.2

December 2025 Investor Presentation

Safe Harbor Statement This presentation and some of our comments during this

presentation may contain projections or other forward-looking statements regarding future events, our future financial performance, and/or the future performance of the industry. These statements are predictions and contain risks and

uncertainties. We refer you to the risk factors in our Annual Report on Form 10-K for the fiscal year ended October 31, 2024 and other subsequent filings with the Securities and Exchange Commission. These documents contain and identify

important factors that could cause the actual results for the Company to differ materially from those contained in our projections or forward-looking statements. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee the accuracy of any forecasts or estimates, and we are not obligated to update any forward-looking statements if our expectations change. 2

Corporate Overview

Europe 4% Taiwan 33% South Korea 19% US 18% Photronics Overview (Nasdaq:

PLAB) $849M Revenue $208M Operating Income $248M Operating Cash Flow $1.46B Market Cap 12/8/2025 ~1,900 Employees ~675 Customers 1969 Founded A Global Merchant Market Leader of Photomasks used in Lithographic Imaging for

Semiconductor and Flat Panel Display production Revenue By Geographic Origin Revenue By Technology All data reflects Trailing Twelve Month figures as of 10/31/25 unless otherwise noted Totals may differ due to

rounding 4 Mainstream 49% High-End 51% Revenue By Product Line Flat Panel Display 28% Integrated Circuits 72% China IC 15% China FPD 11%

Photomasks: Critical Enabler for IC and FPD Manufacturing Integrated Circuit (IC)

photomasks are used to transfer circuit patterns onto semiconductor wafers during the fabrication of integrated circuits. Photomasks are glass substrates used in lithographic systems to transfer the pattern of semiconductor and flat panel

display designs Light Source Photomask Reduction Lens Wafer Stage 5 Flat Panel Display (FPD) photomasksare used in the fabrication of flat screen televisions, PC monitors, tablets, mobile devices and other flat panel displays. Exposure

Process used to Create a TFT Circuit Pattern

Compelling Investment Thesis A global leader in the merchant photomasks industry

critical for semiconductor manufacturing Favorable Industry Trends 6 FAB regionalization/ reshoring of the semiconductor industry Captives increased outsourcing to merchant suppliers Node migration drives ASP expansion and revenue

growth Foldable displays and higher value masks drive FPD opportunity Premier operational execution enables preferred supplier status Consistent delivery of cash flow for strategic flexibility Operational Excellence

