2

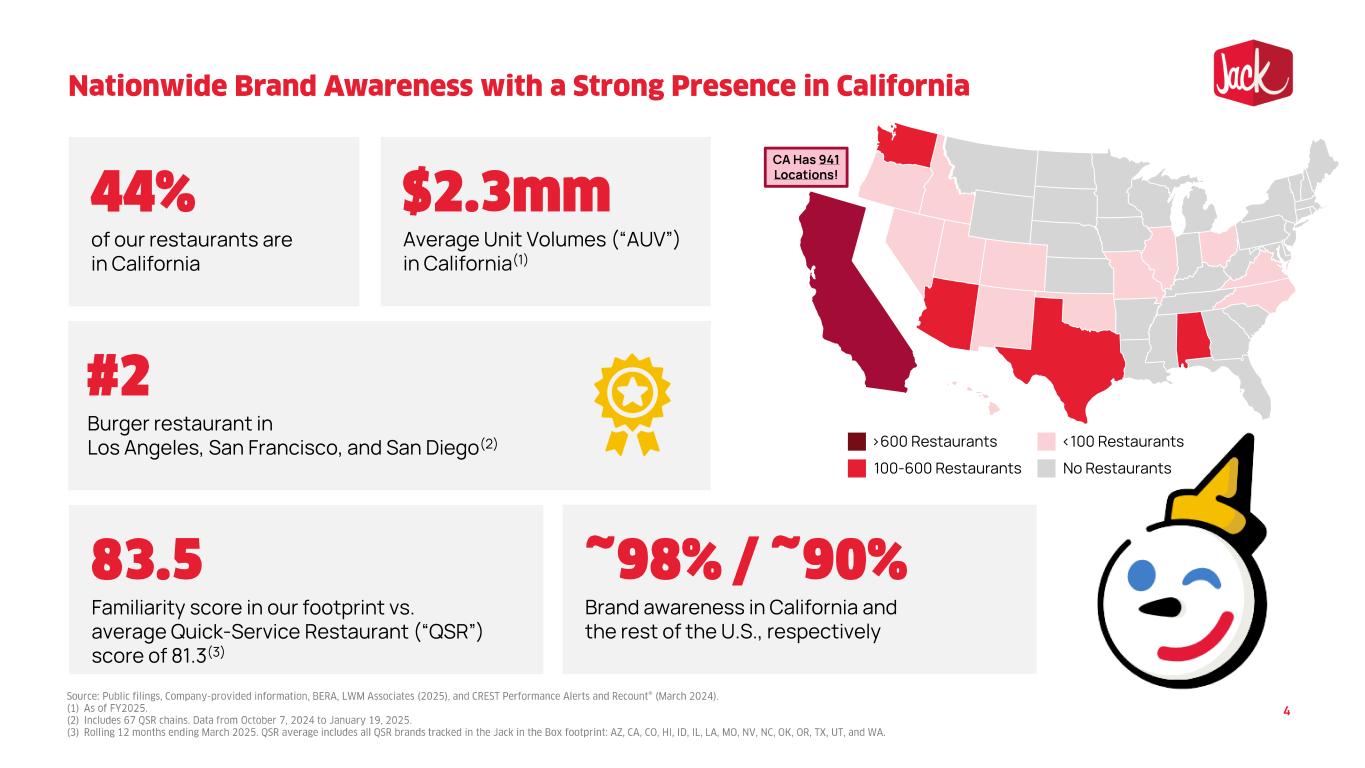

4 of our restaurants are in California Average Unit Volumes (“AUV”) in California(1) Burger restaurant in Los Angeles, San Francisco, and San Diego(2) Familiarity score in our footprint vs. average Quick-Service Restaurant (“QSR”) score of 81.3(3) Brand awareness in California and the rest of the U.S., respectively <100 Restaurants 100-600 Restaurants >600 Restaurants No Restaurants CA Has 941 Locations!

Innovative new menu offerings that drive broad guest appeal Consistent traffic across breakfast, lunch, dinner, and late night, serving our entire menu all day Experienced franchisee leaders ensuring operational excellence Strong unit economics outperforming category averages Appeals to a wide range of consumers #2 burger player in our markets and top 3 QSR in major cities Voted #2 Fast Food Restaurant by USA Today Readers’ Choice 2025 and Favorite Fast Food Restaurant in NV and AZ(1) 5

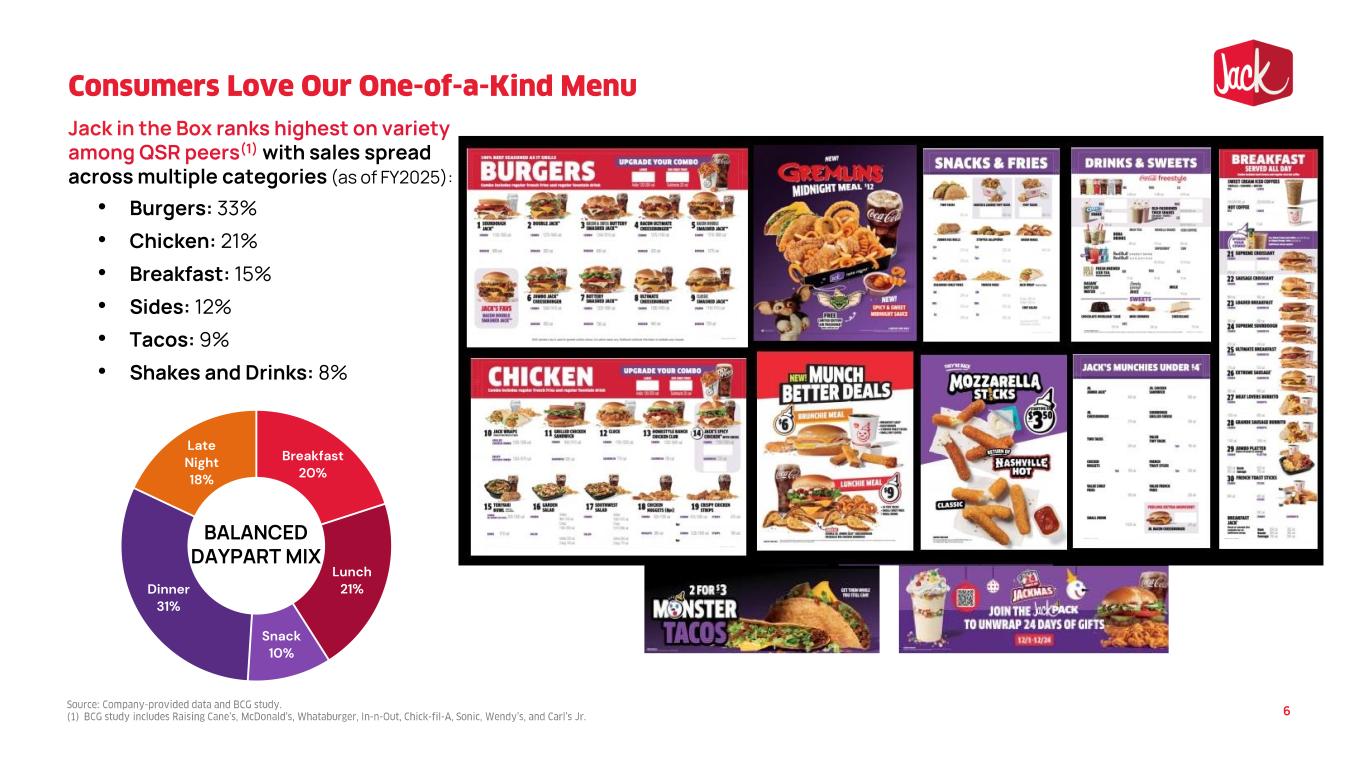

Jack in the Box ranks highest on variety among QSR peers(1) with sales spread across multiple categories (as of FY2025): • Burgers: 33% • Chicken: 21% • Breakfast: 15% • Sides: 12% • Tacos: 9% • Shakes and Drinks: 8% Breakfast 20% Lunch 21% Snack 10% Dinner 31% Late Night 18% BALANCED DAYPART MIX 6

