CREATING A SCALED, CATEGORY-DEFINING RETAILER FOR INCLUSIVE APPAREL INVESTOR PRESENTATION | DECEMBER 11, 2025 .2

Forward-Looking Statements In addition to historical information, this document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which DXL and FullBeauty operate and beliefs of and assumptions made by DXL management and FullBeauty management, involve uncertainties that could significantly affect the financial results of DXL or FullBeauty or the combined company. Words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “seeks” and variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. With respect to any such forward-looking statements, DXL and FullBeauty each claim the protection provided for in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving DXL and FullBeauty, including future financial and operating results and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders, integrating DXL and FullBeauty, and the expected timing for completing the merger — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated with the ability to consummate the merger and the timing of the closing of the merger; the conditions to the completion of the merger, including the receipt of DXL stockholder approval for the merger; the ability to successfully integrate and scale our operations and employees; the ability and timing to realize anticipated benefits and synergies of the merger; the potential impact of the announcement, pendency or consummation of the merger on relationships, including with employees, customers, credit rating agencies, suppliers and competitors; the ability to retain key personnel; the challenging macroeconomic environment, including volatility and changes in global trade policies, and the ability of the combined company to mitigate potential tariff exposure and maintain supply; the ability to achieve performance targets; changes in financial markets, interest rates and foreign currency exchange rates; negative rating agency actions; the outcome of any legal proceedings that may be instituted against DXL or FullBeauty; the risk that any announcements relating to the merger could have adverse effects on the market price of the common stock of DXL; diversion of management’s attention from ongoing business operations and opportunities; and those additional risks and factors detailed in the Proxy Statement referenced below when available and other reports filed with the SEC by DXL from time to time, including those discussed under the heading “Risk Factors” in DXL’s most recently filed Annual Report on Form 10-K. These documents are available through our website or through the SEC’s Electronic Data Gathering and Analysis Retrieval (EDGAR) system at http://www.sec.gov. Neither DXL nor FullBeauty undertakes any duty to update any forward-looking statements contained herein, whether as a result of new information or developments, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Additional Information About the Merger and Where to Find It In connection with the merger, DXL intends to file a proxy statement (the “Proxy Statement”), which will be distributed to the stockholders of DXL in connection with their votes on the issuance of DXL common stock in the merger. Investors and security holders are encouraged to read the Proxy Statement when it becomes available (and any other documents filed with the Securities and Exchange Commission (the “SEC”) in connection with the merger or incorporated by reference into the Proxy Statement) because such documents will contain important information regarding the merger and related matters. Investors and security holders will be able to obtain these documents, and any other documents DXL has filed with the SEC, free of charge at the SEC’s website, www.sec.gov, or by accessing DXL’s website at investor.dxl.com. In addition, documents filed with the SEC by DXL will be available free of charge by writing to DXL at 555 Turnpike Street, Canton, Massachusetts 02021, Attention: Corporate Secretary. Participants in the Solicitation DXL and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of DXL in connection with the merger. Information about DXL’s directors and executive officers, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in DXL’s proxy statement for its 2025 annual meeting of stockholders, which was filed with the SEC on June 30, 2025, including under the headings “Director Compensation,” “Compensation Discussion and Analysis,” “Executive Compensation,” “Security Ownership of Management.” To the extent holdings of DXL common stock by the directors and executive officers of DXL have changed from the amounts of DXL common stock held by such persons as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3, Statements of Changes in Beneficial Ownership on Form 4 or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5, in each case filed with the SEC, including the Form 4s filed by each of the non-executive directors on August 6, 2025, the Form 4s filed by each of the executive officers on September 3, 2025 and the Form 4s filed by each of the non-executive directors on November 5, 2025. FullBeauty and its chief executive officer may be deemed to be participants in the solicitation of proxies from the stockholders of DXL in connection with the Merger. Information about FullBeauty and its chief executive officer is available as .9 to the Form 8-K filed on December 11, 2025. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement regarding the merger when it becomes available. Free copies of this document may be obtained as described above. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Non-GAAP Financial Measures In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation contains the presentation of Adjusted EBITDA, a non-GAAP financial measure. The presentation of this non-GAAP measure is not in accordance with GAAP and should not be considered superior to, or as a substitute for, net income (loss) or any other measure of performance derived in accordance with GAAP. In addition, not all companies calculate Adjusted EBITDA in the same manner and, accordingly, the non-GAAP measures presented in this release may not be comparable to similar Adjusted EBITDA measures used by other companies. As reported in this presentation, Adjusted EBITDA was calculated for both DXL and FullBeauty as earnings for the last twelve months ended November 1, 2025 for DXL and October 25, 2025 for FullBeauty, before interest, taxes, depreciation, and amortization, and adjusted for certain non-recurring items. Each of DXL and FullBeauty makes different adjustments in its calculation of Adjusted EBITDA. Specifically, Adjusted EBITDA for DXL reflects adjustments for the impairment of assets and the accrual for estimated non-recurring legal settlement costs, while Adjusted EBITDA for FullBeauty reflects adjustments for restructuring costs, acquisitions costs, and the accrual for estimated non-recurring legal settlement costs. We believe that providing Adjusted EBITA is useful to investors to evaluate the current performance of DXL and FullBeauty, on a combined basis, and is a key metric to measure profitability and economic productivity. Basis of Presentation for Combined Financial Information The combined financial information presented in this presentation is for illustrative purposes only and is not intended to represent “pro forma” financial information as defined by and required by Article 11 of Regulation S-X. The combined results represent a simple arithmetic summation of the historical financial results of DXL and FullBeauty for the respective periods indicated, without giving effect to any purchase accounting adjustments, financing adjustments, or other transaction-related adjustments that would be required in a compliant pro forma presentation. Consequently, this combined information does not purport to represent what the actual results of operations or financial condition of the combined company would have been had the transaction occurred on the dates indicated, nor does it purport to project the results of operations or financial condition of the combined company for any future period or as of any future date. Investors are cautioned not to place undue reliance on these combined figures as a predictor of future performance.

