Please wait

PRUCO LIFE INSURANCE COMPANY, PHOENIX, ARIZONA

INDEX STRATEGIES SPECIFICATIONS SCHEDULE

ANNUITY NUMBER: [001-00001] EFFECTIVE DATE: [February 1, 2026]

[Cap Rate Index Strategies:

| | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on Effective Date | Initial Index Strategy Term | Initial Index Strategy Base | Guaranteed Minimum Cap Rate | Initial Cap Rate | Buffer |

[Invesco QQQ ETF] | [XXXX.XX] | [1 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[Invesco QQQ ETF] | [XXXX.XX] | [1 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [15.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[15.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[15.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[15.00%] |

[Invesco QQQ ETF] | [XXXX.XX] | [1 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [30.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[100.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

ICC25-FG-SCH-SPC(11/25) 1

| | | | | | | | | | | | | | | | | | | | |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[AB 500 Plus IndexSM] | [XXXX.XX] | [3 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[3 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[AB 500 Plus IndexSM] | [XXXX.XX] | [3 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [20.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[Invesco QQQ ETF] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [20.00%] |

[AB 500 Plus IndexSM] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [20.00%] |

| [Dimensional International Equity Focus Index] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [20.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[30.00%] |

[Invesco QQQ ETF] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [30.00%] |

[AB 500 Plus IndexSM] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [30.00%] |

ICC25-FG-SCH-SPC(11/25) 2

| | | | | | | | | | | | | | | | | | | | |

| [Dimensional International Equity Focus Index] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [30.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[100.00%] |

]

[ Cap Rate with Spread Index Strategies:

| | | | | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on Effective Date | Initial Index Strategy Term | Initial Index Strategy Base | Guaranteed Minimum Cap Rate | Initial Cap Rate | Spread | Buffer |

[Invesco QQQ ETF] | [XXXXX.X X] | [1 Year] | [$XXXXX.XX ] | [X.XX%] | [X.XX%] | [X.XX%] | [10.00%] |

[iShares Russell 2000 ETF] | [XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[X.XX%] |

[X.XX%] |

[X.XX%] |

[10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[XX.XX%] |

[X.XX%] |

[X.XX%] |

[10.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[XX.XX%] |

[X.XX%] |

[X.XX%] |

[10.00%] |

[AB 500 Plus IndexSM] | [XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[XX.XX%] |

[X.XX%] |

[X.XX%] |

[10.00%] |

[Dimensional International Equity Focus Index] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[XX.XX%] |

[X.XX%] |

[X.XX%] |

[10.00%] |

[Invesco QQQ ETF] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[X.XX%] |

[X.XX%] |

[X.XX%] |

[15.00%] |

[iShares Russell 2000 ETF] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[X.XX%] |

[X.XX%] |

[X.XX%] |

[15.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[X.XX%] |

[X.XX%] |

[X.XX%] |

[15.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXXX.X X] |

[1 Year] |

[$XXXXX.XX ] |

[XX.XX%] |

[X.XX%] |

[X.XX%] |

[15.00%] |

Guaranteed Maximum Spread: [3] % for a [1 Year Index Strategy Term].]

ICC25-FG-SCH-SPC(11/25) 3

[ Dual Directional Index Strategies:

| | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on Effective Date | Initial Index Strategy Term | Initial Index Strategy Base | Guaranteed Minimum Cap Rate | Initial Cap Rate | Buffer |

[S&P 500® Index, Price Return (SPX)] | [XXXX.XX] | [1 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[S&P 500® Index, Price Return (SPX)] | [XXXX.XX] | [1 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [15.00%] |

[AB 500 Plus IndexSM] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[Invesco QQQ ETF] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[iShares Russell 2000 ETF] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[S&P 500® Index, Price Return (SPX)] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [10.00%] |

[S&P 500® Index, Price Return (SPX)] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [15.00%] |

[S&P 500® Index, Price Return (SPX)] | [XXXX.XX] | [6 Year] | [$XXXXX.XX] | [XX.XX%] | [XX.XX%] | [20.00%] |

]

