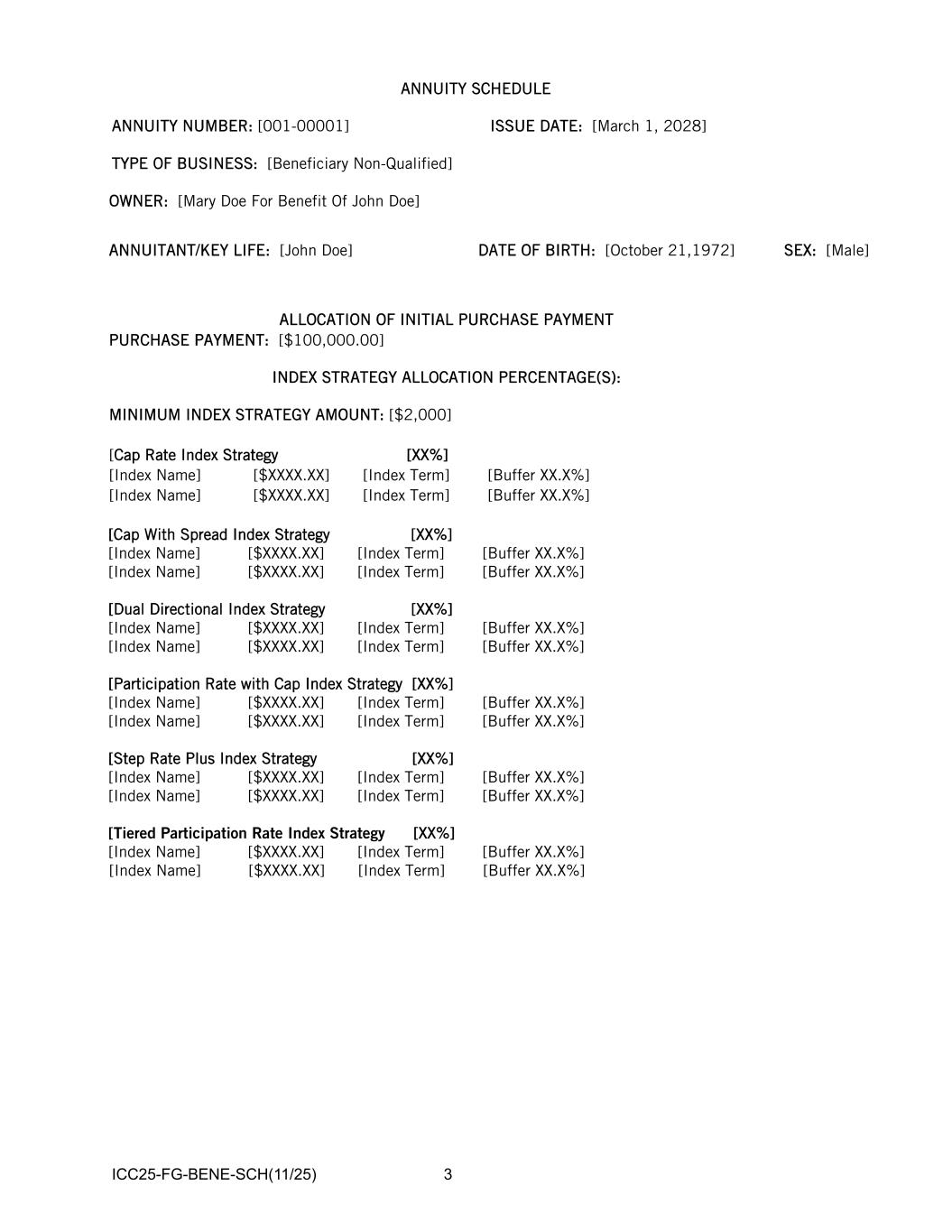

ICC25-FG-BENE-SCH(11/25) 3 ANNUITY SCHEDULE ANNUITY NUMBER: [001-00001] ISSUE DATE: [March 1, 2028] TYPE OF BUSINESS: [Beneficiary Non-Qualified] OWNER: [Mary Doe For Benefit Of John Doe] ANNUITANT/KEY LIFE: [John Doe] DATE OF BIRTH: [October 21,1972] SEX: [Male] ALLOCATION OF INITIAL PURCHASE PAYMENT PURCHASE PAYMENT: [$100,000.00] INDEX STRATEGY ALLOCATION PERCENTAGE(S): MINIMUM INDEX STRATEGY AMOUNT: [$2,000] [Cap Rate Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Cap With Spread Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Dual Directional Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Participation Rate with Cap Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Step Rate Plus Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Tiered Participation Rate Index Strategy [XX%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%] [Index Name] [$XXXX.XX] [Index Term] [Buffer XX.X%]

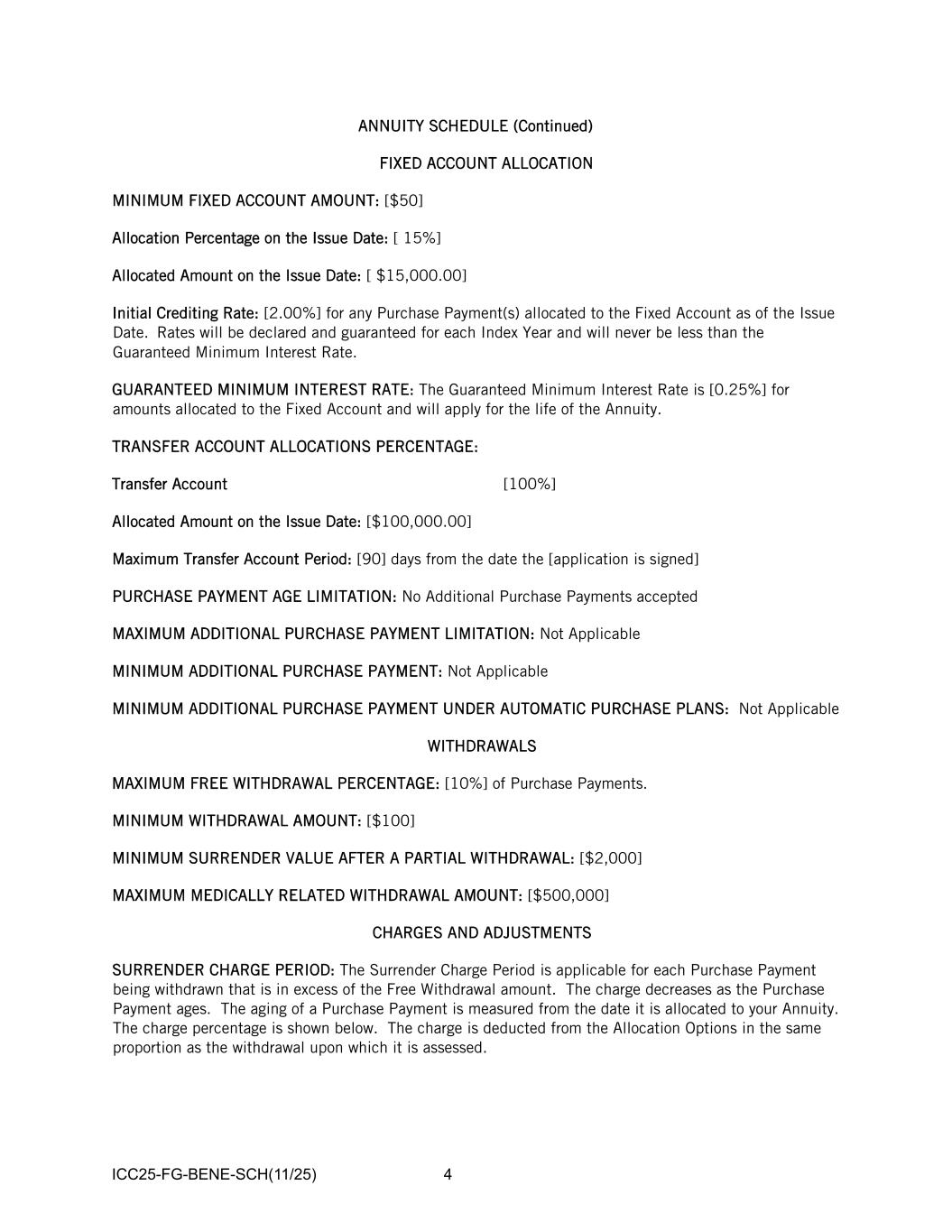

ICC25-FG-BENE-SCH(11/25) 4 ANNUITY SCHEDULE (Continued) FIXED ACCOUNT ALLOCATION MINIMUM FIXED ACCOUNT AMOUNT: [$50] Allocation Percentage on the Issue Date: [ 15%] Allocated Amount on the Issue Date: [ $15,000.00] Initial Crediting Rate: [2.00%] for any Purchase Payment(s) allocated to the Fixed Account as of the