First Quarter Fiscal 2026 November 5, 2025 Investor Presentation .2

Forward-Looking Statements This presentation contains forward-looking statements relating to future events and expectations, including our expectations regarding our estimates and projections for our business outlook for the second quarter of fiscal 2026, each of which is based on certain assumptions and contingencies. The forward-looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and relate to the Company’s performance on a going-forward basis. The forward-looking statements in this investor presentation involve risks and uncertainties, which could cause actual results, performance, or trends to differ materially from those expressed in the forward-looking statements herein or in previous disclosures. The Company believes that all forward-looking statements made by it in this presentation have a reasonable basis, but there can be no assurance that management’s expectations, beliefs, or projections as expressed in the forward-looking statements will actually occur or prove to be correct. In addition to general industry and global economic conditions, factors that could cause actual results to differ materially from those discussed in the forward-looking statements in this presentation include but are not limited to: (i) the failure of any one or more of the assumptions stated herein to prove to be correct; (ii) changes in demand in the Company’s end markets along with the Company’s ability to respond to such market changes; (iii) risks relating to future integration and/or restructuring actions; (iv) fluctuations in purchasing patterns of customers and end users; (v) the ability of the Company to retain and hire key employees; (vi) the terms of the Company’s indebtedness and ability to service such debt in connection with its acquisition of Coherent, Inc.; (vii) the timely release of new products and acceptance of such new products by the market; (viii) the introduction of new products by competitors and other competitive responses; (ix) the Company’s ability to assimilate other recently acquired businesses, and realize synergies, cost savings, and opportunities for growth in connection therewith, together with the risks, costs, and uncertainties associated with such acquisitions; (x) the risks to realizing the benefits of investments in R&D and commercialization of innovations; (xi) the risks that the Company’s stock price will not trade in line with industrial technology leaders; (xii) the impact of trade protection measures, such as import tariffs by the United States or retaliatory actions taken by other countries; and/or (xiii) the risks relating to forward-looking statements and other “Risk Factors” identified from time to time in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the fiscal year ended June 30, 2025, and our subsequently filed Quarterly Reports on Form 10-Q, which filings are available from the SEC. The Company disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events or developments, or otherwise. Unless otherwise indicated in this presentation, all information in this presentation is as of November 5, 2025. This presentation contains non-GAAP financial measures and key metrics relating to the Company’s past performance. We believe the presentation of these non-GAAP financial measures enhances investors' overall understanding of our historical financial performance and assists investors in comparing our performance across reporting periods. These non-GAAP financial measures are in addition to, and not as a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. As required by Regulation G, we have provided reconciliations of those measures to the most directly comparable GAAP measures in the section captioned “GAAP to NON-GAAP RECONCILIATION.” The Company has not provided a quantitative reconciliation of forward-looking non-GAAP gross margin percentage, non-GAAP operating expenses, non-GAAP tax rate and non-GAAP earnings per share, because we cannot, without unreasonable efforts, forecast certain items required to develop comparable GAAP measures. These items include, without limitation, restructuring charges; integration, site consolidation and other expenses; foreign exchange gains (losses); and share based compensation expense. The variability of these items could significantly impact our future GAAP financial results and we believe that the inclusion of any such reconciliations would imply a degree or precision that could be confusing or misleading to investors.