ICC25-FG-SCH-SPC(11/25) 4

[Participation Rate with Cap Index Strategies:

| | | | | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on Effective Date | Initial Index Strategy Term | Initial Index Strategy Base | Initial Participation Rate | Guaranteed Minimum Cap Rate | Initial Cap Rate | Buffer |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[Invesco QQQ ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[AB 500 Plus IndexSM] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[Dimensional International Equity Focus Index] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[AB 500 Plus IndexSM] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

| [Dimensional International Equity Focus Index] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

[Invesco QQQ ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[20.00%] |

Guaranteed Minimum Participation Rate: [100%]

ICC25-FG-SCH-SPC(11/25) 5

[ Tiered Participation Index Strategies:

| | | | | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on EffectiveDate | Initial Index Strategy Term | Initial Index Strategy Base | Initial Tier 1 Participation Rate | Initial Tier 2 Participation Rate | Tier Level | Buffer |

[iShares Russell 2000 ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[Invesco QQQ ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[AB 500 Plus IndexSM] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[Dimensional International Equity Focus Index] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[Invesco QQQ ETF] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[AB 500 Plus IndexSM] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[Dimensional International Equity Focus Index] |

[XXXX.XX] |

[6 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

Guaranteed Minimum Participation Rate: [100%]

Guaranteed Maximum Tier Level: [35%] ]

[Step Rate Plus Index Strategies:

ICC25-FG-SCH-SPC(11/25) 6

| | | | | | | | | | | | | | | | | | | | |

| Index | Index Value on Effective Date | Initial Index Strategy Term | Initial Index Strategy Base | Initial Step Rate | Participation Rate | Buffer |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

[S&P 500® Index, Price Return (SPX)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[10.00%] |

[MSCI EAFE Index, Price Return (MXEA)] |

[XXXX.XX] |

[1 Year] |

[$XXXXX.XX] |

[XX.XX%] |

[XX.XX%] |

[5.00%] |

Guaranteed Minimum Step Rate: [1.00%]

Guaranteed Minimum Participation Rate: [60%]]

VALUES APPLICABLE TO ALL INDEX STRATEGIES:

The Interim Value for the Index Strategies is equal to the sum of (1) and (2), where:

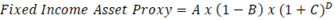

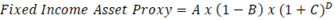

1)The Fixed Income Asset Proxy, or book value of the hypothetical fixed income assets backing an Index Strategy, is calculated as:

where:

A = The Index Strategy Base on the Valuation Day of the calculation;

B = The initial cost of the replicating portfolio of options, expressed as a percentage of the Index Strategy Base on the Index Strategy Start Date;

C = The annual yield that allows the Fixed Income Asset Proxy to accrue to the Index Strategy Base at the end of the Index Strategy Term;

D = The time elapsed since the Index Strategy Start Date; and

2)The Derivative Asset Proxy = the current value of the replicating portfolio of options

When we calculate the Interim Value, we obtain market data for derivative pricing each business day from outside vendors. If we are delayed in receiving these values, and cannot calculate a new Interim Value, we will use the prior business day’s market data for derivative pricing to calculate the Interim Value.

The value of the Derivative Asset Proxy is designated by us and used to estimate the market value of the possibility of gain or loss on the Index Strategy End Date. The value may be positive or negative.

ICC25-FG-SCH-SPC(11/25) 7

IMPORTANT DISCLOSURES:

[S&P 500®:

The FlexGuard® 2.0 is not sponsored, endorsed, sold or promoted by Standard & Poor's Financial Services LLC ("S&P"). Neither S&P nor its third party licensors makes any representation or warranty, express or implied, to the owners of FlexGuard® 2.0 or any member of the public regarding the advisability of investing generally or purchasing FlexGuard® 2.0 particularly or the ability of the S&P 500 Index (the "Index") to track general stock market performance. S&P's only relationship to Prudential is the licensing of certain trademarks and trade names of S&P and of the Index which is determined, composed and calculated by S&P without regard to Prudential or FlexGuard® 2.0. S&P has no obligation to take the needs of Prudential or the owners of FlexGuard® 2.0 into consideration in determining, composing or calculating the Index. S&P is not responsible for and has not participated in the determination of the prices and amount of FlexGuard® 2.0 or the timing of the issuance or sale of FlexGuard® 2.0 or in the determination or calculation of the equation by which FlexGuard® 2.0 may be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of FlexGuard® 2.0.

