SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

HIGH INCOME SECURITIES FUND

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

High Income Securities Fund

(New York Stock Exchange Trading Symbol: PCF)

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 30, 2022

Important Notice regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on

November 30, 2022: The Notice of Annual Meeting of Shareholders and Proxy Statement are available on the Internet at www.highincomesecuritiesfund.com.

To the Shareholders:

Notice is hereby given that the annual meeting (the “Meeting”) of shareholders (herein referred to as “shareholders”) of High Income

Securities Fund, a Massachusetts business trust (the “Fund”), will be held on November 30, 2022 at 11:00 AM, Eastern time, at the offices of Bulldog Investors, Park 80 West, 250 Pehle Avenue, Suite 708, Saddle Brook, NJ 07663, for the following

purposes:

|

(1)

|

To elect seven Trustees (Proposal 1); and

|

| (2) |

To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof.

|

The Board of Trustees has fixed the close of business on September 26, 2022 as the record date for the determination of shareholders

entitled to notice of, and to vote at, this Meeting or any adjournment or postponement thereof. The stock transfer books will not be closed.

Copies of the Fund’s most recent annual and semi-annual report may be ordered free of charge by any Stockholder by writing to the Fund

c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202, or by telephone at 1-888-898-4107 . The Fund’s most recent semi-annual report was mailed to shareholders on April 29, 2022.

. The Fund’s most recent semi-annual report was mailed to shareholders on April 29, 2022.

You are entitled to vote at the Meeting and any adjournment or postponement thereof if you owned shares of the Fund at the close of

business on September 26, 2022. If you attend the Meeting, you may vote your shares in person. Whether or not you expect to attend the Meeting,

please complete, date, sign and return the enclosed proxy card in the enclosed postage paid envelope so that a quorum will be present and a maximum number of shares may be voted. You may change your vote at any time by submitting a

later-dated proxy or by voting at the Meeting.

By order of the Board of Trustees,

Phillip Goldstein

Chairman of the Board

Chairman of the Board

November 1, 2022

|

Your vote is important no matter how many shares you own

|

|

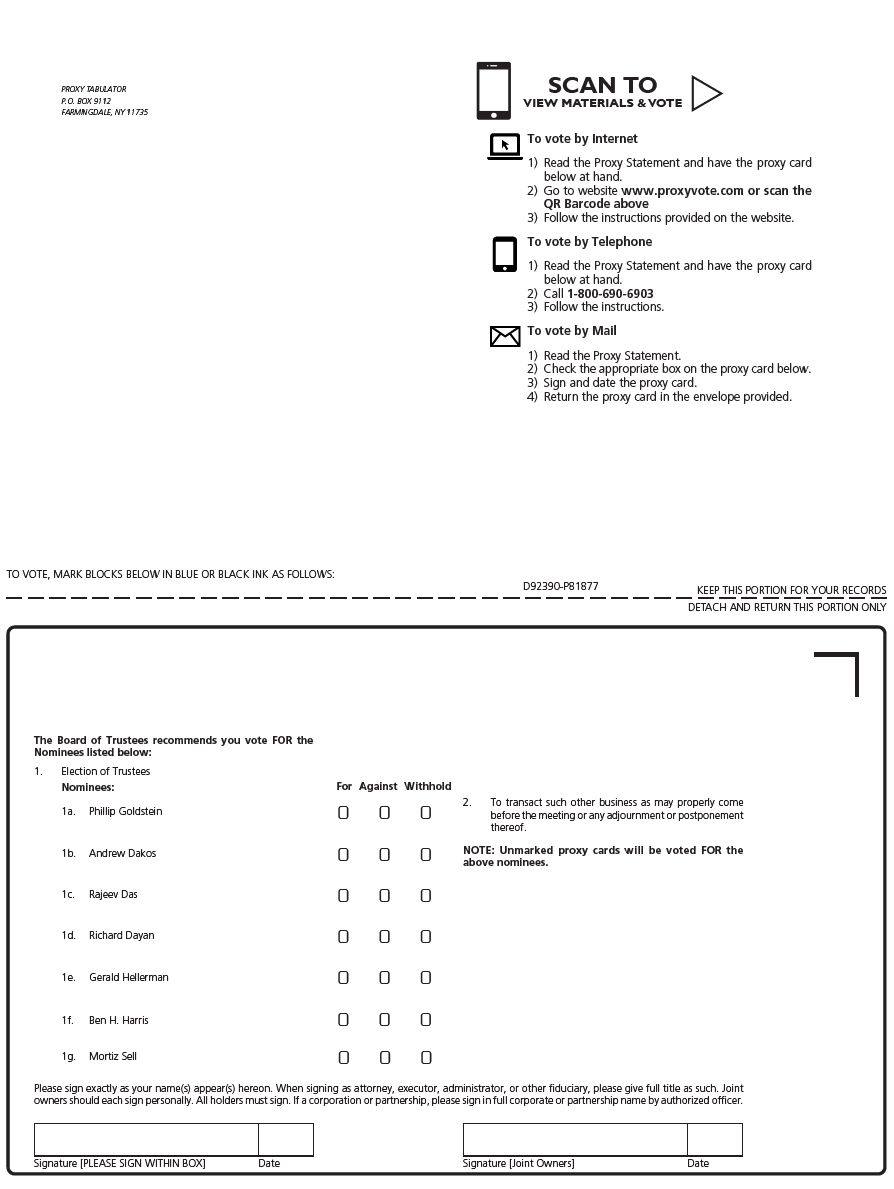

Please indicate your voting instructions on the

enclosed proxy card, date and sign it, and return it in the postage paid envelope provided. If you sign, date and return the proxy

card but give no voting instructions, your shares: (i) will be voted “FOR” the proposal to elect the persons named therein as Trustees (i.e., Proposal 1) and (ii) in the proxies’ discretion, on any other business that may properly arise

at the Meeting. In order to avoid the additional expense to the Fund of further solicitation, we ask your cooperation in mailing in

your enclosed proxy card promptly.

|

Instructions for signing proxy cards

The following general guidelines for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund in

validating your vote if you fail to sign your proxy card properly.