Today’s Presenters 3 Jim Fogarty CEO Peter Stratton CFO Destination XL Group (“DXL”) 39+ Years of Industry Experience FullBeauty Brands (“FBB”) 35+ Years of Industry Experience Destination XL Group (“DXL”) 30+ Years of Industry Experience Harvey Kanter CEO & President

DXL + FullBeauty: Creating a Scaled, Category-Defining Retailer for Inclusive Apparel Combining FullBeauty’s inclusive women’s brands and KingSize with DXL’s Big + Tall expertise to create a category-defining size-inclusive brand portfolio in North America Building a powerful omni-channel and data-driven platform leveraging 296 stores and a leading DTC presence to personalize marketing, optimize inventory and boost customer lifetime value Capturing significant synergy opportunities, with additional commercial synergy upside over time Improved scale, profitability and financial flexibility provides enhanced free cash flow profile to reinvest in growth initiatives while reducing leverage 4

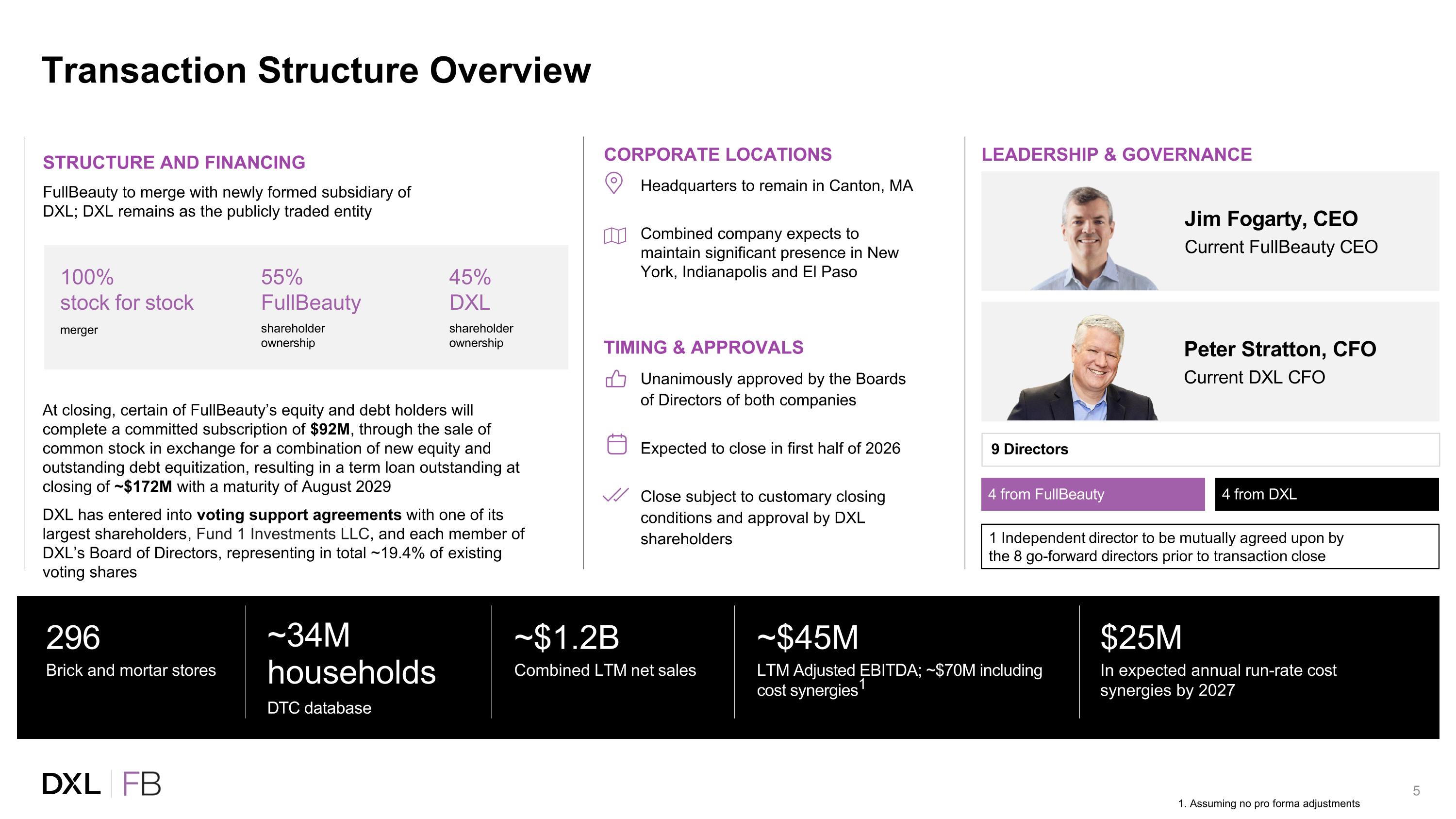

TIMING & APPROVALS Unanimously approved by the Boards of Directors of both companies Expected to close in first half of 2026 Close subject to customary closing conditions and approval by DXL shareholders CORPORATE LOCATIONS Headquarters to remain in Canton, MA Combined company expects to maintain significant presence in New York, Indianapolis and El Paso Transaction Structure Overview 100% stock for stock merger LEADERSHIP & GOVERNANCE Jim Fogarty, CEO Current FullBeauty CEO 9 Directors 1 Independent director to be mutually agreed upon by the 8 go-forward directors prior to transaction close 4 from FullBeauty 4 