Park National Corporation | 1 October 27, 2025 Strategic Partnership with First Citizens Bancshares, Inc. +

Park National Corporation | 2 Risks and uncertainties that could cause actual results to differ include, without limitation: (1) the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; (2) the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction) and the possibility that the proposed transaction does not close when expected or at all because required regulatory approvals, the approval by First Citizens’ shareholders, or other approvals and the other conditions to closing are not received or satisfied on a timely basis or at all; (3) the outcome of any legal proceedings that may be instituted against Park or First Citizens; (4) the possibility that the anticipated benefits of the proposed transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Park and First Citizens operate; (5) the possibility that the integration of the two companies may be more difficult, time- consuming or costly than expected; (6) the impact of purchase accounting with respect to the proposed transaction, or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine their fair value and credit marks; (7) the possibility that the proposed transaction may be more expensive or take longer to complete than anticipated, including as a result of unexpected factors or events; (8) the diversion of management’s attention from ongoing business operations and opportunities; (9) potential adverse reactions of Park’s or First Citizens’ customers or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; (10) a material adverse change in the financial condition of Park or First Citizens; (11) changes in Park’s share price before closing; (12) risks relating to the potential dilutive effect of shares of Park’s common stock to be issued in the proposed transaction; (13) general competitive, economic, political and market conditions; (14) major catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks; and (15) other factors that may affect future results of Park or First Citizens, including, among others, changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates; deposit flows; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board, the Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. These factors are not necessarily all of the factors that could cause Park, First Citizens, or the combined company’s actual results, performance or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable factors, also could harm Park’s, First Citizens’, or the combined company’s results. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that are provided to assist in the understanding of anticipated future financial performance and which statements contain inherent risks and uncertainties. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of Park and First Citizens, respectively, with respect to the proposed transaction, the strategic benefits and financial benefits of the proposed transaction, including the expected impact of the proposed transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share and other operating and return metrics), the timing of the closing of the proposed transaction, and the ability to successfully integrate the combined businesses. Such statements are often characterized by the use of qualified words (and their derivatives) such as “may”, “will”, “anticipate”, “could”, “should”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “plan”, “project”, and “intend”, as well as words of similar meaning or other statements concerning opinions or judgment of Park or First Citizens or their respective management about future events. Forward-looking statements provide current expectations or forecasts of future events and do not guarantee future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties, including those described in Park’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, quarterly reports on Form 10-Q, and other documents subsequently filed by Park with the Securities and Exchange Commission (the “SEC”). Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. The anticipated results may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on Park, First Citizens, or each of their respective businesses or operations. Investors are cautioned not to rely too heavily on any such forward-looking statements. Park and First Citizens urge you to consider all of these risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made by Park and First Citizens. Forward-looking statements speak only as of the date they are made, and Park and First Citizens undertake no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. Safe Harbor Statement

Park National Corporation | 3 No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information about the Transaction and Where to Find It In connection with the proposed transaction, Park intends to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) to register the shares of Park common stock to be issued in connection with the proposed transaction. The Registration Statement will include a proxy statement of First Citizens and a prospectus of Park (the “Proxy Statement/Prospectus”), and Park may file with the SEC other relevant documents concerning the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, FIRST CITIZENS AND THE PROPOSED TRANSACTION AND RELATED MATTERS. A copy of the Registration Statement, Proxy Statement/Prospectus, as well as other filings containing information about Park and First Citizens, may be obtained free of charge at the SEC’s website (http://www.sec.gov) when they are filed. You will also be able to obtain these documents, when they are filed, free of charge, from Park at the “Investor Relations” section of Park’s website at www.parknationalcorp.com. Copies of the Registration Statement, Proxy Statement/Prospectus and the filings with the SEC that will be incorporated by reference therein can also be obtained, without charge, by directing a request to Park’s Investor Relations, Michelle Hamilton, 740-349-6014, media@parknationalbank.com. The information on Park’s website is not, and shall not be deemed to be, a part of this communication or incorporated into other filings Park makes with the SEC. DISCLAIMER Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Management believes that the disclosure of these “non-GAAP” financial measures presents additional information which, when read in conjunction with Park’s consolidated financial statements prepared in accordance with GAAP, assists in analyzing the operating performance, ensures comparability of operating performance from period to period, and facilitates comparisons with the performance of peer financial holding companies, while eliminating certain non-operational effects of acquisitions. Additionally, Park believes this financial information is utilized by regulators and market analysts to evaluate a company’s financial condition, and therefore, such information is useful to investors. The non-GAAP financial measures should not be viewed as substitutes for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The non-GAAP financial measures Park uses may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. This information should be reviewed in conjunction with the financial results disclosed in Park’s Annual Report on Form 10-K for the year ended December 31, 2024, subsequent quarterly 2025 Form 10-Q filings and other subsequent filings with the SEC. A reconciliation from the most directly comparable GAAP financial measures to the non-GAAP financial measures used in this presentation is provided on page 12 of this presentation Safe Harbor Statement and Non-GAAP Disclosure

