2025 Fourth Quarter Earnings Call February 6, 2026 Supplemental information

Encompass Health 2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including the business outlook, guidance and growth targets, future reimbursement rates, labor availability and costs, the effect of tariffs on costs, legislative and regulatory developments, such as the effects of RCD and TEAM, strategy, capital expenditures, acquisition and other development activities, such as the de novo pipeline, costs, growth and timelines, operational and quality of care initiatives, dividend strategies, leverage, repurchases of securities, outstanding shares of common stock, effective tax rates, financial performance, financial assumptions and considerations, balance sheet and cash flow plans, market barriers to entry, and addressable market size. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the earnings release attached as to the Company’s Form 8-K dated February 5, 2026 (the “Q4 Earnings Release Form 8-K”), the Form 10-K for the year ended December 31, 2024, the Forms 10-Q for the quarters ended March 31, 2025, June 30, 2025, September 30, 2025, the Form 10-K for the year ended December 31, 2025, when filed, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. The Q4 Earnings Release Form 8-K provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Forward-looking statements

Encompass Health 3 Summary ................................................................................................................................................................................ 4 Revenue ................................................................................................................................................................................. 5 Adjusted EBITDA .................................................................................................................................................................. 6 Earnings per share ............................................................................................................................................................... 7-8 Adjusted free cash flow ..................................................................................................................................................... 9 2026 Guidance and guidance considerations ............................................................................................................... 10-11 Review Choice Demonstration (“RCD”) ......................................................................................................................... 12 Transforming Episode Accountability Model (“TEAM”) ............................................................................................. 13 Adjusted free cash flow assumptions ............................................................................................................................. 14 Uses of free cash flow ........................................................................................................................................................ 15 Appendix Map of locations ................................................................................................................................................................... 17 Growth targets, fundamentals and value drivers ........................................................................................................ 18 Multiple modalities for capacity expansion .................................................................................................................. 19 Development activity ......................................................................................................................................................... 20 Debt maturity profile and schedule ................................................................................................................................ 21-22 New-store/same-store growth .......................................................................................................................................... 23 Payment sources .................................................................................................................................................................. 24 Operational metrics ............................................................................................................................................................ 25 Share information ................................................................................................................................................................ 26 Reconciliations to GAAP ..................................................................................................................................................... 27-33 End notes ............................................................................................................................................................................... 34-35 Table of contents

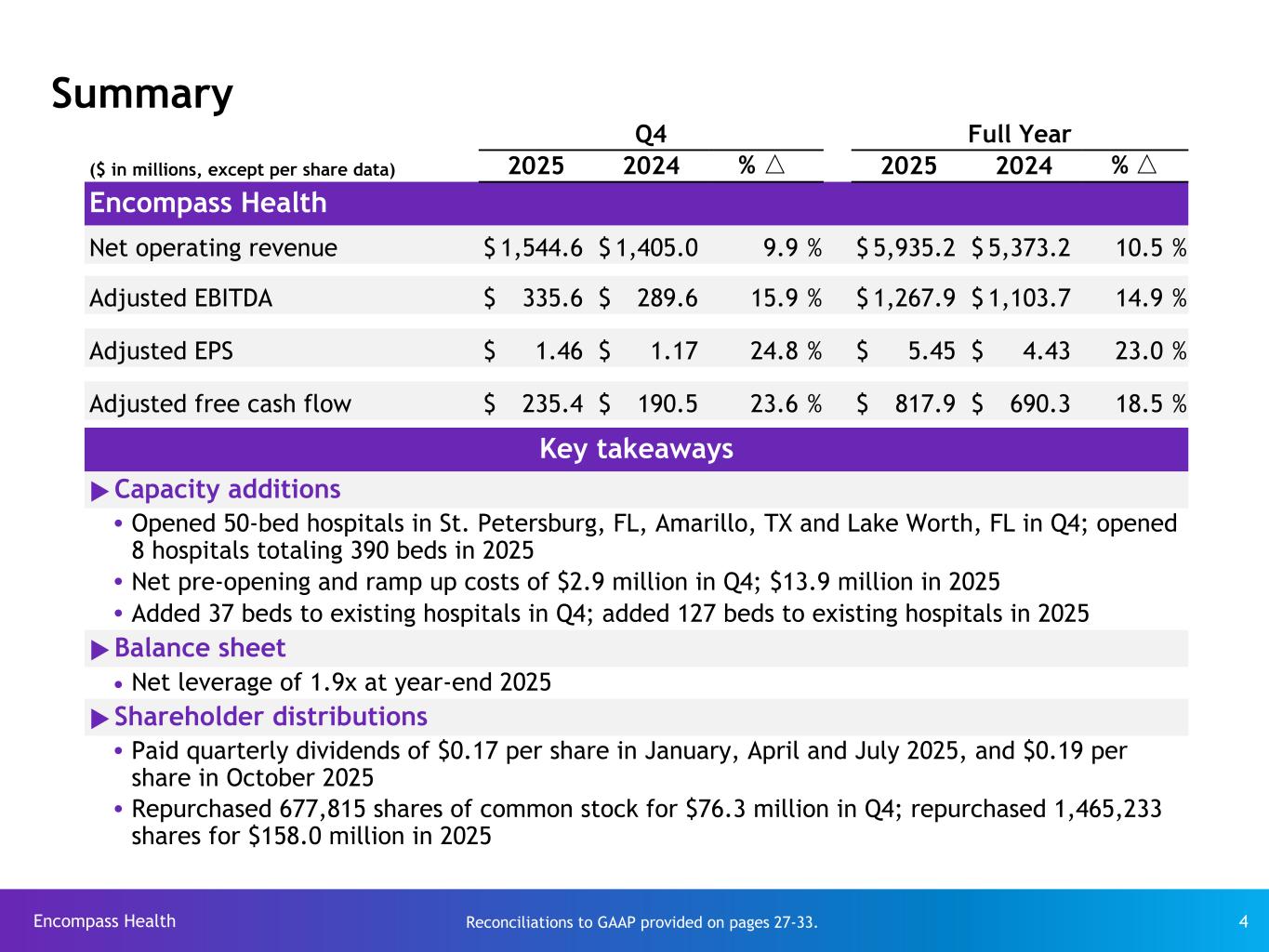

Encompass Health 4 Summary Q4 Full Year ($ in millions, except per share data) 2025 2024 % △ 2025 2024 % △ Encompass Health Net operating revenue $ 1,544.6 $ 1,405.0 9.9 % $ 5,935.2 $ 5,373.2 10.5 % Adjusted EBITDA $ 335.6 $ 289.6 15.9 % $ 1,267.9 $ 1,103.7 14.9 % Adjusted EPS $ 1.46 $ 1.17 24.8 % $ 5.45 $ 4.43 23.0 % Adjusted free cash flow $ 235.4 $ 190.5 23.6 % $ 817.9 $ 690.3 18.5 % Reconciliations to GAAP provided on pages 27-33. Key takeaways uCapacity additions Ÿ Opened 50-bed hospitals in St. Petersburg, FL, Amarillo, TX and Lake Worth, FL in Q4; opened 8 hospitals totaling 390 beds in 2025 Ÿ Net pre-opening and ramp up costs of $2.9 million in Q4; $13.9 million in 2025 Ÿ Added 37 beds to existing hospitals in Q4; added 127 beds to existing hospitals in 2025 uBalance sheet Ÿ Net leverage of 1.9x at year-end 2025 uShareholder distributions Ÿ Paid quarterly dividends of $0.17 per share in January, April and July 2025, and $0.19 per share in October 2025 Ÿ Repurchased 677,815 shares of common stock for $76.3 million in Q4; repurchased 1,465,233 shares for $158.0 million in 2025

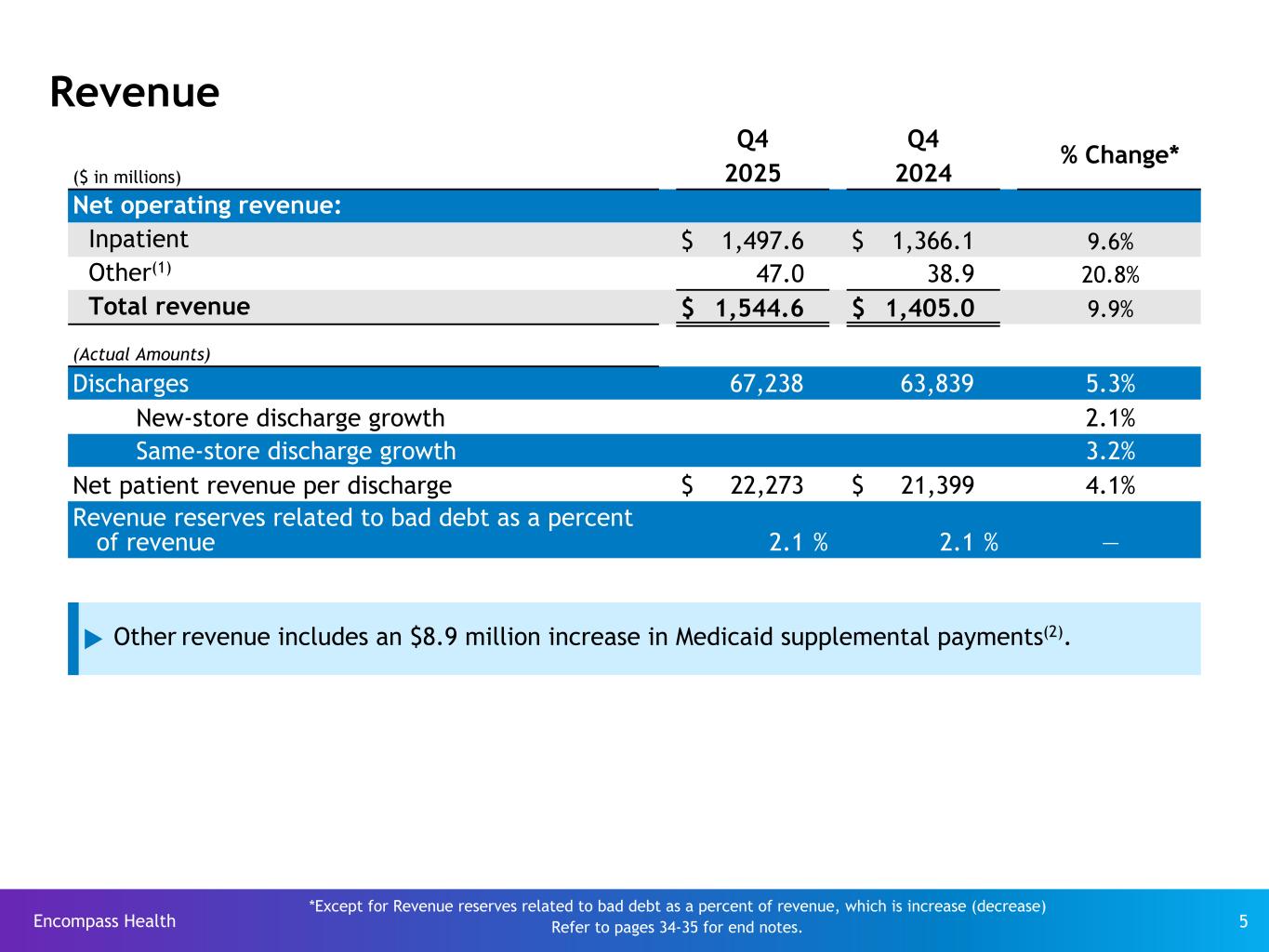

Encompass Health 5 Revenue Q4 Q4 % Change* ($ in millions) 2025 2024 Net operating revenue: Inpatient $ 1,497.6 $ 1,366.1 9.6% Other(1) 47.0 38.9 20.8% Total revenue $ 1,544.6 $ 1,405.0 9.9% (Actual Amounts) Discharges 67,238 63,839 5.3% New-store discharge growth 2.1% Same-store discharge growth 3.2% Net patient revenue per discharge $ 22,273 $ 21,399 4.1% Revenue reserves related to bad debt as a percent of revenue 2.1 % 2.1 % — *Except for Revenue reserves related to bad debt as a percent of revenue, which is increase (decrease) Refer to pages 34-35 for end notes. u Other revenue includes an $8.9 million increase in Medicaid supplemental payments(2).

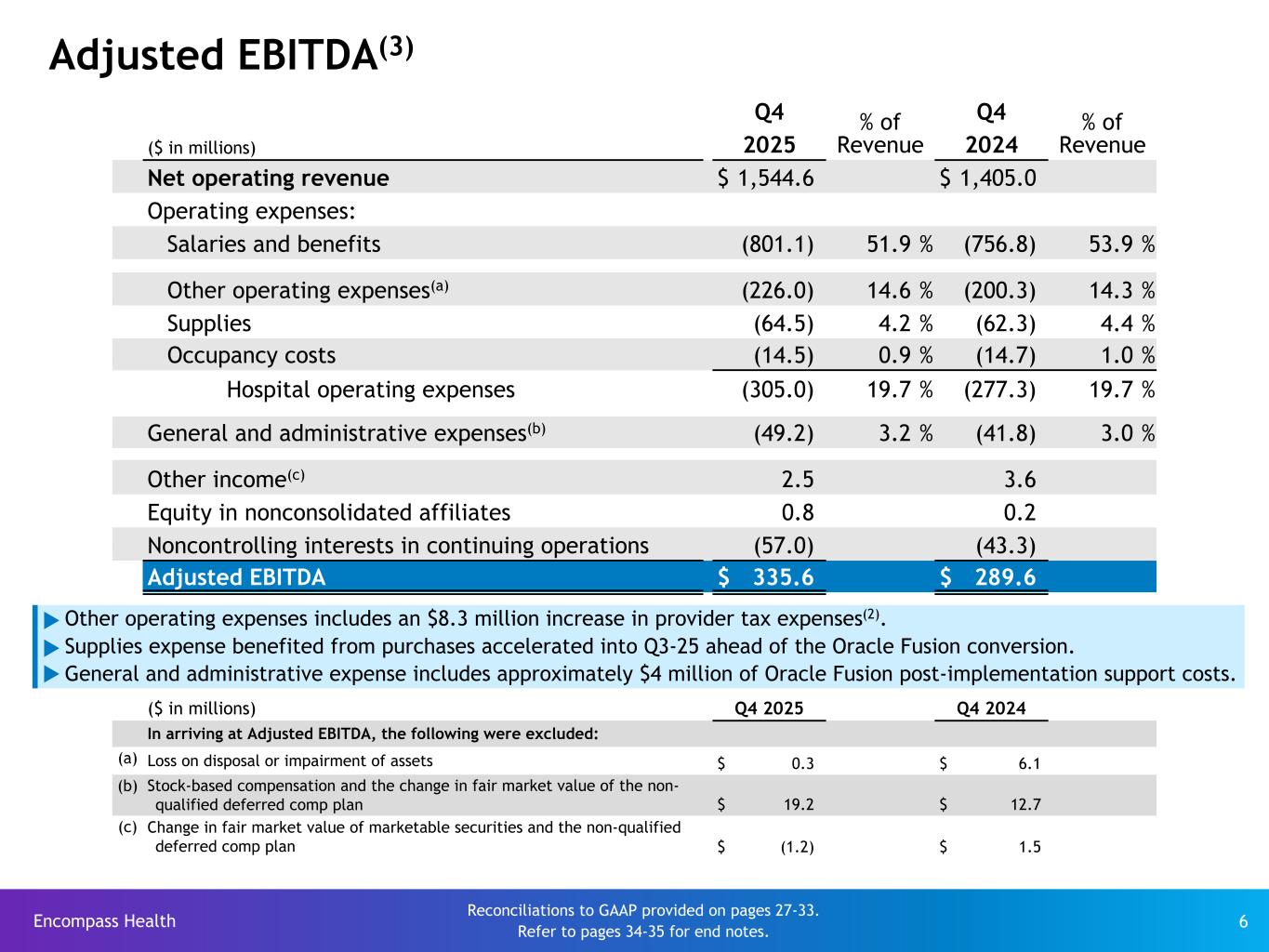

Encompass Health 6 Adjusted EBITDA(3) Q4 % of Revenue Q4 % of Revenue($ in millions) 2025 2024 Net operating revenue $ 1,544.6 $ 1,405.0 Operating expenses: Salaries and benefits (801.1) 51.9 % (756.8) 53.9 % Other operating expenses(a) (226.0) 14.6 % (200.3) 14.3 % Supplies (64.5) 4.2 % (62.3) 4.4 % Occupancy costs (14.5) 0.9 % (14.7) 1.0 % Hospital operating expenses (305.0) 19.7 % (277.3) 19.7 % General and administrative expenses(b) (49.2) 3.2 % (41.8) 3.0 % Other income(c) 2.5 3.6 Equity in nonconsolidated affiliates 0.8 0.2 Noncontrolling interests in continuing operations (57.0) (43.3) Adjusted EBITDA $ 335.6 $ 289.6 ($ in millions) Q4 2025 Q4 2024 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 0.3 $ 6.1 (b) Stock-based compensation and the change in fair market value of the non- qualified deferred comp plan $ 19.2 $ 12.7 (c) Change in fair market value of marketable securities and the non-qualified deferred comp plan $ (1.2) $ 1.5 Reconciliations to GAAP provided on pages 27-33. Refer to pages 34-35 for end notes. uOther operating expenses includes an $8.3 million increase in provider tax expenses(2). u Supplies expense benefited from purchases accelerated into Q3-25 ahead of the Oracle Fusion conversion. uGeneral and administrative expense includes approximately $4 million of Oracle Fusion post-implementation support costs.

