Please wait

Q2 FY26

Letter to Shareholders

November 4, 2025

November 4, 2025

Dear Shareholders,

In Q2 FY26, Cirrus Logic delivered record September quarter revenue of $561.0 million, towards the top end of our guidance range, and GAAP and non-GAAP earnings per share of $2.48 and $2.83, respectively. During the quarter, we were delighted to see multiple smartphone customers introduce their latest-generation devices featuring our audio and high-performance mixed-signal (HPMS) components. Outside of smartphones, we continued to execute on our plan to grow market share in the PC market. Progress in this space included securing our first mainstream consumer laptop design, expanding our collaboration with leading PC platform vendors, and developing new products with superior voice and audio capture capabilities. Additionally, we continue to focus on our general market business, where products tend to enjoy long lifespans and gross margins that are well above our corporate average. During the quarter, we gained design momentum with customers on all 14 variants of our latest-generation ADCs, DACs, and ultra-high-performance audio codec. We also received positive initial feedback on our family of analog front-end components targeting imaging applications and saw increased engagement on our latest timing product family. Looking forward, we are optimistic about the opportunities ahead of us as we continue to leverage our mixed-signal design and signal processing expertise to diversify our product portfolio and expand our addressable market.

Figure A: Cirrus Logic Q2 FY26

| | | | | | | | | | | |

| Q2 FY26 | GAAP | Adj. | Non-GAAP* |

| Revenue | $561.0 | | $561.0 |

| Gross Profit | $294.4 | $0.3 | $294.7 |

| Gross Margin | 52.5% | | 52.5% |

| Operating Expense | $149.6 | ($21.9) | $127.7 |

| Operating Income | $144.8 | $22.2 | $167.0 |

| Operating Profit | 25.8% | | 29.8% |

| Interest Income | $8.7 | | $8.7 |

| Other Expense | $(0.1) | | $(0.1) |

| Income Tax Expense | $21.8 | $3.9 | $25.7 |

| Net Income | $131.6 | $18.4 | $150.0 |

| Diluted EPS | $2.48 | $0.35 | $2.83 |

*Complete GAAP to Non-GAAP reconciliations available on page 11

Numbers may not sum due to rounding

$ millions, except EPS

Revenue and Gross Margin

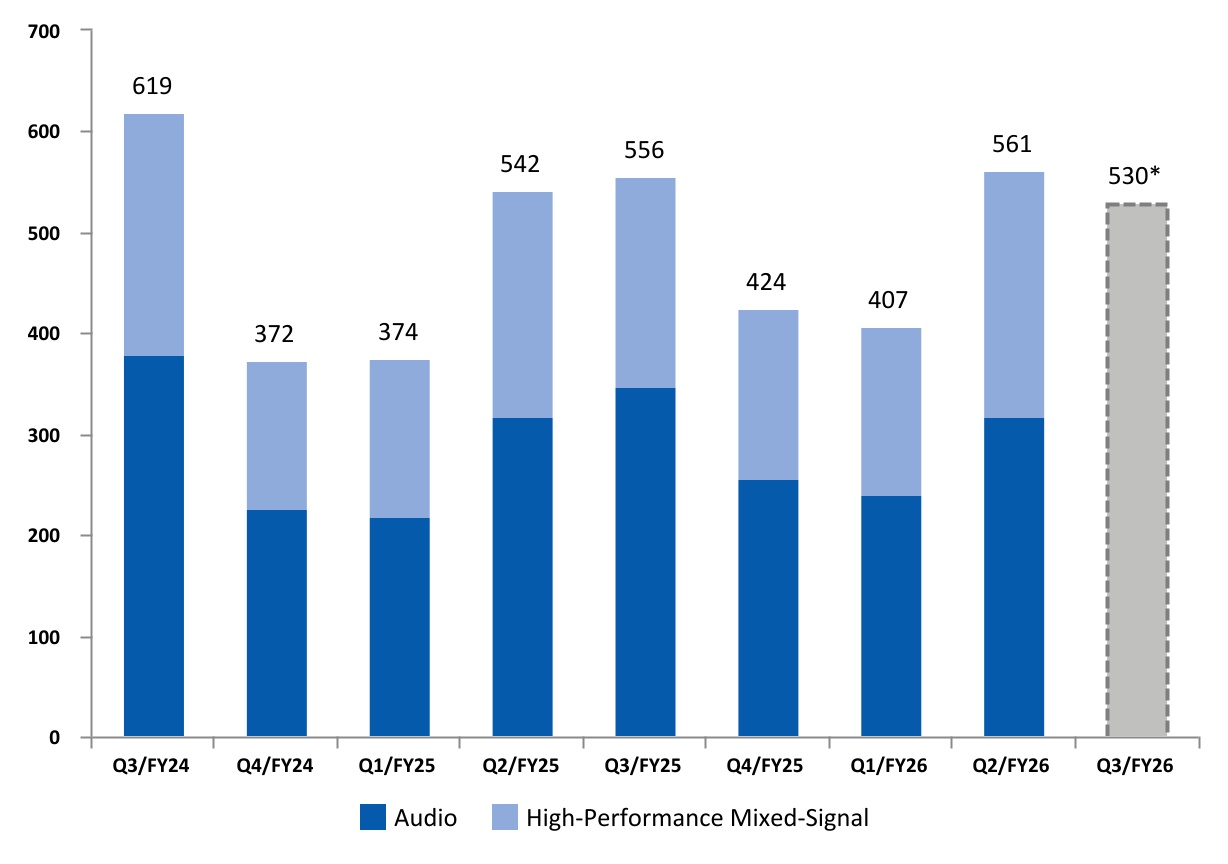

