filed with the Securities and Exchange Commission (“SEC”). Undue reliance should not be placed on these forward-looking statements, which speak only as of the date of this proxy statement. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this proxy statement, except as required by law.

No Incorporation By Reference

This proxy statement includes several website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

Fiscal Year

Our fiscal year ends on January 31. References to “fiscal year 2025,” for example, refer to the fiscal year ended January 31, 2025.

Fiscal Year 2025 Strategic Priorities and Performance Highlights

Autodesk is focused on the convergence of design and make in the cloud, enabled by platform, industry clouds, and AI. Our investments in cloud, platform, and AI will drive growth by providing our customers with increasingly valuable and connected solutions and supporting a much broader customer and developer ecosystem.

In fiscal year 2025, we delivered record revenue and operating income and strong free cash flow, driven by strong renewal rates and continued momentum in our growth businesses like Construction and Fusion.

Against the backdrop of a challenging macro-economic environment and headwinds to new business growth, our strong momentum was sustained by three things: attractive long-term secular growth markets, a focused strategy delivering ever-more valuable and connected solutions to our customers, and a resilient business. Disciplined execution is driving greater operational velocity and efficiency. We are generating greater free cash flow, allowing us to grow the business, further reduce our share count, and enhance value creation over time. We believe these factors will deliver sustainable stockholder value over many years.

Our go-to-market (GTM) model has evolved significantly and purposefully over the years, from the transition to subscription and multi-year contracts billed annually, through self-service enablement, the adoption of direct billing, and more. In fiscal 2025, we completed the launch of our direct billing model (“the new transaction model”) and are now beginning the optimization phase, positioning Autodesk to better meet the evolving needs of its customers and channel partners. This comes from faster and less complex processes and more digital self-service and automation that enable tighter channel partnerships and less duplication of effort. The new transaction model will further unlock long-term value by strengthening our sales and marketing efficiency. On February 27th, 2025, we initiated the optimization phase of our sales and marketing plan; and the reallocation of internal resources to accelerate our strategic priorities. The plan included a 9% headcount reduction, the build out of capabilities needed to enable future optimization, and the distribution of critical expertise globally to remain competitive, resilient, and flexible. These decisive actions will further support our performance and expand our operating margins.

We continue to execute well despite market uncertainty and look forward to the years ahead with excitement and optimism. We recognize there is always more work to be done – but we believe we are well-positioned to sustain this momentum in FY 2026 and beyond, and we are focused on executing our strategy to drive value for shareholders.

| | | | | | | | | | | | | | |

REVENUE | | GAAP OPERATING INCOME | | NON-GAAP OPERATING INCOME (1) |

p 12% from fiscal year 2024 | | p 19% from fiscal year 2024 | | p 14% from fiscal year 2024 |

$6.1B | | $1.4B | | $2.2B |

| | | | |

CASH FLOW FROM OPERATING ACTIVITIES | | FREE CASH FLOW (1) | | RETURNING CAPITAL TO SHAREHOLDERS |

p 23% from fiscal year 2024 | | p 23% from fiscal year 2024 | | Repurchased over the last 4 years |

$1.6B | | $1.6B | | $3.8B |

_________________

(1) A reconciliation of GAAP to non-GAAP results is provided in Appendix A.

Corporate Governance Highlights

Our Board of Directors and Governance

We believe that by staying true to our values, focusing relentlessly on governance, accountability and on the outcomes we seek, we will fulfill our vision of a better world, designed and made for all. One of the key components to achieving our goal is the adoption of strong governance practices, informed by conversations with and participation from our stockholders. The key highlights of our Board corporate governance practices include:

| | | | | | | | | | | |

ü | 9 out of 10 Director Nominees are Independent | ü | Annual Election of Directors and Majority Voting |

ü | Separate Chair and CEO | ü | Proxy Access Right on Market Terms |

ü | Limit on Outside Directorships | ü | 42% of Director Nominees and Upcoming Director Additions are Diverse (including Gender, Sexual Orientation, and Ethnicity) |

ü | Annual Board and Committee Self-Evaluations, Periodically Using a Third-Party Facilitator | ü | Stockholder Engagement with Holders of Over 60% of Our Outstanding Shares in Fiscal Year 2025 |

ü | Director Orientation and Continuing Education and Strategy Programs for Directors | ü | Stock Ownership Policy for Directors and Executive Officers |

ü | Regular Executive Sessions of Independent Directors at Quarterly Board and Committee Meetings | ü | Evergreen Board Refreshment |

ü | Ability of Stockholders to Act by Written Consent and/or Call a Special Meeting of Stockholders | | |

Having a highly qualified and independent Board that is well suited to continue providing effective oversight of our rapidly evolving business is crucial to our long-term success. Our Board believes that having a mix of directors with complementary qualifications, expertise, backgrounds and attributes is essential to meeting its responsibility to provide effective oversight. Our director nominees provide our Board with a balance of relevant critical skills and an effective mix of experience, knowledge, and diverse viewpoints. Of our 10 Board nominees, 9 are independent. In addition, following the conclusion of our Annual Meeting, two new independent directors will be appointed to our Board, as discussed below. Having an independent Board is a key component of our governance strategy.

Our Board is committed to actively soliciting stockholder feedback, which helps inform our strong governance practices. In fiscal year 2025, members of our management team and, in certain instances, independent members of our Board continued their regular outreach and held meetings with stockholders representing over 60% of our outstanding shares. The feedback we received from our stockholders was shared and considered by the Board.

We regularly and continually review our Board composition through an “evergreen” board search process to ensure a thoughtful and balanced mix of institutional knowledge and fresh perspectives, and that the Board’s composition aligns with the evolving needs of our business and the broader industry. Over the past six years, we have appointed five new directors, including most recently John T. Cahill, former Chairman and CEO of Kraft Foods, and Ram R. Krishnan, Executive Vice President and Chief Operating Officer of Emerson, both of whom have exceptional track records of leading large and complex organizations. Their appointments followed a comprehensive search process led by the Corporate Governance and Nominating Committee and aided by a leading independent search firm. Prior to their appointments, we appointed Rami Rahim in 2022 and Dr. Ayanna Howard and Blake Irving in 2019, each of whom have distinguished careers as leaders in industry or academia. In addition, we announced in April 2025 that our Board had appointed Jeff Epstein and A. Christine (Christie) Simons to our Board, effective immediately following the conclusion of the Annual Meeting. Additional information regarding the appointment of Mr. Epstein and Ms. Simons to our Board is included below under the section titled “Governance and Our Board of Directors – Board of Directors.” We also recently announced that three directors, Mary T. McDowell, Lorrie M. Norrington, and Elizabeth (Betsy) Rafael, each of whom have served as Board committee chairs, would not stand for re-election at the Annual Meeting, reflecting this commitment to maintaining a careful balance of tenures.

Our Directors

The following table provides summary information about each of our director nominees, our retiring directors, and our upcoming director additions. Each director is elected annually by a majority of votes cast.