NEITHER S&P, ITS AFFILIATES NOR THEIR THIRD PARTY LICENSORS GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN OR ANY COMMUNICATIONS, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATIONS (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P, ITS AFFILIATES AND THEIR THIRD PARTY LICENSORS SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS OR DELAYS THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE MARKS, THE INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P, ITS AFFILIATES OR THEIR THIRD PARTY LICENSORS BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE OR CONSEQUENTIAL DAMAGES, INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE.

The S&P®, S&P 500® are trademarks of Standard & Poor's Financial Services LLC and have been licensed for use by Prudential.

MSCI EAFE:

THE FlexGuard® 2.0 INDEX LINKED VARIABLE ANNUITY (“FlexGuard® 2.0 ”) IS NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY MSCI INC. ("MSCI"). ANY OF ITS AFFILIATES, ANY OF ITS INFORMATION PROVIDERS OR ANY OTHER THIRD PARTY INVOLVED IN, OR RELATED TO, COMPILING, COMPUTING OR CREA TING ANY MSCI INDEX (COLLECTIVELY, THE "MSCI PARTIES"). THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES ARE SERVICE MARK(S) OF MSCI OR ITS AFFILIATES AND HAVE BEEN LICENSED FOR USE FOR CERTAIN PURPOSES BY PRUDENTIAL. NONE OF THE MSCI PARTIES MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, TO THE ISSUER OR OWNERS OF FlexGuard® 2.0 OR ANY OTHER PERSON OR ENTITY REGARDING THE ADVISABILITY OF INVESTING GENERALLY OR PURCHASING FlexGuard® 2.0 OR THE ABILITY OF ANY MSCI INDEX TO TRACK CORRESPONDING STOCK MARKET PERFORMANCE. MSCI OR ITS AFFILIATES ARE THE LICENSORS OF CERTAIN TRADEMARKS, SERVICE MARKS AND TRADE NAMES AND OF THE MSCI INDEXES WHICH ARE DETERMINED, COMPOSED AND CALCULATED BY MSCI WITHOUT REGARD TO FlexGuard® 2.0 OR THE ISSUER OR OWNERS OF FlexGuard® 2.0 OR ANY OTHER PERSON OR ENTITY. NONE OF THE MSCI PARTIES HAS ANY OBLIGATION TO TAKE THE NEEDS OF THE ISSUER OR OWNERS OF FlexGuard® 2.0 OR ANY OTHER PERSON OR ENTITY INTO CONSIDERATION IN DETERMINING, COMPOSING OR CALCULATING THE MSCI INDEXES. NONE OF THE MSCI PARTIES IS RESPONSIBLE FOR OR HAS PARTICIPATED IN THE DETERMINATION OF THE TIMING OF, PRICES AT, OR QUANTITIES OF FlexGuard® 2.0 TO BE ISSUED OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY OR THE CONSIDERATION INTO WHlCH FlexGuard® 2.0 IS REDEEMABLE. FURTHER, NONE OF THE MSCI PARTIES HAS ANY OBLIGATION OR LIABILITY TO THE ISSUER OR OWNERS OF FlexGuard® 2.0 OR ANY OTHER PERSON OR ENTITY IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR OFFERING OF THIS FUND.

ALTHOUGH MSCI SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE MSCI INDEXES FROM SOURCES THAT MSCI CONSIDERS RELIABLE, NONE OF THE MSCI PARTIES WARRANTS OR GUARANTEES THE ORIGINALlTY, ACCURACY AND/OR THE COMPLETENESS OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. NONE OF THE MSCI PARTIES MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE ISSUER OF FlexGuard® 2.0, OWNERS OF THE FUND, OR ANY OTHER PERSON OR ENTITY, FROM THE USE OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. NONE OF THE MSCI PARTIES SHALL HAVE ANY LIABILlTY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS OF OR IN CONNECTION WITH ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. FURTHER, NONE OF THE MSCI PARTIES MAKES ANY

ICC25-FG-SCH-SPC(11/25) 8

EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, AND THE MSCI PARITES HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILlTY AND FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO EACH MSCI INDEX AND ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL ANY OF THE MSCI PARTIES HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILlTY OF SUCH DAMAGES. No purchaser, seller or holder of this product or any other person or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote this product without first contacting MSCI to determine whether MSCl's permission is required. Under no circumstances may any person or entity claim any affiliation with MSCI without the prior written permission of MSCI.