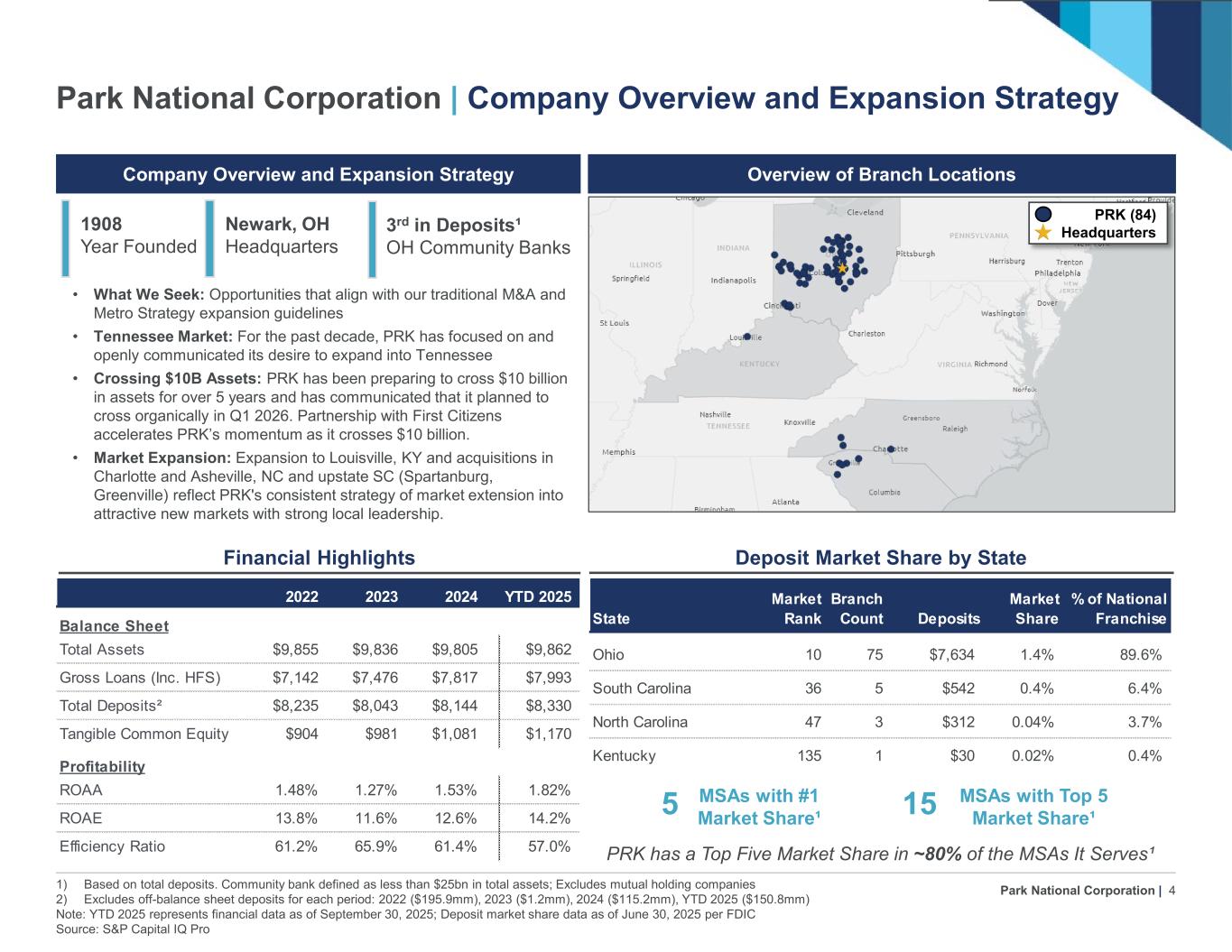

Park National Corporation | 4 1) Based on total deposits. Community bank defined as less than $25bn in total assets; Excludes mutual holding companies 2) Excludes off-balance sheet deposits for each period: 2022 ($195.9mm), 2023 ($1.2mm), 2024 ($115.2mm), YTD 2025 ($150.8mm) Note: YTD 2025 represents financial data as of September 30, 2025; Deposit market share data as of June 30, 2025 per FDIC Source: S&P Capital IQ Pro Park National Corporation | Company Overview and Expansion Strategy 2022 2023 2024 YTD 2025 Balance Sheet Total Assets $9,855 $9,836 $9,805 $9,862 Gross Loans (Inc. HFS) $7,142 $7,476 $7,817 $7,993 Total Deposits² $8,235 $8,043 $8,144 $8,330 Tangible Common Equity $904 $981 $1,081 $1,170 Profitability ROAA 1.48% 1.27% 1.53% 1.82% ROAE 13.8% 11.6% 12.6% 14.2% Efficiency Ratio 61.2% 65.9% 61.4% 57.0% Financial Highlights Deposit Market Share by State Newark, OH Headquarters 3rd in Deposits¹ OH Community Banks Company Overview and Expansion Strategy Overview of Branch Locations • What We Seek: Opportunities that align with our traditional M&A and Metro Strategy expansion guidelines • Tennessee Market: For the past decade, PRK has focused on and openly communicated its desire to expand into Tennessee • Crossing $10B Assets: PRK has been preparing to cross $10 billion in assets for over 5 years and has communicated that it planned to cross organically in Q1 2026. Partnership with First Citizens accelerates PRK’s momentum as it crosses $10 billion. • Market Expansion: Expansion to Louisville, KY and acquisitions in Charlotte and Asheville, NC and upstate SC (Spartanburg, Greenville) reflect PRK's consistent strategy of market extension into attractive new markets with strong local leadership. PRK (84) Headquarters PRK has a Top Five Market Share in ~80% of the MSAs It Serves¹ 1908 Year Founded 5 MSAs with #1 Market Share¹ 15 MSAs with Top 5 Market Share¹ State Market Rank Branch Count Deposits Market Share % of National Franchise Ohio 10 75 $7,634 1.4% 89.6% South Carolina 36 5 $542 0.4% 6.4% North Carolina 47 3 $312 0.04% 3.7% Kentucky 135 1 $30 0.02% 0.4%

