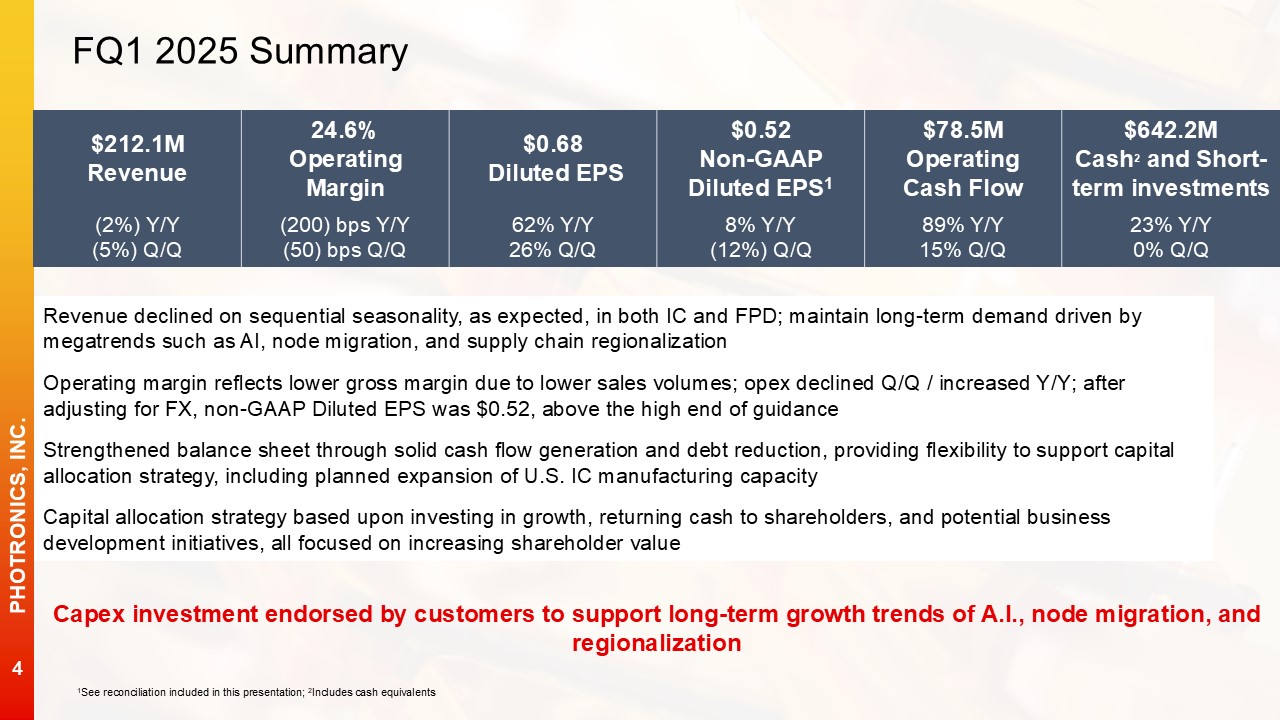

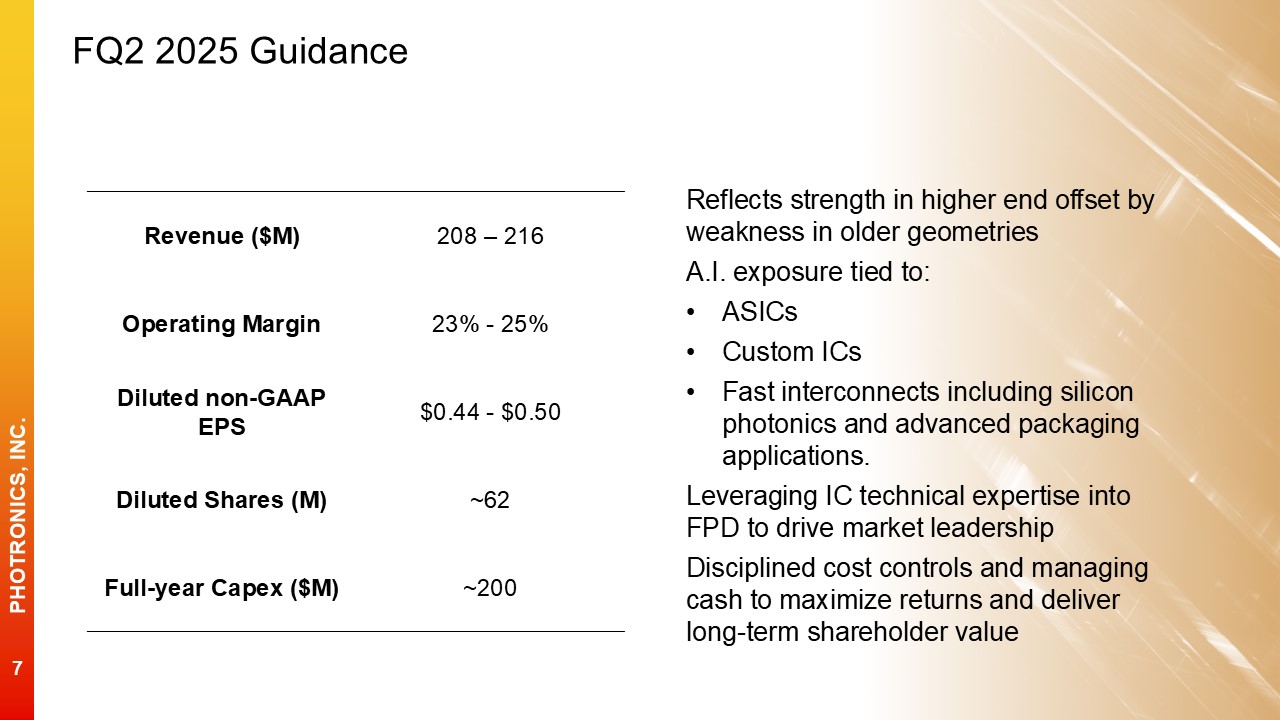

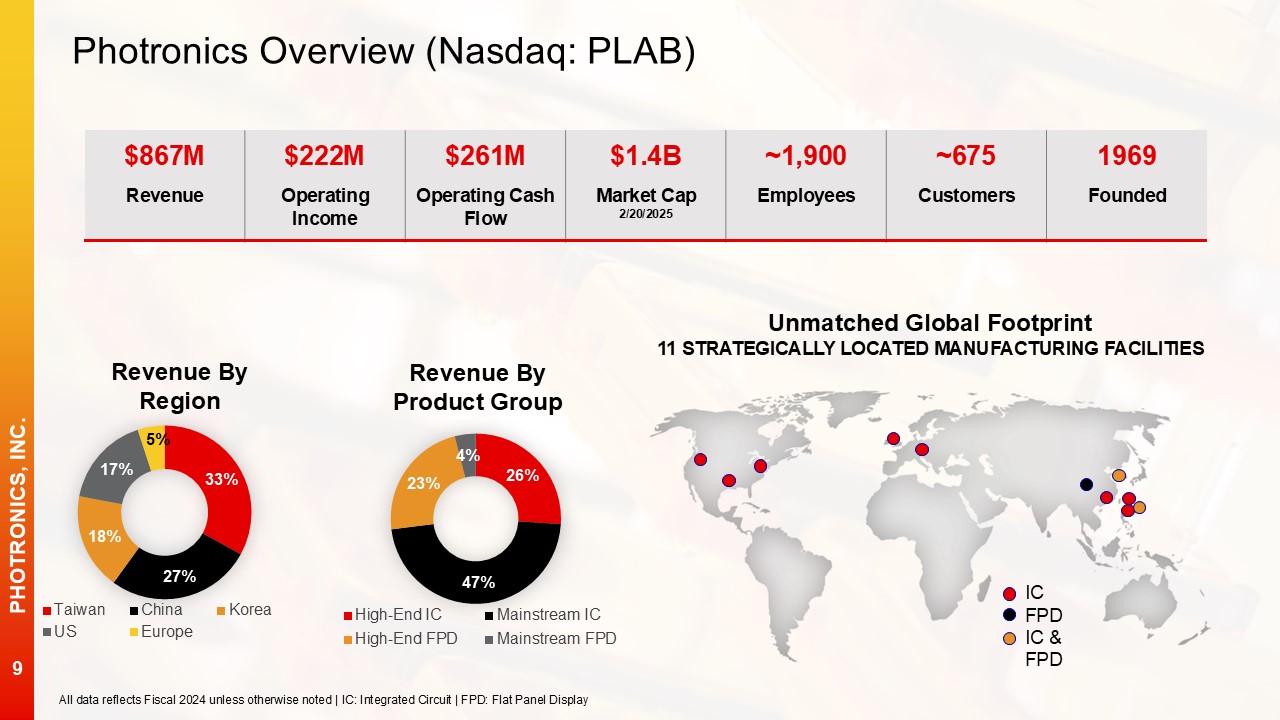

FQ1 2025 Summary Capex investment endorsed by customers to support long-term growth