1. Individual accounts: Sign your name exactly as it appears in the

registration on the proxy card.

2. Joint accounts: Either party may sign, but the name of the party signing

should conform exactly to the name shown in the registration on the proxy card.

3. All other accounts: The capacity of the individual signing the proxy

card should be indicated unless it is reflected in the form of registration. For example:

|

Registration

|

Valid signature

|

|

Corporate accounts

|

|

|

(1) ABC Corp.

|

ABC Corp.

|

|

John Doe, treasurer

|

|

|

(2) ABC Corp.

|

John Doe, treasurer

|

|

(3) ABC Corp. c/o John Doe, treasurer

|

John Doe

|

|

(4) ABC Corp. profit sharing plan

|

John Doe, trustee

|

|

Partnership accounts

|

|

|

(1) The XYZ partnership

|

Jane B. Smith, partner

|

|

(2) Smith and Jones, limited partnership

|

Jane B. Smith, general partner

|

|

Trust accounts

|

|

|

(1) ABC trust account

|

Jane B. Doe, trustee

|

|

(2) Jane B. Doe, trustee u/t/d 12/18/78

|

Jane B. Doe

|

|

Custodial or estate accounts

|

|

|

(1) John B. Smith, Cust. f/b/o

|

|

|

John B. Smith, Jr. UGMA/UTMA

|

John B. Smith

|

|

(2) Estate of John B. Smith

|

John B. Smith, Jr., executor

|

High Income Securities Fund

777 East Wisconsin Avenue, 4th Floor

Milwaukee, Wisconsin 53202

PROXY STATEMENT

November 1, 2022

Introduction

Annual Meeting of Shareholders to

be Held on November 30, 2022

This proxy statement (the “Proxy Statement”) is furnished to the shareholders of High Income Securities Fund, a Massachusetts

business trust (the “Fund”) in connection with the solicitation by the Fund’s Board of Trustees (the “Board”) of proxies to be used at the annual meeting (the “Meeting”) of the shareholders of the Fund to be held on November 30, 2022, 11:00 AM,

Eastern time, at the offices of Bulldog Investors, Park 80 West, 250 Pehle Avenue, Suite 708, Saddle Brook, NJ 07663, or any adjournment or postponement thereof. This Proxy Statement and the related proxy card will first be mailed to shareholders

on or about October 28, 2022 and an electronic copy will be available at www.highincomesecuritiesfund.com.

Quorum. The presence, in

person or by proxy, of shareholders owning at least thirty percent (30%) of the shares entitled to vote on September 26, 2022 shall constitute a quorum for the transaction of business at the Meeting.

Required Vote for Adoption of

Proposals. Proposal 1 (to elect the Trustees) requires the affirmative vote of a plurality of the votes cast, i.e., the nominees receiving the most votes will be elected. Each nominee that receives at least one affirmative vote will be

elected.

As otherwise used herein, “shares” means all of the outstanding transferable units of interest into which the beneficial interest in

the Fund shall be divided into from time to time. The owner of each full share is entitled to one vote, and each fractional share is entitled to a proportionate share of one vote.

A broker non-vote occurs when the broker returns a properly executed proxy for shares held by the broker for a customer but does not

vote on a matter because the broker does not have discretionary voting authority and has not received instructions from the beneficial owner. Abstentions and broker non-votes, if any, will be counted as shares present for purposes of determining

whether a quorum is present at the Meeting but will have no effect on Proposal 1.

The individuals named as proxies on the enclosed proxy card will vote in accordance with your direction as indicated thereon if your

proxy card is received properly executed by you or by your duly appointed agent or attorney-in-fact. If you give no voting instructions, your shares will be voted FOR Proposal 1 and, in the proxies’ discretion, either FOR or AGAINST any other

business that may properly be presented at the Meeting (e.g., adjourning the Meeting to a later date).

1

You may revoke any proxy card by (i) submitting a written notice of revocation to the Fund prior to the Meeting being convened, (ii)

by properly executing and submitting a later-dated proxy, or (iii) by attending the annual meeting and voting in person. If your shares are held in street name through a bank, broker or other financial intermediary, please check your voting

instruction form or contact your bank, broker or other financial intermediary for instructions on how to change or revoke your vote.

As of the record date, September 26, 2022, the Fund had outstanding 17,530,463 shares.

The Fund’s annual report containing financial statements for the fiscal year ended August 31, 2021 has previously

been mailed to shareholders. Shareholders may request, without charge, additional copies of the Fund’s annual report, the most recent semi-annual report preceding such annual report and the semi-annual report for the six months ended February 28,

2022 by writing the Fund, c/o U.S. Bancorp Fund Services, LLC, 777 East Wisconsin Avenue, 4th Floor, Milwaukee, Wisconsin 53202. These reports are also available on the SEC’s website, www.sec.gov.