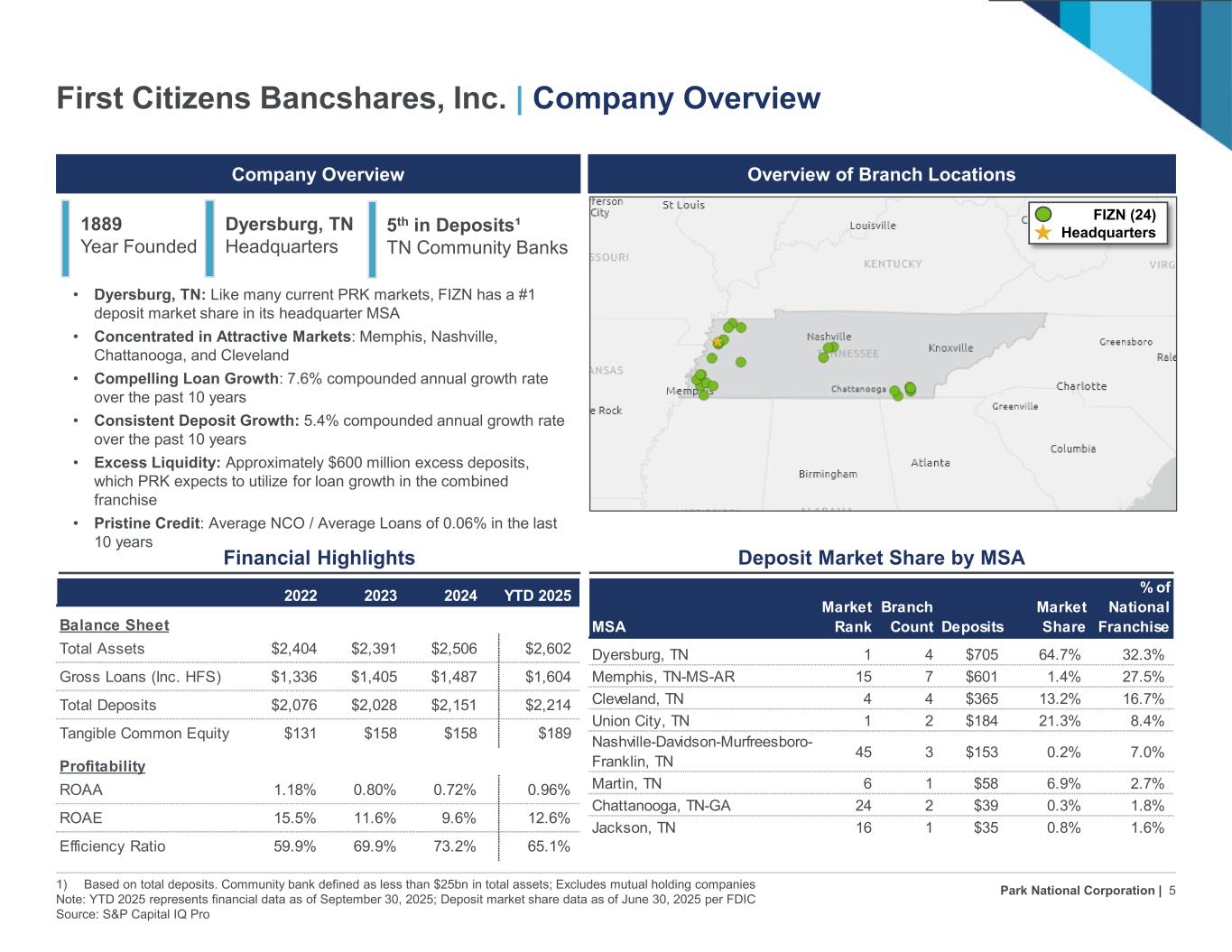

Park National Corporation | 5 1) Based on total deposits. Community bank defined as less than $25bn in total assets; Excludes mutual holding companies Note: YTD 2025 represents financial data as of September 30, 2025; Deposit market share data as of June 30, 2025 per FDIC Source: S&P Capital IQ Pro First Citizens Bancshares, Inc. | Company Overview Financial Highlights Deposit Market Share by MSA Company Overview Overview of Branch Locations • Dyersburg, TN: Like many current PRK markets, FIZN has a #1 deposit market share in its headquarter MSA • Concentrated in Attractive Markets: Memphis, Nashville, Chattanooga, and Cleveland • Compelling Loan Growth: 7.6% compounded annual growth rate over the past 10 years • Consistent Deposit Growth: 5.4% compounded annual growth rate over the past 10 years • Excess Liquidity: Approximately $600 million excess deposits, which PRK expects to utilize for loan growth in the combined franchise • Pristine Credit: Average NCO / Average Loans of 0.06% in the last 10 years 2022 2023 2024 YTD 2025 Balance Sheet Total Assets $2,404 $2,391 $2,506 $2,602 Gross Loans (Inc. HFS) $1,336 $1,405 $1,487 $1,604 Total Deposits $2,076 $2,028 $2,151 $2,214 Tangible Common Equity $131 $158 $158 $189 Profitability ROAA 1.18% 0.80% 0.72% 0.96% ROAE 15.5% 11.6% 9.6% 12.6% Efficiency Ratio 59.9% 69.9% 73.2% 65.1% 1889 Year Founded Dyersburg, TN Headquarters 5th in Deposits¹ TN Community Banks MSA Market Rank Branch Count Deposits Market Share % of National Franchise Dyersburg, TN 1 4 $705 64.7% 32.3% Memphis, TN-MS-AR 15 7 $601 1.4% 27.5% Cleveland, TN 4 4 $365 13.2% 16.7% Union City, TN 1 2 $184 21.3% 8.4% Nashville-Davidson-Murfreesboro- Franklin, TN 45 3 $153 0.2% 7.0% Martin, TN 6 1 $58 6.9% 2.7% Chattanooga, TN-GA 24 2 $39 0.3% 1.8% Jackson, TN 16 1 $35 0.8% 1.6% FIZN (24) Headquarters