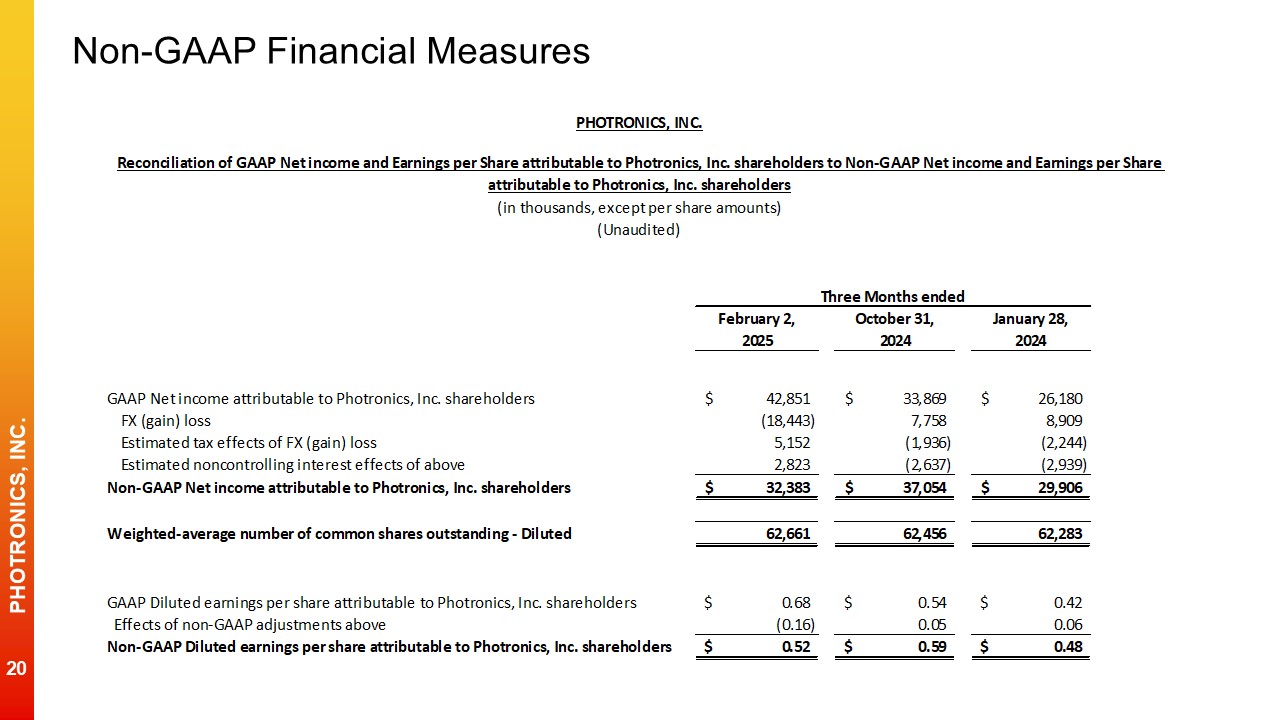

trends of A.I., node migration, and regionalization $212.1M Revenue 24.6% Operating Margin $0.68 Diluted EPS $0.52 Non-GAAP Diluted EPS1 $78.5M Operating Cash Flow $642.2M Cash2 and Short-term investments (2%) Y/Y (5%) Q/Q (200)

