Financial Results For The Third Quarter Ended September 28th 2025 Pilgrim’s Pride Corporation (NASDAQ: PPC)

Cautionary Notes and Forward-Looking Statements Statements contained in this press release that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of Pilgrim’s Pride Corporation and its management are considered forward-looking statements. Without limiting the foregoing, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: matters affecting the poultry industry generally; the ability to execute the Company’s business plan to achieve desired cost savings and profitability; future pricing for feed ingredients and the Company’s products; outbreaks of avian influenza or other diseases, either in Pilgrim’s Pride’s flocks or elsewhere, affecting its ability to conduct its operations and/or demand for its poultry products; contamination of Pilgrim’s Pride’s products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; management of cash resources; restrictions imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes in laws or regulations affecting Pilgrim’s Pride’s operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause the costs of doing business to increase, cause Pilgrim’s Pride to change the way in which it does business, or otherwise disrupt its operations; competitive factors and pricing pressures or the loss of one or more of Pilgrim’s Pride’s largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels, including, but not limited to, the impacts of the Russia-Ukraine conflict; the risk of cyber-attacks, natural disasters, power losses, unauthorized access, telecommunication failures, and other problems on our information systems; and the impact of uncertainties of litigation and other legal matters described in our most recent Form 10-K and Form 10-Q, including the In re Broiler Chicken Antitrust Litigation, as well as other risks described under “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings with the Securities and Exchange Commission. The forward looking statements in this release speak only as of the date hereof, and the Company undertakes no obligation to update any such statement after the date of this release, whether as a result of new information, future developments or otherwise, except as may be required by applicable law Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations This presentation may include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100, including EBITDA, Adjusted EBITDA, LTM EBITDA, Net Debt, Free Cash Flow, Adjusted EBITDA Margin and others. Accordingly, we have provided tables in the accompanying appendix and in our previous filings with the SEC that reconcile these measures to their corresponding GAAP-based measures and explain why these measures are useful to investors, which can be obtained from the Consolidated Statements of Income provided with our previous filings with the SEC. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. 2

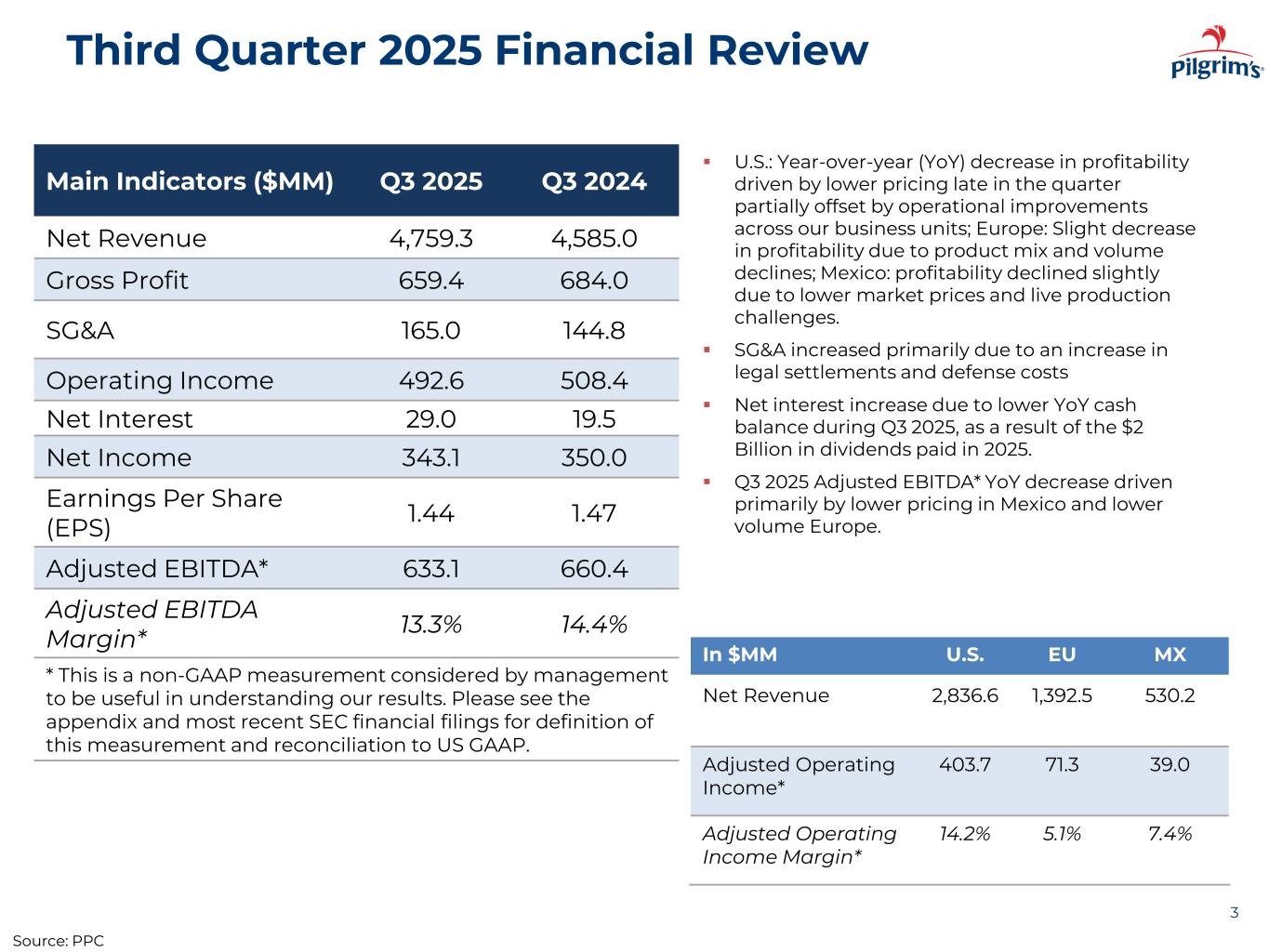

Third Quarter 2025 Financial Review 3 Main Indicators ($MM) Q3 2025 Q3 2024 Net Revenue 4,759.3 4,585.0 Gross Profit 659.4 684.0 SG&A 165.0 144.8 Operating Income 492.6 508.4 Net Interest 29.0 19.5 Net Income 343.1 350.0 Earnings Per Share (EPS) 1.44 1.47 Adjusted EBITDA* 633.1 660.4 Adjusted EBITDA Margin* 13.3% 14.4% * This is a non-GAAP measurement considered by management to be useful in understanding our results. Please see the appendix and most recent SEC financial filings for definition of this measurement and reconciliation to US GAAP. U.S.: Year-over-year (YoY) decrease in profitability driven by lower pricing late in the quarter partially offset by operational improvements across our business units; Europe: Slight decrease in profitability due to product mix and volume declines; Mexico: profitability declined slightly due to lower market prices and live production challenges. SG&A increased primarily due to an increase in legal settlements and defense costs Net interest increase due to lower YoY cash balance during Q3 2025, as a result of the $2 Billion in dividends paid in 2025. Q3 2025 Adjusted EBITDA* YoY decrease driven primarily by lower pricing in Mexico and lower volume Europe. In $MM U.S. EU MX Net Revenue 2,836.6 1,392.5 530.2 Adjusted Operating Income* 403.7 71.3 39.0 Adjusted Operating Income Margin* 14.2% 5.1% 7.4% Source: PPC

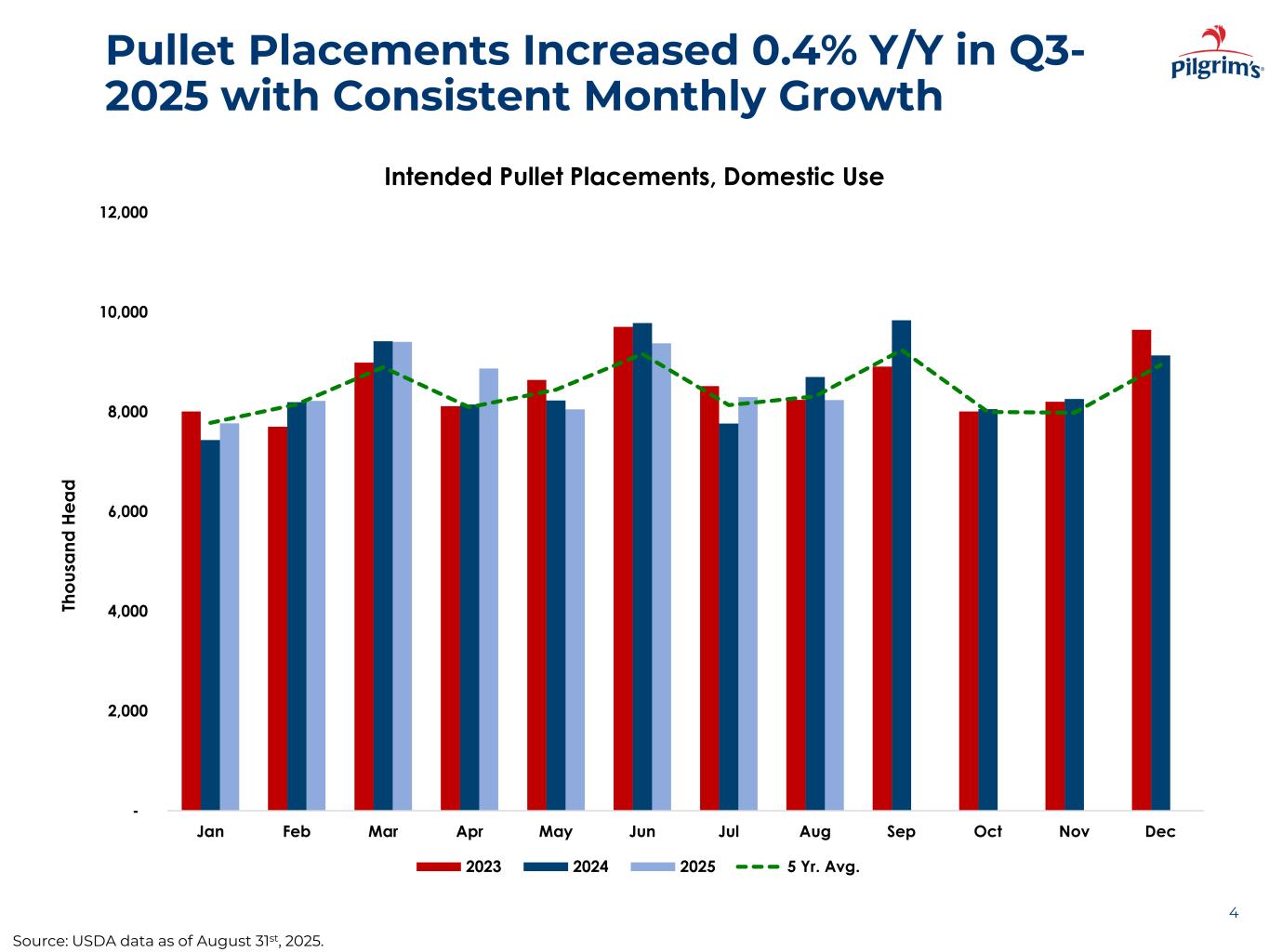

Pullet Placements Increased 0.4% Y/Y in Q3- 2025 with Consistent Monthly Growth 4 - 2,000 4,000 6,000 8,000 10,000 12,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Th ou sa nd H ea d Intended Pullet Placements, Domestic Use 2023 2024 2025 5 Yr. Avg. Source: USDA data as of August 31st, 2025.

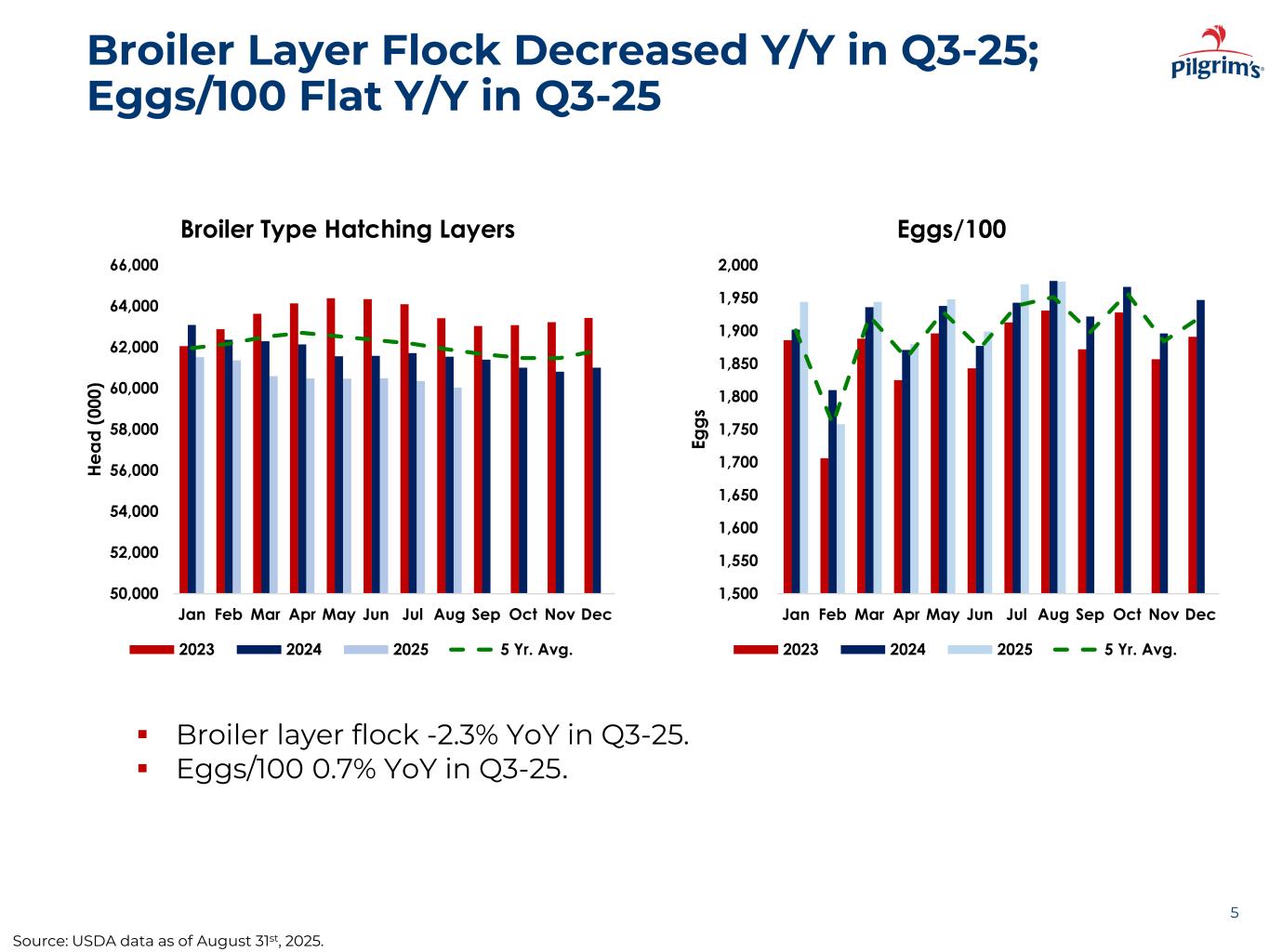

Broiler Layer Flock Decreased Y/Y in Q3-25; Eggs/100 Flat Y/Y in Q3-25 5 Broiler layer flock -2.3% YoY in Q3-25. Eggs/100 0.7% YoY in Q3-25. 1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850 1,900 1,950 2,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Eg gs Eggs/100 2023 2024 2025 5 Yr. Avg. 50,000 52,000 54,000 56,000 58,000 60,000 62,000 64,000 66,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec He ad (0 00 ) Broiler Type Hatching Layers 2023 2024 2025 5 Yr. Avg. Source: USDA data as of August 31st, 2025.