Each of our director nominees, other than Dr. Anagnost, our Chief Executive Officer, is an “independent director” within the meaning of applicable Nasdaq Global Select Market (“NASDAQ”) listing standards. The following table is as of March 31, 2025 but reflects changes in certain board committee leadership and membership as of May 2, 2025.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Principal Occupation | Independent | Committees |

| AC | CHRC | CGNC |

| Director Nominees |

| Andrew Anagnost | 60 | 2017 | President and Chief Executive Officer, Board Director, Autodesk, Inc. | | | | |

| Stacy J. Smith | 62 | 2011 | Executive Chairman, Kioxia Corporation | ü CB | | | ü |

| Karen Blasing | 68 | 2018 | Former Chief Financial Officer,

Guidewire Software, Inc. | ü À | ü | | |

| John T. Cahill | 67 | 2024 | Vice Chair of the Kraft Heinz Company; Former Chairman and CEO of Kraft Foods | ü À | C | | |

| Reid French | 53 | 2017 | Former Chief Executive Officer,

Applied Systems, Inc. | ü

| | C | |

| Dr. Ayanna Howard | 53 | 2019 | Dean of the College of Engineering at The Ohio State University; CTO, Co-founder, Zyrobotics | ü

| | ü | |

| Blake Irving | 65 | 2019 | Former Chief Executive Officer, GoDaddy Inc. | ü | | | C |

| Ram R. Krishnan | 54 | 2024 | Executive Vice President and Chief Operating Officer, Emerson Electric Co. | ü

| | ü | |

| Stephen Milligan | 61 | 2018 | Former Chief Executive Officer,

Western Digital Corporation | ü À | ü | | |

| Rami Rahim | 54 | 2022 | Chief Executive Officer, Juniper Networks, Inc. | ü | | | ü |

| Retiring Directors |

| Mary T. McDowell | 60 | 2010 | Former Chief Executive Officer,

Mitel Networks Corporation | ü | | | |

| Elizabeth (Betsy) Rafael | 63 | 2013 | Former Interim Chief Financial Officer, Autodesk, Inc.; Former Chief Transformation Officer, GoDaddy Inc. | | | | |

| Lorrie M. Norrington | 65 | 2011 | Adviser and Operating Partner,

Lead Edge Capital Management, LLC | ü | | | |

| Upcoming Director Additions |

| Jeff Epstein | 68 | __ | Operating Partner and Head of Corporate Development, Bessemer Venture Partners | ü | | | |

| A. Christine (Christie) Simons | 62 | __ | Senior Partner at Deloitte & Touche LLP | ü | | | |

CB Non-Executive Chair of Board C Committee Chair ü Member À Financial Expert, as defined in the rules of the SEC

AC Audit Committee

CHRC Compensation and Human Resources Committee

CGNC Corporate Governance and Nominating Committee

The current terms of Mary T. McDowell, Lorrie M. Norrington and Elizabeth (Betsy) Rafael will expire at the Annual Meeting, and Mses. McDowell, Norrington and Rafael will not stand for re-election to our Board at the Annual Meeting. Our Board thanks each of Mses. McDowell, Norrington and Rafael for their distinguished service as a director and as chairs of the Compensation and Human Resources Committee, the Corporate Governance and Nominating Committee and the Audit Committee, respectively.

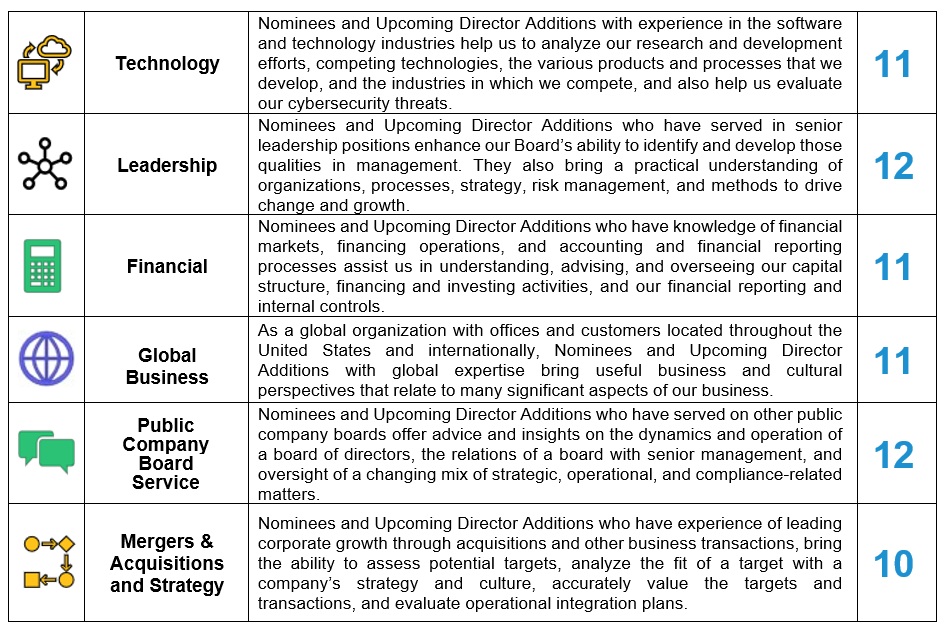

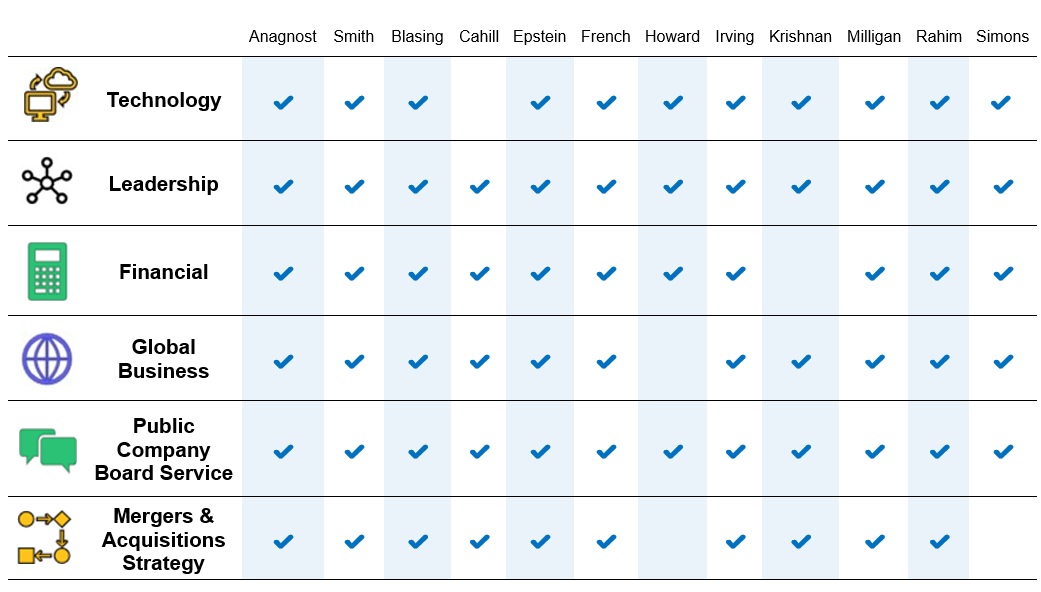

Director Nominees and Upcoming Director Additions’ Skills Metrics

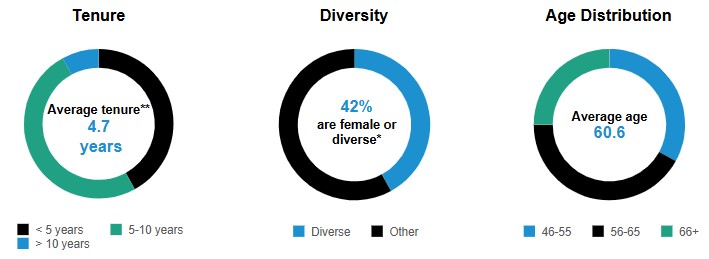

Director Nominees and Upcoming Director Additions’ Demographic Metrics

* Our Board will include three female directors, one of whom identifies as African American, one director who identifies as Middle Eastern and one director who identifies as South Asian.