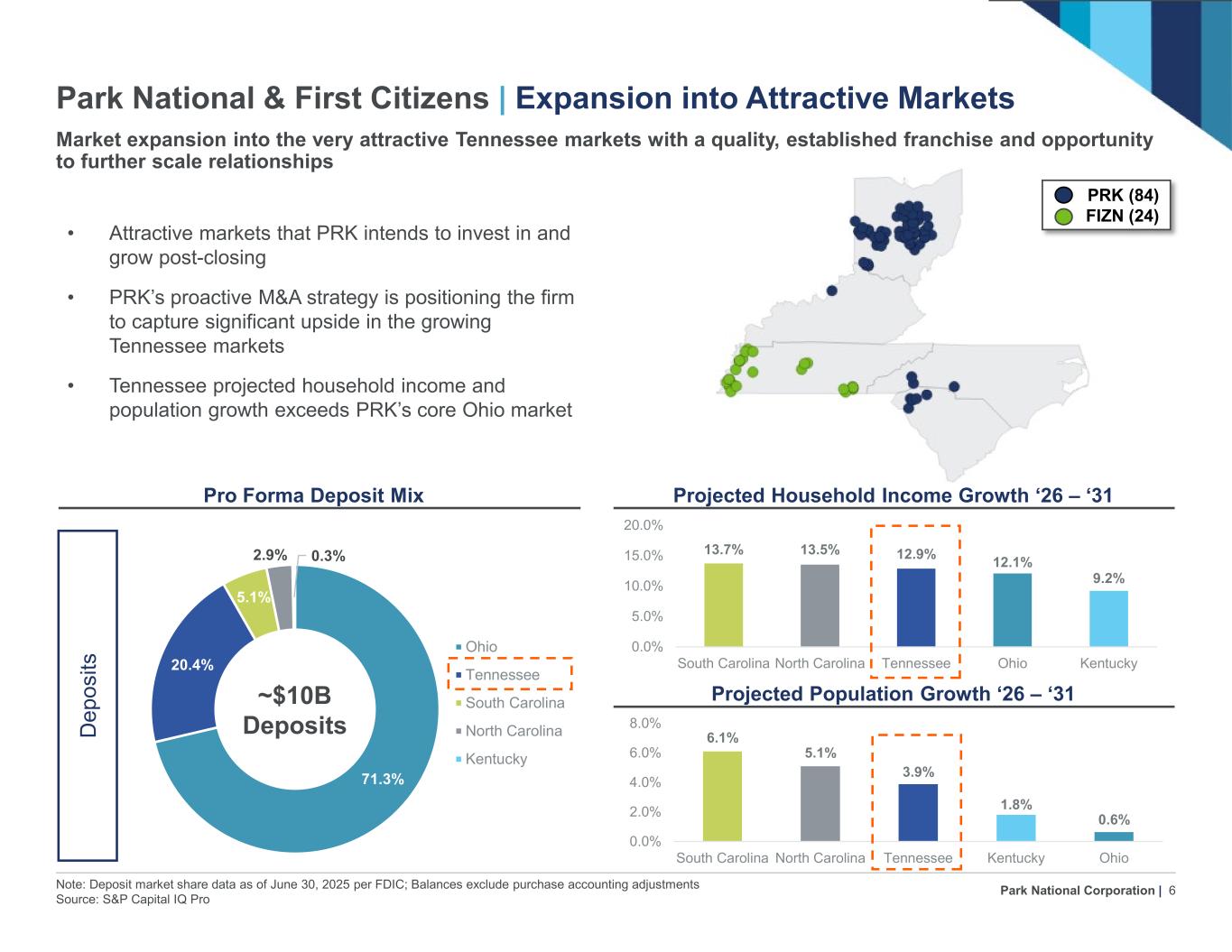

Park National Corporation | 6 Note: Deposit market share data as of June 30, 2025 per FDIC; Balances exclude purchase accounting adjustments Source: S&P Capital IQ Pro Market expansion into the very attractive Tennessee markets with a quality, established franchise and opportunity to further scale relationships Park National & First Citizens | Expansion into Attractive Markets 71.3% 20.4% 5.1% 2.9% 0.3% Ohio Tennessee South Carolina North Carolina Kentucky D ep os its 6.1% 5.1% 3.9% 1.8% 0.6% 0.0% 2.0% 4.0% 6.0% 8.0% South Carolina North Carolina Tennessee Kentucky Ohio 13.7% 13.5% 12.9% 12.1% 9.2% 0.0% 5.0% 10.0% 15.0% 20.0% South Carolina North Carolina Tennessee Ohio Kentucky Projected Population Growth ‘26 – ‘31 Projected Household Income Growth ‘26 – ‘31 ~$10B Deposits Pro Forma Deposit Mix • Attractive markets that PRK intends to invest in and grow post-closing • PRK’s proactive M&A strategy is positioning the firm to capture significant upside in the growing Tennessee markets • Tennessee projected household income and population growth exceeds PRK’s core Ohio market PRK (84) FIZN (24)

