J.P. Morgan 44 th Annual Healthcare Conference Pat J. Beyer President and Chief Executive Officer Todd W. Garner Executive Vice President and Chief Financial Officer January 12 th , 2026

Forward - Looking Information This presentation may contain forward - looking statements based on certain assumptions and contingencies that involve risks and uncertainties, which could cause actual results, performance, or trends to differ materially from those expressed in the forward - looking statements herein or in previous disclosures . For example, in addition to general industry and economic conditions, factors that could cause actual results to differ materially from those in the forward - looking statements may include, but are not limited to the risk factors discussed in the Company's Annual Report on Form 10 - K for the full year ended December 31 , 2024 , listed under the heading Forward - Looking Statements in the Company’s most recently filed Form 10 - Q and other risks and uncertainties, which may be detailed from time to time in reports filed by CONMED with the SEC . Any and all forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and relate to the Company’s performance on a going - forward basis . The Company believes that all forward - looking statements made by it have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections as expressed in the forward - looking statements will actually occur or prove to be correct . Management has disclosed adjusted financial measurements in this presentation that present financial information that is not in accordance with generally accepted accounting principles in the United States (GAAP) . The Company analyzes net sales on a constant currency basis to better measure the comparability of results between periods . To measure earnings performance on a consistent and comparable basis, the Company excludes certain items that affect the comparability of operating results and the trend of earnings . These adjustments are irregular in timing, may not be indicative of past and future performance and are therefore excluded to allow investors to better understand underlying operating trends . These measurements are not a substitute for GAAP measurements . Investors should consider adjusted measures in addition to, and not as a substitute for, or superior to, financial performance measures prepared in accordance with GAAP . We are unable to present a quantitative reconciliation of our expected diluted net earnings per share to expected adjusted diluted net earnings per share as we are unable to predict with reasonable certainty and without unreasonable effort the impact and timing of acquisition, integration and other charges . The financial impact of these items is uncertain and is dependent on various factors, including timing, and could be material to our consolidated statements of income . 2

Empower healthcare providers worldwide to deliver exceptional outcomes for patients. Focus behind the Vision People, Products, Profitability CONMED Vision 3

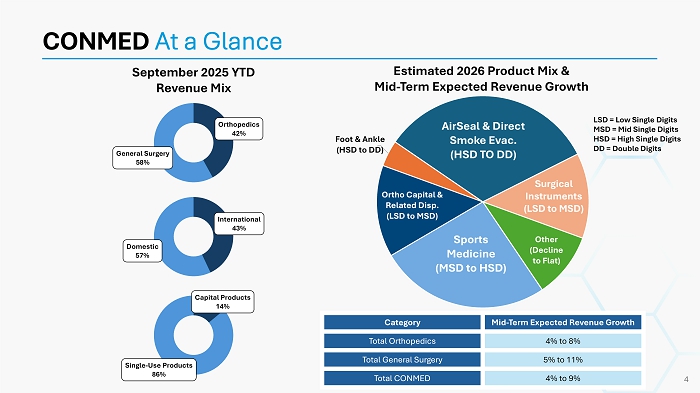

CONMED At a Glance September 2025 YTD Revenue Mix Sports Medicine (MSD to HSD) Ortho Capital & Related Disp. (LSD to MSD) Foot & Ankle (HSD to DD) AirSeal & Direct Smoke Evac. (HSD TO DD) Surgical Instruments (LSD to MSD) Other (Decline to Flat) Estimated 2026 Product Mix & Mid - Term Expected Revenue Growth LSD = Low Single Digits MSD = Mid Single Digits HSD = High Single Digits DD = Double Digits Mid - Term Expected Revenue Growth Category 4% to 8% Total Orthopedics 5% to 11% Total General Surgery 4% to 9% Total CONMED 4 Orthopedics 42% General Surgery 58% International 43% Domestic 57% Capital Products 14% Single - Use Products 86%