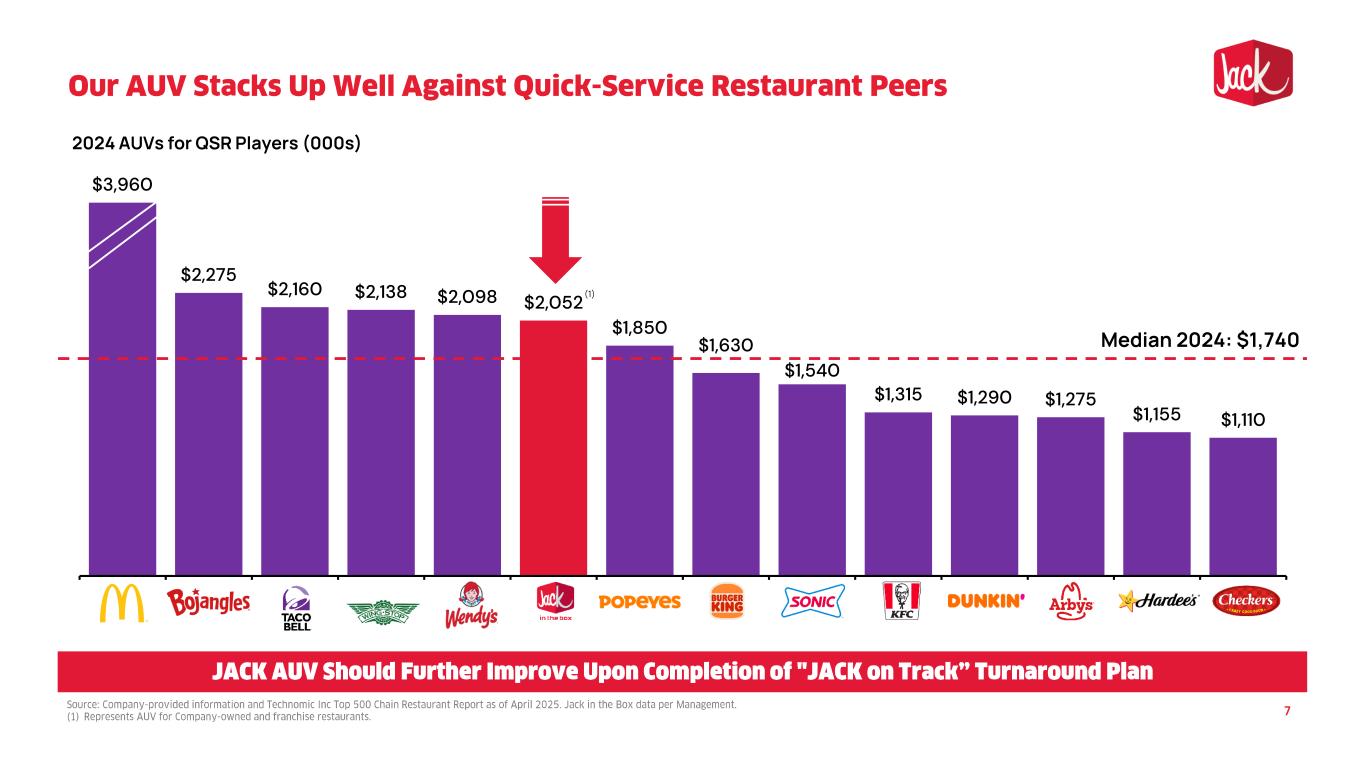

$3,960 $2,275 $2,160 $2,138 $2,098 $2,052 $1,850 $1,630 $1,540 $1,315 $1,290 $1,275 $1,155 $1,110 Median 2024: $1,740 7 2024 AUVs for QSR Players (000s) (1)

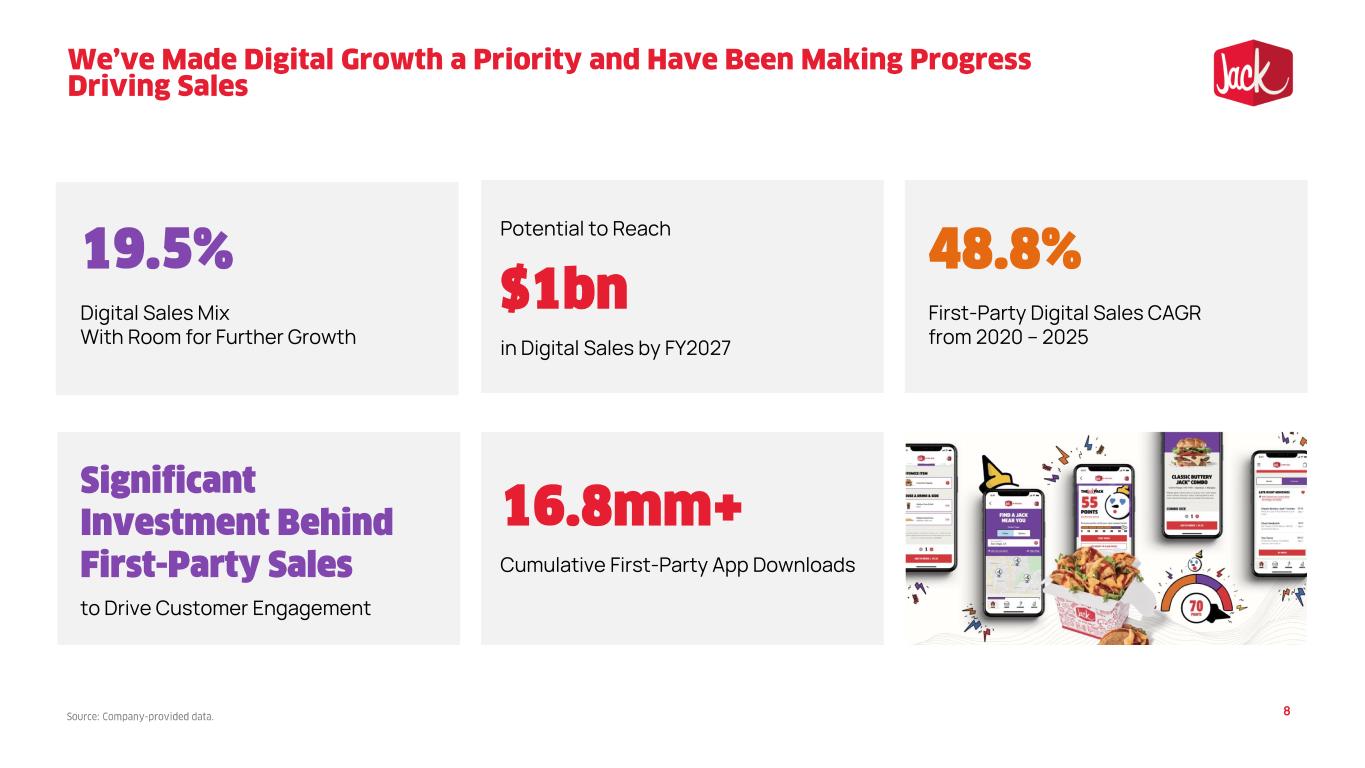

8 to Drive Customer Engagement Digital Sales Mix With Room for Further Growth in Digital Sales by FY2027 Potential to Reach First-Party Digital Sales CAGR from 2020 – 2025 Cumulative First-Party App Downloads

Prioritizing new unit growth led us to leave underperforming restaurants open… …Now we close underperforming restaurants and focus on strengthening unit economics and AUVs Historically did not prioritize technology & digital and fell behind peers… …But we’ve made great progress under a renewed focus on growing digital sales JACK was more focused on scaling via M&A causing underlying operations to suffer… …We’ve sold Del Taco and have reset our focus on what matters We weren’t always consistent in our operations… …Now we have hired a new COO and are focused on investing in needed operational changes 9

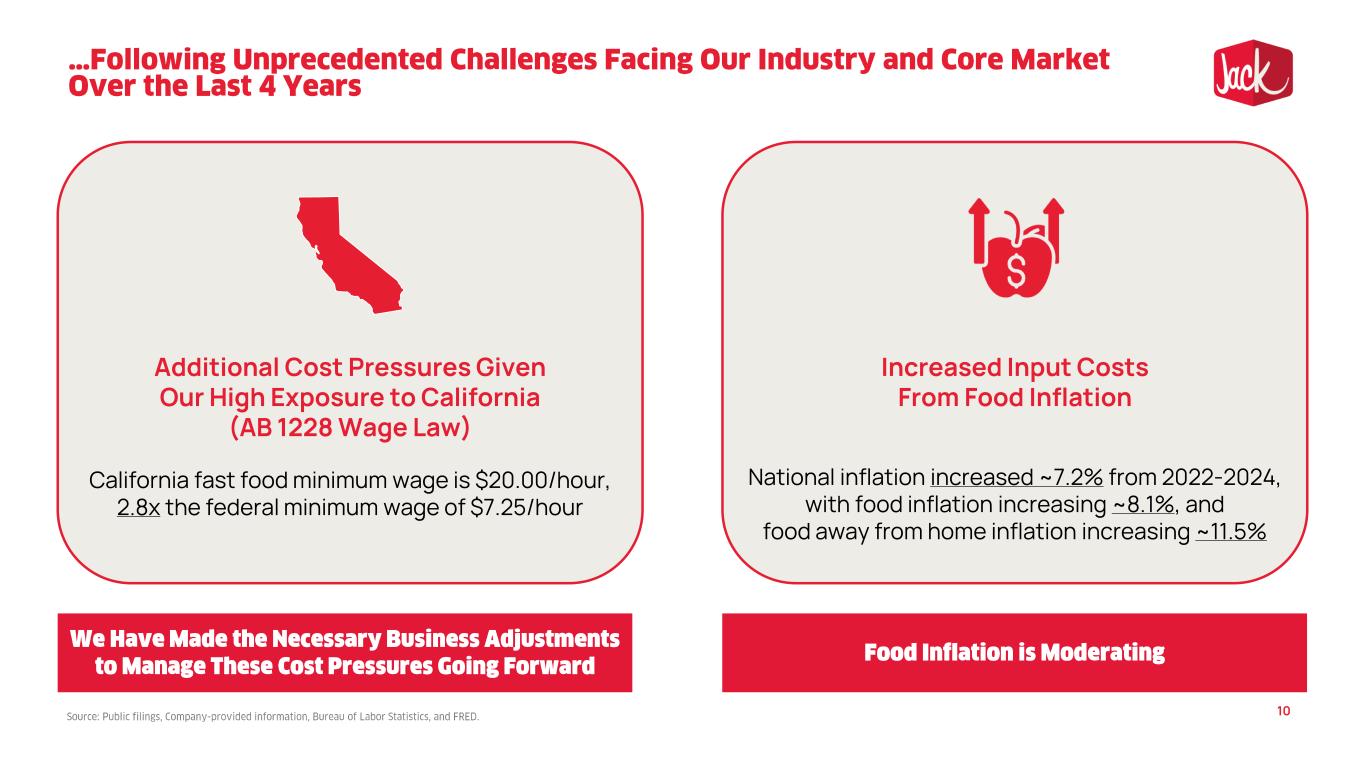

Additional Cost Pressures Given Our High Exposure to California (AB 1228 Wage Law) California fast food minimum wage is $20.00/hour, 2.8x the federal minimum wage of $7.25/hour Increased Input Costs From Food Inflation National inflation increased ~7.2% from 2022-2024, with food inflation increasing ~8.1%, and food away from home inflation increasing ~11.5% 10

in finance and leadership roles across the Deep experience in digital from his time as CFO and Chief Administrative Officer at , where he Served from 2018-2020 and from January 2025 until appointed Interim Principal Executive Officer in February 2025, then CEO in April 2025, providing and its business model Previously held executive roles at with expertise in 12