Revenue for the September quarter was $561.0 million, up thirty-eight percent quarter over quarter and up four percent year over year. The increase in revenue on a sequential basis reflects higher smartphone unit volumes. The year-over-year increase was primarily driven by higher smartphone unit volumes and sales associated with our latest-generation products. This was partially offset by pricing reductions. In the December quarter, we expect revenue to range from $500 million to $560 million, down six percent sequentially and approximately down five percent year over year at the midpoint.

In Q2 FY26, revenue derived from our audio and high-performance mixed-signal product lines represented 57 percent and 43 percent of total revenue, respectively. One customer contributed approximately 90 percent of total revenue in Q2 FY26. Our relationship with our largest customer remains

| | | | | |

Q2 FY26 Letter to Shareholders | 2 |

outstanding, with continued strong design activity across a wide range of products. While we understand there is intense interest in this customer, in accordance with our policy, we do not discuss specifics about this business.

Figure B: Cirrus Logic Revenue ($M) Q3 FY24 to Q3 FY26

*Midpoint of guidance as of November 4, 2025

GAAP gross margin in the September quarter was 52.5 percent, compared to 52.6 percent in Q1 FY26 and 52.2 percent in Q2 FY25. Non-GAAP gross margin in the September quarter was 52.5 percent, compared to 52.6 percent in Q1 FY26 and 52.2 percent in Q2 FY25. On a year-over-year basis, the increase in gross margin was largely due to a more favorable product mix. This was partially offset by higher inventory reserves. In the December quarter, we expect gross margin to range from 51 percent to 53 percent.

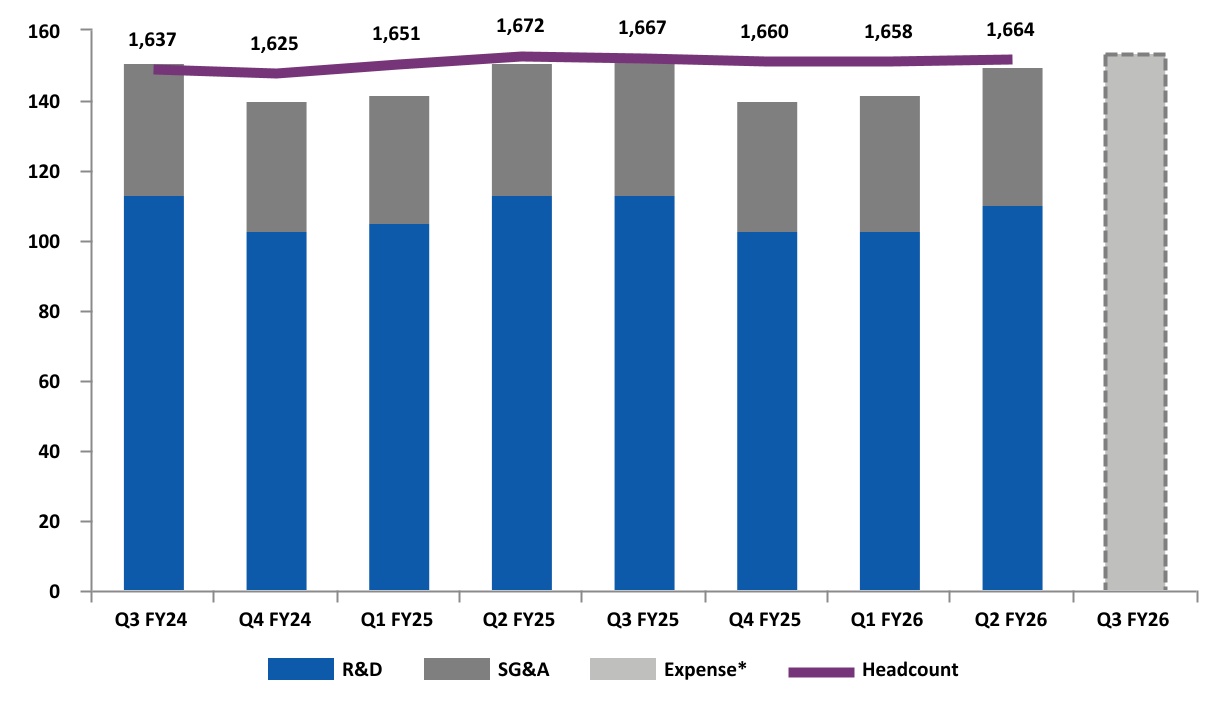

Operating Profit, Tax, and EPS

Operating profit for Q2 FY26 was 25.8 percent on a GAAP basis and 29.8 percent on a non-GAAP basis. GAAP operating expense was $149.6 million and included $20.2 million in stock-based compensation and $1.6 million in amortization of acquisition intangibles. On a sequential basis, GAAP operating expense increased by $8.0 million, primarily driven by higher variable compensation, product development costs that were largely due to tape outs, and facilities-related costs. This was partially offset by a reduction in employee-related expenses. On a year-over-year basis, GAAP operating expense decreased by $1.1 million largely due to lower stock-based compensation and product development costs. This was offset by