Issue Date. Rates will be declared and guaranteed for each Index Year and will never be less than the Guaranteed Minimum Interest Rate. GUARANTEED MINIMUM INTEREST RATE: The Guaranteed Minimum Interest Rate is [0.25%] for amounts allocated to the Fixed Account and will apply for the life of the Annuity. TRANSFER ACCOUNT ALLOCATIONS PERCENTAGE: Transfer Account [100%] Allocated Amount on the Issue Date: [$100,000.00] Maximum Transfer Account Period: [90] days from the date the [application is signed] PURCHASE PAYMENT AGE LIMITATION: No Additional Purchase Payments accepted MAXIMUM ADDITIONAL PURCHASE PAYMENT LIMITATION: Not Applicable MINIMUM ADDITIONAL PURCHASE PAYMENT: Not Applicable MINIMUM ADDITIONAL PURCHASE PAYMENT UNDER AUTOMATIC PURCHASE PLANS: Not Applicable WITHDRAWALS MAXIMUM FREE WITHDRAWAL PERCENTAGE: [10%] of Purchase Payments. MINIMUM WITHDRAWAL AMOUNT: [$100] MINIMUM SURRENDER VALUE AFTER A PARTIAL WITHDRAWAL: [$2,000] MAXIMUM MEDICALLY RELATED WITHDRAWAL AMOUNT: [$500,000] CHARGES AND ADJUSTMENTS SURRENDER CHARGE PERIOD: The Surrender Charge Period is applicable for each Purchase Payment being withdrawn that is in excess of the Free Withdrawal amount. The charge decreases as the Purchase Payment ages. The aging of a Purchase Payment is measured from the date it is allocated to your Annuity. The charge percentage is shown below. The charge is deducted from the Allocation Options in the same proportion as the withdrawal upon which it is assessed.