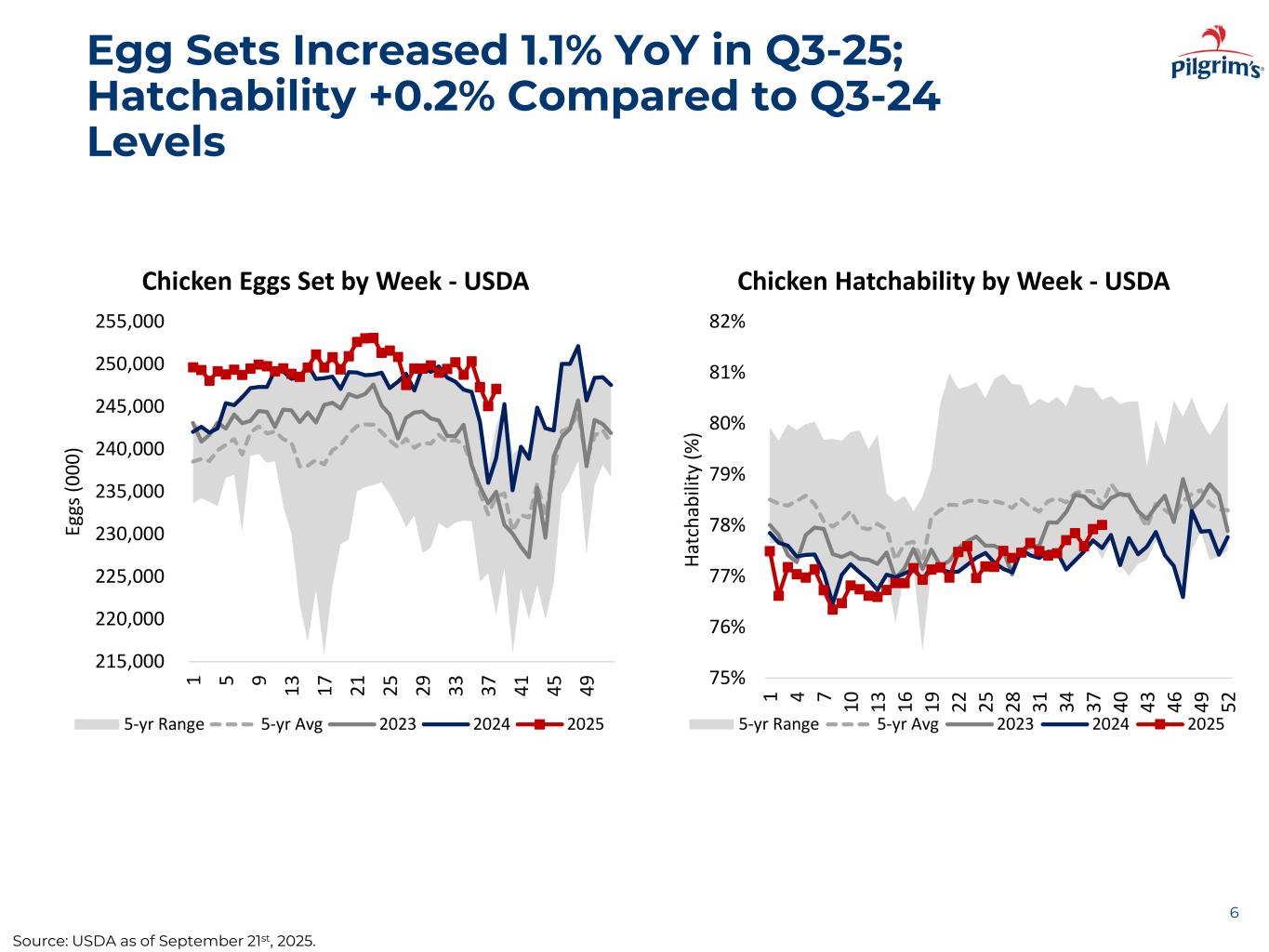

Egg Sets Increased 1.1% YoY in Q3-25; Hatchability +0.2% Compared to Q3-24 Levels 6 215,000 220,000 225,000 230,000 235,000 240,000 245,000 250,000 255,000 1 5 9 13 17 21 25 29 33 37 41 45 49 Eg gs (0 00 ) Chicken Eggs Set by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025 75% 76% 77% 78% 79% 80% 81% 82% 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 Ha tc ha bi lit y (% ) Chicken Hatchability by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025 Source: USDA as of September 21st, 2025.

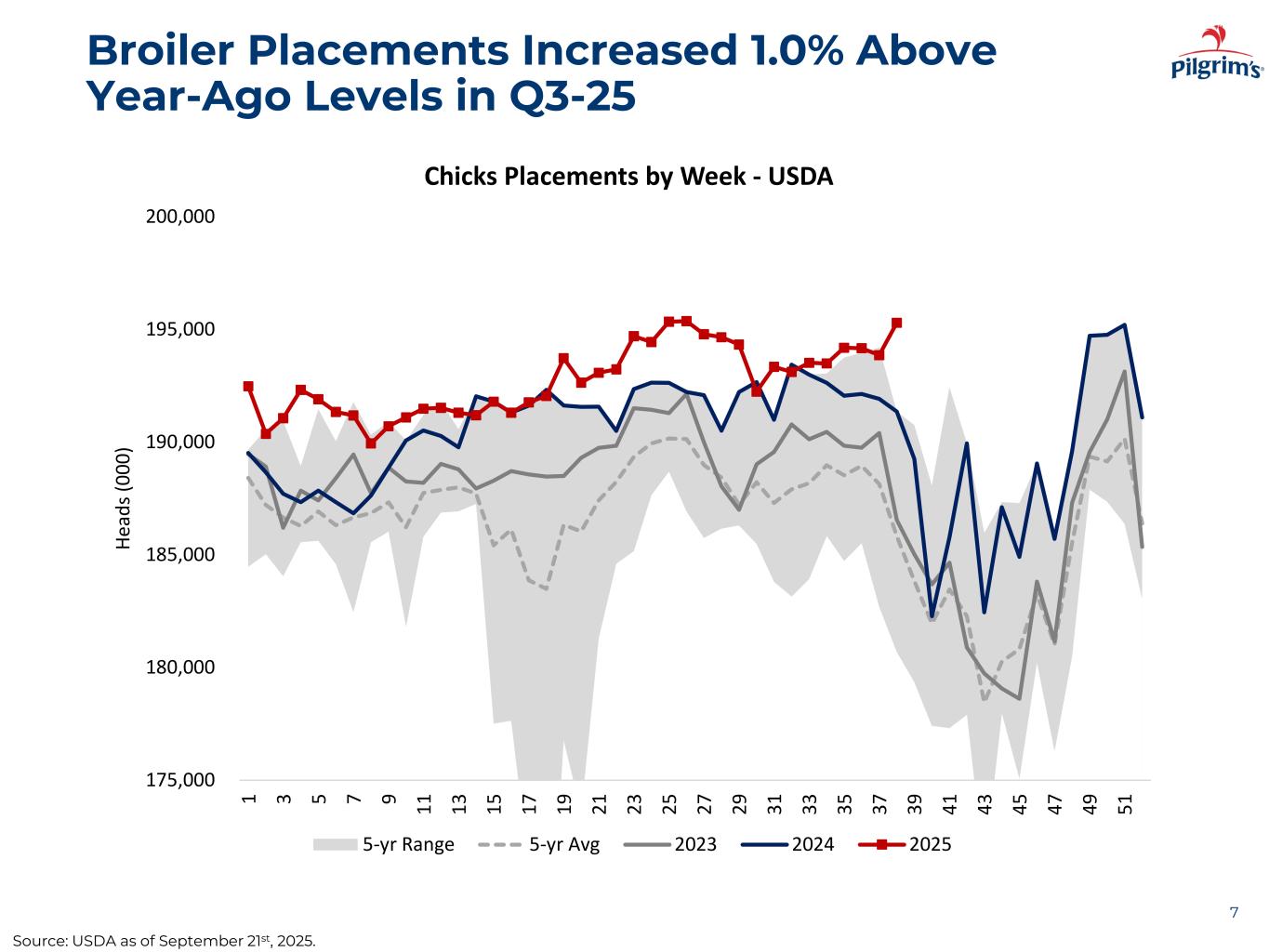

175,000 180,000 185,000 190,000 195,000 200,000 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 He ad s ( 00 0) Chicks Placements by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025 Broiler Placements Increased 1.0% Above Year-Ago Levels in Q3-25 7 Source: USDA as of September 21st, 2025.

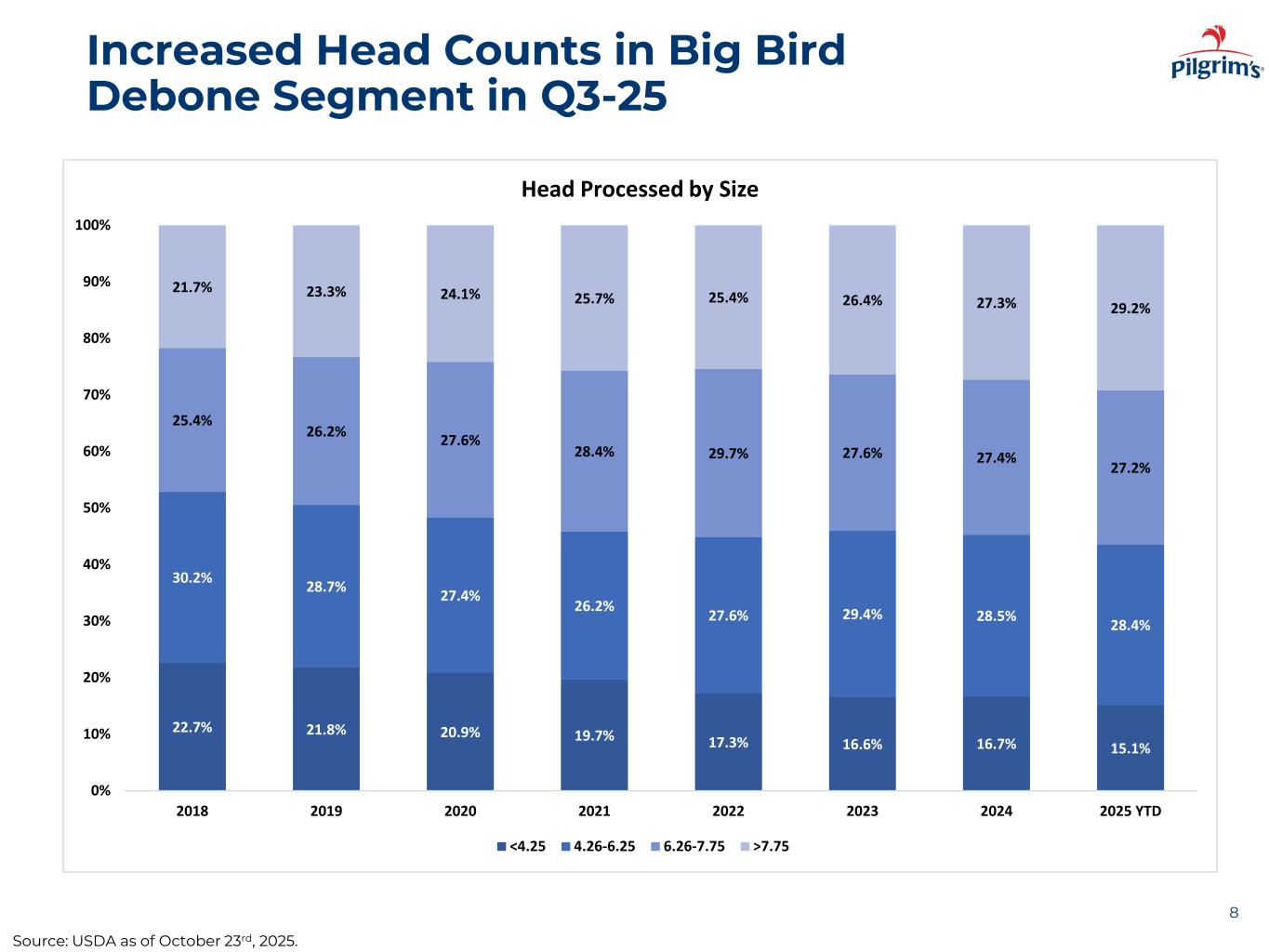

Increased Head Counts in Big Bird Debone Segment in Q3-25 8 22.7% 21.8% 20.9% 19.7% 17.3% 16.6% 16.7% 15.1% 30.2% 28.7% 27.4% 26.2% 27.6% 29.4% 28.5% 28.4% 25.4% 26.2% 27.6% 28.4% 29.7% 27.6% 27.4% 27.2% 21.7% 23.3% 24.1% 25.7% 25.4% 26.4% 27.3% 29.2% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2018 2019 2020 2021 2022 2023 2024 2025 YTD Head Processed by Size <4.25 4.26-6.25 6.26-7.75 >7.75 Source: USDA as of October 23rd, 2025.