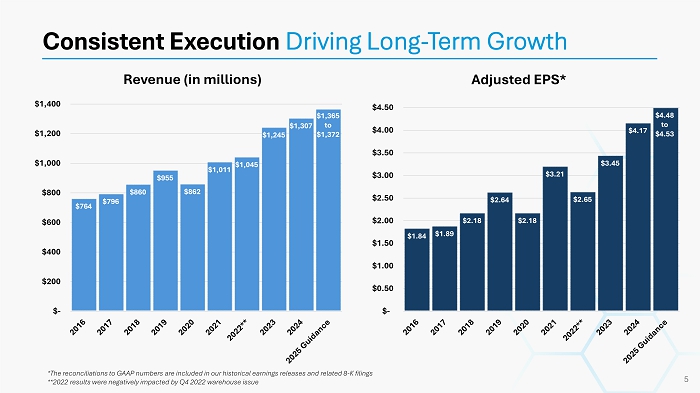

*The reconciliations to GAAP numbers are included in our historical earnings releases and related 8 - K filings **2022 results were negatively impacted by Q4 2022 warehouse issue Consistent Execution Driving Long - Term Growth 5 Revenue (in millions) Adjusted EPS* $764 $796 $860 $955 $862 $1,011 $1,045 $1,245 $1,307 $1,365 to $1,372 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1.84 $1.89 $2.18 $2.64 $2.18 $3.21 $2.65 $3.45 $4.17 $4.48 to $4.53 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50

AirSeal Advanced insufflation system clinically proven to improve surgical outcomes Buffalo Filter Surgical smoke evacuation portfolio positioned for growth with legislative tailwinds and product innovation BioBrace Reinforced bioinductive implant used in 70+ orthopedic and foot & ankle procedures High - Growth Platforms Shaping Our Future 6

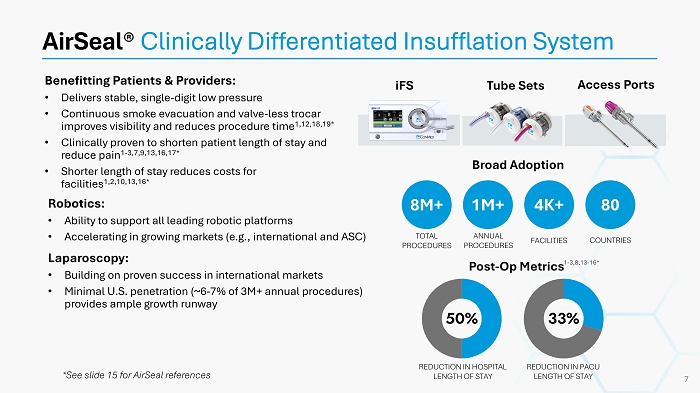

Benefitting Patients & Providers: • Delivers stable, single - digit low pressure • Continuous smoke evacuation and valve - less trocar improves visibility and reduces procedure time 1,12,18,19* • Clinically proven to shorten patient length of stay and reduce pain 1 - 3,7,9,13,16,17* • Shorter length of stay reduces costs for facilities 1,2,10,13,16* AirSeal ® Clinically Differentiated Insufflation System Broad Adoption Post - Op Metrics iFS Tube Sets Access Ports Robotics: • Ability to support all leading robotic platforms • Accelerating in growing markets (e.g., international and ASC) Laparoscopy: • Building on proven success in international markets • Minimal U.S. penetration (~6 - 7% of 3M+ annual procedures) provides ample growth runway 8M+ 1M+ 4K+ 80 TOTAL PROCEDURES ANNUAL PROCEDURES FACILITIES COUNTRIES 1 - 3,8,13 - 16* REDUCTION IN HOSPITAL LENGTH OF STAY REDUCTION IN PACU LENGTH OF STAY 7 *See slide 15 for AirSeal references