from DXL Peter Stratton, CFO Current DXL CFO STRUCTURE AND FINANCING FullBeauty to merge with newly formed subsidiary of DXL; DXL remains as the publicly traded entity 296 Brick and mortar stores ~34M households DTC database ~$1.2B Combined LTM net sales $25M In expected annual run-rate cost synergies by 2027 At closing, certain of FullBeauty’s equity and debt holders will complete a committed subscription of $92M, through the sale of common stock in exchange for a combination of new equity and outstanding debt equitization, resulting in a term loan outstanding at closing of ~$172M with a maturity of August 2029 DXL has entered into voting support agreements with one of its largest shareholders, Fund 1 Investments LLC, and each member of DXL’s Board of Directors, representing in total ~19.4% of existing voting shares 55% FullBeauty shareholder ownership 45% DXL shareholder ownership ~$45M LTM Adjusted EBITDA; ~$70M including cost synergies1 1. Assuming no pro forma adjustments

Compelling Strategic and Financial Benefits Offering one of the broadest and most diverse portfolios across price points, lifestyles and occasions Serving customers across the plus-size and Big + Tall apparel market Bringing together complementary brands, channels and capabilities to better serve plus-size women and Big + Tall men Forming one of the largest omni-channel retailers with increased scale; combined company captures a portion of a largely untapped market Leveraging each company’s strengths to accelerate growth Capturing synergies and creating an enhanced financial position to drive future growth and shareholder returns 6