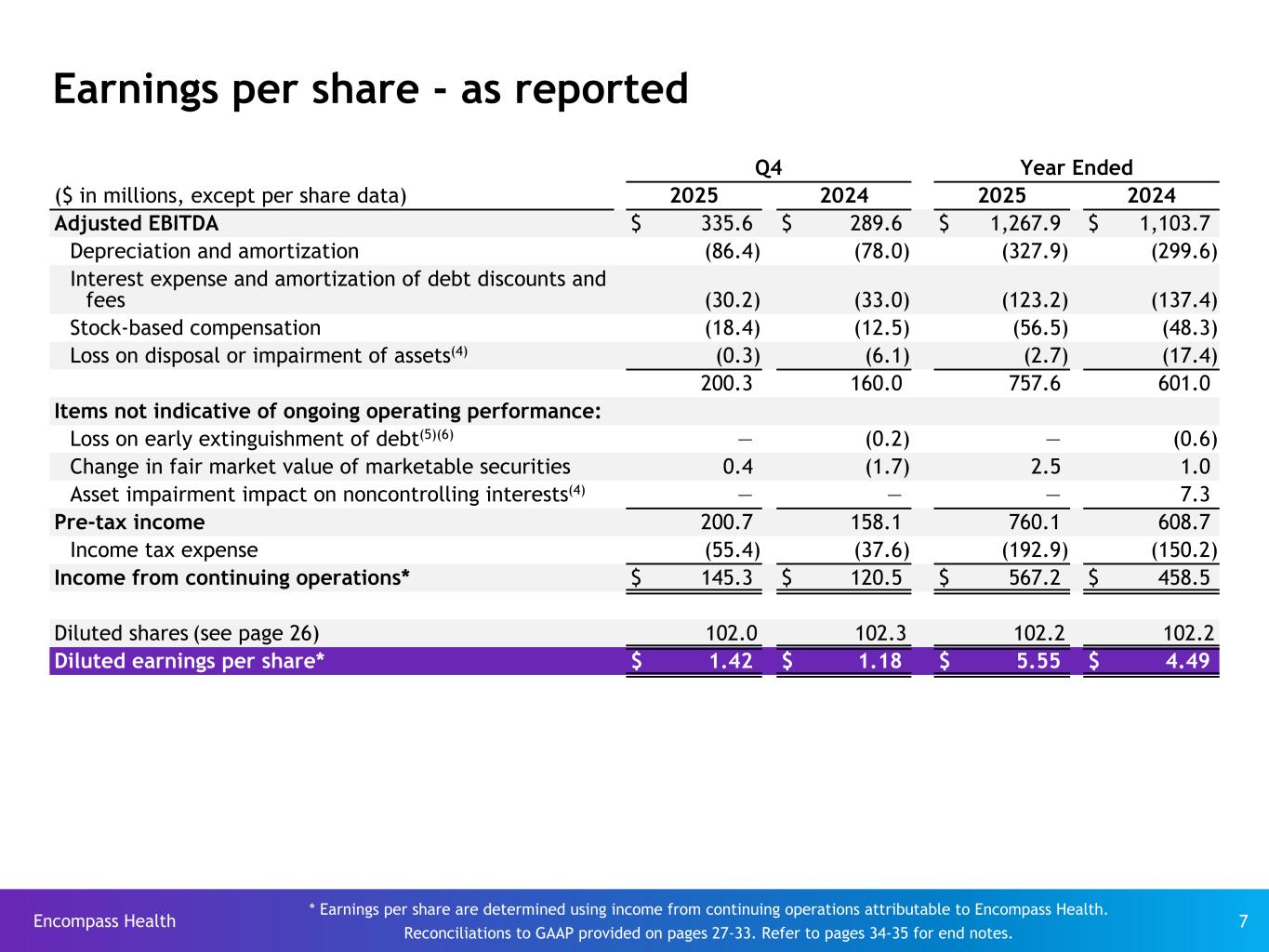

Encompass Health 7 Earnings per share - as reported Q4 Year Ended ($ in millions, except per share data) 2025 2024 2025 2024 Adjusted EBITDA $ 335.6 $ 289.6 $ 1,267.9 $ 1,103.7 Depreciation and amortization (86.4) (78.0) (327.9) (299.6) Interest expense and amortization of debt discounts and fees (30.2) (33.0) (123.2) (137.4) Stock-based compensation (18.4) (12.5) (56.5) (48.3) Loss on disposal or impairment of assets(4) (0.3) (6.1) (2.7) (17.4) 200.3 160.0 757.6 601.0 Items not indicative of ongoing operating performance: Loss on early extinguishment of debt(5)(6) — (0.2) — (0.6) Change in fair market value of marketable securities 0.4 (1.7) 2.5 1.0 Asset impairment impact on noncontrolling interests(4) — — — 7.3 Pre-tax income 200.7 158.1 760.1 608.7 Income tax expense (55.4) (37.6) (192.9) (150.2) Income from continuing operations* $ 145.3 $ 120.5 $ 567.2 $ 458.5 Diluted shares (see page 26) 102.0 102.3 102.2 102.2 Diluted earnings per share* $ 1.42 $ 1.18 $ 5.55 $ 4.49 * Earnings per share are determined using income from continuing operations attributable to Encompass Health. Reconciliations to GAAP provided on pages 27-33. Refer to pages 34-35 for end notes.

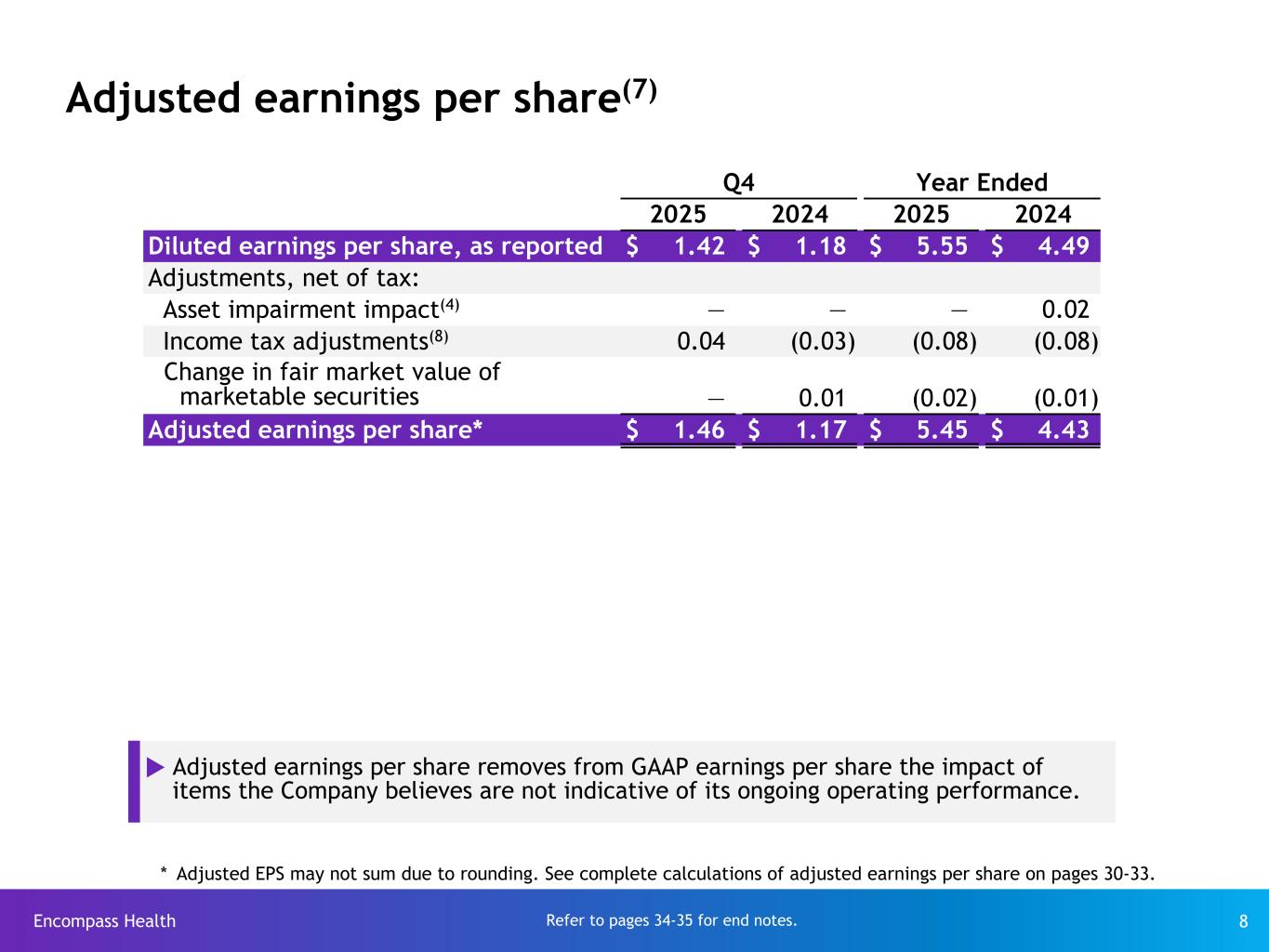

Encompass Health 8 Adjusted earnings per share(7) Refer to pages 34-35 for end notes. Q4 Year Ended 2025 2024 2025 2024 Diluted earnings per share, as reported $ 1.42 $ 1.18 $ 5.55 $ 4.49 Adjustments, net of tax: Asset impairment impact(4) — — — 0.02 Income tax adjustments(8) 0.04 (0.03) (0.08) (0.08) Change in fair market value of marketable securities — 0.01 (0.02) (0.01) Adjusted earnings per share* $ 1.46 $ 1.17 $ 5.45 $ 4.43 u Adjusted earnings per share removes from GAAP earnings per share the impact of items the Company believes are not indicative of its ongoing operating performance. * Adjusted EPS may not sum due to rounding. See complete calculations of adjusted earnings per share on pages 30-33.

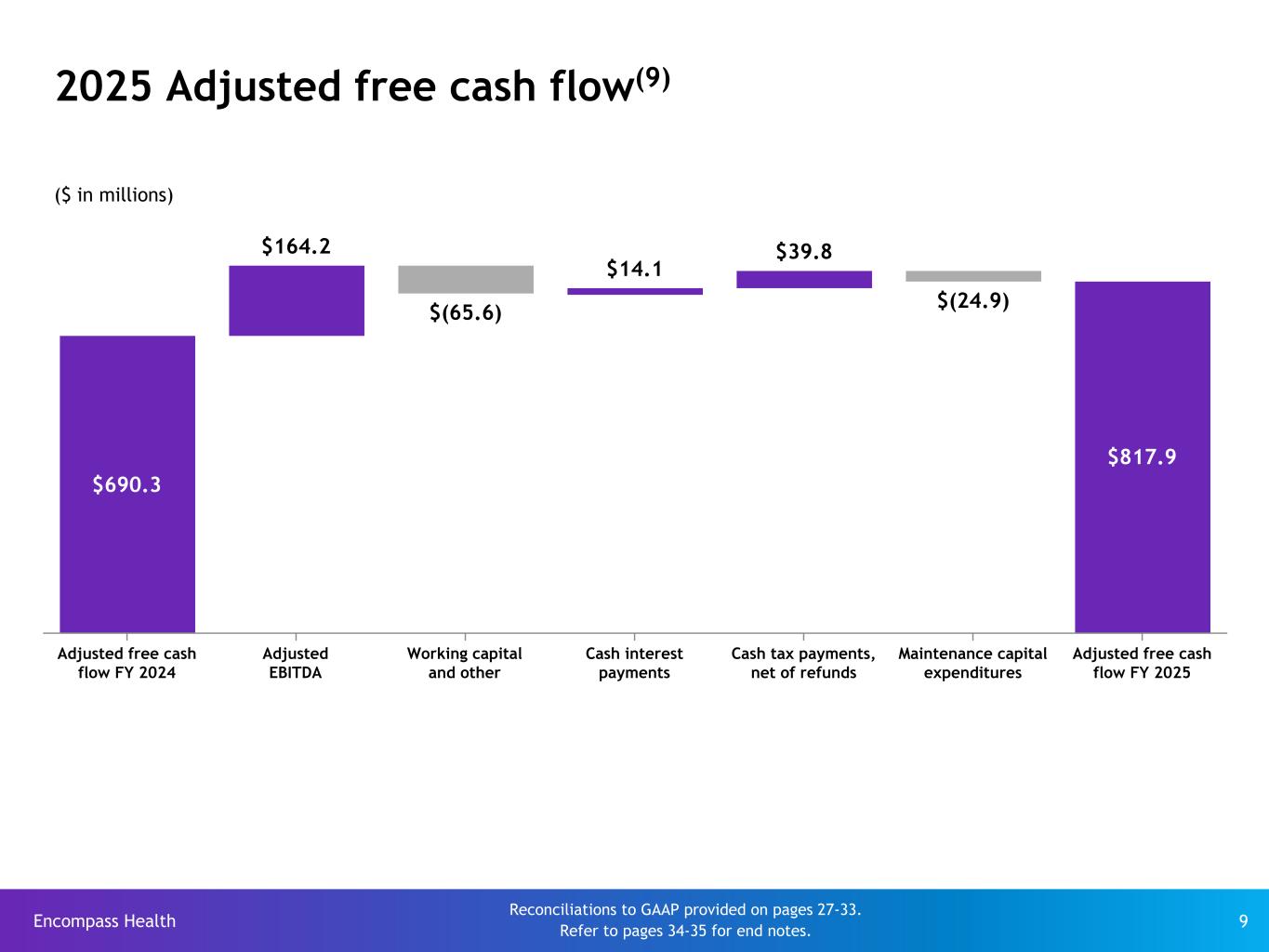

Encompass Health 9 $690.3 $164.2 $(65.6) $14.1 $39.8 $(24.9) $817.9 Adjusted free cash flow FY 2024 Adjusted EBITDA Working capital and other Cash interest payments Cash tax payments, net of refunds Maintenance capital expenditures Adjusted free cash flow FY 2025 2025 Adjusted free cash flow(9) Reconciliations to GAAP provided on pages 27-33. Refer to pages 34-35 for end notes. ($ in millions)

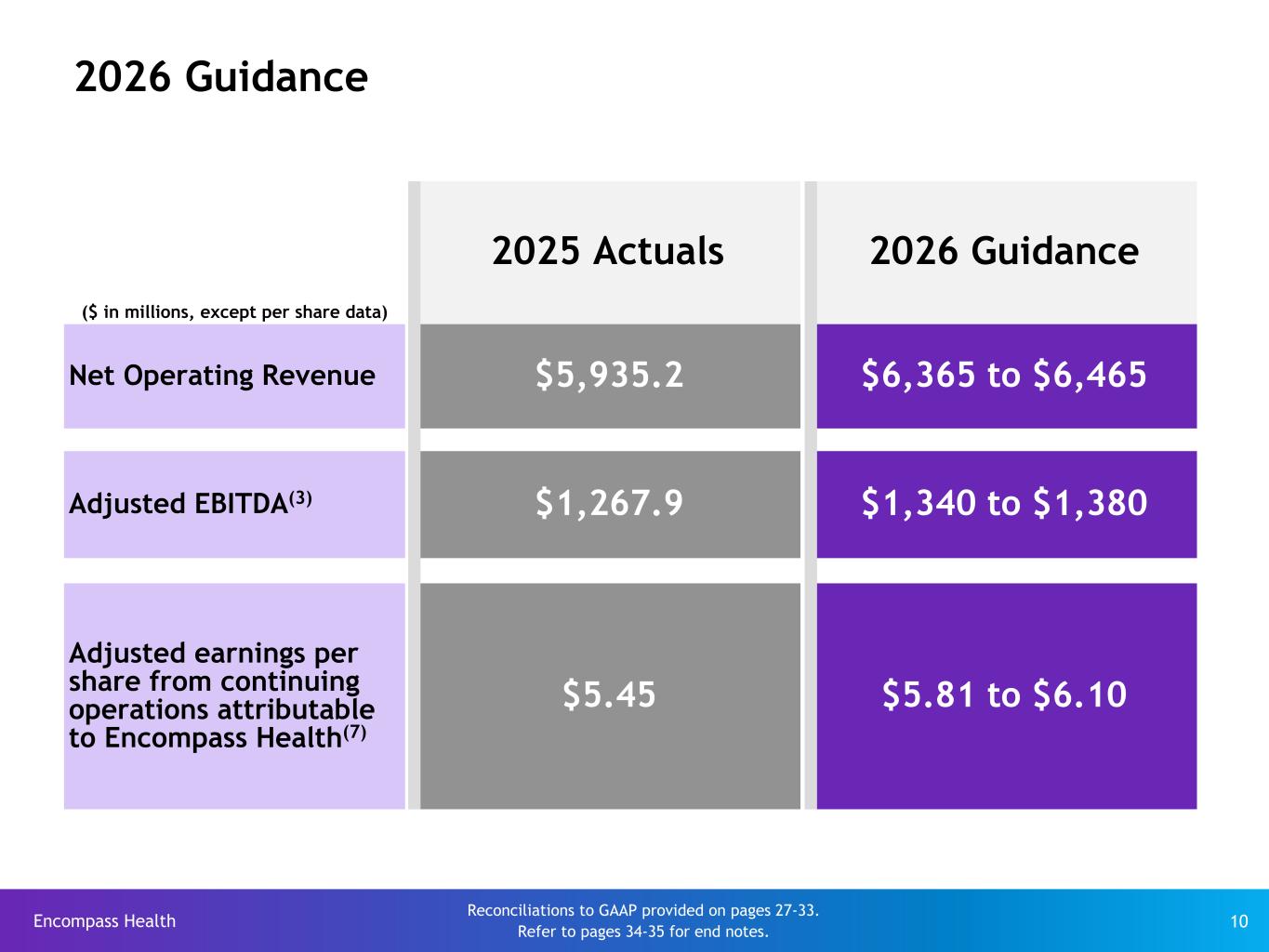

Encompass Health 10 2026 Guidance 2025 Actuals 2026 Guidance ($ in millions, except per share data) Net Operating Revenue $5,935.2 $6,365 to $6,465 Adjusted EBITDA(3) $1,267.9 $1,340 to $1,380 Adjusted earnings per share from continuing operations attributable to Encompass Health(7) $5.45 $5.81 to $6.10 Reconciliations to GAAP provided on pages 27-33. Refer to pages 34-35 for end notes.

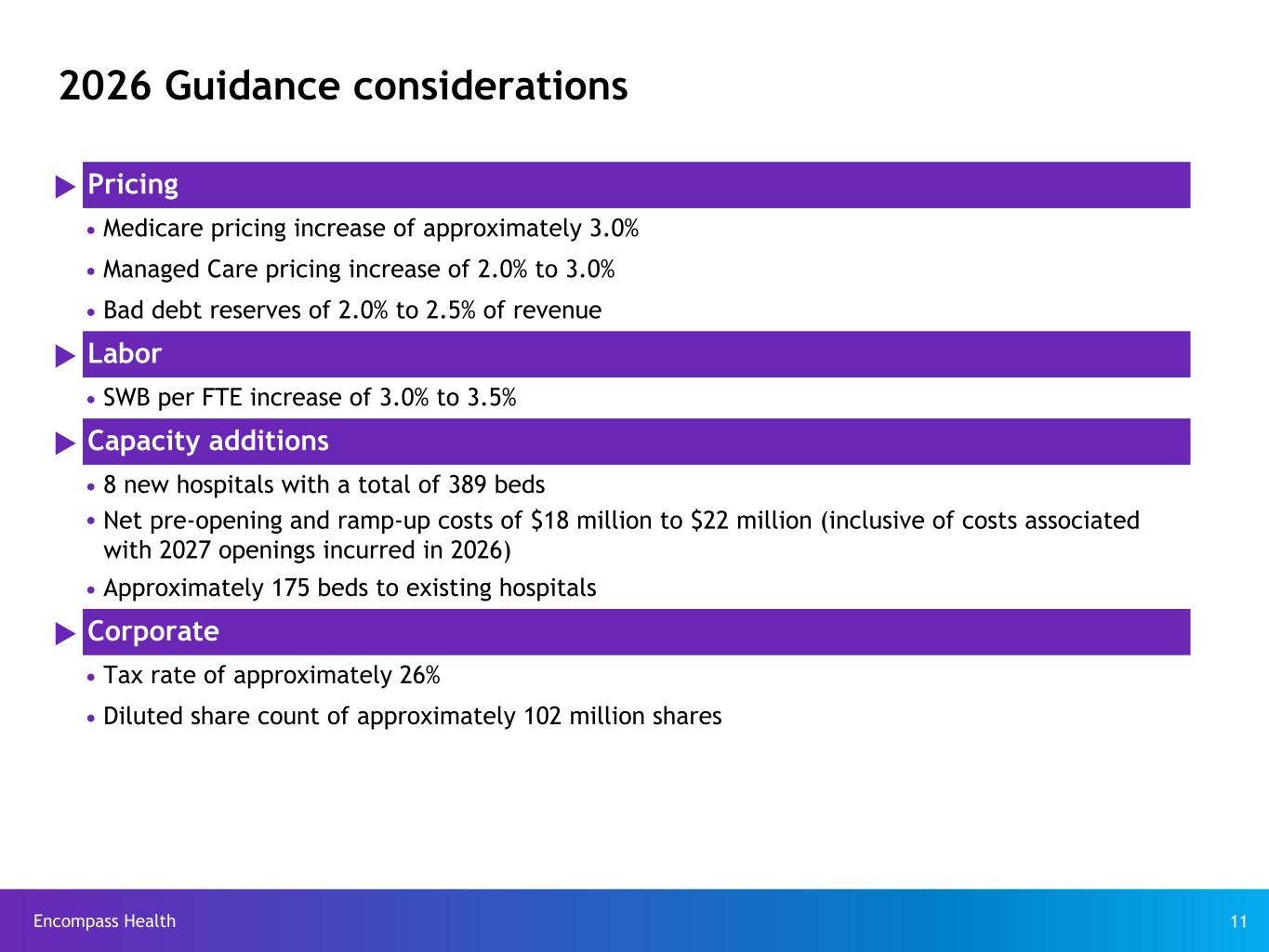

Encompass Health 11 2026 Guidance considerations u Pricing Ÿ Medicare pricing increase of approximately 3.0% Ÿ Managed Care pricing increase of 2.0% to 3.0% Ÿ Bad debt reserves of 2.0% to 2.5% of revenue u Labor Ÿ SWB per FTE increase of 3.0% to 3.5% u Capacity additions Ÿ 8 new hospitals with a total of 389 beds Ÿ Net pre-opening and ramp-up costs of $18 million to $22 million (inclusive of costs associated with 2027 openings incurred in 2026) Ÿ Approximately 175 beds to existing hospitals u Corporate Ÿ Tax rate of approximately 26% Ÿ Diluted share count of approximately 102 million shares