Board Recommendation

With respect to Proposal 1, the Board unanimously recommends that shareholders vote to elect the nominees named herein as Trustees.

Proposal 1.

To elect seven Trustees

To elect seven Trustees

The Board of Trustees currently consists of seven members. At the Meeting, shareholders will be asked to vote for the re-election of Messrs. Phillip

Goldstein, Andrew Dakos, Rajeev Das, Richard Dayan, Gerald Hellerman, Ben H. Harris, and Moritz Sell, as trustees to serve until the 2023 annual meeting of shareholders or thereafter until each of their successors are duly elected and qualified.

Each nominee has indicated that he will serve if elected. If any nominee should become unable to serve, the proxyholders will vote for his replacement if nominated by the Board.

Required Vote. Each Trustee must be elected by a

plurality of the votes cast by the shareholders. Abstentions and broker non-votes will be counted as shares present for quorum purposes, but otherwise will have no effect on the plurality vote required for each Trustee.

Trustees and Officers

Set forth below are the Trustees, nominees for Trustees and officers of the Fund, and their respective ages, business addresses, positions and terms of

office, principal occupations during the past five years, and other directorships held by them on September 1, 2022. Messrs. Hellerman, Sell, Dayan and Harris are each not considered an “interested person” of the Fund within the meaning of the

Investment Company Act of 1940, as amended (the “1940 Act”) (each an “Independent Trustee”). Messrs. Dakos, Goldstein and Das each may be considered Interested Trustees. In the past 10 years, there have been no legal proceedings against any of

the trustees, nominees or officers and none that are pending. Each nominee may be contacted by writing to him c/o High Income Securities Fund, 615 East Michigan Street, Milwaukee, WI 53202.

2

|

Name, Address and Age

|

Position(s) with the Fund

|

Term of Office And Length of Time Served

|

Principal Occupation

During the Past Five Years |

Number of

Portfolios in

Fund Complex

Overseen by

Trustee*

|

Other Directorships held by

Nominee During the Past Five Years |

|

|

INTERESTED TRUSTEE NOMINEES

|

||||||

|

Andrew Dakos (56)

|

President

|

1 Year; Since 2018

|

Partner in Bulldog Investors, LLP since 2009; Principal of the former general partner of several private investment partnerships in the Bulldog

Investors group of private funds.

|

1

|

Director, Special Opportunities Fund, Inc.; Chairman, Swiss Helvetia Fund, Inc.; Director, Brookfield DTLA Fund Office Trust Investor, Inc.;

Trustee, Crossroads Liquidating Trust (until 2020); Director, Emergent Capital, Inc. (until 2017)

|

|

|

Phillip Goldstein (77)

|

Chairman and Secretary

|

1 Year; Since 2018

|

Partner in Bulldog Investors, LLP since 2009; Principal of the former general partner of several private investment partnerships in the Bulldog

Investors group of private funds.

|

1

|

Chairman, The Mexico Equity & Income Fund, Inc.; Chairman, Special Opportunities Fund, Inc.; Director, Brookfield DTLA Fund Office Trust

Investor Inc.; Director, Swiss Helvetia Fund, Inc.; Trustee, Crossroads Liquidating Trust (until 2020); Director, MVC Capital, Inc. (until 2020); Chairman, Emergent Capital, Inc. (until 2017).

|

|

|

Rajeev Das (53)

|

--

|

1 Year; Since 2018

|

Principal of Bulldog Investors, LLP.

|

1

|

Director, The Mexico Equity & Income Fund, Inc.

|

|

|

INDEPENDENT TRUSTEE NOMINEES

|

||||||

|

Gerald Hellerman (85)

|

--

|

1 Year; Since 2018

|

Chief Compliance Officer of The Mexico Equity and Income Fund, Inc. and Special Opportunities Fund, Inc. (through March 2020)

|

1

|

Director, The Mexico Equity and Income Fund, Inc.;

Director, Special Opportunities Fund, Inc.; Trustee, Fiera Capital Series Trust; Director, Swiss Helvetia Fund, Inc.; Director, MVC Capital, Inc. (until 2020); Trustee, Crossroads Liquidating Trust (until 2020), Director, Emergent Capital, Inc. (until 2017); Director, Ironsides Partners Opportunity Offshore Fund Ltd. (until 2016).

|

|

3

|

Moritz Sell (54)

|

--

|

1 Year; Since 2018

|

Founder and Principal of Edison Holdings GmbH and Senior Advisor to Markston International LLC (through December 2020).

|

1

|

Director, Aberdeen Australia Equity Fund; Director, Swiss Helvetia Fund, Inc.; Director, Aberdeen Global Income Fund, Inc.; Director, Aberdeen

Asia-Pacific Income Fund, Inc.; Chairman, Aberdeen Singapore Fund (until 2018); Director, Aberdeen Greater China Fund (until 2018).

|

|

|

Richard Dayan (79)

|

--

|

1 Year; Since 2018

|

Owner of Cactus Trading.

|

1

|

Director, Swiss Helvetia Fund, Inc.; Director of Emergent Capital, Inc. (until 2017).

|

|

|

Ben H. Harris (53)

|

--

|

1 Year; Since 2018

|

Chief Executive Officer of Hormel Harris Investments, LLC; Principal of NBC Bancshares, LLC; Chief Executive Officer of Crossroads Capital, Inc.;

Administrator of Crossroads Liquidating Trust.