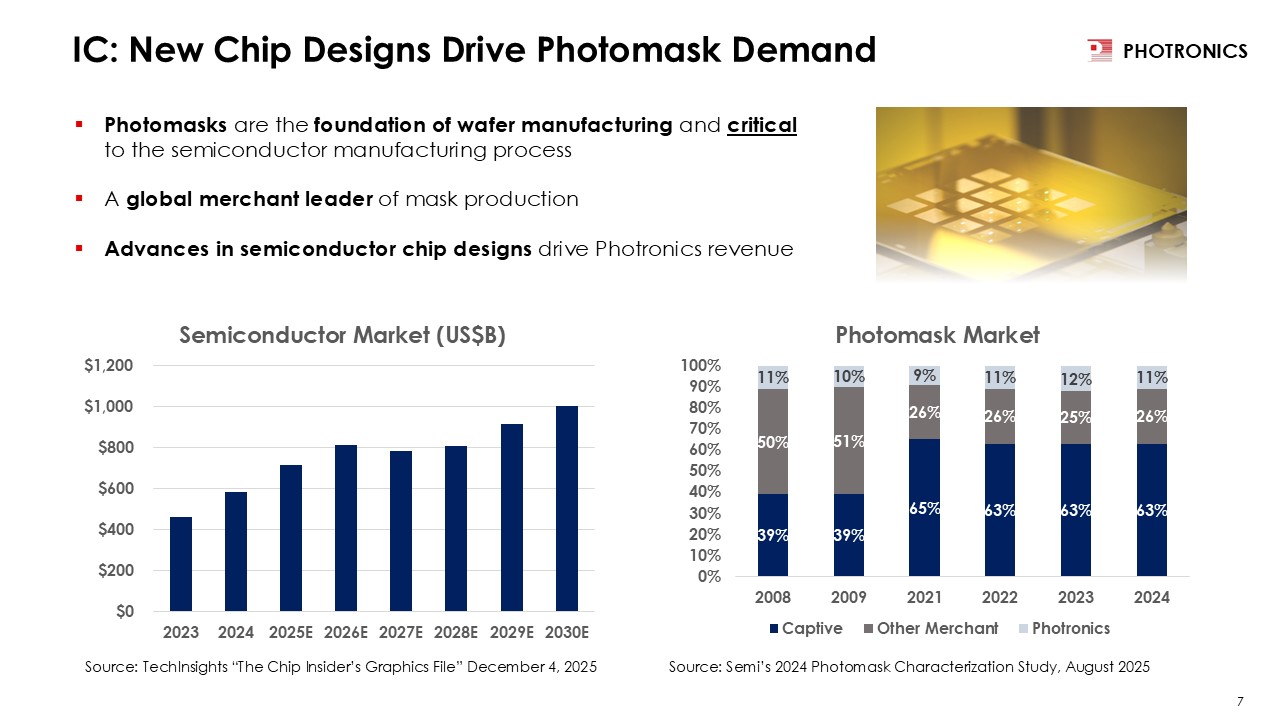

IC: New Chip Designs Drive Photomask Demand Photomasks are the foundation of

wafer manufacturing and critical to the semiconductor manufacturing process A global merchant leader of mask production Advances in semiconductor chip designs drive Photronics revenue 7 Source: Semi’s 2024 Photomask Characterization Study,

August 2025 Source: TechInsights “The Chip Insider’s Graphics File” December 4, 2025

Global Footprint Aligns with Regionalization Trends IC: Integrated Circuit | FPD:

Flat Panel Display 8 Allen, Texas Boise, Idaho Brookfield, Connecticut HQ Bridgend, Wales Cheonan, South Korea Hsinchu, Taiwan Xiamen, China Dresden, Germany Hefei, China Taichung, Taiwan Largest commercial mask maker in Taiwan.

Only high end capable commercial mask maker in US. IC FPD IC & FPD U.S. and Asia investments aligns with industry regionalization trends, and diversifies geographic footprint U.S. capacity and capability extension for mid-range IC

nodes Asia capacity and capability extension to 8nm

Node Migration Drives Mask Set Value Nodes Mask Value 9 Mask pattern

complexity / Mask count per IC Design / Impact of Mask performance on IC yield Drives higher individual mask ASP, more layers per mask set, and higher barriers of entry for competitors Currently participating Planning to participate

FPD: Advanced Displays are Driving Innovation Photronics leverages expertise

gained from IC mask production into FPD mask production Consumer electronics with larger, high-performance displays increase the complexity of mask production Panel makers are developing AMOLED production processes to increase substrate size

to G8.6, requiring larger, high-quality advanced masks Customers rely on Photronics for its market leading AMOLED technology 10

Competitive Advantages Global Footprint Close to customer Aligned with end

markets Flexible supply chain Technology Leader Process expertise Advanced Process-of-Record High barriers to entry Commercial Excellence Customer first Trusted partner Wafer yield enhancement Technology roadmap enabler Operational

Excellence Responsive delivery High yields Cost control Supply chain optimization Teamwork and execution 11