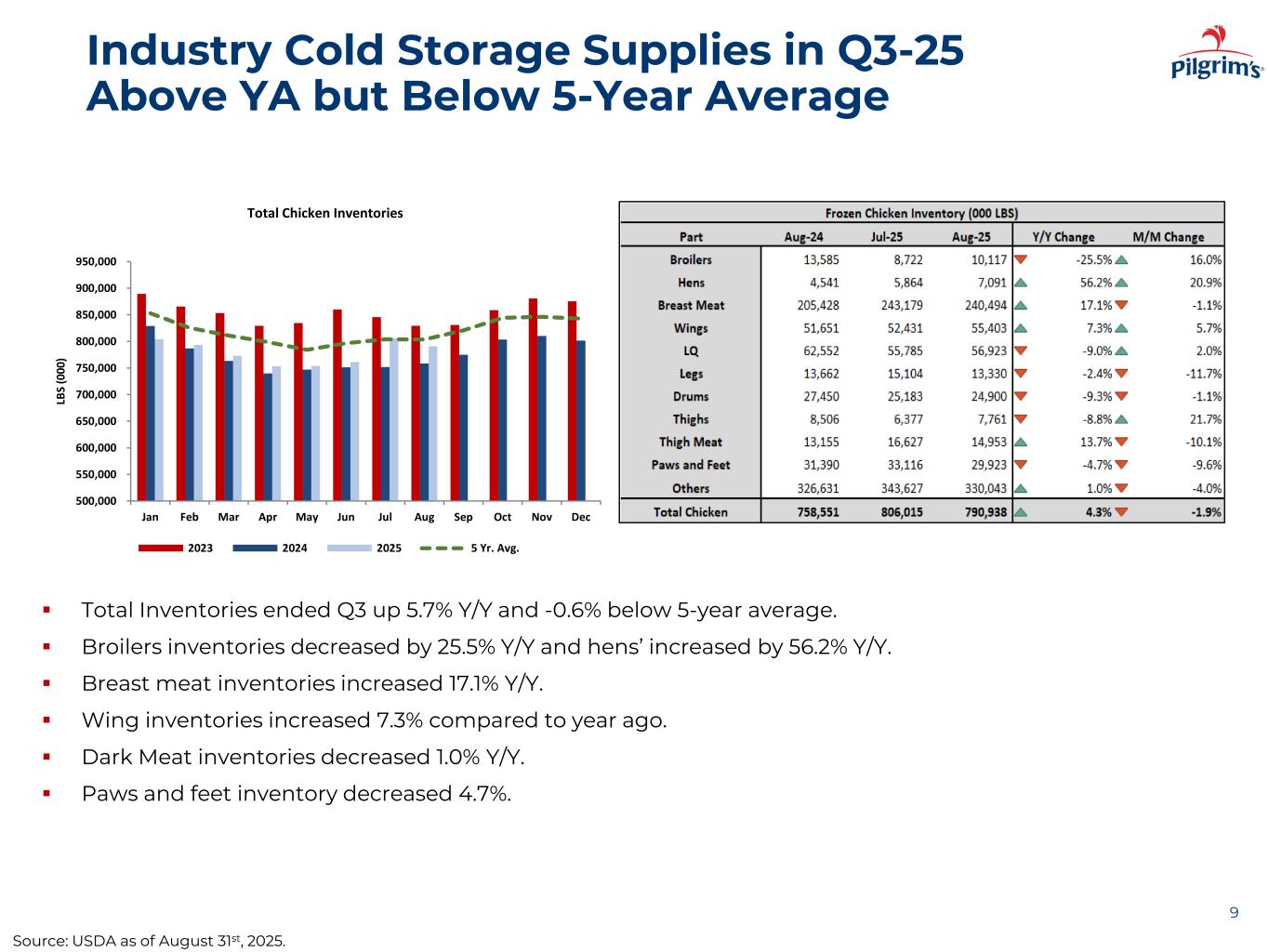

Industry Cold Storage Supplies in Q3-25 Above YA but Below 5-Year Average Total Inventories ended Q3 up 5.7% Y/Y and -0.6% below 5-year average. Broilers inventories decreased by 25.5% Y/Y and hens’ increased by 56.2% Y/Y. Breast meat inventories increased 17.1% Y/Y. Wing inventories increased 7.3% compared to year ago. Dark Meat inventories decreased 1.0% Y/Y. Paws and feet inventory decreased 4.7%. 9 500,000 550,000 600,000 650,000 700,000 750,000 800,000 850,000 900,000 950,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec LB S (0 00 ) Total Chicken Inventories 2023 2024 2025 5 Yr. Avg. Source: USDA as of August 31st, 2025.

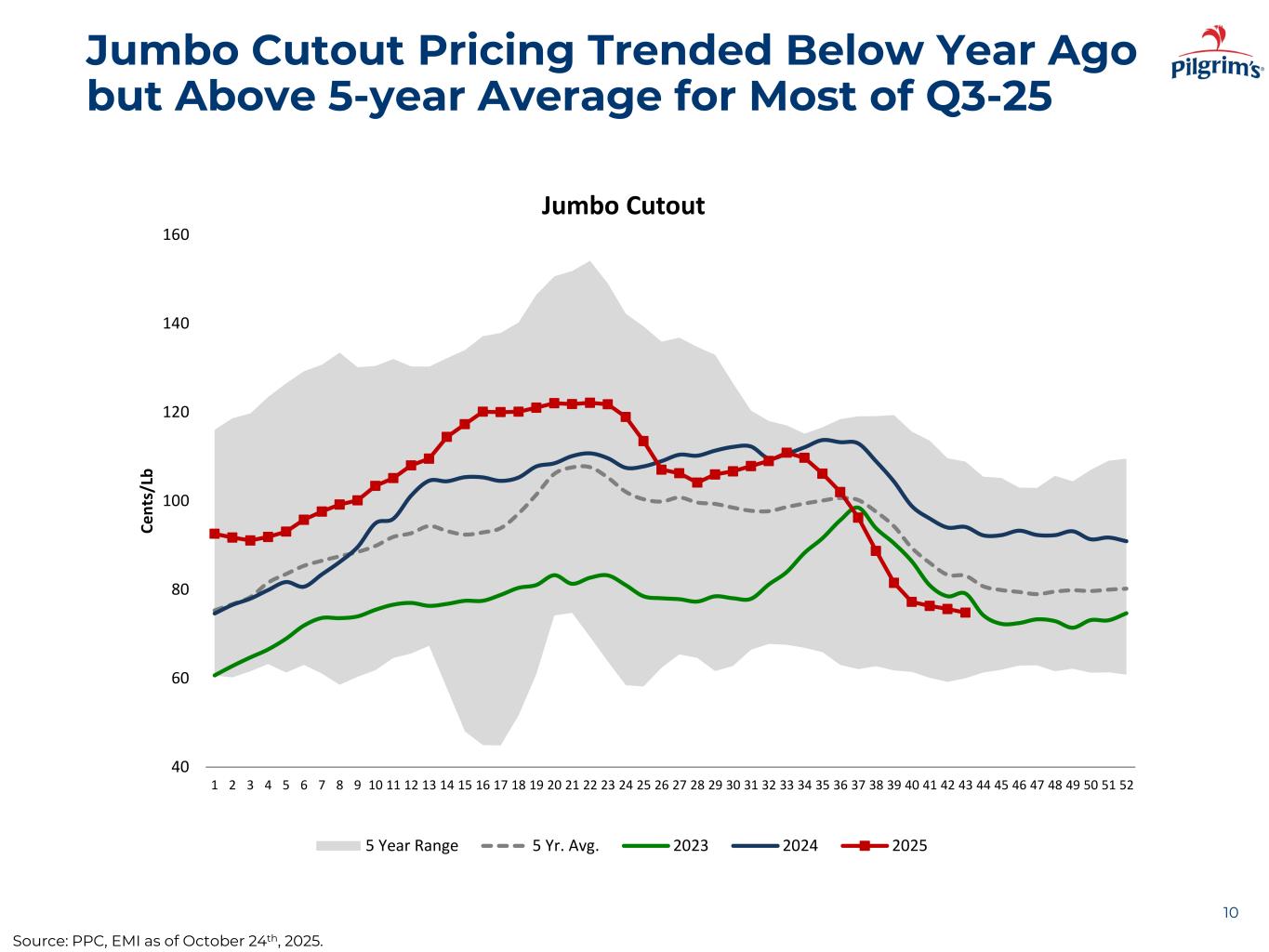

Jumbo Cutout Pricing Trended Below Year Ago but Above 5-year Average for Most of Q3-25 10 40 60 80 100 120 140 160 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 Ce nt s/ Lb Jumbo Cutout 5 Year Range 5 Yr. Avg. 2023 2024 2025 Source: PPC, EMI as of October 24th, 2025.

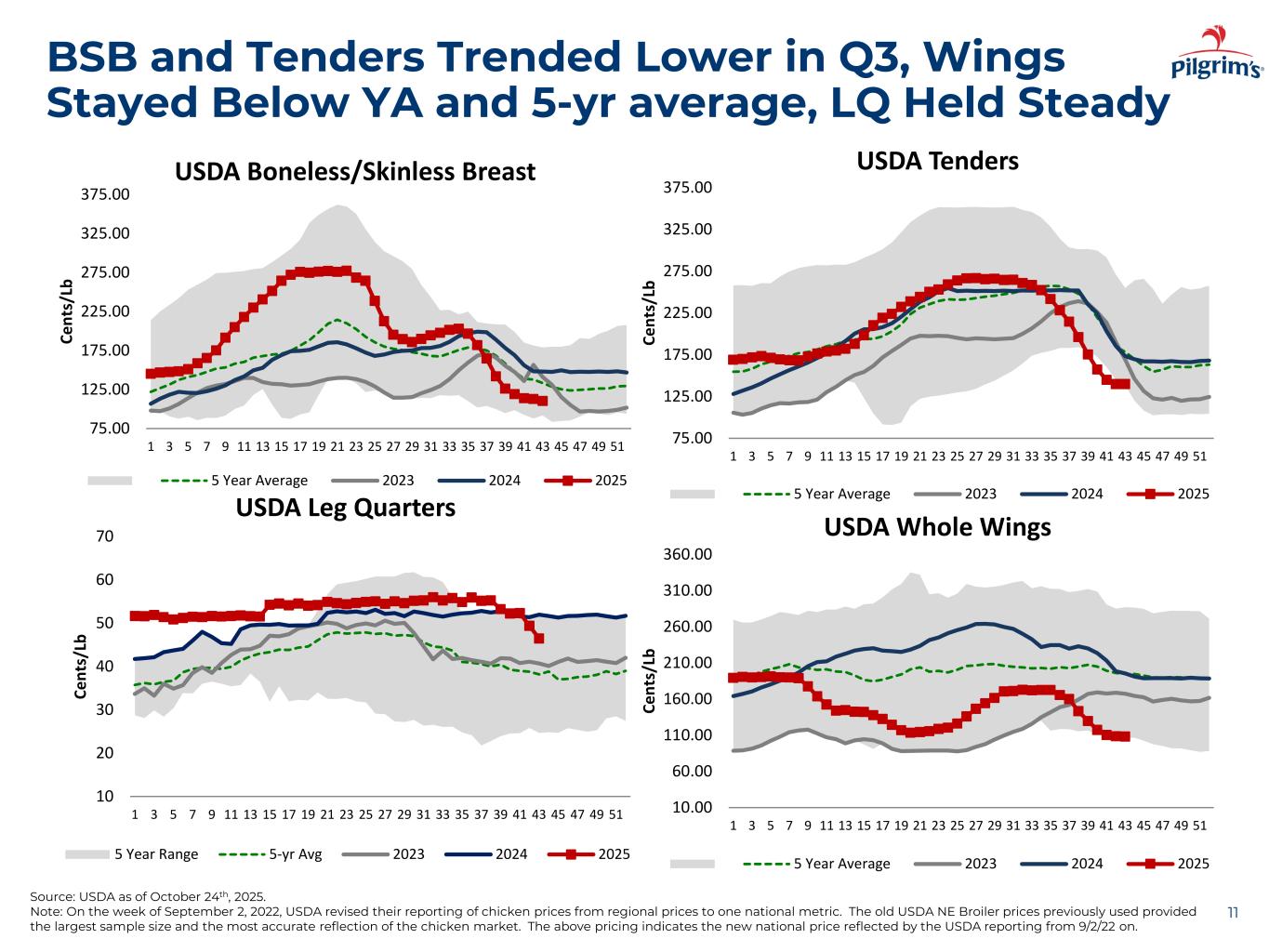

BSB and Tenders Trended Lower in Q3, Wings Stayed Below YA and 5-yr average, LQ Held Steady 11 Source: USDA as of October 24th, 2025. Note: On the week of September 2, 2022, USDA revised their reporting of chicken prices from regional prices to one national metric. The old USDA NE Broiler prices previously used provided the largest sample size and the most accurate reflection of the chicken market. The above pricing indicates the new national price reflected by the USDA reporting from 9/2/22 on. 75.00 125.00 175.00 225.00 275.00 325.00 375.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Ce nt s/ Lb USDA Boneless/Skinless Breast 5 Year Average 2023 2024 2025 75.00 125.00 175.00 225.00 275.00 325.00 375.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Ce nt s/ Lb USDA Tenders 5 Year Average 2023 2024 2025 10 20 30 40 50 60 70 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Ce nt s/ Lb USDA Leg Quarters 5 Year Range 5-yr Avg 2023 2024 2025 10.00 60.00 110.00 160.00 210.00 260.00 310.00 360.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Ce nt s/ Lb USDA Whole Wings 5 Year Average 2023 2024 2025