** Director tenure is measured by completed years of service from the initial month of service through March 31, 2025.

Corporate Governance Guidelines

We believe the highest standards of corporate governance and business conduct are essential to running our business efficiently, serving our stockholders well, and maintaining our integrity in the marketplace. Over the years, we have devoted substantial attention to the subject of corporate governance and have developed Corporate Governance Guidelines, which set forth the principles that guide our Board in overseeing corporate governance, maintaining its independence, evaluating its own performance and the performance of our executive officers, and setting corporate strategy. The Board reviews our governance practices, corporate governance developments, and stockholder feedback on a regular basis to ensure continued effectiveness.

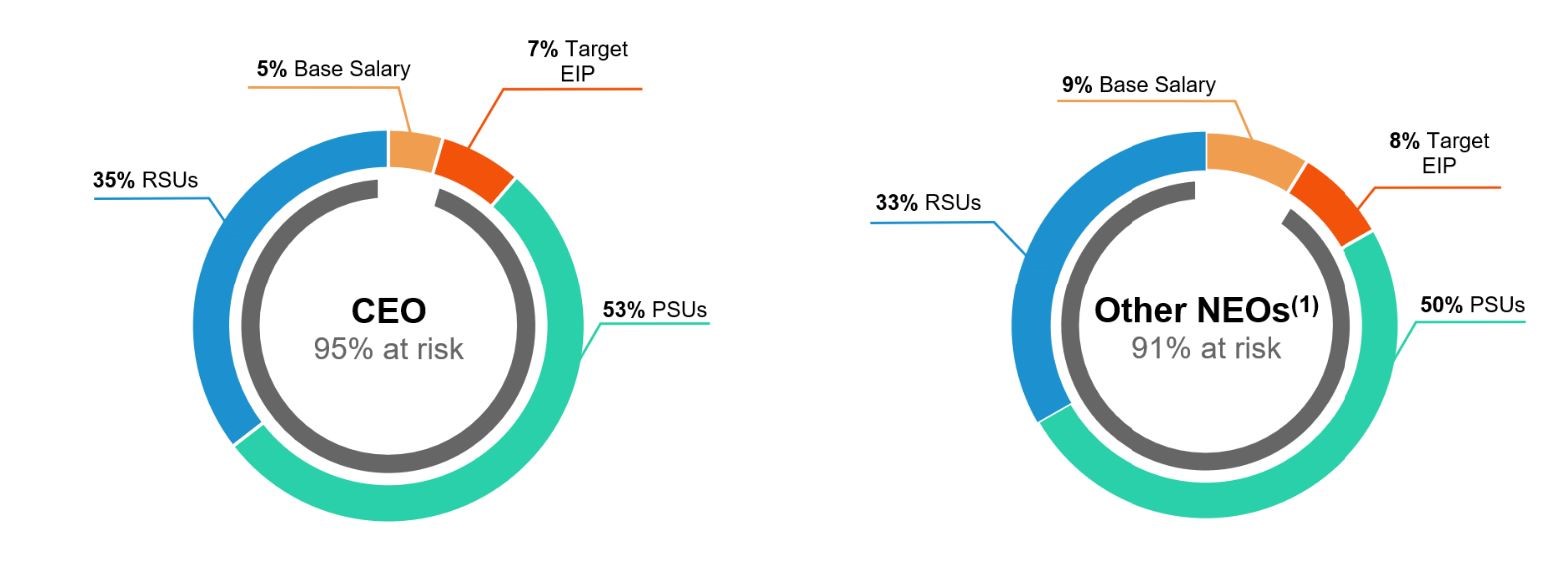

Executive Compensation Highlights

Compensation Guiding Principles

The Compensation and Human Resources Committee believes that Autodesk’s executive compensation program should be designed to attract, motivate, and retain talented executives and provide a rigorous framework that is tied to stockholder returns, company performance, long-term strategic corporate goals, and individual performance. The general compensation objectives are to:

•Recruit and retain the highest caliber of executives through competitive rewards;

•Motivate executive officers to achieve business and financial goals;

•Balance rewards for short- and long-term performance; and

•Align rewards with stockholder value creation.

Within this framework, the total compensation for each executive officer varies based on multiple dimensions:

•Whether Autodesk achieves its short-term and long-term financial and non-financial objectives;

•Autodesk’s TSR relative to companies in the North American Technology Software Index;

•The specific roles and responsibilities of the officer;

•Each officer’s skills, capabilities, contributions, and performance;

•Internal pay alignment considerations; and

•Retention considerations.

Leading Compensation Governance Practices

Autodesk’s executive compensation objectives are supported by policies and strong governance practices that align executives’ interests with the interests of our stockholders. Some of the program’s most notable features are highlighted in the table below and summarized in the section titled “Compensation Discussion and Analysis.”

| | | | | | | | | | | | | | |

| What We Do | | | What We Do Not Do |

| a | Engage in robust stockholder outreach | | x | Provide excise tax gross-up for double-trigger change in control arrangements |

| a | Tie a significant percentage of NEO total pay to achievement of critical financial objectives and stockholder value creation | | x | Allow hedging, pledging, or trading in Autodesk derivative securities |

| a | Employ maximum limits on performance-based cash and equity incentive compensation | | x | Reprice stock options |

| a | Require significant stock ownership holdings | | x | Offer executive benefits that differ from those offered to our other salaried employees or excessive perquisites |

| a | Include a clawback policy in incentive programs | | x | Use fixed-term employment agreements |

| a | Grant more than 50% of top executives’ LTI awards in the form of performance-based awards | | x | Make severance payments to named executive officers who voluntarily terminate their employment |

| a | Ensure effective risk management | | | |

| a | Rely on an independent compensation committee and engage an independent compensation consultant | | | |

Governance and our Board of Directors

Autodesk is committed to the highest standards of corporate ethics and diligent compliance with financial accounting and reporting rules. Our Board provides independent leadership in the exercise of its responsibilities. Our executive officers oversee a strong system of internal controls and compliance with corporate policies and applicable laws and regulations. Our employees operate in a climate of responsibility, candor, and integrity.

Key Highlights of our Board Corporate Governance Practices

| | | | | | | | | | | |

ü | 9 out of 10 Director Nominees are Independent | ü | Annual Election of Directors and Majority Voting |

ü | Separate Chair and CEO | ü | Proxy Access Right on Market Terms |

ü | Limit on Outside Directorships | ü | 42% of Director Nominees and Upcoming Director Additions are Diverse (including Gender, Sexual Orientation, and Ethnicity) |

ü | Annual Board and Committee Self-Evaluations, periodically using a third-party facilitator | ü | Stockholder Engagement with Holders of Over 60% of Our Outstanding Shares in Fiscal Year 2025 |

ü | Director orientation and continuing education and strategy programs for directors | ü | Stock Ownership Policy for Directors and Executive Officers |

ü | Regular Executive Sessions of Independent Directors at quarterly Board and Committee meetings | ü | Evergreen Board Refreshment |

ü | Ability of stockholders to act by written consent and/or call a special meeting of stockholders | | |

Board of Directors

Our business is managed under the direction of our Board, which is currently composed of 13 members. Following the Annual Meeting, the authorized size of the Board will be set at 12 directors. All of our director nominees were elected by stockholders at the 2024 Annual Meeting of Stockholders, except for Mr. Cahill and Mr. Krishnan, who were appointed to the Board in December 2024. Each director is elected annually by a majority of votes cast. Of our 10 nominees, 9 are “independent” within the meaning of the applicable Nasdaq listing standards. There are no family relationships among any of our directors or executive officers.