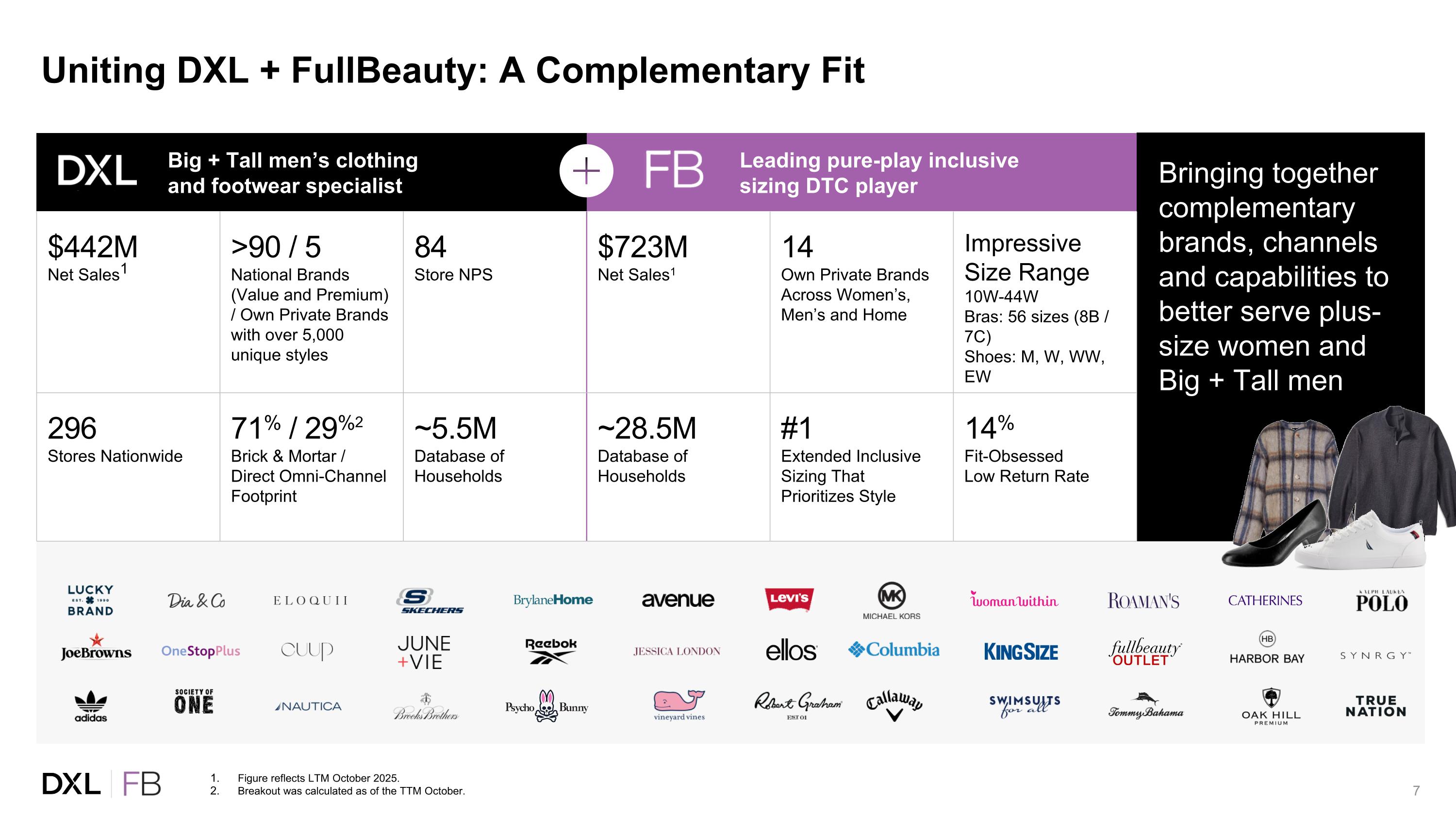

Bringing together complementary brands, channels and capabilities to better serve plus-size women and Big + Tall men Figure reflects LTM October 2025. Breakout was calculated as of the TTM October. Uniting DXL + FullBeauty: A Complementary Fit Big + Tall men’s clothing and footwear specialist Leading pure-play inclusive sizing DTC player $442M Net Sales1 >90 / 5 National Brands (Value and Premium) / Own Private Brands with over 5,000 unique styles 84 Store NPS $723M Net Sales1 14 Own Private Brands Across Women’s, Men’s and Home Impressive Size Range 10W-44W Bras: 56 sizes (8B / 7C) Shoes: M, W, WW, EW 296 Stores Nationwide 71% / 29%2 Brick & Mortar / Direct Omni-Channel Footprint ~5.5M Database of Households ~28.5M Database of Households #1 Extended Inclusive Sizing That Prioritizes Style 14% Fit-Obsessed Low Return Rate

DXL and FBB LTM October 2025 sales splits. Serving Customers Across the Plus-Size and Big + Tall Apparel Market GENDER… ASSORTMENT… …AND CHANNEL BRAND… Combined 1 One of the industry’s broadest and most diverse portfolios to provide customers more brands, more styles and more options 8