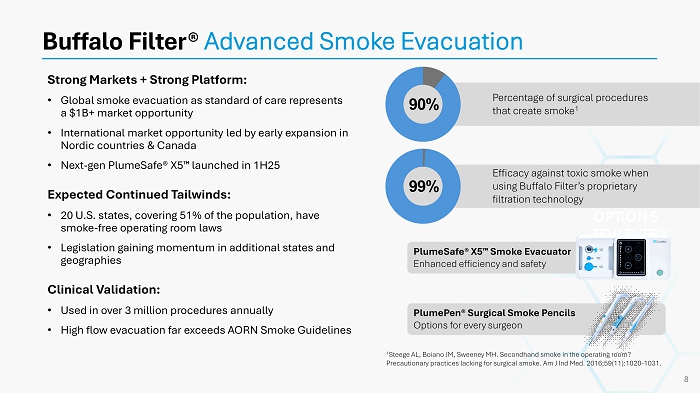

Strong Markets + Strong Platform: • Global smoke evacuation as standard of care represents a $1B+ market opportunity • International market opportunity led by early expansion in Nordic countries & Canada • Next - gen PlumeSafe ® X5 launched in 1H25 Expected Continued Tailwinds: • 20 U.S. states, covering 51% of the population, have smoke - free operating room laws • Legislation gaining momentum in additional states and geographies Clinical Validation: • Used in over 3 million procedures annually • High flow evacuation far exceeds AORN Smoke Guidelines Buffalo Filter® Advanced Smoke Evacuation OPTIONS FOR EVERY SURGEON 1 Steege AL, Boiano JM, Sweeney MH. Secondhand smoke in the operating room? Precautionary practices lacking for surgical smoke. Am J Ind Med. 2016;59(11):1020 - 1031. 8 Percentage of surgical procedures that create smoke 1 90% Efficacy against toxic smoke when using Buffalo Filter’s proprietary filtration technology 99% PlumeSafe ® X5 Smoke Evacuator Enhanced efficiency and safety PlumePen ® Surgical Smoke Pencils Options for every surgeon

Large Market, Significant Unmet Need: • More than 3.7M orthopedic soft - tissue procedures expected annually in the U.S. by 2029 driven by an active, aging population ⁽ ⁴ ⁾ • Biologic limitations and current repair techniques contribute to high re - tear and incomplete healing across key procedures BioBrace® High - Need Sports Medicine Market (1) Barrett et al. Am J Sports Med. 2011 | (2) Rashid et al. Acta Orthop . 2017 | (3) Rettig et al. Am J Sports Med. 2005 | (4) SmartTrak 9 Opportunity for BioBrace : • BioBrace addresses the two root causes of failure: • Lack of biological support • Insufficient mechanical reinforcement • Now expanding across 70+ orthopedic and foot & ankle procedures ACL 497,000 Surgeries (4) Up to 29% graft failure (1) Rotator Cuff 1,000,000 Surgeries (4) Up to 54% re - tear (2) Achilles 50,000 Surgeries (4) Up to 16% re - tear (3)