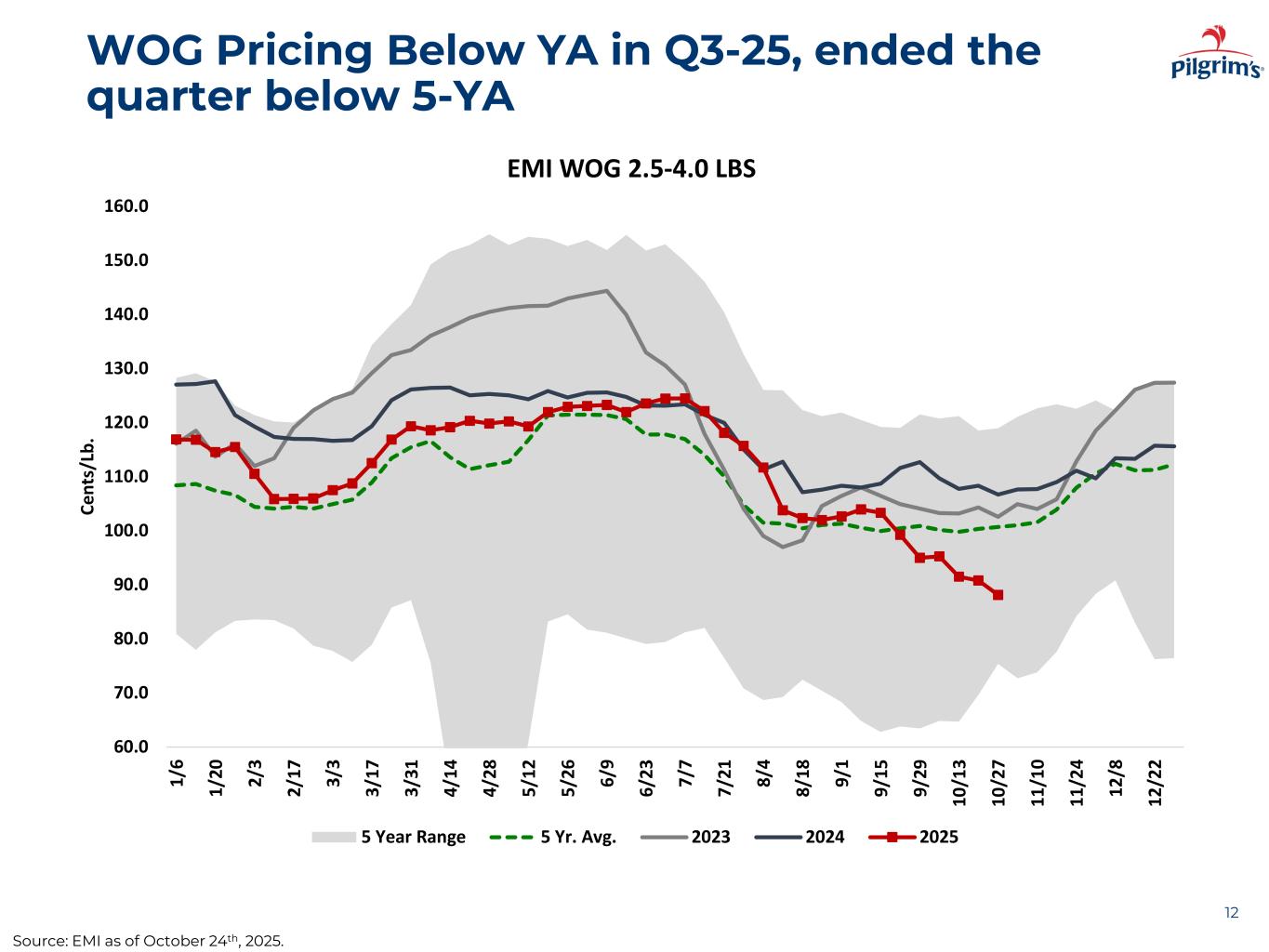

WOG Pricing Below YA in Q3-25, ended the quarter below 5-YA 12 60.0 70.0 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 1/ 6 1/ 20 2/ 3 2/ 17 3/ 3 3/ 17 3/ 31 4/ 14 4/ 28 5/ 12 5/ 26 6/ 9 6/ 23 7/ 7 7/ 21 8/ 4 8/ 18 9/ 1 9/ 15 9/ 29 10 /1 3 10 /2 7 11 /1 0 11 /2 4 12 /8 12 /2 2 Ce nt s/ Lb . EMI WOG 2.5-4.0 LBS 5 Year Range 5 Yr. Avg. 2023 2024 2025 Source: EMI as of October 24th, 2025.

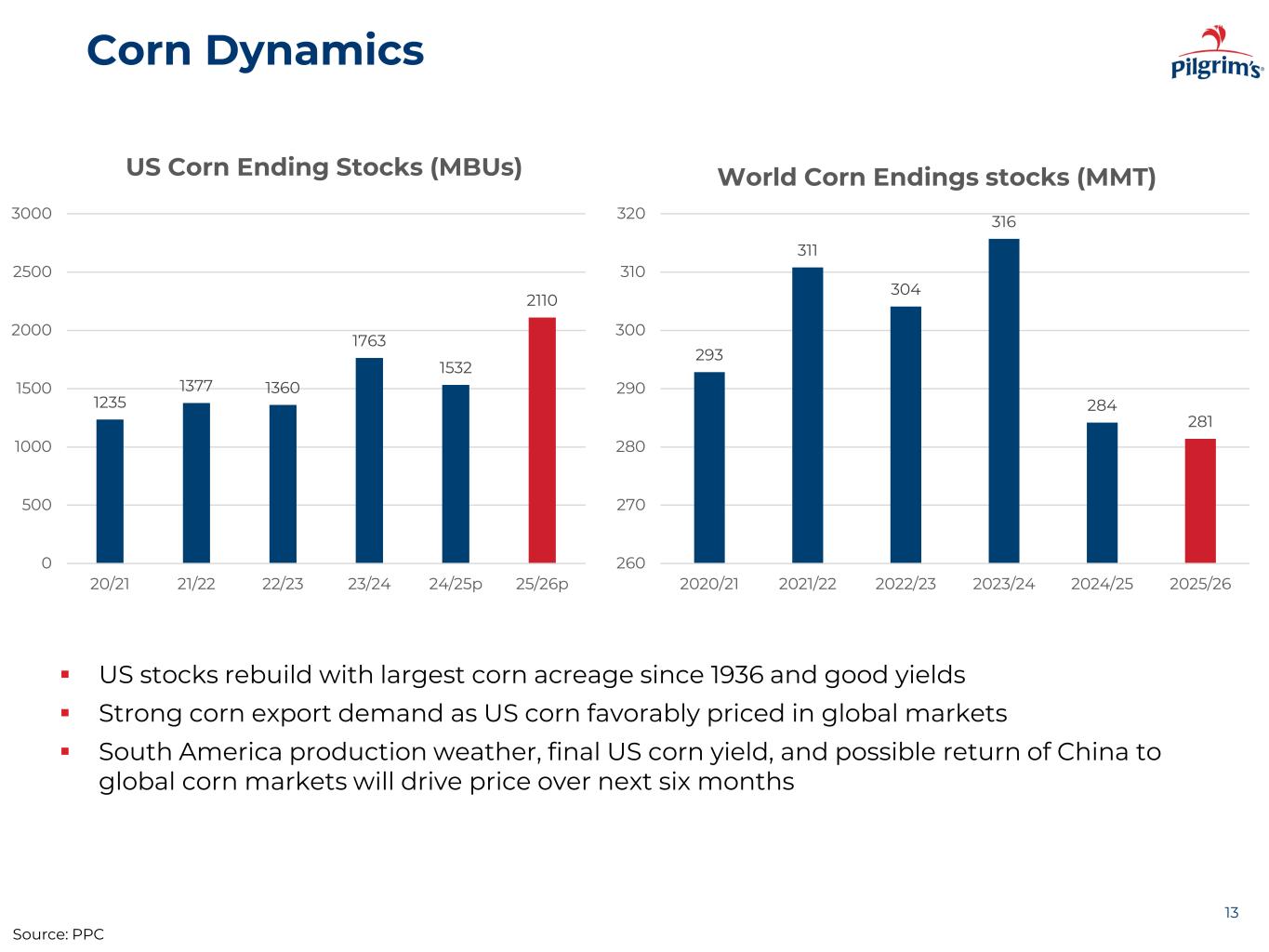

Corn Dynamics 13 Source: PPC US stocks rebuild with largest corn acreage since 1936 and good yields Strong corn export demand as US corn favorably priced in global markets South America production weather, final US corn yield, and possible return of China to global corn markets will drive price over next six months 1235 1377 1360 1763 1532 2110 0 500 1000 1500 2000 2500 3000 20/21 21/22 22/23 23/24 24/25p 25/26p US Corn Ending Stocks (MBUs) 293 311 304 316 284 281 260 270 280 290 300 310 320 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 World Corn Endings stocks (MMT)

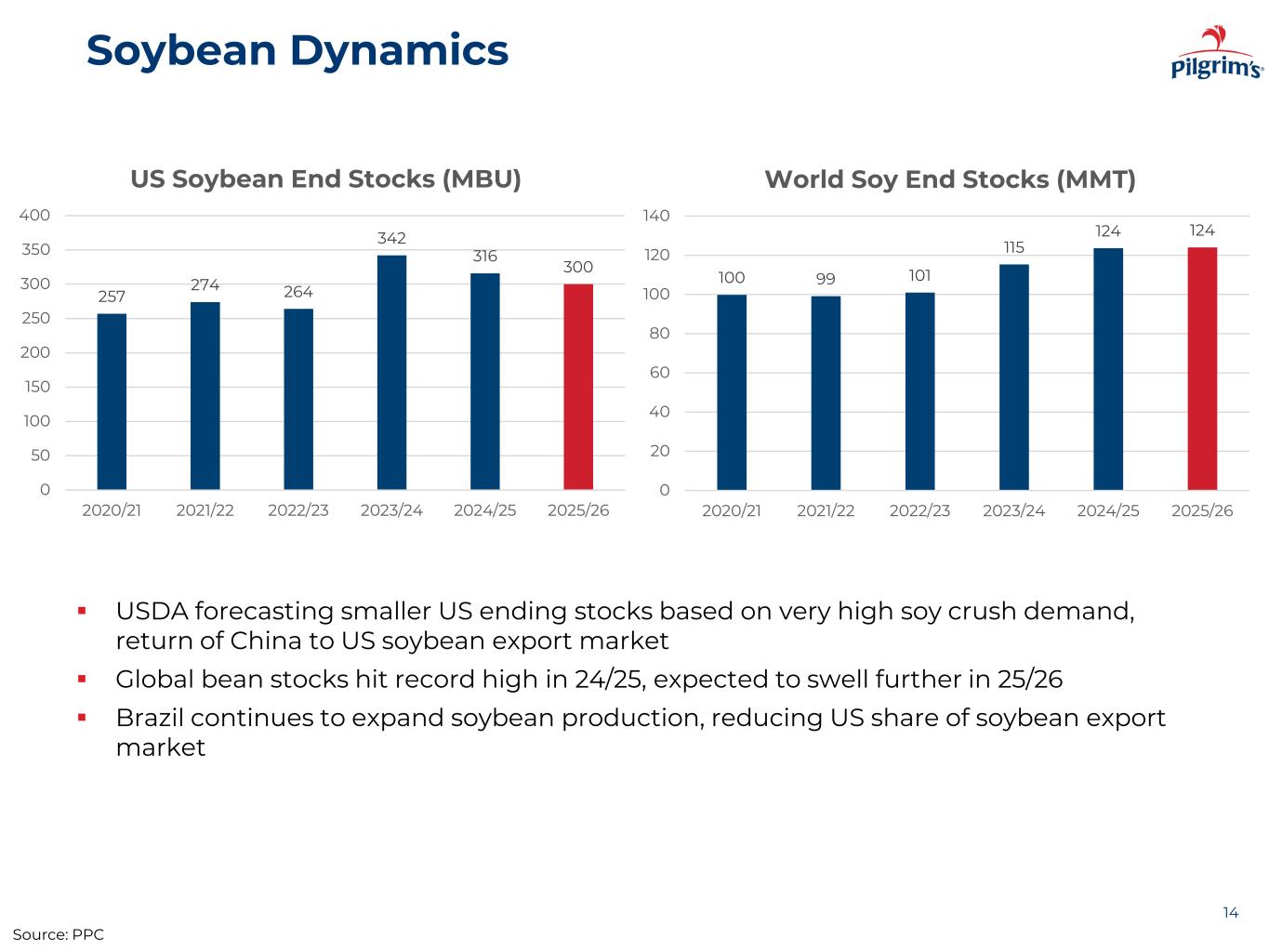

Soybean Dynamics 14 Source: PPC USDA forecasting smaller US ending stocks based on very high soy crush demand, return of China to US soybean export market Global bean stocks hit record high in 24/25, expected to swell further in 25/26 Brazil continues to expand soybean production, reducing US share of soybean export market 257 274 264 342 316 300 0 50 100 150 200 250 300 350 400 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 US Soybean End Stocks (MBU) 100 99 101 115 124 124 0 20 40 60 80 100 120 140 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 World Soy End Stocks (MMT)