We believe that our director nominees are highly qualified and well suited to continue providing effective oversight of our rapidly evolving business, and that they provide our Board with an effective mix of diverse viewpoints. The following table highlights the number of our director nominees who share certain categories of relevant critical skills, experiences and knowledge that uniquely qualify them to serve on our Board. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

As previously disclosed, on April 23, 2025, we entered into a cooperation letter agreement (the “Cooperation Agreement”) with Starboard Value and Opportunity Master Fund Ltd and certain of its affiliates (together, “Starboard Value”). Pursuant to the Cooperation Agreement, our Board appointed Jeff Epstein and A. Christine (Christie) Simons to our Board, effective immediately following the conclusion of the Annual Meeting. The terms of the Cooperation Agreement are fully set forth in Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on April 24, 2025.

Experience and Knowledge of Director Nominees and

Upcoming Director Additions

Independence of the Board

Our Board believes independence is a critical component of our governance strategy, and that its continued independence enables it to be objective in carrying out its oversight responsibilities. Our Corporate Governance Guidelines provide that a substantial majority of our directors will be independent and that each Committee will be made up of solely independent directors. Autodesk’s independent directors meet regularly in executive session, without management present, as part of the quarterly Board meetings, with the intent to facilitate open discussion. Stacy J. Smith, our Chair, presides at these executive sessions.

Key Highlights of our Board Independence Practices

| | | | | | | | | | | |

ü | 9 out of 10 Director Nominees are Independent - We are committed to maintaining a substantial majority of directors who are independent of the Company and management. Except for our CEO, Andrew Anagnost, all director nominees are independent, as are the upcoming director additions. |

ü | We are committed to board refreshment. We aim to strike a balance between retaining directors with deep knowledge of Autodesk and adding directors with a fresh perspective. We regularly assess the balance of skills on our Board to ensure we have a diverse mix of perspectives to support our strategy. The average tenure for our director nominees and upcoming director additions is 4.7 years. |

ü | At each quarterly Board meeting, time is set aside for the independent directors to meet in executive session without management present. Additional executive sessions are held as needed. |

ü | Separate CEO and Chair. Our Chair has a clearly defined set of responsibilities, significant authority, and provides independent Board leadership. |

Director Nominees

The below biographies provide the name, age and certain biographical information as of March 31, 2025, about each nominees and the director’s unique qualifications to serve on the Board.

| | | | | |

| Andrew Anagnost |

| President and Chief Executive Officer, Board Director |

Age: 60 | Director since 2017 |

|

Qualifications and Contributions

•Architect of Autodesk’s business evolution into a global leader in “Design and Make” software with a resilient, subscription-based operating model.

•Spearheaded a multi-year transformation to a new transaction model and go-to-market modernization strategy that have resulted in enhanced profitability and performance.

•Led development of end-to-end customer solutions to expand Autodesk’s total addressable market and establish a strong position in high-growth markets.

•Utilized extensive background in product, platform & business model leadership to refocus investment strategy in cloud, platform and AI.

Career Experience

•2017 – Present: President and Chief Executive Officer, Autodesk, Inc.

•1997 – 2017: Various management and executive roles at Autodesk, Inc., including Vice President, Product Suites and Web Services; Senior Vice President, Business Strategy & Marketing; Chief Marketing Officer; and Co-CEO

•1986 – 1997: Various engineering, sales, marketing and product management positions, including at Lockheed Aeronautical Systems Company and EXA Corporation, and as an NRC post-doctoral fellow at NASA Ames Research Center

Select Board Experience

U.S.-Listed Companies

•HubSpot, Inc., a CRM for marketing, sales and customer service (2023 – Present)

Education

•B.S., Mechanical Engineering, California State University, Northridge

•M.S., Engineering Science, Stanford University

•Ph.D., Aeronautical Engineering and Computer Science, Stanford University

Pursuant to Dr. Anagnost’s employment agreement, Autodesk has agreed to nominate Dr. Anagnost to serve as a member of the Board for as long as he is employed by Autodesk as CEO.

| | | | | |

| Stacy J. Smith |

| Non-Executive Chair of the Board of Directors |

Age: 62 | Director since 2011 | Independent |

| Autodesk Committees: Corporate Governance and Nominating |

|

Qualifications and Contributions

•Global technology leader with extensive expertise in finance, accounting, M&A and capital allocation strategies

•Worked at Intel for three decades in a variety of roles, including as Chief Financial Officer—during which time the company’s total shareholder return increased ~100% and outperformed the S&P 500—as well as Group President of Sales, Manufacturing and Operations, Chief Information Officer, and Head of Europe Middle East and Africa.

•Long track record of significant value creation, including serving as a member of the board of directors during the initial public offerings of Kioxia, Virgin America, and Gevo, the de-SPAC transaction of Metromile, as well as Virgin America’s acquisition by Alaska Airlines.

•Substantial service on public company boards over the past two decades, including Kioxia, where he serves as Executive Chairman.

•Highly engaged Chair who has met with investors representing more than 40% of shares outstanding and attended more than 30 investor meetings in fiscal 2025.

Career Experience

•1988 – 2018: Various executive and management positions at Intel Corporation, including Executive Vice President; Chief Financial Officer; Executive Vice President, Manufacturing, Operations and Sales; and Group President of Sales, Manufacturing and Operations

Select Board Experience

U.S.-Listed Companies

•Wolfspeed, Inc., developer and manufacturer of silicon carbide technologies (2023 – Present)

•Intel Corporation, a multinational technology corporation (2024 – Present)

•Virgin America Inc., a domestic airline (2014 – 2016, until its acquisition by Alaska Airlines)

•Gevo, Inc., renewable chemicals and advanced biofuels company (2010 – 2014)

TSE-Listed Companies

•Kioxia Corporation (formerly Toshiba Memory Corporation), a flash memory and SSD company (2018 –Present)

•The Executive Chair position at Kioxia is not a “representative director” position or a position involving day-to-day management of the company. Instead, it is a customary executive chair position at a Japanese company, a part-time position involving board oversight of management that is not comparable to a U.S. public company CEO or other executive officer position.

Other

•Mr. Smith intends to depart from one of his current public company director positions in the next six months

•The California Chapter of the Nature Conservancy Board of Trustees (2017 – Present)

•University of Texas McCombs School of Business Advisory Board (2007 – 2013); Lifetime Member (2013 – Present)

•Metromile, Inc. (2018 – 2021)

Education

•B.B.A., University of Texas

•M.B.A., University of Texas

| | | | | |

| Karen Blasing |

Age: 68 | Director since 2018 | Independent |

| Autodesk Committees: Audit |

|

Qualifications and Contributions

•Significant executive leadership experience in the technology industry, including serving as CFO at Guidewire Software, Force 10 Networks and Nuance Communications, across different stages of their businesses.

•Established a technology platform at Guidewire Software to enhance engagement among insurers, customers and employees, and was instrumental in the company’s successful transformation from a perpetual license business to a profitable recurring revenue model.

•Extensive operational and financial expertise, having served as CFO of multiple technology companies, with a track record of implementing business model changes.

Career Experience

•2009 – 2015: Chief Financial Officer, Guidewire Software, Inc., a software platform for property and casualty insurance carriers

•2006 – 2009: Chief Financial Officer for Force 10 Networks and Senior Vice President of Finance for Salesforce, Inc.

