Investor Presentation Case for Change Edward Smolyansky and Ludmila Smolyansky December 5, 2025

2 Legal Disclaimer Important Information This communication is not a request for a proxy to vote on any matter. Any written solicitation of a proxy by Mr. Smolyansky will be made through a definitive proxy statement (the “Shareholder Proxy Statement”). Lifeway shareholders are urged to read the Shareholder Proxy Statement, including any amendments or supplements thereto, and any other soliciting materials, when they become available as they will contain important information. Shareholders may obtain, free of charge, copies of the Shareholder Proxy Statement when it becomes available at sec.gov. Participants in the Solicitation Mr. Smolyansky has notified the Company of his intent to nominate himself and George Sent for election as directors of Lifeway at the 2025 Annual Meeting. Each of them may be deemed to be a participant in any solicitation of proxies by Mr. Smolyansky. Lifeway shareholders can find information regarding Mr. Smolyansky and Mr. Sent, and their respective direct or indirect interests, by security holdings or otherwise, in the Schedule 13D/A filed by Mr. Smolyansky with the SEC on November 18, 2025, Annex I to the preliminary proxy statement filed by Mr. Smolyansky with the Securities and Exchange Commission (the “SEC”) on November 24, 2025, the Shareholder Proxy Statement, when it becomes available, and in Mr. Smolyansky’s other filings with the SEC, all of which information is incorporated herein by reference.

Executive Summary • Edward Smolyansky and Ludmila Smolyansky (collectively referred to as ‘us’ or ‘we’) are holders of 26% of shares of Lifeway Foods, Inc. (“Lifeway” or “Company”), making us the largest shareholder of the Company. • As the largest shareholder, our interest is fully aligned with all fellow shareholders. This campaign is about ending a tumultuous period in the Company’s history and building a Board that is both capable and aligned in ensuring long - term success for the Company and its shareholders. • Contrary to Lifeway’s assertions, our campaigns for board independence and strategic review are responsible for significant board refreshment and shareholder value creation. Specifically: ■ 2022: Following the announcement of our proxy campaign, Lifeway added independent directors, Perfecto Sanchez and Juan Carlos (JC) Dalto 1 , to the Board. Subsequently, as part of our Settlement Agreement, Lifeway agreed to delegate the Audit & Corporate Governance Committee to undertake the review of strategic alternatives. ■ 2023: Following notice of breach of the 2022 Settlement Agreement, Lifeway confirmed engagement of a nationally recognized financial advisor. ■ 2025: Our consent solicitation seeking to replace Lifeway’s board, we believe, was instrumental in forcing Lifeway to reach a settlement agreement with Danone North America PBC (“Danone”), which resulted in the latest round of board refreshments. 1. 2. Close price on November 18, 2025 of $21.75 relative to the peak of $33.82 on September 17, 2025 Close price on November 18, 2025 of $21.75 relative to Danone’s final offer price of $27 on November 15, 2024 3

Executive Summary (continued) • Lifeway’s assertions about shareholder value creation must be evaluated in the following context: ■ Approx. 67% of all shares outstanding are held between directors and executive officers, Danone, and us. ■ The small float results in low trading volumes, leading to high share price volatility. ■ Despite claims of record revenue, Lifeway has failed to sustain meaningful growth in share price. As highlighted on slide 33, there are several periods when the share price spiked, but subsequently, lost most of its value within a short period. • Over the past year, the Company has been embroiled in a battle with one of its largest shareholder, Danone, prompted by an unsolicited acquisition offer that ended with a stock price closing at a 35.7% loss 1 in shareholder value relative to its peak since the offer, and an 19.4% loss 2 to Danone’s final offer price, and NO strategic plan to recover any of these losses for shareholders. • We believe, it is disingenuous for Lifeway to claim credit for recent Board refreshments, when they were clearly made under duress. We support the following governance enhancements: ■ The appointment of four new independent directors; ■ The appointment of a new independent Chairman thereby officially separating the role of CEO/Chair formerly held by Julie Smolyansky; ■ The required resignation of the Company’s longest standing director Pol Sikar who served almost 40 years; ■ The requirement for the Board to not nominate Jason Scher for the 2026 annual meeting; and ■ The requirement to hold the 2026 AGM on or before June 30, 2026. 1. 2. Close price on November 18, 2025 of $21.75 relative to the peak of $33.82 on September 17, 2025 Close price on November 18, 2025 of $21.75 relative to Danone’s final offer price of $27 on November 15, 2024 4

Executive Summary (continued) • Notwithstanding our support for the governance enhancements, we raise the following questions, which are yet to be answered by CEO Julie Smolyansky and the incumbent directors: ■ How did Danone’s statement to potentially support our consent solicitation to remove all directors, including the CEO, influence the Board’s decision to negotiate with Danone? ■ Why did the Board grant approval/review rights of four new directors to Danone, which in addition to a former Danone executive continuing to serve as an incumbent director (Juan Carlos Dalto) equates to a majority of the directors, considering Danone had made an unsolicited proposal to acquire Lifeway? We could not find another precedent where a hostile bidder was invited by the target company to review and approve the majority of board members without paying any control premium. ■ Why did the Board delay the 2025 shareholder meeting? ■ Why did it take shareholder pressure from Danone and ourselves, to undertake governance changes such as separating the chair and CEO positions previously held by Julie Smolyansky? ■ What process, if any, did the Board undertake to evaluate the potential fit of nominees recommended by Danone? In particular, we question the addition of the following new directors: – Kirk Chartier : No public board experience, lacks relevant industry experience. – Rachel Drori : No public board experience. – Andee Harris : No public board experience, lacks relevant industry experience. 5

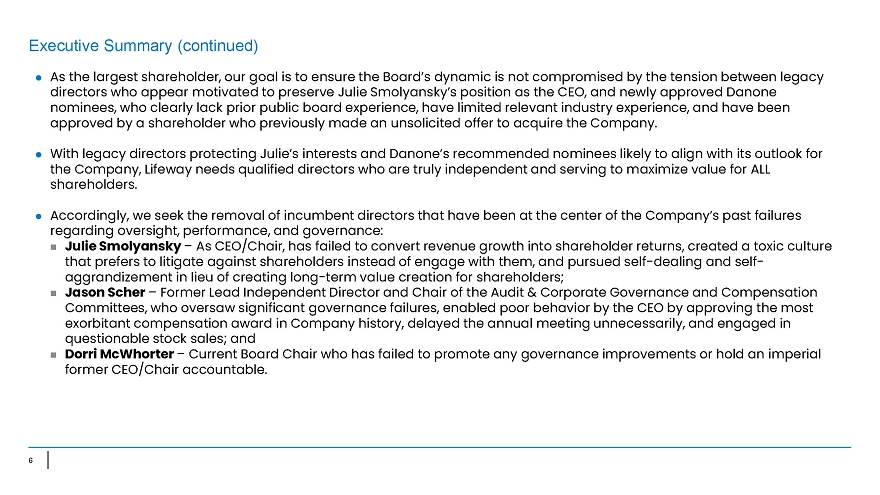

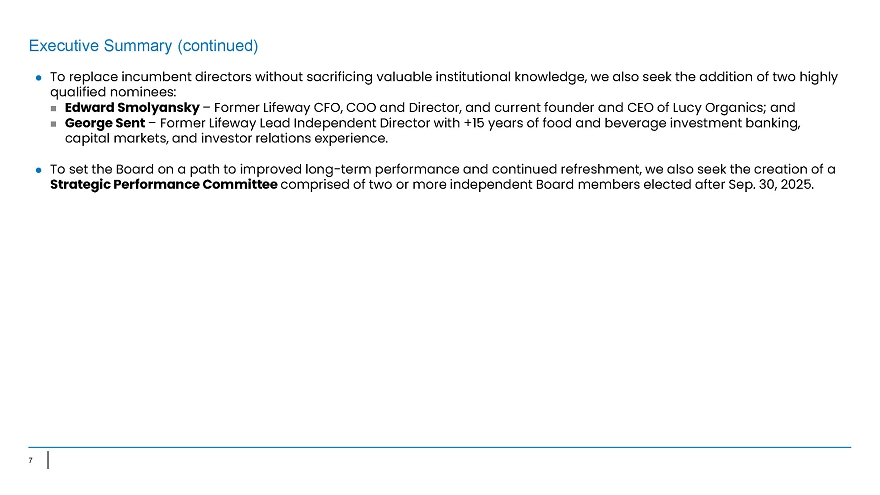

Executive Summary (continued) • As the largest shareholder, our goal is to ensure the Board’s dynamic is not compromised by the tension between legacy directors who appear motivated to preserve Julie Smolyansky’s position as the CEO, and newly approved Danone nominees, who clearly lack prior public board experience, have limited relevant industry experience, and have been approved by a shareholder who previously made an unsolicited offer to acquire the Company. • With legacy directors protecting Julie’s interests and Danone’s recommended nominees likely to align with its outlook for the Company, Lifeway needs qualified directors who are truly independent and serving to maximize value for ALL shareholders. • Accordingly, we seek the removal of incumbent directors that have been at the center of the Company’s past failures regarding oversight, performance, and governance: ■ Julie Smolyansky – As CEO/Chair, has failed to convert revenue growth into shareholder returns, created a toxic culture that prefers to litigate against shareholders instead of engage with them, and pursued self - dealing and self - aggrandizement in lieu of creating long - term value creation for shareholders; ■ Jason Scher – Former Lead Independent Director and Chair of the Audit & Corporate Governance and Compensation Committees, who oversaw significant governance failures, enabled poor behavior by the CEO by approving the most exorbitant compensation award in Company history, delayed the annual meeting unnecessarily, and engaged in questionable stock sales; and ■ Dorri McWhorter – Current Board Chair who has failed to promote any governance improvements or hold an imperial former CEO/Chair accountable. 6

Executive Summary (continued) • To replace incumbent directors without sacrificing valuable institutional knowledge, we also seek the addition of two highly qualified nominees: ■ Edward Smolyansky – Former Lifeway CFO, COO and Director, and current founder and CEO of Lucy Organics; and ■ George Sent – Former Lifeway Lead Independent Director with +15 years of food and beverage investment banking, capital markets, and investor relations experience. • To set the Board on a path to improved long - term performance and continued refreshment, we also seek the creation of a Strategic Performance Committee comprised of two or more independent Board members elected after Sep. 30, 2025. 7