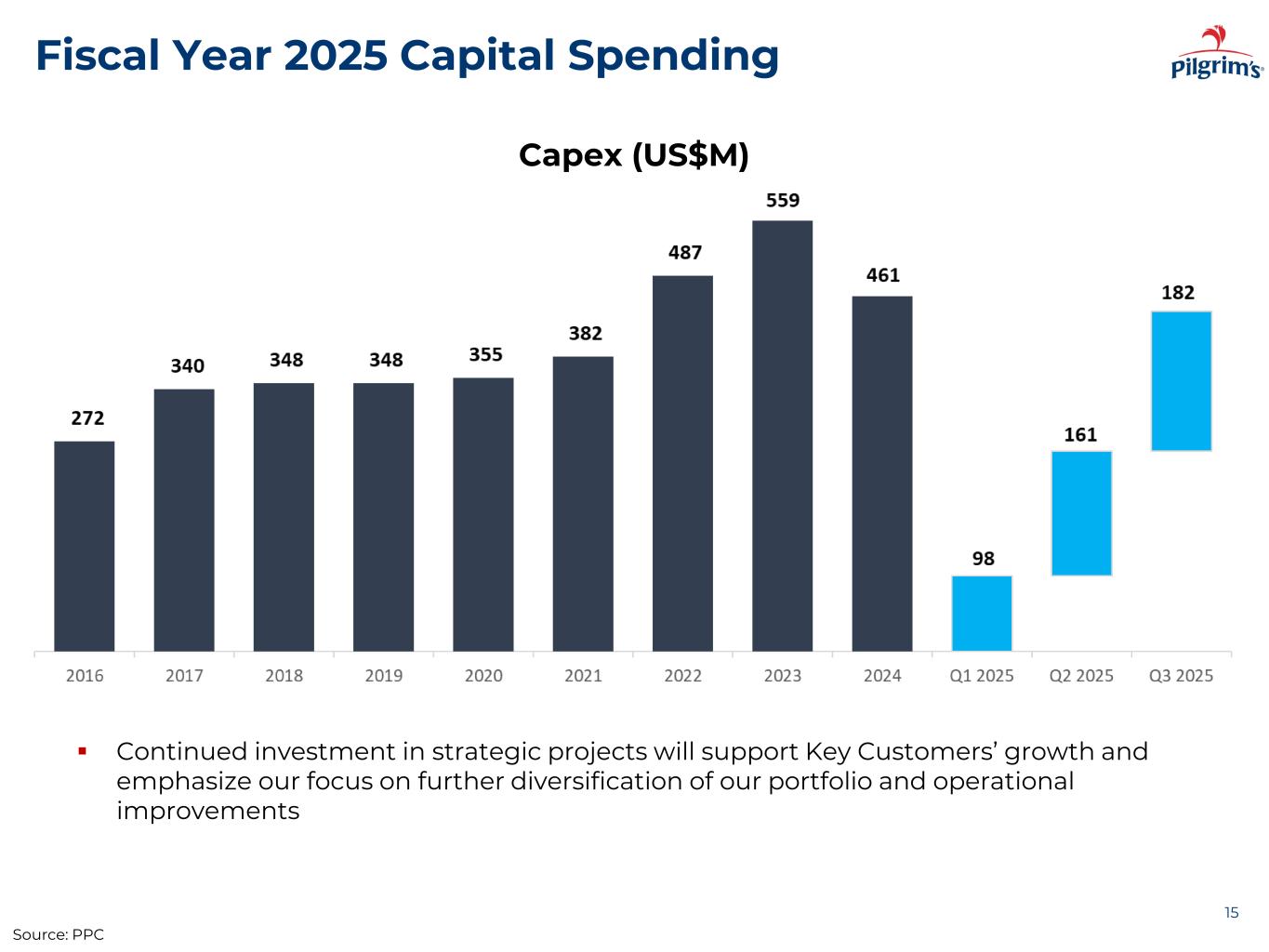

Fiscal Year 2025 Capital Spending 15 Capex (US$M) Continued investment in strategic projects will support Key Customers’ growth and emphasize our focus on further diversification of our portfolio and operational improvements Source: PPC

APPENDIX 16

Appendix: Reconciliation of Adjusted EBITDA 17 “EBITDA” is defined as the sum of net income plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (1) foreign currency transaction losses (gains), (2) costs related to litigation settlements, (3) restructuring activities losses, and (4) net income attributable to noncontrolling interests. EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA applicable to continuing operations. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP. In addition, other companies in our industry may calculate these measures differently limiting their usefulness as a comparative measure. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. These limitations should be compensated for by relying primarily on our U.S. GAAP results and using EBITDA and Adjusted EBITDA only on a supplemental basis. Source: PPC

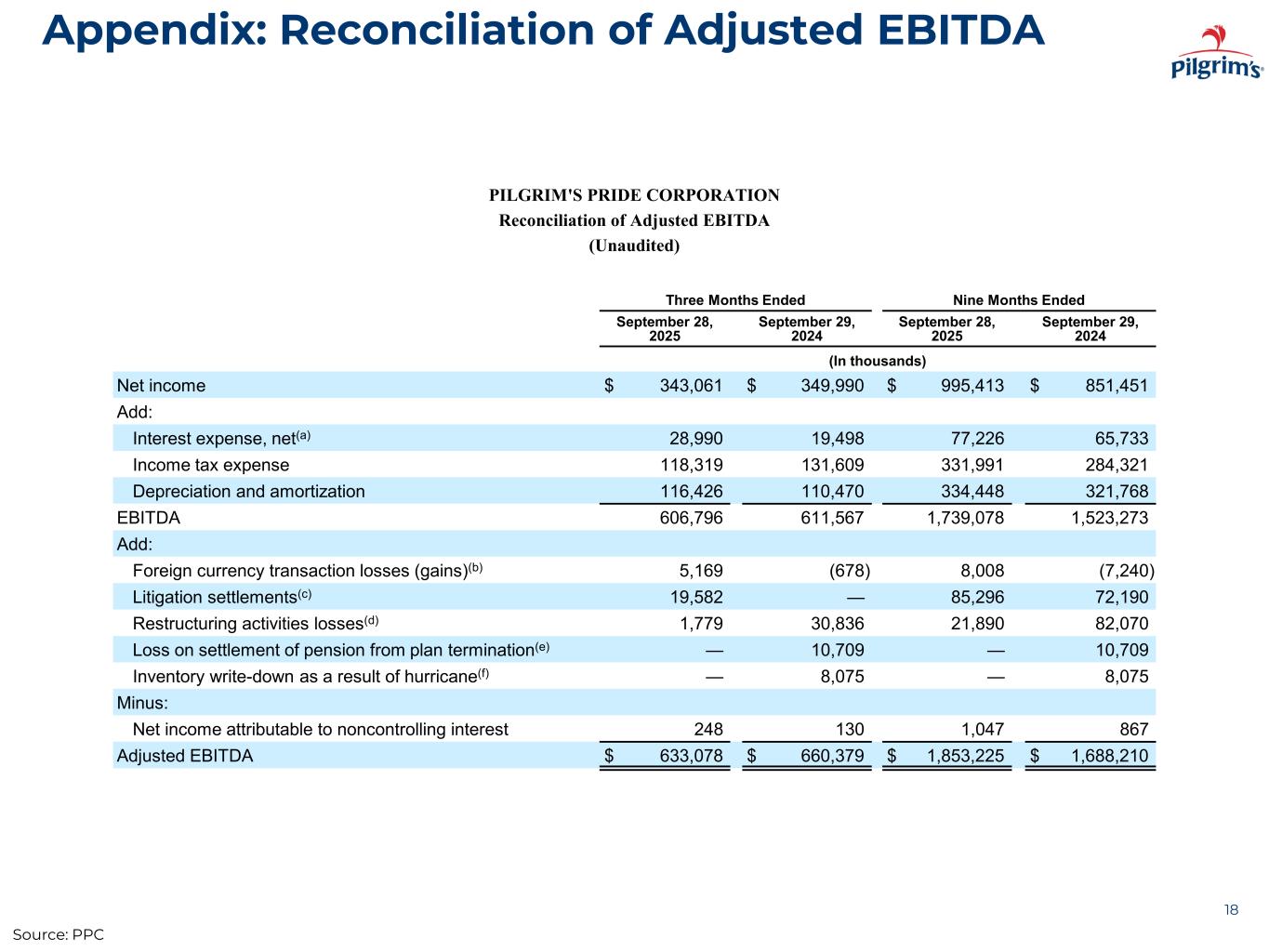

Appendix: Reconciliation of Adjusted EBITDA 18 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) Net income $ 343,061 $ 349,990 $ 995,413 $ 851,451 Add: Interest expense, net(a) 28,990 19,498 77,226 65,733 Income tax expense 118,319 131,609 331,991 284,321 Depreciation and amortization 116,426 110,470 334,448 321,768 EBITDA 606,796 611,567 1,739,078 1,523,273 Add: Foreign currency transaction losses (gains)(b) 5,169 (678) 8,008 (7,240) Litigation settlements(c) 19,582 — 85,296 72,190 Restructuring activities losses(d) 1,779 30,836 21,890 82,070 Loss on settlement of pension from plan termination(e) — 10,709 — 10,709 Inventory write-down as a result of hurricane(f) — 8,075 — 8,075 Minus: Net income attributable to noncontrolling interest 248 130 1,047 867 Adjusted EBITDA $ 633,078 $ 660,379 $ 1,853,225 $ 1,688,210 Source: PPC

Appendix: Reconciliation of Adjusted EBITDA 19 a. Interest expense, net, consists of interest expense less interest income. b. Prior to April 1, 2024, the Company measured the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasured assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasured nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements were previously recognized in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. Effective April 1, 2024, the Company changed the functional currency of its Mexico reportable segment from U.S. dollar to Mexican peso, which means all translation gains/losses on outstanding balances are now recognized in accumulated other comprehensive income. Transactional functional currency gains/losses are included in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. c. This represents amounts recognized for both negotiated litigation settlements and reasonable estimates for probable losses. d. Restructuring activities losses are related to costs incurred, such as severance, lease terminations, asset impairment and other charges, as part of multiple ongoing restructuring initiatives throughout our Europe reportable segment. e. This represents a loss recognized on the settlement of pension plan obligations related to plan terminations of our two U.S. defined benefit plans. f. This primarily represents broiler losses incurred as a result of Hurricane Helene in September 2024. Source: PPC

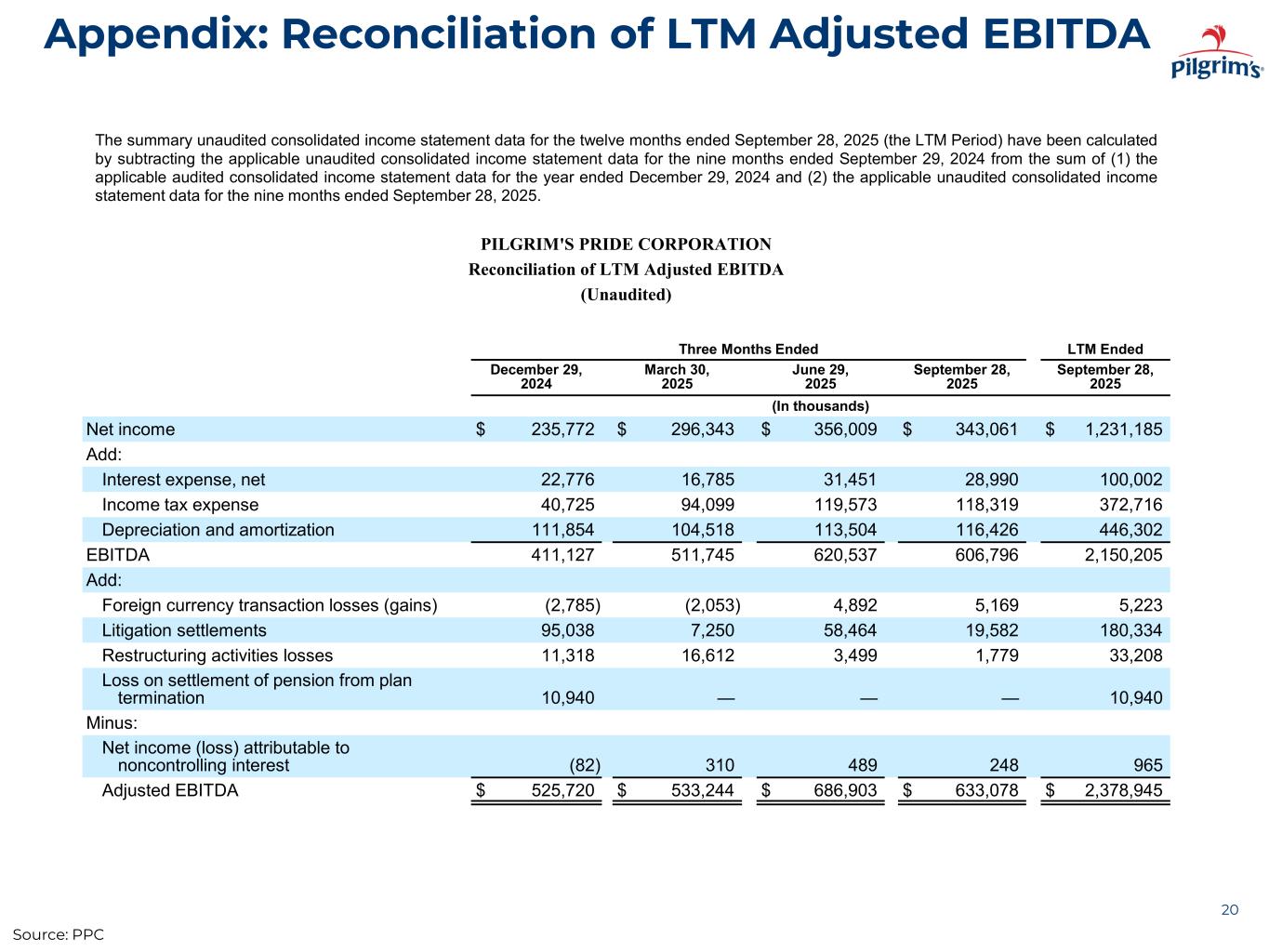

Appendix: Reconciliation of LTM Adjusted EBITDA 20 The summary unaudited consolidated income statement data for the twelve months ended September 28, 2025 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the nine months ended September 29, 2024 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 29, 2024 and (2) the applicable unaudited consolidated income statement data for the nine months ended September 28, 2025. PILGRIM'S PRIDE CORPORATION Reconciliation of LTM Adjusted EBITDA (Unaudited) Three Months Ended LTM Ended December 29, 2024 March 30, 2025 June 29, 2025 September 28, 2025 September 28, 2025 (In thousands) Net income $ 235,772 $ 296,343 $ 356,009 $ 343,061 $ 1,231,185 Add: Interest expense, net 22,776 16,785 31,451 28,990 100,002 Income tax expense 40,725 94,099 119,573 118,319 372,716 Depreciation and amortization 111,854 104,518 113,504 116,426 446,302 EBITDA 411,127 511,745 620,537 606,796 2,150,205 Add: Foreign currency transaction losses (gains) (2,785) (2,053) 4,892 5,169 5,223 Litigation settlements 95,038 7,250 58,464 19,582 180,334 Restructuring activities losses 11,318 16,612 3,499 1,779 33,208 Loss on settlement of pension from plan termination 10,940 — — — 10,940 Minus: Net income (loss) attributable to noncontrolling interest (82) 310 489 248 965 Adjusted EBITDA $ 525,720 $ 533,244 $ 686,903 $ 633,078 $ 2,378,945 Source: PPC