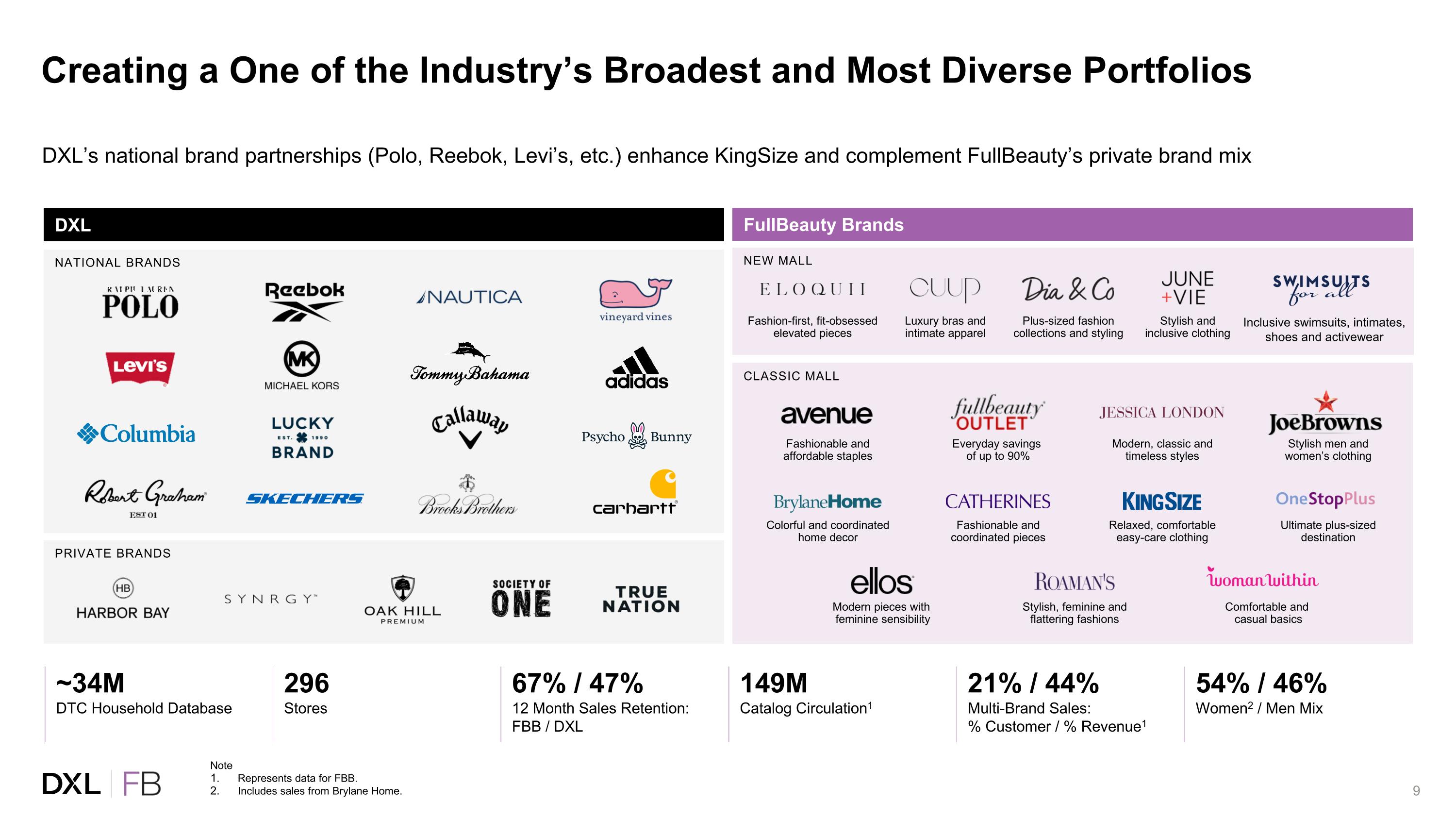

NATIONAL BRANDS NEW MALL CLASSIC MALL DXL FullBeauty Brands Note Represents data for FBB. Includes sales from Brylane Home. Creating a One of the Industry’s Broadest and Most Diverse Portfolios DXL’s national brand partnerships (Polo, Reebok, Levi’s, etc.) enhance KingSize and complement FullBeauty’s private brand mix PRIVATE BRANDS ~34M DTC Household Database 296 Stores 67% / 47% 12 Month Sales Retention: FBB / DXL 149M Catalog Circulation1 21% / 44% Multi-Brand Sales: % Customer / % Revenue1 54% / 46% Women2 / Men Mix Fashionable and affordable staples Modern pieces with feminine sensibility Colorful and coordinated home decor Stylish, feminine and flattering fashions Comfortable and casual basics Fashion-first, fit-obsessed elevated pieces Inclusive swimsuits, intimates, shoes and activewear Stylish men and women’s clothing Luxury bras and intimate apparel Modern, classic and timeless styles Stylish and inclusive clothing Ultimate plus-sized destination Plus-sized fashion collections and styling Relaxed, comfortable easy-care clothing Everyday savings of up to 90% Fashionable and coordinated pieces

The combination forms one of the largest omni-channel retailers with increased scale and reach One of the top players by sales and store count, even before realizing commercial synergies or future M&A Despite its scale, the combined entity only captures a portion of a largely untapped market, highlighting substantial growth potential The combined company delivered approximately $1.2 billion in combined net sales for the twelve months ending October 2025 Scale Matters in Inclusive Sizing Apparel With increased scale and best-in-class capabilities, the combined entity is positioned for continued expansion and value creation in the inclusive sizing sector 10