Objective: Improve Long-Term Financial Performance, Strengthen the Balance Sheet, and Position the Company for Sustainable Growth Accelerate cash flow and pay down debt to strengthen the balance sheet while preserving growth-oriented capital investments Close underperforming restaurants to improve system health and position JACK for consistent net unit growth and competitive unit economics Return to simplicity for Jack in the Box model and investor story 13

Accelerate cash flow by discontinuing dividend and pausing share repurchases, with majority of funds reallocated to debt paydown Closed on sale of Del Taco brand, simplifying Company structure and business model Focus on Franchisee Economics through block closure program, improving system health, and encouraging franchisees to reinvest Preserve growth-oriented capital investments related to technology and restaurant reimage; reducing spend on Company- owned restaurant growth Apply proceeds from targeted real estate sales toward debt reduction 14

• Made the decision to discontinue our dividend as of Q2 2025 • Action expected to preserve ~$35mm annually, which will be primarily directed toward debt reduction • ~$17mm of savings from ceasing dividend in FY2025 • Pause share repurchases until debt reduction goals achieved 15

• On October 15, 2025, sold Del Taco to Yadav Enterprises Inc. for $119mm, subject to customary adjustments • Closed in December 2025 • Net proceeds (after taxes and transaction costs) were used to retire $105mm in debt within our securitization structure on January 9, 2026 16

• Partnering with franchisees to close 150–200 underperforming restaurants • These restaurants underperform with $1.2mm AUV and ($70k) 4-wall EBITDA • 51 closures completed through Q4’25 as part of “JACK on Track” plan with additional closures expected in FY2026 • Closures have had an overall positive impact on our franchisees’ portfolio health • These closures are estimated to improve system 4-wall profitability by ~1% • Early results show strong sales transfer benefit of ~30% to nearby Jack in the Box restaurants 17

• Preserve growth-oriented capital investments related to technology and restaurant reimage • Reduce Company-owned unit openings from 12 in FY2025 to 2 expected in FY2026 • FY2026 CapEx guidance of $45-$55mm, substantially below prior year spend of $88mm 18

• Apply proceeds from targeted real estate sales toward debt reduction • Net proceeds from Del Taco sale have been used for debt reduction • Expect to pay down an additional $200mm+ of debt over the course of the “JACK on Track” plan • Targeting Net Debt / EBITDA of 4-5x upon program completion 19

I got my 1st franchise location in 1983, and I have seen many different leaderships throughout my years. Lance has been doing an excellent job, and he has my support and commitment. We need to let him continue the path he has laid as we are starting to see the improvements. He has my unconditional support. In my opinion since he joined, he strengthened and started to control the situation and brought the Company some stability. Sudesh Sood Owner/Partner/Operator, 150+ Jack in the Box Locations Jack in the Box has been going through a difficult situation, and Lance has done an outstanding job since he took over to try to resolve it and move the brand in the right direction. He has my full support. Lance brings the leadership and experience that we need right now at Jack in the Box. Please let him do his job. Ben Nematzadeh Owner/Partner/Operator, 100+ Jack in the Box Locations During a difficult period for the industry, Lance Tucker has stepped into the unenviable role of CEO at Jack in the Box and delivered steady, pragmatic leadership. Facing heavy franchisor debt and shrinking franchisee margins, he has balanced corporate financial prudence with measures that protect and restore franchisee profitability. Mr. Tucker acted decisively to sell Del Taco—both to reduce debt and to refocus the Company on the Jack in the Box brand—recognizing that we cannot weather this storm without a laser focus on our core business. He also reversed the previous “growth for growth’s sake” approach, reevaluating lease terms and market penetration, and permitting franchisees to close unprofitable locations. Those steps give franchisees much-needed financial respite during the downturn. Throughout his tenure, Mr. Tucker has listened to stakeholders, acknowledged corporate shortcomings, and made tough choices that reflect what is feasible and fair for all parties. His steady, inclusive approach is exactly what the Company needs as we navigate these treacherous waters. We should all continue to support his leadership. Pankaj Bhatia Operator/Partner, 18 Jack in the Box Locations Jack in the Box has been more than a business for our family. As a second- generation operator, it has allowed us to grow, create stability, and now welcome a third generation into the legacy we’ve built together. Lance’s leadership has been instrumental during a challenging time for the brand. He stepped in to pick up the pieces left by previous leadership, establishing a clear path focused on strengthening the brand and ensuring its continued future. Through his commitment to accountability, debt reduction, and long-term sustainability, he continues to show us a confident way forward. Nikki Sood-Bhatia 2nd Generation Franchise Operator for Jack in the Box & Partner Jack in the Box Operators Association President I have been with Jack in the Box since high school and seen some tough times, but this is probably the toughest. Lance and his leadership team have done a superb job of taking control of the situation, dealing with it, and improving it. They have a plan and it is starting to yield results. They have my 100% support. We do not need a change right now! Eddie Nieves Owner/Partner/Operator, 30+ Jack in the Box Locations 20

21

CapEx SG&A Franchise Level Margin Restaurant Count Same Store Sales vs. FY2025 Company-Owned Restaurant Level Margin D&A Adjusted EBITDA 22

CC*AC* Source: Company website, 2026 Proxy statement, and FactSet. AC = Audit Committee CC = Compensation Committee NG = Nominating and Governance Committee CA = Capital Allocation Committee * = Denotes Chair James Myers ACCOUNTING, FINANCE, AND STRATEGIC PLANNING Michael Murphy Independent DirectorIndependent Director MARKETING, CONSUMER BRANDS, AND M&A = Three new independent Directors have joined the Board over the last three years Guillermo Diaz Jr. Independent Director AC, NG • Telecommunications and information technology executive – led at both Cisco Systems and Kloudspot • Proven skill of digital transformation – enhances our customer experience through technology, operational efficiency, and digital engagement DIGITAL TRANSFORMATION EXPERTISE SUPPLY CHAIN MANAGEMENT, FOOD SERVICE, AND HOSPITALITY David Goebel Independent Chair CC, NG • Provides highly relevant, hands-on experience in restaurant operations, concept development, and supply chain management • Proven restaurant operator as the former CEO and President of Applebee’s FINANCE AND RESTAURANT OPERATIONS Lance Tucker CEO Vivien Yeung Independent Director AC, NG • Extensive experience in strategy, marketing, and growth from leadership roles at Kohl’s, Lululemon, and Starbucks • Expertise in channel development and pricing supports our efforts to strengthen brand positioning STRATEGY, PRODUCT MANAGEMENT, AND INTERNATIONAL GROWTH • Decade of experience as a restaurant industry executive leading operational improvements and driving performance – critical for us • Unique perspective on aligning financial discipline with strategic growth in the QSR sector from 20+ years in corporate finance Mark King Independent Director BRAND BUILDING AND FRANCHISE GROWTH AC, NG • As former CEO of Taco Bell, provides deep insight into operations, brand positioning, and innovation – critical perspectives to our turnaround plan execution • Successfully led turnarounds at global brands such as adidas and TaylorMade CC, NG* • Extensive legal and governance expertise, including as General Counsel for Hilton Hotels and H.F. Ahmanson • Hospitality franchising experience is directly relevant to our franchisee model CORPORATE GOVERNANCE, LEGAL ACUMEN, AND RISK MANAGEMENT Independent Director Madeleine Kleiner Enrique Ramirez Independent Director AC, CA RESTAURANT OPERATIONS AND FINANCE • Critical financial expertise and operational insight from his leadership experience in multi-unit retail and global restaurant operations • Valuable strategic insights as former CFO and COO of Darden Restaurants • Financial and operational expertise; former CEO and CFO of Sharp and a former Deloitte partner • Drives transparency, operational efficiency, and strategic oversight with a background in accounting, reporting, governance, and risk management • 35+ years of financial and operational experience • 10 years as a CPA & public company auditor with KPMG, and 25 years with Petco; expertise in M&A, capital markets, consumer brand strategy, and financial reporting CA*, CC • Significant capital allocation, investing, and real estate expertise • Entrepreneurial leadership and deep knowledge of Southern California— our largest market—provide valuable insight into market strategy and shareholder value creation OPERATIONS AND FINANCIAL DISCIPLINE Alan Smolinisky Independent Director CA 24 = top 30 shareholder