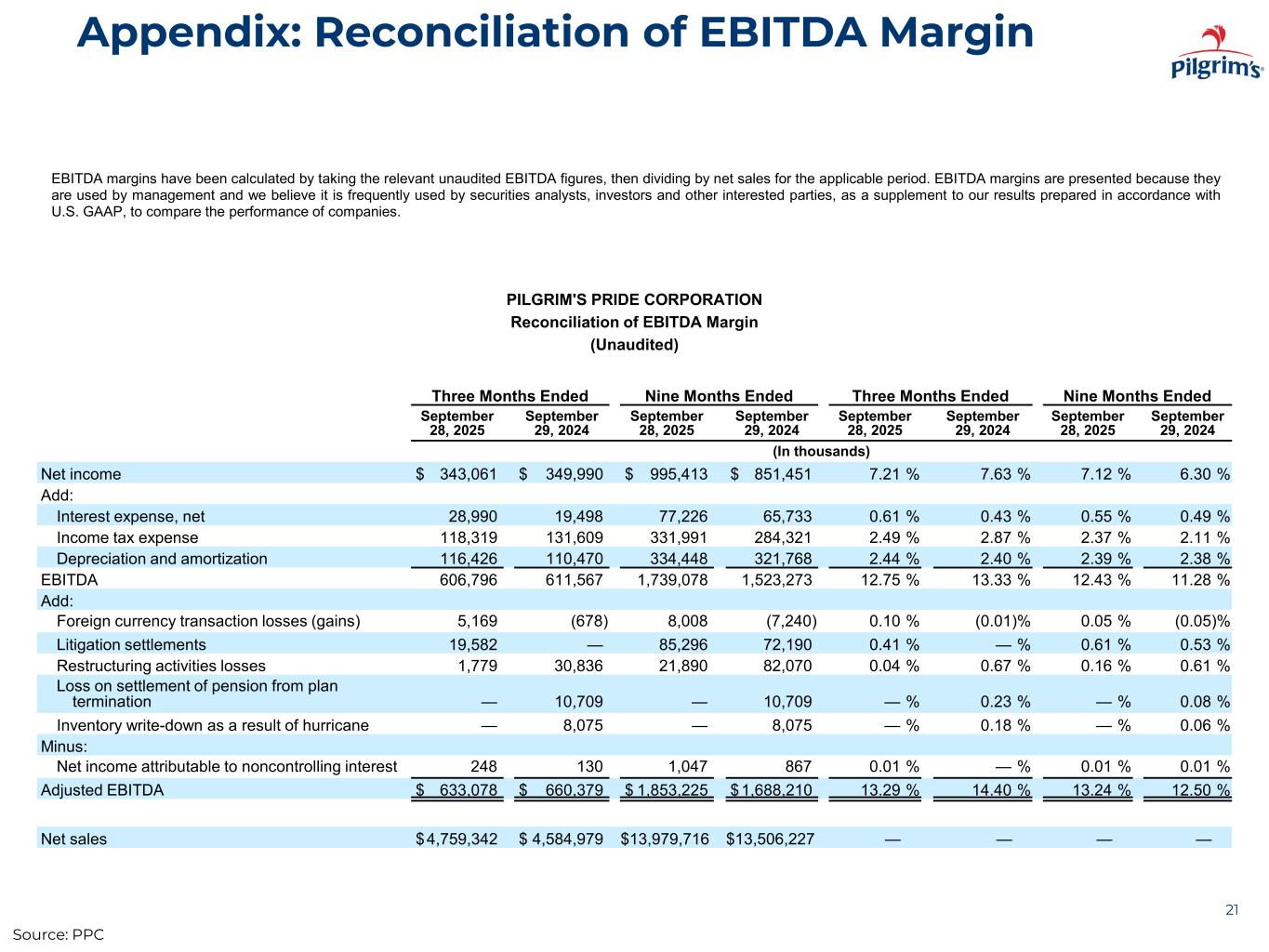

Appendix: Reconciliation of EBITDA Margin 21 EBITDA margins have been calculated by taking the relevant unaudited EBITDA figures, then dividing by net sales for the applicable period. EBITDA margins are presented because they are used by management and we believe it is frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies. Source: PPC PILGRIM'S PRIDE CORPORATION Reconciliation of EBITDA Margin (Unaudited) Three Months Ended Nine Months Ended Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) Net income $ 343,061 $ 349,990 $ 995,413 $ 851,451 7.21 % 7.63 % 7.12 % 6.30 % Add: Interest expense, net 28,990 19,498 77,226 65,733 0.61 % 0.43 % 0.55 % 0.49 % Income tax expense 118,319 131,609 331,991 284,321 2.49 % 2.87 % 2.37 % 2.11 % Depreciation and amortization 116,426 110,470 334,448 321,768 2.44 % 2.40 % 2.39 % 2.38 % EBITDA 606,796 611,567 1,739,078 1,523,273 12.75 % 13.33 % 12.43 % 11.28 % Add: Foreign currency transaction losses (gains) 5,169 (678) 8,008 (7,240) 0.10 % (0.01)% 0.05 % (0.05)% Litigation settlements 19,582 — 85,296 72,190 0.41 % — % 0.61 % 0.53 % Restructuring activities losses 1,779 30,836 21,890 82,070 0.04 % 0.67 % 0.16 % 0.61 % Loss on settlement of pension from plan termination — 10,709 — 10,709 — % 0.23 % — % 0.08 % Inventory write-down as a result of hurricane — 8,075 — 8,075 — % 0.18 % — % 0.06 % Minus: Net income attributable to noncontrolling interest 248 130 1,047 867 0.01 % — % 0.01 % 0.01 % Adjusted EBITDA $ 633,078 $ 660,379 $ 1,853,225 $1,688,210 13.29 % 14.40 % 13.24 % 12.50 % Net sales $4,759,342 $ 4,584,979 $13,979,716 $13,506,227 — — — —

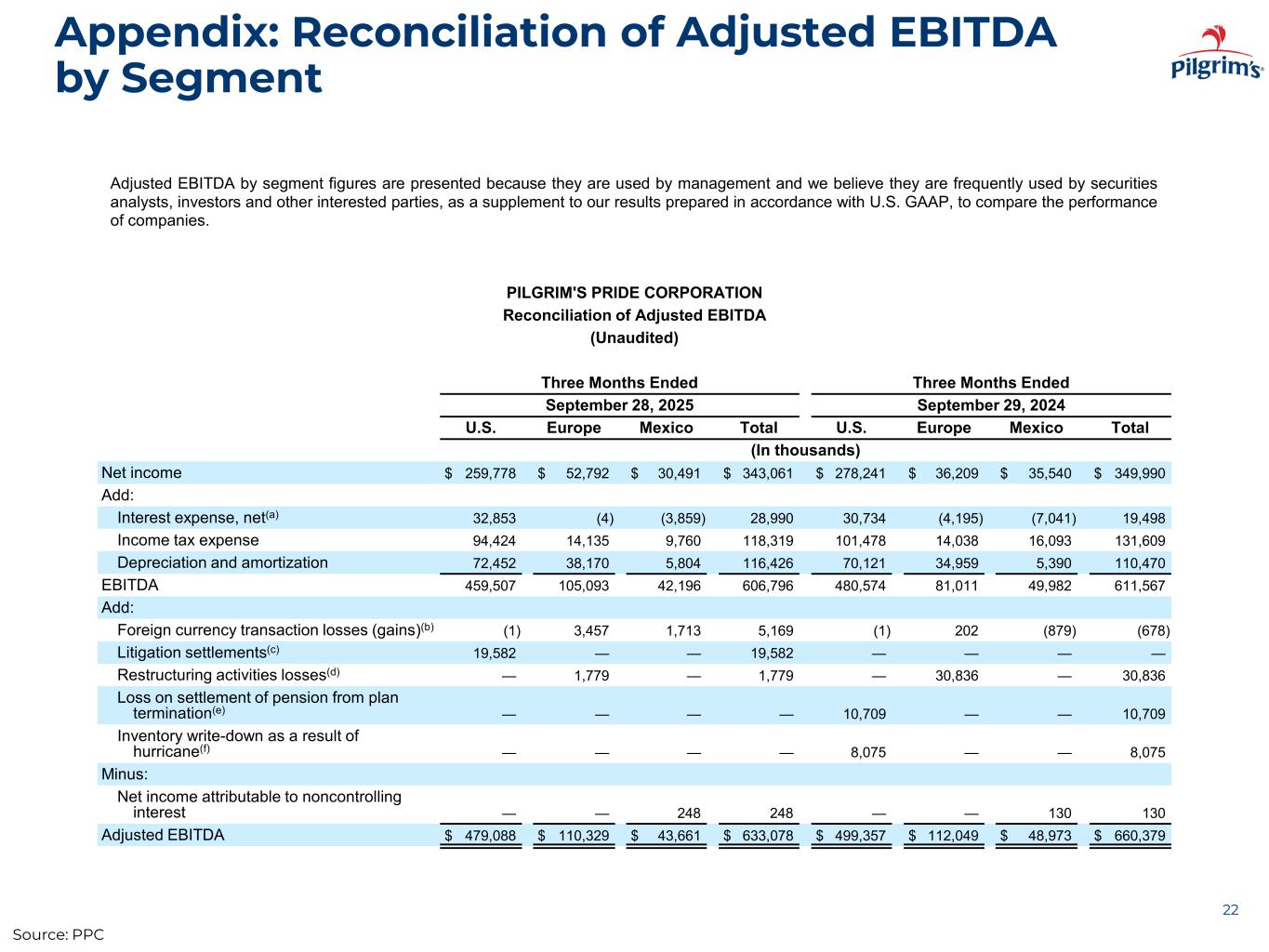

Appendix: Reconciliation of Adjusted EBITDA by Segment 22 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Three Months Ended September 28, 2025 September 29, 2024 U.S. Europe Mexico Total U.S. Europe Mexico Total (In thousands) Net income $ 259,778 $ 52,792 $ 30,491 $ 343,061 $ 278,241 $ 36,209 $ 35,540 $ 349,990 Add: Interest expense, net(a) 32,853 (4) (3,859) 28,990 30,734 (4,195) (7,041) 19,498 Income tax expense 94,424 14,135 9,760 118,319 101,478 14,038 16,093 131,609 Depreciation and amortization 72,452 38,170 5,804 116,426 70,121 34,959 5,390 110,470 EBITDA 459,507 105,093 42,196 606,796 480,574 81,011 49,982 611,567 Add: Foreign currency transaction losses (gains)(b) (1) 3,457 1,713 5,169 (1) 202 (879) (678) Litigation settlements(c) 19,582 — — 19,582 — — — — Restructuring activities losses(d) — 1,779 — 1,779 — 30,836 — 30,836 Loss on settlement of pension from plan termination(e) — — — — 10,709 — — 10,709 Inventory write-down as a result of hurricane(f) — — — — 8,075 — — 8,075 Minus: Net income attributable to noncontrolling interest — — 248 248 — — 130 130 Adjusted EBITDA $ 479,088 $ 110,329 $ 43,661 $ 633,078 $ 499,357 $ 112,049 $ 48,973 $ 660,379 Adjusted EBITDA by segment figures are presented because they are used by management and we believe they are frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies. Source: PPC

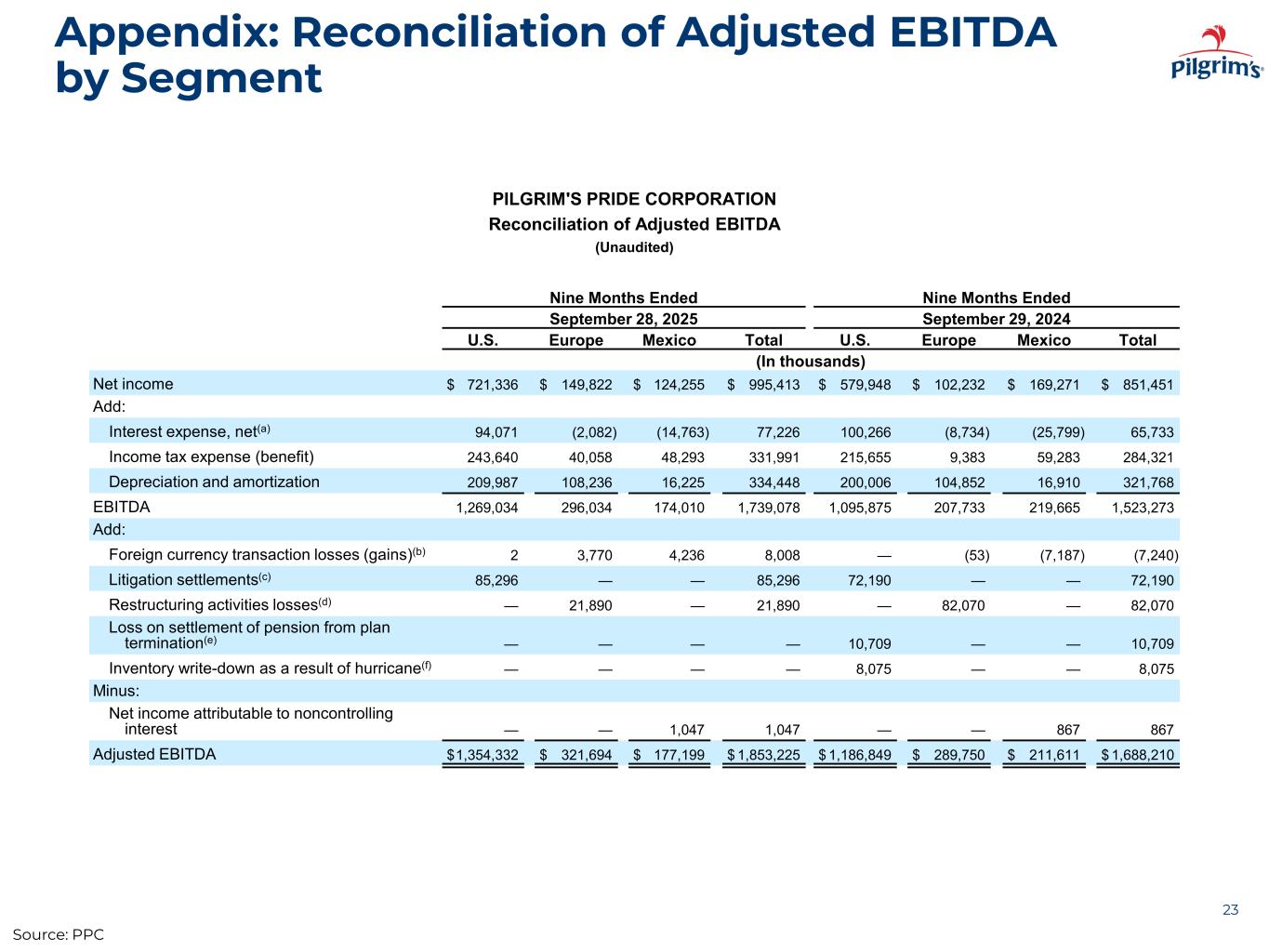

Appendix: Reconciliation of Adjusted EBITDA by Segment 23 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Nine Months Ended Nine Months Ended September 28, 2025 September 29, 2024 U.S. Europe Mexico Total U.S. Europe Mexico Total (In thousands) Net income $ 721,336 $ 149,822 $ 124,255 $ 995,413 $ 579,948 $ 102,232 $ 169,271 $ 851,451 Add: Interest expense, net(a) 94,071 (2,082) (14,763) 77,226 100,266 (8,734) (25,799) 65,733 Income tax expense (benefit) 243,640 40,058 48,293 331,991 215,655 9,383 59,283 284,321 Depreciation and amortization 209,987 108,236 16,225 334,448 200,006 104,852 16,910 321,768 EBITDA 1,269,034 296,034 174,010 1,739,078 1,095,875 207,733 219,665 1,523,273 Add: Foreign currency transaction losses (gains)(b) 2 3,770 4,236 8,008 — (53) (7,187) (7,240) Litigation settlements(c) 85,296 — — 85,296 72,190 — — 72,190 Restructuring activities losses(d) — 21,890 — 21,890 — 82,070 — 82,070 Loss on settlement of pension from plan termination(e) — — — — 10,709 — — 10,709 Inventory write-down as a result of hurricane(f) — — — — 8,075 — — 8,075 Minus: Net income attributable to noncontrolling interest — — 1,047 1,047 — — 867 867 Adjusted EBITDA $1,354,332 $ 321,694 $ 177,199 $ 1,853,225 $ 1,186,849 $ 289,750 $ 211,611 $ 1,688,210 Source: PPC