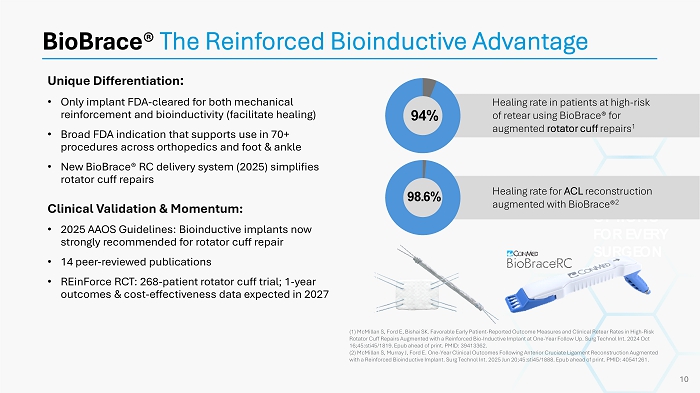

Unique Differentiation : • Only implant FDA - cleared for both mechanical reinforcement and bioinductivity (facilitate healing) • Broad FDA indication that supports use in 70+ procedures across orthopedics and foot & ankle • New BioBrace® RC delivery system (2025) simplifies rotator cuff repairs Clinical Validation & Momentum: • 2025 AAOS Guidelines: Bioinductive implants now strongly recommended for rotator cuff repair • 14 peer - reviewed publications • REinForce RCT: 268 - patient rotator cuff trial; 1 - year outcomes & cost - effectiveness data expected in 2027 BioBrace ® The Reinforced Bioinductive Advantage OPTIONS FOR EVERY SURGEON (1) McMillan S, Ford E, Bishai SK. Favorable Early Patient - Reported Outcome Measures and Clinical Retear Rates in High - Risk Rotator Cuff Repairs Augmented with a Reinforced Bio - Inductive Implant at One - Year Follow Up. Surg Technol Int. 2024 Oct 16;45:sti45/1819. Epub ahead of print. PMID: 39413362. (2) McMillan S, Murray J, Ford E. One - Year Clinical Outcomes Following Anterior Cruciate Ligament Reconstruction Augmented with a Reinforced Bioinductive Implant. Surg Technol Int. 2025 Jun 20;45:sti45/1888. Epub ahead of print. PMID: 40541261. 10 Healing rate in patients at high - risk of retear using BioBrace® for augmented rotator cuff repairs 1 94% Healing rate for ACL reconstruction augmented with BioBrace® 2 98.6%

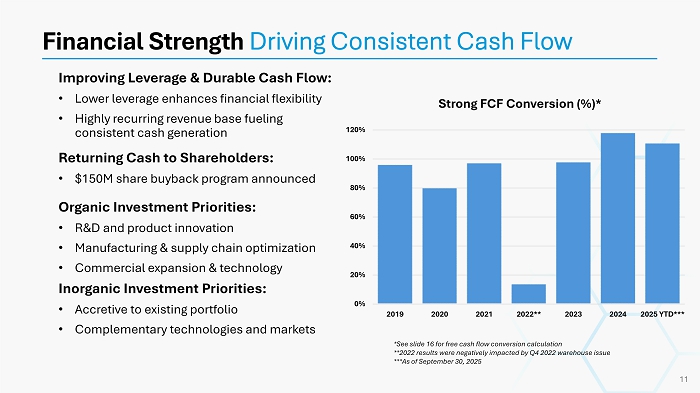

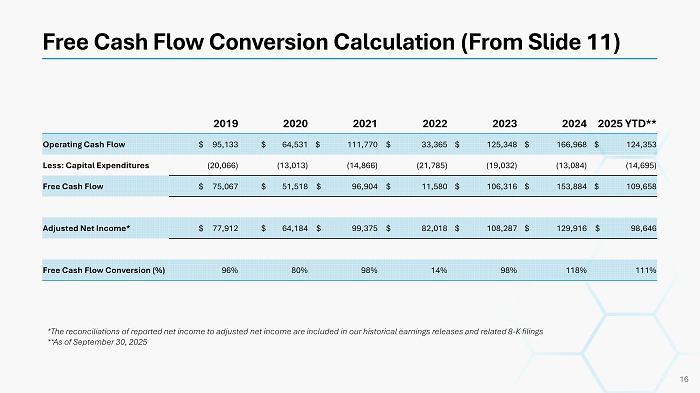

Organic Investment Priorities: • R&D and product innovation • Manufacturing & supply chain optimization • Commercial expansion & technology Inorganic Investment Priorities: • Accretive to existing portfolio • Complementary technologies and markets Improving Leverage & Durable Cash Flow: • Lower leverage enhances financial flexibility • Highly recurring revenue base fueling consistent cash generation Returning Cash to Shareholders: • $150M share buyback program announced Financial Strength Driving Consistent Cash Flow Strong FCF Conversion (%)* 11 0% 20% 40% 60% 80% 100% 120% 2019 2020 2021 2022** 2023 2024 2025 YTD*** *See slide 16 for free cash flow conversion calculation **2022 results were negatively impacted by Q4 2022 warehouse issue ***As of September 30, 2025