Bloomberg U.S. Intermediate Credit Index:

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. ® is a trademark used under license. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”) (collectively, “Bloomberg”), or Bloomberg’s licensors own all proprietary rights in the Bloomberg U.S. Intermediate Credit Index. Bloomberg is the issuer or producer of FlexGuard® 2.0 and Bloomberg has any responsibilities, obligations or duties to owners of FlexGuard® 2.0. The Bloomberg U.S. Intermediate Credit Index is licensed for use by Prudential as the Issuer of FlexGuard® 2.0. The only relationship of Bloomberg with the Issuer in respect of Bloomberg U.S. Intermediate Credit Index is the licensing of the Bloomberg U.S. Intermediate Credit Index, which is determined, composed and calculated by BISL, or any successor thereto, without regard to the Issuer or FlexGuard® 2.0 or the owners of FlexGuard® 2.0.

Additionally, Prudential as the Issuer of FlexGuard® 2.0 may for itself execute transaction(s) in or relating to the Bloomberg U.S. Intermediate Credit Index in connection with FlexGuard® 2.0. Owners purchase FlexGuard® 2.0 from Prudential and owners neither acquire any interest in Bloomberg U.S. Intermediate Credit Index nor enter into any relationship of any kind whatsoever with Bloomberg upon purchasing FlexGuard® 2.0. FlexGuard® 2.0 is not sponsored, endorsed, sold or promoted by Bloomberg. Bloomberg makes no representation or warranty, express or implied, regarding the advisability of purchasing in FlexGuard® 2.0 or the advisability of investing generally or the ability of the Bloomberg U.S. Intermediate Credit Index to track corresponding or relative market performance. Bloomberg has not passed on the legality or suitability of FlexGuard® 2.0 with respect to any person or entity. Bloomberg is not responsible for or has participated in the determination of the timing of, prices at, or quantities of FlexGuard® 2.0 to be issued. Bloomberg has no obligation to take the needs of the Issuer or the owners of FlexGuard® 2.0 or any other third party into consideration in determining, composing or calculating the Bloomberg U.S. Intermediate Credit Index. Bloomberg has no obligation or liability in connection with administration, marketing or trading of FlexGuard® 2.0. The licensing agreement between Bloomberg is solely for the benefit of Bloomberg and not for the benefit of the owners of FlexGuard® 2.0, investors or other third parties. In addition, the licensing agreement between Prudential and Bloomberg is solely for the benefit of Prudential and Bloomberg and not for the benefit of the owners of FlexGuard® 2.0, investors or other third parties.

BLOOMBERG SHALL NOT HAVE ANY LIABILITY TO THE ISSUER, OWNERS OR OTHER THIRD PARTIES FOR THE QUALITY, ACCURACY AND/OR COMPLETENESS OF THEBLOOMBERG U.S. INTERMEDIATE CREDIT INDEX OR ANY DATA INCLUDED THEREIN OR FOR INTERRUPTIONS IN THE DELIVERY OF THEBLOOMBERG U.S. INTERMEDIATE CREDIT INDEX. BLOOMBERG MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE ISSUER, THE OWNERS OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE BLOOMBERG U.S. INTERMEDIATE CREDIT INDEX OR ANY DATA INCLUDED THEREIN. BLOOMBERG MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EACH HEREBY EXPRESSLY DISCLAIMSALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USEWITH RESPECT TO THE BLOOMBERG U.S. INTERMEDIATE CREDIT INDEX OR ANY DATA INCLUDED THEREIN. BLOOMBERG RESERVES THE RIGHT TO CHANGE THE METHODS OF CALCULATION OR PUBLICATION, OR TO CEASE THE CALCULATION OR PUBLICATION OF THE BLOOMBERG U.S. INTERMEDIATE CREDIT INDEX, AND BLOOMBERG SHALL NOT BE LIABLE FOR ANY MISCALCULATION OF OR ANY INCORRECT, DELAYED OR INTERRUPTED PUBLICATION WITH RESPECT TO THE BLOOMBERG U.S. INTERMEDIATE CREDIT INDEX. BLOOMBERG SHALL NOT BE LIABLE FOR ANY DAMAGES, INCLUDING, WITHOUT LIMITATION, ANY SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGES, OR ANY LOST PROFITS, EVEN IF ADVISED OF THE POSSIBLITY OF SUCH, RESULTING FROM THE USE OF THE BLOOMBERG U.S. INTERMEDIATE CREDIT INDEX OR ANY DATA INCLUDED THEREIN OR WITH RESPECT TO FlexGuard® 2.0.