•Also served as Chief Financial Officer for Nuance Communications, Inc. and Counterpane Internet Security, Inc., and held senior finance roles for Informix (now IBM Informix) and Oracle Corporation

Select Board Experience

U.S.-Listed Companies

•Zscaler, Inc., a cloud security company (2017 – Present)

•GitLab, Inc., an AI-powered development, security and operations platform company (2019 – Present)

•Ellie Mae, Inc., a mortgage-focused software company (2015 – 2019)

Education

•B.A., Economics, University of Montana

•B.A., Business Administration, University of Montana

•M.B.A., University of Washington

| | | | | |

| John T. Cahill |

Age: 67 | Director since 2024 | Independent |

| Autodesk Committees: Audit (Chair) |

|

Qualifications and Contributions

•Deep global business and strategy experience with a successful track record of leading large, global companies as Chairman, CEO, CFO and COO through various economic cycles and operational transformations.

•Strong financial and operational expertise, including guiding a business transformation following Kraft Foods’ merger with the H.J. Heinz Company to create one of the world’s largest food and beverage companies, as well as The Pepsi Bottling Group’s separation from PepsiCo and the execution of its IPO.

•Private equity experience, including serving as an Industrial Partner at Ripplewood Holdings, gives him a strong grounding in financial oversight and adds investor perspective to the Board.

•Extensive public board service at American Airlines, Colgate-Palmolive and other global large-cap companies brings valuable corporate governance expertise.

Career Experience

•2015 – Present: Vice Chair, Kraft Heinz Company

•2014 – 2015: Chairman and Chief Executive Officer, Kraft Foods Group, Inc.

•2012 – 2014: Chairman, Kraft Foods Group, Inc.

•2008 – 2011: Ripplewood Holdings LLC, a private equity firm

•1989 – 2007: Various management and executive positions at PepsiCo and subsequently The Pepsi Bottling Group, Inc., including Chairman and Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer.

Select Board Experience

U.S.-Listed Companies

•American Airlines Group Inc., a network air carrier that provides air transportation for passengers and cargo (2013 – Present)

•The Colgate-Palmolive Company, a public consumer products company (2005 – Present)

Other

•The Medical University of South Carolina Foundation

Education

•B.A., Harvard University

•M.B.A., Harvard Business School

2025 Proxy Statement | 11

| | | | | |

| Reid French |

Age: 53 | Director since 2017 | Independent |

| Autodesk Committees: Compensation and Human Resources (Chair) |

|

Qualifications and Contributions

•Executive operational experience leading companies developing novel software applications across multiple industries makes him uniquely qualified to oversee Autodesk’s innovative product pipeline.

•Strong track record of creating significant value for investors, including nearly tripling the size of Applied Systems Inc. and generating a 12x return for investors during his tenure as CEO.

•At Intergraph, executed a multi-year transformation that shifted the public company from legacy CAD to enterprise software, expanding into global B2B vertical markets and increasing market share; oversaw the 2006 go private transaction and subsequent 2010 $2.1 billion sale to Hexagon AB, one of the largest private software exits at the time.

•Expertise in governance and best practices from service on public boards, including Verint Systems.

Career Experience

•2011 – 2019: Chief Executive Officer, Applied Systems, Inc., a cloud software provider to the insurance industry

•2005 – 2010: Chief Operating Officer, Intergraph Corporation, a global geospatial and computer-aided design software company

2003 – 2005: Executive Vice President of Strategic Planning and Corporate Development at Intergraph

Select Board Experience

U.S.-Listed Companies

•Verint Systems Inc., a provider of customer engagement software (2021 – Present)

Other

•Applied Systems, Inc., a cloud software provider to the insurance industry (2011 – 2020)

•JSSI Inc., a provider of maintenance, software and financial services to the private aviation industry (2023 – Present)

•NetDocuments Software, Inc., a cloud-based legal document management software provider (2020 – Present)

Education

•B.A., Economics, Davidson College

•M.B.A., Harvard Business School

| | | | | |

| Dr. Ayanna Howard |

Age: 53 | Director since 2019 | Independent |

| Autodesk Committees: Compensation and Human Resources |

|

Qualifications and Contributions

•Industry expert in robotics, human-computer interaction and artificial intelligence makes her uniquely qualified to oversee Autodesk’s innovation pipeline, including the development of its industry-specific AI foundational models and integration of other innovative technologies.

•Cutting-edge research on robotics and artificial intelligence provides the Board with valuable technical expertise to support Autodesk’s competitive marketplace position, as well as maximize productivity and efficiency both in its internal operations and productivity-enhancing software products.

Career Experience

•2021 – Present: Dean of the College of Engineering, Professor (with tenure) Department of Electrical and Computer Engineering with joint appointment in Computer Science and Engineering, The Ohio State University

•2013 – 2025: Founder and Board Chair of Zyrobotics Inc., a non-profit organization that provides AI-powered STEM tools for early childhood education

•2015 – 2021: Linda J. and Mark C. Smith Professor, School of Electrical & Computer Engineering, Georgia Institute of Technology

•2018 – 2021: Chair of the School of Interactive Computing at Georgia Tech

•1994 – 2005: Senior Robotics Researcher and Deputy Manager in the Office of the Chief Scientist with NASA’s Jet Propulsion Laboratory

Select Board Experience

U.S.-Listed Companies

•Motorola Solutions, Inc., a technology company providing services to public safety agencies and enterprises (2022 – Present)

Other

•Appointed Board Member, U.S. Defense Science Board (2022 – 2025)

•Appointed Member, U.S. National Artificial Intelligence (AI) Advisory Committee (2022 – 2025)

•50 Over 50: Innovation, Forbes List (2024)

•Class of Fellows, National Academy of Inventors (2021)

•Appointed Board Member, Georgia’s State Workforce Development Board (2018 – 2021)

Education

•B.S., Engineering, Brown University

•M.S. and Ph.D., Electrical Engineering, University of Southern California

•M.B.A., Drucker Graduate School of Management

2025 Proxy Statement | 13

| | | | | |

| Blake Irving |

Age: 65 | Director since 2019 | Independent |

Autodesk Committees: Corporate Governance and Nominating (Chair)

|

|

Qualifications and Contributions

•Extensive executive experience successfully developing and executing complex technology companies’ product strategies enables him to provide oversight of Autodesk’s long-term strategic plan and alignment with evolving customer needs.

•Proven track record of shareholder value creation, including transforming GoDaddy.com from a domain-name company into a global cloud platform using predictive analytics and machine learning to power its customers’ digital presence, which led to a doubling of revenue and quadrupling of market value to $9 billion over his five-year tenure as CEO.

•Deep expertise in identifying key talent and cultivating strong company cultures based on innovation and determination, an important component of his success in leading and scaling successful technology companies.

Career Experience

•2013 – 2018: Chief Executive Officer, GoDaddy Inc.

•2010 – 2012: Chief Product Officer, Yahoo! Inc.