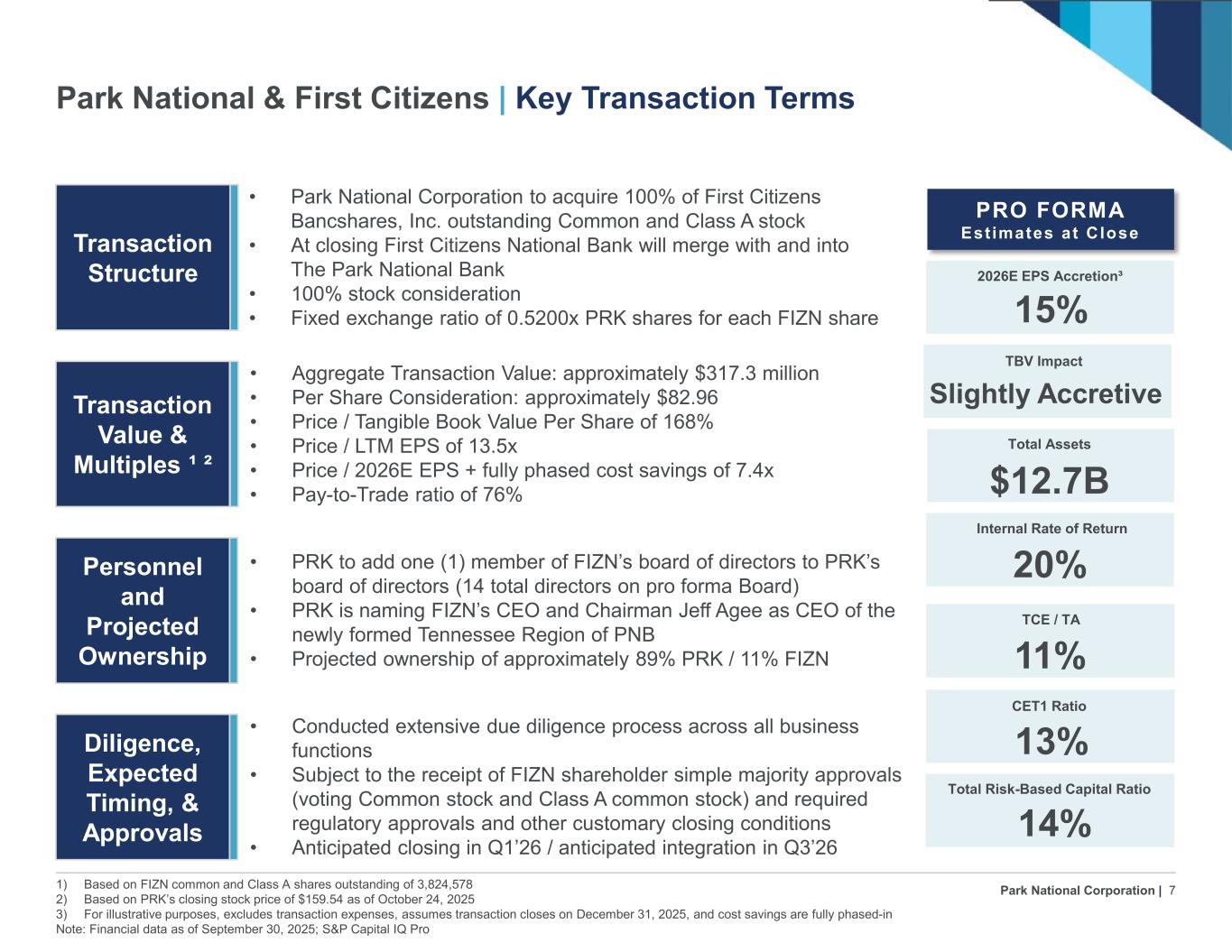

Park National Corporation | 7 1) Based on FIZN common and Class A shares outstanding of 3,824,578 2) Based on PRK’s closing stock price of $159.54 as of October 24, 2025 3) For illustrative purposes, excludes transaction expenses, assumes transaction closes on December 31, 2025, and cost savings are fully phased-in Note: Financial data as of September 30, 2025; S&P Capital IQ Pro Park National & First Citizens | Key Transaction Terms Transaction Structure • Park National Corporation to acquire 100% of First Citizens Bancshares, Inc. outstanding Common and Class A stock • At closing First Citizens National Bank will merge with and into The Park National Bank • 100% stock consideration • Fixed exchange ratio of 0.5200x PRK shares for each FIZN share Transaction Value & Multiples ¹ ² • Aggregate Transaction Value: approximately $317.3 million • Per Share Consideration: approximately $82.96 • Price / Tangible Book Value Per Share of 168% • Price / LTM EPS of 13.5x • Price / 2026E EPS + fully phased cost savings of 7.4x • Pay-to-Trade ratio of 76% Personnel and Projected Ownership • PRK to add one (1) member of FIZN’s board of directors to PRK’s board of directors (14 total directors on pro forma Board) • PRK is naming FIZN’s CEO and Chairman Jeff Agee as CEO of the newly formed Tennessee Region of PNB • Projected ownership of approximately 89% PRK / 11% FIZN Diligence, Expected Timing, & Approvals • Conducted extensive due diligence process across all business functions • Subject to the receipt of FIZN shareholder simple majority approvals (voting Common stock and Class A common stock) and required regulatory approvals and other customary closing conditions • Anticipated closing in Q1’26 / anticipated integration in Q3’26 2026E EPS Accretion³ 15% PRO FORMA Estimates at Close TBV Impact Slightly Accretive Total Assets $12.7B TCE / TA 11% CET1 Ratio 13% Total Risk-Based Capital Ratio 14% Internal Rate of Return 20%

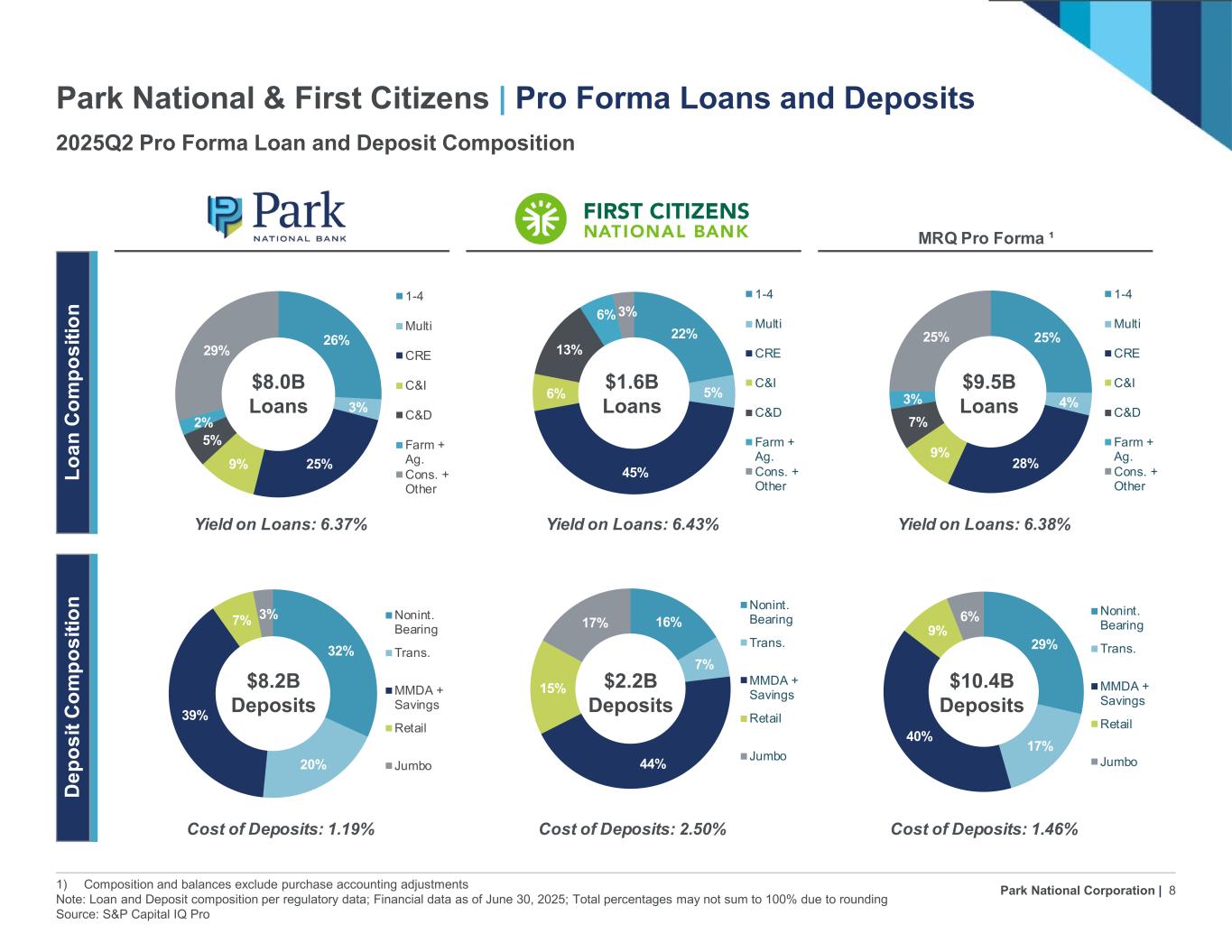

Park National Corporation | 8 MRQ Pro Forma ¹ Yield on Loans: 6.37% Yield on Loans: 6.43% Yield on Loans: 6.38% Cost of Deposits: 1.19% Cost of Deposits: 2.50% Cost of Deposits: 1.46% Lo an C om po si tio n D ep os it C om po si tio n 26% 3% 25% 9% 5% 2% 29% 1-4 Multi CRE C&I C&D Farm + Ag. Cons. + Other 22% 5% 45% 6% 13% 6% 3% 1-4 Multi CRE C&I C&D Farm + Ag. Cons. + Other 25% 4% 28% 9% 7% 3% 25% 1-4 Multi CRE C&I C&D Farm + Ag. Cons. + Other 16% 7% 44% 15% 17% Nonint. Bearing Trans. MMDA + Savings Retail Jumbo 29% 17% 40% 9% 6% Nonint. Bearing Trans. MMDA + Savings Retail Jumbo 32% 20% 39% 7% 3% Nonint. Bearing Trans. MMDA + Savings Retail Jumbo 1) Composition and balances exclude purchase accounting adjustments Note: Loan and Deposit composition per regulatory data; Financial data as of June 30, 2025; Total percentages may not sum to 100% due to rounding Source: S&P Capital IQ Pro Park National & First Citizens | Pro Forma Loans and Deposits $8.0B Loans $8.2B Deposits $1.6B Loans $9.5B Loans $10.4B Deposits $2.2B Deposits 2025Q2 Pro Forma Loan and Deposit Composition