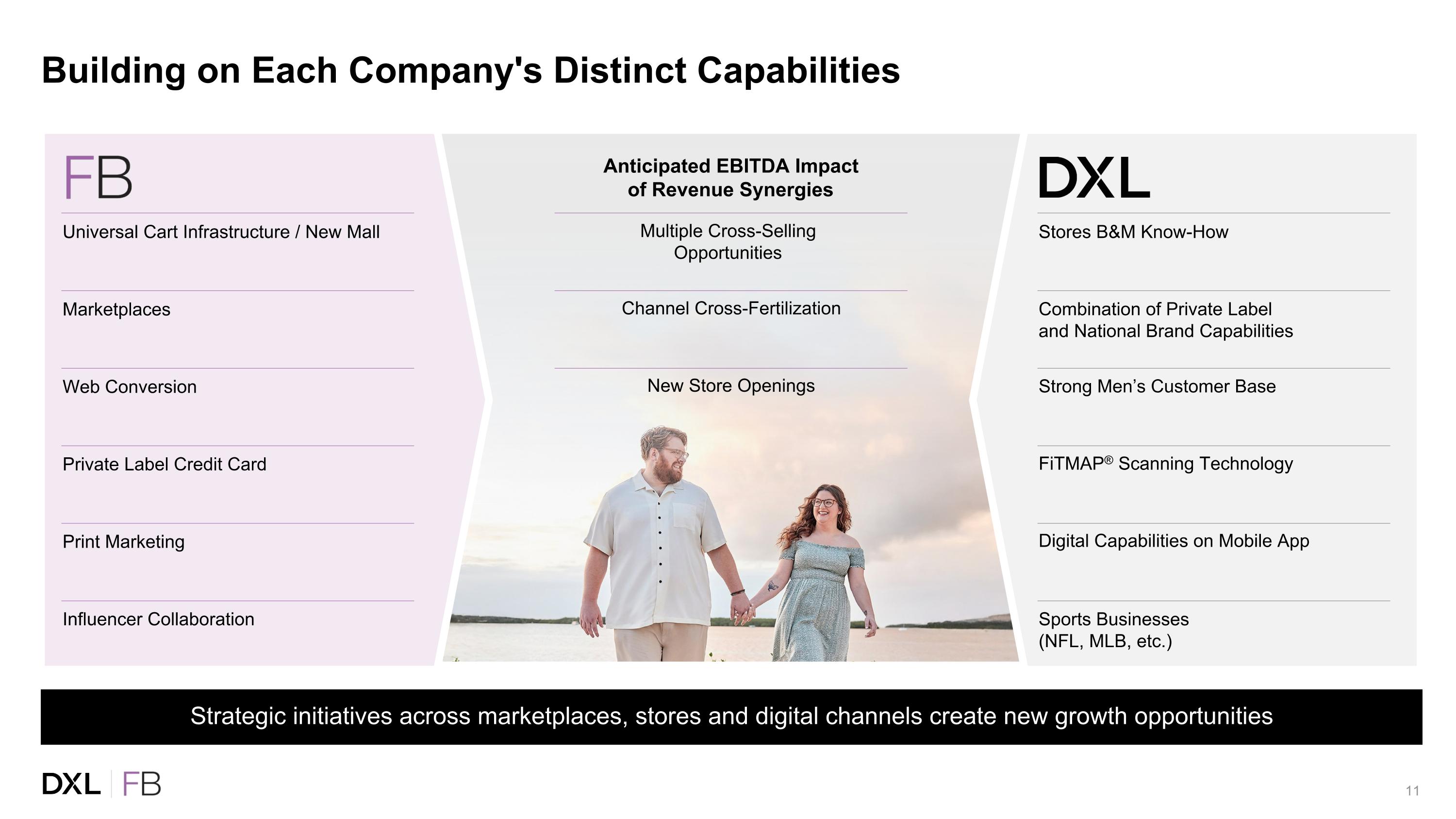

Building on Each Company's Distinct Capabilities Anticipated EBITDA Impact of Revenue Synergies Strategic initiatives across marketplaces, stores and digital channels create new growth opportunities Marketplaces Private Label Credit Card Print Marketing Universal Cart Infrastructure / New Mall Influencer Collaboration Web Conversion Combination of Private Label and National Brand Capabilities Strong Men’s Customer Base Digital Capabilities on Mobile App Sports Businesses (NFL, MLB, etc.) Stores B&M Know-How FiTMAP® Scanning Technology Multiple Cross-Selling Opportunities Channel Cross-Fertilization New Store Openings