| | | | | |

Q2 FY26 Letter to Shareholders | 3 |

higher employee-related expenses, mostly due to annual salary increases. Non-GAAP operating expense for the quarter was $127.7 million, up $8.2 million sequentially and up $0.9 million year over year. The company’s total headcount exiting Q2 was 1,664.

Combined GAAP R&D and SG&A expenses for Q3 FY26 are expected to range from $151 million to $157 million, including approximately $21 million in stock-based compensation expense and $2 million in amortization of acquisition intangibles, resulting in a non-GAAP operating expense range between $128 million and $134 million.

Figure C: GAAP R&D and SG&A Expenses ($M)/Headcount Q3 FY24 to Q3 FY26

*Reflects midpoint of combined R&D and SG&A guidance as of November 4, 2025

For the September quarter, GAAP tax expense was $21.8 million on GAAP pre-tax income of $153.4 million, resulting in an effective tax rate of 14.2 percent. Non-GAAP tax expense for the quarter was $25.7 million on non-GAAP pre-tax income of $175.6 million, resulting in a non-GAAP effective tax rate of 14.6 percent. Both the GAAP and non-GAAP effective tax rates include the year-to-date beneficial impact of the One Big Beautiful Bill Act (the "OBBBA"), which was signed into law on July 4, 2025 and reinstated the immediate tax deductibility of U.S. R&D expenditures, among other provisions. We estimate that our FY26 non-GAAP effective tax rate will range from approximately 16 percent to 18 percent.

GAAP earnings per share for the September quarter was $2.48, compared to earnings per share of $1.14 in the prior quarter and $1.83 in Q2 FY25. Non-GAAP earnings per share for the September quarter was $2.83, versus $1.51 in Q1 FY26 and $2.25 in Q2 FY25.

| | | | | |

Q2 FY26 Letter to Shareholders | 4 |

Balance Sheet

Our cash and investment balance at the end of Q2 FY26 was $896.0 million, up from $847.8 million in the prior quarter and $706.6 million in Q2 FY25. . Cash flow from operations for the September quarter was $92.2 million. During the quarter, we repurchased 361,708 shares at an average price of $110.55, returning $40.0 million of cash to shareholders in the form of buybacks. At the end of Q2 FY26, the company had $414.1 million remaining in its share repurchase authorization. Over the long term, we expect strong cash flow generation, and we will continue to evaluate potential uses of this cash, including investing in the business to pursue organic growth opportunities, M&A, and returning capital to shareholders through share repurchases.

Q2 FY26 inventory was $236.4 million, down from $279.0 million in Q1 FY26. In Q3 FY26, we expect inventory to be slightly down sequentially.

Company Strategy

We remain committed to our three-pronged strategy for growing our business: first, maintaining our leadership position in smartphone audio; second, increasing HPMS content in smartphones; and third, leveraging our strength in audio and HPMS to expand into additional applications and markets with both existing and new components.

Smartphones

In smartphones, the company maintained its position as a leading supplier of audio solutions, as we experienced strong demand for our latest-generation custom boosted amplifier and first 22-nanometer smart codec. These components feature an innovative new architecture that delivers significant power and efficiency improvements while also saving valuable board space and enabling system design flexibility. As a reminder to our shareholders, while many of our products ship into consumer end devices, much of our custom silicon business offers greater returns over a significantly longer period than is typical of consumer products. For example, our latest-generation audio components superseded a codec and amplifiers that had been shipping in high-volume flagship phones for five and six years, respectively. We regard this as an important strength of our business, providing solid long-term visibility, sustained revenue contribution, and the ability to leverage our R&D resources in new areas that can drive further innovation and growth. This past quarter, a leading Android OEM also introduced its latest flagship smartphone featuring two Cirrus Logic boosted amplifiers and a haptic driver. While the majority of our general market R&D investments are focused on developing products for new markets, we continue to engage with customers on next-generation flagship smartphones and expect additional designs from various customers to come to market in the future.

Beyond audio, we continue to pursue opportunities to diversify our revenue and grow our smartphone content with HPMS solutions. Customer engagement with our camera controllers remains strong, and we were delighted to see the technology continue to be featured as an important differentiator in the new generation of devices. We believe there is an exciting path for innovation in camera controllers, and we are engaged on next-generation components that offer further feature and performance enhancements. Additionally, we continue to invest in product development for power and battery technologies, which we view as a longer-term growth driver within our HPMS product line. Today, we have a number of R&D programs underway related to battery performance, health, and longevity. Our teams are focused on

| | | | | |

Q2 FY26 Letter to Shareholders | 5 |

maximizing power efficiency and integrating more digital processing and control alongside analog circuits. We believe our work in this area will contribute to product diversification and broaden our footprint in the years ahead.