The Danone Debacle

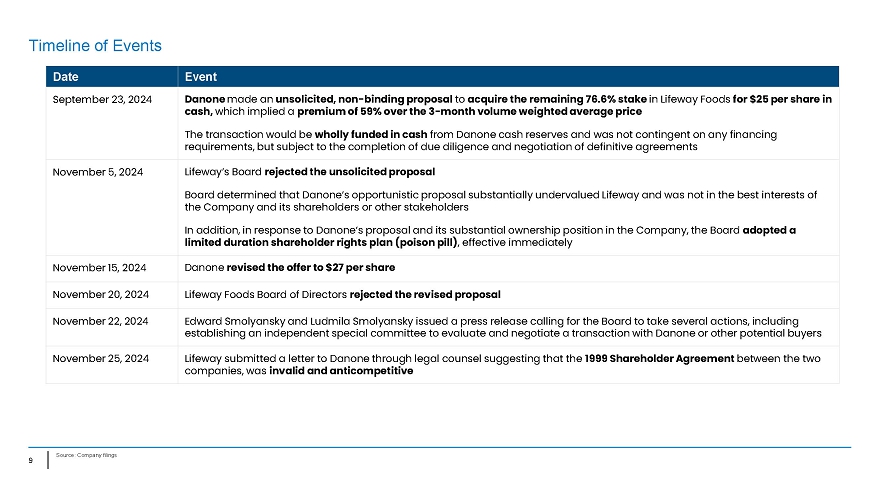

Timeline of Events Source: Company filings 9 Event Date Danone made an unsolicited, non - binding proposal to acquire the remaining 76.6% stake in Lifeway Foods for $25 per share in cash, which implied a premium of 59% over the 3 - month volume weighted average price The transaction would be wholly funded in cash from Danone cash reserves and was not contingent on any financing requirements, but subject to the completion of due diligence and negotiation of definitive agreements September 23, 2024 Lifeway’s Board rejected the unsolicited proposal Board determined that Danone’s opportunistic proposal substantially undervalued Lifeway and was not in the best interests of the Company and its shareholders or other stakeholders In addition, in response to Danone’s proposal and its substantial ownership position in the Company, the Board adopted a limited duration shareholder rights plan (poison pill) , effective immediately November 5, 2024 Danone revised the offer to $27 per share November 15, 2024 Lifeway Foods Board of Directors rejected the revised proposal November 20, 2024 Edward Smolyansky and Ludmila Smolyansky issued a press release calling for the Board to take several actions, including establishing an independent special committee to evaluate and negotiate a transaction with Danone or other potential buyers November 22, 2024 Lifeway submitted a letter to Danone through legal counsel suggesting that the 1999 Shareholder Agreement between the two companies, was invalid and anticompetitive November 25, 2024

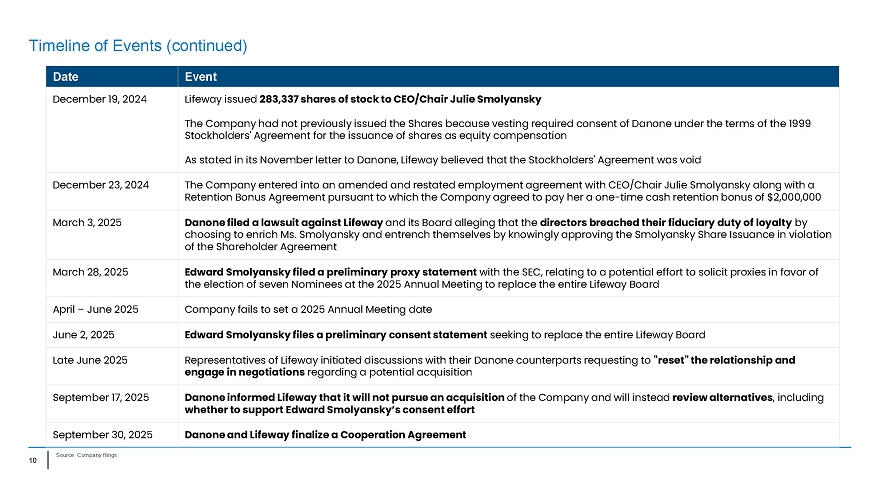

Timeline of Events (continued) Source: Company filings 10 Event Date Lifeway issued 283,337 shares of stock to CEO/Chair Julie Smolyansky The Company had not previously issued the Shares because vesting required consent of Danone under the terms of the 1999 Stockholders' Agreement for the issuance of shares as equity compensation As stated in its November letter to Danone, Lifeway believed that the Stockholders' Agreement was void December 19, 2024 The Company entered into an amended and restated employment agreement with CEO/Chair Julie Smolyansky along with a Retention Bonus Agreement pursuant to which the Company agreed to pay her a one - time cash retention bonus of $2,000,000 December 23, 2024 Danone filed a lawsuit against Lifeway and its Board alleging that the directors breached their fiduciary duty of loyalty by choosing to enrich Ms. Smolyansky and entrench themselves by knowingly approving the Smolyansky Share Issuance in violation of the Shareholder Agreement March 3, 2025 Edward Smolyansky filed a preliminary proxy statement with the SEC, relating to a potential effort to solicit proxies in favor of the election of seven Nominees at the 2025 Annual Meeting to replace the entire Lifeway Board March 28, 2025 Company fails to set a 2025 Annual Meeting date April – June 2025 Edward Smolyansky files a preliminary consent statement seeking to replace the entire Lifeway Board June 2, 2025 Representatives of Lifeway initiated discussions with their Danone counterparts requesting to "reset" the relationship and engage in negotiations regarding a potential acquisition Late June 2025 Danone informed Lifeway that it will not pursue an acquisition of the Company and will instead review alternatives , including whether to support Edward Smolyansky’s consent effort September 17, 2025 Danone and Lifeway finalize a Cooperation Agreement September 30, 2025

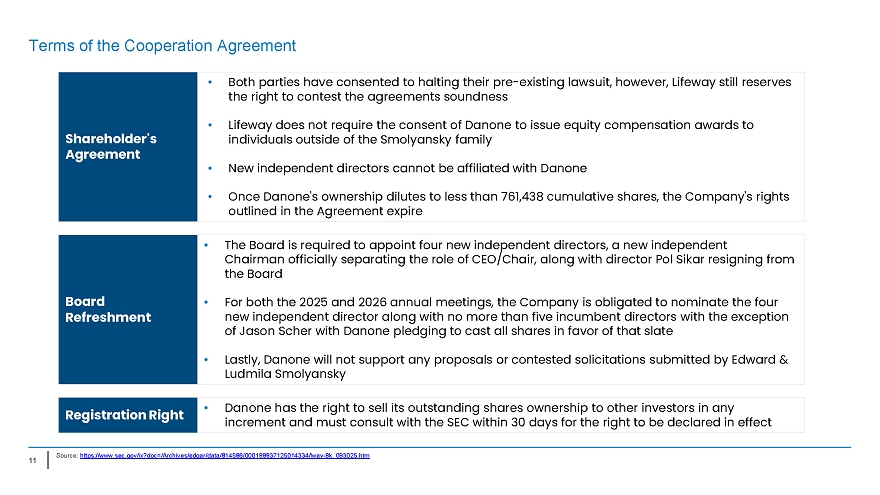

11 Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/814586/000199937125014334/lway - 8k_093025.htm Terms of the Cooperation Agreement • Both parties have consented to halting their pre - existing lawsuit, however, Lifeway still reserves the right to contest the agreements soundness • Lifeway does not require the consent of Danone to issue equity compensation awards to individuals outside of the Smolyansky family • New independent directors cannot be affiliated with Danone • Once Danone's ownership dilutes to less than 761,438 cumulative shares, the Company's rights outlined in the Agreement expire Shareholder's Agreement • The Board is required to appoint four new independent directors, a new independent Chairman officially separating the role of CEO/Chair, along with director Pol Sikar resigning from the Board • For both the 2025 and 2026 annual meetings, the Company is obligated to nominate the four new independent director along with no more than five incumbent directors with the exception of Jason Scher with Danone pledging to cast all shares in favor of that slate • Lastly, Danone will not support any proposals or contested solicitations submitted by Edward & Ludmila Smolyansky Board R e fre s hmen t • Danone has the right to sell its outstanding shares ownership to other investors in any increment and must consult with the SEC within 30 days for the right to be declared in effect Registration Right

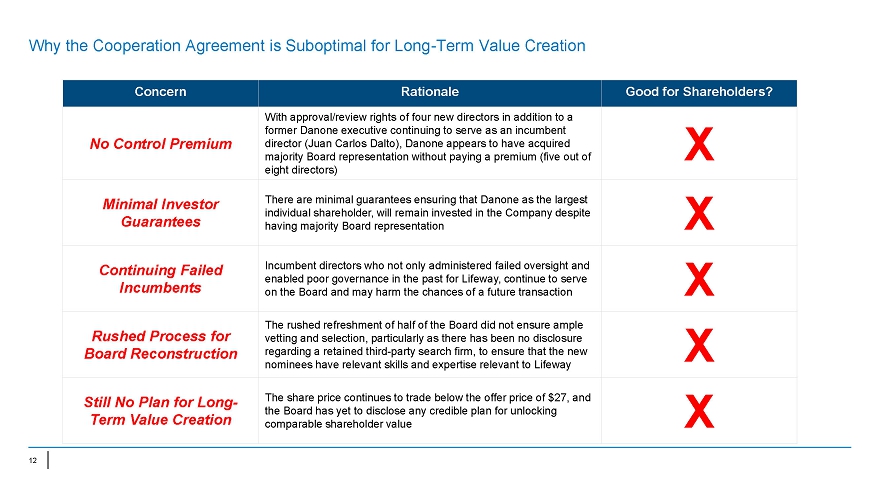

Why the Cooperation Agreement is Suboptimal for Long - Term Value Creation 12 Good for Shareholders? Rationale Concern X With approval/review rights of four new directors in addition to a former Danone executive continuing to serve as an incumbent director (Juan Carlos Dalto), Danone appears to have acquired majority Board representation without paying a premium (five out of eight directors) No Control Premium X There are minimal guarantees ensuring that Danone as the largest individual shareholder, will remain invested in the Company despite having majority Board representation Minimal Investor Guarantees X Incumbent directors who not only administered failed oversight and enabled poor governance in the past for Lifeway, continue to serve on the Board and may harm the chances of a future transaction Continuing Failed Incumbents X The rushed refreshment of half of the Board did not ensure ample vetting and selection, particularly as there has been no disclosure regarding a retained third - party search firm, to ensure that the new nominees have relevant skills and expertise relevant to Lifeway Rushed Process for Board Reconstruction X The share price continues to trade below the offer price of $27, and the Board has yet to disclose any credible plan for unlocking comparable shareholder value Still No Plan for Long - Term Value Creation

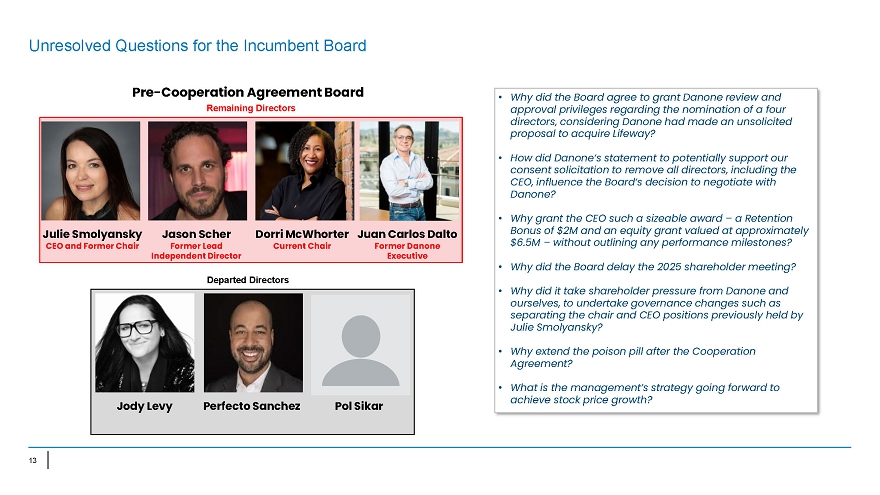

Unresolved Questions for the Incumbent Board CEO and Former Chair Julie Smolyansky Jason Scher Former Lead Independent Director Current Chair Dorri McWhorter Juan Carlos Dalto Former Danone Executive Jody Levy Perfecto Sanchez Pol Sikar Pre - Cooperation Agreement Board Remaining Directors Departed Directors • Why did the Board agree to grant Danone review and approval privileges regarding the nomination of a four directors, considering Danone had made an unsolicited proposal to acquire Lifeway? • How did Danone’s statement to potentially support our consent solicitation to remove all directors, including the CEO, influence the Board’s decision to negotiate with Danone? • Why grant the CEO such a sizeable award – a Retention Bonus of $2M and an equity grant valued at approximately $6.5M – without outlining any performance milestones? • Why did the Board delay the 2025 shareholder meeting? • Why did it take shareholder pressure from Danone and ourselves, to undertake governance changes such as separating the chair and CEO positions previously held by Julie Smolyansky? • Why extend the poison pill after the Cooperation Agreement? • What is the management’s strategy going forward to achieve stock price growth? 13