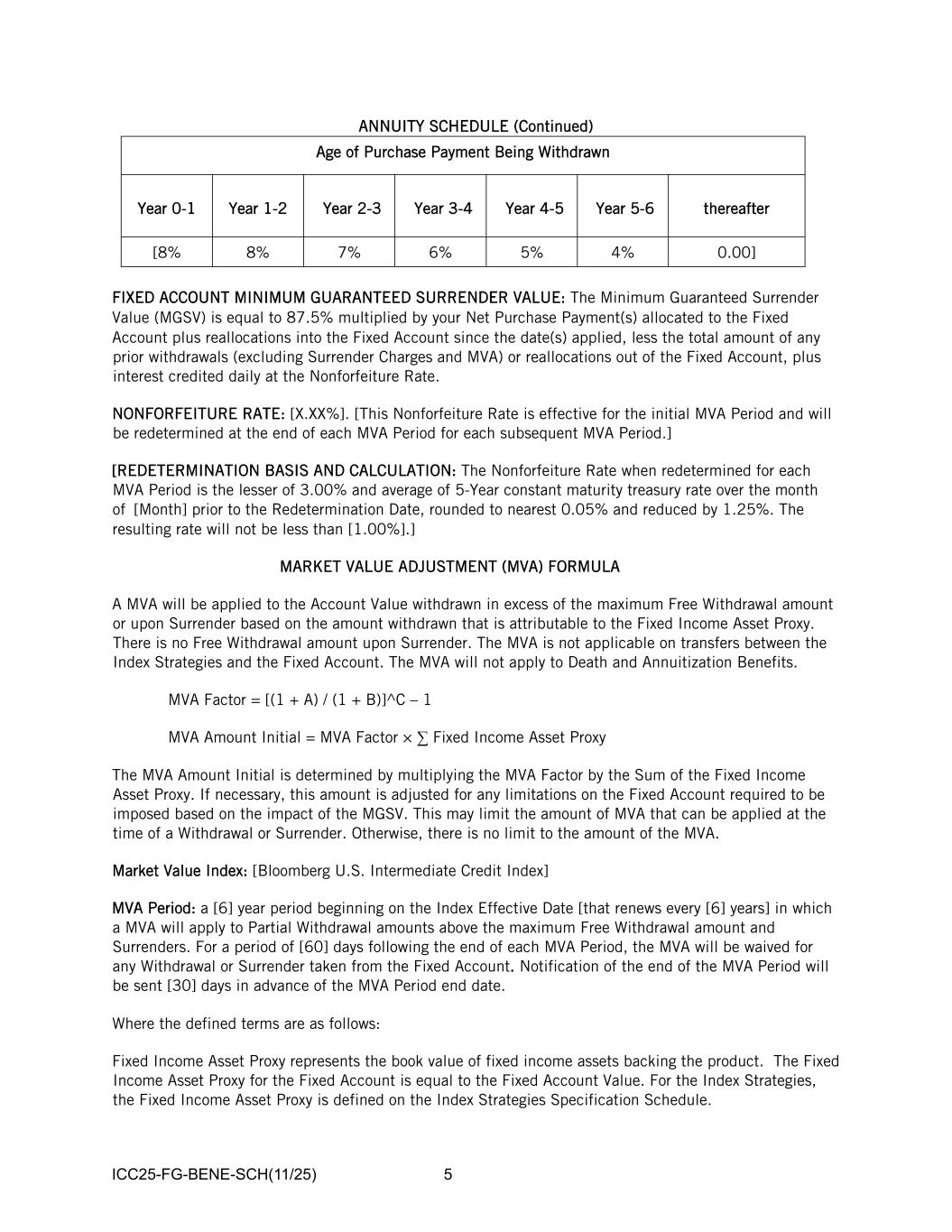

ICC25-FG-BENE-SCH(11/25) 5 ANNUITY SCHEDULE (Continued) Age of Purchase Payment Being Withdrawn Year 0-1 Year 1-2 Year 2-3 Year 3-4 Year 4-5 Year 5-6 thereafter [8% 8% 7% 6% 5% 4% 0.00] FIXED ACCOUNT MINIMUM GUARANTEED SURRENDER VALUE: The Minimum Guaranteed Surrender Value (MGSV) is equal to 87.5% multiplied by your Net Purchase Payment(s) allocated to the Fixed Account plus reallocations into the Fixed Account since the date(s) applied, less the total amount of any prior withdrawals (excluding Surrender Charges and MVA) or reallocations out of the Fixed Account, plus interest credited daily at the Nonforfeiture Rate. NONFORFEITURE RATE: [X.XX%]. [This Nonforfeiture Rate is effective for the initial MVA Period and will be redetermined at the end of each MVA Period for each subsequent MVA Period.] [REDETERMINATION BASIS AND CALCULATION: The Nonforfeiture Rate when redetermined for each MVA Period is the lesser of 3.00% and average of 5-Year constant maturity treasury rate over the month of [Month] prior to the Redetermination Date, rounded to nearest 0.05% and reduced by 1.25%. The resulting