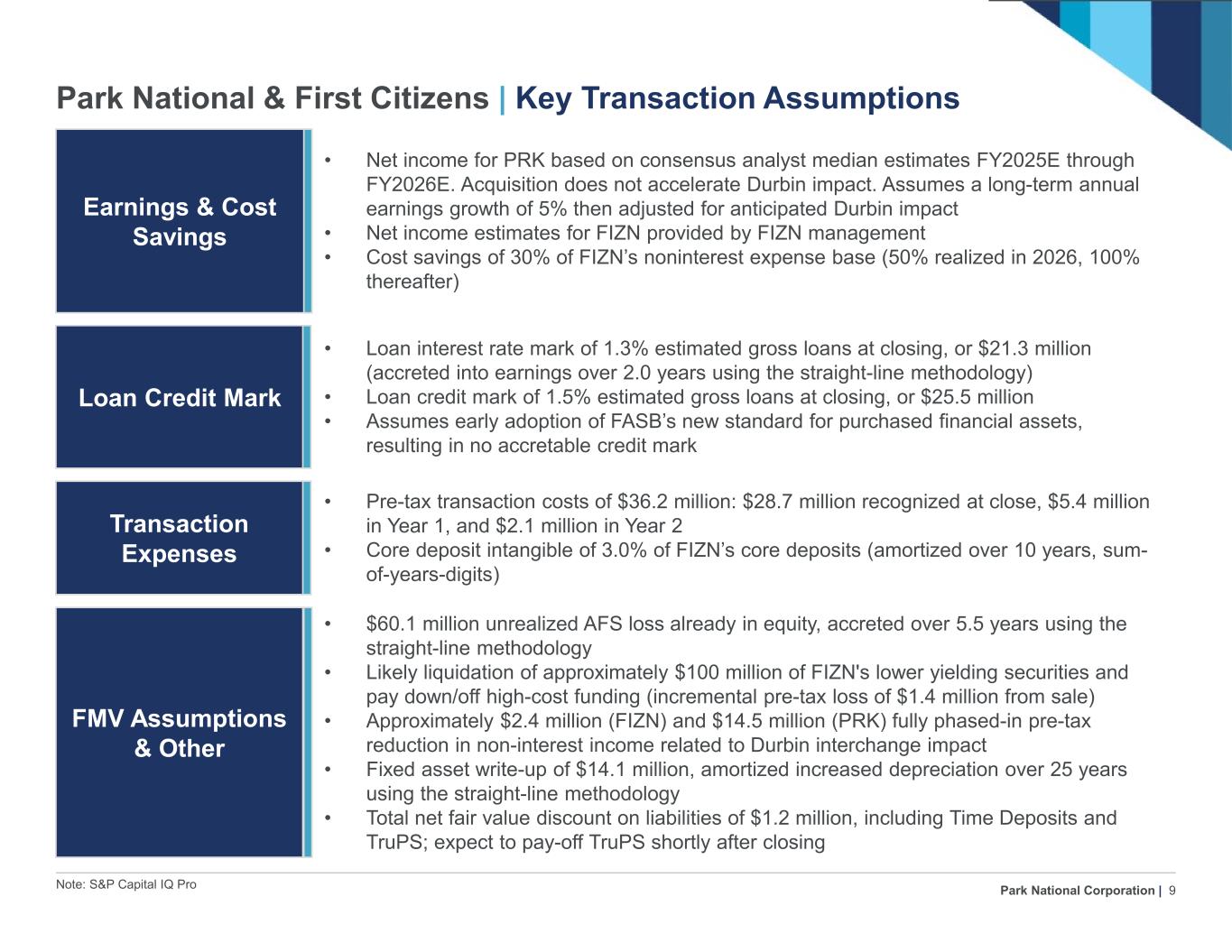

Park National Corporation | 9 Note: S&P Capital IQ Pro Park National & First Citizens | Key Transaction Assumptions Earnings & Cost Savings • Net income for PRK based on consensus analyst median estimates FY2025E through FY2026E. Acquisition does not accelerate Durbin impact. Assumes a long-term annual earnings growth of 5% then adjusted for anticipated Durbin impact • Net income estimates for FIZN provided by FIZN management • Cost savings of 30% of FIZN’s noninterest expense base (50% realized in 2026, 100% thereafter) Loan Credit Mark • Loan interest rate mark of 1.3% estimated gross loans at closing, or $21.3 million (accreted into earnings over 2.0 years using the straight-line methodology) • Loan credit mark of 1.5% estimated gross loans at closing, or $25.5 million • Assumes early adoption of FASB’s new standard for purchased financial assets, resulting in no accretable credit mark Transaction Expenses • Pre-tax transaction costs of $36.2 million: $28.7 million recognized at close, $5.4 million in Year 1, and $2.1 million in Year 2 • Core deposit intangible of 3.0% of FIZN’s core deposits (amortized over 10 years, sum- of-years-digits) FMV Assumptions & Other • $60.1 million unrealized AFS loss already in equity, accreted over 5.5 years using the straight-line methodology • Likely liquidation of approximately $100 million of FIZN's lower yielding securities and pay down/off high-cost funding (incremental pre-tax loss of $1.4 million from sale) • Approximately $2.4 million (FIZN) and $14.5 million (PRK) fully phased-in pre-tax reduction in non-interest income related to Durbin interchange impact • Fixed asset write-up of $14.1 million, amortized increased depreciation over 25 years using the straight-line methodology • Total net fair value discount on liabilities of $1.2 million, including Time Deposits and TruPS; expect to pay-off TruPS shortly after closing