|

1

|

Director, Special Opportunities Fund, Inc.

|

|

|

OFFICERS

|

||||||

|

Andrew Dakos** (56)

|

President

|

1 Year; Since 2018

|

Partner in Bulldog Investors, LLP; Principal of the former general partner of several private investment partnerships in the Bulldog Investors

group of funds.

|

n/a

|

n/a

|

|

4

|

Thomas Antonucci** (53)

|

Treasurer

|

1 Year; Since 2018

|

Director of Operations of Bulldog Investors, LLP

|

n/a

|

n/a

|

|

|

Phillip Goldstein** (77)

|

Chairman and Secretary

|

1 Year; Since 2018

|

Partner in Bulldog Investors, LLP; Principal of the former general partner of several private investment partnerships in the Bulldog Investors

group of funds.

|

n/a

|

n/a

|

|

|

Stephanie Darling** (52)

|

Chief Compliance Officer

|

1 Year; Since 2018

|

General Counsel and Chief Compliance Officer of Bulldog Investors, LLP; Chief Compliance Officer of Special Opportunities Fund, Swiss Helvetia

Fund and Mexico Equity and Income Fund; Principal, the Law Office of Stephanie Darling; Editor-In-Chief, The Investment Lawyer.

|

n/a

|

n/a

|

|

|

*

|

The Fund Complex is comprised of only the Fund.

|

|

|

**

|

Messrs. Dakos, Goldstein, and Antonucci and Ms. Darling each may be considered an “interested person” of the Fund within the meaning of the 1940 Act

because of their positions as officers of the Fund.

|

The Board believes that the significance of each Trustee’s experience, qualifications, attributes or skills is an individual matter (meaning that

experience that is important for one Trustee may not have the same value for another) and that these factors are best evaluated at the Board level, with no single Trustee, or particular factor, being indicative of the Board’s effectiveness. The

Board currently does not have a formal diversity policy in place. The Board determined that each of the Trustees is qualified to serve as a Trustee of the Fund based on a review of the experience, qualifications, attributes and skills of each

Trustee. In reaching this determination, the Board has considered a variety of criteria, including, among other things: character and integrity;

ability to review critically, evaluate, question and discuss information provided, to exercise effective business judgment in protecting shareholder interests and to interact effectively with the other Trustees, service providers, counsel and the

independent registered public accounting firm (“independent auditors”); and willingness and ability to commit the time necessary to perform the duties of a Trustee. Each Trustee’s ability to perform his duties effectively is evidenced by his

experience or achievements in the following areas: management or board experience in the investment management industry or companies in other fields, educational background and professional training; and experience as a Trustee of the

Fund. Information as of September 1, 2022 indicating the specific experience, skills, attributes and qualifications of each Trustee which led to the Board’s determination that the Trustee should serve in this capacity is provided below. In

considering whether an individual is qualified to serve as a Trustee, you should consider the experiences, qualifications, attributes and skills of such Trustee on an individual basis.

5

|

Andrew Dakos

|

Mr. Dakos has been the President and a Trustee of the Fund since 2018. Mr. Dakos has over 20 years of investment management

experience. He is currently a Partner in Bulldog Investors, LLP, an investment adviser registered with the SEC. He is also a principal of the former general partner of several private investment partnerships in the Bulldog Investors group

of private funds. Mr. Dakos is also a director of two other closed-end funds, and one subsidiary of a large commercial real estate company.

|

|

Phillip Goldstein

|

Mr. Goldstein has been the Chairman of the Board and the Secretary of the Fund since 2018. Mr. Goldstein has over 30 years

of investment management experience. He is currently a Partner in Bulldog Investors, LLP, an investment adviser registered with the SEC. He is also a principal of the former general partner of several private investment partnerships in

the Bulldog Investors group of funds. Mr. Goldstein is also a director of three other closed-end funds, and one subsidiary of a large commercial real estate company.

|

|

Rajeev Das

|

Mr. Das has been a Trustee of the Fund since 2018. He has over 20 years of investment management experience and currently

serves as the Head of Trading for Bulldog Investors, LLP, an investment adviser registered with the SEC. In addition to the Fund, Mr. Das serves as a director of one other closed-end fund. Mr. Das is currently the vice-president of a

closed-end fund, where he previously served as a director.

|

|

Gerald Hellerman

|

Mr. Hellerman has been a Trustee of the Fund since 2018. Mr. Hellerman has more than 40 years of financial experience,

including serving as a Financial Analyst and Branch Chief at the U.S. Securities and Exchange Commission, Special Adviser to the U.S. Senate Antitrust and Monopoly Subcommittee and as Chief Financial Analyst at the Antitrust Division of the

U.S. Department of Justice for 17 years. He has served as a director of a number of public companies, including registered investment companies, and as a financial and corporate consultant during the period from 1993 to 2014.

|

|

Moritz Sell

|

Mr. Sell has been a Trustee of the Fund since 2018. Mr. Sell currently serves as Principal of Edison Holdings GMBH, a

commercial real estate and venture capital firm, and as Senior Advisor to Markston International LLC, an independent investment manager. From 1996 to 2013, he served as a Director, Market Strategist and Head of Proprietary Trading (London

Branch) of Landesbank Berlin AG and its predecessor, Landesbank Berlin Holding AG (formerly named Bankgesellschaft Berlin AG). Mr. Sell currently serves as a director of Aberdeen Australia Equity Fund, Swiss Helvetia Fund, Aberdeen Global