Legacy of Failed Governance

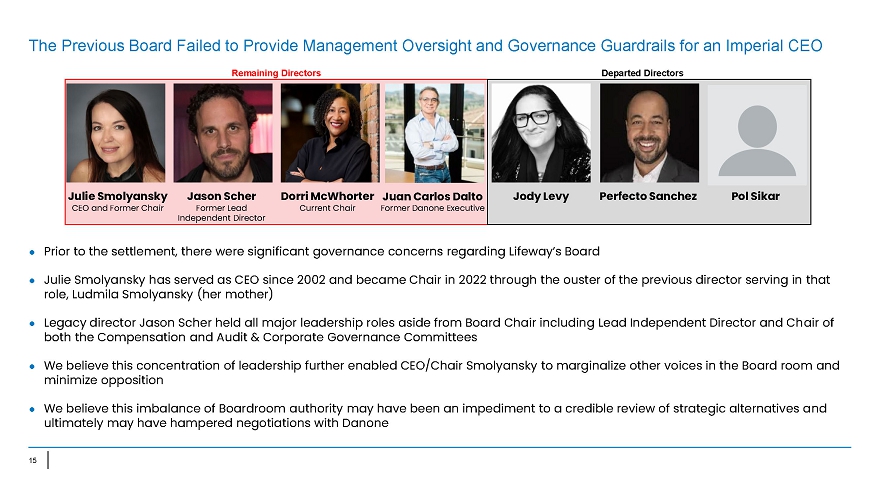

15 Pol Sikar Perfecto Sanchez Jody Levy Dorri McWhorter Juan Carlos Dalto Current Chair Former Danone Executive Jason Scher Former Lead Independent Director Julie Smolyansky CEO and Former Chair • Prior to the settlement, there were significant governance concerns regarding Lifeway’s Board • Julie Smolyansky has served as CEO since 2002 and became Chair in 2022 through the ouster of the previous director serving in that role, Ludmila Smolyansky (her mother) • Legacy director Jason Scher held all major leadership roles aside from Board Chair including Lead Independent Director and Chair of both the Compensation and Audit & Corporate Governance Committees • We believe this concentration of leadership further enabled CEO/Chair Smolyansky to marginalize other voices in the Board room and minimize opposition • We believe this imbalance of Boardroom authority may have been an impediment to a credible review of strategic alternatives and ultimately may have hampered negotiations with Danone The Previous Board Failed to Provide Management Oversight and Governance Guardrails for an Imperial CEO Remaining Directors Departed Directors

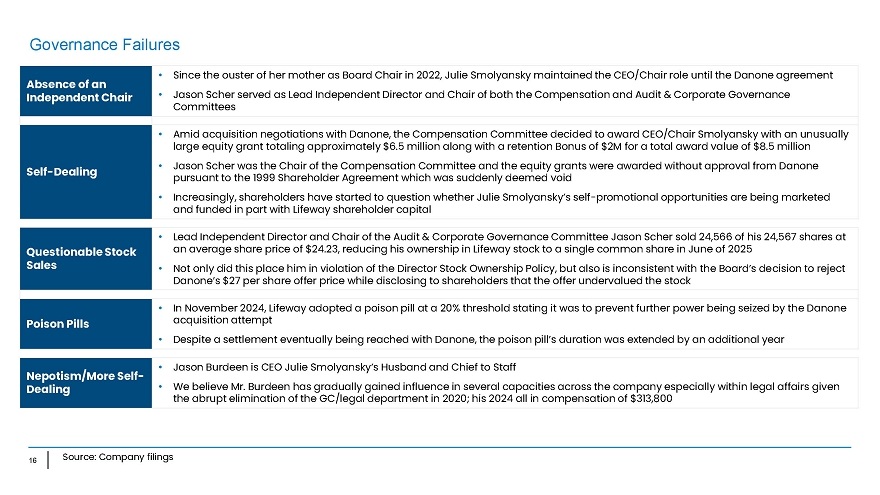

16 Governance Failures Source: Company filings • Since the ouster of her mother as Board Chair in 2022, Julie Smolyansky maintained the CEO/Chair role until the Danone agreement • Jason Scher served as Lead Independent Director and Chair of both the Compensation and Audit & Corporate Governance Committees Absence of an Independent Chair • Amid acquisition negotiations with Danone, the Compensation Committee decided to award CEO/Chair Smolyansky with an unusually large equity grant totaling approximately $6.5 million along with a retention Bonus of $2M for a total award value of $8.5 million • Jason Scher was the Chair of the Compensation Committee and the equity grants were awarded without approval from Danone pursuant to the 1999 Shareholder Agreement which was suddenly deemed void • Increasingly, shareholders have started to question whether Julie Smolyansky’s self - promotional opportunities are being marketed and funded in part with Lifeway shareholder capital Self - Dealing • Lead Independent Director and Chair of the Audit & Corporate Governance Committee Jason Scher sold 24,566 of his 24,567 shares at an average share price of $24.23, reducing his ownership in Lifeway stock to a single common share in June of 2025 • Not only did this place him in violation of the Director Stock Ownership Policy, but also is inconsistent with the Board’s decision to reject Danone’s $27 per share offer price while disclosing to shareholders that the offer undervalued the stock Questionable Stock Sales • In November 2024, Lifeway adopted a poison pill at a 20% threshold stating it was to prevent further power being seized by the Danone acquisition attempt • Despite a settlement eventually being reached with Danone, the poison pill’s duration was extended by an additional year Poison Pills • Jason Burdeen is CEO Julie Smolyansky’s Husband and Chief to Staff • We believe Mr. Burdeen has gradually gained influence in several capacities across the company especially within legal affairs given the abrupt elimination of the GC/legal department in 2020; his 2024 all in compensation of $313,800 Nepotism/More Self - Dealing

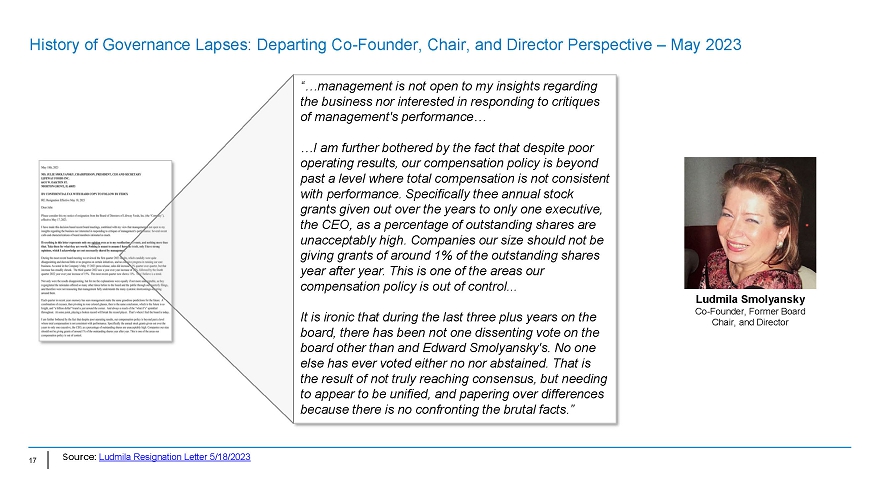

17 History of Governance Lapses: Departing Co - Founder, Chair, and Director Perspective – May 2023 Source: Ludmila Resignation Letter 5/18/2023 “ … management is not open to my insights regarding the business nor interested in responding to critiques of management's performance … …I am further bothered by the fact that despite poor operating results, our compensation policy is beyond past a level where total compensation is not consistent with performance. Specifically thee annual stock grants given out over the years to only one executive, the CEO, as a percentage of outstanding shares are unacceptably high. Companies our size should not be giving grants of around 1% of the outstanding shares year after year. This is one of the areas our compensation policy is out of control... It is ironic that during the last three plus years on the board, there has been not one dissenting vote on the board other than and Edward Smolyansky's. No one else has ever voted either no nor abstained. That is the result of not truly reaching consensus, but needing to appear to be unified, and papering over differences because there is no confronting the brutal facts.” Ludmila Smolyansky Co - Founder, Former Board Chair, and Director

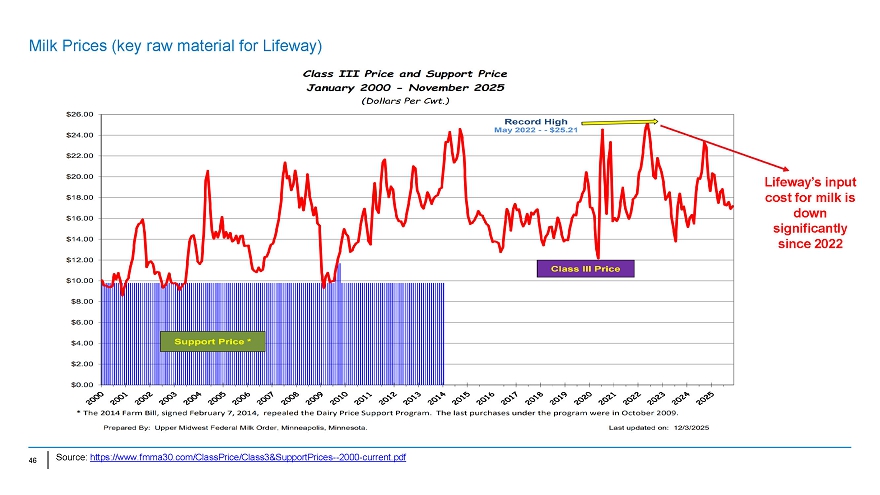

18 History of Governance Lapses: Shareholder Perspective – June 2023 Kanen Wealth Management’s (KWM) Letter to Shareholders (dated June 08, 2023) highlighted several governance challenges that legacy directors had consistently failed to address: • “A CEO who rarely showed up to the Morton Grove office when she resided in Illinois . Even worse, she currently resides in California and is not “hands - on “. • “A Chief of Staff who is the spouse of the CEO and does not have any formal employment agreement, yet collects a six - figure salary” • “We believe the board is misaligned with shareholders and is unwilling to stand - up to the current CEO and address the ongoing profitability issues . We are formally putting all directors on notice . You have a fiduciary responsibility to maximize shareholder value! We are a public company, WE ARE NOT JULIE SMOLANSKY ENTERPRISES!” KWM also addressed the issue of record sales without commensurate growth in profitability or share price: • “We need to be focused on profitability and scaling. The company has a significant catalyst with the price of milk (their core input) continuing to come down which will boost gross margins. Sadly, Julie has yet to boost its net profit margin.” • “Based on our due diligence of comparable transactions, a fair value for LWAY should be between 1.5 - 2 x Revenue. This would yield a value of between $15 - $20 per share . Keep in mind the company also has Real estate worth an estimated $10 mill.” https:// www.globenewswire.com/news - release/2023/06/08/2684694/0/en/David - Kanen - President - of - KWM - writes - letter - to - CEO - and - board - of - LWAY - c alling - for - a - sale - of - the - company - Mr - Kanen - also - stated - his - intention - to - vote - his - shares - in - favor - of - the - director.html