None of the information supplied by Bloomberg and used in this publication may be reproduced in any manner without the prior written permission of Bloomberg,

iShares® Russell 2000 ETF:

ICC25-FG-SCH-SPC(11/25) 9

The iShares Russell 2000 ETF is distributed by BlackRock Investments, LLC. iShares® and BlackRock®, and the corresponding logos, are registered trademarks of BlackRock, Inc. and its affiliates ("BlackRock") and are used under license. BlackRock has licensed certain trademarks and trade names of BlackRock to Pruco Life Insurance Company for certain purposes. Pruco Life Insurance Company's products and services are not sponsored, endorsed, sold, or promoted by BlackRock, and purchasers of such products do not acquire any interest in the iShares® Russell 2000 ETF nor enter into any relationship of any kind with BlackRock. BlackRock makes no representations or warranties, express or implied, to the owners of any products offered by Pruco Life Insurance Company or any member of the public regarding the advisability of purchasing any product or service offered by Pruco Life Insurance Company. BlackRock has no obligation or liability for any errors, omissions, interruptions or use of the iShares® Russell 2000 ETF or any data related thereto, or in connection with the operation, marketing, trading or sale of any Pruco Life Insurance Company product or service offered by Pruco Life Insurance Company.

All rights in the Russell®2000 Index (the "Index") vest in the relevant LSE Group company which owns the

Index. Russell®2000 is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. The Index is calculated by or on behalf of Frank Russell Company or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of Prudential FlexGuard®2.0. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from Prudential FlexGuard® 2.0 or the suitability of the Index for the purpose to which it is being put by Pruco Life Insurance Company.

Invesco QQQ ETF Disclosure:

Invesco Capital Management LLC ("ICM") serves as sponsor of Invesco QQQ TrustSM, Series 1 ("Invesco QQQ ETF") and Invesco Distributors, Inc. ("IDI"), an affiliate of ICM serves as distributor for Invesco QQQ ETF. The mark "Invesco" is the property of Invesco Holding Company Limited and is used under license. That trademark and the ability to offer a product based on Invesco QQQ ETF have been licensed for certain purposes by Pruco Life Insurance Company and its wholly-owned subsidiaries and affiliates (collectively, "Prudential"). Products offered by Prudential are not sponsored, endorsed, sold or promoted by ICM or Invesco Holding Company Limited, and purchasers of such products do not acquire any interest in Invesco QQQ ETF nor enter into any relationship with ICM or its affiliates. ICM makes no representations or warranties, express or implied, to the owners of any products offered by Prudential. ICM has no obligation or liability for any errors, omissions, interruptions or use of Invesco QQQ ETF or any data related thereto, or with the operation, marketing trading or sale of any products or services offered by Prudential. Nasdaq®, Nasdaq-100®, Nasdaq-100 Index®, and QQQ®, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the "Corporations") and are licensed for use for certain purposes by Pruco Life Insurance Company and its wholly-owned subsidiaries and affiliates (collectively, "Prudential"). Prudential FlexGuard® 2.0 ("Product") has not been passed on by the Corporations as to their legality or suitability. The Product is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S).

AB 500 Plus lndexSM:

The AB 500 Plus IndexSM (the "Index") is a rules-based index based upon several US and global equity indices. The Index seeks to tactically allocate to certain indices when their expected return potential is elevated as compared to the expected return potential of the largest US public companies. By following proprietary positioning signals, the index aims to keep a low tracking error to the largest US public companies, while providing differentiated returns via its tactical selection.