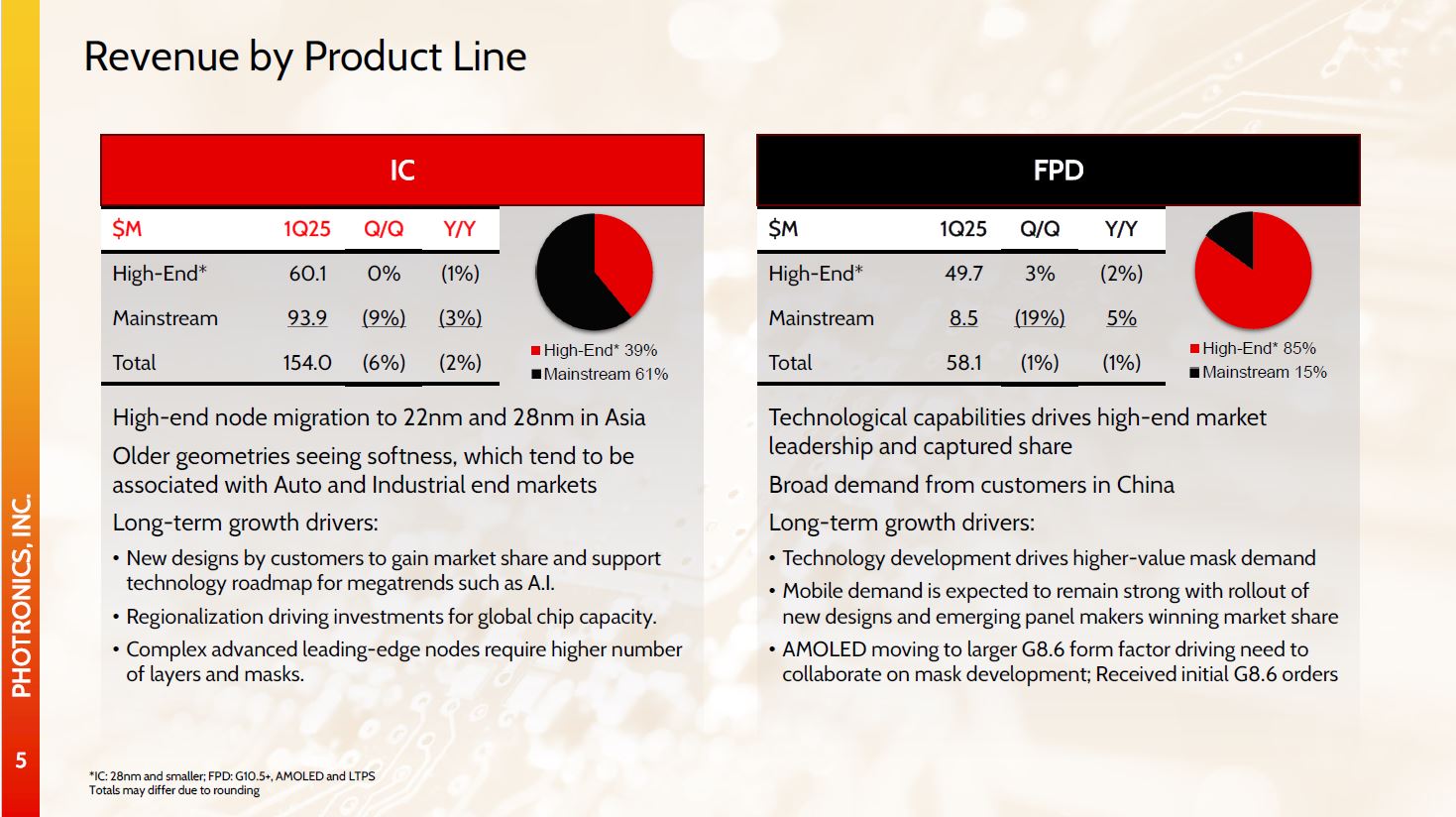

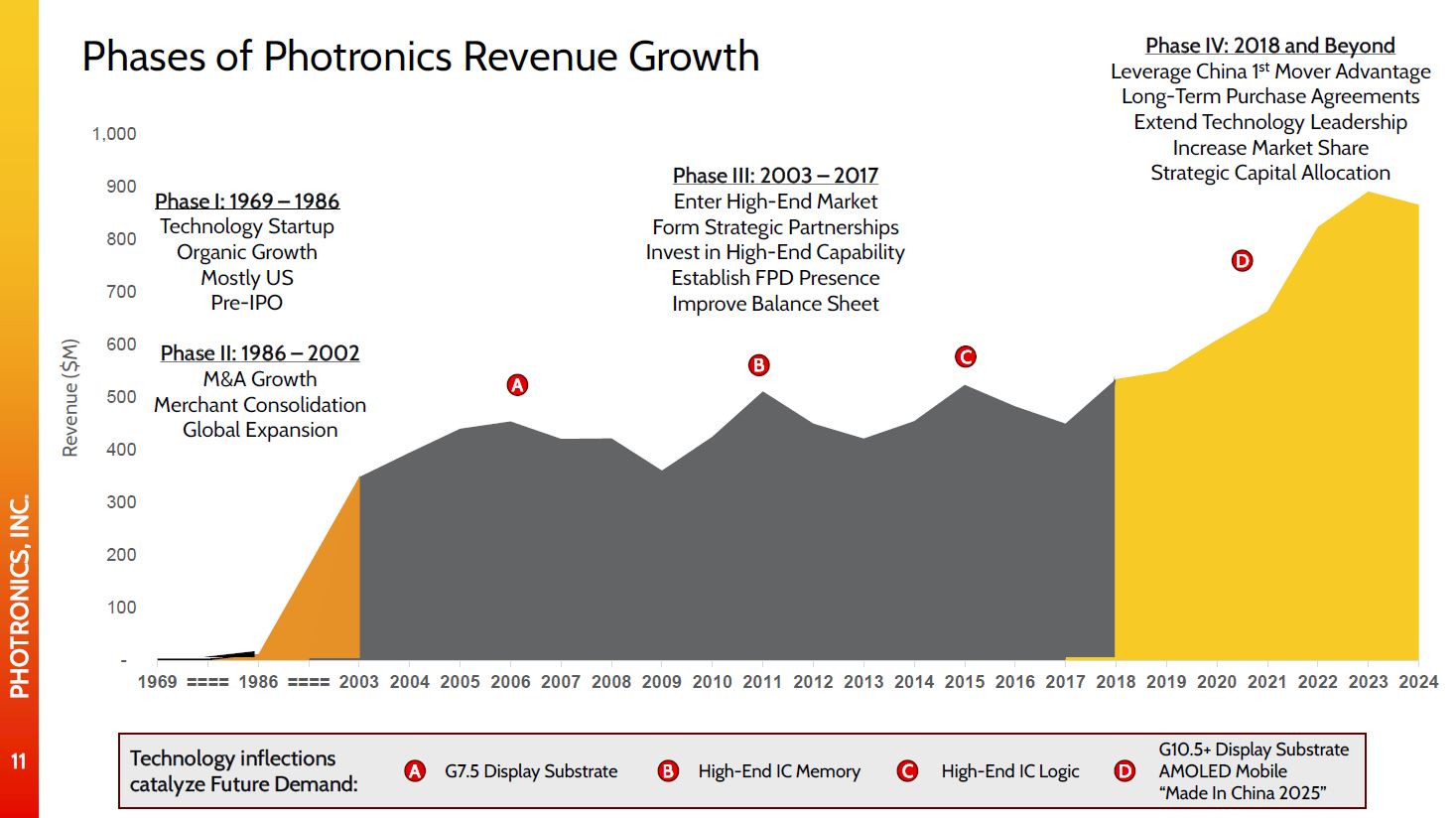

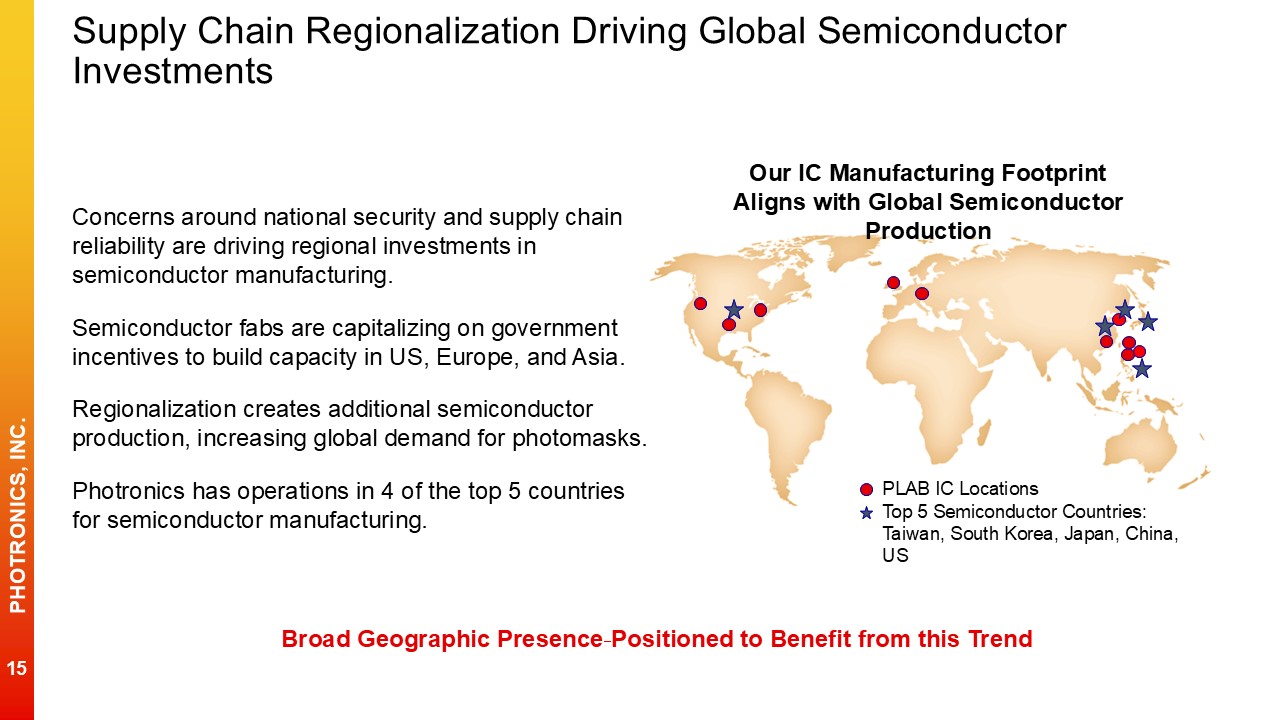

bps Y/Y (50) bps Q/Q 62% Y/Y 26% Q/Q 8% Y/Y (12%) Q/Q 89% Y/Y 15% Q/Q 23% Y/Y 0% Q/Q Revenue declined on sequential seasonality, as expected, in both IC and FPD; maintain long-term demand driven by megatrends such as AI, node migration,