Income Fund and Aberdeen Asia Pacific Income Fund and previously served as a director of Aberdeen Singapore Fund (including as chairman of the board) and Aberdeen Greater China Fund.

|

6

|

Richard Dayan

|

Mr. Dayan has been a Trustee of the Fund since 2018. Mr. Dayan has been the President and owner of Cactus Trading, an

importer and exporter of clothing and accessories since 1990. Mr. Dayan formerly served for fifteen years as controller for Biltmore Textiles, a major textile company. Prior to that, he was an auditor for a public accounting firm.

|

|

Ben H. Harris

|

Mr. Harris has been a Trustee of the Fund since 2018. He has extensive experience in the management of private and public

entities, highly regulated entities and corporate restructurings. In addition to the Fund, Mr. Harris is currently a director of ten private companies and one other closed-end fund.

|

Specific details regarding each Trustee’s principal occupations during the past five years are included in the table above. The summaries set forth above

as to the experience, qualifications, attributes and/or skills of the Trustees do not constitute holding out the Board or any Trustee as having any special expertise or experience, and do not impose any greater responsibility or liability on any

such person or on the Board as a whole than would otherwise be the case.

Board Composition and Leadership Structure. The

Board currently consists of seven individuals, three of whom are Interested Trustees of the Fund. The Chairman of the Board, Mr. Goldstein, is an Interested Trustee and is the Secretary of the Fund. The Board does not have a lead independent

trustee.

The Board believes that its structure facilitates the orderly and efficient flow of information to the Trustees from the service providers with respect

to services provided to the Fund, potential conflicts of interest that could arise from these relationships and other risks that the Fund may face. The Board further believes that its structure allows all of the Trustees to participate in the full

range of the Board’s oversight responsibilities. The Board believes that the orderly and efficient flow of information and the ability to bring each Trustee’s talents to bear in overseeing the Fund’s operations is important, in light of the size

and complexity of the Fund and the risks that the Fund faces. Based on each Trustee’s experience and expertise with closed-end funds the Board believes that its leadership structure is appropriate and efficient. The Board and its committees review

their structures regularly, to help ensure that they remain appropriate as the business and operations of the Fund, and the environment in which the Fund operates, changes.

Currently, the Board has an Audit & Valuation Committee and an Investment Committee. The Board previously had an Investment Search Committee, which

was dissolved in September 2020.

7

Board’s Role in Risk Oversight of the Fund. The

Board oversees risk management for the Fund directly and, as to certain matters, through its committees. The Board exercises its oversight in this regard primarily through requesting and receiving reports from and otherwise working with the Fund’s

senior officers (including the Fund’s President, Chief Compliance Officer and Treasurer), members of the Investment Committee and other personnel of the Fund’s independent auditors, legal counsel and personnel from the Fund’s other service

providers. The Board has adopted, on behalf of the Fund, and periodically reviews with the assistance of the Fund’s Chief Compliance Officer, policies and procedures designed to address certain risks associated with the Fund’s activities. In

addition, the Fund’s service providers also have adopted policies, processes and procedures designed to identify, assess and manage certain risks associated with the Fund’s activities, and the Board receives reports from service providers with

respect to the operation of these policies, processes and procedures as required and/or as the Board deems appropriate.

Compensation of Trustees. The Board does not

have a standing compensation committee. Currently, each Trustee (including Trustees who are “interested persons”) receives an annual retainer equal to $40,000 for serving as a Trustee and attending the quarterly meetings of the Board, paid

quarterly in advance. In addition, each officer of the Fund (except the CCO) receives an annual retainer equal to $30,000, paid quarterly in advance. Each of Messrs. Dakos and Goldstein receives compensation for his service as both a Trustee and

an officer. Each Trustee is entitled to receive such compensation for any partial quarter for which he serves. In addition, the members of the Investment Committee are compensated by the Fund for their positions on the Investment Committee in the

amount of $150,000 each for Phillip Goldstein and Andrew Dakos, and $75,000 for Rajeev Das on an annual basis paid monthly in advance.

Other than described above, Trustees who are “interested persons” of the Fund will not receive any compensation for their services as Trustees. The Fund

does not have a bonus, profit sharing, pension or retirement plan. No other entity affiliated with the Fund pays any compensation to the Trustees. The table below details the amount of compensation the Fund’s Trustees received from the Fund

during the year ended August 31, 2022.

|

Aggregate

|

Pension or

Retirement

Benefits

Accrued as

|

Estimated

|

Total

Compensation

From Fund

and Fund

|

|||

|

Trustee

|

Compensation

From

|

Part of

Fund

|

Annual

Benefits Upon

|

Complex*

Paid to

|

||

|

Name of Trustee

|

Since

|

Fund

|

Expenses

|

Retirement

|

Trustee

|

|

|

Independent Trustees

|

||||||

|

Gerald Hellerman

|

2018

|

$41,250

|

None

|

None

|

$41,250

|

|

|

Moritz Sell

|

2018

|

$37,750

|

None

|

None

|

$37,750

|

|

|

Richard Dayan

|

2018

|

$37,750

|

None

|

None

|

$37,750

|

|

|

Ben H. Harris

|

2018

|

$36,250

|

None

|

None

|

$36,250

|

|

|

Interested Trustees

|

||||||

|

Andrew Dakos

|

2018

|

$198,333

|

None

|

None

|

$198,333

|

|

|

Phillip Goldstein

|

2018

|

$198,333

|

None

|

None

|

$198,333

|

|

|

Rajeev Das

|

2018

|

$102,916

|

None

|

None

|

$102,916

|

|

|

*

|

The Fund Complex is comprised of only the Fund.