•2009 – 2010: Professor, Pepperdine Graziadio Business School

•1992 – 2007: Various senior and management roles at Microsoft Corporation, including most recently as Corporate Vice President of Windows Live Platform Group

Select Board Experience

U.S.-Listed Companies

•DocuSign, Inc., a provider of secure document-management services (2018 – Present)

•ZipRecruiter, Inc., an online marketplace for job seekers and employers (2018 – Present)

•GoDaddy Inc., a provider of solutions for entrepreneurs (2014 – 2018)

Other

•Flowhub, LLC (2020 – Present)

•McLaren Racing Advisory Board (2018 – Present)

Education

•B.A., Art, San Diego State University

•M.B.A., Pepperdine Graziadio Business School

| | | | | |

| Ram R. Krishnan |

Age: 54 | Director since 2024 | Independent |

| Autodesk Committees: Compensation and Human Resources |

|

Qualifications and Contributions

•Significant executive leadership experience, including as COO of Emerson Electric Co., a leading Fortune 500 global industrial automation company, enables him to oversee Autodesk’s long-term strategy as it relates to global sales, business development, supply chain operations, information technology and M&A.

•Extensive technology and software expertise, as well as customer insights, particularly in complex lifecycle automation, providing valuable to insights to support Autodesk’s product development and alignment with evolving customer needs.

•Led major strategic transactions, including Emerson’s $8.2 billion acquisition of National Instruments and the majority stake and eventual full acquisition of Aspen Technology, now valued at $17 billion, enhancing the company’s industrial software capabilities.

Career Experience

•1994 – Present: Various management and executive positions at Emerson Electric Co., including Executive Vice President and Chief Operating Officer (February 2021 – Present); President of Final Control (November 2017 – February 2021); President of Flow Solutions; Vice President of Profit Planning; and Perfect Execution

Select Board Experience

U.S.-Listed Companies

•Aspen Technology, Inc., a provider of supply chain management software and professional services (2022–2025)

Education

•B.S., Metallurgical Engineering, Indian Institute of Technology

•M.S., Materials Engineering, Rensselaer Polytechnic Institute

•M.B.A, Xavier University

2025 Proxy Statement | 15

| | | | | |

| Stephen Milligan |

Age: 61 | Director since 2018 | Independent |

| Autodesk Committees: Audit |

|

Qualifications and Contributions

•Significant executive strategic, operational and financial leadership experience in the technology industry, including as CEO of Western Digital Corp.

•Led Western Digital’s multi-year transformation from a storage component provider to a diversified enabler of data infrastructure following the Company’s acquisition and integration of Hitachi Global Storage Technologies.

•Orchestrated a turnaround as CEO of Hitachi Global Storage Technologies which resulted in significant operational improvement and consistent profitability.

•Strong financial and accounting expertise from extensive CFO and CEO experience.

Career Experience

•2013 – 2020: Chief Executive Officer, Western Digital Corporation

•2012 – 2015: President, Western Digital Corporation

•2009 – 2012: Chief Executive Officer, Hitachi Global Storage Technologies, Inc.

•2007 – 2009: Chief Financial Officer, Hitachi Global Storage Technologies, Inc.

•2002 – 2007: Various senior finance roles, including Chief Financial Officer, Western Digital Corporation

Select Board Experience

U.S.-Listed Companies

•Ross Stores, Inc., a leading brand of discount department stores (2015 – Present)

•Western Digital Corporation, a developer, manufacturer, and provider of data storage devices (2013 – 2020)

Education

•B.S., Accounting, The Ohio State University

| | | | | |

| Rami Rahim |

Age: 54 | Director since 2022 | Independent |

| Autodesk Committees: Corporate Governance and Nominating |

|

Qualifications and Contributions

•Extensive experience in the technology industry, including as CEO of Juniper Networks, a leader in secure AI native networks, enables him to oversee Autodesk’s long-term strategic plan, with particular insights into AI and cybersecurity.

•Transformed Juniper’s strategy and product offerings from hardware-centric solutions into cloud-delivered SaaS solutions almost quadrupling Juniper’s annual recurring revenue (ARR) in five years, redefining the company's future and solidifying its position as a leader in AI.

•Led Juniper Networks to its pending acquisition by Hewlett Packard Enterprise, a transaction expected to accelerate long-term revenue growth and expand margins, while combining complementary portfolios to advance AI-native and edge-to-cloud strategies.

Career Experience

•2014 – Present: Chief Executive Officer, Juniper Networks, Inc.

•1997 – 2014: Various leadership positions at Juniper Networks, including Executive Vice President and General Manager of the Juniper Development and Innovation (JDI) organization; Executive Vice President and General Manager of Platform Systems Division for routing and switching; Senior Vice President of the Edge and Aggregation Business Unit (EABU); and Vice President and General Manager of EABU

Select Board Experience

U.S.-Listed Companies

•Juniper Networks, Inc., a networking and cybersecurity company (2014 – Present)

Education

•B.S., Electrical Engineering, University of Toronto

•M.S., Electrical Engineering, Stanford University

•Member of Institute of Electrical and Electronics Engineers (IEEE)

2025 Proxy Statement | 17

Upcoming Director Additions

The below biographies provide the name, age and certain biographical information as of March 31, 2025, about our upcoming director additions and their unique qualifications to serve on the Board. As discussed above, our upcoming director additions will be appointed to our Board immediately following the conclusion of the Annual Meeting pursuant to the Cooperation Agreement.

| | | | | |

| Jeff Epstein |

Age: 68 | Independent |

|

|

Qualifications and Contributions

•Deep financial and operational experience at large-scale SaaS companies, including serving as EVP and CFO at Oracle, where he led global finance for one of the largest and most profitable technology companies, with a market value of over $150 billion.

•Track record of scaling finance operations and guiding companies through major transformations and transactions, including as CFO of DoubleClick (which was sold to Google for $3.1 billion) and Nielsen’s Media Measurement and Information Group.

•Strong venture experience as an operating partner of Bessemer Venture Partners, a venture capital and private equity firm, where he created and leads the BVP CFO Council and helps portfolio company CEOs and CFOs share best practices.

•Extensive service on public company boards and audit committees gives him unique insights into financial reporting rules, audit procedures and risk management oversight

Career Experience

•2011 – Present: Operating Partner and Head of Corporate Development, Bessemer Venture Partners

•2008 – 2011: Executive Vice President, Chief Financial Officer, Oracle Inc.

•1988 – 2004: Chief Financial Officer roles at several public and private companies, including Nielsen’s Media Measurement and Information Group, DoubleClick (acquired by Google) and King World Productions (acquired by CBS).

Select Board Experience

U.S.-Listed Companies

•Okta, Inc., an identity authentication technology company (2021 – Present)

•AvePoint, Inc., a cloud data management company (2021 – Present)

•Twilio, Inc., a cloud communications company (2017 – Present)

•Couchbase, Inc., a provider of a leading modern database for enterprise applications (2015 – Present)

•Poshmark, Inc., an online marketplace (2018 – 2023)

•Shutterstock, Inc., a global marketplace for stock photography, images and music (2012 – 2021)

•Booking Holdings, Inc., an online travel company (2003 – 2019)

Non-Profit

•Kaiser Permanente, an integrated health care company (2013 – Present)

Education

•B.A., Economics and Political Science, Yale University

•M.B.A, Stanford University Graduate School of Business

| | | | | |

| A. Christine (Christie) Simons |

Age: 62 | Independent |

|

|

Qualifications and Contributions

•Brings over 30 years of experience advising public companies in accounting, financial management and reporting, internal controls and audit functions further enhances the Board’s financial oversight capabilities.

•Senior Partner at Deloitte serving global technology clients in various leadership roles, including leading the firm’s Global Semiconductor Center of Excellence and leading the U.S. Technology, Media & Telecommunications (TMT) Audit & Assurance practice.

•Deep understanding of the business, economic and compliance environments in which Autodesk and many of its global customers operate.