The Index is calculated by a third party ("Calculation Agent") using a methodology developed by Alliance Bernstein L.P. ("AB"). The Prudential FlexGuard® 2.0 indexed variable annuity to which this disclosure applies (the "Product") has been developed solely by Pruco Life Insurance Company ("Licensee"). The Product is not in any way connected to or sponsored, endorsed, sold or promoted by AB or its affiliates. AB does not provide investment advice to the Product or the owners of the Product, and in no event shall any contract owner of a Product be deemed to be a client of AB. AB and Calculation Agent shall have no liability whatsoever to any person arising out of (a) the use of, reliance on, or any error in, the Index or (b) the purchase of, or operation of, the Product. AB makes no claim, prediction, warranty or representation either as to the results to be obtained from the Product or the suitability of the Index for the purpose to which it is being put by Licensee.

Indices and related information provided by AB or its affiliates, as well as the names "Alliance Bernstein" and "AB", the name of the Index, any related trademarks, are intellectual property owned by, licensed from, AB and may not be copied, or used without AB's prior written approval. AB provides Index information to Licensee; any further use of this information is subject to the laws and regulations applicable to Licensee, and Licensee is solely responsible for ensuring that its use of the Index complies with all applicable laws and regulations.

ISHARES® AND BLACKROCK® ARE REGISTERED TRADEMARKS OF BLACKROCK, INC. AND ITS AFFILIATES ("BLACKROCK") AND ARE USED UNDER LICENSE. BLACKROCK MAKES NO REPRESENTATIONS OR WARRANTIES

ICC25-FG-SCH-SPC(11/25) 10

REGARDING THE ADVISABILITY OF INVESTING IN ANY PRODUCT OR THE USE OF ANY SERVICE OFFERED BY ALLIANCE BERNSTEIN. BLACKROCK HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE OPERATION, MARKETING, TRADING OR SALE OF ANY PRODUCT OR SERVICE OFFERED BY ALLIANCE BERNSTEIN.

INVESCO CAPITAL MANAGEMENT LLC ("ICM") SERVES AS SPONSOR OF INVESCO QQQ TRUSTSM, SERIES 1 ("INVESCO QQQ ETF"). THE MARK "INVESCO" IS THE PROPERTY OF INVESCO HOLDING COMPANY LIMITED AND IS USED WITH PERMISSION. PRODUCTS OFFERED BY PRUCO LIFE INSURANCE COMPANY, INCLUDING PRUDENTIAL FLEXGUARD® 2.0 INDEXED VARIABLE ANNUITY, ARE NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY ICM OR INVESCO HOLDING COMPANY LIMITED, AND PURCHASERS OF SUCH PRODUCTS DO NOT ACQUIRE ANY INTEREST IN INVESCO QQQ ETF NOR ENTER INTO ANY RELATIONSHIP WITH ICM OR ITS AFFILIATES. ICM MAKES NO REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, WITH RESPECT TO THE PRUDENTIAL FLEXGUARD® 2.0 INDEXED VARIABLE ANNUITY AND ICM HAS NO OBLIGATION OR LIABILITY FOR ANY ERRORS, OMISSIONS, INTERRUPTIONS OR USE OF INVESCO QQQ ETF OR ANY DATA RELATED THERETO. THE PRUDENTIAL FLEXGUARD® 2.0 INDEXED VARIABLE ANNUITY IS ISSUED, MARKETED, OPERATED, AND MANAGED BY THE PRUCO LIFE INSURANCE COMPANY WHO IS SOLELY AND EXCLUSIVELY RESPONSIBLE FOR THE PRUDENTIAL FLEXGUARD® 2.0 INDEXED VARIABLE ANNUITY.

THE "S&P 500 INDEX" IS A PRODUCT OF S&P DOW JONES INDICES LLC OR ITS AFFILIATES ("SPDJI") AND/OR THEIR THIRD PARTY LICENSORS (AS APPLICABLE), AND HAS BEEN LICENSED FOR USE BY ALLIANCEBERNSTEIN L.P. STANDARD & POOR'S® AND S&P® ARE REGISTERED TRADEMARKS OF STANDARD & POOR'S FINANCIAL SERVICES LLC ("S&P"); DOW JONES® IS A REGISTERED TRADEMARK OF DOW JONES TRADEMARK HOLDINGS LLC ("DOW JONES"); AND THESE TRADEMARKS HAVE BEEN LICENSED FOR USE BY SPDJI AND SUBLICENSED FOR CERTAIN PURPOSES BY ALLIANCEBERNSTEIN L.P. AB 500 PLUS INDEX IS NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY SPDJI, DOW JONES, S&P, THEIR RESPECTIVE AFFILIATES, OR THEIR THIRD PARTY LICENSORS (AS APPLICABLE) AND NONE OF SUCH PARTIES MAKE ANY REPRESENTATION REGARDING THE ADVISABILITY OF INVESTING IN SUCH PRODUCT(S) NOR DO THEY HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS OF THE "S&P 500 INDEX."