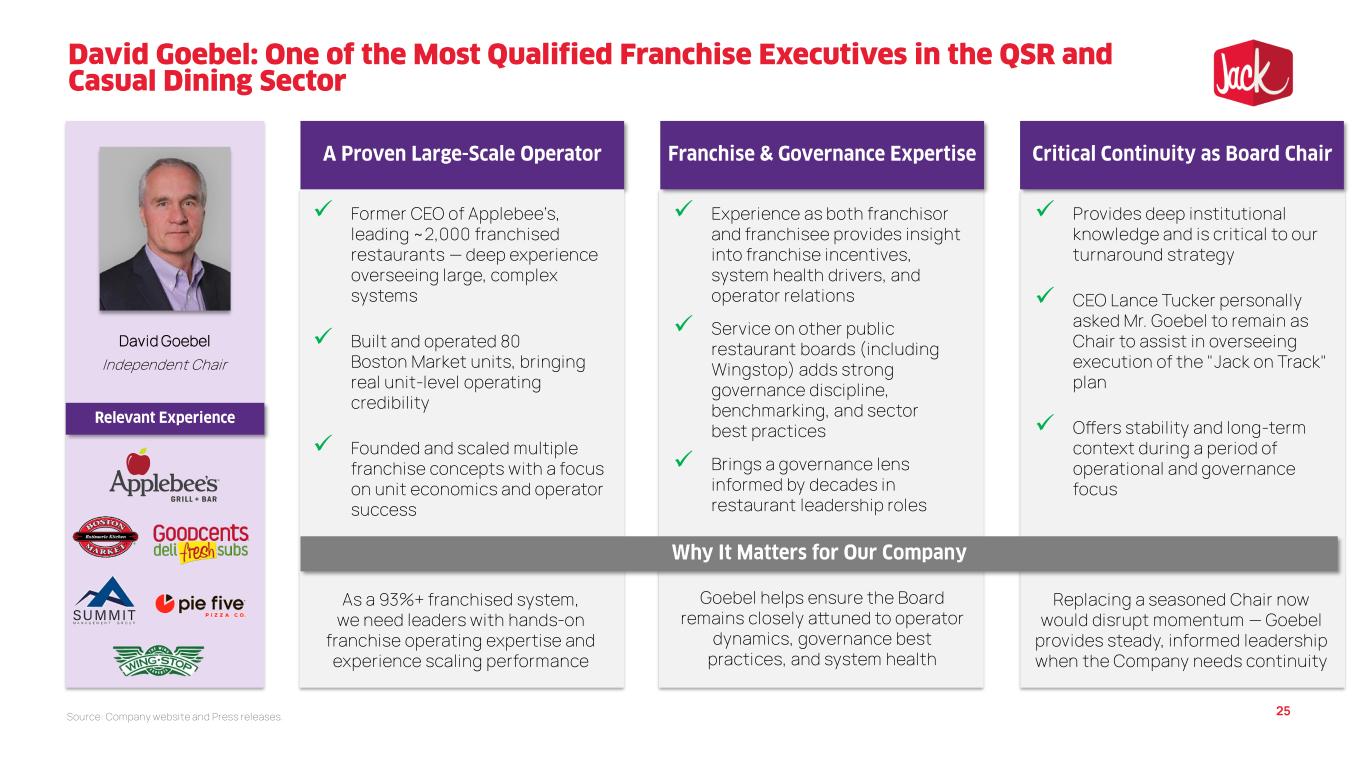

Source: Company website and Press releases. ✓ Former CEO of Applebee’s, leading ~2,000 franchised restaurants — deep experience overseeing large, complex systems ✓ Built and operated 80 Boston Market units, bringing real unit-level operating credibility ✓ Founded and scaled multiple franchise concepts with a focus on unit economics and operator success As a 93%+ franchised system, we need leaders with hands-on franchise operating expertise and experience scaling performance ✓ Experience as both franchisor and franchisee provides insight into franchise incentives, system health drivers, and operator relations ✓ Service on other public restaurant boards (including Wingstop) adds strong governance discipline, benchmarking, and sector best practices ✓ Brings a governance lens informed by decades in restaurant leadership roles ✓ Provides deep institutional knowledge and is critical to our turnaround strategy ✓ CEO Lance Tucker personally asked Mr. Goebel to remain as Chair to assist in overseeing execution of the "Jack on Track" plan ✓ Offers stability and long-term context during a period of operational and governance focus Replacing a seasoned Chair now would disrupt momentum — Goebel provides steady, informed leadership when the Company needs continuity Goebel helps ensure the Board remains closely attuned to operator dynamics, governance best practices, and system health David Goebel Independent Chair 25

Source: Company website and Press releases. Proven track record of driving results and deep experience as a strategic business leader within the restaurant industry. He has worked in finance for corporations across diverse industries, from restaurant franchising and real estate development to technology consulting, education services and online retail Before his return to Jack in the Box in 2025, he served as CFO at Davidson Hospitality as well as CFO of CKE Restaurants, where he led all finance and accounting functions for the organization Mr. Tucker also served as CFO of Jack in the Box from 2018 to 2020, during which he played an instrumental role in implementing the company’s securitization, while returning capital and value to shareholders. His leadership and strategic thinking had a positive impact on the business His resume also includes a 14+ year tenure at Papa John’s International, where he successfully implemented recurring dividends and negotiated joint venture agreements for global business 1. Page highlighting the skillets of Mark and Alan 2. Why each are valuable 3. Biglari told us that we needed additional QSR experience ✓ Extensive QSR & franchise experience: as CEO of Taco Bell, King drove brand strategy and performance both in the U.S. and internationally; deeply understands franchise operations, unit economics, and consumer dynamics in quick-service restaurants ✓ Led two successful turnarounds at global companies: as President of adida North America, doubled market share in under three years, and catapulted the TaylorMade business from $300mm to $1.7bn in sales during his time as President and CEO ✓ Real estate & capital allocation expertise: decades of experience building and scaling businesses in real estate which will benefi us as we return to a asset-light model ✓ Long-term, aligned shareholder: as a meaningful Jack in the Box shareholder (~1.0%), interests are strongly aligned with long-term investors ✓ Proven brand investor & operator: as a Co-Owner of the Los Angeles Dodgers, he has experience with iconic brands and high-profile businesses in our largest market–bringing strategic perspective to our brand evolution The Board needs more QSR experience The Board needs a shareholder perspective •In collaboration with o e of our shareholders, we added two new independent Directors to the Board in November 2025 •We added the former CEO of Taco Bell, adding significant QSR turnaround expertise •We added a significant Jack in the Box shareholder, who has notable expertise in our largest market 26 top 30 shareholder

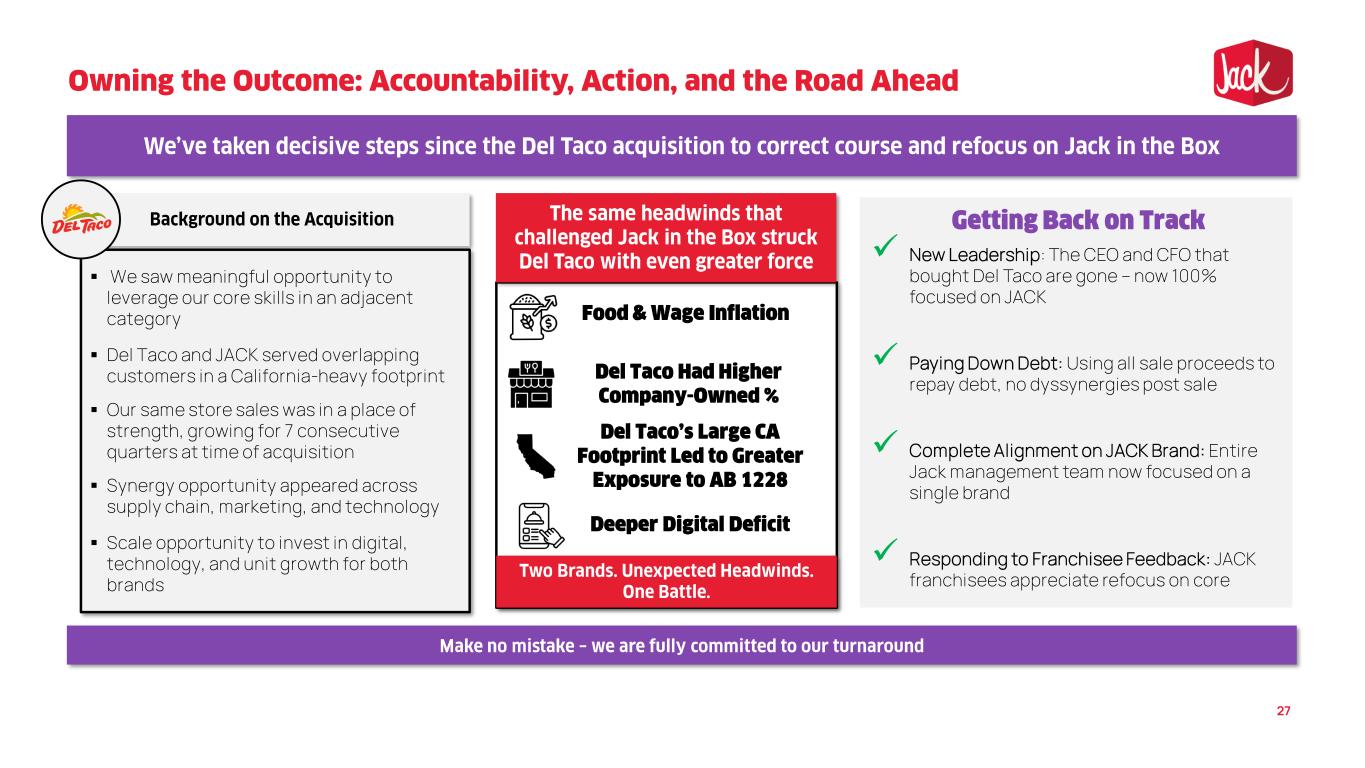

▪ We saw meaningful opportunity to leverage our core skills in an adjacent category ▪ Del Taco and JACK served overlapping customers in a California-heavy footprint ▪ Our same store sales was in a place of strength, growing for 7 consecutive quarters at time of acquisition ▪ Synergy opportunity appeared across supply chain, marketing, and technology ▪ Scale opportunity to invest in digital, technology, and unit growth for both brands ✓ New Leadership: The CEO and CFO that bought Del Taco are gone – now 100% focused on JACK ✓ Paying Down Debt: Using all sale proceeds to repay debt, no dyssynergies post sale ✓ Complete Alignment on JACK Brand: Entire Jack management team now focused on a single brand ✓ Responding to Franchisee Feedback: JACK franchisees appreciate refocus on core 27