Career Experience

•1994 – May 2025: Various leadership positions as a Senior Partner at Deloitte, including leading Deloitte’s Global Semiconductor Center of Excellence and the U.S. Technology, Media & Telecommunications (TMT) Audit & Assurance practice. She also built the firm’s Emerging Growth Company practice in San Francisco and has led the Global Offerings Services group in Taiwan.

Select Board Experience

U.S.-Listed Companies

•Micron Technology, Inc., a memory and storage solutions provider (2025 – Present)

Other

•Board of Directors, California Society of CPAs (2018 – 2022); Chair (2021 – 2022)

•Audit Committee member, American Leadership Forum in Silicon Valley (2013 – 2019)

Education

•B.S., International Business and Finance, University of Boulder Colorado’s Leeds School of Business

Board Leadership Structure

During fiscal year 2025, and since June 2018, Stacy J. Smith has served as our non-executive Chair of the Board. Mr. Smith brings more than two decades of experience as a senior executive in the technology industry, which provides him with critical insight into the operational requirements of a global company, and management and consensus-building skills. These attributes deeply qualify him to lead our Board. As Chairman of Autodesk, Mr. Smith has played a critical role in guiding Autodesk through key transitions, leveraging his deep institutional knowledge to help position the company for continued success. His tenure on the Board, combined with his expertise in leading complex organizations through transformation, makes him uniquely qualified to oversee Autodesk’s ongoing evolution and execution of its strategic priorities.

In his role, Mr. Smith brings his deep understanding of the business to focus on the right strategic opportunities and highlight key risks for the Board’s review. Mr. Smith sets the agenda for each meeting of the Board, in consultation with our CEO, presides at executive sessions, and facilitates communication between the Board, management, and stockholders.

The Board regularly evaluates its leadership structure to ensure that it supports effective independent oversight of Autodesk. Our Corporate Governance Guidelines direct the Board to fill the Chair of the Board and Chief Executive Officer positions after considering a number of factors, including the current size of our business, composition of the Board, current candidates for such positions, and our succession planning goals. Currently, we separate the positions of CEO and non-executive Chair of the Board. In the event the Chair is not an independent director, our Corporate Governance Guidelines provide that the Board must elect a Lead Independent Director. Separating the

2025 Proxy Statement | 19

positions of CEO and Chair of the Board allows our President and CEO to focus on our day-to-day business, while allowing the Chair to lead the Board in its fundamental role of providing independent advice to, and oversight of, management. The Board believes that having an independent director serve as Chair is the appropriate leadership structure for Autodesk at this time and demonstrates our commitment to good corporate governance.

In addition, as described below, our Board has three standing committees consisting entirely of independent directors. The Board delegates substantial responsibility to these committees, which report their activities and actions back to the full Board. We believe having independent committees with independent chairs is an important aspect of the leadership structure of our Board.

Stockholder Engagement

Our Board is committed to ensuring that stockholder insights and feedback inform our strong governance practices. We maintain an open dialogue and actively engage with our stockholders to ensure we thoughtfully consider a diversity of perspectives on issues including strategy, financial and business performance, our executive and employee compensation programs, sustainability, workforce diversity, board composition and governance, and a broad range of ESG issues. We are open to feedback from all shareholders and occasionally invite shareholders to present to our Board.

The office of our Corporate Secretary coordinates annual stockholder engagement with our Investor Relations team and provides a summary of all relevant feedback to our Board. In fiscal year 2025, members of our management team and, in certain instances, independent members of our Board continued our regular outreach and held meetings with stockholders representing over 60% of Autodesk shares, and provided stockholder feedback to the Board. In addition, throughout the year our Investor Relations team engages with our stockholders, frequently, along with Andrew Anagnost, our CEO, Janesh Moorjani, our CFO, and in certain instances, Stacy J. Smith, our Chair.

Fiscal Year 2025 Board Meetings

Each quarter, our Board holds Committee and Board meetings. At each quarterly Board meeting, time is set aside for the independent directors to meet without management present. Additional executive sessions are held as needed. In addition to the quarterly meetings, typically there are other regularly scheduled committee meetings each year.

During fiscal year 2025, the full Board held a total of nine meetings (including regularly scheduled and special meetings), and its three standing committees (an Audit Committee, a Compensation and Human Resources Committee, and a Corporate Governance and Nominating Committee) held a collective total of 39 meetings. Each director attended 100% of the total number of meetings of the Board and committees of which he or she was a member during the period he or she served during fiscal year 2025.

Directors are encouraged, but not required, to attend the Annual Meeting of Stockholders. All of our then-sitting directors attended the 2024 Annual Meeting of Stockholders.

The following table sets forth the number of meetings held by our Board and the committees during fiscal year 2025:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Board | | Audit | | Compensation and Human Resources | | Corporate Governance and Nominating |

Number of meetings held in fiscal year 2025 | | 9 | | 27 | | 7 | | 5 |

Board Committees

To support effective corporate governance, our Board delegates certain responsibilities to its committees, who report on their activities to the Board. These committees have the authority to engage legal counsel or other advisors or consultants as they deem appropriate to carry out their responsibilities.

The table below provides summary information about each director nominee’s committee membership followed by a summary of each committee’s responsibilities. Each committee has a charter describing its specific responsibilities which can be found on our website at https://investors.autodesk.com/corporate-governance/highlights. The following table reflects changes in certain board committee leadership and membership as of May 2, 2025.

| | | | | | | | | | | | | | |

| Name | Independent | Committees |

| Audit Committee | Compensation and Human Resources Committee | Corporate Governance and Nominating Committee |

| Andrew Anagnost | | | | |

| Stacy J. Smith | ü CB | | | ü |

| Karen Blasing | ü | ü | | |

| John T. Cahill | ü | C | | |

| Reid French | ü | | C | |

| Dr. Ayanna Howard | ü | | ü | |

| Blake Irving | ü | | | C |

| Ram R. Krishnan | ü | | ü | |

| Stephen Milligan | ü | ü | | |

| Rami Rahim | ü | | | ü |

Audit Committee

The Audit Committee oversees Autodesk’s financial statements, compliance with our corporate, accounting, and reporting processes, our system of internal accounting and financial controls, and our management of related risks.

The Audit Committee’s responsibilities also include:

•selection, compensation, engagement, retention, termination, and services of our independent registered public accounting firm, including conducting a review of its independence;

•reviewing with management and our independent registered public accounting firm the adequacy of our system of internal financial and disclosure controls;

•reviewing our critical accounting policies and the application of accounting principles;

•reviewing our treasury policies and tax positions;

•overseeing the performance of our internal audit function;

•establishing and overseeing compliance with the procedures for handling complaints regarding accounting, internal accounting controls, or auditing matters, including procedures for confidential, anonymous submission of concerns by employees regarding accounting and auditing matters; and

•overseeing our management of cybersecurity risks relating to financial, accounting, and internal controls matters.

See the Report of the Audit Committee of the Board of Directors on page 75 for more information regarding the functions of the Audit Committee.

Through May 2, 2025, our Audit Committee was comprised of Reid French (Chair), John T. Cahill, Karen Blasing, Dr. Ayanna Howard, and Stephen Milligan. Since that date, our Audit Committee is comprised of John T. Cahill, Karen Blasing, and Stephen Milligan, with Mr. Cahill serving as Chair.

2025 Proxy Statement | 21

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee oversees our corporate governance principles and policies, as well as the process to identify and nominate qualified individuals for Board membership, and Board and committee evaluations.