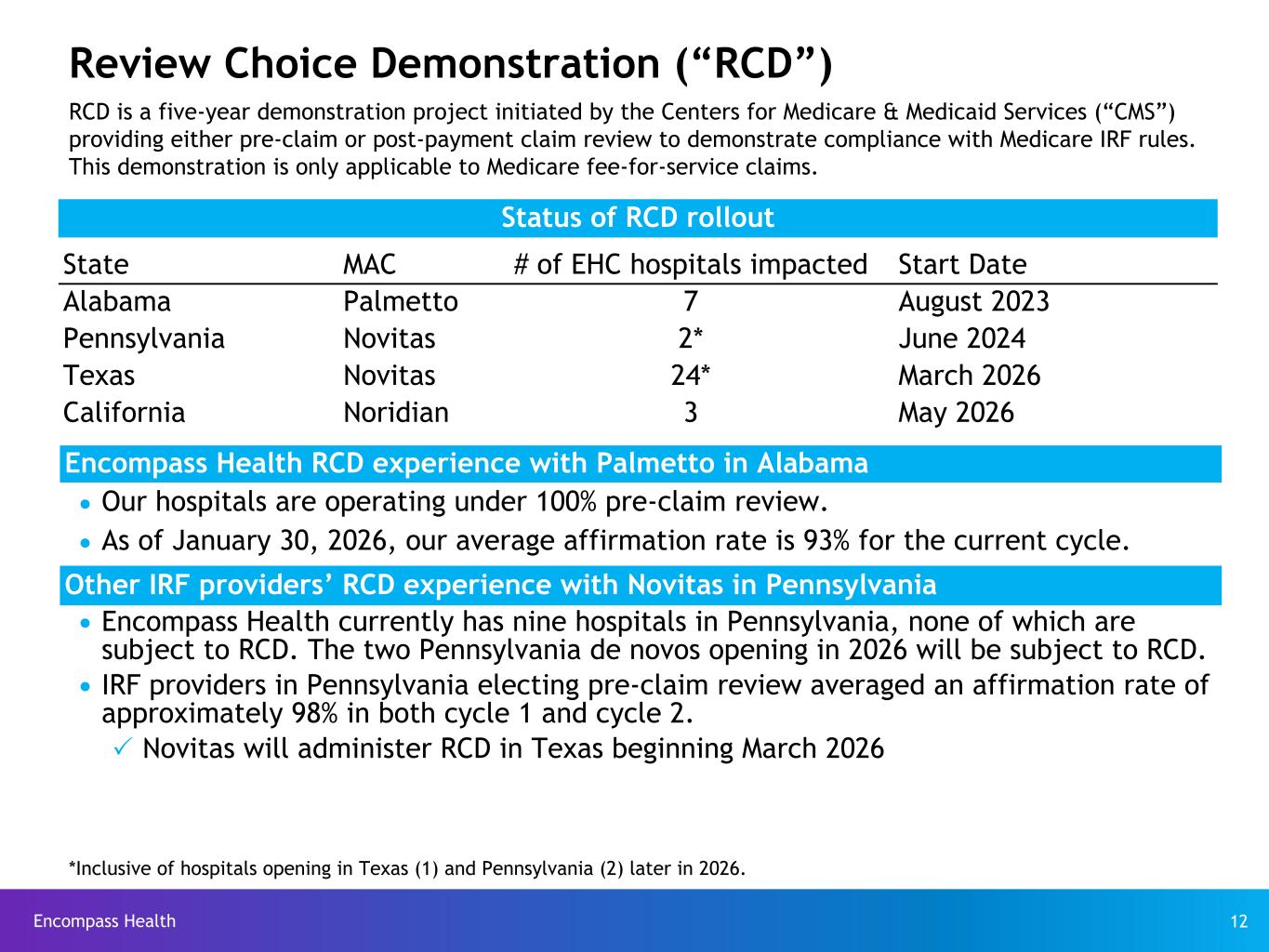

Encompass Health 12 Review Choice Demonstration (“RCD”) RCD is a five-year demonstration project initiated by the Centers for Medicare & Medicaid Services (“CMS”) providing either pre-claim or post-payment claim review to demonstrate compliance with Medicare IRF rules. This demonstration is only applicable to Medicare fee-for-service claims. Encompass Health RCD experience with Palmetto in Alabama Ÿ Our hospitals are operating under 100% pre-claim review. Ÿ As of January 30, 2026, our average affirmation rate is 93% for the current cycle. Other IRF providers’ RCD experience with Novitas in Pennsylvania Ÿ Encompass Health currently has nine hospitals in Pennsylvania, none of which are subject to RCD. The two Pennsylvania de novos opening in 2026 will be subject to RCD. Ÿ IRF providers in Pennsylvania electing pre-claim review averaged an affirmation rate of approximately 98% in both cycle 1 and cycle 2. P Novitas will administer RCD in Texas beginning March 2026 Status of RCD rollout State MAC # of EHC hospitals impacted Start Date Alabama Palmetto 7 August 2023 Pennsylvania Novitas 2* June 2024 Texas Novitas 24* March 2026 California Noridian 3 May 2026 *Inclusive of hospitals opening in Texas (1) and Pennsylvania (2) later in 2026.

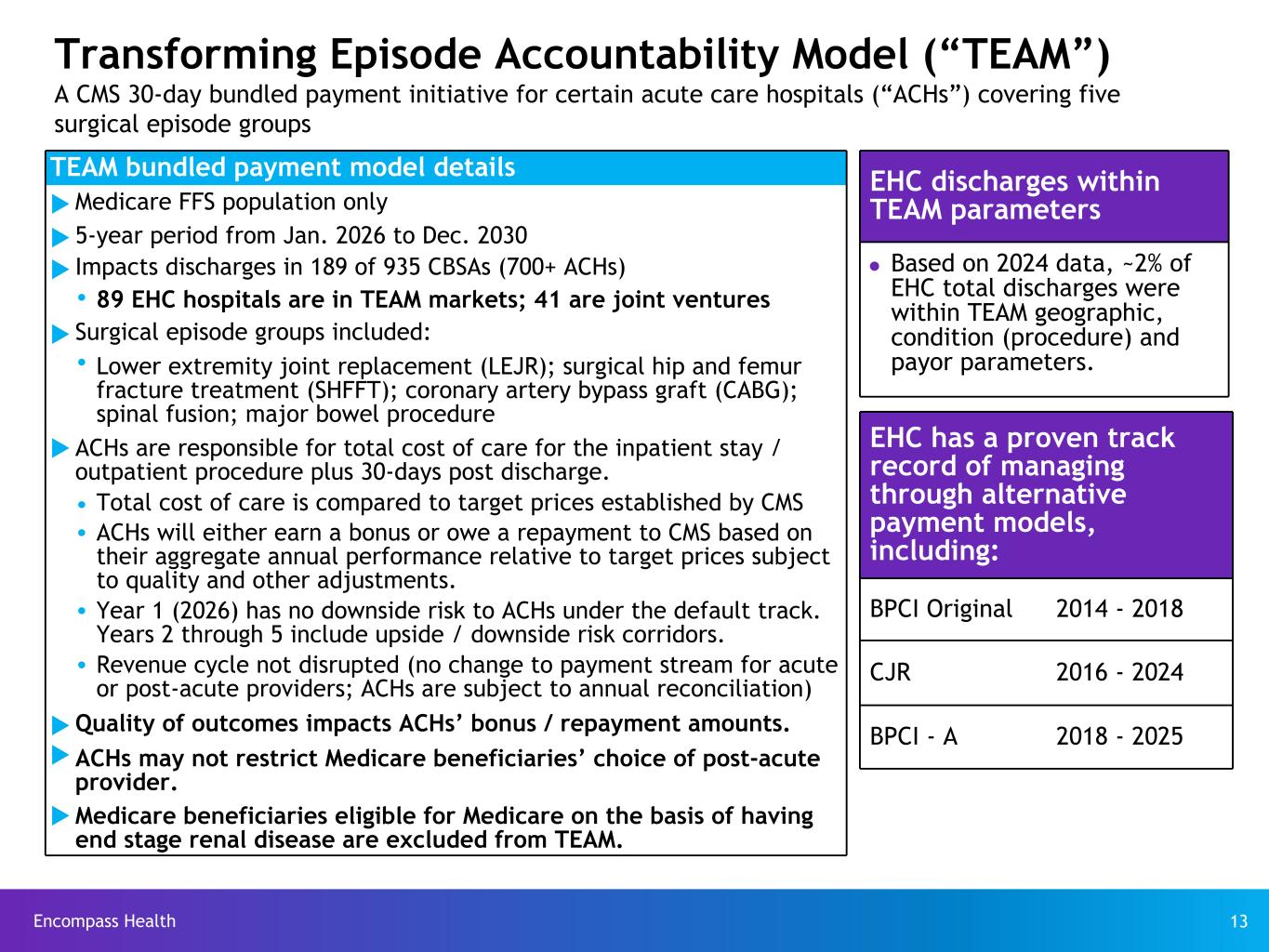

Encompass Health 13 Transforming Episode Accountability Model (“TEAM”) A CMS 30-day bundled payment initiative for certain acute care hospitals (“ACHs”) covering five surgical episode groups TEAM bundled payment model details uMedicare FFS population only u 5-year period from Jan. 2026 to Dec. 2030 u Impacts discharges in 189 of 935 CBSAs (700+ ACHs) Ÿ 89 EHC hospitals are in TEAM markets; 41 are joint ventures u Surgical episode groups included: Ÿ Lower extremity joint replacement (LEJR); surgical hip and femur fracture treatment (SHFFT); coronary artery bypass graft (CABG); spinal fusion; major bowel procedure uACHs are responsible for total cost of care for the inpatient stay / outpatient procedure plus 30-days post discharge. Ÿ Total cost of care is compared to target prices established by CMS Ÿ ACHs will either earn a bonus or owe a repayment to CMS based on their aggregate annual performance relative to target prices subject to quality and other adjustments. Ÿ Year 1 (2026) has no downside risk to ACHs under the default track. Years 2 through 5 include upside / downside risk corridors. Ÿ Revenue cycle not disrupted (no change to payment stream for acute or post-acute providers; ACHs are subject to annual reconciliation) uQuality of outcomes impacts ACHs’ bonus / repayment amounts. uACHs may not restrict Medicare beneficiaries’ choice of post-acute provider. uMedicare beneficiaries eligible for Medicare on the basis of having end stage renal disease are excluded from TEAM. EHC discharges within TEAM parameters Ÿ Based on 2024 data, ~2% of EHC total discharges were within TEAM geographic, condition (procedure) and payor parameters. EHC has a proven track record of managing through alternative payment models, including: BPCI Original 2014 - 2018 CJR 2016 - 2024 BPCI - A 2018 - 2025

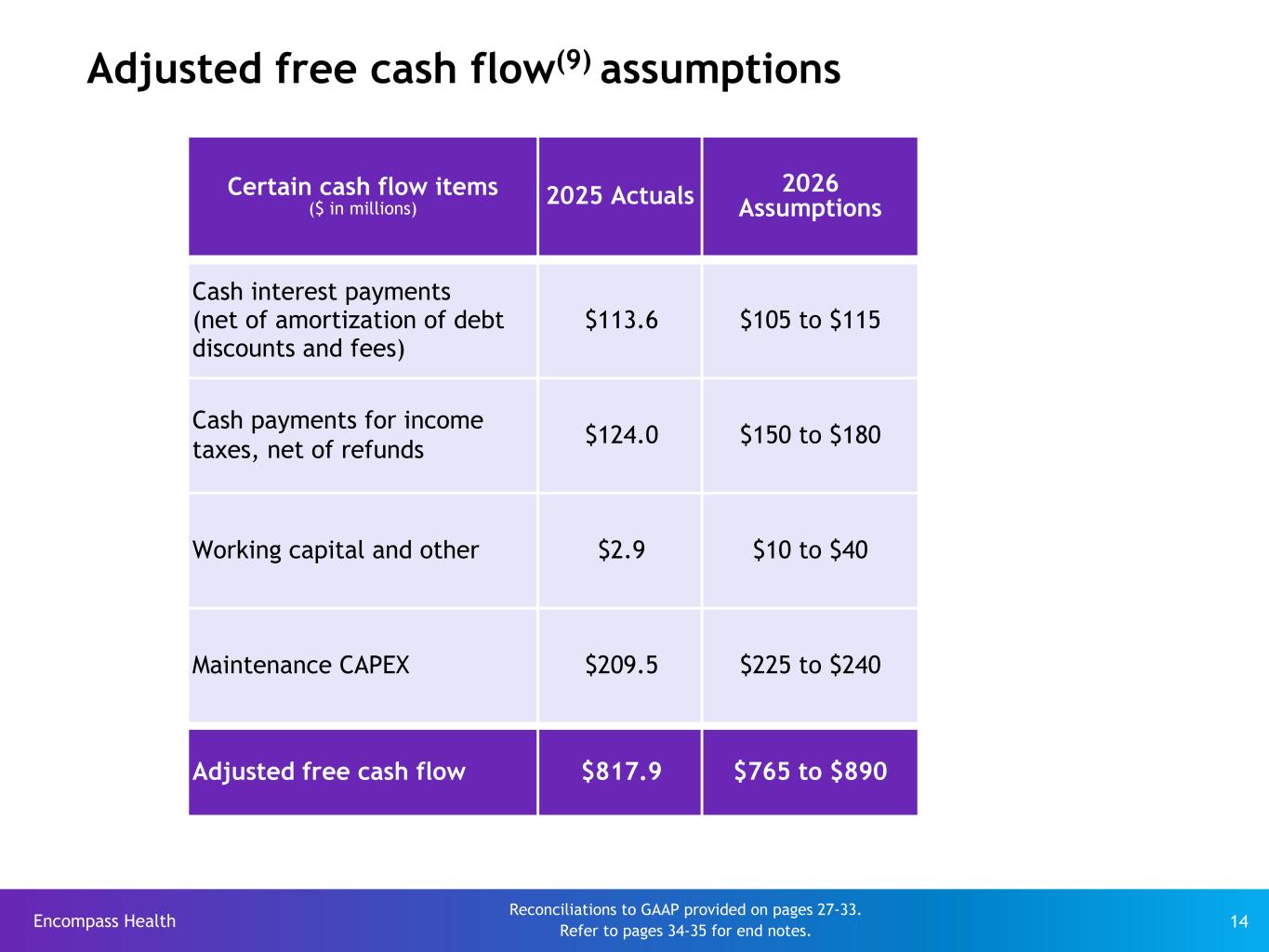

Encompass Health 14 Adjusted free cash flow(9) assumptions Certain cash flow items ($ in millions) 2025 Actuals 2026 Assumptions Cash interest payments (net of amortization of debt discounts and fees) $113.6 $105 to $115 Cash payments for income taxes, net of refunds $124.0 $150 to $180 Working capital and other $2.9 $10 to $40 Maintenance CAPEX $209.5 $225 to $240 Adjusted free cash flow $817.9 $765 to $890 Reconciliations to GAAP provided on pages 27-33. Refer to pages 34-35 for end notes.

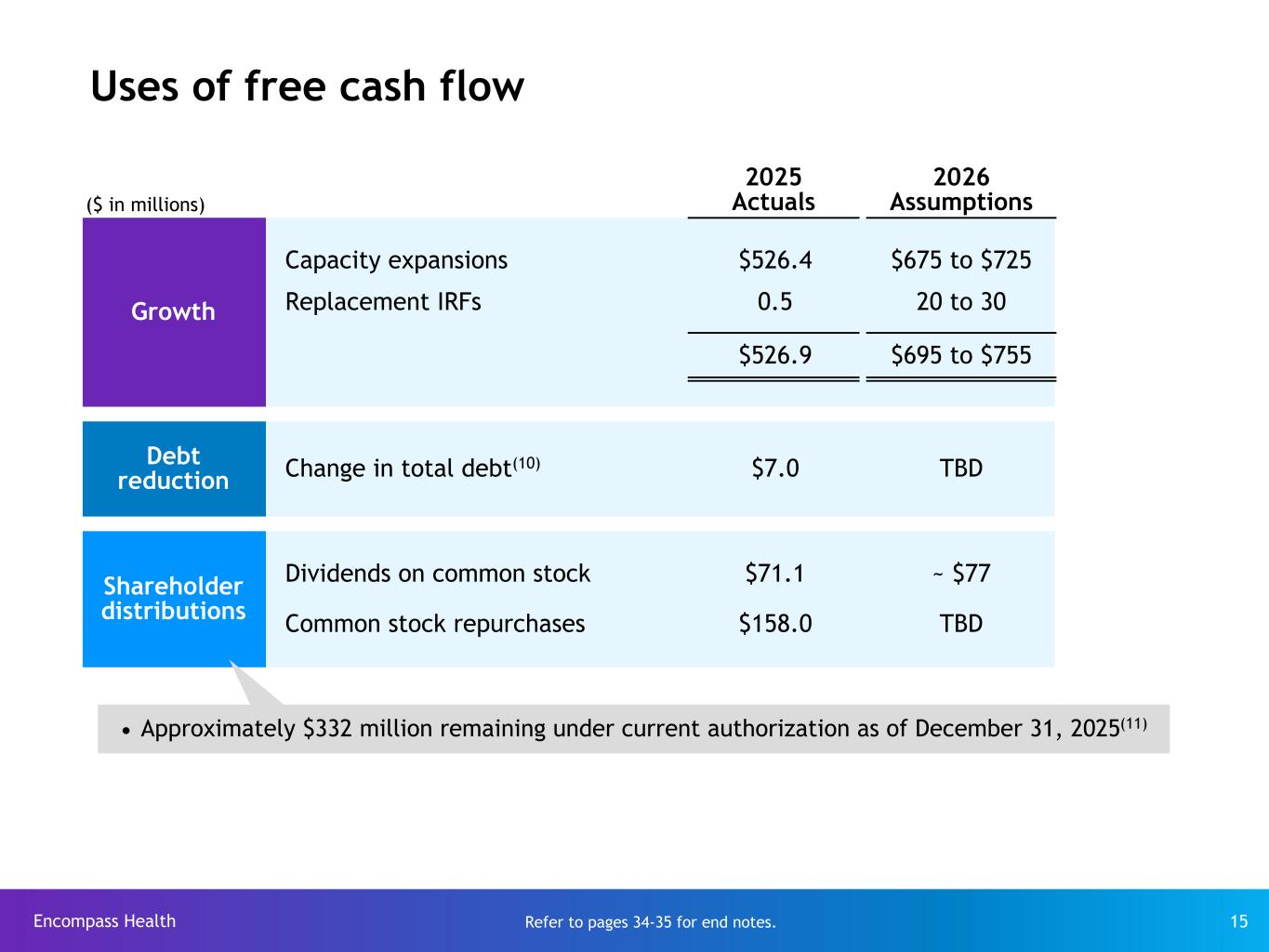

Encompass Health 15 Uses of free cash flow ($ in millions) 2025 Actuals 2026 Assumptions Growth Capacity expansions $526.4 $675 to $725 Replacement IRFs 0.5 20 to 30 $526.9 $695 to $755 Debt reduction Change in total debt(10) $7.0 TBD Shareholder distributions Dividends on common stock $71.1 ~ $77 Common stock repurchases $158.0 TBD Refer to pages 34-35 for end notes. Ÿ Approximately $332 million remaining under current authorization as of December 31, 2025(11)