|

|||||

8

Code of Ethics. The Fund has adopted a code of

ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code may invest in securities for their personal investment

accounts, including securities that may be purchased or held by the Fund, so long as such investments are made pursuant to the code’s requirements. The Board of Trustees adopted a revised code of ethics at a meeting held in June 2019, a copy of

which is available on the Fund’s website at www.highincomesecuritesfund.com. In addition, a copy of the code is available for inspection at the Public Reference Room of the SEC in Washington, D.C. Information regarding the operation of the Public

Reference Room is available by calling the SEC at 1-202-551-8090. A copy of the code is also available on the EDGAR Database on the SEC’s website at www.sec.gov,

and may also be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s

Public Reference Section, Washington, D.C. 20549-0102.

Management Ownership. To the knowledge of the

Fund’s management, as of September 1, 2022 the Trustees and officers of the Fund beneficially owned, as a group, less than 5% of the shares of the Fund’s common stock. The following table sets forth the aggregate dollar range of equity securities

in the Fund that is owned by each Trustee, nominee for Trustee and officer as of September 1, 2022. The information as to beneficial ownership is based on statements furnished to the Fund by each Trustee, nominee for Trustee and principal officer:

|

Name

|

Position

|

Dollar Range of Equity

Securities in the Fund

|

Aggregate Dollar

Range of Equity Securities In

All Funds

Overseen by Trustee in Family of

Investment Companies *

|

|

|

Gerald Hellerman

|

Independent Trustee

|

Over $100,000

|

Over $100,000

|

|

|

Moritz Sell

|

Independent Trustee

|

$50,000-$100,000

|

$50,000-$100,000

|

|

|

Richard Dayan

|

Independent Trustee

|

None

|

None

|

|

|

Ben H. Harris

|

Independent Trustee

|

$50,000-$100,000

|

$50,000-$100,000

|

|

|

Andrew Dakos**

|

Interested Trustee and President

|

Over $100,000

|

Over $100,000

|

|

|

Phillip Goldstein**

|

Interested Trustee and Secretary

|

Over $100,000

|

Over $100,000

|

|

|

Rajeev Das**

|

Interested Trustee

|

None

|

None

|

|

|

Thomas Antonucci**

|

Treasurer

|

None

|

None

|

|

|

Stephanie Darling**

|

Chief Compliance Officer

|

None

|

None

|

|

|

*

|

The Family of Investment Companies is comprised of only the Fund.

|

|||

|

**

|

Messrs. Dakos, Goldstein, Das and Antonucci and Ms. Darling each may be considered an “interested person” of the Fund within the meaning of the 1940 Act.

|

|||

9

Trustee Transactions with Fund Affiliates. Since

the beginning of the last two fiscal years, neither the Trustees nor members of their immediate family have conducted any transactions (or series of transactions) or maintained any direct or indirect relationship in which the amount involved

exceeds $120,000 and to which the Fund or any of its affiliates was a party.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 1 TO

ELECT EACH OF THE NOMINEES FOR TRUSTEE. ANY SIGNED BUT UNMARKED PROXIES WILL BE SO VOTED “FOR” THE ELECTION OF EACH OF THE NOMINEES.

Additional Information about the Board of Trustees

Board Meetings and Committees.

During the fiscal year ended August 31, 2022, the Board met 4 times. During the fiscal year ended August 31, 2022, each present

Trustee and nominee for Trustee attended at least 75% of the meetings of the Board and of the Committees of which he is a member, held since his respective election.

Audit & Valuation Committee. The Board has established an Audit & Valuation Committee whose responsibilities are generally: (i) to oversee the accounting and financial

reporting processes of the Fund and its internal control over financial reporting and, as the Audit Committee deems appropriate, to inquire into the internal control over financial reporting of certain third-party providers; (ii) to oversee the

quality and integrity of the Fund’s financial statements and the independent audit thereof; (iii) to oversee, or, as appropriate, assist Board oversight of, the Fund’s compliance with legal and regulatory requirements that relate to the Fund’s

accounting and financial reporting, internal control over financial reporting and independent audits; (iv) to approve prior to appointment the engagement of the Fund’s independent auditors and, in connection therewith, to review and evaluate the

qualifications, independence and performance of the Fund’s independent auditors; (v) to act as liaison between the Fund’s independent auditors and the full Board; (vi) review all monthly reports and any other interim reports regarding the valuation

of securities in the Fund’s portfolio, and (vii) review and approve the valuation of all fair valued securities.

Although the Audit & Valuation Committee is expected to take a detached and questioning approach to the matters that come before

it, the review of the Fund’s financial statements by the Audit & Valuation Committee is not an audit, nor does the Audit & Valuation Committee’s review substitute for the responsibilities of the Fund’s management for preparing, or the

independent auditors for auditing, the financial statements. Members of the Audit & Valuation Committee are not full-time employees of the Fund and, in serving on the Audit & Valuation Committee, are not, and do not hold themselves out to

be, acting as accountants or auditors. As such, it is not the duty or responsibility of the Audit & Valuation Committee or its members to conduct “field work” or other types of auditing or accounting reviews. In discharging their duties, the

members of the Audit & Valuation Committee are entitled to rely on information, opinions, reports, or statements, including financial statements and other financial data, if prepared or presented by: (1) one or more officers of the Fund whom

such Trustee reasonably believes to be reliable and competent in the matters presented; (2) legal counsel, public accountants, or other persons as to matters the Trustee reasonably believes are within the person’s professional or expert competence;

or (3) a Board committee of which the Trustee is not a member.