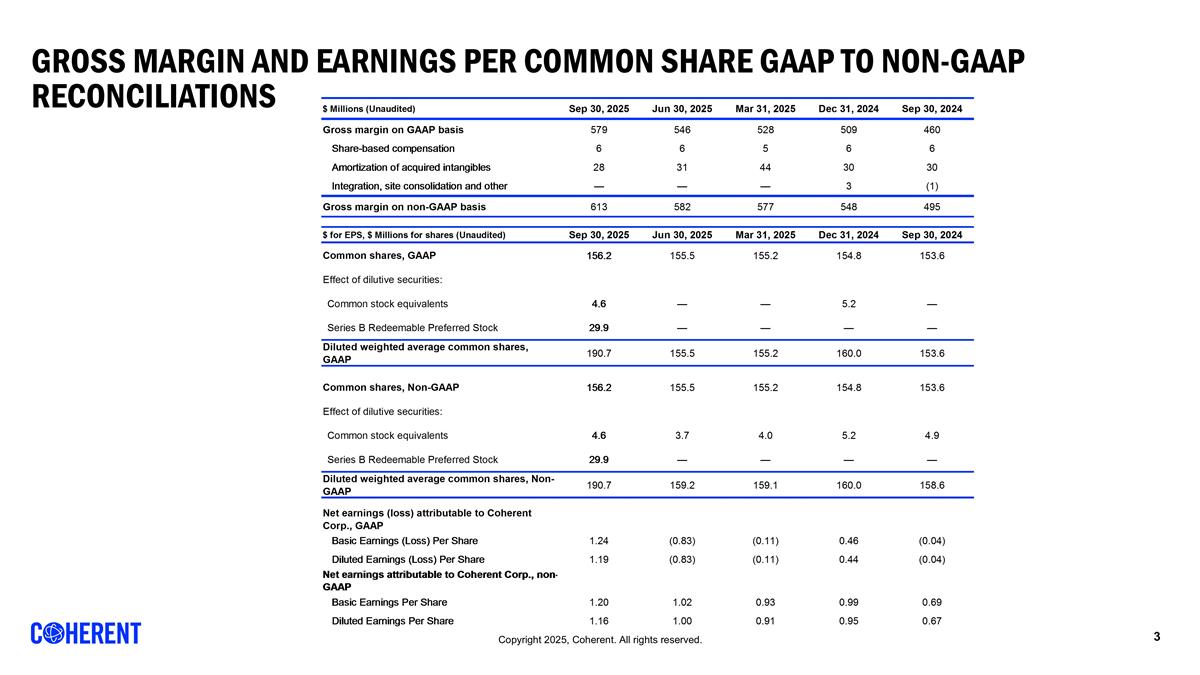

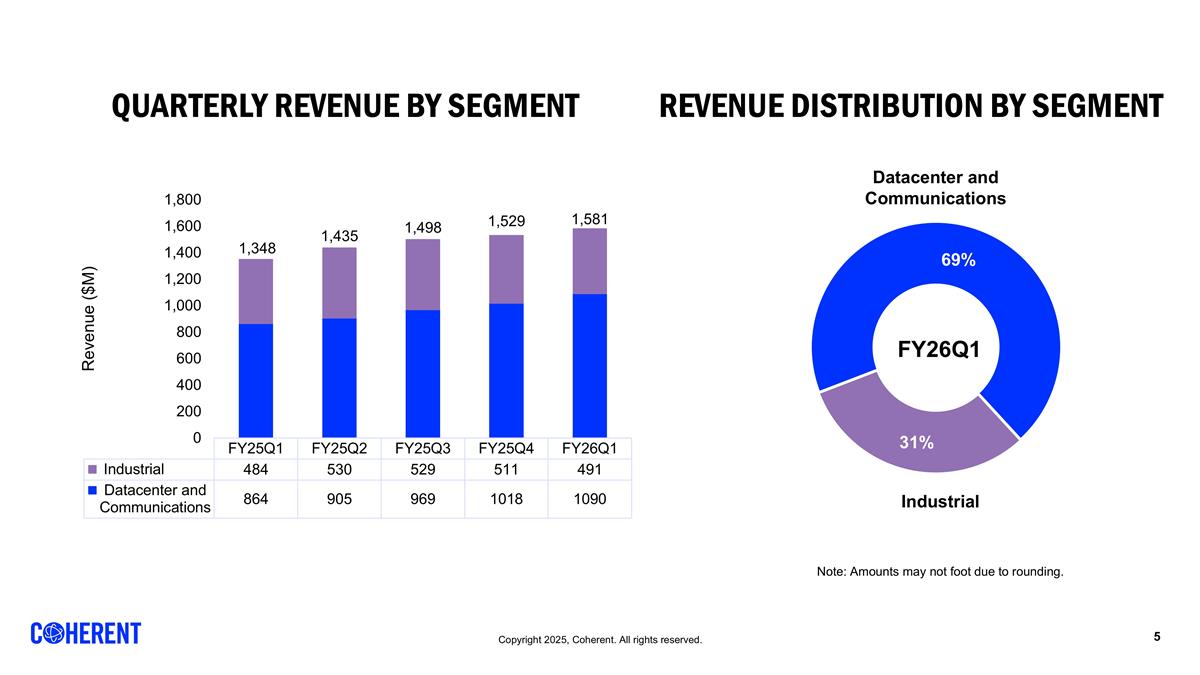

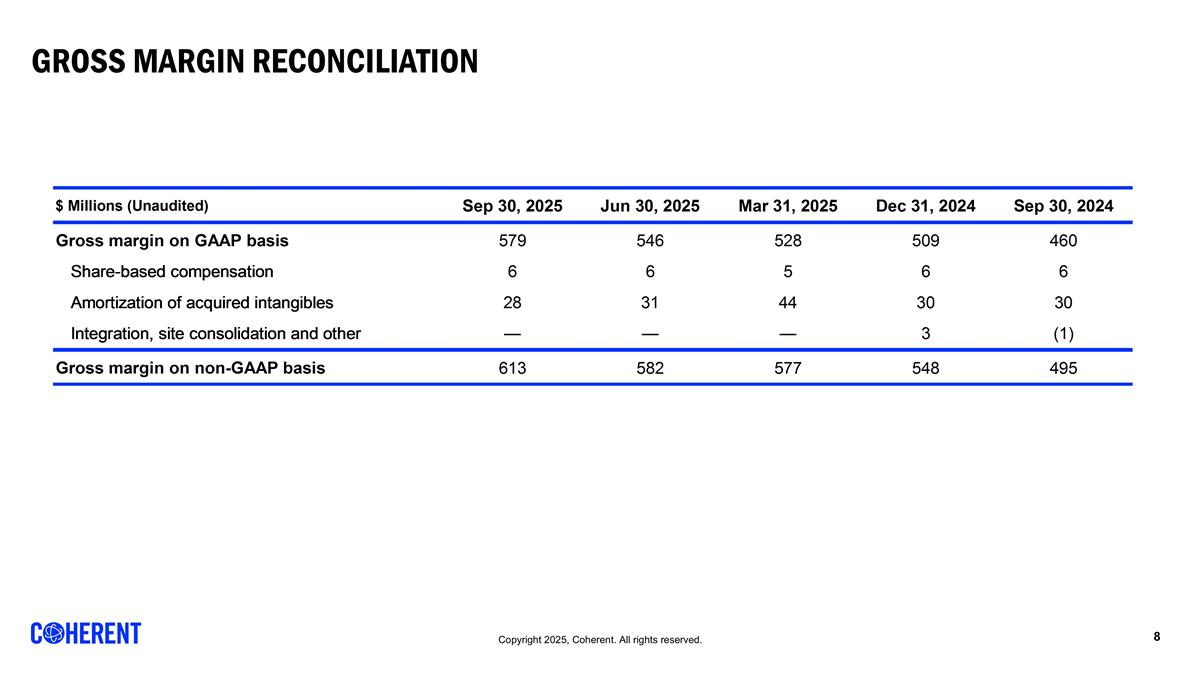

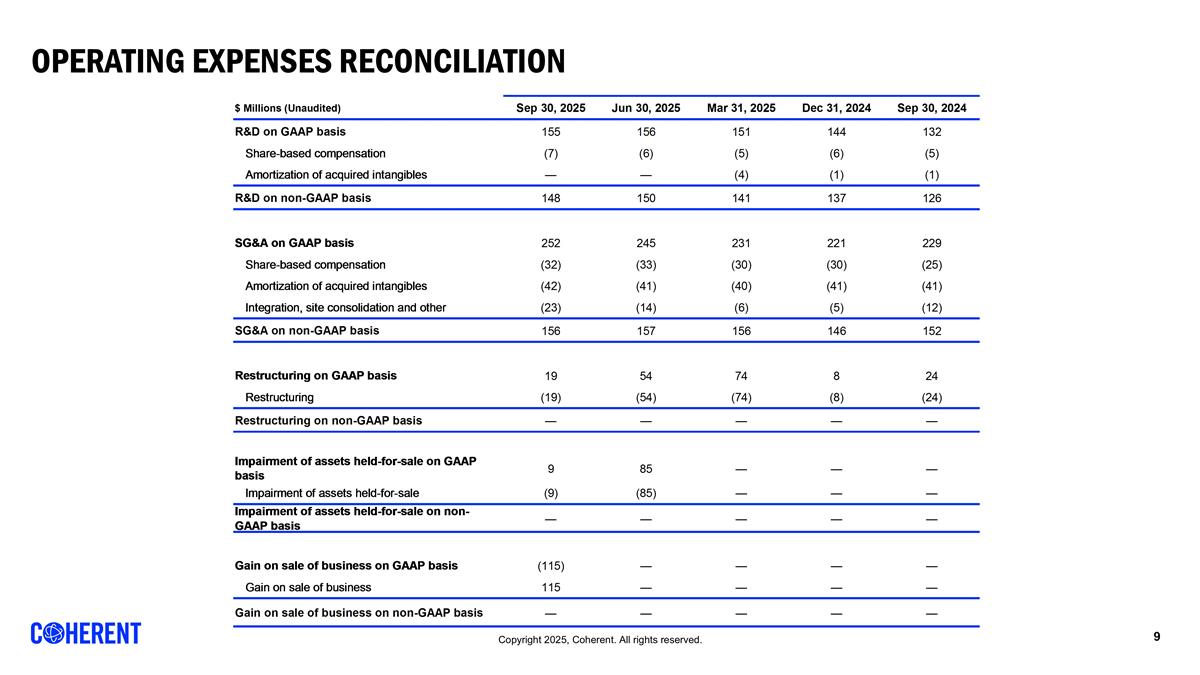

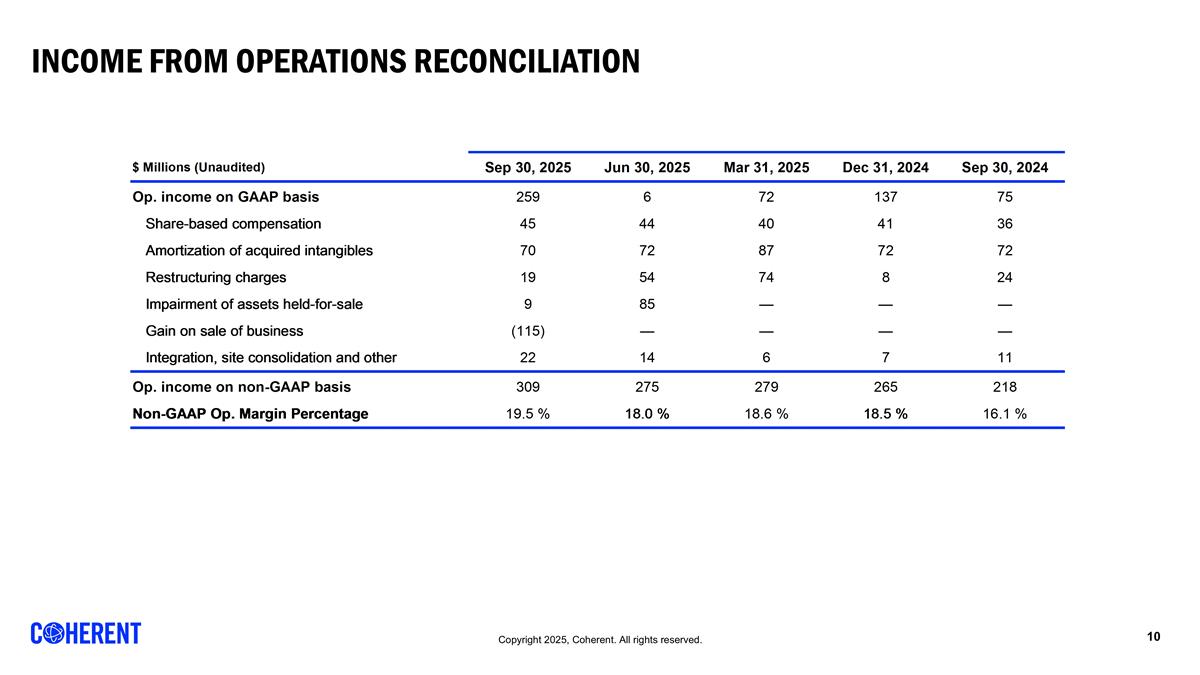

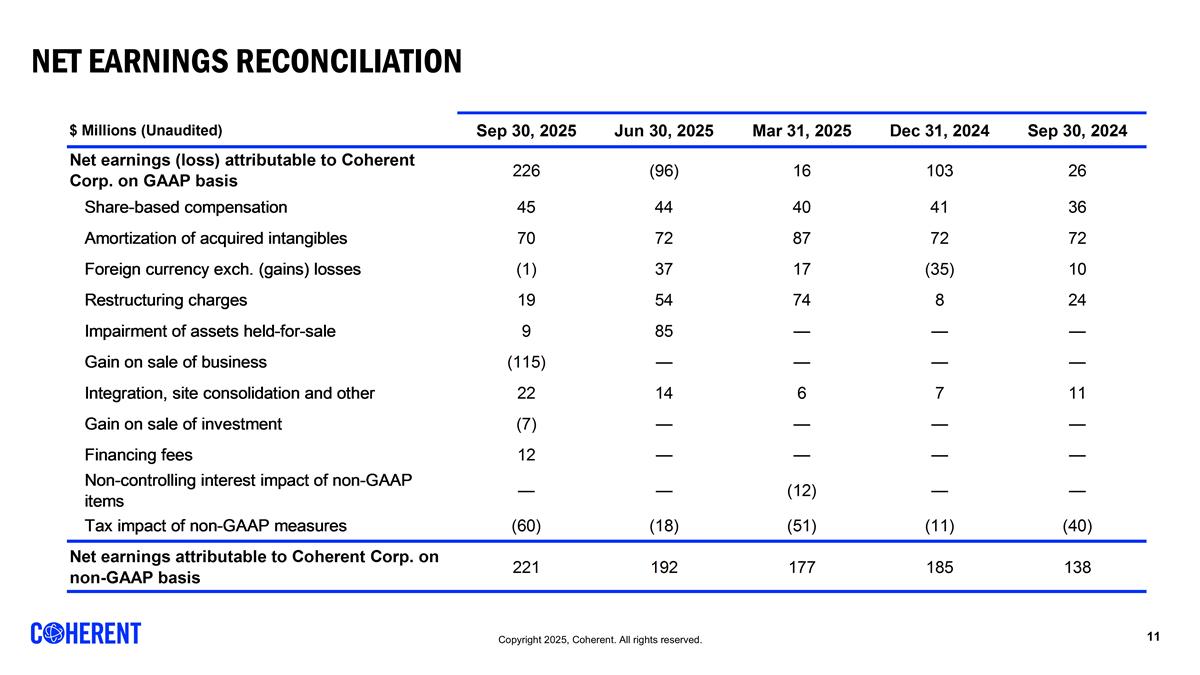

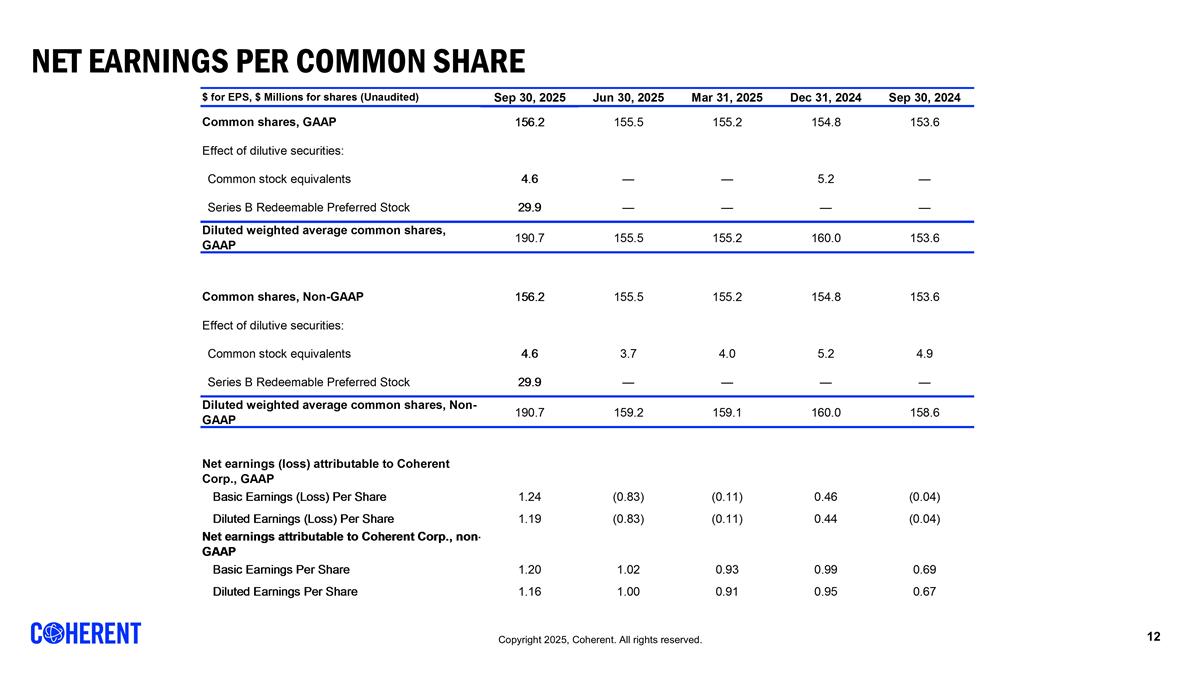

Gross MARGIN and earnings per common share GAAP to Non-GAAP Reconciliations REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION Slide 10 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION Slide 11 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION Slide 12 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE Slide 3 & 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 Slide 3 & 13 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION Not Included $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION Slide 10 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION Slide 11 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION Slide 12 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE Slide 3 & 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 Slide 3 & 13 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION Not Included $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2