Appendix

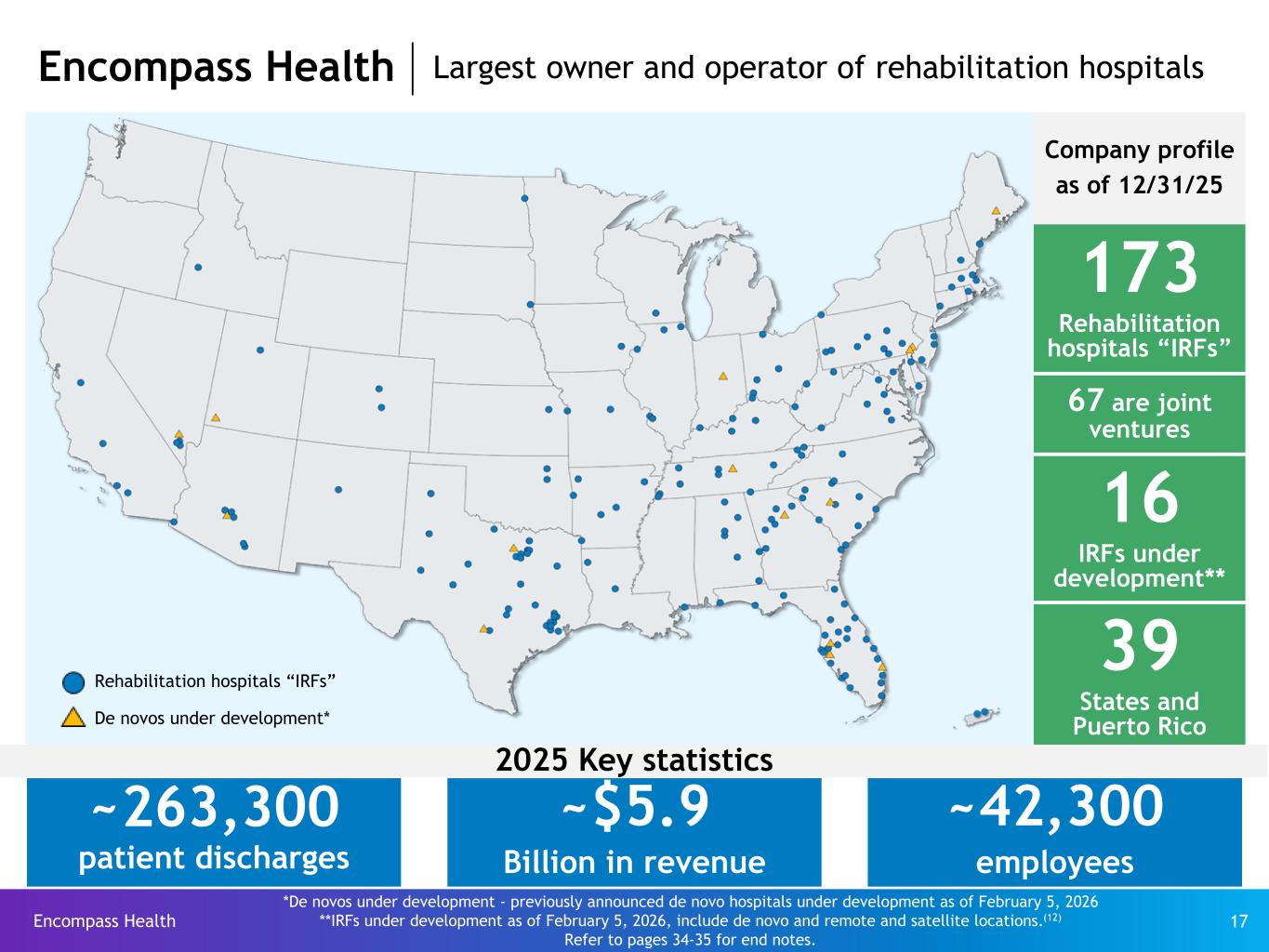

Encompass Health 17 *De novos under development - previously announced de novo hospitals under development as of February 5, 2026 **IRFs under development as of February 5, 2026, include de novo and remote and satellite locations.(12) Refer to pages 34-35 for end notes. Encompass Health Largest owner and operator of rehabilitation hospitals Company profile as of 12/31/25 173 Rehabilitation hospitals “IRFs” 67 are joint ventures 16 IRFs under development** 39 States and Puerto Rico Rehabilitation hospitals “IRFs” De novos under development* 2025 Key statistics ~263,300 patient discharges ~$5.9 Billion in revenue ~42,300 employees

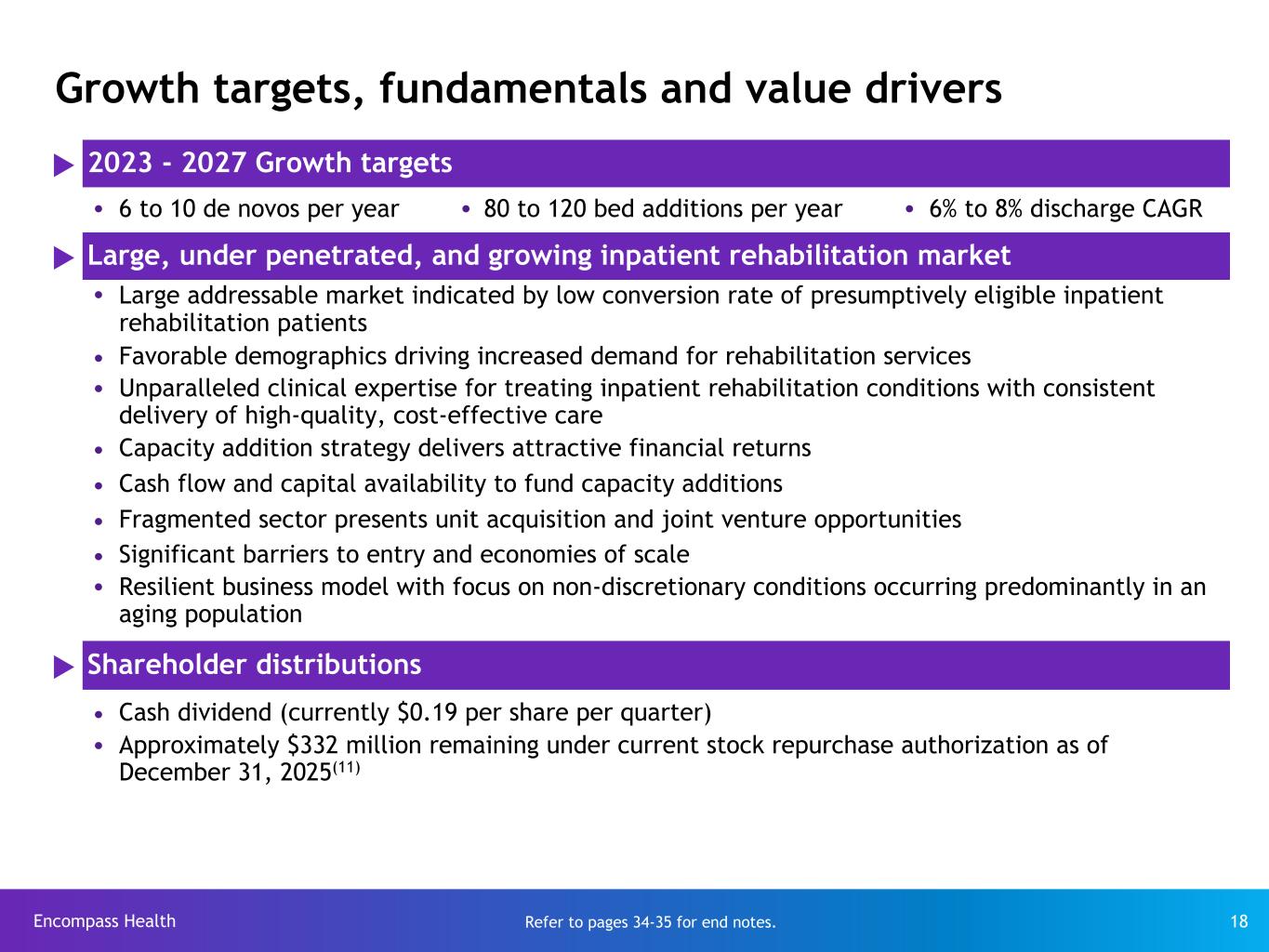

Encompass Health 18 u 2023 - 2027 Growth targets Ÿ 6 to 10 de novos per year Ÿ 80 to 120 bed additions per year Ÿ 6% to 8% discharge CAGR u Large, under penetrated, and growing inpatient rehabilitation market Ÿ Large addressable market indicated by low conversion rate of presumptively eligible inpatient rehabilitation patients Ÿ Favorable demographics driving increased demand for rehabilitation services Ÿ Unparalleled clinical expertise for treating inpatient rehabilitation conditions with consistent delivery of high-quality, cost-effective care Ÿ Capacity addition strategy delivers attractive financial returns Ÿ Cash flow and capital availability to fund capacity additions Ÿ Fragmented sector presents unit acquisition and joint venture opportunities Ÿ Significant barriers to entry and economies of scale Ÿ Resilient business model with focus on non-discretionary conditions occurring predominantly in an aging population u Shareholder distributions Ÿ Cash dividend (currently $0.19 per share per quarter) Ÿ Approximately $332 million remaining under current stock repurchase authorization as of December 31, 2025(11) Refer to pages 34-35 for end notes. Growth targets, fundamentals and value drivers

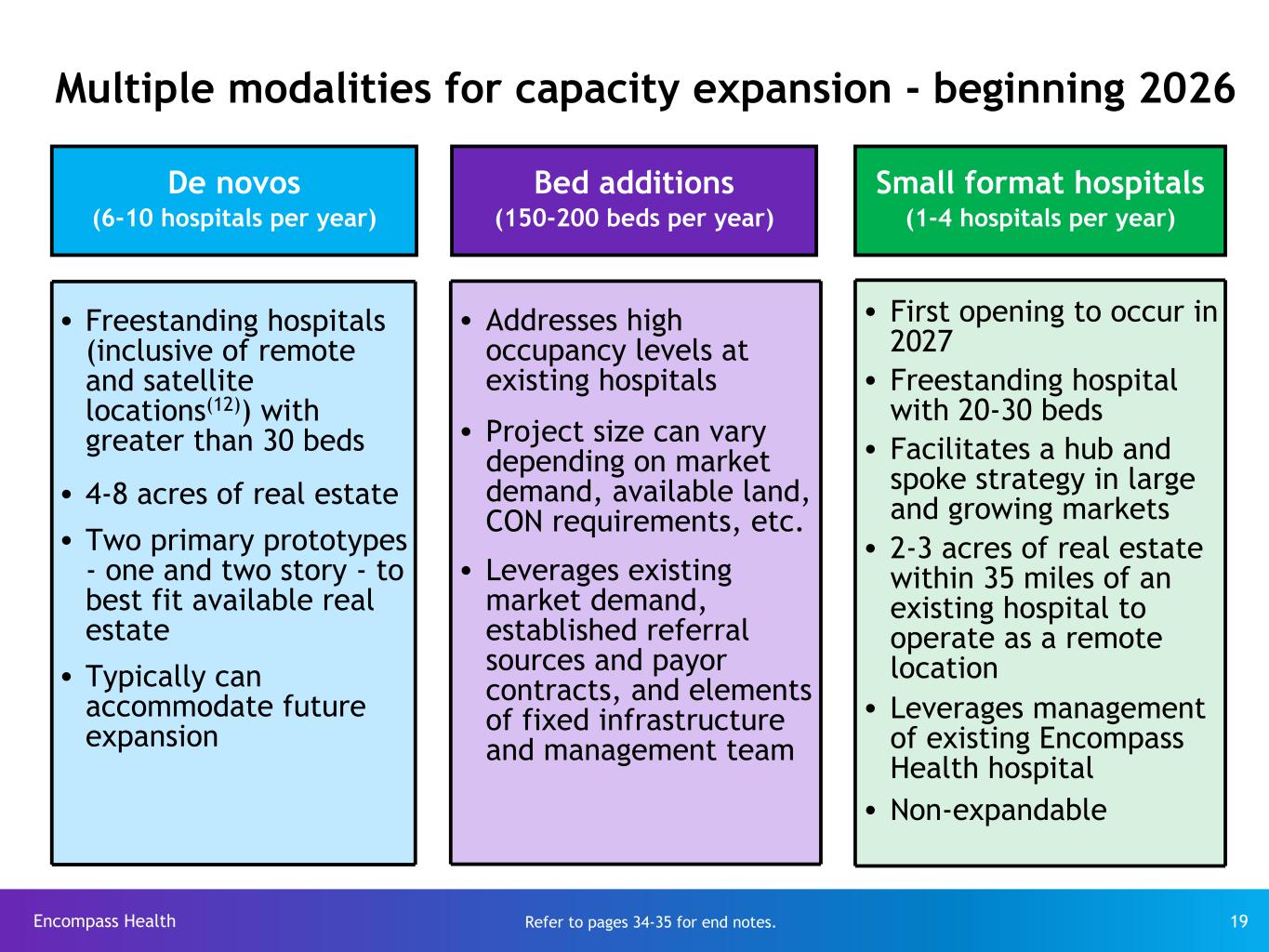

Encompass Health 19 Multiple modalities for capacity expansion - beginning 2026 De novos (6-10 hospitals per year) Bed additions (150-200 beds per year) Small format hospitals (1-4 hospitals per year) Ÿ Freestanding hospitals (inclusive of remote and satellite locations(12)) with greater than 30 beds Ÿ 4-8 acres of real estate Ÿ Two primary prototypes - one and two story - to best fit available real estate Ÿ Typically can accommodate future expansion Ÿ Addresses high occupancy levels at existing hospitals Ÿ Project size can vary depending on market demand, available land, CON requirements, etc. Ÿ Leverages existing market demand, established referral sources and payor contracts, and elements of fixed infrastructure and management team Ÿ First opening to occur in 2027 Ÿ Freestanding hospital with 20-30 beds Ÿ Facilitates a hub and spoke strategy in large and growing markets Ÿ 2-3 acres of real estate within 35 miles of an existing hospital to operate as a remote location Ÿ Leverages management of existing Encompass Health hospital Ÿ Non-expandable Refer to pages 34-35 for end notes.

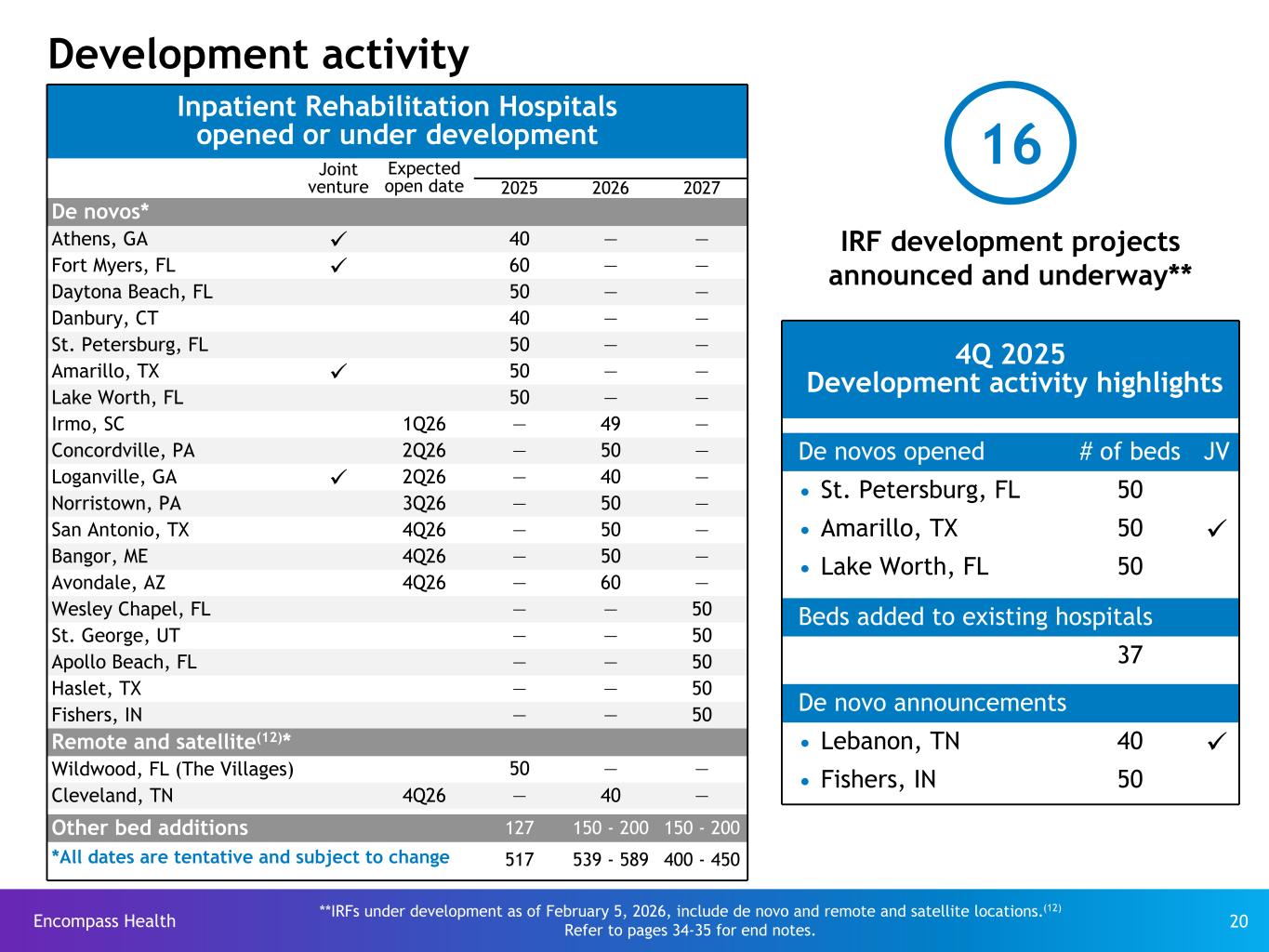

Encompass Health 20 Inpatient Rehabilitation Hospitals opened or under development Joint venture Expected open date 2025 2026 2027 De novos* Athens, GA ü 40 — — Fort Myers, FL ü 60 — — Daytona Beach, FL 50 — — Danbury, CT 40 — — St. Petersburg, FL 50 — — Amarillo, TX ü 50 — — Lake Worth, FL 50 — — Irmo, SC 1Q26 — 49 — Concordville, PA 2Q26 — 50 — Loganville, GA ü 2Q26 — 40 — Norristown, PA 3Q26 — 50 — San Antonio, TX 4Q26 — 50 — Bangor, ME 4Q26 — 50 — Avondale, AZ 4Q26 — 60 — Wesley Chapel, FL — — 50 St. George, UT — — 50 Apollo Beach, FL — — 50 Haslet, TX — — 50 Fishers, IN — — 50 Remote and satellite(12)* Wildwood, FL (The Villages) 50 — — Cleveland, TN 4Q26 — 40 — Other bed additions 127 150 - 200 150 - 200 *All dates are tentative and subject to change 517 539 - 589 400 - 450 Development activity 4Q 2025 Development activity highlights uDe novos opened # of beds JV Ÿ St. Petersburg, FL 50 Ÿ Amarillo, TX 50 ü Ÿ Lake Worth, FL 50 Beds added to existing hospitals 37 De novo announcements Ÿ Lebanon, TN 40 ü Ÿ Fishers, IN 50 IRF development projects announced and underway** 16 **IRFs under development as of February 5, 2026, include de novo and remote and satellite locations.(12) Refer to pages 34-35 for end notes.