10

The Audit & Valuation Committee currently consists of Messrs. Hellerman, Sell and Dayan. None of the members of the Audit &

Valuation Committee has any relationship to the Fund that may interfere with the exercise of his independence from management of the Fund, and each is independent as defined under the listing standards of the New York Stock Exchange (“NYSE”)

applicable to closed-end funds. Mr. Hellerman is the Chairman of the Audit & Valuation Committee. The Board has determined that Mr. Dayan is an “audit committee financial expert” as such term is defined by the Securities Exchange Act of 1934,

as amended. The Board has determined that Mr. Sell’s service on the audit committees of more than three public companies does not impair his ability to effectively serve on the Fund’s Audit & Valuation Committee because, like the Fund, those

other companies are listed closed-end funds and include funds that are part of the same fund complex. The Board’s Audit & Valuation Committee met 4 times during the year ended August 31, 2022.

Investment Committee. In April 2019, the Board established an Investment Committee. The Investment Committee is responsible for, among other things, managing the Fund’s

assets. The Investment Committee will invest the Fund’s assets within the parameters of the Fund’s existing investment policies and restrictions, and will strive to invest in securities that are likely to generate income.

The Investment Committee currently consists of Messrs. Goldstein, Dakos and Das.

Nominees for Trustee. The Board does not have a

standing nominating committee. The full Board participates in the process of identifying and selecting qualified individuals to become Board members and members of Board committees. In nominating candidates, the Board believes that no specific

qualifications or disqualifications are controlling or paramount, and that there are no specific qualities or skills necessary for each candidate to possess. In identifying and evaluating nominees for Trustee, the Board takes into consideration

such factors as it deems appropriate. These factors may include: (i) whether or not the person is an “interested person” as defined in the 1940 Act, meets the independence and experience requirements of the NYSE applicable to closed-end funds and

is otherwise qualified under applicable laws and regulations to serve as a member of the Board; (ii) whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships

with Fund management or Fund service providers or their affiliates; (iii) whether or not the person is willing to serve, and willing and able to commit the time necessary for the performance of the duties of a Board member; (iv) the person’s

judgment, skill, diversity and experience with investment companies and other organizations of comparable purpose, complexity and size and subject to similar legal restrictions and oversight; (v) the interplay of the candidate’s experience with the

experience of other Board members; and (vi) the extent to which the candidate would be a desirable addition to the Board and any committees thereof.

11

The Board will consider nominees recommended by shareholders if a vacancy occurs. In order to recommend a nominee, a shareholder

should send a letter to the Chairman of the Board, c/o High Income Securities Fund, 615 East Michigan Street, Milwaukee, Wisconsin 53202, and indicate on the envelope “Trustee Nominee.” The shareholder’s letter should state the nominee’s name and

should include the nominee’s résumé or curriculum vitae, and must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by shareholders. Shareholders can send other

communications to the Board, c/o the High Income Securities Fund, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Information Concerning the Fund’s

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP (“Tait, Weller”) audited the Fund’s financial statements for the fiscal year ended August 31, 2022 and

has been selected as the Fund’s independent registered public accounting firm for the fiscal year ending August 31, 2023.

A representative of Tait Weller is not expected to be present at the Meeting and therefore will not (i) have the opportunity to make

a statement if he or she so desires or (ii) be available to respond to appropriate questions.

Fees. The following table sets

forth the aggregate fees billed by Tait Weller for the fiscal years ended August 31, 2021 and August 31, 2022, in each case for professional services rendered to the Fund:

|

Service

|

2021

|

|

|

2022

|

|

||||||||

|

Audit Fees

|

$

|

31,500

|

|

$

|

31,500

|

|

|||||||

|

Audit-Related Fees

|

|

--

|

|

|

--

|

|

|||||||

|

Tax Fees

|

|

3,300

|

|

|

3,300

|

|

|||||||

|

All Other Fees

|

|

--

|

|

|

--

|

|

|||||||

|

Total

|

$

|

34,800

|

|

$

|

34,800

|

|

|||||||

Fees included in the “audit fees” category are those associated with the annual audits of financial statements and services that are

normally provided in connection with statutory and regulatory filings.

Fees included in the “audit-related fees” category consist of services related to reading and providing comments on the Fund’s

semi-annual financial statements and the review of profitability report.

Fees included in the “tax fees” category comprise all services performed by professional staff in Tait Weller’s tax division, except

those services related to the audits. This category comprises fees for review of tax compliance, tax return preparation and excise tax calculations.

12

For the fiscal years ended August 31, 2021 and August 31, 2022, there were no fees billed by Tait Weller for other services provided

to the Fund. Fees included in the “all other fees” category would consist of services related to internal control reviews, strategy and other consulting, financial information systems design and implementation, consulting on other information

systems, and other tax services unrelated to the Fund.

Of the time expended by Tait Weller to audit the Fund’s financial statements for the Fund’s most recent fiscal year, less than 50% of

such time involved work performed by persons other than Tait Weller’s full-time, permanent employees.