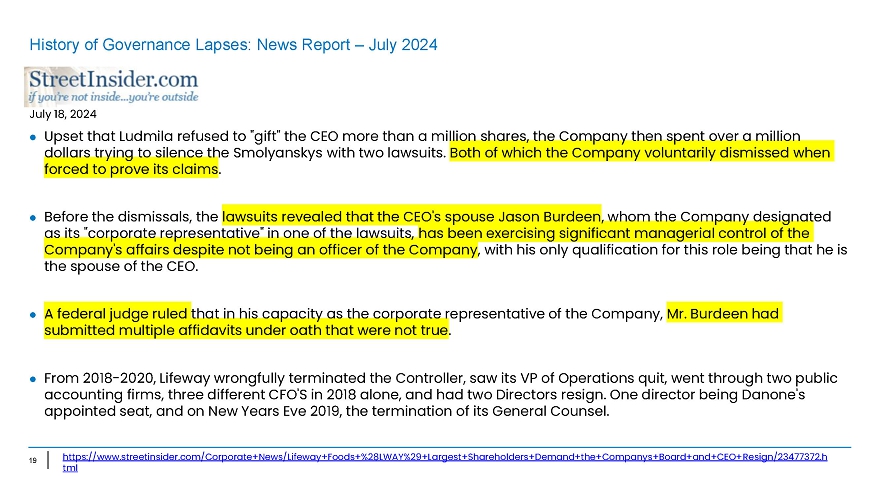

19 July 18, 2024 • Upset that Ludmila refused to "gift" the CEO more than a million shares, the Company then spent over a million dollars trying to silence the Smolyanskys with two lawsuits. Both of which the Company voluntarily dismissed when forced to prove its claims. • Before the dismissals, the lawsuits revealed that the CEO's spouse Jason Burdeen, whom the Company designated as its "corporate representative" in one of the lawsuits, has been exercising significant managerial control of the Company's affairs despite not being an officer of the Company, with his only qualification for this role being that he is the spouse of the CEO. • A federal judge ruled that in his capacity as the corporate representative of the Company, Mr. Burdeen had submitted multiple affidavits under oath that were not true. • From 2018 - 2020, Lifeway wrongfully terminated the Controller, saw its VP of Operations quit, went through two public accounting firms, three different CFO'S in 2018 alone, and had two Directors resign. One director being Danone's appointed seat, and on New Years Eve 2019, the termination of its General Counsel. History of Governance Lapses: News Report – July 2024 https://www.streetinsider.com/Corporate+News/Lifeway+Foods+%28LWAY%29+Largest+Shareholders+Demand+the+Companys+Board+and+CEO+ Res ign/23477372.h tm l

20 Source: David Kanen, President of KWM writes letter to CEO and Board of LWAY Shareholders Have Called for CEO Julie Smolyansky’s Resignation since 2023 “We believe the current board and CEO have been mis - managing the business and not acting in the best interest of its shareholders . We further believe the company’s stock is undervalued, but cannot realize a greater value with the current CEO and board . And most importantly, a CEO who doesn’t seem to care about the company’s profitability nor shareholders. This is clearly the case as our stock has remained under $8 for 5 years while revenue continues to grow. We believe Lifeway’s core Kefir brand can grow revenue significantly in the hands of a skilled management team and CEO who actually shows up to work daily. We need to be focused on profitability and scaling. As investors, it is painful to watch a strong brand be mishandled, and essentially be the executive team’s personal bank account in our opinion. We will vote in favor of Ludmila and Edward’s Board nominees and believe now is the right time to explore strategic alternatives. You have a fiduciary responsibility to maximize shareholder value! We are a public company, WE ARE NOT JULIE SMOLYANSKY ENTERPRISES! We will be holding all of you accountable, to ensure shareholders are prioritized.“ - David Kanen, Letter to CEO Julie Smolyansky, June 8, 2023

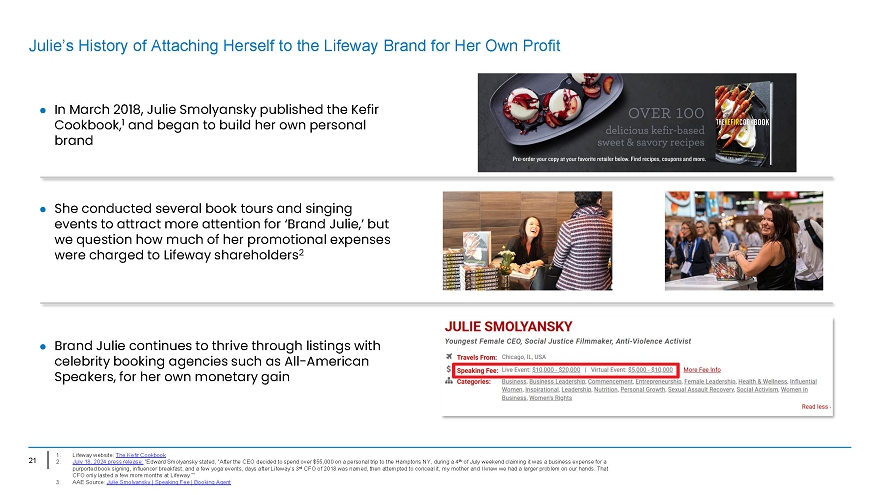

21 Julie’s History of Attaching Herself to the Lifeway Brand for Her Own Profit 1. 2. 3. Lifeway website : The Kefir Cookbook July 18 , 2024 press release : “Edward Smolyansky stated, “After the CEO decided to spend over $ 55 , 000 on a personal trip to the Hamptons NY, during a 4 th of July weekend claiming it was a business expense for a purported book signing, influencer breakfast, and a few yoga events, days after Lifeway’s 3 rd CFO of 2018 was named, then attempted to conceal it, my mother and I knew we had a larger problem on our hands . That CFO only lasted a few more months at Lifeway . ”” AAE Source : Julie Smolyansky | Speaking Fee | Booking Agen t • In March 2018, Julie Smolyansky published the Kefir Cookbook, 1 and began to build her own personal brand • She conducted several book tours and singing events to attract more attention for ‘Brand Julie,’ but we question how much of her promotional expenses were charged to Lifeway shareholders 2 • Brand Julie continues to thrive through listings with celebrity booking agencies such as All - American Speakers, for her own monetary gain

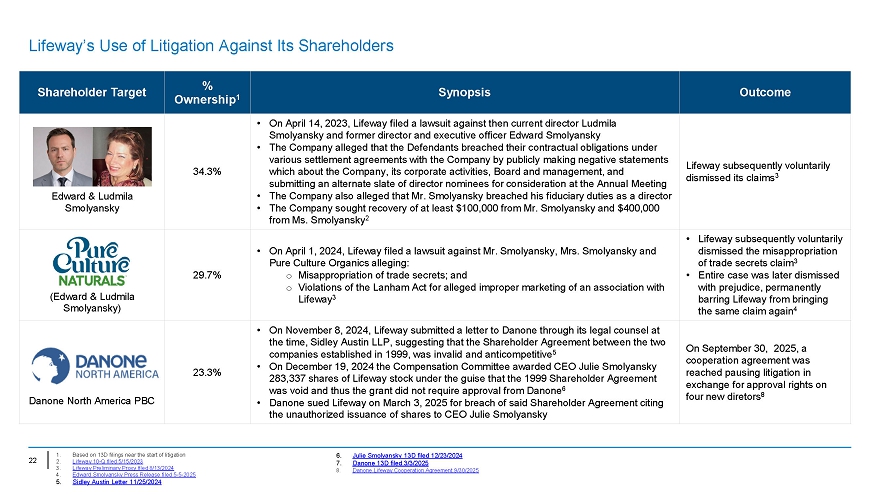

22 Lifeway’s Use of Litigation Against Its Shareholders 1. Based on 13D filings near the start of litigation 2. Lifeway 10 - Q filed 5/15/2023 3. Lifeway Preliminary Proxy filed 8/13/2024 4. Edward Smolyansky Press Release filed 5 - 5 - 2025 5. Sidley Austin Letter 11/25/2024 6. Julie Smolyansky 13D filed 12/23/2024 7. Danone 13D filed 3/3/2025 8. Danone Lifeway Cooperation Agreement 9/30/2025 Outcome Synopsis % Ownership 1 Shareholder Target Lifeway subsequently voluntarily dismissed its claims 3 • On April 14, 2023, Lifeway filed a lawsuit against then current director Ludmila Smolyansky and former director and executive officer Edward Smolyansky • The Company alleged that the Defendants breached their contractual obligations under various settlement agreements with the Company by publicly making negative statements which about the Company, its corporate activities, Board and management, and submitting an alternate slate of director nominees for consideration at the Annual Meeting • The Company also alleged that Mr. Smolyansky breached his fiduciary duties as a director • The Company sought recovery of at least $100,000 from Mr. Smolyansky and $400,000 from Ms. Smolyansky 2 34.3% Edward & Ludmila Smolyansky • Lifeway subsequently voluntarily dismissed the misappropriation of trade secrets claim 3 • Entire case was later dismissed with prejudice, permanently barring Lifeway from bringing the same claim again 4 • On April 1, 2024, Lifeway filed a lawsuit against Mr. Smolyansky, Mrs. Smolyansky and Pure Culture Organics alleging: o Misappropriation of trade secrets; and o Violations of the Lanham Act for alleged improper marketing of an association with Lifeway 3 29.7% (Edward & Ludmila Smolyansky) On September 30, 2025, a cooperation agreement was reached pausing litigation in exchange for approval rights on four new diretors 8 • On November 8, 2024, Lifeway submitted a letter to Danone through its legal counsel at the time, Sidley Austin LLP, suggesting that the Shareholder Agreement between the two companies established in 1999, was invalid and anticompetitive 5 • On December 19 , 2024 the Compensation Committee awarded CEO Julie Smolyansky 283 , 337 shares of Lifeway stock under the guise that the 1999 Shareholder Agreement was void and thus the grant did not require approval from Danone 6 • Danone sued Lifeway on March 3, 2025 for breach of said Shareholder Agreement citing the unauthorized issuance of shares to CEO Julie Smolyansky 23.3% Danone North America PBC