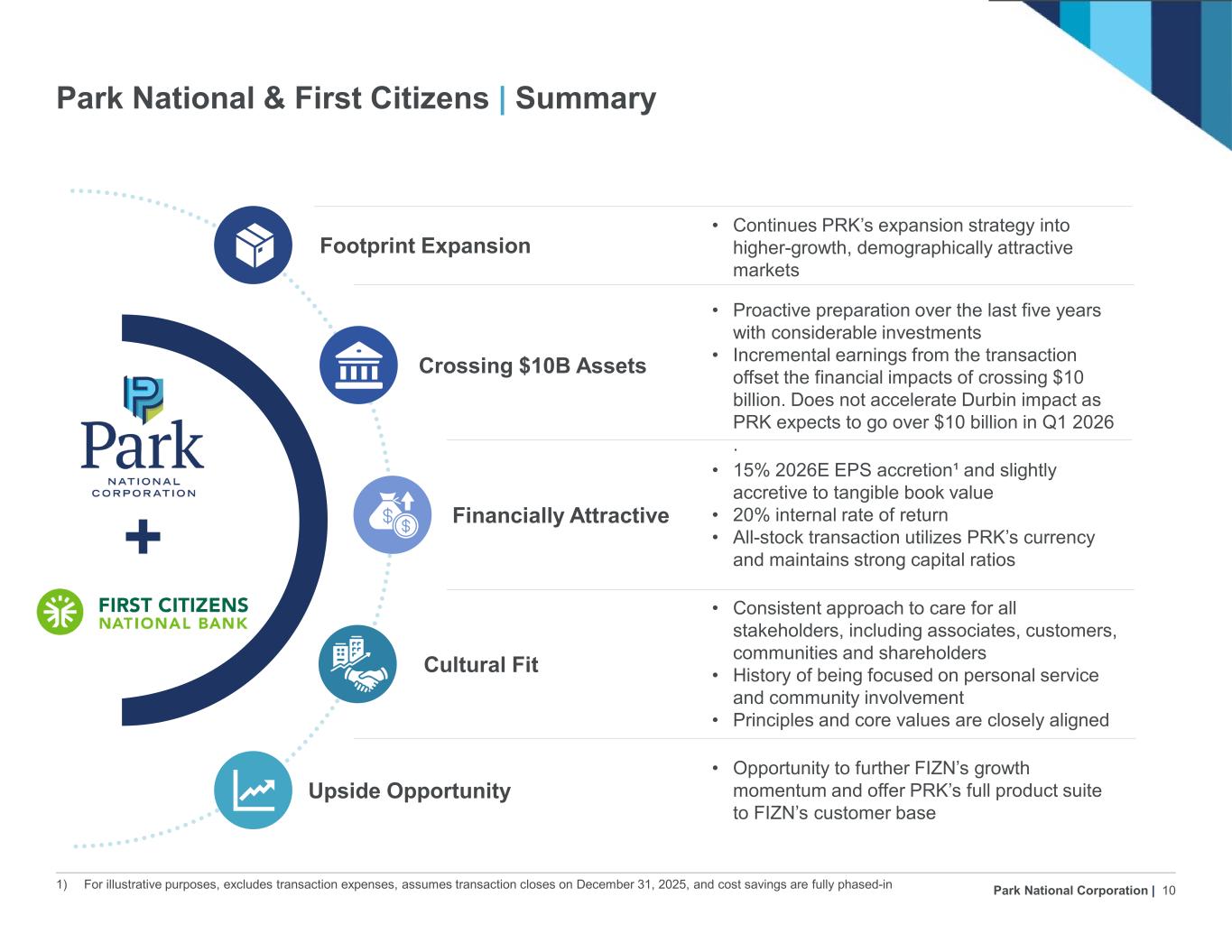

Park National Corporation | 10 1) For illustrative purposes, excludes transaction expenses, assumes transaction closes on December 31, 2025, and cost savings are fully phased-in Park National & First Citizens | Summary Crossing $10B Assets Cultural Fit Footprint Expansion Upside Opportunity Financially Attractive+ • Continues PRK’s expansion strategy into higher-growth, demographically attractive markets • Proactive preparation over the last five years with considerable investments • Incremental earnings from the transaction offset the financial impacts of crossing $10 billion. Does not accelerate Durbin impact as PRK expects to go over $10 billion in Q1 2026 . • 15% 2026E EPS accretion¹ and slightly accretive to tangible book value • 20% internal rate of return • All-stock transaction utilizes PRK’s currency and maintains strong capital ratios • Opportunity to further FIZN’s growth momentum and offer PRK’s full product suite to FIZN’s customer base • Consistent approach to care for all stakeholders, including associates, customers, communities and shareholders • History of being focused on personal service and community involvement • Principles and core values are closely aligned