New Applications and Markets

Outside of smartphones, we are committed to leveraging our intellectual property and engineering capabilities to expand into new applications and markets. Our most immediate opportunity is in the PC market, where we are executing on our plan to meaningfully grow share. During the quarter, design activity across our laptop portfolio was strong, and we expect a range of consumer and commercial laptops featuring our components to come to market over the next year as the adoption of SoundWire Device Class Audio accelerates. Demand for our PC components has been driven by increased customer interest in high-quality audio and the shift toward thinner, lighter, and more power-efficient designs. After our initial success in high-end laptop programs, we are now also strategically focused on expanding into mainstream designs to target higher-volume opportunities. This enables us to capture a greater share of our serviceable addressable market and unlock additional long-term revenue opportunities. Building on our initial wins with mainstream commercial laptops earlier this year, we are delighted to have recently secured our first mainstream consumer laptop design, which is expected to ship during the next calendar year. These strategically important wins validate our capabilities and position the company well to secure more mainstream devices in the future. To enable faster time to market for OEMs, we are expanding our collaboration with leading PC platform vendors with the introduction of new audio and HPMS solutions that address a larger portion of our PC SAM in both commercial and consumer products. Further, as voice increasingly becomes a natural and preferred way to interact with AI-enabled PCs, we are developing new products to capitalize on this opportunity. These products also deliver superior voice and audio capture capabilities, including noise cleanup and voice detection. Additionally, they support ultra-low power modes, which are critical to enable features such as voice wake for AI applications while the device is in standby. We expect the first product with this technology to sample with customers during the December quarter. Overall, we are encouraged by the momentum we are building in the PC market and believe there are significant opportunities for Cirrus Logic to drive long-term revenue growth in these market segments.

While PCs represent a significant growth opportunity outside of smartphones, we also have strong interest in our general market products, which span a large number of customers across the professional audio, automotive, industrial, and imaging end markets. Applications in these areas tend to have long lifespans and gross margins that are well above our corporate average. We are targeting a growing share of these highly profitable market segments by efficiently leveraging our low-power, high-performance intellectual property to develop differentiated components for a wide range of applications and tiers. During the quarter, we gained design momentum with prosumer and automotive customers on all 14 variants of our latest-generation ADCs, DACs, and ultra-high-performance audio codec, and expect new end products utilizing these components to come to market over the next 12 months. Additionally, we are seeing increased engagement from automotive and professional audio customers on our latest timing product family, which began shipping last quarter. The company is also sampling a family of high-performance analog front-end components targeting imaging applications, and initial feedback has been positive. We are extremely pleased with our progress to date in these areas. Looking forward, we plan to further build out this portfolio of products and leverage our mixed-signal design and advanced low-power signal processing expertise to drive growth opportunities in new applications and markets.

| | | | | |

Q2 FY26 Letter to Shareholders | 6 |

Summary and Guidance

For the December quarter, we expect the following results:

•Revenue to range between $500 million and $560 million;

•GAAP gross margin to be between 51 percent and 53 percent; and

•Combined GAAP R&D and SG&A expenses to range between $151 million and $157 million, including approximately $21 million in stock-based compensation expense and $2 million in amortization of acquisition intangibles, resulting in a non-GAAP operating expense range between $128 million and $134 million.

In conclusion, we are proud to have delivered strong financial results for Q2 FY26 while also continuing to execute on our strategy. During the quarter, new flagship smartphones with our components came to market, we continued to build momentum with our PC business, and we had strong customer engagement across our portfolio of general market components. With an extensive intellectual property portfolio and a solid product roadmap, we believe that we are well-positioned to capitalize on the opportunities ahead of us to drive long-term shareholder value.

Sincerely,

| | | | | | | | | | | |

| John Forsyth President & Chief Executive Officer | | Jeff Woolard Chief Financial Officer |

Conference Call Q&A Session

Cirrus Logic will host a live Q&A session at 5 p.m. ET today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website.

A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion or by calling (609) 800-9909 or toll-free at (800) 770-2030 (Access Code: 95424).

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP basis, Cirrus has provided non-GAAP financial information, including non-GAAP net income, diluted earnings per share, operating income and profit, operating expenses, gross margin and profit, tax expense, tax expense impact on earnings per share, effective tax rate, free cash flow, and free cash flow margin. A reconciliation of the adjustments to

| | | | | |

Q2 FY26 Letter to Shareholders | 7 |

GAAP results is included in the tables below. We are also providing guidance on our expected non-GAAP expected effective tax rate. We are not able to provide guidance on our GAAP effective tax rate or a related reconciliation without unreasonable efforts since our future GAAP effective tax rate depends on our future stock price and related stock-based compensation information that is not currently available.