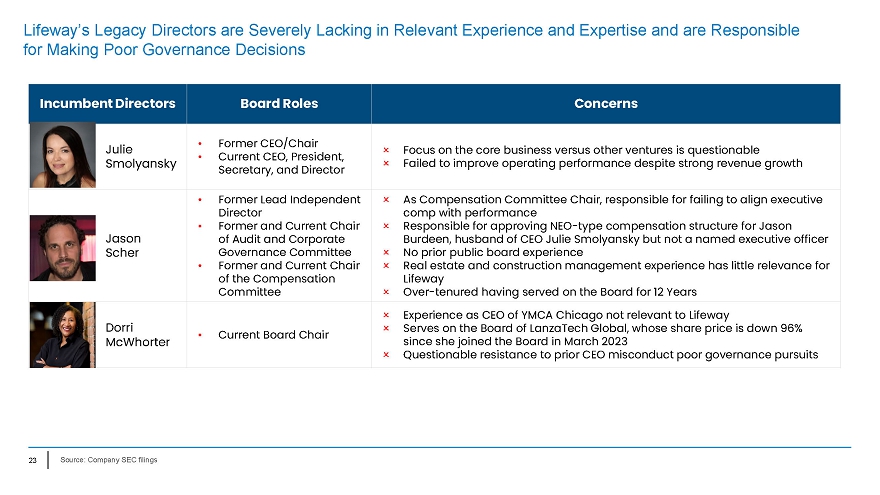

23 Lifeway’s Legacy Directors are Severely Lacking in Relevant Experience and Expertise and are Responsible for Making Poor Governance Decisions Concerns Board Roles Incumbent Directors Focus on the core business versus other ventures is questionable Failed to improve operating performance despite strong revenue growth • Former CEO/Chair • Current CEO, President, Secretary, and Director Julie S m o lyansky As Compensation Committee Chair, responsible for failing to align executive comp with performance Responsible for approving NEO - type compensation structure for Jason Burdeen, husband of CEO Julie Smolyansky but not a named executive officer No prior public board experience Real estate and construction management experience has little relevance for Lifeway Over - tenured having served on the Board for 12 Years • Former Lead Independent Director • Former and Current Chair of Audit and Corporate Governance Committee • Former and Current Chair of the Compensation Committee Ja s on Scher Experience as CEO of YMCA Chicago not relevant to Lifeway Serves on the Board of LanzaTech Global, whose share price is down 96% since she joined the Board in March 2023 Questionable resistance to prior CEO misconduct poor governance pursuits • Current Board Chair Dorri Mc W ho r ter Source: Company SEC filings

Financial Performance ➢ Contrary to management’s claims, Lifeway’s performance has been suboptimal/disappointing ➢ Despite revenue growth, Operating and EBITDA Margins have remained largely stagnant ➢ Investors have little confidence in management’s ability to achieve profitable growth

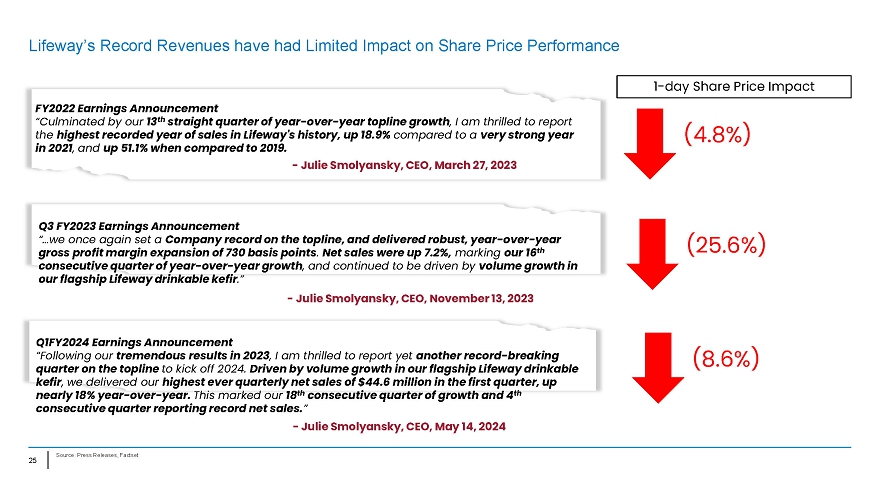

Lifeway’s Record Revenues have had Limited Impact on Share Price Performance FY 2022 Earnings Announcement “Culminated by our 13 th straight quarter of year - over - year topline growth , I am thrilled to report the highest recorded year of sales in Lifeway's history, up 18 . 9 % compared to a very strong year in 2021 , and up 51 . 1 % when compared to 2019 . - Julie Smolyansky, CEO, March 27, 2023 1 - day Share Price Impact (4.8%) Q3 FY2023 Earnings Announcement “…we once again set a Company record on the topline, and delivered robust, year - over - year gross profit margin expansion of 730 basis points . Net sales were up 7.2%, marking our 16 th consecutive quarter of year - over - year growth , and continued to be driven by volume growth in our flagship Lifeway drinkable kefir .” - Julie Smolyansky, CEO, November 13, 2023 Q1FY2024 Earnings Announcement “Following our tremendous results in 2023 , I am thrilled to report yet another record - breaking quarter on the topline to kick off 2024. Driven by volume growth in our flagship Lifeway drinkable kefir , we delivered our highest ever quarterly net sales of $44.6 million in the first quarter, up nearly 18% year - over - year. This marked our 18 th consecutive quarter of growth and 4 th consecutive quarter reporting record net sales. ” - Julie Smolyansky, CEO, May 14, 2024 (25.6 %) (8.6%) Source: Press Releases, Factset 25

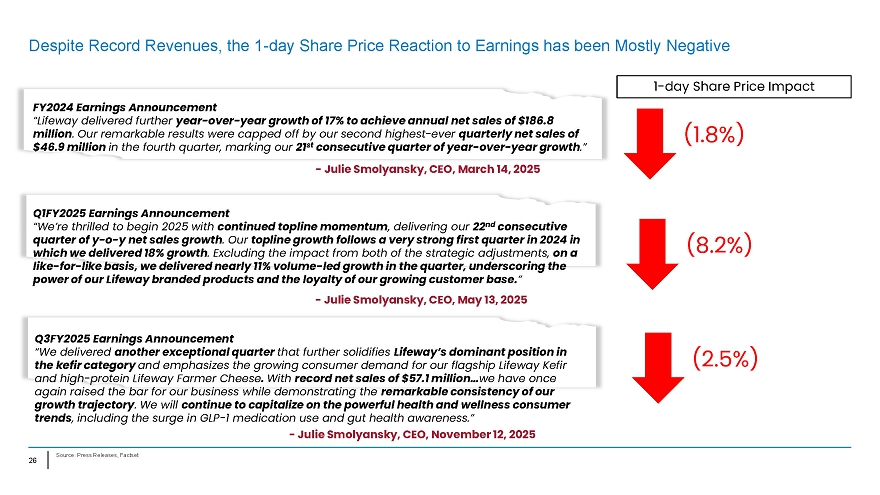

Despite Record Revenues, the 1 - day Share Price Reaction to Earnings has been Mostly Negative FY2024 Earnings Announcement “Lifeway delivered further year - over - year growth of 17% to achieve annual net sales of $186.8 million . Our remarkable results were capped off by our second highest - ever quarterly net sales of $46.9 million in the fourth quarter, marking our 21 st consecutive quarter of year - over - year growth .” - Julie Smolyansky, CEO, March 14, 2025 Q1FY2025 Earnings Announcement “We’re thrilled to begin 2025 with continued topline momentum , delivering our 22 nd consecutive quarter of y - o - y net sales growth . Our topline growth follows a very strong first quarter in 2024 in which we delivered 18% growth . Excluding the impact from both of the strategic adjustments, on a like - for - like basis, we delivered nearly 11% volume - led growth in the quarter, underscoring the power of our Lifeway branded products and the loyalty of our growing customer base. ” - Julie Smolyansky, CEO, May 13, 2025 1 - day Share Price Impact (1.8%) (8.2%) (2.5 % ) Q3FY2025 Earnings Announcement “We delivered another exceptional quarter that further solidifies Lifeway’s dominant position in the kefir category and emphasizes the growing consumer demand for our flagship Lifeway Kefir and high - protein Lifeway Farmer Cheese . With record net sales of $57.1 million… we have once again raised the bar for our business while demonstrating the remarkable consistency of our growth trajectory . We will continue to capitalize on the powerful health and wellness consumer trends , including the surge in GLP - 1 medication use and gut health awareness.” - Julie Smolyansky, CEO, November 12, 2025 Source: Press Releases, Factset 26

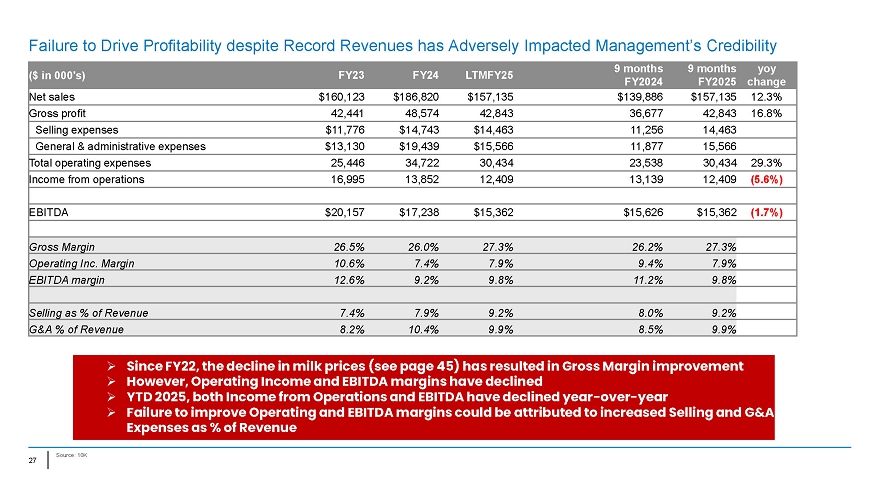

Failure to Drive Profitability despite Record Revenues has Adversely Impacted Management’s Credibility Source: 10K 27 yoy change 9 months F Y 2025 9 months FY2024 L T M F Y 25 F Y 24 F Y 23 ($ in 000's) 12.3% $157, 1 3 5 $139, 8 8 6 $157, 1 3 5 $186, 8 2 0 $160, 1 2 3 Net sales 16.8% 42, 8 43 36, 6 77 42, 8 43 48, 5 74 42, 4 41 Gross profit 14, 4 63 1 1, 2 5 6 $14, 4 6 3 $14, 7 4 3 $ 1 1, 7 7 6 Selling expenses 15, 5 66 1 1, 8 7 7 $15, 5 6 6 $19, 4 3 9 $13, 1 3 0 General & administrative expenses 29.3% 3 0 ,4 34 2 3 ,5 38 3 0 ,4 34 3 4 ,7 22 2 5 ,4 46 Total operating expenses (5.6%) 12, 4 09 13, 1 39 12, 4 09 13, 8 52 16, 9 95 Income from operations (1.7%) $15, 3 6 2 $15, 6 2 6 $15, 3 6 2 $17, 2 3 8 $20, 1 5 7 EBITDA 27. 3 % 26. 2 % 27. 3 % 26. 0 % 26. 5 % Gross Margin 7. 9 % 9 . 4 % 7. 9 % 7. 4 % 10. 6 % Operating Inc. Margin 9. 8 % 1 1. 2 % 9. 8 % 9. 2 % 12. 6 % EBITDA margin 9. 2 % 8 . 0 % 9. 2 % 7. 9 % 7. 4 % Selling as % of Revenue 9. 9 % 8 . 5 % 9. 9 % 10. 4 % 8. 2 % G&A % of Revenue ➢ Since FY22, the decline in milk prices (see page 45) has resulted in Gross Margin improvement ➢ However, Operating Income and EBITDA margins have declined ➢ YTD 2025, both Income from Operations and EBITDA have declined year - over - year ➢ Failure to improve Operating and EBITDA margins could be attributed to increased Selling and G&A Expenses as % of Revenue