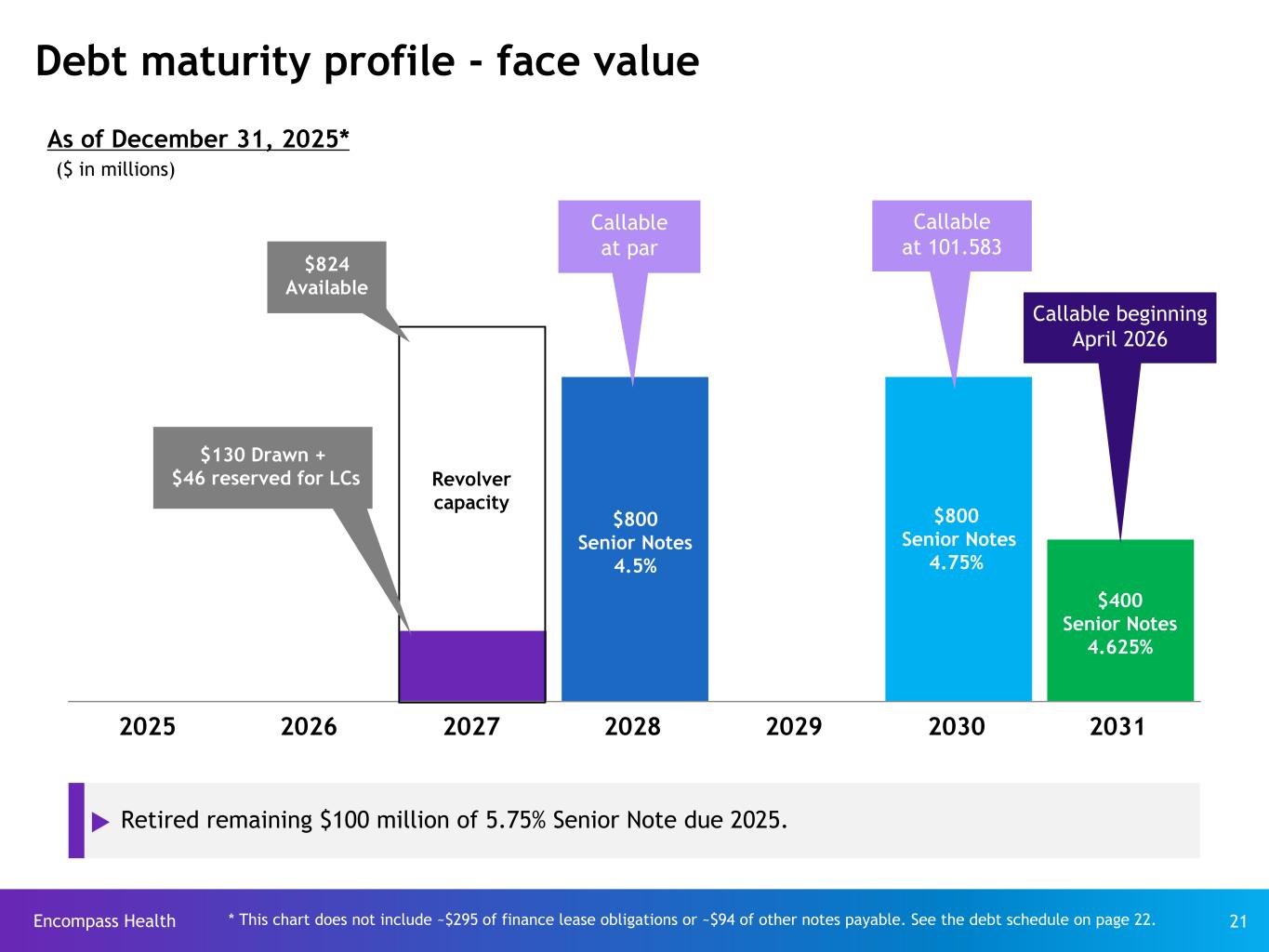

Encompass Health 21 2025 2026 2027 2028 2029 2030 2031 * This chart does not include ~$295 of finance lease obligations or ~$94 of other notes payable. See the debt schedule on page 22. Debt maturity profile - face value ($ in millions) Revolver capacity $800 Senior Notes 4.75% $800 Senior Notes 4.5% As of December 31, 2025* $824 Available $130 Drawn + $46 reserved for LCs Callable at par $400 Senior Notes 4.625% Callable beginning April 2026 Callable at 101.583 u Retired remaining $100 million of 5.75% Senior Note due 2025.

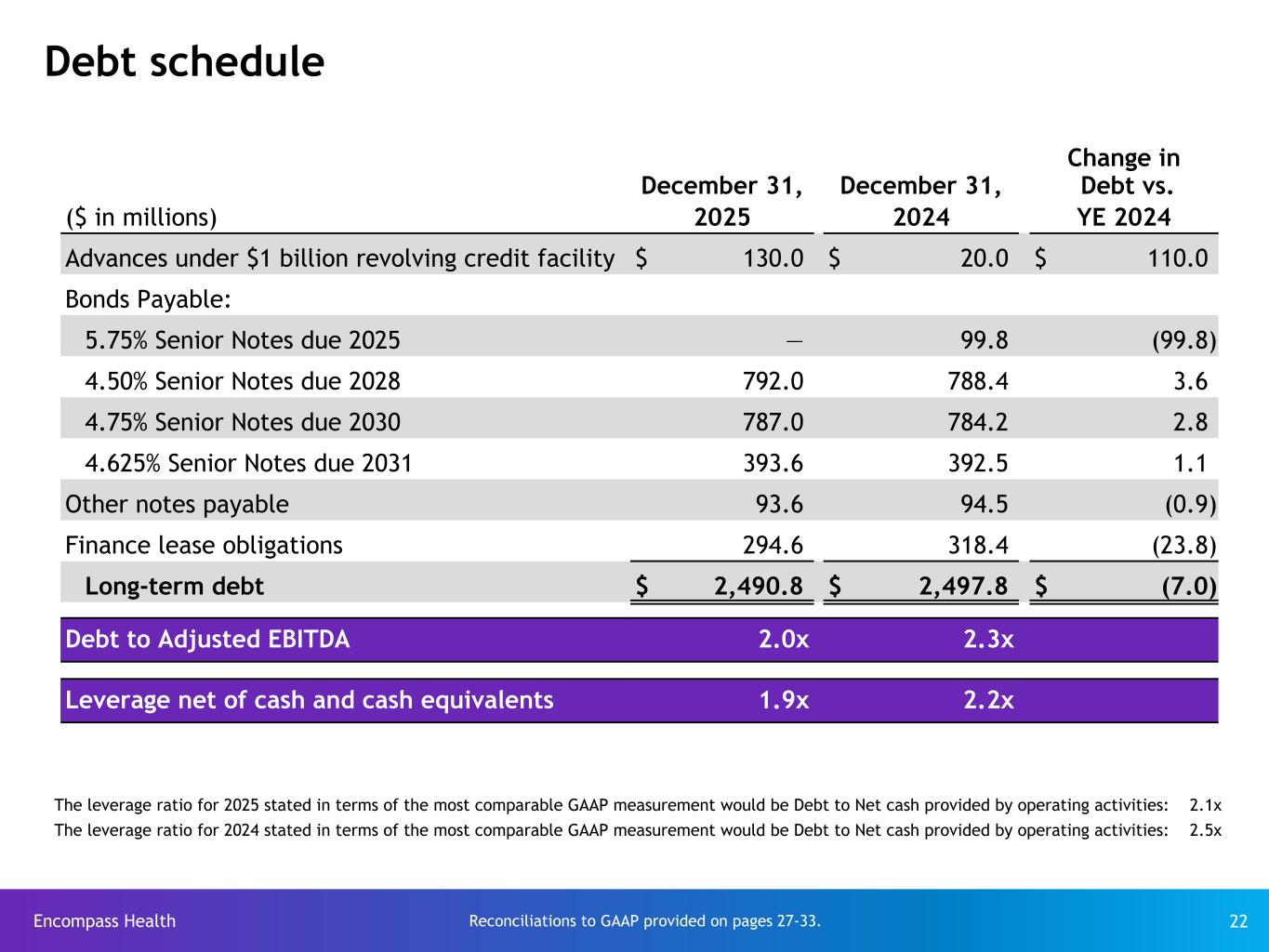

Encompass Health 22 Debt schedule Change in December 31, December 31, Debt vs. ($ in millions) 2025 2024 YE 2024 Advances under $1 billion revolving credit facility $ 130.0 $ 20.0 $ 110.0 Bonds Payable: 5.75% Senior Notes due 2025 — 99.8 (99.8) 4.50% Senior Notes due 2028 792.0 788.4 3.6 4.75% Senior Notes due 2030 787.0 784.2 2.8 4.625% Senior Notes due 2031 393.6 392.5 1.1 Other notes payable 93.6 94.5 (0.9) Finance lease obligations 294.6 318.4 (23.8) Long-term debt $ 2,490.8 $ 2,497.8 $ (7.0) Debt to Adjusted EBITDA 2.0x 2.3x Leverage net of cash and cash equivalents 1.9x 2.2x Reconciliations to GAAP provided on pages 27-33. The leverage ratio for 2025 stated in terms of the most comparable GAAP measurement would be Debt to Net cash provided by operating activities: 2.1x The leverage ratio for 2024 stated in terms of the most comparable GAAP measurement would be Debt to Net cash provided by operating activities: 2.5x

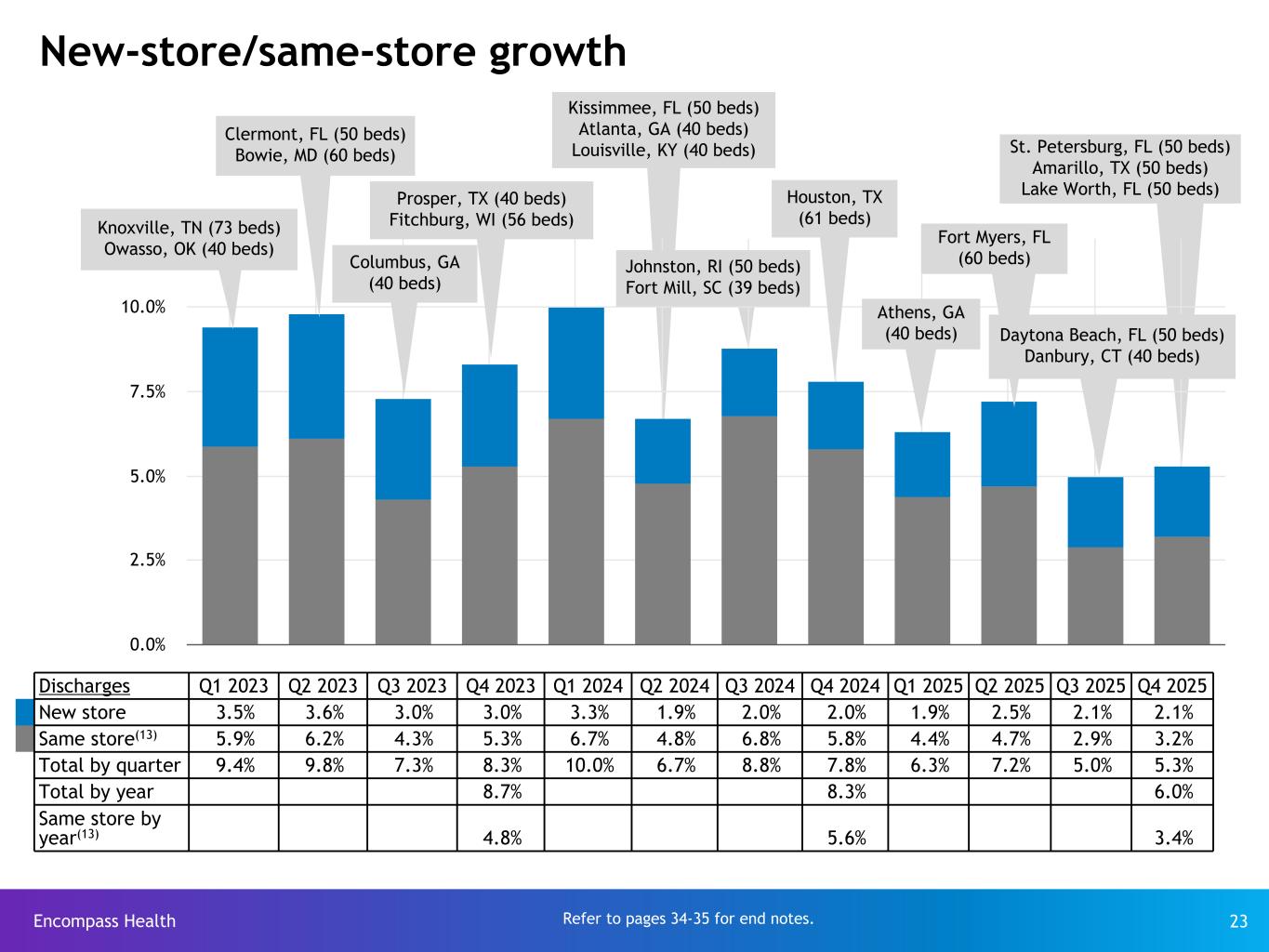

Encompass Health 23 0.0% 2.5% 5.0% 7.5% 10.0% New-store/same-store growth Discharges Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 New store 3.5% 3.6% 3.0% 3.0% 3.3% 1.9% 2.0% 2.0% 1.9% 2.5% 2.1% 2.1% Same store(13) 5.9% 6.2% 4.3% 5.3% 6.7% 4.8% 6.8% 5.8% 4.4% 4.7% 2.9% 3.2% Total by quarter 9.4% 9.8% 7.3% 8.3% 10.0% 6.7% 8.8% 7.8% 6.3% 7.2% 5.0% 5.3% Total by year 8.7% 8.3% 6.0% Same store by year(13) 4.8% 5.6% 3.4% Johnston, RI (50 beds) Fort Mill, SC (39 beds) Athens, GA (40 beds) Knoxville, TN (73 beds) Owasso, OK (40 beds) Clermont, FL (50 beds) Bowie, MD (60 beds) Columbus, GA (40 beds) Prosper, TX (40 beds) Fitchburg, WI (56 beds) Kissimmee, FL (50 beds) Atlanta, GA (40 beds) Louisville, KY (40 beds) Refer to pages 34-35 for end notes. Houston, TX (61 beds) Fort Myers, FL (60 beds) Daytona Beach, FL (50 beds) Danbury, CT (40 beds) St. Petersburg, FL (50 beds) Amarillo, TX (50 beds) Lake Worth, FL (50 beds)

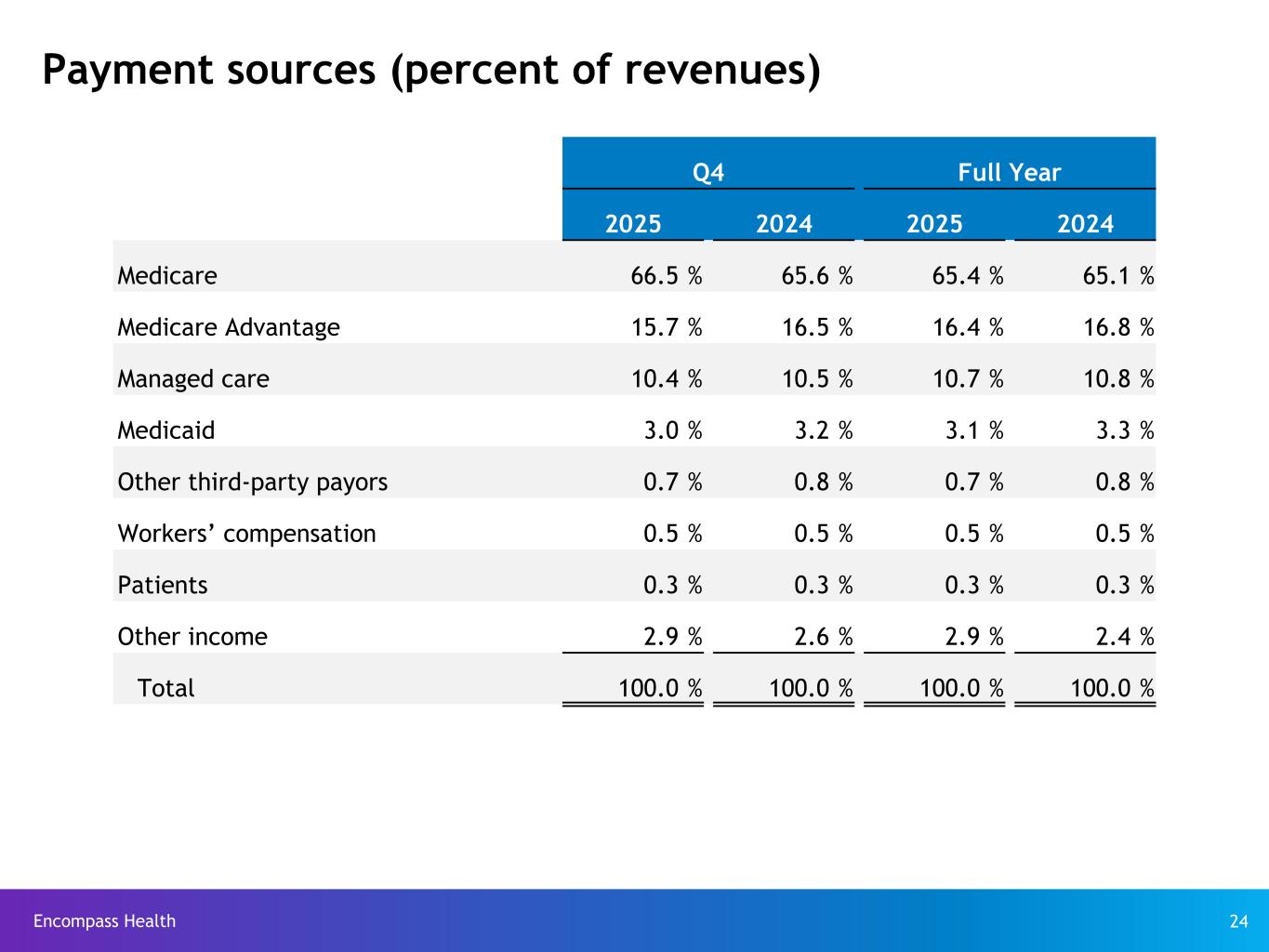

Encompass Health 24 Payment sources (percent of revenues) Q4 Full Year 2025 2024 2025 2024 Medicare 66.5 % 65.6 % 65.4 % 65.1 % Medicare Advantage 15.7 % 16.5 % 16.4 % 16.8 % Managed care 10.4 % 10.5 % 10.7 % 10.8 % Medicaid 3.0 % 3.2 % 3.1 % 3.3 % Other third-party payors 0.7 % 0.8 % 0.7 % 0.8 % Workers’ compensation 0.5 % 0.5 % 0.5 % 0.5 % Patients 0.3 % 0.3 % 0.3 % 0.3 % Other income 2.9 % 2.6 % 2.9 % 2.4 % Total 100.0 % 100.0 % 100.0 % 100.0 %