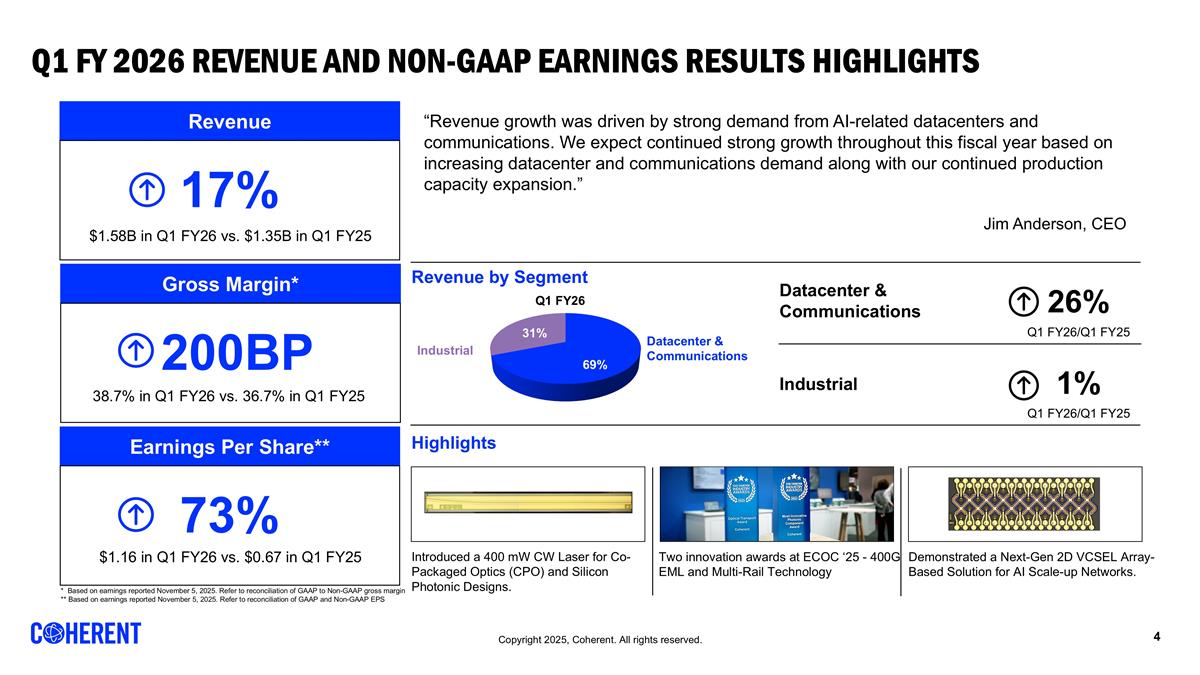

Demonstrated a Next-Gen 2D VCSEL Array-Based Solution for AI Scale-up Networks. Q1 FY 2026 revenue and NON-GAAP Earnings Results Highlights 26% Datacenter & Communications Q1 FY26/Q1 FY25 1% Q1 FY26/Q1 FY25 Industrial Revenue by Segment Highlights Two innovation awards at ECOC ‘25 - 400G EML and Multi-Rail Technology “Revenue growth was driven by strong demand from AI-related datacenters and communications. We expect continued strong growth throughout this fiscal year based on increasing datacenter and communications demand along with our continued production capacity expansion.” Jim Anderson, CEO Revenue 17% $1.58B in Q1 FY26 vs. $1.35B in Q1 FY25 Earnings Per Share** 73% $1.16 in Q1 FY26 vs. $0.67 in Q1 FY25 * Based on earnings reported November 5, 2025. Refer to reconciliation of GAAP to Non-GAAP gross margin ** Based on earnings reported November 5, 2025. Refer to reconciliation of GAAP and Non-GAAP EPS Gross Margin* 200BP 38.7% in Q1 FY26 vs. 36.7% in Q1 FY25 Q1 FY26 Datacenter & Communications Industrial Introduced a 400 mW CW Laser for Co-Packaged Optics (CPO) and Silicon Photonic Designs.

Datacenter and Communications Industrial FY26Q1 Note: Amounts may not foot due to rounding. QUARTERLY REVENUE BY SEGMENT REVENUE DISTRIBUTION BY SEGMENT