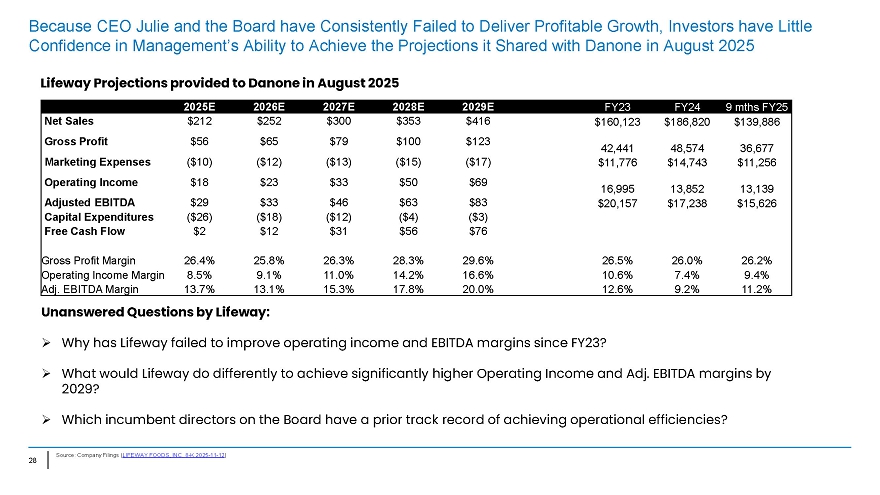

Because CEO Julie and the Board have Consistently Failed to Deliver Profitable Growth, Investors have Little Confidence in Management’s Ability to Achieve the Projections it Shared with Danone in August 2025 Lifeway Projections provided to Danone in August 2025 Source: Company Filings ( LIFEWAY FOODS, INC. 8 - K 2025 - 11 - 12 ) 28 Unanswered Questions by Lifeway: ➢ Why has Lifeway failed to improve operating income and EBITDA margins since FY23? ➢ What would Lifeway do differently to achieve significantly higher Operating Income and Adj. EBITDA margins by 2029? ➢ Which incumbent directors on the Board have a prior track record of achieving operational efficiencies? 9 mths FY25 FY24 FY23 2029E 2028E 2027E 2026E 2025E $139,886 $186,820 $160,123 $416 $353 $300 $252 $212 Net Sales 36,677 48,574 42,441 $123 $100 $79 $65 $56 Gross Profit $11,256 $14,743 $11,776 ($17) ($15) ($13) ($12) ($10) Marketing Expenses 13,139 13,852 16,995 $69 $50 $33 $23 $18 Operating Income $15,626 $17,238 $20,157 $83 $63 $46 $33 $29 Adjusted EBITDA ($3) ($4) ($12) ($18) ($26) Capital Expenditures $76 $56 $31 $12 $2 Free Cash Flow 26.2% 26.0% 26.5% 29.6% 28.3% 26.3% 25.8% 26.4% Gross Profit Margin 9.4% 7.4% 10.6% 16.6% 14.2% 11.0% 9.1% 8.5% Operating Income Margin 11.2% 9.2% 12.6% 20.0% 17.8% 15.3% 13.1% 13.7% Adj. EBITDA Margin

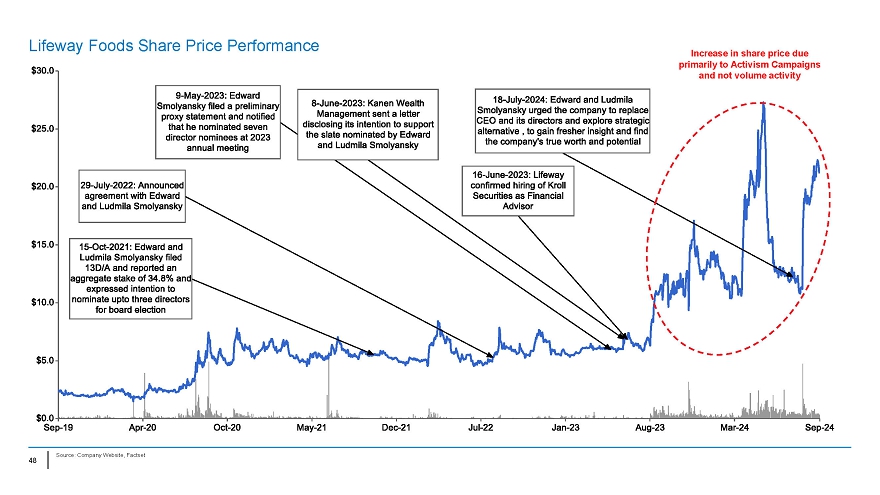

Share Price Performance ➢ Lifeway suffered from subpar Total Shareholder Return (TSR) when we initiated our first campaign in 2021 ➢ Since then, our campaigns for Board change and a strategic review have positively impacted the share price ➢ Shareholder pressure and Danone’s unsolicited offers are primarily responsible for the recent jump in the share price

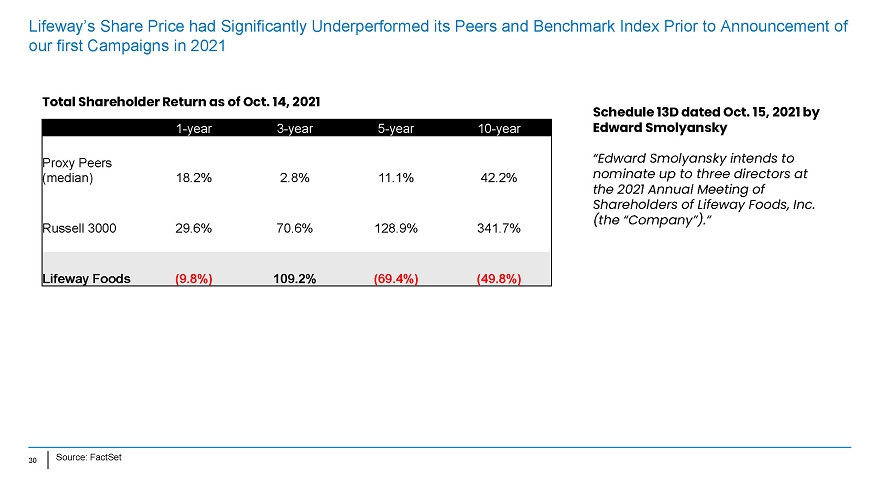

30 Lifeway’s Share Price had Significantly Underperformed its Peers and Benchmark Index Prior to Announcement of our first Campaigns in 2021 Source: FactSet 10 - year 5 - year 3 - year 1 - year 42.2% 11.1% 2.8% 18.2% Proxy Peers (median) 341.7% 128.9% 70.6% 29.6% Russell 3000 (49.8%) (69.4%) 109.2% (9.8%) Lifeway Foods Total Shareholder Return as of Oct. 14, 2021 Schedule 13D dated Oct. 15, 2021 by Edward Smolyansky “Edward Smolyansky intends to nominate up to three directors at the 2021 Annual Meeting of Shareholders of Lifeway Foods, Inc. (the “Company”).”

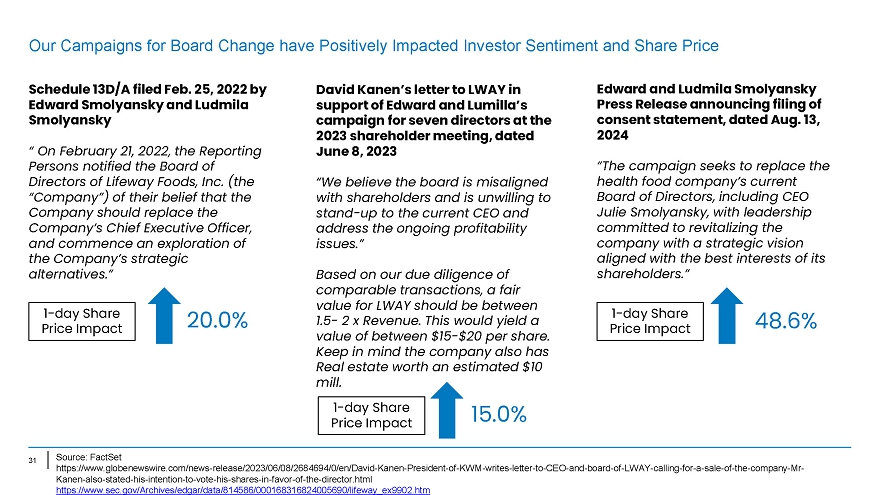

31 Our Campaigns for Board Change have Positively Impacted Investor Sentiment and Share Price Source: FactSet http s://w ww .globenew s wire.com/news - release/2023/06/08/2684694/0/en/David - Kanen - President - of - KWM - writes - letter - to - CEO - and - board - of - LWAY - calling - for - a - sale - of - the - company - Mr - Kanen - also - stated - his - intention - to - vote - his - shares - in - favor - of - the - director.html https://www.sec.gov/Archives/edgar/data/814586/000168316824005690/lifeway_ex9902.htm Schedule 13D/A filed Feb. 25, 2022 by Edward Smolyansky and Ludmila Smolyansky “ On February 21, 2022, the Reporting Persons notified the Board of Directors of Lifeway Foods, Inc. (the “Company”) of their belief that the Company should replace the Company’s Chief Executive Officer, and commence an exploration of the Company’s strategic alternatives.” 20. 0 % 1 - day Share Price Impact David Kanen’s letter to LWAY in support of Edward and Lumilla’s campaign for seven directors at the 2023 shareholder meeting, dated June 8, 2023 “We believe the board is misaligned with shareholders and is unwilling to stand - up to the current CEO and address the ongoing profitability issues.” Based on our due diligence of comparable transactions, a fair value for LWAY should be between 1.5 - 2 x Revenue. This would yield a value of between $15 - $20 per share. Keep in mind the company also has Real estate worth an estimated $10 mill. 15.0% 1 - day Share Price Impact Edward and Ludmila Smolyansky Press Release announcing filing of consent statement, dated Aug. 13, 2024 “The campaign seeks to replace the health food company’s current Board of Directors, including CEO Julie Smolyansky, with leadership committed to revitalizing the company with a strategic vision aligned with the best interests of its shareholders.” 48.6% 1 - day Share Price Impact

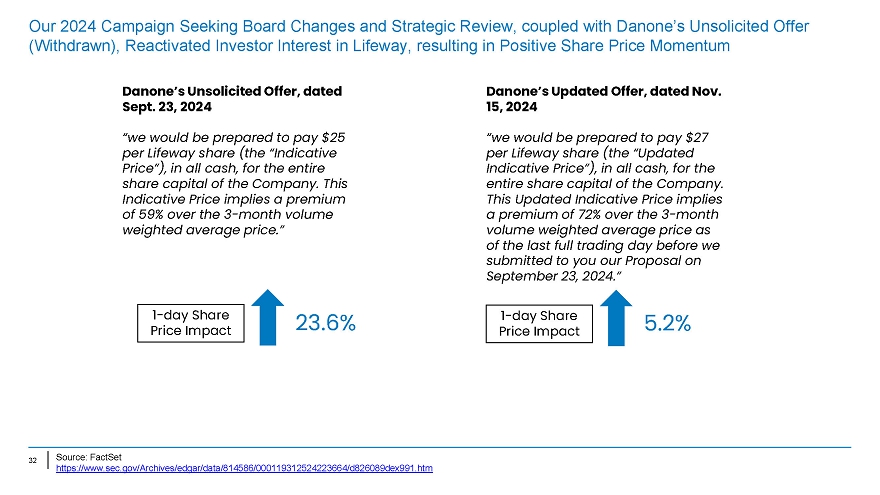

32 Our 2024 Campaign Seeking Board Changes and Strategic Review, coupled with Danone’s Unsolicited Offer (Withdrawn), Reactivated Investor Interest in Lifeway, resulting in Positive Share Price Momentum Danone’s Unsolicited Offer, dated Sept. 23, 2024 “we would be prepared to pay $25 per Lifeway share (the “Indicative Price”), in all cash, for the entire share capital of the Company. This Indicative Price implies a premium of 59% over the 3 - month volume weighted average price.” 23.6% 1 - day Share Price Impact Danone’s Updated Offer, dated Nov. 15, 2024 “we would be prepared to pay $27 per Lifeway share (the “Updated Indicative Price”), in all cash, for the entire share capital of the Company. This Updated Indicative Price implies a premium of 72% over the 3 - month volume weighted average price as of the last full trading day before we submitted to you our Proposal on September 23, 2024.” 5.2% 1 - day Share Price Impact Source: FactSet https://www.sec.gov/Archives/edgar/data/814586/000119312524223664/d826089dex991.htm