Appendix: Reconciliation of Adjusted EBITDA 24 a. Interest expense, net, consists of interest expense less interest income. b. Prior to April 1, 2024, the Company measured the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasured assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasured nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements were previously recognized in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. Effective April 1, 2024, the Company changed the functional currency of its Mexico reportable segment from U.S. dollar to Mexican peso, which means all translation gains/losses on outstanding balances are now recognized in accumulated other comprehensive income. Transactional functional currency gains/losses are included in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. c. This represents amounts recognized for both negotiated litigation settlements and reasonable estimates for probable losses. d. Restructuring activities losses are related to costs incurred, such as severance, lease terminations, asset impairment and other charges, as part of multiple ongoing restructuring initiatives throughout our Europe reportable segment. e. This represents a loss recognized on the settlement of pension plan obligations related to plan terminations of our two U.S. defined benefit plans. f. This primarily represents broiler losses incurred as a result of Hurricane Helene in September 2024. Source: PPC

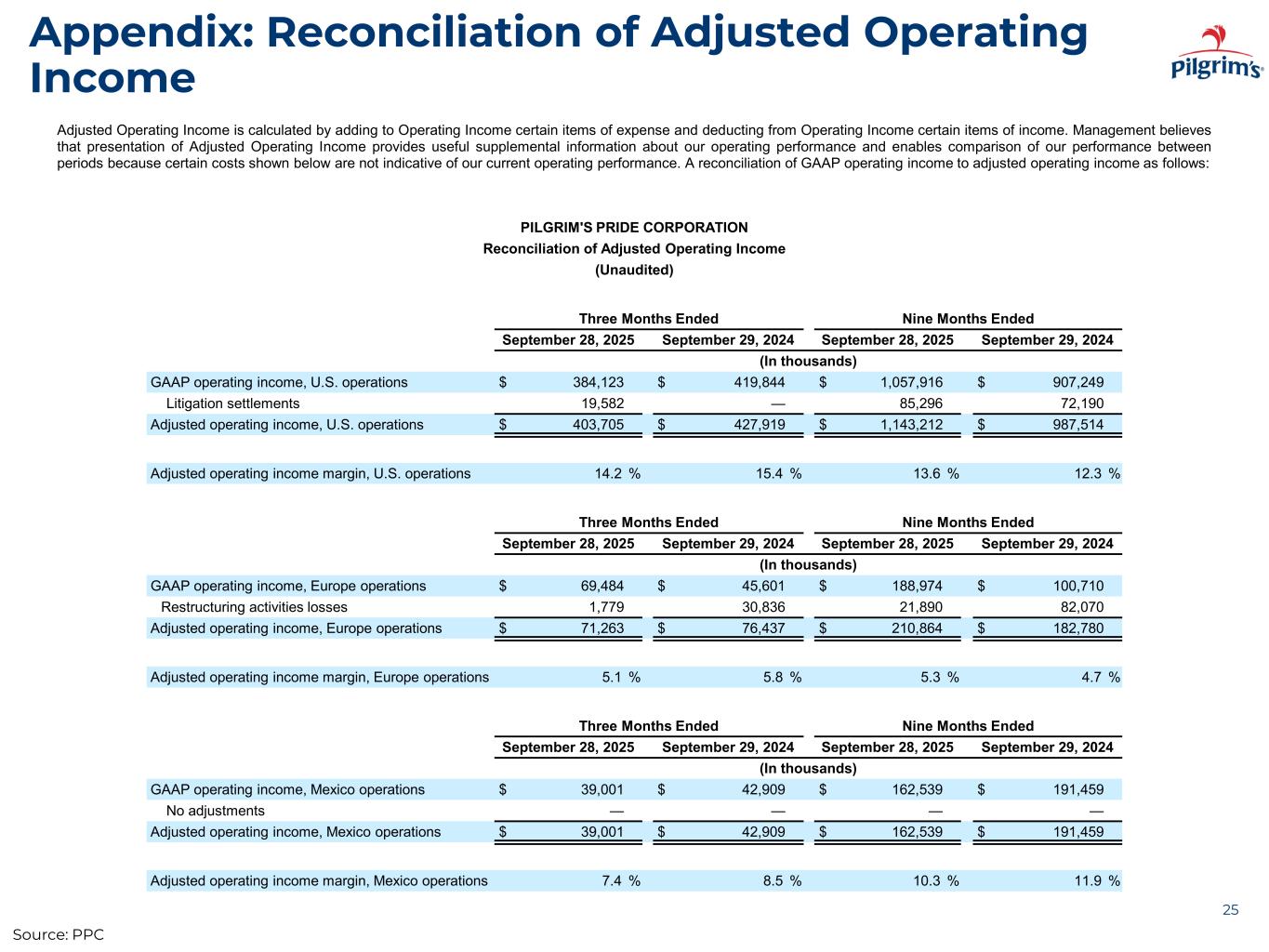

Appendix: Reconciliation of Adjusted Operating Income 25 Adjusted Operating Income is calculated by adding to Operating Income certain items of expense and deducting from Operating Income certain items of income. Management believes that presentation of Adjusted Operating Income provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income to adjusted operating income as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Operating Income (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) GAAP operating income, U.S. operations $ 384,123 $ 419,844 $ 1,057,916 $ 907,249 Litigation settlements 19,582 — 85,296 72,190 Adjusted operating income, U.S. operations $ 403,705 $ 427,919 $ 1,143,212 $ 987,514 Adjusted operating income margin, U.S. operations 14.2 % 15.4 % 13.6 % 12.3 % Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) GAAP operating income, Europe operations $ 69,484 $ 45,601 $ 188,974 $ 100,710 Restructuring activities losses 1,779 30,836 21,890 82,070 Adjusted operating income, Europe operations $ 71,263 $ 76,437 $ 210,864 $ 182,780 Adjusted operating income margin, Europe operations 5.1 % 5.8 % 5.3 % 4.7 % Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) GAAP operating income, Mexico operations $ 39,001 $ 42,909 $ 162,539 $ 191,459 No adjustments — — — — Adjusted operating income, Mexico operations $ 39,001 $ 42,909 $ 162,539 $ 191,459 Adjusted operating income margin, Mexico operations 7.4 % 8.5 % 10.3 % 11.9 % Source: PPC

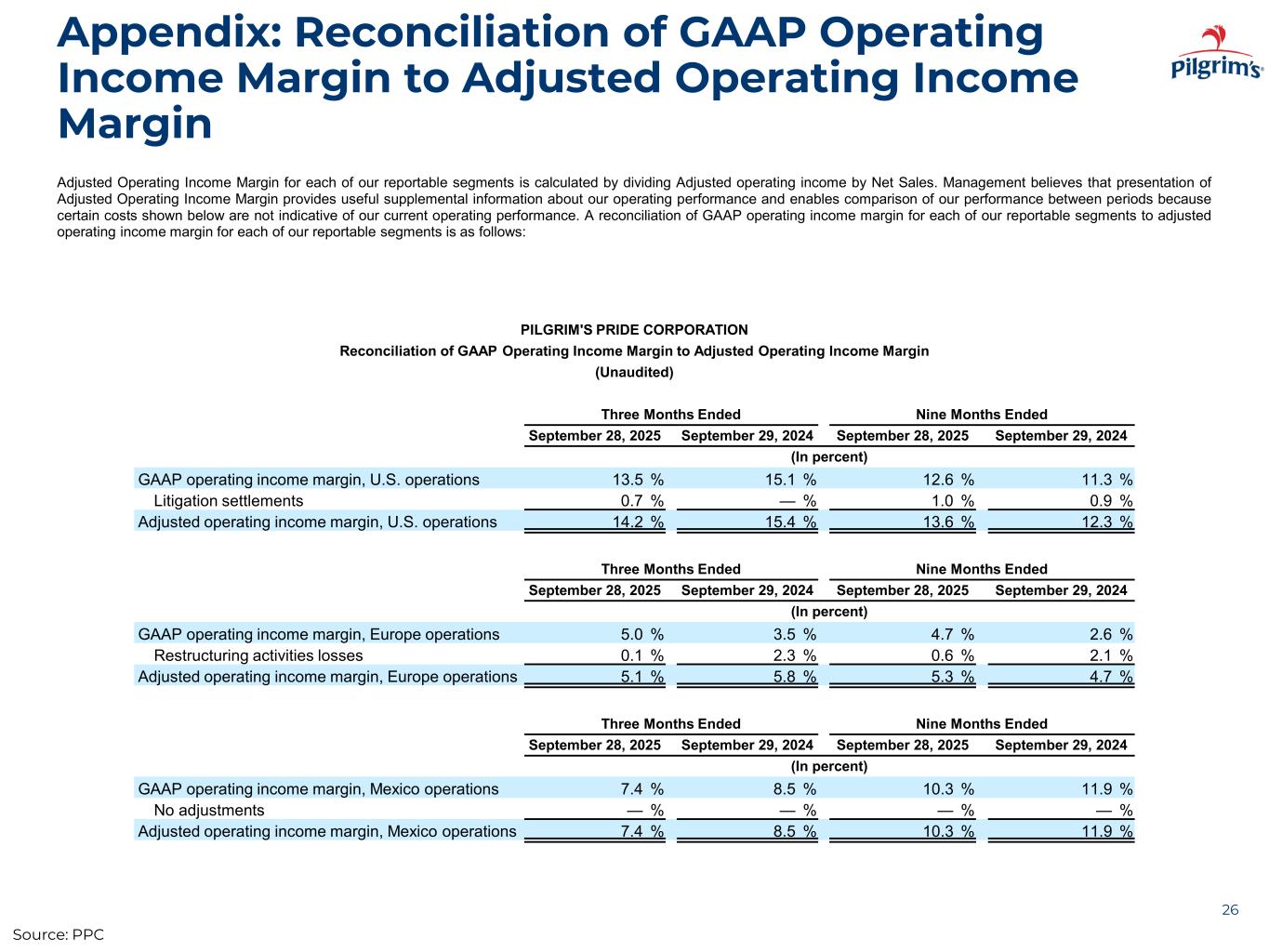

Appendix: Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin 26 Adjusted Operating Income Margin for each of our reportable segments is calculated by dividing Adjusted operating income by Net Sales. Management believes that presentation of Adjusted Operating Income Margin provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income margin for each of our reportable segments to adjusted operating income margin for each of our reportable segments is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In percent) GAAP operating income margin, U.S. operations 13.5 % 15.1 % 12.6 % 11.3 % Litigation settlements 0.7 % — % 1.0 % 0.9 % Adjusted operating income margin, U.S. operations 14.2 % 15.4 % 13.6 % 12.3 % Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In percent) GAAP operating income margin, Europe operations 5.0 % 3.5 % 4.7 % 2.6 % Restructuring activities losses 0.1 % 2.3 % 0.6 % 2.1 % Adjusted operating income margin, Europe operations 5.1 % 5.8 % 5.3 % 4.7 % Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In percent) GAAP operating income margin, Mexico operations 7.4 % 8.5 % 10.3 % 11.9 % No adjustments — % — % — % — % Adjusted operating income margin, Mexico operations 7.4 % 8.5 % 10.3 % 11.9 % Source: PPC