Non-GAAP financial information is not meant as a substitute for GAAP results but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. The non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set forth in this shareholder letter contain forward-looking statements, including statements about our ability to leverage our mixed-signal design and signal processing expertise to diversify our product portfolio and expand our addressable market; our ability to maintain our leadership position in smartphone audio; our ability to increase HPMS content in smartphones; our ability to leverage our strength in audio and HPMS to expand into additional applications and markets with both new and existing components; our expectation that our latest-generation custom boosted amplifier and first 22-nanometer smart codec will ship for multiple generations and provide the company an opportunity for sustained revenue contribution; our ability to deploy R&D resources on new projects that can drive further innovation and growth; our expectation that next-generation flagship smartphones will come to market in the future; our expectation that power and battery technologies will drive longer-term growth, contribute to product diversification, and broaden our footprint in the years ahead; our ability to leverage our intellectual property and engineering capabilities to expand into new applications and markets; our ability to expand into mainstream designs to capture a greater share of our serviceable addressable market and unlock additional long-term revenue opportunities; our expectation that new end products with our components will come to market in the next 12 months; our ability to drive long-term revenue growth and grow market share in the PC market; our expectation that the first product designed to capitalize on opportunities in AI-enabled PCs will sample with customers during the December quarter; our belief there is an exciting path for innovation in camera controllers; our expectation that new end products utilizing our general market components will come to market over the next 12 months; our ability to capitalize on the opportunities ahead of us to drive long-term shareholder value; our expectation that inventory will be down slightly sequentially; our non-GAAP effective tax rate for the full fiscal year 2026; and our forecasts for the third quarter of fiscal year 2026 revenue, gross margin, combined research and development and selling, general and administrative expense levels, stock-based compensation expense, and amortization of acquisition intangibles. In some cases, forward-looking statements are identified by words such as “emerge,” “expect,” “anticipate,” “foresee,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” “will,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies, or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates, and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially, and readers should not place undue reliance on such statements. These risks and uncertainties include, but are not limited to, the following: the level and timing of orders and shipments during the third quarter of fiscal year 2026, customer cancellations of orders, or the failure to place orders consistent with forecasts; changes in government trade policies, including the imposition of tariffs and export restrictions; global economic conditions and uncertainty;

| | | | | |

Q2 FY26 Letter to Shareholders | 8 |

and the risk factors listed in our Form 10-K for the year ended March 29, 2025 and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise.

Cirrus Logic, Cirrus and the Cirrus Logic logo are registered trademarks of Cirrus Logic, Inc. All other company or product names noted herein may be trademarks of their respective holders.

| | | | | |

Q2 FY26 Letter to Shareholders | 9 |

Summary of Financial Data Below:

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(in thousands, except per share data; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| Sep. 27,

2025 | | Jun. 28,

2025 | | Sep. 28,

2024 | | Sep. 27,

2025 | | Sep. 28,

2024 |

| Q2'26 | | Q1'26 | | Q2'25 | | Q2'26 | | Q2'25 |

| Audio | $ | 318,214 | | | $ | 240,043 | | | $ | 316,588 | | | $ | 558,257 | | | $ | 535,558 | |

| High-Performance Mixed-Signal | 242,746 | | | 167,229 | | | 225,269 | | | 409,975 | | | 380,325 | |

| Net sales | 560,960 | | | 407,272 | | | 541,857 | | | 968,232 | | | 915,883 | |

| Cost of sales | 266,586 | | | 193,242 | | | 259,267 | | | 459,828 | | | 444,368 | |

| Gross profit | 294,374 | | | 214,030 | | | 282,590 | | | 508,404 | | | 471,515 | |

| Gross margin | 52.5 | % | | 52.6 | % | | 52.2 | % | | 52.5 | % | | 51.5 | % |

| | | | | | | | | |

| Research and development | 110,021 | | | 102,892 | | | 112,925 | | | 212,913 | | | 218,288 | |

| Selling, general and administrative | 39,589 | | | 38,744 | | | 37,813 | | | 78,333 | | | 74,583 | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating expenses | 149,610 | | | 141,636 | | | 150,738 | | | 291,246 | | | 292,871 | |

| | | | | | | | | |

| Income from operations | 144,764 | | | 72,394 | | | 131,852 | | | 217,158 | | | 178,644 | |

| | | | | | | | | |

| Interest income | 8,695 | | | 8,622 | | | 8,134 | | | 17,317 | | | 16,336 | |

| Other income (expense) | (63) | | | (388) | | | 19 | | | (451) | | | 1,628 | |

| Income before income taxes | 153,396 | | | 80,628 | | | 140,005 | | | 234,024 | | | 196,608 | |

| Provision for income taxes | 21,800 | | | 19,931 | | | 37,865 | | | 41,731 | | | 52,373 | |

| Net income | $ | 131,596 | | | $ | 60,697 | | | $ | 102,140 | | | $ | 192,293 | | | $ | 144,235 | |

| | | | | | | | | |

| Basic earnings per share | $ | 2.57 | | | $ | 1.17 | | | $ | 1.92 | | | $ | 3.74 | | | $ | 2.70 | |

| Diluted earnings per share: | $ | 2.48 | | | $ | 1.14 | | | $ | 1.83 | | | $ | 3.61 | | | $ | 2.59 | |

| | | | | | | | | |

| Weighted average number of shares: | | | | | | | | | |

| Basic | 51,175 | | | 51,727 | | | 53,275 | | | 51,451 | | | 53,354 | |

| Diluted | 53,054 | | | 53,319 | | | 55,800 | | | 53,195 | | | 55,753 | |

| | | | | | | | | |

Prepared in accordance with Generally Accepted Accounting Principles

| | | | | |

Q2 FY26 Letter to Shareholders | 10 |

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION CONTINUED

(in thousands, except per share data; unaudited)