Any data shown for the Index prior to its inception is hypothetical and back-casted using criteria applied retroactively, and it has several inherent limitations. Pre-inception data, does not represent actual changes in the Index value. It benefits from hindsight, and the Index rules were selected with knowledge of factors that would affect the performance of the Index. Had the Index rules been established at the start of the period shown, the Index criteria may have been different and may not have produced the Index values shown. There are frequently significant differences between hypothetical Index values and the actual Index values.

The rules for computing the Index value include an annual 0.75% reduction. The published Index value is inclusive of this reduction.

PAST CHANGES IN THE VALUE OF THE INDEX IS NOT A GUARANTEE OR A RELIABLE INDICATOR OF FUTURE RESULTS. NEITHER HISTORICAL NOR HYPOTHETICAL HISTORICAL CHANGES IN VALUE OF THE INDEX SHOULD BE TAKEN AS AN INDICATION OF FUTURE RESULTS.

AB MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO ANY INDEX, ANY RELATED INFORMATION, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THE QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS OF SUCH INDEX, RELATED INFORMATION OR PRODUCTS). FURTHER, AB MAKES NO EXPRESS OR IMPLIED WARRANTY OF ANY KIND, AND AB HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO EACH AB INDEX AND ANY DATA INCLUDED

THEREIN.

Dimensional International Equity Focus Index:

The Dimensional International Equity Focus Index (the “Index”) is sponsored published by Dimensional Fund Advisors LP ("Dimensional"). References to Dimensional include its respective directors, officers, employees, representatives, delegates or agents. The use of "Dimensional" in the name of the Index and the related stylized mark(s) are service marks of Dimensional and have been licensed for use by Pruco Life Insurance Company ("PRUCO"). PRUCO has entered into a license agreement with Dimensional providing for the right to use the Index and related trademarks in connection with the FlexGuard® 2.0 indexed variable annuity (the "Financial Product"). The Financial Product is not sponsored, endorsed, sold or promoted by Dimensional, and Dimensional makes no representation regarding the advisability of the purchase of such Financial Product. Dimensional has no responsibilities, obligations or duties to purchasers of the Financial Product, nor does Dimensional make any express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use with respect to the Index, or as to results to be obtained

ICC25-FG-SCH-SPC(11/25) 11

by a Financial Product or any other person or entity from the use of the Index, trading based on the Index, the levels of the Index at any particular time on any particular date, or any data included therein, either in connection with the Financial Product or for any other use. Dimensional has no obligation or liability in connection with the administration, marketing or selling of the Financial Product. In certain circumstances, Dimensional may suspend or terminate the Index. Dimensional has appointed a third-party agent (the "Index Calculation Agent") to calculate and maintain the Index. While Dimensional is responsible for the operation of the Index, certain aspects have thus been outsourced to the Index Calculation Agent. Dimensional does not guarantee the accuracy, timeliness or completeness of the Index, or any data included therein or the calculation thereof or any communications with respect thereto. Dimensional has no liability for any errors, omissions or interruptions of the Index or in connection with its use. In no event shall Dimensional have any liability of whatever nature for any losses, damages, costs, claims and expenses (including any special, punitive, direct, indirect or consequential damages [including lost profits]) arising out of matters relating to the use of the Index, even if notified of the possibility of such damages. Dimensional has provided PRUCO with all material information related to the Index methodology and the maintenance, operation and calculation of the Index. Dimensional makes no representation with respect to the completeness of information related to the Index provided by PRUCO in connection with the offer or

sale of any Financial Product. Dimensional acts as principal and not as agent or fiduciary of any other person. Dimensional has not published or approved this document, nor does Dimensional accept any

responsibility for its contents or use.]

ICC25-FG-SCH-SPC(11/25) 12