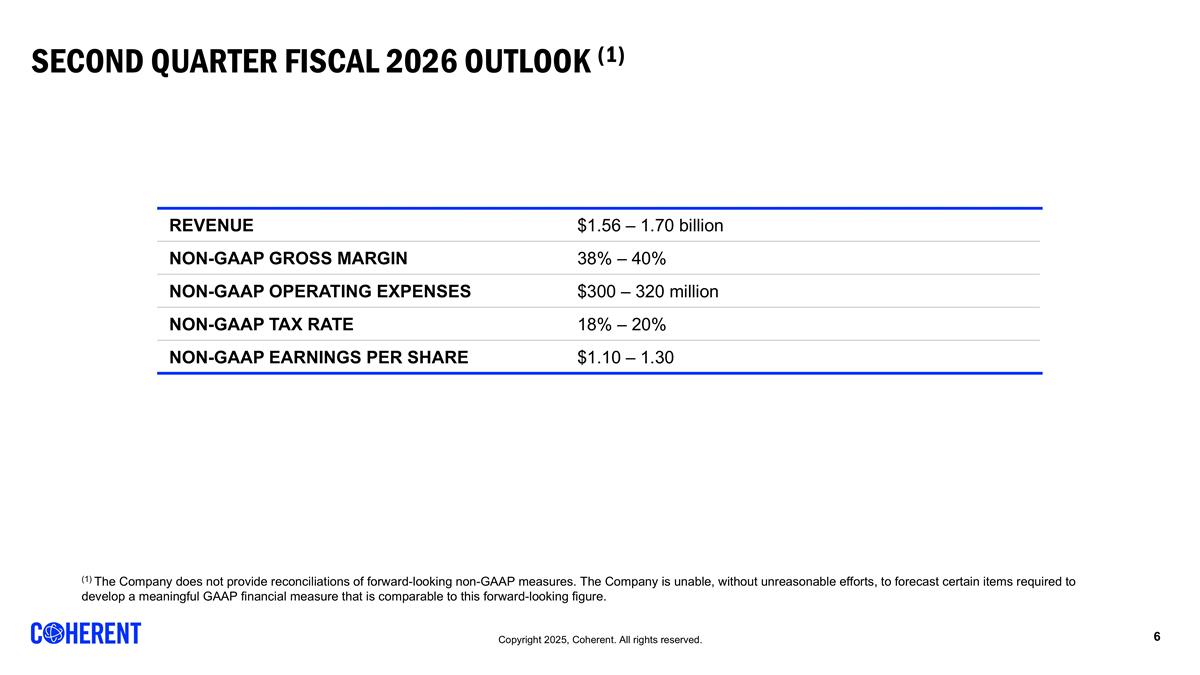

SECOND quarter fiscal 2026 Outlook (1) REVENUE $1.56 – 1.70 billion NON-GAAP GROSS MARGIN 38% – 40% NON-GAAP OPERATING EXPENSES $300 – 320 million NON-GAAP TAX RATE 18% – 20% NON-GAAP EARNINGS PER SHARE $1.10 – 1.30 (1) The Company does not provide reconciliations of forward-looking non-GAAP measures. The Company is unable, without unreasonable efforts, to forecast certain items required to develop a meaningful GAAP financial measure that is comparable to this forward-looking figure.

Gaap to Non-Gaap Reconciliation

Gross MARGIN Reconciliation REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION Slide 10 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION Slide 11 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION Slide 12 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 Slide 13 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION Slide 3 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION Slide 10 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION Slide 11 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION Slide 12 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE Slide 9 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 Slide 13 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION Slide 3 $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2

Operating Expenses Reconciliation REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2