(not prepared in accordance with GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP financial information is not meant as financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. | |

| | | | | | | | | | |

| Three Months Ended | | Six Months Ended | |

| Sep. 27,

2025 | | Jun. 28,

2025 | | Sep. 28,

2024 | | Sep. 27,

2025 | | Sep. 28,

2024 | |

| Net Income Reconciliation | Q2'26 | | Q1'26 | | Q2'25 | | Q2'26 | | Q2'25 | |

| GAAP Net Income | $ | 131,596 | | | $ | 60,697 | | | $ | 102,140 | | | $ | 192,293 | | | $ | 144,235 | | |

| Amortization of acquisition intangibles | 1,648 | | | 1,647 | | | 1,864 | | | 3,295 | | | 3,836 | | |

| Stock-based compensation expense | 20,597 | | | 20,809 | | | 22,447 | | | 41,406 | | | 43,832 | | |

| Lease impairment | — | | | — | | | — | | | — | | | 1,019 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjustment to income taxes | (3,861) | | | (2,839) | | | (1,162) | | | (6,700) | | | (5,267) | | |

| Non-GAAP Net Income | $ | 149,980 | | | $ | 80,314 | | | $ | 125,289 | | | $ | 230,294 | | | $ | 187,655 | | |

| | | | | | | | | | |

| Earnings Per Share Reconciliation | | | | | | | | | | |

| GAAP Diluted earnings per share | $ | 2.48 | | | $ | 1.14 | | | $ | 1.83 | | | $ | 3.61 | | | $ | 2.59 | | |

| Effect of Amortization of acquisition intangibles | 0.03 | | | 0.03 | | | 0.04 | | | 0.06 | | | 0.07 | | |

| Effect of Stock-based compensation expense | 0.39 | | | 0.39 | | | 0.40 | | | 0.78 | | | 0.79 | | |

| Effect of Lease impairment | — | | | — | | | — | | | — | | | 0.02 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Effect of Adjustment to income taxes | (0.07) | | | (0.05) | | | (0.02) | | | (0.12) | | | (0.10) | | |

| Non-GAAP Diluted earnings per share | $ | 2.83 | | | $ | 1.51 | | | $ | 2.25 | | | $ | 4.33 | | | $ | 3.37 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Operating Income Reconciliation | | | | | | | | | | |

| GAAP Operating Income | $ | 144,764 | | | $ | 72,394 | | | $ | 131,852 | | | $ | 217,158 | | | $ | 178,644 | | |

| GAAP Operating Profit | 25.8 | % | | 17.8 | % | | 24.3 | % | | 22.4 | % | | 19.5 | % | |

| Amortization of acquisition intangibles | 1,648 | | | 1,647 | | | 1,864 | | | 3,295 | | | 3,836 | | |

| Stock-based compensation expense - COGS | 363 | | | 300 | | | 355 | | | 663 | | | 621 | | |

| Stock-based compensation expense - R&D | 13,019 | | | 13,072 | | | 15,844 | | | 26,091 | | | 31,607 | | |

| Stock-based compensation expense - SG&A | 7,215 | | | 7,437 | | | 6,248 | | | 14,652 | | | 11,604 | | |

| Lease impairment | — | | | — | | | — | | | — | | | 1,019 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-GAAP Operating Income | $ | 167,009 | | | $ | 94,850 | | | $ | 156,163 | | | $ | 261,859 | | | $ | 227,331 | | |

| Non-GAAP Operating Profit | 29.8 | % | | 23.3 | % | | 28.8 | % | | 27.0 | % | | 24.8 | % | |

| | | | | | | | | | |

| Operating Expense Reconciliation | | | | | | | | | | |

| GAAP Operating Expenses | $ | 149,610 | | | $ | 141,636 | | | $ | 150,738 | | | $ | 291,246 | | | $ | 292,871 | | |

| Amortization of acquisition intangibles | (1,648) | | | (1,647) | | | (1,864) | | | (3,295) | | | (3,836) | | |

| Stock-based compensation expense - R&D | (13,019) | | | (13,072) | | | (15,844) | | | (26,091) | | | (31,607) | | |

| Stock-based compensation expense - SG&A | (7,215) | | | (7,437) | | | (6,248) | | | (14,652) | | | (11,604) | | |

| Lease impairment | — | | | — | | | — | | | — | | | (1,019) | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-GAAP Operating Expenses | $ | 127,728 | | | $ | 119,480 | | | $ | 126,782 | | | $ | 247,208 | | | $ | 244,805 | | |