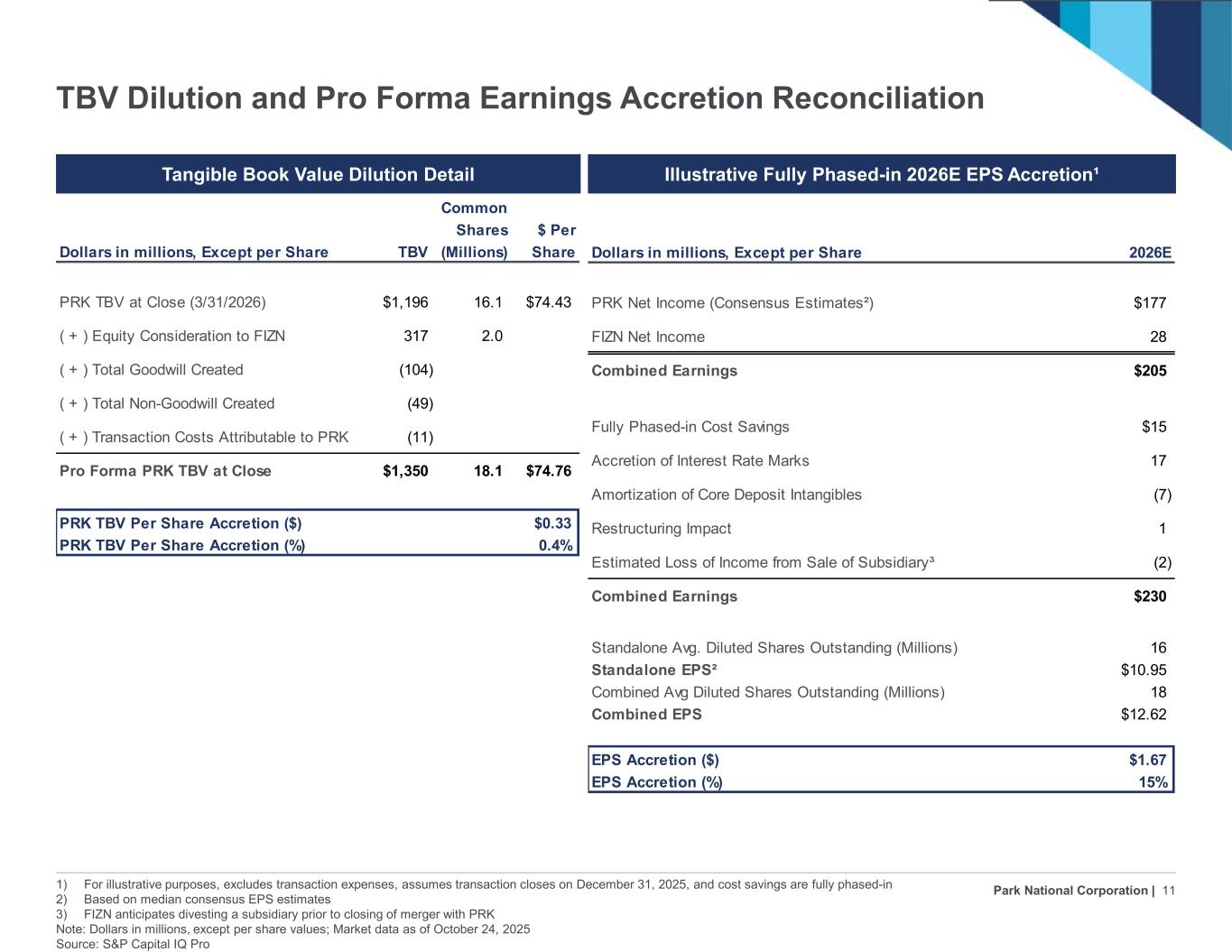

Park National Corporation | 11 1) For illustrative purposes, excludes transaction expenses, assumes transaction closes on December 31, 2025, and cost savings are fully phased-in 2) Based on median consensus EPS estimates 3) FIZN anticipates divesting a subsidiary prior to closing of merger with PRK Note: Dollars in millions, except per share values; Market data as of October 24, 2025 Source: S&P Capital IQ Pro TBV Dilution and Pro Forma Earnings Accretion Reconciliation Tangible Book Value Dilution Detail Illustrative Fully Phased-in 2026E EPS Accretion¹ Common Shares $ Per Dollars in millions, Except per Share TBV (Millions) Share PRK TBV at Close (3/31/2026) $1,196 16.1 $74.43 ( + ) Equity Consideration to FIZN 317 2.0 ( + ) Total Goodwill Created (104) ( + ) Total Non-Goodwill Created (49) ( + ) Transaction Costs Attributable to PRK (11) Pro Forma PRK TBV at Close $1,350 18.1 $74.76 PRK TBV Per Share Accretion ($) $0.33 PRK TBV Per Share Accretion (%) 0.4% Dollars in millions, Except per Share 2026E PRK Net Income (Consensus Estimates²) $177 FIZN Net Income 28 Combined Earnings $205 Fully Phased-in Cost Savings $15 Accretion of Interest Rate Marks 17 Amortization of Core Deposit Intangibles (7) Restructuring Impact 1 Estimated Loss of Income from Sale of Subsidiary³ (2) Combined Earnings $230 Standalone Avg. Diluted Shares Outstanding (Millions) 16 Standalone EPS² $10.95 Combined Avg Diluted Shares Outstanding (Millions) 18 Combined EPS $12.62 EPS Accretion ($) $1.67 EPS Accretion (%) 15%

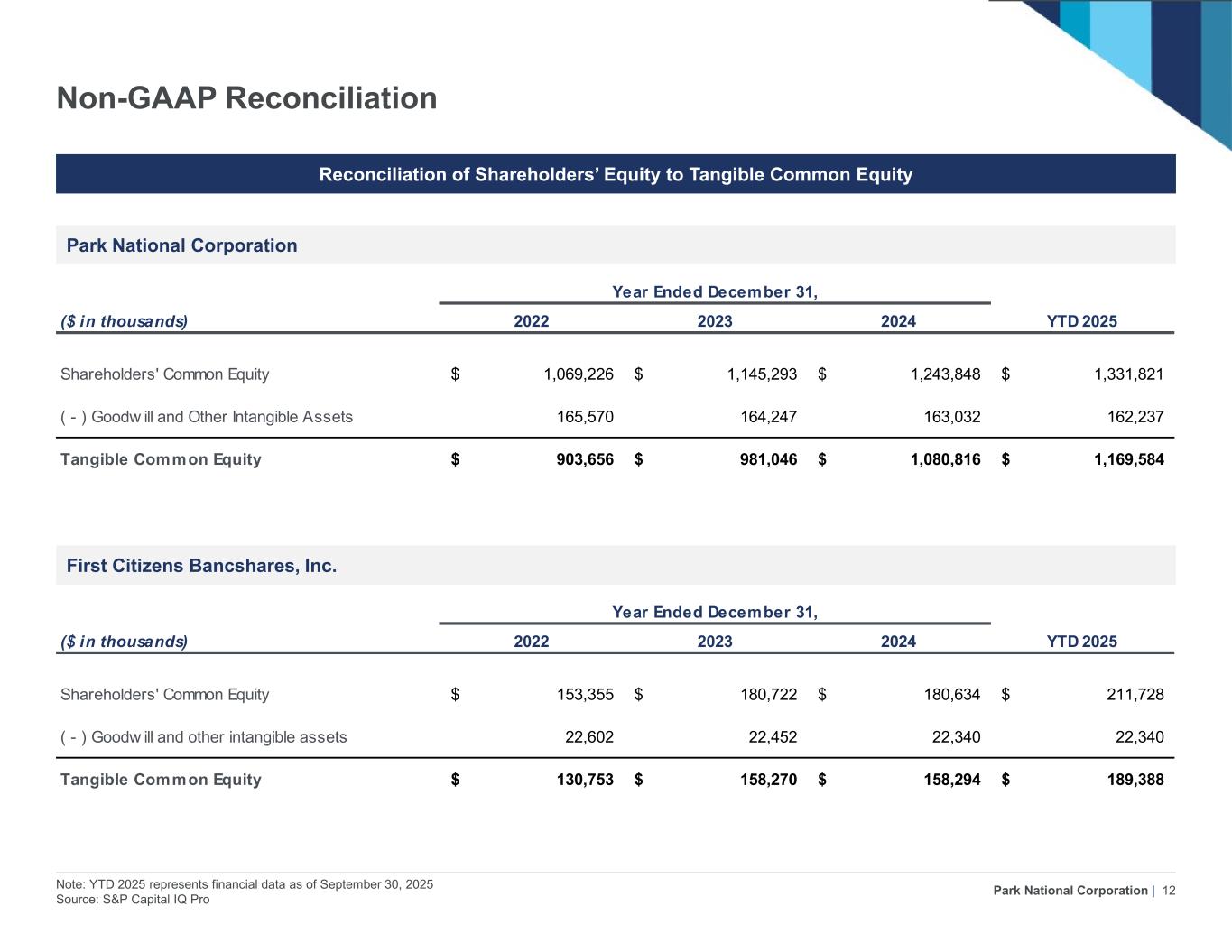

Park National Corporation | 12 Note: YTD 2025 represents financial data as of September 30, 2025 Source: S&P Capital IQ Pro Non-GAAP Reconciliation Reconciliation of Shareholders’ Equity to Tangible Common Equity Park National Corporation Year Ended December 31, ($ in thousands) 2022 2023 2024 YTD 2025 Shareholders' Common Equity 1,069,226$ 1,145,293$ 1,243,848$ 1,331,821$ ( - ) Goodw ill and Other Intangible Assets 165,570 164,247 163,032 162,237 Tangible Common Equity 903,656$ 981,046$ 1,080,816$ 1,169,584$ First Citizens Bancshares, Inc. Year Ended December 31, ($ in thousands) 2022 2023 2024 YTD 2025 Shareholders' Common Equity 153,355$ 180,722$ 180,634$ 211,728$ ( - ) Goodw ill and other intangible assets 22,602 22,452 22,340 22,340 Tangible Common Equity 130,753$ 158,270$ 158,294$ 189,388$