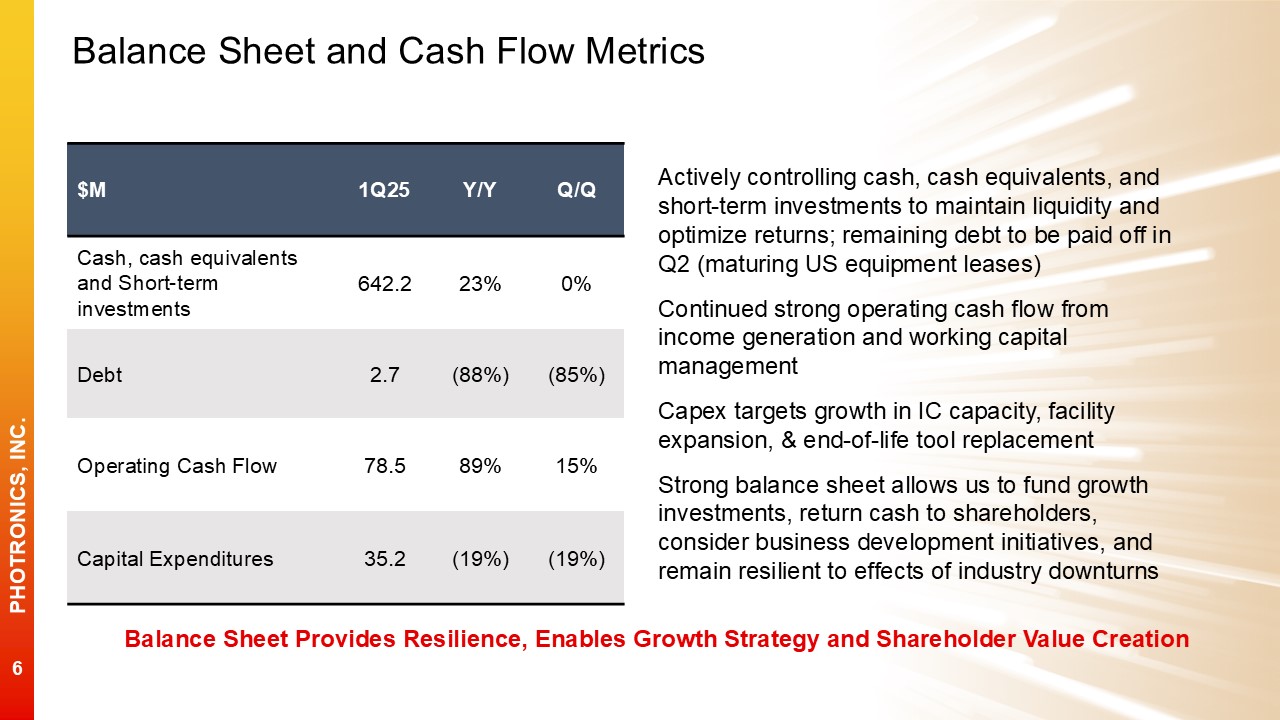

and supply chain regionalization Operating margin reflects lower gross margin due to lower sales volumes; opex declined Q/Q / increased Y/Y; after adjusting for FX, non-GAAP Diluted EPS was $0.52, above the high end of guidance Strengthened

balance sheet through solid cash flow generation and debt reduction, providing flexibility to support capital allocation strategy, including planned expansion of U.S. IC manufacturing capacity Capital allocation strategy based upon investing in

growth, returning cash to shareholders, and potential business development initiatives, all focused on increasing shareholder value 1See reconciliation included in this presentation; 2Includes cash equivalents