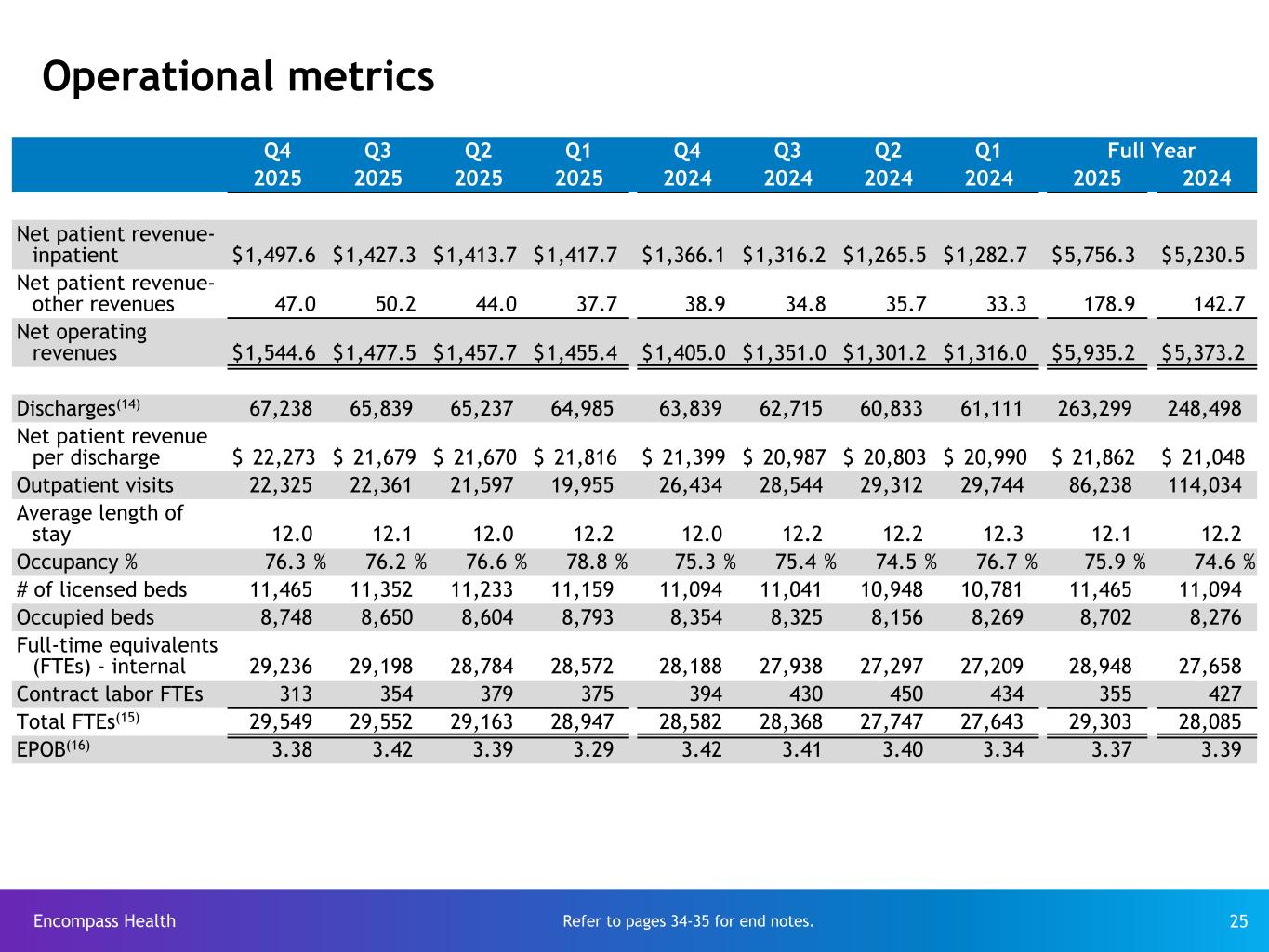

Encompass Health 25 Operational metrics Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2025 2025 2025 2025 2024 2024 2024 2024 2025 2024 Net patient revenue- inpatient $ 1,497.6 $ 1,427.3 $ 1,413.7 $ 1,417.7 $ 1,366.1 $ 1,316.2 $ 1,265.5 $ 1,282.7 $ 5,756.3 $ 5,230.5 Net patient revenue- other revenues 47.0 50.2 44.0 37.7 38.9 34.8 35.7 33.3 178.9 142.7 Net operating revenues $ 1,544.6 $ 1,477.5 $ 1,457.7 $ 1,455.4 $ 1,405.0 $ 1,351.0 $ 1,301.2 $ 1,316.0 $ 5,935.2 $ 5,373.2 Discharges(14) 67,238 65,839 65,237 64,985 63,839 62,715 60,833 61,111 263,299 248,498 Net patient revenue per discharge $ 22,273 $ 21,679 $ 21,670 $ 21,816 $ 21,399 $ 20,987 $ 20,803 $ 20,990 $ 21,862 $ 21,048 Outpatient visits 22,325 22,361 21,597 19,955 26,434 28,544 29,312 29,744 86,238 114,034 Average length of stay 12.0 12.1 12.0 12.2 12.0 12.2 12.2 12.3 12.1 12.2 Occupancy % 76.3 % 76.2 % 76.6 % 78.8 % 75.3 % 75.4 % 74.5 % 76.7 % 75.9 % 74.6 % # of licensed beds 11,465 11,352 11,233 11,159 11,094 11,041 10,948 10,781 11,465 11,094 Occupied beds 8,748 8,650 8,604 8,793 8,354 8,325 8,156 8,269 8,702 8,276 Full-time equivalents (FTEs) - internal 29,236 29,198 28,784 28,572 28,188 27,938 27,297 27,209 28,948 27,658 Contract labor FTEs 313 354 379 375 394 430 450 434 355 427 Total FTEs(15) 29,549 29,552 29,163 28,947 28,582 28,368 27,747 27,643 29,303 28,085 EPOB(16) 3.38 3.42 3.39 3.29 3.42 3.41 3.40 3.34 3.37 3.39 Refer to pages 34-35 for end notes.

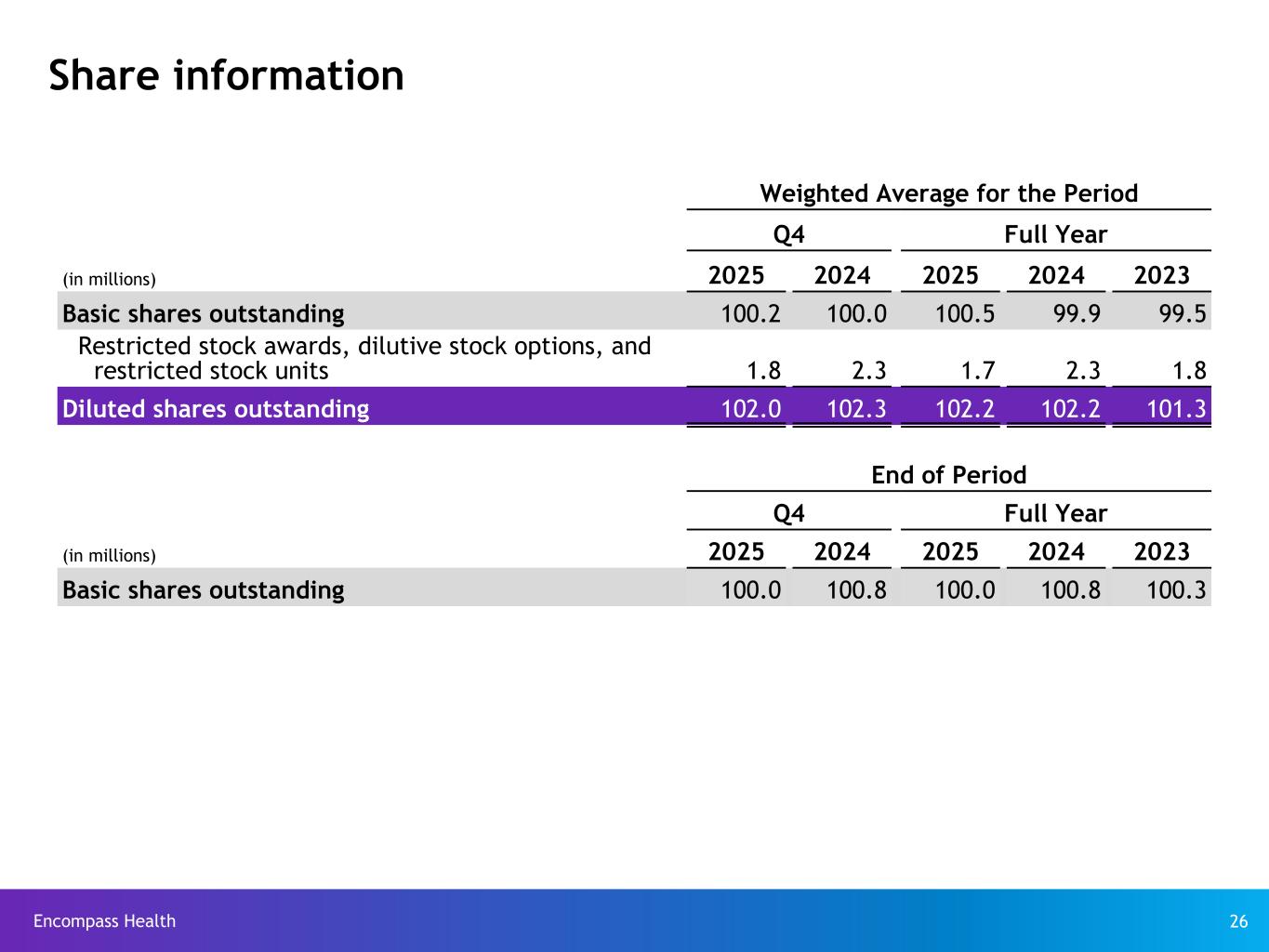

Encompass Health 26 Share information Weighted Average for the Period Q4 Full Year (in millions) 2025 2024 2025 2024 2023 Basic shares outstanding 100.2 100.0 100.5 99.9 99.5 Restricted stock awards, dilutive stock options, and restricted stock units 1.8 2.3 1.7 2.3 1.8 Diluted shares outstanding 102.0 102.3 102.2 102.2 101.3 End of Period Q4 Full Year (in millions) 2025 2024 2025 2024 2023 Basic shares outstanding 100.0 100.8 100.0 100.8 100.3

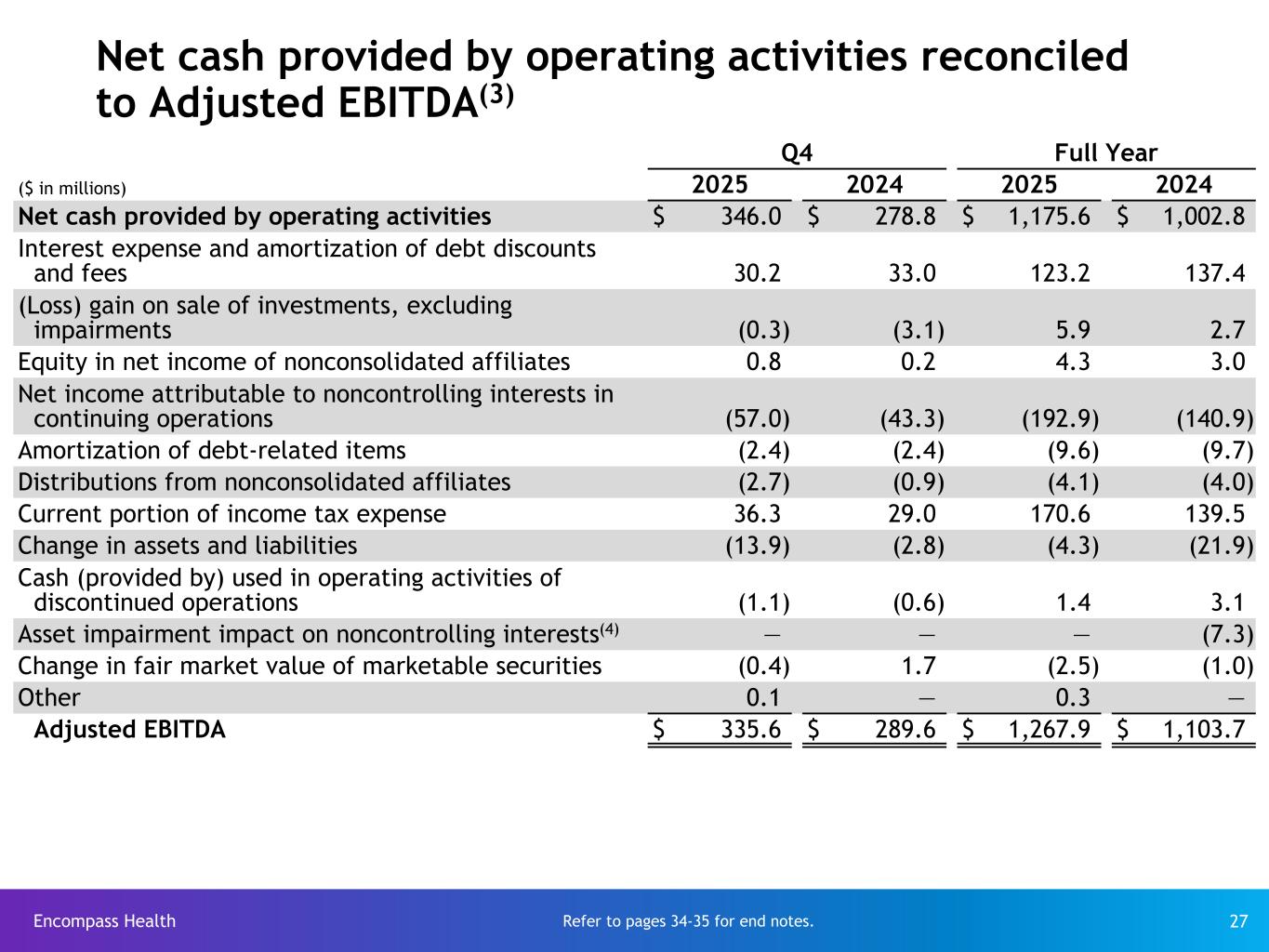

Encompass Health 27 Net cash provided by operating activities reconciled to Adjusted EBITDA(3) Q4 Full Year ($ in millions) 2025 2024 2025 2024 Net cash provided by operating activities $ 346.0 $ 278.8 $ 1,175.6 $ 1,002.8 Interest expense and amortization of debt discounts and fees 30.2 33.0 123.2 137.4 (Loss) gain on sale of investments, excluding impairments (0.3) (3.1) 5.9 2.7 Equity in net income of nonconsolidated affiliates 0.8 0.2 4.3 3.0 Net income attributable to noncontrolling interests in continuing operations (57.0) (43.3) (192.9) (140.9) Amortization of debt-related items (2.4) (2.4) (9.6) (9.7) Distributions from nonconsolidated affiliates (2.7) (0.9) (4.1) (4.0) Current portion of income tax expense 36.3 29.0 170.6 139.5 Change in assets and liabilities (13.9) (2.8) (4.3) (21.9) Cash (provided by) used in operating activities of discontinued operations (1.1) (0.6) 1.4 3.1 Asset impairment impact on noncontrolling interests(4) — — — (7.3) Change in fair market value of marketable securities (0.4) 1.7 (2.5) (1.0) Other 0.1 — 0.3 — Adjusted EBITDA $ 335.6 $ 289.6 $ 1,267.9 $ 1,103.7 Refer to pages 34-35 for end notes.

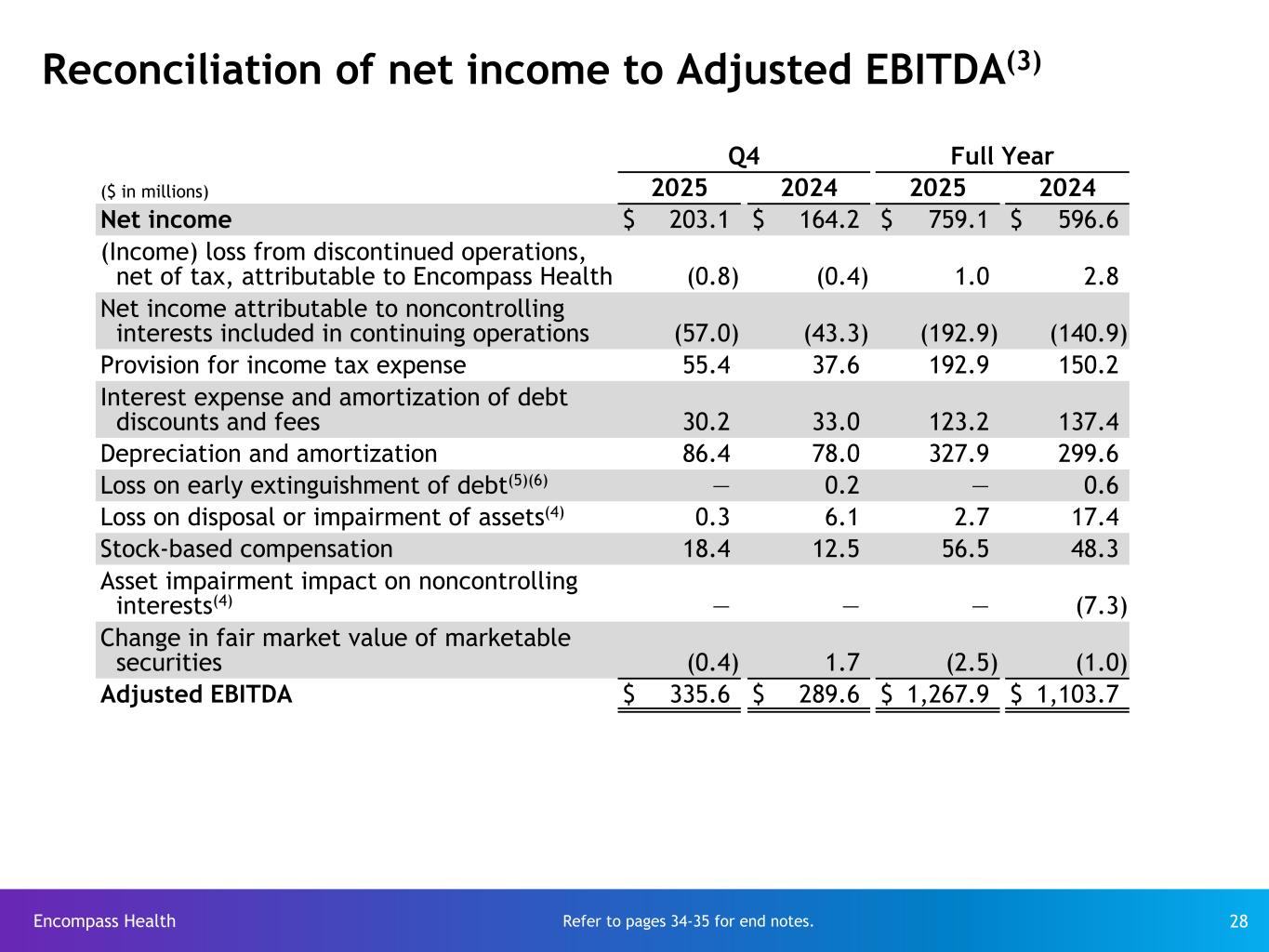

Encompass Health 28 Reconciliation of net income to Adjusted EBITDA(3) Q4 Full Year ($ in millions) 2025 2024 2025 2024 Net income $ 203.1 $ 164.2 $ 759.1 $ 596.6 (Income) loss from discontinued operations, net of tax, attributable to Encompass Health (0.8) (0.4) 1.0 2.8 Net income attributable to noncontrolling interests included in continuing operations (57.0) (43.3) (192.9) (140.9) Provision for income tax expense 55.4 37.6 192.9 150.2 Interest expense and amortization of debt discounts and fees 30.2 33.0 123.2 137.4 Depreciation and amortization 86.4 78.0 327.9 299.6 Loss on early extinguishment of debt(5)(6) — 0.2 — 0.6 Loss on disposal or impairment of assets(4) 0.3 6.1 2.7 17.4 Stock-based compensation 18.4 12.5 56.5 48.3 Asset impairment impact on noncontrolling interests(4) — — — (7.3) Change in fair market value of marketable securities (0.4) 1.7 (2.5) (1.0) Adjusted EBITDA $ 335.6 $ 289.6 $ 1,267.9 $ 1,103.7 Refer to pages 34-35 for end notes.