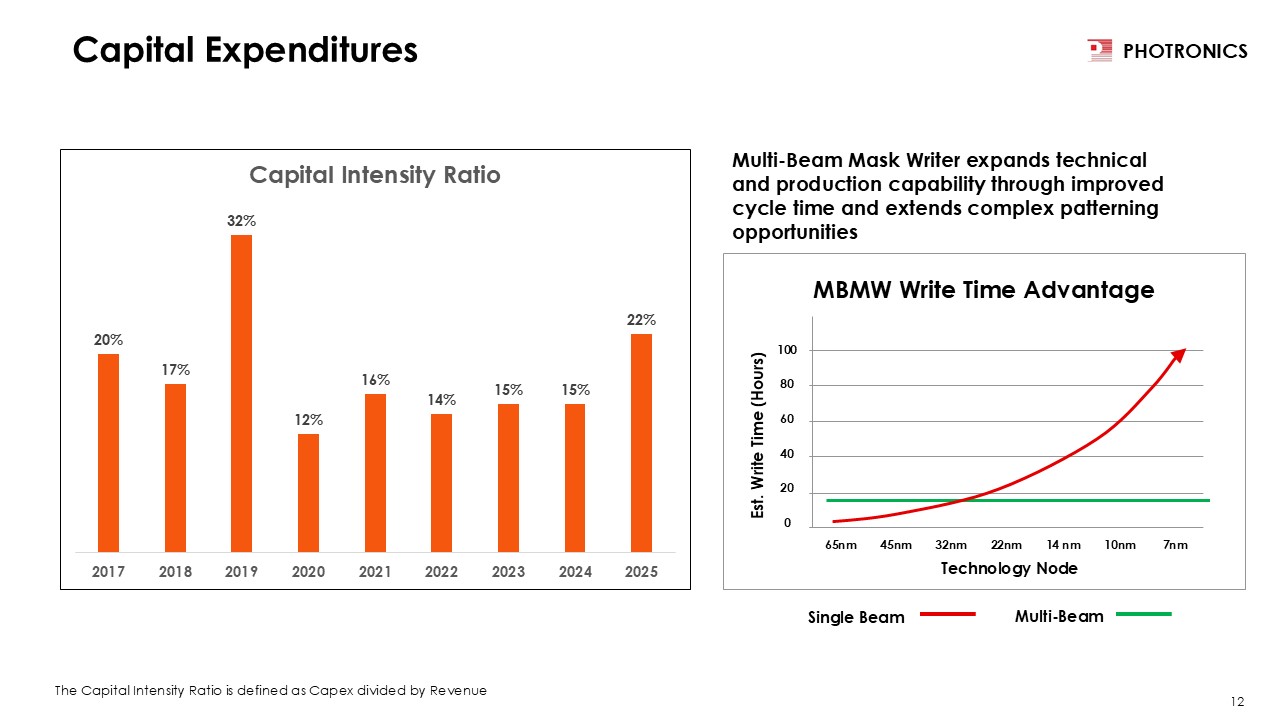

Capital Expenditures The Capital Intensity Ratio is defined as Capex divided by

Revenue Multi-Beam Mask Writer expands technical and production capability through improved cycle time and extends complex patterning opportunities MBMW Write Time Advantage Technology Node 100 80 60 40 20 0 Est. Write Time