rate will not be less than [1.00%].] MARKET VALUE ADJUSTMENT (MVA) FORMULA A MVA will be applied to the Account Value withdrawn in excess of the maximum Free Withdrawal amount or upon Surrender based on the amount withdrawn that is attributable to the Fixed Income Asset Proxy. There is no Free Withdrawal amount upon Surrender. The MVA is not applicable on transfers between the Index Strategies and the Fixed Account. The MVA will not apply to Death and Annuitization Benefits. MVA Factor = [(1 + A) / (1 + B)]^C – 1 MVA Amount Initial = MVA Factor × ∑ Fixed Income Asset Proxy The MVA Amount Initial is determined by multiplying the MVA Factor by the Sum of the Fixed Income Asset Proxy. If necessary, this amount is adjusted for any limitations on the Fixed Account required to be imposed based on the impact of the MGSV. This may limit the amount of MVA that can be applied at the time of a Withdrawal or Surrender. Otherwise, there is no limit to the amount of the MVA. Market Value Index: [Bloomberg U.S. Intermediate Credit Index] MVA Period: a [6] year period beginning on the Index Effective Date [that renews every [6] years] in which a MVA will apply to Partial Withdrawal amounts above the maximum Free Withdrawal amount and Surrenders. For a period of [60] days following the end of each MVA Period, the