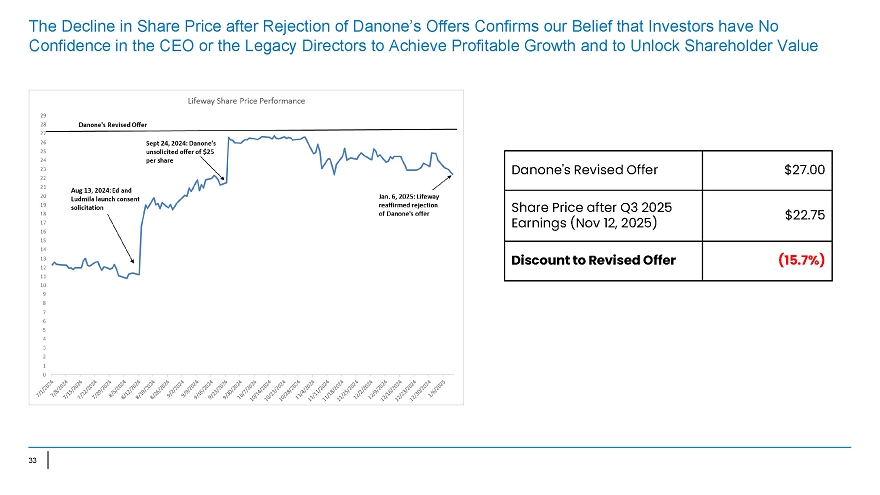

The Decline in Share Price after Rejection of Danone’s Offers Confirms our Belief that Investors have No Confidence in the CEO or the Legacy Directors to Achieve Profitable Growth and to Unlock Shareholder Value $27. 0 0 Danone's Revised Offer $22.75 Share Price after Q3 2025 Earnings (Nov 12, 2025) (15. 7 %) Discount to Revised Offer 33

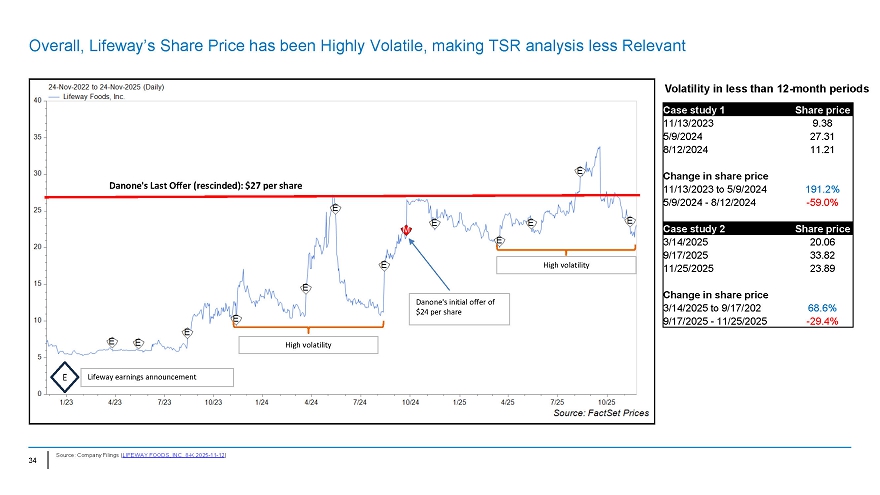

Source: Company Filings ( LIFEWAY FOODS, INC. 8 - K 2025 - 11 - 12 ) Danone's Last Offer (rescinded): $27 per share Danone's initial offer of $24 per share E Lifeway earnings announcement High volatility 34 High volatility Share price Case study 1 9.38 11/13/2023 27.31 5/9/2024 11.21 8/12/2024 Change in share price 191.2% 11/13/2023 to 5/9/2024 - 59.0% 5/9/2024 - 8/12/2024 Share price Case study 2 20.06 3/14/2025 33.82 9/17/2025 23.89 11/25/2025 Change in share price 68.6% 3/14/2025 to 9/17/202 - 29.4% 9/17/2025 - 11/25/2025 Overall, Lifeway’s Share Price has been Highly Volatile, making TSR analysis less Relevant Volatility in less than 12 - month periods

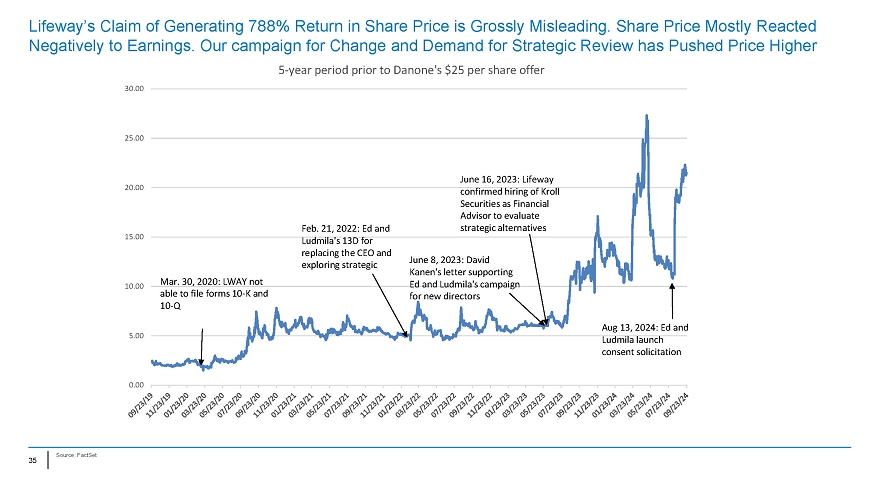

0.00 5.00 10.00 15.00 20.00 25.00 30.00 Lifeway’s Claim of Generating 788% Return in Share Price is Grossly Misleading. Share Price Mostly Reacted Negatively to Earnings. Our campaign for Change and Demand for Strategic Review has Pushed Price Higher 5 - year period prior to Danone's $25 per share offer Source: FactSet 35 Aug 13, 2024: Ed and Ludmila launch consent solicitation Feb. 21, 2022: Ed and Ludmila's 13D for replacing the CEO and exploring strategic June 8, 2023: David Kanen's letter supporting Ed and Ludmila's campaign for new directors Mar. 30, 2020: LWAY not able to file forms 10 - K and 10 - Q June 16, 2023: Lifeway confirmed hiring of Kroll Securities as Financial Advisor to evaluate strategic alternatives

Our Nominees

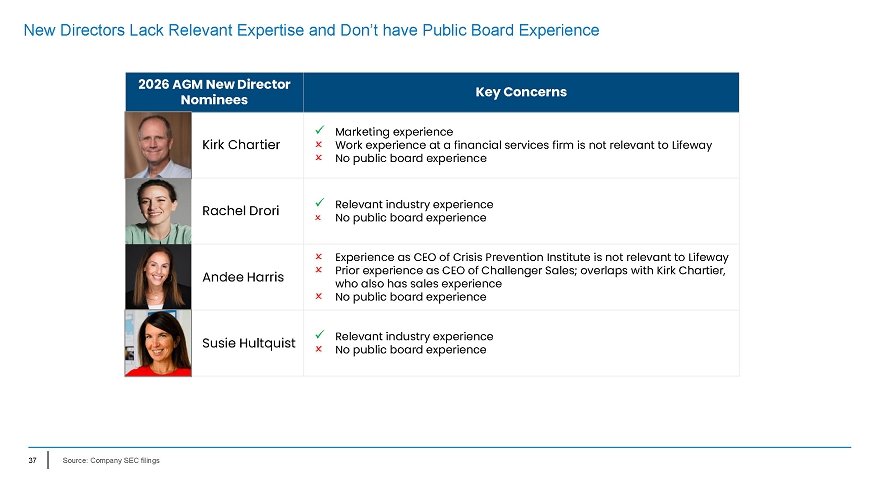

New Directors Lack Relevant Expertise and Don’t have Public Board Experience Key Concerns 2026 AGM New Director Nominees ✓ Marketing experience Work experience at a financial services firm is not relevant to Lifeway No public board experience Kirk Chartier ✓ Relevant industry experience No public board experience Rachel Drori Experience as CEO of Crisis Prevention Institute is not relevant to Lifeway Prior experience as CEO of Challenger Sales; overlaps with Kirk Chartier, who also has sales experience No public board experience Andee Harris ✓ Relevant industry experience No public board experience Susie Hultquist 37 Source: Company SEC filings

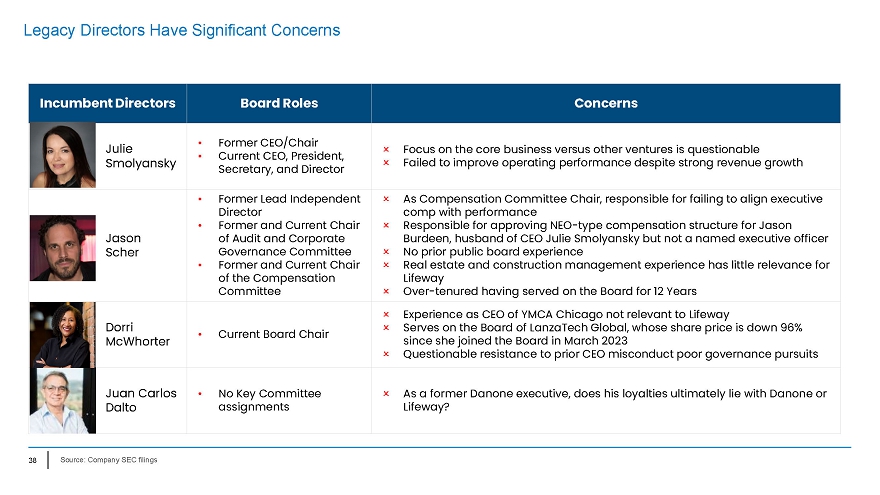

Legacy Directors Have Significant Concerns Concerns Board Roles Incumbent Directors Focus on the core business versus other ventures is questionable Failed to improve operating performance despite strong revenue growth • Former CEO/Chair • Current CEO, President, Secretary, and Director Julie Smolyansky As Compensation Committee Chair, responsible for failing to align executive comp with performance Responsible for approving NEO - type compensation structure for Jason Burdeen, husband of CEO Julie Smolyansky but not a named executive officer No prior public board experience Real estate and construction management experience has little relevance for Lifeway Over - tenured having served on the Board for 12 Years • Former Lead Independent Director • Former and Current Chair of Audit and Corporate Governance Committee • Former and Current Chair of the Compensation Committee Ja s on Scher Experience as CEO of YMCA Chicago not relevant to Lifeway Serves on the Board of LanzaTech Global, whose share price is down 96% since she joined the Board in March 2023 Questionable resistance to prior CEO misconduct poor governance pursuits • Current Board Chair Dorri Mc W ho r ter As a former Danone executive, does his loyalties ultimately lie with Danone or Lifeway? • No Key Committee assignments Juan Carlos Dalto 38 Source: Company SEC filings