(Hours) 65nm 45nm 32nm 22nm 14 nm 10nm 7nm 12 Single Beam Multi-Beam

Fiscal Q4 2025 Financial Results

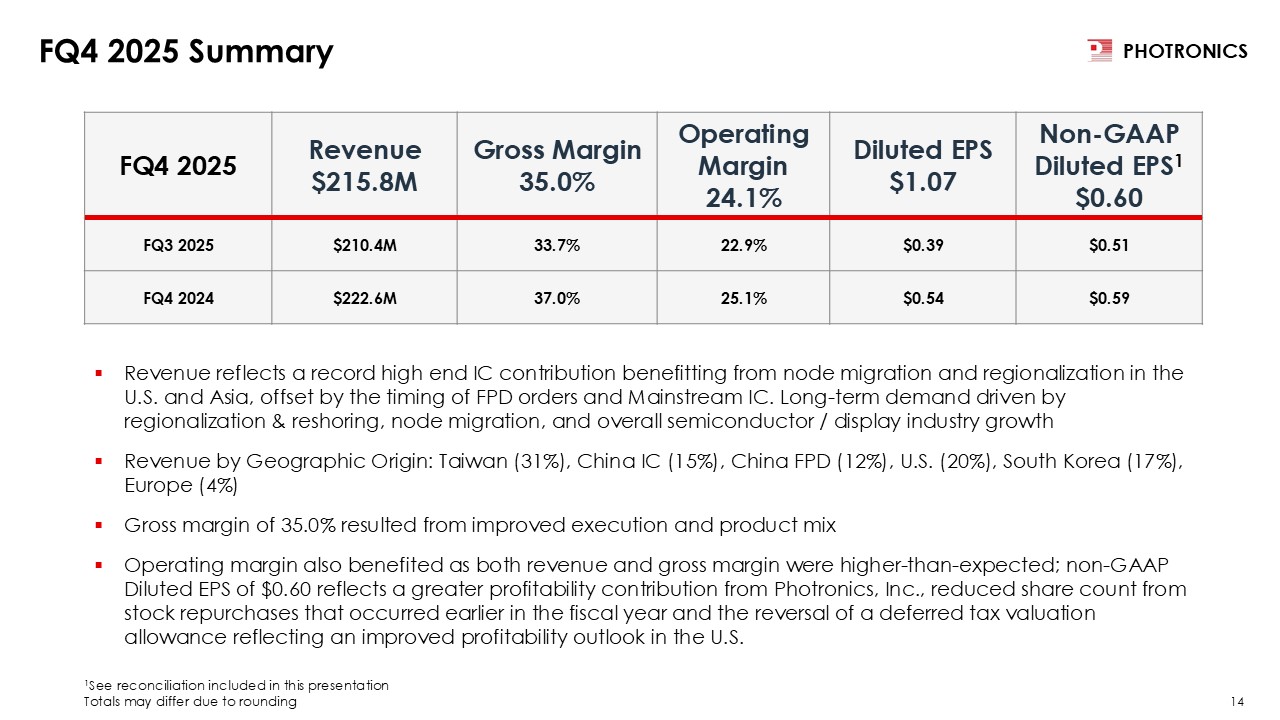

FQ4 2025 Summary FQ4 2025 Revenue $215.8M Gross Margin 35.0% Operating

Margin 24.1% Diluted EPS $1.07 Non-GAAP Diluted EPS1 $0.60 FQ3 2025 $210.4M 33.7% 22.9% $0.39 $0.51 FQ4 2024 $222.6M 37.0% 25.1% $0.54 $0.59 1See reconciliation included in this presentation Totals may differ due to

rounding 14 Revenue reflects a record high end IC contribution benefitting from node migration and regionalization in the U.S. and Asia, offset by the timing of FPD orders and Mainstream IC. Long-term demand driven by regionalization &

reshoring, node migration, and overall semiconductor / display industry growth Revenue by Geographic Origin: Taiwan (31%), China IC (15%), China FPD (12%), U.S. (20%), South Korea (17%), Europe (4%) Gross margin of 35.0% resulted from

improved execution and product mix Operating margin also benefited as both revenue and gross margin were higher-than-expected; non-GAAP Diluted EPS of $0.60 reflects a greater profitability contribution from Photronics, Inc., reduced share

count from stock repurchases that occurred earlier in the fiscal year and the reversal of a deferred tax valuation allowance reflecting an improved profitability outlook in the U.S.