MVA will be waived for any Withdrawal or Surrender taken from the Fixed Account. Notification of the end of the MVA Period will be sent [30] days in advance of the MVA Period end date. Where the defined terms are as follows: Fixed Income Asset Proxy represents the book value of fixed income assets backing the product. The Fixed Income Asset Proxy for the Fixed Account is equal to the Fixed Account Value. For the Index Strategies, the Fixed Income Asset Proxy is defined on the Index Strategies Specification Schedule.

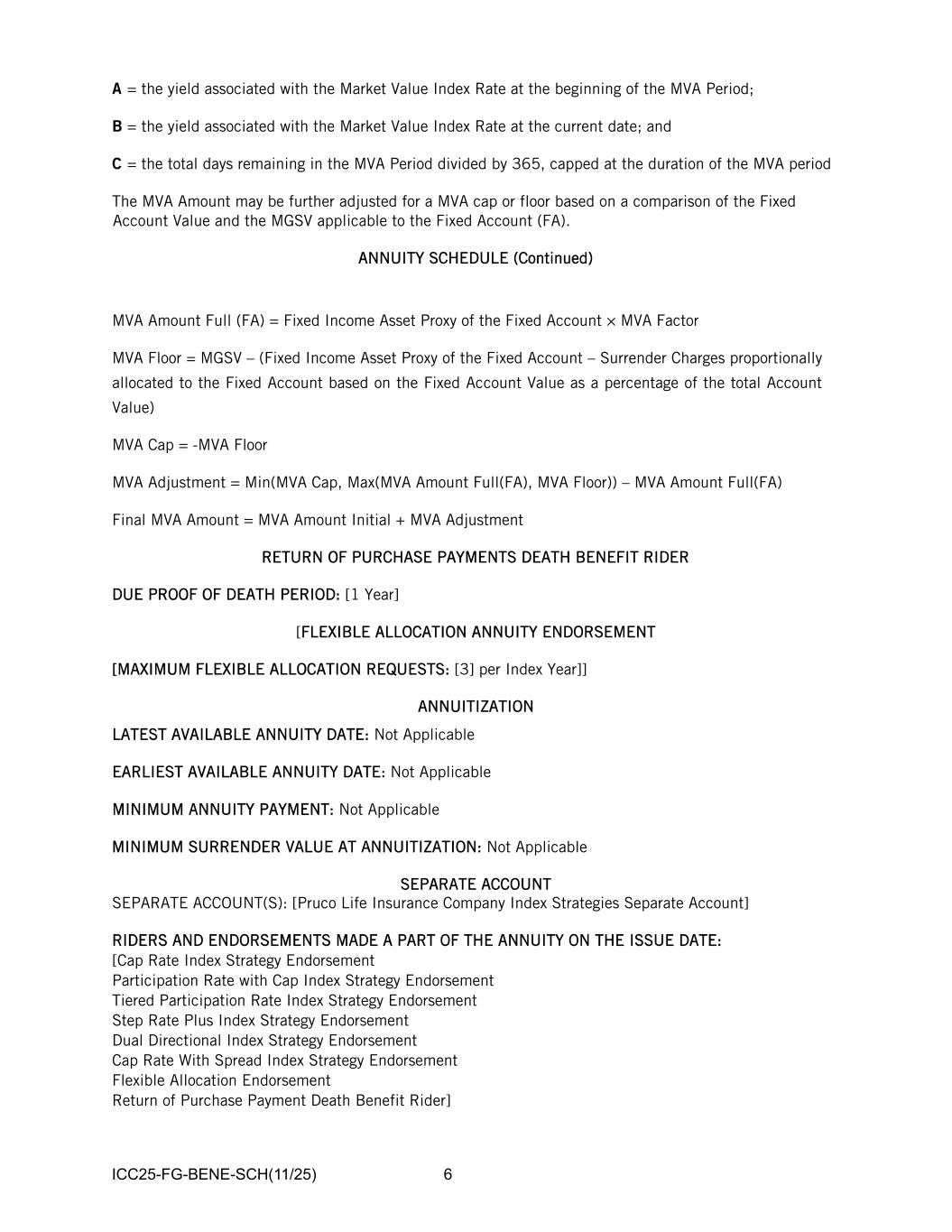

ICC25-FG-BENE-SCH(11/25) 6 A = the yield associated with the Market Value Index Rate at the beginning of the MVA Period; B = the yield associated with the Market Value Index Rate at the current date; and C = the total days remaining in the MVA Period divided by 365, capped at the duration of the MVA period The MVA Amount may be further adjusted for a MVA cap or floor based on a comparison of the Fixed Account Value and the MGSV applicable to the Fixed Account (FA). ANNUITY SCHEDULE (Continued) MVA Amount Full (FA) = Fixed Income Asset Proxy of the Fixed Account × MVA Factor MVA Floor = MGSV – (Fixed Income Asset Proxy of the Fixed Account – Surrender Charges proportionally allocated to the Fixed Account based on the Fixed Account Value as a