| | | | | | | | | | |

| Gross Margin/Profit Reconciliation | | | | | | | | | | |

| GAAP Gross Profit | $ | 294,374 | | | $ | 214,030 | | | $ | 282,590 | | | $ | 508,404 | | | $ | 471,515 | | |

| GAAP Gross Margin | 52.5 | % | | 52.6 | % | | 52.2 | % | | 52.5 | % | | 51.5 | % | |

| | | | | | | | | | |

| Stock-based compensation expense - COGS | 363 | | | 300 | | | 355 | | | 663 | | | 621 | | |

| Non-GAAP Gross Profit | $ | 294,737 | | | $ | 214,330 | | | $ | 282,945 | | | $ | 509,067 | | | $ | 472,136 | | |

| Non-GAAP Gross Margin | 52.5 | % | | 52.6 | % | | 52.2 | % | | 52.6 | % | | 51.5 | % | |

| | | | | | | | | | |

| Effective Tax Rate Reconciliation | | | | | | | | | | |

| GAAP Tax Expense | $ | 21,800 | | | $ | 19,931 | | | $ | 37,865 | | | $ | 41,731 | | | $ | 52,373 | | |

| GAAP Effective Tax Rate | 14.2 | % | | 24.7 | % | | 27.0 | % | | 17.8 | % | | 26.6 | % | |

| Adjustments to income taxes | 3,861 | | | 2,839 | | | 1,162 | | | 6,700 | | | 5,267 | | |

| Non-GAAP Tax Expense | $ | 25,661 | | | $ | 22,770 | | | $ | 39,027 | | | $ | 48,431 | | | $ | 57,640 | | |

| Non-GAAP Effective Tax Rate | 14.6 | % | | 22.1 | % | | 23.8 | % | | 17.4 | % | | 23.5 | % | |

| | | | | | | | | | |

| Tax Impact to EPS Reconciliation | | | | | | | | | | |

| GAAP Tax Expense | $ | 0.41 | | | $ | 0.37 | | | $ | 0.68 | | | $ | 0.78 | | | $ | 0.94 | | |

| Adjustments to income taxes | 0.07 | | | 0.05 | | | 0.02 | | | 0.12 | | | 0.10 | | |

| Non-GAAP Tax Expense | $ | 0.48 | | | $ | 0.42 | | | $ | 0.70 | | | $ | 0.90 | | | $ | 1.04 | | |

| | | | | |

Q2 FY26 Letter to Shareholders | 11 |

CONSOLIDATED CONDENSED BALANCE SHEET

(in thousands; unaudited)

| | | | | | | | | | | | | | | | | |

| Sep. 27,

2025 | | Mar. 29,

2025 | | Sep. 28,

2024 |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 593,476 | | | $ | 539,620 | | | $ | 445,759 | |

| Marketable securities | 52,424 | | | 56,160 | | | 32,499 | |

| Accounts receivable, net | 355,397 | | | 216,009 | | | 324,098 | |

| Inventories | 236,409 | | | 299,092 | | | 271,765 | |

| Prepaid wafers | 45,056 | | | 52,560 | | | 71,740 | |

| Other current assets | 84,238 | | | 76,293 | | | 79,044 | |

| Total current Assets | 1,367,000 | | | 1,239,734 | | | 1,224,905 | |

| | | | | |

| Long-term marketable securities | 250,146 | | | 239,036 | | | 228,302 | |

| Right-of-use lease assets | 125,315 | | | 126,688 | | | 133,316 | |

| Property and equipment, net | 151,154 | | | 159,900 | | | 168,265 | |

| Intangibles, net | 24,451 | | | 27,461 | | | 25,700 | |

| Goodwill | 435,936 | | | 435,936 | | | 435,936 | |

| Deferred tax asset | 46,511 | | | 48,150 | | | 48,619 | |

| Long-term prepaid wafers | — | | | 15,512 | | | 37,804 | |

| Other assets | 29,170 | | | 34,656 | | | 53,292 | |

| Total assets | $ | 2,429,683 | | | $ | 2,327,073 | | | $ | 2,356,139 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities | | | | | |

| Accounts payable | $ | 79,974 | | | $ | 63,162 | | | $ | 91,899 | |

| Accrued salaries and benefits | 52,689 | | | 52,075 | | | 51,861 | |

| Lease liability | 19,481 | | | 21,811 | | | 22,800 | |

| | | | | |

| Other accrued liabilities | 58,179 | | | 58,140 | | | 62,716 | |

| Total current liabilities | 210,323 | | | 195,188 | | | 229,276 | |

| | | | | |

| Non-current lease liability | 120,985 | | | 121,908 | | | 129,806 | |

| Non-current income taxes | 45,357 | | | 44,040 | | | 42,683 | |

| | | | | |

| Other long-term liabilities | 10,576 | | | 16,488 | | | 26,247 | |

| Total long-term liabilities | 176,918 | | | 182,436 | | | 198,736 | |

| | | | | |

| Stockholders' equity: | | | | | |

| Capital stock | 1,903,638 | | | 1,860,281 | | | 1,819,589 | |

| Accumulated earnings | 139,025 | | | 90,351 | | | 107,233 | |

| Accumulated other comprehensive (loss) income | (221) | | | (1,183) | | | 1,305 | |

| Total stockholders' equity | 2,042,442 | | | 1,949,449 | | | 1,928,127 | |

| Total liabilities and stockholders' equity | $ | 2,429,683 | | | $ | 2,327,073 | | | $ | 2,356,139 | |