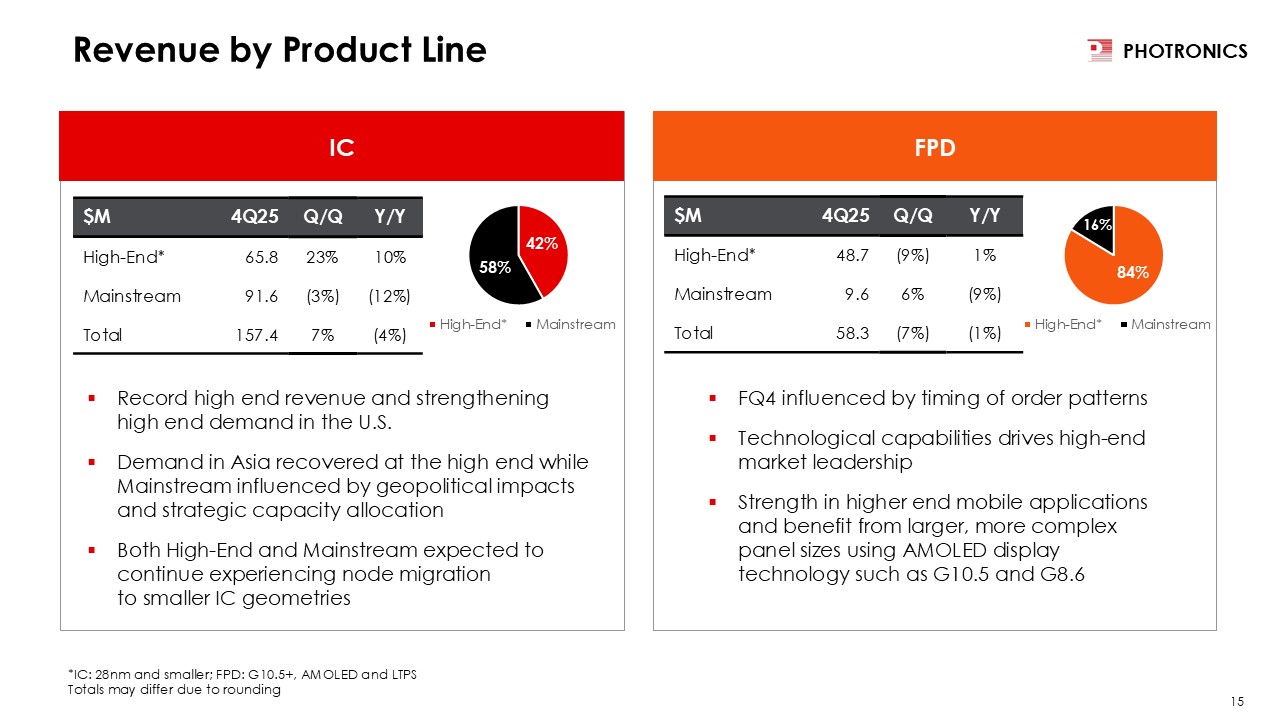

Revenue by Product

Line $M 4Q25 Q/Q Y/Y High-End* 65.8 23% 10% Mainstream 91.6 (3%) (12%) Total 157.4 7% (4%) Record high end revenue and strengthening high end demand in the U.S. Demand in Asia recovered at the high end while Mainstream

influenced by geopolitical impacts and strategic capacity allocation Both High-End and Mainstream expected to continue experiencing node migration to smaller IC geometries *IC: 28nm and smaller; FPD: G10.5+, AMOLED and LTPS Totals may

differ due to rounding FQ4 influenced by timing of order patterns Technological capabilities drives high-end market leadership Strength in higher end mobile applications and benefit from larger, more complex panel sizes using AMOLED display

technology such as G10.5 and G8.6 $M 4Q25 Q/Q Y/Y High-End* 48.7 (9%) 1% Mainstream 9.6 6% (9%) Total 58.3 (7%) (1%) IC FPD 15

Strong operating cash flow contribution across most major geographic regions FQ4

capex expanded IC facility and capacity in the U.S. & end-of-life tool replacement globally Capital allocation: Organic growth investments: target capex of $330M in fiscal 2026 to expand U.S. and South Korea operations and for end-of-life

tool upgrades Business development initiatives: leverage and enhance core competencies Return cash to shareholders: Repurchased $97M throughout Fiscal 2025; $28M currently authorized Balance Sheet and Cash Flow

Metrics $M 4Q25 3Q25 4Q24 Cash, cash equivalents and Short-term investments 588.2 575.8 640.7 Debt 0.02 0.03 18.0 Operating Cash Flow 87.8 50.1 68.4 Capital Expenditures 67.5 24.8 43.2 16