The Corporate Governance and Nominating Committee’s responsibilities include:

•developing general criteria regarding the qualifications and selection of members of the Board;

•determining skills, characteristics, and experiences desired for candidates and overseeing director succession planning;

•recommending candidates for election to the Board;

•developing overall governance guidelines;

•periodically reviewing matters related to our policies and practices concerning environmental, social and governance (“ESG”) initiatives, political contributions and lobbying activities;

•overseeing the performance and evaluation of the Board and individual directors; and

•reviewing and making recommendations regarding director composition and the mandates of Board committees.

Through May 2, 2025, our Corporate Governance and Nominating Committee was comprised of Lorrie M. Norrington (Chair), Stacy J. Smith, and Blake Irving. Since that date, our Corporate Governance and Nominating Committee is comprised of Blake Irving, Stacy J. Smith, and Rami Rahim, with Mr. Irving serving as Chair.

Compensation and Human Resources Committee

The Compensation and Human Resources Committee oversees the compensation and benefits for our executive officers, recommends our CEO’s compensation to the independent members of the Board for approval, and grants stock options, RSUs, and PSUs to executive officers and non-executive employees under our stock plans.

As non-employee directors, the members of the Compensation and Human Resources Committee are not eligible to participate in Autodesk’s discretionary employee stock programs. For Fiscal Year 2025, RSUs were granted in June 2024 to all our non-employee directors, automatically, pursuant to the Director Compensation Policy and under the 2024 Equity Incentive Plan.

The Compensation and Human Resource Committee’s responsibilities also include:

•reviewing and approving the corporate goals and objectives relevant to our CEO and executive officer compensation;

•evaluating CEO and executive officer performance;

•reviewing executive and leadership development policies and practices;

•reviewing and administering Autodesk’s clawback policy;

•reviewing succession plans for our CEO and other senior management;

•periodically reviewing matters related to human capital management;

•overseeing matters relating to stockholder approval of executive compensation, including advisory say-on-pay votes; and

•overseeing the management of risks associated with our compensation policies and programs.

See the section titled “Compensation Discussion and Analysis” for a description of our processes and procedures for determining executive compensation. The Compensation and Human Resources Committee may form and delegate authority to subcommittees when appropriate.

The Compensation Committee Report is included in this Proxy Statement on page 50.

Through May 2, 2025, our Compensation and Human Resources Committee was comprised of Mary T. McDowell (Chair), Blake Irving, and Rami Rahim. Since that date, our Compensation and Human Resources Committee is comprised of Reid French, Dr. Ayanna Howard, and Ram R. Krishnan, with Mr. French serving as Chair.

Independence of the Board and our Governance Practices

Our Board believes independence is a critical component of our governance strategy, and that it’s continued independence enables it to be objective in carrying out its oversight responsibilities. Our Corporate Governance Guidelines provide that a substantial majority of our directors will be independent and that each Committee will be made up of solely independent directors. Autodesk’s independent directors meet regularly in executive session, without management present, as part of the quarterly Board meetings, with the intent to facilitate open discussion. Stacy J. Smith, our Chair, presides at these executive sessions.

Each year, and before a new director is appointed, the Board must affirmatively determine a director has no relationship that would interfere with the exercise of independent judgment in carrying out their responsibilities as a director. Annually, each director also completes a detailed questionnaire that provides information about relationships that might affect the determination of independence. Autodesk management provides the Corporate Governance and Nominating Committee and the Board with the relevant information from the questionnaires along with known facts and circumstances of any relationship bearing on the independence of a director or nominee. The Corporate Governance and Nominating Committee then completes an assessment of each director considering all known relevant facts and circumstances concerning any relationship bearing on the independence of a director or nominee. This process includes evaluating whether any identified relationship otherwise adversely affects a director’s independence and affirmatively determining that the director has no material relationship with Autodesk, another director, or as a partner, stockholder, or officer of an organization that has a relationship with Autodesk. As part of its annual review process, our Corporate Governance and Nominating Committee also considers a director’s tenure.

As required by the Nasdaq listing standards, a majority of the members of our Board qualify as “independent.” The Board has determined that, with the exception of Dr. Anagnost, our President and CEO, and our Former Interim CFO, Elizabeth (Betsy) Rafael, all of its current members are “independent directors” as that term is defined by applicable Nasdaq listing standards. That definition includes a series of objective tests, including that the director is not an employee of the company and has not engaged in various types of business dealings with the company. In addition, as further required by applicable Nasdaq listing standards, the Board has made a subjective determination as to each independent director that no relationships exist that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Based on the review and recommendation by the Corporate Governance and Nominating Committee, the Board analyzed the independence of each current director. The Board determined that each of Mses. Blasing, Howard, McDowell, and Norrington, and Messrs. Cahill, French, Irving, Krishnan, Milligan, Rahim and Smith meet the standards of independence under our Corporate Governance Guidelines and the Nasdaq listing standards, including that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment. In addition, the Board determined that each of Mr. Epstein and Ms. Simons, our upcoming director additions, meet the standards of independence under our Corporate Governance Guidelines and the Nasdaq listing standards, including that each upcoming director addition is free of any relationship that would interfere with his or her individual exercise of independent judgment.

Certain Relationships and Related Party Transactions

Compensation Committee Interlocks

The members of the Compensation and Human Resources Committee during fiscal 2025 were Mary T. McDowell, Reid French and Rami Rahim, and the current members are Reid French, Dr. Ayanna Howard, and Ram R. Krishnan. No director who served as a member of the Compensation and Human Resources Committee during fiscal year 2025 is or was formerly an officer or employee of Autodesk or any of its subsidiaries. No interlocking relationship existed between any director who served as a member of the Compensation and Human Resources Committee during fiscal year 2025 and the compensation committee of any other company, nor has any such interlocking relationship existed in the past.

2025 Proxy Statement | 23

Related Party Transactions

Our Audit Committee has established a written policy and procedures for review and approval of related-party transactions. Autodesk’s Related Party Transactions Policy states that all transactions between Autodesk and its wholly owned subsidiaries and any of its directors, executive officers, nominees for director or owners of 5% or more of our stock, or their immediate family members, where the amount involved exceeds $120,000, require the approval of both our Chief Financial Officer and the Audit Committee. If a related-party transaction subject to review involves directly or indirectly a member of the Audit Committee or the Chief Financial Officer (or one of their immediate family members), such Audit Committee member or Chief Financial Officer will recuse him or herself from the review. The Chief Financial Officer and the Audit Committee shall approve or ratify only those transactions that are deemed to be not inconsistent with the best interests of the Company as a whole. Non-routine transactions with vendors and suppliers of Autodesk and its wholly-owned subsidiaries require the prior written approval of the Chief Accounting Officer.

During fiscal year 2025, there were ordinary course transactions between Autodesk and certain related entities, for example for the purchase of software licenses by companies of which a director is an executive officer or where an executive officer was previously employed. None of these transactions constituted a related-party transaction that required approval by the Audit Committee.

Director Orientation and Continuing Education

Our orientation programs are designed to familiarize new directors with our businesses, strategies, and policies and assist new directors in developing knowledge about Autodesk and the industry to optimize their service on the Board.

Regular continuing education programs enhance directors’ skills and knowledge to perform their responsibilities. These programs may include internally developed programs or programs presented by third parties.

In November 2024, all of our directors attended Autodesk University, which is our learning event of the year geared towards design professionals, in order to hear new ideas and inspiring stories from our executives, leaders, and customers.

Director Stock Ownership Policy