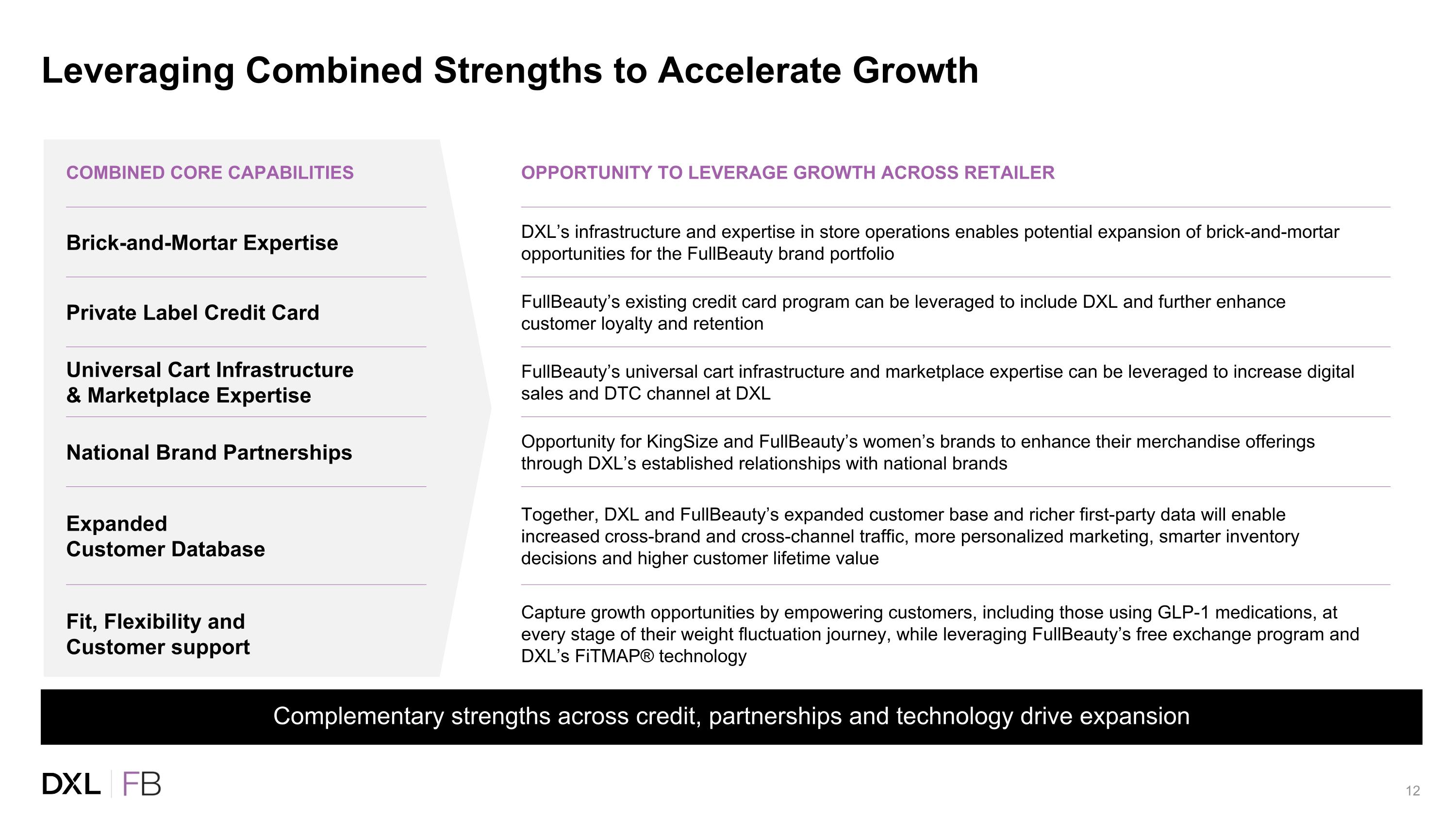

COMBINED CORE CAPABILITIES OPPORTUNITY TO LEVERAGE GROWTH ACROSS RETAILER Brick-and-Mortar Expertise DXL’s infrastructure and expertise in store operations enables potential expansion of brick-and-mortar opportunities for the FullBeauty brand portfolio Private Label Credit Card FullBeauty’s existing credit card program can be leveraged to include DXL and further enhance customer loyalty and retention Universal Cart Infrastructure & Marketplace Expertise FullBeauty’s universal cart infrastructure and marketplace expertise can be leveraged to increase digital sales and DTC channel at DXL National Brand Partnerships Opportunity for KingSize and FullBeauty’s women’s brands to enhance their merchandise offerings through DXL’s established relationships with national brands Expanded Customer Database Together, DXL and FullBeauty’s expanded customer base and richer first-party data will enable increased cross-brand and cross-channel traffic, more personalized marketing, smarter inventory decisions and higher customer lifetime value Fit, Flexibility and Customer support Capture growth opportunities by empowering customers, including those using GLP-1 medications, at every stage of their weight fluctuation journey, while leveraging FullBeauty’s free exchange program and DXL’s FiTMAP® technology Leveraging Combined Strengths to Accelerate Growth Complementary strengths across credit, partnerships and technology drive expansion