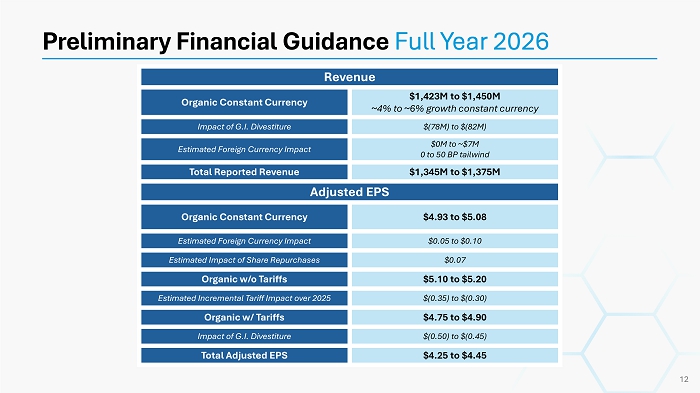

Preliminary Financial Guidance Full Year 2026 Revenue $1,423M to $1,450M ~4% to ~6% growth constant currency Organic Constant Currency $(78M) to $(82M) Impact of G.I. Divestiture $0M to ~$7M 0 to 50 BP tailwind Estimated Foreign Currency Impact $1,345M to $1,375M Total Reported Revenue Adjusted EPS $4.93 to $5.08 Organic Constant Currency $0.05 to $0.10 Estimated Foreign Currency Impact $0.07 Estimated Impact of Share Repurchases $5.10 to $5.20 Organic w/o Tariffs $(0.35) to $(0.30) Estimated Incremental Tariff Impact over 2025 $4.75 to $4.90 Organic w/ Tariffs $(0.50) to $(0.45) Impact of G.I. Divestiture $4.25 to $4.45 Total Adjusted EPS 12

Partners with the United Way to serve communities where we operate in the U.S. CONMED manufacturing operations have recycling programs including eScrap , metal, cardboard, plastic, and paper. Effective board leadership and independent oversight. 100% independent standing board committees and regular executive sessions of independent directors. Together We Are Making A Difference for a Better Tomorrow Environmental Social Governance 98% of employees participated in the Gallup Q12 Employee Engagement Survey. Committed to maintaining a quality system that provides safe and effective products and services that meet the needs and requirements of our patients, customers, company stakeholders and all regulatory requirements. Use of ISO 14001 and 45001 as a framework to harmonize an Environmental Management System across CONMED. Development of capabilities to measure and understand greenhouse gas emissions associated with our operations, and to identify areas of high impact and opportunities for reduction. CONMED’s executive leadership is responsible for setting the ethical code and overseeing compliance. In addition to oversight by the full Board, the ESG Steering Committee provides strategic direction and prioritization of ESG initiatives. Environmental, Social and Governance 13

» Leveraging Growth Drivers Focusing on high - growth, high - margin products: AirSeal , Buffalo Filter, BioBrace » Optimizing Portfolio Exiting gastroenterology to align resources with minimally invasive surgery, smoke evacuation, and orthopedic soft tissue repair » Transforming Supply Chain Driving supply chain transformation focused on resiliency, predictability, scalability, and efficiency » Strengthening Balance Sheet Enhancing balance sheet to drive growth and shareholder returns CONMED Driven to Win 14