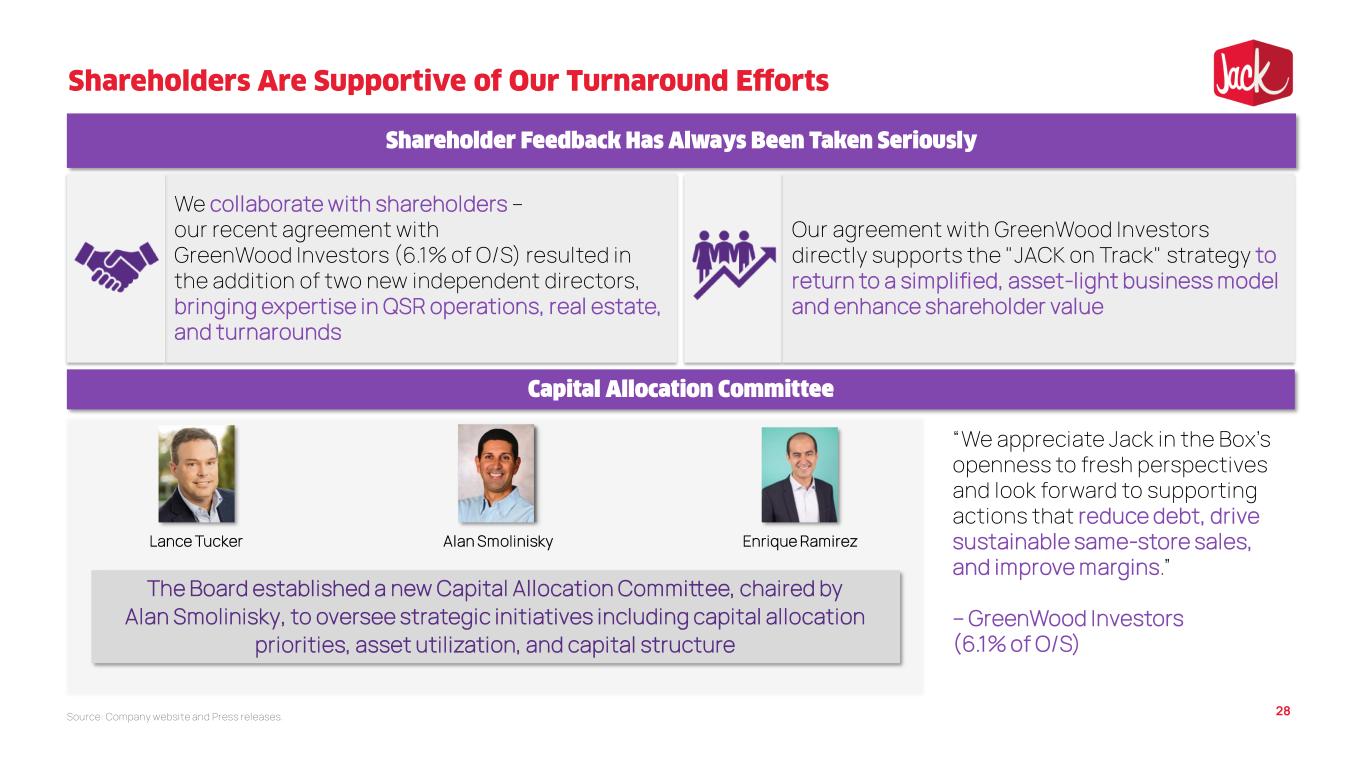

Source: Company website and Press releases. The Board established a new Capital Allocation Committee, chaired by Alan Smolinisky, to oversee strategic initiatives including capital allocation priorities, asset utilization, and capital structure Enrique RamirezLance Tucker Alan Smolinisky Our agreement with GreenWood Investors directly supports the "JACK on Track" strategy to return to a simplified, asset-light business model and enhance shareholder value We collaborate with shareholders – our recent agreement with GreenWood Investors (6.1% of O/S) resulted in the addition of two new independent directors, bringing expertise in QSR operations, real estate, and turnarounds “We appreciate Jack in the Box’s openness to fresh perspectives and look forward to supporting actions that reduce debt, drive sustainable same-store sales, and improve margins.” – GreenWood Investors (6.1% of O/S) 28

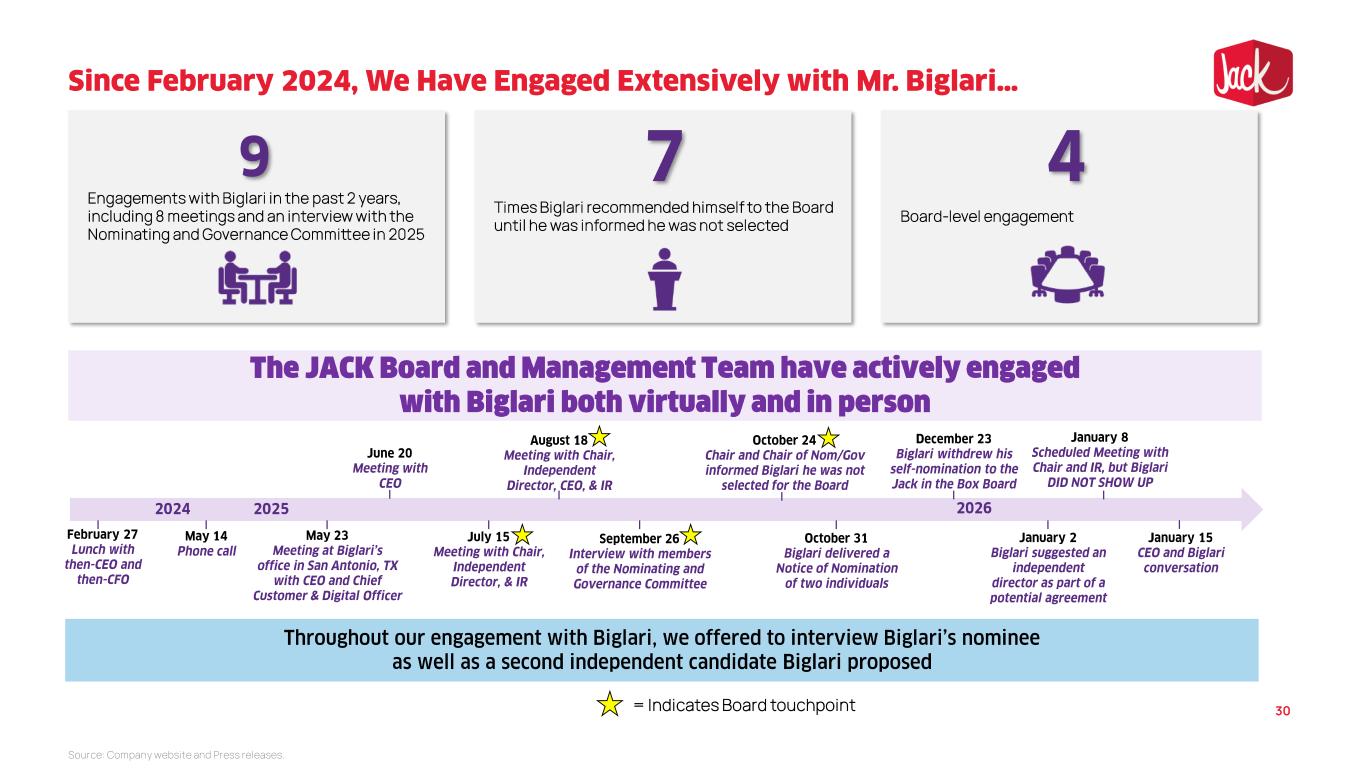

Board-level engagementTimes Biglari recommended himself to the Board until he was informed he was not selected Engagements with Biglari in the past 2 years, including 8 meetings and an interview with the Nominating and Governance Committee in 2025 Source: Company website and Press releases. = Indicates Board touchpoint 30