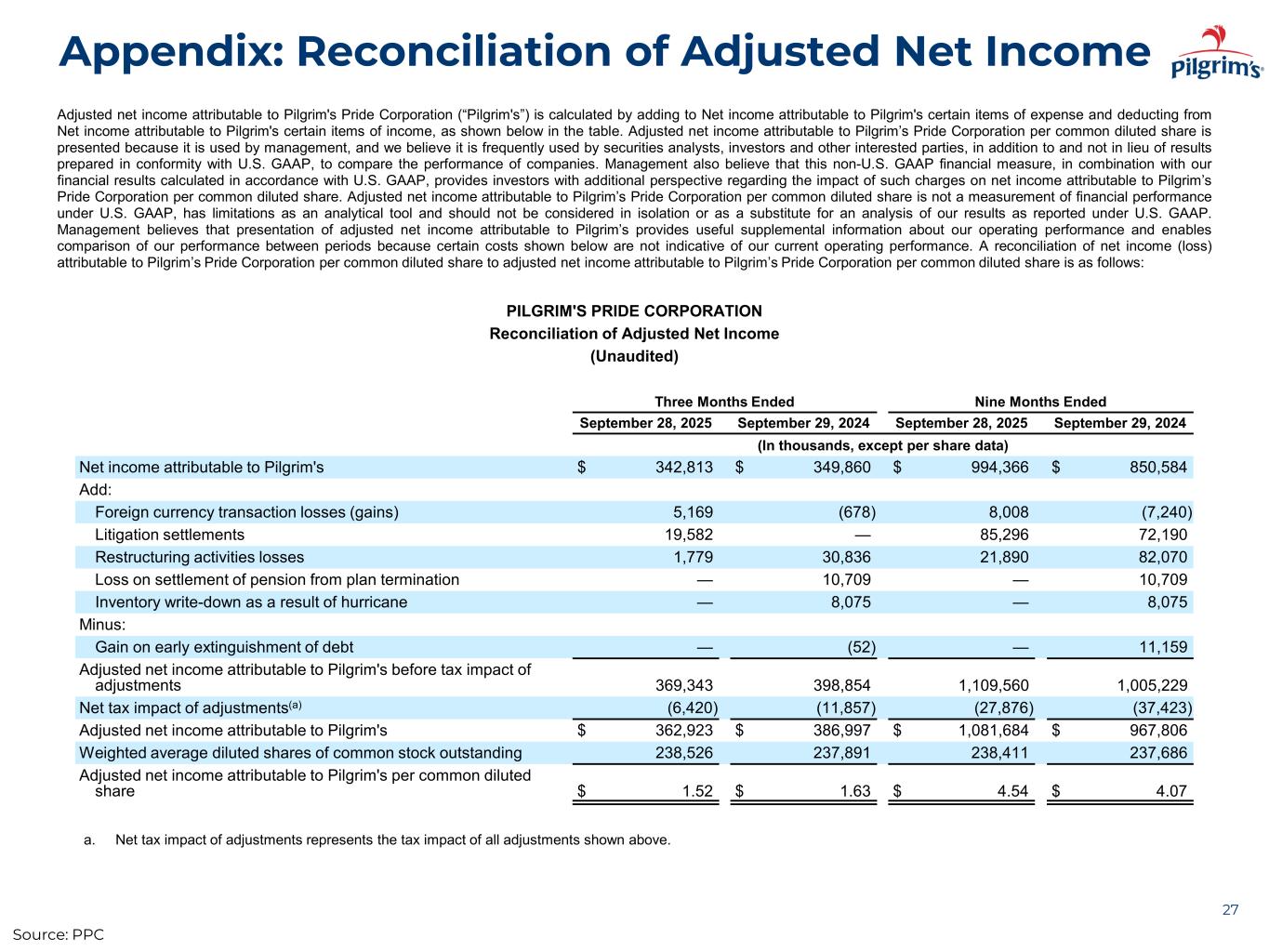

Appendix: Reconciliation of Adjusted Net Income 27 Adjusted net income attributable to Pilgrim's Pride Corporation (“Pilgrim's”) is calculated by adding to Net income attributable to Pilgrim's certain items of expense and deducting from Net income attributable to Pilgrim's certain items of income, as shown below in the table. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with U.S. GAAP, to compare the performance of companies. Management also believe that this non-U.S. GAAP financial measure, in combination with our financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of such charges on net income attributable to Pilgrim’s Pride Corporation per common diluted share. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is not a measurement of financial performance under U.S. GAAP, has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results as reported under U.S. GAAP. Management believes that presentation of adjusted net income attributable to Pilgrim’s provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of net income (loss) attributable to Pilgrim’s Pride Corporation per common diluted share to adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Net Income (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands, except per share data) Net income attributable to Pilgrim's $ 342,813 $ 349,860 $ 994,366 $ 850,584 Add: Foreign currency transaction losses (gains) 5,169 (678) 8,008 (7,240) Litigation settlements 19,582 — 85,296 72,190 Restructuring activities losses 1,779 30,836 21,890 82,070 Loss on settlement of pension from plan termination — 10,709 — 10,709 Inventory write-down as a result of hurricane — 8,075 — 8,075 Minus: Gain on early extinguishment of debt — (52) — 11,159 Adjusted net income attributable to Pilgrim's before tax impact of adjustments 369,343 398,854 1,109,560 1,005,229 Net tax impact of adjustments(a) (6,420) (11,857) (27,876) (37,423) Adjusted net income attributable to Pilgrim's $ 362,923 $ 386,997 $ 1,081,684 $ 967,806 Weighted average diluted shares of common stock outstanding 238,526 237,891 238,411 237,686 Adjusted net income attributable to Pilgrim's per common diluted share $ 1.52 $ 1.63 $ 4.54 $ 4.07 a. Net tax impact of adjustments represents the tax impact of all adjustments shown above. Source: PPC

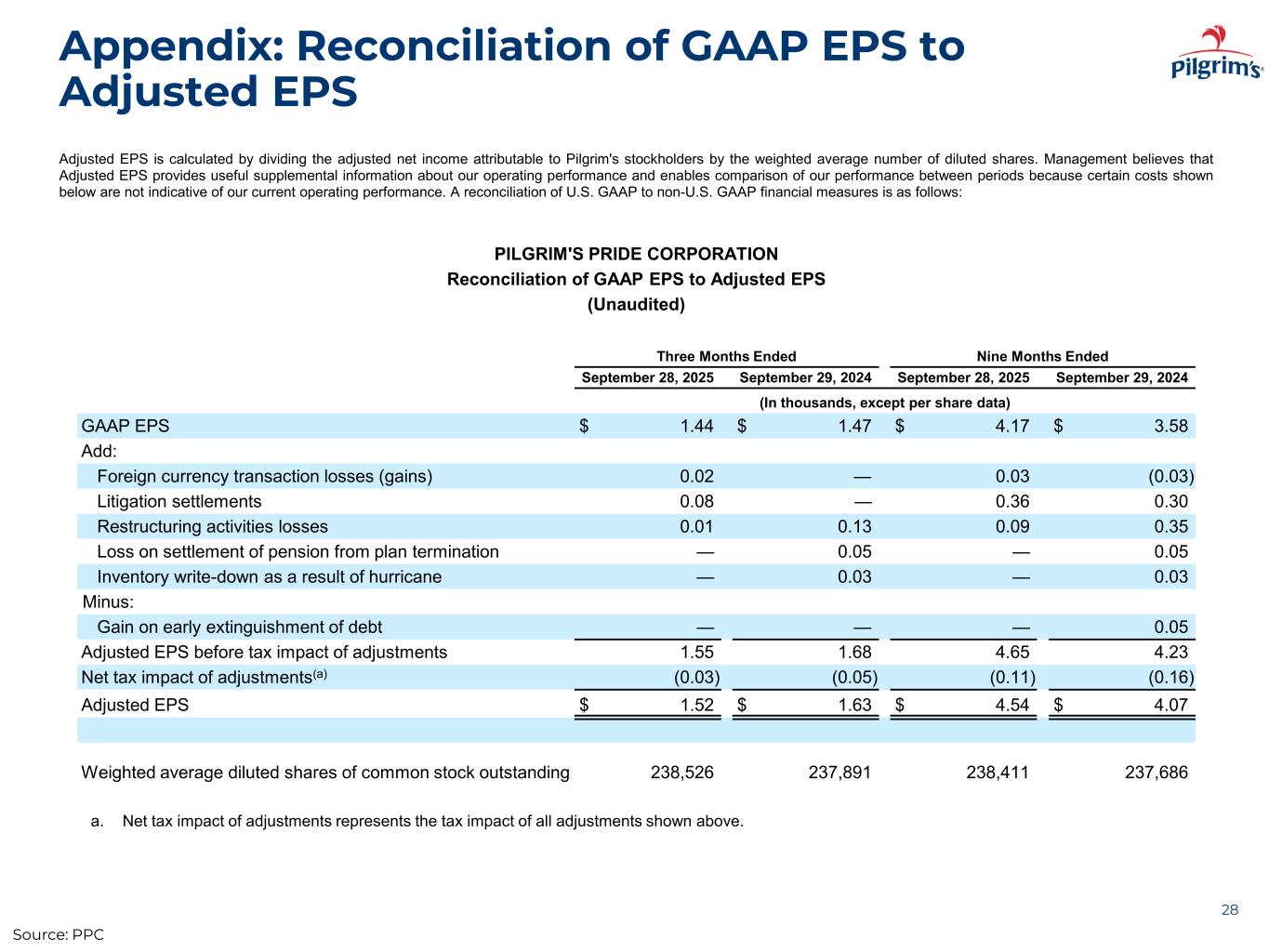

Appendix: Reconciliation of GAAP EPS to Adjusted EPS 28 Adjusted EPS is calculated by dividing the adjusted net income attributable to Pilgrim's stockholders by the weighted average number of diluted shares. Management believes that Adjusted EPS provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of U.S. GAAP to non-U.S. GAAP financial measures is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands, except per share data) GAAP EPS $ 1.44 $ 1.47 $ 4.17 $ 3.58 Add: Foreign currency transaction losses (gains) 0.02 — 0.03 (0.03) Litigation settlements 0.08 — 0.36 0.30 Restructuring activities losses 0.01 0.13 0.09 0.35 Loss on settlement of pension from plan termination — 0.05 — 0.05 Inventory write-down as a result of hurricane — 0.03 — 0.03 Minus: Gain on early extinguishment of debt — — — 0.05 Adjusted EPS before tax impact of adjustments 1.55 1.68 4.65 4.23 Net tax impact of adjustments(a) (0.03) (0.05) (0.11) (0.16) Adjusted EPS $ 1.52 $ 1.63 $ 4.54 $ 4.07 Weighted average diluted shares of common stock outstanding 238,526 237,891 238,411 237,686 a. Net tax impact of adjustments represents the tax impact of all adjustments shown above. Source: PPC

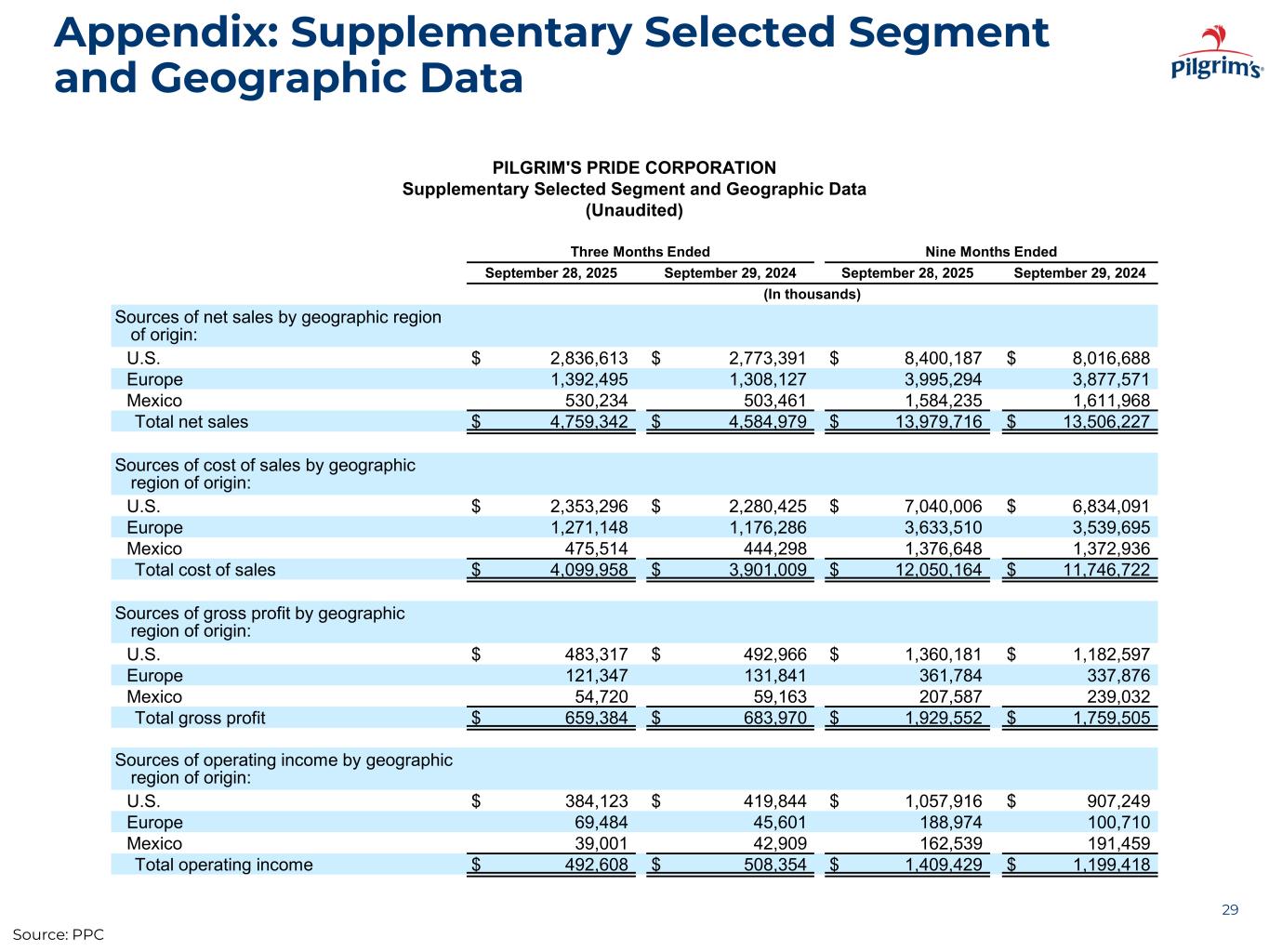

Appendix: Supplementary Selected Segment and Geographic Data 29 PILGRIM'S PRIDE CORPORATION Supplementary Selected Segment and Geographic Data (Unaudited) Three Months Ended Nine Months Ended September 28, 2025 September 29, 2024 September 28, 2025 September 29, 2024 (In thousands) Sources of net sales by geographic region of origin: U.S. $ 2,836,613 $ 2,773,391 $ 8,400,187 $ 8,016,688 Europe 1,392,495 1,308,127 3,995,294 3,877,571 Mexico 530,234 503,461 1,584,235 1,611,968 Total net sales $ 4,759,342 $ 4,584,979 $ 13,979,716 $ 13,506,227 Sources of cost of sales by geographic region of origin: U.S. $ 2,353,296 $ 2,280,425 $ 7,040,006 $ 6,834,091 Europe 1,271,148 1,176,286 3,633,510 3,539,695 Mexico 475,514 444,298 1,376,648 1,372,936 Total cost of sales $ 4,099,958 $ 3,901,009 $ 12,050,164 $ 11,746,722 Sources of gross profit by geographic region of origin: U.S. $ 483,317 $ 492,966 $ 1,360,181 $ 1,182,597 Europe 121,347 131,841 361,784 337,876 Mexico 54,720 59,163 207,587 239,032 Total gross profit $ 659,384 $ 683,970 $ 1,929,552 $ 1,759,505 Sources of operating income by geographic region of origin: U.S. $ 384,123 $ 419,844 $ 1,057,916 $ 907,249 Europe 69,484 45,601 188,974 100,710 Mexico 39,001 42,909 162,539 191,459 Total operating income $ 492,608 $ 508,354 $ 1,409,429 $ 1,199,418 Source: PPC