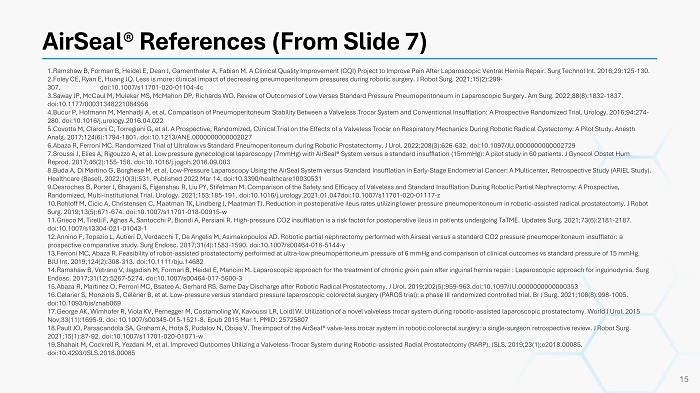

AirSeal ® References (From Slide 7) 1.Ramshaw B, Forman B, Heidel E, Dean J, Gamenthaler A, Fabian M. A Clinical Quality Improvement (CQI) Project to Improve Pain After Laparoscopic Ventral Hernia Repair. Surg Tech no l Int. 2016;29:125 - 130. 2.Foley CE, Ryan E, Huang JQ. Less is more: clinical impact of decreasing pneumoperitoneum pressures during robotic surgery. J R obot Surg. 2021;15(2):299 - 307. doi:10.1007/s11701 - 020 - 01104 - 4c 3.Saway JP, McCaul M, Mulekar MS, McMahon DP, Richards WO. Review of Outcomes of Low Verses Standard Pressure Pneumoperitoneu m i n Laparoscopic Surgery. Am Surg. 2022;88(8):1832 - 1837. doi:10.1177/00031348221084956 4.Bucur P, Hofmann M, Menhadji A, et al. Comparison of Pneumoperitoneum Stability Between a Valveless Trocar System and Conventional Insufflation: A Prospec ti ve Randomized Trial. Urology. 2016;94:274 - 280. doi:10.1016/j.urology.2016.04.022 5.Covotta M, Claroni C, Torregiani G, et al. A Prospective, Randomized, Clinical Trial on the Effects of a Valveless Trocar on Respiratory Mechani cs During Robotic Radical Cystectomy: A Pilot Study. Anesth Analg . 2017;124(6):1794 - 1801. doi:10.1213/ANE.0000000000002027 6.Abaza R, Ferroni MC. Randomized Trial of Ultralow vs Standard Pneumoperitoneum during Robotic Prostatectomy. J Urol. 2022;2 08( 3):626 - 632. doi:10.1097/JU.0000000000002729 7.Sroussi J, Elies A, Rigouzzo A, et al. Low pressure gynecological laparoscopy (7mmHg) with AirSeal ® System versus a standard insufflation (15mmHg): A pilot study in 60 patients. J Gynecol Obstet Hum Reprod . 2017;46(2):155 - 158. doi:10.1016/j.jogoh.2016.09.003 8.Buda A, Di Martino G, Borghese M, et al. Low - Pressure Laparoscopy Using the AirSeal System versus Standard Insufflation in Early - Stage Endometrial Cancer: A Multicenter, Retrospective Study (ARIEL Study). Healthcare (Basel). 2022;10(3):531. Published 2022 Mar 14. doi:10.3390/healthcare10030531 9.Desroches B, Porter J, Bhayani S, Figenshau R, Liu PY, Stifelman M. Comparison of the Safety and Efficacy of Valveless and Standard Insufflation During Robotic Partial N ep hrectomy: A Prospective, Randomized, Multi - institutional Trial. Urology. 2021;153:185 - 191. doi:10.1016/j.urology.2021.01.047doi:10.1007/s11701 - 020 - 01117 - z 10.Rohloff M, Cicic A, Christensen C, Maatman TK, Lindberg J, Maatman TJ. Reduction in postoperative ileus rates utilizing lo wer pressure pneumoperitoneum in robotic - assisted radical prostatectomy. J Robot Surg. 2019;13(5):671 - 674. doi:10.1007/s11701 - 018 - 00915 - w 11.Grieco M, Tirelli F, Agnes A, Santocchi P, Biondi A, Persiani R. High - pressure CO2 insufflation is a risk factor for postoperative ileus in patients undergoing TaTME . Updates Surg. 2021;73(6):2181 - 2187. doi:10.1007/s13304 - 021 - 01043 - 1 12.Annino F, Topazio L, Autieri D, Verdacchi T, De Angelis M, Asimakopoulos AD. Robotic partial nephrectomy performed with Airseal versus a standard CO2 pressure pneumoperitoneum insufflator: a prospective comparative study. Surg Endosc . 