Prepared in accordance with Generally Accepted Accounting Principles

| | | | | |

Q2 FY26 Letter to Shareholders | 12 |

CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS

(in thousands; unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| Sep. 27, | | Sep. 28, |

| 2025 | | 2024 |

| Q2'26 | | Q2'25 |

| Cash flows from operating activities: | | | |

| Net income | $ | 131,596 | | | $ | 102,140 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 12,704 | | | 12,618 | |

| Stock-based compensation expense | 20,597 | | | 22,447 | |

| Deferred income taxes | 7,470 | | | 4,984 | |

| Loss on retirement or write-off of long-lived assets | — | | | 12 | |

| Other non-cash charges | 68 | | | 87 | |

| | | |

| | | |

| Net change in operating assets and liabilities: | | | |

| Accounts receivable, net | (141,312) | | | (134,019) | |

| Inventories | 42,575 | | | (39,199) | |

| Prepaid wafers | 16,878 | | | 25,531 | |

| Other assets | (8,485) | | | (341) | |

| Accounts payable and other accrued liabilities | 29,451 | | | 27,268 | |

| Income taxes payable | (19,328) | | | (13,297) | |

| | | |

| Net cash provided by operating activities | 92,214 | | | 8,231 | |

| Cash flows from investing activities: | | | |

| Maturities and sales of available-for-sale marketable securities | 39,752 | | | 835 | |

| Purchases of available-for-sale marketable securities | (43,171) | | | (3,577) | |

| Purchases of property, equipment and software | (3,868) | | | (2,670) | |

| Investments in technology | (642) | | | (70) | |

| | | |

| Net cash used in investing activities | (7,929) | | | (5,482) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Net proceeds from the issuance of common stock | 1,568 | | | 4,859 | |

| Repurchase of stock to satisfy employee tax withholding obligations | (1,261) | | | (3,207) | |

| Repurchase and retirement of common stock | (39,986) | | | (49,993) | |

| Net cash used in financing activities | (39,679) | | | (48,341) | |

| Net increase (decrease) in cash and cash equivalents | 44,606 | | | (45,592) | |

| Cash and cash equivalents at beginning of period | 548,870 | | | 491,351 | |

| Cash and cash equivalents at end of period | $ | 593,476 | | | $ | 445,759 | |

Prepared in accordance with Generally Accepted Accounting Principles

| | | | | |

Q2 FY26 Letter to Shareholders | 13 |

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(in thousands; unaudited)

Free cash flow, a non-GAAP financial measure, is GAAP cash flow from operations (or cash provided by operating activities) less capital expenditures. Capital expenditures include purchases of property, equipment and software as well as investments in technology, as presented within our GAAP Consolidated Condensed Statement of Cash Flows. Free cash flow margin represents free cash flow divided by revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended | | Three Months Ended |

| | | | | | | | | |

| Sep. 27, | | Sep. 27, | | Jun. 28, | | Mar. 29, | | Dec. 28, |

| 2025 | | 2025 | | 2025 | | 2025 | | 2024 |

| Q2'26 | | Q2'26 | | Q1'26 | | Q4'25 | | Q3'25 |

| Net cash provided by operating activities (GAAP) | $ | 557,319 | | | $ | 92,214 | | | $ | 116,131 | | | $ | 130,386 | | | $ | 218,588 | |

| Capital expenditures | (23,148) | | | (4,510) | | | (2,770) | | | (9,181) | | | (6,687) | |

| Free Cash Flow (Non-GAAP) | $ | 534,171 | | | $ | 87,704 | | | $ | 113,361 | | | $ | 121,205 | | | $ | 211,901 | |

| | | | | | | | | |

| Cash Flow from Operations as a Percentage of Revenue (GAAP) | 29 | % | | 16 | % | | 29 | % | | 31 | % | | 39 | % |

| Capital Expenditures as a Percentage of Revenue (GAAP) | 1 | % | | 1 | % | | 1 | % | | 2 | % | | 1 | % |

| Free Cash Flow Margin (Non-GAAP) | 27 | % | | 16 | % | | 28 | % | | 29 | % | | 38 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | |

Q2 FY26 Letter to Shareholders | 14 |

| | | | | | | | |

| RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION |

| (in millions; unaudited) |

| (not prepared in accordance with GAAP) |

| | |

| | Q3 FY26 |

| | Guidance |

| Operating Expense Reconciliation | | |

| GAAP Operating Expenses | | $151 - 157 |

| Stock-based compensation expense | | (21) | |

| Amortization of acquisition intangibles | | (2) | |

| | |

| Non-GAAP Operating Expenses | | $128 - 134 |

| | | | | |

Q2 FY26 Letter to Shareholders | 15 |