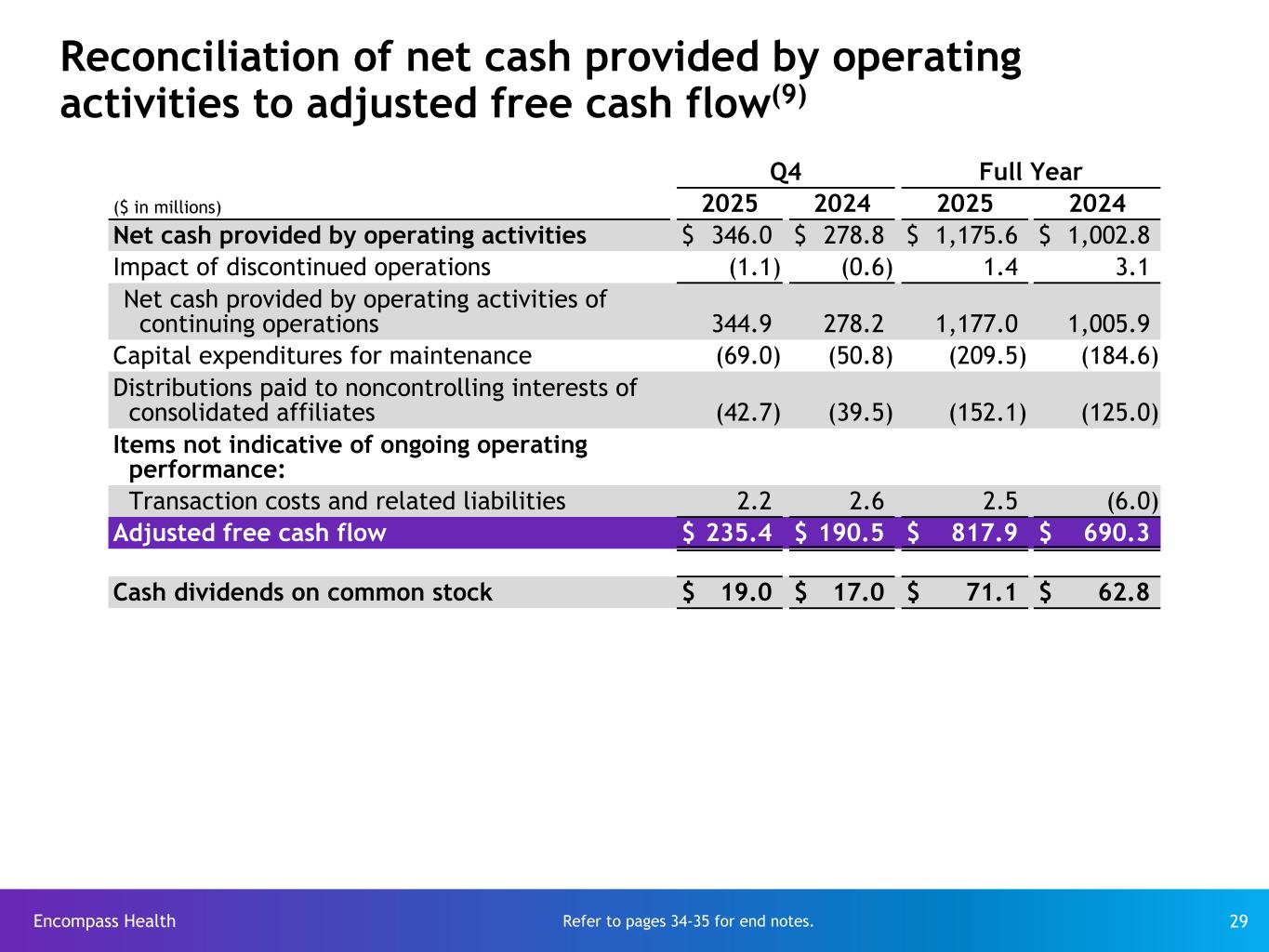

Encompass Health 29 Reconciliation of net cash provided by operating activities to adjusted free cash flow(9) Q4 Full Year ($ in millions) 2025 2024 2025 2024 Net cash provided by operating activities $ 346.0 $ 278.8 $ 1,175.6 $ 1,002.8 Impact of discontinued operations (1.1) (0.6) 1.4 3.1 Net cash provided by operating activities of continuing operations 344.9 278.2 1,177.0 1,005.9 Capital expenditures for maintenance (69.0) (50.8) (209.5) (184.6) Distributions paid to noncontrolling interests of consolidated affiliates (42.7) (39.5) (152.1) (125.0) Items not indicative of ongoing operating performance: Transaction costs and related liabilities 2.2 2.6 2.5 (6.0) Adjusted free cash flow $ 235.4 $ 190.5 $ 817.9 $ 690.3 Cash dividends on common stock $ 19.0 $ 17.0 $ 71.1 $ 62.8 Refer to pages 34-35 for end notes.

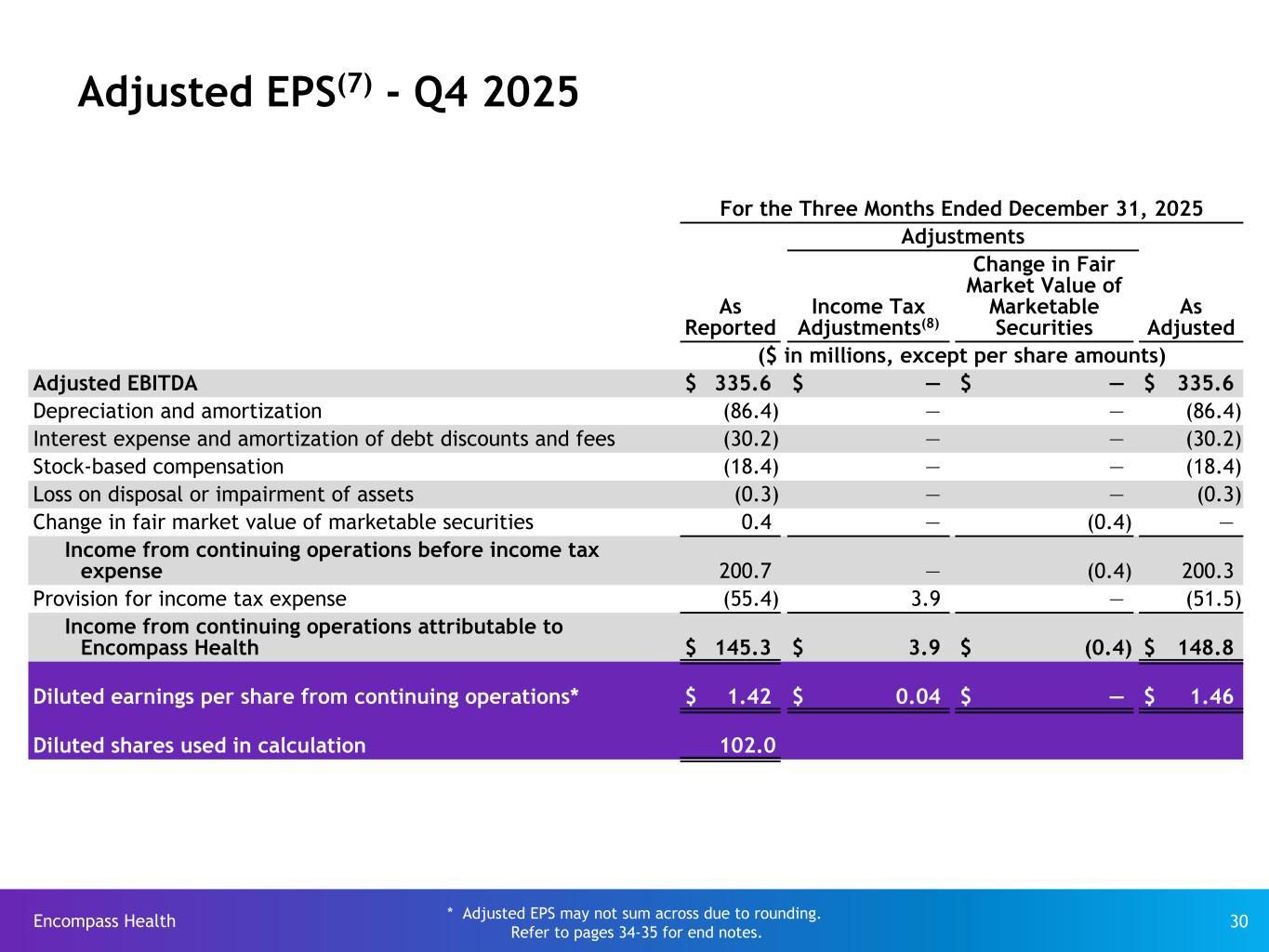

Encompass Health 30 Adjusted EPS(7) - Q4 2025 For the Three Months Ended December 31, 2025 Adjustments As Reported Income Tax Adjustments(8) Change in Fair Market Value of Marketable Securities As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 335.6 $ — $ — $ 335.6 Depreciation and amortization (86.4) — — (86.4) Interest expense and amortization of debt discounts and fees (30.2) — — (30.2) Stock-based compensation (18.4) — — (18.4) Loss on disposal or impairment of assets (0.3) — — (0.3) Change in fair market value of marketable securities 0.4 — (0.4) — Income from continuing operations before income tax expense 200.7 — (0.4) 200.3 Provision for income tax expense (55.4) 3.9 — (51.5) Income from continuing operations attributable to Encompass Health $ 145.3 $ 3.9 $ (0.4) $ 148.8 Diluted earnings per share from continuing operations* $ 1.42 $ 0.04 $ — $ 1.46 Diluted shares used in calculation 102.0 * Adjusted EPS may not sum across due to rounding. Refer to pages 34-35 for end notes.

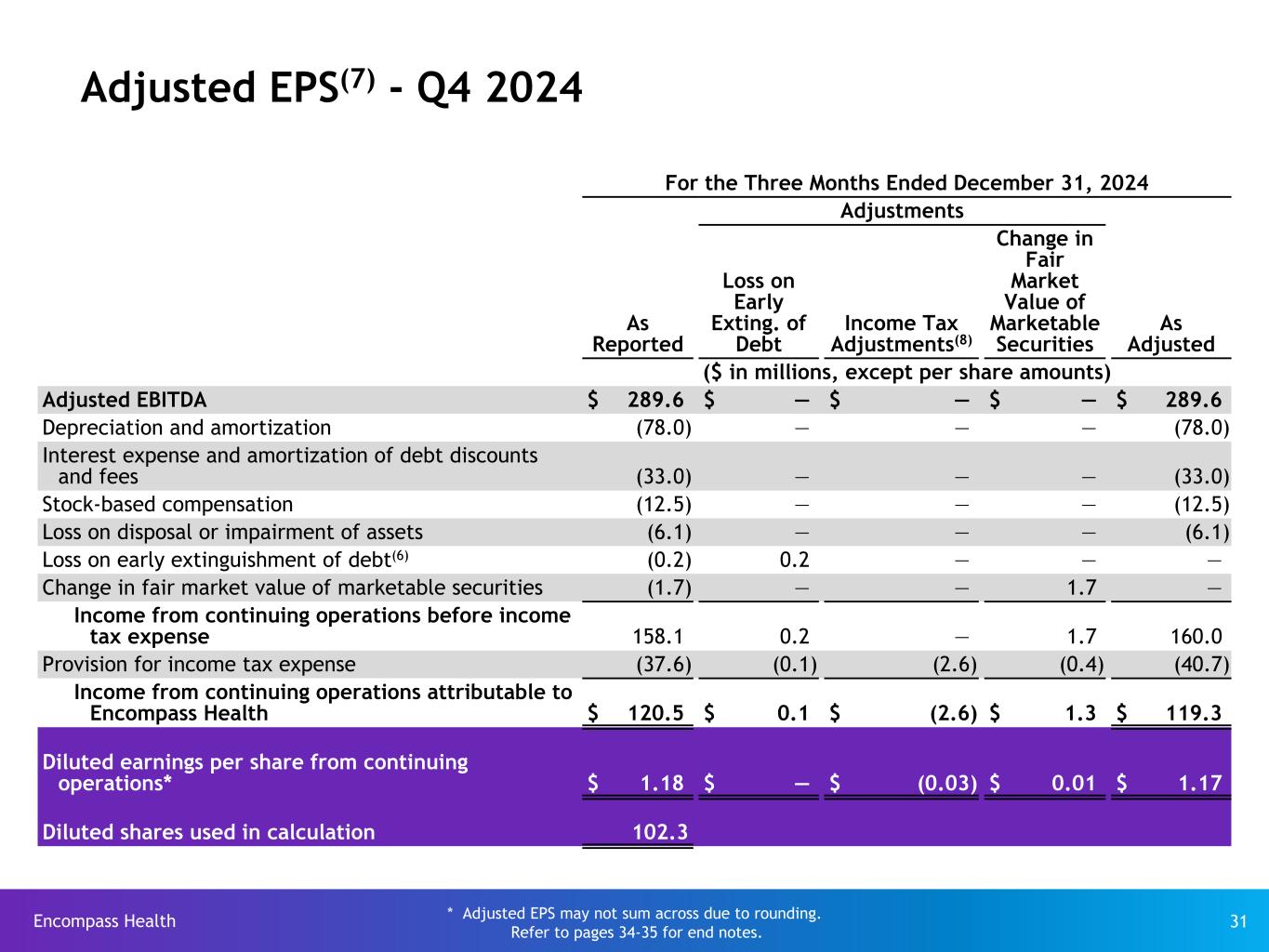

Encompass Health 31 For the Three Months Ended December 31, 2024 Adjustments As Reported Loss on Early Exting. of Debt Income Tax Adjustments(8) Change in Fair Market Value of Marketable Securities As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 289.6 $ — $ — $ — $ 289.6 Depreciation and amortization (78.0) — — — (78.0) Interest expense and amortization of debt discounts and fees (33.0) — — — (33.0) Stock-based compensation (12.5) — — — (12.5) Loss on disposal or impairment of assets (6.1) — — — (6.1) Loss on early extinguishment of debt(6) (0.2) 0.2 — — — Change in fair market value of marketable securities (1.7) — — 1.7 — Income from continuing operations before income tax expense 158.1 0.2 — 1.7 160.0 Provision for income tax expense (37.6) (0.1) (2.6) (0.4) (40.7) Income from continuing operations attributable to Encompass Health $ 120.5 $ 0.1 $ (2.6) $ 1.3 $ 119.3 Diluted earnings per share from continuing operations* $ 1.18 $ — $ (0.03) $ 0.01 $ 1.17 Diluted shares used in calculation 102.3 Adjusted EPS(7) - Q4 2024 * Adjusted EPS may not sum across due to rounding. Refer to pages 34-35 for end notes.

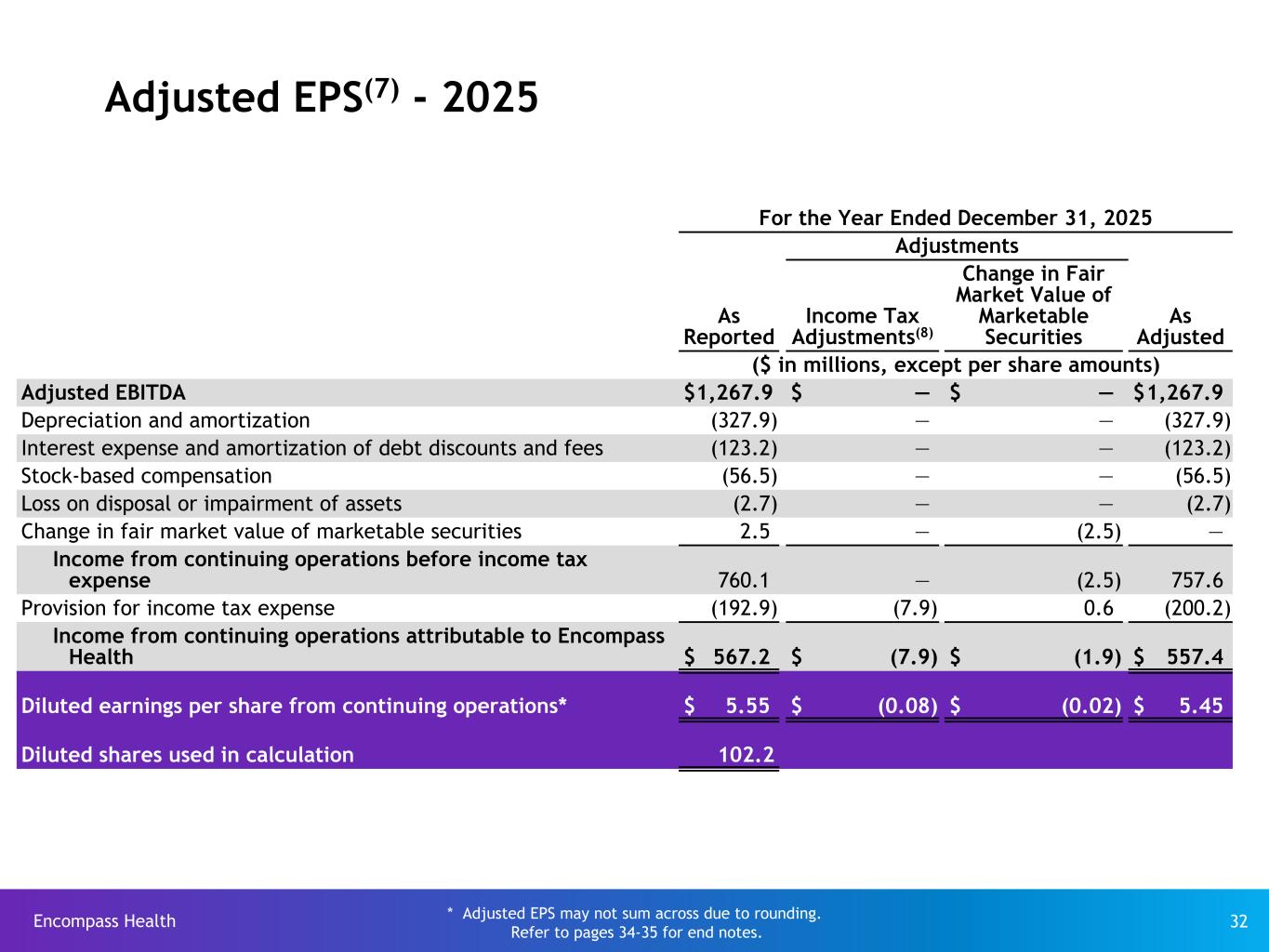

Encompass Health 32 For the Year Ended December 31, 2025 Adjustments As Reported Income Tax Adjustments(8) Change in Fair Market Value of Marketable Securities As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 1,267.9 $ — $ — $ 1,267.9 Depreciation and amortization (327.9) — — (327.9) Interest expense and amortization of debt discounts and fees (123.2) — — (123.2) Stock-based compensation (56.5) — — (56.5) Loss on disposal or impairment of assets (2.7) — — (2.7) Change in fair market value of marketable securities 2.5 — (2.5) — Income from continuing operations before income tax expense 760.1 — (2.5) 757.6 Provision for income tax expense (192.9) (7.9) 0.6 (200.2) Income from continuing operations attributable to Encompass Health $ 567.2 $ (7.9) $ (1.9) $ 557.4 Diluted earnings per share from continuing operations* $ 5.55 $ (0.08) $ (0.02) $ 5.45 Diluted shares used in calculation 102.2 * Adjusted EPS may not sum across due to rounding. Refer to pages 34-35 for end notes. Adjusted EPS(7) - 2025