Income from Operations Reconciliation REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 REVENUE BY SEGMENT [Data used for bar graph] $ Millions 45,565 45,657 45,747 45,838 45,930 Datacenter and Communications 864 905 969 1,018 1,090 0.69000000000000006 Industrial 484 530 529 511 491 0.31 Total 1,348 1,435 1,498 1,529 1,581 1 REVENUE BY REGION [Data used for bar graph] $ Millions 45,382 45,473 45,565 45,657 45,747 North America 688 756 807 860 944 0.63 0.1 0.37 Europe 182 182 169 167 173 0.12 0.04 -0.05 Japan & Korea 155 167 165 187 177 0.12 -0.05 0.14000000000000001 China 154 173 170 184 161 0.11 rounded to foot -0.13 0.05 Other 30 36 37 37 43 0.03 0.16 0.43 Total 1,209 1,314 1,348 1,435 1,498 1 0.04 0.24 GROSS MARGIN RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Fair value adjustment on acquired inventory 0 Start-up costs 0 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 OPERATING EXPENSES RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 R&D on GAAP basis 155 156 151 144 132 Share-based compensation -7 -6 -5 -6 -5 Amortization of acquired intangibles 0 0 -4 -1 -1 Start-up costs 0 Integration, site consolidation and other 0 0 0 0 0 R&D on non-GAAP basis 148 150 141 137 126 SG&A on GAAP basis 252 245 231 221 229 Share-based compensation -32 -33 -30 -30 -25 Amortization of acquired intangibles -42 -41 -40 -41 -41 Financing fees 0 0 0 0 0 Integration, site consolidation and other -23 -14 -6 -5 -12 SG&A on non-GAAP basis 156 157 156 146 152 Restructuring on GAAP basis 19 54 74 8 24 Restructuring -19 -54 -74 -8 -24 Restructuring on non-GAAP basis 0 0 0 0 0 Impairment of assets held-for-sale on GAAP basis 9 85 0 0 0 Impairment of assets held-for-sale -9 -85 0 0 0 Impairment of assets held-for-sale on non-GAAP basis 0 0 0 0 0 Gain on sale of business on GAAP basis -,115 0 0 0 0 Gain on sale of business 115 0 0 0 0 Gain on sale of business on non-GAAP basis 0 0 0 0 0 INCOME FROM OPERATIONS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Op. income on GAAP basis 259 6 72 137 75 Share-based compensation 45 44 40 41 36 Fair value adjustment on acquired inventory 0 0 0 0 0 Amortization of acquired intangibles 70 72 87 72 72 Start-up costs 0 0 0 0 0 Restructuring charges 19 54 74 8 24 Transaction fees and financing 0 0 0 0 0 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Op. income on non-GAAP basis 309 275 279 265 218 Non-GAAP Op. Margin Percentage 0.19500000000000001 0.18 0.18600000000000003 0.185 0.161 NET EARNINGS RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) attributable to Coherent Corp. on GAAP basis 226 -96 16 103 26 Share-based compensation 45 44 40 41 36 Amortization of acquired intangibles 70 72 87 72 72 Fair value adjustment on acquired inventory 0 Start-up costs 0 Foreign currency exch. (gains) losses -1 37 17 -35 10 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Gain on sale of investment -7 0 0 0 0 Financing fees 12 0 0 0 0 Non-controlling interest impact of non-GAAP items 0 0 -12 0 0 Tax impact of non-GAAP measures -60 -18 -51 -11 -40 . Net earnings attributable to Coherent Corp. on non-GAAP basis 221 192 177 185 138 GROSS MARGIN AND EARNINGS PER COMMON SHARE $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Gross margin on GAAP basis 579 546 528 509 460 Share-based compensation 6 6 5 6 6 Amortization of acquired intangibles 28 31 44 30 30 Integration, site consolidation and other 0 0 0 3 -1 Gross margin on non-GAAP basis 613 582 577 548 495 $ for EPS, $ Millions for shares (Unaudited) 45,930 45,838 45,747 45,657 45,565 Common shares, GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 0 0 5.2 0 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, GAAP 190.7 155.5 155.19999999999999 160 153.6 Common shares, Non-GAAP 156.19999999999999 155.5 155.19999999999999 154.80000000000001 153.6 Effect of dilutive securities: Common stock equivalents 4.5999999999999996 3.7 4 5.2 4.9000000000000004 Series B Redeemable Preferred Stock 29.9 0 0 0 0 Diluted weighted average common shares, Non-GAAP 190.7 159.19999999999999 159.1 160 158.6 Net earnings (loss) attributable to Coherent Corp., GAAP Basic Earnings (Loss) Per Share 1.24 -0.83 -0.11 0.46 -0.04 Diluted Earnings (Loss) Per Share 1.19 -0.83 -0.11 0.44 -0.04 Net earnings attributable to Coherent Corp., non-GAAP Basic Earnings Per Share 1.2 1.02 0.93 0.99 0.69 Diluted Earnings Per Share 1.1599999999999999 1 0.91 0.95 0.67 NET EARNINGS, GAAP, AND ADJUSTED EBITDA RECONCILIATION $ Millions (Unaudited) 45,930 45,838 45,747 45,657 45,565 Net earnings (loss) on GAAP basis 225 -98 2 102 25 Income taxes (benefit) -8 35 8 27 -6 Depreciation and amortization 122 135 147 135 138 Interest expense 59 55 57 64 67 Interest income -10 -11 -10 -12 -13 EBITDA 389 116 204 316 211 EBITDA margin 0.24600000000000002 7.5999999999999998 0.13600000000000001 0.22 0.156 Prelim. fair value adj. on acquired inv. 0 0 Share-based compensation 45 44 40 41 36 Foreign currency exch. (gains) losses -1 37 17 -35 10 Start-up costs 0 0 0 Restructuring charges 19 54 74 8 24 Impairment of assets held-for-sale 9 85 0 0 0 Gain on sale of business -,115 0 0 0 0 Financing fees 6 0 0 0 0 Integration, site consolidation and other 22 14 6 7 11 Adjusted EBITDA 374 350 341 337 291 Less: adjusted EBITDA attributable to noncontrolling interests 0 1 1 1 1 Adjusted EBITDA attributable to Coherent Corp. 373 351 342 338 292 Adjusted EBITDA margin attributable to Coherent Corp. 0.23600000000000002 0.22899999999999998 0.22800000000000001 0.23600000000000002 0.21600000000000003 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 QTD End Market Distribution of Q1FY25 QTD Revenue Reported Segments Q1FY24 Revenue Q1FY25 Revenue Q1FY24/Q1FY25 Revenue Growth Q1FY25 Op Margin - GAAP Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 864 1,090 0.26 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 484 491 0.02 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue #REF! #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2 SEGMENT REVENUE BY END MARKETS FOR Q1FY25 YTD End Market Distribution of Ytd Q1FY25 YTD Revenue Reported Segments Ytd Q1FY24 Revenue Ytd Q1FY25 Revenue Ytd Q1FY24/Q1FY25 Revenue Growth Ytd Q1FY25 Op Margin - GAAP Ytd Q1FY25 Op Margin - Non-GAAP Industrial Communications Electronics Instrumentation Materials Segment 0 1,090 #DIV/0! 0.10300000000000001 0.23699999999999999 #DIV/0! #DIV/0! 0.3 0.04 Networking Segment 0 491 #DIV/0! 0.22800000000000001 0.247 #DIV/0! #DIV/0! 0 0.01 Lasers Segment #REF! #REF! #REF! #REF! 0.79 0 0 0.21 Total Revenue 0 #REF! #REF! 0.16399999999999998 0.19500000000000001 #DIV/0! #DIV/0! 0.05 7.0000000000000007E-2