With respect to Rule 2-01(c)(7)(i)(C) of Regulation S-X, there were no audit-related fees, or tax fees that were approved by the

Audit & Valuation Committee pursuant to the de minimis exception for the fiscal years ended August 31, 2021 and August 31, 2022, and there were no amounts that were required to be approved by the Audit Committee pursuant to the de minimis

exception for the fiscal years ended August 31, 2021 and August 31, 2022, on behalf of the Fund’s service providers that relate directly to the operations and financial reporting of the Fund.

All of the services performed by Tait Weller, including audit related and non-audit related services, were pre-approved by the Audit

& Valuation Committee as required under such committee’s charter.

For the fiscal year ended August 31, 2022, the aggregate fees billed by Tait Weller for non-audit services rendered on behalf of the

Fund were $0.

Audit Committee Pre-Approval

The Audit & Valuation Committee charter contained the Audit & Valuation Committee’s pre-approval policies and

procedures. Reproduced below is an excerpt from the Audit & Valuation Committee charter regarding such policies and procedures:

The Audit & Valuation Committee shall:

approve prior to appointment the engagement of the auditor to provide other audit services to the Fund or to provide non-audit

services to the Fund, any member of its investment committee, which is responsible for the management of the Fund’s assets (the “Investment Committee”) or any entity controlling, controlled by, or under common control with such member (“Investment

Committee Affiliate”) that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund.

Audit Committee Report

The Audit & Valuation Committee has met and held discussions with the Administrator and Tait Weller. Tait Weller represented to

the Audit & Valuation Committee that the Fund’s financial statements were prepared in accordance with U.S. generally accepted accounting principles and the Audit & Valuation Committee has reviewed and discussed the financial statements with

the Administrator and Tait Weller. The Audit & Valuation Committee also discussed with Tait Weller matters required to be discussed by Auditing Standard No. 16.

13

Tait Weller also provided to the Audit & Valuation Committee the written disclosures required by Public Company Accounting

Oversight Board Rule 3526 (Communication with Audit Committees Concerning Independence), and the Audit & Valuation Committee discussed with Tait Weller its independence, in light of the services Tait Weller is providing.

Based upon the Audit & Valuation Committee’s discussion with the Administrator and Tait Weller and the Audit & Valuation

Committee’s review of the representations of the Administrator and the report of Tait Weller to the Audit & Valuation Committee, the Audit & Valuation Committee recommended that the Board of Trustee include the audited financial statements

in the Fund’s Annual Report for the fiscal year ended August 31, 2022, to be filed with the SEC.

Gerald Hellerman

Moritz Sell

Richard Dayan

14

Other Information

Beneficial Ownership of Shares

Beneficial Ownership of Shares. Based

solely upon a review of public filings, the Fund’s management knew of the following persons who owned, as of September 1, 2022, 5% or more of the shares of the Fund.

|

Name and address of beneficial owner

|

Amount and nature of

beneficial ownership

|

Percent of class*

|

|

|

Cetera Financial Group Inc.

|

984,273

|

5.61%**

|

|

|

First Trust Advisors LP

|

897,237

|

5.12%**

|

* Percent of class is based on the number of shares outstanding as of September 1, 2022.

** Based on the most recent

information (as of September 1, 2022) provided by Bloomberg L.P.

Section 16(a) Beneficial

Ownership Reporting Compliance

The Fund is not aware of any outstanding report required to be filed pursuant to Section 16(a) of the Securities Exchange Act of 1934

by any trustee or officer.

Shareholder Proposals

The Meeting is an annual meeting of the Fund’s shareholders. Any shareholder who wishes to submit proposal to be

considered at the Fund’s next annual meeting of shareholders in 2023 should send such proposals to the Secretary of High Income Securities Fund, c/o the Administrator, 615 East Michigan Street, Milwaukee, Wisconsin 53202. Shareholder proposals

must be received by the Fund no later than the close of business on July 4, 2023 to receive consideration for inclusion in the Fund’s proxy materials relating to that meeting under Rule 14a-8 of the Exchange Act. Shareholder proposals that are

submitted in a timely manner will not necessarily be included in the Fund’s proxy materials. Inclusion of such proposals is subject to limitations under the federal securities laws and informational requirements of the Fund’s Amended and Restated

Bylaws, as in effect from time to time.

In order for a shareholder to bring a proposal (other than proposals sought to be included in the Fund’s proxy

statement pursuant to Rule 14a-8 of the Exchange Act) before the 2023 annual meeting, such shareholder must deliver a written notice of such proposal to the Secretary of High Income Securities Fund, c/o the Administrator, 615 East Michigan Street,

Milwaukee, Wisconsin 53202, between September 1, 2023 and October 1, 2023.

15

Shareholders are advised to review the Fund’s Amended and Restated Bylaws, which contains additional requirements

about advance notice of shareholder proposals.

Important notice regarding the

availability of proxy materials for the annual meeting of shareholders to be held on November 30, 2022:

The notice of annual meeting of shareholders and this Proxy Statement, along with the Fund’s annual report for the

fiscal year ended August 31, 2022, are available free of charge at www.highincomesecuritiesfund.com.

16

Other Business

The Fund’s Board knows of no business to be presented at the Meeting other than the matters set forth in this Proxy Statement, but

should any other matter requiring a vote of shareholders arise, the proxies will vote thereon according to their discretion.

By order of the Board of Trustees,

Phillip Goldstein

Chairman of the Board

Chairman of the Board

November 1, 2022

|

It is important that you execute and return your proxy promptly.

|

17