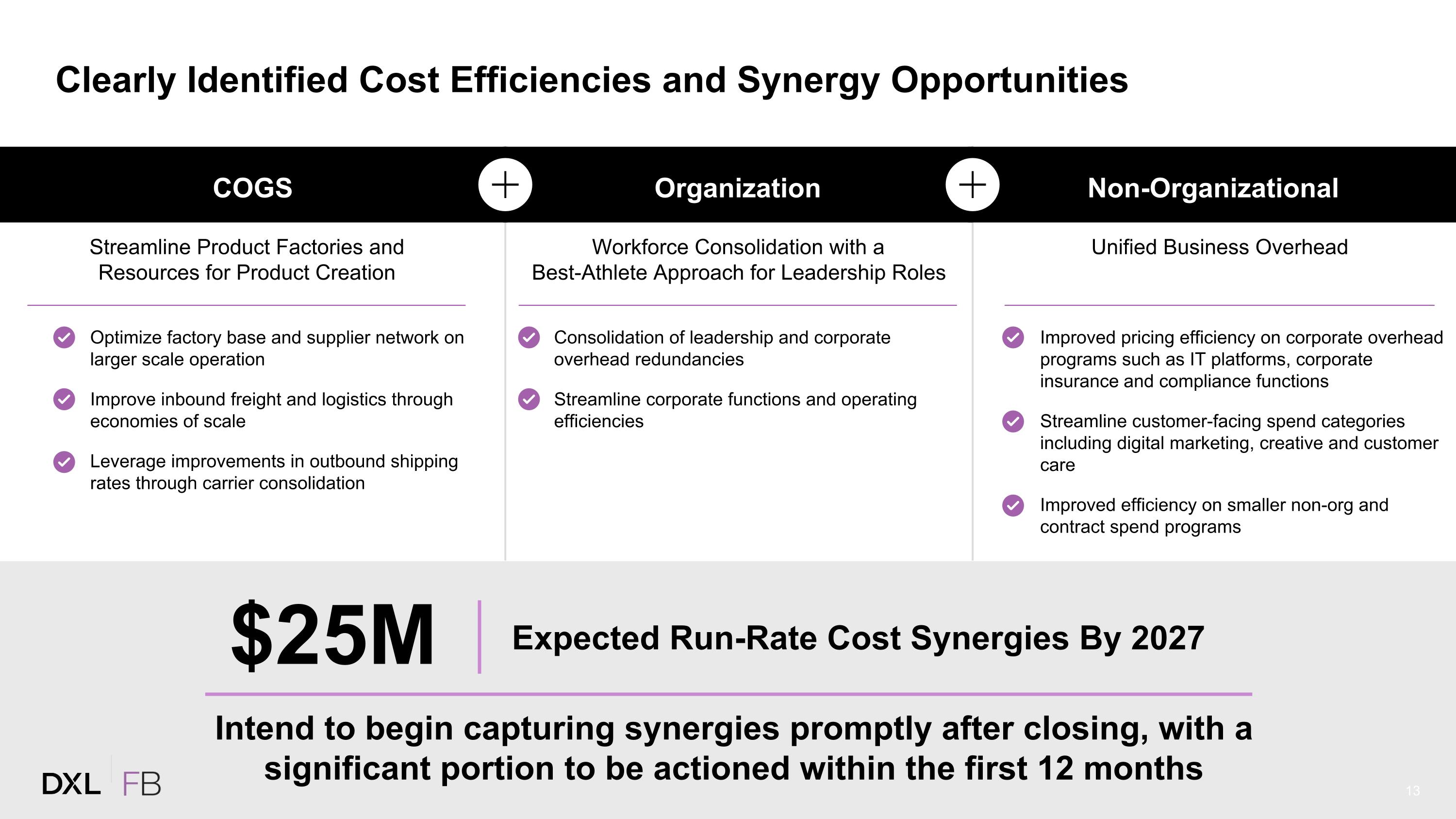

Clearly Identified Cost Efficiencies and Synergy Opportunities $25M Organization Consolidation of leadership and corporate overhead redundancies Streamline corporate functions and operating efficiencies COGS Optimize factory base and supplier network on larger scale operation Improve inbound freight and logistics through economies of scale Leverage improvements in outbound shipping rates through carrier consolidation Non-Organizational Improved pricing efficiency on corporate overhead programs such as IT platforms, corporate insurance and compliance functions Streamline customer-facing spend categories including digital marketing, creative and customer care Improved efficiency on smaller non-org and contract spend programs Expected Run-Rate Cost Synergies By 2027 Streamline Product Factories and Resources for Product Creation Workforce Consolidation with a Best-Athlete Approach for Leadership Roles Unified Business Overhead 13 Intend to begin capturing synergies promptly after closing, with a significant portion to be actioned within the first 12 months

One of the Largest Inclusive-Sizing Apparel Retailers A Retailer Built for Sustainable Growth 54% Women’s / 46% Men’s 73% DTC / 27% Brick & Mortar ~$1.2B Combined LTM Net Sales Capital Structure Maintains Future Flexibility And Proper Growth Investments ~$172M Term Loan With Maturity Extension of Two Years to August 2029 Expect to Generate $25M Annual Run-Rate Cost Savings By 2027 ~$70M Pro Forma Adjusted LTM EBITDA Including Run-Rate Cost Synergies1 1. Assuming no pro forma adjustments

DXL + FullBeauty: Creating a Scaled, Category-Defining Retailer for Inclusive Apparel Combining FullBeauty’s inclusive women’s brands and KingSize with DXL’s Big + Tall expertise to create a category-defining size-inclusive brand portfolio in North America Building a powerful omni-channel and data-driven platform leveraging 296 stores and a leading DTC presence to personalize marketing, optimize inventory and boost customer lifetime value Capturing significant synergy opportunities, with additional commercial synergy upside over time Improved scale, profitability and financial flexibility provides enhanced free cash flow profile to reinvest in growth initiatives while reducing leverage 15

Q&A