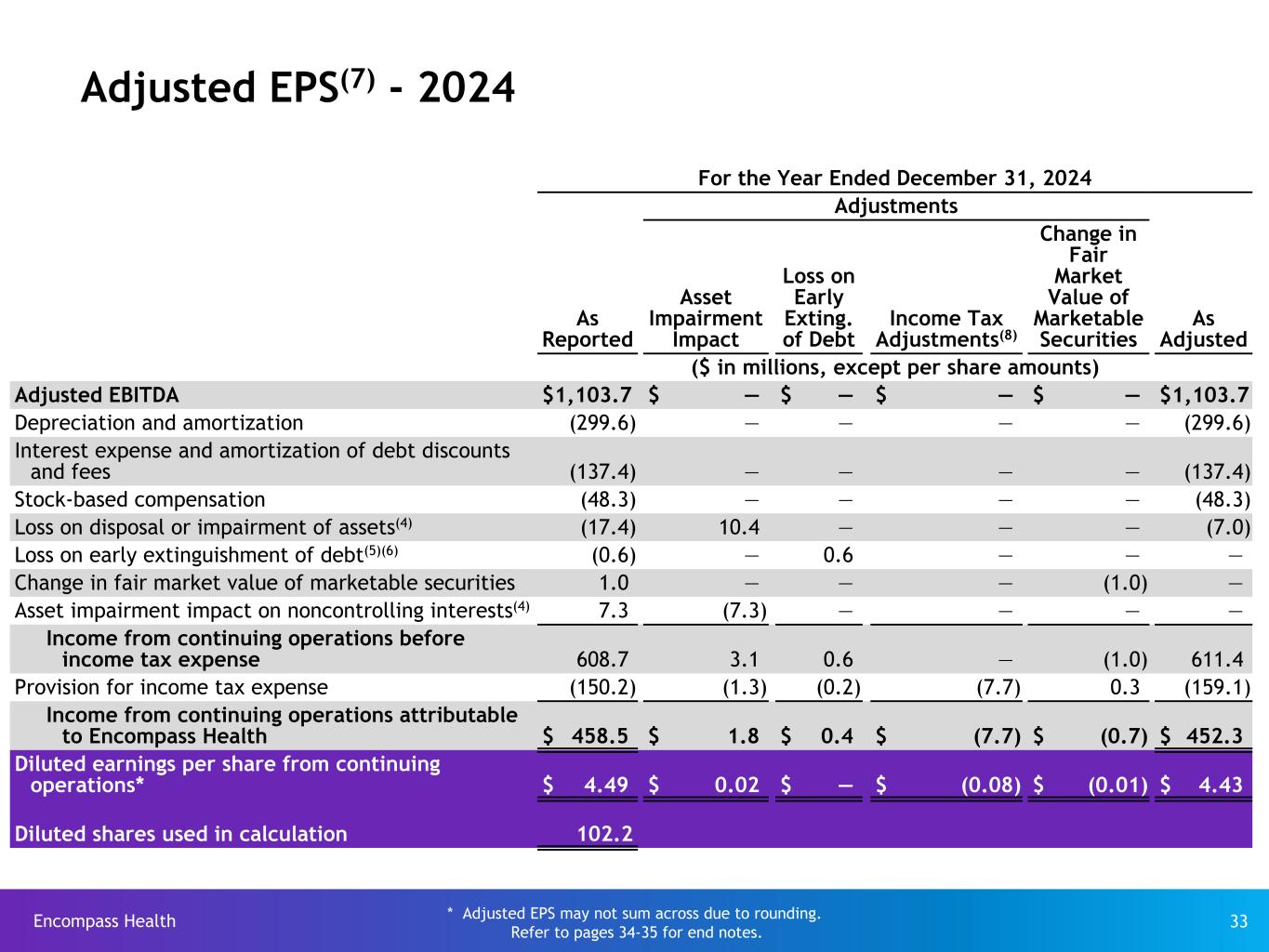

Encompass Health 33 For the Year Ended December 31, 2024 Adjustments As Reported Asset Impairment Impact Loss on Early Exting. of Debt Income Tax Adjustments(8) Change in Fair Market Value of Marketable Securities As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 1,103.7 $ — $ — $ — $ — $ 1,103.7 Depreciation and amortization (299.6) — — — — (299.6) Interest expense and amortization of debt discounts and fees (137.4) — — — — (137.4) Stock-based compensation (48.3) — — — — (48.3) Loss on disposal or impairment of assets(4) (17.4) 10.4 — — — (7.0) Loss on early extinguishment of debt(5)(6) (0.6) — 0.6 — — — Change in fair market value of marketable securities 1.0 — — — (1.0) — Asset impairment impact on noncontrolling interests(4) 7.3 (7.3) — — — — Income from continuing operations before income tax expense 608.7 3.1 0.6 — (1.0) 611.4 Provision for income tax expense (150.2) (1.3) (0.2) (7.7) 0.3 (159.1) Income from continuing operations attributable to Encompass Health $ 458.5 $ 1.8 $ 0.4 $ (7.7) $ (0.7) $ 452.3 Diluted earnings per share from continuing operations* $ 4.49 $ 0.02 $ — $ (0.08) $ (0.01) $ 4.43 Diluted shares used in calculation 102.2 Adjusted EPS(7) - 2024 * Adjusted EPS may not sum across due to rounding. Refer to pages 34-35 for end notes.

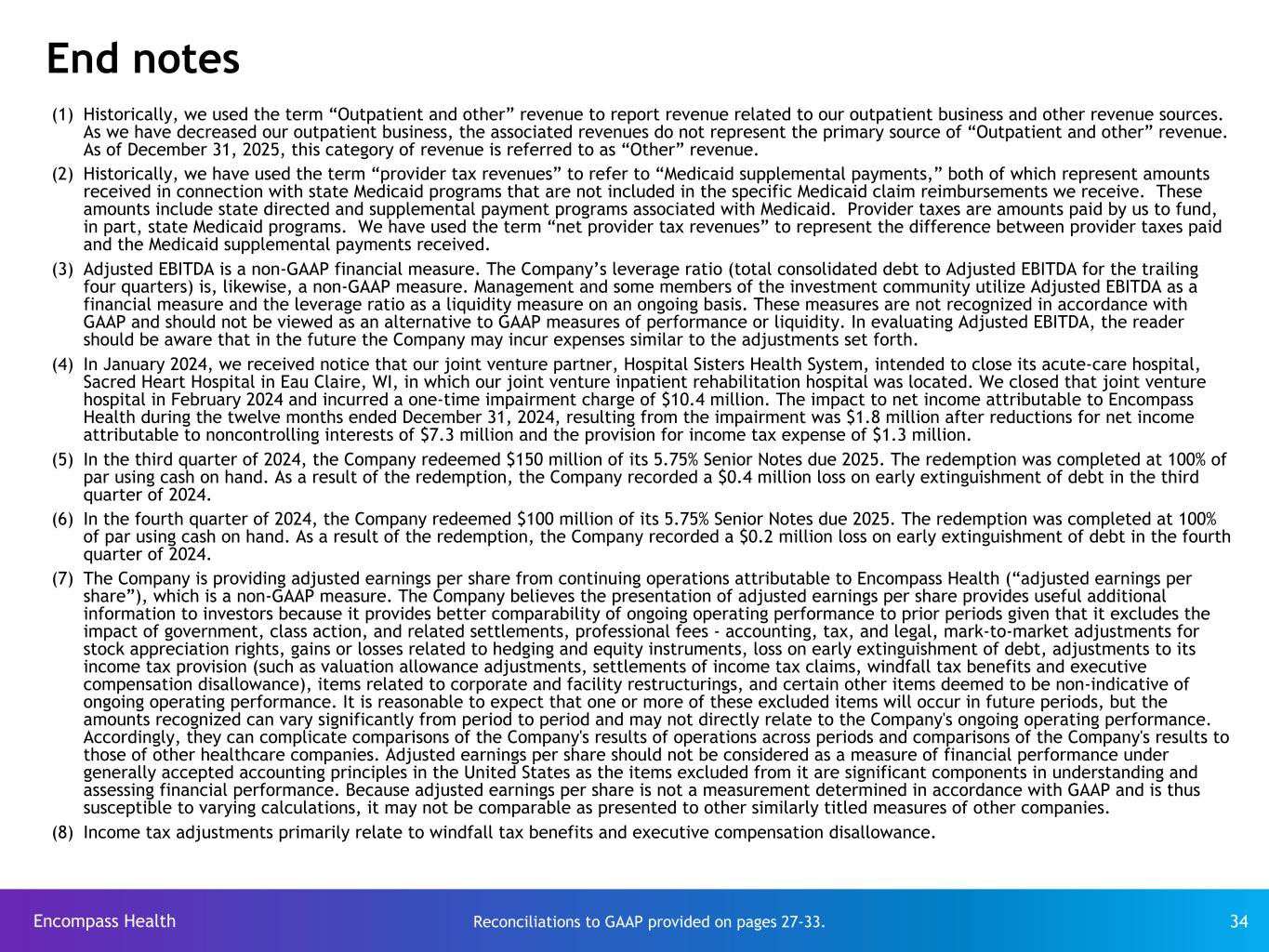

Encompass Health 34 End notes Reconciliations to GAAP provided on pages 27-33. (1) Historically, we used the term “Outpatient and other” revenue to report revenue related to our outpatient business and other revenue sources. As we have decreased our outpatient business, the associated revenues do not represent the primary source of “Outpatient and other” revenue. As of December 31, 2025, this category of revenue is referred to as “Other” revenue. (2) Historically, we have used the term “provider tax revenues” to refer to “Medicaid supplemental payments,” both of which represent amounts received in connection with state Medicaid programs that are not included in the specific Medicaid claim reimbursements we receive. These amounts include state directed and supplemental payment programs associated with Medicaid. Provider taxes are amounts paid by us to fund, in part, state Medicaid programs. We have used the term “net provider tax revenues” to represent the difference between provider taxes paid and the Medicaid supplemental payments received. (3) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future the Company may incur expenses similar to the adjustments set forth. (4) In January 2024, we received notice that our joint venture partner, Hospital Sisters Health System, intended to close its acute-care hospital, Sacred Heart Hospital in Eau Claire, WI, in which our joint venture inpatient rehabilitation hospital was located. We closed that joint venture hospital in February 2024 and incurred a one-time impairment charge of $10.4 million. The impact to net income attributable to Encompass Health during the twelve months ended December 31, 2024, resulting from the impairment was $1.8 million after reductions for net income attributable to noncontrolling interests of $7.3 million and the provision for income tax expense of $1.3 million. (5) In the third quarter of 2024, the Company redeemed $150 million of its 5.75% Senior Notes due 2025. The redemption was completed at 100% of par using cash on hand. As a result of the redemption, the Company recorded a $0.4 million loss on early extinguishment of debt in the third quarter of 2024. (6) In the fourth quarter of 2024, the Company redeemed $100 million of its 5.75% Senior Notes due 2025. The redemption was completed at 100% of par using cash on hand. As a result of the redemption, the Company recorded a $0.2 million loss on early extinguishment of debt in the fourth quarter of 2024. (7) The Company is providing adjusted earnings per share from continuing operations attributable to Encompass Health (“adjusted earnings per share”), which is a non-GAAP measure. The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods given that it excludes the impact of government, class action, and related settlements, professional fees - accounting, tax, and legal, mark-to-market adjustments for stock appreciation rights, gains or losses related to hedging and equity instruments, loss on early extinguishment of debt, adjustments to its income tax provision (such as valuation allowance adjustments, settlements of income tax claims, windfall tax benefits and executive compensation disallowance), items related to corporate and facility restructurings, and certain other items deemed to be non-indicative of ongoing operating performance. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company's ongoing operating performance. Accordingly, they can complicate comparisons of the Company's results of operations across periods and comparisons of the Company's results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies. (8) Income tax adjustments primarily relate to windfall tax benefits and executive compensation disallowance.

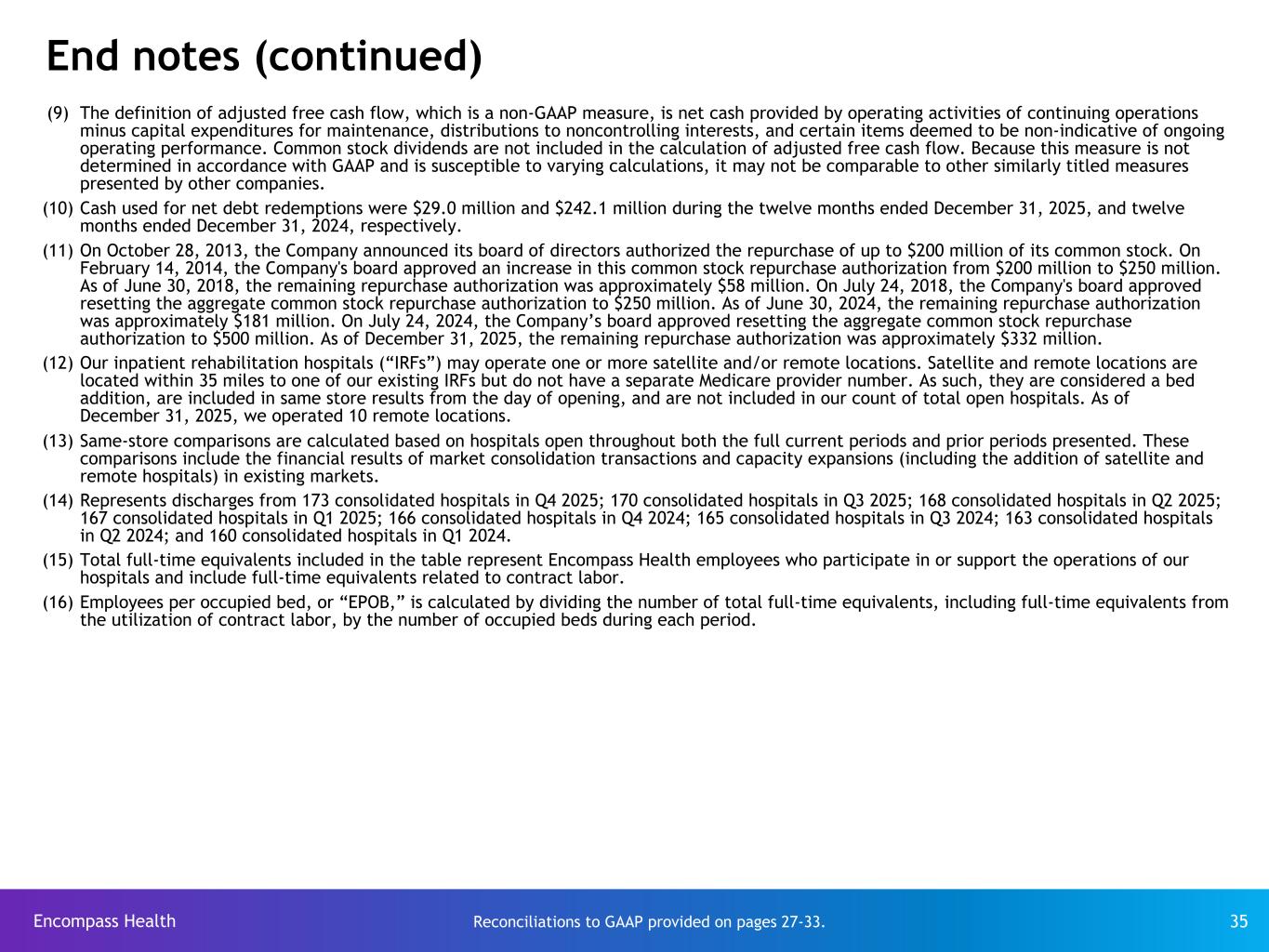

Encompass Health 35 End notes (continued) (9) The definition of adjusted free cash flow, which is a non-GAAP measure, is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, distributions to noncontrolling interests, and certain items deemed to be non-indicative of ongoing operating performance. Common stock dividends are not included in the calculation of adjusted free cash flow. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. (10) Cash used for net debt redemptions were $29.0 million and $242.1 million during the twelve months ended December 31, 2025, and twelve months ended December 31, 2024, respectively. (11) On October 28, 2013, the Company announced its board of directors authorized the repurchase of up to $200 million of its common stock. On February 14, 2014, the Company's board approved an increase in this common stock repurchase authorization from $200 million to $250 million. As of June 30, 2018, the remaining repurchase authorization was approximately $58 million. On July 24, 2018, the Company's board approved resetting the aggregate common stock repurchase authorization to $250 million. As of June 30, 2024, the remaining repurchase authorization was approximately $181 million. On July 24, 2024, the Company’s board approved resetting the aggregate common stock repurchase authorization to $500 million. As of December 31, 2025, the remaining repurchase authorization was approximately $332 million. (12) Our inpatient rehabilitation hospitals (“IRFs”) may operate one or more satellite and/or remote locations. Satellite and remote locations are located within 35 miles to one of our existing IRFs but do not have a separate Medicare provider number. As such, they are considered a bed addition, are included in same store results from the day of opening, and are not included in our count of total open hospitals. As of December 31, 2025, we operated 10 remote locations. (13) Same-store comparisons are calculated based on hospitals open throughout both the full current periods and prior periods presented. These comparisons include the financial results of market consolidation transactions and capacity expansions (including the addition of satellite and remote hospitals) in existing markets. (14) Represents discharges from 173 consolidated hospitals in Q4 2025; 170 consolidated hospitals in Q3 2025; 168 consolidated hospitals in Q2 2025; 167 consolidated hospitals in Q1 2025; 166 consolidated hospitals in Q4 2024; 165 consolidated hospitals in Q3 2024; 163 consolidated hospitals in Q2 2024; and 160 consolidated hospitals in Q1 2024. (15) Total full-time equivalents included in the table represent Encompass Health employees who participate in or support the operations of our hospitals and include full-time equivalents related to contract labor. (16) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of total full-time equivalents, including full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. Reconciliations to GAAP provided on pages 27-33.