Our Nominee: George Sent › George Sent currently serves as a Managing Director at Cascadia Capital, an investment bank, serving clients in the food, beverage and agricultural sectors › Joined Cascadia Capital from KeyBank Capital Markets, where he worked from 2013 through 2018 as Head of M&A for food & beverage, including sell - side, buy - side and strategic advisory assignments › Former Executive Director – Consumer and Investment Retail Banker with Lazard from 2010 – 2013 › Former Head of Corporate Finance and Investor Relations at The J.M. Smucker Company, and as an investment banker with Goldman Sachs › Former lead independent director and Chairperson of the Company’s Audit and Corporate Governance Committee, prior to his departure from the Board in January 2020 › Became a Certified Public Accountant in 2002 and holds an undergraduate degree from the University of Cincinnati and an M.B.A. from Cornell University in 2001, where he was a Johnson School Finance Fellow › Currently serves on the Food Science Advisory Council at Cornell University Source: Press Releases, Factset 39

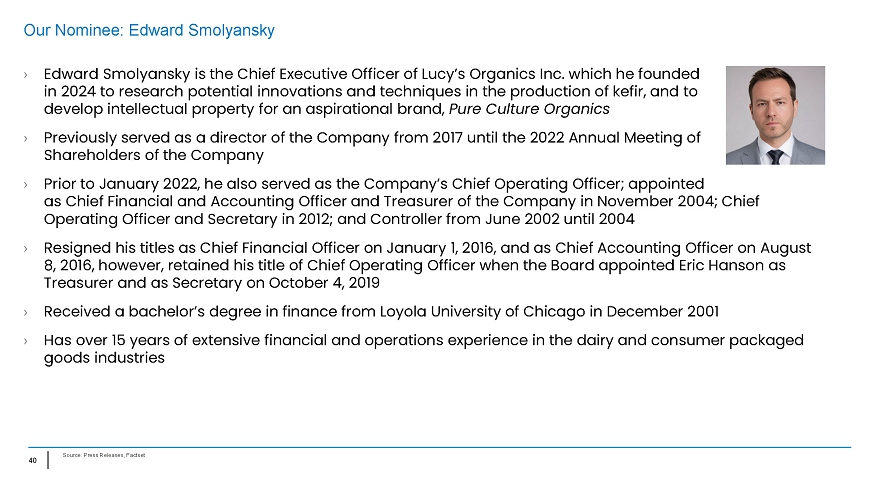

Our Nominee: Edward Smolyansky › Edward Smolyansky is the Chief Executive Officer of Lucy’s Organics Inc . which he founded in 2024 to research potential innovations and techniques in the production of kefir, and to develop intellectual property for an aspirational brand, Pure Culture Organics › Previously served as a director of the Company from 2017 until the 2022 Annual Meeting of Shareholders of the Company › Prior to January 2022, he also served as the Company’s Chief Operating Officer; appointed as Chief Financial and Accounting Officer and Treasurer of the Company in November 2004; Chief Operating Officer and Secretary in 2012; and Controller from June 2002 until 2004 › Resigned his titles as Chief Financial Officer on January 1, 2016, and as Chief Accounting Officer on August 8, 2016, however, retained his title of Chief Operating Officer when the Board appointed Eric Hanson as Treasurer and as Secretary on October 4, 2019 › Received a bachelor’s degree in finance from Loyola University of Chicago in December 2001 › Has over 15 years of extensive financial and operations experience in the dairy and consumer packaged goods industries Source: Press Releases, Factset 49

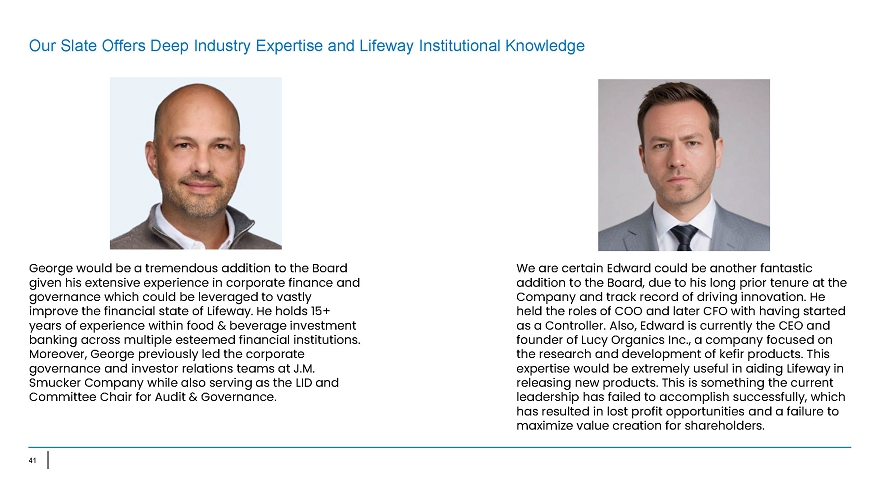

Our Slate Offers Deep Industry Expertise and Lifeway Institutional Knowledge George would be a tremendous addition to the Board given his extensive experience in corporate finance and governance which could be leveraged to vastly improve the financial state of Lifeway. He holds 15+ years of experience within food & beverage investment banking across multiple esteemed financial institutions. Moreover, George previously led the corporate governance and investor relations teams at J.M. Smucker Company while also serving as the LID and Committee Chair for Audit & Governance. We are certain Edward could be another fantastic addition to the Board, due to his long prior tenure at the Company and track record of driving innovation. He held the roles of COO and later CFO with having started as a Controller. Also, Edward is currently the CEO and founder of Lucy Organics Inc., a company focused on the research and development of kefir products. This expertise would be extremely useful in aiding Lifeway in releasing new products. This is something the current leadership has failed to accomplish successfully, which has resulted in lost profit opportunities and a failure to maximize value creation for shareholders. 41

Performance and Strategy Committee

Shareholder Proposal: Establishment of a Performance Review Committee › Another component is the establishment of a performance committee to evaluate the effectiveness and rationale of executive management policies. › This committee is to be comprised of at least two independent directors who have been appointed since Lifeway announced its agreement to pursue proper Board refreshment. › In the past, the Board has repeatedly failed to exercise proper oversight of Lifeway’s executive management team, including its CEO › We believe that this lack of oversight directly resulted in the previously announced determination by Danone that it would no longer pursue an acquisition of Lifeway. › We believe that this decision materially harmed the ability of Lifeway’s shareholders to achieve liquidity for their shares at a meaningful premium to recent trading prices › The current members of the Board who were serving as directors during the course of Danone’s due diligence review of Lifeway, will no longer be able to conduct an effective, thorough and disinterested review of Lifeway’s executive management team, its strategic plan or its strategic alternatives . › The company is clearly at an inflection point, where directors need to act to not only ensure long term value creation but also to prevent their rights from no longer being violated. › A vote FOR this proposal would better align pay with performance. 43 Source: Edward Smolyansky letter to shareholders October 17, 2025

Lifeway's Rebuttal to the Proposal is Misleading and Lacks Validity R ea l ity 44 › Compensation Committee Chair Jason Scher has demonstrated concerning lapses in oversight. The most notable incident being awarding unauthorized shares to Julie Smolyansky which sparked the Danone lawsuit. › The Compensation Committee decided to award CEO/Chair Smolyansky with an unusually large equity grant totaling approximately $6.5 million along with a retention Bonus of $2M for a total award value of $8.5 million › Board refreshment in 2022 was exclusively driven by Edward Smolyansky, and this later became apart of the July settlement agreement. › Ludmila was not re - nominated likely due to internal feuding from Julie's Smolyansky's need to consolidate more control over the Company rather than actions to promote independent oversight. › Board refreshment should occur regardless of external matters, this is clearly and excuse meant to detract focus from their poor governance practices. Lifeway Rationale for Voting Against › The Compensation Committee is comprised of independent directors and is responsible for assessing all pay for performance matters. › The Board will be majority independent new directors by June 2026, who will reside on all committees and have primary guidance in new strategic undertakings. › There have been extensive refreshment initiatives since 2021 with the additions of independent directors such as Dorri McWhorter and Juan Carlos Dalto. › Also, Ludmila Smolyansky was not on the nomination slate in 2023 which fostered greater independent oversight. › Board refreshment was delayed in 2024 because of time allocated to shareholder related matters. › Only two nominees have been on the Board for more than five years, with one being Jason Scher is not going to be nominated for the next AGM. Source: Company SEC filings. 2025 Proxy Statement: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000814586/000168316825008317/lifeway_iprec14a.htm

Appendix

46 Milk Prices (key raw material for Lifeway) Source: https://www.fmma30.com/ClassPrice/Class3&SupportPrices -- 2000 - current.pdf Lifeway’s input cost for milk is down significantly since 2022

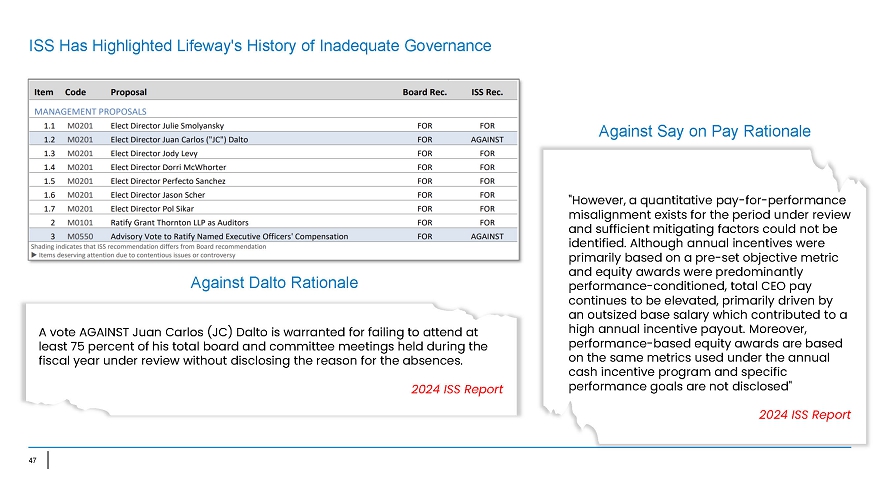

ISS Has Highlighted Lifeway's History of Inadequate Governance "However, a quantitative pay - for - performance misalignment exists for the period under review and sufficient mitigating factors could not be identified. Although annual incentives were primarily based on a pre - set objective metric and equity awards were predominantly performance - conditioned, total CEO pay continues to be elevated, primarily driven by an outsized base salary which contributed to a high annual incentive payout. Moreover, performance - based equity awards are based on the same metrics used under the annual cash incentive program and specific performance goals are not disclosed" 2024 ISS Report A vote AGAINST Juan Carlos (JC) Dalto is warranted for failing to attend at least 75 percent of his total board and committee meetings held during the fiscal year under review without disclosing the reason for the absences. 2024 ISS Report 47 Against Dalto Rationale Against Say on Pay Rationale

Lifeway Foods Share Price Performance 48 Source: Company Website, Factset Increase in share price due primarily to Activism Campaigns and not volume activity