UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| JACK IN THE BOX INC. |

(Name of Registrant as Specified In Its Charter) |

BIGLARI CAPITAL CORP. THE LION FUND, L.P. THE LION FUND II, L.P. BIGLARI HOLDINGS INC. FIRST GUARD INSURANCE COMPANY SOUTHERN PIONEER PROPERTY AND CASUALTY INSURANCE COMPANY BIGLARI REINSURANCE LTD. BIGLARI INSURANCE GROUP INC. WESTERN SIZZLIN CORPORATION STEAK N SHAKE INC. SARDAR BIGLARI DOUGLAS THOMPSON |

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Biglari Capital Corp., together with the other participants named herein (collectively, “Biglari”), intends to file a preliminary proxy statement and accompanying GOLD universal proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of Biglari’s highly qualified director nominees at the 2026 annual meeting of stockholders (the “Annual Meeting”) of Jack in the Box Inc. (the “Company”), a Delaware corporation.

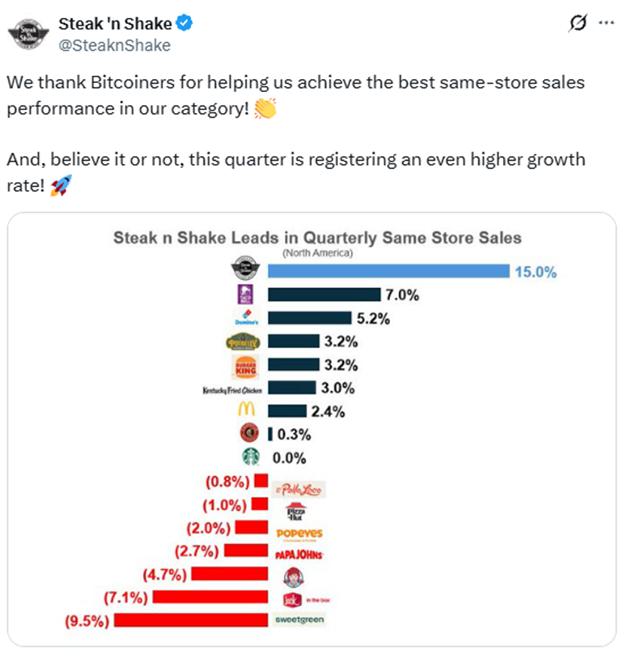

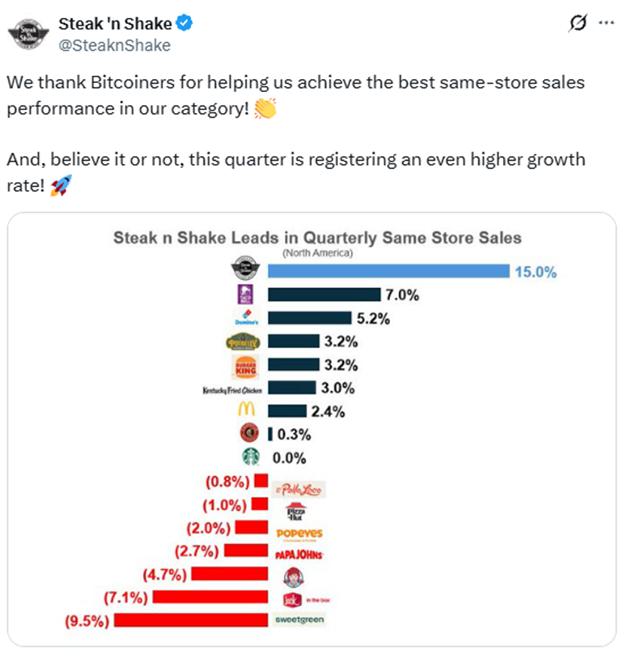

On November 14, 2025, Biglari posted the following to X (formerly known as Twitter):

Certain Information Concerning the Participants

Biglari Capital Corp., together with the other participants named herein (collectively, “Biglari”), intends to file a preliminary proxy statement and accompanying GOLD universal proxy card with the SEC to be used to solicit votes for the election of Biglari’s highly-qualified director nominees at the 2026 annual meeting of stockholders of the Company.

BIGLARI STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Biglari Capital Corp. (“BCC”), The Lion Fund, L.P. (“TLF”), The Lion Fund II, L.P. (“TLF II”), Biglari Holdings Inc. (“BH”), First Guard Insurance Company (“First Guard”), Southern Pioneer Property and Casualty Insurance Company (“Southern Pioneer”), Biglari Reinsurance Ltd. (“Biglari Reinsurance”), Biglari Insurance Group Inc. (“Biglari Insurance”), Western Sizzlin Corporation (“Western Sizzlin”), Steak n Shake Inc. (“Steak n Shake”), Sardar Biglari and Douglas Thompson.

As of the date hereof, TLF beneficially owns directly 542,700 shares of Common Stock, TLF II beneficially owns directly 1,140,952 shares of Common Stock, Southern Pioneer beneficially owns directly 106,317 shares of Common Stock, First Guard beneficially owns directly 21,900 shares of Common Stock, Biglari Reinsurance beneficially owns directly 20,000 shares of Common Stock and Western Sizzlin beneficially owns directly 52,400 shares of Common Stock. BCC, as the general partner of TLF and TLF II, may be deemed to beneficially own the 1,683,652 shares of Common Stock owned in the aggregate by TLF and TLF II. Biglari Reinsurance, as the parent company of each of Southern Pioneer and First Guard, may be deemed to beneficially own the 128,217 shares of Common Stock owned in the aggregate by Southern Pioneer and First Guard. Biglari Insurance, as the parent company of Biglari Reinsurance, may be deemed to beneficially own the 148,217 shares of Common Stock owned in the aggregate by Southern Pioneer, First Guard and Biglari Reinsurance. Biglari Holdings, as the parent company of Biglari Insurance and Western Sizzlin, may be deemed to beneficially own the 200,617 shares of Common Stock owned in the aggregate by Southern Pioneer, First Guard, Biglari Reinsurance and Western Sizzlin. Mr. Biglari, as the Chairman and Chief Executive Officer of each of BCC and Biglari Holdings, may be deemed to beneficially own the 1,884,269 shares of Common Stock owned in the aggregate by TLF, TLF II, Southern Pioneer, First Guard, Biglari Reinsurance, and Western Sizzlin. Neither Steak n Shake nor Mr. Thompson beneficially own any securities of the Company.