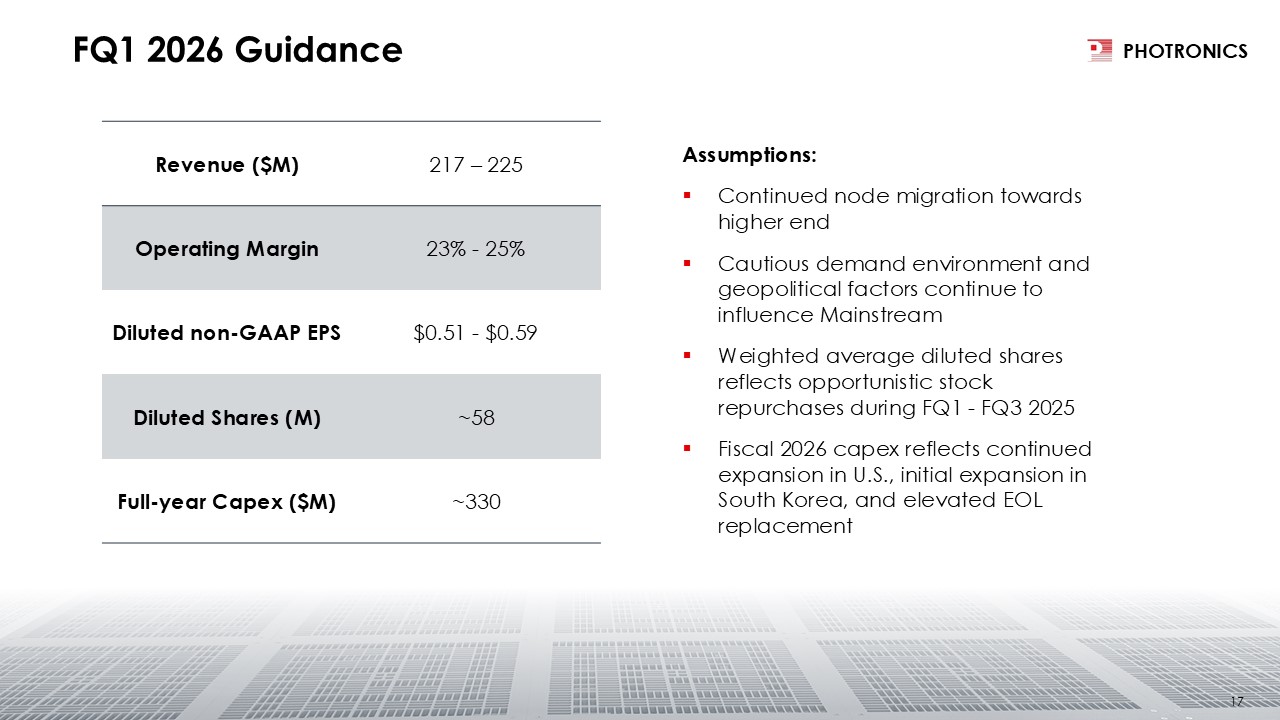

FQ1 2026 Guidance Assumptions: Continued node migration towards higher

end Cautious demand environment and geopolitical factors continue to influence Mainstream Weighted average diluted shares reflects opportunistic stock repurchases during FQ1 - FQ3 2025 Fiscal 2026 capex reflects continued expansion in U.S.,

initial expansion in South Korea, and elevated EOL replacement Revenue ($M) 217 – 225 Operating Margin 23% - 25% Diluted non-GAAP EPS $0.51 - $0.59 Diluted Shares (M) ~58 Full-year Capex ($M) ~330 17

Appendix

Non-GAAP Financial Measures Non-GAAP Net Income attributable to Photronics, Inc.

shareholders and non-GAAP diluted earnings per share attributable to Photronics, Inc. shareholders are non-GAAP financial measures as such term is defined by Regulation G of the Securities and Exchange Commission, and may differ from similarly

named non-GAAP financial measures used by other companies. The attached financial supplement reconciles Photronics, Inc. financial results under GAAP to non-GAAP financial information. We believe these non-GAAP financial measures that exclude

certain items are useful for analysts and investors to evaluate our on-going performance because they enable a more meaningful comparison of our projected performance with our historical results. These non-GAAP metrics are not a measure of

consolidated operating results under U.S. GAAP and should not be considered as an alternative to Net income (loss), Net income (loss) per share, Net Cash provided by operating activities or any other measure of consolidated results under U.S.

GAAP. The items excluded from these non-GAAP metrics, but included in the calculation of their closest GAAP equivalent, are significant components of the condensed consolidated statement of income and must be considered in performing a

comprehensive assessment of overall financial performance. Please refer to the non-GAAP reconciliations on the following page. 19

Non-GAAP Financial Measures 20