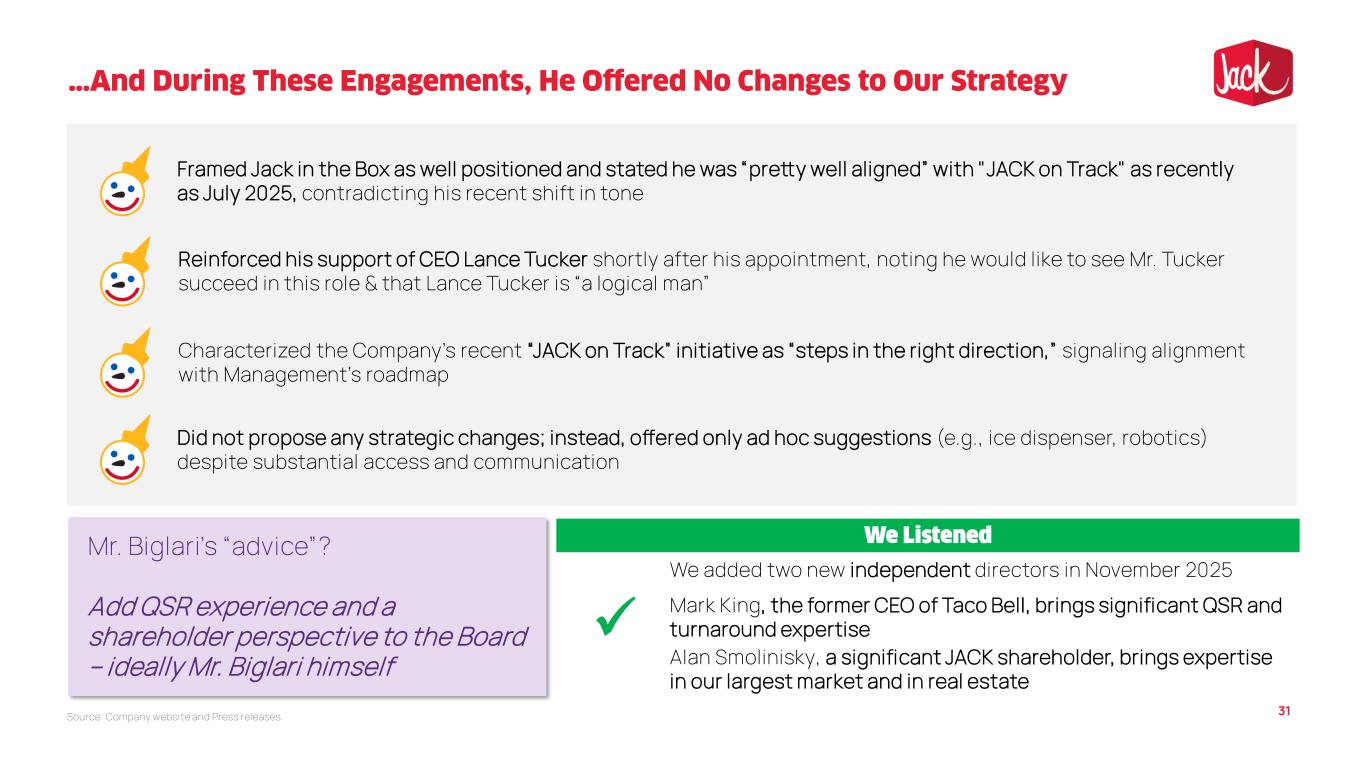

Source: Company website and Press releases. Framed Jack in the Box as well positioned and stated he was “pretty well aligned” with "JACK on Track" as recently as July 2025, contradicting his recent shift in tone Reinforced his support of CEO Lance Tucker shortly after his appointment, noting he would like to see Mr. Tucker succeed in this role & that Lance Tucker is “a logical man” Did not propose any strategic changes; instead, offered only ad hoc suggestions (e.g., ice dispenser, robotics) despite substantial access and communication Characterized the Company’s recent “JACK on Track” initiative as “steps in the right direction,” signaling alignment with Management’s roadmap Mr. Biglari’s “advice”? Add QSR experience and a shareholder perspective to the Board -- ideally Mr. Biglari himself • We added two new independent directors in November 2025 • Mark King, the former CEO of Taco Bell, brings significant QSR and turnaround expertise • Alan Smolinisky, a significant JACK shareholder, brings expertise in our largest market and in real estate 31

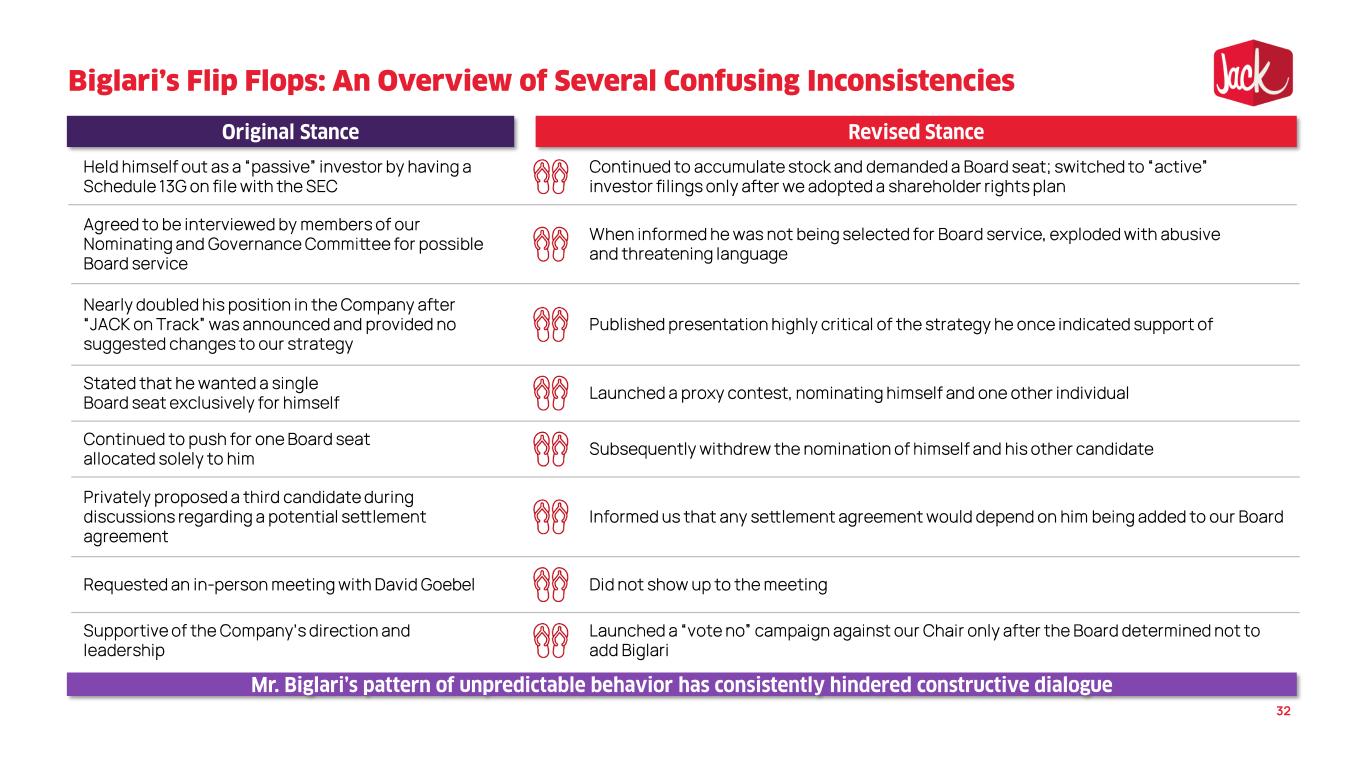

32 Held himself out as a “passive” investor by having a Schedule 13G on file with the SEC Continued to accumulate stock and demanded a Board seat; switched to “active” investor filings only after we adopted a shareholder rights plan Stated that he wanted a single Board seat exclusively for himself Launched a proxy contest, nominating himself and one other individual Continued to push for one Board seat allocated solely to him Subsequently withdrew the nomination of himself and his other candidate Informed us that any settlement agreement would depend on him being added to our Board Privately proposed a third candidate during discussions regarding a potential settlement agreement Supportive of the Company’s direction and leadership Launched a “vote no” campaign against our Chair only after the Board determined not to add Biglari Nearly doubled his position in the Company after “JACK on Track” was announced and provided no suggested changes to our strategy Published presentation highly critical of the strategy he once indicated support of Agreed to be interviewed by members of our Nominating and Governance Committee for possible Board service When informed he was not being selected for Board service, exploded with abusive and threatening language Requested an in-person meeting with David Goebel Did not show up to the meeting

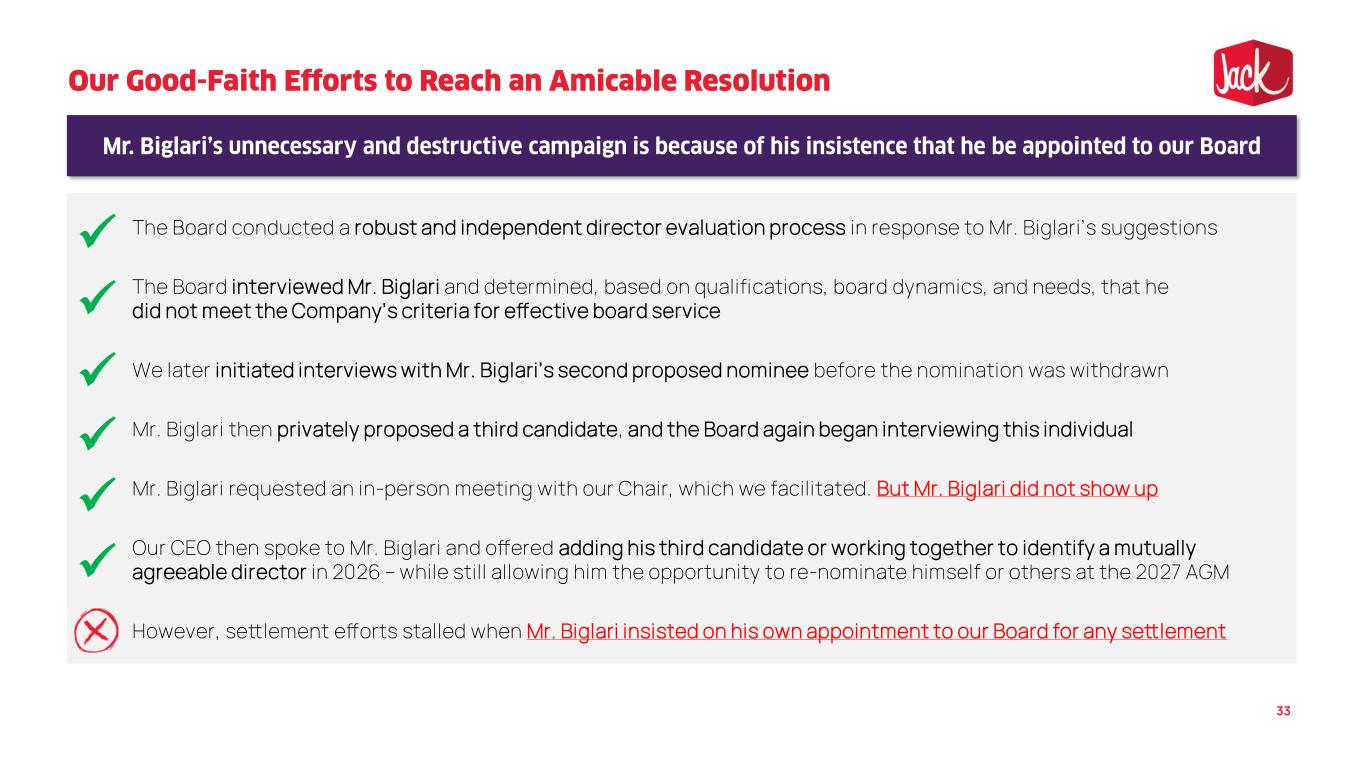

The Board conducted a robust and independent director evaluation process in response to Mr. Biglari’s suggestions The Board interviewed Mr. Biglari and determined, based on qualifications, board dynamics, and needs, that he did not meet the Company’s criteria for effective board service We later initiated interviews with Mr. Biglari’s second proposed nominee before the nomination was withdrawn Mr. Biglari then privately proposed a third candidate, and the Board again began interviewing this individual Mr. Biglari requested an in-person meeting with our Chair, which we facilitated. But Mr. Biglari did not show up Our CEO then spoke to Mr. Biglari and offered adding his third candidate or working together to identify a mutually agreeable director in 2026 – while still allowing him the opportunity to re-nominate himself or others at the 2027 AGM However, settlement efforts stalled when Mr. Biglari insisted on his own appointment to our Board for any settlement ✓ ✓ ✓ ✓ ✓ ✓ 33