2017;31(4):1583 - 1590. doi:10.1007/s00464 - 016 - 5144 - y 13.Ferroni MC, Abaza R. Feasibility of robot - assisted prostatectomy performed at ultra - low pneumoperitoneum pressure of 6 mmHg a nd comparison of clinical outcomes vs standard pressure of 15 mmHg. BJU Int. 2019;124(2):308 - 313. doi:10.1111/bju.14682 14.Ramshaw B, Vetrano V, Jagadish M, Forman B, Heidel E, Mancini M. Laparoscopic approach for the treatment of chronic groin pai n after inguinal hernia repair : Laparoscopic approach for inguinodynia . Surg Endosc . 2017;31(12):5267 - 5274. doi:10.1007/s00464 - 017 - 5600 - 3 15.Abaza R, Martinez O, Ferroni MC, Bsatee A, Gerhard RS. Same Day Discharge after Robotic Radical Prostatectomy. J Urol. 2019;202(5):959 - 963.doi:10.1097/JU.0000000000000 353 16.Celarier S, Monziols S, Célérier B, et al. Low - pressure versus standard pressure laparoscopic colorectal surgery (PAROS trial): a phase III randomized controlle d trial. Br J Surg. 2021;108(8):998 - 1005. doi:10.1093/ bjs /znab069 17.George AK, Wimhofer R, Viola KV, Pernegger M, Costamoling W, Kavoussi LR, Loidl W. Utilization of a novel valveless trocar system during robotic - assisted laparoscopic prostatectomy. Wor ld J Urol. 2015 Nov;33(11):1695 - 9. doi : 10.1007/s00345 - 015 - 1521 - 8. Epub 2015 Mar 1. PMID: 25725807 18.Paull JO, Parsacandola SA, Graham A, Hota S, Pudalov N, Obias V. The impact of the AirSeal ® valve - less trocar system in robotic colorectal surgery: a single - surgeon retrospective review. J Robot Surg. 2021;15(1):87 - 92. doi:10.1007/s11701 - 020 - 01071 - w 19.Shahait M, Cockrell R, Yezdani M, et al. Improved Outcomes Utilizing a Valveless - Trocar System during Robotic - assisted Radial Prostatectomy (RARP). JSLS. 2019 ;23(1):e2018.00085. doi:10.4293/JSLS.2018.00085 15

Free Cash Flow Conversion Calculation (From Slide 11) 16 2025 YTD** 2024 2023 2022 2021 2020 2019 $ 124,353 $ 166,968 $ 125,348 $ 33,365 $ 111,770 $ 64,531 $ 95,133 Operating Cash Flow (14,695) (13,084) (19,032) (21,785) (14,866) (13,013) (20,066) Less: Capital Expenditures $ 109,658 $ 153,884 $ 106,316 $ 11,580 $ 96,904 $ 51,518 $ 75,067 Free Cash Flow $ 98,646 $ 129,916 $ 108,287 $ 82,018 $ 99,375 $ 64,184 $ 77,912 Adjusted Net Income* 111% 118% 98% 14% 98% 80% 96% Free Cash Flow Conversion (%) *The reconciliations of reported net income to adjusted net income are included in our historical earnings releases and relat ed 8 - K filings **As of September 30, 2025