percentage of the total Account Value) MVA Cap = -MVA Floor MVA Adjustment = Min(MVA Cap, Max(MVA Amount Full(FA), MVA Floor)) – MVA Amount Full(FA) Final MVA Amount = MVA Amount Initial + MVA Adjustment RETURN OF PURCHASE PAYMENTS DEATH BENEFIT RIDER DUE PROOF OF DEATH PERIOD: [1 Year] [FLEXIBLE ALLOCATION ANNUITY ENDORSEMENT [MAXIMUM FLEXIBLE ALLOCATION REQUESTS: [3] per Index Year]] ANNUITIZATION LATEST AVAILABLE ANNUITY DATE: Not Applicable EARLIEST AVAILABLE ANNUITY DATE: Not Applicable MINIMUM ANNUITY PAYMENT: Not Applicable MINIMUM SURRENDER VALUE AT ANNUITIZATION: Not Applicable SEPARATE ACCOUNT SEPARATE ACCOUNT(S): [Pruco Life Insurance Company Index Strategies Separate Account] RIDERS AND ENDORSEMENTS MADE A PART OF THE ANNUITY ON THE ISSUE DATE: [Cap Rate Index Strategy Endorsement Participation Rate with Cap Index Strategy Endorsement Tiered Participation Rate Index Strategy Endorsement Step Rate Plus Index Strategy Endorsement Dual Directional Index Strategy Endorsement Cap Rate With Spread Index Strategy Endorsement Flexible Allocation Endorsement Return of Purchase Payment Death Benefit Rider]

ICC25-FG-BENE-SCH(11/25) 7 [ALABAMA INSURANCE DEPARTMENT CONTACT: 201 Monroe St, Suite 402, P.O.Box 303351 Montgomery, AL 36130-3351 Phone: 334-269-3550 Email: Insdept@insurance.alabama.gov]