At prior investments, Biglari’s campaigns have coincided with prolonged underperformance and governance disputes. Actions taken at other companies have been perceived as prioritizing visibility over sustainable value and distracting management from execution Biglari’s repeated, unsuccessful proxy campaigns demonstrate a pattern of prolonged governance disruption without durable value creation. These campaigns consumed significant management and Board attention, created recurring shareholder distraction, and failed to deliver strategic or financial improvements Highly visible, promotional stunts in prior campaigns as well as recent behavior in interactions with our Board have raised concerns about professionalism and alignment with governance best practices. Such behavior risks creating unnecessary noise and distraction at a time when we must remain focused on executing our turnaround strategy 35

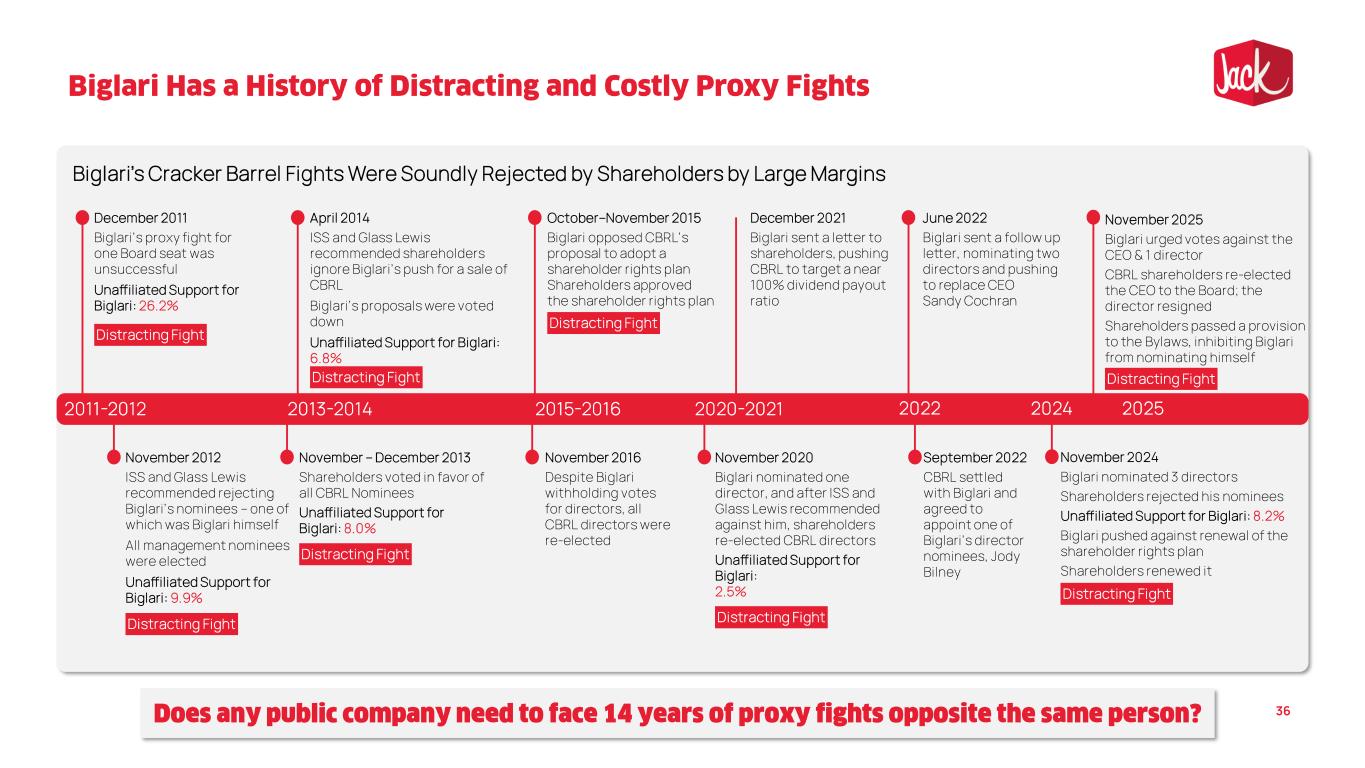

Biglari’s Cracker Barrel Fights Were Soundly Rejected by Shareholders by Large Margins November 2012 ISS and Glass Lewis recommended rejecting Biglari’s nominees – one of which was Biglari himself All management nominees were elected Unaffiliated Support for Biglari: 9.9% November – December 2013 Shareholders voted in favor of all CBRL Nominees Unaffiliated Support for Biglari: 8.0% December 2011 Biglari’s proxy fight for one Board seat was unsuccessful Unaffiliated Support for Biglari: 26.2% Distracting Fight 2011-2012 April 2014 ISS and Glass Lewis recommended shareholders ignore Biglari’s push for a sale of CBRL Biglari’s proposals were voted down Unaffiliated Support for Biglari: 6.8% 2013-2014 October–November 2015 Biglari opposed CBRL’s proposal to adopt a shareholder rights plan Shareholders approved the shareholder rights plan November 2016 Despite Biglari withholding votes for directors, all CBRL directors were re-elected 2015-2016 December 2021 Biglari sent a letter to shareholders, pushing CBRL to target a near 100% dividend payout ratio November 2020 Biglari nominated one director, and after ISS and Glass Lewis recommended against him, shareholders re-elected CBRL directors Unaffiliated Support for Biglari: 2.5% 2020-2021 June 2022 Biglari sent a follow up letter, nominating two directors and pushing to replace CEO Sandy Cochran September 2022 CBRL settled with Biglari and agreed to appoint one of Biglari’s director nominees, Jody Bilney 2022 November 2025 Biglari urged votes against the CEO & 1 director CBRL shareholders re-elected the CEO to the Board; the director resigned Shareholders passed a provision to the Bylaws, inhibiting Biglari from nominating himself November 2024 Biglari nominated 3 directors Shareholders rejected his nominees Unaffiliated Support for Biglari: 8.2% Biglari pushed against renewal of the shareholder rights plan Shareholders renewed it 2024 2025 36 Distracting Fight Distracting Fight Distracting Fight Distracting Fight Distracting Fight Distracting Fight Distracting Fight

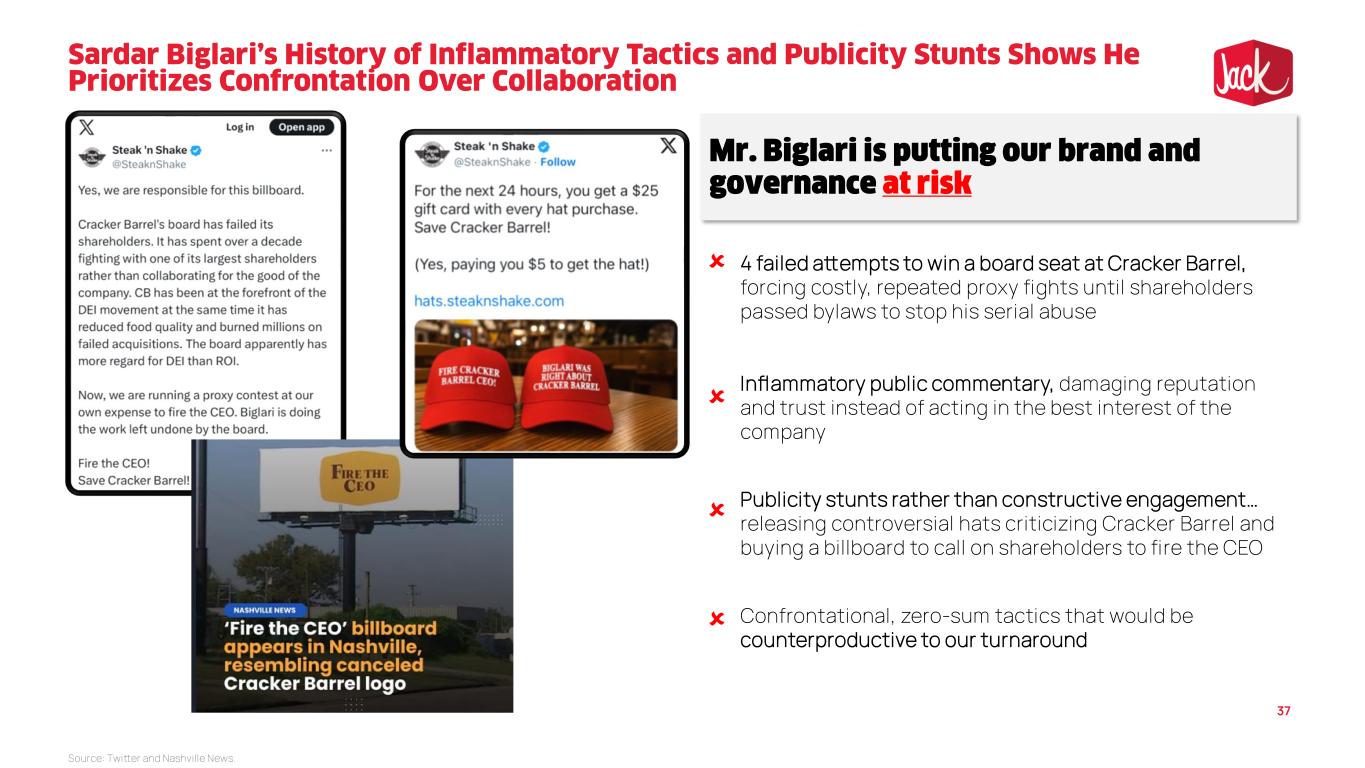

Source: Twitter and Nashville News. Confrontational, zero-sum tactics that would be counterproductive to our turnaround 4 failed attempts to win a board seat at Cracker Barrel, forcing costly, repeated proxy fights until shareholders passed bylaws to stop his serial abuse Inflammatory public commentary, damaging reputation and trust instead of acting in the best interest of the company Publicity stunts rather than constructive engagement… releasing controversial hats criticizing Cracker Barrel and buying a billboard to call on shareholders to fire the CEO 37

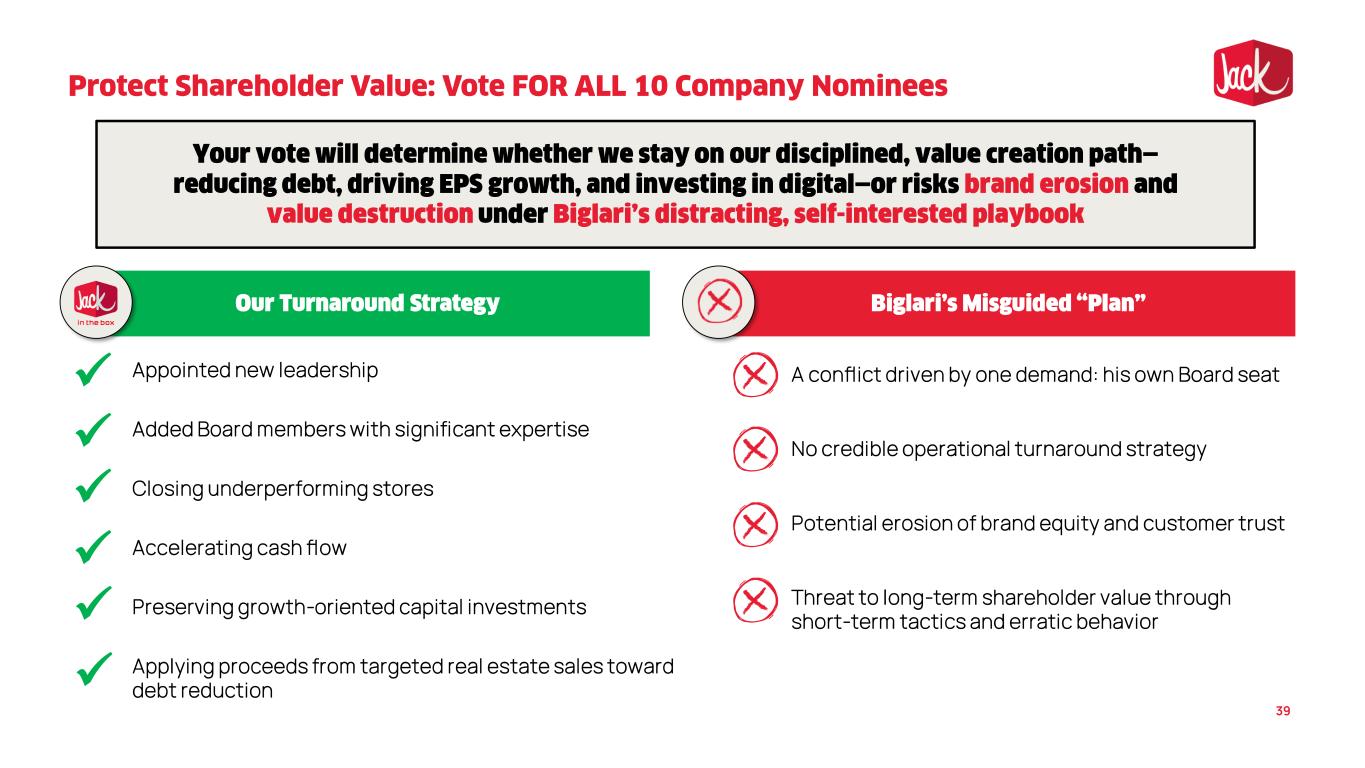

Appointed new leadership Added Board members with significant expertise Closing underperforming stores Accelerating cash flow Preserving growth-oriented capital investments Applying proceeds from targeted real estate sales toward debt reduction ✓ ✓ A conflict driven by one demand: his own Board seat No credible operational turnaround strategy Potential erosion of brand equity and customer trust Threat to long-term shareholder value through short-term tactics and erratic behavior ✓ ✓ ✓ ✓ 39

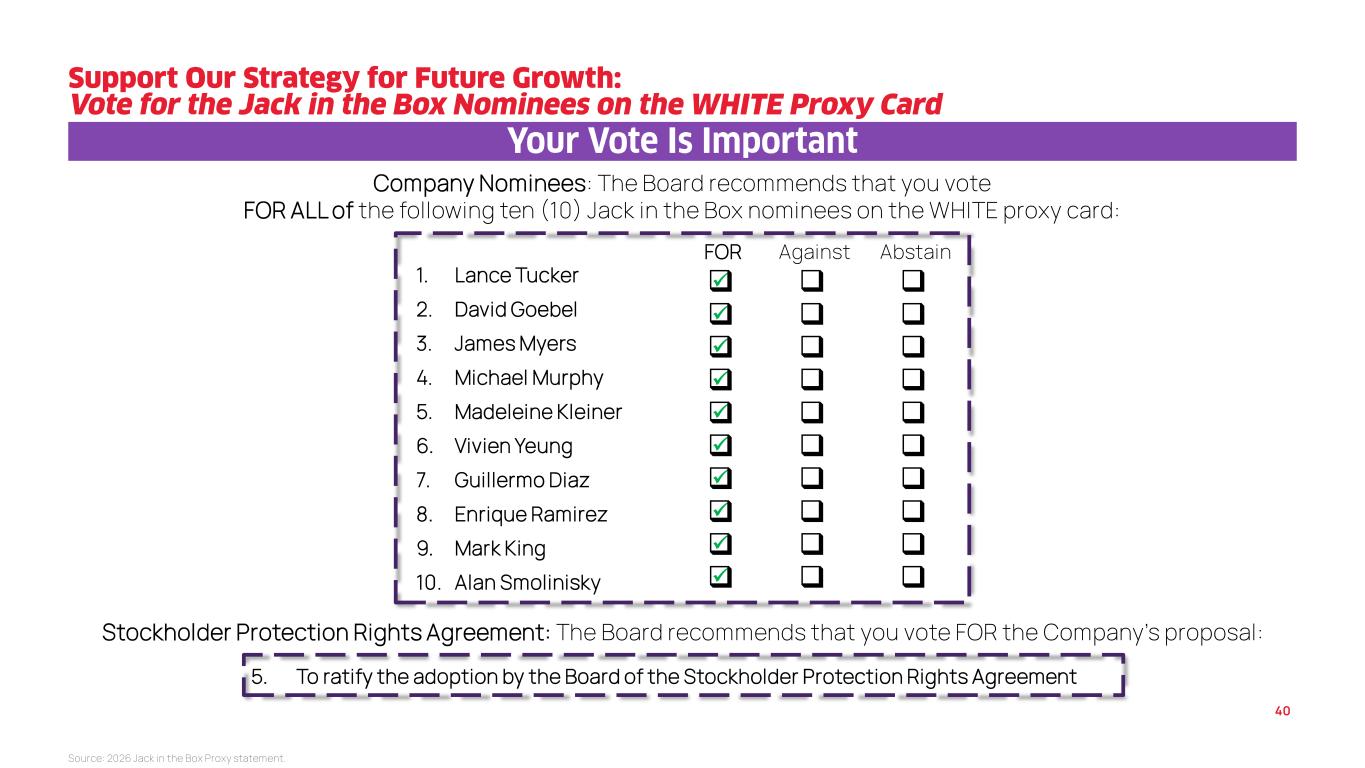

Company Nominees: The Board recommends that you vote FOR ALL of the following ten (10) Jack in the Box nominees on the WHITE proxy card: ✓ Source: 2026 Jack in the Box Proxy statement. 40 ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Stockholder Protection Rights Agreement: The Board recommends that you vote FOR the Company’s proposal: 5. To ratify the adoption by the Board of the Stockholder Protection Rights Agreement Against ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ FOR ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ 1. Lance Tucker 2. David Goebel 3. James Myers 4. Michael Murphy 5. Madeleine Kleiner 6. Vivien Yeung 7. Guillermo Diaz 8. Enrique Ramirez 9. Mark King 10. Alan Smolinisky Abstain ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑ ❑

✓ ✓ ✓ ✓ ✓ Source: Public filings. 42 • • •